Investment Thesis Financial Data as of March 31, 2017 Dated: May 8, 2017 Exhibit 99.1

Investment Thesis Executive Summary Slides 2 to 13 Financial Data as of March 31, 2017 Dated: May 8, 2017

Forward-Looking Statements This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, descriptions of Old National Bancorp’s (“Old National’s”) financial condition, results of operations, asset and credit quality trends and profitability. Forward-looking statements can be identified by the use of the words “anticipate,” “believe,” “expect,” “intend,” “could” and “should,” and other words of similar meaning. These forward-looking statements express management’s current expectations or forecasts of future events and, by their nature, are subject to risks and uncertainties and there are a number of factors that could cause actual results to differ materially from those in such statements. Factors that might cause such a difference include, but are not limited to: expected cost savings, synergies and other financial benefits from the recently completed mergers might not be realized within the expected timeframes and costs or difficulties relating to integration matters might be greater than expected; market, economic, operational, liquidity, credit and interest rate risks associated with Old National’s business; competition; government legislation and policies (including the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and its related regulations); ability of Old National to execute its business plan; changes in the economy which could materially impact credit quality trends and the ability to generate loans and gather deposits; failure or circumvention of our internal controls; failure or disruption of our information systems; significant changes in accounting, tax or regulatory practices or requirements; new legal obligations or liabilities or unfavorable resolutions of litigations; disruptive technologies in payment systems and other services traditionally provided by banks; computer hacking and other cybersecurity threats; other matters discussed in this presentation and other factors identified in our Annual Report on Form 10-K and other periodic filings with the SEC. These forward-looking statements are made only as of the date of this presentation, and Old National does not undertake an obligation to release revisions to these forward-looking statements to reflect events or conditions after the date of this presentation.

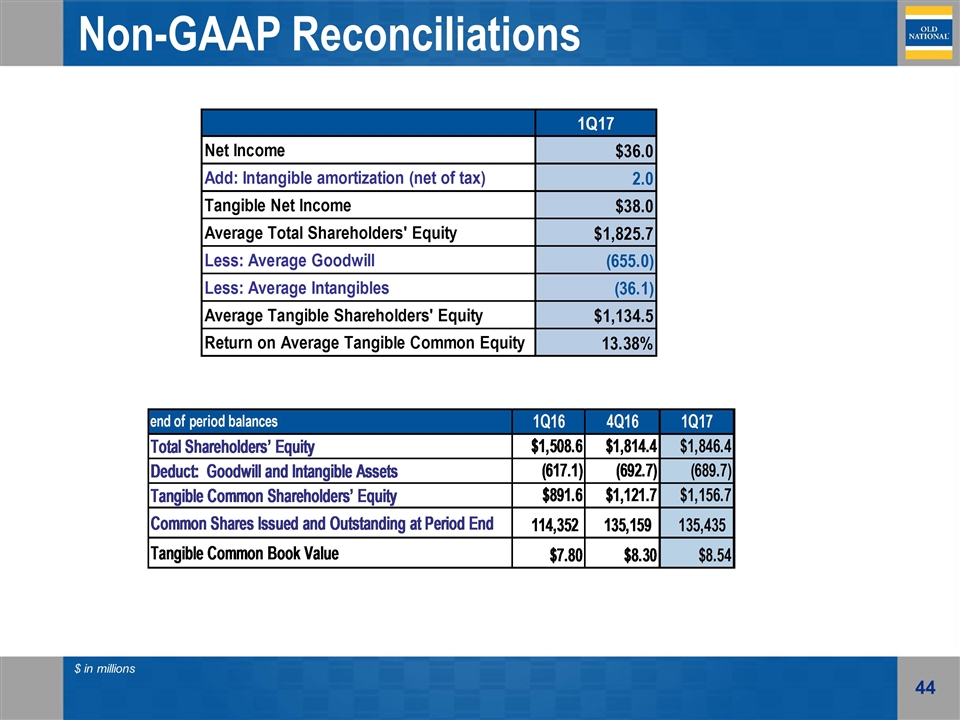

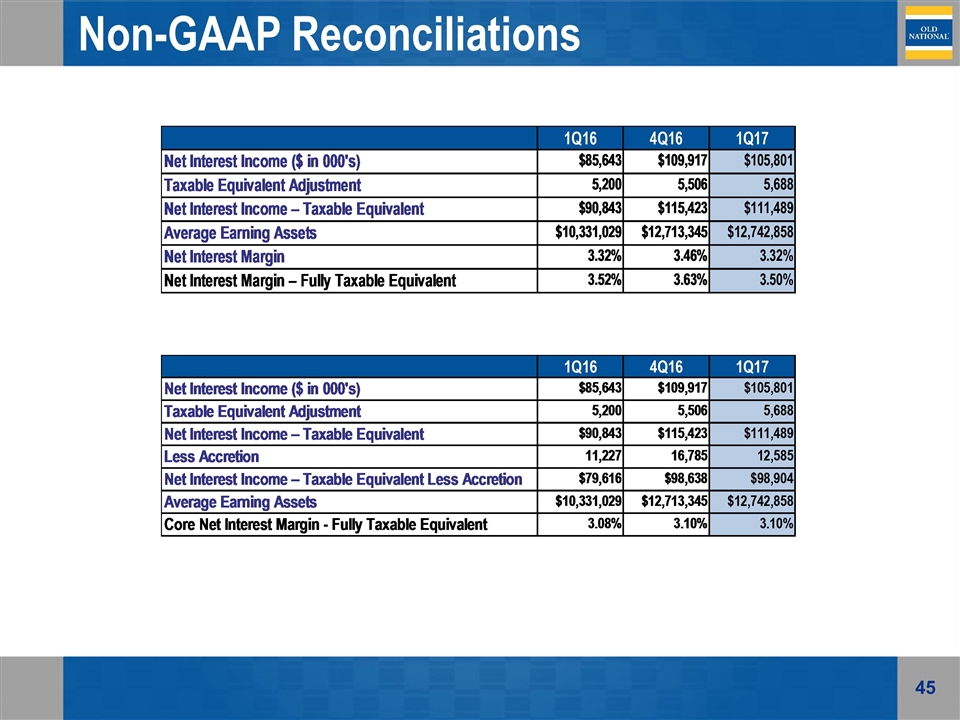

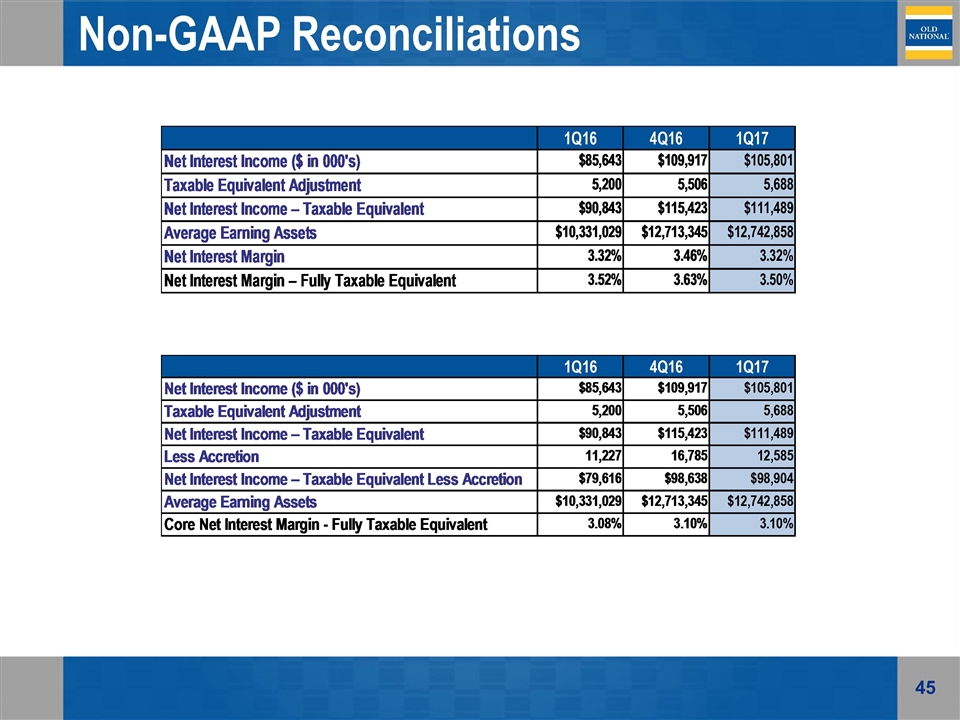

Non-GAAP Financial Measures These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant's historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the registrant; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, Old National Bancorp has provided reconciliations within the slides, as necessary, of the non-GAAP financial measure to the most directly comparable GAAP financial measure.

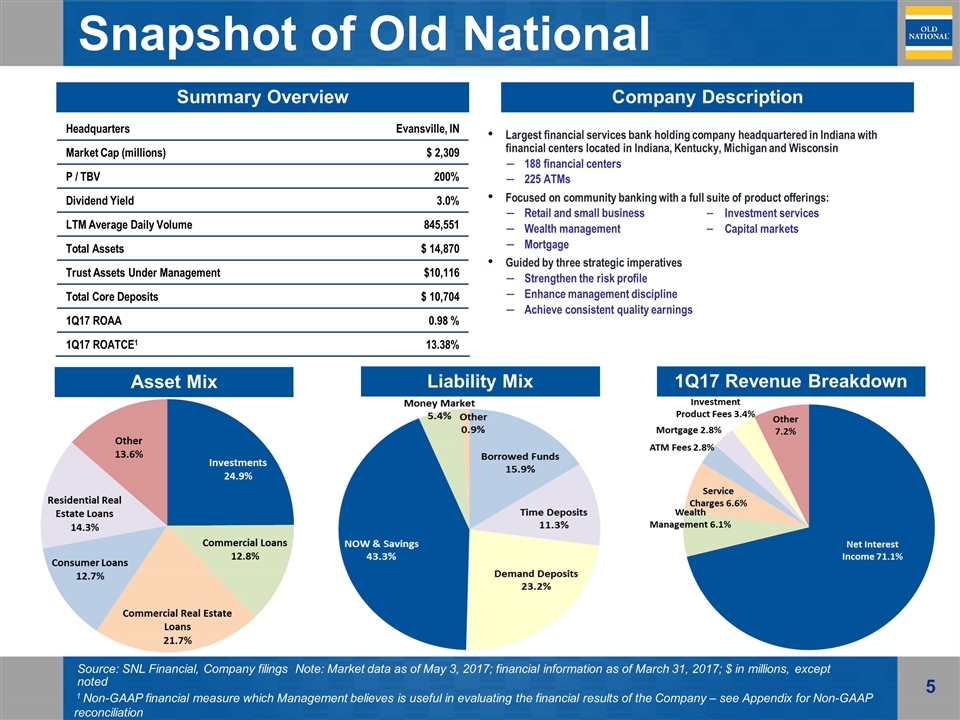

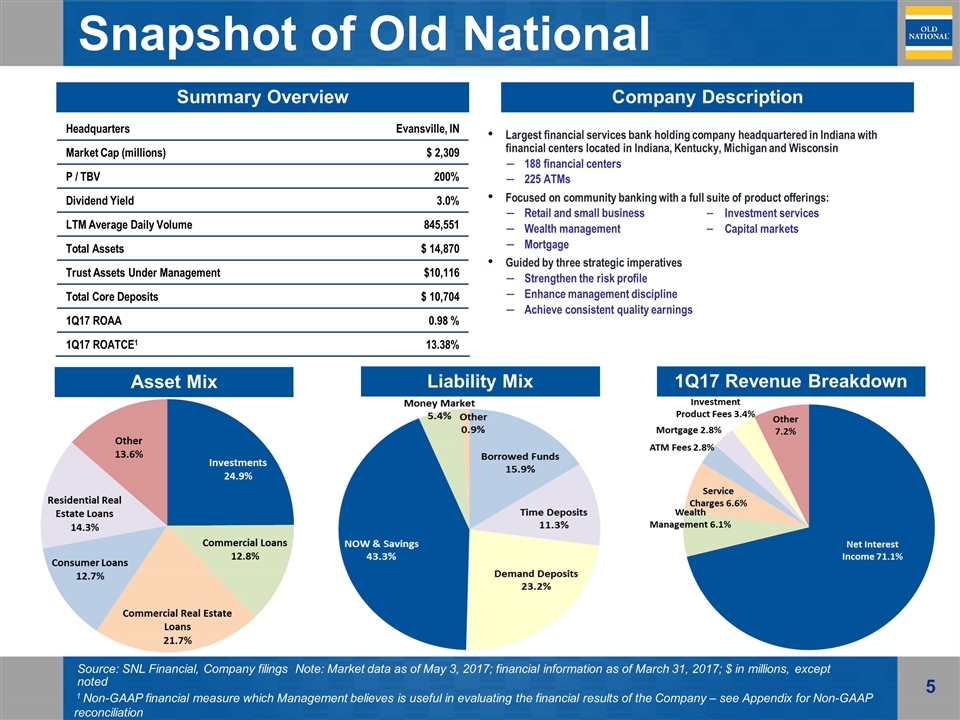

Snapshot of Old National Largest financial services bank holding company headquartered in Indiana with financial centers located in Indiana, Kentucky, Michigan and Wisconsin 188 financial centers 225 ATMs Focused on community banking with a full suite of product offerings: Retail and small business Wealth management Mortgage Guided by three strategic imperatives Strengthen the risk profile Enhance management discipline Achieve consistent quality earnings Summary Overview Company Description Headquarters Evansville, IN Market Cap (millions) $ 2,309 P / TBV 200% Dividend Yield 3.0% LTM Average Daily Volume 845,551 Total Assets $ 14,870 Trust Assets Under Management $10,116 Total Core Deposits $ 10,704 1Q17 ROAA 0.98 % 1Q17 ROATCE1 13.38% Investment services Capital markets Asset Mix Liability Mix 1Q17 Revenue Breakdown Source: SNL Financial, Company filings Note: Market data as of May 3, 2017; financial information as of March 31, 2017; $ in millions, except noted 1 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation

A Strategic Framework for Creating Long-Term Shareholder Value Attractive footprint that offers room to expand in higher-growth markets and leading share in mature markets Consistent financial performance with focus on building tangible book value and providing adequate return for our shareholders Diverse loan portfolio with growth accelerating while maintaining strong credit metrics Disciplined acquisitions that are exceeding expectations with robust future opportunities Good stewards of capital – organic growth, dividend / share repurchases and acquisitions

Commitment to Excellence

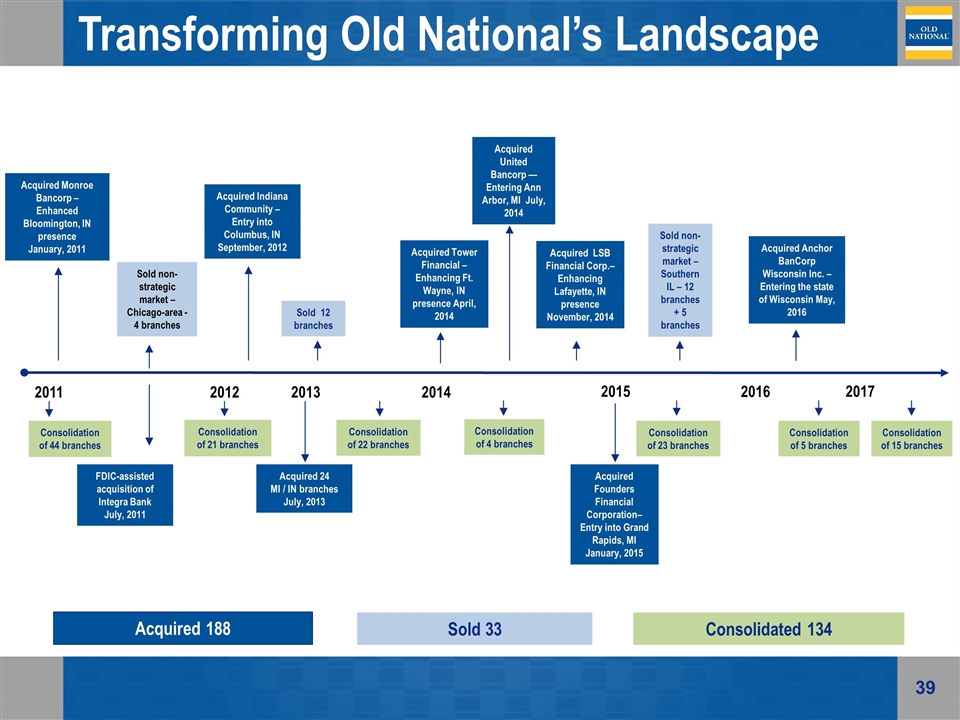

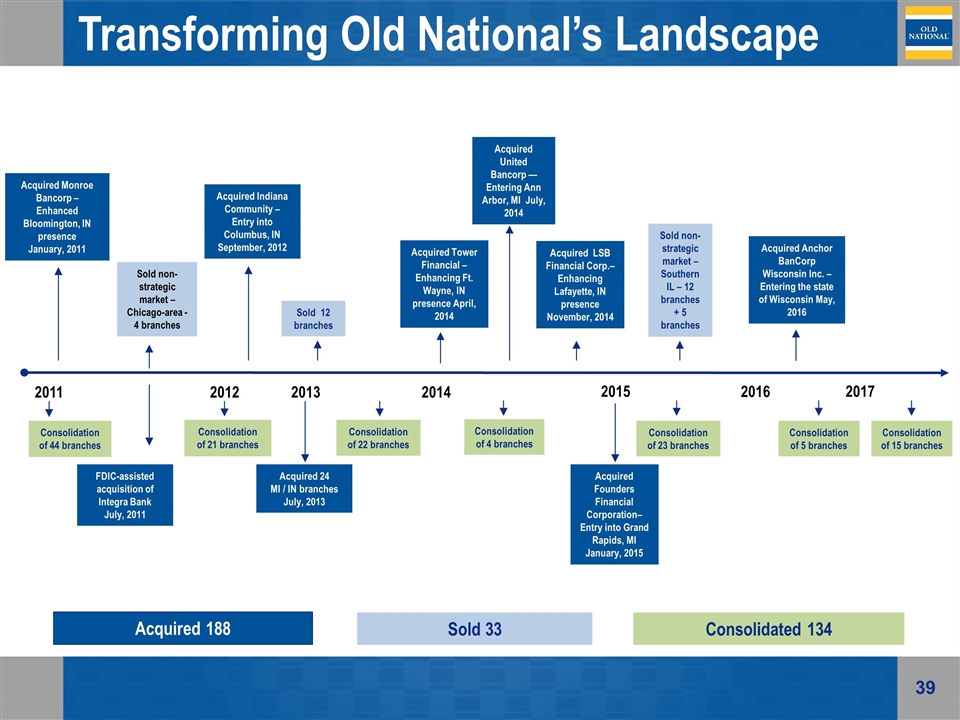

ONB’s Transformational Journey Since 2011, Old National has transformed its franchise by reducing low-return businesses and low-growth markets and investing in higher-growth markets Acquisitions 7 whole-bank, 1 FDIC and 1 branch purchase Divestitures Insurance agency business Exited Southern Illinois market (12 branches) 21 additional branches Consolidations 134 branches

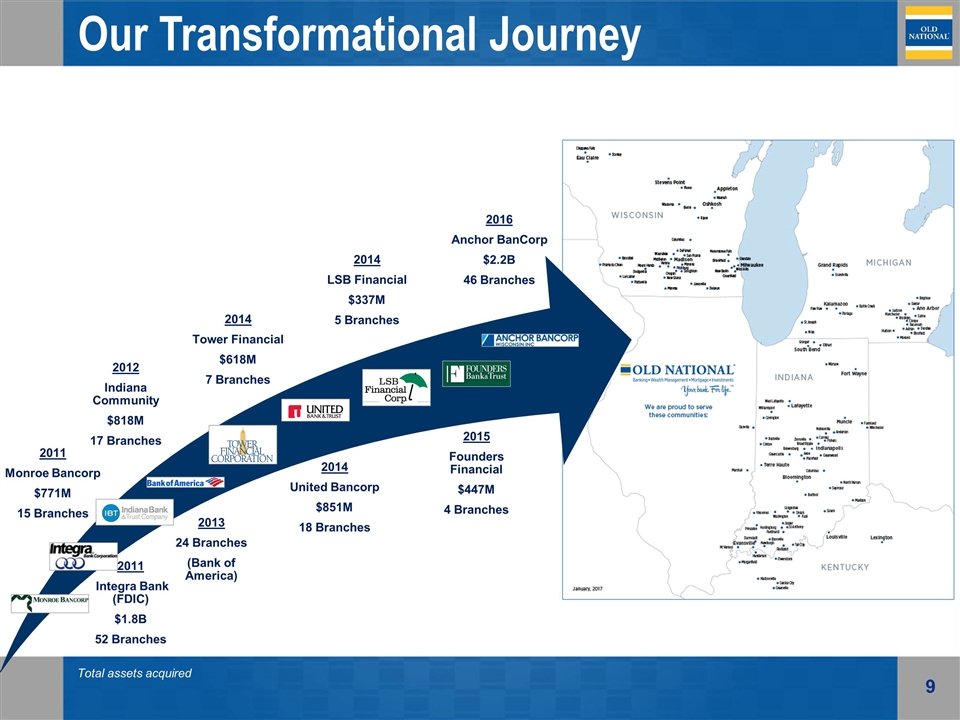

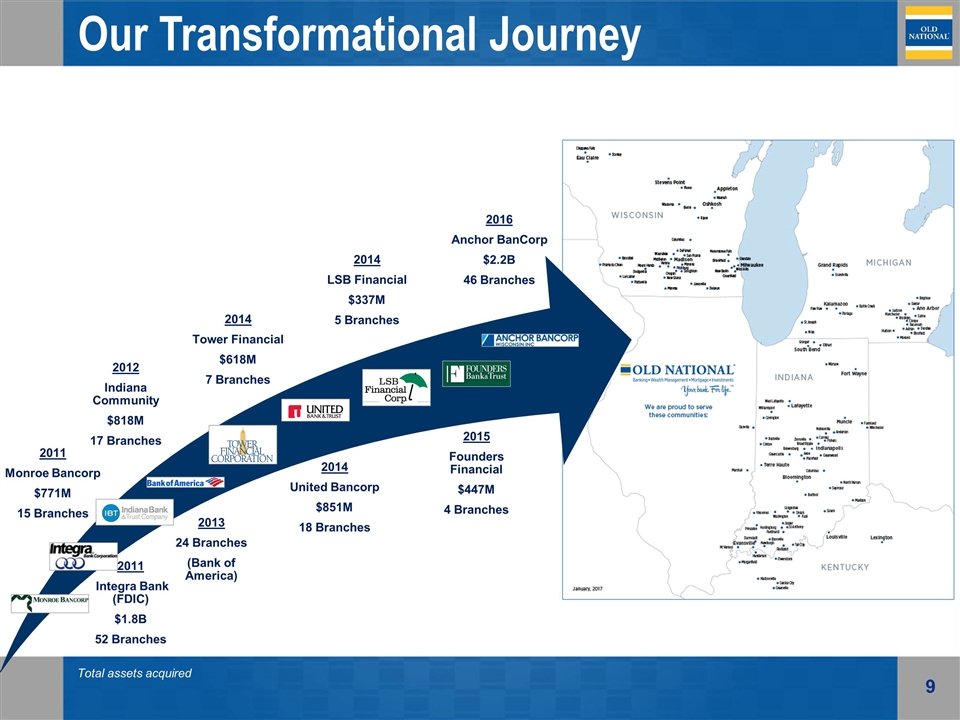

Our Transformational Journey 2011 Monroe Bancorp $771M 15 Branches 2012 Indiana Community $818M 17 Branches 2014 Tower Financial $618M 7 Branches 2014 United Bancorp $851M 18 Branches 2013 24 Branches (Bank of America) 2011 Integra Bank (FDIC) $1.8B 52 Branches 2014 LSB Financial $337M 5 Branches 2015 Founders Financial $447M 4 Branches 2016 Anchor BanCorp $2.2B 46 Branches Total assets acquired

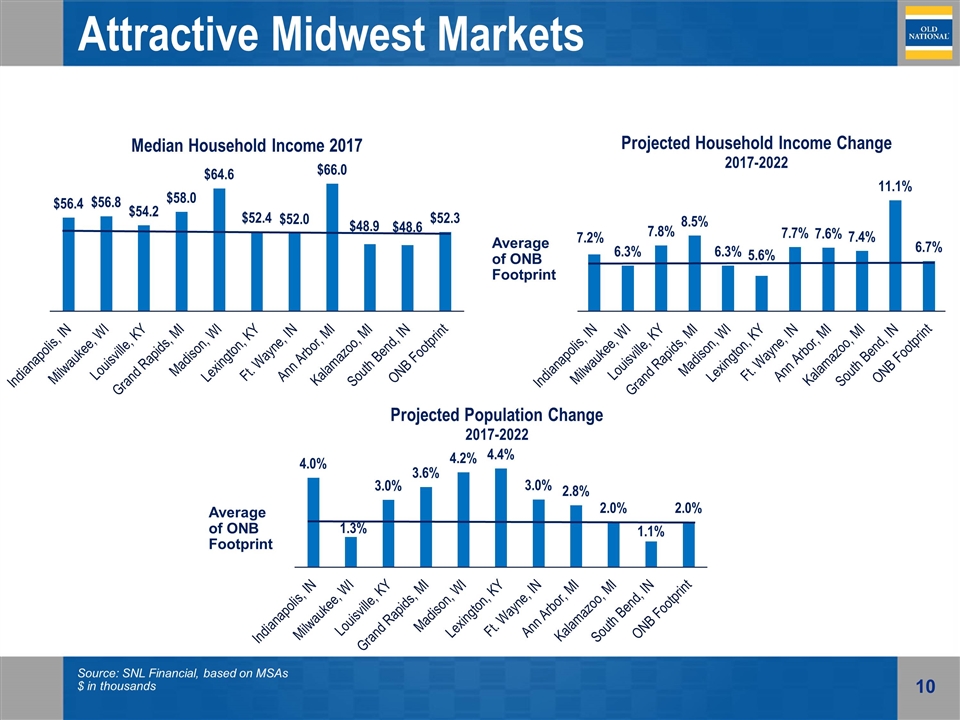

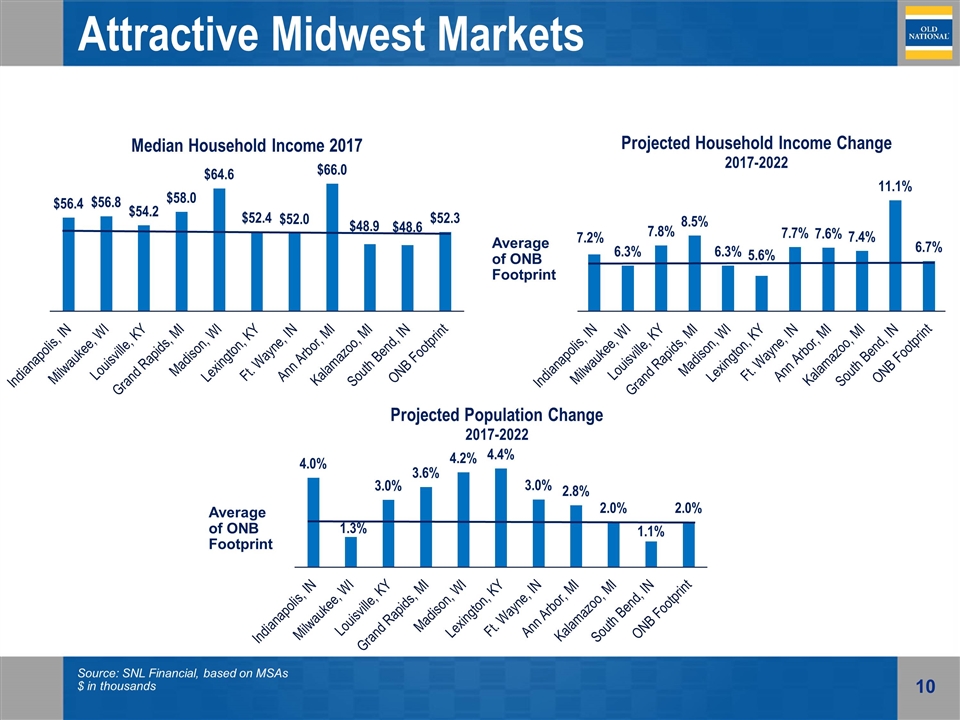

Attractive Midwest Markets Source: SNL Financial, based on MSAs $ in thousands Average of ONB Footprint Average of ONB Footprint

Attractive Midwest Markets Indianapolis, IN Milwaukee, WI Louisville, KY Grand Rapids, MI Madison, WI MSA Population: 2.0 million MSA Population: 1.6 million MSA Population: 1.3 million MSA Population: 1.1 million MSA Population: 652K Major industries include: Scientific and technical services, pharmaceutical, insurance and healthcare Major industries include: manufacturing, healthcare, insurance, and tourism Major industries include: Healthcare, tourism, logistics, and manufacturing Major industries include: Office furniture, healthcare, consumer goods and grocery Major industries include: Advanced manufacturing, agriculture, healthcare, information technology and life sciences Headquarters to Eli Lilly, Anthem, Conseco and the NCAA Headquarters to Harley-Davidson, Rockwell Automation, Johnson Controls and Manpower Headquarters to Yum! Brands, Humana, Hillerich & Bradsby (Louisville Slugger) and Churchill Downs – also large UPS and Ford plants Headquarters to Steelcase, Amway, Meijer, Spectrum Health and Gordon Foods Headquarters to American Family, Spectrum Brands, Epic Health Systems, Exact Sciences, Promega and the University of Wisconsin 20 Branches, Loans: $640M Core Deposits: $863M 6 Branches, Loans: $596M Core Deposits: $155M 6 Branches, Loans: $668M Core Deposits: $243 M 4 Branches, Loans: $321M Core Deposits: $260M 27 Branches, Loans: $758M Core Deposits: $1.2B Sources: Population from SNL Financial; Industry and company data from City-Data.com, Forbes.com Branch Count, Loan and Deposit data as of March 31, 2017, and based on ONB’s internal regional reporting structure Lexington, KY Ft. Wayne, IN Ann Arbor, MI Kalamazoo, MI South Bend, IN MSA Population: 509K MSA Population: 434K MSA Population: 362K MSA Population: 337K MSA Population: 321K Major industries include: Thoroughbred horse farms, horse racing, agribusiness and technology Major industries include: Healthcare, manufacturing and insurance Major industries include: Automotive, IT/Software, life sciences and healthcare Major industries include: automotive component manufacturing, pharmaceutical and medical products Major industries include: education and health services, wholesale trade and manufacturing Headquarters to Lexmark International, the University of Kentucky – also large Toyota plant Headquarters to Steel Dynamics, Vera Bradley – also large General Motors plant Headquarters to Borders Group, Domino’s Pizza, Zingerman’s and the University of Michigan Headquarters to Stryker, Pfizer Global Manufacturing and Upjohn Headquarters to AM General and the University of Notre Dame – also Honeywell plant 1 Branch, Loans: $53M Core Deposits: $18M 6 Branches, Loans: $332M Core Deposits: $387M 14 Branches, Loans: $599M Core Deposits: $677M 11 Branches, Loans: $201M Core Deposits: $334M 6 Branches, Loans: $259M Core Deposits: $247M

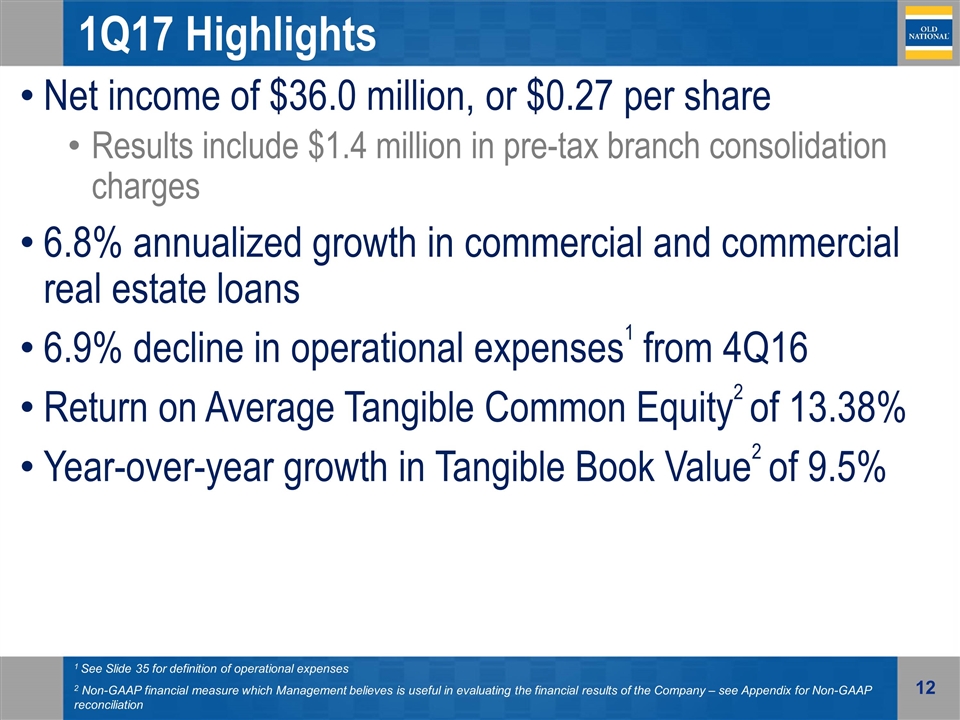

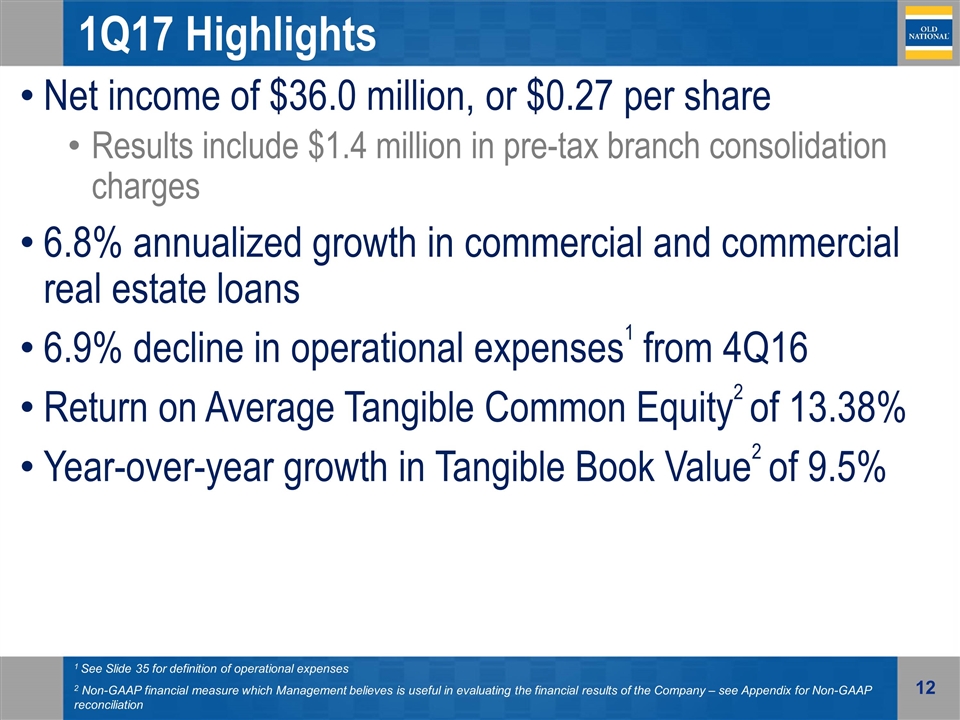

1Q17 Highlights Net income of $36.0 million, or $0.27 per share Results include $1.4 million in pre-tax branch consolidation charges 6.8% annualized growth in commercial and commercial real estate loans 6.9% decline in operational expenses1 from 4Q16 Return on Average Tangible Common Equity2 of 13.38% Year-over-year growth in Tangible Book Value2 of 9.5% 1 See Slide 35 for definition of operational expenses 2 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation 2

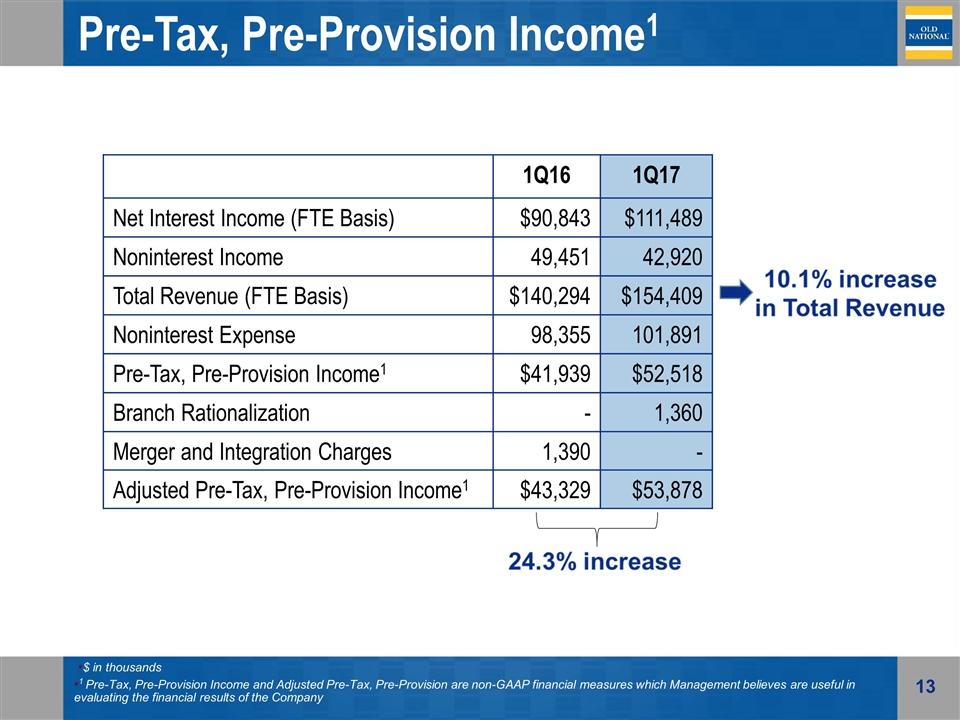

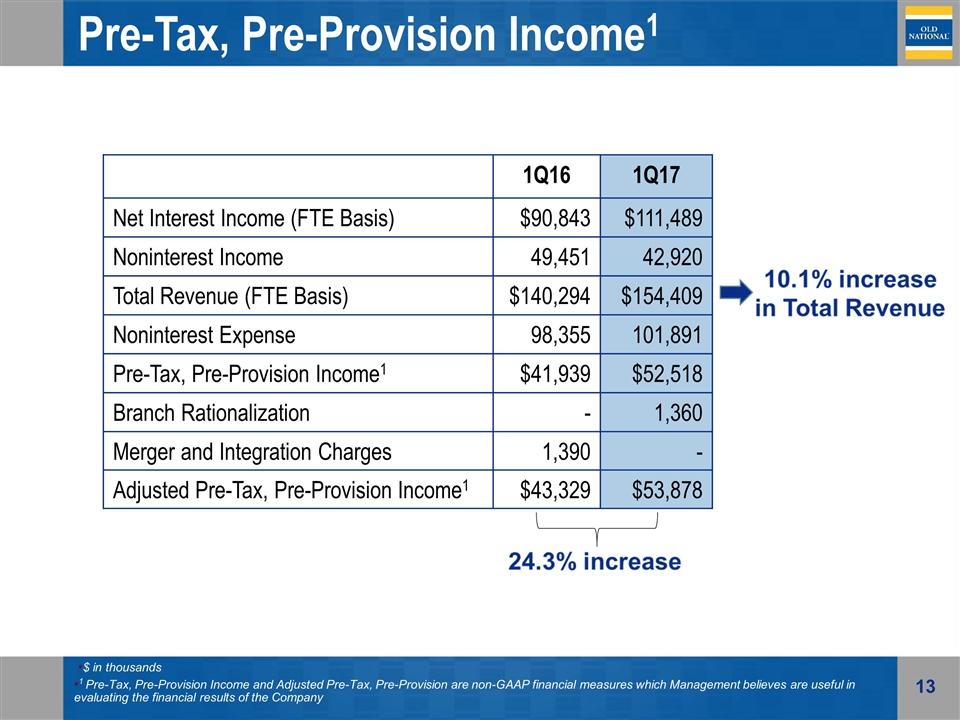

Pre-Tax, Pre-Provision Income1 1Q16 1Q17 Net Interest Income (FTE Basis) $90,843 $111,489 Noninterest Income 49,451 42,920 Total Revenue (FTE Basis) $140,294 $154,409 Noninterest Expense 98,355 101,891 Pre-Tax, Pre-Provision Income1 $41,939 $52,518 Branch Rationalization - 1,360 Merger and Integration Charges 1,390 - Adjusted Pre-Tax, Pre-Provision Income1 $43,329 $53,878 $ in thousands 1 Pre-Tax, Pre-Provision Income and Adjusted Pre-Tax, Pre-Provision are non-GAAP financial measures which Management believes are useful in evaluating the financial results of the Company

Investment Thesis Financial Data as of March 31, 2017 Dated: May 8, 2017

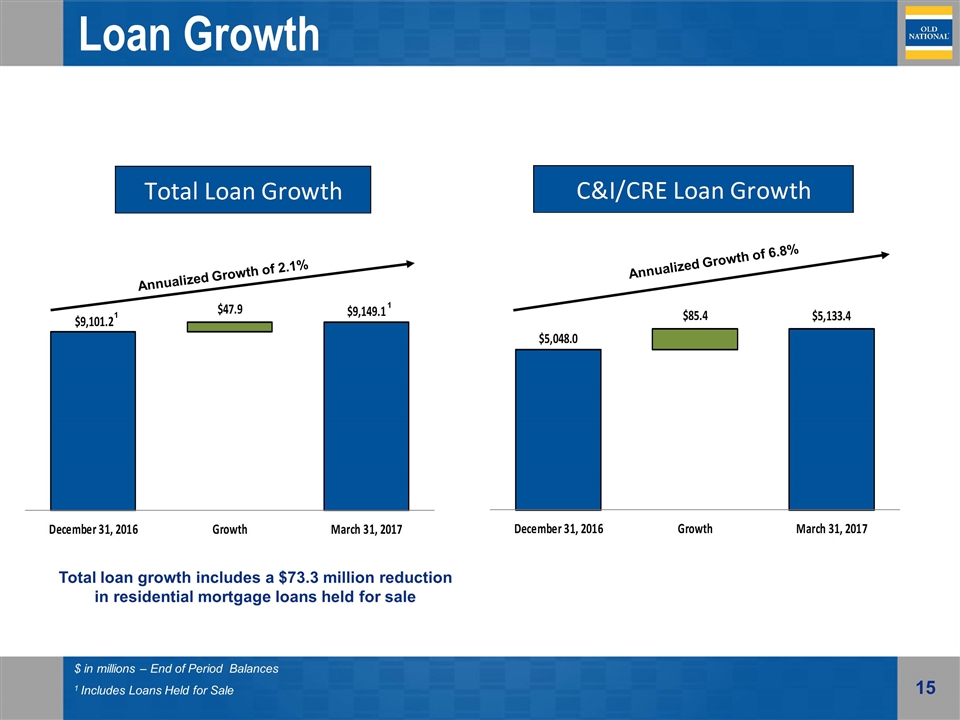

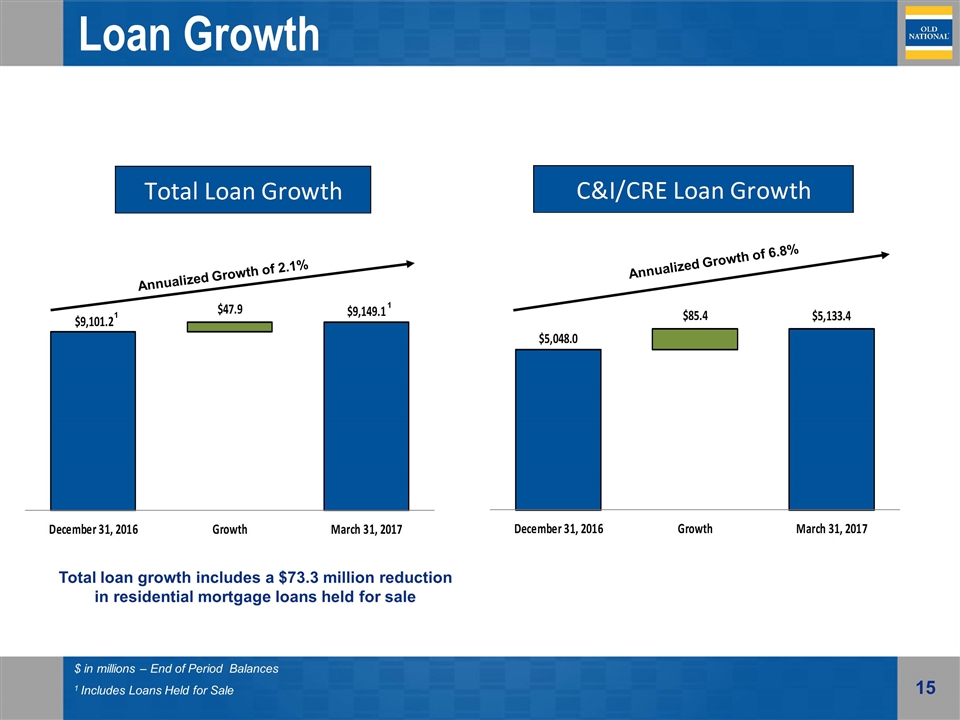

Loan Growth $ in millions – End of Period Balances 1 Includes Loans Held for Sale 1 1 Annualized Growth of 2.1% Annualized Growth of 6.8% Total loan growth includes a $73.3 million reduction in residential mortgage loans held for sale

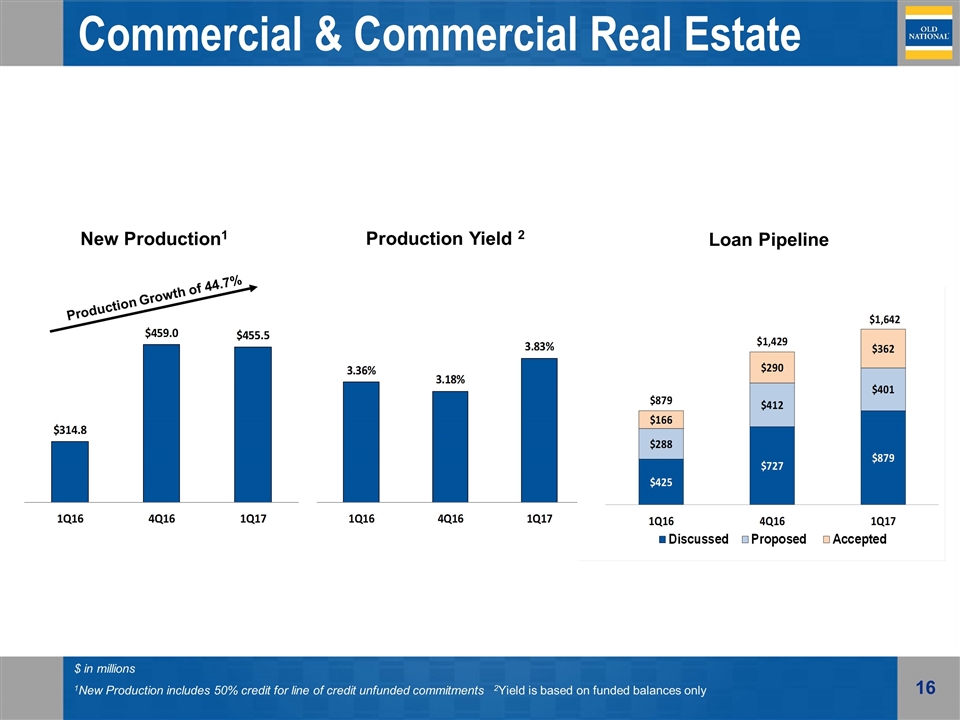

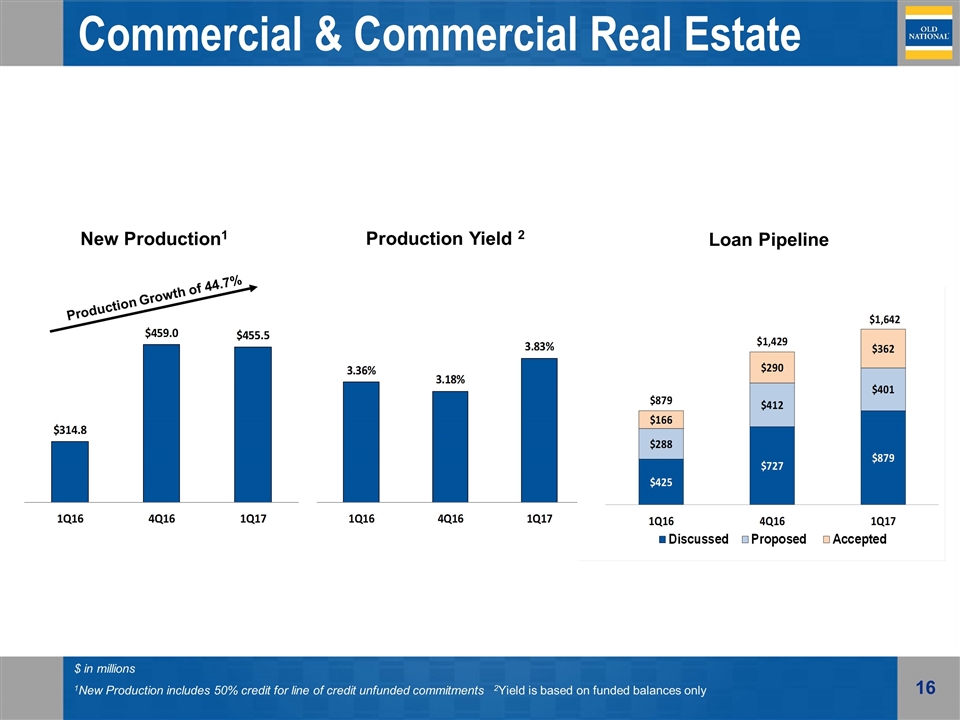

Commercial & Commercial Real Estate Loans $ in millions 1New Production includes 50% credit for line of credit unfunded commitments 2Yield is based on funded balances only New Production1 Production Yield 2 Loan Pipeline Production Growth of 44.7%

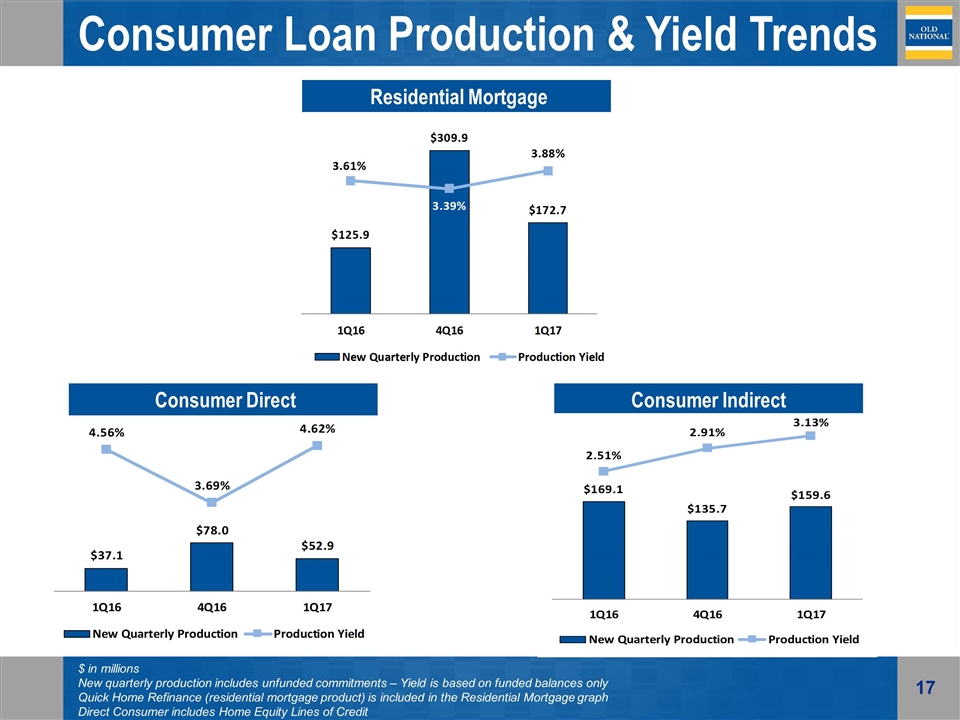

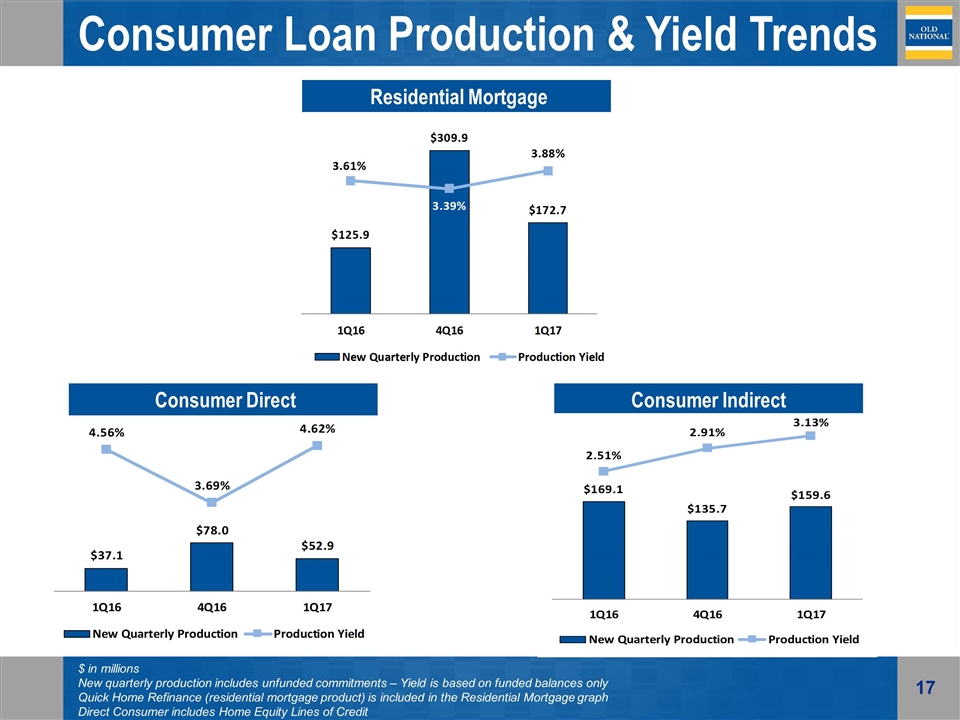

Consumer Loan Production & Yield Trends $ in millions New quarterly production includes unfunded commitments – Yield is based on funded balances only Quick Home Refinance (residential mortgage product) is included in the Residential Mortgage graph Direct Consumer includes Home Equity Lines of Credit Consumer Direct Consumer Indirect Residential Mortgage

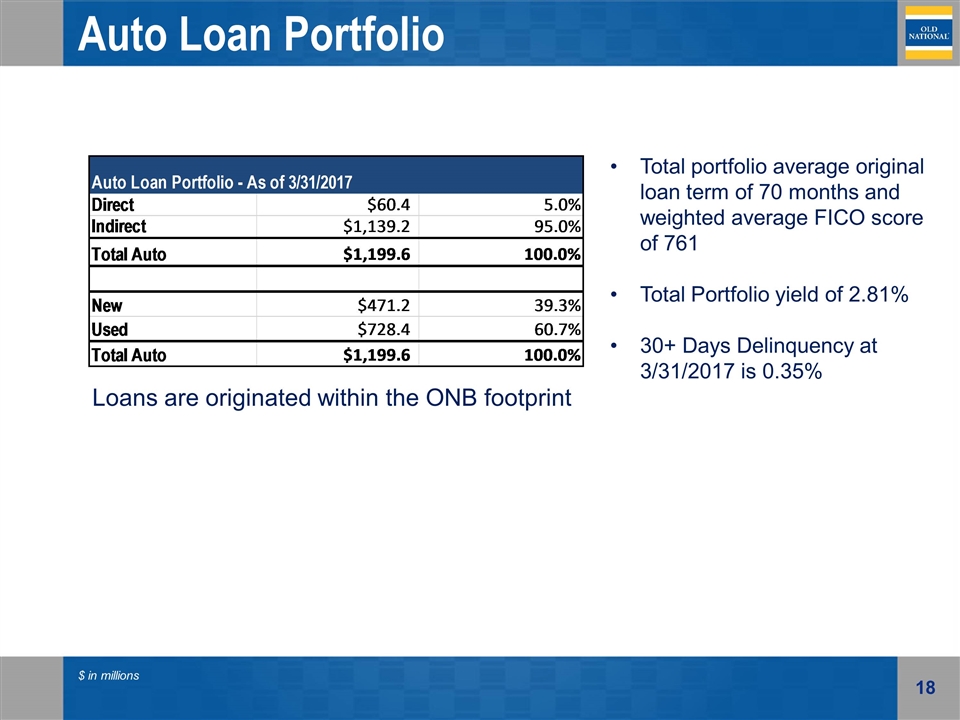

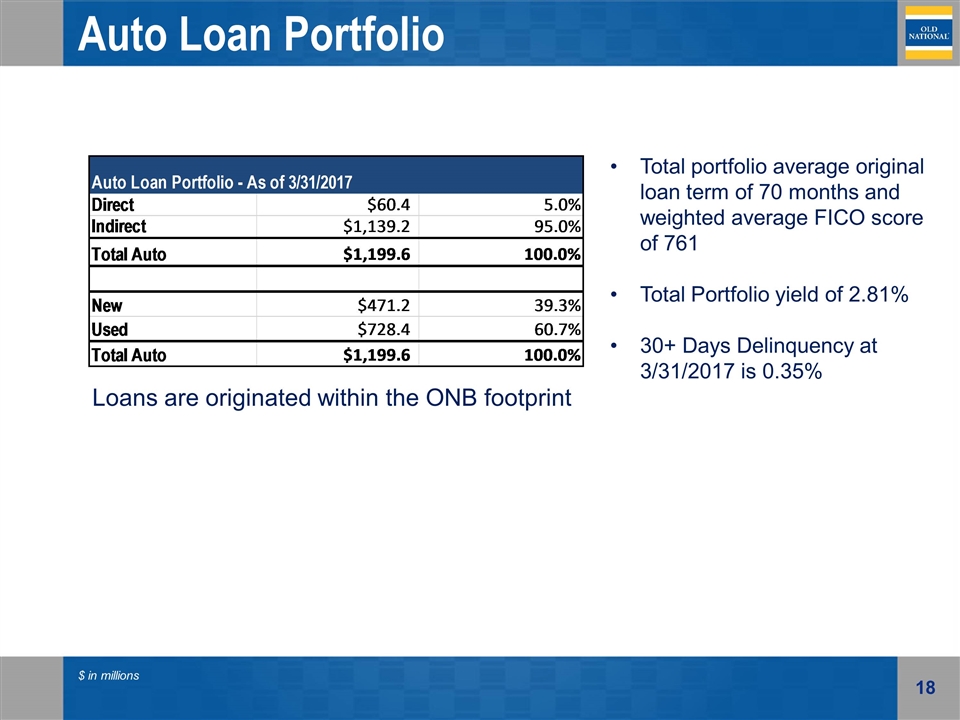

Auto Loan Portfolio $ in millions Total portfolio average original loan term of 70 months and weighted average FICO score of 761 Total Portfolio yield of 2.81% 30+ Days Delinquency at 3/31/2017 is 0.35% Loans are originated within the ONB footprint

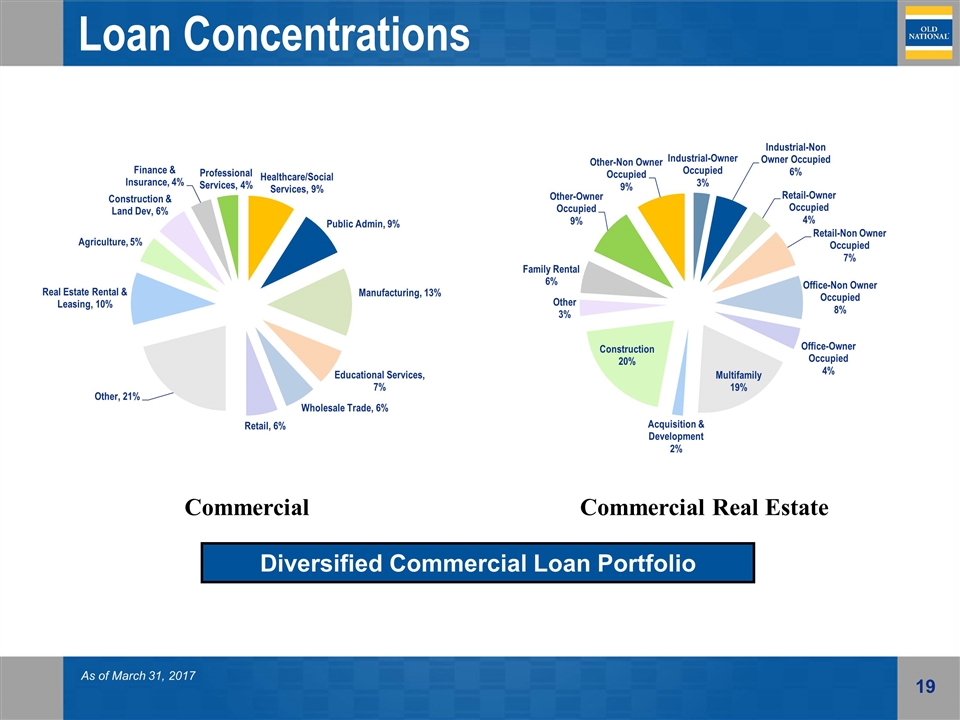

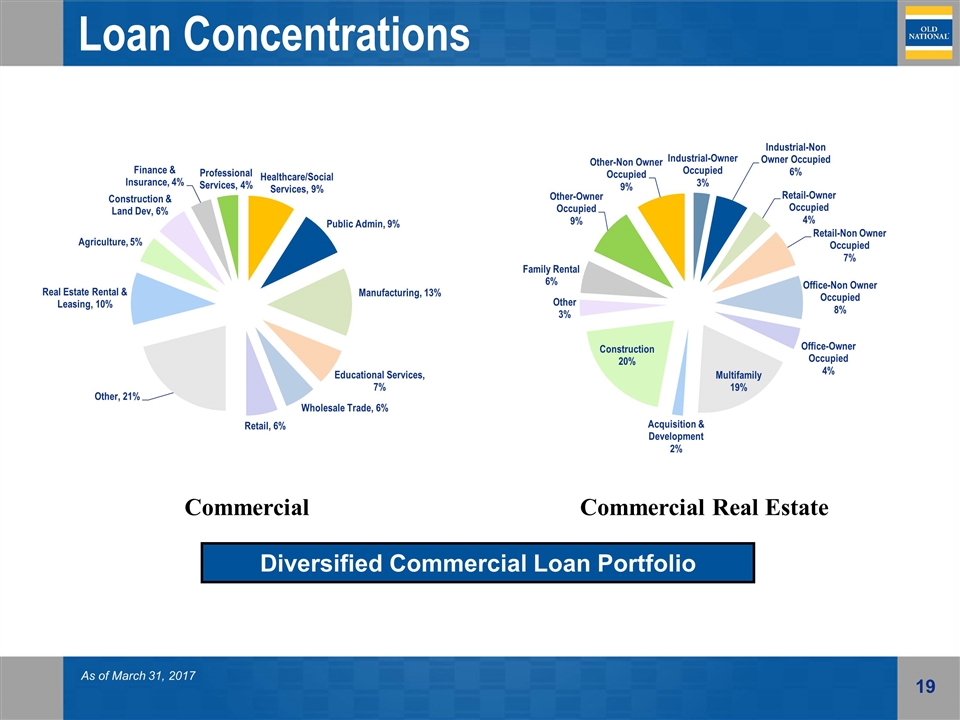

Loan Concentrations As of March 31, 2017 Commercial Commercial Real Estate Diversified Commercial Loan Portfolio

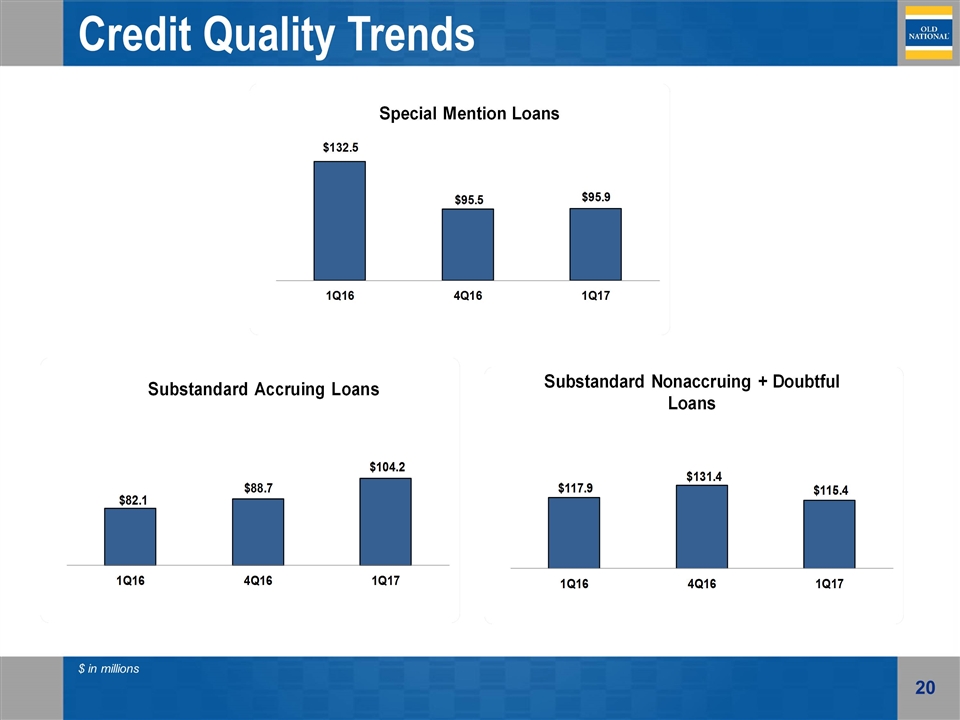

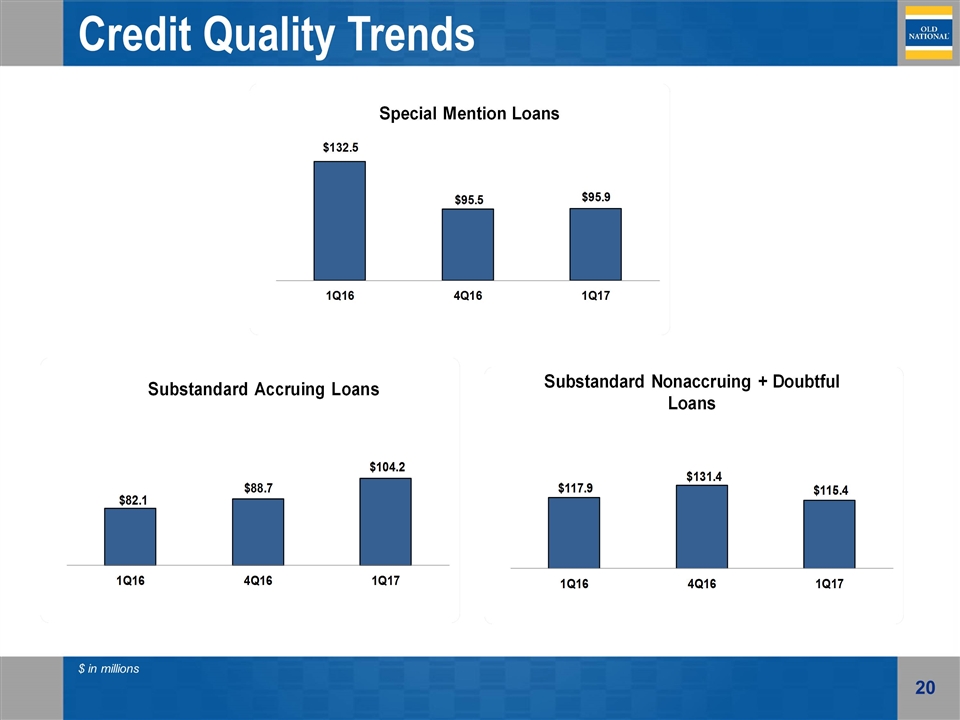

$ in millions Credit Quality Trends

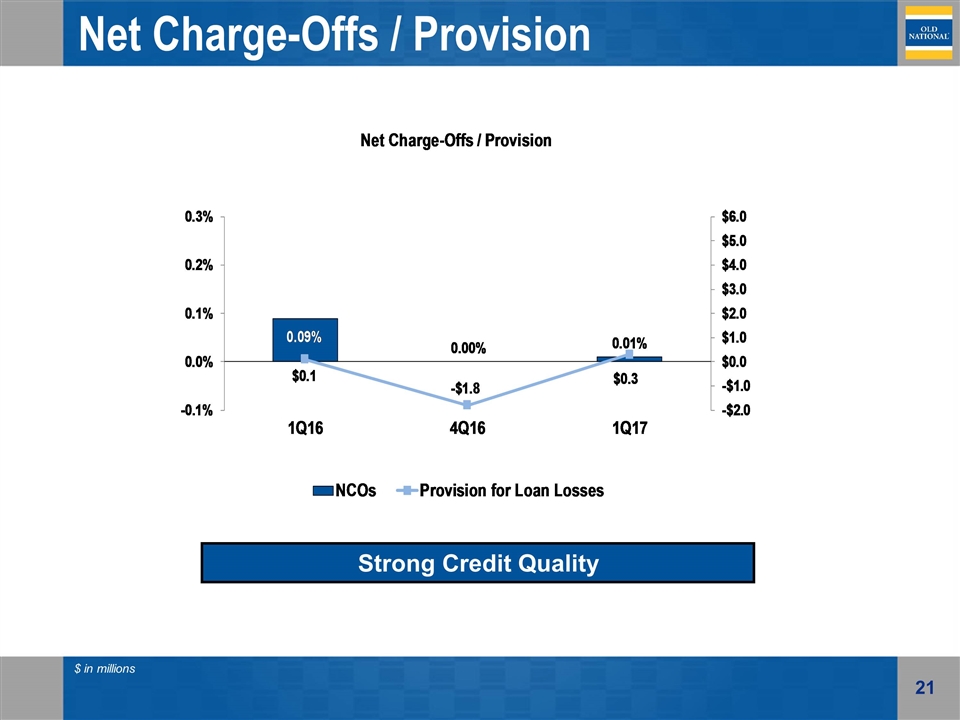

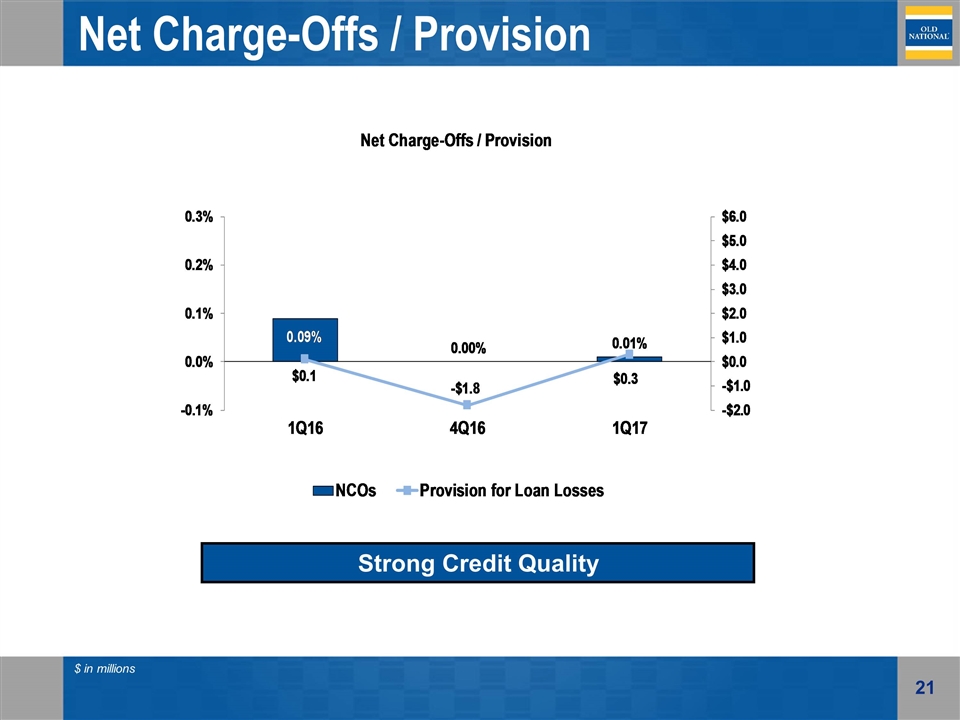

Net Charge-Offs / Provision $ in millions Strong Credit Quality

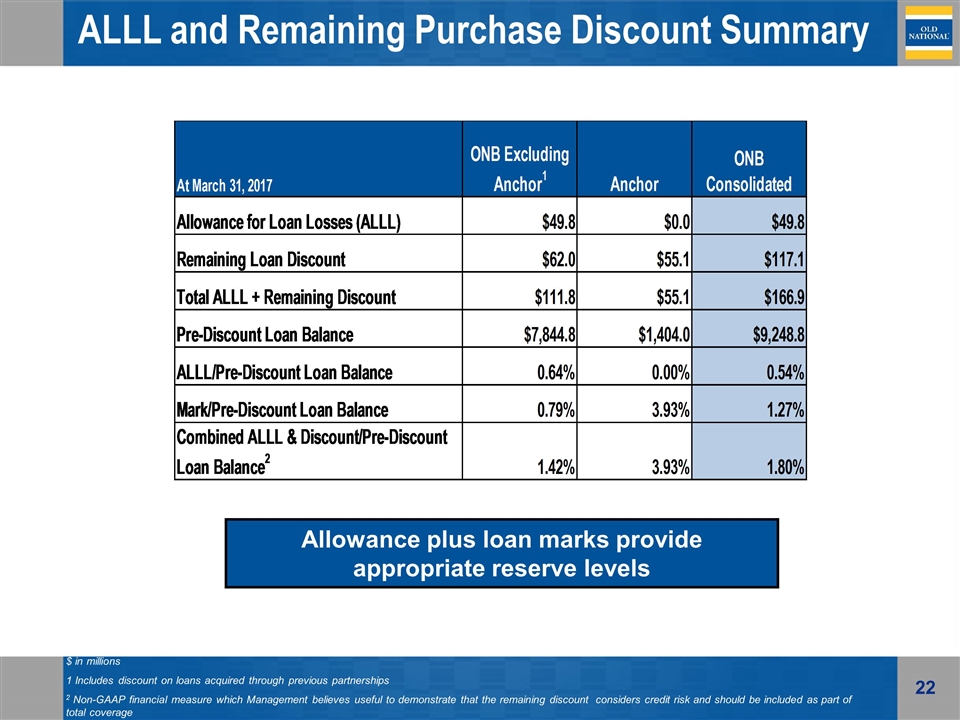

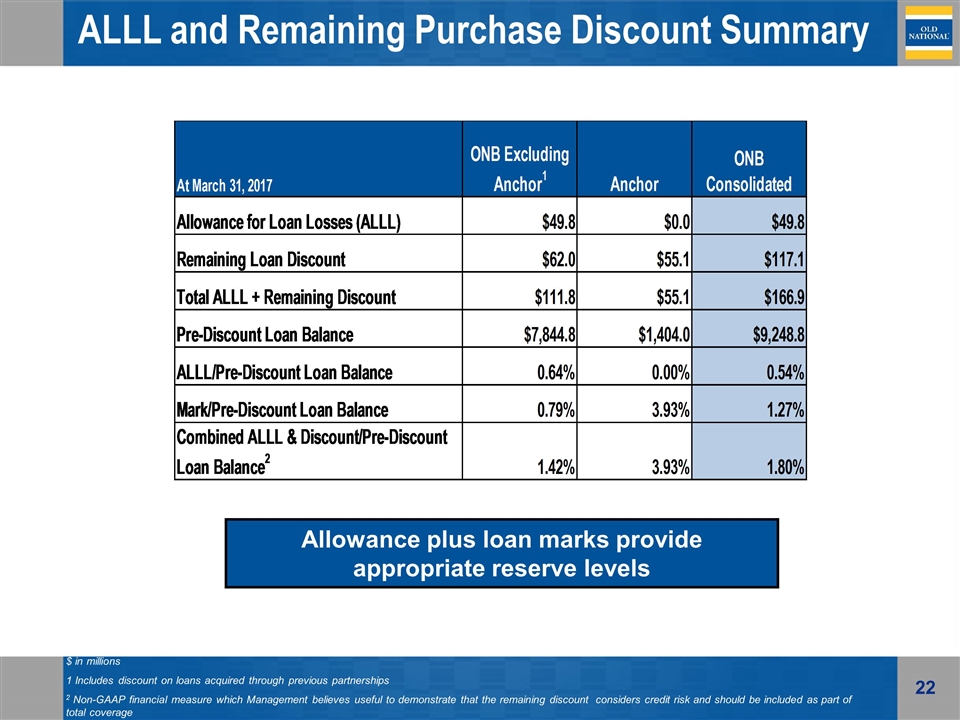

ALLL and Remaining Purchase Discount Summary $ in millions 1 Includes discount on loans acquired through previous partnerships 2 Non-GAAP financial measure which Management believes useful to demonstrate that the remaining discount considers credit risk and should be included as part of total coverage Allowance plus loan marks provide appropriate reserve levels

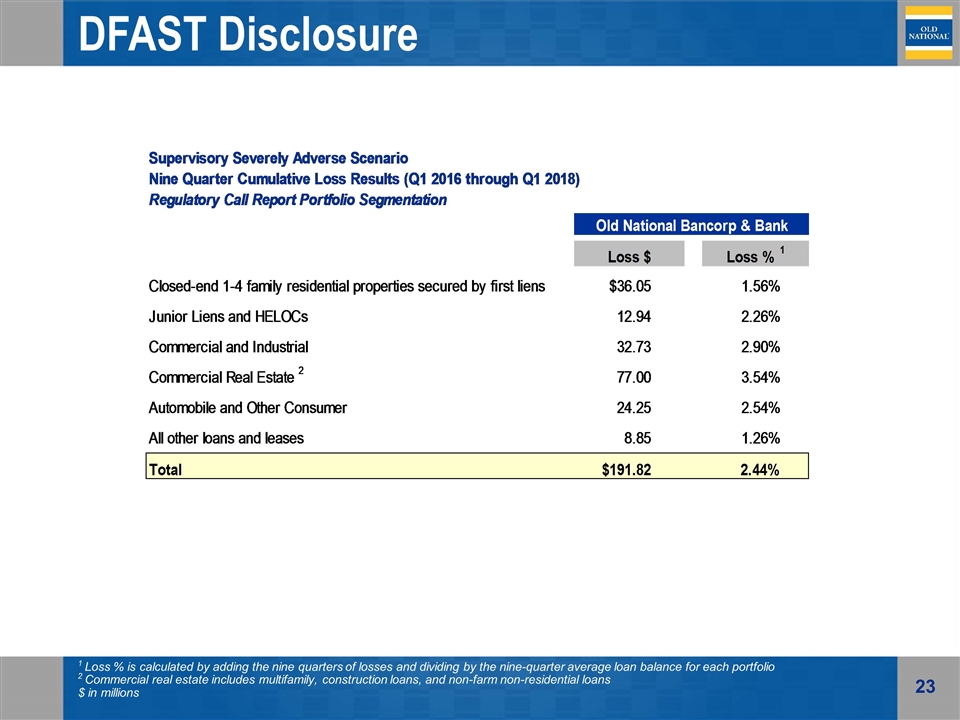

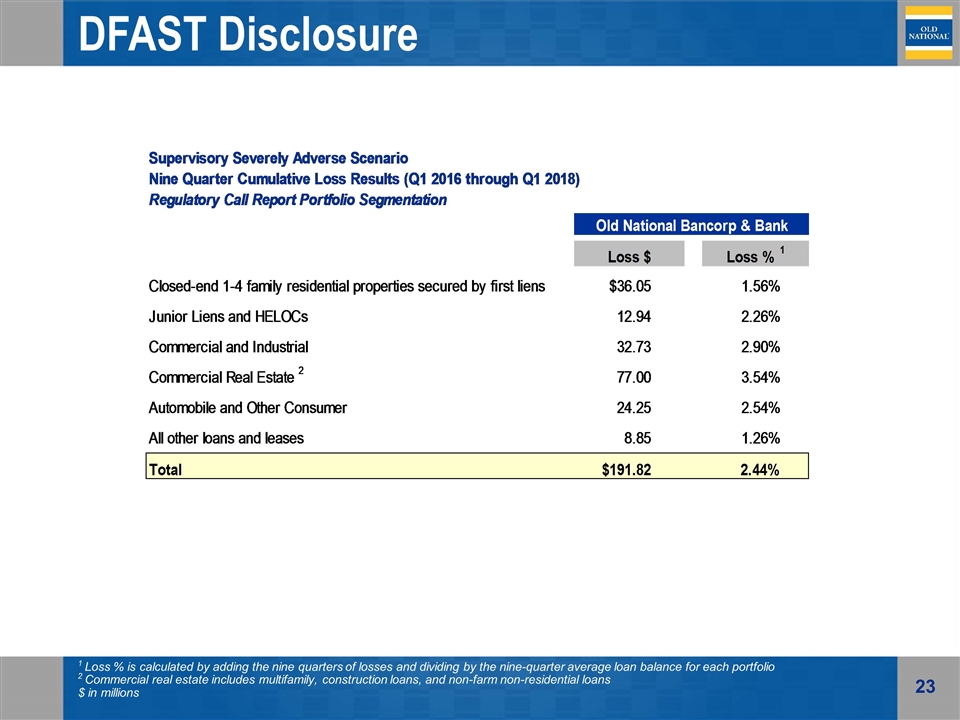

DFAST Disclosure 1 Loss % is calculated by adding the nine quarters of losses and dividing by the nine-quarter average loan balance for each portfolio 2 Commercial real estate includes multifamily, construction loans, and non-farm non-residential loans $ in millions

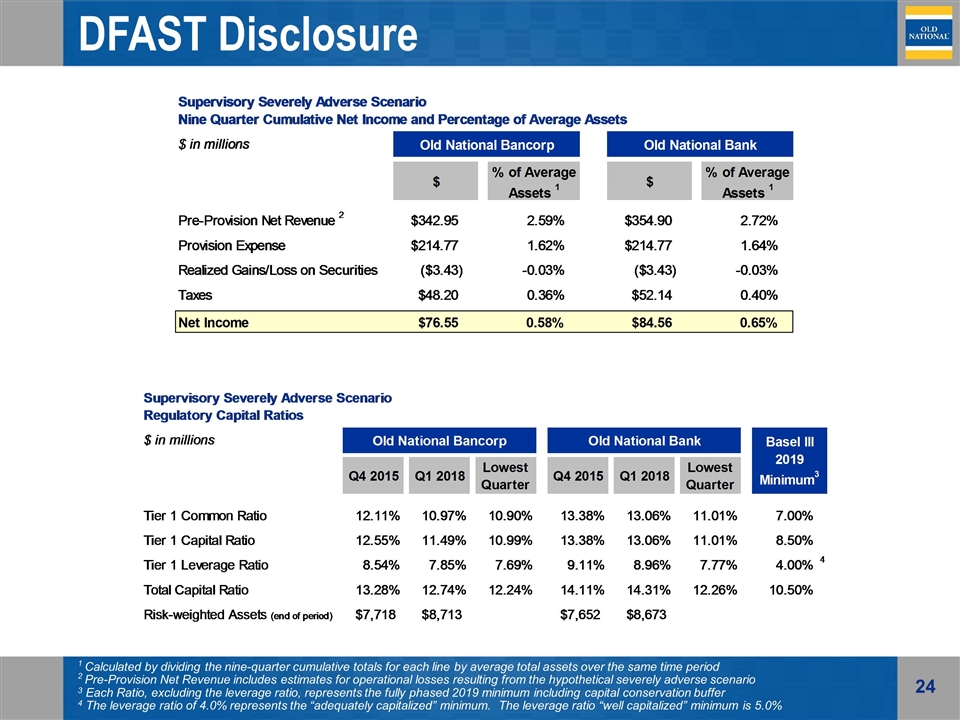

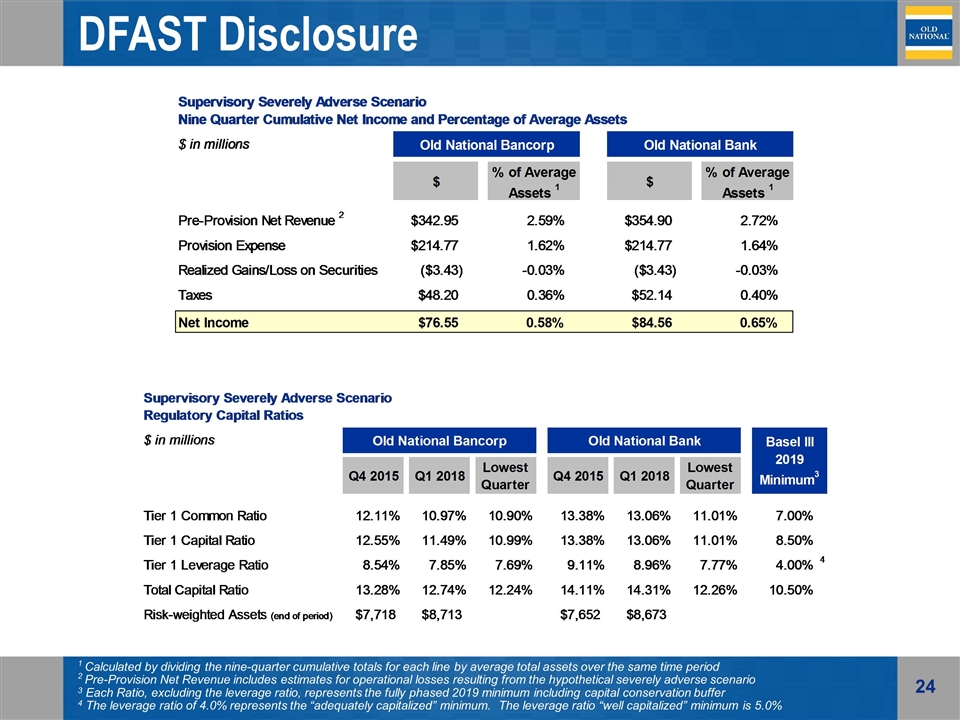

DFAST Disclosure 1 Calculated by dividing the nine-quarter cumulative totals for each line by average total assets over the same time period 2 Pre-Provision Net Revenue includes estimates for operational losses resulting from the hypothetical severely adverse scenario 3 Each Ratio, excluding the leverage ratio, represents the fully phased 2019 minimum including capital conservation buffer 4 The leverage ratio of 4.0% represents the “adequately capitalized” minimum. The leverage ratio “well capitalized” minimum is 5.0%

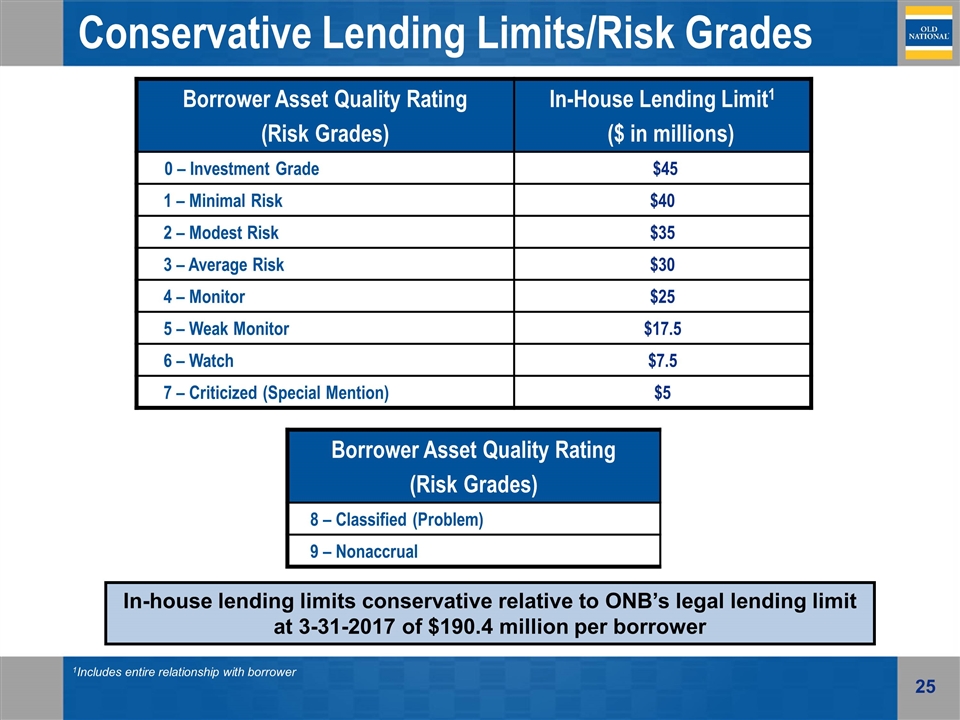

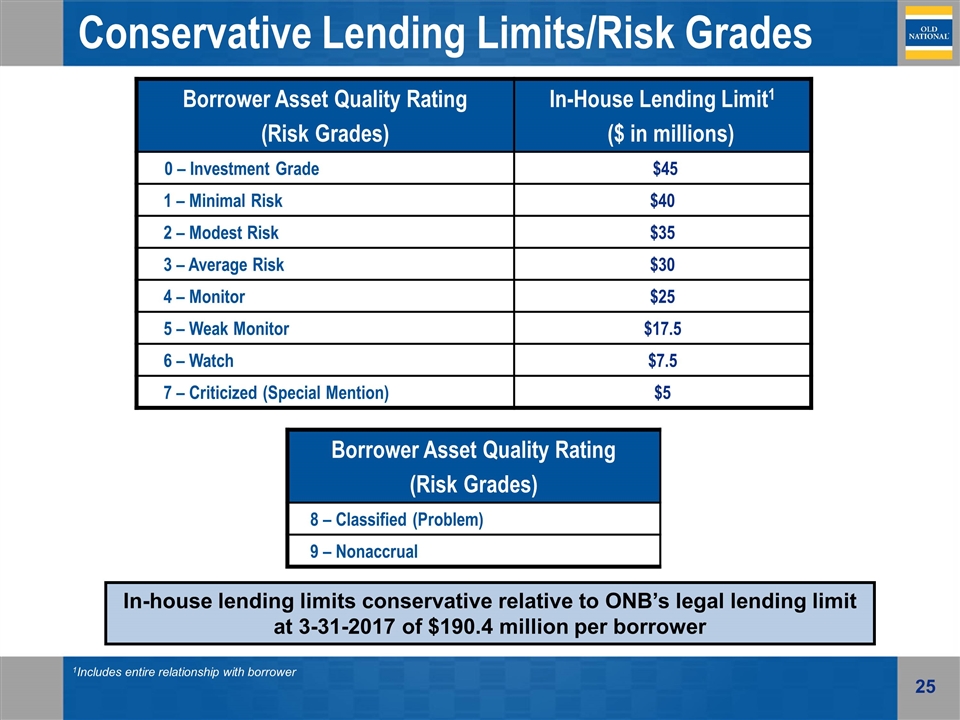

Conservative Lending Limits/Risk Grades Borrower Asset Quality Rating (Risk Grades) In-House Lending Limit1 ($ in millions) 0 – Investment Grade $45 1 – Minimal Risk $40 2 – Modest Risk $35 3 – Average Risk $30 4 – Monitor $25 5 – Weak Monitor $17.5 6 – Watch $7.5 7 – Criticized (Special Mention) $5 In-house lending limits conservative relative to ONB’s legal lending limit at 3-31-2017 of $190.4 million per borrower 1Includes entire relationship with borrower Borrower Asset Quality Rating (Risk Grades) 8 – Classified (Problem) 9 – Nonaccrual

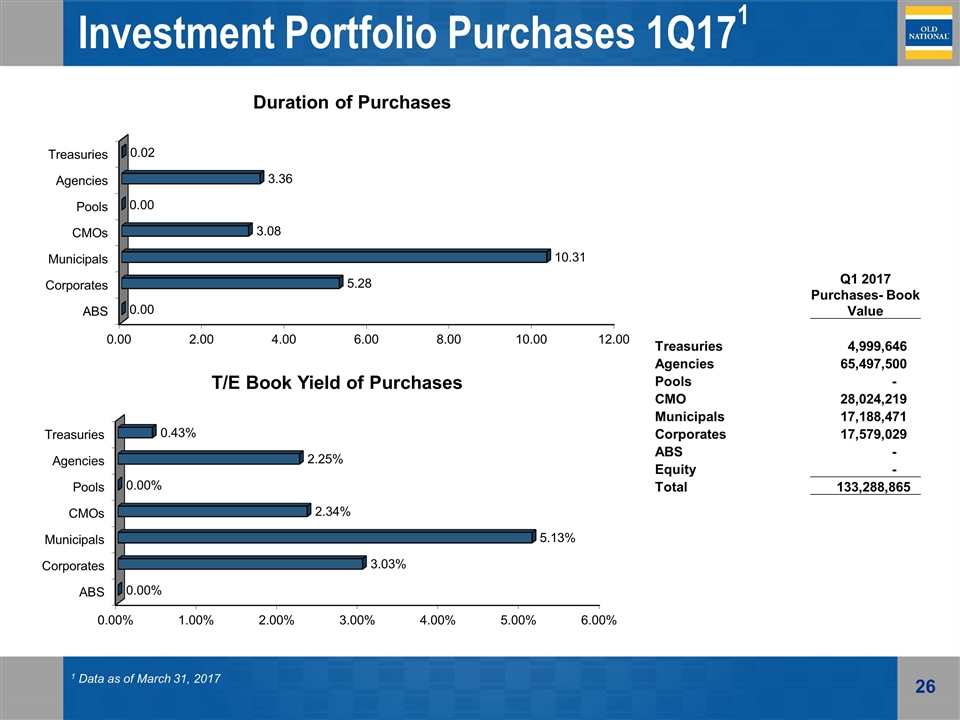

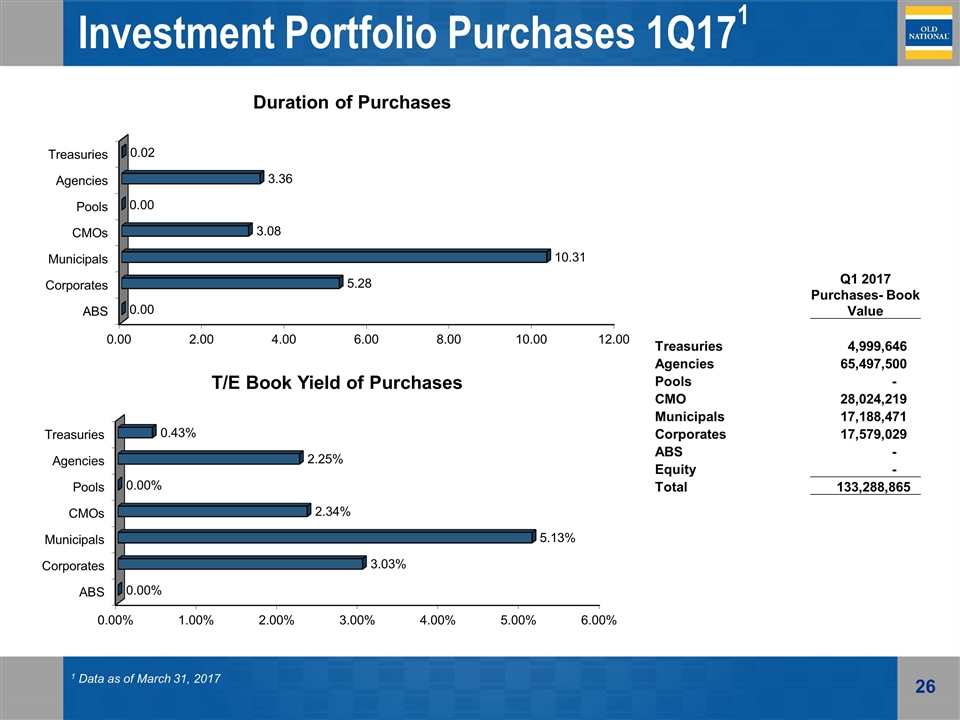

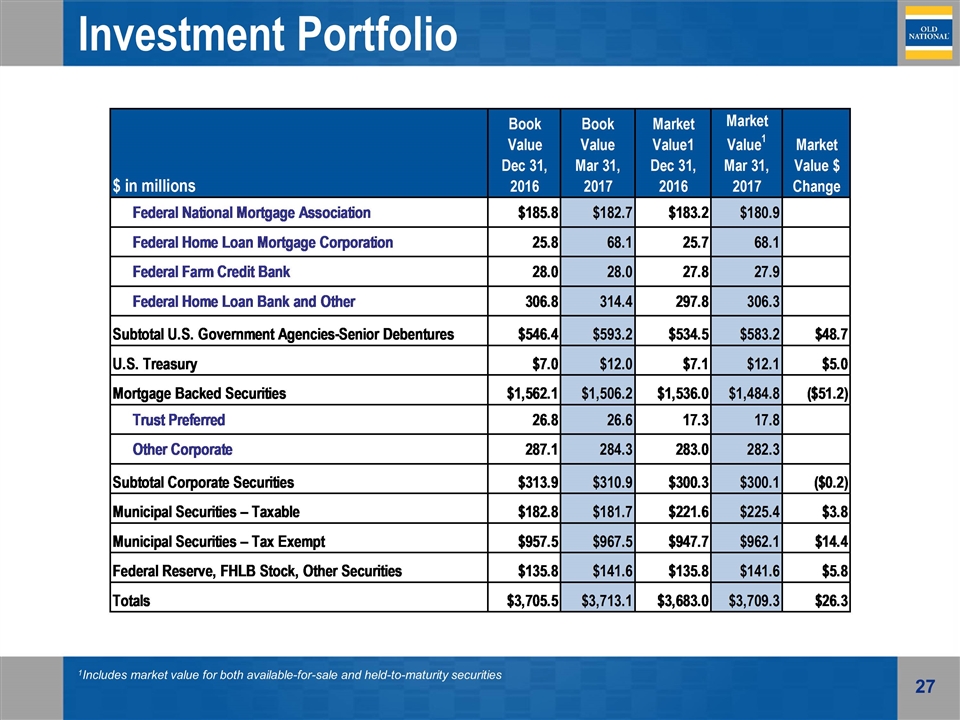

Investment Portfolio Purchases 1Q171 1 Data as of March 31, 2017 Q1 2017 Purchases- Book Value Treasuries 4,999,646 Agencies 65,497,500 Pools - CMO 28,024,219 Municipals 17,188,471 Corporates 17,579,029 ABS - Equity - Total 133,288,865

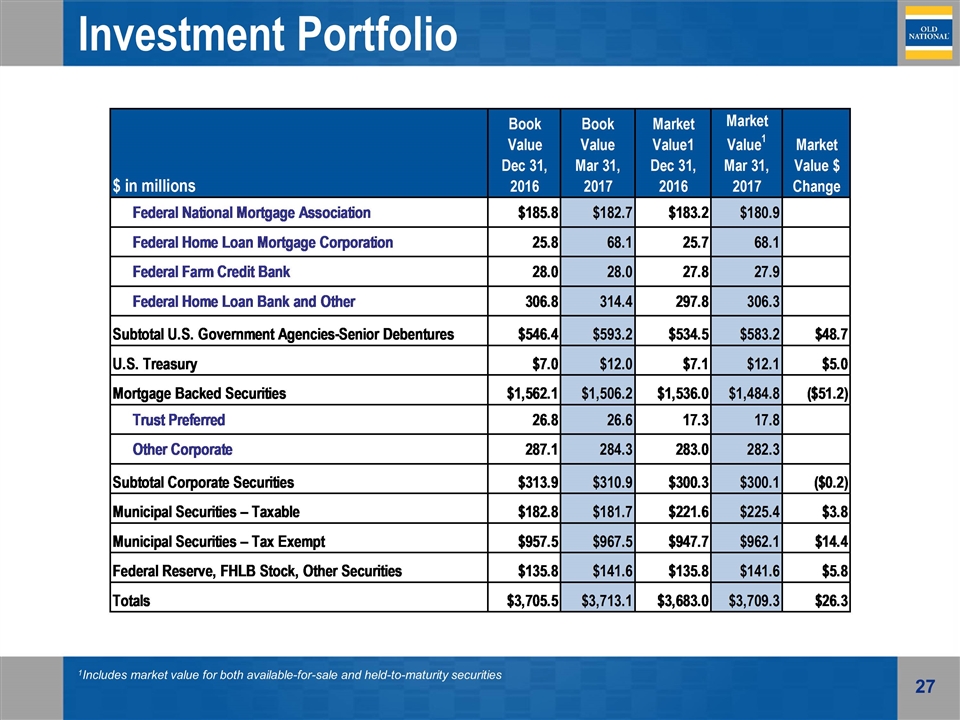

Investment Portfolio 1Includes market value for both available-for-sale and held-to-maturity securities

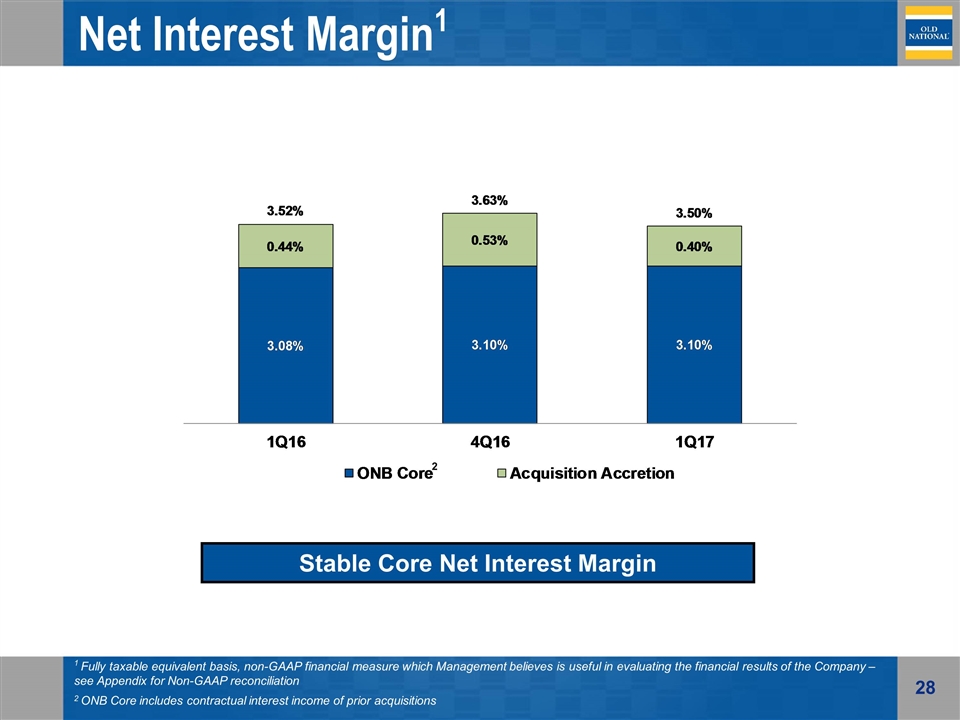

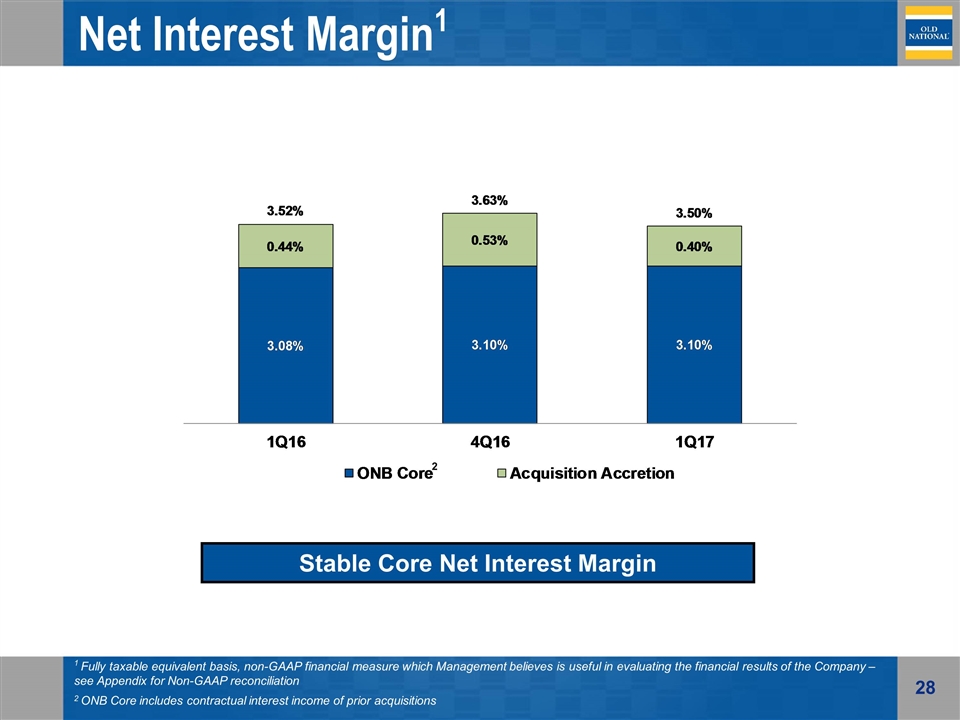

Net Interest Margin1 1 Fully taxable equivalent basis, non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation 2 ONB Core includes contractual interest income of prior acquisitions 2 Stable Core Net Interest Margin

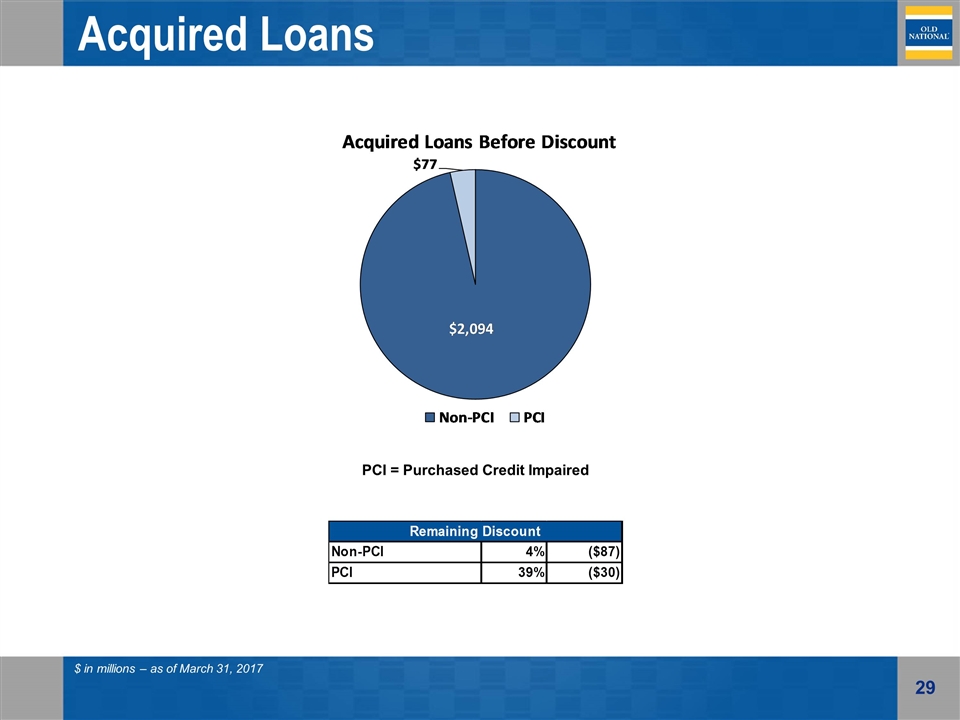

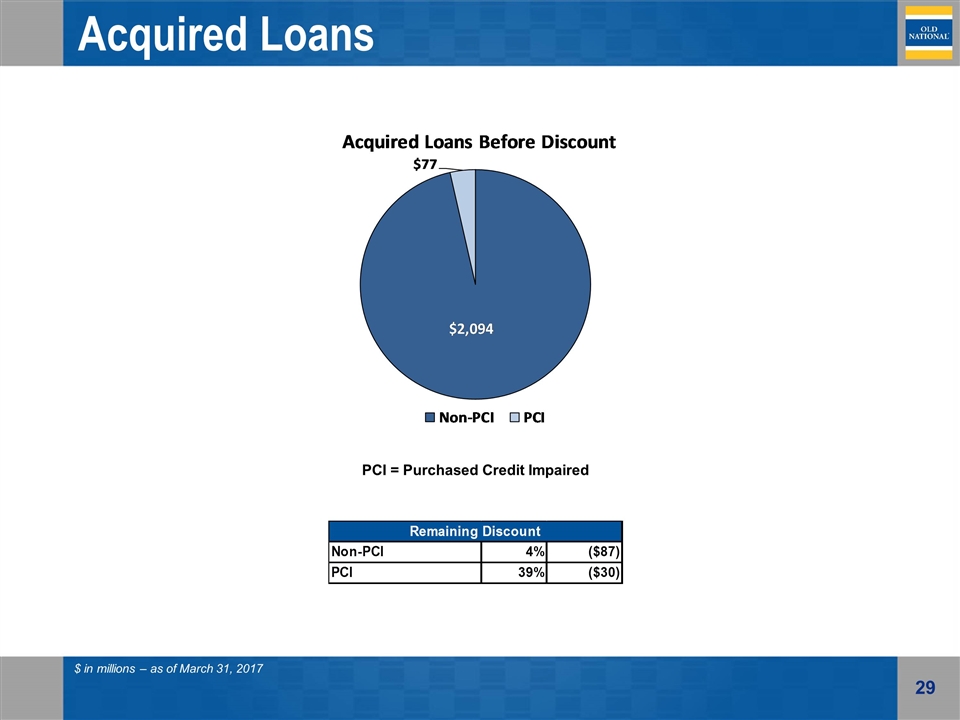

Acquired Loans $ in millions – as of March 31, 2017 PCI = Purchased Credit Impaired

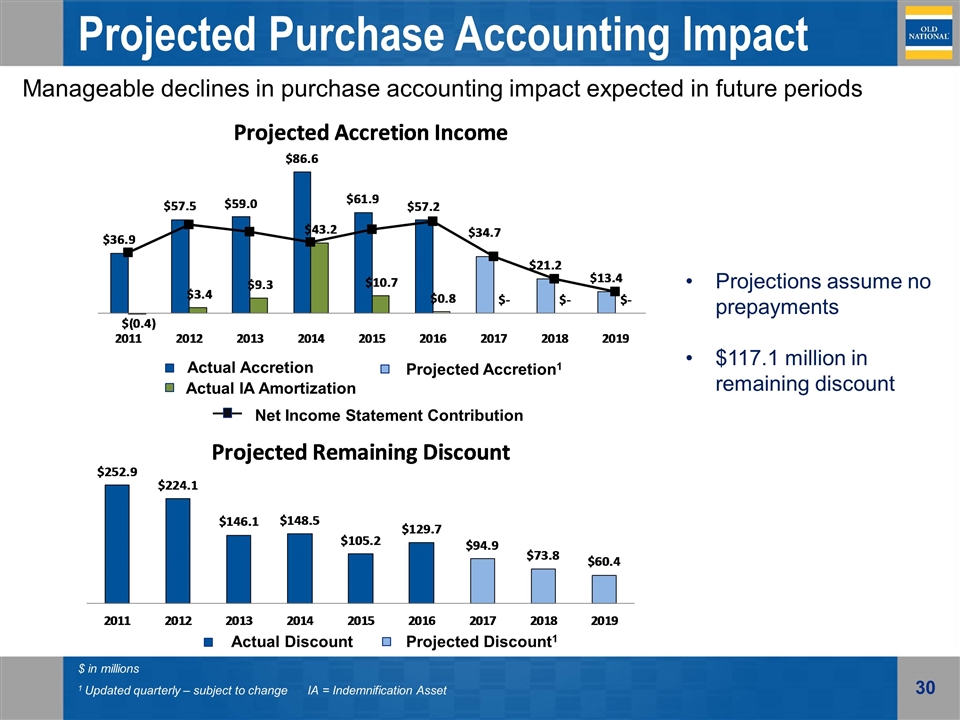

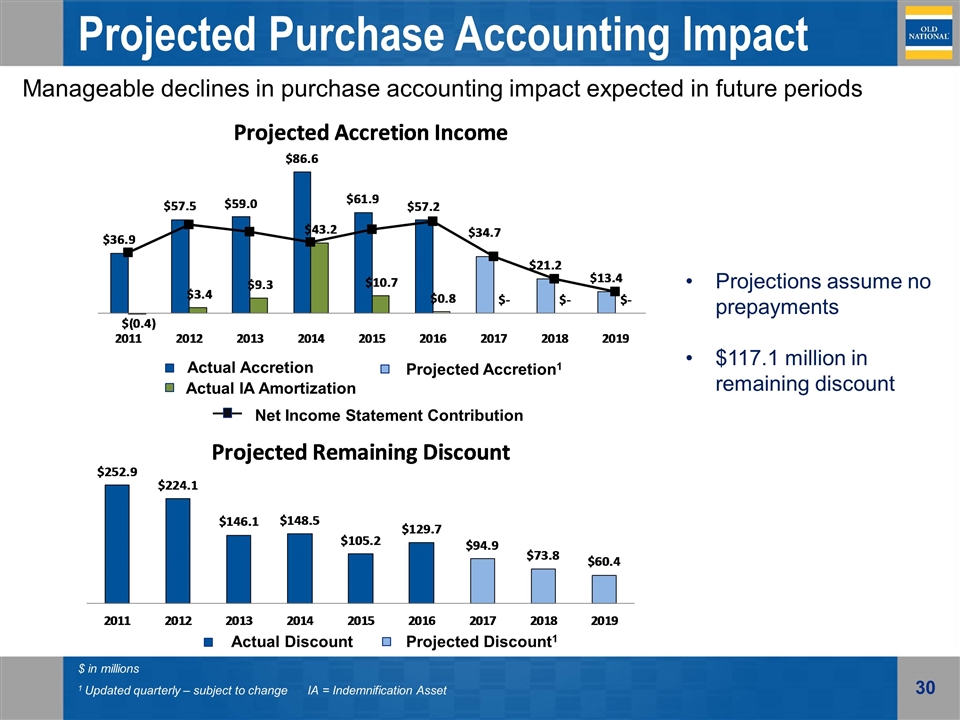

Projected Purchase Accounting Impact Actual Accretion Projected Accretion1 Actual Discount Projected Discount1 $ in millions 1 Updated quarterly – subject to change IA = Indemnification Asset Manageable declines in purchase accounting impact expected in future periods Actual IA Amortization Net Income Statement Contribution Projections assume no prepayments $117.1 million in remaining discount

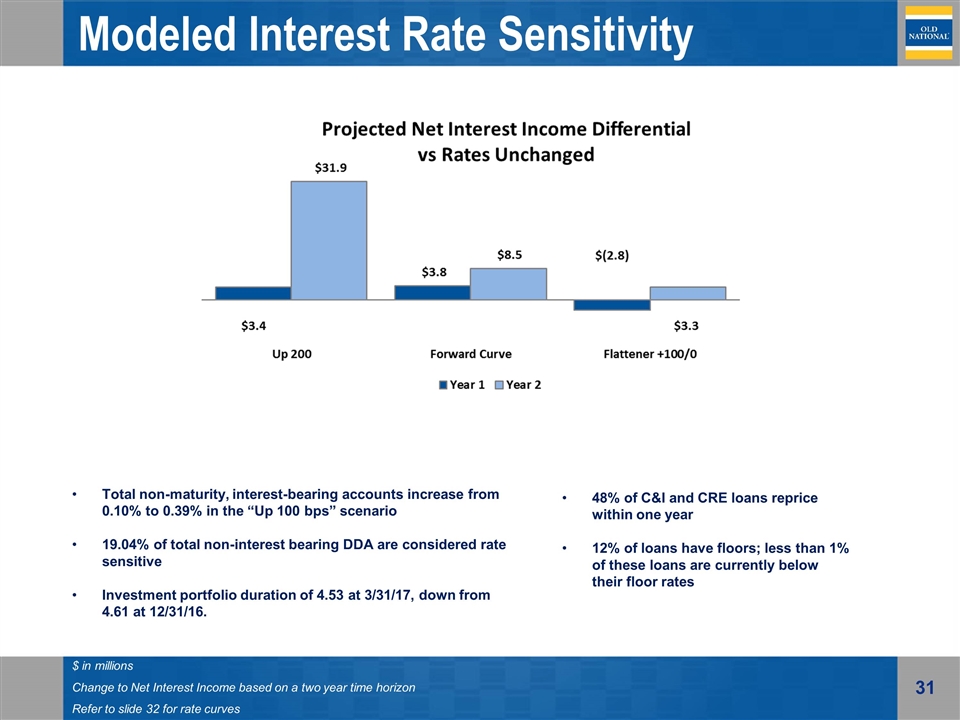

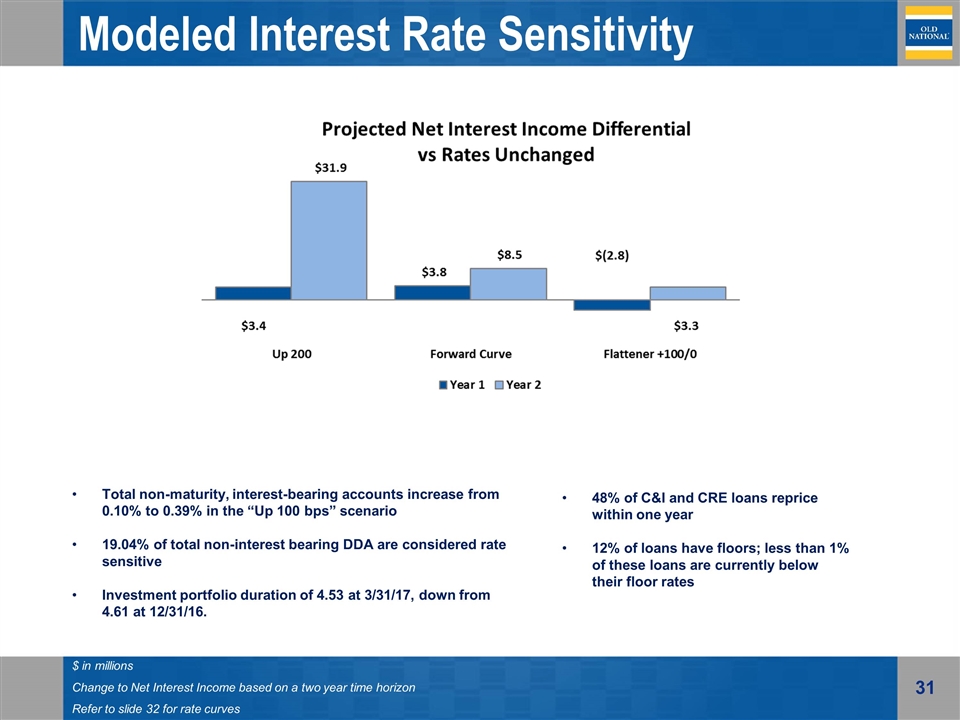

$ in millions Change to Net Interest Income based on a two year time horizon Refer to slide 32 for rate curves Total non-maturity, interest-bearing accounts increase from 0.10% to 0.39% in the “Up 100 bps” scenario 19.04% of total non-interest bearing DDA are considered rate sensitive Investment portfolio duration of 4.53 at 3/31/17, down from 4.61 at 12/31/16. Modeled Interest Rate Sensitivity 48% of C&I and CRE loans reprice within one year 12% of loans have floors; less than 1% of these loans are currently below their floor rates

Interest Rate Curves

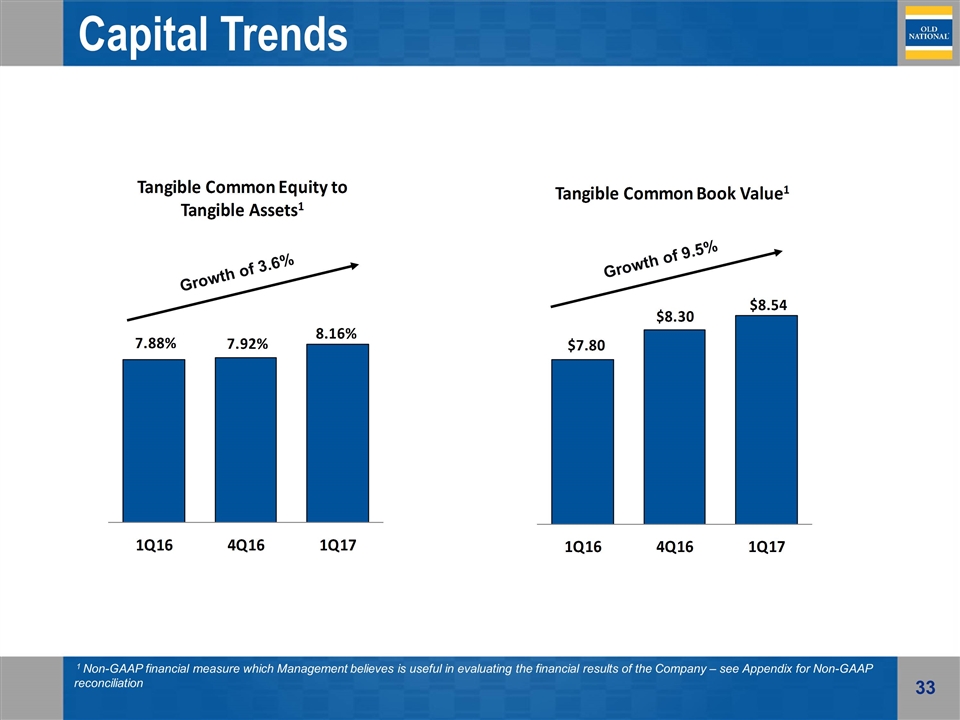

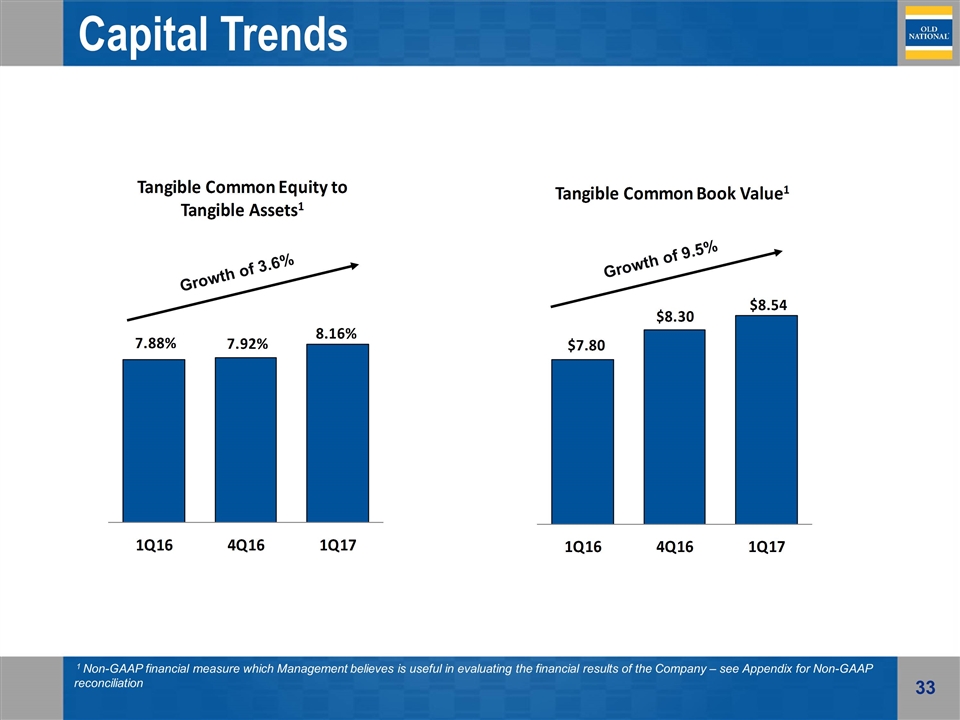

Capital Trends 1 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation Growth of 9.5% Growth of 3.6%

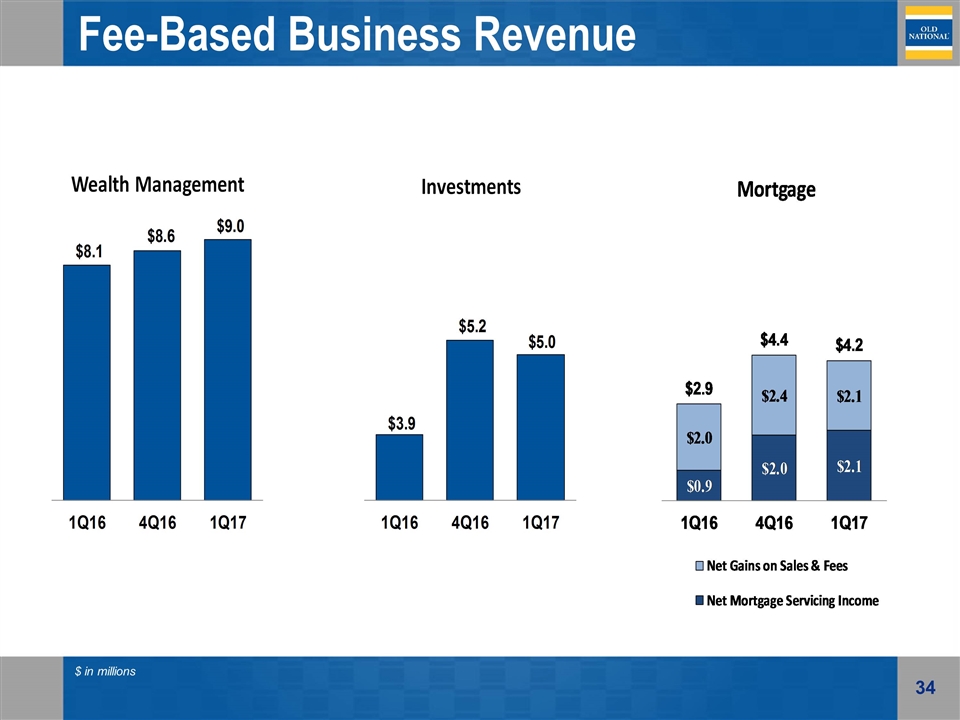

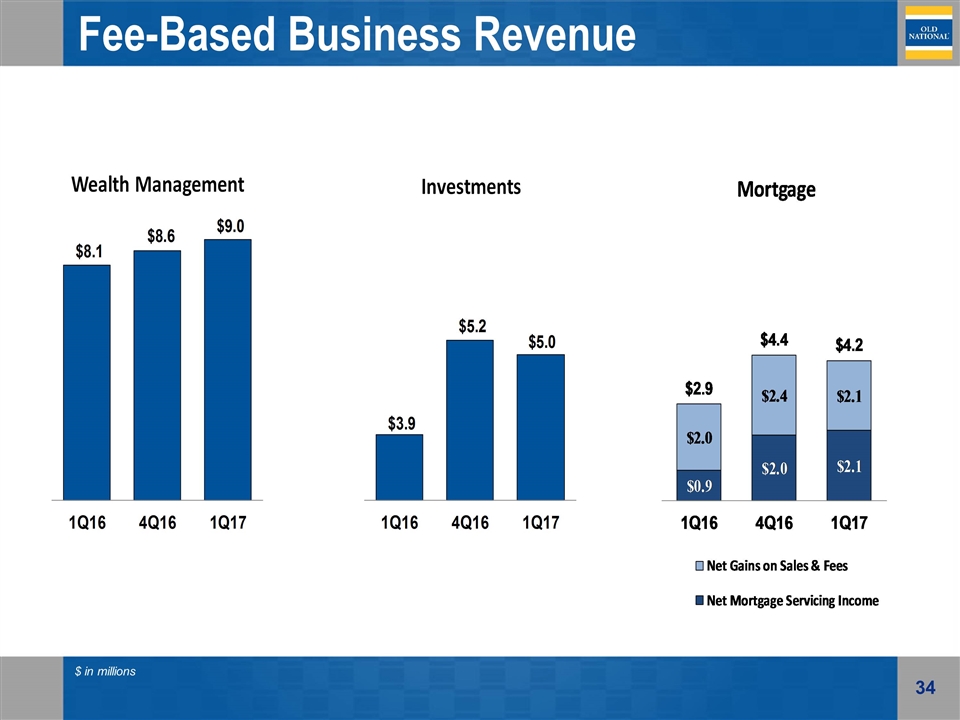

Fee-Based Business Revenue $ in millions

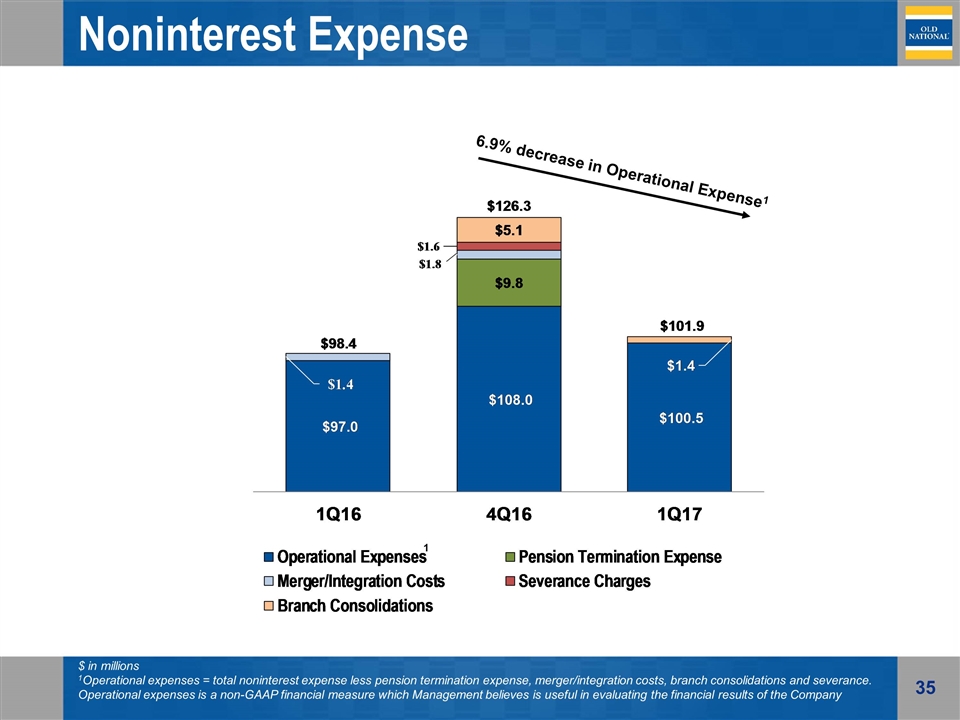

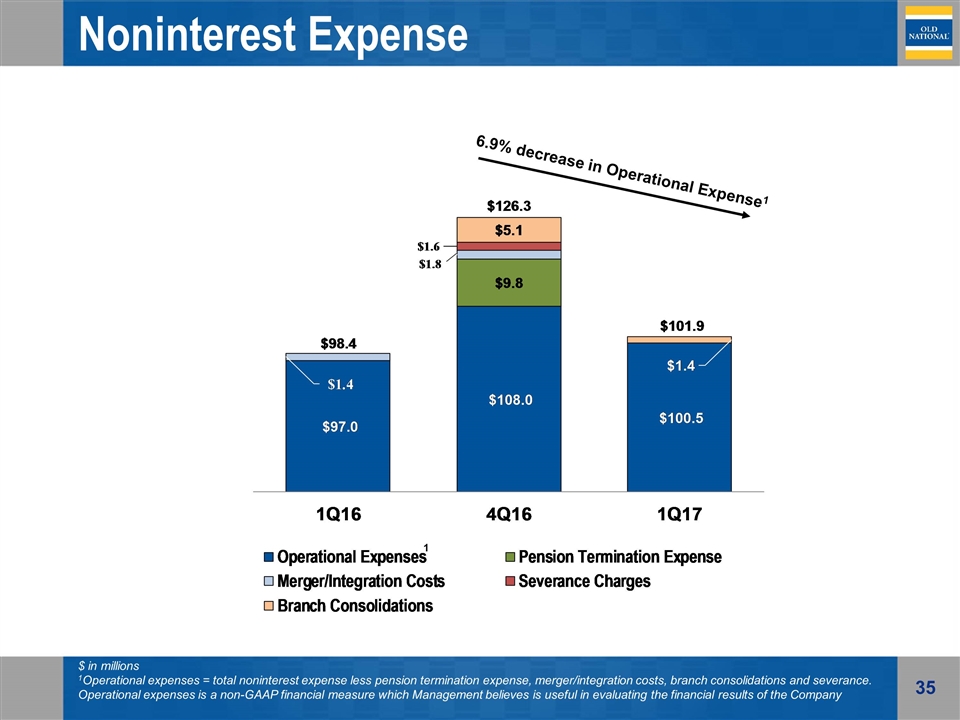

$ in millions 1Operational expenses = total noninterest expense less pension termination expense, merger/integration costs, branch consolidations and severance. Operational expenses is a non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company Noninterest Expense 1 6.9% decrease in Operational Expense1

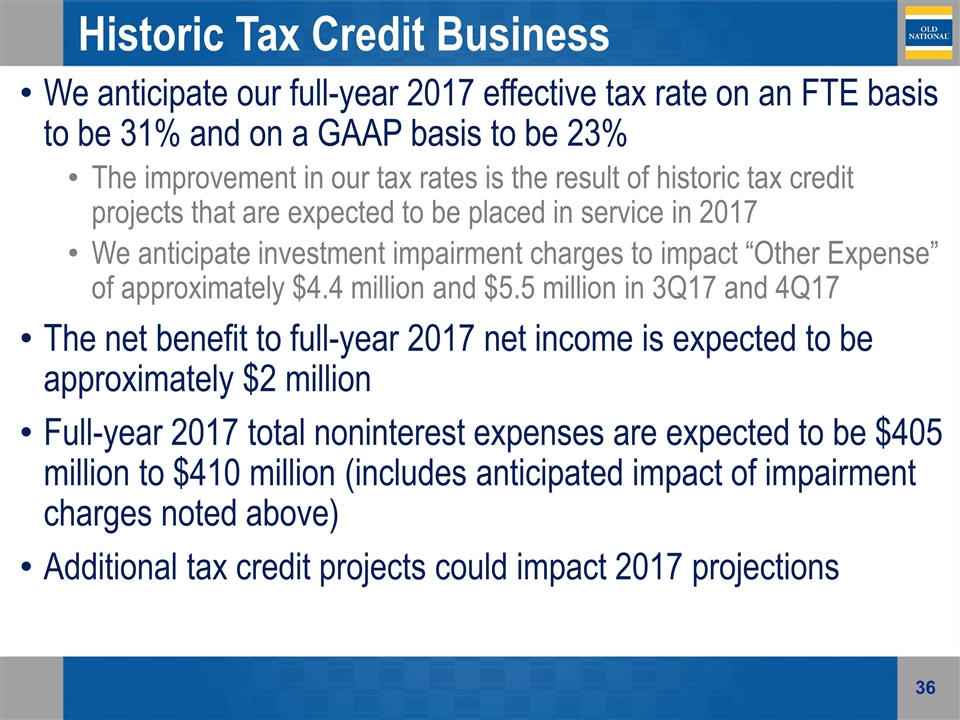

Historic Tax Credit Business We anticipate our full-year 2017 effective tax rate on an FTE basis to be 31% and on a GAAP basis to be 23% The improvement in our tax rates is the result of historic tax credit projects that are expected to be placed in service in 2017 We anticipate investment impairment charges to impact “Other Expense” of approximately $4.4 million and $5.5 million in 3Q17 and 4Q17 The net benefit to full-year 2017 net income is expected to be approximately $2 million Full-year 2017 total noninterest expenses are expected to be $405 million to $410 million (includes anticipated impact of impairment charges noted above) Additional tax credit projects could impact 2017 projections

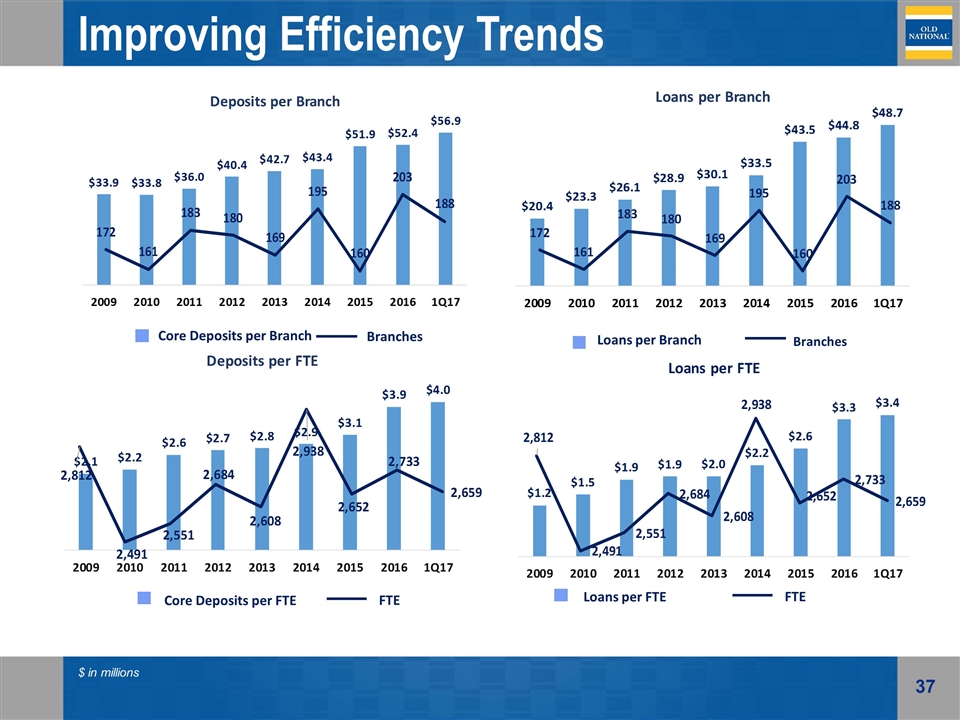

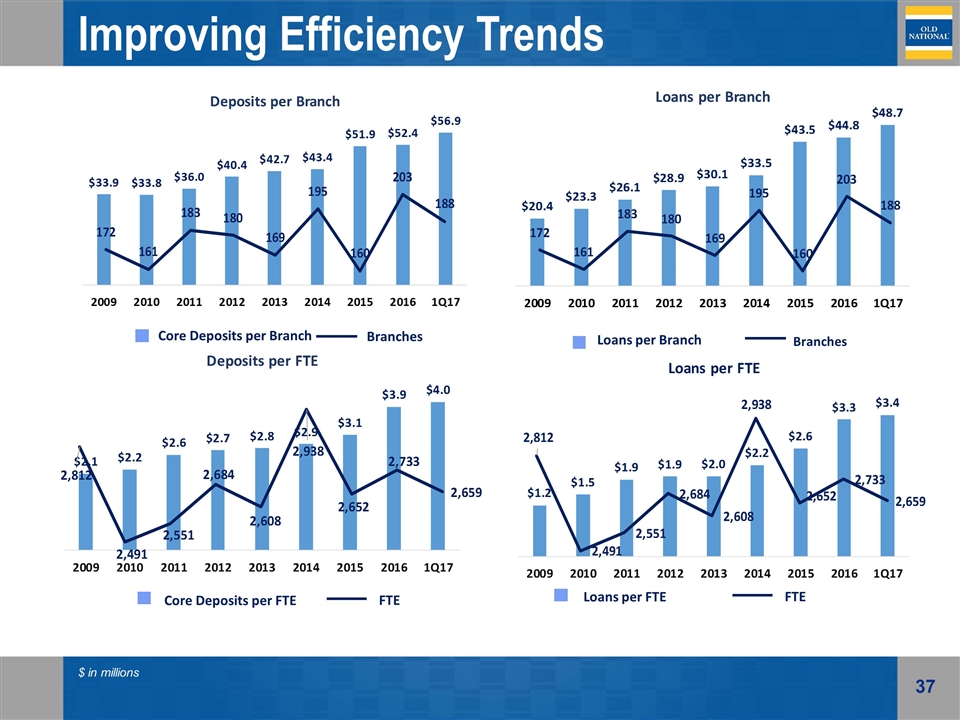

Improving Efficiency Trends Core Deposits per Branch Branches $ in millions

Rationalizing Distribution Channels Driving efficiencies through increased branch size and investment in mobile and online banking Consolidated 47 branches since January 1, 2014 Increased average deposits per branch by 33% Launched new online and mobile solution January 16, 2016 Increased online users 58% Increased mobile users 285%

2011 2012 2013 Acquired Monroe Bancorp – Enhanced Bloomington, IN presence January, 2011 Acquired Indiana Community – Entry into Columbus, IN September, 2012 FDIC-assisted acquisition of Integra Bank July, 2011 Sold non-strategic market – Chicago-area - 4 branches Consolidation of 21 branches Acquired 24 MI / IN branches July, 2013 Consolidation of 44 branches Sold 12 branches Consolidation of 22 branches Acquired 188 Sold 33 Consolidated 134 Acquired Tower Financial – Enhancing Ft. Wayne, IN presence April, 2014 Acquired United Bancorp — Entering Ann Arbor, MI July, 2014 2014 Consolidation of 4 branches Acquired LSB Financial Corp.– Enhancing Lafayette, IN presence November, 2014 Acquired Founders Financial Corporation– Entry into Grand Rapids, MI January, 2015 2015 Consolidation of 23 branches Transforming Old National’s Landscape Sold non-strategic market – Southern IL – 12 branches + 5 branches 2016 Acquired Anchor BanCorp Wisconsin Inc. – Entering the state of Wisconsin May, 2016 Consolidation of 5 branches 2017 Consolidation of 15 branches

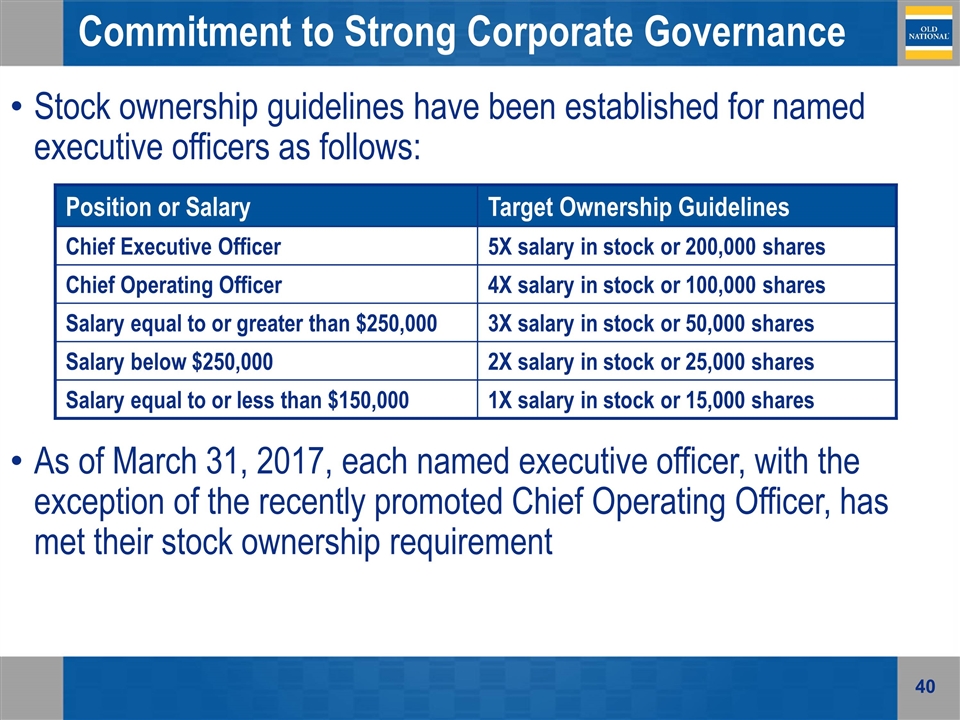

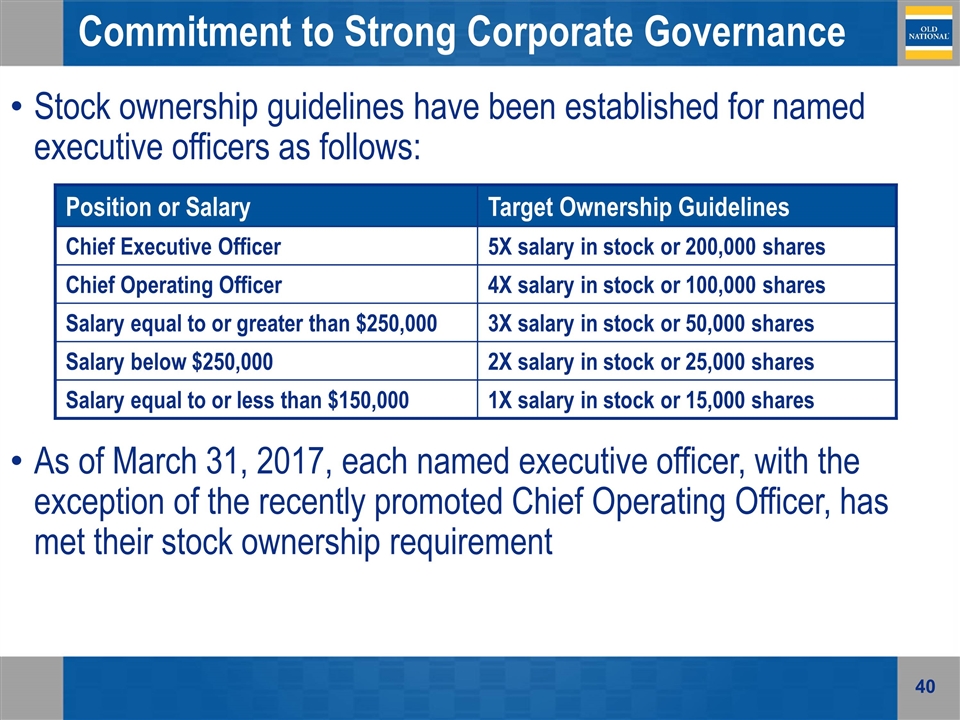

Position or Salary Target Ownership Guidelines Chief Executive Officer 5X salary in stock or 200,000 shares Chief Operating Officer 4X salary in stock or 100,000 shares Salary equal to or greater than $250,000 3X salary in stock or 50,000 shares Salary below $250,000 2X salary in stock or 25,000 shares Salary equal to or less than $150,000 1X salary in stock or 15,000 shares Stock ownership guidelines have been established for named executive officers as follows: As of March 31, 2017, each named executive officer, with the exception of the recently promoted Chief Operating Officer, has met their stock ownership requirement Commitment to Strong Corporate Governance

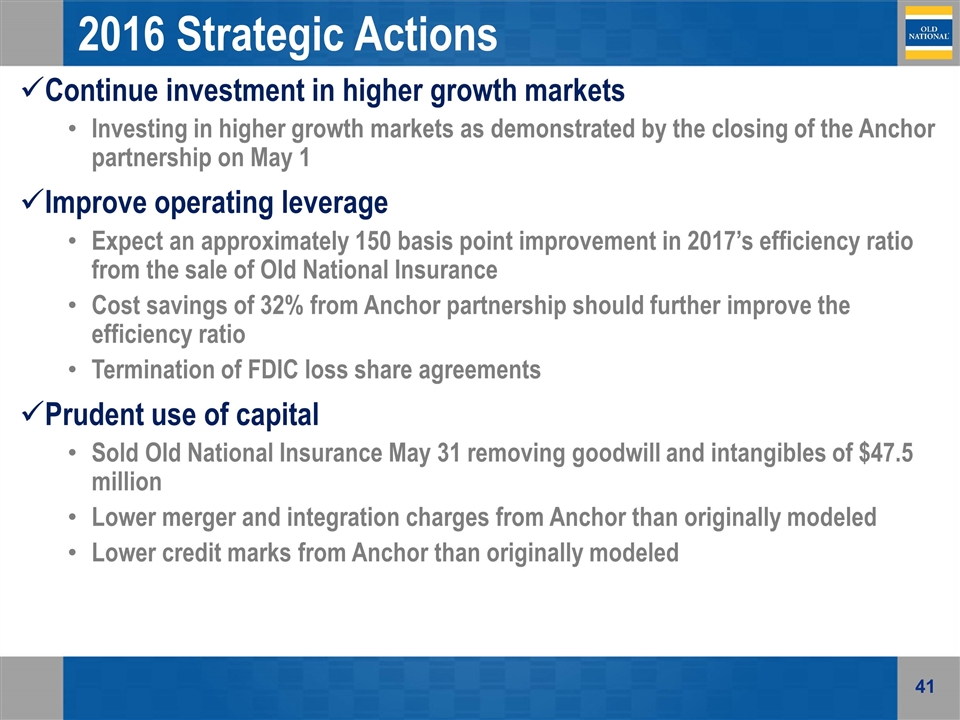

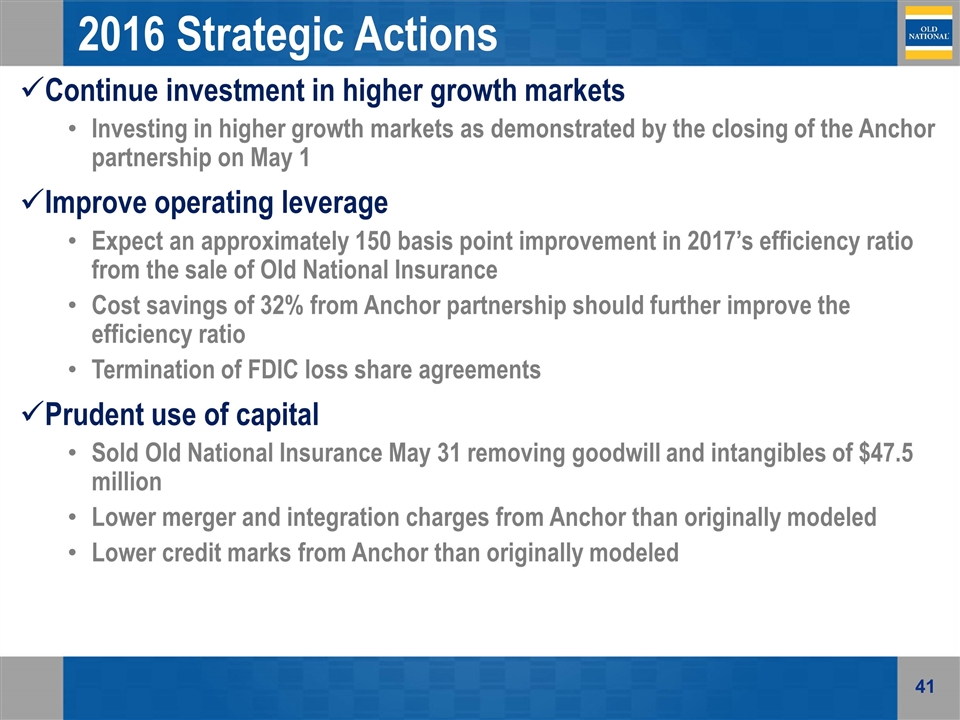

2016 Strategic Actions Continue investment in higher growth markets Investing in higher growth markets as demonstrated by the closing of the Anchor partnership on May 1 Improve operating leverage Expect an approximately 150 basis point improvement in 2017’s efficiency ratio from the sale of Old National Insurance Cost savings of 32% from Anchor partnership should further improve the efficiency ratio Termination of FDIC loss share agreements Prudent use of capital Sold Old National Insurance May 31 removing goodwill and intangibles of $47.5 million Lower merger and integration charges from Anchor than originally modeled Lower credit marks from Anchor than originally modeled

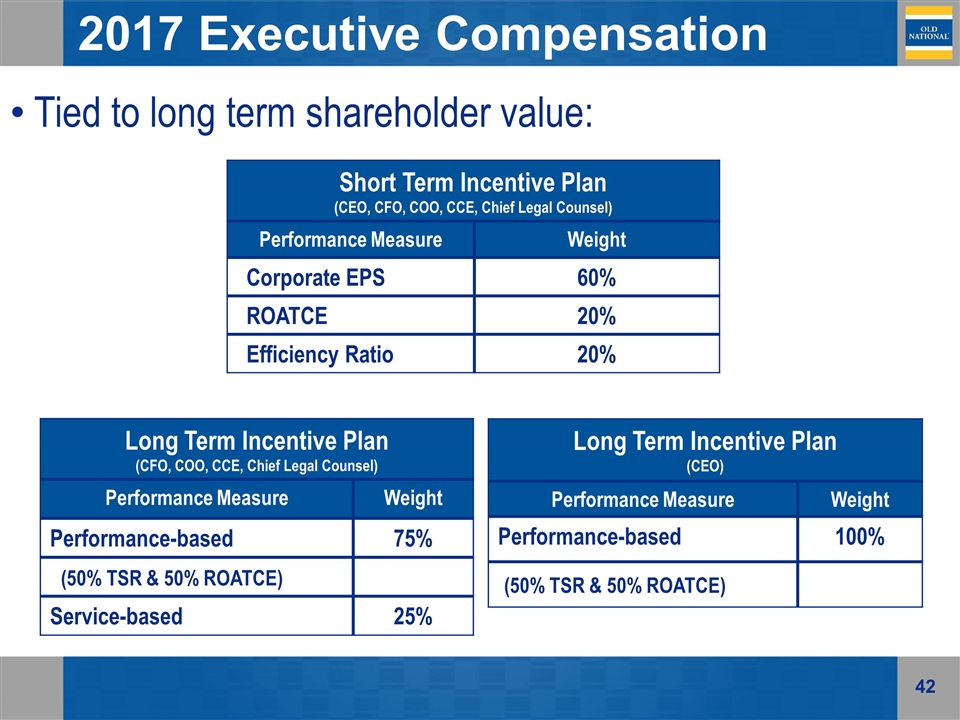

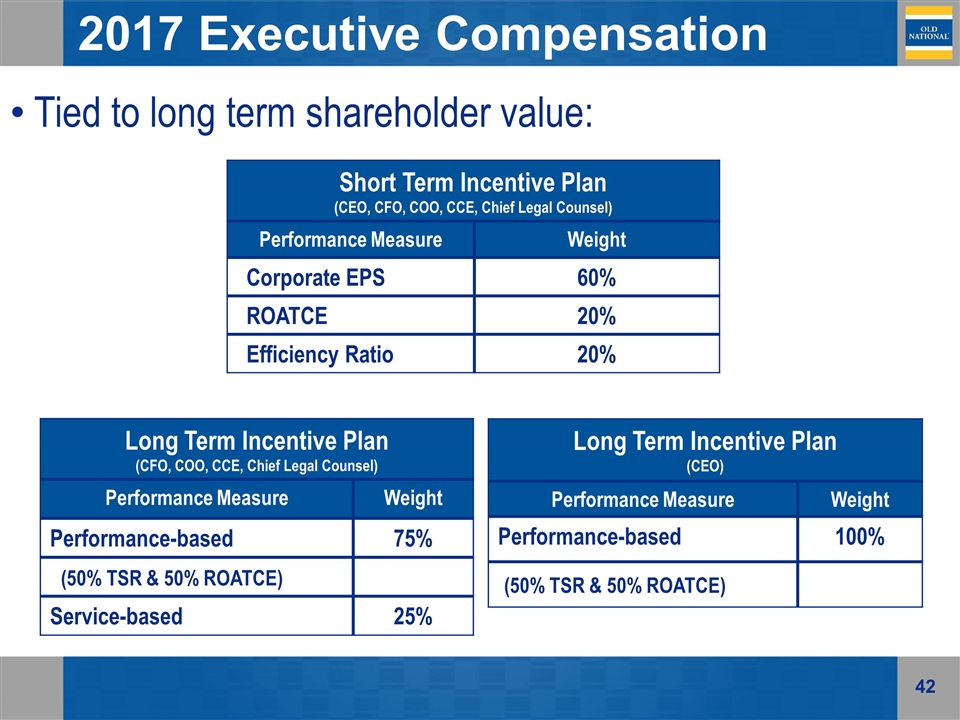

2017 Executive Compensation Short Term Incentive Plan (CEO, CFO, COO, CCE, Chief Legal Counsel) Performance Measure Weight Corporate EPS 60% ROATCE 20% Efficiency Ratio 20% Tied to long term shareholder value: Long Term Incentive Plan (CFO, COO, CCE, Chief Legal Counsel) Performance Measure Weight Performance-based 75% (50% TSR & 50% ROATCE) Service-based 25% Long Term Incentive Plan (CEO) Performance Measure Weight Performance-based 100% (50% TSR & 50% ROATCE)

Appendix

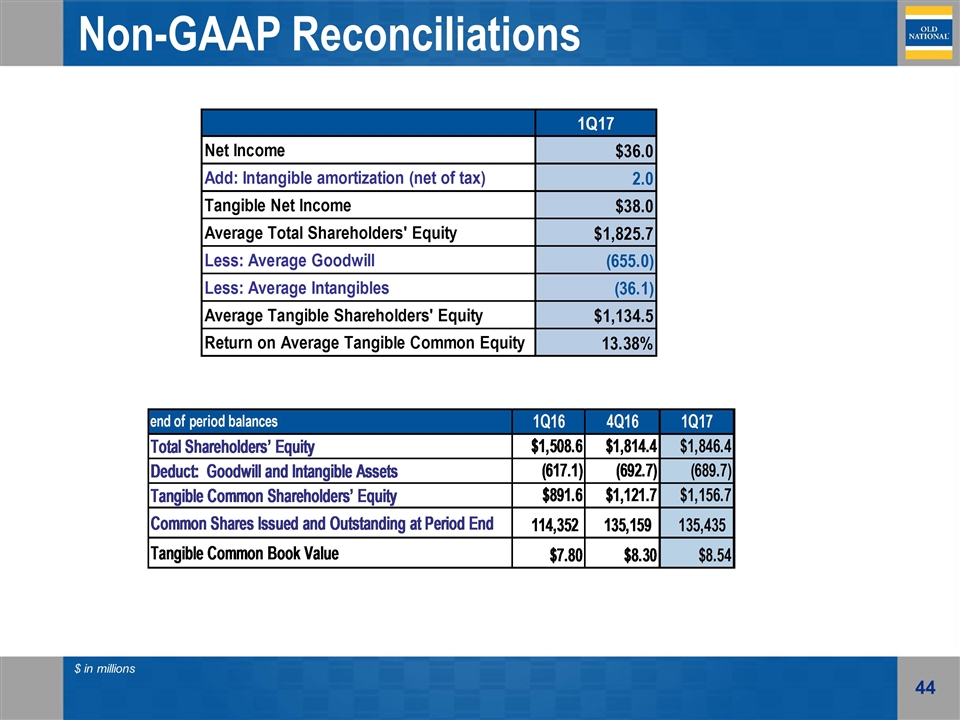

Non-GAAP Reconciliations $ in millions

Non-GAAP Reconciliations

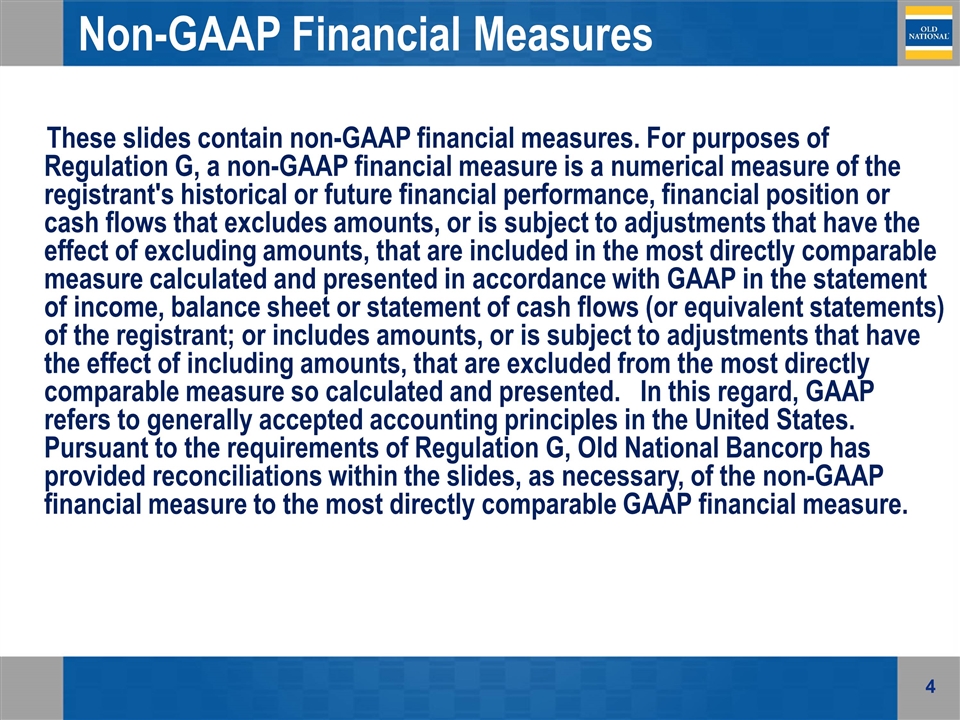

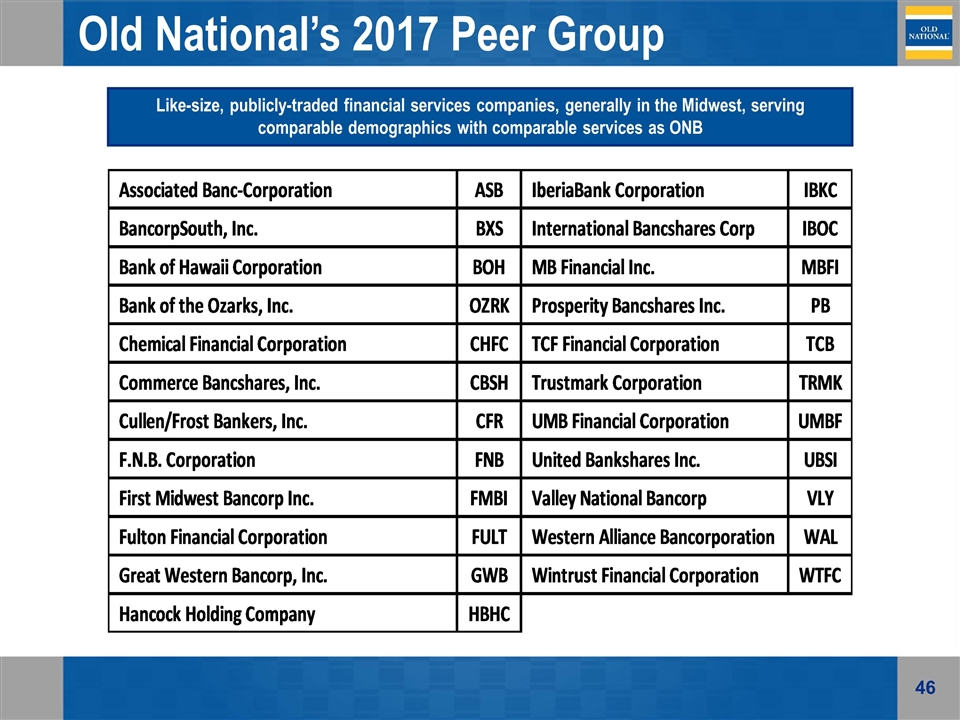

Old National’s 2017 Peer Group Like-size, publicly-traded financial services companies, generally in the Midwest, serving comparable demographics with comparable services as ONB

Old National Investor Relations Contact Additional information can be found on the Investor Relations web pages at www.oldnational.com Investor Inquiries: Lynell J. Walton, CPA SVP – Director of Investor Relations 812-464-1366 lynell.walton@oldnational.com