Beyond ordinary banking Investor Presentation H o r i z o n B a n c o r p , I n c . ( N A S D A Q : H B N C ) S e c o n d Q u a r t e r E n d e d J u n e 3 0 , 2 0 2 4 J u l y 2 4 , 2 0 2 4

Important Information Forward-Looking Statements 2 This presentation may contain forward–looking statements regarding the financial performance, business prospects, growth and operating strategies of Horizon Bancorp, Inc. and its affiliates (collectively, “Horizon”). For these statements, Horizon claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in this press release should be considered in conjunction with the other information available about Horizon, including the information in the filings we make with the Securities and Exchange Commission (the “SEC”). Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance. Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include: current financial conditions within the banking industry, including the effects of recent failures of other financial institutions, liquidity levels, and responses by the Federal Reserve, Department of the Treasury, and the Federal Deposit Insurance Corporation to address these issues; changes in the level and volatility of interest rates, changes in spreads on earning assets and changes in interest bearing liabilities; increased interest rate sensitivity; the ability of Horizon to remediate its material weaknesses in its internal control over financial reporting; continuing increases in inflation; loss of key Horizon personnel; increases in disintermediation; potential loss of fee income, including interchange fees, as new and emerging alternative payment platforms take a greater market share of the payment systems; estimates of fair value of certain of Horizon’s assets and liabilities; changes in prepayment speeds, loan originations, credit losses, market values, collateral securing loans and other assets; changes in sources of liquidity; economic conditions and their impact on Horizon and its customers, including local and global economic recovery from the pandemic; legislative and regulatory actions and reforms; changes in accounting policies or procedures as may be adopted and required by regulatory agencies; litigation, regulatory enforcement, and legal compliance risk and costs; rapid technological developments and changes; cyber terrorism and data security breaches; the rising costs of cybersecurity; the ability of the U.S. federal government to manage federal debt limits; climate change and social justice initiatives; the inability to realize cost savings or revenues or to effectively implement integration plans and other consequences associated with mergers, acquisitions, and divestitures; acts of terrorism, war and global conflicts, such as the Russia and Ukraine conflict and the Israel and Hamas conflict; and supply chain disruptions and delays. These and additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Horizon’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K) filed with the SEC and available at the SEC’s website (www.sec.gov). Undue reliance should not be placed on the forward–looking statements, which speak only as of the date hereof. Horizon does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward– looking statement is made, or reflect the occurrence of unanticipated events, except to the extent required by law.

Seasoned Management Team 3 Kathie A. DeRuiter EVP & Senior Operations Officer • 35 Years of banking and operational experience • 24 Years as Senior Bank Operations Officer • 27 Years with Horizon Todd A. Etzler EVP & Corporate Secretary & General Counsel • 33 Years of corporate legal experience and 14 years of General Counsel experience • 7 Years with Horizon Lynn M. Kerber EVP & Chief Commercial Banking Officer • 34 Years of banking experience • 7 Years with Horizon Thomas M. Prame President & Chief Executive Officer • 30 Years of banking experience • 3 Years with Horizon Mark E. Secor EVP & Chief Administration Officer • 36 Years of banking and public accounting experience • 17 Years with Horizon John R. Stewart, CFA EVP & Chief Financial Officer • 22 Years of banking, investment management and corporate finance experience • Joined Horizon in 2024

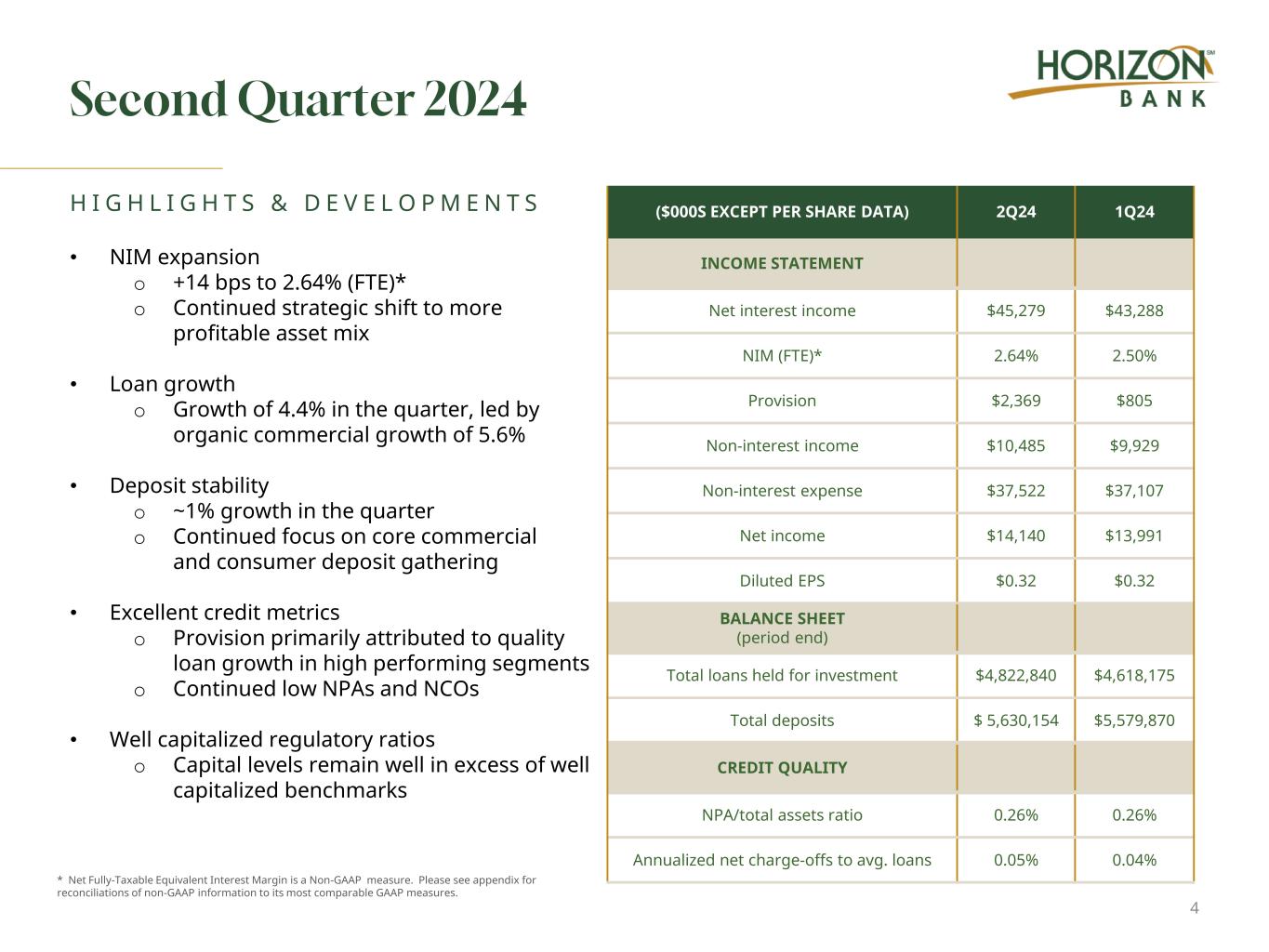

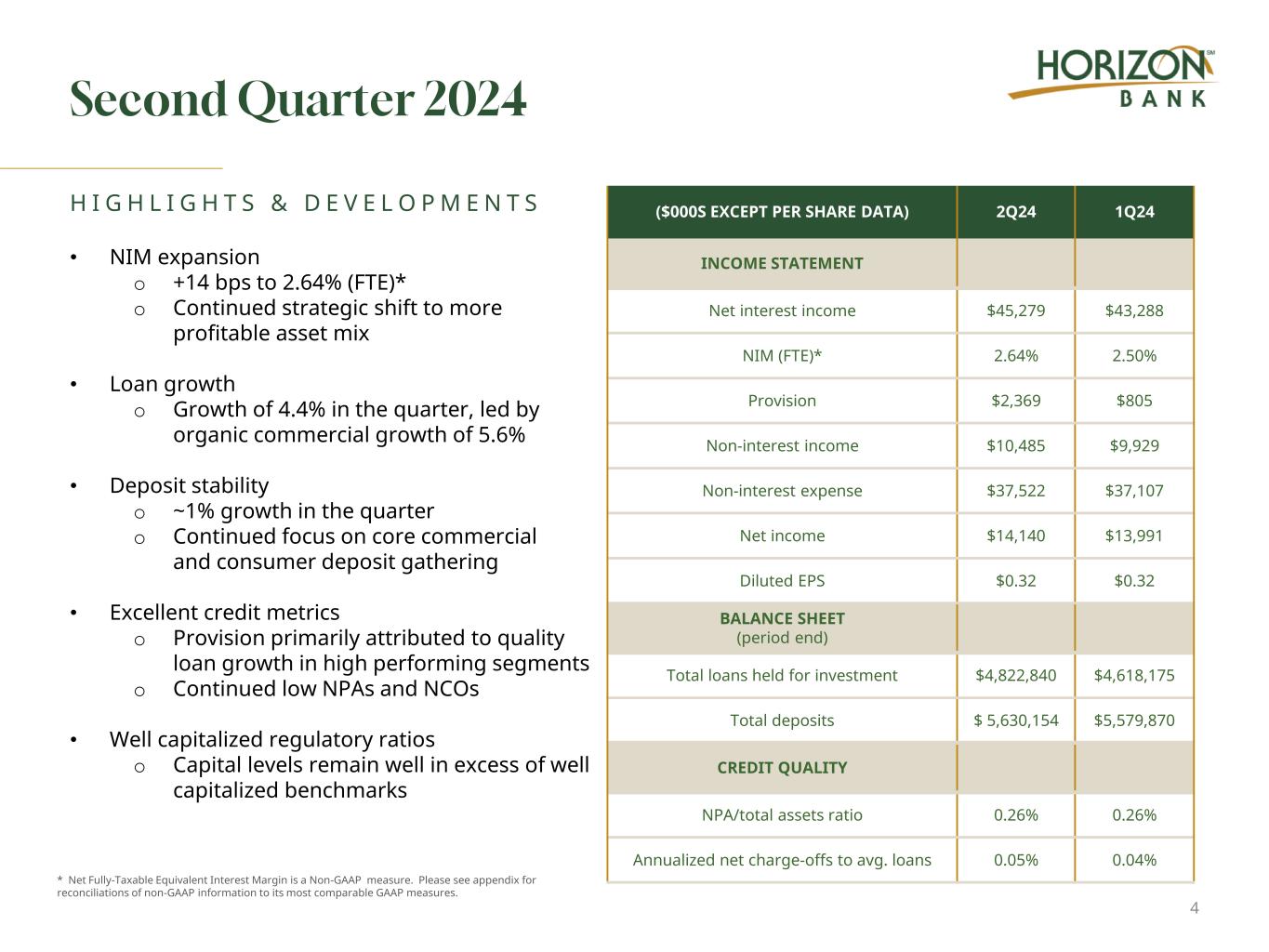

Second Quarter 2024 4 ($000S EXCEPT PER SHARE DATA) 2Q24 1Q24 INCOME STATEMENT Net interest income $45,279 $43,288 NIM (FTE)* 2.64% 2.50% Provision $2,369 $805 Non-interest income $10,485 $9,929 Non-interest expense $37,522 $37,107 Net income $14,140 $13,991 Diluted EPS $0.32 $0.32 BALANCE SHEET (period end) Total loans held for investment $4,822,840 $4,618,175 Total deposits $ 5,630,154 $5,579,870 CREDIT QUALITY NPA/total assets ratio 0.26% 0.26% Annualized net charge-offs to avg. loans 0.05% 0.04% H I G H L I G H T S & D E V E L O P M E N T S • NIM expansion o +14 bps to 2.64% (FTE)* o Continued strategic shift to more profitable asset mix • Loan growth o Growth of 4.4% in the quarter, led by organic commercial growth of 5.6% • Deposit stability o ~1% growth in the quarter o Continued focus on core commercial and consumer deposit gathering • Excellent credit metrics o Provision primarily attributed to quality loan growth in high performing segments o Continued low NPAs and NCOs • Well capitalized regulatory ratios o Capital levels remain well in excess of well capitalized benchmarks * Net Fully-Taxable Equivalent Interest Margin is a Non-GAAP measure. Please see appendix for reconciliations of non-GAAP information to its most comparable GAAP measures.

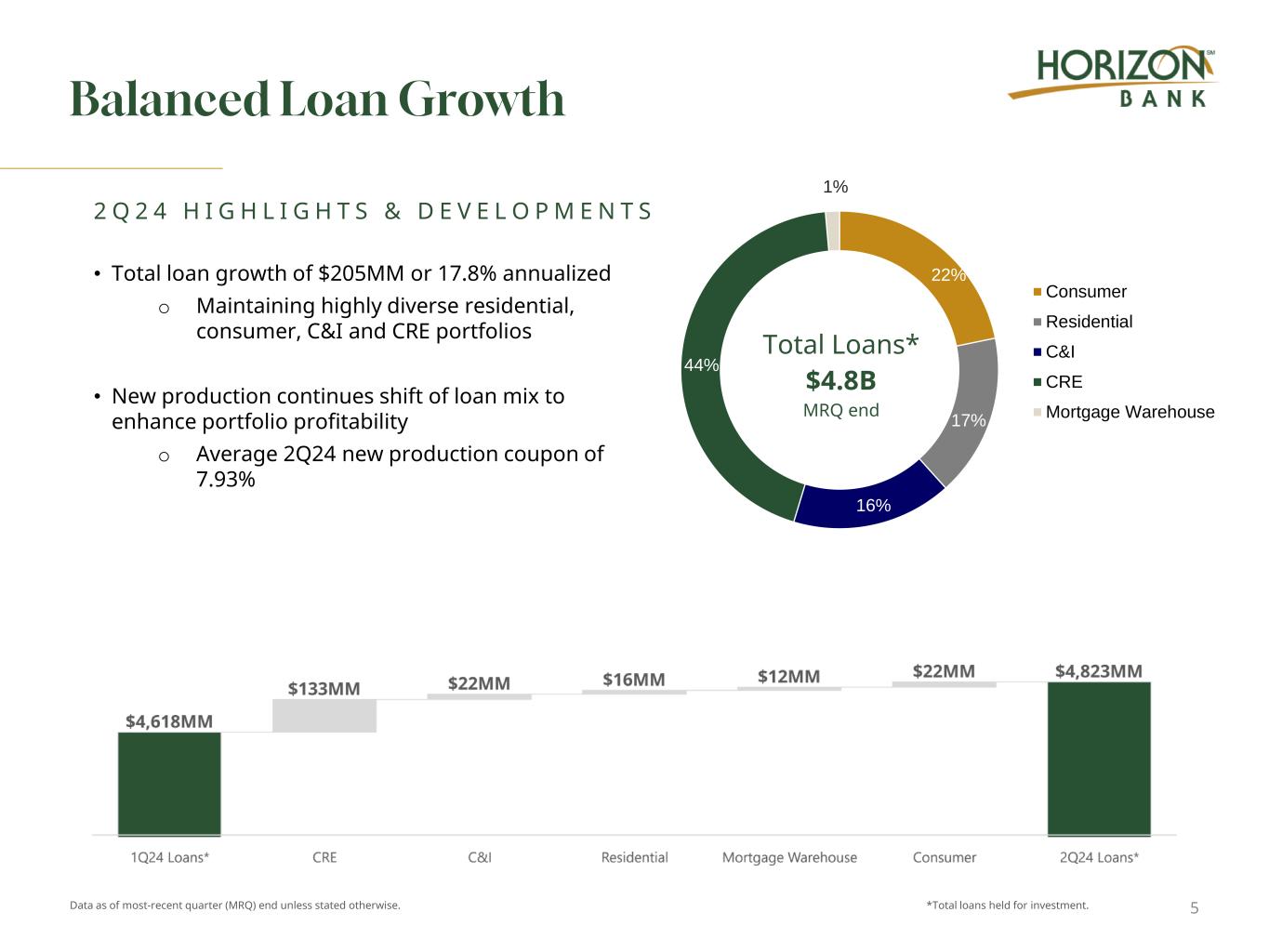

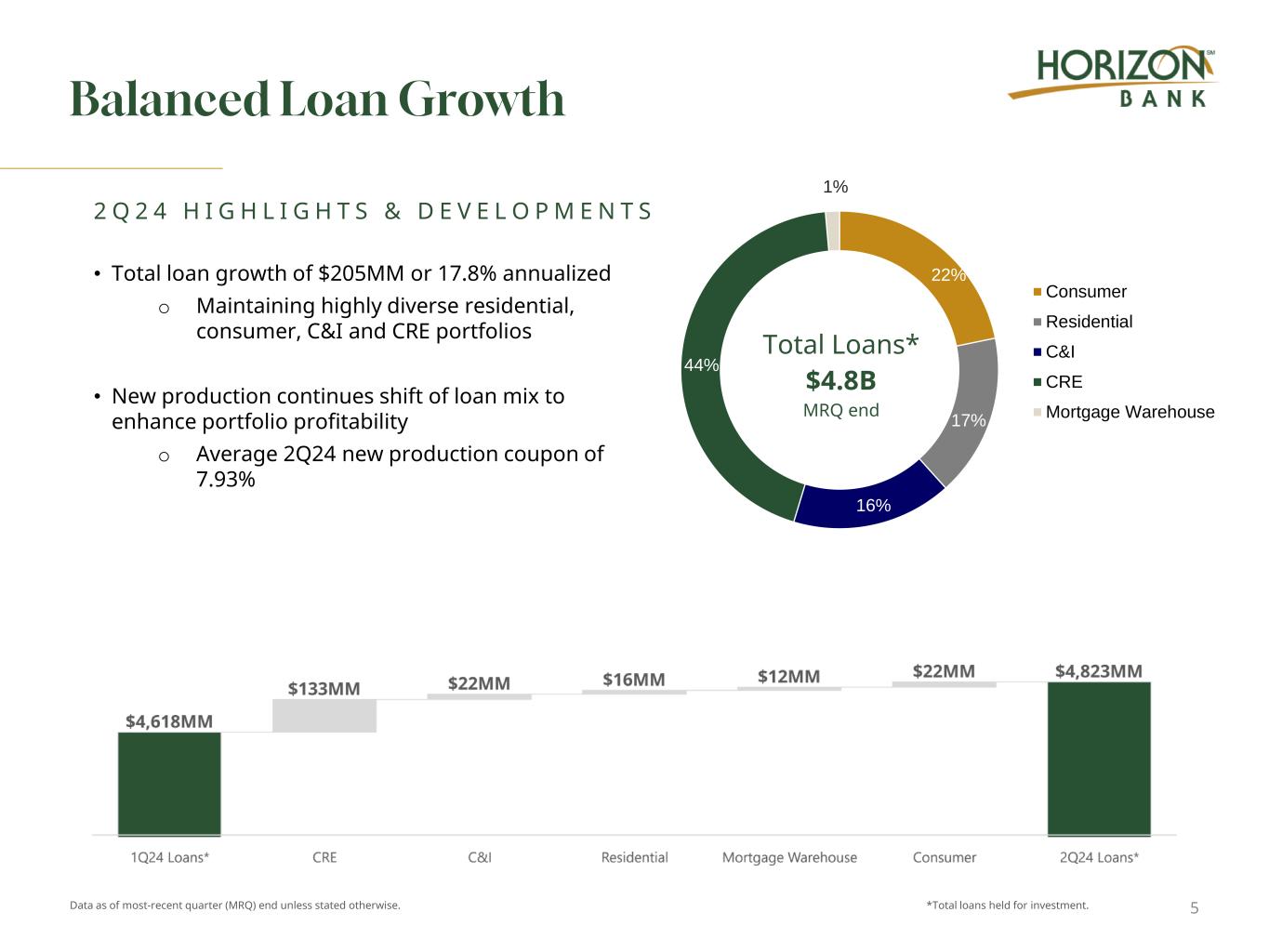

Balanced Loan Growth Data as of most-recent quarter (MRQ) end unless stated otherwise. *Total loans held for investment. 22% 17% 16% 44% 1% Total Loans* $4.8B MRQ end Consumer Residential C&I CRE Mortgage Warehouse 5 2 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S • Total loan growth of $205MM or 17.8% annualized o Maintaining highly diverse residential, consumer, C&I and CRE portfolios • New production continues shift of loan mix to enhance portfolio profitability o Average 2Q24 new production coupon of 7.93%

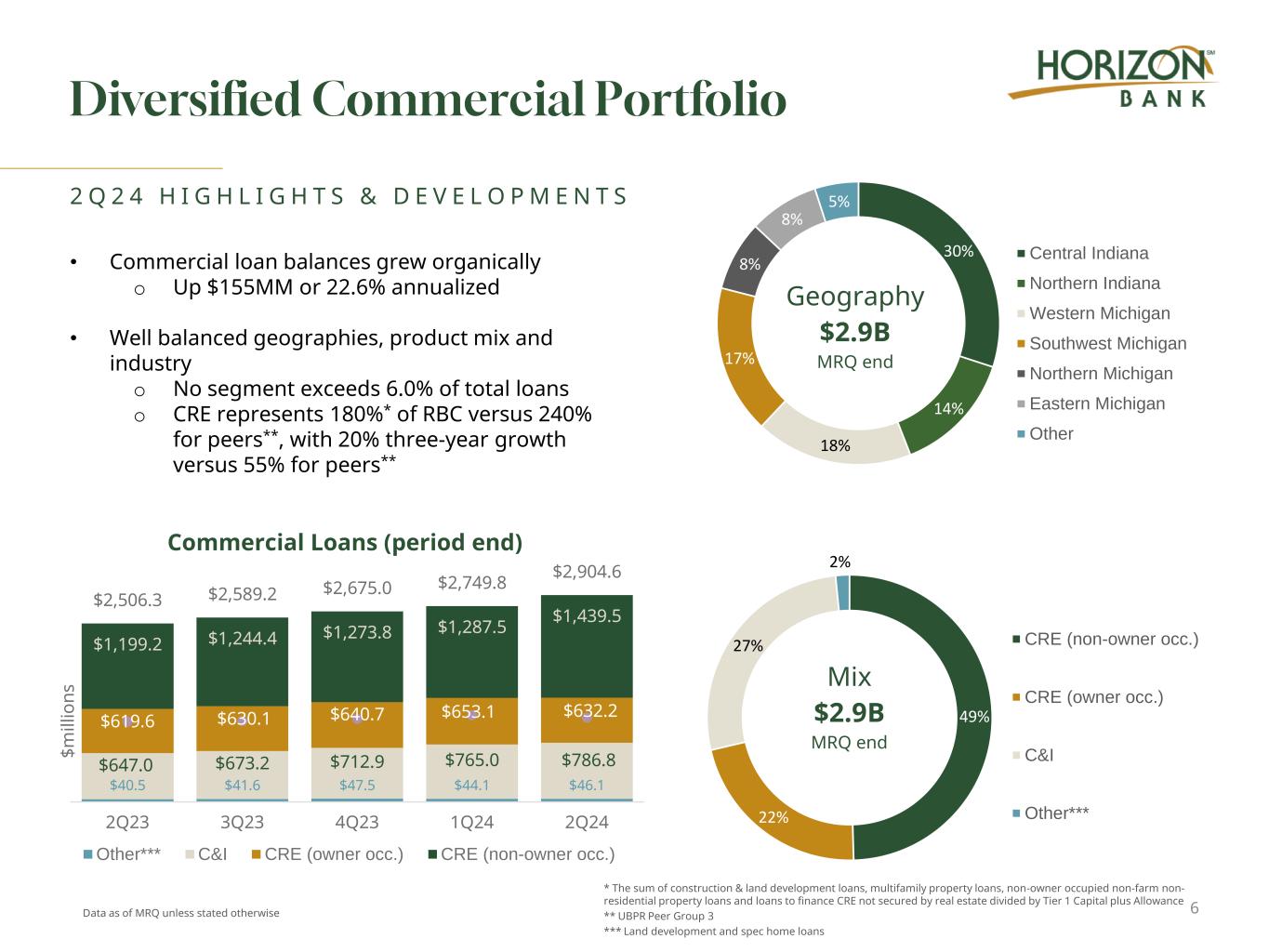

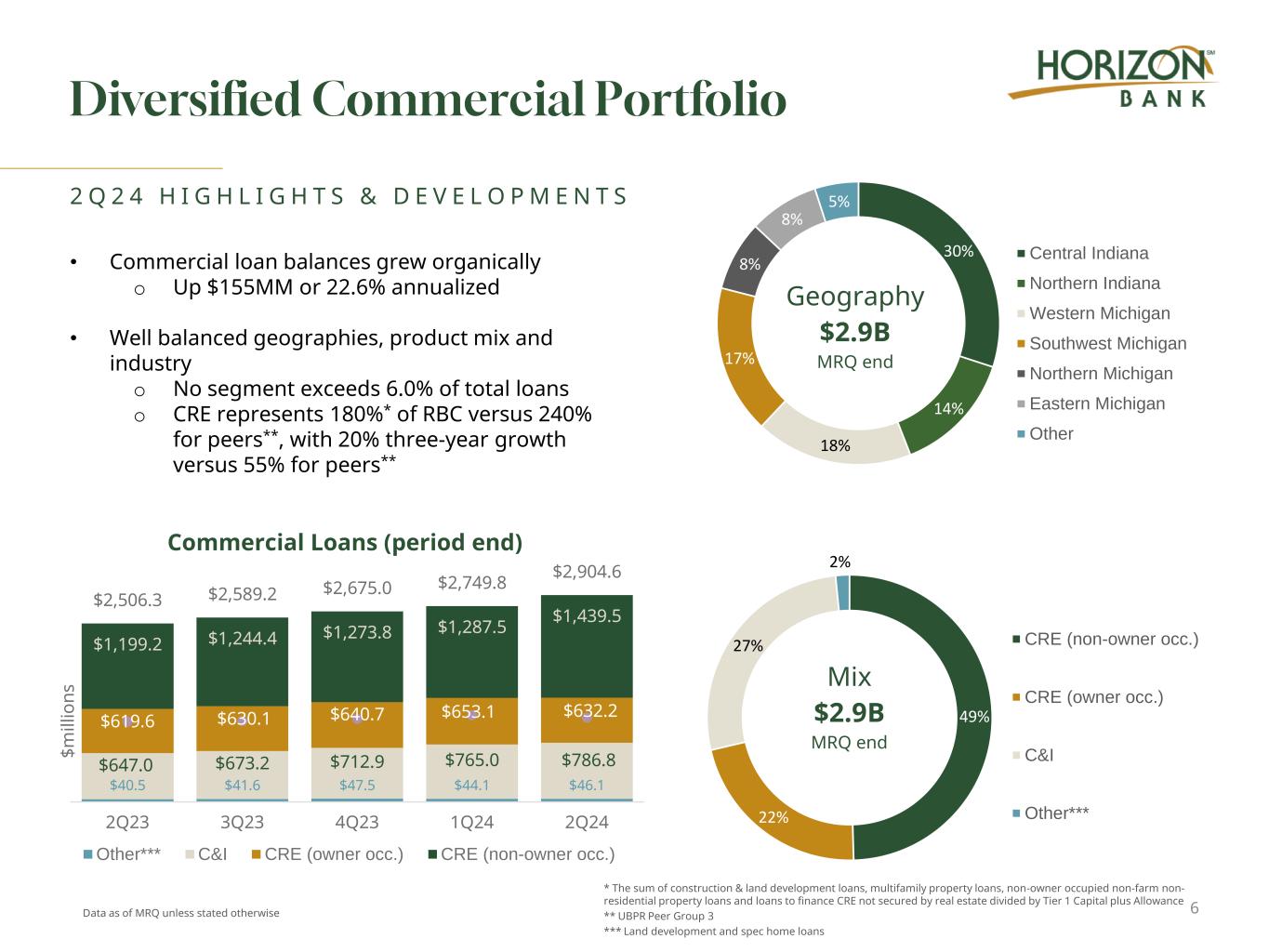

30% 14% 18% 17% 8% 8% 5% Geography $2.9B MRQ end Central Indiana Northern Indiana Western Michigan Southwest Michigan Northern Michigan Eastern Michigan Other Diversified Commercial Portfolio 49% 22% 27% 2% Mix $2.9B MRQ end CRE (non-owner occ.) CRE (owner occ.) C&I Other*** 2 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S * The sum of construction & land development loans, multifamily property loans, non-owner occupied non-farm non- residential property loans and loans to finance CRE not secured by real estate divided by Tier 1 Capital plus Allowance ** UBPR Peer Group 3 *** Land development and spec home loans 6 $40.5 $41.6 $47.5 $44.1 $46.1 $647.0 $673.2 $712.9 $765.0 $786.8 $619.6 $630.1 $640.7 $653.1 $632.2 $1,199.2 $1,244.4 $1,273.8 $1,287.5 $1,439.5 $2,506.3 $2,589.2 $2,675.0 $2,749.8 $2,904.6 2Q23 3Q23 4Q23 1Q24 2Q24 Commercial Loans (period end) Other*** C&I CRE (owner occ.) CRE (non-owner occ.) $m ill io ns • Commercial loan balances grew organically o Up $155MM or 22.6% annualized • Well balanced geographies, product mix and industry o No segment exceeds 6.0% of total loans o CRE represents 180%* of RBC versus 240% for peers**, with 20% three-year growth versus 55% for peers** Data as of MRQ unless stated otherwise

Well-Managed CRE Maturities $m ill io ns $197 $93 9% 4% All rates <7% rates Loans Outstanding % of Total Adjusted CRE* 2024 Maturities Remaining Average Rate 6.37% $m ill io ns $191 $118 9% 6% All rates <7% rates Loans Outstanding % of Total Adjusted CRE* 2025 Maturities Average Rate 5.73% Data as of MRQ end. * Adjusted CRE excludes loans closed, non-accrual and matured prior to 2024. 7

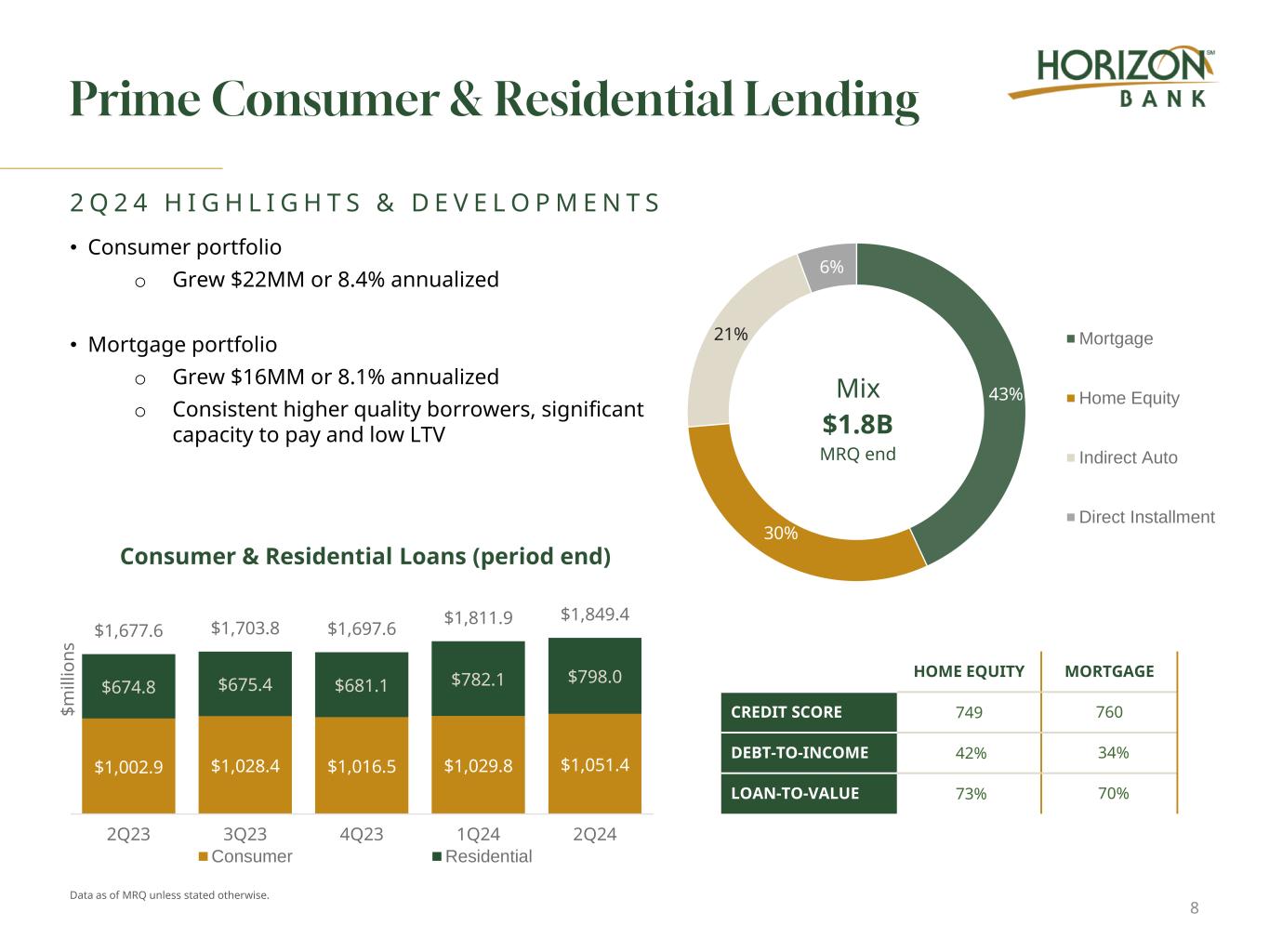

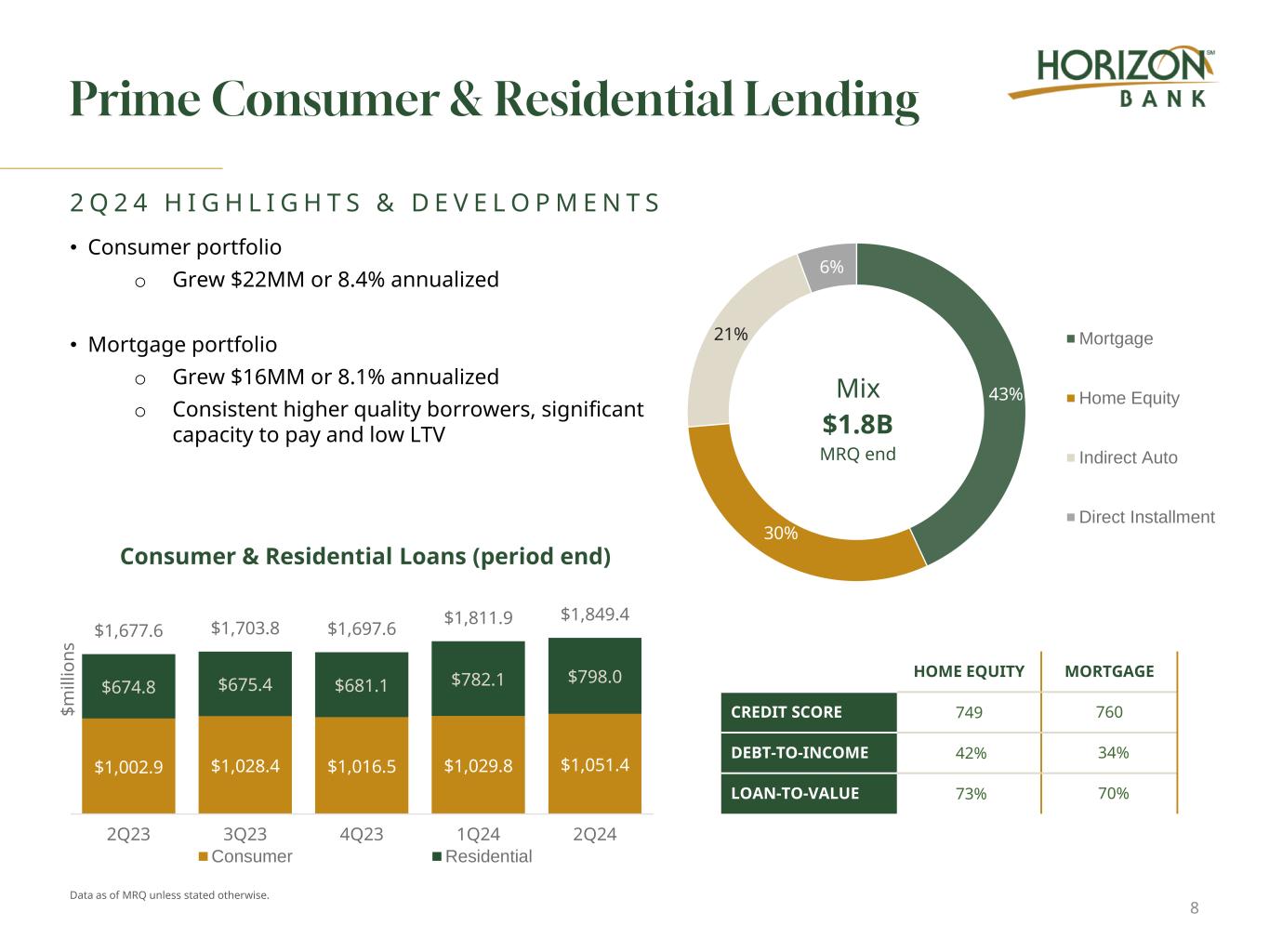

Prime Consumer & Residential Lending 2 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S 43% 30% 21% 6% Mix $1.8B MRQ end Mortgage Home Equity Indirect Auto Direct Installment HOME EQUITY MORTGAGE CREDIT SCORE 749 760 DEBT-TO-INCOME 42% 34% LOAN-TO-VALUE 73% 70% Data as of MRQ unless stated otherwise. 8 • Consumer portfolio o Grew $22MM or 8.4% annualized • Mortgage portfolio o Grew $16MM or 8.1% annualized o Consistent higher quality borrowers, significant capacity to pay and low LTV $1,002.9 $1,028.4 $1,016.5 $1,029.8 $1,051.4 $674.8 $675.4 $681.1 $782.1 $798.0 $1,677.6 $1,703.8 $1,697.6 $1,811.9 $1,849.4 2Q23 3Q23 4Q23 1Q24 2Q24 Consumer Residential $m ill io ns Consumer & Residential Loans (period end)

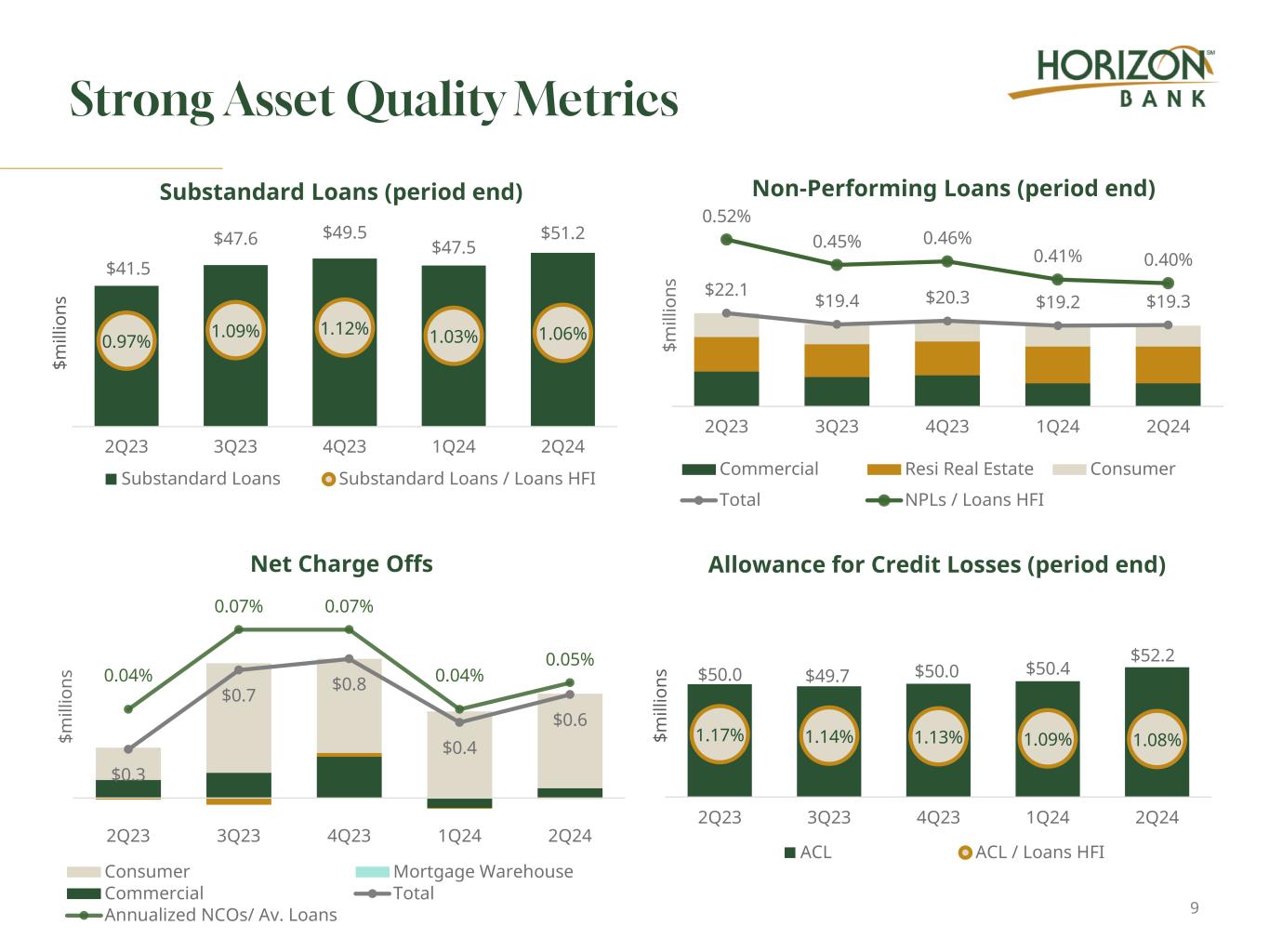

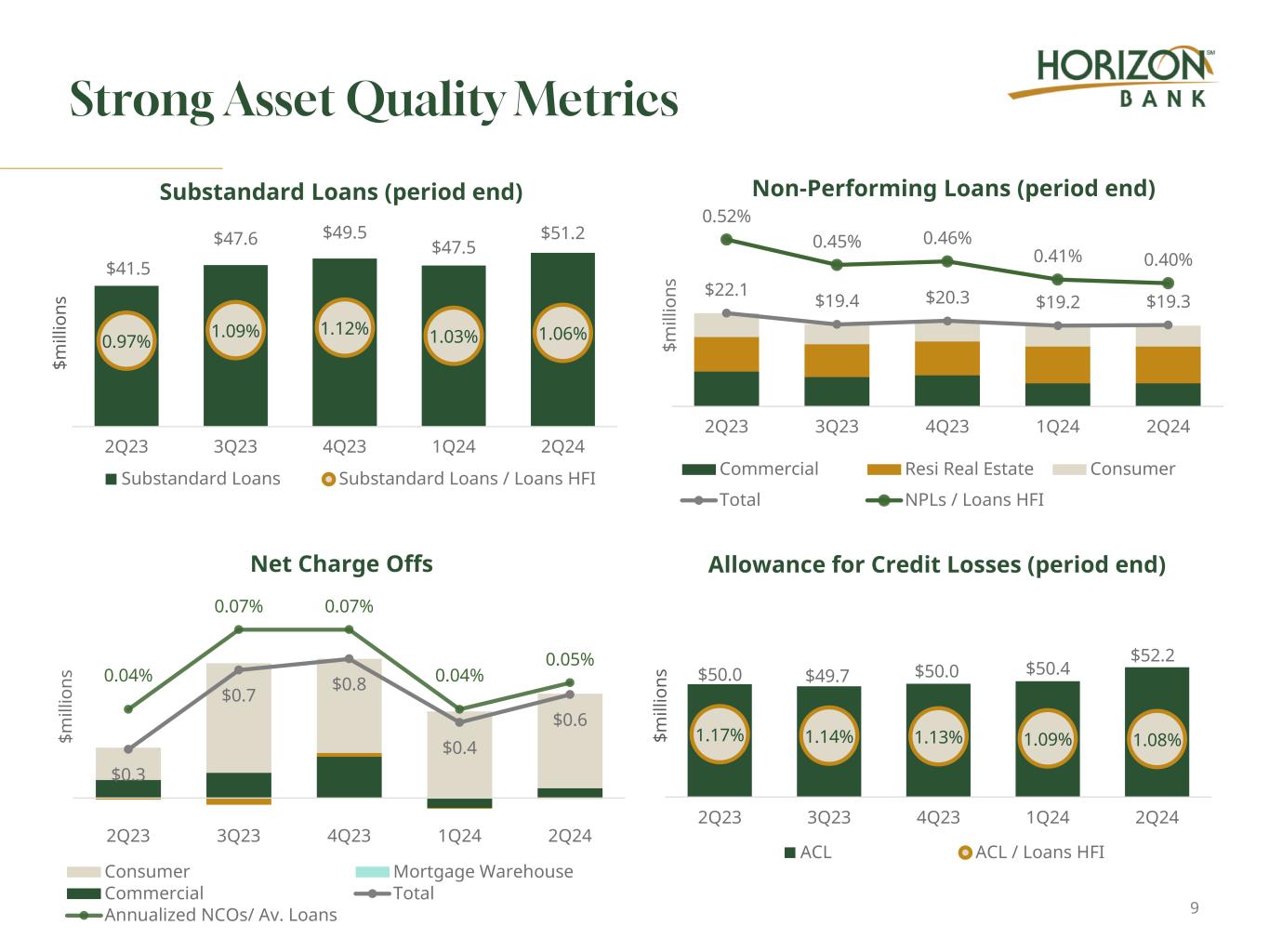

Strong Asset Quality Metrics $0.3 $0.7 $0.8 $0.4 $0.6 0.04% 0.07% 0.07% 0.04% 0.05% 2Q23 3Q23 4Q23 1Q24 2Q24 Net Charge Offs Consumer Mortgage Warehouse Commercial Total Annualized NCOs/ Av. Loans $m ill io ns $22.1 $19.4 $20.3 $19.2 $19.3 0.52% 0.45% 0.46% 0.41% 0.40% 2Q23 3Q23 4Q23 1Q24 2Q24 Non-Performing Loans (period end) Commercial Resi Real Estate Consumer Total NPLs / Loans HFI $m ill io ns $m ill io ns $50.0 $49.7 $50.0 $50.4 $52.2 1.17% 1.14% 1.13% 1.09% 1.08% 2Q23 3Q23 4Q23 1Q24 2Q24 ACL ACL / Loans HFI Allowance for Credit Losses (period end) $m ill io ns $41.5 $47.6 $49.5 $47.5 $51.2 0.97% 1.09% 1.12% 1.03% 1.06% 2Q23 3Q23 4Q23 1Q24 2Q24 Substandard Loans Substandard Loans / Loans HFI Substandard Loans (period end) 9

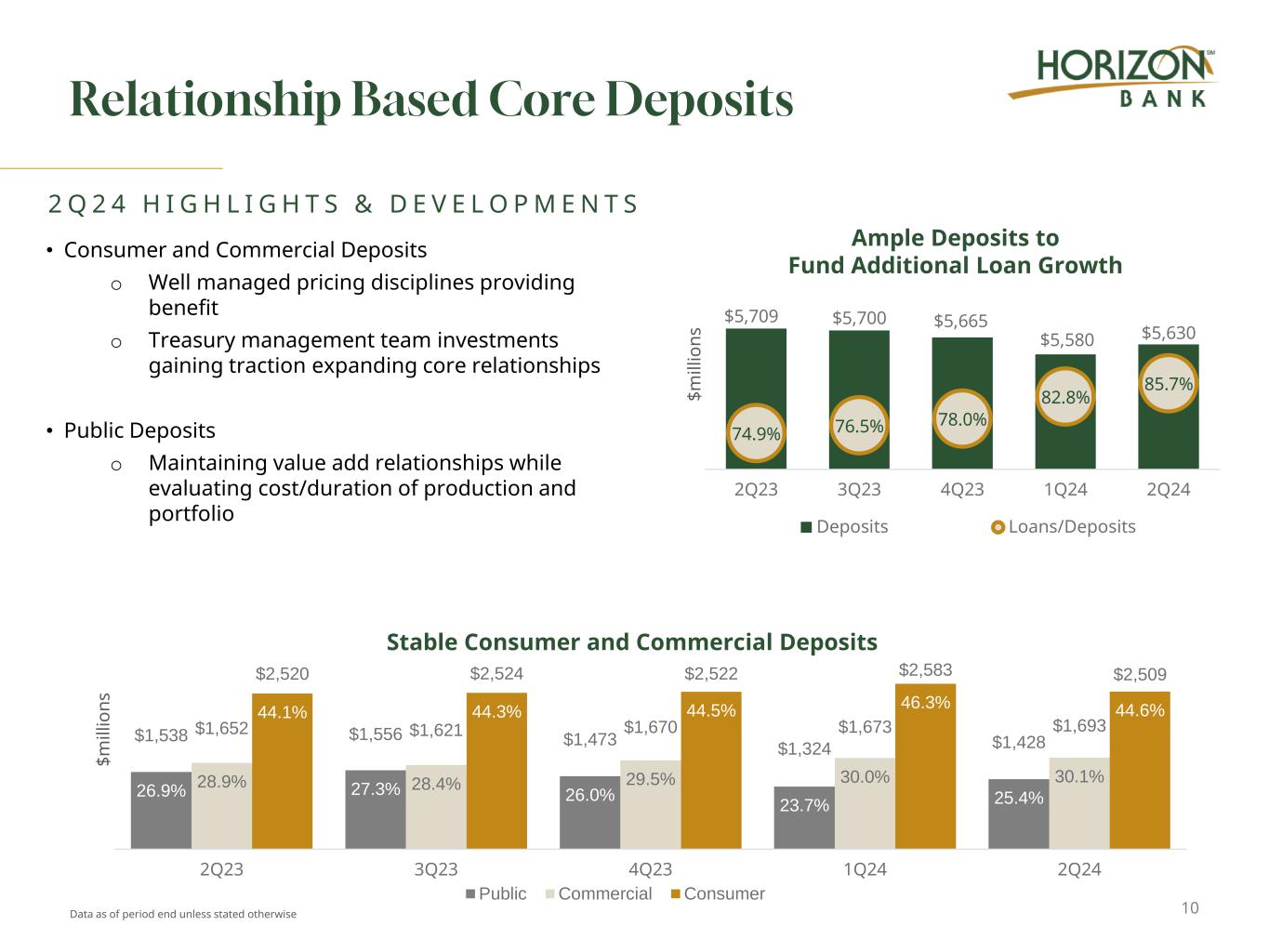

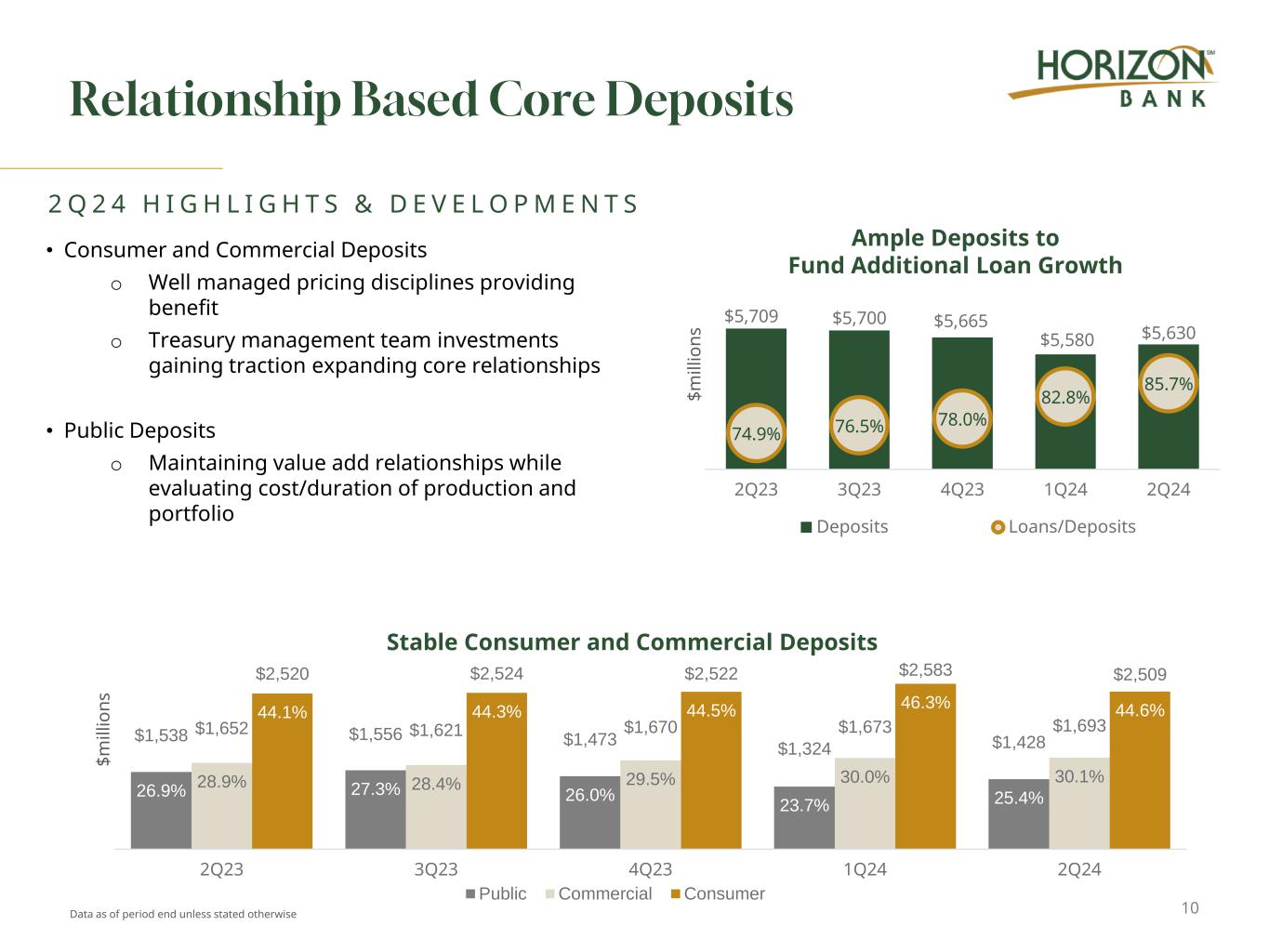

Data as of period end unless stated otherwise Relationship Based Core Deposits $m ill io ns $5,709 $5,700 $5,665 $5,580 $5,630 74.9% 76.5% 78.0% 82.8% 85.7% 2Q23 3Q23 4Q23 1Q24 2Q24 Deposits Loans/Deposits Ample Deposits to Fund Additional Loan Growth 10 2 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S • Consumer and Commercial Deposits o Well managed pricing disciplines providing benefit o Treasury management team investments gaining traction expanding core relationships • Public Deposits o Maintaining value add relationships while evaluating cost/duration of production and portfolio 26.9% 27.3% 26.0% 23.7% 25.4% 28.9% 28.4% 29.5% 30.0% 30.1% 44.1% 44.3% 44.5% 46.3% 44.6% $1,538 $1,556 $1,473 $1,324 $1,428 $1,652 $1,621 $1,670 $1,673 $1,693 $2,520 $2,524 $2,522 $2,583 $2,509 2Q23 3Q23 4Q23 1Q24 2Q24 Stable Consumer and Commercial Deposits Public Commercial Consumer $m ill io ns

Granular and Tenured Deposits 11 Seasoned, Core Deposit Base • Consumer: $6K avg. account balance 11 year avg. tenure • Commercial: $54K avg. account balance 10 year avg. tenure • Public: $288K avg. account balance 11 year avg. tenure 51% of Balances in Checking Accounts • Daily operating accounts of clients • Long tenured relationships of 11 years 81% of Balances Insured/Collateralized • Significant portion of deposits covered by FDIC, Collateralized or IntraFi • Additional coverage through Indiana Public Deposit Insurance Fund (PDIF) 56% 25% 19% Total Deposits $5.6B MRQ End FDIC Insured <$250K, Collateralized and/or Third-Party Insured (e.g., IntraFi and Indiana PDIF) Other deposits 81% Data as of most-recent quarter (MRQ) end unless stated otherwise.

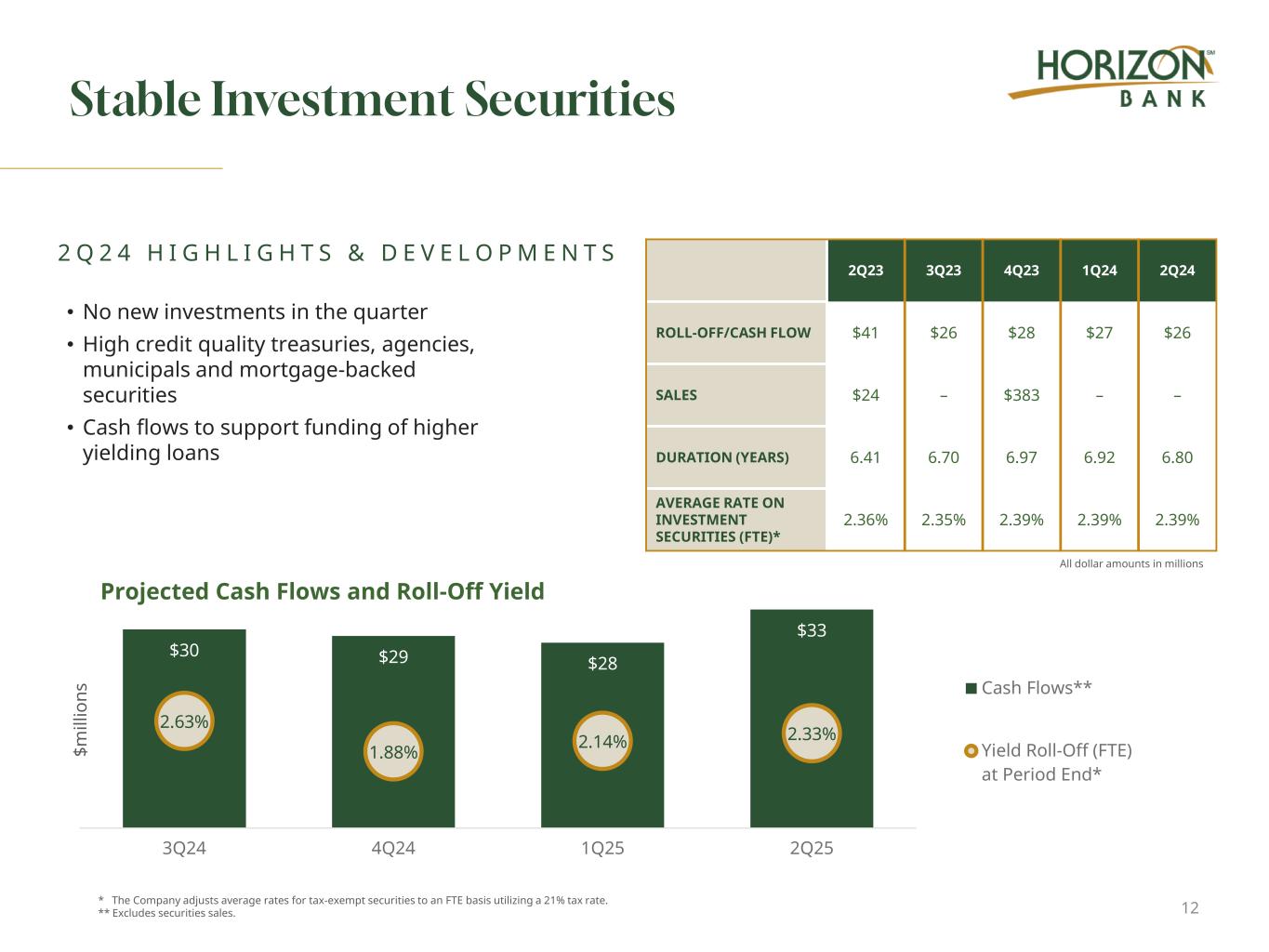

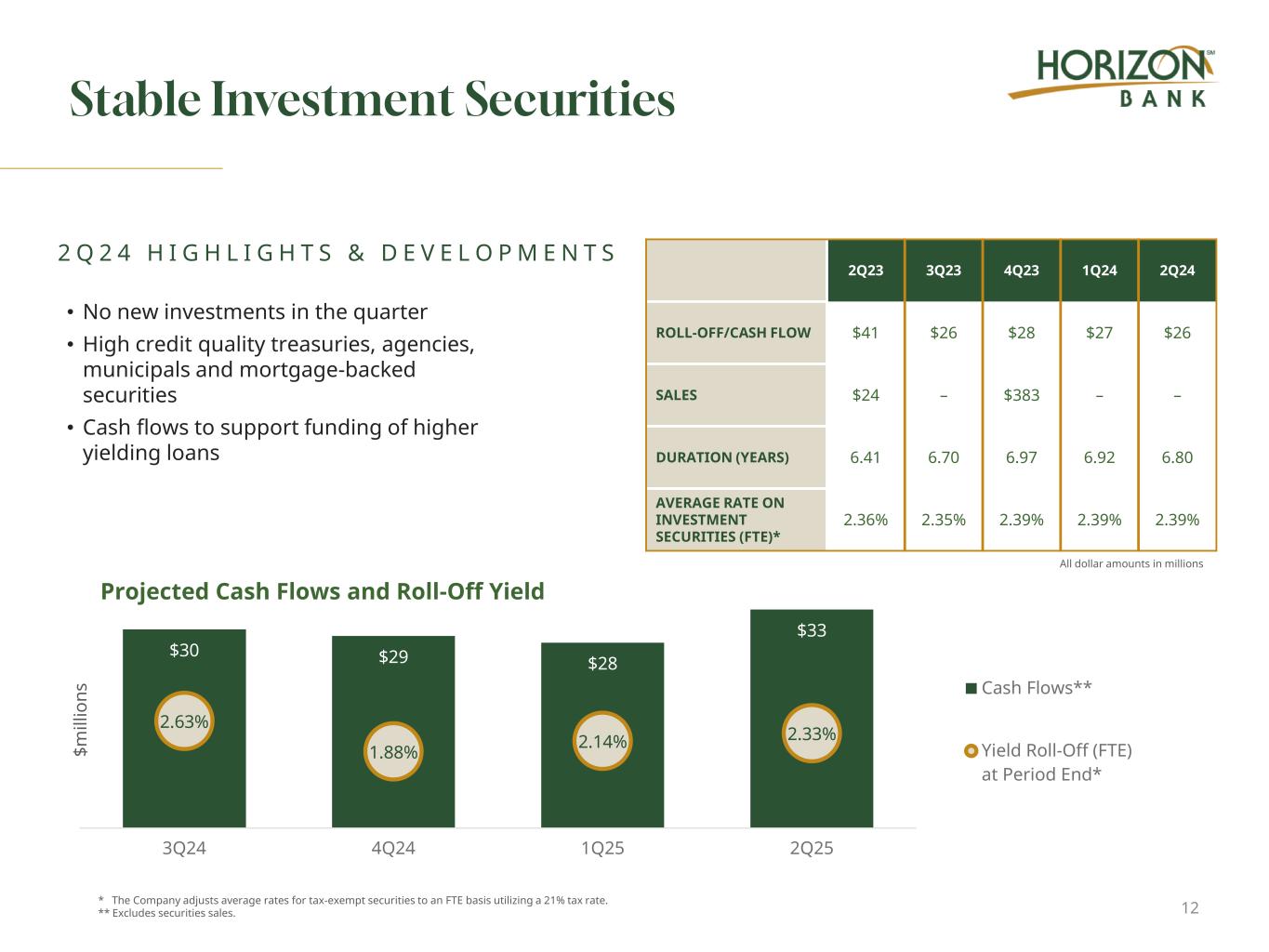

Stable Investment Securities 12 2 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S 2Q23 3Q23 4Q23 1Q24 2Q24 ROLL-OFF/CASH FLOW $41 $26 $28 $27 $26 SALES $24 – $383 – – DURATION (YEARS) 6.41 6.70 6.97 6.92 6.80 AVERAGE RATE ON INVESTMENT SECURITIES (FTE)* 2.36% 2.35% 2.39% 2.39% 2.39% $m ill io ns $30 $29 $28 $33 2.63% 1.88% 2.14% 2.33% 3Q24 4Q24 1Q25 2Q25 Projected Cash Flows and Roll-Off Yield Cash Flows** Yield Roll-Off (FTE) at Period End* • No new investments in the quarter • High credit quality treasuries, agencies, municipals and mortgage-backed securities • Cash flows to support funding of higher yielding loans All dollar amounts in millions * The Company adjusts average rates for tax-exempt securities to an FTE basis utilizing a 21% tax rate. ** Excludes securities sales.

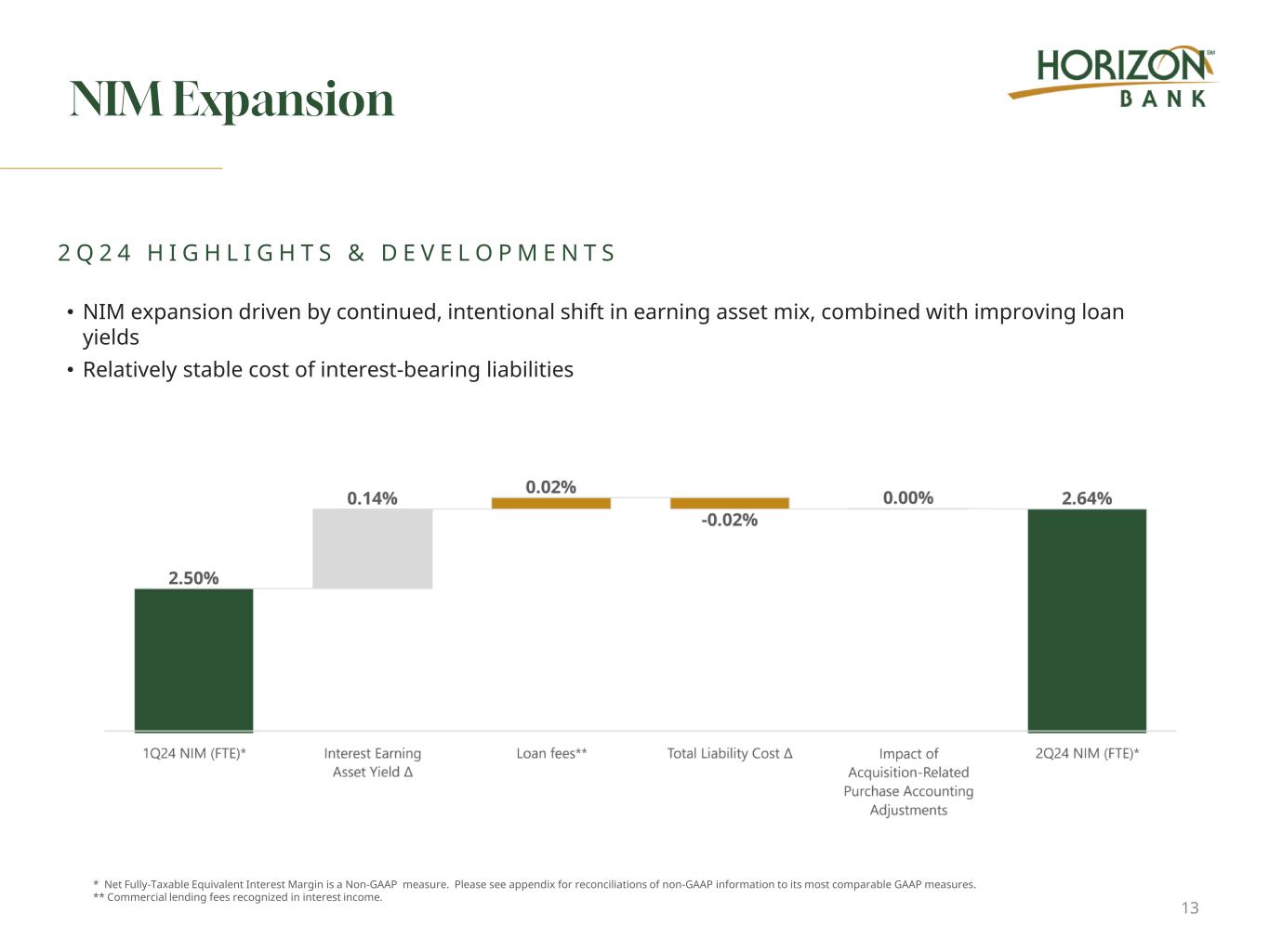

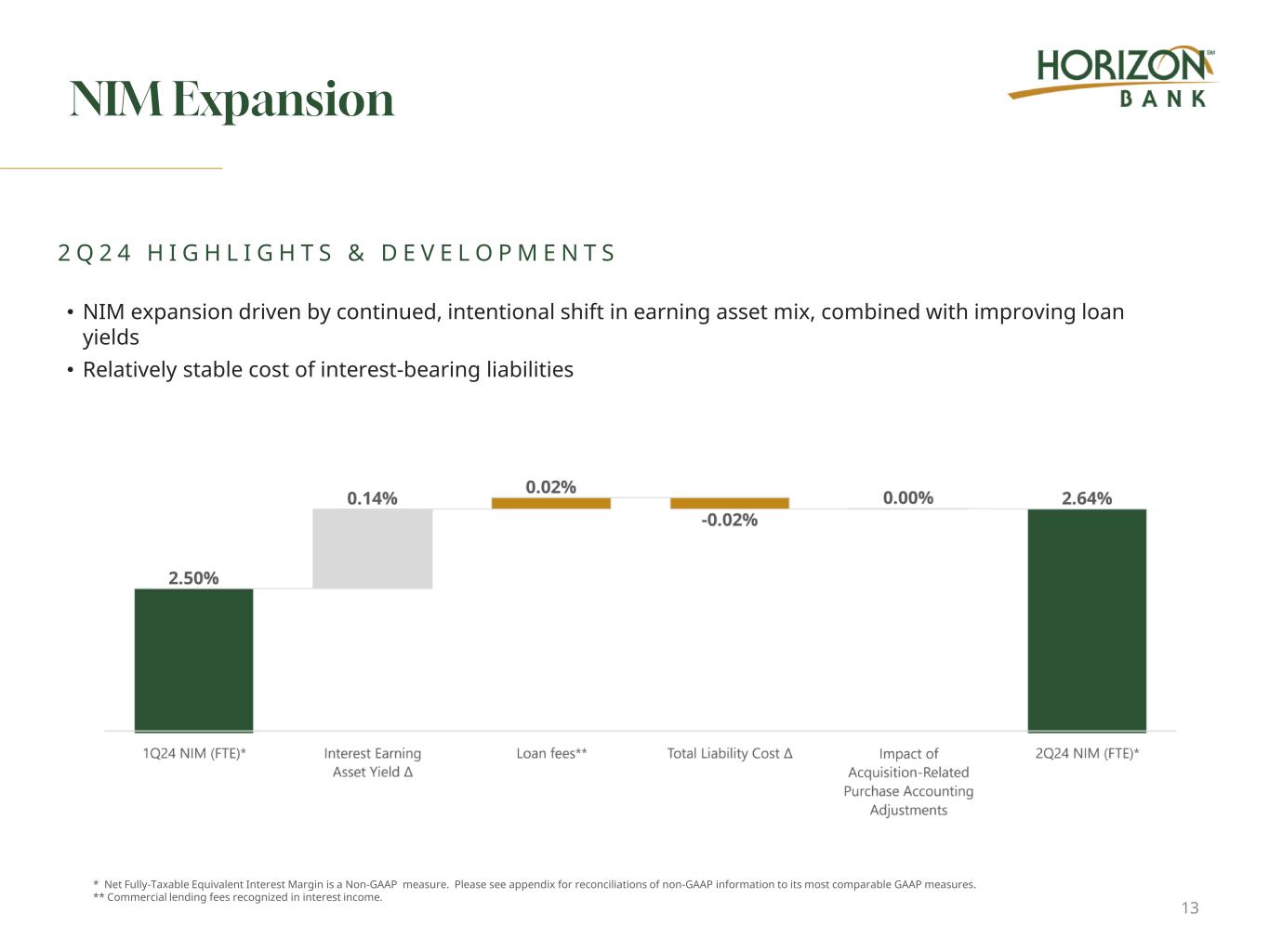

NIM Expansion 13 * Net Fully-Taxable Equivalent Interest Margin is a Non-GAAP measure. Please see appendix for reconciliations of non-GAAP information to its most comparable GAAP measures. ** Commercial lending fees recognized in interest income. 2 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S • NIM expansion driven by continued, intentional shift in earning asset mix, combined with improving loan yields • Relatively stable cost of interest-bearing liabilities

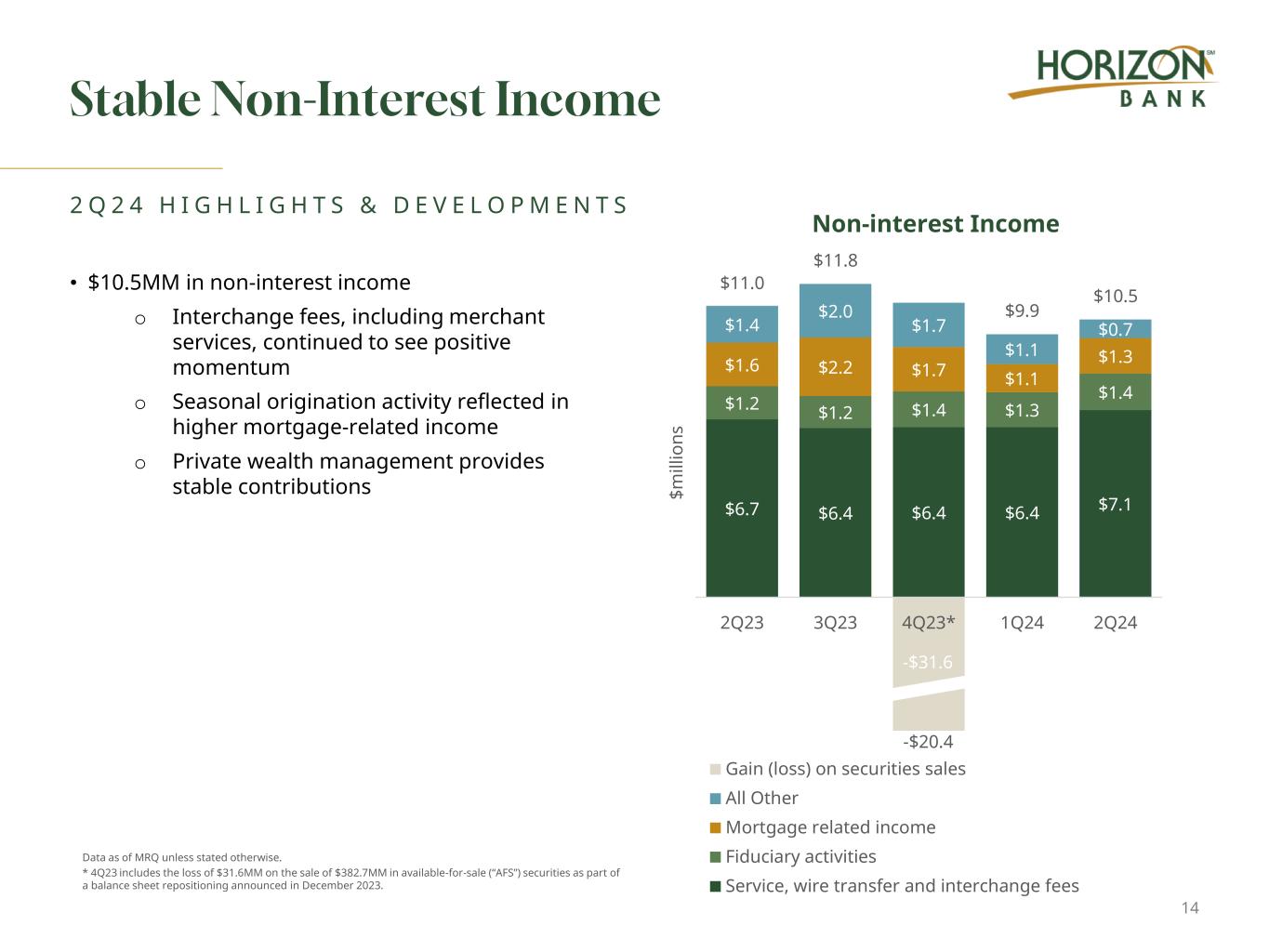

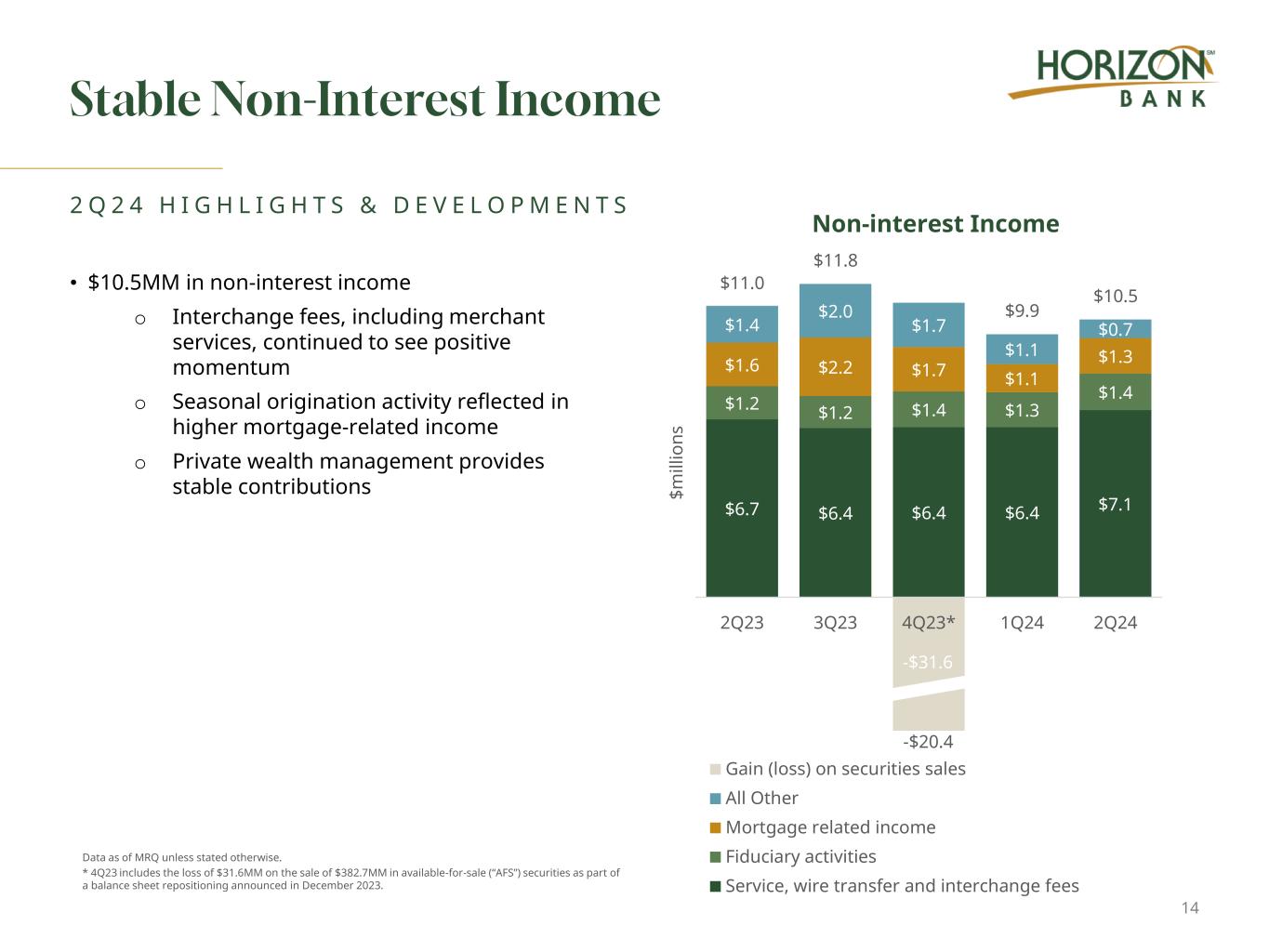

Stable Non-Interest Income 2 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S 14 Non-interest Income $6.7 $6.4 $6.4 $6.4 $7.1 $1.2 $1.2 $1.4 $1.3 $1.4 $1.6 $2.2 $1.7 $1.1 $1.3 $1.4 $2.0 $1.7 $1.1 $0.7 -$31.6 $11.0 $11.8 $9.9 $10.5 2Q23 3Q23 4Q23* 1Q24 2Q24 Gain (loss) on securities sales All Other Mortgage related income Fiduciary activities Service, wire transfer and interchange fees Data as of MRQ unless stated otherwise. * 4Q23 includes the loss of $31.6MM on the sale of $382.7MM in available-for-sale (“AFS”) securities as part of a balance sheet repositioning announced in December 2023. • $10.5MM in non-interest income o Interchange fees, including merchant services, continued to see positive momentum o Seasonal origination activity reflected in higher mortgage-related income o Private wealth management provides stable contributions $m ill io ns -$20.4

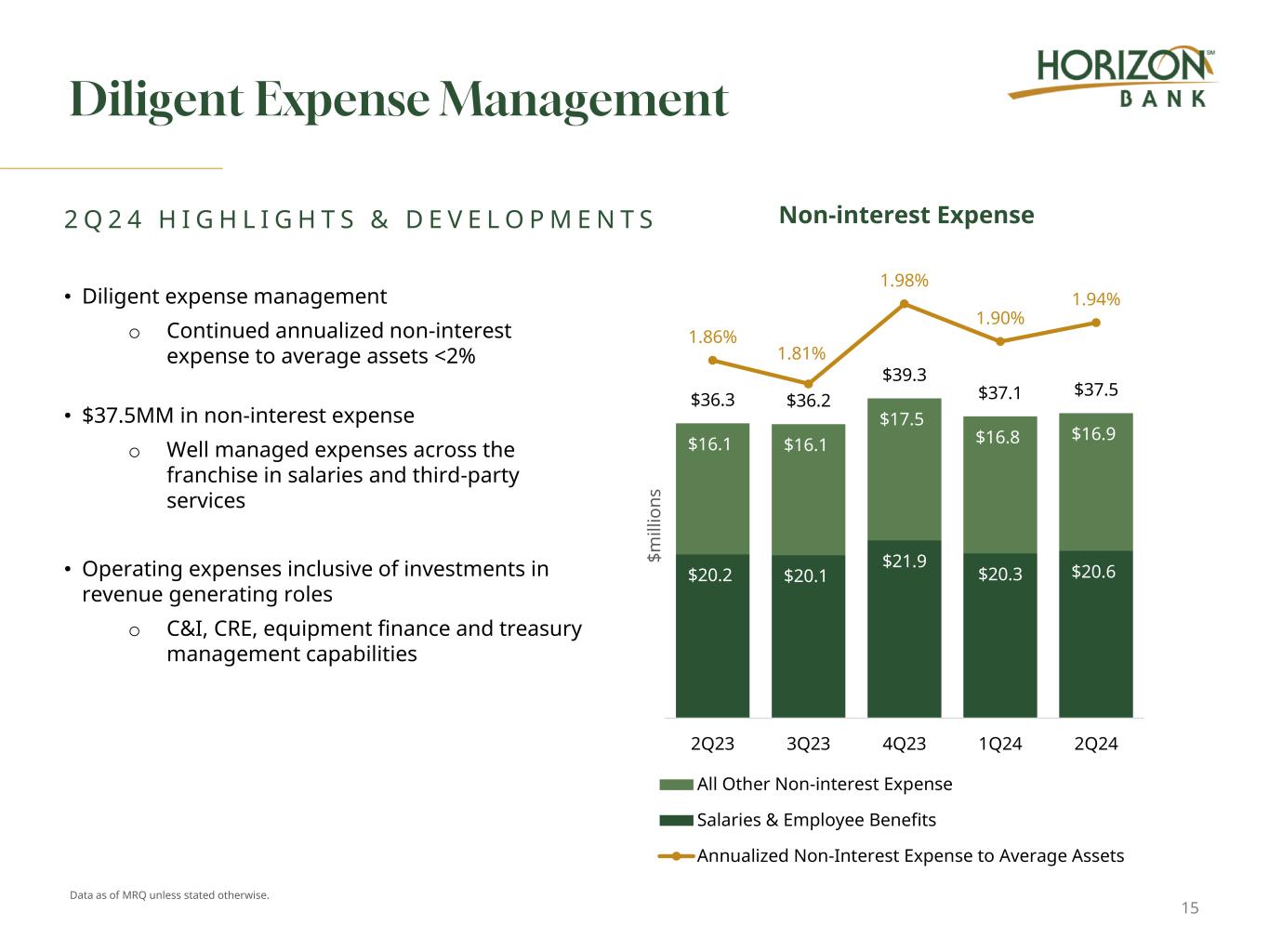

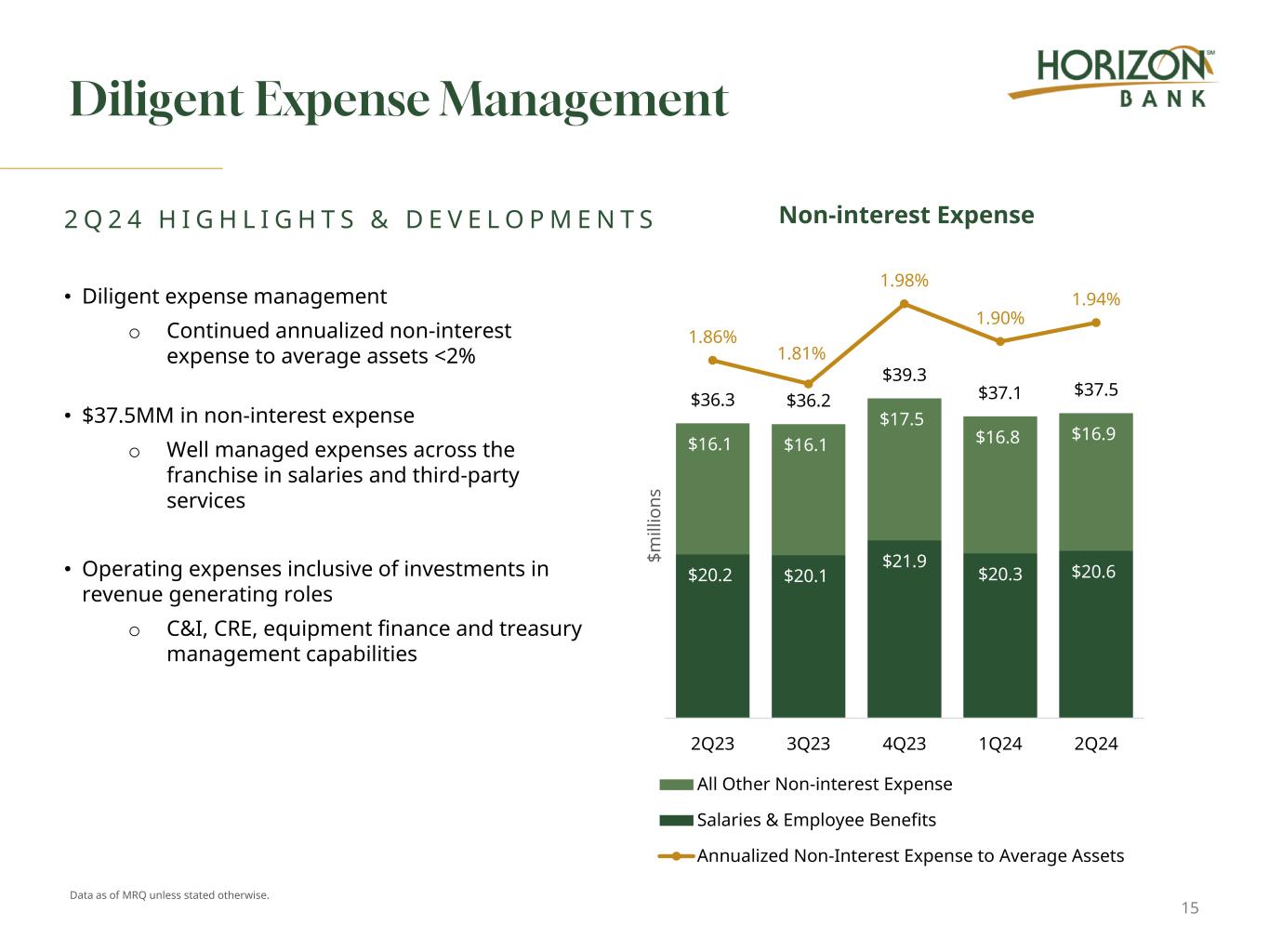

Diligent Expense Management 2 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S 15 Non-interest Expense $20.2 $20.1 $21.9 $20.3 $20.6 $16.1 $16.1 $17.5 $16.8 $16.9 $36.3 $36.2 $39.3 $37.1 $37.5 1.86% 1.81% 1.98% 1.90% 1.94% 2Q23 3Q23 4Q23 1Q24 2Q24 All Other Non-interest Expense Salaries & Employee Benefits Annualized Non-Interest Expense to Average Assets Data as of MRQ unless stated otherwise. • Diligent expense management o Continued annualized non-interest expense to average assets <2% • $37.5MM in non-interest expense o Well managed expenses across the franchise in salaries and third-party services • Operating expenses inclusive of investments in revenue generating roles o C&I, CRE, equipment finance and treasury management capabilities $m ill io ns

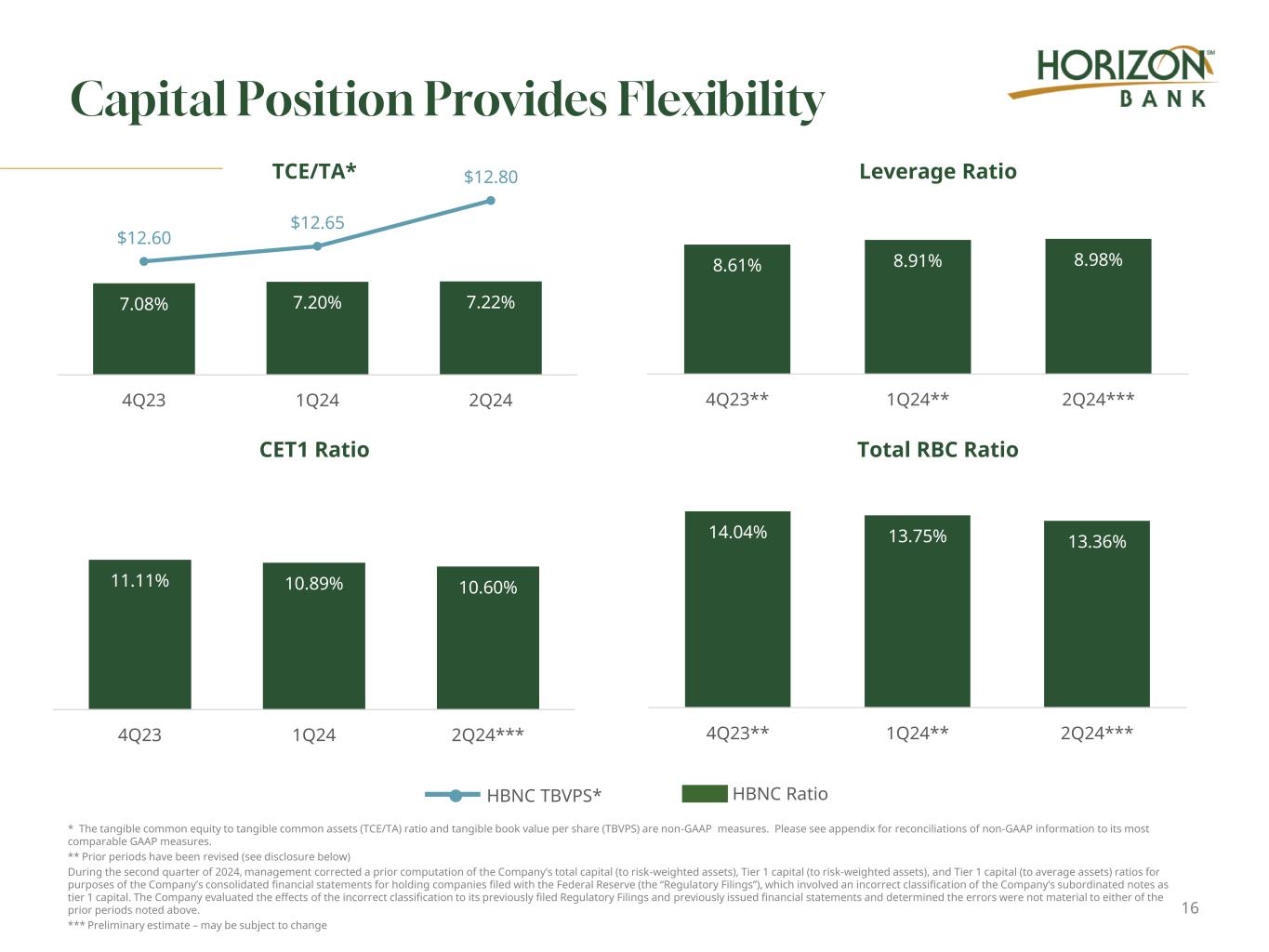

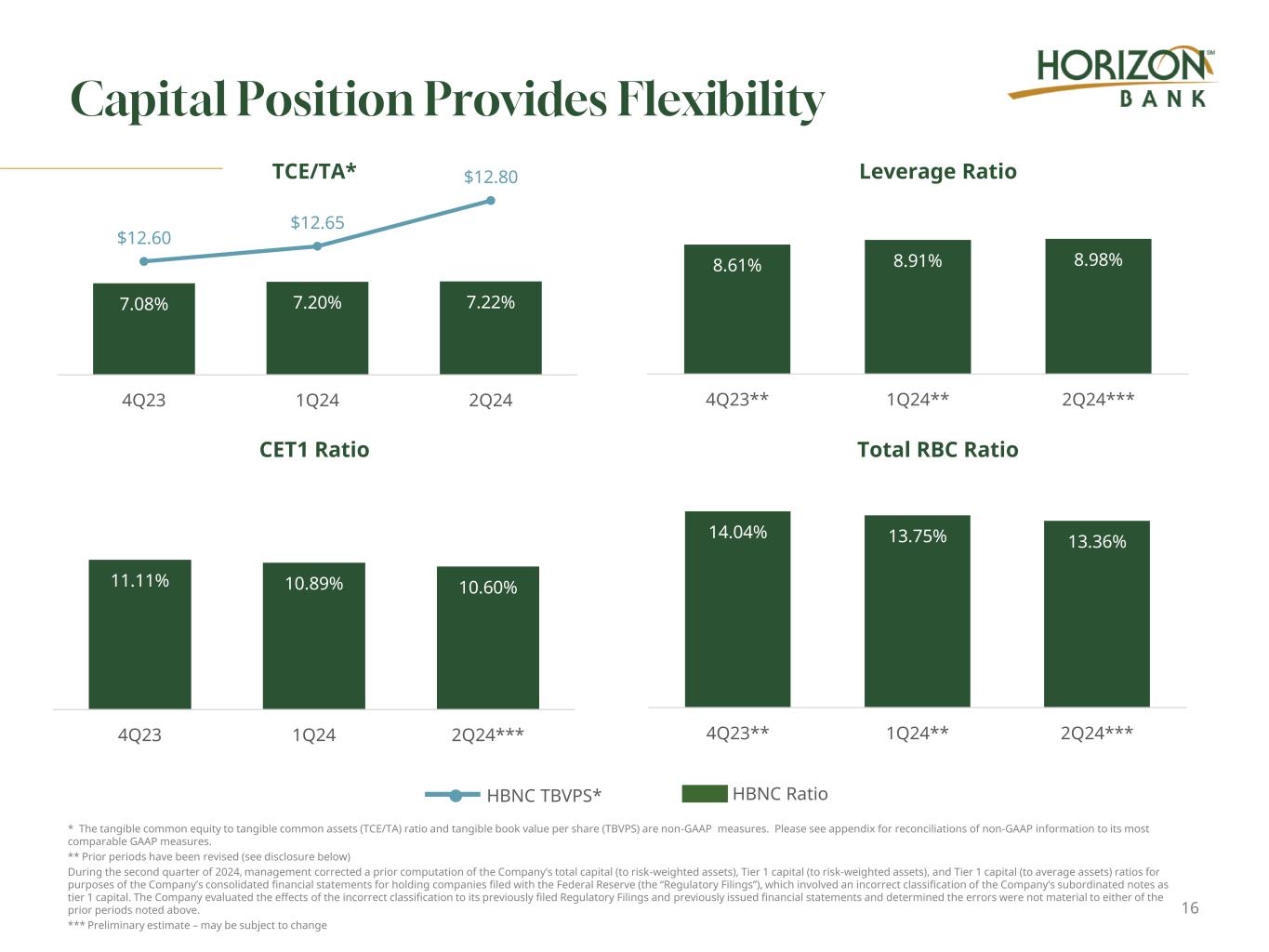

7.08% 7.20% 7.22% $12.60 $12.65 $12.80 4Q23 1Q24 2Q24 11.11% 10.89% 10.60% 4Q23 1Q24 2Q24*** TCE/TA* CET1 Ratio Capital Position Provides Flexibility * The tangible common equity to tangible common assets (TCE/TA) ratio and tangible book value per share (TBVPS) are non-GAAP measures. Please see appendix for reconciliations of non-GAAP information to its most comparable GAAP measures. ** Prior periods have been revised (see disclosure below) During the second quarter of 2024, management corrected a prior computation of the Company’s total capital (to risk-weighted assets), Tier 1 capital (to risk-weighted assets), and Tier 1 capital (to average assets) ratios for purposes of the Company’s consolidated financial statements for holding companies filed with the Federal Reserve (the “Regulatory Filings”), which involved an incorrect classification of the Company’s subordinated notes as tier 1 capital. The Company evaluated the effects of the incorrect classification to its previously filed Regulatory Filings and previously issued financial statements and determined the errors were not material to either of the prior periods noted above. *** Preliminary estimate – may be subject to change 8.61% 8.91% 8.98% 4Q23** 1Q24** 2Q24*** 14.04% 13.75% 13.36% 4Q23** 1Q24** 2Q24*** Leverage Ratio Total RBC Ratio 16 HBNC RatioHBNC TBVPS*

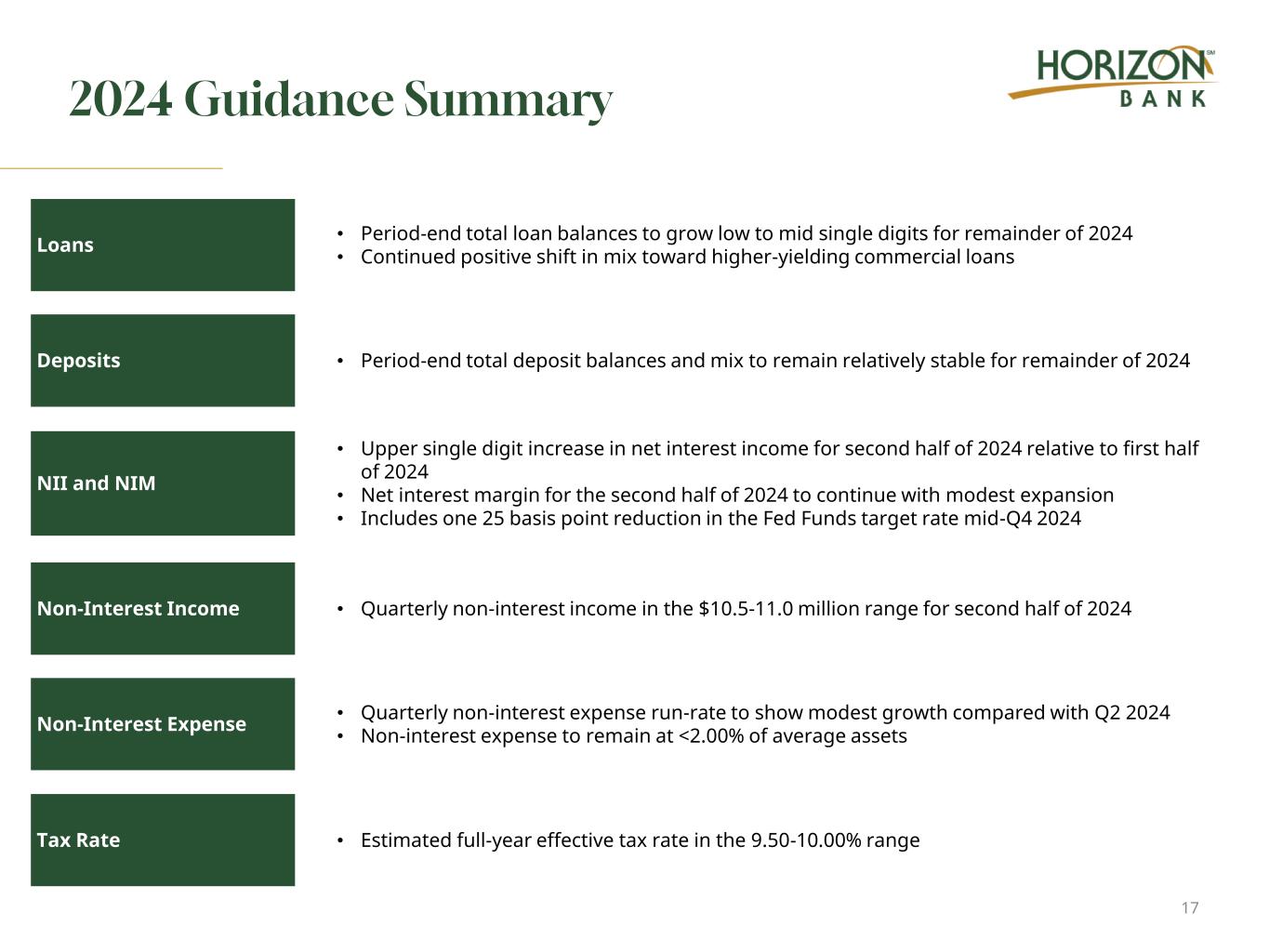

2024 Guidance Summary 17 Loans • Period-end total loan balances to grow low to mid single digits for remainder of 2024 • Continued positive shift in mix toward higher-yielding commercial loans Deposits • Period-end total deposit balances and mix to remain relatively stable for remainder of 2024 NII and NIM • Upper single digit increase in net interest income for second half of 2024 relative to first half of 2024 • Net interest margin for the second half of 2024 to continue with modest expansion • Includes one 25 basis point reduction in the Fed Funds target rate mid-Q4 2024 Non-Interest Income • Quarterly non-interest income in the $10.5-11.0 million range for second half of 2024 Non-Interest Expense • Quarterly non-interest expense run-rate to show modest growth compared with Q2 2024 • Non-interest expense to remain at <2.00% of average assets Tax Rate • Estimated full-year effective tax rate in the 9.50-10.00% range

Why Horizon? 18 P R O V E N O P E R A T O R Constant, High Quality Loan Growth Positive momentum with annualized loan growth of 17.8%, led by commercial platform Liquidity to continue to reinvest in core lending platforms to improve financial performance A proven history of excellent credit metrics A proven history of excellent credit metrics: 5 basis points of annualized net charge- offs and 1.08% allowance for credit losses Tenured And Stable Deposit Base With Significant Liquidity Stable, granular deposit base, average account tenure 10+ years Disciplined pricing management, creating shareholder value Well balanced portfolio of consumer, commercial and public deposits, providing stability and low risk profile, with 81% deposits insured/ collateralized Well Managed Operating Culture Consistent expense results of <2.00% operating expenses to average assets Key investments focused on increasing shareholder value by expanding relationship based revenue teams (Commercial/Leasing, Treasury Management, Wealth) Compelling Value Supported By Commitment To Dividend P/EPS of 11.77x 4.2% dividend yield, and targeted dividend payout ratio of 30-40% aligned with capital retention strategy 30+ year record of uninterrupted quarterly cash dividends to shareholders. Horizon financial data as of MRQ unless stated otherwise. Price multiples as of 7/18/2024.

Appendix

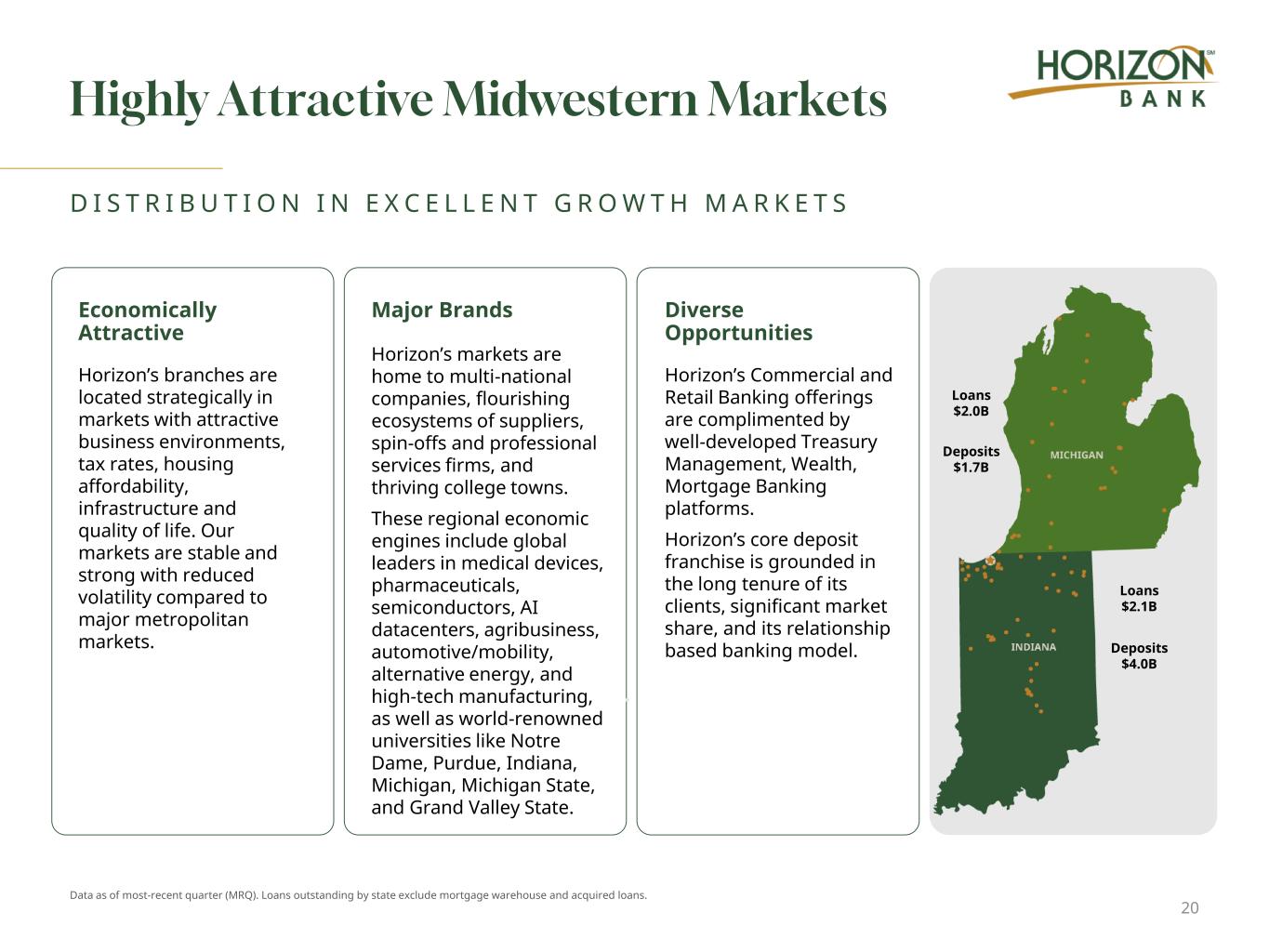

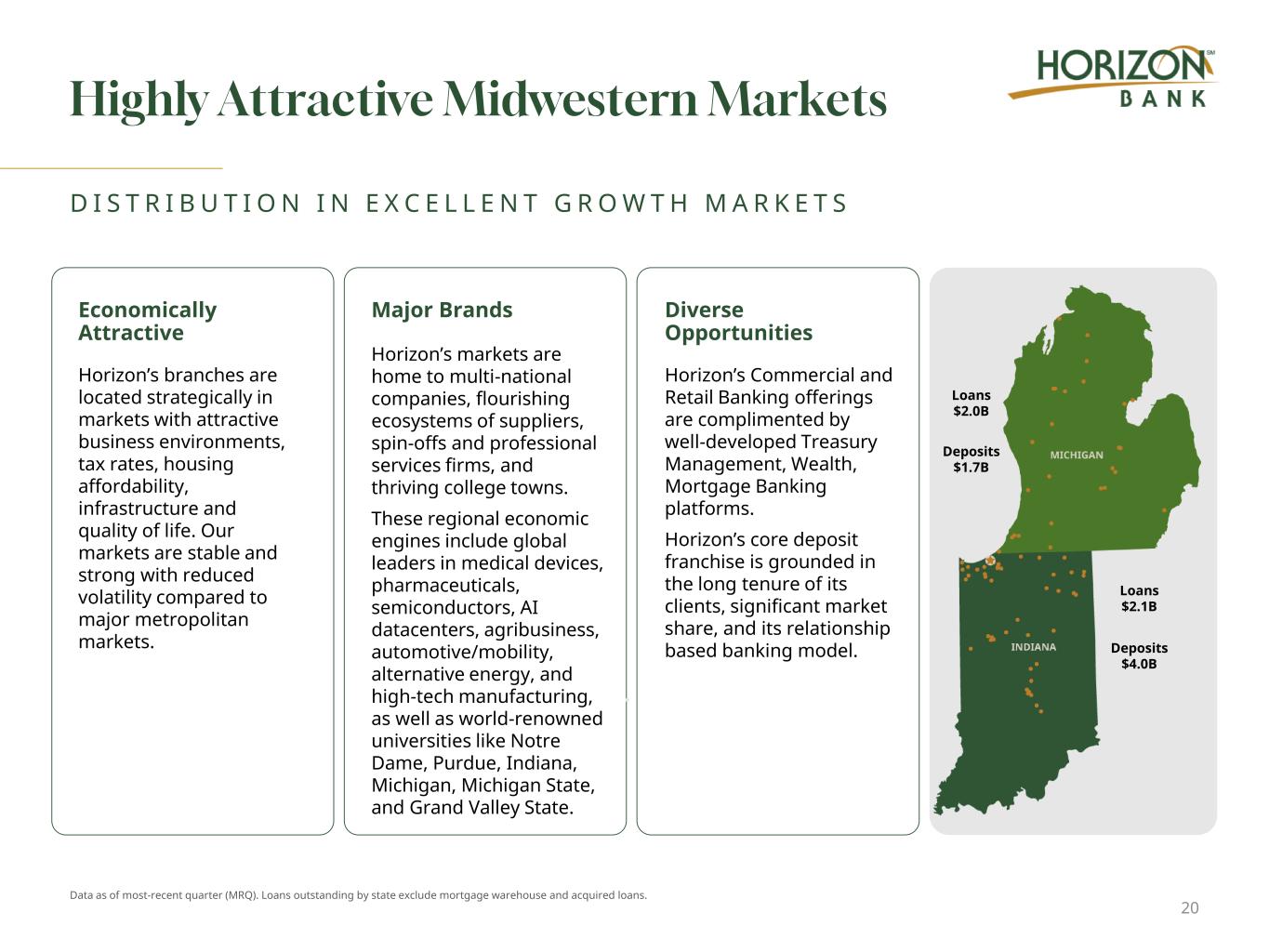

Highly Attractive Midwestern Markets 20 D I S T R I B U T I O N I N E X C E L L E N T G R O W T H M A R K E T S Economically Attractive Horizon’s branches are located strategically in markets with attractive business environments, tax rates, housing affordability, infrastructure and quality of life. Our markets are stable and strong with reduced volatility compared to major metropolitan markets. Major Brands Horizon’s markets are home to multi-national companies, flourishing ecosystems of suppliers, spin-offs and professional services firms, and thriving college towns. These regional economic engines include global leaders in medical devices, pharmaceuticals, semiconductors, AI datacenters, agribusiness, automotive/mobility, alternative energy, and high-tech manufacturing, as well as world-renowned universities like Notre Dame, Purdue, Indiana, Michigan, Michigan State, and Grand Valley State. Diverse Opportunities Horizon’s Commercial and Retail Banking offerings are complimented by well-developed Treasury Management, Wealth, Mortgage Banking platforms. Horizon’s core deposit franchise is grounded in the long tenure of its clients, significant market share, and its relationship based banking model. Loans $2.1B Loans $2.0B Deposits $1.7B Deposits $4.0B Data as of most-recent quarter (MRQ). Loans outstanding by state exclude mortgage warehouse and acquired loans.

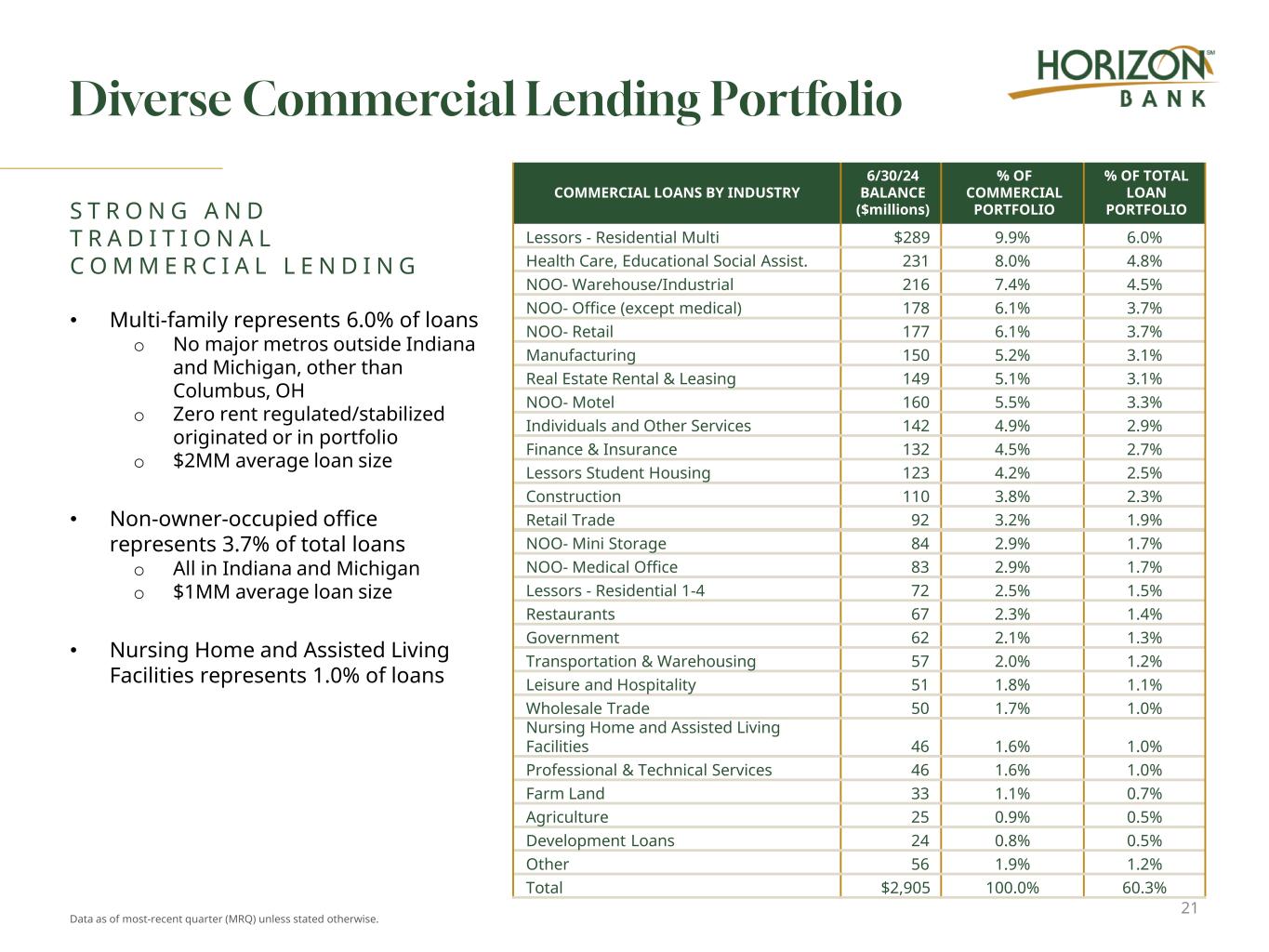

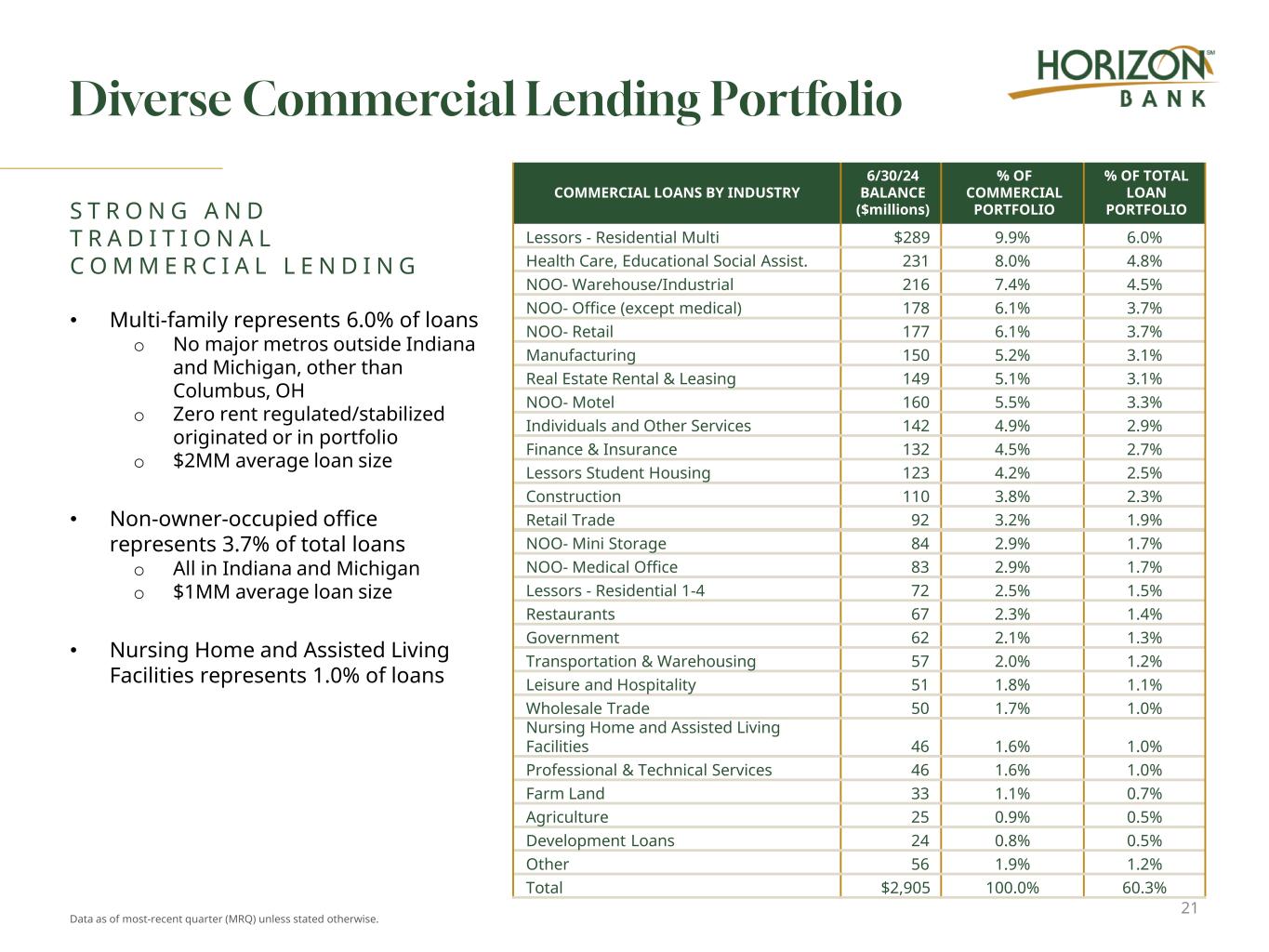

Diverse Commercial Lending Portfolio 21 COMMERCIAL LOANS BY INDUSTRY 6/30/24 BALANCE ($millions) % OF COMMERCIAL PORTFOLIO % OF TOTAL LOAN PORTFOLIO Lessors - Residential Multi $289 9.9% 6.0% Health Care, Educational Social Assist. 231 8.0% 4.8% NOO- Warehouse/Industrial 216 7.4% 4.5% NOO- Office (except medical) 178 6.1% 3.7% NOO- Retail 177 6.1% 3.7% Manufacturing 150 5.2% 3.1% Real Estate Rental & Leasing 149 5.1% 3.1% NOO- Motel 160 5.5% 3.3% Individuals and Other Services 142 4.9% 2.9% Finance & Insurance 132 4.5% 2.7% Lessors Student Housing 123 4.2% 2.5% Construction 110 3.8% 2.3% Retail Trade 92 3.2% 1.9% NOO- Mini Storage 84 2.9% 1.7% NOO- Medical Office 83 2.9% 1.7% Lessors - Residential 1-4 72 2.5% 1.5% Restaurants 67 2.3% 1.4% Government 62 2.1% 1.3% Transportation & Warehousing 57 2.0% 1.2% Leisure and Hospitality 51 1.8% 1.1% Wholesale Trade 50 1.7% 1.0% Nursing Home and Assisted Living Facilities 46 1.6% 1.0% Professional & Technical Services 46 1.6% 1.0% Farm Land 33 1.1% 0.7% Agriculture 25 0.9% 0.5% Development Loans 24 0.8% 0.5% Other 56 1.9% 1.2% Total $2,905 100.0% 60.3% S T R O N G A N D T R A D I T I O N A L C O M M E R C I A L L E N D I N G • Multi-family represents 6.0% of loans o No major metros outside Indiana and Michigan, other than Columbus, OH o Zero rent regulated/stabilized originated or in portfolio o $2MM average loan size • Non-owner-occupied office represents 3.7% of total loans o All in Indiana and Michigan o $1MM average loan size • Nursing Home and Assisted Living Facilities represents 1.0% of loans Data as of most-recent quarter (MRQ) unless stated otherwise.

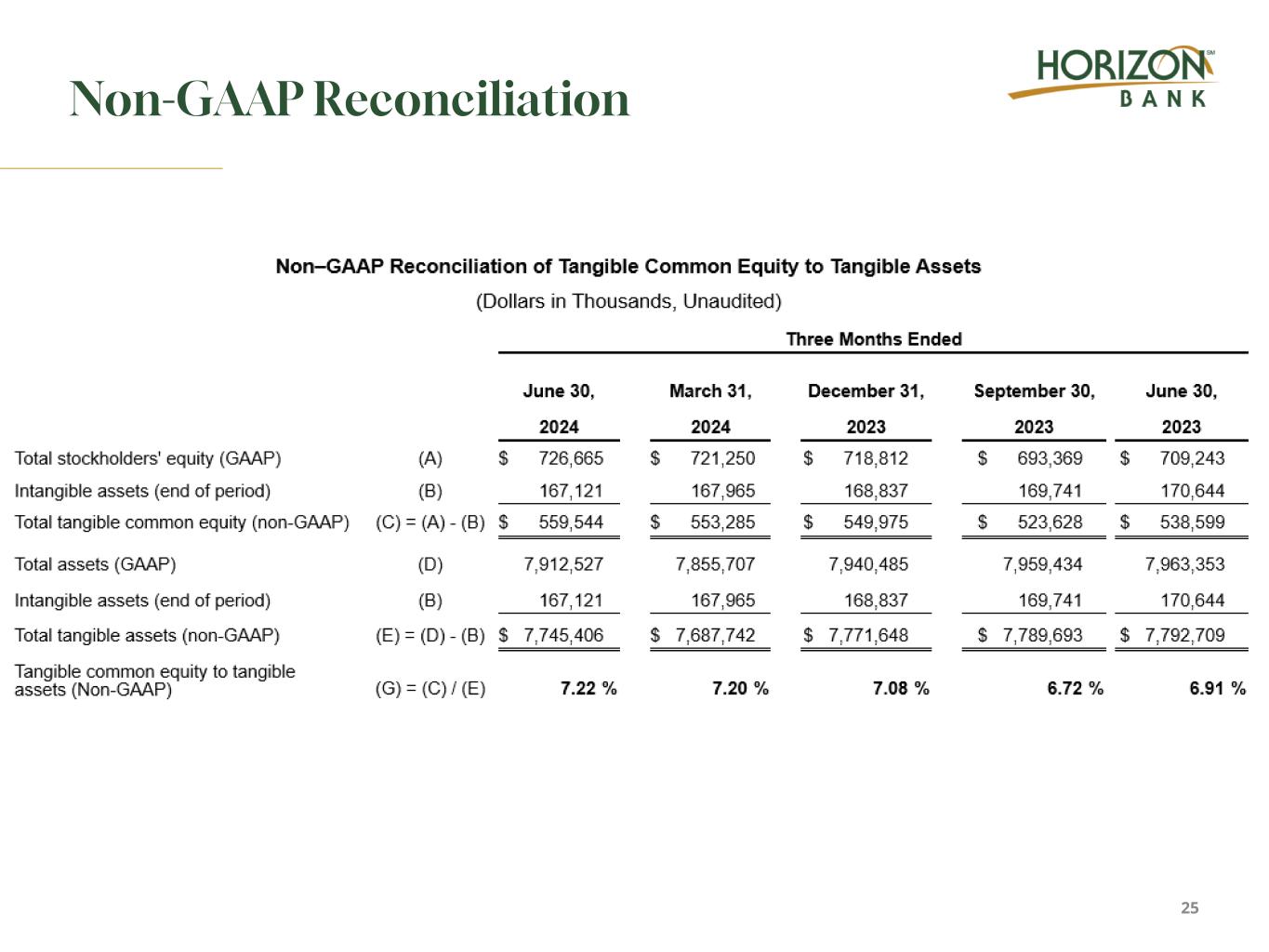

Use of Non-GAAP Financial Measures 22 Certain information set forth in this presentation refers to financial measures determined by methods other than in accordance with GAAP. In each case, we have identified special circumstances that we consider to be non-recurring and have excluded them. We believe that this shows the impact of such events as acquisition-related purchase accounting adjustments and swap termination fees, among others we have identified in our reconciliations. Horizon believes these non-GAAP financial measures are helpful to investors and provide a greater understanding of our business and financial results without giving effect to the purchase accounting impacts and one-time costs of acquisitions and non–recurring items. These measures are not necessarily comparable to similar measures that may be presented by other companies and should not be considered in isolation or as a substitute for the related GAAP measure. See the tables and other information below and contained elsewhere in this presentation for reconciliations of the non-GAAP information identified herein and its most comparable GAAP measures.

Non-GAAP Reconciliation 23

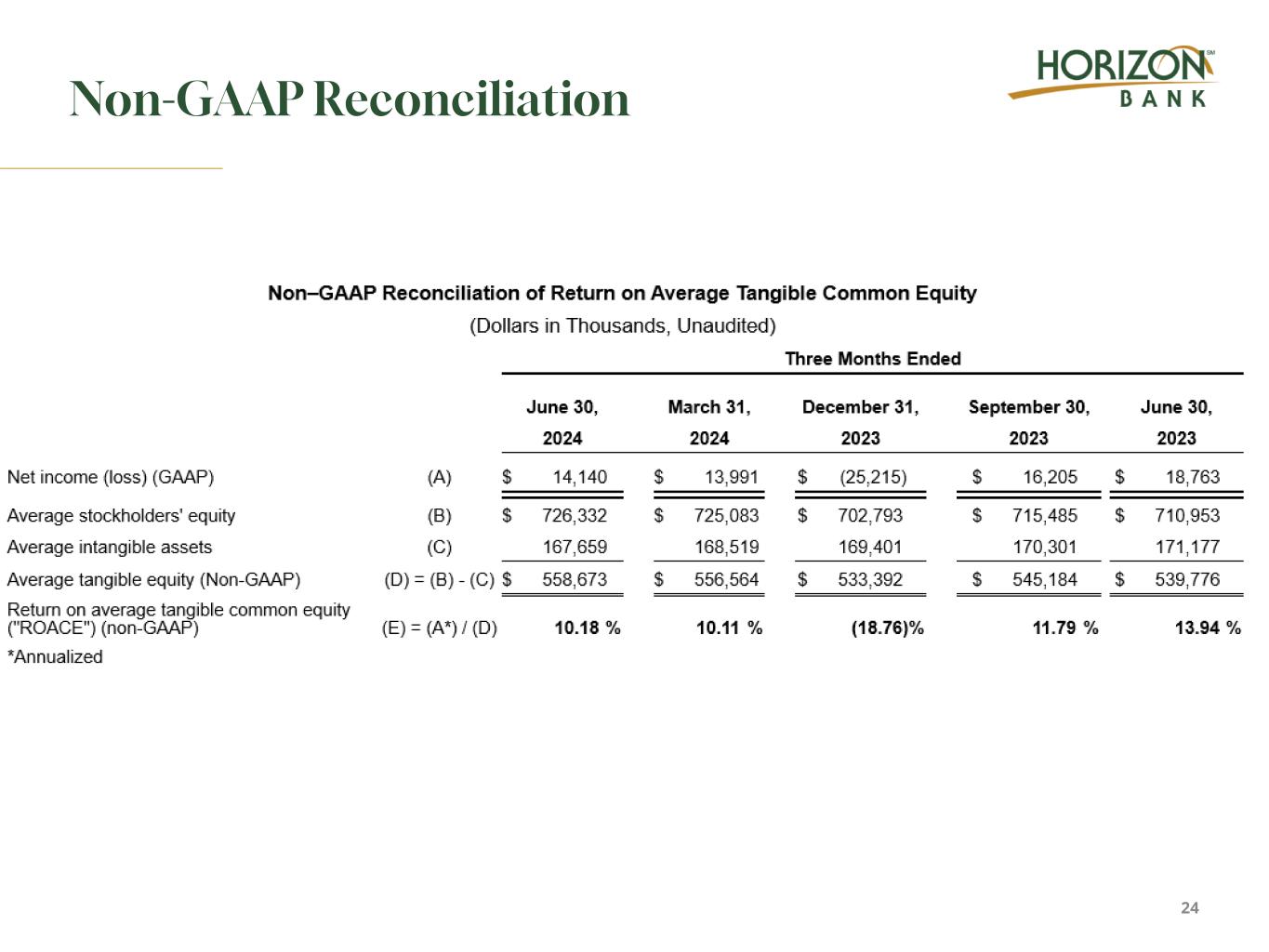

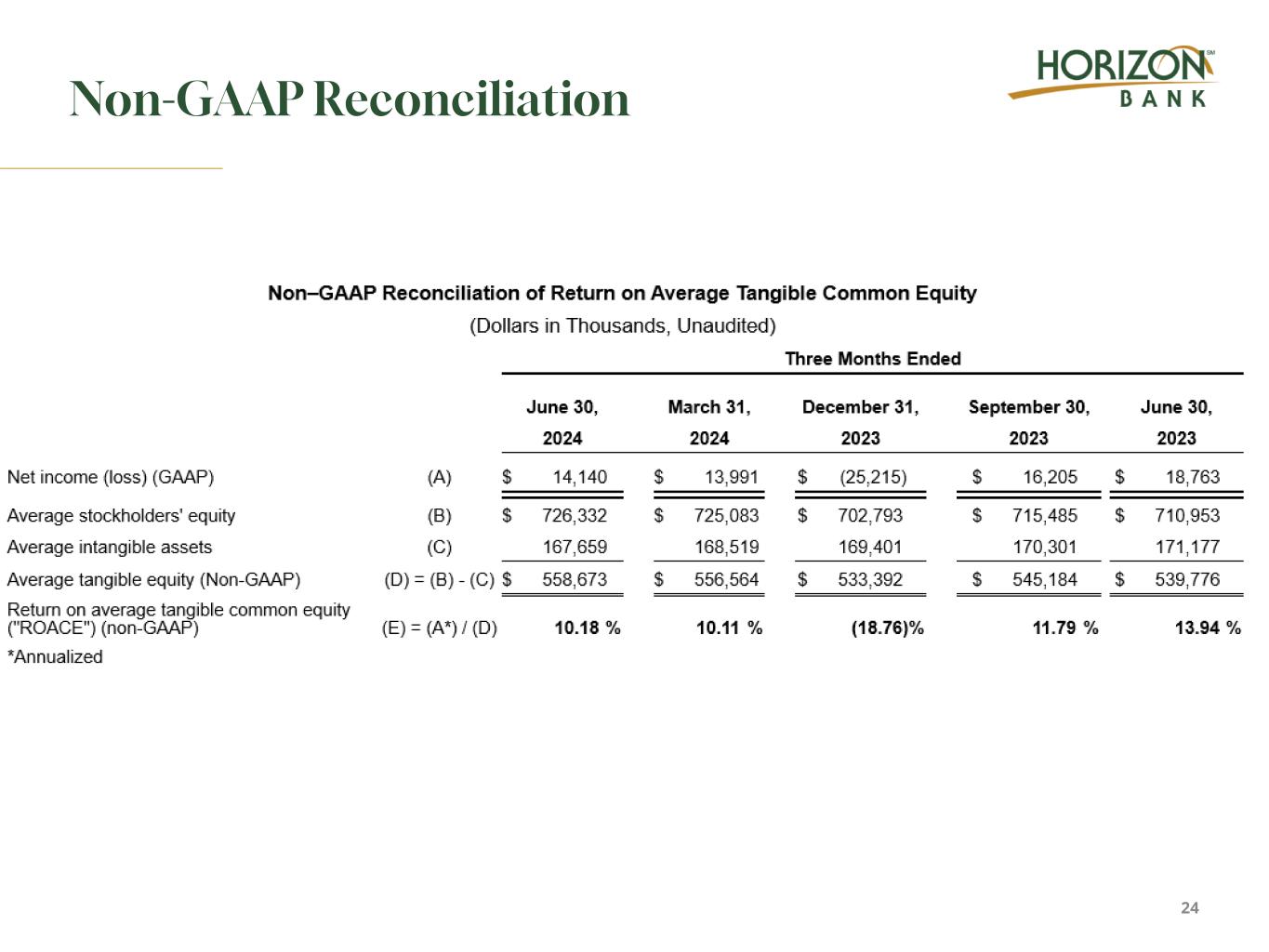

Non-GAAP Reconciliation 24

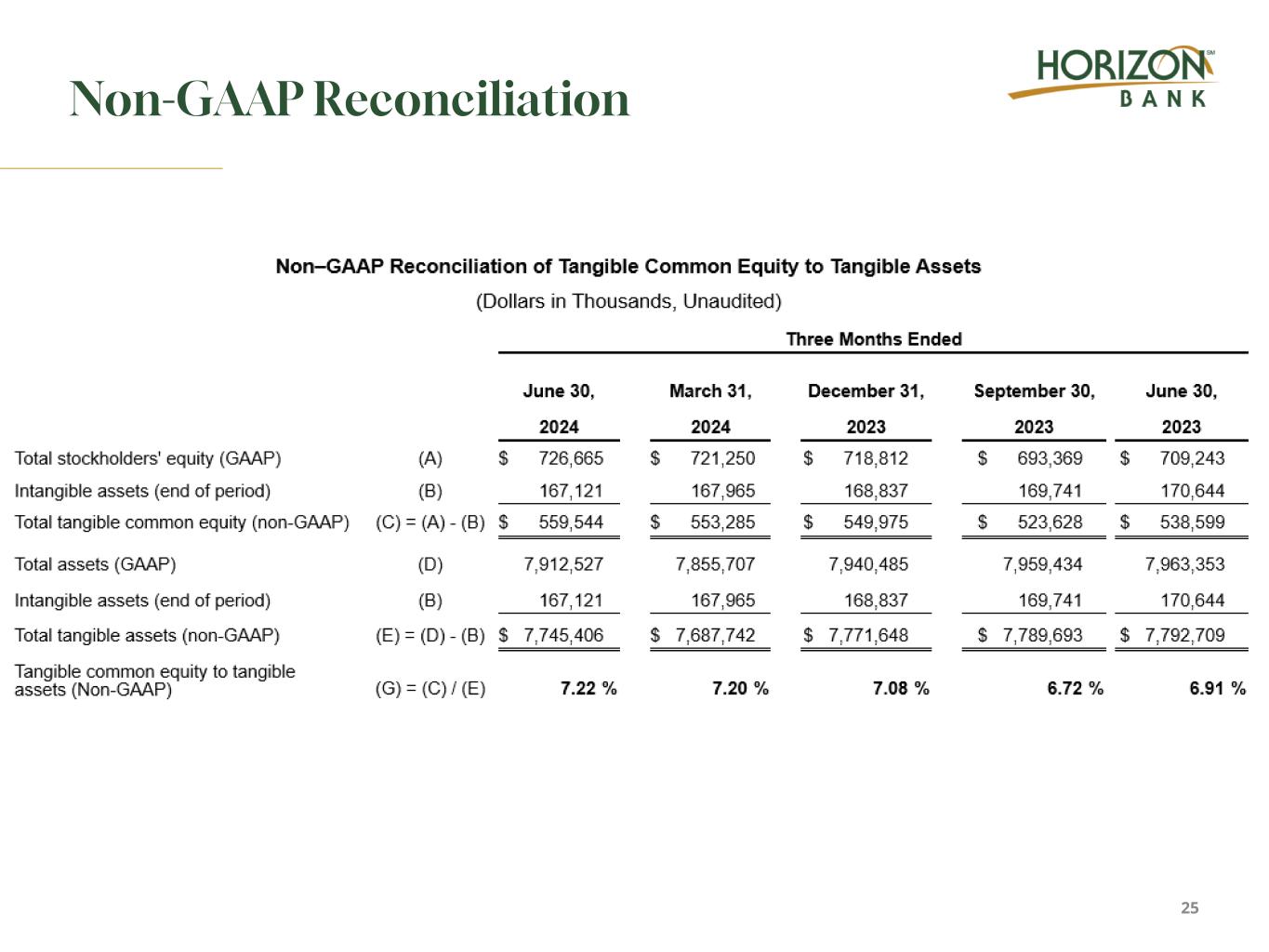

Non-GAAP Reconciliation 25

Thank you John R. Stewart, CFA Executive Vice President & Chief Financial Officer 515 Franklin Street, Michigan City, IN 46360 219-814-5833 Investor.HorizonBank.com