Exhibit 99.3

Delivering Shareholder Value

April 15, 2014

Disclaimers

Safe Harbor Statement

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: Statements in this presentation regarding Aaron’s, Inc.’s business that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by the use of words such as “expect,” “anticipate,” “believe,” “estimate,” “potential,” “should” or similar words. Examples of such statements include Aaron’s plans for value creation and delivery of long-term shareholder value; long-term financial targets; potential share repurchases; industry outlook; and expectations regarding accretion to earnings, increased revenues, returns to shareholders, expansion of customer base and the other expected strategic and financial benefits of the acquisition. These statements are based on current expectations, forecasts and assumptions of Aaron’s that involve risks and uncertainties which could cause actual results to differ materially from those contained in the forward-looking statements. These risks and uncertainties include: changes in general economic conditions; the impact of competition; the impact of litigation; changes to customer demand; Aaron’s ability to maintain customer privacy and information security; the cost and time required of Aaron’s management and employees and general disruption to Aaron’s operations associated with responding to any potential proxy contest; the ability to achieve expected synergies and operating efficiencies from the acquisition; the ability to successfully integrate Progressive’s operations; such integration may be more difficult, time-consuming or costly than expected; revenues following the acquisition may be lower than expected; operating costs, customer loss and business disruption may be greater than expected following the acquisition; the retention of certain key employees at Progressive; the amount of the costs, fees, expenses and charges related to the acquisition; and the risks and uncertainties discussed under “Risk Factors” in Aaron’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013. Aaron’s assumes no obligation to update the information included in this press release, whether as a result of new information, future events or otherwise.

Additional Information and Where To Find It

This communication may be deemed to be solicitation material in connection with the Aaron’s 2014 Annual Meeting of Shareholders. Aaron’s will be filing documents with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the 2014 Annual Meeting of Shareholders, including the filing by Aaron’s of a proxy statement. SHAREHOLDERS ARE URGED TO READ THE AARON’S PROXY STATEMENT AND ACCOMPANYING PROXY CARD FOR THE 2014 ANNUAL MEETING OF SHAREHOLDERS WHEN IT BECOMES AVAILABLE, AS WELL AS OTHER DOCUMENTS FILED WITH THE SEC, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders may obtain these documents (when they are available) free of charge at the SEC’s website, http://www.sec.gov, and at the Investor Relations section of the Aaron’s website, http://www.aarons.com. The final Proxy Statement for the 2014 Annual Meeting of Shareholders will be mailed to shareholders of Aaron’s.

Participants in Solicitation

Aaron’s and its directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from shareholders in connection with the Aaron’s 2014 Annual Meeting of Shareholders. Information concerning such participants and their direct or indirect interests, including their beneficial ownership in Aaron’s, is available in the Aaron’s Proxy Statement for the 2013 Annual Meeting of Shareholders filed with the SEC on April 8, 2013, and will be set forth in the Proxy Statement and other materials to be filed with the SEC in connection with the 2014 Annual Meeting of Shareholders when it becomes available. Information regarding the direct and indirect beneficial ownership of the Aaron’s directors and executive officers in Aaron’s securities is also included in their respective SEC filings on Forms 3, 4 and 5. Shareholders are advised to read Aaron’s Proxy Statement for the 2014 Annual Meeting of Shareholders and other relevant documents when they become available, because they will contain important information. You can obtain free copies of these documents from Aaron’s as described above.

1

Aaron’s Up to Today

Aaron’s has enjoyed a long and successfuluccessful historyistory in lease-to-own and wee remainemain the market leadereader

However, the competitiveompetitive dynamics of the industryndustry are evolving, as is our addressable customer base

Today we are pleased to outline the next steps in that process as we shape Aaron’s to deliver shareholder value

2

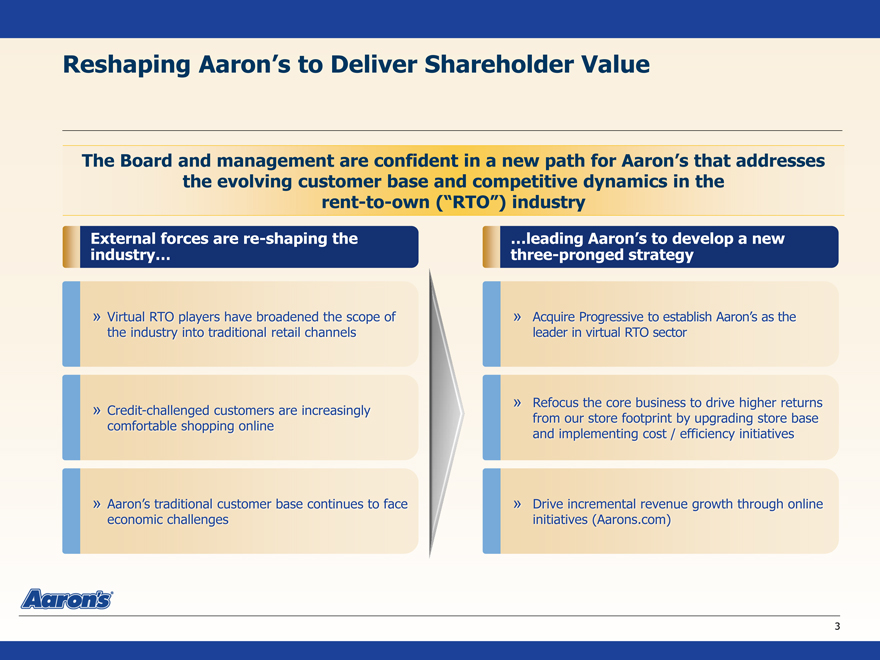

Reshaping Aaron’s to Deliver Shareholder Value

The Board and management are confident in a new path for Aaron’s that addresses

the evolving customer base and competitive dynamics in the rent-to-own (“RTO”) industry

External forces are re-shaping the industry …

Virtual RTO players have broadened the scope of the industry into traditional retail channels

Credit-challenged customers are increasingly comfortable shopping online

Aaron’s traditional customer base continues to face economic challenges

…leading Aaron’s to develop a new three-pronged strategy

Acquire Progressive to establish Aaron’s as the leader in virtual RTO sector

Refocus the core business to drive higher returns from our store footprint by upgrading store base and implementing cost / efficiency initiatives

Drive incremental revenue growth through online initiatives (Aarons.com)

3

Agenda and Speakers

Overview of Our Plan for

Value Creation

RON ALLEN IL DANIELSON

CEO EVP and CFO

The Progressive Acquisition

RAY ROBINSON

Chairman

Update on Transaction Committee STEVE MICHAELS JOHN ROBINSON Review and Vintage Proposal President

EVP and Progressive CEO

Summary / Q&A

4

I. Overview of Our Plan for Value Creation

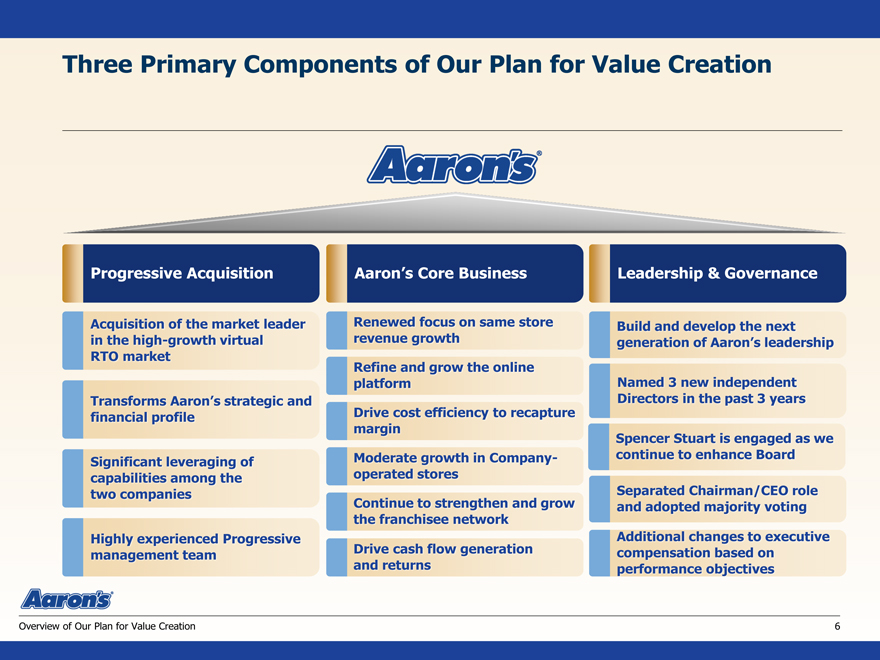

Three Primary Components of Our Plan for Value Creation

Progressive Acquisition Aaron’s Core Business

in the high-growth virtual revenue growth RTO market

Refine and grow the online platform Transforms Aaron’s Strategic and

financial profile margin

Moderate growth in Company -operated stores Continue to strengthen and grow the franchisee network Highly experienced Progressive management team Drive cash flow generation and returns

Acquisition of the market leader in the high-growth virtual RTO market

Transforms Aaron’s strategic and financial profile

Significant leveraging of capabilities among the two companies

Leadership & Goverance

Bulid and develop the next generation of Aaron’s leadership

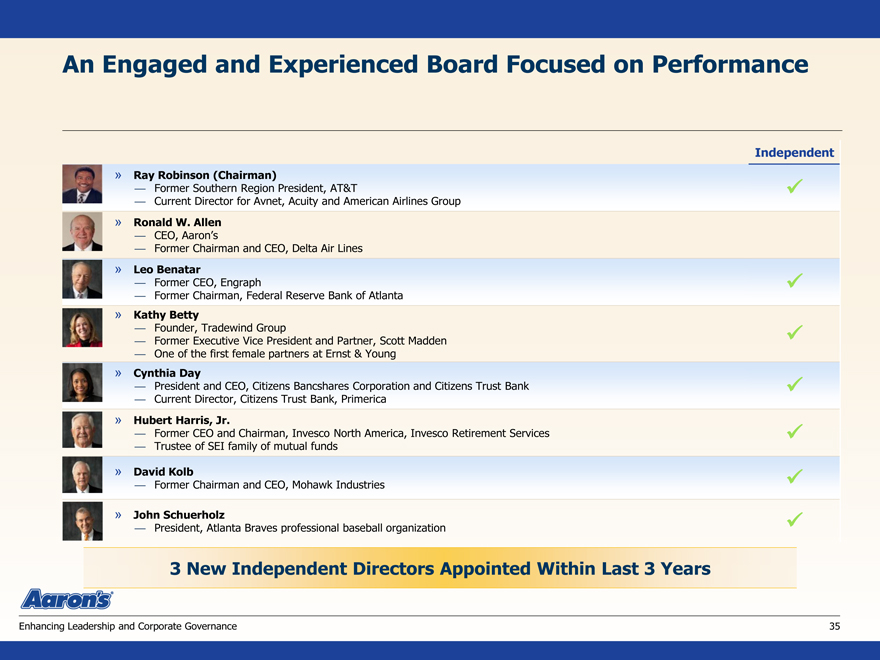

Named 3 new independent Directors in the past 3 years

Spencer Stuart is engaged as we continue to enhance Board

Separated Chairamna/CEO role and adopted majority voting

Additional changes to executive compensation based on performance objectives

Overview of Our Plan for Value Creation

6

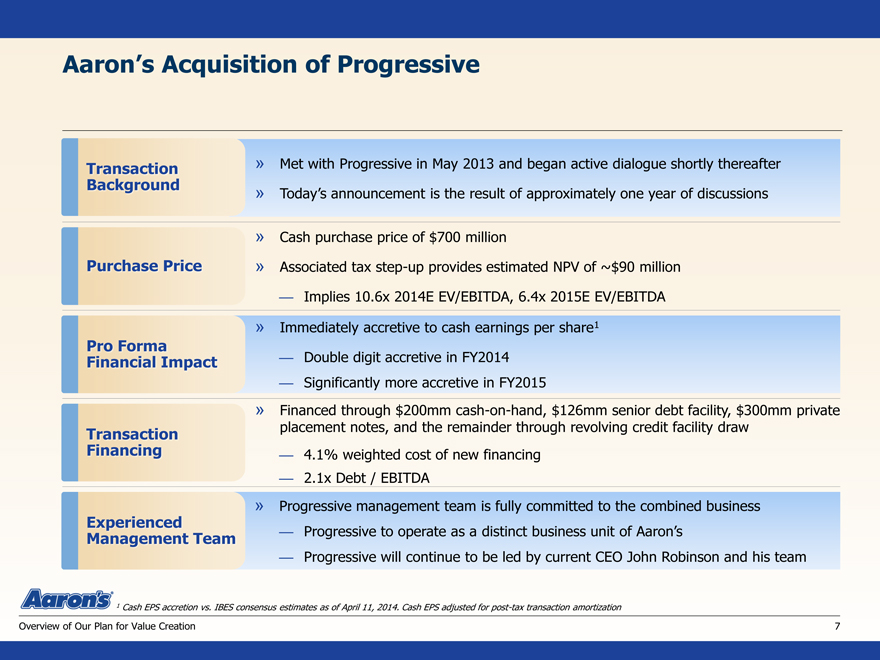

Aaron’s Acquisition of Progressive

Transaction » Met with Progressive in May 2013 and began active dialogue shortly thereafter

Background » Today’s announcement is the result of approximately one year of discussions

» Cash purchase price of $700 million

Purchase Price » Associated tax step-up provides estimated NPV of ~$90 million

— Implies 10.6x 2014E EV/EBITDA, 6.4x 2015E EV/EBITDA

» Immediately accretive to cash earnings per share1

Pro Forma

Financial Impact — Double digit accretive in FY2014

— Significantly more accretive in FY2015

» Financed through $200mm cash-on-hand, $126mm senior debt facility, $300mm private

Transaction placement notes, and the remainder through revolving credit facility draw

Financing — 4.1% weighted cost of new financing

— 2.1x Debt / EBITDA

» Progressive management team is fully committed to the combined business

Experienced

Management Team — Progressive to operate as a distinct business unit of Aaron’s

— Progressive will continue to be led by current CEO John Robinson and his team

1 Cash EPS accretion vs. IBES consensus estimates as of April 11, 2014. Cash EPS adjusted for post-tax transaction amortization

Overview of Our Plan for Value Creation 7

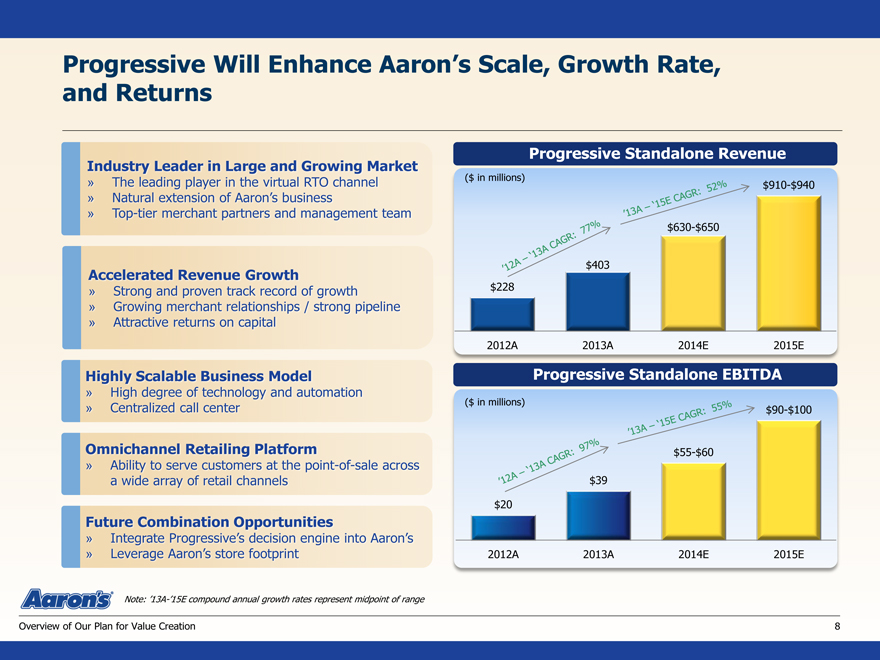

Progressive Will Enhance Aaron’s Scale, Growth Rate, and Returns

The leading player in the virtual RTO channel

Natural extension of Aaron’s business

Industry Leader in Large and Growing Market

Top-tier merchant partners and management team

Omnichannel Retailingetailing Platform

» Ability to serve customers at the point-of-sale across oss

a wide array of retail channels

Future Combination Opportunities

Integrate Progressive’s decision engine into Aaron’s

Leverage Aaron’s store footprint

Note: ’13A-’15E compound annual growth rates represent midpoint of range

Overview of Our Plan for Value Creation

Accelerated Revenue Growth

Strong and proven track record of growth

Growing merchant relationship/ strong pipeline

Attractive returns on capital

Highly Scalable Business Model

High degree of technology and automation

Centralized call center

($in millions)

($in millions)

$228

$403

$630-$650

$910-$940

2012A 2013A 2014E 2015E

$20

$39

‘12A-’13A CAGR: 77% ‘13A-’15E CAGR: 525

‘12A-’13A CAGR: 97% ‘13A-’15E CAGR: 55%

$55-$60

$90-$100

Progressive Standalone EBITDA

Progressive Standalone Revenue

8

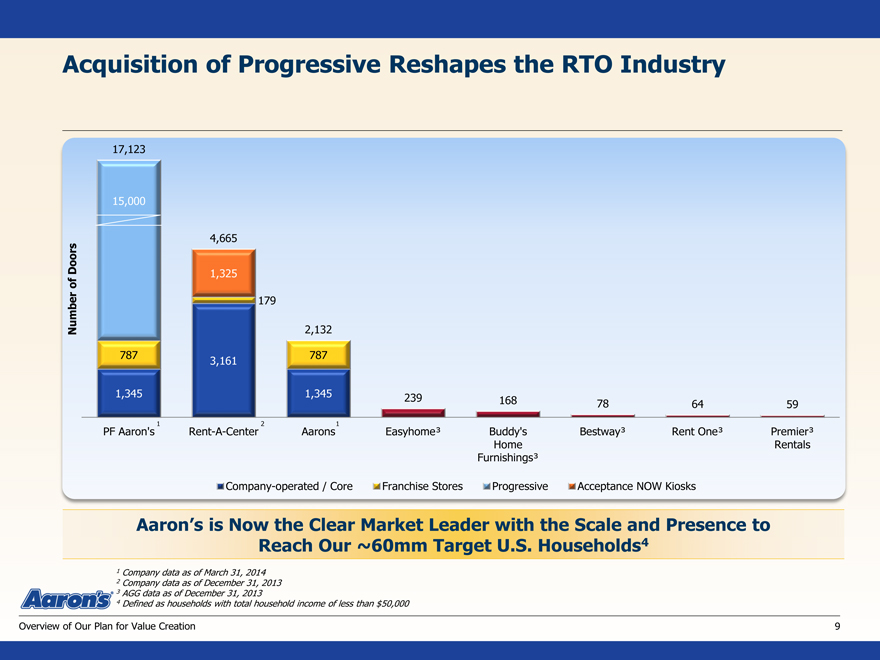

Acquisition of Progressive Reshapes the RTO Industry

17,123

15,000

4,665

Doors of 1,325 Number 179

2,132 787 787 3,161

1,345 1,345 239

168 78 64 59

112

PF Aaron’s Rent-A-Center Aarons Easyhome³ Buddy’s Bestway³ Rent One³ Premier³ Home Rentals Furnishings³

Company -operated / Core Franchise Stores Progressive Acceptance NOW Kiosks

Aaron’s is Now the Clear Market Leader with the Scale and Presence to Reach Our ~60mm Target U.S. Households 4

1 Company data as of March 31, 2014

2 Company data as of December 31, 2013

3 AGG data as of December 31, 2013

4 Defined as households with total household income of less than $50,000

Overview of Our Plan for Value Creation

9

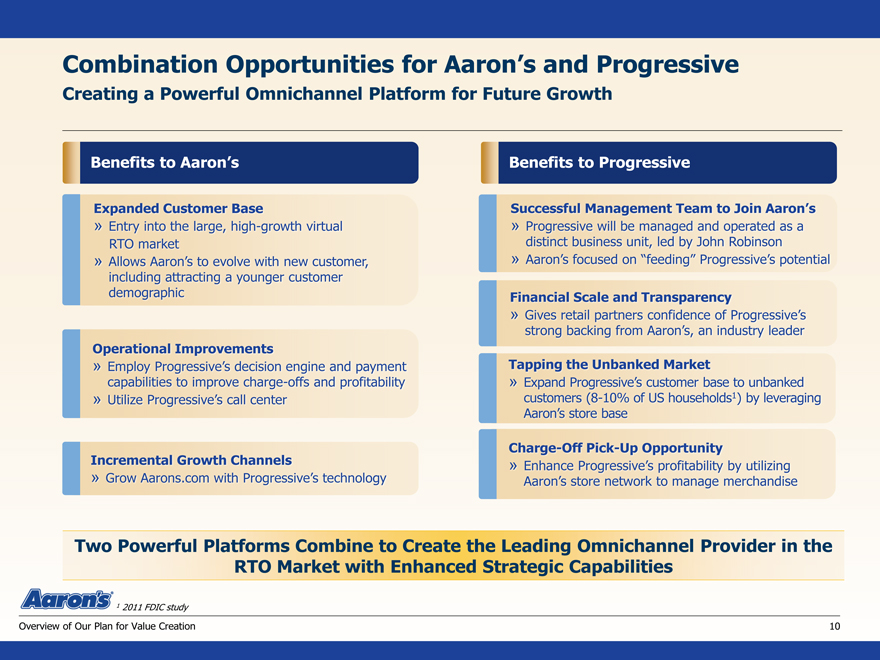

Combination Opportunities for Aaron’s and Progressive

Creating a Powerful Omnichannel Platform for Future Growth

Benefits to Aaron’s Benefits to Progressive

» Allows Aaron’s to evolve with new customer, » Aaron’s focused on “feeding” Progressive’s potential including attracting a younger customer demographic

Operational Improvements

» Employ Progressives decision engine and payment capabilities to improve charge-offs and profitability

» Utilize Progressives call center

Incremental Growth Channels

» Grow Aarons.com with Progressives technology

Successful Management Team to Join Aaron’s

» Progressive will be managed and operated as a distinct business unit, led by John Robinson

» Aarons focused on “feeding” Progressives potential

Financial Scale and Transparency

» Gives retail partners confidence of Progressives strong backing from Aarons, an industry leader

Tapping the Unbanked Market

» Expand Progressives customer base to unbanked customers (8-10% of US households1) by leveraging

Aarons store base

Charge-Off Pick-Up Opportunity

» Enhance Progressives profitability by utilizing Aarons store network to manage merchandise

1 2011 FDIC study

Two Powerful Platforms Combine to Create the Leading Omnichannel Provider in the RTO Market with Enhanced Strategic Capabilities

Overview of Our Plan for Value Creation 10

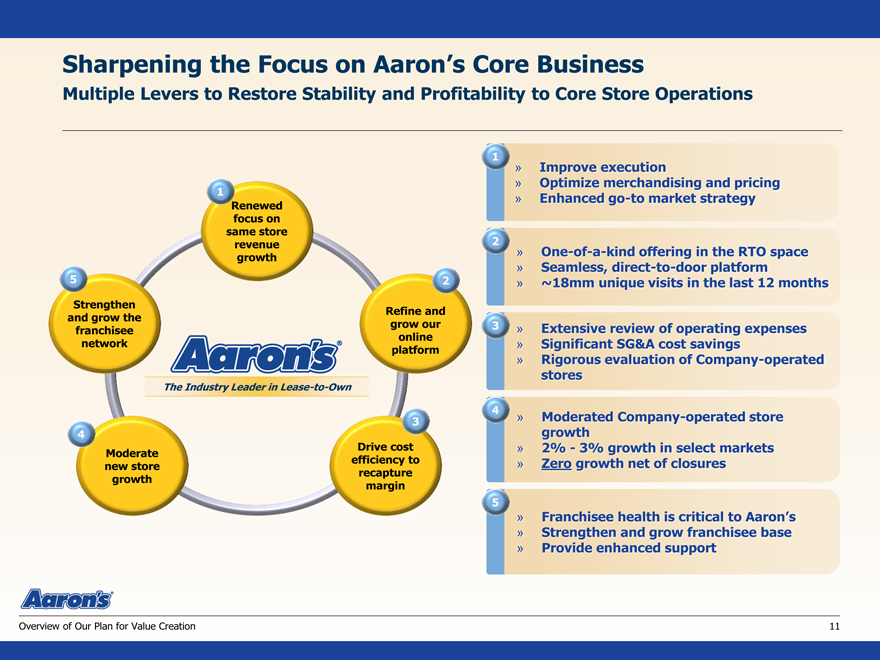

Sharpening the Focus on Aaron’s Core Business

Multiple Levers to Restore Stability and Profitability to Core Store Operations

1

Renewed focus on same store revenue growth

5 2 Strengthen Refine and and grow the grow our franchisee online network platform

The Industry Leader in Lease-to-Own

4 3 Drive cost Moderate efficiency to new store recapture growth margin

Improve execution

Optimize merchandising and pricing

Enhanced go-to market strategy

One-of-a-kind offering in the RTO space

Seamless, direct-to-door platform

~18mm unique visits in the last 12 months

Extensive review of operating expenses

Significant SG&A cost savings

Rigorous evaluation of Company-operated stores

Overview of Our Plan for Value Creation 11

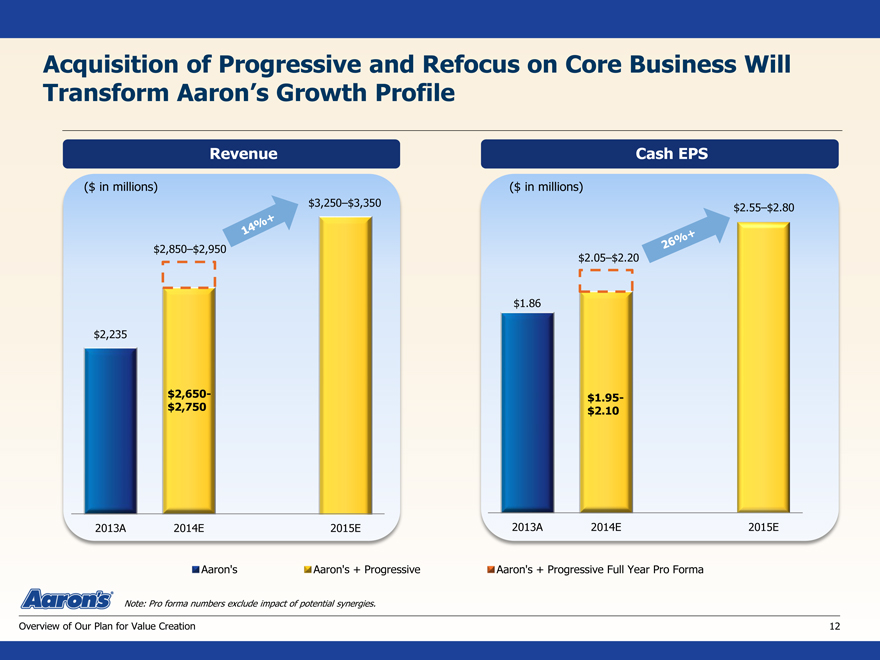

Acquisition of Progressive and Refocus on Core Business Will Transform Aaron’s Growth Profile

Revenue Cash EPS

($ in millions) ($ in millions) $3,250–$3,350 $2.55–$2.80

$2,850–$2,950 $2.05–$2.20

$1.86

$2,235

$2,650-$1.95-$2,750 $2.10

2013A 2014E 2015E 2013A 2014E 2015E

Aaron’s Aaron’s + Progressive Aaron’s + Progressive Full Year Pro Forma

Note: Pro forma numbers exclude impact of potential synergies.

Overview of Our Plan for Value Creation

12

II.The Progressive Acquisition

Progressive’s Strengths and Future Opportunities

Massively Untapped Market Opportunity

Industry Leading Scale/Leader in Virtual RTO

Strong Value Proposition to Merchants and Consumers Proprietary Technology and Automated Decision Engine Highly Experienced Management Team

The Progressive Acquisition 14

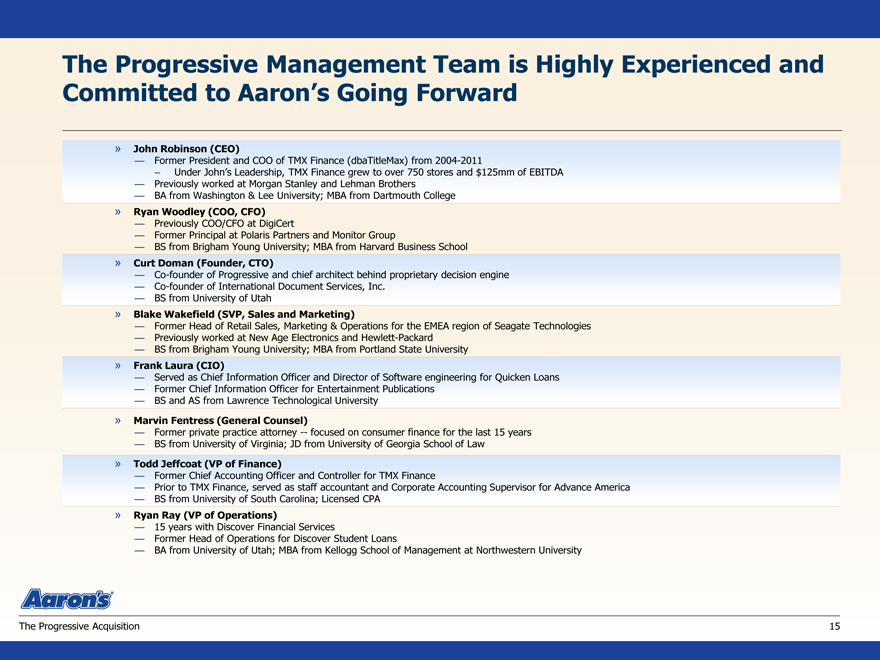

The Progressive Management Team is Highly Experienced and Committed to Aaron’s Going Forward

John Robinson (CEO)

Former President and COO of TMX Finance (dbaTitleMax) from 2004-2011

– Under John’s Leadership, TMX Finance grew to over 750 stores and $125mm of EBITDA

Previously worked at Morgan Stanley and Lehman Brothers

BA from Washington & Lee University; MBA from Dartmouth College

Ryan Woodley (COO, CFO)

Previously COO/CFO at DigiCert

Former Principal at Polaris Partners and Monitor Group

BS from Brigham Young University; MBA from Harvard Business School

Curt Doman (Founder, CTO)

Co-founder of Progressive and chief architect behind proprietary decision engine

Co-founder of International Document Services, Inc.

BS from University of Utah

Blake Wakefield (SVP, Sales and Marketing)

Former Head of Retail Sales, Marketing & Operations for the EMEA region of Seagate Technologies

Previously worked at New Age Electronics and Hewlett-Packard

BS from Brigham Young University; MBA from Portland State University

Frank Laura (CIO)

Served as Chief Information Officer and Director of Software engineering for Quicken Loans

Former Chief Information Officer for Entertainment Publications

BS and AS from Lawrence Technological University

Marvin Fentress (General Counsel)

Former private practice attorney -- focused on consumer finance for the last 15 years

BS from University of Virginia; JD from University of Georgia School of Law

Todd Jeffcoat (VP of Finance)

Former Chief Accounting Officer and Controller for TMX Finance

Prior to TMX Finance, served as staff accountant and Corporate Accounting Supervisor for Advance America

BS from University of South Carolina; Licensed CPA

Ryan Ray (VP of Operations)

15 years with Discover Financial Services

Former Head of Operations for Discover Student Loans

BA from University of Utah; MBA from Kellogg School of Management at Northwestern University

The Progressive Acquisition

15

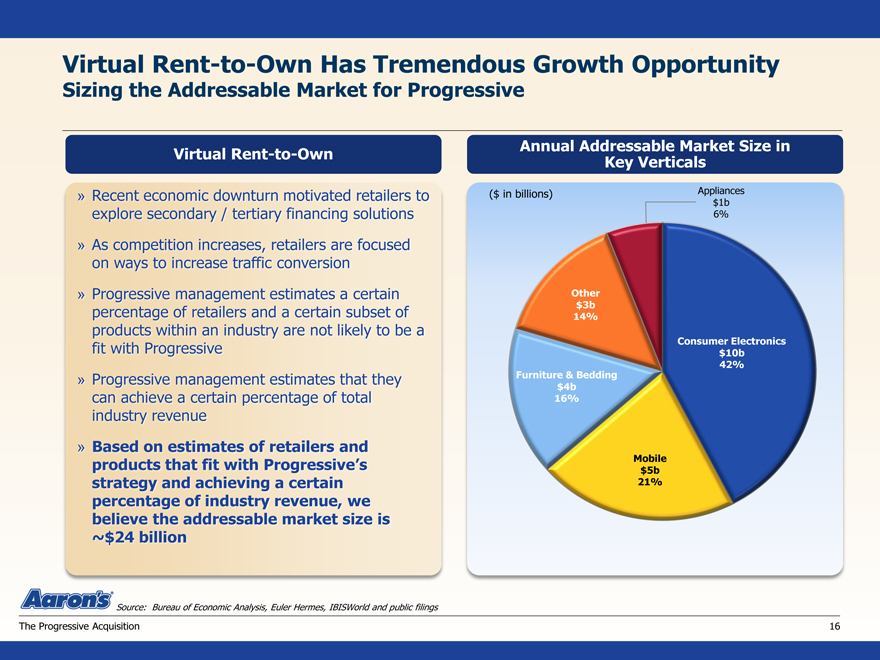

Virtual Rent-to-Own Has Tremendous Growth Opportunity

Sizing the Addressable Market for Progressive

Virtual Rent-to-Own Annual Addressable Market Size in

Key Verticals

($ in billions) Appliances

$1b

6%

Other $3b 14%

Consumer Electronics $10b 42% Furniture & Bedding $4b 16%

Mobile $5b 21%

FRecent economic downturn motivated retailers to explore secondary / tertiary financing solutions

As competition increase, retailers are focused on ways to increase traffic conversion

Progressive management estimateds a sertain percentage of retialers and a certain subset of products within a industry are not likely to be a fit with progressive

Progressive management estimates that they can achieve a certain percentage of total industry revenue

Based on estimastes of retailers and products that fit with progressive’s strategy and achieving a certain percentage of industry revenue, we believe the addressable market size is ~$24 billion

Source: Bureau of Economic Analysis, Euler Hermes, IBISWorld and public filings

The Progressive Acquisition 16

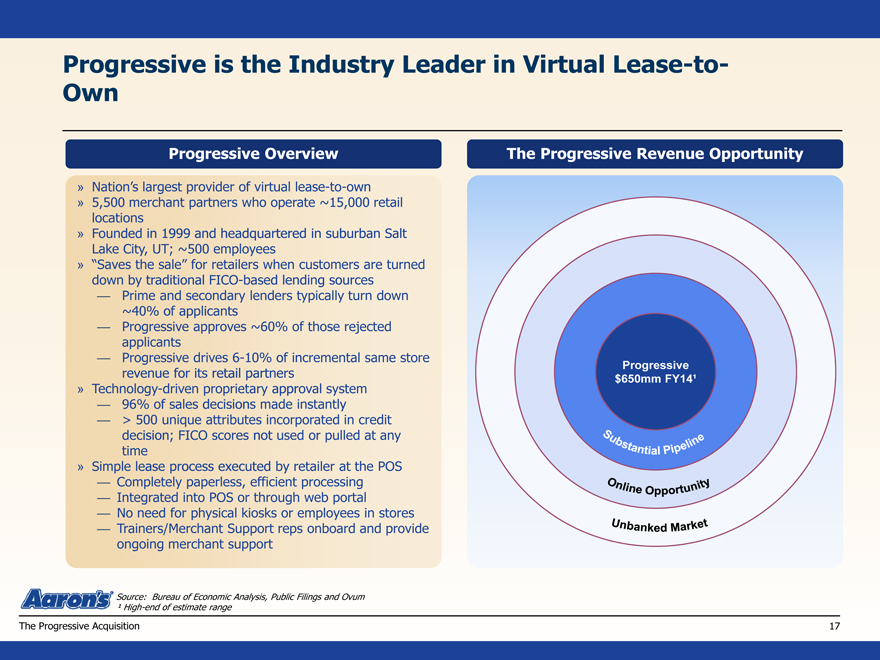

Progressive is the Industry Leader in Virtual Lease-to-Own

Progressive Overview

Nation’s largest provider of virtual lease-to-own

5,500 merchant partners who operate ~15,000 retail locations

Founded in 1999 and headquartered in suburban Salt Lake City, UT; ~500 employees

“Saves the sale” for retailers when customers are turned down by traditional FICO-based lending sources

Prime and secondary lenders typically turn down ~40% of applicants

Progressive approves ~60% of those rejected applicants

Progressive drives 6-10% of incremental same store revenue for its retail partners

Technology-driven proprietary approval system

96% of sales decisions made instantly

> 500 unique attributes incorporated in credit decision; FICO scores not used or pulled at any time

Simple lease process executed by retailer at the POS

Completely paperless, efficient processing

Integrated into POS or through web portal

No need for physical kiosks or employees in stores

Trainers/Merchant Support reps onboard and provide ongoing merchant support

The Progressive Revenue Opportunity

Progressive $650mm FY14¹

Substantial Pipeline

Online Opportunity

Unbanked Market

Source: Bureau of Economic Analysis, Public Filings and Ovum

¹ High-end of estimate range

The Progressive Acquisition

17

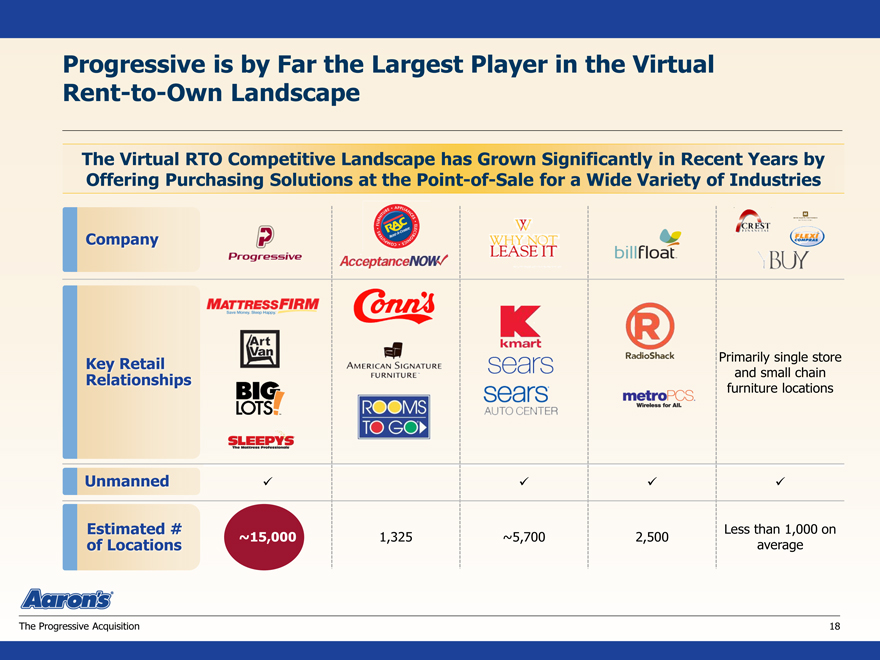

Progressive is by Far the Largest Player in the Virtual Rent-to-Own Landscape

The Virtual RTO Competitive Landscape has Grown Significantly in Recent Years by Offering Purchasing Solutions at the Point-of-Sale for a Wide Variety of Industries

Company

Key Retail Relationships

Unmanned

Estimated # of Locations

1,325 ~5,700 2,500 Less than 1,000 on average

Primarily single store and small chain furniture locations

The Progressive Acquisition 18

Progressive is a High Growth, Best-in-Class Industry Leader

Delivered Invoice Volume Provides Revenue Visibility Invoice Volume

Q1 invoice volume and count beatbudget by 15% and 22%, respectively

($ in millions) $123 $114 $75 $81 $89 $64 $45 $45 $48

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2012A 2013A 2014A

Revenue

($ in millions) $910-$940 $630-$650 $403 $228

2012A 2013A 2014E 2015E

EBITDA

($ in millions) $90-$100

$55-$60 $39 $20

2012A 2013A 2014E 2015E

Invoice volume is a key leading indicator of future revenue and earnings

Represents retail value of newly leased products

Cumulative payments per invoice contract are highly predictable

Progressive has profitably grown invoice volume rapidly since inception

Q1 2014 invoice volume was ~15% ahead of budget

Progressive’s exposure to large and ultra-large merchants helps to drive outperformance

Given our typical collection profile, Q1 outperformance will be reflected in FY2014E revenue growth

Note: ’12A-’15E compound annual growth rates shown to midpoint of range

The Progressive Acquisition 19

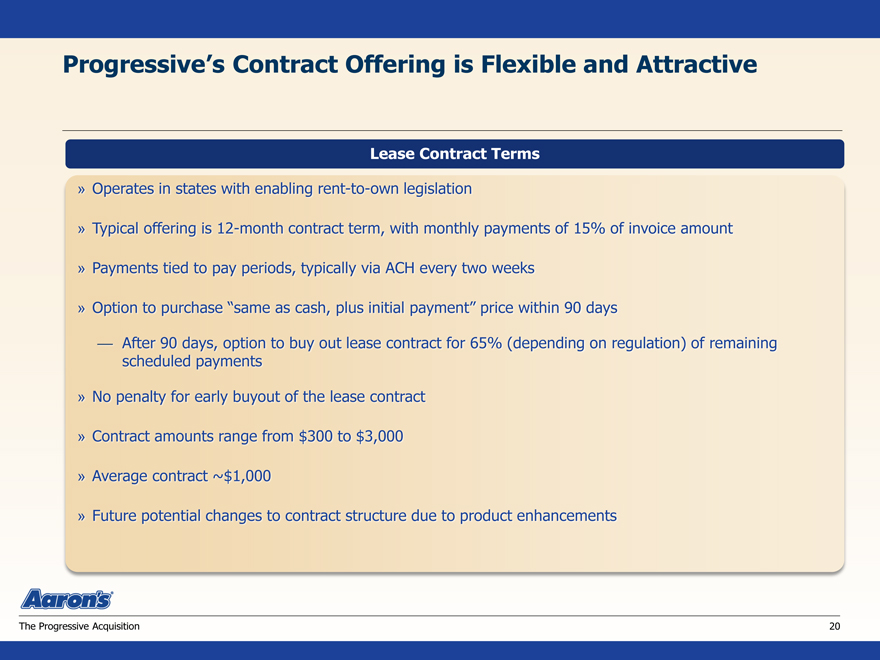

Operates in states with enabling rent-to-own legislation

Typical offering is 12-month contract term, with monthly payments of 15% of invoice amount

Payments tied to pay periods, typically via ACH every two weeks

Option to purchase “same as cash, plus initial payment” price within 90 days

After 90 days, option to buy out lease contract for 65% (depending on regulation) of remaining scheduled payments

No penalty for early buyout of the lease contract

Contract amounts range from $300 to $3,000

Average contract ~$1,000

Future potential changes to contract structure due to product enhancements

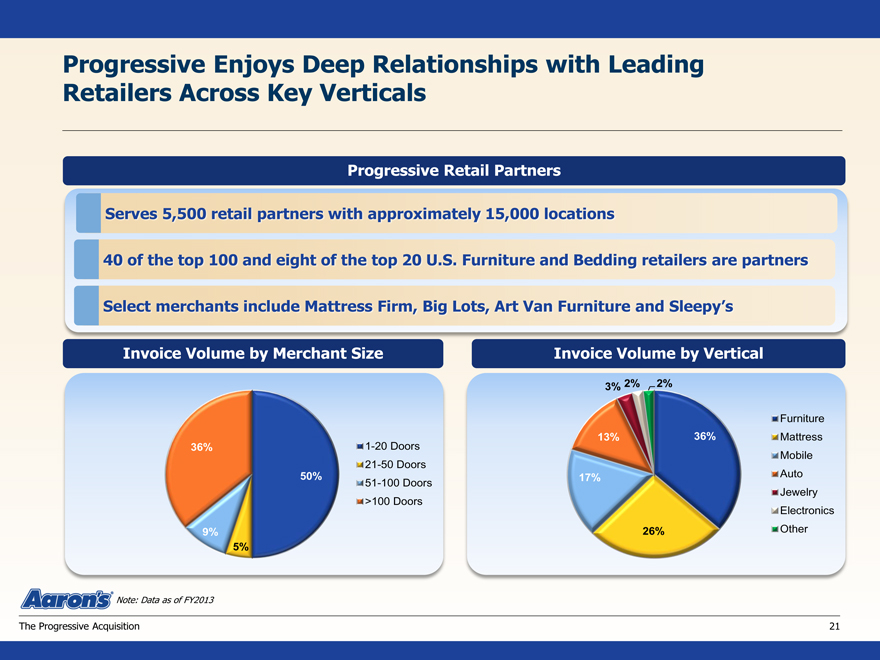

Progressive Enjoys Deep Relationships with Leading Retailers Across Key Verticals

Progressive Retail Partners

Serves 5,500 retail partners with approximately 15,000 locations

40 of the top 100 and eight of the top 20 U.S. Furniture and Bedding retailers are partners

Select lect merchants rchants include Mattress ttress Firm, Big Lots, Art Vanrm, Furniture and Sleepy’s

Invoice Volume by Merchant Size Invoice Volume by Vertical

3% 2% 2%

Furniture 1-20 Doors 13% 36% Mattress

36%

21-50 Doors Mobile 50% 51-100 Doors 17% Auto >100 Doors Jewelry Electronics

9% 26% Other 5%

Note: Data as of FY2013

The Progressive Acquisition 21

Reshaping Our Core Business

Aaron’s is the Leading Lease-to-Own Specialty Retailer

Historical Revenue Historical EBITDA and Competitive Strengths 1 ($mm) Margin ($mm) A Winning Concept and Focus On Monthly $1,877 $2,013 $2,213 $2,235 13.9% 14.0%

13.2% $1,753 12.8% 12.4%

Contracts

$310 $280 $277 $248 $225

Fast Ownership With No Long Term Obligation

2009 2010 2011 2012 2013 2009 2010 2011 2012 2013

StoreBase 2 Product Mix3

Company-operated Other Furniture 63% Computers

Attractive Store Layouts Franchised 3% 35%

1,345 Stores 10% 37% 787 Stores

Wide Merchandise Selection

Appliances Consumer

20% Electronics

32%

Leading Brands Competitive Pricing

1 EBITDA adjusted to exclude one-time items relating to litigation, severance, and disposal activities

2 As of March 2014

3 As of February 28, 2014; Excludes RIMCO assets sold in January 2014

Reshaping Our Core Business

23

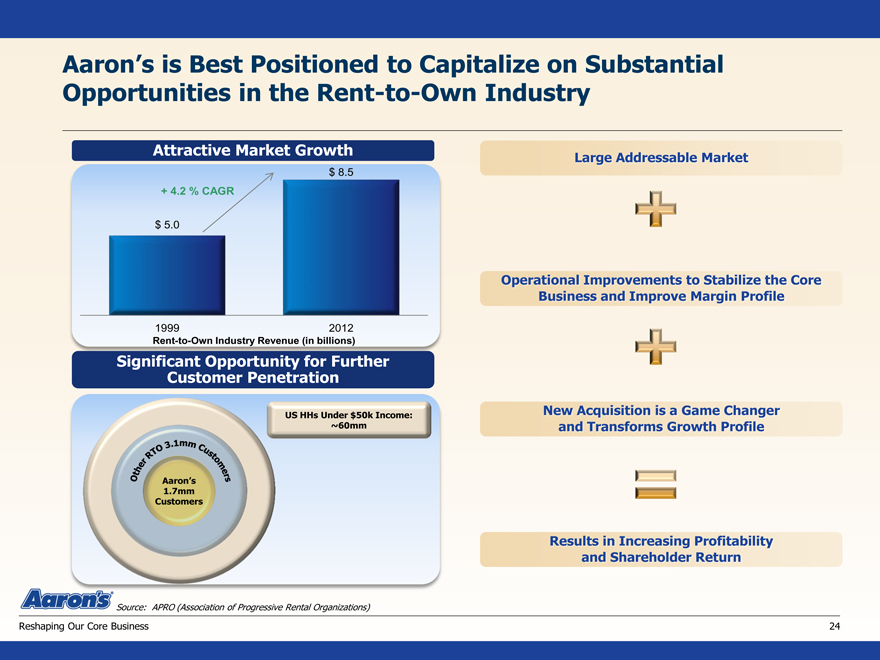

Aaron’s is Best Positioned to Capitalize on Substantial Opportunities in the Rent-to-Own Industry

Attractive Market Growth

Large Addressable Market

$ 8.5

+ 4.2 % CAGR

$ 5.0

Operational Improvements to Stabilize the Core Business and Improve Margin Profile

1999 2012

Rent-to-Own Industry Revenue (in billions)

Significant Opportunity for Further Customer Penetration

US HHs Under $50k Income: New Acquisition isaGame Changer ~60mm and Transforms Growth Profile

Aaron’s 1.7mm Customers

Results in Increasing Profitability and Shareholder Return

Source: APRO (Association of Progressive Rental Organizations)

Reshaping Our Core Business 24

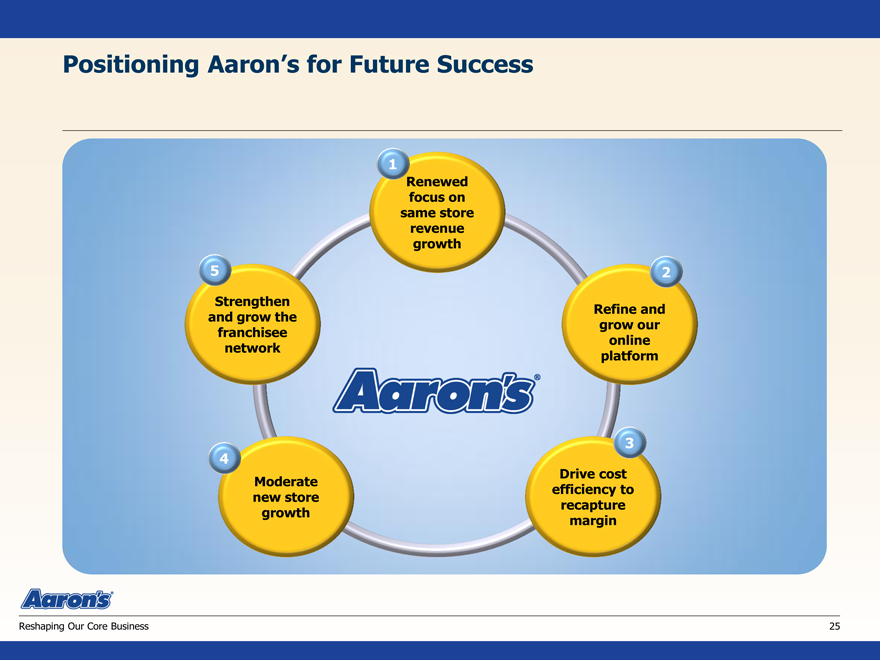

Positioning Aaron’s for Future Success

1

Renewed focus on same store revenue growth

5 2

Strengthen Refine and

and grow the grow our

franchisee online

network platform

3 4

Drive cost Moderate efficiency to new store recapture growth margin

Reshaping Our Core Business 25

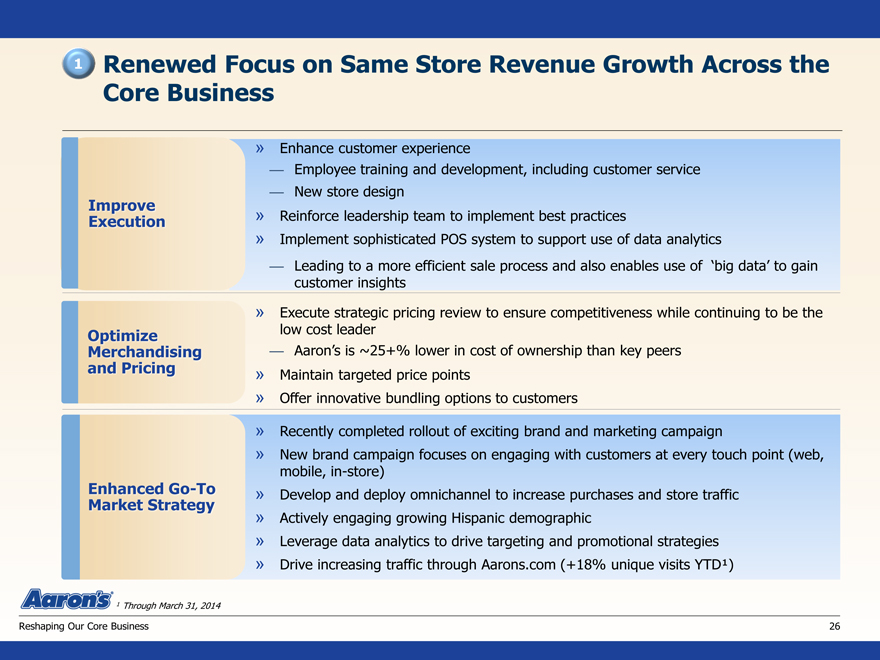

1 Renewed Focus on Same Store Revenue Growth Across the Core Business

» Enhance customer experience

— Employee training and development, including customer service

— New store design

» Reinforce leadership team to implement best practices

» Implement sophisticated POS system to support use of data analytics

— Leading to a more efficient sale process and also enables use of ‘big data’ to gain

customer insights

» Execute strategic pricing review to ensure competitiveness while continuing to be the

Optimize low cost leader

Improve Execution

Optimize Merchandising and Pricing

Enhance Go-To Market Strategy

Merchandising — Aaron’s is ~25+% lower in cost of ownership than key peers

and Pricing » Maintain targeted price points

» Offer innovative bundling options to customers

» Recently completed rollout of exciting brand and marketing campaign

» New brand campaign focuses on engaging with customers at every touch point (web,

mobile, in-store)

» Develop and deploy omnichannel to increase purchases and store traffic

» Actively engaging growing Hispanic demographic

» Leverage data analytics to drive targeting and promotional strategies

» Drive increasing traffic through Aarons.com (+18% unique visits YTD¹)

1 Through March 31, 2014

Reshaping Our Core Business 26

1 “Own the Life You Want” Branding and Marketing Campaign Supported by Enhanced Digital Offerings

Aaron’s to engage with customers at every touch point

owning easy through lease ownership, so you can own the life you want”

for success

Will be supported by enhanced digital offerings to allow more connectivity with customers at every touch point (e.g., web, mobile or in-store)

Aaron’s to engage with customers at every touch point

Emphasizes Aaron’s brand promise – “makes owning easy through lease ownership, so you can own the life you want”

Captures the spirit of the American Dream for success

Builds upon unique point of difference – Aaron’s has a proven track record of helping customers attain ownership

Commercials to be in English and Spanish as new marketing strategies will engage the growing Hispanic demographic

Will be supported by enhanced digital offerings to allow more connectivity with customers at every touch point (e.g., web, mobile or in-store)

Reshaping Our Core Business 27

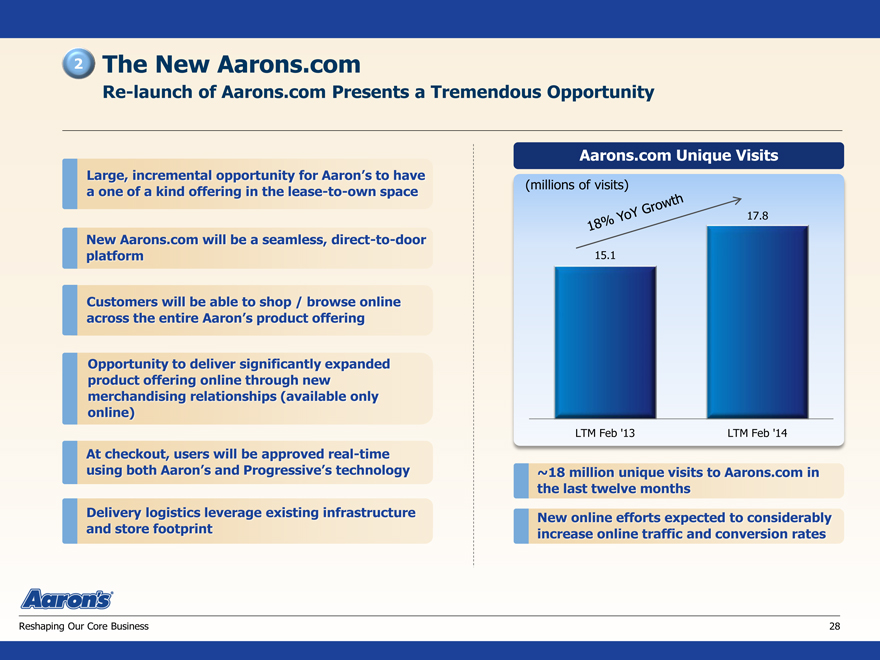

2 The New Aarons. com

Re-launch of Aarons. com Presents a Tremendous Opportunity

Aarons. com Unique Visits

Large, incremental opportunity for Aaron’s to have

(millions of visits) a one of a kind offering in the lease-to-own space

17.8

platform 15.1

LTM Feb ‘13 LTM Feb ‘14

At checkout, users will be approved real-time using both Aaron’s and Progressive’s technology

Delivery logistics leverage existing infrastructure New online efforts expected to considerably and store footprint increase online traffic and conversion rates

~18 million unique visits to Aarons.com in the last twelve months

New online efforts expected to considerably increase online traffic and conversion rates

Reshaping Our Core Business 28

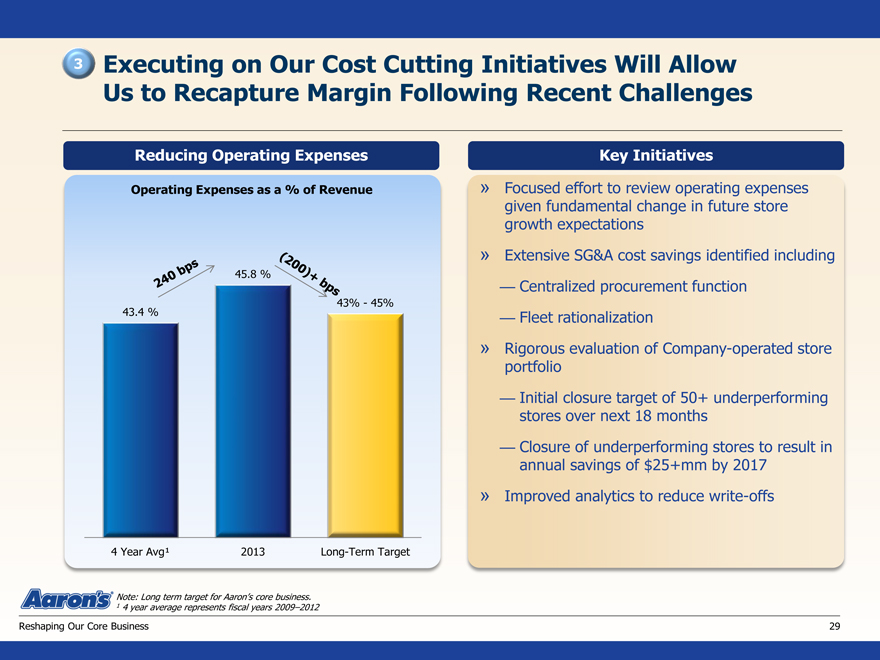

3 Executing on Our Cost Cutting Initiatives Will Allow Us to Recapture Margin Following Recent Challenges

Reducing Operating Expenses Key Initiatives

Operating Expenses as a % of Revenue

45.8 %

43%—45% 43.4 %

240 bps

(200) + bps

Key Initiatives

Focused effort to review operating expenses given fundamental change in future store growth expectations Extensive SG&A cost savings identified including

Centralized procurement function

Fleet rationalization

Rigorous evaluation of Company-operated store portfolio

Initial closure target of 50+ underperforming stores over next 18 months

Closure of underperforming stores to result in annual savings of $25+mm by 2017 Improved analytics to reduce write-offs

4 Year Avg¹ 2013 Long-Term Target

Note: Long term target for Aaron’s core business. 1 4 year average represents fiscal years 2009–2012

Reshaping Our Core Business 29

4 Moderation of Store Growth Following Rigorous Evaluation of Our Company-operated Portfolio

Be Strategic and Disciplined in Opening New Company-operated Stores

2%-3% new Company-operated store openings per year

Target attractive key markets such as California and New York

Company-operated store growth offset by store closures of underperforming locations

Support Our Franchisee Operators as They Continue to Grow and Build the Brand

Anticipate 3% -4% growth per year in our franchised store base

Potential to Re-Franchise Select Company-operated Stores

Continue to Refine HomeSmart Model Before Considering Further Rollout

Focus on Smart and Profitable Growth in Select Markets

Reshaping Our Core Business 30

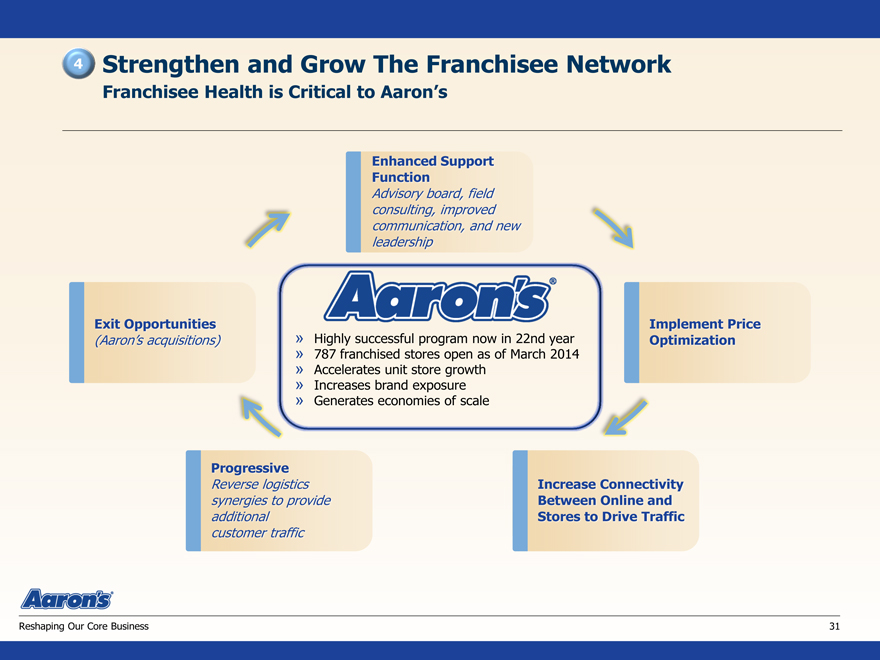

4 Strengthen and Grow The Franchisee Network

Franchisee Health is Critical to Aaron’s

Enhanced Support Function

Advisory board, field consulting, improved communication, and new leadership

Exit Opportunities Implement Price

(Aaron’s acquisitions) Optimization

Highly successful program now in 22nd year

787 franchised stores open as of March 2014

Accelerates unit store growth

Increases borad exposure

Generates economies of scale

Progressive

Reserve logistics synergies to provide additional customer traffic

Increase Connectivity Between Online and Stores to Drive Traffic

synergies to provide Between Online and

additional Stores to Drive Traffic

customer traffic

Reshaping Our Core Business 31

IV. Enhancing Leadership and Corporate Governance

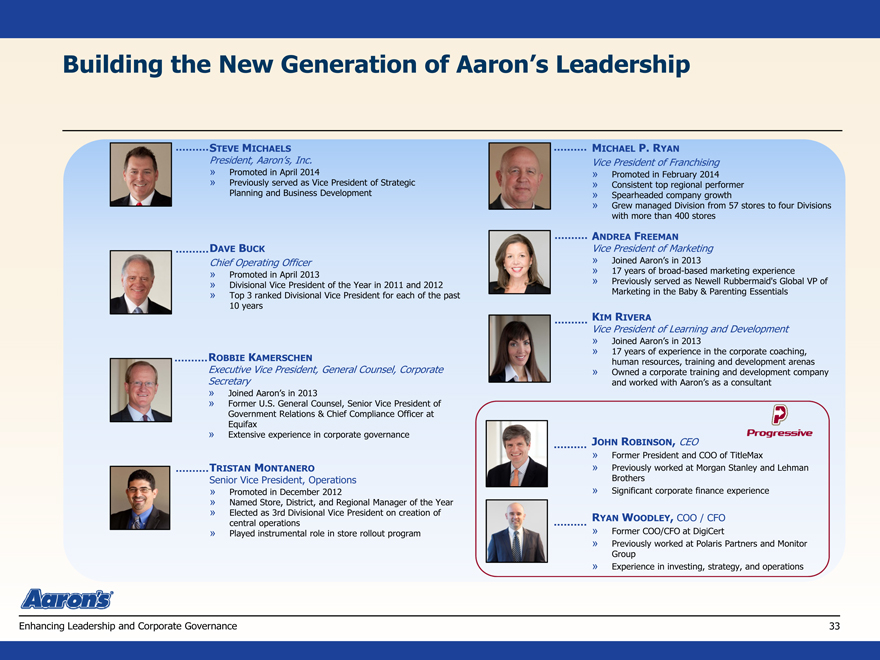

Building the New Generation of Aaron’s Leadership

STEVE MICHAELS

President, Aaron’s, Inc.

» Promoted in April 2014

» Previously served as Vice President of Strategic Planning and Business Development

DAVE BUCK

Chief Operating Officer

» Promoted in April 2013

» Divisional Vice President of the Year in 2011 and 2012

» Top 3 ranked Divisional Vice President for each of the past 10 years

ROBBIE KAMERSCHEN

Executive Vice President, General Counsel, Corporate Secretary

» Joined Aaron’s in 2013

» Former U.S. General Counsel, Senior Vice President of Government Relations & Chief Compliance Officer at Equifax

» Extensive experience in corporate governance

TRISTAN MONTANERO

Senior Vice President, Operations

» Promoted in December 2012

» Named Store, District, and Regional Manager of the Year

» Elected as 3rd Divisional Vice President on creation of central operations

» Played instrumental role in store rollout program

MICHAEL P. RYAN

Vice President of Franchising

» Promoted in February 2014

» Consistent top regional performer

» Spearheaded company growth

» Grew managed Division from 57 stores to four Divisions with more than 400 stores

ANDREA FREEMAN

Vice President of Marketing

» Joined Aaron’s in 2013

» 17 years of broad-based marketing experience

» Previously served as Newell Rubbermaid’s Global VP of Marketing in the Baby & Parenting Essentials

KIM RIVERA

Vice President of Learning and Development

» Joined Aaron’s in 2013

» 17 years of experience in the corporate coaching, human resources, training and development arenas

» Owned a corporate training and development company and worked with Aaron’s as a consultant

Progressive

JOHN ROBINSON, CEO

» Former President and COO of TitleMax

» Previously worked at Morgan Stanley and Lehman Brothers

» Significant corporate finance experience

RYAN WOODLEY, COO / CFO

» Former COO/CFO at DigiCert

» Previously worked at Polaris Partners and Monitor Group

» Experience in investing, strategy, and operations

Enhancing Leadership and Corporate Governance

33

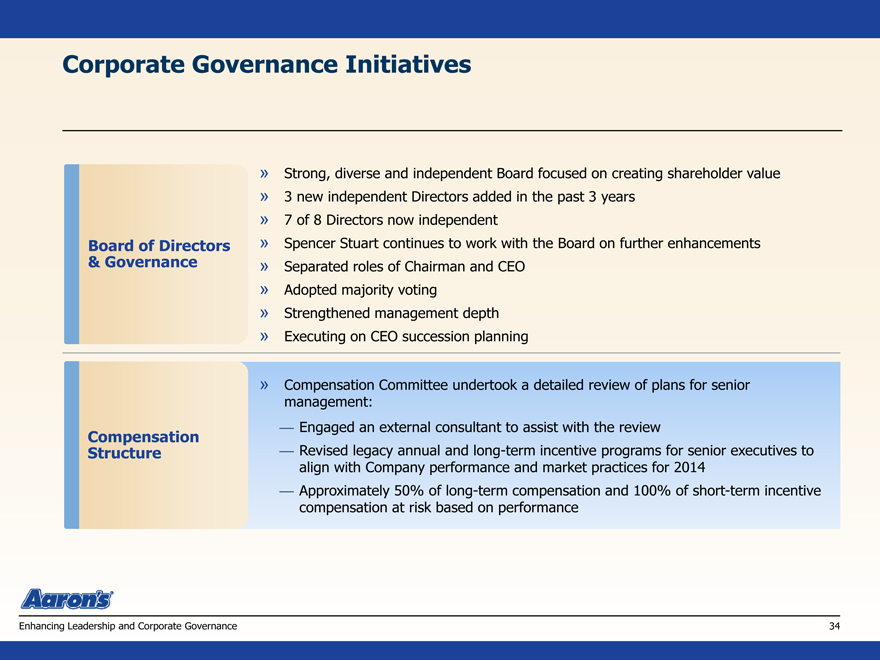

Corporate Governance Initiatives

Board of Directors & Governance

» Strong, diverse and independent Board focused on creating shareholder value

» 3 new independent Directors added in the past 3 years

» 7 of 8 Directors now independent

» Spencer Stuart continues to work with the Board on further enhancements

» Separated roles of Chairman and CEO

» Adopted majority voting

» Strengthened management depth

» Executing on CEO succession planning

Compensation Structure

» Compensation Committee undertook a detailed review of plans for senior management:

— Engaged an external consultant to assist with the review

— Revised legacy annual and long-term incentive programs for senior executives to align with Company performance and market practices for 2014

— Approximately 50% of long-term compensation and 100% of short-term incentive compensation at risk based on performance

Enhancing Leadership and Corporate Governance

34

An Engaged and Experienced Board Focused on Performance

Independent

» Ray Robinson (Chairman)

— Former Southern Region President, AT&T

— Current Director for Avnet, Acuity and American Airlines Group

» Ronald W. Allen

CEO, Aaron’s

Former Chairman and CEO, Delta Air Lines

» Leo Benatar

— Former CEO, Engraph

— Former Chairman, Federal Reserve Bank of Atlanta

» Kathy Betty

— Founder, Tradewind Group

— Former Executive Vice President and Partner, Scott Madden

— One of the first female partners at Ernst & Young

» Cynthia Day

— President and CEO, Citizens Bancshares Corporation and Citizens Trust Bank

— Current Director, Citizens Trust Bank, Primerica

» Hubert Harris, Jr.

— Former CEO and Chairman, Invesco North America, Invesco Retirement Services

— Trustee of SEI family of mutual funds

» David Kolb

— Former Chairman and CEO, Mohawk Industries

» John Schuerholz

— President, Atlanta Braves professional baseball organization

Enhancing Leadership and Corporate Governance

35

V. Update On Transaction Committee Review and

Vintage Proposal

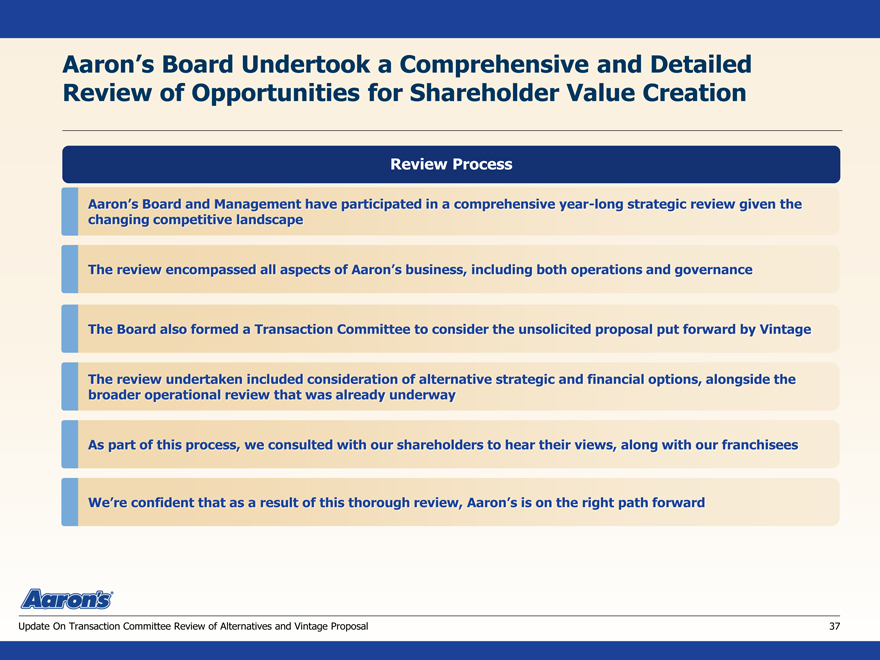

Aaron’s Board Undertook a Comprehensive and Detailed Review of Opportunities for Shareholder Value Creation

Review Process

Aaron’s Board and Management have participated in a comprehensive year-long strategic review given the changing competitive landscape

The review encompassed all aspects of Aaron’s business, including both operations and governance

the Board also formed a transaction Committee to consider the unsolicited proposal put forward by Vintage

The review undertaken included consideration of alternative strategic and financial options, alongside the broader operational review that was already underway

As part of this process, we consulted with our shareholders to hear their views, along with our franchisees

We’re confident that as a result of this thorough review, Aaron’s is on the right path forward

Update On Transaction Committee Review of Alternatives and Vintage Proposal 37

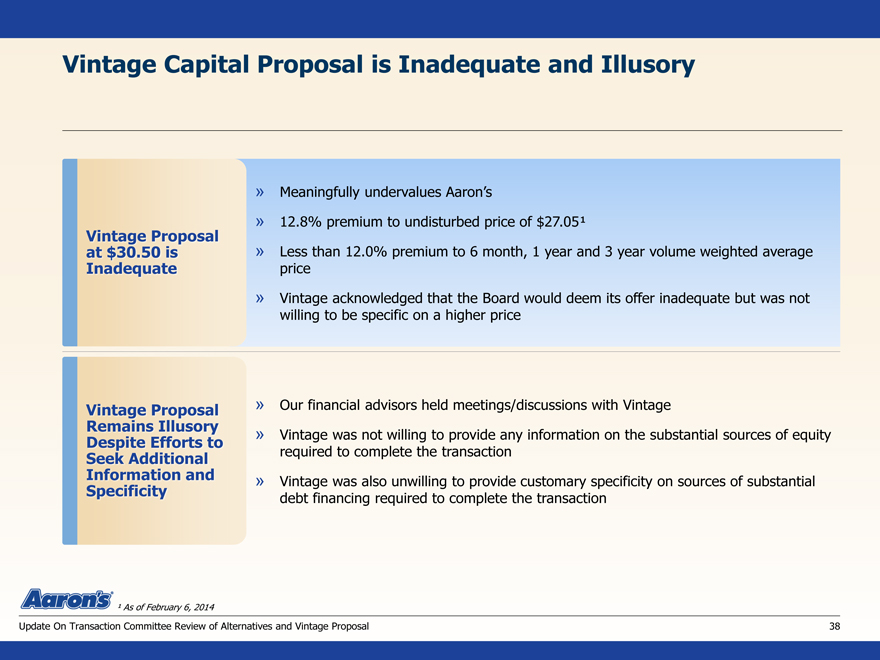

Vintage Capital Proposal is Inadequate and Illusory

Meaningfully undervalues Aaron’s

12.8% premium to undisturbed price of $27.051

Less than 12.0% premium to 6 month, 1 year and 3 year volume weighted average price

Vintage acknowledged that the Board would deem its offer inadequate but was not willing to be specific on a higher price

Our financial advisors held meetings/discussions with Vintage

Vintage was not willing to provide any information on the substantial sources of equity required to complete the transaction

Vintage was also unwilling to provide customary specificity on sources of substantial debt financing required to complete the transaction

¹As of February 6, 2014

Update On Transaction Committee Review of Alternatives and Vintage Proposal 38

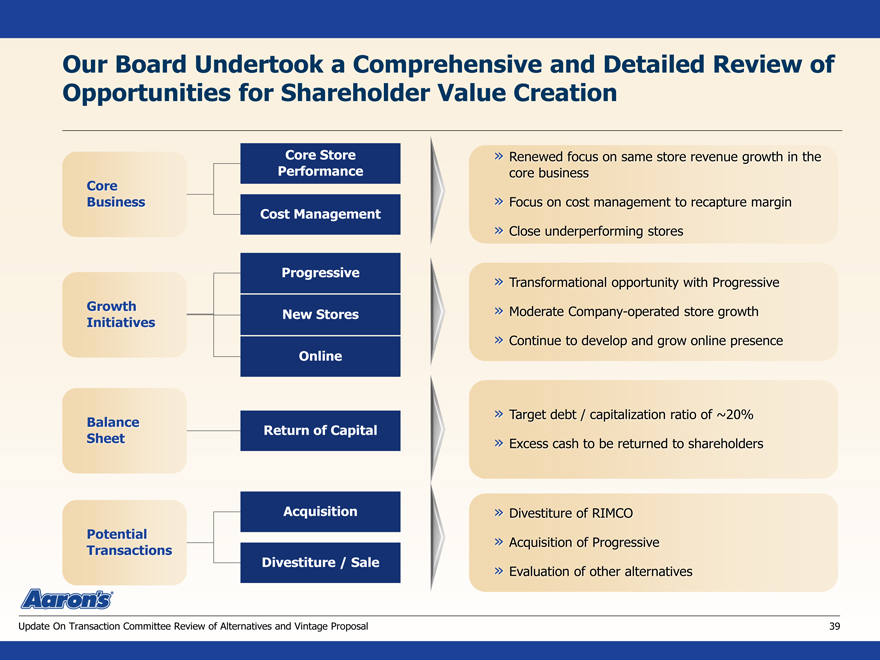

Our Board Undertook a Comprehensive and Detailed Review of Opportunities for Shareholder Value Creation

Core Store Performance Core Business Cost Management

Progressive

GrowthInitiatives

New Stores

Online

Balance

Return of Capital

Acquisition Potential Transactions

Divestiture / Sale

Renewed focus on same storeor revenue growth in the core business

Focus on cost management to recapture margin

Close underperforming stores

Transformational opportunity with Progressive

Moderate Company-operated storee growth

Continue to develop and grow online presence

Target debt / capitalization ratio of ~20%

Excess cash to be returned to shareholders

Divestiture of RIMCO

Acquisition of Progressive

Evaluation of other alternatives

Update On Transaction Committee Review of Alternatives and Vintage Proposal

39

VI. Summary / Q&A

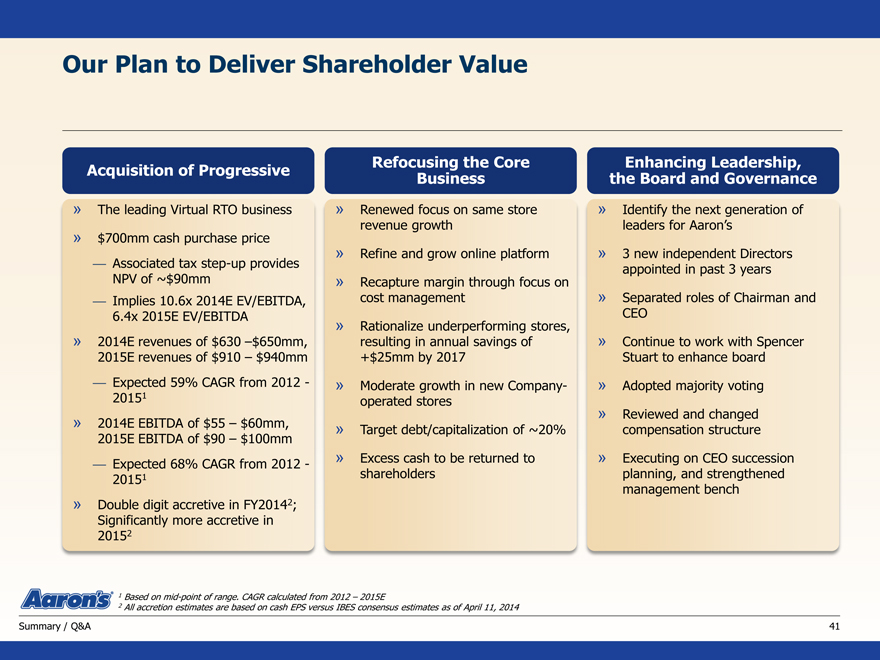

Our Plan to Deliver Shareholder Value

Acquisition of Progressive

The leading Virtual RTO business $700mm cash purchase price

— Associated tax step-up provides NPV of ~$90mm

— Implies 10.6x 2014E EV/EBITDA, 6.4x 2015E EV/EBITDA

2014E revenues of $630 –$650mm, 2015E revenues of $910 – $940mm

— Expected 59% CAGR from 2012 -20151 2014E EBITDA of $55 – $60mm, 2015E EBITDA of $90 – $100mm

— Expected 68% CAGR from 2012 -20151 Double digit accretive in FY20142; Significantly more accretive in

20152

Refocusing the Core Business

Renewed focus on same store revenue growth

Refine and grow online platform

Recapture margin through focus on cost management Rationalize underperforming stores, resulting in annual savings of

+$25mm by 2017

Moderate growth in new Company-operated stores Target debt/capitalization of ~20% Excess cash to be returned to shareholders

Enhancing Leadership, the Board and Governance

Identify the next generation of leaders for Aarons

3 new independent Directors appointed in past 3 years Separated roles of Chairman and CEO

Continue to work with Spencer Stuart to enhance board Adopted majority voting Reviewed and changed compensation structure Executing on CEO succession planning, and strengthened management bench

Summary / Q&A

1 Based on mid-point of range. CAGR calculated from 2012 –2015E

2 All accretion estimates are based on cash EPS versus IBES consensus estimates as of April 11, 2014

41