Common Stock: Nasdaq: STRR Series A 10% Preferred Stock: Nasdaq: STRRP Growing shareholder value through operational excellence and disciplined capital allocation A Diversified Holding Company Investor Presentation April 2023

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements in this release that are not statements of historical fact are hereby identified as “forward-looking statements” for the purpose of the safe harbor provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking Statements include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to acquisitions and related integration, development of commercially viable products, novel technologies, and modern applicable services, (ii) projections of income (including income/loss), EBITDA, earnings (including earnings/loss) per share, capital expenditures, cost reductions, capital structure or other financial items, (iii) the future financial performance of the Company or acquisition targets and (iv) the assumptions underlying or relating to any statement described above. Moreover, forward-looking statements necessarily involve assumptions on the Company’s part. These forward- looking statements generally are identified by the words “believe”, “expect”, “anticipate”, “estimate”, “project”, “intend”, “plan”, “should”, “may”, “will”, “would”, “will be”, “will continue” or similar expressions. Such forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon the Company's current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which the Company has no control over. Actual results and the timing of certain events and circumstances may differ materially from those described above as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, the substantial amount of debt of the Company and the Company’s ability to repay or refinance it or incur additional debt in the future; the Company’s need for a significant amount of cash to service and repay the debt and to pay dividends on the Company’s preferred stock; the restrictions contained in the debt agreements that limit the discretion of management in operating the business; legal, regulatory, political and economic risks in markets and public health crises that reduce economic activity and cause restrictions on operations (including the recent coronavirus COVID-19 outbreak); the length of time associated with servicing customers; losses of significant contracts or failure to get potential contracts being discussed; disruptions in the relationship with third party vendors; accounts receivable turnover; insufficient cash flows and resulting lack of liquidity; the Company's inability to expand the Company's business; unfavorable changes in the extensive governmental legislation and regulations governing healthcare providers and the provision of healthcare services and the competitive impact of such changes (including unfavorable changes to reimbursement policies); high costs of regulatory compliance; the liability and compliance costs regarding environmental regulations; the underlying condition of the technology support industry; the lack of product diversification; development and introduction of new technologies and intense competition in the healthcare industry; existing or increased competition; risks to the price and volatility of the Company’s common stock and preferred stock; stock volatility and in liquidity; risks to preferred stockholders of not receiving dividends and risks to the Company’s ability to pursue growth opportunities if the Company continues to pay dividends according to the terms of the Company’s preferred stock; the Company’s ability to execute on its business strategy (including any cost reduction plans); the Company’s failure to realize expected benefits of restructuring and cost-cutting actions; the Company’s ability to preserve and monetize its net operating losses; risks associated with the Company’s possible pursuit of acquisitions; the Company’s ability to consummate successful acquisitions and execute related integration, as well as factors related to the Company’s business including economic and financial market conditions generally and economic conditions in the Company’s markets; failure to keep pace with evolving technologies and difficulties integrating technologies; system failures; losses of key management personnel and the inability to attract and retain highly qualified management and personnel in the future; and the continued demand for and market acceptance of the Company’s services. For a detailed discussion of cautionary statements and risks that may affect the Company’s future results of operations and financial results, please refer to the Company’s filings with the Securities and Exchange Commission, including, but not limited to, the risk factors in the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. This release reflects management’s views as of the date presented. All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Non-GAAP Financial Measures: The information provided herein includes certain non-GAAP financial measures. These non-GAAP financial measures are intended to supplement the GAAP financial information by providing additional insight regarding results of operations of the Company. The non-GAAP adjusted EBITDA financial measures used by the Company are intended to provide an enhanced understanding of our underlying operational measures to manage the Company’s business, to evaluate performance compared to prior periods and the marketplace, and to establish operational goals. Certain items are excluded from these non-GAAP financial measures to provide additional comparability measures from period to period. These non-GAAP financial measures will not be defined in the same manner by all companies and may not be comparable to other companies. Specifically, this presentation presents the non-GAAP financial measures “Adjusted EBITDA” (defined as “earnings before interest, taxes, depreciation, amortization adjusted for stock- based compensation and other one-time transaction costs such as merger and acquisitions, financing and etc.”). The most directly comparable measures for these non-GAAP financial measures are net income and diluted net income per share. All future figures based on guidance after conversion into a diversified holding company. 2 Forward-looking Statements

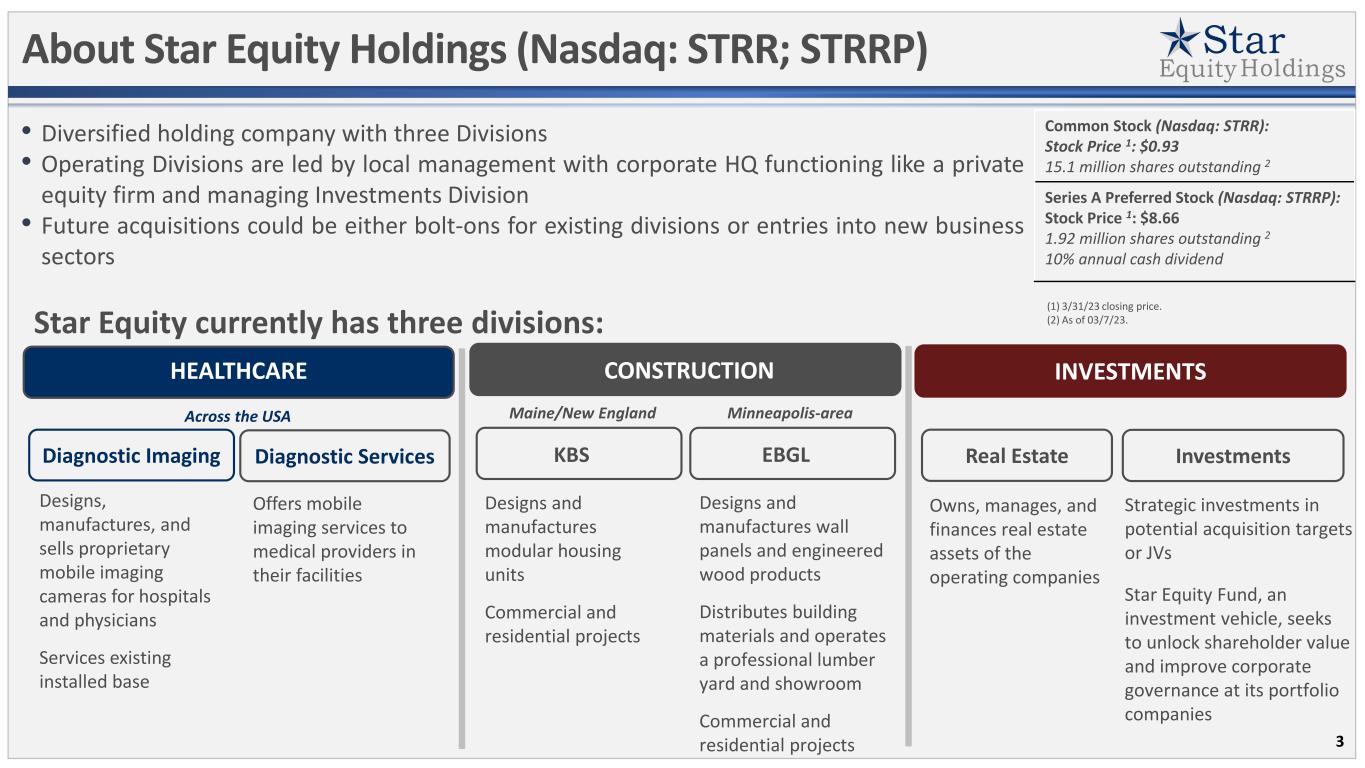

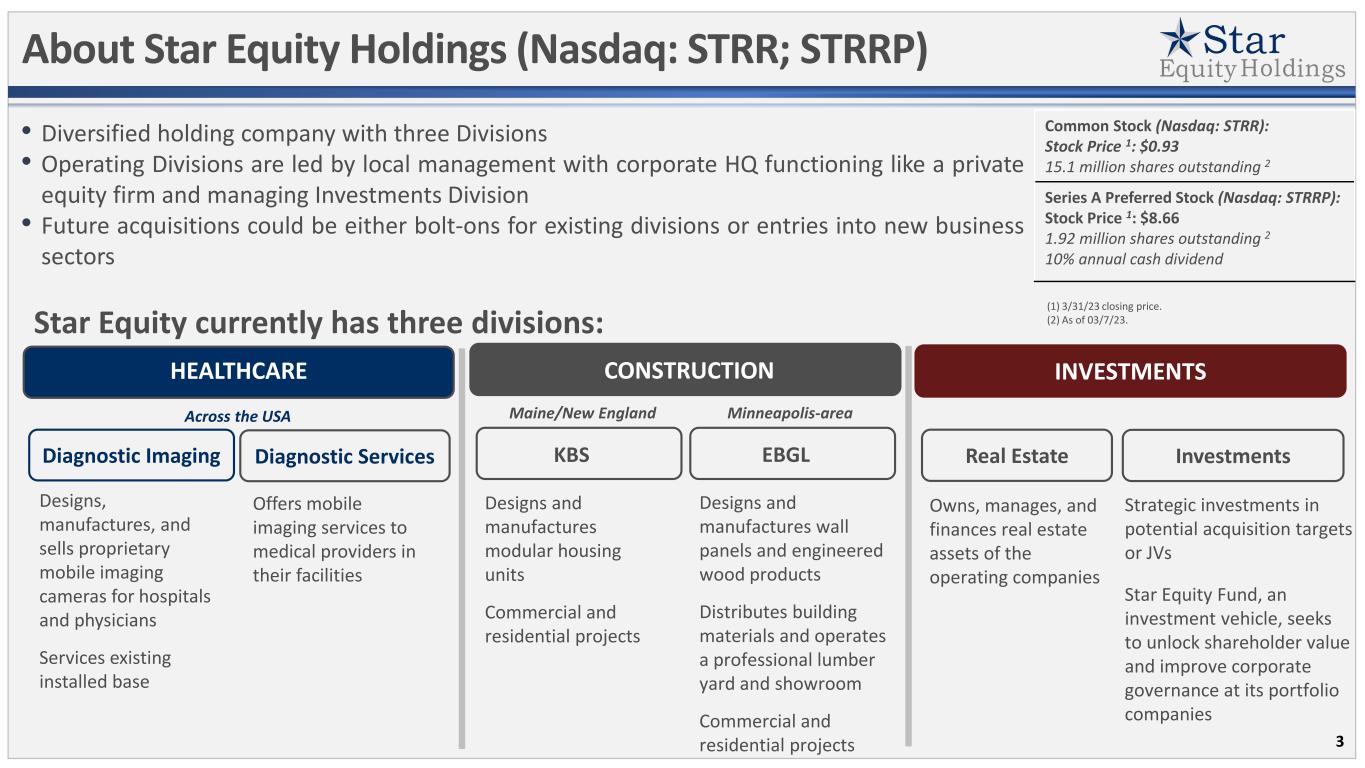

About Star Equity Holdings (Nasdaq: STRR; STRRP) Star Equity currently has three divisions: Diagnostic ServicesDiagnostic Imaging Across the USA HEALTHCARE KBS EBGL CONSTRUCTION Designs, manufactures, and sells proprietary mobile imaging cameras for hospitals and physicians Services existing installed base Offers mobile imaging services to medical providers in their facilities Designs and manufactures modular housing units Commercial and residential projects Designs and manufactures wall panels and engineered wood products Distributes building materials and operates a professional lumber yard and showroom Commercial and residential projects INVESTMENTS Real Estate Investments Maine/New England Minneapolis-area Owns, manages, and finances real estate assets of the operating companies Strategic investments in potential acquisition targets or JVs Star Equity Fund, an investment vehicle, seeks to unlock shareholder value and improve corporate governance at its portfolio companies • Diversified holding company with three Divisions • Operating Divisions are led by local management with corporate HQ functioning like a private equity firm and managing Investments Division • Future acquisitions could be either bolt-ons for existing divisions or entries into new business sectors Common Stock (Nasdaq: STRR): Stock Price 1: $0.93 15.1 million shares outstanding 2 Series A Preferred Stock (Nasdaq: STRRP): Stock Price 1: $8.66 1.92 million shares outstanding 2 10% annual cash dividend 3 (1) 3/31/23 closing price. (2) As of 03/7/23.

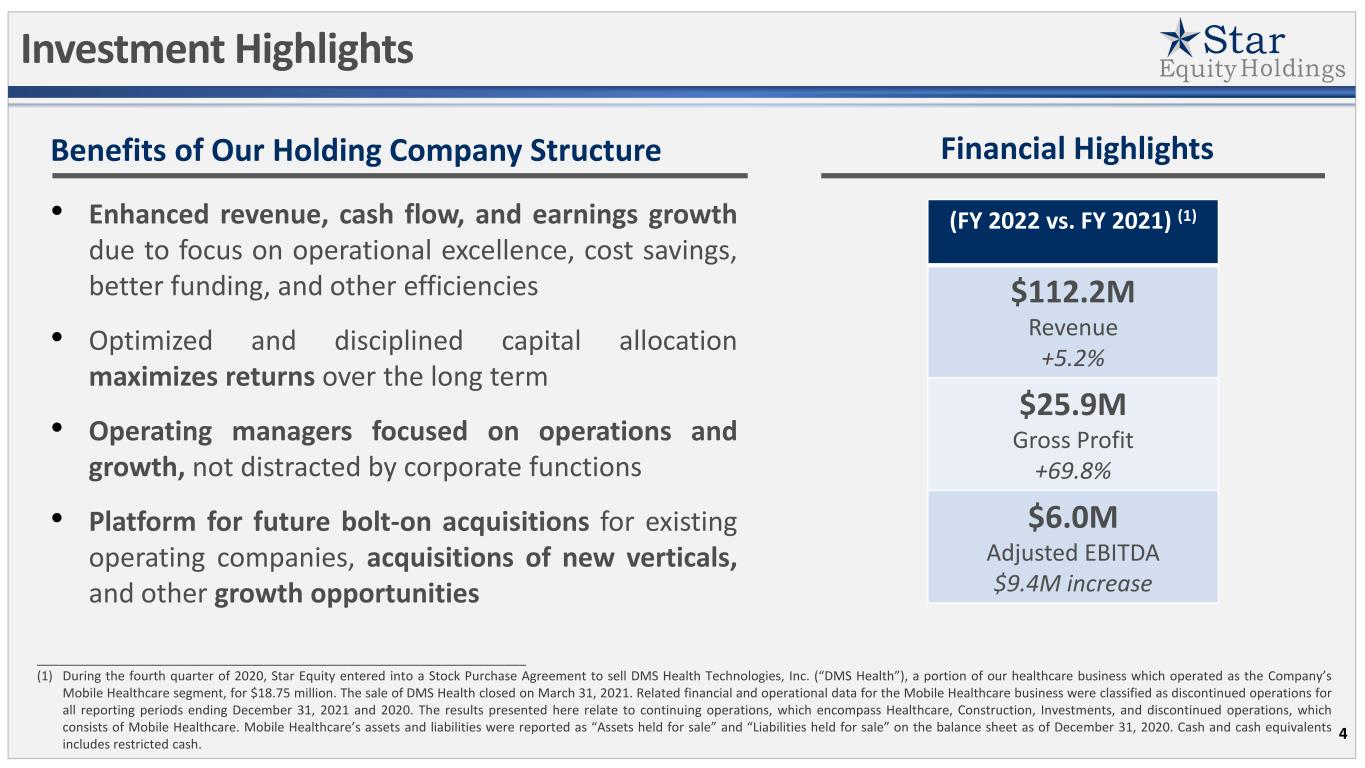

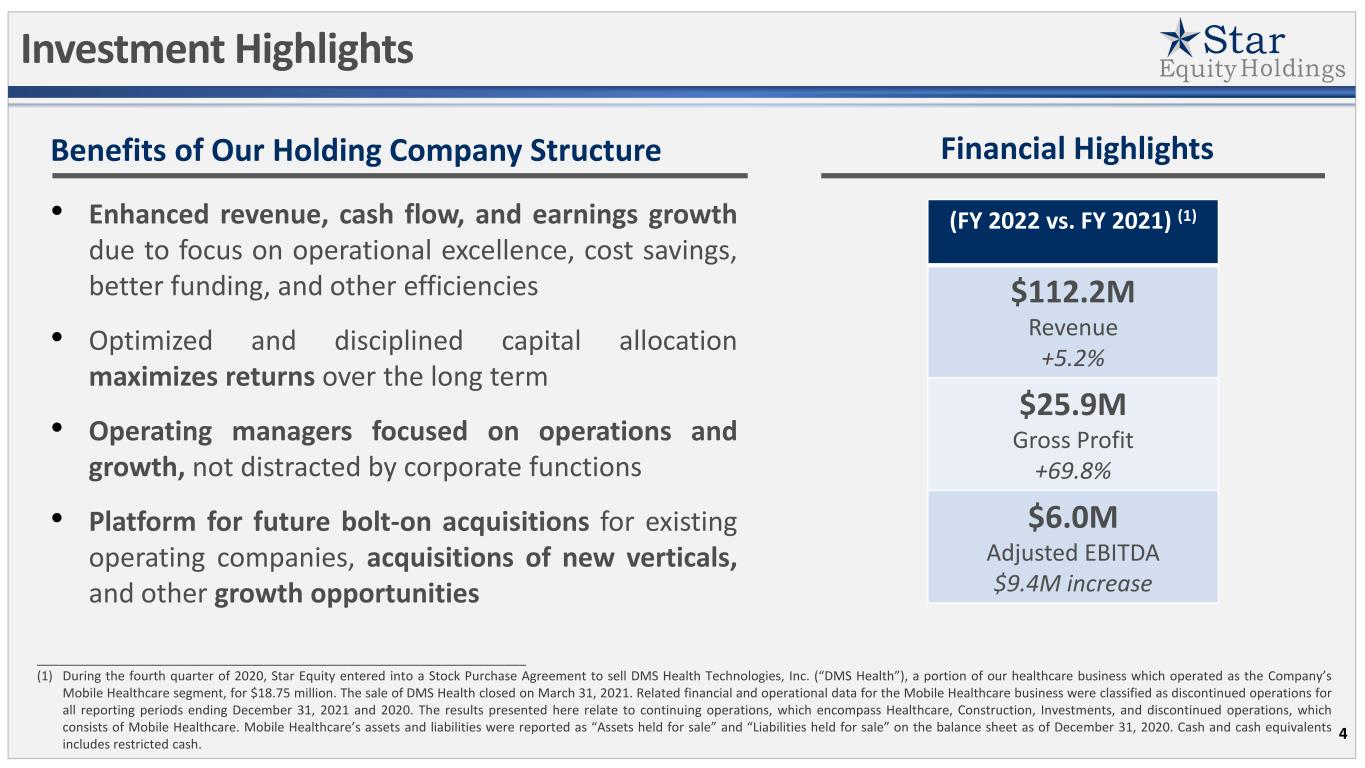

Investment Highlights Benefits of Our Holding Company Structure • Enhanced revenue, cash flow, and earnings growth due to focus on operational excellence, cost savings, better funding, and other efficiencies • Optimized and disciplined capital allocation maximizes returns over the long term • Operating managers focused on operations and growth, not distracted by corporate functions • Platform for future bolt-on acquisitions for existing operating companies, acquisitions of new verticals, and other growth opportunities _____________________________________________________________________ (1) During the fourth quarter of 2020, Star Equity entered into a Stock Purchase Agreement to sell DMS Health Technologies, Inc. (“DMS Health”), a portion of our healthcare business which operated as the Company’s Mobile Healthcare segment, for $18.75 million. The sale of DMS Health closed on March 31, 2021. Related financial and operational data for the Mobile Healthcare business were classified as discontinued operations for all reporting periods ending December 31, 2021 and 2020. The results presented here relate to continuing operations, which encompass Healthcare, Construction, Investments, and discontinued operations, which consists of Mobile Healthcare. Mobile Healthcare’s assets and liabilities were reported as “Assets held for sale” and “Liabilities held for sale” on the balance sheet as of December 31, 2020. Cash and cash equivalents includes restricted cash. Financial Highlights 4 (FY 2022 vs. FY 2021) (1) $112.2M Revenue +5.2% $25.9M Gross Profit +69.8% $6.0M Adjusted EBITDA $9.4M increase

Business Divisions and Corporate Structure Construction Future Acquisition 2 Future Acquisition 3 Healthcare CURRENT OPERATING BUSINESSES Investments (future acquisitions to create new business divisions) • Capital Allocation • Strategic Leadership & Oversight • Mentor Operating Management Teams • Restructurings & Turnarounds • Mergers, Acquisitions, & Dispositions • Bank Relationships • Capital Markets • Investor Relations • Financial Reporting, FP&A • Compliance & Legal • Manage Investments Division OPERATING Managers • Manage Operating Businesses • Develop Organic Growth Opportunities • Pursue Bolt-on Acquisitions (bolt-on acquisitions to expand existing divisions) FUTURE OPERATING BUSINESSES CORP-LEVEL MANAGEMENT 5 Future Acquisition 1

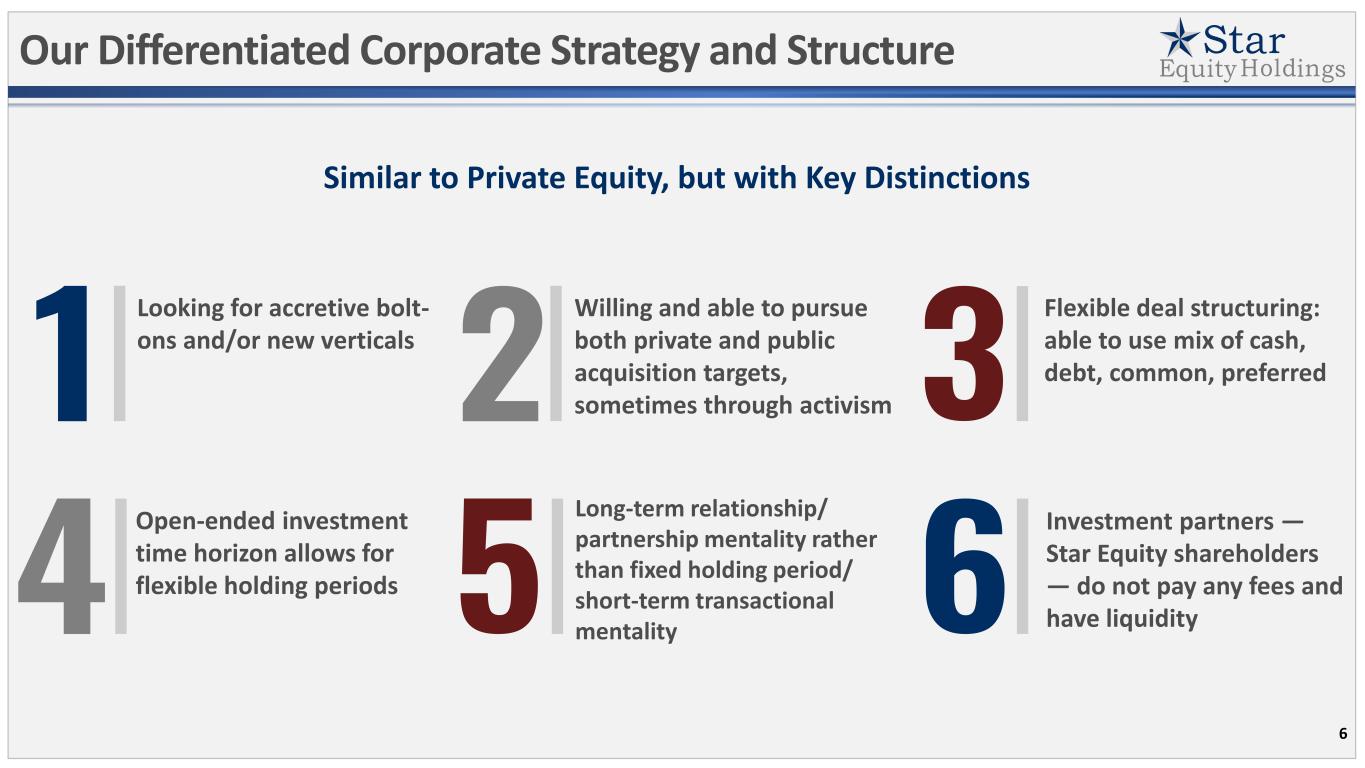

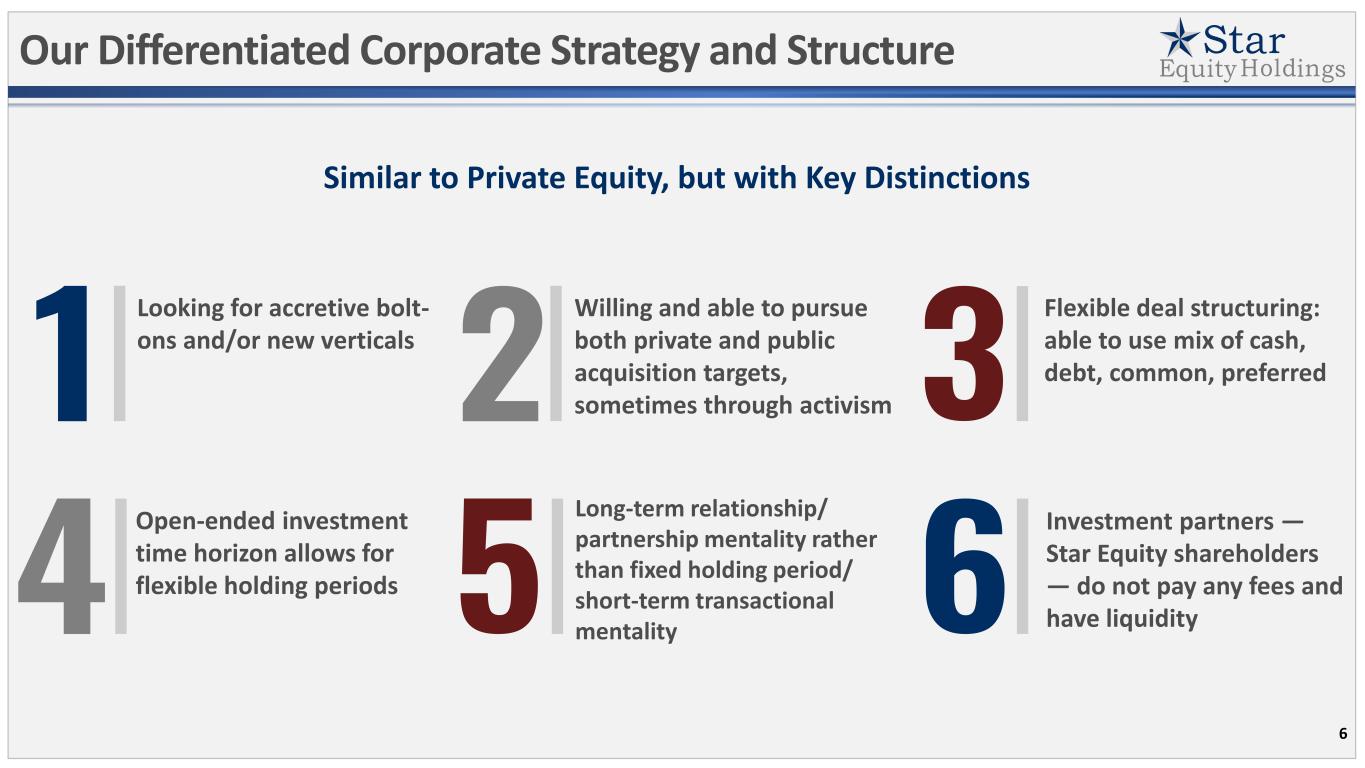

Our Differentiated Corporate Strategy and Structure Similar to Private Equity, but with Key Distinctions 6 Investment partners — Star Equity shareholders — do not pay any fees and have liquidity Long-term relationship/ partnership mentality rather than fixed holding period/ short-term transactional mentality Willing and able to pursue both private and public acquisition targets, sometimes through activism Open-ended investment time horizon allows for flexible holding periods Looking for accretive bolt- ons and/or new verticals Flexible deal structuring: able to use mix of cash, debt, common, preferred

Financial Highlights and Growth Initiatives Growing SHAREHOLDER VALUE through OPERATIONAL EXCELLENCE AND DISCIPLINED CAPITAL ALLOCATION 7

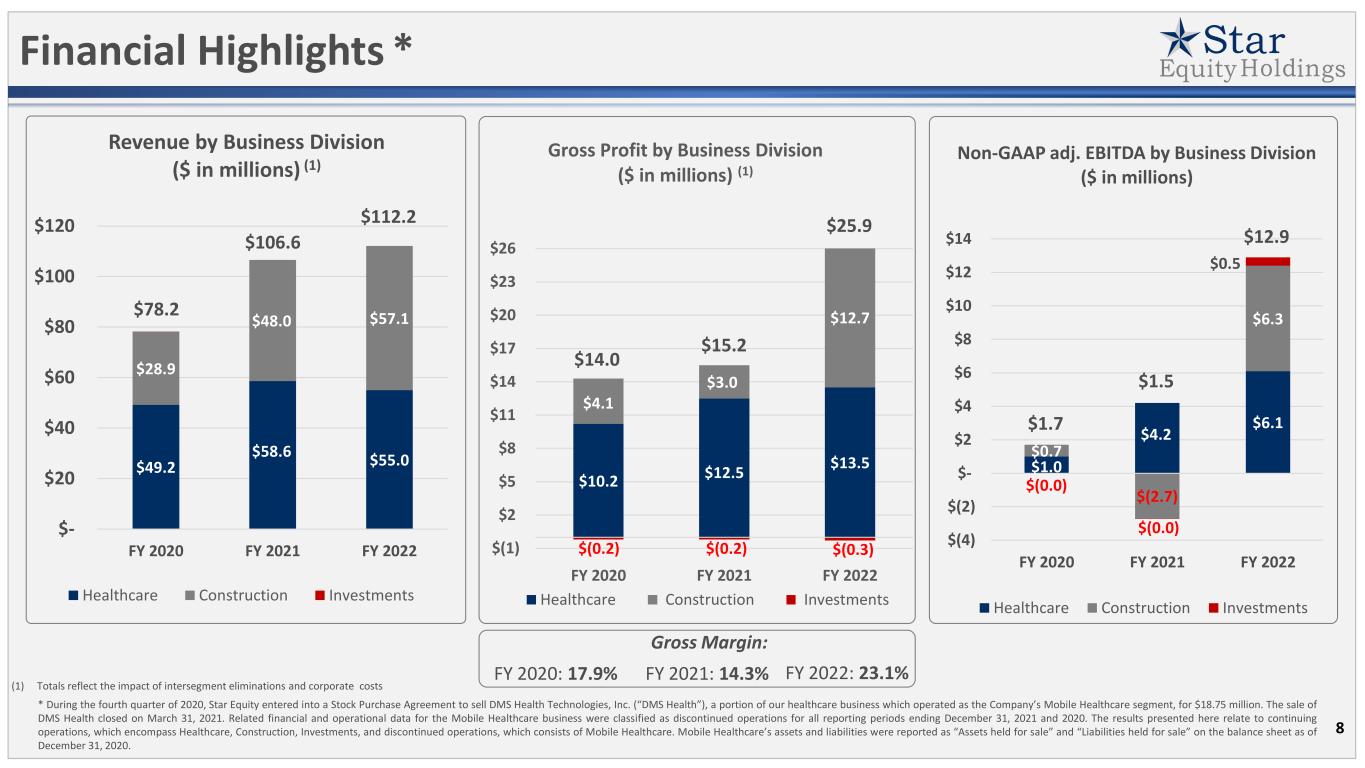

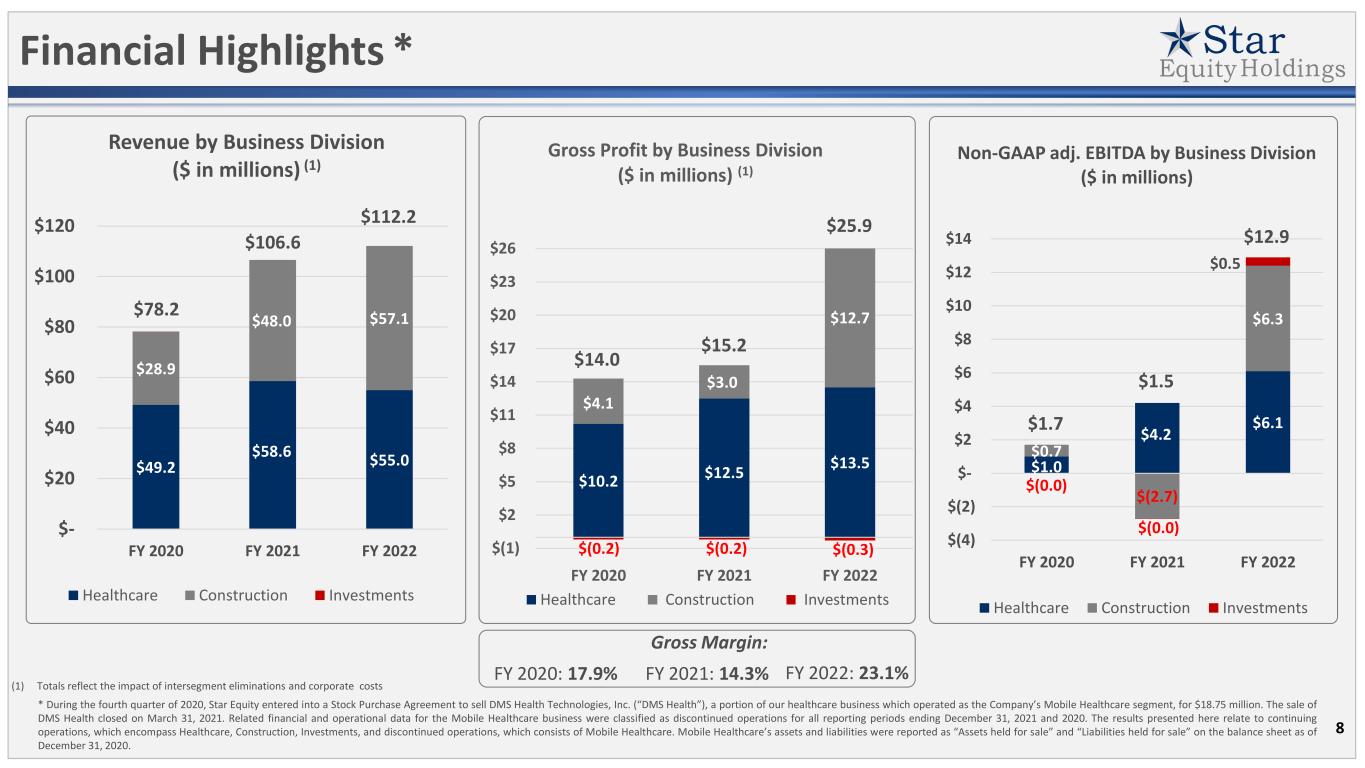

Financial Highlights * $49.2 $58.6 $55.0 $28.9 $48.0 $57.1 $- $20 $40 $60 $80 $100 $120 FY 2020 FY 2021 FY 2022 Revenue by Business Division ($ in millions) (1) Healthcare Construction Investments $10.2 $12.5 $13.5 $4.1 $3.0 $12.7 $(1) $2 $5 $8 $11 $14 $17 $20 $23 $26 FY 2020 FY 2021 FY 2022 Gross Profit by Business Division ($ in millions) (1) Healthcare Construction Investments $(0.2) $(0.3)$(0.2) $106.6 $78.2 $15.2 $14.0 8 * During the fourth quarter of 2020, Star Equity entered into a Stock Purchase Agreement to sell DMS Health Technologies, Inc. (“DMS Health”), a portion of our healthcare business which operated as the Company’s Mobile Healthcare segment, for $18.75 million. The sale of DMS Health closed on March 31, 2021. Related financial and operational data for the Mobile Healthcare business were classified as discontinued operations for all reporting periods ending December 31, 2021 and 2020. The results presented here relate to continuing operations, which encompass Healthcare, Construction, Investments, and discontinued operations, which consists of Mobile Healthcare. Mobile Healthcare’s assets and liabilities were reported as “Assets held for sale” and “Liabilities held for sale” on the balance sheet as of December 31, 2020. FY 2020: 17.9% FY 2021: 14.3% Gross Margin: (1) Totals reflect the impact of intersegment eliminations and corporate costs $112.2 $25.9 FY 2022: 23.1% $1.0 $4.2 $6.1 $0.7 $(2.7) $6.3 $(0.0) $(0.0) $0.5 $(4) $(2) $- $2 $4 $6 $8 $10 $12 $14 FY 2020 FY 2021 FY 2022 Non-GAAP adj. EBITDA by Business Division ($ in millions) Healthcare Construction Investments $1.7 $1.5 $12.9

Growth Strategy Seeking attractive acquisition opportunities to: ORGANIC GROWTH OPPORTUNITIES Healthcare • Increase sales of proprietary, high-margin portable nuclear imaging cameras through continues hardware design and upgrades • Expand high-margin, post-warranty camera support contracts through increased sales efforts • For diagnostic services, increase camera utilization and customer density at all points of service thereby increasing overall revenue and gross margin • Expand geographic footprint through new and innovative product and service offerings DISCIPLINED ACQUISITION STRATEGY 9 Construction • Increase KBS’s modular manufacturing output by expanding South Paris plant and eventually re-opening Oxford plant • Long-term goal of mid-teens annual organic growth at KBS (CAGR from 2019 through 2022 = 33%) • Long-term goal of high single-digit annual organic growth at EBGL (CAGR from 2019 through 2022 = 16%) • KBS and EBGL can expand presence in their markets by growing output and adding new products and services Investments • Three owned plants have separate credit facility, lowering the cost of capital, with proceeds used to grow and support the Construction Division • Create new business divisions• Expand existing business divisions through bolt-on acquisitions

Our Acquisition Strategy TARGETS: PUBLIC OR PRIVATE COMPANIES • Bolt-ons for existing platform businesses or creation of new divisions • Market cap of $5-50M and more valuable inside our holding company structure • Existing assets, earnings, and cash flows (no start-ups or venture capital-type situations) • High SG&A and public company costs as a percentage of revenue that can be significantly reduced as part of Star Equity • Opportunities for improved operating and financial performance inside of Star Equity • Businesses with growth potential and strong operating management teams ACQUISITION SYNERGIES: • Operating management teams freed up to maximize operations and pursue growth opportunities • Sharing certain corporate functions reduces corporate overhead costs • Lower cost of capital • Better access to capital • Better capital allocation 10

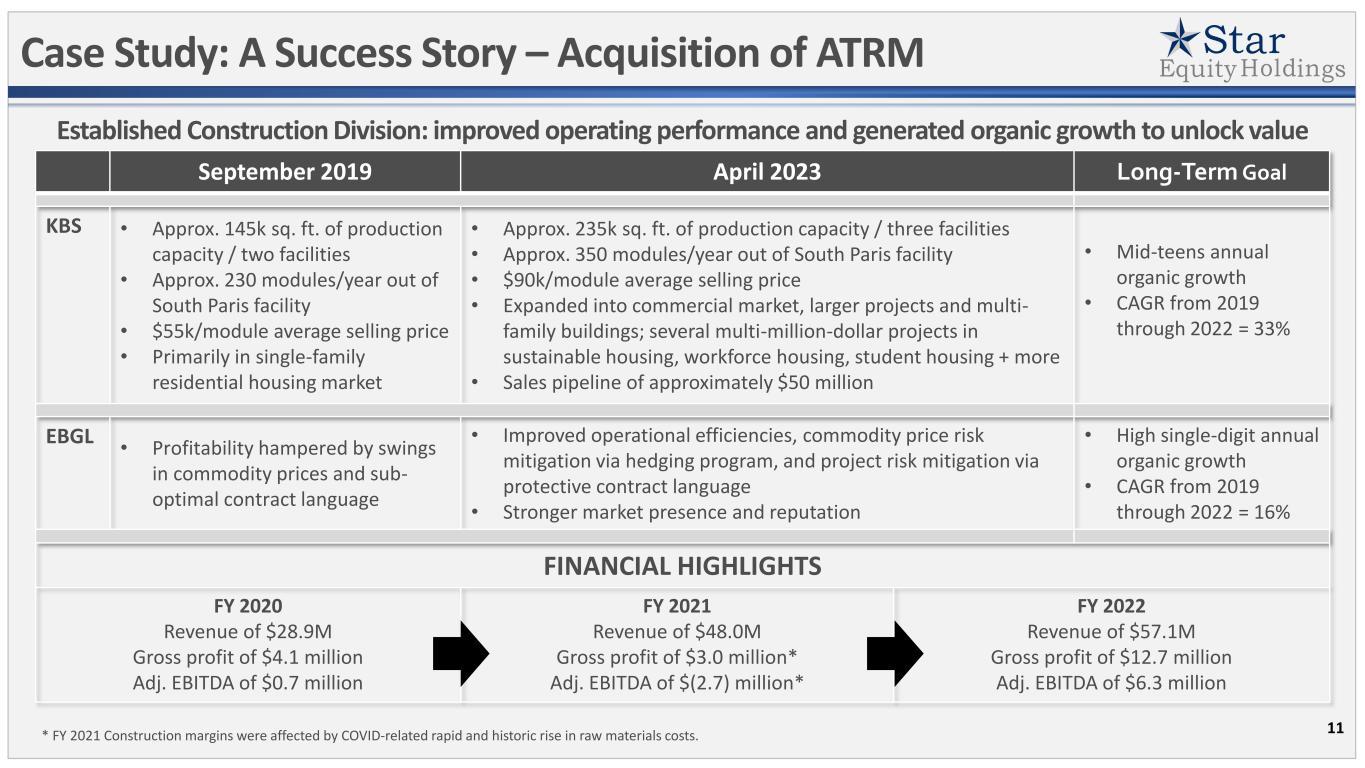

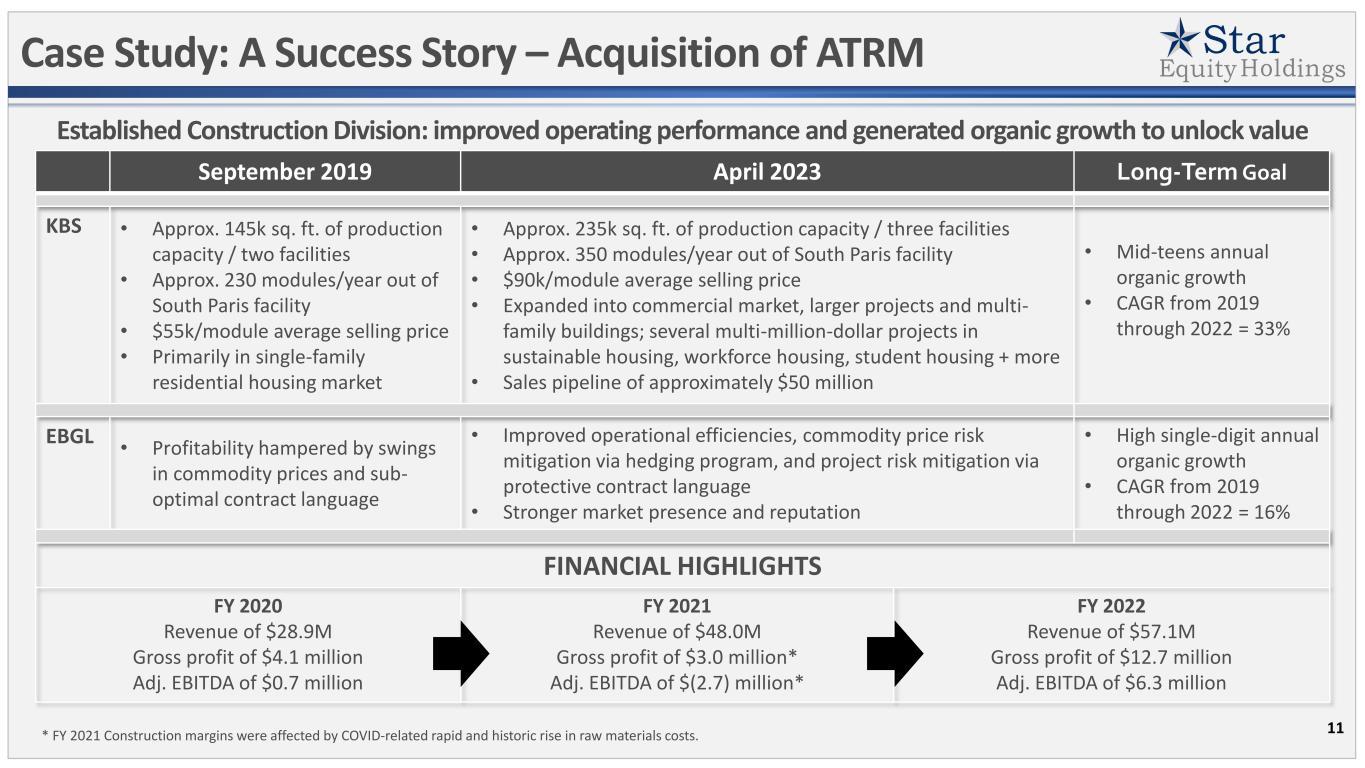

Case Study: A Success Story – Acquisition of ATRM 11 September 2019 April 2023 Long-TermGoal KBS • Approx. 145k sq. ft. of production capacity / two facilities • Approx. 230 modules/year out of South Paris facility • $55k/module average selling price • Primarily in single-family residential housing market • Approx. 235k sq. ft. of production capacity / three facilities • Approx. 350 modules/year out of South Paris facility • $90k/module average selling price • Expanded into commercial market, larger projects and multi- family buildings; several multi-million-dollar projects in sustainable housing, workforce housing, student housing + more • Sales pipeline of approximately $50 million • Mid-teens annual organic growth • CAGR from 2019 through 2022 = 33% EBGL • Profitability hampered by swings in commodity prices and sub- optimal contract language • Improved operational efficiencies, commodity price risk mitigation via hedging program, and project risk mitigation via protective contract language • Stronger market presence and reputation • High single-digit annual organic growth • CAGR from 2019 through 2022 = 16% FINANCIAL HIGHLIGHTS FY 2020 Revenue of $28.9M Gross profit of $4.1 million Adj. EBITDA of $0.7 million FY 2021 Revenue of $48.0M Gross profit of $3.0 million* Adj. EBITDA of $(2.7) million* FY 2022 Revenue of $57.1M Gross profit of $12.7 million Adj. EBITDA of $6.3 million Established Construction Division: improved operating performance and generated organic growth to unlock value * FY 2021 Construction margins were affected by COVID-related rapid and historic rise in raw materials costs.

Business Divisions: Healthcare 12

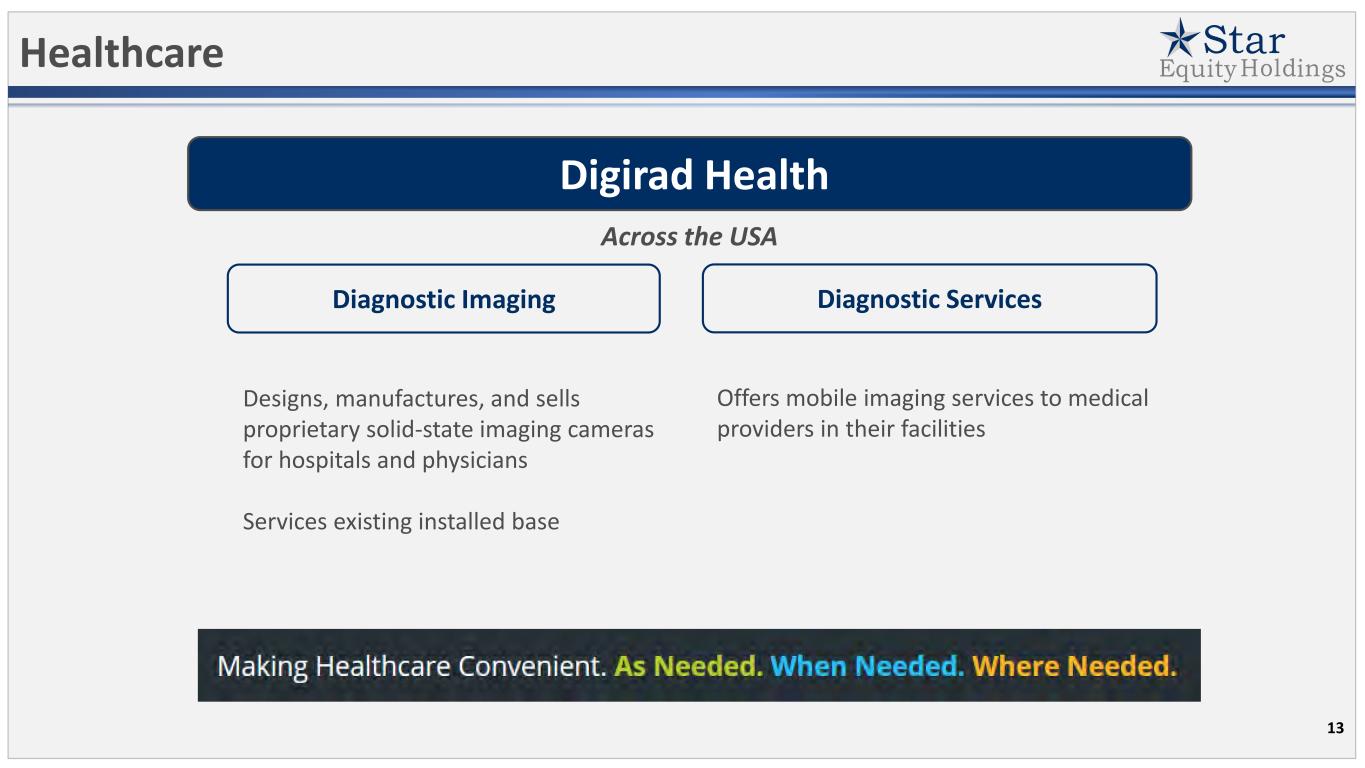

Healthcare Diagnostic ServicesDiagnostic Imaging Across the USA Digirad Health Designs, manufactures, and sells proprietary solid-state imaging cameras for hospitals and physicians Services existing installed base Offers mobile imaging services to medical providers in their facilities 13

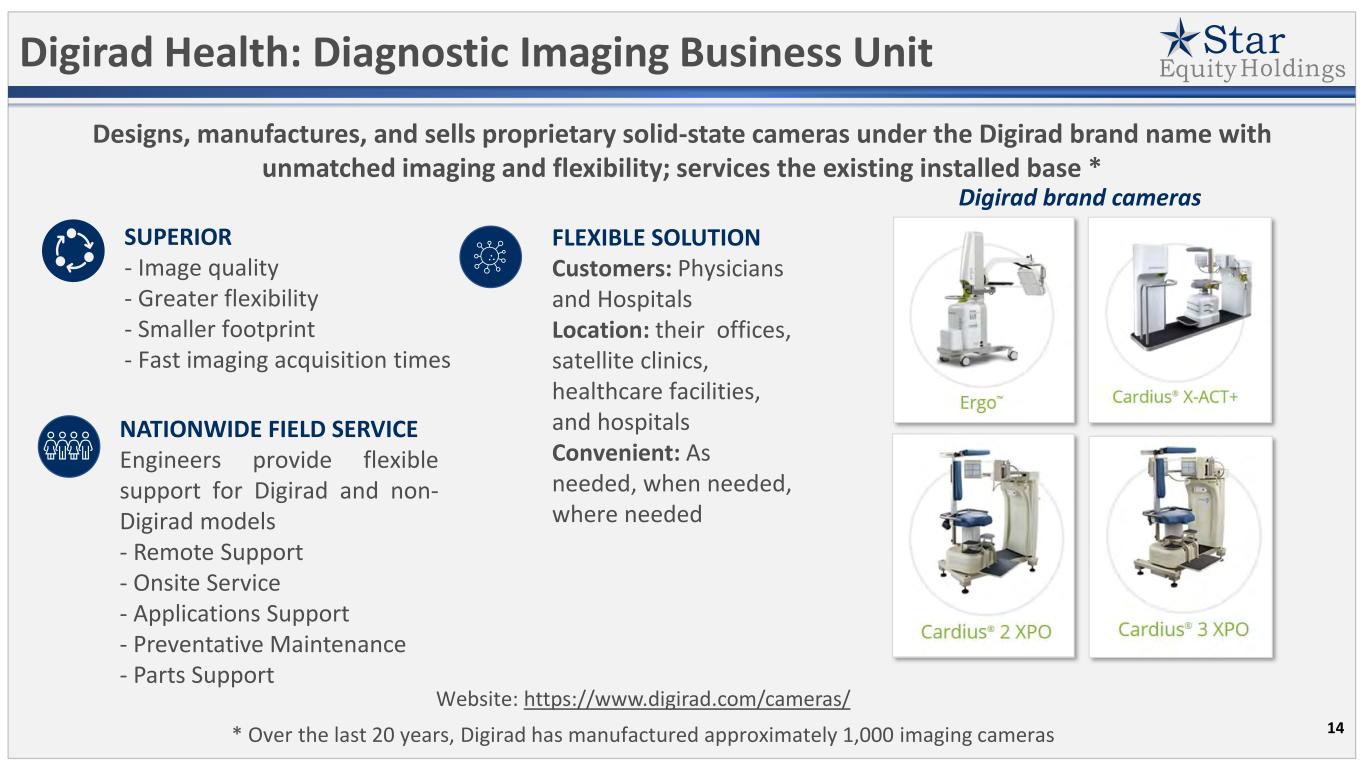

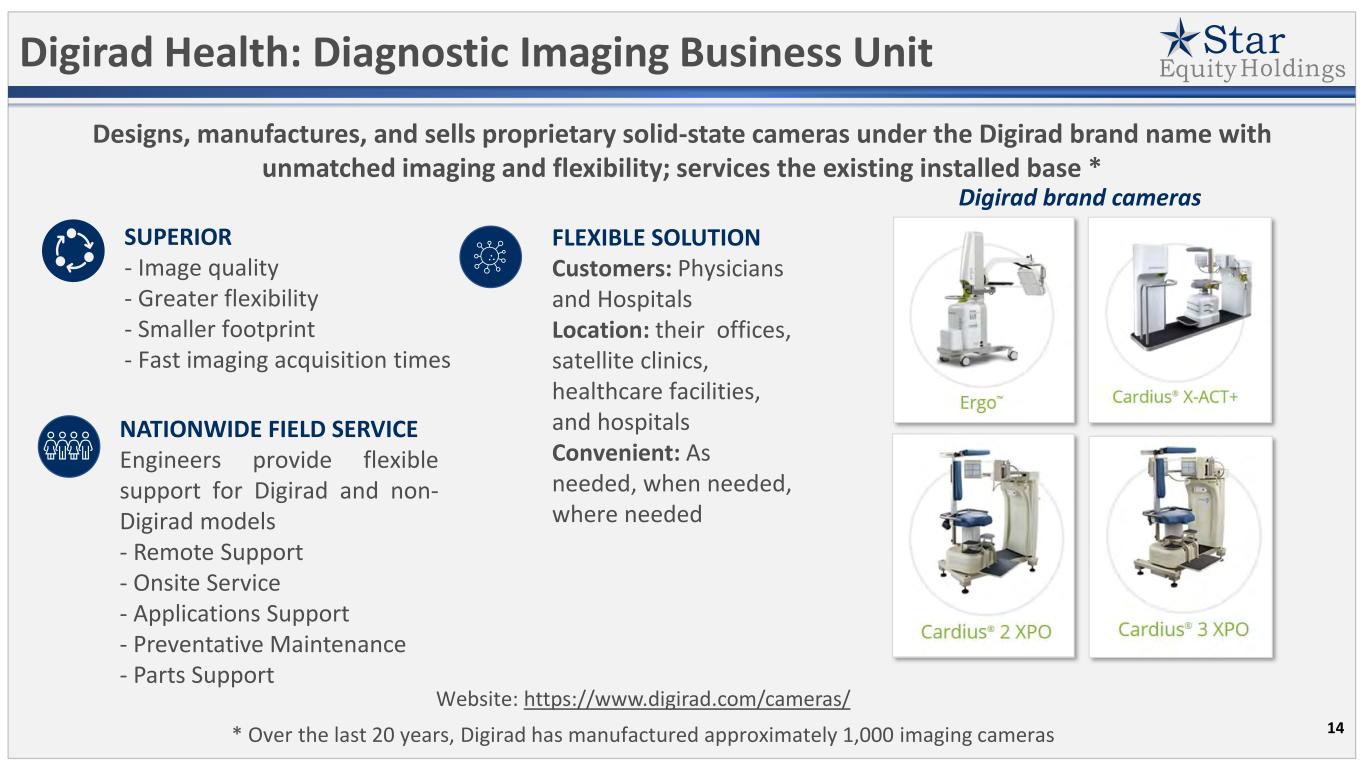

Digirad Health: Diagnostic Imaging Business Unit Designs, manufactures, and sells proprietary solid-state cameras under the Digirad brand name with unmatched imaging and flexibility; services the existing installed base * SUPERIOR - Image quality - Greater flexibility - Smaller footprint - Fast imaging acquisition times NATIONWIDE FIELD SERVICE Engineers provide flexible support for Digirad and non- Digirad models - Remote Support - Onsite Service - Applications Support - Preventative Maintenance - Parts Support Website: https://www.digirad.com/cameras/ FLEXIBLE SOLUTION Customers: Physicians and Hospitals Location: their offices, satellite clinics, healthcare facilities, and hospitals Convenient: As needed, when needed, where needed * Over the last 20 years, Digirad has manufactured approximately 1,000 imaging cameras Digirad brand cameras 14

Offers mobile imaging services to medical providers on-site at their facilities as an alternative to purchasing equipment themselves or outsourcing procedures to other providers Digirad Health: Diagnostic Services Business Unit Website: https://www.digirad.com/diagnostic-services/ STAFF Offers highly-skilled, trained, and certified nuclear medicine technologists and cardiac stress technicians MAINTENANCE Services all major brands of nuclear gamma cameras ACCREDITATION Assists clients with accreditation process SOLUTIONS / EQUIPMENT Provides turnkey, diagnostic solutions to hospitals and healthcare systems; offers a variety of solid-state imaging cameras (fixed-site and mobile systems) LICENSING Extensive portfolio of existing licenses and certifications SUPPLIES Wide range of nuclear imaging supplies and radiopharmaceuticals Mainly Digirad cameras 15

$49.2 $58.6 $55.0 $- $10 $20 $30 $40 $50 $60 FY 2020 FY 2021 FY 2022 Revenue ($ in millions) Healthcare: Financial Summary * $10.2 $12.5 $13.5 $- $2 $4 $6 $8 $10 $12 $14 $16 FY 2020 FY 2021 FY 2022 Gross Profit ($ in millions) * During the fourth quarter of 2020, Star Equity entered into a Stock Purchase Agreement to sell DMS Health Technologies, Inc. (“DMS Health”), a portion of our healthcare business which operated as the Company’s Mobile Healthcare segment, for $18.75 million. The sale of DMS Health closed on March 31, 2021. Related financial and operational data for the Mobile Healthcare business were classified as discontinued operations for all reporting periods ending December 31, 2021 and 2020. The results presented here relate to continuing operations, which encompass Healthcare, Construction, Investments, and discontinued operations, which consists of Mobile Healthcare. Mobile Healthcare’s assets and liabilities were reported as “Assets held for sale” and “Liabilities held for sale” on the balance sheet as of December 31, 2020. 16 In 2022, our Healthcare division continued to rebound to more normal levels following the COVID slowdown in 2020. Profitability improved in 2022 as we focused on pursuing higher margin business while also decreasing SG&A. FY 2020: 20.6% FY 2021: 21.3% Gross Margin: FY 2022: 24.6% $1.0 $4.2 $6.1 $- $1 $2 $3 $4 $5 $6 $7 FY 2020 FY 2021 FY 2022 Non-GAAP adj. EBITDA ($ in millions)

Business Divisions: Construction 17

Construction KBS Builders EBGL Construction • Designs and manufactures custom, modular housing units for single-family and multi-family projects • Rapidly expanding presence in commercial-scale projects including in the Greater Boston Area • Largest known production capacity of any modular manufacturer in New England • Designs and manufactures structural wall panels for commercial-scale, multi-family projects • Designs and manufactures engineered wood products for single family homes and residential developments • Distributes building materials and operates a professional lumber yard and showroom Maine/New England Minneapolis-area 18

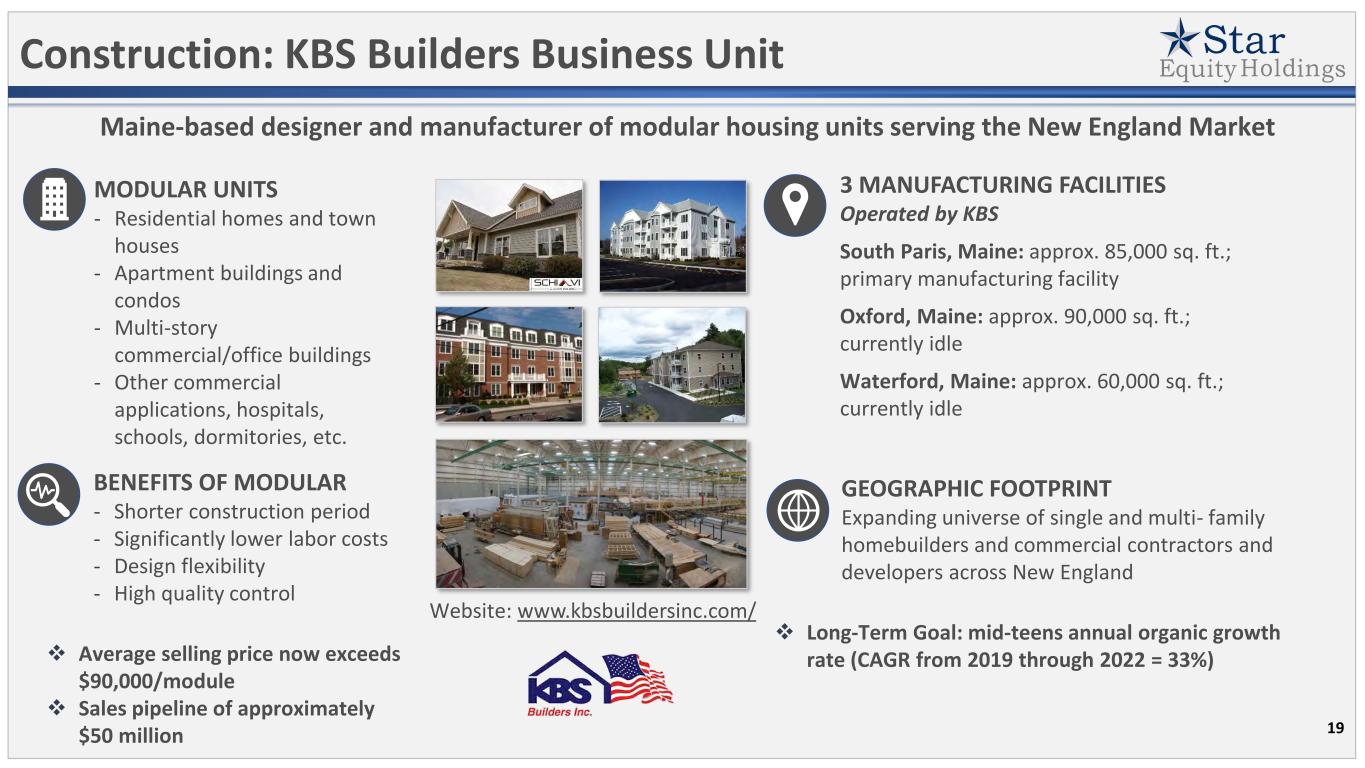

MODULAR UNITS - Residential homes and town houses - Apartment buildings and condos - Multi-story commercial/office buildings - Other commercial applications, hospitals, schools, dormitories, etc. Construction: KBS Builders Business Unit Maine-based designer and manufacturer of modular housing units serving the New England Market BENEFITS OF MODULAR - Shorter construction period - Significantly lower labor costs - Design flexibility - High quality control 3 MANUFACTURING FACILITIES Operated by KBS South Paris, Maine: approx. 85,000 sq. ft.; primary manufacturing facility Oxford, Maine: approx. 90,000 sq. ft.; currently idle Waterford, Maine: approx. 60,000 sq. ft.; currently idle GEOGRAPHIC FOOTPRINT Expanding universe of single and multi- family homebuilders and commercial contractors and developers across New England Website: www.kbsbuildersinc.com/ ❖ Long-Term Goal: mid-teens annual organic growth rate (CAGR from 2019 through 2022 = 33%)❖ Average selling price now exceeds $90,000/module ❖ Sales pipeline of approximately $50 million 19

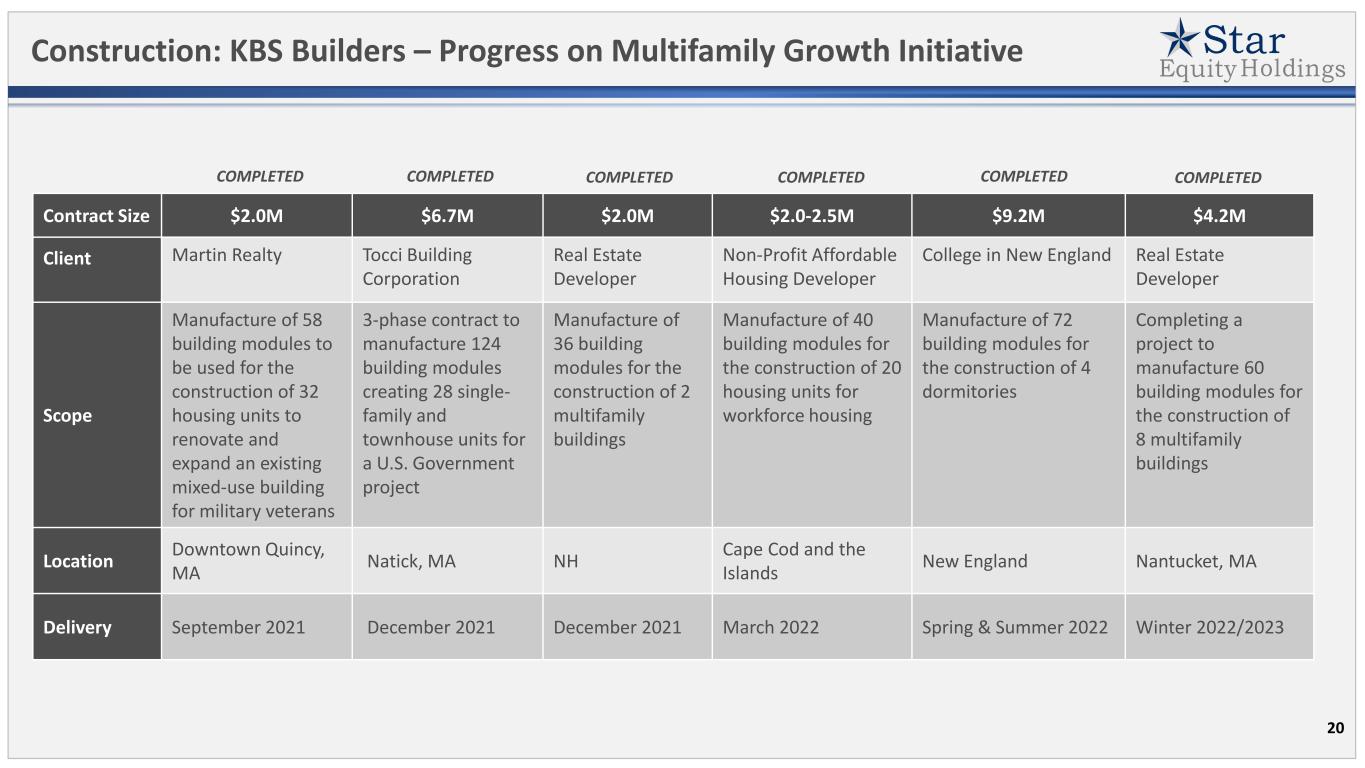

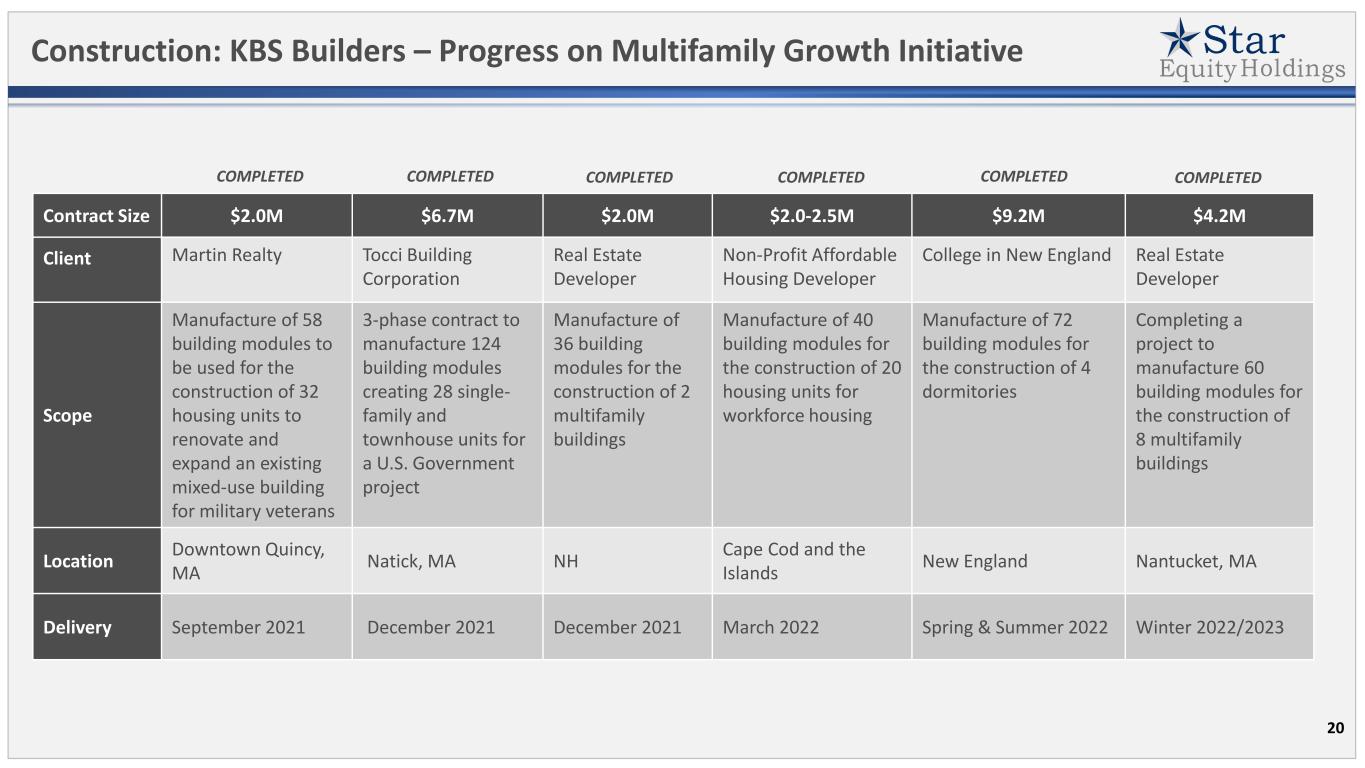

Construction: KBS Builders – Progress on Multifamily Growth Initiative 20 Contract Size $2.0M $6.7M $2.0M $2.0-2.5M $9.2M $4.2M Client Martin Realty Tocci Building Corporation Real Estate Developer Non-Profit Affordable Housing Developer College in New England Real Estate Developer Scope Manufacture of 58 building modules to be used for the construction of 32 housing units to renovate and expand an existing mixed-use building for military veterans 3-phase contract to manufacture 124 building modules creating 28 single- family and townhouse units for a U.S. Government project Manufacture of 36 building modules for the construction of 2 multifamily buildings Manufacture of 40 building modules for the construction of 20 housing units for workforce housing Manufacture of 72 building modules for the construction of 4 dormitories Completing a project to manufacture 60 building modules for the construction of 8 multifamily buildings Location Downtown Quincy, MA Natick, MA NH Cape Cod and the Islands New England Nantucket, MA Delivery September 2021 December 2021 December 2021 March 2022 Spring & Summer 2022 Winter 2022/2023 COMPLETED COMPLETED COMPLETED COMPLETED COMPLETEDCOMPLETED

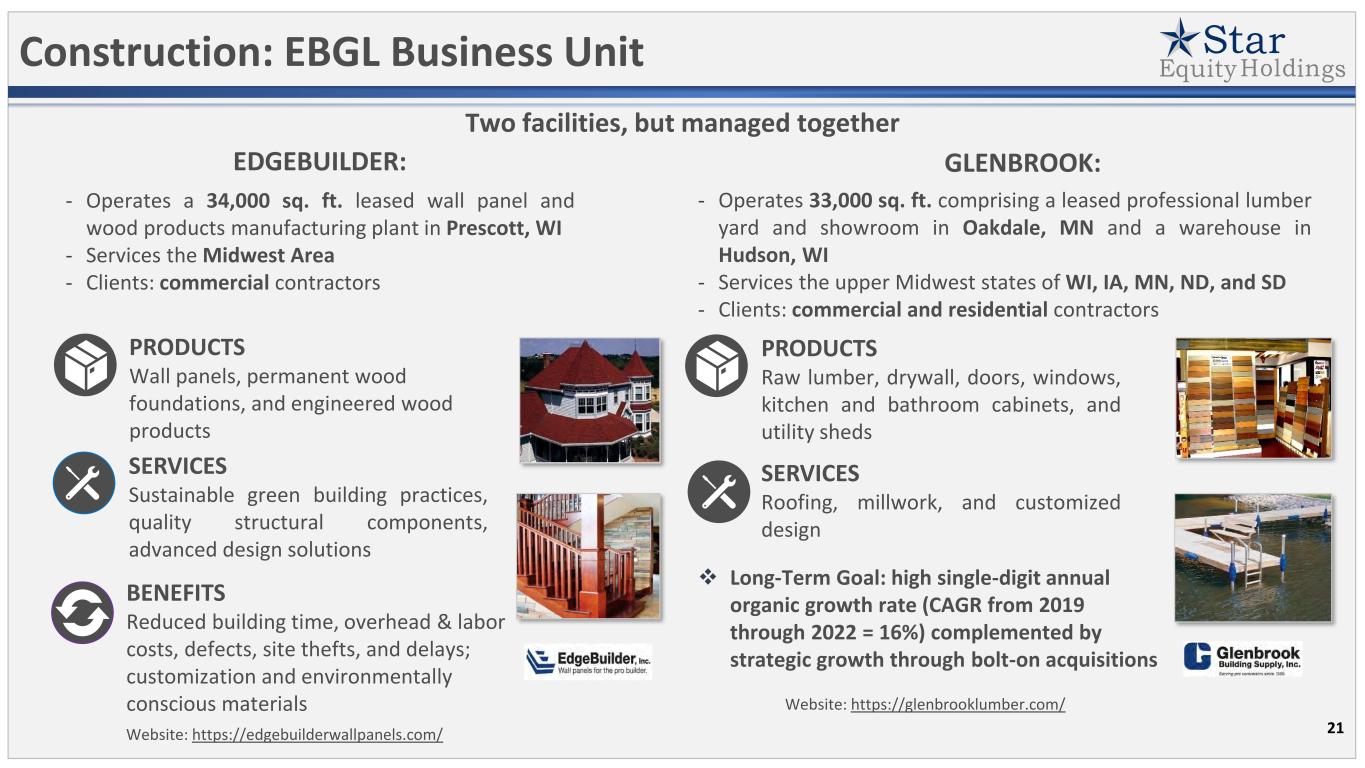

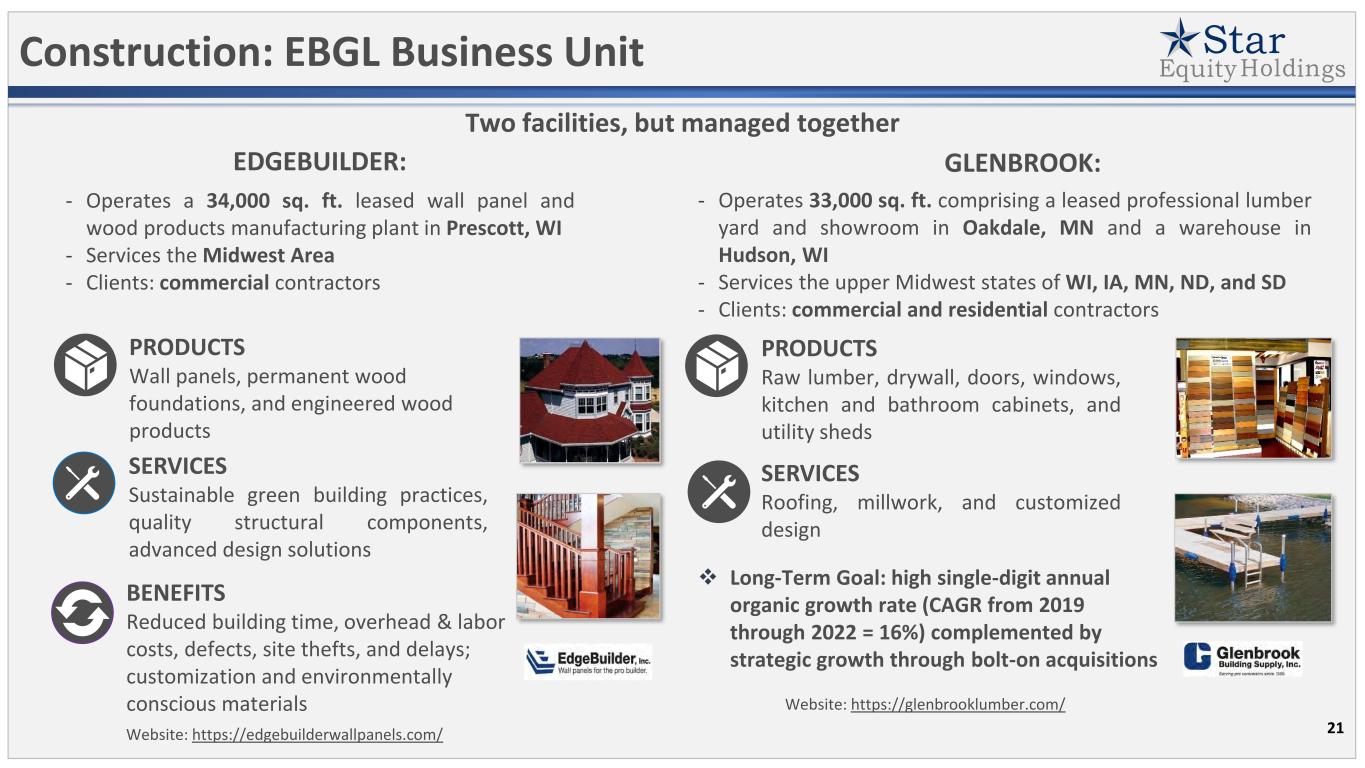

Website: https://edgebuilderwallpanels.com/ Construction: EBGL Business Unit - Operates a 34,000 sq. ft. leased wall panel and wood products manufacturing plant in Prescott, WI - Services the Midwest Area - Clients: commercial contractors - Operates 33,000 sq. ft. comprising a leased professional lumber yard and showroom in Oakdale, MN and a warehouse in Hudson, WI - Services the upper Midwest states of WI, IA, MN, ND, and SD - Clients: commercial and residential contractors Two facilities, but managed together PRODUCTS Raw lumber, drywall, doors, windows, kitchen and bathroom cabinets, and utility sheds SERVICES Roofing, millwork, and customized design PRODUCTS Wall panels, permanent wood foundations, and engineered wood products SERVICES Sustainable green building practices, quality structural components, advanced design solutions BENEFITS Reduced building time, overhead & labor costs, defects, site thefts, and delays; customization and environmentally conscious materials Website: https://glenbrooklumber.com/ EDGEBUILDER: GLENBROOK: 21 ❖ Long-Term Goal: high single-digit annual organic growth rate (CAGR from 2019 through 2022 = 16%) complemented by strategic growth through bolt-on acquisitions

Construction: Financial Summary $28.9 $48.0 $57.1 $- $10 $20 $30 $40 $50 $60 FY 2020 FY 2021 FY 2022 Revenue ($ in millions) $4.1 $3.0 $12.7 $- $2 $4 $6 $8 $10 $12 $14 FY 2020 FY 2021 FY 2022 Gross Profit ($ in millions) 22 • During 2021, to offset COVID-related rapid and historic rise in raw materials costs, the division significantly increased pricing, improved operations and implemented commodity price risk mitigation, which significantly improved gross margin starting in Q4 2021. • In 2022, margins further benefited from these increases; going forward we expect annual Construction gross margin to remain above 20%. FY 2020: 14.0% FY 2021: 6.3% Gross Margin: FY 2022: 22.2% $0.7 ($2.7) $6.3 $(4) $(2) $- $2 $4 $6 $8 FY 2020 FY 2021 FY 2022 Non-GAAP adj. EBITDA ($ in millions)

Business Divisions: Investments 23

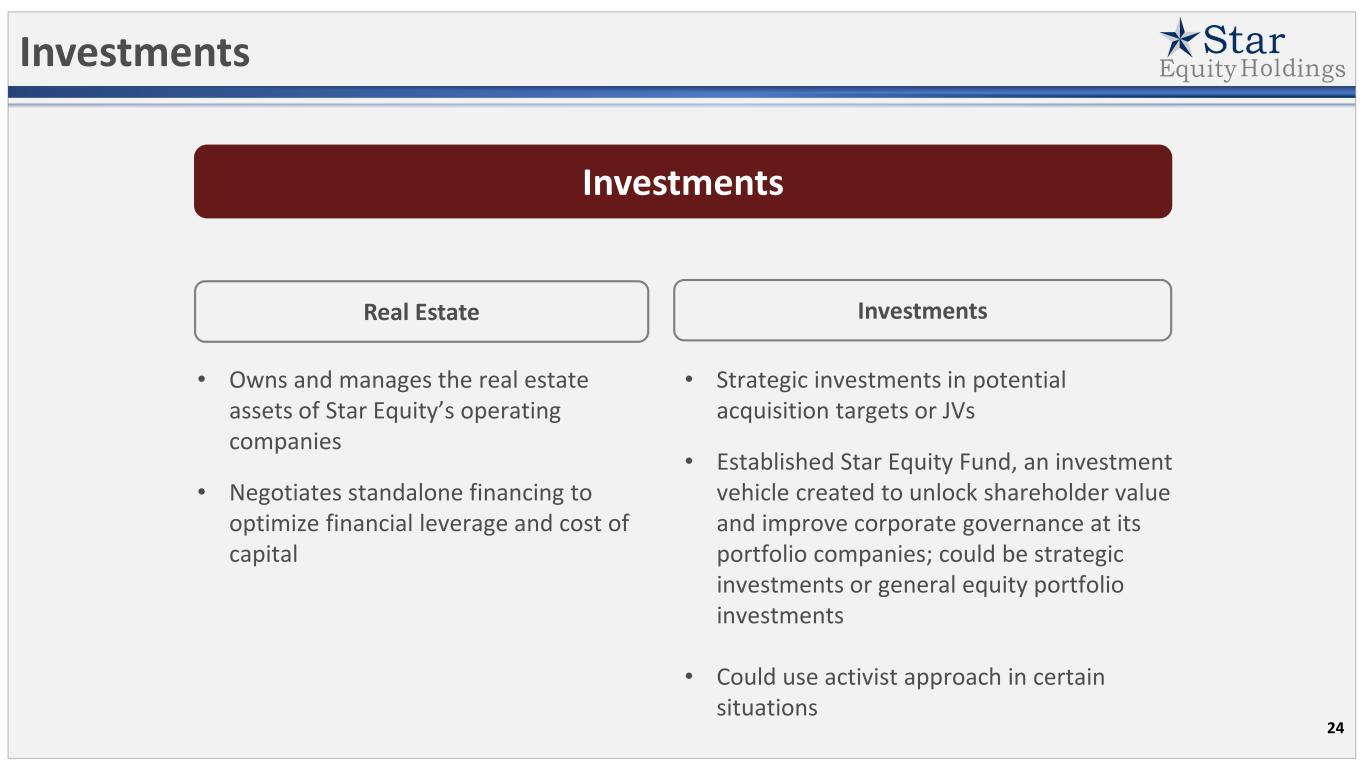

Investments Investments Real Estate Investments • Owns and manages the real estate assets of Star Equity’s operating companies • Negotiates standalone financing to optimize financial leverage and cost of capital • Strategic investments in potential acquisition targets or JVs • Established Star Equity Fund, an investment vehicle created to unlock shareholder value and improve corporate governance at its portfolio companies; could be strategic investments or general equity portfolio investments • Could use activist approach in certain situations 24

Real Estate • Star Real Estate (“SRE”) acquired and manages three manufacturing plants in Maine; two plants were purchased from KBS and a third from a private company • All involved in the construction of modular buildings for residential, multi-family, and commercial projects STRATEGY • Future acquisition targets could have underappreciated real estate assets that could be placed into SRE • SRE has raised its own debt and is self-funded • Optimizes financial leverage and cost of capital SIGNIFICANT STRATEGIC VALUE & UPSIDE POTENTIAL • Three plants are within 15 miles of each other – the largest known modular manufacturing footprint in New England o Primary manufacturing facility; can be expanded o Other two plants are idle • Increase capacity available to handle increased demand and entrance into new lines of business Formed in April 2019 with two sale-leaseback transactions: 25

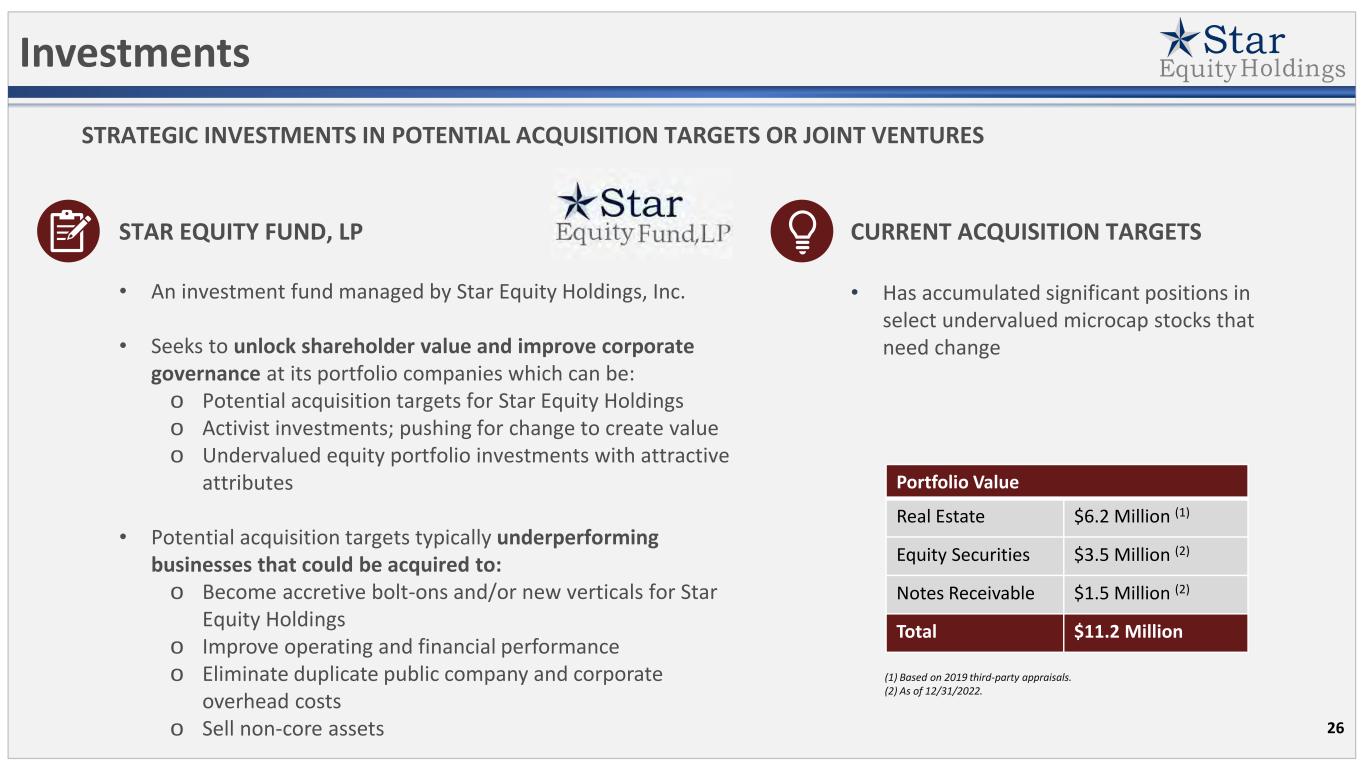

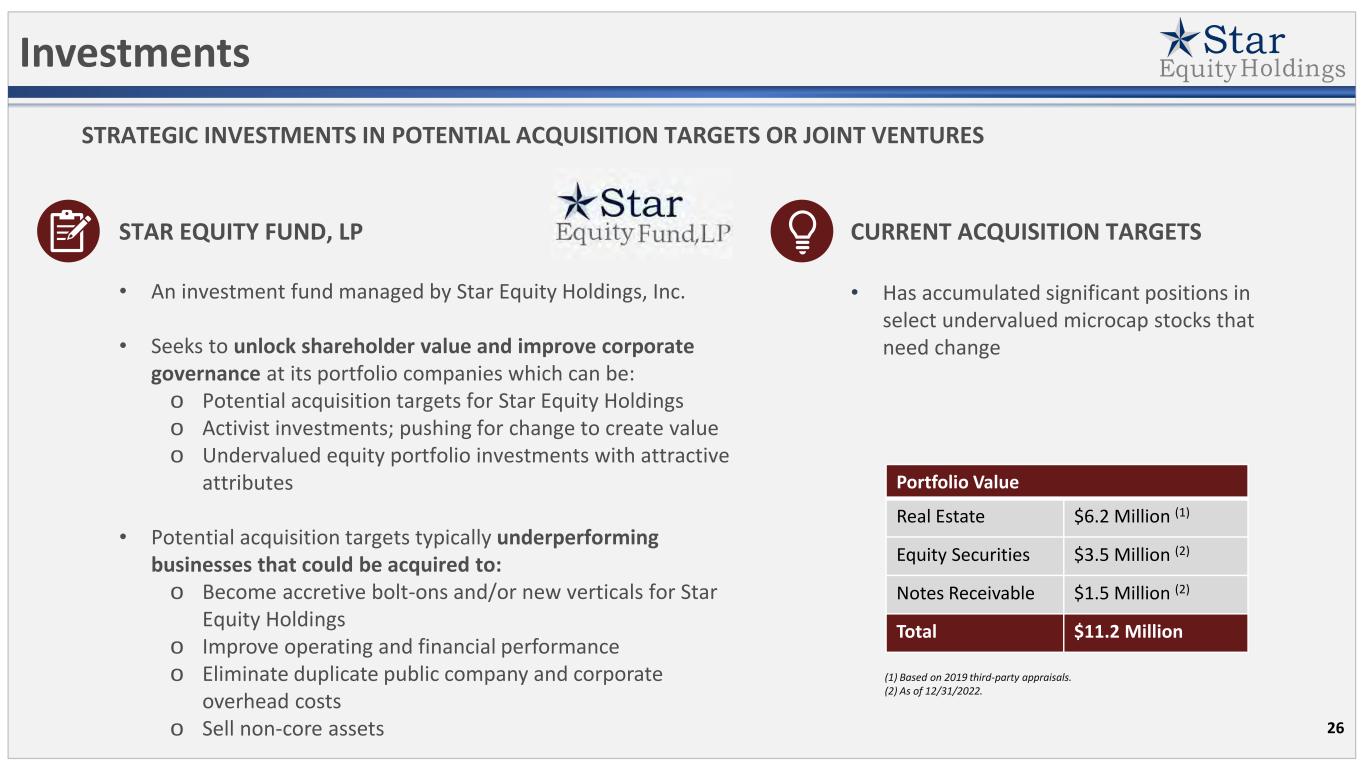

Investments STAR EQUITY FUND, LP • An investment fund managed by Star Equity Holdings, Inc. • Seeks to unlock shareholder value and improve corporate governance at its portfolio companies which can be: o Potential acquisition targets for Star Equity Holdings o Activist investments; pushing for change to create value o Undervalued equity portfolio investments with attractive attributes • Potential acquisition targets typically underperforming businesses that could be acquired to: o Become accretive bolt-ons and/or new verticals for Star Equity Holdings o Improve operating and financial performance o Eliminate duplicate public company and corporate overhead costs o Sell non-core assets CURRENT ACQUISITION TARGETS • Has accumulated significant positions in select undervalued microcap stocks that need change STRATEGIC INVESTMENTS IN POTENTIAL ACQUISITION TARGETS OR JOINT VENTURES 26 Portfolio Value Real Estate $6.2 Million (1) Equity Securities $3.5 Million (2) Notes Receivable $1.5 Million (2) Total $11.2 Million (1) Based on 2019 third-party appraisals. (2) As of 12/31/2022.

Investment Highlights Diversified business lines with multiple revenue streams Healthcare division historically has provided stable cash flow Construction division substantially improved top & bottom line (since its acquisition) and has additional significant growth potential FY 2022: $112.2M of revenue (+5.2% vs FY 2021), $25.9M of gross profit (+69.8% vs. FY 2021) Platform for future bolt-on acquisitions & other growth opportunities Experienced management team with public company track record 27

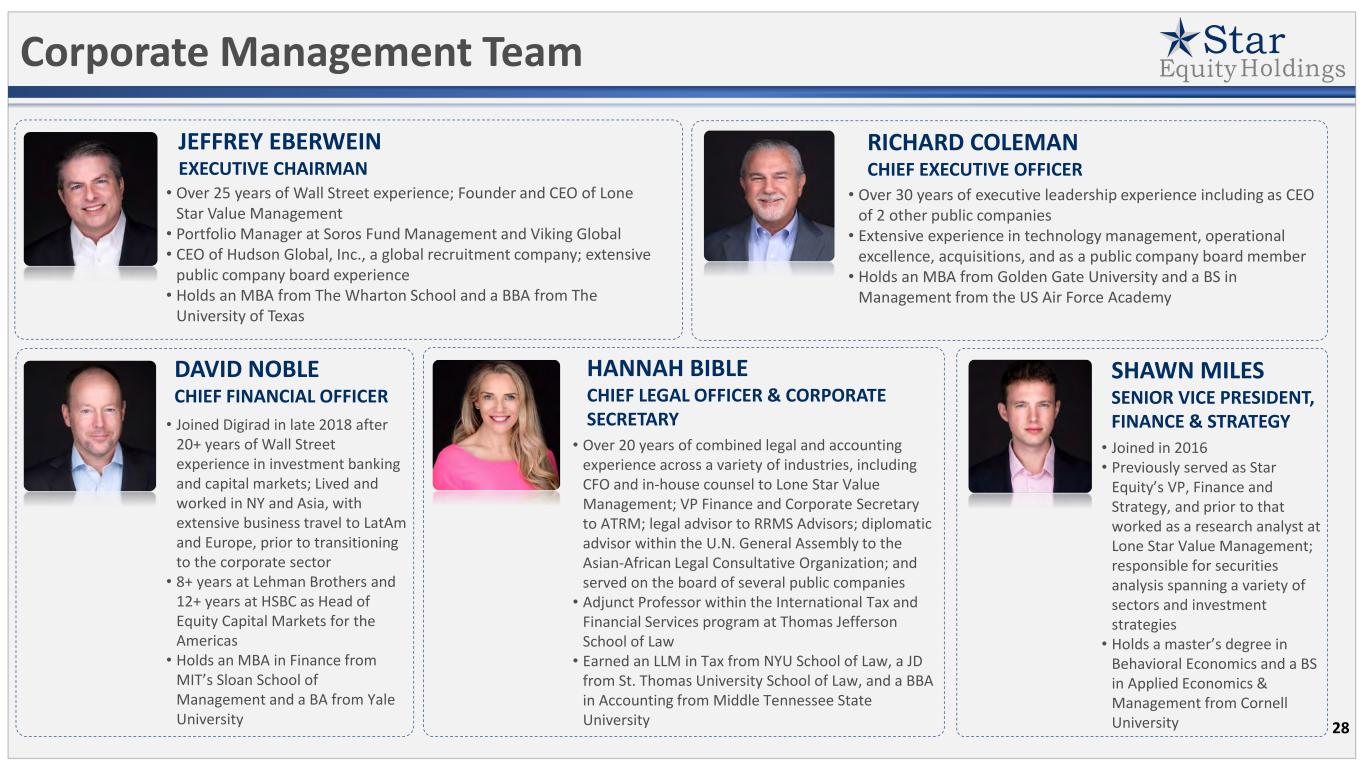

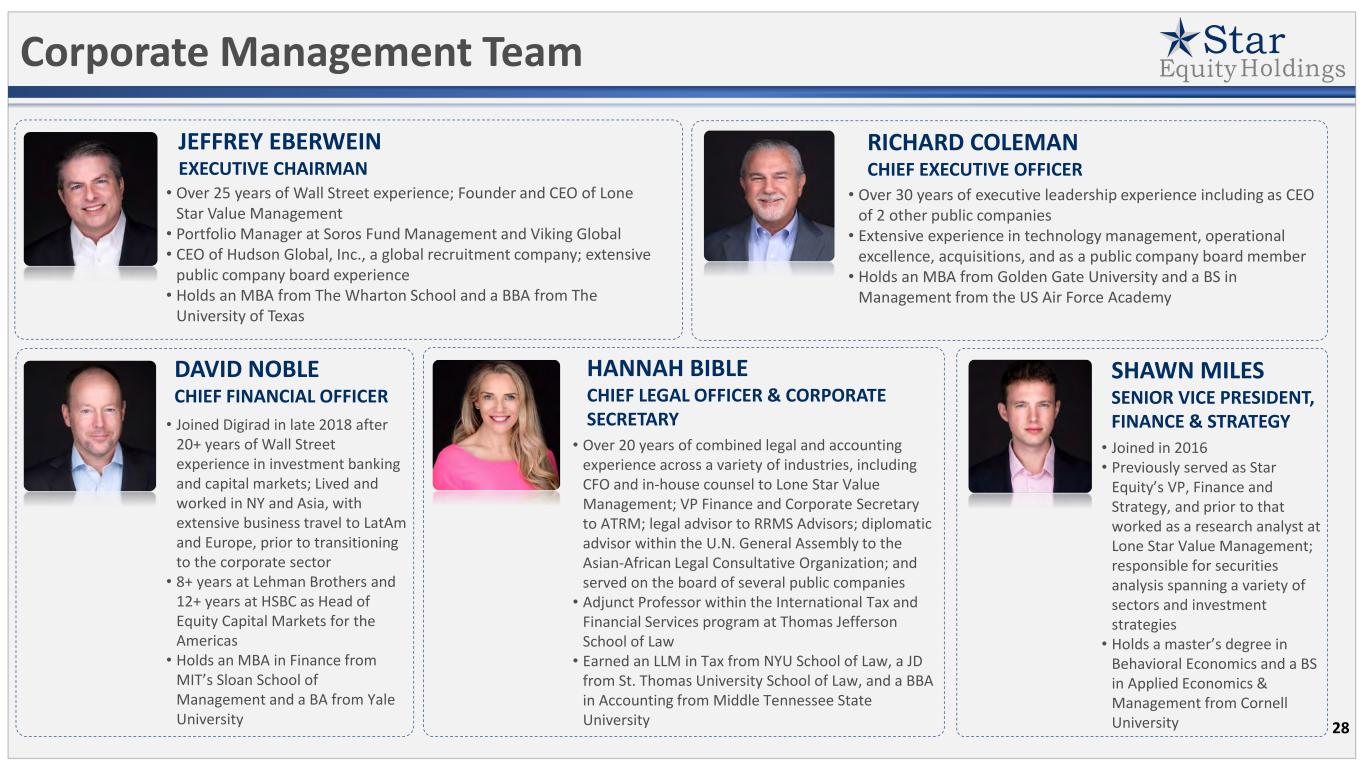

RICHARD COLEMAN CHIEF EXECUTIVE OFFICER Corporate Management Team JEFFREY EBERWEIN EXECUTIVE CHAIRMAN • Over 25 years of Wall Street experience; Founder and CEO of Lone Star Value Management • Portfolio Manager at Soros Fund Management and Viking Global • CEO of Hudson Global, Inc., a global recruitment company; extensive public company board experience • Holds an MBA from The Wharton School and a BBA from The University of Texas 28 DAVID NOBLE CHIEF FINANCIAL OFFICER • Joined Digirad in late 2018 after 20+ years of Wall Street experience in investment banking and capital markets; Lived and worked in NY and Asia, with extensive business travel to LatAm and Europe, prior to transitioning to the corporate sector • 8+ years at Lehman Brothers and 12+ years at HSBC as Head of Equity Capital Markets for the Americas • Holds an MBA in Finance from MIT’s Sloan School of Management and a BA from Yale University • Over 30 years of executive leadership experience including as CEO of 2 other public companies • Extensive experience in technology management, operational excellence, acquisitions, and as a public company board member • Holds an MBA from Golden Gate University and a BS in Management from the US Air Force Academy SHAWN MILES SENIOR VICE PRESIDENT, FINANCE & STRATEGY HANNAH BIBLE CHIEF LEGAL OFFICER & CORPORATE SECRETARY • Over 20 years of combined legal and accounting experience across a variety of industries, including CFO and in-house counsel to Lone Star Value Management; VP Finance and Corporate Secretary to ATRM; legal advisor to RRMS Advisors; diplomatic advisor within the U.N. General Assembly to the Asian-African Legal Consultative Organization; and served on the board of several public companies • Adjunct Professor within the International Tax and Financial Services program at Thomas Jefferson School of Law • Earned an LLM in Tax from NYU School of Law, a JD from St. Thomas University School of Law, and a BBA in Accounting from Middle Tennessee State University • Joined in 2016 • Previously served as Star Equity’s VP, Finance and Strategy, and prior to that worked as a research analyst at Lone Star Value Management; responsible for securities analysis spanning a variety of sectors and investment strategies • Holds a master’s degree in Behavioral Economics and a BS in Applied Economics & Management from Cornell University

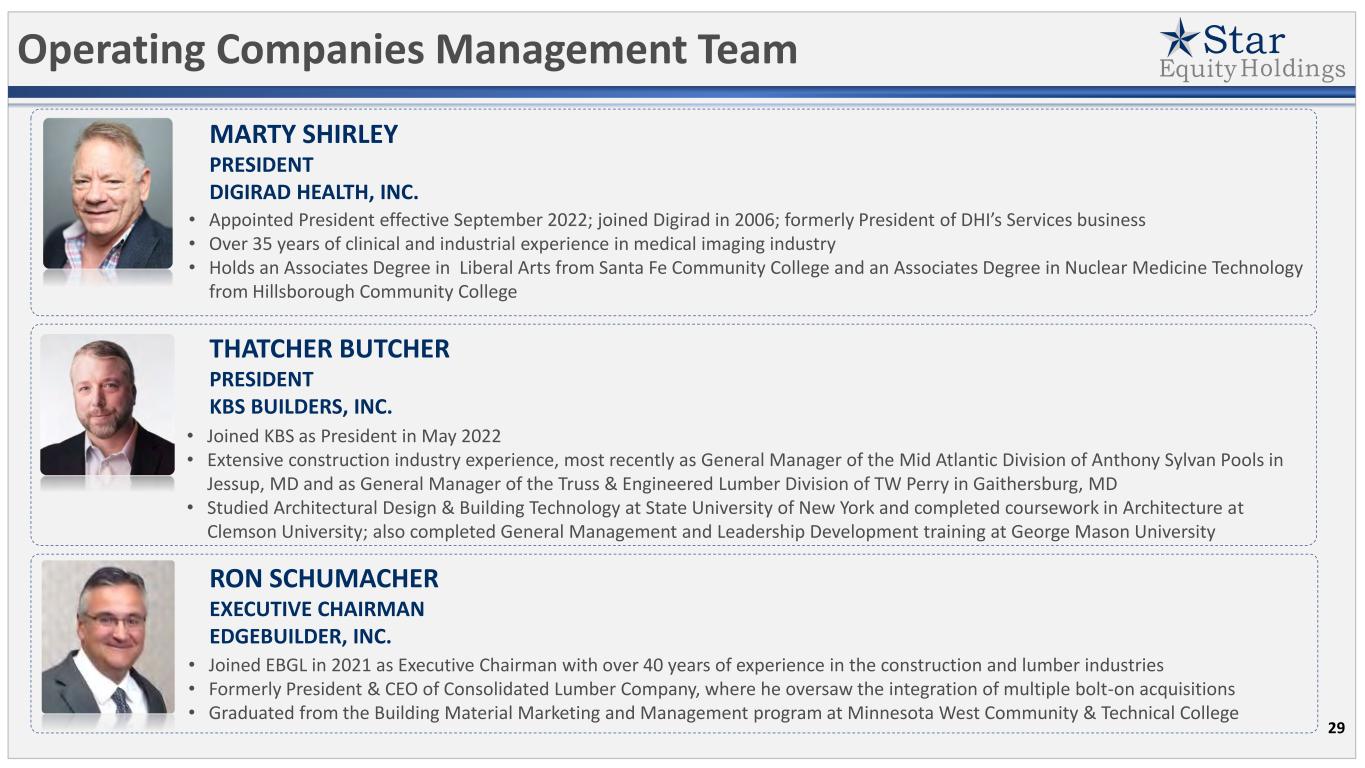

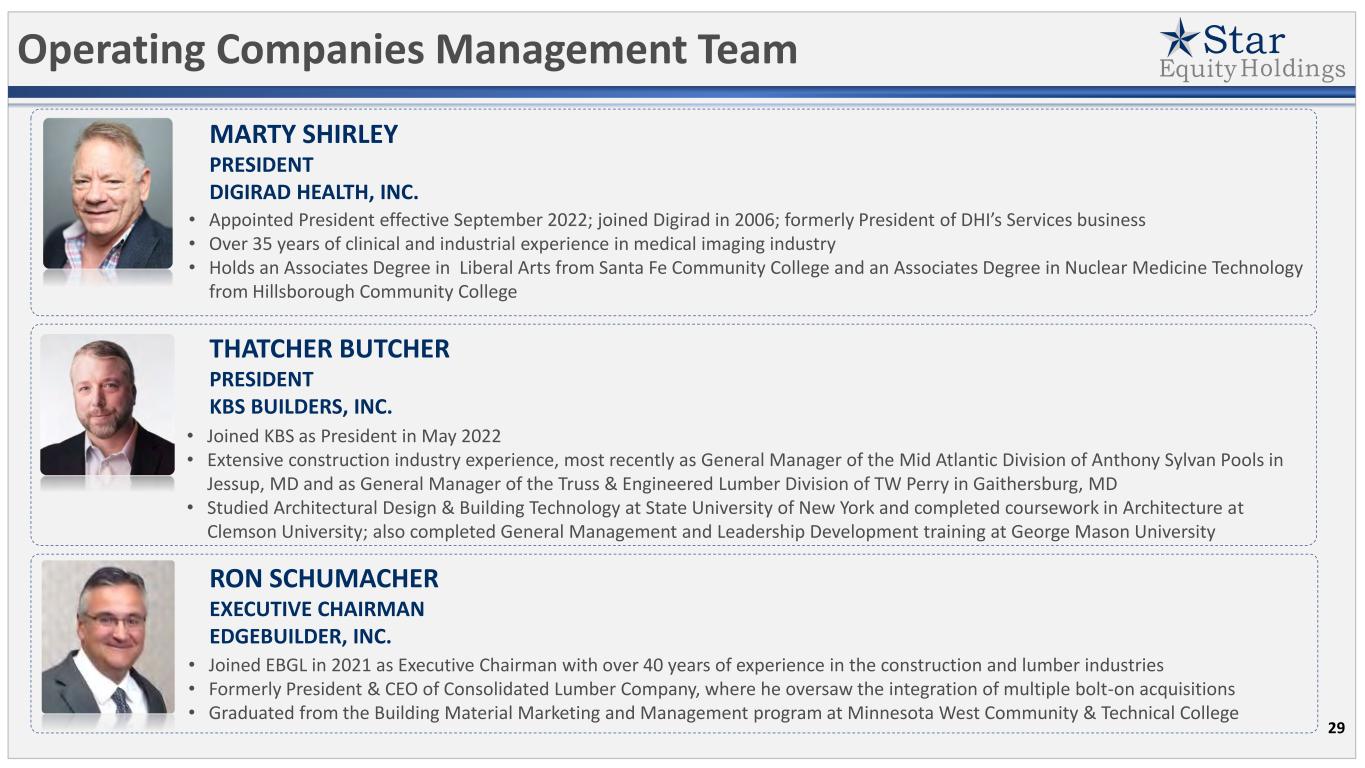

RON SCHUMACHER EXECUTIVE CHAIRMAN EDGEBUILDER, INC. Operating Companies Management Team MARTY SHIRLEY PRESIDENT DIGIRAD HEALTH, INC. • Appointed President effective September 2022; joined Digirad in 2006; formerly President of DHI’s Services business • Over 35 years of clinical and industrial experience in medical imaging industry • Holds an Associates Degree in Liberal Arts from Santa Fe Community College and an Associates Degree in Nuclear Medicine Technology from Hillsborough Community College 29 THATCHER BUTCHER PRESIDENT KBS BUILDERS, INC. • Joined KBS as President in May 2022 • Extensive construction industry experience, most recently as General Manager of the Mid Atlantic Division of Anthony Sylvan Pools in Jessup, MD and as General Manager of the Truss & Engineered Lumber Division of TW Perry in Gaithersburg, MD • Studied Architectural Design & Building Technology at State University of New York and completed coursework in Architecture at Clemson University; also completed General Management and Leadership Development training at George Mason University • Joined EBGL in 2021 as Executive Chairman with over 40 years of experience in the construction and lumber industries • Formerly President & CEO of Consolidated Lumber Company, where he oversaw the integration of multiple bolt-on acquisitions • Graduated from the Building Material Marketing and Management program at Minnesota West Community & Technical College

30

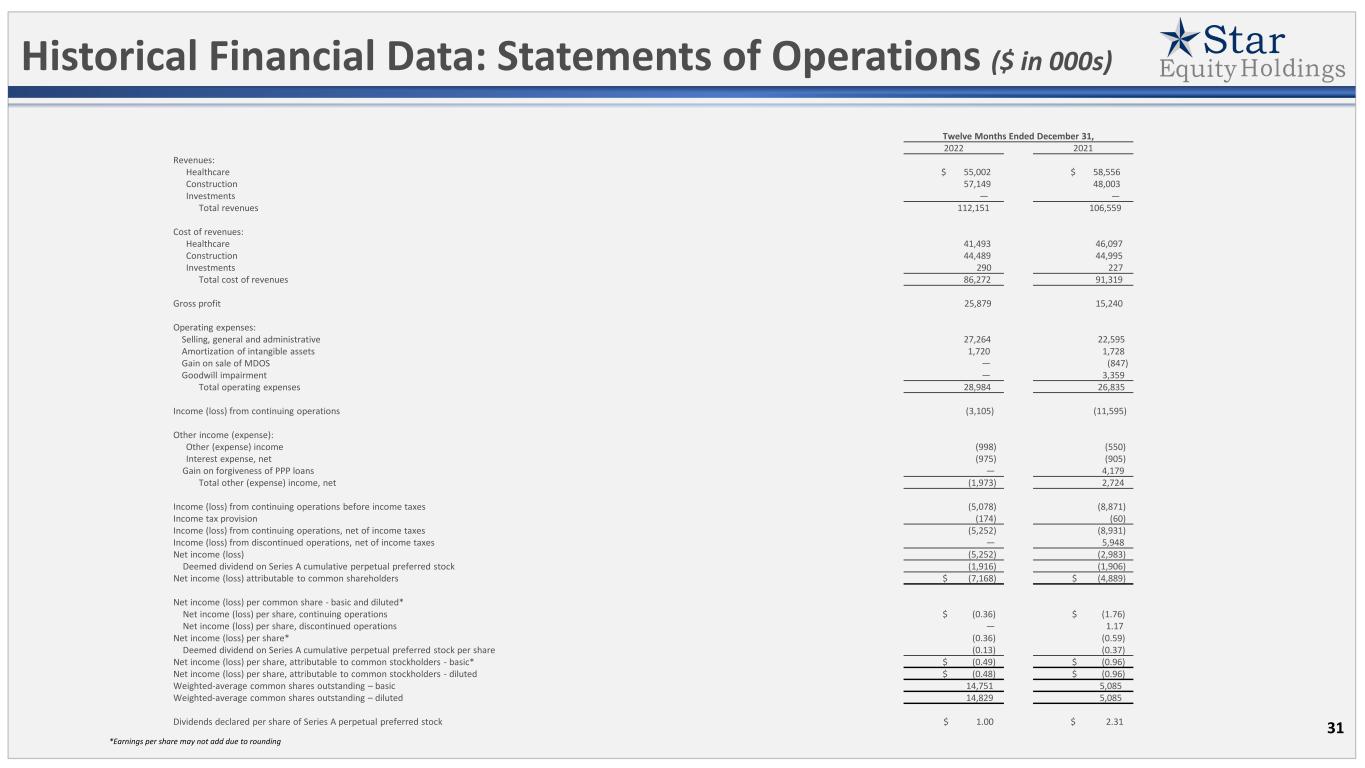

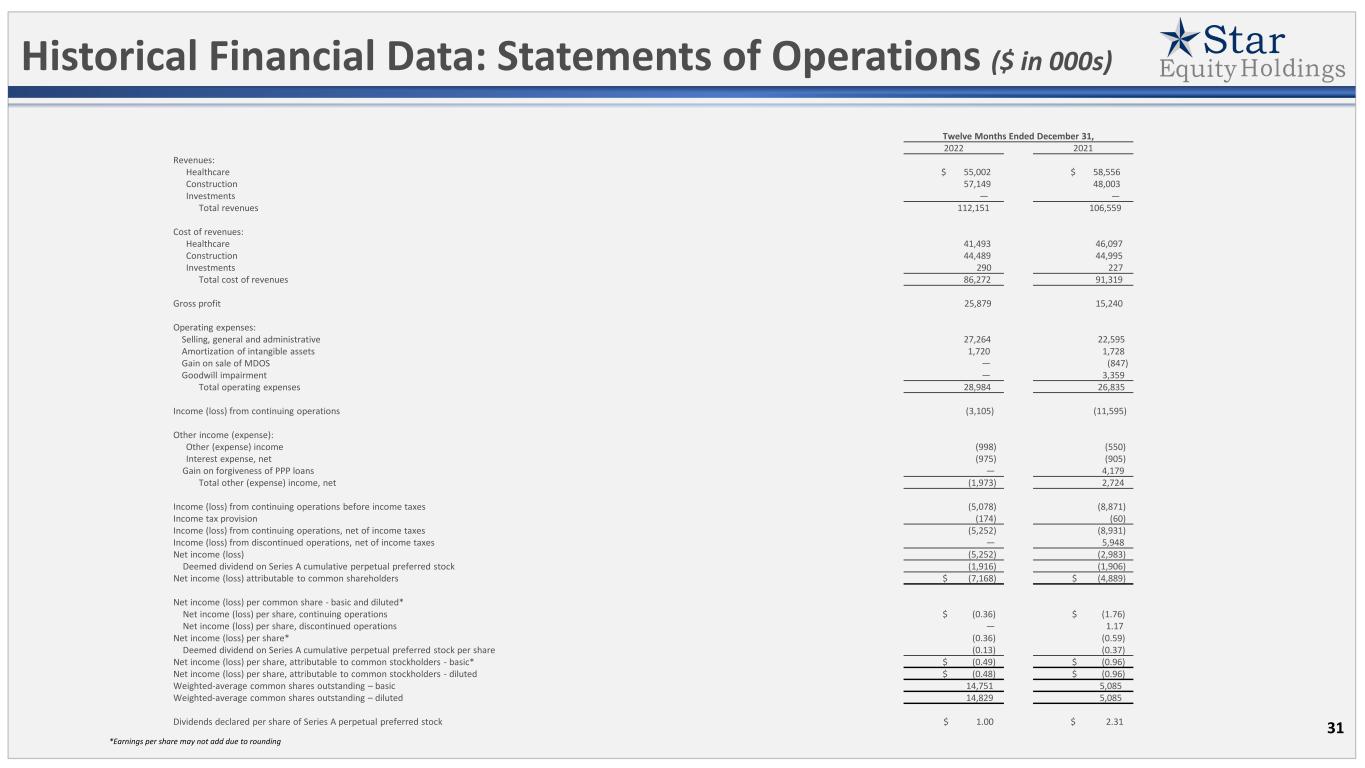

Historical Financial Data: Statements of Operations ($ in 000s) 31 Twelve Months Ended December 31, 2022 2021 Revenues: Healthcare $ 55,002 $ 58,556 Construction 57,149 48,003 Investments — — Total revenues 112,151 106,559 Cost of revenues: Healthcare 41,493 46,097 Construction 44,489 44,995 Investments 290 227 Total cost of revenues 86,272 91,319 Gross profit 25,879 15,240 Operating expenses: Selling, general and administrative 27,264 22,595 Amortization of intangible assets 1,720 1,728 Gain on sale of MDOS — (847) Goodwill impairment — 3,359 Total operating expenses 28,984 26,835 Income (loss) from continuing operations (3,105) (11,595) Other income (expense): Other (expense) income (998) (550) Interest expense, net (975) (905) Gain on forgiveness of PPP loans — 4,179 Total other (expense) income, net (1,973) 2,724 Income (loss) from continuing operations before income taxes (5,078) (8,871) Income tax provision (174) (60) Income (loss) from continuing operations, net of income taxes (5,252) (8,931) Income (loss) from discontinued operations, net of income taxes — 5,948 Net income (loss) (5,252) (2,983) Deemed dividend on Series A cumulative perpetual preferred stock (1,916) (1,906) Net income (loss) attributable to common shareholders $ (7,168) $ (4,889) Net income (loss) per common share - basic and diluted* Net income (loss) per share, continuing operations $ (0.36) $ (1.76) Net income (loss) per share, discontinued operations — 1.17 Net income (loss) per share* (0.36) (0.59) Deemed dividend on Series A cumulative perpetual preferred stock per share (0.13) (0.37) Net income (loss) per share, attributable to common stockholders - basic* $ (0.49) $ (0.96) Net income (loss) per share, attributable to common stockholders - diluted $ (0.48) $ (0.96) Weighted-average common shares outstanding – basic 14,751 5,085 Weighted-average common shares outstanding – diluted 14,829 5,085 Dividends declared per share of Series A perpetual preferred stock $ 1.00 $ 2.31 *Earnings per share may not add due to rounding

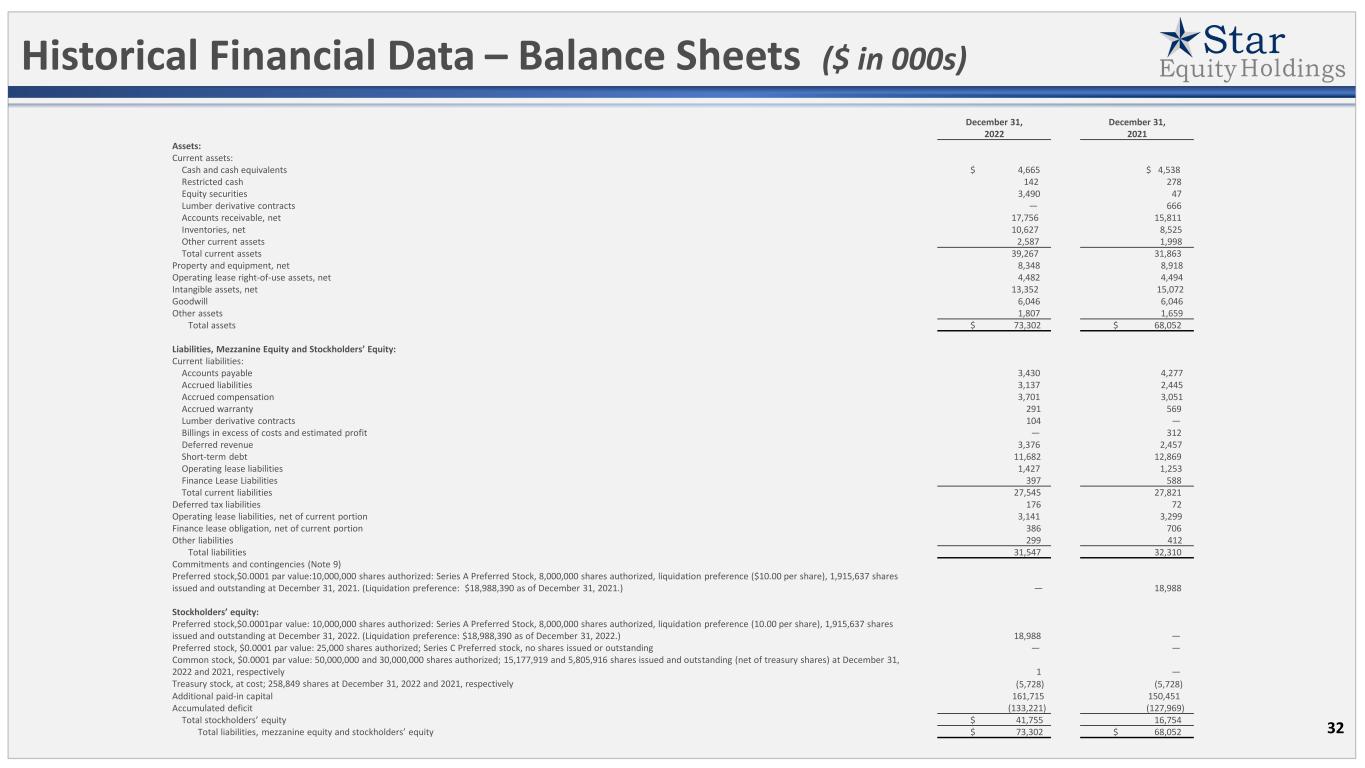

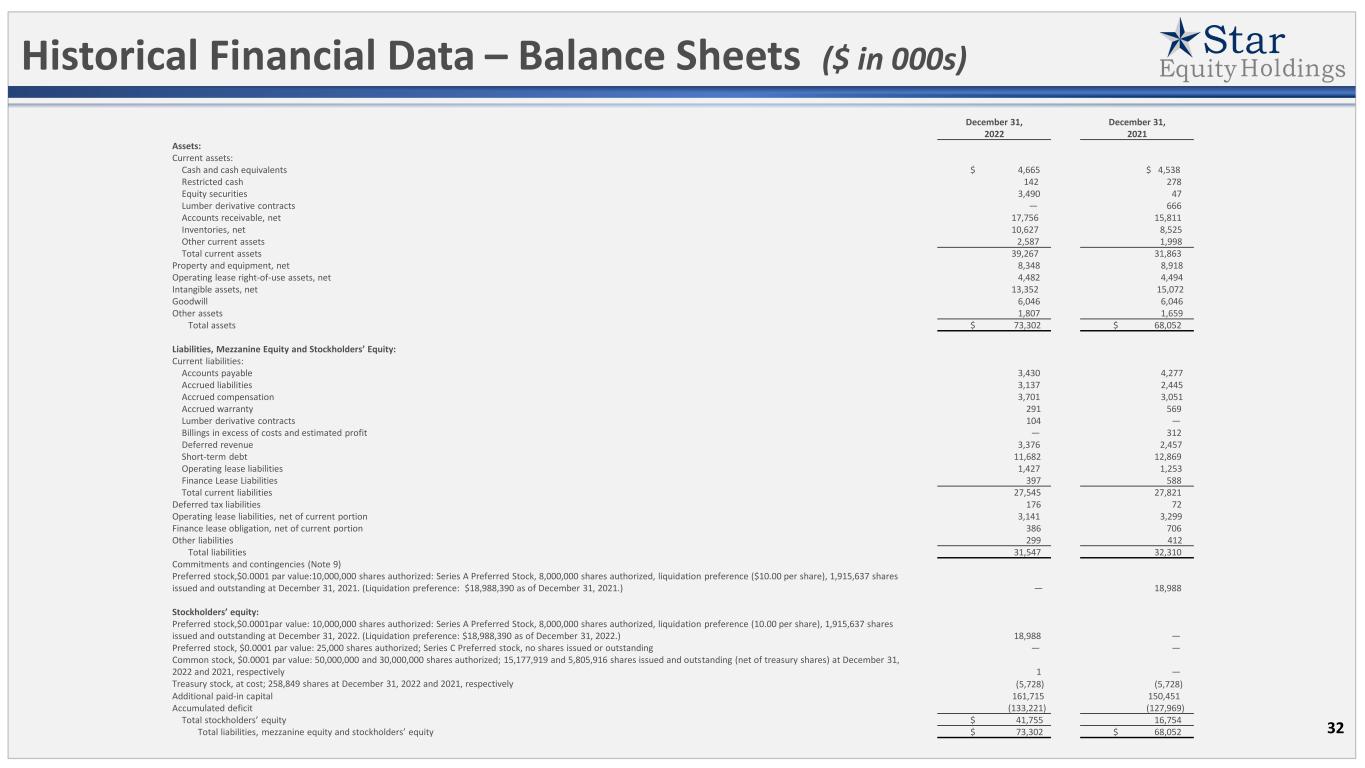

Historical Financial Data – Balance Sheets ($ in 000s) 32 December 31, 2022 December 31, 2021 Assets: Current assets: Cash and cash equivalents $ 4,665 $ 4,538 Restricted cash 142 278 Equity securities 3,490 47 Lumber derivative contracts — 666 Accounts receivable, net 17,756 15,811 Inventories, net 10,627 8,525 Other current assets 2,587 1,998 Total current assets 39,267 31,863 Property and equipment, net 8,348 8,918 Operating lease right-of-use assets, net 4,482 4,494 Intangible assets, net 13,352 15,072 Goodwill 6,046 6,046 Other assets 1,807 1,659 Total assets $ 73,302 $ 68,052 Liabilities, Mezzanine Equity and Stockholders’ Equity: Current liabilities: Accounts payable 3,430 4,277 Accrued liabilities 3,137 2,445 Accrued compensation 3,701 3,051 Accrued warranty 291 569 Lumber derivative contracts 104 — Billings in excess of costs and estimated profit — 312 Deferred revenue 3,376 2,457 Short-term debt 11,682 12,869 Operating lease liabilities 1,427 1,253 Finance Lease Liabilities 397 588 Total current liabilities 27,545 27,821 Deferred tax liabilities 176 72 Operating lease liabilities, net of current portion 3,141 3,299 Finance lease obligation, net of current portion 386 706 Other liabilities 299 412 Total liabilities 31,547 32,310 Commitments and contingencies (Note 9) Preferred stock,$0.0001 par value:10,000,000 shares authorized: Series A Preferred Stock, 8,000,000 shares authorized, liquidation preference ($10.00 per share), 1,915,637 shares issued and outstanding at December 31, 2021. (Liquidation preference: $18,988,390 as of December 31, 2021.) — 18,988 Stockholders’ equity: Preferred stock,$0.0001par value: 10,000,000 shares authorized: Series A Preferred Stock, 8,000,000 shares authorized, liquidation preference (10.00 per share), 1,915,637 shares issued and outstanding at December 31, 2022. (Liquidation preference: $18,988,390 as of December 31, 2022.) 18,988 — Preferred stock, $0.0001 par value: 25,000 shares authorized; Series C Preferred stock, no shares issued or outstanding — — Common stock, $0.0001 par value: 50,000,000 and 30,000,000 shares authorized; 15,177,919 and 5,805,916 shares issued and outstanding (net of treasury shares) at December 31, 2022 and 2021, respectively 1 — Treasury stock, at cost; 258,849 shares at December 31, 2022 and 2021, respectively (5,728) (5,728) Additional paid-in capital 161,715 150,451 Accumulated deficit (133,221) (127,969) Total stockholders’ equity $ 41,755 16,754 Total liabilities, mezzanine equity and stockholders’ equity $ 73,302 $ 68,052

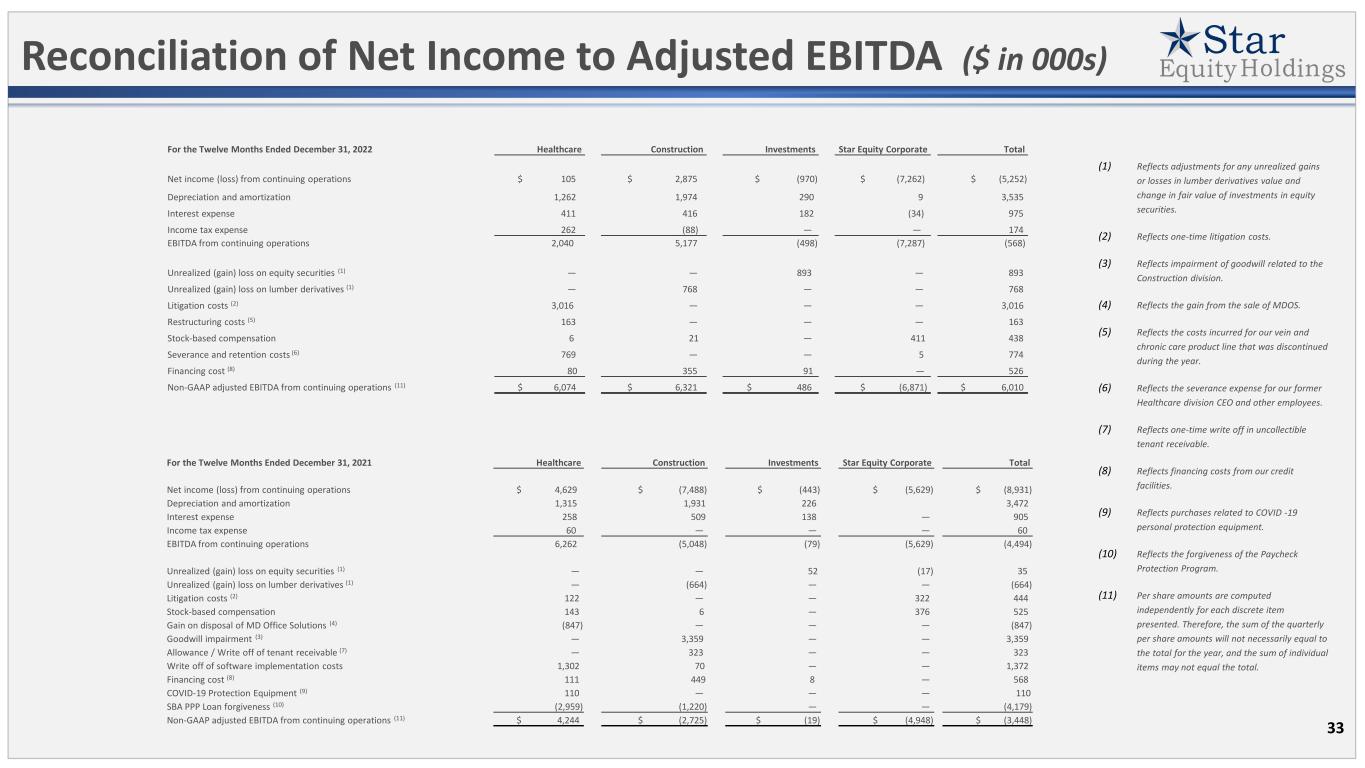

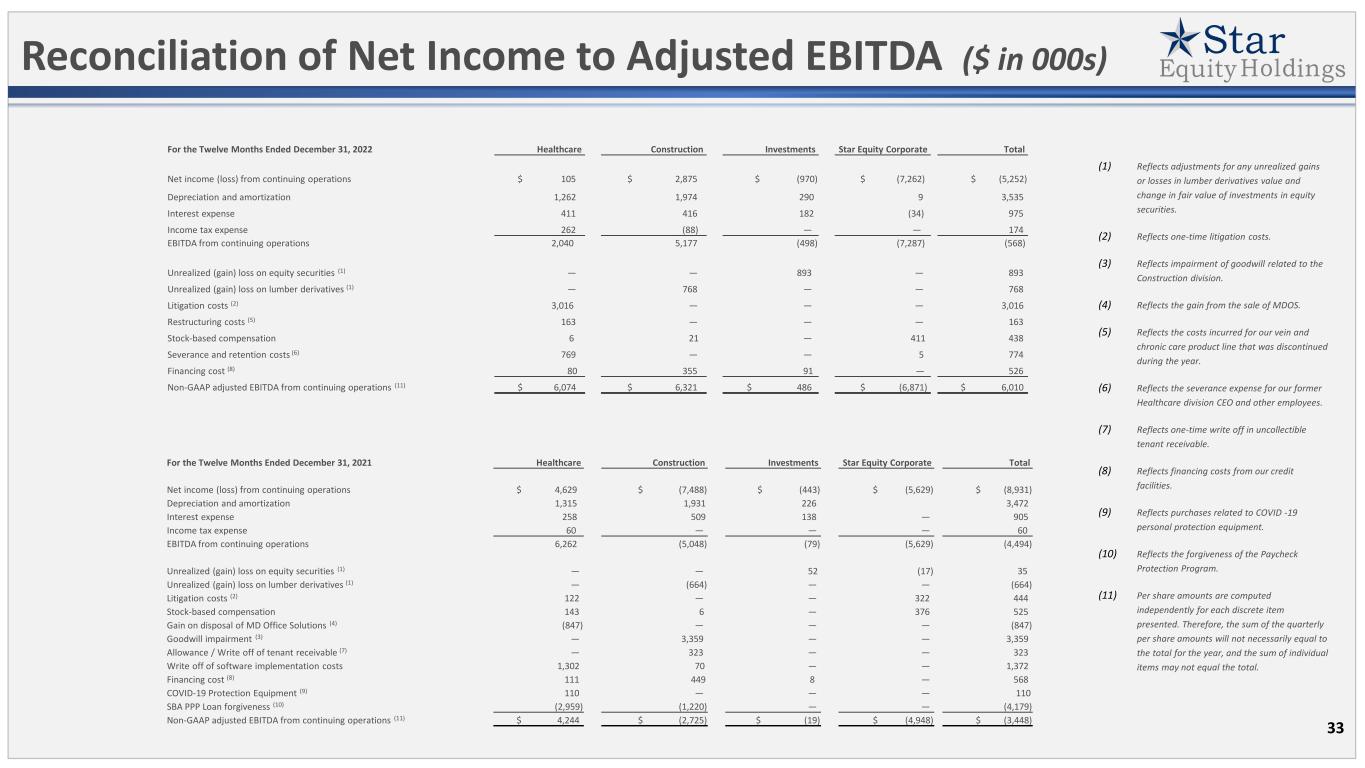

Reconciliation of Net Income to Adjusted EBITDA ($ in 000s) (1) Reflects adjustments for any unrealized gains or losses in lumber derivatives value and change in fair value of investments in equity securities. (2) Reflects one-time litigation costs. (3) Reflects impairment of goodwill related to the Construction division. (4) Reflects the gain from the sale of MDOS. (5) Reflects the costs incurred for our vein and chronic care product line that was discontinued during the year. (6) Reflects the severance expense for our former Healthcare division CEO and other employees. (7) Reflects one-time write off in uncollectible tenant receivable. (8) Reflects financing costs from our credit facilities. (9) Reflects purchases related to COVID -19 personal protection equipment. (10) Reflects the forgiveness of the Paycheck Protection Program. (11) Per share amounts are computed independently for each discrete item presented. Therefore, the sum of the quarterly per share amounts will not necessarily equal to the total for the year, and the sum of individual items may not equal the total. 33 For the Twelve Months Ended December 31, 2022 Healthcare Construction Investments Star Equity Corporate Total Net income (loss) from continuing operations $ 105 $ 2,875 $ (970) $ (7,262) $ (5,252) Depreciation and amortization 1,262 1,974 290 9 3,535 Interest expense 411 416 182 (34) 975 Income tax expense 262 (88) — — 174 EBITDA from continuing operations 2,040 5,177 (498) (7,287) (568) Unrealized (gain) loss on equity securities (1) — — 893 — 893 Unrealized (gain) loss on lumber derivatives (1) — 768 — — 768 Litigation costs (2) 3,016 — — — 3,016 Restructuring costs (5) 163 — — — 163 Stock-based compensation 6 21 — 411 438 Severance and retention costs (6) 769 — — 5 774 Financing cost (8) 80 355 91 — 526 Non-GAAP adjusted EBITDA from continuing operations (11) $ 6,074 $ 6,321 $ 486 $ (6,871) $ 6,010 For the Twelve Months Ended December 31, 2021 Healthcare Construction Investments Star Equity Corporate Total Net income (loss) from continuing operations $ 4,629 $ (7,488) $ (443) $ (5,629) $ (8,931) Depreciation and amortization 1,315 1,931 226 3,472 Interest expense 258 509 138 — 905 Income tax expense 60 — — — 60 EBITDA from continuing operations 6,262 (5,048) (79) (5,629) (4,494) Unrealized (gain) loss on equity securities (1) — — 52 (17) 35 Unrealized (gain) loss on lumber derivatives (1) — (664) — — (664) Litigation costs (2) 122 — — 322 444 Stock-based compensation 143 6 — 376 525 Gain on disposal of MD Office Solutions (4) (847) — — — (847) Goodwill impairment (3) — 3,359 — — 3,359 Allowance / Write off of tenant receivable (7) — 323 — — 323 Write off of software implementation costs 1,302 70 — — 1,372 Financing cost (8) 111 449 8 — 568 COVID-19 Protection Equipment (9) 110 — — — 110 SBA PPP Loan forgiveness (10) (2,959) (1,220) — — (4,179) Non-GAAP adjusted EBITDA from continuing operations (11) $ 4,244 $ (2,725) $ (19) $ (4,948) $ (3,448)

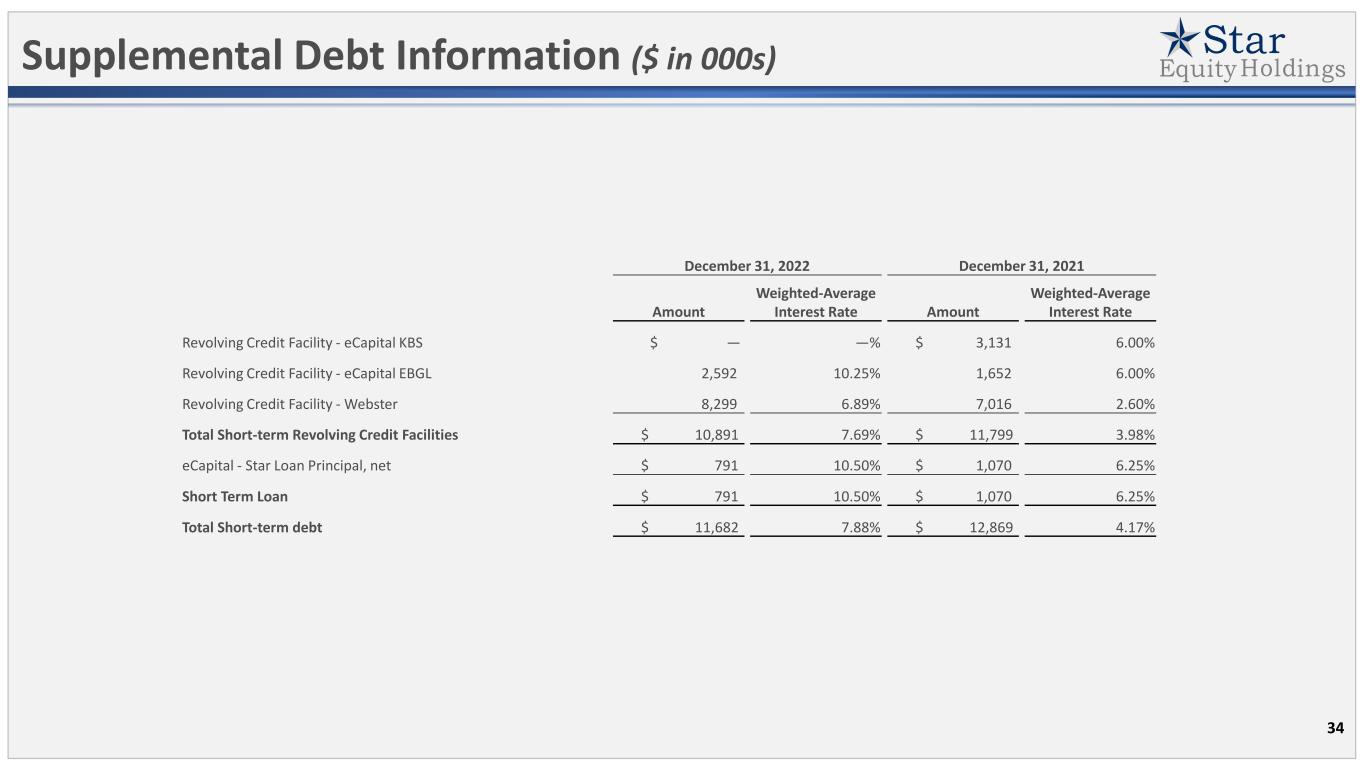

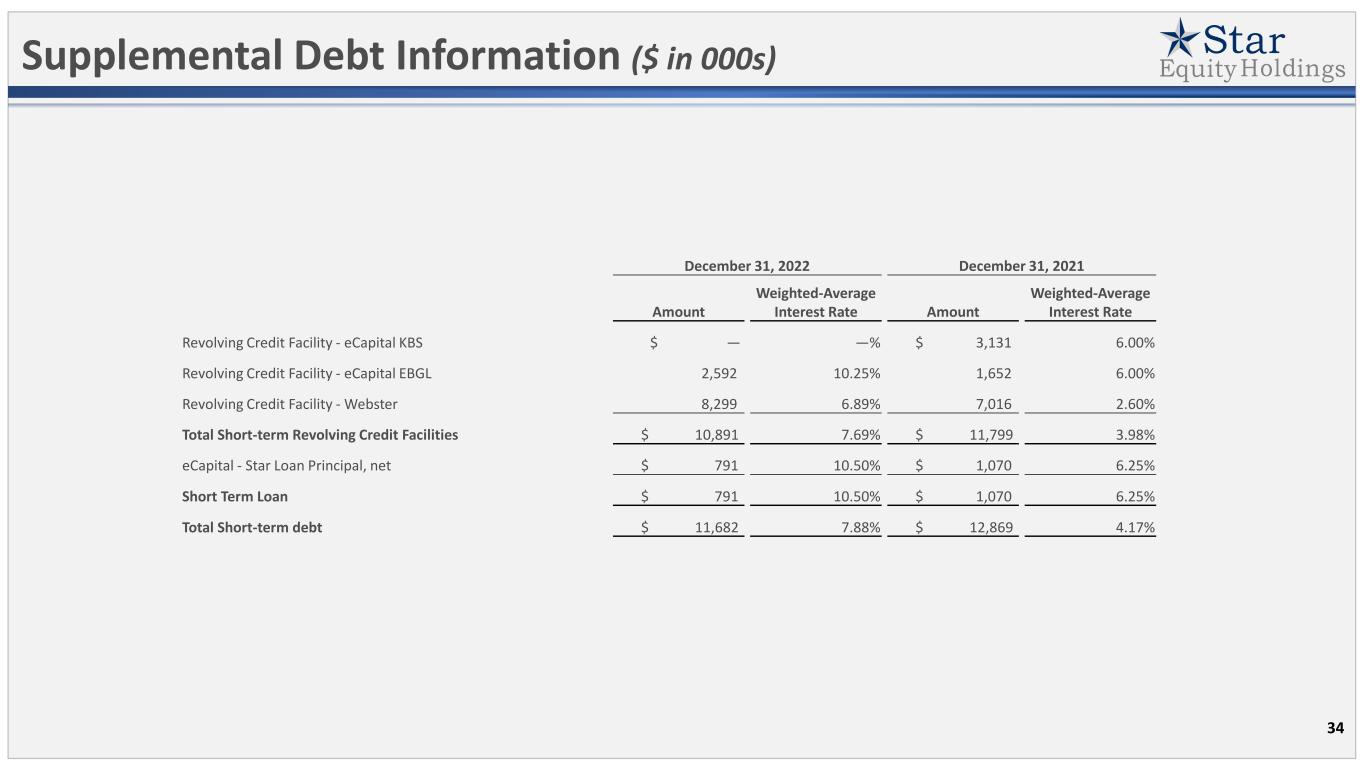

Supplemental Debt Information ($ in 000s) 34 December 31, 2022 December 31, 2021 Amount Weighted-Average Interest Rate Amount Weighted-Average Interest Rate Revolving Credit Facility - eCapital KBS $ — —% $ 3,131 6.00% Revolving Credit Facility - eCapital EBGL 2,592 10.25% 1,652 6.00% Revolving Credit Facility - Webster 8,299 6.89% 7,016 2.60% Total Short-term Revolving Credit Facilities $ 10,891 7.69% $ 11,799 3.98% eCapital - Star Loan Principal, net $ 791 10.50% $ 1,070 6.25% Short Term Loan $ 791 10.50% $ 1,070 6.25% Total Short-term debt $ 11,682 7.88% $ 12,869 4.17%

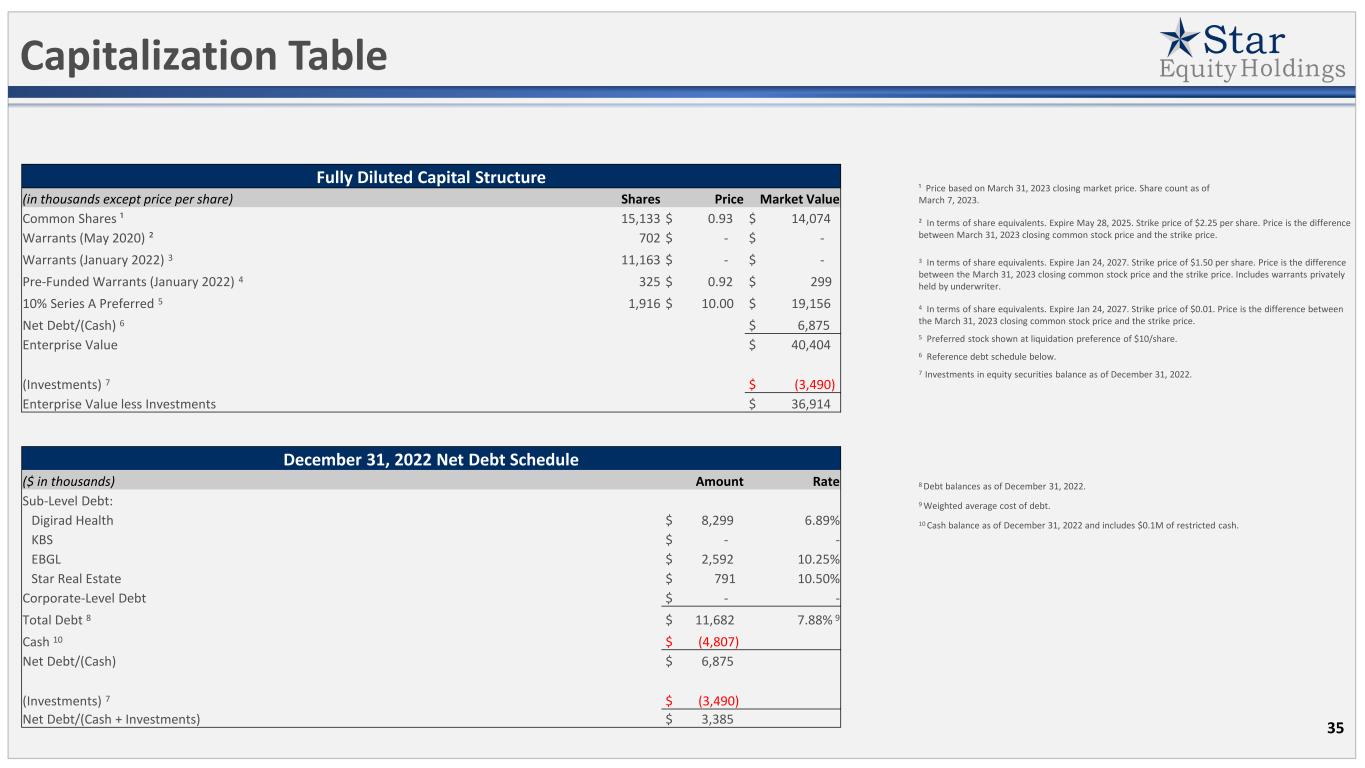

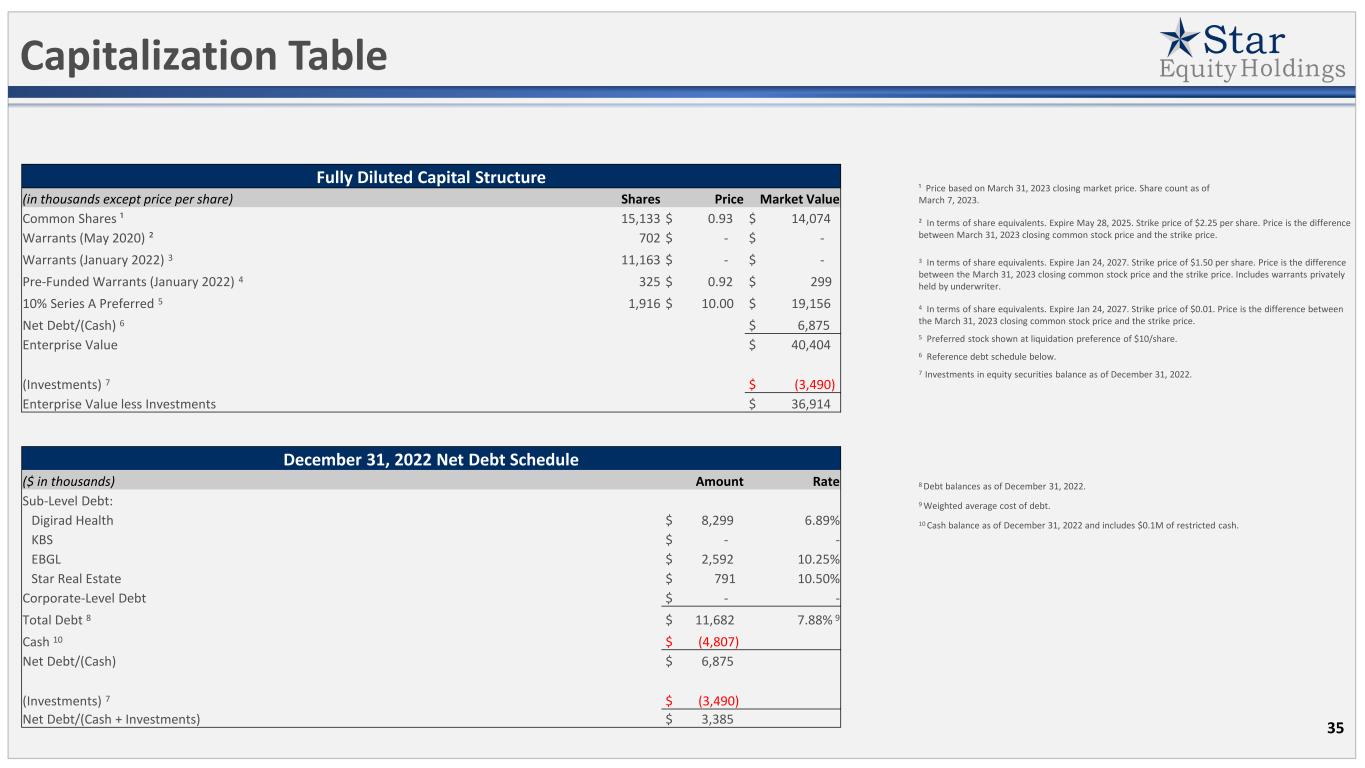

35 Capitalization Table 8 Debt balances as of December 31, 2022. 9 Weighted average cost of debt. 10 Cash balance as of December 31, 2022 and includes $0.1M of restricted cash. ¹ Price based on March 31, 2023 closing market price. Share count as of March 7, 2023. ² In terms of share equivalents. Expire May 28, 2025. Strike price of $2.25 per share. Price is the difference between March 31, 2023 closing common stock price and the strike price. 3 In terms of share equivalents. Expire Jan 24, 2027. Strike price of $1.50 per share. Price is the difference between the March 31, 2023 closing common stock price and the strike price. Includes warrants privately held by underwriter. 4 In terms of share equivalents. Expire Jan 24, 2027. Strike price of $0.01. Price is the difference between the March 31, 2023 closing common stock price and the strike price. 5 Preferred stock shown at liquidation preference of $10/share. 6 Reference debt schedule below. 7 Investments in equity securities balance as of December 31, 2022. Fully Diluted Capital Structure (in thousands except price per share) Shares Price Market Value Common Shares ¹ 15,133 $ 0.93 $ 14,074 Warrants (May 2020) ² 702 $ - $ - Warrants (January 2022) 3 11,163 $ - $ - Pre-Funded Warrants (January 2022) 4 325 $ 0.92 $ 299 10% Series A Preferred 5 1,916 $ 10.00 $ 19,156 Net Debt/(Cash) 6 $ 6,875 Enterprise Value $ 40,404 (Investments) 7 $ (3,490) Enterprise Value less Investments $ 36,914 December 31, 2022 Net Debt Schedule ($ in thousands) Amount Rate Sub-Level Debt: Digirad Health $ 8,299 6.89% KBS $ - - EBGL $ 2,592 10.25% Star Real Estate $ 791 10.50% Corporate-Level Debt $ - - Total Debt 8 $ 11,682 7.88% 9 Cash 10 $ (4,807) Net Debt/(Cash) $ 6,875 (Investments) 7 $ (3,490) Net Debt/(Cash + Investments) $ 3,385

Other Publicly-Traded Holding Companies 36 (1) Based on data as of 3/31/23 - $ in millions. (2) Incentive fees paid to management teams. (3) SPLP is a publicly-traded partnership as opposed to a C-corp structure. Small Cap: Ticker Market Cap(1) Business Highlights Elah Holdings Inc. ELLH 44 • Recently reorganized holding company • Co-sponsored by funds managed by 210 Capital and Goldman Sachs Asset Management Crawford United Corp CRAWA 59 • Aerospace manufacturing • Marketing technology • Metal, silicone, and hydraulic hoses • Air handling and energy efficient solutions Great Elm Group Inc. GEG 69 • Durable medical equipment • Investment management and Real estate ALJ Regional Holdings Inc. ALJJ 70 • Business process outsourcing services BBX Capital Corp BBXIA 93 • Vacation ownership interests • Real estate • Chocolate and confectionary products Aimia Inc. AIMFF 226 • Holding Company • Communications Services SWK Holdings Corp SWKH 229 • Financial services for life science companies, including royalty-related financing INNOVATE Corp VATE 234 • Infrastructure • Life sciences • Broadcasting Boston Omaha Corp(2) BOC 730 • Insurance services • Outdoor advertising services B. Riley Financial Inc. RILY 818 • Financial services • Internet access and related subscription services • Telecom and VOIP services Steel Partners Holdings LP(2),(3) SPLP 946 • Diversified industrial manufacturing • Oil drilling and production services • Financial services Compass Diversified Holdings CODI 1,378 • Consumer goods manufacturing • Environmental services

Contact Us Investor Relations Lena Cati The Equity Group Inc. Senior Vice President 212-836-9611 / lcati@equityny.com 37 Jeff Eberwein Executive Chairman Rick Coleman CEO David Noble CFO admin@starequity.com