E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® A NASDAQ Traded Company - Symbol HBNC INVESTOR PRESENTATION | OCTOBER 26, 2022

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Forward-Looking Statements This press release may contain forward–looking statements regarding the financial performance, business prospects, growth and operating strategies of Horizon Bancorp, Inc. and its affiliates (collectively, “Horizon”). For these statements, Horizon claims the protection of the safe harbor for forward–looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in this press release should be considered in conjunction with the other information available about Horizon, including the information in the filings we make with the Securities and Exchange Commission (the “SEC”). Forward–looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward– looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance. Although management believes that the expectations reflected in such forward–looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include: changes in the level and volatility of interest rates, changes in spreads on earning assets and changes in interest bearing liabilities; increased interest rate sensitivity; continuing increases in inflation; loss of key Horizon personnel; increases in disintermediation; potential loss of fee income, including interchange fees, as new and emerging alternative payment platforms take a greater market share of the payment systems; estimates of fair value of certain of Horizon’s assets and liabilities; changes in prepayment speeds, loan originations, credit losses, market values, collateral securing loans and other assets; changes in sources of liquidity; continuing risks and uncertainties relating to the COVID–19 pandemic and government responses thereto; legislative and regulatory actions and reforms; changes in accounting policies or procedures as may be adopted and required by regulatory agencies; litigation, regulatory enforcement, and legal compliance risk and costs; rapid technological developments and changes; cyber terrorism and data security breaches; the rising costs of cybersecurity; the ability of the U.S. federal government to manage federal debt limits; climate change and social justice initiatives; material changes outside the U.S. or in overseas relations, including changes in U.S. trade relations related to imposition of tariffs, Brexit, and the phase out of the London Interbank Offered Rate (“LIBOR”); the inability to realize cost savings or revenues or to effectively implement integration plans and other consequences associated with mergers, acquisitions, and divestitures; acts of terrorism, war and global conflicts, such as the Russia and Ukraine conflict; and supply chain disruptions and delays. These and additional factors that could cause actual results to differ materially from those expressed in the forward–looking statements are discussed in Horizon’s reports (such as the Annual Report on Form 10–K, Quarterly Reports on Form 10–Q, and Current Reports on Form 8–K) filed with the SEC and available at the SEC’s Internet website (www.sec.gov). Undue reliance should not be placed on the forward–looking statements, which speak only as of the date hereof. Horizon does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions that may be made to update any forward–looking statement to reflect the events or circumstances after the date on which the forward–looking statement is made, or reflect the occurrence of unanticipated events, except to the extent required by law. Non-GAAP Measures Certain non-GAAP financial measures are presented herein. Horizon believes they are useful to investors and provide a greater understanding of Horizon’s business without giving effect to non-recurring costs and non-core items. For each non-GAAP financial measure, we have presented comparable GAAP measures and reconciliations of the non-GAAP measures to those GAAP measures in the Appendix to this presentation. Please see slides 39-57. Important Information 2

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Corporate Overview 3

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 3Q22 Highlights Meeting or Exceeding Our 2022 Goals Goals 3Q22 Change % vs. Linked Quarter Year-to- date Total Loan Growth, Annualized(1) 7.8% 14.5% Commercial Loan Growth, Annualized(1) 10-14% 1.80% 13.80% Consumer Loan Growth, Annualized(1) 10-14% 6.00% 31.70% Non-interest Expense/Average Assets, Annualized <2.00% 1.99% 1.99% ROAA >1.30% 1.24% 1.29% ROAE >12.50% 13.89% 13.97% (1) Excludes PPP loans and sold commercial participation loans 4

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 5 Disciplined operating culture Compelling value supported by commitment to dividend Well-established long-term growth goals Very attractive Midwest markets Diversified mix of businesses delivers very strong operational performance Why Horizon? A High-Performing Operator in Growth Markets (1) Footnote Index included in Appendix (see slides 39-57 for non-GAAP reconciliation) 1.29% ROAA, 18.73% ROATE & 1.99% operating expenses/avg. assets YTD Closed 7 branches in 2022. Annual impact will be realized in 2023 166% P/TBV and 8.4x P/E (TTM) with a 3.6% dividend yield 30-year record of quarterly cash dividends to shareholders. 2022 annual dividend of 64¢/share (28.8% payout ratio) 17% average asset growth 2017-2021 14% annualized loan growth YTD (excluding PPP and sold commercial participation loans) Stable core deposit base funded primarily by a granular portfolio of consumer and business clients 30 minutes from downtown Chicago benefiting from Illinois exodus Attractive Midwest Markets with favorable infrastructure investment, rising household income and growing manufacturing, healthcare, and educational industries >50% of loan portfolio is commercial with growth of $51 million or 7% annualized in Q3. Portfolio well balanced across multiple segments and markets Consumer loan growth of $51 million or 24% annualized with strong growth in both indirect and consumer lending Mortgage loans increased $25 million or 17% annualized. Organic growth of high quality borrowers within local markets

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 6 Mark E. Secor EVP & Chief Financial Officer • 33 Years of Banking and Public Accounting Experience • 13 Years with Horizon as CFO and EVP of Horizon Kathie A. DeRuiter EVP & Senior Operations Officer • 32 Years of Banking and Operational Experience • 21 Years as Senior Bank Operations Officer Todd A. Etzler EVP & Corporate Secretary & General Counsel • 30 Years of Corporate Legal Experience and 11 years of General Counsel Experience • 4 Years as SVP and General Counsel Craig M. Dwight Chairman & CEO • 43 Years of Banking Experience • 23 Years as President or CEO of Bank Seasoned Management Team Lynn M. Kerber EVP & Chief Commercial Banking Officer • 31 Years of Banking Experience • 4 Years with Horizon as Senior Commercial Credit Officer Noe S. Najera EVP, Senior Retail & Mortgage Lending Officer • 20 Years of Banking Experience • 6 Years with Horizon, 3 Years as SVP Retail Lending * As of April 1, 2022 Thomas M. Prame President • 28 Years of Banking Experience • 20 Years in Executive Leadership Roles

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® A History of Profitable Growth Positioned Well for Future Organic Growth $0.72 $0.76 $0.91 $1.13 $1.22 $1.26 $1.31 $1.39 $1.40 $1.55 $1.85 $1.76 $2.08 $2.65 $3.14 $3.96 $4.25 $5.24 $5.89 $7.36 $7.72 $5 $7 $7 $7 $7 $8 $9 $9 $10 $13 $20 $20 $18 $21 $24 $33 $53 $67 $68 $87 $94 - 10 20 30 40 50 60 70 80 90 100 - 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Sept. '22 TTM Total Assets ($B) Net Income ($M) CAGRs 2002 through 2021 Total Assets – 13.0% Net Income – 20.0% 7 12 15 Organic Expansions M&A Transactions

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 8 * U.S. Bureau of Economic Analysis, retrieved from FRED, Federal Reserve Bank of St. Louis, fred.stlouisfed.org, April 18, 2022. Built to Outpace GDP & Industry Over Long-Term Assets Grew 29% ex. PPP During 2021 23% 5% 21% 23% 8% 3% 4% 6% 1% 10% 20% -5% 18% 28% 18% 26% 7% 24% 12% 25% 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 HBNC Annual Asset Growth, ex. PPP PPP Contribution to HBNC Annual Asset Growth GDP Annual Growth* All Commercial Bank Annual Asset Growth* Well-Established Long-Term Goals Meaningfully outpace GDP and industry ~50/50 growth organic/acquired Organic growth of ≥3x GDP growth 2012 - 2021 2017 - 2021 20% average asset growth 4.7x GDP 3.3x banks 24% average asset growth 4.9x GDP 3.3x banks

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 9 Multiple Revenue Streams Diversifies Risk 9 Retail Banking Business Banking Mortgage Banking Wealth Management Complementary Revenue Streams that are Counter-Cyclical to Varying Economic Cycles Serving the Right Side of Chicago Headquartered in Michigan City, IN, with 73 locations in attractive markets in Indiana and Michigan Double commuter track addition to the South Shore train lines supports growth in Northwest Indiana, which offers proximity to Chicago, with lower taxes and cost of living Major colleges and universities throughout footprint, including Notre Dame University, Purdue University, University of Michigan and Michigan State University Note: Total loan figures for Indiana and Michigan are as of 9/30/22 and do not include Mortgage Warehouse. INDIANA 9/30/22 Loans: $2.2B 56% of Loans MICHIGAN 9/30/22 Loans: $1.7B 44% of Loans OHIO ILLINOIS WISCONSIN KENTUCKY $1.7B IN LOANS $2.2B IN LOANS Diversified & Attractive Footprint

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 10 Michigan City, IN / La Porte, IN (Legacy) Indianapolis, IN (Growth) Northwest Indiana (Growth) Lafayette, IN (Growth) Southwest Michigan* (Growth) $1.2B Deposits $791M Deposits $709M Deposits $344M Deposits$561M Deposits 8 Branches 8 Branches 10 Branches 5 Branches8 Branches • Similar culture and economic base to legacy markets in Northern Indiana • Grand Rapids one of the most attractive markets in the Midwest • Purdue University collaborates with contiguous cities of Lafayette and West Lafayette • Subaru expanding facilities • Double commuter track addition to the South Shore train lines • High cost of living in Chicago • Population density of Chicago • Greater Indianapolis area exhibits strong growth • Significant manufacturing, healthcare, and education industries • Over $1.5B in public and private investments since 2012 • Double commuter track addition to the South Shore train lines Source: S&P Global Market Intelligence. Note: Core market demographics reflect MSA data. Deposit data as of 6/30/22. *Southwest Michigan defined as the MSAs of Niles, Grand Rapids-Kentwood and Kalamazoo-Portage. Demographic data weighted by HBNC deposits. Attractive & Stable Midwest Markets Top 5 Markets by Deposits Michigan City, IN La Porte, IN Indianapolis, IN Northwest Indiana Southwest Michigan* Lafayette, IN Median HHI $53,255 $65,306 $74,285 $58,856 $59,404 ’20 – ’25 HHI Growth 6.8% 11.2% 11.5% 11.8% 10.9% ’20 – ’25 Pop. Growth 0.12% 3.81% 0.08% 1.02% 3.86%

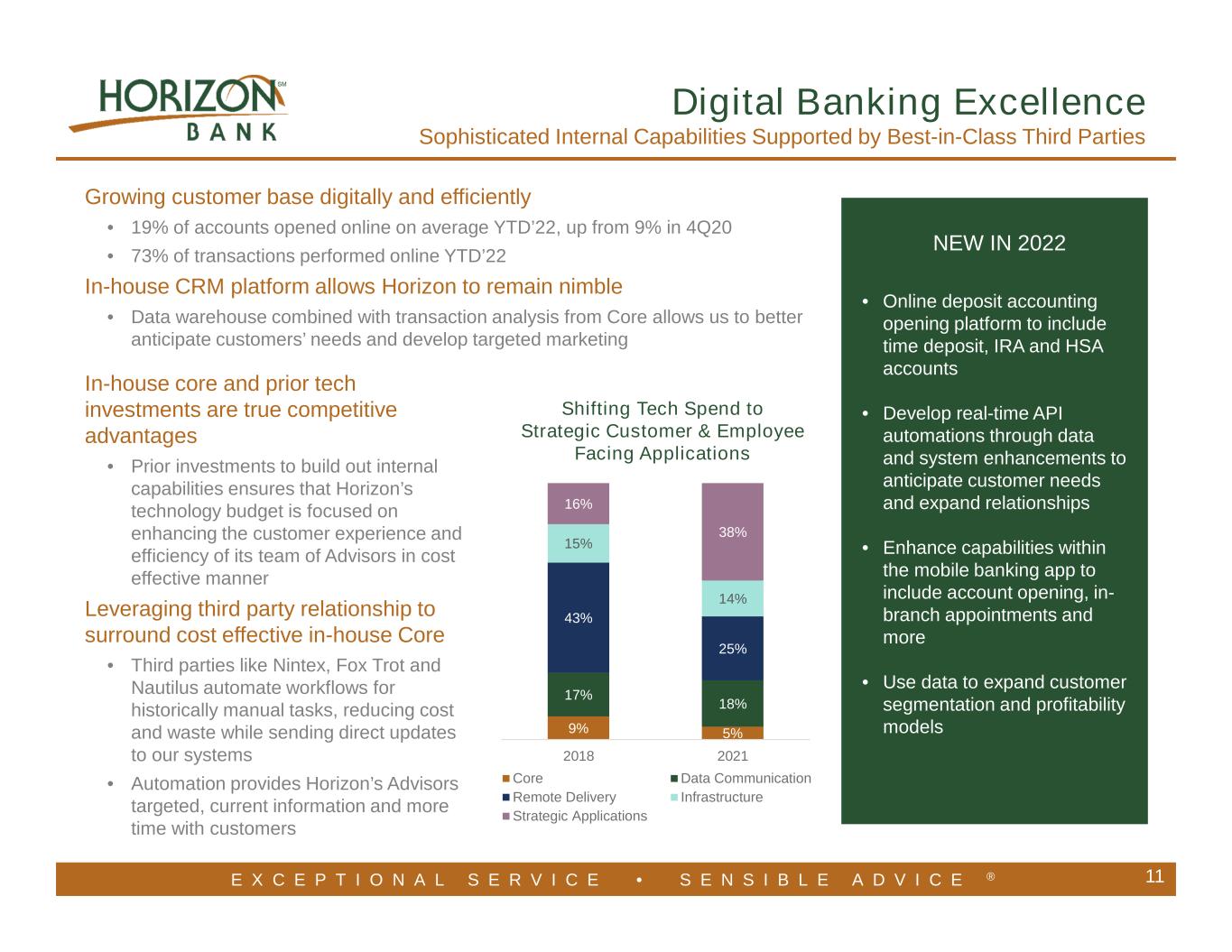

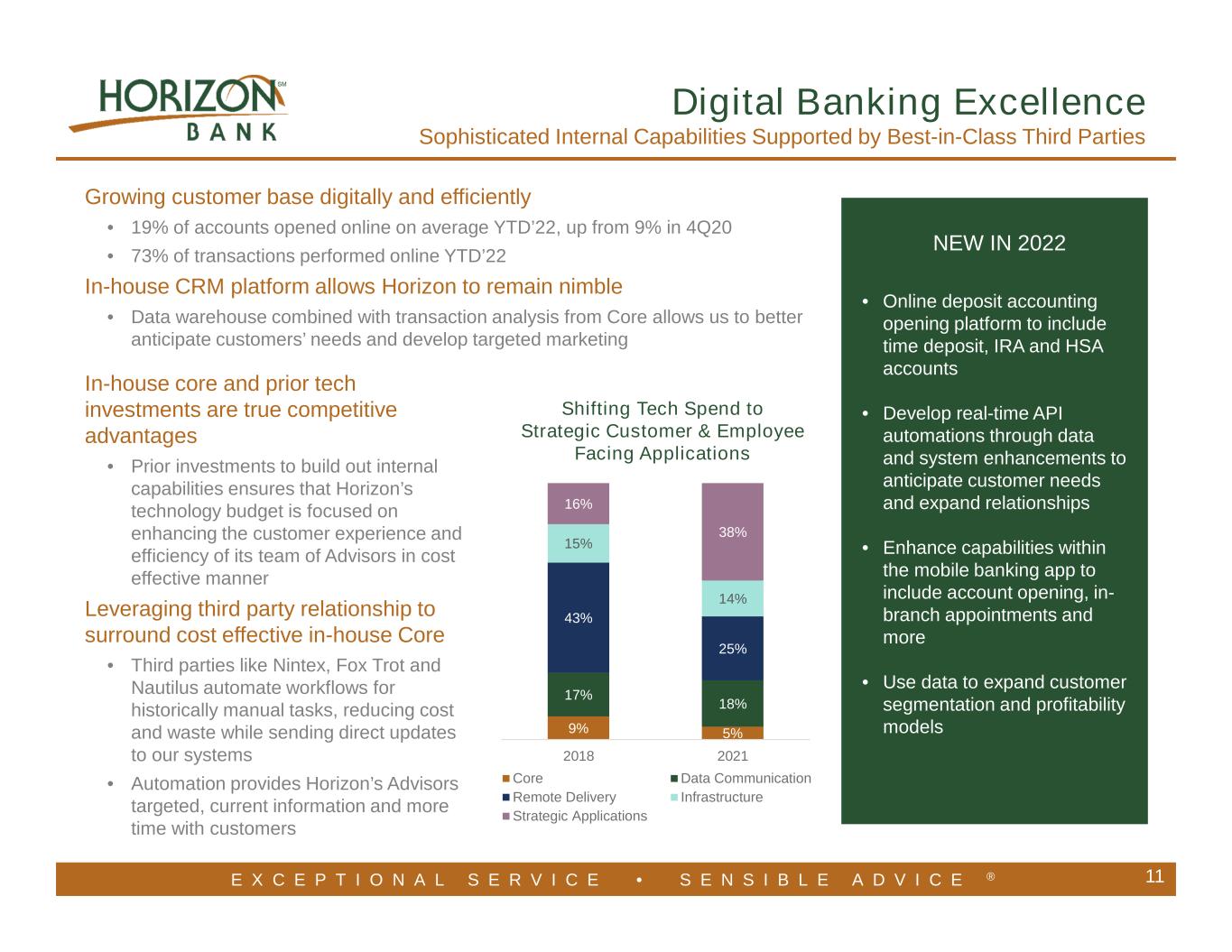

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Digital Banking Excellence Sophisticated Internal Capabilities Supported by Best-in-Class Third Parties NEW IN 2022 • Online deposit accounting opening platform to include time deposit, IRA and HSA accounts • Develop real-time API automations through data and system enhancements to anticipate customer needs and expand relationships • Enhance capabilities within the mobile banking app to include account opening, in- branch appointments and more • Use data to expand customer segmentation and profitability models Growing customer base digitally and efficiently • 19% of accounts opened online on average YTD’22, up from 9% in 4Q20 • 73% of transactions performed online YTD’22 In-house CRM platform allows Horizon to remain nimble • Data warehouse combined with transaction analysis from Core allows us to better anticipate customers’ needs and develop targeted marketing Shifting Tech Spend to Strategic Customer & Employee Facing Applications 9% 5% 17% 18% 43% 25% 15% 14% 16% 38% 2018 2021 Core Data Communication Remote Delivery Infrastructure Strategic Applications In-house core and prior tech investments are true competitive advantages • Prior investments to build out internal capabilities ensures that Horizon’s technology budget is focused on enhancing the customer experience and efficiency of its team of Advisors in cost effective manner Leveraging third party relationship to surround cost effective in-house Core • Third parties like Nintex, Fox Trot and Nautilus automate workflows for historically manual tasks, reducing cost and waste while sending direct updates to our systems • Automation provides Horizon’s Advisors targeted, current information and more time with customers 11

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Community Banking at Scale Efficient Utilization of Talent, Technology & Branch Network 50 50 50 60 65 81 32 32 46 56 62 63 74 73 78 665 701 716 839 788 900 0 200 400 600 800 1000 - 50 100 150 200 250 2016 2017 2018 2019 2020 2021 Evolving Multi-Channel Delivery ATMs ITMs Branches Employees $5.4 $5.8 $6.0 $6.5 $7.3 $8.7 $- $1 $2 $3 $4 $5 $6 $7 $8 $9 $10 - 150,000 300,000 450,000 600,000 750,000 900,000 2016 2017 2018 2019 2020 2021 M ill io n s Technology Meeting Customer Demands & Enhancing Efficiency of Team Digital Transactions Branch Transactions Total Assets / Employee Technology enhances Advisors’ ability to serve customers and enhance bottom-line • Video banking team serves multiple markets through robust network of 46 interactive teller machines (ITMs) • ITMs proved to be valuable and scalable amid the pandemic, with 14 new ITMs rolled out ahead of 2021 branch acquisition • 84% of online chats answered by bots, freeing Advisors to provide more value-added services to customers • Three bank owned and operated Communication Centers supported by branch staff as needed • Investments in technology improve efficiency as measured by growth in assets per employee from $5.4 million in 2016 to $8.7 million in 2021 12

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 13 Productive Use of Capital Deploying capital through productive acquisitions and to drive organic growth • Completed acquisition of 14 Michigan branches and associated deposits and loans in 3Q21, adding mass and scale to Horizon’s Midland market and extending its footprint into attractive markets in the northern and central regions of Michigan’s lower peninsula • Investing in commercial lenders and consumer platforms to leverage capital through organic loan growth Longstanding dividend • 30+ years of uninterrupted quarterly cash dividend • Horizon increased its quarterly dividend during the second quarter of 2022 by 6.3% to $0.16 per share, resulting in tenth dividend increase in the last 11 years • Current implied annualized dividend yield of 3.6% as of September 30, 2022 • Strong cash position at the holding company represents approximately 6 quarters of the current dividend plus fixed costs FUTURE OUTLOOK Targeted dividend payout ratio of 25-35% Current focus is on Organic Growth Opportunistic acquisitions with focus on lease models

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 14 Financial Highlights

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 15 $ M $28.2 $23.4 $25.7 $29.1 $25.2 $23.0 $23.7 $23.6 $24.2 $23.8 $0.52 $0.54 $0.54 $0.56 $0.55 3Q21 4Q21 1Q22 2Q22 3Q22 Adj. Net Income(1) Pre-tax, Pre-provision Income Adj. Net Income Adj. EPS 14.34% 14.45% 14.56% 16.84% 14.71% 3Q21 4Q21 1Q22 2Q22 3Q22 Adj. PTPP ROACE(1) Adj. PTPP ROACE $45.7 $48.2 $47.3 $51.8 $52.5 3.12% 2.86% 2.93% 3.12% 3.08% 3Q21 4Q21 1Q22 2Q22 3Q22 Adj. Net Interest Income(1) Adj. Net Interest Income Adj. NIM $ M (1) Footnote Index included in Appendix (see slides 39-57 for non-GAAP reconciliation) 16.58% 17.42% 17.70% 19.86% 18.71% 3Q21 4Q21 1Q22 2Q22 3Q22 Adj. ROATE(1) Adj. ROATE Strong Core Earnings

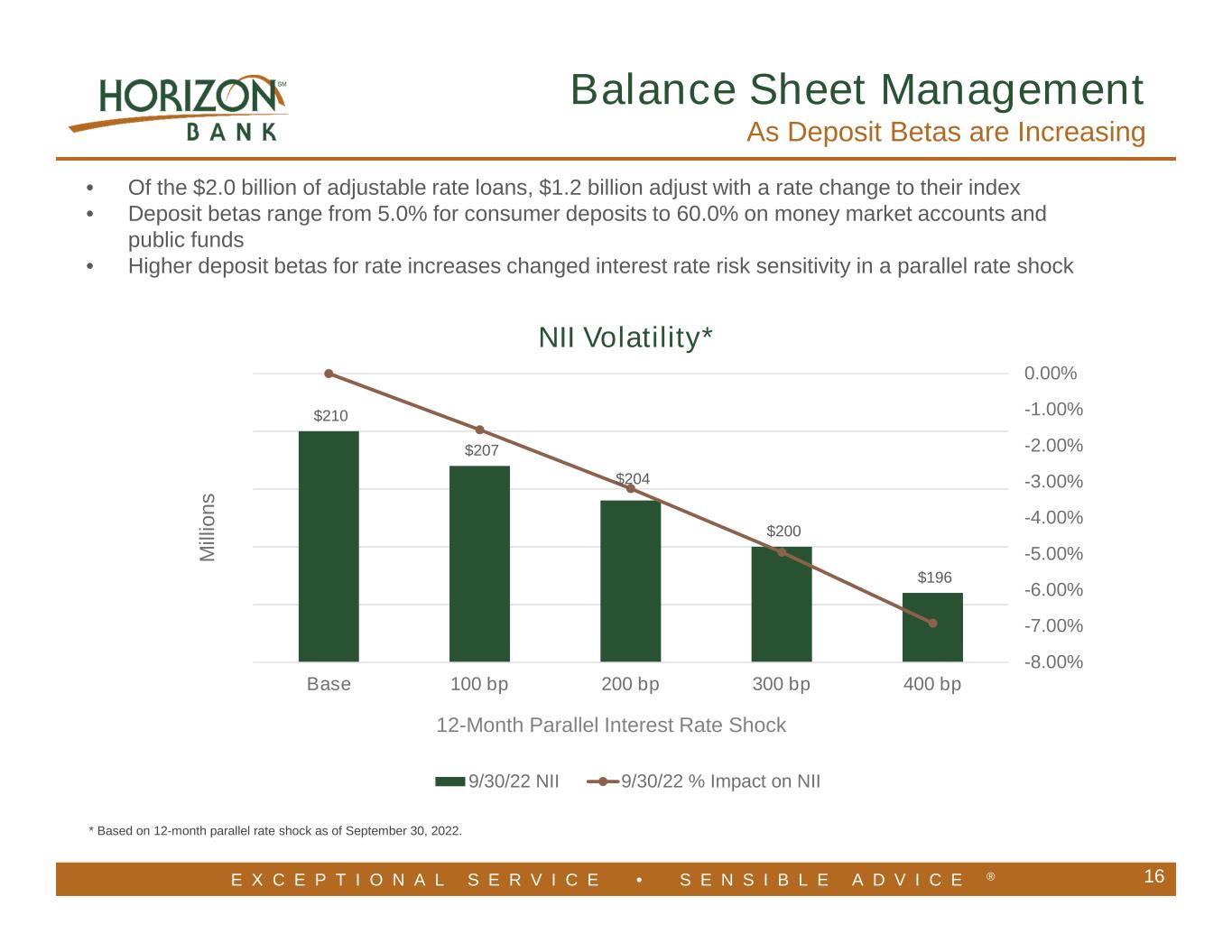

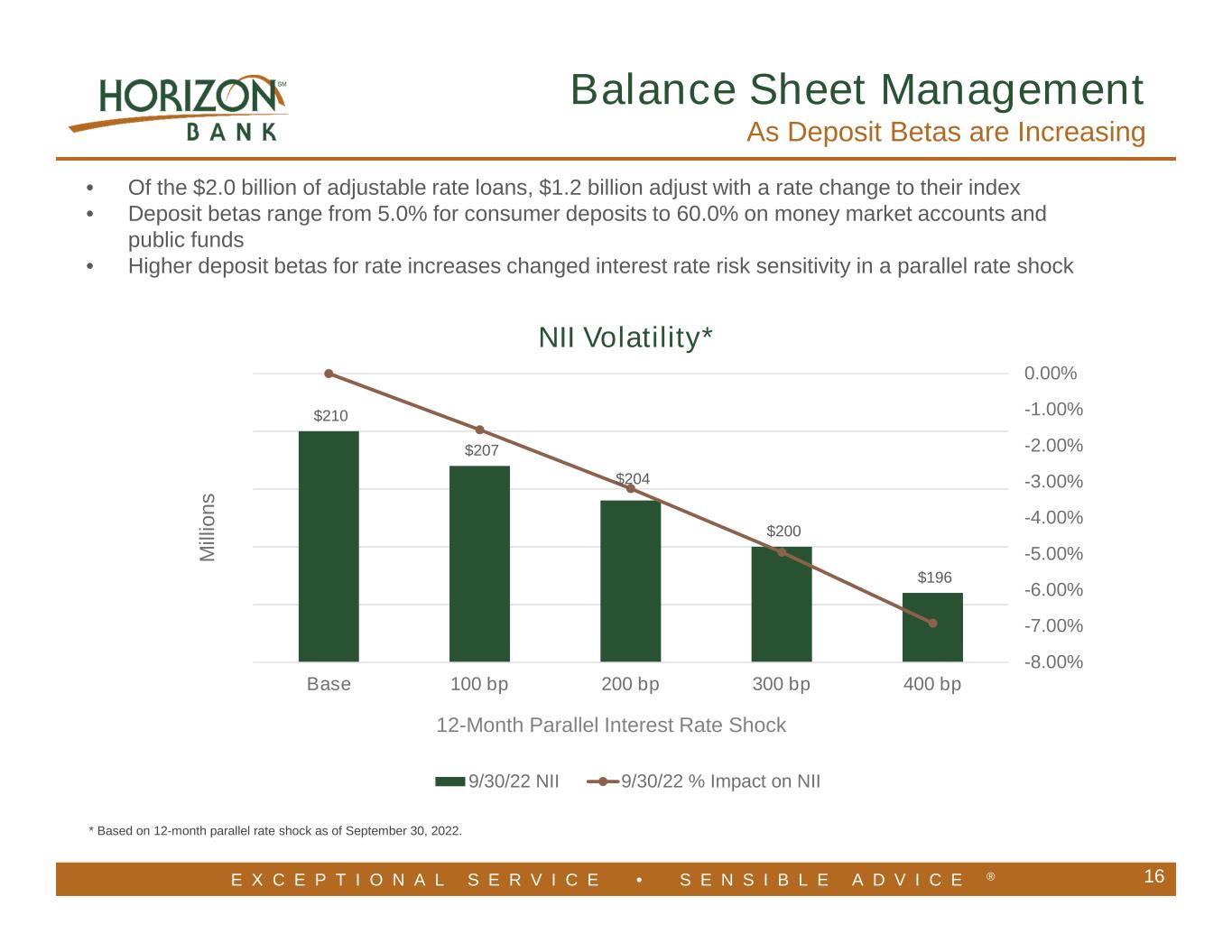

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 16 Balance Sheet Management As Deposit Betas are Increasing • Of the $2.0 billion of adjustable rate loans, $1.2 billion adjust with a rate change to their index • Deposit betas range from 5.0% for consumer deposits to 60.0% on money market accounts and public funds • Higher deposit betas for rate increases changed interest rate risk sensitivity in a parallel rate shock * Based on 12-month parallel rate shock as of September 30, 2022. $210 $207 $204 $200 $196 -8.00% -7.00% -6.00% -5.00% -4.00% -3.00% -2.00% -1.00% 0.00% Base 100 bp 200 bp 300 bp 400 bp M ill io n s NII Volatility* 9/30/22 NII 9/30/22 % Impact on NII 12-Month Parallel Interest Rate Shock

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 3.66% 3.71% 3.63% 3.61% 3.58% 3.60% 3.59% 3.43% 3.46% 3.61% 3.67% 3.49% 3.44% 3.35% 3.27% 3.44% 3.17% 3.13% 3.12% 2.86% 2.93% 3.12% 3.08% 0.48% 0.50% 0.55% 0.63% 0.70% 0.82% 0.93% 1.07% 1.19% 1.13% 1.10% 1.04% 0.95% 0.60% 0.53% 0.45% 0.40% 0.35% 0.30% 0.25% 0.24% 0.27% 0.55% 0.80% 1.05% 1.25% 1.29% 1.53% 1.80% 2.01% 2.28% 2.50% 2.50% 2.30% 1.83% 1.40% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.29% 0.94% 2.35% 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 Net Interest Margin Adj. NIM (1) Adj. Cost of Core Funds (1) Avg. Fed Funds Rate (2) • Loan growth, cash deployed to higher yielding assets and increasing interest rates to increase net interest income • Cost of core funds increased 28 basis points during the quarter, the average Fed Funds rate increased 141 basis points 17 (1) Footnote Index included in Appendix (see slides 39-57 for non-GAAP reconciliation) (2) Source: S&P Global Market Intelligence. Focus on Increasing Net Interest Income

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Fed Agy CMO, 3% State and Muni, 51% Fed Agy MBS, 18% Private labeled MBS, 1% U.S. Treasury, 19% Corp, 8% Total Investments at 9/30/22 $3.0B 18 • Investment portfolio cash flows are helping to fund higher yielding loans • Book yield of 2.28%, effective duration of 6.95 years • $48 million of cash flows expected over the next quarter and $227 million expected in 2023 • At September 30, 2022, the Company had approximately $640 million in unused lines of credit and $2.1 billion of unpledged securities Investment Portfolio Significant Contribution to Interest Income Securities Portfolio Detail Security Type ($000s) 3Q 2022 Amortized Cost 2Q 2022 Amortized Cost QoQ Change 3Q 2022 Duration (yrs) U.S. Treasury and federal agencies $589 $590 $(1) 5.05 Mortgage-backed 707 735 (28) 5.29 Corporate securities 249 248 1 5.03 State and municipal 1,634 1,643 (9) 8.73 Total Securities $3,179 $3,216 $(37) 6.95

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 19 • Accumulated Other Comprehensive Income (“AOCI”) loss reduced Tangible Common Equity (“TCE”) to 6.25%, or by 3.55%, in the third quarter • We have the intent and ability to hold the investments to maturity and no plans to sell • Cash flows can be used to fund future high single digit loan growth • Retained earnings and investments moving down the curve would earnback capital loss • No impact to regulatory capital ratios • With an additional 200bp parallel shock to the AFS investments over the next quarter, TCE is estimated to be 5.22%, or another 103bp decline from the third quarter • Bank capital ratios exceed regulatory capital ratios for “well capitalized” banks with leverage and risk based capital ratios of 8.84% and 13.65%, respectively • AOCI only considers AFS investments and derivatives, the economic value of equity (“EVE”) increased when comparing September 30, 2022 to September 30, 2021, when deposits are included in the valuations Other Comprehensive Income

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Non-interest bearing 23% Interest bearing(1) 64% CDs 13% 20 • In-market relationships and strategic pricing, contributed to total deposit cost of 0.28% • Deposit beta’s have lagged short term rate increases as we are disciplined in holding total deposit costs down, only increased 20bps since the first quarter • Account and deposit retention data very strong to date Average Cost(1) Average Deposits ($000s) 3Q 2022 Average Balances 2Q 2022 Average Balances 3Q 2022 (QTD) 2Q 2022 (QTD) Non-interest bearing $1,351,857 $1,335,779 0.00% 0.00% Interest bearing (excluding CDs) $3,708,419 $3,796,619 0.29% 0.09% Time Deposits (CDs) $770,322 $744,340 0.72% 0.47% Total Deposits $5,830,598 $5,876,738 0.28% 0.11% (1) Footnote Index included in Appendix (see slides 39-57 for non-GAAP reconciliation) Stable Low Cost Core Deposits Total Deposits at 9/30/22 $5.8B

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® • Annualized non-interest expense was 1.99% of average assets, supporting full year 2022 target of less than 2% • Planned 2022 branch rationalization payback in approximately six months after one time charges of ~ $380,000 recorded during 2Q ‘22 • Planned cost saves in 2023 in cyclical business models with continued branch rationalization review 21 3Q ’22 Highlights (1) Footnote Index included in Appendix (see slides 39-57 for non-GAAP reconciliation) Good Expense Control 2.05% 1.95% 2.03% 1.95% 1.99% $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 3Q21 4Q21 1Q22 2Q22 3Q22 Other Loan Expense Outside Services & Consultants Professional Fees Data Processing Net Occupancy Expenses Salaries & Employee Benefits Annualized Non-Interest Expense to Average Assets Non-interest Expense Breakout ($M)(1)

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Loan Portfolio Review 22

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Northern Indiana, 19% Central Indiana, 29%Other, 3% Michigan, 49% Geography at 9/30/22 Non-Owner Occupied Real Estate, 49.9% C&I, 23.5% Owner Occ. Real Estate, 22.7% Agriculture, 2.4% Develop./Land, 1.0% Res. Spec. Homes, 0.5% Category at 9/30/22 $2.4 billion in Total Commercial Loans Robust Commercial Loan Growth 23 • Commercial loan portfolio, excluding PPP and sold participation loans, increased approximately $41.8 million, or 7.2% annualized, during Q3 2022. • Continued positive trends with net funding of commercial loans of $117 million for Q3 compared to $142 million for Q2. New originations included construction projects which will benefit future quarters. • Q3 loan growth approximately 23% owner occupied real estate, 23% C&I, 17% retail and/or mixed use and 10% lessors 1-4 family. • Commercial pipeline positioned at $126 million entering Q4 compared to a pipeline of $160 million at the start of Q3.

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 24 • Excellent Production in 2021, Q1 2022, Q2 2022 & Q3 2022 • Strong production of $149M • Portfolio gained $51 million, representing 6.0% quarterly growth, or 23.9% annualized • Continued high quality originations YTD with 87% Loan to Value, 771 avg. credit score & 27% Debt to Income • Balanced lending growth in Q3. Indirect (+$33 million), Consumer (+$18 million). • Holding Asset Quality to Historical Norms • 99.7% secured consumer loans • 87.8% prime, with credit scores ≥700 • HELOC combined LTV limited to 89.9% • Low, single digit exception rate on approvals • Low delinquency at 0.56% and YTD net charge- offs of 0.07% Indirect Auto, 55.6% Direct Auto, 3.3% Home Equity Term, 5.1% HELOCs, 32.5% RV & Boat, 2.8% Unsecured, 0.3% Other, 0.4% Total Outstanding at 9/30/22 $900M Excellent Consumer Loan Growth

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 25 Jumbo, 47.2% Rental, 0.9% Conforming, 46.6% Construction, 5.3% Total Outstanding at 9/30/22 $635M Prime Mortgage Loan Portfolio • Gain on sale of mortgage loans (“GOS”) and mortgage warehousing income constituted only 3.8% of total 3Q22 revenue • GOS income totaled $1.4 million during 3Q22, down from $2.5 million during 2Q22, reflective of industry origination trends • Positioned well for current marketplace opportunities • Strong construction loan program to take advantage of fast growing new construction segment of market • Installed best in class construction desk software, creating a better client/builder experience with increased draw oversight and risk management practices • Adjusting cost structure to new volume norms • High Quality Portfolio • Underwriting to Fannie Mae guidelines • Full documentation of employment, income and asset verification • 43.2% of mortgages held in portfolio are ARMs • Average credit score 740

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® -$18 $1,412 $136 $284 $138 0.04% 0.01% 3Q21 4Q21 1Q22 2Q22 3Q22 Net Charge Offs NCOs NCOs/Average Loans $ 0 0 0 s $29,374 $19,019 $20,113 $20,206 $19,158 0.80% 0.53% 0.54% 0.51% 0.48% 3Q21 4Q21 1Q22 2Q22 3Q22 Non-Performing Loans NPLs (period end) NPLs/Loans (period end) $ 0 0 0 s $1,112 -$2,071 -$1,386 $240 -$601 3Q21 4Q21 1Q22 2Q22 3Q22 $ 0 0 0 s 26 CECL $56,779 $54,286 $52,508 $52,350 $51,369 1.55% 1.51% 1.41% 1.33% 1.28% 3Q21 4Q21 1Q22 2Q22 3Q22 ACL ACL/Loans Strong Asset Quality Metrics Allowance for Credit Losses (“ACL”) (CECL Implementation 1Q20) $ 0 0 0 s Credit Loss Expense (CECL Implementation 1Q20) 3Q22 ACL/Loans excluding PPP Loans = 1.28% 3Q22 ACL/Loans excluding PPP & Warehouse Loans = 1.30%

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 27 Key Franchise Highlights Positioned well for growth in 2022 and 2023, expansion of consumer dealer network, 20% increase in CLOs, 14 offices acquired and closed 10 offices in 2021 and closing 7 more offices in 2022 Granular low cost core deposits Growth oriented Midwest markets with balanced industrial bases and population inflows Low Credit Risk Profile – High quality balance sheet with strong liquidity – approximately $3.1 billion of cash and securities as of 9/30/22 Robust capital position 14.1% Tier 1 and 15.1% Total RBC as of 9/30/22 Building for loan growth, with complementary counter-cyclical revenue streams Historical run rate demonstrates strong core operating earnings 30-year unbroken quarterly cash dividend record, with strong cash position at the holding company and ability to dividend a significant amount of cash from the bank

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Annual Commercial Loan Growth 10% 10-14% 13.8% Reduction in Mortgage Originations 15-18% 15-18% 27.07% Annual Consumer Loan Growth 5-9% 10-14% 31.70% Annual Expenses to Average Assets <2.00% <2.00% 1.99% ROAA >1.20% >1.30% 1.29% ROAE >12.5% >12.5% 13.97% Exceeding Announced 2022 Goals 28 Initial Goal 4Q21 Update Goal 1Q22 Actual 3Q22 YTD

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 29 Appendix

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 30 (1) Net Reserve Build is equal to the provision for credit losses net of net charge-offs/recoveries. Stable Credit Loss Reserves ($000s, unaudited) 9/30/22 Net Reserve(1) 3Q22 Net Reserve(1) 2Q22 Net Reserve(1) 1Q22 12/31/21 Commercial $ 33,806 $ (996) $ (2,987) $ (2,986) $ 40,775 Retail Mortgage 5,137 715 71 495 3,856 Warehousing 1,024 (43) 12 (4) 1,059 Consumer 11,402 (657) 2,746 717 8,596 Allowance for Credit Losses $ 51,369 $ (981) $ (158) $ (1,778) $ 54,286 ACL/Total Loans 1.28% 1.51% Acquired Loan Discount $ 6,587 $ (619) $ (1,122) $ (769) $ 9,097

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Commercial, $2,404M, 60% Residential Mortgage, $635M, 16% Consumer, $900M, 22% Mortgage Warehouse, $74M, 2% Held For Sale, $2M, 0% 31 Gross Loans at 9/30/22 $4.0B Commercial Loans by Industry ($M) 9/30/22 Balance % of Commercial Portfolio % of Total Loan Portfolio Lessors – Residential Multi Family $220 9.1% 5.5% Health Care, Educational & Social 180 7.5% 4.5% Office (except medical) 162 6.7% 4.0% Hotel 157 6.5% 3.9% Retail 156 6.5% 3.9% Individual and Other Services 155 6.4% 3.9% Lessors – Student Housing 151 6.3% 3.8% Real Estate Rental & Leasing 132 5.5% 3.3% Warehouse/Industrial 132 5.5% 3.3% Manufacturing 105 4.4% 2.6% Finance & Insurance 98 4.1% 2.4% Construction 89 3.7% 2.2% Retail Trade 74 3.1% 1.8% Medical Office 71 2.9% 1.8% Lessors – Residential 1–4 Family 67 2.8% 1.7% Restaurants 64 2.7% 1.6% Mini Storage 52 2.2% 1.3% Leisure and Hospitality 51 2.1% 1.3% Professional & Technical Services 45 1.9% 1.1% Government 38 1.6% 0.9% Transportation & Warehousing 35 1.5% 0.9% Farm Land 34 1.4% 0.8% Wholesale Trade 32 1.3% 0.8% Agriculture 24 1.0% 0.6% Other 80 3.3% 2.0% Total $2,404 100.0% 59.9% Diversified & Granular Loan Portfolio

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 1% 2% 3% 3% 3% 6% 6% 7% 7% 7% 9% Farm Land Mini Storage All Others Lessors - Residential 1-4 Medical Office Warehouse/ Industrial Lessors Student Housing Retail Motel Office (except medical) Lessors - Residential Multi Note: Data as of 9/30/22 1% 1% 1% 1% 2% 2% 2% 2% 3% 4% 4% Wholesale Trade Construction Professional & Technical Services All Others Restaurants Leisure and Hospitality Retail Trade Manufacturing Individuals and Other Services Real Estate Rental & Leasing Health Care, Edu. Social Assist. 1% 1% 1% 1% 1% 1% 1% 2% 2% 3% 3% 3% 4% Professional & Technical Services Transportation & Warehousing Restaurants Agriculture Retail Trade All Others Government Real Estate Rental & Leasing Manufacturing Construction Health Care, Educational Social Assist. Individuals and Other Services Finance & Insurance 32 Non-Owner Occupied CRE – % of Total Commercial Loans Owner Occupied CRE – % of Total Commercial Loans 53% of Total Commercial Loans $1.3 billion 23% of Total Commercial Loans $0.5 billion C&I Loans – % of Total Commercial Loans 24% of Total Commercial Loans $0.6 billion Low Levels of Concentrated Exposure Commercial Portfolio By Industry Type

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Commercial loans: • 64% fixed / 36% variable • 24% of variable rate commercial loans have floors, 16% of which are at their floor Retained mortgage loans: • 57% fixed / 43% variable • 94% of variable rate mortgage loans have floors, 11% of which are at their floor Consumer loans: • 67% fixed / 33% variable • 72% of variable rate consumer loans have floors, 11% of which are at their floor 33 Stable Loan Yields $4.0 $4.0 $3.8 $3.6 $3.5 $3.6 $3.6 $3.8 $3.9 4.39% 4.72% 4.39% 4.43% 4.56% 4.52% 4.26% 4.45% 4.79% 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 Yield on Loans (%) / Total Average Loans ($B) Total Average Loans Yield on Loans (%)

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 11.1% 11.6% 12.0% 11.3% 12.0% 11.2% 11.2% 11.8% 12.2% 12.0% 12.1% 11.3% 2017 2018 2019 2020 2021 3Q22 9.9% 10.1% 10.5% 10.7% 9.1% 9.6% 9.7% 10.0% 10.2% 9.1% 8.9% 9.1% 2017 2018 2019 2020 2021 3Q22 12.9% 13.4% 14.0% 14.9% 15.7% 14.5%13.1% 13.5% 13.6% 14.3% 14.2% 13.7% 2017 2018 2019 2020 2021 3Q22 Source: S&P Global Market Intelligence. Note: Company closed the acquisition of Salin Bancshares, Inc. in March 2019. 34 TCE / TA (%) Leverage Ratio (%) Total RBC Ratio (%) 4.0% Adequate + Buffer 7.0% KBW Regional Bank Index Median - MRQ Robust Capital Foundation 10.5% HBNC Ratio 8.5% 8.8% 9.3% 9.1% 7.6% 6.3% 9.1% 9.2% 9.6% 8.6% 8.3% 7.0% 2017 2018 2019 2020 2021 3Q22 CET1 Ratio (%)

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 35 (1) Footnote Index included in Appendix (see slide 54 for non-GAAP reconciliation) (2) As calculated by S&P Global Market Intelligence. Historical Financials ($M except per share data) 2016 2017 2018 2019 2020 2021 9/30/21 12/31/21 3/31/22 6/30/22 9/30/22 Balance Sheet: Total Assets $3,141 $3,964 $4,247 $5,247 $5,887 $7,375 $7,534 $7,375 $7,420 $7,641 $7,719 Gross Loans $2,144 $2,838 $3,014 $3,641 $3,881 $3,657 $3,665 $3,657 $3,715 $3,941 $4,014 Deposits $2,471 $2,881 $3,139 $3,931 $4,531 $5,803 $5,980 $5,803 $5,851 $5,846 $5,831 Tangible Common Equity $255 $325 $362 $478 $517 $548 $525 $548 $503 $484 $472 Profitability: Net Income $23.9 $33.1 $53.1 $66.5 $68.5 $87.1 $23.1 $21.4 $23.6 $24.9 $23.8 Return on Average Assets 0.81% 0.97% 1.31% 1.35% 1.22% 1.34% 1.41% 1.14% 1.31% 1.33% 1.24% Return on Average Equity 7.9% 8.7% 11.2% 11.0% 10.3% 12.2% 12.6% 11.8% 13.3% 14.7% 13.9% Net Interest Margin 3.29% 3.75% 3.71% 3.69% 3.44% 3.13% 3.17% 2.97% 2.99% 3.19% 3.13% Efficiency Ratio(1) 71.5% 65.3% 60.7% 59.9% 57.0% 58.1% 54.9% 62.7% 58.7% 55.6% 60.3% Asset Quality(2): NPAs & 90+ PD / Assets 0.44% 0.44% 0.41% 0.47% 0.49% 0.00% 0.43% 0.31% 0.30% 0.28% 0.29% NPAs & 90+ PD / Loans + OREO 0.65% 0.61% 0.57% 0.68% 0.74% 0.00% 0.88% 0.62% 0.61% 0.55% 0.56% Reserves / Total Loans 0.69% 0.58% 0.59% 0.49% 1.47% 1.51% 1.55% 1.51% 1.41% 1.33% 1.28% NCOs / Avg. Loans 0.08% 0.04% 0.05% 0.06% 0.05% 0.05% 0.00% 0.04% 0.00% 0.01% 0.00% Bancorp Capital Ratios: TCE Ratio 8.3% 8.5% 8.8% 9.4% 9.1% 7.6% 7.1% 7.6% 6.9% 6.5% 6.3% Leverage Ratio 10.4% 9.9% 10.1% 10.5% 10.7% 9.2% 10.0% 9.2% 9.7% 9.6% 9.6% Tier 1 Capital Ratio 13.2% 12.4% 12.8% 13.5% 14.0% 14.1% 14.3% 14.1% 14.1% 13.7% 13.6% Total Capital Ratio 13.9% 12.9% 13.4% 14.0% 14.9% 15.4% 15.3% 15.4% 15.2% 14.6% 14.5% Year Ended December 31, Quarter Ended,

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 36 Leader In Our Core Markets Source: S&P Global Market Intelligence. Deposit data as of 6/30/22, estimated pro forma for recent or pending transactions per S&P Global Market Intelligence MSA HBNC Rank HBNC Branches HBNC Market Share Deposits in Market ($M) Michigan City-La Porte, IN 1 8 55.3% $1,184 Indianapolis-Carmel-Anderson, IN 16 8 1.0% 791 Chicago-Naperville-Elgin, IL-IN-WI 47 10 0.1% 709 Lafayette-West Lafayette, IN 4 5 7.1% 344 Lansing-East Lansing, MI 12 4 2.4% 278 Niles, MI 4 5 12.0% 275 Detroit-Warren-Dearborn, MI 22 1 0.1% 224 Midland, MI 2 2 19.0% 219 Cadillac, MI 2 3 29.0% 219 Grand Rapids-Kentwood, MI 18 2 0.6% 192 Logansport, IN 3 1 17.5% 163 Columbus, IN 6 1 6.4% 118 Fort Wayne, IN 13 3 1.2% 114 Auburn, IN 3 2 11.9% 114 Warsaw, IN 5 2 5.1% 101 Kalamazoo-Portage, MI 9 1 2.0% 94 Big Rapids, MI 4 1 11.5% 80 Marion, IN 6 1 7.0% 68 Sturgis, MI 5 1 5.9% 62 Kokomo, IN 7 1 3.0% 47 Elkhart-Goshen, IN 10 1 0.9% 44 Kendallville, IN 5 1 4.8% 39 Saginaw, MI 12 1 0.8% 21 South Bend-Mishawaka, IN-MI 15 1 0.3% 17 Total Franchise 76 $5,900

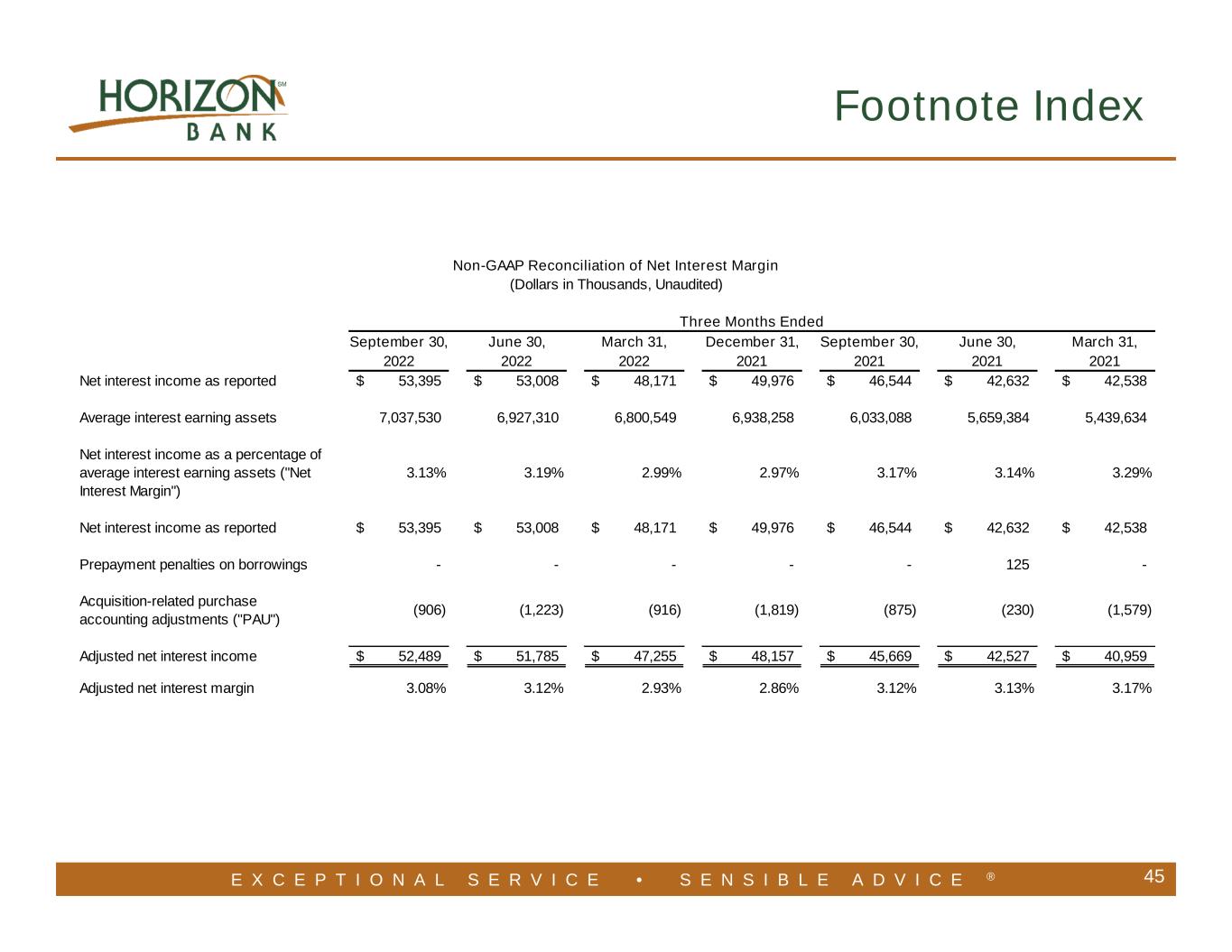

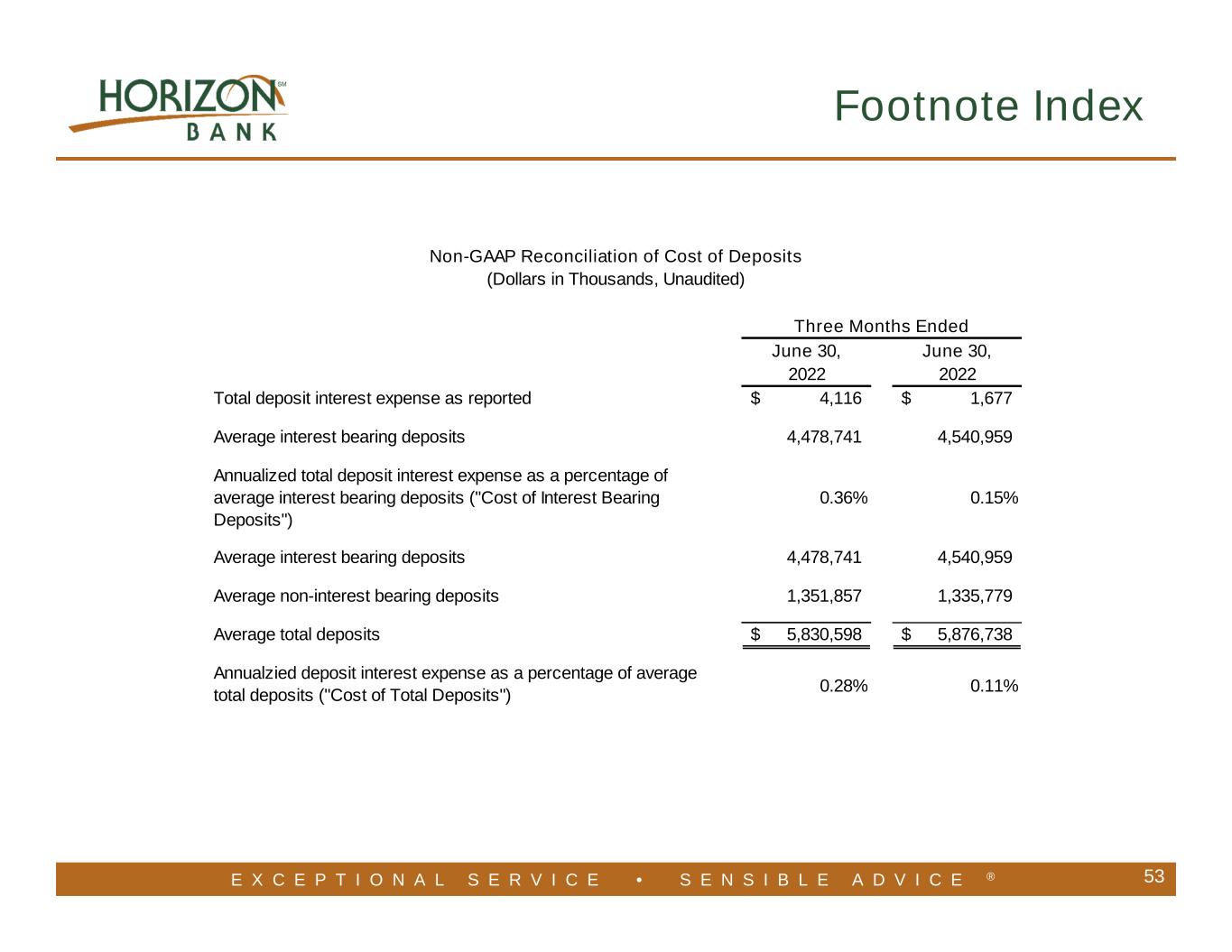

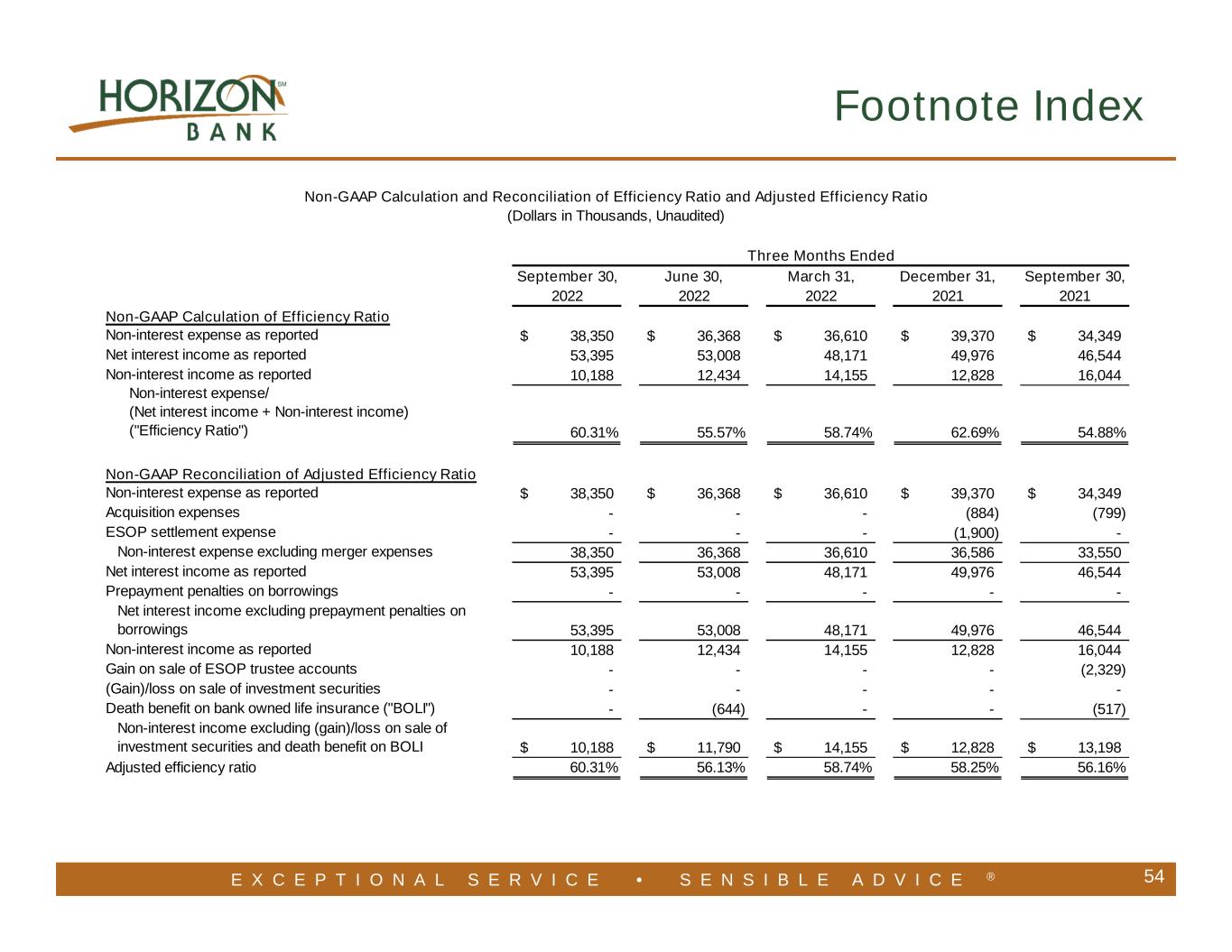

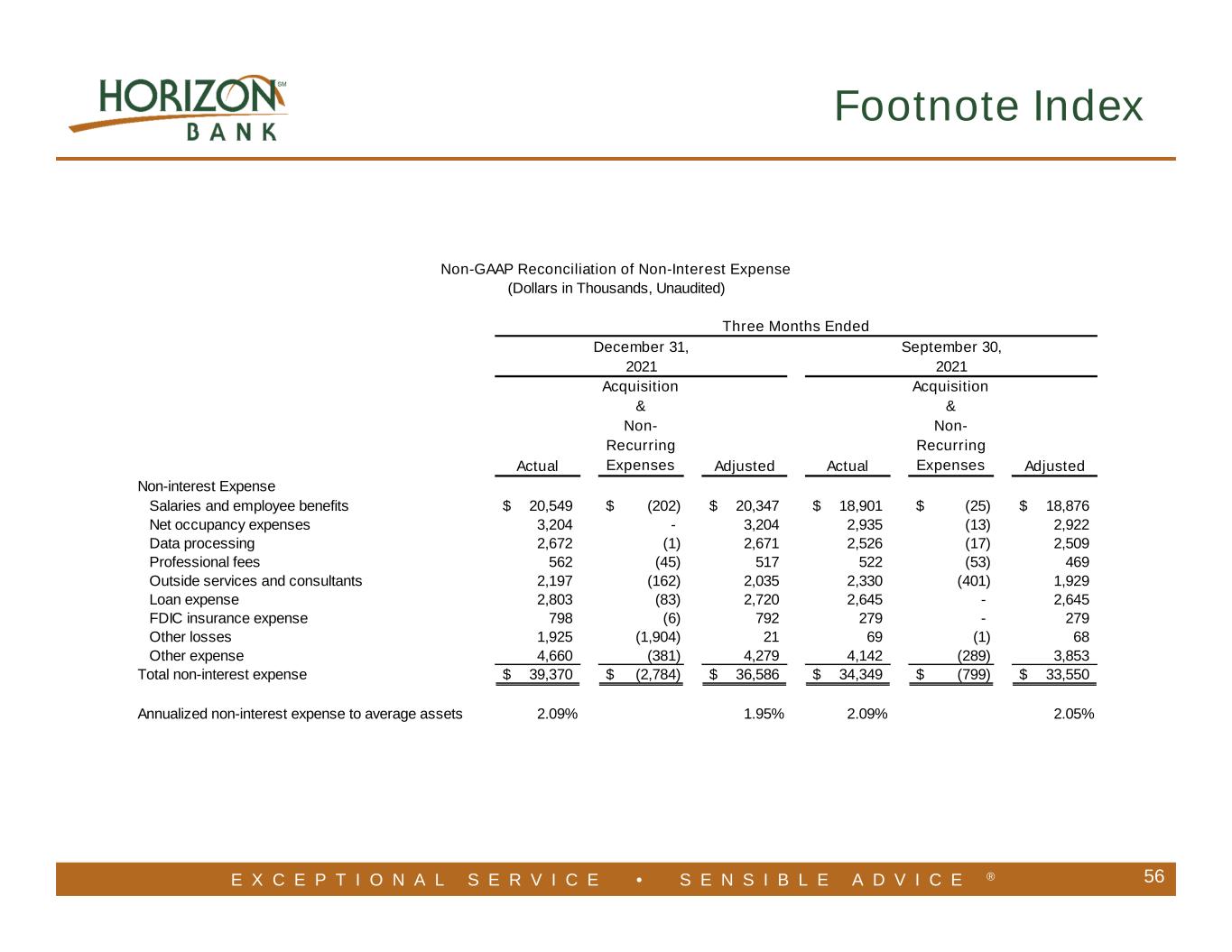

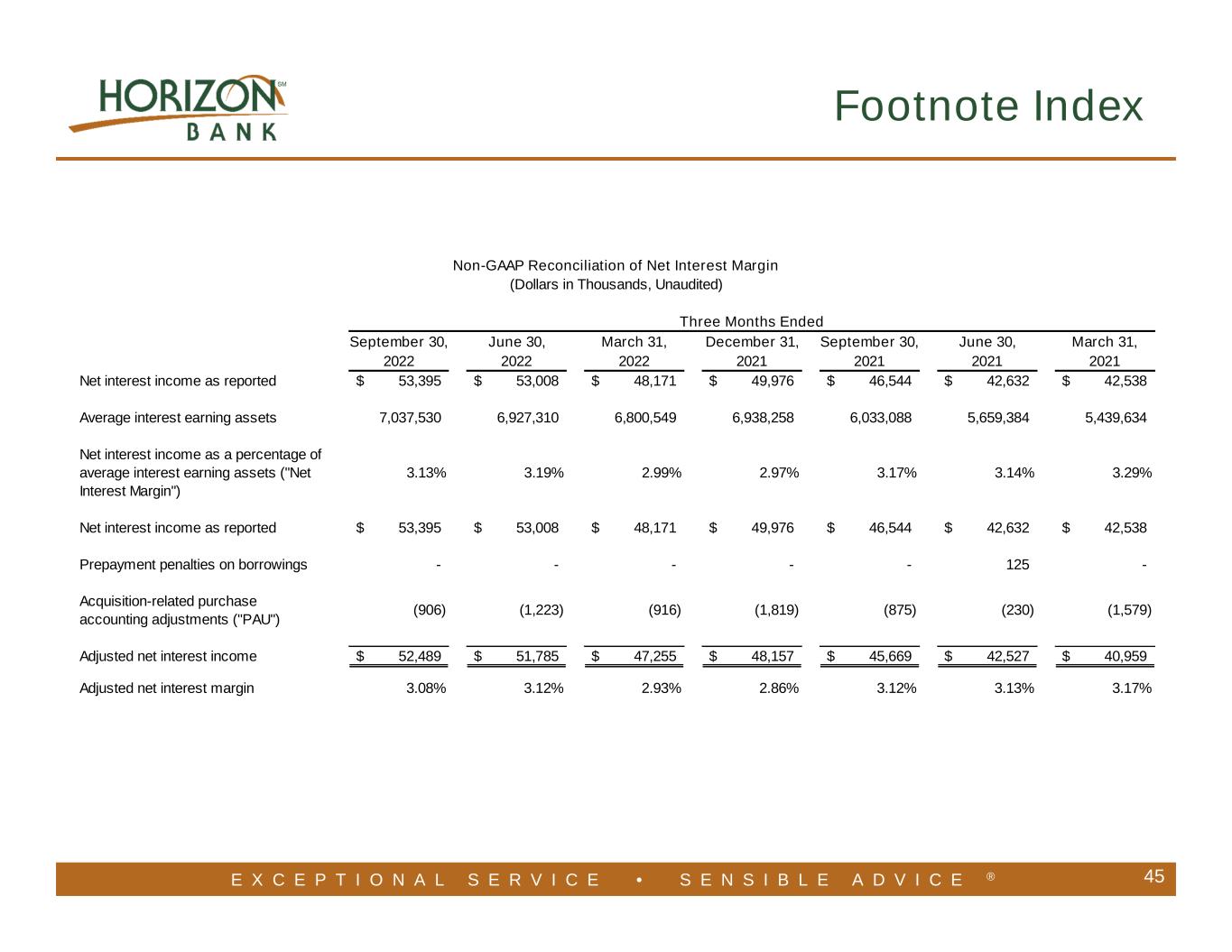

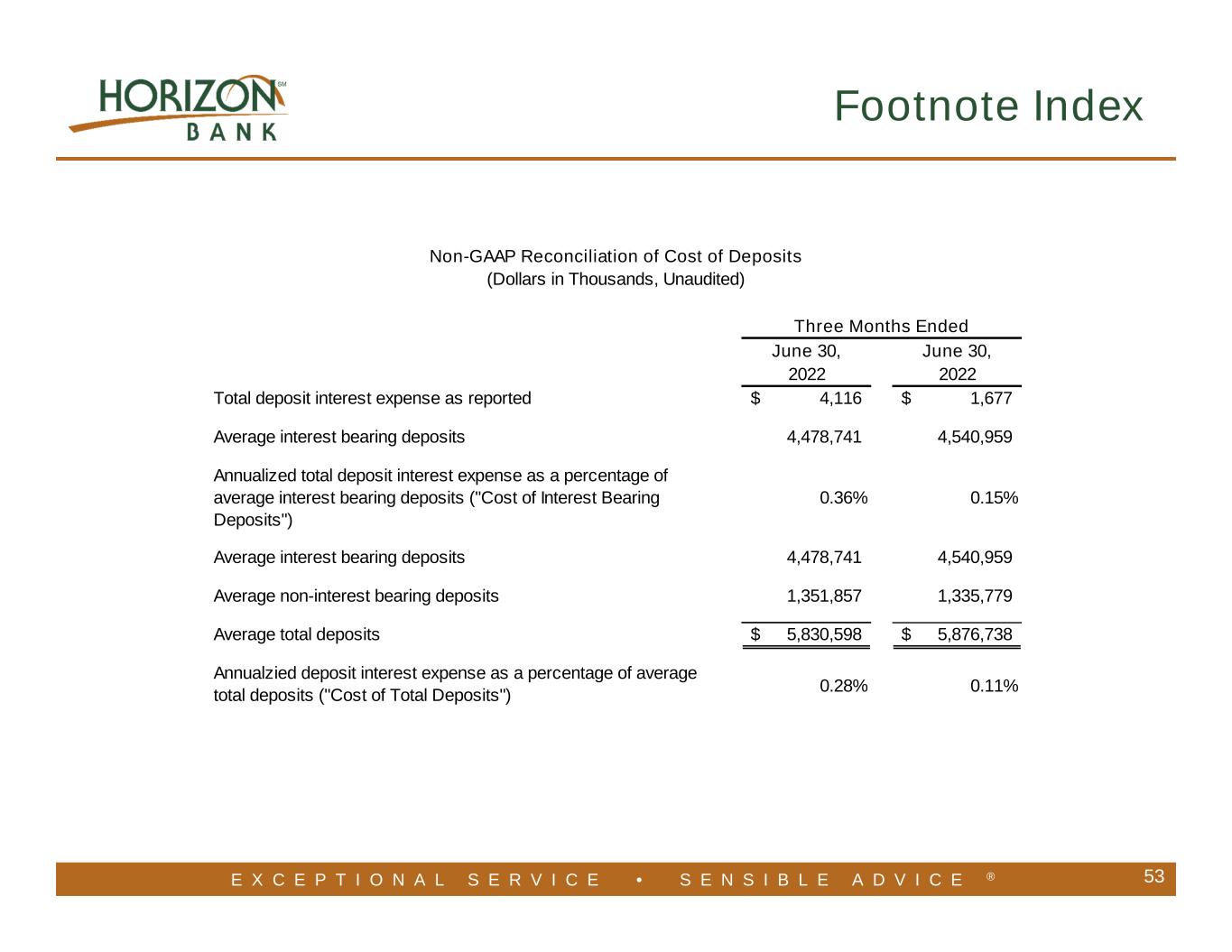

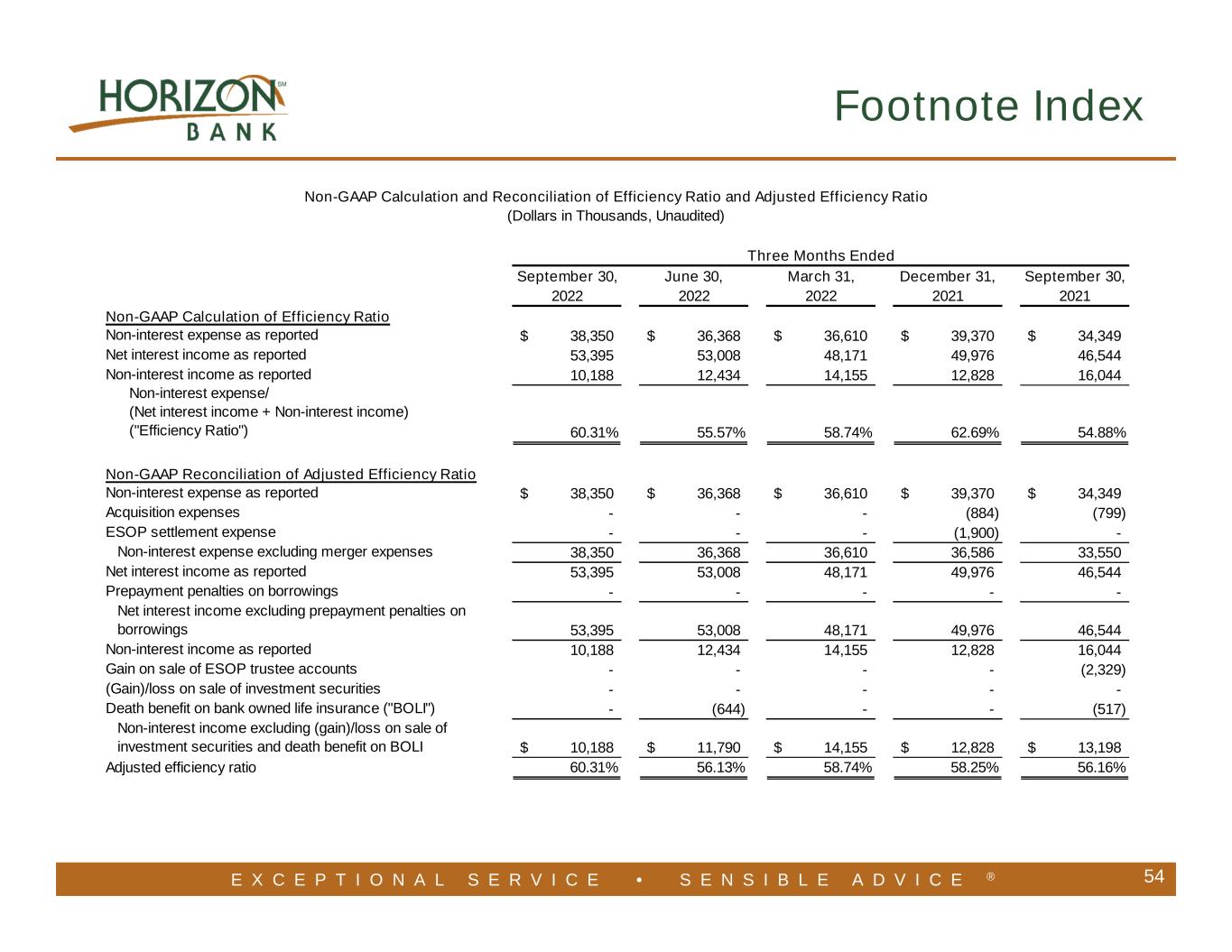

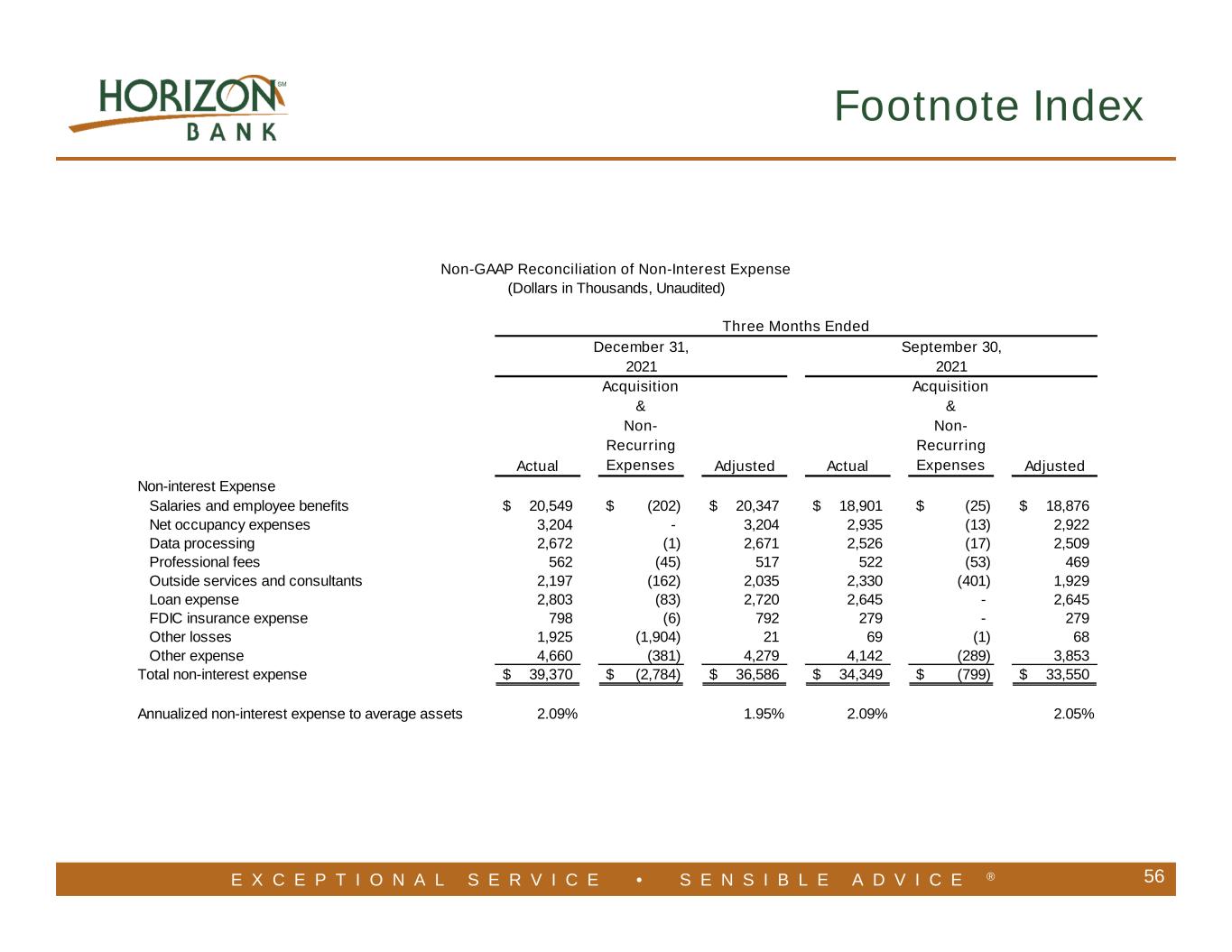

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 37 Slide 5 • Return on average tangible equity excludes average intangible assets from average equity. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) Slide 15 • Adjusted net income and adjusted diluted EPS excludes one-time acquisition expenses, credit loss expense on acquired loans, gain on sale of ESOP trustee accounts, Department of Labor (“DOL”) ESOP settlement expenses, (gain)/loss on sale of securities, prepayment penalties on borrowings, net of tax and death benefit on bank owned life insurance. (See further in the Appendix for a reconciliation of these non- GAAP amounts to their GAAP counterparts.) • Pre-tax, pre-provision income excludes income tax expense and credit loss expense. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) • Adjusted net interest income and adjusted net interest margin exclude acquisition-related purchase accounting adjustments and prepayment penalties on borrowings. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) • Adjusted ROATE and Adjusted pre-tax, pre-provision ROACE exclude one-time acquisition expenses, credit loss expense on acquired loans, gain on sale of ESOP trustee accounts, DOL ESOP settlement expenses, (gain)/loss on sale of securities, prepayment penalties on borrowings, net of tax and death benefit on bank owned life insurance. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) Slide 17 • Adjusted net interest income and adjusted net interest margin excludes prepayment penalties on borrowings and acquisition-related purchase accounting adjustments. Adjusted cost of core funds includes average balances of non-interest bearing deposits and excludes prepayment penalties on borrowings. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) Slide 20 • Average cost of average total deposits includes average balances of non-interest bearing deposits. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) Slide 21 • Adjusted non-interest expense excludes one-time acquisition expenses and DOL ESOP settlement expenses. Adjusted efficiency ratio excludes one-time acquisition expenses, gain on sale of ESOP trustee accounts, DOL ESOP settlement expense, (gain)/loss on sale of securities and death benefit on bank owned life insurance. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) Footnote Index

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 38 Slides 39-57 Use of Non-GAAP Financial Measures • Certain information set forth in the presentation materials refers to financial measures determined by methods other than in accordance with GAAP. Horizon believes these non-GAAP financial measures are helpful to investors and provide a greater understanding of our business without giving effect to purchase accounting impacts, one-time acquisition and other non-recurring costs and non-core items. These measures are not necessarily comparable to similar measures that may be presented by other companies and should not be considered in isolation or as a substitute for the related GAAP measure. Footnote Index

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 39 Footnote Index September 30, June 30, March 31, December 31, September 30, 2022 2022 2022 2021 2021 Net income as reported 23,821$ 24,859$ 23,563$ 21,425$ 23,071$ Acquisition expenses - - - 884 799 Tax effect - - - (184) (166) Net income excluding acquisition expenses 23,821 24,859 23,563 22,125 23,704 Credit loss expense acquired loans - - - - 2,034 Tax effect - - - - (427) Net income excluding credit loss expense acquired loans 23,821 24,859 23,563 22,125 25,311 Gain on sale of ESOP trustee accounts - - - - (2,329) Tax effect - - - - 489 Net income excluding gain on sale of ESOP business line 23,821 24,859 23,563 22,125 23,471 ESOP settlement expense - - - 1,900 - Tax effect - - - (315) - Net income excluding ESOP settlement expense 23,821 24,859 23,563 23,710 23,471 (Gain)/loss on sale of investment securities - - - - - Tax effect - - - - - Net income excluding (gain)/loss on sale of investment securities 23,821 24,859 23,563 23,710 23,471 Death benefit on bank owned life insurance ("BOLI") - (644) - - (517) Net income excluding death benefit on BOLI 23,821 24,215 23,563 23,710 22,954 Prepayment penalties on borrowings - - - - - Tax effect - - - - - Net income excluding prepayment penalties on borrowings 23,821 24,215 23,563 23,710 22,954 Adjusted net income 23,821$ 24,215$ 23,563$ 23,710$ 22,954$ Three Months Ended Non-GAAP Reconciliation of Net Income (Dollars in Thousands, Unaudited)

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 40 Footnote Index September 30, June 30, March 31, December 31, September 30, 2022 2022 2022 2021 2021 Diluted EPS as reported 0.55$ 0.57$ 0.54$ 0.49$ 0.52$ Acquisition expenses - - - 0.02 0.02 Tax effect - - - - - Diluted EPS excluding acquisition expenses 0.55 0.57 0.54 0.51 0.54 Credit loss expense acquired loans - - - - 0.05 Tax effect - - - - (0.01) Diluted EPS excluding credit loss expense acquired loans 0.55 0.57 0.54 0.51 0.58 Gain on sale of ESOP trustee accounts - - - - (0.05) Tax effect - - - - 0.01 Diluted EPS excluding gain on sale of ESOP business line 0.55 0.57 0.54 0.51 0.54 ESOP settlement expense - - - 0.04 - Tax effect - - - (0.01) - Diluted EPS excluding ESOP settlement expense 0.55 0.57 0.54 0.54 0.54 (Gain)/loss on sale of investment securities - - - - - Tax effect - - - - - Diluted EPS excluding (gain)/loss on sale of investment securities 0.55 0.57 0.54 0.54 0.54 Death benefit on bank owned life insurance ("BOLI") - (0.01) - - (0.02) Diluted EPS excluding death benefit on BOLI 0.55 0.56 0.54 0.54 0.52 Prepayment penalties on borrowings - - - - - Tax effect - - - - - Diluted EPS excluding prepayment penalties on borrowings 0.55 0.56 0.54 0.54 0.52 Adjusted diluted EPS 0.55$ 0.56$ 0.54$ 0.54$ 0.52$ Three Months Ended Non-GAAP Reconciliation of Diluted Earnings per Share (Dollars in Thousands, Unaudited)

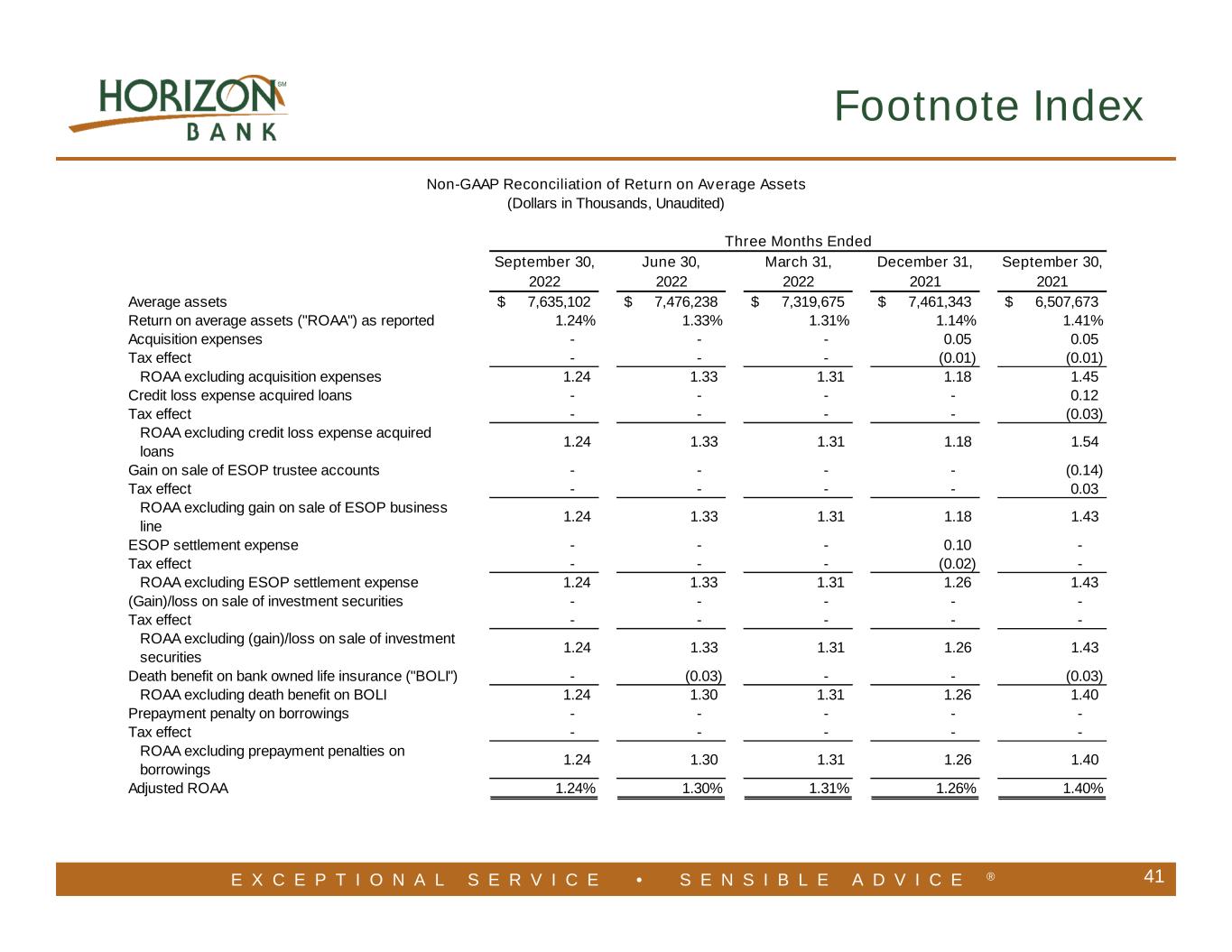

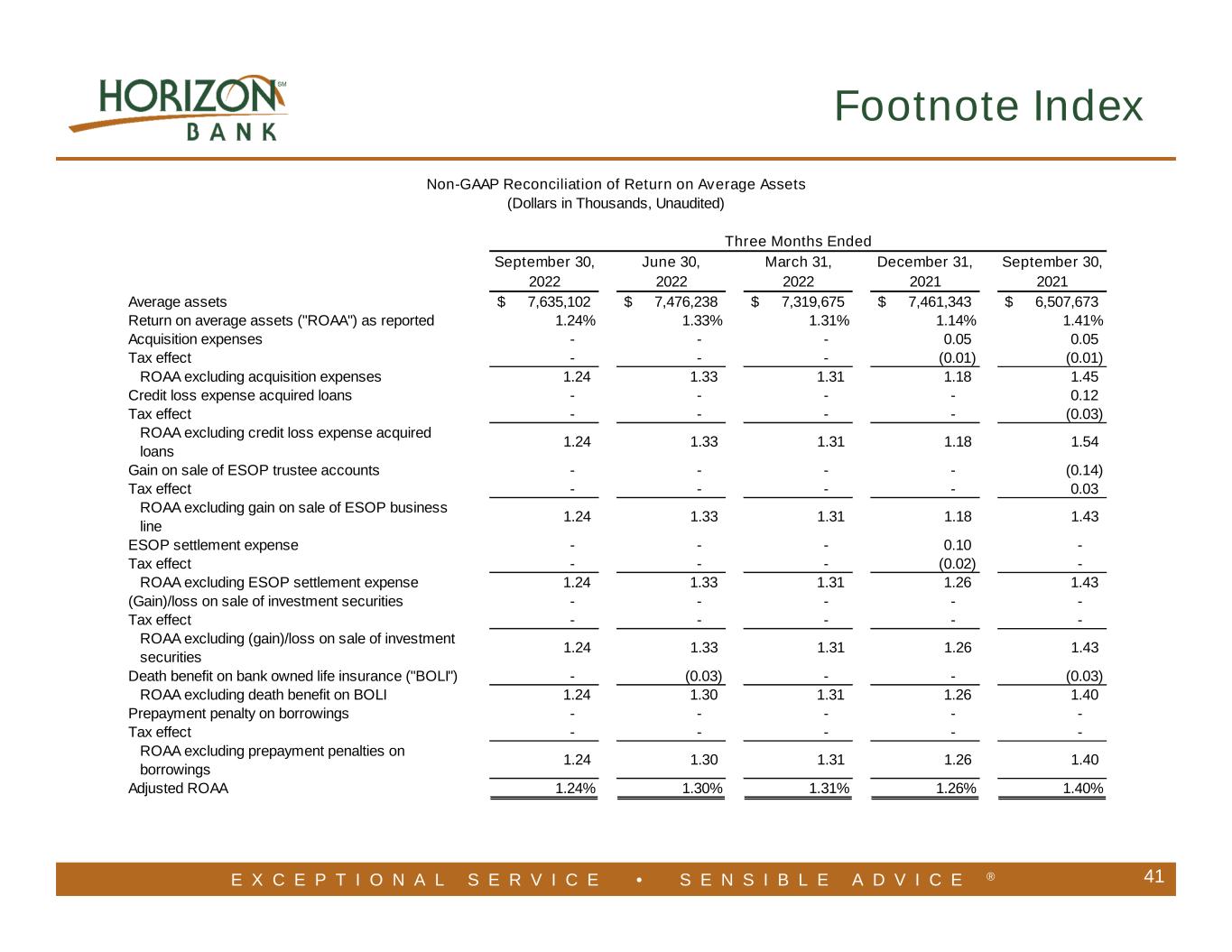

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 41 Footnote Index September 30, June 30, March 31, December 31, September 30, 2022 2022 2022 2021 2021 Average assets 7,635,102$ 7,476,238$ 7,319,675$ 7,461,343$ 6,507,673$ Return on average assets ("ROAA") as reported 1.24% 1.33% 1.31% 1.14% 1.41% Acquisition expenses - - - 0.05 0.05 Tax effect - - - (0.01) (0.01) ROAA excluding acquisition expenses 1.24 1.33 1.31 1.18 1.45 Credit loss expense acquired loans - - - - 0.12 Tax effect - - - - (0.03) ROAA excluding credit loss expense acquired loans 1.24 1.33 1.31 1.18 1.54 Gain on sale of ESOP trustee accounts - - - - (0.14) Tax effect - - - - 0.03 ROAA excluding gain on sale of ESOP business line 1.24 1.33 1.31 1.18 1.43 ESOP settlement expense - - - 0.10 - Tax effect - - - (0.02) - ROAA excluding ESOP settlement expense 1.24 1.33 1.31 1.26 1.43 (Gain)/loss on sale of investment securities - - - - - Tax effect - - - - - ROAA excluding (gain)/loss on sale of investment securities 1.24 1.33 1.31 1.26 1.43 Death benefit on bank owned life insurance ("BOLI") - (0.03) - - (0.03) ROAA excluding death benefit on BOLI 1.24 1.30 1.31 1.26 1.40 Prepayment penalty on borrowings - - - - - Tax effect - - - - - ROAA excluding prepayment penalties on borrowings 1.24 1.30 1.31 1.26 1.40 Adjusted ROAA 1.24% 1.30% 1.31% 1.26% 1.40% Three Months Ended Non-GAAP Reconciliation of Return on Average Assets (Dollars in Thousands, Unaudited)

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 42 Footnote Index September 30, June 30, March 31, December 31, September 30, 2022 2022 2022 2021 2021 Average common equity 680,376$ 677,299$ 716,341$ 719,643$ 724,412$ Return on average common equity ("ROACE") as reported 13.89% 14.72% 13.34% 11.81% 12.64% Acquisition expenses - - - 0.49 0.44 Tax effect - - - (0.10) (0.09) ROACE excluding acquisition expenses 13.89 14.72 13.34 12.20 12.99 Credit loss expense acquired loans - - - - 1.11 Tax effect - - - - (0.23) ROACE excluding credit loss expense acquired loans 13.89 14.72 13.34 12.20 13.87 Gain on sale of ESOP trustee accounts - - - - (1.28) Tax effect - - - - 0.27 ROACE excluding gain on sale of ESOP business line 13.89 14.72 13.34 12.20 12.86 ESOP settlement expense - - - 1.05 - Tax effect - - - (0.17) - ROACE excluding ESOP settlement expense 13.89 14.72 13.34 13.08 12.86 (Gain)/loss on sale of investment securities - - - - - Tax effect - - - - - ROACE excluding (gain)/loss on sale of investment securities 13.89 14.72 13.34 13.08 12.86 Death benefit on bank owned life insurance ("BOLI") - (0.38) - - (0.28) ROACE excluding death benefit on BOLI 13.89 14.34 13.34 13.08 12.58 Prepayment penalty on borrowings - - - - - Tax effect - - - - - ROACE excluding prepayment penalties on borrowings 13.89 14.34 13.34 13.08 12.58 Adjusted ROACE 13.89% 14.34% 13.34% 13.08% 12.58% Three Months Ended Non-GAAP Reconciliation of Return on Average Common Equity (Dollars in Thousands, Unaudited)

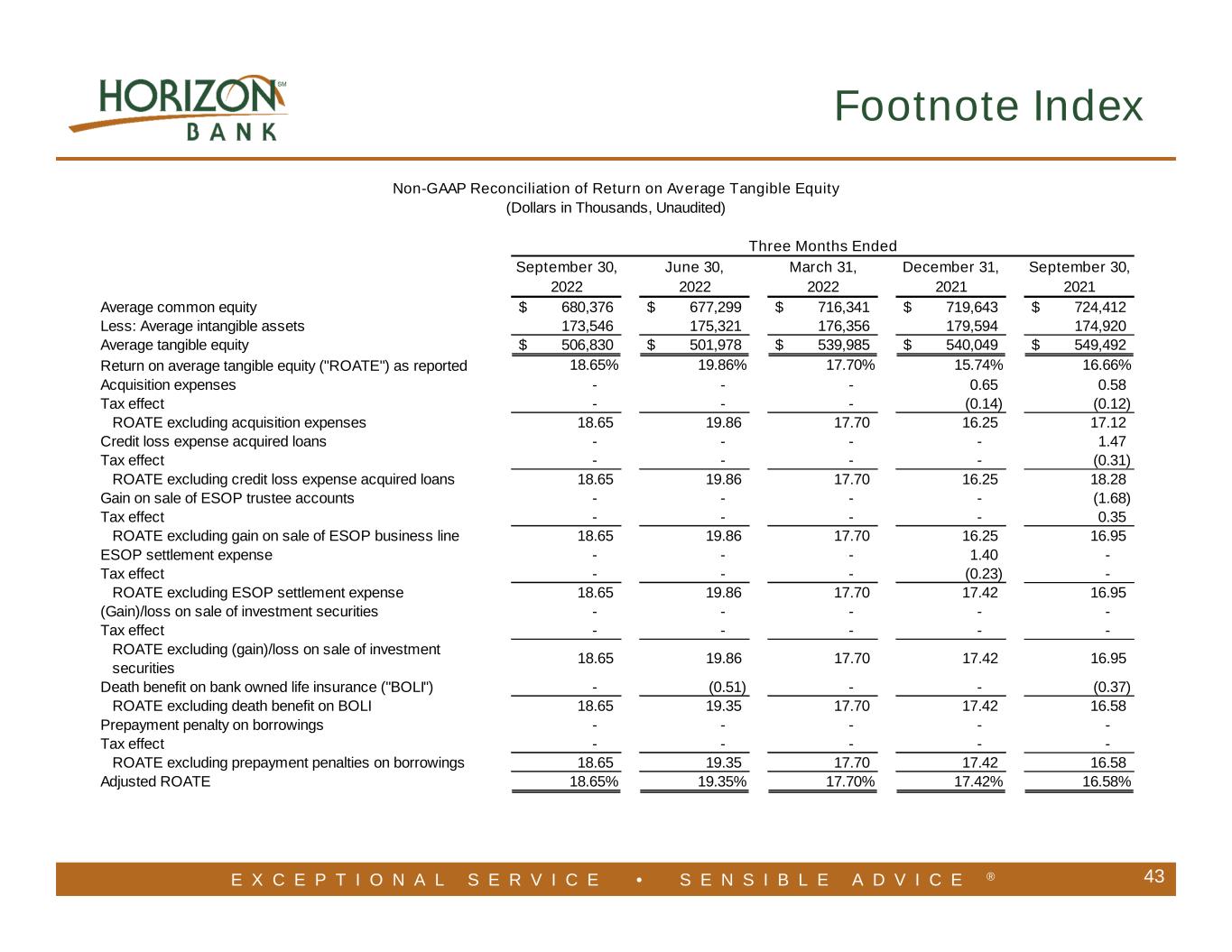

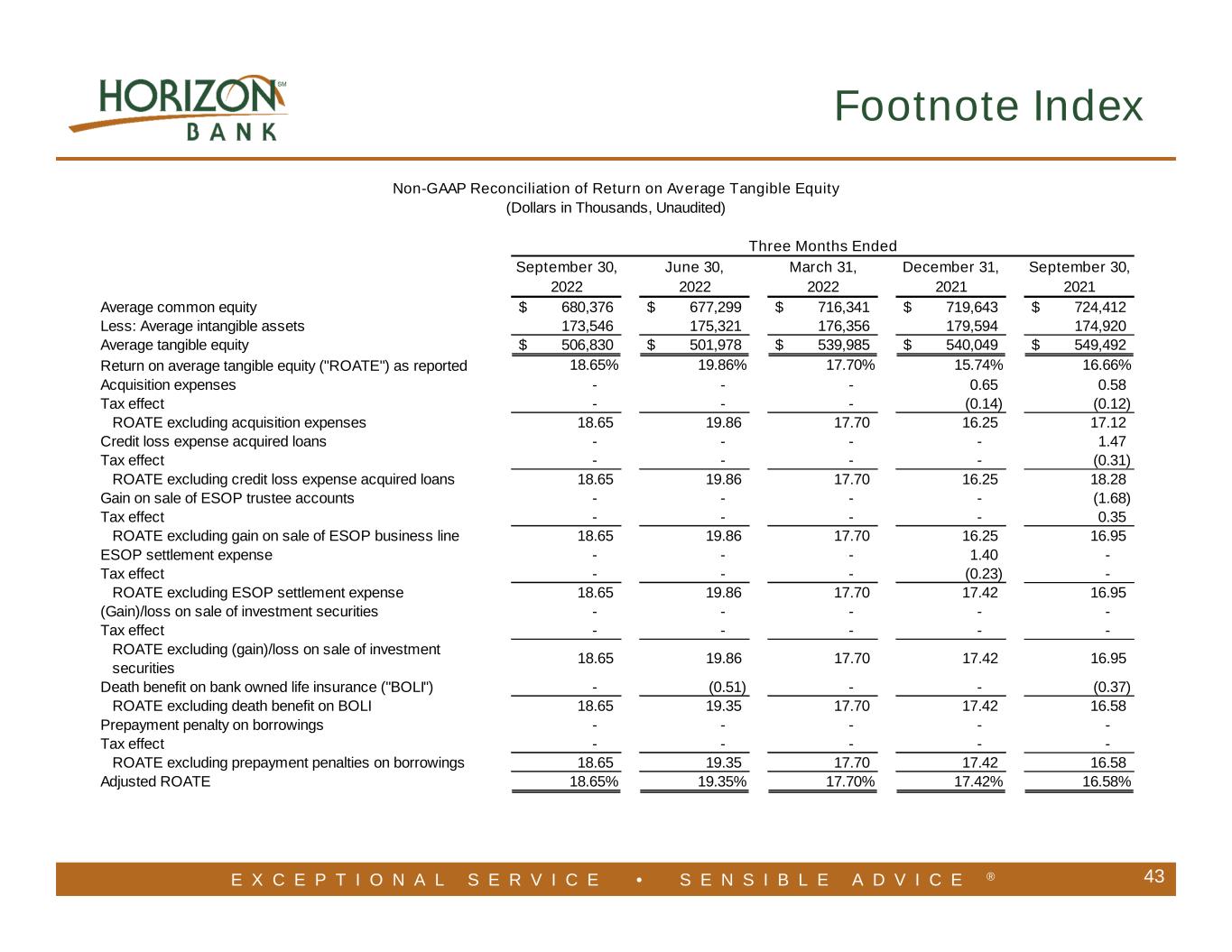

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 43 Footnote Index September 30, June 30, March 31, December 31, September 30, 2022 2022 2022 2021 2021 Average common equity 680,376$ 677,299$ 716,341$ 719,643$ 724,412$ Less: Average intangible assets 173,546 175,321 176,356 179,594 174,920 Average tangible equity 506,830$ 501,978$ 539,985$ 540,049$ 549,492$ Return on average tangible equity ("ROATE") as reported 18.65% 19.86% 17.70% 15.74% 16.66% Acquisition expenses - - - 0.65 0.58 Tax effect - - - (0.14) (0.12) ROATE excluding acquisition expenses 18.65 19.86 17.70 16.25 17.12 Credit loss expense acquired loans - - - - 1.47 Tax effect - - - - (0.31) ROATE excluding credit loss expense acquired loans 18.65 19.86 17.70 16.25 18.28 Gain on sale of ESOP trustee accounts - - - - (1.68) Tax effect - - - - 0.35 ROATE excluding gain on sale of ESOP business line 18.65 19.86 17.70 16.25 16.95 ESOP settlement expense - - - 1.40 - Tax effect - - - (0.23) - ROATE excluding ESOP settlement expense 18.65 19.86 17.70 17.42 16.95 (Gain)/loss on sale of investment securities - - - - - Tax effect - - - - - ROATE excluding (gain)/loss on sale of investment securities 18.65 19.86 17.70 17.42 16.95 Death benefit on bank owned life insurance ("BOLI") - (0.51) - - (0.37) ROATE excluding death benefit on BOLI 18.65 19.35 17.70 17.42 16.58 Prepayment penalty on borrowings - - - - - Tax effect - - - - - ROATE excluding prepayment penalties on borrowings 18.65 19.35 17.70 17.42 16.58 Adjusted ROATE 18.65% 19.35% 17.70% 17.42% 16.58% Non-GAAP Reconciliation of Return on Average Tangible Equity (Dollars in Thousands, Unaudited) Three Months Ended

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 44 Footnote Index September 30, June 30, March 31, December 31, September 30, 2022 2022 2022 2021 2021 Pre-tax income 25,834$ 28,834$ 27,102$ 25,505$ 27,127$ Provision for credit losses (601) 240 (1,386) (2,071) 1,112 Pre-tax, pre-provision net income 25,233$ 29,074$ 25,716$ 23,434$ 28,239$ Pre-tax, pre-provision net income 25,233$ 29,074$ 25,716$ 23,434$ 28,239$ Acquisition expenses - - - 884 799 Gain on sale of ESOP trustee accounts - - - - (2,329) ESOP one-time expense - - - 1,900 - (Gain)/loss on sale of investment securities - - - - - Death benefit on bank owned life insurance - (644) - - (517) Prepayment penalties on borrowings - - - - - Adjusted pre-tax, pre-provision net income 25,233$ 28,430$ 25,716$ 26,218$ 26,192$ Average common equity 680,376$ 677,299$ 716,341$ 719,643$ 724,412$ Unadjusted pre-tax, pre-provision ROACE 14.71% 17.22% 14.56% 12.92% 15.47% Adjusted pre-tax, pre-provision ROACE 14.71% 16.84% 14.56% 14.45% 14.34% Non-GAAP Reconciliation of Pre-Tax, Pre-Provision Net Income (Dollars in Thousands, Unaudited) Three Months Ended

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 45 Footnote Index September 30, June 30, March 31, December 31, September 30, June 30, March 31, 2022 2022 2022 2021 2021 2021 2021 Net interest income as reported 53,395$ 53,008$ 48,171$ 49,976$ 46,544$ 42,632$ 42,538$ Average interest earning assets 7,037,530 6,927,310 6,800,549 6,938,258 6,033,088 5,659,384 5,439,634 Net interest income as a percentage of average interest earning assets ("Net Interest Margin") 3.13% 3.19% 2.99% 2.97% 3.17% 3.14% 3.29% Net interest income as reported 53,395$ 53,008$ 48,171$ 49,976$ 46,544$ 42,632$ 42,538$ Prepayment penalties on borrowings - - - - - 125 - Acquisition-related purchase accounting adjustments ("PAU") (906) (1,223) (916) (1,819) (875) (230) (1,579) Adjusted net interest income 52,489$ 51,785$ 47,255$ 48,157$ 45,669$ 42,527$ 40,959$ Adjusted net interest margin 3.08% 3.12% 2.93% 2.86% 3.12% 3.13% 3.17% Non-GAAP Reconciliation of Net Interest Margin (Dollars in Thousands, Unaudited) Three Months Ended

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 46 Footnote Index December 31, September 30, June 30, March 31, December 31, September 30, June 30, March 31, 2020 2020 2020 2020 2019 2019 2019 2019 Net interest income as reported 43,622$ 43,397$ 42,996$ 40,925$ 41,519$ 43,463$ 41,529$ 34,280$ Average interest earning assets 5,365,888 5,251,611 5,112,636 4,746,202 4,748,217 4,623,985 4,566,674 3,929,296 Net interest income as a percentage of average interest earning assets ("Net Interest Margin") 3.34% 3.39% 3.47% 3.56% 3.58% 3.82% 3.73% 3.62% Net interest income as reported 43,622$ 43,397$ 42,996$ 40,925$ 41,519$ 43,463$ 41,529$ 34,280$ Prepayment penalties on borrowings 3,804 - - - - - - - Acquisition-related purchase accounting adjustments ("PAU") (2,461) (1,488) (1,553) (1,434) (1,042) (1,739) (1,299) (1,510) Adjusted net interest income 44,965$ 41,909$ 41,443$ 39,491$ 40,477$ 41,724$ 40,230$ 32,770$ Adjusted net interest margin 3.44% 3.27% 3.35% 3.44% 3.49% 3.67% 3.61% 3.46% Non-GAAP Reconciliation of Net Interest Margin (Dollars in Thousands, Unaudited) Three Months Ended

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 47 Footnote Index December 31, September 30, June 30, March 31, December 31, September 30, June 30, March 31, 2018 2018 2018 2018 2017 2017 2017 2017 Net interest income as reported 33,836$ 33,772$ 33,550$ 33,411$ 31,455$ 27,879$ 27,198$ 25,568$ Average interest earning assets 3,808,822 3,717,139 3,638,801 3,580,143 3,471,169 3,078,611 2,943,627 2,797,429 Net interest income as a percentage of average interest earning assets ("Net Interest Margin") 3.60% 3.67% 3.78% 3.81% 3.71% 3.71% 3.84% 3.80% Net interest income as reported 33,836$ 33,772$ 33,550$ 33,411$ 31,455$ 27,879$ 27,198$ 25,568$ Prepayment penalties on borrowings - - - - - - - - Acquisition-related purchase accounting adjustments ("PAU") (1,629) (789) (1,634) (2,037) (868) (661) (939) (1,016) Adjusted net interest income 32,207$ 32,983$ 31,916$ 31,374$ 30,587$ 27,218$ 26,259$ 24,552$ Adjusted net interest margin 3.43% 3.59% 3.60% 3.58% 3.61% 3.63% 3.71% 3.66% Three Months Ended Non-GAAP Reconciliation of Net Interest Margin (Dollars in Thousands, Unaudited)

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 48 Footnote Index December 31, September 30, June 30, March 31, 2016 2016 2016 2016 Net interest income as reported 20,939$ 24,410$ 20,869$ 19,774$ Average interest earning assets 2,932,145 2,957,944 2,471,354 2,367,250 Net interest income as a percentage of average interest earning assets ("Net Interest Margin") 2.92% 3.37% 3.48% 3.45% Net interest income as reported 20,939$ 24,410$ 20,869$ 19,774$ Prepayment penalties on borrowings 4,839 - - - Acquisition-related purchase accounting adjustments ("PAU") (900) (459) (397) (547) Adjusted net interest income 24,878$ 23,951$ 20,472$ 19,227$ Adjusted net interest margin 3.45% 3.31% 3.42% 3.36% Three Months Ended Non-GAAP Reconciliation of Net Interest Margin (Dollars in Thousands, Unaudited)

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 49 Footnote Index September 30, June 30, March 31, December 31, September 30, June 30, March 31, 2022 2022 2022 2021 2021 2021 2021 Total interest expense as reported 9,635$ 4,564$ 3,911$ 4,142$ 4,324$ 4,788$ 5,051$ Average interest bearing liabilities 5,549,661 5,411,381 5,237,779 5,322,968 4,545,332 4,249,932 4,116,568 Annualized total interest expense as a percentage of average interest bearing liabilities ("Cost of Interest Bearing Liabilities") 0.69% 0.34% 0.30% 0.31% 0.38% 0.45% 0.50% Total interest expense as reported 9,635$ 4,564$ 3,911$ 4,142$ 4,324$ 4,788$ 5,051$ Prepayment penalties on borrowings - - - - - (125) - Adjusted interest expense 9,635$ 4,564$ 3,911$ 4,142$ 4,324$ 4,663$ 5,051$ Average interest bearing liablities 5,549,661 5,411,381 5,237,779 5,322,968 4,545,332 4,249,932 4,116,568 Average non-interest bearing deposits 1,351,857 1,335,779 1,322,781 1,366,621 1,180,890 1,139,068 1,063,268 Average core funding 6,901,518$ 6,747,160$ 6,560,560$ 6,689,589$ 5,726,222$ 5,389,000$ 5,179,836$ Annualzied adjusted interest expense as a percentage of average core funding ("Adjusted Cost of Core Funds") 0.55% 0.27% 0.24% 0.25% 0.30% 0.35% 0.40% Non-GAAP Reconciliation of Cost of Interest Bearing Liabilities (Dollars in Thousands, Unaudited) Three Months Ended

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 50 Footnote Index December 31, September 30, June 30, March 31, December 31, September 30, June 30, March 31, 2020 2020 2020 2020 2019 2019 2019 2019 Total interest expense as reported 9,612$ 6,749$ 7,348$ 10,729$ 11,879$ 12,248$ 12,321$ 11,093$ Average interest bearing liabilities 4,077,223 4,027,057 3,975,297 3,814,785 3,794,943 3,601,144 3,570,713 3,131,276 Annualized total interest expense as a percentage of average interest bearing liabilities ("Cost of Interest Bearing Liabilities") 0.94% 0.67% 0.74% 1.13% 1.24% 1.35% 1.38% 1.44% Total interest expense as reported 9,612$ 6,749$ 7,348$ 10,729$ 11,879$ 12,248$ 12,321$ 11,093$ Prepayment penalties on borrowings (3,804) - - - - - - - Adjusted interest expense 5,808$ 6,749$ 7,348$ 10,729$ 11,879$ 12,248$ 12,321$ 11,093$ Average interest bearing liablities 4,077,223 4,027,057 3,975,297 3,814,785 3,794,943 3,601,144 3,570,713 3,131,276 Average non-interest bearing deposits 1,037,232 996,427 924,890 717,257 747,513 818,164 818,872 643,601 Average core funding 5,114,455$ 5,023,484$ 4,900,187$ 4,532,042$ 4,542,456$ 4,419,308$ 4,389,585$ 3,774,877$ Annualzied adjusted interest expense as a percentage of average core funding ("Adjusted Cost of Core Funds") 0.45% 0.53% 0.60% 0.95% 1.04% 1.10% 1.13% 1.19% Non-GAAP Reconciliation of Cost of Interest Bearing Liabilities (Dollars in Thousands, Unaudited) Three Months Ended

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 51 Footnote Index December 31, September 30, June 30, March 31, December 31, September 30, June 30, March 31, 2018 2018 2018 2018 2017 2017 2017 2017 Total interest expense as reported 9,894$ 8,499$ 7,191$ 6,015$ 5,319$ 4,191$ 3,607$ 3,266$ Average interest bearing liabilities 3,021,310 2,971,074 2,929,913 2,869,372 2,766,948 2,459,262 2,375,827 2,246,550 Annualized total interest expense as a percentage of average interest bearing liabilities ("Cost of Interest Bearing Liabilities") 1.30% 1.13% 0.98% 0.85% 0.76% 0.68% 0.61% 0.59% Total interest expense as reported 9,894$ 8,499$ 7,191$ 6,015$ 5,319$ 4,191$ 3,607$ 3,266$ Prepayment penalties on borrowings - - - - - - - - Adjusted interest expense 9,894$ 8,499$ 7,191$ 6,015$ 5,319$ 4,191$ 3,607$ 3,266$ Average interest bearing liablities 3,021,310 2,971,074 2,929,913 2,869,372 2,766,948 2,459,262 2,375,827 2,246,550 Average non-interest bearing deposits 656,114 640,983 605,188 595,644 603,733 540,109 499,446 491,154 Average core funding 3,677,424$ 3,612,057$ 3,535,101$ 3,465,016$ 3,370,681$ 2,999,371$ 2,875,273$ 2,737,704$ Annualzied adjusted interest expense as a percentage of average core funding ("Adjusted Cost of Core Funds") 1.07% 0.93% 0.82% 0.70% 0.63% 0.55% 0.50% 0.48% Non-GAAP Reconciliation of Cost of Interest Bearing Liabilities (Dollars in Thousands, Unaudited) Three Months Ended

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 52 Footnote Index December 31, September 30, June 30, March 31, 2016 2016 2016 2016 Total interest expense as reported 8,450$ 4,552$ 3,781$ 3,754$ Average interest bearing liabilities 2,369,810 2,443,986 2,058,463 1,974,325 Annualized total interest expense as a percentage of average interest bearing liabilities ("Cost of Interest Bearing Liabilities") 1.42% 0.74% 0.74% 0.76% Total interest expense as reported 8,450$ 4,552$ 3,781$ 3,754$ Prepayment penalties on borrowings (4,839) - - - Adjusted interest expense 3,611$ 4,552$ 3,781$ 3,754$ Average interest bearing liablities 2,369,810 2,443,986 2,058,463 1,974,325 Average non-interest bearing deposits 504,274 462,253 364,822 339,141 Average core funding 2,874,084$ 2,906,239$ 2,423,285$ 2,313,466$ Annualzied adjusted interest expense as a percentage of average core funding ("Adjusted Cost of Core Funds") 0.50% 0.62% 0.63% 0.66% Three Months Ended Non-GAAP Reconciliation of Cost of Interest Bearing Liabilities (Dollars in Thousands, Unaudited)

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 53 Footnote Index June 30, June 30, 2022 2022 Total deposit interest expense as reported 4,116$ 1,677$ Average interest bearing deposits 4,478,741 4,540,959 Annualized total deposit interest expense as a percentage of average interest bearing deposits ("Cost of Interest Bearing Deposits") 0.36% 0.15% Average interest bearing deposits 4,478,741 4,540,959 Average non-interest bearing deposits 1,351,857 1,335,779 Average total deposits 5,830,598$ 5,876,738$ Annualzied deposit interest expense as a percentage of average total deposits ("Cost of Total Deposits") 0.28% 0.11% Three Months Ended Non-GAAP Reconciliation of Cost of Deposits (Dollars in Thousands, Unaudited)

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 54 Footnote Index September 30, June 30, March 31, December 31, September 30, 2022 2022 2022 2021 2021 Non-GAAP Calculation of Efficiency Ratio Non-interest expense as reported 38,350$ 36,368$ 36,610$ 39,370$ 34,349$ Net interest income as reported 53,395 53,008 48,171 49,976 46,544 Non-interest income as reported 10,188 12,434 14,155 12,828 16,044 Non-interest expense/ (Net interest income + Non-interest income) ("Efficiency Ratio") 60.31% 55.57% 58.74% 62.69% 54.88% Non-GAAP Reconciliation of Adjusted Efficiency Ratio Non-interest expense as reported 38,350$ 36,368$ 36,610$ 39,370$ 34,349$ Acquisition expenses - - - (884) (799) ESOP settlement expense - - - (1,900) - Non-interest expense excluding merger expenses 38,350 36,368 36,610 36,586 33,550 Net interest income as reported 53,395 53,008 48,171 49,976 46,544 Prepayment penalties on borrowings - - - - - Net interest income excluding prepayment penalties on borrowings 53,395 53,008 48,171 49,976 46,544 Non-interest income as reported 10,188 12,434 14,155 12,828 16,044 Gain on sale of ESOP trustee accounts - - - - (2,329) (Gain)/loss on sale of investment securities - - - - - Death benefit on bank owned life insurance ("BOLI") - (644) - - (517) Non-interest income excluding (gain)/loss on sale of investment securities and death benefit on BOLI 10,188$ 11,790$ 14,155$ 12,828$ 13,198$ Adjusted efficiency ratio 60.31% 56.13% 58.74% 58.25% 56.16% Non-GAAP Calculation and Reconciliation of Efficiency Ratio and Adjusted Efficiency Ratio (Dollars in Thousands, Unaudited) Three Months Ended

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 55 Footnote Index Actual Acquisition & Non- Recurring Expenses Adjusted Actual Acquisition & Non- Recurring Expenses Adjusted Actual Acquisition & Non- Recurring Expenses Adjusted Non-interest Expense Salaries and employee benefits 20,613$ -$ 20,613$ 19,957$ -$ 19,957$ 19,735$ -$ 19,735$ Net occupancy expenses 3,293 - 3,293 3,190 - 3,190 3,561 - 3,561 Data processing 2,539 - 2,539 2,607 - 2,607 2,537 - 2,537 Professional fees 552 - 552 283 - 283 314 - 314 Outside services and consultants 2,855 - 2,855 2,485 - 2,485 2,525 - 2,525 Loan expense 2,926 - 2,926 2,497 - 2,497 2,545 - 2,545 FDIC insurance expense 670 - 670 775 - 775 725 - 725 Other losses 398 - 398 362 - 362 168 - 168 Other expense 4,504 - 4,504 4,212 - 4,212 4,500 - 4,500 Total non-interest expense 38,350$ -$ 38,350$ 36,368$ -$ 36,368$ 36,610$ -$ 36,610$ Annualized non-interest expense to average assets 1.99% 1.99% 1.95% 1.95% 2.03% 2.03% 2022 Non-GAAP Reconciliation of Non-Interest Expense (Dollars in Thousands, Unaudited) Three Months Ended September 30, June 30, March 31, 20222022

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 56 Footnote Index Actual Acquisition & Non- Recurring Expenses Adjusted Actual Acquisition & Non- Recurring Expenses Adjusted Non-interest Expense Salaries and employee benefits 20,549$ (202)$ 20,347$ 18,901$ (25)$ 18,876$ Net occupancy expenses 3,204 - 3,204 2,935 (13) 2,922 Data processing 2,672 (1) 2,671 2,526 (17) 2,509 Professional fees 562 (45) 517 522 (53) 469 Outside services and consultants 2,197 (162) 2,035 2,330 (401) 1,929 Loan expense 2,803 (83) 2,720 2,645 - 2,645 FDIC insurance expense 798 (6) 792 279 - 279 Other losses 1,925 (1,904) 21 69 (1) 68 Other expense 4,660 (381) 4,279 4,142 (289) 3,853 Total non-interest expense 39,370$ (2,784)$ 36,586$ 34,349$ (799)$ 33,550$ Annualized non-interest expense to average assets 2.09% 1.95% 2.09% 2.05% Three Months Ended Non-GAAP Reconciliation of Non-Interest Expense (Dollars in Thousands, Unaudited) December 31, September 30, 2021 2021

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 57 Footnote Index Actual Acquisition & Non- Recurring Expenses Adjusted Actual Acquisition & Non- Recurring Expenses Adjusted Non-interest Expense Salaries and employee benefits 17,730$ -$ 17,730$ 16,871$ -$ 16,871$ Net occupancy expenses 3,084 - 3,084 3,318 - 3,318 Data processing 2,388 - 2,388 2,376 - 2,376 Professional fees 588 (51) 537 544 - 544 Outside services and consultants 2,220 (187) 2,033 1,702 - 1,702 Loan expense 3,107 - 3,107 2,822 - 2,822 FDIC insurance expense 500 - 500 800 - 800 Other losses 6 - 6 283 - 283 Other expense 3,765 (4) 3,761 3,456 - 3,456 Total non-interest expense 33,388$ (242)$ 33,146$ 32,172$ -$ 32,172$ Annualized non-interest expense to average assets 2.18% 2.16% 2.20% 2.20% March 31, 2021 Three Months Ended Non-GAAP Reconciliation of Non-Interest Expense (Dollars in Thousands, Unaudited) June 30, 2021