UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

HENRY COUNTY BANCSHARES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

HENRY COUNTY BANCSHARES, INC.

4806 N. HENRY BOULEVARD

STOCKBRIDGE, GEORGIA 30281

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Dear Fellow Shareholder:

We cordially invite you to attend the 2009 Annual Meeting of Shareholders of Henry County Bancshares, Inc., the holding company for The First State Bank. At the meeting, we will report on our performance in 2008 and answer your questions. We look forward to discussing both our accomplishments and our plans with you. We hope that you can attend the meeting and we look forward to seeing you there.

This letter serves as your official notice that we will hold the meeting on April 21, 2009 at 6:30 p.m. at our office at 4806 N. Henry Boulevard, Stockbridge, Georgia 30281 for the following purposes:

| | 1. | To elect the 2009 Board of Directors; and |

| | 2. | To transact any other business that may properly come before the meeting or any adjournment of the meeting. |

Shareholders owning our common stock at the close of business on March 12, 2009 are entitled to attend and vote at the meeting.

Please use this opportunity to take part in the affairs of your Company by voting on the business to come before this meeting. Even if you plan to attend the meeting, we encourage you to complete and return the enclosed proxy to Anita Jarvis at the above listed address, as promptly as possible, in the envelope provided.

|

| By Order of the Board of Directors, |

|

|

| David H. Gill |

| President and Chief Executive Officer |

March 24, 2009

Stockbridge, Georgia

HENRY COUNTY BANCSHARES, INC.

4806 N. HENRY BOULEVARD

STOCKBRIDGE, GEORGIA 30281

PROXY STATEMENT FOR ANNUAL MEETING OF

SHAREHOLDERS TO BE HELD ON APRIL 21, 2009

Our Board of Directors is soliciting proxies for the 2009 Annual Meeting of Shareholders. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the meeting. We encourage you to read it carefully.

VOTING INFORMATION

The Board set March 12, 2009 as the record date for the meeting. Shareholders owning our common stock at the close of business on that date are entitled to attend and vote at the meeting, with each share entitled to one vote. There were 14,245,690 shares of common stock outstanding as of March 12, 2009. A majority of the outstanding shares of common stock represented at the meeting will constitute a quorum.

When you sign the proxy card, you appoint David H. Gill or William C. Strom, Jr. as your representative at the meeting. Mr. Gill and Mr. Strom, or either of them, will vote your proxy as you have instructed them on the proxy card. If you submit a proxy but do not specify how you would like it to be voted, Mr. Gill or Mr. Strom will vote your proxy FOR the election to the Board of Directors of all nominees listed below under “Election Of Directors.” We are not aware of any other matters to be considered at the meeting. However, if any other matters come before the meeting, Mr. Gill or Mr. Strom will vote your proxy on such matters in accordance with their judgment.

You may revoke your proxy and change your vote at any time before the polls close at the meeting. You may do this by signing and delivering another proxy with a later date or by voting in person at the meeting.

We are paying for the costs of preparing and mailing the proxy materials and of reimbursing brokers and others for their expenses of forwarding copies of the proxy materials to our shareholders. Our officers and employees may assist in soliciting proxies but will not receive additional compensation for doing so. The Annual Report of the Company accompanies this proxy statement. We are distributing this proxy statement and the Annual Report on or about March 24, 2009.

NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS

We have posted materials related to the 2009 annual meeting on the Internet. The following materials are available on the Internet at www.firststateonline.com/home/about:

| | • | | This proxy statement for the 2009 annual meeting. |

| | • | | The Company’s annual report on Form 10-K filed with the Securities and Exchange Commission. |

1

PROPOSAL NO. 1: ELECTION OF DIRECTORS

Each member of the Board of Directors is elected each year so that the terms of the Board members expire at each annual meeting. The terms of the current directors will expire at the 2009 Annual Shareholders Meeting. Our directors are:

| | | | |

Paul J. Cates, Jr. | | David H. Gill | | William C. Strom, Jr. |

Phillip H. Cook | | Edwin C. Kelley, Jr. | | Ronald M. Turpin |

H.K. Elliott, Jr. | | Mary Lynn E. Lambert | | James C. Waggoner |

G.R. Foster III | | Robert O. Linch | | |

Shareholders will elect the nominees as directors at the meeting to serve a one-year term, expiring at the 2010 Annual Meeting of Shareholders. The directors will be elected by a plurality of the votes cast at the meeting. This means that the 11 nominees receiving the highest number of votes will be elected. Abstentions and broker non-votes will not be considered to be either affirmative or negative votes.

The Board of Directors recommends that you elect each of the 11 nominees as directors.

If you submit a proxy but do not specify how you would like it to be voted, Mr. Gill or Mr. Strom will vote your proxy to elect each of the nominees. If any of these nominees is unable or fails to accept nomination or election (which we do not anticipate), Mr. Gill or Mr. Strom will vote instead for a replacement to be recommended by the Board of Directors, unless you specifically instruct otherwise in the proxy.

Set forth below is certain information about the nominees, each of whom has been a director of the Company and is also a director of The First State Bank.

Paul J. Cates, Jr. - President, Planters Warehouse and Lumber.

H. K. Elliott, Jr. - Owner, Elliott Construction Company.

G. R. Foster, III - Dentist.

David H. Gill - Mr. Gill has served as President of the Bank and of the Company since 2000. Prior to that time he served as Executive Vice President of the Bank and Vice President of the Company.

Edwin C. Kelley, Jr. - Owner, Buddy Kelley Properties.

Mary Lynn E. Lambert - Co-owner of a sand and gravel business.

Robert O. Linch - Private Investor.

William C. Strom, Jr. - Mr. Strom has served as Executive Vice President and Chief Credit Officer of the Bank since 2000 and Secretary of the Company since 1997. Mr. Strom served as Vice President of the Bank from 1995 to 2000.

Ronald M. Turpin - Retired builder.

James C. Waggoner - Owner, Stockbridge Veterinary Hospital.

Phillip H. Cook - Certified Public Accountant, Retired Partner KPMG LLP.

2

DESCRIPTION OF BUSINESS

General

Henry County Bancshares, Inc. (the “Company”), headquartered in Stockbridge, Georgia, is a Georgia business corporation which operates as a bank holding company. The Company was incorporated on June 22, 1982 for the purpose of reorganizing The First State Bank (the “Bank”) to operate within a holding company structure. The Bank is a wholly owned subsidiary of the Company.

The Company’s principal activities consist of owning and supervising the Bank, which engages in a full service commercial and consumer banking business, as well as a variety of deposit services provided to its customers. The Bank also conducts mortgage lending operations through its wholly owned subsidiary, First Metro Mortgage Co., which provides the Company’s customers with a wide range of mortgage banking services and products.

The Company, through the Bank, derives substantially all of its income from the furnishing of banking and banking related services.

The Company directs the policies and coordinates the financial resources of the Bank. The Company provides and performs various technical and advisory services for its subsidiaries, coordinates their general policies and activities, and participates in their major decisions.

The First State Bank, Stockbridge, Georgia

The Bank was chartered by the Georgia Department of Banking and Finance in 1964. The Bank operates through its main office at 4806 North Henry Boulevard, Stockbridge, Georgia, as well as six (6) full service branches located at 1810 Hudson Bridge Road in Stockbridge, 295 Fairview Road in Ellenwood, 114 John Frank Ward Boulevard in McDonough, 4979 Bill Gardner Parkway in Locust Grove, 2316 Highway 155 in McDonough and 1908 Highway 81 East in McDonough. The Bank owns two lots for the construction of future branches, one at the intersection of Chambers Road and Jonesboro Road in Henry County, as well as one in Butts County located at 620 W. Third Street in Jackson. The Bank owns an additional parcel of real estate adjacent to its main office location in Stockbridge, Georgia, upon which is situated a small house leased to an unaffiliated insurance company.

The Bank engages in a full service commercial and consumer banking business in its primary market area of Henry County and surrounding counties, as well as a variety of deposit services provided to its customers. The Bank offers on-line banking services to its customers. Checking, savings, money market accounts and other time deposits are the primary sources of the Bank’s funds for loans and investments. The Bank offers a full complement of lending activities, including commercial, consumer installment, real estate, home equity and second mortgage loans, with particular emphasis on short and medium term obligations. Commercial lending activities are directed principally to businesses whose demands for funds fall within the Bank’s lending limits. Consumer lending is oriented primarily to the needs of the Bank’s customers. Real estate loans include short term acquisition and construction loans. The Bank focuses primarily on residential and commercial construction loans, commercial loans secured by machinery and equipment with a developed resale market, working capital loans on a secured short term basis to established businesses in the primary service area, home equity loans of up to 80% of the current market value of the underlying real estate, residential real estate loans of up to 90% of value with adjustable rates or balloon payments due within five (5) years, and loans secured by savings accounts, other time accounts, cash value of life insurance, readily marketable stocks and bonds, or general use machinery and equipment for which a resale market has developed. The Bank makes both secured and unsecured loans to persons and

3

entities which meet criteria established by the Bank and the executive committee. Approximately 95% of the Bank’s loan portfolio is concentrated in loans secured by real estate, most of which is located in the Bank’s primary market area. The Bank, as a matter of state law and bank policy, does not extend credit to any single borrower or group of related borrowers in excess of 25% of statutory capital, or approximately $12,000,000. The lending policies and procedures of the Bank are periodically reviewed and modified by the Board of Directors of the Bank in order to ensure risks are acceptable and to protect the Bank’s financial position in the market. Among other services offered are drive-up windows, night deposits, safe deposits, traveler’s checks, credit cards, cashier’s checks, notary public and other customary bank services. The Bank does not offer trust services.

The Bank maintains correspondent relationships with Silverton Bank, SunTrust Bank, Federal Home Loan Bank, Compass Bank, and the Federal Reserve Bank of Atlanta. These banks provide certain services to the Bank such as investing excess funds, wire transfer of funds, safekeeping of investment securities, loan participation and investment advice.

The banking business in and around Henry County, Georgia is highly competitive which includes certain major banks which have acquired formerly locally owned institutions. These banks have considerably greater resources and lending limits than the Bank. In addition to commercial banks and savings banks, the Bank competes with other financial institutions, such as credit unions, agricultural credit associations, and investment firms which provide services similar to checking accounts and commercial lending. The Bank competes with numerous institutions within the primary service areas, including local branches of Bank of America, SunTrust Bank, Wachovia and BB&T. As of December 31, 2008 the Bank held approximately 26% of the deposit accounts in the Henry County area. Neither the Company nor the Bank generates a material amount of revenue from foreign countries, nor does either have material long-lived assets, customer relationships, mortgages or servicing rights, deferred policy acquisition costs, or deferred tax assets in foreign countries. Thus, the Company has no significant risks attributable to foreign operations.

The Bank relies substantially on personal conduct of its officers, directors and shareholders, as well as a broad product line, competitive services, and an aggressive local advertising campaign and promotional activities to attract business and to acquaint potential customers with the Bank’s personal services. The Bank’s marketing approach emphasizes the advantages of dealing with an independent, locally owned and headquartered commercial bank attuned to the particular needs of small to medium size businesses, professionals and individuals in the community.

A history of the Bank’s financial position for the fiscal years ended December 31, 2006, 2007 and 2008, is as follows:

| | | | | | | | | | |

| | | Years Ended |

| | | 2008 | | | 2007 | | 2006 |

Total Assets | | $ | 656,245,974 | | | $ | 719,528,021 | | $ | 695,051,272 |

Total Deposits | | $ | 591,106,388 | | | $ | 626,781,211 | | $ | 596,673,741 |

Net Income | | $ | (14,165,268 | ) | | $ | 8,858,040 | | $ | 12,556,572 |

First Metro Mortgage Co.

First Metro Mortgage Co. was formed in 1985 to provide mortgage loan origination services in the same primary market area as the Bank. Its offices are located at the Bank’s branch facility on Hudson Bridge Road in Stockbridge, Georgia. First Metro Mortgage Co. initiates long term mortgage loans but immediately sells those loans in the secondary market to investors pursuant to agreements between the investors and the company prior to funding. All loans are sold without recourse, and the Bank does not retain servicing rights or obligations with respect to those loans. First Metro Mortgage Co. realized

4

net loss of $149,874 for 2008, compared to a net loss of $121,124 for 2007, and a net loss of $110,029 in 2006. First Metro Mortgage Co. was merged into and became a subsidiary of The First State Bank, effective July 1, 2003.

Employees

As of December 31, 2008, the Bank had 134 full-time employees and 20 part-time employees. None of the Bank’s employees are represented by a collective bargaining group. The Bank considers its relationships with its employees to be good.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

General

There is no established public trading market for the Company’s common stock. It is not traded on an exchange or in the over-the-counter market. There is no assurance that an active market will develop for the Company’s common stock in the future. Therefore, management of the Company is furnished with only limited information concerning trades of the Company’s common stock. The following table sets forth for each quarter during the most two recent fiscal years the number of shares traded and the high and low per share sales price to the extent known to management.

| | | | | | | | | | | |

YEAR 2008 | | NUMBER OF SHARES TRADED | | | HIGH SALES PRICE (Per Share) | | | LOW SALES PRICE (Per Share) | |

First Quarter | | 102,091 | | | $ | 13.50 | | | $ | 11.00 | |

Second Quarter | | 52,570 | | | $ | 13.50 | | | $ | 11.00 | |

Third Quarter | | 13,121 | | | $ | 13.50 | | | $ | 12.00 | |

Fourth Quarter | | 6,330 | | | $ | 13.50 | | | $ | 10.50 | |

| | | | | | | | | | | |

YEAR 2007 | | NUMBER OF SHARES TRADED | | | HIGH SALES PRICE (Per Share) | | | LOW SALES PRICE (Per Share) | |

First Quarter | | 14,984 | | | $ | 13.50 | | | $ | 13.00 | |

Second Quarter | | 29,724 | | | $ | 14.00 | | | $ | 13.50 | |

Third Quarter | | 20,350 | | | $ | 14.50 | | | $ | 13.50 | |

Fourth Quarter | | 170,683 | | | $ | 13.50 | | | $ | 13.50 | |

5

The Company has historically paid dividends on an annual basis. Any declaration and payment of dividends will be based on the Company’s earnings, economic conditions, and the evaluation by the Board of Directors of other relevant factors. The Company’s ability to pay dividends is dependent on cash dividends paid to it by the Bank. The ability of the Bank to pay dividends to the Company is restricted by applicable regulatory requirements. Currently, the Bank is prohibited from paying dividends to the Company without prior regulatory approval. The following table sets forth cash dividends which have been declared and paid by the Company since January 1, 2006.

| | | |

| | | Cash Dividends Declared

Per Share ($) |

Fiscal 2008 | | | |

First Quarter | | $ | .06 per share |

Second Quarter | | $ | .06 per share |

Third Quarter | | $ | .03 per share |

Fourth Quarter | | $ | .00 per share |

Fiscal 2007 | | | |

First Quarter | | $ | .06 per share |

Second Quarter | | $ | .06 per share |

Third Quarter | | $ | .06 per share |

Fourth Quarter | | $ | .10 per share |

Fiscal 2006 | | | |

First Quarter | | $ | .05 per share |

Second Quarter | | $ | .05 per share |

Third Quarter | | $ | .05 per share |

Fourth Quarter | | $ | .16 per share |

| | (1) | All dividends per share have been adjusted to reflect a two for one stock-split effective December 14, 2006. |

As of March 1, 2009, 14,245,690 shares of common stock were outstanding and held of record by approximately 604 persons (not including the number of persons or entities holding stock in nominee or street name through various brokerage houses).

The holders of the Company’s common stock are entitled to receive dividends when and if declared by the Board of Directors out of funds legally available. Funds for the payment of dividends of the Company are primarily obtained from dividends paid by the Bank.

There are no shares of the Company’s common stock that are subject to outstanding options or warrants to purchase, or that are convertible into, common equity of the Company.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The Company recognizes that an important reason for its success is its ability to attract and retain executive and senior management that can lead the daily operations of the Company in accordance with the policy guidelines of the Board. The management team of the Company must effectively carry out those programs that are required for the Company to meet its short term objectives, as well as reach its long term strategic goals. An effective and comprehensive compensation program is an important component of the overall strategy for management recruitment and retention. The compensation program should be fair, reasonable and competitive in the Company’s market environment.

6

The Company has established a Senior Management Compensation Committee (the “Committee”) which is charged with developing compensation strategies and making compensation policies for executive officers. The Committee makes compensation recommendations to the Board of Directors (the “Board”), which has adopted those recommendations without alteration. The Committee directs the executive compensation policy for the Company and its wholly owned subsidiary, The First State Bank. The Committee is composed solely of independent directors and has available to it such resources as it feels are necessary to ensure that the compensation levels are competitive in the market. The Committee may interview senior and executive management to determine those compensation issues that are most effective in meeting the Company’s objectives. The Committee consults with legal counsel as necessary and other such outside advisors as it deems proper to ensure availability of the appropriate information to assist in its deliberations. The Committee takes into consideration the experience level of the executives and their overall importance to the strategic initiatives the Company may undertake. The Committee typically makes two separate recommendations to the Board for executive compensation adjustments. The first recommendation, in the early part of the year, is to grant any adjustment in the base salary of the senior executives. The second major recommendation to the Board is a recommendation for annual bonus compensation based on performance for the year.

The elements of the compensation program are designed to attract and retain management best suited to the Company. The program is also crafted to provide a mechanism to align the interests of the management with those of the Company. A third goal of the compensation program is to reward executives for reaching or exceeding stated goals.

The Company includes a number of components in its compensation program. These components include cash, non-cash benefits, retirement programs, insurance protection and perquisites. Cash is used for base salary and for regular annual bonus purposes. Cash bonuses are typically paid based on the performance of the Company as a whole and the evaluated performance of each individual manager. Non-cash benefits include vacation, sick and personal day allowances. Retirement programs include profit sharing contributions, matching contributions to a 401(k) program and deferred compensation arrangements. Insurance protection includes health insurance for the executives (with the availability of dependent coverage at the executive’s expense), life insurance, both short and long term disability insurance and other health related group insurance coverage available at the executive’s expense. Perquisites include the use of a company vehicle for business and personal travel, routine expense reimbursements for business related activities, educational opportunities and social memberships.

The Committee meets as needed to review the Company’s objectives for the year and the performance of executive and senior management in meeting those objectives. The Committee also reviews industry comparisons of compensation. In 2008, the Committee used the resources of the Georgia Banker’s Association Annual Salary Survey, a compilation of responding Georgia financial institutions stratified by size and geographical location. The Committee also consulted the Mauldin & Jenkins Bank Executive Compensation Survey, a regional survey of southeastern banks also stratified by size and geographical location. These outside sources provide the Committee with a framework to evaluate the trend in bank executive compensation as well as to provide the Committee with defined local standards to determine competitive compensation components. The Committee did not use these surveys as a template for compensation decisions for salary ranges or to establish salaries, but rather as a resource to validate or redefine the assumptions of the Committee. From these resources the Committee determined the Company’s executive compensation to be consistent with comparable financial institutions located in its geographical location.

The Committee has wide discretion in its evaluation of executive management’s performance and the most effective manner in which to reward performance. There were no specific targets provided to management with defined benefits upon meeting those targets. However, the Company did adopt overall goals and targets independent from the Committee. The Committee did establish general

7

criteria upon which to evaluate and reward performance. The Committee evaluates performance of the Company for the year relative to peer groupings, such as may be available from the FDIC in the form of call reports or Uniform Bank Performance Reports, with special emphasis on core deposit growth, loan growth, expense controls, audit controls, earnings and stock pricing, all of which are metrics which characteristically can enhance shareholder value. Deposit growth, earnings and stock value in a difficult market for peer group financial stocks were the greatest contributing components in determining year end bonus awards. The Committee reviewed the Company performance in each of the areas as outlined above. The Committee weighted the performance of the Company in each area defined as a Committee goal to arrive at a pool of bonus funds to be distributed to senior and executive managers, adjusting the pool for performance above or below the Committee’s desired performance level. Based on an evaluation of the contribution of each of the executives in meeting predetermined Committee goals and their individual contributions in attaining those goals, the Committee recommended to the Board specific individual bonus payments and which were adopted by the Board as disclosed in the Summary Compensation Table below.

In 2007 the Committee recognized that the availability of stock ownership in the Company was an important component of aligning the financial interests of the executives with those of the shareholders. Additionally, the Committee evaluated the competitive market and found that a significant percentage of financial institutions have included stock ownership as an integral part of compensation programs. Because of the desire to align the financial interests of the executives with those of the shareholders as well as to maintain a compensation strategy that would both reward the executives for performance and be calculated to provide an incentive for retention, the Committee recommended that a limited amount of the Company’s treasury stock be made available for purchase by the executives. The stock purchases were offered to the executives at the prevailing fair market price. No such purchases were offered in 2008.

In 2008, the Committee determined that the financial performance of the Company was such that the cessation of certain long-standing compensation practices was warranted. To that end, the Company did not make any discretionary profit sharing contributions to the account of any employee. Year end bonuses, which had traditionally been between 7.00% and 8.00% of salaries, were reduced by at least 50%. No additional bonuses were paid to senior executives as had been prior years practice.

The Summary Compensation Table below identifies the compensation levels of certain executive officers of the Company.

Compensation Committee Report

The Compensation Committee of the Company has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussions, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement.

The Compensation Committee

Mary Lynn E. Lambert, Chairperson

G.R. Foster, III

H. K. Elliott, Jr.

Edwin C. Kelley, Jr.

Robert O. Linch

Phillip H. Cook

Compensation Committee Interlocks and Insider Participation

No interlocks or insider participation exists within the Compensation Committee. The Compensation Committee is comprised solely of independent directors.

8

2008 SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | |

Name and Principal

Position | | Year | | Salary ($) | | Bonus

($) | | Stock

Awards

($) | | Option

Awards

($) | | Non-Equity

Incentive Plan

Compensation

($) | | Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

($) | | All Other

Compensation

($) | | | Total

($) |

David H. Gill CEO | | 2008 | | 285,050 | | 11,402 | | | | | | | | | | 65,714 | | | $ | 362,166 |

| | 2007 | | 274,050 | | 141,924 | | 0 | | 0 | | 0 | | 0 | | 85,580 | (1) | | $ | 501,554 |

| | 2006 | | 252,200 | | 150,176 | | 0 | | 0 | | 0 | | 0 | | 77,677 | (1) | | $ | 480,053 |

| | | | | | | | | |

William C. Strom, Jr. | | 2008 | | 208,124 | | 8,325 | | | | | | | | | | 37,866 | | | $ | 254,315 |

Executive Vice President | | 2007 | | 200,124 | | 88,010 | | 0 | | 0 | | 0 | | 0 | | 51,127 | (2) | | $ | 339,261 |

| | 2006 | | 185,300 | | 92,824 | | 0 | | 0 | | 0 | | 0 | | 48,553 | (2) | | $ | 326,677 |

| | | | | | | | | |

Thomas L. Redding | | 2008 | | 126,500 | | 4,744 | | | | | | | | | | 2,600 | | | $ | 133,844 |

Sr. Vice President & CFO | | 2007 | | 121,500 | | 36,133 | | 0 | | 0 | | 0 | | 0 | | 12,203 | (3) | | $ | 169,836 |

| | 2006 | | 112,500 | | 38,437 | | 0 | | 0 | | 0 | | 0 | | 13,345 | (3) | | $ | 164,282 |

| | | | | | | | | |

M. Debra Walker | | 2008 | | 113,580 | | 4,401 | | | | | | | | | | 1,610 | | | $ | 119,591 |

Sr. Vice President & COO | | 2007 | | 109,080 | | 44,454 | | 0 | | 0 | | 0 | | 0 | | 11,247 | (4) | | $ | 164,781 |

| | 2006 | | 101,000 | | 45,327 | | 0 | | 0 | | 0 | | 0 | | 13,083 | (4) | | $ | 159,410 |

| (1) | Includes director’s fees of $33,000 in 2008, $33,000 in 2007 and $32,250 in 2006. Also includes liability incurred by the Company for the Employee’s Salary Continuation Plan in the amount of $28,411 in 2008, $26,455 in 2007 and $24,925 in 2006. 401(k) match for 2008 was $4,600, for 2007 was $5,571 and for 2006 was $5,146. Profit Sharing Contribution for 2008 was $0.00, for 2007 was $20,554 and for 2006 was $15,356. |

| (2) | Includes director’s fees of $15,000 in 2008, $15,000 in 2007 and $14,250 in 2006. Also includes liability incurred by the Company for the Employee’s Salary Continuation Plan in the amount of $18,742 in 2008, $17,636 in 2007 and $16,617 in 2006. 401(k) match for 2008 was $4,124, for 2007 was $4,082 and for 2006 was $3,789. Profit Sharing Contribution for 2008 was $0.00, for 2007 was $15,009 and in 2006 was $15,356. |

| (3) | Includes 401(k) match of $2,600 for 2008, $3,110 for 2007 and $2,972 for 2006 and Profit Sharing Contribution of $0.00 for 2008, $9,113 and $10,373 in 2007 and 2006, respectively. |

| (4) | Includes 401(k) match of $1,610 for 2008, $3,066 for 2007 and $2,914 for 2006 and Profit Sharing Contribution of $0.00 for 2008, $8,181 and $10,169 in 2007 and 2006, respectively. |

Not included in Other Compensation:

| | | | | | | | | | | | |

| | | Year | | Medical | | | Dental | | Life Ins. Prem. |

David Gill | | 2008 | | $ | 5,047.92 | | | $ | 317.40 | | $ | 1,145.00 |

| | 2007 | | $ | 4,762.00 | | | $ | 302.28 | | $ | 1,347.00 |

| | 2006 | | $ | 3,807.36 | | | $ | 302.28 | | $ | 3,007.00 |

| | | | |

William Strom | | 2008 | | $ | 6,035.28 | | | $ | 317.40 | | $ | 1,145.00 |

| | 2007 | | $ | 4,762.00 | | | $ | 302.28 | | $ | 1,347.00 |

| | 2006 | | $ | 3,807.36 | | | $ | 302.28 | | $ | 3,274.00 |

| | | | |

Tom Redding | | 2008 | | $ | 6,667.00 | | | $ | 317.40 | | $ | 1,043.00 |

| | 2007 | | $ | 5,585.00 | | | $ | 302.28 | | $ | 1,181.00 |

| | 2006 | | $ | 5,074.00 | | | $ | 302.28 | | $ | 1,728.60 |

| | | | |

M. Debra Walker | | 2008 | | $ | 1,680.00 | (annuity) | | | n/a | | $ | 946.80 |

| | 2007 | | $ | 1,680.00 | (annuity) | | | n/a | | $ | 1,068.80 |

| | 2006 | | $ | 1,680.00 | (annuity) | | | n/a | | $ | 1,836.12 |

9

2008 NONQUALIFIED DEFERRED COMPENSATION TABLE

| | | | | | | | | | | | | |

Name | | Executive

Contributions

in Last

Fiscal Year

($) | | Registrant

Contributions

in Last

Fiscal Year

($) | | Aggregate Earnings

in Last

Fiscal Year

($) | | Aggregate

Withdrawals /

Distributions

($) | | Aggregate

Balance at

Last Fiscal

Year-End

($) |

David H. Gill | | $ | 15,000.00 | | 0 | | $ | 13,113.52 | | 0 | | $ | 231,893.46 |

William C. Strom, Jr. | | $ | 10,000.00 | | 0 | | $ | 8,742.38 | | 0 | | $ | 154,596.04 |

2008 DIRECTOR COMPENSATION TABLE

| | | | | | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash

($) | | Stock Awards

($) | | Option Awards

($) | | Non-Equity

Incentive Plan

Compensation

($) | | Change

in Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

($) | | All Other

Compensation

($) | | Total

($) |

Robert O. Linch | | $ | 36,375 | | 0 | | 0 | | 0 | | 0 | | 0 | | $ | 36,375 |

H. K. Elliott, Jr. | | $ | 33,000 | | 0 | | 0 | | 0 | | 0 | | 0 | | $ | 33,000 |

Edwin C. Kelley, Jr. | | $ | 34,250 | | 0 | | 0 | | 0 | | 0 | | 0 | | $ | 34,250 |

James C. Waggoner | | $ | 16,000 | | 0 | | 0 | | 0 | | 0 | | 0 | | $ | 16,000 |

G. R. Foster, III | | $ | 38,875 | | 0 | | 0 | | 0 | | 0 | | 0 | | $ | 38,875 |

Ronald M. Turpin | | $ | 35,000 | | 0 | | 0 | | 0 | | 0 | | 0 | | $ | 35,000 |

Mary Lynn Lambert | | $ | 17,800 | | 0 | | 0 | | 0 | | 0 | | 0 | | $ | 17,800 |

Paul J. Cates | | $ | 17,250 | | 0 | | 0 | | 0 | | 0 | | 0 | | $ | 17,250 |

Phillip H. Cook | | $ | 16,000 | | 0 | | 0 | | 0 | | 0 | | 0 | | $ | 16,000 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATION

Please See Appendix A.

HENRY COUNTY BANCSHARES, INC. AND SUBSIDIARIES

SELECTED FINANCIAL DATA, CONSOLIDATED FINANCIAL

STATEMENTS AND SUPPLEMENTAL DATA

Please see Appendix B.

10

Directors and Executive Officers

The Board of Directors of the Company is currently composed of the following eleven persons, each of whom serves for a term of one (1) year. Executive officers are elected annually by the Board of Directors and serve at the Board’s discretion.

The following table sets forth information with respect to the current directors, nominees and executive officers of the Company:

| | | | | | |

| | | | |

| NAME | | AGE | | POSITION | | YEAR FIRST ELECTED

OR APPOINTED (1) |

Paul J. Cates, Jr. | | 67 | | Director | | 2002 |

H. K. Elliott, Jr. | | 67 | | Director | | 1977 |

G. R. Foster, III | | 62 | | Director, Chairman of the Board | | 1999 |

David H. Gill | | 54 | | President, Director | | 1997 |

Edwin C. Kelley, Jr. | | 58 | | Director | | 1994 |

Mary Lynn E. Lambert | | 51 | | Director | | 2001 |

Robert O. Linch | | 79 | | Director | | 1975 |

William C. Strom, Jr. | | 59 | | Director, Executive Vice President of the Bank and Secretary of the Company | | 2005 |

Ronald M. Turpin | | 65 | | Director | | 1999 |

James C. Waggoner | | 64 | | Director | | 1994 |

Thomas L. Redding | | 50 | | Chief Financial Officer | | — |

Phillip H. Cook | | 54 | | Director | | 2007 |

| (1) | Refers to the year the individual first became a director of the Bank or Company. All directors of the Bank in June 1982 became directors of the Company when it was incorporated in June 1982. |

11

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

General

The following table sets forth, as of December 31, 2008, persons or groups who are known by the Company to own more than five percent (5%) of the Company’s common stock and, as of December 31, 2008, common stock ownership by directors and executive officers of the Company. Other than as noted below, management knows of no other person or group that owns more than five percent (5%) of the outstanding shares of common stock of the Company.

| | | | |

NAME AND ADDRESS OF BENEFICIAL OWNER | | AMOUNT AND NATURE OF BENEFICIAL OWNERSHIP(1) | | PERCENT OF SHARES OF COMMON STOCK OUTSTANDING |

Paul J. Cates, Jr. 863 McGarity Road McDonough, GA 30252 | | 74,089 Shares | | (2) |

H. K. Elliott, Jr. 2865 Camp Branch Road Buford, Georgia 30519 | | 207,293 Shares | | 1.46% |

G. R. Foster, III 950 Turner Church Road McDonough, GA 30252 | | 26,750 Shares | | (2) |

David H. Gill 109 Magnolia Place Stockbridge, GA 30281 | | 135,502 Shares | | (2) |

Edwin C. Kelley, Jr. 1540 Dogwood Drive Greensboro, GA 30642 | | 78,920 Shares | | (2) |

Mary Lynn E. Lambert 1409 Highway 42 S McDonough, GA 30252 | | 112,382 Shares | | (2) |

Robert O. Linch 230 Darwish Drive McDonough, GA 30252 | | 900,224 Shares | | 6.31% |

William C. Strom, Jr. 156 Cotton Creek Drive McDonough, GA 30252 | | 26,916 Shares | | (2) |

Ronald M. Turpin 812 Elliott Road McDonough, GA 30252 | | 65,864 Shares | | (2) |

James C. Waggoner 268 Butlers Bridge Road McDonough, GA 30252 | | 57,020 Shares | | (2) |

Thomas L. Redding 303 Landing Point Stockbridge, GA 30281 | | 6,500 Shares | | (2) |

Phillip H. Cook 5000 Lakeridge Close McDonough, GA 30253 | | 10,209 Shares | | (2) |

| All directors, nominees and officers as a group (12 persons) | | 1,701,669 Shares | | 11.94% |

12

| (1) | Includes shares of common stock held directly as well as by spouses or minor children, in trust and other indirect ownership, over which shares the individuals effectively exercise sole voting and investment power. |

| (2) | Less than 1% of the common stock outstanding. |

CORPORATE GOVERNANCE

Meetings and Committees of the Board of Directors

During the year ended December 31, 2008, the Board of Directors of the Company held eight meetings and the Board of Directors of The First State Bank held twelve meetings. All of the directors of the Company and The First State Bank attended at least 75% of the aggregate of such board meetings and the meetings of each committee on which they served. All of the Directors, with the exceptions of David H. Gill and William C. Strom, Jr., are independent pursuant to the NASDAQ Stock Market (“NASDAQ”) rules and listing standards regarding director independence.

Audit Committee

Henry County Bancshares, Inc. has an Audit Committee of the Board of Directors (the “Audit Committee”), which is comprised of five independent members, as independence for audit committee members is defined by the rules of NASDAQ. The Audit Committee recommends to the Board of Directors the independent accountants to be selected as the Company’s auditors and reviews the audit plan, financial statements and audit results.

The names of each member of Henry County Bancshares, Inc.’s Audit Committee are: Directors Cates, Cook, Turpin, Lambert, and Waggoner. Mr. Cook serves as Chairman of the Audit Committee. The Board of Directors has adopted a written charter for the Audit Committee, a copy of which was provided as Appendix C to last year’s proxy statement. The charter was not amended in 2008. The Company does have an Audit Committee financial expert serving on its Audit Committee. Mr. Phillip H. Cook, a certified public accountant and retired partner with the accounting firm KPMG LLP, has been determined by the Board to meet the criteria for a financial expert as provided in the SEC’s regulations pursuant to Section 407 of the Sarbanes-Oxley Act of 2002. Mr. Cook is independent as defined by the rules of NASDAQ.

The Audit Committee met four times in 2008. The Audit Committee has the responsibility of reviewing the Company’s financial statements, evaluating internal accounting controls, reviewing reports of regulatory authorities, and determining that all audits and examinations required by law are performed. The committee recommends to the Board the appointment of the independent auditors for the next fiscal year, reviews and approves the auditor’s audit plans, and reviews with the independent auditors the results of the audit and management’s responses. The Audit Committee is responsible for overseeing the entire audit function and appraising the effectiveness of internal and external audit efforts. The Audit Committee reports its findings to the Board of Directors.

Audit Committee Report

During the fiscal year 2008, Henry County Bancshares, Inc. retained its principal auditor, Mauldin & Jenkins, LLC, to provide audit and non-audit services. The Audit Committee has considered whether provisions of non-audit services by its principal auditor is compatible with maintaining auditor independence.

13

The Audit Committee has reviewed and discussed the audited financial statements as of and for the year ended December 31, 2008 with management. The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards (“SAS”) No. 61 (Codifications of Statements on Auditing Standards, AU ‘ 380),Communications with Audit Committees, as amended and adopted by the Public Company Accounting Oversight Board in Rule 3200T. The Audit Committee has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as adopted by the Public Company Accounting Oversight Board in Rule 3600T, and has discussed with the independent accountants their independence. The Audit Committee has concluded that the independent auditors are independent from the Company and its management. Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements referred to above be included in Henry County Bancshares, Inc.’s Annual Report on Form 10-K for the year 2008 for filing with the Securities and Exchange Commission.

| | |

Submitted by the members of the Audit Committee: | | Paul J. Cates, Jr. |

| | Phillip H. Cook |

| | Ronald M. Turpin |

| | Mary Lynn E. Lambert |

| | James C. Waggoner |

Nominating Committee

Each year, the Chairman of the Board of Directors appoints a Nominating Committee to serve a one-year term. In 2008, the Nominating Committee was composed solely of independent Directors pursuant to NASDAQ rules. The members of the Nominating Committee are: Directors Elliott, Turpin, Foster, Kelley and Linch. Director candidates are nominated by the Nominating Committee. The Committee does not currently have a formal written policy or process for identifying and evaluating director nominees. However, all director candidates must satisfy the requirements set forth by the Georgia Department of Banking and Finance and meet the following minimum criteria for a position on the Company’s Board of Directors: independence; highest personal and professional ethics and integrity; willing to devote sufficient time to fulfilling duties as a director; and impact on the diversity of the Board’s overall composition in terms of age, skills, experience in business, government and education. The Committee’s policy for consideration of a nominee recommended by shareholders is as follows: Shareholders who would like for an individual to be considered by the Nominating Committee should submit the proposed name to the committee for its consideration no later than October 1 of the calendar year preceding the next shareholder’s meeting. In order for the committee to consider the prospective nominee, a biographical summary and qualifications and such other information as must be disclosed to meet SEC reporting requirements must be provided. The Nominating Committee would then evaluate the proposed nominee using the criteria outlined above and would consider such a person in comparison to all other candidates. The Nominating Committee is not obligated to nominate any such individual for election. This information may be sent to The First State Bank, P. O. Box 928, 4806 N. Henry Boulevard, Stockbridge, Georgia. The nomination should be sent to the attention of the Chairman of the Board. No such shareholder nominations have been received by the Company for this Annual Meeting.

The Nominating Committee has a written charter, a copy of which was provided as Appendix D in last year’s proxy statement. The charter is not available on the Company’s website. The charter was not amended in 2008.

14

Compensation Committee

Executive compensation is recommended to the full board by the Company’s Senior Management Compensation Committee (the “Compensation Committee”), which in 2008 consisted of Mary Lynn E. Lambert, Chairperson, G. R. Foster, III, H. K. Elliott, Jr., Edwin C. Kelley, Jr., Phillip H. Cook and Robert O. Linch. The Compensation Committee met several times in 2008. The Committee is compromised solely of non-employee Directors, all of whom the Board has determined are independent pursuant to NASDAQ rules.

The general philosophy of the Compensation Committee is to provide executive compensation designed to enhance shareholder value, including annual compensation, consisting of salary and bonus awards, and long-term compensation, consisting of stock options and other equity based compensation. To this end, the Compensation Committee designs compensation plans and incentives to link the financial interests of the Company’s executive officers to the interest of its shareholders, to encourage support of the Company’s long-term goals, to align the executive compensation to the Company’s performance, to attract and retain talented leadership and to encourage significant ownership of the Company’s common stock by executive officers.

The Compensation Committee meets in the fall of each fiscal year to establish performance goals for the Company, including profit growth, loan and deposit growth, and loan-to-deposit ratio growth. The performance of the Bank as measured by those goals in the ensuing year is a factor given considerable weight by the Compensation Committee in recommending compensation of executive officers for the following fiscal year, including salary and bonuses.

No executive officers nor consultants played any role in determining or recommending the amount or form of executive or director compensation.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Interests of Management and Others in Certain Transactions

The Bank has followed a policy of granting various types of loans to executive officers and directors and to entities with which they are affiliated. The loans have been made in the ordinary course of business and on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with the Bank’s other customers, and do not involve more than the normal risk of collectibility, or present other unfavorable features. As of December 31, 2008 directors and executive officers of the Company and entities with which they are affiliated were indebted to the Bank in the aggregate amount of $125,396. Also, Director Edwin C. Kelley, Jr. acted as the Company’s real estate broker in a transaction that took place in August of 2007. The Company’s wholly owned subsidiary, The First State Bank purchased two lots in Jackson, Georgia for future branch expansion. The total dollar amount of the transaction was $465,000. Mr. Kelley was paid a commission by the seller in the amount of $8,500. Otherwise, neither the Company nor the Bank has during the last two (2) years entered into, nor is there proposed, any transaction in which any director, executive officer, director nominee, or principal shareholder, or any member of their immediate family, had a direct or indirect material interest.

15

Legal Proceedings

During the previous five years, no director or executive officer was the subject of a legal proceeding (as defined below) that is material to an evaluation of the ability or integrity of any director or executive officer. A “legal proceeding” includes: (a) any bankruptcy petition filed by or against any business of which such person was a general partner or executive prior to that time; (b) any conviction in a criminal proceeding or subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (c) any order, judgment, or decree of any court of competent jurisdiction, or any Federal or State authority permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of commodities business, securities or banking activities; and (d) any finding by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodity Futures Trading Commission of a violation of a federal or state securities or commodities law (such finding having not been reversed, suspended or vacated).

Compliance with Section 16(a) of the Securities Exchange Act of 1934

Based solely upon a review of Forms 3, 4 and 5, and amendments thereto or written representations of certain reporting persons furnished to the Company under Rule 16a-3(d) during 2008, no person who, at any time during 2008, was a director, officer or beneficial owner of more than 10% of any class of equity securities of the Company failed to file on a timely basis any reports required by Section 16(a) during the 2008 fiscal year or previously.

Independent Public Accountant

The Company has selected the firm of Mauldin & Jenkins, LLC to serve as the independent auditors to the Company for the year ending December 31, 2008. The Company does not expect a representative from this firm to attend the annual meeting.

During fiscal years 2007 and 2008, the Company retained its principal auditor, Mauldin & Jenkins, LLC, to provide services in the following categories and amounts:

| | | | | | |

| | | 2007 | | 2008 |

Audit Fees (1) | | $ | 153,000 | | $ | 160,860 |

Audit Related Fees (2) | | | 13,500 | | | 18,054 |

Tax Fees (3) | | | 8,782 | | | 12,400 |

All Other Fees | | | - | | | - |

| | | | | | |

Total | | $ | 175,282 | | $ | 191,314 |

| (1) | Audit fees consist of fees for the audit of the Company’s financial statements and review of financial statements included in the Company’s quarterly report. |

| (2) | Audit related fees consist of fees for the audit of the Company’s employee benefit plan. |

| (3) | Tax fees consist of fees for the preparation of federal and state income tax returns. |

All non-audit services are pre-approved by the Audit Committee. None of the tax or expenses paid in connection with the principal accountant’s engagement for audited financial statements were attributable to work performed by persons other than the principal accountant’s employees.

Changes in and Disagreement with Accountants on Accounting and Financial Disclosure

The Company’s principal accountant has not changed during the Company’s two (2) most recent fiscal years or any subsequent interim period. There has been no Form 8-K filed within 24 months prior

16

to the date of the most recent financial statements reporting a change of accounting or reporting disagreements on any matter of accounting principle, practice, financial statement disclosure or auditing scope or procedure.

Shareholder Communications to the Board of Directors

Our Board of Directors has a long standing policy of providing a process for shareholders to send communications directly to the Board of Directors. Shareholders are informed if they want to send a communication to the Board or a particular director, they may either send it to David Gill’s attention or to the attention of the Chairman of the Board, and a mailbox is provided for the Chairman to receive sealed communications.

The Company does not have a formal policy on director attendance at the Company’s annual meeting; however all directors are encouraged to attend and the full board was in attendance at last year’s annual meeting.

Shareholder Proposals for the 2010 Annual Meeting of Shareholders

In order for shareholder proposals to be eligible for consideration by the Company for inclusion in the Company’s proxy statement and form of proxy relating to the annual meeting for the fiscal year 2009 (the 2010 Annual Meeting), they must deliver a written copy of their proposal to the principal executive offices of the Company no later than December 17, 2009. To ensure prompt receipt by the Company, the proposal should be sent certified mail, return receipt requested. Proposals must comply with the Company’s bylaws relating to shareholder proposals in order to be included in the Company’s proxy materials. Any shareholder who intends to propose any other matter to be acted upon at the 2009 Annual Meeting of Shareholders (but not include such proposal in the Company’s Proxy Statement) must inform the Company no later than March 7, 2010. If notice is not provided by that date, the persons named in the Company’s proxy for the 2010 Annual Meeting will be allowed to exercise their discretionary authority to vote upon any such proposal without the matter having been discussed in the Proxy Statement for the 2010 Annual Meeting.

UPON WRITTEN REQUEST, A COPY OF OUR MOST RECENT ANNUAL REPORT ON FORM 10-K, INCLUDING FINANCIAL STATEMENTS AND THE FINANCIAL SCHEDULES AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION SHALL BE FURNISHED TO SHAREHOLDERS WITHOUT CHARGE. PLEASE DIRECT YOUR WRITTEN REQUEST TO: DAVID H. GILL, HENRY COUNTY BANCSHARES, INC., P. O. BOX 928, STOCKBRIDGE, GEORGIA 30281.

March 24, 2009

17

TABLE OF APPENDICES

Appendix A Management’s Discussion and Analysis of Financial Condition and Results of Operation

Appendix B Selected Financial Data, Consolidated Financial Statements and Supplemental Data

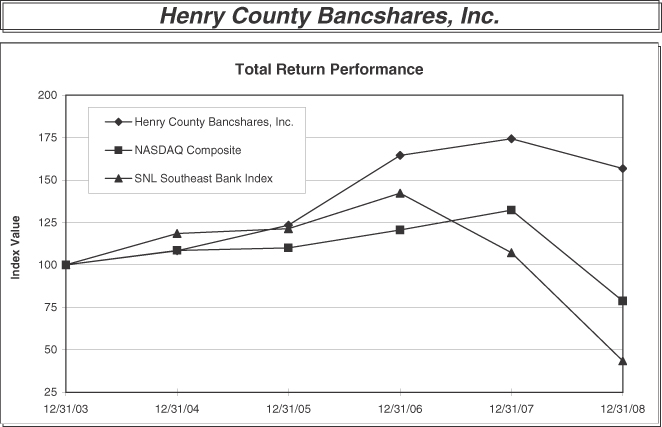

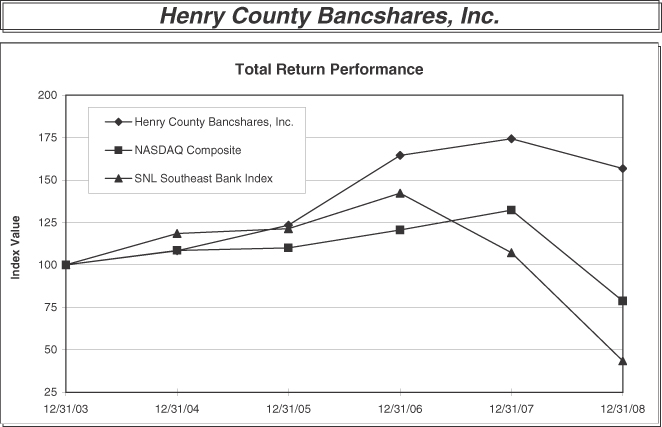

Appendix C Performance Graph

18

APPENDIX A

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following is a discussion of our financial condition and the financial condition of our bank subsidiary, The First State Bank and our mortgage subsidiary, First Metro Mortgage Co. at December 31, 2008 and 2007 and the results of operations for the three years in the period ended December 31, 2008. The purpose of this discussion is to focus on information about our financial condition and results of operations that are not otherwise apparent from our audited financial statements. Reference should be made to those statements and the selected financial data presented elsewhere in this report for an understanding of the following discussion and analysis.

A-1

A Warning About Forward-Looking Statements

We may from time to time make written or oral forward-looking statements, including statements contained in our filings with the Securities and Exchange Commission and reports to stockholders. Statements made by us, other than those concerning historical information, should be considered forward-looking and subject to various risks and uncertainties. Forward-looking statements are made based upon management’s belief as well as assumptions made by, and information currently available to, management pursuant to “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Our actual results may differ materially from the results anticipated in forward-looking statements due to a variety of factors, including governmental monetary and fiscal policies, deposit levels, loan demand, loan collateral values, securities portfolio values, interest rate risk management, the effects of competition in the banking business from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market funds and other financial institutions operating in our market area and elsewhere, including institutions operating through the Internet, changes in governmental regulation relating to the banking industry, including regulations relating to branching and acquisitions, failure of assumptions underlying the establishment of reserves for loan losses, including the value of collateral underlying delinquent loans and other factors. We caution that these factors are not exclusive. We do not undertake to update any forward-looking statement that may be made from time to time by us, or on our behalf.

Critical Accounting Policies

Our accounting and reporting policies are in accordance with accounting principles generally accepted in the United States of America as defined by the Public Company Accounting Oversight Board and conform to general practices within the banking industry. Our significant accounting policies are described in the notes to the consolidated financial statements. Certain accounting policies require management to make significant estimates and assumptions, which have a material impact on the carrying value of certain assets and liabilities, and we consider these to be critical accounting policies. The estimates and assumptions used are based on historical experience and other factors that management believes to be reasonable under the circumstances. Actual results could differ significantly from these estimates and assumptions, which could have a material impact on the carrying value of assets and liabilities at the balance sheet dates and results of operations for the reporting periods.

We believe the following are critical accounting policies in the preparation of our financial statements that require the most significant estimates and assumptions that are particularly susceptible to a significant change.

Allowance for loan losses

The allowance for loan losses represents management’s estimate of probable credit losses inherent in the loan portfolio. Estimating the amount of the allowance for loan losses requires significant judgment and the use of estimates related to the fair market value or the estimated net realizable value of underlying collateral on impaired loans, estimated losses on non-impaired loans based on historical loss experience, management’s evaluation of the current loan portfolio, and consideration of current economic trends and conditions. Loan losses are charged against the allowance, while recoveries of amounts previously charged off are credited to the allowance. A provision for loan losses is charged to operations based on management’s periodic evaluation of the factors previously mentioned, as well as other pertinent factors.

The allowance for loan losses consists of specific and general components. The components of the allowance for loan losses represent an estimate pursuant to either Statement of Financial Accounting Standards (“SFAS”) No. 5,Accounting for Contingencies, or SFAS 114,Accounting by Creditors for

A-2

Impairment of a Loan.The allocated component of the allowance for loan losses reflects expected losses resulting from analyses developed through specific credit allocations for individual problem or potential problem loans and general allocations based on historical loss experience for each loan category. The specific credit allocations are based on regular analyses of loan relationships typically in excess of $500,000 but may include a review of other loan relationships on which full collection may not be reasonably assumed. These analyses involve judgment in estimating the amount of loss associated with the specific loans, including estimating the underlying collateral values. The historical loss experience used in determining general allocations is determined using the average of actual losses incurred over the most recent five years for each type of loan. The historical loss experience is adjusted for known changes in economic conditions as well as other qualitative factors. The resulting loss allocation factors are applied to the balance of each type of loan after removing the balance of impaired loans from each category.

Although management believes its processes for determining the allowance adequately consider all the potential factors that could potentially result in credit losses, the process includes subjective elements and may be susceptible to significant change. In addition there could be potential problem loans in the portfolio that have not been identified as problems because they continue to perform as set forth in the loan agreements. Continued weaknesses in our market area could cause currently performing credits to deteriorate. To the extent actual outcomes differ from management estimates, additional provision for loan losses could be required that could adversely affect earnings or financial position in future periods.

Additional information on the Company’s loan portfolio and allowance for loan losses can be found in the sections of Management’s Discussion and Analysis titled “Risk Elements” and “Allowance for Loan Losses” and in Note 1 to the Consolidated Financial Statements.

Other Real Estate Owned

Other real estate, consisting of properties obtained through foreclosure or in satisfaction of loans, is adjusted to fair value upon transfer of the real estate held as collateral to other real estate owned. Subsequently, other real estate owned is carried at the lower of carrying value or fair value, determined on the basis of current appraisals, comparable sales, and other estimates of value obtained principally from independent sources, adjusted for estimated selling costs. At the time of foreclosure, any excess of the loan balance over fair value of the real estate held as collateral is recorded as a charge to the allowance for loan losses. Gains or losses on sale and any subsequent adjustments to the value are recorded as a component of non-interest expense.

Overview

In 2008, Henry County experienced a continued deterioration in the local economy, largely centered on depressed housing sales and real estate values as well as significant local job losses due to reductions in construction and land development activity. The recession currently being experienced nationally is exacerbated in the Company’s market area due to a significant dependence on the housing industry in the south Metropolitan Atlanta area to drive the local economy. The Company’s performance reflects the impact of slowed economic activity, depressed real estate values, reduced sales and a challenging banking environment. An exacerbating factor in attempting to resolve problem assets is the uncertainty of the local real estate market. Housing sales have fallen to approximately 10% of prior year levels. Markets are distorted by liquidation efforts resulting in great uncertainty in property values. The significant increase in distressed properties for sale coupled with a lack of liquidity in the real estate market has depressed property values significantly. The reliability of appraisals is subject to uncertainties, as there are few true arms-length sales for comparison purposes.

A-3

This set of circumstances creates two separate but equally significant situations for the Company. The first is that borrowers who depend on sale of real property for retirement of their loans are unable to generate necessary cash flow for their on-going needs. As those borrowers deplete cash reserves and exhaust other resources, it becomes increasingly difficult to meet debt service obligations. This problem results in a rising level of troubled assets. The second impact is that the Company has an increasingly difficult time in evaluating the value of collateral that supports troubled loans and serves as the bank’s last resort recovery source. Current accounting standards require that the Bank identify loans that are considered impaired and evaluate the potential for loss should the loan be satisfied by liquidation of the collateral. This evaluation forms the basis for one of the Company’s most critical accounting decisions, yet it is the most difficult to reliably quantify. The actual market value of real property, which is the underlying collateral in almost all of the Bank’s troubled assets, is exceedingly difficult to determine in the face of an illiquid market. While the Company uses appraisals and evaluations of the real property by knowledgeable individuals, including input from several members of the board of directors, the value of real estate in this market is unstable and is sometimes a moving target.

The Company’s performance in 2008 was characterized by increasing levels of problem loans, necessitating substantial additions to the allowance for loan losses. Coupled with an extremely low interest rate environment and compressed margins, the Company saw earnings decline significantly. The Company operated at a loss of $14,346,711 compared to earnings in 2007 of $8,708,726. The largest component of the change in earnings was the provision for loan losses, which totaled $24,285,750 in 2008 compared to $2,959,254 in 2007. The Company elected to charge off those portions of loans that were deemed to be ultimately uncollectible though it continues to actively attempt to collect such loans. In addition, the Company wrote down the value of owned real estate $2,910,836, reflecting the deteriorating nature of real estate values.

Nationally, the country remains in recession, with the banking segment one of the hardest hit sectors of the economy. The Company is not immune to the same issues facing many of the countries banks. The current actions of the federal government to alleviate the recession have an as yet unknown impact. Most economists do not predict any possibility of recovery in the first half of 2009. The success of the Company in resolving its troubled assets will be largely tied to the stabilization of real property values and the return of our market area to a more viable economy.

Financial Condition at December 31, 2008 and 2007

The following is a summary of our balance sheets for the periods indicated:

| | | | | | |

| | | December 31, |

| | | 2008 | | 2007 |

| | | (Dollars in Thousands) |

Cash and due from banks | | $ | 14,039 | | $ | 16,826 |

Interest-bearing deposits in banks | | | 1,500 | | | 2,732 |

Federal funds sold | | | 14,300 | | | 9,500 |

Securities | | | 65,460 | | | 93,781 |

Loans held for sale | | | - | | | 950 |

Loans, net | | | 515,878 | | | 561,730 |

Premises and equipment | | | 9,776 | | | 10,341 |

Other real estate | | | 18,398 | | | 10,394 |

Other assets | | | 16,526 | | | 12,742 |

| | | | | | |

| | $ | 655,877 | | $ | 718,996 |

| | | | | | |

Total deposits | | $ | 590,477 | | $ | 625,851 |

Other borrowings | | | 2,598 | | | 13,424 |

Other liabilities | | | 3,460 | | | 4,187 |

Stockholders’ equity | | | 59,342 | | | 75,534 |

| | | | | | |

| | $ | 655,877 | | $ | 718,996 |

| | | | | | |

A-4

As of December 31, 2008, we had total assets of $656 million, a decrease of 8.78% from December 31, 2007. Total interest-earning assets were $615 million at December 31, 2008 as compared to $676 million at December 31, 2007 or 94% of total assets, respectively. Our primary interest-earning assets at December 31, 2008 were loans, which made up 87% of total interest-earning assets as compared to 84% at December 31, 2007. Net loans decreased by $45.8 million, primarily due to the transfer of $14.1 million to other real estate owned as a result of foreclosures during 2008 and the charge-off of impaired loans totaling $12.5 million during the fourth quarter of 2008. The remaining decrease in net outstanding loans is a result of increased allowance for loan losses of $10.0 million, as well as normal pay down activity as we have experienced a slowing of new loan production during 2008. Other real estate owned increased by $8.0 million during 2008 as transfers of loans through foreclosure of $14.1 million was offset by sales of other real estate owned of $3.2 million, and additional write downs during 2008 of $2.9 million.

Decreases in investment securities of $28.3 million, coupled with decreases in cash and due from banks of $2.8 million were primarily used to offset decreases in time deposits during 2008. Total deposits decreased $35.4 million during 2008. The decrease in deposit accounts was primarily a result of decreases in non-brokered retail time deposits of $50.8 million, offset by increases in brokered time deposits of $34.2 million. Brokered time deposits totaled $44.8 million costing a weighted average rate of 3.46% and represented less than 8% of total deposits at December 31, 2008. Interests bearing checking, savings and demand deposits have decreased $18.8 million during 2008.

The decrease in retail time deposits reflects a strategic decision by the Company to allow higher-priced time deposits where there were no other customer relationships to be withdrawn upon maturity rather than maintain higher interest rates. The bulk of these deposits matured during the first nine months of 2008, allowing the Company to replace this funding with lower cost brokered time deposits. Other borrowings decreased $10.8 million during 2008, primarily as a result of the retirement of Federal Home Loan Bank advances in the amount of $6.4 million. Our total equity decreased by $16.1 million for 2008 as a result of net losses of $14.3 million, purchases of treasury stock of $61,000, and dividends paid of $2.1 million, offset by increased unrealized gains on securities available for sale of $353,000.

The securities portfolio provides the Company with a source of liquidity and a relatively stable source of income. The Company’s investment policy focuses on the use of the securities portfolio to manage the interest rate risk created by the inherent mismatch of the loan and deposit portfolios. The Company’s asset/liability management committee meets quarterly to review economic trends and makes recommendations as to the structure of the securities portfolio based upon this review and the Company’s projected funding needs.

Our securities portfolio, consisting of U.S. Government and Agency, mortgage-backed, municipal and equity securities amounted to $65.5 million at December 31, 2008. Net unrealized gains on securities available-for-sale were $1,194,783 at December 31, 2008 as compared to net unrealized gains of $660,202 at December 31, 2007. Net unrealized losses on securities held-to-maturity were $11,029 at December 31, 2008 as compared to net unrealized losses of $21,289 at December 31, 2007. We have not specifically identified any securities for sale in future periods, which, if so designated, would require a charge to operations if the market value would not be reasonably expected to recover prior to the time of sale.

Since lending activities generate the primary source of revenue, the Company’s main objective is to adhere to sound lending practices. The Board of Directors has delegated loan policy decisions and loan approval authority to the Executive Committee of the Board of Directors. The Executive Committee is composed of five outside directors and the Chief Executive Officer. The Executive Committee establishes lending policies that include underwriting guidelines on the various types of

A-5

loans made as well as guidance on loan terms. The Company employs a loan approval process in which individual loan officers are provided with independent approval authority based upon their experience and training. When prospective loans are analyzed, both interest rate and credit quality objectives are considered in determining whether to make a given loan. Parameters are set on the amount of credit that can be extended to one borrower. The largest amount that can generally be extended to any one borrower without obtaining approval from the Executive Committee of the Board of Directors is $150,000. The Executive Committee is authorized to extend credit to one borrower on an unsecured basis of up to 15% of statutory capital or approximately $7.2 million and on a secured basis of up to 25% of statutory capital or approximately $12 million.

The Bank offers a variety of loans to retail customers in the communities we serve.

Consumer Loans:

Consumer loans in general carry a moderate degree of risk compared to other loans. They are historically more risky than traditional residential real estate but less risky than commercial loans. Risk of default is generally determined by the well being of the national and local economies. During times of economic stress there is usually some level of job loss both nationally and locally, which directly affects the ability of the consumer to repay debt. Risk on consumer type loans is generally managed through policy limitations on debt levels consumer borrowers may carry and limitations on loan terms and amounts depending upon collateral type.

Various types of consumer loans include the following:

| | - | | Home equity loans - open and closed end |

| | - | | Loans secured by deposits |

| | - | | Secured and unsecured personal loans |

The various types of consumer loans all carry varying degrees of risk for the Bank. Loans secured by deposits carry little or no risk and in our experience have had a zero default rate. Home equity lines carry additional risk because of the increased difficulty of converting real estate to cash in the event of a default. However, underwriting policy provides mitigation to this risk in the form of a maximum loan to value ratio of 90% on a collateral type that has historically appreciated in value. The Bank also requires the customer to carry adequate insurance coverage to pay all mortgage debt in full if the collateral is destroyed. Vehicle financing carries additional risks over loans secured by real estate in that the collateral is declining in value over the life of the loan and is mobile. Risks inherent in vehicle financing are managed by matching the loan term with the age and remaining useful life of the collateral to ensure the customer always has an equity position and is never “upside down.” Collateral is protected by requiring the customer to carry insurance showing the Bank as loss payee. The Bank also has a blanket policy that covers the Bank in the event of a lapse in the borrower’s coverage and also provides assistance in locating collateral when necessary. Secured personal loans carry additional risks over the previous types in that they are generally smaller and made to borrowers with somewhat limited financial resources and credit histories. These loans are secured by a variety of collateral with varying degrees of marketability in the event of default. Risk on these types of loans is managed primarily at the underwriting level with guidelines for debt to income ratio limitations and conservative collateral valuations. Unsecured personal loans carry the greatest degree of risk in the consumer portfolio. Without collateral, the Bank is completely dependent on the commitment of the borrower to repay and the stability of the borrower’s income stream. Again, primary risk management occurs at the underwriting stage with guidelines for debt to income ratios, time in present job and in industry and policy guidelines relative to loan size as a percentage of net worth and liquid assets.

A-6

Commercial and Industrial Loans

The Bank makes loans to small and medium sized businesses in our primary trade area for purposes such as new or upgrades to plant and equipment, inventory acquisition and various working capital purposes. Commercial loans are granted to borrowers based on cash flow, ability to repay and degree of management expertise. This type loan may be subject to many different types of risk, which will differ depending on the particular industry the borrower is involved with. General risks to an industry, or segment of an industry, are monitored by senior management on an ongoing basis, when warranted. Individual borrowers who may be at risk due to an industry condition may be more closely analyzed and reviewed at a Loan Committee or Board of Directors level. On a regular basis, commercial and industrial borrowers are required to submit statements of financial condition relative to their business to the Bank for review. These statements are analyzed for trends and the loan is assigned a credit grade accordingly. Based on this grade the loan may receive an increased degree of scrutiny by management up to and including additional loss reserves being required.

This type loan is almost always collateralized. Generally, business assets are used and may consist of general intangibles, inventory, equipment or real estate. Collateral is subject to risk relative to conversion to a liquid asset if necessary as well as risks associated with degree of specialization, mobility and general collectibility in a default situation. To mitigate this risk to collateral, it is underwritten to strict standards including valuations and general acceptability based on the Bank’s ability to monitor its ongoing health and value.

Commercial Real Estate: