Investment Thesis Financial Data as of 6-30-16 Dated: August 15, 2016 Exhibit 99.1

Investment Thesis Executive Summary Slides 2 to 15 Financial Data as of 6-30-16 Dated: August 15, 2016

Forward-Looking Statements This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements about the expected financial benefits and other effects of the divestiture of Old National Bancorp’s (“Old National”) wholly-owned subsidiary, ONB Insurance Group, Inc. (“Old National Insurance”) as well as descriptions of Old National’s financial condition, results of operations, asset and credit quality trends and profitability. Forward-looking statements can be identified by the use of the words “anticipate,” “believe,” “expect,” “intend,” “could” and “should,” and other words of similar meaning. These forward-looking statements express management’s current expectations or forecasts of future events and, by their nature, are subject to risks and uncertainties and there are a number of factors that could cause actual results to differ materially from those in such statements. Factors that might cause such a difference include, but are not limited to: expected cost savings, synergies and other financial benefits from the recently completed mergers might not be realized within the expected timeframes and costs or difficulties relating to integration matters might be greater than expected; market, economic, operational, liquidity, credit and interest rate risks associated with Old National’s business; competition; government legislation and policies (including the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and its related regulations); ability of Old National to execute its business plan (including integrating the recently completed merger with Anchor Bancorp Wisconsin Inc (“Anchor”); changes in the economy which could materially impact credit quality trends and the ability to generate loans and gather deposits; failure or circumvention of our internal controls; failure or disruption of our information systems; significant changes in accounting, tax or regulatory practices or requirements; new legal obligations or liabilities or unfavorable resolutions of litigations; disruptive technologies in payment systems and other services traditionally provided by banks; computer hacking and other cybersecurity threats; other matters discussed in this presentation and other factors identified in our Annual Report on Form 10-K and other periodic filings with the SEC. These forward-looking statements are made only as of the date of this presentation, and Old National does not undertake an obligation to release revisions to these forward-looking statements to reflect events or conditions after the date of this presentation.

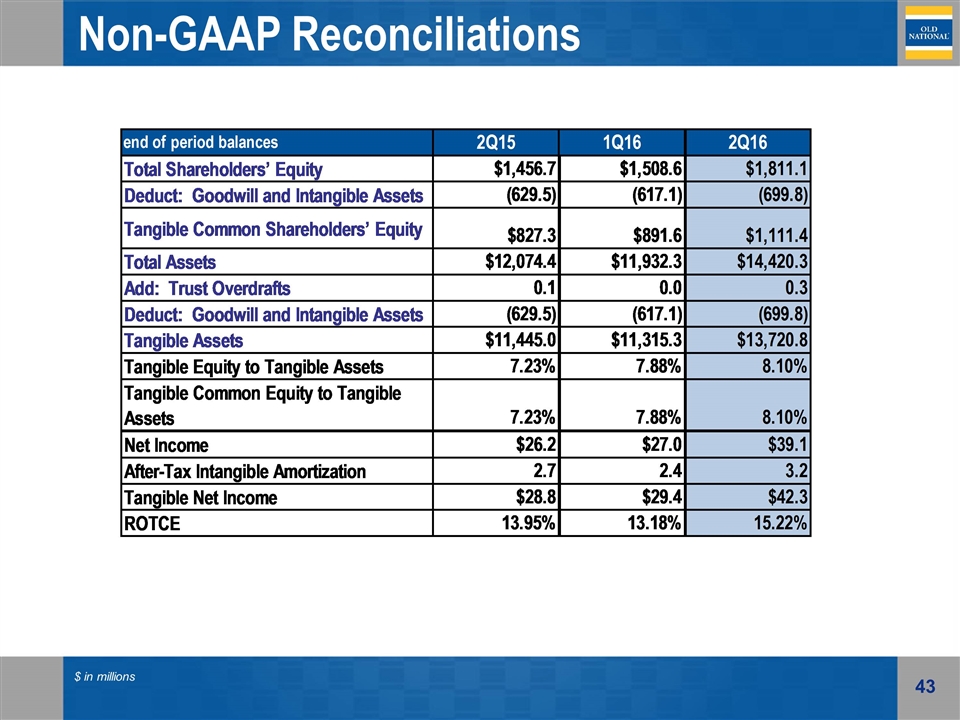

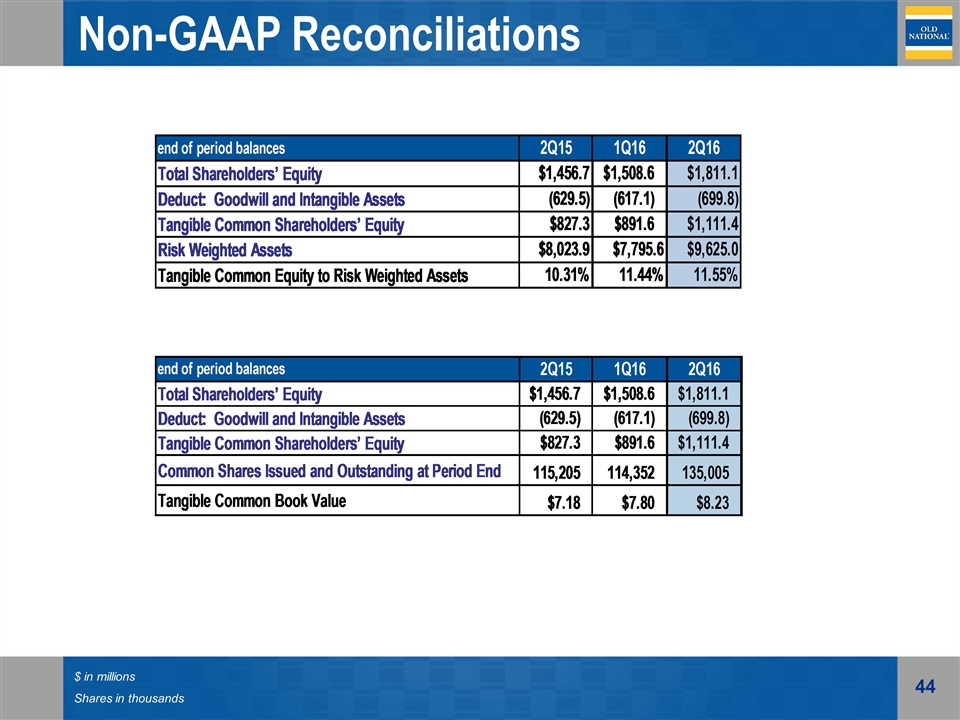

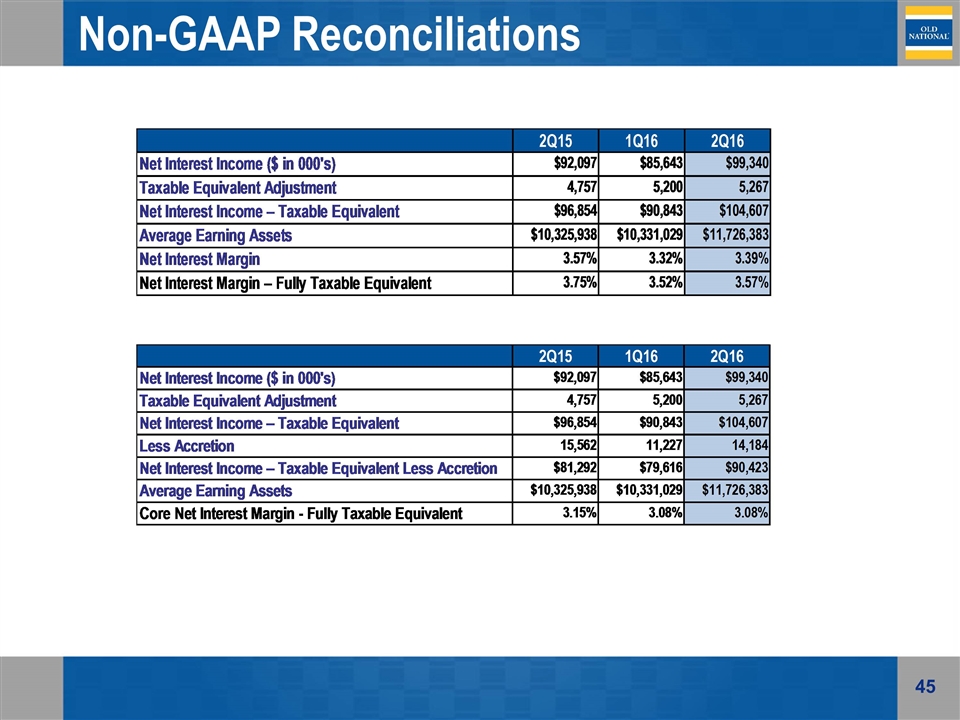

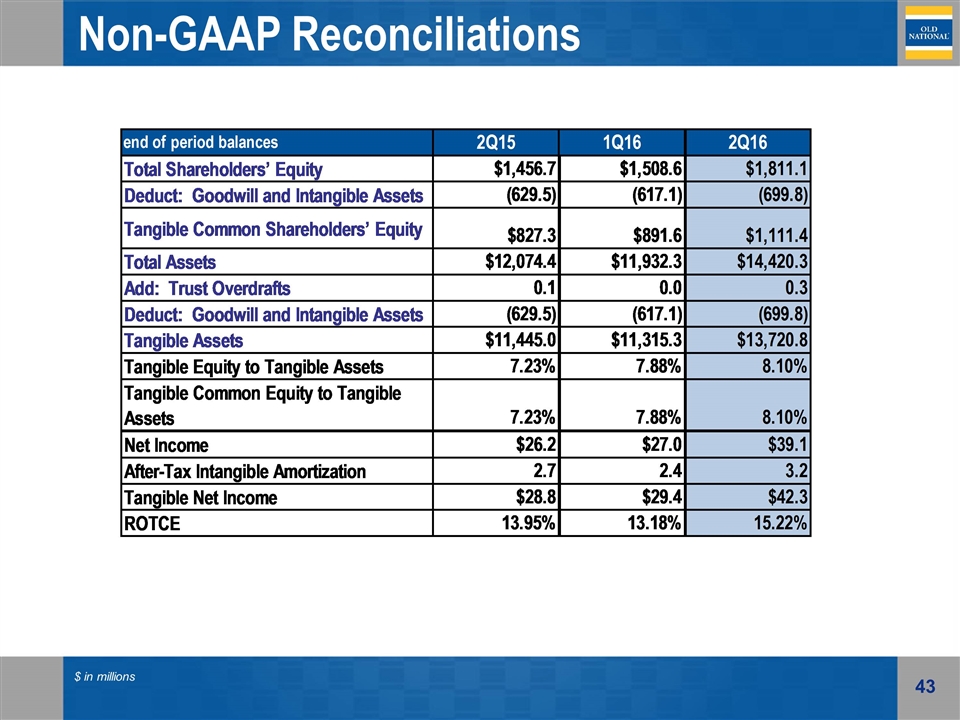

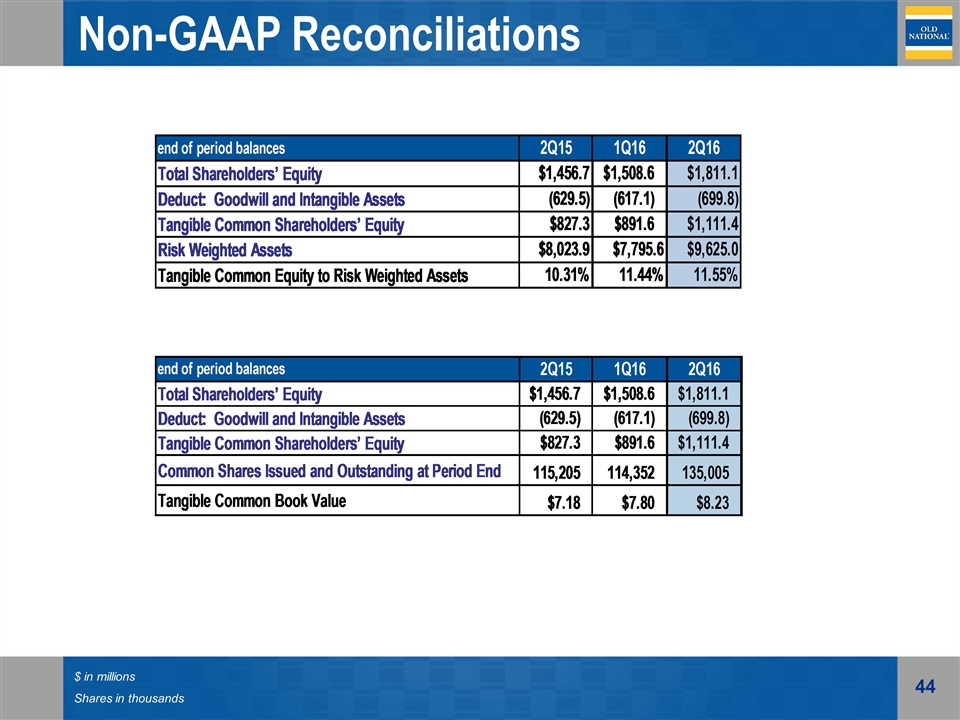

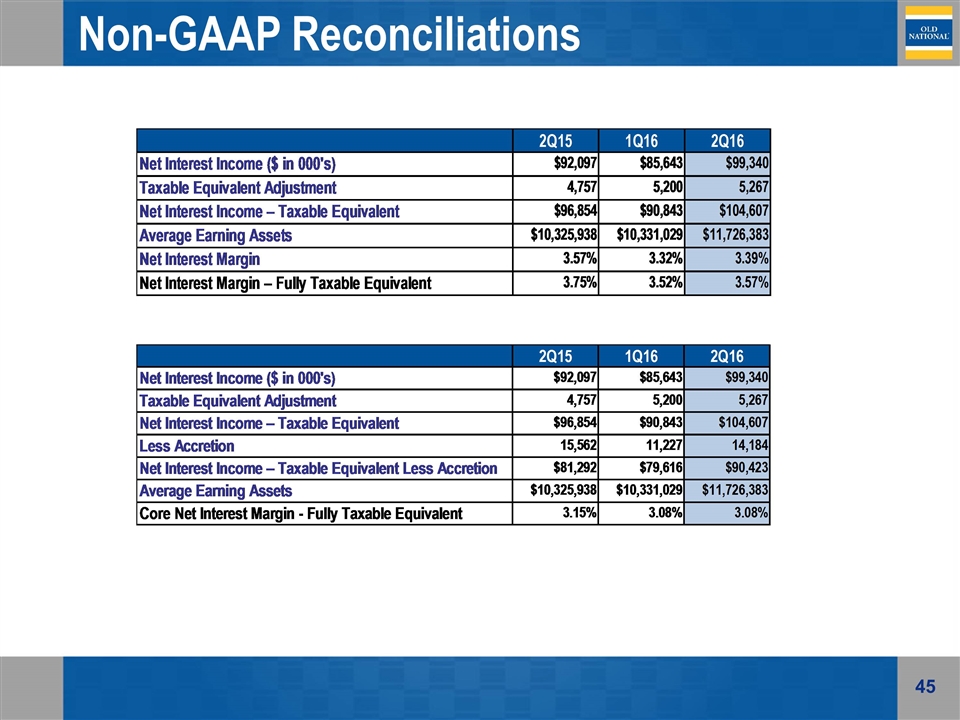

Non-GAAP Financial Measures These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant's historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the registrant; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, Old National Bancorp has provided reconciliations within the slides, as necessary, of the non-GAAP financial measure to the most directly comparable GAAP financial measure.

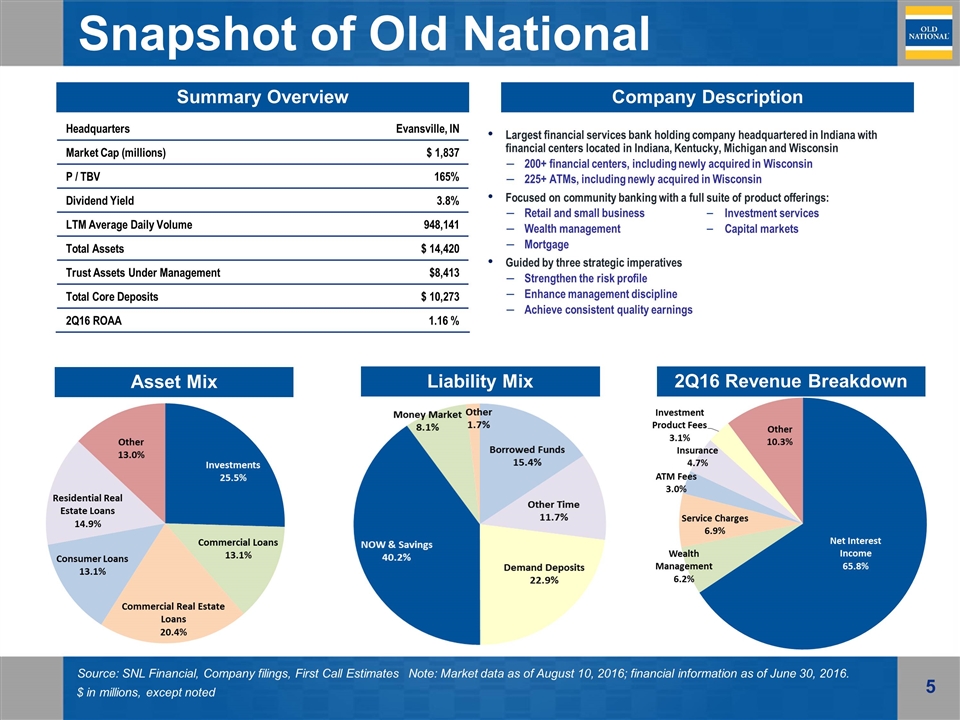

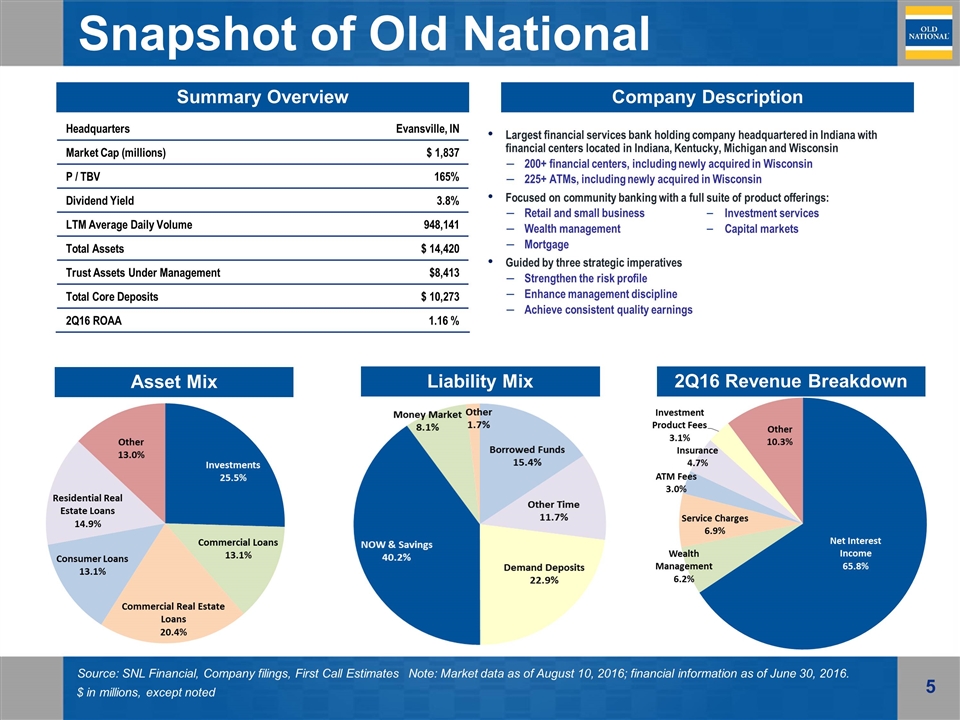

Snapshot of Old National Largest financial services bank holding company headquartered in Indiana with financial centers located in Indiana, Kentucky, Michigan and Wisconsin 200+ financial centers, including newly acquired in Wisconsin 225+ ATMs, including newly acquired in Wisconsin Focused on community banking with a full suite of product offerings: Retail and small business Wealth management Mortgage Guided by three strategic imperatives Strengthen the risk profile Enhance management discipline Achieve consistent quality earnings Source: SNL Financial, Company filings, First Call Estimates Note: Market data as of August 10, 2016; financial information as of June 30, 2016. Summary Overview Company Description Headquarters Evansville, IN Market Cap (millions) $ 1,837 P / TBV 165% Dividend Yield 3.8% LTM Average Daily Volume 948,141 Total Assets $ 14,420 Trust Assets Under Management $8,413 Total Core Deposits $ 10,273 2Q16 ROAA 1.16 % $ in millions, except noted Investment services Capital markets Asset Mix Liability Mix 2Q16 Revenue Breakdown

A Strategic Framework for Creating Long-Term Shareholder Value Attractive footprint that offers both leading share in mature markets and room to expand in higher growth markets Consistent financial performance with distinct revenue streams and actions taken to improve efficiency Diverse loan portfolio with growth accelerating while maintaining strong credit metrics Disciplined acquisitions that are exceeding expectations with robust future opportunities Steward of capital – organic growth, dividend / share repurchases, and acquisitions Achieving strategic imperatives

Commitment to Excellence

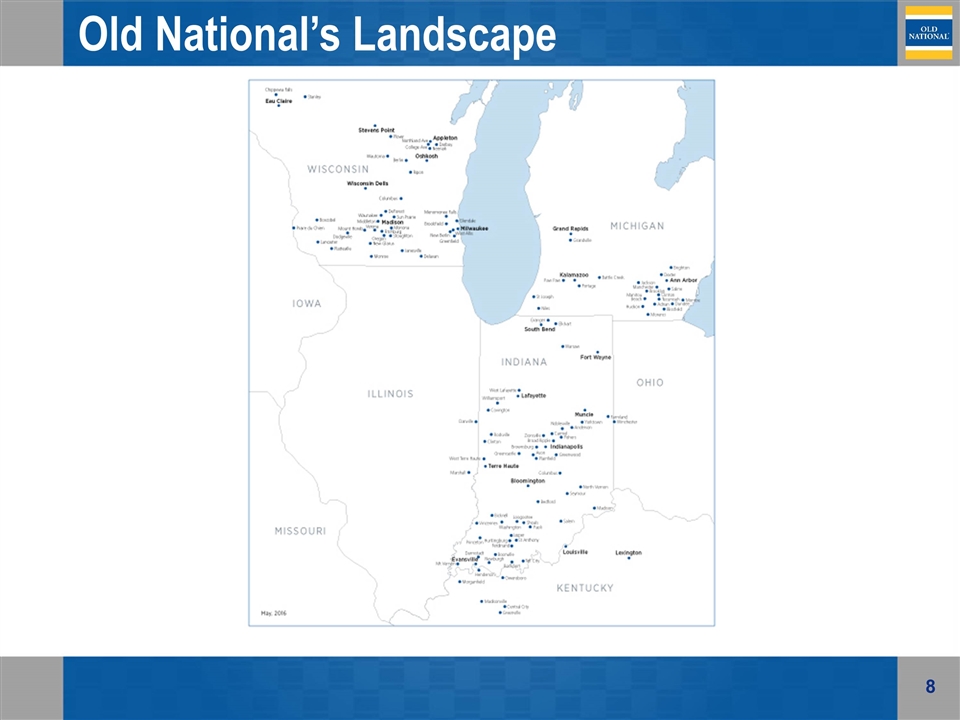

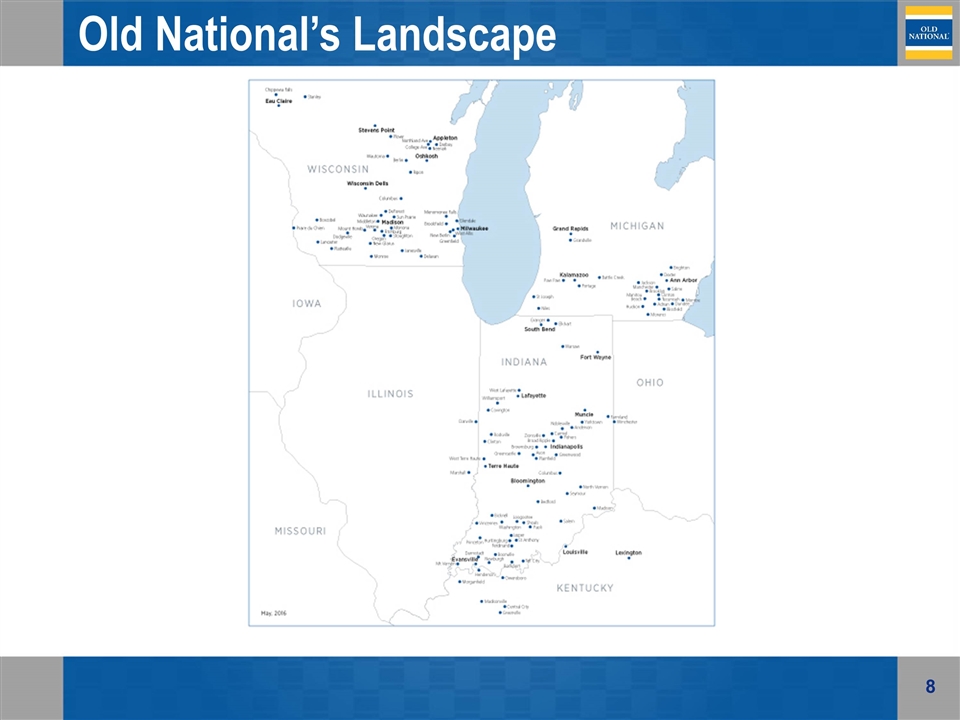

Old National’s Landscape

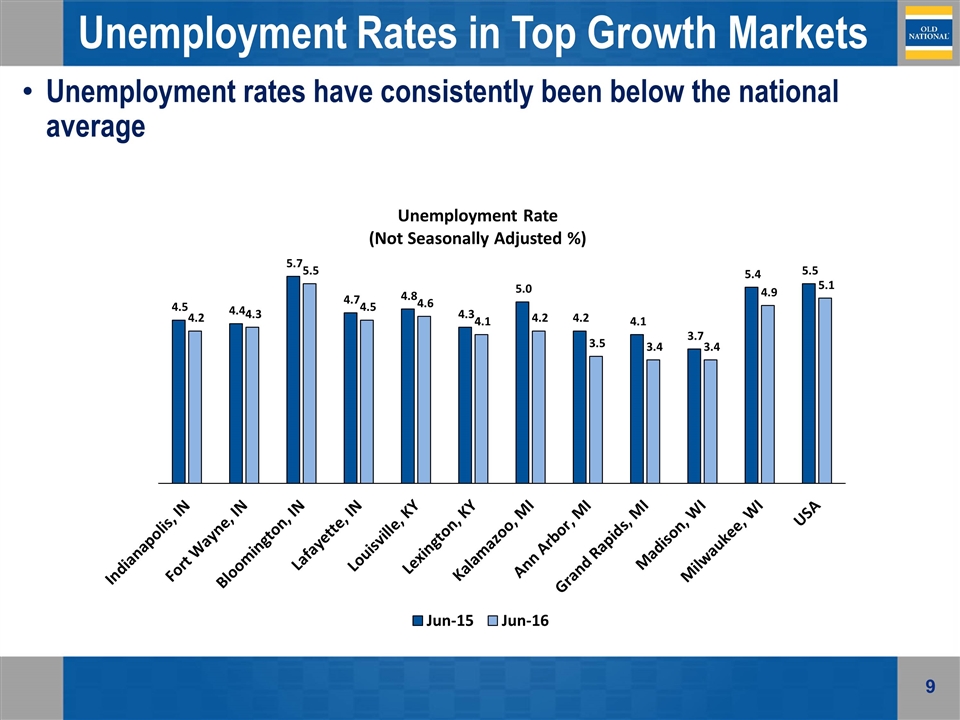

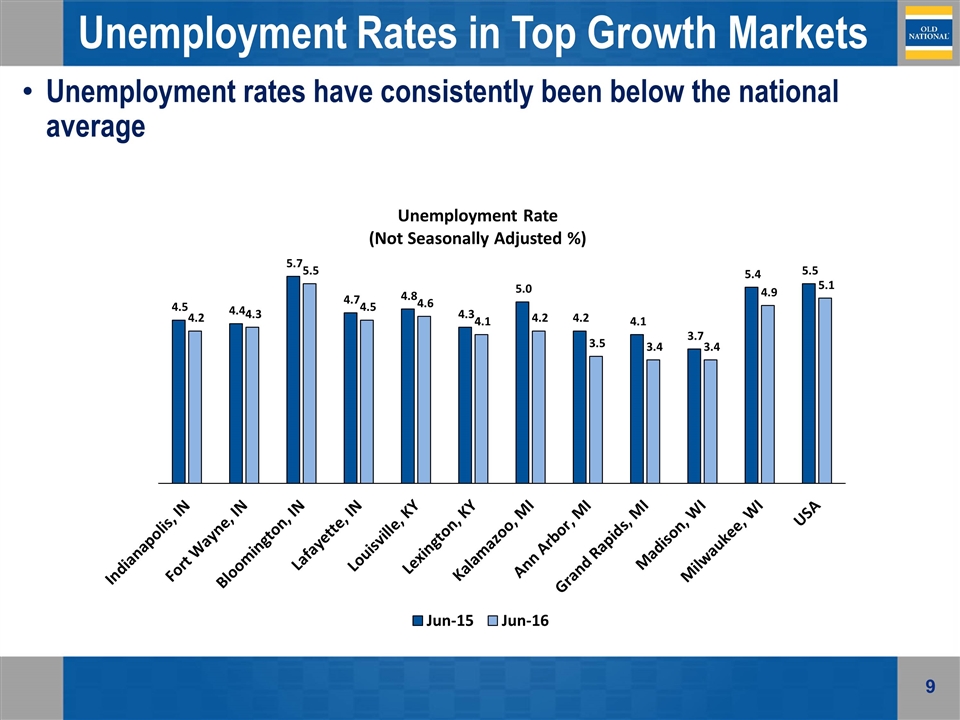

Unemployment Rates in Top Growth Markets Unemployment rates have consistently been below the national average

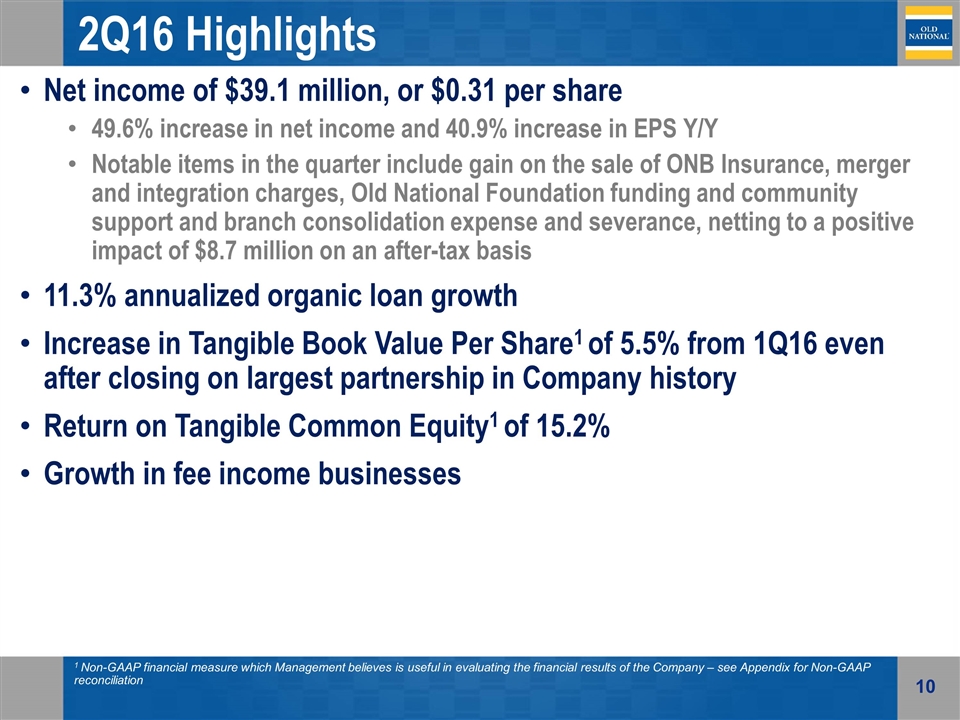

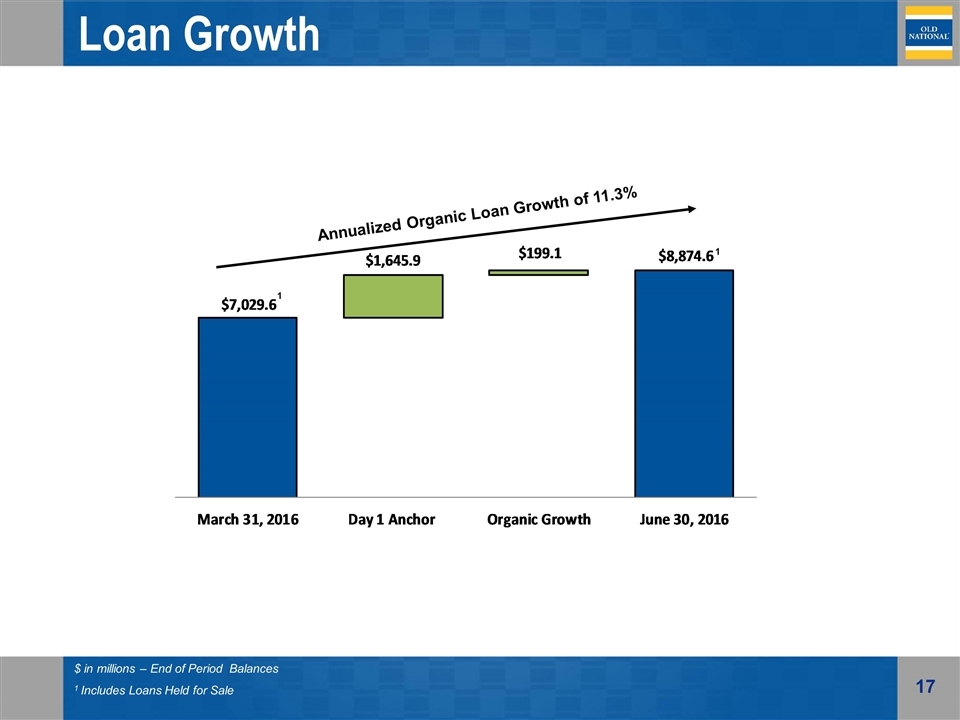

2Q16 Highlights Net income of $39.1 million, or $0.31 per share 49.6% increase in net income and 40.9% increase in EPS Y/Y Notable items in the quarter include gain on the sale of ONB Insurance, merger and integration charges, Old National Foundation funding and community support and branch consolidation expense and severance, netting to a positive impact of $8.7 million on an after-tax basis 11.3% annualized organic loan growth Increase in Tangible Book Value Per Share1 of 5.5% from 1Q16 even after closing on largest partnership in Company history Return on Tangible Common Equity1 of 15.2% Growth in fee income businesses 1 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation

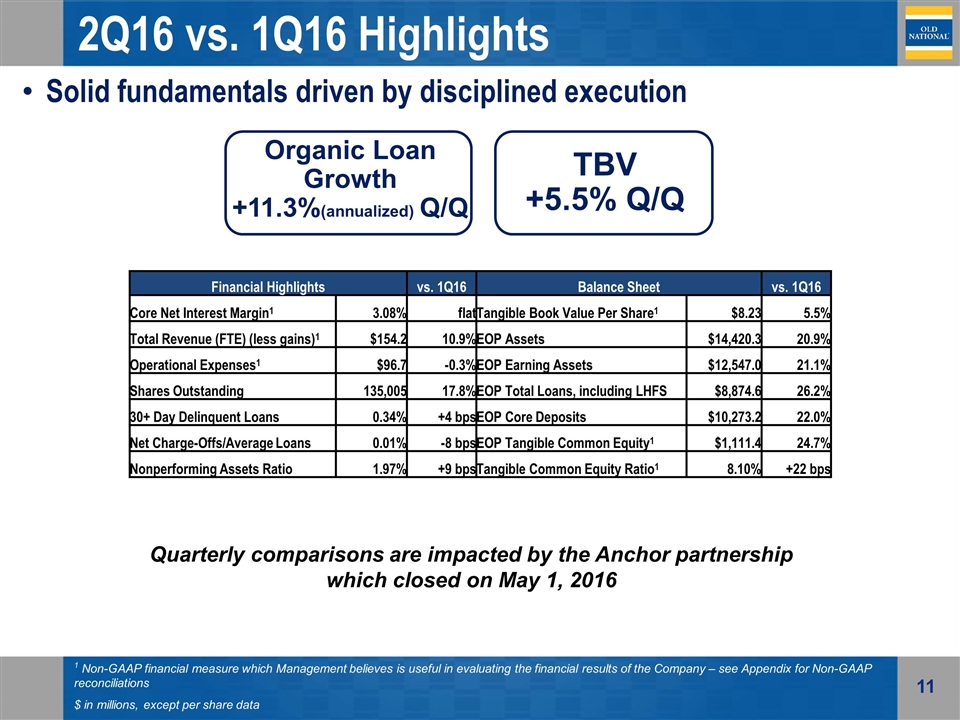

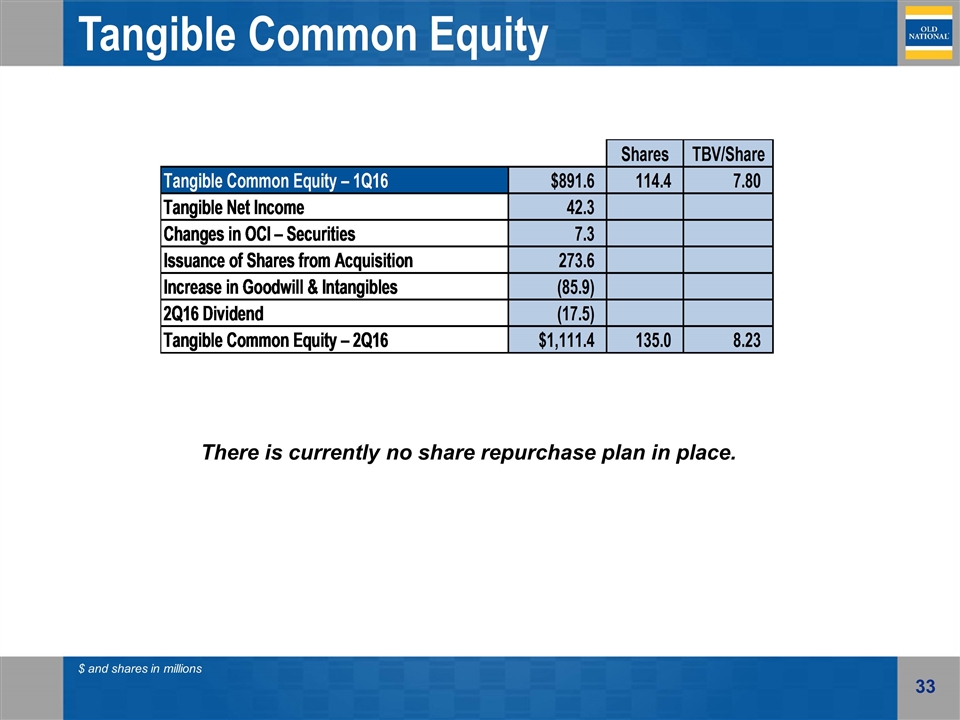

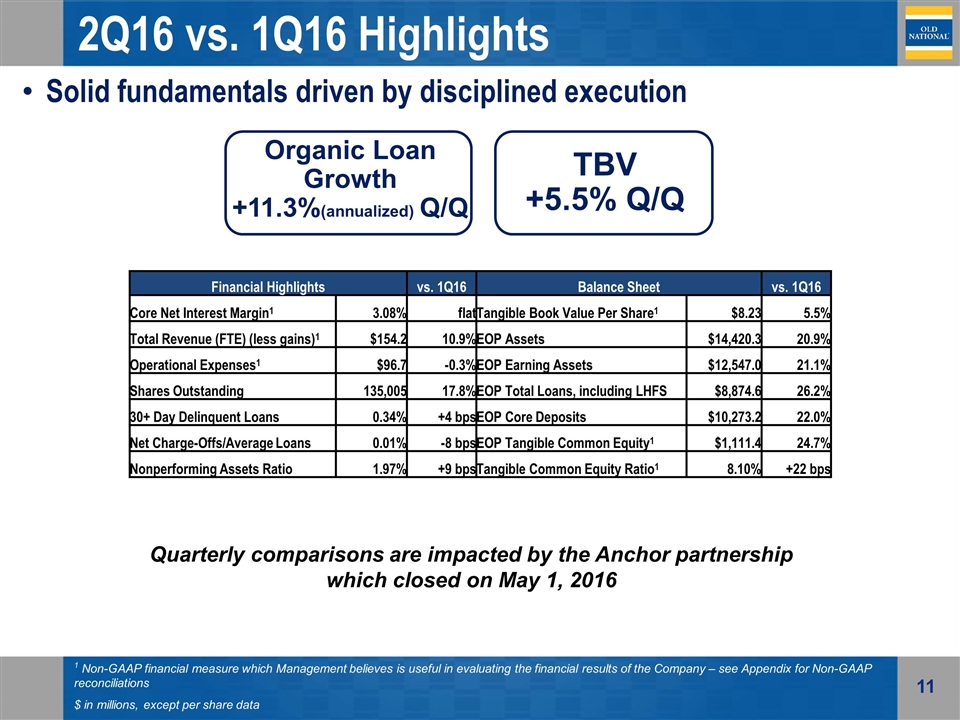

2Q16 vs. 1Q16 Highlights Solid fundamentals driven by disciplined execution Organic Loan Growth +11.3%(annualized) Q/Q TBV +5.5% Q/Q 1 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliations $ in millions, except per share data Financial Highlights vs. 1Q16 Balance Sheet vs. 1Q16 Core Net Interest Margin1 3.08% flat Tangible Book Value Per Share1 $8.23 5.5% Total Revenue (FTE) (less gains)1 $154.2 10.9% EOP Assets $14,420.3 20.9% Operational Expenses1 $96.7 -0.3% EOP Earning Assets $12,547.0 21.1% Shares Outstanding 135,005 17.8% EOP Total Loans, including LHFS $8,874.6 26.2% 30+ Day Delinquent Loans 0.34% +4 bps EOP Core Deposits $10,273.2 22.0% Net Charge-Offs/Average Loans 0.01% -8 bps EOP Tangible Common Equity1 $1,111.4 24.7% Nonperforming Assets Ratio 1.97% +9 bps Tangible Common Equity Ratio1 8.10% +22 bps Quarterly comparisons are impacted by the Anchor partnership which closed on May 1, 2016

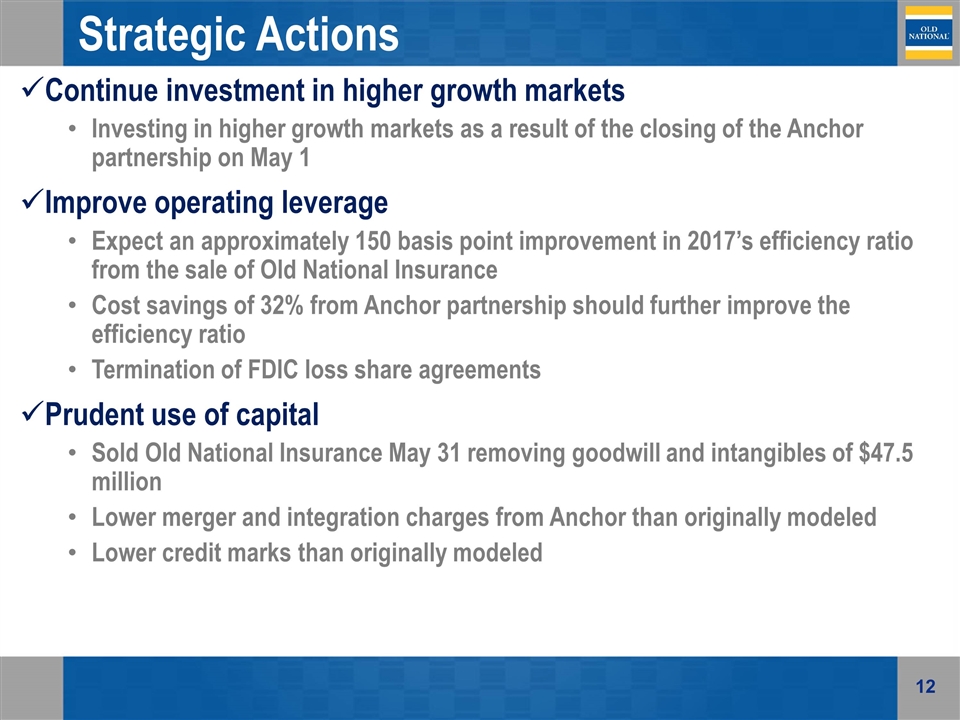

Strategic Actions Continue investment in higher growth markets Investing in higher growth markets as a result of the closing of the Anchor partnership on May 1 Improve operating leverage Expect an approximately 150 basis point improvement in 2017’s efficiency ratio from the sale of Old National Insurance Cost savings of 32% from Anchor partnership should further improve the efficiency ratio Termination of FDIC loss share agreements Prudent use of capital Sold Old National Insurance May 31 removing goodwill and intangibles of $47.5 million Lower merger and integration charges from Anchor than originally modeled Lower credit marks than originally modeled

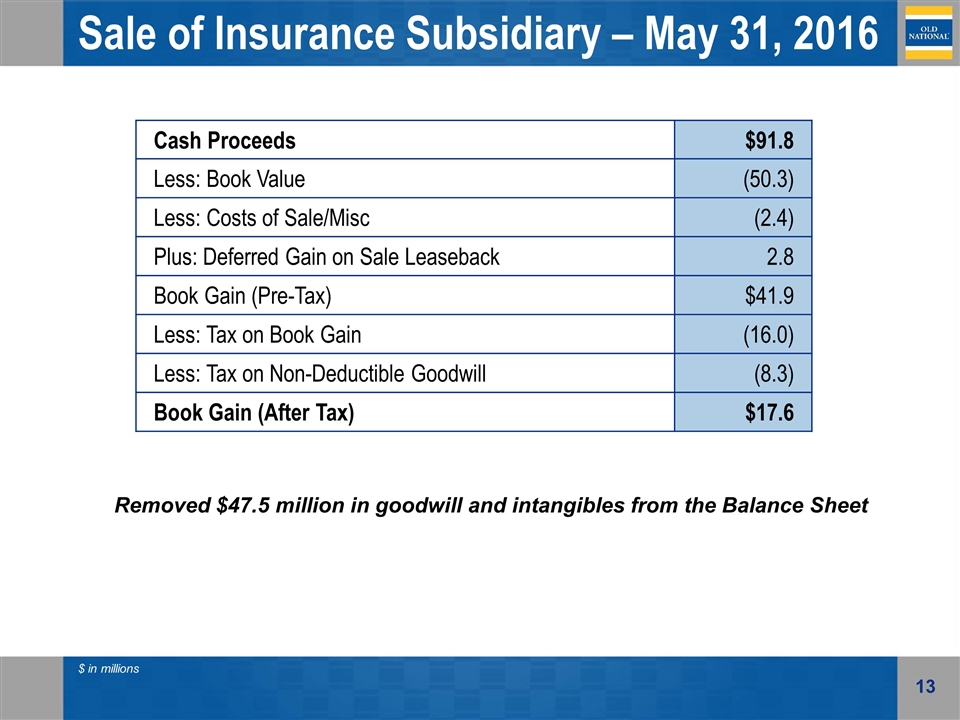

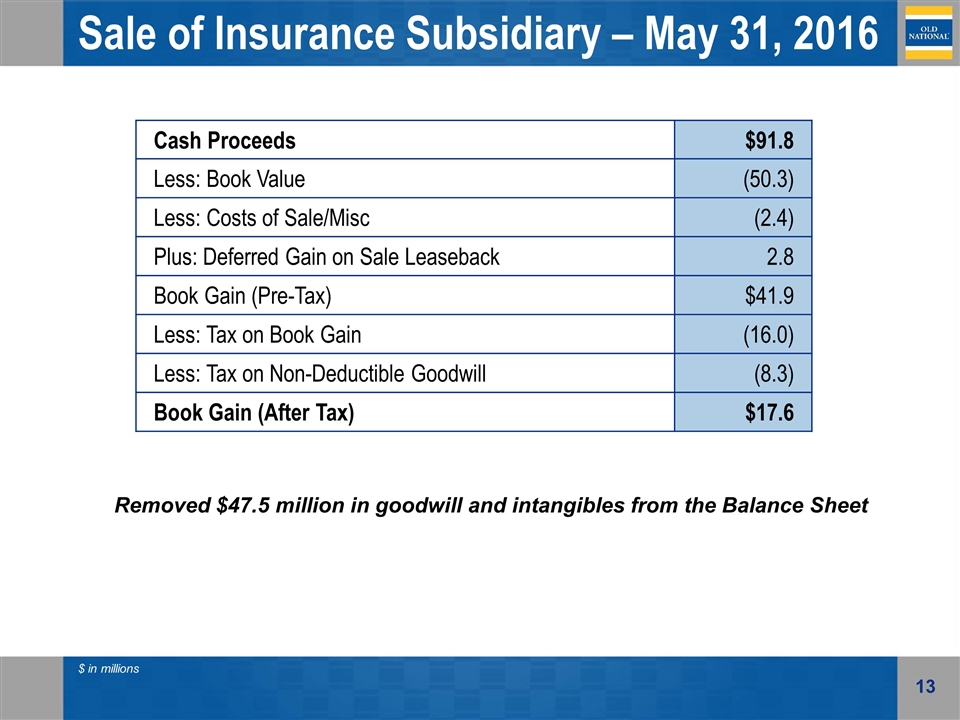

Sale of Insurance Subsidiary – May 31, 2016 Cash Proceeds $91.8 Less: Book Value (50.3) Less: Costs of Sale/Misc (2.4) Plus: Deferred Gain on Sale Leaseback 2.8 Book Gain (Pre-Tax) $41.9 Less: Tax on Book Gain (16.0) Less: Tax on Non-Deductible Goodwill (8.3) Book Gain (After Tax) $17.6 $ in millions Removed $47.5 million in goodwill and intangibles from the Balance Sheet

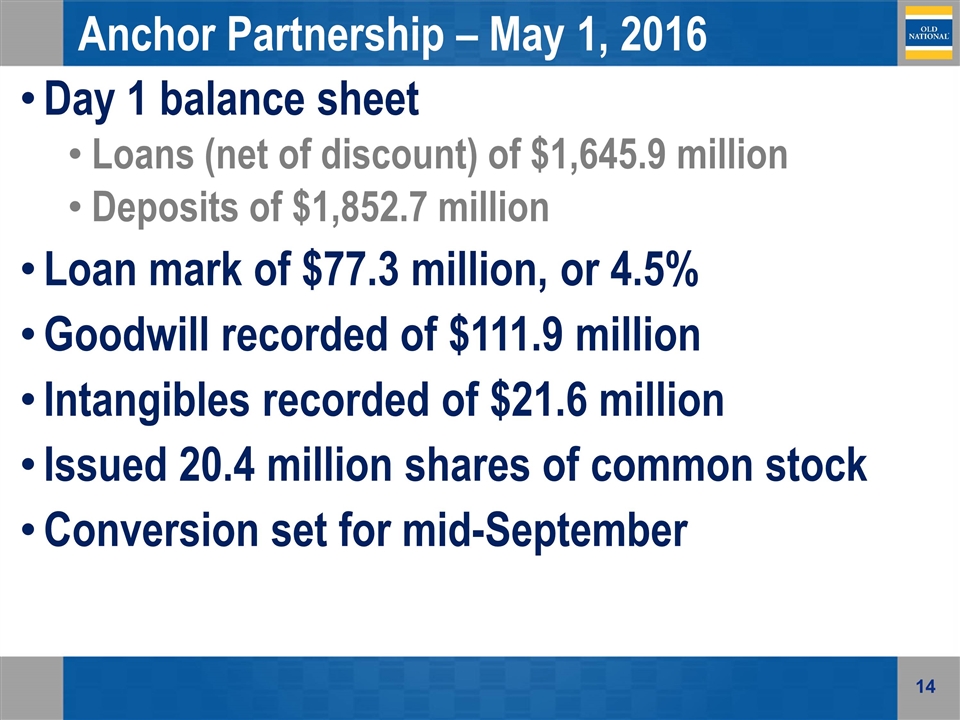

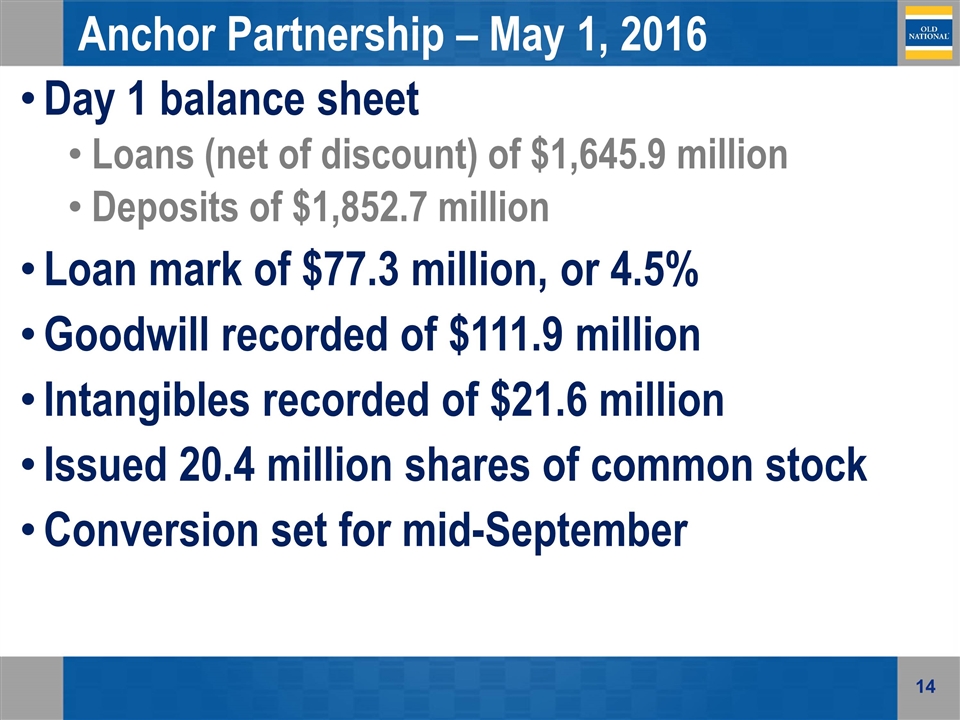

Anchor Partnership – May 1, 2016 Day 1 balance sheet Loans (net of discount) of $1,645.9 million Deposits of $1,852.7 million Loan mark of $77.3 million, or 4.5% Goodwill recorded of $111.9 million Intangibles recorded of $21.6 million Issued 20.4 million shares of common stock Conversion set for mid-September

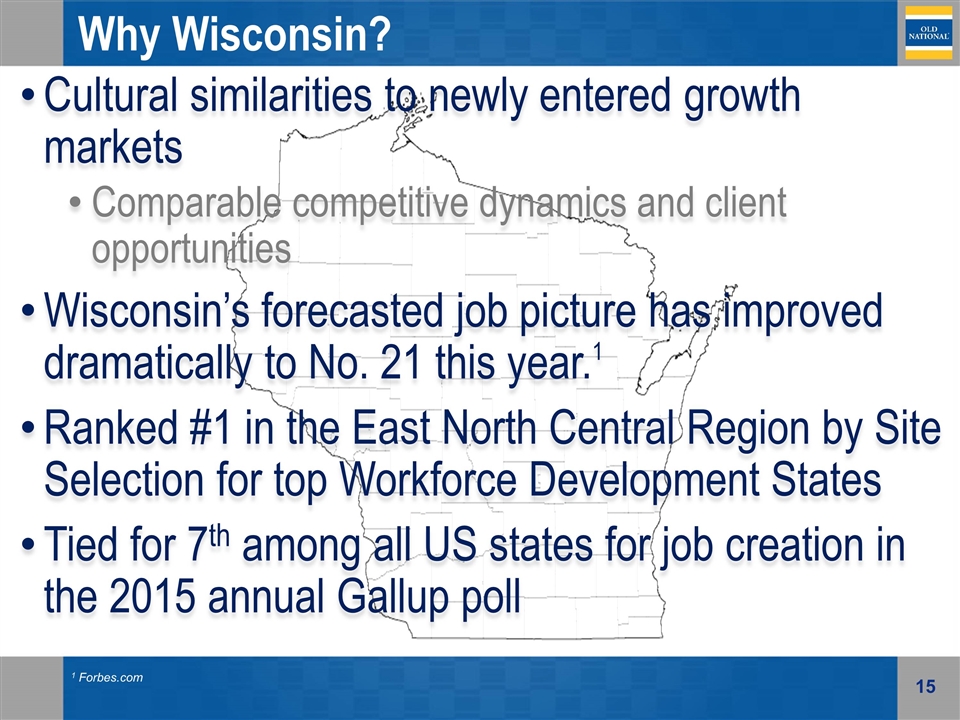

Why Wisconsin? Cultural similarities to newly entered growth markets Comparable competitive dynamics and client opportunities Wisconsin’s forecasted job picture has improved dramatically to No. 21 this year.1 Ranked #1 in the East North Central Region by Site Selection for top Workforce Development States Tied for 7th among all US states for job creation in the 2015 annual Gallup poll 1 Forbes.com

Investment Thesis Financial Data as of 6-30-16 Dated: August 15, 2016

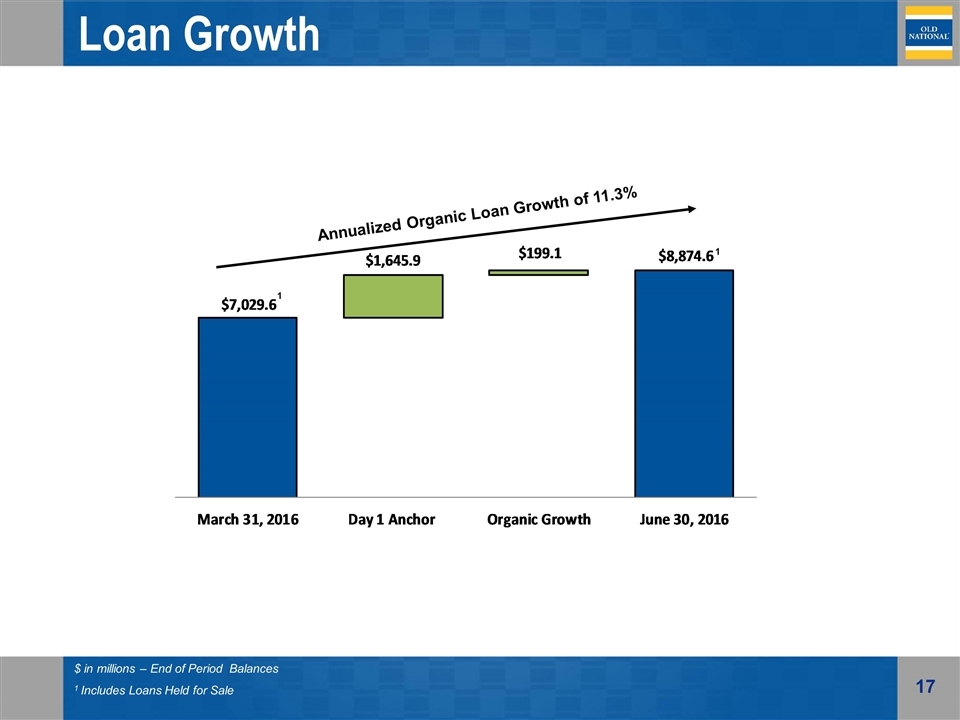

Loan Growth $ in millions – End of Period Balances 1 Includes Loans Held for Sale 1 1 Annualized Organic Loan Growth of 11.3%

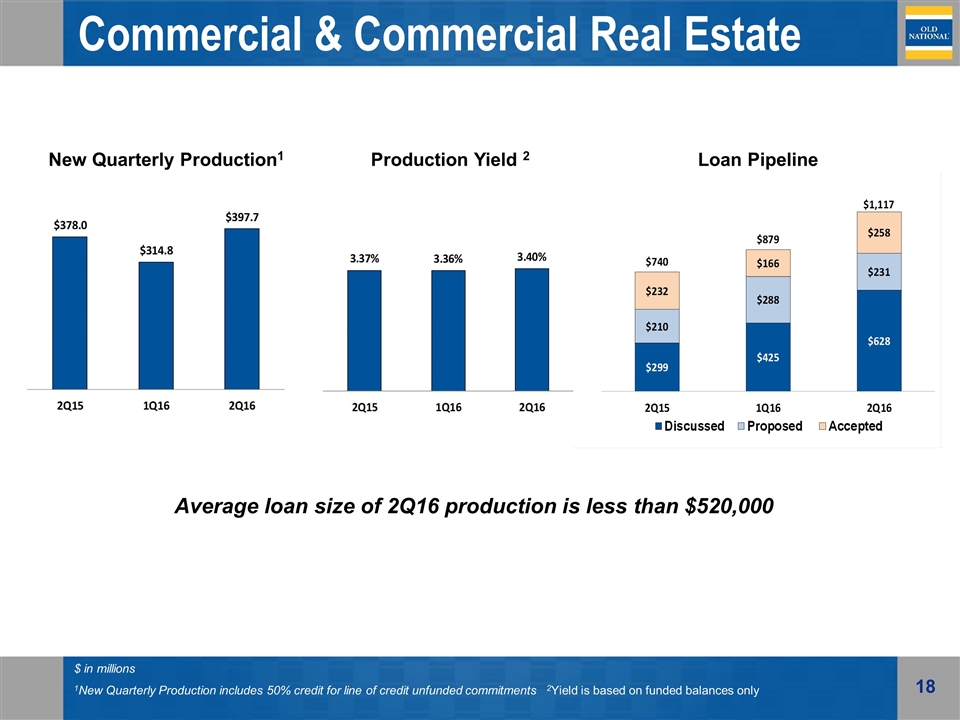

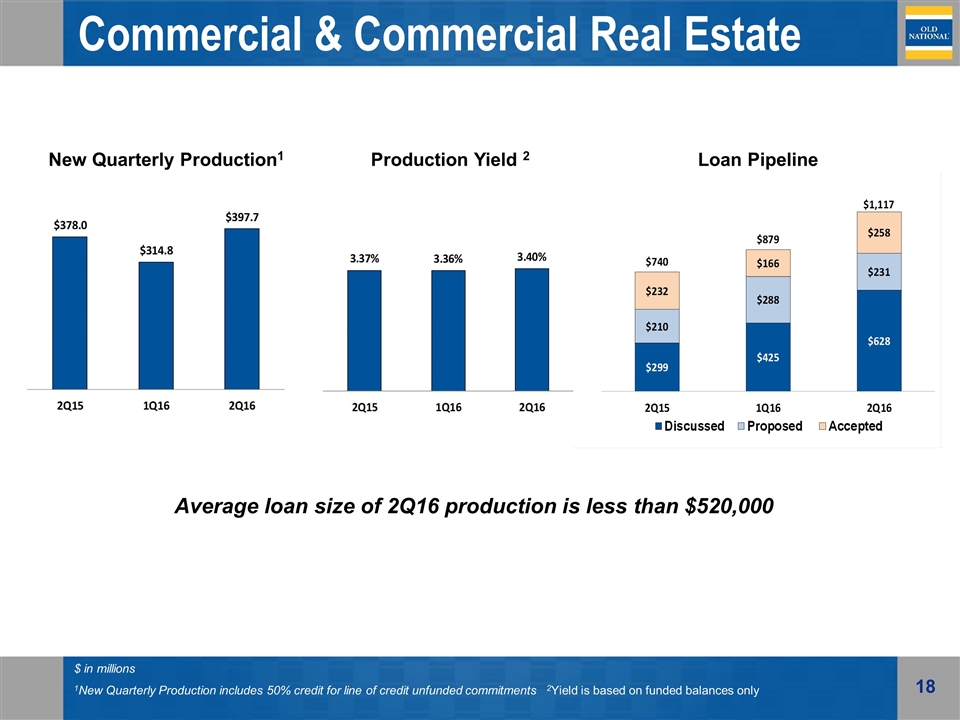

Commercial & Commercial Real Estate Loans $ in millions 1New Quarterly Production includes 50% credit for line of credit unfunded commitments 2Yield is based on funded balances only New Quarterly Production1 Production Yield 2 Average loan size of 2Q16 production is less than $520,000 Loan Pipeline

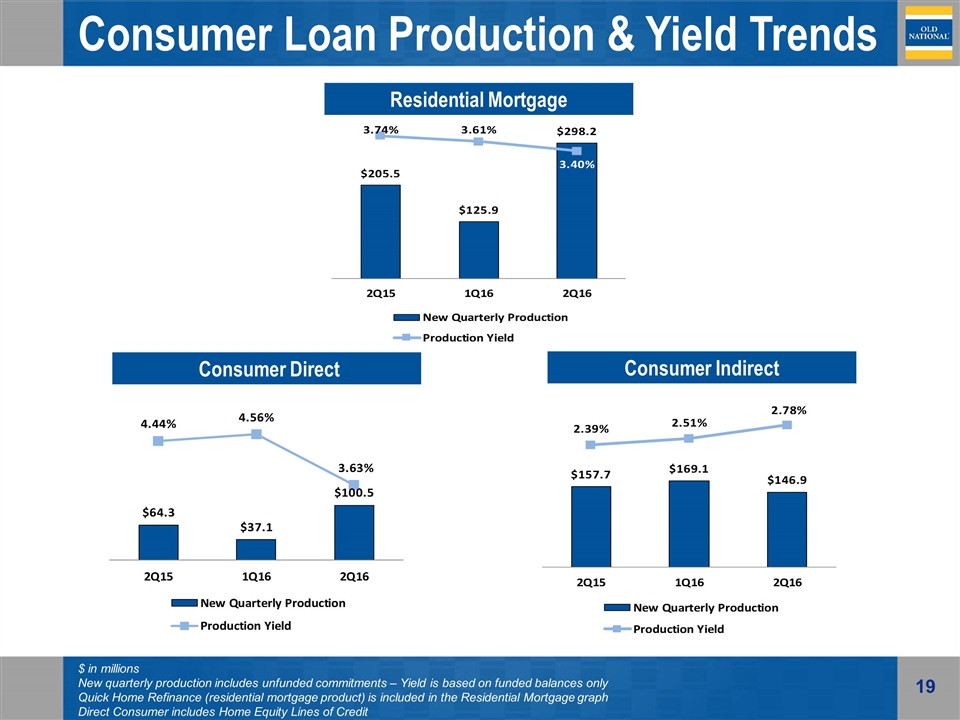

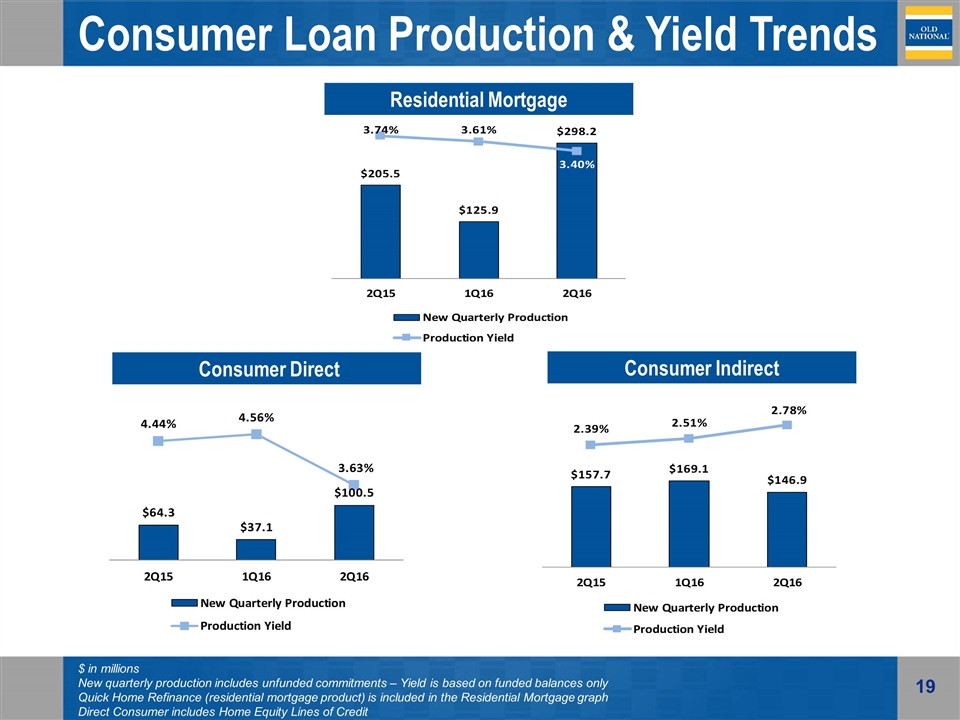

Consumer Loan Production & Yield Trends $ in millions New quarterly production includes unfunded commitments – Yield is based on funded balances only Quick Home Refinance (residential mortgage product) is included in the Residential Mortgage graph Direct Consumer includes Home Equity Lines of Credit Consumer Direct Consumer Indirect Residential Mortgage

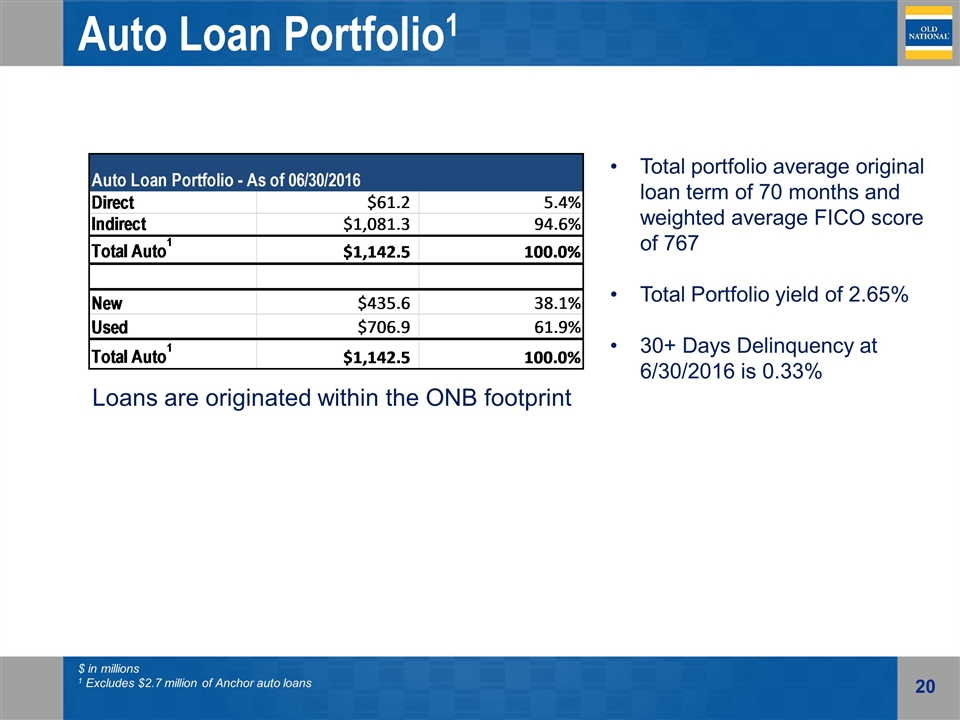

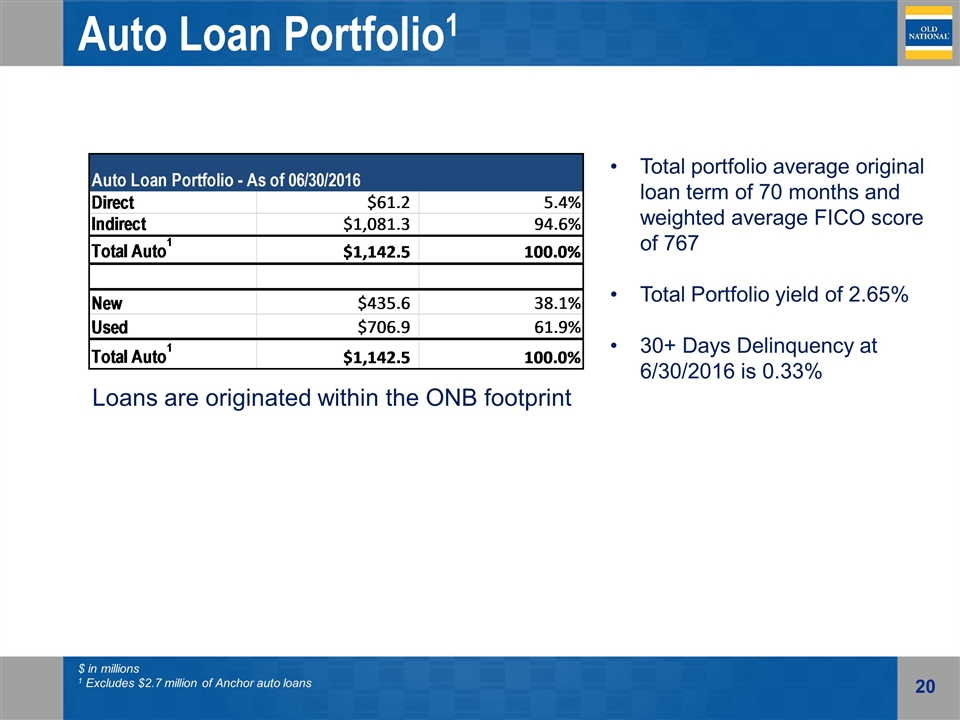

Auto Loan Portfolio1 $ in millions 1 Excludes $2.7 million of Anchor auto loans Total portfolio average original loan term of 70 months and weighted average FICO score of 767 Total Portfolio yield of 2.65% 30+ Days Delinquency at 6/30/2016 is 0.33% Loans are originated within the ONB footprint

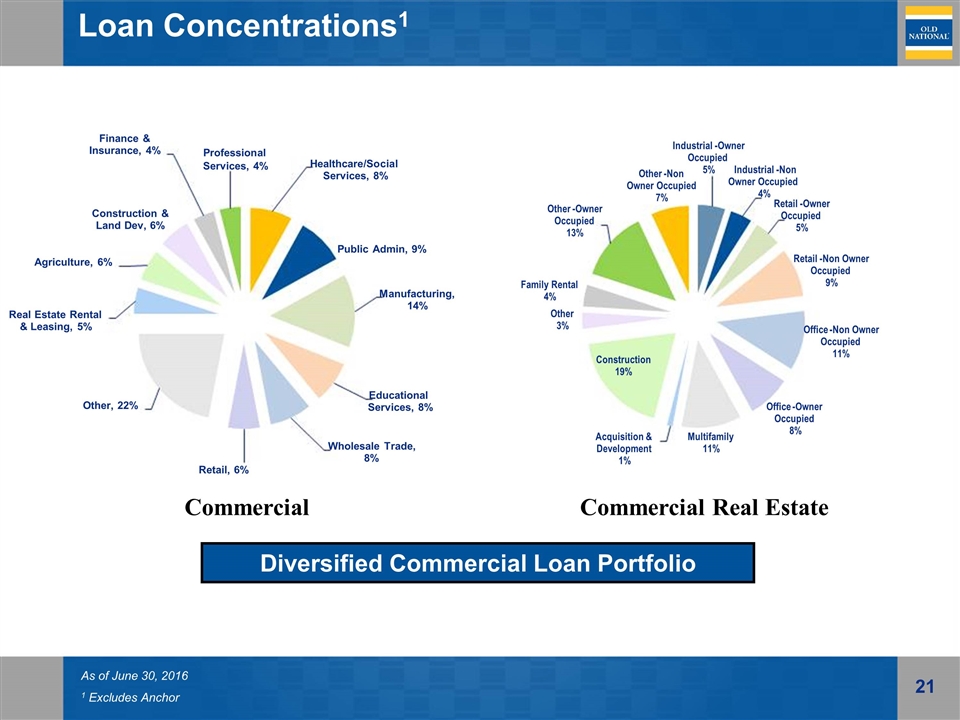

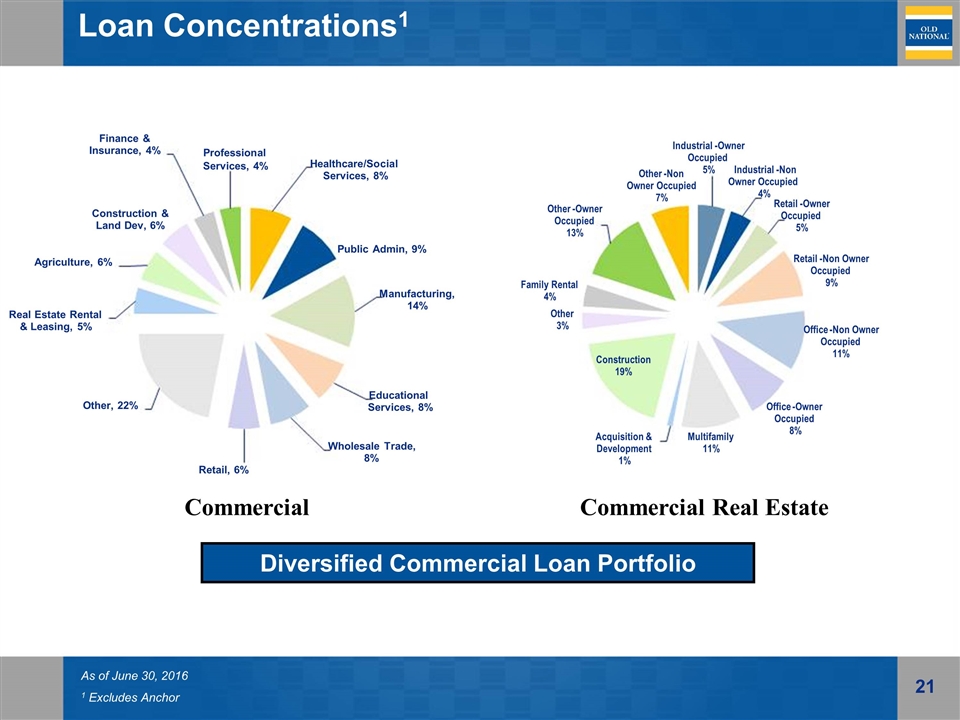

Loan Concentrations1 As of June 30, 2016 1 Excludes Anchor Commercial Commercial Real Estate Diversified Commercial Loan Portfolio Healthcare/Social Services, 8% Public Admin, 9% Manufacturing, 14% Educational Services, 8% Wholesale Trade, 8% Retail, 6% Other, 22% Real Estate Rental & Leasing, 5% Agriculture, 6% Construction & Land Dev, 6% Finance & Insurance, 4% Professional Services, 4% Industrial - Owner Occupied 5% Industrial - Non Owner Occupied 4% Retail - Owner Occupied 5% Retail - Non Owner Occupied 9% Office - Non Owner Occupied 11% Office - Owner Occupied 8% Multifamily 11% Acquisition & Development 1% Construction 19% Other 3% Family Rental 4% Other - Owner Occupied 13% Other - Non Owner Occupied 7%

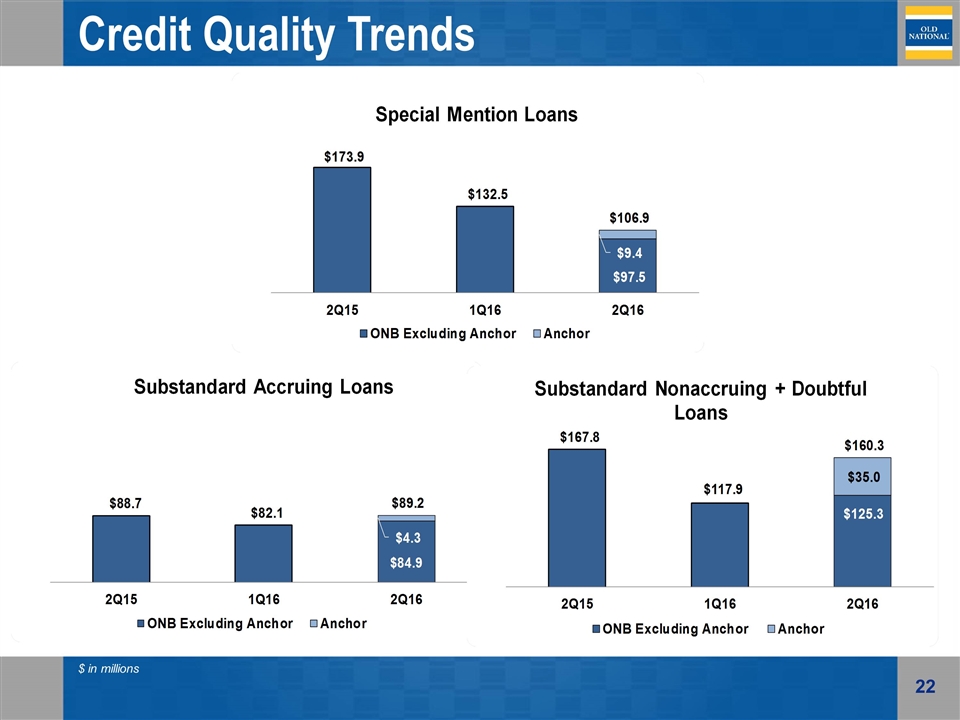

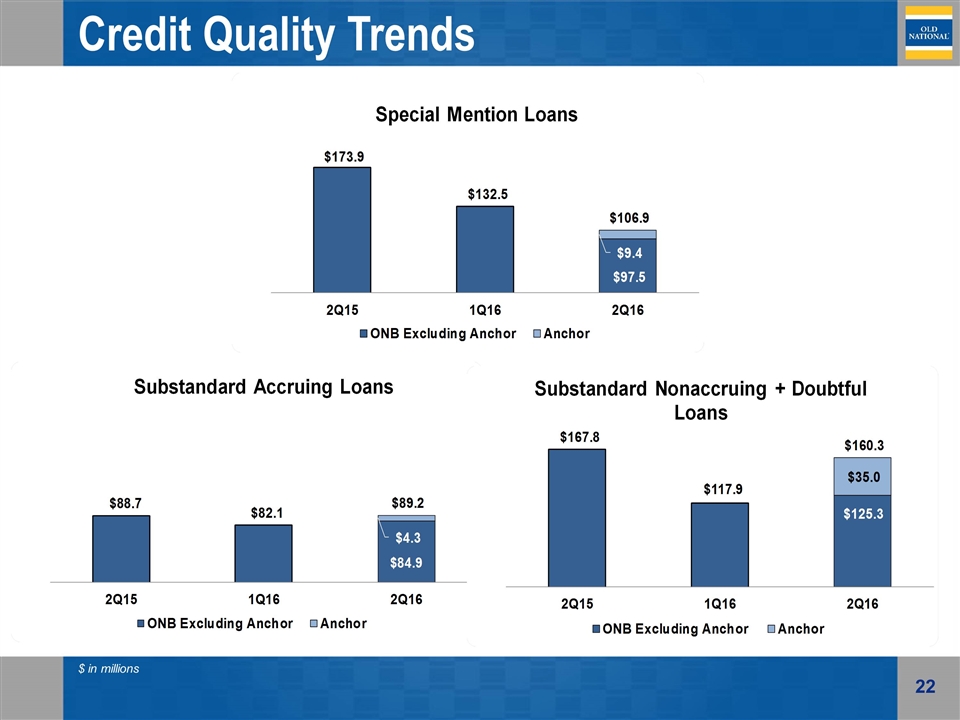

$ in millions Credit Quality Trends

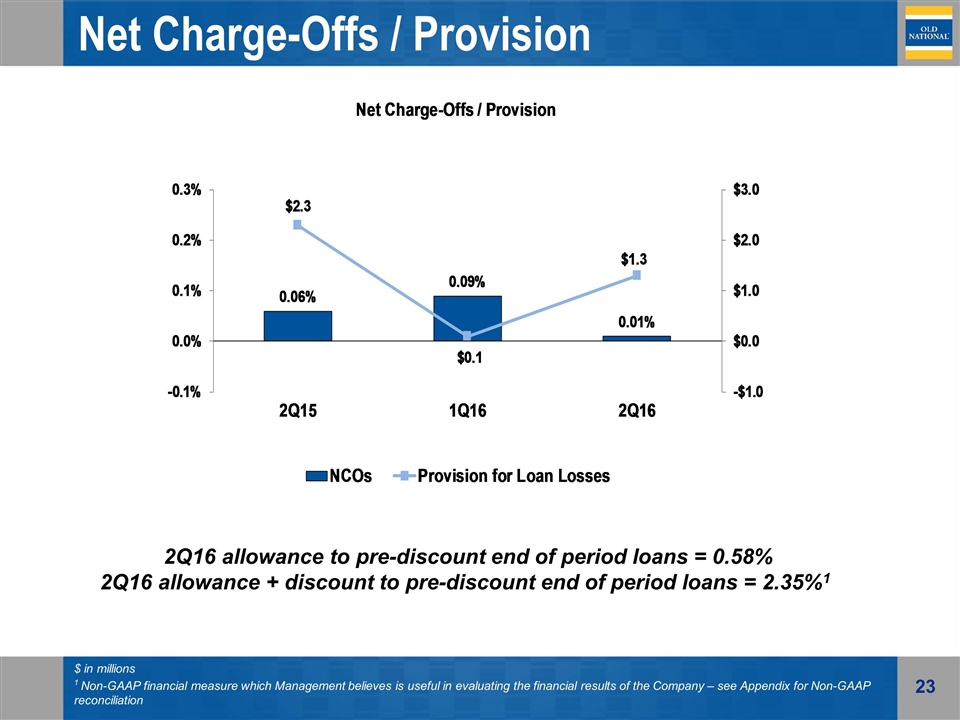

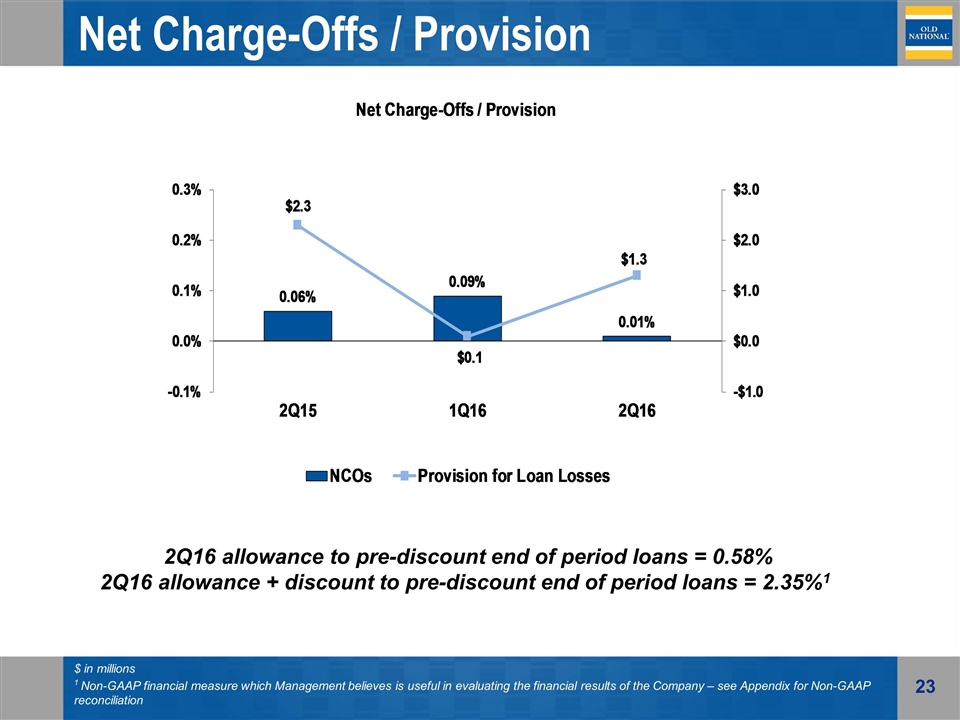

Net Charge-Offs / Provision $ in millions 2Q16 allowance to pre-discount end of period loans = 0.58% 2Q16 allowance + discount to pre-discount end of period loans = 2.35%1 1 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation

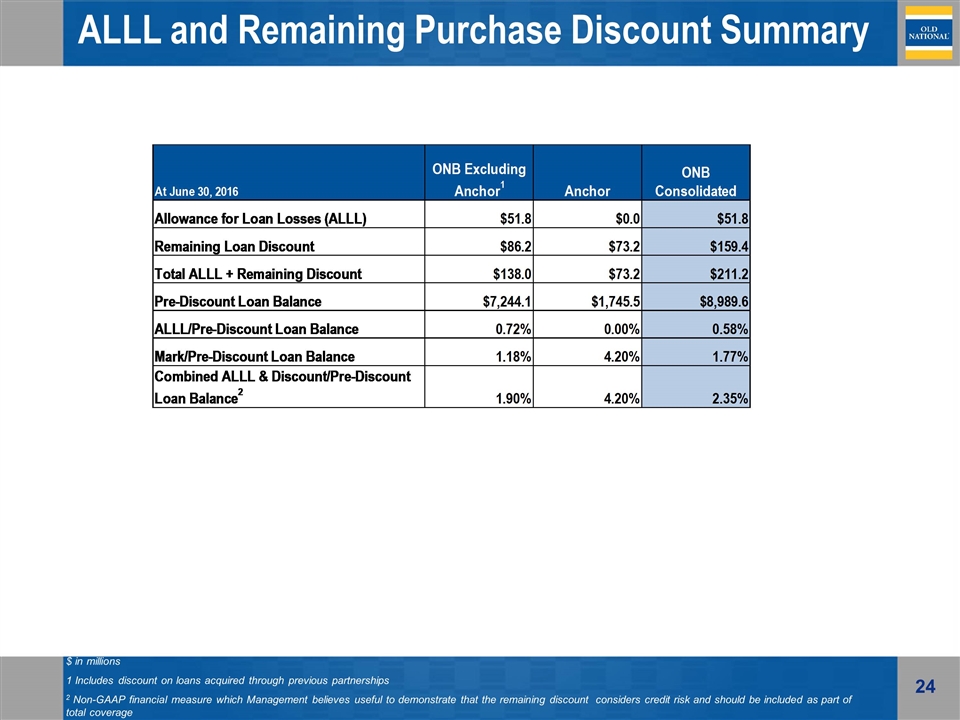

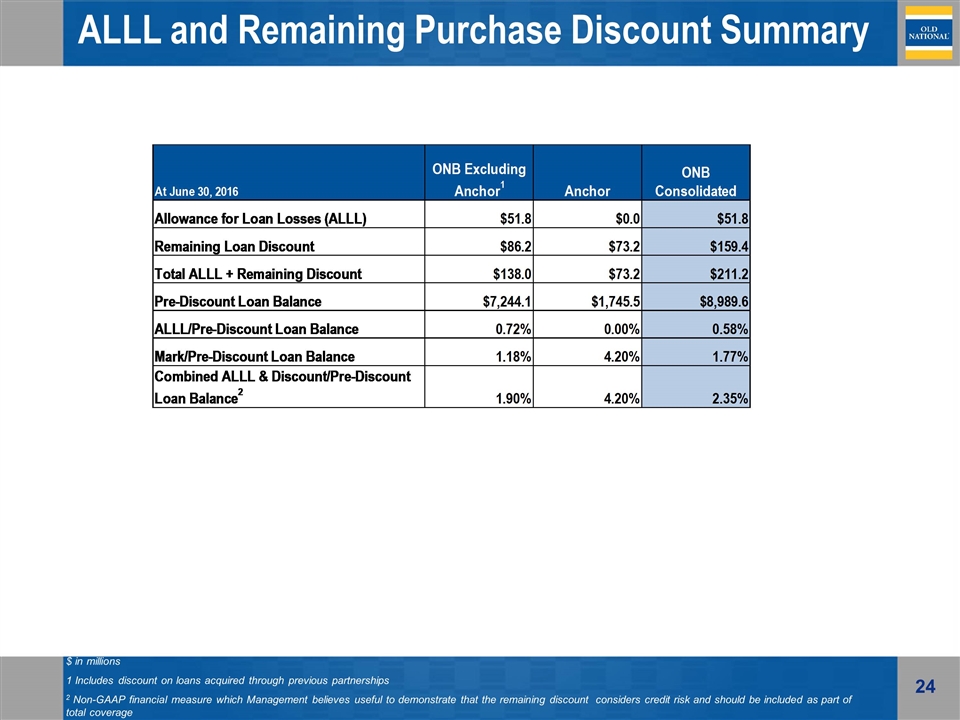

ALLL and Remaining Purchase Discount Summary $ in millions 1 Includes discount on loans acquired through previous partnerships 2 Non-GAAP financial measure which Management believes useful to demonstrate that the remaining discount considers credit risk and should be included as part of total coverage

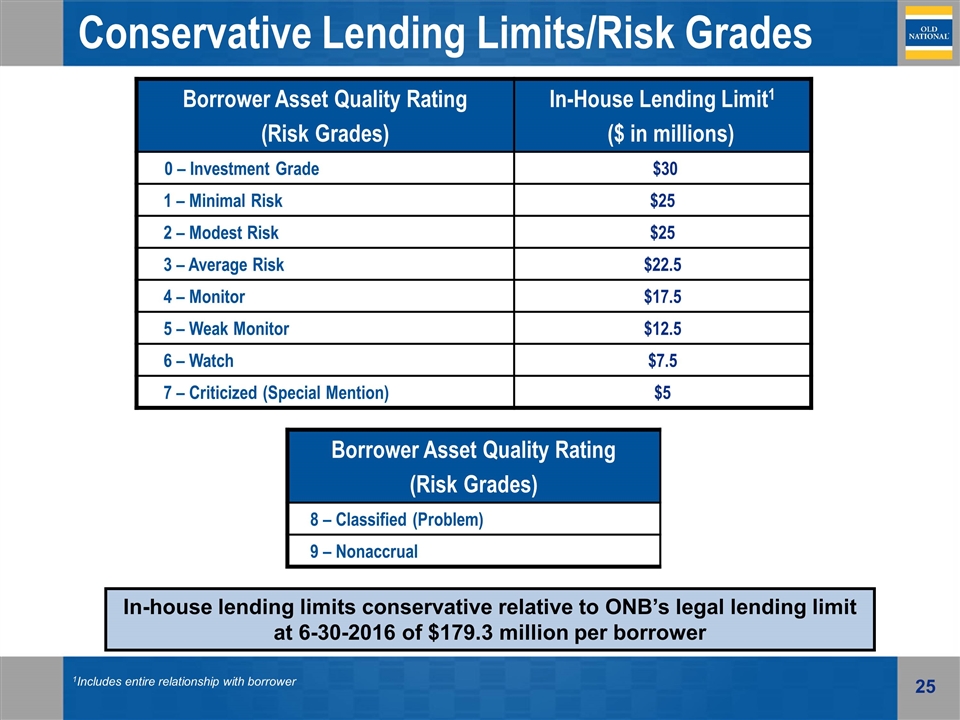

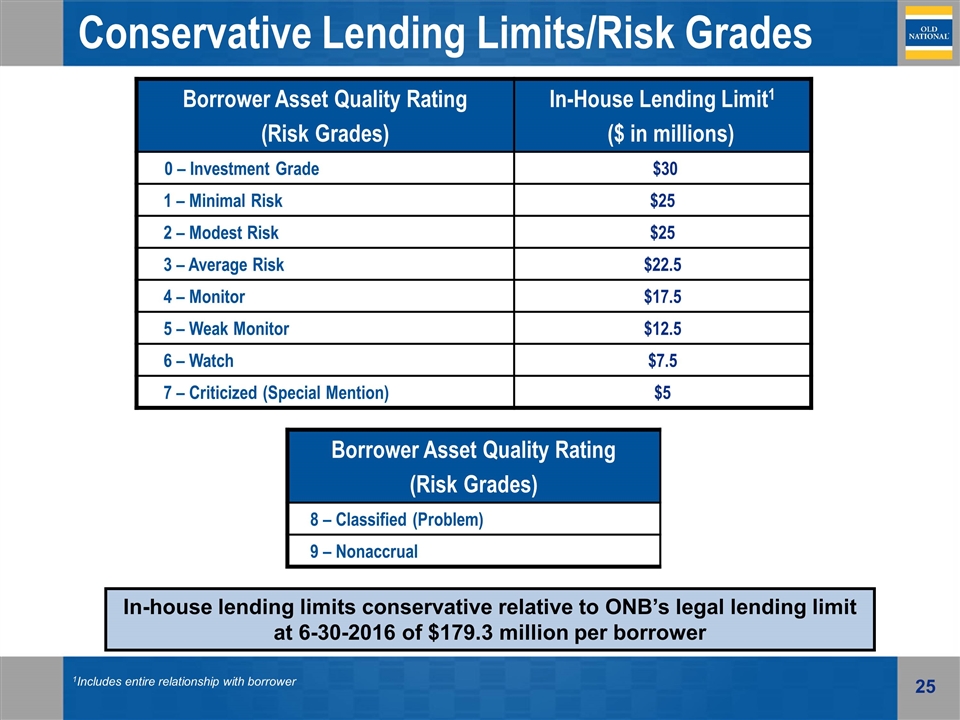

Conservative Lending Limits/Risk Grades Borrower Asset Quality Rating (Risk Grades) In-House Lending Limit1 ($ in millions) 0 – Investment Grade $30 1 – Minimal Risk $25 2 – Modest Risk $25 3 – Average Risk $22.5 4 – Monitor $17.5 5 – Weak Monitor $12.5 6 – Watch $7.5 7 – Criticized (Special Mention) $5 In-house lending limits conservative relative to ONB’s legal lending limit at 6-30-2016 of $179.3 million per borrower 1Includes entire relationship with borrower Borrower Asset Quality Rating (Risk Grades) 8 – Classified (Problem) 9 – Nonaccrual

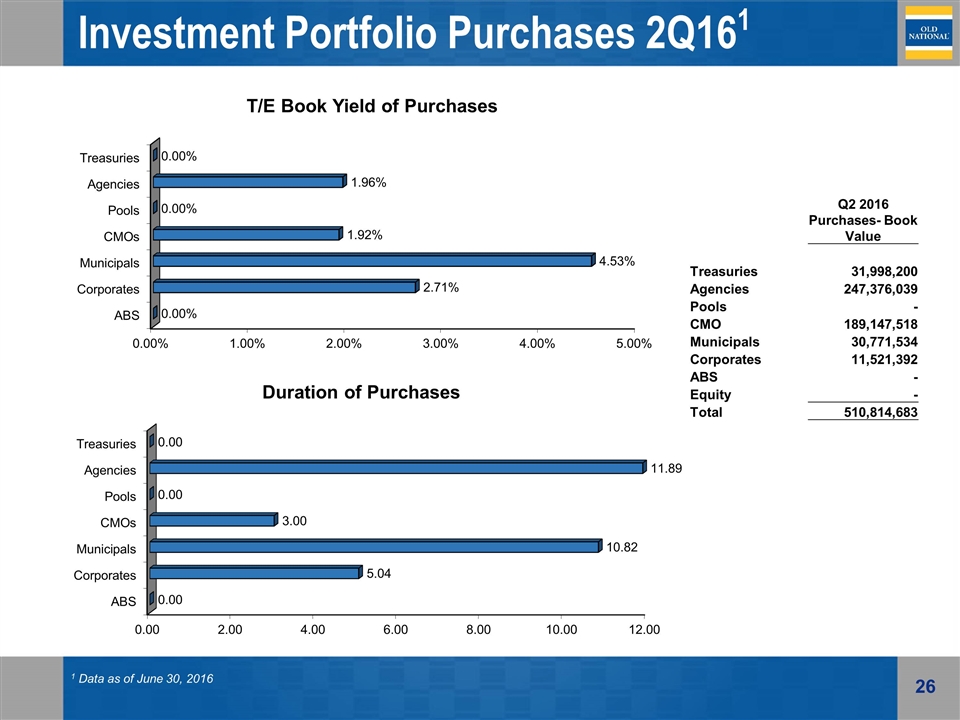

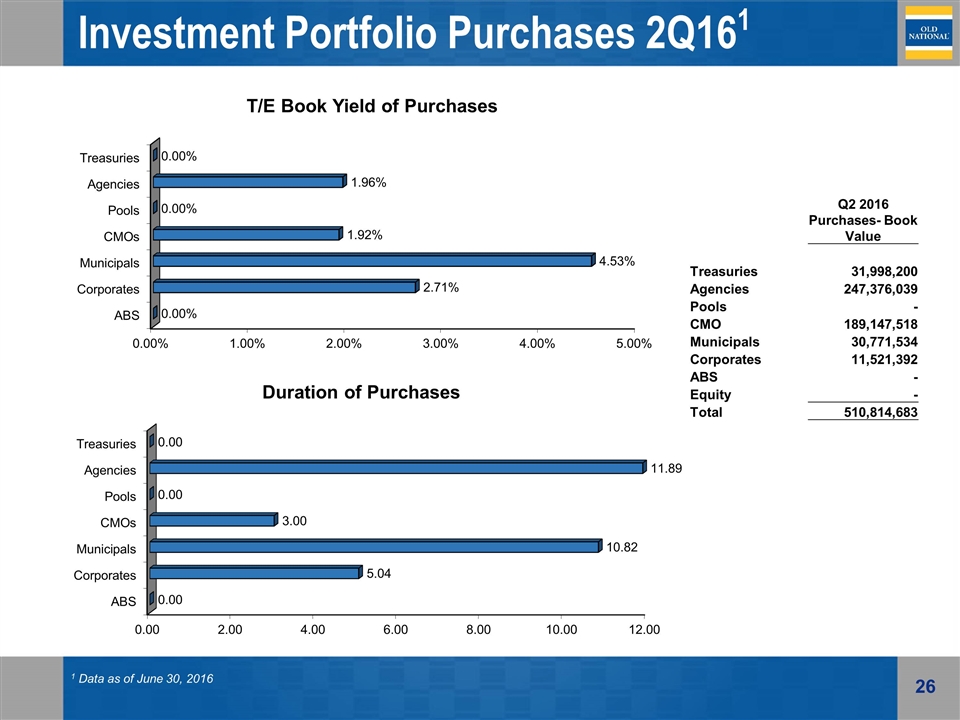

Investment Portfolio Purchases 2Q161 1 Data as of June 30, 2016 Q2 2016 Purchases- Book Value Treasuries 31,998,200 Agencies 247,376,039 Pools - CMO 189,147,518 Municipals 30,771,534 Corporates 11,521,392 ABS - Equity - Total 510,814,683

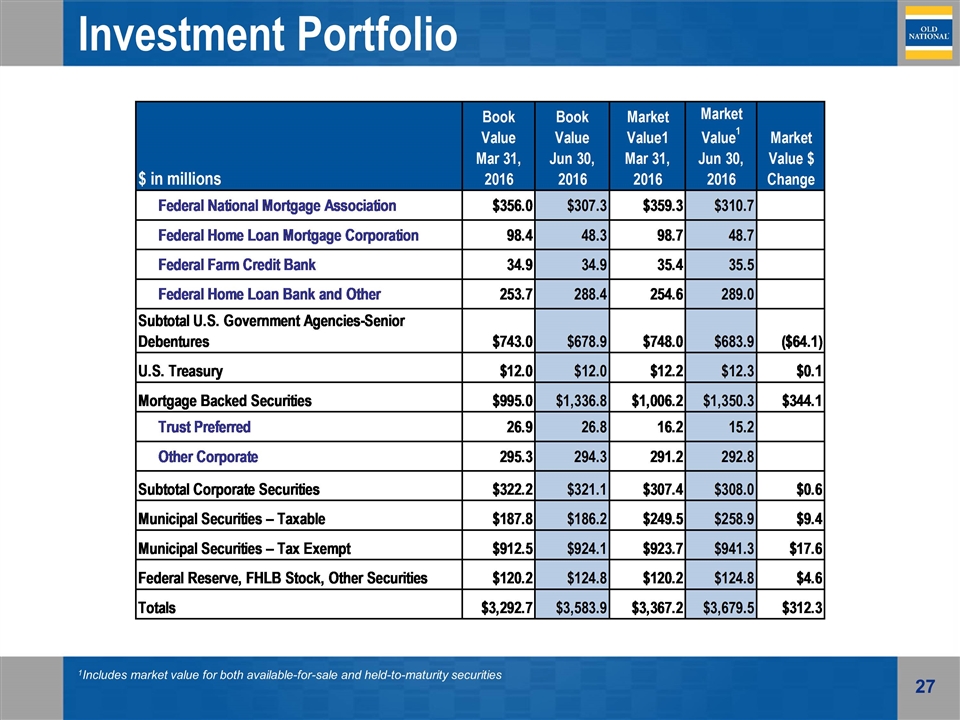

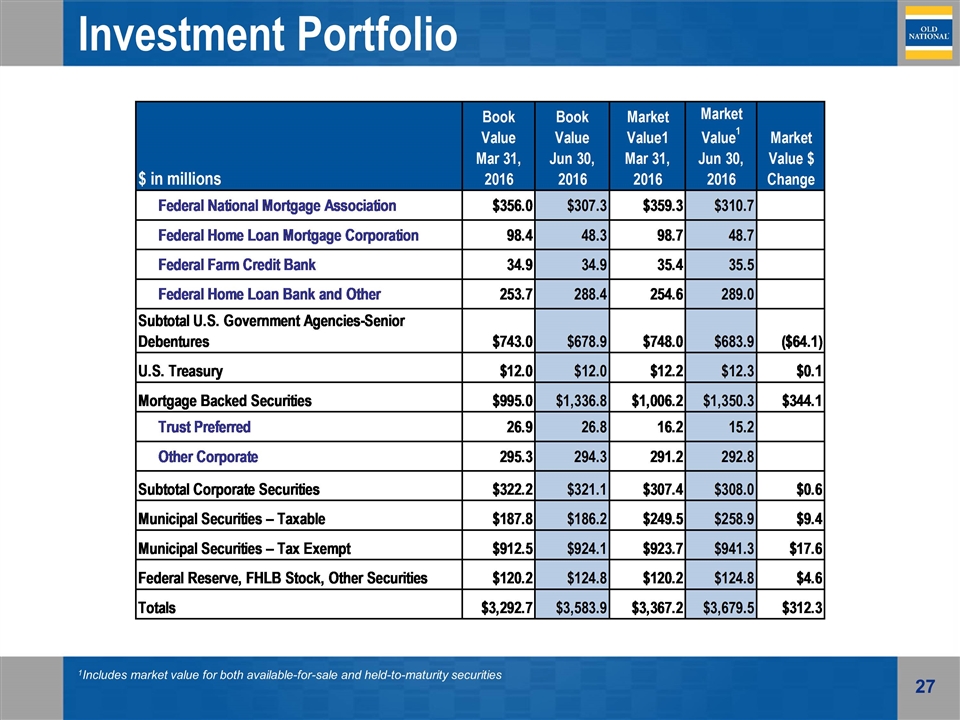

Investment Portfolio 1Includes market value for both available-for-sale and held-to-maturity securities

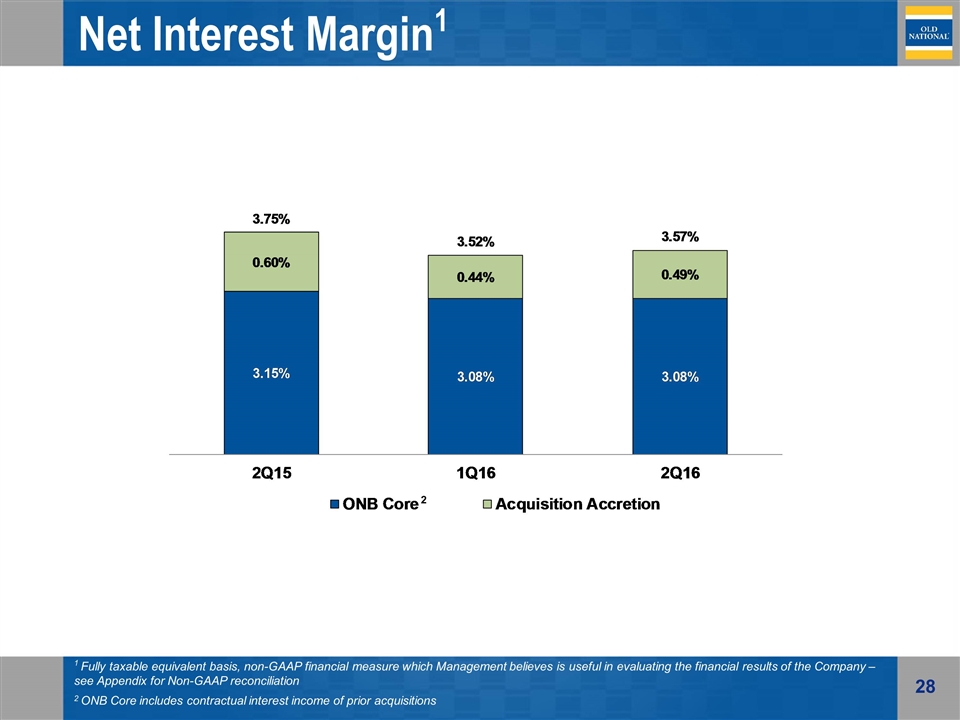

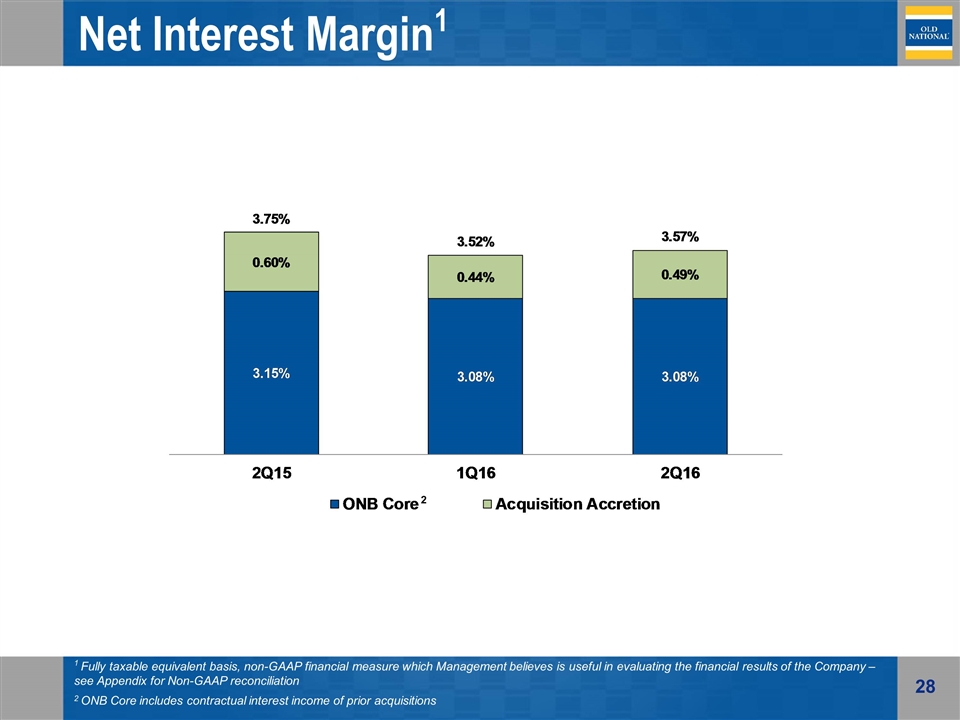

Net Interest Margin1 1 Fully taxable equivalent basis, non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation 2 ONB Core includes contractual interest income of prior acquisitions 2

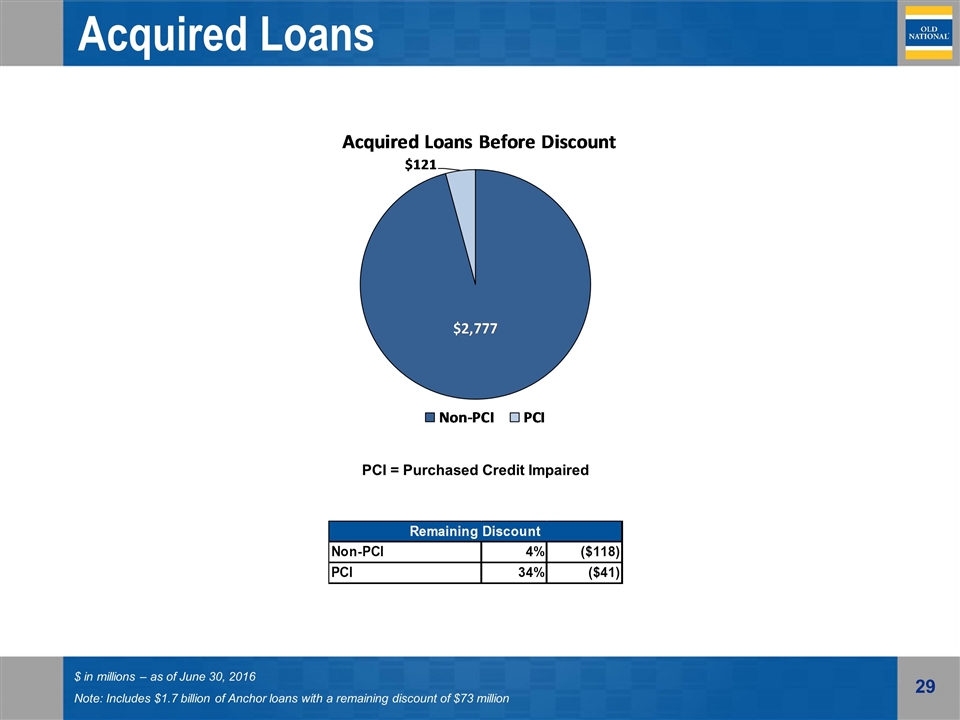

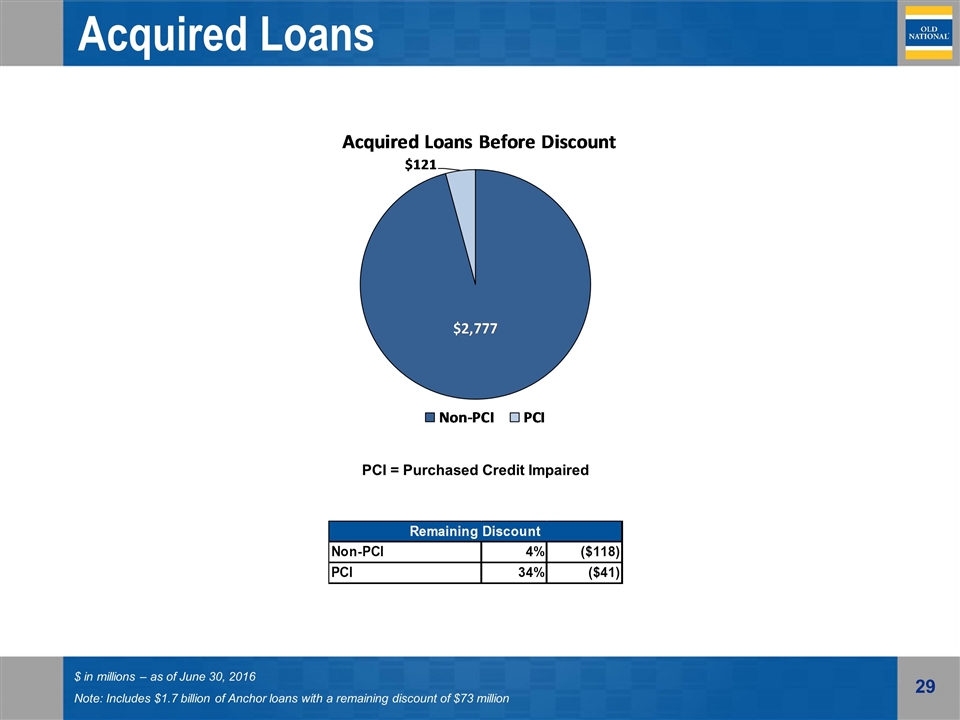

Acquired Loans $ in millions – as of June 30, 2016 Note: Includes $1.7 billion of Anchor loans with a remaining discount of $73 million PCI = Purchased Credit Impaired

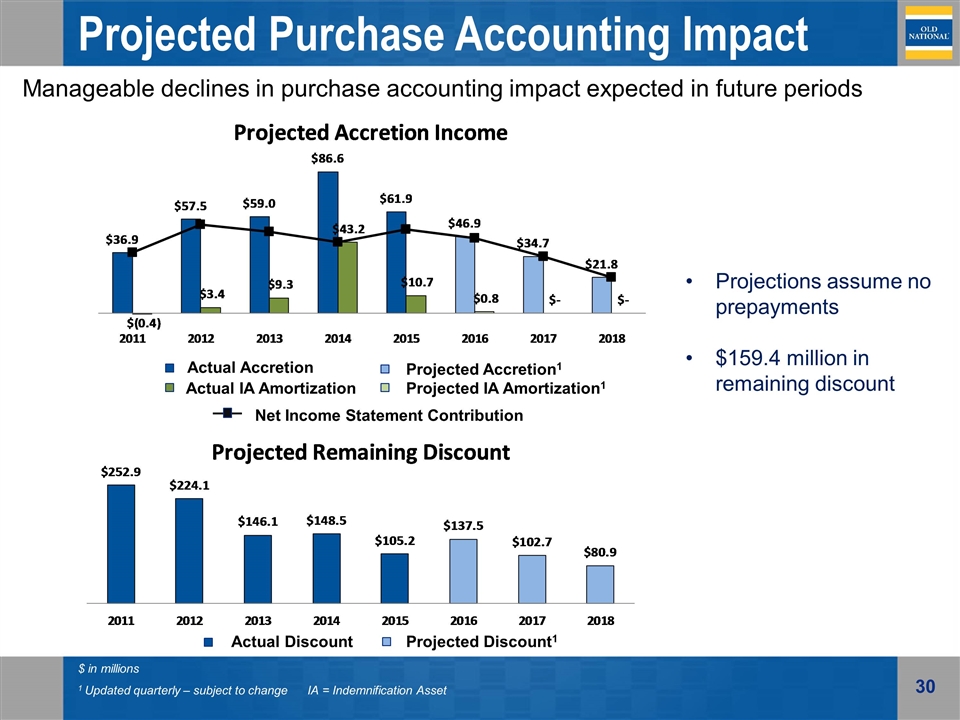

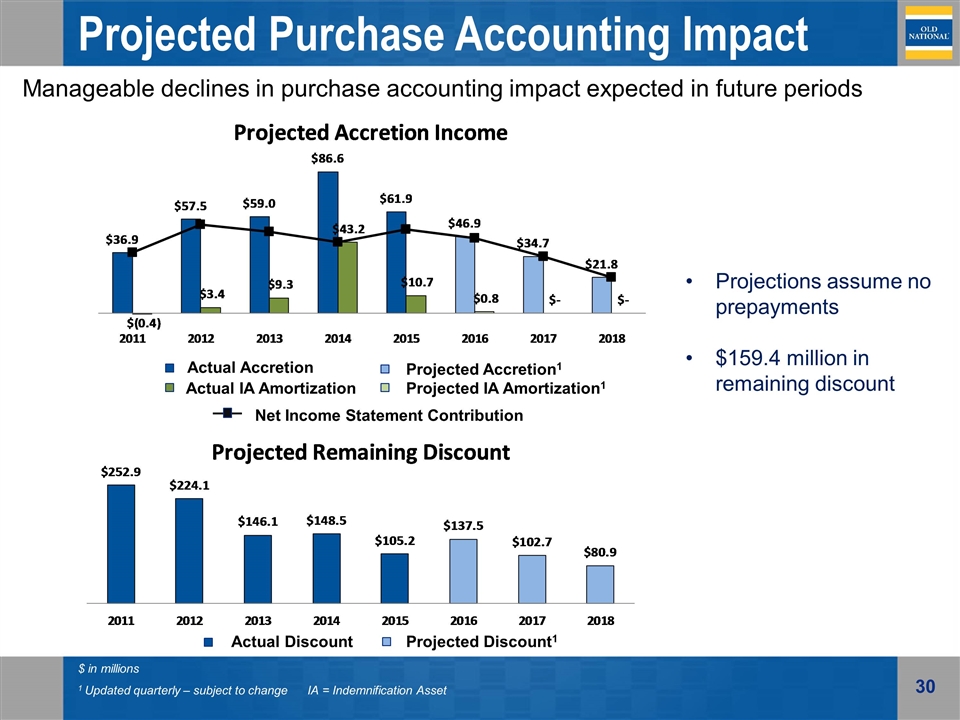

Projected Purchase Accounting Impact Actual Accretion Projected Accretion1 Actual Discount Projected Discount1 $ in millions 1 Updated quarterly – subject to change IA = Indemnification Asset Manageable declines in purchase accounting impact expected in future periods Actual IA Amortization Projected IA Amortization1 Net Income Statement Contribution Projections assume no prepayments $159.4 million in remaining discount

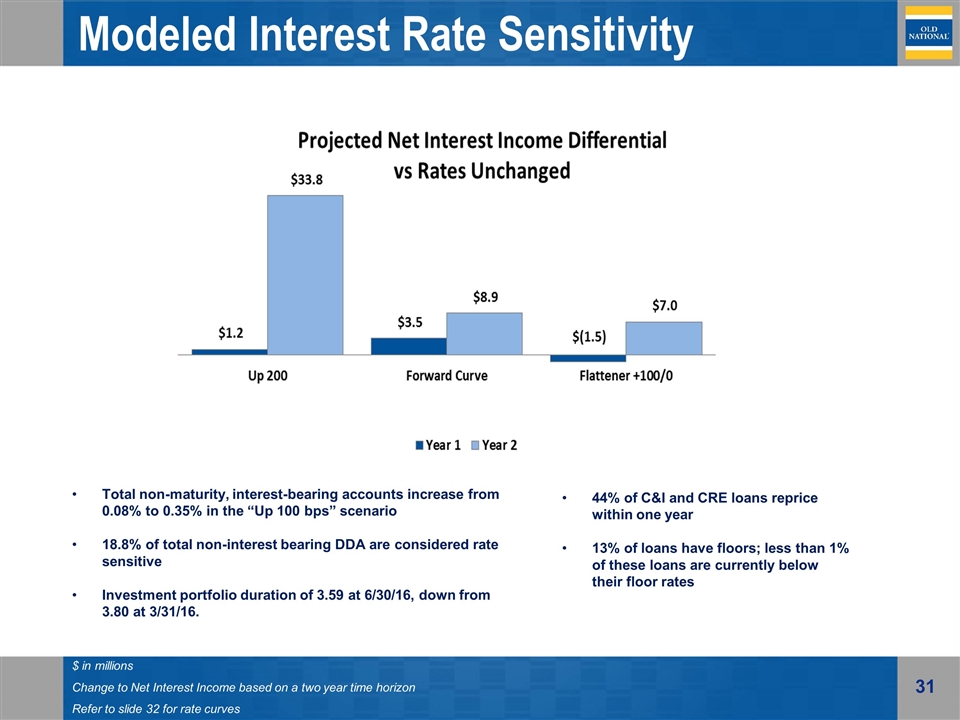

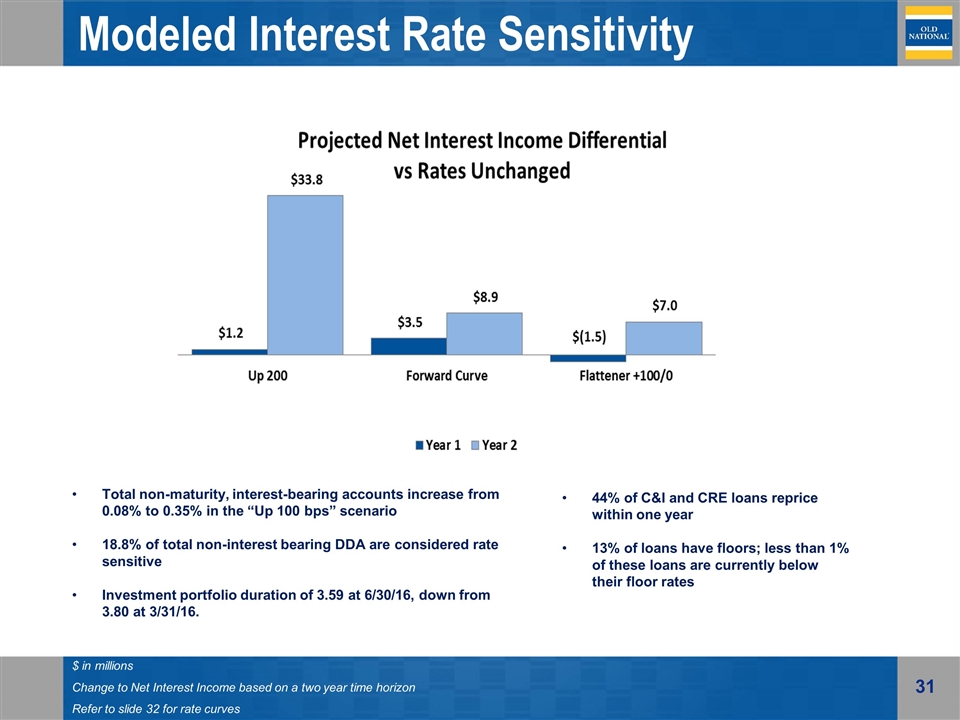

$ in millions Change to Net Interest Income based on a two year time horizon Refer to slide 32 for rate curves Total non-maturity, interest-bearing accounts increase from 0.08% to 0.35% in the “Up 100 bps” scenario 18.8% of total non-interest bearing DDA are considered rate sensitive Investment portfolio duration of 3.59 at 6/30/16, down from 3.80 at 3/31/16. Modeled Interest Rate Sensitivity 44% of C&I and CRE loans reprice within one year 13% of loans have floors; less than 1% of these loans are currently below their floor rates

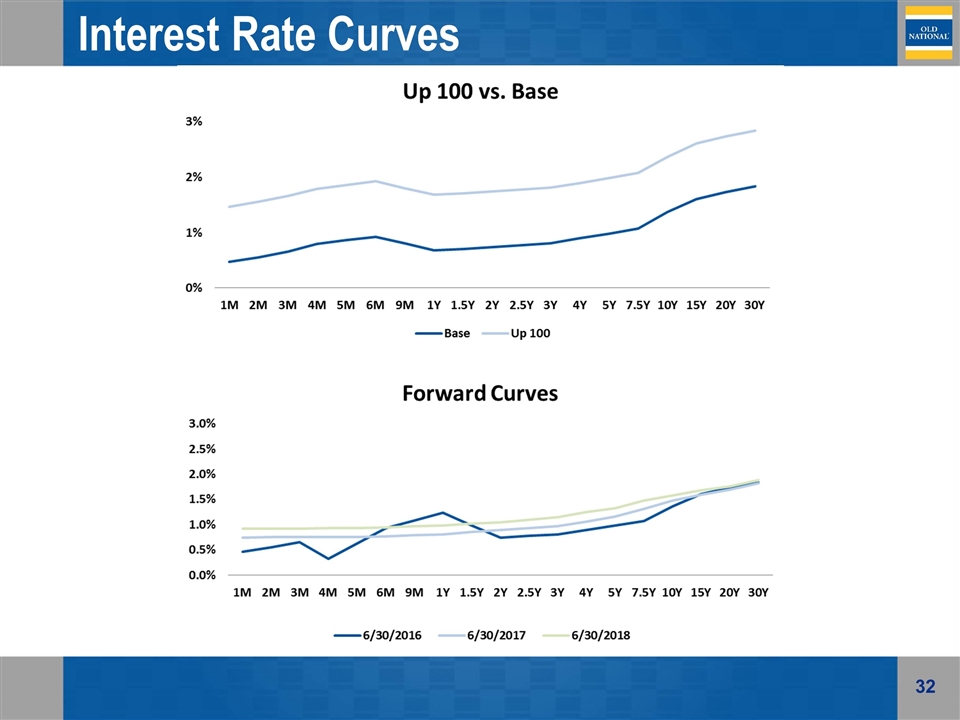

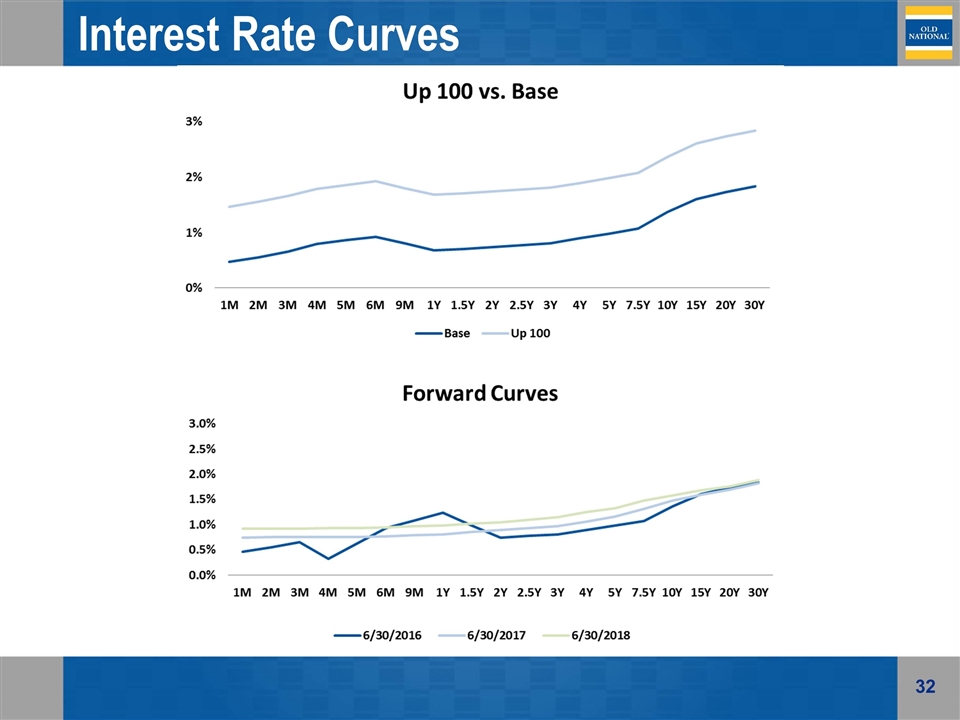

Interest Rate Curves

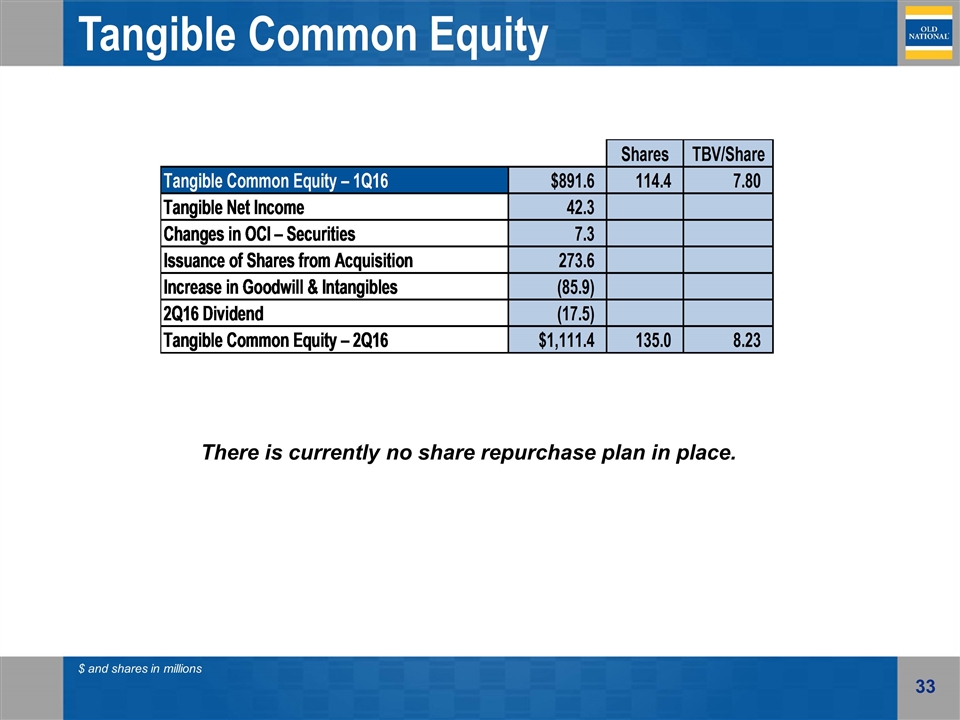

Tangible Common Equity There is currently no share repurchase plan in place. $ and shares in millions

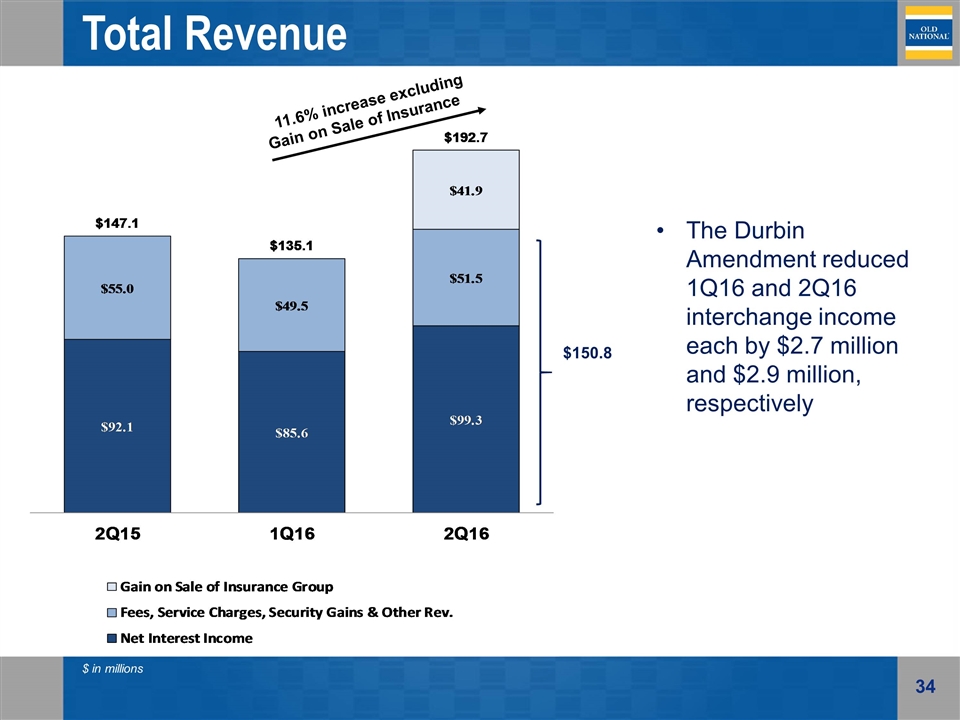

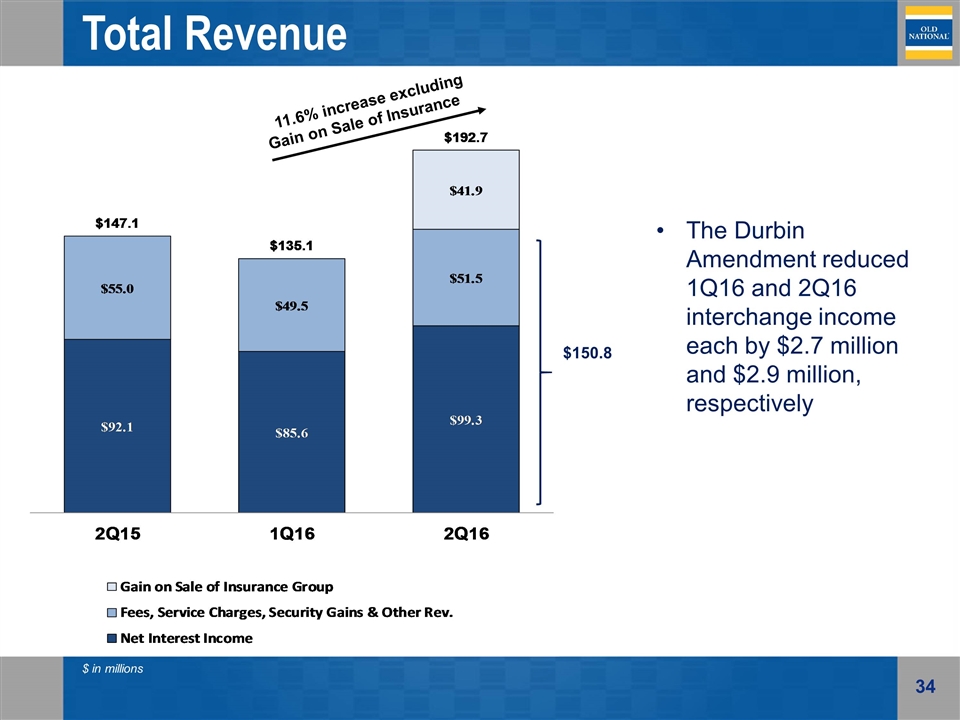

$ in millions Total Revenue $150.8 The Durbin Amendment reduced 1Q16 and 2Q16 interchange income each by $2.7 million and $2.9 million, respectively 11.6% increase excluding Gain on Sale of Insurance

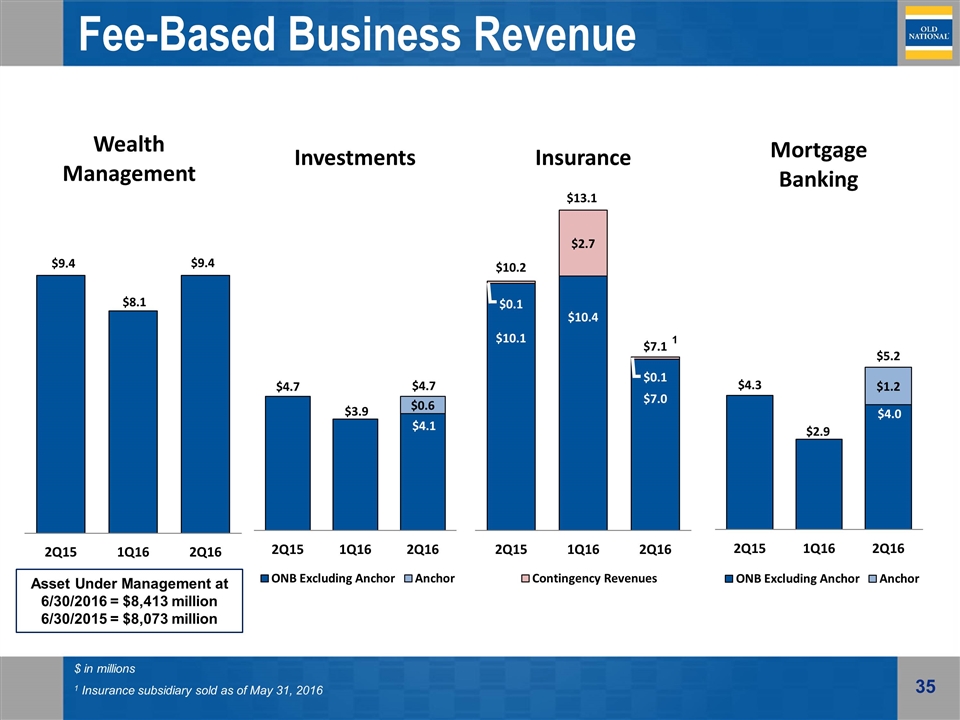

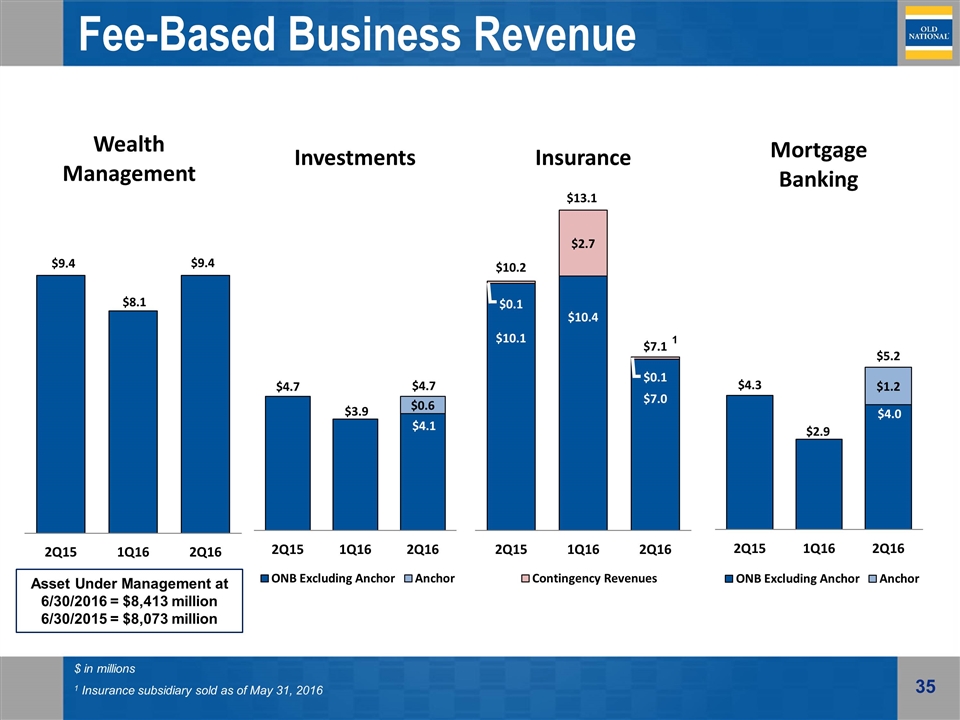

Fee-Based Business Revenue $ in millions 1 Insurance subsidiary sold as of May 31, 2016 Asset Under Management at 6/30/2016 = $8,413 million 6/30/2015 = $8,073 million 1

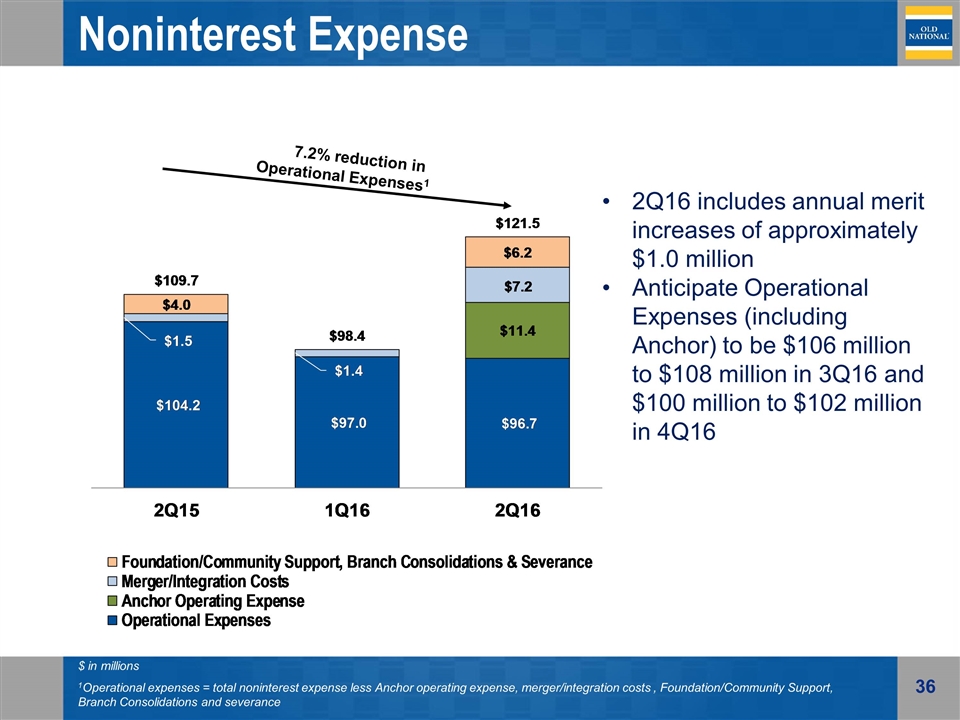

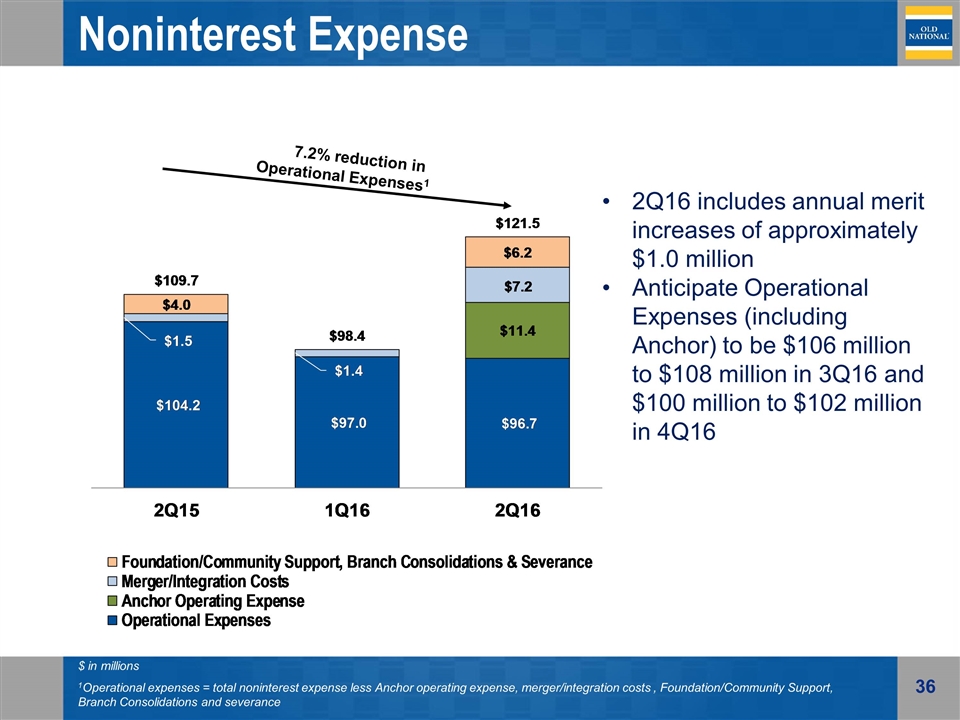

$ in millions 1Operational expenses = total noninterest expense less Anchor operating expense, merger/integration costs , Foundation/Community Support, Branch Consolidations and severance 2Q16 includes annual merit increases of approximately $1.0 million Anticipate Operational Expenses (including Anchor) to be $106 million to $108 million in 3Q16 and $100 million to $102 million in 4Q16 Noninterest Expense 7.2% reduction in Operational Expenses1

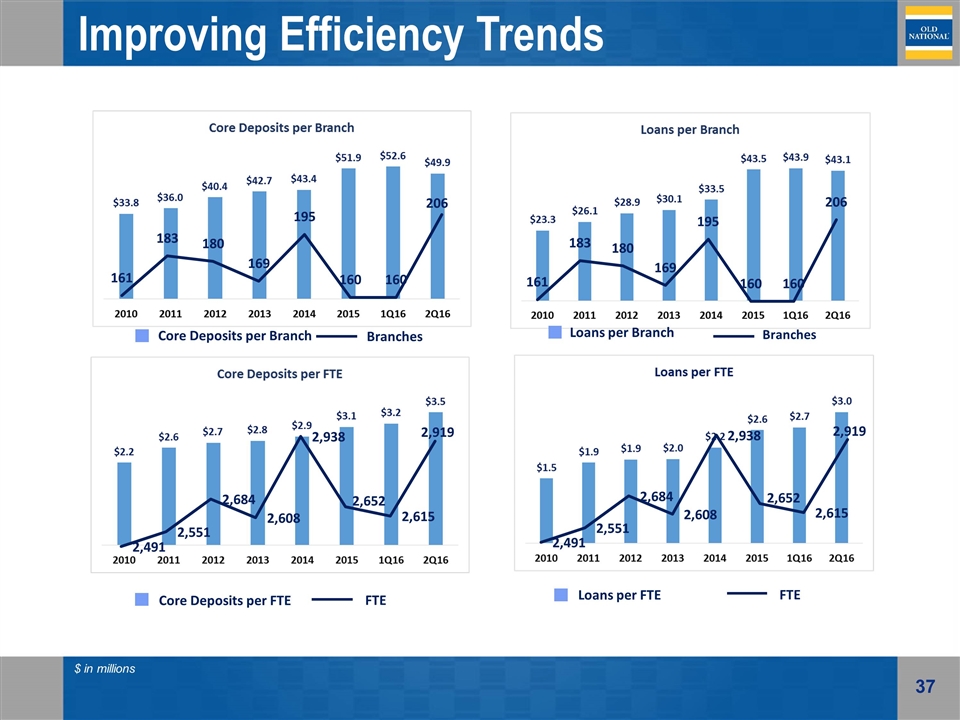

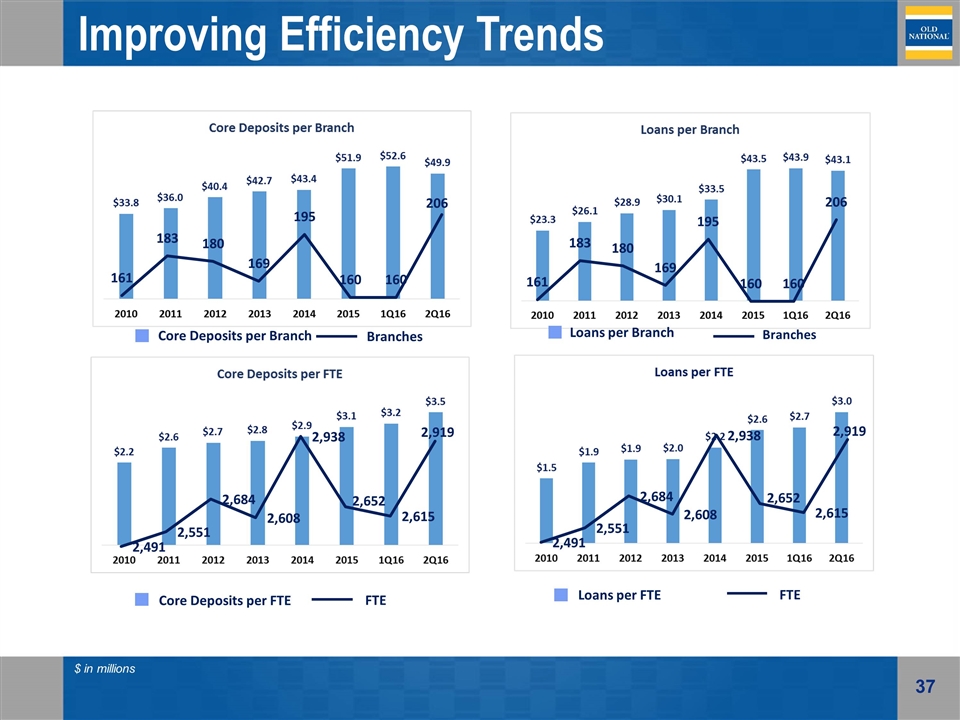

Improving Efficiency Trends Core Deposits per Branch Branches $ in millions

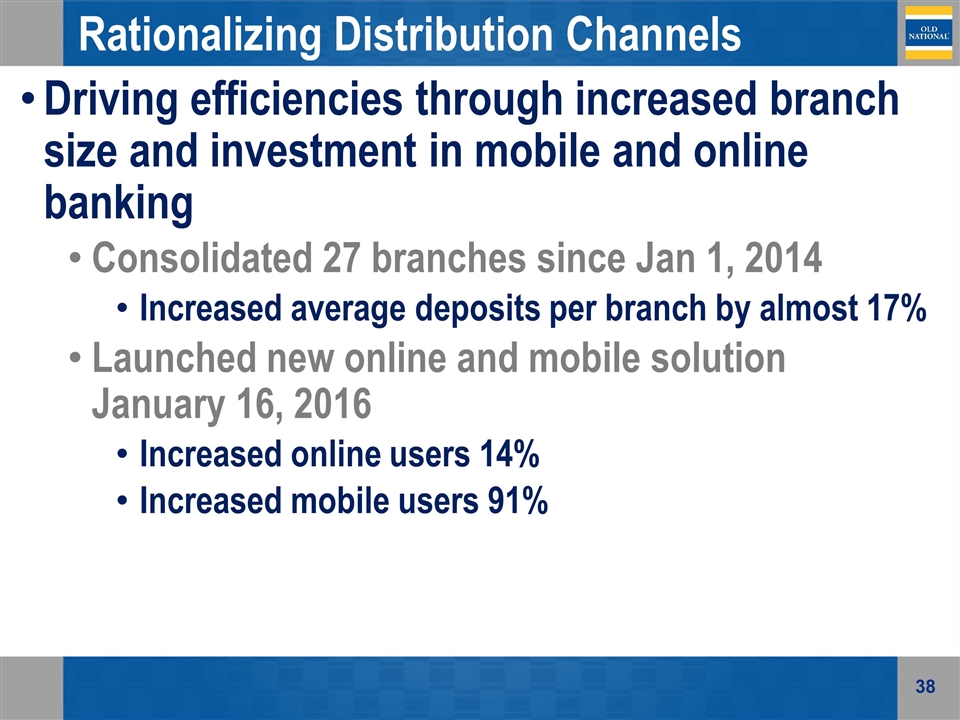

Rationalizing Distribution Channels Driving efficiencies through increased branch size and investment in mobile and online banking Consolidated 27 branches since Jan 1, 2014 Increased average deposits per branch by almost 17% Launched new online and mobile solution January 16, 2016 Increased online users 14% Increased mobile users 91%

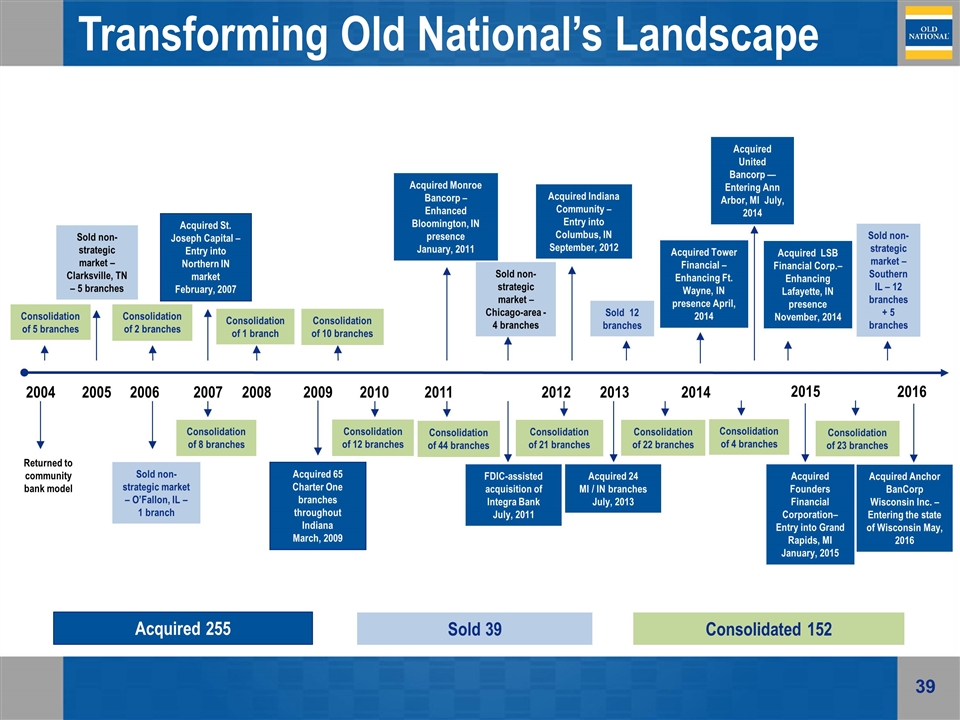

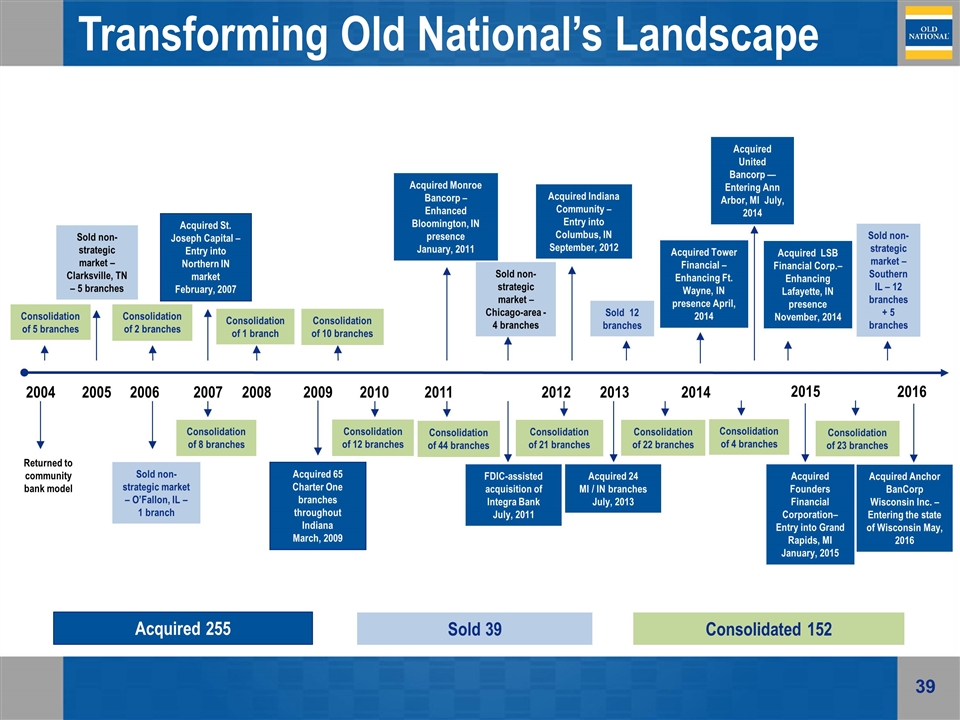

Returned to community bank model 2004 2005 Sold non-strategic market – Clarksville, TN – 5 branches 2006 Sold non-strategic market – O’Fallon, IL – 1 branch 2007 2008 2009 2010 2011 2012 2013 Acquired St. Joseph Capital – Entry into Northern IN market February, 2007 Acquired 65 Charter One branches throughout Indiana March, 2009 Acquired Monroe Bancorp – Enhanced Bloomington, IN presence January, 2011 Acquired Indiana Community – Entry into Columbus, IN September, 2012 FDIC-assisted acquisition of Integra Bank July, 2011 Sold non-strategic market – Chicago-area - 4 branches Consolidation of 21 branches Acquired 24 MI / IN branches July, 2013 Consolidation of 2 branches Consolidation of 8 branches Consolidation of 1 branch Consolidation of 10 branches Consolidation of 12 branches Consolidation of 44 branches Consolidation of 5 branches Sold 12 branches Consolidation of 22 branches Acquired 255 Sold 39 Consolidated 152 Acquired Tower Financial – Enhancing Ft. Wayne, IN presence April, 2014 Acquired United Bancorp — Entering Ann Arbor, MI July, 2014 2014 Consolidation of 4 branches Acquired LSB Financial Corp.– Enhancing Lafayette, IN presence November, 2014 Acquired Founders Financial Corporation– Entry into Grand Rapids, MI January, 2015 2015 Consolidation of 23 branches Transforming Old National’s Landscape Sold non-strategic market – Southern IL – 12 branches + 5 branches 2016 Acquired Anchor BanCorp Wisconsin Inc. – Entering the state of Wisconsin May, 2016

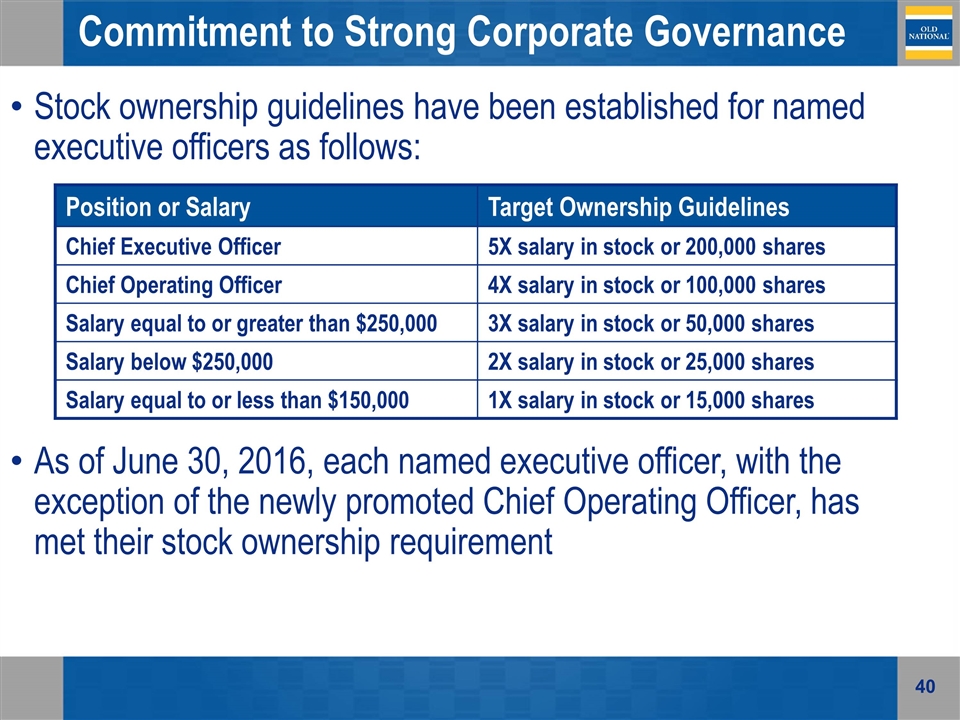

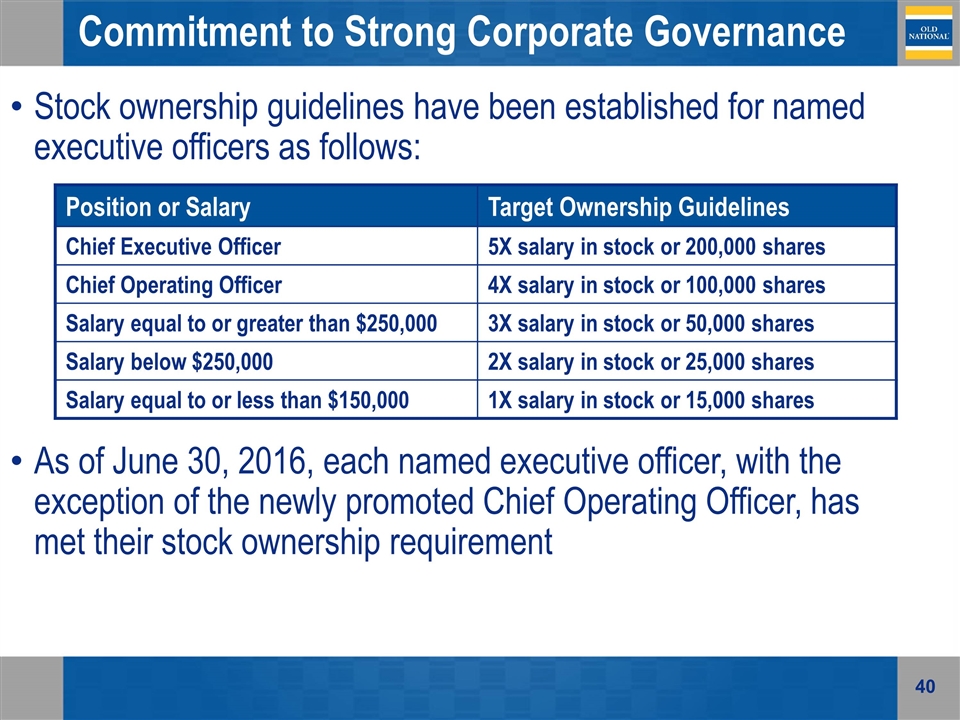

Position or Salary Target Ownership Guidelines Chief Executive Officer 5X salary in stock or 200,000 shares Chief Operating Officer 4X salary in stock or 100,000 shares Salary equal to or greater than $250,000 3X salary in stock or 50,000 shares Salary below $250,000 2X salary in stock or 25,000 shares Salary equal to or less than $150,000 1X salary in stock or 15,000 shares Stock ownership guidelines have been established for named executive officers as follows: As of June 30, 2016, each named executive officer, with the exception of the newly promoted Chief Operating Officer, has met their stock ownership requirement Commitment to Strong Corporate Governance

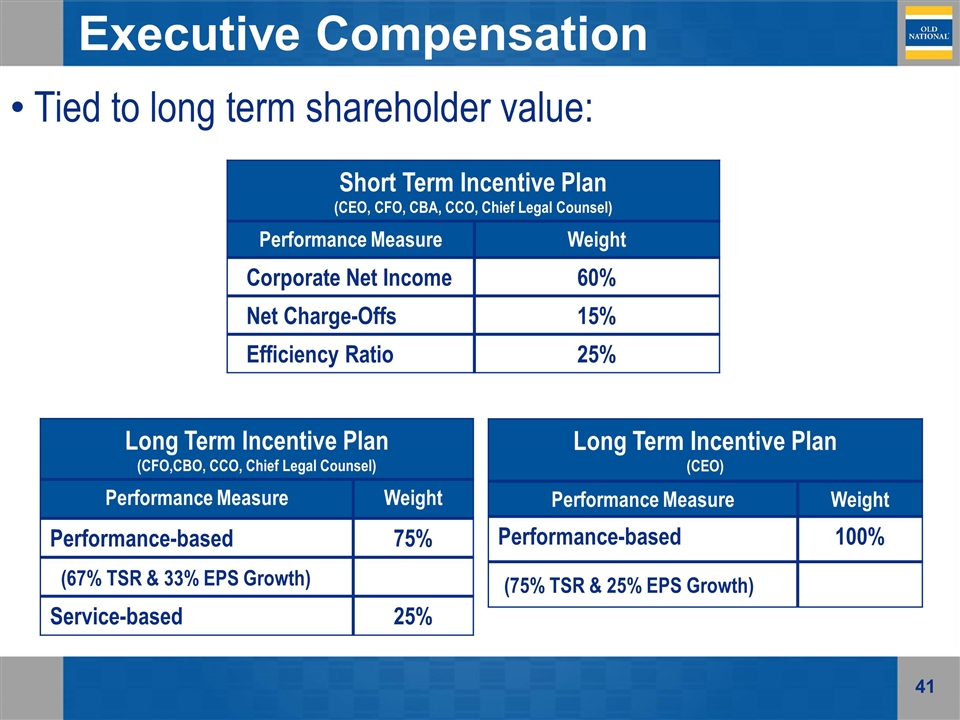

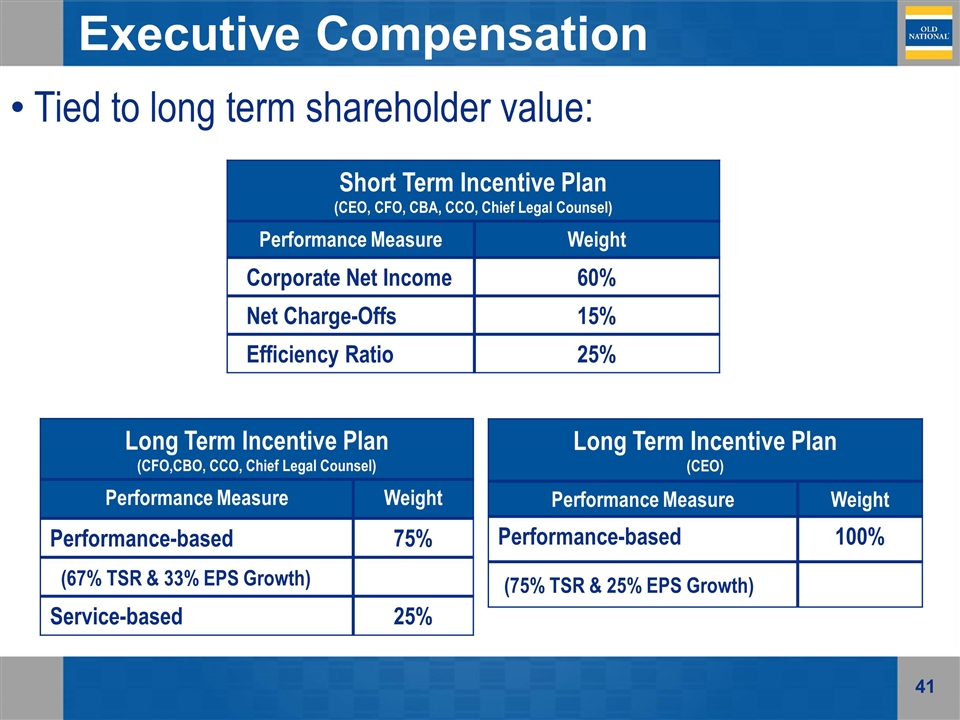

Executive Compensation Short Term Incentive Plan (CEO, CFO, CBA, CCO, Chief Legal Counsel) Performance Measure Weight Corporate Net Income 60% Net Charge-Offs 15% Efficiency Ratio 25% Tied to long term shareholder value: Long Term Incentive Plan (CFO,CBO, CCO, Chief Legal Counsel) Performance Measure Weight Performance-based 75% (67% TSR & 33% EPS Growth) Service-based 25% Long Term Incentive Plan (CEO) Performance Measure Weight Performance-based 100% (75% TSR & 25% EPS Growth)

Appendix

Non-GAAP Reconciliations $ in millions

Non-GAAP Reconciliations $ in millions Shares in thousands

Non-GAAP Reconciliations

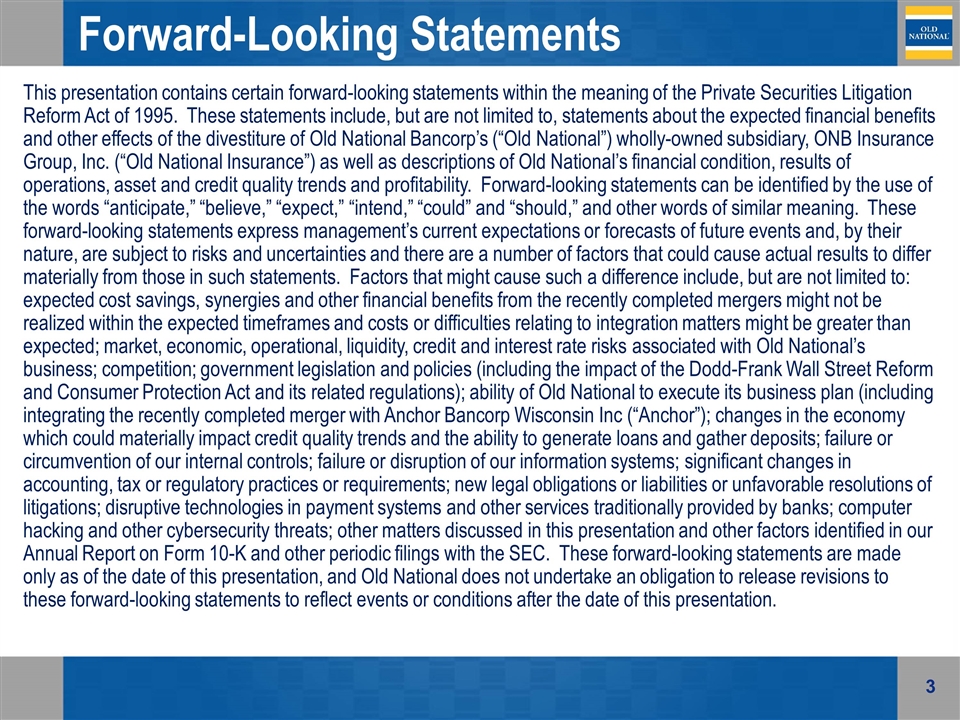

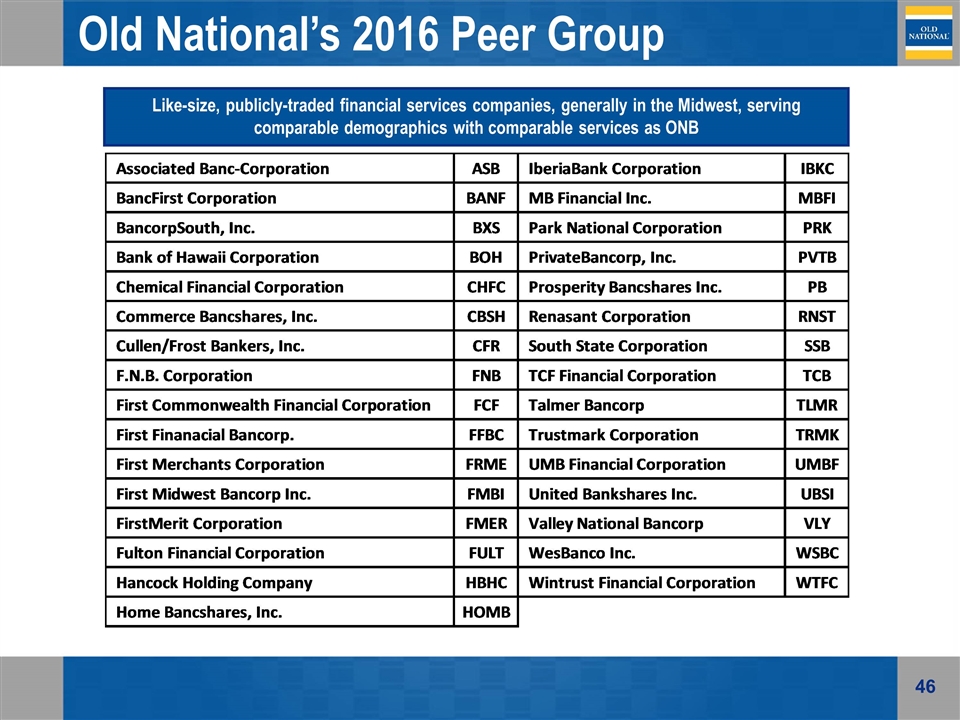

Old National’s 2016 Peer Group Like-size, publicly-traded financial services companies, generally in the Midwest, serving comparable demographics with comparable services as ONB

Investor Contact Additional information can be found on the Investor Relations web pages at www.oldnational.com Investor Inquiries: Lynell J. Walton, CPA SVP – Director of Investor Relations 812-464-1366 lynell.walton@oldnational.com