UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

FORM 10-K |

| |

| [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the fiscal year ended December 31, 2006 |

| |

| [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| Commission File Number: 0-22606 |

|

Britton & Koontz Capital Corporation |

| (Exact name of registrant as specified in its charter) |

| |

| | |

| Mississippi | 64-0665423 |

| (State or other jurisdiction of incorporation or organization) | I.R.S. Employer Identification No. |

| | |

| |

| 500 Main Street |

| Natchez, Mississippi 39120 |

| (Address of principal executive offices) (Zip Code) |

| |

| (601) 445-5576 |

| (Registrant’s Telephone Number, Including Area Code) |

| Securities registered pursuant to Section 12(b) of the Exchange Act: |

| Title of each class | Common Stock, $2.50 Par Value |

| Name of each exchange on which registered | The NASDAQ Capital Market |

| | |

| |

| Securities registered pursuant to Section 12(g) of the Exchange Act: |

None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. [ ] Yes [X] No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check One)

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes [X] No

The aggregate market value of the registrant’s voting stock held by non-affiliates at February 26, 2007, computed by reference to the price of $19.38 per share, the price at which the registrant’s voting stock was last sold as of June 30, 2006, is $36,181,045.

The registrant had 2,117,966 shares of common stock outstanding as of March 15, 2007.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Definitive Proxy Statement of Britton & Koontz Capital Corporation with respect to its 2007 Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

| | PART I | |

| BUSINESS | * |

| RISK FACTORS | * |

| UNRESOLVED STAFF COMMENTS | * |

| PROPERTIES | * |

| LEGAL PROCEEDINGS | * |

| SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | * |

| | | |

| | PART II | |

| MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED | |

| | STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY | |

| | SECURITIES | * |

| SELECTED FINANCIAL DATA | * |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | * |

| QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | * |

| FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | * |

| CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | * |

| CONTROLS AND PROCEDURES. | * |

| OTHER INFORMATION | * |

| | | |

| | PART III | |

| DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | ** |

| EXECUTIVE COMPENSATION | ** |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | ** |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | ** |

| PRINCIPAL ACCOUNTING FEES AND SERVICES | ** |

| | | |

| | PART IV | |

| EXHIBITS, FINANCIAL STATEMENT SCHEDULES | * |

* Included herein.

| ** | Incorporated by reference from Britton & Koontz Capital Corporation’s Definitive Proxy Statement for its 2007 Annual Meeting of Shareholders in accordance with Instruction G(3) of Form 10-K. |

PART I

This Annual Report on Form 10-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Although Britton & Koontz Capital Corporation (the “Company”) believes that the expectations reflected in such forward-looking statements are reasonable, such forward-looking statements are based on numerous assumptions (some of which may prove to be incorrect) and are subject to risks and uncertainties which could cause the actual results to differ materially from the Company’s expectations. Such statements are based on management’s beliefs as well as assumptions made by and information currently available to management. When used in the Company’s documents or oral presentations, the words “anticipate”, “estimate”, “expect”, “objective”, “projection”, “forecast”, “goal” and similar expressions are intended to identify forward-looking statements. In addition to any assumptions and other factors referred to specifically in connection with such forward-looking statements, factors that could cause the Company’s actual results to differ materially from those contemplated in any forward-looking statements include, among others, increased competition, regulatory factors, economic conditions, changing market conditions, availability or cost of capital, employee workforce factors, costs and other effects of legal and administrative proceedings, and changes in federal, state or local legislative requirements. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of changes in actual results or changes in assumptions or on account of other factors affecting such statements.

The information set forth in this Annual Report on Form 10-K is as of March 14, 2007, unless otherwise indicated herein.

General

The Company

Britton & Koontz Capital Corporation was organized as a Mississippi business corporation in July 1982. Later that year, the Company became a one-bank holding company registered under the Bank Holding Company Act of 1956, as amended (the “BHCA”), when it acquired all of the issued and outstanding shares of Britton & Koontz Bank, National Association, a national banking association headquartered in Natchez, Mississippi (the “Bank”). The Bank is a wholly-owned subsidiary of the Company, and stock of the Bank is the Company’s most significant asset. On April 17, 2001, B&K Title Insurance Agency, Inc. was organized as a Mississippi corporation (“B&K Insurance”); in May 2001, the Company acquired all of the outstanding common stock of B&K Insurance, making it the Company’s second wholly-owned subsidiary.

The Company’s major source of income in 2006 was dividends from the Bank in the amount of $2.5 million. The Company expects that dividends from the Bank will continue to be the Company’s major source of income in 2007. As of December 31, 2006, the Company had total assets of approximately $369 million and total consolidated shareholders’ equity of approximately $34 million. Financial information about the Company, including information with respect to revenues from external customers, profit and loss and total assets for 2006, 2005 and 2004, is contained in Item 8, “Financial Statements and Supplementary Data.”

The Company has entered into a Trust Services Agreement with National Independent Trust Company, a national banking association, d/b/a Argent Trust Company, headquartered in Ruston, Louisiana. Effective January 1, 2007, Argent Trust Company assumed all responsibilities associated with the Bank’s trust services, having been duly appointed successor trustee for all Bank trust accounts. Argent Trust Company performs certain fiduciary services for customers transferred from and referred by the Bank to Argent Trust Company. In return, the Bank receives a specified percentage of the fee income generated by Argent Trust Company.

As of December 31, 2006, the Company discontinued issuing title insurance policies through B&K Insurance. See “The Insurance Agency” below for more information.

The Bank

The Bank provides commercial and consumer banking and trust services to customers in Adams and Warren Counties, Mississippi, and East Baton Rouge Parish, Louisiana, and the adjoining counties and parishes in Mississippi and Louisiana. A loan production office was opened in Madison, Mississippi, on February 1, 2003, which was converted into a full service branch in 2004. Management decided to leave the Madison market in November, 2004 in order to allocate its resources to its remaining markets. In 2004, the Bank completed the construction of a new branch in Vicksburg, Mississippi, and closed three branches in Baton Rouge, Louisiana, moving into a larger, more visible facility on Bluebonnet Boulevard in Baton Rouge. The Bank also sold its Shields Lane branch in Natchez, Mississippi, in 2004, while completing the renovation of its existing Tracetown branch in Natchez, which houses its mortgage banking operations. As a result of these actions, the Bank now conducts its full-service banking business from its main office and two branch offices in Natchez, Mississippi, two branches in Vicksburg, Mississippi, and one branch office in Baton Rouge, Louisiana. The geographical area serviced by the Bank is economically diverse and includes public and private sector industries, including government service, manufacturing, tourism, agriculture and oil and gas exploration. The Bank is not dependent on any one customer or group of customers in any of its activities, and it has no foreign operations.

The products and services offered by the Bank include personal and commercial checking accounts, money market deposit accounts, savings accounts, automated clearinghouse services, safe deposit box facilities, and brokerage services. The Bank also offers access to automated teller machines and cash management services including money transfer, direct deposit payroll and sweep accounts. The Bank is a full-service residential and commercial mortgage lender and engages in other commercial and consumer lending activities, including, among other things, the issuance of VISA credit cards and letters of credit.

In 1995, the Bank became an Internet service provider (ISP) for the Natchez area and eventually extended its service to the Vicksburg, Mississippi market. In 1996, the Bank began offering Internet-based online banking using SumxNet, a software product developed by Sumx Inc. (“Sumx”), See “Investment in Sumx” below. In the second quarter of 2004, the Bank completed the sale of its ISP to Canufly.net, a company providing Internet services in Mississippi and Louisiana.

Income from the Bank’s lending activities, including loan interest and fees, represent the largest component of the Bank’s total operating revenues. This source accounted for 70%, 66% and 62% of the Bank’s total operating revenue during 2006, 2005 and 2004, respectively, and the Company expects that income from lending activities will continue to be the leading source of income related to the Bank’s activities. In addition to business and consumer lending, the bank invests a portion of its total assets in the securities market in order to earn a higher return compared to overnight positions. Investment security purchases are monitored closely and managed on a monthly basis by an asset liability committee comprised of four outside directors along with the bank’s Chief Executive Officer and Chief Financial Officer. Investment income represents the second largest source of revenue for the Bank. For the 2006, 2005 and 2004 fiscal years, revenue in this segment amounted to 20%, 24% and 26% of the Bank’s total operating revenue, respectively.

The Insurance Agency

B&K Insurance has entered into an agreement, as agent, to issue policies of title insurance upon properties in all counties of the State of Mississippi in the name of Mississippi Guaranty Title Insurance Company, a Mississippi corporation. B&K Insurance is not a separately-reportable segment for financial reporting purposes. B&K Insurance discontinued its operations as of December 31, 2006, due to limited demand for business and continuing fixed costs associated with maintaining B&K Insurance services. B&K Insurance will not be dissolved but will continue to be included as a 100% owned subsidiary of the Company. The Company does not expect any material adverse impact on earnings in 2007 on account of the discontinuation of B&K Insurance’s operations.

Investment in Sumx

In December 1998, the Company invested $1 million in Sumx, a Mississippi corporation established to develop and market internet-based electronic banking solutions for the financial industry. On September 15, 2001, the Company acquired 240,000 shares of Series B Preferred Stock of Sumx for $250,000. In exchange for such investments, the Company received approximately 37% preferred interest in the voting stock of Sumx. During the second quarter of 2002, the Company wrote off its $1,250,000 investment in Sumx, as well as approximately $711,000 of advances to Sumx, due to the uncertainty regarding Sumx’s future prospects and valuation.

On December 31, 2004, the Company sold its entire preferred interest in Sumx back to Sumx for $20,000. As further consideration, the Company received a non-exclusive license to use Sumx’s Internet banking software at no charge. The license has an initial term of five years, with automatic one year renewal terms thereafter unless a party gives the other party notice of non-renewal at least six months prior to the expiration of the then-current term. During 2006, the Company decided to discontinue using this software and began using the internet banking software provided by Harland Financial, its core account processing company. Finally, the Company agreed to cancel and forgive all indebtedness, obligations and encumbrances of any kind owed by Sumx to the Company.

Competition

There is significant competition among banks and bank holding companies in the Bank’s market areas and throughout Mississippi and Louisiana. The Bank competes with both national and state banks, savings and loan associations and credit unions for loans and deposits. The Bank also competes with large national banks from the principal cities in Louisiana and Mississippi for certain commercial loans. All of these numerous institutions, including the Bank, compete in the delivery of products and services on the basis of availability, quality and pricing. Most institutions track total deposits as an appropriate measure of penetration in each market. The Bank's market share, in relation to total deposits, is 37% and 4% for Adams and Warren Counties in Mississippi, respectively and .53% in East Baton Rouge Parish in Louisiana.

The deregulation of depository institutions as well as the increased ability of non-banking financial institutions, such as finance companies, investment companies, insurance companies, brokerage companies and several governmental agencies, to provide services previously reserved to commercial banks has further intensified competition. Accordingly, the Bank now competes with these non-banking financial institutions, all of which are engaged in marketing various types of loans, commercial paper, short-term obligations, investments and other services. Because non-banking financial institutions are not subject to the same regulatory restrictions as banks and bank holding companies, in many instances they may operate with greater flexibility. The continued deregulation of the financial services industry may have a detrimental effect on the Bank’s long-term growth and profitability.

In addition to the deregulation of the financial services industry, the increasing liberalization of the laws and regulations affecting the conduct of interstate banking activities makes it possible that competition in the Bank’s geographical market area will increase. If large, regional bank holding companies acquire branches in the Bank’s market area, they may offer a wider range of services than are currently offered by the Bank. Some of these regional competitors may take full advantage of the powers of “financial holding companies,” as defined in the Gramm-Leach-Bliley Financial Services Modernization Act of 1999, which allows such competitors to offer products and services not offered by the Bank. In addition, these competitors are likely to be better capitalized than the Bank and the Company.

Employees

As of December 31, 2006, the Company had three full-time employees, who are also employees of the Bank and compensated by the Bank. The Bank’s employees decreased from 102 full-time and 10 part-time employees at December 31, 2005, to 97 full-time and 11 part-time at December 31, 2006. The employees are not represented by a collective bargaining agreement. The Company believes that its relationship with its employees is good.

Supervision and Regulation

General

The banking industry is extensively regulated under federal and state law. As a bank holding company, the Company is subject to regulation under the BHCA and to supervision by the Board of Governors of the Federal Reserve System (the “Federal Reserve”). Pursuant to the BHCA, the Company may not directly or indirectly acquire the ownership or control of more than 5% of any class of voting shares or substantially all of the assets of any other company, including a bank, without the prior approval of the Federal Reserve. The BHCA further limits the activities of both the Company and the Bank to the business of banking and activities closely related or incidental to banking.

As a national bank, the Bank is subject to supervision and regular examination by the Office of the Comptroller of the Currency (the “Comptroller”). The examinations are undertaken to ensure the protection of the Bank Insurance Fund (“BIF”). Pursuant to the terms of the Federal Deposit Insurance Act (the “FDIA”), the deposits of the Bank are insured through the BIF and the Savings Association Insurance Fund of the Federal Deposit Insurance Corporation (the “FDIC”). Accordingly, the Bank is subject to regulation by the FDIC and is also subject to the Federal Reserve’s requirements to maintain reserves against deposits, restrictions on the types and amounts of loans that may be granted and the interest that may be charged thereon, and limitations on the types of investments that may be made and the types of services that may be offered.

In 1991, Congress enacted the Federal Deposit Insurance Corporation Improvement Act (“FDICIA”), which, among other things, substantially revised the depository institution regulatory and funding provisions of the FDIA. FDICIA also expanded the regulatory and enforcement powers of bank regulatory agencies. Most significantly, FDICIA mandates annual examinations of banks by their primary regulators and requires the federal banking agencies to take prompt “corrective action” whenever financial institutions do not meet minimum capital requirements. FDICIA establishes five capital tiers: “well capitalized,” “adequately capitalized,” “undercapitalized,” “significantly undercapitalized” and “critically undercapitalized.” A depository institution’s capitalization status will depend on how well its capital levels compare to various relevant capital measures and certain other factors, as established by regulation. As of December 31, 2006, the Bank maintained a capital level which qualified it as being “well capitalized” under such regulations.

FDICIA also prohibits a depository institution from making any capital distribution (including payment of a dividend) or paying any management fee to its holding company if the depository institution would thereafter be “undercapitalized.”

The banking industry is affected by the policies of the Federal Reserve. An important function of the Federal Reserve is to regulate the national supply of bank credit to moderate recessions and to curb inflation. Among the instruments of monetary policy used by the Federal Reserve to implement its objectives are: open-market operations in U.S. Government securities, changes in the discount rate on bank borrowings and changes in reserve requirements on bank deposits. Changes in any of these policies can affect how the Bank operates and generates revenues.

Interstate Banking and Branching Legislation

Federal Law. In 1994, Congress passed the Riegle-Neal Interstate Banking and Branching Efficiency Act (“Riegle-Neal”), which affected the interstate banking and branching abilities of bank holding companies and banks. Riegle-Neal authorizes a national bank domiciled in one state to establish branches in any other state as long as neither state has opted out of interstate branching between the date of enactment of Riegle-Neal and May 31, 1997. Riegle-Neal, however, does allow states to preserve certain restrictions on the entry of out-of-state banks, such as the fashion in which entry can be made, an age requirement for a bank being merged or acquired, and a deposit cap. Under Riegle-Neal, once a bank has established a branch in another state, it may exercise the same rights in that state as national and state banks enjoy in that state, including the ability to branch intra-state.

Riegle-Neal also permits states to allow banks to enter the state by establishing a de novo branch in that state. In order to allow de novo entry into a particular state, that state’s banking laws must expressly provide for de novo branching. Once a bank has established a branch in a host state through de novo branching, it may exercise the same rights in that state as national and state banks enjoy, including the ability to branch intra-state. If a state opts out of interstate branching, no bank domiciled in that state may establish branches in other states, and no bank domiciled in another state may establish branches in that state.

Mississippi Law. On March 29, 1996, the Governor of Mississippi signed into law a bill in which Mississippi elected to opt in to interstate branching, effective May 1, 1997. As enacted, the bill (1) allows all Mississippi banks to establish branches in any other state pursuant to the entry rules in the potential host state, and (2) allows out-of-state banks to establish branches in Mississippi pursuant to Mississippi’s entry rules. The bill does not authorize de novo branching into Mississippi. An out-of-state bank can establish branches in Mississippi only by (1) merging with a Mississippi-domiciled bank, (2) buying all of the assets of a Mississippi-domiciled bank, or (3) buying all of the assets in Mississippi of an out-of-state bank which has branches in Mississippi. All interstate branching transactions require appropriate regulatory approval.

On December 1, 2000, the Bank acquired its first interstate branch offices in Baton Rouge, Louisiana. Under applicable law, the Bank, with the approval of the Comptroller, can establish additional de novo branch offices within the States of Mississippi and Louisiana. The Company from time to time evaluates merger and acquisition opportunities, as well as opportunities to establish additional branch offices, and it anticipates that it will continue to evaluate such opportunities.

Financial Modernization

The Gramm-Leach-Bliley Financial Services Modernization Act of 1999 (the “GLB Act”) was enacted into law on November 12, 1999. The GLB Act potentially affects every facet of a depository institution’s operations. The GLB Act does three fundamental things affecting the banking industry: (a) repeals key provisions of the Glass-Steagall Act to permit commercial banks to affiliate with securities firms, insurance companies and other financial service providers; (b) establishes a statutory framework pursuant to which full affiliations can occur between these entities; and (c) provides financial services organizations with flexibility in structuring these new financial affiliations through a new entity called a “financial holding company” or through a financial subsidiary.

As a result of the GLB Act, banks will be able to offer customers a wide range of financial products and services without the restraints of previous legislation. In addition, bank holding companies and other financial services providers will be able to commence new activities or new affiliations much more readily. To take advantage of the new provisions of the GLB Act, a bank holding company must elect to become a financial holding company. The Company has elected to become a financial holding company.

Anti-Money Laundering

On October 26, 2001, the President signed the USA PATRIOT Act of 2001 into law. This act contains the International Money Laundering Abatement and Financial Anti-Terrorism Act of 2001 (the “IMLAFA”). The IMLAFA substantially broadens existing anti-money laundering legislation and the extraterritorial jurisdiction of the United States, imposes new compliance and due diligence obligations, creates new crimes and penalties, compels the production of documents located both inside and outside the United States, including those of foreign institutions that have a correspondent relationship in the United States, and clarifies the safe harbor from civil liability to customers. The U.S. Treasury Department has issued a number of regulations implementing the USA PATRIOT Act that apply certain of its requirements to financial institutions such as the Bank. The regulations impose new obligations on financial institutions to maintain appropriate policies, procedures and controls to detect, prevent and report money laundering and terrorist financing. The IMLAFA requires all “financial institutions,” as defined, to establish anti-money laundering compliance and due diligence programs no later than April 2002. Such programs must include, among other things, adequate policies, the designation of a compliance officer, employee training programs, and an independent audit function to review and test the program. The Company believes that it has complied with the IMLAFA requirements as currently in effect.

Further Changes in Regulatory Requirements

The United States Congress and the Mississippi legislature have periodically considered and adopted legislation that has adversely affected the profitability of the banking industry. See “Competition” above. Future legislation could further modify or eliminate geographic and other business restrictions on banks and bank holding companies and current prohibitions affecting other financial institutions, including mutual funds, securities brokerage firms, insurance companies, banks from other states and investment banking firms. The effect of any such legislation on the business of the Company or the Bank cannot be accurately predicted. The Company also cannot predict what legislation might be enacted or what other implementing regulations might be adopted, and if enacted or adopted, the effect thereof.

Restrictions on Dividends

The Company is a legal entity separate and distinct from the Bank, and substantially all of the Company’s revenues result from amounts paid by the Bank, as dividends, to the Company. The payment of dividends by the Bank is, of course, dependent upon its earnings and financial condition. The Bank, however, as a national bank, is also subject to legal limitations on the amount of its earnings that it may pay as dividends. Under federal law, the directors of a national bank, after making proper deduction for all expenses and other deductions required by the Comptroller, may credit net profits to the Bank’s undivided profits account and may declare a dividend from that account of so much of the net profits as they judge expedient. The Comptroller and the Federal Reserve have each indicated that banking organizations should generally pay dividends only out of current operating earnings.

Further, in connection with the Company’s acquisition of Natchez First Federal in 1993, the Bank assumed a liquidation account of approximately $2.8 million which has the effect of prohibiting the payment of dividends if the Bank’s net worth would thereby be reduced below $2.8 million.

Corporate Governance

The Sarbanes-Oxley Act of 2002 (the “Sarbanes Act”) requires publicly traded companies to adhere to several directives designed to prevent corporate misconduct. Additional duties have been placed on officers, directors, auditors and attorneys of public companies. The Sarbanes Act requires certifications regarding financial statement accuracy and internal control adequacy by the chief executive officer and chief financial officer of the Company in periodic and annual reports filed with the Securities and Exchange Commission (the “SEC”). The Sarbanes Act also accelerates insider reporting obligations under Section 16 of the Securities Exchange Act of 1934, as amended, restricts certain executive officer and director transactions, imposes new obligations on corporate audit committees and provides for enhanced review by the SEC. The SEC has delayed the compliance date for non-accelerated filers to include a management report on internal control of financial reporting (and make a related certification) until the filer's first fiscal year ending after December 15, 2007.

In addition to the other information contained in or incorporated by reference into this Annual Report on Form 10-K and the exhibits hereto, the following risk factors should be considered carefully in evaluating our business. The risks disclosed below, either alone or in combination, could materially adversely affect the business, financial condition or results of operations of the Company. Additional risks not presently known to us, or that we currently deem immaterial, may also adversely affect our business, financial condition or results of operations.

Risks Related To Our Business and Industry

We are subject to interest rate risk.

Our earnings and cash flows are largely dependent upon the net interest income of the Bank. Net interest income is the difference between interest earned on assets, such as loans and securities, and the cost of interest-bearing liabilities, such as deposits and borrowed funds. Interest rates are highly sensitive to many factors that are beyond our control, including general economic conditions and policies of various governmental and regulatory agencies and, in particular, the FRB. Changes in monetary policy, including changes in interest rates, could influence not only the interest we receive on loans and securities and the amount of interest we pay on deposits and borrowings, but such changes could also affect (i) our ability to originate loans and obtain deposits, which could reduce the amount of fee income generated, (ii) the fair value of our financial assets and liabilities, and (iii) the average duration of our mortgage-backed securities portfolio. If the interest rates paid on deposits and other borrowings increase at a faster rate than the interest rates received on loans and other investments, our net interest income could be adversely affected, which in turn could negatively affect our earnings. Earnings could also be adversely affected if the interest rates received on loans and other investments fall more quickly than the interest rates paid on deposits and other borrowings.

Although management believes it has implemented effective asset and liability management strategies to reduce the potential effects of changes in interest rates on the results of operations of the Company, any substantial, unexpected, prolonged change in market interest rates could have a material adverse effect on our financial condition and results of operations. Volatility in interest rates may also result in disintermediation, which is the flow of funds away from financial institutions into direct investments, such as U.S. Government and Agency securities and other investment vehicles, including mutual funds, which generally pay higher rates of return than financial institutions because of the absence of federal insurance premiums and reserve requirements. Disintermediation could also result in material adverse effects on our financial condition and results of operations.

A discussion of the policies and procedures used to identify, assess and manage certain interest rate risk is set forth in Item 7A, “Qualitative and Quantitative Disclosures about Market Risk.”

We are subject to lending risk.

There are inherent risks associated with our lending activities. These risks include, among other things, the impact of changes in interest rates and changes in the economic conditions in the markets where we operate as well as those across the United States. Increases in interest rates and/or weakening economic conditions could adversely impact the ability of borrowers to repay outstanding loans or the value of the collateral securing these loans.

As of December 31, 2006, approximately 61% of the bank’s loan portfolio consisted of commercial, construction and commercial real estate loans compared to 55% at December 31, 2005. These types of loans are generally viewed as having more risk of default than residential real estate loans or consumer loans due primarily to the large amounts loaned to individual borrowers. Because the loan portfolio contains a significant number of commercial, construction and commercial real estate loans with relatively large balances, the deterioration of one or a few of these loans could cause a significant increase in non-performing loans. An increase in non-performing loans could result in a net loss of earnings from these loans, an increase in the provision for possible loan losses and an increase in loan charge-offs, all of which could have a material adverse effect on our financial condition and results of operations.

The allowance for possible loan losses may be insufficient.

Although we try to maintain diversification within our loan portfolio in order to minimize the effect of economic conditions within a particular industry, management also maintains an allowance for loan losses, which is a reserve established through a provision for loan losses charged to expense, to absorb probable credit losses inherent in the entire loan portfolio. The appropriate level of the allowance is based on management’s quarterly analysis of the loan portfolio and represents an amount that management deems adequate to provide for inherent losses, including collective impairment. Among other considerations in establishing the allowance for loan losses, management considers economic conditions reflected within industry segments, the unemployment rate in our markets, loan segmentation, and historical losses that are inherent in the loan portfolio. The determination of the appropriate level of the allowance for loan losses inherently involves a high degree of subjectivity and requires management to make significant estimates of current credit risks and future trends, all of which may undergo material changes. Changes in economic conditions affecting borrowers, new information regarding existing loans, identification of additional problem loans and other factors, both within and outside of our control, may require an increase in the allowance for loan losses.

In addition, bank regulatory agencies periodically review the allowance for loan losses and may require an increase in the provision for loan losses or the recognition of further loan charge-offs, based on judgments different than those of management. In addition, if charge-offs in future periods exceed the allowance for loan losses we will need additional provisions to increase the allowance for loan losses. Any increases in the allowance for loan losses will result in a decrease in net income and, possibly, capital, and may have a material adverse effect on our financial condition and results of operations. A discussion of the policies and procedures related to management’s process for determining the appropriate level of the allowance for loan losses is set forth in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Bank holding companies depend on the accuracy and completeness of information about customers and counterparties.

In deciding whether to extend credit or enter into other transactions, we often rely on information furnished by or on behalf of customers and counterparties, including financial statements, credit reports and other financial information. We may also rely on representations of those customers, counterparties or other third parties, such as independent auditors, as to the accuracy and completeness of that information. Reliance on inaccurate or misleading financial statements, credit reports or other financial information could have a material adverse impact on our business and, in turn, our financial condition and results of operations.

We are subject to environmental liability risk associated with lending activities.

A significant portion of the loan portfolio is secured by real property. During the ordinary course of business, we may foreclose on and take title to properties securing certain loans. In doing so, there is a risk that hazardous or toxic substances could be found on these properties. If hazardous or toxic substances are found, we may be liable for remediation costs, as well as for personal injury and property damage. Environmental laws may require us to incur substantial expenses and may materially reduce the affected property’s value or limit the ability of the Company to use or sell the affected property. In addition, future laws or more stringent interpretations or enforcement policies with respect to existing laws may increase our exposure to environmental liability. Although management has policies and procedures to perform an environmental review during the loan application process and also before initiating any foreclosure action on real property, these reviews may not be sufficient to detect all potential environmental hazards. The remediation costs and any other financial liabilities associated with an environmental hazard could have a material adverse effect on our financial condition and results of operations.

The profitability of the Company depends significantly on economic conditions in the States of Mississippi and Louisiana.

Our success depends primarily on the general economic conditions of the State of Mississippi and the State of Louisiana and the specific local markets in which we operate.

Unlike larger national or other regional banks that are more geographically diversified, we provide banking and financial services to customers primarily in Natchez and Vicksburg, Mississippi, and Baton Rouge, Louisiana. The local economic conditions in these areas have a significant impact on the demand for our products and services as well as the ability of our customers to repay loans, the value of the collateral securing loans and the stability of our deposit funding sources.

The earnings of bank holding companies are significantly affected by general business and economic conditions.

In addition to the risks associated with the general economic conditions in the markets in which we operate, our operations and profitability are also impacted by general business and economic conditions in the United States and abroad. These conditions include short-term and long-term interest rates, inflation, money supply, political issues, legislative and regulatory changes, fluctuations in both debt and equity capital markets, broad trends in industry and finance, and the strength of the U.S. economy and the local economies in which we operate, all of which are beyond our control. Deterioration in economic conditions could result in an increase in loan delinquencies and non-performing assets, decreases in loan collateral values and a decrease in demand for our products and services, among other things, any of which could have a material adverse impact on our financial condition and results of operations.

We operate in a highly competitive industry and market area.

We face substantial competition in all areas of our operations from a variety of different competitors, many of which are larger and have greater financial resources. Such competitors primarily include national, regional and community banks within the various markets in which we operate. We also face competition from many other types of financial institutions, including savings and loan associations, credit unions, finance companies, brokerage firms, insurance companies, factoring companies and other financial intermediaries. The information under the heading “Competition” in Item 1, “Business,” provides more information regarding the competitive conditions in our markets.

Our industry could become even more competitive as a result of legislative, regulatory and technological changes and continued consolidation. Banks, securities firms and insurance companies can merge under the umbrella of a financial holding company, which can offer virtually any type of financial service, including banking, securities underwriting, insurance (both agency and underwriting) and merchant banking. Also, technology has lowered barriers to entry and made it possible for non-banks to offer products and services traditionally provided by banks, such as automatic transfer and automatic payment systems. Many of our competitors have fewer regulatory constraints and may have lower cost structures. Additionally, many of our competitors have substantially greater resources than us, including higher total assets and capitalization, greater access to capital markets and a broader offering of financial services.

Our ability to compete successfully depends on a number of factors, including, among other things:

| · | The ability to develop, maintain and build upon long-term customer relationships based on top quality service, high ethical standards and safe, sound assets. |

| · | The ability to expand the Company’s market position. |

| · | The scope, relevance and pricing of products and services offered to meet customer needs and demands. |

| · | The rate at which we introduce new products and services relative to our competitors. |

| · | Customer satisfaction with our level of service. |

| · | Industry and general economic trends. |

Failure to perform in any of these areas could significantly weaken our competitive position, which could adversely affect our growth and profitability, which, in turn, could have a material adverse effect on our financial condition and results of operations.

We are subject to extensive government regulation and supervision.

The Company and the Bank are subject to extensive federal and state regulation and supervision. Banking regulations are primarily intended to protect depositors’ funds, federal deposit insurance funds and the banking system as a whole, not the economic or other interests of shareholders. These regulations affect our lending practices, capital structure, investment practices, dividend policy and growth, among other things. Changes to statutes, regulations or regulatory policies, including changes in interpretation or implementation of the foregoing, could affect the Company and/or the Bank in substantial and unpredictable ways. Such changes could subject us to additional costs, limit the types of financial services and products we may offer and/or increase the ability of non-banks to offer competing financial services and products, among other things.

Under regulatory capital adequacy guidelines and other regulatory requirements, the Company and the Bank must meet guidelines that include quantitative measures of assets, liabilities and certain off-balance sheet items, subject to qualitative judgments by regulators about components, risk weightings and other factors. If we fail to meet these minimum capital guidelines and other regulatory requirements, our financial condition would be materially and adversely affected. Our failure to maintain the status of “well capitalized” under our regulatory framework could affect the confidence of our customers in us, thus compromising our competitive position. In addition, failure to maintain the status of “well capitalized” under our regulatory framework or “well managed” under regulatory examination procedures could compromise our status as a bank holding company and related eligibility for a streamlined review process for acquisition proposals.

We are also subject to laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes Act and new SEC regulations. These laws, regulations and standards are subject to varying interpretations in many cases, and as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies, which could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We are committed to maintaining high standards of corporate governance and public disclosure. As a result, our efforts to comply with evolving laws, regulations and standards have resulted in, and are likely to continue to result in, increased expenses and a diversion of management time and attention.

Failure to comply with laws, regulations or policies could also result in sanctions by regulatory agencies and/or civil money penalties, which could have a material adverse effect on our business, financial condition and results of operations. While we have policies and procedures designed to prevent any such violations, there can be no assurance that such violations will not occur. The information under the heading “Supervision and Regulation” in Item 1, “Business,” and Note N, “Regulatory Matters” to the Consolidated Financial Statements of the Company in Item 8, “Financial Statements and Supplementary Data,” provides more information regarding the regulatory environment in which we and the Bank operate.

Slower than anticipated growth in new branches and new product and service offerings could result in reduced income.

We have placed a strategic emphasis on expanding our branch network and product offerings. Executing this strategy carries risks of slower than anticipated growth both in new branches and new products. New branches and products require a significant investment of both financial and personnel resources. Lower than expected loan and deposit growth in new investments can decrease anticipated revenues and net income generated by those investments, and opening new branches and introducing new products could result in more additional expenses than anticipated and divert resources from current core operations.

We are substantially dependent on dividends from the Bank for our revenues.

The Company is a separate and distinct legal entity from the Bank, and it receives substantially all of its revenue from dividends from the Bank. These dividends are the principal source of funds to pay dividends on our common stock and interest and principal on debt. Various federal and/or state laws and regulations limit the amount of dividends that the Bank may pay to the Company. In the event the Bank is unable to pay dividends to us, we may not be able to service debt, pay obligations or pay dividends on our common stock. The inability to receive dividends from the Bank could have a material adverse effect on our business, financial condition and results of operations. The information under the heading “Supervision and Regulation” in Item 1, “Business,” provides a discussion about the restrictions governing the Bank’s ability to transfer funds to us.

We may not be able to attract and retain skilled people.

Our success depends in part on our ability to retain key executives and to attract and retain additional qualified personnel who have experience both in sophisticated banking matters and in operating a bank of our size. Competition for such personnel is strong in the banking industry, and we may not be successful in attracting or retaining the personnel we require. The unexpected loss of one or more of our key personnel could have a material adverse impact on our business because of their skills, knowledge of our markets, years of industry experience and the difficulty of promptly finding qualified replacements. We expect to effectively compete in this area by offering financial packages that are competitive within the industry.

Consumers may decide not to use banks to complete their financial transactions.

While we continually attempt to use technology to offer new products and services, at the same time, technology and other changes are allowing parties to complete financial transactions that historically have involved banks through alternative methods. For example, consumers can now maintain funds in brokerage accounts or mutual funds that would have historically been held as bank deposits. Consumers can also complete transactions such as paying bills and/or transferring funds directly without the assistance of banks. The process of eliminating banks as intermediaries, known as disintermediation, could result in the loss of fee income, as well as the loss of customer deposits and the related income generated from those deposits. The loss of these revenue streams and the lower cost deposits as a source of funds could have a material adverse effect on our financial condition and results of operations.

Severe weather, natural disasters, acts of war or terrorism and other external events could significantly impact our business.

Severe weather, natural disasters, acts of war or terrorism and other adverse external events could have a significant impact on the ability of the Company to conduct business. Such events could affect the stability of our deposit base, impair the ability of borrowers to repay outstanding loans, impair the value of collateral securing loans, cause significant property damage, result in loss of revenue and/or cause us to incur additional expenses. For example, during 2005, Hurricanes Katrina and Rita made landfall and subsequently caused extensive flooding and destruction along the coastal areas of the Gulf of Mexico. Although our operations were not disrupted by these hurricanes or their aftermath, other severe weather or natural disasters, acts of war or terrorism or other adverse external events may occur in the future. Although management has established disaster recovery policies and procedures, the occurrence of any such event could have a material adverse effect on our business, which, in turn, could have a material adverse effect on our financial condition and results of operations.

Risks Associated With Our Common Stock

Our stock price can be volatile.

Stock price volatility may make it more difficult for you to resell your common stock when you want and at prices you find attractive. Our stock price can fluctuate significantly in response to a variety of factors including, among other things:

| · | Actual or anticipated variations in quarterly results of operations. |

| · | Recommendations by securities analysts. |

| · | Operating and stock price performance of other companies that investors deem comparable to the Company. |

| · | News reports relating to trends, concerns and other issues in the banking and financial services industry. |

| · | Perceptions in the marketplace regarding us and/or our competitors. |

| · | New technology used, or services offered, by competitors. |

| · | Significant acquisitions or business combinations, strategic partnerships, joint ventures or capital commitments by or involving us or our competitors. |

| · | Failure to integrate acquisitions or realize anticipated benefits from acquisitions. |

| · | Changes in government regulations. |

| · | Geopolitical conditions such as acts or threats of terrorism or military conflicts. |

General market fluctuations, industry factors and general economic and political conditions and events, such as economic slowdowns or recessions, interest rate changes or credit loss trends, could also cause our stock price to decrease regardless of operating results.

The trading volume in our common stock is less than that of other larger bank holding companies.

Our common stock is listed for trading on The NASDAQ Capital Market; the average daily trading volume in our common stock is low, generally less than that of many of our competitors and other larger bank holding companies. A public trading market having the desired characteristics of depth, liquidity and orderliness depends on the presence in the marketplace of willing buyers and sellers of our common stock at any given time. This presence depends on the individual decisions of investors and general economic and market conditions over which we have no control. Given the lower trading volume of our common stock, significant sales of our common stock, or the expectation of these sales, could cause volatility in the price of our common stock.

An investment in our common stock is not an insured deposit.

Our common stock is not a bank deposit and, therefore, is not insured against loss by the FDIC, any deposit insurance fund or by any other public or private entity. Investment in our common stock is inherently risky for the reasons described in this “Risk Factors” section and elsewhere in this report and is subject to the same market forces that affect the price of common stock in any company. As a result, if you acquire our common stock, you may lose some or all of your investment.

Our Restated Articles of Association and By-laws, our Shareholder Rights Plan, as well as certain banking laws, may have an anti-takeover effect.

Provisions of our Restated Articles of Association and By-laws as well as our Shareholder Rights Plan, which are exhibits to this Annual Report on Form 10-K, and federal banking laws, including regulatory approval requirements, could make it more difficult for a third party to acquire the Company, even if doing so would be perceived to be beneficial to our shareholders. The combination of these provisions impedes a non-negotiated merger or other business combination, which, in turn, could adversely affect the market price of our common stock.

None.

The Company has its principal offices in its headquarters building at 500 Main Street, Natchez, Adams County, Mississippi 39120, which is owned and occupied by the Bank. The Bank owns the property on four additional branches and leases the property for one of its branches. In the judgment of management, the facilities of the Company and the Bank are generally suitable, adequately insured and provide for the continuing needs of the Company and the Bank. All branches operated are full service and the list below describes the locations and general character of the properties owned and leased by the Company and the Bank:

Location | Own/Lease | Use | Approximate Office Space (square feet) |

Natchez | | | |

500 Main Street Natchez, Mississippi | Owned | Main Office | 33,790 |

411 Highway 61 N. Natchez, Mississippi | Owned | Branch Office | 1,671 |

55A Sgt. Prentiss Drive Natchez, Mississippi | Owned | Branch Office | 10,720 |

| | | | |

Vicksburg | | | |

2059 Highway 61 N. Vicksburg, Mississippi | Owned | Branch Office | 3,050 |

2150 S. Frontage Road Vicksburg, Mississippi | Owned | Branch Office | 4,570 |

| | | | |

Baton Rouge | | | |

8810 Bluebonnet Suites A & B Baton Rouge, Louisiana | Lease | Branch Office | 5,112 |

The lease for the Company’s branch located at 8810 Bluebonnet Boulevard, in Baton Rouge, Louisiana is for a ten year period beginning October 1, 2003.

The Company and the Bank are currently not involved in any material pending legal proceedings.

There were no matters submitted to the Company’s shareholders during the fourth quarter of 2006.

PART II

Information Regarding our Common Stock

The Company’s common stock is listed on The NASDAQ Capital Market, and trades under the symbol “BKBK.” The table below sets forth dividends per share and the high and low sales prices ranges for the common stock, as reported by NASDAQ, for the last two fiscal years.

| | | | | | | | |

| | | Dividends Per Share | | High | | Low | |

2006 | | | | | | | |

| 4th Quarter | | $ | .18 | | $ | 20.95 | | $ | 19.16 | |

| 3rd Quarter | | | .18 | | | 21.50 | | | 18.85 | |

| 2nd Quarter | | | .18 | | | 23.04 | | | 18.25 | |

| 1st Quarter | | | .18 | | | 24.00 | | | 19.89 | |

| | | | | | | | | | | |

2005 | | | | | | | | | | |

| 4th Quarter | | $ | .18 | | $ | 21.48 | | $ | 20.07 | |

| 3rd Quarter | | | .18 | | | 21.68 | | | 19.56 | |

| 2nd Quarter | | | .33 | | | 22.80 | | | 17.01 | |

| 1st Quarter | | | | | | 19.50 | | | 17.70 | |

On March 1, 2007, there were 558 shareholders of record of the Company’s common stock.

The Company did not repurchase any equity securities during the 4th quarter of 2006.

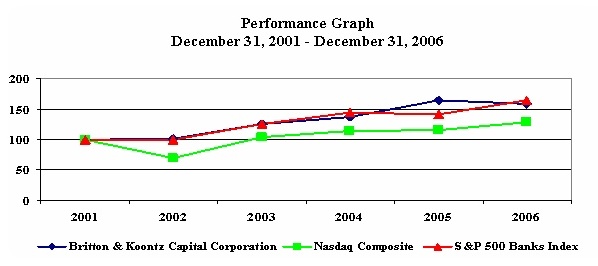

Stock Performance Graph

The following performance graph compares the performance of our common stock to the Nasdaq Composite Index and to the S&P 500 Banks Index for our reporting period. The performance graph assumes that the value of the investment in our common stock, the Nasdaq Composite Index and to the S&P 500 Banks Index was $100 at December 31, 2001, and that all dividends were reinvested.

| | 12/31/2001 | 12/31/2002 | 12/31/2003 | 12/31/2004 | 12/31/2005 | 12/31/2006 |

Britton & Koontz Capital Corporation | 100.00 | 101.41 | 124.58 | 136.48 | 163.40 | 158.74 |

Nasdaq Composite | 100.00 | 68.76 | 103.68 | 113.16 | 115.57 | 127.58 |

S&P 500 Banks Index (1) | 100.00 | 98.97 | 125.34 | 143.42 | 141.38 | 164.17 |

(1) | The companies in the S&P 500 Banks Index are: BB&T Corporation, Comerica Incorporated, Commerce Banc, New Jersey, Compass Bancshares, Inc., Countrywide Financial Corporation, Federal National Mortgage Association, Fifth Third Bancorp, First Horizon National Corporation, Federal Home Loan Mortgage Corporation, Huntington Bancshares Incorporated, Keycorp, M&T Bank Corporation, Marshall & Ilsley Corporation, MGIC Investment Corporation, National City Corporation, The PNC Financial Services Group, Inc., Regions Financial Corporation, Sovereign Bancorp, Inc., Suntrust Banks, Inc., Synovus Financial Corporation, U.S. Bancorp, Wachovia Corporation, Washington Mutual, Inc., Wells Fargo & Company and Zions Bancorporation. |

There can be no assurance that our common stock performance will continue in the future with the same or similar trends depicted in the performance graph above. We do not and will not make or endorse any predictions as to future stock performance.

| ($ IN THOUSANDS, EXCEPT PER SHARE DATA) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

YEAR END ACTUAL BALANCES | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total Assets | | $ | 369,318 | | $ | 389,260 | | $ | 377,351 | | $ | 373,032 | | $ | 308,879 | |

| Investment Securities | | | 107,370 | | | 121,783 | | | 137,303 | | | 141,135 | | | 97,059 | |

| Gross Loans (net of unearned income) | | | 243,534 | | | 244,912 | | | 219,311 | | | 206,591 | | | 180,398 | |

| Loans held for sale | | | 55 | | | 171 | | | 1,688 | | | 3,102 | | | 4,393 | |

| Allowance for Loan Losses | | | 2,344 | | | 2,378 | | | 2,237 | | | 2,070 | | | 2,129 | |

| Total Deposits | | | 253,757 | | | 257,377 | | | 226,288 | | | 232,934 | | | 233,012 | |

| Total Long-Term Debt | | | 39,579 | | | 53,041 | | | 60,078 | | | 65,711 | | | 30,315 | |

| Stockholders’ Equity | | | 33,597 | | | 31,260 | | | 31,152 | | | 30,197 | | | 29,329 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

YEAR END AVERAGE BALANCES | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Total Assets | | | 376,626 | | | 390,317 | | | 375,496 | | | 340,566 | | | 299,600 | |

| Earning Assets | | | 357,407 | | | 370,609 | | | 354,004 | | | 320,337 | | | 280,233 | |

| Investment Securities | | | 112,458 | | | 132,843 | | | 134,993 | | | 116,520 | | | 92,502 | |

| Gross Loans (net of unearned income)* | | | 242,910 | | | 236,796 | | | 218,301 | | | 201,595 | | | 182,744 | |

| Allowance for Loan Losses | | | 2,444 | | | 2,379 | | | 2,224 | | | 2,209 | | | 2,008 | |

| Total Deposits | | | 255,713 | | | 236,440 | | | 230,437 | | | 237,019 | | | 220,095 | |

| Total Long-Term Debt | | | 46,241 | | | 70,760 | | | 67,665 | | | 44,359 | | | 34,088 | |

| Stockholders’ Equity | | | 32,248 | | | 31,347 | | | 30,853 | | | 30,181 | | | 29,323 | |

| | | | | | | | | | | | | | | | | |

| *Includes loans held for sale | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

SUMMARY OF EARNINGS | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Total Interest Income | | | 23,708 | | | 22,000 | | | 19,774 | | | 19,565 | | | 19,854 | |

| Total Interest Expense | | | 10,206 | | | 8,445 | | | 6,465 | | | 6,329 | | | 7,205 | |

| Net Interest Income | | | 13,502 | | | 13,555 | | | 13,309 | | | 13,236 | | | 12,649 | |

| Provision for Loan Losses | | | 475 | | | 300 | | | 390 | | | 670 | | | 1,025 | |

| Non-interest Income | | | 2,462 | | | 2,418 | | | 2,678 | | | 2,767 | | | 870 | |

| Non-interest Expense | | | 10,716 | | | 11,630 | | | 11,973 | | | 11,844 | | | 10,266 | |

| Income Tax Expense | | | 1,194 | | | 815 | | | 780 | | | 750 | | | 988 | |

| Net Income | | | 3,579 | | | 3,228 | | | 2,844 | | | 2,739 | | | 1,240 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

PER SHARE DATA | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Earnings Per Share-Basic | | | 1.69 | | | 1.53 | | | 1.35 | | | 1.30 | | | 0.59 | |

| Earnings Per Share - Diluted | | | 1.69 | | | 1.52 | | | 1.34 | | | 1.29 | | | 0.59 | |

| Cash Dividends | | | 0.72 | | | 0.69 | | | 0.64 | | | 0.64 | | | 0.62 | |

| Book Value | | | 15.86 | | | 14.77 | | | 14.72 | | | 14.29 | | | 13.88 | |

| Year End Stock Price | | | 19.76 | | | 21.10 | | | 18.25 | | | 17.27 | | | 14.60 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

OTHER KEY INFORMATION | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Return on Average Assets | | | 0.95 | % | | 0.83 | % | | 0.76 | % | | .080 | % | | 0.41 | % |

| Return on Average Equity | | | 11.10 | % | | 10.30 | % | | 9.22 | % | | 9.07 | % | | 4.23 | % |

| Dividend Payout | | | 42.60 | % | | 45.10 | % | | 47.41 | % | | 49.23 | % | | 105.08 | % |

| Efficiency Ratio | | | 63.11 | % | | 68.52 | % | | 70.51 | % | | 69.80 | % | | 70.79 | % |

| Net Interest Income/Average Earning Assets | | | 3.78 | % | | 3.66 | % | | 3.76 | % | | 4.13 | % | | 4.51 | % |

| Allowance for Loan Losses/Loans | | | 0.96 | % | | 0.97 | % | | 1.02 | % | | 1.00 | % | | 1.18 | % |

| Non Performing Loans/Loans | | | 0.59 | % | | 0.51 | % | | 0.41 | % | | 0.74 | % | | 1.29 | % |

| Loans/Deposits | | | 95.97 | % | | 95.16 | % | | 96.92 | % | | 88.69 | % | | 77.42 | % |

| Total Stockholders’ Equity/Assets | | | 9.10 | % | | 8.03 | % | | 8.26 | % | | 8.10 | % | | 9.50 | % |

| Total Risk-Based Ratio | | | 15.27 | % | | 14.44 | % | | 15.43 | % | | 15.39 | % | | 14.71 | % |

| Tier 1 Risk-Based Ratio | | | 14.40 | % | | 13.55 | % | | 14.49 | % | | 14.48 | % | | 13.61 | % |

| Tier 1 Leverage Ratio | | | 10.45 | % | | 9.31 | % | | 9.23 | % | | 9.23 | % | | 8.71 | % |

| | | | | | | | | | | | | | | | | |

| Weighted Average Share Outstanding: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Basic | | | 2,117,529 | | | 2,116,316 | | | 2,114,649 | | | 2,113,087 | | | 2,109,809 | |

| Diluted | | | 2,121,846 | | | 2,120.951 | | | 2,118,181 | | | 2,116,163 | | | 2,112,405 | |

This discussion presents a review of the major factors that have affected the financial condition, changes in financial condition and results of operations of Britton & Koontz Capital Corporation (the “Company”) and its subsidiaries, principally Britton & Koontz Bank, N.A. (the “Bank”), as of and for the three years ended December 31, 2006.

SUMMARY

During the past three years, the Company has emphasized loan and deposit growth and reduction of personnel expenses while also devoting considerable efforts to consolidate and realign branches and Bank premises. The Company ended 2004 with six locations and 131 employees, down from ten locations and 149 employees the year before. During 2005, the Company continued its efforts to streamline operations and ended the year with 107 employees. The Company also experienced excellent growth in its loan and deposits in 2005, as loans increased $24 million to $245 million and total deposits increased $31 million to $257 million. The Company’s loan growth in 2005 came primarily from growth in business and industrial commercial real estate loans, including residential land development and construction loans and 1-4 family residential mortgage loans. Throughout 2005, the Company operated in an environment where short-term rates continued to move upward while long-term rates remained the same or decreased, thus creating a flatter yield curve. This scenario contributed to the decline in net interest margin to 3.66% at December 31, 2005, from 3.76% at December 31, 2004. While declining margins were prevalent throughout the industry, management believes that the Company’s growth in loans during 2005 helped offset the negative effects associated with a flat yield curve and actually slowed margin compression. Another major factor that aided in preventing additional declines in net interest margin and stabilizing net interest margin in 2005 was the 29% increase in the Company’s non-interest bearing deposits since December 31, 2004.

The Federal Reserve began raising short-term rates in 2004 and had raised the benchmark rate 13 times through December 31, 2005, to 4.25%. As 2006 began, it became clear that the Company would face significant pressure on its interest margins as the Fed Funds rate was increased an additional 4 times, ending 2006 at 5.25%. Not only was the short-term rate increase elevating funding costs, but at the same time intermediate and longer-term rates on earning assets remained the same, or even decreased, effectively capping asset yields. This flattening and inversion of the yield curve contributed heavily to the lower levels of the Company’s net interest income in 2006. In light of the changes in the yield curve, management determined in 2006 that, while it would continue to aggressively seek out new opportunities to grow the Bank’s loans, investments and deposits, such growth should come only from assets whose margins justified the risk associated with the asset and that otherwise satisfied the Company’s credit standards. Management also determined that, if such growth opportunities were not available for one type of asset, funds would be directed to those assets where such growth opportunities were present and otherwise would be used to pay down long-term debt, which itself would improve the Company’s net interest income and interest margins. Accordingly, in 2006 cash flows from the investment portfolio and the residential mortgage portfolio were redirected into higher-yielding commercial loans and to the reduction in borrowings from the Federal Home Loan Bank of Dallas (“FHLB”). These commercial loans increased $19 million while borrowing declined by a similar amount. The effect of this redirection of cash flows was to lower the level of total assets and the level of total liabilities by approximately $20 million each. The new commercial loans and the reduction of FHLB borrowings also increased the Company’s net interest income during 2006. This increase, however, was offset by the negative effects of the interest rate environment during 2006. More information about the volume and rate variances can be seen under the heading “Average Balances and Yield Analysis” and “Net Interest Income.”

The Company currently leases a branch on Bluebonnet Boulevard and intends to acquire a second site in Baton Rouge during the year. Management also plans to add a third branch in Baton Rouge by 2010. Capital expenditures for equipment and software in 2007 are projected to be approximately $400 thousand. Management expects that new purchases in 2007 will be offset by an estimated $785 thousand in depreciation expense.

In 2006, the Company reported net income of $3.6 million, or $1.69 per basic and diluted share, representing an 11% increase over the $3.2 million, or $1.53 and $1.52 per basic and diluted share, of net income reported at December 31, 2005, and a 26% increase compared to net income of $2.8 million, or $1.35 and $1.34 per basic and diluted share, reported at December 31, 2004. Return on average equity for the years 2006, 2005 and 2004 was 11.10%, 10.30% and 9.22%, respectively. Net interest margins increased to 3.78% at December 31, 2006, from 3.66% at December 31, 2005 and 3.76% at December 31, 2004.

FINANCIAL CONDITION

Assets

Total assets decreased 5%, or $19.9 million, during 2006 to $369.3 million from $389.3 million at December 31, 2005. The decline in assets is primarily due to the redirection of cash flows from both the investment portfolio and the residential mortgage portfolio into new commercial loans and the reduction in FHLB borrowings. The strategy had the effect of lowering the Bank’s total assets but also improving both interest margins and net interest income.

Total assets increased 3%, or $11.9 million, during 2005 to $389.3 million from $377.4 million at December 31, 2004. Growth in assets was primarily due to increases in loans held for investment of $25.5 million, net of unearned interest and allowance for loan losses, offset by reductions of $15.5 million in investment securities.

Average Earning Assets. Interest income from earning assets represents the Company’s main source of revenue. Average earning assets for the year ended December 31, 2006, totaled $357.4 million, a $13.2 million, or 3.6%, decrease compared to December 31, 2005. The decrease was made up of a $20.4 million, or 15.3%, decrease in average investment securities primarily offset by a $6.1 million, or 2.6%, increase in average loans. Average earning assets for the period ended December 31, 2004, totaled $354 million.

Investment Securities. Investment securities primarily consist of mortgage-backed, municipal, corporate and agency securities. Securities that are deemed to be held-to-maturity (“HTM”) are accounted for by the amortized cost method and represent approximately 36% of total securities at December 31, 2006. Those securities designated available-for-sale (“AFS”) are accounted for at fair value and represent approximately 60% of the total at December 31, 2006. Equity securities account for the remaining 4%. Management determines the classification of its securities at acquisition. Total HTM and AFS investment securities fell by $13.3 million, or 11%, to $103.0 million at December 31, 2006, from $116.3 million at December 31, 2005. From 2004 to 2005, total HTM and AFS investment securities fell by $15.5 million, or 12%, to $116.3 million at December 31, 2005, from $131.8 million at December 31, 2004. In both 2005 and 2006, the flat yield curve discouraged reinvestment of proceeds from investments back into the market; consequently, cash flows from investments were used to fund new loan growth and reduce borrowings.

Equity securities at December 31, 2006 are comprised primarily of Federal Reserve Bank stock of $522 thousand, FHLB stock of $3.5 million, the Company’s $155 thousand interest in its B&K Bank Statutory Trust and ECD Investments, LLC membership interests of $100 thousand. These securities fell $1.2 million to $4.3 million in 2006 from $5.5 million in 2005, due to mandatory redemption recalculations of $1.4 million of FHLB stock.

The amortized cost of the Bank’s investment securities at December 31, 2006, 2005 and 2004, are summarized as follows:

| | | | | | | | |

| | | | | Amortized Cost | | | |

| | | | | | | | |

| | | 12/31/06 | | 12/31/05 | | 12/31/04 | |

| | | | | | | | |

| Obligations of other U.S. Government | | | | | | | | | | |

| Agencies and Corporations | | $ | 68,015,850 | | $ | 82,864,118 | | $ | 94,369,933 | |

| Obligations of State and | | | | | | | | | | |

| Political Subdivisions | | | 36,175,580 | | | 34,904,765 | | | 35,321,401 | |

| Privately Issued Collateralized | | | | | | | | | | |

| Mortgage Obligations | | | - | | | 127,770 | | | 173,419 | |

| Corporate Securities | | | - | | | - | | | 1,007,752 | |

| | | | | | | | | | | |

| | | $ | 104,191,430 | | $ | 117,896,653 | | $ | 130,872,505 | |

The amortized cost of investment securities at December 31, 2006, by contractual maturity (including mortgage backed securities) is shown below. Expected maturities may differ from contractual maturities because borrowers may have the right to call or prepay obligations with or without call or prepayment penalties. Yields on tax-exempt municipal securities have been computed on a book equivalent basis which takes into account the coupon rate paid by the issuer adjusted by any premium paid or discount received on the security at settlement date.

| | | Amortized | | Weighted | |

| | | Cost | | Average Yield | |

| | | | | | |

| Due in one year or less | | $ | 5,993,800 | | | 4.116 | % |

| Due after one year through five years | | | 5,848,745 | | | 5.235 | % |

| Due after five years through ten years | | | 56,029,464 | | | 5.175 | % |

| Due after ten years | | | 36,319,421 | | | 5.723 | % |

| Total | | $ | 104,191,430 | | | 5.308 | % |

| | | | | | | | |

Loans. Loans represent the Company’s largest source of revenue. Total loans at December 31, 2006, were $243.6 million, a decrease of $1.5 million compared to December 31, 2005. Total loans at December 31, 2005 were $245.1 million, an increase of $24.1 million compared to December 31, 2004. The Company experienced loan growth in its Baton Rouge, Louisiana market of $25.1 million in 2006. Loan demand in the small business and commercial real estate sector in this market has been brisk, and the Company’s lending staff has been especially successful in attracting new business. Total loans in Baton Rouge amounted to $84.0 million, representing approximately 34% of the Company’s loan portfolio. The Vicksburg market ended December 31, 2006, with $42 million in loans, representing 17% of the portfolio, a drop since the previous year of 4%. The Natchez, Mississippi market ended 2006 virtually the same as the previous year. The Company’s 1-4 family mortgage loans that are held in the its treasury management branch decreased $18.6 million. The decrease in the mortgage portfolio resulted from the Company’s decision to table fund and sell predominately all of its 1-4 family residential loans in the secondary market. Loan growth in the Baton Rouge market was funded by operating activities and excess cash flows from investment securities and residential mortgage loans. Table 1 presents the Bank’s loan portfolio, including loans held for sale, at the end of the last five years. The Company has no foreign loan activities.

TABLE 1: COMPOSITION OF LOAN PORTFOLIO

| | | 12/31/06 | | 12/31/05 | | 12/31/04 | | 12/31/03 | | 12/31/02 | |

| Commercial, financial and agricultural | | $ | 28,385,000 | | $ | 32,868,000 | | $ | 31,589,000 | | $ | 31,853,000 | | $ | 34,264,000 | |

| Real estate-construction | | | 44,592,000 | | | 30,069,000 | | | 18,360,000 | | | 14,690,000 | | | 7,207,000 | |

| Real estate-residential | | | 83,256,000 | | | 98,488,000 | | | 92,889,000 | | | 91,031,000 | | | 73,590,000 | |

| Real Estate-other | | | 76,473,000 | | | 70,875,000 | | | 63,685,000 | | | 57,826,000 | | | 53,694,000 | |

| Installment | | | 10,680,000 | | | 12,478,000 | | | 14,229,000 | | | 14,195,000 | | | 15,881,000 | |

| Other | | | 203,000 | | | 306,000 | | | 249,000 | | | 102,000 | | | 170,000 | |

| | | | | | | | | | | | | | | | | |

| Total loans | | $ | 243,589,000 | | $ | 245,084,000 | | $ | 221,001,000 | | $ | 209,697,000 | | $ | 184,806,000 | |

The following table sets forth as of December 31, 2006, the periods in which the Bank’s commercial, financial and agricultural loans and its real estate-construction loans mature or reprice and the total amount of all such loans due after one year having (a) predetermined interest rates and (b) floating or adjustable rates. Loan maturities are based upon contract terms and specific maturity dates. Loans with balloon payments and longer amortizations are often repriced and extended beyond the initial maturity when credit conditions remain satisfactory.

| | | | | Due after | | | | | |

| | | Due in | | one year | | | | | |

| | | one year | | through | | Due after | | | |

| | | or less | | five years | | five years | | Total | |

| | | | | | | | | | |

| Commercial, financial and agricultural | | $ | 13,993,000 | | $ | 14,004,000 | | $ | 388,000 | | $ | 28,385,000 | |

| Real estate-construction | | | 28,033,000 | | | 12,927,000 | | | 3,632,000 | | | 44,592,000 | |

| | | | | | | | | | | | | | |

| Total | | $ | 42,026,000 | | $ | 26,931,000 | | $ | 4,020,000 | | $ | 72,977,000 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |