Exhibit 99.1 2nd Quarter 2023 Investment Thesis August 31, 2023

Slides 5 — 13 Executive Summary

3 These materials contain certain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”), notwithstanding that such statements are not specifically identified as such. In addition, certain statements may be contained in our future filings with the SEC, in press releases, and in oral and written statements made by us or with our approval that are not statements of historical fact and constitute forward-looking statements within the meaning of the Act. These statements include, but are not limited to, descriptions of Old National’s financial condition, results of operations, asset and credit quality trends, profitability and business plans or opportunities. Forward-looking statements can be identified by the use of the words "anticipate," "believe," "contemplate," "could," "estimate," "expect," "intend," "may," "outlook," "plan," "should," and "will," and other words of similar meaning. These forward-looking statements express management’s current expectations or forecasts of future events and, by their nature, are subject to risks and uncertainties. There are a number of factors that could cause actual results or outcomes to differ materially from those in such statements. Factors that might cause such a difference include, but are not limited to: competition; government legislation, regulations and policies; the ability of Old National to execute its business plan; unanticipated changes in our liquidity position, including but not limited to changes in our access to sources of liquidity and capital to address our liquidity needs; changes in economic conditions and economic and business uncertainty which could materially impact credit quality trends and the ability to generate loans and gather deposits; inflation and governmental responses to inflation, including increasing interest rates; market, economic, operational, liquidity, credit, and interest rate risks associated with our business; our ability to successfully manage our credit risk and the sufficiency of our allowance for credit losses; uncertainty about the discontinued use of LIBOR and the transition to an alternative rate; the potential impact of future business combinations on our performance and financial condition, including our ability to successfully integrate the businesses and the success of revenue-generating and cost reduction initiatives; failure or circumvention of our internal controls; operational risks or risk management failures by us or critical third parties, including without limitation with respect to data processing, information systems, cybersecurity, technological changes, vendor issues, business interruption, and fraud risks; significant changes in accounting, tax or regulatory practices or requirements; new legal obligations or liabilities; disruptive technologies in payment systems and other services traditionally provided by banks; failure or disruption of our information systems; computer hacking and other cybersecurity threats; the effects of climate change on Old National and its customers, borrowers, or service providers; political and economic uncertainty and instability; the impacts of pandemics, epidemics and other infectious disease outbreaks; other matters discussed in these materials; and other factors identified in our Annual Report on Form 10-K for the year ended December 31, 2022 and other filings with the Securities and Exchange Commission. These forward-looking statements are made only as of the date of these materials and are not guarantees of future results, performance or outcomes, and Old National does not undertake an obligation to update these forward-looking statements to reflect events or conditions after the date of these materials. Forward-Looking Statements

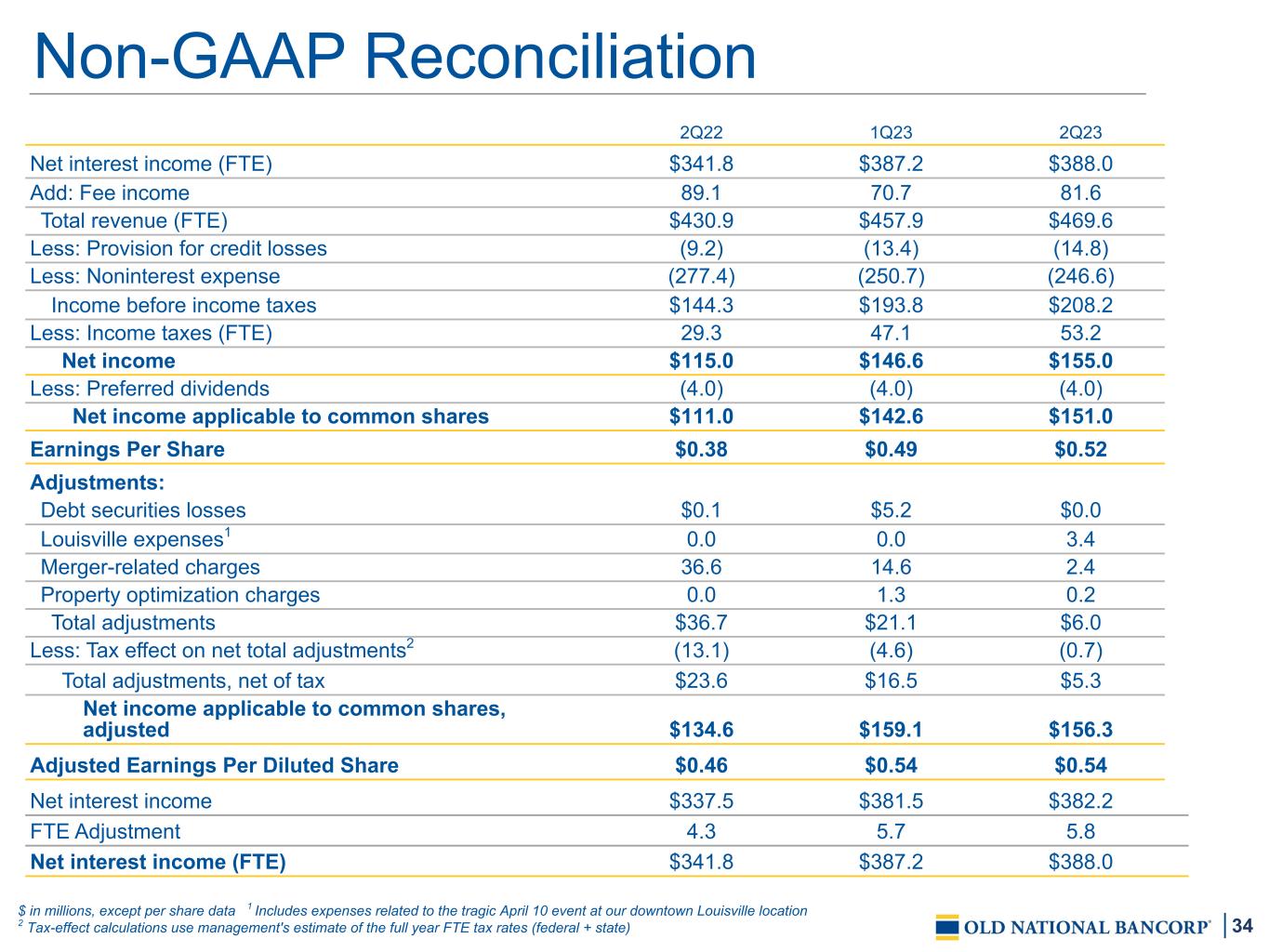

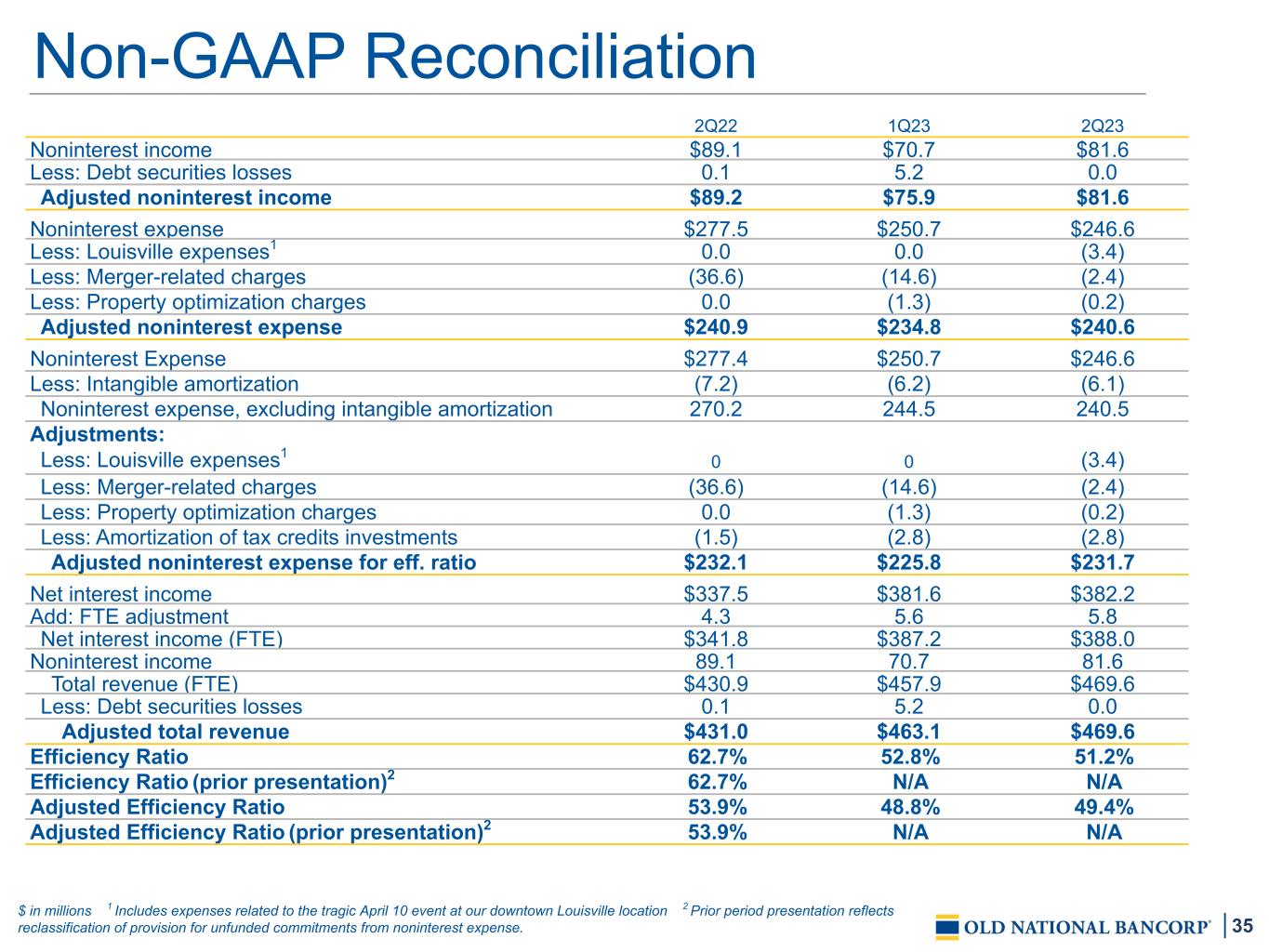

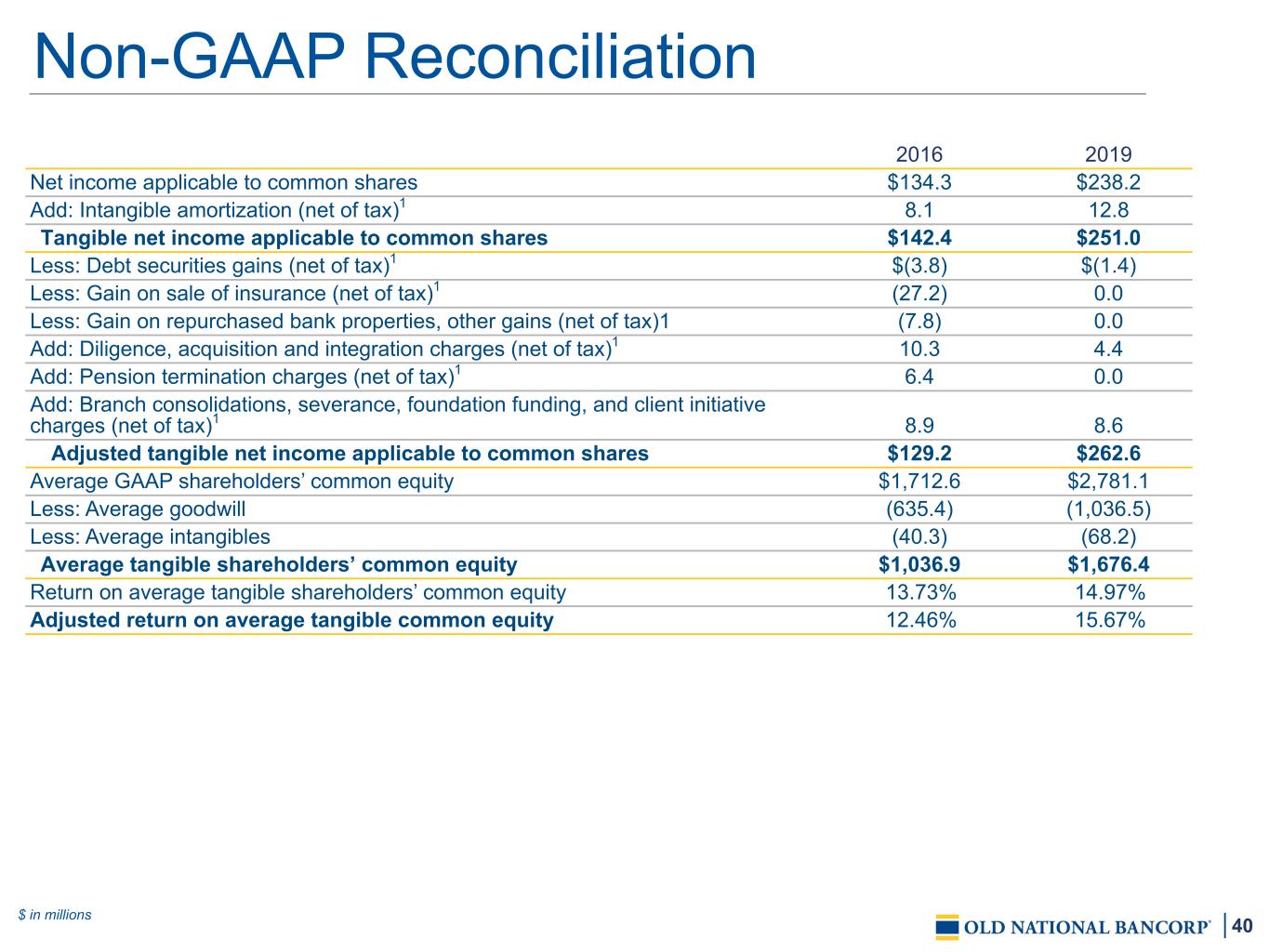

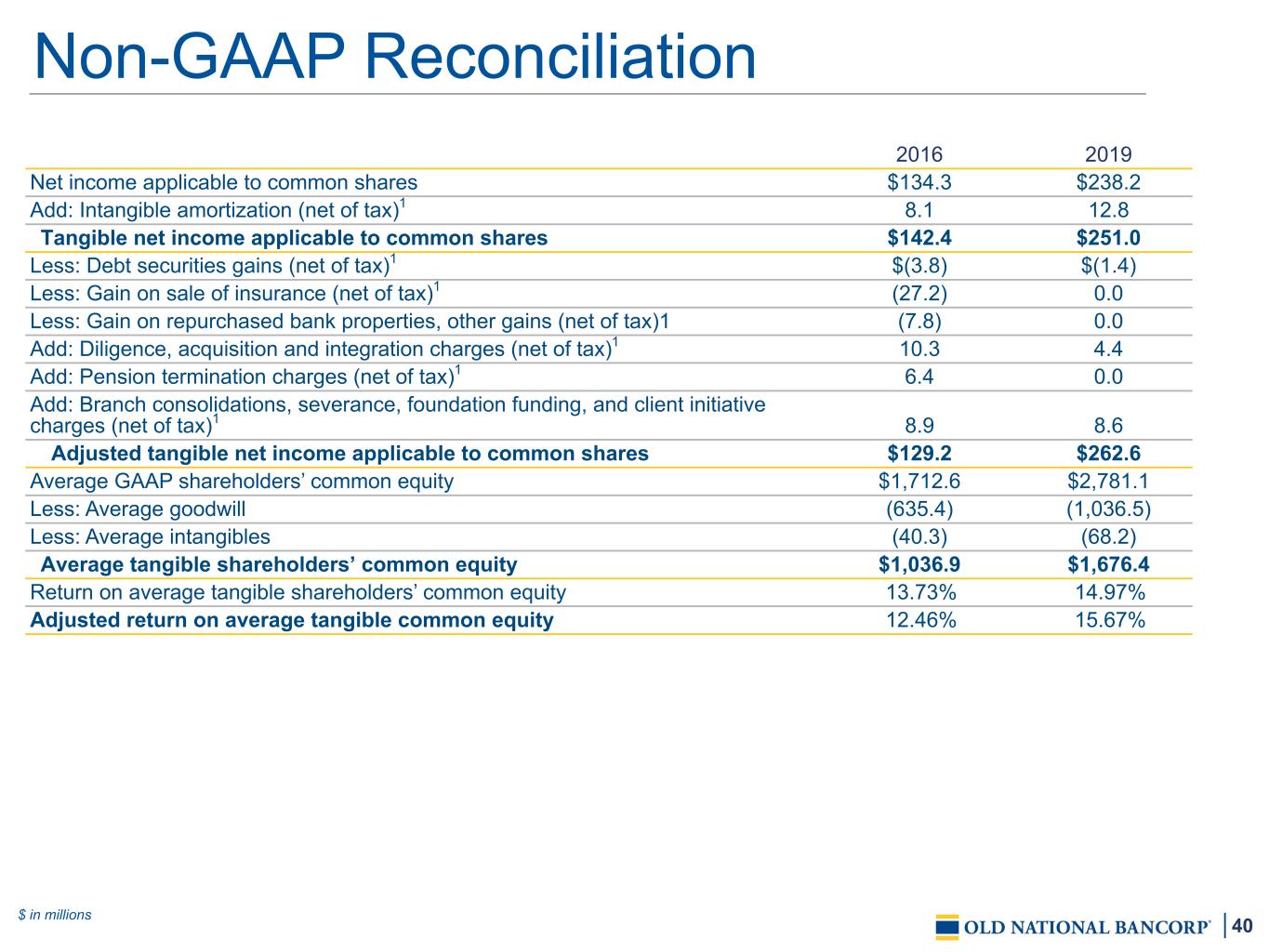

4 Non-GAAP Financial Measures The Company's accounting and reporting policies conform to U.S. generally accepted accounting principles ("GAAP") and general practices within the banking industry. As a supplement to GAAP, the Company provides non-GAAP performance results, which the Company believes are useful because they assist investors in assessing the Company's operating performance. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the appendix to this financial review. The Company presents EPS, the efficiency ratio, return on average common equity, and return on average tangible common equity, net income applicable to common shares, all adjusted for certain notable items. These items include the CECL Day 1 non-purchased credit deteriorated (“non-PCD”) provision expense, Louisville expenses1, merger-related charges associated with completed acquisitions, gain on sale of health savings accounts, property optimization charges, and net securities gains/losses. Management believes excluding these items from EPS, the efficiency ratio, return on average common equity, and return on average tangible common equity may be useful in assessing the Company's underlying operational performance since these transactions do not pertain to its core business operations and their exclusion may facilitate better comparability between periods. Management believes that excluding merger-related charges and the CECL Day 1 non-PCD provision expense from these metrics may be useful to the Company, as well as analysts and investors, since these expenses can vary significantly based on the size, type, and structure of each acquisition. Additionally, management believes excluding these items from these metrics may enhance comparability for peer comparison purposes. The Company presents adjusted noninterest expense, which excludes Louisville expenses1, merger-related charges and property optimization charges, as well as adjusted noninterest income, which excludes the gain on sale of health savings accounts and gains/losses on sales of debt securities. Management believes that excluding these items from noninterest expense and noninterest income may be useful in assessing the Company’s underlying operational performance as these items either do not pertain to its core business operations or their exclusion may facilitate better comparability between periods and for peer comparison purposes. The tax-equivalent adjustment to net interest income and net interest margin recognizes the income tax savings when comparing taxable and tax-exempt assets. Interest income and yields on tax-exempt securities and loans are presented using the current federal income tax rate of 21%. Management believes that it is standard practice in the banking industry to present net interest income and net interest margin on a fully tax-equivalent basis and that it may enhance comparability for peer comparison purposes. In management's view, tangible common equity measures are capital adequacy metrics that may be meaningful to the Company, as well as analysts and investors, in assessing the Company's use of equity and in facilitating comparisons with peers. These non-GAAP measures are valuable indicators of a financial institution's capital strength since they eliminate intangible assets from stockholders' equity and retain the effect of accumulated other comprehensive loss in stockholders' equity. Although intended to enhance investors' understanding of the Company's business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP. In addition, these non-GAAP financial measures may differ from those used by other financial institutions to assess their business and performance. See the following reconciliations in the "Non-GAAP Reconciliations" section for details on the calculation of these measures to the extent presented herein. 1 Includes expenses related to the tragic April 10 event at our downtown Louisville location

5 4.47x 2023 earnings estimate The Best of Offense and Defense Financial data as of or for the quarter ended June 30, 2023, except as noted 1 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation 2 Includes the estimate of Old National Bank federally uninsured deposits for regulatory purposes, as adjusted for $1.5 billion of affiliate deposits and $4.2 billion of collateralized or otherwise insured deposits TBV - tangible common book value OFFENSE Top quartile 2Q23 financial metrics • 22.1% Adj. ROATCE1 • 49.4% Adj. Eff. Ratio1 • 17.4% increase in YoY Adj. EPS1 Ample liquidity and capital • >70% of insured deposits to total deposits2 • 90% loan-to-deposit ratio • 10.14% CET1 capital to RWA • TBV1 up 9% YoY; up 15% excluding AOCI DEFENSE Quality, peer-lending deposit franchise • Cycle to date total deposit beta of 23% with low 2Q23 cost of 115 bps • 75% of core deposits have tenure >5 years • Growth in total deposits of 4% and core deposits of 2% Strong credit culture • Well-reserved — 100% weighted Moody’s S3 scenario • $338 million allowance for credit losses, or 1.04% of total loans, includes ~4% reserve on PCD loans • Additionally, $90 million of discount on acquired loans • Granular and diversified loans portfolio -- average commercial loan size < $1 million • Low net charge-offs of 6 bps, excluding PCD loans Meaningful upside to stock price

6 Commitment to Excellence

7 Snapshot of Old National Key Financial Metrics3 Cost of Total Deposits 115 bps Cycle to Date Total Deposit Beta 23% Insured deposits to Total Deposits5 >70% Loans to Total Deposits 90% Tangible Book Value $10.03 Efficiency Ratio As Reported/ Adjusted2 51.2% / 49.4% Net Charge Offs / Average Loans, excluding PCD 0.06 % 90+ Day Delinquent Loans 0.00% Non-Performing Loans/ Total Loans 0.91% Tangible Common Equity to Tangible Assets 6.3% CRE Non- Owner Occupied 31% CRE Owner Occupied 11% C&I 30% Residential Real Estate 24% Summary1 Headquarters Evansville, IN Market Cap $4,483 P/ TBV 153% Dividend Yield 3.7% LTM Average Daily Volume (Actual) 2,009,107 Total Assets $48,497 Wealth Assets Under Management $28,714 2Q23 ROATCE As Reported/ Adjusted2 21.4% / 22.1% • 6th largest commercial bank headquartered in Midwest - top 30 banking company based in the U.S. by assets • 256 branches and 348 ATMs Company Description Time 15% Demand 29% NOW 21% Savings 15% Money Market 20% Loan Mix3,4 Deposit Mix3 $ in millions, except as noted 1 Market data as of 08/30/2023 2 Non-GAAP financial measures that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation 3 As of or for the three months ended 6/30/2023 4 Includes loans held for sale 5 Includes the estimate of Old National Bank federally uninsured deposits for regulatory purposes, as adjusted for $1.5 billion of affiliate deposits and $4.2 billion of collateralized or otherwise insured deposits. PCD - purchased credit deteriorated ROATCE - return on average tangible common equity Consumer 4%

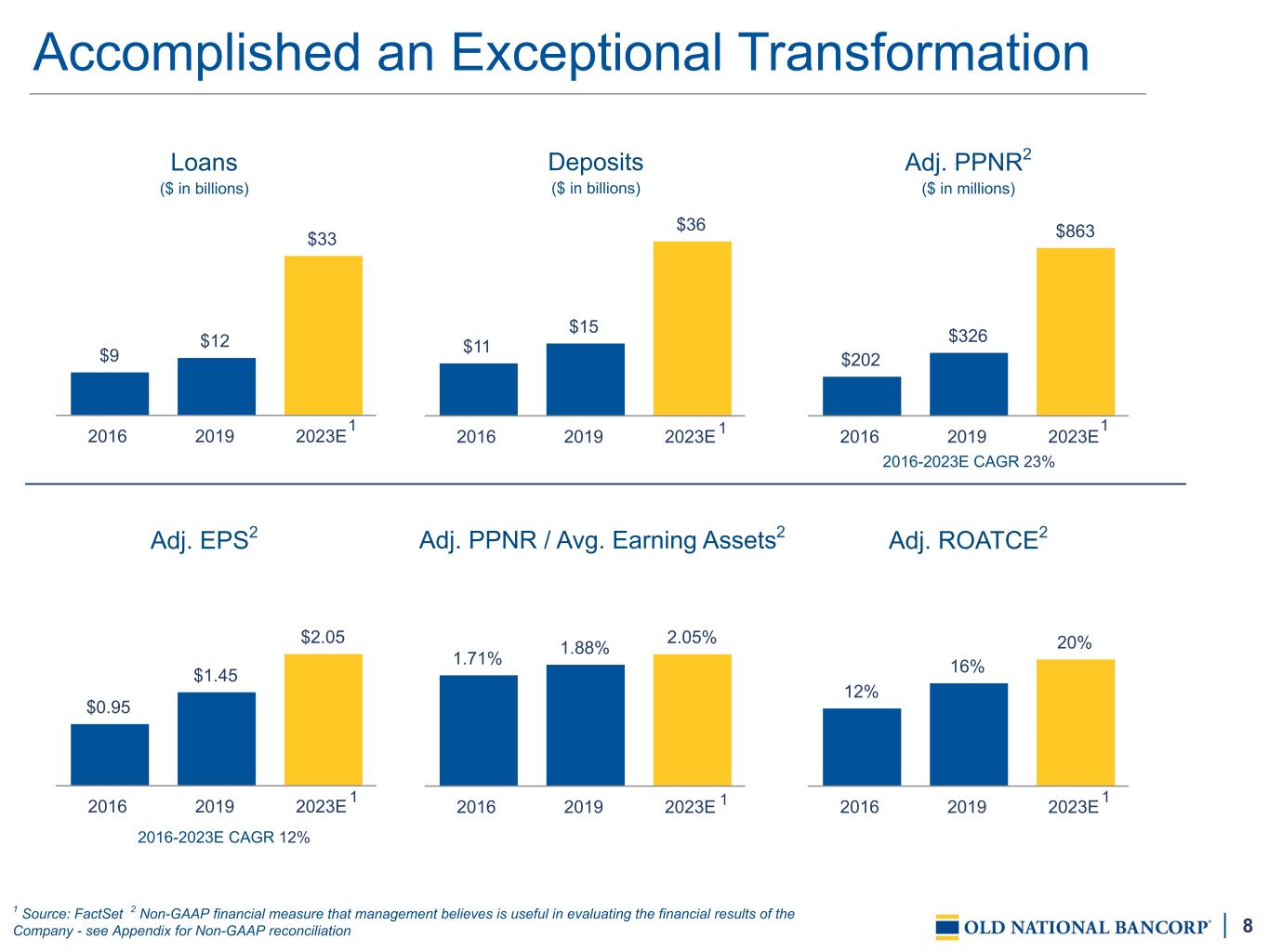

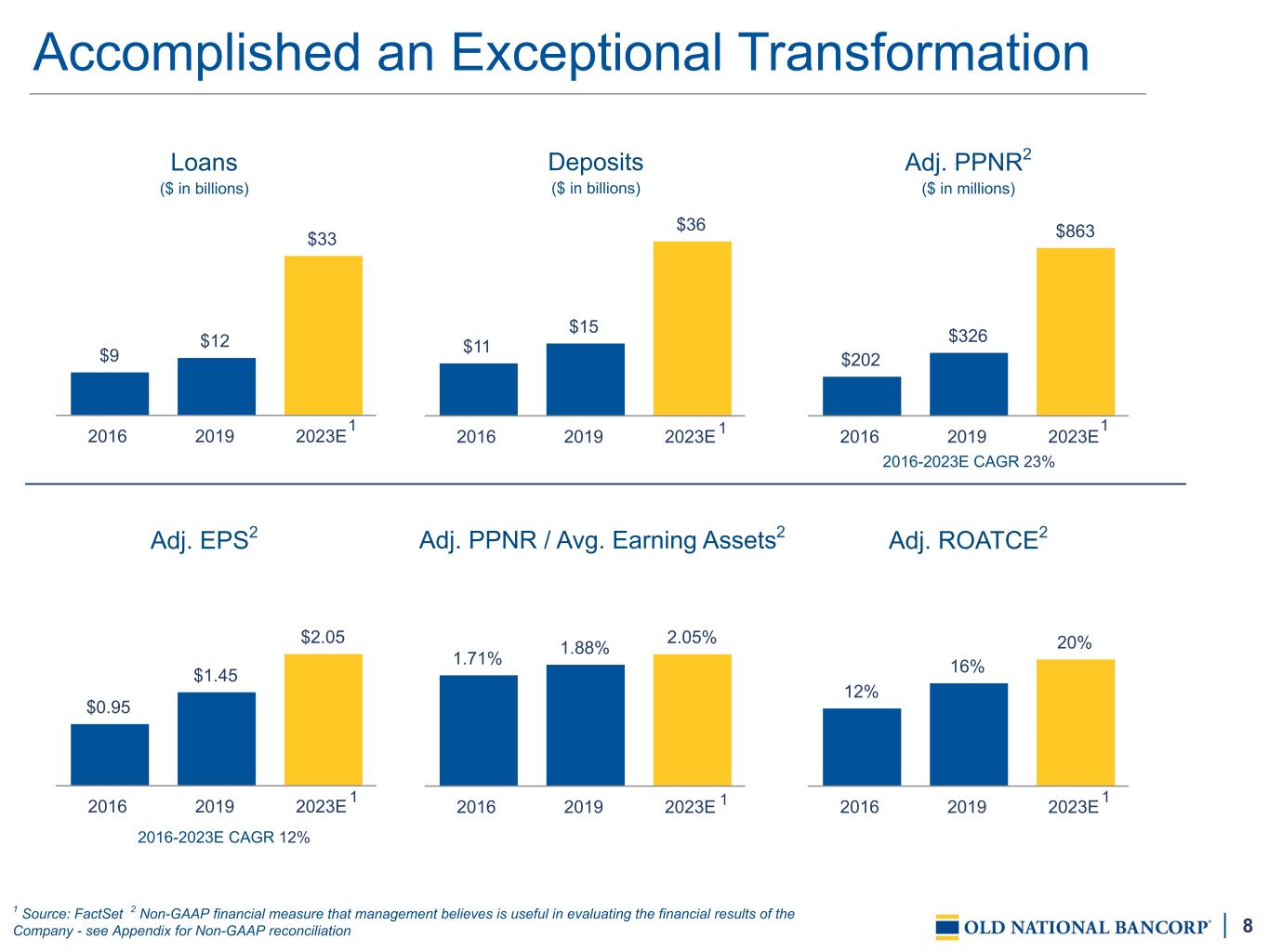

8 $9 $12 $33 2016 2019 2023E $11 $15 $36 2016 2019 2023E $202 $326 $863 2016 2019 2023E $0.95 $1.45 $2.05 2016 2019 2023E 1.71% 1.88% 2.05% 2016 2019 2023E 12% 16% 20% 2016 2019 2023E Loans ($ in billions) Deposits ($ in billions) Adj. PPNR2 ($ in millions) Adj. EPS2 Adj. PPNR / Avg. Earning Assets2 Adj. ROATCE2 111 111 2016-2023E CAGR 23% 2016-2023E CAGR 12% Accomplished an Exceptional Transformation 1 Source: FactSet 2 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation

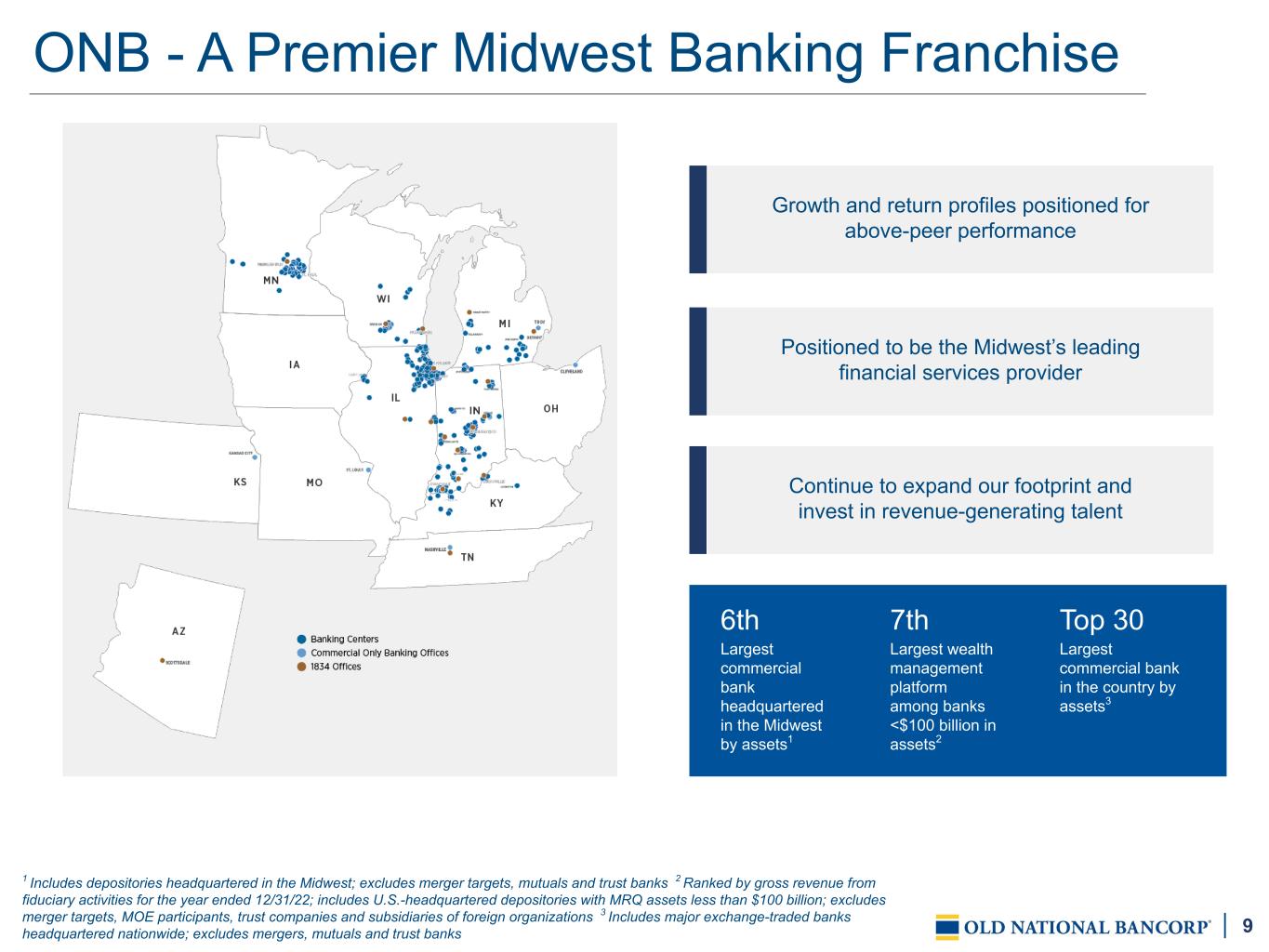

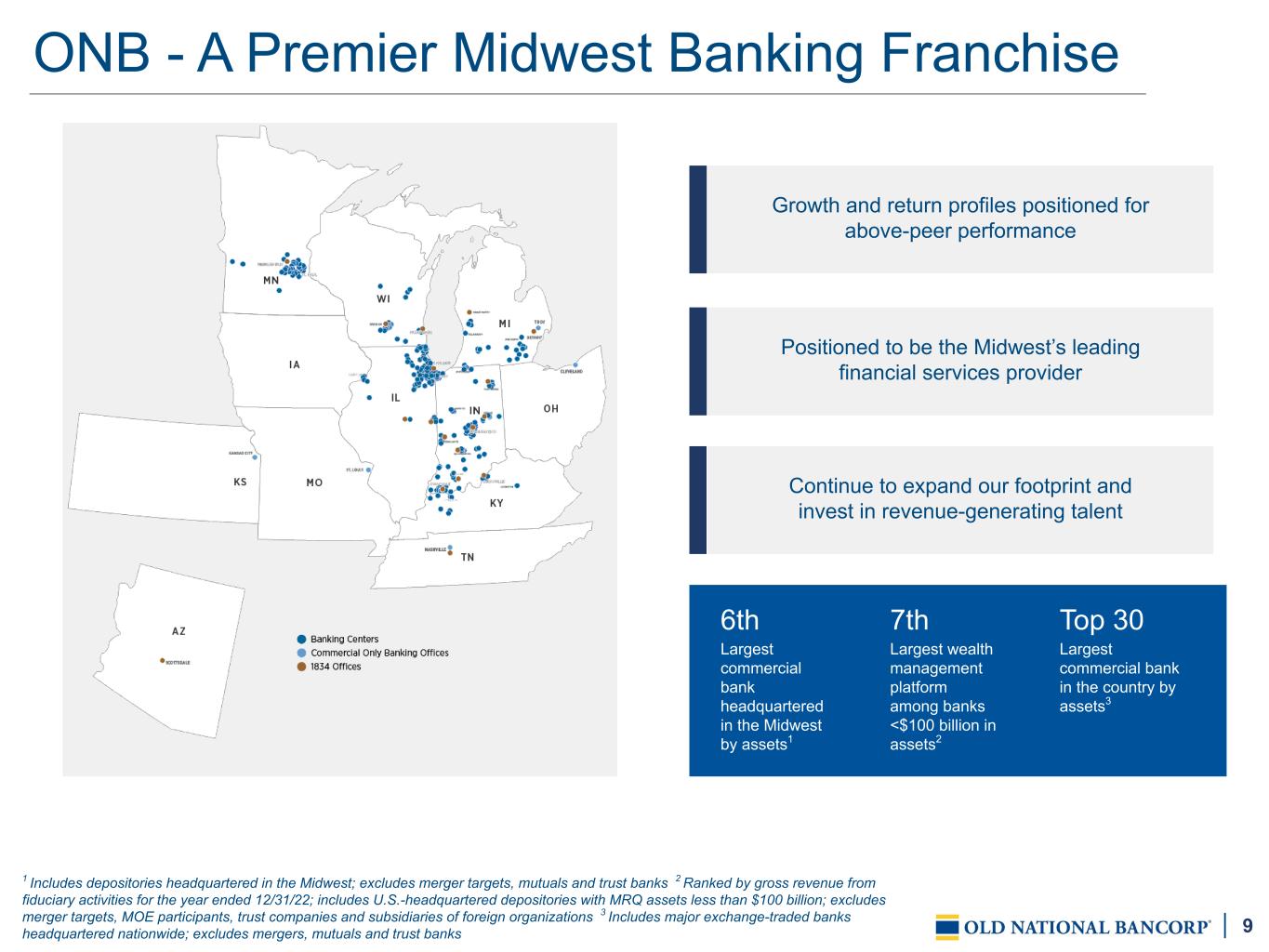

9 7th Largest wealth management platform among banks <$100 billion in assets2 6th Largest commercial bank headquartered in the Midwest by assets1 ONB - A Premier Midwest Banking Franchise Top 30 Largest commercial bank in the country by assets3 1 Includes depositories headquartered in the Midwest; excludes merger targets, mutuals and trust banks 2 Ranked by gross revenue from fiduciary activities for the year ended 12/31/22; includes U.S.-headquartered depositories with MRQ assets less than $100 billion; excludes merger targets, MOE participants, trust companies and subsidiaries of foreign organizations 3 Includes major exchange-traded banks headquartered nationwide; excludes mergers, mutuals and trust banks Growth and return profiles positioned for above-peer performance Positioned to be the Midwest’s leading financial services provider Continue to expand our footprint and invest in revenue-generating talent

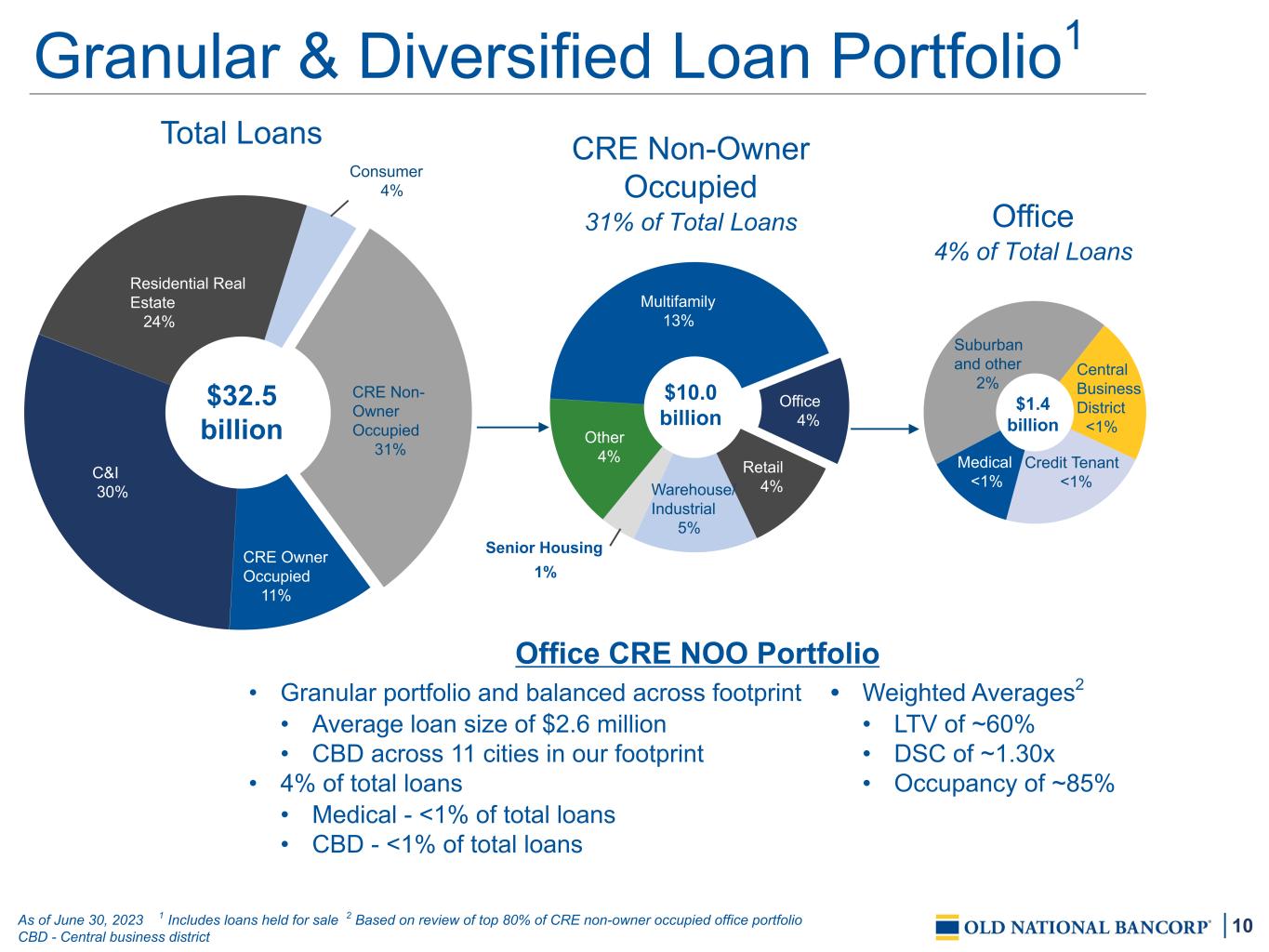

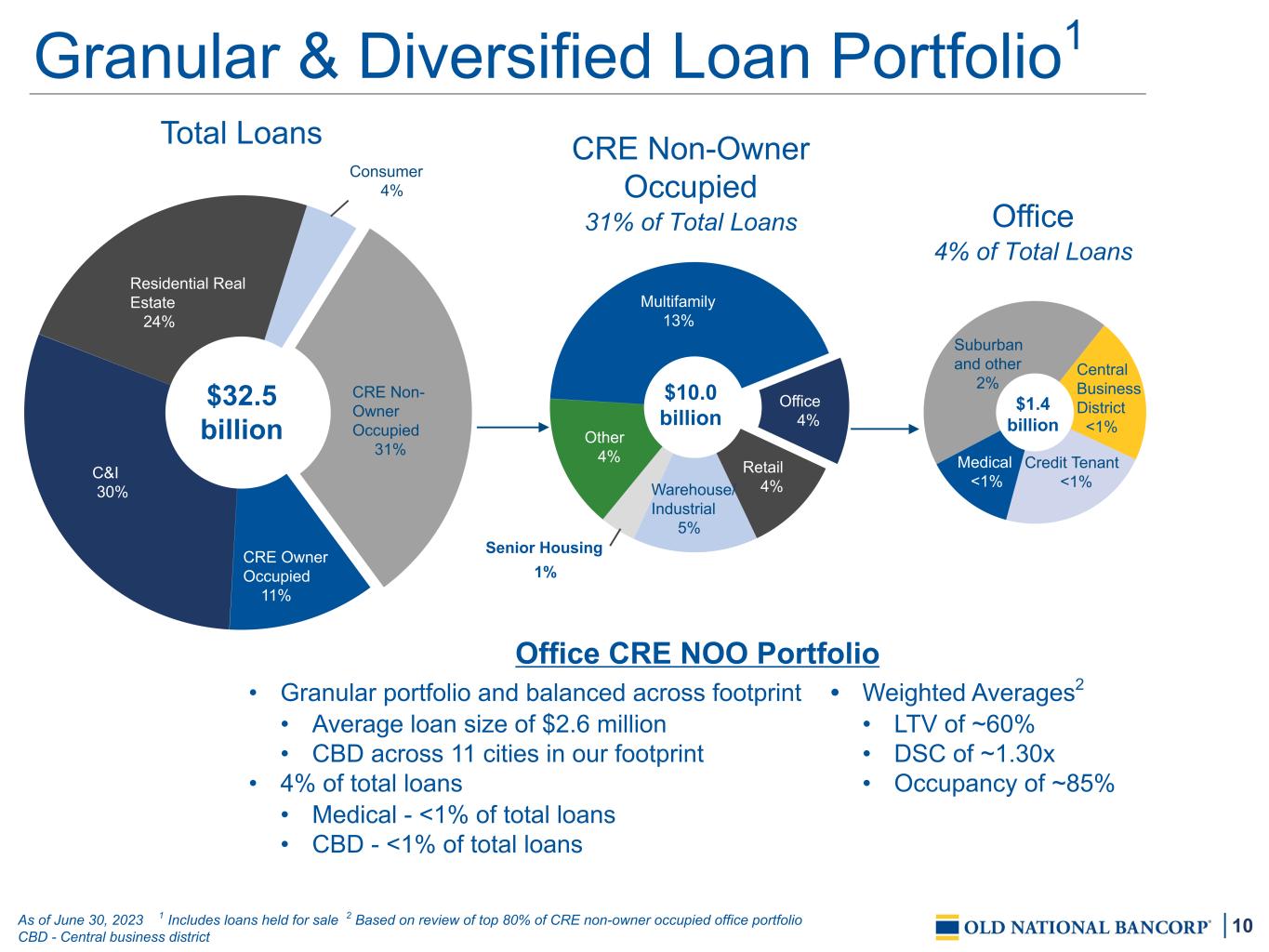

10 Retail 4%Warehouse/ Industrial 5% Other 4% Multifamily 13% Office 4% CRE Non- Owner Occupied 31% CRE Owner Occupied 11% C&I 30% Residential Real Estate 24% Consumer 4% Granular & Diversified Loan Portfolio1 As of June 30, 2023 1 Includes loans held for sale 2 Based on review of top 80% of CRE non-owner occupied office portfolio CBD - Central business district Office CRE NOO Portfolio • Granular portfolio and balanced across footprint • Average loan size of $2.6 million • CBD across 11 cities in our footprint • 4% of total loans • Medical - <1% of total loans • CBD - <1% of total loans • Weighted Averages2 • LTV of ~60% • DSC of ~1.30x • Occupancy of ~85% Credit Tenant <1% Medical <1% Suburban and other 2% Central Business District <1% $1.4 billion Office 4% of Total Loans $10.0 billion CRE Non-Owner Occupied 31% of Total Loans Senior Housing 1% Total Loans $32.5 billion

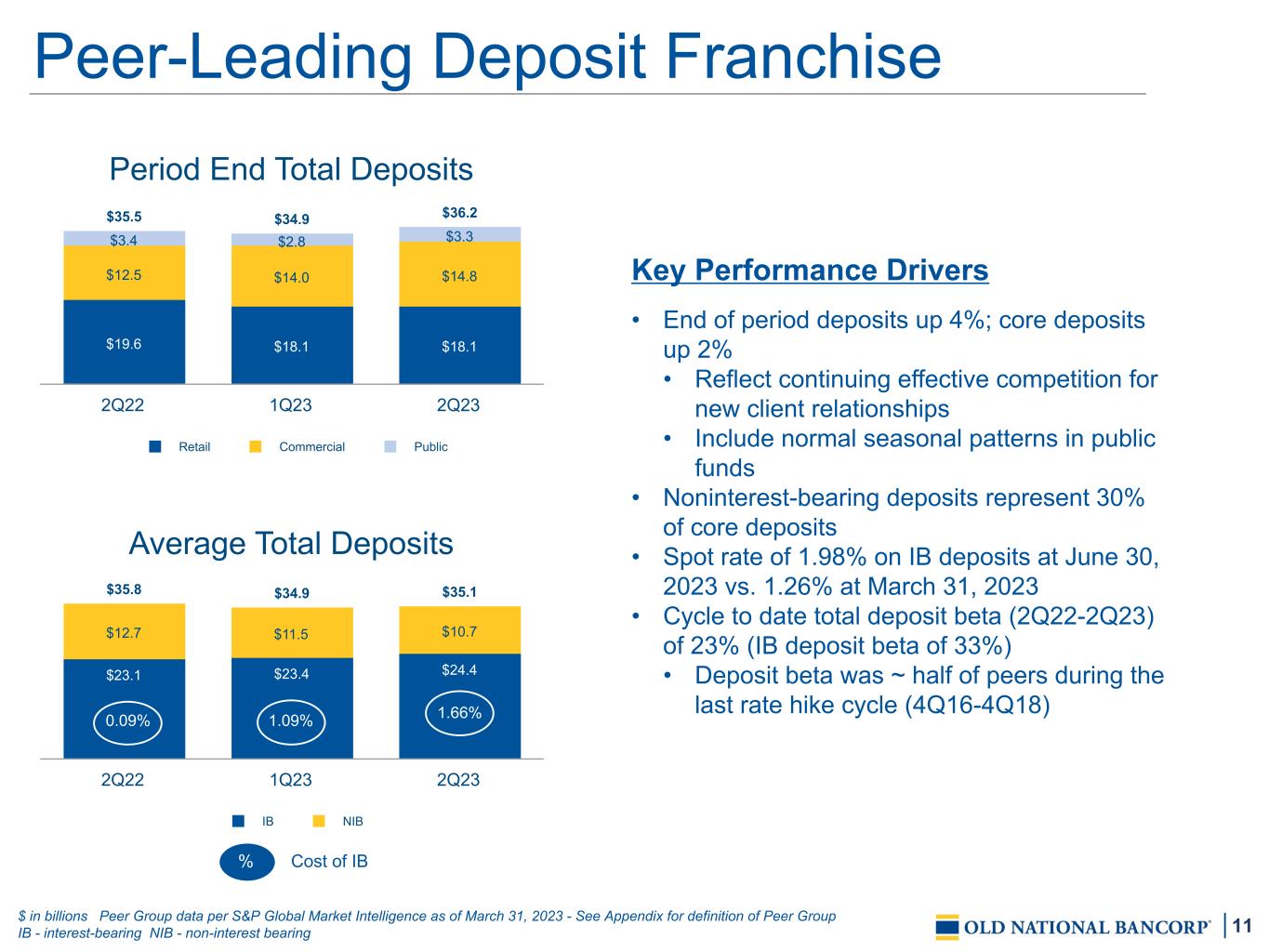

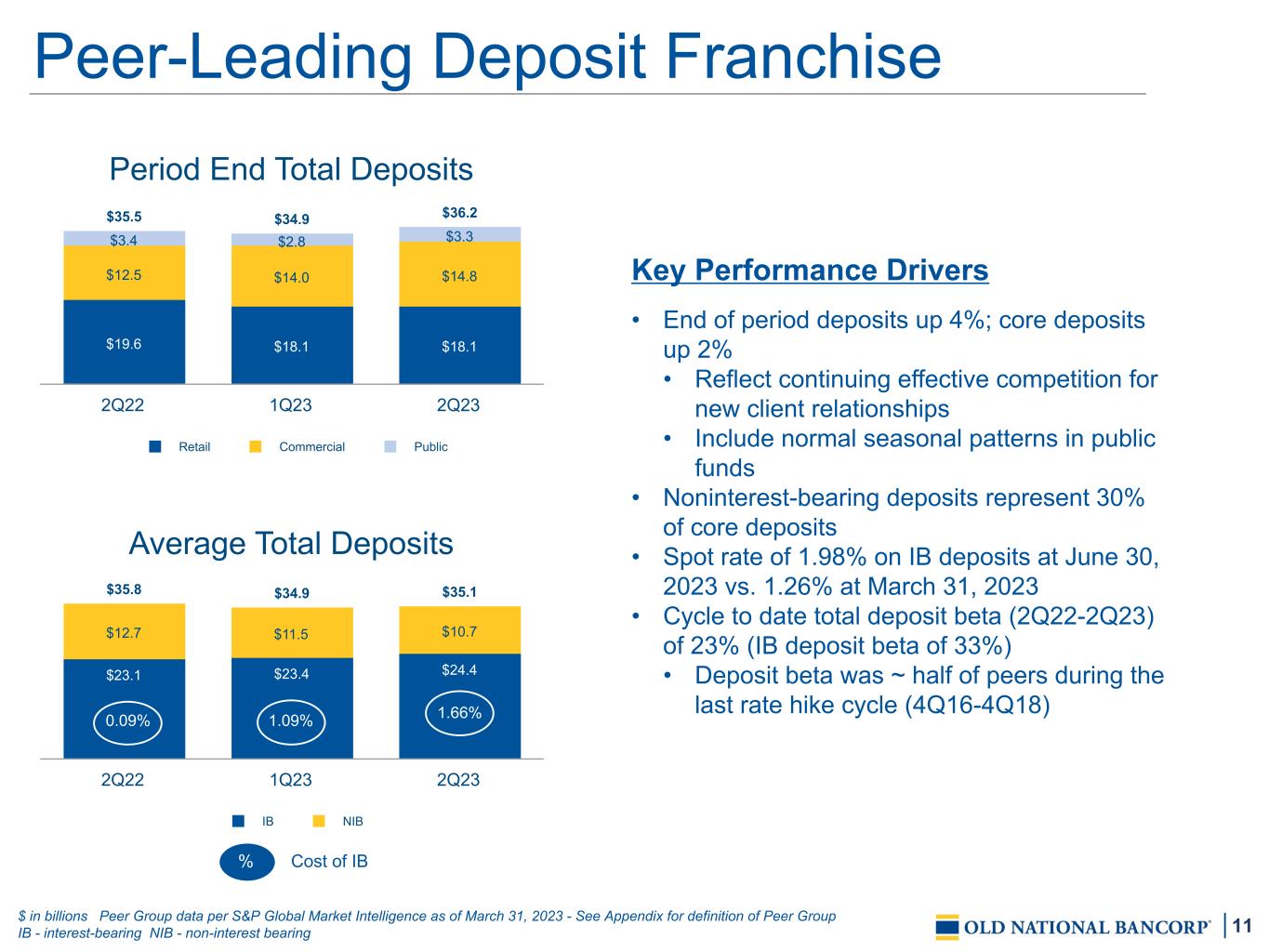

11 Peer-Leading Deposit Franchise Key Performance Drivers • End of period deposits up 4%; core deposits up 2% • Reflect continuing effective competition for new client relationships • Include normal seasonal patterns in public funds • Noninterest-bearing deposits represent 30% of core deposits • Spot rate of 1.98% on IB deposits at June 30, 2023 vs. 1.26% at March 31, 2023 • Cycle to date total deposit beta (2Q22-2Q23) of 23% (IB deposit beta of 33%) • Deposit beta was ~ half of peers during the last rate hike cycle (4Q16-4Q18) $ in billions Peer Group data per S&P Global Market Intelligence as of March 31, 2023 - See Appendix for definition of Peer Group IB - interest-bearing NIB - non-interest bearing Average Total Deposits $35.8 $34.9 $35.1 $23.1 $23.4 $24.4 $12.7 $11.5 $10.7 IB NIB 2Q22 1Q23 2Q23 Period End Total Deposits $35.5 $34.9 $36.2 $19.6 $18.1 $18.1 $12.5 $14.0 $14.8 $3.4 $2.8 $3.3 Retail Commercial Public 2Q22 1Q23 2Q23 Cost of IB% 1.09%0.09% 1.66%

12 Core Deposit Tenure 25% 25%20% 30% <5 years 5-15 years 15-25 years >25 years 75% >5 years Deposit Highlights • Insured deposits2 >70% of total deposits • Granular low-cost deposit franchise • Top 20 deposit clients represents only 5.1% of total deposits; weighted average tenure > 30 years; ~75% collateralized or insured • 81% of accounts have balances <$25k; average balance of ~$4,500 • Exception and special pricing • <25% of total deposits • Weighted average rate of 3.77% Average Core Account Balance ONB Peer Average $0-$250k >$250k $16k $955k $24k $1.4mm 1 Granular, Long-Tenured Deposit Base $ in billions, unless otherwise stated As of June 30, 2023 1 Peer Group data per S&P Global Market Intelligence as of June 30, 2023 - See Appendix for definition of Peer Group 2 Includes the estimate of Old National Bank federally uninsured deposits for regulatory purposes, as adjusted for $1.5 billion of affiliate deposits and $4.2 billion of collateralized or otherwise insured deposits. k - thousand IB - interest-bearing mm - millions Brokered Deposits/ Total Deposits 10.6% 3.5% Peers - 2Q23 Peer Avg - 2Q23 ONB - 2Q23 11

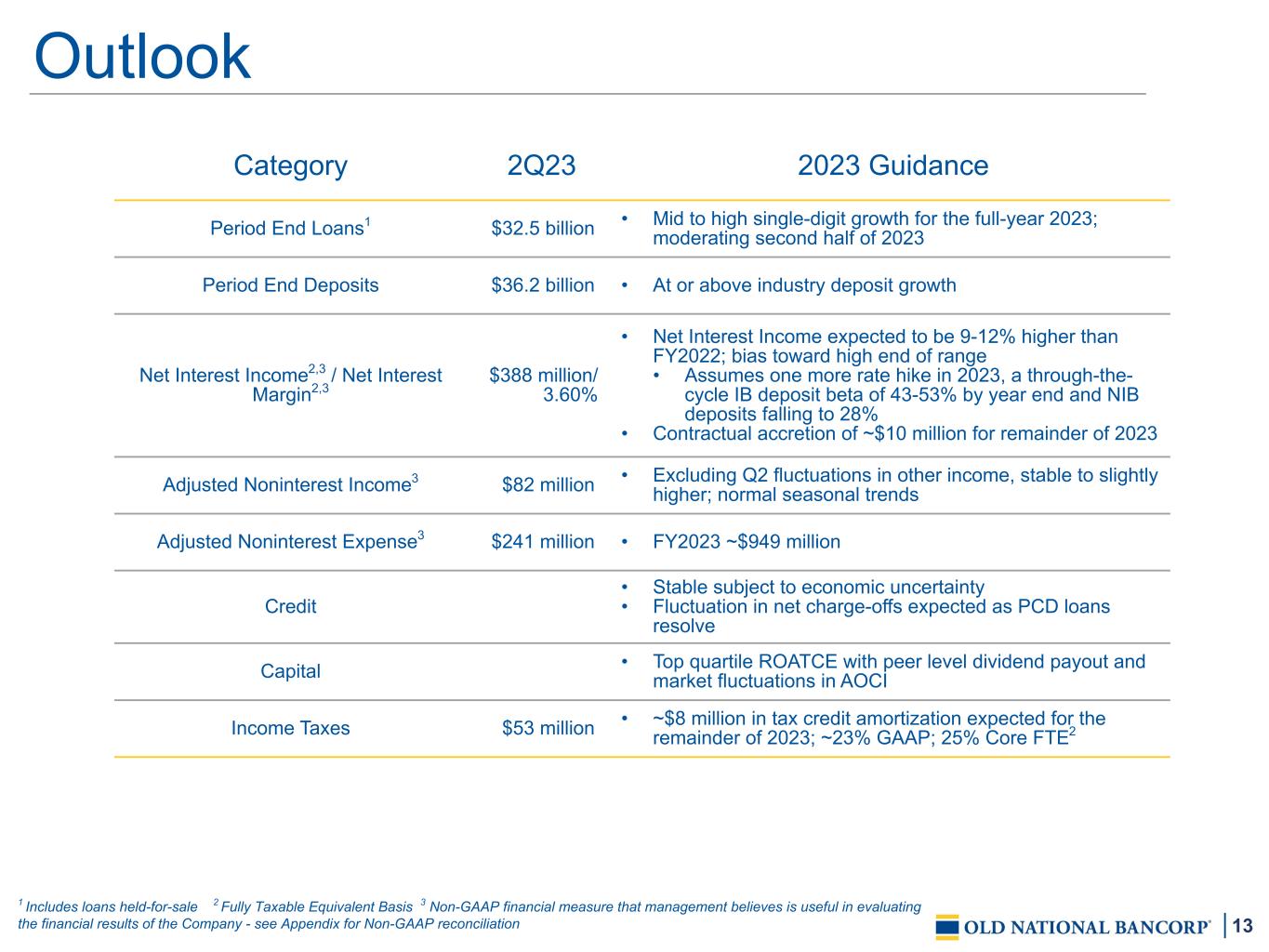

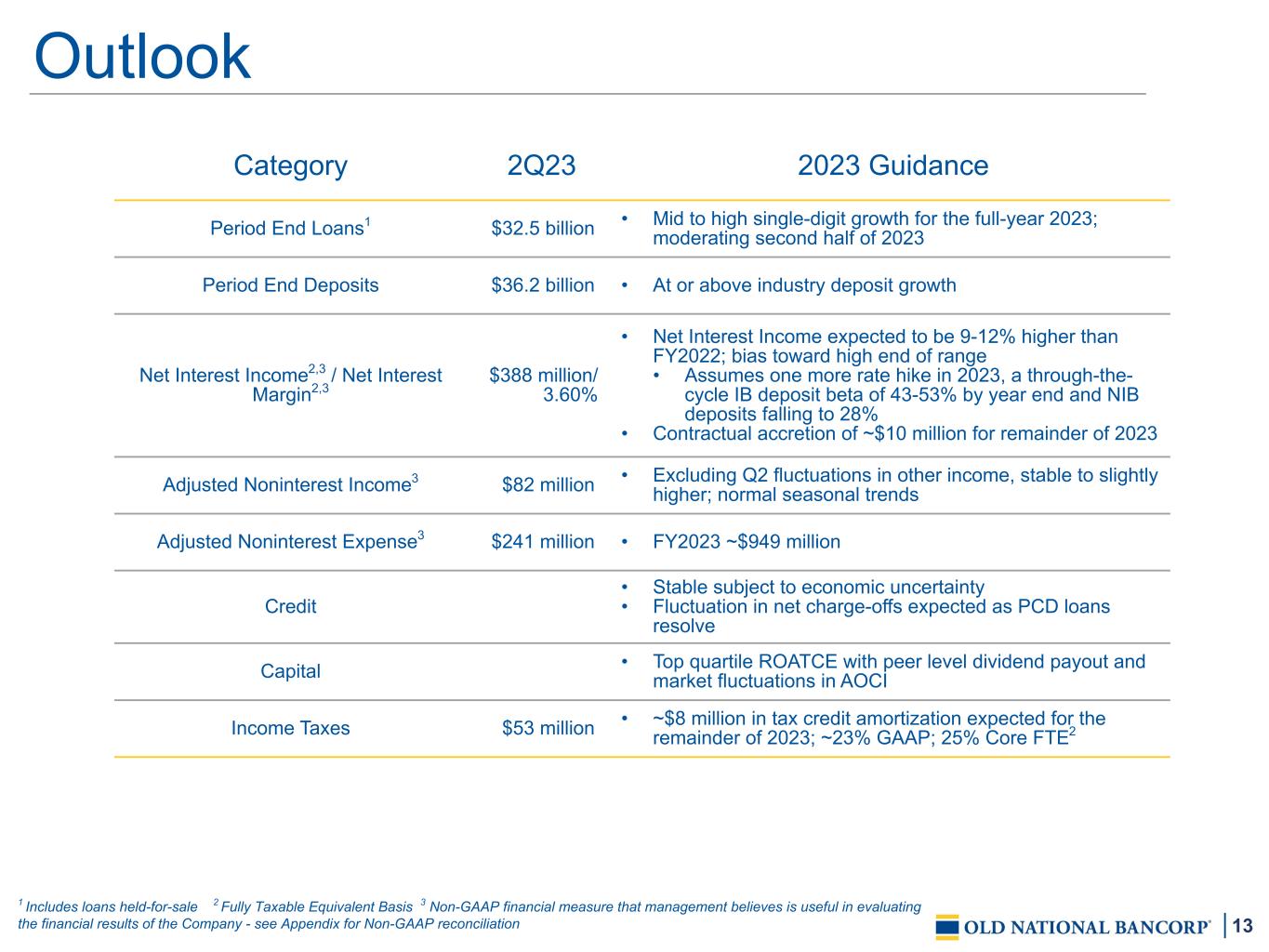

13 Outlook Category 2Q23 2023 Guidance Period End Loans1 $32.5 billion • Mid to high single-digit growth for the full-year 2023; moderating second half of 2023 Period End Deposits $36.2 billion • At or above industry deposit growth Net Interest Income2,3 / Net Interest Margin2,3 $388 million/ 3.60% • Net Interest Income expected to be 9-12% higher than FY2022; bias toward high end of range • Assumes one more rate hike in 2023, a through-the- cycle IB deposit beta of 43-53% by year end and NIB deposits falling to 28% • Contractual accretion of ~$10 million for remainder of 2023 Adjusted Noninterest Income3 $82 million • Excluding Q2 fluctuations in other income, stable to slightly higher; normal seasonal trends Adjusted Noninterest Expense3 $241 million • FY2023 ~$949 million Credit • Stable subject to economic uncertainty • Fluctuation in net charge-offs expected as PCD loans resolve Capital • Top quartile ROATCE with peer level dividend payout and market fluctuations in AOCI Income Taxes $53 million • ~$8 million in tax credit amortization expected for the remainder of 2023; ~23% GAAP; 25% Core FTE2 1 Includes loans held-for-sale 2 Fully Taxable Equivalent Basis 3 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation

Financial Details Data as of June 30, 2023

15 Strong Second-Quarter 2023 Highlights $ in Millions, except per share data 1 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation NCOs - net charge-offs PCD - purchased credit deteriorated TCE - tangible common equity TBV - tangible common book value AOCI - accumulated other comprehensive income Key Performance Drivers ▪ Increased net interest income vs. 1Q23 ▪ Granular, peer-leading deposit franchise ▪ Growth in total deposits of 4% and core deposits of 2% ▪ Credit quality remains stable, NCOs of 6 bps excluding PCD loans ▪ Well-managed expenses ▪ Disciplined and balanced loan growth ▪ TBV1 up 9% YoY; up 15% YoY excluding AOCI Reported Adjusted1 EPS $0.52 $0.54 Net Income $151 $156 Return on Average Assets 1.29% 1.33% Return on Average TCE1 21.4% 22.1% Efficiency Ratio1 51.2% 49.4% Tangible common book value1 $10.03 Total Cost of Deposits 115 bps Total Deposit Beta (cycle to date) 23%

16 2Q23 1Q23 2Q22 % Change End of Period Balances 2Q23 vs. 1Q23 2Q23 vs. 2Q22 Available-for-sale securities, at fair value $6,501 $6,687 $7,568 (3)% (14)% Held-to-maturity securities, at amortized cost $3,055 $3,071 $3,084 (1)% (1)% Total loans1 $32,547 $31,833 $29,580 2% 10% Total assets $48,497 $47,843 $45,748 1% 6% Total deposits $36,231 $34,918 $35,539 4% 2% Borrowings $6,034 $6,740 $4,384 (10)% 38% Total liabilities $43,205 $42,565 $40,670 2% 6% Shareholders’s equity $5,292 $5,277 $5,079 —% 4% CET1 capital to RWA2 10.14% 9.98% 9.90% 2% 2% AOCI $(809) $(708) $(569) (14)% (42)% Tangible common book value3 $10.03 $9.98 $9.23 1% 9% Tangible common book value, excluding AOCI3 $12.80 $12.41 $11.17 3% 15% Loans / Deposits 90% 91% 83% (1)% 8% Liquid, Well-Capitalized Balance Sheet $ in millions 1 Includes loans held-for-sale 2 2Q23 figures are preliminary 3 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation AOCI - accumulated other comprehensive income CET1 - common equity Tier 1 RWA - risk-weighted assets

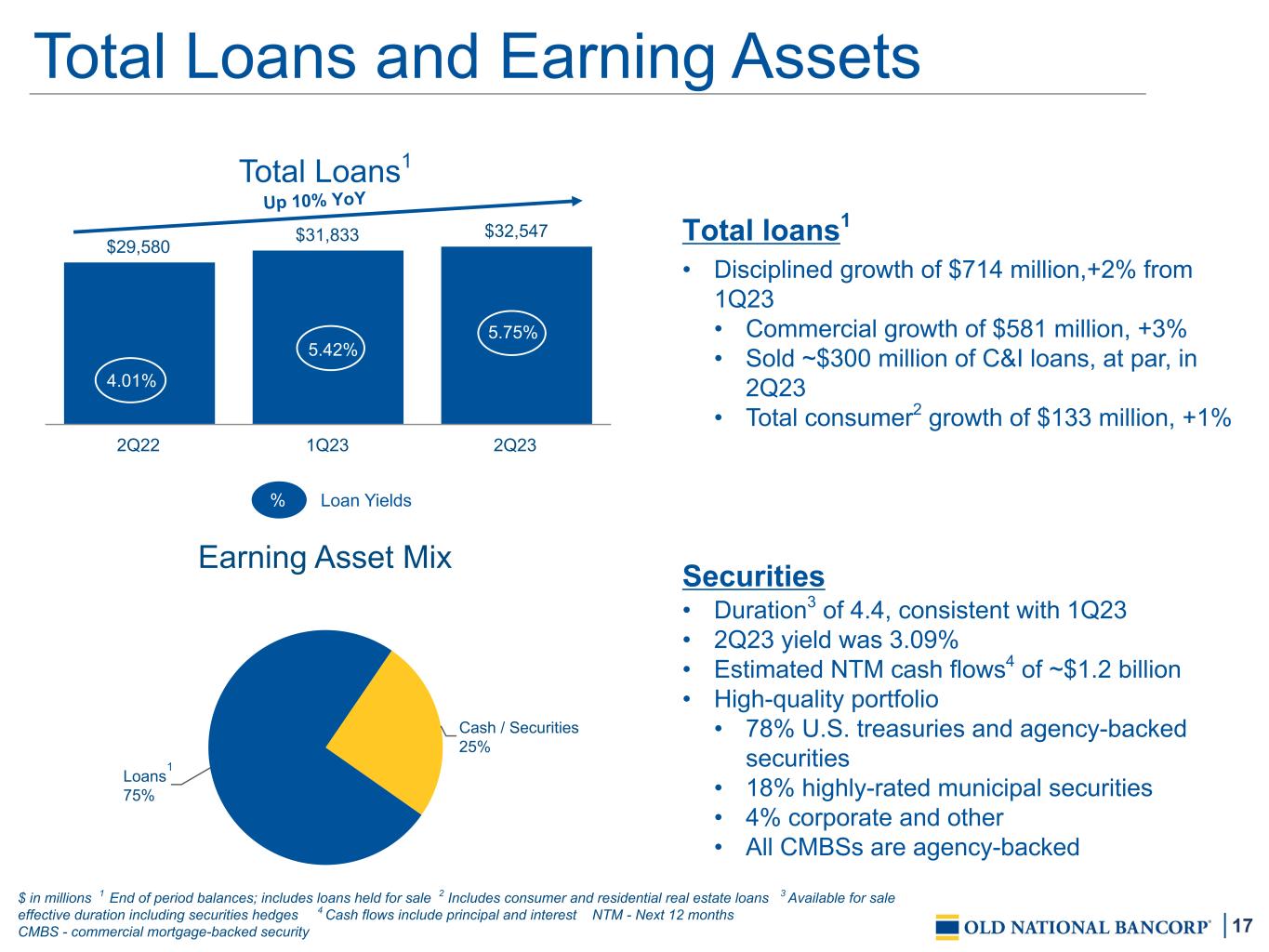

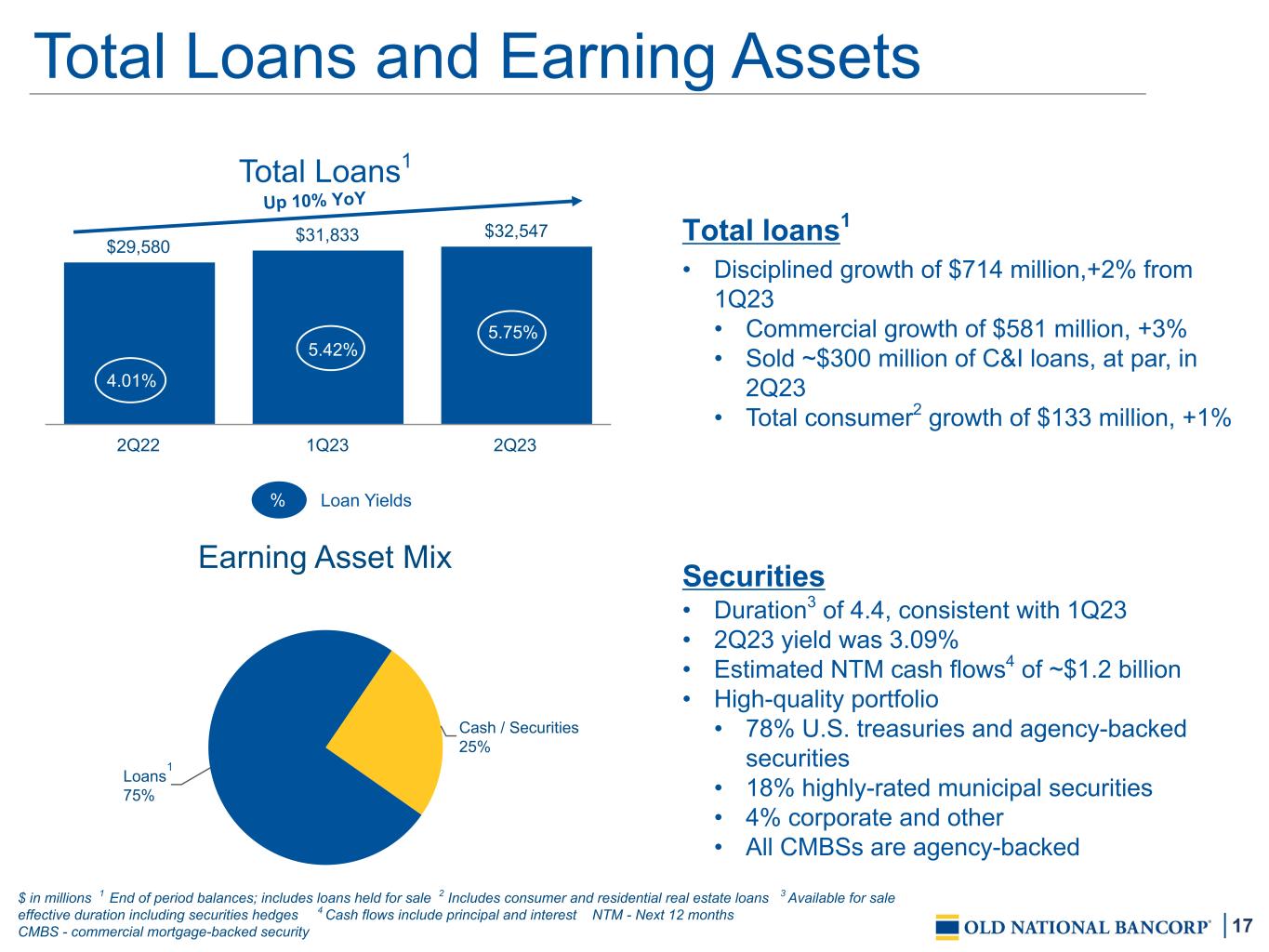

17 3.64% 4.01% 4.54% 5.08% 5.42% % $29,580 $31,833 $32,547 2Q22 1Q23 2Q23 5.42% Loan Yields Total Loans and Earning Assets Total loans1 • Disciplined growth of $714 million,+2% from 1Q23 • Commercial growth of $581 million, +3% • Sold ~$300 million of C&I loans, at par, in 2Q23 • Total consumer2 growth of $133 million, +1% Securities • Duration3 of 4.4, consistent with 1Q23 • 2Q23 yield was 3.09% • Estimated NTM cash flows4 of ~$1.2 billion • High-quality portfolio • 78% U.S. treasuries and agency-backed securities • 18% highly-rated municipal securities • 4% corporate and other • All CMBSs are agency-backed Earning Asset Mix Loans 75% Cash / Securities 25% Total Loans1 Up 10% YoY $ in millions 1 End of period balances; includes loans held for sale 2 Includes consumer and residential real estate loans 3 Available for sale effective duration including securities hedges 4 Cash flows include principal and interest NTM - Next 12 months CMBS - commercial mortgage-backed security 4.01% 75 1

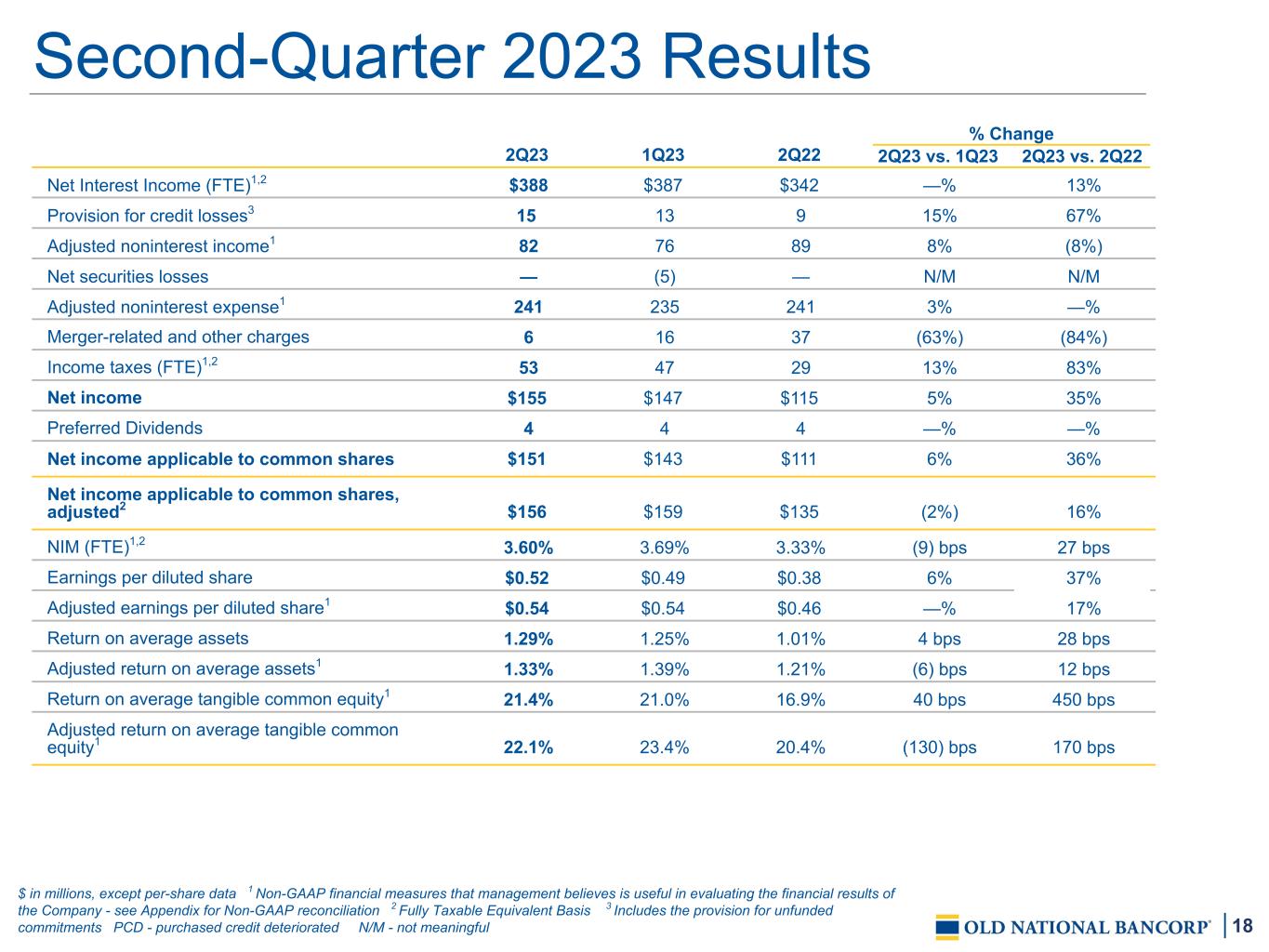

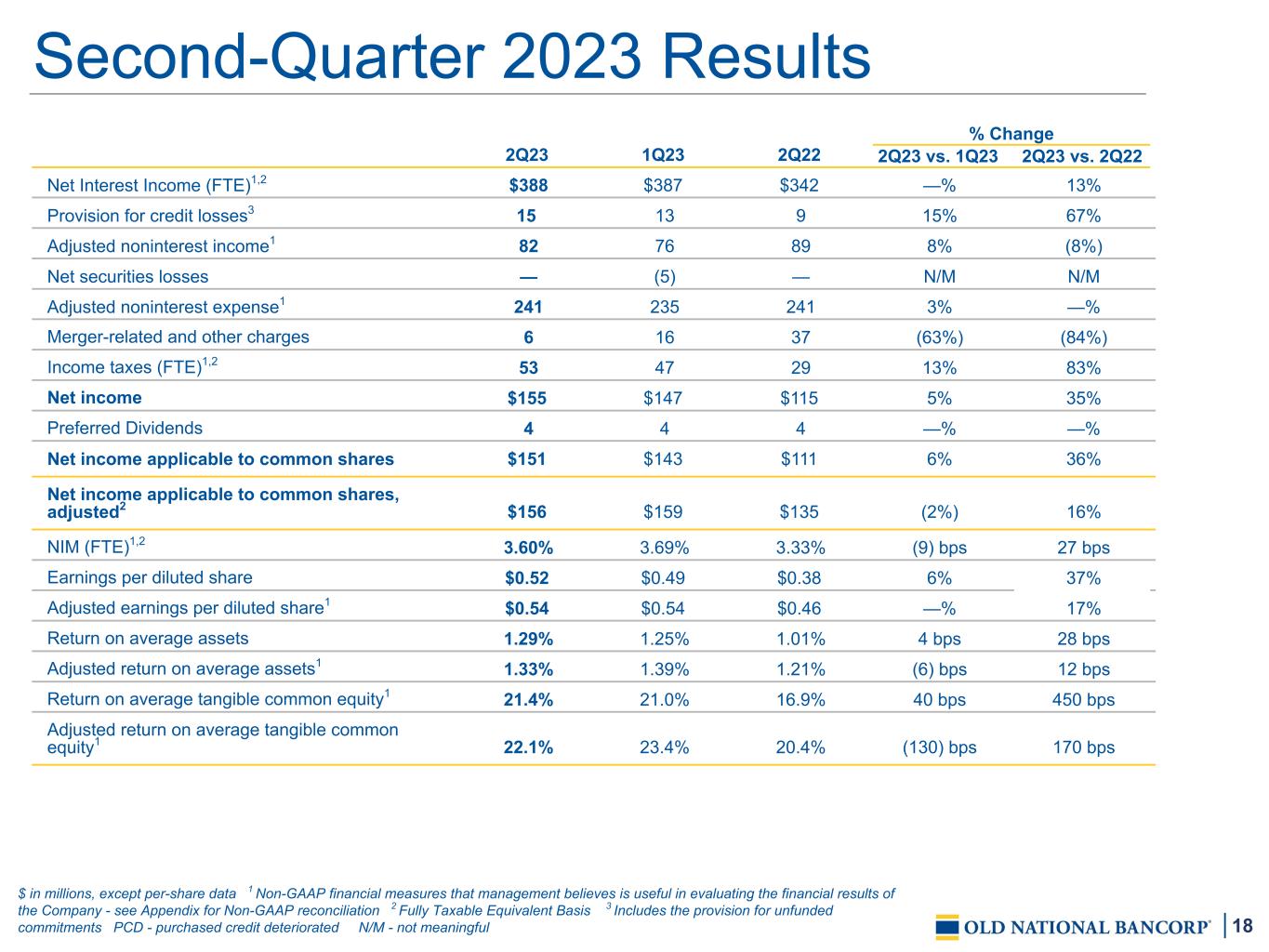

18 $ in millions, except per-share data 1 Non-GAAP financial measures that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation 2 Fully Taxable Equivalent Basis 3 Includes the provision for unfunded commitments PCD - purchased credit deteriorated N/M - not meaningful Second-Quarter 2023 Results 2Q23 1Q23 2Q22 % Change 2Q23 vs. 1Q23 2Q23 vs. 2Q22 Net Interest Income (FTE)1,2 $388 $387 $342 —% 13% Provision for credit losses3 15 13 9 15% 67% Adjusted noninterest income1 82 76 89 8% (8%) Net securities losses — (5) — N/M N/M Adjusted noninterest expense1 241 235 241 3% —% Merger-related and other charges 6 16 37 (63%) (84%) Income taxes (FTE)1,2 53 47 29 13% 83% Net income $155 $147 $115 5% 35% Preferred Dividends 4 4 4 —% —% Net income applicable to common shares $151 $143 $111 6% 36% Net income applicable to common shares, adjusted2 $156 $159 $135 (2%) 16% NIM (FTE)1,2 3.60% 3.69% 3.33% (9) bps 27 bps Earnings per diluted share $0.52 $0.49 $0.38 6% 37% Adjusted earnings per diluted share1 $0.54 $0.54 $0.46 —% 17% Return on average assets 1.29% 1.25% 1.01% 4 bps 28 bps Adjusted return on average assets1 1.33% 1.39% 1.21% (6) bps 12 bps Return on average tangible common equity1 21.4% 21.0% 16.9% 40 bps 450 bps Adjusted return on average tangible common equity1 22.1% 23.4% 20.4% (130) bps 170 bps

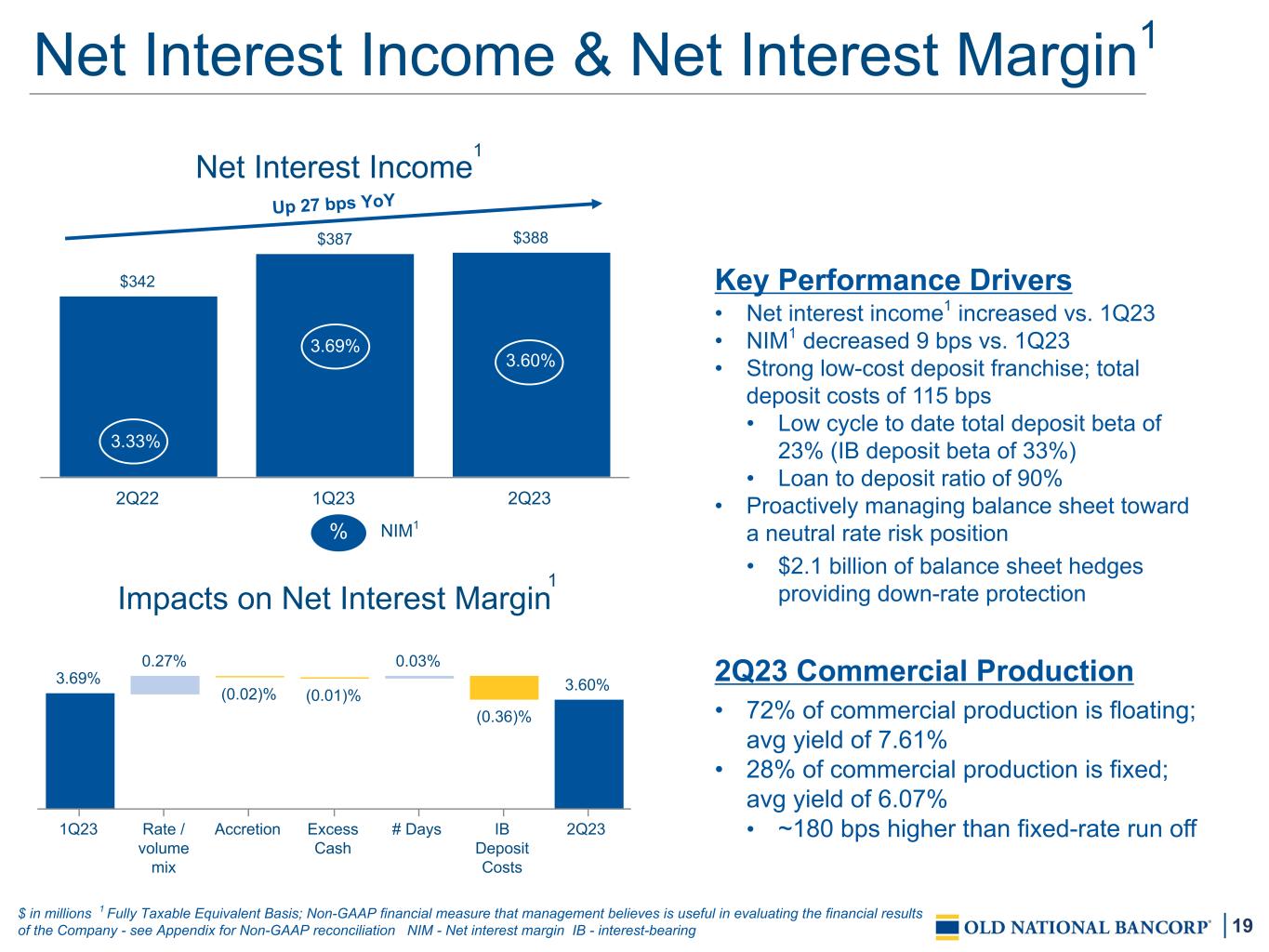

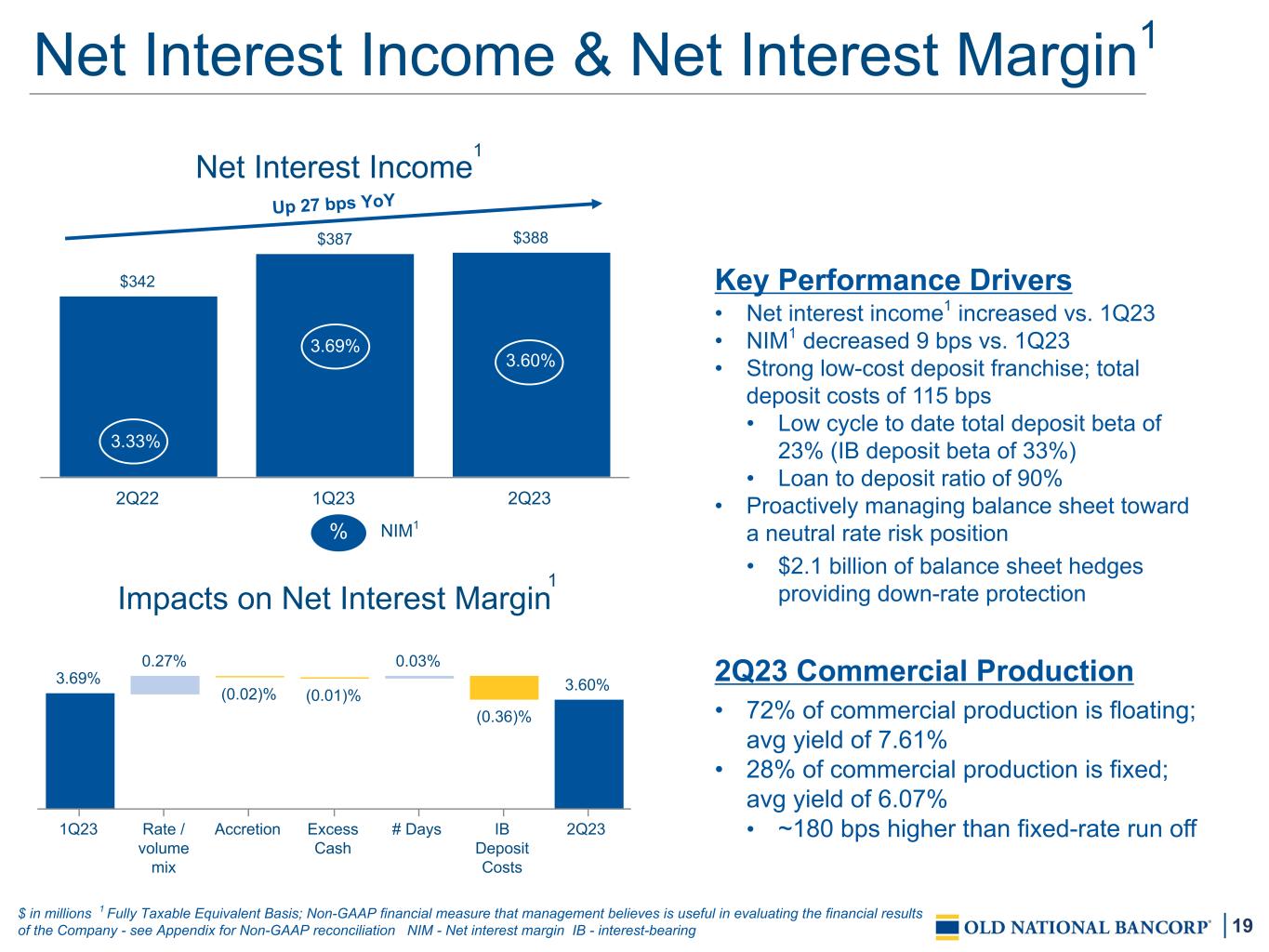

19 Impacts on Net Interest Margin 3.69% 0.27% (0.02)% (0.01)% 0.03% (0.36)% 3.60% 1Q23 Rate / volume mix Accretion Excess Cash # Days IB Deposit Costs 2Q23 $ in millions 1 Fully Taxable Equivalent Basis; Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation NIM - Net interest margin IB - interest-bearing 1 Key Performance Drivers • Net interest income1 increased vs. 1Q23 • NIM1 decreased 9 bps vs. 1Q23 • Strong low-cost deposit franchise; total deposit costs of 115 bps • Low cycle to date total deposit beta of 23% (IB deposit beta of 33%) • Loan to deposit ratio of 90% • Proactively managing balance sheet toward a neutral rate risk position • $2.1 billion of balance sheet hedges providing down-rate protection Net Interest Income $342 $387 $388 2Q22 1Q23 2Q23 NIM1% 3.60% 3.69% 3.33% 1 Net Interest Income & Net Interest Margin1 Up 27 bps YoY 2Q23 Commercial Production • 72% of commercial production is floating; avg yield of 7.61% • 28% of commercial production is fixed; avg yield of 6.07% • ~180 bps higher than fixed-rate run off

20 Noninterest Income $ in millions 1 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation 2 Residential mortgage production includes quick home refinance product Key Performance Drivers • 8% higher due to: • Bank fees, increased client transactions • Other income driven by company- owned life insurance income, recovery of an other asset and derivative valuations • 2Q23 Mortgage Activity • Production was $334 million2 ▪ 94% purchase / 6% refi ▪ 35% sold in secondary market • Quarter-end pipeline at $151 million 2Q23 1Q23 2Q22 Bank Fees $29 $27 $32 Wealth Fees 27 27 28 Mortgage Fees 4 3 6 Capital Markets 6 7 7 Other 16 12 16 Adjusted Noninterest Income1 $82 $76 $89

21 Noninterest Expense $ in millions 1 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation Key Performance Drivers • 2Q23 adjusted noninterest expense1 well- controlled • Salaries & employee benefits higher resulting from $5 million of year-to-date performance-driven incentive accrual true-up in 2Q23 • 2Q23 adjusted efficiency ratio1 of 49.4% 2Q23 1Q23 2Q22 Salary & Employee Benefits $131 $126 $140 Occupancy & Equipment 34 34 33 Technology & Communication 24 23 28 Other 52 52 40 Adjusted Noninterest Expense1 $241 $235 $241

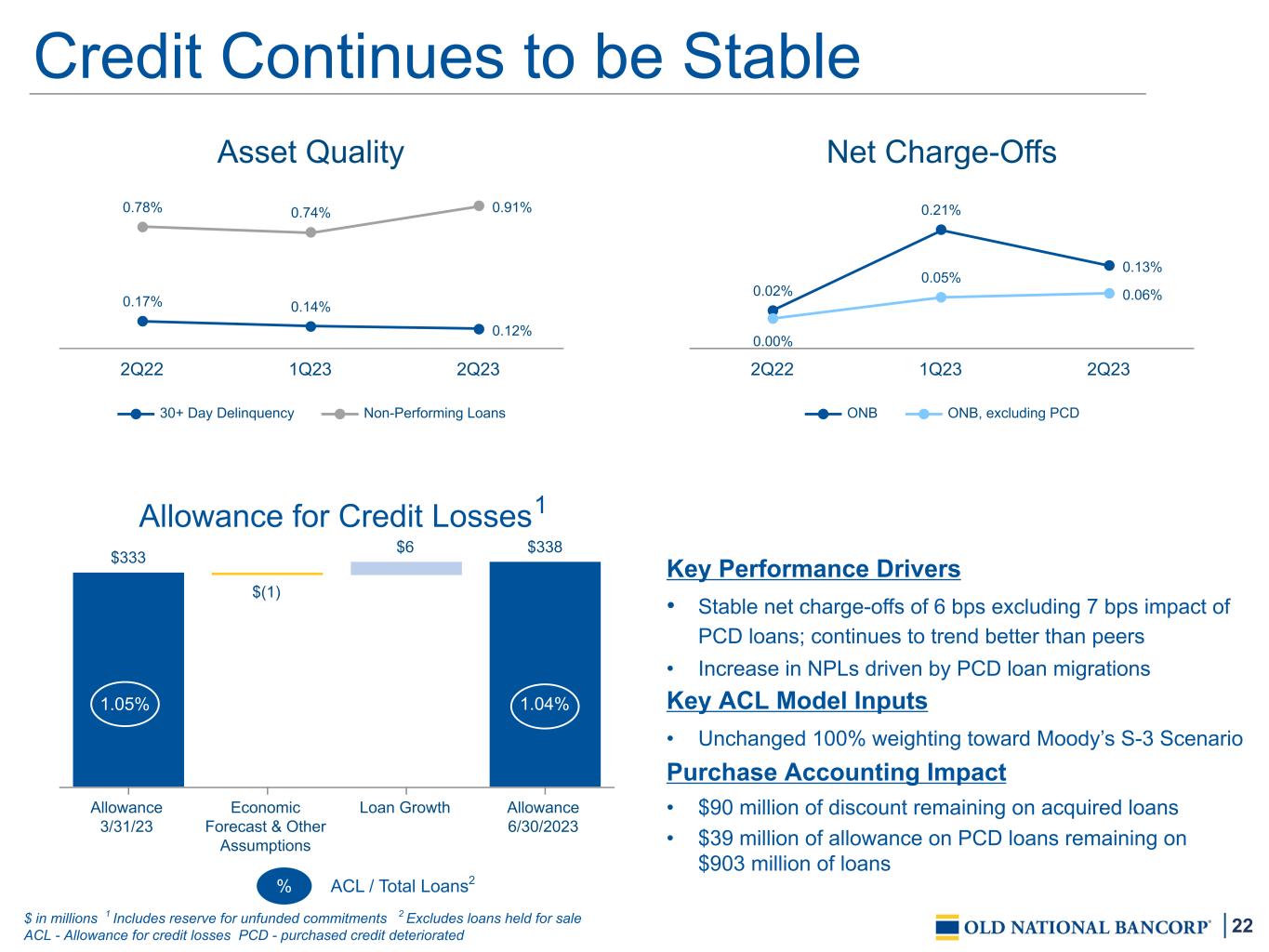

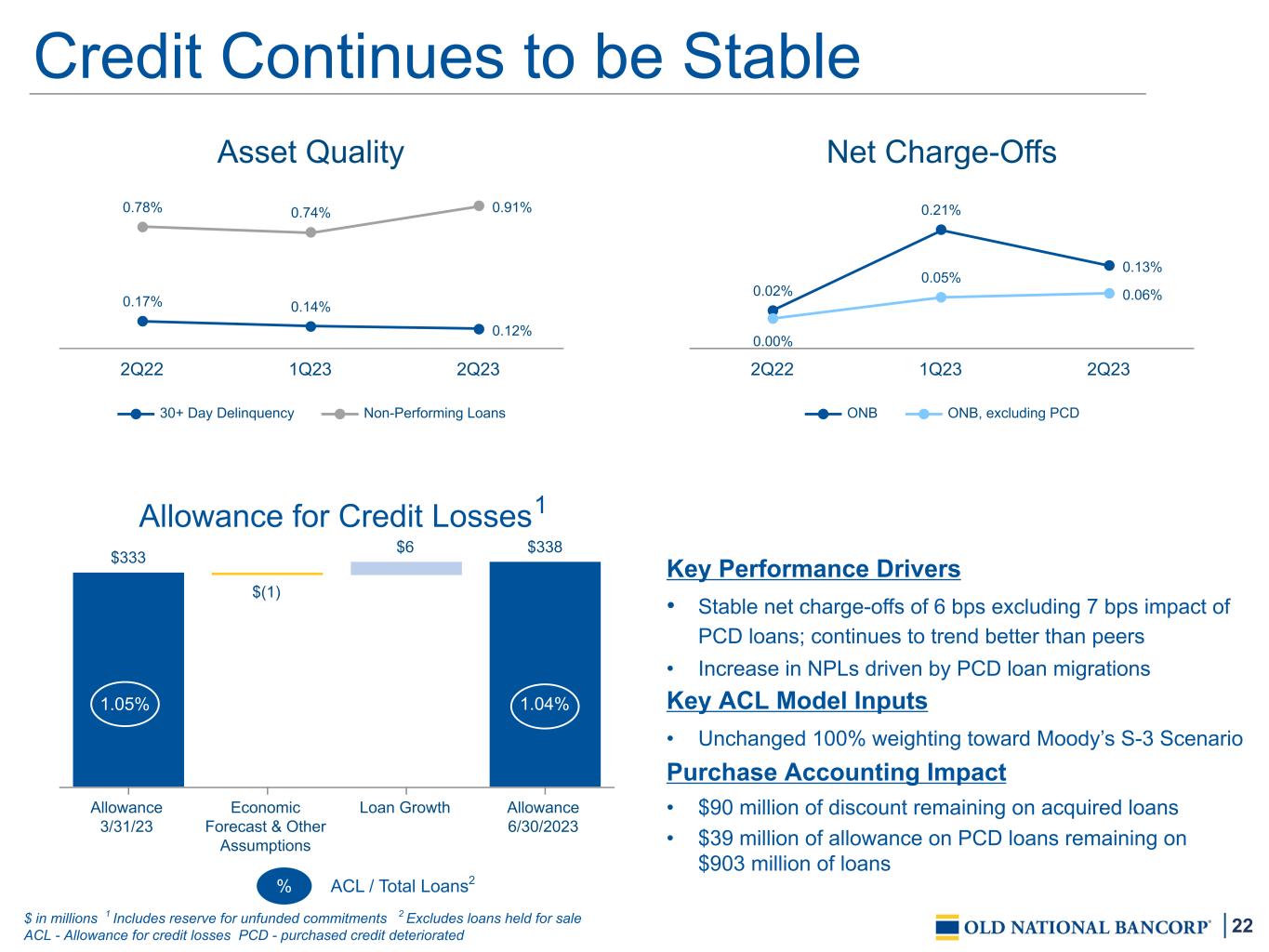

22 Allowance for Credit Losses $333 $(1) $6 $338 Allowance 3/31/23 Economic Forecast & Other Assumptions Loan Growth Allowance 6/30/2023 Credit Continues to be Stable Asset Quality 0.17% 0.14% 0.12% 0.78% 0.74% 0.91% 30+ Day Delinquency Non-Performing Loans 2Q22 1Q23 2Q23 $ in millions 1 Includes reserve for unfunded commitments 2 Excludes loans held for sale ACL - Allowance for credit losses PCD - purchased credit deteriorated Key Performance Drivers • Stable net charge-offs of 6 bps excluding 7 bps impact of PCD loans; continues to trend better than peers • Increase in NPLs driven by PCD loan migrations Key ACL Model Inputs • Unchanged 100% weighting toward Moody’s S-3 Scenario Purchase Accounting Impact • $90 million of discount remaining on acquired loans • $39 million of allowance on PCD loans remaining on $903 million of loans ACL / Total Loans2 1.05% 1.04% % 1 Net Charge-Offs 0.02% 0.21% 0.13% 0.00% 0.05% 0.06% ONB ONB, excluding PCD 2Q22 1Q23 2Q23

Key Areas of Focus

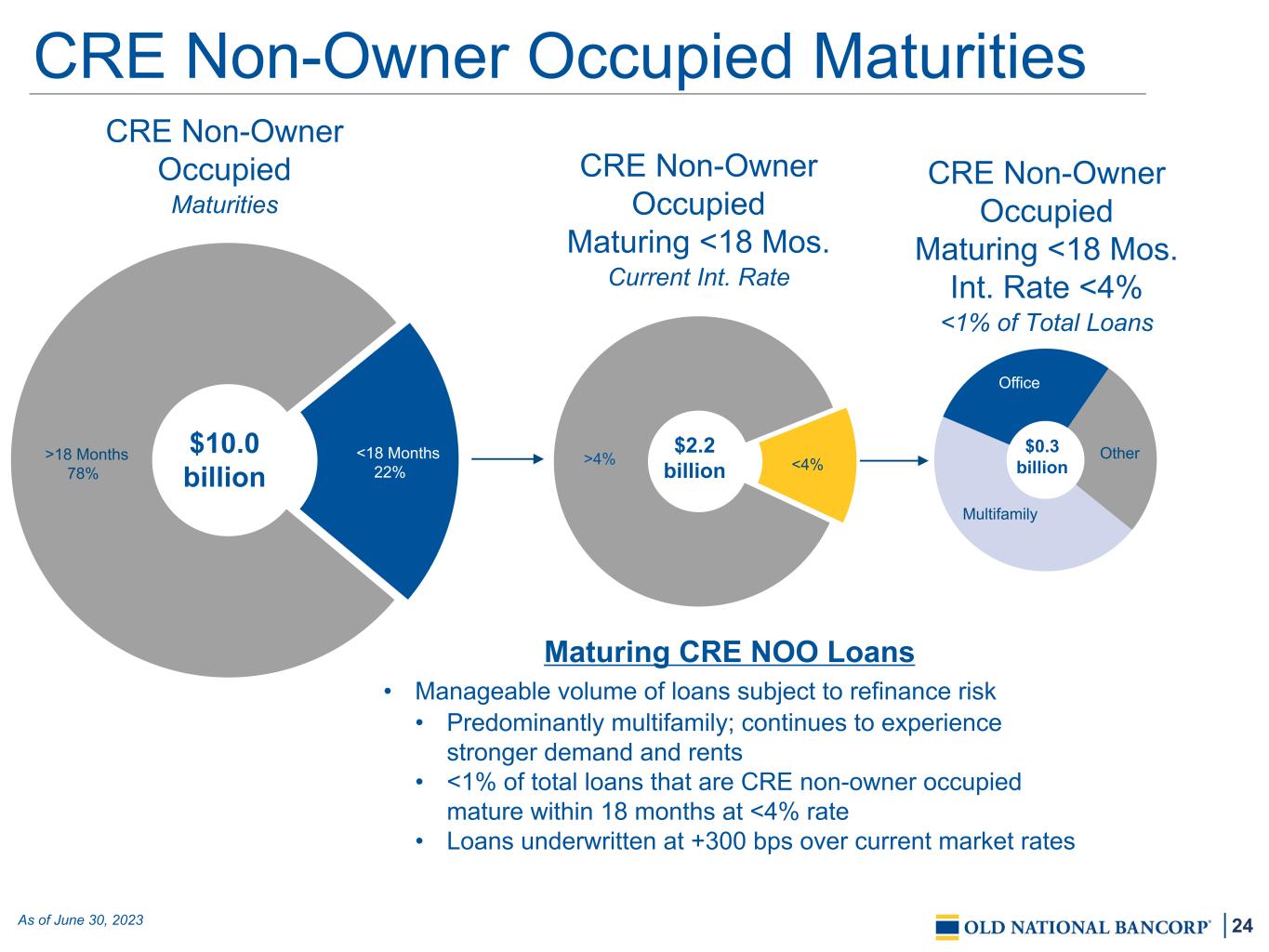

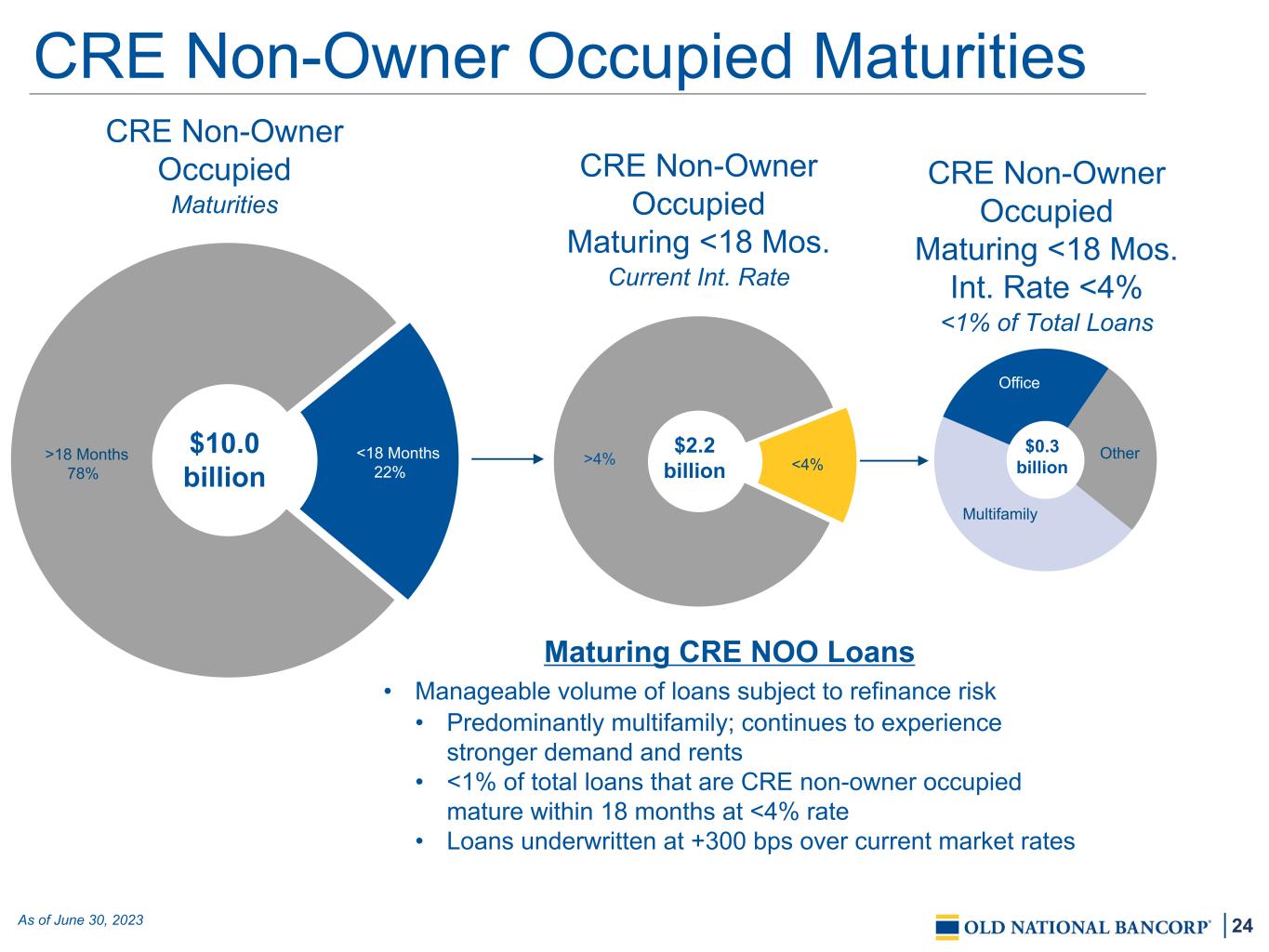

24 >4% <4%>18 Months 78% <18 Months 22% CRE Non-Owner Occupied Maturities As of June 30, 2023 Maturing CRE NOO Loans • Manageable volume of loans subject to refinance risk • Predominantly multifamily; continues to experience stronger demand and rents • <1% of total loans that are CRE non-owner occupied mature within 18 months at <4% rate • Loans underwritten at +300 bps over current market rates Multifamily Office Other$0.3 billion $2.2 billion CRE Non-Owner Occupied Maturing <18 Mos. Current Int. Rate $10.0 billion CRE Non-Owner Occupied Maturities CRE Non-Owner Occupied Maturing <18 Mos. Int. Rate <4% <1% of Total Loans

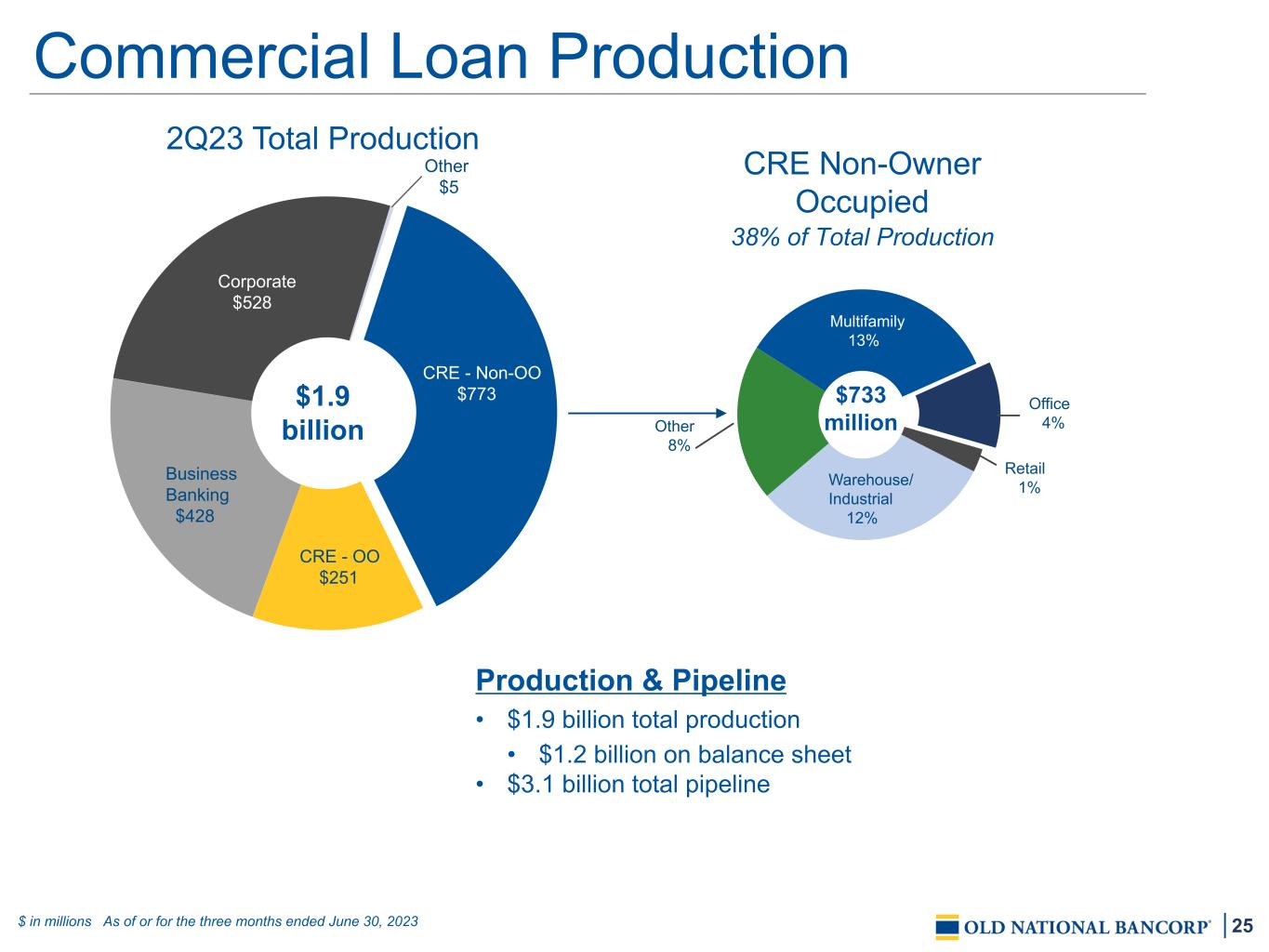

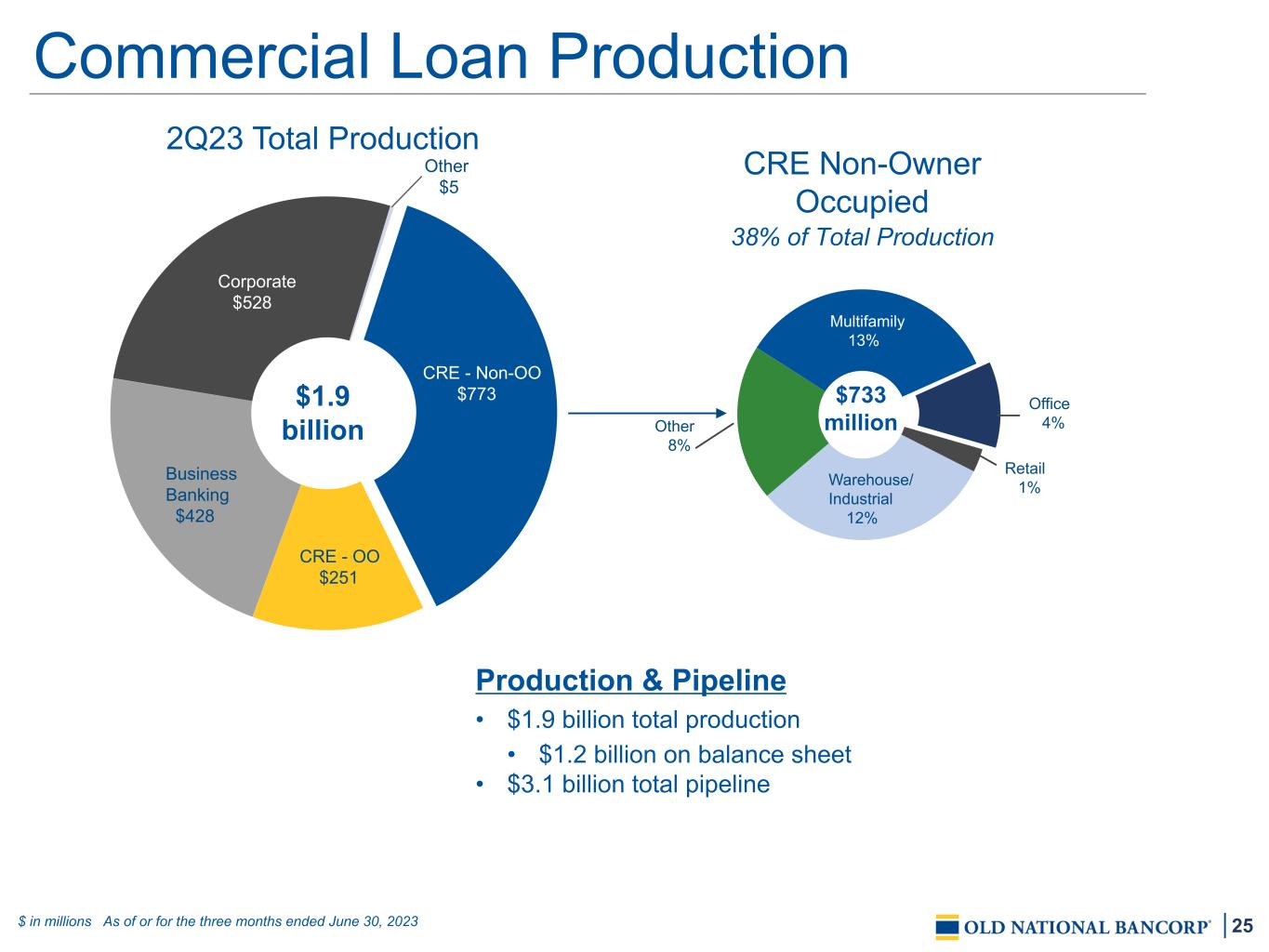

25 Commercial Loan Production $ in millions As of or for the three months ended June 30, 2023 Production & Pipeline • $1.9 billion total production • $1.2 billion on balance sheet • $3.1 billion total pipeline Retail 1%Warehouse/ Industrial 12% Other 8% Multifamily 13% Office 4% CRE - Non-OO $773 CRE - OO $251 Business Banking $428 Corporate $528 Other $5 $1.9 billion $733 million 2Q23 Total Production CRE Non-Owner Occupied 38% of Total Production

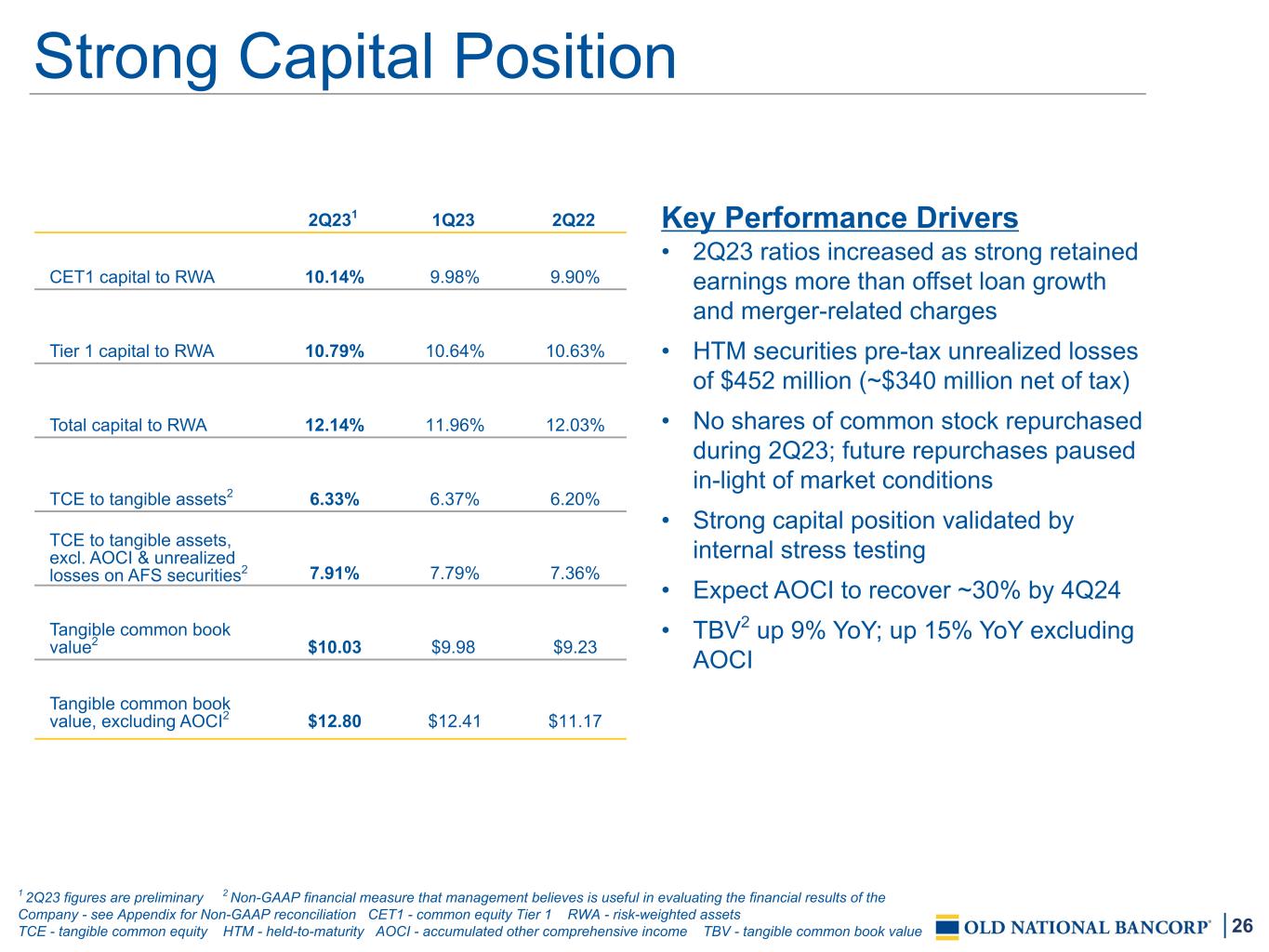

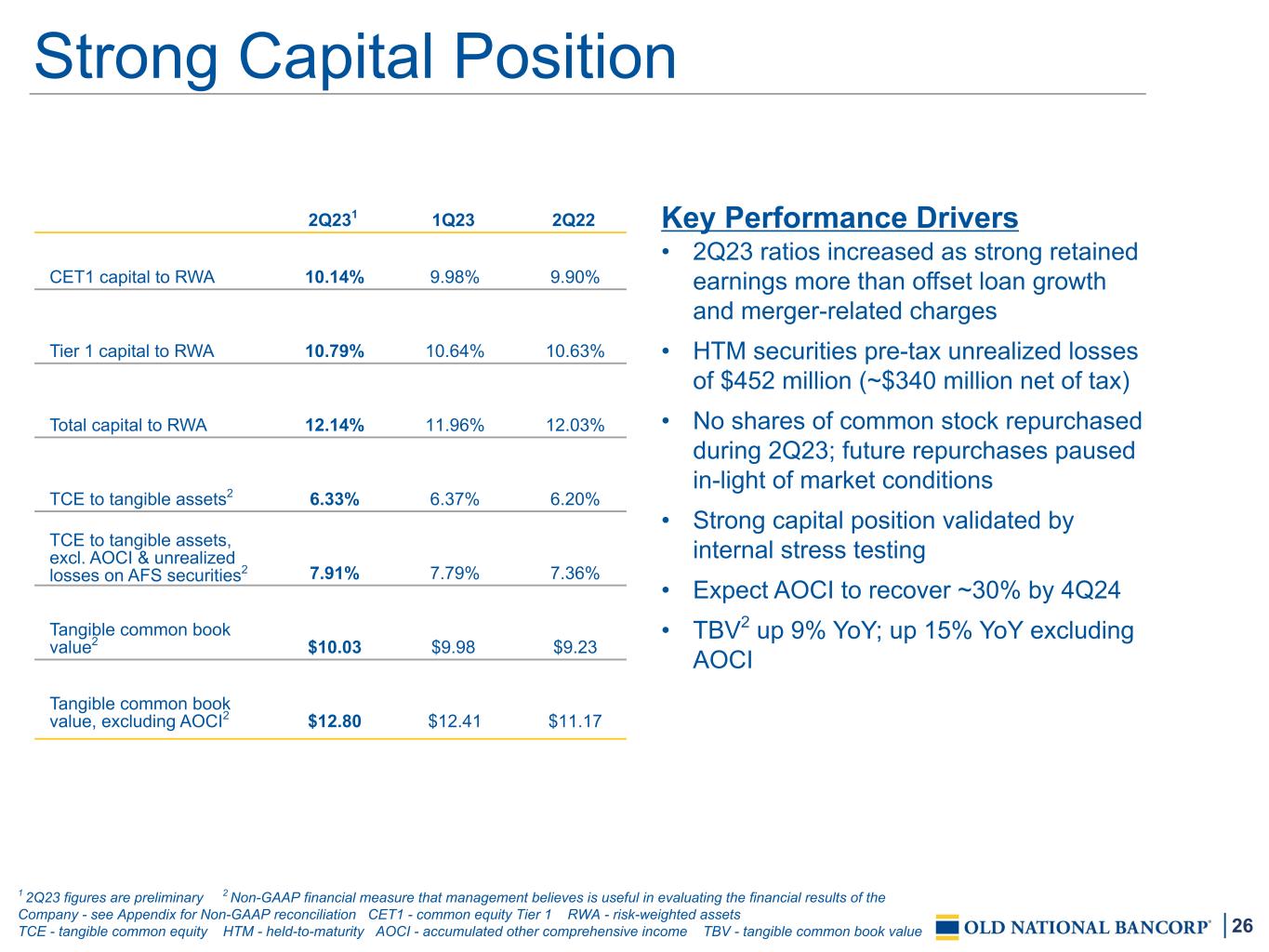

26 Key Performance Drivers • 2Q23 ratios increased as strong retained earnings more than offset loan growth and merger-related charges • HTM securities pre-tax unrealized losses of $452 million (~$340 million net of tax) • No shares of common stock repurchased during 2Q23; future repurchases paused in-light of market conditions • Strong capital position validated by internal stress testing • Expect AOCI to recover ~30% by 4Q24 • TBV2 up 9% YoY; up 15% YoY excluding AOCI Strong Capital Position 1 2Q23 figures are preliminary 2 Non-GAAP financial measure that management believes is useful in evaluating the financial results of the Company - see Appendix for Non-GAAP reconciliation CET1 - common equity Tier 1 RWA - risk-weighted assets TCE - tangible common equity HTM - held-to-maturity AOCI - accumulated other comprehensive income TBV - tangible common book value 2Q231 1Q23 2Q22 CET1 capital to RWA 10.14% 9.98% 9.90% Tier 1 capital to RWA 10.79% 10.64% 10.63% Total capital to RWA 12.14% 11.96% 12.03% TCE to tangible assets2 6.33% 6.37% 6.20% TCE to tangible assets, excl. AOCI & unrealized losses on AFS securities2 7.91% 7.79% 7.36% Tangible common book value2 $10.03 $9.98 $9.23 Tangible common book value, excluding AOCI2 $12.80 $12.41 $11.17

Appendix Appendix

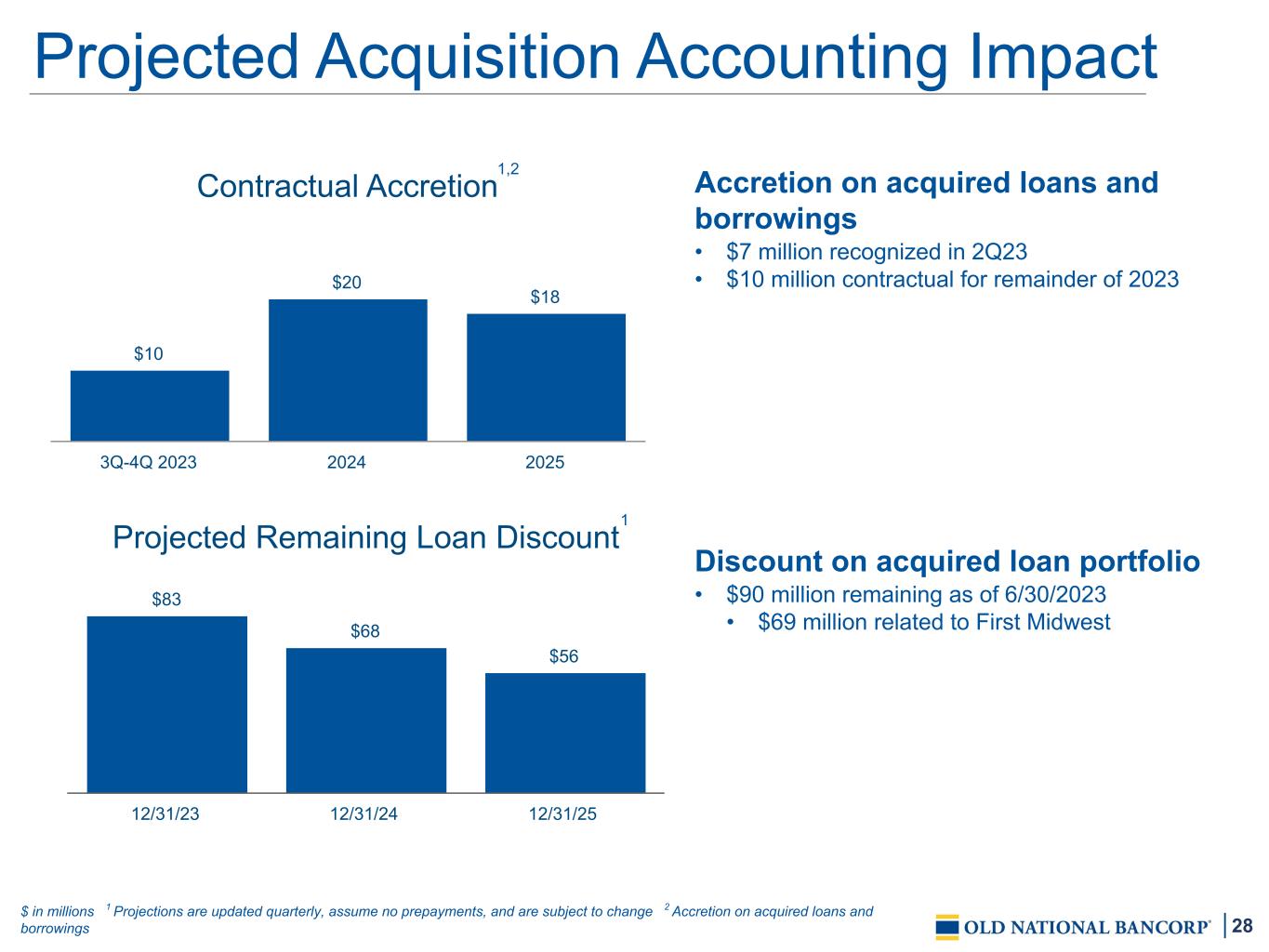

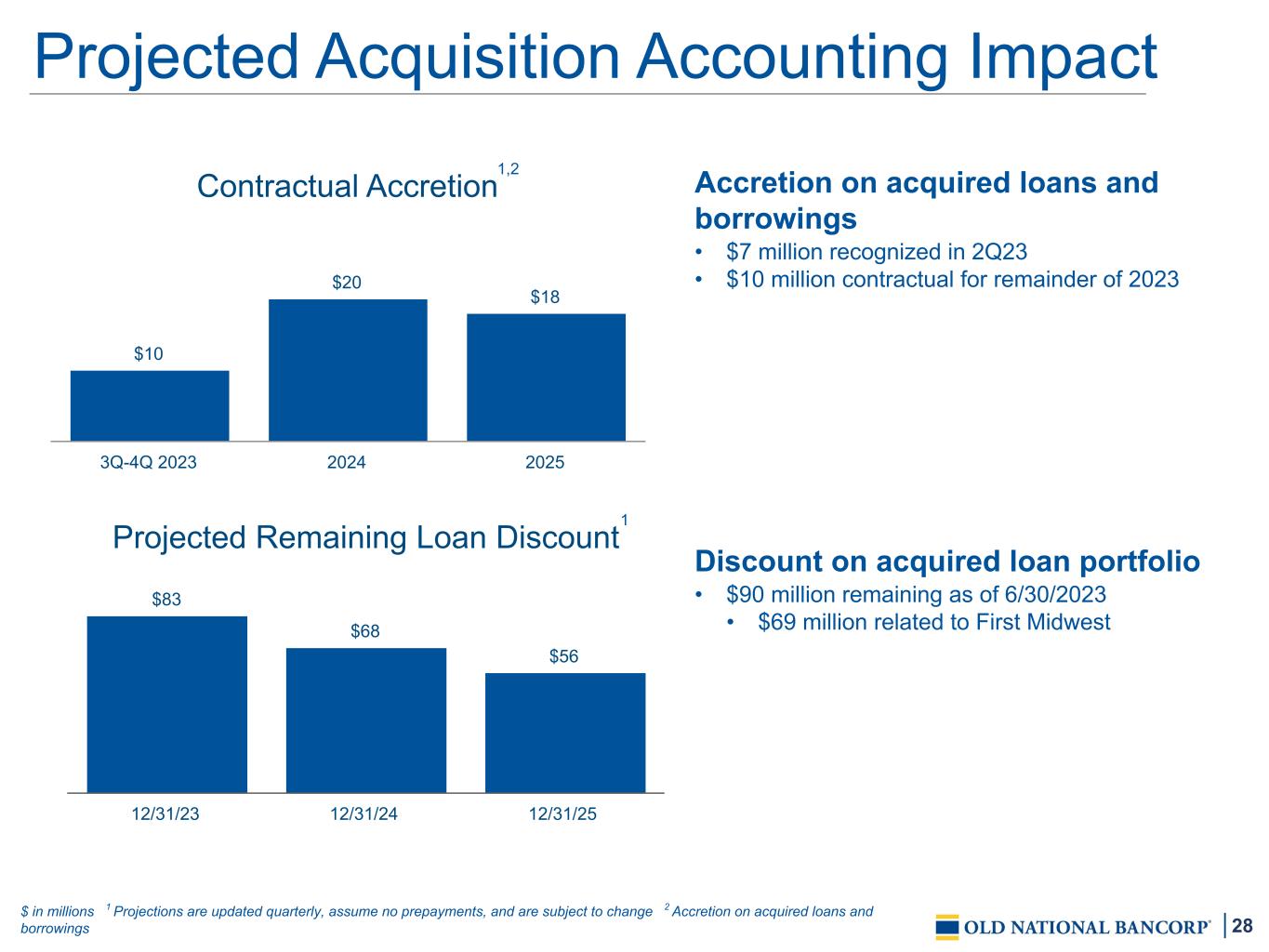

28 Accretion on acquired loans and borrowings • $7 million recognized in 2Q23 • $10 million contractual for remainder of 2023 Discount on acquired loan portfolio • $90 million remaining as of 6/30/2023 • $69 million related to First Midwest Contractual Accretion $10 $20 $18 3Q-4Q 2023 2024 2025 Projected Remaining Loan Discount $83 $68 $56 12/31/23 12/31/24 12/31/25 $ in millions 1 Projections are updated quarterly, assume no prepayments, and are subject to change 2 Accretion on acquired loans and borrowings 1,2 1 Projected Acquisition Accounting Impact

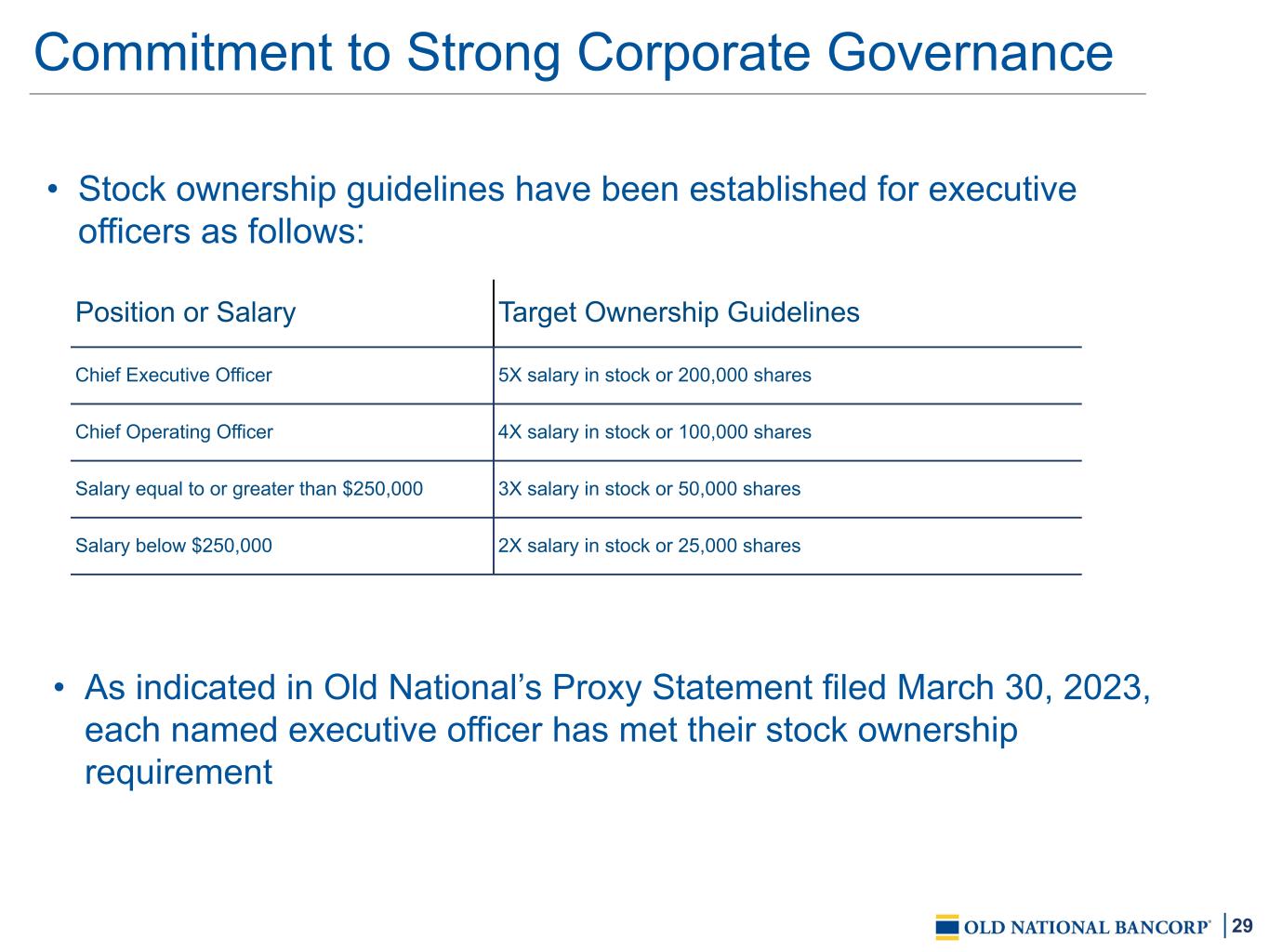

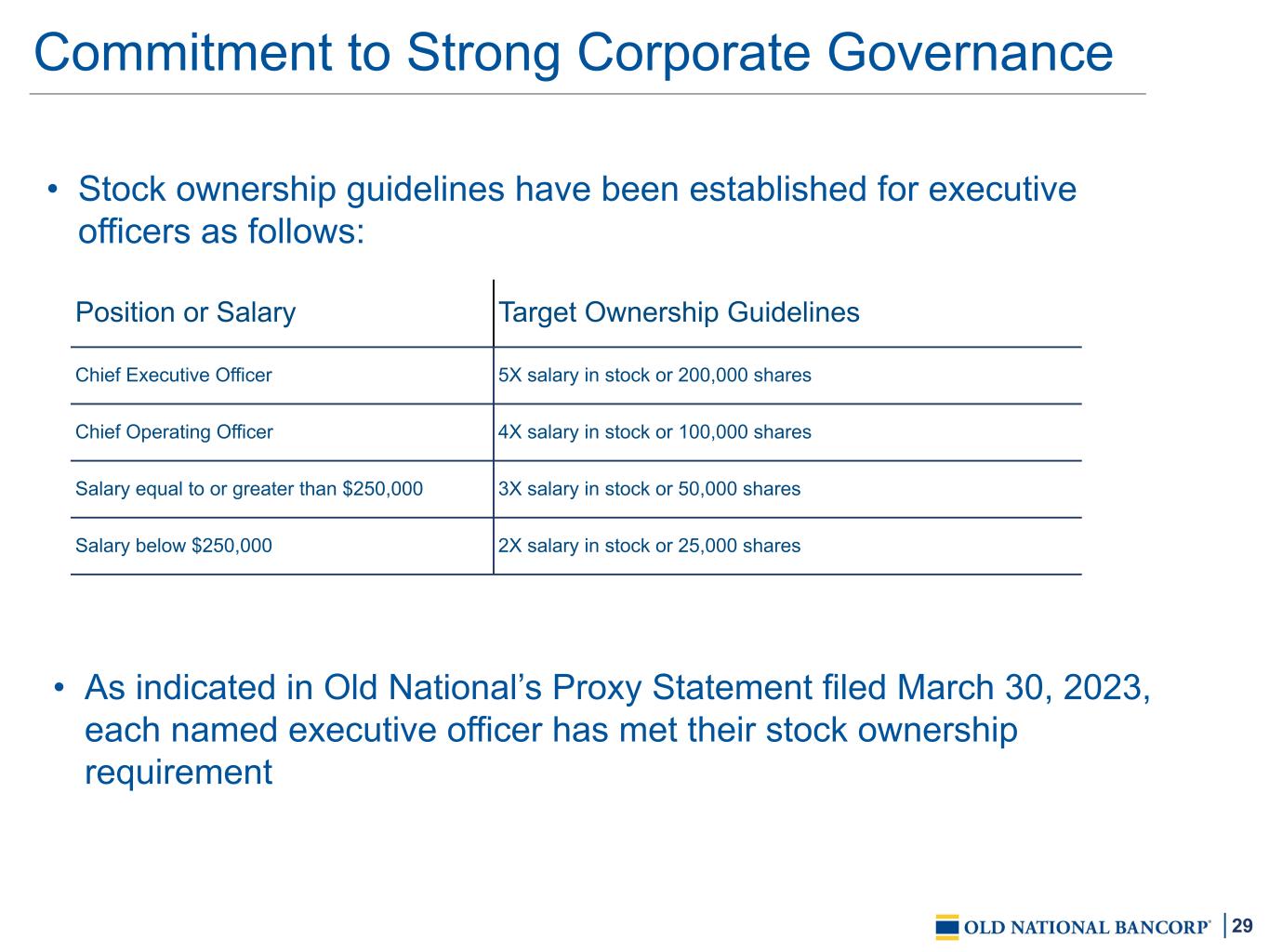

29 Position or Salary Target Ownership Guidelines Chief Executive Officer 5X salary in stock or 200,000 shares Chief Operating Officer 4X salary in stock or 100,000 shares Salary equal to or greater than $250,000 3X salary in stock or 50,000 shares Salary below $250,000 2X salary in stock or 25,000 shares • Stock ownership guidelines have been established for executive officers as follows: • As indicated in Old National’s Proxy Statement filed March 30, 2023, each named executive officer has met their stock ownership requirement Commitment to Strong Corporate Governance

30 Old National’s 2022 Environmental, Social and Governance (“ESG”) Report showcases our commitment to: • Strong corporate governance • Putting our clients at the center of all we do • Investing in our team members • Diversity, equity and inclusion • Strengthening our communities • Sustainability To view ONB’s ESG Report and Sustainability Accounting Standards Board (“SASB”) Index, go to oldnational.com/esg Commitment to Corporate Social Responsibility

31 ESG At A Glance - 2022

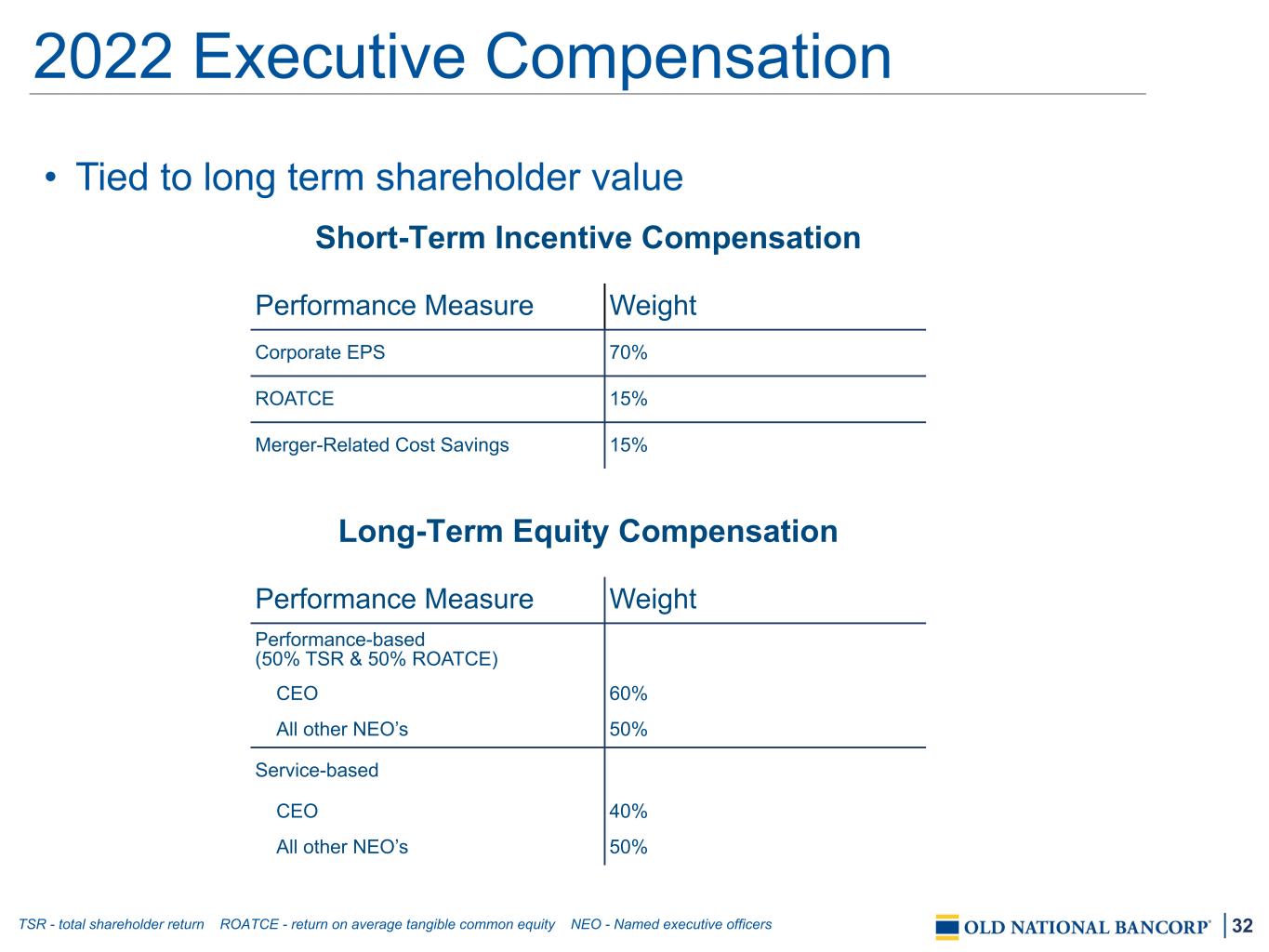

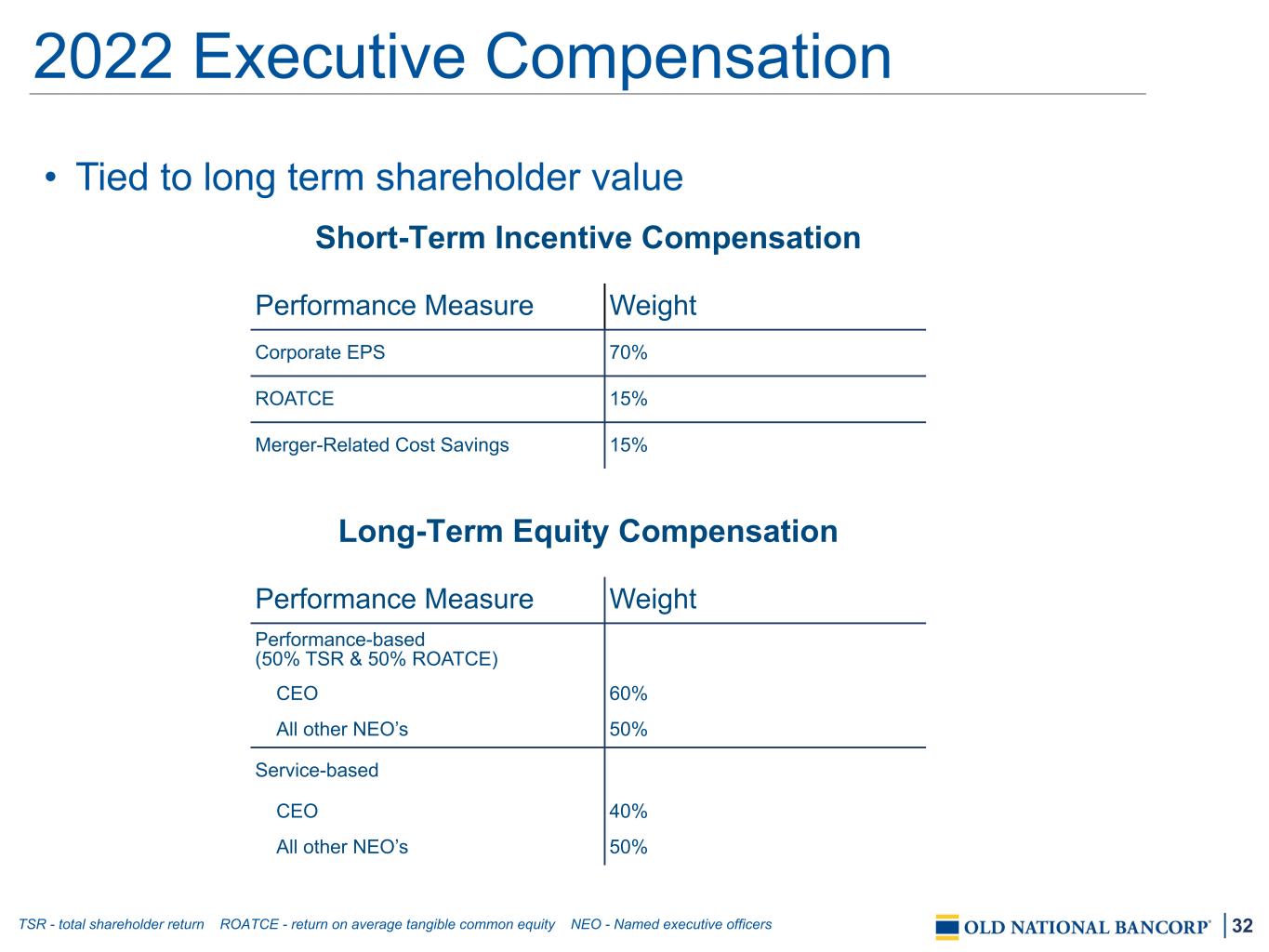

32 Short-Term Incentive Compensation Performance Measure Weight Corporate EPS 70% ROATCE 15% Merger-Related Cost Savings 15% Long-Term Equity Compensation Performance Measure Weight Performance-based (50% TSR & 50% ROATCE) CEO 60% All other NEO’s 50% Service-based CEO 40% All other NEO’s 50% • Tied to long term shareholder value 2022 Executive Compensation TSR - total shareholder return ROATCE - return on average tangible common equity NEO - Named executive officers

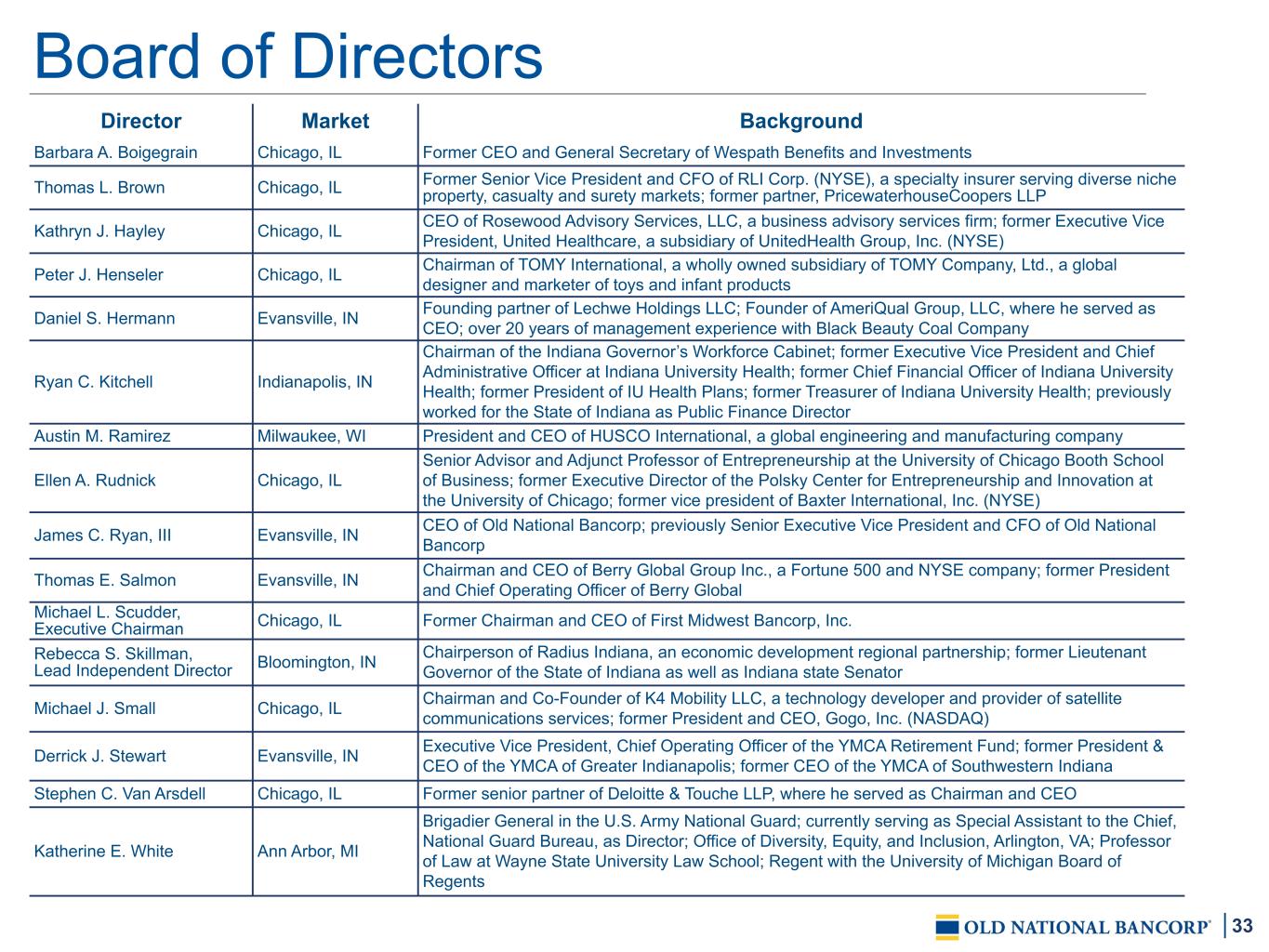

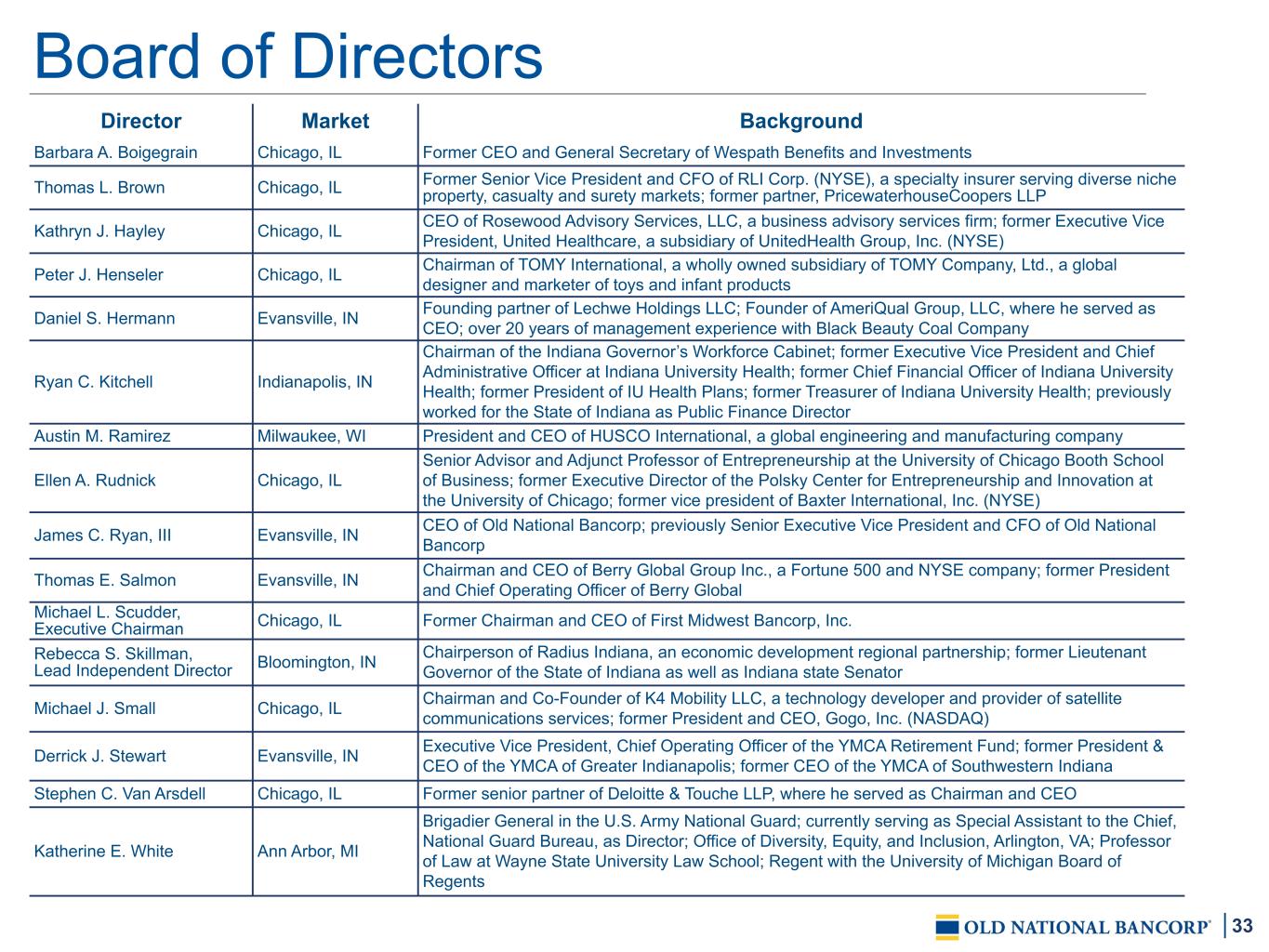

33 Director Market Background Barbara A. Boigegrain Chicago, IL Former CEO and General Secretary of Wespath Benefits and Investments Thomas L. Brown Chicago, IL Former Senior Vice President and CFO of RLI Corp. (NYSE), a specialty insurer serving diverse niche property, casualty and surety markets; former partner, PricewaterhouseCoopers LLP Kathryn J. Hayley Chicago, IL CEO of Rosewood Advisory Services, LLC, a business advisory services firm; former Executive Vice President, United Healthcare, a subsidiary of UnitedHealth Group, Inc. (NYSE) Peter J. Henseler Chicago, IL Chairman of TOMY International, a wholly owned subsidiary of TOMY Company, Ltd., a global designer and marketer of toys and infant products Daniel S. Hermann Evansville, IN Founding partner of Lechwe Holdings LLC; Founder of AmeriQual Group, LLC, where he served as CEO; over 20 years of management experience with Black Beauty Coal Company Ryan C. Kitchell Indianapolis, IN Chairman of the Indiana Governor’s Workforce Cabinet; former Executive Vice President and Chief Administrative Officer at Indiana University Health; former Chief Financial Officer of Indiana University Health; former President of IU Health Plans; former Treasurer of Indiana University Health; previously worked for the State of Indiana as Public Finance Director Austin M. Ramirez Milwaukee, WI President and CEO of HUSCO International, a global engineering and manufacturing company Ellen A. Rudnick Chicago, IL Senior Advisor and Adjunct Professor of Entrepreneurship at the University of Chicago Booth School of Business; former Executive Director of the Polsky Center for Entrepreneurship and Innovation at the University of Chicago; former vice president of Baxter International, Inc. (NYSE) James C. Ryan, III Evansville, IN CEO of Old National Bancorp; previously Senior Executive Vice President and CFO of Old National Bancorp Thomas E. Salmon Evansville, IN Chairman and CEO of Berry Global Group Inc., a Fortune 500 and NYSE company; former President and Chief Operating Officer of Berry Global Michael L. Scudder, Executive Chairman Chicago, IL Former Chairman and CEO of First Midwest Bancorp, Inc. Rebecca S. Skillman, Lead Independent Director Bloomington, IN Chairperson of Radius Indiana, an economic development regional partnership; former Lieutenant Governor of the State of Indiana as well as Indiana state Senator Michael J. Small Chicago, IL Chairman and Co-Founder of K4 Mobility LLC, a technology developer and provider of satellite communications services; former President and CEO, Gogo, Inc. (NASDAQ) Derrick J. Stewart Evansville, IN Executive Vice President, Chief Operating Officer of the YMCA Retirement Fund; former President & CEO of the YMCA of Greater Indianapolis; former CEO of the YMCA of Southwestern Indiana Stephen C. Van Arsdell Chicago, IL Former senior partner of Deloitte & Touche LLP, where he served as Chairman and CEO Katherine E. White Ann Arbor, MI Brigadier General in the U.S. Army National Guard; currently serving as Special Assistant to the Chief, National Guard Bureau, as Director; Office of Diversity, Equity, and Inclusion, Arlington, VA; Professor of Law at Wayne State University Law School; Regent with the University of Michigan Board of Regents Board of Directors

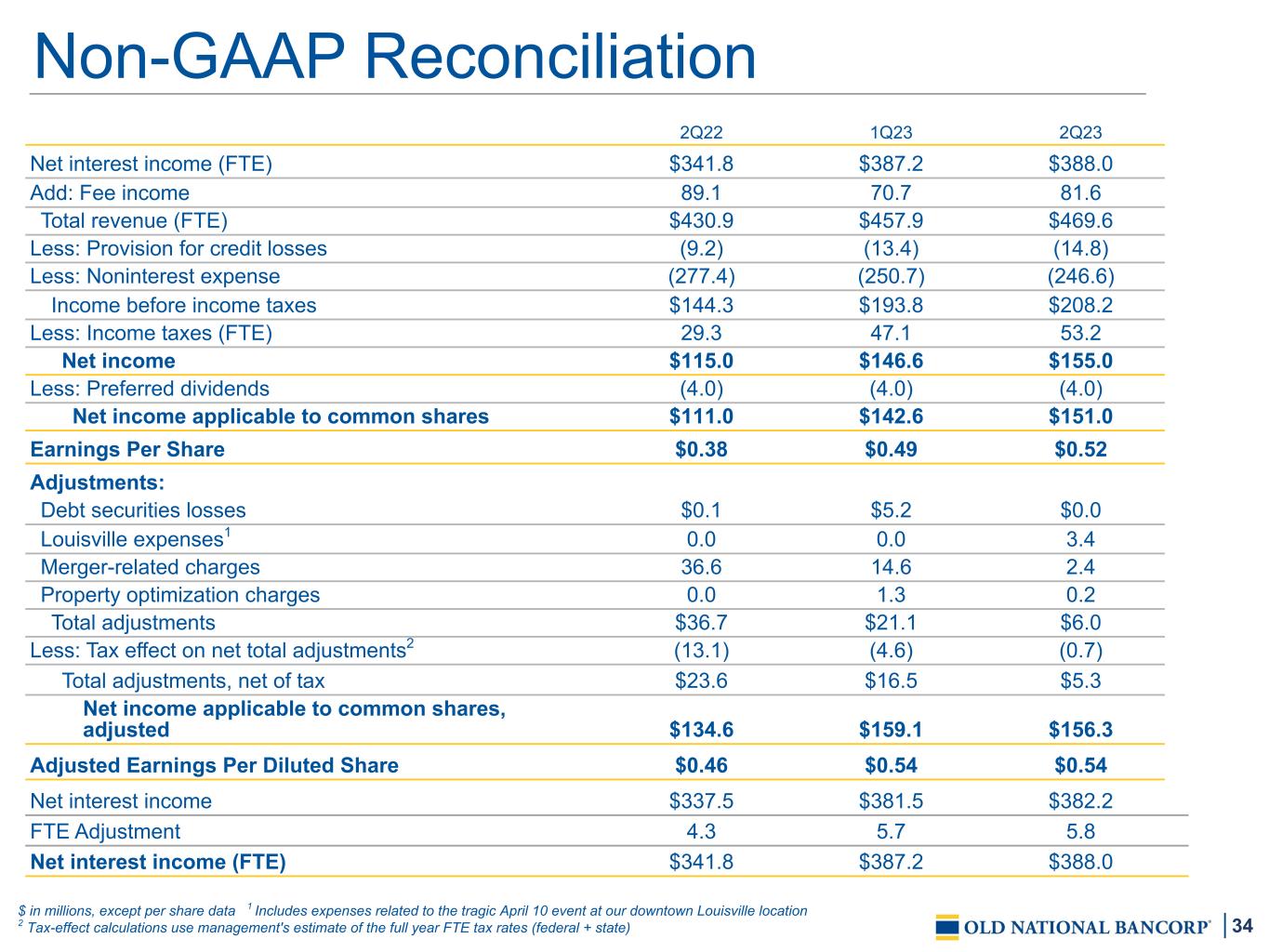

34 Non-GAAP Reconciliation 2Q22 1Q23 2Q23 Net interest income (FTE) $341.8 $387.2 $388.0 Add: Fee income 89.1 70.7 81.6 Total revenue (FTE) $430.9 $457.9 $469.6 Less: Provision for credit losses (9.2) (13.4) (14.8) Less: Noninterest expense (277.4) (250.7) (246.6) Income before income taxes $144.3 $193.8 $208.2 Less: Income taxes (FTE) 29.3 47.1 53.2 Net income $115.0 $146.6 $155.0 Less: Preferred dividends (4.0) (4.0) (4.0) Net income applicable to common shares $111.0 $142.6 $151.0 Earnings Per Share $0.38 $0.49 $0.52 Adjustments: Debt securities losses $0.1 $5.2 $0.0 Louisville expenses1 0.0 0.0 3.4 Merger-related charges 36.6 14.6 2.4 Property optimization charges 0.0 1.3 0.2 Total adjustments $36.7 $21.1 $6.0 Less: Tax effect on net total adjustments2 (13.1) (4.6) (0.7) Total adjustments, net of tax $23.6 $16.5 $5.3 Net income applicable to common shares, adjusted $134.6 $159.1 $156.3 Adjusted Earnings Per Diluted Share $0.46 $0.54 $0.54 Net interest income $337.5 $381.5 $382.2 FTE Adjustment 4.3 5.7 5.8 Net interest income (FTE) $341.8 $387.2 $388.0 $ in millions, except per share data 1 Includes expenses related to the tragic April 10 event at our downtown Louisville location 2 Tax-effect calculations use management's estimate of the full year FTE tax rates (federal + state)

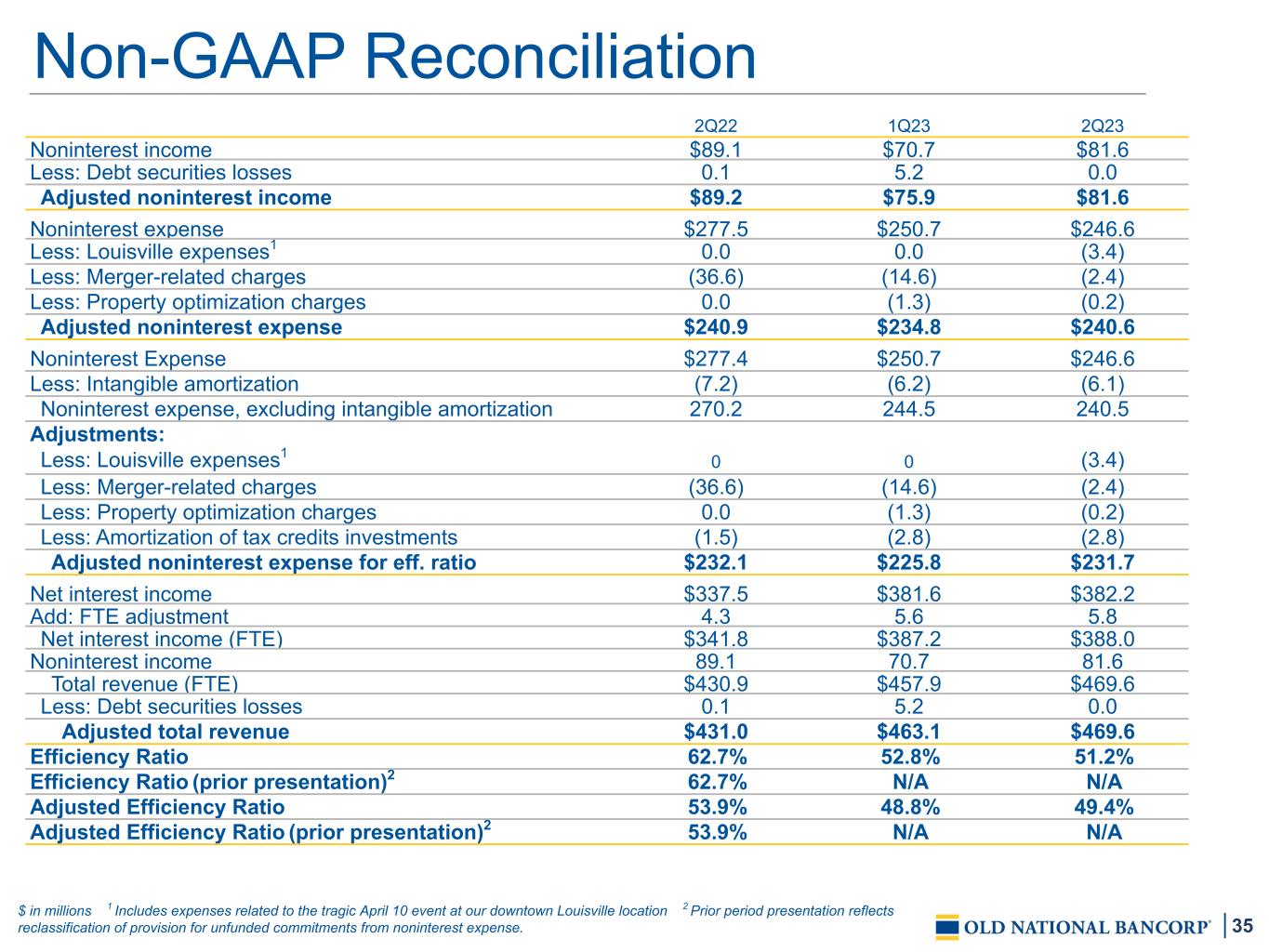

35 Non-GAAP Reconciliation 2Q22 1Q23 2Q23 Noninterest income $89.1 $70.7 $81.6 Less: Debt securities losses 0.1 5.2 0.0 Adjusted noninterest income $89.2 $75.9 $81.6 Noninterest expense $277.5 $250.7 $246.6 Less: Louisville expenses1 0.0 0.0 (3.4) Less: Merger-related charges (36.6) (14.6) (2.4) Less: Property optimization charges 0.0 (1.3) (0.2) Adjusted noninterest expense $240.9 $234.8 $240.6 Noninterest Expense $277.4 $250.7 $246.6 Less: Intangible amortization (7.2) (6.2) (6.1) Noninterest expense, excluding intangible amortization 270.2 244.5 240.5 Adjustments: Less: Louisville expenses1 0 0 (3.4) Less: Merger-related charges (36.6) (14.6) (2.4) Less: Property optimization charges 0.0 (1.3) (0.2) Less: Amortization of tax credits investments (1.5) (2.8) (2.8) Adjusted noninterest expense for eff. ratio $232.1 $225.8 $231.7 Net interest income $337.5 $381.6 $382.2 Add: FTE adjustment 4.3 5.6 5.8 Net interest income (FTE) $341.8 $387.2 $388.0 Noninterest income 89.1 70.7 81.6 Total revenue (FTE) $430.9 $457.9 $469.6 Less: Debt securities losses 0.1 5.2 0.0 Adjusted total revenue $431.0 $463.1 $469.6 Efficiency Ratio 62.7% 52.8% 51.2% Efficiency Ratio (prior presentation)2 62.7% N/A N/A Adjusted Efficiency Ratio 53.9% 48.8% 49.4% Adjusted Efficiency Ratio (prior presentation)2 53.9% N/A N/A $ in millions 1 Includes expenses related to the tragic April 10 event at our downtown Louisville location 2 Prior period presentation reflects reclassification of provision for unfunded commitments from noninterest expense.

36 Non-GAAP Reconciliation 2Q22 1Q23 2Q23 Net interest income $337.5 $381.6 $382.2 FTE adjustment 4.3 5.6 5.8 Net interest income (FTE) $341.8 $387.2 $388.0 Average earnings assets $41,003.3 $41,941.9 $43,097.2 Net interest margin 3.29% 3.64% 3.55% Net interest margin (FTE) 3.33% 3.69% 3.60% Net income applicable to common shares $111.0 $142.6 $151.0 Add: Intangible amortization, net of tax1 5.4 4.6 4.5 Tangible net income applicable to common shares $116.4 $147.2 $155.5 Total adjustments, net of tax $23.6 $16.5 $5.3 Adjusted tangible net income applicable to common shares $140.0 $163.7 $160.8 Average GAAP shareholders’ common equity $4,886.2 $4,922.5 $5,030.1 Less: Average goodwill and other intangible assets (2,137.0) (2,122.2) (2,115.9) Average tangible shareholders’ common equity $2,749.2 $2,800.3 $2,914.2 Return on average tangible shareholders’ common equity 16.9% 21.0% 21.4% Adjusted return on average tangible common equity 20.4% 23.4% 22.1% Net income $115.0 $146.6 $155.0 Total adjustments, net of tax 23.6 16.5 5.3 Adjusted Net Income $138.6 $163.1 $160.3 Average Assets $45,733.4 $46,982.5 $48,099.6 Return on average assets 1.01% 1.25% 1.29% Adjusted return on average assets 1.21% 1.39% 1.33% $ in millions 1 Tax-effect calculations use management's estimate of the full year FTE tax rates (federal + state) 2 Certain reclassifications were made to conform to the current presentation

37 Non-GAAP Reconciliation 2Q22 1Q23 2Q23 Shareholders' equity $5,078.8 $5,277.4 $5,292.1 Less: Preferred equity (243.7) (243.7) (243.7) Shareholders' common equity 4,835.1 5,033.7 5,048.4 Less: Goodwill and other intangible assets (2,131.8) (2,118.9) (2,112.9) Tangible shareholders' common equity 2,703.3 2,914.8 2,935.5 Less: AOCI 569.1 708.4 808.6 Tangible shareholders' common equity, excl. AOCI $3,272.4 $3,623.2 $3,744.1 Common shares outstanding 292.9 291.9 292.6 Tangible common book value $9.23 $9.98 $10.03 Tangible common book value, excluding AOCI $11.17 $12.41 $12.80 Total assets $45,748.4 $47,842.6 $48,496.8 Less: Goodwill and other intangible assets (2,131.8) (2,118.9) (2,112.9) Tangible assets 43,616.6 45,723.7 46,383.9 Less: unrealized losses on AFS securities 844.4 814.5 934.7 Tangible assets, excluding unrealized losses on AFS securities $44,461.0 $46,538.2 $47,318.6 Tangible shareholders’ common equity to tangible assets 6.20% 6.37% 6.33% Tangible shareholders’ common equity to tangible assets, excluding AOCI and unrealized losses on AFS securities 7.36% 7.79% 7.91% $ in millions 1 Tax-effect calculations use management's estimate of the full year FTE tax rates (federal + state) 2 Certain reclassifications were made to conform to the current presentation

38 2016 2019 Net interest income (FTE) $424.0 $617.2 Add: Fee income 252.8 199.3 Total revenue (FTE) $676.8 $816.5 Less: Noninterest expense 454.1 508.5 PPRN $222.7 $308.0 Adjustments: Debt securities gains $(5.8) $(1.9) Gain on sale of insurance (41.9) 0.0 Gain on repurchased bank properties, other gains (12.0) 0.0 Adjusted revenue $617.1 $814.6 Adjustments: ONB Way charges 0.0 (11.4) Merger related charges (15.9) (6.0) Amortization of tax credit investments 0.0 (2.7) Less: Pension termination charges (9.8) 0.0 Less: Branch consolidations, severance, Foundation funding, and client initiative charges (13.7) $0.0 Adjusted expense $414.7 $488.4 PPRN $202.4 $326.2 Average interest-earning assets $11,841.0 $17,385.2 Adjusted PPRN to average assets 1.71% 1.88% Non-GAAP Reconciliation $ in millions, except per share data

39 2016 2019 Net interest income (FTE) $424.0 $617.2 Add: Fee income 252.8 199.3 Total revenue (FTE) $676.8 $816.5 Less: Provision for credit losses (0.9) (4.7) Less: Noninterest expense (454.1) (508.5) Income before income taxes $221.8 $303.3 Less: Income taxes (FTE) 87.5 65.1 Net income $134.3 $238.2 Earnings Per Share $1.05 $1.38 Adjustments: Debt securities (gains) losses $(5.8) $(1.9) Gain on sale of Insurance (41.9) 0.0 Gain on repurchased bank properties, other gains (12.0) 0.0 ONB Way charges 0.0 11.4 Merger related charges 15.9 6.0 Less: Pension termination charges 9.8 0.0 Less: Branch consolidations, severance, Foundation funding, and client initiative charges 13.7 0.0 Total adjustments $(20.3) $15.5 Less: Tax effect on net total adjustments1 (7.1) 3.8 After-Tax Net Total Adjustments $(13.2) $11.7 Net income applicable to common shares, adjusted $121.1 $249.9 Adjusted Earnings Per Diluted Share $0.95 $1.45 Non-GAAP Reconciliation $ in millions, except per share data

40 2016 2019 Net income applicable to common shares $134.3 $238.2 Add: Intangible amortization (net of tax)1 8.1 12.8 Tangible net income applicable to common shares $142.4 $251.0 Less: Debt securities gains (net of tax)1 $(3.8) $(1.4) Less: Gain on sale of insurance (net of tax)1 (27.2) 0.0 Less: Gain on repurchased bank properties, other gains (net of tax)1 (7.8) 0.0 Add: Diligence, acquisition and integration charges (net of tax)1 10.3 4.4 Add: Pension termination charges (net of tax)1 6.4 0.0 Add: Branch consolidations, severance, foundation funding, and client initiative charges (net of tax)1 8.9 8.6 Adjusted tangible net income applicable to common shares $129.2 $262.6 Average GAAP shareholders’ common equity $1,712.6 $2,781.1 Less: Average goodwill (635.4) (1,036.5) Less: Average intangibles (40.3) (68.2) Average tangible shareholders’ common equity $1,036.9 $1,676.4 Return on average tangible shareholders’ common equity 13.73% 14.97% Adjusted return on average tangible common equity 12.46% 15.67% Non-GAAP Reconciliation $ in millions

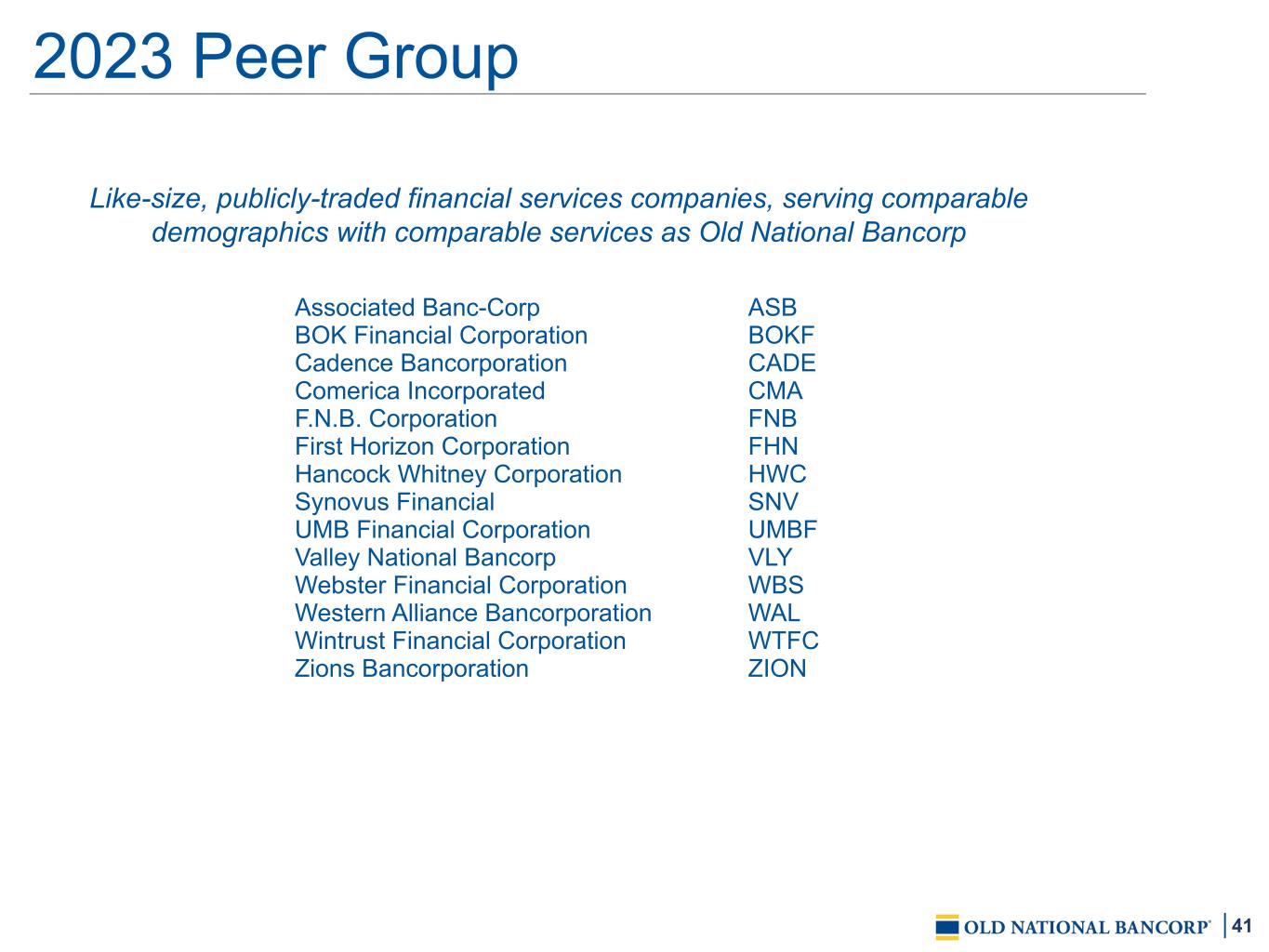

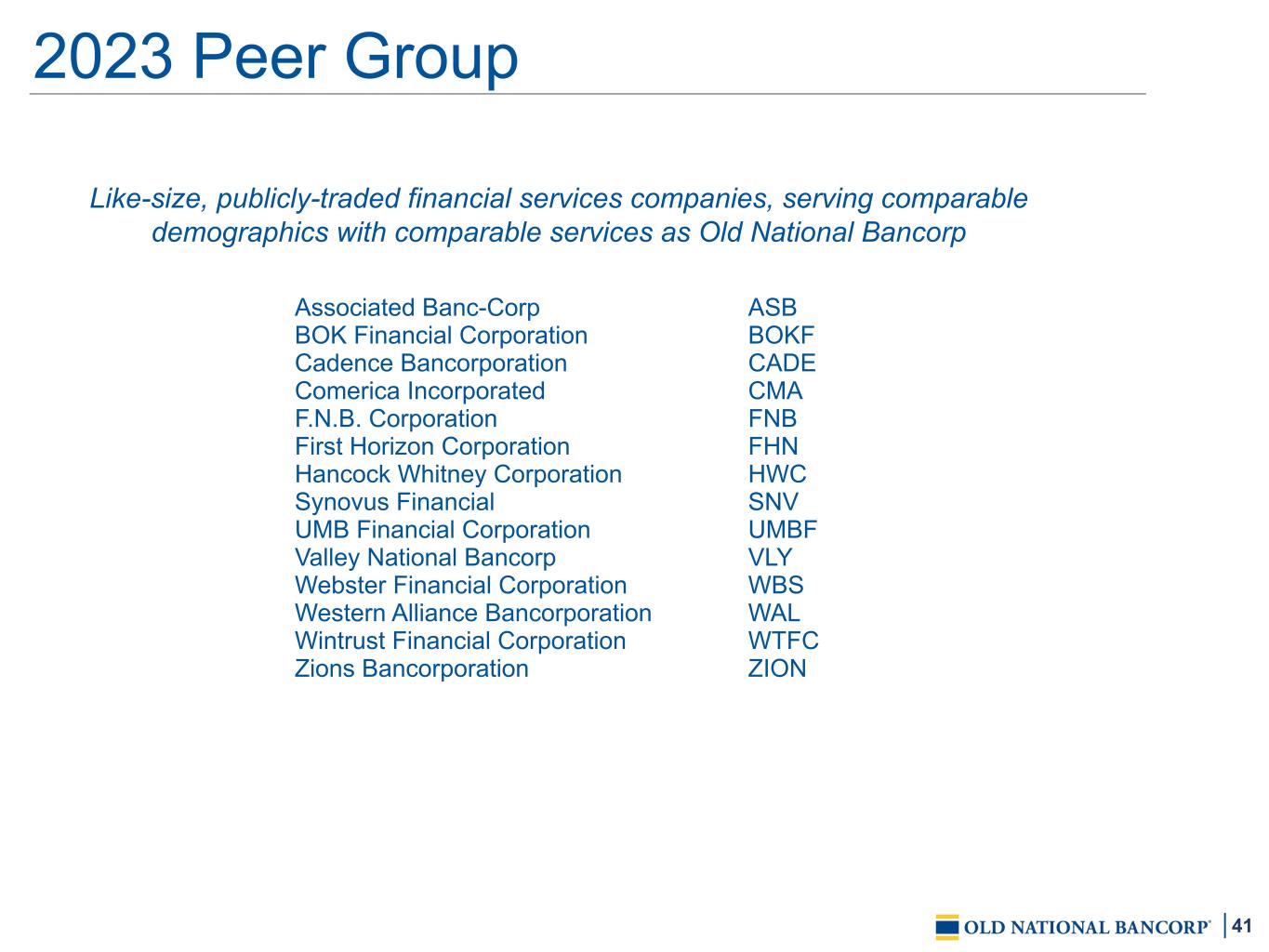

41 Associated Banc-Corp ASB BOK Financial Corporation BOKF Cadence Bancorporation CADE Comerica Incorporated CMA F.N.B. Corporation FNB First Horizon Corporation FHN Hancock Whitney Corporation HWC Synovus Financial SNV UMB Financial Corporation UMBF Valley National Bancorp VLY Webster Financial Corporation WBS Western Alliance Bancorporation WAL Wintrust Financial Corporation WTFC Zions Bancorporation ZION Like-size, publicly-traded financial services companies, serving comparable demographics with comparable services as Old National Bancorp 2023 Peer Group

42 Additional information can be found on the Investor Relations web pages at www.oldnational.com Investor Inquiries: Lynell J. Walton Durchholz, CPA SVP - Director of Investor Relations 812-464-1366 lynell.walton@oldnational.com Old National Investor Relations Contact