QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant /x/

|

| Filed by a Party other than the Registrant / / |

Check the appropriate box: |

| / / | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| /x/ | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12

|

CHIRON CORPORATION

|

|

| (Name of Registrant as Specified In Its Charter) | |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| |

Payment of Filing Fee (Check the appropriate box):

| | | No fee required. |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1)

and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

/ / |

|

Fee paid previously with preliminary materials. |

/ / |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

March 29, 2002

DearCHIRON CORPORATION STOCKHOLDER:

Please join us for the 2002 Annual Meeting of Stockholders of Chiron Corporation. The meeting will be held on Thursday, May 16, 2002, at 10:00 a.m. in the auditorium at our Emeryville headquarters, located at 1450 53rd Street in Emeryville, California 94608.

At this year's Annual Meeting, we will ask our stockholders to elect four directors, approve the appointment of Chiron's independent auditors, and transact any other business that may properly come before the meeting. If you own shares of Chiron's common stock at the close of business on March 18, 2002, you will be entitled to notice of, and to vote at the Annual Meeting.

Additional information about the items of business to be discussed at our Annual Meeting is given in the attached Notice of Annual Meeting and Proxy Statement. We also include in this package: Chiron's 2001 Annual Report in summary form with my letter to stockholders, selected financial data and highlights of Chiron's operations, and the Annual Report on Form 10-K for 2001, which contains Chiron's audited consolidated financial statements.

I urge you to carefully review the proxy materials and to voteFOR the director nominees andFOR the appointment of Chiron's independent auditors.

We hope to see you at the May 16, 2002 Annual Meeting.

| | | Sincerely, |

|

|

|

|

|

Seán P. Lance |

| | | Chairman of the Board, President

and Chief Executive Officer |

CHIRON CORPORATION

4560 Horton Street

Emeryville, California 94608

(510) 655-8370

Corporate Internet Site:http://www.chiron.com

NOTICE OF 2002 ANNUAL MEETING OF STOCKHOLDERS

The 2002 Annual Meeting of Stockholders of Chiron Corporation ("Chiron" or the "Company") will be held on Thursday, May 16, 2002 at 10:00 a.m. at 1450 53rd Street, Emeryville, California 94608.

The purposes of the meeting are:

1. To elect four directors to serve for a three-year term until the annual meeting of stockholders in 2005 and until their successors have been elected;

2. To ratify the appointment of Ernst & Young LLP as Chiron's independent auditors for the fiscal year ending December 31, 2002; and

3. To transact any other business that may properly come before the meeting and any and all adjournments or postponements thereof.

Stockholders who owned shares of our common stock at the close of business on Monday, March 18, 2002 are entitled to notice of, to vote at, and attend the meeting and any and all adjournments or postponements of that meeting. We shall have available for your inspection, during normal business hours, at 4560 Horton Street, Emeryville, California 94608, a complete list of the stockholders of record ten days prior to the meeting. If you desire, you may examine the list for any legally valid purpose related to the meeting.

Regardless of whether you plan to attend the meeting, please vote by signing, dating and returning the enclosed proxy card in the accompanying reply envelope, or vote electronically over the Internet or by telephone.Voting in these ways will not prevent you from voting in person at the meeting. If you received your proxy materials over the Internet, you will not receive a proxy card in the mail. If your shares are held in a bank or brokerage account and you did not receive the proxy materials electronically, you may be able to vote your proxy over the Internet or by telephone. For specific instructions, please refer to the information provided with your proxy card and described on page 1 of this document.

Live audio of the Annual Meeting will be webcast and available on-line for three days after the date of the meeting athttp://www.chiron.com/investor/index.htm.

| |

|

|---|

| | | BY ORDER OF THE BOARD OF DIRECTORS |

|

|

|

|

|

William G. Green

Senior Vice President,

General Counsel and Secretary |

Emeryville, California

March 29, 2002

TABLE OF CONTENTS

| | Page

|

|---|

| GENERAL INFORMATION | | 1 |

| | Voting Rights, Information and Procedures | | 1 |

| | Open Enrollment Site | | 1 |

| | Methods of Voting | | 1 |

| | Revoking Your Proxy | | 2 |

| | Quorum Requirement | | 2 |

| | Votes Required for Each Proposal | | 3 |

| | Voting of Shares held by Novartis AG | | 3 |

| | Broker Non-Votes; Tabulation of Votes | | 3 |

| | Voting Confidentiality | | 4 |

| | Voting Results | | 4 |

| | Proxy Solicitation Costs | | 4 |

| PROPOSAL 1—ELECTION OF DIRECTORS | | 4 |

| | Nominees for Director for a Three-Year Term Expiring at the Annual Meeting of Stockholders in 2005 | | 5 |

| | Directors Continuing in Office until the Annual Meeting of Stockholders in 2004 | | 6 |

| | Directors Continuing in Office until the Annual Meeting of Stockholders in 2003 | | 7 |

| BOARD MEETINGS AND COMMITTEES | | 7 |

| | Compensation of Directors | | 9 |

| | Director Indemnification Agreements | | 10 |

| PROPOSAL 2—RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS | | 11 |

| | Relationship with Independent Auditors | | 11 |

| STOCK OWNERSHIP | | 13 |

| | Ownership of Major Stockholders | | 13 |

| | Ownership of Directors and Executive Officers | | 13 |

| EXECUTIVE COMPENSATION AND RELATED INFORMATION | | 15 |

| | Compensation of Executive Officers | | 15 |

| | Option Grants | | 16 |

| | Options Exercised | | 18 |

| | Employment, Supplemental Pension and Other Benefit Agreements; Change in Control Arrangements | | 18 |

| | COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | | 22 |

| | COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION | | 22 |

| REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS | | 25 |

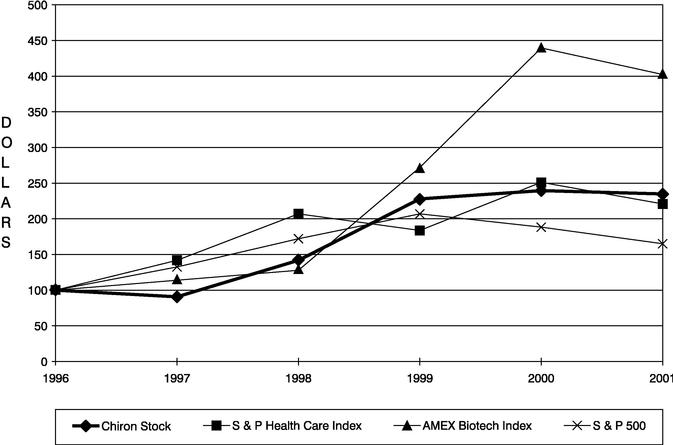

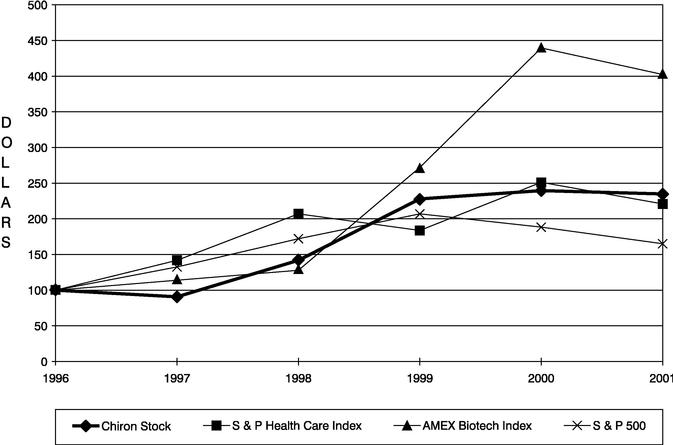

| STOCK PERFORMANCE GRAPH | | 26 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | 27 |

| | Relationship with Novartis AG | | 27 |

| | Loans to Executive Officers | | 31 |

| | iMetrikus License | | 32 |

| | Sale of Amsterdam Facility | | 32 |

| | University of California at Berkeley | | 33 |

| | Certain Consulting Arrangements | | 33 |

| OTHER INFORMATION | | 33 |

| | Section 16(a) Beneficial Ownership Reporting Compliance | | 33 |

| | Stockholder Proposals—2003 Annual Meeting | | 33 |

| | No Incorporation by Reference | | 34 |

| | Other Business | | 34 |

| | Annual Report and Financial Statements | | 34 |

PROXY STATEMENT

GENERAL INFORMATION

The enclosed proxy is solicited on behalf of the Board of Directors of CHIRON CORPORATION, a Delaware corporation ("Chiron" or the "Company") for use at Chiron's 2002 Annual Meeting of Stockholders (the "Annual Meeting"), and at any and all adjournments or postponements of that meeting. The Annual Meeting will be held at 10:00 a.m. on Thursday, May 16, 2002 in the auditorium at our headquarters located at 1450 53rd Street, Emeryville, California 94608. Chiron's principal executive offices are located at 4560 Horton Street, Emeryville, California 94608.

This proxy statement contains important information concerning the Annual Meeting, the proposals on which you are being asked to vote, and information you may find useful in determining how to vote and voting procedures. Chiron's Board of Directors is sending this proxy statement and accompanying materials on or about March 29, 2002 to all stockholders of Chiron as of March 18, 2002 (the "record date"). If you owned shares of Chiron's common stock at the close of business on March 18, 2002, you will be considered a "stockholder of record", and you are entitled to notice of, to vote at, and attend the Annual Meeting. On the record date, there were 189,907,858 shares of Chiron's common stock issued and outstanding.

Voting Rights, Information and Procedures

Chiron has one type of security entitled to vote at the Annual Meeting, its common stock. As a stockholder of Chiron, you have a right to vote on certain matters affecting Chiron. You are entitled to one vote for each share of Chiron's common stock you owned at the close of business on the record date of March 18, 2002. Chiron's Restated Certificate of Incorporation does not provide for cumulative voting.

You are being asked to vote on the following proposals which will be presented at the Annual Meeting:

- •

- The election of the four named nominees for directors;

- •

- The approval of the appointment of Ernst & Young LLP as Chiron's independent auditors; and

- •

- Any other matters properly introduced at the Annual Meeting.

Open Enrollment Site

You may enroll now for electronic delivery of proxy materials on Chiron's web site and help Chiron lower its printing and mailing costs. In conjunction with Investor Communication Services, a division of ADP Information Services, Chiron has created a new web site—"Chiron's Electronic Delivery and Voting Enrollment Site". The site is located athttp://www.chiron.com/investor/shareholder/index.htm. If you enroll, we will deliver Chiron's proxy materials to you over the Internet beginning in 2003, and we will no longer send paper copies of these documents. This will continue until you notify us otherwise. To enroll, please follow the easy directions on the web page at that site.

Methods of Voting

You may vote by mail, by telephone, over the Internet or in person at the Annual Meeting. Your shares will be voted in accordance with your instructions. If you do not provide voting instructions, the persons named as your proxies will vote your shares FOR the four named nominees for directors, FOR approval of the appointment of Ernst & Young LLP as Chiron's independent auditors, and at their discretion as to other matters that may properly come before the Annual Meeting.

1

Voting by Mail. By signing and returning the proxy card in the enclosed prepaid and addressed envelope, you are enabling the individuals named on the proxy card (known as "proxies" or "proxy holders") to vote your shares at the meeting in the manner you indicate. We encourage you to sign and return the proxy card even if you plan to attend the meeting. In this way, your shares will be voted if you are unable to attend the meeting. If you received more than one proxy card, your shares are held in multiple accounts. Please sign and return all proxy cards to ensure that all of your shares are voted.

Voting by Telephone. To vote by telephone through services provided by ADP Investor Communication Services, call the phone number printed on your proxy cards or voting instruction form, and follow the instructions provided on each proxy card or by e-mail.

If you vote by telephone, you do not need to complete and mail your proxy card.

Voting over the Internet. To vote over the Internet through services provided by ADP Investor Communication Services, log on to the Internet at:http://www.proxyvote.com and follow the instructions at that site. A link to that site is provided from Chiron's web site athttp:/www.chiron.com/investor.

If you vote on the Internet, you do not need to complete and mail your proxy card.

Voting in Person at the Annual Meeting. If you plan to attend the meeting and vote in person, we will provide you with a ballot at the meeting. If your shares are registered directly in your name, you are considered the stockholder of record and you have the right to vote in person at the meeting.

If your shares are held in the name of your broker or other nominee, you are considered the "beneficial owner" of shares held in street name. If you wish to vote at the meeting, you will need to bring with you to the meeting a legal proxy from your broker or other nominee authorizing you to vote such shares.

Revoking Your Proxy

You may revoke your proxy at any time before it is voted at the Annual Meeting. In order to do this, you must:

- •

- Provide written notice of the revocation to William G. Green, Chiron's Secretary, before the Annual Meeting;

- •

- Sign and return another proxy bearing a later date; or

- •

- Attend the Annual Meeting and vote in person.

Quorum Requirement

A quorum, which is a majority of the outstanding shares of Chiron's common stock entitled to vote as of the record date, must be present in order to hold the Annual Meeting and to conduct business. As of the close of business on the record date, Chiron had 189,907,858 shares of common stock outstanding and entitled to vote at the Annual Meeting. Shares are counted as being present at the meeting if you appear in person at the meeting or if you vote your shares on the Internet, by telephone or by submitting a properly executed proxy card. If any broker non-votes (as described below) are present at the meeting, they will be counted as present for the purposes of determining a quorum, but will not affect voting results.

2

Votes Required for Each Proposal

The vote required and the method of calculation for the proposals to be considered at the Annual Meeting are as follows:

Item 1—Election of Directors. The four nominees receiving the highest number of votes, in person or by proxy, will be elected as directors.

You may vote "For" the nominees for the election of directors or you may "Withhold" your vote with respect to one or more nominees. If you return a proxy card that withholds your vote from the election of all directors, your shares will be counted for the purpose of determining a quorum but will not be counted in the vote on any director.

Item 2—Appointment of Ernst & Young LLP as Chiron's Independent Auditors. Approval of the appointment of Chiron's independent auditors requires the affirmative vote of a majority of the shares present at the meeting, in person or by proxy.

You may vote "For", "Against" , or "Abstain" from the proposal to approve the appointment of Ernst & Young LLP as Chiron's independent auditors. If you return a proxy card that indicates an abstention from voting on the proposal to approve the appointment of Ernst & Young LLP as Chiron's independent auditors, the shares represented will be counted as present for the purpose of determining a quorum, but they will not be voted on this matter at the meeting.

Voting of Shares held by Novartis AG

Chiron has a close relationship with Novartis AG, or "Novartis", under certain agreements to research, develop, and market products together (a "strategic alliance"). Novartis also holds approximately 42% of Chiron's outstanding common stock as of February 1, 2002. Under the Governance Agreement dated as of November 20, 1994 with Novartis, Novartis may, among other things, designate three candidates to be nominated to Chiron's Board of Directors. (If Novartis' ownership of Chiron's outstanding common stock drops to less than 30%, the number of candidates Novartis is permitted to designate declines.) So long as Chiron's Board has the required number of directors designated by Novartis, Novartis has to: (i) be present to establish a quorum at stockholder meetings relating to election of directors, and (ii) vote all of its shares of common stock in favor of any nominee selected in accordance with the Governance Agreement. Chiron believes that Novartis will vote all of its shares FOR each of the four named nominees described below under "Proposal 1—Election of Directors".

Please read the section entitled "Certain Relationships and Related Transactions" to learn more about Chiron's relationship with Novartis.

Broker Non-Votes; Tabulation of Votes

If you are the beneficial owner of your shares of Chiron's common stock, but do not hold the shares in your name, the brokerage firm that holds your shares has the authority to vote your non-voted shares (known as "broker non-votes") on certain routine matters. Both proposals at this Annual Meeting are routine matters. Consequently, if you do not give a proxy to vote your shares, your brokerage firm may either leave your shares unvoted or vote your shares on these routine matters. To the extent your brokerage firm votes shares on your behalf on the proposals, your shares will be counted as present for the purpose of determining a quorum.

The Board of Directors has appointed an inspector of elections who will tabulate the votes for the Annual Meeting. Affirmative votes, negative votes, abstentions and broker non-votes will be separately tabulated.

3

Voting Confidentiality

Your proxy, ballot and voting tabulation are handled on a confidential basis to protect your voting privacy. Information will not be disclosed to Chiron except as required by law. If you write comments on your proxy, your comments will be provided to Chiron, but how you voted will remain confidential.

Voting Results

Final voting results will be announced at the meeting and will be published in Chiron's Quarterly Report on Form 10-Q for the second quarter ending June 30, 2002, filed with the Securities and Exchange Commission, or SEC. After the report is filed, you may obtain a copy by:

- •

- Visiting our web site athttp://www.chiron.com/investor/shareholder/index.htm;

- •

- Contacting our Investor Relations department at 1-510-655-8730; or

- •

- Viewing our Form 10-Q for the second quarter of fiscal 2002 on the SEC's web site athttp://www.sec.gov.

Proxy Solicitation Costs

Chiron will bear the entire costs of the preparation, assembly, printing and mailing of the proxy materials, including creation of the web sites to enable our stockholders to vote electronically over the Internet and receive materials electronically (known as "solicitation"). We will furnish copies of the solicitation materials to banks, brokerage houses, custodians, nominees and fiduciaries who hold shares of Chiron's common stock in their names so that they may forward them to beneficial owners. Chiron will reimburse brokerage firms and other custodians for their reasonable out-of-pocket expenses for forwarding the proxy materials. Certain officers, directors and regular employees of Chiron may solicit proxies by telephone, facsimile or in person. Those persons will not receive any extra compensation for their services.

PROPOSAL 1—ELECTION OF DIRECTORS

Chiron's Board of Directors is divided into three classes. Each class has, as nearly as possible, an equal number of directors who are elected at each annual stockholders meeting to hold office for staggered three-year terms in accordance with Chiron's Restated Certificate of Incorporation. Chiron's Amended and Restated Bylaws, or Bylaws, authorize the Board to fill vacancies and to increase or decrease the size of the Board between annual stockholders meetings. In February 2001, Chiron's Board amended its Bylaws to provide that, effective as of May 16, 2001, the number of directors on Chiron's Board was reduced from eleven to ten, until such time when the Board, in its sole discretion, increases the number to eleven.

Under the Governance Agreement with Novartis, Chiron's Board must include a certain number of members who are: (i) officers of Chiron's management (known as "Management Directors"); (ii) directors designated by Novartis (known as "Investor Directors"), and (iii) directors who meet certain criteria that demonstrate they are independent from both Chiron and Novartis (known as "Independent Directors"). Under the Governance Agreement, Chiron's Independent Directors are required to take certain actions under special circumstances. Please see the section entitled "Certain Relationships and Related Party Transactions-Relationship with Novartis AG" for a description of the circumstances.

Your proxy holder will vote your shares FOR the Board's nominees unless you instruct otherwise. If a nominee is unable or declines to serve as a director, your proxy holder will vote for any nominee designated by the Board to fill the vacancy, unless you withhold this authority. As of the date of this proxy statement, Chiron's Board of Directors is not aware of any nominee who is unable or will decline to serve as a director. If elected at the Annual Meeting, each director will serve until the 2005 annual

4

meeting of stockholders and until he is succeeded by another qualified director who has been elected or appointed, or until his death, resignation or removal, whichever occurs first.

Nominees for Director for Election for a Three-Year Term Expiring at the Annual Meeting of Stockholders in 2005

The Nominating Committee of Chiron's Board has nominated four candidates to the Board: Mr. Coleman, Dr. Herrling, Dr. Rutter and Mr. Schuler. All nominees are presently directors of Chiron's Board, whose term expires in 2002.

There is no family relationship between any of the nominees or between any of the nominees and any of Chiron's executive officers. Chiron's executive officers serve at the pleasure of the Board of Directors. Detailed information about Chiron's directors, including the four nominees, and the term for which each director serves, is provided below.

Lewis W. Coleman, 60, Independent Director

Mr. Coleman has been a director of Chiron since 1991. He is currently the President of the Gordon & Betty Moore Foundation, an educational, environmental and scientific research foundation located in San Francisco, California which was founded in November 2000. Prior to that, Mr. Coleman was the Chairman and a member of the Executive Committee of Banc of America Securities, formerly known as Montgomery Securities, from 1998 until his resignation in December 2000. Before he joined Banc of America Securities in December 1995, Mr. Coleman spent ten years at BankAmerica Corporation in San Francisco. He began as the Chief Credit Officer in the World Banking Group, Bank of America's wholesale banking division. Mr. Coleman later became Head of Capital Markets, responsible for all trading activity. He also served as Head of the World Banking Group before he became Bank of America's Vice Chairman of the Board and Chief Financial Officer. Previously, he spent 13 years with Wells Fargo & Co. in a variety of wholesale and retail banking positions. He culminated his career there as Chairman of the Credit Policy Committee. Mr. Coleman currently serves as a director of Northrup Grumman Corp., a NYSE company. He serves on numerous boards and is actively involved in community affairs in San Francisco.

Paul L. Herrling, 55, Investor Director

Dr. Herrling has been a director of Chiron since 1997. He is currently the Head of Research at Novartis Pharma AG and a member of the Novartis Pharma Executive Board. Previously, Dr. Herrling was Head of Preclinical Research Basel and Vice President and Deputy Member of the Board of Management, Sandoz Pharma Ltd., from 1992 through 1993. He was Head of Corporate Research and Senior Vice President and Member of the Board of Management for Sandoz Pharma Ltd. from 1994 through 1996. In November 2001, Dr. Herrling was appointed to the Professorship for Drug Discovery Sciences at the University of Basel, Switzerland.

William J. Rutter, 74, Management Director

Dr. Rutter co-founded Chiron and has been Chairman of the Board from Chiron's inception in 1981 until May 1999, when he became Chairman Emeritus. Dr. Rutter is currently a consultant to Chiron. Dr. Rutter served as a director of Ciba and subsequently Novartis from 1995 until April 1999. From 1997 to 2001, Dr. Rutter served as chairman of the board for the Bay Area Life Science Alliance, an organization devoted to the development of the UCSF Mission Bay Campus. From 1992 to 1999, Dr. Rutter served on the Board of Overseers, Harvard University. He currently serves on the Board for the Carnegie Institution of Washington, and on the National Research Council Governing Board. He is chairman of the boards of Synco Bio Partners Holding B.V. in Amsterdam; iMetrikus, Inc. in San Diego, California; PraxSys Biosystems, Inc. in Danville, California; and Silgen Corporation in China. Since January 2000, Dr. Rutter has served as a director and a member of the audit committee of

5

Sangamo Biosciences, Inc., a company that conducts research and development of novel transcription factors for the regulation of genes. Dr. Rutter also is on the board of several privately-held companies: Cytokinetics, Inc. (a cell-biology driven biopharmaceutical company); GeneSoft Inc. (a company that develops pharmaceuticals that modulate gene expressions); Proteomic Systems (a biotechnology company focused on developing advanced technology for drug development); Ventria BioScience (a biotechnology company which makes high value food products); and Structural Genomics (a drug discovery company).

Jack W. Schuler, 61, Independent Director

Mr. Schuler has been a director of Chiron since 1990. He is currently the Chairman of Stericycle, Inc., a company that processes, sterilizes and recycles medical waste, and Chairman of Ventana Medical Systems, Inc., a company that develops and manufactures instruments/reagent systems that automate histology. From 1987 to 1989, he was President and Chief Operating Officer of Abbott Laboratories. He joined Abbott in 1972 as Director of Sales and Marketing for the diagnostics division, and held a series of diagnostic sales and management positions. He served on the Abbott Board of Directors from 1985 to 1989. Mr. Schuler is a member of the Board of Directors of Medtronics, Inc.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE IN FAVOR OF EACH NAMED NOMINEE.

Directors Continuing in Office until the Annual Meeting of Stockholders in 2004

Vaughn D. Bryson, 63, Independent Director

Mr. Bryson has been a director of Chiron since June 1997. He is President of Life Science Advisors, LLC, a consulting firm focused on assisting biopharmaceutical and medical device firms in building shareholder value. He is also the President and a founder of Clinical Products, Inc., a medical foods company. Mr. Bryson was a 32 year-employee of Eli Lilly and Company, a global research-based pharmaceutical corporation, where he served as President and Chief Executive Officer from 1991 until June 1993. He was Executive Vice President from 1986 until 1991. Mr. Bryson was a member of the board of directors of Lilly from 1984 until his retirement in 1993. From April 1994 to December 1996, Mr. Bryson was Vice Chairman of Vector Securities International, Inc., an investment banking firm.

Pierre E. Douaze, 61, Investor Director

Mr. Douaze has been a director of Chiron since 1995. He was a member of the Executive Committee of management of Ciba-Geigy Limited from 1991 to 1996, and Head of Ciba-Geigy Limited's Pharma and Self-Medication Division from 1989 to 1996. From December 1996 through December 1997, he was a member of the Executive Committee of Novartis and Head of its Healthcare Division and Pharma Sector. In December 1997, Mr. Douaze retired from Novartis. He currently serves as a member of the boards of Serono; deVGen N.V.; and the Galenica Group, Switzerland. He also serves as a director of VIFOR.

Edward E. Penhoet, 61, Independent Director

Dr. Penhoet co-founded Chiron and has been a director since its inception in 1981. He served as Chiron's Chief Executive Officer until May 1998, when Seán P. Lance became President and Chief Executive Officer, and Dr. Penhoet became Vice Chairman. Dr. Penhoet served as Chiron's Vice Chairman and as a consultant until February 2001. He has been appointed the Dean of the School of Public Health, at the University of California at Berkeley since July 1998. Dr. Penhoet has been a faculty member of the Biochemistry Department at the University of California, Berkeley for 27 years. From March 1997 to January 1999, Dr. Penhoet served as Chairman of the California Healthcare Institute, a public policy research and advocacy organization located in La Jolla, California. Since September 2000, Dr. Penhoet has been a consulting director of Alta Partners, a venture capital firm.

6

During 2001, Dr. Penhoet also served on the boards of directors of Kaiser Permanente, Zymogenetics, Inc., Renovis, Inc. and Eyetech Pharmaceuticals, Inc.

Directors Continuing in Office until the Annual Meeting of Stockholders in 2003

Raymund Breu, 57, Investor Director

Dr. Breu has been a director of Chiron since May 1999. He is the Chief Financial Officer and a Member of the Executive Committee of Novartis. Dr. Breu is responsible for all finance activities of the Novartis Group worldwide. He assumed those positions upon the formation of Novartis in December 1996, when Ciba-Geigy Limited merged with Sandoz Ltd. Prior to that, Dr. Breu spent over 20 years with Sandoz Ltd. and affiliates, serving in various capacities: as the Head of Group Finance and a Member of the Sandoz Executive Board (1993 to 1996); Group Treasurer of Sandoz Ltd. (1990 to 1993); Chief Financial Officer of Sandoz Corporation (1985 to 1990), where he was responsible for all Sandoz finance activities in the US; and Head of Finances for the affiliated companies of Sandoz in the UK (1982 to 1985).

Seán P. Lance, 54, Management Director

Mr. Lance was appointed President and Chief Executive Officer of Chiron in May 1998. He assumed the position of Chairman of Chiron's Board in May 1999. Mr. Lance joined Chiron from Glaxo Wellcome plc. where he spent more than twelve years in positions of national and global management responsibility, including Chief Operating Officer and Chief Executive designate. Mr. Lance began his pharmaceutical industry career in the Republic of South Africa at the Noristan Group of Companies, Ltd. in 1967. Mr. Lance has assumed leadership roles in a variety of national and international pharmaceutical associations, and is a past president of the International Federation of Pharmaceutical Manufacturers Associations (IFPMA). Mr. Lance currently serves on the Board of Directors for the California Healthcare Institute (CHI), Global Alliance TB Drug Development (GATB), Bay Area Bioscience and iKnowMed.

Pieter J. Strijkert, 66, Independent Director

Dr. Strijkert has been a director of Chiron since 1987. He currently serves as chairman of the board of two Dutch companies: Crucell N.V. and Pamgene B.V. Dr. Strijkert is chairman of the board of a Belgian company, deVGen N.V. Dr. Strijkert also is a director of Paratek Pharmaceuticals, Inc. Previously, he was a member of the Management Board of Gist-Brocades N.V., a fermentation and pharmaceutical company headquartered in The Netherlands, from 1985 until 1995, and was Chairman of the Supervisory Board of International Bio-Synthetics B.V.

BOARD MEETINGS AND COMMITTEES

The Board of Directors met four times for a total of seven days during 2001, and acted by unanimous written consent on seven occasions during the last year. Under the Governance Agreement with Novartis, if Chiron or one of its affiliates wants to collaborate or work together with Novartis or one of its affiliates in any transaction or arrangement involving either party, a majority of the Independent Directors must first approve such project. On this basis, the Independent Directors of Chiron met four additional times during 2001.

Chiron has five standing committees of the Board: an Audit Committee, a Compensation Committee, a Stock Option Plan Administration Committee, a Nominating Committee, and a Strategic Planning Committee. All of the committees, except the Strategic Planning Committee, are active. Under the Governance Agreement with Novartis, the number of Investor Directors on each committee, except in the case of the Nominating Committee (as described below), shall be in the same proportion as the number of Investor Directors on Chiron's Board.

7

The Audit Committee is responsible for finance, budget, audit, internal control, accounting, and related matters. Mr. Coleman is the Chairman and Dr. Breu and Mr. Schuler are members. Mr. Coleman and Mr. Schuler are non-employee directors, as defined in Rule 16b-3(b)(3)(i) of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The Audit Committee met five times during 2001. This committee provides primary oversight on behalf of the Board of selection, engagement, performance and termination of independent auditors for the annual audit of Chiron's financial statements. It also oversees Chiron's tax, legal, regulatory and business ethical compliance. All other functions are described in the Audit Committee Charter. This committee reviews the Audit Committee Charter annually. The Report of the Audit Committee for last year is included in these proxy materials.

The Compensation Committee's principal functions are to: (i) evaluate the performance of Chiron's executive officers; (ii) consider and plan for executive officer succession; (iii) review and approve executive compensation; (iv) review the design and competitiveness of Chiron's compensation plans generally; and (v) administer Chiron's stock option, stock purchase and executive officer variable cash compensation plans. Mr. Bryson chairs this committee, and Mr. Coleman, Dr. Breu, and Dr. Strijkert are members. Mr. Bryson, Mr. Coleman and Dr. Strijkert are non-employee directors. The Compensation Committee met four times, and acted on one occasion by unanimous written consent, during 2001. The report of the Compensation Committee for last year is included in these proxy materials. The committee also approves certain terms of stock option awards for officers and directors of Chiron who are subject to Section 16(b) of the Exchange Act, for which the Compensation Committee has determined that such approval is necessary to exempt the transaction from the liability provisions of Section 16(b). Those terms include the disposition features of stock options or other stock-related transactions with Chiron's executive officers or directors. When a vote is taken concerning the disposition features of those awards, the remaining members of the committee, consisting of at least two non-employee directors, are empowered to independently approve the disposition features, so long as the members who are not non-employee directors abstain from, or refuse to, vote.

The Board has delegated to the Stock Option Plan Administration Committee authority to make routine stock option grants under Chiron's 1991 Stock Option Plan. The grants are calculated according to the policies, procedures and methodologies approved by this committee. The committee also approves the acceleration of vesting of terms of stock options held by employees and consultants, except Chiron's executive officers or directors. Seán P. Lance is the sole member of this committee. Until May 2001, Dr. Lewis "Rusty" T. Williams, former Chief Scientific Officer and President of Research and Development for Chiron, served as the second member on this committee. When Dr. Williams decided not to stand for re-election to the Board last year, the number of members on the committee was reduced from two to one, with the consent of Novartis. The committee acted on 13 occasions by written consent during 2001.

The Nominating Committee is responsible for matters relating to composition of the Board, including recruitment, nomination and succession. The Governance Agreement contains certain provisions relating to the composition and procedures of the Nominating Committee. Please see the section entitled "Certain Relationships and Related Transactions—Relationship with Novartis AG". Dr. Breu, Mr. Douaze, Mr. Lance and Dr. Rutter are members of this committee. Dr. Rutter continues to serve as chairman, having been designated in May 2001, as a member of this committee who would occupy the position specified by the Governance Agreement to be held by an Independent Director, with the consent of Novartis and the Independent Directors. The committee met three times during 2001. The Nominating Committee has not established a procedure for considering nominees for director nominated by Chiron stockholders. Stockholders may nominate candidates for director in accordance with the advance notice and other procedures contained in Chiron's Bylaws.

During 2001, each of the directors of the Board attended at least 75% of all Board and applicable committee meetings on which he served.

8

Compensation of Directors

Directors who are officers of Chiron do not receive any additional compensation for their services as directors. During the last year, non-employee directors of Chiron received the following cash compensation:

- •

- A quarterly retainer fee of $4,000 payable during each of the first, second, third and fourth quarters, for a total of $16,000 per year;

- •

- An additional fee of $2,000 for each Board meeting attended in person;

- •

- An additional fee of $500 for each telephone meeting of the Board;

- •

- An additional fee of $200 per hour, up to a maximum of $1,000 per day, for time spent on meetings of committees of the Board on days when no meeting of the Board is held;

- •

- An additional retainer fee of $1,250 payable in each of the first, second, third and fourth quarters, for a total of $5,000 per year for each non-employee director who chairs one of Chiron's committees of the Board; and

- •

- Reimbursement of reasonable expenses to attend Board and committee meetings (except for the Investor Directors, for which all travel expenses are paid by Novartis).

The Investor Directors are required to pay over to Novartis all fees received from Chiron for director services under the terms of their employment with Novartis, except Mr. Douaze. In accordance with Novartis' instructions, Chiron pays those fees directly to Novartis.

Non-employee directors also participate in Chiron's 1991 Stock Option Plan. Before February 2001, Chiron granted its non-employee directors "automatic option grants" annually, on the last business day of the second quarter of each year (known as "automatic grant dates"). Each continuing non-employee director could purchase a certain number of shares of Chiron's common stock based on a specific formula. The formula was determined by dividing $100,000 (subject to cost-of-living increases after 1996) by the average stock price of a share of Chiron's common stock over the preceding twelve months. On the date that a person first became a non-employee director (if other than an automatic grant date), he or she received an automatic option grant to purchase a pro-rata number of shares of Chiron's common stock, based on the number of months the non-employee director would serve as a director before the next automatic grant date. Each automatic option grant has an exercise price equal to the fair market value of Chiron's common stock on the grant date and a term of ten years. The option expires three months after the optionee ceases to serve as a director, employee, consultant or independent contractor (twelve months if due to disability or death). Automatic options are immediately exercisable. However, if a non-employee director ceases providing services to Chiron or its subsidiaries as a director, employee, consultant or independent contractor, Chiron may repurchase the shares at the original exercise price. This repurchase right lapses in equal annual installments over five years from the grant date, as long as the director continues to provide services to Chiron, and lapses immediately, in full, upon death or disability.

In addition, before February 2001, each newly elected or appointed non-employee director was automatically granted the right to receive a certain number of shares of Chiron's common stock ("automatic share right") purchasable with $40,000 on the date of the election or appointment. (A similar $40,000 share right was granted to existing directors on the 1996 automatic grant date.) On each subsequent automatic grant date, Chiron automatically granted the non-employee director a $25,000 share right as long as the individual was serving as a non-employee director. If a non-employee director was newly elected or appointed on a date other than on an automatic grant date, then on the next automatic grant date after his or her election or appointment, the non-employee director was granted a pro rated $25,000 share right, based on the number of months the individual served as a non-employee director before such automatic grant date. The dollar values were subject to cost-of-living increases

9

after 1996. Share rights vest in equal annual installments over five years from the grant date, as long as the non-employee director continued to provide services to Chiron. The automatic share rights vest in full upon death or disability.

Effective on and after February 2001, Chiron's Board approved amendments to non-employee directors' compensation. The amendments simplified non-employee director compensation by:

- (i)

- eliminating the automatic share right awards;

- (ii)

- changing the annual automatic option grant from an option based on a formula to an option to purchase 15,000 shares of Chiron's common stock, and reducing the vesting schedule for the option from five years to six months; and

- (iii)

- implementing an initial option grant feature, so that each newly elected or appointed non-employee director automatically receives an option grant to purchase 30,000 shares of Chiron's common stock, which vests over a three-year period (known as the "Initial Option Grant").

Beginning in 2001, when a director is first elected or appointed to Chiron's Board, he receives an option to purchase 30,000 shares of Chiron's common stock. On the automatic grant date, each continuing non-employee director receives an option to purchase 15,000 shares of Chiron's common stock (known as the "Annual Option Grant"). Each continuing non-employee director (who was newly elected or appointed on a date after the previous year's automatic grant date) also receives a reduced Annual Option Grant, determined by multiplying 1,250 by the number of whole calendar months between the non-employee director's election or appointment date and the current automatic grant date. Each Annual Option Grant has an exercise price equal to the fair market value of Chiron's common stock on the grant date and a term of ten years. The option expires three months after the optionee ceases to serve as a director, employee, consultant or independent contractor (twelve months if due to disability or death). Automatic options are immediately exercisable. However, if a non-employee director ceases providing services to Chiron or its subsidiaries as a director, employee, consultant or independent contractor, Chiron may repurchase the shares at the original exercise price. For each Initial Option Grant, Chiron's repurchase right lapses in equal annual installments over three years from the grant date, as long as the director continues to provide services to Chiron, and lapses immediately, in full, upon death or disability. For each Annual Option Grant, Chiron's repurchase right lapses in full six months after the grant date and lapses immediately, in full, upon death or disability.

Director Indemnification Agreements

Chiron has agreed to protect its directors, to the full extent permitted under its Bylaws and by law, against damage, loss or injury, that a person might suffer because he or she is or was a director of Chiron (known as "indemnify"), including reimbursement of expenses that a director might incur in any legal proceedings in defending any legal actions while serving as a director of Chiron. The indemnification agreements: (i) confirm the present indemnity provided to them by Chiron's Bylaws and give assurances that the indemnity will continue to be provided even if the Bylaws are changed in the future, and (ii) provide that the directors would be indemnified to the maximum extent permitted by law against all expenses (including attorneys' fees), judgments, fines, and settlement amounts incurred or paid by them in any action or proceeding, including any action by or in the right of Chiron, because they are serving as a director, officer or similar official of any other company or enterprise when they are serving in such capacities at the request of Chiron. The indemnification agreements further provide that expenses incurred by a director in such cases shall be paid by Chiron in advance, subject to the director's obligation to reimburse Chiron in the event it is ultimately determined that the director is not entitled to be indemnified for such expenses under any of the provisions of the indemnification agreement. Chiron will not indemnify any director under the agreements as described in clause (ii), above, if it is finally determined that a director's conduct is knowingly fraudulent, deliberately dishonest, or constitutes willful misconduct. In addition, Chiron will not indemnify any

10

director if a court finally determines that the indemnification is not lawful, or where it has been determined that a director has profited from a purchase or sale of Chiron's securities and violated Section 16(b) of the Exchange Act or of any laws. The indemnification agreements also contain provisions designed to protect Chiron from unreasonable settlements or redundant legal expenditures.

PROPOSAL 2—RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

Chiron's Board of Directors has selected Ernst & Young LLP as its independent auditors effective for the fiscal year commencing January 1, 2002. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting. They will have the opportunity to make a statement if they desire to do so and to respond to appropriate questions.

Neither Chiron's Restated Certificate of Incorporation nor its Bylaws require the stockholders to ratify the selection of Ernst & Young LLP as Chiron's independent auditors. However, Chiron's Board recommends the stockholders ratify the Board's selection of Ernst & Young LLP. If the stockholders do not ratify the appointment, the Audit Committee and Board will reconsider the selection. Even if the selection is ratified, the Board may, at its discretion, direct the appointment of different independent auditors at any time during the year if it determines that such a change would be in Chiron's best interests and in the best interests of Chiron's stockholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE RATIFICATION

OF THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT AUDITORS.

Relationship with Independent Auditors

KPMG LLP served as Chiron's independent auditors for the most recently completed fiscal year. In December 2001, Chiron determined that KPMG LLP's appointment as independent auditors would cease following the completion of the audit of the Company's financial statements for the fiscal year ended December 31, 2001. Chiron's Audit Committee approved the decision to change independent auditors. Representatives of KPMG LLP will not be present at the Annual Meeting.

In connection with the audits of the two fiscal years ended December 31, 2001 and the subsequent interim period through March 5, 2002, there were no disagreements with KPMG LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements (if not resolved to KPMG LLP's satisfaction) would have caused KPMG LLP to refer to such matters in their reports. The audit reports of KPMG LLP on Chiron's consolidated financial statements as of and for the fiscal years ended December 31, 2001 and 2000 did not contain any adverse opinion or disclaimer of opinion, nor were those opinions qualified or modified as to uncertainty, audit scope or accounting principles. KPMG LLP's letter to Chiron confirming the above information was included as Exhibit 16 to Chiron's annual report on Form 10-K for the year ended December 31, 2001 filed with the SEC on March 6, 2002, and as Exhibit 16.1 to Chiron's current report on Form 8-K/A which was filed with the SEC on March 21, 2002. During that period, there were "no reportable events" within the meaning of Item 304(a)(1)(v) of Regulation S-K promulgated under the Securities Act of 1933, as amended.

During Chiron's two most recent fiscal years ended December 31, 2001 and the subsequent interim period through March 5, 2002, we did not consult with Ernst & Young LLP regarding any of the matters or events set forth in Item 304 (a) (2) (i) and (ii) of Regulation S-K, except that we engaged Ernst & Young LLP in July 2001 to assist us in the identification of the accounting, tax and economic impacts of a proposed leasing transaction, and to provide overall transaction coordination services. We also consulted with KPMG LLP on application of accounting principles regarding this proposed leasing transaction.

11

Audit Fees. For fiscal 2001, KPMG LLP billed Chiron $1,101,252 in fees for audit of the Company's annual financial statements included in the annual report on Form 10-K and review of Chiron's unaudited interim quarterly financial statements included in its quarterly reports on Form 10-Q.

Financial Information Systems Design and Implementation Fees. Chiron did not engage KPMG LLP to provide advice concerning financial information systems design and implementation during fiscal 2001.

Other Fees. The aggregate fees billed by KPMG LLP for professional services rendered other than described above were $1,224,216,which included fees for non-audit services of $667,475 and audit-related services of $556,741. Non-audit services consisted of tax compliance and internal audit services. Audit-related services included the issuances of letters to underwriters, audits of financial statements of certain employee benefit plans, review of registration statements and the issuances of consents.

The Audit Committee determined that the services provided by and fees paid to KPMG LLP were compatible with maintaining the independent auditors' independence.

12

STOCK OWNERSHIP

The following tables set forth ownership of Chiron's common stock by major stockholders, directors and executive officers of the Company as of February 1, 2002. As of that date, there were 189,513,227 shares of Chiron's common stock issued and outstanding.

Ownership of Major Stockholders

The following table lists all persons or entities known by Chiron to own 5% or more of the outstanding shares of Chiron's common stock.

Name and Address of Beneficial Owner

| | Amount and Nature of

Beneficial Ownership

| | Percent of

Class

| |

|---|

Novartis AG

35 Lichstrasse

CH-4002

Basel, Switzerland | | 79,320,078 | (1) | 42 | % |

Salomon Smith Barney Inc.

388 Greenwich Street

New York, New York 10013 | | 10,008,010 | (2) | 5 | % |

Salomon Brothers Holding Company Inc.

388 Greenwich Street

New York, New York 10013 | | 10,031,746 | (2) | 5 | % |

Salomon Smith Barney Holdings Inc.

388 Greenwich Street

New York, New York 10013 | | 17,824,644 | (2) | 9 | % |

Citigroup Inc.

399 Park Avenue

New York, New York 10043 | | 17,866,351 | (2) | 9 | % |

- (1)

- Novartis may acquire up to 55% of Chiron's outstanding common stock through purchases on the open market and participate pro rata in certain issuances of new securities by Chiron under the Governance Agreement. If a majority of Chiron's Independent Directors approve a transaction, Novartis may increase its ownership interest up to 79.9%. Also, in accordance with an additional agreement between Chiron and Novartis called the Market Price Option Agreement, if certain conditions are met, Novartis may purchase shares of Chiron's common stock directly from Chiron in an amount up to 55% of the outstanding shares of Chiron's common stock. Please see the section entitled "Certain Relationships and Related Transactions" for a further discussion of Chiron's relationships with Novartis.

- (2)

- Salomon Smith Barney Inc., Salomon Brothers Holding Company Inc., Salomon Smith Barney Holdings Inc. and Citigroup Inc. jointly filed a Schedule 13G with the SEC on January 22, 2002, pursuant to which each of the reporting persons disclosed that the shares shown above include shares held by the other reporting persons.

Ownership of Directors and Executive Officers

This table shows how much Chiron common stock is beneficially owned by: (a) each of the directors, (b) each of the Chief Executive Officer and the four other most highly compensated officers of Chiron, or named executive officers, and (c) the directors and executive officers of Chiron as a group. "Beneficial ownership" is determined in accordance with the rules of the SEC and refers to shares that a director or executive officer has the power to vote, or the power to dispose of, and stock options that are exercisable currently or become exercisable within 60 days of February 1, 2002. Unless

13

otherwise indicated, the address of each of the individuals named below is: c/o Chiron Corporation, 4560 Horton Street, Emeryville, California 94608.

| | Shares Beneficially Owned

| |

|---|

Name of Beneficial Owner

| | Number (1)(2)(3)

| | Percent

| |

|---|

| Non-Employee Directors: | | | | | |

| Raymund Breu | | 24,697 | | * | |

| Vaughn D. Bryson | | 36,582 | | * | |

| Lewis W. Coleman | | 79,543 | (4) | * | |

| Pierre E. Douaze | | 58,971 | | * | |

| Paul L. Herrling | | 38,184 | | * | |

| Edward E. Penhoet | | 384,754 | | * | |

| William J. Rutter | | 3,869,083 | | 2 | % |

| Jack W. Schuler | | 81,833 | (5) | * | |

| Pieter J. Strijkert | | 52,787 | | * | |

Named Executive Officers: |

|

|

|

* |

|

| Seán P. Lance (also a Director) | | 959,466 | | * | |

| Rajen K. Dalal | | 176,931 | | * | |

| William G. Green | | 473,686 | | * | |

| Peder K. Jensen | | 54,564 | | * | |

| James R. Sulat | | 233,964 | | * | |

| | | | | * | |

Directors and Executive Officers as a Group

(19 persons) | | 6,808,076 | | 4 | % |

- *

- Less than 1%.

- (1)

- This disclosure is made pursuant to certain rules and regulations promulgated by the SEC and the number of shares shown as being beneficially owned may not be deemed to be beneficially owned for other purposes. Except as subject to applicable community property laws or indicated by footnote below, the persons named in this table have sole voting and/or investment power with respect to all shares.

- (2)

- These amounts include shares that the persons named in this table have a right to acquire as of February 1, 2002, or within 60 days after that date, through the exercise of stock options they hold in Chiron's 1991 Stock Option Plan, as follows: Dr. Breu, 23,682 shares; Mr. Bryson, 33,479 shares; Mr. Coleman, 72,875 shares; Mr. Douaze, 54,771 shares; Dr. Herrling, 34,962 shares; Dr. Penhoet, 162,952 shares; Dr. Rutter, 1,158,348 shares; Mr. Schuler, 25,708 shares; Dr. Strijkert, 40,171 shares; Mr. Lance, 954,687 shares; Mr. Dalal, 145,235 shares; Mr. Green, 450,914 shares; Dr. Jensen, 47,709 shares; and Mr. Sulat, 230,417 shares; and all directors and executive officers as a group, 3,671,916 shares.

- (3)

- These amounts do not include the number of shares of Chiron's common stock which are beneficially held by, and issuable to, the following persons when their respective restricted automatic share right grants have vested:

- (a)

- non-employee directors, as follows: Dr. Breu, 1,889 shares; Mr. Bryson, 2,293 shares; Mr. Coleman, 2,137 shares; Mr. Douaze, 2,137 shares; Dr. Herrling, 2,323 shares; Dr. Penhoet, 590 shares; Dr. Rutter, 590 shares; Mr. Schuler, 1,752 shares and Dr. Strijkert, 2,137 shares.

- (b)

- certain named executive officers, as follows: Mr. Jensen, 15,000 shares, and all executive officers as a group, 43,929 shares.

Please see the section entitled "Executive Compensation and Related Information—Compensation of Executive Officers" for a description of the terms under which the share rights are issued.

- (4)

- These shares are held in a family trust, the Lewis W. Coleman and Susan G. Coleman Family Trust uta dated November 29, 1995, of which Mr. Coleman and his wife are the trustees.

- (5)

- Includes 4,000 shares held by Mr. Schuler's wife, Renate.

14

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Compensation of Executive Officers

This table shows the compensation awarded to, earned by or paid to Chiron's Chief Executive Officer and the four other most highly compensated executive officers (known as the "named executive officers") during each of Chiron's last three fiscal years for all services rendered in all capacities to Chiron.

Summary Compensation Table

| | Annual Compensation

| | Long-Term Compensation Awards

| |

|

|---|

Name and Principal Position

| | Fiscal

Year

| | Salary ($)

| | Bonus ($)

| | Restricted Stock

Awards ($)

| | Securities

Underlying

Options/

SARs (#)

| | All Other

Compensation($)(9)

|

|---|

Seán P. Lance(1)

Chairman of the Board,

President and Chief Executive

Officer | | 2001

2000

1999 | | 742,308

700,000

700,000 | | 1,250,000

1,250,000

1,000,000 | | | —

—

— | | 750,000

550,000

100,000 | | 146,728

128,863

79,952 |

Rajen K. Dalal(2)

Vice President;

President, Chiron Blood

Testing | | 2001

2000

1999 | | 326,923

305,385

271,692 | | 250,000

375,000

358,500 | |

$

| —

2,118,750

— |

(7)

| 120,000

95,000

35,000 | | 32,548

19,755

19,972 |

William G. Green(3)

Senior Vice President,

General Counsel and

Secretary | | 2001

2000

1999 | | 433,077

392,692

377,692 | | 345,000

320,000

285,000 | | | —

—

— | | 225,000

143,000

50,000 | | 37,900

30,498

27,863 |

Peder K. Jensen(4)

Vice President,

Head of Development | | 2001

2000

1999 | | 337,292

320,492

131,154 | | 190,000

190,000

124,400 |

(6) |

$ | —

—

642,188 |

(8) | 100,000

64,000

140,000 | | 60,099

111,273

70,348 |

James R. Sulat(5)

Vice President,

Chief Financial Officer | | 2001

2000

1999 | | 369,308

336,000

321,154 | | 275,000

260,000

252,000 | | | —

—

— | | 225,000

158,000

45,000 | | 29,008

23,520

9,500 |

- (1)

- Mr. Lance was appointed President and Chief Executive Officer effective May 1, 1998. "All Other Compensation" for Mr. Lance in 2001 includes the following: a special award of $47,293 (see the section entitled "Loans to Executive Officers"); Chiron's contributions of $71,815 under Chiron's Supplemental Executive Retirement Plan on behalf of Mr. Lance; $11,250 for the lease of a vehicle by Chiron for Mr. Lance's personal use; $7,500 as reimbursement to Mr. Lance for financial/tax planning services; and $2,070 paid on behalf of Mr. Lance by Chiron for the purchase of life insurance.

- (2)

- "All Other Compensation" for Mr. Dalal in 2001 includes the following: Chiron's contributions of $21,276 under Chiron's Supplemental Executive Retirement Plan on behalf of Mr. Dalal; $3,122 reimbursement to Mr. Dalal for financial/tax planning services; and $1,350 paid on his behalf by Chiron for the purchase of life insurance. Mr. Dalal resigned from his positions with Chiron effective as of March 15, 2002.

- (3)

- "All Other Compensation" for Mr. Green in 2001 includes the following: Chiron's contributions of $23,323 under Chiron's Supplemental Executive Retirement Plan on behalf of Mr. Green; $4,595 reimbursement to Mr. Green for financial/tax planning services; and $2,374 paid on his behalf by Chiron for the purchase of life insurance.

- (4)

- "All Other Compensation" for Dr. Jensen in 2001 includes the following: forgivable loan/interest from Chiron in the amount of $35,000; Chiron's contributions of $14,292 under Chiron's Supplemental Executive Retirement Plan on behalf of Dr. Jensen; $2,657 reimbursement to Dr. Jensen for financial/tax planning services; and $1,350 paid on his behalf by Chiron for the purchase of life insurance.

15

- (5)

- "All Other Compensation" for Mr. Sulat in 2001 includes Chiron's contributions of $18,372 under Chiron's Supplemental Executive Retirement Plan on behalf of Mr. Sulat and $3,836 reimbursement to Mr. Sulat for financial/tax planning services.

- (6)

- Includes a hiring bonus of $50,000 paid to Dr. Jensen in 1999.

- (7)

- On January 1, 2000, Chiron granted to Mr. Dalal restricted share rights for 50,000 shares of Chiron's common stock. This amount is based on the closing market price of Chiron's common stock on the last trading date prior to the grant date. As of January 2002, Mr. Dalal's share rights had fully vested, and Mr. Dalal had all of the rights as a stockholder, including any rights to dividends. As of December 31, 2001, Mr. Dalal's restricted share rights had an aggregate value of $2,192,000.

- (8)

- On August 2, 1999, Chiron granted to Dr. Jensen restricted share rights for 25,000 shares of Chiron's common stock. This amount is based on the closing market price of Chiron's common stock on the last trading date prior to the grant date. On August 2, 2001, share rights for 10,000 shares of Chiron's common stock vested. Share rights for the remaining 15,000 shares of Chiron's common stock will vest on August 2, 2003. Until such time as Chiron issues a stock certificate for shares underlying his share rights, Dr. Jensen shall have no rights as a stockholder, including any rights to dividends. As of December 31, 2001, Dr. Jensen's restricted share rights had an aggregate value of $1,096,000.

- (9)

- In addition to the items described in footnotes 1-5 above, "All Other Compensation" includes contributions to match pretax elective deferral contributions made by Chiron, on behalf of each named executive officer, under Chiron's 401(k) Plan, a plan providing for broad-based employee participation. Each contribution made in 2001 was $6,800.

Option Grants

Stock Option Grants in Last Fiscal Year. This table shows options granted (excluding LTIP option grants, described separately below) to the named executive officers under Chiron's 1991 Stock Option Plan during 2001.

| | Individual Grants (1)(2)

| | Potential Realizable Value At Assumed

Annual Rates of Stock Price

Appreciation for Option Term (4)

|

|---|

Name

| | Number of

Securities

Underlying

Options/SARs

Granted(#)

| | % of Total

Options/SARs

Granted to

Employees in

Fiscal Year

| | Exercise or

Base Price

($/Sh)(3)

| | Expiration

Date

| | 0%($)

| | 5%($)

| | 10%($)

|

|---|

| Seán P. Lance | | 500,000 | | 7.2170 | | 45.719 | | 2/16/11 | | -0- | | 14,376,154 | | 36,431,996 |

| Rajen K. Dalal | | 50,000 | | 0.7217 | | 45.719 | | 2/16/11 | | -0- | | 1,437,615 | | 3,643,200 |

| William G. Green | | 150,000 | | 2.1651 | | 45.719 | | 2/16/11 | | -0- | | 4,312,846 | | 10,929,599 |

| Peder K. Jensen | | 50,000 | | 0.7217 | | 45.719 | | 2/16/11 | | -0- | | 1,437,615 | | 3,643,200 |

| James R. Sulat | | 150,000 | | 2.1651 | | 45.719 | | 2/16/11 | | -0- | | 4,312,846 | | 10,929,599 |

- (1)

- Chiron granted the options listed in this table on February 16, 2001. The options were based on, among other things, performance of the named executive officers in year 2000. The exercise price of these options is equal to the average between the reported high and reported low prices of Chiron's common stock on February 16, 2001, as reported on the NASDAQ National Market System.

In February 2002, Chiron also granted stock options to the named executive officers based on, among other things, 2001 performance, as follows: Mr. Lance, 500,000; Mr. Dalal, -0-; Mr. Green, 100,000; Dr. Jensen, 50,000; Mr. Sulat, 100,000. The exercise price of these options is $42.535 per share, based on the average between the reported high and reported low prices of Chiron's common stock on February 21, 2002, as reported on the NASDAQ National Market System. The options expire on February 21, 2012.

- (2)

- Generally, the options described above are exercisable as to 25% of the granted shares beginning one year after grant. The balance is exercisable in equal monthly installments over the next 36 months, assuming continued employment with Chiron or one of its subsidiaries. To the extent not already exercisable, the options generally become exercisable in the event of an agreement to dispose of all or substantially all of the assets or outstanding stock of Chiron by means of merger, consolidation, reorganization or liquidation, unless the options are assumed by the successor entity. Further, if a successor corporation or parent thereof assumes

16

options in connection with a "change in control" of Chiron and within 24 calendar months of such change in control there is a "qualifying termination" of the named executive officer's employment, his options will become fully vested. Please refer to the section entitled "Change in Control Arrangements" below for a general description of the effect of a change in control on stock options.

- (3)

- When options are exercised, the exercise price and any related tax withholding obligations are generally paid in cash, or at the discretion of Chiron's Compensation Committee, in shares of Chiron's common stock which have been held the requisite period in order to avoid a charge to Chiron's earnings. If that occurs, the shares are valued as of the exercise date. Under certain conditions, the shares are valued from the proceeds of a same-day sale of the shares acquired when the option is exercised. The Compensation Committee may also assist an optionee in exercising an option by authorizing Chiron to extend a loan in an amount sufficient to cover the purchase price and related tax withholding obligations.

- (4)

- As required by the SEC rules, these columns show gains that may exist for the respective options, assuming that the market price for Chiron's common stock appreciates from the date of grant over a ten-year period at the annual compounded rates of 5% and 10%, respectively. The market price of Chiron's common stock at February 2011 would be $74.47 per share and $118.58 per share, respectively.

There is no assurance that either the assumed rates of appreciation or any appreciation will occur. The amounts are calculated from the average of the reported high and low prices on the respective grant date, as reported on the NASDAQ National Market System. If the price of Chiron's common stock does not increase above the exercise price, no value will be realizable from these options.

Long-Term Incentive Plans—Awards in Last Fiscal Year. Chiron's Executive Long-Term Incentive Plan is a stock price-based plan ("LTIP") and falls under Chiron's 1991 Stock Option Plan. The table below shows the LTIP options granted to the named executive officers during 2001.

Name

| | No. of Shares, Units

or Other Rights (#)(1)

| | Performance or Other Period

until Maturation or Payout(2)

|

|---|

| Seán P. Lance | | 250,000 | | 01/02/11 |

| Rajen K. Dalal | | 70,000 | | 01/02/11 |

| William G. Green | | 75,000 | | 01/02/11 |

| Peder K. Jensen | | 50,000 | | 01/02/11 |

| James R. Sulat | | 75,000 | | 01/02/11 |

- (1)

- Chiron granted the options listed in this table on January 2, 2001. The exercise price of these options is equal to the average between the reported high and reported low prices of Chiron's common stock on January 2, 2001, as reported on the NASDAQ National Market System.

In January 2002, Chiron also granted LTIP options to the named executive officers in the following amounts: Mr. Lance, 300,000; Mr. Dalal, 85,000; Mr. Green, 85,000; Dr. Jensen, 60,000; and Mr. Sulat, 100,000. The exercise price of the LTIP options is $43.18 per share, based on the average between the reported high and reported low prices of Chiron's common stock on January 2, 2002, as reported on the NASDAQ National Market System. The LTIP options expire on January 2, 2012.

- (2)

- Generally, the LTIP options are exercisable upon the earlier of seven years after grant (assuming continued employment with Chiron or one of its subsidiaries) or the achievement of specified performance objectives set by Chiron's Board. Each LTIP option agreement describes in detail the performance objectives and vesting schedule. See the section entitled "Compensation Committee Report on Executive Compensation" for a general discussion of the performance objectives. The LTIP options expire ten years after grant. Of the amounts shown in the above table, 171,600 LTIP options vested on January 2, 2002.

To the extent not already exercisable, the LTIP options generally become exercisable in the event of an agreement to dispose of all or substantially all of the assets or outstanding stock of Chiron by means of merger, consolidation, reorganization or liquidation, unless the LTIP options are assumed by the successor entity. Further, if a successor corporation or parent thereof assumes the LTIP options in connection with a change in control of Chiron and the named executive officer is terminated in a qualifying termination before the last day of the last measurement period for the stated LTIP options, the options will fully vest. Please refer to the section entitled "Change in Control Arrangements" below for a general description of the effect of a change in control on stock options.

17

Options Exercised

Aggregated Option/SAR Exercises in Last Fiscal Year and Fiscal Year-End Option/SAR Values. The table below shows all stock options exercised by the named executive officers during last year, and the number and value of options they held at the end of 2001.

| |

| |

| | Number of Securities Underlying

Unexercised Options at Fiscal Year-End(#)(1)

| | Value of Unexercised

In-the-Money

Options at Fiscal Year-End ($)(2)

|

|---|

Name

| | Shares Acquired on

Exercise(#)

| | Value Realized ($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Seán P. Lance | | 0 | | 0 | | 715,104 | | 1,434,896 | | 13,475,145 | | 6,971,850 |

| Rajen K. Dalal | | 113,125 | | 4,286,310 | | 112,485 | (1) | 212,916 | | 2,388,204 | | 508,321 |

| William G. Green | | 20,000 | | 792,250 | | 389,289 | (1) | 353,166 | | 9,163,116 | | 546,046 |

| Peder K. Jensen | | 91,667 | | 1,548,212 | | 11,000 | | 226,333 | | 0 | | 1,516,346 |

| James R. Sulat | | 0 | | 0 | | 163,667 | | 414,333 | | 2,885,898 | | 1,783,281 |

- (1)

- The number of securities includes unexercised, unsurrendered options which the named executive officers are entitled to surrender for cash payments from Novartis pursuant to an agreement entered into with Novartis in November 1994 (known as the "Novartis option surrender program"). Please refer to the section entitled "Certain Relationships and Related Transactions-Relationship with Novartis AG". Rajen K. Dalal and William G. Green held, respectively, 280 and 931 options under this program as of the end of last year.

- (2)

- The value of all unexercised, unsurrendered options is calculated in accordance with SEC rules using the average between the reported high and reported low prices of Chiron's common stock on December 31, 2001 ($44.60), as reported on the NASDAQ National Market System. The amount payable under the Novartis option surrender program is $29.25 per share. Since this amount is less than the year-end market value, the incremental value of options which each holder is entitled to surrender under the Novartis option surrender program is $0.

Employment, Supplemental Pension and Other Benefit Agreements; Change in Control Arrangements

Employment Agreements. In March 1998, Chiron entered into an agreement with Mr. Seán P. Lance, Chairman of the Board, President and Chief Executive Officer, the terms of which include: (i) a base salary of $700,000 per year, which may be increased, but not decreased, annually by the Board of Directors; (ii) Mr. Lance participates in Chiron's executive officer variable cash compensation program, under which he will receive an annual cash bonus equal to 100% of his base salary if the targeted level of performance is satisfied, with a maximum bonus of 200% if performance substantially exceeds the targeted level; (iii) Mr. Lance participates in Chiron's long-term incentive plan, based upon performance as determined by the Board's Compensation Committee, with a targeted value of the annual award at the grant date of 200% of Mr. Lance's base salary; (iv) Mr. Lance was granted options to purchase 750,000 shares of Chiron's common stock under Chiron's 1991 Stock Option Plan, as to which 125,000 shares vested upon the first annual anniversary of Mr. Lance's employment with Chiron, 475,000 shares vest in 48 successive equal monthly installments commencing on the first anniversary of Mr. Lance's employment, and the remaining 150,000 option shares vest on the fifth annual anniversary of Mr. Lance's employment, provided that 75,000 of the 150,000 may vest as early as the end of three years based upon attainment of certain performance goals; (v) Chiron provides Mr. Lance with the lease of a company car and tax and financial services planning; and (vi) Chiron reimbursed expenses associated with Mr. Lance's relocation to California. If Mr. Lance's employment with Chiron is terminated other than for cause, or if Mr. Lance resigns for good reason, the 1998 agreement provides that he will continue to receive: (a) his base salary for three years following the termination date, provided he may elect to receive a lump sum payment equal to the discounted value of such salary; (b) in lieu of his cash bonus, a payment equal to three times the higher of his targeted bonus in the year of termination or his highest bonus during the preceding three years, payable over the salary

18

continuation period or, at Mr. Lance's option, in a discounted lump sum; (c) continued health care and life insurance coverage for a three year period, subject to the payment by Mr. Lance of premiums not paid by Chiron under Chiron's cafeteria benefit plan; (d) reasonable repatriation assistance; and (e) accelerated vesting of stock options that would otherwise have vested during the next three years following termination. Under the agreement, "good reason" is defined to include a substantial diminution in Mr. Lance's duties and responsibilities or the assignment to Mr. Lance of duties inconsistent with his position; relocation of Chiron's headquarters more than 30 miles from its present location; reduction of Mr. Lance's base salary or failure to provide compensation at least equal to that provided for under compensation or benefit plans currently in effect; material breach by Chiron of its obligations under Mr. Lance's employment agreement or the failure of Chiron to obtain satisfactory agreement from any successor to Chiron to assume Mr. Lance's employment agreement. The agreement further provides that no change in control, including any transaction in which Novartis increases its ownership interest in Chiron, will itself constitute good reason. Pursuant to the March 1998 agreement, Chiron provided Mr. Lance a loan in the principal amount of $1 million with a ten year term to purchase a residence. The terms of Mr. Lance's loan are more particularly described under the section entitled "Loans to Executive Officers". In May 2001, Chiron's Board determined that certain performance goals were attained, and authorized acceleration of vesting of the 75,000 options described above.