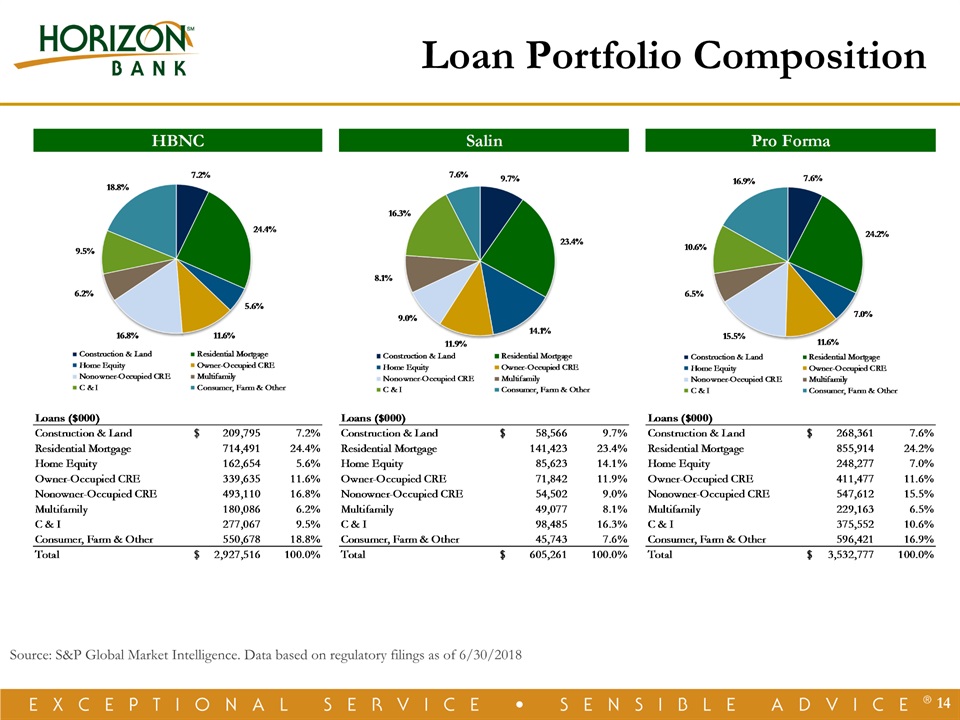

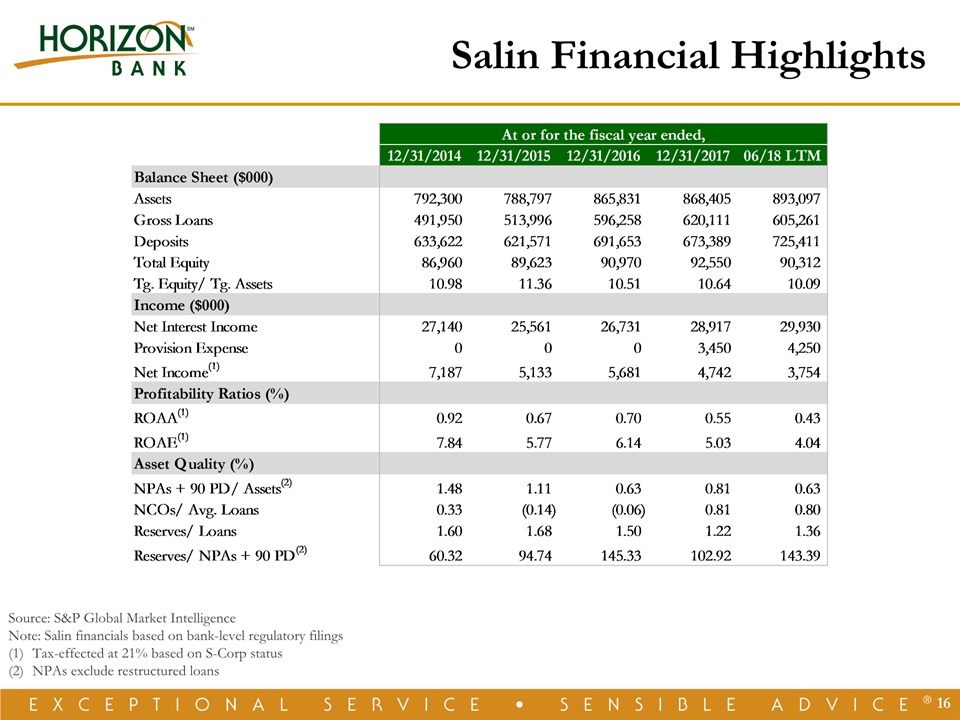

4 Salin Bancshares, Inc. Company Profile Headquartered in Indianapolis, Indiana; founded in 1902 Branch presence in central and northern Indiana markets that are of strategic importance to HorizonSuperb deposit base – non-CD deposits represent more than 90% of total deposits and non-interest bearing deposits equal approximately 27% of total deposits(1)Clean balance sheet with NPAs to total assets of 0.64% and LLR’s to gross loans of 1.36%(1)Pro forma the combined company will have a top 7 deposit market share for banks headquartered in Indiana Financial Highlights(1) ($000s) 2016 2017 LTM 6/30/18 Assets $865,831 $868,405 $893,097 Loans 596,258 620,111 605,261 Deposits 691,653 673,389 725,411 Net Income(2) 5,681 4,742 3,754 ROAA(2) 0.70% 0.55% 0.43% TCE/TA 10.51% 10.64% 10.09% NPAs/Assets 0.71% 0.82% 0.64% HBNC(3) Salin(1) Pro Forma Locations 66 20 86 Assets $4,151 M $893 M $5,044 M Loans $2,940 M $605 M $3,545 M Deposits $3,129 M $725 M $3,844 M Pending Salin BranchesHBNC Branches Source: S&P Global Market Intelligence; 2018 FDIC Summary of DepositsBased on bank-level regulatory data as of June 30, 2018 (2) Tax-effected at 21% based on S-Corp status (3) HBNC financials as of September 30, 2018