UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 |

|

Filed by the Registrant ý |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | Definitive Proxy Statement |

ý | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

|

CHIRON CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

ý | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | | |

Searchable text section of graphics shown above

[LOGO]

Novartis Merger:

Presentation to Stockholders

March 2006

Agenda

1. Chiron’s Perspective on the Transaction

2. Questions & Answers

3. Session with Chiron Directors*

* “Directors” throughout this presentation refers to the Non-Novartis Directors. See Annex A for biographical material on the Directors.

[LOGO]

2

Fair Price and Better Than Status Quo

• Novartis has had the right to acquire Chiron since 1994

• Appropriate time

• 11 month process to allow time to address business challenges

• No significant near-term milestones to drive value

• Fair price: Determined by Directors following careful consideration of opportunities and risks

• BioPharma - tifacogin significant opportunity but high risk; molecular oncology promising but very early

• Vaccines - substantial opportunity but ongoing challenges and intensified competition

• Blood Testing - strong commercial capabilities but key patents expiring and no proven development or manufacturing capabilities

• Royalties - significant to earnings but expected to decline as key patents expire

• Better than status quo: significant downside risk in absence of Novartis deal

• Valuation of management’s long range plan shows significant risk of lower value

• Continued operational challenges and execution risks

• Potentially protracted uncertainty may impact operations (including ability to hire and retain key personnel) and share price

3

Novartis Has the Right to Acquire Chiron

• Under the 1994 Agreements, Novartis has the right to acquire Chiron in accordance with a specified process

• Directors leveraged Chiron’s rights under Governance Agreement to achieve optimal outcome for Chiron stockholders

Governance Agreement enabled Directors to optimize outcome

4

Appropriate time | |

| |

Better than status quo | |

| |

Fair price | |

5

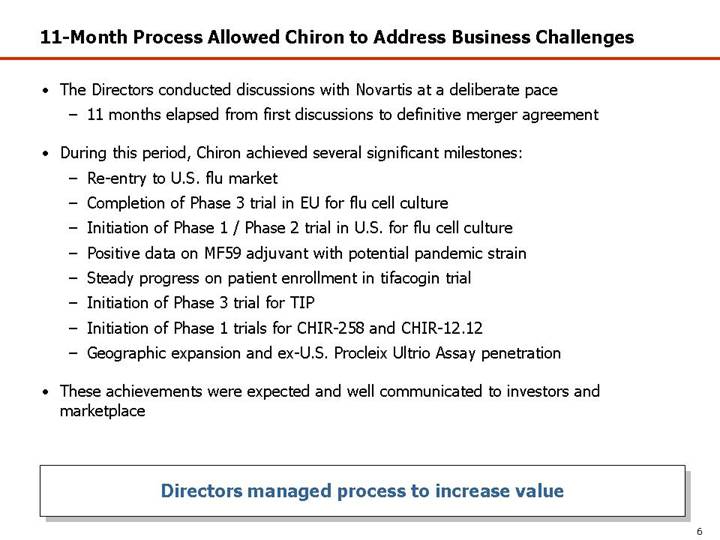

11-Month Process Allowed Chiron to Address Business Challenges

• The Directors conducted discussions with Novartis at a deliberate pace

• 11 months elapsed from first discussions to definitive merger agreement

• During this period, Chiron achieved several significant milestones:

• Re-entry to U.S. flu market

• Completion of Phase 3 trial in EU for flu cell culture

• Initiation of Phase 1 / Phase 2 trial in U.S. for flu cell culture

• Positive data on MF59 adjuvant with potential pandemic strain

• Steady progress on patient enrollment in tifacogin trial

• Initiation of Phase 3 trial for TIP

• Initiation of Phase 1 trials for CHIR-258 and CHIR-12.12

• Geographic expansion and ex-U.S. Procleix Ultrio Assay penetration

• These achievements were expected and well communicated to investors and marketplace

Directors managed process to increase value

6

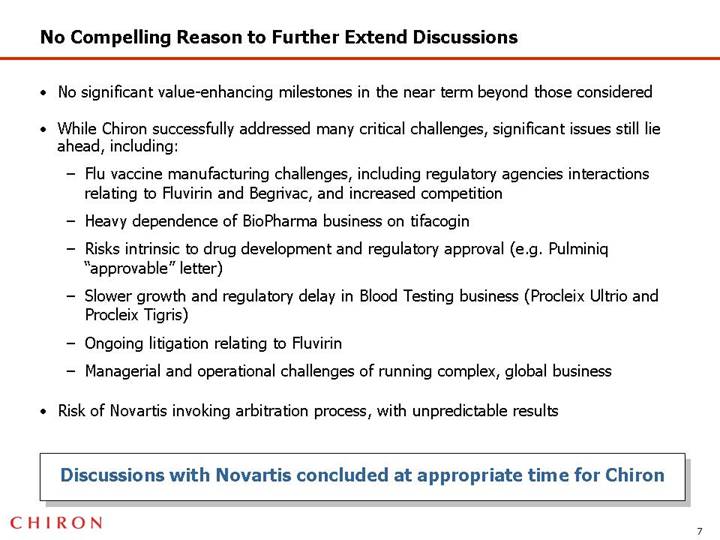

No Compelling Reason to Further Extend Discussions

• No significant value-enhancing milestones in the near term beyond those considered

• While Chiron successfully addressed many critical challenges, significant issues still lie ahead, including:

• Flu vaccine manufacturing challenges, including regulatory agencies interactions relating to Fluvirin and Begrivac, and increased competition

• Heavy dependence of BioPharma business on tifacogin

• Risks intrinsic to drug development and regulatory approval (e.g. Pulminiq “approvable” letter)

• Slower growth and regulatory delay in Blood Testing business (Procleix Ultrio and Procleix Tigris)

• Ongoing litigation relating to Fluvirin

• Managerial and operational challenges of running complex, global business

• Risk of Novartis invoking arbitration process, with unpredictable results

Discussions with Novartis concluded at appropriate time for Chiron

7

Appropriate time | |

| |

Better than status quo | |

| |

Fair price | |

8

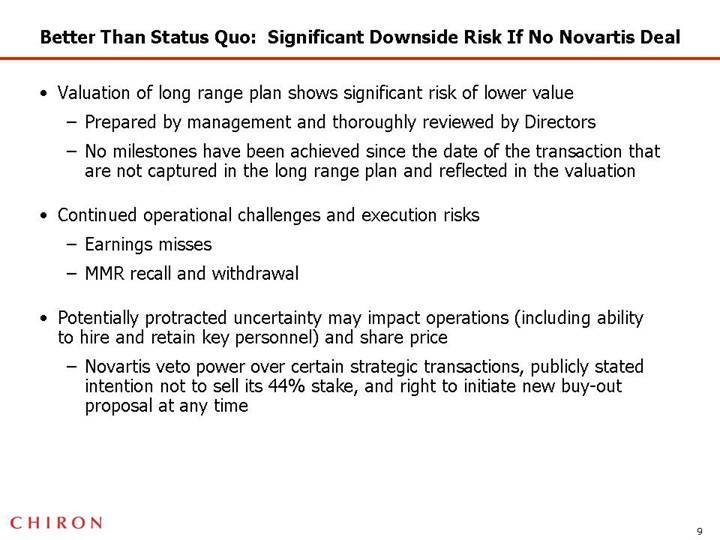

Better Than Status Quo: Significant Downside Risk If No Novartis Deal

• Valuation of long range plan shows significant risk of lower value

• Prepared by management and thoroughly reviewed by Directors

• No milestones have been achieved since the date of the transaction that are not captured in the long range plan and reflected in the valuation

• Continued operational challenges and execution risks

• Earnings misses

• MMR recall and withdrawal

• Potentially protracted uncertainty may impact operations (including ability to hire and retain key personnel) and share price

• Novartis veto power over certain strategic transactions, publicly stated intention not to sell its 44% stake, and right to initiate new buy-out proposal at any time

9

Appropriate time | |

| |

Better than status quo | |

| |

Fair price | |

• Determined by Directors with significant industry and financial expertise following careful consideration of opportunities and risks

10

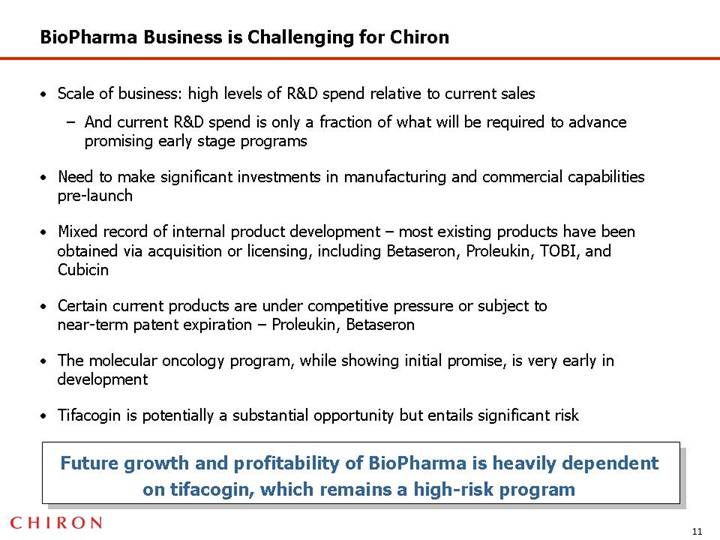

BioPharma Business is Challenging for Chiron

• Scale of business: high levels of R&D spend relative to current sales

• And current R&D spend is only a fraction of what will be required to advance promising early stage programs

• Need to make significant investments in manufacturing and commercial capabilities pre-launch

• Mixed record of internal product development – most existing products have been obtained via acquisition or licensing, including Betaseron, Proleukin, TOBI, and Cubicin

• Certain current products are under competitive pressure or subject to near-term patent expiration – Proleukin, Betaseron

• The molecular oncology program, while showing initial promise, is very early in development

• Tifacogin is potentially a substantial opportunity but entails significant risk

Future growth and profitability of BioPharma is heavily dependent on tifacogin, which remains a high-risk program

11

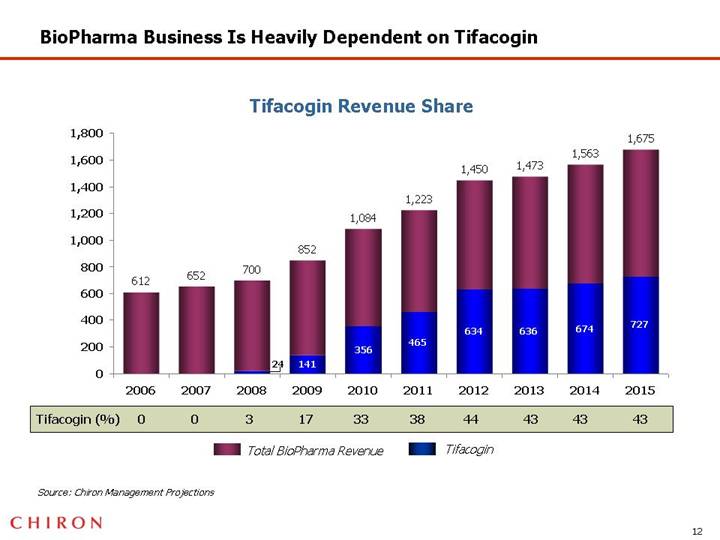

BioPharma Business Is Heavily Dependent on Tifacogin

Tifacogin Revenue Share

[CHART]

Source: Chiron Management Projections

12

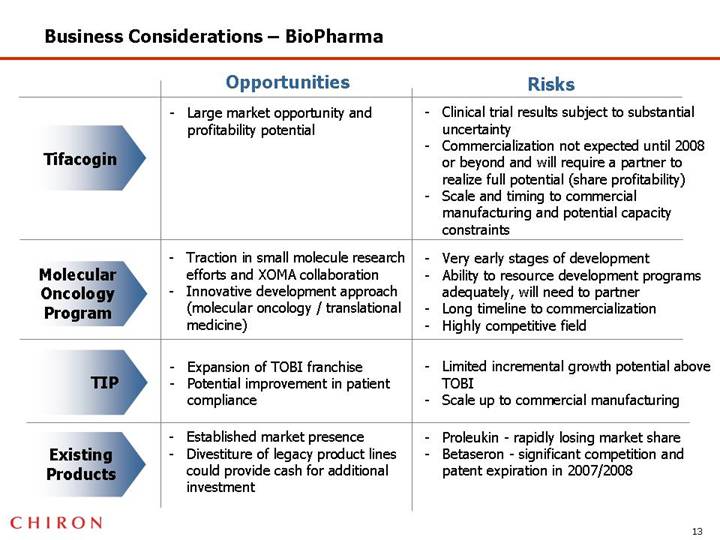

Business Considerations – BioPharma

| | Opportunities | | Risks |

| | | | |

Tifacogin | | • Large market opportunity and profitability potential | | • Clinical trial results subject to substantial uncertainty • Commercialization not expected until 2008 or beyond and will require a partner to realize full potential (share profitability) • Scale and timing to commercial manufacturing and potential capacity constraints |

| | | | |

Molecular Oncology Program | | • Traction in small molecule research efforts and XOMA collaboration • Innovative development approach (molecular oncology / translational medicine) | | • Very early stages of development • Ability to resource development programs adequately, will need to partner • Long timeline to commercialization • Highly competitive field |

| | | | |

TIP | | • Expansion of TOBI franchise • Potential improvement in patient compliance | | • Limited incremental growth potential above TOBI • Scale up to commercial manufacturing |

| | | | |

Existing Products | | • Established market presence • Divestiture of legacy product lines could provide cash for additional investment | | • Proleukin - rapidly losing market share • Betaseron - significant competition and patent expiration in 2007/2008 |

13

Vaccines Represents Substantial Opportunity But Has Risks

• Traditional egg-based influenza vaccines, including Fluvirin vaccine and Begrivac vaccine, have fueled Chiron’s vaccines growth

• While remediation efforts to date have been successful, financial and reputational costs to Chiron are substantial

• GMP compliance will require continuous improvement to meet ever higher regulatory standards over time

• Chiron’s competitive position in influenza market has declined with new market entrants, including GSK and CSL

• Flu cell culture conversion, which is a significant opportunity for Vaccines segment, faces developmental, regulatory, and manufacturing hurdles

• Pandemic flu is an important strategic opportunity, although incremental commercial value is uncertain and technical challenges must be overcome

• Meningitis B program is promising and proprietary, but development, manufacturing, and commercial risks remain; MenACWY will be second to market

Vaccines business remains an attractive opportunity but key products and programs face intensifying competition and on-going challenges

14

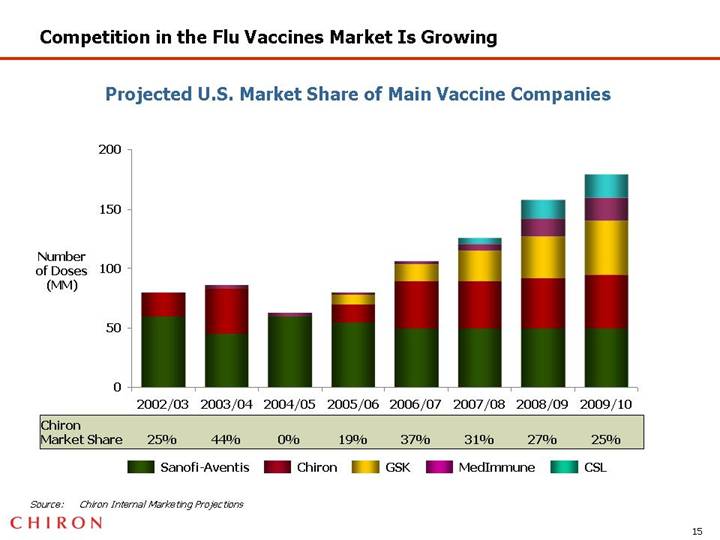

Competition in the Flu Vaccines Market Is Growing

Projected U.S. Market Share of Main Vaccine Companies

[CHART]

Source: Chiron Internal Marketing Projections

15

Pandemic Influenza Vaccine Strategy Presents Challenges

PRIOR TO A PANDEMIC

• Until there is an actual pandemic, opportunity may be limited to government stockpiling (manufacturing between seasonal campaigns) and government funding of R&D

• Commercial potential for stockpiling is unclear

• So far, limited demand…government tenders have been small

• Larger demand would require additional capacity

• Narrow window between seasonal campaigns heightens capacity constraints

• Each country has different specifications

• Government pressure on pricing

• Competition is intensifying

• GSK, MedImmune and Sanofi-Pasteur have initiated or plan to initiate development

16

Pandemic Influenza Vaccine Strategy Presents Challenges

DURING A PANDEMIC

• An actual pandemic may lead to year-round production of pandemic strain in lieu of seasonal campaigns for a brief period

• Proprietary adjuvant MF59 may reduce antigen requirements and increase supplies

• Government pressure on pricing may lead to lower margins

• But in order to produce a commercial pandemic vaccine, technical obstacles must first be addressed…

• Pandemic vaccine may require higher number of doses than seasonal vaccine

• Adjuvants may be required to improve immunogenicity

• Manufacturing yields expected to be relatively low

• Unclear that these technical obstacles will be resolved before pandemic arrives

• …and the regulatory pathway is still not clear

• No currently approved pandemic vaccines

• FDA and EMEA may have different requirements

• FDA has not approved any adjuvant other than alum

• Flu cell culture production, which is not reliant on egg supply, may afford an advantage

• Significant capital investment is required (U.S.: $350-$400MM, EU: $80-$100MM)

17

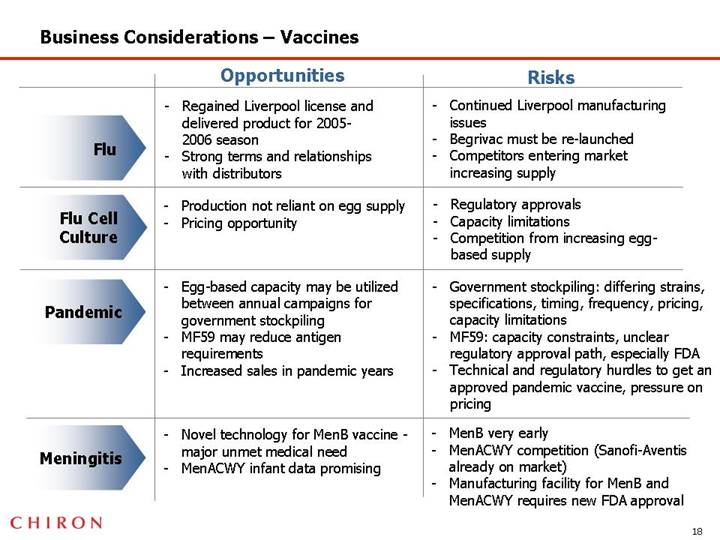

Business Considerations – Vaccines

| | Opportunities | | Risks |

| | | | |

Flu | | • Regained Liverpool license and delivered product for 2005-2006 season • Strong terms and relationships with distributors | | • Continued Liverpool manufacturing issues • Begrivac must be re-launched • Competitors entering market increasing supply |

| | | | |

Flu Cell Culture | | • Production not reliant on egg supply • Pricing opportunity | | • Regulatory approvals • Capacity limitations • Competition from increasing egg-based supply |

| | | | |

Pandemic | | • Egg-based capacity may be utilized between annual campaigns for government stockpiling • MF59 may reduce antigen requirements • Increased sales in pandemic years | | • Government stockpiling: differing strains, specifications, timing, frequency, pricing, capacity limitations • MF59: capacity constraints, unclear regulatory approval path, especially FDA • Technical and regulatory hurdles to get an approved pandemic vaccine, pressure on pricing |

| | | | |

Meningitis | | • Novel technology for MenB vaccine - major unmet medical need • MenACWY infant data promising | | • MenB very early • MenACWY competition (Sanofi-Aventis already on market) • Manufacturing facility for MenB and MenACWY requires new FDA approval |

18

Blood Testing Business is Strong But Has Limited Growth Potential

• Strong commercial capabilities and solid intellectual property

• Growth is slowing

• Key patents are facing expiration

• Chiron has no proven internal development or manufacturing capabilities for “next generation” platform

19

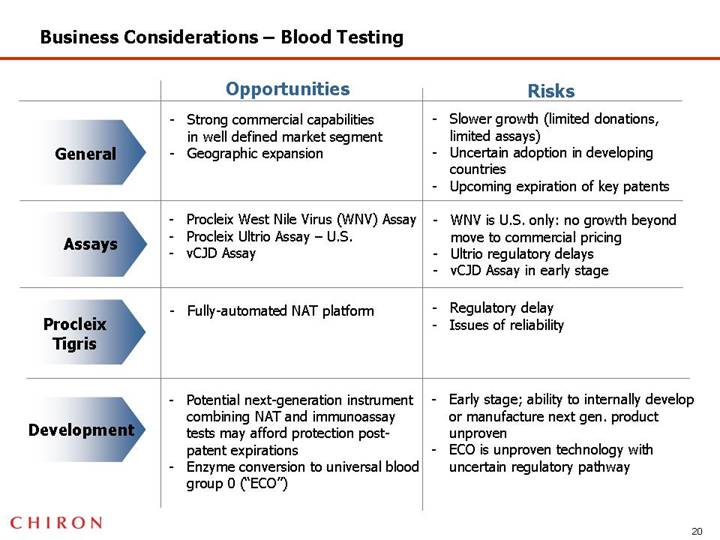

Business Considerations – Blood Testing

| | Opportunities | | Risks |

| | | | |

General | | • Strong commercial capabilities in well defined market segment • Geographic expansion | | • Slower growth (limited donations, limited assays) • Uncertain adoption in developing countries • Upcoming expiration of key patents |

| | | | |

Assays | | • Procleix West Nile Virus (WNV) Assay • Procleix Ultrio Assay – U.S. • vCJD Assay | | • WNV is U.S. only: no growth beyond move to commercial pricing • Ultrio regulatory delays • vCJD Assay in early stage |

| | | | |

Procleix Tigris | | • Fully-automated NAT platform | | • Regulatory delay • Issues of reliability |

| | | | |

Development | | • Potential next-generation instrument combining NAT and immunoassay tests may afford protection post-patent expirations • Enzyme conversion to universal blood group 0 (“ECO”) | | • Early stage; ability to internally develop or manufacture next gen. product unproven • ECO is unproven technology with uncertain regulatory pathway |

20

Directors Managed Process to Achieve Fair Price

• Conducted by Directors with significant industry and financial expertise *

• Independent, top-tier financial and legal advisors

• Transaction timeline managed by Directors to achieve an optimal outcome

• Threat of invoking additional procedural rights provided for in Governance Agreement, such as arbitration and delay, resulted in fair price for stockholders

• Unanimous approval by Directors

* See Annex A

21

$45 Offer Represents Fair Value for Chiron Stockholders

• In assessing the transaction, Directors carefully considered the business risks and opportunities described above

• The Directors required and relied on certain analyses, and also obtained fairness opinions from two independent financial advisors, Credit Suisse and Morgan Stanley

• Industry-accepted methodologies and sensitivities to projected business performance

• Historical trading ranges

• Prior to initial offer, research analysts forward price targets of $32 -$42 per share

• Selected companies analysis

• Discounted cash flow analysis, consolidated and sum of the parts

• Various sensitivity analyses and additional data

• $45 value is supported by and attractive relative to ranges implied by analysis and Chiron’s intrinsic value and reflects a significant portion of synergy value available to Novartis

• Value represents outcome of extensive negotiation and careful timing by Directors

$45 offer deemed by Directors to be fair and most attractive alternative available to Chiron

22

Fair Price and Better Than Status Quo

• Novartis has had the right to acquire Chiron since 1994

• Appropriate time

• 11 month process to allow time to address business challenges

• No significant near-term milestones to drive value

• Fair price: Determined by Directors following careful consideration of opportunities and risks

• BioPharma - heavily dependent on high risk tifacogin program

• Vaccines - substantial opportunity but ongoing challenges and intensified competition

• Blood Testing - strong commercial capabilities but key patents expiring and no proven development or manufacturing capabilities

• Royalties - significant to earnings but expected to decline as key patents expire

• Better than status quo

• Management’s long range plan would not produce higher value

• Continued operational challenges and execution risks

• Significant downside risk in absence of Novartis deal

• Novartis veto power over certain strategic transactions, publicly stated intention not to sell its 44% stake, and right to initiate new buy-out proposal at any time

• Potentially protracted uncertainty may impact operations (including ability to hire and retain key personnel) and share price

23

Annex A: Independent Directors’ Biographies

Vaughn D. Bryson

Director since 1997; former President and CEO of Eli Lilly

Lewis W. Coleman

Director since 1991; former Chairman and CEO of Bank of America Securities

J. Richard Fredericks

Director since 2003; Chairman of Dionis Capital, a New York based-hedge fund focusing on the financial services industry

Howard H. Pien

Chairman and CEO Chiron; former President of Pharmaceuticals International at GSK

Denise O’ Leary

Director since 2002; former General Partner of Menlo Ventures, a private venture capital firm

Edward Penhoet, Ph.D.

Director since 1981; Co-Founder, Former President and CEO of Chiron

Peter J. Strijkert, M.D.

Director since 1987; Chairman of Crucell N.V., a biotechnology company focused on developing products that prevent and treat infectious diseases

24

[LOGO]

Novartis Merger:

Presentation to Stockholders

March 2006