Investment Thesis FINANCIAL DATA AS OF March 31, 2020 DATED: May 8, 2020 Exhibit 99.1

Executive Summary SLIDES 2 TO 22

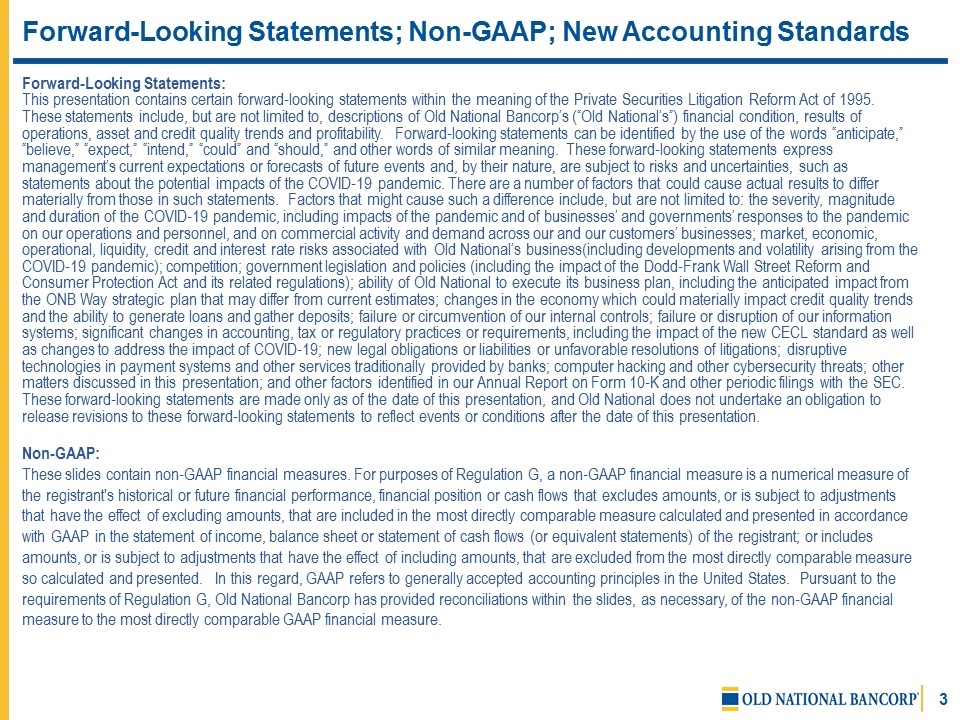

Forward-Looking Statements; Non-GAAP; New Accounting Standards Forward-Looking Statements: This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, descriptions of Old National Bancorp’s (“Old National’s”) financial condition, results of operations, asset and credit quality trends and profitability. Forward-looking statements can be identified by the use of the words “anticipate,” “believe,” “expect,” “intend,” “could” and “should,” and other words of similar meaning. These forward-looking statements express management’s current expectations or forecasts of future events and, by their nature, are subject to risks and uncertainties, such as statements about the potential impacts of the COVID-19 pandemic. There are a number of factors that could cause actual results to differ materially from those in such statements. Factors that might cause such a difference include, but are not limited to: the severity, magnitude and duration of the COVID-19 pandemic, including impacts of the pandemic and of businesses’ and governments’ responses to the pandemic on our operations and personnel, and on commercial activity and demand across our and our customers’ businesses; market, economic, operational, liquidity, credit and interest rate risks associated with Old National’s business(including developments and volatility arising from the COVID-19 pandemic); competition; government legislation and policies (including the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and its related regulations); ability of Old National to execute its business plan, including the anticipated impact from the ONB Way strategic plan that may differ from current estimates; changes in the economy which could materially impact credit quality trends and the ability to generate loans and gather deposits; failure or circumvention of our internal controls; failure or disruption of our information systems; significant changes in accounting, tax or regulatory practices or requirements, including the impact of the new CECL standard as well as changes to address the impact of COVID-19; new legal obligations or liabilities or unfavorable resolutions of litigations; disruptive technologies in payment systems and other services traditionally provided by banks; computer hacking and other cybersecurity threats; other matters discussed in this presentation; and other factors identified in our Annual Report on Form 10-K and other periodic filings with the SEC. These forward-looking statements are made only as of the date of this presentation, and Old National does not undertake an obligation to release revisions to these forward-looking statements to reflect events or conditions after the date of this presentation. Non-GAAP: These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant's historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the registrant; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, Old National Bancorp has provided reconciliations within the slides, as necessary, of the non-GAAP financial measure to the most directly comparable GAAP financial measure.

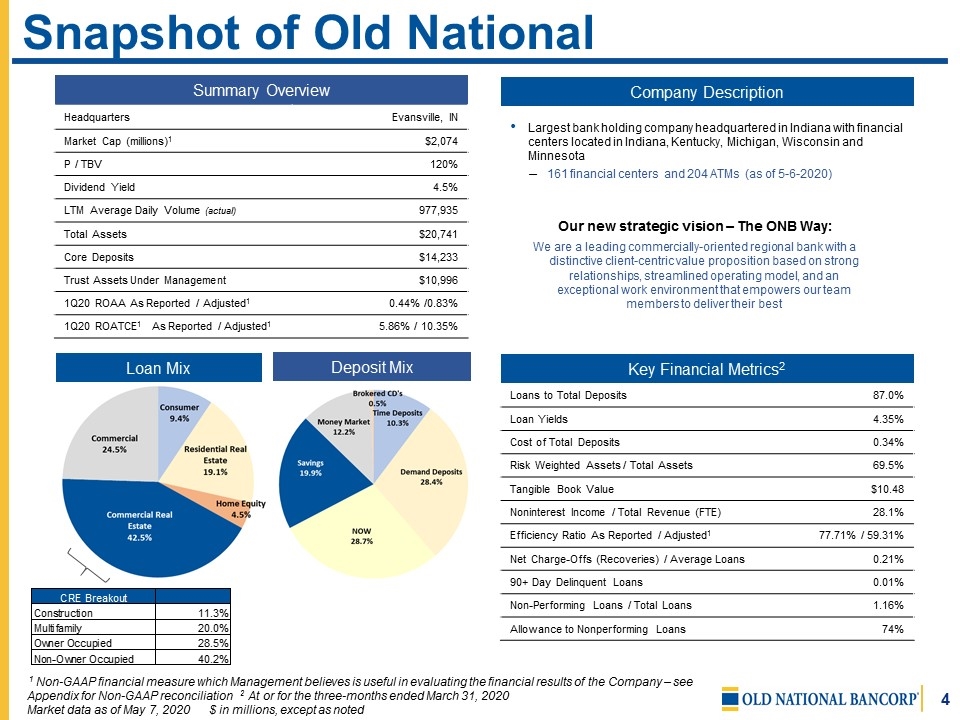

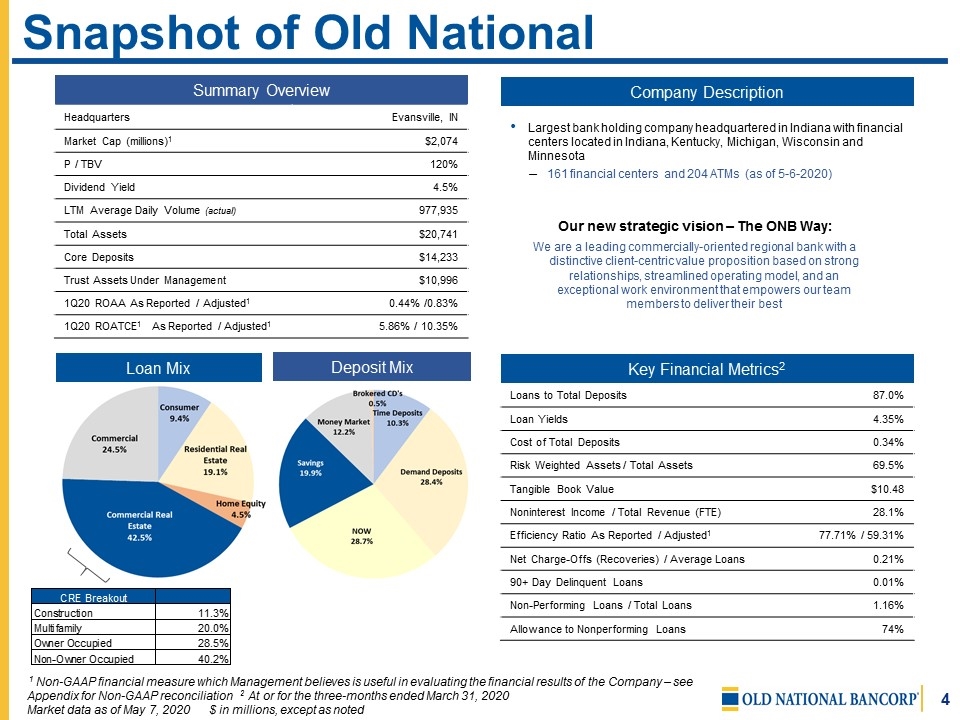

Snapshot of Old National Largest bank holding company headquartered in Indiana with financial centers located in Indiana, Kentucky, Michigan, Wisconsin and Minnesota 161 financial centers and 204 ATMs (as of 5-6-2020) Summary Overview Company Description Headquarters Evansville, IN Market Cap (millions)1 $2,074 P / TBV 120% Dividend Yield 4.5% LTM Average Daily Volume (actual) 977,935 Total Assets $20,741 Core Deposits $14,233 Trust Assets Under Management $10,996 1Q20 ROAA As Reported / Adjusted1 0.44% /0.83% 1Q20 ROATCE1 As Reported / Adjusted1 5.86% / 10.35% Loan Mix Deposit Mix 1 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation 2 At or for the three-months ended March 31, 2020 Market data as of May 7, 2020 $ in millions, except as noted Loans to Total Deposits 87.0% Loan Yields 4.35% Cost of Total Deposits 0.34% Risk Weighted Assets / Total Assets 69.5% Tangible Book Value $10.48 Noninterest Income / Total Revenue (FTE) 28.1% Efficiency Ratio As Reported / Adjusted1 77.71% / 59.31% Net Charge-Offs (Recoveries) / Average Loans 0.21% 90+ Day Delinquent Loans 0.01% Non-Performing Loans / Total Loans 1.16% Allowance to Nonperforming Loans 74% Key Financial Metrics2 Our new strategic vision – The ONB Way: We are a leading commercially-oriented regional bank with a distinctive client-centric value proposition based on strong relationships, streamlined operating model, and an exceptional work environment that empowers our team members to deliver their best

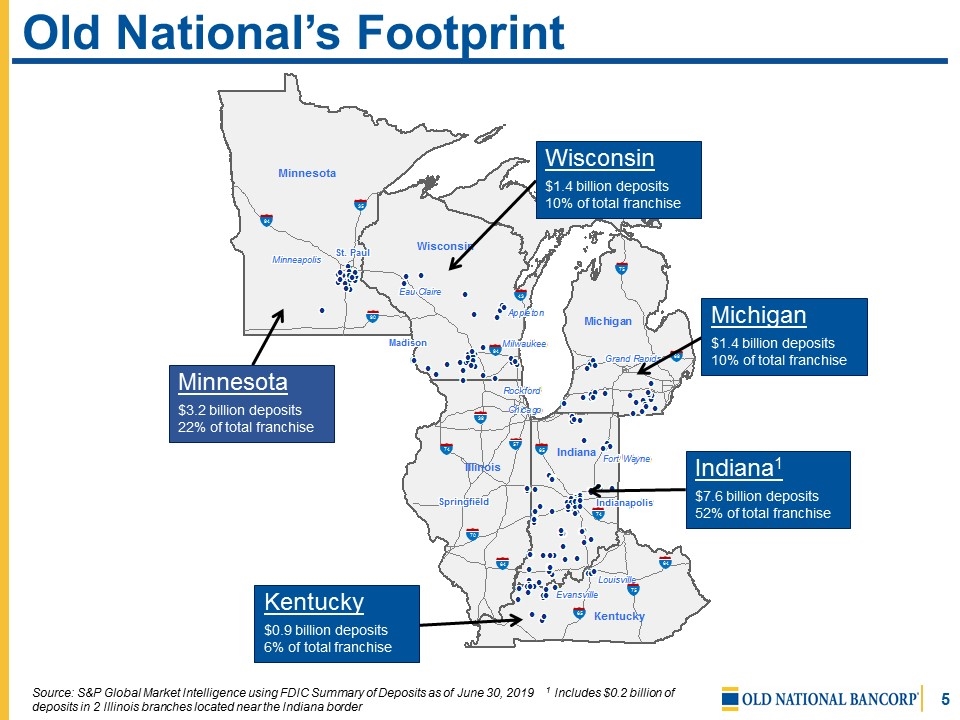

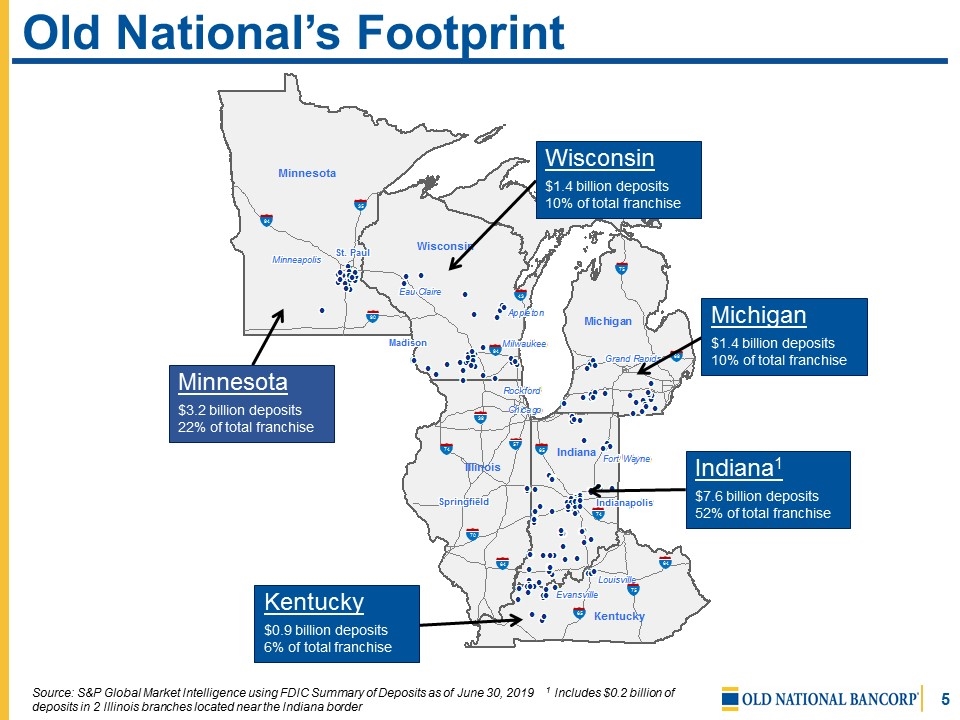

Old National’s Footprint 75 69 74 70 64 57 39 75 64 65 90 94 43 65 74 35 94 Indiana1 $7.6 billion deposits 52% of total franchise Michigan $1.4 billion deposits 10% of total franchise Wisconsin $1.4 billion deposits 10% of total franchise Kentucky $0.9 billion deposits 6% of total franchise Minnesota $3.2 billion deposits 22% of total franchise Source: S&P Global Market Intelligence using FDIC Summary of Deposits as of June 30, 2019 1 Includes $0.2 billion of deposits in 2 Illinois branches located near the Indiana border

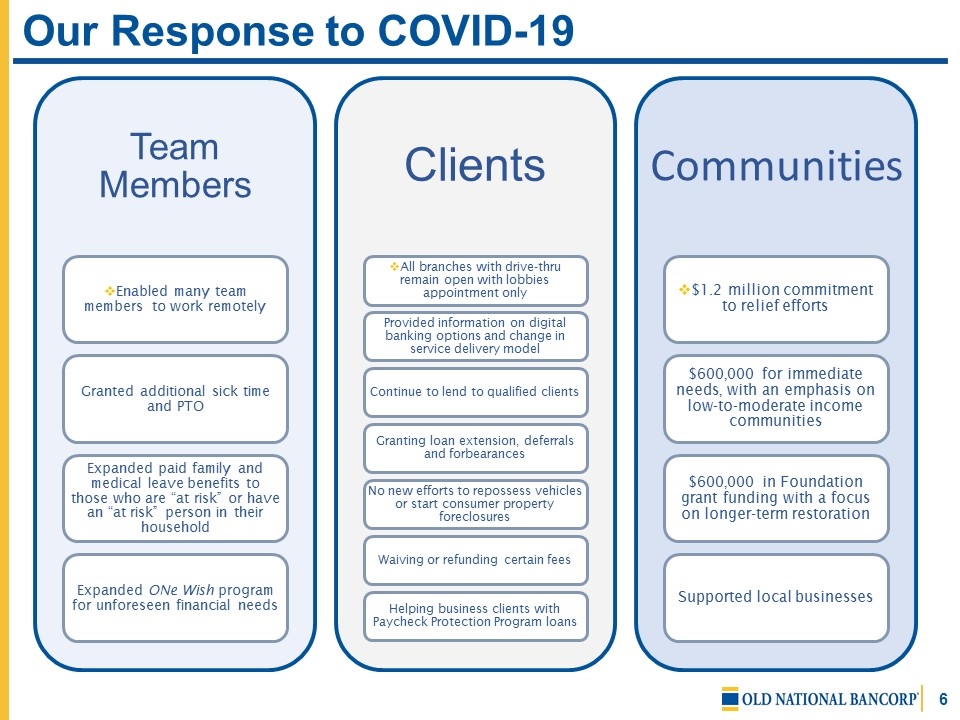

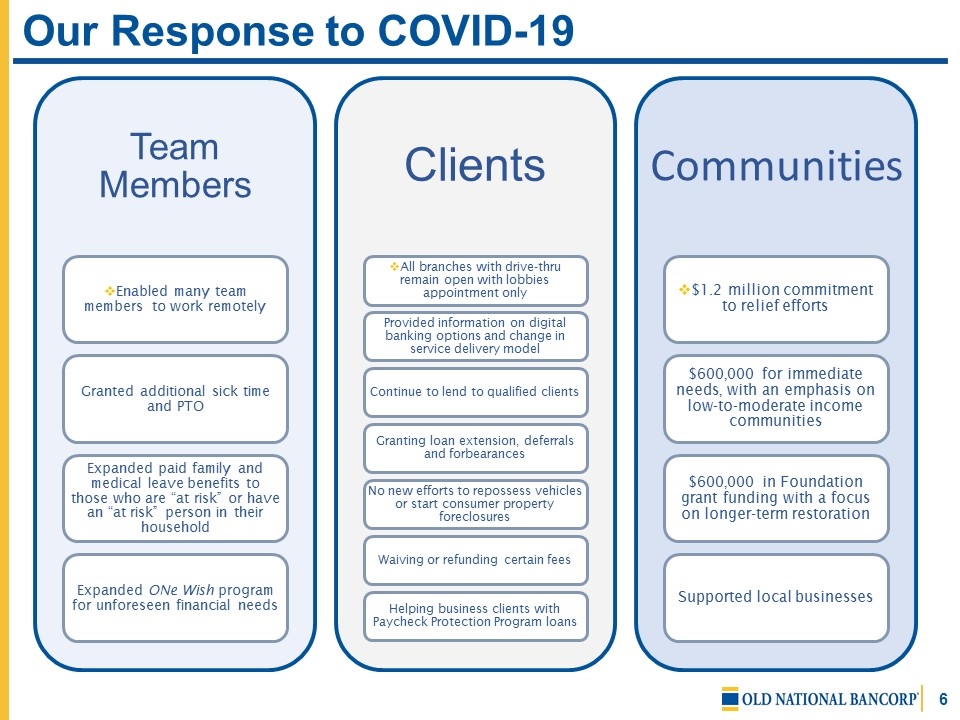

Our Response to COVID-19 Team Members Enabled many team members to work remotely Clients All branches with drive-thru remain open with lobbies appointment only $1.2 million commitment to relief efforts Granted additional sick time and PTO Expanded paid family and medical leave benefits to those who are “at risk” or have an “at risk” person in their household Expanded ONe Wish program for unforeseen financial needs Provided information on digital banking options and change in service delivery model Continue to lend to qualified clients Granting loan extension, deferrals and forbearances No new efforts to repossess vehicles or start consumer property foreclosures Waiving or refunding certain fees Helping business clients with Paycheck Protection Program loans Communities $600,000 for immediate needs, with an emphasis on low-to-moderate income communities $600,000 in Foundation grant funding with a focus on longer-term restoration Supported local businesses

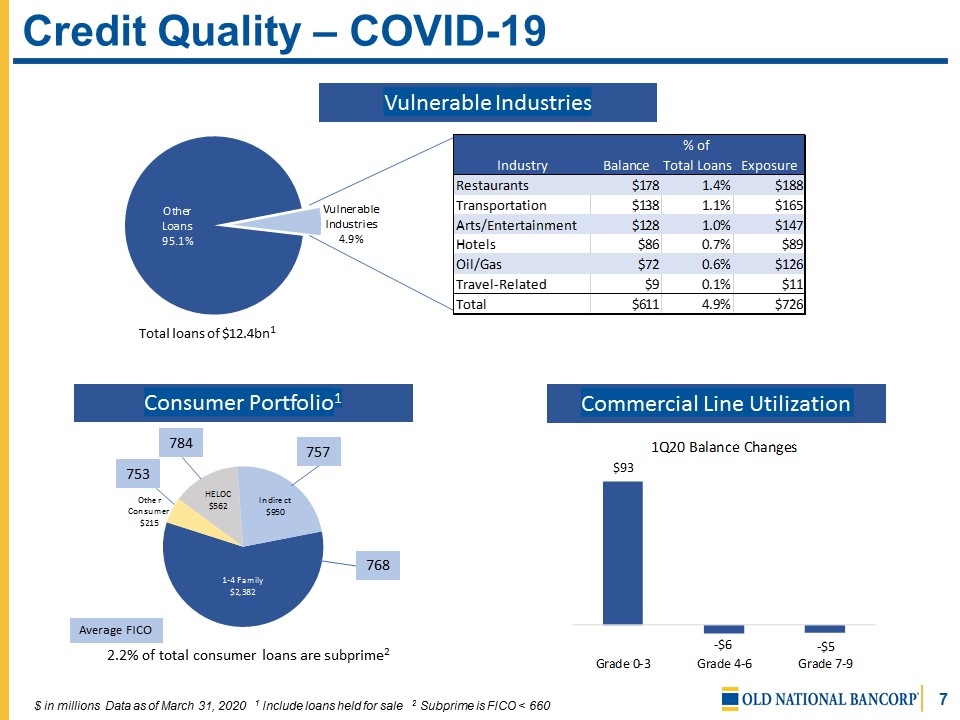

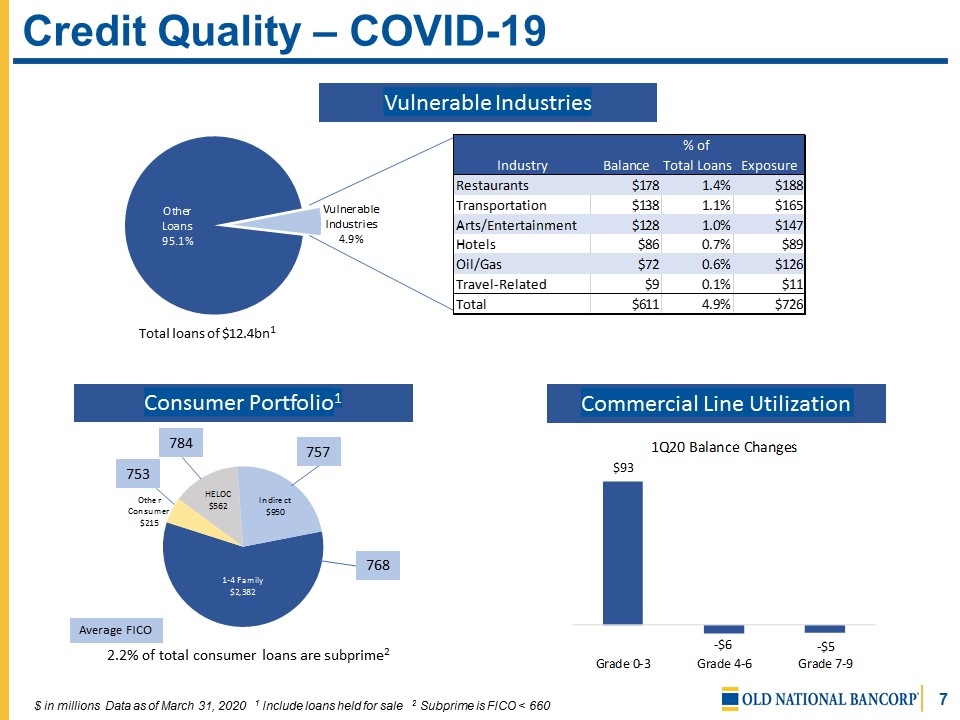

Credit Quality – COVID-19 $ in millions Data as of March 31, 2020 1 Include loans held for sale 2 Subprime is FICO < 660 Vulnerable Industries Consumer Portfolio1 Total loans of $12.4bn1 Commercial Line Utilization 2.2% of total consumer loans are subprime2 757 Average FICO 784 768 753

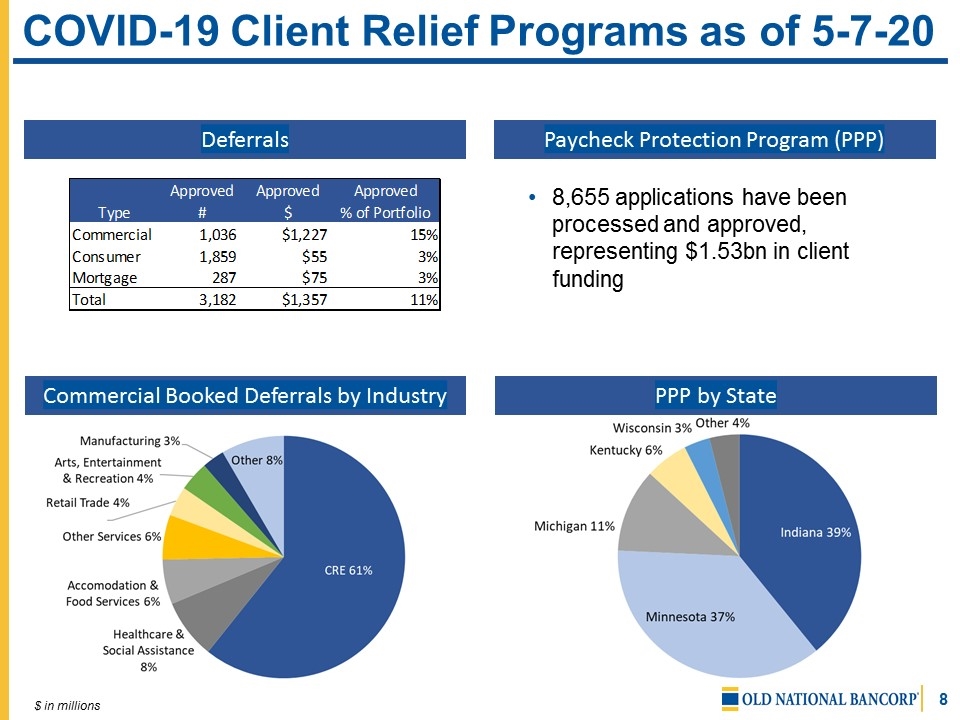

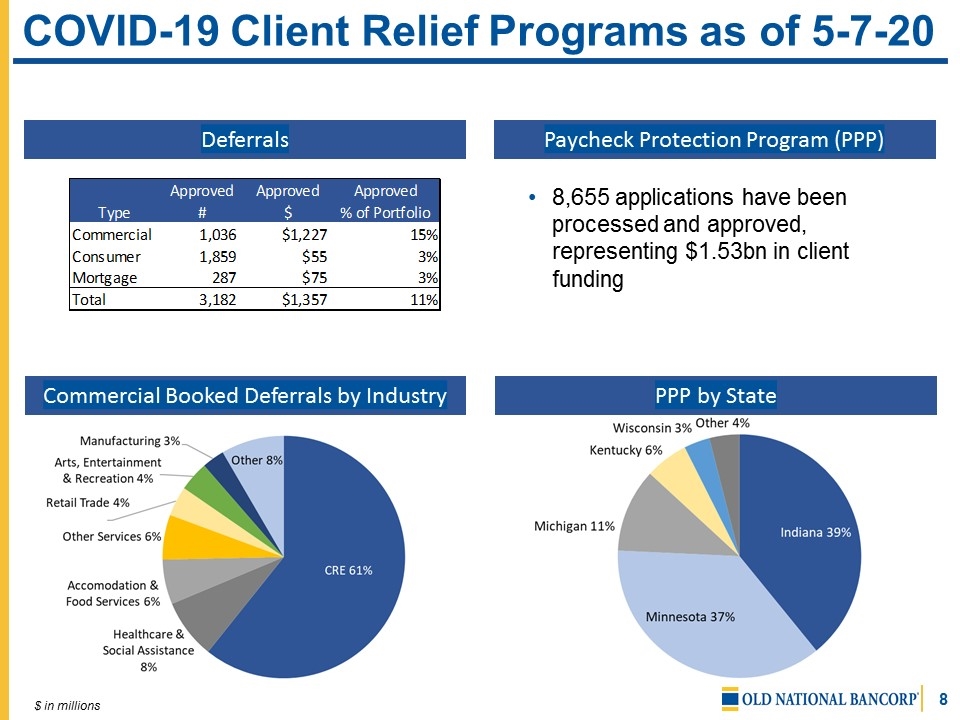

COVID-19 Client Relief Programs as of 5-7-20 $ in millions Commercial Booked Deferrals by Industry Deferrals Paycheck Protection Program (PPP) 8,655 applications have been processed and approved, representing $1.53bn in client funding PPP by State

Our New Strategic Vision – The ONB Way We are a leading commercially-oriented regional bank with a distinctive client-centric value proposition based on strong relationships, streamlined operating model, and an exceptional work environment that empowers our team members to deliver their best

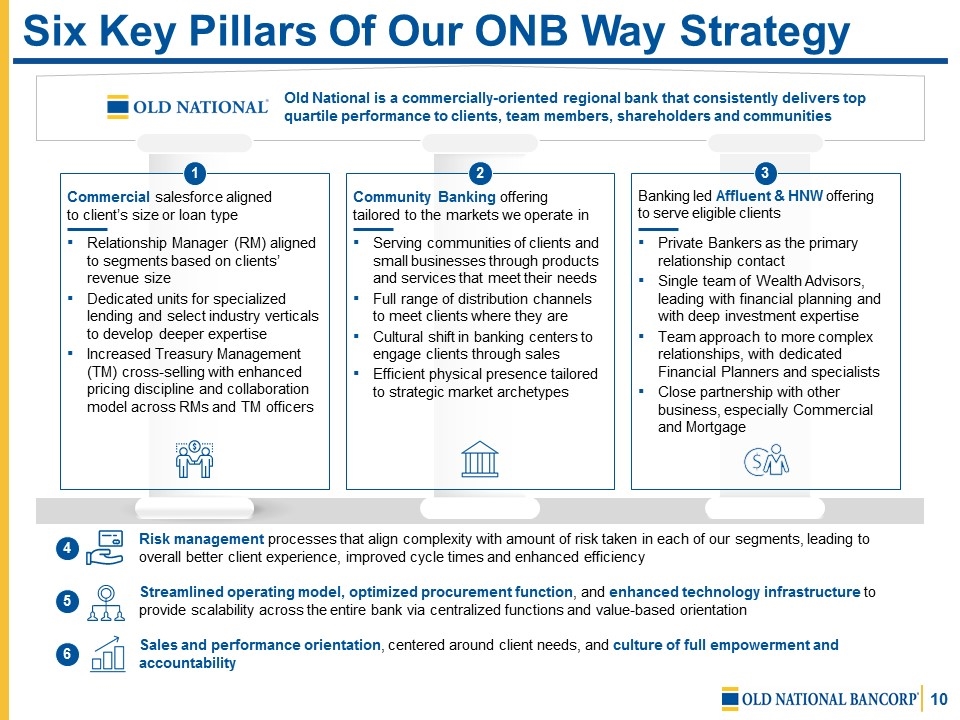

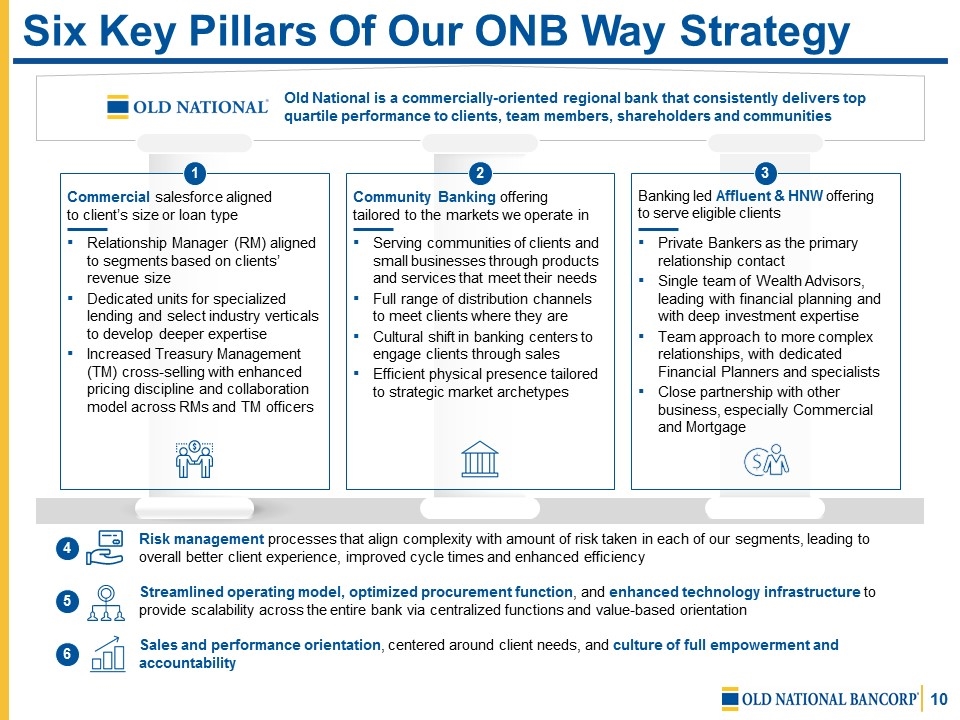

Six Key Pillars Of Our ONB Way Strategy Old National is a commercially-oriented regional bank that consistently delivers top quartile performance to clients, team members, shareholders and communities Commercial salesforce aligned to client’s size or loan type Relationship Manager (RM) aligned to segments based on clients’ revenue size Dedicated units for specialized lending and select industry verticals to develop deeper expertise Increased Treasury Management (TM) cross-selling with enhanced pricing discipline and collaboration model across RMs and TM officers Community Banking offering tailored to the markets we operate in Serving communities of clients and small businesses through products and services that meet their needs Full range of distribution channels to meet clients where they are Cultural shift in banking centers to engage clients through sales Efficient physical presence tailored to strategic market archetypes Banking led Affluent & HNW offering to serve eligible clients Private Bankers as the primary relationship contact Single team of Wealth Advisors, leading with financial planning and with deep investment expertise Team approach to more complex relationships, with dedicated Financial Planners and specialists Close partnership with other business, especially Commercial and Mortgage 3 2 1 Risk management processes that align complexity with amount of risk taken in each of our segments, leading to overall better client experience, improved cycle times and enhanced efficiency 4 Streamlined operating model, optimized procurement function, and enhanced technology infrastructure to provide scalability across the entire bank via centralized functions and value-based orientation 5 Sales and performance orientation, centered around client needs, and culture of full empowerment and accountability 6

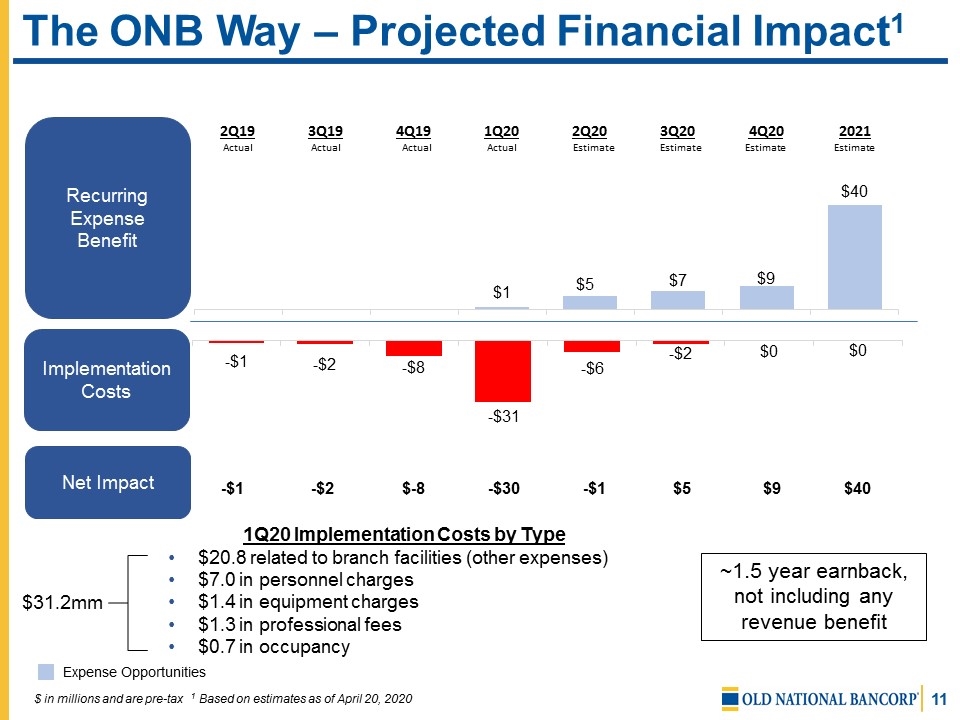

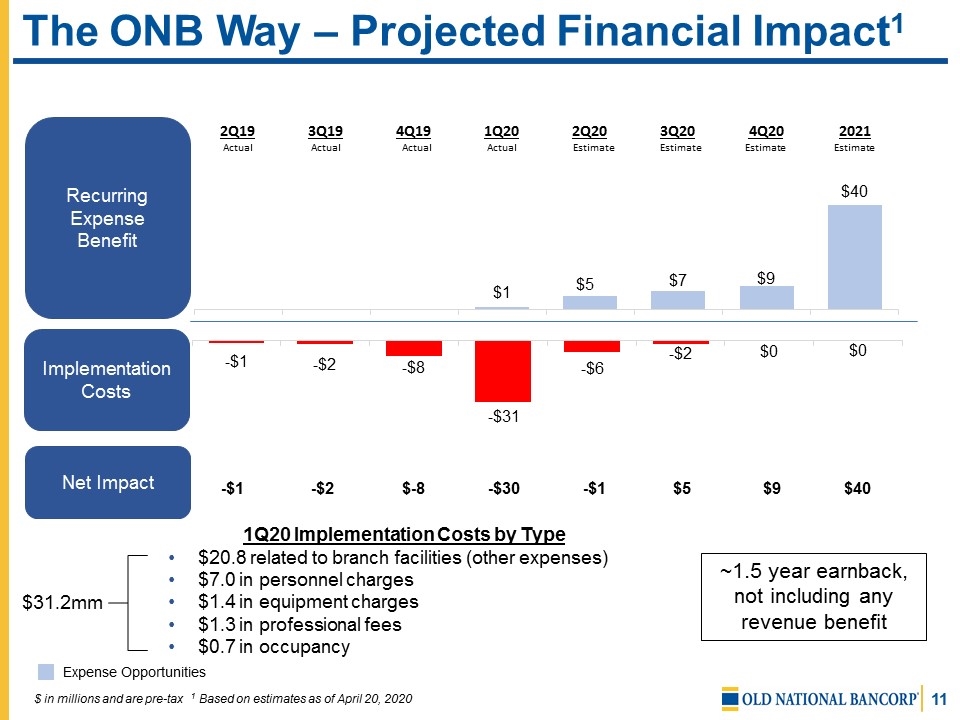

The ONB Way – Projected Financial Impact1 Recurring Expense Benefit Implementation Costs Expense Opportunities Net Impact -$1 -$2 $-8 -$30 -$1 $5 $9 $40 $ in millions and are pre-tax 1 Based on estimates as of April 20, 2020 1Q20 Implementation Costs by Type $20.8 related to branch facilities (other expenses) $7.0 in personnel charges $1.4 in equipment charges $1.3 in professional fees $0.7 in occupancy $31.2mm ~1.5 year earnback, not including any revenue benefit Actual Actual Actual Actual Estimate Estimate Estimate Estimate

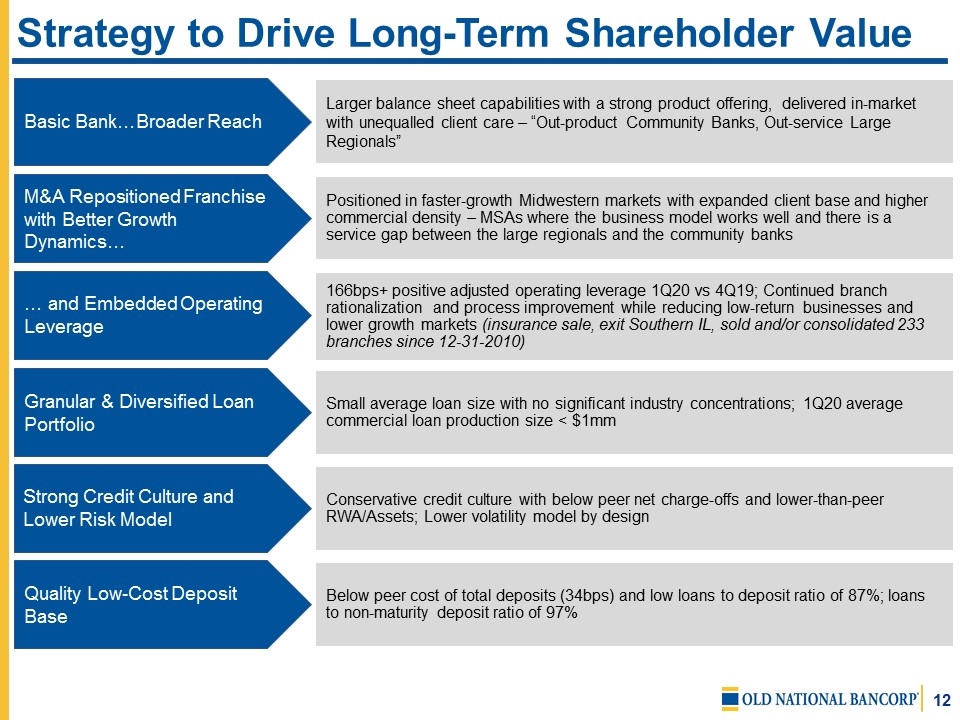

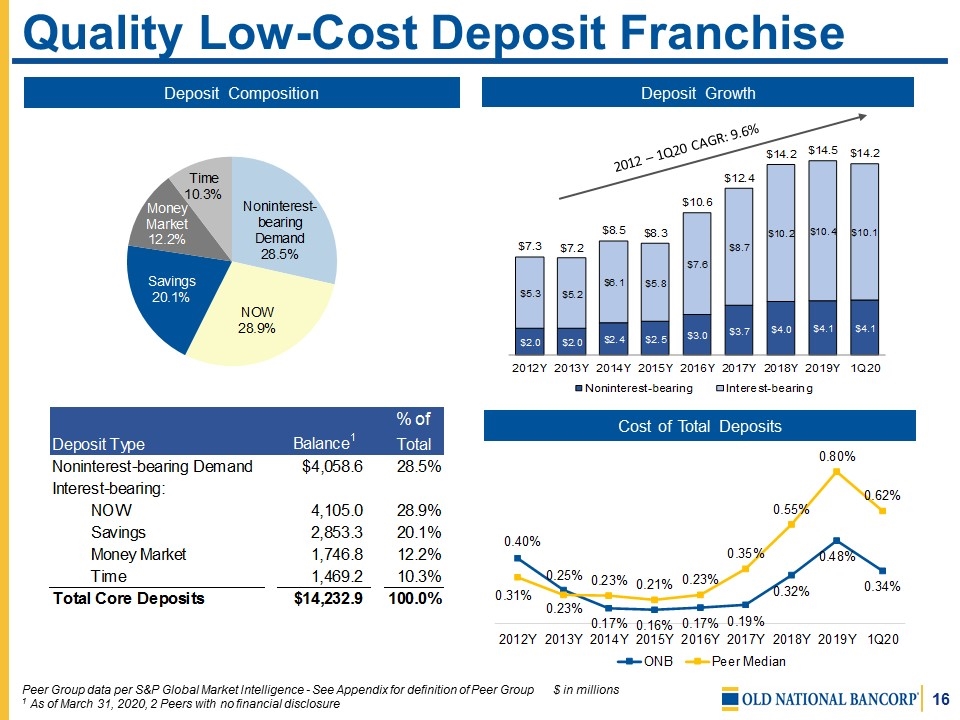

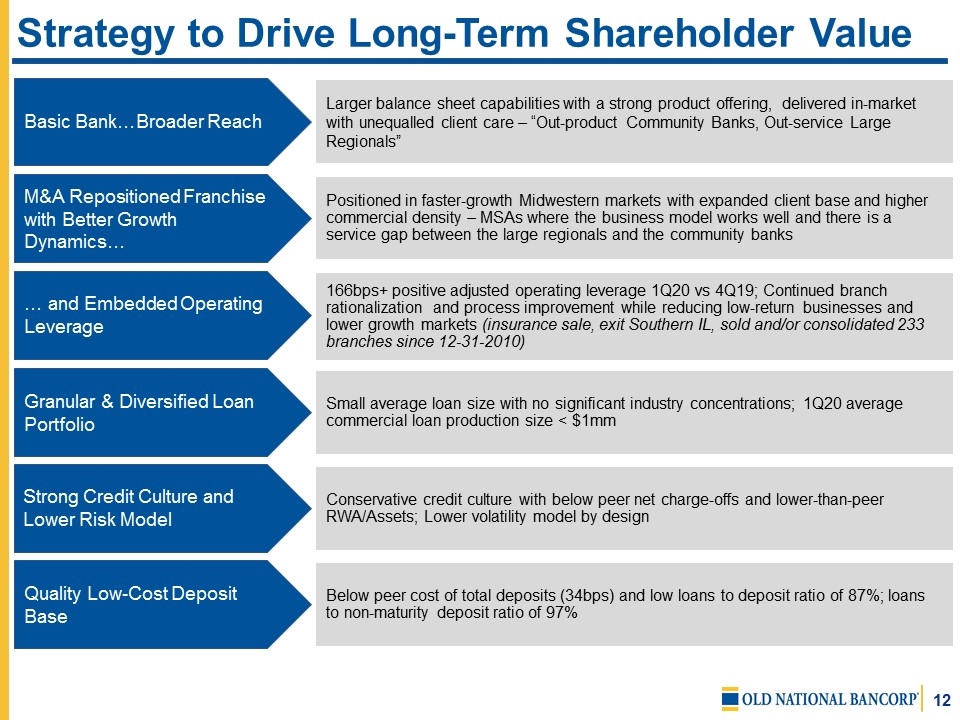

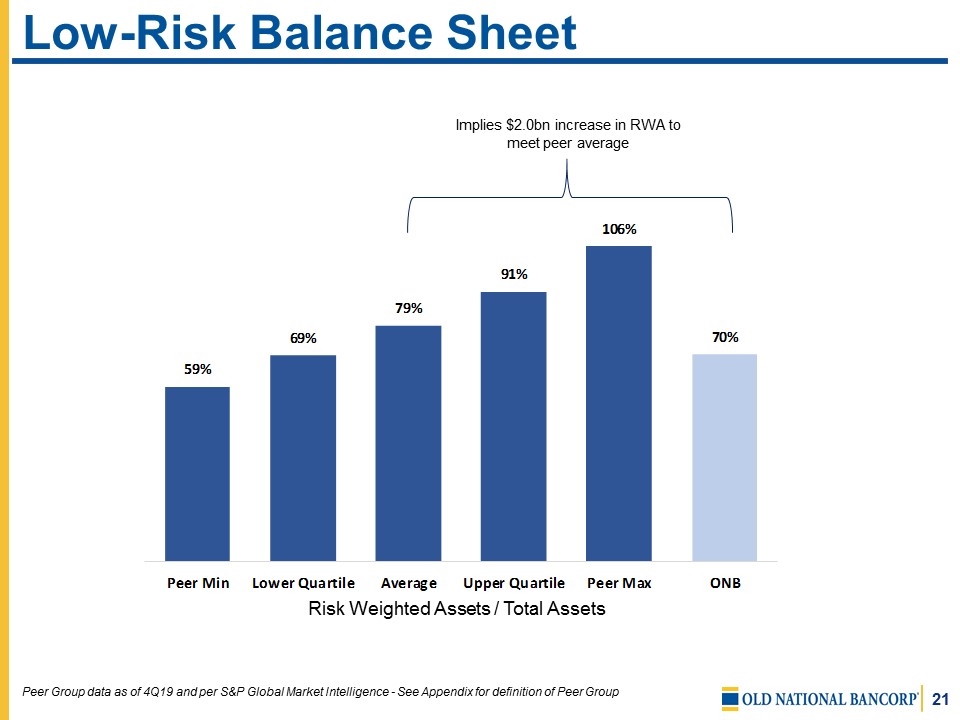

Strategy to Drive Long-Term Shareholder Value Larger balance sheet capabilities with a strong product offering, delivered in-market with unequalled client care – “Out-product Community Banks, Out-service Large Regionals” Basic Bank…Broader Reach M&A Repositioned Franchise with Better Growth Dynamics… … and Embedded Operating Leverage Strong Credit Culture and Lower Risk Model Granular & Diversified Loan Portfolio Positioned in faster-growth Midwestern markets with expanded client base and higher commercial density – MSAs where the business model works well and there is a service gap between the large regionals and the community banks 166bps+ positive adjusted operating leverage 1Q20 vs 4Q19; Continued branch rationalization and process improvement while reducing low-return businesses and lower growth markets (insurance sale, exit Southern IL, sold and/or consolidated 233 branches since 12-31-2010) Conservative credit culture with below peer net charge-offs and lower-than-peer RWA/Assets; Lower volatility model by design Small average loan size with no significant industry concentrations; 1Q20 average commercial loan production size < $1mm Quality Low-Cost Deposit Base Below peer cost of total deposits (34bps) and low loans to deposit ratio of 87%; loans to non-maturity deposit ratio of 97%

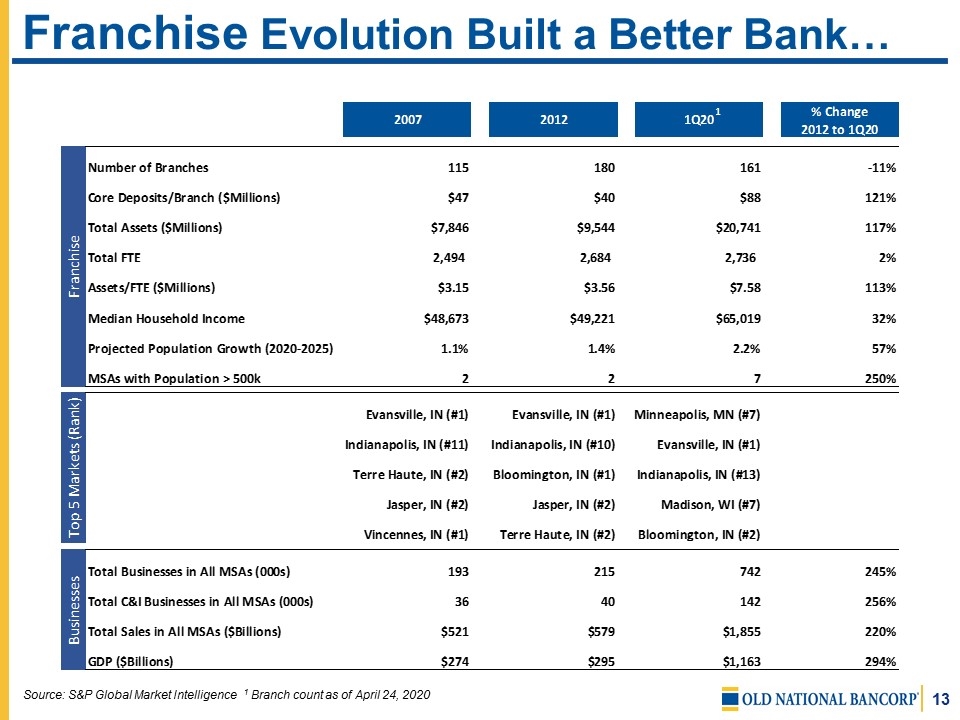

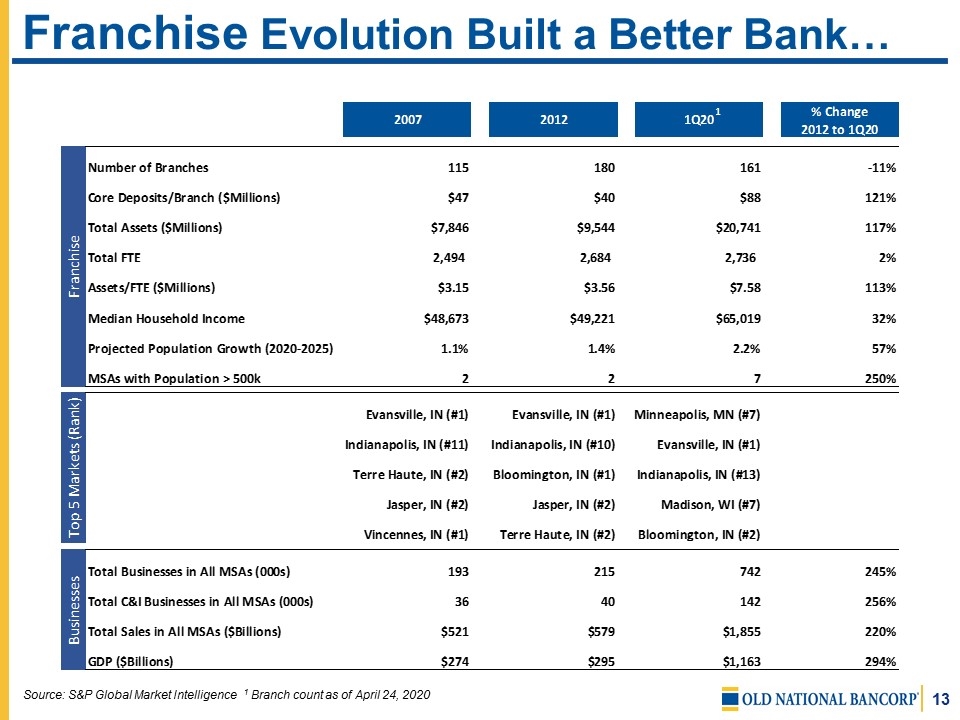

Franchise Evolution Built a Better Bank… Source: S&P Global Market Intelligence 1 Branch count as of April 24, 2020 1

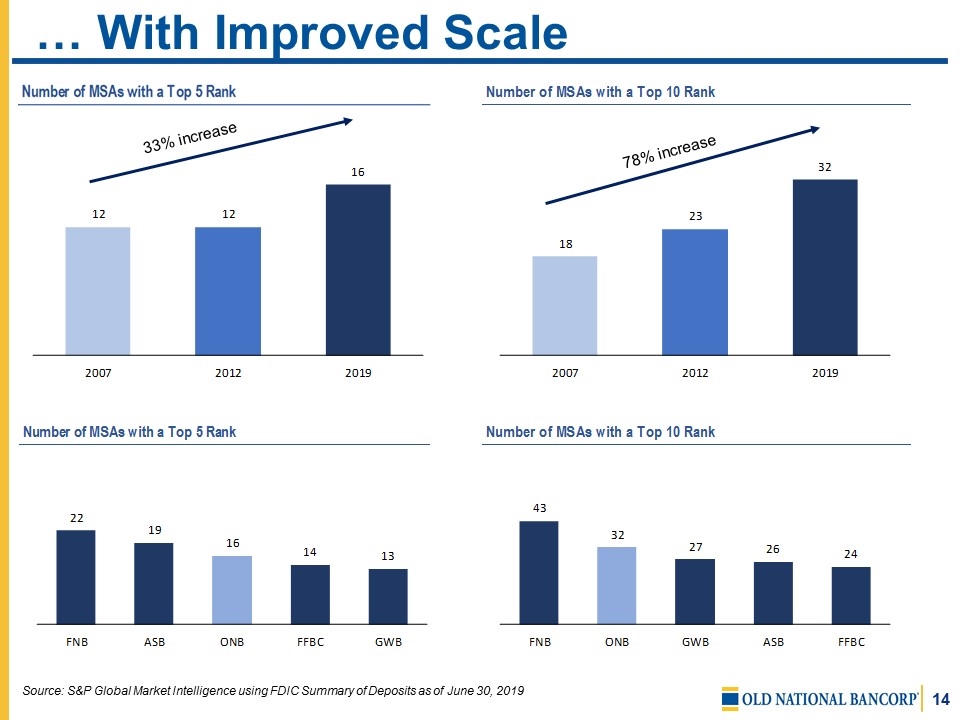

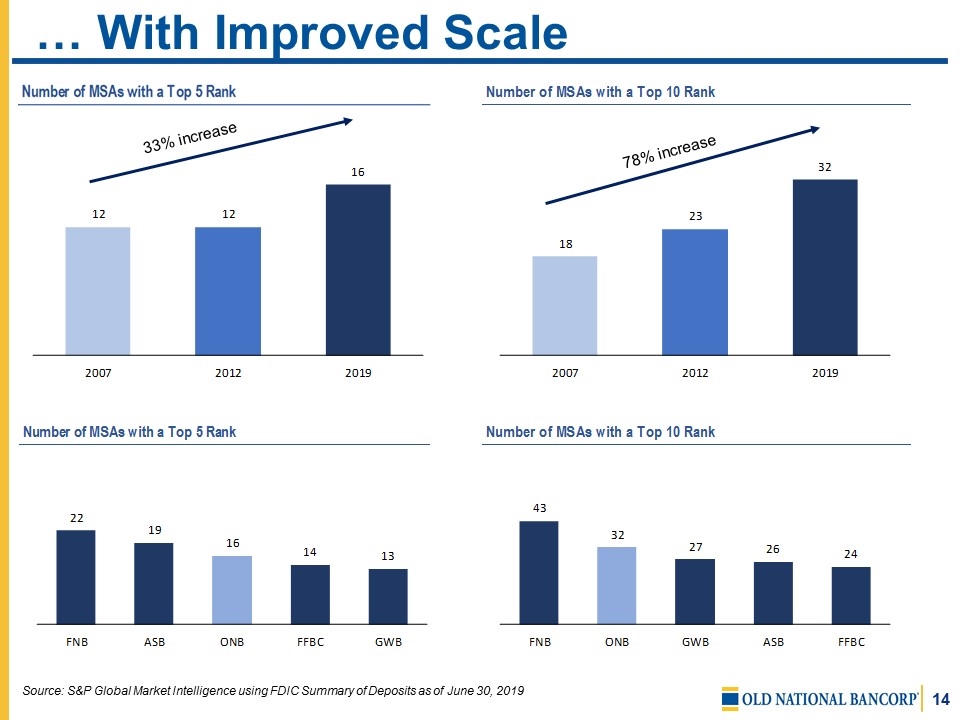

… With Improved Scale Source: S&P Global Market Intelligence using FDIC Summary of Deposits as of June 30, 2019 33% increase 78% increase

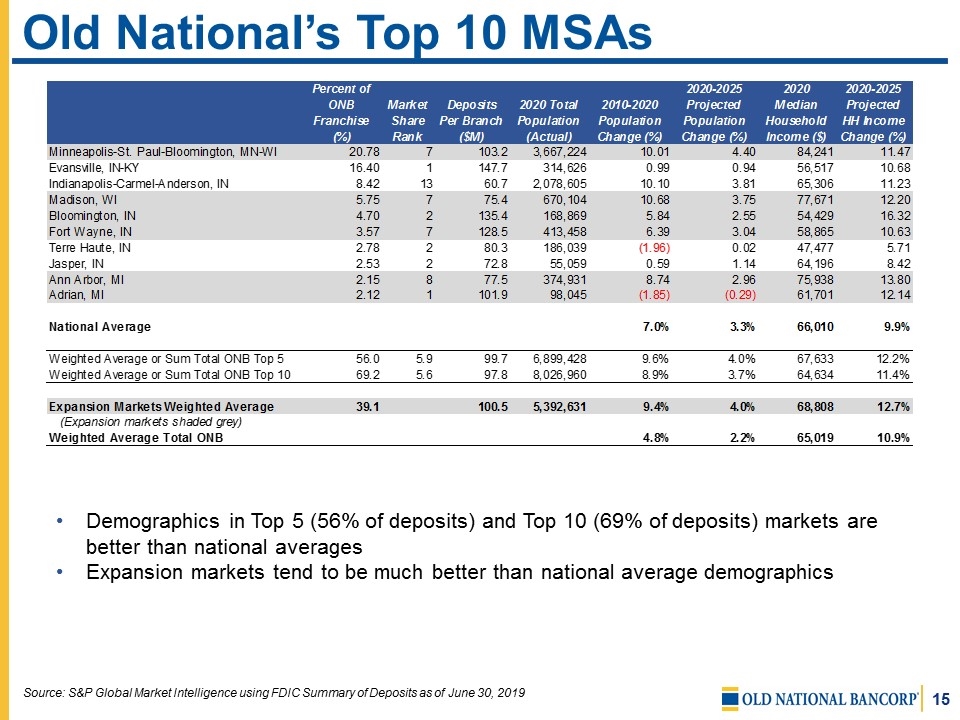

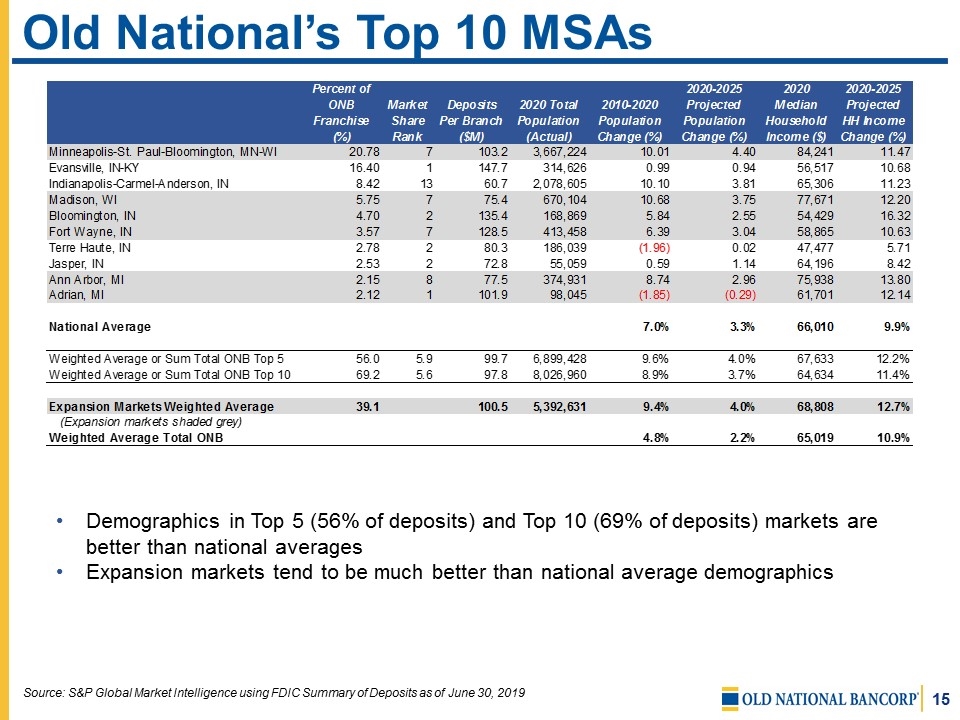

Old National’s Top 10 MSAs Demographics in Top 5 (56% of deposits) and Top 10 (69% of deposits) markets are better than national averages Expansion markets tend to be much better than national average demographics Source: S&P Global Market Intelligence using FDIC Summary of Deposits as of June 30, 2019

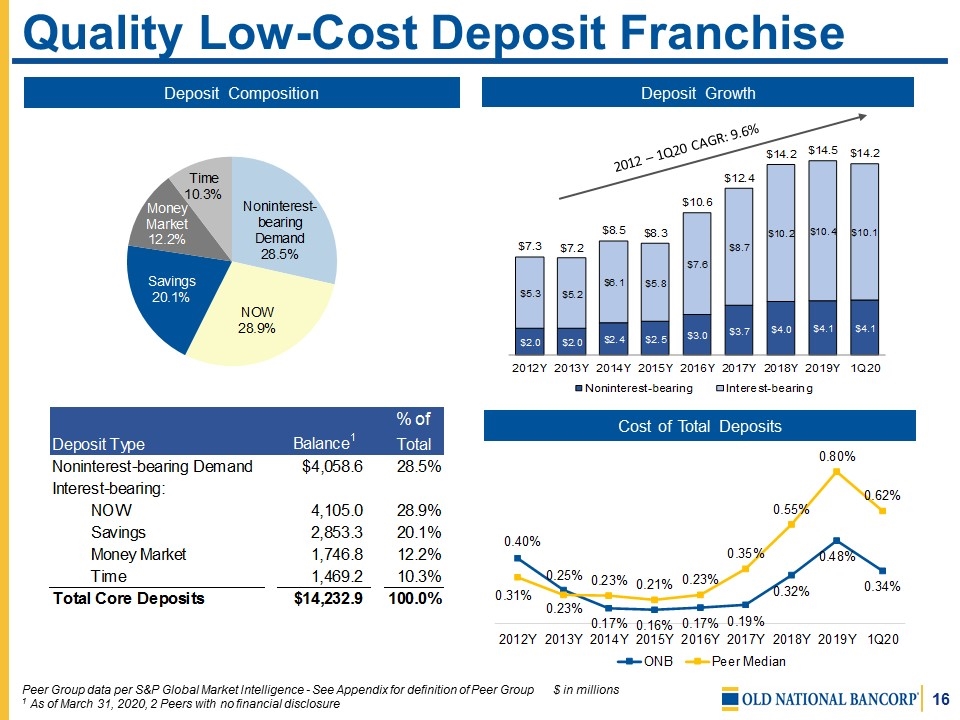

Deposit Composition Deposit Growth 2012 – 1Q20 CAGR: 9.6% Cost of Total Deposits Peer Group data per S&P Global Market Intelligence - See Appendix for definition of Peer Group $ in millions 1 As of March 31, 2020, 2 Peers with no financial disclosure Quality Low-Cost Deposit Franchise

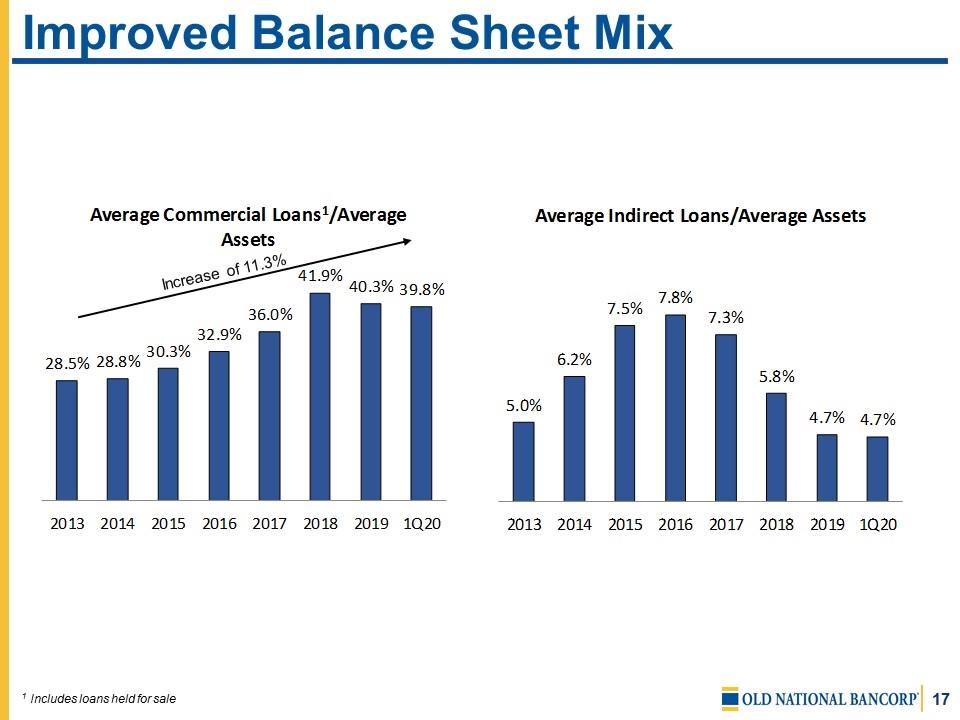

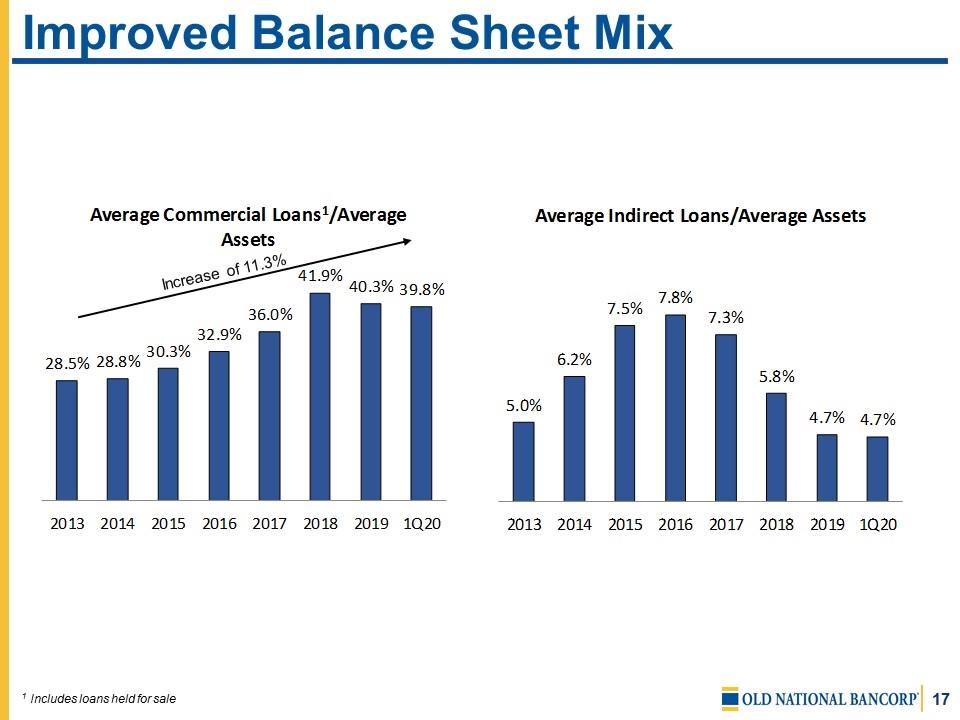

Improved Balance Sheet Mix Increase of 11.3% 1 Includes loans held for sale

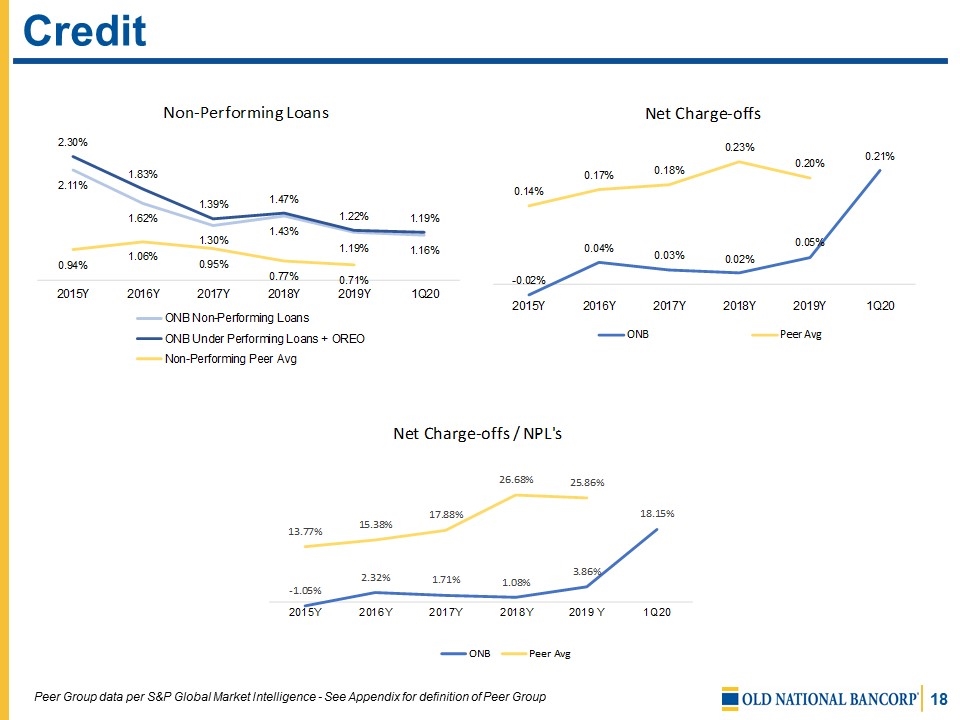

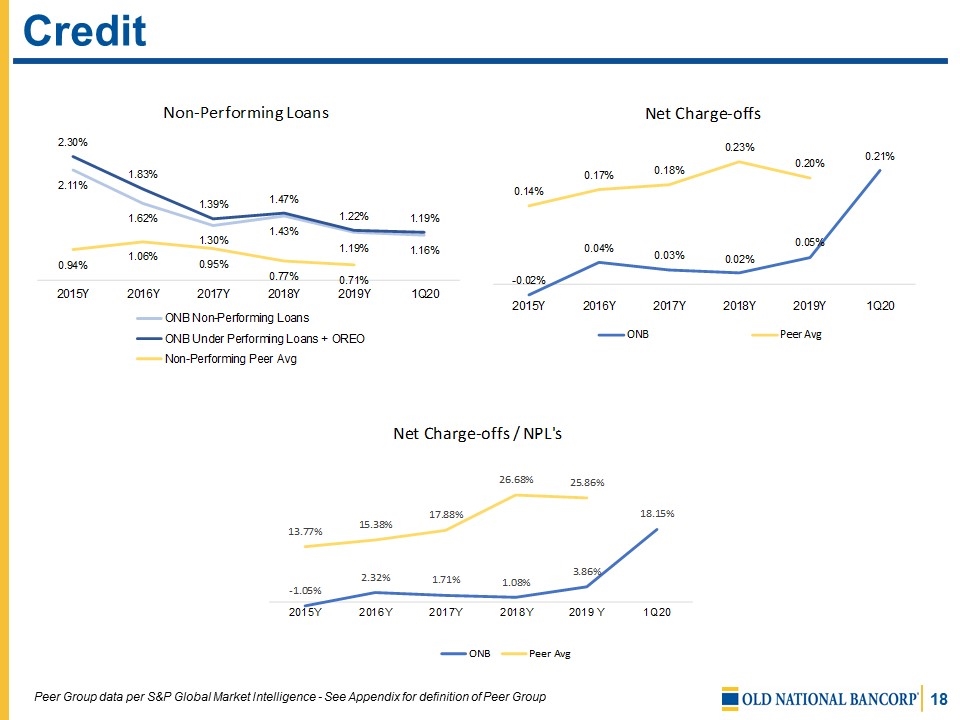

Credit Peer Group data per S&P Global Market Intelligence - See Appendix for definition of Peer Group

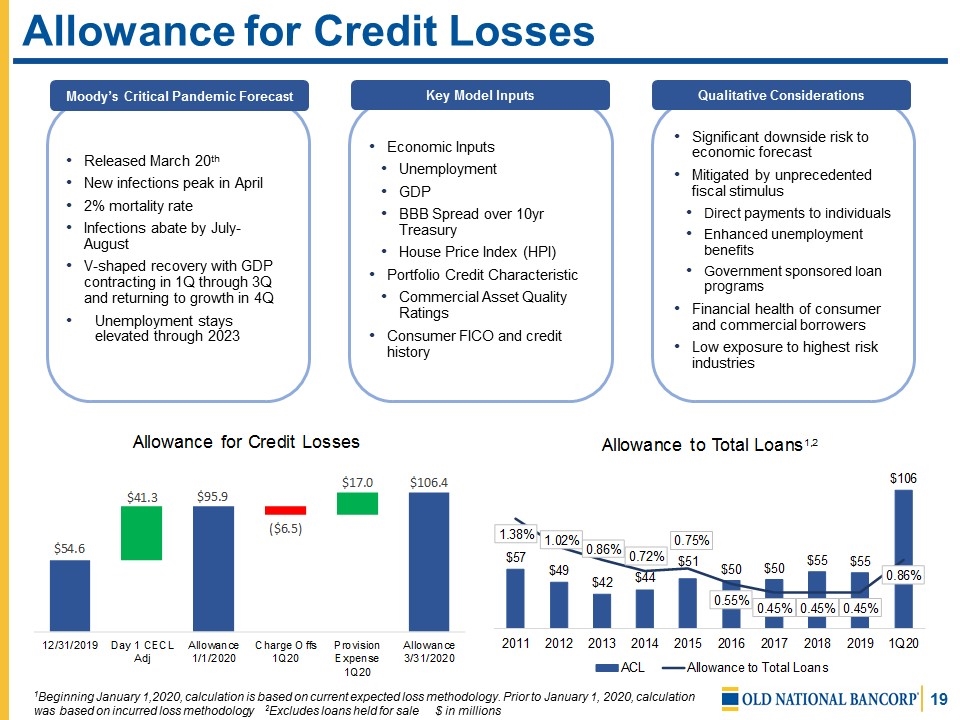

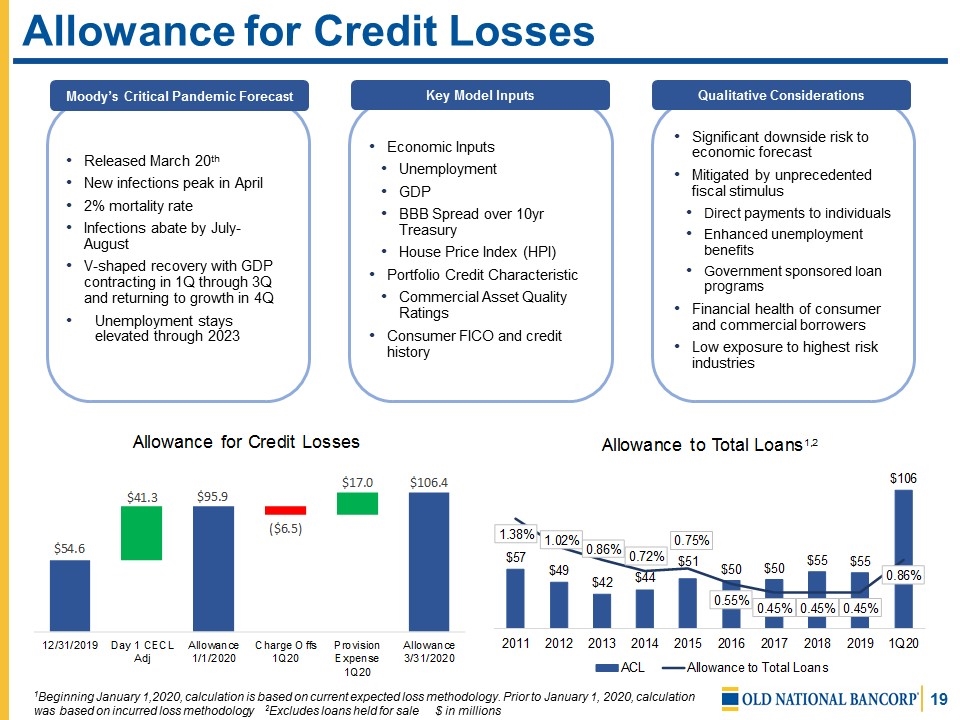

Allowance for Credit Losses Released March 20th New infections peak in April 2% mortality rate Infections abate by July-August V-shaped recovery with GDP contracting in 1Q through 3Q and returning to growth in 4Q Unemployment stays elevated through 2023 Economic Inputs Unemployment GDP BBB Spread over 10yr Treasury House Price Index (HPI) Portfolio Credit Characteristic Commercial Asset Quality Ratings Consumer FICO and credit history Significant downside risk to economic forecast Mitigated by unprecedented fiscal stimulus Direct payments to individuals Enhanced unemployment benefits Government sponsored loan programs Financial health of consumer and commercial borrowers Low exposure to highest risk industries 1Beginning January 1,2020, calculation is based on current expected loss methodology. Prior to January 1, 2020, calculation was based on incurred loss methodology 2Excludes loans held for sale $ in millions Moody’s Critical Pandemic Forecast Key Model Inputs Qualitative Considerations

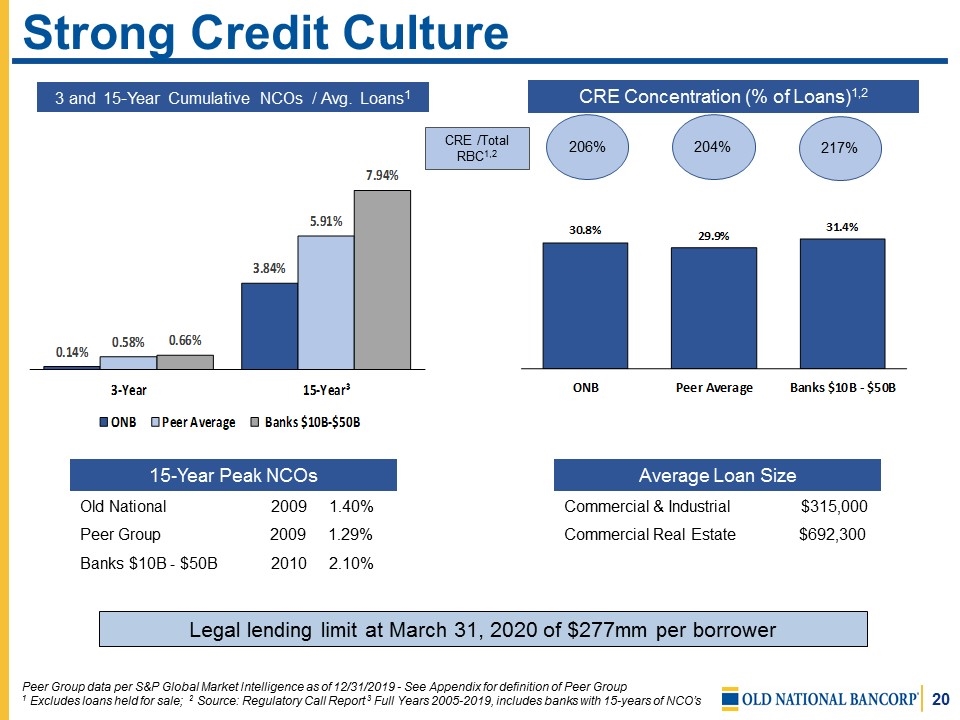

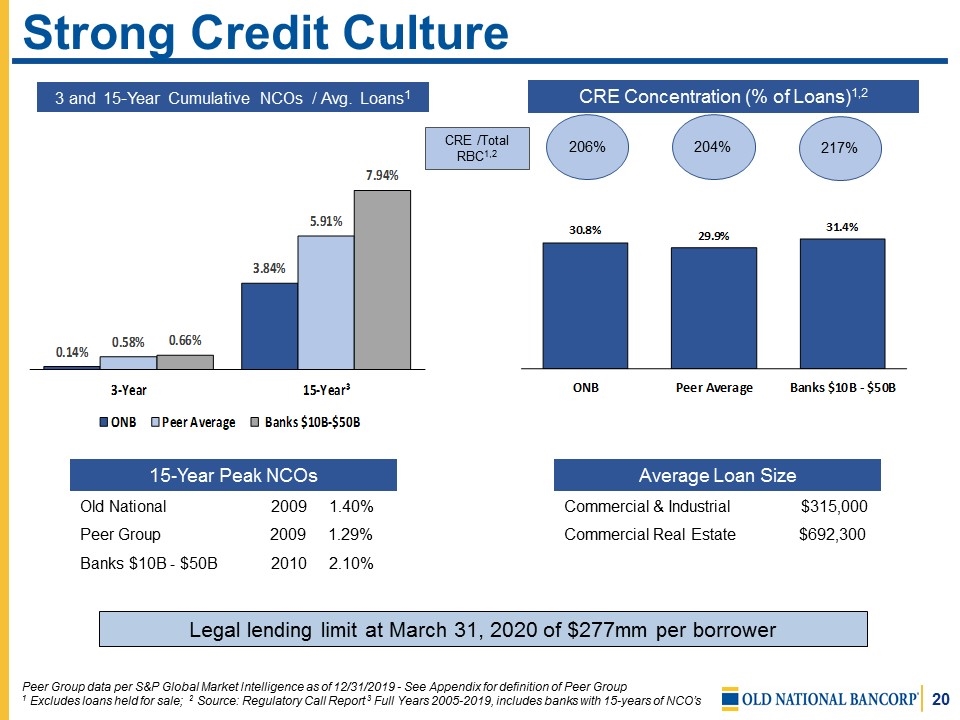

Strong Credit Culture Peer Group data per S&P Global Market Intelligence as of 12/31/2019 - See Appendix for definition of Peer Group 1 Excludes loans held for sale; 2 Source: Regulatory Call Report 3 Full Years 2005-2019, includes banks with 15-years of NCO’s Legal lending limit at March 31, 2020 of $277mm per borrower 3 and 15-Year Cumulative NCOs / Avg. Loans1 CRE Concentration (% of Loans)1,2 206% 204% 217% CRE /Total RBC1,2 Average Loan Size Commercial & Industrial $315,000 Commercial Real Estate $692,300 15-Year Peak NCOs Old National 2009 1.40% Peer Group 2009 1.29% Banks $10B - $50B 2010 2.10%

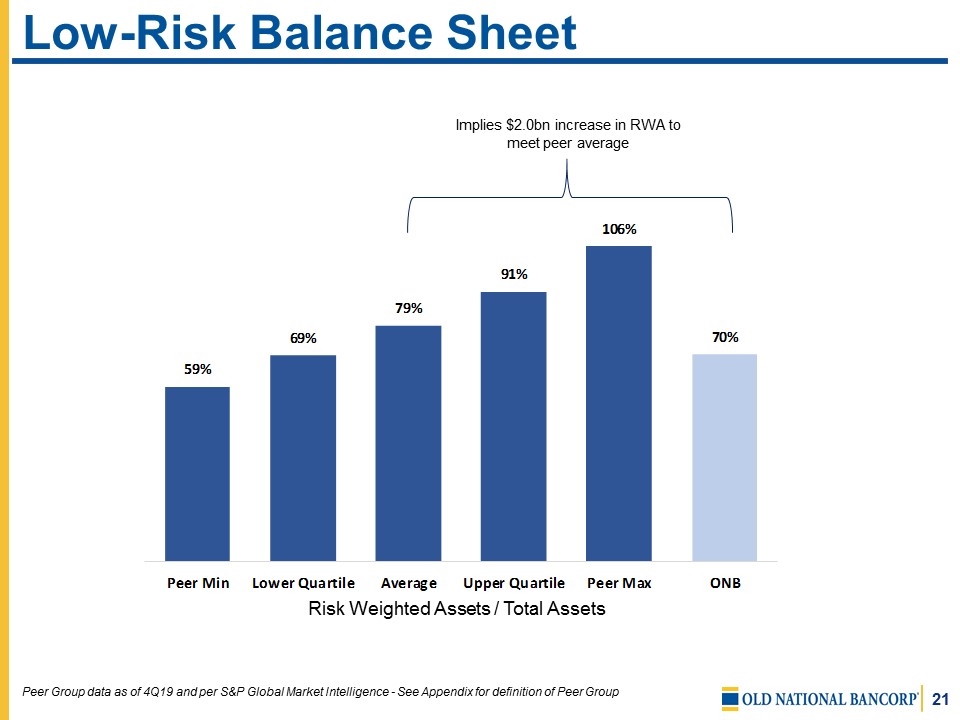

Low-Risk Balance Sheet Implies $2.0bn increase in RWA to meet peer average Peer Group data as of 4Q19 and per S&P Global Market Intelligence - See Appendix for definition of Peer Group Risk Weighted Assets / Total Assets

Commitment to Excellence

Financial Details FINANCIAL DATA AS OF March 31, 2020 DATED: May 8, 2020

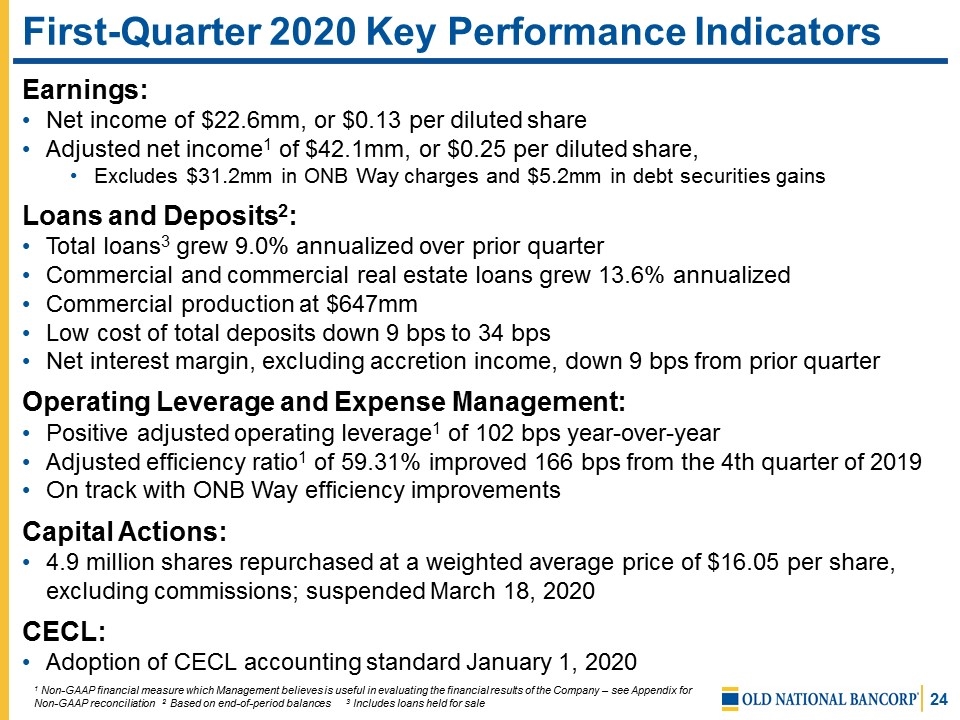

First-Quarter 2020 Key Performance Indicators Earnings: Net income of $22.6mm, or $0.13 per diluted share Adjusted net income1 of $42.1mm, or $0.25 per diluted share, Excludes $31.2mm in ONB Way charges and $5.2mm in debt securities gains Loans and Deposits2: Total loans3 grew 9.0% annualized over prior quarter Commercial and commercial real estate loans grew 13.6% annualized Commercial production at $647mm Low cost of total deposits down 9 bps to 34 bps Net interest margin, excluding accretion income, down 9 bps from prior quarter Operating Leverage and Expense Management: Positive adjusted operating leverage1 of 102 bps year-over-year Adjusted efficiency ratio1 of 59.31% improved 166 bps from the 4th quarter of 2019 On track with ONB Way efficiency improvements Capital Actions: 4.9 million shares repurchased at a weighted average price of $16.05 per share, excluding commissions; suspended March 18, 2020 CECL: Adoption of CECL accounting standard January 1, 2020 1 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation 2 Based on end-of-period balances 3 Includes loans held for sale

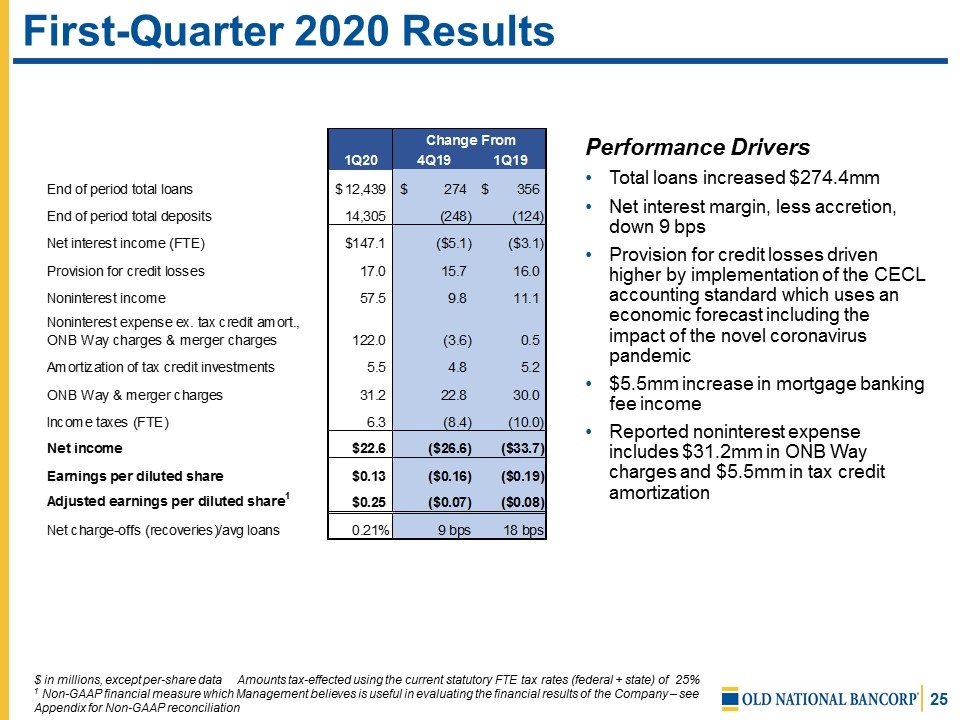

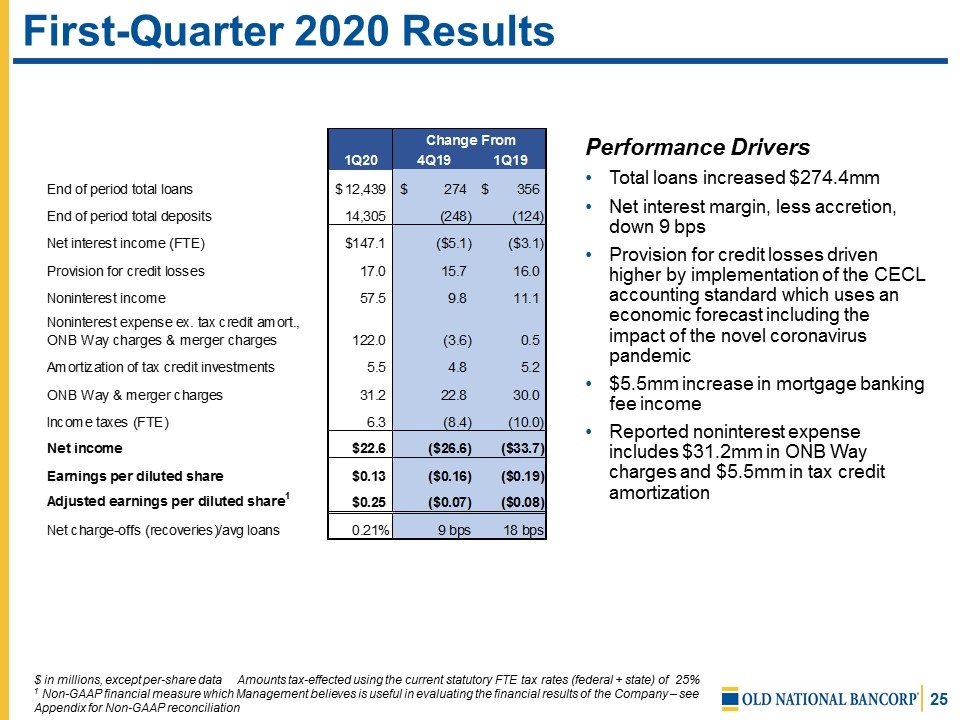

First-Quarter 2020 Results Performance Drivers Total loans increased $274.4mm Net interest margin, less accretion, down 9 bps Provision for credit losses driven higher by implementation of the CECL accounting standard which uses an economic forecast including the impact of the novel coronavirus pandemic $5.5mm increase in mortgage banking fee income Reported noninterest expense includes $31.2mm in ONB Way charges and $5.5mm in tax credit amortization $ in millions, except per-share data Amounts tax-effected using the current statutory FTE tax rates (federal + state) of 25% 1 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation

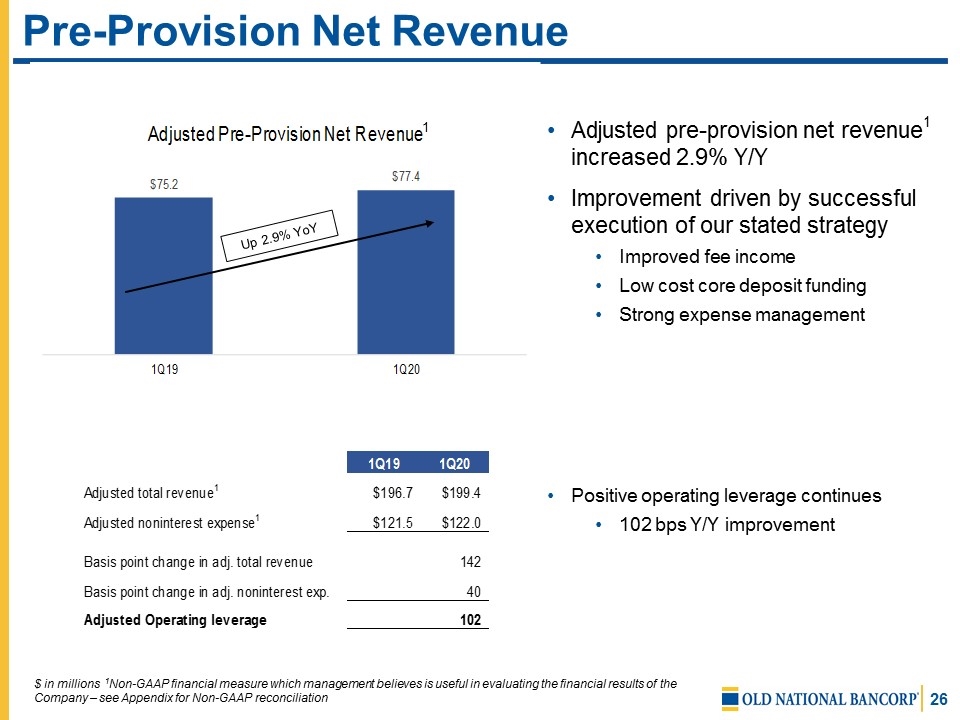

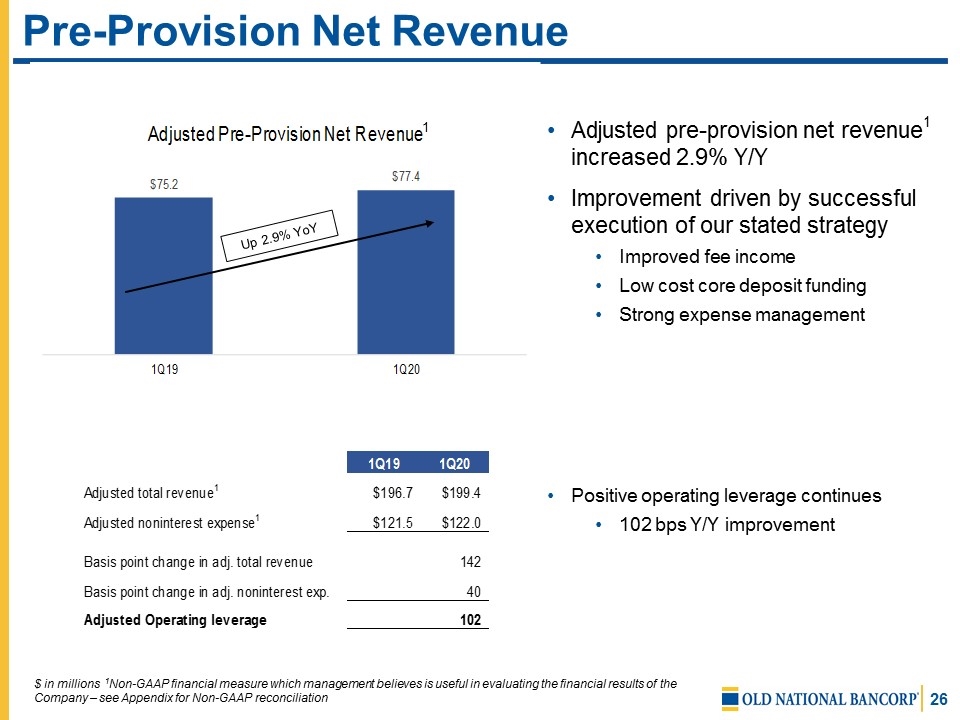

Pre-Provision Net Revenue Adjusted pre-provision net revenue1 increased 2.9% Y/Y Improvement driven by successful execution of our stated strategy Improved fee income Low cost core deposit funding Strong expense management Positive operating leverage continues 102 bps Y/Y improvement 1 Up 2.9% YoY $ in millions 1Non-GAAP financial measure which management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation

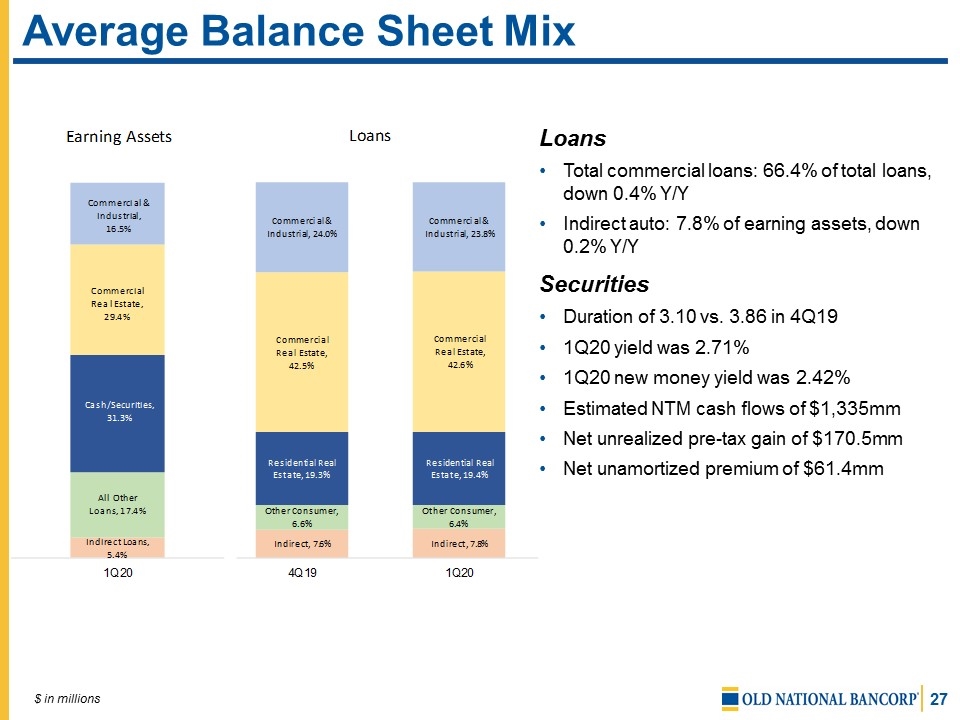

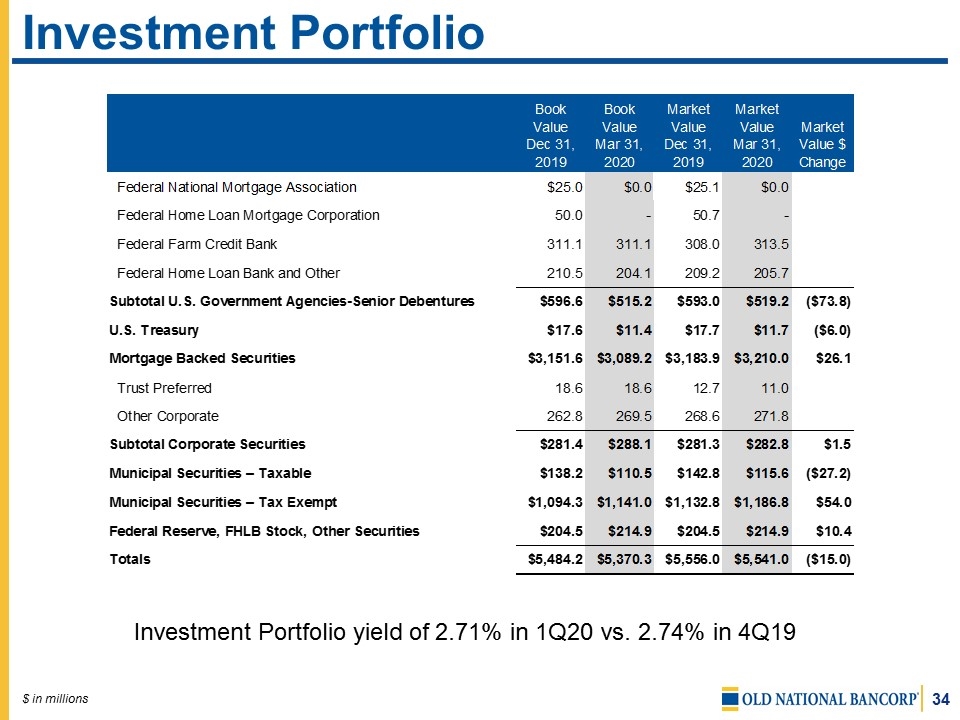

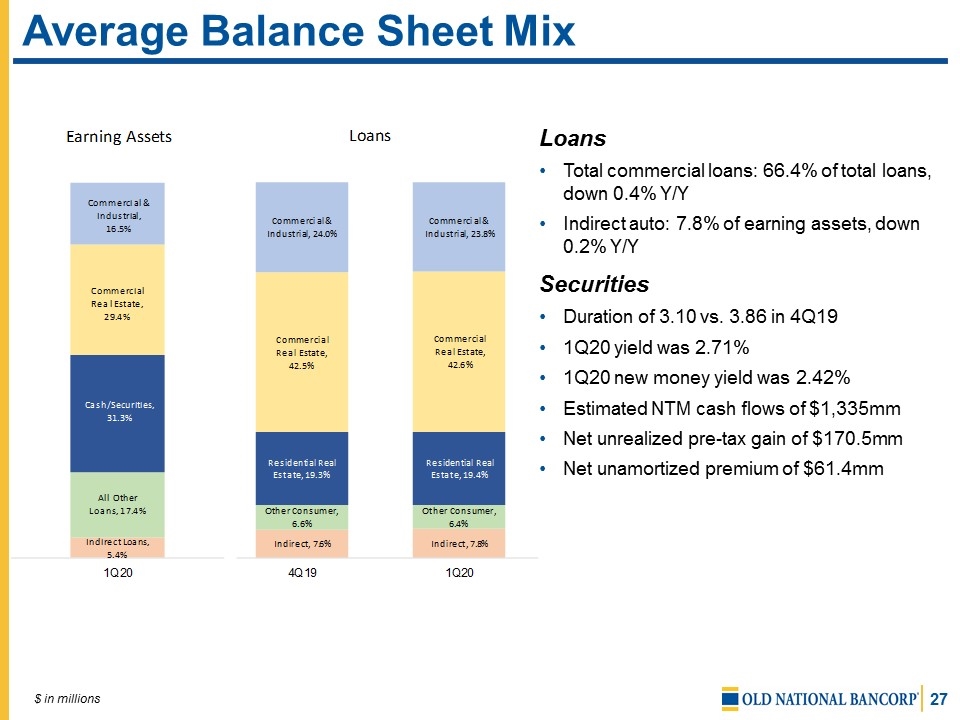

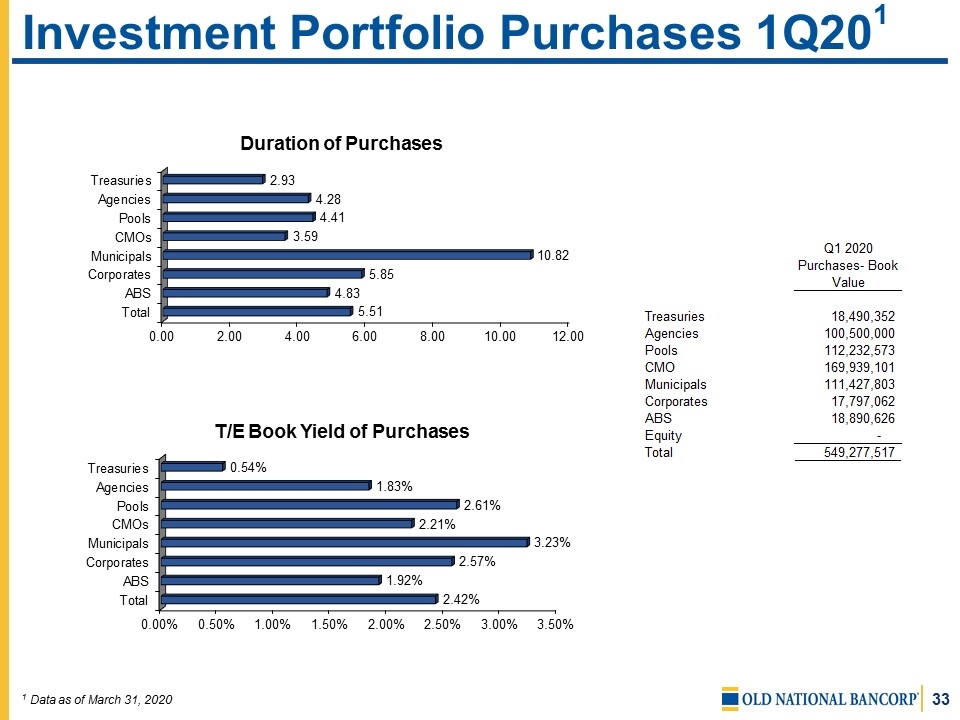

Average Balance Sheet Mix $ in millions Loans Total commercial loans: 66.4% of total loans, down 0.4% Y/Y Indirect auto: 7.8% of earning assets, down 0.2% Y/Y Securities Duration of 3.10 vs. 3.86 in 4Q19 1Q20 yield was 2.71% 1Q20 new money yield was 2.42% Estimated NTM cash flows of $1,335mm Net unrealized pre-tax gain of $170.5mm Net unamortized premium of $61.4mm

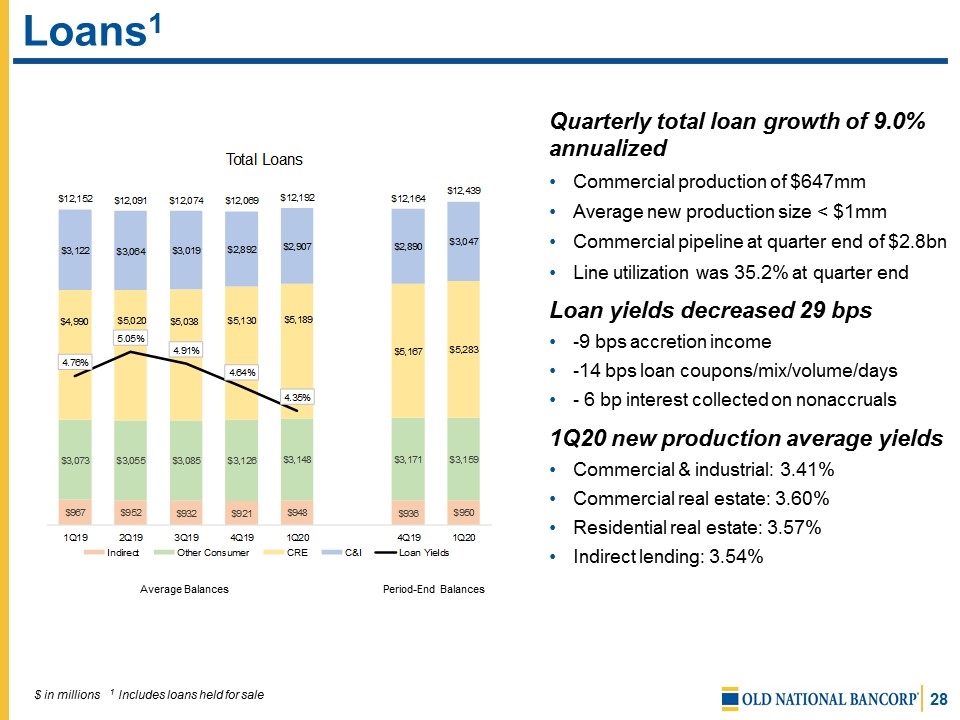

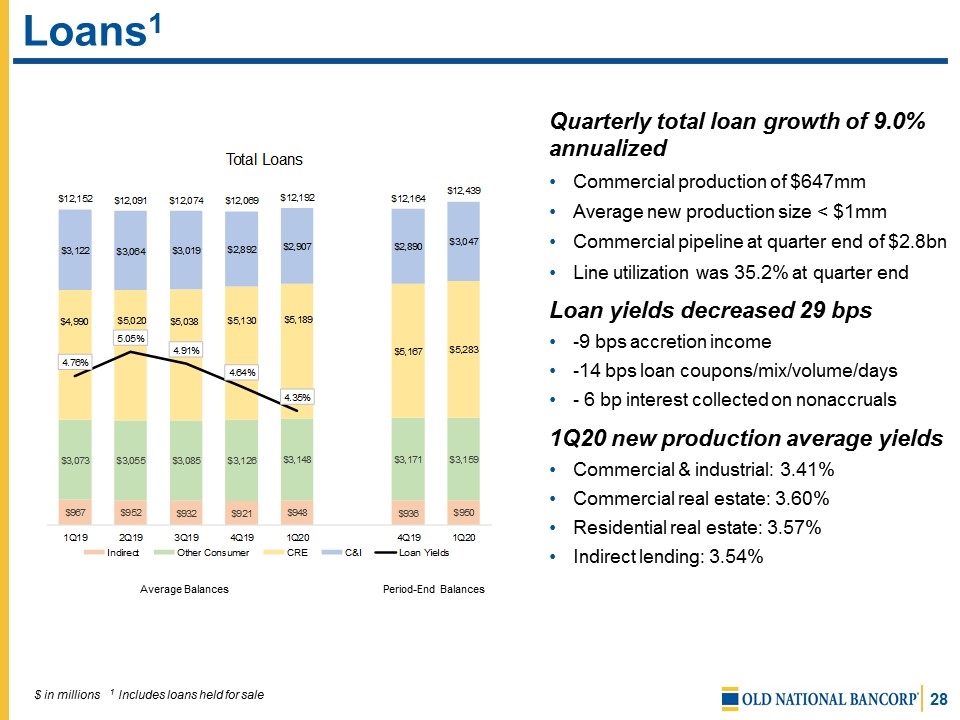

Loans1 $ in millions 1 Includes loans held for sale Average Balances Period-End Balances Quarterly total loan growth of 9.0% annualized Commercial production of $647mm Average new production size < $1mm Commercial pipeline at quarter end of $2.8bn Line utilization was 35.2% at quarter end Loan yields decreased 29 bps -9 bps accretion income -14 bps loan coupons/mix/volume/days - 6 bp interest collected on nonaccruals 1Q20 new production average yields Commercial & industrial: 3.41% Commercial real estate: 3.60% Residential real estate: 3.57% Indirect lending: 3.54%

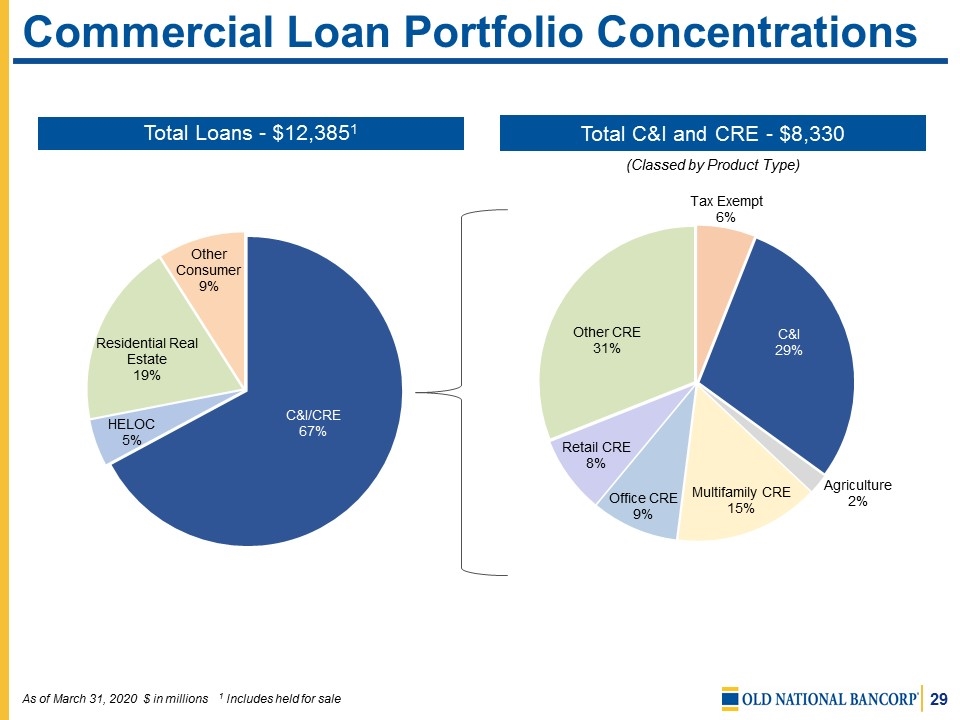

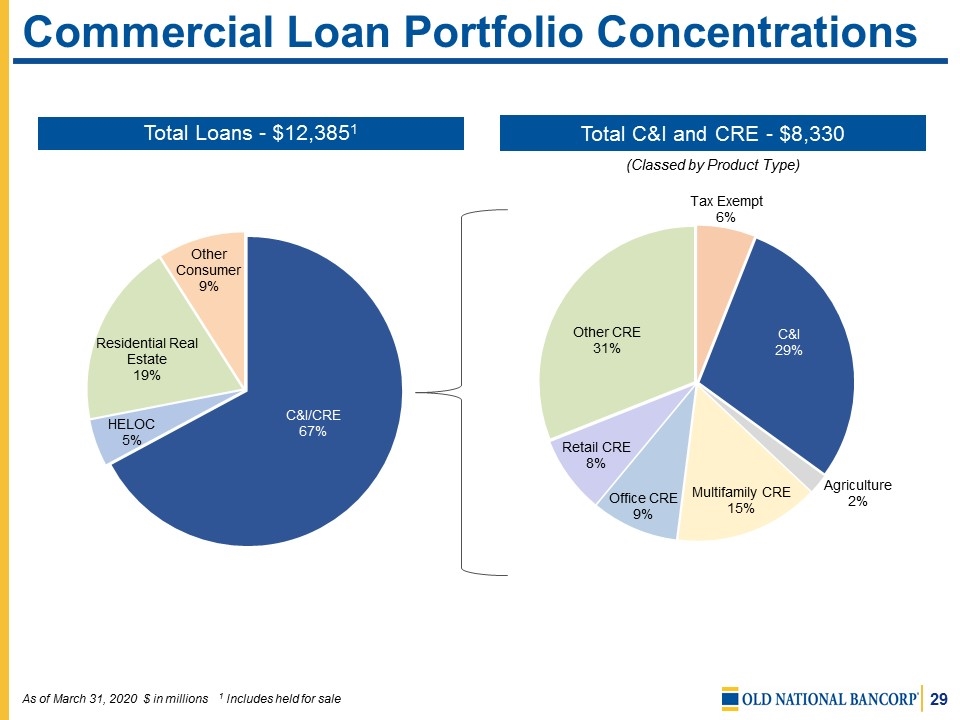

Commercial Loan Portfolio Concentrations As of March 31, 2020 $ in millions 1 Includes held for sale Total C&I and CRE - $8,330 (Classed by Product Type)

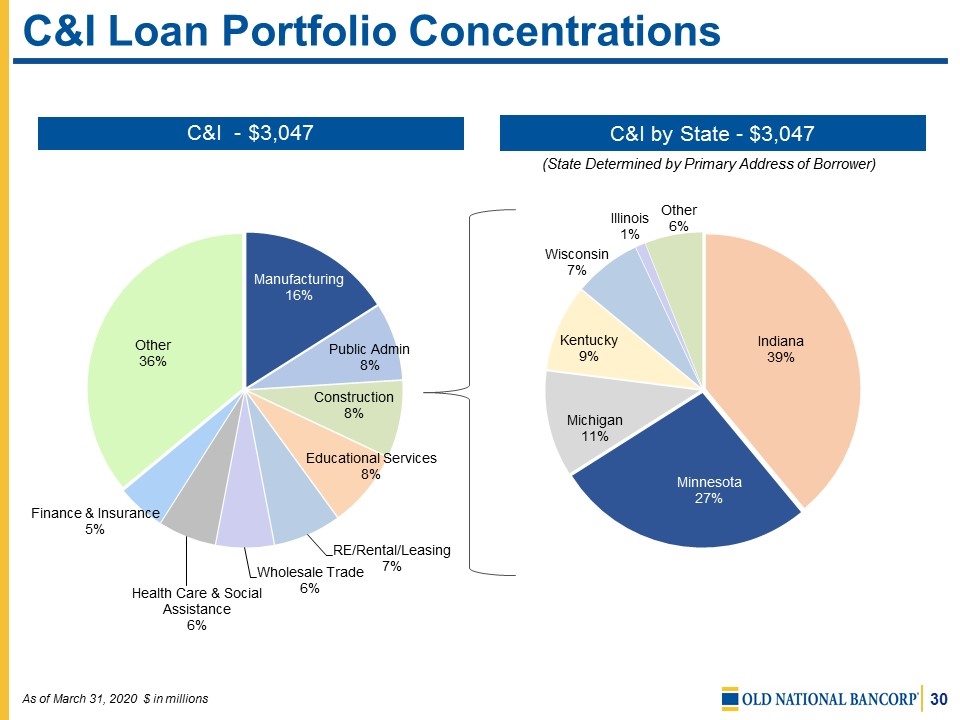

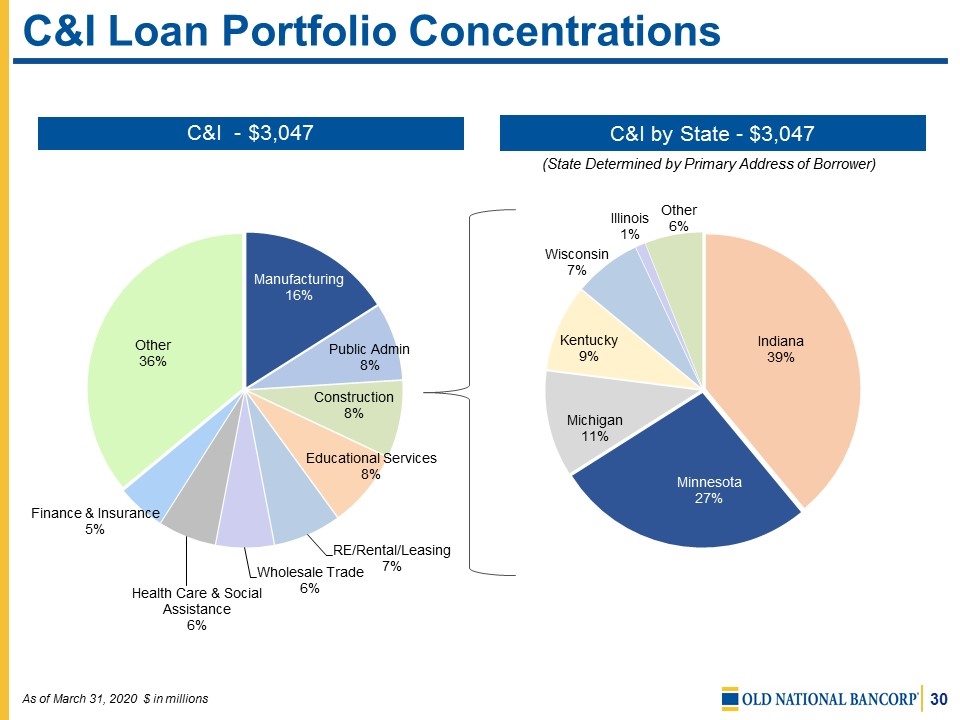

C&I Loan Portfolio Concentrations As of March 31, 2020 $ in millions C&I by State - $3,047 (State Determined by Primary Address of Borrower)

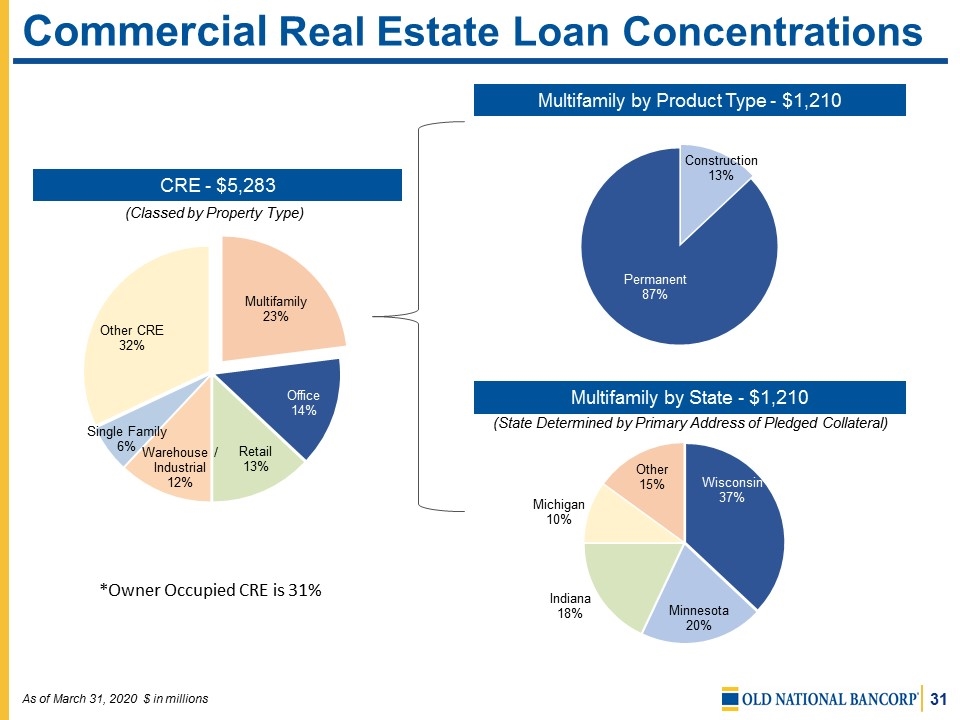

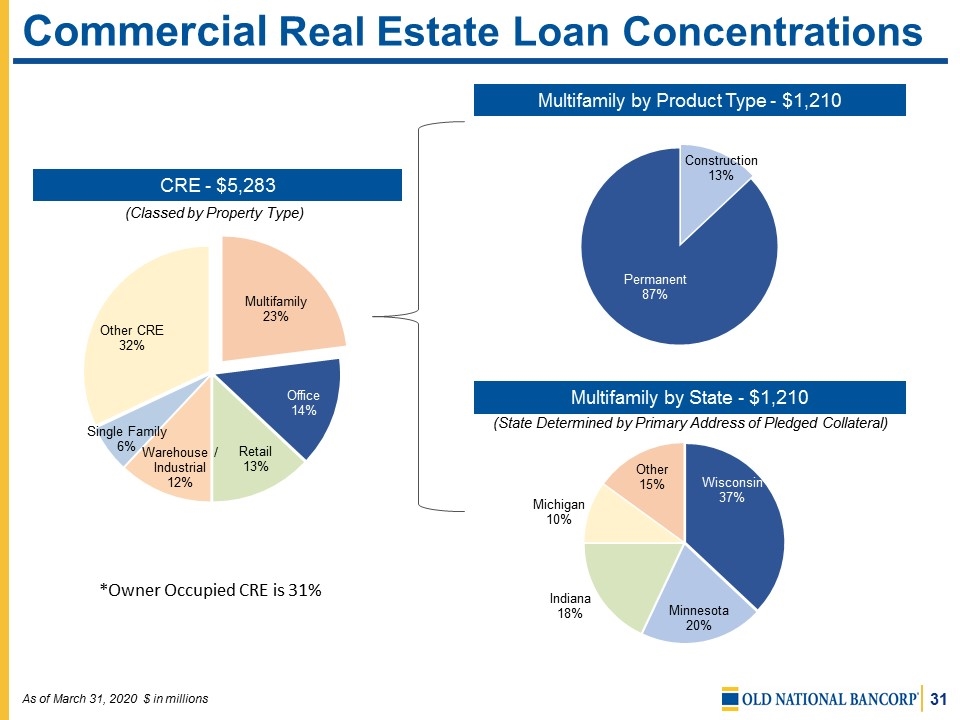

Commercial Real Estate Loan Concentrations CRE - $5,283 (Classed by Property Type) Multifamily by Product Type - $1,210 Multifamily by State - $1,210 (State Determined by Primary Address of Pledged Collateral) *Owner Occupied CRE is 31% As of March 31, 2020 $ in millions

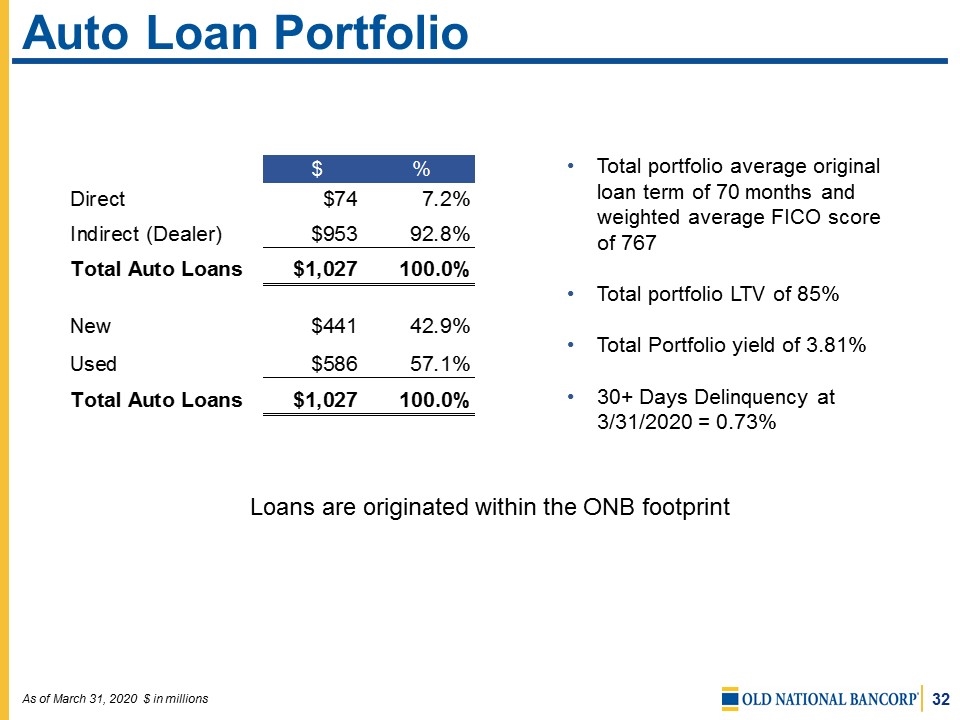

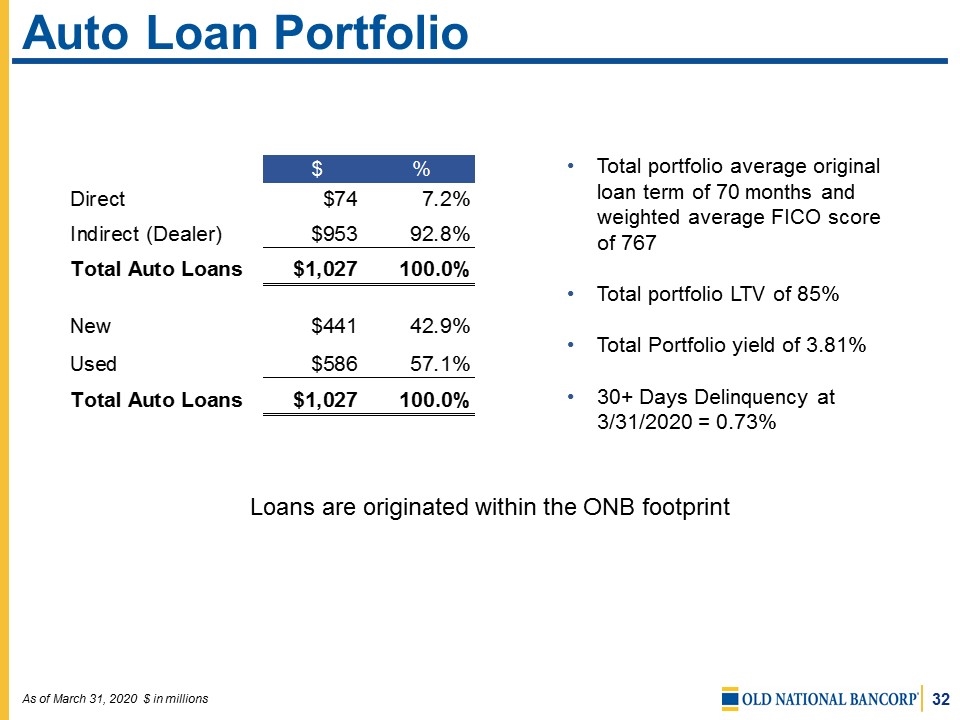

Auto Loan Portfolio Total portfolio average original loan term of 70 months and weighted average FICO score of 767 Total portfolio LTV of 85% Total Portfolio yield of 3.81% 30+ Days Delinquency at 3/31/2020 = 0.73% Loans are originated within the ONB footprint As of March 31, 2020 $ in millions

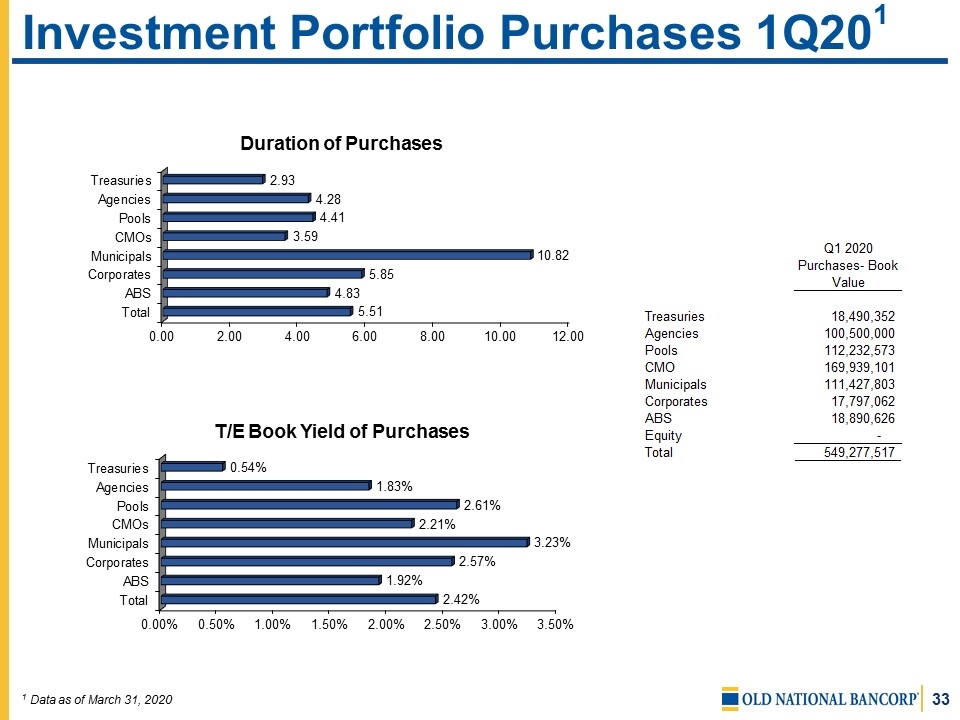

Investment Portfolio Purchases 1Q201 1 Data as of March 31, 2020

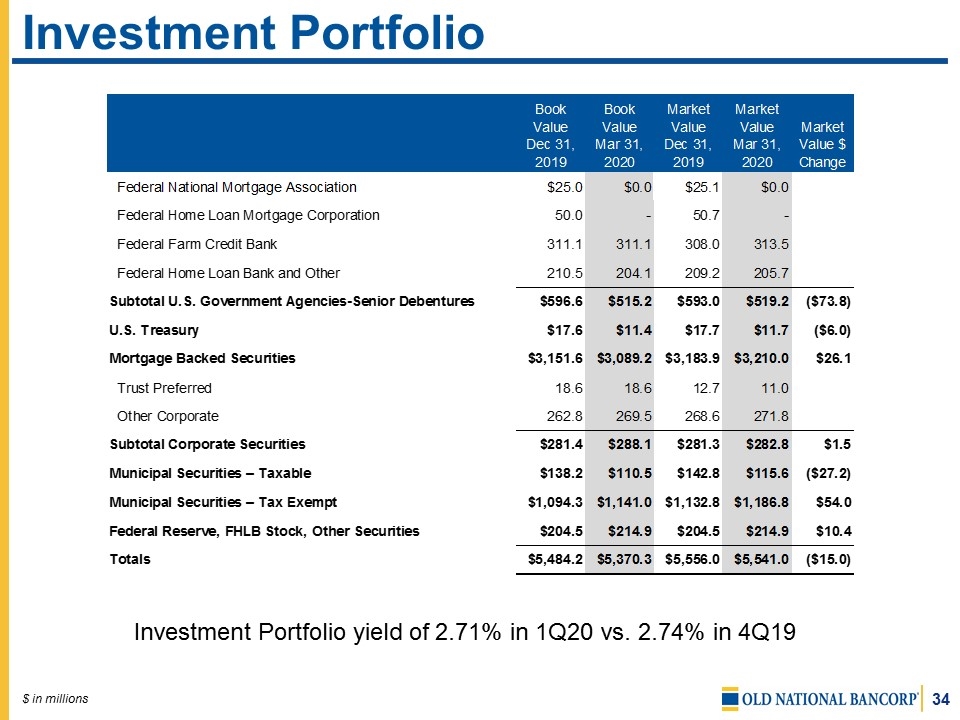

Investment Portfolio $ in millions Investment Portfolio yield of 2.71% in 1Q20 vs. 2.74% in 4Q19

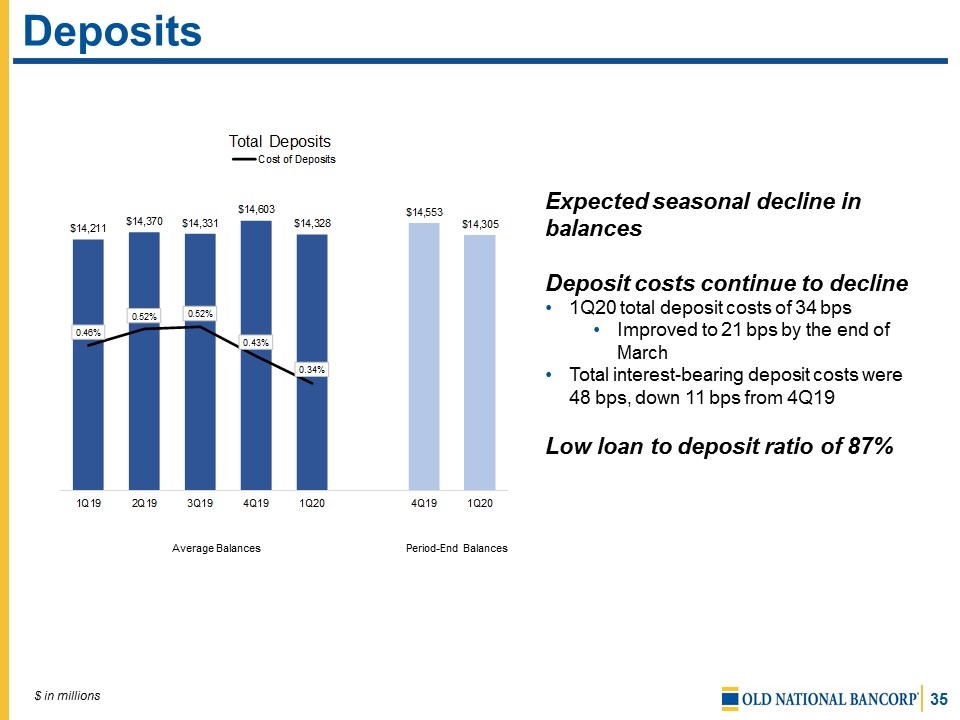

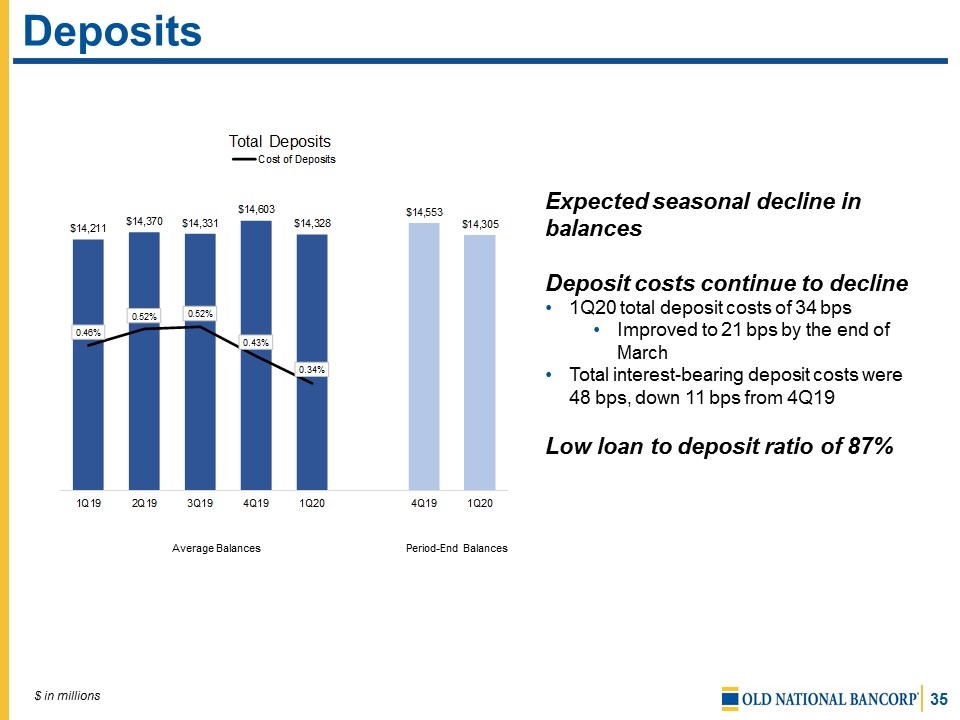

Deposits Average Balances Period-End Balances Expected seasonal decline in balances Deposit costs continue to decline 1Q20 total deposit costs of 34 bps Improved to 21 bps by the end of March Total interest-bearing deposit costs were 48 bps, down 11 bps from 4Q19 Low loan to deposit ratio of 87% $ in millions

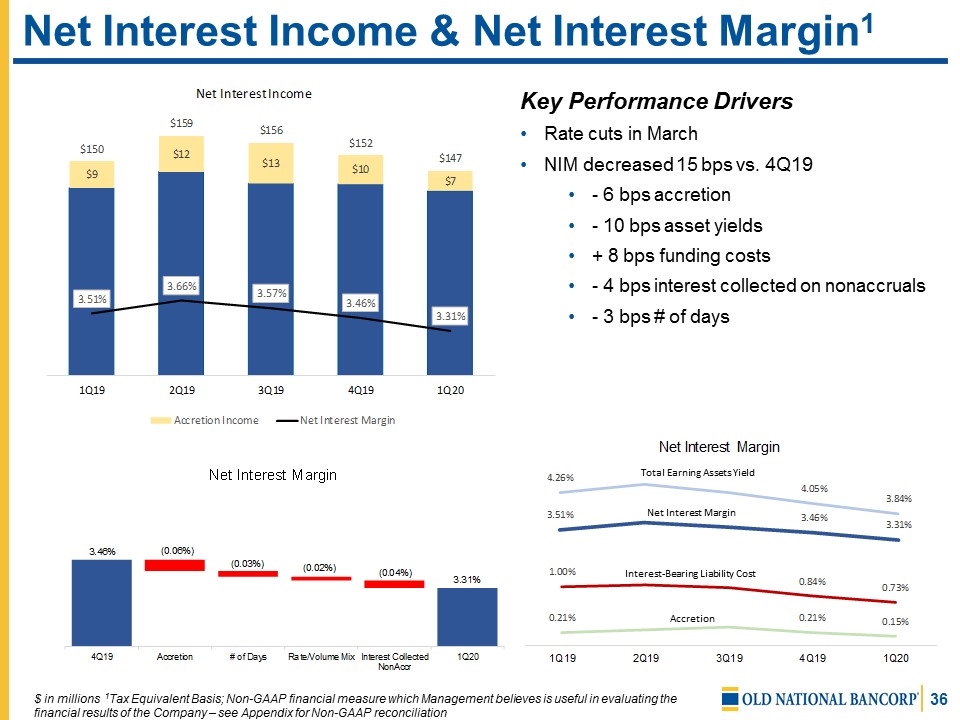

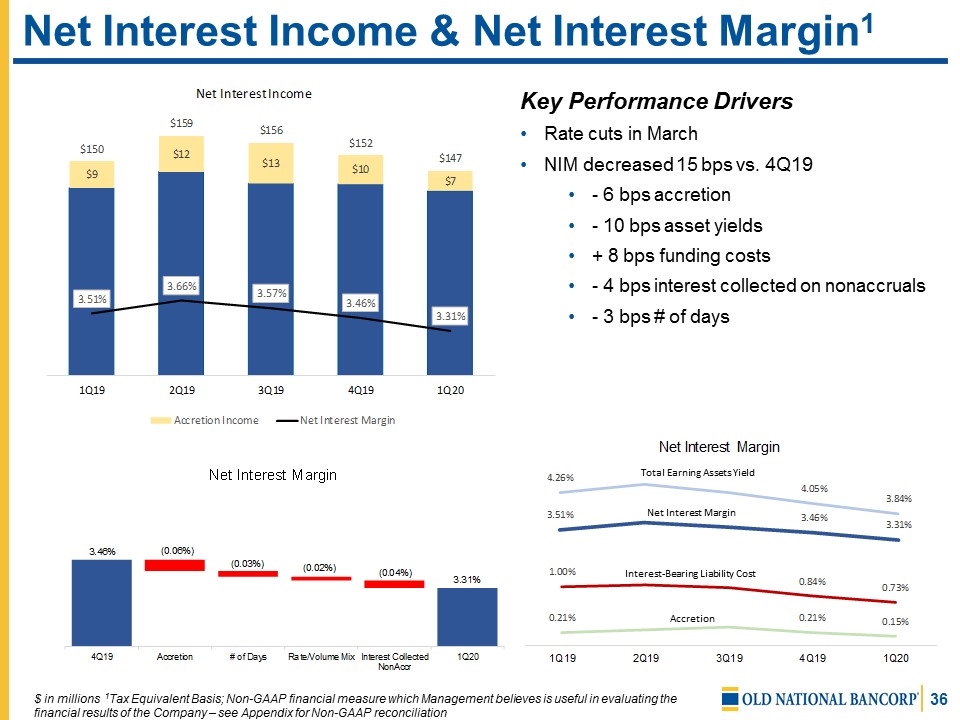

Key Performance Drivers Rate cuts in March NIM decreased 15 bps vs. 4Q19 - 6 bps accretion - 10 bps asset yields + 8 bps funding costs - 4 bps interest collected on nonaccruals - 3 bps # of days Net Interest Income & Net Interest Margin1 $ in millions 1Tax Equivalent Basis; Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation Total Earning Assets Yield Net Interest Margin Interest-Bearing Liability Cost Accretion

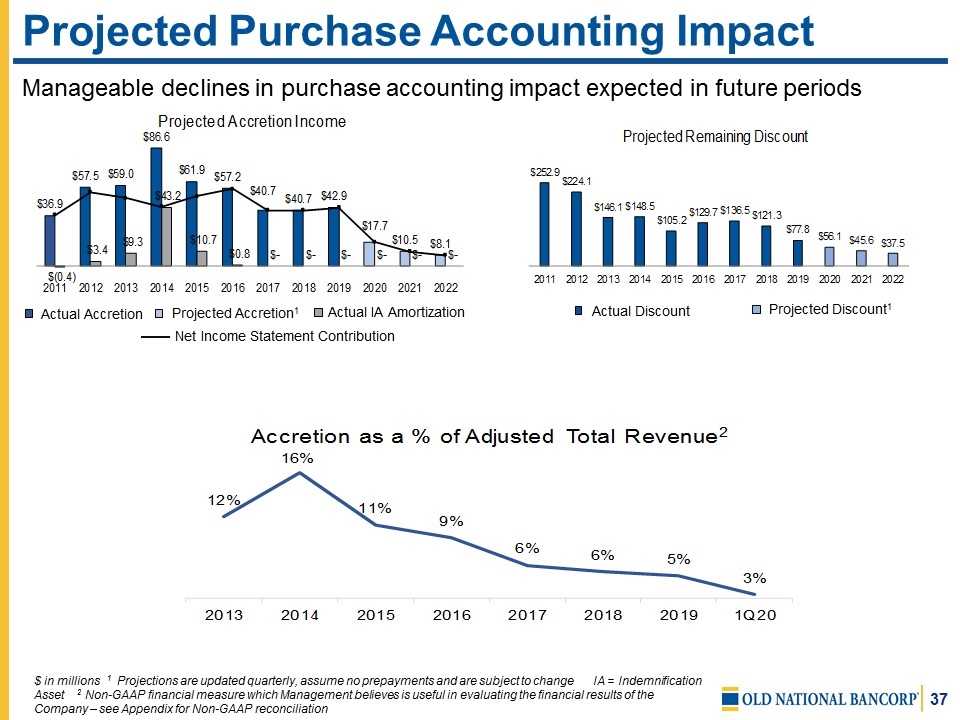

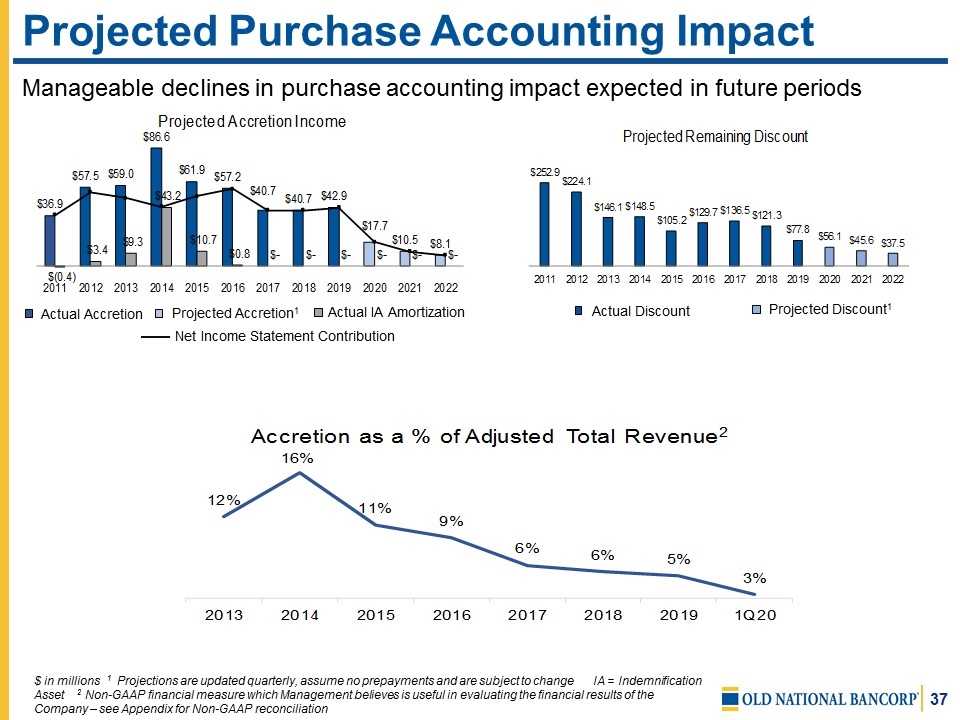

Projected Purchase Accounting Impact Actual Accretion Projected Accretion1 Actual Discount Projected Discount1 Manageable declines in purchase accounting impact expected in future periods Actual IA Amortization Net Income Statement Contribution $ in millions 1 Projections are updated quarterly, assume no prepayments and are subject to change IA = Indemnification Asset 2 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation

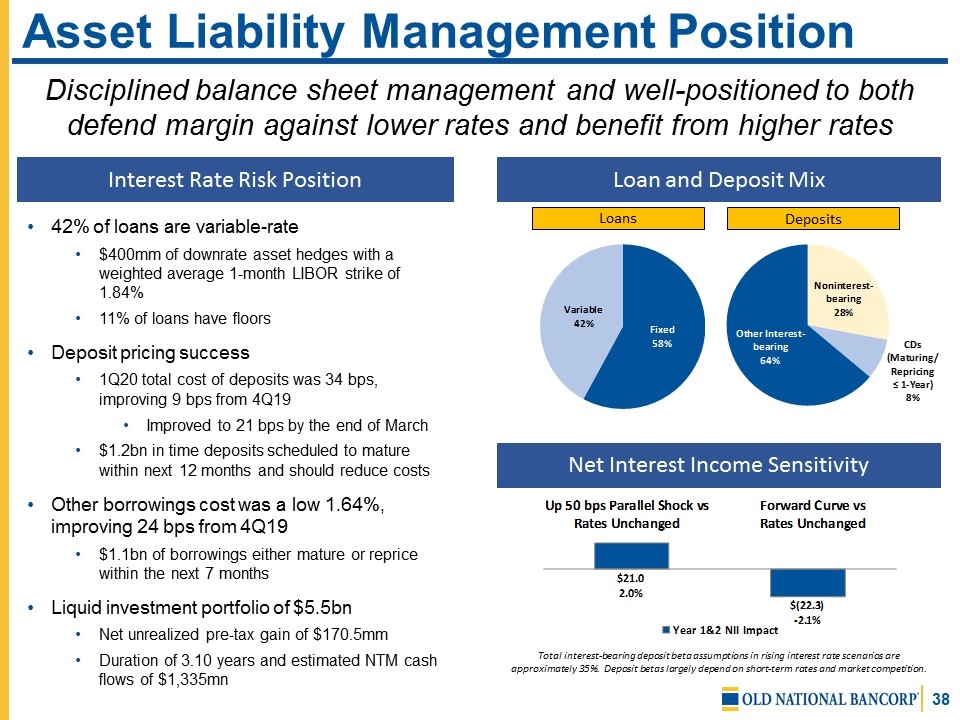

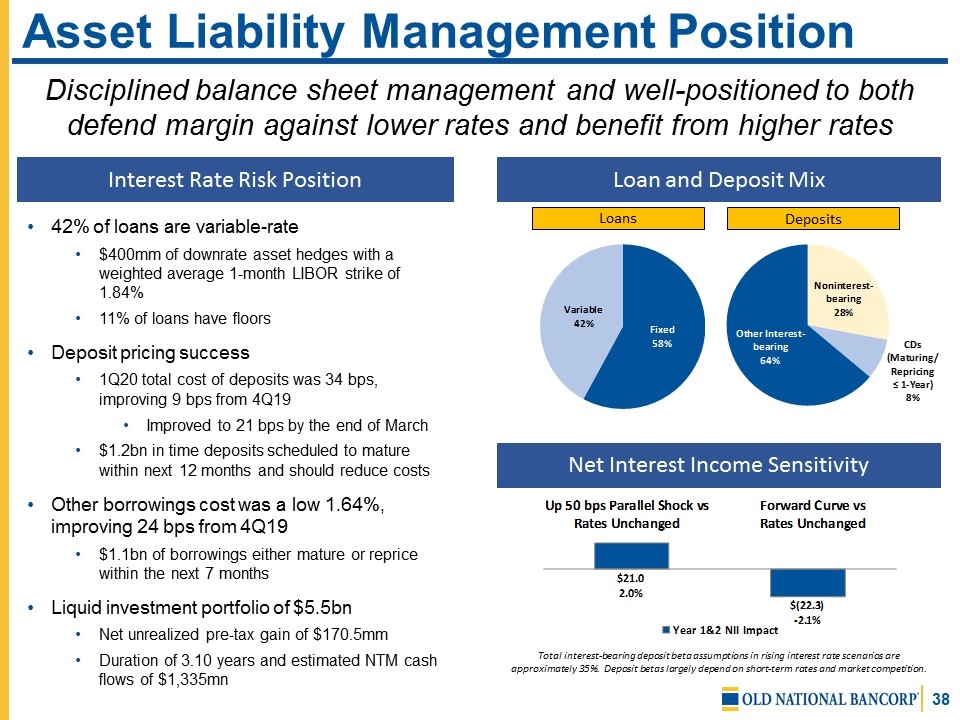

Asset Liability Management Position 42% of loans are variable-rate $400mm of downrate asset hedges with a weighted average 1-month LIBOR strike of 1.84% 11% of loans have floors Deposit pricing success 1Q20 total cost of deposits was 34 bps, improving 9 bps from 4Q19 Improved to 21 bps by the end of March $1.2bn in time deposits scheduled to mature within next 12 months and should reduce costs Other borrowings cost was a low 1.64%, improving 24 bps from 4Q19 $1.1bn of borrowings either mature or reprice within the next 7 months Liquid investment portfolio of $5.5bn Net unrealized pre-tax gain of $170.5mm Duration of 3.10 years and estimated NTM cash flows of $1,335mn Net Interest Income Sensitivity Disciplined balance sheet management and well-positioned to both defend margin against lower rates and benefit from higher rates Interest Rate Risk Position Total interest-bearing deposit beta assumptions in rising interest rate scenarios are approximately 35%. Deposit betas largely depend on short-term rates and market competition. Loan and Deposit Mix Loans Deposits

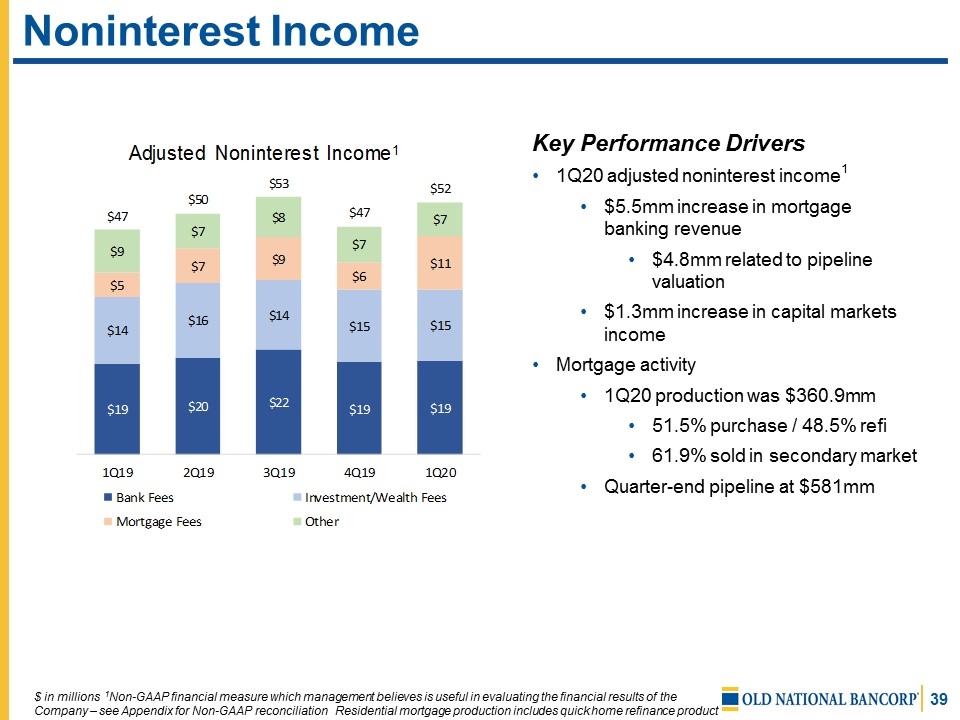

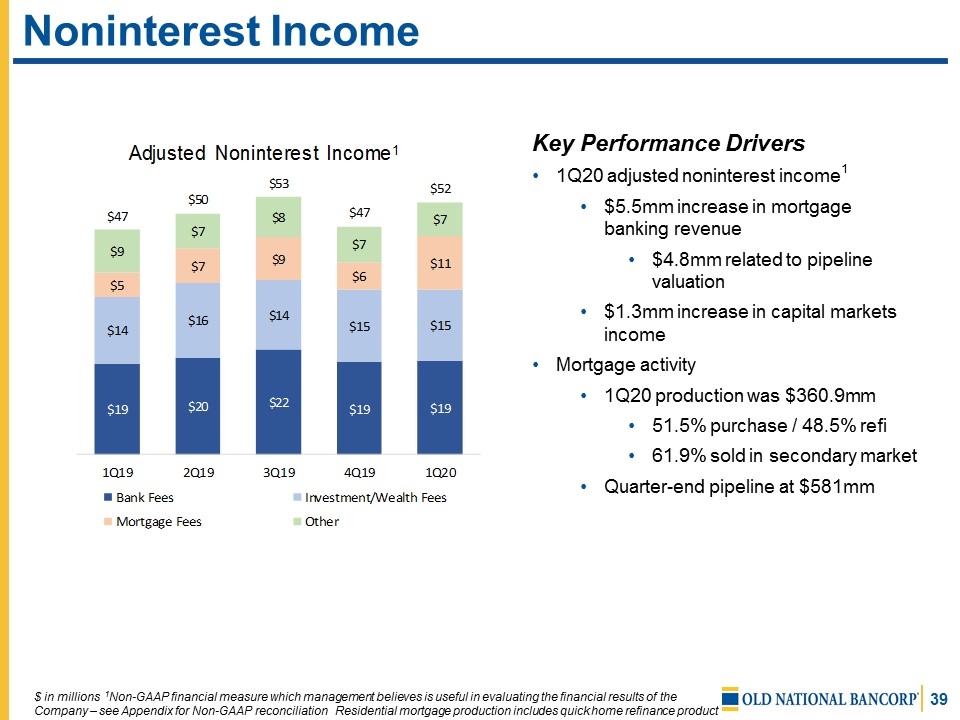

Noninterest Income $ in millions 1Non-GAAP financial measure which management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation Residential mortgage production includes quick home refinance product Key Performance Drivers 1Q20 adjusted noninterest income1 $5.5mm increase in mortgage banking revenue $4.8mm related to pipeline valuation $1.3mm increase in capital markets income Mortgage activity 1Q20 production was $360.9mm 51.5% purchase / 48.5% refi 61.9% sold in secondary market Quarter-end pipeline at $581mm

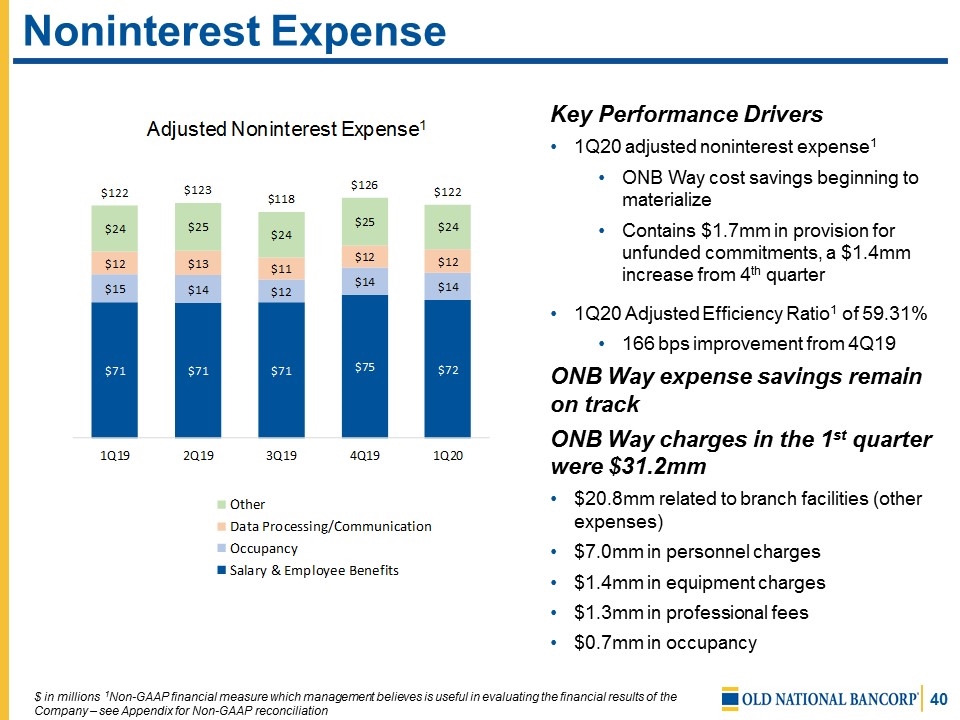

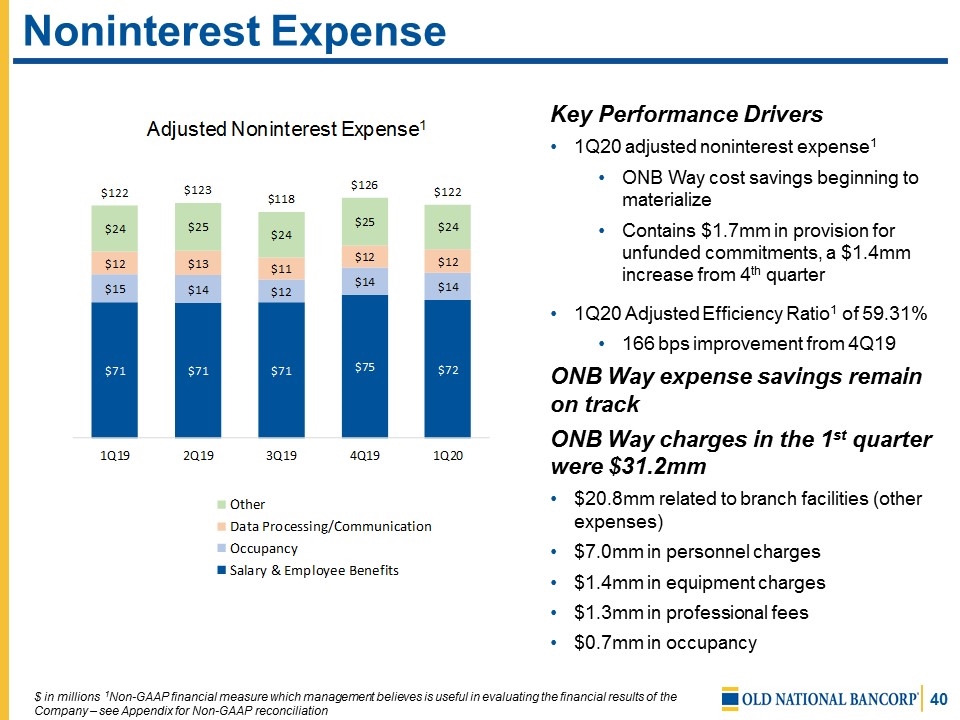

Noninterest Expense $ in millions 1Non-GAAP financial measure which management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation Key Performance Drivers 1Q20 adjusted noninterest expense1 ONB Way cost savings beginning to materialize Contains $1.7mm in provision for unfunded commitments, a $1.4mm increase from 4th quarter 1Q20 Adjusted Efficiency Ratio1 of 59.31% 166 bps improvement from 4Q19 ONB Way expense savings remain on track ONB Way charges in the 1st quarter were $31.2mm $20.8mm related to branch facilities (other expenses) $7.0mm in personnel charges $1.4mm in equipment charges $1.3mm in professional fees $0.7mm in occupancy

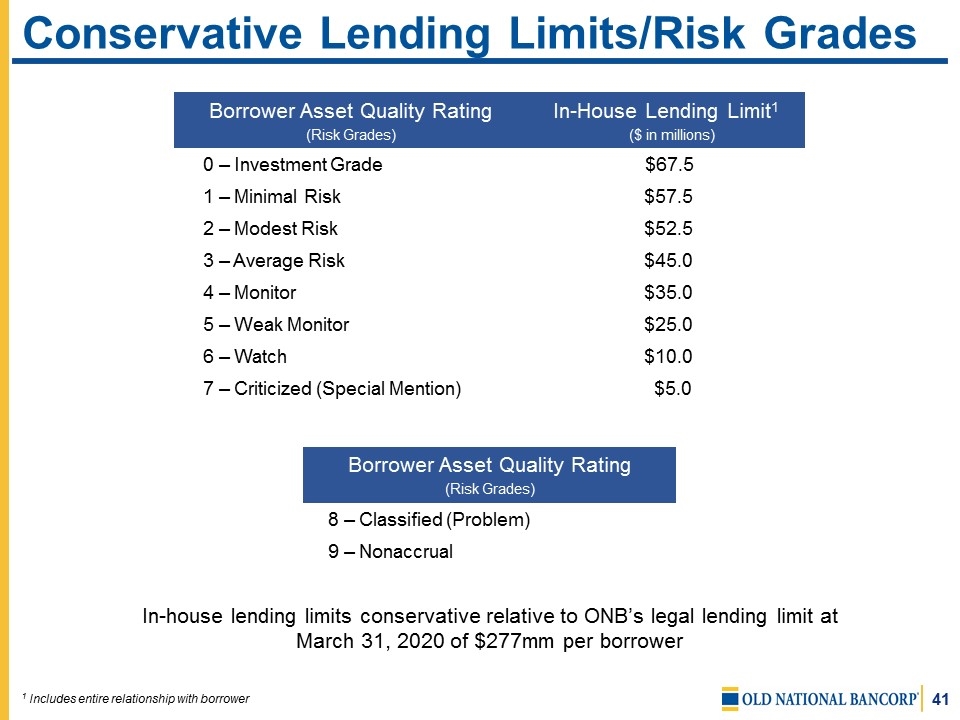

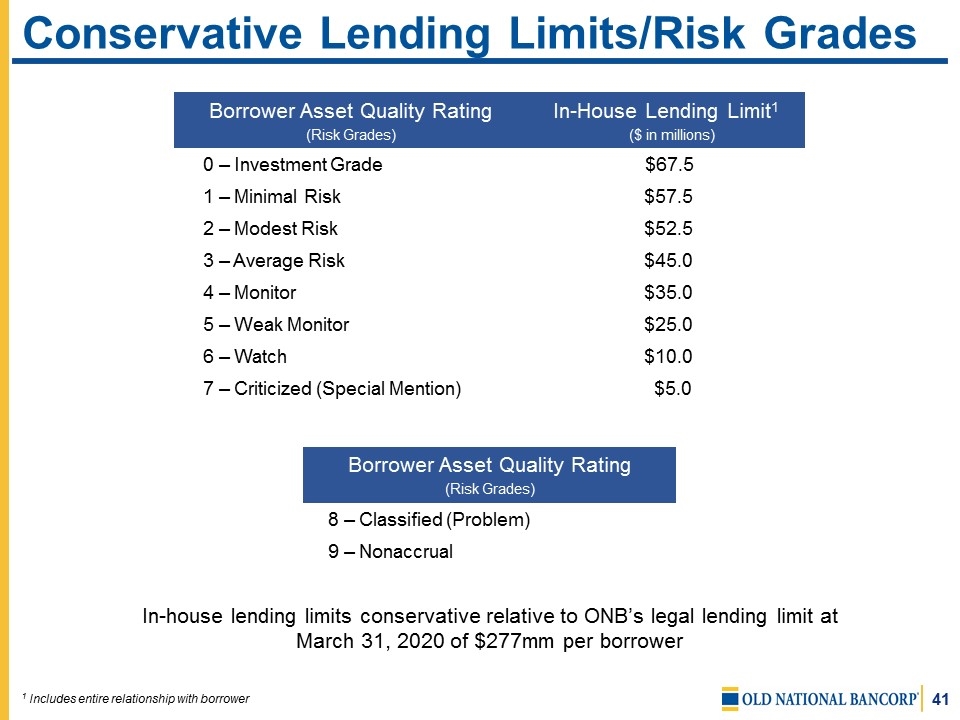

Conservative Lending Limits/Risk Grades Borrower Asset Quality Rating (Risk Grades) In-House Lending Limit1 ($ in millions) 0 – Investment Grade $67.5 1 – Minimal Risk $57.5 2 – Modest Risk $52.5 3 – Average Risk $45.0 4 – Monitor $35.0 5 – Weak Monitor $25.0 6 – Watch $10.0 7 – Criticized (Special Mention) $5.0 In-house lending limits conservative relative to ONB’s legal lending limit at March 31, 2020 of $277mm per borrower 1 Includes entire relationship with borrower Borrower Asset Quality Rating (Risk Grades) 8 – Classified (Problem) 9 – Nonaccrual

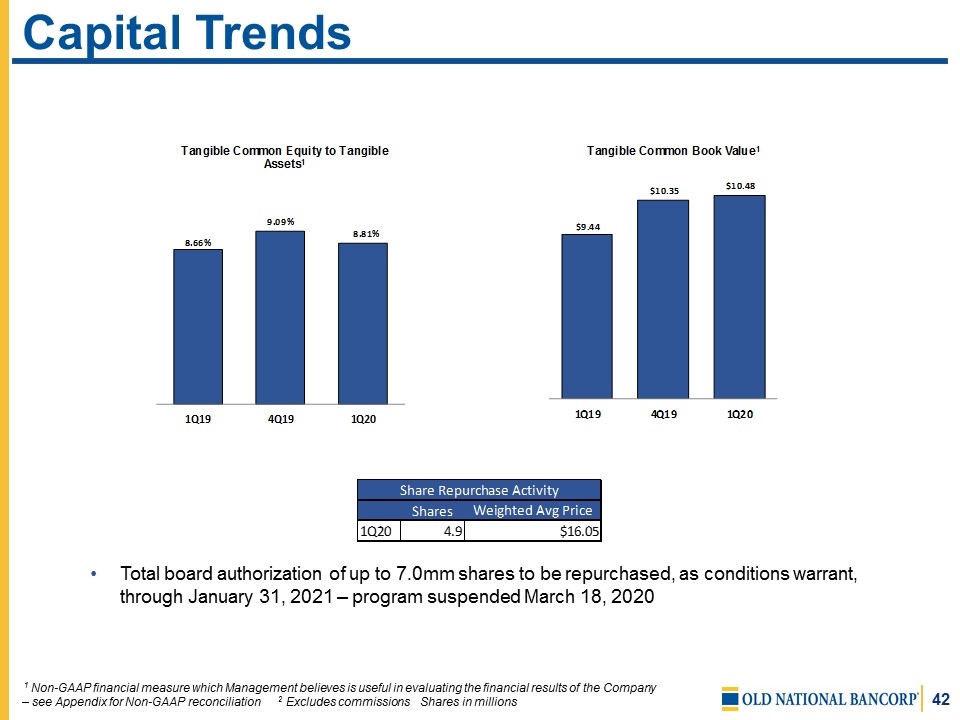

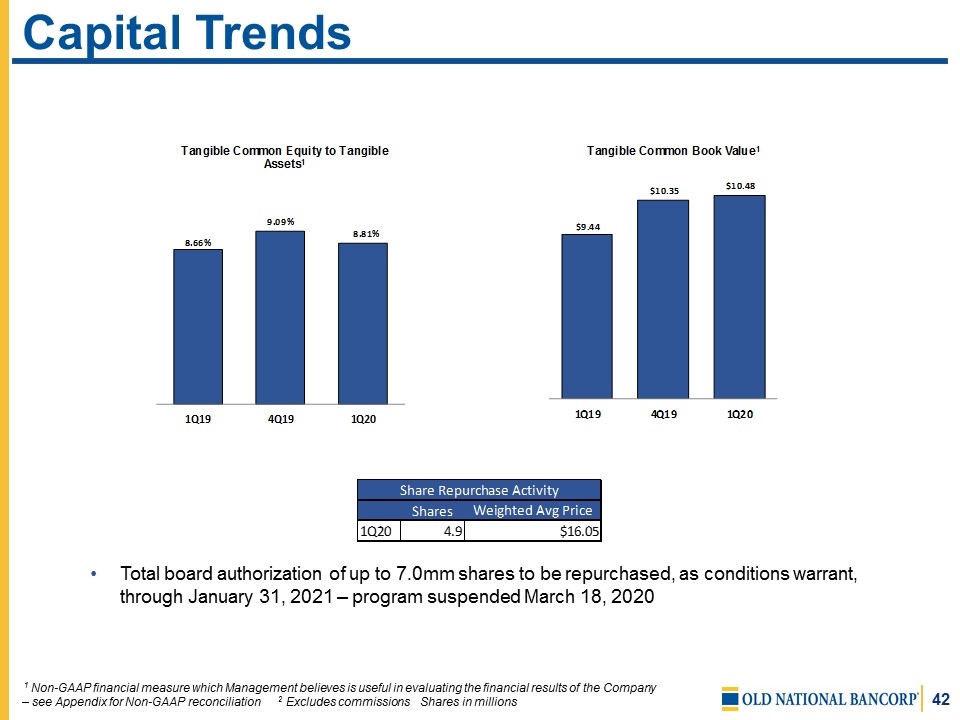

Capital Trends 1 Non-GAAP financial measure which Management believes is useful in evaluating the financial results of the Company – see Appendix for Non-GAAP reconciliation 2 Excludes commissions Shares in millions Total board authorization of up to 7.0mm shares to be repurchased, as conditions warrant, through January 31, 2021 – program suspended March 18, 2020

Branch Actions Driving efficiencies through increased branch size and investment in mobile and online banking Consolidated 103 branches since January 2014 Increased core deposits per branch by 119% since 2009 Launched new online and mobile solution January 2016 Increased mobile users by over 530% As part of The ONB Way, recently consolidated 31 branches throughout the footprint in April 2020

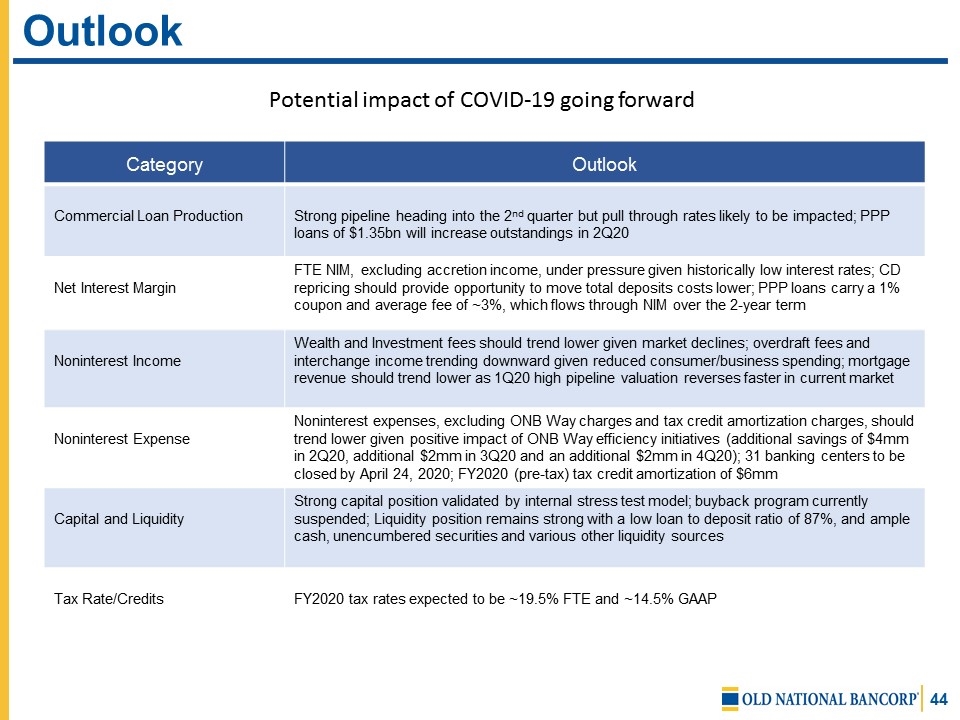

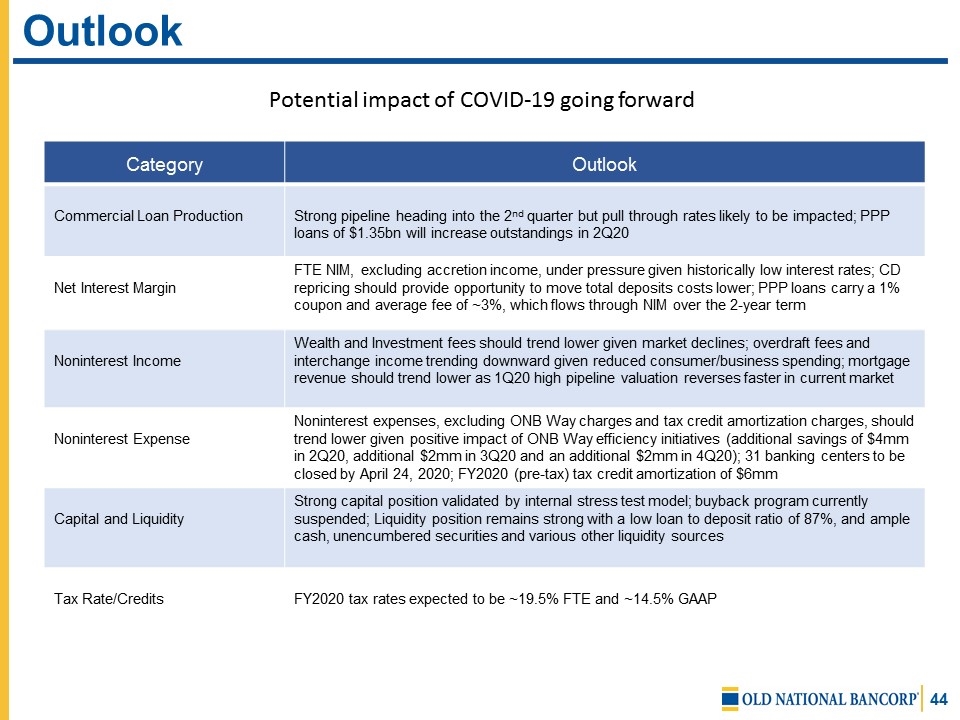

Outlook Category Outlook Commercial Loan Production Strong pipeline heading into the 2nd quarter but pull through rates likely to be impacted; PPP loans of $1.35bn will increase outstandings in 2Q20 Net Interest Margin FTE NIM, excluding accretion income, under pressure given historically low interest rates; CD repricing should provide opportunity to move total deposits costs lower; PPP loans carry a 1% coupon and average fee of ~3%, which flows through NIM over the 2-year term Noninterest Income Wealth and Investment fees should trend lower given market declines; overdraft fees and interchange income trending downward given reduced consumer/business spending; mortgage revenue should trend lower as 1Q20 high pipeline valuation reverses faster in current market Noninterest Expense Noninterest expenses, excluding ONB Way charges and tax credit amortization charges, should trend lower given positive impact of ONB Way efficiency initiatives (additional savings of $4mm in 2Q20, additional $2mm in 3Q20 and an additional $2mm in 4Q20); 31 banking centers to be closed by April 24, 2020; FY2020 (pre-tax) tax credit amortization of $6mm Capital and Liquidity Strong capital position validated by internal stress test model; buyback program currently suspended; Liquidity position remains strong with a low loan to deposit ratio of 87%, and ample cash, unencumbered securities and various other liquidity sources Tax Rate/Credits FY2020 tax rates expected to be ~19.5% FTE and ~14.5% GAAP Potential impact of COVID-19 going forward

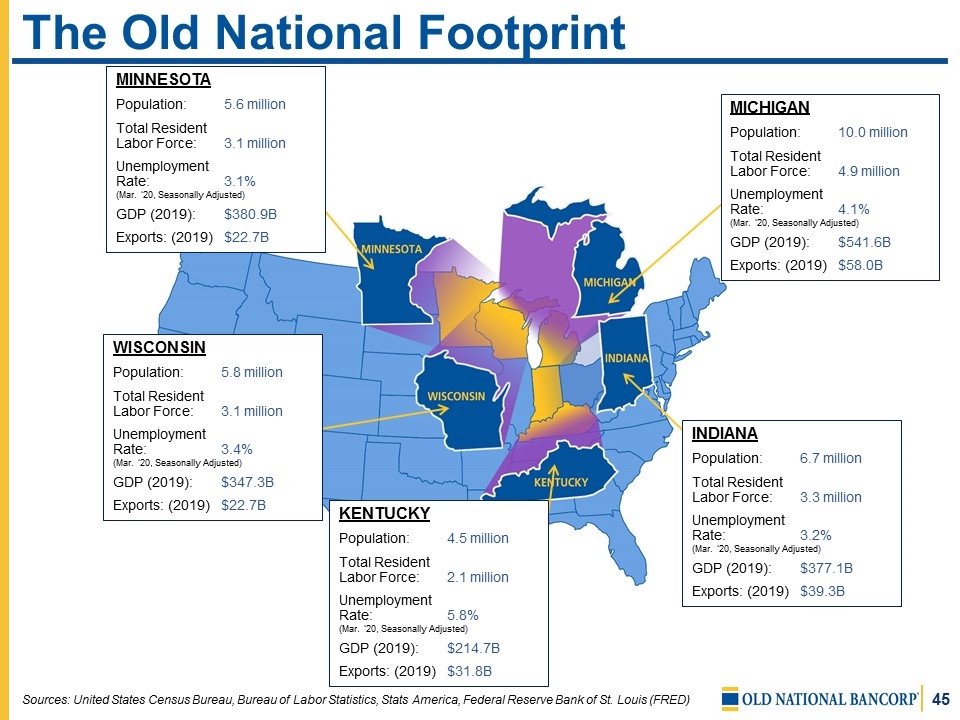

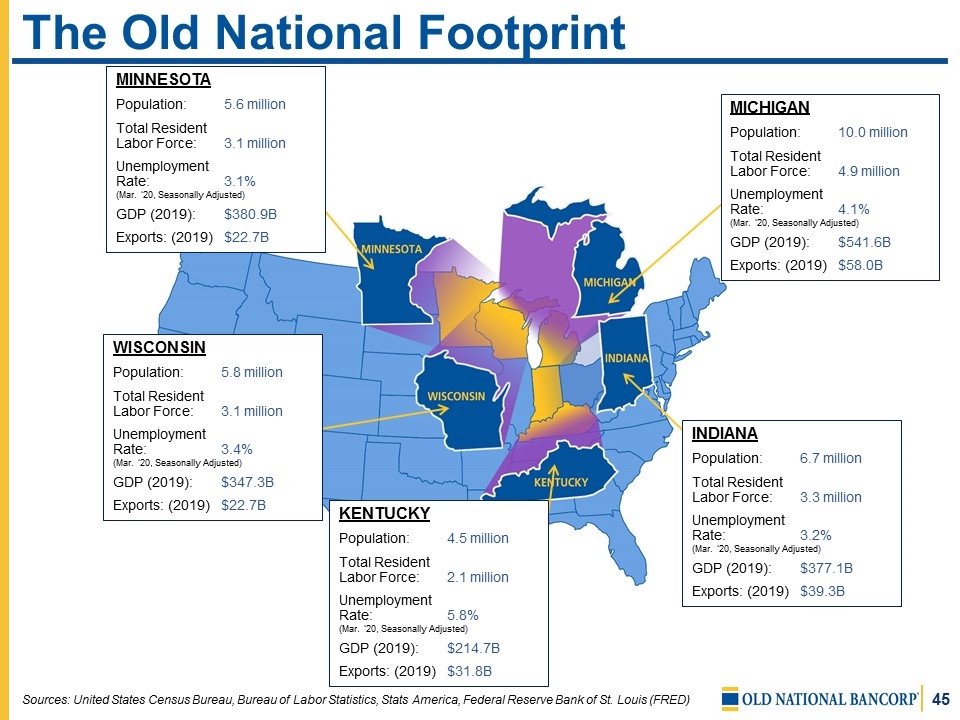

The Old National Footprint Sources: United States Census Bureau, Bureau of Labor Statistics, Stats America, Federal Reserve Bank of St. Louis (FRED) INDIANA Population: 6.7 million Total Resident Labor Force:3.3 million Unemployment Rate:3.2% (Mar. ‘20, Seasonally Adjusted) GDP (2019): $377.1B Exports: (2019)$39.3B KENTUCKY Population: 4.5 million Total Resident Labor Force:2.1 million Unemployment Rate:5.8% (Mar. ‘20, Seasonally Adjusted) GDP (2019): $214.7B Exports: (2019)$31.8B WISCONSIN Population: 5.8 million Total Resident Labor Force:3.1 million Unemployment Rate:3.4% (Mar. ‘20, Seasonally Adjusted) GDP (2019): $347.3B Exports: (2019)$22.7B MINNESOTA Population: 5.6 million Total Resident Labor Force:3.1 million Unemployment Rate:3.1% (Mar. ‘20, Seasonally Adjusted) GDP (2019): $380.9B Exports: (2019)$22.7B MICHIGAN Population: 10.0 million Total Resident Labor Force:4.9 million Unemployment Rate:4.1% (Mar. ‘20, Seasonally Adjusted) GDP (2019): $541.6B Exports: (2019)$58.0B

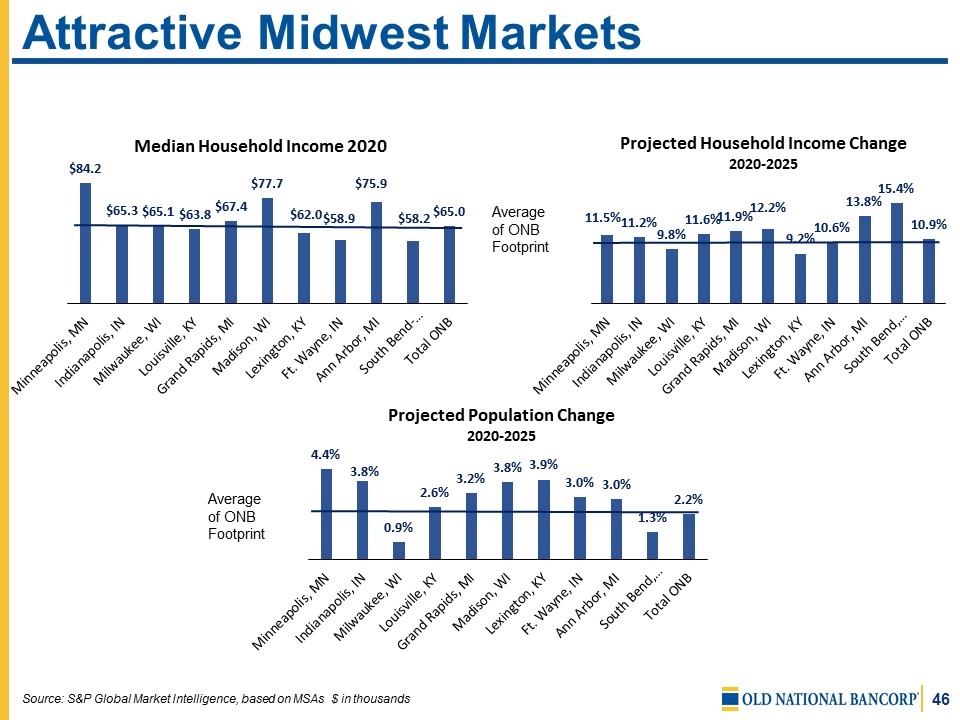

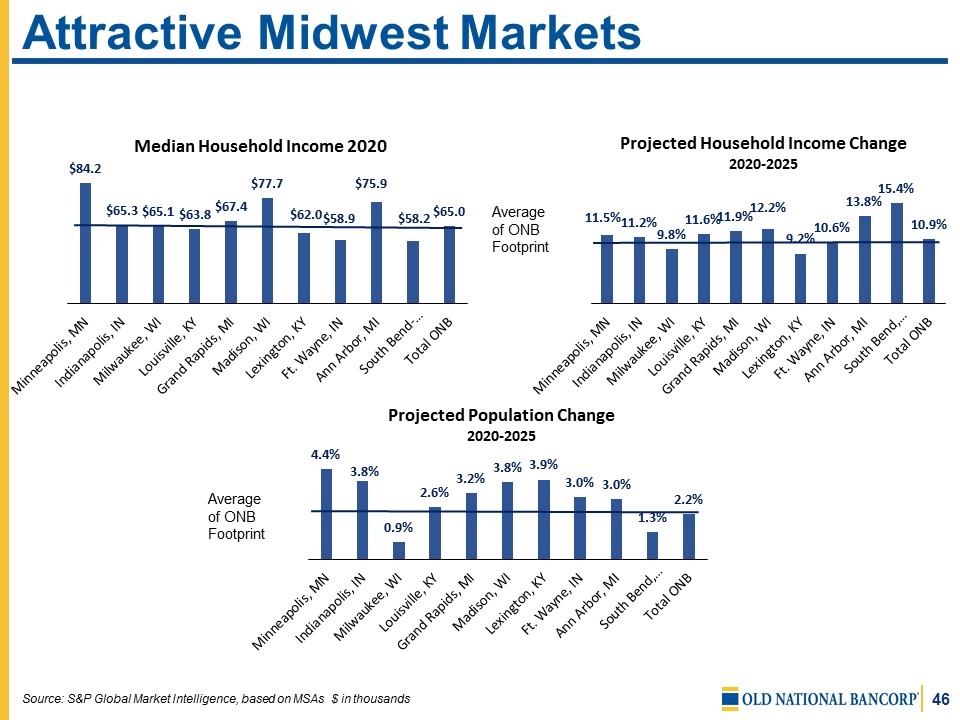

Attractive Midwest Markets Source: S&P Global Market Intelligence, based on MSAs $ in thousands Average of ONB Footprint Average of ONB Footprint

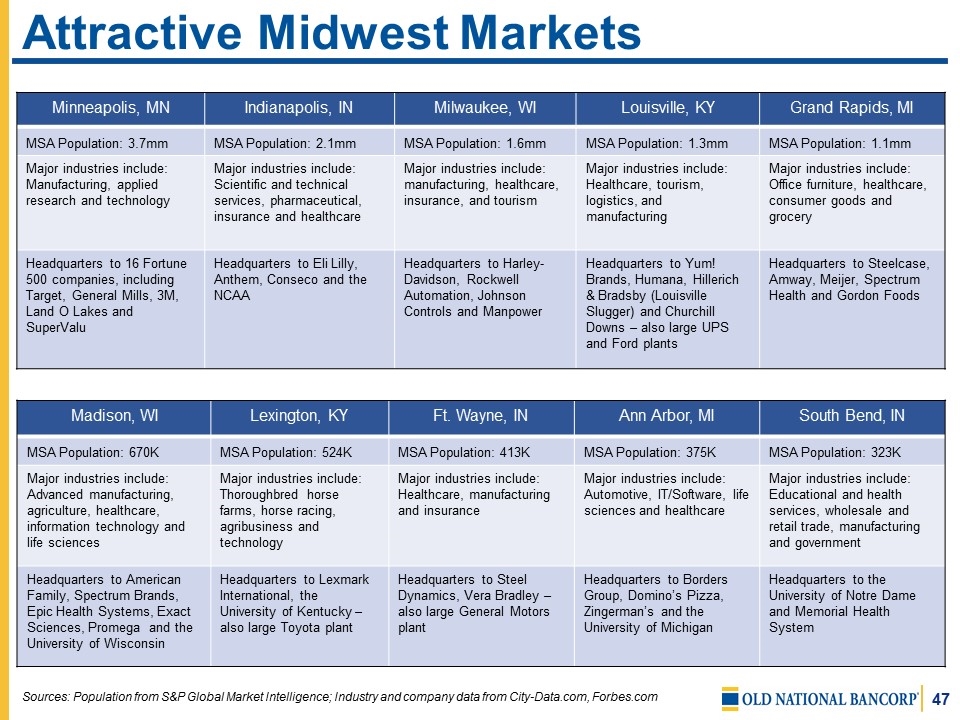

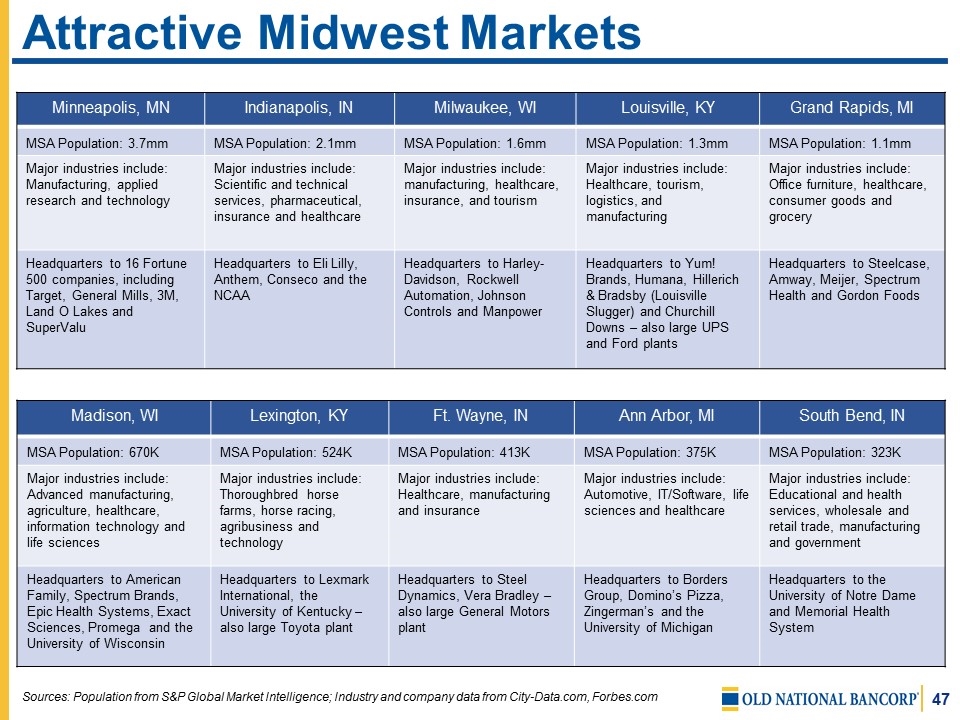

Attractive Midwest Markets Minneapolis, MN Indianapolis, IN Milwaukee, WI Louisville, KY Grand Rapids, MI MSA Population: 3.7mm MSA Population: 2.1mm MSA Population: 1.6mm MSA Population: 1.3mm MSA Population: 1.1mm Major industries include: Manufacturing, applied research and technology Major industries include: Scientific and technical services, pharmaceutical, insurance and healthcare Major industries include: manufacturing, healthcare, insurance, and tourism Major industries include: Healthcare, tourism, logistics, and manufacturing Major industries include: Office furniture, healthcare, consumer goods and grocery Headquarters to 16 Fortune 500 companies, including Target, General Mills, 3M, Land O Lakes and SuperValu Headquarters to Eli Lilly, Anthem, Conseco and the NCAA Headquarters to Harley-Davidson, Rockwell Automation, Johnson Controls and Manpower Headquarters to Yum! Brands, Humana, Hillerich & Bradsby (Louisville Slugger) and Churchill Downs – also large UPS and Ford plants Headquarters to Steelcase, Amway, Meijer, Spectrum Health and Gordon Foods Sources: Population from S&P Global Market Intelligence; Industry and company data from City-Data.com, Forbes.com Madison, WI Lexington, KY Ft. Wayne, IN Ann Arbor, MI South Bend, IN MSA Population: 670K MSA Population: 524K MSA Population: 413K MSA Population: 375K MSA Population: 323K Major industries include: Advanced manufacturing, agriculture, healthcare, information technology and life sciences Major industries include: Thoroughbred horse farms, horse racing, agribusiness and technology Major industries include: Healthcare, manufacturing and insurance Major industries include: Automotive, IT/Software, life sciences and healthcare Major industries include: Educational and health services, wholesale and retail trade, manufacturing and government Headquarters to American Family, Spectrum Brands, Epic Health Systems, Exact Sciences, Promega and the University of Wisconsin Headquarters to Lexmark International, the University of Kentucky – also large Toyota plant Headquarters to Steel Dynamics, Vera Bradley – also large General Motors plant Headquarters to Borders Group, Domino’s Pizza, Zingerman’s and the University of Michigan Headquarters to the University of Notre Dame and Memorial Health System

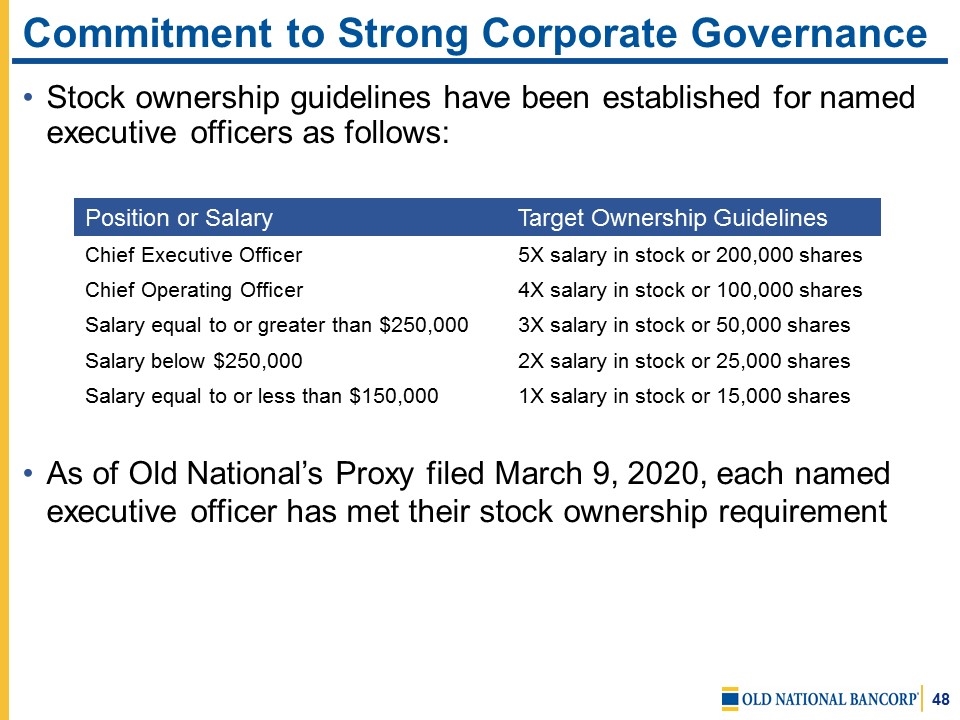

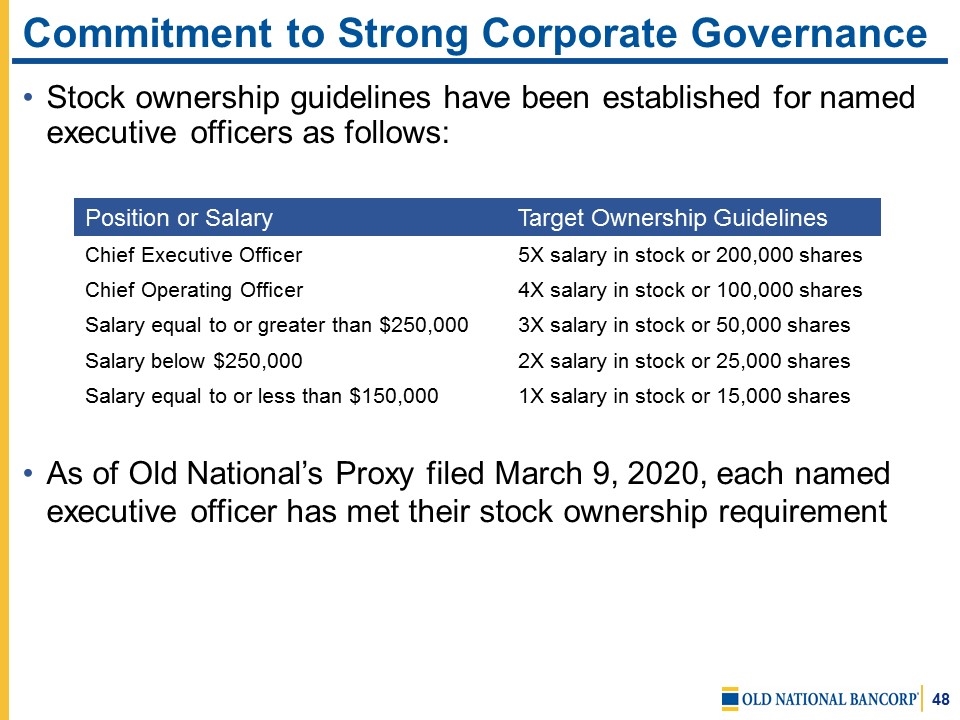

Position or Salary Target Ownership Guidelines Chief Executive Officer 5X salary in stock or 200,000 shares Chief Operating Officer 4X salary in stock or 100,000 shares Salary equal to or greater than $250,000 3X salary in stock or 50,000 shares Salary below $250,000 2X salary in stock or 25,000 shares Salary equal to or less than $150,000 1X salary in stock or 15,000 shares Stock ownership guidelines have been established for named executive officers as follows: As of Old National’s Proxy filed March 9, 2020, each named executive officer has met their stock ownership requirement Commitment to Strong Corporate Governance

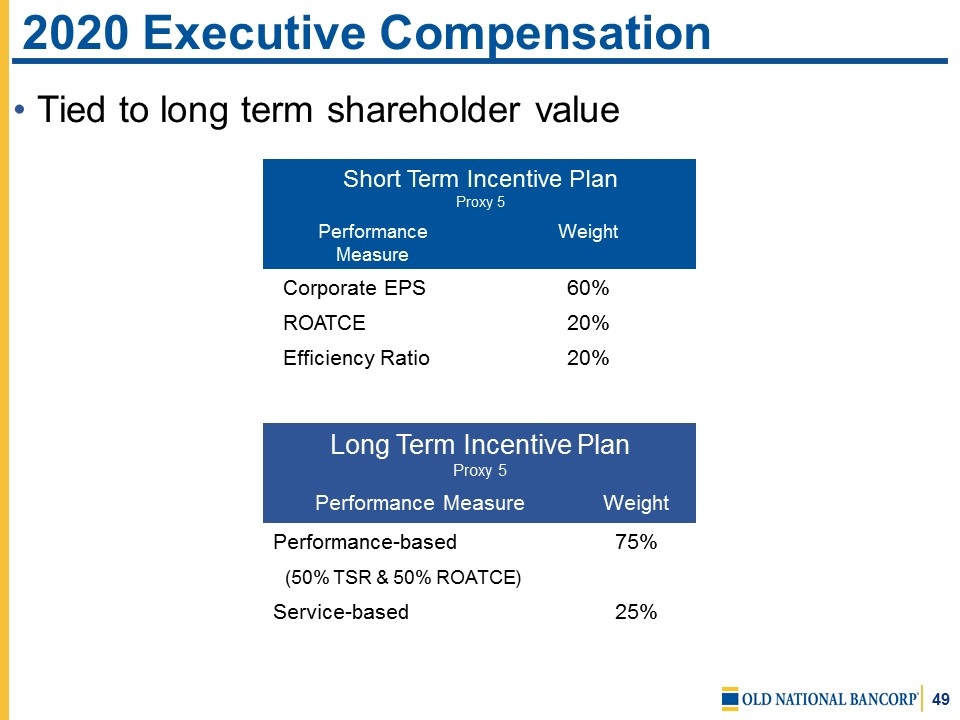

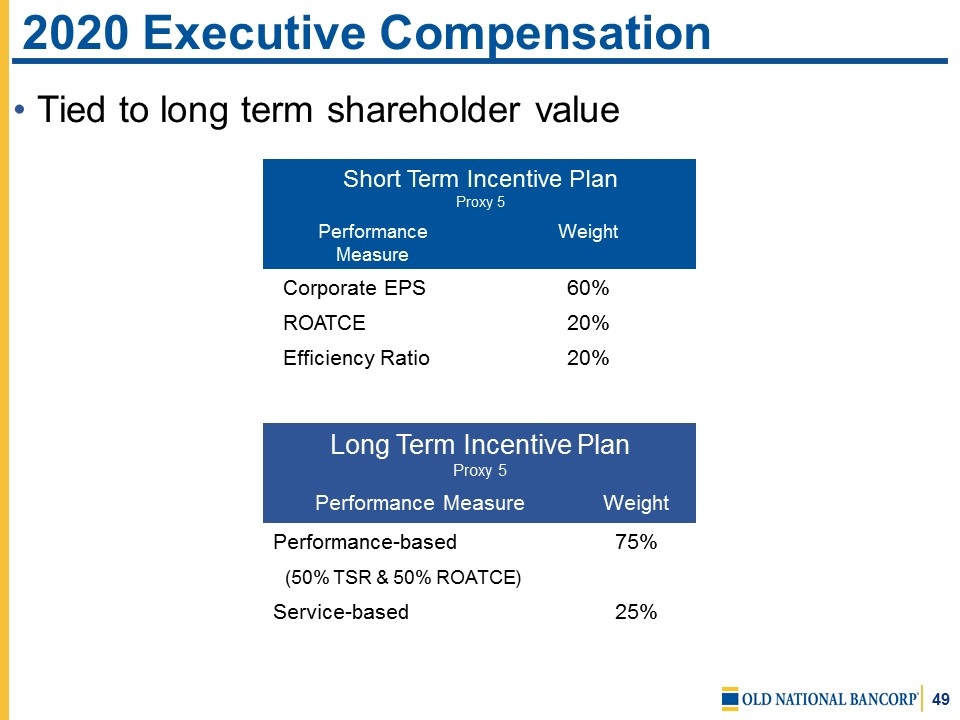

2020 Executive Compensation Short Term Incentive Plan Proxy 5 Performance Measure Weight Corporate EPS 60% ROATCE 20% Efficiency Ratio 20% Tied to long term shareholder value Long Term Incentive Plan Proxy 5 Performance Measure Weight Performance-based 75% (50% TSR & 50% ROATCE) Service-based 25%

Commitment to Diversity & Inclusion Old National is fully committed to supporting a rich culture of diversity as a cornerstone to our success 29% of Old National’s Executive Operating Group are women 68% of all Old National associates are women

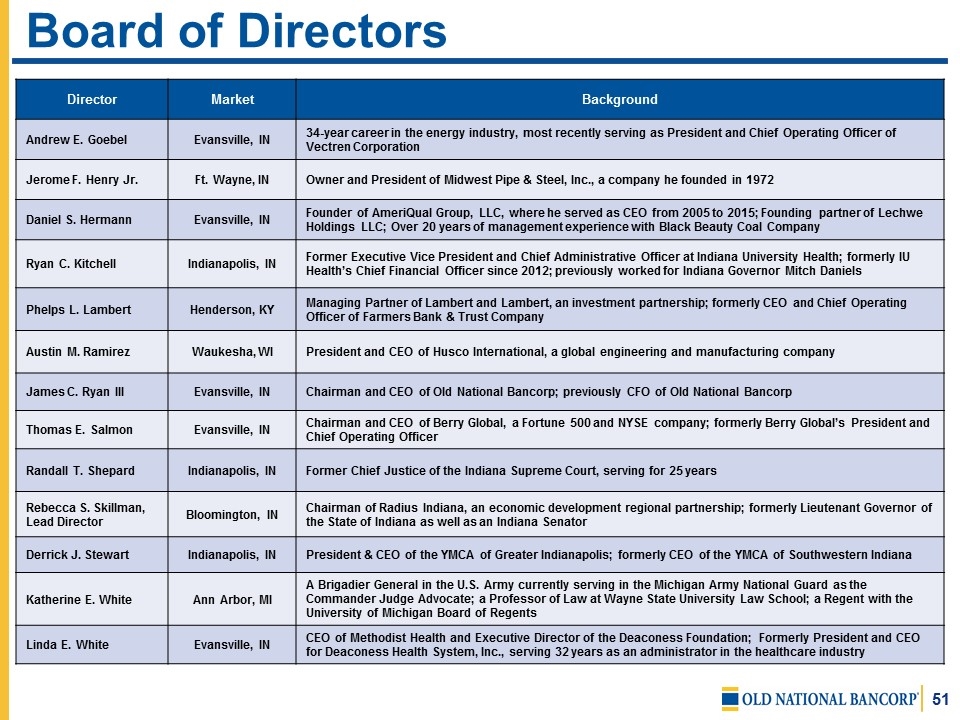

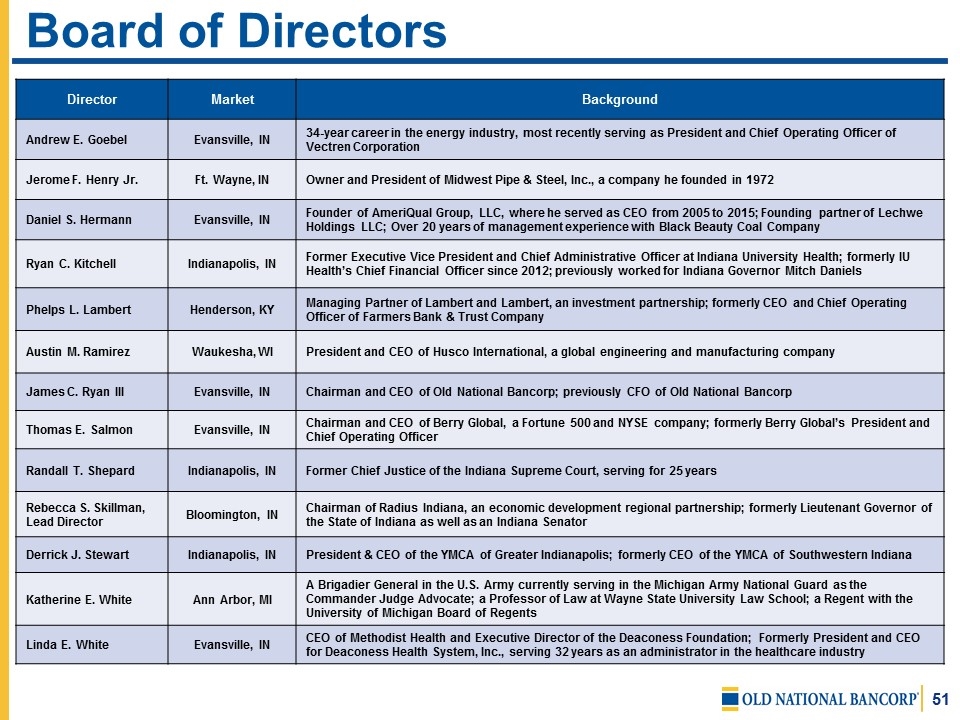

Board of Directors Director Market Background Andrew E. Goebel Evansville, IN 34-year career in the energy industry, most recently serving as President and Chief Operating Officer of Vectren Corporation Jerome F. Henry Jr. Ft. Wayne, IN Owner and President of Midwest Pipe & Steel, Inc., a company he founded in 1972 Daniel S. Hermann Evansville, IN Founder of AmeriQual Group, LLC, where he served as CEO from 2005 to 2015; Founding partner of Lechwe Holdings LLC; Over 20 years of management experience with Black Beauty Coal Company Ryan C. Kitchell Indianapolis, IN Former Executive Vice President and Chief Administrative Officer at Indiana University Health; formerly IU Health’s Chief Financial Officer since 2012; previously worked for Indiana Governor Mitch Daniels Phelps L. Lambert Henderson, KY Managing Partner of Lambert and Lambert, an investment partnership; formerly CEO and Chief Operating Officer of Farmers Bank & Trust Company Austin M. Ramirez Waukesha, WI President and CEO of Husco International, a global engineering and manufacturing company James C. Ryan III Evansville, IN Chairman and CEO of Old National Bancorp; previously CFO of Old National Bancorp Thomas E. Salmon Evansville, IN Chairman and CEO of Berry Global, a Fortune 500 and NYSE company; formerly Berry Global’s President and Chief Operating Officer Randall T. Shepard Indianapolis, IN Former Chief Justice of the Indiana Supreme Court, serving for 25 years Rebecca S. Skillman, Lead Director Bloomington, IN Chairman of Radius Indiana, an economic development regional partnership; formerly Lieutenant Governor of the State of Indiana as well as an Indiana Senator Derrick J. Stewart Indianapolis, IN President & CEO of the YMCA of Greater Indianapolis; formerly CEO of the YMCA of Southwestern Indiana Katherine E. White Ann Arbor, MI A Brigadier General in the U.S. Army currently serving in the Michigan Army National Guard as the Commander Judge Advocate; a Professor of Law at Wayne State University Law School; a Regent with the University of Michigan Board of Regents Linda E. White Evansville, IN CEO of Methodist Health and Executive Director of the Deaconess Foundation; Formerly President and CEO for Deaconess Health System, Inc., serving 32 years as an administrator in the healthcare industry

Appendix

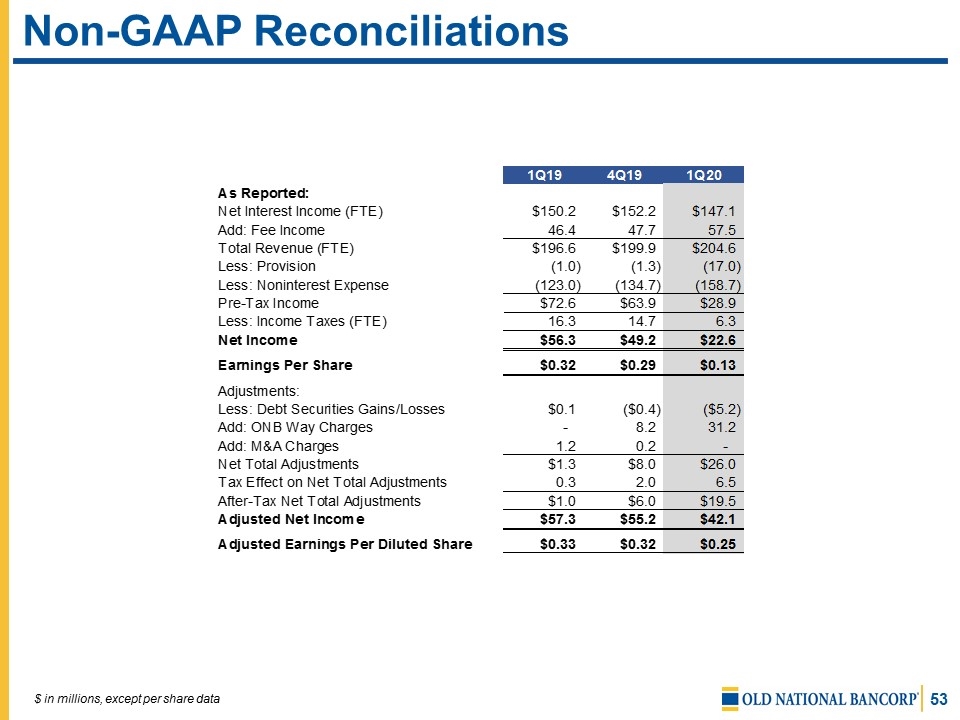

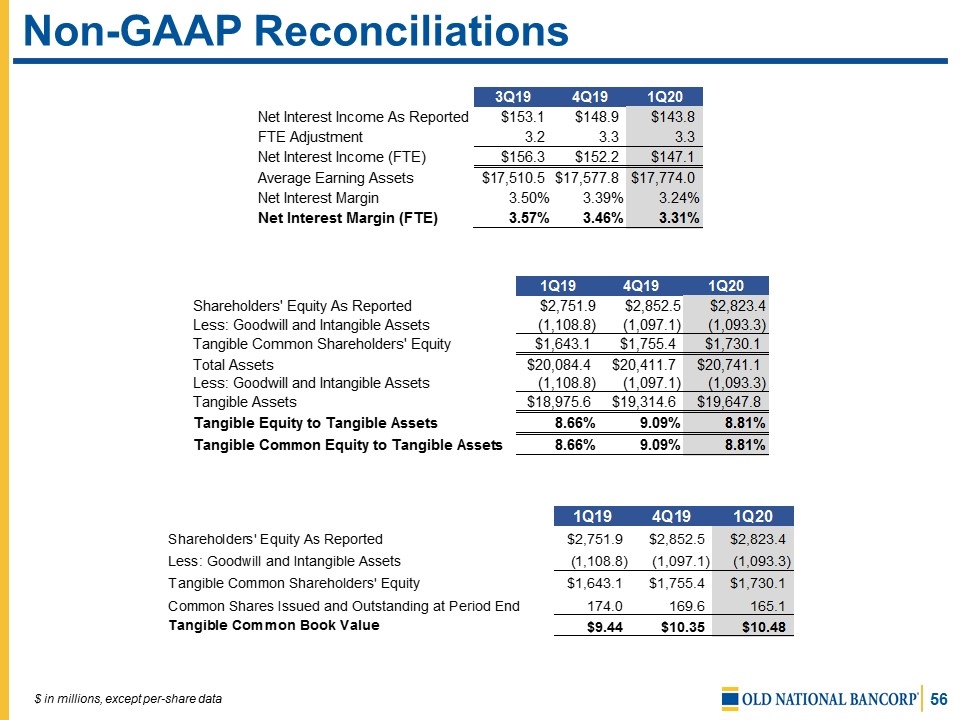

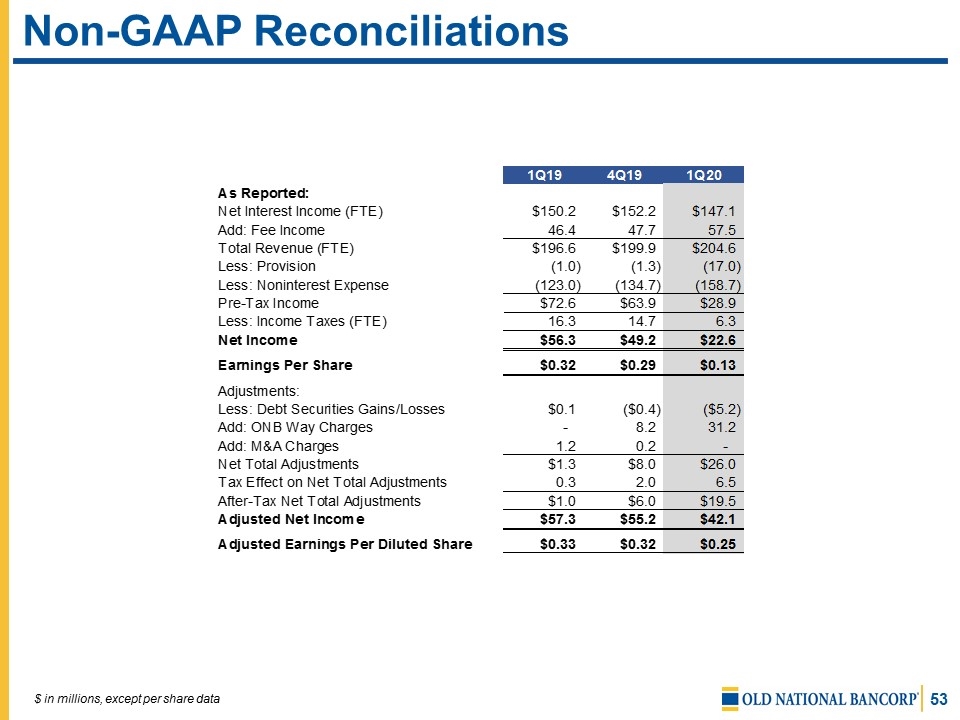

Non-GAAP Reconciliations $ in millions, except per share data

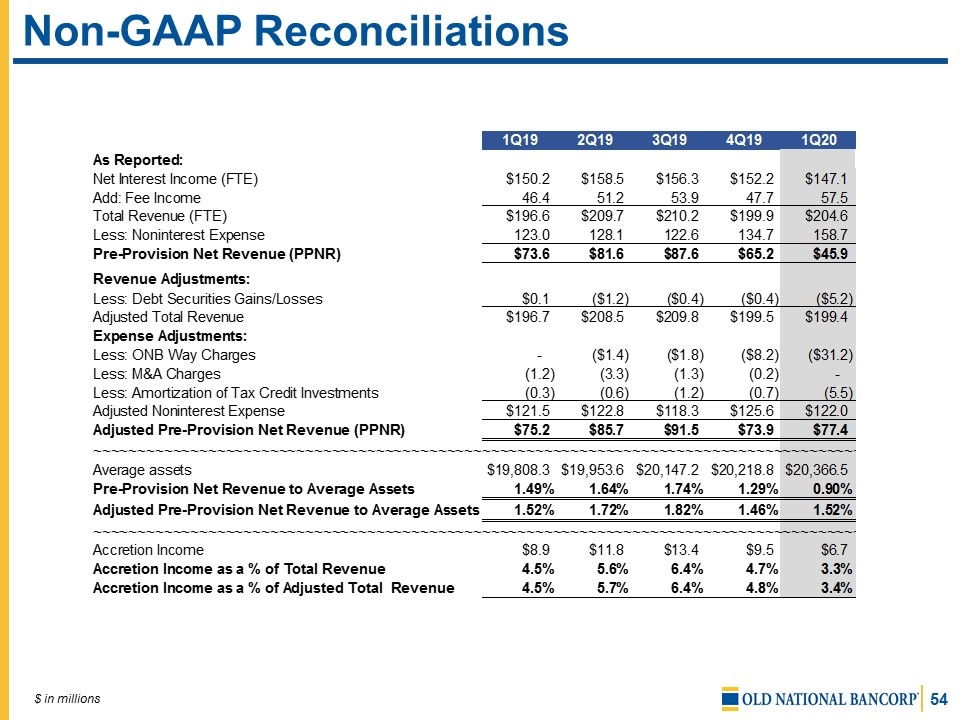

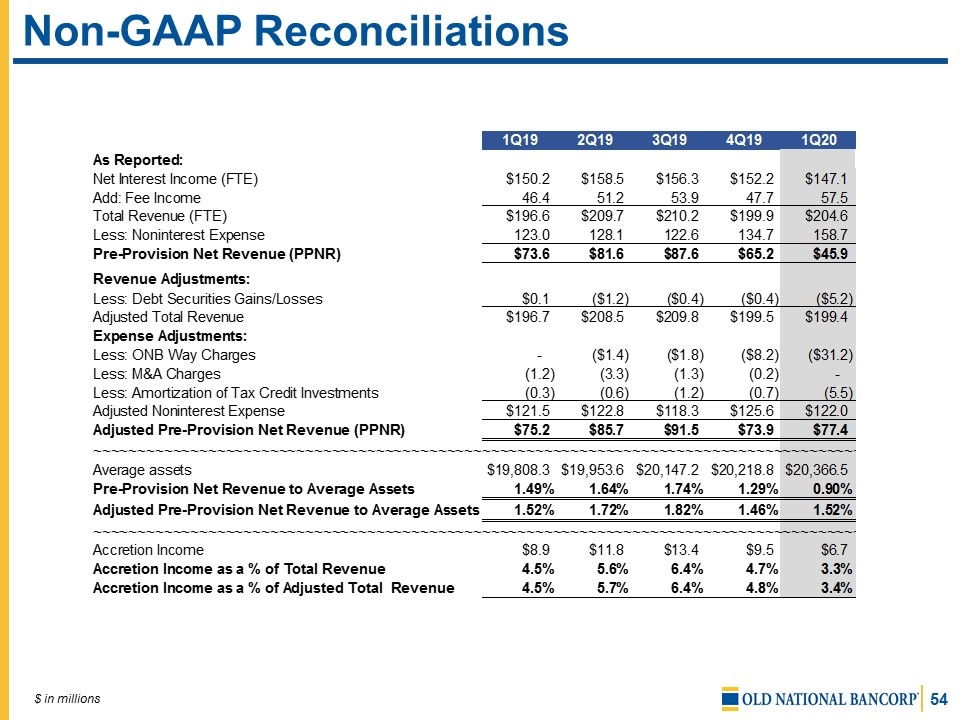

Non-GAAP Reconciliations $ in millions

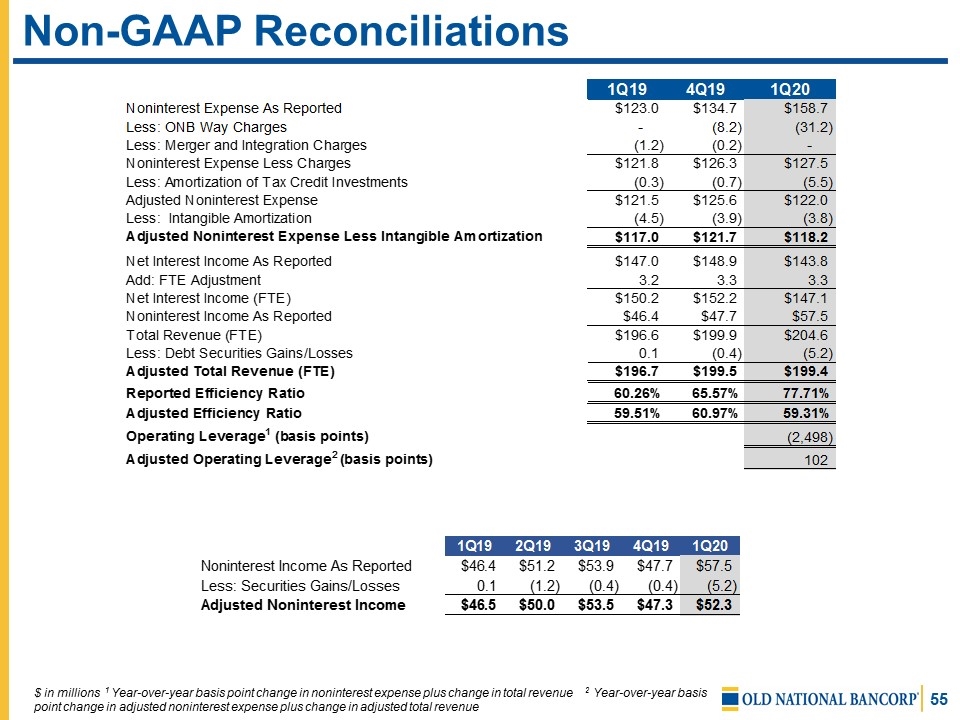

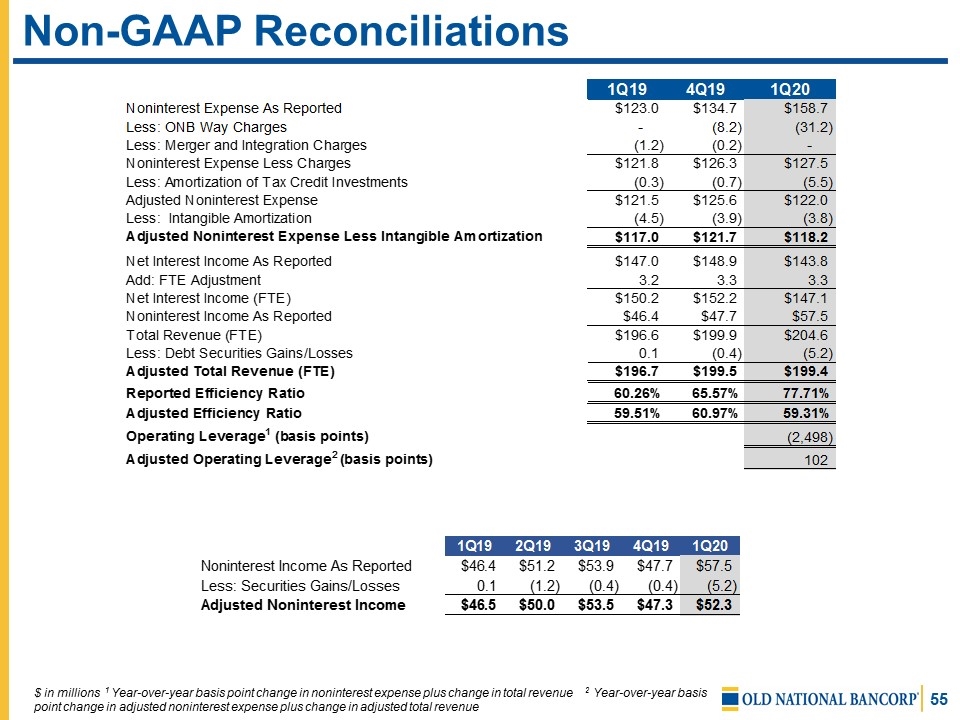

Non-GAAP Reconciliations $ in millions 1 Year-over-year basis point change in noninterest expense plus change in total revenue 2 Year-over-year basis point change in adjusted noninterest expense plus change in adjusted total revenue

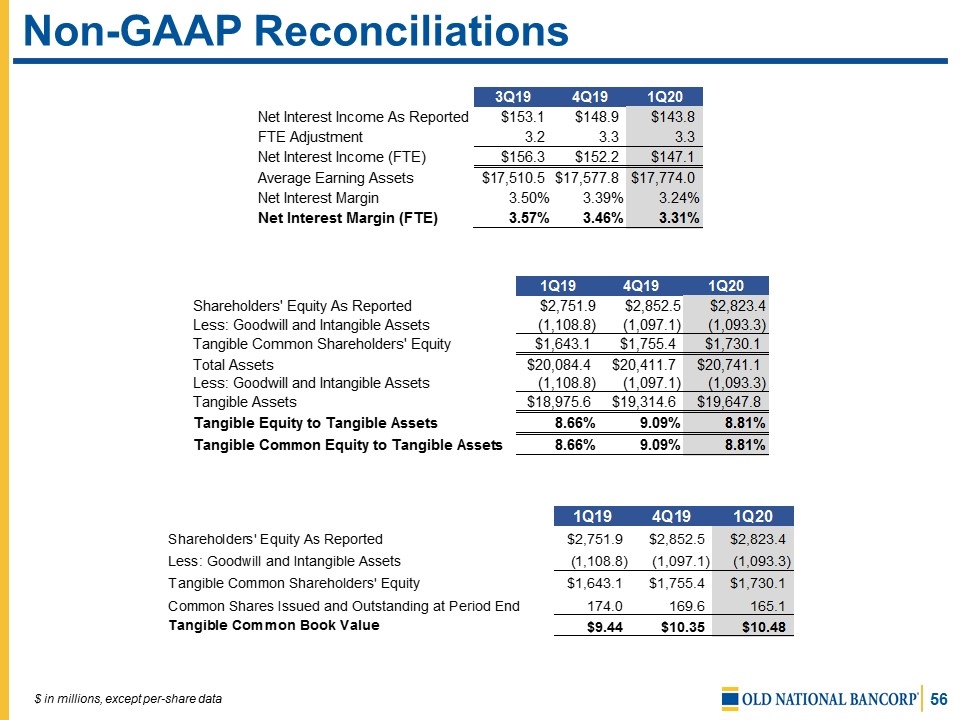

Non-GAAP Reconciliations $ in millions, except per-share data

Peer Group Like-size, publicly-traded financial services companies, generally in the Midwest, serving comparable demographics with comparable services as ONB

Old National Investor Relations Contact Additional information can be found on the Investor Relations web pages at www.oldnational.com Investor Inquiries: Lynell J. Walton, CPA SVP – Director of Investor Relations 812-464-1366 lynell.walton@oldnational.com