The following table sets forth information concerning individual grants of stock options made during fiscal year 2005 to the Named Executive Officers.

The following table sets forth information concerning the fiscal year-end value of unexercised options. No options to purchase shares of Common Stock were exercised by any of the Named Executive Officers during fiscal year 2005.

Employment contracts and termination of employment and change-in-control arrangements

On April 11, 2006, the Company entered into an employment agreement (‘‘Employment Agreement’’) with Mason N. Carter, setting forth the new terms of Mr. Carter’s employment as President and Chief Executive Officer of the Company. The Employment Agreement supersedes and replaces in its entirety the employment agreement, dated as of December 19, 1996, as amended on January 1, 1998, by and between the Company and Mr. Carter. Pursuant to the Employment Agreement, Mr. Carter’s annual base salary is $332,000. The initial term of the Employment Agreement ends on December 31, 2010, and will be renewable for successive 12-month periods unless terminated pursuant to the terms of the Employment Agreement. If, within 12 months after a ‘‘change in control’’ (as defined in the Employment Agreement) of the Company, Mr. Carter resigns for ‘‘good reason’’ or is dismissed without ‘‘cause’’ (as such terms are defined therein), the Company will pay Mr. Carter the greater of three times the then applicable ‘‘base salary’’ (as defined therein) and (b) the base salary from the date of termination to the end of the ‘‘term’’ (as defined therein) and to continue to provide health insurance benefits for the later of (x) the three years following the termination and (y) the end of the term.

In addition, Mr. Carter will be eligible to participate in the Company’s medical benefits, life insurance, 401(k) and similar programs generally available to employees. Mr. Carter will also be eligible

to participate in the Company’s stock purchase, stock option, and long term incentive plans, and to receive bonuses, in the sole discretion of the Compensation Committee of the Company’s Board of Directors. The Company will maintain a $500,000 term life insurance policy for Mr. Carter’s beneficiaries.

Mr. Carter will be entitled to receive a ‘‘Special Retirement Benefit’’ (as defined in the Employment Agreement) of $75,000 per year if the Company achieves pre-tax earnings of $9 million in the aggregate over the three fiscal years prior to his retirement at or over age 65 (‘‘Performance Target’’). In addition, Mr. Carter would receive the Special Retirement Benefit if he is terminated by the Company without cause, resigns for ‘‘good reason,’’ or his employment is terminated as a result of a ‘‘disability,’’ and in any such case the Company has also achieved the Performance Target. During the term and for a period of three years following such retirement or termination (‘‘Restrictive Period’’), and for as long as Mr. Carter is receiving the Special Retirement Benefit, Mr. Carter is bound to a non-competition and non-solicitation agreement with the Company. However, if after the Restrictive Period, Mr. Carter gives written notice to the Company of his forfeiture of the Special Retirement Benefit, Mr. Carter would be released from the non-competition and non-solicitation agreement.

On March 29, 2006, the Compensation Committee of the Board of Directors adopted the Company's Amended and Restated Severance Plan (which replaces the previous plan adopted in September 2003) for key executives. The new plan provides, among other things, that if an executive is terminated by the Company without ‘‘cause’’ or the executive resigns for ‘‘good reason’’ (as such terms are defined in the plan) within 12 months following a ‘‘change in control’’ (as defined therein) the Company, or any successor to the Company, is obligated to pay to the executive one or two times (as determined by the Compensation Committee) his annual base salary and to continue to provide health insurance benefits for 24 months (to the extent not covered by any new employer). All payments under the plan will be payable at such times as determined by the Compensation Committee provided that all such payments are made prior to the later of (1) March 15 of the calendar year following the year in which the termination occurs and (2) two and one-half months after the end of the Company's year end in which such termination occurred. All payments will be made so as to comply with Section 409A of the Internal Revenue Code of 1986, as amended (the ‘‘Code’’). In connection with any payment under the plan, the Compensation Committee may require that the executive enter into non-competition/non-solicitation and confidentiality agreements as it deems appropriate. If an executive has entered into an agreement with the Company, which agreement covers the subject matter of the plan, such agreement will govern so that the executive will not be entitled to payments under both the agreement and the plan. The Amended and Restated Severance Plan is filed as an exhibit to the Company's Annual Report on Form 10-K for the year ending December 31, 2005.

Certain relationships and related transactions

In May 1998, the Company sold 22,000 shares of Common Stock to Mason N. Carter, Chairman, President and Chief Executive Officer of the Company, at a price of $11.60 per share, which approximated the average closing price of the Company's Common Stock during the first quarter of 1998. The Company lent Mr. Carter $255,000 in connection with the purchase of these shares and combined that loan with a prior loan to Mr. Carter in the amount of $105,000. The resulting total principal amount of $360,000 was payable May 4, 2003 and bore interest at a variable interest rate based on the prime rate. This loan was further amended on July 29, 2002. Accrued interest of $40,000 was added to principal, bringing the new principal amount of the loan to $400,000, the due date was extended to May 4, 2006, and interest (at the same rate as was previously applicable) was payable monthly. Mr. Carter has pledged 33,000 shares of Common Stock as security for this loan, which is a full-recourse loan.

On March 29, 2006, the Company entered into an agreement with Mr. Carter, its Chairman, President and Chief Executive Officer, to purchase, and on April 24, 2006 the Company purchased, 42,105 shares of the Company's common stock owned by Mr. Carter for a purchase price of $9.50 per share (the closing price of the common stock on March 29, 2006), resulting in a total purchase price for the shares of $399,998. As a condition to the Company's obligation to purchase the shares, concurrent with the Company's payment of the purchase price Mr. Carter repaid to the Company $400,000 in full satisfaction of Mr. Carter's promissory note in favor of the Company dated July 29, 2002.

11

On August 31, 2000, in connection with an amendment of Mr. Carter's employment agreement, the Company loaned Mr. Carter an additional $280,000. Interest on the loan varies and is based on the prime rate, payable in accordance with Mr. Carter's employment agreement. Each year the Company is required to forgive 20% of the amount due under this loan and the accrued interest thereon. During 2005, the Company forgave $56,000 of principal and $3,000 of accrued interest and paid a tax gross-up benefit of $4,300. During 2004, the Company forgave $56,000 of principal and $4,500 of accrued interest and paid a tax gross-up benefit of $6,100. During 2003, the Company forgave $56,000 of principal and $6,800 of accrued interest and paid $8,300 for a tax gross-up benefit. The forgiveness in 2005 resulted in satisfaction of the loan.

During fiscal years 2005, 2004 and 2003, respectively, the Company's General Counsel, Katten Muchin Rosenman LLP (formerly, KMZ Rosenman), was paid $243,000, $288,000, and $359,000 for providing legal services to the Company. Mr. E. Cohen (a director) is Counsel to the firm of Katten Muchin Rosenman LLP but does not share in any fees paid by the Company to the firm.

During fiscal years 2005, 2004, and 2003, the Company retained Career Consultants, Inc. and SK Associates to perform executive searches and to provide other services to the Company. The Company paid an aggregate of $5,000, $8,000, and $40,000 to these companies during 2005, 2004, and 2003, respectively. Dr. Goldberg (a director) is the Chairman and Chief Executive Officer of each of these companies.

During fiscal year 2003, Mr. A. Cohen (a director) was paid $12,000 for providing financial consulting services to the Company. This consulting fee was terminated as of April 30, 2003.

During each of fiscal years 2005, 2004, and 2003, Dr. Oliner (a director) was paid $36,000 for providing technology-related consulting services to the Company.

On February 28, 2002, the Company sold to DuPont 528,413 shares of Common Stock, representing approximately 16.6% of the Company's outstanding Common Stock after giving effect to the sale, for an aggregate purchase price of $5,284,000. The Company and DuPont have also agreed to work together to better understand the dynamics of the markets for high-frequency electronic components and modules. David B. Miller, Vice President and General Manager of DuPont, was appointed to the Company's Board of Directors.

During fiscal years 2005, 2004, and 2003, respectively, DuPont was paid $54,000, $84,000, and $109,000 for providing technological and marketing related personnel and services on a cost-sharing basis to the Company. Mr. Miller is an officer of DuPont, but does not share in any of these payments.

On December 13, 2004 Infineon Technologies AG (‘‘Infineon’’), at such time a beneficial owner of approximately 15% of the Company’s Common Stock, sold 475,000 shares of the Company’s Common Stock to four purchasers in a privately-negotiated transaction. Two purchasers in such transaction, K Holdings LLC and Hampshire Investments, Limited, each of which is affiliated with Ludwig G. Kuttner (a nominee for director), purchased shares representing an aggregate of approximately 9.6% of the Company’s Common Stock. Infineon also assigned to each purchaser certain registration rights to such shares under the existing registration rights agreements Infineon had with the Company. In connection with the transaction, the Company and Infineon terminated the Stock Purchase and Exclusivity Letter Agreement dated April 7, 2000, as amended, which provided that the Company would design, develop and produce exclusively for Infineon certain Multi-Mix® products that incorporate active RF power transistors for use in certain wireless base station applications, television transmitters and certain other applications that are intended for Bluetooth transceivers.

DuPont and the four purchasers above hold registration rights which currently give them the right to register an aggregate of 1,003,413 shares of Common Stock of the Company.

12

COMPENSATION OF DIRECTORS

Each director who is not an employee of the Company receives a monthly director’s fee of $1,500, plus an additional $500 for each meeting of the Board of Directors and of any Committees of the Board attended. In addition, the Chair of the Audit Committee receives an annual fee of $2,500 for his services in such capacity. The directors are also reimbursed for reasonable travel expenses incurred in attending Board and Committee meetings. In addition, pursuant to the 2001 Stock Option Plan, each non-employee director is annually granted an immediately exercisable option to purchase 2,500 shares of the Common Stock on the date of each annual meeting of stockholders. Each such grant is at the fair market value on the date of grant and will expire on the tenth anniversary of the date of the grant.

On April 26, 2006, the Board of Directors adopted the 2006 Non-Employee Directors’ Stock Plan, subject to stockholder approval. If the Plan is approved, each non-employee director would receive an annual grant of 1,500 restricted shares in 2006 or such other amount as the Board may decide from year to year in the future, which will vest in three equal annual installments. See Proposal 5 ‘‘2006 Non-Employee Directors’ Stock Plan’’ at page 28.

STOCK OWNERSHIP OF DIRECTORS, EXECUTIVE OFFICERS

AND CERTAIN STOCKHOLDERS

The following table sets forth, as of the Record Date, information concerning the Common Stock owned by (i) persons known to the Company who are beneficial owners of more than five percent of the Common Stock (ii) each director, director nominee and Named Executive Officer of the Company, and (iii) all directors, director nominees and executive officers of the Company as a group, that was either provided by the person to the Company or is publicly available from filings made with the SEC.

|  |  |  |  |  |  |  |  |  |  |

| Name and Address of Beneficial Owners |  | Amount and Nature of Beneficial

Ownership† (direct except as noted) |  | Percent of Class |

E.I. DuPont de Nemours and Company

1007 Market Street

Wilmington, DE 19898 |  | | 528,413 | (1) |  | | 16.84 | % |

Lior Bregman

10 Sinclair Terrace

Short Hills, NJ 07078 |  | | 313,600 | (2) |  | | 9.99 | % |

Ludwig G. Kuttner

Hampshire Investments, Limited

K Holdings, LLC

627 Plank Road

Keene, VA 22946 |  | | 300,000 | (3) |  | | 9.56 | % |

| Adam Smith Investment Partners, L.P., its affiliates and associates |  | | 204,900 | (4) |  | | 6.53 | % |

Arthur A. Oliner

11 Dawes Road

Lexington, MA 02173 |  | | 206,568 | (5) |  | | 6.52 | % |

Mason N. Carter

c/o Merrimac Industries, Inc.

41 Fairfield Place

West Caldwell, NJ 07006 |  | | 125,875 | (6) |  | | 3.87 | % |

Joel H. Goldberg

c/o C.C.I. / SK Associates, Inc.

1767 Morris Avenue

Union, NJ 07083 |  | | 57,150 | (7) |  | | 1.81 | % |

|

13

|  |  |  |  |  |  |  |  |  |  |

| Name and Address of Beneficial Owners |  | Amount and Nature of Beneficial

Ownership† (direct except as noted) |  | Percent of Class |

Edward H. Cohen

c/o Katten Muchin Zavis Rosenman

575 Madison Avenue

New York, NY 10022 |  | | 25,500 | (8) |  | | | * |

Albert H. Cohen

5347 Hunt Club Way

Sarasota, FL 34238 |  | | 15,000 | (9) |  | | | * |

Harold J. Raveché

c/o Stevens Institute of Technology

Castle Point on Hudson

Hoboken, NJ 07030 |  | | 12,759 | (10) |  | | | * |

David B. Miller

c/o DuPont Electronic Technologies

14 T.W. Alexander Drive

Research Triangle Park, NC 27709 |  | | 12,500 | (11) |  | | | * |

Fernando L. Fernandez

2159 El Amigo Road

Del Mar, CA 92014 |  | | 7,500 | (12) |  | | | * |

James J. Logothetis

c/o Merrimac Industries, Inc.

41 Fairfield Place

West Caldwell, NJ 07006 |  | | 33,801 | (13) |  | | 1.06 | % |

Reynold K. Green

c/o Merrimac Industries, Inc.

41 Fairfield Place

West Caldwell, NJ 07006 |  | | 24,459 | (14) |  | | | * |

Michael M. Ghadaksaz

c/o Merrimac Industries, Inc.

41 Fairfield Place

West Caldwell, NJ 07006 |  | | 20,000 | (15) |  | | | * |

Robert V. Condon

c/o Merrimac Industries, Inc.

41 Fairfield Place

West Caldwell, NJ 07006 |  | | 15,084 | (16) |  | | | * |

All directors, director nominees and

executive officers as a group (18 persons) |  | | 910,930 | (17) |  | | 26.34 | % |

|

|  |

| † | In accordance with Rule 13d-3 of the Securities Exchange Act of 1934, a person is deemed to be the beneficial owner of securities if such person has or shares voting power or investment power with respect to such securities or has the right to acquire beneficial ownership within 60 days. |

|  |

| * | The percentage of shares beneficially owned does not exceed 1% of the class. |

|  |

| (1) | Consists of shares owned by DuPont Chemical and Energy Operations, Inc. (‘‘DCEO’’). |

|  |

| (2) | Information as to the shares of Common Stock beneficially owned by Lior Bregman is as of February 17, 2006, as set forth in a Form 4 filed with the SEC on February 17, 2006. |

|  |

| (3) | 250,000 shares of Common Stock are held directly by K Holdings, LLC and 50,000 are held directly by Hampshire Investments, Limited. Mr. Kuttner is the principal member of K Holdings, LLC and owns 80% of the outstanding interests in Hampshire Investments, Limited. Information as to |

14

|  |

| shares of Common Stock beneficially owned by Mr. Kuttner, K Holdings, LLC and Hampshire Investments, Limited is as of January 5, 2005, as set forth in a Schedule 13D filed with the SEC on January 6, 2005. |

|  |

| (4) | Adam Smith Investment Partners, L.P., its affiliates and associates include Adam Smith Investment Partners, L.P. (‘‘ASIP’’), Adam Smith Capital Management LLC (‘‘ASCM’’), Diamond Capital Management (‘‘DCM’’), Adam Smith Investments, Ltd. (‘‘ASI’’), Richard Grossman, Orin Hirschman and Richard and Ana Grossman JTWROS. The principal executive offices of ASIP, ASCM and DCM, and the business address of Richard Grossman, are located at 101 East 52nd Street, New York, New York 10022. The business address of Orin Hirschman is located at 6006 Berkeley Ave., Baltimore, MD 21209. The principal executive office of ASI is c/o Insinger Trust (BVI) Limited, Tropic Isle Building, P.O. Box 438, Road Town, Tortola, British Virgin Islands. Information as to the shares of Common Stock beneficially owned by ASIP, ASCM, DCM, ASI, Richard Grossman, Orin Hirschman and Richard and Ana Grossman is as of December 31, 2003, as set forth in a Schedule 13G/A filed with the SEC on February 17, 2004. |

|  |

| (5) | Includes 29,000 shares subject to stock options that are exercisable currently or within 60 days, and 9,528 shares owned by Dr. Oliner’s wife. |

|  |

| (6) | Includes 111,000 shares subject to stock options that are exercisable currently or within 60 days. |

|  |

| (7) | Includes 12,500 shares subject to stock options that are exercisable currently or within 60 days. |

|  |

| (8) | Includes 12,500 shares subject to stock options that are exercisable currently or within 60 days. |

|  |

| (9) | Includes 10,000 shares subject to stock options that are exercisable currently or within 60 days. |

|  |

| (10) | Includes 12,500 shares subject to stock options that are exercisable currently or within 60 days. |

|  |

| (11) | David B. Miller disclaims beneficial ownership of the shares owned by DCEO. Includes 12,500 shares subject to stock options that are exercisable currently or within 60 days. |

|  |

| (12) | Includes 7,500 shares subject to stock options that are exercisable currently or within 60 days. |

|  |

| (13) | Includes 33,500 shares subject to stock options that are exercisable currently or within 60 days. |

|  |

| (14) | Includes 11,750 shares subject to stock options that are exercisable currently or within 60 days. |

|  |

| (15) | Includes 20,000 shares subject to stock options that are exercisable currently or within 60 days. |

|  |

| (16) | Includes 2,750 shares subject to stock options that are exercisable currently or within 60 days. |

|  |

| (17) | Includes 320,100 shares subject to stock options and 936 shares subject to the Company’s stock purchase plan that are exercisable currently or within 60 days. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and executive officers, and persons who own more than ten percent of the Common Stock, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) reports they file.

To the Company’s knowledge, based solely on its review of the copies of such reports furnished to the Company and written representations that no other reports were required, the Company’s officers, directors and greater than ten percent stockholders complied with these Section 16(a) filing requirements with respect to the Common Stock during the fiscal year ended December 31, 2005.

15

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION IN COMPENSATION DECISIONS

During fiscal 2005, the Compensation Committee consisted of Mr. A. Cohen (chair), Mr. E. Cohen and Dr. Goldberg. None of the members of the Compensation Committee was, during such year, an officer of the Company or any of its subsidiaries or had any relationship with the Company other than serving as a director of the Company. In addition, no executive officer of the Company served as a director or a member of the compensation committee of any other entity one of whose executive officers served as a director or on the Compensation Committee of the Company.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Mr. A. Cohen (chair), Mr. E. Cohen and Dr. Goldberg currently serve on the Compensation Committee. The responsibilities of the Compensation Committee include fixing the compensation, including salaries and bonuses, of the chief executive officer and all other senior executive officers of the Company and administering the Company’s equity-based employee incentive benefit plans.

Compensation Policy

The Compensation Committee believes that the Company’s executive officers constitute a highly qualified management team, and that the stability of the management team is important. In order to promote stability, the Company’s executive compensation is designed to provide salaries sufficient to attract, motivate and retain members of the management team and incentive compensation linked to corporate performance and long-term total return to stockholders. The Committee’s overall objectives are to attract and retain the best possible executive talent, to motivate executives to achieve the goals inherent in the Company's business strategy, to link executive and Stockholder interests and to reward individual contributions as well as overall business results.

The major elements of the Company’s executive compensation program are base salaries, incentive bonuses and long-term incentive compensation in the form of a long-term incentive plan, stock purchase programs and stock options. Executive officers are also entitled to customary benefits generally available to all co-workers of the Company, including group medical and life insurance and participation in the Company’s Savings and Investment Plan.

Base Salaries

Annual base salaries for executive officers are determined by evaluating the performance of the individuals and their contributions to the performance of the Company. Financial results, as well as non-financial measures such as the magnitude of responsibility of the position, individual experience, and the Compensation Committee’s knowledge of compensation practices for comparable positions at other companies are considered. The Compensation Committee also relies heavily upon the recommendations of Mr. Carter in setting the compensation of executive officers reporting to him.

Bonuses

The Compensation Committee has the authority to award annual bonuses to executive officers on a discretionary basis. Such bonuses are awarded to executive officers to provide incentives. Bonuses are intended to focus the executives’ attention on short-term or annual business results as well as progress toward long-term, strategic objectives. For fiscal year 2005, no bonuses were awarded to any executive officers.

Compensation of Chief Executive Officer

Mr. Carter is subject to an employment agreement pursuant to which he will serve as President and Chief Executive Officer of the Company for a minimum annual base salary of $332,000. Mr. Carter will also be eligible to participate in the Company’s stock purchase, stock option, and long term incentive plans, and to receive bonuses, in the sole discretion of the Compensation Committee of the Company’s Board of Directors. He will also be eligible for a $75,000 annual retirement benefit if certain financial performance targets are achieved. The Committee determined to enter into this new agreement with

16

Mr. Carter at this time (replacing his old agreement which expired on December 31, 2002 and which has been automatically annually renewed pursuant to its terms since then), in order to secure for the Company the long term benefits of his services during this critical phase in the Company’s growth and as it manages the complex engineering, marketing and expansion of its Multi-Mix® product lines. The Compensation Committee believes Mr. Carter’s industry knowledge and experience and his understanding of the Company’s complex technologies makes him singularly situated to implement the Company’s strategies, and it is in the Company’s best interests to ensure his continued service.

In determining Mr. Carter’s salary for 2005, the Committee considered the various factors described above for executive officers.

Long-Term Incentives

Under the Company’s option plans, stock options are granted to executives and key employees of the Company. Stock options are designed to focus the executives’ attention on stock values and to align the interests of executives with those of the stockholders. Stock options are customarily granted at prices equal to the fair market value at the date of grant and are not exercisable until the first anniversary of the date of grant. The options generally remain exercisable during employment until the tenth anniversary of the date of grant. This approach provides an incentive to executives to increase stockholder value over the long term since the full benefit of the options cannot be realized unless stock price appreciation occurs over a number of years.

In 2005, the Committee granted options to purchase 10,000 shares of Common Stock to Mr. Ghadaksaz and 8,250 shares to Mr. Green. No other executive officer received a grant of stock options from the Company in 2005.

In 2006, the Board adopted the 2006 Stock Option Plan, 2006 Key Employee Incentive Plan, and 2006 Non-Employee Directors’ Stock Plan. See Proposal 3 ‘‘2006 Stock Option Plan’’ at page 20, Proposal 4 ‘‘2006 Key Employee Incentive Plan’’ at page 25, and Proposal 5 ‘‘2006 Non-Employee Directors’ Stock Plan’’ at page 28. As explained below, the Board approved these plans with the recommendation of the Compensation Committee, each subject to stockholder approval, in order to (i) in the case of the 2006 Stock Option Plan, replace the 2001 Stock Option Plan, which only has 19,700 shares remaining available for grant, (ii) in the case of the 2006 Key Employee Incentive Plan, to replace the 2001 Key Employee Incentive Plan (which expired on April 20, 2006) to effect certain updating changes required by tax law, and to raise the targets to be achieved in order for management to obtain the benefits of the Plan, and (iii) in the case of the 2006 Non-Employee Directors’ Stock Plan, to provide additional compensation to the non-employee directors in line with the Company’s competitors and to align their interests with those of the stockholders.

Tax Deductibility of Executive Compensation

Section 162(m) of the Code, limits the amount of compensation a publicly-held corporation may deduct as a business expense for Federal income tax purposes. The deductibility limit, which applies to a company's chief executive officer and the four other most highly compensated executive officers, is $1 million, subject to certain exceptions. The exceptions include the general exclusion of performance-based compensation from the calculation of an executive officer's compensation for purposes of determining whether his or her compensation exceeds the deductibility limit. Although the Company has not in the past paid its executive officers compensation which is not fully deductible, the Compensation Committee also recognizes that in certain instances it may be in the best interest of the Company to provide compensation that is not fully deductible.

| Compensation Committee |

| Albert H. Cohen, Chair

Edward H. Cohen

Joel H. Goldberg |

17

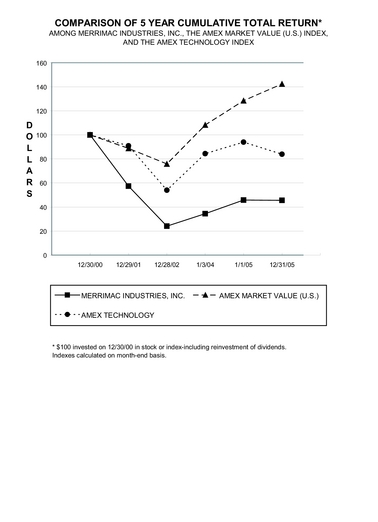

STOCK PERFORMANCE CHART

The following performance graph is a line graph comparing the yearly change in the cumulative total stockholder return on the Common Stock against the cumulative return of the AMEX Stock Market (U.S. Companies), and a line of business index comprised of the AMEX Technologies Index for the five fiscal years ended December 31, 2005.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Cumulative Total Return |

| |  | 12/30/00 |  | 12/29/01 |  | 12/28/02 |  | 1/3/04 |  | 1/1/05 |  | 12/31/05 |

| MERRIMAC INDUSTRIES, INC. |  | | 100.00 | |  | | 57.32 | |  | | 24.05 | |  | | 34.43 | |  | | 45.77 | |  | | 45.57 | |

| AMEX MARKET VALUE (U.S.) |  | | 100.00 | |  | | 88.73 | |  | | 75.76 | |  | | 108.19 | |  | | 128.37 | |  | | 142.31 | |

| AMEX TECHNOLOGY |  | | 100.00 | |  | | 90.91 | |  | | 53.94 | |  | | 84.40 | |  | | 93.92 | |  | | 83.94 | |

|

18

RATIFICATION OF SELECTION

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

(Proposal 2)

The Audit Committee has selected Grant Thornton LLP as independent registered public accounting firm to audit and report upon the consolidated financial statements of the Company for fiscal year 2006. The Board of Directors recommends that the stockholders ratify the selection of Grant Thornton LLP.

A representative of Grant Thornton LLP is expected to be present at the Meeting to respond to appropriate questions, and to make a statement if he desires.

Audit Fees. The aggregate fees billed or to be billed by the Company’s independent registered public accounting firm for each of the last two fiscal years for professional services rendered for the audit of the Company’s annual financial statements, review of financial statements included in the Company’s quarterly reports on Form 10-Q and services that were provided in connection with statutory and regulatory filings or engagements were $360,200 in 2005, which includes $234,400 for the 2005 audit, $59,500 for additional 2004 audit fees, an SEC review fee of $14,500, and $51,800 for 2005 quarterly reviews, and $254,000 in 2004, consisting of $28,000 billed by Ernst & Young LLP, the Company’s independent registered public accounting firm until June 16, 2004, and $226,000 billed by Grant Thornton LLP.

Audit-related Fees. The aggregate fees billed or to be billed by the Company’s independent registered public accounting firm for each of the last two fiscal years for assurance and related services that were reasonably related to the performance of the audit or review of the Company’s financial statements were $13,000 for 2004 billed by Ernst & Young LLP. The nature of the services performed for these fees was services provided in connection with the employee savings and investment plan audits and accounting consultations.

Tax Fees. The aggregate fees billed by the Company’s independent registered public accounting firm in each of the last two fiscal years for professional services rendered for tax compliance, tax advice and tax planning were $43,200 in 2005 by Grant Thornton LLP, and $61,000 in 2004, consisting of $15,000 billed by Grant Thornton LLP and $46,000 billed by Ernst & Young LLP. The nature of the services performed for these fees was tax return preparation and services provided in connection with net operating loss carryforward limitations.

All Other Fees. The aggregate fees billed by the Company’s independent registered public accounting firm in each of the last two fiscal years for products and services other than those reported in the three prior categories were $11,500 billed by Ernst & Young LLP for 2005. The nature of the services performed for these fees was for consents in 2005 financial statements.

Prior Auditors

On June 16, 2004, the Audit Committee dismissed Ernst & Young LLP as the Company's independent registered public accounting firm.

The audit reports of Ernst & Young LLP on the Company's consolidated financial statements as of and for the fiscal years ending December 28, 2002 and January 3, 2004 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

During the fiscal years ended December 28, 2002 and January 3, 2004, and for the interim period through June 16, 2004, the date the engagement of Ernst & Young LLP by the Company ended, there were no disagreements with Ernst & Young LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which, if not resolved to Ernst & Young LLP’s satisfaction, would have caused them to make reference to the subject matter of the disagreement in connection with their reports. During the fiscal years ended December 28, 2002 and January 3, 2004, and for the interim period through June 16, 2004, the date the engagement of Ernst & Young LLP by the Company ended, Ernst & Young LLP did not advise the Company of any reportable events under Item 304(a)(1)(iv)(B) of Regulation S-B promulgated under the Securities Exchange Act of 1934. The

19

Company provided Ernst & Young LLP with a copy of the foregoing disclosures. Attached as Exhibit 16.1 to the Company’s Form 8-K filed with the SEC on June 17, 2004 is a copy of the letter from Ernst & Young LLP to the Securities and Exchange Commission, dated June 16, 2004, stating that it agreed with such statements.

On June 16, 2004, the Audit Committee of the Board of Directors of the Company engaged Grant Thornton LLP as the Company's new independent registered public accounting firm. During the fiscal years ended December 28, 2002 and January 3, 2004, and for the interim period through June 16, 2004, the date the engagement of Ernst & Young LLP by the Company ended, neither the Company nor anyone acting on the Company's behalf consulted Grant Thornton LLP regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed; or the type of audit opinion that might be rendered on the Company's financial statements, and neither a written report nor oral advice was provided by Grant Thornton LLP to the Company that Grant Thornton LLP concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issues; or (ii) any matter that was either the subject of a ‘‘disagreement’’ or ‘‘event,’’ as those terms are described in Item 304(a)(1)(iv) and (v) of Regulation S-K.

Policy on Pre-Approval of Services Provided by Independent Auditors

The Audit Committee has established policies and procedures regarding pre-approval of all services provided by the independent auditors. The Audit Committee will annually review and pre-approve the services that may be provided by the independent auditors without obtaining specific pre-approval from the Audit Committee. Unless a type of service has received general pre-approval, it requires specific pre-approval by the Audit Committee if it is to be provided by the independent auditors. The Audit Committee may delegate, subject to any rules or limitations it may deem appropriate, to one or more designated members of the Audit Committee the authority to grant such pre-approvals; provided, however, that the decisions of any member to whom authority is so delegated to pre-approve an activity shall be presented to the full Audit Committee at its next scheduled meeting. The Audit Committee has delegated such pre-approval authority to Edward H. Cohen, Chair of the Audit Committee. The Audit Committee pre-approved all audit and permitted non-audit services in 2004 as well as those that were provided in 2003 after the pre-approval requirements under the Sarbanes-Oxley Act became effective on May 6, 2003. The Company’s pre-approval policy can be found on the Company’s website at www.merrimacind.com.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A

VOTE FOR RATIFICATION OF GRANT THORNTON LLP AS

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2006.

Ratification of Grant Thornton LLP as independent registered public accounting firm for 2006 requires the affirmative vote of a majority of the shares present at the Meeting and entitled to vote on the ratification of the independent registered public accounting firm. Unless otherwise indicated, the accompanying form of proxy will be voted FOR the proposal to ratify Grant Thornton LLP as the registered public accounting firm for 2006. Although stockholder ratification of the Board of Directors’ action in this respect is not required, the Board of Directors considers it desirable for stockholders to pass upon the selection of auditors and, if the stockholders disapprove of the selection, intends to reconsider the selection of auditors for the fiscal year 2007, since it would be impractical to replace the Company’s auditors so late into the Company’s current fiscal year.

APPROVAL OF THE 2006 STOCK OPTION PLAN

(Proposal 3)

On April 26, 2006, the Board of Directors adopted, subject to stockholder approval, the 2006 Stock Option Plan. The 2006 Stock Option Plan is intended to replace the 2001 Stock Option Plan, which will be terminated if the 2006 Stock Option Plan is approved by stockholders. As of the date of this Proxy Statement, there are only 19,700 shares of Common Stock available for the grant of options under the 2001 Stock Option Plan. Any outstanding options granted under the 2001 Stock Option Plan will continue to be governed by their applicable plans.

20

The following summary of certain features of the 2006 Stock Option Plan is qualified in its entirety by reference to the full text of the 2006 Stock Option Plan, which is Exhibit A to this Proxy Statement.

The 2006 Stock Option Plan authorizes the grant of an aggregate of 500,000 shares of Common Stock to employees of and consultants to the Company and to directors of the Company. Under the 2006 Stock Option Plan, the Company may grant to eligible individuals incentive stock options, as defined in Section 422 of the Code, and/or non-qualified stock options.

Nature and Purposes of the 2006 Stock Option Plan

The purposes of the 2006 Stock Option Plan are to attract, retain and motivate employees, compensate consultants, and to enable employees, consultants and directors, including non-employee directors, to participate in the long-term growth of the Company by providing for or increasing the proprietary interests of such persons in the Company, thereby assisting the Company to achieve its long-range goals. Based on current employment as of the date of this Proxy Statement, the approximate number of persons eligible to participate in the 2006 Stock Option Plan is 240.

Duration and Modification

The 2006 Stock Option Plan may be terminated, amended, altered, or discontinued at any time by the Board, but no amendment may impair the rights of a participant without the participant’s consent, subject to the terms of the 2006 Stock Option Plan. In addition, the 2006 Stock Option Plan may not be amended without the approval of the Company’s stockholders to the extent such approval is required by law or listing requirement on which the Company’s equity securities are publicly traded. Options may not be granted under the 2006 Stock Option Plan after March 28, 2016, or earlier as the Compensation Committee may determine.

Administration

The 2006 Stock Option Plan is administered by the Compensation Committee. The Compensation Committee currently consists of Messrs. A. Cohen and E. Cohen and Dr. Goldberg.

The members of the Compensation Committee are appointed annually by the Board. The Compensation Committee, among other things, has the authority to adopt, alter and repeal the administrative rules, guidelines and practices governing the operation of the 2006 Stock Option Plan, to determine the participants, the time and terms and conditions under which the options may be granted in the 2006 Stock Option Plan, and to interpret the provisions of the 2006 Stock Option Plan.

Description of Options

Under the 2006 Stock Option Plan, the per share purchase price of incentive stock options may not be less than the fair market value of a share of Common Stock, which is the closing sale price of the Common Stock on the American Stock Exchange on the day prior to the day of grant, and the per share purchase price of non-qualified stock options will be determined by the Compensation Committee. The aggregate fair market value of the shares of Common Stock for which a participant may be granted incentive stock options which are exercisable for the first time in any calendar year may not exceed $100,000. No participant may, during any calendar year, be granted options to purchase more than 35,000 shares of the Common Stock.

Options granted under the 2006 Stock Option Plan generally become exercisable with respect to one-third of the underlying shares on the first anniversary of the date of grant, with respect to two-thirds of the underlying shares on the second anniversary of the date of grant, and with respect to 100% of the underlying shares on the third anniversary of the date of grant, unless otherwise determined by the Compensation Committee at the time of the grant of the option. The Compensation Committee may permit any option to be exercised in whole or in part prior to the time that it would otherwise be exercisable. Upon the exercise of an option, the option price may be paid in cash, by certified or bank check, in shares of Common Stock, or other lawful consideration as the Compensation Committee may determine. An option may not be exercisable more than 10 years from the date of grant.

21

In the event of the death of a participant, outstanding options granted to the participant may be exercised at any time prior to the expiration date of the option or within 12 months following the participant’s death, whichever is shorter. In the event of the disability or retirement of a participant, outstanding options granted to the participant may be exercised prior to the expiration date of the option, or within three months in the case of a disability that does not meet the definition of ‘‘permanent and total disability’’ under Section 22(e) of the Code, or within 12 months if the disability meets the definition of ‘‘permanent and total disability’’ under Section 22(e) of the Code, whichever time period is shorter. If a participant’s employment by, or service for, the Company is terminated by the Company (other than for cause), outstanding options that have vested generally will terminate 30 days after such participant’s termination date, or if earlier, the termination date of such option, and unvested options will terminate immediately upon participant’s termination. If a participant voluntarily leaves the employ or service of the Company (other than upon retirement) or is terminated for cause, outstanding options granted to the participant will be cancelled and terminated immediately.

Securities Subject to the 2006 Stock Option Plan

There are 500,000 authorized but unissued shares of Common Stock that have been reserved for issuance upon the exercise of options granted under the 2006 Stock Option Plan. If any option expires or is terminated before exercise or is forfeited for any reason, to the extent shares of Common Stock subject to such option are not delivered to the participant, such shares of Common Stock shall again be available for grant under the 2006 Stock Option Plan. Shares of Common Stock issued under the plan may consist in whole or in part of authorized but unissued shares of Common Stock or treasury shares.

The market value of the Common Stock, as of April 26, 2006 was $9.20 per share.

New Plan Benefits

Because participation in the 2006 Stock Option Plan and the amount and terms of awards under the 2006 Stock Option Plan are at the discretion of the Compensation Committee (subject to the terms of the 2006 Stock Option Plan), benefits are not currently determinable. Compensation paid and other benefits granted to Named Executive Officers of the Company for the 2005 fiscal year are set forth in the Summary Compensation Table. If the 2006 Stock Option Plan had been in effect in 2005, the persons and groups shown in the following table would have received the number of stock options shown below, which are the same number of stock options as were actually granted to the persons and groups in 2005 under the 2001 Stock Option Plan. If, however, the 2006 Stock Option Plan had been in effect in 2005, the Company may have made additional grants to certain executive officers; however, such amounts are not determinable.

22

Merrimac Industries, Inc. 2006 Stock Option Plan

|  |  |  |  |  |  |

| Name and Position |  | Number of options |

| Mason N. Carter, Chairman of the Board, President and Chief Executive Officer |  | | 0 | |

| Robert V. Condon, Vice President, Finance, Chief Financial Officer, Treasurer and Secretary |  | | 0 | |

| Reynold K. Green, Vice President and Chief Operating Officer |  | | 8,250 | |

| Michael M. Ghadaksaz, Vice President, Market Development |  | | 10,000 | |

| James J. Logothetis, Vice President and Chief Technology Officer |  | | 0 | |

| Executive Group |  | | 18,250 | |

| Non-Executive Director Group |  | | 17,500 | |

| Non-Executive Officer Employee Group |  | | 6,850 | |

|

Federal Income Tax Consequences of Issuance and Exercise of Options

The following discussion of the Federal income tax consequences of the granting and exercise of options under the 2006 Stock Option Plan, and the sale of Common Stock acquired as a result thereof, is based on an analysis of the Code, existing laws, judicial decisions and administrative rulings and regulations, all of which are subject to change. In addition to being subject to the Federal income tax consequences described below, a participant may also be subject to state and/or local income tax consequences in the jurisdiction in which he or she works and/or resides.

Non-Qualified Stock Options

In general, no income will generally be recognized by a participant at the time a non-qualified stock option is granted. Ordinary income will be recognized by a participant at the time a non-qualified stock option is exercised, and the amount of such income will be equal to the excess of the fair market value on the exercise date of the shares issued to the participant over the option price. In the case of an employee, this ordinary (compensation) income will also constitute wages subject to withholding, and the participant will be required to make whatever arrangements are necessary to ensure that the amount of the tax required to be withheld is available for payment.

Section 409A of the Code (‘‘Section 409A’’) makes substantial changes to the federal income tax treatment of nonqualified deferred compensation plans. Section 409A was enacted as part of the American Jobs Creation Act of 2004 and generally became effective for amounts deferred on or after January 1, 2005. The Company currently does not intend to make grants under the 2006 Stock Option Plan that constitute deferred compensation subject to Section 409A and that do not comply with the requirements of Section 409A to avoid liability thereunder. However, should such grants be made, participants may be required to recognize ordinary income prior to the time such option is exercised, possibly as early as the time such option is granted. In addition, the participant may be subject to an additional tax equal to 20% of the amount of such ordinary income and payment of interest on such ordinary income and interest on such income and additional tax. Although the Internal Revenue Service has issued some guidance regarding compliance with Section 409A, it is anticipated that the IRS will issue further guidance regarding the interpretation and application of Section 409A, particularly with respect to the determination of any taxes and interest payable thereunder.

The Company will generally be entitled to a deduction for Federal income tax purposes at such time and in an amount equal to the amount of ordinary income that the participant is required to be included in his or her income upon the exercise of a non-qualified stock option.

23

If a participant makes payment of the option price by delivering shares of Common Stock, the participant generally will not recognize any gain as a result of such delivery, but the amount of gain, if any, which is not so recognized will be excluded from his or her basis in the new shares received. However, the use by a participant of shares previously acquired pursuant to the exercise of an incentive stock option to exercise an incentive stock option will be treated as a disposition subject to taxation as ordinary income (as described below) if the transferred shares are not held by the participant for the requisite holding period.

Capital gain or loss on a subsequent sale or other disposition of the shares acquired upon the exercise of a non-qualified stock option will be measured by the difference between the amount realized on the disposition and the tax basis of such shares. The tax basis of the shares acquired upon the exercise of any non-qualified stock option will be equal to the sum of the exercise price of such non-qualified stock option and the amount included in income with respect to such option.

If a participant transfers a non-qualified stock option by gift, the participant will recognize ordinary income at the time that the transferee exercises the option. The Company will be required to report the ordinary income recognized by the participant, and to withhold income and employment taxes, and pay the Company's share of employment taxes, with respect to such ordinary income. The participant may also be subject to federal gift tax on the value of the transferred non-qualified stock option at the time that the transfer of the non-qualified stock option is considered completed for gift purposes. The Internal Revenue Service takes the position that the transfer is not complete until the non-qualified stock option is fully vested.

Incentive Stock Options

In general, neither the grant nor the exercise of an incentive stock option will result in taxable income to a participant or a deduction to the Company. However, for purposes of the alternative minimum tax, the spread on the exercise of an incentive stock option will be considered as part of the participant’s income.

The sale of Common Stock received pursuant to the exercise of an incentive stock option which satisfies the holding period rules will result in capital gain to a participant and will not result in a tax deduction to the Company. To receive incentive stock option treatment as to the shares acquired upon exercise of an incentive stock option, a participant must neither dispose of such shares within two years after such incentive stock option is granted nor within one year after the exercise of such incentive stock option. In addition, a participant generally must be an employee of the Company or a subsidiary of the Company at all times between the date of grant and the date three months before exercise of such incentive stock option. If an incentive stock option is exercised more than three months after the termination of a participant’s employment with the Company, the option will be treated as a non-qualified stock option.

If the holding period rules are not satisfied, any gain recognized on the disposition of the shares acquired upon the exercise of the incentive stock option will be treated as ordinary (compensation ) income to the extent such gain equals the lesser of (a) the fair market value of the shares on the date of exercise minus the option price or (b) the amount realized on the disposition minus the option price, will be treated as ordinary (compensation) income, with any remaining gain being treated as capital gain. The Company generally will be entitled to a deduction equal to the amount of such ordinary income.

If a participant makes payment of the option price by delivering shares of Common Stock, the participant generally will not recognize any gain as a result of such delivery, but the amount of gain, if any, which is not so recognized will be excluded from his or her basis in the new shares received. However, the use by a participant of shares previously acquired pursuant to the exercise of an incentive stock option to exercise an incentive stock option will be treated as a disposition subject to taxation as ordinary income if the transferred shares are not held by the participant for the requisite holding period.

24

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A

VOTE FOR THE APPROVAL OF THE 2006 STOCK OPTION PLAN

Approval of the 2006 Stock Option Plan requires the affirmative vote of a majority of the shares present at the Meeting and entitled to vote on the 2006 Stock Option Plan. Unless otherwise indicated, the accompanying form of proxy will be voted FOR the proposal to adopt the 2006 Stock Option Plan.

APPROVAL OF THE 2006 KEY EMPLOYEE INCENTIVE PLAN

(Proposal 4)

On April 26, 2006, the Board of Directors adopted, subject to stockholder approval, the 2006 Key Employee Incentive Plan (‘‘2006 Incentive Plan’’). The 2006 Incentive Plan replaces the 2001 Key Employee Incentive Plan, which terminated on April 20, 2006. The purpose of the 2006 Incentive Plan is to give the Company a competitive advantage in retaining and motivating key officers and employees and to provide the Company and its subsidiaries with a stock plan providing incentives linked to increases in stockholder value.

The 2006 Incentive Plan is substantially similar to the 2001 Key Employee Incentive Plan. The changes primarily relate to updating for changes in applicable tax law and to raise the target market capitalization levels to be achieved by the Company in order for the 2006 Incentive Plan participants to receive the benefits of the 2006 Incentive Plan.

The following is a summary of certain provisions of the 2006 Incentive Plan, which summary is qualified in its entirety by reference to the full text of the 2006 Incentive Plan attached as Exhibit B to this Proxy Statement.

Administration and Eligibility

The 2006 Incentive Plan will be administered by the Compensation Committee. The Compensation Committee will determine the participants within 90 days of the date of adoption by the Board and will allocate to each participant the percentage share of the restricted shares (‘‘Restricted Shares’’) that will be granted to each participant (the ‘‘Award Percentage’’) if the Company achieves the performance goals provided in the 2006 Incentive Plan.

Plan Features

The number of Restricted Shares issued under the 2006 Incentive Plan will depend on whether the Company achieves two target market capitalizations during the five-year period beginning on March 29, 2006 (the ‘‘Effective Date’’). If the Company attains or achieves an average market capitalization equal to or greater than $58,000,000 during any six-month period during the five-year period beginning on the Effective Date (the ‘‘$58,000,000 Market Capitalization’’), then each participant who shall still be in the employ of the Company on the last day of such six-month period will be issued the number of Restricted Shares determined by multiplying (a) his or her Award Percentage, (b) 5% and (c) the average market capitalization during such six-month period.

If the Company attains or achieves an average market capitalization equal to or greater than $93,000,000 over the course of any six-month period during the five-year period beginning on the Effective Date (the ‘‘$93,000,000 Market Capitalization’’), then each participant who shall still be in the employ of the Company on the last day of such six-month period will be awarded the number of Restricted Shares determined by multiplying (a) his or her Award Percentage, (b) 5% and (c) the average market capitalization during such six-month period and dividing the product by the average fair market value of the Common Stock during such six-month period. Such six-month periods may be, in whole or in part, coterminous with, the six-month period in which the $58,000,000 Market Capitalization is achieved. In no event can Restricted Shares be issued upon attainment of either the $58,000,000 Market Capitalization or the $93,000,000 Market Capitalization more than once during the five-year term of the 2006 Incentive Plan.

25

For purposes of the 2006 Incentive Plan, market capitalization is defined as the number of outstanding shares of Common Stock (excluding any shares of Common Stock issued subsequent to the Effective Date, other than shares of Common Stock issued upon the exercise of stock options granted to employees, directors or consultants or through the purchase of shares of Common Stock under any stock purchase plan) on a fully diluted basis, multiplied by the fair market value per share of the Common Stock.

In the event of a change in control prior to the achievement of the $58,000,000 Market Capitalization, the $58,000,000 Market Capitalization will be deemed to be achieved if the number of outstanding shares of Common Stock (calculated on a fully diluted basis) on the date of the change in control multiplied by the fair market value determined as of the date of the change of control is equal to or greater than $58,000,000. Similarly, the $93,000,000 Market Capitalization will be deemed to be achieved if such number of shares on the date of the change of control multiplied by the fair market value as of the date of the change of control is equal to or greater than $93,000,000.

The maximum value of an award of Restricted Shares which may be issued to any participant upon achievement (or deemed achievement) of the $58,000,000 Market Capitalization is $1,500,000 (based on the fair market value on the date of issuance of such shares). The maximum value of an award of Restricted Shares which may be issued to any participant upon achievement (or deemed achievement) of the $93,000,000 Market Capitalization is $3,500,000 (based on the fair market value of the Common Stock on the date of issuance of the Restricted Shares). In the event a change in control shall occur which results in a change of control market capitalization equal to or greater than $93,000,000 prior to achievement of the $58,000,000 Market Capitalization, the maximum award would be $5,000,000.

The Restricted Shares will vest ratably in annual installments over a three-year period commencing on the date of issuance. Unvested Restricted Shares shall accelerate and become vested upon the death, disability or retirement of a participant and upon the participant's termination without cause. Upon a participant's termination of employment for any reason other than death, disability, retirement or involuntary termination of employment without cause (i.e., the participant's employment is terminated by the Company for cause, or the participant resigns voluntarily), all unvested Restricted Shares are forfeited by the participant. In addition, the participant's Restricted Shares will vest upon the termination by the participant of the participant's employment with the Company due to a material diminution of the participant's duties and responsibilities or a substantial reduction in the participant's compensation and benefits, or as otherwise provided in the participant's written employment agreement, if the participant's written employment agreement with the Company in effect at the time of such termination provides for such vesting. During the vesting period and for two years thereafter the Restricted Shares may not be sold, assigned, transferred, pledged or otherwise encumbered, except that a participant will be permitted to sell such number of shares as may be required to satisfy his federal, state and local tax liability incurred as a result of the vesting of the Restricted Shares or, under certain circumstances, as a result of the issuance of the Restricted Shares.

The market value of the Common Stock, as of April 26, 2006 was $9.20 per share.

Change in Capitalization

The 2006 Incentive Plan provides that, in the event of any change in corporate capitalization, such as a stock split or a corporate transaction, such as any merger, consolidation, separation, spin-off or other distribution of stock or property of the Company (including any extraordinary cash dividends), or any reorganization or partial or complete liquidation of the Company, the Committee may make such substitution or adjustments in the aggregate number and kind of shares available for issuance under the 2006 Incentive Plan, to the extent necessary to account for any such change in corporate capitalization or such other equitable substitution or adjustments as may be determined to be appropriate by the Compensation Committee.

Term and Amendment

The 2006 Incentive Plan will terminate at the end of ten years after its Effective Date; provided that the Restricted Shares outstanding as of such date will not be affected or impaired by the termination of

26

the 2006 Incentive Plan. The Board may amend, alter, or terminate the 2006 Incentive Plan, but no amendment may impair the rights of a participant without the participant’s consent. In addition, the 2006 Incentive Plan may not be amended without the approval of the Company’s stockholders to the extent such approval is required by law or listing requirement on which the Company’s equity securities are publicly traded.

New Plan Benefits

The benefits which a participant will receive in the event that the 2006 Incentive Plan is approved by the stockholders or which would have been received if the Plan had been in effect during fiscal year 2005 cannot be determined because receipt of Restricted Shares is dependent upon the extent to which proposed goals are achieved and future stock prices and the Restricted Shares are subject to a vesting period. The following table sets forth the Award Percentage granted under the 2006 Incentive Plan (subject to stockholder approval of the 2006 Incentive Plan) for each of the Named Executive Officers and all executive officers as a group, all non-executive directors as a group and all non-executive employees as a group.

Merrimac Industries, Inc. 2006 Key Employee Incentive Plan

|  |  |  |  |  |  |

| Name and Position |  | Award Percentage |

| Mason N. Carter, Chairman of the Board, President and Chief Executive Officer |  | | 29.5 | % |

| Reynold K. Green, Vice President and Chief Operating Officer |  | | 13.6 | % |

| Robert V. Condon, Vice President, Finance, Chief Financial Officer, Treasurer and Secretary |  | | 11.4 | % |

| Michael M. Ghadaksaz, Vice President, Market Development |  | | 11.4 | % |

| James J. Logothetis, Vice President and Chief Technology Officer |  | | 9.1 | % |

| Executive Group |  | | 100 | % |

| Non-Executive Director Group |  | | 0 | % |

| Non-Executive Officer Employee Group |  | | 0 | % |

|

Federal Income Tax Consequences

The following discussion of the Federal income tax consequences of the issuance, vesting, sale and forfeiture of Restricted Shares is based on an analysis of the Code, as currently in effect, existing laws, judicial decisions and administrative rulings and regulations, all of which are subject to change. In addition to being subject to the Federal income tax consequences described below, a participant may also be subject to state and local tax consequences in the jurisdiction in which he works and/or resides.

No income will be recognized by a participant at the time Restricted Shares are issued to him. Ordinary income will be recognized by a participant at the time such Restricted Shares vest. The amount of such ordinary income will be equal to the fair market value of the Common Stock on the vesting date. This ordinary (compensation) income will also constitute wages subject to withholding and the participant will be required to make whatever arrangements are necessary to ensure that the amount of tax required to be withheld is available for payment. Any subsequent gain or loss will be a capital gain or loss with the participant's holding period being measured from the vesting date and with the participant's basis being equal to the fair market value of the shares on such date.

Notwithstanding the foregoing, a participant may, within 30 days after Restricted Shares are issued to him under the 2006 Incentive Plan, elect (a ‘‘Section 83(b) Election’’) under Section 83(b) of the Code

27

to include in income as of the date of their issuance the fair market value of such Restricted Shares, notwithstanding that such shares are subject to a ‘‘substantial risk of forfeiture’’ within the contemplation of Section 83 of the Code. Such income will be ordinary (compensation) income which will also constitute wages subject to withholding and the participant will be required to make whatever arrangements are necessary to ensure that the amount required to be withheld is available for payment. If subsequently such Restricted Shares are forfeited to the Company, such event will not be a taxable event to the participant. Upon the eventual sale of the Restricted Shares, any gain or loss will be a capital gain or loss with the Participant's holding period being determined by reference to the date of issuance and his basis being the fair market value thereof on the date of issuance. If a participant makes a Section 83(b) Election, and subsequently retransfers the Restricted Shares to the Company, he will not be entitled to a deduction with respect thereto and will not have a capital loss as a result thereof.

The Company generally will be entitled to a deduction for Federal income tax purposes in an amount equal to the amount included in income by the participant.

To the extent permitted by the Committee, the participant may satisfy his withholding obligations by delivering to the Company shares of the Common Stock having a fair market value equal to the amount required to be withheld. Such delivery will be deemed to be a sale for Federal income tax purposes.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE APPROVAL OF THE 2006 KEY EMPLOYEE INCENTIVE PLAN

Approval of the 2006 Key Employee Incentive Plan requires the affirmative vote of a majority of the shares present at the Meeting and entitled to vote on the 2006 Key Employee Incentive Plan. Unless otherwise indicated, the accompanying form of proxy will be voted FOR the proposal to adopt the 2006 Key Employee Incentive Plan.

APPROVAL OF THE 2006 NON-EMPLOYEE DIRECTORS’ STOCK PLAN

(Proposal 5)

On April 26, 2006, the Board of Directors adopted, subject to stockholder approval, the 2006 Non-Employee Directors’ Stock Plan. The following summary of certain features of the 2006 Non-Employee Directors’ Stock Plan is qualified in its entirety by reference to the full text of the 2006 Non-Employee Directors’ Stock Plan, which is Exhibit C to this Proxy Statement.

The 2006 Non-Employee Directors’ Stock Plan is a new plan that authorizes the grant of an aggregate of 100,000 shares of Common Stock to the non-employee directors of the Company. Under the 2006 Non-Employee Directors’ Stock Plan, the Company will grant to non-employee directors a grant of Common Stock (‘‘Award’’). If the plan is approved by the stockholders, each non-employee director will receive an Award of 1,500 shares in 2006 or such other amount as the Board of Directors may decide from year to year in the future following the Company’s annual meeting of stockholders.

Nature and Purpose of the 2006 Non-Employee Directors’ Stock Plan

The purpose of the 2006 Non-Employee Directors’ Stock Plan is to attract, retain and motivate the most capable non-employee directors, to align the interests of the Company’s non-employee directors and stockholders, and to generally increase the effectiveness of the Company’s non-employee director compensation structure, thereby assisting the Company to achieve its long-range goals. The Company’s directors have not modified director fees received by non-employee directors for the past nine years. In an effort to continue to compensate the non-employee directors in line with the Company’s competitors, and align their interests with those of the stockholders, this new plan has been adopted.

Duration and Modification

The 2006 Non-Employee Directors’ Stock Plan may be terminated, amended, altered, or discontinued at any time by the Board, but no amendment may impair the rights of a participant without the participant’s consent, subject to the terms of the 2006 Non-Employee Directors’ Stock Plan. In addition,

28

the 2006 Non-Employee Directors’ Stock Plan may not be amended without the approval of the Company’s stockholders to the extent such approval is required by law or listing requirement on which the Company’s equity securities are publicly traded. Awards may not be granted under the 2006 Non-Employee Directors’ Stock Plan after December 31, 2015, or earlier as the Board may determine.

Administration and Eligibility

The 2006 Non-Employee Directors’ Stock Plan is administered by the Board of Directors. Among other things, the Board will have the authority, subject to the terms of the 2006 Non-Employee Directors’ Stock Plan, to grant Awards, to determine the number of Awards granted to any participant, and to determine the terms and conditions of any Award. Except as otherwise determined by the Board, each individual who is a non-employee director of the Company will be eligible to participate in the 2006 Non-Employee Directors’ Stock Plan. The number of persons eligible to participate in the 2006 Non-Employee Directors’ Stock Plan is eight.

Plan Features

Awards granted under the 2006 Non-Employee Directors’ Stock Plan generally become unrestricted with respect to one-third of the underlying shares on the first anniversary of the date of grant, with respect to an additional one-third of the underlying shares on the second anniversary of the date of grant, and with respect to 100% of the underlying shares on the third anniversary of the date of grant, unless otherwise determined by the Board in the applicable agreement of the Award at the time of the grant of the Award. The Board may accelerate the exercisability of all or any portion of any Award prior to the time that it would otherwise be exercisable, subject to the provisions of the 2006 Non-Employee Directors’ Stock Plan.

In the event of the death, disability or retirement of a participant, or if the participant’s service as a non-employee director of the Company is terminated by the Company without cause, all unvested Awards will become fully vested on the date the participant’s service shall terminate. If a participant’s service as a non-employee director to the Company is terminated by the Company for cause, the non-employee director forfeits all Awards, whether or not then vested. If a participant resigns his position as a non-employee director of the Company of his own accord, the participant will retain all vested Awards and must forfeit as of the date of such resignation all unvested Awards. If a participant does not stand for re-election as a non-employee director at an annual meeting at the request of the Company, other than a request made for cause, the vesting of unvested Awards held by the participant shall be accelerated and such Awards will vest on the date of the annual meeting at which the participant does not stand for re-election.

Securities Subject to the 2006 Non-Employee Directors’ Stock Plan

There are 100,000 shares of Common Stock that have been reserved for issuance upon the grant of Awards under the 2006 Non-Employee Directors’ Stock Plan. If any Award in respect of shares of Common Stock is terminated before exercise or is forfeited for any reason, to the extent shares of Common Stock subject to such Award are not delivered to the participant, such shares of Common Stock shall again be available for grant under the 2006 Non-Employee Directors’ Stock Plan. Shares of Common Stock issued under the 2006 Non-Employee Directors’ Stock Plan may consist in whole or in part of authorized but unissued shares of Common Stock or treasury shares.

The market value of the Common Stock, as of April 26, 2006 was $9.20 per share.

Change in Capitalization

The 2006 Non-Employee Directors’ Stock Plan provides that, in the event of any change in corporate capitalization, such as a stock dividend, extraordinary cash dividend or a corporate transaction, such as any merger, consolidation, spin-off, or other similar transaction that affects the Common Stock of the Company such that an adjustment is required in order to preserve the benefits or potential benefits intended to be granted under the 2006 Non-Employee Directors’ Stock Plan to the participants, the Board

29

may make such adjustment in the aggregate number and kind of shares available for issuance under the 2006 Non-Employee Directors’ Stock Plan, or the Board may make provision for a cash payment with respect to any outstanding Awards held by a participant, subject to the terms of the 2006 Non-Employee Directors’ Stock Plan.

New Plan Benefits

If the 2006 Non-Employee Directors’ Stock Plan had been in effect in 2005, the persons shown in the following table would have received the number of stock Awards shown below. No other stock Awards would have been granted under the 2006 Non-Employee Directors’ Stock Plan in 2005 had the 2006 Non-Employee Directors’ Stock Plan been in effect in 2005.

Merrimac Industries, Inc. 2006 Non-Employee Directors’ Stock Plan

|  |  |  |  |  |  |

| Name of Non-Employee Directors |  | Number of Shares |

| Albert H. Cohen |  | | 1,500 | |

| Edward H. Cohen |  | | 1,500 | |

| Fernando L. Fernandez |  | | 1,500 | |

| Joel H. Goldberg |  | | 1,500 | |

| Ludwig G. Kuttner |  | | 1,500 | (1) |

| David B. Miller |  | | 1,500 | |

| Arthur A. Oliner |  | | 1,500 | |

| Harold J. Raveché |  | | 1,500 | |

| Non-Executive Director Group |  | | 12,000 | |

|

|  |

| (1) | Mr. Kuttner is standing for election as a new Class I director. If he had been serving as a director in 2005, he would have received 1,500 shares if the 2006 Non-Employee Directors' Stock Plan had been in effect in 2005. |

Federal Income Tax Consequences

The following discussion of the Federal income tax consequences of the issuance, vesting, sale and forfeiture of Award Stock is based on an analysis of the Code, as currently in effect, existing laws, judicial decisions and administrative rulings and regulations, all of which are subject to change. In addition to being subject to the Federal income tax consequences described below, a participant may also be subject to state and local tax consequences in the jurisdiction in which he works and/or resides.

No income will be recognized by a participant at the time Award Stock is issued to him. Ordinary income will be recognized by a participant at the time such Award Stock vests. The amount of such ordinary income will be equal to the fair market value of the Common Stock on the vesting date. Any subsequent gain or loss will be a capital gain or loss with the participant's holding period being measured from the vesting date and with the participant's basis being equal to the fair market value of the shares on such date.

Notwithstanding the foregoing, a participant may, within 30 days after Award Stock is issued to him under the 2006 Non-Employee Directors’ Stock Plan, elect (a ‘‘Section 83(b) Election’’) under Section 83(b) of the Code to include in income as of the date of their issuance the fair market value of such Award Stock, notwithstanding that such Award Stock is subject to a ‘‘substantial risk of forfeiture’’ within the contemplation of Section 83 of the Code. Such income will be ordinary (compensation) income. If subsequently such Award Stock is forfeited to the Company, such event will not be a taxable event to the participant. Upon the eventual sale of the Award Stock, any gain or loss will be a capital gain or loss with the participant's holding period being determined by reference to the date of issuance and his basis being the fair market value thereof on the date of issuance. If a participant makes a Section 83(b) Election, and subsequently retransfers the Award Stock to the Company, he will not be entitled to a deduction with respect thereto and will not have a capital loss as a result thereof.

30

The Company generally will be entitled to a deduction for Federal income tax purposes in an amount equal to the amount included in income by the participant.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE APPROVAL OF THE 2006 NON-EMPLOYEE DIRECTORS’ STOCK PLAN

Approval of the 2006 Non-Employee Directors’ Stock Plan requires the affirmative vote of a majority of the shares present at the Meeting and entitled to vote on the 2006 Non-Employee Directors’ Stock Plan. Unless otherwise indicated, the accompanying form of proxy will be voted FOR the proposal to adopt the 2006 Non-Employee Directors’ Stock Plan.

Equity Compensation Plan Information

The following table gives information as of December 31, 2005, about the Company’s common stock that may be issued upon the exercise of options, warrants and rights under the Company’s existing equity compensation plans:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | (a) |  | (b) |  | (c) |

| Plan category |  | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights |  | Weighted-average

exercise price of

outstanding options,

warrants and rights |  | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding securities

reflected in column (a)) |

| Equity compensation plans approved by security holders |  | | 397,869 | |  | $ | 9.81 | |  | | 19,300 | |

| Equity compensation plans not approved by security holders |  | | 33,000 | (1) |  | $ | 10.00 | |  | | 0 | |

| Total |  | | 430,869 | |  | $ | 9.83 | |  | | 19,300 | |

|

|  |