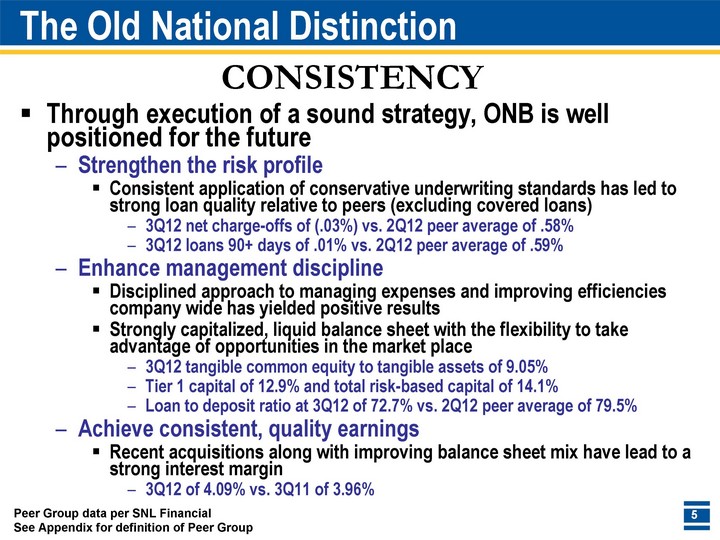

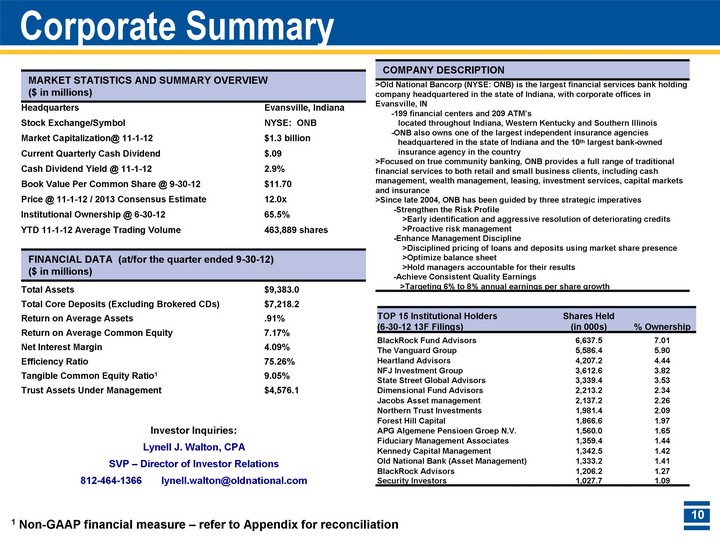

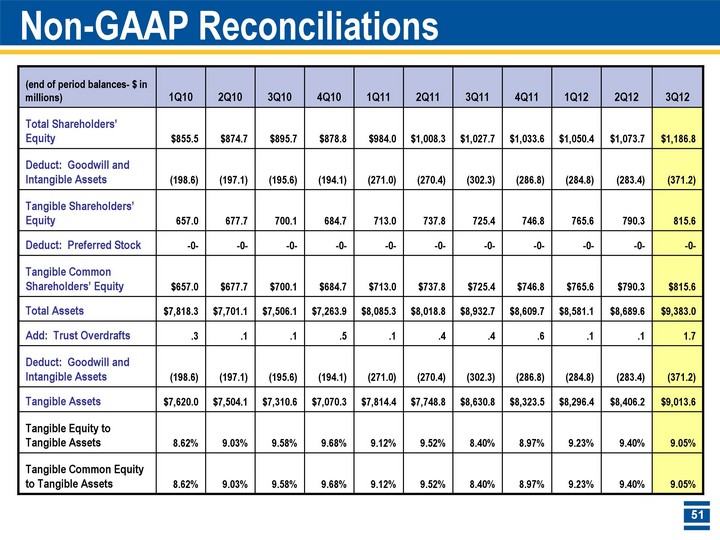

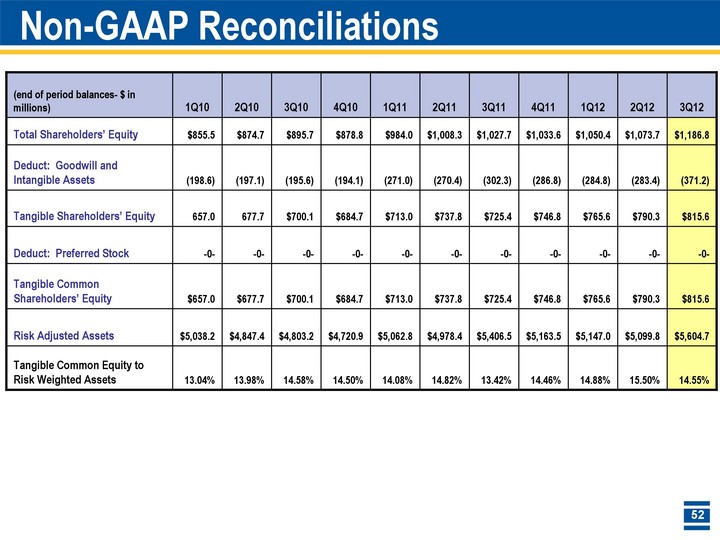

| Corporate Summary MARKET STATISTICS AND SUMMARY OVERVIEW ($ in millions) MARKET STATISTICS AND SUMMARY OVERVIEW ($ in millions) MARKET STATISTICS AND SUMMARY OVERVIEW ($ in millions) Headquarters Headquarters Evansville, Indiana Evansville, Indiana Evansville, Indiana Evansville, Indiana Stock Exchange/Symbol Stock Exchange/Symbol NYSE: ONB NYSE: ONB Market Capitalization@ 11-1-12 Market Capitalization@ 11-1-12 $1.3 billion $1.3 billion Current Quarterly Cash Dividend Current Quarterly Cash Dividend $.09 $.09 Cash Dividend Yield @ 11-1-12 Cash Dividend Yield @ 11-1-12 2.9% 2.9% Book Value Per Common Share @ 9-30-12 Book Value Per Common Share @ 9-30-12 $11.70 $11.70 Price @ 11-1-12 / 2013 Consensus Estimate Price @ 11-1-12 / 2013 Consensus Estimate 12.0x 12.0x Institutional Ownership @ 6-30-12 Institutional Ownership @ 6-30-12 65.5% 65.5% YTD 11-1-12 Average Trading Volume YTD 11-1-12 Average Trading Volume 463,889 shares 463,889 shares FINANCIAL DATA (at/for the quarter ended 9-30-12) ($ in millions) FINANCIAL DATA (at/for the quarter ended 9-30-12) ($ in millions) FINANCIAL DATA (at/for the quarter ended 9-30-12) ($ in millions) FINANCIAL DATA (at/for the quarter ended 9-30-12) ($ in millions) FINANCIAL DATA (at/for the quarter ended 9-30-12) ($ in millions) Total Assets $9,383.0 $9,383.0 Total Core Deposits (Excluding Brokered CDs) $7,218.2 $7,218.2 Return on Average Assets .91% .91% Return on Average Common Equity 7.17% 7.17% Net Interest Margin 4.09% 4.09% Efficiency Ratio 75.26% 75.26% Tangible Common Equity Ratio1 9.05% 9.05% Trust Assets Under Management $4,576.1 $4,576.1 COMPANY DESCRIPTION >Old National Bancorp (NYSE: ONB) is the largest financial services bank holding company headquartered in the state of Indiana, with corporate offices in Evansville, IN -199 financial centers and 209 ATM's located throughout Indiana, Western Kentucky and Southern Illinois -ONB also owns one of the largest independent insurance agencies headquartered in the state of Indiana and the 10th largest bank-owned insurance agency in the country >Focused on true community banking, ONB provides a full range of traditional financial services to both retail and small business clients, including cash management, wealth management, leasing, investment services, capital markets and insurance >Since late 2004, ONB has been guided by three strategic imperatives -Strengthen the Risk Profile >Early identification and aggressive resolution of deteriorating credits >Proactive risk management -Enhance Management Discipline >Disciplined pricing of loans and deposits using market share presence >Optimize balance sheet >Hold managers accountable for their results -Achieve Consistent Quality Earnings >Targeting 6% to 8% annual earnings per share growth Investor Inquiries: Lynell J. Walton, CPA SVP - Director of Investor Relations 812-464-1366 lynell.walton@oldnational.com TOP 15 Institutional Holders (6-30-12 13F Filings) Shares Held (in 000s) % Ownership BlackRock Fund Advisors 6,637.5 7.01 The Vanguard Group 5,586.4 5.90 Heartland Advisors 4,207.2 4.44 NFJ Investment Group 3,612.6 3.82 State Street Global Advisors 3,339.4 3.53 Dimensional Fund Advisors 2,213.2 2.34 Jacobs Asset management 2,137.2 2.26 Northern Trust Investments 1,981.4 2.09 Forest Hill Capital 1,866.6 1.97 APG Algemene Pensioen Groep N.V. 1,560.0 1.65 Fiduciary Management Associates 1,359.4 1.44 Kennedy Capital Management 1,342.5 1.42 Old National Bank (Asset Management) 1,333.2 1.41 BlackRock Advisors 1,206.2 1.27 Security Investors 1,027.7 1.09 1 Non-GAAP financial measure - refer to Appendix for reconciliation |