E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® A NASDAQ Traded Company - Symbol HBNC INVESTOR PRESENTATION JANUARY 24, 2024

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Forward-Looking Statements This presentation may contain forward–looking statements regarding the financial performance, business prospects, growth and operating strategies of Horizon Bancorp, Inc. and its affiliates (collectively, “Horizon”). For these statements, Horizon claims the protection of the safe harbor for forward–looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in this presentation should be considered in conjunction with the other information available about Horizon, including the information in the filings we make with the Securities and Exchange Commission (the “SEC”). Forward–looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward–looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance. Although management believes that the expectations reflected in such forward–looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include: current financial conditions within the banking industry, including the effects of recent failures of other financial institutions, liquidity levels, and responses by the Federal Reserve, Department of the Treasury, and the Federal Deposit Insurance Corporation to address these issues; changes in the level and volatility of interest rates, changes in spreads on earning assets and changes in interest bearing liabilities; increased interest rate sensitivity; the ability of Horizon to remediate its material weaknesses in its internal control over financial reporting; continuing increases in inflation; loss of key Horizon personnel; increases in disintermediation; potential loss of fee income, including interchange fees, as new and emerging alternative payment platforms take a greater market share of the payment systems; estimates of fair value of certain of Horizon’s assets and liabilities; changes in prepayment speeds, loan originations, credit losses, market values, collateral securing loans and other assets; changes in sources of liquidity; economic conditions and their impact on Horizon and its customers, including local and global economic recovery from the pandemic; legislative and regulatory actions and reforms; changes in accounting policies or procedures as may be adopted and required by regulatory agencies; litigation, regulatory enforcement, and legal compliance risk and costs; rapid technological developments and changes; cyber terrorism and data security breaches; the rising costs of cybersecurity; the ability of the U.S. federal government to manage federal debt limits; climate change and social justice initiatives; material changes outside the U.S. or in overseas relations, including changes in U.S. trade relations related to imposition of tariffs, Brexit, and the phase out of the London Interbank Offered Rate (“LIBOR”); the inability to realize cost savings or revenues or to effectively implement integration plans and other consequences associated with mergers, acquisitions and divestitures; acts of terrorism, war and global conflicts, such as the ongoing conflicts between Russia and Ukraine and Israel and Hamas; and supply chain disruptions and delays. These and additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Horizon’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10- Q, and Current Reports on Form 8-K) filed with the SEC and available at the SEC’s website (www.sec.gov). Undue reliance should not be placed on the forward- looking statements, which speak only as of the date hereof. Horizon does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward-looking statement is made, or reflect the occurrence of unanticipated events, except to the extent required by law. Non-GAAP Measures Certain non-GAAP financial measures are presented herein. Horizon believes they are useful to investors and provide a greater understanding of Horizon’s business without giving effect to non-recurring costs and non-core items. For each non-GAAP financial measure, we have presented comparable GAAP measures and reconciliations of the non-GAAP measures to those GAAP measures in the Appendix to this presentation. Please see slides 26-33. Important Information 2

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 3 Mark E. Secor EVP & Chief Financial Officer • 35 Years of Banking and Public Accounting Experience • 16 Years with Horizon Kathie A. DeRuiter EVP & Senior Operations Officer • 34 Years of Banking and Operational Experience • 23 Years as Senior Bank Operations Officer • 26 Years with Horizon Todd A. Etzler EVP & Corporate Secretary & General Counsel • 32 Years of Corporate Legal Experience and 13 years of General Counsel Experience • 6 Years with Horizon Lynn M. Kerber EVP & Chief Commercial Banking Officer • 33 Years of Banking Experience • 6 Years with Horizon Thomas M. Prame President & Chief Executive Officer • 29 Years of Banking Experience • 2 Years with Horizon Experienced Leadership Team

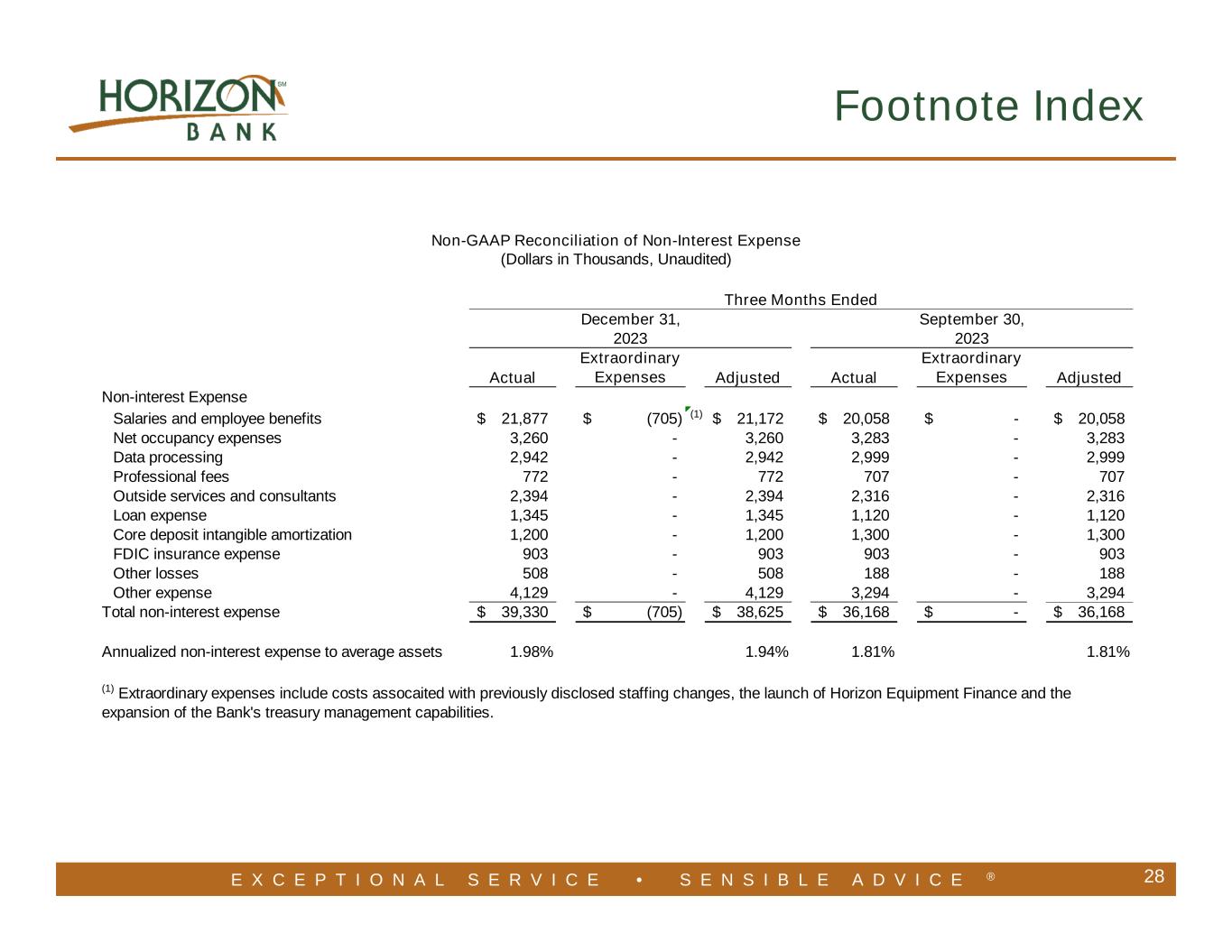

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 4 4Q23 Highlights * 4Q23 results reflect after-tax loss of $32.7 million from balance sheet repositioning announced on December 12, 2023, including a $31.6 million pre-tax loss on the sale of securities and tax penalties and charges on the surrender of $112.8 million in bank owned life insurance (BOLI) ** The company incurred $705,000 in extraordinary expenses including costs associated with previously disclosed staffing changes, the launch of Horizon Equipment Finance and the expansion of the Bank’s treasury management capabilities ^ See Footnote Index and non-GAAP reconciliations in Appendix ($000s except per share data) 4Q23 3Q23 Income Statement Net interest income $42,257 $42,090 NIM 2.43% 2.41% Provision $1,274 $263 Non-interest income* $(20,449) $11,830 Non-interest expense** $39,330 $36,168 Income tax* $5,432 $1,284 Net income $(25,215) $16,205 Diluted EPS $(0.58) $0.37 Net impact of balance sheet repositioning* $0.89 -- Extraordinary expenses** $0.02 -- Adjusted diluted EPS^ $0.33 $0.37 Balance Sheet Total loans $4,419,048 $4,361,830 Total deposits $5,664,893 $5,700,097 Credit Quality NPA / total assets ratio 0.27% 0.26% Net charge-offs to avg. loans for the period 0.02% 0.02% Fourth Quarter Highlights • Strong annualized loan growth – 5.2% o Led by 13.1% annualized growth in commercial o Launch of Horizon Equipment Finance expected to meaningfully add to organic loan growth in 2024 • Excellent credit metrics o Continued low non-performing loans and charge-offs o Provision expense aligned with loan growth and consistent low net charge-off levels • Net interest margin expansion – 2 bps o Reflective of continued disciplined pricing of loans and deposits, quality loan growth and early benefit of December balance sheet repositioning • Cash position of $519.4 million at period end o Reflects proceeds of December balance sheet repositioning o Provides significant funding flexibility as cash is expected to be deployed into higher yielding loans and other liquid assets throughout 2024. • Adjusted net income of $14.1 million, or $0.33/share^ o Excluding impact of balance sheet repositioning* and extraordinary expenses** • Continued disciplined operating model o 1.98% of non-interest expense/average assets, annualized o 1.94%, excluding extraordinary expenses**

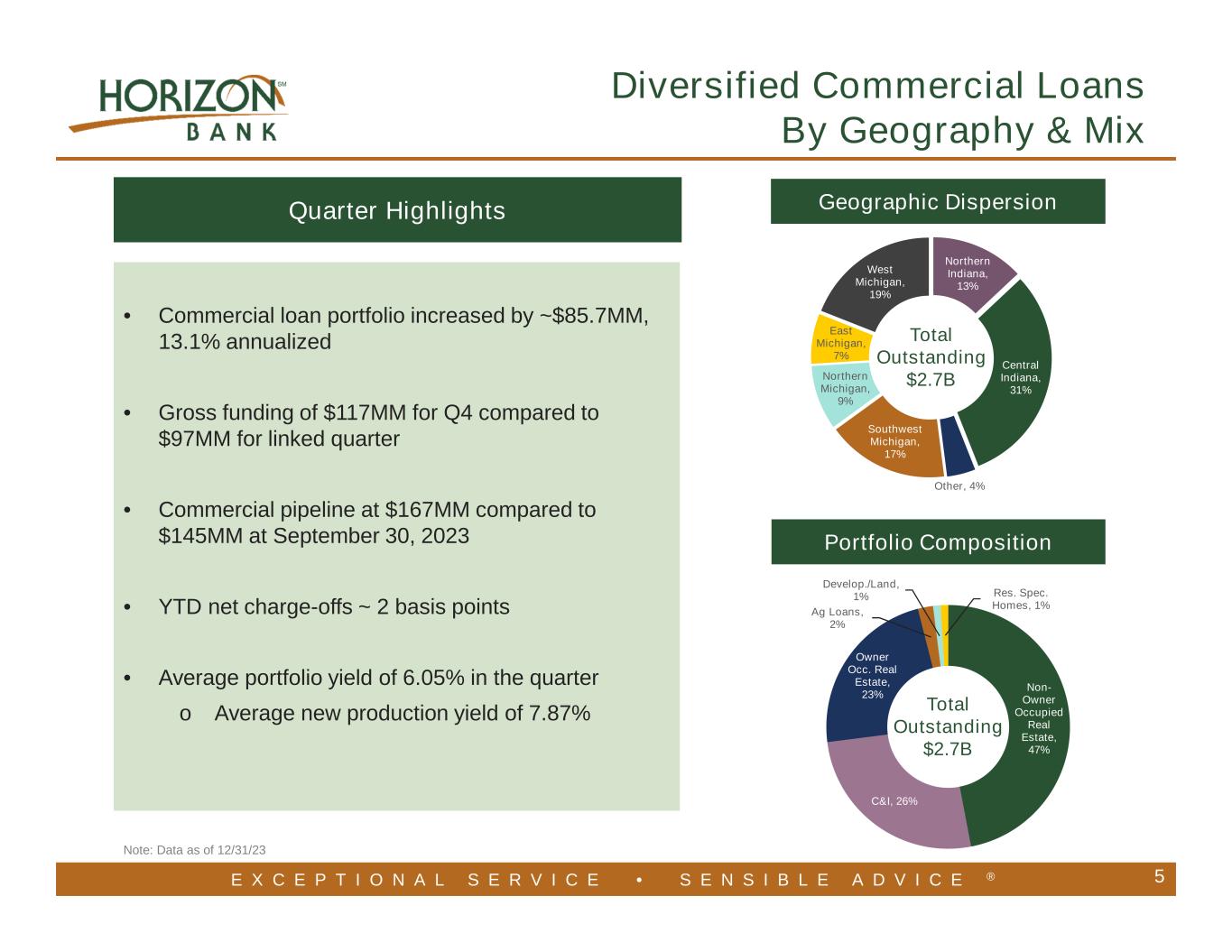

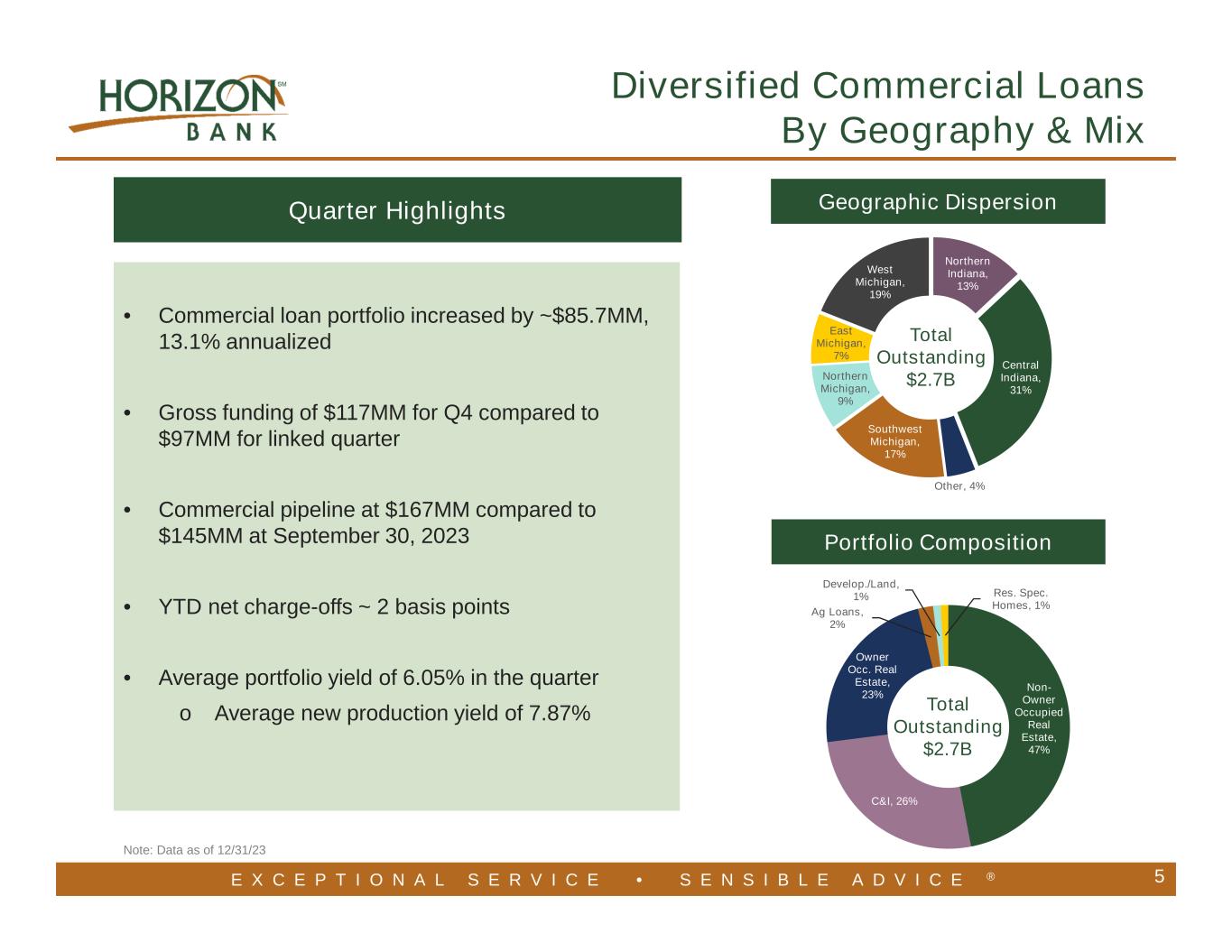

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® • Commercial loan portfolio increased by ~$85.7MM, 13.1% annualized • Gross funding of $117MM for Q4 compared to $97MM for linked quarter • Commercial pipeline at $167MM compared to $145MM at September 30, 2023 • YTD net charge-offs ~ 2 basis points • Average portfolio yield of 6.05% in the quarter o Average new production yield of 7.87% Diversified Commercial Loans By Geography & Mix 5 Northern Indiana, 13% Central Indiana, 31% Other, 4% Southwest Michigan, 17% Northern Michigan, 9% East Michigan, 7% West Michigan, 19% Geographic Dispersion Non- Owner Occupied Real Estate, 47% C&I, 26% Owner Occ. Real Estate, 23% Ag Loans, 2% Develop./Land, 1% Res. Spec. Homes, 1% Portfolio Composition Quarter Highlights Note: Data as of 12/31/23 Total Outstanding $2.7B Total Outstanding $2.7B

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Commercial, $2,675M, 61% Residential Mortgage, $681M, 15% Consumer, $1,016M, 23% Mortgage Warehouse, $45M, 1% Held For Sale, $1M, 0% 6 Gross Loans $4.4B Commercial Loans by Industry ($M) 12/31/23 Balance % of Commercial Portfolio % of Total Loan Portfolio Lessors – Residential Multi Family $271 10.1% 6.1% Health Care, Educational & Social 232 8.7% 5.3% Warehouse/Industrial 170 6.4% 3.8% Individual and Other Services 167 6.2% 3.8% Retail 165 6.2% 3.7% Hotel 161 6.0% 3.6% Office (except medical) 155 5.8% 3.5% Real Estate Rental & Leasing 138 5.2% 3.1% Manufacturing 137 5.1% 3.1% Finance & Insurance 131 4.9% 3.0% Lessors – Student Housing 108 4.0% 2.4% Construction 95 3.6% 2.1% Retail Trade 87 3.3% 2.0% Lessors – Residential 1–4 Family 75 2.8% 1.7% Mini Storage 74 2.8% 1.7% Medical Office 73 2.7% 1.7% Government 67 2.5% 1.5% Restaurants 64 2.4% 1.4% Leisure and Hospitality 48 1.8% 1.1% Professional & Technical Services 44 1.6% 1.0% Transportation & Warehousing 39 1.4% 0.9% Wholesale Trade 38 1.4% 0.9% Farm Land 32 1.2% 0.7% Development Loans 24 0.9% 0.5% Other 80 3.0% 1.9% Total $2,675 100.0% 60.5% Diversified & Granular Loan Portfolio Note: Data as of 12/31/23

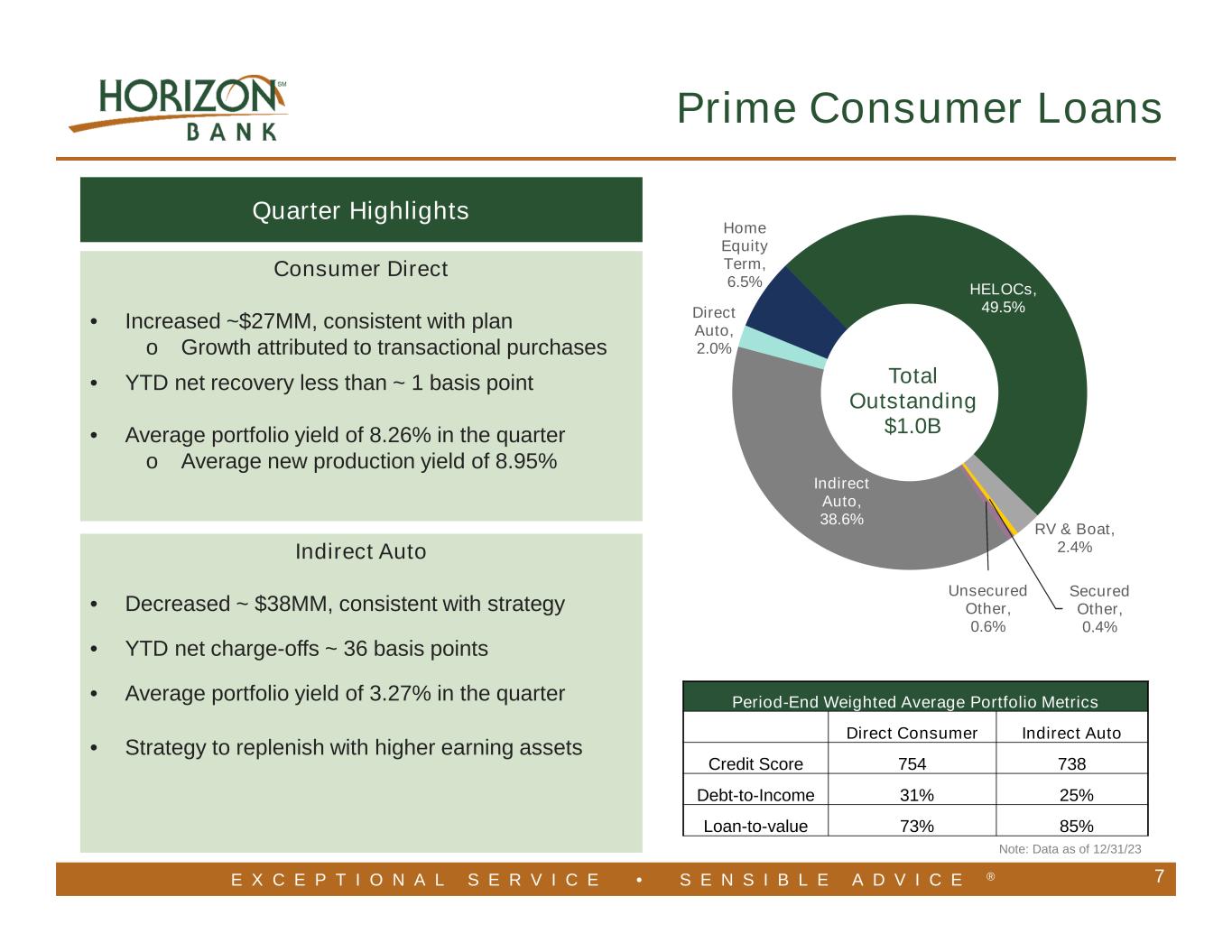

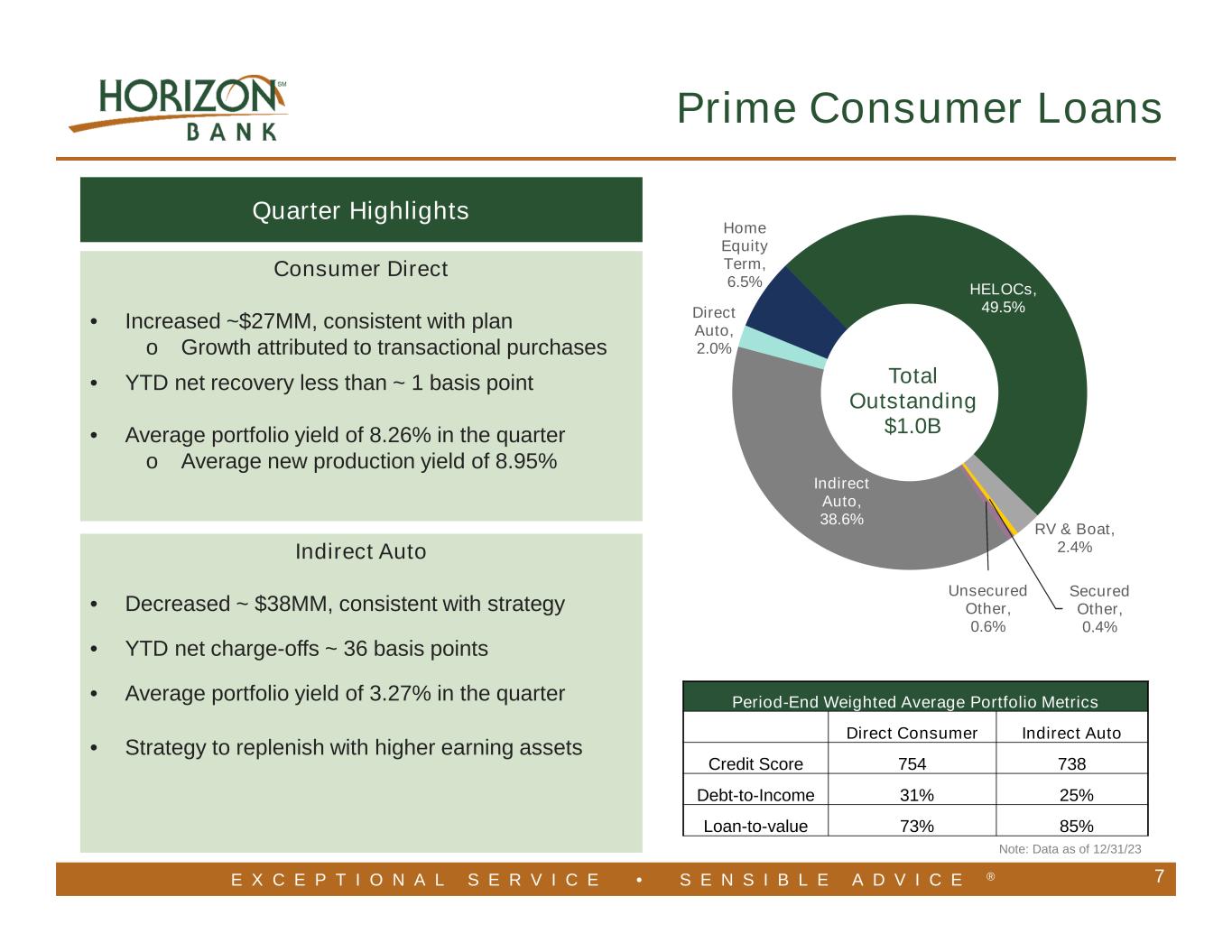

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 7 Prime Consumer Loans Consumer Direct • Increased ~$27MM, consistent with plan o Growth attributed to transactional purchases • YTD net recovery less than ~ 1 basis point • Average portfolio yield of 8.26% in the quarter o Average new production yield of 8.95% Quarter Highlights Direct Auto, 2.0% Home Equity Term, 6.5% HELOCs, 49.5% RV & Boat, 2.4% Secured Other, 0.4% Unsecured Other, 0.6% Indirect Auto, 38.6% Total Outstanding $1.0B Period-End Weighted Average Portfolio Metrics Direct Consumer Indirect Auto Credit Score 754 738 Debt-to-Income 31% 25% Loan-to-value 73% 85% Note: Data as of 12/31/23 Indirect Auto • Decreased ~ $38MM, consistent with strategy • YTD net charge-offs ~ 36 basis points • Average portfolio yield of 3.27% in the quarter • Strategy to replenish with higher earning assets

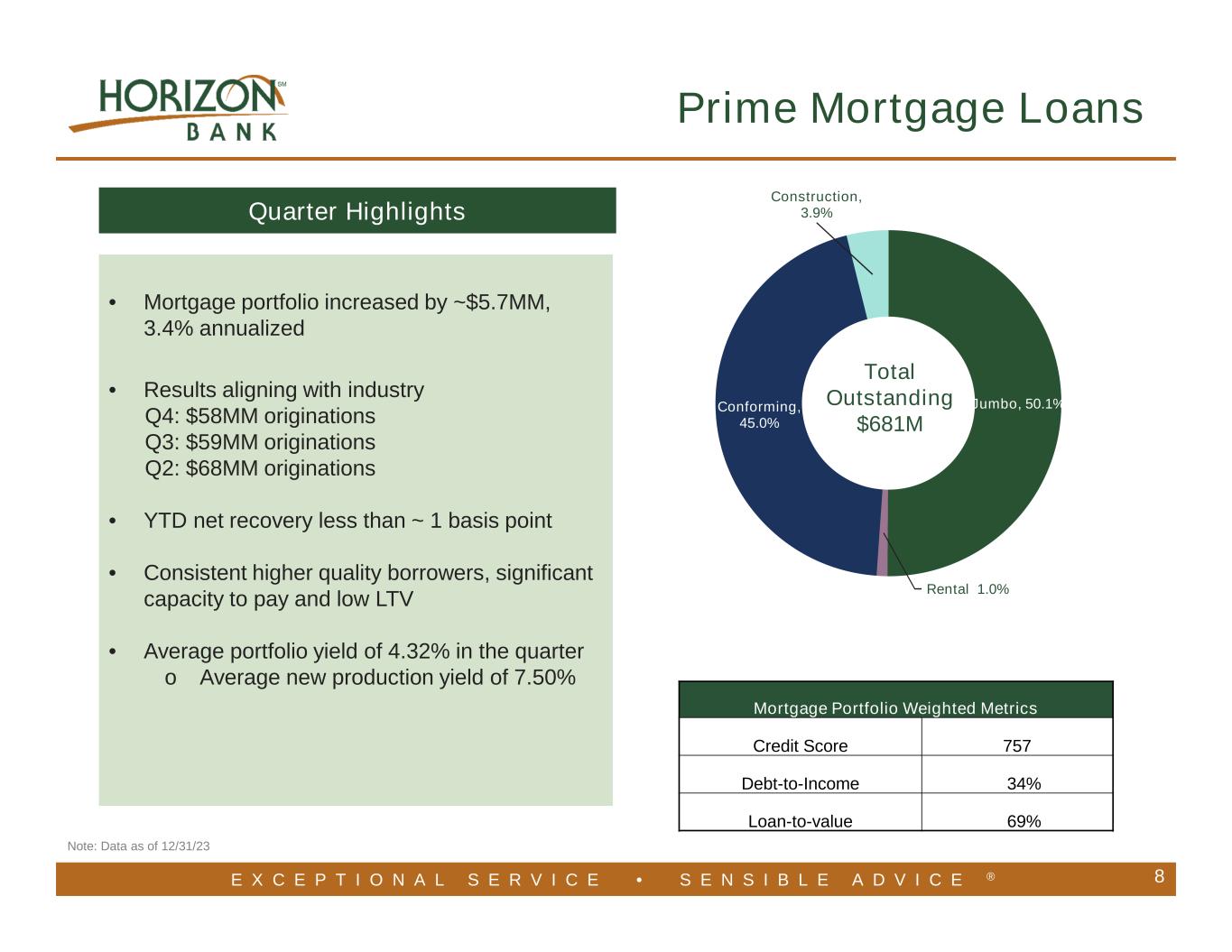

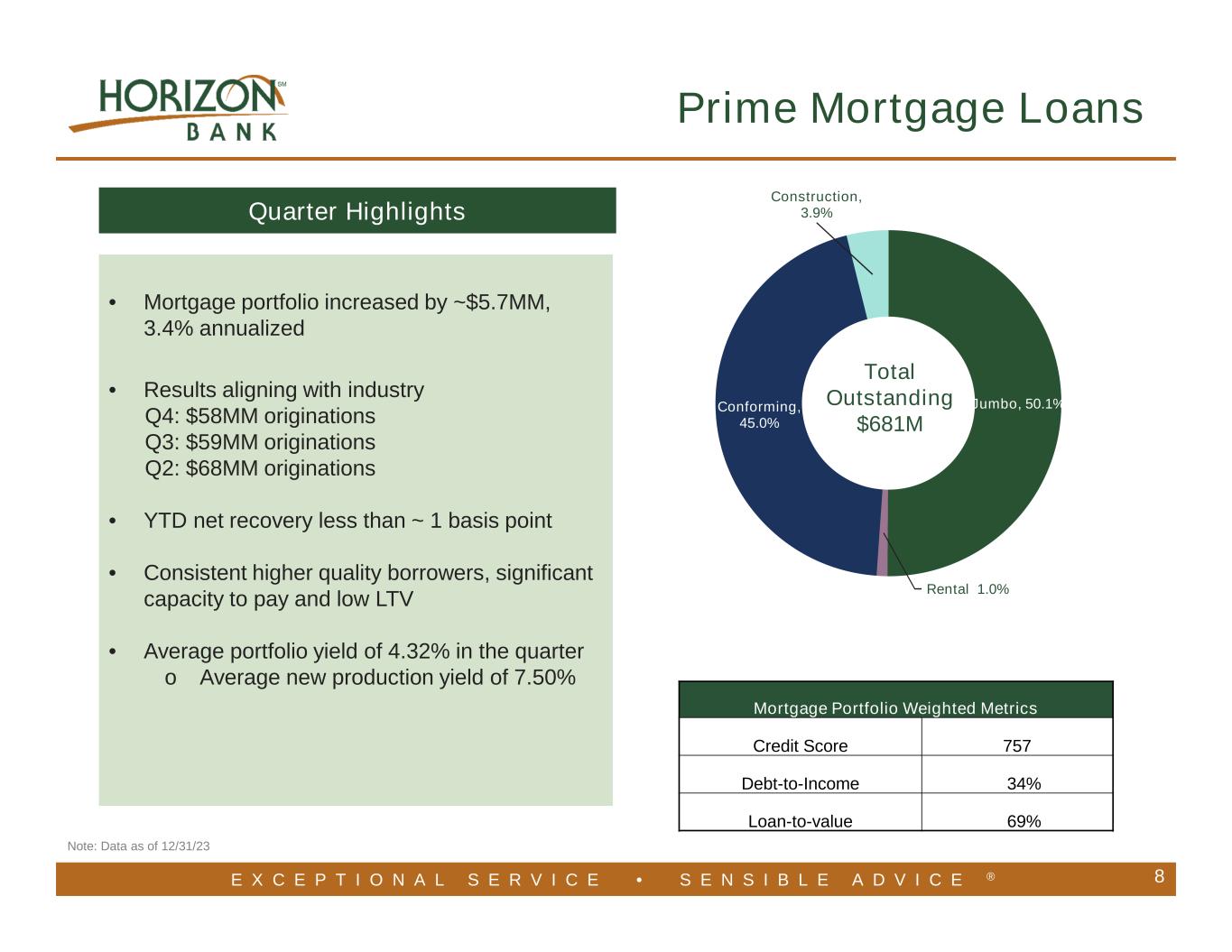

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 8 Prime Mortgage Loans • Mortgage portfolio increased by ~$5.7MM, 3.4% annualized • Results aligning with industry Q4: $58MM originations Q3: $59MM originations Q2: $68MM originations • YTD net recovery less than ~ 1 basis point • Consistent higher quality borrowers, significant capacity to pay and low LTV • Average portfolio yield of 4.32% in the quarter o Average new production yield of 7.50% Mortgage Portfolio Weighted Metrics Credit Score 757 Debt-to-Income 34% Loan-to-value 69% Jumbo, 50.1% Rental, 1.0% Conforming, 45.0% Construction, 3.9% Total Outstanding $681M Quarter Highlights Note: Data as of 12/31/23

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® $285 $379 $274 $722 $785 0.01% 0.01% 0.01% 0.02% 0.02% 4Q22 1Q23 2Q23 3Q23 4Q23 Net Charge Offs Commercial Resi Real Estate Consumer Total NCOs/Average Loans $ 0 0 0 s $21,840 $19,797 $22,109 $19,448 $19,625 0.52% 0.47% 0.52% 0.45% 0.44% 4Q22 1Q23 2Q23 3Q23 4Q23 Non-Performing Loans (period end) Commercial Resi Real Estate Consumer Total NPLs/Loans $ 0 0 0 s 9 CECL $50,464 $49,526 $49,976 $49,699 $50,029 1.21% 1.17% 1.17% 1.14% 1.13% 4Q22 1Q23 2Q23 3Q23 4Q23 ACL ACL/Loans Strong Asset Quality Metrics Allowance for Credit Losses (period end) $ 0 0 0 s 30-89 Days Delinquent (period end) $ 0 0 0 s $10,709 $13,971 $10,913 $13,090 $16,595 0.25% 0.33% 0.26% 0.30% 0.38% 4Q22 1Q23 2Q23 3Q23 4Q23 39 to 89 days delinquent Delinquencies/Loans

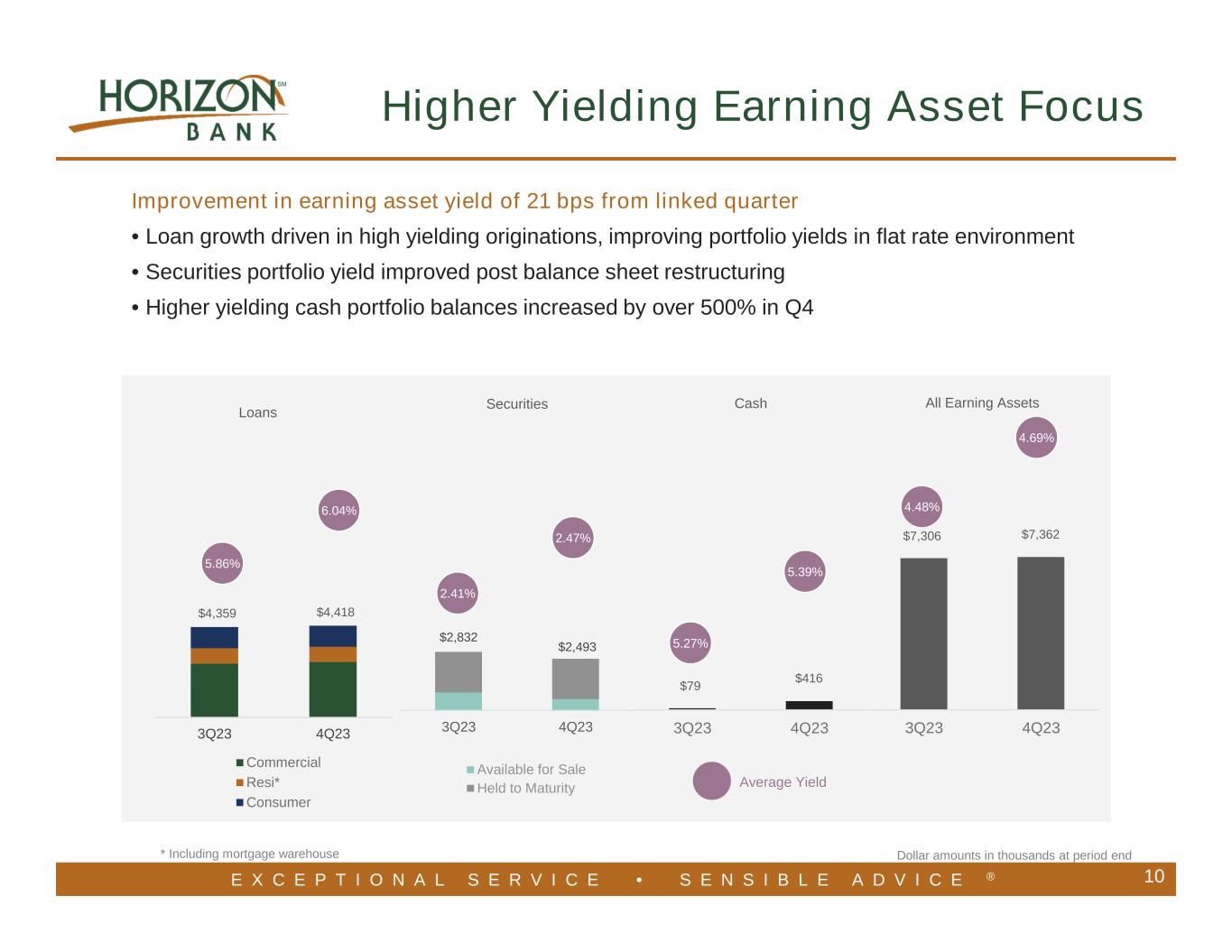

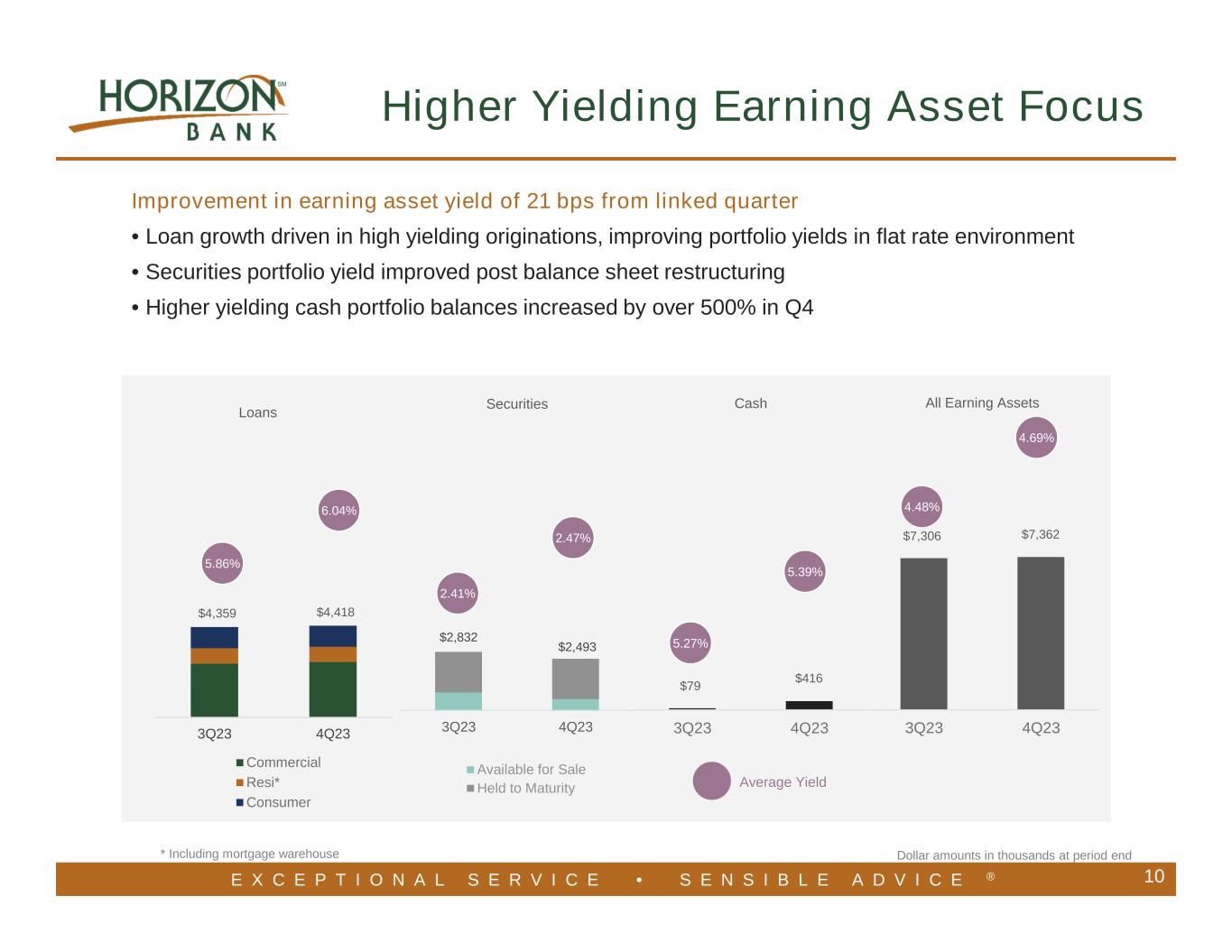

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® * Including mortgage warehouse 10 Higher Yielding Earning Asset Focus $4,359 $4,418 3Q23 4Q23 Loans Commercial Resi* Consumer $2,832 $2,493 3Q23 4Q23 Securities Available for Sale Held to Maturity $7,306 $7,362 3Q23 4Q23 All Earning Assets $79 $416 3Q23 4Q23 Cash 5.86% 6.04% Average Yield Dollar amounts in thousands at period end 2.41% 2.47% 5.27% 5.39% 4.48% 4.69% Improvement in earning asset yield of 21 bps from linked quarter • Loan growth driven in high yielding originations, improving portfolio yields in flat rate environment • Securities portfolio yield improved post balance sheet restructuring • Higher yielding cash portfolio balances increased by over 500% in Q4

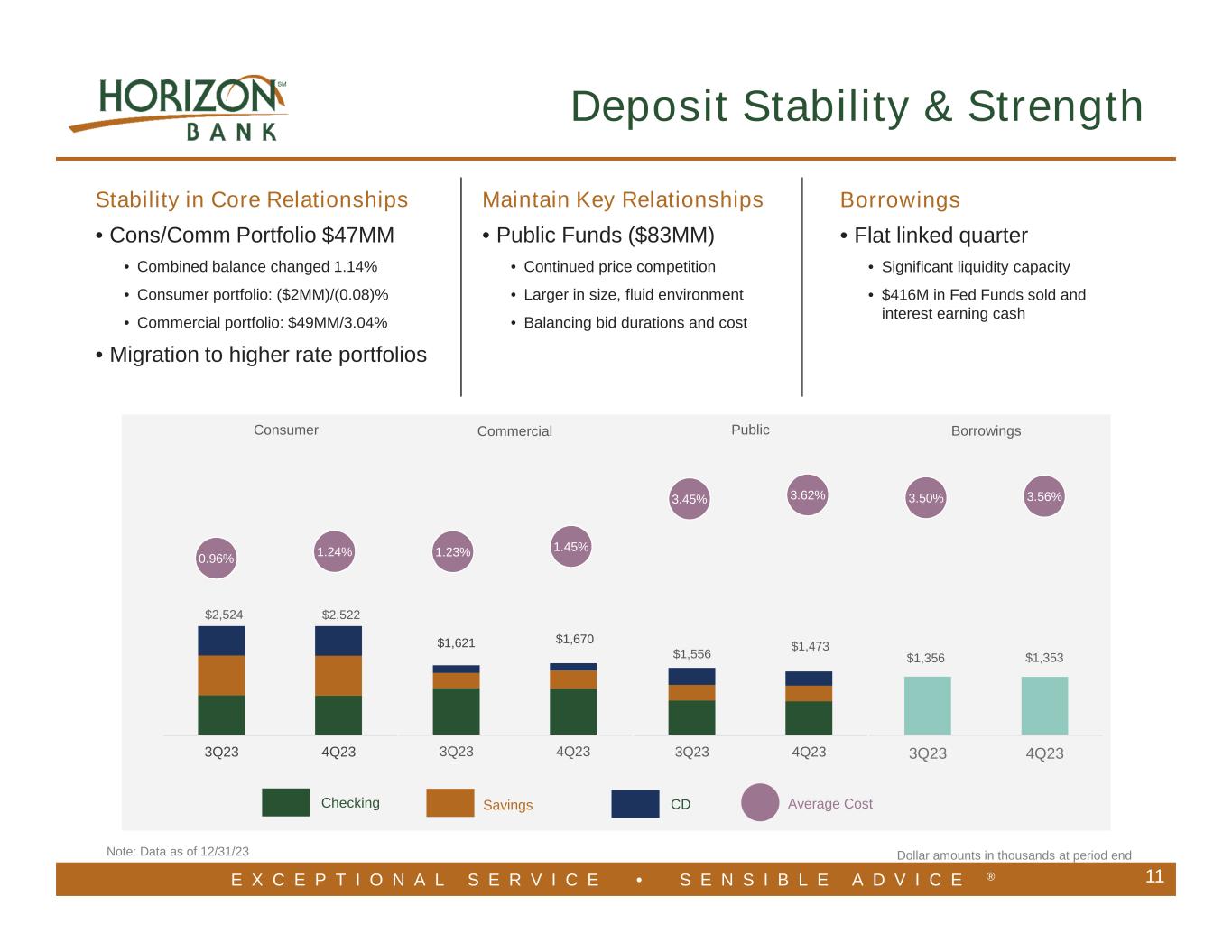

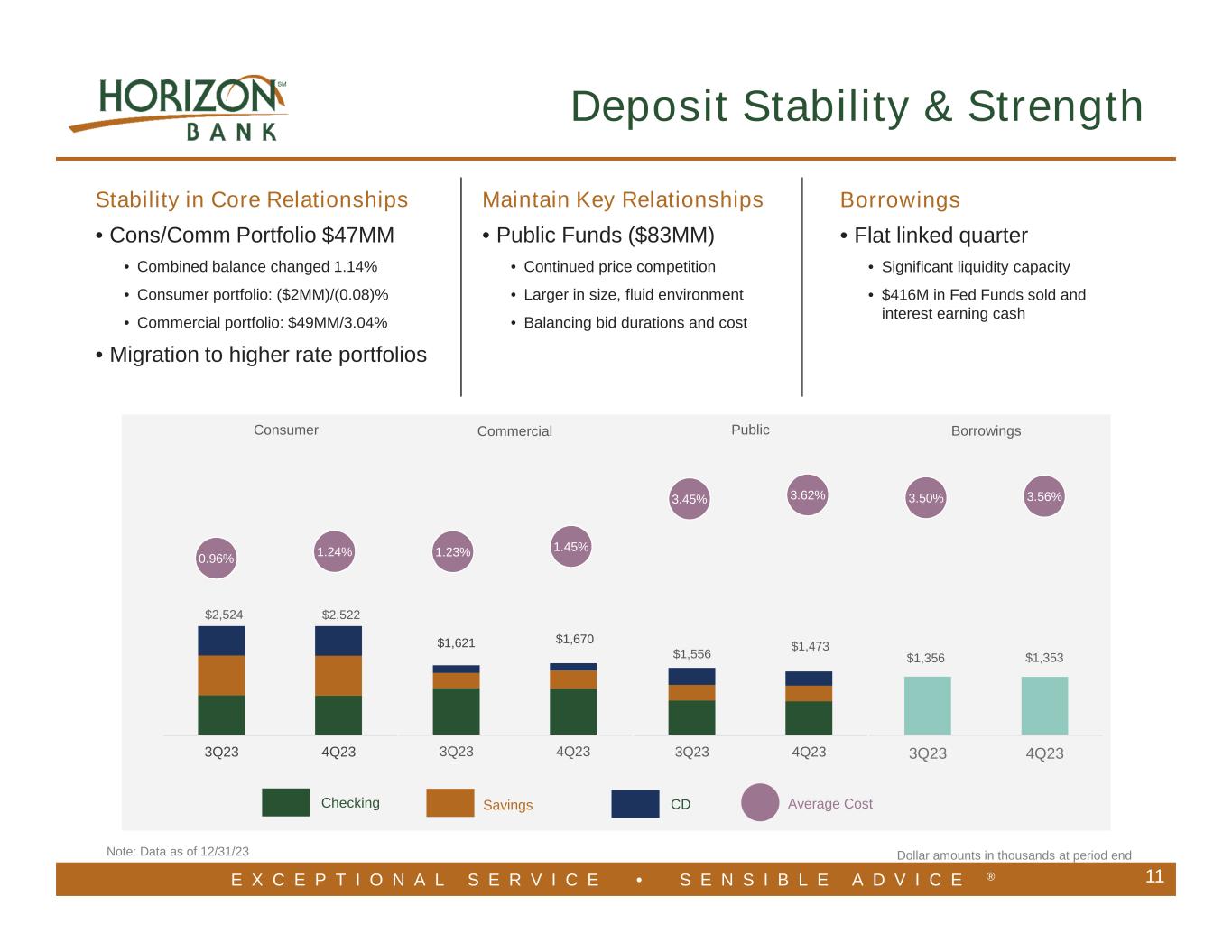

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® $1,556 $1,473 3Q23 4Q23 Public Note: Data as of 12/31/23 11 Deposit Stability & Strength Maintain Key Relationships • Public Funds ($83MM) • Continued price competition • Larger in size, fluid environment • Balancing bid durations and cost Stability in Core Relationships • Cons/Comm Portfolio $47MM • Combined balance changed 1.14% • Consumer portfolio: ($2MM)/(0.08)% • Commercial portfolio: $49MM/3.04% • Migration to higher rate portfolios Borrowings • Flat linked quarter • Significant liquidity capacity • $416M in Fed Funds sold and interest earning cash Checking Savings CD $2,524 $2,522 3Q23 4Q23 Consumer $1,621 $1,670 3Q23 4Q23 Commercial $1,356 $1,353 3Q23 4Q23 Borrowings Average Cost 0.96% 1.24% 1.23% 1.45% 3.45% 3.62% 3.50% 3.56% Dollar amounts in thousands at period end

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Positioned for Further NIM Expansion 12 4Q23 Net Interest Margin Ahead of expected 2024 deployment of December balance sheet repositioning proceeds* * Balance sheet repositioning announced on December 12, 2023 included sale of $382.7mm of AFS securities and surrender of $112.8mm in BOLI. NIM expansion in the fourth quarter • The increase in the interest earning asset yield more than outpaced the increase in interest bearing liability costs • The balance sheet restructure had minimal impact during the quarter, benefits will come in future periods

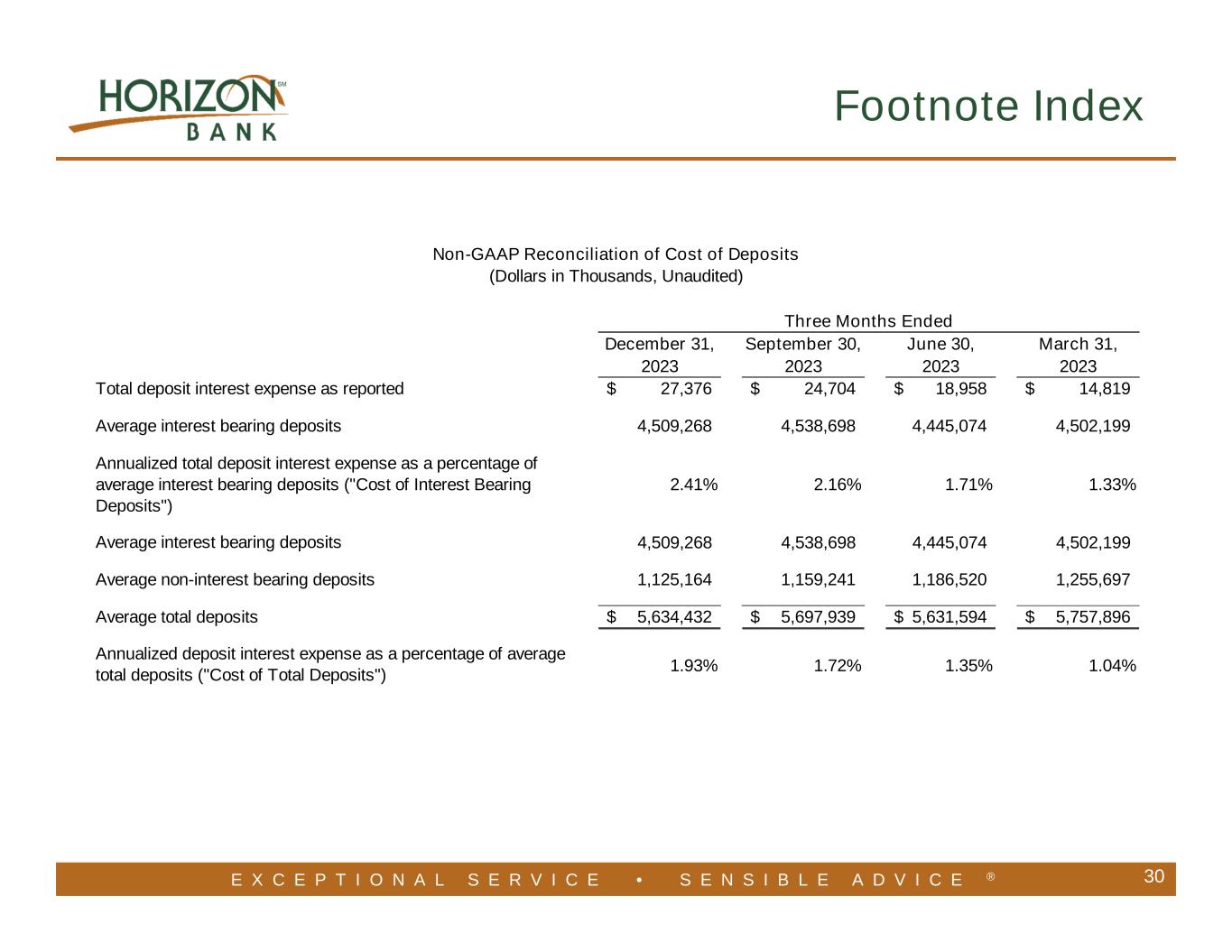

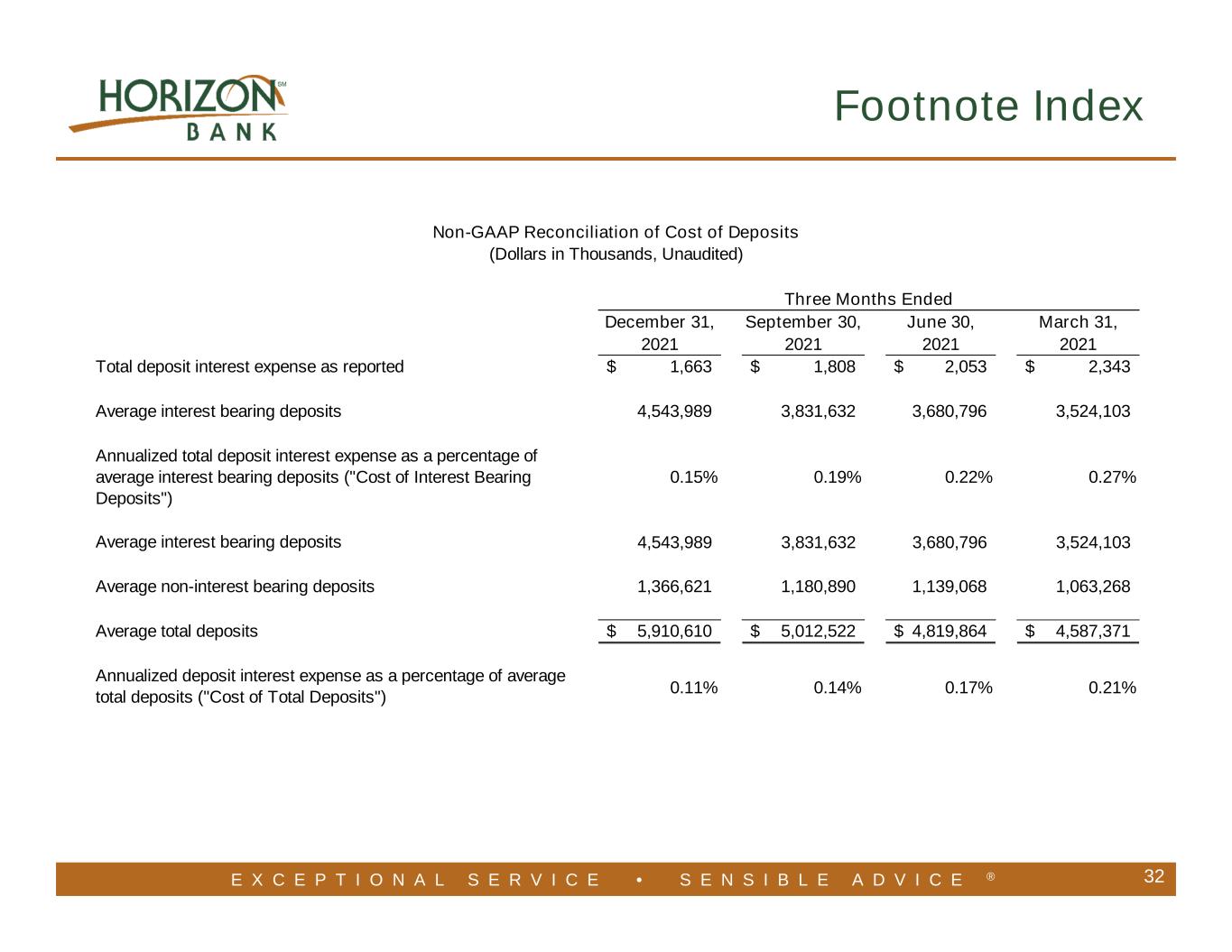

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Continued Focus on Pricing Discipline 13 4.22% 4.25% 4.38% 4.34% 4.10% 4.33% 4.61% 5.02% 5.44% 5.78% 5.86% 6.04% 4.20% 4.14% 4.17% 4.17% 4.11% 4.25% 4.67% 5.10% 5.36% 5.50% 5.71% 0.21% 0.17% 0.14% 0.11% 0.10% 0.11% 0.28% 0.71% 1.04% 1.35% 1.72% 1.93% 0.27% 0.22% 0.19% 0.17% 0.16% 0.19% 0.37% 0.75% 1.26% 1.63% 1.95% 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 Average Loan Yields and Deposit Costs HBNC Loan Yield Peer Median Loan Yield HBNC Cost of Deposits(1) Peer Median Cost of Deposits (1) See Footnote Index and non-GAAP reconciliations in Appendix. 376 bps 411 bps Peer medians for U.S. commercial banks listed on the Nasdaq or NYSE with assets of $5B-$10B at MRQ end, according to data from S&P Capital IQ Pro on December 18, 2023. HBNC Cost HBNC Yield

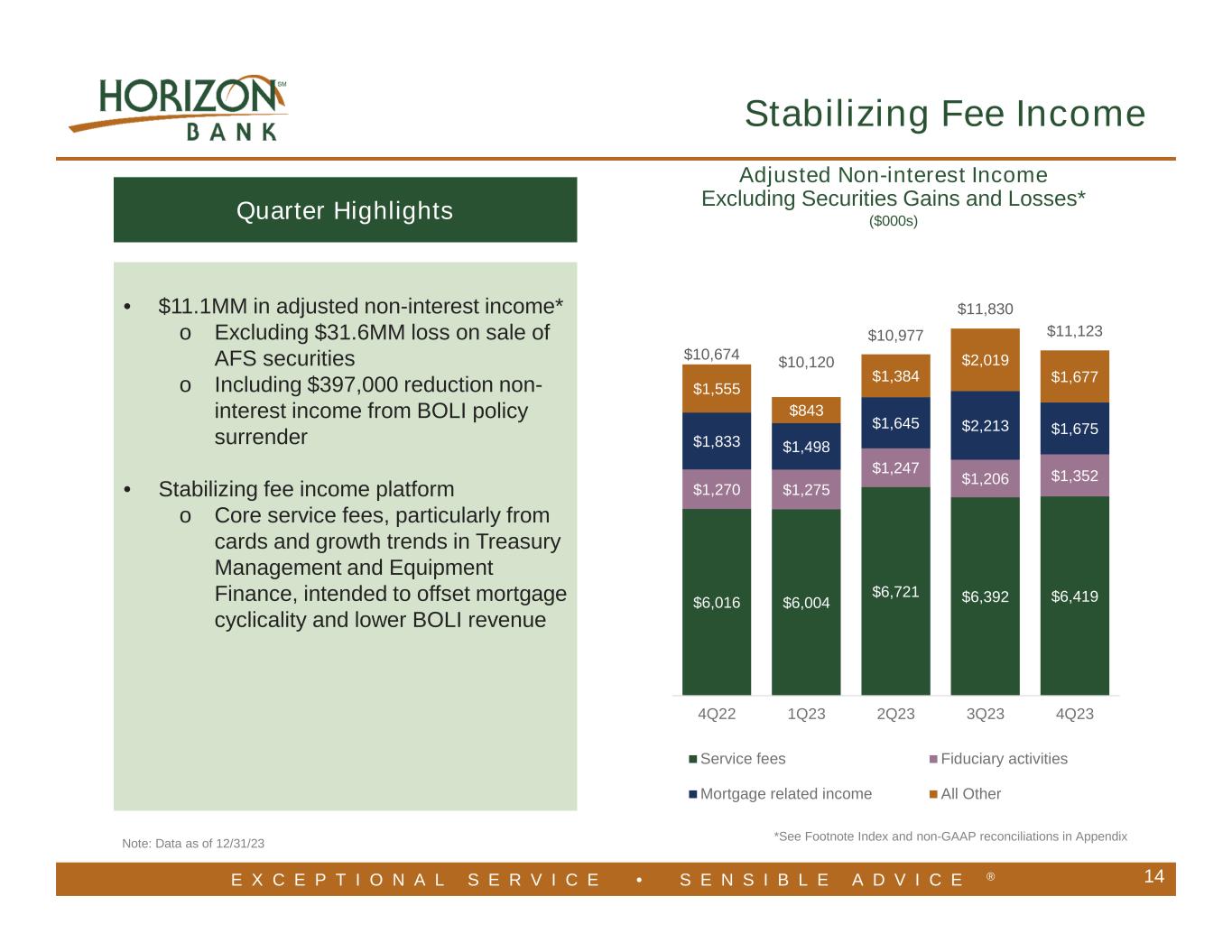

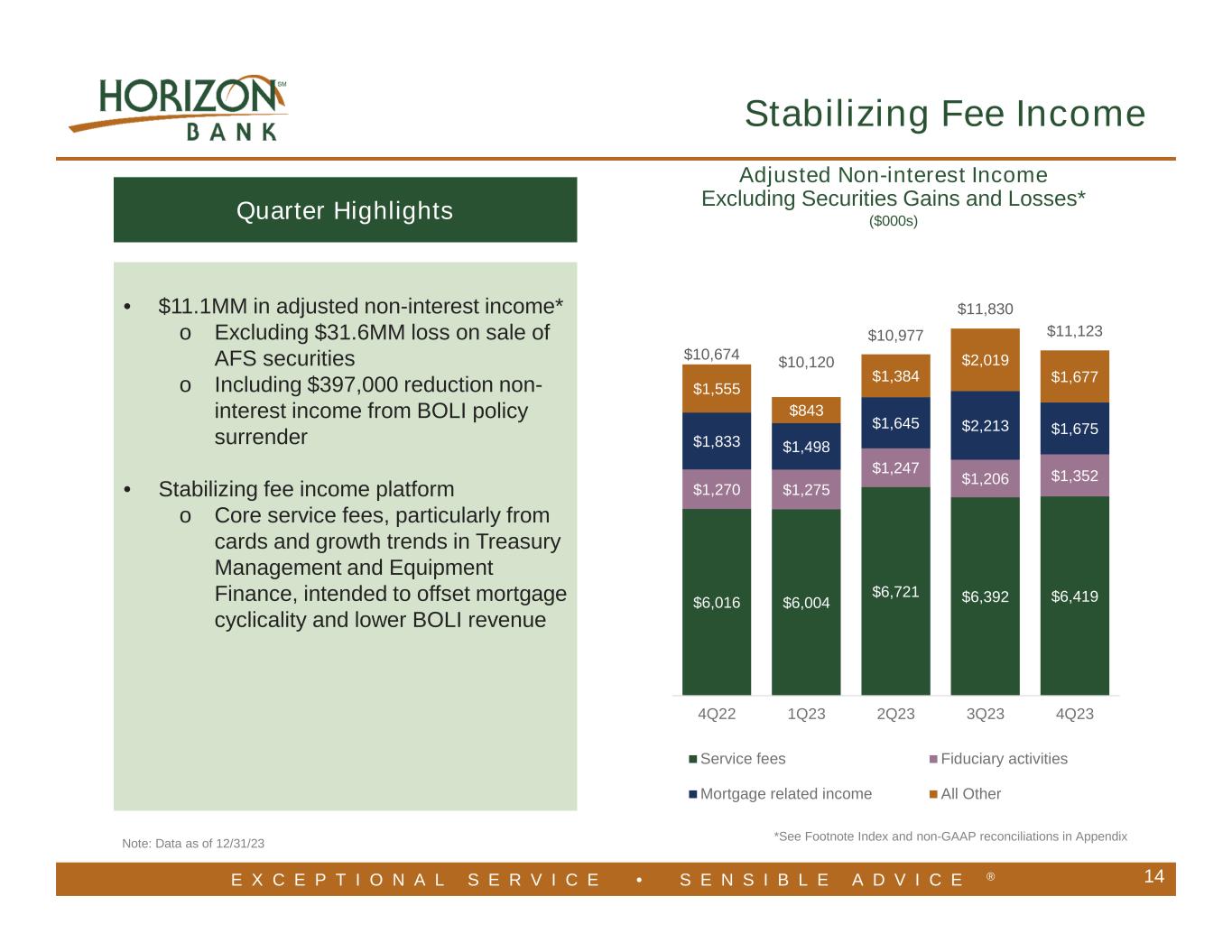

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 14 Stabilizing Fee Income Adjusted Non-interest Income Excluding Securities Gains and Losses* ($000s) $6,016 $6,004 $6,721 $6,392 $6,419 $1,270 $1,275 $1,247 $1,206 $1,352 $1,833 $1,498 $1,645 $2,213 $1,675 $1,555 $843 $1,384 $2,019 $1,677 $10,674 $10,120 $10,977 $11,830 $11,123 4Q22 1Q23 2Q23 3Q23 4Q23 Service fees Fiduciary activities Mortgage related income All Other • $11.1MM in adjusted non-interest income* o Excluding $31.6MM loss on sale of AFS securities o Including $397,000 reduction non- interest income from BOLI policy surrender • Stabilizing fee income platform o Core service fees, particularly from cards and growth trends in Treasury Management and Equipment Finance, intended to offset mortgage cyclicality and lower BOLI revenue Quarter Highlights Note: Data as of 12/31/23 *See Footnote Index and non-GAAP reconciliations in Appendix

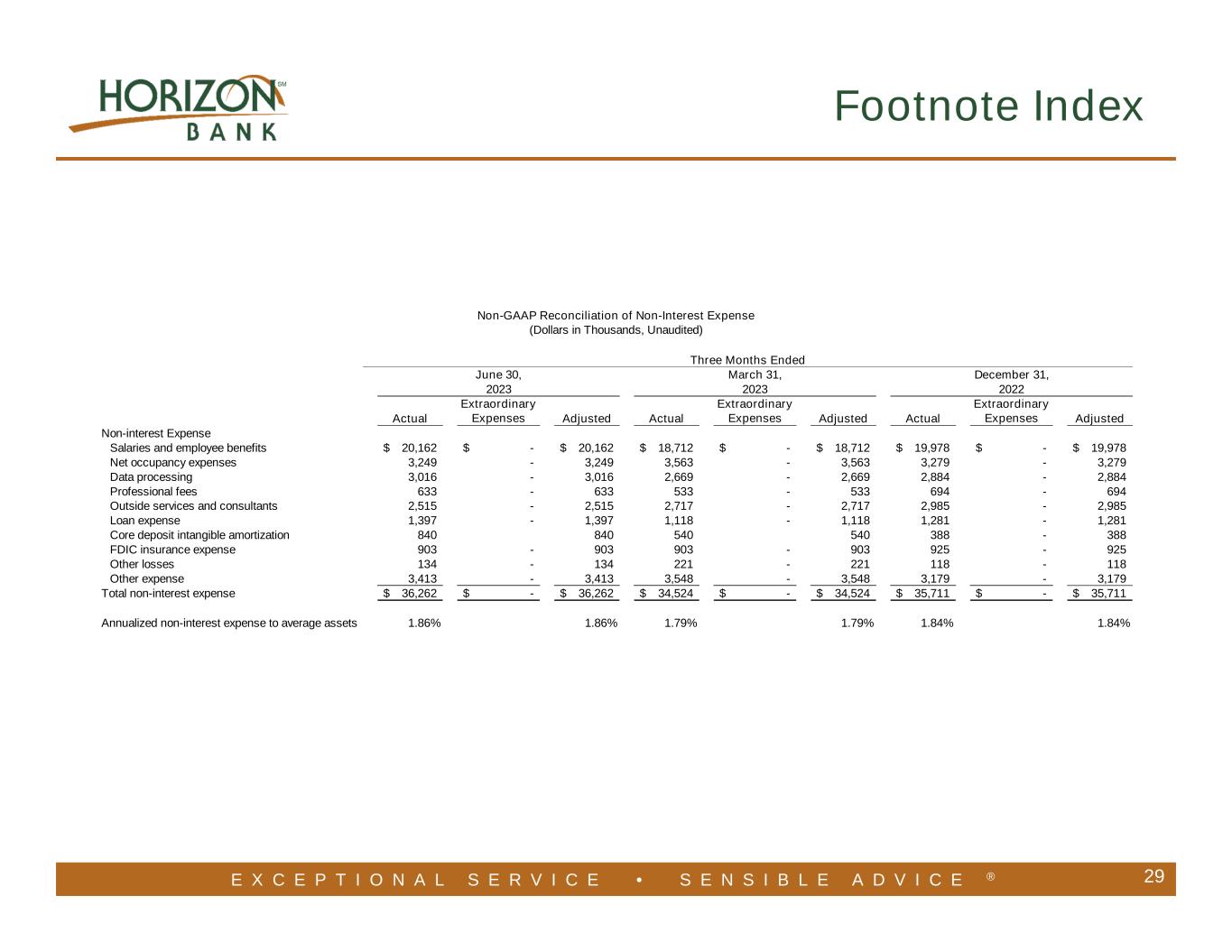

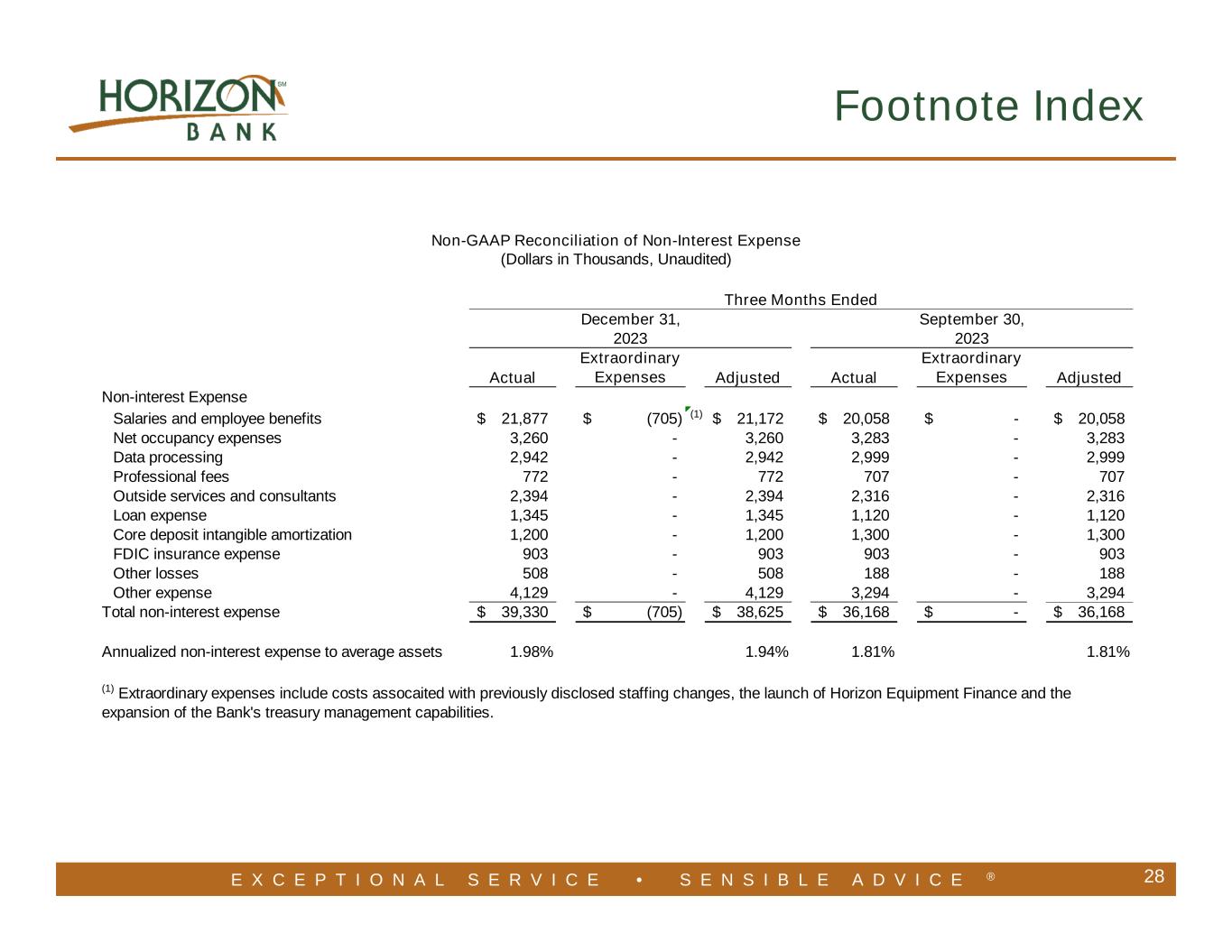

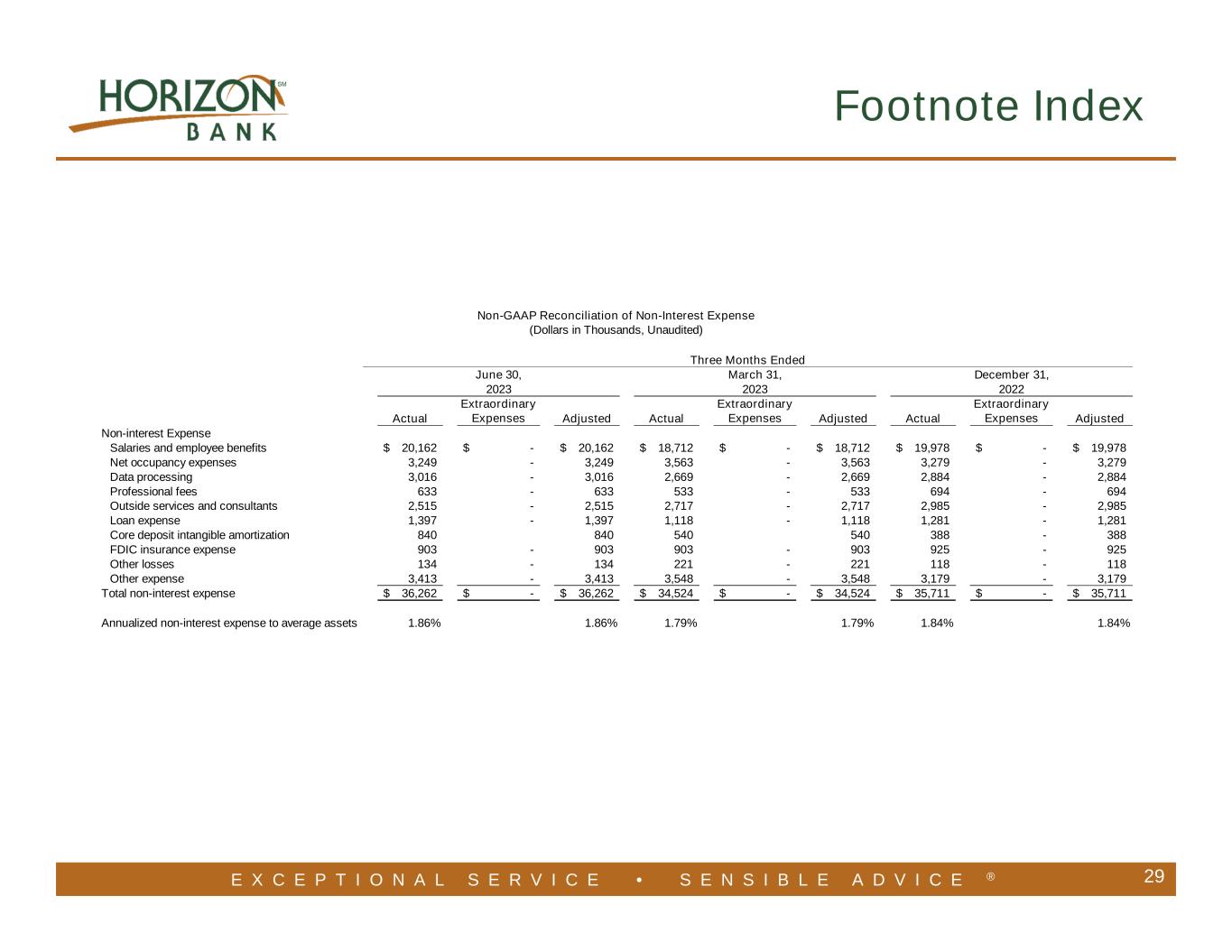

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 15 Diligent Expense Management $19,978 $18,712 $20,162 $20,058 $21,172 $15,733 $15,812 $16,100 $16,110 $17,453$35,711 $34,524 $36,262 $36,168 $38,625 1.84% 1.79% 1.86% 1.81% 1.94% 4Q22 1Q23 2Q23 3Q23 4Q23* All Other Non-interest Expense* Salaries & Employee Benefits* Annualized Non-Interest Expense to Average Assets* Adjusted Non-interest Expense* ($000s) • $38.6MM in adjusted operating expenses* o Excluding $705,000 in extraordinary expenses associated with previously disclosed staffing changes, the launch of Horizon Equipment Finance and the expansion of the Bank’s treasury management capabilities • Operating expenses will continue to reflect investments in revenue generating roles o C&I, CRE, Equipment Finance and Treasury Management capabilities, in particular • Adjusted operating expense* to average assets annualized o 1.94% for the quarter o 1.85% YTD Quarter Highlights Note: Data as of 12/31/23 *4Q23 excluding non-operating expenses. See Footnote Index and non-GAAP reconciliations in Appendix.

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 16 High-Quality Investment Securities Available for Sale (AFS) Securities on December 31, 2023 Held to Maturity (HTM) Securities on December 31, 2023 Amortized Cost Unrealized Loss, Net Fair Value** Duration (years) Amortized Cost** Unrealized Loss, Net Fair Value Duration (years) $72,938 $(8,561) $64,377 ~4.6 U.S. Treasury and federal agencies $287,259 $(41,299) $245,960 ~6.2 353,299 (49,269) 304,030 ~7.6 State and municipal 1,088,499 (149,138) 939,361 ~9.7 3,931 (351) 3,580 ~4.9 Federal agency CMOs 51,325 (7,846) 43,479 ~4.5 161,130 (23,833) 137,297 ~4.9 Federal agency mortgage-backed pools 323,649 (48,621) 275,028 ~5.4 -- -- -- -- Private labeled mortgage-backed pools 32,329 (4,595) 27,734 ~3.7 43,317 (5,350) 37,967 ~4.6 Corporate Notes 162,734 (25,538) 137,196 ~5.8 $634,615 $(87,364) $547,251 ~6.3 Total $1,945,638 $(277,037) $1,668,758 ~7.2 All dollar amounts in thousands 4Q22 1Q23 2Q23 3Q23 4Q23 Scheduled Next Quarter* Scheduled Next 12 Months* Roll-off / Cash Flow $28,000 $25,000 $41,000 $26,000 $28,000 $34,000 $105,000 Sales - $65,000 $24,000 - $383,000 Duration (years) 6.74 6.58 6.41 6.70 6.97 Book yield 2.30% 2.22% 2.21% 2.21% 2.25% * Excludes securities sales • Portfolio with positive spread over deposit costs • Cash flows to support funding of higher yielding loans **Book value, representing fair value for AFS securities and amortized cost for HTM securities

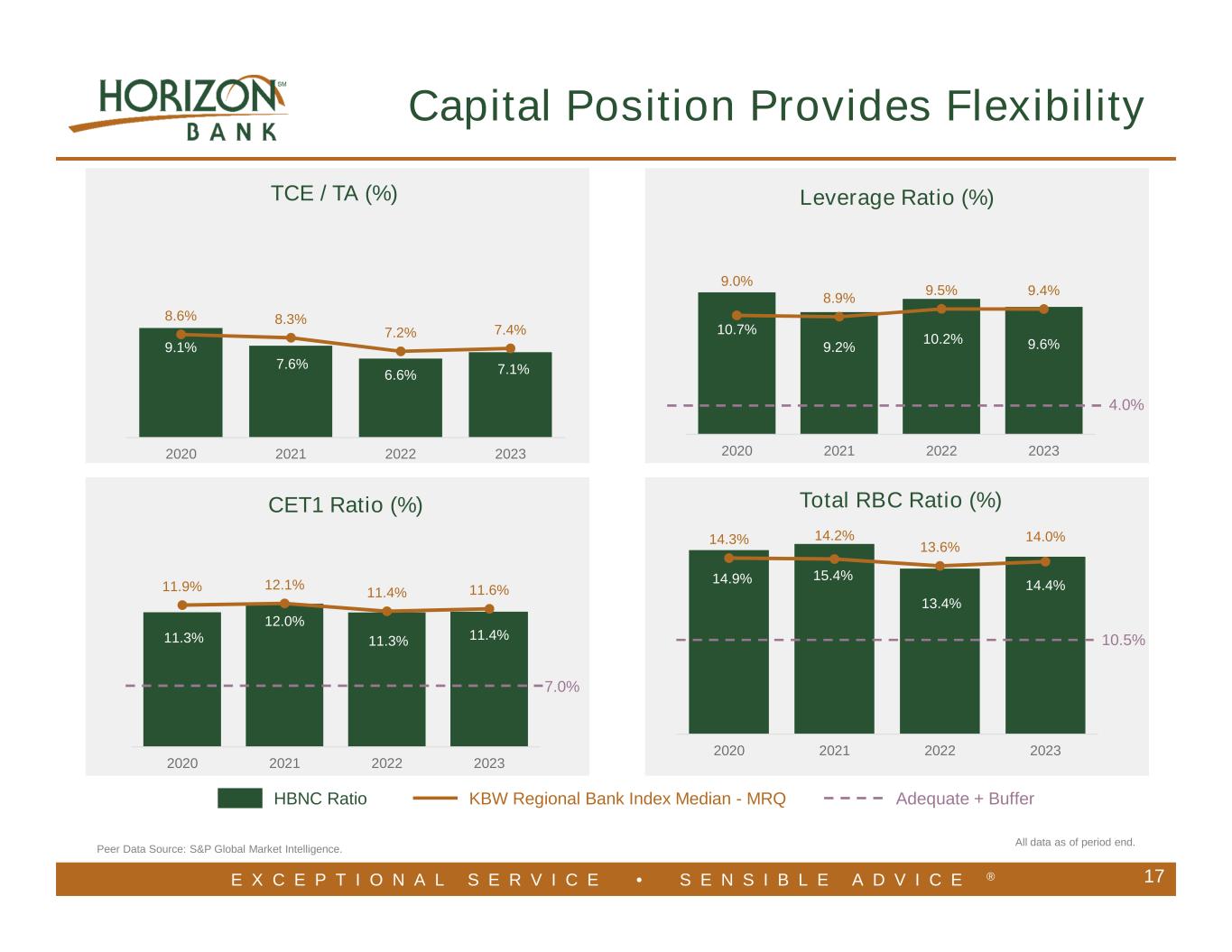

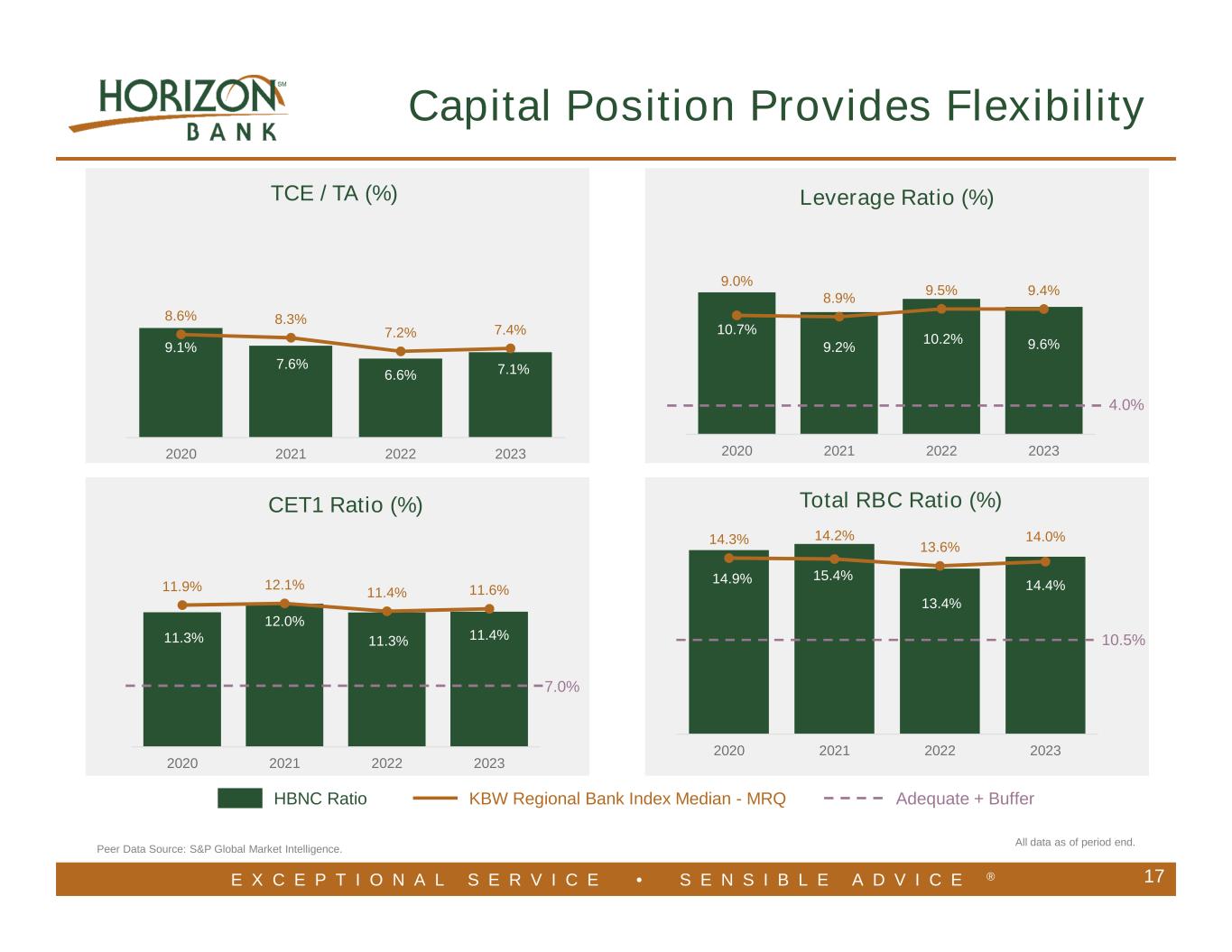

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 11.3% 12.0% 11.3% 11.4% 11.9% 12.1% 11.4% 11.6% 2020 2021 2022 2023 10.7% 9.2% 10.2% 9.6% 9.0% 8.9% 9.5% 9.4% 2020 2021 2022 2023 14.9% 15.4% 13.4% 14.4% 14.3% 14.2% 13.6% 14.0% 2020 2021 2022 2023 Peer Data Source: S&P Global Market Intelligence. TCE / TA (%) Leverage Ratio (%) Total RBC Ratio (%) 4.0% Adequate + Buffer 7.0% KBW Regional Bank Index Median - MRQ Capital Position Provides Flexibility 10.5% HBNC Ratio 9.1% 7.6% 6.6% 7.1% 8.6% 8.3% 7.2% 7.4% 2020 2021 2022 2023 CET1 Ratio (%) 17 All data as of period end.

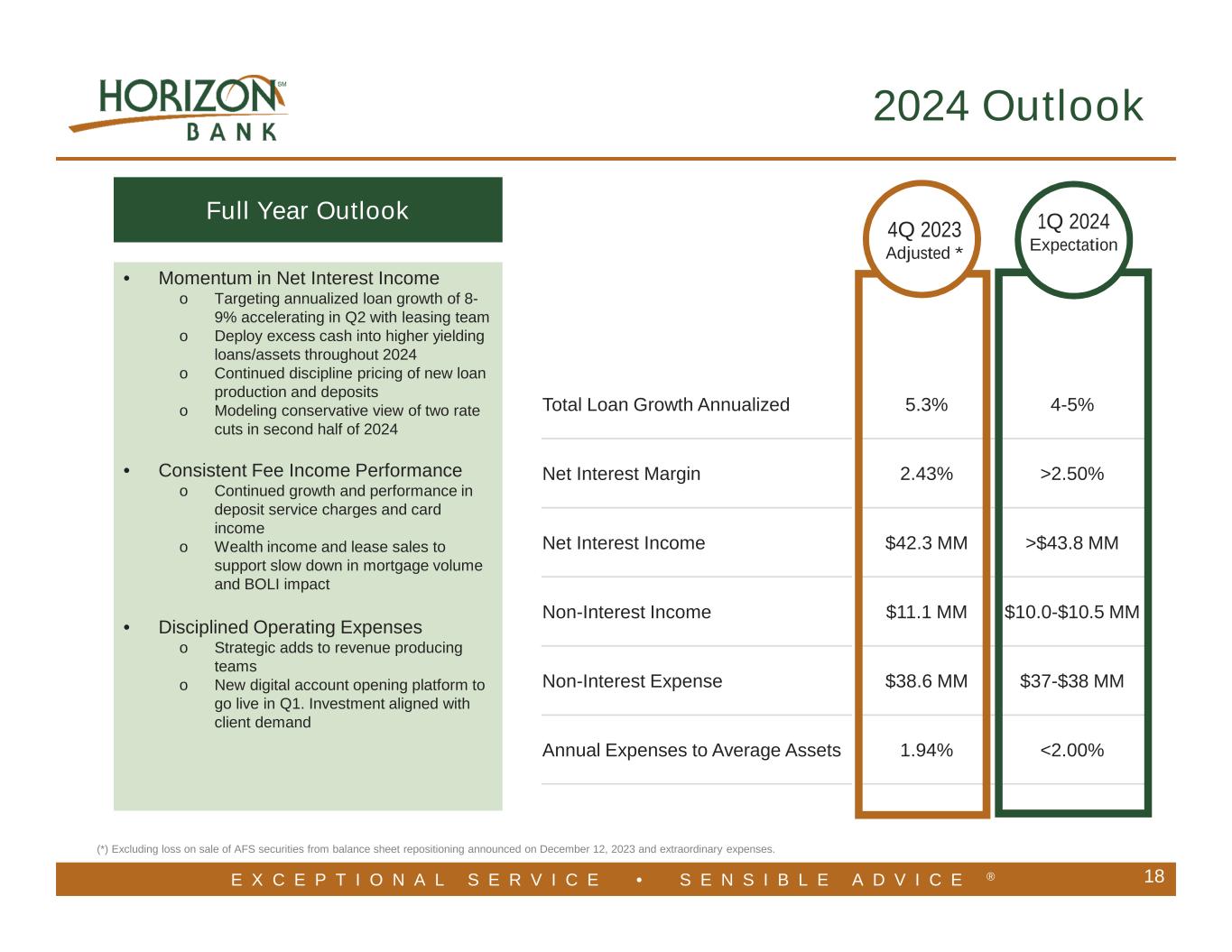

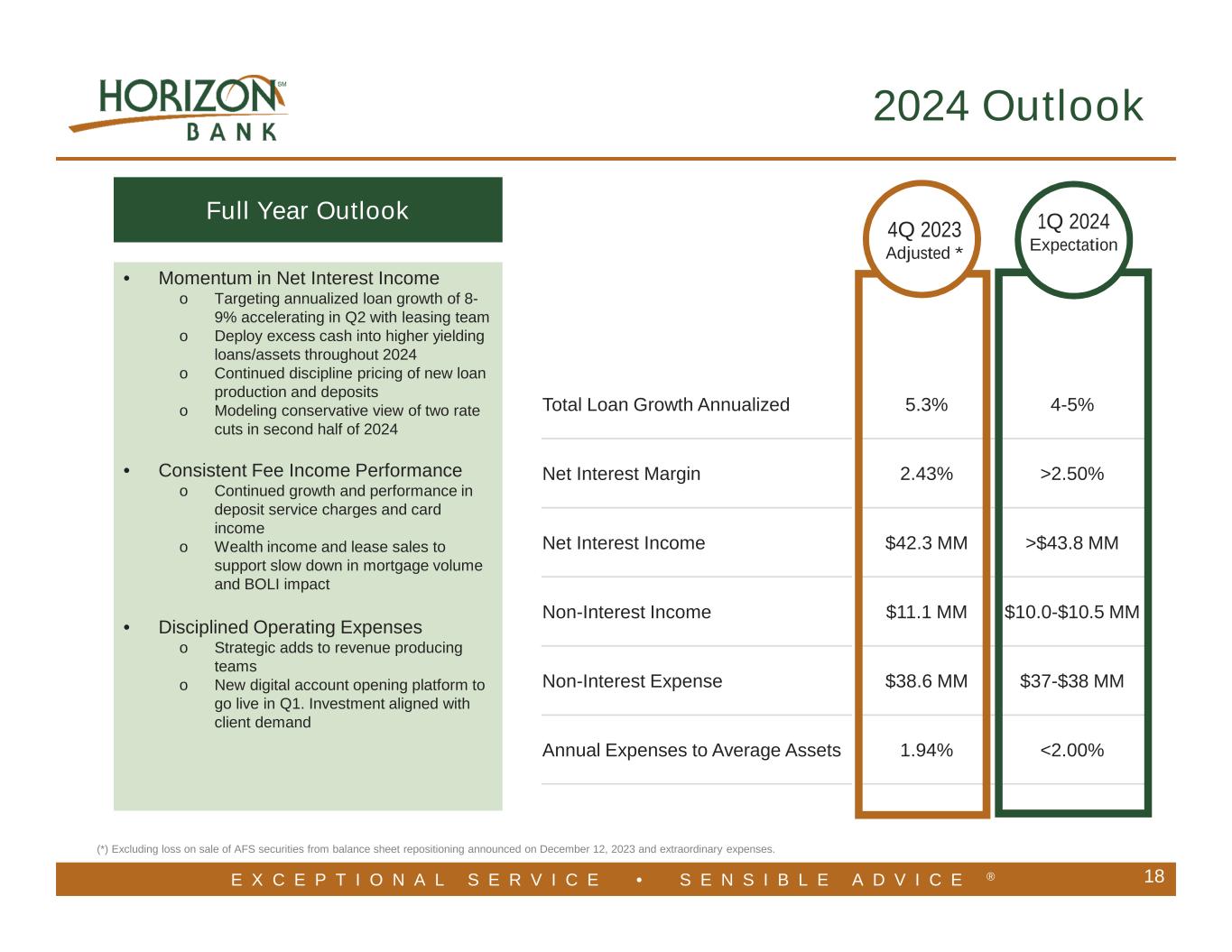

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Total Loan Growth Annualized 5.3% 4-5% Net Interest Margin 2.43% >2.50% Net Interest Income $42.3 MM >$43.8 MM Non-Interest Income $11.1 MM $10.0-$10.5 MM Non-Interest Expense $38.6 MM $37-$38 MM Annual Expenses to Average Assets 1.94% <2.00% 2024 Outlook 4Q 2023 Adjusted * 18 1Q 2024 Expectation • Momentum in Net Interest Income o Targeting annualized loan growth of 8- 9% accelerating in Q2 with leasing team o Deploy excess cash into higher yielding loans/assets throughout 2024 o Continued discipline pricing of new loan production and deposits o Modeling conservative view of two rate cuts in second half of 2024 • Consistent Fee Income Performance o Continued growth and performance in deposit service charges and card income o Wealth income and lease sales to support slow down in mortgage volume and BOLI impact • Disciplined Operating Expenses o Strategic adds to revenue producing teams o New digital account opening platform to go live in Q1. Investment aligned with client demand Full Year Outlook (*) Excluding loss on sale of AFS securities from balance sheet repositioning announced on December 12, 2023 and extraordinary expenses.

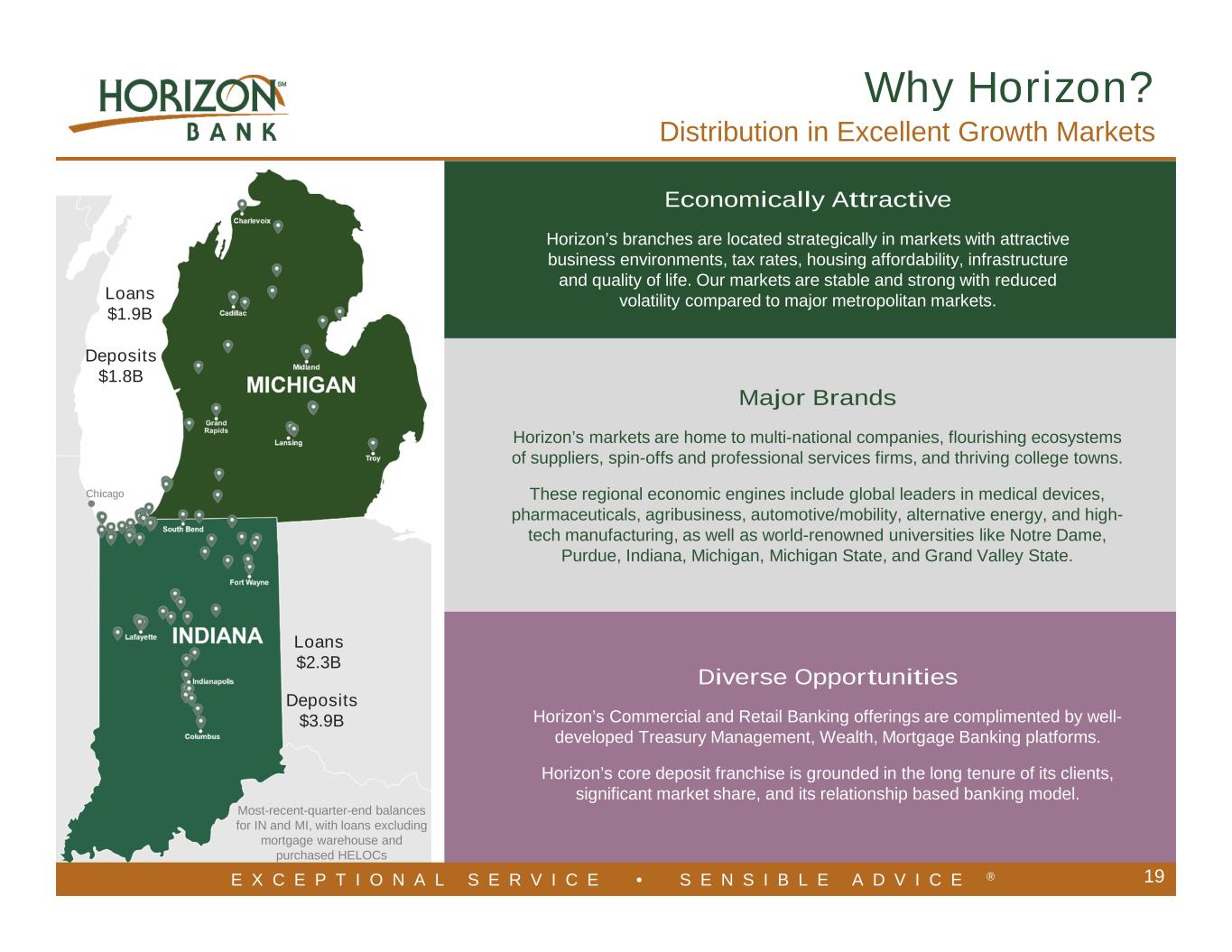

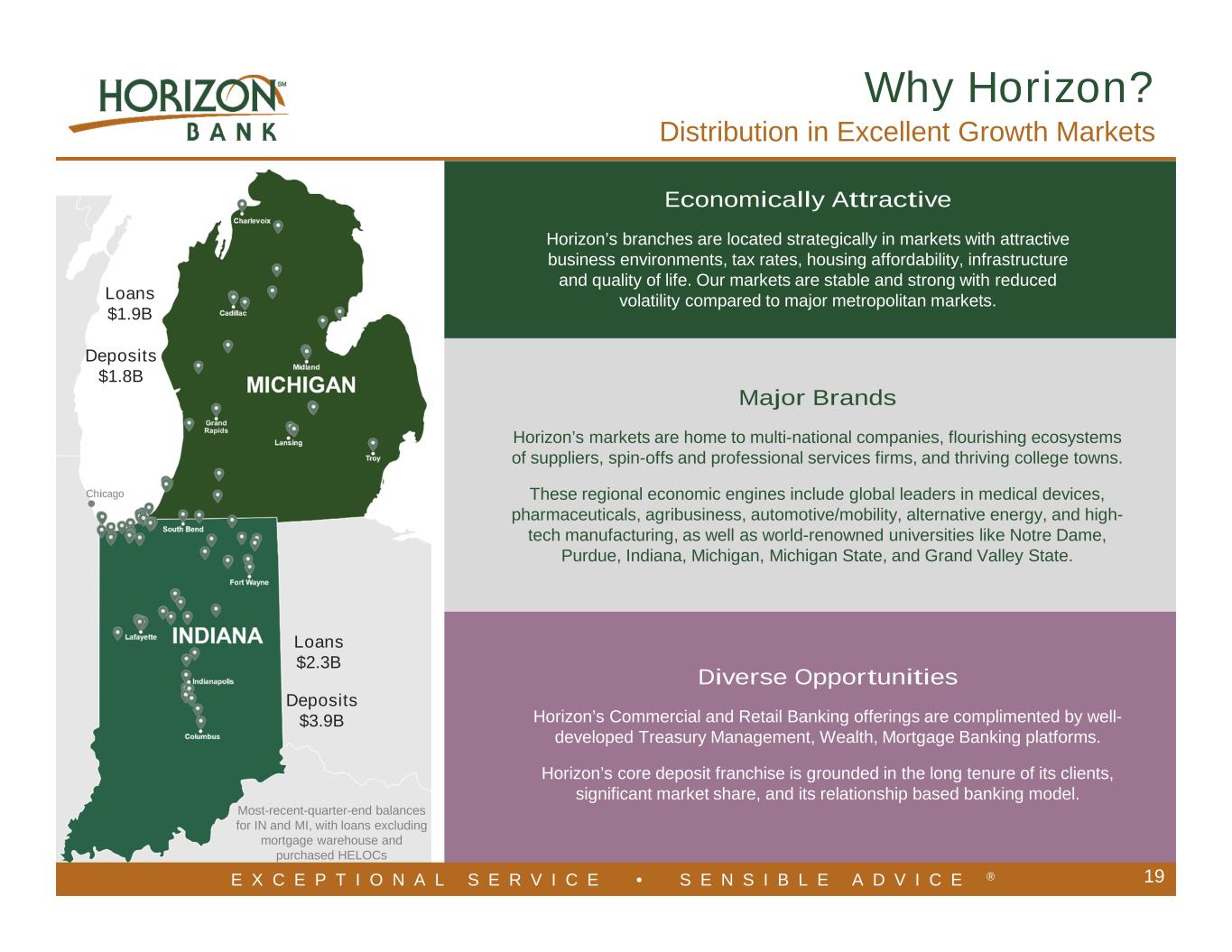

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 19 Major Brands Horizon’s markets are home to multi-national companies, flourishing ecosystems of suppliers, spin-offs and professional services firms, and thriving college towns. These regional economic engines include global leaders in medical devices, pharmaceuticals, agribusiness, automotive/mobility, alternative energy, and high- tech manufacturing, as well as world-renowned universities like Notre Dame, Purdue, Indiana, Michigan, Michigan State, and Grand Valley State. Most-recent-quarter-end balances for IN and MI, with loans excluding mortgage warehouse and purchased HELOCs Loans $2.3B Loans $1.9B Chicago Economically Attractive Horizon’s branches are located strategically in markets with attractive business environments, tax rates, housing affordability, infrastructure and quality of life. Our markets are stable and strong with reduced volatility compared to major metropolitan markets. Diverse Opportunities Horizon’s Commercial and Retail Banking offerings are complimented by well- developed Treasury Management, Wealth, Mortgage Banking platforms. Horizon’s core deposit franchise is grounded in the long tenure of its clients, significant market share, and its relationship based banking model. Deposits $1.8B Deposits $3.9B Why Horizon? Distribution in Excellent Growth Markets

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Very attractive Midwest markets Consistent and Strong loan growth with low credit risk profile Tenured and stable deposit base with significant liquidity Disciplined operating culture Compelling value supported by commitment to dividend Disciplined expense management results, 1.85% operating expenses/average assets year to date Excellent credit metrics with low non-performing loans and charge-offs 20 Why Horizon? Positive Momentum Moving into 2024 Stable, granular deposit base, average account tenure over 10 years Actively managing funding cost to create shareholder value Significant liquidity of $2.9 billion in availability; 79% deposits insured/collateralized Strategic branch distribution throughout highly desirable markets Core markets are experiencing significant investment in infrastructure and strong, growing local economies Flourishing ecosystem of diverse industry of suppliers, professional service firms and vendor partners P/adjusted EPS of 8.7x 4.8% dividend yield, and targeted dividend payout ratio of 30-40% aligned with capital retention strategy 30-year record of uninterrupted quarterly cash dividends to shareholders Cash represents approximately 8 quarters of the current dividend plus fixed costs Positive momentum with loan growth of 5.2% annualized led by commercial platform with 13%+ annualized growth in Q4 Abundant cash position to continue to reinvest in core lending platforms and new equipment leasing vertical A proven history of excellent credit metrics: 2 basis points charge-offs, 1.13% allowance for credit losses at most-recent quarter end Price multiples as of 1/19/24

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 21 Appendix

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 1% 2% 3% 3% 3% 4% 6% 6% 6% 6% 10% Farm Land All Others Medical Office Mini Storage Lessors - Residential 1-4 Lessors Student Housing Office (except medical) Motel Retail Warehouse/Industrial Lessors - Residential Multi Note: Data as of 12/31/23. All percentages are of total commercial loans. 1% 1% 1% 1% 2% 2% 2% 2% 2% 3% 6% Wholesale Trade Professional & Technical Services All Others Construction Leisure and Hospitality Restaurants Manufacturing Retail Trade Real Estate Rental & Leasing Individuals and Other Services Health Care, Edu. Social Assist. 1% 1% 1% 1% 1% 1% 2% 3% 3% 3% 3% 3% 5% Professional & Technical Services Wholesale Trade Restaurants Transportation & Warehousing Retail Trade All Others Construction Government Real Estate Rental & Leasing Health Care, Educational Social Assist. Manufacturing Individuals and Other Services Finance & Insurance 22 Non-Owner Occupied CRE – 50% of Total Commercial Loans ~$1.3 Billion Owner Occupied CRE – 23% of Total Commercial Loans ~$0.6 Billion C&I Loans – 27% of Total Commercial Loans ~$0.7 Billion Diversified Commercial Loans By Industry Commercial Loans - $2.675 Billion

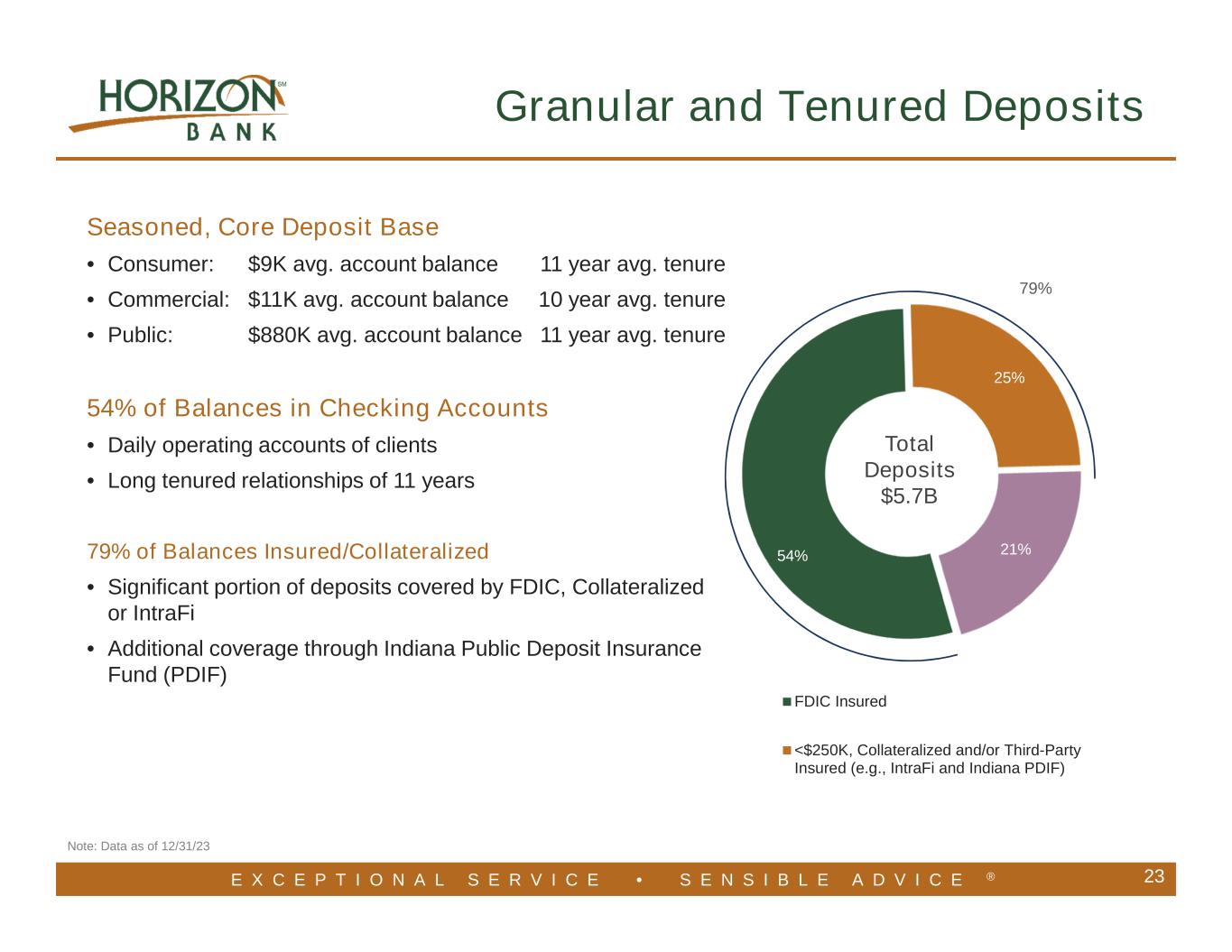

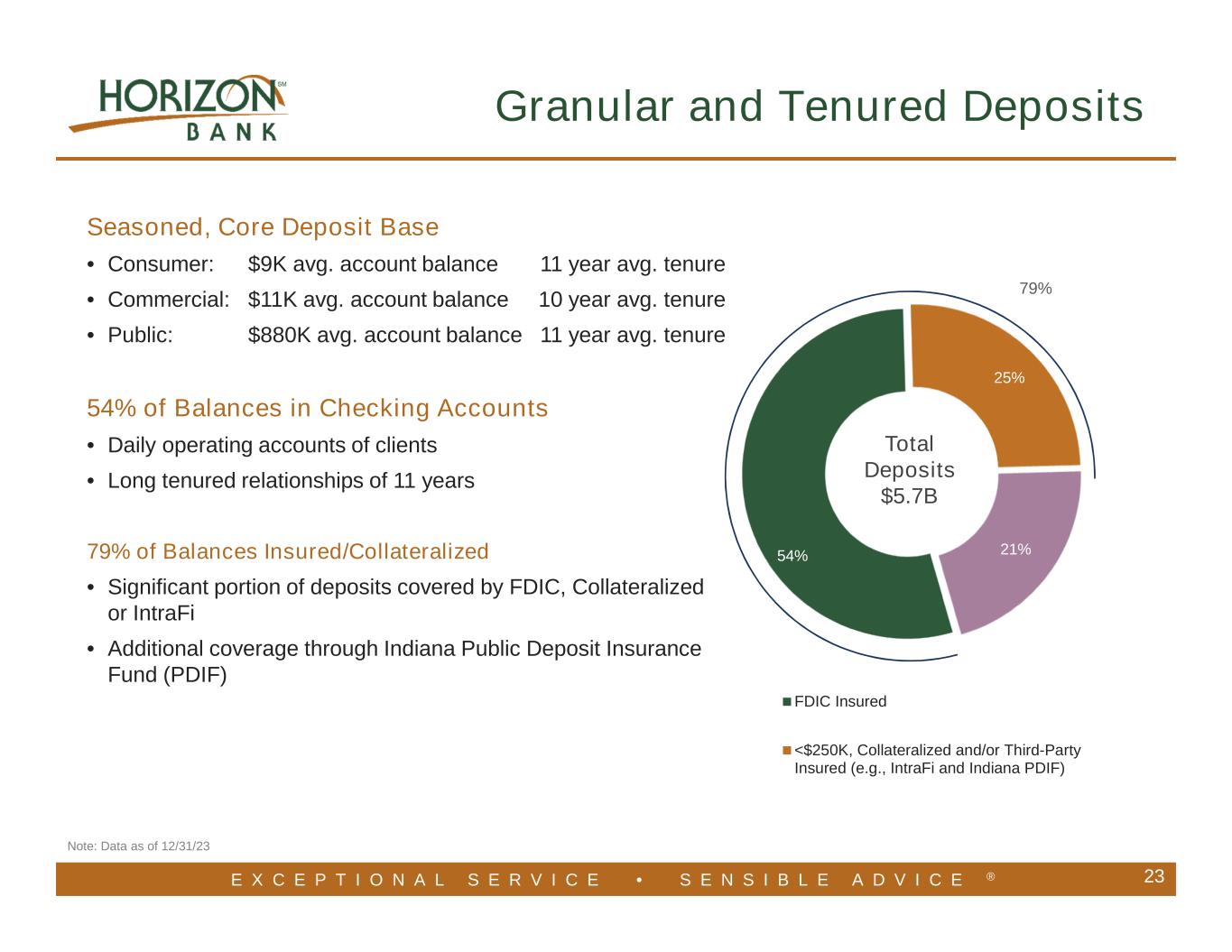

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Note: Data as of 12/31/23 Seasoned, Core Deposit Base • Consumer: $9K avg. account balance 11 year avg. tenure • Commercial: $11K avg. account balance 10 year avg. tenure • Public: $880K avg. account balance 11 year avg. tenure 54% of Balances in Checking Accounts • Daily operating accounts of clients • Long tenured relationships of 11 years 79% of Balances Insured/Collateralized • Significant portion of deposits covered by FDIC, Collateralized or IntraFi • Additional coverage through Indiana Public Deposit Insurance Fund (PDIF) Granular and Tenured Deposits 54% 25% 21% FDIC Insured <$250K, Collateralized and/or Third-Party Insured (e.g., IntraFi and Indiana PDIF) 79% Total Deposits $5.7B 23

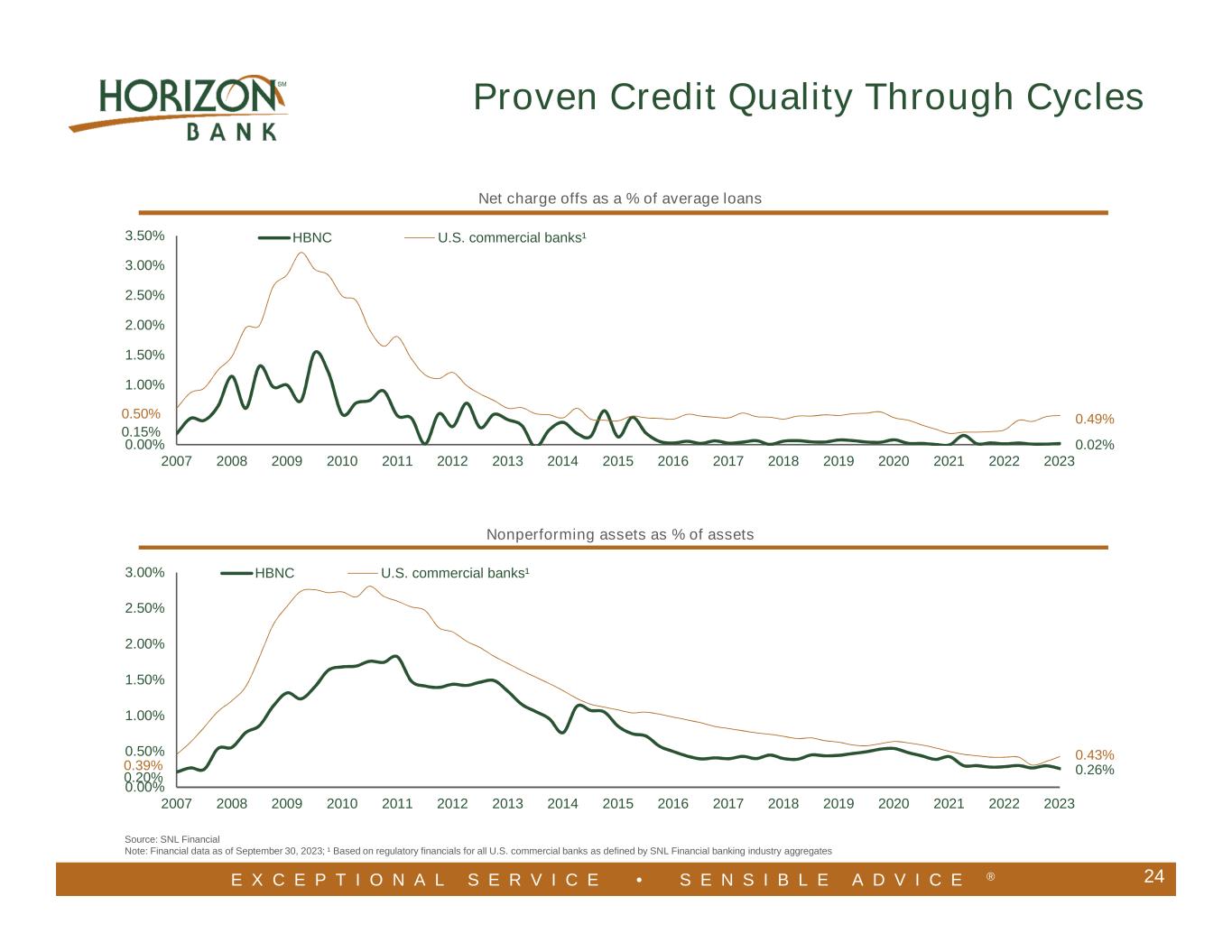

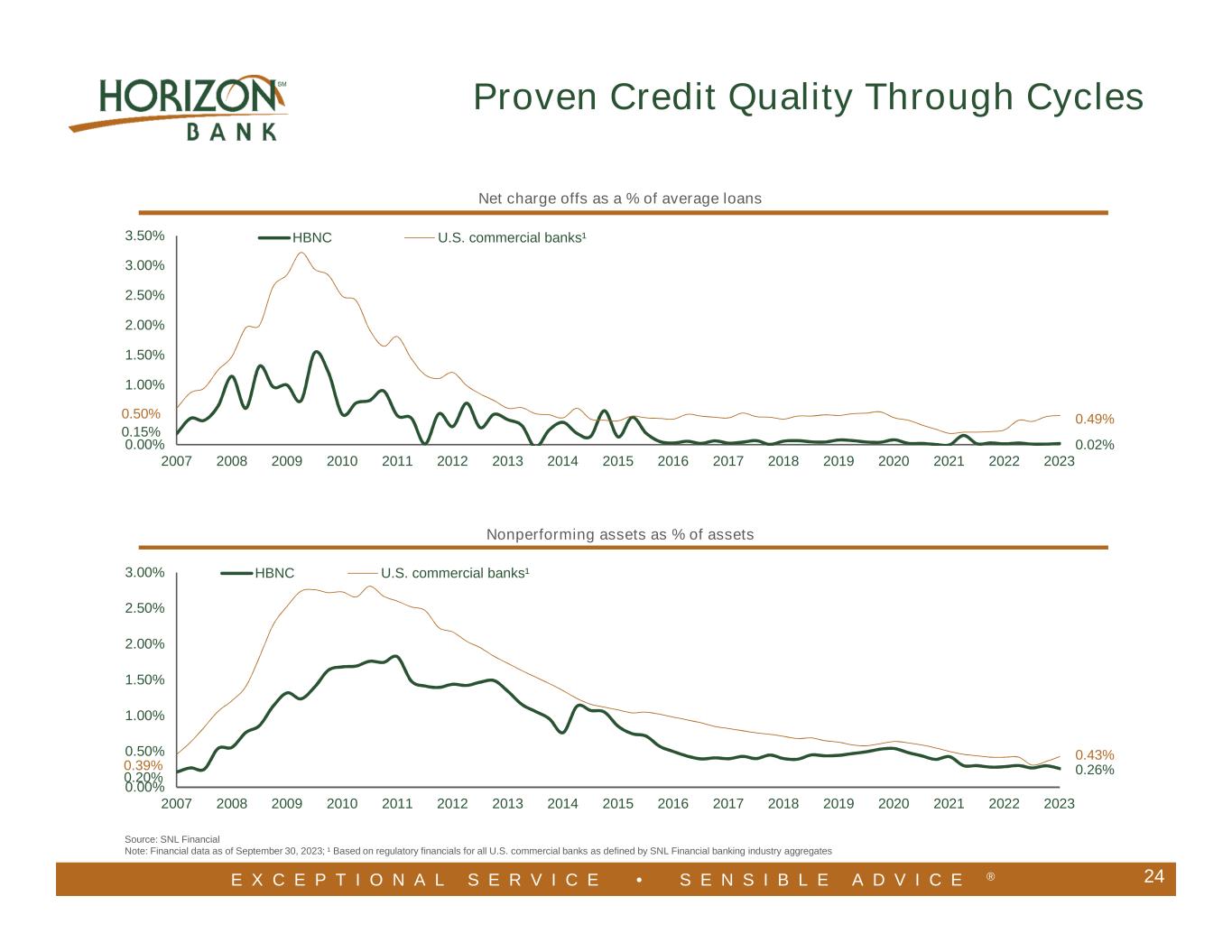

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 HBNC U.S. commercial banks¹ Net charge offs as a % of average loans 0.15% 0.50 0.49% 0.02% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 HBNC U.S. commercial banks¹ Nonperforming assets as % of assets 0.20% 0.39% 0.43% 0.26% Source: SNL Financial Note: Financial data as of September 30, 2023; ¹ Based on regulatory financials for all U.S. commercial banks as defined by SNL Financial banking industry aggregates Proven Credit Quality Through Cycles 24

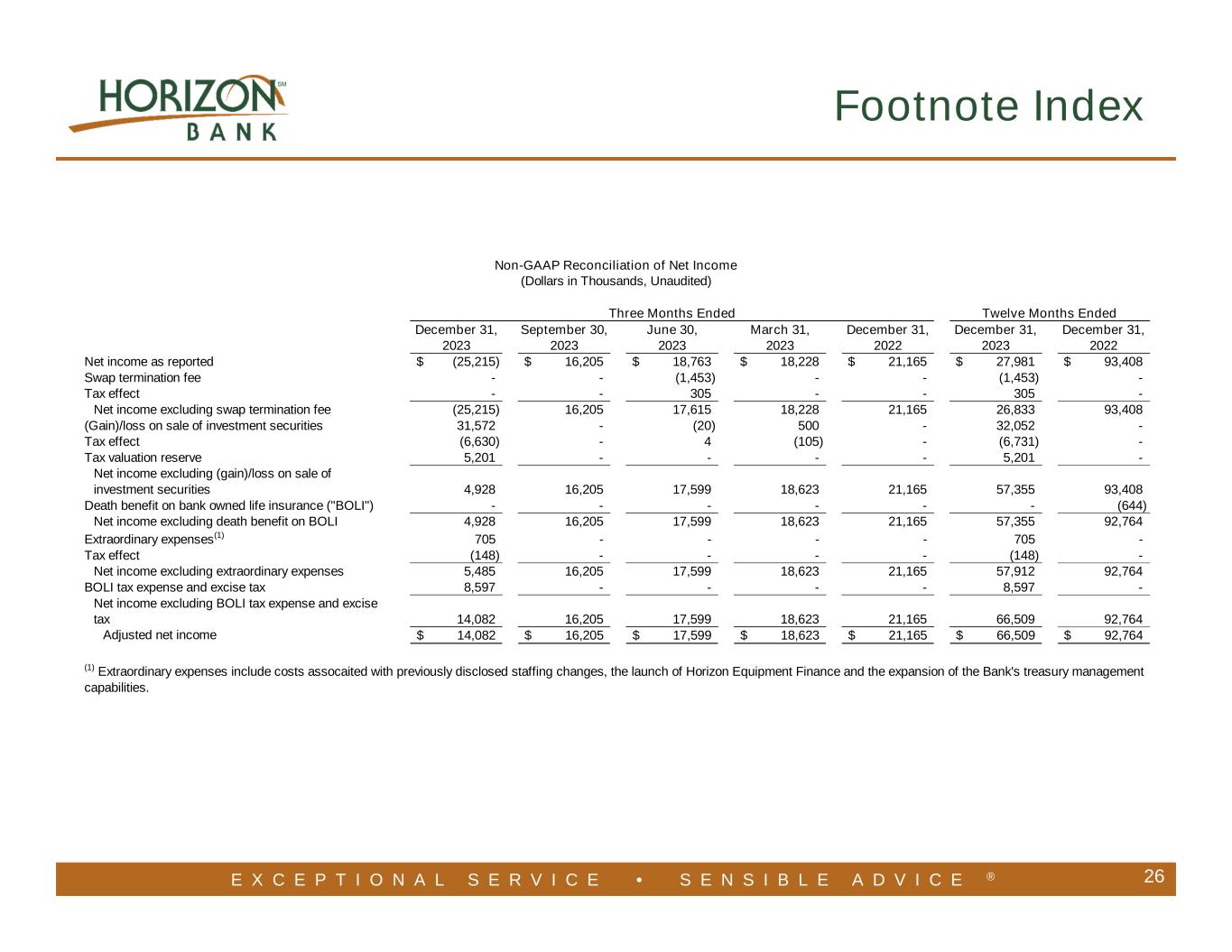

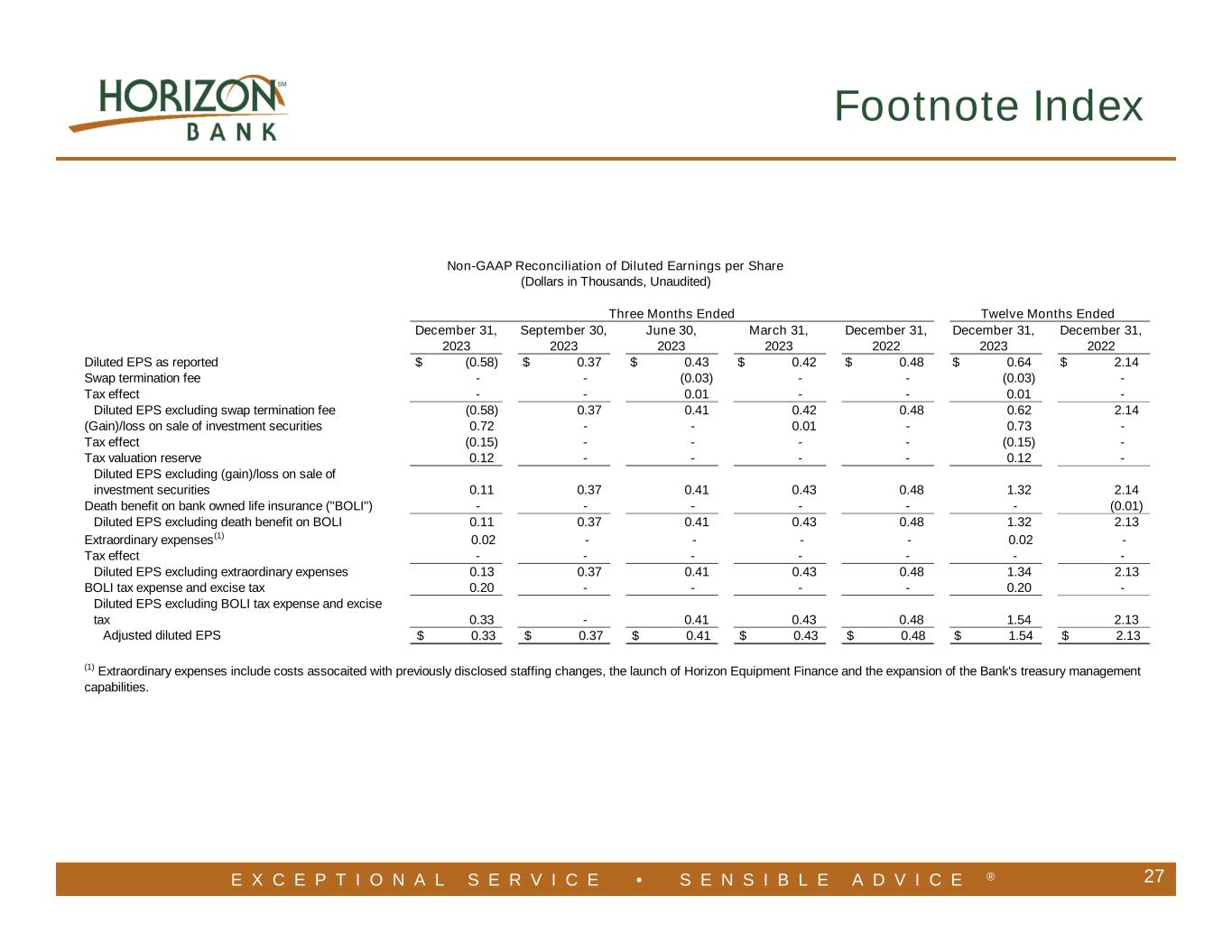

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 25 Slide 4 • Adjusted net income and adjusted diluted earnings per share exclude swap termination fees, gain/(loss) on sale of investment securities and extraordinary expenses, including costs associated with previously disclosed staffing changes, the launch of Horizon Equipment Finance and the expansion of the Bank’s treasury management capabilities, net of tax, and BOLI tax expense and excise tax. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) • Adjusted non-interest expense and adjusted non-interest expense to average assets excludes extraordinary expenses, including costs associated with previously disclosed staffing changes, the launch of Horizon Equipment Finance and the expansion of the Bank’s treasury management capabilities. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) Slide 13 • Average cost of average total deposits includes average balances of non-interest bearing deposits. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) Slide 14 • Adjusted non-interest income excludes gain/(loss) on sale of investment securities. (See further in the Appendix for a reconciliation of these non- GAAP amounts to their GAAP counterparts.) Slide 15 • Adjusted non-interest expense excludes extraordinary expenses, including costs associated with previously disclosed staffing changes, the launch of Horizon Equipment Finance and the expansion of the Bank’s treasury management capabilities. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) Slide 18 • Adjusted non-interest income excludes gain/(loss) on sale of investment securities. (See further in the Appendix for a reconciliation of these non- GAAP amounts to their GAAP counterparts.) • Adjusted non-interest expense and adjusted non-interest expense to average assets excludes extraordinary expenses, including costs associated with previously disclosed staffing changes, the launch of Horizon Equipment Finance and the expansion of the Bank’s treasury management capabilities. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) Slides 26-33 Use of Non-GAAP Financial Measures • Certain information set forth in the presentation materials refers to financial measures determined by methods other than in accordance with GAAP. Horizon believes these non-GAAP financial measures are helpful to investors and provide a greater understanding of our business without giving effect to purchase accounting impacts, one-time acquisition and other non-recurring costs and non-core items. These measures are not necessarily comparable to similar measures that may be presented by other companies and should not be considered in isolation or as a substitute for the related GAAP measure. Footnote Index

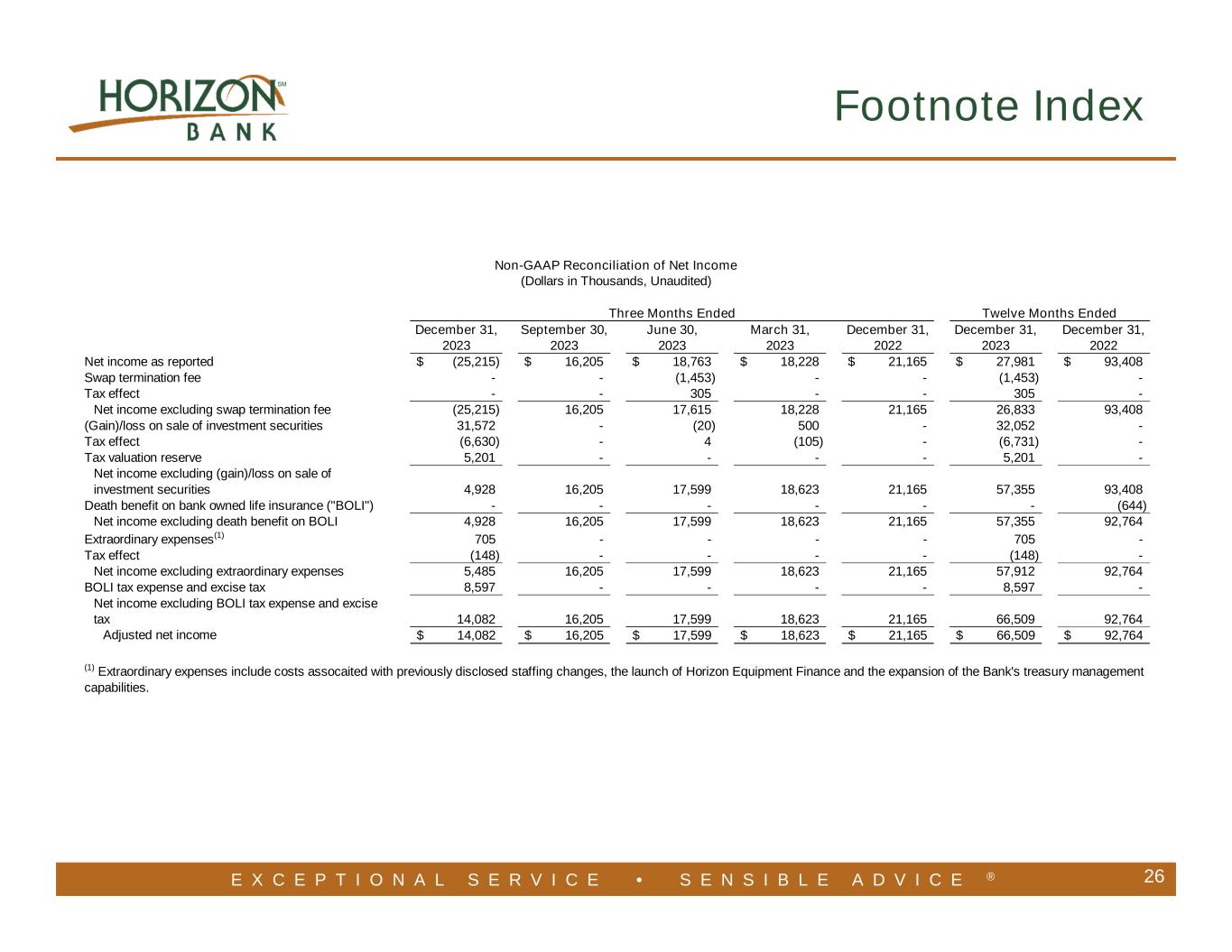

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 26 Footnote Index December 31, September 30, June 30, March 31, December 31, December 31, December 31, 2023 2023 2023 2023 2022 2023 2022 Net income as reported (25,215)$ 16,205$ 18,763$ 18,228$ 21,165$ 27,981$ 93,408$ Swap termination fee - - (1,453) - - (1,453) - Tax effect - - 305 - - 305 - Net income excluding swap termination fee (25,215) 16,205 17,615 18,228 21,165 26,833 93,408 (Gain)/loss on sale of investment securities 31,572 - (20) 500 - 32,052 - Tax effect (6,630) - 4 (105) - (6,731) - Tax valuation reserve 5,201 - - - - 5,201 - Net income excluding (gain)/loss on sale of investment securities 4,928 16,205 17,599 18,623 21,165 57,355 93,408 Death benefit on bank owned life insurance ("BOLI") - - - - - - (644) Net income excluding death benefit on BOLI 4,928 16,205 17,599 18,623 21,165 57,355 92,764 Extraordinary expenses(1) 705 - - - - 705 - Tax effect (148) - - - - (148) - Net income excluding extraordinary expenses 5,485 16,205 17,599 18,623 21,165 57,912 92,764 BOLI tax expense and excise tax 8,597 - - - - 8,597 - Net income excluding BOLI tax expense and excise tax 14,082 16,205 17,599 18,623 21,165 66,509 92,764 Adjusted net income 14,082$ 16,205$ 17,599$ 18,623$ 21,165$ 66,509$ 92,764$ Three Months Ended Twelve Months Ended Non-GAAP Reconciliation of Net Income (Dollars in Thousands, Unaudited) (1) Extraordinary expenses include costs assocaited with previously disclosed staffing changes, the launch of Horizon Equipment Finance and the expansion of the Bank's treasury management capabilities.

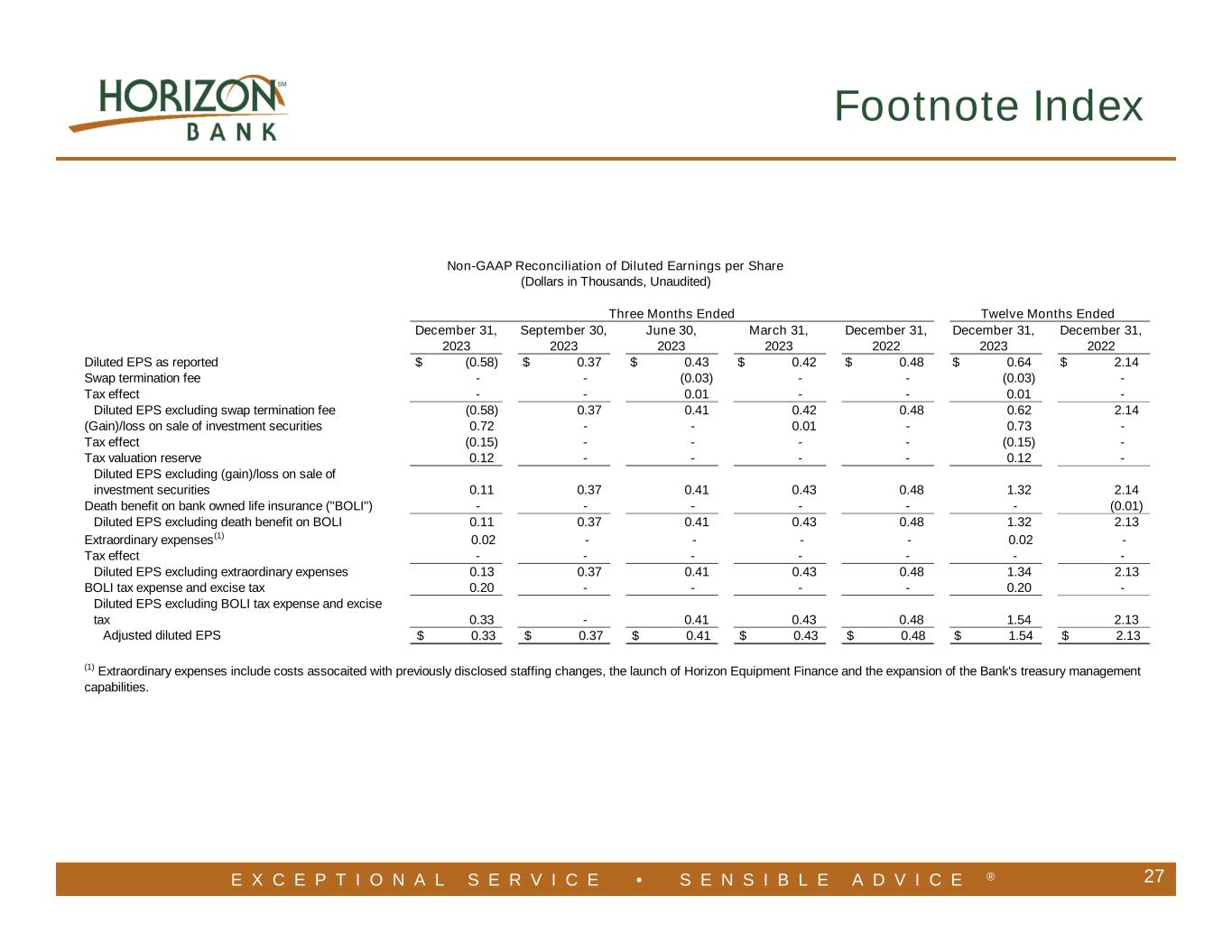

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 27 Footnote Index December 31, September 30, June 30, March 31, December 31, December 31, December 31, 2023 2023 2023 2023 2022 2023 2022 Diluted EPS as reported (0.58)$ 0.37$ 0.43$ 0.42$ 0.48$ 0.64$ 2.14$ Swap termination fee - - (0.03) - - (0.03) - Tax effect - - 0.01 - - 0.01 - Diluted EPS excluding swap termination fee (0.58) 0.37 0.41 0.42 0.48 0.62 2.14 (Gain)/loss on sale of investment securities 0.72 - - 0.01 - 0.73 - Tax effect (0.15) - - - - (0.15) - Tax valuation reserve 0.12 - - - - 0.12 - Diluted EPS excluding (gain)/loss on sale of investment securities 0.11 0.37 0.41 0.43 0.48 1.32 2.14 Death benefit on bank owned life insurance ("BOLI") - - - - - - (0.01) Diluted EPS excluding death benefit on BOLI 0.11 0.37 0.41 0.43 0.48 1.32 2.13 Extraordinary expenses(1) 0.02 - - - - 0.02 - Tax effect - - - - - - - Diluted EPS excluding extraordinary expenses 0.13 0.37 0.41 0.43 0.48 1.34 2.13 BOLI tax expense and excise tax 0.20 - - - - 0.20 - Diluted EPS excluding BOLI tax expense and excise tax 0.33 - 0.41 0.43 0.48 1.54 2.13 Adjusted diluted EPS 0.33$ 0.37$ 0.41$ 0.43$ 0.48$ 1.54$ 2.13$ (1) Extraordinary expenses include costs assocaited with previously disclosed staffing changes, the launch of Horizon Equipment Finance and the expansion of the Bank's treasury management capabilities. Three Months Ended Twelve Months Ended Non-GAAP Reconciliation of Diluted Earnings per Share (Dollars in Thousands, Unaudited)

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 28 Footnote Index Actual Extraordinary Expenses Adjusted Actual Extraordinary Expenses Adjusted Non-interest Expense Salaries and employee benefits 21,877$ (705)$ (1) 21,172$ 20,058$ -$ 20,058$ Net occupancy expenses 3,260 - 3,260 3,283 - 3,283 Data processing 2,942 - 2,942 2,999 - 2,999 Professional fees 772 - 772 707 - 707 Outside services and consultants 2,394 - 2,394 2,316 - 2,316 Loan expense 1,345 - 1,345 1,120 - 1,120 Core deposit intangible amortization 1,200 - 1,200 1,300 - 1,300 FDIC insurance expense 903 - 903 903 - 903 Other losses 508 - 508 188 - 188 Other expense 4,129 - 4,129 3,294 - 3,294 Total non-interest expense 39,330$ (705)$ 38,625$ 36,168$ -$ 36,168$ Annualized non-interest expense to average assets 1.98% 1.94% 1.81% 1.81% (1) Extraordinary expenses include costs assocaited with previously disclosed staffing changes, the launch of Horizon Equipment Finance and the expansion of the Bank's treasury management capabilities. Three Months Ended Non-GAAP Reconciliation of Non-Interest Expense (Dollars in Thousands, Unaudited) 2023 December 31, September 30, 2023

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 29 Footnote Index Actual Extraordinary Expenses Adjusted Actual Extraordinary Expenses Adjusted Actual Extraordinary Expenses Adjusted Non-interest Expense Salaries and employee benefits 20,162$ -$ 20,162$ 18,712$ -$ 18,712$ 19,978$ -$ 19,978$ Net occupancy expenses 3,249 - 3,249 3,563 - 3,563 3,279 - 3,279 Data processing 3,016 - 3,016 2,669 - 2,669 2,884 - 2,884 Professional fees 633 - 633 533 - 533 694 - 694 Outside services and consultants 2,515 - 2,515 2,717 - 2,717 2,985 - 2,985 Loan expense 1,397 - 1,397 1,118 - 1,118 1,281 - 1,281 Core deposit intangible amortization 840 840 540 540 388 - 388 FDIC insurance expense 903 - 903 903 - 903 925 - 925 Other losses 134 - 134 221 - 221 118 - 118 Other expense 3,413 - 3,413 3,548 - 3,548 3,179 - 3,179 Total non-interest expense 36,262$ -$ 36,262$ 34,524$ -$ 34,524$ 35,711$ -$ 35,711$ Annualized non-interest expense to average assets 1.86% 1.86% 1.79% 1.79% 1.84% 1.84% 2023 June 30, March 31, Three Months Ended Non-GAAP Reconciliation of Non-Interest Expense (Dollars in Thousands, Unaudited) December 31, 20222023

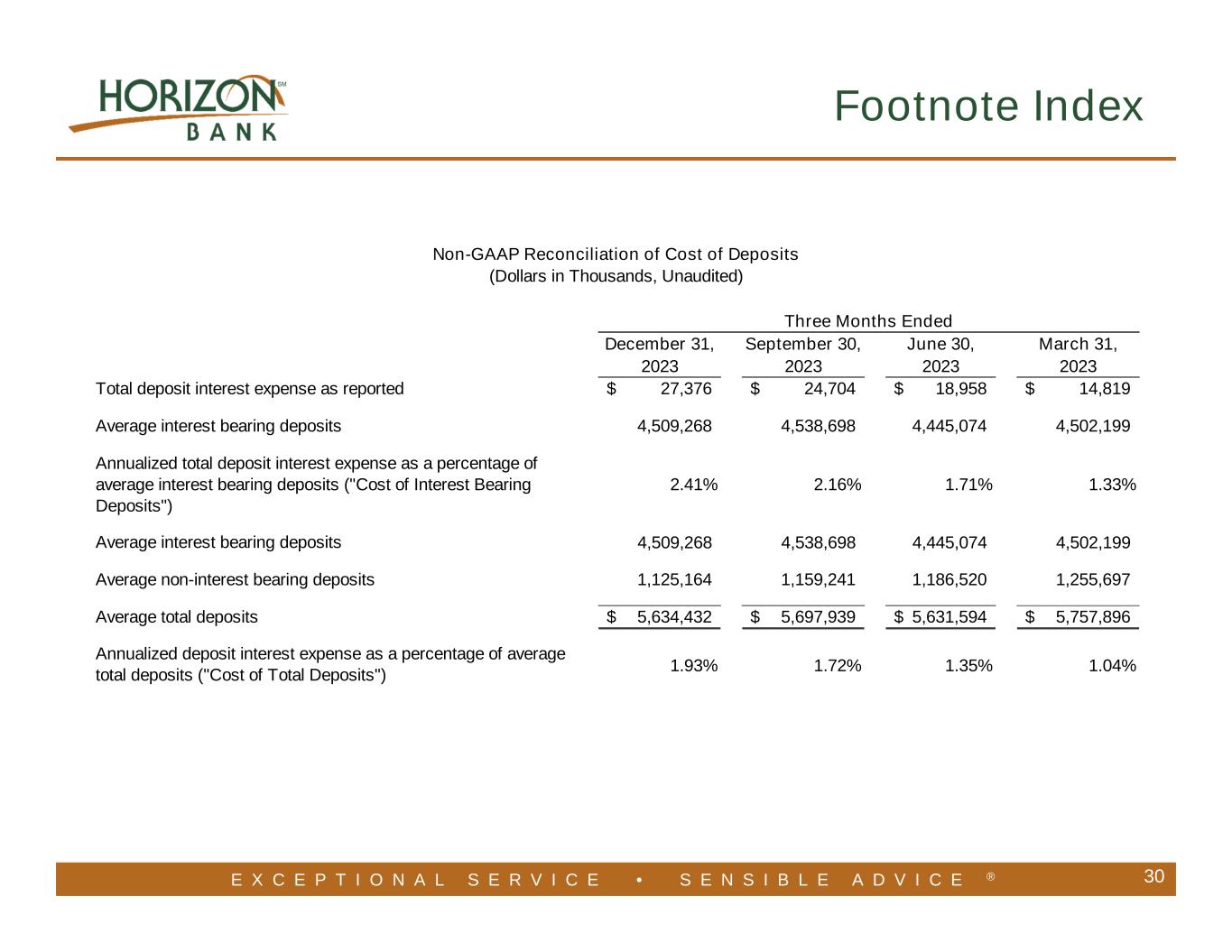

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 30 Footnote Index December 31, September 30, June 30, March 31, 2023 2023 2023 2023 Total deposit interest expense as reported 27,376$ 24,704$ 18,958$ 14,819$ Average interest bearing deposits 4,509,268 4,538,698 4,445,074 4,502,199 Annualized total deposit interest expense as a percentage of average interest bearing deposits ("Cost of Interest Bearing Deposits") 2.41% 2.16% 1.71% 1.33% Average interest bearing deposits 4,509,268 4,538,698 4,445,074 4,502,199 Average non-interest bearing deposits 1,125,164 1,159,241 1,186,520 1,255,697 Average total deposits 5,634,432$ 5,697,939$ 5,631,594$ 5,757,896$ Annualized deposit interest expense as a percentage of average total deposits ("Cost of Total Deposits") 1.93% 1.72% 1.35% 1.04% Non-GAAP Reconciliation of Cost of Deposits (Dollars in Thousands, Unaudited) Three Months Ended

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 31 Footnote Index December 31, September 30, June 30, March 31, 2022 2022 2022 2022 Total deposit interest expense as reported 10,520$ 4,116$ 1,677$ 1,496$ Average interest bearing deposits 4,555,887 4,478,741 4,540,959 4,478,621 Annualized total deposit interest expense as a percentage of average interest bearing deposits ("Cost of Interest Bearing Deposits") 0.92% 0.36% 0.15% 0.14% Average interest bearing deposits 4,555,887 4,478,741 4,540,959 4,478,621 Average non-interest bearing deposits 1,321,139 1,351,857 1,335,779 1,322,781 Average total deposits 5,877,026$ 5,830,598$ 5,876,738$ 5,801,402$ Annualized deposit interest expense as a percentage of average total deposits ("Cost of Total Deposits") 0.71% 0.28% 0.11% 0.10% Three Months Ended Non-GAAP Reconciliation of Cost of Deposits (Dollars in Thousands, Unaudited)

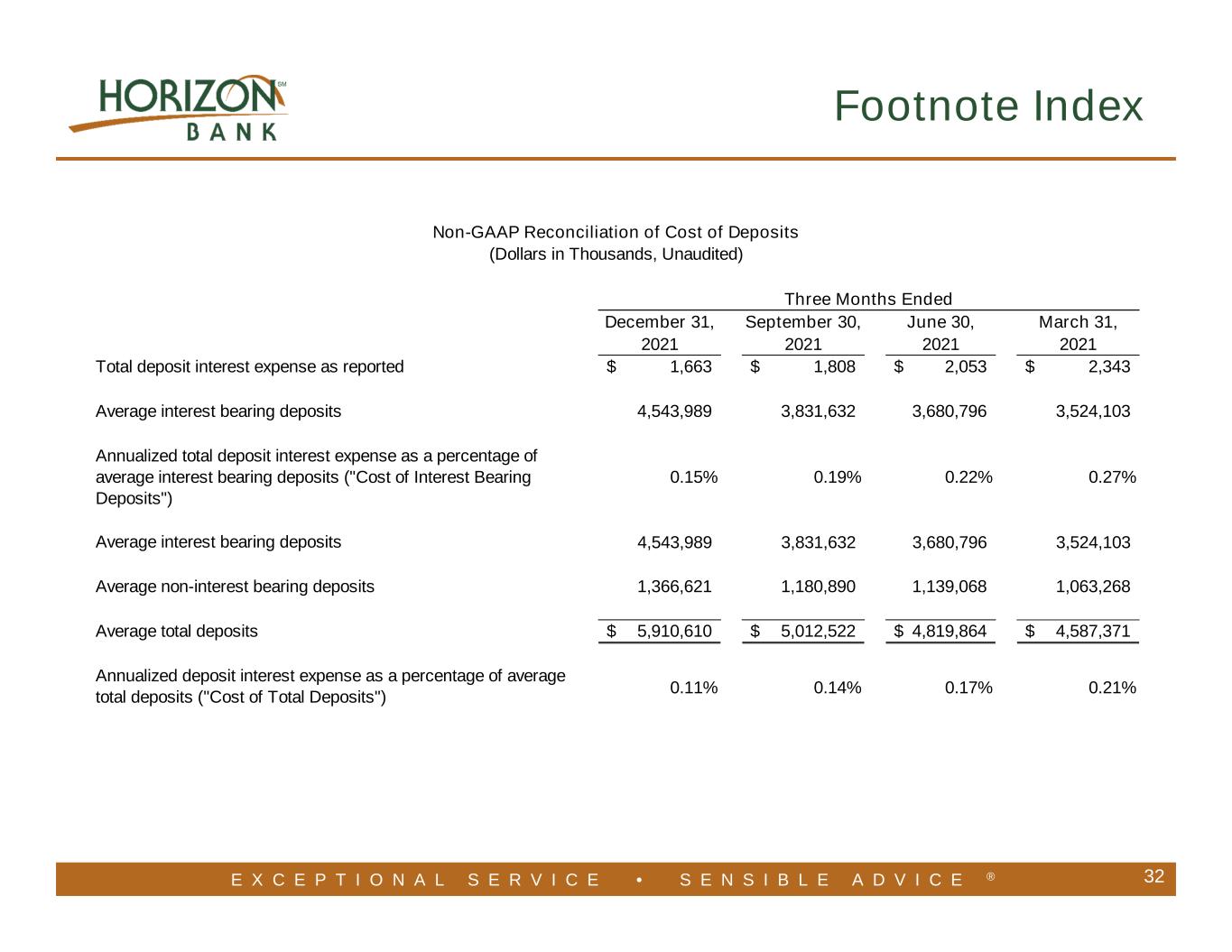

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 32 Footnote Index December 31, September 30, June 30, March 31, 2021 2021 2021 2021 Total deposit interest expense as reported 1,663$ 1,808$ 2,053$ 2,343$ Average interest bearing deposits 4,543,989 3,831,632 3,680,796 3,524,103 Annualized total deposit interest expense as a percentage of average interest bearing deposits ("Cost of Interest Bearing Deposits") 0.15% 0.19% 0.22% 0.27% Average interest bearing deposits 4,543,989 3,831,632 3,680,796 3,524,103 Average non-interest bearing deposits 1,366,621 1,180,890 1,139,068 1,063,268 Average total deposits 5,910,610$ 5,012,522$ 4,819,864$ 4,587,371$ Annualized deposit interest expense as a percentage of average total deposits ("Cost of Total Deposits") 0.11% 0.14% 0.17% 0.21% Three Months Ended Non-GAAP Reconciliation of Cost of Deposits (Dollars in Thousands, Unaudited)

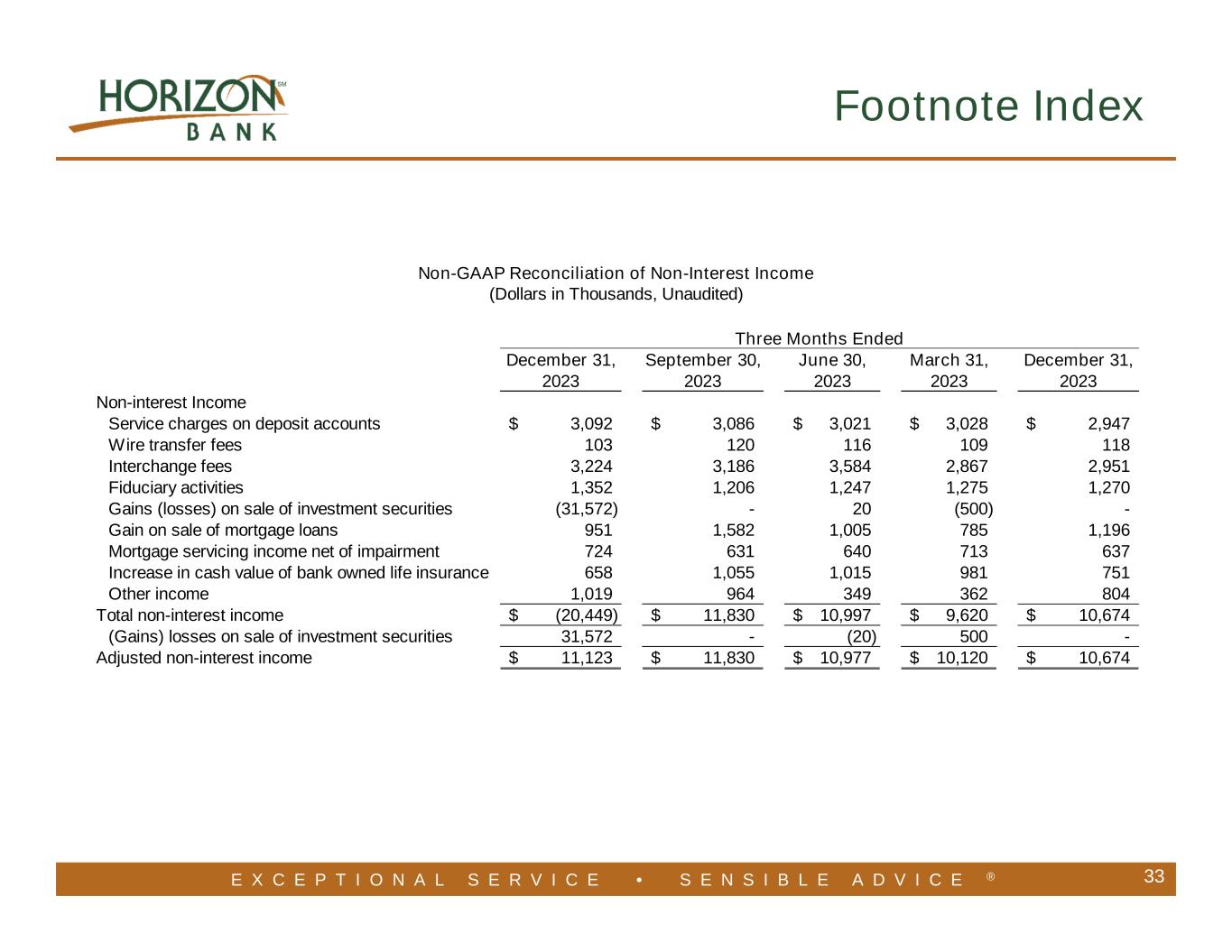

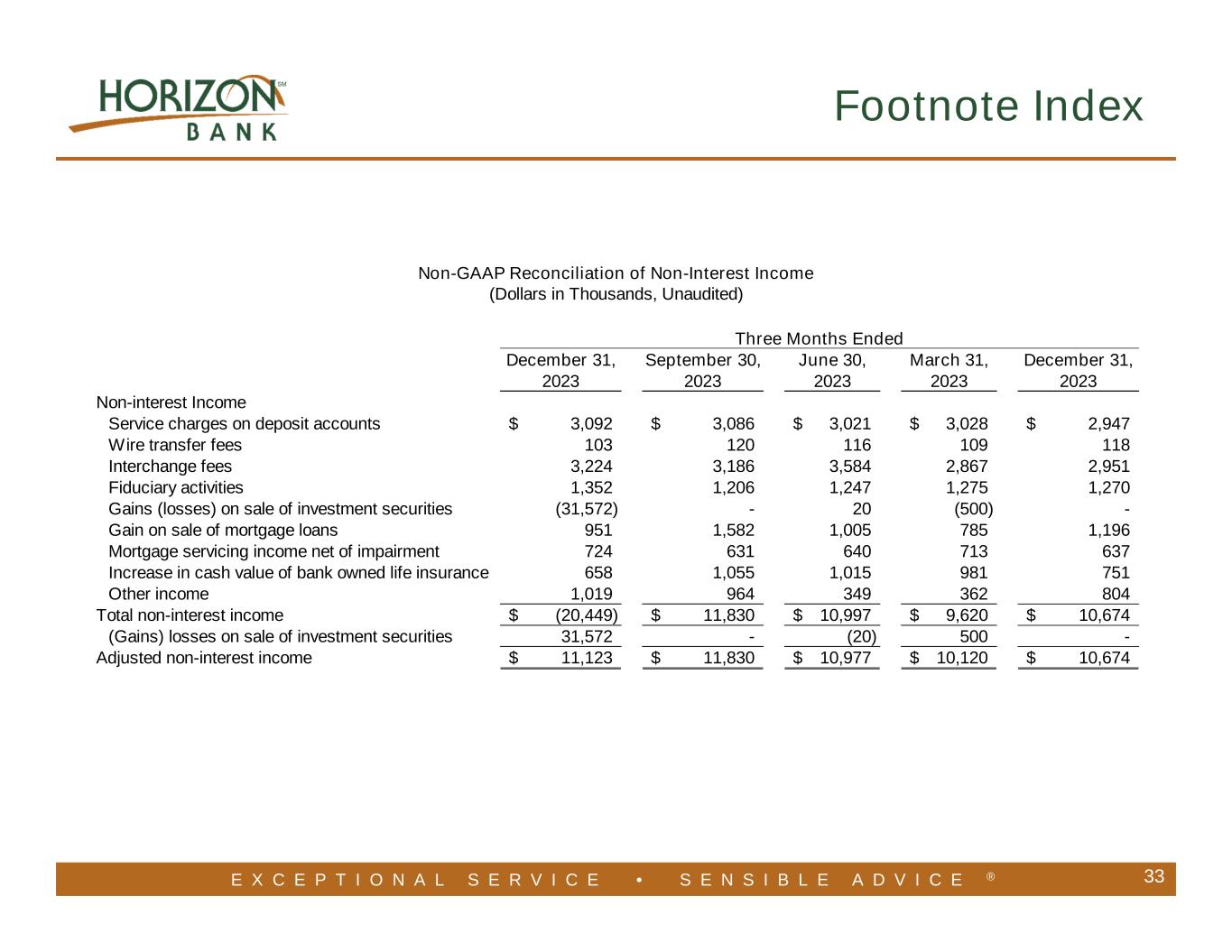

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 33 Footnote Index December 31, September 30, June 30, March 31, December 31, 2023 2023 2023 2023 2023 Non-interest Income Service charges on deposit accounts 3,092$ 3,086$ 3,021$ 3,028$ 2,947$ Wire transfer fees 103 120 116 109 118 Interchange fees 3,224 3,186 3,584 2,867 2,951 Fiduciary activities 1,352 1,206 1,247 1,275 1,270 Gains (losses) on sale of investment securities (31,572) - 20 (500) - Gain on sale of mortgage loans 951 1,582 1,005 785 1,196 Mortgage servicing income net of impairment 724 631 640 713 637 Increase in cash value of bank owned life insurance 658 1,055 1,015 981 751 Other income 1,019 964 349 362 804 Total non-interest income (20,449)$ 11,830$ 10,997$ 9,620$ 10,674$ (Gains) losses on sale of investment securities 31,572 - (20) 500 - Adjusted non-interest income 11,123$ 11,830$ 10,977$ 10,120$ 10,674$ Three Months Ended Non-GAAP Reconciliation of Non-Interest Income (Dollars in Thousands, Unaudited)

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Investor Relations Contact 34 Mark E. Secor Executive Vice President and Chief Financial Officer Horizon Bancorp, Inc. 515 Franklin Street Michigan City, IN 46360 219-873–2611 Investor.HorizonBank.com