- ONB Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Old National Bancorp (ONB) PRE 14APreliminary proxy

Filed: 28 Feb 20, 4:07pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

OLD NATIONAL BANCORP

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(4) and0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

SEC 1913 (02-02) | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

OLD NATIONAL BANCORP

Notice of

Annual Meeting and

Proxy Statement

|

Annual Meeting of Shareholders

April 30, 2020

Old National Bancorp

One Main Street

Evansville, Indiana 47708

Notice of Annual Meeting of Shareholders

To Our Shareholders:

The 2020 Annual Meeting of Shareholders of Old National Bancorp (the “Company”) will be held in the Schlottman Auditorium at the Old National Bank headquarters located on the 4th floor at One Main Street, Evansville, Indiana, on Thursday, April 30, 2020, at 9:00 a.m. Central Daylight Time for the following purposes:

| (1) | Election of the Company’s Board of Directors consisting of thirteen Directors to serve for one year and until the election and qualification of their successors. |

| (2) | Approval of the Amendment to Article IV of the Articles of Incorporation to increase the number of authorized shares of capital stock of the Company from 302,000,000 to 330,000,000 and preferred stock from 2,000,000 to 30,000,000. |

| (3) | Approval of the Amendment to Article VIII of the Articles of Incorporation to Allow Shareholders to Amend theBy-Laws of the Company. |

| (4) | Approval of anon-binding advisory proposal on Executive Compensation. |

| (5) | Ratification of the appointment of Crowe LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31,2020. |

| (6) | Transaction of such other matters as may properly come before the meeting or any adjournments and postponements thereof. |

Common shareholders of record at the close of business on February 24, 2020 are entitled to notice of, and to vote at, the Annual Meeting.

By Order of the Board of Directors

Jeffrey L. Knight

Executive Vice President,

Chief Legal Counsel and

Corporate Secretary

March , 2020

IMPORTANT

Please submit your proxy promptly by mail or by Internet. In order that there may be proper representation at the meeting, you are urged to complete, sign, date and return the proxy card in the envelope provided to you or vote by Internet, whether or not you plan to attend the meeting. No postage is required if mailed in the United States.

Section I – Corporate Governance at Old National Bancorp

|

| 5

|

| |

Report of the Corporate Governance Committee and Other Board Matters | 5 | |||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

Policy regarding Consideration of Director Candidates Recommended by Shareholders | 7 | |||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 11 | ||||

| 12 | ||||

| 14 | ||||

| 15 | ||||

Section II – Director Compensation and Election of Directors

|

| 16

|

| |

| 16 | ||||

| 17 | ||||

| 19 | ||||

| 20 | ||||

| 29 | ||||

Section III – Executive Compensation

|

| 30

|

| |

| 30 | ||||

| 32 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 43 | ||||

| 53 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 59 | ||||

| 60 | ||||

Potential Payments on Termination of Employment and Change in Control | 62 | |||

Section IV – Security Ownership

|

| 68

|

| |

Common Stock Beneficially Owned by Directors and Executive Officers | 68 | |||

| 70 | ||||

| 70 | ||||

Old National Bancorp

2020 Proxy Statement – Summary

The following summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all the information you should consider. You should read the entire Proxy Statement carefully before voting.

GENERAL INFORMATION

(see pages 1 through 4)

| Meeting:Annual Meeting of Shareholders | Date: Thursday, April 30, 2020 | Time: 9:00 a.m. Central Daylight Time |

Location:Old National Bank, One Main Street, Evansville, Indiana – Schlottman Auditorium 4th Floor

Record Date: February 24, 2020

Voting: Shareholders as of the Record Date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals being voted on.

Admission:You must provide an admission ticket or proof of stock ownership to enter the meeting. Please see page 2 for further information.

Webcast:We will provide a live webcast of the Annual Meeting that can be accessed from the Investor Relations section of our website atwww.oldnational.com.

PROPOSALS TO BE VOTED ON AND BOARD VOTING RECOMMENDATIONS

| Proposals | Recommendation | Page Reference for more detail | ||

• Election of Directors | FOR Each Director Nominee | 19 | ||

• Approval of Amendment of the Articles of Incorporation to increase the number of authorized shares of capital stock of the Company from 302,000,000 to 330,000,000 and preferred stock from 2,000,000 to 30,000,000 | FOR | 71 | ||

• Approval of Amendment VIII of the Articles of Incorporation to allow shareholders to amend theBy-Laws of the company | FOR | 73 | ||

• Approval of anon-binding advisory proposal on Executive Compensation | FOR | 75 | ||

• Ratification of the appointment of Crowe LLP as independent accountants for 2020 | FOR | 76 | ||

DIRECTOR NOMINEES

(see pages 20 through 28)

| Name | Age | Director Since | Occupation | Independent | ||||

| Andrew E. Goebel | 72 | 2000 | Retired President & COO, Vectren Corporation | Yes | ||||

| Jerome F. Henry, Jr. | 69 | 2014 | President, Midwest Pipe & Steel, Inc. | Yes | ||||

| Daniel S. Hermann | 62 | * | Retired CEO, AmeriQual Group, LLC | Yes | ||||

| Ryan C. Kitchell | 46 | 2018 | Former EVP & Chief Administrative Officer, Indiana University Health | Yes | ||||

| Phelps L. Lambert | 72 | 1990 | Managing Partner, Lambert & Lambert Real Estate Development | Yes | ||||

| Austin M. Ramirez | 41 | * | President & CEO, Husco International | Yes | ||||

| Name | Age | Director Since | Occupation | Independent | ||||

| James C. Ryan, III | 48 | 2019 | Chairman & CEO, Old National Bancorp | No | ||||

| Thomas E. Salmon | 56 | 2018 | Chairman & CEO, Berry Global Group, Inc. | Yes | ||||

| Randall T. Shepard | 73 | 2012 | Former Chief Justice, Indiana Supreme Court | Yes | ||||

| Rebecca S. Skillman | 69 | 2013 | Chairman, Radius Indiana; Former Lt. Governor, State of Indiana | Yes | ||||

| Derrick J. Stewart | 42 | 2015 | President & CEO, YMCA of Greater Indianapolis | Yes | ||||

| Katherine E. White | 53 | 2015 | Professor of Law, Wayne State University Law School | Yes | ||||

| Linda E. White | 70 | 2008 | CEO, Methodist Health; Executive Director, Deaconess Foundation | Yes | ||||

| * | Nominated for initial term |

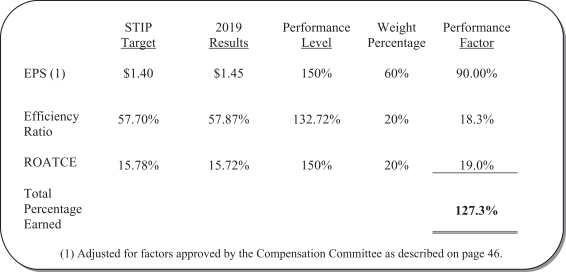

2019 FINANCIAL HIGHLIGHTS

(see page 34)

In 2019, the Company delivered record operating results. Financial highlights for 2019 include:

| • | EPS $1.38 |

| • | Net Income $238.2 million |

| • | ROE 8.57% |

| • | ROA 1.19% |

| • | Efficiency Ratio 60.35% |

| • | NetCharge-Off (Recovery) Ratio 0.05% |

| • | Provision Expense $4.7 million |

EXECUTIVE COMPENSATION

Set forth below is the 2019 compensation for each Named Executive Officer (“NEO”) as determined under Securities and Exchange Commission (“SEC”) rules. See the notes accompanying the 2019 Summary Compensation Table on page 55 for additional information.

| Name and Principal Position | Salary | Non-Equity Incentive Plan Compensation | Stock Awards | Change in Pension Value and Nonqualified | All Other Compensation | Total | ||||||||||||||||||

Robert G. Jones | $725,000 | $1,153,656 | $864,128 | $207,975 | $78,533 | $3,029,292 | ||||||||||||||||||

Executive Chairman/Former CEO | ||||||||||||||||||||||||

James C. Ryan, III | $646,154 | $945,937 | $925,588 | $8,002 | $50,107 | $2,575,788 | ||||||||||||||||||

CEO | ||||||||||||||||||||||||

Brendon B. Falconer | $341,308 | $282,415 | $276,162 | $2 | $19,866 | $919,753 | ||||||||||||||||||

Senor EVP and CFO | ||||||||||||||||||||||||

James A. Sandgren | $491,538 | $438,010 | $404,588 | $5,551 | $59,344 | $1,399,031 | ||||||||||||||||||

President and Chief Operating Officer | ||||||||||||||||||||||||

Jeffrey L. Knight | $361,423 | $230,046 | $202,294 | $596 | $25,901 | $820,260 | ||||||||||||||||||

EVP and Chief Legal Counsel | ||||||||||||||||||||||||

Todd C. Clark | $360,385 | $229,385 | $160,449 | $3,190 | $23,763 | $819,017 | ||||||||||||||||||

EVP and Chief Information/Strategic Innovation Officer | ||||||||||||||||||||||||

Old National Bancorp

One Main Street

Evansville, Indiana 47708

Proxy Statement

For the Annual Meeting of Shareholders to be held on

April 30, 2020, at 9:00 a.m. Central Daylight Time at the

Old National Bank Headquarters

Schlottman Auditorium – 4th Floor

One Main Street, Evansville, IN 47708

Important Notice Regarding the Availability of Proxy Materials

for the Shareholders’ Meeting to be held on April 30, 2020

The Proxy Statement and 2019 Annual Report to Shareholders are available at:

www.cstproxy.com/oldnational/2020

General Information about the Annual Meeting of Shareholders and Voting

This Proxy Statement relates to the Annual Meeting of Shareholders (“Annual Meeting”) of Old National Bancorp (the “Company” or “Old National”) to be held on April 30, 2020, at 9:00 a.m. Central Daylight Time. These proxy materials are being furnished by the Company in connection with a solicitation of proxies by the Company’s Board of Directors (the “Board”).

We are pleased to take advantage of the Securities and Exchange Commission (“SEC”) rule that permits companies to furnish proxy materials to shareholders over the Internet. On or about March 19, 2020 we will begin mailing Notice of Internet Availability of Proxy Materials (“Notice”). The Notice contains instructions on how to vote online, or in the alternative, request a paper copy of the proxy materials and a proxy card. By furnishing the Notice and providing access to our proxy materials by the Internet, we are lowering costs and reducing the environmental impact of our Annual Meeting.

Who can attend the Annual Meeting?

Only shareholders of the Company of record as of February 24, 2020 (the “Record Date”), their authorized representatives and guests of the Company, may attend the Annual Meeting. Admission will be by ticket only.

Who may vote at the Annual Meeting?

These proxy materials are provided to holders of the Company’s common stock who were holders of record on the Record Date. Only the Company’s common shareholders of record on the Record Date are entitled to vote at the Annual Meeting. As of the Record Date, 169,010,021 shares of the Company’s common stock were outstanding.

As of the Record Date, to the knowledge of the Company, no person or firm, other than BlackRock, Inc., The Vanguard Group, Inc., and Dimensional Fund Advisors, LP beneficially owned more than 5% of the common stock of the Company outstanding on that date. As of the Record Date, no individual Director, nominee or officer beneficially owned more than 5% of the common stock of the Company outstanding.

Voting and Proxy Procedures

Each share of the Company’s common stock outstanding on the Record Date will be entitled to one vote at the Annual Meeting. If you receive the Notice by mail, you will not receive a printed copy of the proxy materials unless you request the materials by following the instructions included in the Notice.

1

If your shares are registered in your name, you may vote your shares by Internet, or by completing, signing, dating and returning the requested proxy card in the postage-paid envelope provided. Simply follow the easy instructions on the proxy card or Notice provided. You may also vote in person at the meeting. Execution of the proxy card or voting via Internet will not affect your right to attend the Annual Meeting. If your shares are held in “street name” through a broker, bank or other nominee, please follow the instructions provided by your nominee on the voting instruction form or Notice in order to vote your shares by Internet, or by signing, dating and returning the voting instruction form in the enclosed postage-paid envelope. If you desire to vote in person at the Annual Meeting, you must provide a legal proxy from your bank, broker or other nominee.

Shares of the Company’s common stock for which instructions are received will be voted in accordance with the shareholder’s instructions. If you send in your proxy card or use Internet voting, but do not specify how you want to vote your shares, the proxy holders will vote them FOR each of the items being proposed by the Board and in the discretion of the proxy holders as to any other business that may properly come before the Annual Meeting and any adjournment or postponement thereof.

Can I change my vote after I return the proxy card or after voting electronically?

If you are a shareholder whose shares are registered in your name, you may revoke your proxy at any time before it is voted by one of the following methods:

| • | Submitting another proper proxy with a more recent date than that of the proxy first given by: |

(1) following the Internet voting instructions, or

(2) completing, signing, dating and returning a proxy card to the Company’s Corporate Secretary.

| • | Sending written notice of revocation to the Company’s Corporate Secretary. |

| • | Attending the Annual Meeting and voting by ballot (although attendance at the Annual Meeting will not, in and of itself, revoke a proxy). |

If you hold your shares in “street name” through a broker, you may revoke your proxy by following instructions provided by your broker. No notice of revocation or later-dated proxy will be effective until received by the Company’s Corporate Secretary at or prior to the Annual Meeting.

How do I receive an admission ticket?

If you are a registered shareholder (your shares are held in your name) and plan to attend the meeting, your Annual Meeting admission ticket will be included in the Notice being mailed on or about March 19, 2020, or if you receive hard copies of the proxy material, the admission ticket can be detached from the top portion of the proxy card.

If your shares are held in “street name” (in the name of a bank, broker or other holder of record) and you plan to attend the meeting, you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the Record Date for admittance to the meeting.

No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the meeting.

Will the Annual Meeting be webcast?

Our Annual Meeting will be webcast on April 30, 2020. You are invited to visitwww.oldnational.com at 9:00 a.m. Central Daylight Time on April 30, 2020, to access the webcast of the meeting. Registration for the webcast is not required. An archived copy of the webcast will also be available on our website through April 29, 2021.

2

How many votes are needed to have the proposals pass?

Election of Directors. Directors are elected by a plurality of the votes cast by shareholders entitled to vote, which means that nominees who receive the greatest number of votes will be elected, even if such amount is less than a majority of the votes cast.

Our Board has adopted a corporate governance policy regarding Director elections that is contained in our Corporate Governance Guidelines. The policy provides that in any uncontested election, any nominee for Director who receives a greater number of votes “withheld” for his or her election than votes “for” such election will tender his or her resignation as a Director promptly following the certification of the shareholder vote. The Corporate Governance and Nominating Committee, without participation by any Director so tendering his or her resignation, will consider the resignation offer and recommend to the Board whether to accept it. The Board, without participation by any Director so tendering his or her resignation, will act on the Corporate Governance and Nominating Committee’s recommendation no later than 90 days following the date of the Annual Meeting at which the election occurred. If the Board decides to accept the Director’s resignation, the Corporate Governance and Nominating Committee will recommend to the Board whether to fill the resulting vacancy or to reduce the size of the Board. We will promptly disclose the Board’s decision and the reasons for the decision in a broadly disseminated press release that will also be furnished to the SEC on Form8-K.

Approval of the Amendment to Article IV of the Articles of Incorporation. The affirmative vote of a majority of the shares present or by proxy is required to approve the Amendment to Article IV of the Articles of Incorporation.

Approval of the Amendment to Article VIII of the Articles of Incorporation. The affirmative vote of a majority of the shares present or by proxy is required to approve the Amendment to Article VIII of the Articles of Incorporation.

Approval ofNon-Binding Advisory Proposal on Executive Compensation. The advisory vote on executive compensation will be determined by the vote of a majority of the shares present or by proxy. Because the vote is advisory, it will not be binding on the Board. The Board will review the voting results and take into consideration when making future decisions regarding executive compensation.

Ratification of Independent Registered Public Accounting Firm. The affirmative vote of a majority of the shares present in person or by proxy is required for ratification of the appointment of Crowe LLP as the independent registered public accounting firm of the Company for fiscal year 2020.

What is “householding”?

We have adopted a procedure called “householding,” which has been approved by the SEC. Under this procedure, a single copy of the annual report and proxy statement will be sent to any household at which two or more shareholders reside if they appear to be members of the same family, unless one of the shareholders at that address notifies us that they wish to receive individual copies. This procedure reduces our printing costs and mailing fees.

Shareholders who participate in householding will continue to receive separate proxy cards.

Householding will not affect dividend check mailings in any way.

If a single copy of the annual report and proxy statement was delivered to an address that you share with another shareholder, we will promptly deliver a separate copy to you upon your written or oral request to the Company’s Transfer Agent, Continental Stock Transfer & Trust Company at1-888-266-6791, at 1 State Street, New York, New York 10004-1561, or via email to proxy@continentalstock.com.

Shareholders sharing an address who are receiving multiple copies of the annual report and proxy statement may request a single copy by contacting the Company’s Transfer Agent, Continental Stock Transfer & Trust Company using the contact information set forth above.

3

A number of brokerage firms have instituted householding. If you hold your shares in “street name,” please contact your bank, broker, or other holder of record to request information about householding.

How are abstentions and brokernon-votes treated?

An abstention from voting on a matter by a shareholder present in person or represented by proxy at the Annual Meeting will not affect the outcome of the election of directors. Abstentions will have the same effect as a vote against each of the other proposals to be voted on at the Annual Meeting.

If your shares are held in “street name” and you do not give your broker voting instructions, your broker will have discretion to vote your shares only for the proposal to ratify the appointment of the independent registered public accounting firm. or each of the other proposals to be voted on at the Annual Meeting, the votes associated with shares held in “street name” for which you do not give your broker voting instructions will be considered “brokernon-votes,” which means your broker will not have discretion to vote your shares on those matters. Brokernon-votes will not affect the outcome of the election of directors or the advisory vote on executive compensation. Brokernon-votes will have same effect as a vote against the proposal to amend our Articles to allow shareholders to amend ourBy-Laws and the proposal to amend our Articles to increase the number of our authorized shares of capital and preferred stock.

How do I designate my proxy?

If you wish to give your proxy to someone other than the proxies identified on the proxy card, you may do so by crossing out all the names of the proxy members appearing on the proxy card and inserting the name of another person. The signed card must be presented at the Annual Meeting by the person you have designated on the proxy card.

Who will pay for the costs involved in the solicitation of proxies?

The Company will pay all costs of preparing, assembling, printing and distributing the proxy materials. In addition to solicitations by mail, Directors and Officers of the Company and its subsidiaries may solicit proxies personally, by telephone, telefax, electronic mail or in person, but such persons will not be specially compensated for their services. In addition, we have retained Laurel Hill Advisory Group, LLC to assist in the solicitation of proxies at the cost of approximately $8,500, plus reimbursement of certain expenses.

We will, upon request, reimburse brokerage firms and others for their reasonable expenses incurred for forwarding solicitation material to beneficial owners of stock.

Other Matters Related to the Meeting

Only matters brought before the Annual Meeting in accordance with the Company’sBy-Laws will be considered. Aside from the items listed above in the Notice of Annual Meeting, the Company does not know of any other matters that will be presented at the Annual Meeting. However, if any other matters properly come before the Annual Meeting or any adjournment, the proxy holders will vote them in accordance with their best judgment.

Should any nominee for Director become unable or unwilling to accept nomination or election, the persons acting under the proxy intend to vote for the election of another person recommended by the Corporate Governance and Nominating Committee and nominated by the Board. The Company has no reason to believe that any of the nominees will be unable or unwilling to serve if elected to office.

4

Section I – Corporate Governance at Old National Bancorp

Report of the Corporate Governance and

Nominating Committee and Other Board Matters

The Corporate Governance and Nominating Committee (“Governance Committee”) is primarily responsible for corporate governance matters affecting the Company and its subsidiaries. The Governance Committee operates under a written charter which conforms to the requirements of the SEC and the NASDAQ.

Board Leadership Structure and Function

The Board, which is elected by the shareholders, selects the Operating Group, which is the executive management team charged with the conduct of the Company’s business. Having selected the Operating Group, the Board acts as an advisor and counselor to management and ultimately monitors its performance. The Board has the responsibility for overseeing the affairs of the Company and, thus, an obligation to keep informed about the Company’s business. This involvement enables the Board to provide guidance to management in formulating and developing plans and to exercise its decision-making authority on appropriate matters of importance to the Company. Acting as a full Board and through the Board’s seven standing committees, the Board oversees and approves the Company’s strategic plan. The Board regularly reviews the Company’s progress against its strategic plan and exercises oversight and decision-making authority regarding strategic areas of importance to the Company.

The Company’s Corporate Governance Guidelines provide for an independent Lead Director, currently Rebecca S. Skillman, who presides at all meetings of the Board at which the Chairman is not present; leads executive sessions of the Board; consults and meets with any or all outside Directors as required and represents such Directors in discussions with management of the Company on corporate governance issues and other matters; ensures that the Board, committees of the Board, individual Directors and management of the Company understand and discharge their duties and obligations under the Company’s system of corporate governance; mentors and counsels new members of the Board to assist them in becoming active and effective Directors; leads the Board in the annual evaluation of the Chairman and Chief Executive Officer’s (“CEO”) performance; acts in an advisory capacity to the Chairman and CEO in all matters concerning the interests of the Board and relationships between management and the Board; and performs such other duties and responsibilities as may be delegated to the Lead Director by the Board from time to time.

The Board appointed Robert G. Jones to serve as Chairman of the Board and appointed Rebecca S. Skillman to serve as Lead Director to be effective upon commencement of the Annual Meeting in 2016. Following Mr. Jones’ retirement in January of 2020, the Board appointed CEO James C. Ryan, III to serve as Chairman of the Board. The Board believes that it is in the best interests of the Company to have Mr. Ryan serve as Chairman as well as CEO. The Board believes the current governance structure is working effectively, especially in light of the fact that the Company has a strong Lead Director. The Board will annually review the effectiveness of this arrangement and believes this structure is in the best interest of shareholders and serves the Company well at this time.

Executive sessions, or meetings of outside Directors without management present, are held at regular intervals for both the Board and the Committees. Ms. Skillman, the current Lead Director of the Board, chaired the executive sessions of the Board in 2019. The Board meets in executive session a minimum of four times each year.

The Board met six times during 2019. Each Director attended 75% or more of Board meetings and meetings of Committees on which he or she served in 2019. Directors as a group attended an average of 97.28% of the Board meetings and meetings of Committees on which they served in 2019.

5

Governance Committee Scope of Responsibilities

The Governance Committee has responsibility for recruiting and nominating new Directors, assessing the independence ofnon-management Directors, leading the Board in its annual performance evaluation, reviewing and assessing the adequacy of the Corporate Governance Guidelines and retaining outside advisors as needed to assist and advise the Board with respect to legal and other matters. The Governance Committee is also responsible for reviewing with the full Board, on an annual basis, the requisite skills and characteristics of Board members as well as the composition of the Board as a whole.

Among the Governance Committee’s responsibilities as described in its charter is to oversee CEO succession planning and leadership development for potential CEO candidates. The Board plans for succession of the CEO and annually reviews the succession strategy for an “unplanned” and “planned” event. As part of this process, the independent directors annually review the Governance Committee’s recommended candidates for consideration as the CEO under either a planned or unplanned scenario. The criteria used when assessing the qualifications of potential CEO successors include certain leadership, management and personal behaviors. The leadership behaviors include the ability to attract and develop talent, drive and execution, empowering others, shaping strategy and leading change. The management behaviors include communication and climate setting, establishing plans and priorities, managing and improving processes and performance monitoring and management. The personal behaviors important to the Governance Committee in evaluating potential CEO candidates include the following: embodies the values that make the Company’s culture distinctive, acts with honor and character, makes and maintains personal relationships with associates, clients and shareholders, demonstrates courage and serves as a champion of the Company’s culture. The individual must also possess the skill and talent to lead the organization in a positive manner with wisdom, enthusiasm and humility.

The Company has not established a formal policy regarding Director attendance at its Annual Meeting, but it encourages all Directors to attend these meetings and reimburses expenses associated with attendance. The Chairman presides at the Annual Meeting. All the Directors attended the Annual Meeting in 2019.

Code of Conduct and Code of Ethics

The Board has adopted a Code of Business Conduct and Ethics that sets forth important Company policies and procedures in conducting our business in a legal, ethical and responsible manner. These standards are applicable to all our Directors and employees, including the Company’s CEO, CFO and Controller. In addition, the Board has adopted the Code of Ethics for CEO and Senior Financial Officers that supplements the Code of Business Conduct and Ethics by providing more specific requirements and guidance on certain topics. The Code of Ethics for CEO and Senior Financial Officers applies to the Company’s CEO, CFO and Controller. The Code of Business Conduct and Ethics and the Code of Ethics for CEO and Senior Financial Officers are available on our website atwww.oldnational.com. We will post any material amendments to, or waivers from, our Code of Business Conduct and Ethics and Code of Ethics for Senior Financial Officers on our website within two days following the date of such amendment or waiver.

Employees are required to report any conduct they believe in good faith to be an actual or apparent violation of our Codes of Conduct. In addition, as required under the Sarbanes-Oxley Act of 2002, the Audit Committee has established confidential procedures to receive, retain and treat complaints received regarding accounting, internal accounting controls, or auditing matters and the confidential, anonymous submission by Company employees of concerns regarding questionable accounting or auditing matters.

The Code of Business Conduct and Ethics addresses, among other things, the following topics: responsibilities of every Old National associate; seeking answers and reporting violations; making ethical decisions; civility and respect for one another; preventing discrimination and harassment; preventing substance

6

abuse and violence; protecting confidential information; guidelines for protecting private information; using company assets responsibly; reporting accurately and honestly; engaging in political activities; working with media; ethical handling of personal transactions; preventing conflicts of interest; serving onfor-profit andnon-profit boards; ethical handling of gifts, meals and entertainment; preventing fraud; prohibiting insider trading; competing fairly; and earning incentives.

Corporate Governance Guidelines

The Board has adopted the Corporate Governance Guidelines that, along with the Company’s corporate charter,By-Laws and charters of the various committees of the Board, provide the foundation for the Company’s governance. Among other things, our Corporate Governance Guidelines set forth the:

| • | minimum qualifications for Directors; |

| • | independence standards for Directors; |

| • | responsibilities of Directors; |

| • | majority voting policy applicable to Director elections; |

| • | committees of the Board; |

| • | Directors’ compensation and expense reimbursement; |

| • | procedures for Director orientation and development; |

| • | procedures for an annual review of the CEO and management succession planning; |

| • | stock ownership guidelines for executives and Directors; |

| • | bonus recoupment or “clawback” policy; |

| • | procedures for an annual self-evaluation of the Board; and |

| • | content of the Company’s Code of Business Conduct and Ethics. |

Communications from Shareholders to Directors

The Board believes that it is important that a direct and open line of communication exist between the Board and the Company’s shareholders and other interested parties. Consequently, the Board has adopted the procedures described in the following paragraph for communications to Directors.

Any shareholder or other interested party who desires to contact Old National’s Chairman or the other members of the Board may do so by writing to: Board of Directors, c/o Corporate Secretary, Old National Bancorp, P.O. Box 718, Evansville, IN 47705-0718. Communications received are distributed to the Lead Director or other members of the Board, as appropriate, depending on the facts and circumstances outlined in the communication received. For example, if any complaints regarding accounting, internal accounting controls and auditing matters are received, then the Corporate Secretary will forward them to the Chairman of the Audit Committee for review.

Policy Regarding Consideration of Director Candidates Recommended by Shareholders

The Company’s nomination procedures for Directors are governed by itsBy-Laws. Each year the Governance Committee makes a recommendation to the entire Board regarding nominees for election as Directors. The Governance Committee will review suggestions from shareholders regarding nominees for election as Directors. All such suggestions from shareholders must be submitted in writing to the Governance Committee at the Company’s principal executive office not less than 120 days in advance of the date of the annual or special meeting of shareholders at which Directors are to be elected. All written suggestions of shareholders must set forth:

| • | the name and address of the shareholder making the suggestion; |

| • | the number and class of shares owned by such shareholder; |

7

| • | the name, address and age of the suggested nominee for election as Director; |

| • | the nominee’s principal occupation during the five years preceding the date of suggestion; |

| • | all other information concerning the nominee as would be required to be included in the proxy statement used to solicit proxies for the election of the suggested nominee; and |

| • | such other information as the Governance Committee may reasonably request. |

Consent of the suggested nominee to serve as a Director of the Company, if elected, must also be included with the written suggestion.

In seeking individuals to serve as Directors, the Governance Committee seeks members from diverse professional backgrounds who combine a broad spectrum of experience and expertise. Directors should have an active interest in the business of the Company, possess a willingness to represent the best interests of all shareholders, be able to objectively appraise management performance, possess the highest personal and professional ethics, integrity and values, and be able to comprehend and advise management on complicated issues that face the Company and Board. In addition, such nominees should not have any interest that would materially impair their ability to exercise independent judgment, or otherwise discharge the fiduciary duties owed as a Director to the Company and its shareholders.

Directors should also demonstrate achievement in one or more fields of business or professional, governmental, communal, scientific or educational endeavors. Directors are expected to have sound judgment, borne of management or policy making experience that demonstrates an ability to function effectively in an oversight role. In addition, Directors should have a general appreciation regarding major issues facing public companies of a size and operational scope similar to that of the Company. These issues include contemporary governance concerns, regulatory obligations of an SEC reporting financial holding company, strategic business planning and basic concepts of corporate finance.

The Company does not currently have a formal diversity policy. However, the Corporate Governance Guidelines state that the Board seeks members with diverse professional backgrounds. The Board also annually reviews the requisite skills and characteristics of Board members as well as the composition of the Board as a whole. The annual assessment includes a review of the skills, experience and diversity of the Board in the context of the needs of the Board.

Determination with Respect to the Independence of Directors

It is the policy of the Board that a majority of its members be independent from management, and the Board has adopted Director Independence Standards that meet the listing standards of the NASDAQ. The Independence Standards are incorporated in our Corporate Governance Guidelines which can be viewed under the Investor Relations/Corporate Governance link on the Company’s website atwww.oldnational.com.

In accordance with our Corporate Governance Guidelines, the Board undertook its annual review of Director independence. During this review, the Board considered any and all commercial and charitable relationships of Directors, including transactions and relationships between each Director or any member of his or her immediate family and the Company and its subsidiaries. Following the review, the Board affirmatively determined, by applying the Director Independence Standards contained in the Corporate Governance Guidelines, that each of our Directors nominated for election at this Annual Meeting is independent of the Company and its management in that none has a direct or indirect material relationship with the Company, with the exception of James C. Ryan, III, Chairman and CEO.

The independent Directors of the Company are Alan W. Braun, Andrew E. Goebel, Jerome F. Henry, Jr., Phelps L. Lambert, Ryan C. Kitchell, Thomas E. Salmon, Randall T. Shepard, Rebecca S. Skillman, Derrick J. Stewart, Katherine E. White and Linda E. White. The onlynon-independent Directors in 2019 were CEO James C. Ryan, III and former CEO Robert G. Jones. Following Mr. Jones’ retirement in January 2020, Chairman and CEO James C. Ryan, III is currently the onlynon-independent Director.

8

In addition, all members of the Audit Committee, the Talent Development and Compensation Committee and the Governance Committee satisfy the standards of independence applicable to members of such committees established under applicable law, the listing requirements of the NASDAQ and the Director Independence Standards set forth in the Company’s Corporate Governance Guidelines.

Determination with respect to Director Qualifications

Members of the Board must possess certain basic personal and professional qualities in order to properly discharge their fiduciary duties to shareholders, provide effective oversight of the management of the Company and monitor the Company’s adherence to principles of sound corporate governance. In seeking individuals to serve as Directors, the Governance Committee seeks members from diverse professional backgrounds who combine a broad spectrum of experience and expertise. The Directors of the Company have an active interest in the business of the Company and possess a willingness to represent the best interests of all shareholders without favoring or advancing any particular shareholder or other constituency of the Company. The Directors are able to objectively appraise management performance, and they possess the highest personal and professional ethics, integrity and values, and are able to comprehend and advise management on complicated issues that face the Company and Board.

In addition to the general skills stated above, the Directors do not have any interests that would materially impair their ability to exercise independent judgment, or otherwise discharge the fiduciary duties owed as a Director to the Company and its shareholders. As stated on pages 20 through 28, our Directors and Nominees have demonstrated significant achievement and generally have significant management experience in one or more fields of business, professional, governmental, communal, and educational endeavors. We believe that our Directors’ extensive management or policy-making experience provides them with the skills and judgment necessary to function effectively in an oversight role. Given the tenure of most of the Directors on our Board, they have a general appreciation regarding major issues facing public companies.

The following table lists the current membership of the Company’s standing Board Committees.

| Director | Audit | Talent Development and Compensation | Corporate Governance and Nominating | Funds Manage- ment | Enterprise Risk | Culture, Community and | Finance and | |||||||

Alan W. Braun (1) | X | X | Chair | |||||||||||

Andrew E. Goebel | Chair | X | X | X | ||||||||||

Jerome F. Henry, Jr. | X | X | ||||||||||||

Ryan C. Kitchell | X | X | ||||||||||||

Phelps L. Lambert | X | X | Chair | X | ||||||||||

James C. Ryan, III | ||||||||||||||

Thomas E. Salmon | X | |||||||||||||

Randall T. Shepard | X | X | Chair | |||||||||||

Rebecca S. Skillman | X | Chair | X | |||||||||||

Derrick J. Stewart | Chair | X | X | |||||||||||

Katherine E. White | X | X | X | |||||||||||

Linda E. White | Chair | X | X | |||||||||||

| (1) | Mr. Braun will not stand forre-election at the Annual Meeting on April 30, 2020. |

9

The members of the Company’s Board are elected to various committees. The standing committees of the Board include an Audit Committee; a Talent Development and Compensation Committee; a Corporate Governance and Nominating Committee; a Funds Management Committee; an Enterprise Risk Committee; a Culture, Community and Social Responsibility Committee; and a Finance and Corporate Development Committee.

The current members of the Audit Committee are Andrew E. Goebel (Chair), Jerome F. Henry, Jr., Ryan C. Kitchell, and Phelps L. Lambert. The Audit Committee held eight meetings during 2019. The functions of the Audit Committee are described under ‘‘Report of the Audit Committee’’ on page 79. The Audit Committee has adopted a written charter which has been approved by the Board.

The current members of the Talent Development and Compensation Committee are Derrick J. Stewart (Chair), Thomas E. Salmon, Randall T. Shepard and Rebecca S. Skillman. The Talent Development and Compensation Committee met five times during 2019. The functions of the Talent Development and Compensation Committee are described under “Scope of Responsibilities” on page 32. The Talent Development and Compensation Committee has adopted a written charter which has been approved by the Board.

The current members of the Governance Committee are Rebecca S. Skillman (Chair), Phelps L. Lambert, Randall T. Shepard and Katherine E. White. The Governance Committee met four times in 2019. The functions of the Governance Committee are described under ‘‘Governance Committee Scope of Responsibilities” on page 6. The Governance Committee has adopted a written charter which has been approved by the Board.

The current members of the Enterprise Risk Committee are Linda E. White (Chair), Alan W. Braun, Andrew E. Goebel and Katherine E. White. The Enterprise Risk Committee met four times in 2019. The function of the Enterprise Risk Committee is to oversee the Company’s policies, procedures and practices relating to credit, operational, fraud, information technology/cyber and compliance risk. The Enterprise Risk Committee has retained an outside cyber security consultant. The Enterprise Risk Committee has adopted a written charter which has been approved by the Board.

The current members of the Culture, Community and Social Responsibility Committee are Randall T. Shepard (Chair), Derrick J. Stewart and Linda E. White. The Culture, Community and Social Responsibility Committee met four times in 2019. The Culture, Community and Social Responsibility Committee has the responsibility to review the Company’s compliance with the Community Reinvestment Act, Fair Lending Practices, associate commitment and diversity, supplier diversity and the Company’s Affirmative Action Plan. The Culture, Community and Social Responsibility Committee also monitors the activities of the Old National Bank Foundation through which major charitable gifts from the Company are funded. The Culture, Community and Social Responsibility Committee has adopted a written charter which has been approved by the Board.

The current members of the Funds Management Committee are Phelps L. Lambert (Chair), Alan W. Braun, Andrew E. Goebel, Jerome F. Henry, Jr., and Katherine E. White. The Funds Management Committee met four times during 2019. The function of the Funds Management Committee is to monitor the balance sheet risk profile of the Company, including credit, interest rate, liquidity and capital risks. The Funds Management Committee is also responsible for reviewing and approving the investment policy for the Company. The Funds Management Committee has adopted a written charter which has been approved by the Board.

The current members of the Finance and Corporate Development Committee are Alan W. Braun (Chair), Andrew E. Goebel, Phelps L. Lambert, Ryan C. Kitchell, Derrick J. Stewart, Rebecca S. Skillman and Linda E. White. The Committee met five times in 2019. The function of the Finance and Corporate Development Committee is to review management’s financial forecasts, goals and budget and to monitor and provide appropriate feedback concerning the financial performance of the Company, overseeing the mergers and acquisition activity, as well as other strategic corporate development opportunities of the Company. The Finance and Corporate Development Committee has adopted a written charter which has been approved by the Board.

10

2019 Work of the Governance Committee

During the year, the Governance Committee evaluated each Board member’s committee assignments in light of the applicable qualification requirements, including additional independence requirements of certain committees. Based upon this evaluation, the Governance Committee recommended that Randall T. Shepard be appointed to the Governance Committee. This was the only change made in 2019 to the committee composition and leadership.

As required by the Governance Committee’s Charter, which is posted on the Company’s website atwww.oldnational.com, the Governance Committee conducted an annual review of the Corporate Governance Guidelines applicable to the full Board. Based upon that review, the Governance Committee concluded that only minor modifications were advisable. The current Corporate Governance Guidelines are posted on the Company’s website atwww.oldnational.com.

At its January 24, 2019 meeting, the Chair of the Governance Committee and Lead Director administered the annual Board performance evaluation process pursuant to which the Board reviews its performance. The Board also reviewed the independence of Board members and determined that all the members of the Board were independent, with the exception of Robert G. Jones, who served as CEO until May 2, 2019 and Chairman until January 31, 2020, and James C. Ryan, III who became CEO and a Board member on May 2, 2019 and Chairman on January 31, 2020.

The Governance Committee continued its work in 2019 to oversee the CEO succession planning and the leadership development process for potential internal CEO candidates and continued to use Russell Reynolds Associates to assist in the development of candidates.

The Governance Committee also continued its work in 2019 to oversee the succession planning process for Directors who will retire at this annual meeting and who will retire in the next few years. In that regard, the Governance Committee engaged in a search process in the states of Indiana, Minnesota, and Wisconsin seeking to identify prospective candidates in those markets who meet the qualifications outlined in the Company’s Corporate Governance Guidelines, and who have the time and skills to serve on the board. The Company identified Daniel S. Hermann, founder and former CEO of AmeriQual Group, which is headquartered in Evansville, Indiana. The Company also identified Austin M. Ramirez, President and CEO of Husco International, which is headquartered in Waukesha, Wisconsin. Information concerning Mr. Hermann and Mr. Ramirez can be found on pages 21 and 22. The nominees standing for election, other than nominees who are executive officers, or directors standing for re-election, were identified by a committee comprised of independent directors, the CEO and other executive officers.

Decisions regarding ournon-employee director compensation program are approved by our full board of directors based on recommendations by the Governance Committee. In making such recommendations, the Governance Committee takes into consideration the director compensation practices of peer companies and whether such recommendations align with the interests of our shareholders. The Governance Committee reviews the total compensation of ournon-employee directors and each element of our director compensation program on a regular basis.

In anticipation of the retirement of Robert G. Jones as Chairman at the end of the January 30, 2020 Board meeting, the Governance Committee undertook in 2019 to evaluate the effectiveness of maintaining the combination of the Chairman and CEO roles which began in 2016. The Governance Committee evaluated current practices of peer group companies, reviewed academic and other professional publications and consulted with outside legal counsel concerning the appropriate governance structure. At the Company’s January 30, 2020 Board meeting, the Board of Directors, following discussion and evaluation of the Company’s current governance structure, determined to elect James C. Ryan III as the Chairman of the Company. The Board, in making this determination, took into consideration the fact that Rebecca S. Skillman has served the Company well as Lead Director and that combining the roles of Chairman and CEO in 2016 had served the Company well operationally and was in the best interests of shareholders.

11

The Governance Committee also engaged Willis Towers Watson (“WTW”), the compensation consultant retained by the Company’s Talent Development and Compensation Committee, to provide analysis and advice to the Committee and Board with respect to Director compensation. WTW noted that the Company has a higher number of committees than most peer companies (see peer companies listed on page 43) which require the Company’s directors to invest increased time and energy in serving on the Board and committees. WTW also noted that it is a challenge to recruit and retain highly-qualified directors who are willing to shoulder an escalating workload and the time commitment required for board service, particularly in a highly-regulated industry. It was because of these issues, and the fact that the average director pay at the Company was the lowest among Proxy peers, that WTW recommended enhancements to the director compensation structure at the Company.

At the January 30, 2020 meeting of the Board of Directors, the Directors voted to make changes to the annual retainer for Board members and changes to the Committee chair and Committee member retainers in order to align director compensation more competitively to the 50th percentile of peers. The Board, in taking this action, alsore-aligned the cash and equity portion of director compensation to be 45% equity and 55% cash, from what was previously 40% equity and 60% cash. This action was taken to align director compensation with shareholder interests and to align the Company’s director compensation with peer group practices. The following changes were also approved by the Board:

| • | The annual Board cash retainer was increased from $40,000 to $45,000. |

| • | The annual Board equity grant value was increased from $40,000 to $60,000. |

| • | The Audit Committee chair retainer was increased from $15,000 to $17,500 and the Talent Development and Compensation Committee chair retainer was increased from $12,000 to $14,500. |

| • | The chair retainer for all other committees was increased from $10,000 to $12,500. |

| • | The Audit Committee member retainer was increased from $7,500 to $10,000 and the Talent Development and Compensation Committee and Enterprise Risk Committee member retainers were increased from $6,000 to $8,500. |

| • | The member retainer for all other committees was increased from $5,000 to $7,500. |

| • | A market-basedone-year vesting period for the equity portion of the annual retainer was implemented. |

In addition to the changes listed above, the Lead Director will continue to be paid a $25,000 premium over and above the fees paid to her for membership on committees on which she serves.

Environmental, Social and Governance

Our Company is committed to strengthening the communities we serve through associate volunteerism, corporate philanthropy as well as environmental responsibility and sustainability, serving as a cornerstone of the local community, and maintaining transparency in governance. Highlights of our environmental, social and governance initiatives are summarized below.

Our People

The Company is dedicated to being a financial industry leader in corporate governance and business ethics. Our Board of Directors is composed of Directors with diverse professional and business experience. All of our Directors, other than the CEO, are independent. They all share a commitment to fostering an effective risk environment coupled with a strong internal audit structure. Their unwavering commitment protects our clients, shareholders and reputation. Our Code of Ethics reflects the Company’s expectation for the conduct of our directors, officers and associates. Through recurring training and disclosures, as well as periodic communication

12

related to specific topics, the Company maintains the highest level of ethical conduct. We have been recognized by the Ethisphere Institute as one of the World’s Most Ethical Companies for the ninth straight year.

|  |  |

11% of our Associates represent diverse races & ethnic backgrounds | 67% of our Associates are women | 100% of our Associates participated in training |

Diversity, Equity & Inclusion.Our Company respects, values and invites diversity in our workforce, customers, suppliers, marketplace and community. We seek to recognize the unique contribution each individual brings to our company, and we are fully committed to supporting a rich culture of diversity as a cornerstone to our success. As part of our commitment to maintaining a positive, welcoming and ethical workplace, we have an initiative called “Speak Up” that empowers a team of associates to be Cultural Champions to listen and serve as advocates for their fellow associates.

Women in Leadership. All three female members of the Company’s Board of Directors were recognized in the December 2019 issue of WomenInc. magazine, as part of the magazine’s list of “Most Influential Corporate Directors.”

Achieve Ability.At Old National, we focus on an individual’s talent and not their disability. We are committed to increasing representation of individuals with disabilities in all levels of our workforce and our recruitment efforts reflect this commitment. In addition to our internal efforts, we desire to assist individuals with disabilities in gaining successful employment through our community partnerships through Achieve Ability. The Achieve Ability mentoring program connects executive leaders and individuals with disabilities for a year-long mutually beneficial mentoring relationship. Since its inception in 2014, more than 40 mentees have taken part in this mentoring program.

Catalyst.Our Company provides professional development opportunities to associates and seeks to improve retention, development and job satisfaction of associates from diverse groups by providing career skills training, peer mentoring, and opportunities to interact with senior leaders. Since 2015, 98 associates have participated in this talent development program that engages associates from racial minority groups.

Competitive Benefits.We support our associates in all aspects of life. We offer competitive benefits for associates and their loved ones, as well as an environment to help them achieve a healthy balance between their work and personal life. We offer paid family-friendly leave, comprehensive retirement plans, reimbursements for education, and other health, wellness, and financial benefits.

Awards and Recognition.In 2019, our commitment to being an employer of choice earned us the following recognition and awards:

American Association of People with Disabilities “Best Places to Work for Disability Inclusion”

G.I. Jobs(R)“Military Friendly Employer (Silver)”

DiversityMBA Magazine“Best Companies for Women & Diverse Managers to Work”

National Organization on Disability“Leading Disability Employer”

Bloomberg“Leader in Gender Equality”

Ethisphere“World’s Most Ethical Companies”

13

Our Community

For 185 years, the Company has been focused on strengthening the communities we serve. We accomplish this through volunteerism, corporate sponsorships, foundation grants,non-profit board service by associates, donations of physical assets, and advancing financial literacy and education.

|  |  | ||

66,500+ hours volunteered by our associates in 2019 | Over $6.7 million donated to nonprofits that help build economic opportunity in our communities | 833 financial education sessions taught by our Associates in 2019 |

Economic Development.We promote economic development through investment in community-strengthening initiatives like historical real estate, affordable housing and alternative energy projects. The Company has financed projects that have created 151 affordable apartments. Throughout our footprint, we have invested over $251 million for the creation of new affordable housing, economic development, community revitalization and stabilization, and community services forlow-to-moderate individuals and families, as well as the rehabilitation of historic buildings that have redeveloped in the communities we serve.

Grants and Sponsorships.Our Company donated more than $6.7 million through Old National Bank Foundation grants and sponsorships. We also donated more than $778,135 to the United Way through associate and corporate giving.

100 Men Who Cook.In 2019, in addition to other events at separate locations in the Company’s footprint, Old National raised over $215,000 for The Children’s Museum of Evansville at the Evansville “100 Men Who Cook” annual community fundraising event. Our Company has raised over $8.4 million in the past decade for localnon-profit entities through this event across the Company’s footprint.

Financial Education.The Company’s commitment to the community extends to teaching financial literacy through programs such as Real-Life Finance, Bank On, VITA Tax Preparation, Junior Achievement, and 12 Steps to Financial Success. Old National reached 21,343 participants through financial education in 2019 which totaled more than 1,853 hours of teaching.

Environmental Awareness

Our Company supports environmental awareness and sustainability by encouraging and empowering recycling, responsible waste management practices and energy conservation throughout the organization. Old National’s Sustainability Committee or “Green Team” routinely evaluates our environmental-friendly practices and identifies strategies for improvement. We invested $1.9 million in solar arrays to produce renewable energy. In addition, we installed a solar array on our newest banking center in Darmstadt, Indiana that has produced approximately 28,858 kilowatts and avoided 22.5 tons of CO2 emissions. In 2019, we invested approximately $1.6 million in LED lighting to reduce energy consumption. We continually evaluate opportunities to reduce energy dependence in areas such as facilities, equipment, operations, shipping and business travel.

Additional detail into the Company’s environmental initiatives will be included in future Community and Social Responsibility Reports. The Company’s Community and Social Responsibility may be found on our website atwww.oldnational.com.

Availability of Corporate Governance Documents

The Company’s Corporate Governance Guidelines (including the Director Independence Standards), Board committee charters for the Audit Committee, Governance Committee, and the Talent Development and

14

Compensation Committee, as well as the Code of Business Conduct and Ethics, and the Code of Ethics for CEO and Senior Financial Officers can be viewed under the Investor Relations/Corporate Governance link on the Company’s website atwww.oldnational.com. These documents, as well as charters for all the Company’s Board committees, are available in print to any interested party who requests them by writing to: Corporate Secretary, Old National Bancorp, P.O. Box 718, Evansville, IN 47705-0718.

The entire Board is involved in overseeing risk associated with the Company. The charters of certain committees of the Board assign oversight responsibility for particular areas of risk. The Board and its committees monitor risks associated with their respective principal areas of focus through regular meetings with management and representatives of outside advisors.

The following is a summary of oversight responsibility for particular areas of risk:

| • | Audit Committee. Risks and exposures associated with accounting, financial reporting, tax and maintaining effective internal controls for financial reporting. |

| • | Enterprise Risk Committee. Credit, regulatory, operational, cybersecurity, enterprise and reputational risks, as well as litigation that may present material risk to the Company. |

| • | Governance Committee. Risks associated with CEO succession planning, as well as corporate governance, including compliance with listing standards, committee assignments, conflicts of interest and director succession planning. |

| • | Funds Management Committee. Liquidity, capital and interest rate risks. |

| • | Talent Development and Compensation Committee. Risks associated with the Company’s compensation programs and arrangements, including cash and equity incentive plans. |

| • | Culture, Community and Social Responsibility Committee. Risks associated with associate and customer commitment, the Community Reinvestment Act, fair lending, associate and supplier diversity and the Company’s Affirmative Action Plan. |

| • | Finance and Corporate Development Committee. Budgeting and forecasting oversight, management of budget risks and oversight of strategic acquisition opportunities of the Company. |

15

Section II – Director Compensation and Election of Directors

Director Compensation Overview

The Governance Committee annually reviews and recommends the compensation for ournon-employee Directors. No fees are paid to Directors who are also employees. As a starting point for its recommendations, the Governance Committee uses the peer group compensation data prepared for the Compensation Committee by the compensation consultant. The Committee seeks to establish Board compensation that is competitive with the market practices within the Company’s Peer Group and geographic footprint.

Retainers

For 2019, we paid each outside Director an annual retainer of $80,000 for serving as a Director. Of this amount, we paid $40,000 in cash and $40,000 in the form of our stock. We paid the cash compensation in four equal quarterly payments and the stock retainer was paid in two equal installments in May and November. In addition, the Lead Director of the Board was paid an additional $25,000 retainer for her duties as Lead Director.

For 2019, we paid the Audit Committee Chairman an additional retainer of $15,000, the Talent Development and Compensation Committee Chairman an additional $12,000, and all other committee chairpersons an additional retainer of $10,000. In 2019, committee members of the Audit Committee received an additional retainer of $7,500. Committee members of the Talent Development and Compensation Committee and the Enterprise Risk Committee received retainers of $6,000 and all other committee members received retainers of $5,000. Robert G. Jones, former Chairman, received no compensation for his Directorship. James C. Ryan, III, Chairman and CEO, is now the only inside Director on the Board and receives no compensation for his Directorship.

Deferred Compensation Plan

We maintain a nonqualified deferred compensation plan, known as the “Directors’ Deferred Compensation Plan,” for ournon-employee Directors. A Director may defer 25%, 50%, 75%, or 100% of his or her cash compensation pursuant to the plan. We credit a Director’s plan account with earnings based on the hypothetical earnings of an investment fund consisting of Company stock, the return on a recognized market index selected by the Talent Development and Compensation Committee, or a combination of the two, as elected by the Director. For the market index fund, we use a Bloomberg index, which approximates the risk and return associated with a diversified high-quality corporate bond fund.

All amounts paid under the plan are paid from our general assets and are subject to the claims of our creditors. In most circumstances, deferred amounts are not distributed to the Director until after termination of his or her service. In general, the Director may elect to receive his or her plan benefits in a lump sum or in annual installments over two to ten years.

16

The following table shows all outside Director compensation paid for 2019.

Name | Fees Earned | Stock ($) | Change in Pension ($) | Total ($) | ||||||||||||

| (a) | (b) | (c) | (f) | (h) | ||||||||||||

Rebecca S. Skillman, Lead Director | 86,000 | (3) | 39,989 | 125,989 | ||||||||||||

Alan W. Braun | 61,000 | (4) | 39,989 | 100,989 | ||||||||||||

Andrew E. Goebel | 71,000 | (5) | 39,989 | 110,989 | ||||||||||||

Jerome F. Henry, Jr. | 52,500 | (6) | 39,989 | 92,489 | ||||||||||||

Ryan C. Kitchell | 52,500 | (7) | 39,989 | 16,146 | 108,635 | |||||||||||

Phelps L. Lambert | 67,500 | (8) | 39,989 | 79,575 | 187,064 | |||||||||||

Thomas E. Salmon | 46,000 | (9) | 39,989 | 11,415 | 97,404 | |||||||||||

Randall T. Shepard | 56,000 | (10) | 39,989 | 95,989 | ||||||||||||

Kelly N. Stanley | 15,625 | (11) | 13,329 | 15,524 | 44,478 | |||||||||||

Derrick J. Stewart | 62,000 | (12) | 39,989 | 8,950 | 110,939 | |||||||||||

Katherine E. White | 54,500 | (13) | 39,989 | 24,202 | 118,691 | |||||||||||

Linda E. White | 60,000 | (14) | 39,989 | 193,288 | 293,277 | |||||||||||

(1) On May 3, 2019, Alan W. Braun, Andrew E. Goebel, Jerome F. Henry, Jr., Ryan Kitchell, Phelps L. Lambert, Thomas E. Salmon, Randall T. Shepard, Rebecca S. Skillman, Derrick J. Stewart, Katherine E. White and Linda E. White each received 1,188 shares of Company stock at a stock price of $16.83 per share with a Grant Date Fair Value of $19,994.04 and Kelly N. Stanley received 792 shares of Company stock at a stock price of $16.83 per share with a Grant Date Fair Value of $13,329.36. On November 1, 2019, Alan W. Braun, Andrew E. Goebel, Jerome F. Henry, Jr., Ryan Kitchell, Phelps L. Lambert, Thomas E. Salmon, Randall T. Shepard, Rebecca S. Skillman, Derrick J. Stewart, Katherine E. White and Linda E. White each received 1,109 shares of Company stock at a stock price of $18.03 with a Grant Date Fair Value of $19,995.27.

(2) The amounts specified in Column (f) are attributable entirely to earnings credits under our Directors Deferred Compensation Plan in excess of the applicable federal long-term rate, with compounding (as described by Section 1274(d) of the Internal Revenue Code).

(3) Includes $40,000 cash retainer, $10,000 Governance Committee Chair retainer, $6,000 Talent Development and Compensation Committee member retainer, $5,000 retainer for membership on the Finance and Corporate Development Committee, and a $25,000 retainer for serving as Lead Director.

(4) Includes $40,000 cash retainer, $10,000 Finance and Corporate Development Committee Chair retainer and $11,000 retainer for membership on the Enterprise Risk Committee and Funds Management Committee.

(5) Includes $40,000 cash retainer, $15,000 Audit Committee Chair retainer, and $16,000 retainer for membership on the Enterprise Risk Committee, Funds Management Committee and Finance and Corporate Development Committee.

(6) Includes $40,000 cash retainer, $7,500 for Audit Committee membership, and $5,000 for Funds Management Committee membership.

(7) Includes 40,000 cash retainer, $7,500 for Audit Committee membership, and $5,000 for Finance and Corporate Development Committee membership.

17

(8) Includes $40,000 cash retainer, $10,000 Funds Management Committee Chair retainer, $7,500 retainer for Audit Committee membership, and $10,000 retainer for membership on the Governance Committee and Finance and Corporate Development Committee.

(9) Includes $40,000 cash retainer and $6,000 retainer for membership on the Talent Development and Compensation Committee.

(10) Includes $40,000 cash retainer, $6,000 retainer for membership on the Talent Development and Compensation Committee, and $10,000 retainer for membership on the Culture, Community & Social Responsibility Committee and the Governance Committee.

(11) Includes $10,000 cash retainer, $2,500 Culture, Community & Social Responsibility Committee Chair retainer, $1,875 Audit Committee member retainer, and $1,250 Governance Committee member retainer. Mr. Stanley retired from the Board on May 2, 2019.

(12) Includes $40,000 cash retainer, $12,000 Talent Development and Compensation Committee Chair retainer, and $10,000 retainer for membership on the Culture, Community & Social Responsibility Committee and the Finance and Corporate Development Committee.

(13) Includes $40,000 cash retainer, $6,000 retainer for membership on the Enterprise Risk Committee, $8,500 retainer for membership on the Funds Management Committee and Governance Committee.

(14) Includes $40,000 cash retainer, $10,000 Enterprise Risk Committee Chair retainer, and $10,000 retainer for membership on the Culture, Community & Social Responsibility Committee and Finance and Corporate Development Committee.

18

(Item 1 on Proxy Card)

The first item to be acted upon at the Annual Meeting is the election of thirteen Directors to the Board of the Company. Each of the persons elected will serve a term of one year and until the election and qualification of his or her successor.

If any Director nominee named in this proxy statement shall become unable or decline to serve (an event which the Board does not anticipate), the persons named as proxies will have discretionary authority to vote for a substitute nominee named by the Board, if the Board determines to fill such nominee’s position. Unless authorization is withheld, the proxy, when properly validated, will be voted ‘‘FOR’’ the election as Directors of all the nominees listed in this proxy statement.

Size and Tenure of Directors

TheBy-Laws of the Company currently provide for the Board to be comprised of 15 Directors. The Board currently contemplates taking action to either reduce the size of the Board to 13 persons or to fill the remaining vacancies. The proxies may not be voted for a greater number of persons than are presently nominated as Directors. Approximately 63% of ournon-executive directors have a tenure of nine years or less. Additionally, 16% of our Board of Directors represents an ethnic minority demographic.

Retirement Policy

A Director of the Company shall no longer qualify to serve as a Director effective as of the end of the term during which the Director becomes seventy-five (75) years of age.

Nominees for Election

Pages 20 through 28 contain the following information with respect to each Director nominee of the Company: name; principal occupation or business experience for the last five years; skills and other qualifications to serve on the Board; age; and the year in which the nominee or incumbent Director first became a Director of the Company. The number of shares of common stock of the Company beneficially owned by the nominee or incumbent Director as of February 24, 2020 and the percentage that the shares beneficially owned represent of the total outstanding shares of the Company as of February 24, 2020 can be found on page 68. The nominees standing for election, other than nominees who are executive officers or directors standing forre-election, were identified by a committee comprised of independent directors, the CEO and other executive officers. The number of shares of common stock of the Company shown as being beneficially owned by each Director nominee or incumbent Director includes those over which he or she has either sole or shared voting or investment power.

Board Qualifications and Experience

The Corporate Governance & Nominating Committee actively seeks individuals qualified to become board members for recommendation to the Board and regularly reviews the qualifications of board members.

Listed below is certain biographical information of each of the nominees for election including his or her principal occupation and other business affiliations.

19

Nominees for Directors to be Elected

Andrew E. Goebel

|

Mr. Goebel, 72, was elected to the Board in 2000. He is Chairman of the Audit Committee and is an “Audit Committee Financial Expert” as defined by the SEC. He is a member of the Funds Management Committee, the Finance and Corporate Development Committee and the Enterprise Risk Committee. Mr. Goebel has served as a financial and management consultant since 2003.

Mr. Goebel brings to the Board, among other skills and qualifications, a34-year career in the energy industry where he served in various capacities including President and Chief Operating Officer of Vectren Corporation from where he retired in 2003. He also has significant experience as a senior executive of a large public company and significant experience in finance.

Mr. Goebel holds a BSBA and an MBA from the University of Evansville. He serves as a director of two privately-held companies headquartered in Southwest Indiana, including South Central, Inc. and Community Natural Gas Company, Inc. He also serves as a director of Indiana-American Water Company, headquartered in Greenwood, Indiana, a wholly-owned subsidiary of American Water Works Company, the largest publicly traded water utility in the country. He is a member of the Board of Trustees of the University of Evansville and serves in leadership positions for several other nonprofit and civic organizations. | |

Director Since:2000 Age:72

Committees:

Audit

Enterprise Risk

Funds Management

Finance and Corporate Development

| ||

Jerome F. Henry, Jr.

|