Investment Thesis FINANCIAL DATA AS OF September 30, 2021 DATED: November 3, 2021 Exhibit 99.1

Executive Summary Slides 5-17

3 Forward-Looking Statements This communication includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to Old National’s future plans, objectives, performance, revenues, growth, profits, operating expenses or Old National’s underlying assumptions; First Midwest’s and Old National’s beliefs, goals, intentions, and expectations regarding their proposed merger (“proposed transaction”), revenues, earnings, loan production, asset quality, and capital levels, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of expected losses on loans; our assessments of interest rate and other market risks; our ability to achieve our financial and other strategic goals; the expected timing of completion of the proposed transaction; the expected cost savings, synergies and other anticipated benefits from the proposed transaction; and other statements that are not historical facts. Forward‐looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” “will,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. These forward-looking statements include, without limitation, those relating to the terms, timing and closing of the proposed transaction. Additionally, forward‐looking statements speak only as of the date they are made; Old National does not assume any duty, and does not undertake, to update such forward‐looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events, or otherwise. Furthermore, because forward‐looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those indicated in such forward-looking statements as a result of a variety of factors, many of which are beyond the control of Old National. Such statements are based upon the current beliefs and expectations of the management of Old National and are subject to significant risks and uncertainties outside of the control of the parties. Caution should be exercised against placing undue reliance on forward-looking statements. The factors that could cause actual results to differ materially include the following: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between First Midwest and Old National; the outcome of any legal proceedings that may be instituted against First Midwest or Old National; the possibility that the proposed transaction will not close when expected or at all because required regulatory or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all, or are obtained subject to conditions that are not anticipated (and the risk that required regulatory approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction); the ability of First Midwest and Old National to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the common stock of either or both parties to the proposed transaction; the possibility that the anticipated benefits of the proposed transaction will not be realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where First Midwest and Old National do business; certain restrictions during the pendency of the proposed transaction that may impact the parties’ ability to pursue certain business opportunities or strategic transactions; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected timeframes or at all and to successfully integrate First Midwest’s operations and those of Old National; such integration may be more difficult, time consuming or costly than expected; revenues following the proposed transaction may be lower than expected; First Midwest’s and Old National’s success in executing their respective business plans and strategies and managing the risks involved in the foregoing; the dilution caused by Old National’s issuance of additional shares of its capital stock in connection with the proposed transaction; effects of the announcement, pendency or completion of the proposed transaction on the ability of First Midwest and Old National to retain customers and retain and hire key personnel and maintain relationships with their suppliers, and on their operating results and businesses generally; risks related to the potential impact of general economic, political and market factors on the companies or the proposed transaction and other factors that may affect future results of First Midwest and Old National; uncertainty as to the extent of the duration, scope, and impacts of the COVID-19 pandemic on First Midwest, Old National and the proposed transaction; and the other factors discussed in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of each of First Midwest’s and Old National’s Annual Report on Form 10‐K for the year ended December 31, 2020, in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of each of First Midwest’s and Old National’s Quarterly Report on Form 10‐Q for the quarter ended June 30, 2021, and in other reports First Midwest and Old National file with the U.S. Securities and Exchange Commission (the “SEC”).

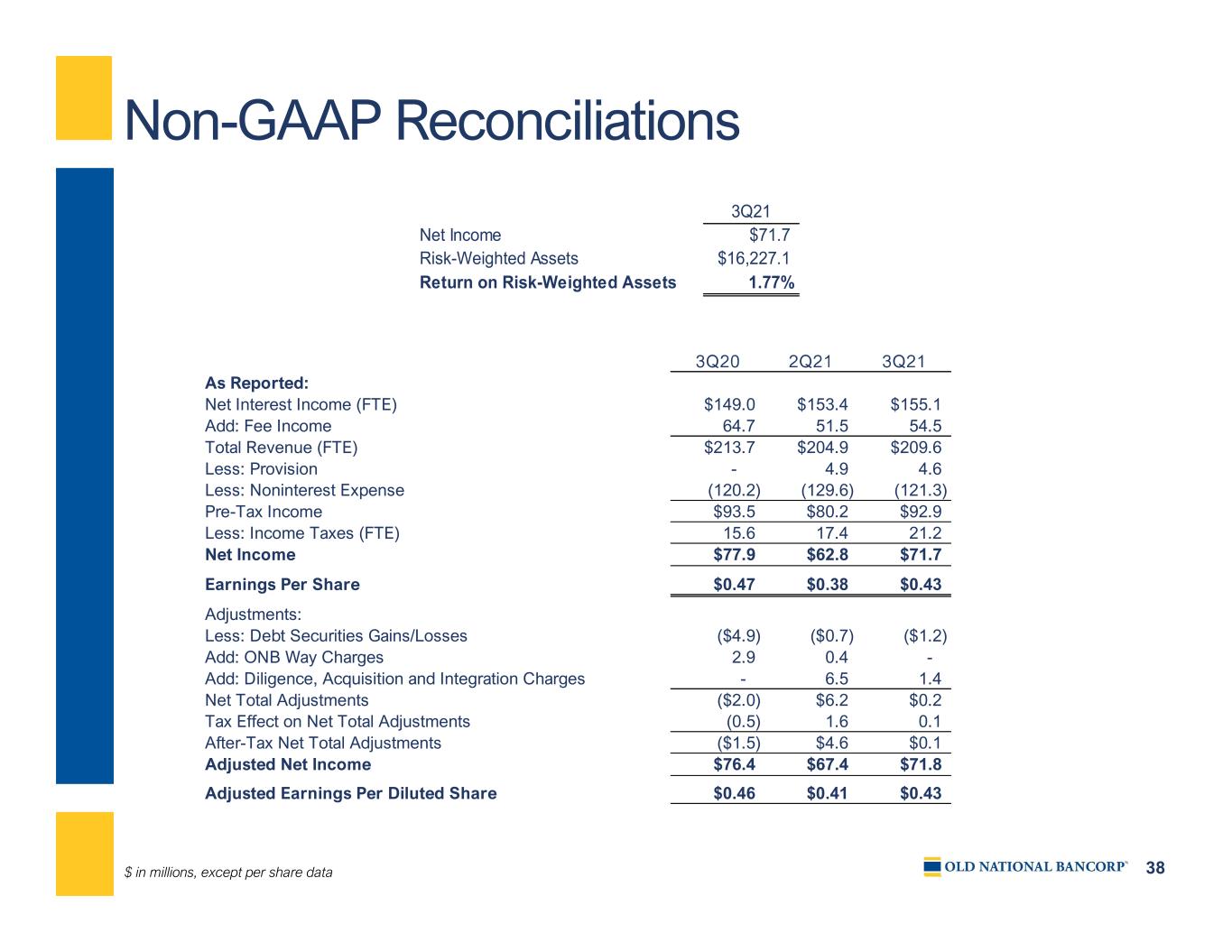

4 Non-GAAP Financial Measures These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant's historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the registrant; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, Old National Bancorp has provided reconciliations within the slides, as necessary, of the non-GAAP financial measure to the most directly comparable GAAP financial measure.

5 Snapshot of Old National Summary Company Description • Largest bank holding company headquartered in Indiana with financial centers located in Indiana, Kentucky, Michigan, Minnesota and Wisconsin • 162 financial centers and 192 ATMs Our strategic vision--The ONB Way • We are a leading commercially-oriented regional bank with a distinctive client-centric value proposition based on strong relationships, streamlined operating model, and an exceptional work environment that empowers our team members to deliver their best Key Financial MetricsLoan Mix Deposit Mix 1 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation 2 At or for the three-months ended September 30, 2021 Market data as of October 29, 2021 $ in millions, except as noted Consumer 7.4% Residential Real Estate 16.7% Home Equity 4.1% Commercial Real Estate 46.1% Commercial 25.7% Time Deposits 5.1% Demand Deposits 35.5% NOW 27.3% Savings 20.5% Money Market 11.6% Headquarters Evansville, IN Market Cap $2,832 P/ TBV 144% Dividend Yield 3.3% LTM Average Daily Volume (Actual) 950,441 Total Assets $24,019 Wealth Assets Under Management $18,691 3Q21 ROAA As Reported/ Adjusted1 1.20%/ 1.20% 3Q21 ROATCE As Reported/ Adjusted1 15.13%/ 15.16% Loans to Total Deposits 74.9% Cost of Total Deposits 0.06% Return on Risk Weighted Assets 1.77% Tangible Book Value $11.83 Noninterest Income/ Total Revenue (FTE) 26.0% Efficiency Ratio As Reported/ Adjusted1 56.86%/55.38% Net Charge Offs (Recoveries)/ Average Loans -0.09% 90+ Day Delinquent Loans 0.00% Non-Performing Loans/ Total Loans 0.94% Tangible Common Equity to Tangible Assets 8.55%

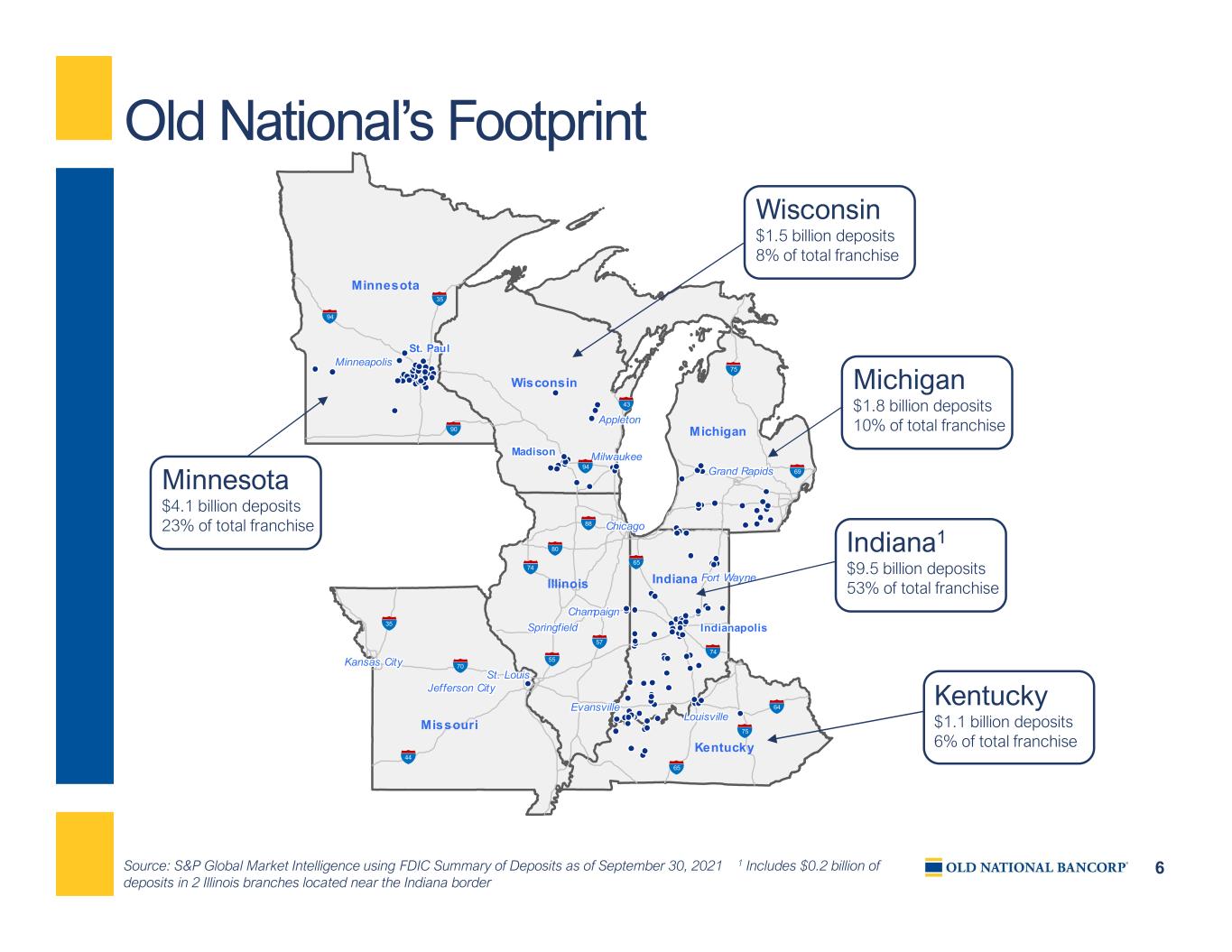

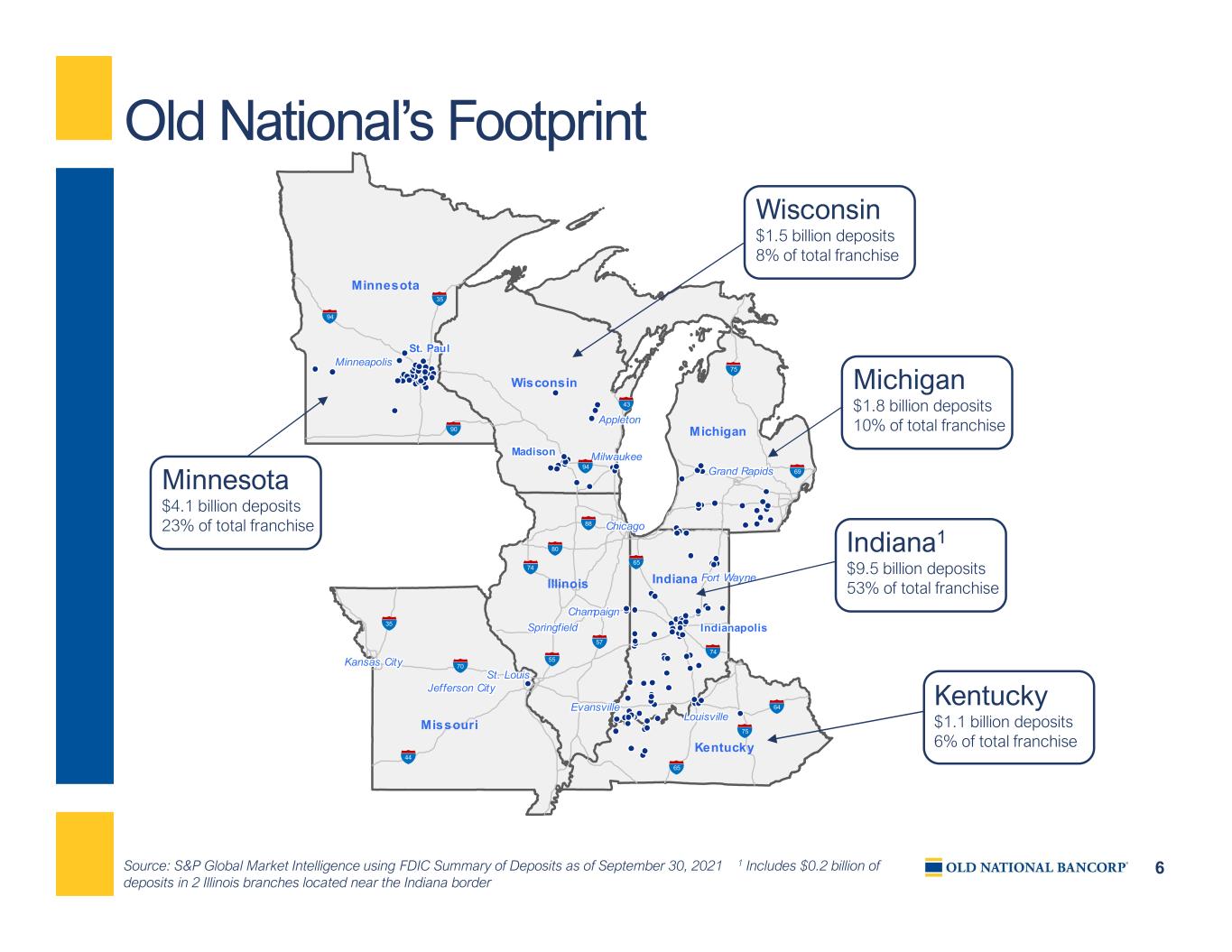

6 IndianaIllinois Missouri Minnesota Michigan Kentucky Fort Waynet r yFo t a net t rr yyFo t a net Fo t a ne Champaigniha paigniiiha paigniha paign Grand Rapids ir sand apid i irr ssand apid iand apid IndianapolisI i liIndianapolisI i liI i liIn ia a lisI i liIn ia a lis Louisvillei illsvLoui illei illi illisvisviLou i lei lLou i le St. Louist. ist. Louit. it. isst. Louit. it. Loui Evansvilleillv svan illeillillv svv svE an i lei lan i le Milwaukeeil kil au eeilil kkil au eeilil au ee Appletonl tppletonl tl tppletonl tppleton Madisoniadisoniiadisoniadison St. Paul. lt. aul. l. ltt. aul. l. aul Minneapolisi lisinneapolii lii lissinneapolii liinneapoli Wisconsin Chicagoichi agoiicchi agoihi ago Springfieldi fi lrp ingfieldi fi li fi lrr ddp ingfieli fi lp ingfiel Kansas City its s yan a it it its s ys s yan a it itan a it Jefferson Cityff itrJ s yeffe on itff itff itrrJ s yJ s yeffe on itff iteffe on it 75 69 75 64 65 90 94 43 65 74 35 94 57 55 74 80 88 35 70 44 Old National’s Footprint Source: S&P Global Market Intelligence using FDIC Summary of Deposits as of September 30, 2021 1 Includes $0.2 billion of deposits in 2 Illinois branches located near the Indiana border Minnesota $4.1 billion deposits 23% of total franchise Indiana1 $9.5 billion deposits 53% of total franchise Michigan $1.8 billion deposits 10% of total franchise Wisconsin $1.5 billion deposits 8% of total franchise Kentucky $1.1 billion deposits 6% of total franchise

7 Attractive Midwest Markets Source: S&P Global Market Intelligence, based on MSAs Loans & Deposits in millions Excludes PPP $86.4 $69.2 $66.2 $66.6 $64.5 $68.8 $78.2 $63.9 $60.9 $78.8 $66.7 Median Household Income 2021 (000s) 10.0% 9.6% 8.8% 9.4% 9.8% 10.2% 11.3% 9.6% 9.5% 12.6% 9.4% Projected Household Income Change 2021-2026 4.0% 0.3% 3.7% 0.6% 2.0% 2.7% 3.3% 3.1% 3.1% 1.7% 2.0% Projected Population Change 2021-2026 Average of ONB Footprint Average of ONB Footprint Average of ONB Footprint $2,596 $1,228 $713 $546 $718 $738 $549 $237 $214 $4,022 $1,733 $888 $886 $279 $231 $379 $443 $71 Minneapolis, MN Indianapolis, IN Madison, WI Ann Arbor, MI Louisville, KY Milwaukee, WI Grand Rapids, MI Ft. Wayne, IN Lexington, KY Loans Deposits

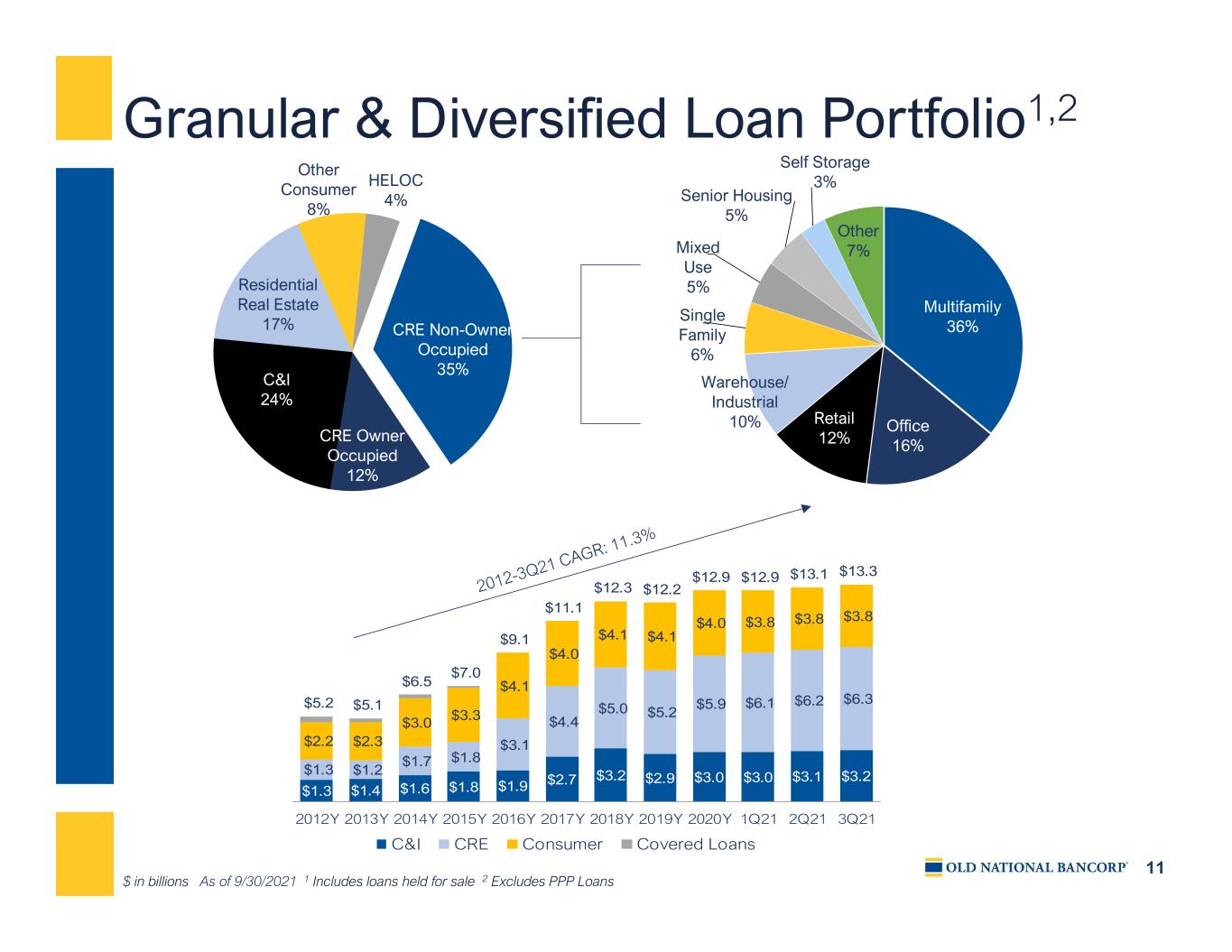

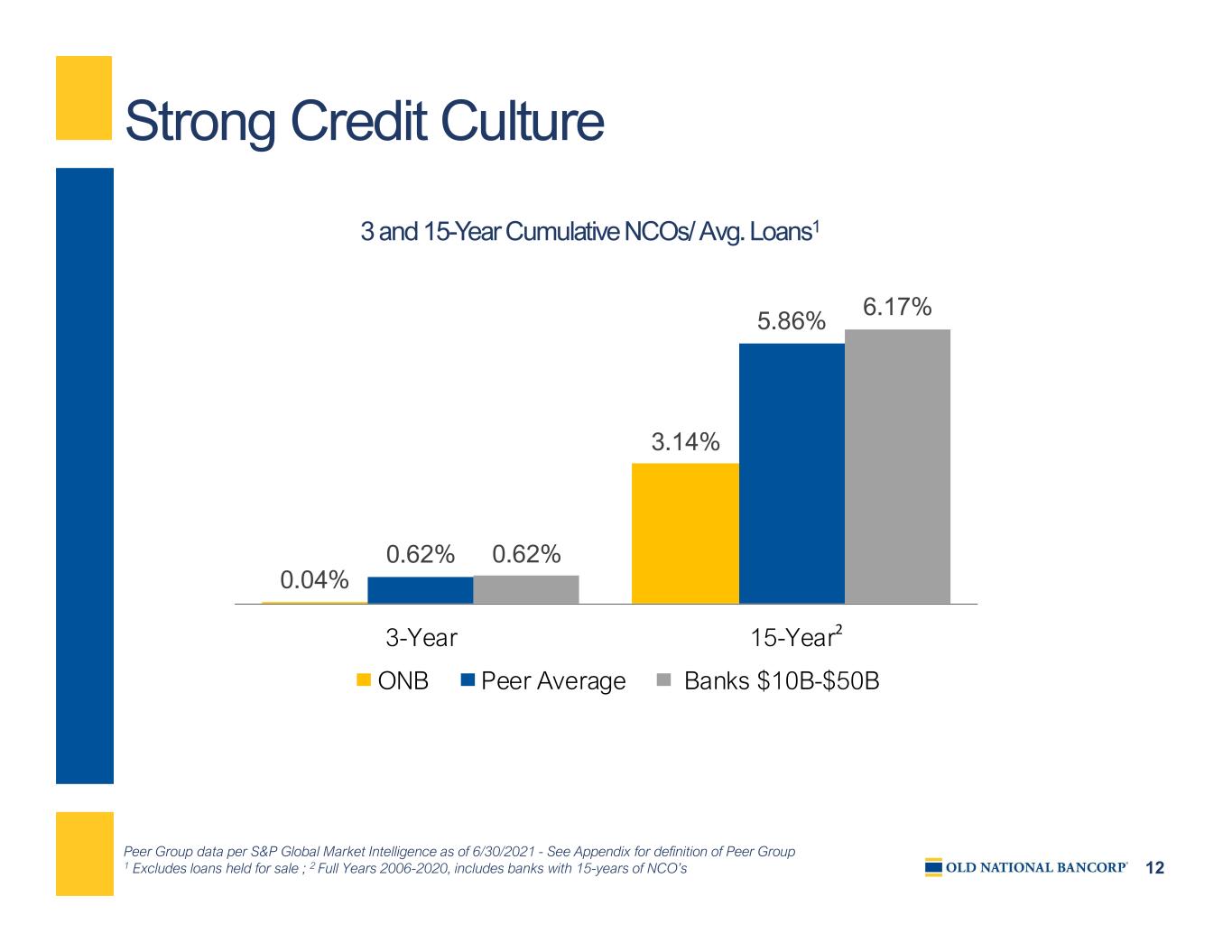

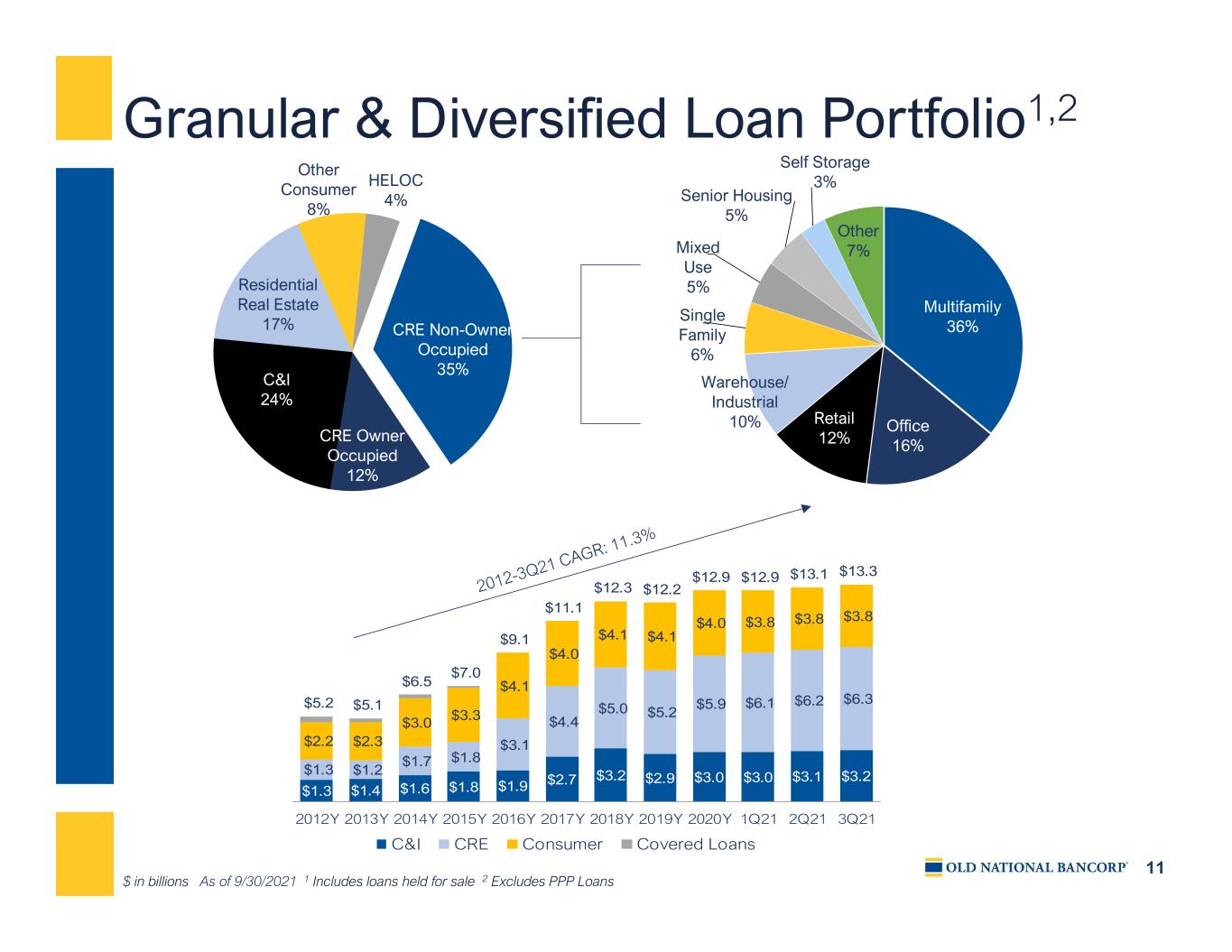

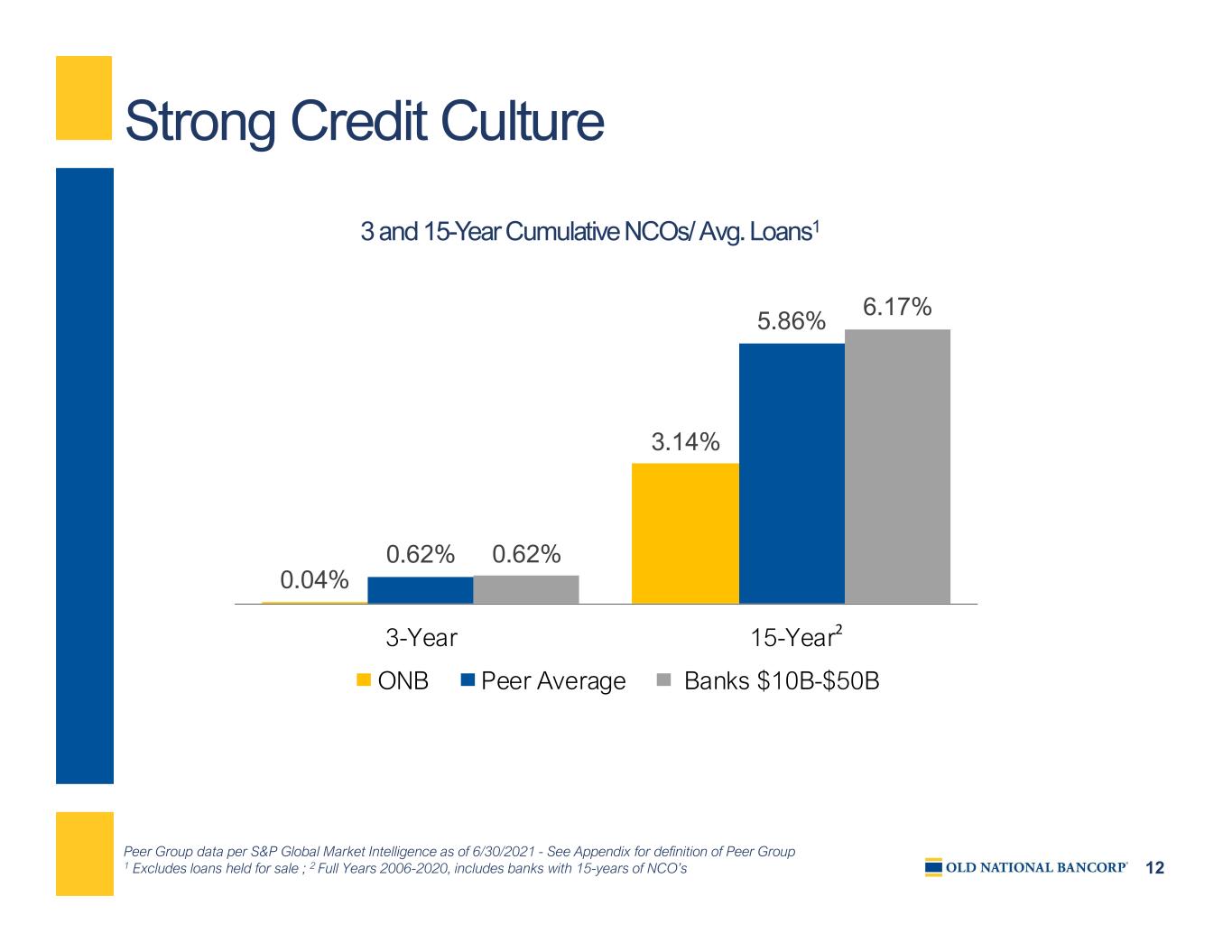

8 Why ONB? Our Investment Thesis The Old National Proposition Granular & Diversified Loan Portfolio Average Commercial & Industrial loan size ~$295,000 and average Commercial Real Estate loan size ~$931,000; diversified by product type with no significant industry concentrations; primarily to clients within the Old National footprint Strong Credit Culture and Lower Risk Model Conservative credit culture with below peer net charge-offs and lower-than-peer RWA/Assets; Lower volatility model by design Quality Low-Cost Deposit Base Low loans to deposits ratio of 75%; Below peer cost of total deposits (6 bps) Proven Acquirer Successfully executed and integrated 11 acquisitions since 2011 while the ONB Way provides a streamlined operating model and scalability for future M&A opportunities Old National is a leading commercially-oriented regional bank with a distinctive client-centric value proposition based on strong relationships, streamlined operating model, and an exceptional work environment that empowers our team members to deliver their best

9 Franchise Evolution Built a Better Bank Source: S&P Global Market Intelligence $ in millions unless noted otherwise $5,447 $7,279 $18,196 $47 $40 $112 2007 2012 3Q21 Core Deposits Core Deposits/Branch $7,846 $9,544 $24,019 $3.15 $3.56 $9.97 2007 2012 3Q21 Total Assets Assets/FTE 193 215 725 2007 2012 3Q21 Total Businesses in All MSAs (000s) (C&I = 36) (C&I = 40) (C&I = 139) $521 $579 $1,840 $274 $295 $1,023 2007 2012 3Q21 Total Sales in All MSAs ($Billions) GDP ($Billions) Assets per FTEDeposits per Branch Sales and GDPTotal Businesses Key market expansions in Minnesota (2017/2018), Wisconsin (2016), Michigan (2014/2015)

10 $2.4 $2.5 $3.0 $3.7 $4.0 $4.1 $5.6 $6.1 $6.2 $6.4 $6.1 $5.8 $7.6 $8.7 $10.2 $10.4 $11.3 $11.7 $11.7 $11.8 $8.5 $8.3 $10.6 $12.4 $14.2 $14.5 $16.9 $17.8 $17.9 $18.2 2014Y 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 1Q21 2Q21 3Q21 Noninterest-bearing Interest-bearing Noninterest- bearing Demand 35.4% NOW 27.2% Savings 20.4% Money Market 11.5% Time 5.5% Quality Low-Cost Deposit Franchise $ in billions Peer Group data per S&P Global Market Intelligence - See Appendix for definition of Peer Group As of 9/30/2021 1 Peer with no financial disclosure Deposit Growth Deposit Composition Cost of Total Deposits 0.17% 0.16% 0.17% 0.19% 0.32% 0.48% 0.18% 0.07% 0.06% 0.06% 0.27% 0.25% 0.26% 0.37% 0.59% 0.80% 0.37% 0.16% 0.12% 0.10% 2014Y 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 1Q21 2Q21 3Q21 ONB Peer Median

11 CRE Non-Owner Occupied 35% CRE Owner Occupied 12% C&I 24% Residential Real Estate 17% Other Consumer 8% HELOC 4% Multifamily 36% Office 16% Retail 12% Warehouse/ Industrial 10% Single Family 6% Mixed Use 5% Senior Housing 5% Self Storage 3% Other 7% Granular & Diversified Loan Portfolio1,2 $ in billions As of 9/30/2021 1 Includes loans held for sale 2 Excludes PPP Loans $1.3 $1.4 $1.6 $1.8 $1.9 $2.7 $3.2 $2.9 $3.0 $3.0 $3.1 $3.2$1.3 $1.2 $1.7 $1.8 $3.1 $4.4 $5.0 $5.2 $5.9 $6.1 $6.2 $6.3 $2.2 $2.3 $3.0 $3.3 $4.1 $4.0 $4.1 $4.1 $4.0 $3.8 $3.8 $3.8 $5.2 $5.1 $6.5 $7.0 $9.1 $11.1 $12.3 $12.2 $12.9 $12.9 $13.1 $13.3 2012Y 2013Y 2014Y 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 1Q21 2Q21 3Q21 C&I CRE Consumer Covered Loans

12 Strong Credit Culture Peer Group data per S&P Global Market Intelligence as of 6/30/2021 - See Appendix for definition of Peer Group 1 Excludes loans held for sale ; 2 Full Years 2006-2020, includes banks with 15-years of NCO’s 3 and 15-Year Cumulative NCOs/ Avg. Loans1 0.04% 3.14% 0.62% 5.86% 0.62% 6.17% 3-Year 15-Year ONB Peer Average Banks $10B-$50B 2

13 Conservative Lending Limit/Risk Grades In-house lending limits conservative relative to ONB’s legal lending limit of $312mm per borrower $ in millions 1 Includes entire relationship with borrower Borrower Asset Quality Rating (Risk Grades) In-House Lending Limit1 0 – Investment Grade $75.0 1 – Minimal Risk $65.0 2 – Modest Risk $57.5 3 – Average Risk $50.0 4 – Monitor $40.0 5 – Weak Monitor $30.0 6 – Watch $15.0 Borrower Asset Quality Rating (Risk Grades) 7 – Criticized (Special Mention) 8 – Classified (Problem) 9 – Nonaccrual

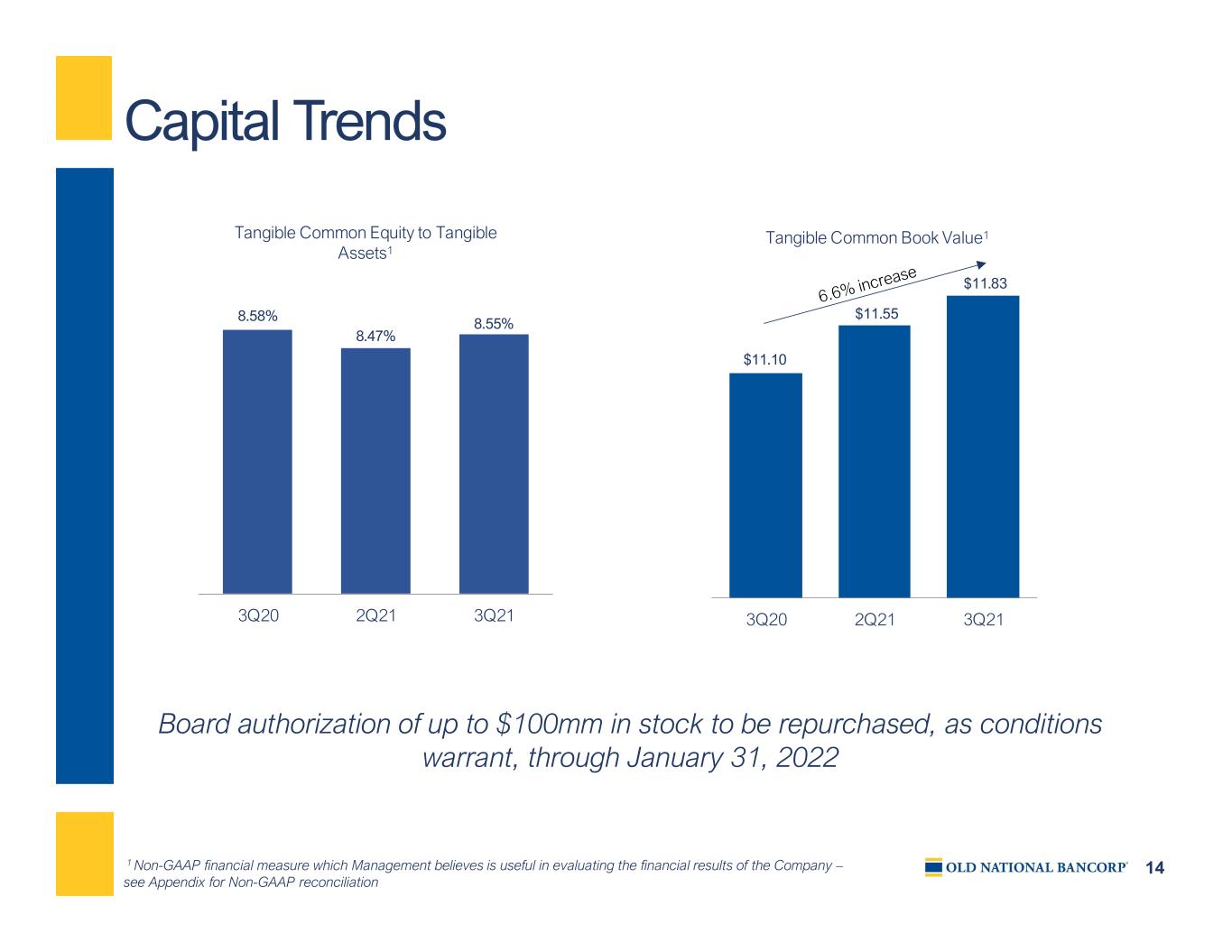

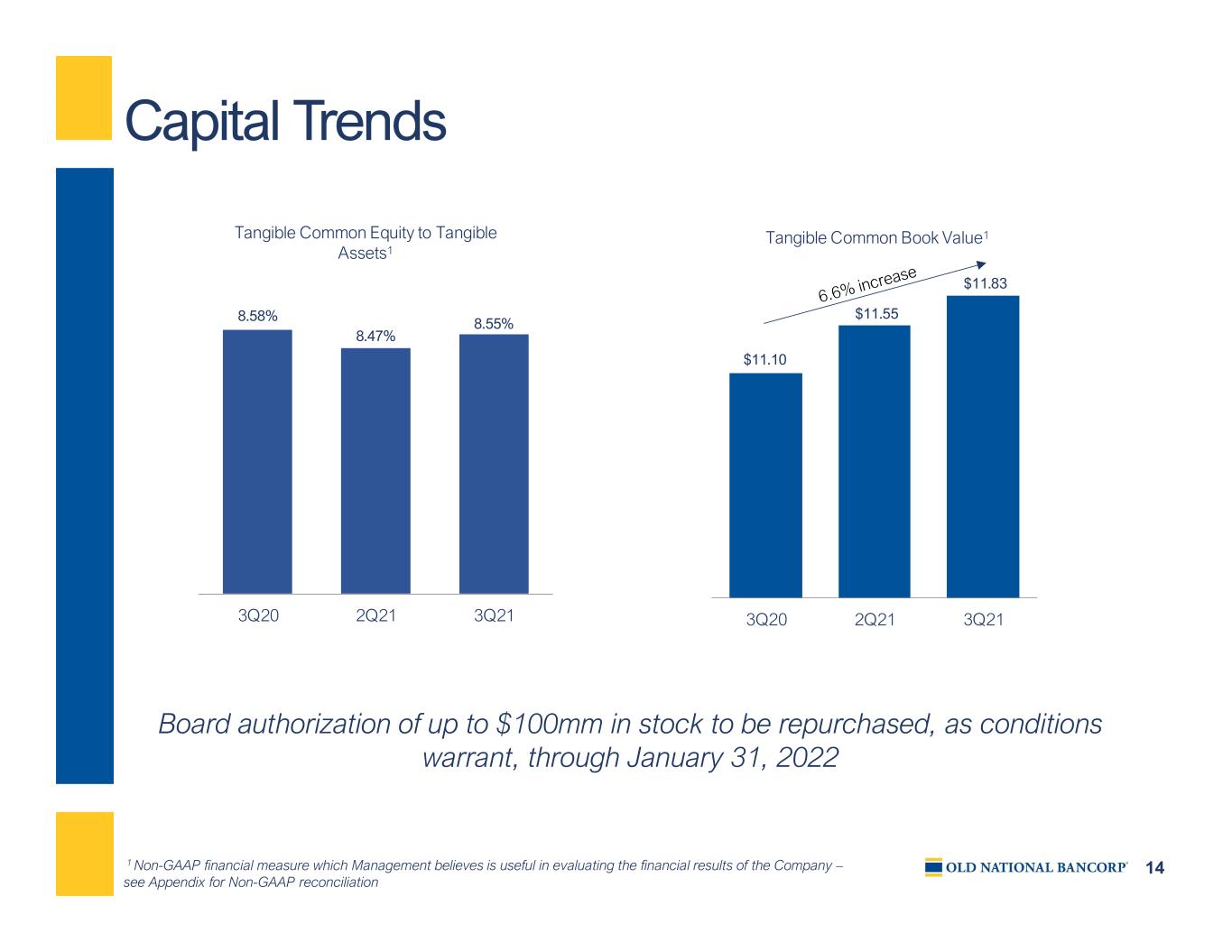

14 Capital Trends Board authorization of up to $100mm in stock to be repurchased, as conditions warrant, through January 31, 2022 1 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation 8.58% 8.47% 8.55% 3Q20 2Q21 3Q21 Tangible Common Equity to Tangible Assets1 $11.10 $11.55 $11.83 3Q20 2Q21 3Q21 Tangible Common Book Value1

15 Commitment to Corporate Social Responsibility Old National’s inaugural Environment, Social and Governance (ESG) Report showcases our commitment to: • Strong corporate governance • Putting our clients at the center of all we do • Investing in our team members • Diversity, equity and inclusion • Strengthening our communities • Sustainability To view ONB’s ESG Report and Sustainability Accounting Standards Board (SASB) Report, go to oldnational.com/esg

16 ONB’s ESG At A Glance – 2020

17 Commitment to Excellence

Financial Details FINANCIAL DATA AS OF September 30, 2021 DATED: November 3, 2021

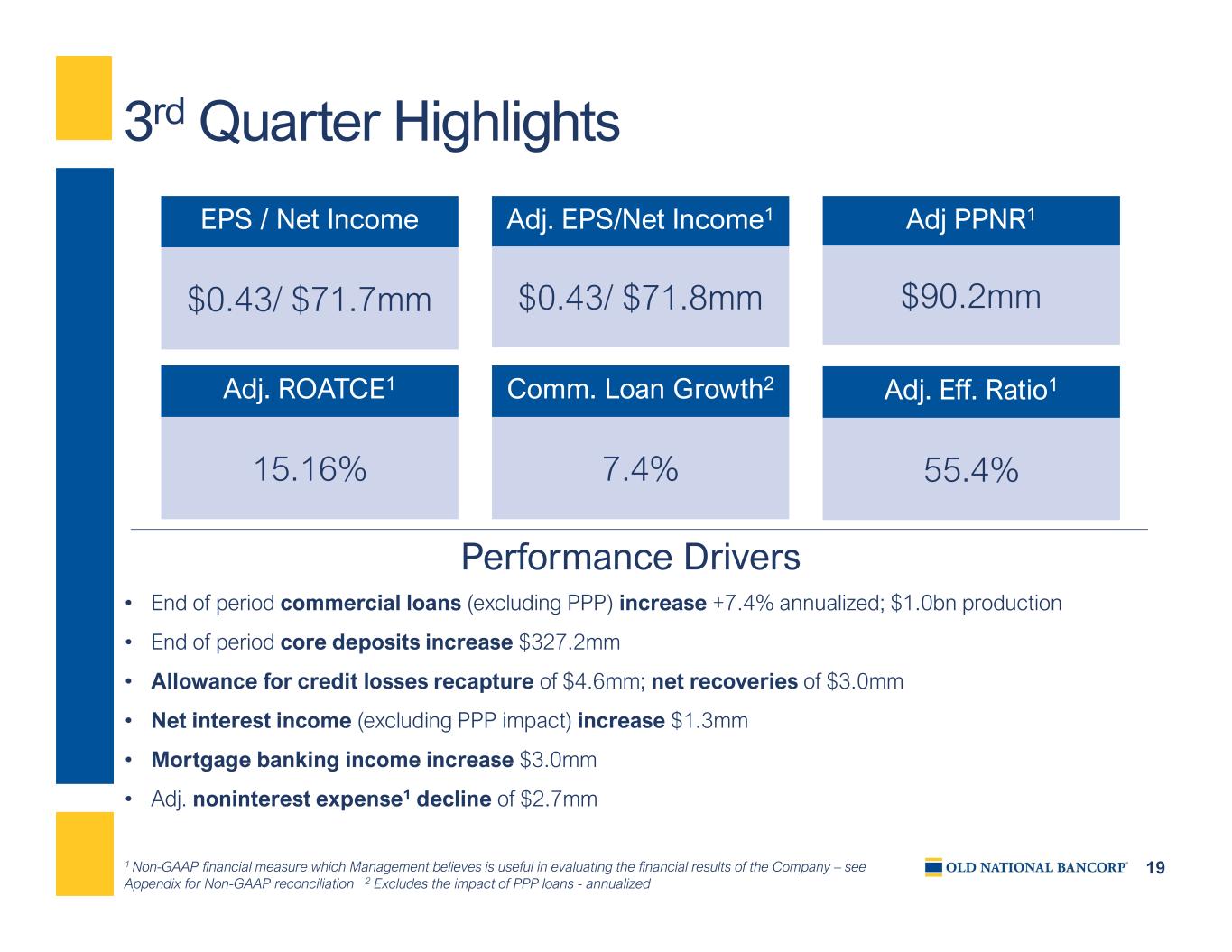

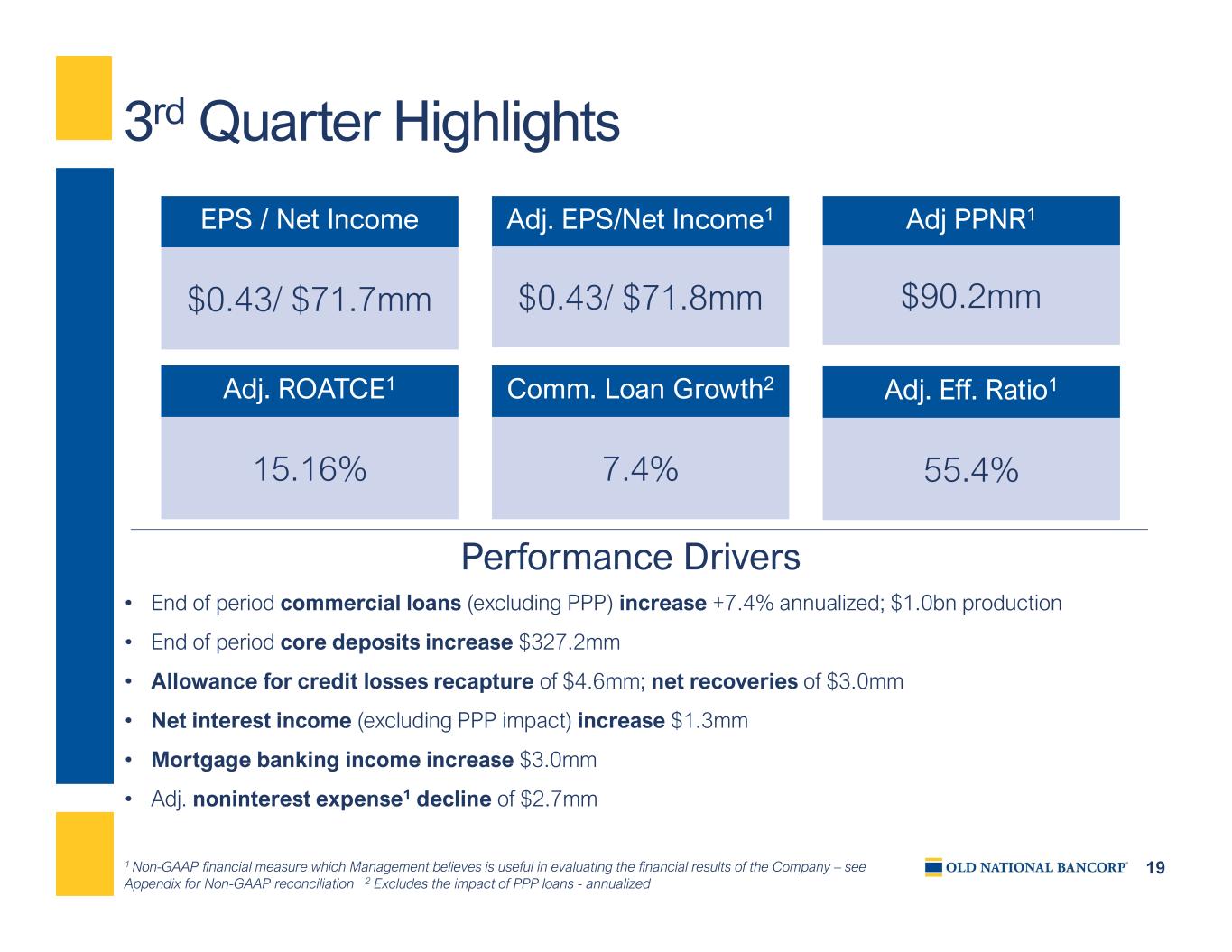

19 3rd Quarter Highlights Performance Drivers • End of period commercial loans (excluding PPP) increase +7.4% annualized; $1.0bn production • End of period core deposits increase $327.2mm • Allowance for credit losses recapture of $4.6mm; net recoveries of $3.0mm • Net interest income (excluding PPP impact) increase $1.3mm • Mortgage banking income increase $3.0mm • Adj. noninterest expense1 decline of $2.7mm 1 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation 2 Excludes the impact of PPP loans - annualized EPS / Net Income $0.43/ $71.7mm Adj. EPS/Net Income1 $0.43/ $71.8mm Adj PPNR1 $90.2mm Adj. ROATCE1 15.16% Comm. Loan Growth2 7.4% Adj. Eff. Ratio1 55.4%

20 Partnership Update Q3 Momentum Accomplishments and Next Steps Established joint Integration Office with experienced integration leaders across both companies Strong team member commitment and excitement about opportunities in the larger, combined company SEC and bank regulatory filings completed; received OCC approval Received strong merger approval from ONB and FMBI stockholders Merger expected to close as soon as we receive Federal Reserve approval; anticipate system conversion Q2 ‘22 • Core systems selected • Decisioning completed on majority of go-forward systems and applications • Transitioning from conversion planning phase to execution phase of our integration plan • Finalized combined executive leadership team • Organizational charts completed and communicated for line of business leaders Kendra Vanzo Chief Admin. Officer Evansville ONB Jeff Newcom Chief Risk Officer Chicago FMBI

21 Change vs. 3Q21 2Q21 3Q20 End of period total loans 13,636$ (199)$ (342)$ annualized growth -5.7% End of period core deposits 18,196 327 1,689 annualized growth 7.3% Net interest income (FTE) 155.1 1.7 6.1 Provision for credit losses (4.6) 0.3 (4.6) Noninterest income 54.5 3.0 (10.2) Noninterest expense ex. tax credit amort., ONB Way charges & merger charges 118.2 (2.7) 4.0 Amortization of tax credit investments 1.7 (0.1) (1.4) ONB Way, Diligence, Acquisition and Integration Charges 1.4 (5.5) (1.5) Income taxes (FTE) 21.2 3.8 5.6 Net income $71.7 $8.9 ($6.2) Earnings per diluted share $0.43 $0.05 ($0.04) Adjusted earnings per diluted share1 $0.43 $0.02 ($0.03) Net charge-offs (recoveries)/avg loans -0.09% -8 bps - • Allowance for credit losses decreased $1.6mm • Net recoveries $3.0mm Third-Quarter 2021 Results $ in millions, except per-share data 1 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation 2 Excludes PPP loans Linked-Quarter Performance Drivers • Increase of $1.3mm excluding increase of $0.3mm in PPP interest and fees • Strong total commercial production of $1.0bn resulting in over 7.4% annualized commercial loan growth2 • Decrease in PPP balances of $366mm • Mortgage income increased $3.0mm • Gains on sales of debt securities increased $0.5mm • Growth in noninterest-bearing checking and savings balances • Current FTE tax rate of 22.8% • Announced merger with First Midwest • Reduction in salaries & employee benefits and occupancy expense

22 Commercial Loans1 and Earning Assets1 Total commercial loans • Increase of $1.0bn YoY +11% • Increase of $172mm from 2Q21 +7% annualized 3Q21 new production avg yields1 • Commercial and industrial: 3.26% • Commercial real estate: 2.91% • 72% of commercial production is floating rate $ in millions 1 Excludes PPP Loans $8,487 $8,960 $9,019 $9,269 $9,441 3Q20 4Q20 1Q21 2Q21 3Q21 Total Commercial Loans $2,924 $2,055 $2,632 $2,630 $2,682 $978 $1,197 $718 $1,067 $975 3Q20 4Q20 1Q21 2Q21 3Q21 Commercial Production/Pipeline Pipeline Production Securities • Duration of 4.50 vs. 4.26 in 2Q21 • 3Q21 yield was 2.08% • 3Q21 new money yield was 1.62% Commercial 45% Cash/Securities 36% Consumer 8% Residential 11% Earning Asset Mix

23 Deposits/Funding Core deposit balances increased $327mm from 2Q21 Deposit costs continue to decline • 3Q21 total deposit costs of 6 bps • Total interest-bearing liabilities costs were 29 bps, down 1 bp from 2Q21 Low loan to deposit ratio of 75% $ in millions $9,742 $9,971 $10,347 $10,678 $10,664 $10,723 $10,763 $5,291 $5,644 $5,756 $6,140 $6,314 $6,143 $6,440 $1,404 $1,196 $1,239 $1,035 $998 $1,003 $993 $16,437 $16,811 $17,342 $17,853 $17,976 $17,869 $18,196 0.13% 0.09% 0.07% 0.06% 0.06% 3Q20 4Q20 1Q21 2Q21 3Q21 2Q21 3Q21 Total Deposits Transaction Noninterest-Bearing Time Cost of Deposits Average Balances Period-End Balances

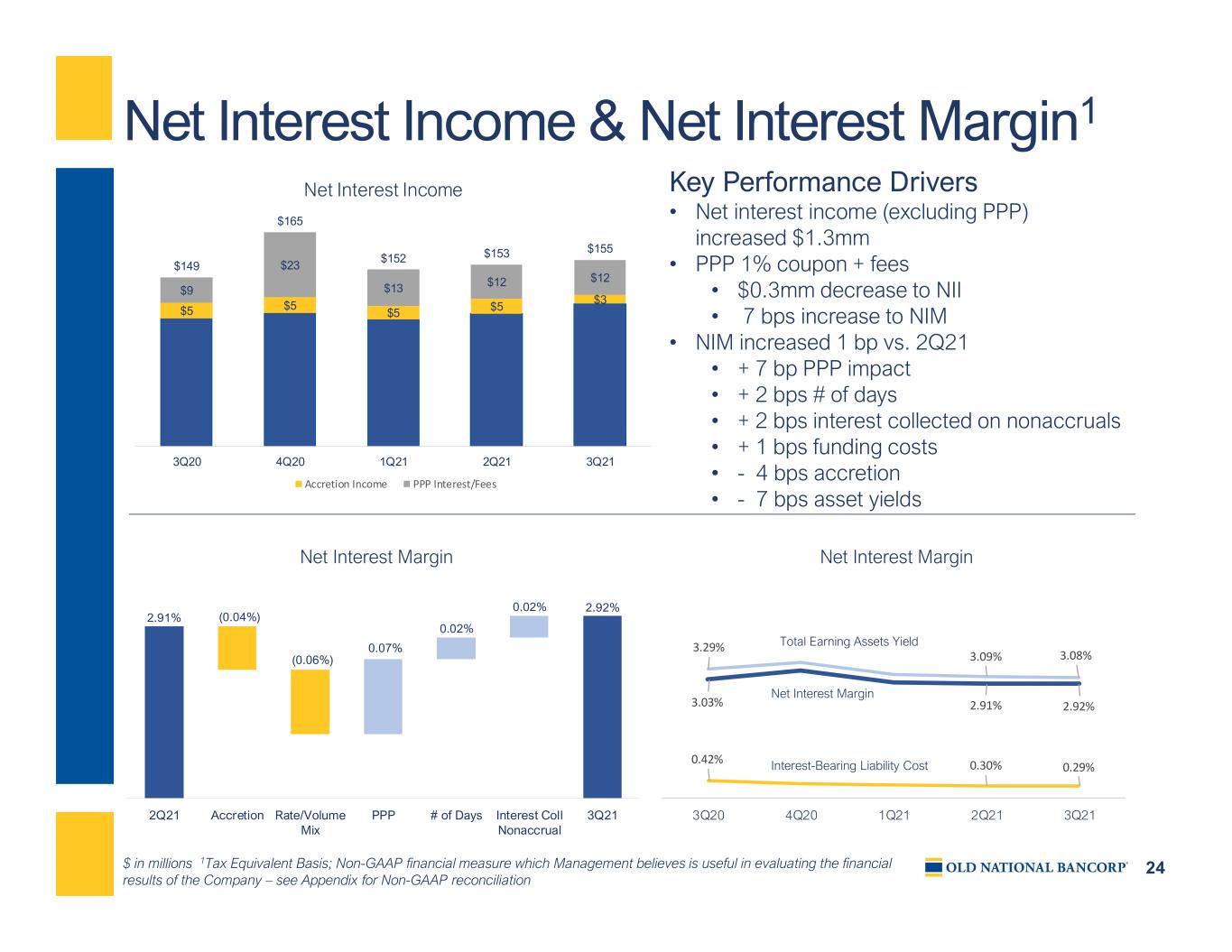

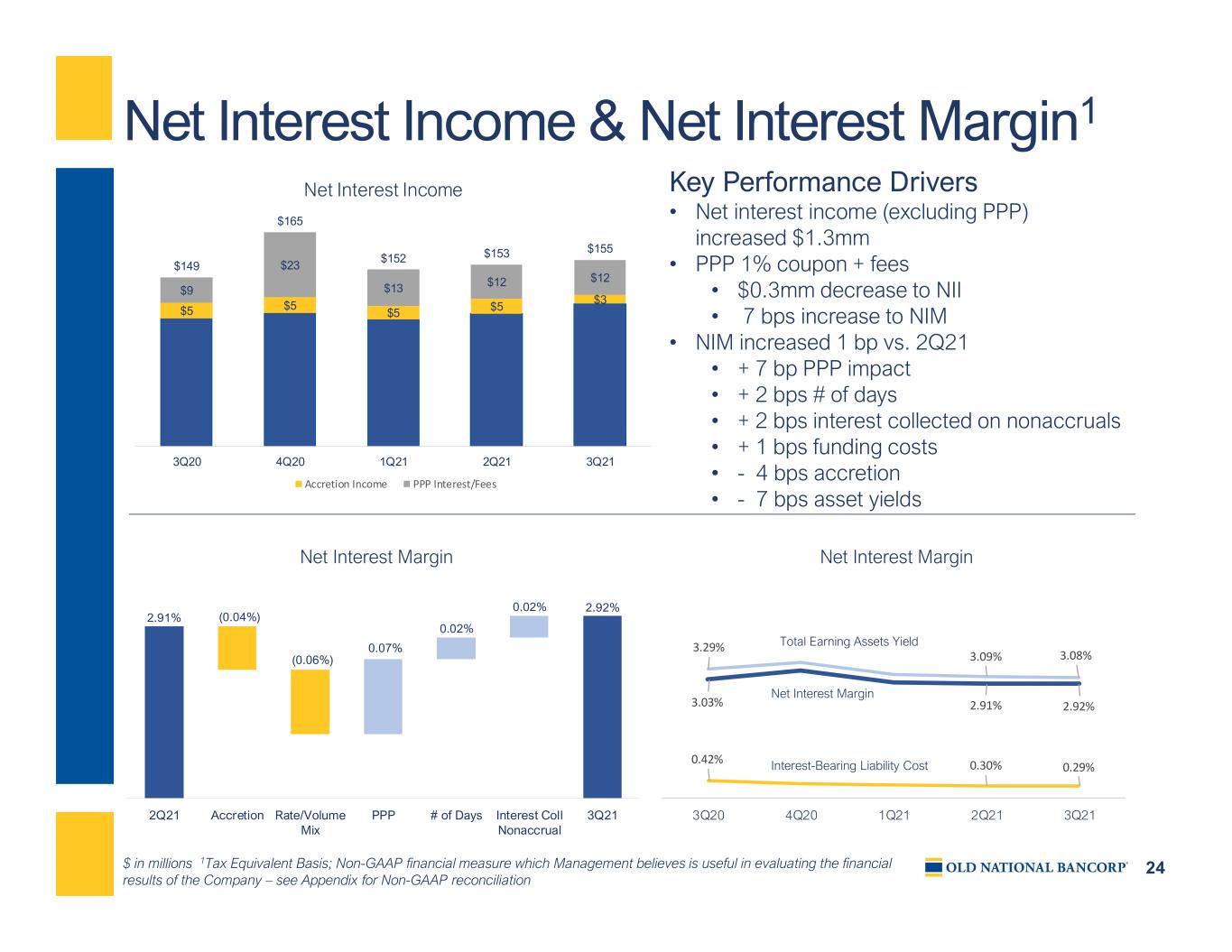

24 3.29% 3.09% 3.08% 3.03% 2.91% 2.92% 0.42% 0.30% 0.29% 3Q20 4Q20 1Q21 2Q21 3Q21 Net Interest Income & Net Interest Margin1 Key Performance Drivers • Net interest income (excluding PPP) increased $1.3mm • PPP 1% coupon + fees • $0.3mm decrease to NII • 7 bps increase to NIM • NIM increased 1 bp vs. 2Q21 • + 7 bp PPP impact • + 2 bps # of days • + 2 bps interest collected on nonaccruals • + 1 bps funding costs • - 4 bps accretion • - 7 bps asset yields $ in millions 1Tax Equivalent Basis; Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation $5 $5 $5 $5 $3 $9 $23 $13 $12 $12 $149 $165 $152 $153 $155 3Q20 4Q20 1Q21 2Q21 3Q21 Net Interest Income Accretion Income PPP Interest/Fees Total Earning Assets Yield Net Interest Margin Interest-Bearing Liability Cost Net Interest Margin Net Interest Margin 2.91% 2.92% (0.04%) (0.06%) 0.07% 0.02% 0.02% 2Q21 Accretion Rate/Volume Mix PPP # of Days Interest Coll Nonaccrual 3Q21

25 Noninterest Income Key Performance Drivers • 3Q21 adjusted noninterest income • $3.0mm increase in mortgage income • $5.4mm increase due to stabilizing pipeline valuation • $2.1mm decrease in gain on sales • Gain on sale margins declined to 2.40% in 3Q21 vs. 2.78% in 2Q21 • 3Q21 Mortgage activity • Production was $441mm • 64% purchase / 36% refi • 64% sold in secondary market • Quarter-end pipeline at $324mm $ in millions 1Non-GAAP financial measure which management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation Residential mortgage production includes quick home refinance product $14 $14 $13 $14 $14 $15 $15 $16 $17 $17 $18 $16 $17 $8 $11 $5 $7 $4 $6 $6 $8 $6 $5 $6 $5 $60 $58 $55 $51 $53 3Q20 4Q20 1Q21 2Q21 3Q21 Adjusted Noninterest Income1 Bank Fees Investment/Wealth Fees Mortgage Fees Capital Markets Other

26 Noninterest Expense Key Performance Drivers • 3Q21 adjusted noninterest expense • Reductions in salaries & benefits and occupancy expense • 3Q21 adjusted efficiency ratio of 55.4% $ in millions 1Non-GAAP financial measure which management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation $69 $77 $68 $73 $71 $14 $13 $15 $14 $13 $9 $12 $12 $12 $11 $22 $27 $20 $22 $23 $114 $129 $115 $121 $118 3Q20 4Q20 1Q21 2Q21 3Q21 Adjusted Noninterest Expense1 Salary & Employee Benefits Occupancy Data Processing/Communication Other Diligence, Integration & Merger Charges of $1.4mm in 3Q21 • All in Professional Fees

27 Paycheck Protection Program (PPP) $ in millions 1 Net of unearned fees Remaining unamortized fees at 9/30/21 • $0.3mm from Round 1 • $13.7mm from Round 2 95% of Round 1 loans have been forgiven by the SBA 51% of Round 2 loans have been forgiven by the SBA $721 ($366) $355 2Q21 Forgiveness/Paydowns 3Q21 Paycheck Protection Program Balances1

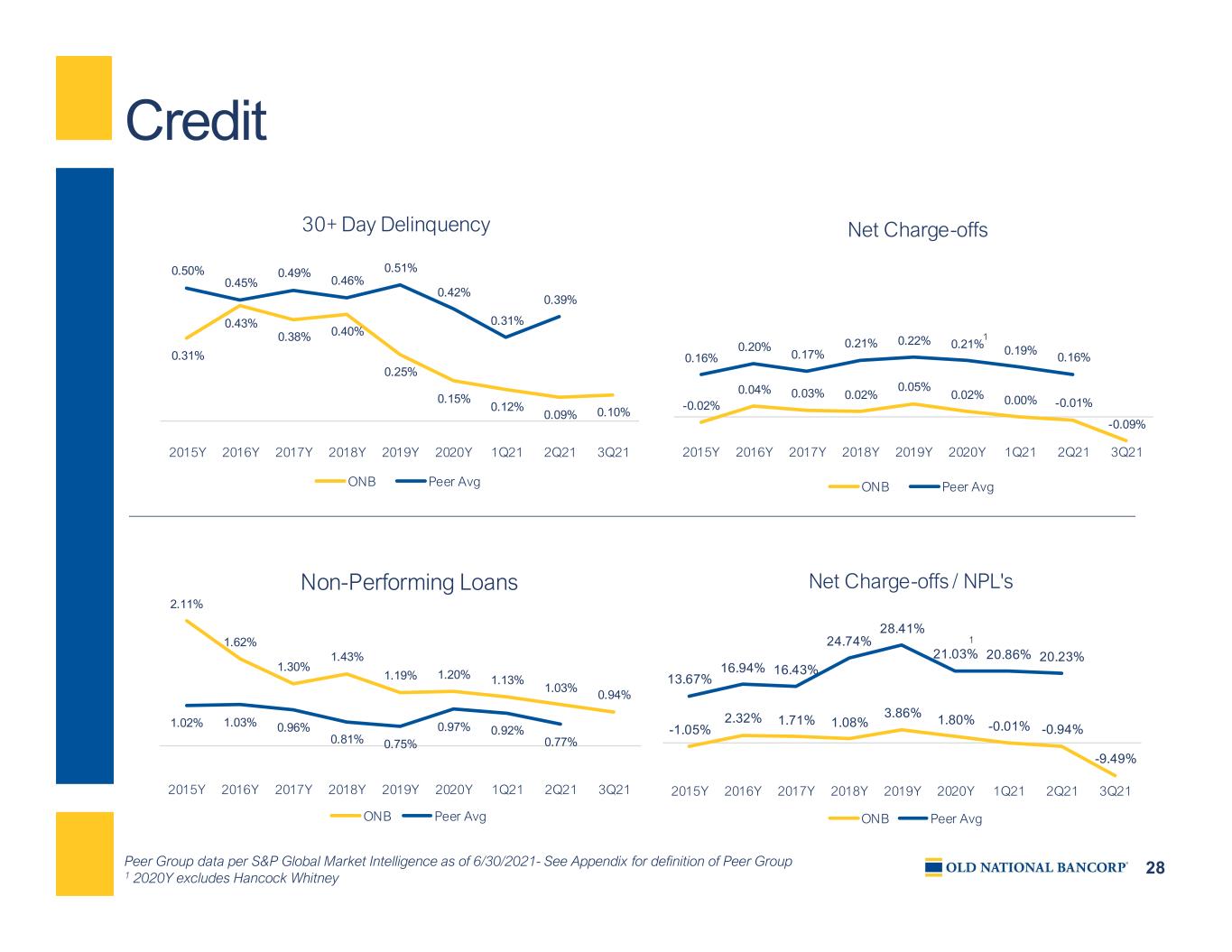

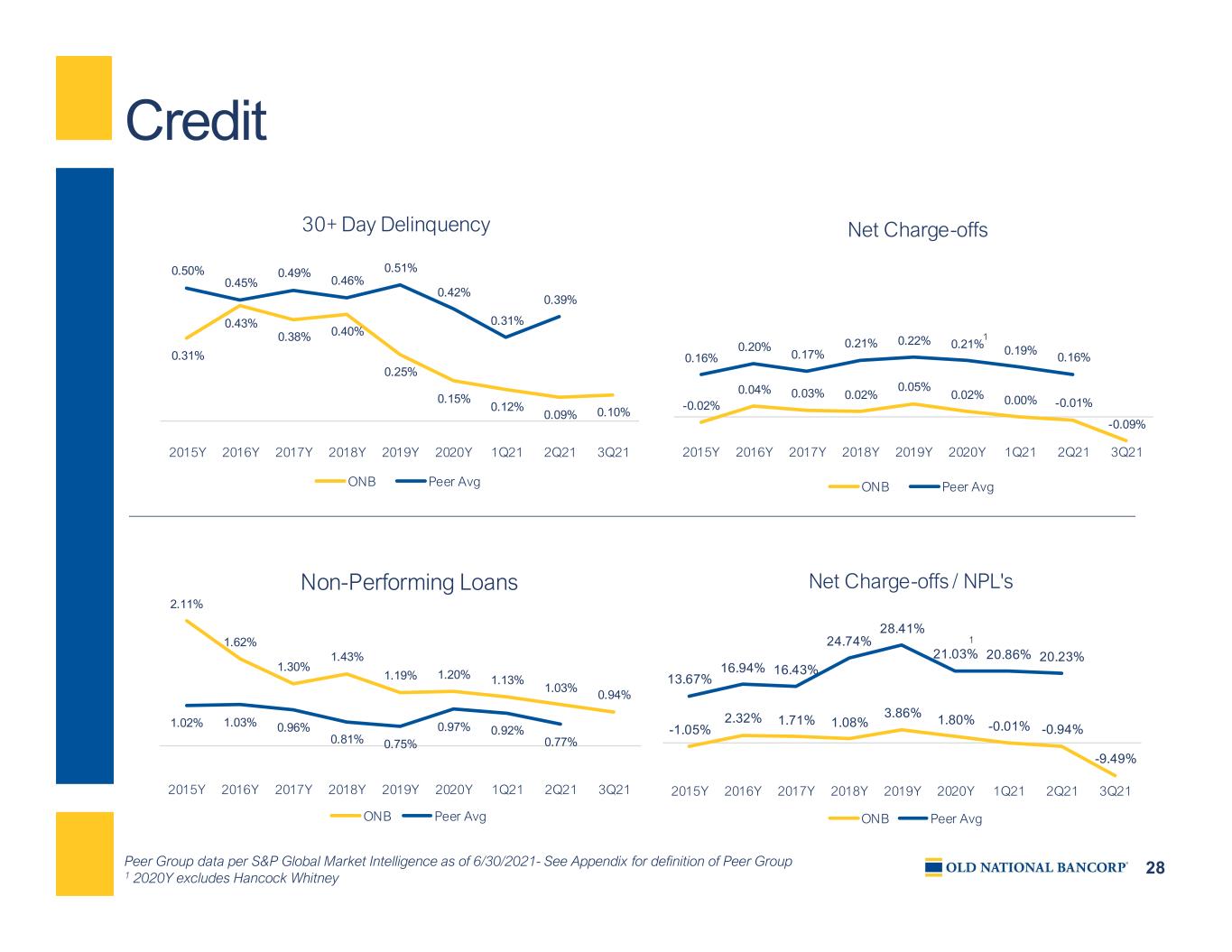

28 -1.05% 2.32% 1.71% 1.08% 3.86% 1.80% -0.01% -0.94% -9.49% 13.67% 16.94% 16.43% 24.74% 28.41% 21.03% 20.86% 20.23% 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 1Q21 2Q21 3Q21 Net Charge-offs / NPL's ONB Peer Avg -0.02% 0.04% 0.03% 0.02% 0.05% 0.02% 0.00% -0.01% -0.09% 0.16% 0.20% 0.17% 0.21% 0.22% 0.21% 0.19% 0.16% 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 1Q21 2Q21 3Q21 Net Charge-offs ONB Peer Avg Credit Peer Group data per S&P Global Market Intelligence as of 6/30/2021- See Appendix for definition of Peer Group 1 2020Y excludes Hancock Whitney 1 1 0.31% 0.43% 0.38% 0.40% 0.25% 0.15% 0.12% 0.09% 0.10% 0.50% 0.45% 0.49% 0.46% 0.51% 0.42% 0.31% 0.39% 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 1Q21 2Q21 3Q21 30+ Day Delinquency ONB Peer Avg 2.11% 1.62% 1.30% 1.43% 1.19% 1.20% 1.13% 1.03% 0.94% 1.02% 1.03% 0.96% 0.81% 0.75% 0.97% 0.92% 0.77% 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 1Q21 2Q21 3Q21 Non-Performing Loans ONB Peer Avg

29 Allowance for Credit Losses 1 Excludes loans held for sale $ in millions $109.4 ($3.6) $1.6 $0.5 $107.9 Allowance 6/30/2021 Economic Forecast Portfolio Changes Qualitative Factors Allowance 9/30/2021 Allowance for Credit Losses Key Economic Assumptions Other Key Model Inputs • Commercial Asset Quality Ratings • Consumer Credit Bureau Score • Loan To Value • Portfolio segment • Seasoning $96 $106 $131 $114 $109 $108 0.79% 0.86% 0.95% 0.82% 0.79% 0.79% 1.02% 0.89% 0.84% 0.82% 1/1/2020 1Q20 4Q20 1Q21 2Q21 3Q21 Allowance to Total Loans1 ACL Allowance to Total Loans Allowance to Total Loans (less PPP) Discount on acquired portfolio • $37.7mm remaining as of 9/30/2021 3Q21 4Q21 2022 2023 2024 2025 GDP Change 5.0% 7.5% 4.3% 2.3% 2.8% 2.5% Unemployment Rate 5.2% 4.5% 3.6% 3.5% 3.7% 4.1% BBB Spread/10Y Treasury 1.9% 2.1% 2.6% 2.6% 2.6% 2.5%

30 Outlook Category Outlook Commercial Loans Healthy pipeline heading into 4Q bodes well for future growth; Expect half of the remaining PPP balances to run off in the 4th quarter Net Interest Income / Net Interest Margin Net interest income, excluding PPP, should remain relatively stable given expected earning asset growth; FTE NIM, excluding accretion income, under pressure from continued low interest rate environment and excess liquidity; timing of remaining PPP fees will coincide with timing of loan forgiveness Noninterest Income Mortgage revenue will be subject to industry trends and should be seasonally lower in the 4th quarter; strong commercial activity should support capital markets revenue; all other fee lines expected to be stable in the near term Noninterest Expense Noninterest expenses, excluding diligence, acquisition and integration charges and tax credit amortization, should be ~$121mm in the 4th quarter Capital and Liquidity Strong capital position validated by internal stress test model; liquidity position remains strong with a low loan to deposit ratio of 75% Tax Rate/Credit Expect 4Q21 tax credit amortization of ~$1mm; FY2021 tax rates expected to be ~22% FTE and ~19% GAAP Does not include the impact of the pending merger with First Midwest

Appendix

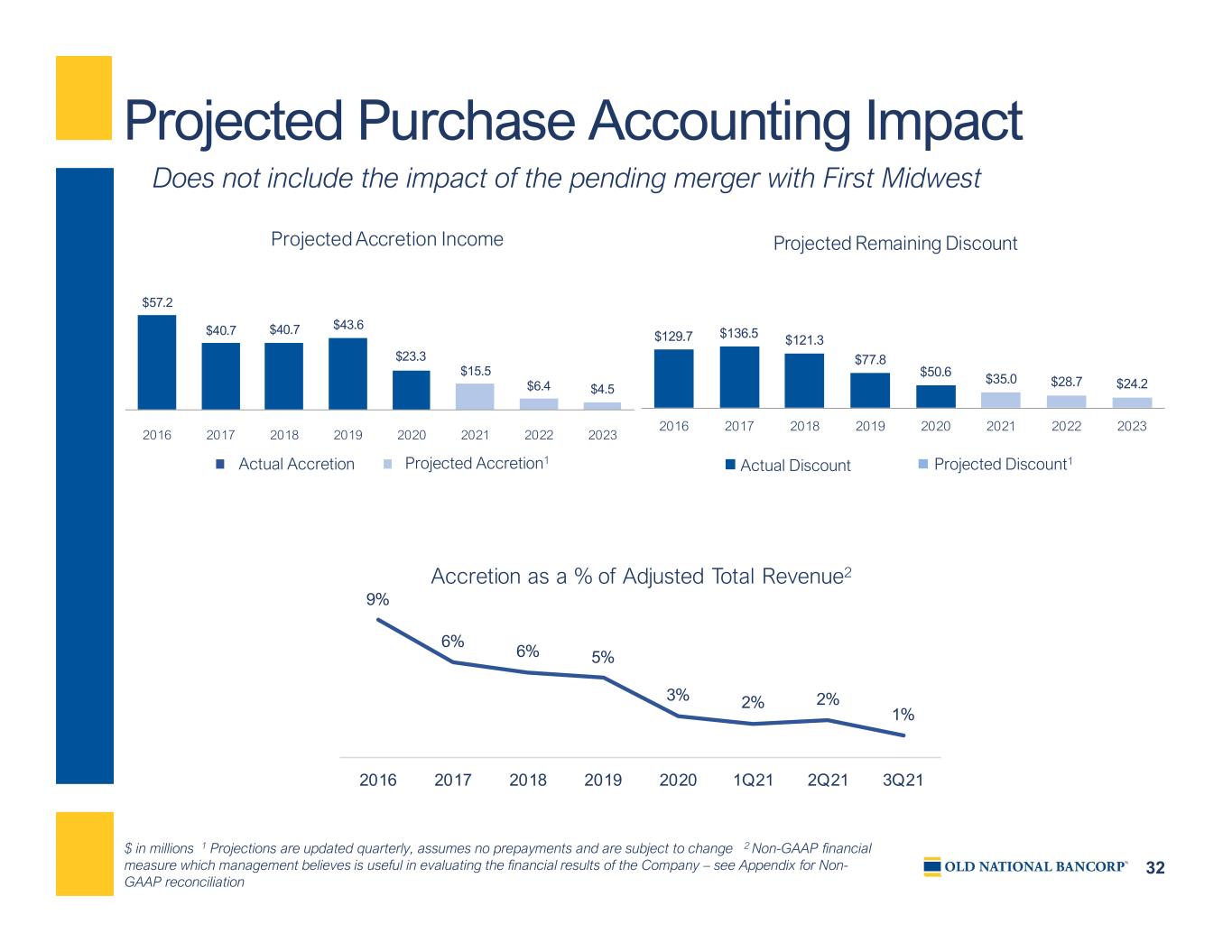

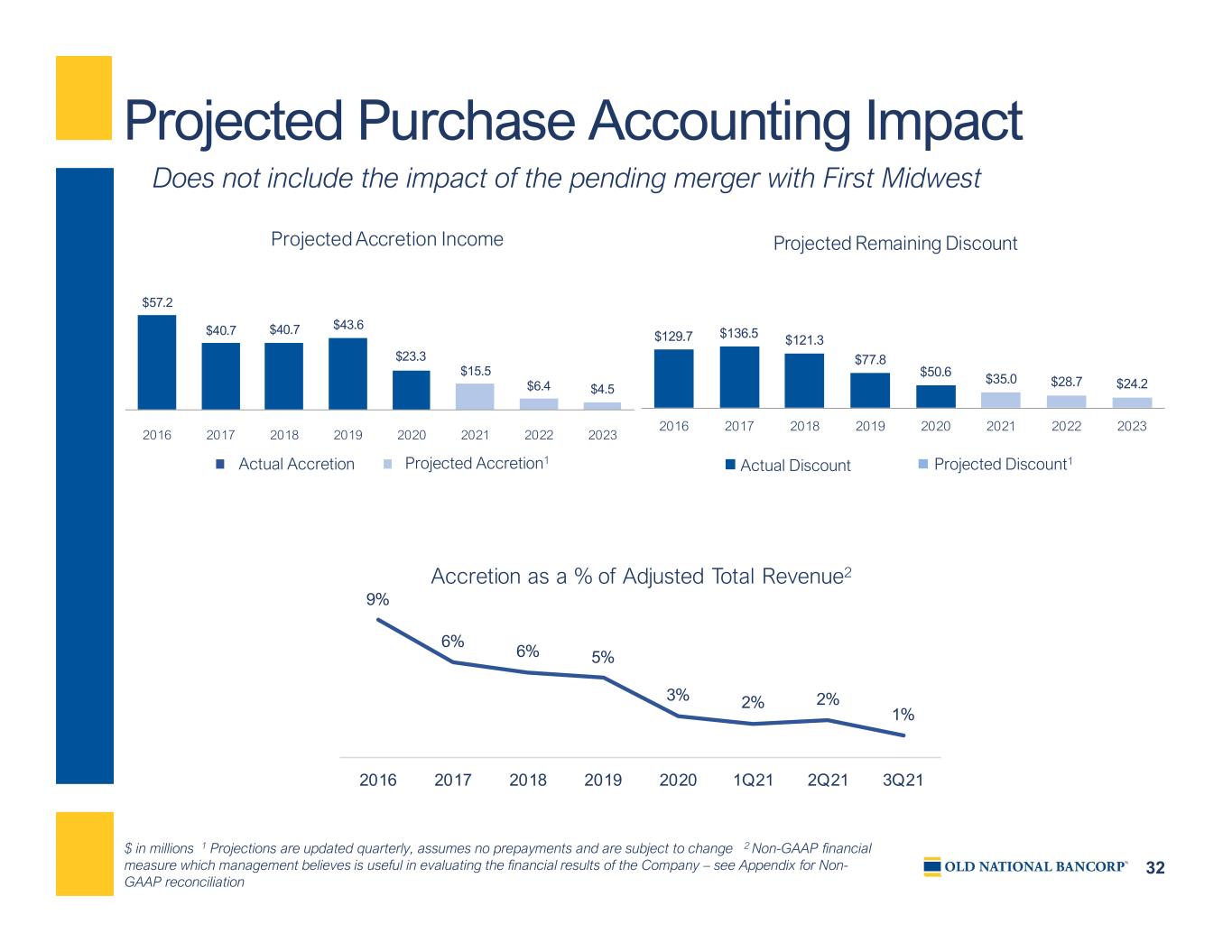

32 Projected Purchase Accounting Impact $ in millions 1 Projections are updated quarterly, assumes no prepayments and are subject to change 2 Non-GAAP financial measure which management believes is useful in evaluating the financial results of the Company – see Appendix for Non- GAAP reconciliation Does not include the impact of the pending merger with First Midwest Actual Accretion Projected Accretion1 Actual Discount Projected Discount1 9% 6% 6% 5% 3% 2% 2% 1% 2016 2017 2018 2019 2020 1Q21 2Q21 3Q21 Accretion as a % of Adjusted Total Revenue2 $57.2 $40.7 $40.7 $43.6 $23.3 $15.5 $6.4 $4.5 2016 2017 2018 2019 2020 2021 2022 2023 Projected Accretion Income $129.7 $136.5 $121.3 $77.8 $50.6 $35.0 $28.7 $24.2 2016 2017 2018 2019 2020 2021 2022 2023 Projected Remaining Discount

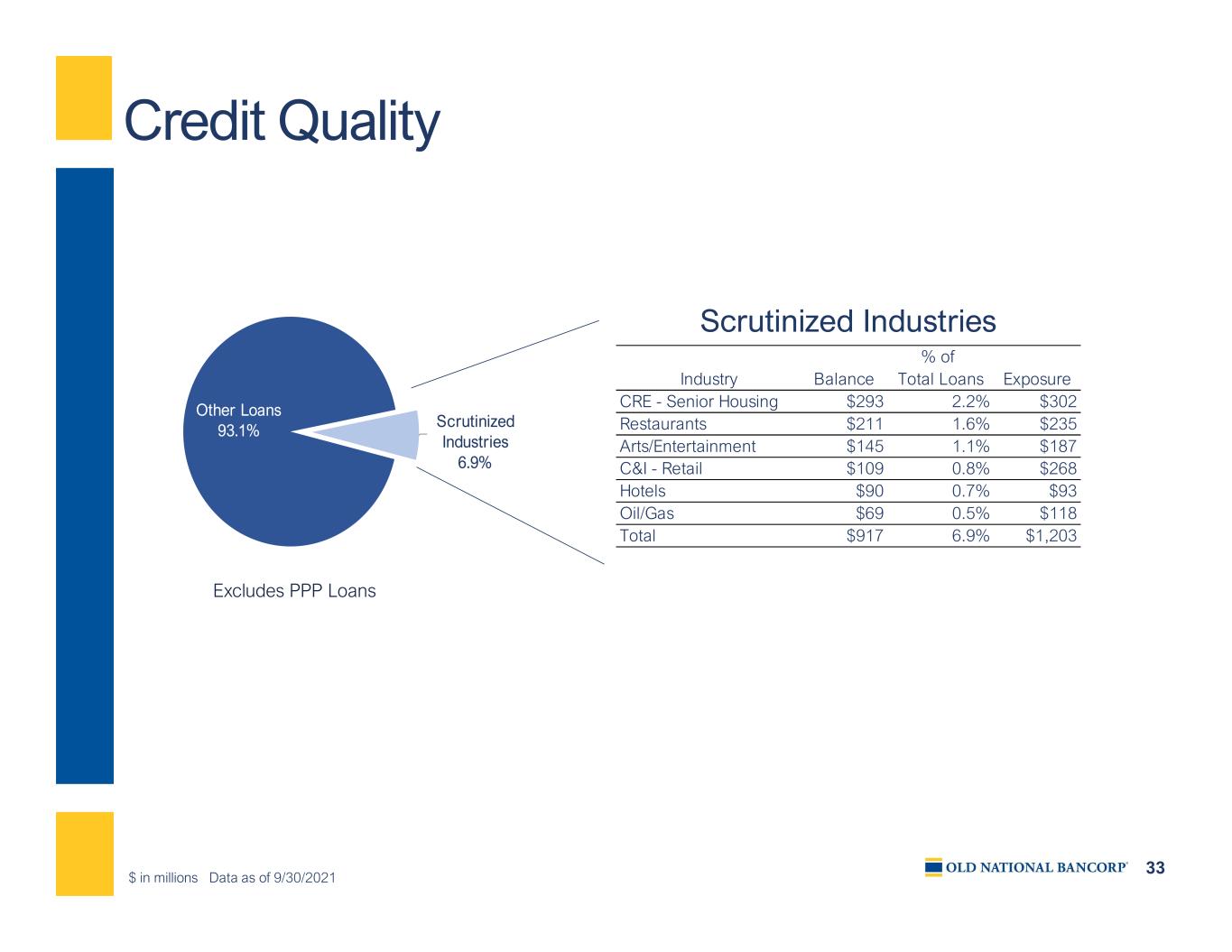

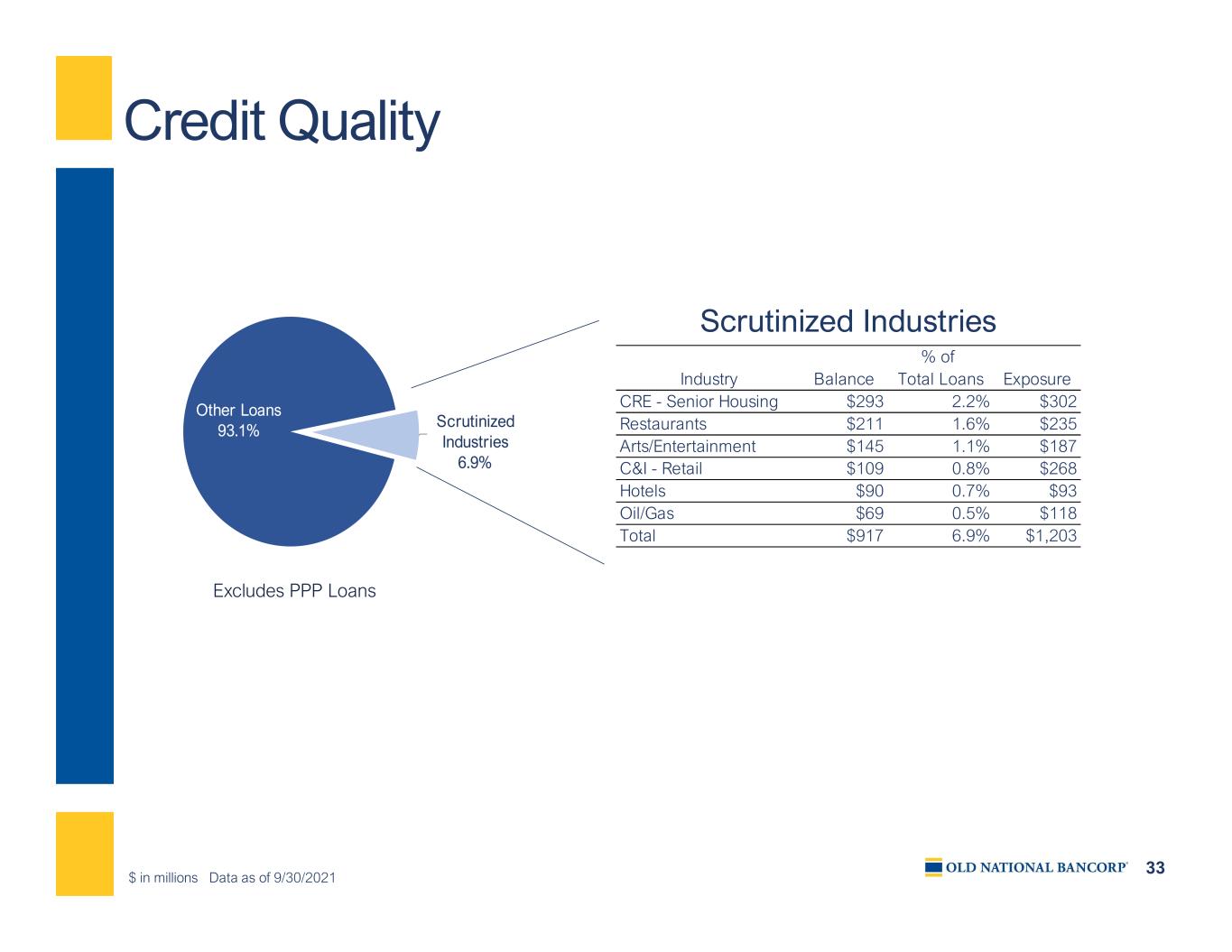

33 Scrutinized Industries 6.9% Other Loans 93.1% Credit Quality Scrutinized Industries $ in millions Data as of 9/30/2021 Excludes PPP Loans % of Industry Balance Total Loans Exposure CRE - Senior Housing $293 2.2% $302 Restaurants $211 1.6% $235 Arts/Entertainment $145 1.1% $187 C&I - Retail $109 0.8% $268 Hotels $90 0.7% $93 Oil/Gas $69 0.5% $118 Total $917 6.9% $1,203

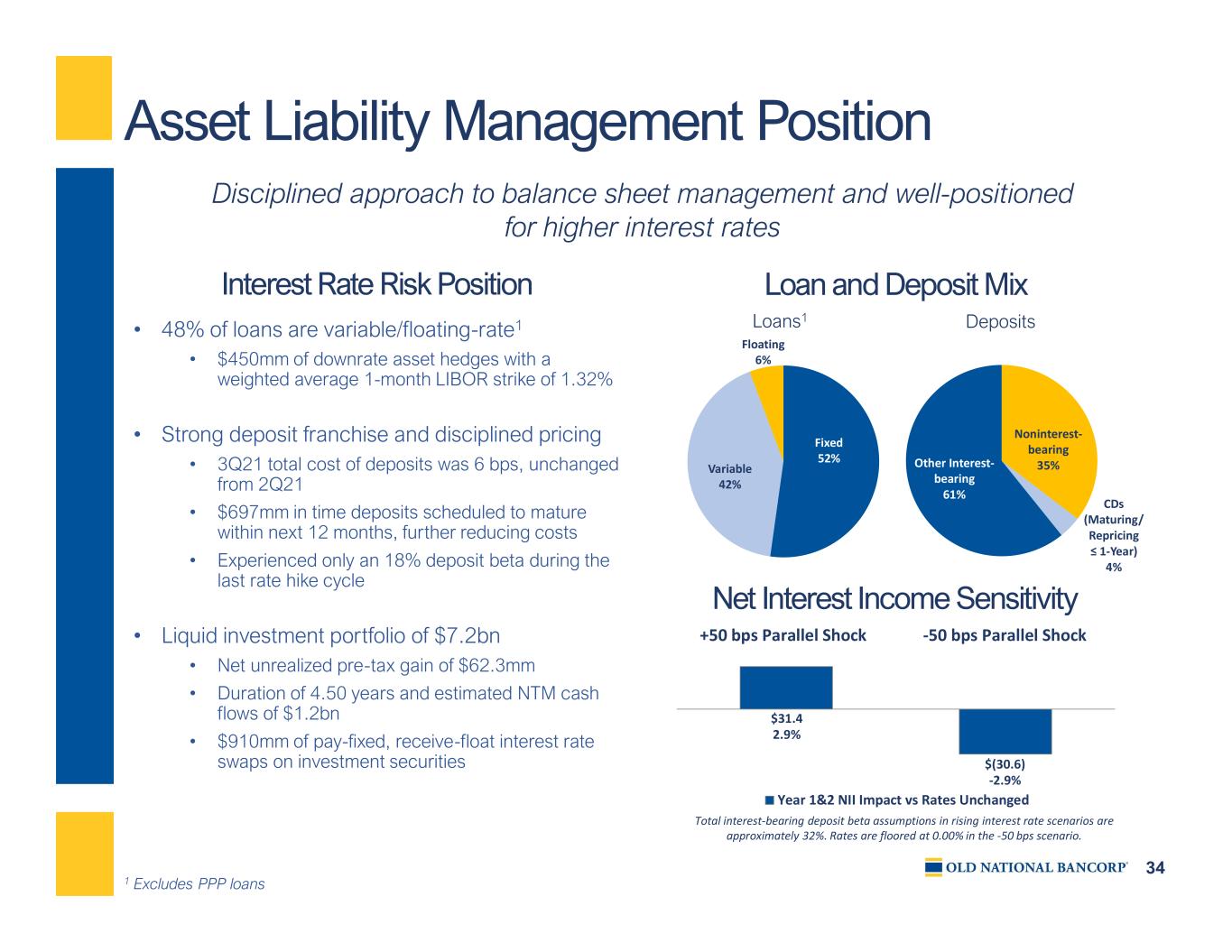

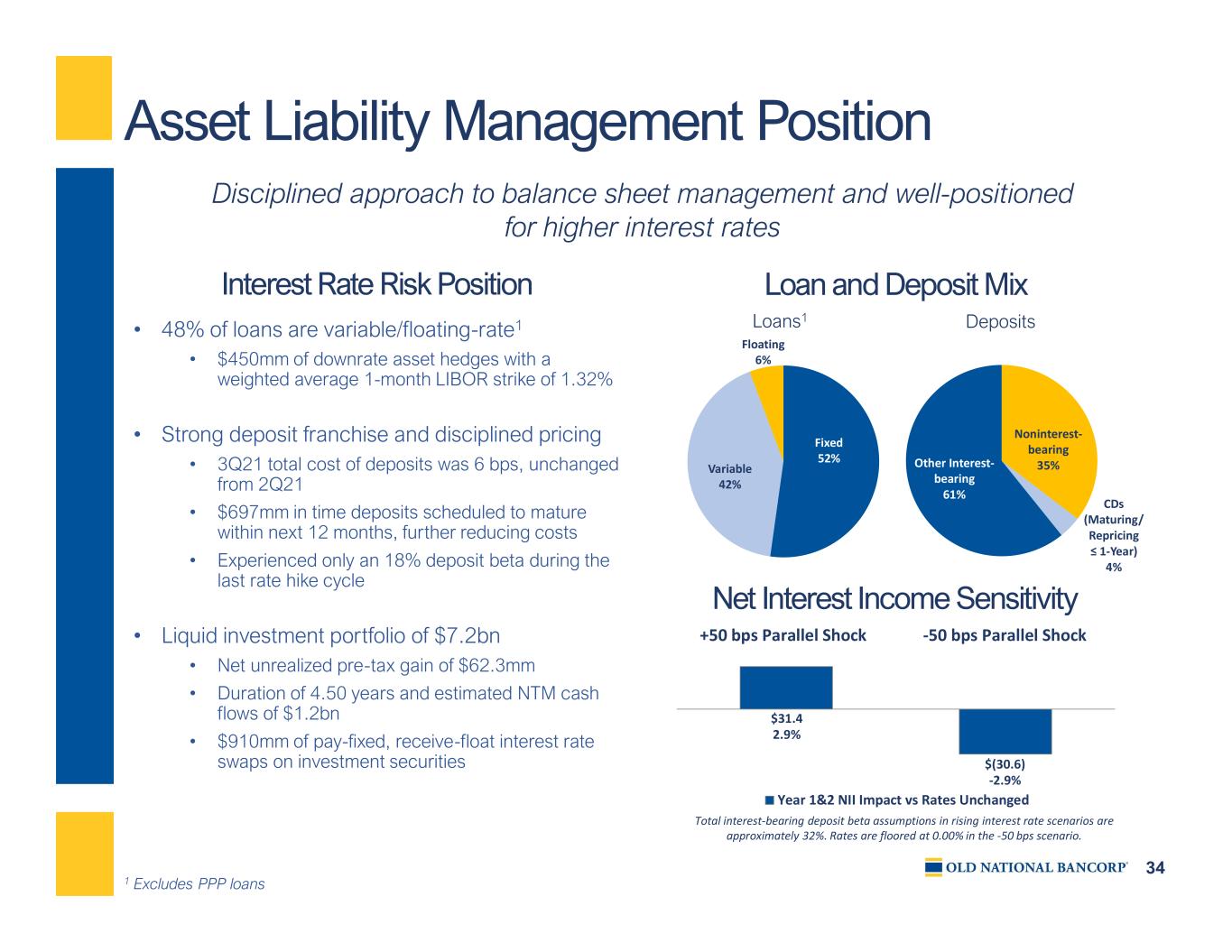

34 Fixed 52% Variable 42% Floating 6% Noninterest- bearing 35% CDs (Maturing/ Repricing ≤ 1-Year) 4% Other Interest- bearing 61% Year 1&2 NII Impact vs Rates Unchanged $31.4 2.9% $(30.6) -2.9% +50 bps Parallel Shock -50 bps Parallel Shock • 48% of loans are variable/floating-rate1 • $450mm of downrate asset hedges with a weighted average 1-month LIBOR strike of 1.32% • Strong deposit franchise and disciplined pricing • 3Q21 total cost of deposits was 6 bps, unchanged from 2Q21 • $697mm in time deposits scheduled to mature within next 12 months, further reducing costs • Experienced only an 18% deposit beta during the last rate hike cycle • Liquid investment portfolio of $7.2bn • Net unrealized pre-tax gain of $62.3mm • Duration of 4.50 years and estimated NTM cash flows of $1.2bn • $910mm of pay-fixed, receive-float interest rate swaps on investment securities Net Interest Income Sensitivity Disciplined approach to balance sheet management and well-positioned for higher interest rates Interest Rate Risk Position Loan and Deposit Mix Loans1 Deposits Asset Liability Management Position 1 Excludes PPP loans Total interest-bearing deposit beta assumptions in rising interest rate scenarios are approximately 32%. Rates are floored at 0.00% in the -50 bps scenario.

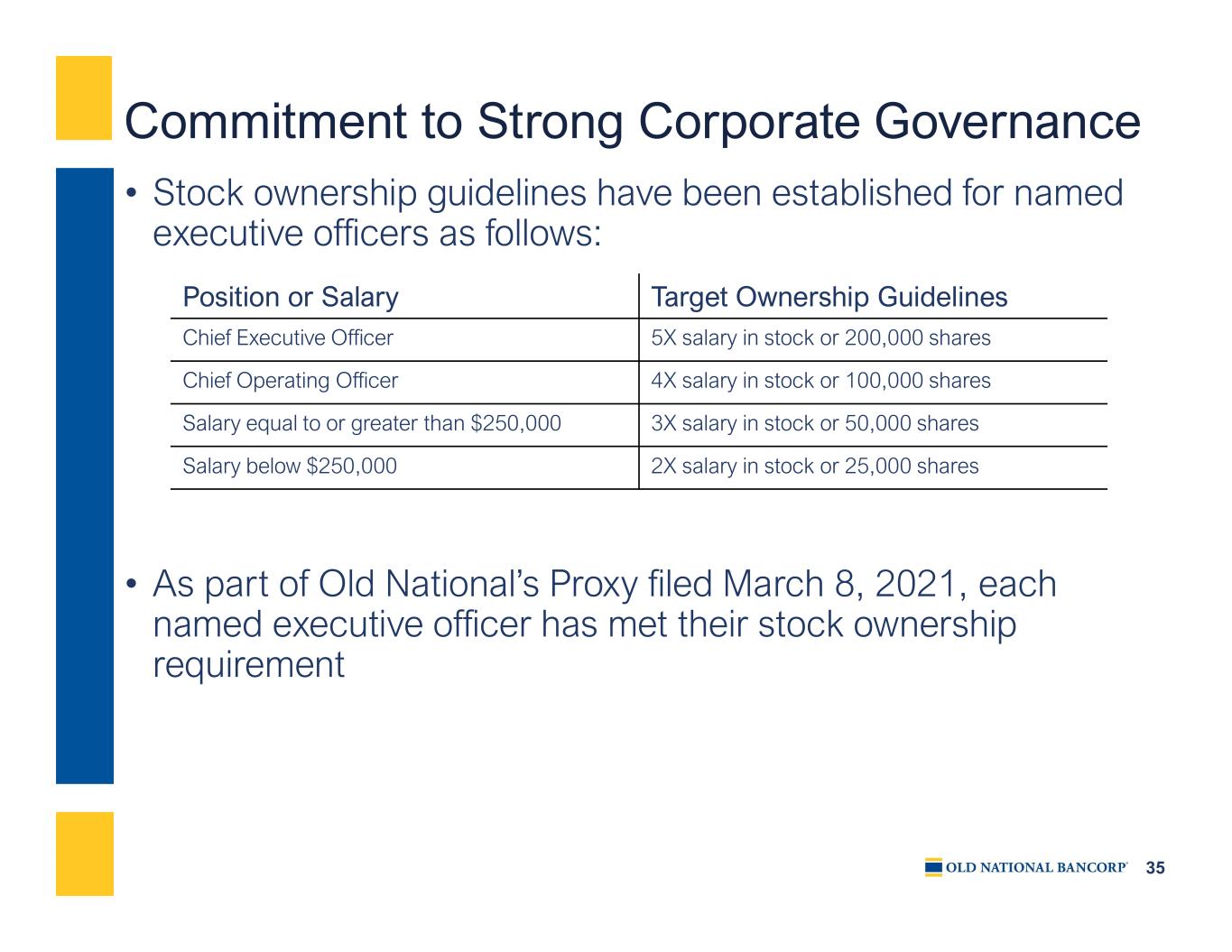

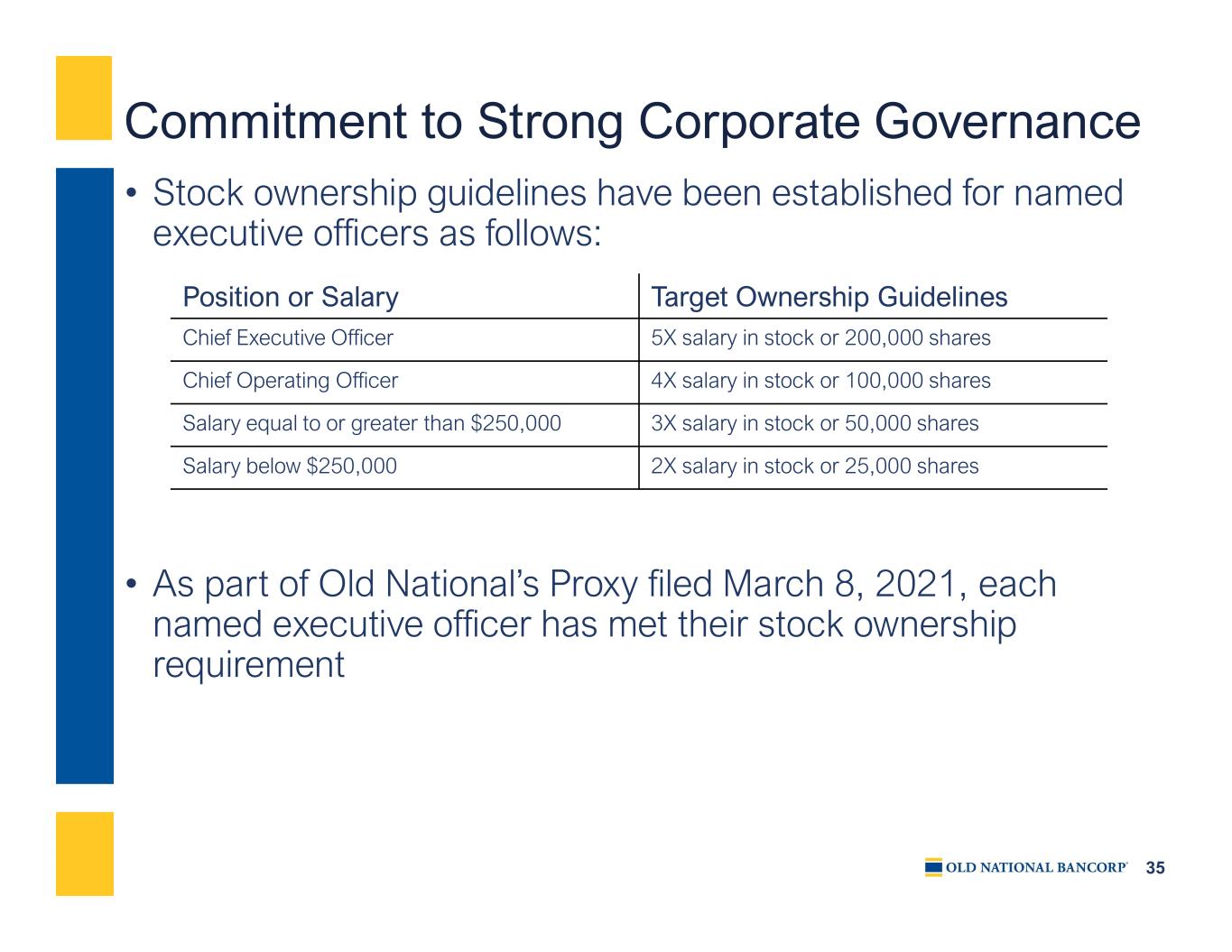

35 Commitment to Strong Corporate Governance • Stock ownership guidelines have been established for named executive officers as follows: • As part of Old National’s Proxy filed March 8, 2021, each named executive officer has met their stock ownership requirement Position or Salary Target Ownership Guidelines Chief Executive Officer 5X salary in stock or 200,000 shares Chief Operating Officer 4X salary in stock or 100,000 shares Salary equal to or greater than $250,000 3X salary in stock or 50,000 shares Salary below $250,000 2X salary in stock or 25,000 shares

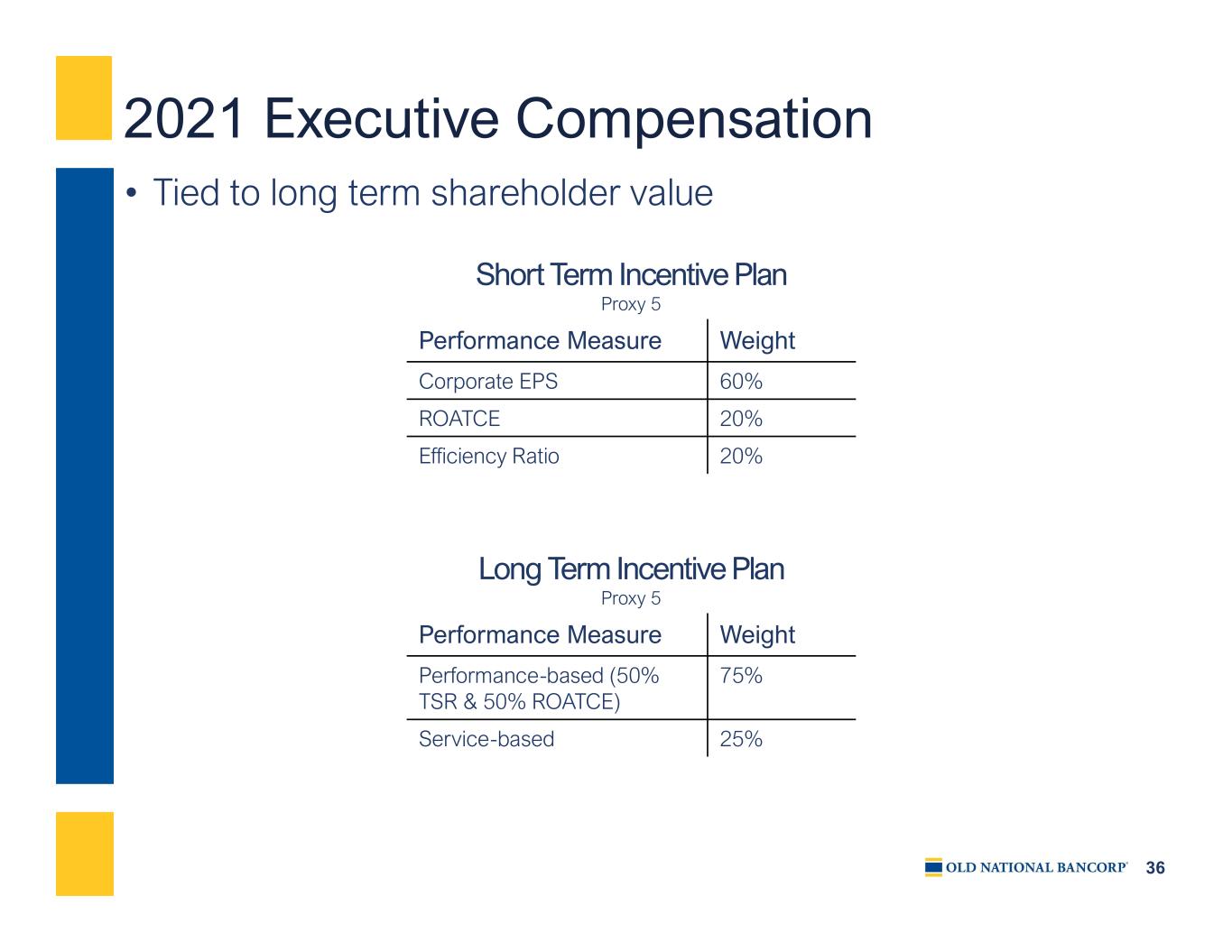

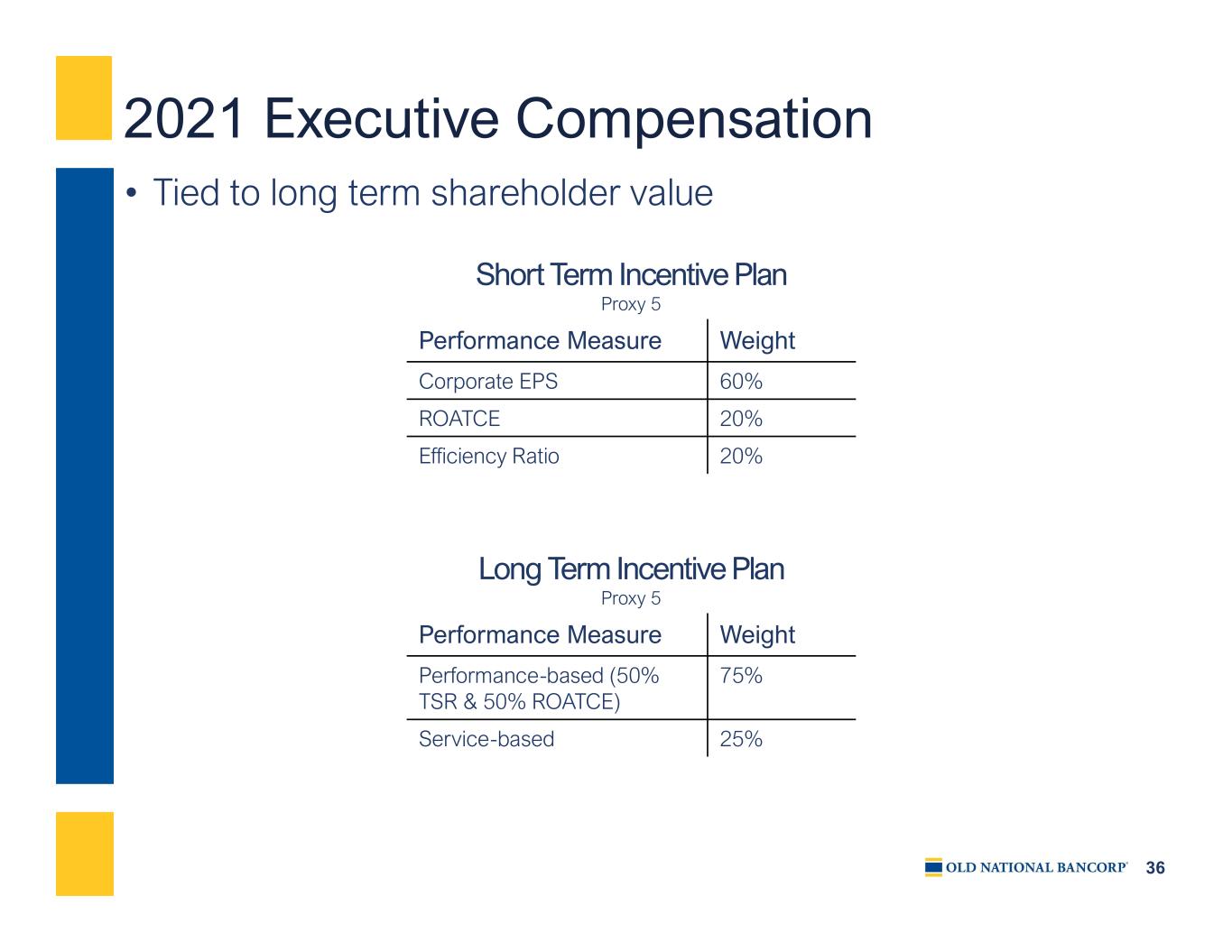

36 2021 Executive Compensation • Tied to long term shareholder value Performance Measure Weight Corporate EPS 60% ROATCE 20% Efficiency Ratio 20% Short Term Incentive Plan Proxy 5 Performance Measure Weight Performance-based (50% TSR & 50% ROATCE) 75% Service-based 25% Long Term Incentive Plan Proxy 5

37 Board of Directors Director Market Background Andrew E. Goebel Evansville, IN 34-year career in the energy industry, most recently serving as President and Chief Operating Officer of Vectren Corporation Jerome F. Henry Jr. Ft. Wayne, IN Owner and President of Midwest Pipe & Steel, Inc., a company he founded in 1972 Daniel S. Hermann Evansville, IN Founder of AmeriQual Group, LLC, where he served as CEO from 2005 to 2015; Founding partner of Lechwe Holdings LLC; Over 20 years of management experience with Black Beauty Coal Company Ryan C. Kitchell Indianapolis, IN Former Executive Vice President and Chief Administrative Officer at Indiana University Health; formerly IU Health’s Chief Financial Officer since 2012; previously worked for Indiana Governor Mitch Daniels Phelps L. Lambert Henderson, KY Managing Partner of Lambert and Lambert, an investment partnership; formerly CEO and Chief Operating Officer of Farmers Bank & Trust Company Austin M. Ramirez Waukesha, WI President and CEO of Husco International, a global engineering and manufacturing company James C. Ryan III, Chairman Evansville, IN Chairman and CEO of Old National Bancorp; previously CFO of Old National Bancorp Thomas E. Salmon Evansville, IN Chairman and CEO of Berry Global, a Fortune 500 and NYSE company; formerly Berry Global’s President and Chief Operating Officer Randall T. Shepard Indianapolis, IN Former Chief Justice of the Indiana Supreme Court, serving for 25 years Rebecca S. Skillman, Lead Director Bloomington, IN Chairman of Radius Indiana, an economic development regional partnership; formerly Lieutenant Governor of the State of Indiana as well as an Indiana Senator Derrick J. Stewart Indianapolis, IN President & CEO of the YMCA of Greater Indianapolis; formerly CEO of the YMCA of Southwestern Indiana Katherine E. White Ann Arbor, MI A Brigadier General in the U.S. Army currently serving in the Michigan Army National Guard as the Deputy Commanding General of the 46th Military Police Command in Lansing, Michigan; a Professor of Law at Wayne State University Law School; a Regent with the University of Michigan Board of Regents Linda E. White Evansville, IN Chief Administrative Officer of Deaconess Henderson Hospital and Executive Director of the Deaconess Foundation; Formerly President and CEO for Deaconess Health System, Inc., serving 32 years as an administrator in the healthcare industry

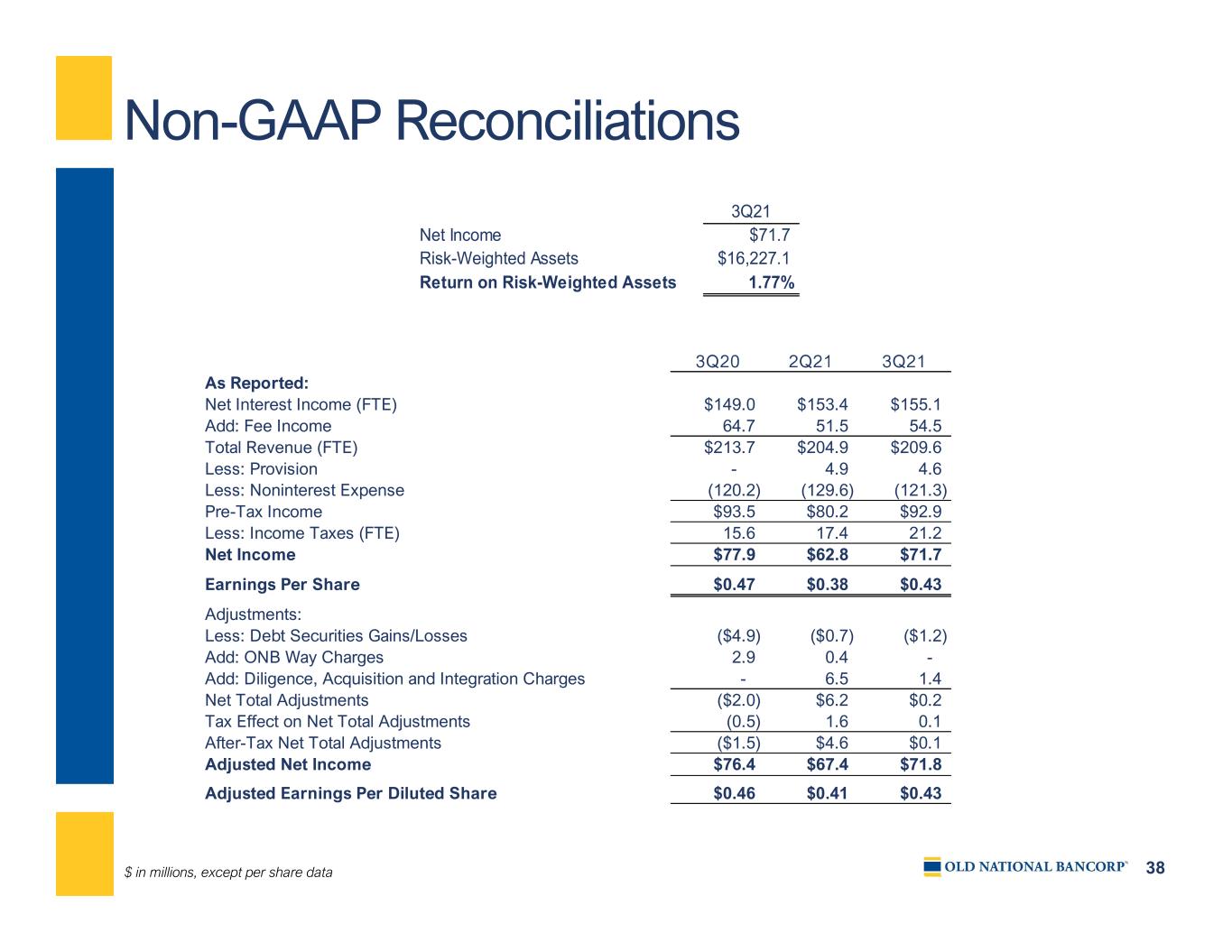

38 Non-GAAP Reconciliations $ in millions, except per share data 3Q21 Net Income $71.7 Risk-Weighted Assets $16,227.1 Return on Risk-Weighted Assets 1.77% 3Q20 2Q21 3Q21 As Reported: Net Interest Income (FTE) $149.0 $153.4 $155.1 Add: Fee Income 64.7 51.5 54.5 Total Revenue (FTE) $213.7 $204.9 $209.6 Less: Provision - 4.9 4.6 Less: Noninterest Expense (120.2) (129.6) (121.3) Pre-Tax Income $93.5 $80.2 $92.9 Less: Income Taxes (FTE) 15.6 17.4 21.2 Net Income $77.9 $62.8 $71.7 Earnings Per Share $0.47 $0.38 $0.43 Adjustments: Less: Debt Securities Gains/Losses ($4.9) ($0.7) ($1.2) Add: ONB Way Charges 2.9 0.4 - Add: Diligence, Acquisition and Integration Charges - 6.5 1.4 Net Total Adjustments ($2.0) $6.2 $0.2 Tax Effect on Net Total Adjustments (0.5) 1.6 0.1 After-Tax Net Total Adjustments ($1.5) $4.6 $0.1 Adjusted Net Income $76.4 $67.4 $71.8 Adjusted Earnings Per Diluted Share $0.46 $0.41 $0.43

39 Non-GAAP Reconciliations $ in millions 3Q20 4Q20 1Q21 2Q21 3Q21 As Reported: Net Interest Income (FTE) $149.0 $164.6 $151.6 $153.4 $155.1 Add: Fee Income 64.7 58.5 56.7 51.5 54.5 Total Revenue (FTE) $213.7 $223.1 $208.3 $204.9 $209.6 Less: Noninterest Expense 120.2 142.3 117.7 129.6 121.3 Pre-Provision Net Revenue (PPNR) $93.5 $80.8 $90.6 $75.3 $88.3 Revenue Adjustments: Less: Debt Securities Gains/Losses ($4.9) ($0.2) ($2.0) ($0.7) ($1.2) Less: Gain/Loss on Branch Actions - (0.1) - - - Adjusted Total Revenue $208.8 $222.8 $206.3 $204.2 $208.4 Expense Adjustments: Less: ONB Way Charges ($2.9) ($3.6) ($1.5) ($0.4) - Less: Diligence, Acquisition and Integration Charges - - - (6.5) (1.4) Less: Amortization of Tax Credit Investments (3.1) (9.9) (1.2) (1.8) (1.7) Adjusted Noninterest Expense $114.2 $128.8 $115.0 $120.9 $118.2 Adjusted Pre-Provision Net Revenue (PPNR) $94.6 $94.0 $91.3 $83.3 $90.2 Accretion Income $5.4 $5.4 $4.7 $5.1 $3.0 Accretion Income as a % of Total Revenue 2.5% 2.4% 2.3% 2.5% 1.4% Accretion Income as a % of Adjusted Total Revenue 2.6% 2.4% 2.3% 2.5% 1.4%

40 Non-GAAP Reconciliations $ in millions 3Q20 2Q21 3Q21 Noninterest Expense As Reported $120.2 $129.6 $121.3 Less: ONB Way Charges (2.9) (0.4) - Less: Diligence, Acquisition and Integration Charges - (6.5) (1.4) Noninterest Expense Less Charges $117.3 $122.7 $119.9 Less: Amortization of Tax Credit Investments (3.1) (1.8) (1.7) Adjusted Noninterest Expense $114.2 $120.9 $118.2 Less: Intangible Amortization (3.4) (2.9) (2.8) Adjusted Noninterest Expense Less Intangible Amortization $110.8 $118.0 $115.4 Net Interest Income As Reported $145.6 $149.9 $151.6 Add: FTE Adjustment 3.4 3.5 3.5 Net Interest Income (FTE) $149.0 $153.4 $155.1 Noninterest Income As Reported $64.7 $51.5 $54.5 Total Revenue (FTE) $213.7 $204.9 $209.6 Less: Debt Securities Gains/Losses (4.9) (0.7) (1.2) Adjusted Total Revenue (FTE) $208.8 $204.2 $208.4 Reported Efficiency Ratio 55.93% 62.05% 56.86% Adjusted Efficiency Ratio 53.06% 57.74% 55.38%

41 Non-GAAP Reconciliations $ in millions , except per share data 3Q20 2Q21 3Q21 Net Interest Income As Reported $145.6 $149.9 $151.6 FTE Adjustment 3.4 3.5 3.5 Net Interest Income (FTE) $149.0 $153.4 $155.1 Average Earning Assets $19,654.3 $21,095.3 $21,228.6 Net Interest Margin 2.96% 2.84% 2.86% Net Interest Margin (FTE) 3.03% 2.91% 2.92% 3Q20 4Q20 1Q21 2Q21 3Q21 Noninterest Income As Reported $64.7 $58.5 $56.7 $51.5 $54.5 Less: Debt Securities Gains/Losses (4.9) (0.2) (2.0) (0.7) (1.2) Less: Gain/Loss on Branch Actions - (0.1) - - - Adjusted Noninterest Income $59.8 $58.2 $54.7 $50.8 $53.3 3Q20 2Q21 3Q21 Shareholders' Equity As Reported $2,921.2 $2,991.1 $3,035.9 Less: Goodwill and Intangible Assets (1,086.3) (1,077.0) (1,074.2) Tangible Common Shareholders' Equity $1,834.9 $1,914.1 $1,961.7 Common Shares Issued and Outstanding at Period End 165.3 165.7 165.8 Tangible Common Book Value $11.10 $11.55 $11.83 3Q20 2Q21 3Q21 Shareholders' Equity As Reported $2,921.2 $2,991.1 $3,035.9 Less: Goodwill and Intangible Assets (1,086.3) (1,077.0) (1,074.2) Tangible Common Shareholders' Equity $1,834.9 $1,914.1 $1,961.7 Total Assets $22,460.5 $23,675.7 $24,018.7 Add: Trust Overdrafts - - 0.1 Less: Goodwill and Intangible Assets (1,086.3) (1,077.0) (1,074.2) Tangible Assets $21,374.2 $22,598.7 $22,944.6 Tangible Equity to Tangible Assets 8.58% 8.47% 8.55% Tangible Common Equity to Tangible Assets 8.58% 8.47% 8.55%

42 Non-GAAP Reconciliations $ in millions 3Q21 Net Income As Reported $71.7 Add: Intangible Amortization (net of tax) 2.1 Tangible Net Income $73.8 Less: Debt Securities Gains/Losses (net of tax) (0.9) Add: Diligence, Acquisition and Integration Charges (net of tax) 1.1 Adjusted Tangible Net Income (Loss) $74.0 Average Total Shareholders' Equity As Reported $3,027.9 Less: Average Goodwill (1,037.0) Less: Average Intangibles (38.6) Average Tangible Shareholders' Equity $1,952.3 Return on Average Tangible Common Equity 15.13% Adjusted Return on Average Tangible Common Equity 15.16% 3Q21 Net Income As Reported $71.7 Less: Debt Securities Gains/Losses (net of tax) (0.9) Add: Diligence, Acquisition and Integration Charges (net of tax) 1.1 Adjusted Net Income $71.9 Average Total Assets $23,869.3 Return on Average Assets 1.20% Adjusted Return on Average Assets 1.20%

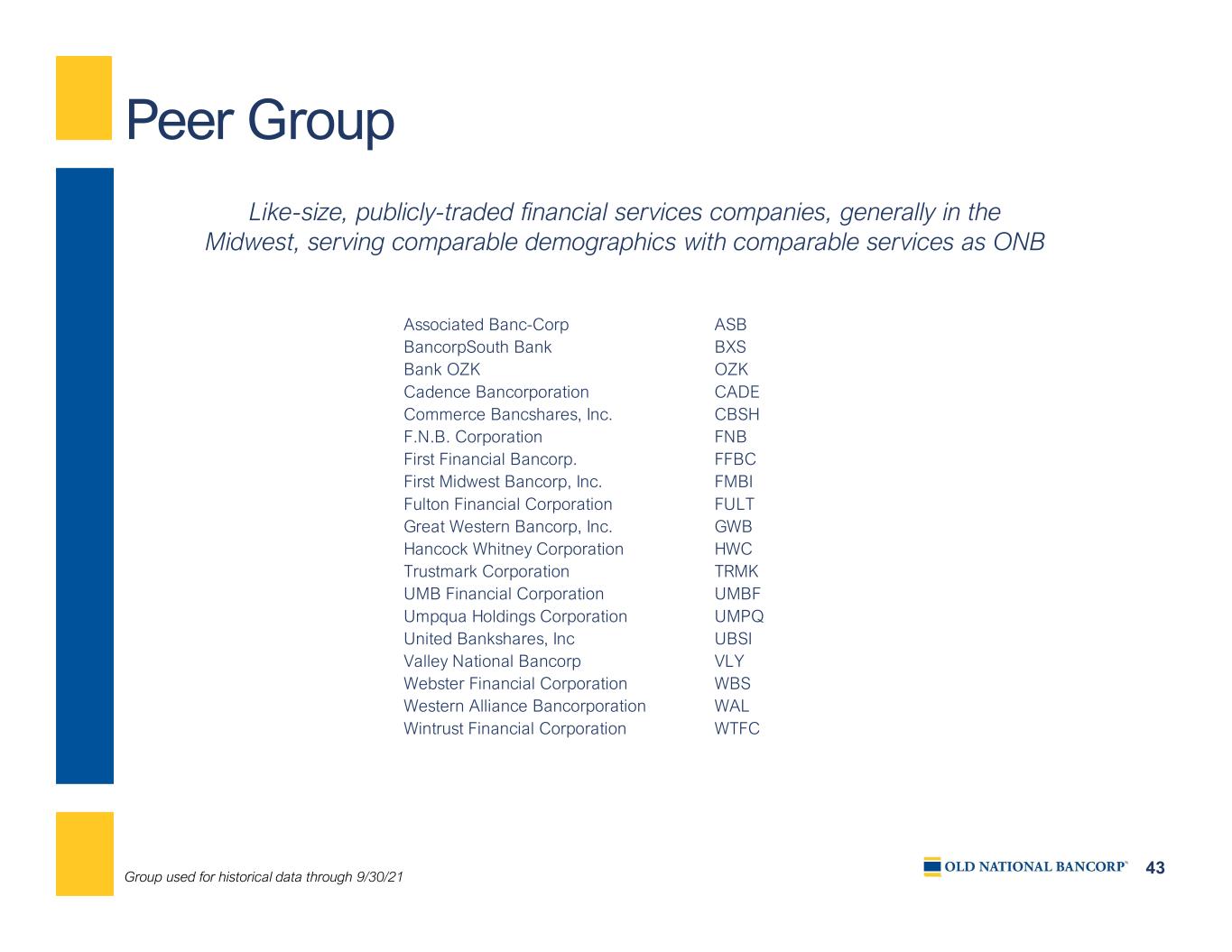

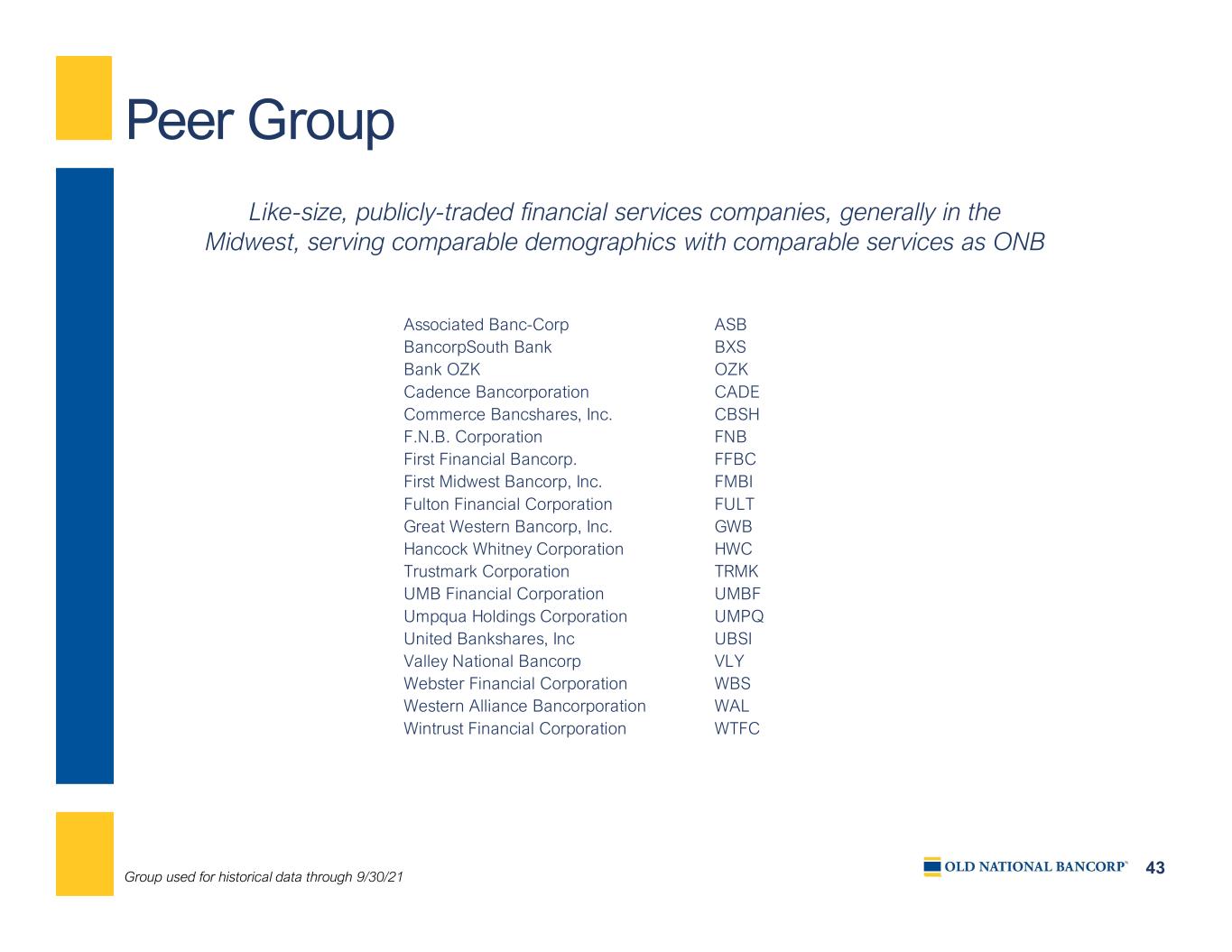

43 Peer Group Like-size, publicly-traded financial services companies, generally in the Midwest, serving comparable demographics with comparable services as ONB Associated Banc-Corp ASB BancorpSouth Bank BXS Bank OZK OZK Cadence Bancorporation CADE Commerce Bancshares, Inc. CBSH F.N.B. Corporation FNB First Financial Bancorp. FFBC First Midwest Bancorp, Inc. FMBI Fulton Financial Corporation FULT Great Western Bancorp, Inc. GWB Hancock Whitney Corporation HWC Trustmark Corporation TRMK UMB Financial Corporation UMBF Umpqua Holdings Corporation UMPQ United Bankshares, Inc UBSI Valley National Bancorp VLY Webster Financial Corporation WBS Western Alliance Bancorporation WAL Wintrust Financial Corporation WTFC Group used for historical data through 9/30/21

44 Old National Investor Relations Contact Additional information can be found on the Investor Relations web pages at www.oldnational.com Investor Inquiries: Lynell J. Walton, CPA SVP – Director of Investor Relations 812-464-1366 lynell.walton@oldnational.com