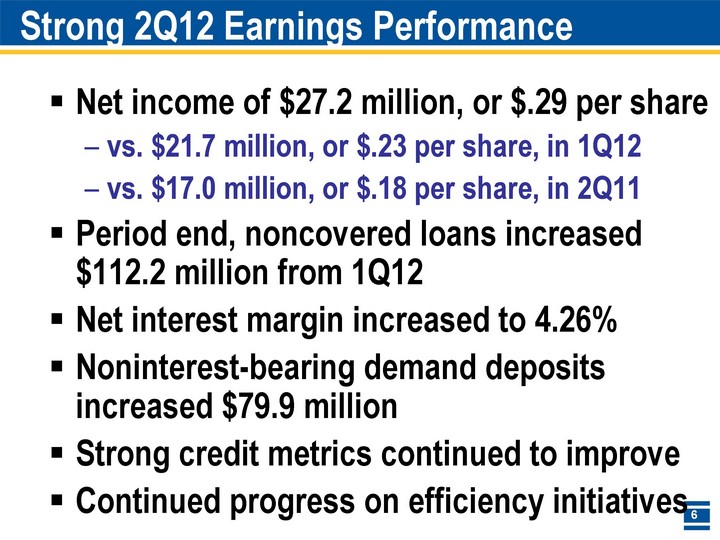

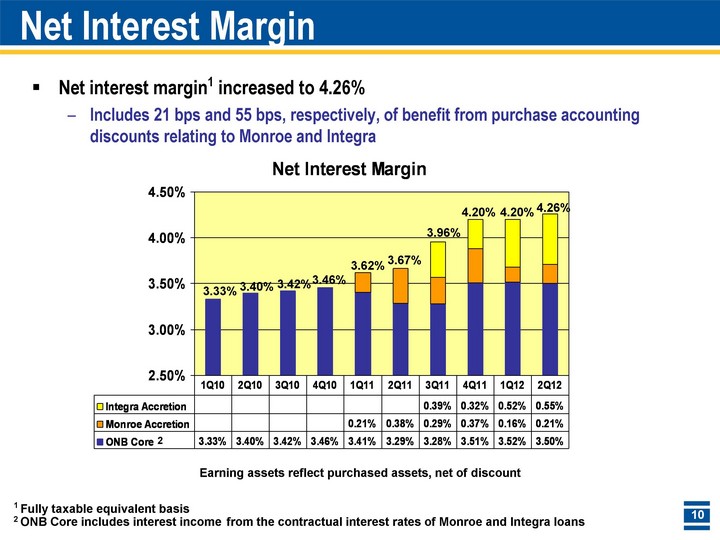

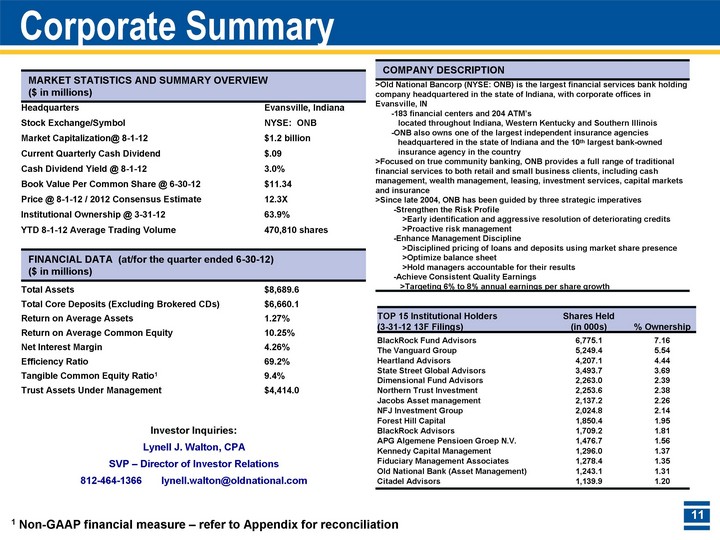

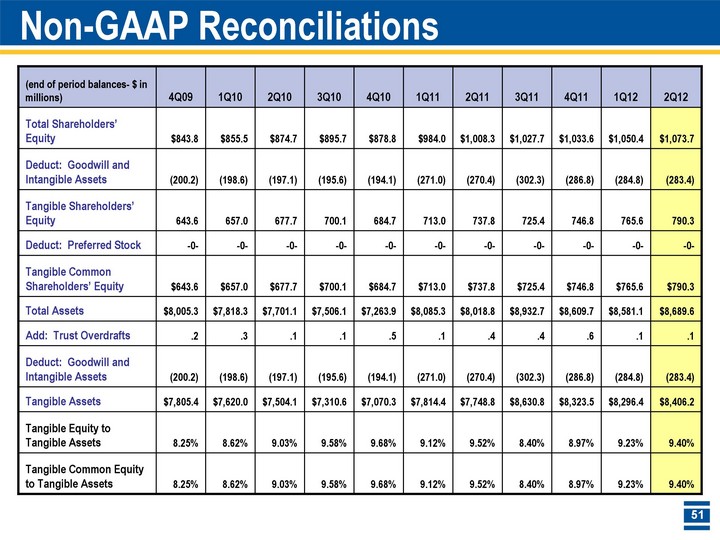

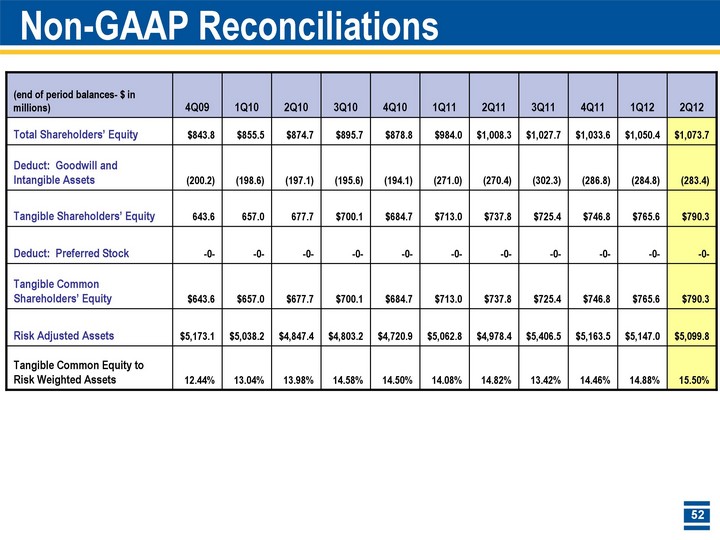

| Corporate Summary MARKET STATISTICS AND SUMMARY OVERVIEW ($ in millions) MARKET STATISTICS AND SUMMARY OVERVIEW ($ in millions) MARKET STATISTICS AND SUMMARY OVERVIEW ($ in millions) Headquarters Headquarters Evansville, Indiana Evansville, Indiana Evansville, Indiana Evansville, Indiana Stock Exchange/Symbol Stock Exchange/Symbol NYSE: ONB NYSE: ONB Market Capitalization@ 8-1-12 Market Capitalization@ 8-1-12 $1.2 billion $1.2 billion Current Quarterly Cash Dividend Current Quarterly Cash Dividend $.09 $.09 Cash Dividend Yield @ 8-1-12 Cash Dividend Yield @ 8-1-12 3.0% 3.0% Book Value Per Common Share @ 6-30-12 Book Value Per Common Share @ 6-30-12 $11.34 $11.34 Price @ 8-1-12 / 2012 Consensus Estimate Price @ 8-1-12 / 2012 Consensus Estimate 12.3X 12.3X Institutional Ownership @ 3-31-12 Institutional Ownership @ 3-31-12 63.9% 63.9% YTD 8-1-12 Average Trading Volume YTD 8-1-12 Average Trading Volume 470,810 shares 470,810 shares FINANCIAL DATA (at/for the quarter ended 6-30-12) ($ in millions) FINANCIAL DATA (at/for the quarter ended 6-30-12) ($ in millions) FINANCIAL DATA (at/for the quarter ended 6-30-12) ($ in millions) FINANCIAL DATA (at/for the quarter ended 6-30-12) ($ in millions) FINANCIAL DATA (at/for the quarter ended 6-30-12) ($ in millions) Total Assets $8,689.6 $8,689.6 Total Core Deposits (Excluding Brokered CDs) $6,660.1 $6,660.1 Return on Average Assets 1.27% 1.27% Return on Average Common Equity 10.25% 10.25% Net Interest Margin 4.26% 4.26% Efficiency Ratio 69.2% 69.2% Tangible Common Equity Ratio1 9.4% 9.4% Trust Assets Under Management $4,414.0 $4,414.0 COMPANY DESCRIPTION >Old National Bancorp (NYSE: ONB) is the largest financial services bank holding company headquartered in the state of Indiana, with corporate offices in Evansville, IN -183 financial centers and 204 ATM's located throughout Indiana, Western Kentucky and Southern Illinois -ONB also owns one of the largest independent insurance agencies headquartered in the state of Indiana and the 10th largest bank-owned insurance agency in the country >Focused on true community banking, ONB provides a full range of traditional financial services to both retail and small business clients, including cash management, wealth management, leasing, investment services, capital markets and insurance >Since late 2004, ONB has been guided by three strategic imperatives -Strengthen the Risk Profile >Early identification and aggressive resolution of deteriorating credits >Proactive risk management -Enhance Management Discipline >Disciplined pricing of loans and deposits using market share presence >Optimize balance sheet >Hold managers accountable for their results -Achieve Consistent Quality Earnings >Targeting 6% to 8% annual earnings per share growth Investor Inquiries: Lynell J. Walton, CPA SVP - Director of Investor Relations 812-464-1366 lynell.walton@oldnational.com TOP 15 Institutional Holders (3-31-12 13F Filings) Shares Held (in 000s) % Ownership BlackRock Fund Advisors 6,775.1 7.16 The Vanguard Group 5,249.4 5.54 Heartland Advisors 4,207.1 4.44 State Street Global Advisors 3,493.7 3.69 Dimensional Fund Advisors 2,263.0 2.39 Northern Trust Investment 2,253.6 2.38 Jacobs Asset management 2,137.2 2.26 NFJ Investment Group 2,024.8 2.14 Forest Hill Capital 1,850.4 1.95 BlackRock Advisors 1,709.2 1.81 APG Algemene Pensioen Groep N.V. 1,476.7 1.56 Kennedy Capital Management 1,296.0 1.37 Fiduciary Management Associates 1,278.4 1.35 Old National Bank (Asset Management) 1,243.1 1.31 Citadel Advisors 1,139.9 1.20 1 Non-GAAP financial measure - refer to Appendix for reconciliation |