UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

Palmetto Bancshares, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

March 17, 2008

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of Palmetto Bancshares, Inc. to be held on April 15, 2008, at 2:00 p.m. at The Palmetto Bank, Corporate Center, 301 Hillcrest Drive, Laurens, South Carolina, 29360.

The following Notice of the Annual Meeting of Shareholders and Proxy Statement describe the formal business to be transacted at the Annual Meeting of Shareholders. Directors and executive officers of Palmetto Bancshares, Inc., as well as representatives of Elliott Davis, LLC, the Company’s independent registered public accounting firm, will be present to respond to any appropriate questions shareholders may have. The Elliott Davis, LLC representatives will have the opportunity to make a statement if they desire to do so.

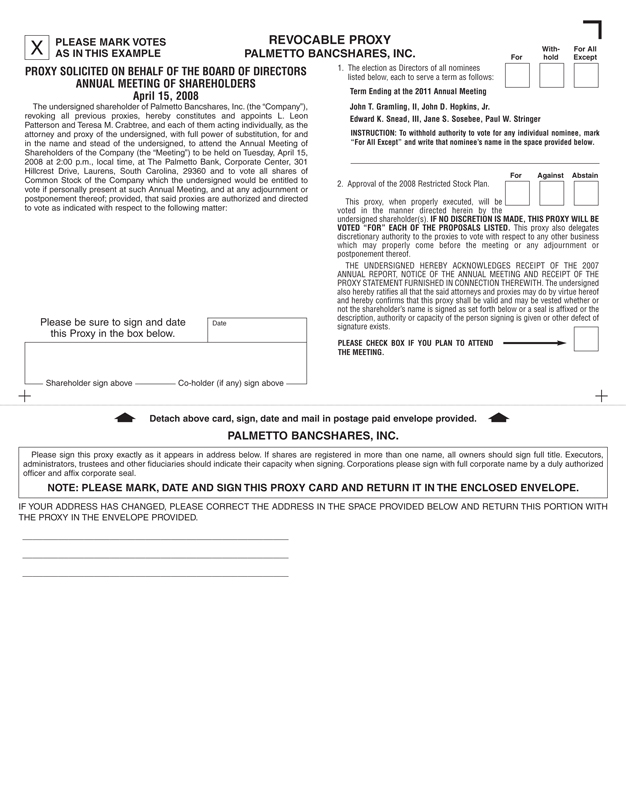

To ensure proper representation of your shares of common stock at the Annual Meeting of Shareholders, please sign, date, and return the enclosed Proxy Card as soon as possible, even if you currently plan to attend the Annual Meeting of Shareholders. This will not prevent you from voting in person but will ensure that your vote will be counted in the event that you are unable to attend.

Sincerely,

L. LEON PATTERSON

Chairman and

Chief Executive Officer

PALMETTO BANCSHARES, INC.

301 HILLCREST DRIVE

POST OFFICE BOX 49

LAURENS, SOUTH CAROLINA 29360

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 15, 2008

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Palmetto Bancshares, Inc. will be held on April 15, 2008, at 2:00 p.m. at The Palmetto Bank, Corporate Center, 301 Hillcrest Drive, Laurens, South Carolina, 29360 for the following purposes:

| 1. | To elect five directors of Palmetto Bancshares, Inc.; |

| 2. | To approve the Palmetto Bancshares, Inc. 2008 Restricted Stock Plan; and |

| 3. | To consider and act upon such other matters as may properly come before the Annual Meeting of Shareholders or any adjournment thereof. |

The Board of Directors of Palmetto Bancshares, Inc. is not aware of any business, other than the election of directors and the approval of the Palmetto Bancshares, Inc. 2008 Restricted Stock Plan, to come before the Annual Meeting of Shareholders.

Shareholders of record at the close of business on March 3, 2008 are entitled to receive notice of and to vote at the Annual Meeting of Shareholders and any adjournment thereof.

Whether or not you plan to attend the Annual Meeting of Shareholders, please complete and sign the enclosed Proxy Card, which is solicited by Palmetto Bancshares, Inc.’s Board of Directors, and mail it promptly in the enclosed envelope. If you wish, you may withdraw your Proxy Card and vote your shares of common stock in person at the Annual Meeting of Shareholders.

By Order of the Board of Directors,

TERESA M. CRABTREE

Corporate Secretary

Laurens, South Carolina

March 17, 2008

PLEASE COMPLETE, SIGN, AND DATE THE ENCLOSED PROXY CARD AND MAIL IT IN THE SELF-ADDRESSED, POSTAGE-PAID ENVELOPE AS SOON AS POSSIBLE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING OF SHAREHOLDERS. IF YOU WISH, YOU MAY WITHDRAW YOUR PROXY CARD AND VOTE YOUR SHARES OF COMMON STOCK IN PERSON AT THE ANNUAL MEETING OF SHAREHOLDERS.

PROXY STATEMENT

of

PALMETTO BANCSHARES, INC.

301 HILLCREST DRIVE

POST OFFICE BOX 49

LAURENS, SOUTH CAROLINA 29360

ANNUAL MEETING OF SHAREHOLDERS

APRIL 15, 2008

This Notice of Annual Meeting of Shareholders (the “Meeting”), Proxy Statement, and Proxy Card (collectively, the “Proxy Materials”) are being furnished to shareholders in connection with a solicitation of proxies by the Board of Directors of Palmetto Bancshares, Inc. Palmetto Bancshares, Inc. is the holding company for The Palmetto Bank (the “Bank”). Throughout this Proxy Statement, the “Company” refers to Palmetto Bancshares, Inc. and its subsidiary, the Bank. This solicitation is being made in connection with the Annual Meeting of Shareholders to be held at 2:00 p.m. on April 15, 2008 at 301 Hillcrest Drive, Laurens, South Carolina, 29360. The enclosed Proxy Materials are being mailed on or about March 17, 2008.

VOTING AND PROXY PROCEDURE

Shareholders Entitled to Vote

Shareholders of record as of the close of business on March 3, 2008 (the “Voting Record Date”) are entitled to one vote for each share of $5.00 par value common stock of the Company then held. As of the close of business on the Voting Record Date, the Company had 6,432,265 shares of common stock outstanding and entitled to vote.

Voting and Proxy Procedures

The Company’s Board of Directors (the “Board”) solicits proxies so that each shareholder has the opportunity to vote on each proposal being considered at the Meeting. Each share of common stock outstanding on the Voting Record Date will be entitled to one vote at the Meeting.

If you are a shareholder whose shares are registered in your name, you may vote your shares in person at the Meeting or by sending in your Proxy Card as described below. Execution of the enclosed Proxy Card, by completing, signing, dating, and mailing the enclosed Proxy Card in the envelope provided will not impact your right to attend the Meeting.

If your shares of common stock are held in “street name” through a broker, bank, or other nominee, you may receive a separate voting instruction form with this Proxy Statement.

Proxies for which instructions are received will be voted in accordance with the shareholder’s instructions. If you send in your Proxy Card but do not specify how you want to vote your shares of common stock, the Company will vote them FOR the nominees for director and FOR each of the other items being proposed by the Board of Directors and in the discretion of the proxy holders as to any other business that may properly come before the Meeting and any adjournment of the Meeting.

Proxy Revocation Procedures

If you are a shareholder whose shares of common stock are registered in your name, you may revoke your Proxy Card at any time before it is voted by one of the following methods:

| • | Submitting a duly executed Proxy Card bearing a later date that is received by the Company’s Corporate Secretary prior to the Meeting; |

1

| • | Filing a written notice of revocation with the Company’s Corporate Secretary prior to the Meeting; or |

| • | Appearing at the Meeting in person and giving the Company’s Corporate Secretary notice of your intention to vote in person (attendance at the Meeting will not, in and of itself, revoke a previously executed Proxy Card). |

If you hold your shares of common stock in “street name” through a broker, bank, or other nominee, you may revoke your Proxy Card by following instructions provided by your broker, bank, or nominee. No notice of revocation or later dated Proxy Card will be effective until received by the Company’s Corporate Secretary within the deadlines noted above.

Quorum

The presence, in person or by proxy, of at least a majority of the total number of outstanding shares of common stock entitled to vote is necessary to constitute a quorum at the Meeting. Abstentions and broker nonvotes (which occur if a broker or other nominee does not have discretionary authority and has not received voting instructions from the beneficial owner with respect to the particular item) will be counted as shares of common stock present and entitled to vote at the Meeting for purposes of determining the existence of a quorum.

Other Matters Related to the Meeting

Only matters brought before the Meeting in accordance with the Company’s Bylaws will be considered. Other than the election of directors and the approval of the Palmetto Bancshares, Inc. 2008 Restricted Stock Plan, the Company does not know of any other matters that will be presented at the Meeting. However, if any other matters properly come before the Meeting or any adjournment, the proxy holders will vote them in accordance with their best judgment.

Should any nominee for director become unable to accept nomination or election, the persons acting under the Proxy Card intend to vote for the election of another person recommended by the Corporate Governance and Nominating Committee of the Board of Directors and nominated by the Board of Directors. The Company has confirmed each nominee’s willingness to serve, if elected, and has no reason to believe that any of the five nominees for director will be unable to serve if elected to office.

Representatives of Elliott Davis, LLC, the Company’s independent registered public accounting firm, will be present at the Meeting to respond to any appropriate questions shareholders may have. Elliott Davis, LLC representatives will have the opportunity to make a statement if they desire to do so.

PROPOSAL 1—ELECTION OF DIRECTORS

General Information Regarding Election of Directors

The directors to be elected at the Meeting will be elected by a plurality of the votes cast by shareholders present in person or by proxy and entitled to vote. Votes may be cast “FOR,” or shareholders may “WITHHOLD” their vote, for each nominee for election as director. Abstentions and broker nonvotes with respect to nominees will not be considered to be either affirmative or negative votes and will have no other impact on the election of directors. Shareholders do not have cumulative voting rights with respect to the election of directors.

The Board of Directors is divided into three classes. At each Meeting, the Company’s shareholders elect the members of one of the three classes to three-year terms. At this Meeting, five directors are being nominated for reelection for terms expiring at the 2011 Annual Meeting of Shareholders. Proxies, unless indicated to the contrary, will be voted “FOR” the reelection of the five nominees.

2

Information on Nominees and Directors

The Board of Directors nominates for election to the Board of Directors the five persons listed as nominees below. Unless shareholders “WITHHOLD” their vote for a nominee, the persons named in the enclosed Proxy Card intend to vote “FOR” the election of these nominees. The following tables set forth information regarding each nominee and continuing director, including his or her name, age, period he or she has served as a director, and occupation over the past five years.

Nominees for Reelection as Director at the 2008 Annual Meeting of Shareholders

for Terms Ending at the 2011 Annual Meeting of Shareholders

John T. Gramling, II | ||||

Age (1) Director Since (2) Term Expiring | 66 1984 2011 | During the past five years, Mr. Gramling has served as President of Gramling Brothers, Inc., an umbrella company engaged in the operation of orchards, real estate, development, surveying, and investments. | ||

John D. Hopkins, Jr. | ||||

Age (1) Director Since (2) Term Expiring | 56 2004 2011 | Mr. Hopkins has served as President and owner of The Fieldstone Group, a diversified investment and development company with real estate, farm, land, and timber holdings, since 2000. Prior to 2000, Mr. Hopkins was employed with Owens Corning for 26 years.

Mr. Hopkins has served on the Board of the Upcountry History Museum since 2002. He serves on the Anderson University Foundation Council and as a member of the Donaldson Development Commission for the Donaldson Center Industrial Air Park. | ||

Edward K. Snead, III | ||||

Age (1) Director Since (2) Term Expiring | 48 1997 2011 | Mr. Snead has been the owner and President of Snead Builders Supply Company, Inc., a Greenwood, South Carolina based family owned and operated building supply store, since 1981. | ||

Jane S. Sosebee | ||||

Age (1) Director Since (2) Term Expiring | 51 2006 2011 | Ms. Sosebee has been with AT&T (formerly Southern Bell and BellSouth) since 1979 and has held the position of Director - External Affairs since November 2007.

Ms. Sosebee currently serves as Chair for the Greenville Chamber of Commerce for 2008. Additionally, she serves on the Board of the Clemson University Foundation, the Tri-County Technical College Foundation, the Upstate Alliance, the Peace Center, Innovate Anderson, and the Oconee Alliance. | ||

Paul W. Stringer | ||||

Age (1) Director Since (2) Term Expiring | 64 1986 2011 | Mr. Stringer has served as President and Chief Operating Officer of Palmetto Bancshares, Inc. since April 1994. From April 1990 to April 1994, he served as Executive Vice President of Palmetto Bancshares, Inc. From June 1982 to April 1990, Mr. Stringer served as Vice President of Palmetto Bancshares, Inc.

Mr. Stringer has been Chairman of the Board of Directors and Chief Executive Officer of The Palmetto Bank since January 2004. He served as President and Chief Operating Officer of The Palmetto Bank from March 1986 to December 2003. Mr. Stringer served as Executive Vice | ||

3

| President of The Palmetto Bank from May 1981 to February 1986, as Senior Vice President from July 1978 to April 1981, and as Vice President from January 1977 to June 1978. | ||||

| (1) | At December 31, 2007 |

| (2) | Does not include prior service, if any, on the Company’s banking subsidiary community bank boards |

Continuing Directors Whose Terms End at the 2009 Annual Meeting of Shareholders

L. Leon Patterson | ||||

Age (1) Director Since (2) Term Expiring | 66 1971 2009 | Mr. Patterson has served as Chairman of the Board of Directors and Chief Executive Officer of Palmetto Bancshares, Inc. since April 1990. From June 1982 to April 1994, he served as President of Palmetto Bancshares, Inc.

Mr. Patterson served as Chairman of the Board and Chief Executive Officer of The Palmetto Bank from March 1986 to January 2004. Mr. Patterson also served as Chairman of the Board and President of The Palmetto Bank from January 1978 to February 1986, and he served as President of The Palmetto Bank in 1977.

Mr. Patterson currently serves as a Board member of the Greenville County Art Museum Association, as a Board member of Upstate Forever, an Upstate educational and advocacy organization for smart growth, and as an executive Board member of Upstate Alliance, an Upstate global marketing organization. | ||

Sam B. Phillips, Jr. | ||||

Age (1) Director Since (2) Term Expiring | 66 2000 2009 | Mr. Phillips has been Chief Executive Officer and owner of S.B. Phillips Company, Inc., an umbrella organization for several other businesses including Phillips Staffing Services, a temporary staffing agency in Greenville, South Carolina, since 1968. He has served as Chairman for S.B. Phillips Company, Inc. since 1968 and as President and owner of Phillips Properties, Inc., a real estate holding company, since 1993.

Mr. Phillips is the sole shareholder of Fairway Group of SC, LLC, Eagle Zone, LLC, and Cobblestone Group, Inc. He is a partner of WPP Water LLC, WSM Holdings, LLC, and Wyatt Real Estate Opportunity Fund, LLC. Mr. Phillips serves as a partner and Board member of SubAir Systems, LLC, Woodhead, LLC (DBA Graniteville Specialty Fabrics), Meridian Resources, Inc., and Innovative Adhesives, Inc. Since 2005, Mr. Phillips has been a Partner and Board Member in Four Equestrian Partners, LLC, a land development company. He is General Partner of Azalea Fund II, LLC and is a Limited Partner of Azalea Fund I, LLC. He also serves on the Board of Directors of St. Francis Hospital and the Boy Scouts of America. | ||

L. Stewart Spinks | ||||

Age (1) Director Since (2) Term Expiring | 61 2006 2009 | Mr. Spinks founded the Spinx Oil Company in 1972. He now serves as The Spinx Company, Inc.’s Chief Executive Officer. Spinx is the largest privately held gasoline convenience retailer in South Carolina. Mr. Spinks has served as Chief Executive Officer of Enigma, Inc., a real estate development company, since 1984, of Spinx Foods, Inc. since 1996, and of TRS, Inc., an equipment leasing company, since 1985. | ||

4

Mr. Spinks serves on the Boards of The Society of Independent Gasoline Marketers Association, South Carolina Independent Colleges, the Boy Scouts of America, the Greenville Chamber of Commerce, the Greenville Tech Foundation, Furman University, the Furman Foundation, Taste of the Nations, and the Urban League. | ||||

J. David Wasson, Jr. | ||||

Age (1) Director Since (2) Term Expiring | 62 1979 2009 | Mr. Wasson has been President and Chief Executive Officer of Laurens Electric Cooperative, Inc., a member-owned rural electric cooperative in Upstate South Carolina, since 1974.

Mr. Wasson serves on the Board of National Rural Utilities Cooperative Finance Corporation. | ||

| (1) | At December 31, 2007 |

| (2) | Does not include prior service, if any, on the Company’s banking subsidiary community bank boards |

Continuing Directors Whose Terms End at the 2010 Annual Meeting of Shareholders

W. Fred Davis, Jr. | ||||

Age (1) Director Since (2) Term Expiring | 64 1978 2010 | Mr. Davis was owner and President of Palmetto Spinning Corporation, where he was employed from 1969 to 1995. Mr. Davis retired in 1995. | ||

David P. George, Jr. | ||||

Age (1) Director Since (2) Term Expiring | 66 1973 2010 | Mr. George retired as General Manager of George Motor Company, an automobile dealership in Laurens, South Carolina, in 2004. He had served in that capacity since 1964. | ||

Michael D. Glenn | ||||

Age (1) Director Since (2) Term Expiring | 67 1994 2010 | Mr. Glenn has been a partner with the law firm of Glenn, Haigler, McClain & Stathakis, LLP since 1993. From 1983 to 1992 he was a sole practitioner in Anderson, South Carolina. | ||

Albert V. Smith | ||||

Age (1) Director Since (2) Term Expiring | 61 2006 2010 | Mr. Smith has been the sole proprietor with Albert V. Smith, Professional Association Law Firm since 1989. Prior to 1989, Mr. Smith was a Partner in the law firms of Turnipseed, Holland and Smith and Turnipseed, Smith and Smith.

Mr. Smith is a member of the South Carolina, American, and national Bar Associations, the South Carolina Bar Committee on Character and Fitness, and the Spartanburg County Commission on Higher Education. | ||

Ann B. Smith | ||||

Age (1) Director Since (2) Term Expiring | 46 1997 2010 | Ms. Smith served as the Director of Annual Giving for Clemson University from 1986 to November 2007. Ms. Smith has served as the Clemson University Academic Program Coordinator for Development since November 2007. | ||

| (1) | At December 31, 2007 |

| (2) | Does not include prior service, if any, on the Company’s banking subsidiary community bank boards |

5

PROPOSAL 2—APPROVAL OF 2008 RESTRICTED STOCK PLAN

On February 19, 2008, the Company’s Board of Directors adopted, subject to shareholder approval, the Palmetto Bancshares, Inc. 2008 Restricted Stock Plan (the “Plan”), which provides for the grant of stock awards to the Company’s employees, officers, and directors. A total of 250,000 shares of common stock have been reserved for issuance pursuant to awards under the Plan, subject to its anti-dilution provisions. The following summary of the material features of the Plan is qualified in its entirety by reference to the copy of the Plan that is attached as Appendix A to this Proxy Statement.

Purpose of the Plan

In the past, the Company has utilized stock option awards to attract highly qualified personnel and to reward exceptional performance by employees. However, the Board of Directors believes that restricted stock is a more desirable method of attracting additional personnel and rewarding exceptional performance by employees through awards that encourage stock ownership in the Company. The Company believes that those individuals upon whom the responsibilities for the successful administration and management of the Company rest, and whose present and potential contributions to the Company are of importance, should be allowed to acquire and maintain stock ownership, thereby strengthening their concern for the welfare of the Company. By providing such individuals with additional incentives and rewards, the Board of Directors believes that the Plan will enhance the profitability of the Company. Under the Plan, the Company may grant awards to its employees, officers, and directors. Although the Company has not yet identified any specific individuals who will receive restricted stock grants under the Plan or determined the amount of restricted stock grants to be made to any particular group of individuals, it believes that restricted stock grants under the Plan will likely be to the same employees that were subject to awards under the Company’s 1997 Stock Compensation Plan under which 34 individuals were granted stock option awards over the ten year period.

Administration of the Plan

The Plan provides that it is to be administered by a committee appointed by the Board of Directors and comprised of two or more “outside” directors, within the meaning of section 162(m) of the Internal Revenue Code of 1986 and within the meaning of the term “nonemployee director” as defined in Rule 16b-3 under the Securities Exchange Act of 1934. The Board of Directors has appointed its Compensation Committee to perform the duties of the committee under the Plan. The Compensation Committee will administer the Plan and will have sole authority, in its discretion, to determine which employees or directors will receive awards under the Plan, the number of shares to be subject to each award, and the forfeiture restrictions (as defined below) for each award. The Compensation Committee will have additional powers delegated to it under the Plan, including the power to construe the Plan and the restricted stock agreements executed with recipients of awards thereunder and to determine the terms, restrictions, and provisions of each agreement. The Compensation Committee may also correct any defect or supply any omission or reconcile any inconsistency in the Plan or in any agreement in the manner and to the extent it deems expedient. The determinations of the Compensation Committee on these matters will be conclusive.

The Plan provides for awards of “restricted stock,” consisting of shares of common stock that are issued to the participant at the time the award is made or at some later date, which are subject to certain restrictions against disposition and certain obligations to forfeit such restricted stock shares to the Company under certain circumstances. The forfeiture restrictions, which may be different for each award, will be determined by the Compensation Committee in its sole discretion, and the Compensation Committee may provide that the forfeiture restrictions will lapse upon:

| • | The attainment of one or more performance targets established by the Compensation Committee based upon, among other things, common stock share price, earnings per common share, market share, sales, net income, return on investment, or return on shareholders’ equity; |

6

| • | The participant’s continued employment with the Company, or continued service as a director, for a specified period of time; |

| • | The occurrence of any event or the satisfaction of any other condition specified by the Compensation Committee in its sole discretion; or |

| • | A combination of any of the foregoing. |

Restricted stock will be represented by a stock certificate registered in the name of the participant. The participant will have the right to receive dividends, if any, with respect to such shares of restricted stock. In addition, unless otherwise provided in an agreement, the participant will have the right to vote such restricted stock shares and to enjoy all other stockholder rights, except that the Company will retain custody of the stock certificate and the participant may not sell, transfer, pledge, or otherwise dispose of the restricted stock shares until the forfeiture restrictions have expired. A breach of the terms and conditions established by the Compensation Committee pursuant to an award will cause a forfeiture of the award. The Compensation Committee expects that participants generally will not be required to make any payment for common stock received pursuant to an award, except to the extent otherwise determined by the Compensation Committee or required by law.

The Compensation Committee may, in its discretion, fully vest any or all restricted stock awarded to a participant and, upon such vesting, all forfeiture restrictions applicable to the stock will terminate. Any such action by the Compensation Committee may vary among individual participants and may vary among awards held by any individual participant. The Compensation Committee may not, however, take any action with respect to an award that has been granted to a “covered employee,” within the meaning of Treasury Regulation Section 1.162-27(c)(2), if such award has been designed to meet the exception for performance-based compensation under Section 162(m) of the Internal Revenue Code.

Promptly after a restricted stock award is made, the Company and the participants will enter into a restricted stock agreement setting forth the terms of the award and such other matters as the Compensation Committee may determine to be appropriate. The terms and provisions of the restricted stock agreements need not be identical, and the Compensation Committee may, in its sole discretion, amend an outstanding restricted stock agreement at any time in any manner that is not inconsistent with the provisions of the Plan.

Amendment and Termination of the Plan

The Board of Directors, in its discretion, may terminate the Plan at any time with respect to any shares of common stock for which awards have not been granted. The Board of Directors will have the right to alter or amend the Plan or any part thereof at any time, except that it may not change any outstanding award that would impair the rights of the grantee without the consent of the participant, and it may not, without approval of the Company’s shareholders, amend the Plan to increase the maximum aggregate number of shares that may be issued under the Plan, change the class of individuals eligible to receive awards under the Plan, or amend or delete the provision of the Plan pertaining to the last sentence of the fourth paragraph under “Administration of the Plan,” above regarding amendment of awards intended to qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code. Except for awards then outstanding, the Plan will terminate and no further awards will be granted after the expiration of 10 years following the date of its adoption by the Board of Directors, if not earlier terminated.

Capital Changes

In the event of a stock dividend, stock split, reorganization, merger, recapitalization, or other change impacting the Company’s common stock, such proportionate adjustments, if any, as the Compensation Committee deems appropriate will be made with respect to the aggregate number of shares of common stock that

7

may be issued under the Plan, the number of shares issuable pursuant to each outstanding award made under the Plan, and the maximum number of shares that may be subject to awards granted to any one individual under the Plan.

Tax Impacts of Participation in the Plan

Under the Internal Revenue Code as presently in effect, a participant generally will not recognize any income for federal income tax purposes at the time an award is made, nor will the Company be entitled to a tax deduction at that time, unless the participant elects to recognize income at the time the award is made. If the participant does not make such election, the value of the common stock will be taxable to the participant as ordinary income in the year in which the forfeiture restrictions lapse with respect to such restricted stock shares of stock. The Company has the right to deduct, in connection with all awards, any taxes required by law to be withheld and to require any payments required to enable it to satisfy its withholding obligations. The Company will generally be allowed an income tax deduction equal to the ordinary income recognized by the participant at the time of such recognition.

The Company may not deduct compensation of more than $1 million that is paid in a taxable year to certain “covered employees,” as defined in Section 162(m) of the Internal Revenue Code. The deduction limit, however, does not apply to certain types of compensation including qualified performance-based compensation. Compensation attributable to awards currently contemplated by the Compensation Committee under the Plan will generally not be qualified performance-based compensation and, therefore, will be subject to the deduction limit.

Under Section 280G of the Internal Revenue Code, the Company may not deduct certain compensation payable in connection with a change of control. The Company, at its discretion, may determine not to accelerate the vesting of awards in conjunction with a change of control of the Company to avoid these accelerated payments becoming nondeductible under Section 280G.

Plan Benefits

Because no awards have been granted under the Plan as of the date of this Proxy Statement and all awards will be granted at the discretion of the Compensation Committee, it is not possible for the Company to determine and disclose the amounts of awards that may be granted to the Named Executive Officers, as subsequently defined, and the executive officers as a whole, if the Plan is approved.

Reasons for Authorization and Vote Required

The Palmetto Bancshares, Inc. 2008 Restricted Stock Plan is being submitted to the shareholders for approval, and the Company’s Board of Directors recommends a vote “FOR” approval of the Palmetto Bancshares, Inc. 2008 Restricted Stock Plan. Assuming the presence of a quorum, the approval of this proposal requires that the votes cast favoring the proposal exceed the votes cast opposing the proposal. Abstentions and broker non-votes will have no effect upon the vote on this matter.

8

EXECUTIVE OFFICERS

The Board of Directors appoints Palmetto Bancshares, Inc.’s executive officers. All executive officers serve until their successors are duly appointed or until their earlier death, resignation, or retirement. The following persons served as executive officers of Palmetto Bancshares, Inc. or its subsidiary during the year ended December 31, 2007.

Name | Age (1) | Palmetto Bancshares, Inc. and Subsidiary Offices Held | ||

L. Leon Patterson | * | * | ||

Paul W. Stringer | * | * | ||

George A. Douglas, Jr. | 56 | Mr. Douglas has served as President and Chief Retail Officer of The Palmetto Bank since January 2004. Mr. Douglas served as Executive Vice President of The Palmetto Bank from September 1999 to December 2003 and as Senior Vice President of The Palmetto Bank from July 1993 to August 1999. | ||

Ralph M. Burns, III | 57 | Mr. Burns has served as Treasurer of Palmetto Bancshares, Inc. since April 1998 and served as a Vice President of Palmetto Bancshares, Inc. from April 1990 to April 1998.

Mr. Burns has served as Executive Vice President of The Palmetto Bank since September 1999. From January 1982 until September 1999, he served as Senior Vice President and Cashier of The Palmetto Bank. From January 1978 to December 1981, he served as Assistant Vice President and Cashier of The Palmetto Bank, and from January 1976 to December 1977, Mr. Burns served as Assistant Cashier of The Palmetto Bank. | ||

W. Michael Ellison | 55 | Mr. Ellison has served as Executive Vice President and Chief Credit Officer of The Palmetto Bank since January 2001. He served as Senior Vice President from March 2000 to December 2000. Prior to March 2000, Mr. Ellison served as Senior Vice President at Community First Bank in Walhalla, South Carolina. | ||

Teresa W. Knight | 52 | Ms. Knight has served as Executive Vice President of The Palmetto Bank since September 1999. She served as Senior Vice President of The Palmetto Bank from January 1993 to August 1999. From July 1987 to December 1993, she served as Vice President of The Palmetto Bank. | ||

Hubert E. Tuttle, III | 39 | Mr. Tuttle has served as Executive Vice President of The Palmetto Bank since January 2006. From January 2001 until that time, Mr. Tuttle served as Senior Vice President of The Palmetto Bank. From August 1997 until December 2000, Mr. Tuttle served as Vice President of The Palmetto Bank. | ||

Matthew I. Walter | 42 | Mr. Walter has served as Executive Vice Present of The Palmetto Bank since January 2006. From January 2000 until December 2005, Mr. Walter served as Senior Vice President of The Palmetto Bank. From January 1997 until December 1999, Mr. Walter served as Vice President of The Palmetto Bank, and from January 1994 until December 1996, Mr. Walter served as an officer of The Palmetto Bank. Between August 1990 and December 1993, Mr. Walter held three positions concurrently including Management Trainee, Commercial Loan Officer, and Assistant Investment Officer. | ||

| (1) | At December 31, 2007 |

| * | Information included in Proposal 1—Election of Directors—Information on Nominees and Directors, as these individuals are also directors or director nominees of Palmetto Bancshares, Inc. |

9

Effective January 31, 2008, Mr. Ralph M. Burns, III, retired from his positions at Palmetto Bancshares, Inc. and The Palmetto Bank.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Persons and groups beneficially owning in excess of five percent of the Company’s common stock are required to file reports with the Securities and Exchange Commission disclosing their ownership pursuant to the Securities Exchange Act of 1934, as amended. The following table sets forth, as of January 1, 2008, certain information as to those persons who were beneficial owners of more than five percent of the outstanding shares of the Company’s common stock. As of January 1, 2008, management knows of no persons, other than L. Leon Patterson, that beneficially owned more than five percent of the outstanding shares of the Company’s common stock. The Company inquires of directors and Named Executive Officers, as subsequently defined, regarding their knowledge of beneficial owners that may own more than five percent of the Company’s common stock. In addition, the Company’s Corporate Secretary reviews share ownership records to determine any additional owners that may own greater than five percent of the Company’s common stock. The information summarized in the following table is exclusively based on these inquiries and the reports described above.

The following table also sets forth, as of January 1, 2008, information as to the shares of the Company’s common stock beneficially owned by (a) all directors and nominees for director, (b) the registrant’s principal executive officer, all individuals serving as the registrant’s principal financial officer and the registrant’s other three most highly compensated executive officers other than the principal executive officer who received total compensation in excess of $100,000 during the fiscal year ended December 31, 2007 (“Named Executive Officers”) and (c) all executive officers and directors of the Company as a group.

Beneficial Owner | Common Stock Beneficially Owned (#) | Common Stock Subject to a Right to Acquire (1) (#) | Percent of Common Stock (2) (%) | |||||

Directors | ||||||||

Employee Directors | ||||||||

L. Leon Patterson 301 Hillcrest Drive Laurens, South Carolina 29360 | 567,621 | (4) | — | 8.6 | ||||

Paul W. Stringer | 85,858 | (5) | — | 1.3 | ||||

Nonemployee Directors | ||||||||

W. Fred Davis, Jr. | 38,711 | (6) | — | (3 | ) | |||

David P. George, Jr. | 13,511 | — | (3 | ) | ||||

Michael D. Glenn | 10,730 | (7) | 5,000 | (3 | ) | |||

John T. Gramling, II | 15,000 | (8) | 4,000 | (3 | ) | |||

John D. Hopkins, Jr. | 40,500 | (9) | 3,000 | (3 | ) | |||

Sam B. Phillips, Jr. | 27,488 | 5,000 | (3 | ) | ||||

Albert V. Smith | 836 | 2,000 | (3 | ) | ||||

Ann B. Smith | 6,200 | (10) | — | (3 | ) | |||

Edward K. Snead, III | 20,270 | (11) | — | (3 | ) | |||

Jane S. Sosebee | 100 | 2,000 | (3 | ) | ||||

L. Stewart Spinks | 1,100 | 1,000 | (3 | ) | ||||

J. David Wasson, Jr. | 12,800 | (12) | — | (3 | ) | |||

Named Executive Officers | ||||||||

George A. Douglas, Jr. | 18,000 | (13) | 19,200 | (3 | ) | |||

Teresa W. Knight | 31,495 | (14) | 22,735 | (3 | ) | |||

Ralph M. Burns, III | 55,782 | (15) | — | (3 | ) | |||

Directors and Named Executive Officers as a group | 946,002 | 63,935 | 15.4 | |||||

| (1) | Includes equity incentive compensation in the form of stock options grants awarded under the Company’s 1997 Stock Compensation Plan that are exercisable within 60 days of the close of business on the Voting Record Date. These shares are separately reported in this column and are not included in the Common Stock Beneficially Owned column. |

10

| (2) | The percentages of beneficial ownership have been calculated based on 6,421,765 outstanding shares of the Company’s common stock (outstanding as of December 31, 2007). In addition, under Rule 13d-3 of the Exchange Act of 1934, the percentages have been computed on the assumption that shares of the Company’s common stock that can be acquired within 60 days of the close of business on the Voting Record Date upon the exercise of options by that person or group are outstanding. |

| (3) | Beneficial ownership does not exceed one percent of the class so owned as computed per note (2) above. |

| (4) | The number of shares of common stock beneficially owned by Mr. Patterson includes 31,490 shares held in his 401(k) account, 54,014 shares owned by Mr. Patterson’s wife, and 20,387 shares owned jointly by Mrs. Patterson and her mother. Mr. Patterson is also a Named Executive Officer of the Company. |

| (5) | The number of shares of common stock beneficially owned by Mr. Stringer includes 25,858 shares held in his 401(k) account. Mr. Stringer is also a Named Executive Officer of the Company. |

| (6) | The number of shares of common stock beneficially owned by Mr. Davis includes 15,800 shares directly owned with his wife, 15,209 shares directly owned but managed by Delaware Charter and Trust, 2,934 shares owned by his wife but managed by Delaware Charter and Trust, and 60 shares owned by his wife. |

| (7) | The number of shares of common stock beneficially owned by Mr. Glenn includes 8,500 shares directly owned but managed by Delaware Charter and Trust. In addition, Mr. Glenn exercised his common stock subject to a right to acquire in January 2008. |

| (8) | The number of shares of common stock beneficially owned by Mr. Gramling includes 9,000 shares directly owned but managed by Delaware Charter and Trust. In addition, Mr. Gramling exercised his common stock subject to a right to acquire in January 2008. |

| (9) | The number of shares of common stock beneficially owned by Mr. Hopkins includes 37,974 shares directly owned but managed by Delaware Charter and Trust and 250 shares held in trust for each his son and daughter as to which Mr. Hopkins acts as custodian. Additionally, 8,000 shares of Mr. Hopkin’s stock are pledged to the Bank as loan collateral. |

| (10) | The number of shares of common stock beneficially owned by Ms. Smith includes 500 shares indirectly owned within trust accounts for her two sons, as to which she acts as custodian. |

| (11) | The number of shares of common stock beneficially owned by Mr. Snead includes 3,534 total shares indirectly owned within separate trust accounts for his two sons and one daughter, as to which he acts as custodian. Also included are 1,410 shares owned by Mr. Snead’s wife and 1,575 shares in a trust for which he serves as trustee. |

| (12) | The number of shares of common stock beneficially owned by Mr. Wasson includes 5,400 shares directly owned with his wife. |

| (13) | The number of shares of common stock beneficially owned by Mr. Douglas includes 264 shares directly owned jointly with his wife, and 1,736 shares held in an IRA account. |

| (14) | The number of shares of common stock beneficially owned by Ms. Knight includes 8,910 shares held in her 401(k) account, and 2,120 shares directly owned jointly with her husband. |

| (15) | The number of shares of common stock beneficially owned by Mr. Burns includes 16,342 shares held in his 401(k) account. |

11

INFORMATION ABOUT THE COMPANY’S BOARD OF DIRECTORS AND ITS BOARD COMMITTEES

Role and Functioning of the Board of Directors

The Board of Directors, which is elected by the shareholders, is the ultimate decision-making body of the Company, except for those matters reserved to the shareholders. The Board of Directors selects the management team, which is charged with the conduct of the Company’s business. Having selected the management team, the Board of Directors acts as an advisor and counselor to management and monitors its performance.

Each year, members of management set aside specific periods to develop, discuss, and refine the Company’s long-range operating plan and overall corporate strategy. Specific operating priorities are developed to effectuate such long-range plans. Some of the priorities are short-term in focus while others are based on longer-term planning horizons. This group reviews the conclusions reached at its meetings with the Board of Directors who ultimately approves the overall corporate strategy and long-range operating plan. At subsequent Board of Directors meetings, the Board of Directors reviews the Company’s progress against its strategic plans and exercises oversight and decision-making authority regarding areas of strategic importance.

Determinations With Respect to the Independence of Directors

The Board of Directors makes an annual determination regarding the independence of each of Palmetto Bancshares, Inc.’s directors under the definition found in Section 303A.02 of the New York Stock Exchange Company Manual. The Board of Directors last made these determinations for each of its members in March 2008.

The Board of Directors has determined that twelve of its fourteen directors are independent as contemplated under the rules of the New York Stock Exchange Company Manual. The two individuals who are not independent, Messrs. Patterson and Stringer, are both executive officers of Palmetto Bancshares, Inc.

Meetings of the Board of Directors

The Board of Directors conducts its business through Board of Directors meetings and through meetings of its committees. During the year ended December 31, 2007, the Board of Directors held 11 meetings.

At the invitation of the Board of Directors, members of management attend meetings or portions thereof for the purpose of participating in discussions.

Board Committee Membership and Meetings

The Company’s Board of Directors has a standing Audit Committee, Compensation Committee, and Corporate Governance and Nominating Committee. The following table shows the current members of these committees.

Director | Audit | Compensation | Corporate Governance and Nominating | |||

W. Fred Davis, Jr. | X | |||||

Michael D. Glenn | X | |||||

John D. Hopkins, Jr. | X | X | ||||

Sam B. Phillips, Jr. | X | X | ||||

Ann B. Smith | X | X | ||||

L. Stewart Spinks | X | |||||

J. David Wasson, Jr. | X | X | ||||

Meetings during 2007 | 4 | 4 | 2 | |||

12

The Company’s Board of Directors also has nonstanding Credit and Trust Committees. The following table shows the current members of these committees. These committees meet on a monthly basis.

Director | Credit | Trust | ||

W. Fred Davis, Jr. | X | |||

David P. George, Jr. | X | |||

Michael D. Glenn | X | |||

John T. Gramling, II | X | |||

Albert V. Smith | X | |||

Edward K. Snead, III | X | |||

Jane S. Sosebee | X | |||

Director Attendance at Board Meetings, Standing Committee Meetings, and the Annual Meeting of Shareholders

Only one of the Company’s directors, L. Stewart Spinks, attended less than 75 percent of the total meetings of the Board of Directors and the total meetings held by all committees of the Board of Directors on which he served during the year ended December 31, 2007.

The Company has not established a formal policy regarding director attendance at its Annual Meeting of Shareholders, but it encourages all directors to attend these meetings. The Chairman of the Board of Directors presides at the Annual Meeting of Shareholders. All members of the Board of Directors attended the 2007 Annual Meeting of Shareholders.

Board Compensation

The following table summarizes the compensation of the Company’s nonemployee directors during the year ended December 31, 2007. Compensation of the employee directors during the year ended December 31, 2007 is included in the Summary Compensation Table within Executive Compensation included herein.

Name | Fees Earned or Paid in Cash ($) | Option Awards ($) (1) | Total ($) | Aggregate Number of Option Awards Outstanding at Year-End (#) | ||||

W. Fred Davis, Jr. | 25,500 | — | 25,500 | — | ||||

David P. George, Jr. | 25,500 | — | 25,500 | — | ||||

Michael D. Glenn | 25,500 | — | 25,500 | 5,000 | ||||

John T. Gramling, II | 25,500 | — | 25,500 | 4,000 | ||||

John D. Hopkins, Jr. | 25,500 | 5,190 | 30,690 | 5,000 | ||||

Sam B. Phillips, Jr. | 25,500 | — | 25,500 | 5,000 | ||||

Albert V. Smith | 25,500 | 4,290 | 29,790 | 5,000 | ||||

Ann B. Smith | 25,500 | — | 25,500 | — | ||||

Edward K. Snead, III | 25,500 | — | 25,500 | — | ||||

Jane S. Sosebee | 25,500 | 4,290 | 29,790 | 5,000 | ||||

L. Stewart Spinks | 22,500 | 4,790 | 27,290 | 4,000 | ||||

J. David Wasson, Jr. | 25,500 | — | 25,500 | — | ||||

| (1) | Represents expense recognized in accordance with SFAS 123(R) for stock option grants. Stock option grants to Mr. Smith, Ms. Sosebee, and Mr. Spinks were awarded in 2006. Stock option grants awarded to Mr. Smith and Ms. Sosebee had a grant date fair value of $4.29 per share and those awarded to Mr. Spinks had a grant date fair value of $4.79 per share. Mr. Hopkins’ stock option grants were awarded in 2005 and had a grant date fair value of $5.19 per share. The Company cautions that the amounts reported for these |

13

grants may not represent the amounts that the directors will actually realize from the awards. Whether, and to what extent, a director realizes value will depend on the Company’s actual operating performance, common stock price fluctuations, and the director’s continued service. |

During the year ended December 31, 2007, both management and nonmanagement members of the Company���s Board of Directors received monthly meeting fees of $1,500 and an annual retainer of $7,500 for additional services provided to the Company as directors including, but not limited to, committee membership and related responsibilities. Directors of Palmetto Bancshares, Inc. also serve on the Board of Directors of The Palmetto Bank. Directors receive no additional compensation related to their service on The Palmetto Bank’s Board of Directors. All directors receive the same forms of compensation with regard to service to the Company on its Board of Directors. If a director misses more than one Board meeting in a calendar year and the Company does not excuse such absences, the director forfeits his or her monthly fee. During 2007, L. Stewart Spinks had two unexcused absences that resulted in forfeiture of monthly compensation

Directors of the Company participate in the 1997 Stock Compensation Plan. The terms and conditions of stock option grants to directors under the 1997 Stock Compensation Plan are the same as for stock option grants to employees of the Company under the 1997 Stock Compensation Plan. See Compensation Discussion and Analysis within Compensation Committee Matters for a discussion regarding the Company’s equity incentive compensation plan.

Audit Committee Matters

Role and Functioning of the Audit Committee

The Audit Committee of the Board of Directors, chaired by Ann B. Smith, (i) monitors the integrity of the financial reporting process and systems of internal controls regarding finance, accounting, regulatory, and legal compliance; (ii) appoints, sets the compensation for, and oversees the work of the Company’s independent registered public accounting firm; (iii) provides an avenue of communication among the independent registered public accounting firm, management, employees, the internal auditing department, and the Board of Directors; and (iv) reviews the independent audit plan and results of the audit engagement.

Audit Committee Independence

The Board of Directors has determined that all members of the Company’s Audit Committee are independent, as defined in Section 303A.02 of the New York Stock Exchange Company Manual.

Audit Committee Charter

The Audit Committee of the Company’s Board of Directors operates under a written charter adopted by the Board of Directors on January 16, 2001, as amended, a copy of which is not available on the Company’s website but was attached as Appendix A to the Proxy Statement for the Annual Meeting of Shareholders held April 17, 2007.

Audit Committee Financial Expert

Although the Board of Directors has determined that the Audit Committee of Palmetto Bancshares, Inc. does not have an “Audit Committee financial expert,” as that term is defined by applicable Securities and Exchange Commission rules, the Board of Directors believes that the current members of the Audit Committee are fully capable of satisfying their Audit Committee responsibilities based on their experience and background. Audit Committee members each individually have many of the attributes used by the Securities and Exchange Commission to define an “Audit Committee financial expert” through past or current service as noted in each member’s business experience included herein. Specifically the Company’s Audit Committee members are able

14

to read and understand fundamental financial statements, have a clear understanding of generally accepted accounting principles, have an understanding of internal controls and procedures for financial reporting, and understand their responsibilities as Audit Committee members. In addition, for these and other responsibilities, the Audit Committee is authorized to retain outside counsel, experts, and other advisors as it deems necessary to provide financial accounting expertise in any instance where members of the Audit Committee believe such assistance would be useful.

Audit Committee Preapproval Policy

On December 18, 2007, the Audit Committee approved a Preapproval of Independent Registered Public Accounting Firm Services Policy. The policy addresses the protocol for preapproval of both audit and nonaudit services provided to the Company and its subsidiary by its independent registered public accounting firm. Generally, the policy requires that, in accordance with Section 202 of the Sarbanes Oxley Act of 2002, all auditing services and nonaudit services, including nonprohibited tax services provided to the Company by its independent registered public accounting firm, be preapproved by the Audit Committee in accordance with the following guidelines:

| • | Preapproval by the Audit Committee must be in advance of the work to be completed; |

| • | The Audit Committee or designated Audit Committee member must perform preapproval, and it cannot delegate the preapproval responsibility to a member of management; |

| • | The Audit Committee cannot preapprove services based upon broad, nondetailed descriptions (e.g., tax compliance services) and must be provided with a detailed explanation of each particular service to be provided so the Committee knows precisely what services it is being asked to preapprove and can make a well reasoned assessment of the impact of the service on the auditor’s independence; and |

| • | Monetary limits alone may not be established as the only basis for the preapproval of deminimus amounts. There has to be a clear, specific explanation provided as to what are the particular services to be provided, subject to the monetary limit, to ensure that the Audit Committee is fully informed about each service. |

The policy provides that the Audit Committee may delegate to one or more designated members of the Audit Committee, who are independent directors of the Board of Directors, the authority to grant required preapprovals. The decision of any member to whom authority is delegated to preapprove an activity shall be presented to the full Audit Committee at its next scheduled meeting. The Committee appoints a member annually to have the authority to grant required preapprovals. The policy also provides for deminimus exceptions to the preapproval requirements. With regard to the approval of nonauditing services, the Audit Committee considers, when applicable, various factors including, but not limited to, whether it would be beneficial to have the service provided by the independent registered public accounting firm and whether the service could compromise the independence of the independent registered public accounting firm. The Audit Committee, either in its entirety or through its designee, preapproved all of the engagements for the audit of the Company, audit related engagements, and tax engagements of Elliott Davis, LLC related to the years ended December 31, 2007 and December 31, 2006. Additionally, during the year, there were no fees billed for professional services described in Paragraph (c)(4) of Rule 2-01 of Regulation S-X rendered by Elliott Davis, LLC.

15

Auditing and Related Fees

The following table summarizes fees paid to Elliott Davis, LLC for professional services rendered associated with the audit of the Company’s financial statements for the years ended December 31, 2007 and 2006. Out-of-pocket expenses reimbursed to Elliott Davis, LLC by the Company are excluded from the table.

| 2007 | 2006 | ||||

Audit Fees (1) | $ | 198,500 | 175,950 | ||

Audit-Related Fees (2) | 27,800 | 24,760 | |||

Audit Fees and Audit Related Fees | 226,300 | 200,710 | |||

Tax Fees (3) | 15,295 | 23,387 | |||

All Other Fees | — | — | |||

Total Fees | $ | 241,595 | 224,097 | ||

| (1) | Audit fees include fees for the audit of annual financial statements, the review of quarterly financial statements, and required procedures performed with regard to the Company’s internal controls over financial reporting. |

| (2) | Audit related fees consisted of fees for audits of the Company’s employee benefit plans as well as payments made with regard to miscellaneous audit related assistance. Due to the fact that the fees for the 2007 audits of the Company’s employee benefits plans have not yet been determined, such fees are assumed to approximate those paid for 2006. |

| (3) | Tax fees consisted of fees for tax consultation and compliance services in conjunction with the preparation of the Company’s tax returns. |

Audit Committee Report

Management is responsible for the Company’s internal controls and financial reporting process. The Company’s independent registered public accounting firm is responsible for performing an independent audit of the Company’s financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) and issuing a report thereon and annually auditing management’s assessment of the effectiveness of internal control over financial reporting. One of the Audit Committee’s responsibilities is to monitor and oversee these processes. Other duties and responsibilities of the Audit Committee are to monitor (i) the integrity of the Company’s financial statements, including the financial reporting process and systems of internal controls regarding finance and accounting; (ii) the compliance by the Company with legal and regulatory requirements; (iii) the performance of the Company’s internal auditors and the independence and performance of its external independent registered public accounting firm; (iv) significant reports regarding the Company prepared by the internal auditors; and (v) employee and shareholder complaints regarding accounting, audit, or internal control issues. A full description of the Audit Committee’s responsibilities is included in the Audit Committee’s Charter. The Audit Committee has the authority to conduct or authorize investigations into any matters within the scope of its responsibilities and has the authority to retain, at the Company’s expense, such outside counsel, experts, and other advisors as it deems appropriate to assist it in the conduct of any such investigation.

In fulfilling its responsibilities, the Audit Committee reviewed and held discussions with management and the independent registered public accounting firm regarding the audited financial statements for the year ended December 31, 2007. Management represented to the Audit Committee that the Company’s financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee discussed with the independent registered public accounting firm matters required to be discussed by Statements of Auditing Standards (“SAS”) No. 61, “Communication with Audit Committees,” as amended by SAS No. 90, “Audit Committee Communications.”

16

The Company’s independent registered public accounting firm also provided to the Audit Committee the written disclosures and the letter required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and the Audit Committee discussed with the independent registered public accounting firm that firm’s independence. In particular, the Audit Committee considered whether the provision of the services set forth in Auditing and Related Fees above is compatible with maintaining the independence of the independent registered public accounting firm and determined that no independence issues arose as a result of such services. Services to be provided by Elliott Davis, LLC to the Company are preapproved by the Audit Committee or its designee as set forth in Audit Committee Preapproval Policy above to ensure that such services do not impair the independent registered public accounting firm’s independence with the Company.

The Audit Committee selects, subject to Board of Directors’ approval, the Company’s independent registered public accounting firm. After reviewing the independence and performance of Elliott Davis, LLC during the 2007 year end audit and discussing significant audit-related issues with representatives of Elliott Davis, LLC, the Audit Committee recommended to the Board of Directors, and the Board of Directors approved, the reappointment of Elliott Davis, LLC as Palmetto Bancshares, Inc.’s independent registered public accounting firm for 2008.

Based on the Audit Committee’s discussions with management and the independent registered public accounting firm, its review of the audited financial statements for the year ended December 31, 2007, the representations of management, and the report of the independent registered public accounting firm to the Audit Committee, the Audit Committee recommended that the Board of Directors include the Company’s audited financial statements in its Annual Report on Form 10-K for the year ended December 31, 2007 filed with the Securities and Exchange Commission.

The following independent directors, who comprise the Audit Committee, provide this report.

W. Fred Davis, Jr.

Ann B. Smith, Chair

L. Stewart Spinks

J. David Wasson, Jr.

Compensation Committee Matters

Role and Functioning of the Compensation Committee

The Compensation Committee, chaired by J. David Wasson, Jr., is primarily responsible for establishing and monitoring compensation and benefit plan policies of the Company and making recommendations to the full Board regarding compensation and benefits for the Company’s employees. The Compensation Committee has the authority to conduct or authorize investigations into any matters within the scope of its responsibilities and has the authority to retain, at the Company’s expense, such outside counsel, experts, and other advisors as it deems appropriate to assist it in the conduct of any such investigation.

Compensation Committee Independence

The Board of Directors has determined that all members of the Company’s Compensation Committee are independent, as defined in Section 303A.02 of the New York Stock Exchange Company Manual.

Compensation Committee Charter

Although the Compensation Committee does not have a formal charter, it operates under a set of “guidelines” outlining committee duties and responsibilities. The committee is currently drafting a formal charter document.

17

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee was an officer or employee of the Company or its subsidiary during the year ended December 31, 2007, was formerly an officer or employee of the Company or its subsidiary, or had any relationship otherwise requiring disclosure.

Code of Ethics

During 2007, the Board of Directors approved, and the Company adopted, a Code of Ethics for Executive Management and Senior Financial Officers. The Code of Ethics for Executive Management and Senior Financial Officers applies to the executive management, senior financial officers, and directors of the Company, including the Bank. The Code of Ethics for Executive Management and Senior Financial Officers was adopted to address issues specific to such individuals and to supplement the Company’s existing Code of Ethics, which applies more broadly to all of the officers and employees of the Company. The Code of Ethics for Executive Management and Senior Financial Officers is intended to focus executive management, senior financial officers, and directors on areas of ethical risk, provide guidance to help these officers recognize and deal with ethical issues, provide mechanisms to report unethical conduct, and promote fair and accurate disclosure of financial reporting.

The Company’s codes of ethics, including its Code of Ethics for Executive Management and Senior Financial Officers, are not available on the Company’s website but will be furnished, without charge, upon written request to Teresa W. Knight, The Palmetto Bank, Post Office Box 49, Laurens, South Carolina 29360. The Company will disclose any amendments to or waivers from its codes of ethics that apply to its principal executive officer, principal financial officer, principal accounting officer, or controller or persons performing similar functions by filing a Current Report on Form 8-K with the Securities and Exchange Commission.

Compensation Discussion and Analysis

General Compensation Philosophy. The goal of the Company’s compensation program is the same as the goal for operating the Company—to create long-term value for its shareholders. To this end, the Company has designed compensation programs for all Company employees, including its Named Executive Officers, to reward them for sustained financial and operating performance and leadership excellence, to align their interests with those of the Company’s shareholders, and to encourage employees to remain with the Company for long and productive careers. Most compensation elements simultaneously fulfill one or more of these objectives. In addition, the Company’s nonequity incentive plan and equity incentive compensation plan, which are significant elements of its officer’s compensation program, directly link compensation to performance to ensure that its compensation program is aligned with the Company’s strategic goals.

Compensation Components and Objectives. Key elements of the compensation of Named Executive Officers may include:

| • | Base salary; |

| • | Annual cash compensation under the Company’s nonequity incentive compensation plan; |

| • | Equity compensation under the Company’s equity incentive compensation plan; and |

| • | Benefits and perquisites. |

The Company generally does not adhere to rigid formulas in determining the amount and mix of compensation elements. The Company relies on the achievement of financial goals only with regard to payments under its nonequity incentive plan. Decisions regarding the amount of compensation payable in one form do not necessarily impact the decisions made regarding the amount of compensation payable in another form. Additionally, the Compensation Committee does not have a policy for allocating between long-term and currently paid compensation nor between cash and noncash compensation. Historically, the Company has not

18

considered the weighting of compensation between long-term and currently paid or between cash and noncash. Instead, as explained within this report, it has set base salary at competitive levels and incentivized officers through its equity and nonequity incentive compensation plans. Both plans are administered consistently for employees within management levels.

In addition to the compensation components noted above, until January 2008, the Company offered a defined benefit pension plan. The Company’s defined benefit pension plan is administered in the same manner for all employees. During the fourth quarter of 2007, the Company notified employees that, effective 2008, it would freeze accrued pension benefits for employees with regard to the Company’s defined benefit pension plan. Although no accrued benefits will be lost, employees will no longer accrue benefits after 2007. The decision was made to freeze the defined benefit pension plan because of the uncertainty of future costs of defined benefits resulting from such plans being captive to the volatility of capital markets and the increased burden of government regulation. The impact of the freeze of the defined benefit pension plan on the mix of compensation is expected to be addressed by the Compensation Committee during 2008. No changes were made to the amounts or mix of other elements of compensation during 2007 as a result of this freeze.

Base Salary. Base salary is designed to provide competitive levels of compensation to the Company’s employees based on their experience, duties, and scope of responsibility. The Company pays base salaries because it is necessary to recruit and retain employees. Base salary levels are also important because they are used to determine the target amount of nonequity incentive awards, and they are used for computing 401(k) plan contributions and, prior to December 31, 2007, salary levels with regard to the Company’s defined benefit pension plan.

Nonequity Incentive Compensation Plan. In addition to base salary, the Company provides nonequity incentive compensation to its officers to assist the Company in meeting annual performance targets set by the Board. Performance targets are determined by the Company’s Compensation Committee at the beginning of each year, and awards are calculated at the end of the year based on the results of the Company’s performance during the year.

The nonequity incentive compensation plan provides that key officers, designated each year by the Compensation Committee, including the Named Executive Officers, will receive up to 50% of their base salary in nonequity incentive compensation if 100% of the targets, as approved by the Board, are met and exceeded by specified amounts. Targets are determined based on the Company’s annual Profit Plan projections which the Company believes establish superior standards of performance. The incentives become payable within a range surrounding the targets under the belief that falling just short of a “stretch goal” also adds long-term value for the Company’s shareholders and exceeding a “stretch goal” adds additional long-term value for the Company’s shareholders. The plan utilizes a point system for determining nonequity incentive compensation based on the extent to which the targets are met. No nonequity incentive compensation was paid to the Company’s Named Executive Officers with regard to 2007 outside the parameters of the nonequity incentive compensation plan.

19

Standards of measurement are recommended annually by the Compensation Committee and are approved by the Board of Directors. Although the standards of measurement and weights of such standards vary by participant, the standards for all Named Executive Officers were the same with regard to 2007 performance. Standards of measurement for the 2007 plan for Named Executive Officers and their relative weighting are summarized in the following table.

Standards of Measurement | Percentage of Standards of Measurement | Maximum Earnings Potential as a Percentage of Base Salary | Target Resulting in | Target Resulting in | 2007 Earnings as a Percentage of Base Salary | ||||||||

Return on average assets | 25.0 | % | 12.5 | % | 1.27% & Under | 1.38% & Over | 7.5 | % | |||||

Return on average shareholders’ equity | 25.0 | 12.5 | 13.50% & Under | 15.50% & Over | 10.0 | ||||||||

Net interest margin | 10.0 | 5.0 | 4.61% & Under | 4.73% & Over | — | ||||||||

Operating efficiency ratio | 10.0 | 5.0 | 63% & Over | 62% & Under | 4.0 | ||||||||

Net loans charged-off ratio | 10.0 | 5.0 | 0.23% & Over | 0.15% & Under | 2.0 | ||||||||

Deposit growth | 10.0 | 5.0 | 3% & Under | 7% & Over | 3.0 | ||||||||

Loan growth | 10.0 | 5.0 | 6% & Under | 10% & Over | 5.0 | ||||||||

| 100.0 | % | 50.0 | % | 31.5 | % | ||||||||

With the exception of the operating efficiency ratio, which replaced the overhead ratio, the standards of measurement for the Named Executive Officers have remained unchanged since the inception of the nonequity incentive compensation plan. However, the range of potential earnings with regard to each standard of measurement vary annually based on the Company’s annual Profit Plan projections. Named Executive Officers earned 31.5%, 46%, and 43% of their respective base salaries under the plan during 2007, 2006, and 2005, respectively. All payments under the nonequity incentive compensation plan are actually paid in the first quarter of the following year.

Equity Incentive Compensation Plan. The Company provides equity incentive compensation because it believes that such compensation recognizes scope of responsibilities, rewards demonstrated performance and leadership, motivates future superior performance, aligns the interests of the recipients with the interests of shareholders by increasing the recipient’s equity stake in the Company, and motivates recipients to remain with the Company through the term of the awards.

The Company weighs the cost of stock option grants with their potential benefits as a compensation tool. The Company believes that equity incentive compensation effectively balances its objectives of incentivizing recipients on creating future long-term value to shareholders with the Company’s objective of rewarding prior performance. The Company has historically awarded equity incentive compensation in the form of stock option grants which only have value to the extent the price of the Company’s common stock on the date of exercise exceeds the price on the grant date. Therefore, stock option grants result in compensation only if the common stock price increases over the term of the award.

Historically, the Company has not granted equity incentive compensation on an annual basis. Instead, stock option grants typically are made when employees are appointed to key management positions. None of the Named Executive Officers were granted equity incentive compensation during 2007 because such individuals had been appointed to key management positions, and therefore granted equity incentive compensation, prior to 2007. Equity incentive compensation in the form of stock option grants under the 1997 Stock Compensation Plan may be allotted to participants in such amounts as the Board of Directors or Compensation Committee, in its sole discretion, may from time to time determine. At December 31, 2007, there were no stock options available for grant under the 1997 Stock Compensation Plan.

20

The exercise price of each stock option grant is the fair market value of Palmetto Bancshares, Inc. stock on the date of grant, which is the date of the Compensation Committee and Board of Directors meeting at which equity incentive compensation award grants are approved. Under the 1997 Stock Compensation Plan, stock option grants are exercisable in five equal annual installments beginning the year of the grant date and have a maximum ten-year term. Additionally, stock option grants terminate prior to the expiration of their term on the date the optionee ceases to be a director or employee of the Company unless the optionee dies, becomes permanently or totally disabled, or resigns or retires with the consent of the Company, in which case the participant may exercise the previously unexercised portion of the stock option at any time within three months after the participant’s resignation or retirement to the extent the participant could have exercised the stock option awards immediately prior to such resignation or retirement.

Option recipients, including the Company’s Named Executive Officers, are required to hold for at least six months any net shares of Company common stock received through the exercise of stock options. The Company prohibits the purchase or sale of stock options or derivative securities that are directly linked to Palmetto Bancshares, Inc. stock.

As noted above, at December 31, 2007, there were no stock options available for grant under the 1997 Stock Compensation Plan. Due to recent accounting changes with regard to equity compensation plans, the Company’s management and the Board’s Compensation Committee considered both stock options and restricted stock for inclusion in its future equity incentive compensation program. A stock option is a contractual right to buy stock at some future date at a price established at the time the option is granted. Stock option agreements typically condition the employee’s right to purchase stock on continuous employment until the lapse of one or more vesting periods. Stock option agreements also may include additional restrictions on the stock purchased by means of the option. In contrast, restricted stock is normally an outright grant of shares to an employee, pursuant to an agreement that limits the employee’s right to sell, transfer, or pledge that stock until a vesting period has lapsed. The agreement typically permits the Company to repurchase the stock at a nominal price if the employee ceases to be employed by the Company before the vesting period has ended. Outlined below are further comparisons of restricted stock versus stock option equity incentive compensation plans.

Restricted Stock | Stock Options | |

• Less dilutive to shareholders | • More dilutive to shareholders | |

• Immediately dilutive | • Not immediately dilutive | |

• Always has value | • May or may not have value | |

• Taxable upon vesting | • Taxable upon exercising | |

• Receive dividends | • Do not receive dividends until exercised | |

As noted in Proposal 2, the Company’s Board of Directors adopted, subject to shareholder approval, the Palmetto Bancshares, Inc. 2008 Restricted Stock Plan, which provides for the grant of stock awards to the Company’s employees, officers, and directors.

Benefits and Perquisites. The Company offers senior management, including, but not limited to, its Named Executive Officers, various benefits on the same terms as other employees. During 2007, these benefits included medical and dental benefits, life insurance, long-term disability coverage, a 401(k) plan, and a defined benefit pension plan. Employees also receive personal time off and discounted loan rates under programs generally available to all full-time employees. Such benefits are offered to provide for the health, welfare, and future financial security of the Company’s employees as well as for the alignment of employee and shareholder interests.

Employees are given the opportunity to participate in the Company’s 401(k) plan designed to supplement the employee’s retirement income. Under the plan, the Company makes contributions to a fund that will pay the employee benefits during retirement. Employees are eligible to participate in the 401(k) plan after completing

21