Investment Thesis Financial Data as of 12-31-15 Dated: February 9, 2016 Exhibit 99.1

Investment Thesis Executive Summary Slides 2 to 17 Financial Data as of 12-31-15 Dated: February 9, 2016

Additional Information for Shareholders of Anchor BanCorp Wisconsin Inc. Communications in this document do not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger, Old National Bancorp (“ONB”) will file with the Securities and Exchange Commission (“SEC”) a Registration Statement on Form S-4 that will include a Proxy Statement of Anchor BanCorp Wisconsin Inc. (“Anchor”) and a Prospectus of ONB, as well as other relevant documents concerning the proposed transaction. Shareholders are urged to read the Registration Statement and the Proxy Statement/Prospectus regarding the merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about ONB and Anchor, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from ONB at www.oldnational.com under the tab “Investor Relations” and then under the heading “Financial Information” or from Anchor by accessing Anchor’s website at www.anchorbank.com under the tab “About Us.” ONB and Anchor and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Anchor in connection with the proposed merger. Information about the directors and executive officers of ONB is set forth in the proxy statement for ONB’s 2015 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 13, 2015. Information about the directors and executive officers of Anchor is set forth in the proxy statement for Anchor’s 2015 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 27, 2015. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph.

Forward-Looking Statements This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements about the expected timing, completion, financial benefits and other effects of the proposed merger between ONB and Anchor. Forward-looking statements can be identified by the use of the words “anticipate,” “believe,” “expect,” “intend,” “could” and “should,” and other words of similar meaning. These forward-looking statements express management’s current expectations or forecasts of future events and, by their nature, are subject to risks and uncertainties and there are a number of factors that could cause actual results to differ materially from those in such statements. Factors that might cause such a difference include, but are not limited to: expected cost savings, synergies and other financial benefits from the proposed merger might not be realized within the expected time frames and costs or difficulties relating to integration matters might be greater than expected; the requisite shareholder and regulatory approvals for the proposed merger might not be obtained; satisfaction of other closing conditions; delay in closing the proposed merger; the reaction to the transaction of the companies’ customers and employees; market, economic, operational, liquidity, credit and interest rate risks associated with ONB’s and Anchor’s businesses; competition; government legislation and policies (including the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and its related regulations); ability of ONB and Anchor to execute their respective business plans (including integrating the ONB and Anchor businesses); changes in the economy which could materially impact credit quality trends and the ability to generate loans and gather deposits; failure or circumvention of our internal controls; failure or disruption of our information systems; significant changes in accounting, tax or regulatory practices or requirements; new legal obligations or liabilities or unfavorable resolutions of litigations; other factors identified in ONB’s Annual Report on Form 10-K and other periodic filings with the SEC and other factors identified in this presentation. These forward-looking statements are made only as of the date of this presentation, and neither ONB nor Anchor undertakes an obligation to release revisions to these forward-looking statements to reflect events or conditions after the date of this presentation.

Non-GAAP Financial Measures These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant's historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the registrant; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, Old National Bancorp has provided reconciliations within the slides, as necessary, of the non-GAAP financial measure to the most directly comparable GAAP financial measure.

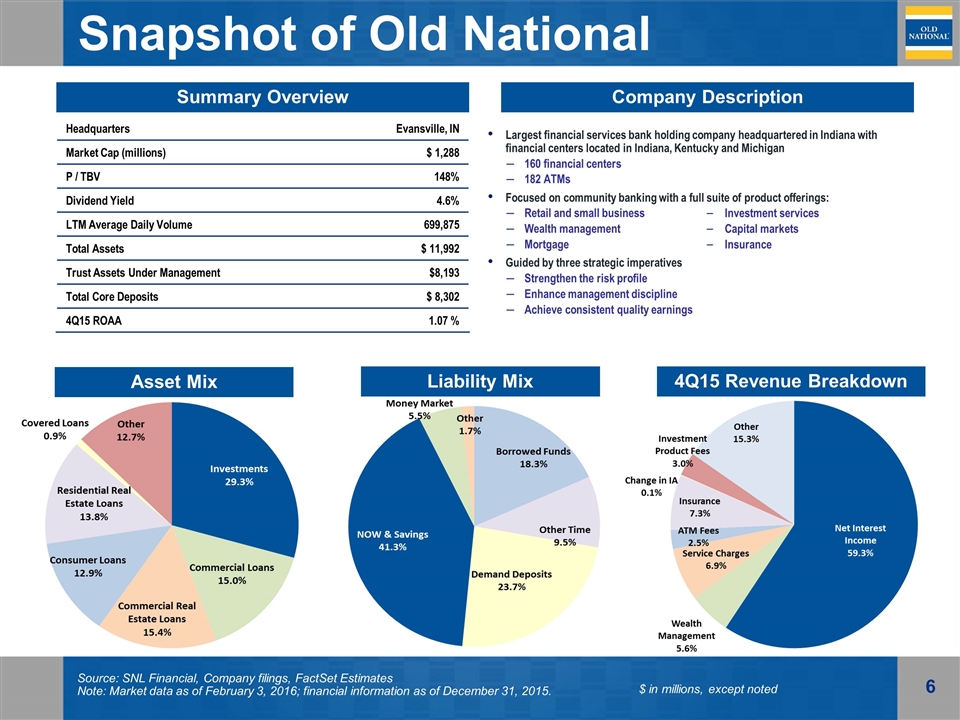

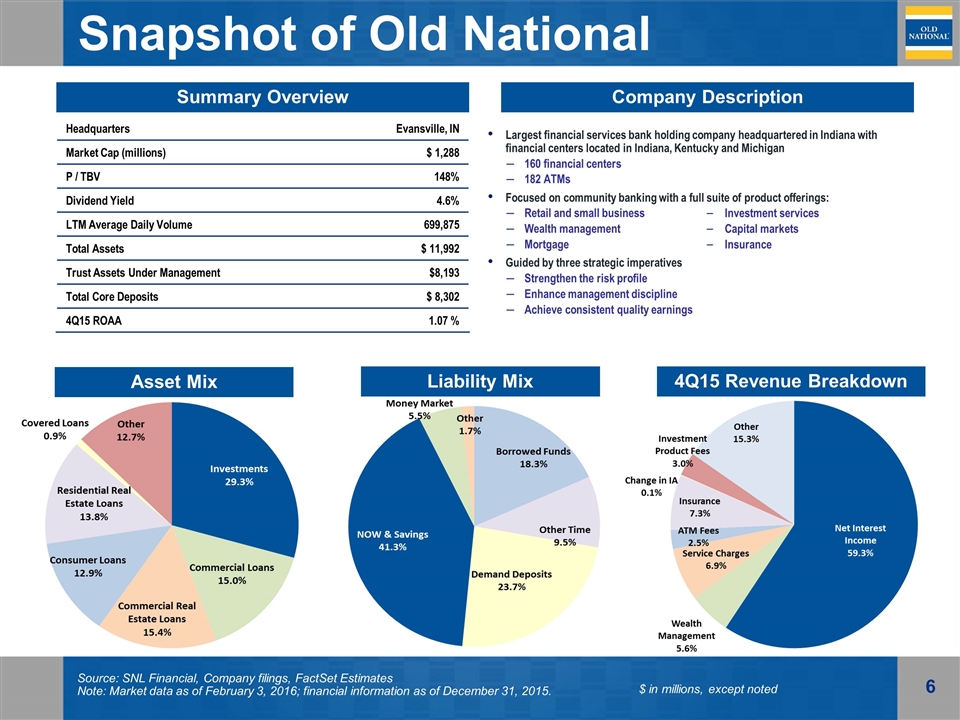

Snapshot of Old National Largest financial services bank holding company headquartered in Indiana with financial centers located in Indiana, Kentucky and Michigan 160 financial centers 182 ATMs Focused on community banking with a full suite of product offerings: Retail and small business Wealth management Mortgage Guided by three strategic imperatives Strengthen the risk profile Enhance management discipline Achieve consistent quality earnings Source: SNL Financial, Company filings, FactSet Estimates Note: Market data as of February 3, 2016; financial information as of December 31, 2015. Summary Overview Company Description Headquarters Evansville, IN Market Cap (millions) $ 1,288 P / TBV 148% Dividend Yield 4.6% LTM Average Daily Volume 699,875 Total Assets $ 11,992 Trust Assets Under Management $8,193 Total Core Deposits $ 8,302 4Q15 ROAA 1.07 % $ in millions, except noted Investment services Capital markets Insurance Asset Mix Liability Mix 4Q15 Revenue Breakdown

A Strategic Framework for Creating Long-Term Shareholder Value Attractive footprint that offers both leading share in mature markets and room to expand in higher growth markets Consistent financial performance with distinct revenue streams and actions taken to improve efficiency Diverse loan portfolio with growth accelerating while maintaining strong credit metrics Disciplined acquisitions that are exceeding expectations with robust future opportunities Steward of capital – organic growth, dividend / share repurchases, and acquisitions Achieving strategic imperatives

Commitment to Excellence

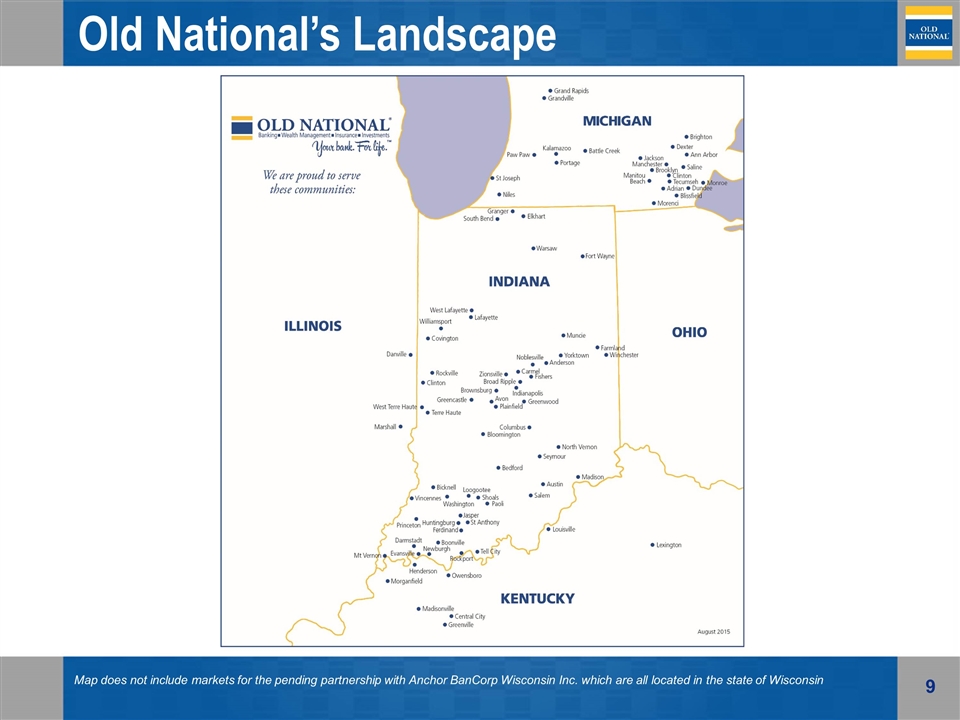

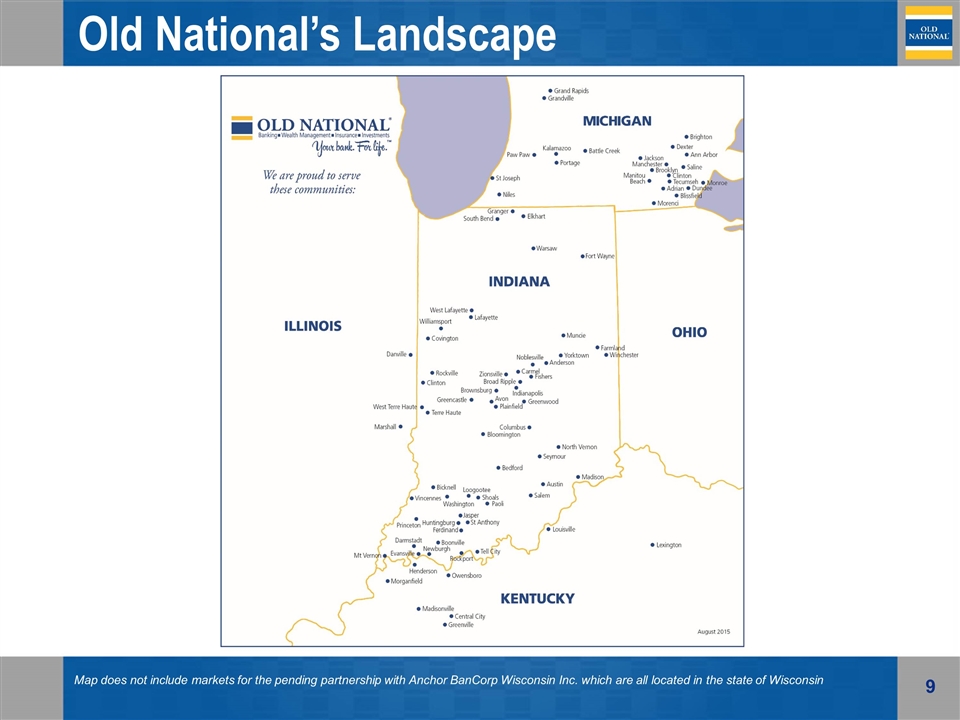

Old National’s Landscape Map does not include markets for the pending partnership with Anchor BanCorp Wisconsin Inc. which are all located in the state of Wisconsin

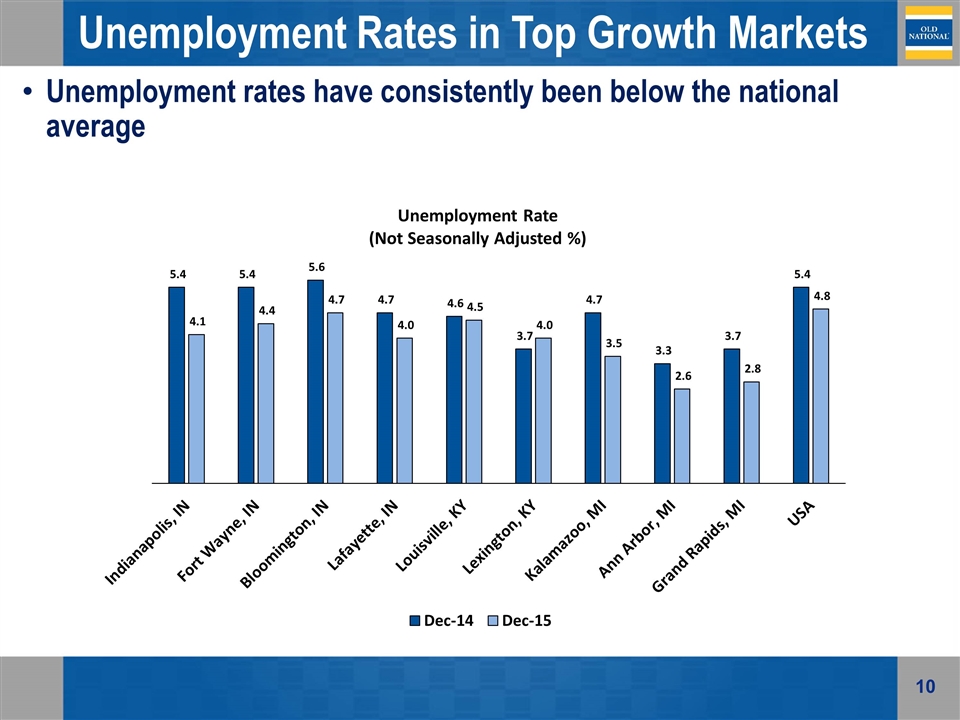

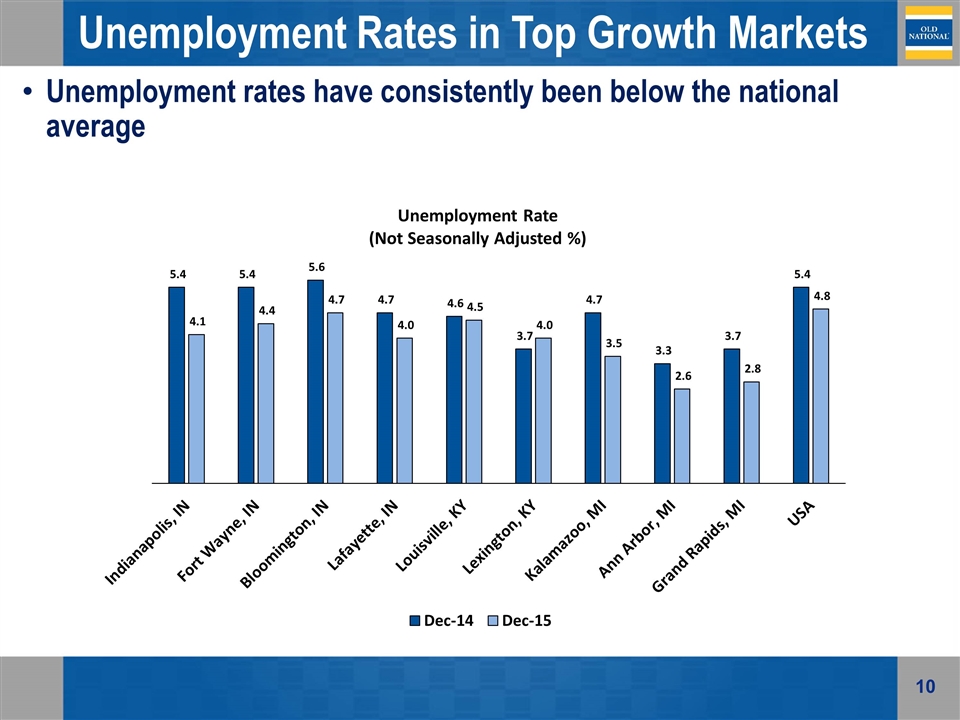

Unemployment Rates in Top Growth Markets Unemployment rates have consistently been below the national average

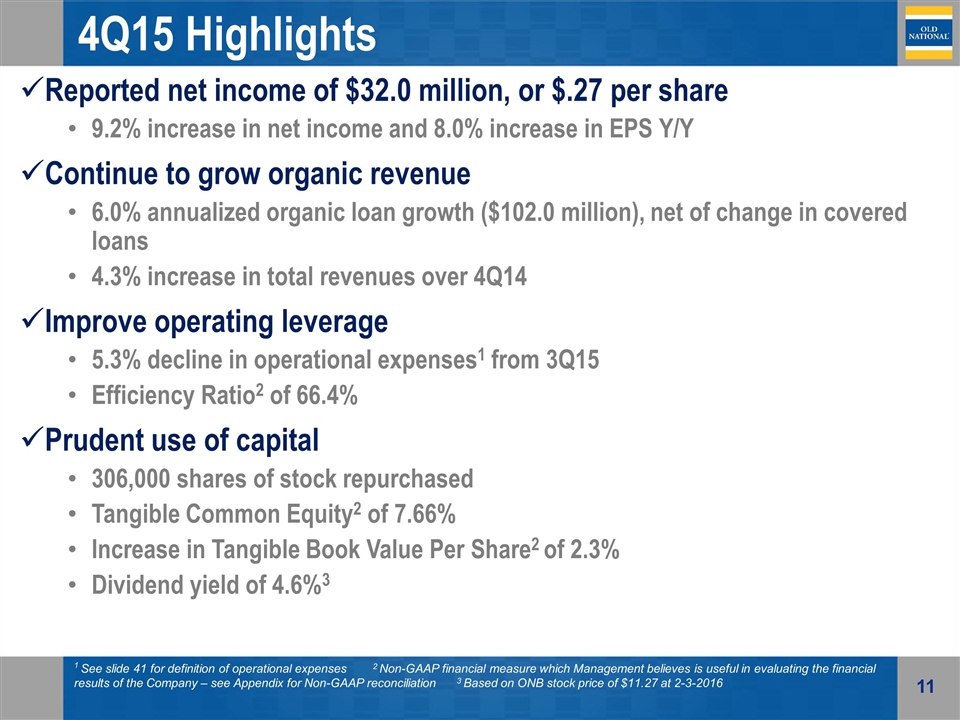

4Q15 Highlights Reported net income of $32.0 million, or $.27 per share 9.2% increase in net income and 8.0% increase in EPS Y/Y Continue to grow organic revenue 6.0% annualized organic loan growth ($102.0 million), net of change in covered loans 4.3% increase in total revenues over 4Q14 Improve operating leverage 5.3% decline in operational expenses1 from 3Q15 Efficiency Ratio2 of 66.4% Prudent use of capital 306,000 shares of stock repurchased Tangible Common Equity2 of 7.66% Increase in Tangible Book Value Per Share2 of 2.3% Dividend yield of 4.6%3 1 See slide 41 for definition of operational expenses 2 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation 3 Based on ONB stock price of $11.27 at 2-3-2016

2015 vs 2014 Highlights Reported net income of $116.7 million, or $1.00 per share 12.6% increase in net income and 5.3% increase in EPS Continue to grow organic revenue 5.1% organic loan growth ($324.1 million), excluding covered, acquired and sold loans 12.3% increase in total revenues (despite $5.4 million decline from Durbin) Improve operating leverage 1.8% decline in operational expenses from 4Q14 Sold non-strategic market (Southern IL) + 5 other branches Implemented successful voluntary early retirement program Consolidated 23 branches Repurchased 14 bank properties Deposits per branch exceeds $50 million, 30% increase from 2012 Prudent use of capital 6.3 million shares of stock repurchased Stable Tangible Book Value Per Share1 despite partnership activity 1 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation

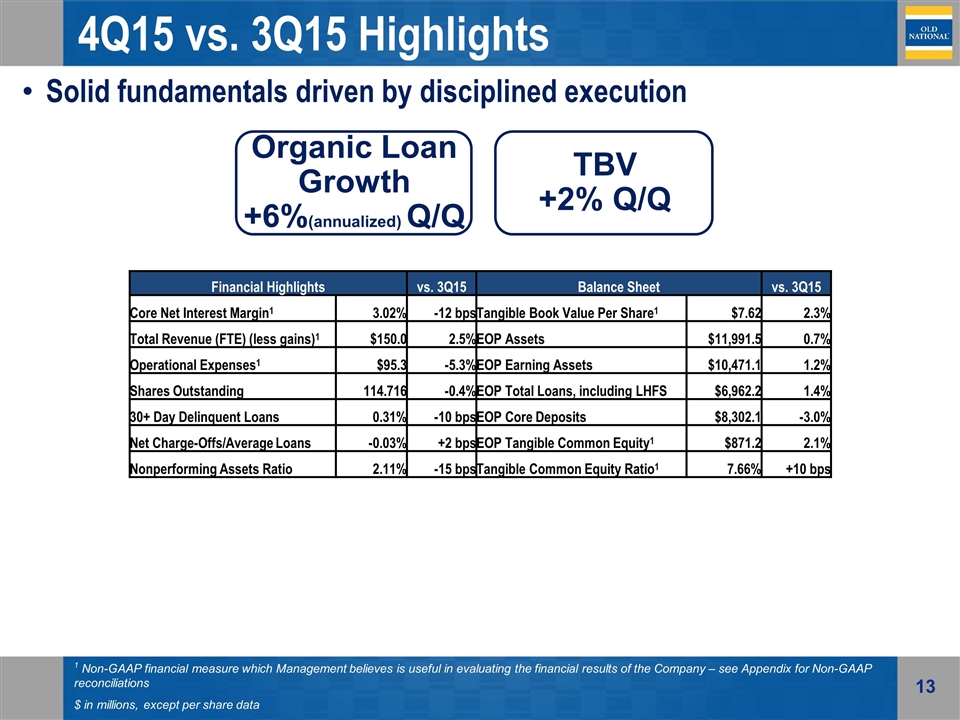

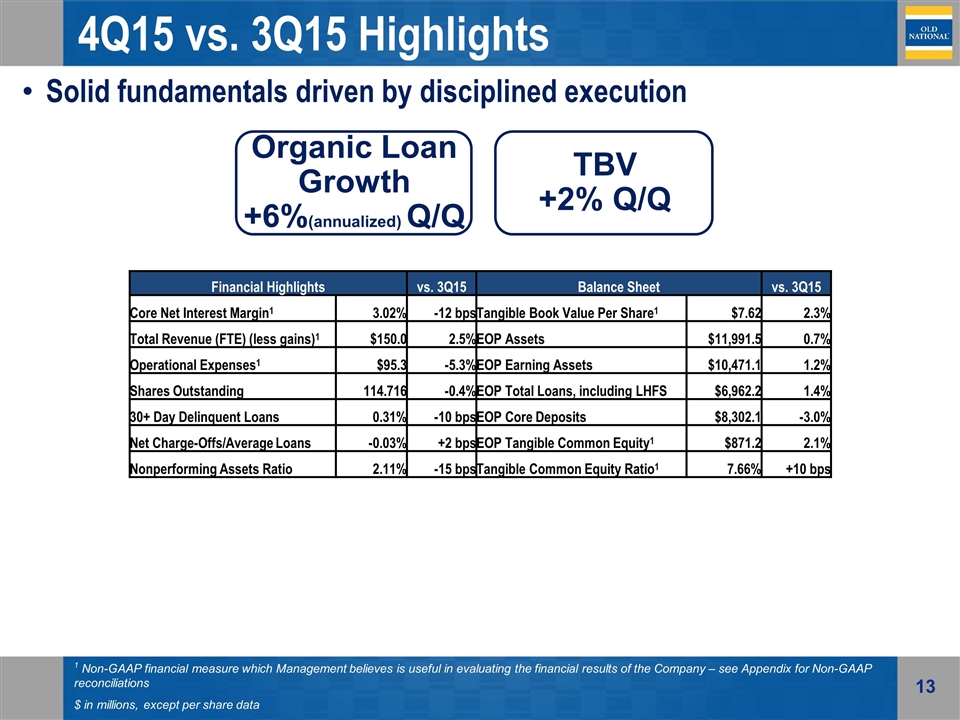

4Q15 vs. 3Q15 Highlights Solid fundamentals driven by disciplined execution Organic Loan Growth +6%(annualized) Q/Q TBV +2% Q/Q 1 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliations $ in millions, except per share data Financial Highlights vs. 3Q15 Balance Sheet vs. 3Q15 Core Net Interest Margin1 3.02% -12 bps Tangible Book Value Per Share1 $7.62 2.3% Total Revenue (FTE) (less gains)1 $150.0 2.5% EOP Assets $11,991.5 0.7% Operational Expenses1 $95.3 -5.3% EOP Earning Assets $10,471.1 1.2% Shares Outstanding 114.716 -0.4% EOP Total Loans, including LHFS $6,962.2 1.4% 30+ Day Delinquent Loans 0.31% -10 bps EOP Core Deposits $8,302.1 -3.0% Net Charge-Offs/Average Loans -0.03% +2 bps EOP Tangible Common Equity1 $871.2 2.1% Nonperforming Assets Ratio 2.11% -15 bps Tangible Common Equity Ratio1 7.66% +10 bps

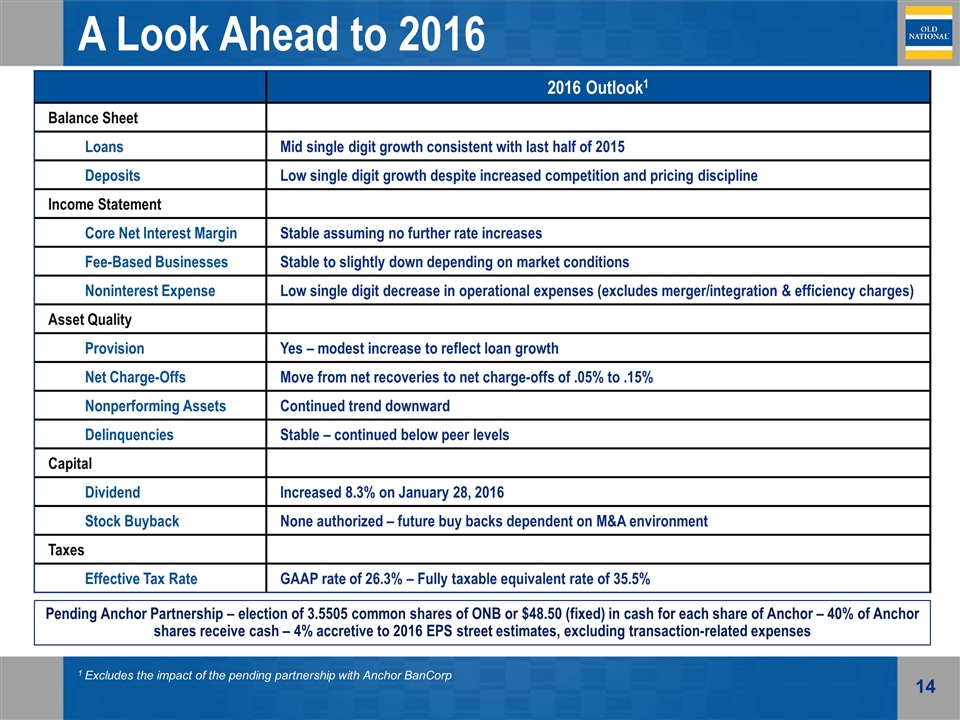

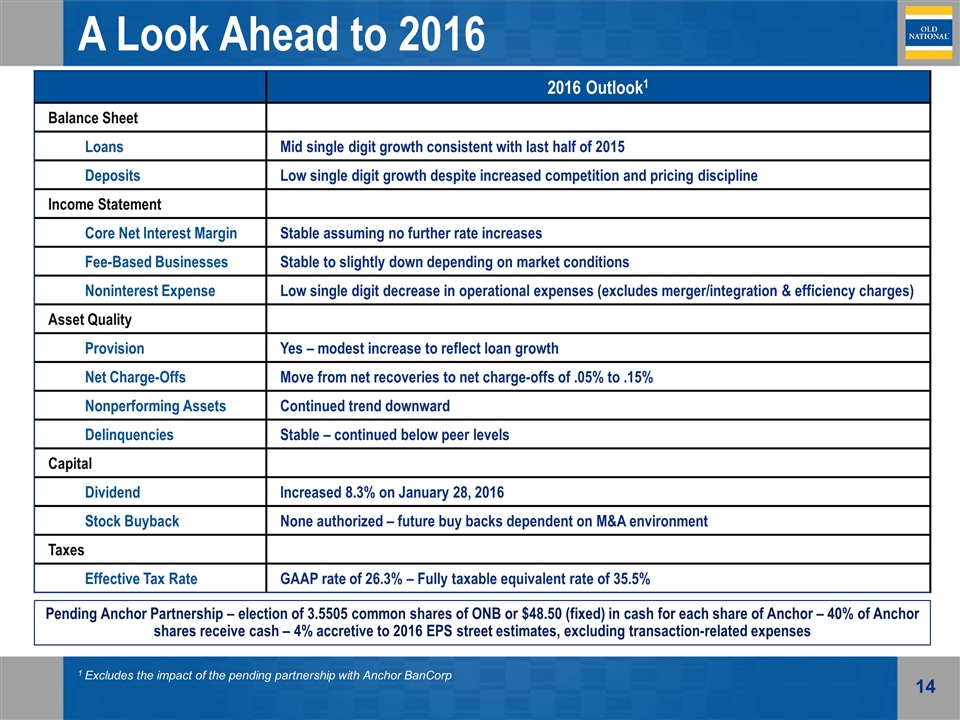

A Look Ahead to 2016 2016 Outlook1 Balance Sheet Loans Mid single digit growth consistent with last half of 2015 Deposits Low single digit growth despite increased competition and pricing discipline Income Statement Core Net Interest Margin Stable assuming no further rate increases Fee-Based Businesses Stable to slightly down depending on market conditions Noninterest Expense Low single digit decrease in operational expenses (excludes merger/integration & efficiency charges) Asset Quality Provision Yes – modest increase to reflect loan growth Net Charge-Offs Move from net recoveries to net charge-offs of .05% to .15% Nonperforming Assets Continued trend downward Delinquencies Stable – continued below peer levels Capital Dividend Increased 8.3% on January 28, 2016 Stock Buyback None authorized – future buy backs dependent on M&A environment Taxes Effective Tax Rate GAAP rate of 26.3% – Fully taxable equivalent rate of 35.5% 1 Excludes the impact of the pending partnership with Anchor BanCorp Pending Anchor Partnership – election of 3.5505 common shares of ONB or $48.50 (fixed) in cash for each share of Anchor – 40% of Anchor shares receive cash – 4% accretive to 2016 EPS street estimates, excluding transaction-related expenses

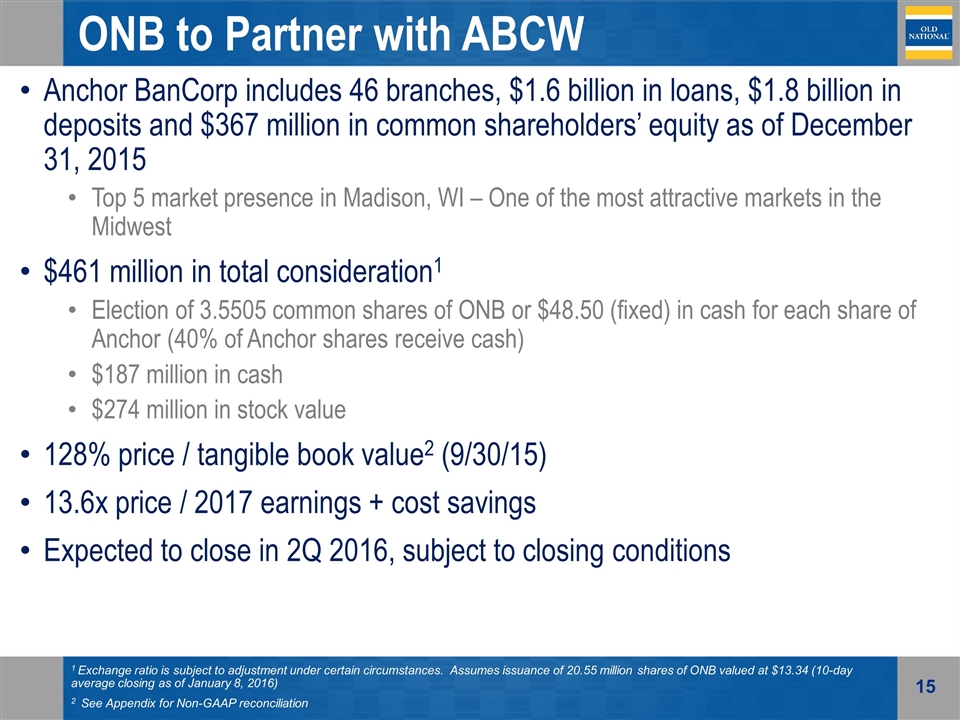

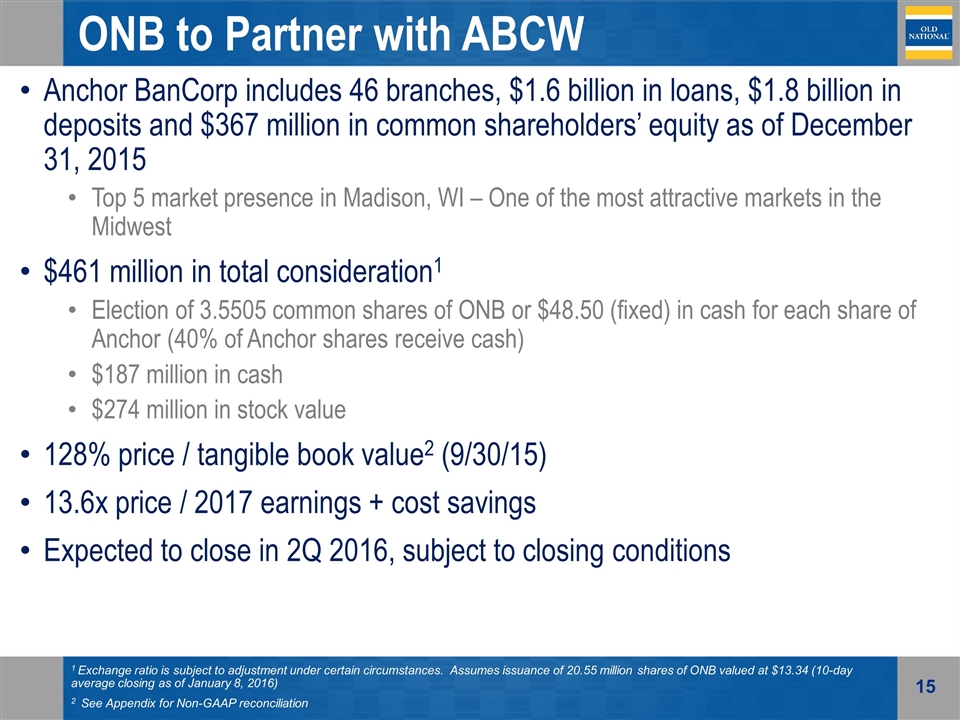

ONB to Partner with ABCW Anchor BanCorp includes 46 branches, $1.6 billion in loans, $1.8 billion in deposits and $367 million in common shareholders’ equity as of December 31, 2015 Top 5 market presence in Madison, WI – One of the most attractive markets in the Midwest $461 million in total consideration1 Election of 3.5505 common shares of ONB or $48.50 (fixed) in cash for each share of Anchor (40% of Anchor shares receive cash) $187 million in cash $274 million in stock value 128% price / tangible book value2 (9/30/15) 13.6x price / 2017 earnings + cost savings Expected to close in 2Q 2016, subject to closing conditions 1 Exchange ratio is subject to adjustment under certain circumstances. Assumes issuance of 20.55 million shares of ONB valued at $13.34 (10-day average closing as of January 8, 2016) 2 See Appendix for Non-GAAP reconciliation

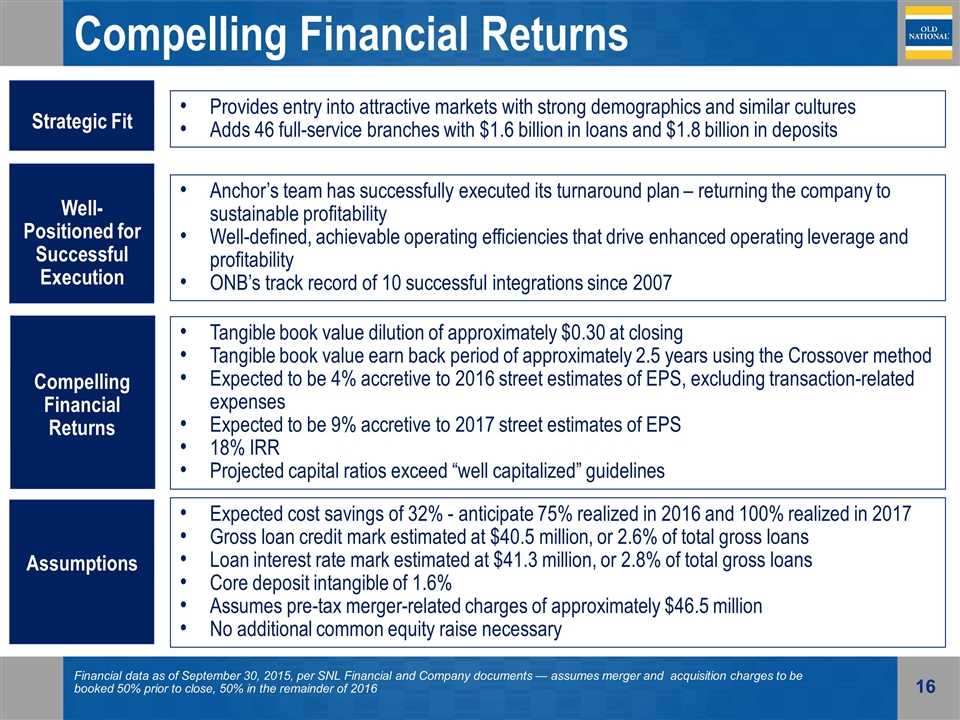

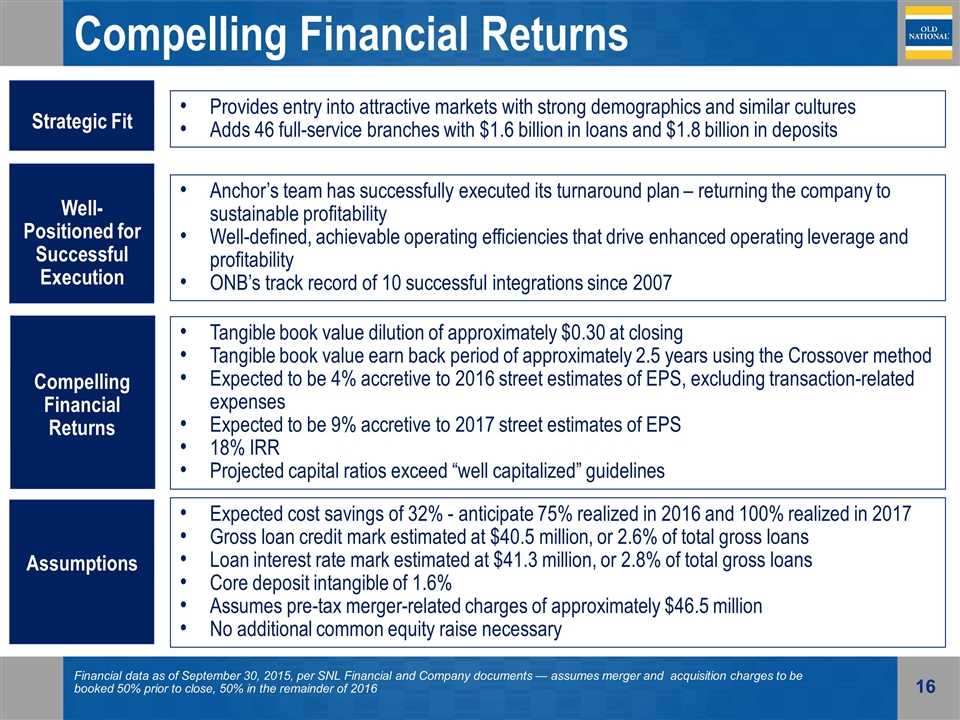

Compelling Financial Returns Strategic Fit Financial data as of September 30, 2015, per SNL Financial and Company documents — assumes merger and acquisition charges to be booked 50% prior to close, 50% in the remainder of 2016 Well-Positioned for Successful Execution Anchor’s team has successfully executed its turnaround plan – returning the company to sustainable profitability Well-defined, achievable operating efficiencies that drive enhanced operating leverage and profitability ONB’s track record of 10 successful integrations since 2007 Provides entry into attractive markets with strong demographics and similar cultures Adds 46 full-service branches with $1.6 billion in loans and $1.8 billion in deposits Compelling Financial Returns Tangible book value dilution of approximately $0.30 at closing Tangible book value earn back period of approximately 2.5 years using the Crossover method Expected to be 4% accretive to 2016 street estimates of EPS, excluding transaction-related expenses Expected to be 9% accretive to 2017 street estimates of EPS 18% IRR Projected capital ratios exceed “well capitalized” guidelines Assumptions Expected cost savings of 32% - anticipate 75% realized in 2016 and 100% realized in 2017 Gross loan credit mark estimated at $40.5 million, or 2.6% of total gross loans Loan interest rate mark estimated at $41.3 million, or 2.8% of total gross loans Core deposit intangible of 1.6% Assumes pre-tax merger-related charges of approximately $46.5 million No additional common equity raise necessary

Why Wisconsin? Cultural similarities to newly entered growth markets Comparable competitive dynamics and client opportunities Wisconsin’s forecasted job picture has improved dramatically to No. 21 this year.1 Ranked #1 in the East North Central Region by Site Selection for top Workforce Development States Tied for 7th among all US states for job creation in the 2015 annual Gallup poll 1 Forbes.com

Investment Thesis Financial Data as of 12-31-15 Dated: February 9, 2016

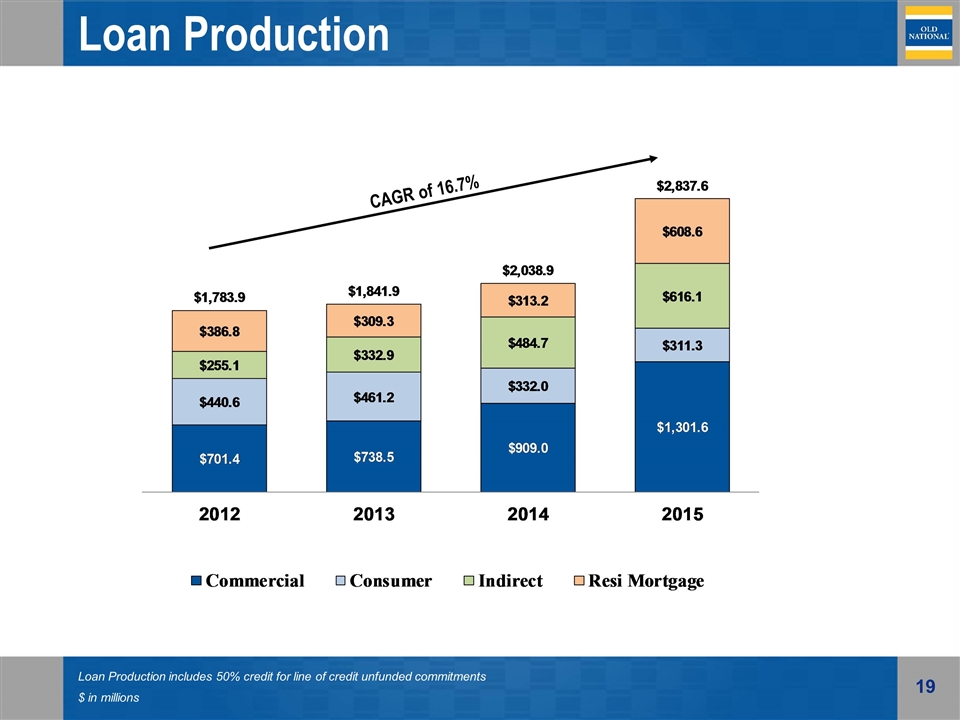

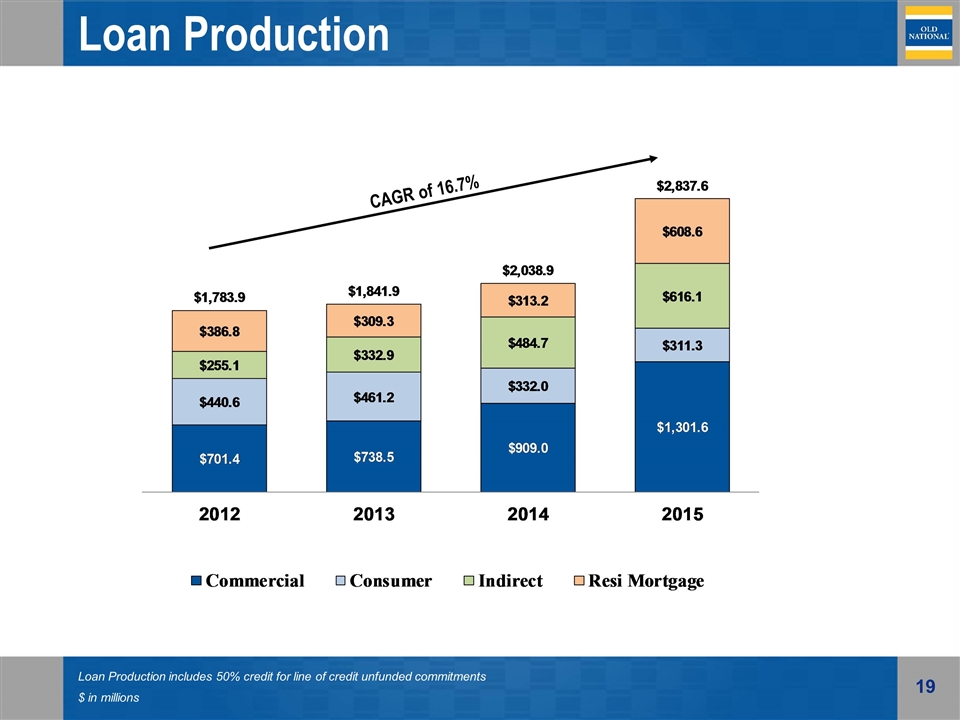

Loan Production CAGR of 16.7% Loan Production includes 50% credit for line of credit unfunded commitments $ in millions

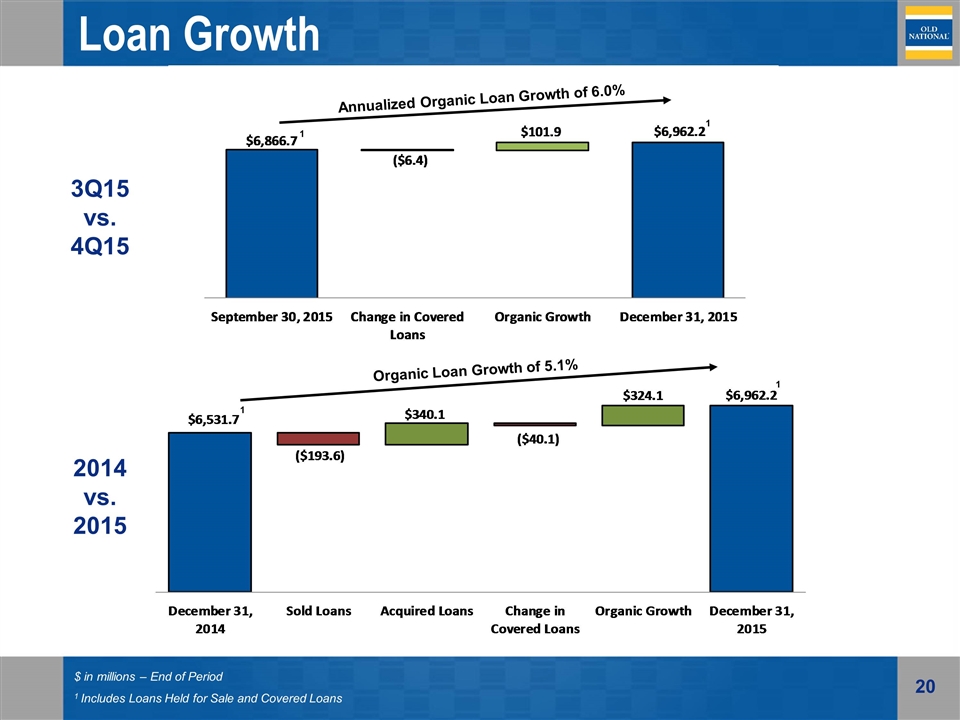

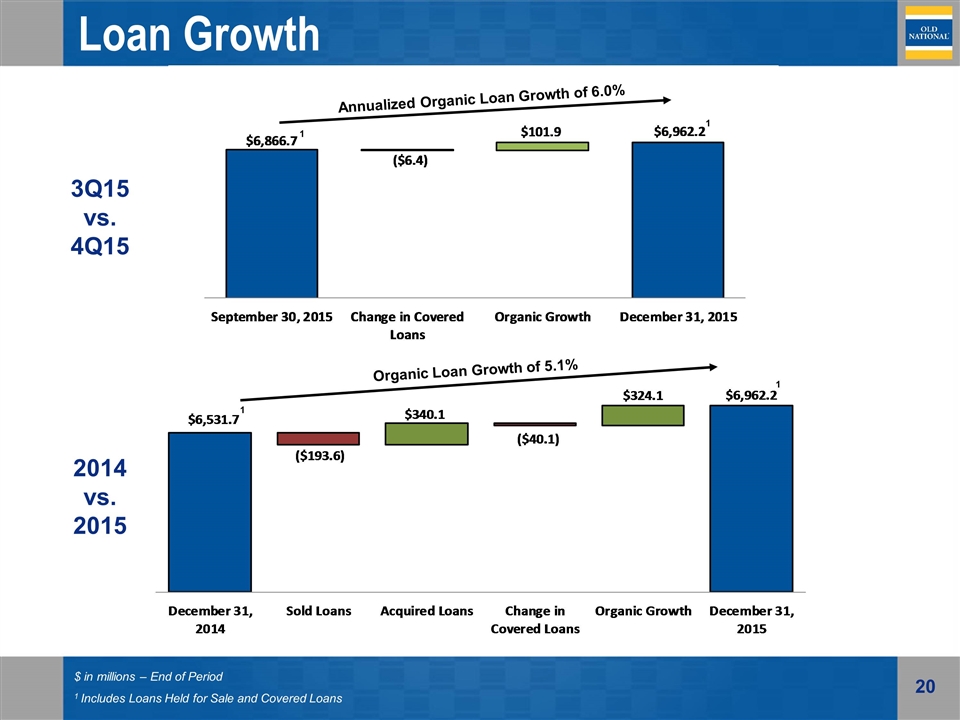

Loan Growth $ in millions – End of Period 1 Includes Loans Held for Sale and Covered Loans 1 1 Annualized Organic Loan Growth of 6.0% 1 1 Organic Loan Growth of 5.1% 3Q15 vs. 4Q15 2014 vs. 2015

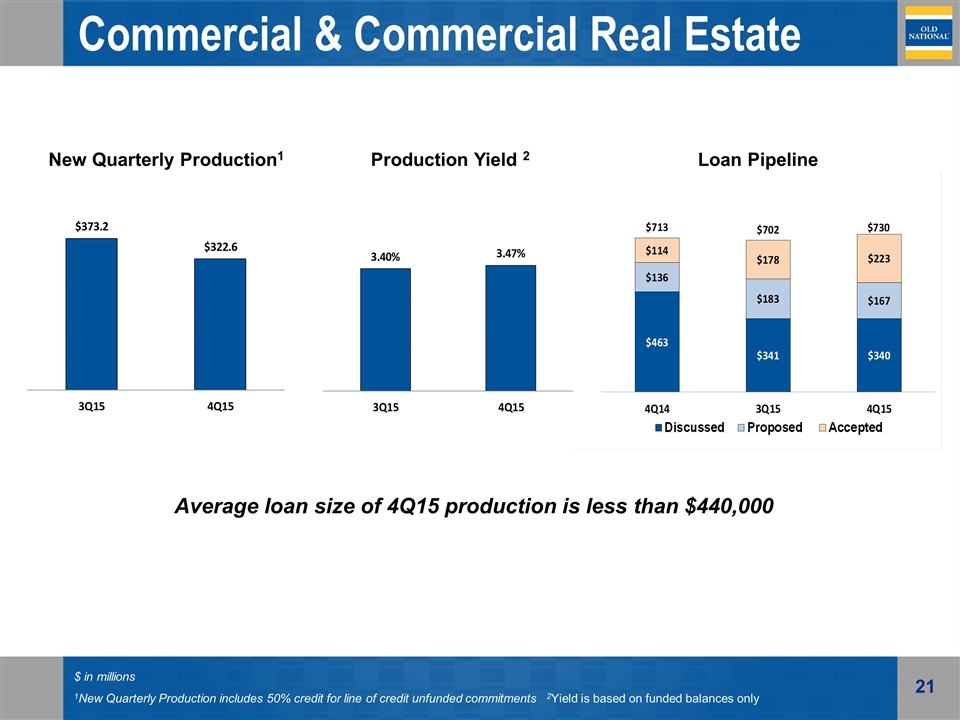

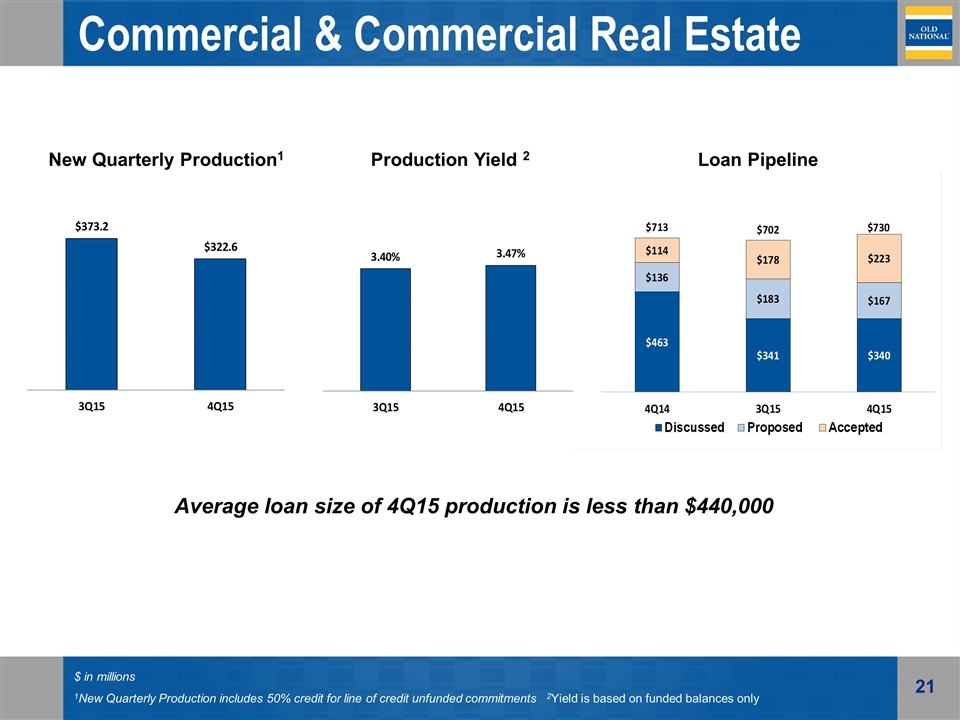

Commercial & Commercial Real Estate Loans $ in millions 1New Quarterly Production includes 50% credit for line of credit unfunded commitments 2Yield is based on funded balances only New Quarterly Production1 Production Yield 2 Average loan size of 4Q15 production is less than $440,000 Loan Pipeline

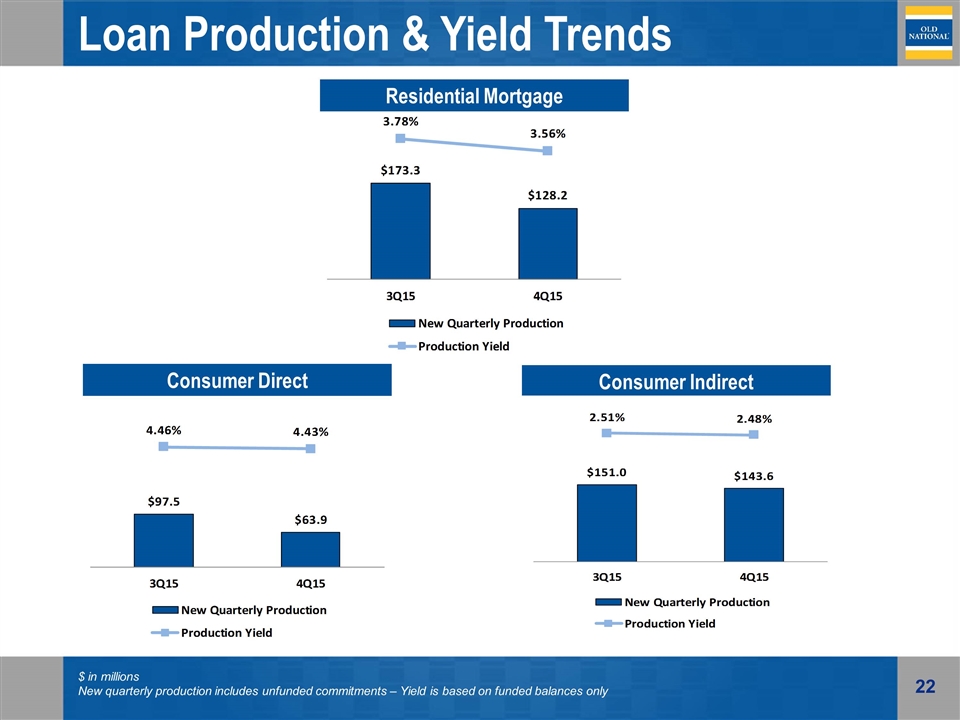

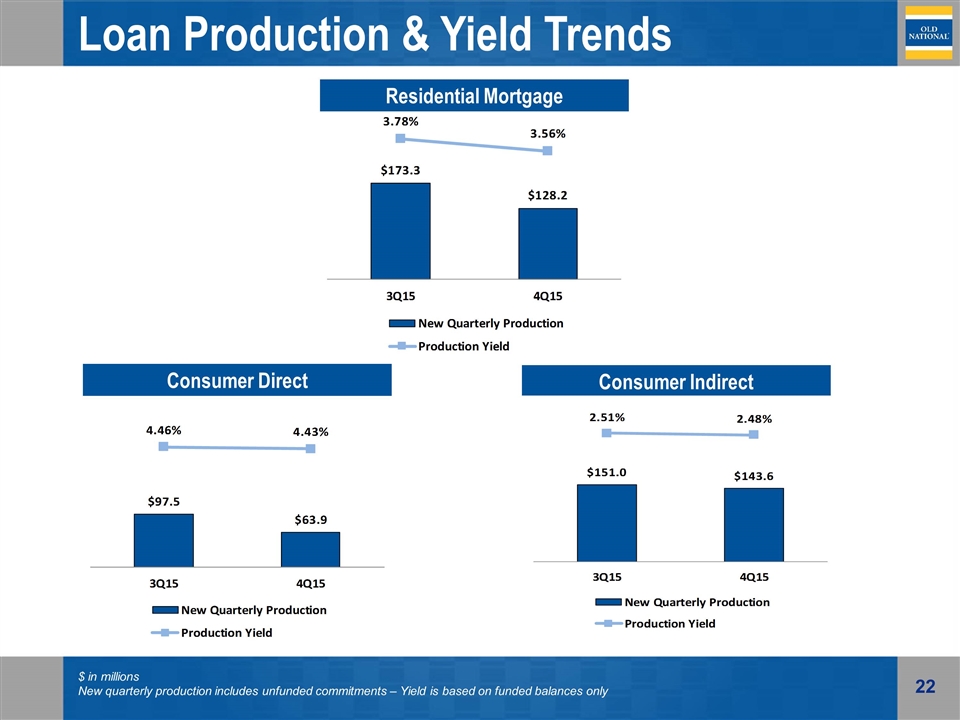

Loan Production & Yield Trends $ in millions New quarterly production includes unfunded commitments – Yield is based on funded balances only Residential Mortgage Consumer Direct Consumer Indirect

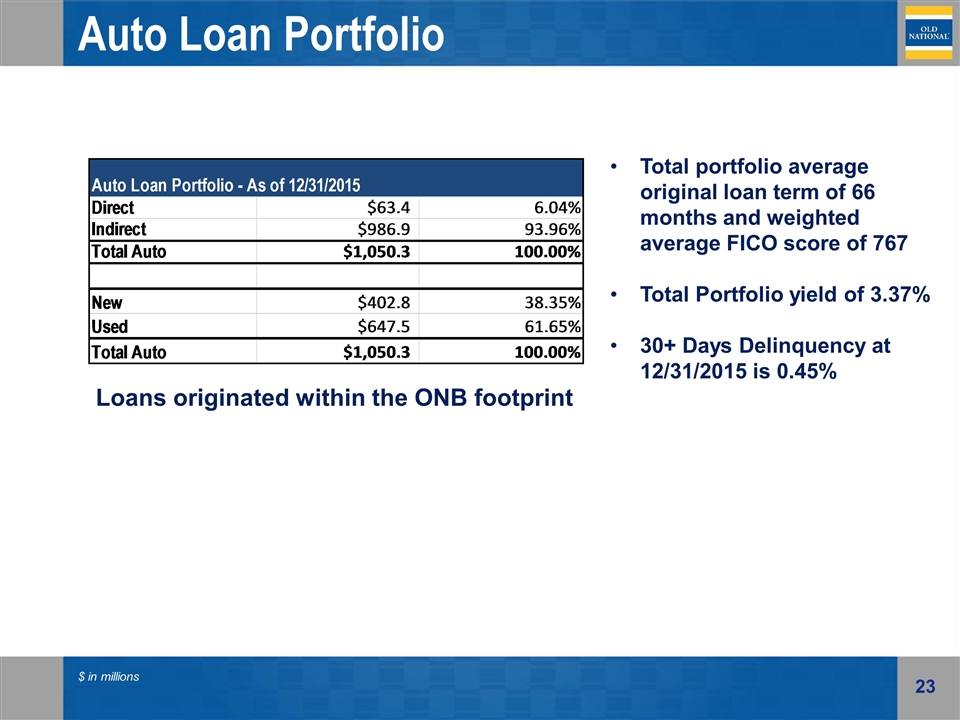

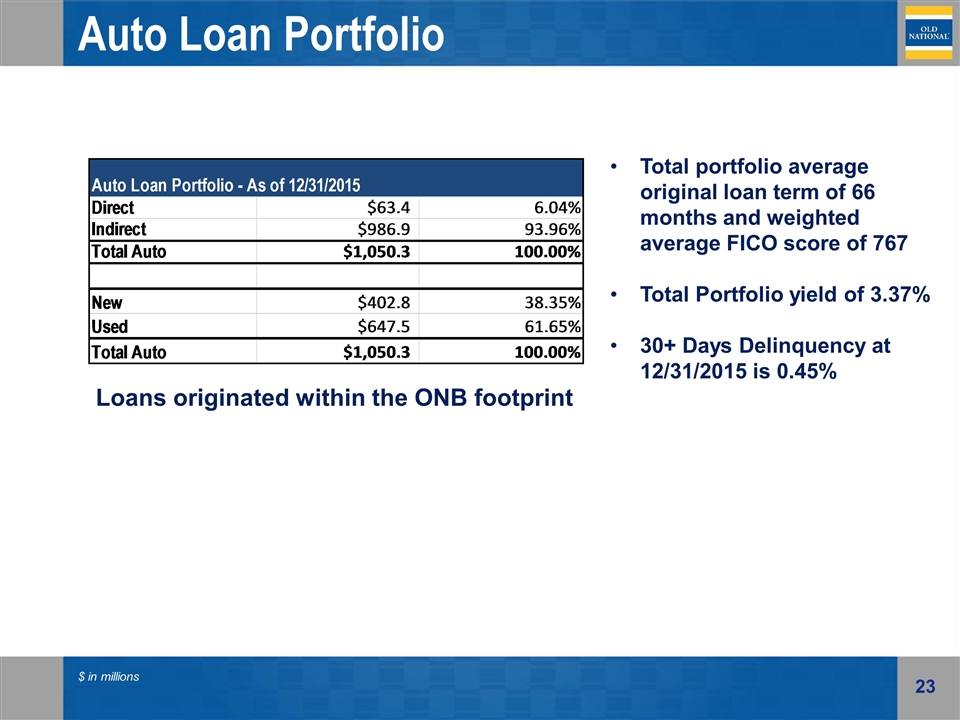

Auto Loan Portfolio $ in millions Total portfolio average original loan term of 66 months and weighted average FICO score of 767 Total Portfolio yield of 3.37% 30+ Days Delinquency at 12/31/2015 is 0.45% Loans originated within the ONB footprint

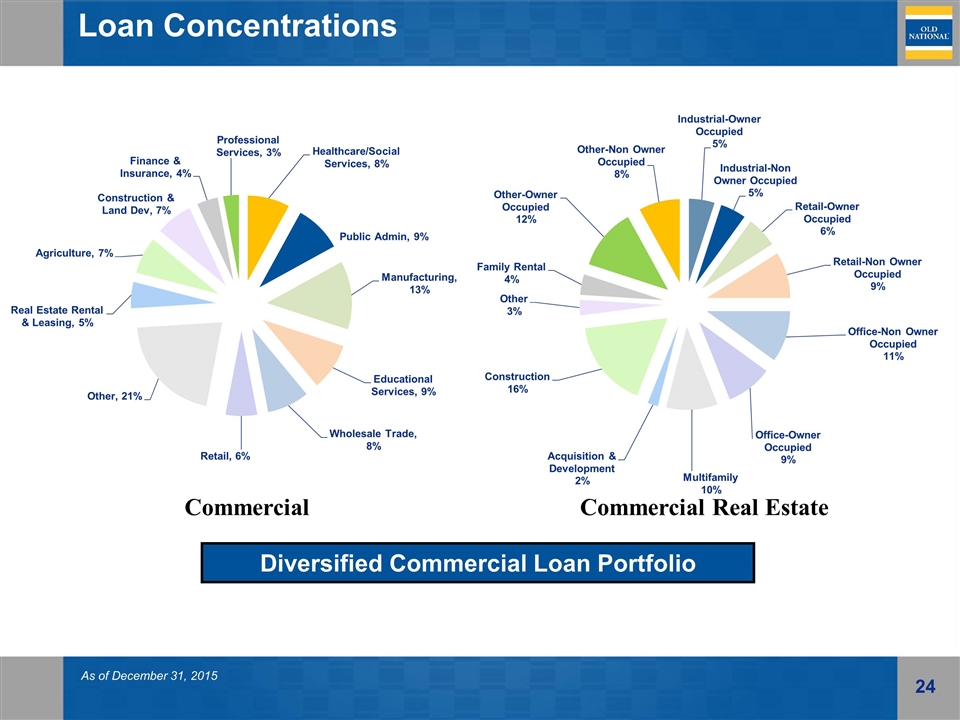

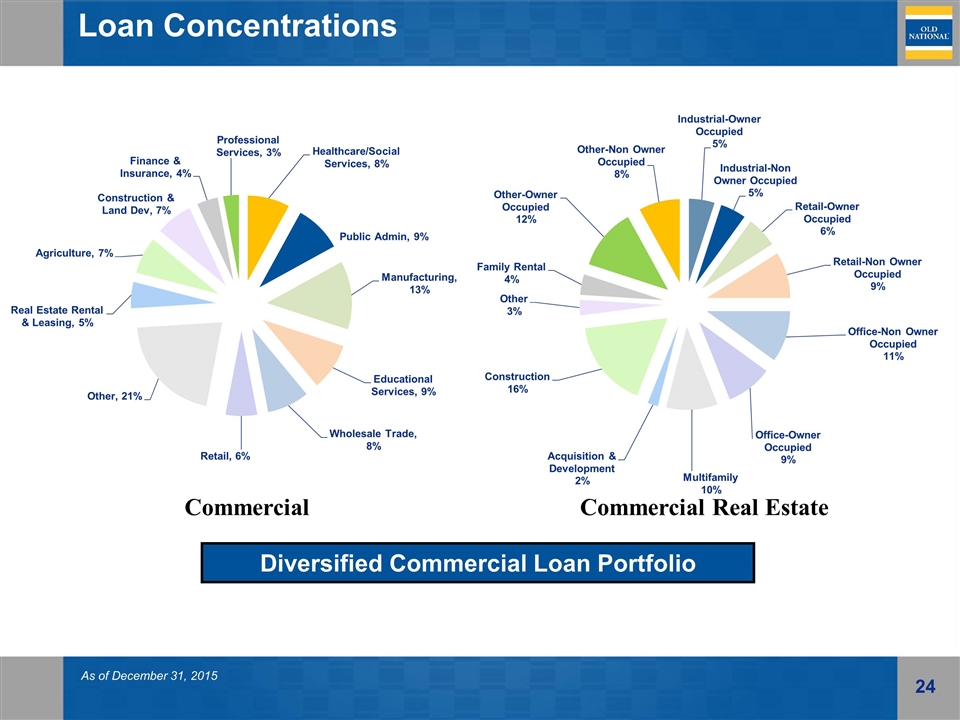

Loan Concentrations As of December 31, 2015 Commercial Commercial Real Estate Diversified Commercial Loan Portfolio

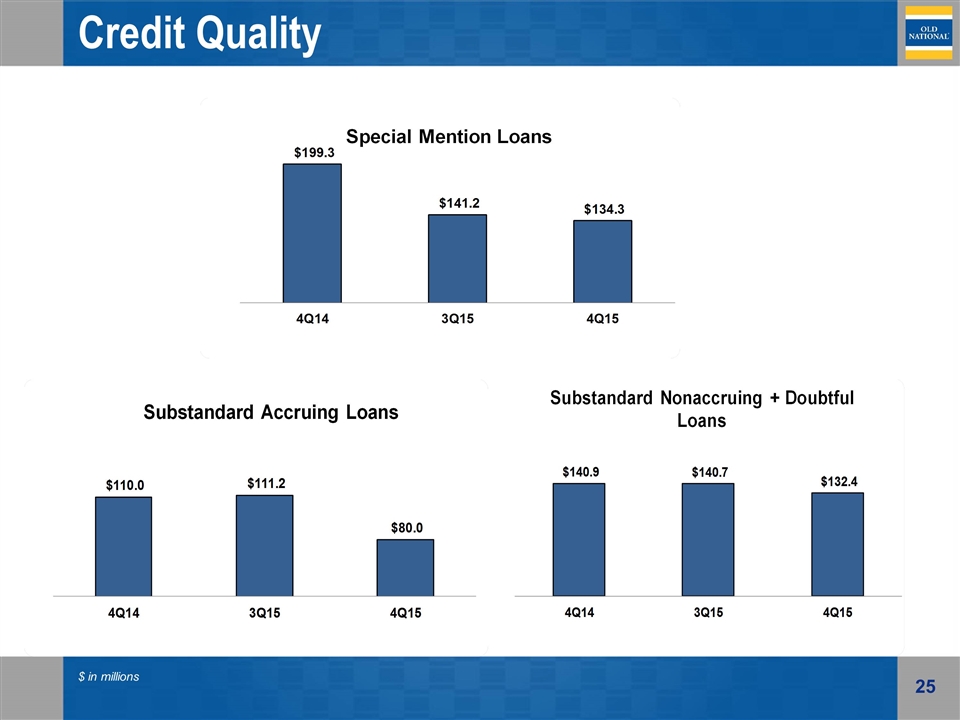

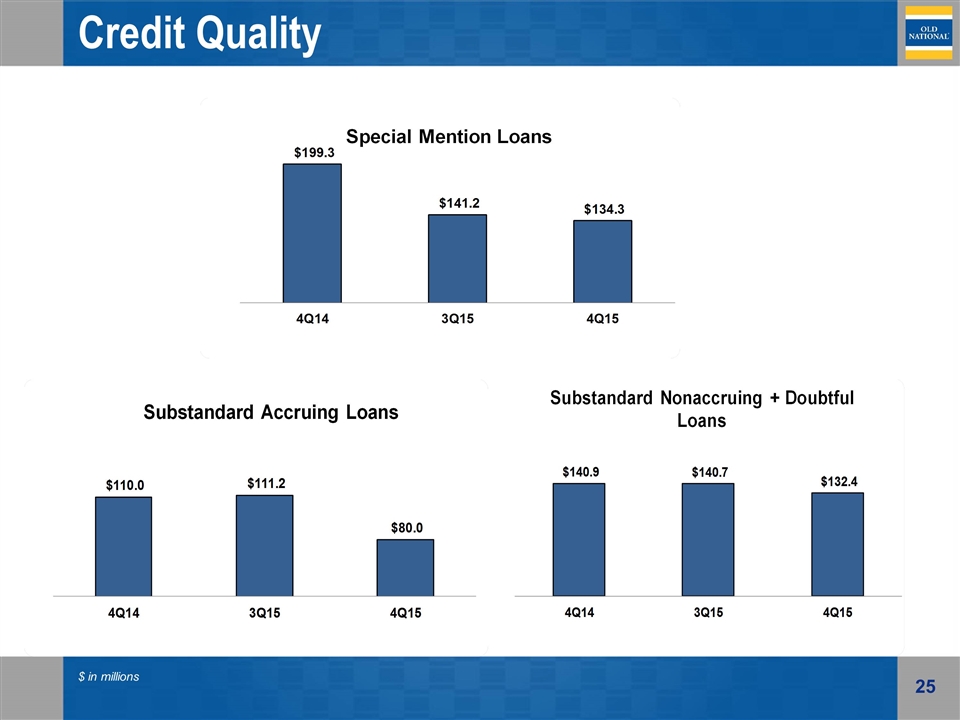

$ in millions Credit Quality

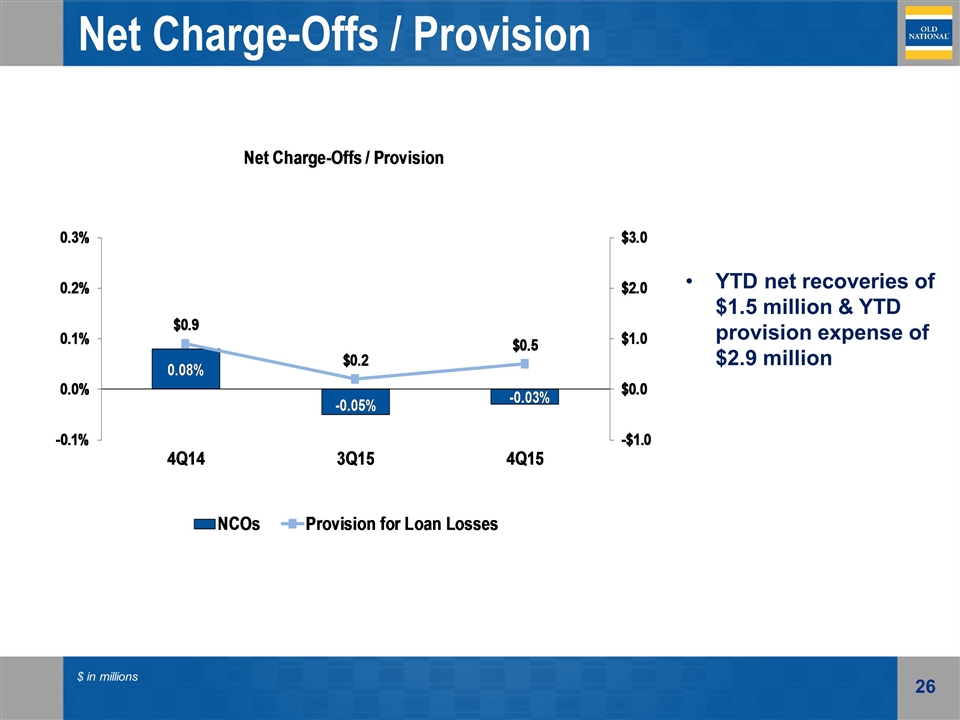

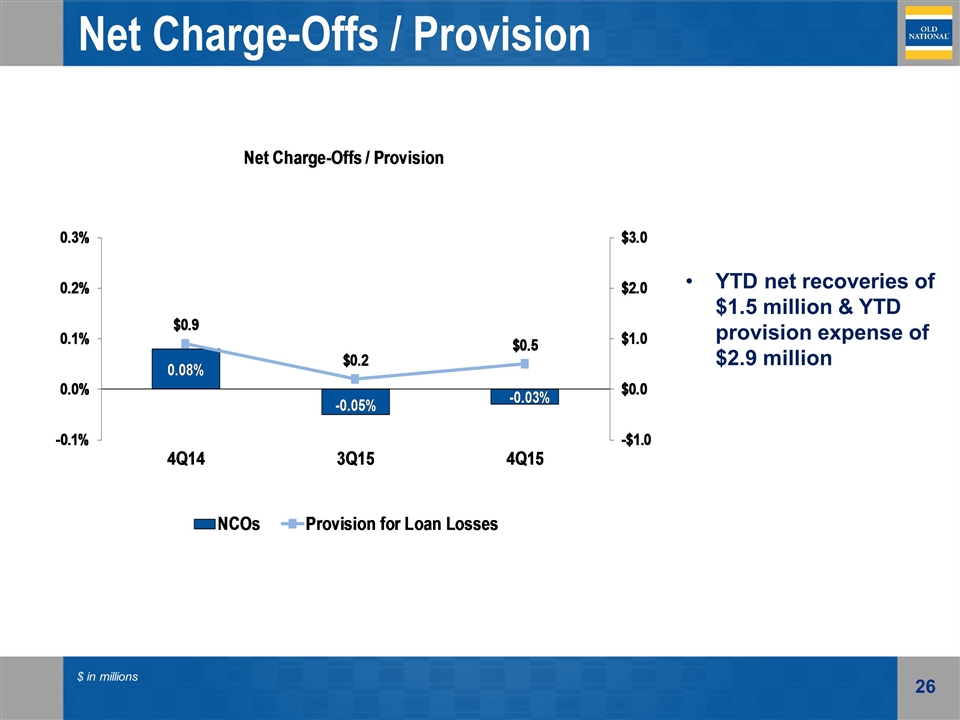

Net Charge-Offs / Provision $ in millions YTD net recoveries of $1.5 million & YTD provision expense of $2.9 million

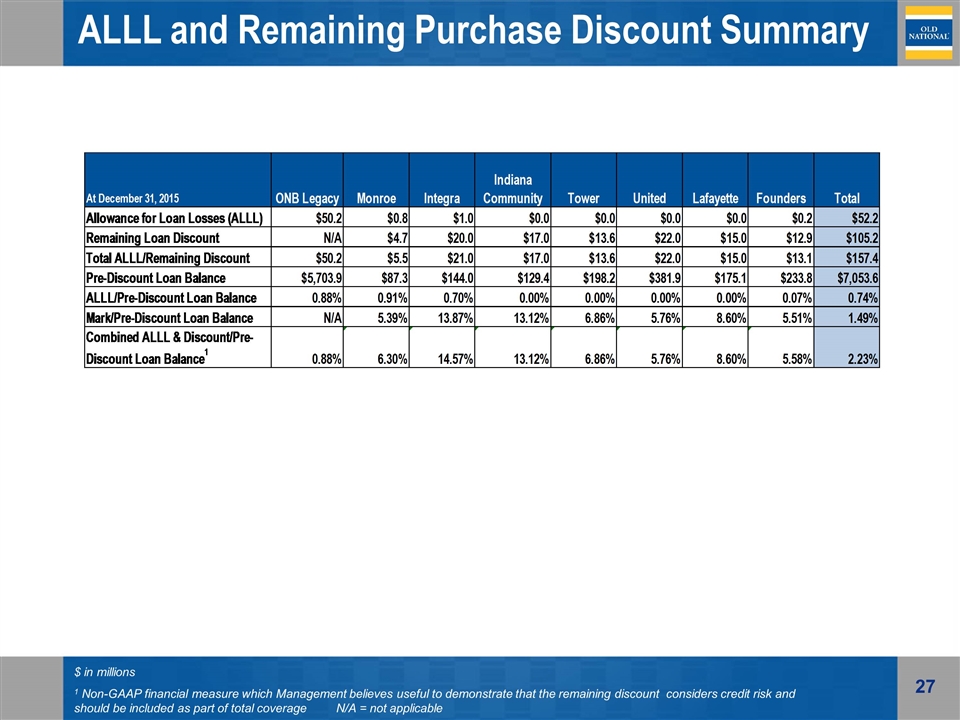

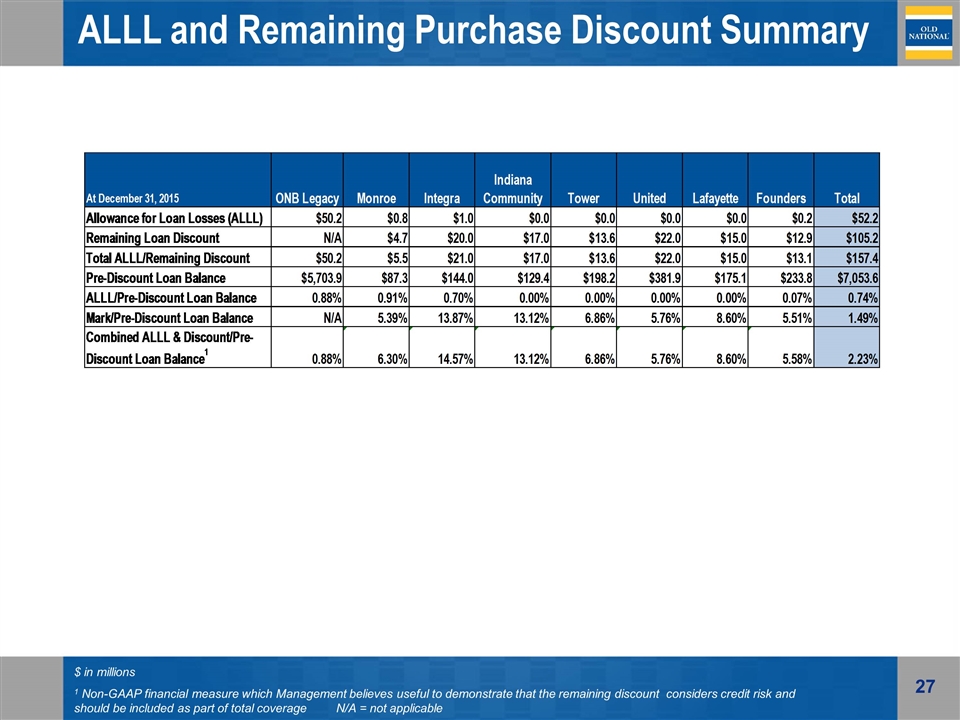

ALLL and Remaining Purchase Discount Summary $ in millions 1 Non-GAAP financial measure which Management believes useful to demonstrate that the remaining discount considers credit risk and should be included as part of total coverage N/A = not applicable

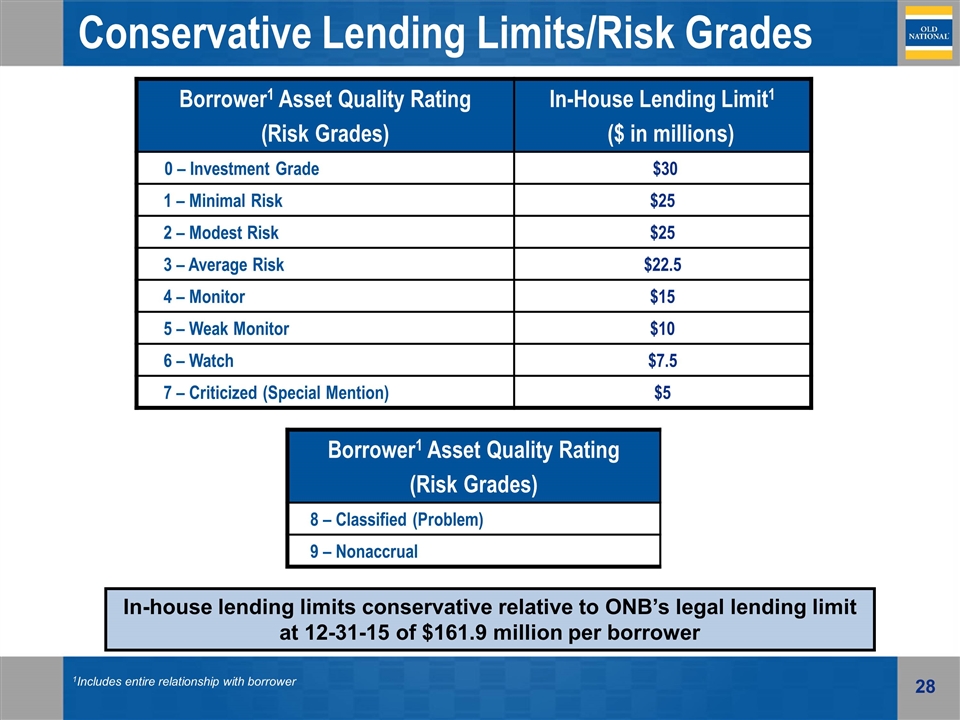

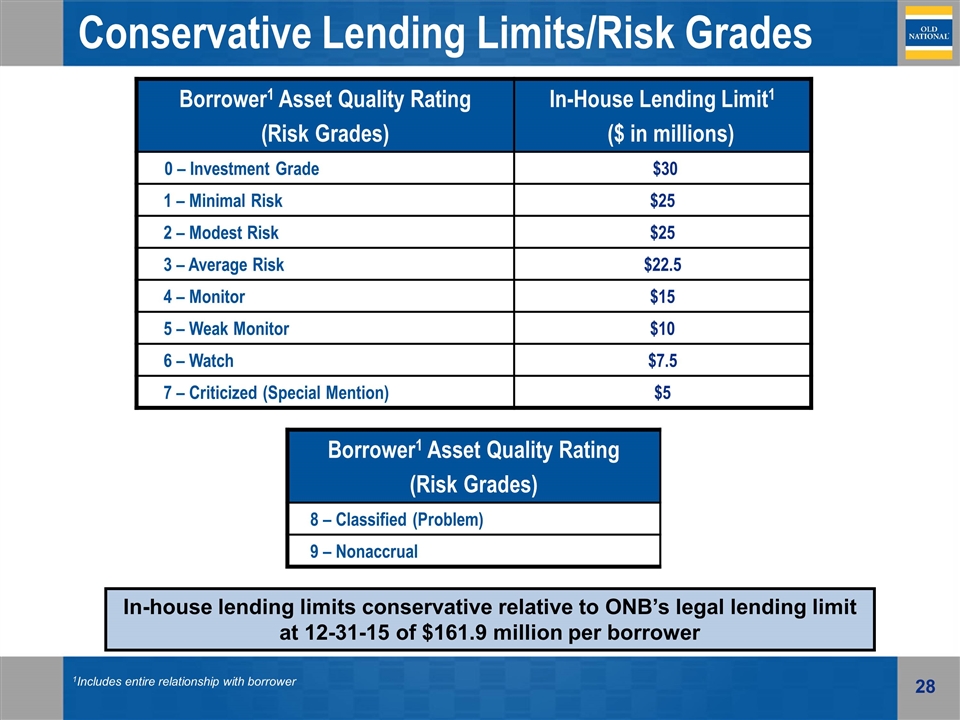

Conservative Lending Limits/Risk Grades Borrower1 Asset Quality Rating (Risk Grades) In-House Lending Limit1 ($ in millions) 0 – Investment Grade $30 1 – Minimal Risk $25 2 – Modest Risk $25 3 – Average Risk $22.5 4 – Monitor $15 5 – Weak Monitor $10 6 – Watch $7.5 7 – Criticized (Special Mention) $5 In-house lending limits conservative relative to ONB’s legal lending limit at 12-31-15 of $161.9 million per borrower 1Includes entire relationship with borrower Borrower1 Asset Quality Rating (Risk Grades) 8 – Classified (Problem) 9 – Nonaccrual

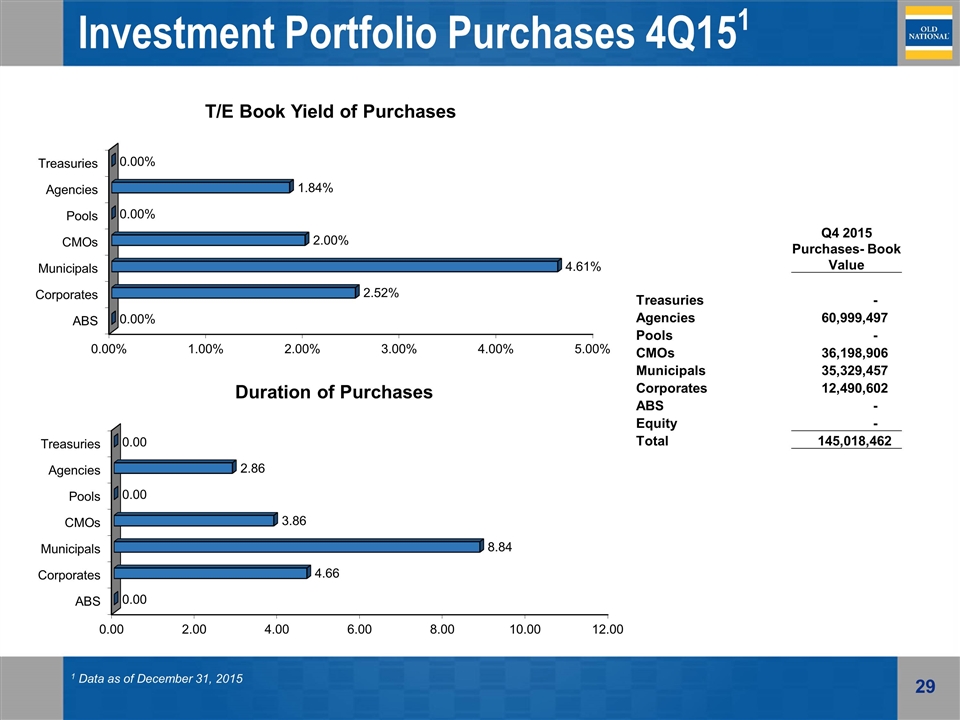

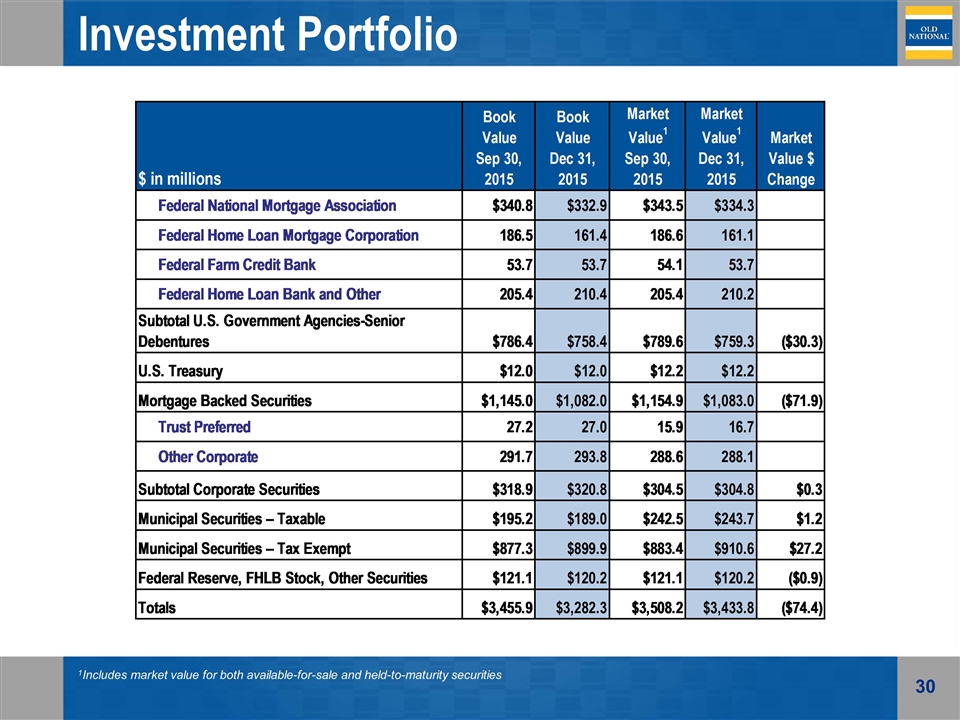

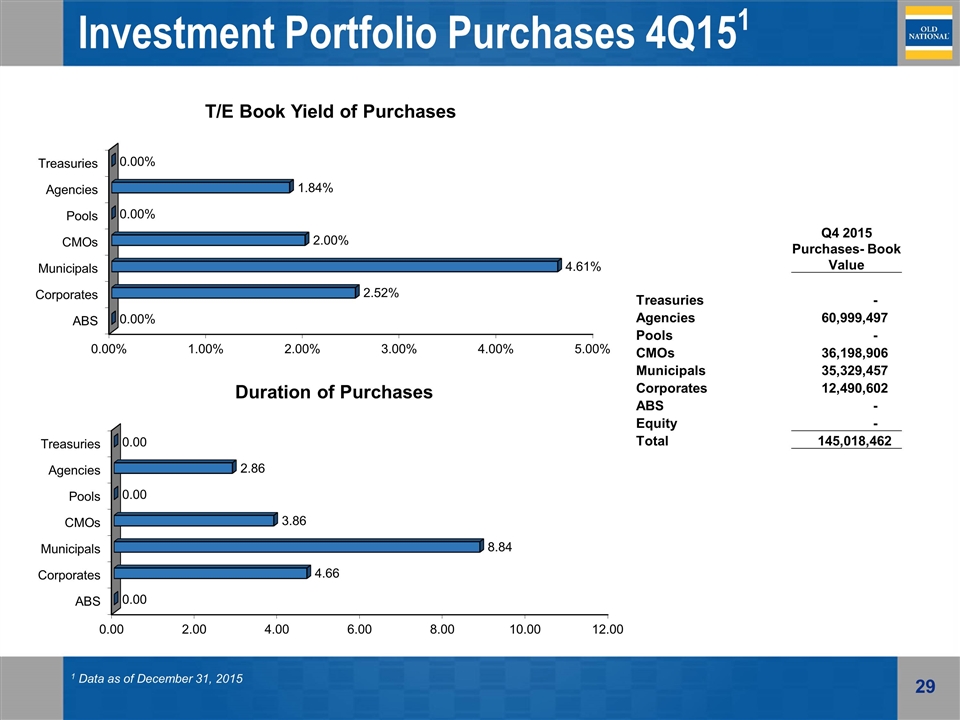

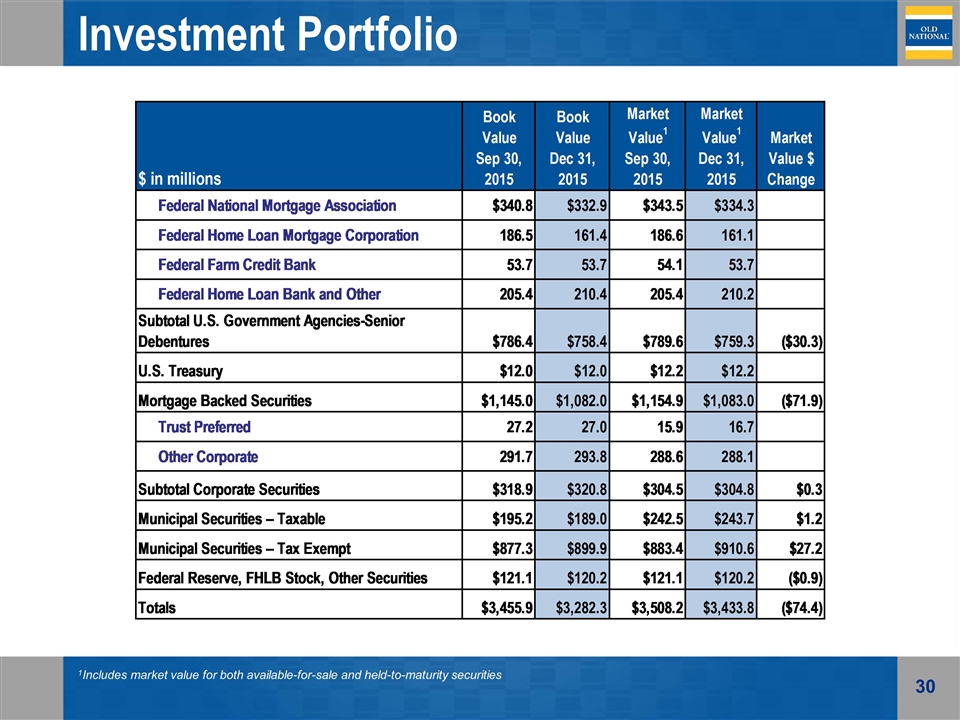

Investment Portfolio Purchases 4Q151 1 Data as of December 31, 2015 Q4 2015 Purchases- Book Value Treasuries - Agencies 60,999,497 Pools - CMOs 36,198,906 Municipals 35,329,457 Corporates 12,490,602 ABS - Equity - Total 145,018,462

Investment Portfolio 1Includes market value for both available-for-sale and held-to-maturity securities

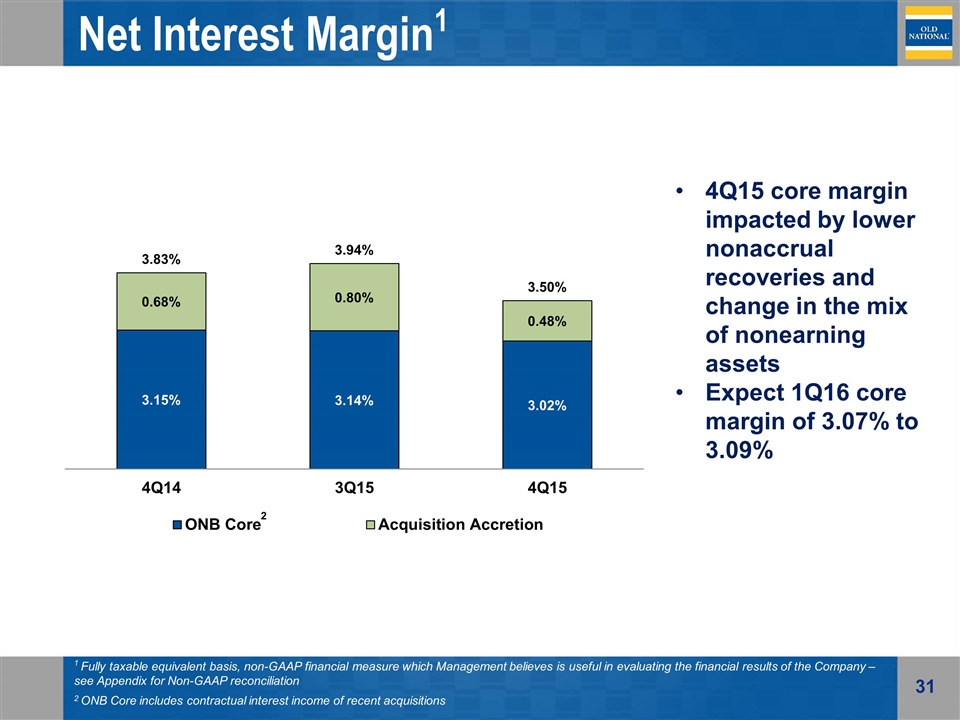

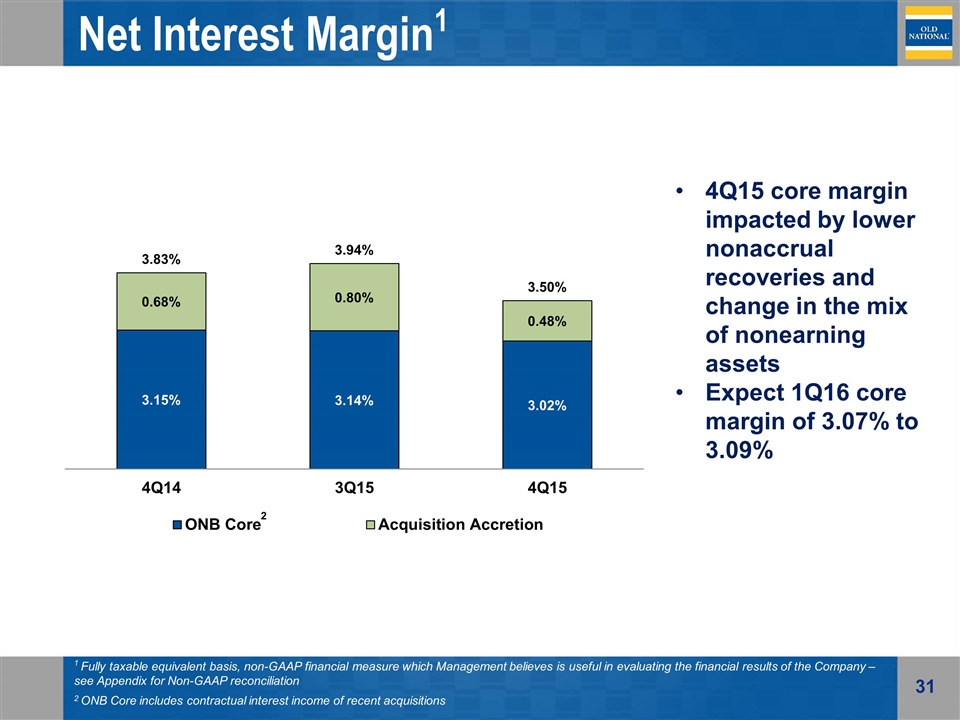

Net Interest Margin1 1 Fully taxable equivalent basis, non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation 2 ONB Core includes contractual interest income of recent acquisitions 2 4Q15 core margin impacted by lower nonaccrual recoveries and change in the mix of nonearning assets Expect 1Q16 core margin of 3.07% to 3.09%

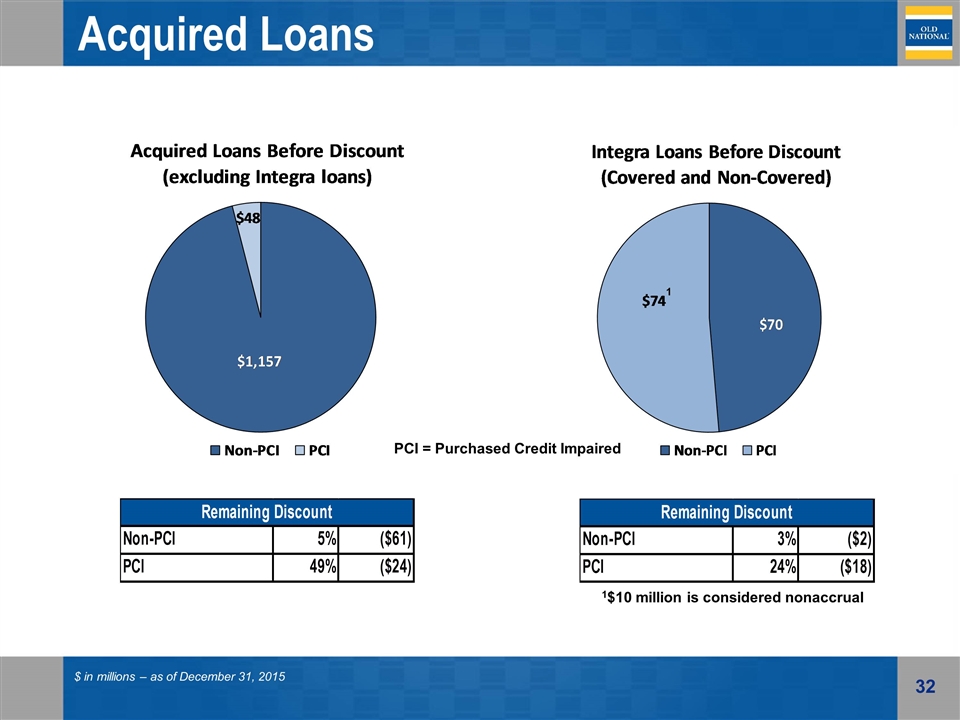

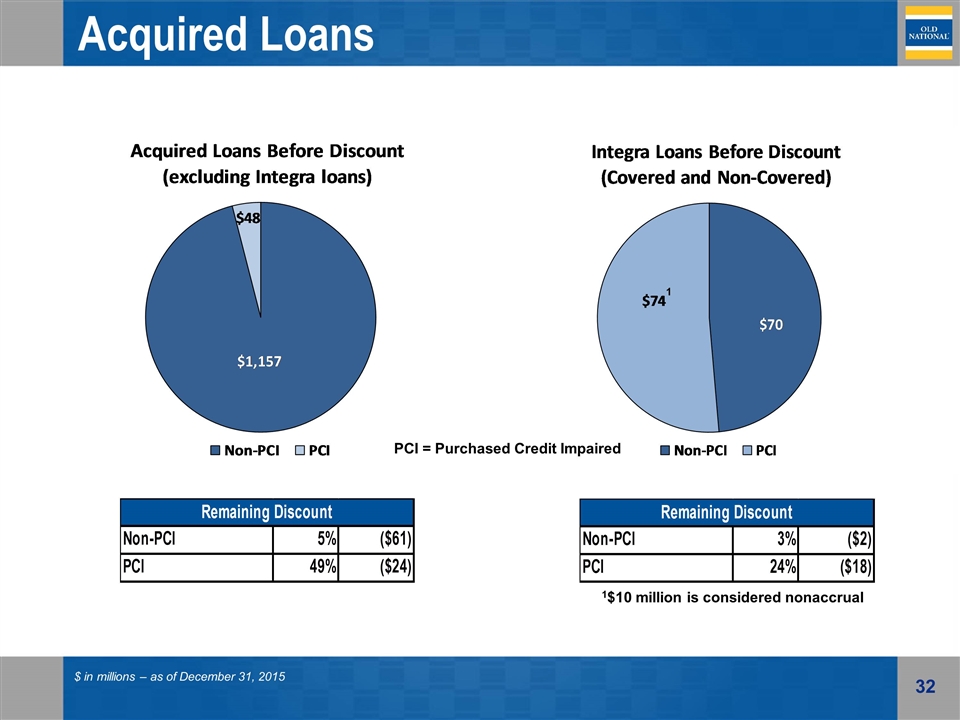

Acquired Loans $ in millions – as of December 31, 2015 1 1$10 million is considered nonaccrual PCI = Purchased Credit Impaired

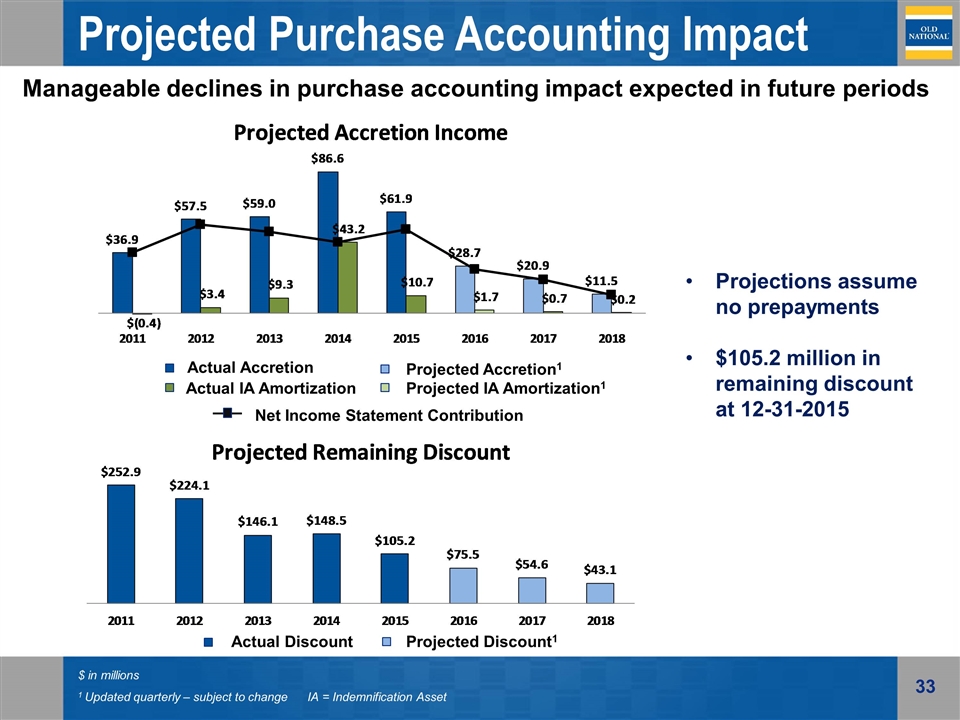

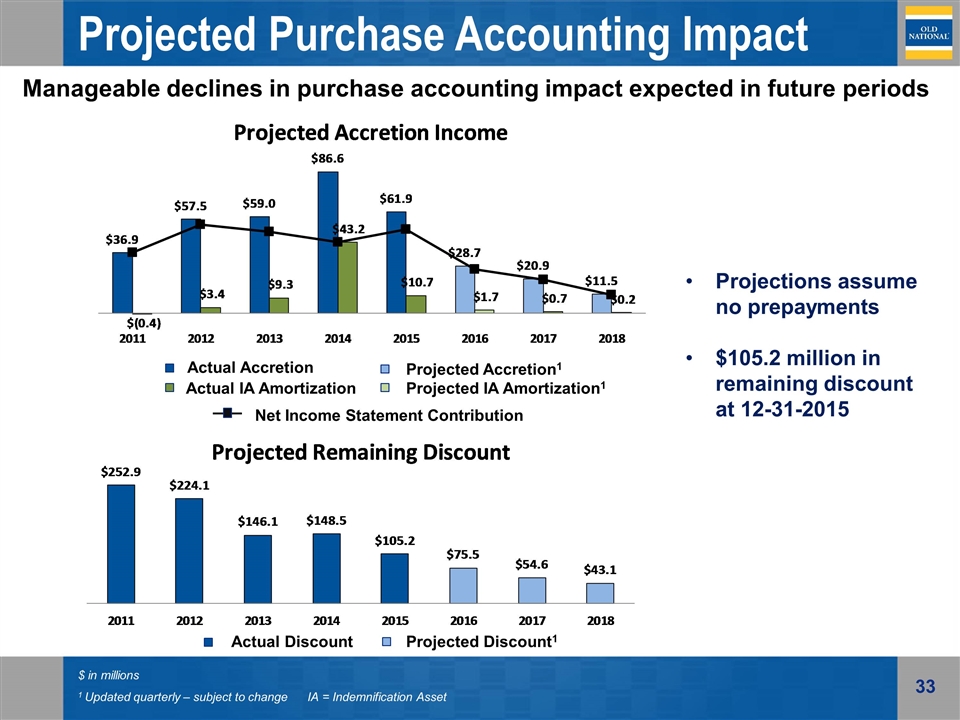

Projected Purchase Accounting Impact Actual Accretion Projected Accretion1 Actual Discount Projected Discount1 $ in millions 1 Updated quarterly – subject to change IA = Indemnification Asset Manageable declines in purchase accounting impact expected in future periods Actual IA Amortization Projected IA Amortization1 Net Income Statement Contribution Projections assume no prepayments $105.2 million in remaining discount at 12-31-2015

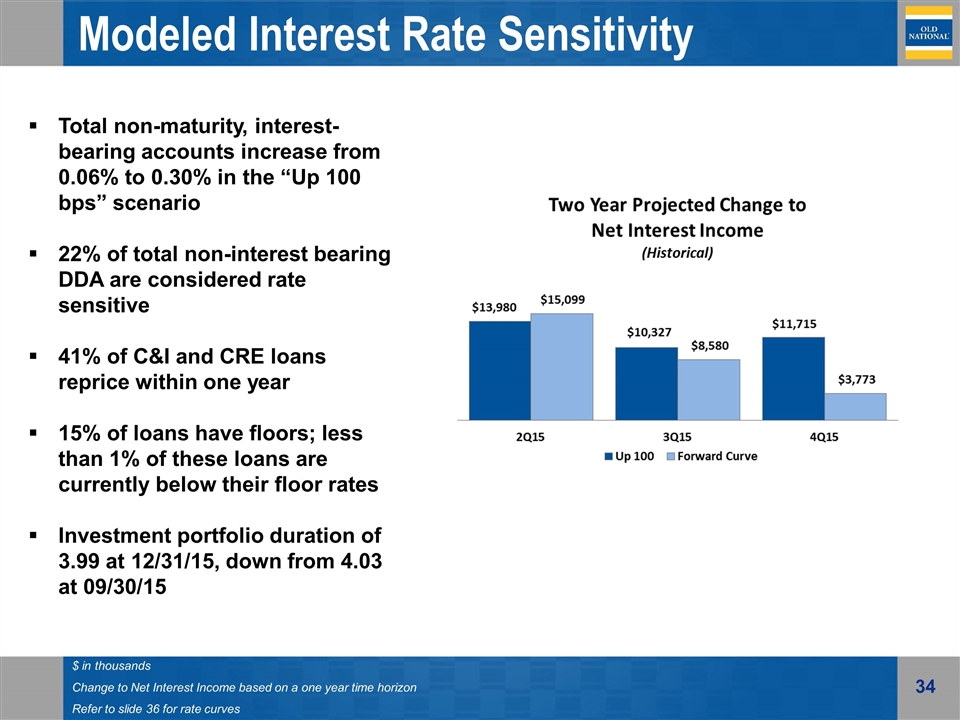

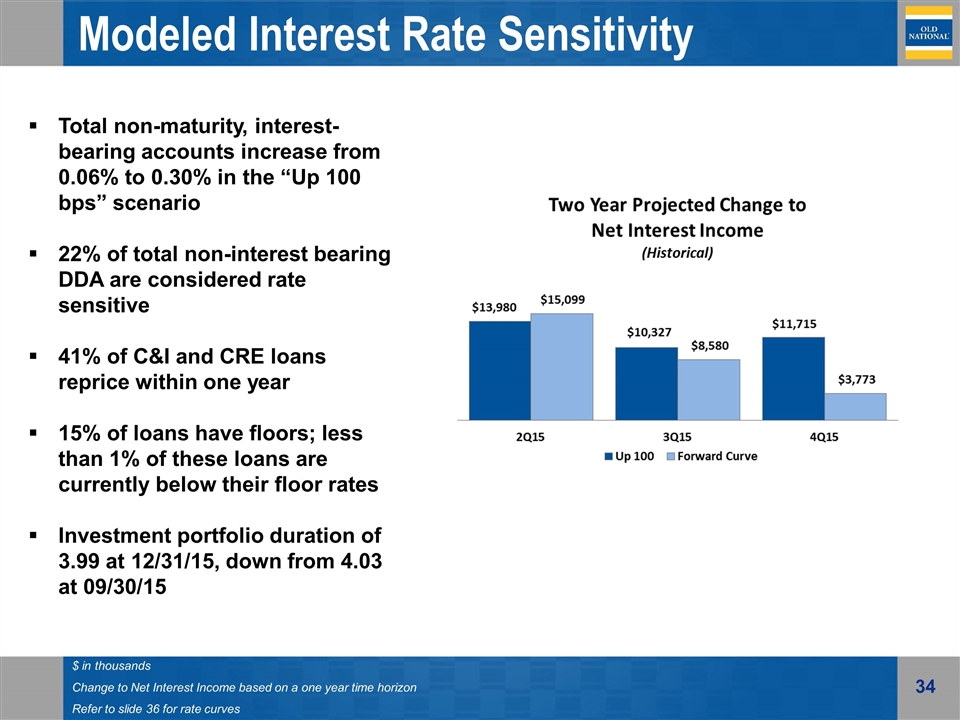

$ in thousands Change to Net Interest Income based on a one year time horizon Refer to slide 36 for rate curves Total non-maturity, interest-bearing accounts increase from 0.06% to 0.30% in the “Up 100 bps” scenario 22% of total non-interest bearing DDA are considered rate sensitive 41% of C&I and CRE loans reprice within one year 15% of loans have floors; less than 1% of these loans are currently below their floor rates Investment portfolio duration of 3.99 at 12/31/15, down from 4.03 at 09/30/15 Modeled Interest Rate Sensitivity

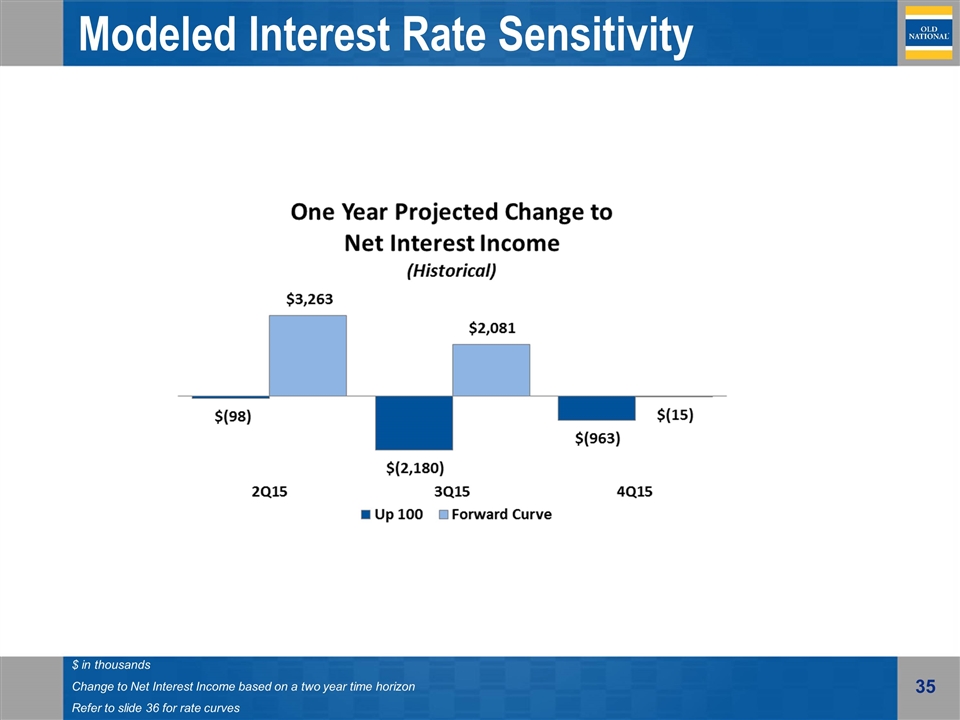

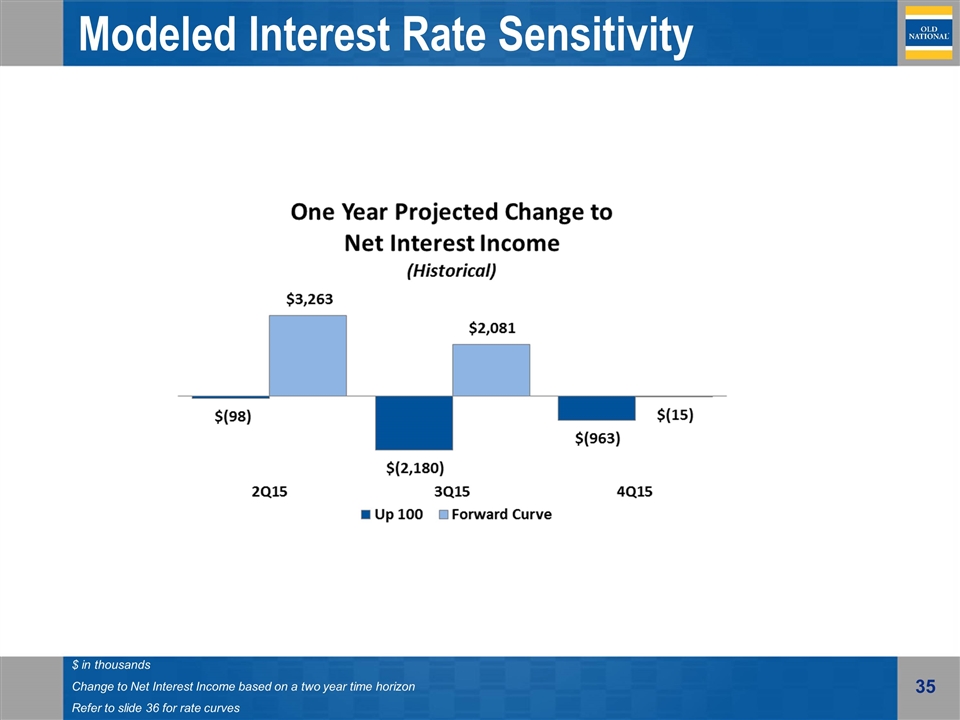

$ in thousands Change to Net Interest Income based on a two year time horizon Refer to slide 36 for rate curves Modeled Interest Rate Sensitivity

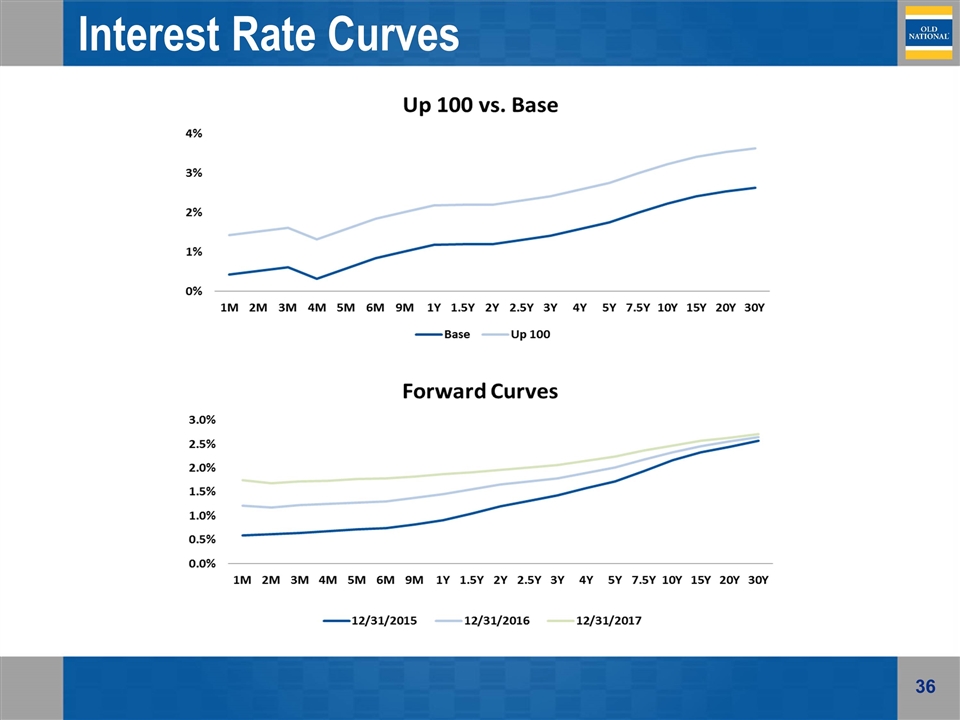

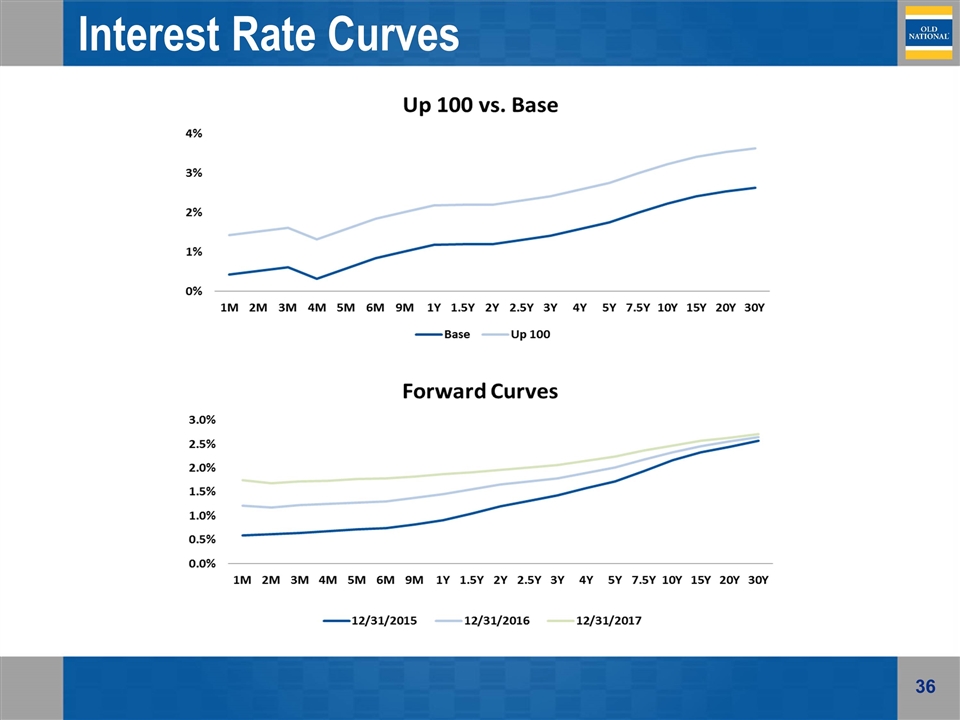

Interest Rate Curves

Tangible Common Equity1 306,000 shares of stock repurchased at an average price of $13.97 during 4Q15 $ and shares in millions 1 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation Shares TBV/Share Tangible Common Equity – 3Q15 $853.2 114.5 7.45 Tangible Net Income 34.5 Changes in OCI – Securities (4.2) 4Q15 Dividend (13.7) 4Q15 Share Repurchase (4.5) Other 5.9 Tangible Common Equity – 4Q15 $871.2 114.3 7.62

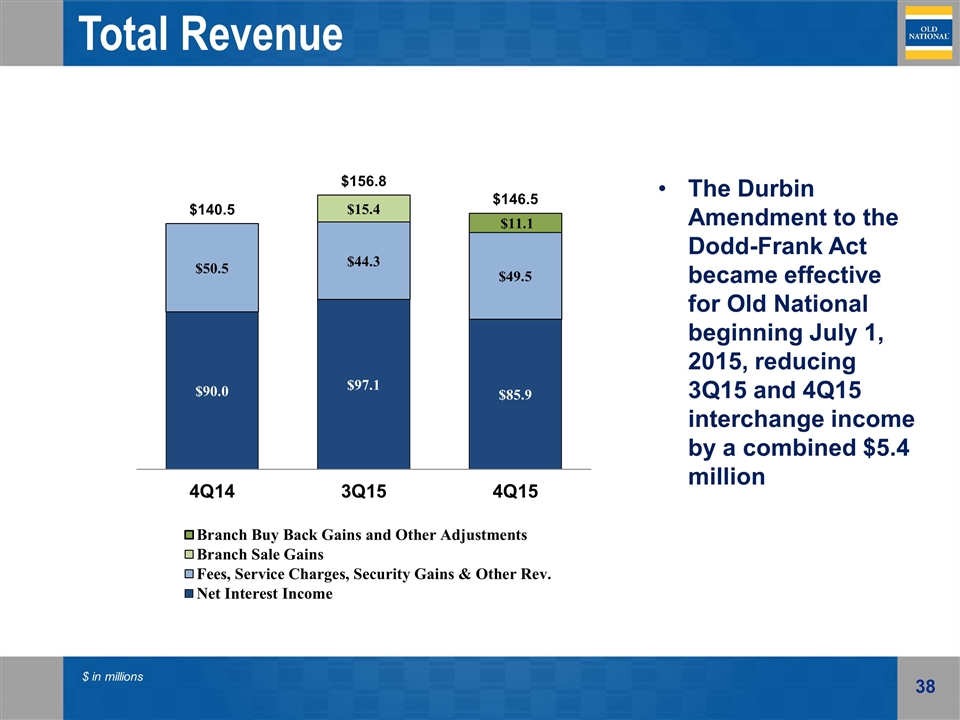

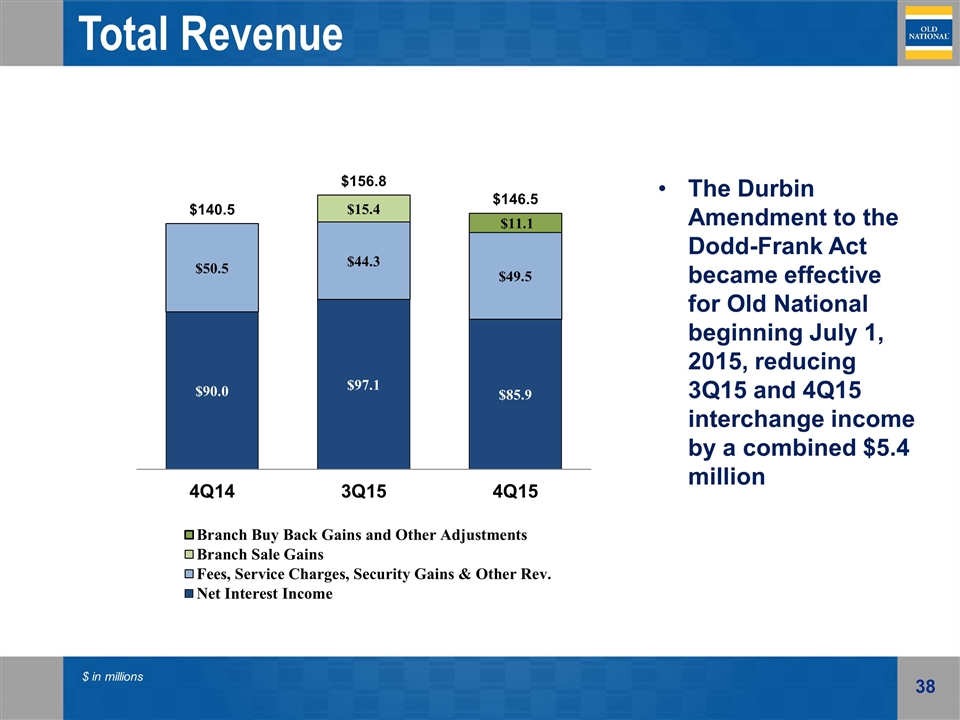

$ in millions Total Revenue The Durbin Amendment to the Dodd-Frank Act became effective for Old National beginning July 1, 2015, reducing 3Q15 and 4Q15 interchange income by a combined $5.4 million

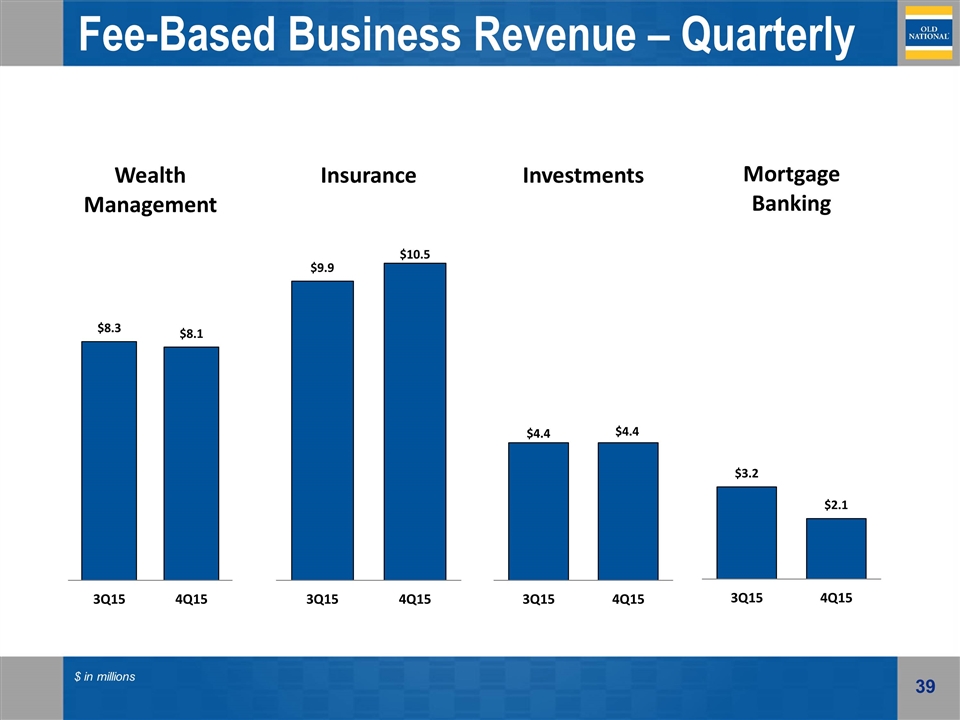

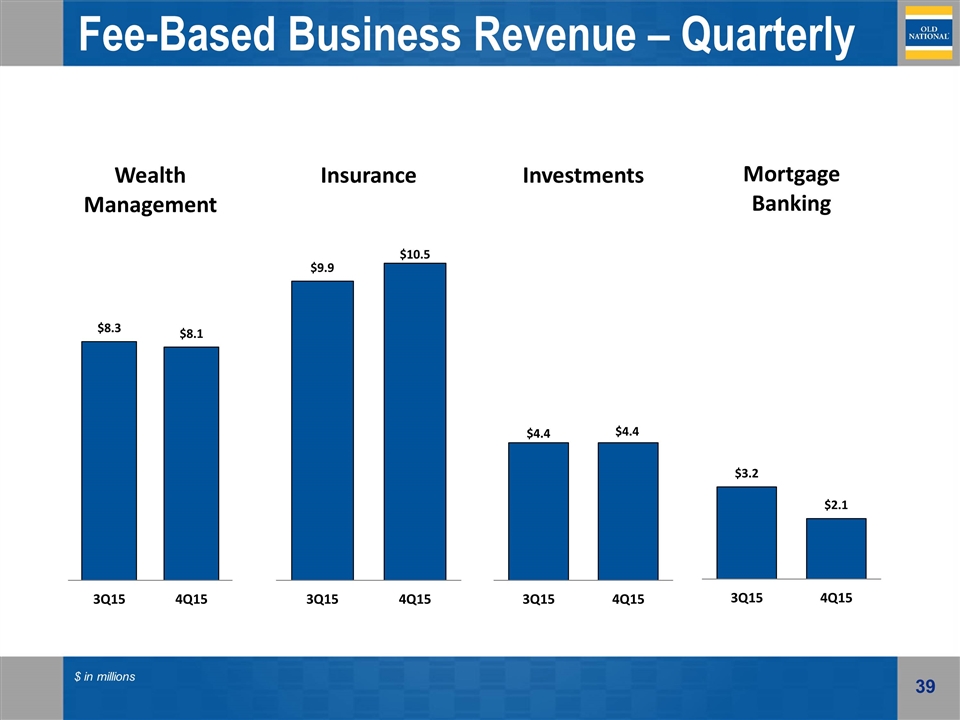

Fee-Based Business Revenue – Quarterly $ in millions

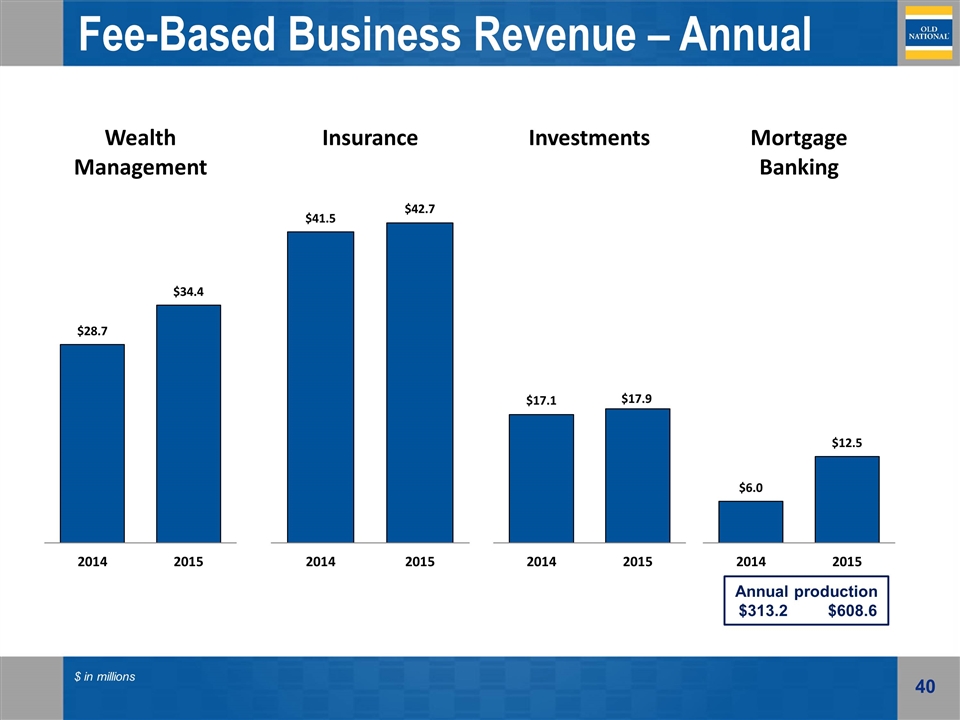

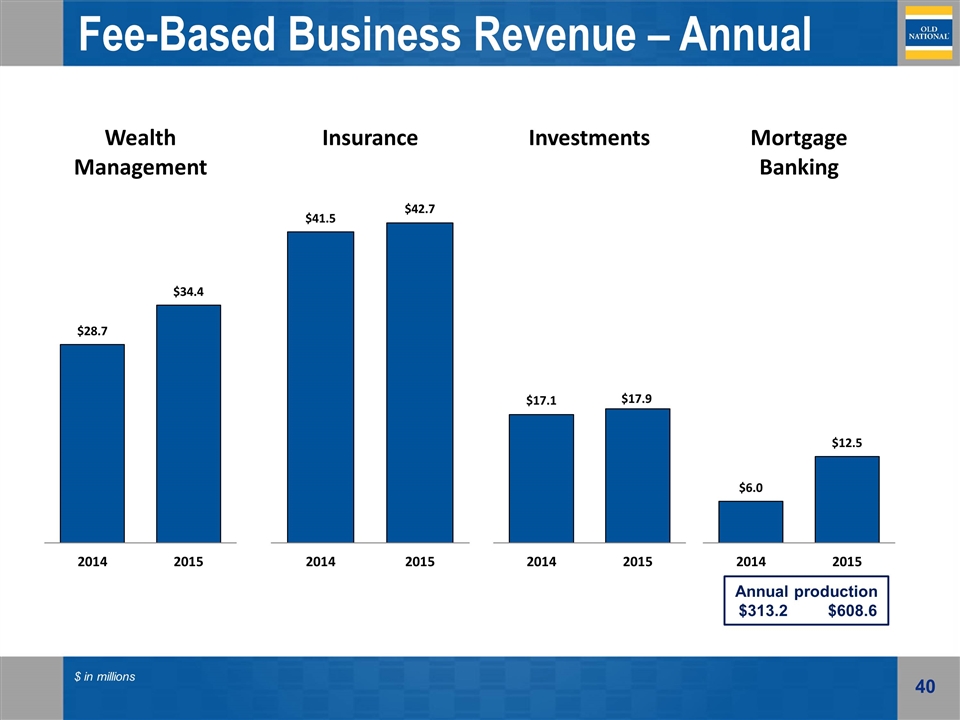

Fee-Based Business Revenue – Annual $ in millions Annual production $313.2 $608.6

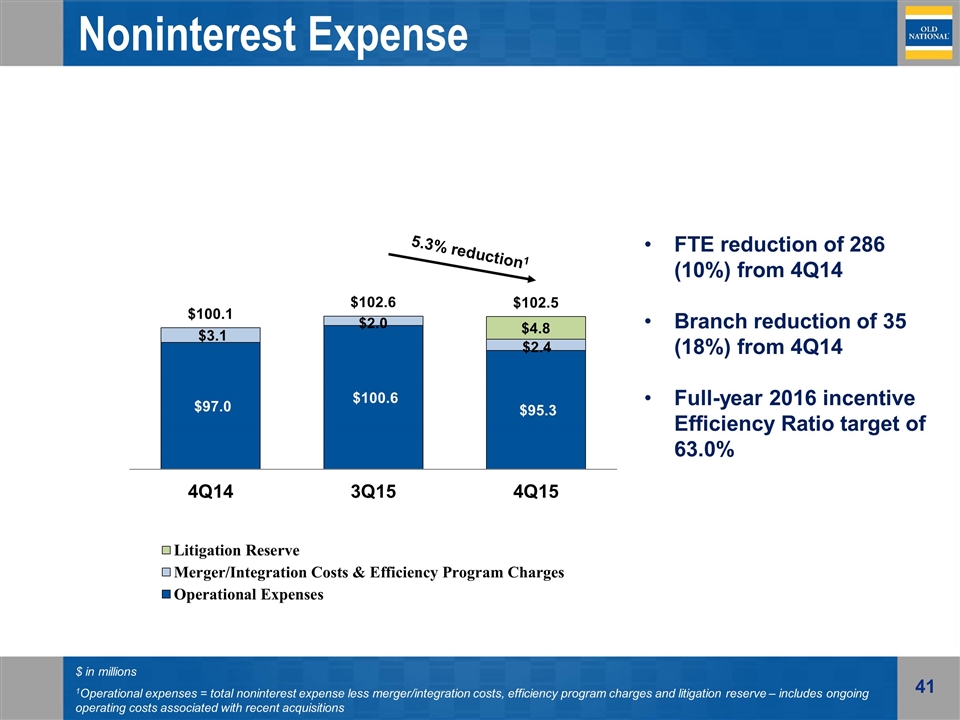

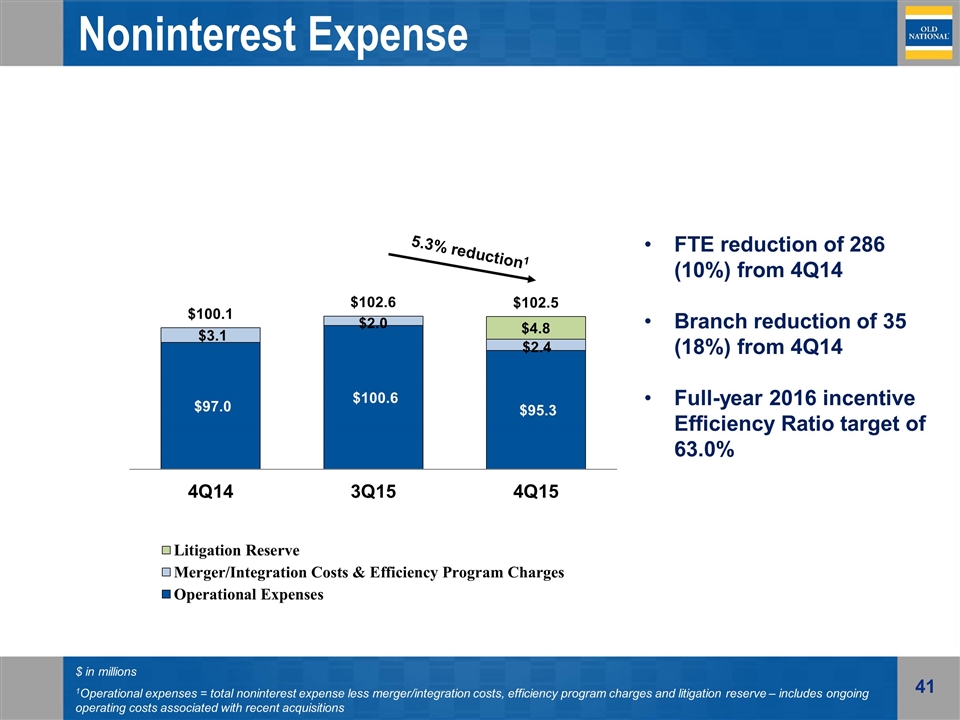

$ in millions 1Operational expenses = total noninterest expense less merger/integration costs, efficiency program charges and litigation reserve – includes ongoing operating costs associated with recent acquisitions FTE reduction of 286 (10%) from 4Q14 Branch reduction of 35 (18%) from 4Q14 Full-year 2016 incentive Efficiency Ratio target of 63.0% 5.3% reduction1 Noninterest Expense

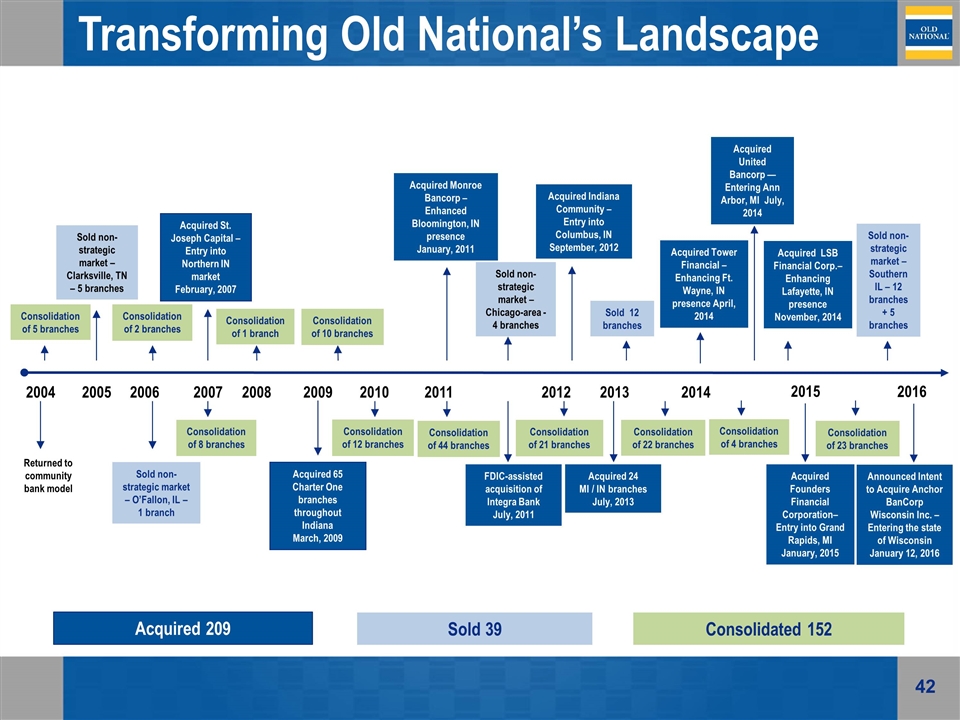

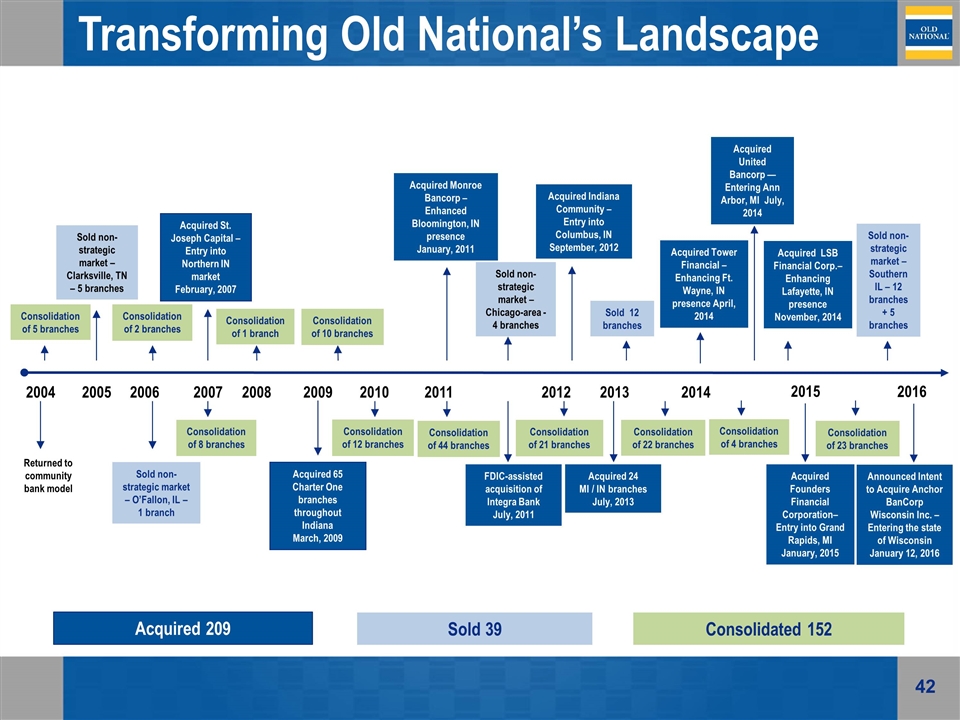

Returned to community bank model 2004 2005 Sold non-strategic market – Clarksville, TN – 5 branches 2006 Sold non-strategic market – O’Fallon, IL – 1 branch 2007 2008 2009 2010 2011 2012 2013 Acquired St. Joseph Capital – Entry into Northern IN market February, 2007 Acquired 65 Charter One branches throughout Indiana March, 2009 Acquired Monroe Bancorp – Enhanced Bloomington, IN presence January, 2011 Acquired Indiana Community – Entry into Columbus, IN September, 2012 FDIC-assisted acquisition of Integra Bank July, 2011 Sold non-strategic market – Chicago-area - 4 branches Consolidation of 21 branches Acquired 24 MI / IN branches July, 2013 Consolidation of 2 branches Consolidation of 8 branches Consolidation of 1 branch Consolidation of 10 branches Consolidation of 12 branches Consolidation of 44 branches Consolidation of 5 branches Sold 12 branches Consolidation of 22 branches Acquired 209 Sold 39 Consolidated 152 Acquired Tower Financial – Enhancing Ft. Wayne, IN presence April, 2014 Acquired United Bancorp — Entering Ann Arbor, MI July, 2014 2014 Consolidation of 4 branches Acquired LSB Financial Corp.– Enhancing Lafayette, IN presence November, 2014 Acquired Founders Financial Corporation– Entry into Grand Rapids, MI January, 2015 2015 Consolidation of 23 branches Transforming Old National’s Landscape Sold non-strategic market – Southern IL – 12 branches + 5 branches 2016 Announced Intent to Acquire Anchor BanCorp Wisconsin Inc. – Entering the state of Wisconsin January 12, 2016

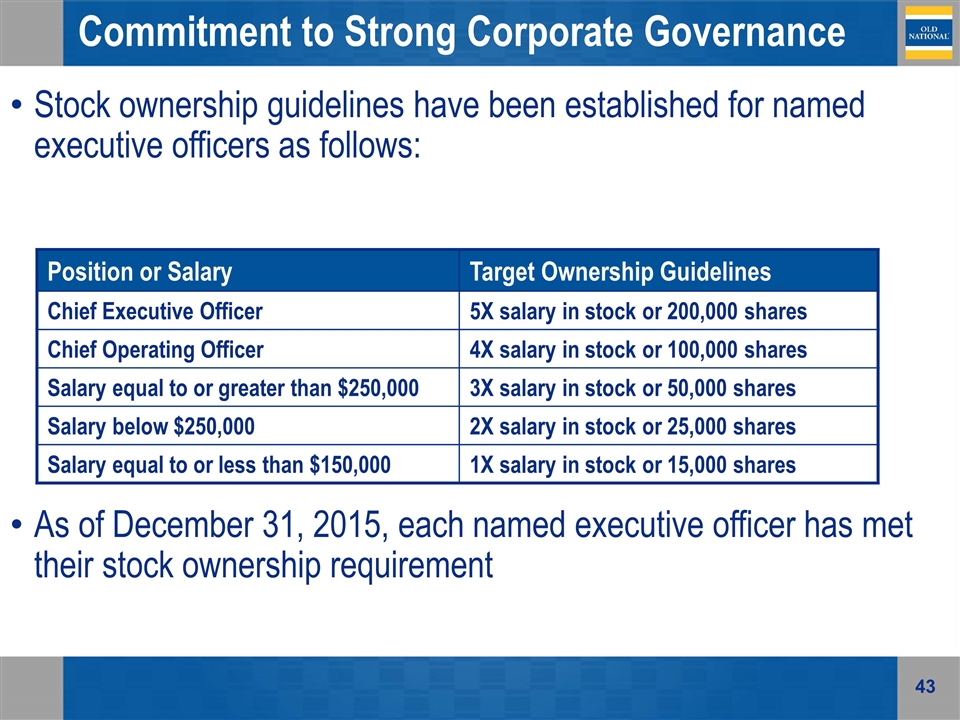

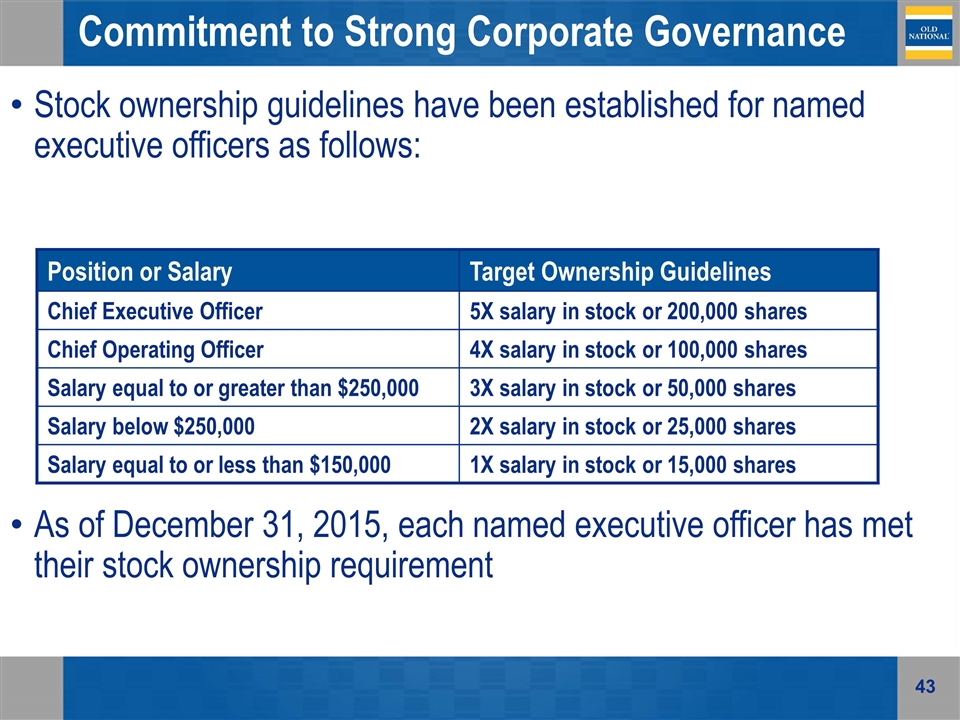

Position or Salary Target Ownership Guidelines Chief Executive Officer 5X salary in stock or 200,000 shares Chief Operating Officer 4X salary in stock or 100,000 shares Salary equal to or greater than $250,000 3X salary in stock or 50,000 shares Salary below $250,000 2X salary in stock or 25,000 shares Salary equal to or less than $150,000 1X salary in stock or 15,000 shares Stock ownership guidelines have been established for named executive officers as follows: As of December 31, 2015, each named executive officer has met their stock ownership requirement Commitment to Strong Corporate Governance

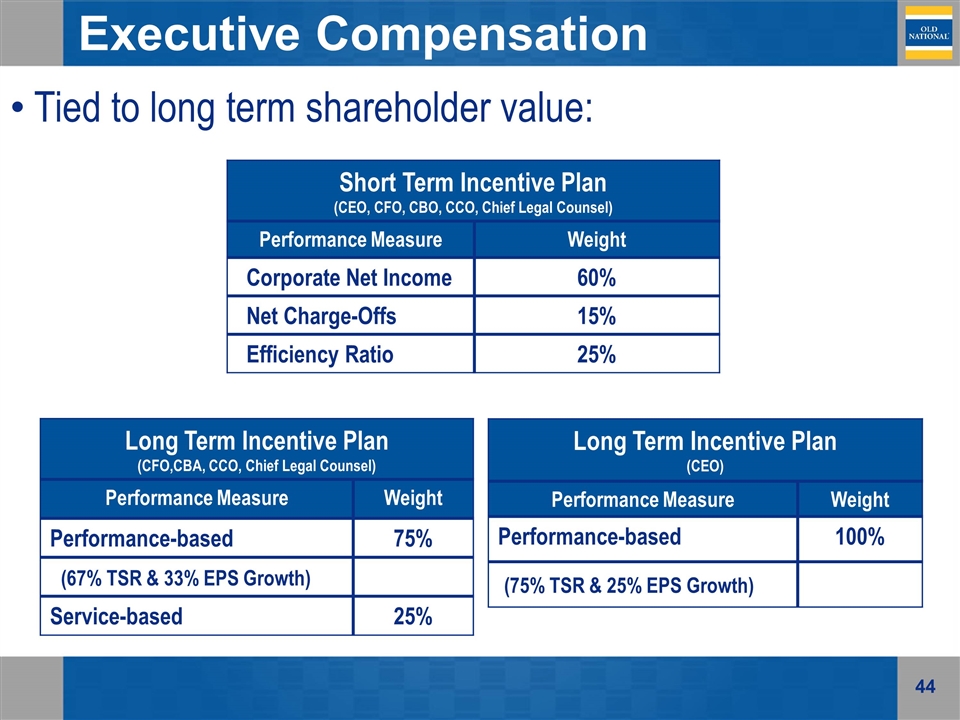

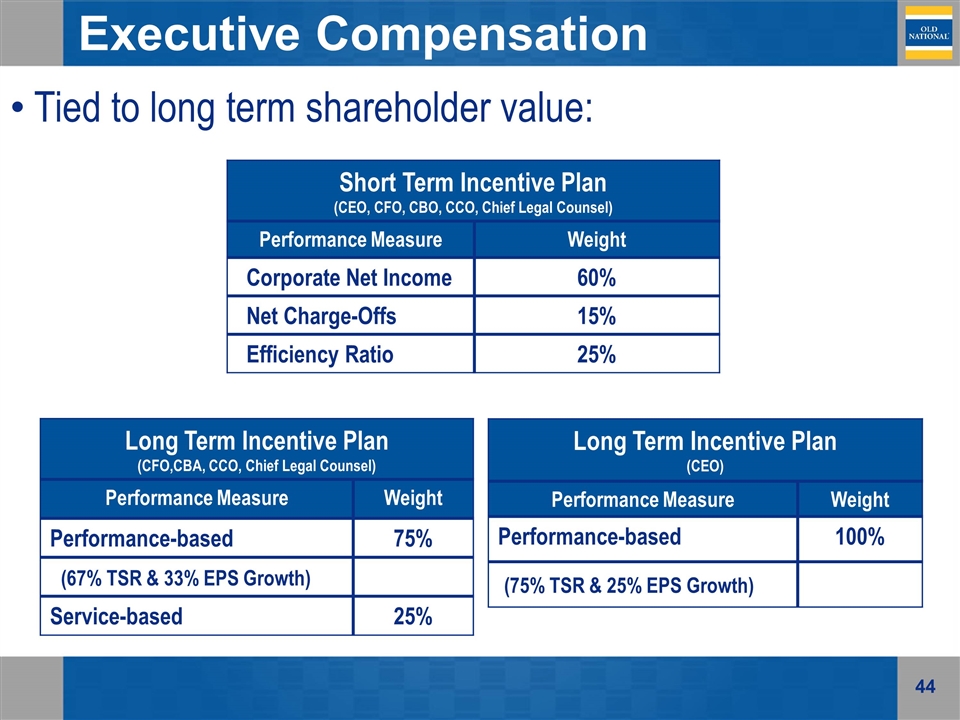

Executive Compensation Short Term Incentive Plan (CEO, CFO, CBO, CCO, Chief Legal Counsel) Performance Measure Weight Corporate Net Income 60% Net Charge-Offs 15% Efficiency Ratio 25% Tied to long term shareholder value: Long Term Incentive Plan (CFO,CBA, CCO, Chief Legal Counsel) Performance Measure Weight Performance-based 75% (67% TSR & 33% EPS Growth) Service-based 25% Long Term Incentive Plan (CEO) Performance Measure Weight Performance-based 100% (75% TSR & 25% EPS Growth)

Appendix

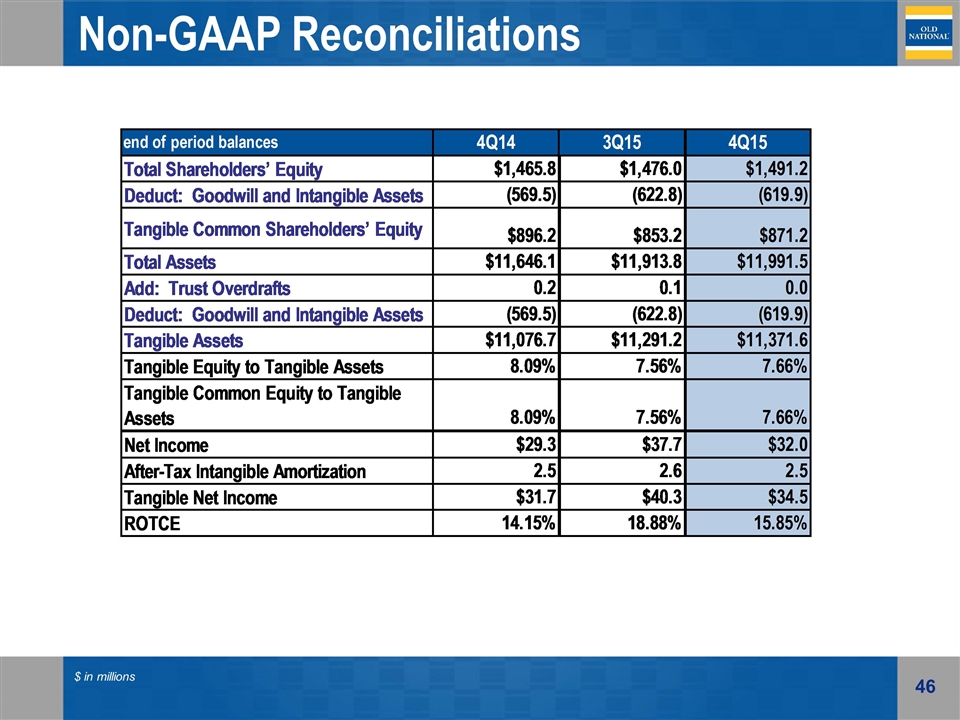

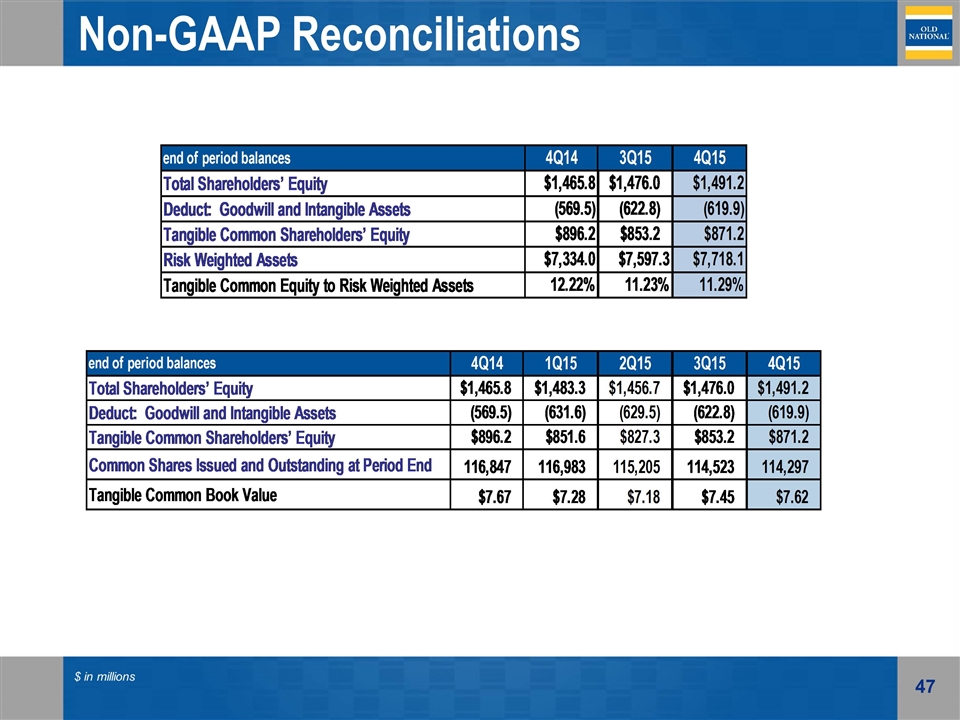

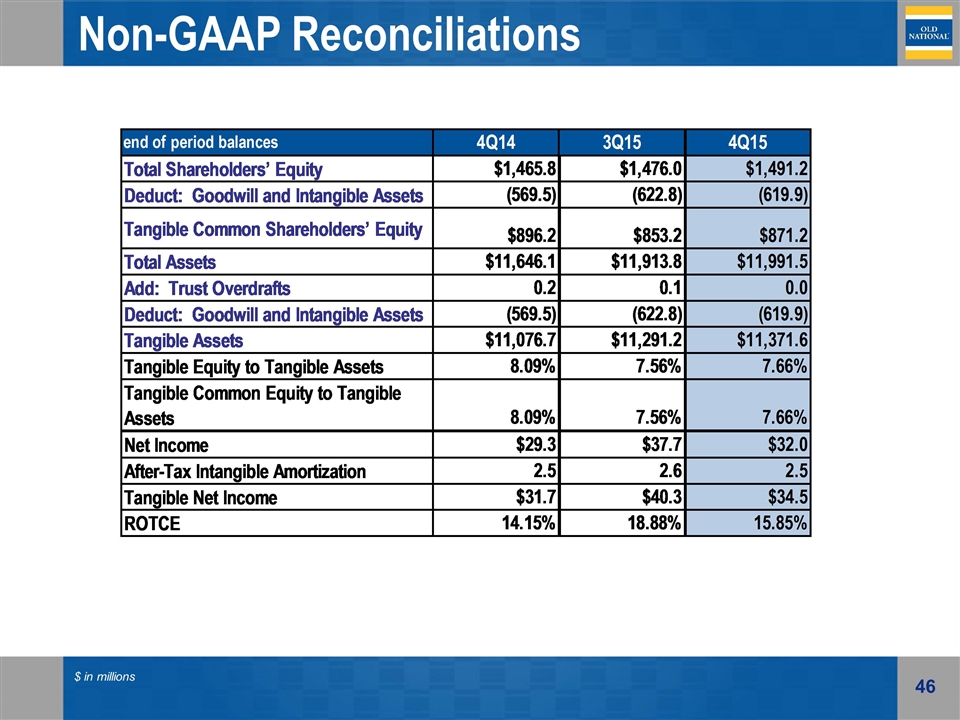

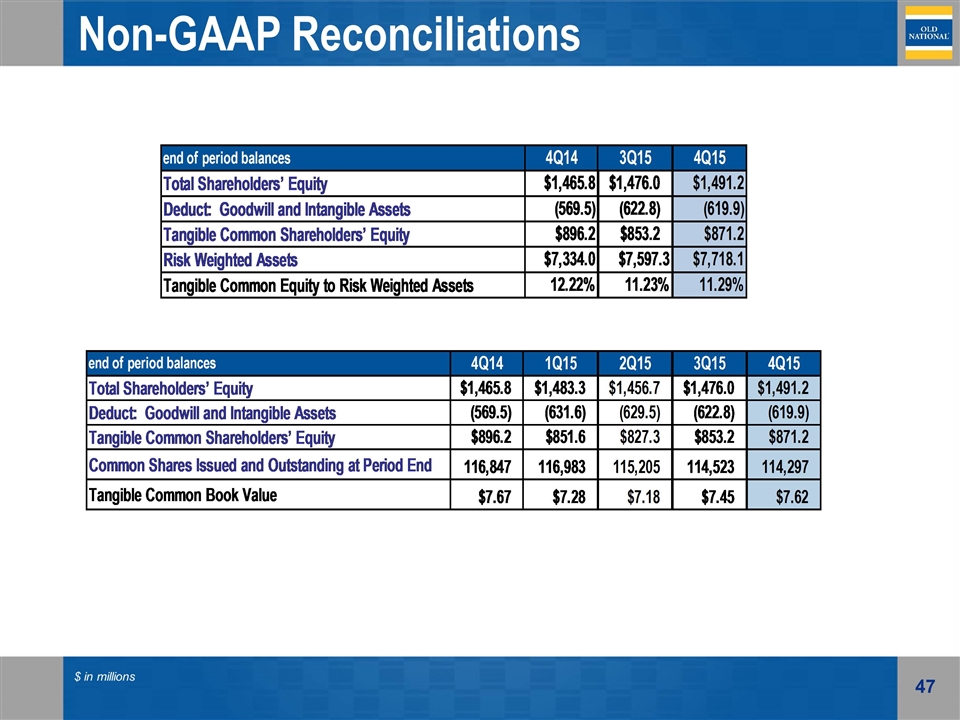

Non-GAAP Reconciliations $ in millions

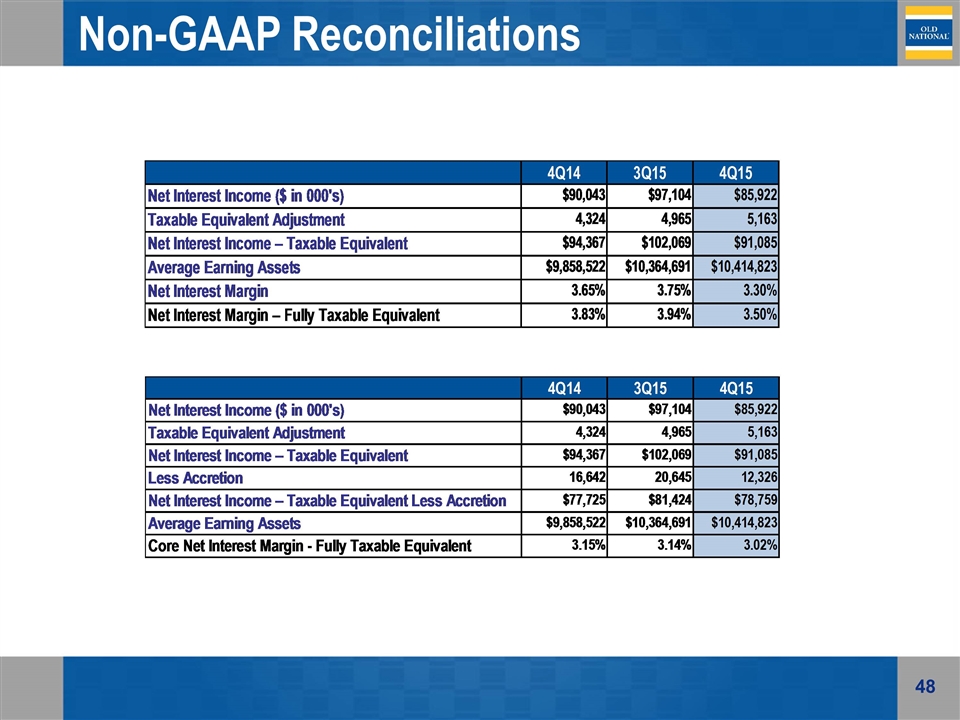

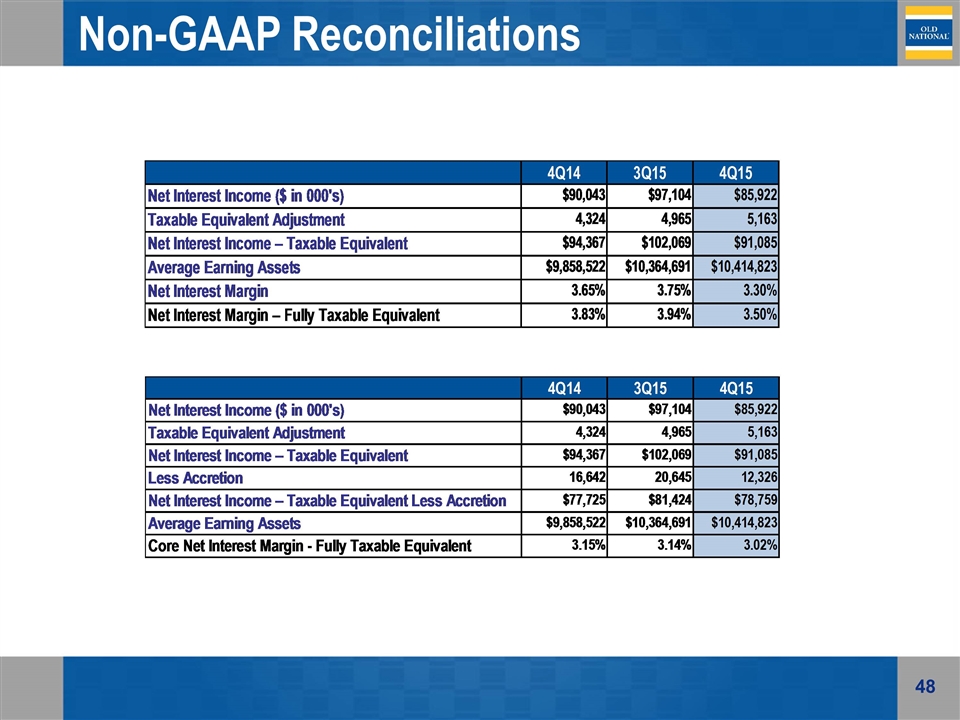

Non-GAAP Reconciliations $ in millions

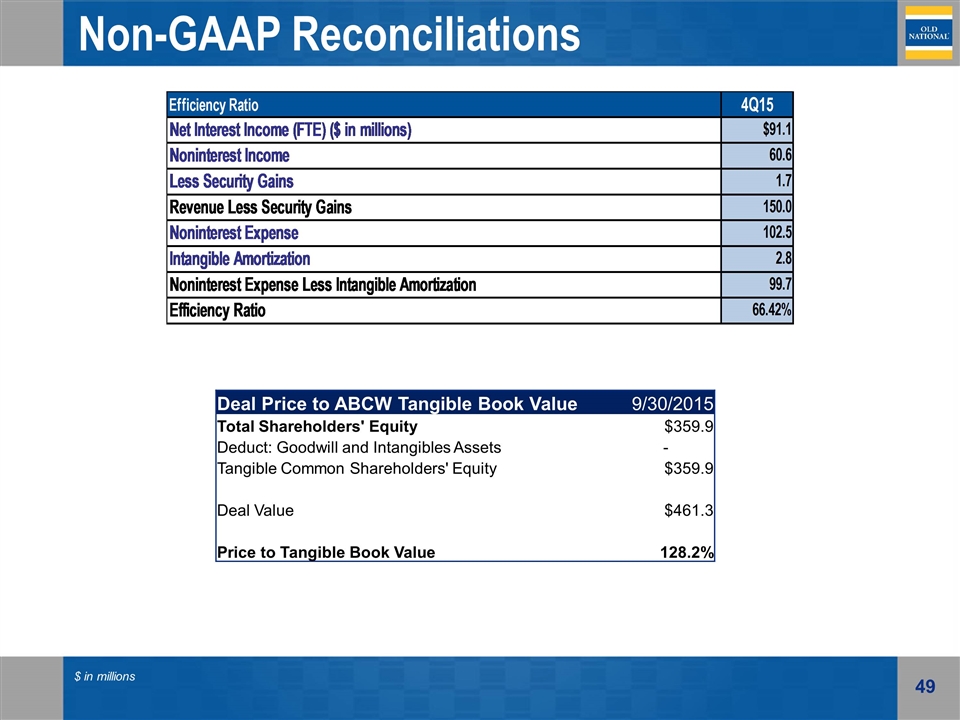

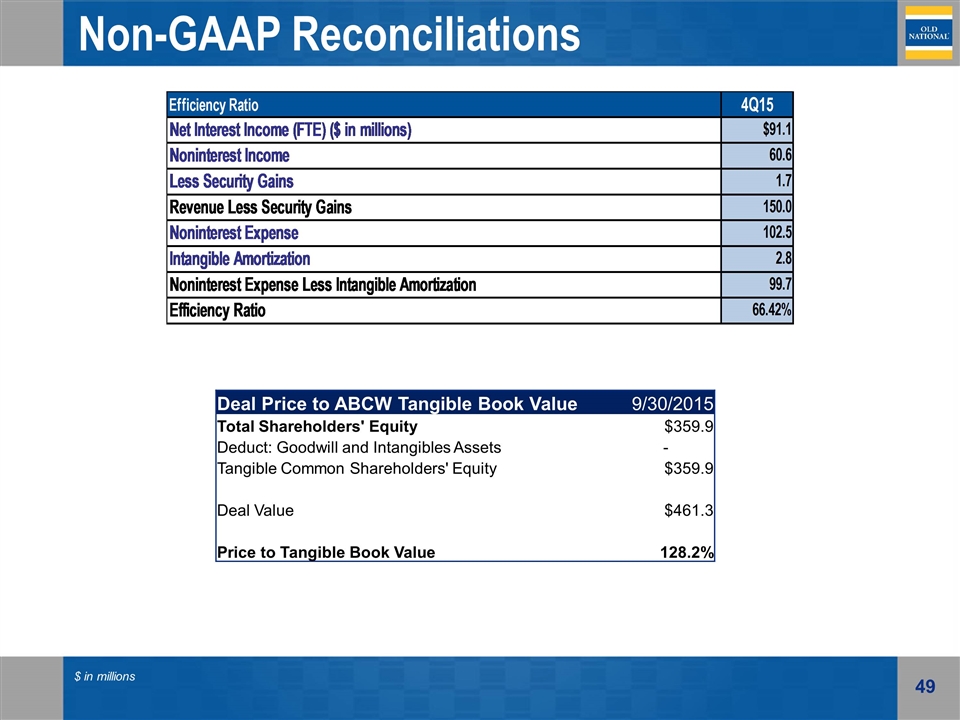

Non-GAAP Reconciliations

Non-GAAP Reconciliations $ in millions Deal Price to ABCW Tangible Book Value 9/30/2015 Total Shareholders' Equity $359.9 Deduct: Goodwill and Intangibles Assets - Tangible Common Shareholders' Equity $359.9 Deal Value $461.3 Price to Tangible Book Value 128.2%

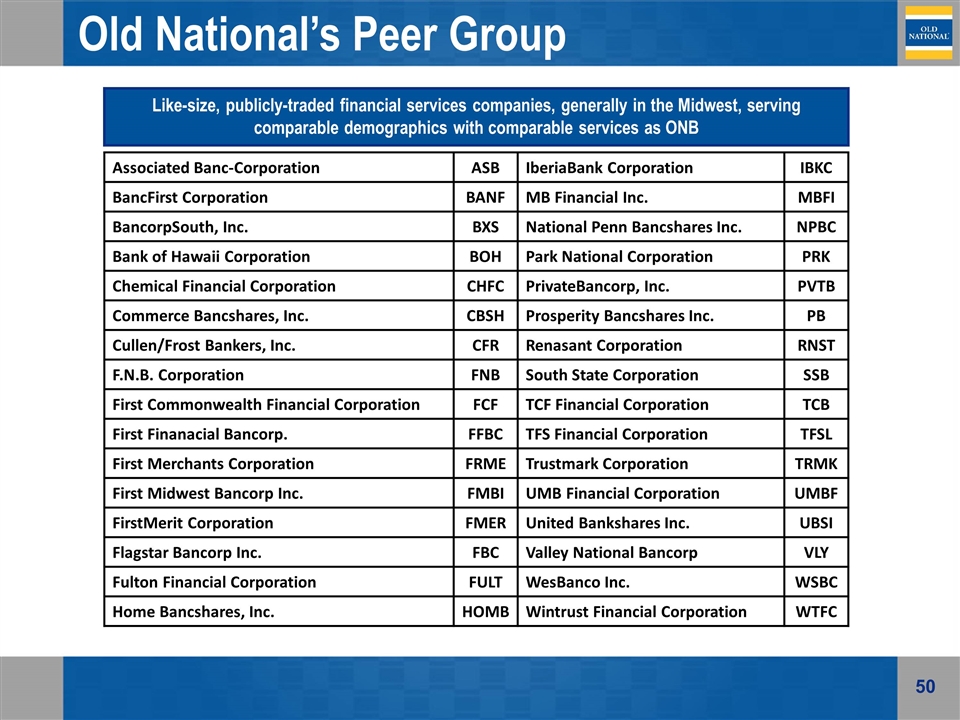

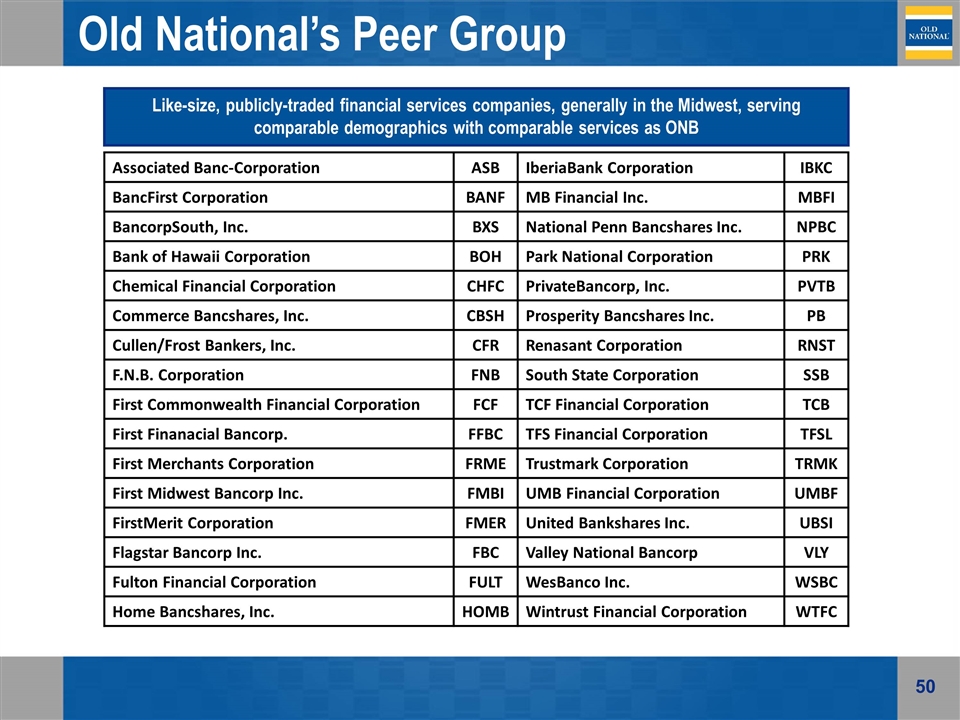

Old National’s Peer Group Like-size, publicly-traded financial services companies, generally in the Midwest, serving comparable demographics with comparable services as ONB Associated Banc-Corporation ASB IberiaBank Corporation IBKC BancFirst Corporation BANF MB Financial Inc. MBFI BancorpSouth, Inc. BXS National Penn Bancshares Inc. NPBC Bank of Hawaii Corporation BOH Park National Corporation PRK Chemical Financial Corporation CHFC PrivateBancorp, Inc. PVTB Commerce Bancshares, Inc. CBSH Prosperity Bancshares Inc. PB Cullen/Frost Bankers, Inc. CFR Renasant Corporation RNST F.N.B. Corporation FNB South State Corporation SSB First Commonwealth Financial Corporation FCF TCF Financial Corporation TCB First Finanacial Bancorp. FFBC TFS Financial Corporation TFSL First Merchants Corporation FRME Trustmark Corporation TRMK First Midwest Bancorp Inc. FMBI UMB Financial Corporation UMBF FirstMerit Corporation FMER United Bankshares Inc. UBSI Flagstar Bancorp Inc. FBC Valley National Bancorp VLY Fulton Financial Corporation FULT WesBanco Inc. WSBC Home Bancshares, Inc. HOMB Wintrust Financial Corporation WTFC

Investor Contact Additional information can be found on the Investor Relations web pages at www.oldnational.com Investor Inquiries: Lynell J. Walton, CPA SVP – Director of Investor Relations 812-464-1366 lynell.walton@oldnational.com