Searchable text section of graphics shown above

[LOGO]

Novartis Merger:

Presentation to Stockholders

March 2006

Agenda

1. Chiron’s Perspective on the Transaction

2. Questions & Answers

3. Session with Chiron Directors*

* “Directors” throughout this presentation refers to the Non-Novartis Directors. See Annex A for biographical material on the Directors.

[LOGO]

2

Fair Price and Better Than Status Quo

• Novartis has had the right to acquire Chiron since 1994

• Appropriate time

• 11 month process to allow time to address business challenges

• No significant near-term milestones to drive value

• Fair price: Determined by Directors following careful consideration of opportunities and risks

• BioPharma - tifacogin significant opportunity but high risk; molecular oncology promising but very early

• Vaccines - substantial opportunity but ongoing challenges and intensified competition

• Blood Testing - strong commercial capabilities but key patents expiring and no proven development or manufacturing capabilities

• Royalties - significant to earnings but expected to decline as key patents expire

• Better than status quo: significant downside risk in absence of Novartis deal

• Valuation of management’s long range plan shows significant risk of lower value

• Continued operational challenges and execution risks

• Potentially protracted uncertainty may impact operations (including ability to hire and retain key personnel) and share price

3

Novartis Has the Right to Acquire Chiron

• Under the 1994 Agreements, Novartis has the right to acquire Chiron in accordance with a specified process

• Directors leveraged Chiron’s rights under Governance Agreement to achieve optimal outcome for Chiron stockholders

Governance Agreement enabled Directors to optimize outcome

4

Appropriate time | |

| |

Better than status quo | |

| |

Fair price | |

5

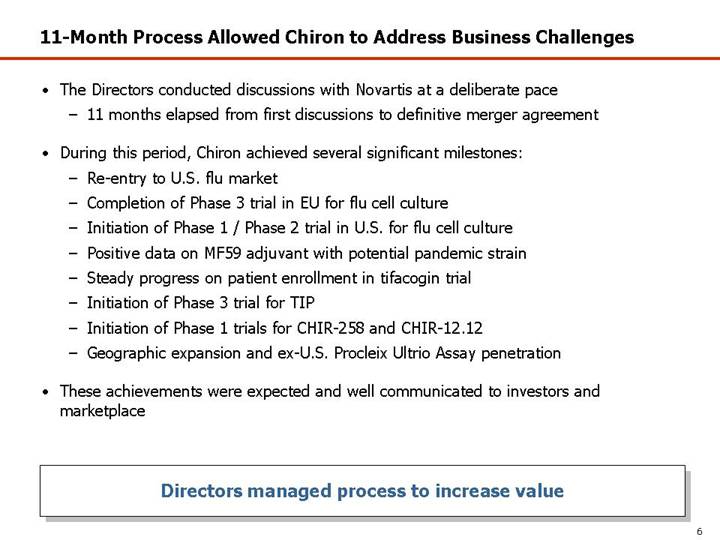

11-Month Process Allowed Chiron to Address Business Challenges

• The Directors conducted discussions with Novartis at a deliberate pace

• 11 months elapsed from first discussions to definitive merger agreement

• During this period, Chiron achieved several significant milestones:

• Re-entry to U.S. flu market

• Completion of Phase 3 trial in EU for flu cell culture

• Initiation of Phase 1 / Phase 2 trial in U.S. for flu cell culture

• Positive data on MF59 adjuvant with potential pandemic strain

• Steady progress on patient enrollment in tifacogin trial

• Initiation of Phase 3 trial for TIP

• Initiation of Phase 1 trials for CHIR-258 and CHIR-12.12

• Geographic expansion and ex-U.S. Procleix Ultrio Assay penetration

• These achievements were expected and well communicated to investors and marketplace

Directors managed process to increase value

6

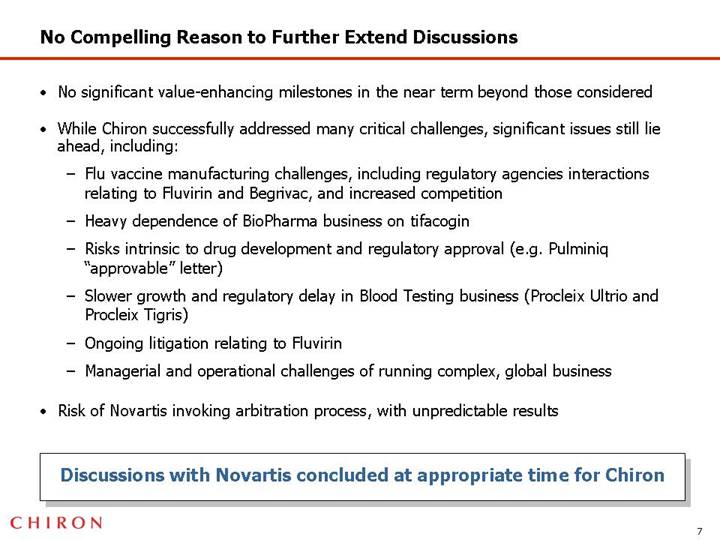

No Compelling Reason to Further Extend Discussions

• No significant value-enhancing milestones in the near term beyond those considered

• While Chiron successfully addressed many critical challenges, significant issues still lie ahead, including:

• Flu vaccine manufacturing challenges, including regulatory agencies interactions relating to Fluvirin and Begrivac, and increased competition

• Heavy dependence of BioPharma business on tifacogin

• Risks intrinsic to drug development and regulatory approval (e.g. Pulminiq “approvable” letter)

• Slower growth and regulatory delay in Blood Testing business (Procleix Ultrio and Procleix Tigris)

• Ongoing litigation relating to Fluvirin

• Managerial and operational challenges of running complex, global business

• Risk of Novartis invoking arbitration process, with unpredictable results

Discussions with Novartis concluded at appropriate time for Chiron

7

Appropriate time | |

| |

Better than status quo | |

| |

Fair price | |

8

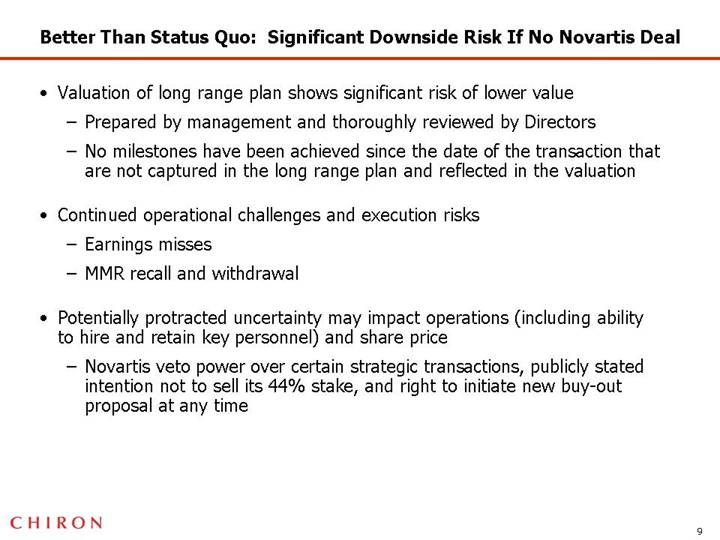

Better Than Status Quo: Significant Downside Risk If No Novartis Deal

• Valuation of long range plan shows significant risk of lower value

• Prepared by management and thoroughly reviewed by Directors

• No milestones have been achieved since the date of the transaction that are not captured in the long range plan and reflected in the valuation

• Continued operational challenges and execution risks

• Earnings misses

• MMR recall and withdrawal

• Potentially protracted uncertainty may impact operations (including ability to hire and retain key personnel) and share price

• Novartis veto power over certain strategic transactions, publicly stated intention not to sell its 44% stake, and right to initiate new buy-out proposal at any time

9

Appropriate time | |

| |

Better than status quo | |

| |

Fair price | |

• Determined by Directors with significant industry and financial expertise following careful consideration of opportunities and risks

10

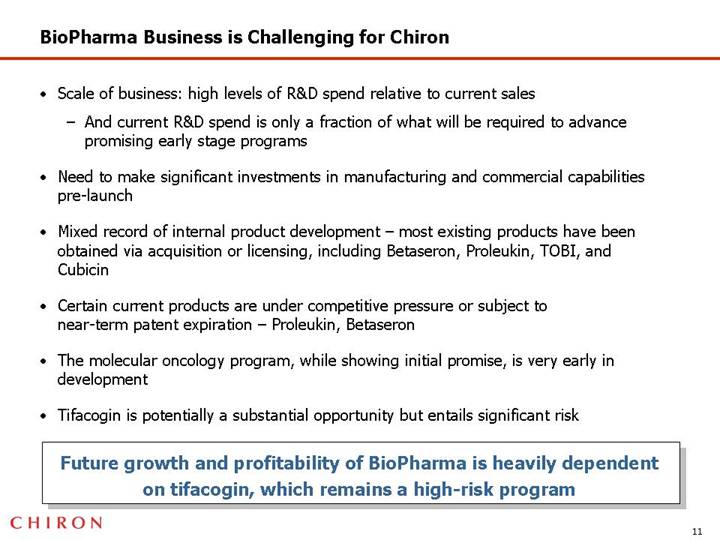

BioPharma Business is Challenging for Chiron

• Scale of business: high levels of R&D spend relative to current sales

• And current R&D spend is only a fraction of what will be required to advance promising early stage programs

• Need to make significant investments in manufacturing and commercial capabilities pre-launch

• Mixed record of internal product development – most existing products have been obtained via acquisition or licensing, including Betaseron, Proleukin, TOBI, and Cubicin

• Certain current products are under competitive pressure or subject to near-term patent expiration – Proleukin, Betaseron

• The molecular oncology program, while showing initial promise, is very early in development

• Tifacogin is potentially a substantial opportunity but entails significant risk

Future growth and profitability of BioPharma is heavily dependent on tifacogin, which remains a high-risk program

11

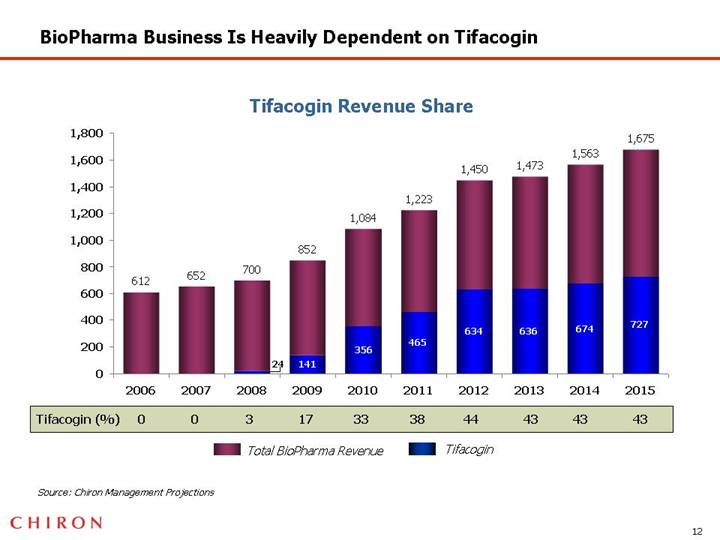

BioPharma Business Is Heavily Dependent on Tifacogin

Tifacogin Revenue Share

[CHART]

Source: Chiron Management Projections

12

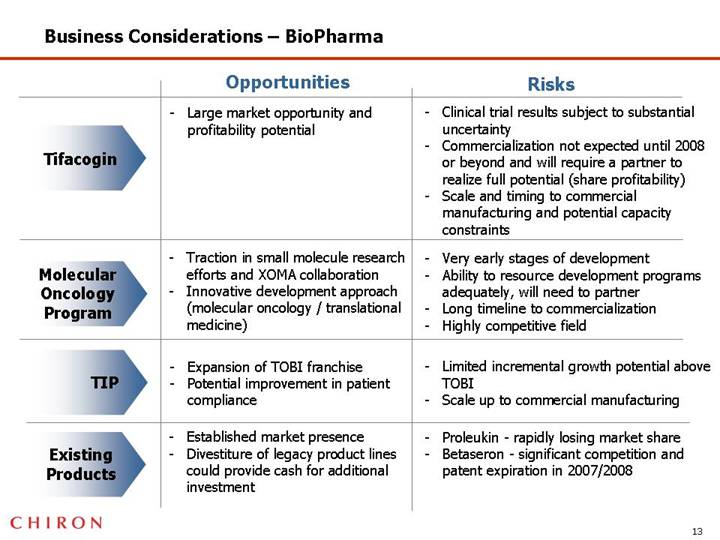

Business Considerations – BioPharma

| | Opportunities | | Risks |

| | | | |

Tifacogin | | • Large market opportunity and profitability potential | | • Clinical trial results subject to substantial uncertainty • Commercialization not expected until 2008 or beyond and will require a partner to realize full potential (share profitability) • Scale and timing to commercial manufacturing and potential capacity constraints |

| | | | |

Molecular Oncology Program | | • Traction in small molecule research efforts and XOMA collaboration • Innovative development approach (molecular oncology / translational medicine) | | • Very early stages of development • Ability to resource development programs adequately, will need to partner • Long timeline to commercialization • Highly competitive field |

| | | | |

TIP | | • Expansion of TOBI franchise • Potential improvement in patient compliance | | • Limited incremental growth potential above TOBI • Scale up to commercial manufacturing |

| | | | |

Existing Products | | • Established market presence • Divestiture of legacy product lines could provide cash for additional investment | | • Proleukin - rapidly losing market share • Betaseron - significant competition and patent expiration in 2007/2008 |

13

Vaccines Represents Substantial Opportunity But Has Risks

• Traditional egg-based influenza vaccines, including Fluvirin vaccine and Begrivac vaccine, have fueled Chiron’s vaccines growth

• While remediation efforts to date have been successful, financial and reputational costs to Chiron are substantial

• GMP compliance will require continuous improvement to meet ever higher regulatory standards over time

• Chiron’s competitive position in influenza market has declined with new market entrants, including GSK and CSL

• Flu cell culture conversion, which is a significant opportunity for Vaccines segment, faces developmental, regulatory, and manufacturing hurdles

• Pandemic flu is an important strategic opportunity, although incremental commercial value is uncertain and technical challenges must be overcome

• Meningitis B program is promising and proprietary, but development, manufacturing, and commercial risks remain; MenACWY will be second to market

Vaccines business remains an attractive opportunity but key products and programs face intensifying competition and on-going challenges

14

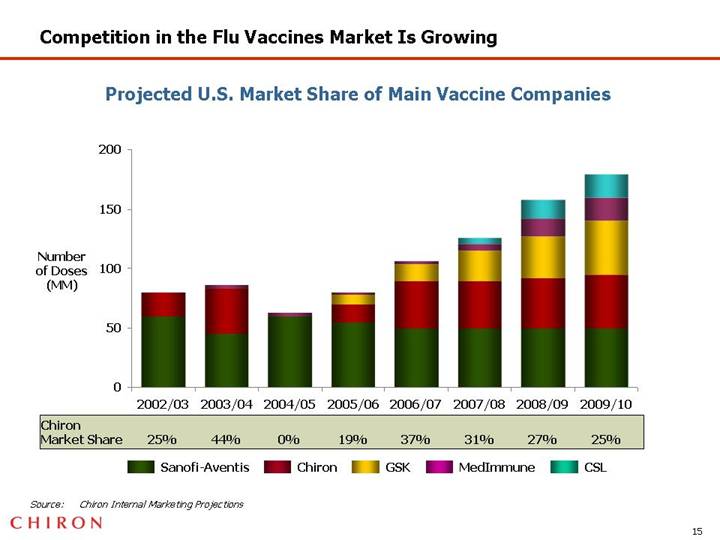

Competition in the Flu Vaccines Market Is Growing

Projected U.S. Market Share of Main Vaccine Companies

[CHART]

Source: Chiron Internal Marketing Projections

15

Pandemic Influenza Vaccine Strategy Presents Challenges

PRIOR TO A PANDEMIC

• Until there is an actual pandemic, opportunity may be limited to government stockpiling (manufacturing between seasonal campaigns) and government funding of R&D

• Commercial potential for stockpiling is unclear

• So far, limited demand…government tenders have been small

• Larger demand would require additional capacity

• Narrow window between seasonal campaigns heightens capacity constraints

• Each country has different specifications

• Government pressure on pricing

• Competition is intensifying

• GSK, MedImmune and Sanofi-Pasteur have initiated or plan to initiate development

16

Pandemic Influenza Vaccine Strategy Presents Challenges

DURING A PANDEMIC

• An actual pandemic may lead to year-round production of pandemic strain in lieu of seasonal campaigns for a brief period

• Proprietary adjuvant MF59 may reduce antigen requirements and increase supplies

• Government pressure on pricing may lead to lower margins

• But in order to produce a commercial pandemic vaccine, technical obstacles must first be addressed…

• Pandemic vaccine may require higher number of doses than seasonal vaccine

• Adjuvants may be required to improve immunogenicity

• Manufacturing yields expected to be relatively low

• Unclear that these technical obstacles will be resolved before pandemic arrives

• …and the regulatory pathway is still not clear

• No currently approved pandemic vaccines

• FDA and EMEA may have different requirements

• FDA has not approved any adjuvant other than alum

• Flu cell culture production, which is not reliant on egg supply, may afford an advantage

• Significant capital investment is required (U.S.: $350-$400MM, EU: $80-$100MM)

17

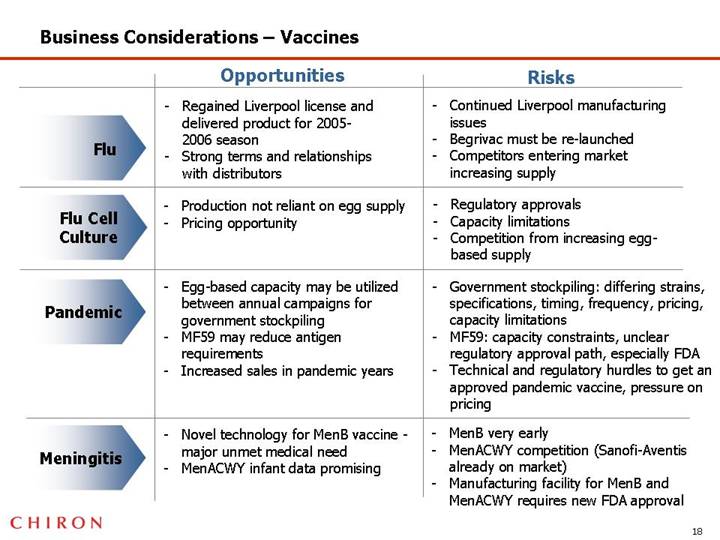

Business Considerations – Vaccines

| | Opportunities | | Risks |

| | | | |

Flu | | • Regained Liverpool license and delivered product for 2005-2006 season • Strong terms and relationships with distributors | | • Continued Liverpool manufacturing issues • Begrivac must be re-launched • Competitors entering market increasing supply |

| | | | |

Flu Cell Culture | | • Production not reliant on egg supply • Pricing opportunity | | • Regulatory approvals • Capacity limitations • Competition from increasing egg-based supply |

| | | | |

Pandemic | | • Egg-based capacity may be utilized between annual campaigns for government stockpiling • MF59 may reduce antigen requirements • Increased sales in pandemic years | | • Government stockpiling: differing strains, specifications, timing, frequency, pricing, capacity limitations • MF59: capacity constraints, unclear regulatory approval path, especially FDA • Technical and regulatory hurdles to get an approved pandemic vaccine, pressure on pricing |

| | | | |

Meningitis | | • Novel technology for MenB vaccine - major unmet medical need • MenACWY infant data promising | | • MenB very early • MenACWY competition (Sanofi-Aventis already on market) • Manufacturing facility for MenB and MenACWY requires new FDA approval |

18

Blood Testing Business is Strong But Has Limited Growth Potential

• Strong commercial capabilities and solid intellectual property

• Growth is slowing

• Key patents are facing expiration

• Chiron has no proven internal development or manufacturing capabilities for “next generation” platform

19

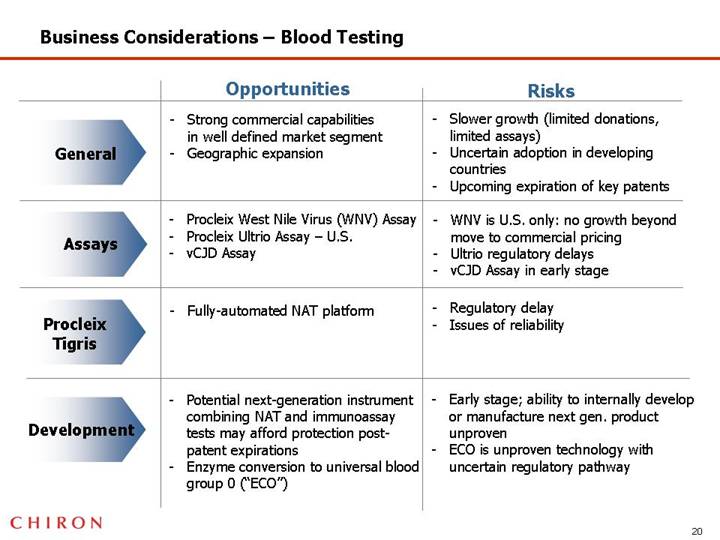

Business Considerations – Blood Testing

| | Opportunities | | Risks |

| | | | |

General | | • Strong commercial capabilities in well defined market segment • Geographic expansion | | • Slower growth (limited donations, limited assays) • Uncertain adoption in developing countries • Upcoming expiration of key patents |

| | | | |

Assays | | • Procleix West Nile Virus (WNV) Assay • Procleix Ultrio Assay – U.S. • vCJD Assay | | • WNV is U.S. only: no growth beyond move to commercial pricing • Ultrio regulatory delays • vCJD Assay in early stage |

| | | | |

Procleix Tigris | | • Fully-automated NAT platform | | • Regulatory delay • Issues of reliability |

| | | | |

Development | | • Potential next-generation instrument combining NAT and immunoassay tests may afford protection post-patent expirations • Enzyme conversion to universal blood group 0 (“ECO”) | | • Early stage; ability to internally develop or manufacture next gen. product unproven • ECO is unproven technology with uncertain regulatory pathway |

20

Directors Managed Process to Achieve Fair Price

• Conducted by Directors with significant industry and financial expertise *

• Independent, top-tier financial and legal advisors

• Transaction timeline managed by Directors to achieve an optimal outcome

• Threat of invoking additional procedural rights provided for in Governance Agreement, such as arbitration and delay, resulted in fair price for stockholders

• Unanimous approval by Directors

* See Annex A

21

$45 Offer Represents Fair Value for Chiron Stockholders

• In assessing the transaction, Directors carefully considered the business risks and opportunities described above

• The Directors required and relied on certain analyses, and also obtained fairness opinions from two independent financial advisors, Credit Suisse and Morgan Stanley

• Industry-accepted methodologies and sensitivities to projected business performance

• Historical trading ranges

• Prior to initial offer, research analysts forward price targets of $32 -$42 per share

• Selected companies analysis

• Discounted cash flow analysis, consolidated and sum of the parts

• Various sensitivity analyses and additional data

• $45 value is supported by and attractive relative to ranges implied by analysis and Chiron’s intrinsic value and reflects a significant portion of synergy value available to Novartis

• Value represents outcome of extensive negotiation and careful timing by Directors

$45 offer deemed by Directors to be fair and most attractive alternative available to Chiron

22

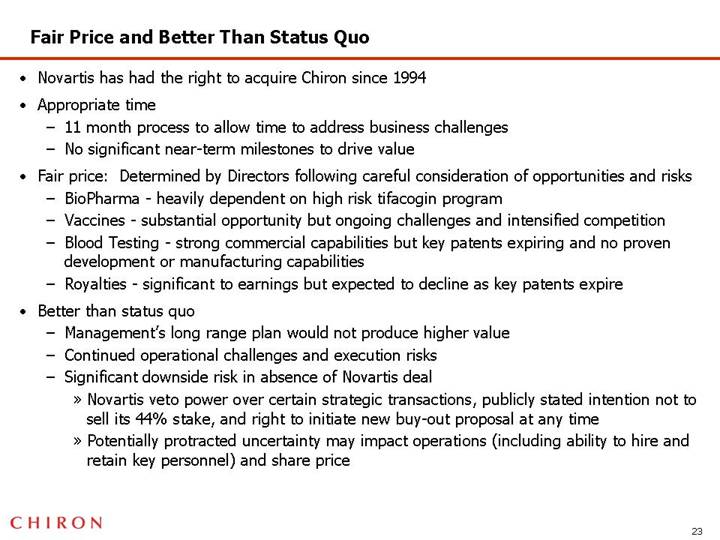

Fair Price and Better Than Status Quo

• Novartis has had the right to acquire Chiron since 1994

• Appropriate time

• 11 month process to allow time to address business challenges

• No significant near-term milestones to drive value

• Fair price: Determined by Directors following careful consideration of opportunities and risks

• BioPharma - heavily dependent on high risk tifacogin program

• Vaccines - substantial opportunity but ongoing challenges and intensified competition

• Blood Testing - strong commercial capabilities but key patents expiring and no proven development or manufacturing capabilities

• Royalties - significant to earnings but expected to decline as key patents expire

• Better than status quo

• Management’s long range plan would not produce higher value

• Continued operational challenges and execution risks

• Significant downside risk in absence of Novartis deal

• Novartis veto power over certain strategic transactions, publicly stated intention not to sell its 44% stake, and right to initiate new buy-out proposal at any time

• Potentially protracted uncertainty may impact operations (including ability to hire and retain key personnel) and share price

23

Annex A: Independent Directors’ Biographies

Vaughn D. Bryson

Director since 1997; former President and CEO of Eli Lilly

Lewis W. Coleman

Director since 1991; former Chairman and CEO of Bank of America Securities

J. Richard Fredericks

Director since 2003; Chairman of Dionis Capital, a New York based-hedge fund focusing on the financial services industry

Howard H. Pien

Chairman and CEO Chiron; former President of Pharmaceuticals International at GSK

Denise O’ Leary

Director since 2002; former General Partner of Menlo Ventures, a private venture capital firm

Edward Penhoet, Ph.D.

Director since 1981; Co-Founder, Former President and CEO of Chiron

Peter J. Strijkert, M.D.

Director since 1987; Chairman of Crucell N.V., a biotechnology company focused on developing products that prevent and treat infectious diseases

24

[LOGO]

Novartis Merger:

Presentation to Stockholders

March 2006