Searchable text section of graphics shown above

Project Heron

Presentation to the Board of Directors

PRELIMINARY | SUBJECT TO FURTHER REVIEW AND EVALUATION

April 3,2006

THESE MATERIALS MAY NOT BE USED OR RELIED UPON FOR ANY PURPOSE OTHER THAN AS SPECIFICALLY CONTEMPLATED BY A WRITTEN AGREEMENT WITH CREDIT SUISSE AND MORGAN STANLEY.

1

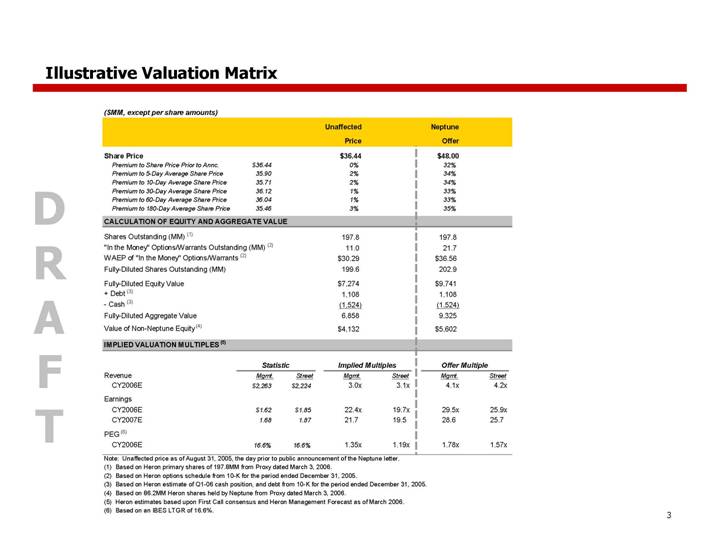

Illustrative Valuation Matrix

($MM, except per share amounts)

| | | | Unaffected | | Neptune | |

| | | | Price | | Offer | |

| | | | | | | |

Share Price | | | | $ | 36.44 | | $ | 48.00 | |

Premium to Share Price Prior to Annc. | | $ | 36.44 | | 0 | % | 32 | % |

Premium to 5-Day Average Share Price | | 35.90 | | 2 | % | 34 | % |

Premium to 10-Day Average Share Price | | 35.71 | | 2 | % | 34 | % |

Premium to 30-Day Average Share Price | | 36.12 | | 1 | % | 33 | % |

Premium to 60-Day Average Share Price | | 36.04 | | 1 | % | 33 | % |

Premium to 180-Day Average Share Price | | 35.46 | | 3 | % | 35 | % |

| | | | | | | |

CALCULATION OF EQUITY AND AGGREGATE VALUE | | | | | | | |

| | | | | | | |

Shares Outstanding (MM) (1) | | | | 197.8 | | 197.8 | |

“In the Money” Options/Warrants Outstanding (MM) (2) | | | | 11.0 | | 21.7 | |

WAEP of “In the Money” Options/Warrants (2) | | | | $ | 30.29 | | $ | 36.56 | |

Fully-Diluted Shares Outstanding (MM) | | | | 199.6 | | 202.9 | |

Fully-Diluted Equity Value | | | | $ | 7,274 | | $ | 9,741 | |

+ Debt (3) | | | | 1,108 | | 1,108 | |

- Cash (3) | | | | (1,524 | ) | (1,524 | ) |

Fully-Diluted Aggregate Value | | | | 6,858 | | 9,325 | |

Value of Non-Neptune Equity (4) | | | | $ | 4,132 | | $ | 5,602 | |

| | | | | | | | | | |

IMPLIED VALUATION MULTIPLES (5)

| | Statistic | | Implied Multiples | | Offer Multiple | |

| | Mgmt. | | Street | | Mgmt. | | Street | | Mgmt. | | Street | |

Revenue | | | | | | | | | | | | | |

CY2006E | | $ | 2,263 | | $ | 2,224 | | 3.0 | x | 3.1 | x | 4.1 | x | 4.2 | x |

| | | | | | | | | | | | | | | |

Earnings | | | | | | | | | | | | | |

CY2006E | | $ | 1.62 | | $ | 1.85 | | 22.4 | x | 19.7 | x | 29.5 | x | 25.9 | x |

CY2007E | | 1.68 | | 1.87 | | 21.7 | | 19.5 | | 28.6 | | 25.7 | |

| | | | | | | | | | | | | |

PEG (6) | | | | | | | | | | | | | |

CY2006E | | 16.6 | % | 16.6 | % | 1.35 | x | 1.19 | x | 1.78 | x | 1.57 | x |

Note: Unaffected price as of August 31, 2005, the day prior to public announcement of the Neptune letter.

(1) Based on Heron primary shares of 197.8MM from Proxy dated March 3, 2006.

(2) Based on Heron options schedule from 10-K for the period ended December 31, 2005.

(3) Based on Heron estimate of Q1-06 cash position, and debt from 10-K for the period ended December 31, 2005.

(4) Based on 86.2MM Heron shares held by Neptune from Proxy dated March 3, 2006.

(5) Heron estimates based upon First Call consensus and Heron Management Forecast as of March 2006.

(6) Based on an IBES LTGR of 16.6%.

4

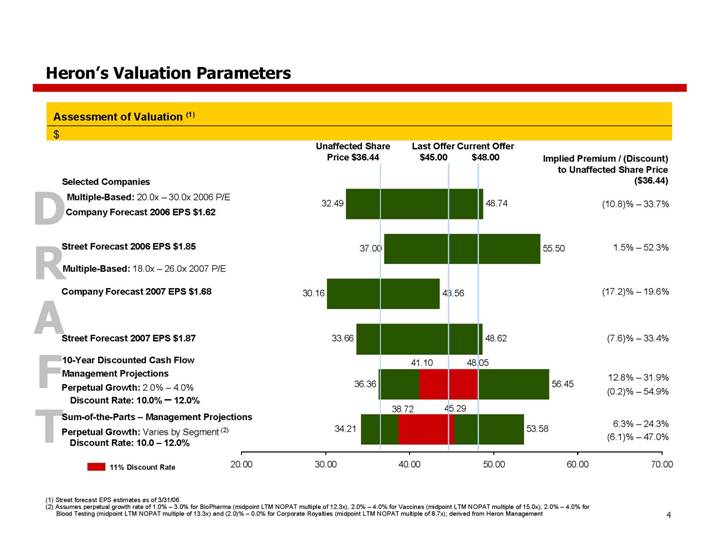

Heron’s Valuation Parameters

Assessment of Valuation (1)

$

[CHART]

(1) Street forecast EPS estimates as of 3/31/06

(2) Assumes perpetual growth rate of 1.0% 3.0% for BioPharma (midpoint LTM NOPAT multiple of 12.3x), 2.0% 4.0% for Vaccines (midpoint LTM NOPAT multiple of 15.0x), 2.0% 4.0% for Blood Testing (midpoint LTM NOPAT multiple of 13.3x) and (2.0)% 0.0% for Corporate Royalties (midpoint LTM NOPAT multiple of 8.7x); derived from Heron Management

5

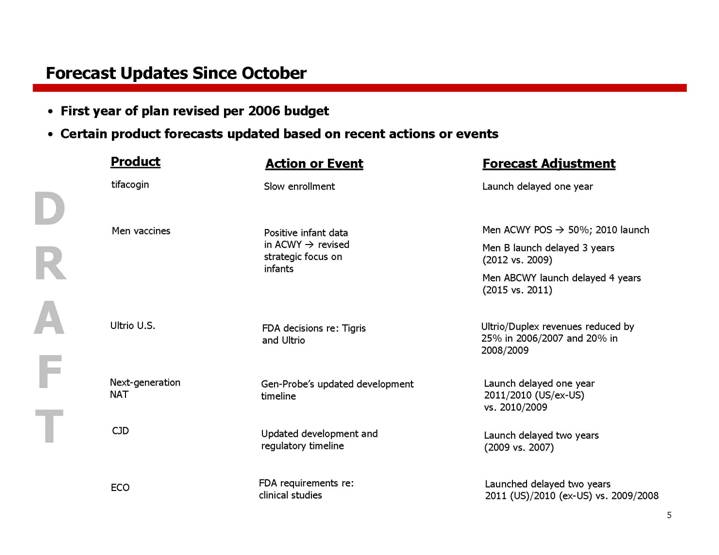

Forecast Updates Since October

• First year of plan revised per 2006 budget

• Certain product forecasts updated based on recent actions or events

Product | | Action or Event | | Forecast Adjustment |

| | | | |

tifacogin | | Slow enrollment | | Launch delayed one year |

| | | | |

Men vaccines | | Positive infant data in ACWY –> revised strategic focus on infants | | Men ACWY POS –> 50%; 2010 launch Men B launch delayed 3 years (2012 vs. 2009) Men ABCWY launch delayed 4 years (2015 vs. 2011) |

| | | | |

Ultrio U.S. | | FDA decisions re: Tigris and Ultrio | | Ultrio/Duplex revenues reduced by 25% in 2006/2007 and 20% in 2008/2009 |

| | | | |

Next-generation

NAT | | Gen-Probe’s updated development timeline | | Launch delayed one year 2011/2010 (US/ex-US) vs. 2010/2009 |

| | | | |

CJD | | Updated development and regulatory timeline | | Launch delayed two years (2009 vs. 2007) |

| | | | |

ECO | | FDA requirements re: clinical studies | | Launched delayed two years 2011 (US)/2010 (ex-US) vs. 2009/2008 |

6

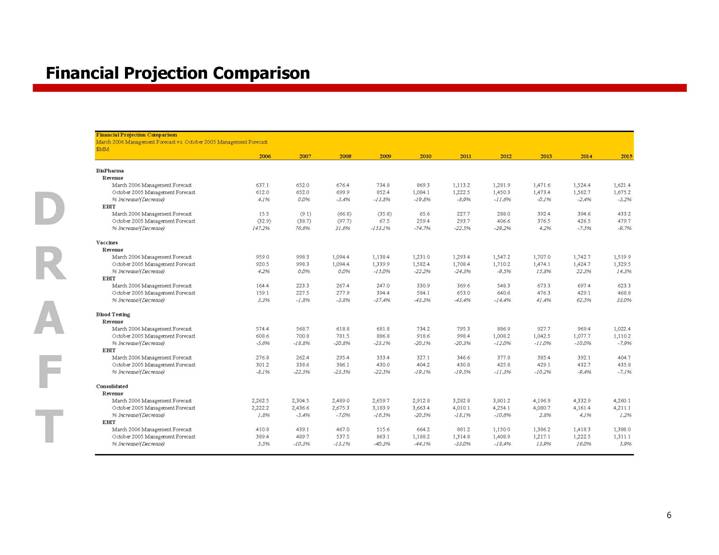

Financial Projection Comparison

Financial Projection Comparison

March 2006 Management Forecast vs. October 2005 Management Forecast $MM

| | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | | 2015 | |

BioPharma | | | | | | | | | | | | | | | | | | | | | |

Revenue | | | | | | | | | | | | | | | | | | | | | |

March 2006 Management Forecast | | 637.1 | | 652.0 | | 676.4 | | 734.8 | | 869.3 | | 1,113.2 | | 1,281.9 | | 1,471.6 | | 1,524.4 | | 1,621.4 | |

October 2005 Management Forecast | | 612.0 | | 652.0 | | 699.9 | | 852.4 | | 1,084.1 | | 1,222.5 | | 1,450.3 | | 1,473.4 | | 1,562.7 | | 1,675.2 | |

% Increase/(Decrease) | | 4.1 | % | 0.0 | % | -3.4 | % | -13.8 | % | -19.8 | % | -8.9 | % | -11.6 | % | -0.1 | % | -2.4 | % | -3.2 | % |

EBIT | | | | | | | | | | | | | | | | | | | | | |

March 2006 Management Forecast | | 15.5 | | (9.1 | ) | (66.8 | ) | (35.8 | ) | 65.6 | | 227.7 | | 288.0 | | 392.4 | | 394.6 | | 433.2 | |

October 2005 Management Forecast | | (32.9 | ) | (38.7 | ) | (97.7 | ) | 67.5 | | 259.4 | | 293.7 | | 406.6 | | 376.5 | | 426.5 | | 479.7 | |

% Increase/(Decrease) | | 147.2 | % | 76.6 | % | 31.6 | % | -153.1 | % | -74.7 | % | -22.5 | % | -29.2 | % | 4.2 | % | -7.5 | % | -9.7 | % |

| | | | | | | | | | | | | | | | | | | | | |

Vaccines | | | | | | | | | | | | | | | | | | | | | |

Revenue | | | | | | | | | | | | | | | | | | | | | |

March 2006 Management Forecast | | 959.0 | | 998.3 | | 1,094.4 | | 1,138.4 | | 1,231.0 | | 1,293.4 | | 1,547.2 | | 1,707.0 | | 1,742.7 | | 1,519.9 | |

October 2005 Management Forecast | | 920.5 | | 998.3 | | 1,094.4 | | 1,339.9 | | 1,582.4 | | 1,708.4 | | 1,710.2 | | 1,474.1 | | 1,424.7 | | 1,329.5 | |

% Increase/(Decrease) | | 4.2 | % | 0.0 | % | 0.0 | % | -15.0 | % | -22.2 | % | -24.3 | % | -9.5 | % | 15.8 | % | 22.3 | % | 14.3 | % |

EBIT | | | | | | | | | | | | | | | | | | | | | |

March 2006 Management Forecast | | 164.4 | | 223.3 | | 267.4 | | 247.0 | | 330.9 | | 369.6 | | 548.3 | | 673.3 | | 697.4 | | 623.3 | |

October 2005 Management Forecast | | 159.1 | | 227.5 | | 277.9 | | 394.4 | | 584.1 | | 653.0 | | 640.6 | | 476.3 | | 429.1 | | 468.8 | |

% Increase/(Decrease) | | 3.3 | % | -1.8 | % | -3.8 | % | -37.4 | % | -43.3 | % | -43.4 | % | -14.4 | % | 41.4 | % | 62.5 | % | 33.0 | % |

| | | | | | | | | | | | | | | | | | | | | |

Blood Testing | | | | | | | | | | | | | | | | | | | | | |

Revenue | | | | | | | | | | | | | | | | | | | | | |

March 2006 Management Forecast | | 574.4 | | 568.7 | | 618.8 | | 681.8 | | 734.2 | | 795.3 | | 886.9 | | 927.7 | | 969.4 | | 1,022.4 | |

October 2005 Management Forecast | | 608.6 | | 700.8 | | 781.5 | | 886.8 | | 918.6 | | 998.4 | | 1,008.2 | | 1,042.5 | | 1,077.7 | | 1,110.2 | |

% Increase/(Decrease) | | -5.6 | % | -18.8 | % | -20.8 | % | -23.1 | % | -20.1 | % | -20.3 | % | -12.0 | % | -11.0 | % | -10.0 | % | -7.9 | % |

EBIT | | | | | | | | | | | | | | | | | | | | | |

March 2006 Management Forecast | | 276.8 | | 262.4 | | 295.4 | | 333.4 | | 327.1 | | 346.6 | | 377.8 | | 385.4 | | 392.1 | | 404.7 | |

October 2005 Management Forecast | | 301.2 | | 338.6 | | 386.1 | | 430.0 | | 404.2 | | 430.8 | | 425.8 | | 429.1 | | 432.7 | | 435.8 | |

% Increase/(Decrease) | | -8.1 | % | -22.5 | % | -23.5 | % | -22.5 | % | -19.1 | % | -19.5 | % | -11.3 | % | -10.2 | % | -9.4 | % | -7.1 | % |

| | | | | | | | | | | | | | | | | | | | | |

Consolidated | | | | | | | | | | | | | | | | | | | | | |

Revenue | | | | | | | | | | | | | | | | | | | | | |

March 2006 Management Forecast | | 2,262.5 | | 2,304.5 | | 2,489.0 | | 2,659.7 | | 2,912.8 | | 3,282.8 | | 3,801.2 | | 4,196.9 | | 4,332.9 | | 4,260.1 | |

October 2005 Management Forecast | | 2,222.2 | | 2,436.6 | | 2,675.3 | | 3,183.9 | | 3,663.4 | | 4,010.1 | | 4,254.1 | | 4,080.7 | | 4,161.4 | | 4,211.1 | |

% Increase/(Decrease) | | 1.8 | % | -5.4 | % | -7.0 | % | -16.5 | % | -20.5 | % | -18.1 | % | -10.6 | % | 2.8 | % | 4.1 | % | 1.2 | % |

EBIT | | | | | | | | | | | | | | | | | | | | | |

March 2006 Management Forecast | | 410.8 | | 439.1 | | 467.0 | | 515.6 | | 664.2 | | 881.2 | | 1,150.0 | | 1,386.2 | | 1,418.3 | | 1,388.0 | |

October 2005 Management Forecast | | 389.4 | | 489.7 | | 537.5 | | 863.1 | | 1,188.2 | | 1,314.8 | | 1,408.9 | | 1,217.1 | | 1,222.5 | | 1,311.1 | |

% Increase/(Decrease) | | 5.5 | % | -10.3 | % | -13.1 | % | -40.3 | % | -44.1 | % | -33.0 | % | -18.4 | % | 13.9 | % | 16.0 | % | 5.9 | % |

7

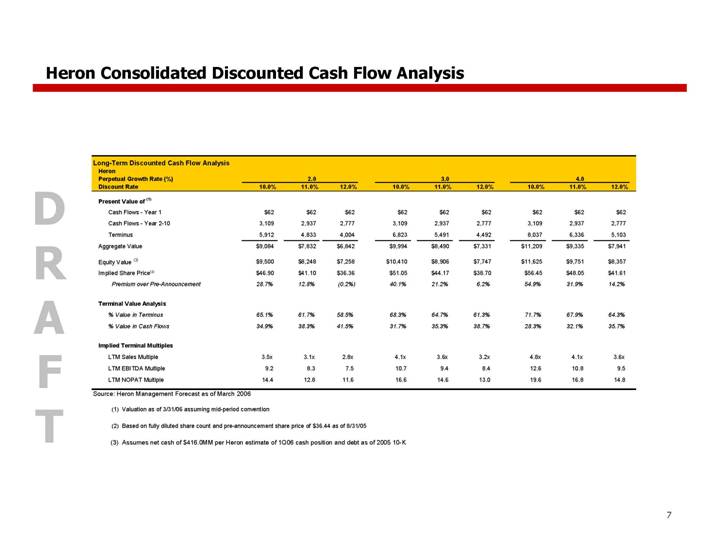

Heron Consolidated Discounted Cash Flow Analysis

Long-Term Discounted Cash Flow Analysis

Heron | | | | | | | | | | | | | | | | | | | |

Perpetual Growth Rate (%) | | 2.0 | | 3.0 | | 4.0 | |

Discount Rate | | 10.0% | | 11.0% | | 12.0% | | 10.0% | | 11.0% | | 12.0% | | 10.0% | | 11.0% | | 12.0% | |

Present Value of (1) | | | | | | | | | | | | | | | | | | | |

Cash Flows - Year 1 | | $ | 62 | | $ | 62 | | $ | 62 | | $ | 62 | | $ | 62 | | $ | 62 | | $ | 62 | | $ | 62 | | $ | 62 | |

Cash Flows - Year 2-10 | | 3,109 | | 2,937 | | 2,777 | | 3,109 | | 2,937 | | 2,777 | | 3,109 | | 2,937 | | 2,777 | |

Terminus | | 5,912 | | 4,833 | | 4,004 | | 6,823 | | 5,491 | | 4,492 | | 8,037 | | 6,336 | | 5,103 | |

Aggregate Value | | $ | 9,084 | | $ | 7,832 | | $ | 6,842 | | $ | 9,994 | | $ | 8,490 | | $ | 7,331 | | $ | 11,209 | | $ | 9,335 | | $ | 7,941 | |

| | | | | | | | | | | | | | | | | | | |

Equity Value (3) | | $ | 9,500 | | $ | 8,248 | | $ | 7,258 | | $ | 10,410 | | $ | 8,906 | | $ | 7,747 | | $ | 11,625 | | $ | 9,751 | | $ | 8,357 | |

Implied Share Price(2) | | $ | 46.90 | | $ | 41.10 | | $ | 36.36 | | $ | 51.05 | | $ | 44.17 | | $ | 38.70 | | $ | 56.45 | | $ | 48.05 | | $ | 41.61 | |

Premium over Pre-Announcement | | 28.7 | % | 12.8 | % | (0.2 | )% | 40.1 | % | 21.2 | % | 6.2 | % | 54.9 | % | 31.9 | % | 14.2 | % |

| | | | | | | | | | | | | | | | | | | |

Terminal Value Analysis | | | | | | | | | | | | | | | | | | | |

% Value in Terminus | | 65.1 | % | 61.7 | % | 58.5 | % | 68.3 | % | 64.7 | % | 61.3 | % | 71.7 | % | 67.9 | % | 64.3 | % |

% Value in Cash Flows | | 34.9 | % | 38.3 | % | 41.5 | % | 31.7 | % | 35.3 | % | 38.7 | % | 28.3 | % | 32.1 | % | 35.7 | % |

| | | | | | | | | | | | | | | | | | | |

Implied Terminal Multiples | | | | | | | | | | | | | | | | | | | |

LTM Sales Multiple | | 3.5 | x | 3.1 | x | 2.8 | x | 4.1 | x | 3.6 | x | 3.2 | x | 4.8 | x | 4.1 | x | 3.6 | x |

LTM EBITDA Multiple | | 9.2 | | 8.3 | | 7.5 | | 10.7 | | 9.4 | | 8.4 | | 12.6 | | 10.8 | | 9.5 | |

LTM NOPAT Multiple | | 14.4 | | 12.8 | | 11.6 | | 16.6 | | 14.6 | | 13.0 | | 19.6 | | 16.8 | | 14.8 | |

Source: Heron Management Forecast as of March 2006

(1) Valuation as of 3/31/06 assuming mid-period convention

(2) Based on fully diluted share count and pre-announcement share price of $36.44 as of 8/31/05

(3) Assumes net cash of $416.0MM per Heron estimate of 1Q06 cash position and debt as of 2005 10-K

8

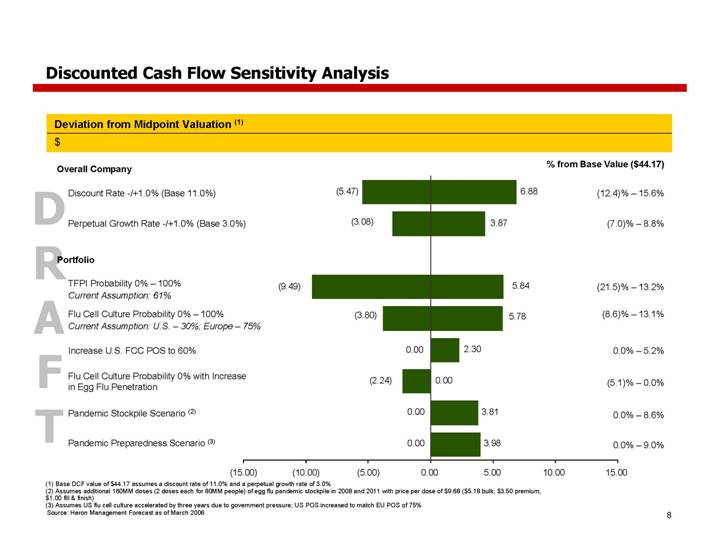

Discounted Cash Flow Sensitivity Analysis

Deviation from Midpoint Valuation (1) $

[CHART]

(1) Base DCF value of $44.17 assumes a discount rate of 11.0% and a perpetual growth rate of 3.0%

(2) Assumes additional 160MM doses (2 doses each for 80MM people) of egg flu pandemic stockpile in 2008 and 2011 with price per dose of $9.68 ($5.18 bulk, $3.50 premium, $1.00 fill & finish)

(3) Assumes US flu cell culture accelerated by three years due to government pressure; US POS increased to match EUP OS of 75% Source: Heron Management Forecast as of March 2006

9

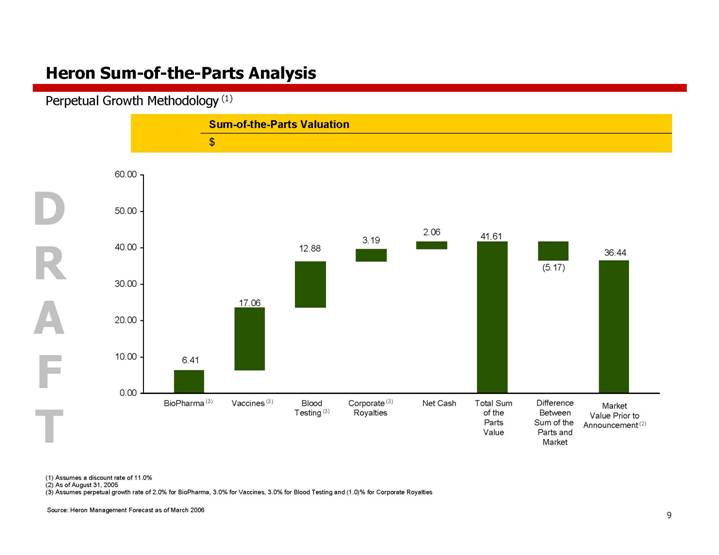

Heron Sum-of-the-Parts Analysis

Perpetual Growth Methodology (1)

Sum-of-the-Parts Valuation

[CHART]

(1) Assumes a discount rate of 11.0%

(2) As of August 31, 2005

(3) Assumes perpetual growth rate of 2.0% for BioPharma, 3.0% for Vaccines, 3.0% for Blood Testing and (1.0)% for Corporate Royalties

Source: Heron Management Forecast as of March 2006

10

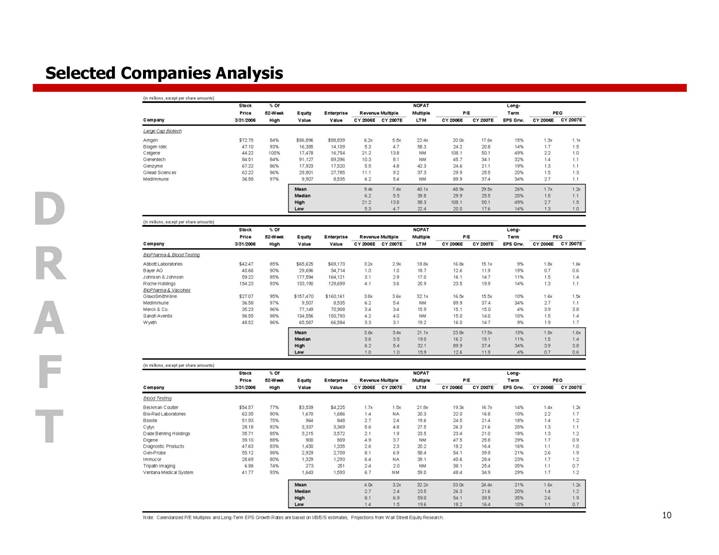

Selected Companies Analysis

(in millions, except per share amounts)

| | Stock | | % Of | | | | | | | | | | NOPAT | | | | | | Long- | | | | | |

| | Price | | 52-Week | | Equity | | Enterprise | | Revenue Multiple | | Multiple | | P/E | | Term | | PEG | |

Company | | 3/31/2006 | | High | | Value | | Value | | CY 2006E | | CY 2007E | | LTM | | CY 2006E | | CY 2007E | | EPS Grw. | | CY 2006E | | CY 2007E | |

Large Cap Biotech | | | | | | | | | | | | | | | | | | | | | | | | | |

Amgen | | $ | 72.75 | | 84 | % | $ | 86,896 | | $ | 88,839 | | 6.2 | x | 5.5 | x | 22.4 | x | 20.0 | x | 17.6 | x | 15 | % | 1.3 | x | 1.1 | x |

Biogen Idec | | 47.10 | | 93 | % | 16,385 | | 14,109 | | 5.3 | | 4.7 | | 58.3 | | 24.2 | | 20.8 | | 14 | % | 1.7 | | 1.5 | |

Celgene | | 44.22 | | 100 | % | 17,478 | | 16,754 | | 21.2 | | 13.8 | | NM | | 108.1 | | 50.1 | | 49 | % | 2.2 | | 1.0 | |

Genentech | | 84.51 | | 84 | % | 91,127 | | 89,396 | | 10.3 | | 8.1 | | NM | | 45.7 | | 34.1 | | 32 | % | 1.4 | | 1.1 | |

Genzyme | | 67.22 | | 86 | % | 17,923 | | 17,520 | | 5.5 | | 4.8 | | 42.3 | | 24.6 | | 21.1 | | 19 | % | 1.3 | | 1.1 | |

Gilead Sciences | | 62.22 | | 96 | % | 29,801 | | 27,785 | | 11.1 | | 9.2 | | 37.3 | | 29.9 | | 25.5 | | 20 | % | 1.5 | | 1.3 | |

MedImmune | | 36.58 | | 97 | % | 9,507 | | 8,535 | | 6.2 | | 5.4 | | NM | | 89.9 | | 37.4 | | 34 | % | 2.7 | | 1.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Mean | | | | 9.4 | x | 7.4 | x | 40.1 | x | 48.9 | x | 29.5 | x | 26 | % | 1.7 | x | 1.2 | x |

| | | | | | Median | | | | 6.2 | | 5.5 | | 39.8 | | 29.9 | | 25.5 | | 20 | % | 1.5 | | 1.1 | |

| | | | | | High | | | | 21.2 | | 13.8 | | 58.3 | | 108.1 | | 50.1 | | 49 | % | 2.7 | | 1.5 | |

| | | | | | Low | | | | 5.3 | | 4.7 | | 22.4 | | 20.0 | | 17.6 | | 14 | % | 1.3 | | 1.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(in millions, except per share amounts)

| | Stock | | % Of | | | | | | | | | | NOPAT | | | | | | Long- | | | | | |

| | Price | | 52-Week | | Equity | | Enterprise | | Revenue Multiple | | Multiple | | P/E | | Term | | PEG | |

Company | | 3/31/2006 | | High | | Value | | Value | | CY 2006E | | CY 2007E | | LTM | | CY 2006E | | CY 2007E | | EPS Grw. | | CY 2006E | | CY 2007E | |

BioPharma & Blood Testing | | | | | | | | | | | | | | | | | | | | | | | | | |

Abbott Laboratories | | $ | 42.47 | | 85 | % | $ | 65,625 | | $ | 69,173 | | 3.2 | x | 2.9 | x | 18.8 | x | 16.8 | x | 15.1 | x | 9 | % | 1.8 | x | 1.6 | x |

Bayer AG | | 40.66 | | 90 | % | 29,696 | | 34,714 | | 1.0 | | 1.0 | | 18.7 | | 12.6 | | 11.9 | | 19 | % | 0.7 | | 0.6 | |

Johnson & Johnson | | 59.22 | | 85 | % | 177,594 | | 164,121 | | 3.1 | | 2.9 | | 17.0 | | 16.1 | | 14.7 | | 11 | % | 1.5 | | 1.4 | |

Roche Holdings | | 154.23 | | 93 | % | 133,190 | | 129,699 | | 4.1 | | 3.6 | | 20.9 | | 23.5 | | 19.9 | | 14 | % | 1.3 | | 1.1 | |

BioPharma & Vaccines | | | | | | | | | | | | | | | | | | | | | | | | | |

GlaxoSmithKline | | $ | 27.07 | | 95 | % | $ | 157,470 | | $ | 160,161 | | 3.8 | x | 3.6 | x | 32.1 | x | 16.5 | x | 15.5 | x | 10 | % | 1.6 | x | 1.5 | x |

MedImmune | | 36.58 | | 97 | % | 9,507 | | 8,535 | | 6.2 | | 5.4 | | NM | | 89.9 | | 37.4 | | 34 | % | 2.7 | | 1.1 | |

Merck & Co. | | 35.23 | | 96 | % | 77,149 | | 70,908 | | 3.4 | | 3.4 | | 15.9 | | 15.1 | | 15.0 | | 4 | % | 3.9 | | 3.8 | |

Sanofi Aventis | | 96.55 | | 98 | % | 134,556 | | 150,793 | | 4.2 | | 4.0 | | NM | | 15.0 | | 14.0 | | 10 | % | 1.5 | | 1.4 | |

Wyeth | | 48.52 | | 96 | % | 65,587 | | 66,584 | | 3.3 | | 3.1 | | 19.2 | | 16.0 | | 14.7 | | 9 | % | 1.9 | | 1.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Mean | | | | 3.6 | x | 3.4 | x | 21.1 | x | 23.8 | x | 17.5 | x | 13 | % | 1.8 | x | 1.6 | x |

| | | | | | Median | | | | 3.6 | | 3.5 | | 19.0 | | 16.2 | | 15.1 | | 11 | % | 1.5 | | 1.4 | |

| | | | | | High | | | | 6.2 | | 5.4 | | 32.1 | | 89.9 | | 37.4 | | 34 | % | 3.9 | | 3.8 | |

| | | | | | Low | | | | 1.0 | | 1.0 | | 15.9 | | 12.6 | | 11.9 | | 4 | % | 0.7 | | 0.6 | |

(in millions, except per share amounts)

| | Stock | | % Of | | | | | | | | | | NOPAT | | | | | | Long- | | | | | |

| | Price | | 52-Week | | Equity | | Enterprise | | Revenue Multiple | | Multiple | | P/E | | Term | | PEG | |

Company | | 3/31/2006 | | High | | Value | | Value | | CY 2006E | | CY 2007E | | LTM | | CY 2006E | | CY 2007E | | EPS Grw. | | CY 2006E | | CY 2007E | |

Blood Testing | | | | | | | | | | | | | | | | | | | | | | | | | |

Beckman Coulter | | $ | 54.57 | | 77 | % | $ | 3,539 | | $ | 4,225 | | 1.7 | x | 1.5 | x | 21.8 | x | 19.3 | x | 16.7 | x | 14 | % | 1.4 | x | 1.2 | x |

Bio-Rad Laboratories | | 62.35 | | 90 | % | 1,670 | | 1,686 | | 1.4 | | NA | | 20.3 | | 22.0 | | 16.8 | | 10 | % | 2.2 | | 1.7 | |

Biosite | | 51.93 | | 75 | % | 964 | | 848 | | 2.7 | | 2.4 | | 19.6 | | 24.5 | | 21.4 | | 18 | % | 1.4 | | 1.2 | |

Cytyc | | 28.18 | | 92 | % | 3,337 | | 3,369 | | 5.6 | | 4.8 | | 27.5 | | 26.3 | | 21.6 | | 20 | % | 1.3 | | 1.1 | |

Dade Behring Holdings | | 35.71 | | 85 | % | 3,215 | | 3,572 | | 2.1 | | 1.9 | | 23.5 | | 23.4 | | 21.0 | | 18 | % | 1.3 | | 1.2 | |

Digene | | 39.10 | | 88 | % | 900 | | 809 | | 4.9 | | 3.7 | | NM | | 47.5 | | 25.8 | | 29 | % | 1.7 | | 0.9 | |

Diagnostic Products | | 47.63 | | 83 | % | 1,430 | | 1,335 | | 2.6 | | 2.3 | | 20.2 | | 18.2 | | 16.4 | | 16 | % | 1.1 | | 1.0 | |

Gen-Probe | | 55.12 | | 98 | % | 2,929 | | 2,709 | | 8.1 | | 6.9 | | 58.4 | | 54.1 | | 39.9 | | 21 | % | 2.6 | | 1.9 | |

Immucor | | 28.69 | | 80 | % | 1,329 | | 1,293 | | 6.4 | | NA | | 39.1 | | 40.6 | | 28.4 | | 23 | % | 1.7 | | 1.2 | |

Tripath Imaging | | 6.98 | | 74 | % | 273 | | 251 | | 2.4 | | 2.0 | | NM | | 38.1 | | 25.4 | | 35 | % | 1.1 | | 0.7 | |

Ventana Medical System | | 41.77 | | 93 | % | 1,643 | | 1,593 | | 6.7 | | NM | | 59.0 | | 48.4 | | 34.9 | | 29 | % | 1.7 | | 1.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Mean | | | | 4.0 | x | 3.2 | x | 32.2 | x | 33.0 | x | 24.4 | x | 21 | % | 1.6 | x | 1.2 | x |

| | | | | | Median | | | | 2.7 | | 2.4 | | 23.5 | | 26.3 | | 21.6 | | 20 | % | 1.4 | | 1.2 | |

| | | | | | High | | | | 8.1 | | 6.9 | | 59.0 | | 54.1 | | 39.9 | | 35 | % | 2.6 | | 1.9 | |

| | | | | | Low | | | | 1.4 | | 1.5 | | 19.6 | | 18.2 | | 16.4 | | 10 | % | 1.1 | | 0.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Note: Calendarized P/E Multiples and Long-Term EPS Growth Rates are based on I/B/E/S estimates; Projections from Wall Street Equity Research.

11

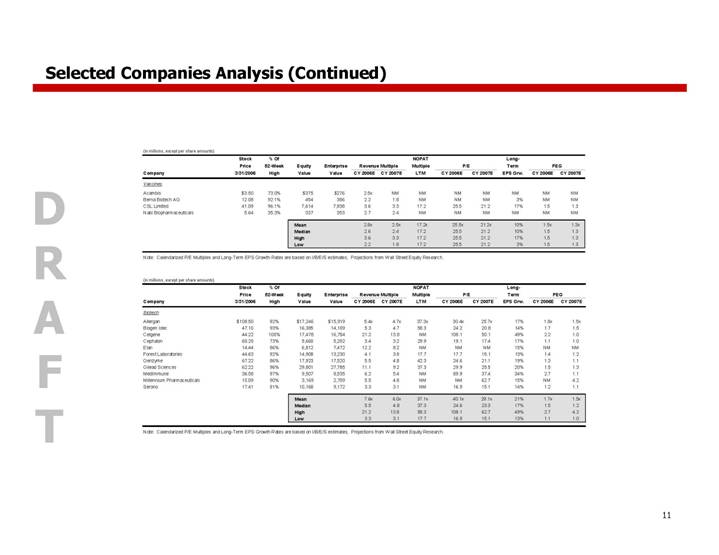

(in millions, except per share amounts)

| | Stock | | % Of | | | | | | | | | | NOPAT | | | | | | Long- | | | | | |

| | Price | | 52-Week | | Equity | | Enterprise | | Revenue Multiple | | Multiple | | P/E | | Term | | PEG | |

Company | | 3/31/2006 | | High | | Value | | Value | | CY 2006E | | CY 2007E | | LTM | | CY 2006E | | CY 2007E | | EPS Grw. | | CY 2006E | | CY 2007E | |

Vaccines | | | | | | | | | | | | | | | | | | | | | | | | | |

Acambis | | $ | 3.50 | | 73.0 | % | $ | 375 | | $ | 276 | | 2.5 | x | NM | | NM | | NM | | NM | | NM | | NM | | NM | |

Berna Biotech AG | | 12.08 | | 92.1 | % | 454 | | 386 | | 2.2 | | 1.8 | | NM | | NM | | NM | | 3 | % | NM | | NM | |

CSL Limited | | 41.09 | | 96.1 | % | 7,614 | | 7,938 | | 3.6 | | 3.3 | | 17.2 | | 25.5 | | 21.2 | | 17 | % | 1.5 | | 1.3 | |

Nabi Biopharmaceuticals | | 5.64 | | 35.3 | % | 337 | | 353 | | 2.7 | | 2.4 | | NM | | NM | | NM | | NM | | NM | | NM | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Mean | | | | 2.8 | x | 2.5 | x | 17.2 | x | 25.5 | x | 21.2 | x | 10 | % | 1.5 | x | 1.3 | x |

| | | | | | Median | | | | 2.6 | | 2.4 | | 17.2 | | 25.5 | | 21.2 | | 10 | % | 1.5 | | 1.3 | |

| | | | | | High | | | | 3.6 | | 3.3 | | 17.2 | | 25.5 | | 21.2 | | 17 | % | 1.5 | | 1.3 | |

| | | | | | Low | | | | 2.2 | | 1.8 | | 17.2 | | 25.5 | | 21.2 | | 3 | % | 1.5 | | 1.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Note: Calendarized P/E Multiples and Long-Term EPS Growth Rates are based on I/B/E/S estimates; Projections from Wall Street Equity Research.

(in millions, except per share amounts)

| | Stock | | % Of | | | | | | | | | | NOPAT | | | | | | Long- | | | | | |

| | Price | | 52-Week | | Equity | | Enterprise | | Revenue Multiple | | Multiple | | P/E | | Term | | PEG | |

Company | | 3/31/2006 | | High | | Value | | Value | | CY 2006E | | CY 2007E | | LTM | | CY 2006E | | CY 2007E | | EPS Grw. | | CY 2006E | | CY 2007E | |

Biotech | | | | | | | | | | | | | | | | | | | | | | | | | |

Allergan | | $ | 108.50 | | 92 | % | $ | 17,246 | | $ | 15,919 | | 5.4 | x | 4.7 | x | 37.3 | x | 30.4 | x | 25.7 | x | 17 | % | 1.8 | x | 1.5 | x |

Biogen Idec | | 47.10 | | 93 | % | 16,385 | | 14,109 | | 5.3 | | 4.7 | | 58.3 | | 24.2 | | 20.8 | | 14 | % | 1.7 | | 1.5 | |

Celgene | | 44.22 | | 100 | % | 17,478 | | 16,754 | | 21.2 | | 13.8 | | NM | | 108.1 | | 50.1 | | 49 | % | 2.2 | | 1.0 | |

Cephalon | | 60.25 | | 73 | % | 5,660 | | 5,202 | | 3.4 | | 3.2 | | 29.9 | | 19.1 | | 17.4 | | 17 | % | 1.1 | | 1.0 | |

Elan | | 14.44 | | 86 | % | 6,812 | | 7,472 | | 12.2 | | 8.2 | | NM | | NM | | NM | | 15 | % | NM | | NM | |

Forest Laboratories | | 44.63 | | 92 | % | 14,908 | | 13,230 | | 4.1 | | 3.8 | | 17.7 | | 17.7 | | 15.1 | | 13 | % | 1.4 | | 1.2 | |

Genzyme | | 67.22 | | 86 | % | 17,923 | | 17,520 | | 5.5 | | 4.8 | | 42.3 | | 24.6 | | 21.1 | | 19 | % | 1.3 | | 1.1 | |

Gilead Sciences | | 62.22 | | 96 | % | 29,801 | | 27,785 | | 11.1 | | 9.2 | | 37.3 | | 29.9 | | 25.5 | | 20 | % | 1.5 | | 1.3 | |

MedImmune | | 36.58 | | 97 | % | 9,507 | | 8,535 | | 6.2 | | 5.4 | | NM | | 89.9 | | 37.4 | | 34 | % | 2.7 | | 1.1 | |

Millennium Pharmaceuticals | | 10.09 | | 90 | % | 3,169 | | 2,709 | | 5.5 | | 4.8 | | NM | | NM | | 62.7 | | 15 | % | NM | | 4.2 | |

Serono | | 17.41 | | 81 | % | 10,168 | | 9,172 | | 3.3 | | 3.1 | | NM | | 16.9 | | 15.1 | | 14 | % | 1.2 | | 1.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Mean | | | | 7.6 | x | 6.0 | x | 37.1 | x | 40.1 | x | 29.1 | x | 21 | % | 1.7 | x | 1.5 | x |

| | | | | | Median | | | | 5.5 | | 4.8 | | 37.3 | | 24.6 | | 23.3 | | 17 | % | 1.5 | | 1.2 | |

| | | | | | High | | | | 21.2 | | 13.8 | | 58.3 | | 108.1 | | 62.7 | | 49 | % | 2.7 | | 4.2 | |

| | | | | | Low | | | | 3.3 | | 3.1 | | 17.7 | | 16.9 | | 15.1 | | 13 | % | 1.1 | | 1.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Note: Calendarized P/E Multiples and Long-Term EPS Growth Rates are based on I/B/E/S estimates; Projections from Wall Street Equity Research.

12

2. Review of Heron Management Plan

13

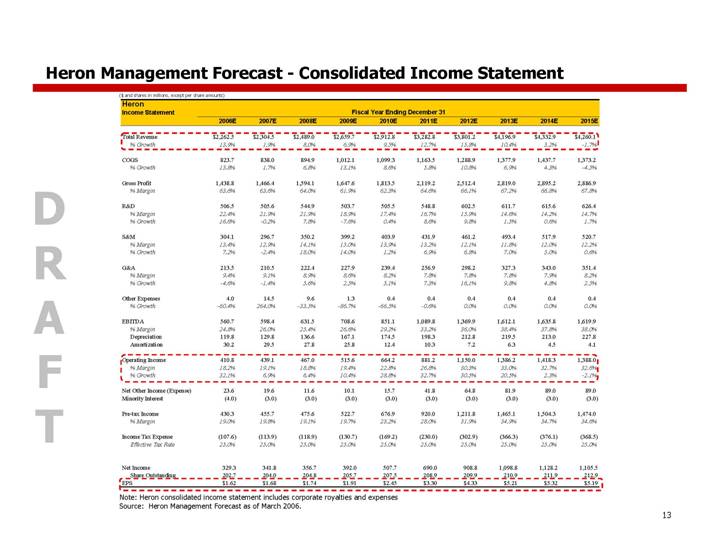

Heron Management Forecast -Consolidated Income Statement

($ and shares in millions, except per share amounts)

Heron | | Fiscal Year Ending December 31 | |

Income Statement | | 2006E | | 2007E | | 2008E | | 2009E | | 2010E | | 2011E | | 2012E | | 2013E | | 2014E | | 2015E | |

| | | | | | | | | | | | | | | | | | | | | |

Total Revenue | | $ | 2,262.5 | | $ | 2,304.5 | | $ | 2,489.0 | | $ | 2,659.7 | | $ | 2,912.8 | | $ | 3,282.8 | | $ | 3,801.2 | | $ | 4,196.9 | | $ | 4,332.9 | | $ | 4,260.1 | |

% Growth | | 13.9 | % | 1.9 | % | 8.0 | % | 6.9 | % | 9.5 | % | 12.7 | % | 15.8 | % | 10.4 | % | 3.2 | % | -1.7 | % |

| | | | | | | | | | | | | | | | | | | | | |

COGS | | 823.7 | | 838.0 | | 894.9 | | 1,012.1 | | 1,099.3 | | 1,163.5 | | 1,288.9 | | 1,377.9 | | 1,437.7 | | 1,373.2 | |

% Growth | | 13.8 | % | 1.7 | % | 6.8 | % | 13.1 | % | 8.6 | % | 5.8 | % | 10.8 | % | 6.9 | % | 4.3 | % | -4.5 | % |

| | | | | | | | | | | | | | | | | | | | | |

Gross Profit | | 1,438.8 | | 1,466.4 | | 1,594.1 | | 1,647.6 | | 1,813.5 | | 2,119.2 | | 2,512.4 | | 2,819.0 | | 2,895.2 | | 2,886.9 | |

% Margin | | 63.6 | % | 63.6 | % | 64.0 | % | 61.9 | % | 62.3 | % | 64.6 | % | 66.1 | % | 67.2 | % | 66.8 | % | 67.8 | % |

| | | | | | | | | | | | | | | | | | | | | |

R&D | | 506.5 | | 505.6 | | 544.9 | | 503.7 | | 505.5 | | 548.8 | | 602.5 | | 611.7 | | 615.6 | | 626.4 | |

% Margin | | 22.4 | % | 21.9 | % | 21.9 | % | 18.9 | % | 17.4 | % | 16.7 | % | 15.9 | % | 14.6 | % | 14.2 | % | 14.7 | % |

% Growth | | 16.6 | % | -0.2 | % | 7.8 | % | -7.6 | % | 0.4 | % | 8.6 | % | 9.8 | % | 1.5 | % | 0.6 | % | 1.7 | % |

| | | | | | | | | | | | | | | | | | | | | |

S&M | | 304.1 | | 296.7 | | 350.2 | | 399.2 | | 403.9 | | 431.9 | | 461.2 | | 493.4 | | 517.9 | | 520.7 | |

% Margin | | 13.4 | % | 12.9 | % | 14.1 | % | 15.0 | % | 13.9 | % | 13.2 | % | 12.1 | % | 11.8 | % | 12.0 | % | 12.2 | % |

% Growth | | 7.2 | % | -2.4 | % | 18.0 | % | 14.0 | % | 1.2 | % | 6.9 | % | 6.8 | % | 7.0 | % | 5.0 | % | 0.6 | % |

| | | | | | | | | | | | | | | | | | | | | |

G&A | | 213.5 | | 210.5 | | 222.4 | | 227.9 | | 239.4 | | 256.9 | | 298.2 | | 327.3 | | 343.0 | | 351.4 | |

% Margin | | 9.4 | % | 9.1 | % | 8.9 | % | 8.6 | % | 8.2 | % | 7.8 | % | 7.8 | % | 7.8 | % | 7.9 | % | 8.2 | % |

% Growth | | -4.6 | % | -1.4 | % | 5.6 | % | 2.5 | % | 5.1 | % | 7.3 | % | 16.1 | % | 9.8 | % | 4.8 | % | 2.5 | % |

| | | | | | | | | | | | | | | | | | | | | |

Other Expenses | | 4.0 | | 14.5 | | 9.6 | | 1.3 | | 0.4 | | 0.4 | | 0.4 | | 0.4 | | 0.4 | | 0.4 | |

% Growth | | -60.4 | % | 264.0 | % | -33.5 | % | -86.7 | % | -66.5 | % | -0.6 | % | 0.0 | % | 0.0 | % | 0.0 | % | 0.0 | % |

| | | | | | | | | | | | | | | | | | | | | |

EBITDA | | 560.7 | | 598.4 | | 631.5 | | 708.6 | | 851.1 | | 1,089.8 | | 1,369.9 | | 1,612.1 | | 1,635.8 | | 1,619.9 | |

% Margin | | 24.8 | % | 26.0 | % | 25.4 | % | 26.6 | % | 29.2 | % | 33.2 | % | 36.0 | % | 38.4 | % | 37.8 | % | 38.0 | % |

Depreciation | | 119.8 | | 129.8 | | 136.6 | | 167.1 | | 174.5 | | 198.3 | | 212.8 | | 219.5 | | 213.0 | | 227.8 | |

Amortization | | 30.2 | | 29.5 | | 27.8 | | 25.8 | | 12.4 | | 10.3 | | 7.2 | | 6.3 | | 4.5 | | 4.1 | |

| | | | | | | | | | | | | | | | | | | | | |

Operating Income | | 410.8 | | 439.1 | | 467.0 | | 515.6 | | 664.2 | | 881.2 | | 1,150.0 | | 1,386.2 | | 1,418.3 | | 1,388.0 | |

% Margin | | 18.2 | % | 19.1 | % | 18.8 | % | 19.4 | % | 22.8 | % | 26.8 | % | 30.3 | % | 33.0 | % | 32.7 | % | 32.6 | % |

% Growth | | 32.1 | % | 6.9 | % | 6.4 | % | 10.4 | % | 28.8 | % | 32.7 | % | 30.5 | % | 20.5 | % | 2.3 | % | -2.1 | % |

| | | | | | | | | | | | | | | | | | | | | |

Net Other Income (Expense) | | 23.6 | | 19.6 | | 11.6 | | 10.1 | | 15.7 | | 41.8 | | 64.8 | | 81.9 | | 89.0 | | 89.0 | |

Minority Interest | | (4.0 | ) | (3.0 | ) | (3.0 | ) | (3.0 | ) | (3.0 | ) | (3.0 | ) | (3.0 | ) | (3.0 | ) | (3.0 | ) | (3.0 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Pre-tax Income | | 430.3 | | 455.7 | | 475.6 | | 522.7 | | 676.9 | | 920.0 | | 1,211.8 | | 1,465.1 | | 1,504.3 | | 1,474.0 | |

% Margin | | 19.0 | % | 19.8 | % | 19.1 | % | 19.7 | % | 23.2 | % | 28.0 | % | 31.9 | % | 34.9 | % | 34.7 | % | 34.6 | % |

| | | | | | | | | | | | | | | | | | | | | |

Income Tax Expense | | (107.6 | ) | (113.9 | ) | (118.9 | ) | (130.7 | ) | (169.2 | ) | (230.0 | ) | (302.9 | ) | (366.3 | ) | (376.1 | ) | (368.5 | ) |

Effective Tax Rate | | 25.0 | % | 25.0 | % | 25.0 | % | 25.0 | % | 25.0 | % | 25.0 | % | 25.0 | % | 25.0 | % | 25.0 | % | 25.0 | % |

| | | | | | | | | | | | | | | | | | | | | |

Net Income | | 329.3 | | 341.8 | | 356.7 | | 392.0 | | 507.7 | | 690.0 | | 908.8 | | 1,098.8 | | 1,128.2 | | 1,105.5 | |

Share Outstanding | | 202.7 | | 204.0 | | 204.8 | | 205.7 | | 207.5 | | 208.9 | | 209.9 | | 210.9 | | 211.9 | | 212.9 | |

EPS | | $ | 1.62 | | $ | 1.68 | | $ | 1.74 | | $ | 1.91 | | $ | 2.45 | | $ | 3.30 | | $ | 4.33 | | $ | 5.21 | | $ | 5.32 | | $ | 5.19 | |

Note: Heron consolidated income statement includes corporate royalties and expenses

Source: Heron Management Forecast as of March 2006.

14

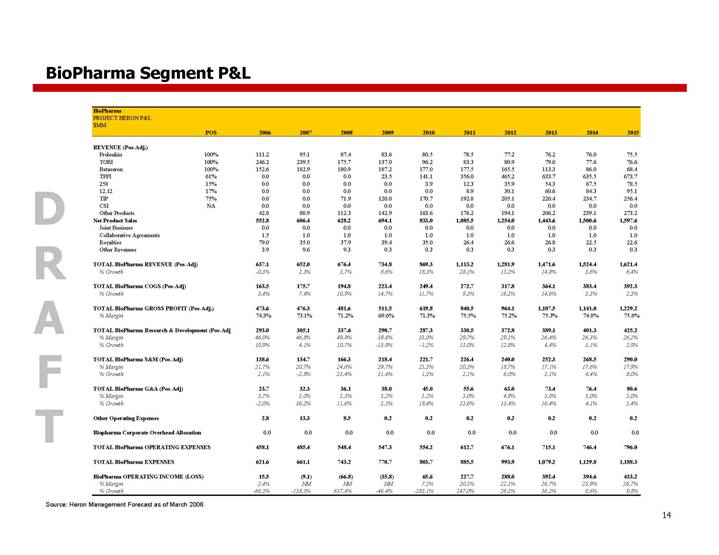

BioPharma Segment P&L

BioPharma | | | | | | | | | | | | | | | | | | | | | | | |

PROJECT HERON P&L | | | | | | | | | | | | | | | | | | | | | | | |

$MM | | POS | | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | | 2015 | |

| | | | | | | | | �� | | | | | | | | | | | | | | |

REVENUE (Pos-Adj.) | | | | | | | | | | | | | | | | | | | | | | | |

Proleukin | | 100 | % | 111.2 | | 95.1 | | 87.4 | | 83.6 | | 80.5 | | 78.5 | | 77.2 | | 76.2 | | 76.0 | | 75.5 | |

TOBI | | 100 | % | 246.2 | | 239.5 | | 175.7 | | 137.0 | | 96.2 | | 83.3 | | 80.9 | | 79.0 | | 77.6 | | 76.6 | |

Betaseron | | 100 | % | 152.6 | | 182.9 | | 180.9 | | 187.2 | | 177.0 | | 177.5 | | 165.5 | | 113.3 | | 86.0 | | 68.4 | |

TFPI | | 61 | % | 0.0 | | 0.0 | | 0.0 | | 23.5 | | 141.1 | | 356.0 | | 465.2 | | 633.7 | | 635.5 | | 673.7 | |

258 | | 15 | % | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 3.9 | | 12.3 | | 35.9 | | 54.3 | | 67.5 | | 78.5 | |

12.12 | | 17 | % | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 8.9 | | 30.1 | | 60.6 | | 84.3 | | 95.1 | |

TIP | | 75 | % | 0.0 | | 0.0 | | 71.9 | | 120.0 | | 170.7 | | 192.8 | | 205.1 | | 220.4 | | 234.7 | | 256.4 | |

CSI | | NA | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | |

Other Products | | | | 42.8 | | 88.9 | | 112.3 | | 142.9 | | 163.6 | | 176.2 | | 194.1 | | 206.2 | | 239.1 | | 273.2 | |

Net Product Sales | | | | 552.8 | | 606.4 | | 628.2 | | 694.1 | | 833.0 | | 1,085.5 | | 1,254.0 | | 1,443.6 | | 1,500.6 | | 1,597.6 | |

Joint Business | | | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | |

Collaborative Agreements | | | | 1.5 | | 1.0 | | 1.0 | | 1.0 | | 1.0 | | 1.0 | | 1.0 | | 1.0 | | 1.0 | | 1.0 | |

Royalties | | | | 79.0 | | 35.0 | | 37.9 | | 39.4 | | 35.0 | | 26.4 | | 26.6 | | 26.8 | | 22.5 | | 22.6 | |

Other Revenues | | | | 3.9 | | 9.6 | | 9.3 | | 0.3 | | 0.3 | | 0.3 | | 0.3 | | 0.3 | | 0.3 | | 0.3 | |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL BioPharma REVENUE (Pos-Adj) | | | | 637.1 | | 652.0 | | 676.4 | | 734.8 | | 869.3 | | 1,113.2 | | 1,281.9 | | 1,471.6 | | 1,524.4 | | 1,621.4 | |

% Growth | | | | -0.3 | % | 2.3 | % | 3.7 | % | 8.6 | % | 18.3 | % | 28.1 | % | 15.2 | % | 14.8 | % | 3.6 | % | 6.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL BioPharma COGS (Pos-Adj) | | | | 163.5 | | 175.7 | | 194.8 | | 223.4 | | 249.4 | | 272.7 | | 317.8 | | 364.1 | | 383.4 | | 392.3 | |

% Growth | | | | 3.4 | % | 7.4 | % | 10.9 | % | 14.7 | % | 11.7 | % | 9.3 | % | 16.5 | % | 14.6 | % | 5.3 | % | 2.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL BioPharma GROSS PROFIT (Pos-Adj.) | | | | 473.6 | | 476.3 | | 481.6 | | 511.5 | | 619.8 | | 840.5 | | 964.1 | | 1,107.5 | | 1,141.0 | | 1,229.2 | |

% Margin | | | | 74.3 | % | 73.1 | % | 71.2 | % | 69.6 | % | 71.3 | % | 75.5 | % | 75.2 | % | 75.3 | % | 74.8 | % | 75.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL BioPharma Research & Development (Pos-Adj | | | | 293.0 | | 305.1 | | 337.6 | | 290.7 | | 287.3 | | 330.5 | | 372.8 | | 389.1 | | 401.3 | | 425.2 | |

% Margin | | | | 46.0 | % | 46.8 | % | 49.9 | % | 39.6 | % | 33.0 | % | 29.7 | % | 29.1 | % | 26.4 | % | 26.3 | % | 26.2 | % |

% Growth | | | | 10.9 | % | 4.1 | % | 10.7 | % | -13.9 | % | -1.2 | % | 15.0 | % | 12.8 | % | 4.4 | % | 3.1 | % | 5.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL BioPharma S&M (Pos-Adj) | | | | 138.6 | | 134.7 | | 166.3 | | 218.4 | | 221.7 | | 226.4 | | 240.0 | | 252.3 | | 268.5 | | 290.0 | |

% Margin | | | | 21.7 | % | 20.7 | % | 24.6 | % | 29.7 | % | 25.5 | % | 20.3 | % | 18.7 | % | 17.1 | % | 17.6 | % | 17.9 | % |

% Growth | | | | 2.1 | % | -2.8 | % | 23.4 | % | 31.4 | % | 1.5 | % | 2.1 | % | 6.0 | % | 5.1 | % | 6.4 | % | 8.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL BioPharma G&A (Pos-Adj) | | | | 23.7 | | 32.3 | | 36.1 | | 38.0 | | 45.0 | | 55.6 | | 63.0 | | 73.4 | | 76.4 | | 80.6 | |

% Margin | | | | 3.7 | % | 5.0 | % | 5.3 | % | 5.2 | % | 5.2 | % | 5.0 | % | 4.9 | % | 5.0 | % | 5.0 | % | 5.0 | % |

% Growth | | | | -2.0 | % | 36.2 | % | 11.6 | % | 5.3 | % | 18.4 | % | 23.6 | % | 13.4 | % | 16.4 | % | 4.1 | % | 5.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

Other Operating Expenses | | | | 2.8 | | 13.3 | | 8.5 | | 0.2 | | 0.2 | | 0.2 | | 0.2 | | 0.2 | | 0.2 | | 0.2 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Biopharma Corporate Overhead Allocation | | | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL BioPharma OPERATING EXPENSES | | | | 458.1 | | 485.4 | | 548.4 | | 547.3 | | 554.2 | | 612.7 | | 676.1 | | 715.1 | | 746.4 | | 796.0 | |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL BioPharma EXPENSES | | | | 621.6 | | 661.1 | | 743.2 | | 770.7 | | 803.7 | | 885.5 | | 993.9 | | 1,079.2 | | 1,129.8 | | 1,188.3 | |

| | | | | | | | | | | | | | | | | | | | | | | |

BioPharma OPERATING INCOME (LOSS) | | | | 15.5 | | (9.1 | ) | (66.8 | ) | (35.8 | ) | 65.6 | | 227.7 | | 288.0 | | 392.4 | | 394.6 | | 433.2 | |

% Margin | | | | 2.4 | % | NM | | NM | | NM | | 7.5 | % | 20.5 | % | 22.5 | % | 26.7 | % | 25.9 | % | 26.7 | % |

% Growth | | | | -66.3 | % | -158.3 | % | 637.4 | % | -46.4 | % | -283.1 | % | 247.0 | % | 26.5 | % | 36.2 | % | 0.6 | % | 9.8 | % |

Source: Heron Management Forecast as of March 2006

15

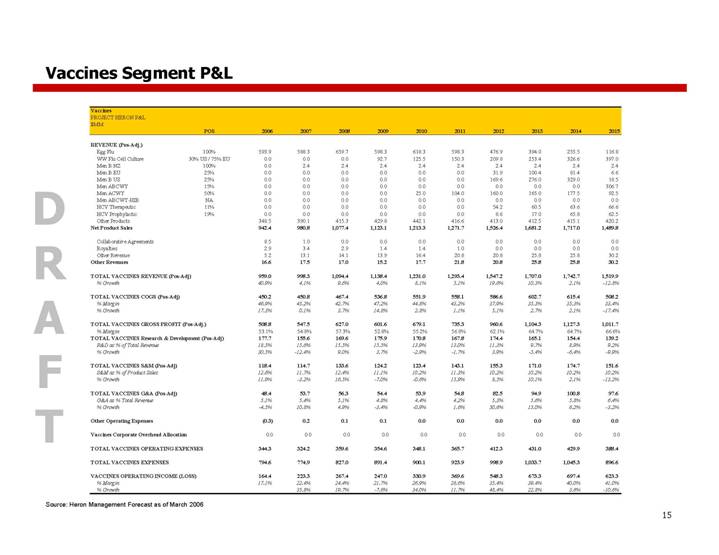

Vaccines Segment P&L

Vaccines | | | | | | | | | | | | | | | | | | | | | | | |

PROJECT HERON P&L | | | | | | | | | | | | | | | | | | | | | | | |

$MM | | POS | | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | | 2015 | |

| | | | | | | | | | | | | | | | | | | | | | | |

REVENUE (Pos-Adj.) | | | | | | | | | | | | | | | | | | | | | | | |

Egg Flu | | 100 | % | 593.9 | | 588.3 | | 659.7 | | 598.3 | | 618.3 | | 598.3 | | 476.9 | | 394.0 | | 255.5 | | 116.8 | |

WW Flu Cell Culture | | 30% US / 75% EU | | 0.0 | | 0.0 | | 0.0 | | 92.7 | | 125.5 | | 150.3 | | 209.8 | | 253.4 | | 326.6 | | 397.0 | |

Men B NZ | | 100 | % | 0.0 | | 2.4 | | 2.4 | | 2.4 | | 2.4 | | 2.4 | | 2.4 | | 2.4 | | 2.4 | | 2.4 | |

Men B EU | | 25 | % | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 31.9 | | 100.4 | | 81.4 | | 6.6 | |

Men B US | | 25 | % | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 169.6 | | 276.0 | | 329.0 | | 18.5 | |

Men ABCWY | | 15 | % | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 306.7 | |

Men ACWY | | 50 | % | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 25.0 | | 104.0 | | 160.0 | | 165.0 | | 177.5 | | 92.5 | |

Men ABCWY-HIB | | NA | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | |

HCV Therapeutic | | 11 | % | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 54.2 | | 60.5 | | 63.6 | | 66.6 | |

HCV Prophylactic | | 19 | % | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 8.6 | | 17.0 | | 65.8 | | 62.5 | |

Other Products | | | | 348.5 | | 390.1 | | 415.3 | | 429.8 | | 442.1 | | 416.6 | | 413.0 | | 412.5 | | 415.1 | | 420.2 | |

Net Product Sales | | | | 942.4 | | 980.8 | | 1,077.4 | | 1,123.1 | | 1,213.3 | | 1,271.7 | | 1,526.4 | | 1,681.2 | | 1,717.0 | | 1,489.8 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Collaborative Agreements | | | | 8.5 | | 1.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | |

Royalties | | | | 2.9 | | 3.4 | | 2.9 | | 1.4 | | 1.4 | | 1.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | |

Other Revenue | | | | 5.2 | | 13.1 | | 14.1 | | 13.9 | | 16.4 | | 20.8 | | 20.8 | | 25.8 | | 25.8 | | 30.2 | |

Other Revenues | | | | 16.6 | | 17.5 | | 17.0 | | 15.2 | | 17.7 | | 21.8 | | 20.8 | | 25.8 | | 25.8 | | 30.2 | |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL VACCINES REVENUE (Pos-Adj) | | | | 959.0 | | 998.3 | | 1,094.4 | | 1,138.4 | | 1,231.0 | | 1,293.4 | | 1,547.2 | | 1,707.0 | | 1,742.7 | | 1,519.9 | |

% Growth | | | | 40.9 | % | 4.1 | % | 9.6 | % | 4.0 | % | 8.1 | % | 5.1 | % | 19.6 | % | 10.3 | % | 2.1 | % | -12.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL VACCINES COGS (Pos-Adj) | | | | 450.2 | | 450.8 | | 467.4 | | 536.8 | | 551.9 | | 558.1 | | 586.6 | | 602.7 | | 615.4 | | 508.2 | |

% Margin | | | | 46.9 | % | 45.2 | % | 42.7 | % | 47.2 | % | 44.8 | % | 43.2 | % | 37.9 | % | 35.3 | % | 35.3 | % | 33.4 | % |

% Growth | | | | 17.3 | % | 0.1 | % | 3.7 | % | 14.8 | % | 2.8 | % | 1.1 | % | 5.1 | % | 2.7 | % | 2.1 | % | -17.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL VACCINES GROSS PROFIT (Pos-Adj.) | | | | 508.8 | | 547.5 | | 627.0 | | 601.6 | | 679.1 | | 735.3 | | 960.6 | | 1,104.3 | | 1,127.3 | | 1,011.7 | |

% Margin | | | | 53.1 | % | 54.8 | % | 57.3 | % | 52.8 | % | 55.2 | % | 56.8 | % | 62.1 | % | 64.7 | % | 64.7 | % | 66.6 | % |

TOTAL VACCINES Research & Development (Pos-Adj) | | | | 177.7 | | 155.6 | | 169.6 | | 175.9 | | 170.8 | | 167.8 | | 174.4 | | 165.1 | | 154.4 | | 139.2 | |

R&D as% of Total Revenue | | | | 18.5 | % | 15.6 | % | 15.5 | % | 15.5 | % | 13.9 | % | 13.0 | % | 11.3 | % | 9.7 | % | 8.9 | % | 9.2 | % |

% Growth | | | | 30.5 | % | -12.4 | % | 9.0 | % | 3.7 | % | -2.9 | % | -1.7 | % | 3.9 | % | -5.4 | % | -6.4 | % | -9.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL VACCINES S&M (Pos-Adj) | | | | 118.4 | | 114.7 | | 133.6 | | 124.2 | | 123.4 | | 143.1 | | 155.3 | | 171.0 | | 174.7 | | 151.6 | |

S&M as% of Product Sales | | | | 12.6 | % | 11.7 | % | 12.4 | % | 11.1 | % | 10.2 | % | 11.3 | % | 10.2 | % | 10.2 | % | 10.2 | % | 10.2 | % |

% Growth | | | | 11.9 | % | -3.2 | % | 16.5 | % | -7.0 | % | -0.6 | % | 15.9 | % | 8.5 | % | 10.1 | % | 2.1 | % | -13.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL VACCINES G&A (Pos-Adj) | | | | 48.4 | | 53.7 | | 56.3 | | 54.4 | | 53.9 | | 54.8 | | 82.5 | | 94.9 | | 100.8 | | 97.6 | |

G&A as% Total Revenue | | | | 5.1 | % | 5.4 | % | 5.1 | % | 4.8 | % | 4.4 | % | 4.2 | % | 5.3 | % | 5.6 | % | 5.8 | % | 6.4 | % |

% Growth | | | | -4.5 | % | 10.8 | % | 4.9 | % | -3.4 | % | -0.9 | % | 1.6 | % | 50.6 | % | 15.0 | % | 6.2 | % | -3.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

Other Operating Expenses | | | | (0.3 | ) | 0.2 | | 0.1 | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Vaccines Corporate Overhead Allocation | | | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL VACCINES OPERATING EXPENSES | | | | 344.3 | | 324.2 | | 359.6 | | 354.6 | | 348.1 | | 365.7 | | 412.3 | | 431.0 | | 429.9 | | 388.4 | |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL VACCINES EXPENSES | | | | 794.6 | | 774.9 | | 827.0 | | 891.4 | | 900.1 | | 923.9 | | 998.9 | | 1,033.7 | | 1,045.3 | | 896.6 | |

| | | | | | | | | | | | | | | | | | | | | | | |

VACCINES OPERATING INCOME (LOSS) | | | | 164.4 | | 223.3 | | 267.4 | | 247.0 | | 330.9 | | 369.6 | | 548.3 | | 673.3 | | 697.4 | | 623.3 | |

% Margin | | | | 17.1 | % | 22.4 | % | 24.4 | % | 21.7 | % | 26.9 | % | 28.6 | % | 35.4 | % | 39.4 | % | 40.0 | % | 41.0 | % |

% Growth | | | | | | 35.8 | % | 19.7 | % | -7.6 | % | 34.0 | % | 11.7 | % | 48.4 | % | 22.8 | % | 3.6 | % | -10.6 | % |

Source: Heron Management Forecast as of March 2006

16

Blood Testing Segment P&L

BLOOD TESTING | | | | | | | | | | | | | | | | | | | | | | | |

PROJECT HERON P&L | | | | | | | | | | | | | | | | | | | | | | | |

$MM | | POS | | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | | 2015 | |

| | | | | | | | | | | | | | | | | | | | | | | |

REVENUE (Pos-Adj.) | | | | | | | | | | | | | | | | | | | | | | | |

NAT | | | | | | | | | | | | | | | | | | | | | | | |

Current Products | | | | | | | | | | | | | | | | | | | | | | | |

Duplex | | 100 | % | 66.9 | | 18.0 | | 20.5 | | 20.5 | | 20.5 | | 18.5 | | 16.5 | | 14.5 | | 12.6 | | 10.6 | |

dHBV | | 100 | % | 1.3 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | |

Ultrio | | 100 | % | 171.8 | | 265.1 | | 304.6 | | 327.1 | | 315.3 | | 286.3 | | 250.9 | | 216.8 | | 184.3 | | 152.4 | |

WNV | | 100 | % | 43.3 | | 57.6 | | 57.6 | | 57.6 | | 53.7 | | 48.0 | | 42.2 | | 36.5 | | 30.8 | | 25.1 | |

Total Current Products Revenue | | | | 283.3 | | 340.6 | | 382.6 | | 405.2 | | 389.4 | | 352.8 | | 309.6 | | 267.9 | | 227.7 | | 188.0 | |

| | | | | | | | | | | | | | | | | | | | | | | |

New Products | | | | | | | | | | | | | | | | | | | | | | | |

Blood Type Conversion | | 35 | % | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 12.7 | | 33.2 | | 61.9 | | 85.7 | | 99.4 | | 111.9 | |

Bacterial Detection | | NA | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | |

Parvo | | 75 | % | 0.0 | | 0.3 | | 3.0 | | 13.2 | | 11.8 | | 10.5 | | 9.1 | | 7.7 | | 6.4 | | 5.1 | |

Prion | | 50 | % | 0.0 | | 0.0 | | 0.0 | | 37.7 | | 68.8 | | 74.1 | | 83.7 | | 90.5 | | 89.4 | | 90.6 | |

Next Generation NAT | | 100 | % | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 74.1 | | 153.2 | | 253.2 | | 308.8 | | 381.9 | | 465.0 | |

Total New Products Revenue | | | | 0.0 | | 0.3 | | 3.0 | | 50.9 | | 167.4 | | 271.0 | | 407.8 | | 492.7 | | 577.0 | | 672.5 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total Instrument & Service Revenue | | | | 28.2 | | 16.3 | | 19.7 | | 13.8 | | 9.4 | | 8.3 | | 7.7 | | 6.8 | | 6.0 | | 4.5 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Other Plasma Sales | | | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total NAT Product Revenue | | | | 311.5 | | 357.3 | | 405.4 | | 469.9 | | 566.2 | | 632.0 | | 725.1 | | 767.4 | | 810.7 | | 865.1 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Plasma Royalties (Homebrew) | | | | 11.0 | | 11.0 | | 18.8 | | 8.3 | | 6.6 | | 6.0 | | 6.0 | | 6.0 | | 6.0 | | 6.0 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Whole Blood and Plasma Royalties (Roche) | | | | 54.4 | | 50.2 | | 46.0 | | 56.8 | | 18.8 | | 18.8 | | 18.9 | | 18.9 | | 19.0 | | 19.1 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total NAT Royalty Revenue | | | | 65.4 | | 61.1 | | 64.8 | | 65.1 | | 25.4 | | 24.8 | | 24.9 | | 24.9 | | 25.0 | | 25.1 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Grants for R&D (Other) | | | | 1.0 | | 1.0 | | 1.0 | | 1.0 | | 1.0 | | 1.0 | | 1.0 | | 1.0 | | 1.0 | | 1.0 | |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL NAT REVENUE | | | | 377.9 | | 419.4 | | 471.2 | | 536.0 | | 592.7 | | 657.9 | | 751.0 | | 793.4 | | 836.7 | | 891.2 | |

% Growth | | | | -8.9 | % | 11.0 | % | 12.4 | % | 13.7 | % | 10.6 | % | 11.0 | % | 14.2 | % | 5.6 | % | 5.5 | % | 6.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

ORTHO JOINT BUSINESS | | | | | | | | | | | | | | | | | | | | | | | |

Product Sales | | | | 26.3 | | 26.5 | | 26.8 | | 27.1 | | 27.3 | | 27.6 | | 27.9 | | 28.2 | | 28.4 | | 28.7 | |

Hep Retro Amortization (Royalty) | | | | 5.0 | | 5.0 | | 5.0 | | 5.0 | | 2.5 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | |

Contract Revenues | | | | 10.1 | | 10.2 | | 10.3 | | 10.4 | | 10.5 | | 10.6 | | 10.7 | | 10.8 | | 10.9 | | 11.0 | |

Joint Business Profits | | | | 109.8 | | 107.6 | | 105.4 | | 103.3 | | 101.2 | | 99.2 | | 97.2 | | 95.3 | | 93.4 | | 91.5 | |

TOTAL ORTHO REVENUE | | | | 151.2 | | 149.3 | | 147.5 | | 145.8 | | 141.6 | | 137.4 | | 135.8 | | 134.3 | | 132.8 | | 131.3 | |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL BLOOD TESTING REVENUE | | | | 574.4 | | 568.7 | | 618.8 | | 681.8 | | 734.2 | | 795.3 | | 886.9 | | 927.7 | | 969.4 | | 1,022.4 | |

% Growth | | | | 5.7 | % | -1.0 | % | 8.8 | % | 10.2 | % | 7.7 | % | 8.3 | % | 11.5 | % | 4.6 | % | 4.5 | % | 5.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL BLOOD TESTING COGS | | | | 210.0 | | 211.6 | | 232.7 | | 252.0 | | 298.0 | | 332.7 | | 384.4 | | 411.1 | | 438.9 | | 472.7 | |

% Growth | | | | 15.7 | % | 0.8 | % | 10.0 | % | 8.3 | % | 18.2 | % | 11.6 | % | 15.6 | % | 6.9 | % | 6.7 | % | 7.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL BLOOD TESTING GROSS PROFIT (Pos-Adj.) | | | | 364.5 | | 357.1 | | 386.1 | | 429.8 | | 436.3 | | 462.6 | | 502.4 | | 516.5 | | 530.6 | | 549.8 | |

% Margin | | | | 63.4 | % | 62.8 | % | 62.4 | % | 63.0 | % | 59.4 | % | 58.2 | % | 56.7 | % | 55.7 | % | 54.7 | % | 53.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL BLOOD TESTING R&D | | | | 33.1 | | 42.2 | | 34.8 | | 34.1 | | 44.4 | | 47.3 | | 52.1 | | 54.2 | | 56.5 | | 58.3 | |

% Margin | | | | 5.8 | % | 7.4 | % | 5.6 | % | 5.0 | % | 6.1 | % | 6.0 | % | 5.9 | % | 5.8 | % | 5.8 | % | 5.7 | % |

% Growth | | | | 5.7 | % | 27.4 | % | -17.4 | % | -2.0 | % | 30.2 | % | 6.5 | % | 10.1 | % | 4.0 | % | 4.2 | % | 3.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL BLOOD TESTING S&M | | | | 47.1 | | 47.3 | | 50.3 | | 56.6 | | 58.8 | | 62.4 | | 65.9 | | 70.0 | | 74.7 | | 79.1 | |

% Margin | | | | 8.2 | % | 8.3 | % | 8.1 | % | 8.3 | % | 8.0 | % | 7.8 | % | 7.4 | % | 7.5 | % | 7.7 | % | 7.7 | % |

% Growth | | | | 11.6 | % | 0.4 | % | 6.4 | % | 12.3 | % | 3.9 | % | 6.1 | % | 5.7 | % | 6.2 | % | 6.7 | % | 5.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL BLOOD TESTING G&A | | | | 6.2 | | 5.2 | | 5.4 | | 5.7 | | 6.0 | | 6.3 | | 6.6 | | 7.0 | | 7.3 | | 7.7 | |

% Margin | | | | 1.1 | % | 0.9 | % | 0.9 | % | 0.8 | % | 0.8 | % | 0.8 | % | 0.7 | % | 0.7 | % | 0.8 | % | 0.8 | % |

% Growth | | | | 11.4 | % | -16.0 | % | 5.0 | % | 5.0 | % | 5.0 | % | 5.0 | % | 5.0 | % | 5.0 | % | 5.0 | % | 5.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

Other Expenses | | | | 1.3 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Blood Testing Corporate Overhead Allocation | | | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL OPERATING EXPENSES | | | | 87.7 | | 94.7 | | 90.6 | | 96.4 | | 109.2 | | 116.0 | | 124.6 | | 131.2 | | 138.5 | | 145.1 | |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL EXPENSES | | | | 297.6 | | 306.3 | | 323.3 | | 348.4 | | 407.2 | | 448.7 | | 509.1 | | 542.3 | | 577.4 | | 617.7 | |

| | | | | | | | | | | | | | | | | | | | | | | |

BLOOD TESTING OPERATING INCOME (LOSS) | | | | 276.8 | | 262.4 | | 295.4 | | 333.4 | | 327.1 | | 346.6 | | 377.8 | | 385.4 | | 392.1 | | 404.7 | |

% Margin | | | | 48.2 | % | 46.1 | % | 47.7 | % | 48.9 | % | 44.5 | % | 43.6 | % | 42.6 | % | 41.5 | % | 40.4 | % | 39.6 | % |

% Growth | | | | -1.6 | % | -5.2 | % | 12.6 | % | 12.8 | % | -1.9 | % | 6.0 | % | 9.0 | % | 2.0 | % | 1.7 | % | 3.2 | % |

Source: Heron Management Forecast as of March 2006

17

Credit Suisse and Morgan Stanley do not provide any tax advice. Any tax statement herein regarding any US federal tax is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding any penalties. Any such statement herein was written to support the marketing or promotion of the transaction(s) or matter(s) to which the statement relates. Each taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor.

These materials have been provided to you by Credit Suisse and Morgan Stanley in connection with an actual or potential mandate or engagement and may not be used or relied upon for any purpose other than as specifically contemplated by a written agreement with Credit Suisse or Morgan Stanley. In addition, these materials may not be disclosed, in whole or in part, or summarized or otherwise referred to except as agreed in writing by Credit Suisse and Morgan Stanley. The information used in preparing these materials was obtained from or through you or your representatives or from public sources. Credit Suisse and Morgan Stanley assume no responsibility for independent verification of such information and have relied on such information being complete and accurate in all material respects. To the extent such information includes estimates and forecasts of future financial performance (including estimates of potential cost savings and synergies) prepared by or reviewed or discussed with the managements of your company and/or other potential transaction participants or obtained from public sources, we have assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such managements (or, with respect to estimates and forecasts obtained from public sources, represent reasonable estimates). These materials were designed for use by specific persons familiar with the business and the affairs of your company and Credit Suisse and Morgan Stanley assume no obligation to update or otherwise revise these materials. Nothing contained herein should be construed as tax, accounting or legal advice. You (and each of your employees, representatives or other agents) may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of the transactions contemplated by these materials and all materials of any kind (including opinions or other tax analyses) that are provided to you relating to such tax treatment and structure. For this purpose, the tax treatment of a transaction is the purported or claimed U.S. federal income tax treatment of the transaction and the tax structure of a transaction is any fact that may be relevant to understanding the purported or claimed U.S. federal income tax treatment of the transaction.

Credit Suisse and Morgan Stanley have adopted policies and guidelines designed to preserve the independence of its research analysts. Credit Suisse’s and Morgan Stanley’s policies prohibit employees from directly or indirectly offering a favorable research rating or specific price target, or offering to change a research rating or price target, as consideration for or an inducement to obtain business or other compensation. Credit Suisse’s and Morgan Stanley’s policies prohibit research analysts from being compensated for their involvement in investment banking transactions.

18