UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

BRITTON & KOONTZ CAPITAL CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1.) | Title of each class of securities to which transaction applies: |

| | 2.) | Aggregate number of securities to which transaction applies: |

| | 3.) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4.) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of filing. |

| | 1.) | Amount previously paid: |

| | 2.) | Form, Schedule or Registration Statement No.: |

BRITTON & KOONTZ CAPITAL CORPORATION

500 Main Street

Natchez, Mississippi 39120

March 17, 2006

Dear Fellow Shareholder:

On behalf of the Board of Directors, we cordially invite you to attend the 2006 Annual Meeting of Shareholders of Britton & Koontz Capital Corporation. The Annual Meeting will be held beginning at 3:30 p.m., local time, on Tuesday, April 25, 2006, in the lobby of the main office of Britton & Koontz Bank, N.A., 500 Main Street, Natchez, Mississippi. The formal notice of the Annual Meeting appears on the next page.

Enclosed is our proxy statement for the 2006 Annual Meeting, in which (i) we seek your support for the election as directors of those nominees named in the enclosed proxy statement, for an amendment to the company’s Restated Articles of Association to eliminate cumulative voting rights in the election of directors and for any adjournment of the annual meeting, if necessary in the judgment of the Board, for the purpose of soliciting additional proxies in favor of the foregoing proposals or against the shareholder proposal, and (ii) we urge you to vote against a shareholder proposal. This proxy statement and the accompanying proxy card are first being distributed to our shareholders on or about March 17, 2006. Our annual report to shareholders for the fiscal year ended December 31, 2005, accompanies this proxy statement.

We urge you to review the proxy statement carefully. Regardless of the number of shares you own, it is important that your shares be represented and voted at the meeting. Please take a moment now to sign, date and mail the enclosed proxy card in the postage prepaid envelope. Your Board of Directors recommends a vote“FOR” the election as directors of those nominees selected by our Board of Directors and named in the enclosed proxy statement, a vote“FOR” the amendment to our Restated Articles of Association to eliminate cumulative voting rights in the election of directors, a vote“AGAINST” the shareholder proposal set forth in the proxy statement, and a vote“FOR” any adjournment of the annual meeting to another time or place, if necessary in the judgment of the Board, for the purpose of soliciting additional proxies in favor of the Board’s proposals or against the shareholder proposal.

We are gratified by our shareholders’ continued interest in Britton & Koontz, and are pleased that in the past so many of you have voted your shares. We look forward to seeing you at the Annual Meeting.

| | |

| |  |

W. Page Ogden Chairman of the Board President, Chief Executive Officer | | Robert R. Punches Vice Chairman of the Board |

BRITTON & KOONTZ CAPITAL CORPORATION

500 Main Street

Natchez, Mississippi 39120

Notice of Annual Meeting of Shareholders

to be held on Tuesday, April 25, 2006

Notice is hereby given that the Annual Meeting of Shareholders of Britton & Koontz Capital Corporation will be held beginning at 3:30 p.m., local time, on Tuesday, April 25, 2006, in the lobby of the main office of Britton & Koontz Bank, N.A., 500 Main Street, Natchez, Mississippi. The Annual Meeting has been called for the following purposes:

| | 1. | to elect two Class I directors to serve until the expiration of their respective three-year terms in 2009 or until their successors are elected and qualified; |

| | 2. | to elect one Class III director to serve until the expiration of his two-year term in 2008 or until his successor is elected and qualified; |

| | 3. | to approve an amendment to the Company’s Restated Articles of Association to eliminate cumulative voting rights in the election of directors; |

| | 4. | to vote on a shareholder proposal, if properly presented; |

| | 5. | to approve any adjournment of the annual meeting to another time or place, if necessary in the judgment of the Board of Directors, for the purpose of soliciting additional proxies in favor of Proposal Nos. 1, 2 and 3 above or against Proposal No. 4 above; and |

| | 6. | to transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

As described in the “Other Matters” section of the accompanying proxy statement, the Board has been advised that at the Annual Meeting a stockholder may nominate a candidate for election as a Class I director or a Class III director. Even if another candidate is nominated at the meeting, the Board unanimously recommends that shareholders vote for the Board’s nominees for election as directors.

The Board of Directors has fixed the close of business on Tuesday, March 14, 2006, as the record date for the determination of the shareholders entitled to notice of, and to vote at, the Annual Meeting.

Your attention is directed to, and you are encouraged to carefully read, the proxy statement accompanying this Notice of Annual Meeting for a more complete description of the business to be presented and acted upon at the meeting.

All shareholders are cordially invited to attend the meeting in person.Regardless of whether you plan to attend, however, please sign and date the enclosed proxy card and return it in the envelope provided as promptly as possible. A proxy may be revoked at any time before it is voted at the meeting.

By Order of the Board of Directors

Cliffie S. Anderson, Corporate Secretary

Natchez, Mississippi

March 17, 2006

TABLE OF CONTENTS

i

ii

BRITTON & KOONTZ CAPITAL CORPORATION

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD TUESDAY, APRIL 25, 2006

This proxy statement is furnished to the shareholders of Britton & Koontz Capital Corporation in connection with the solicitation of proxies by the Board of Directors for use at the 2006 Annual Meeting of Shareholders to be held at 3:30 p.m., local time, on Tuesday, April 26, 2005, at the main office of Britton & Koontz Bank, N.A., 500 Main Street, Natchez, Mississippi, as well as in connection with any adjournments or postponements of that meeting. In this proxy statement, Britton & Koontz Capital Corporation is referred to as “we,” “our,” “us,” or “the Company,” and Britton & Koontz Bank, N.A. is referred to as “the Bank.”

VOTING PROCEDURES

Who is soliciting proxies from the shareholders?

The Board of Directors of the Company is soliciting the enclosed proxy. The proxy provides you with the opportunity to vote on the proposals presented at the annual meeting, whether or not you attend the meeting.

What will be voted on at the annual meeting?

The enclosed proxy provides the opportunity for you to vote on the following proposals:

1. The election of two Class I directors to serve until the expiration of their respective three-year terms, or until their successors are elected and qualified;

2. The election of one Class III director to serve until the expiration of his two-year term, or until his successor is elected and qualified;

3. An amendment to the Company’s Restated Articles of Association to eliminate cumulative voting rights in the election of directors;

4. A shareholder proposal, if properly presented; and

5. Any adjournment of the annual meeting to another time or place, if necessary in the judgment of the Board of Directors, for the purpose of soliciting additional proxies in favor of Proposal Nos. 1, 2 and 3 or against Proposal No. 4.

For each proposal to elect directors, you may vote for all of the nominees in each class for election as director, for one or more nominees in each class but not the others (to the extent more than one director is to be elected), or withhold your vote for all nominees in that class. For the remaining proposals, you may vote for the approval of the proposal or against its approval, or you may abstain from voting on the proposal. The proxy card also gives the proxy holders discretionary authority to vote the shares represented by the proxy on any matter, other than the above proposals, that is properly presented for action at the annual meeting.

Who bears the cost of the proxy solicitation?

We bear the cost of solicitation of proxies, including expenses incurred in connection with preparing and mailing the proxy statement. The initial solicitation will be by mail. We have retained American Stock Transfer & Trust Company and The Altman Group, Inc. to assist in the solicitation of proxies from banks, brokers and nominees of shareholders for the annual meeting. The Company estimates that American Stock

1

Transfer & Trust Company’s fees will not exceed $1,000, plus out-of-pocket costs and expenses, and that The Altman Group’s fees will not exceed $8,000, plus out-of-pocket costs and expenses. The Company has agreed to indemnify and hold The Altman Group harmless against any liability incurred in connection with the solicitation of proxies (unless the liability results from The Altman Group’s negligence or misconduct).

Additionally, our directors, officers and regular employees may contact shareholders to request that they return their proxies; such contact may occur by means of the mail, telephone, the Internet or personal contact. A director, officer or regular employee of the Company will not receive any additional compensation for undertaking such efforts. We will also, in accordance with the regulations of the Securities and Exchange Commission, reimburse brokerage firms and other persons representing beneficial owners of our common stock for their reasonable expenses in forwarding solicitation material to such beneficial owners.

Who can vote at the annual meeting?

Our Board of Directors has fixed the close of business on Tuesday, March 14, 2006, as the record date for our annual meeting. Only shareholders of record on that date are entitled to receive notice of and vote at the annual meeting. As of March 14, 2006, the Company’s only outstanding class of securities was common stock, $2.50 par value per share. On that date, the Company had 12,000,000 shares authorized, of which 2,117,086 shares were issued.

How many votes must be present to hold the annual meeting?

A “quorum” must be present to hold the Company’s annual meeting. A majority of the votes entitled to be cast at the annual meeting constitutes a quorum. Your shares, once represented for any purpose at the annual meeting, are deemed present for purposes of determining a quorum for the remainder of the meeting and for any adjournment, unless a new record date is set for the adjourned meeting. This is true even if you abstain from voting with respect to any matter brought before the annual meeting.

What vote is required for approval of proposals at the annual meeting?

For all proposals brought before the annual meeting, except the election of directors, each proposal is approved if the votes cast in favor of the proposal are greater than the votes cast opposing the proposal.

Our shareholders are entitled to one vote for each share held, except that as to the proposals to elect directors, shareholders may cumulate their votes.

How are directors elected?

At the annual meeting, you will consider two proposals to elect directors, one proposal to elect two Class I directors and another to elect one Class III director. Directors are elected by plurality vote; the candidates in each class who receive the highest number of votes cast, up to the number of directors to be elected, are elected.

The election of directors is subject to cumulative voting, as the proposal to amend the Company’s Restated Articles of Association, if approved at all, will not take effect until after the annual meeting. Cumulative voting entitles you to a number of votes equal to the number of directors to be elected in that class multiplied by the number of shares you hold. You may give one nominee in a single class all of your votes or, if there is more than one nominee for election in a class, you may distribute your total votes among all or several nominees in the class. For example:

Two Class I directors will be elected at the annual meeting. If you own ten shares, you have 20 votes for Class I directors. You can elect to cast all votes for a single director, cast ten votes for each of the Board’s two nominees or allocate your 20 votes between the Board’s two nominees in Class I in a different manner.

It is intended that shares represented by proxies solicited pursuant to this proxy statement will be voted for the election of the Board’s nominees for Class I directors and the Board’s nominee for Class III director to the extent

2

proxies do not contain voting instructions with respect to the election of directors. The persons authorized to vote shares represented by executed proxies will have full discretion and authority to vote cumulatively and allocate votes among any or all of the nominees of the Board in such manner as they may determine, to the extent an executed proxy does not withhold authority to vote for the election of directors or for any particular nominee or provide specific instructions regarding the allocation of votes.

The Board has been advised that a shareholder may nominate his own candidate for election as a Class I or Class III director at the annual meeting. If shareholders attending the annual meeting cumulate their votes such that both of the Board’s nominees for Class I director cannot be elected, the proxy holders intend to cumulate votes to elect Robert R. Punches, absent specific instructions on the executed proxy withholding authority for all nominees or for Mr. Punches in particular or directing how votes should be cumulated. With respect to the election of one Class III director, the proxies, to the extent that they possess discretionary voting authority, intend to vote all shares for the Board’s nominee for director (since only one Class III director is to be elected, and thus each share is entitled to only one vote for Class III directors, the allocation of cumulative votes among nominees is not applicable).

How are votes cast?

You can vote either in person at the annual meeting (if you, rather than your broker, are the record holder of the stock) or by proxy, whether or not you attend the annual meeting. To vote by proxy, you must fill out the enclosed proxy card, date and sign it, and either return it in the enclosed postage-paid envelope in time for the Company to receive it prior to the annual meeting or attend the annual meeting and return the proxy at that time.

How will the proxy be voted, and how are votes counted?

When your proxy card is returned, properly signed and dated, the shares represented by the proxy will be voted as you instructed on the card at the annual meeting, including any adjournments or postponements of the meeting. If your proxy card is signed, but no instructions are given, the shares represented by the proxy will be voted at the annual meeting and any adjournments or postponements as follows:

| | • | | “FOR” the election of nominees Bethany L. Overton and Robert R. Punches as Class I directors. |

| | • | | “FOR” the election of nominee A.J. Ferguson as a Class III director. |

| | • | | “FOR” the approval of an amendment to the Company’s Restated Articles of Association to eliminate cumulative voting rights in the election of directors. |

| | • | | “AGAINST” the shareholder proposal described in this proxy statement, if properly presented. |

| | • | | “FOR” the adjournment of the annual meeting to another time or place, if necessary in the judgment of the Board of Directors, for the purpose of soliciting additional proxies in favor of the Board’s proposals or against the shareholder proposal. |

Under Mississippi law, an abstention by a shareholder who is either present in person at the annual meeting or represented by proxy is not a vote “cast” and is counted neither “for” nor “against” the matter subject to the abstention. As noted above, to the extent that the proxy holders possess discretionary voting authority, the proxy holders will cumulate votes in such a manner as to elect both of the Board’s nominees for Class I director. If it is clear that shares have been cumulatively voted such that both of the Board’s nominees for Class I director cannot be elected, the proxy holders intend to cumulate votes in order to elect Robert R. Punches.

If you hold your shares in a broker’s name (sometimes called “street name” or “nominee name”), you must provide voting instructions to your broker. If you do not provide instructions to your broker, the shares will not be voted on any matter on which your broker does not have discretionary authority to vote, which may include some of the proposals to be voted on at the annual meeting. A vote that is not cast for this reason is called a

3

“broker non-vote.” Broker non-votes will be treated as shares present for the purpose of determining whether a quorum is present at the meeting, but they will not be considered present for purposes of calculating the vote on a particular matter, nor will they be counted as a vote FOR or AGAINST a matter or as an abstention on the matter.

How are shares in the Company’s ESOP voted?

If you are an employee of the Company who participates in the Britton & Koontz Capital Corporation Employee Stock Ownership Plan (the “ESOP”), you can vote the number of shares of common stock allocated to you under the ESOP, determined as of the close of business on March 14, 2006. The trustee of the ESOP, the Bank, acts as a proxy and actually votes the shares. If you do not return a signed proxy card within the time required, the Bank will not vote these shares. If you sign and return the proxy card for your ESOP shares, but give no specific voting instructions, the Bank will vote the shares represented by the proxy at the annual meeting and any adjournments or postponements in the manner described in the question immediately above.

Can a proxy be revoked?

Yes. You can revoke your proxy at any time before it is voted by giving written notice to the corporate secretary of the Company before the annual meeting or by granting a subsequent proxy. If you, rather than your broker, are a record holder of our stock, a proxy can also be revoked by appearing in person and voting at the annual meeting. Written notice of the revocation of a proxy should be delivered to the following address: Cliffie S. Anderson, Britton & Koontz Capital Corporation, 500 Main Street, Natchez, Mississippi 39120.

4

STOCK OWNERSHIP

Does any person or group own 5% or more of the Company’s common stock?

The following table sets forth information regarding the beneficial ownership of the our common stock as of March 14, 2006, by each person or entity, including any group (as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, referred to as the “Exchange Act”), known to the Company to be the beneficial owner of 5% or more of the our outstanding common stock. Beneficial ownership has been determined under Rule 13d-3 promulgated under the Exchange Act.

| | | | | |

Name and Address | | Number of Shares

Beneficially

Owned | | Percentage

Ownership(1) | |

Lanneau Shareholder Group(2): | | | | | |

Anna Rose M. Lanneau | | 76,179 | | 3.6 | % |

750 Hwy. 61 South Natchez, Mississippi 39120 | | | | | |

| | |

Bazile R. Lanneau, Jr. | | 63,718 | | 3.0 | % |

790 Hwy. 61 South Natchez, Mississippi 39120 | | | | | |

| | |

Bazile R. Lanneau | | 34,669 | | 1.6 | % |

750 Hwy. 61 South Natchez, Mississippi 39120 | | | | | |

| | |

Keith P. Lanneau | | 15,020 | | 0.7 | % |

2151 E. Lakeshore Dr. Baton Rouge, Louisiana 70808 | | | | | |

| | |

Jeri Jean M. Lanneau | | 63 | | 0.003 | % |

790 Hwy. 61 South Natchez, Mississippi 39120 | | | | | |

| | | | | |

Total | | 189,649 | | 9.0 | % |

| | |

Hot Creek Capital, L.L.C., Hot Creek Investors, L.P.

and David M. W. Harvey(3) | | 147,542 | | 7.0 | % |

6900 South McCarran Blvd. Suite 3040 Reno, Nevada 89509 | | | | | |

| | |

Britton & Koontz Capital Corporation Employee | | 160,630 | | 7.6 | % |

Stock Ownership Plan(4) | | | | | |

500 Main Street Natchez, Mississippi 39120 | | | | | |

| (1) | Based upon 2,117,086 shares of Company common stock outstanding as of March 14, 2006. |

| (2) | Based on a Schedule 13D jointly filed by Anna Rose M. Lanneau, Bazile R. Lanneau, Jr., Bazile R. Lanneau, Keith P. Lanneau and Jeri Jean M. Lanneau on July 15, 2005, with the Securities and Exchange Commission indicating that they constitute a “group” as that term is used in Section 13(d)(3) of the Exchange Act. Each member of such group has indicated in such Schedule 13D that he or she has sole voting and dispositive power with respect to the shares indicated opposite such member’s name in the table above. |

| (3) | Based on a Schedule 13D jointly filed by Hot Creek Investors, L.P. (“HC-LP”), Hot Creek Capital, L.L.C. (“HC-GP”) and David M. W. Harvey (“Harvey”) on May 23, 2005, with the Securities and Exchange Commission indicating that HC-LP, HC-GP and Harvey constitute a group. HC-LP holds all of the shares of the Company’s common stock. HC-GP is the General Partner of HC-LP, and Harvey is the principal member of HC-GP. In these capacities, HC-GP and Harvey exercise shared dispositive and shared voting power with respect to shares held by HC-LP. |

5

| (4) | The Bank, as trustee, holds the shares in the ESOP. All of the shares held in the ESOP are allocated to individual participant accounts. Participants have voting rights for shares allocated to their accounts and benefits are distributed according to plan terms. The trustee votes the shares in accordance with instructions received from the participants. If a signed proxy card is not returned within the time required, the Bank will not vote these shares. For a proxy card that is signed and returned, but which provides no specific voting instructions, the Bank will vote the shares represented by the proxy at the annual meeting and any adjournments or postponements as described in the question “How will the proxy be voted, and how are votes counted?” under the heading “Voting Procedures.” |

How much stock is beneficially owned by the directors and executive officers of the Company?

The following table sets forth, as of March 14, 2006, the number of shares of our common stock beneficially owned by (i) all directors and nominees for director, (ii) our chief executive officer and (iii) all directors and executive officers as a group. Unless otherwise noted, the named persons have sole voting and investment power with respect to the shares indicated (subject to any applicable community property laws). The address of each director and executive officer is the address of our executive offices.

| | | | | |

| | | Number of Shares

Beneficially

Owned(1) | | Percentage

Ownership(2) | |

Directors and Nominees | | | | | |

W. W. Allen, Jr.(3) | | 4,184 | | * | |

Craig A. Bradford, D.M.D.(4) | | 23,412 | | 1.1 | % |

A. J. Ferguson | | 12,180 | | * | |

George R. Kurz | | 3,500 | | * | |

Bethany L. Overton | | 3,188 | | * | |

R. Andrew Patty II | | 9,486 | | * | |

Robert R. Punches | | 10,644 | | * | |

Vinod K. Thukral, Ph.D.(5) | | 42,274 | | 2.0 | % |

| | |

Named Executive Officers | | | | | |

W. Page Ogden(6) | | 57,606 | | 2.7 | % |

| | |

Directors and executive officers as a group | | | | | |

(10 persons)(7) | | 169,928 | | 8.0 | % |

| (1) | Includes shares as to which such person, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has beneficial ownership, the right to acquire beneficial ownership within 60 days of March 14, 2006, or shares voting power and/or investment power as these terms are defined in Rule 13d-3 of the Exchange Act. Also includes shares allocated to participant accounts under the ESOP, with respect to which each individual has voting power. |

| (2) | Based upon 2,117,086 shares of Company common stock outstanding as of March 14, 2006. |

| (3) | Includes 20 shares held by Mr. Allen as custodian for his son and 20 shares owned by his wife, of which he disclaims beneficial ownership. |

| (4) | Includes 2,901 shares owned by Mr. Bradford’s wife, of which he disclaims beneficial ownership. |

| (5) | Includes 15,810 shares held by Thukral Holdings, LLC over which Dr. Thukral has sole voting power. |

| (6) | Includes 8,800 shares that Mr. Ogden may acquire pursuant to currently exercisable stock options, 14,413 shares held in an IRA and 11,149 shares which have been allocated to Mr. Ogden’s account in the ESOP. |

| (7) | To the extent that any shares of common stock are deemed to be beneficially owned by more than one director and/or executive officer, they are included only once in the total number of shares beneficially owned by all directors and executive officers as a group. |

6

Section 16(a) Beneficial Ownership Reporting Compliance

Pursuant to Section 16(a) of the Exchange Act, our directors, executives officers, and any person beneficially owning more than ten percent of our common stock are required to report their initial ownership of our common stock and any subsequent changes in that ownership to the Securities and Exchange Commission.

Based solely upon a review of Forms 3 and 4 and amendments thereto furnished to us during 2005, and any Form 5 and amendments thereto furnished to us with respect to fiscal year 2005, and certain written representations made by our directors, officers and ten percent beneficial owners, we believe that during 2005, our officers, directors and ten percent beneficial owners complied with all applicable Section 16(a) filing requirements.

BOARD OF DIRECTORS

How many directors serve on the Board, and who are the directors?

Effective as of the annual meeting, a total of eight directors serve on our Board. There are three classes of directors. Currently, the Board is composed of nine directors, with four directors in Class I, three directors in Class II and two directors in Class III. Assuming that all of the Company’s nominees for election at the annual meeting are elected, after the annual meeting there will be two directors in Class I and three directors in each of Class II and Class III. The current term of office for the Company’s Class I directors expires at the 2006 annual meeting, while the current term of office for our Class II directors expires at the 2007 annual meeting and the current term of office for our Class III directors expires at the 2008 annual meeting.

One director who currently serves as a Class I director, A.J. Ferguson, has been nominated for election as a Class III director. Mr. Ferguson is approaching the Board’s mandatory retirement age for directors, which is age 72. By serving as a Class III director rather than as a Class I director, Mr. Ferguson’s term will coincide more closely with his upcoming retirement while maintaining the size of the Board’s classes as nearly equal as possible, as required under the Company’s Restated Articles of Association.

| | | | | | |

Name | | Age | | Director

Since | | Business Experience During Past Five Years |

A. J. Ferguson (Class I) | | 70 | | 1982 | | Mr. Ferguson is a self-employed certified petroleum geologist. He also is a director and Treasurer of Energy Drilling Co., an oil well drilling company, and the Secretary of Highland Corp., a land-lease company. |

| | | |

Bethany L. Overton (Class I) | | 68 | | 1989 | | Mrs. Overton is the President of Lambdin- Bisland Realty Co., a real estate company. Mrs. Overton was previously a partner in Access Travel, a travel agency, and the Vice President of Oilwell Acquisition Co., an oil operating and production company from 1986 through 1996. |

| | | |

Robert R. Punches (Class I) | | 56 | | 1984 | | Mr. Punches is the Vice Chairman of the Company’s Board and is a partner in the Natchez law firm of Gwin, Lewis & Punches, LLP. Mr. Punches is also a partner/member of various timber management companies. |

| | | |

W. W. Allen, Jr. (Class II) | | 54 | | 1988 | | Mr. Allen is President of Allen Petroleum Services, Inc., an oil and gas exploration and petroleum land services company. Mr. Allen is also a partner in various timber management companies and an officer in Dutch Ann Foods, Inc., a pie shell and tart business. Mr. Allen is also the Chairman of the Natchez Adams County Development Authority. |

7

| | | | | | |

Name | | Age | | Director

Since | | Business Experience During Past Five Years |

Craig A. Bradford, D.M.D. (Class II) | | 50 | | 1988 | | Dr. Bradford is a dentist engaged primarily in pediatric dentistry. He is also a partner in various timber management companies and is an officer of Mount Olive Farms, LLC, a firm that raises and shows horses. |

| | | |

Vinod K. Thukral, Ph.D. (Class II) | | 61 | | 2000 | | Dr. Thukral is a manager of VT Venture Group, LLC, a company attempting to organize a bank in California. He was formerly a director of Louisiana Bancshares, Inc., and a professor at Tulane University, both in the Business Department and in the School of Public Health. |

| | | |

George R. Kurz (Class III) | | 51 | | 2005 | | Mr. Kurz is a principal and vice president of Kurz & Hebert, a company engaged in the sales, leasing and management of real property, and a board member of the Baton Rouge Chamber of Commerce. |

| | | |

R. Andrew Patty II (Class III) | | 40 | | 2000 | | Mr. Patty is a patent attorney and a member of Sieberth & Patty, LLC, a law firm in Baton Rouge, Louisiana. Mr. Patty is also a member and co-manager of S&P Realty LLC, a real estate company. |

Are the directors independent?

Our Board has determined that each of A. J. Ferguson, Bethany L. Overton, Robert R. Punches, W. W. Allen, Jr., Craig A. Bradford, D.M.D., George R. Kurz, R. Andrew Patty II and Vinod K. Thukral, Ph.D. is an “independent director” as defined under Rule 4200(a)(15) of the Nasdaq Marketplace Rules. This constitutes a majority of the members of our Board. All of the continuing directors also presently serve on the Board of Directors of the Bank. There are no family relationships between any director, executive officer or person nominated to become a director.

From May 2004 to May 2005, Mr. Patty was a vice president of the Company. He was given this title so that, in the event that a signature for the Company was required on a legal document in addition to the Chief Executive Officer’s signature and the Company’s Secretary/Treasurer was not available or permitted to provide such signature, he could provide the required signature. Mr. Patty was never required to sign any document for the Company as a vice president of the Company during his tenure as such, nor did he perform (and he was not expected to perform) any other duties or responsibilities for the Company. Mr. Patty, who was actively engaged in the practice of law over the relevant time period, did not receive any compensation in connection with his office. At no time did the Company consider Mr. Patty an employee of the Company or the Bank. Based on these facts, the Board of Directors determined that Mr. Patty was an “independent director” as defined in Rule 4200(a)(15) of the Nasdaq Marketplace Rules, notwithstanding that he held the title of vice president.

How are directors compensated?

During 2005, each director received an annual retainer of $9,600 for service as a member of our Board. The Chairman of the Board received $7,200 for service as a member of the Board. The Vice-Chairman of the Board received an additional fee of $9,600 for his service. In addition to these amounts, each non-employee director serving on the Board’s executive, audit, nominating and compensation committees received a monthly fee in the amount of $150. The audit committee chairman also received an additional monthly fee of $250 for his service. The Bank also paid a monthly fee in the amount of $50 for service on its trust committee, a monthly fee in the amount of $150 for service on its asset and liability management committee and a monthly fee in the amount of $150 for service on its loan committee.

8

How many meetings did the Board hold during 2005?

During the fiscal year ended December 31, 2005, the Board of Directors met twelve times. Each director attended at least 75% of the aggregate of all meetings held by the Board and the committees on which he or she served. The members of the Board who are “independent directors” under Nasdaq Rule 4200(a)(15) met in executive session seven times in 2005.

The Board of Directors has no written policy as to its members’ attendance at the annual meeting of shareholders; however, it is the practice of Board members to attend the annual shareholders’ meetings. Last year, nine of the ten members of the Board attended the annual shareholders’ meeting held on Tuesday, April 26, 2005, and we expect the entire Board to attend this year’s meeting.

How may a shareholder communicate with the Board?

The Board has not adopted a formal procedure that shareholders must follow to send communications to it. However, we have an unwritten “open door” policy for our customers and shareholders, which we believe satisfactorily ensures that the views of stockholders are heard by the Board or individual directors, as applicable. The Board does receive communications from shareholders, from time to time, and addresses those communications as appropriate. Shareholders can send communication to the Board by contacting any officer of the Company, our general counsel, Robert R. Punches, or our President, W. Page Ogden, in any one of the following ways:

| | • | | In writing, to Britton & Koontz Capital Corporation, ATTN: W. Page Ogden, 500 Main Street, Natchez, Mississippi 39120; |

| | • | | By e-mail, at corporate@bkbank.com; or |

| | • | | By phone, at (601) 445-5576 or facsimile, at (601) 445-2481. |

Mr. Ogden will forward written and e-mail correspondence to the appropriate addressee. If a shareholder requests information or asks questions that can more efficiently be answered by management, management will respond without the Board of Directors. Any shareholder communication concerning employee fraud or accounting matters will be forwarded to the audit committee. Any communication relating to corporate governance or requiring action by the Board will be forwarded to the full Board.

Are directors and other officers indebted to the Bank?

Certain of our directors and officers, businesses with which they are associated and members of their immediate families are customers of the Bank and had transactions with the Bank in the ordinary course of its business during the Bank’s fiscal year ended December 31, 2005. In the opinion of the Board of Directors, these transactions were made in the ordinary course of business and were made on substantially the same terms (including, in the case of loan transactions, interest rates and collateral) as those prevailing at the time for comparable transactions with other persons. The Board believes that any loan transactions between the Bank and our directors and officers do not involve more than the normal risk of collectibility or present other unfavorable features.

What related party transactions involve the Board of Directors?

During 2005, the law firm of Gwin, Lewis & Punches, LLP, of which Mr. Robert R. Punches, a director, is a partner, provided legal services to the Company and the Bank. The Company expects that the firm will continue to represent the Company as general counsel in the future.

9

COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors and the Bank have established various joint committees, including the executive committee, the audit committee, the nominating committee, the compensation committee, the trust investment committee, the asset/liability management committee and the director’s loan committee. The composition and functions of the audit, compensation and nominating committees are described in more detail below.

Who serves on the audit committee, and what are its responsibilities?

Messrs. Allen (Chairman), Bradford, Patty, and Thukral are members of the audit committee. No member of the audit committee is an employee of either the Company or the Bank. Each member of the audit committee is an “independent director” as defined in Rule 4200(a)(15) of the Nasdaq Marketplace Rules and meets the criteria for independence under Rule 10A-3 promulgated under the Exchange Act.

Although the Board has determined that Mr. Thukral meets the “financial sophistication” requirements under Rule 4350(d) of the Nasdaq Marketplace Rules, the Board has determined that none of the current members of the audit committee qualify as an “audit committee financial expert” as such term is defined under Securities and Exchange Commission regulations. Prior to the 2004 annual meeting, after its evaluation of current Board members, the Board of Directors undertook a search within our local markets to locate an individual who would satisfy both the Securities and Exchange Commission’s criteria for financial experts and the Board’s director qualifications and who was otherwise willing to serve on the Company’s Board. The Company’s headquarter location outside of a major metropolitan area, among other factors, contributed to the Board’s inability to find a suitable candidate. The Board intends in 2006 to continue its search to identify an individual willing to serve on the Board who meets the criteria for an audit committee financial expert and the Board’s director qualifications.

Under our Restated Articles of Association and Bylaws, the Board has the authority to fix the number of directors serving on the Board, as long as the number is between five and twenty five members. Under our Restated Articles of Association, however, any vacancies created on the Board can only be filled by an election occurring at an annual meeting of shareholders. Therefore, the Board will be unable to increase its size and appoint an individual qualifying as an audit committee financial expert to the Board, and subsequently the audit committee, prior to the 2007 annual meeting of shareholders.

The audit committee has adopted a written Audit Committee Charter that governs its operations, a copy of which was attached as Appendix A to our proxy statement for the 2004 Annual Meeting of Shareholders.

The purpose of the audit committee is to oversee our financial reporting process on behalf of the Board of Directors. The audit committee has sole authority to select, evaluate, appoint and replace the independent auditor and to approve in advance all audit engagement fees and terms and non-audit engagements with the independent auditors. The audit committee’s other duties and responsibilities include assisting the Board relating to:

| | • | | Monitoring the integrity of our financial statements and financial reporting process and our systems of internal accounting and financial controls; |

| | • | | The performance of the internal audit function; |

| | • | | The annual independent audit of our financial statements and the evaluation of the independent auditors’ qualifications, independence and performance; |

| | • | | Our compliance with legal and regulatory requirements, including our disclosure controls and procedures; and |

| | • | | The fulfillment of the other responsibilities set out in the audit committee charter. |

In addition, the audit committee is responsible for establishing procedures for (i) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and (ii) the confidential, anonymous submission by employees of the Company of any concerns regarding questionable accounting or auditing matters.

During 2005, the audit committee held eight meetings.

10

Who serves on the compensation committee, and what are its responsibilities?

The Board of Directors established a compensation committee in August, 2005. Messrs. Allen, Ferguson, Punches (Chairman) and Patty are the members of the compensation committee. Each of the current members of the compensation committee is an “independent director” as defined under Rule 4200(a)(15) of the Nasdaq Marketplace Rules. The compensation committee has the responsibility to review and approve the Company’s compensation and benefit programs, to ensure the competitiveness of such compensation and benefit programs and to advise the Board concerning the development and succession of key executives. The compensation committee has adopted a charter, a copy of the charter is attached as Appendix A to this proxy statement. During 2005, the compensation committee met three times.

Prior to the establishment of the compensation committee, the Board’s executive committee performed the functions of the compensation committee, as discussed above. Messrs. Ferguson, Ogden, Patty and Punches (Chairman) were members of the executive committee at the time when compensation for the Company’s executive officers in 2005 was determined. Messrs. Ferguson, Patty and Punches are “independent directors” as that term is defined in Rule 4200(a)(15) of the Nasdaq Marketplace Rules. The full executive committee, including Mr. Ogden, made recommendations to the full Board regarding salaries for and other compensation (including grants of stock options) to executive officers; Mr. Ogden did not, however, participate in the actual Board deliberations or determinations regarding salaries for and other compensation to executive officers. The executive committee met three times in 2004 for the purpose of setting the 2005 compensation for the Company’s executive officers.

Who serves on the nominating committee, and what are its responsibilities?

In July, 2005, the Board established a nominating committee. The current members of the nominating committee are Messrs. Allen, Ferguson, Punches (Chairman) and Patty, each of whom is an “independent director,” as that term is defined in Rule 4200(a)(15) of the Nasdaq Marketplace Rules. The nominating committee has adopted a charter. Although the charter is not available on the Company’s website, a copy of the charter is attached as Appendix B to this proxy statement. The nominating committee did not meet in 2005, but it did meet twice in 2006 to recommend to the full Board the nominees listed in this proxy statement for election at the annual meeting.

The nominating committee interviews, evaluates, nominates and recommends individuals for membership on the Company’s Board of Directors and the committees of the Board. In assessing potential new directors, the nominating committee specifically looks at the candidate’s qualifications in light of the needs of the Board and the Company at that time, given the then-current mix of director attributes.

Any potential director must possess certain minimum qualifications, qualities and skills that are necessary for election as a director. First, a candidate must meet the eligibility requirements set forth in our bylaws. Next, candidates for director must also satisfy the following criteria:

| | • | | The “independence” of the candidate under Rule 10A-3 promulgated under the Exchange Act and for purposes of Rule 4200(a)(15) of the Nasdaq Marketplace Rules; |

| | • | | Significant business experience in banking, or in marketing, financial, legal, accounting or other professional disciplines; |

| | • | | Familiarity with and participation in the local community; |

| | • | | Prominence and a highly-respected reputation in their profession; |

| | • | | A global business and social perspective; |

| | • | | A record of honest and ethical conduct, personal integrity and independent judgment; |

| | • | | The ability to represent the interests of our shareholders; and |

| | • | | Sufficient time available to devote to Board activities and to enhance their knowledge of our industry. |

11

The approval of the nominating committee is necessary for the candidate to be selected as a nominee for election to the Board. Nominees for election to the Board of Directors are proposed to the Board from various sources, including management and members of the Board of Directors. The Board will also consider candidates recommended by shareholders. Such recommendations should be made in writing and delivered to the nominating committee at the following address: Corporate Secretary, Britton & Koontz Capital Corporation, 500 Main Street, Natchez, Mississippi 39120.

Recommendations for director candidates for the 2007 Annual Meeting of Shareholders must be received by the Corporate Secretary no later than December 15, 2006, as provided in our Bylaws. The shareholder’s notice must set forth as to each nominee:

| | • | | The reason for making such nomination; |

| | • | | All arrangements or understandings between the recommending shareholder and the nominee; |

| | • | | All information relating to such nominee that is required to be disclosed in solicitations of proxies for the election of directors pursuant to Regulation 14A under the Exchange Act; and |

| | • | | The nominee’s written consent to being named in the proxy statement and to serve as a director if elected. |

The shareholders’ notice must also set forth the name and address of the nominating shareholder and the class and amount of such shareholder’s beneficial ownership of our stock, including evidence to support the shareholders’ ownership of such shares. If a shareholder intends to recommend a nominee for election as director or proposes any other business for consideration at an annual meeting of the Company on behalf of the beneficial owner of the shares that the recommending shareholder is the record owner of, the recommending shareholder must also provide the name and address of such beneficial owner, as well as the class and number of shares of Company stock owned by such beneficial owner.

The Board may choose not to consider an unsolicited recommendation if no vacancy exists on the Board and the Board does not perceive a need to increase the size of the Board. In addition, the Board only considers shareholder-recommended candidates who meet the eligibility requirements for directors set forth in our bylaws. The Board utilizes the same criteria to evaluate shareholder-recommended candidates as it uses to evaluate any other candidate.

EXECUTIVE OFFICERS AND EXECUTIVE COMPENSATION

Who are the executive officers of the Company?

W. Page Ogden and William M. Salters are the Company’s only executive officers. The following table sets forth certain information with respect to Mr. Ogden and Mr. Salters. Mr. Ogden has entered into an employment agreement with the Company, while Mr. Salters is appointed annually by the Board of Directors and serves at the discretion of the Board.

| | | | | | |

Name | | Officer

Since | | Age | | Position with the Company |

W. Page Ogden | | 1988 | | 59 | | President and Chief Executive Officer of the Company and the Bank. |

| | | |

William M. Salters | | 2004 | | 50 | | Chief Financial Officer of the Company and the Bank. |

The following is a brief summary of the business experience of Mr. Ogden and Mr. Salters:

W. Page Ogden has served as President and Chief Executive Officer of the Company and the Bank since May of 1989. He joined the Bank in February of 1988 and served as the Bank’s Senior Vice President and Senior Lending Officer until he assumed his current positions. Mr. Ogden previously served as Vice President of

12

Premier Bank, N.A. of Baton Rouge, Louisiana. Mr. Ogden was employed by Premier Bank in various capacities, including trust, commercial lending, credit policy and administration for thirteen years prior to joining the Bank.

William M. Salters has served as Chief Financial Officer of the Company and the Bank since June, 2004. He joined the Bank in July of 1993 when the Company acquired Natchez First Federal Savings Bank. Since then he has served as the Bank’s Vice President in charge of credit administration and Senior Vice President and Controller in charge of financial and regulatory reporting. Mr. Salters was previously employed by Natchez First Federal Savings Bank where he served as Vice President and Treasurer in charge of various areas including accounting, loan servicing and teller administration.

How does the Company compensate its executive officers?

The following Summary Compensation Table describes the compensation earned or paid to Mr. Ogden, our chief executive officer, who is the only executive officer of the Company who earns more than $100,000 in salary and bonus annually.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation | | | Long-Term

Compensation | | | |

Name and Principal Position | | Year | | Salary | | Bonus | | Other Annual

Compensation | | | Securities

Underlying

Options (#) | | All Other Compensation | |

W. Page Ogden President and Chief Executive Officer | | 2005

2004

2003 | | $

$

$ | 160,000

160,000

160,000 | | $

$

$ | 50,000

35,000

35,000 | | $

$

$ | 7,200

7,200

7,200 | (1)

| | 0

0

0 | | $

| 28,985

32,189

34,216 | (2)

|

| (1) | Represents the amount of director fees received during the year. |

| (2) | For 2005, includes Company accruals in the amount of $20,632 in connection with the Salary Continuation Plan, the payment of which is subject to certain future contingencies, Company contributions to the 401(k) plan of $7,930 and Company paid life insurance premiums in the amount of $423. |

Do executive officers receive equity compensation?

Yes. The Company maintains a stock option plan, the Britton & Koontz Capital Corporation Long-Term Incentive Plan. An aggregate of 160,000 shares of common stock has been reserved for issuance under the plan. As of December 31, 2005, options to purchase 35,520 shares were outstanding. There were no stock option grants to Mr. Ogden during 2005.

The following table provides information about the unexercised options held by Mr. Ogden on December 31, 2005. No options were exercised by Mr. Ogden during 2005.

Aggregated Option Exercises In 2005

and 2005 Year-End Option Values

| | | | | | | | | | | | | | | |

Name | | Number of

Shares

Acquired

on Exercise | | Value

Realized | | Number of Securities

Underlying Unexercised

Options at December 31, 2005 | | Value of Unexercised

In-The-Money Options at

December 31, 2005(1) |

| | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

W. Page Ogden | | 0 | | $ | 0 | | 8,800 | | 1,200 | | $ | 10,208 | | $ | 1,392 |

| (1) | Based upon an exercise price of $19.94 per share and the closing sales price of the Company’s common stock as of December 31, 2005 of $21.10 per share. |

13

Does the Company have employment agreements?

We have entered into an employment agreement with W. Page Ogden. The base term of the employment agreement expires on December 31, 2005, and the agreement provides for successive one-year terms thereafter, expiring each year on December 31st. The agreement automatically renews, unless notice is given 90 days prior to the expiration of each term by either of the respective parties. We can terminate the employment agreement, and Mr. Ogden’s employment thereunder, with or without cause. If termination is on account of cause (including a breach of fiduciary duty or other similar types of misconduct), Mr. Ogden will not receive any severance pay. If we terminate Mr. Ogden’s employment without cause, we are required to pay Mr. Ogden a lump sum equal to the greater of $80,000 or six months of his then current salary. As of the date of this proxy statement, the amount of this payment would be $80,000.

Mr. Ogden has the use of an automobile; we also pay country club, professional, and civic organization dues on behalf of Mr. Ogden. Mr. Ogden is entitled to all of the benefits that are available to other employees of the Company and the Bank, such as health and disability insurance.

Does the Company have any other benefits plans?

Yes. We have an ESOP, a group medical health plan and a 401(k) plan. In addition, effective September 26, 1994, we entered into a Salary Continuation Agreement with Mr. Ogden. This agreement provides for the payment of normal and early retirement benefits and provides that in the event there is a “change of control” of the Company (as defined in the agreement) and Mr. Ogden’s employment with the Company is terminated within 36 months of the change of control, then Mr. Ogden will be paid the greater of (a) a lump sum cash payment ($250,000) or (b) the total balance in his retirement account.

REPORT OF THE COMPENSATION COMMITTEE

Four non-employee directors serve on the Board’s compensation committee, and each committee member is an “independent director” under Rule 4200(a)(15) of the Nasdaq Marketplace Rules. The compensation committee has the responsibility to review and approve the Company’s compensation and benefit programs, to ensure the competitiveness of such compensation and benefit programs, and to advise the Board concerning the development and succession of key executives. The committee was formed in 2005 and held three meetings that year.

Prior to the formation of the compensation committee in August, 2005, the Board’s executive committee set the salary of the Company’s executive officers. In 2004, the executive committee met twice to consider the compensation of the Company’s executive officers for 2005. Messrs. Ferguson, Patty and Punches, who are also members of the compensation committee and “independent directors” under Rule 4200(a)(15) of the Nasdaq Marketplace Rules, were members of the executive committee, as well as Mr. Ogden and Albert W. Metcalfe (who retired as a director of the Company effective as of the 2005 annual meeting). The executive committee determined the 2005 compensation for the Company’s executive officers, although Mr. Ogden did not participate in committee deliberations or determinations with respect to his compensation.

Where this report discusses the policies and actions relating to the determination of executive compensation prior to the formation of the Company’s compensation committee, such discussion reflects the policies and actions of the Company’s executive committee.

Compensation Goals and Program Components

The Company’s executive compensation program consists of base salary, short-term cash incentives, and long-term, equity-based incentives. The program is intended to permit flexibility in the Company’s compensation practices, to retain and motivate the Company’s key executives, and to align the short and long-term performance of the Company with the compensation of its chief executive officer.

14

Compensation of the Chief Executive Officer

In setting the chief executive officer’s compensation, the compensation committee reviews all components of the chief executive officer’s compensation, including salary, bonus, long-term incentive compensation, accumulated realized and unrealized stock option gains, the dollar value to the chief executive officer and the cost to the Company of all perquisites and other personal benefits, the earnings and accumulated payout obligations under our deferred compensation plans and under potential change-in-control scenarios. Based on this review, the committee has determined that the chief executive officer’s total compensation in the aggregate is reasonable and not excessive. The committee’s analysis regarding the chief components of the chief executive officer’s compensation is set forth below.

Base Salary. The compensation committee is charged with annually reviewing and setting the chief executive officer’s base salary. To determine the adjustment, the committee ordinarily will review performance by evaluating four measures:

| | • | | The Company’s financial goals, which are quantitative measures related to the Company’s earnings per share, return on investment and stock value, growth in the Bank’s loans and deposits, and curtailment of the Bank’s operating expenses, among other measures; |

| | • | | Improvement in qualitative measures, such as relationships with the Bank’s officers and employees, the Board and the Company’s shareholders; |

| | • | | Progress towards the Company’s strategic goals, which in 2005 included the implementation of the Company’s reduction in staffing force plan, succession planning, acquisitions, and market expansion; and |

| | • | | The base salary paid to chief executive officers of banks similar in size to the Bank, taking into account that the Company is a publicly-traded company. |

The chief executive officer also ordinarily addresses the committee and discusses his performance. Based on the committee’s evaluation of the chief executive’s performance and his comments, the committee, without the chief executive officer present, then determines base salary. The determination is discretionary, no single measure or group of measures is determinative, and no weighting system is assigned to the measures. During 2004, the executive committee used this process to maintain the base salary of the chief executive officer at $160,000.

The compensation committee met in 2005 to set the chief executive’s base salary, effective as of January 1, 2006, using the process described above. Again, the determination of the compensation committee was discretionary; no specific weight or relevance was assigned to any of the above factors evaluated by the compensation committee. Beginning January 1, 2006, the base salary of the chief executive officer was set at $160,000, which is same as his base salary in 2005.

Annual Cash Incentive. The Company has an annual bonus program under which cash incentive may be awarded to all employees, including the chief executive officer. The overall bonus amount is determined on the basis of the Company’s annual earnings measured against budgeted targets established by the compensation committee at the beginning of each fiscal year. For the 2005 fiscal year, the compensation committee considered that the chief executive officer completed certain strategic projects set by the Board, including expense management through the implementation of a reduction in staffing force plan, core growth of loans and deposits, and continued strengthening of the risk management profile of the company. Based on the company’s earnings improvement and factors contributing to the improvement, the chief executive officer received an incentive bonus payment of $50,000, or 31% of his base compensation.

Long-Term Incentives. The Company also maintains a long-term, equity-based incentive plan, the Britton & Koontz Capital Corporation Long-Term Incentive Plan. Grants and awards under the plan are intended to align the interests of key employees with shareholders and to serve as a retention device. Consistent with previous fiscal years, however, no options to acquire shares of the Company’s common stock were granted to the Company’s chief executive officer. At this time, the compensation committee prefers to grant the chief executive officer incentives in the form of cash.

15

Other Compensation and Benefits. The Company maintains a number of broad-based benefit plans in which the executive officers participate, including a group medical plan and a 401(k) plan. These plans are intended to provide basic health and retirement benefits to all of the Company’s employees. The Company has also entered into a Salary Continuation Plan with its chief executive officer which will result in the payment of approximately $250,000 upon the occurrence of a change in control of the Company.

Also, the Company has entered into an employment agreement with the chief executive officer. This employment agreement provides for successive one-year terms, expiring each year on December 31. The employment agreement automatically renews unless notice of non-renewal is given at least 90 days prior to the expiration of the current term. The compensation committee determined that it was appropriate to allow the employment agreement to renew for another one year term ending December 31, 2006. Under this employment agreement, the chief executive officer will receive approximately $80,000 upon his termination of employment by the Company.

Section 162(m)

Section 162(m) of the Internal Revenue Code of 1986, as amended, limits to $1 million in any taxable year the deduction a company may claim for compensation paid to each of its chief executive and four other highest paid officers, unless certain performance-based conditions are satisfied. Base salary and incentive bonuses are subject to the limitation. No options were granted under the Company’s long-term incentive plan in 2005. The compensation committee does not anticipate the payment of any current compensation to an executive officer that would be affected by the limit.

Compensation Committee:

| | |

W.W. Allen, Jr. | | Robert R. Punches (Chairman) |

A.J. Ferguson | | R. Andrew Patty II |

February 22, 2006

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The members of the compensation committee during 2005 were W.W. Allen, Jr., A.J. Ferguson, Robert R. Punches (Chairman) and R. Andrew Patty II. As described under the heading “Board of Directors,” Mr. Patty was a vice president of the Company from May, 2004 to May, 2005. Other than Mr. Patty, there are no members of the compensation committee who were officers or employees of the Company or any of its subsidiaries during 2005 or were formerly officers of the Company. Certain members of the Company’s Compensation Committee have relationships with the Company, described earlier in this proxy statement in the question “What related party transactions involve the Board of Directors?” under the heading “Board of Directors.”

16

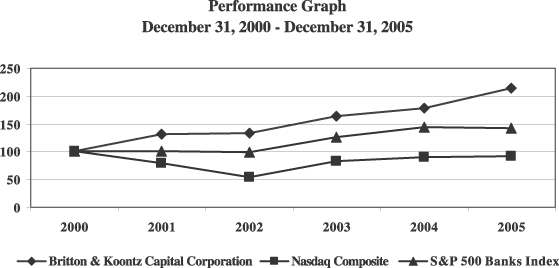

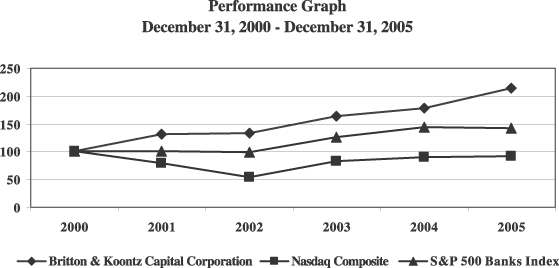

STOCK PERFORMANCE GRAPH

The following performance graph compares the performance of the Company’s common stock to the Nasdaq Composite Index and to the S&P 500 Banks Index for the Company’s reporting period. The performance graph assumes that the value of the investment in the Company’s common stock, the Nasdaq Composite Index and to the S&P 500 Banks Index was $100 at January 1, 2001, and that all dividends were reinvested.

| | | | | | | | | | | | | | | | | | |

| | | December 31, |

| | | 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 |

Britton & Koontz Capital Corporation | | $ | 100.00 | | $ | 130.73 | | $ | 132.57 | | $ | 162.86 | | $ | 178.42 | | $ | 213.61 |

Nasdaq Composite Index | | | 100.00 | | | 79.18 | | | 54.45 | | | 82.10 | | | 89.61 | | | 91.51 |

S&P 500 Banks Index(1) | | | 100.00 | | | 100.02 | | | 98.99 | | | 125.39 | | | 143.49 | | | 141.44 |

| (1) | The companies in the S&P 500 Banks Index are: Amsouth Bancorporation, BankAmerica Corporation, BB&T Corporation, Comerica Incorporated, Compass Bancshares, Inc., Countrywide Financial Corporation, Federal National Mortgage Association, Fifth Third Bancorp, First Horizon National Corporation, Federal Home Loan Mortgage Corporation, Golden West Financial Corporation, Huntington Bancshares Incorporated, Keycorp, M&T Bank Corporation, Marshall & Ilsley Corporation, MGIC Investment Corporation, National City Corporation, North Fork Bancorporation, Inc., The PNC Financial Services Group, Inc., Regions Financial Corporation, Sovereign Bancorp, Inc., Suntrust Banks, Inc., Synovus Financial Corporation, U.S. Bancorp, Wachovia Corporation, Washington Mutual, Inc., Wells Fargo & Company and Zions Bancorporation. |

There can be no assurance that the Company’s common stock performance will continue in the future with the same or similar trends depicted in the performance graph above. The Company does not and will not make or endorse any predictions as to future stock performance.

17

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

Who are the Company’s auditors?

The Company’s consolidated financial statements for the year ended December 31, 2005, were audited by the firm of Hannis T. Bourgeois, LLP. A representative of Hannis T. Bourgeois, LLP is expected to be present at the annual meeting. If present, the representative will have the opportunity to make a statement if he or she desires to do so and will be available to respond to appropriate questions. The audit committee has selected Hannis T. Bourgeois, LLP as its independent registered public accountants for the fiscal year ended December 31, 2006.

What fees were paid to the auditors in 2004 and 2005?

Fees billed by Hannis T. Bourgeois, LLP for professional services rendered for the fiscal year ending December 31, 2005 and 2004 are shown below.

| | | | | | |

| | | 2005 | | 2004 |

Audit Fees(1) | | $ | 49,000 | | $ | 44,900 |

Audit-Related Fees(2) | | | 2,560 | | | 6,645 |

Tax Fees(3) | | | 0 | | | 0 |

All Other Fees(4) | | | 0 | | | 2,145 |

| | | | | | |

Total | | $ | 51,560 | | $ | 53,690 |

| | | | | | |

| (1) | “Audit Fees” include amounts paid for the audit of our annual financial statements and review of the financial statements included in our Forms 10-Q in 2005 and Forms 10-QSB in 2004 and other regulatory filings. |

| (2) | “Audit-Related Fees” consist of fees for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements. This category includes fees related to the audit and attest services not required by statute or regulations, due diligence related to mergers, acquisitions and investments, employee benefit plan audits and consultations concerning financial accounting and reporting standards. |

| (3) | “Tax Fees” consists of amounts paid for tax compliance, advice and planning, which include the preparation and filing of required federal and state income and other tax forms. |

| (4) | “All Other Fees” consist of costs incurred in connection with a presentation at a direct seminar in 2004. |

In accordance with the procedures set forth in its charter, the audit committee pre-approves all auditing services and permitted non-audit services (including fees and terms of those services) to be performed for the Company by its independent registered public accountant prior to the engagement of the independent registered public accountant with respect to such services, subject to the de minimis exceptions for non-audit services permitted by the Exchange Act, which are approved by the audit committee prior to the completion of the audit. For fiscal years 2004 and 2005, none of the fees listed under Audit-Related Fees, Tax Fees or All Other Fees were covered by the de minimis exception for non-audit services permitted by the Exchange Act. The audit committee has considered whether the provision of services by Hannis T. Bourgeois, LLP for Company other than audit services is compatible with maintaining Hannis T. Bourgeois, LLP’s independence, and has concluded that it is compatible.

REPORT OF THE AUDIT COMMITTEE

The information provided in this section shall not be deemed to be proxy “soliciting material” or to be “filed” with the Securities and Exchange Commission or subject to its proxy regulations or to the liabilities of Section 18 of the Exchange Act, other than as provided in Item 7(d)(3)(v) of Regulation 14A-101. The information provided in this section shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act.

18

Management has the responsibility of preparing our financial statements and Hannis T. Bourgeois, LLP, our independent auditors, has the responsibility for the audit of those statements. The audit committee oversees our financial reporting process on behalf of the Board of Directors. The audit committee has sole authority to select, evaluate, appoint and replace the independent auditor. The audit committee’s other duties and responsibilities include assisting the Board relating to:

| | • | | Monitoring the integrity of our financial statements and financial reporting process and our systems of internal accounting and financial controls; |

| | • | | The performance of the internal audit function; |

| | • | | The annual independent audit of our financial statements, the engagement of the independent auditors and the evaluation of the independent auditors’ qualifications, independence and performance; |

| | • | | Our compliance with legal and regulatory requirements, including our disclosure controls and procedures; and |

| | • | | The fulfillment of the other responsibilities set out in the audit committee charter. |

The audit committee, in fulfilling its oversight responsibilities, reviewed and discussed our audited financial statements for the year ended December 31, 2005, with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The audit committee held eight meetings during 2005. The meetings were designed to facilitate and encourage private communication between the audit committee, our internal auditors and the independent auditors. The audit committee discussed with our internal auditors and the independent auditors the overall scope and plan of their respective audits. The audit committee met with the internal auditors and the independent auditors, with and without management present, to discuss the results of their examinations, their evaluation of our internal controls, and the overall quality of our financial reporting.

During these meetings, the audit committee reviewed and discussed the audited financial statements with management of the Company and the independent auditors. The audit committee reviewed with the independent auditors their judgments as to the quality, not just the acceptability, of our accounting principals and such other matters as are required to be discussed with the audit committee under generally accepted auditing standards, including, without limitation, the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). In addition, the audit committee has received the written disclosures and letter regarding independence from the independent auditors as required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committee), has discussed this information regarding Hannis T. Bourgeois, LLP’s independence with Hannis T. Bourgeois, LLP, and has considered the compatibility of non-audit services with the independence of Hannis T. Bourgeois, LLP.

Based upon the review and discussions referred to above, the audit committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005, for filing with the Securities and Exchange Commission.

Audit committee:

W. W. Allen, Jr. (Chairman)

Craig A. Bradford, D.M.D.

R. Andrew Patty II

Vinod K. Thukral, Ph.D.

March[14], 2006

19

PROPOSAL NOS. 1 AND 2—ELECTION OF DIRECTORS

What are the voting procedures?

Shares represented by your properly signed and dated proxy card will be voted in accordance with your instructions on the card at the annual meeting. To the extent proxies do not contain voting instructions with respect to the election of directors, it is intended that shares represented by proxies solicited pursuant to this proxy statement will be voted for the election of the Board’s nominees for Class I directors and the Board’s nominee for Class III director. The persons authorized to vote shares represented by executed proxies will have full discretion and authority to vote cumulatively and allocate votes among any or all of the nominees of the Board in such manner as they may determine, to the extent an executed proxy does not withhold authority to vote for the election of directors or for any particular nominee or provide specific instructions regarding the allocation of votes.

The Board has been advised that a shareholder may nominate his own candidate for election as a Class I or Class III director at the annual meeting. If shareholders attending the annual meeting cumulate their votes such that both of the Board’s nominees for Class I director cannot be elected, the proxy holders intend to cumulate votes to elect Robert R. Punches, absent specific instructions on the executed proxy withholding authority for all nominees or for Mr. Punches in particular or directing how votes should be cumulated. With respect to the election of one Class III director, the proxies, to the extent that they possess discretionary voting authority, will vote all shares for the Board’s nominee for director (since only one Class III director is to be elected, and thus each share is entitled to only one vote for Class III directors, the allocation of cumulative votes among nominees is not applicable).

If for any reason one or more of the Board’s nominees is not available as a candidate for election as a Class I or Class III director, an event that the Board of Directors does not anticipate, the proxy holders will vote, in their discretion, for another candidate or candidates nominated by the Board.

Proposal No. 1—Election of Two Class I Directors

The two Class I directors elected at our annual meeting will serve a three-year term, or until the 2009 annual meeting. The Board has nominated for election as Class I directors:

| | • | | Bethany L. Overton; and |

Both of the above nominees for election as a Class I director currently serves on our Board of Directors, and information about each nominee’s age and experience can be found earlier in this proxy statement. If elected, it is anticipated that Mr. Punches will be appointed Chairman of the Board.

In the election of the two Class I directors, you are entitled to cast two votes for each share held, and you may cumulate your votes. You may give one nominee in a single class all of your votes or, if there is more than one nominee for election in a class, you may distribute your total votes among all or several nominees in the class. Additional information regarding voting for directors is described in more detail under the heading “What are the voting procedures” above

The Board of Directors unanimously recommends a vote “FOR” the election of Bethany L. Overton and Robert R. Punches as Class I directors to the Board of Directors.

Proposal No. 2—Election of One Class III Director

The Class III director elected at our annual meeting will serve a two-year term, or until the 2008 annual meeting. The Board has nominated A.J. Ferguson for election as a Class III director.

20

Mr. Ferguson currently serves on our Board of Directors, and information about his age and experience can be found earlier in this proxy statement. In the election of one Class III director, you are entitled to cast one vote for each share held, and you may cumulate your votes (with only one director to be elected, cumulative voting and non-cumulative voting are the same).

The Board of Directors unanimously recommends a vote “FOR” the election of

A.J. Ferguson as a Class III director to the Board of Directors.

PROPOSAL NO. 3—AMENDMENT OF THE COMPANY’S RESTATED ARTICLES OF ASSOCIATION TO ELIMINATE CUMULATIVE VOTING RIGHTS

IN THE ELECTION OF DIRECTORS

What are the general considerations?