- LRCX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Lam Research (LRCX) DEF 14ADefinitive proxy

Filed: 17 Oct 02, 12:00am

Schedule 14A (Rule 14a-101) INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 Filed by the registrant [X] Filed by a party other than the registrant [ ] Check the appropriate box: [ ] Preliminary Proxy Statement [ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) [ X] Definitive Proxy Statement [ ] Definitive Additional Materials [ ] Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 LAM RESEARCH CORPORATION (Name of Registrant as specified in its Charter) Payment of Filing Fee (Check the appropriate box): [ X] No fee required [ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: [ ] Fee paid previously with preliminary materials [ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount previously paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: |

|

|

Proxy Statement and October 14, 2002 Fellow Stockholders, Fiscal 2002 was a difficult period for Lam Research Corporation. The Company posted its first annual loss since fiscal 1999. Our global semiconductor customers addressed historically poor market conditions and made deep capital spending cuts. This situation has affected all capital equipment suppliers; according to market researcher Gartner Dataquest, overall industry revenues declined almost 29% in calendar year 2001 with a further decline of 27% forecasted for calendar year 2002. Times like these test the mettle of individuals and organizations, and we have responded with dedication, innovation, and stamina. Despite the difficult environment, we maintained a strong overall cash position of over $600 million following the September 2002 payback of our $310 million bond. We gained market share in critical Asian markets and in sales of 300-mm capable systems. In one of the most important structural changes in the history of our company, we adopted new outsourcing strategies and practices that position us to be leaner and stronger fundamentally, and better able to weather our industry’s business cycles. While outsourcing is not new to the semiconductor equipment industry, our approach reaches the core of our operations, financial model, and ability to assemble and retain the teams of highly skilled people who will build our future. At the heart of the plan is a transition to a more variable cost structure, which will allow expenses to track revenues more closely. We are shifting the execution of the labor-intensive transaction functions of manufacturing and warehousing and special-skills functions of information technology and facilities support and maintenance to world-class suppliers. Lam employees will be focused on the core functions required for success — product development, marketing, sales, and customer support — and the critical activities that support these core functions. This new approach provides many advantages, among them:

|

|

This strategy is already bearing fruit in our 2300TM Series of etch systems designed for next-generation processing of both 200- and 300-mm wafers. From a design perspective, these systems meet or exceed customer demand for powerful automated process control software, ease of service, and common parts (in fact, changing just nine parts alters the 2300 VersysTM etch system’s function from silicon to metal etch). On the manufacturing side, we have transferred the manufacturing of major assemblies and modules to our contract manufacturing suppliers and are already seeing cost and cycle-time benefits. We intend to apply these same practices to our mature 200-mm Alliance®-based etch products as well. Our investment in R&D was just over $179 million in fiscal 2002. While accounting for a higher percentage of revenues (19%) than we are targeting long term, this investment is essential to our ongoing effort to build market share in sub-180 nm applications. During fiscal 2002, we believe we achieved a significant increase in market share for sub-180 nm dielectric etch. Our leadership in etch is based on our patented TCP® and Dual Frequency ConfinedTM plasma technologies and positions us well for advanced and emerging device production. For CMP, our focus is on copper and shallow-trench isolation (STI) processes, which we expect to represent about half the available market by 2005. The semiconductor industry is the foundation of the trillion-dollar global electronics industry and represents one of the greatest concentrations of technology in the world. Although the current business environment is difficult, the chronic over capacity that has existed since 1996 is being corrected by the reduced capital expenditures that have affected our revenue levels. We believe that the semiconductor industry will once again experience the strong demand for new products that has historically characterized the beginning of a new cycle of growth. We are well positioned to benefit as investment in semiconductor manufacturing returns to levels that will support this next cycle. Before closing, we would like to note that fiscal 2002 included events that reminded us all of the need for strong communities and community values. We witnessed manmade and natural tragedies and the evidence of how quickly enterprises can crumble when not responsibly managed. At Lam, we continued our tradition of providing direct financial assistance to charities, including those helping the victims of the September 11th terrorist attacks and the Dresden flooding. As a company, we also reaffirm our commitment to forthright, ethical operations at all levels. Sincerely,  James W. Bagley  Stephen G. Newberry |

|

LAM RESEARCH CORPORATION NOTICE OF ANNUAL MEETING OF STOCKHOLDERS To the Stockholders: NOTICE IS HEREBY GIVEN that the 2002 Annual Meeting of Stockholders of Lam Research Corporation, a Delaware corporation (the “Company”), will be held on Thursday, November 7, 2002, 11:00 a.m., local time, at the principal executive offices of the Company at 4650 Cushing Parkway, Fremont, California 94538, for the following purposes: |

| ||

| 1. | to elect directors to serve for the ensuing year, and until their successors are elected; |

| ||

| 2. | to ratify the appointment of Ernst & Young LLP as independent auditors of the Company for the fiscal year ending June 29, 2003; and |

| ||

| 3. | to transact such other business as may properly come before the meeting, or any adjournment thereof. |

|

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Only stockholders of record at the close of business on September 13, 2002, are entitled to notice of and to vote at the meeting, and for any adjournment thereof. All stockholders are cordially invited to attend the meeting in person. However, to assure your representation at the meeting, you are urged to vote by proxy via telephone, Internet, or mail in accordance with the voting instructions on the proxy card. If you vote by mail, mark, sign, and date the enclosed proxy and return it as promptly as possible in the postage-prepaid and return-addressed envelope enclosed for that purpose. However, any stockholder of record attending the meeting may vote in person, even if he or she has returned a proxy. |

|

By Order of the Board of Directors, |

Fremont, California YOUR VOTE IS IMPORTANT In order to assure your representation at the meeting, you are requested to vote by proxy via telephone, Internet, or mail in accordance with the voting instructions on the proxy card. If you vote by mail, you should mark, sign, and date the enclosed proxy card as promptly as possible and return it in the enclosed return-addressed envelope. (No postage is needed if mailed in the United States.) |

|

LAM RESEARCH CORPORATION PROXY STATEMENT TABLE OF CONTENTS |

| Page | |

|---|---|

| Information Concerning Solicitation and Voting | 1 |

| Proposal No. 1 — Election of Directors | 3 |

| Security Ownership of Certain Beneficial Owners and Management | 6 |

| Director Compensation | 7 |

| Executive Compensation and Other Information | 7 |

| Certain Relationships and Related Transactions | 12 |

| Compensation Committee Interlocks and Insider Participation | 12 |

| Report of the Compensation Committee | 12 |

| Report of the Audit Committee | 15 |

| Relationship with Independent Auditors | 15 |

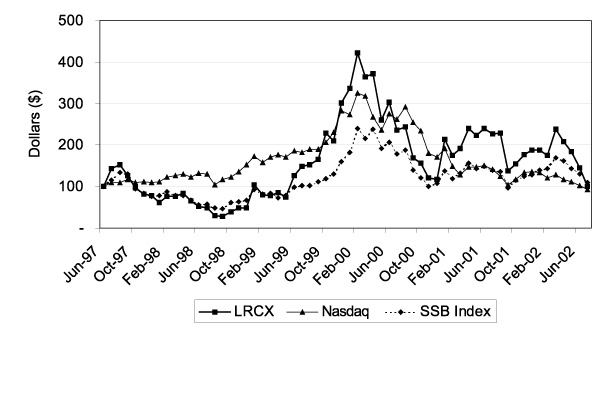

| Comparative Stock Performance | 16 |

| Proposal No. 2 — Ratification of Appointment of Independent Auditors | 17 |

| Section 16(a) Beneficial Ownership Reporting Compliance | 18 |

| Other Matters | 18 |

|

LAM RESEARCH CORPORATION PROXY STATEMENT FOR 2002 ANNUAL MEETING OF STOCKHOLDERS INFORMATION CONCERNING SOLICITATION AND VOTING General The enclosed proxy is solicited on behalf of Lam Research Corporation, a Delaware corporation (the “Company”), for use at the Annual Meeting of Stockholders to be held Thursday, November 7, 2002, at 11:00 a.m., local time (the “Annual Meeting”), or for any adjournment thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at the principal executive offices of the Company at 4650 Cushing Parkway, Fremont, California 94538. The Company’s telephone number at that location is (510) 572-0200. These proxy solicitation materials will be mailed on or about October 14, 2002, to all stockholders entitled to vote at the meeting. A copy of Lam Research Corporation’s 2002 Annual Report to Stockholders is attached to and accompanies this Proxy Statement. Record Date and Principal Share Ownership Stockholders of record at the close of business on September 13, 2002 are entitled to receive notice of and to vote at the Annual Meeting. At the record date, 125,257,046 shares of the Company’s Common Stock were outstanding. Revocability of Proxies Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to the Company a written notice of revocation or a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person. However, attending the Annual Meeting in and of itself does not constitute a revocation of a proxy. Voting and Solicitation Each stockholder voting on the election of directors may cumulate such stockholder’s votes and give one candidate a number of votes equal to the number of directors to be elected (seven at this meeting) multiplied by the number of shares held by such stockholder, or distribute the stockholder’s votes on the same principle among as many candidates as the stockholder deems appropriate. However, votes cannot be cast for more than seven candidates. No stockholder shall be entitled to cumulate votes for a candidate unless the candidate’s name has been placed in nomination prior to the voting. Where no vote is specified or where a vote FOR all nominees is marked, the cumulative votes represented by a proxy will be cast, unless contrary instructions are given, at the direction of the proxy holders in order to elect as many nominees as believed possible under the then-prevailing circumstances. If a stockholder desires to cumulate his or her votes, the accompanying proxy card should be marked to indicate clearly that the stockholder desires to exercise the right to cumulate votes and should specify how the votes are to be allocated among the nominees for directors. For example, a stockholder may write next to the name of the nominee or nominees for whom the stockholder desires to cast votes the number of votes to be cast for such nominee or nominees. Alternatively, without exercising his or her right to vote cumulatively, a stockholder may instruct the proxy holders not to vote for one or more nominees by writing the name(s) of such nominee or nominees on the space provided on the proxy card. Unless indicated to the contrary in the space provided on the proxy card, if a stockholder withholds authority to vote for one or more nominees, all cumulative votes of such stockholder will be distributed among the remaining nominees at the discretion of the proxy holders. On all other matters, each share has one vote. Votes cast by proxy or in person at the Annual Meeting will be tabulated by the Inspector of Elections (the “Inspector”). The Inspector will also determine whether or not a quorum is present. The seven candidates for election as directors at the Annual Meeting who receive the highest number of affirmative votes will be elected. The ratification of the independent auditors for the Company for the current fiscal year will require |

|

the affirmative vote of a majority of the shares of the Company’s Common Stock present or represented and entitled to vote at the Annual Meeting. In general, Delaware law provides that a quorum consists of a majority of the shares entitled to vote at the Annual Meeting. Abstentions will be treated as shares that are present or represented and entitled to vote for purposes of determining the presence of a quorum but will not be treated as votes in favor of approving any matter submitted to the stockholders for a vote. Thus, abstentions will have the same effect in this regard as negative votes. Any proxy that is properly dated, executed, and returned using the form of proxy enclosed will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares will be voted for the election of directors, for ratification of the appointment of the designated independent auditors, and, with respect to any other matter or matters that may come before the meeting, as the proxy holders deem advisable in accordance with their best judgment. If a broker indicates on the enclosed proxy or its substitute that he or she does not have discretionary authority as to certain shares to vote on a particular matter (“broker non-votes”), or with respect to shares as to which proxy authority has been withheld with respect to a matter, those shares will be counted as present in determining whether a quorum for the meeting is present but will not be considered as present or represented with respect to that matter. Thus broker non-votes will have no effect on either of the two proposals being voted on at the Annual Meeting. The Company believes that the tabulation procedures to be followed by the Inspector are consistent with the general statutory requirements in Delaware concerning voting of shares and determination of a quorum. Employee participants in the Lam Savings Plus Plan, Lam Research 401(k) (the “401(k) Plan”) who held Company stock in their personal 401(k) Plan accounts as of the record date are being provided with this Proxy Statement as a 401(k) Plan participant so that each such stockholder may vote his or her interest in the Company’s Common Stock as held in the 401(k) Plan. Upon receipt of properly marked and returned proxies, Lam Research Corporation as the 401(k) Plan Administrator or Security Trust Corporation as the Trustee will vote the aggregate voted proxies of the 401(k) Plan participants in accordance with the proxies received. If a 401(k) Plan participant does not vote his or her interest with respect to the proposals to be voted on at this year’s Annual Meeting, then those non-voted shares will not be voted. The cost of soliciting proxies will be borne by the Company. The Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. Proxies may also be solicited by certain of the Company’s directors, officers, and regular employees, without additional compensation, personally or by telephone or other communication means. Stockholder Proposals to be Included in the Company’s 2003 Proxy Statement Pursuant to Rule 14a-8(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), some stockholder proposals may be eligible for inclusion in the Company’s 2003 proxy statement. Any such proposal must be received by the Company no later than June 6, 2003. Stockholders interested in submitting such a proposal are advised to contact counsel familiar with the detailed requirements of the applicable securities rules. Stockholder Proposals and Nominations to be Voted on at 2003 Annual Meeting Stockholders of the Company may submit proposals, in addition to Rule 14a-8(e) proposals referred to above, that they believe should be voted on at the Annual Meeting or nominate persons for election to the Board of Directors. In accordance with the Company’s bylaws, any such proposal or nomination for the 2003 annual meeting, currently scheduled for November 6, 2003, must be submitted in writing and received by the Secretary of the Company no earlier than August 8, 2003, and no later than September 5, 2003. The submission must include certain specified information concerning the proposal or nominee, as the case may be, and information about the proponent and the proponent’s ownership of Common Stock of the Company. Proposals or nominations that do not meet the requirements will not be entertained at the annual meeting. Submissions or |

|

questions should be sent to: George Schisler, Jr., Office of the Secretary, 4650 Cushing Parkway, Fremont, California 94538. PROPOSAL NO. 1 Nominees A board of seven directors is to be elected at the Annual Meeting. The bylaws of the Company provide that the number of directors shall be fixed at seven. The proxies cannot be voted for a greater number of persons than the seven nominees named below. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the Company’s seven nominees named below, each of whom is currently a director of the Company. If any nominee of the Company should decline or be unable to serve as a director as of the time of the Annual Meeting, the proxies will be voted for any substitute nominee whom shall be designated by the present Board of Directors to fill the vacancy. The Company is not aware of any nominee who will be unable or will decline to serve as a director. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner in accordance with cumulative voting as will assure the election of as many of the nominees listed below as possible, and in such event the specific nominees to be voted for will be determined by the proxy holders. Discretionary authority to cumulate the votes held by the proxy holders is solicited by this Proxy Statement. The term of office of each person elected as a director will continue until the next annual meeting of stockholders, or until a successor has been elected and qualified. THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS A VOTE “FOR” EACH OF THE SEVEN NOMINEES FOR DIRECTOR SET FORTH BELOW. The following table sets forth certain information concerning the nominees, which is based on data furnished by them: |

| Nominees for Director | Age | Director Since | Principal Occupation and Business Experience During Past Five Years |

|---|---|---|---|

James W. Bagley | 63 | 1997 | Mr. Bagley has been Chief Executive Officer and a director of the Company since the merger of Lam and OnTrak Systems, Inc., in August 1997. Effective September 1, 1998, he was appointed Chairman of the Board of Directors. From June 1996 to August 1997, Mr. Bagley served as Chairman of the Board and Chief Executive Officer of OnTrak. He was formerly Chief Operating Officer and Vice Chairman of the Board of Applied Materials, Inc., where he also served in other senior executive positions during his 15-year tenure. Mr. Bagley held various management positions at Texas Instruments, Inc., before he joined Applied Materials. Mr. Bagley is currently a director of Micron Technology, Inc., Teradyne, Inc., and Wind River Systems, Inc. |

|

| Nominees for Director | Age | Director Since | Principal Occupation and Business Experience During Past Five Years |

|---|---|---|---|

David G. Arscott(1) | 58 | 1980 | Mr. Arscott has been a director of the Company since 1980, and was Chairman of the Board of Directors from 1982 to 1984. He is currently, and has been since 1988, a General Partner of Compass Management Partners, an investment management firm. From 1978 to 1988, Mr. Arscott was a Managing General Partner of Arscott, Norton & Associates, a venture capital firm. |

Robert M. Berdahl(2,3) | 65 | 2001 | Dr. Berdahl has been a director of the Company since January 2001. He is currently Chancellor of the University of California, Berkeley, and has held that post since 1997. From 1993 to 1997, Dr. Berdahl was President of the University of Texas at Austin, and from 1986 to 1993, he was Vice Chancellor of Academic Affairs of the University of Illinois at Urbana-Champaign. |

Richard J. Elkus, Jr.(1,3) | 67 | 1997 | Mr. Elkus has been a director of the Company since August 1997. He is currently, and has been since 1996, Co-Chairman of Voyan Technology. From February 1994 until April 1997, Mr. Elkus was Vice Chairman of the Board of Tencor Instruments, Inc. From February 1994 to September 1996, Mr. Elkus was Executive Vice President of Tencor Instruments. He is also currently a director of KLA-Tencor Corporation, Virage Logic, and SOPRA SA. |

Jack R. Harris(2) | 60 | 1982 | Mr. Harris has been a director of the Company since 1982. Mr. Harris is currently, and since 1999 has been, Chairman of HT, Inc., First Derivative Systems, and Innovative Robotic Solutions. From 1986 until September 1999, Mr. Harris was Chairman, Chief Executive Officer, and President of Optical Specialties, Inc. Mr. Harris is also currently a director of Ahsoon, L-3 ILEX Systems, and Metara, Inc. |

Grant M. Inman(1,3) | 60 | 1981 | Mr. Inman has been a director of the Company since 1981. Mr. Inman is currently a General Partner of Inman Investment Management. From 1985 until 1998, Mr. Inman was a General Partner of Inman & Bowman, a venture capital investment partnership. Mr. Inman is also currently a director of Paychex, Inc., and Wind River Systems, Inc., and a Trustee of the University of California Berkeley Foundation and the University of Oregon Foundation. |

|

| Nominees for Director | Age | Director Since | Principal Occupation and Business Experience During Past Five Years |

|---|---|---|---|

Kenneth M. Thompson(2) | 64 | 1998 | Mr. Thompson has been a director of the Company since 1998. Prior to joining the Board, Mr. Thompson was employed by Intel Corporation for 25 years in various management positions, most recently as Vice President of Technology Manufacturing Engineering. Mr. Thompson currently serves as a director of Brooks-PRI Automation, Inc., and Baguda Wear, Inc. |

(1) Member of Audit Committee. (2) Member of Compensation Committee. (3) Member of Nominating Committee. Board Meetings and Committees The Board of Directors of the Company held a total of five regularly scheduled or special meetings during the fiscal year ended June 30, 2002. The Board of Directors has an Audit Committee, a Compensation Committee, and a Nominating Committee. From July 2001 to April 2002, the Audit Committee consisted of Messrs. Arscott, Berdahl, Elkus, Harris, Inman, and Thompson. From April 2002 to the present, the Audit Committee has consisted of Messrs. Arscott, Elkus, and Inman. All Audit Committee members have been independent, non-employee directors. The Audit Committee held six meetings during fiscal 2002. This committee recommends to the Board for its approval and for ratification by the stockholders the engagement of the Company’s independent auditors to serve the following fiscal year, reviews the scope of the audit, considers comments made by the independent auditors with respect to accounting procedures and internal controls and the consideration given thereto by the Company’s management, and reviews internal accounting procedures and controls with the Company’s financial and accounting staff. From July 2001 to April 2002, the Compensation Committee consisted of Messrs. Arscott, Harris, and Inman. From April 2002 to the present, the Committee has consisted of Messrs. Berdahl, Harris, and Thompson. All Compensation Committee members have been independent, non-employee directors. The Compensation Committee held three meetings during fiscal 2002. This committee recommends the salary level, incentives, and other forms of compensation for the chief executive officer, subject to approval by the independent members of the Board; approves salary levels, incentives, and other forms of compensation for the other executive officers of the Company; administers the Company’s various incentive compensation and benefit plans; and recommends policies relating to such compensation and benefit plans. This committee also has authority with respect to grants of stock options, restricted stock, deferred stock, and performance share awards to officers and other employees of the Company. The Board formed a Nominating Committee in April 2002. The Nominating Committee membership consists of Messrs. Berdahl, Elkus, and Inman. All Nominating Committee members are independent, non-employee directors. The Nominating Committee held no meetings during fiscal 2002, but held a meeting in July 2002. This committee exists to recommend and nominate candidates to serve as directors on the Board of Directors. In July 2002, the Nominating Committee approved the nominees for director of the Company as set forth in Proposal No. 1 above. The Nominating Committee will consider for nomination persons properly nominated by stockholders. In order for the Nominating Committee to consider the nomination of a person submitted by a stockholder, such nomination must be made in accordance with the Company’s by-laws and other procedures described above in the section captioned, “Stockholder Proposals and Nominations to be Voted on at 2003 Annual Meeting.” |

|

SECURITY OWNERSHIP OF CERTAIN The table below sets forth the beneficial ownership of shares of Common Stock of the Company by: (i) each person or entity whom, based on information obtained, the Company believes beneficially owned more than 5% of the Company’s Common Stock, and the address of each such person or entity (“5% stockholder”); (ii) each current director of the Company; (iii) each named executive officer (“named executive”) described below in the section of this proxy statement captioned “Executive Compensation and Other Information”; and (iv) all current directors and current executive officers as a group. With the exception of 5% stockholders, the information below concerning the number of shares beneficially owned is provided with respect to holdings as of September 13, 2002, and, with respect to the 5% stockholders, the information below is provided with respect to holdings as of June 30, 2002 (unless otherwise identified). The percentage is calculated using 125,257,046 as the number of shares outstanding as of September 13, 2002. |

| Name of Person or Identity of Group | Shares Beneficially Owned | Percent of Class | ||||||

|---|---|---|---|---|---|---|---|---|

| Fidelity Management & Research Co. | 15,973,231 | (1) | 12.75 | % | ||||

| 82 Devonshire Street | ||||||||

| Boston, Massachusetts 02109 | ||||||||

| Putnam Investment Management, Inc. | 10,942,230 | (1) | 8.74 | % | ||||

| 1 Post Office Square | ||||||||

| Boston, Massachusetts 02109 | ||||||||

| AIM Management Group, Inc. | 6,886,845 | (1) | 5.50 | % | ||||

| 11 Greenway Plaza, Suite 100 | ||||||||

| Houston, Texas 77046 | ||||||||

| James W. Bagley | 4,654,000 | (2) | 3.72 | % | ||||

| David G. Arscott | 252,417 | (2) | * | |||||

| Robert Berdahl | 24,000 | (2) | * | |||||

| Richard J. Elkus, Jr. | 110,370 | (2) | * | |||||

| Jack R. Harris | 162,000 | (2) | * | |||||

| Grant M. Inman | 249,499 | (2) | * | |||||

| Kenneth M. Thompson | 60,000 | (2) | * | |||||

| Stephen G. Newberry | 1,115,250 | (2,4) | * | |||||

| Mercedes Johnson | 257,688 | (2) | * | |||||

| Nicolas J. Bright | 261,021 | (2,5) | * | |||||

| Craig A. Garber | 77,511 | (2,6) | * | |||||

| All current directors and current executive officers | ||||||||

| as a group (12 persons)(3) | 7,389,846 | (2) | 5.90 | % | ||||

* | Less than one percent |

(1) | This information was obtained from the Nasdaq National Market, Inc., and was identified as representing the entity’s quarterly 13F filing with the SEC reflecting holdings as of June 30, 2002. |

(2) | Includes shares subject to outstanding options that are currently exercisable or exercisable within 60 days after September 13, 2002, with respect to: Mr. Bagley, 4,354,000 options; Mr. Arscott, 159,000 options; Dr. Berdahl, 24,000 options; Mr. Elkus, 78,000 options; Mr. Harris, 150,000 options; Mr. Inman, 132,000 options; Mr. Thompson, 60,000 options; Mr. Newberry, 1,055,250 options; Ms. Johnson, 245,150 options; Mr. Bright, 259,749 options; and Mr. Garber, 71,775 options (including options held by Mr. Garber’s spouse, see footnote 6 below) respectively. |

(3) | Current directors and current executive officers, as of September 13, 2002, include: Mr. Bagley, Mr. Arscott, Dr. Berdahl, Mr. Elkus, Mr. Harris, Mr. Inman, Mr. Thompson, Mr. Newberry, Ms. Johnson, Mr. Bright, Mr. Steven Lindsay, and Mr. Ernest Maddock. |

|

(4) | On August 24, 2001, the Stephen and Shelley Newberry Living Trust (the “Trust”) entered into a two-year variable pre-paid forward contract. At maturity on August 25, 2003, the Trust will deliver a minimum of 40,000 shares of common stock and a maximum of 60,000 shares based upon the closing offer price at the close of trading on the maturity date. At the Trust’s option, it may deliver cash in an amount equivalent to the value of the required number of shares on the maturity date. |

(5) | Includes 240 shares held in trust for dependent children. |

(6) | Figure for Mr. Garber’s beneficially held shares includes 3,788 shares held by his spouse, of which 1,214 are outstanding options. |

DIRECTOR COMPENSATION Directors who are not employees of the Company customarily receive annual retainers of $36,000. In fiscal 2002, this amount was reduced by 10%, to $32,400, so that the directors would participate commensurately in the Company’s executive salary reduction program adopted in fiscal 2002 in response to industry conditions. In addition, each person who is a non-employee director is automatically granted on or about December 15 of each calendar year an option to purchase 12,000 shares of the Company’s Common Stock under the Company’s Amended and Restated 1997 Stock Incentive Plan, at an exercise price per share equal to the fair market value of one share of the Company’s Common Stock on the date of grant. Each option has a term of ten years and is immediately exercisable. The plan provides that unexercised options may be exercisable for six months following termination of director status by death or disability. EXECUTIVE COMPENSATION AND OTHER INFORMATION Summary of Cash and Certain Other Compensation The following table provides, for the three fiscal years ended June 30, 2002, June 24, 2001, and June 25, 2000, respectively, certain summary information concerning compensation paid or accrued by the Company to or on behalf of the Company’s Chief Executive Officer, James W. Bagley, and each of the four other most highly compensated executive officers of the Company (determined as of the end of the last fiscal year) (the “named executives”). |

|

Summary Compensation Table |

| Annual Compensation | Long-Term Compensation(3) | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position | Year | Salary($)(1) | Bonus($)(1) | Other Annual Compen- sation($)(2) | Number of Securities Underlying Options(#) | All Other Compen- sation($) | ||||||||||||||

| James W. Bagley | 2002 | 90,006 | 283 | 1,000 | ||||||||||||||||

| Chairman of the Board & | 2001 | 97,704 | 129 | |||||||||||||||||

| Chief Executive Officer | 2000 | 99,507 | 96 | 4,758 | (4) | |||||||||||||||

| Stephen G. Newberry | 2002 | 472,500 | 570 | 205,250 | 126,310 | (5) | ||||||||||||||

| President & Chief | 2001 | 487,696 | 300,000 | 528 | 126,310 | (5) | ||||||||||||||

| Operating Officer | 2000 | 471,942 | 1,539 | 126,310 | (5) | |||||||||||||||

| Mercedes Johnson | 2002 | 282,385 | 98 | 5,300 | 6,190 | (8) | ||||||||||||||

| Sr. Vice President, | 2001 | 307,162 | 202,500 | (6) | 94 | 38,000 | (7) | 6,698 | (8) | |||||||||||

| Finance, & Chief | 2000 | 297,043 | 37,500 | (6) | 99 | 6,315 | (8) | |||||||||||||

| Financial Officer | ||||||||||||||||||||

| Nicolas J. Bright | 2002 | 245,500 | 56,726 | 336 | 356,949 | 4,379 | (9) | |||||||||||||

| Sr. Vice President & Gen. | 2001 | 323,790 | 161,084 | 5.164 | (9) | |||||||||||||||

| Manager, Global Products | 2000 | 317,350 | 4,493 | 59,000 | 8,020 | (9) | ||||||||||||||

| Craig A. Garber | 2002 | 200,446 | 15,000 | (10) | 2,014 | 6,038 | (11) | |||||||||||||

| Vice President, Corporate | 2001 | 198,850 | 189,469 | 14,000 | (7) | 5,029 | (11) | |||||||||||||

| Finance & Treasurer | 2000 | 188,047 | 60,367 | (10) | 799 | (11) | ||||||||||||||

(1) | Includes amounts and bonuses earned in fiscal 2002, 2001, and 2000, but deferred at the election of executive officer under the Company’s deferred compensation plans and the Company’s Employee Savings Plus Plan, a qualified defined contribution plan under Section 401(k) of the Internal Revenue Code of 1986 (as amended) (“401(k) Plan”). |

(2) | Reflects interest earned on deferred compensation, to the extent that the interest rate exceeded 120% of the applicable federal long-term rate. |

(3) | The Company has not issued restricted stock awards in the past three fiscal years. The Company last issued restricted stock awards in June 1996. |

(4) | Consists of the Company’s matching contributions to the Company’s 401(k) Plan in the amounts of $1,947 for 2000 and $2,811 for term life insurance premiums for 2000. |

(5) | Includes for fiscal 2002, 2001, and 2000, $125,000 reflecting Mr. Newberry’s interest in signing bonus received at the outset of his employment with the Company and held in his deferred compensation account, which interest vested on the first anniversary of his employment with the Company. See “Employment and Termination Agreements, Changes of Control Arrangements, and Retirement Benefits,” “Employment Agreement with Steven G. Newberry,” below. Also includes $1,310 for term life insurance premiums for 2002, 2001, and 2000, respectively. |

(6) | Includes a bonus of $37,500 paid on the anniversary of Ms. Johnson’s employment and an additional bonus during fiscal 2001. |

(7) | The officers voluntarily rescinded these stock option awards in August 2001. |

(8) | Consists of the Company’s matching contributions to the Company’s 401(k) Plan in the amounts of $4,891 for 2002, $5,388 for 2001, and $5,260 for 2000 and Company-paid term life insurance premiums of $1,299 for 2002, $1,310 for 2001, and $1,055 for 2000. |

(9) | Consists of the Company’s matching contributions to the Company’s 401(k) Plan in the amounts of $4,379 for 2002, $5,164 for 2001, and $8,020 for 2000. |

|

(10) | Consists of salary bonus in the amount of $174,469 and $45,367 for 2001 and 2000, respectively, and forgivable loan of $15,000 for 2002, 2001, and 2000. |

(11) | Consists of the Company’s matching contributions to the Company’s 401(k) Plan in the amounts of $5,490 for 2002 and $4,229 for 2001 and Company-paid term life insurance premiums of $548 for 2002, $800 for 2001, and $799 for 2000. |

Stock Plans The following table summarizes stock option grants made to the named executives during the fiscal year ended June 30, 2002. The Company does not grant stock appreciation rights (SARs). OPTION GRANTS IN LAST FISCAL YEAR |

| Individual Grants | Potential Realizable Value at Assumed Annual | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number of Securities Underlying | Percent of Total Options Granted to Employees in | Exercise of Base Price | Expiration | Rates of Stock Price Appreciation for Option Term | ||||||||||||||||

| Name of Executive (a) | Options (#) (b) | Fiscal Year (c) | ($/Sh) (d) | Date (e) | 5% (f) | 10% (g) | ||||||||||||||

| James W. Bagley | 1,000 | .01 | % | $ | 16.14 | 10/1/2011 | $ | 10,150 | $ | 25,723 | ||||||||||

| Stephen G. Newberry | 5,250 | .05 | % | $ | 16.14 | 10/1/2011 | $ | 53,289 | $ | 135,046 | ||||||||||

| 200,000 | 2.08 | % | $ | 25.66 | 4/30/2009 | $ | 2,089,239 | $ | 4,868,816 | |||||||||||

| Mercedes Johnson | 2,000 | .02 | % | $ | 21.64 | 2/28/2009 | $ | 17,619 | $ | 41,060 | ||||||||||

| 3,300 | .03 | % | $ | 21.64 | 2/28/2009 | $ | 29,072 | $ | 67,750 | |||||||||||

| Nicolas J. Bright | 2,949 | .03 | % | $ | 16.14 | 10/1/2011 | $ | 29,933 | $ | 75,857 | ||||||||||

| 4,000 | .04 | % | $ | 22.79 | 12/24/2011 | $ | 57,330 | $ | 145,286 | |||||||||||

| 30,000 | .31 | % | $ | 22.05 | 2/27/2009 | $ | 269,297 | $ | 627,576 | |||||||||||

| 320,000 | 3.33 | % | $ | 25.66 | 4/30/2009 | $ | 3,342,783 | $ | 7,790,106 | |||||||||||

| Craig A. Garber | 2,014 | .02 | % | $ | 21.64 | 2/28/2009 | $ | 17,743 | $ | 41,348 | ||||||||||

The following table provides certain information concerning the exercise of options to purchase the Company’s Common Stock in the fiscal year ended June 30, 2002, and the unexercised options held as of June 30, 2002, by the named executives. Aggregated Option Exercises by Named Executives in Last Fiscal Year, |

| No. of Shares Acquired on | Value | No. of Unexercised Options at Fiscal Year-End | Value of Unexercised In-The-Money Options at Fiscal Year-End(2) | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name of Executive | Exercise | Realized($)(1) | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||||

| James W. Bagley | 0 | $ | 0 | 4,305,500 | 48,500 | $ | 34,508,030 | $ | 1,840 | |||||||||||

| Stephen G. Newberry | 0 | $ | 0 | 1,050,000 | 1,105,250 | $ | 13,099,335 | $ | 9,660 | |||||||||||

| Mercedes Johnson | 0 | $ | 0 | 239,850 | 125,300 | $ | 2,766,550 | $ | 982,914 | |||||||||||

| Nicolas J. Bright | 0 | $ | 0 | 226,800 | 517,649 | $ | 2,484,281 | $ | 1,026,748 | |||||||||||

| Craig A. Garber(3) | 0 | $ | 0 | 98,103 | 71,898 | $ | 1,063,795 | $ | 344,340 | |||||||||||

(1) | Market value of underlying securities at exercise, minus the exercise price. |

(2) | Market value of underlying securities at fiscal year-end, minus the exercise price. |

(3) | Includes shares held by spouse. |

|

Employment and Termination Agreements, Employment Agreement with James W. Bagley On July 1, 1997, the Company signed an employment agreement with James W. Bagley, which became effective on August 6, 1997 (the “Bagley Agreement”). The term of the Bagley Agreement was five years. It expired pursuant to its term on August 5, 2002. There is currently no written employment agreement between the Company and Mr. Bagley. The Company and Mr. Bagley are currently negotiating a new employment agreement and expect to enter into it during fiscal 2003. The recently expired Bagley Agreement provided for a base salary at the annualized rate of $100,000. Mr. Bagley was not entitled to participate in any performance bonus plan of the Company, unless otherwise determined by the Board of Directors. As an incentive to joining the Company, Mr. Bagley was granted non-qualified stock options to purchase 750,000 shares of Common Stock (the “Incentive Options”). In lieu of additional base compensation or participation in performance bonus plans, the Company granted Mr. Bagley non-qualified stock options to purchase 675,000 shares of Common Stock (the “Base Options”). Under the Bagley Agreement, Mr. Bagley was also entitled to participate in the Company’s Elective Deferred Compensation Plan and other benefit plans and compensation programs generally maintained for other key executives of the Company. In the event of a change in control of the Company or the involuntary termination of Mr. Bagley without cause, all unvested Incentive Options would automatically have accelerated in full so as to become fully vested. Mr. Bagley would have had two years from the date of termination in which to exercise such options. If Mr. Bagley’s employment had been involuntarily terminated without cause on or after the first anniversary of the effective date of the Bagley Agreement, he would have been entitled to receive a lump sum payment of $100,000 and automatic vesting of any unvested portion of the Base Options that would have vested within the one-year period following the date of such termination (which vested options may be exercised within two years of termination). The Bagley Agreement provided that for a period of twelve months following Mr. Bagley’s termination of employment with the Company (other than through expiration of the Bagley Agreement), Mr. Bagley could not have performed services respecting certain aspects of semiconductor manufacturing equipment and/or software for anyone other than the Company, and he could not have solicited any of the Company’s employees to become employed by any other business enterprise. Employment Agreement with Stephen G. Newberry On August 5, 1997, the Company signed an employment agreement with Stephen G. Newberry (the “Newberry Agreement”). The term of the Newberry Agreement was five years. It expired pursuant to its term on August 5, 2002. There is currently no written employment agreement between the Company and Mr. Newberry. The Company and Mr. Newberry are currently negotiating a new employment agreement and expect to enter into it during fiscal 2003. The Newberry Agreement provided for a base salary at the annualized rate of $450,000, which was to be reviewed at least annually by the Board of Directors for possible increases. Mr. Newberry was not entitled to participate in any performance bonus plan of the Company, unless otherwise determined by the Board of Directors. As an incentive to joining the Company, Mr. Newberry was granted non-qualified stock options to purchase 600,000 shares of Common Stock (the “Incentive Options”). In lieu of additional base compensation or participation in performance bonus plans, the Company granted Mr. Newberry non-qualified stock options to purchase 300,000 shares of Common Stock (the “Base Options”). Under the Newberry Agreement, Mr. Newberry was also entitled to participate in the Company’s Elective Deferred Compensation Plan and other benefit plans and compensation programs generally maintained for other |

|

key executives of the Company. Mr. Newberry also received a deferred signing bonus in the amount of $500,000, the entire amount of which was held in a deferred compensation account, pursuant to the Company’s Elective Deferred Compensation Plan, with Mr. Newberry’s interest in the account vesting in equal installments of 25% on each of the first four anniversaries following August 5, 1997. In the event of a change in control of the Company or involuntary termination without cause, all unvested Incentive Options would have automatically accelerated in full so as to become fully vested, as would have any Base Options that would have vested within the one-year period following the date of such termination. Mr. Newberry would have had two years from the date of termination in which to exercise such options. If Mr. Newberry’s employment had been involuntarily terminated without cause on or after the first anniversary of the effective date of the Newberry Agreement, he would have been entitled to receive a lump sum payment equal to one times his then annual base compensation. The Newberry Agreement provided that for a period of twelve months following Mr. Newberry’s termination of employment with the Company (other than through expiration of the Newberry Agreement), Mr. Newberry could not solicit any of the Company’s employees to become employed by any other business enterprise. Employment Agreement with Mercedes Johnson On December 11, 1999, the Company signed an employment agreement with Mercedes Johnson (the “Johnson Agreement”). The term of the Johnson Agreement is three years, unless earlier terminated by the Company or Ms. Johnson. The Johnson Agreement provides for a base salary, which is unspecified and is to be reviewed at least annually by the Board of Directors for possible increases. Ms. Johnson is not entitled to participate in any performance bonus plan of the Company, unless otherwise determined by the Board of Directors. As an incentive to joining the Company, Ms. Johnson was granted a non-qualified stock option to purchase 225,000 shares of Common Stock and, during 1998, Ms. Johnson was granted non-qualified stock options to purchase an additional 330,000 shares of Common Stock (collectively, these option grants are referred to as the “Incentive Options”). Under the Johnson Agreement, Ms. Johnson is entitled to participate in the Company’s Elective Deferred Compensation Plan and other benefit plans and compensation programs generally maintained for other key executives of the Company. In the event of Ms. Johnson’s involuntary termination without cause, Ms. Johnson will be placed on a one-year leave of absence beginning on the termination date. During the leave of absence, Ms. Johnson will continue to make herself available for special projects as are delegated to her by the Company’s Chief Executive Officer. She will receive her base compensation, any targeted bonus, her executive benefits (except those that are available only to active Lam employees), and continued vesting of all previously granted stock options during the leave of absence. If the involuntary termination occurs after a change in control of the company, the Incentive Options shall automatically be accelerated in full so as to become completely vested on the termination date. The Johnson Agreement also provides that for a period of six months following the termination of any leave of absence arising as a result of involuntary termination Ms. Johnson may not solicit any of the Company’s employees to become employed in any other business enterprise. Change of Control Arrangements In addition to the change of control provisions in the foregoing agreements, the Company’s Stock Option Plans and Employee Stock Purchase Plans provide that, upon a merger of the Company with or into another corporation or the sale of substantially all of the assets of the Company, each outstanding option or right to purchase Common Stock shall be assumed, or an equivalent option or right substituted, by the successor corporation or a parent or subsidiary of the successor corporation. In the event that the successor corporation does not agree to assume the option or right or substitute an equivalent option or right, some or all of the options granted under certain of the Stock Option Plans shall be fully exercisable, and all of the rights granted under |

|

the Employee Stock Purchase Plans shall be fully exercisable following the merger for a period from the date of notice by the Board of Directors. Following the expiration of such periods, the options and rights will terminate. Under certain other Stock Option Plans, the Plan Administrator may make other adjustments or provisions to compensate option holders. Retirement Medical and Dental Benefits The Board of Directors approved a plan in July 1996 allowing executives who retire from the Company to continue to participate in the Company’s group medical and dental plans after retirement. Additionally, in July 1998, the Board amended the Elective Deferred Compensation Plan to provide that any participant 55 years or older may petition the Board for an early distribution of benefits under the Plan. Any such early distribution would not affect a participant’s ability to continue to participate and earn benefits under this Plan. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS Loan to Steve Newberry In May 2001, Stephen G. Newberry signed a promissory note with the Company entitling him to borrow up to $1,000,000 from the Company at 6.75% simple interest. The loan is secured by a mortgage on Mr. Newberry’s personal residence and is repayable, in full, together with accrued interest, no later than May 8, 2005. As of June 30, 2002, Mr. Newberry had been advanced $1,000,000 against that promissory note, of which $1,000,000 of principal, plus accrued interest, remains outstanding as of October 1, 2002. COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION No persons who were members of the Compensation Committee during fiscal year 2002 had any relationship requiring disclosure under this section. REPORT OF THE COMPENSATION COMMITTEE Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933, as amended (“Securities Act”), or the Securities Exchange Act of 1934, as amended (“Exchange Act”), that might incorporate all or portions of future filings, including this Proxy Statement, the following Report of the Compensation Committee, and the Performance Graph below, shall not be incorporated by reference into any such filings, nor shall they be deemed to be soliciting material or deemed filed with the Securities and Exchange Commission (“SEC”) under the Securities Act or the Exchange Act. The Compensation Committee (the “Committee”) of the Board of Directors, composed of three non-employee directors, determines and administers the Company’s executive compensation policies and programs. This committee also approves some, but not all, grants of stock options, restricted stock, deferred stock, and performance share awards to officers and certain other employees of the Company. Compensation Policies One of the Committee’s primary goals in setting compensation policies is to maintain competitive, progressive programs to attract, retain, and motivate high-caliber executives; foster teamwork; and maximize the long-term success of the Company by appropriately rewarding such individuals for their achievements. Another goal is to provide an incentive to executives to focus efforts on long-term strategic goals for the Company by closely aligning their financial interests with stockholder interests. To attain these goals, the Committee has designed the Company’s executive compensation program to include base salary, annual incentives, and long-term incentives. In formulating and administering the individual elements of the Company’s executive compensation program, the Committee emphasizes planning, implementing, and achieving long-term objectives and strives |

|

to use prudent judgment in establishing performance objectives, evaluating performance, and determining actual incentive awards. The Committee believes that the Company’s executive compensation programs have met these objectives. The Company has been able to attract and retain the executive talent necessary to support the corporation and promote long-term growth. The Company has also been able to reduce the payment of bonuses during those periods in which the Company’s revenue and gross margins were depressed. Compensation Components Base Salary The Committee establishes the base salaries of executive officers, after review of relevant data of other executives with similar responsibilities from published industry reports and surveys of similarly situated companies. Accordingly, the Committee strives to maintain the Company’s annual executive salaries at levels competitive with the market average base salaries of executive officers in similar positions. The market comprises similarly sized high-technology companies within and outside the Company’s industry. In addition, a large portion of each executive officer’s compensation may be annual incentives in the form of a cash bonus, provided certain target performance objectives are met. Annual Incentives Incentive bonuses may be provided to executives as part of a competitive compensation package. The bonus levels are intended to provide the appropriate elements of variability and risk. Bonus payments may be tied specifically to targeted corporate performance. The Committee will establish a base bonus amount, determined through review of a competitive market survey for executives at similar levels, which will be incrementally reduced if the Company does not meet its targeted performance or increased if the Company exceeds its targeted performance. There is no minimum or maximum percentage by which a bonus can be reduced or increased. Long-Term Incentives Stock Options The Committee grants stock options to focus an executive’s attention on the long-term performance of the Company and on maximizing stockholder value. The grant of stock options is closely tied to individual executive performance. The Committee grants such stock options after a review of various factors, including the executive’s potential contributions to the Company, current equity ownership in the Company, and vesting rates of existing stock options, if any. Stock options are granted with an exercise price equal to the fair market value of the Company’s stock at the time of grant and utilize vesting periods intended to encourage retention of executive officers. Because of the direct benefit executive officers receive through improved stock performance, the Committee believes stock options serve to align the interests of executive officers closely with those of other stockholders. Restricted Stock Restricted stock awards may be granted to executives under the 1996 Restricted Stock Plan (which was approved by the Company’s stockholders in 1995). The award of restricted stock is based on the Company’s performance measured against quarterly targets. Because the restricted stock does not vest until five years after the date of the award, the 1996 Restricted Stock Plan is expected to serve as a retention tool, as well as a means of aligning executive and stockholder interests. Shares were last issued under the Restricted Stock Plan in June 1996. Deferred Compensation Plan Another component of the Company’s executive compensation program is the Elective Deferred Compensation Plan (the “Deferred Plan”), a voluntary, non-tax-qualified, deferred compensation plan that encourages officers to save for retirement. Under the Deferred Plan, participants are entitled to defer |

|

compensation until retirement, death, other termination of employment, or until specified dates. As amended by the Board in July 1998, Deferred Plan participants 55 years or older may petition the Board for an early distribution of benefits, which early distribution would not affect the participant’s ability to continue to participate or earn benefits under the Deferred Plan. Participants receive a fixed-rate yield based on the average annual interest rate of 10-year United States Treasury Notes for the previous ten years. An enhanced yield of up to 115% of the fixed-rate yield will be payable in the event of death, retirement under certain circumstances, and termination of employment after plan participation for a specified number of years. Because the benefits of the Deferred Plan increase with each year of participation, offering the Deferred Plan to executives encourages them to stay with the Company. Compensation of Chief Executive Officer The Committee bases the compensation of the Company’s Chief Executive Officer on the policies and procedures described above. In determining the Chief Executive Officer’s base salary and bonus (if any), the Committee examines compensation levels for other chief executive officers in high-technology firms within and outside the industry. The Committee compares this information to the relevant performance of such firms relative to the Company’s performance. James W. Bagley In accordance with the Bagley Agreement, Mr. Bagley, Chief Executive Officer since August 6, 1997, was to receive a base salary in fiscal 2002 of $100,000. This amount was reduced by ten percent (10%) in fiscal 2002, in exchange for 1,000 stock options (as detailed in the table above entitled “Option Grants in Last Fiscal Year”), commensurate with the Company’s ongoing executive salary reduction program. Mr. Bagley is not entitled to participate in any performance bonus plan of the Company, unless otherwise determined by the Board of Directors. As an incentive to joining the Company, Mr. Bagley was granted in 1997 non-qualified stock options to purchase 1,425,000 shares of Common Stock and received an additional grant in fiscal 1999 of options to purchase 1,440,000 shares of Common Stock. See the discussion of Mr. Bagley’s Employment Agreement in “Employment and Termination Agreements, Change of Control Arrangements and Retirement Benefits,” above. Effect of Section 162(m) of the Internal Revenue Code Section 162(m) of the Code generally limits the corporate deduction for compensation paid to certain executive officers to $1 million, unless the compensation is performance-based. The Committee has carefully considered the potential impact of this tax code provision on the Company and has concluded in general that the best interests of the Company and the stockholders will be served if certain of the Company’s stock-based long-term incentives qualify as performance-based compensation within the meaning of the Code. It is the Committee’s intention that, so long as it is consistent with the Company’s overall compensation objectives, virtually all executive compensation will be deductible by the Company for federal income tax purposes. |

| |

|

REPORT OF THE AUDIT COMMITTEE Under the guidance of a written charter adopted by the Board of Directors, the purpose of the Audit Committee is to monitor the integrity of the financial statements of the Company, oversee the independence of the Company’s independent auditors, and recommend to the Board the selection of the independent auditors. Each of the members of the Audit Committee meets the independence requirements of Nasdaq. Management has the primary responsibility for the system of internal control and the financial reporting process. The independent auditors have the responsibility to express an opinion on the financial statements based on an audit conducted in accordance with generally accepted auditing standards. The Audit Committee has the responsibility to monitor and oversee these processes. In this context and in connection with the audited financial statements contained in the Company’s Annual Report on Form 10-K, the Audit Committee:

|

| |

RELATIONSHIP WITH INDEPENDENT AUDITORS Ernst & Young LLP has audited the Company’s consolidated financial statements since the Company’s inception. In accordance with standing policy, Ernst & Young LLP periodically changes the personnel who work on the audit. Audit Fees and Fees for Non-Audit Services Audit services of Ernst & Young LLP during the 2002 fiscal year included the examination of the company’s consolidated financial statements and services related to filings with the Securities and Exchange Commission (SEC) and other regulatory bodies. Fees for the last annual audit were $450,000, and all other fees to Ernst & Young LLP in fiscal 2002 were $430,000, including audit-related services of $238,000 and non-audit services of $192,000. Audit-related services generally include fees for statutory audits, accounting consultations, and reviews of SEC registration statements. Non-audit services generally include fees for tax accounting and advisory services. |

|

Fees for Financial Information Systems Design and Implementation Ernst & Young LLP did not provide any services related to financial information systems design and implementation during fiscal 2002. The Audit Committee reviewed summaries of the services provided by Ernst & Young LLP and the related fees and has determined that the provision of non-audit services is compatible with maintaining the independence of Ernst & Young LLP as the Company’s auditors. COMPARATIVE STOCK PERFORMANCE Set forth below is a line graph comparing the cumulative total stockholder return on the Company’s Common Stock (“LRCX”) for the last five fiscal years against the cumulative total return on the Nasdaq Composite Index (U.S. companies only) (“Nasdaq”), and the Salomon Smith Barney Semiconductor Equipment Index (“SSB Index”) over the same period. The graph and table assume that the investment in Lam Common Stock and each index was $100 on July 1, 1997, and that dividends, if any, were reinvested. This data has been furnished by Salomon Smith Barney. The Nasdaq Composite Index and the SSB Index are based on a calendar year. The Company’s return is based on its fiscal year. The stock price performance shown on the graph below is not necessarily indicative of future price performance. Lam Research Corporation  |

|

PROPOSAL NO. 2 Unless marked otherwise, proxies received will be voted “FOR” the ratification of the appointment of Ernst & Young LLP as the independent auditors for the Company for the current fiscal year. Ernst & Young LLP have been the Company’s independent auditors since fiscal year 1981. The audit services of Ernst & Young LLP during fiscal 2002 included the examination of the consolidated financial statements of the Company and services related to filings with the SEC and other regulatory bodies. The Audit Committee of the Company meets with Ernst & Young LLP on an annual or more frequent basis. At such time, the Audit Committee reviews both audit and non-audit services performed by Ernst & Young LLP for the preceding year, as well as the fees charged for such services. Among other things, the Committee examines the effect that the performance of non-audit services may have upon the independence of the auditors. For more information, see the “Audit Committee Report” and the “Relationship with Independent Auditors” sections above. A representative of Ernst & Young LLP is expected to be present at the Annual Meeting and will have an opportunity to make a statement if he or she so desires. The representative will also be available to respond to appropriate questions from the stockholders. Approval of Proposal No. 2 will require the affirmative vote of a majority of the outstanding shares of Common Stock present or represented and voting on the Proposal at the Annual Meeting. THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT AUDITORS FOR FISCAL YEAR 2003. |

|

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE Section 16(a) of the Exchange Act requires the Company’s executive officers, directors, and persons who own more than 10% of a registered class of the Company’s equity securities to file an initial report of ownership on Form 3 and changes in ownership on Forms 4 or 5 with the SEC. Executive officers, directors, and greater than 10% stockholders are also required by SEC rules to furnish the Company with copies of all Section 16(a) forms they file. Specific due dates for these reports have been established, and the Company is required to disclose in this Proxy Statement any failure to file such reports on a timely basis. Based solely on its review of the copies of such forms received by it, or written representations from certain reporting persons, the Company believes that all of these requirements were satisfied during the 2002 fiscal year. OTHER MATTERS The Company knows of no other matters to be submitted to the meeting. If any other matters properly come before the meeting, it is the intention of the proxy holders named in the enclosed form of Proxy to vote the shares they represent as the Board of Directors may recommend. It is important that your stock be represented at the meeting, regardless of the number of shares you hold. You are, therefore, urged to execute and return, at your earliest convenience, the accompanying proxy card in the enclosed envelope or otherwise exercise your stockholder voting rights by telephone or Internet, as provided in the materials accompanying this Proxy. |

| By Order of The Board of Directors, |

|

|

C/O DANIEL RABAGO | VOTE BY INTERNET —www.proxyvote.com VOTE BY PHONE — 1-800-690-6903 VOTE BY MAIL |

| | |

DETACH AND RETURN THIS PORTION ONLY

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

LAM RESEARCH CORP.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD

OF DIRECTORS OF THE COMPANY.

Vote On Directors | For | Withhold | For All | To withhold authority to vote, mark “For All Except” |

Vote On Proposal 2. Proposal to ratify the appointment of Ernst & Young LLP as the independent auditors of the Company for the fiscal year 2003. | For | Against | Abstain |

(This Proxy should be marked, dated and signed by the stockholder(s) exactly as his or her name appears hereon, and returned promptly in the enclosed envelope. Persons signing in a fiduciary capacity should so indicate. If shares are held by joint tenants or as community property, all such stockholders should sign.)

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY, USING THE ENCLOSED RETURN-ADDRESSED AND POSTAGE-PAID ENVELOPE.

*HOUSEHOLDING ELECTION (HH) Mark “FOR” to enroll this account to receive certain future security holder documents in a single package per household. Mark “AGAINST” if you do not want to participate. See enclosed notice. To change your election in the future, call 1-800-542-1061. |

|

*HOUSEHOLDING ELECTION (HH) |

|

For |

|

| For address changes and/or comments, please check this box and write them on the back where indicated. If you plan on attending the meeting, please check box to the right. | / / / / |

Signature [PLEASE SIGN WITHIN BOX] Date |

|

Signature (Joint Owners) Date |

|

|

|

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

OF

LAM RESEARCH CORPORATION

IN CONJUNCTION WITH THE

2002 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

NOVEMBER 7, 2002

The undersigned stockholder of LAM RESEARCH CORPORATION, a Delaware corporation (the “Company”), hereby acknowledges receipt of the Notice of Annual Meeting of Stockholders and Proxy Statement, each dated October 14, 2002, and the 2002 Annual Report to Stockholders, and hereby appoints James W. Bagley and George M. Schisler, Jr., or either of them, proxy holders and attorneys-in-fact, with full power to each of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the 2002 Annual Meeting of Stockholders of LAM RESEARCH CORPORATION to be held on Thursday, November 7, 2002 at 11:00 a.m. local time, at the principal executive offices of the Company at 4650 Cushing Parkway, Fremont, California 94538, and for any adjournment or adjournments thereof, and to vote all shares of Common Stock which the undersigned would be entitled to vote if then and there personally present, on the matters set forth below and, in their discretion, upon such other matter or matters which may properly come before the meeting or any adjournment or adjournments thereof.

THIS PROXY WILL BE VOTED AS DIRECTED OR, IF NO CONTRARY DIRECTION IS INDICATED, WILL BE VOTED FOR THE ELECTION OF DIRECTORS, FOR THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT AUDITORS FOR THE CURRENT FISCAL YEAR AND, AS SAID PROXY HOLDERS DEEM ADVISABLE, ON SUCH OTHER MATTER OR MATTERS AS MAY PROPERLY COME BEFORE THE MEETING.

(CONTINUED AND TO BE SIGNED ON REVERSE SIDE)

|

Address Changes/Comments:

|

(If you noted any address changes/comments above, please mark corresponding box on other side.)

|