Timber Technologies, LLC and Affiliate Colfax, Wisconsin Combined Financial Statements December 31, 2023 and 2022 Timber Technologies, LLC and Affiliate Table of Contents Page Independent Auditor's Report 1 - 2 Combined Financial Statements Combined Balance Sheets 3 Combined Statements of Operations 4 Combined Statements of Changes in Members' Equity 5 Combined Statements of Cash Flows 6 Notes to the Combined Financial Statements 7 - 12 Independent Auditor's Report To the Members' Timber Technologies, LLC and Affiliate Colfax, Wisconsin Opinion We have audited the accompanying combined financial statements of Timber Technologies, LLC and Affiliate (the Entity), which comprise the combined balance sheets as of December 31, 2023 and 2022, and the related combined statements of operations, changes in members' equity and cash flows for the years then ended, and the related notes to the combined financial statements. In our opinion, the combined financial statements referred to above present fairly, in all material respects, the financial position of Timber Technologies, LLC and Affiliate as of December 31, 2023 and 2022, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Our responsibilities under those standards are further described in the Auditor's Responsibilities for the Audit of the combined Financial Statements section of our report. We are required to be independent of Timber Technologies, LLC and Affiliate and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Financial Statements Management is responsible for the preparation and fair presentation of these combined financial statements in accordance with accounting principles generally accepted in the United States of America and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of combined financial statements that are free from material misstatement, whether due to fraud or error. In preparing the combined financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about Timber Technologies, LLC and Affiliate's ability to continue as a going concern within one year after the date that the combined financial statements are available to be issued. Auditor's Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the combined financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with generally accepted auditing standards will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in aggregate, they would influence the judgment made by a reasonable user based on the combined financial statements. 1 MN: Eden Prairie, Mankato, Minneapolis (t) 952.893.9320 FL: Naples (t) 239.325.1100 BoulayGroup.com Independent Auditor's Report In performing an audit in accordance with generally accepted auditing standards, we: Exercise professional judgment and maintain professional skepticism throughout the audit. Identify and assess the risks of material misstatement of the combined financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the combined financial statements. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances but not for the purpose of expressing an opinion on the effectiveness of Timber Technologies, LLC and Affiliate's internal control. Accordingly, no such opinion is expressed. Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management as well as evaluate the overall presentation of the combined financial statements. Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about Timber Technologies, LLC and Affiliate's ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control related matters that we identified during the audit. Minneapolis, Minnesota July 24, 2024 2

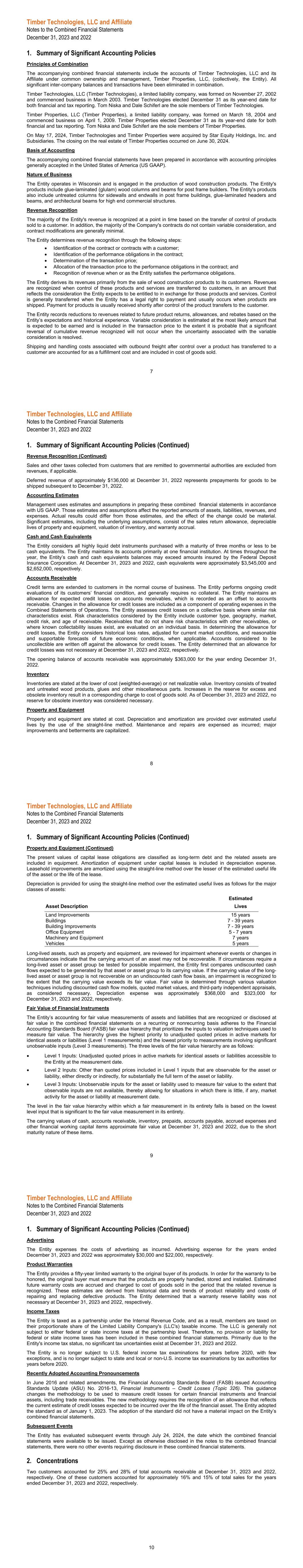

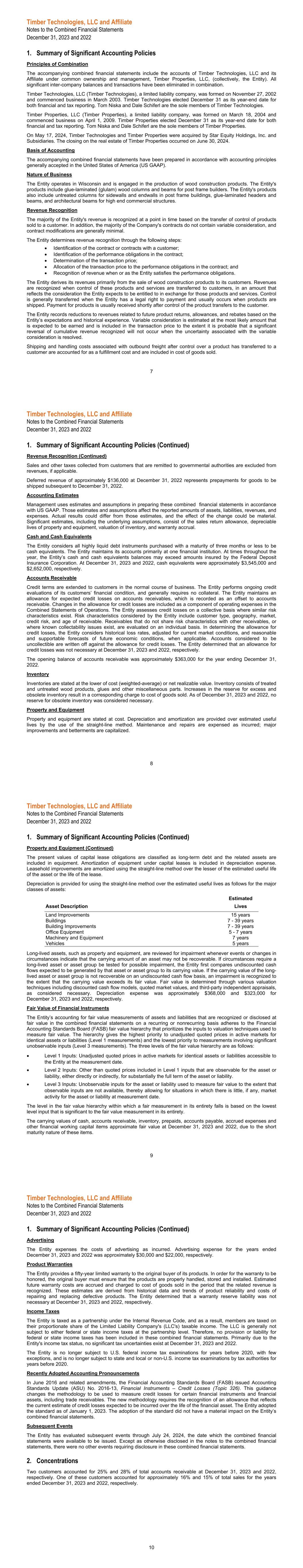

Timber Technologies, LLC and Affiliate Combined Balance Sheets December 31, 2023 2022 Assets Current assets Cash and cash equivalents $ 4,228,380 $ 3,962,819 Accounts receivable 691,042 578,143 Inventory 1,078,380 1,285,866 Other current assets 4,109 4,044 Total current assets 6,001,911 5,830,872 Property and equipment, net 4,535,146 3,910,448 Total Assets $ 10,537,057 $ 9,741,320 Liabilities And Members' Equity Current liabilities Accounts payable $ 206,259 $ 328,473 Accrued expenses 284,443 253,729 Deferred revenue - 135,503 Accrued distributions 500,000 - Total current liabilities 990,702 717,705 Commitments and contingencies Members' equity 9,546,355 9,023,615 Total Liabilities And Members' Equity $ 10,537,057 $ 9,741,320 The accompanying notes are an integral part of these combined financial statements. 3 Timber Technologies, LLC and Affiliate Combined Statements of Operations For the Years Ended December 31, 2023 % of Revenue, net 2022 % of Revenue, net Revenue, net $ 18,686,082 %100.0 $ 19,790,974 %100.0 Cost of revenues 11,738,993 %62.8 13,435,575 %67.9 Gross profit 6,947,089 %37.2 6,355,399 %32.1 Operating expenses 1,419,440 %7.6 1,223,047 %6.2 Operating income 5,527,649 %29.6 5,132,352 %25.9 Other income Interest income 59,258 %0.3 14,870 %0.1 Other income 40,294 %0.2 1,057 %- Total other income 99,552 %0.5 15,927 %0.1 Net Income $ 5,627,201 %30.1 $ 5,148,279 %26.0 The accompanying notes are an integral part of these combined financial statements. 4 Timber Technologies, LLC and Affiliate Combined Statements of Changes in Members' Equity For the Years Ended December 31, 2023 and 2022 Members' Equity [1] Affiliate's Members' Equity [2] Total Members' Equity Balance at December 31, 2021 $ 5,147,151 $ 3,095,787 $ 8,242,938 Dividends/distributions (4,267,601) (100,001) (4,367,602) Net income (loss) 4,997,909 150,370 5,148,279 Balance at December 31, 2022 5,877,459 3,146,156 9,023,615 Distributions (4,604,461) (500,000) (5,104,461) Net income (loss) 5,435,125 192,076 5,627,201 Balance at December 31, 2023 $ 6,708,123 $ 2,838,232 $ 9,546,355 [1] - Members' equity includes Timber Technologies, LLC. Timber Properties has 50 voting and 50 non-voting membership units authorized, issued, and outstanding. [2] - Affiliates' equity includes Timber Properties, LLC. Timber Properties has 50 voting and 50 non-voting membership units authorized, issued, and outstanding. The accompanying notes are an integral part of these combined financial statements. 5 Timber Technologies, LLC and Affiliate Combined Statements of Cash Flows For the Years Ended December 31, 2023 2022 Cash Flows from Operating Activities Net income $ 5,627,201 $ 5,148,279 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation 367,982 322,875 Gain on sale of asset - (33,000) Changes in operating assets and liabilities: Accounts receivable (112,899) (215,020) Inventory 207,486 (472,525) Other current assets (65) (4,044) Accounts payable (122,214) 159,176 Accrued expenses 30,714 84,103 Deferred revenue (135,503) 135,503 Net cash provided by operating activities 5,862,702 5,125,347 Cash Flows from Investing Activities Capital expenditures (992,680) (834,505) Proceeds from sale of equipment - 33,000 Net cash used in investing activities (992,680) (801,505) Cash Flows from Financing Activities Distributions paid to members (4,604,461) (4,367,602) Net cash used in financing activities (4,604,461) (4,367,602) Net Increase (Decrease) in Cash and Cash Equivalents 265,561 (43,760) Cash and Cash Equivalents - Beginning of Year 3,962,819 4,006,579 Cash and Cash Equivalents - End of Year $ 4,228,380 $ 3,962,819 Supplemental Disclosure of Non-Cash Investing and Financing Activities: Accrued distributions $ 500,000 $ - The accompanying notes are an integral part of these combined financial statements. 6

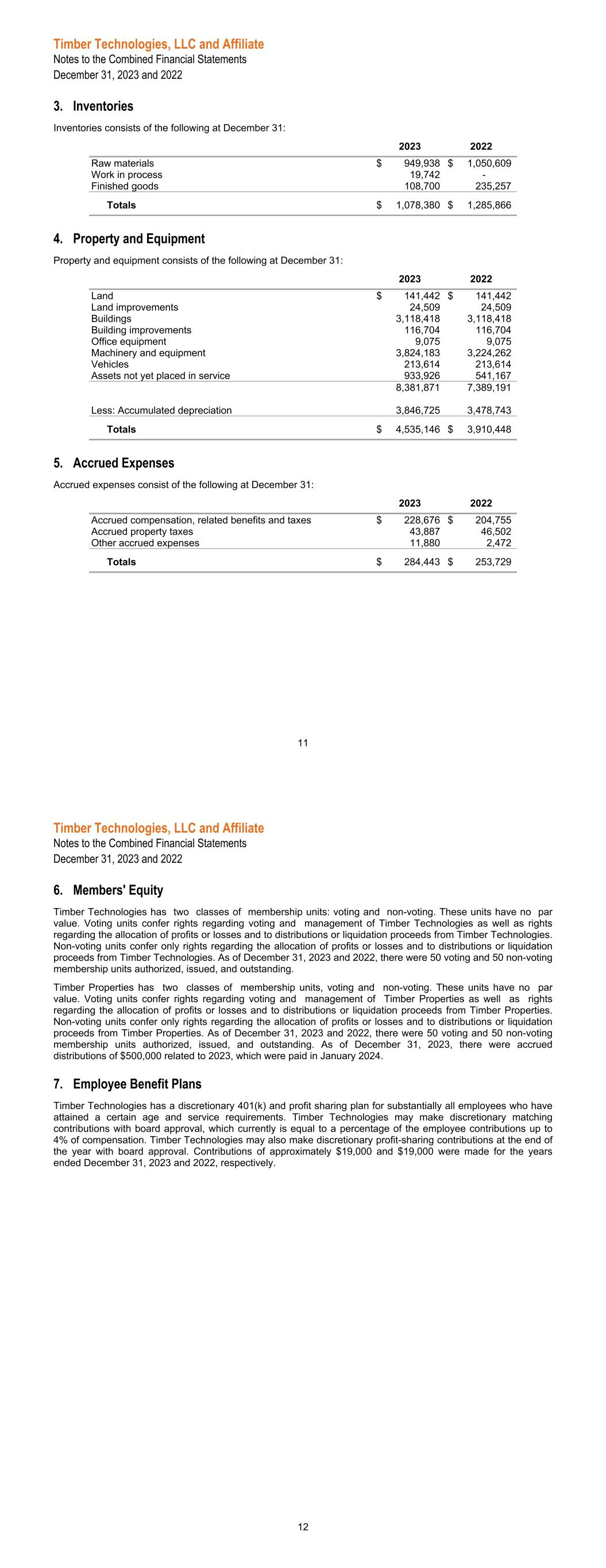

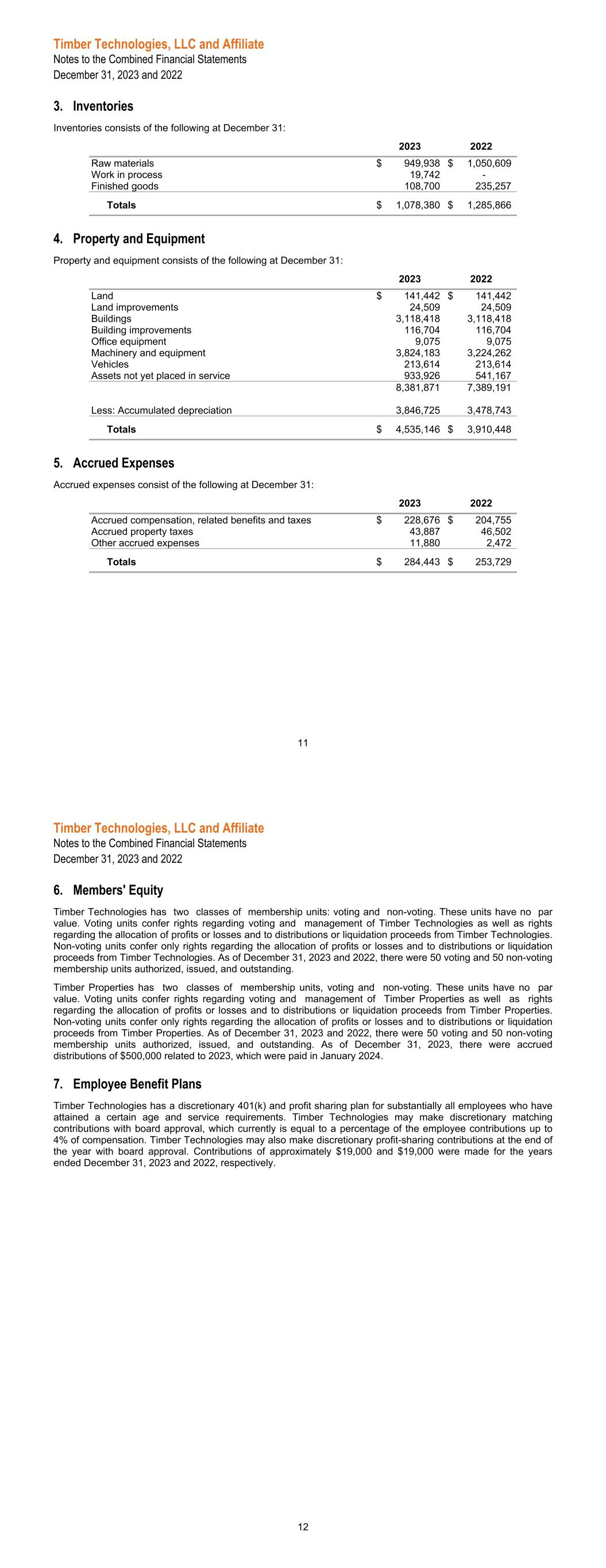

Timber Technologies, LLC and Affiliate Notes to the Combined Financial Statements December 31, 2023 and 2022 1. Summary of Significant Accounting Policies Principles of Combination The accompanying combined financial statements include the accounts of Timber Technologies, LLC and its Affiliate under common ownership and management, Timber Properties, LLC, (collectively, the Entity). All significant inter-company balances and transactions have been eliminated in combination. Timber Technologies, LLC (Timber Technologies), a limited liability company, was formed on November 27, 2002 and commenced business in March 2003. Timber Technologies elected December 31 as its year-end date for both financial and tax reporting. Tom Niska and Dale Schiferl are the sole members of Timber Technologies. Timber Properties, LLC (Timber Properties), a limited liability company, was formed on March 18, 2004 and commenced business on April 1, 2009. Timber Properties elected December 31 as its year-end date for both financial and tax reporting. Tom Niska and Dale Schiferl are the sole members of Timber Properties. On May 17, 2024, Timber Technologies and Timber Properties were acquired by Star Equity Holdings, Inc. and Subsidiaries. The closing on the real estate of Timber Properties occurred on June 30, 2024. Basis of Accounting The accompanying combined financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (US GAAP). Nature of Business The Entity operates in Wisconsin and is engaged in the production of wood construction products. The Entity's products include glue-laminated (glulam) wood columns and beams for post frame builders. The Entity's products also include untreated columns for sidewalls and endwalls in post frame buildings, glue-laminated headers and beams, and architectural beams for high end commercial structures. Revenue Recognition The majority of the Entity's revenue is recognized at a point in time based on the transfer of control of products sold to a customer. In addition, the majority of the Company's contracts do not contain variable consideration, and contract modifications are generally minimal. The Entity determines revenue recognition through the following steps: Identification of the contract or contracts with a customer; Identification of the performance obligations in the contract; Determination of the transaction price; Allocation of the transaction price to the performance obligations in the contract; and Recognition of revenue when or as the Entity satisfies the performance obligations. The Entity derives its revenues primarily from the sale of wood construction products to its customers. Revenues are recognized when control of these products and services are transferred to customers, in an amount that reflects the consideration the Entity expects to be entitled to in exchange for those products and services. Control is generally transferred when the Entity has a legal right to payment and usually occurs when products are shipped. Payment for products is usually received shortly after control of the product transfers to the customer. The Entity records reductions to revenues related to future product returns, allowances, and rebates based on the Entity’s expectations and historical experience. Variable consideration is estimated at the most likely amount that is expected to be earned and is included in the transaction price to the extent it is probable that a significant reversal of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is resolved. Shipping and handling costs associated with outbound freight after control over a product has transferred to a customer are accounted for as a fulfillment cost and are included in cost of goods sold. 7 Timber Technologies, LLC and Affiliate Notes to the Combined Financial Statements December 31, 2023 and 2022 1. Summary of Significant Accounting Policies (Continued) Revenue Recognition (Continued) Sales and other taxes collected from customers that are remitted to governmental authorities are excluded from revenues, if applicable. Deferred revenue of approximately $136,000 at December 31, 2022 represents prepayments for goods to be shipped subsequent to December 31, 2022. Accounting Estimates Management uses estimates and assumptions in preparing these combined financial statements in accordance with US GAAP. Those estimates and assumptions affect the reported amounts of assets, liabilities, revenues, and expenses. Actual results could differ from those estimates, and the effect of the change could be material. Significant estimates, including the underlying assumptions, consist of the sales return allowance, depreciable lives of property and equipment, valuation of inventory, and warranty accrual. Cash and Cash Equivalents The Entity considers all highly liquid debt instruments purchased with a maturity of three months or less to be cash equivalents. The Entity maintains its accounts primarily at one financial institution. At times throughout the year, the Entity’s cash and cash equivalents balances may exceed amounts insured by the Federal Deposit Insurance Corporation. At December 31, 2023 and 2022, cash equivalents were approximately $3,545,000 and $2,652,000, respectively. Accounts Receivable Credit terms are extended to customers in the normal course of business. The Entity performs ongoing credit evaluations of its customers’ financial condition, and generally requires no collateral. The Entity maintains an allowance for expected credit losses on accounts receivables, which is recorded as an offset to accounts receivable. Changes in the allowance for credit losses are included as a component of operating expenses in the Combined Statements of Operations. The Entity assesses credit losses on a collective basis where similar risk characteristics exist. Risk characteristics considered by the Entity include customer type, geography, market, credit risk, and age of receivable. Receivables that do not share risk characteristics with other receivables, or where known collectability issues exist, are evaluated on an individual basis. In determining the allowance for credit losses, the Entity considers historical loss rates, adjusted for current market conditions, and reasonable and supportable forecasts of future economic conditions, when applicable. Accounts considered to be uncollectible are written off against the allowance for credit losses. The Entity determined that an allowance for credit losses was not necessary at December 31, 2023 and 2022, respectively. The opening balance of accounts receivable was approximately $363,000 for the year ending December 31, 2022. Inventory Inventories are stated at the lower of cost (weighted-average) or net realizable value. Inventory consists of treated and untreated wood products, glues and other miscellaneous parts. Increases in the reserve for excess and obsolete inventory result in a corresponding charge to cost of goods sold. As of December 31, 2023 and 2022, no reserve for obsolete inventory was considered necessary. Property and Equipment Property and equipment are stated at cost. Depreciation and amortization are provided over estimated useful lives by the use of the straight-line method. Maintenance and repairs are expensed as incurred; major improvements and betterments are capitalized. 8 Timber Technologies, LLC and Affiliate Notes to the Combined Financial Statements December 31, 2023 and 2022 1. Summary of Significant Accounting Policies (Continued) Property and Equipment (Continued) The present values of capital lease obligations are classified as long-term debt and the related assets are included in equipment. Amortization of equipment under capital leases is included in depreciation expense. Leasehold improvements are amortized using the straight-line method over the lesser of the estimated useful life of the asset or the life of the lease. Depreciation is provided for using the straight-line method over the estimated useful lives as follows for the major classes of assets: Asset Description Estimated Lives Land Improvements 15 years Buildings 7 - 39 years Building Improvements 7 - 39 years Office Equipment 5 - 7 years Machinery and Equipment 7 years Vehicles 5 years Long-lived assets, such as property and equipment, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. If circumstances require a long-lived asset or asset group be tested for possible impairment, the Entity first compares undiscounted cash flows expected to be generated by that asset or asset group to its carrying value. If the carrying value of the long- lived asset or asset group is not recoverable on an undiscounted cash flow basis, an impairment is recognized to the extent that the carrying value exceeds its fair value. Fair value is determined through various valuation techniques including discounted cash flow models, quoted market values, and third-party independent appraisals, as considered necessary. Depreciation expense was approximately $368,000 and $323,000 for December 31, 2023 and 2022, respectively. Fair Value of Financial Instruments The Entity’s accounting for fair value measurements of assets and liabilities that are recognized or disclosed at fair value in the combined financial statements on a recurring or nonrecurring basis adheres to the Financial Accounting Standards Board (FASB) fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to measurements involving significant unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are as follows: Level 1 Inputs: Unadjusted quoted prices in active markets for identical assets or liabilities accessible to the Entity at the measurement date. Level 2 Inputs: Other than quoted prices included in Level 1 inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the asset or liability. Level 3 Inputs: Unobservable inputs for the asset or liability used to measure fair value to the extent that observable inputs are not available, thereby allowing for situations in which there is little, if any, market activity for the asset or liability at measurement date. The level in the fair value hierarchy within which a fair measurement in its entirety falls is based on the lowest level input that is significant to the fair value measurement in its entirety. The carrying values of cash, accounts receivable, inventory, prepaids, accounts payable, accrued expenses and other financial working capital items approximate fair value at December 31, 2023 and 2022, due to the short maturity nature of these items. 9 Timber Technologies, LLC and Affiliate Notes to the Combined Financial Statements December 31, 2023 and 2022 1. Summary of Significant Accounting Policies (Continued) Advertising The Entity expenses the costs of advertising as incurred. Advertising expense for the years ended December 31, 2023 and 2022 was approximately $30,000 and $22,000, respectively. Product Warranties The Entity provides a fifty-year limited warranty to the original buyer of its products. In order for the warranty to be honored, the original buyer must ensure that the products are properly handled, stored and installed. Estimated future warranty costs are accrued and charged to cost of goods sold in the period that the related revenue is recognized. These estimates are derived from historical data and trends of product reliability and costs of repairing and replacing defective products. The Entity determined that a warranty reserve liability was not necessary at December 31, 2023 and 2022, respectively. Income Taxes The Entity is taxed as a partnership under the Internal Revenue Code, and as a result, members are taxed on their proportionate share of the Limited Liability Company's (LLC's) taxable income. The LLC is generally not subject to either federal or state income taxes at the partnership level. Therefore, no provision or liability for federal or state income taxes has been included in these combined financial statements. Primarily due to the Entity's income tax status, no significant tax uncertainties exist at December 31, 2023 and 2022. The Entity is no longer subject to U.S. federal income tax examinations for years before 2020, with few exceptions, and is no longer subject to state and local or non-U.S. income tax examinations by tax authorities for years before 2020. Recently Adopted Accounting Pronouncements In June 2016 and related amendments, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2016-13, Financial Instruments – Credit Losses (Topic 326). This guidance changes the methodology to be used to measure credit losses for certain financial instruments and financial assets, including trade receivables. The new methodology requires the recognition of an allowance that reflects the current estimate of credit losses expected to be incurred over the life of the financial asset. The Entity adopted the standard as of January 1, 2023. The adoption of the standard did not have a material impact on the Entity’s combined financial statements. Subsequent Events The Entity has evaluated subsequent events through July 24, 2024, the date which the combined financial statements were available to be issued. Except as otherwise disclosed in the notes to the combined financial statements, there were no other events requiring disclosure in these combined financial statements. 2. Concentrations Two customers accounted for 25% and 28% of total accounts receivable at December 31, 2023 and 2022, respectively. One of these customers accounted for approximately 16% and 15% of total sales for the years ended December 31, 2023 and 2022, respectively. 10

Timber Technologies, LLC and Affiliate Notes to the Combined Financial Statements December 31, 2023 and 2022 3. Inventories Inventories consists of the following at December 31: 2023 2022 Raw materials $ 949,938 $ 1,050,609 Work in process 19,742 - Finished goods 108,700 235,257 Totals $ 1,078,380 $ 1,285,866 4. Property and Equipment Property and equipment consists of the following at December 31: 2023 2022 Land $ 141,442 $ 141,442 Land improvements 24,509 24,509 Buildings 3,118,418 3,118,418 Building improvements 116,704 116,704 Office equipment 9,075 9,075 Machinery and equipment 3,824,183 3,224,262 Vehicles 213,614 213,614 Assets not yet placed in service 933,926 541,167 8,381,871 7,389,191 Less: Accumulated depreciation 3,846,725 3,478,743 Totals $ 4,535,146 $ 3,910,448 5. Accrued Expenses Accrued expenses consist of the following at December 31: 2023 2022 Accrued compensation, related benefits and taxes $ 228,676 $ 204,755 Accrued property taxes 43,887 46,502 Other accrued expenses 11,880 2,472 Totals $ 284,443 $ 253,729 11 Timber Technologies, LLC and Affiliate Notes to the Combined Financial Statements December 31, 2023 and 2022 6. Members' Equity Timber Technologies has two classes of membership units: voting and non-voting. These units have no par value. Voting units confer rights regarding voting and management of Timber Technologies as well as rights regarding the allocation of profits or losses and to distributions or liquidation proceeds from Timber Technologies. Non-voting units confer only rights regarding the allocation of profits or losses and to distributions or liquidation proceeds from Timber Technologies. As of December 31, 2023 and 2022, there were 50 voting and 50 non-voting membership units authorized, issued, and outstanding. Timber Properties has two classes of membership units, voting and non-voting. These units have no par value. Voting units confer rights regarding voting and management of Timber Properties as well as rights regarding the allocation of profits or losses and to distributions or liquidation proceeds from Timber Properties. Non-voting units confer only rights regarding the allocation of profits or losses and to distributions or liquidation proceeds from Timber Properties. As of December 31, 2023 and 2022, there were 50 voting and 50 non-voting membership units authorized, issued, and outstanding. As of December 31, 2023, there were accrued distributions of $500,000 related to 2023, which were paid in January 2024. 7. Employee Benefit Plans Timber Technologies has a discretionary 401(k) and profit sharing plan for substantially all employees who have attained a certain age and service requirements. Timber Technologies may make discretionary matching contributions with board approval, which currently is equal to a percentage of the employee contributions up to 4% of compensation. Timber Technologies may also make discretionary profit-sharing contributions at the end of the year with board approval. Contributions of approximately $19,000 and $19,000 were made for the years ended December 31, 2023 and 2022, respectively. 12