UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3583

Fidelity Mt. Vernon Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | November 30 |

| |

Date of reporting period: | November 30, 2016 |

Item 1.

Reports to Stockholders

Fidelity® Growth Company Fund Class K

Annual Report November 30, 2016 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-835-5092 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2017 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended November 30, 2016 | Past 1 year | Past 5 years | Past 10 years |

| Class K | 3.59% | 15.74% | 9.97% |

The initial offering of Class K shares took place on May 9, 2008. Returns prior to May 9, 2008 are those of Fidelity® Growth Company Fund, the original class of the fund.

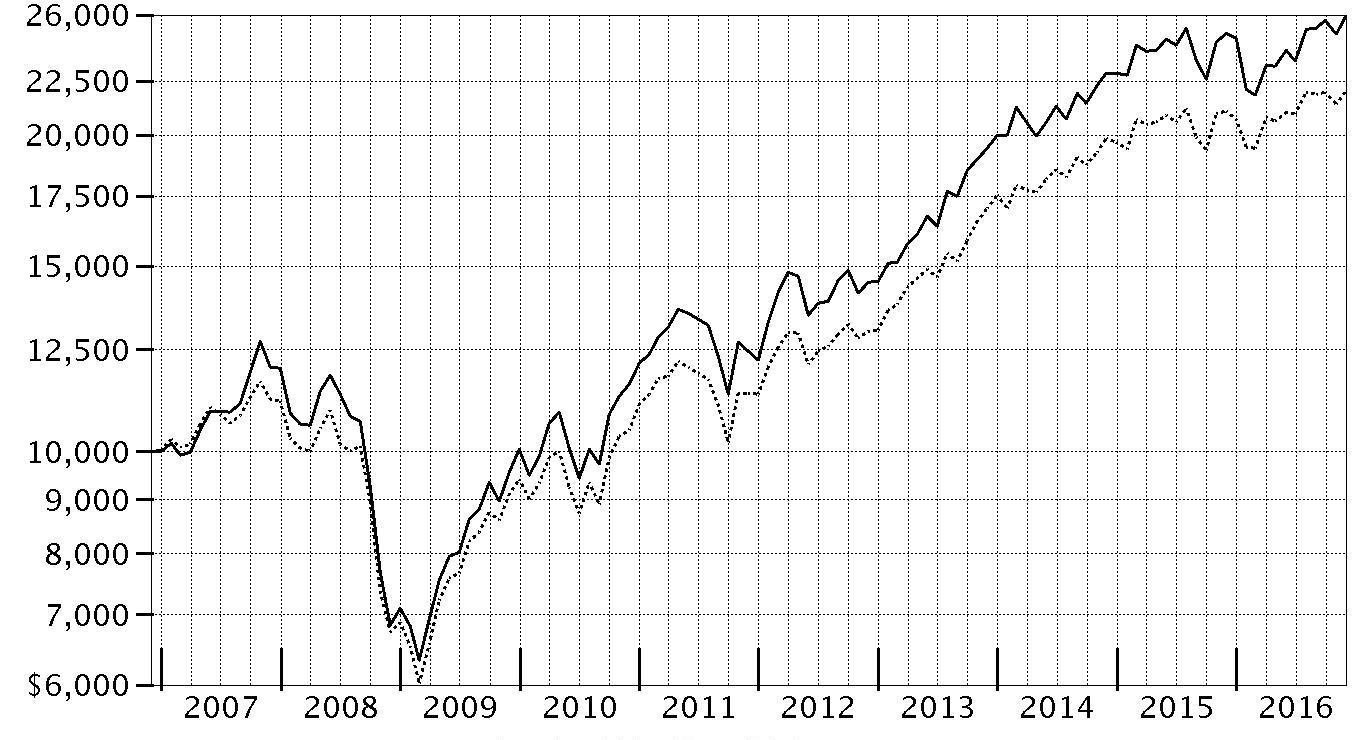

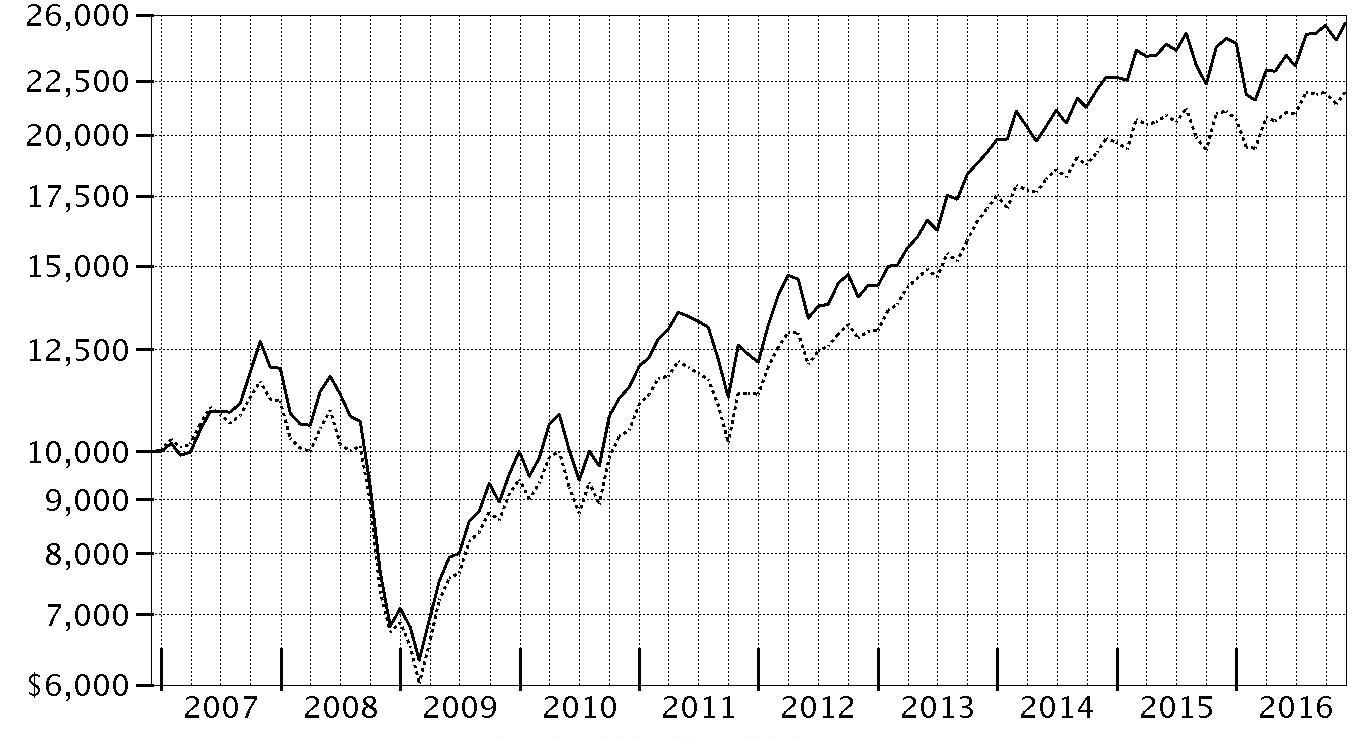

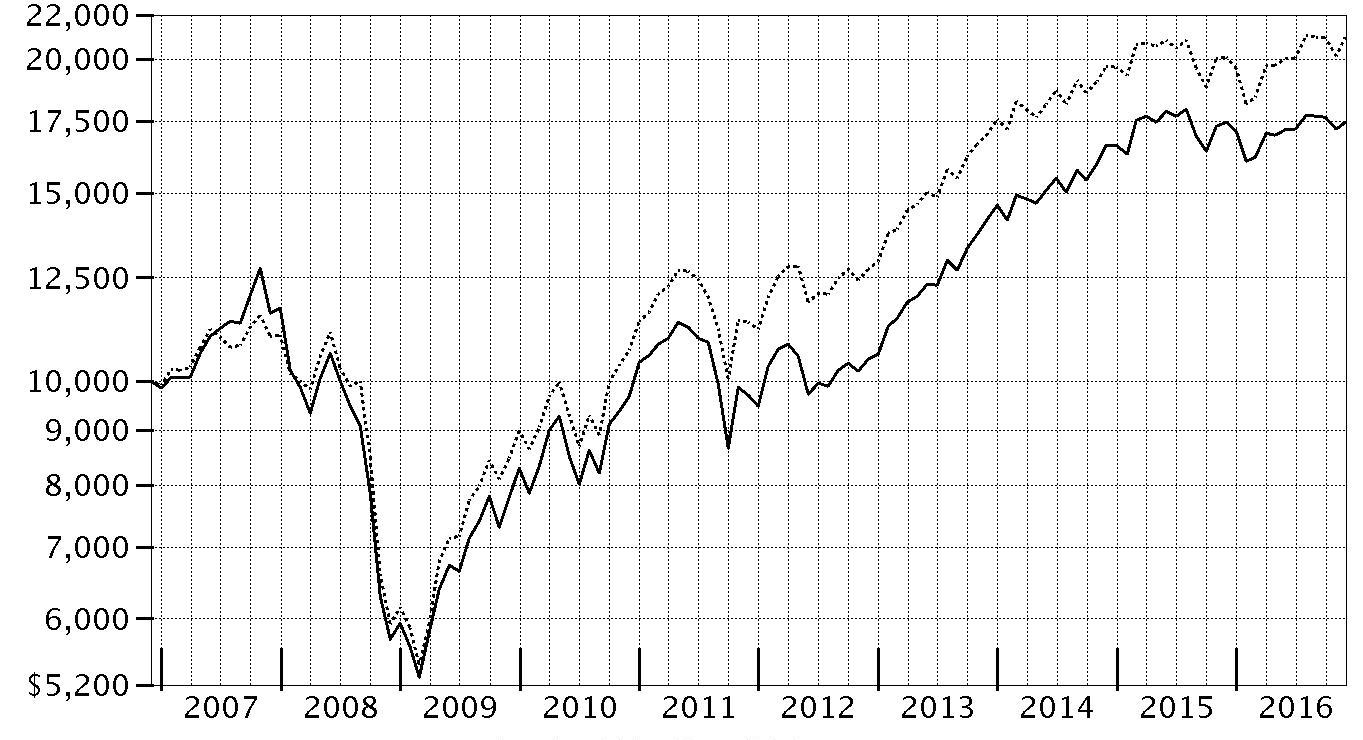

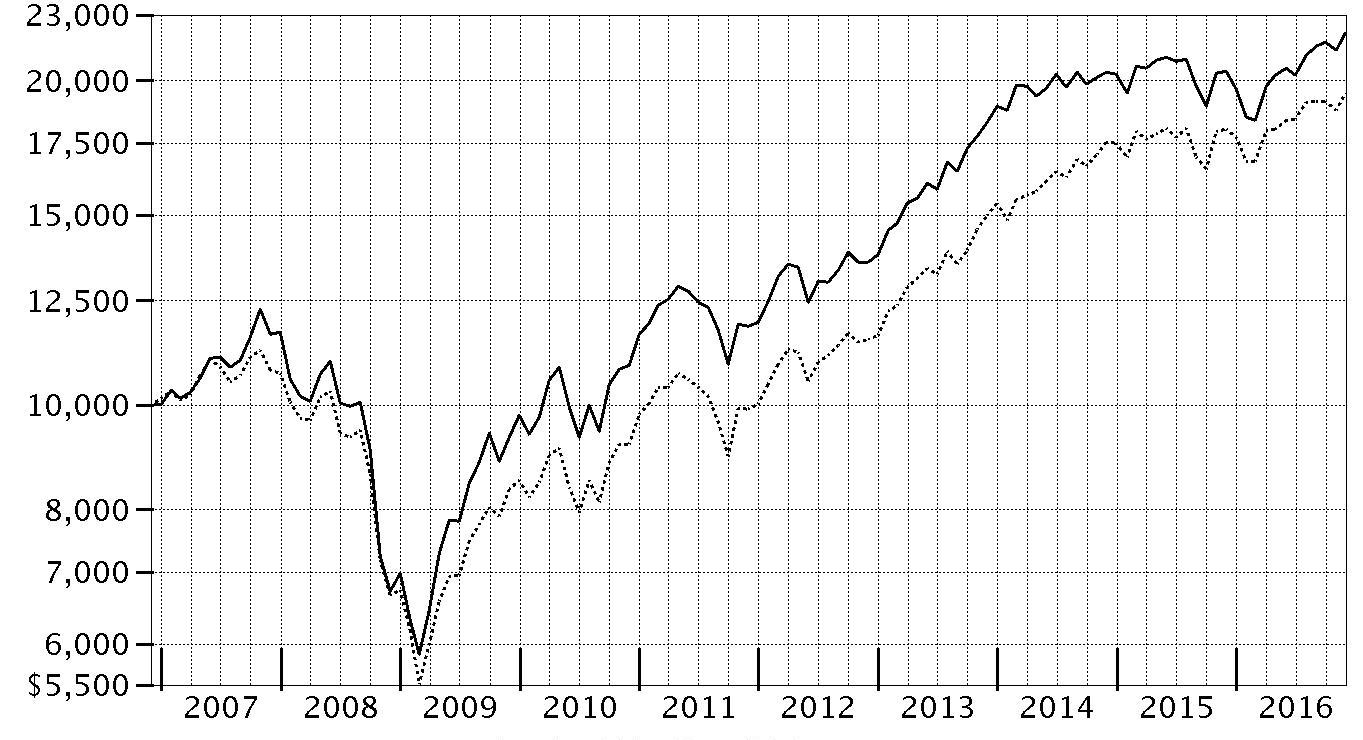

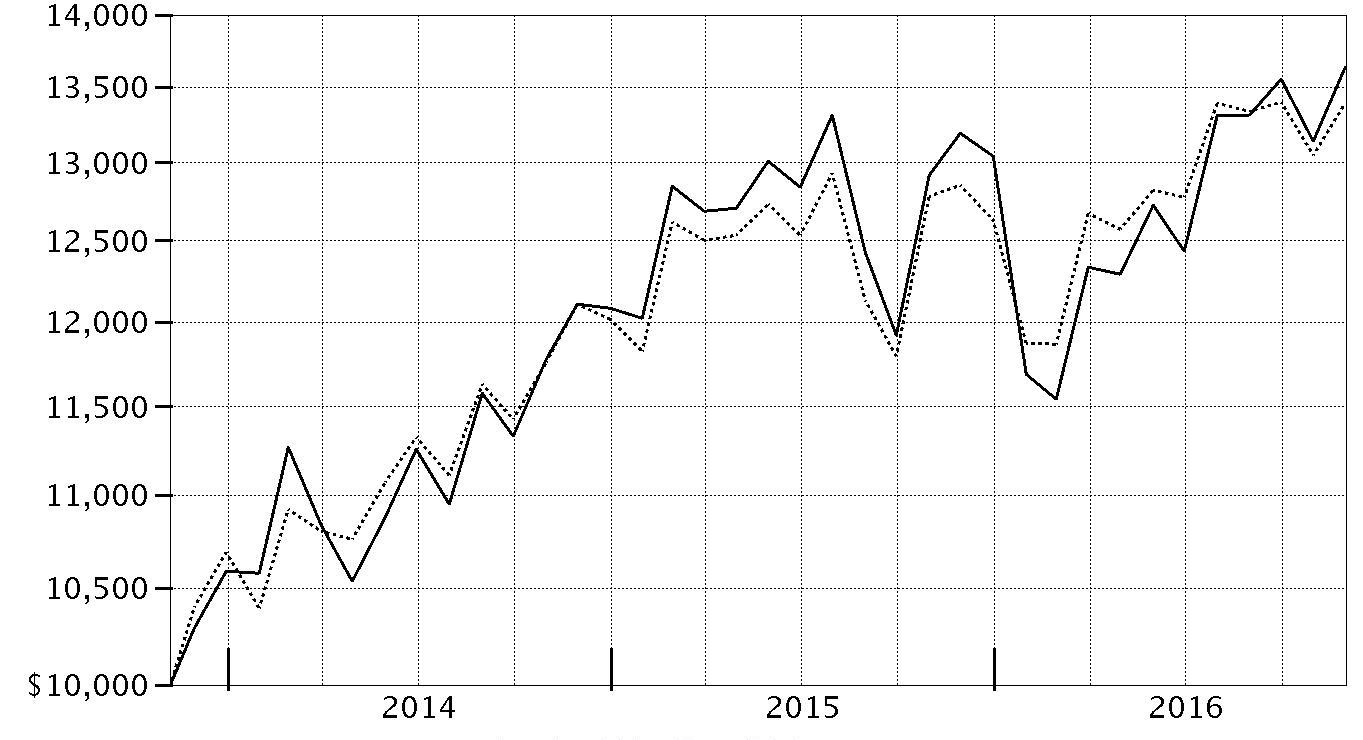

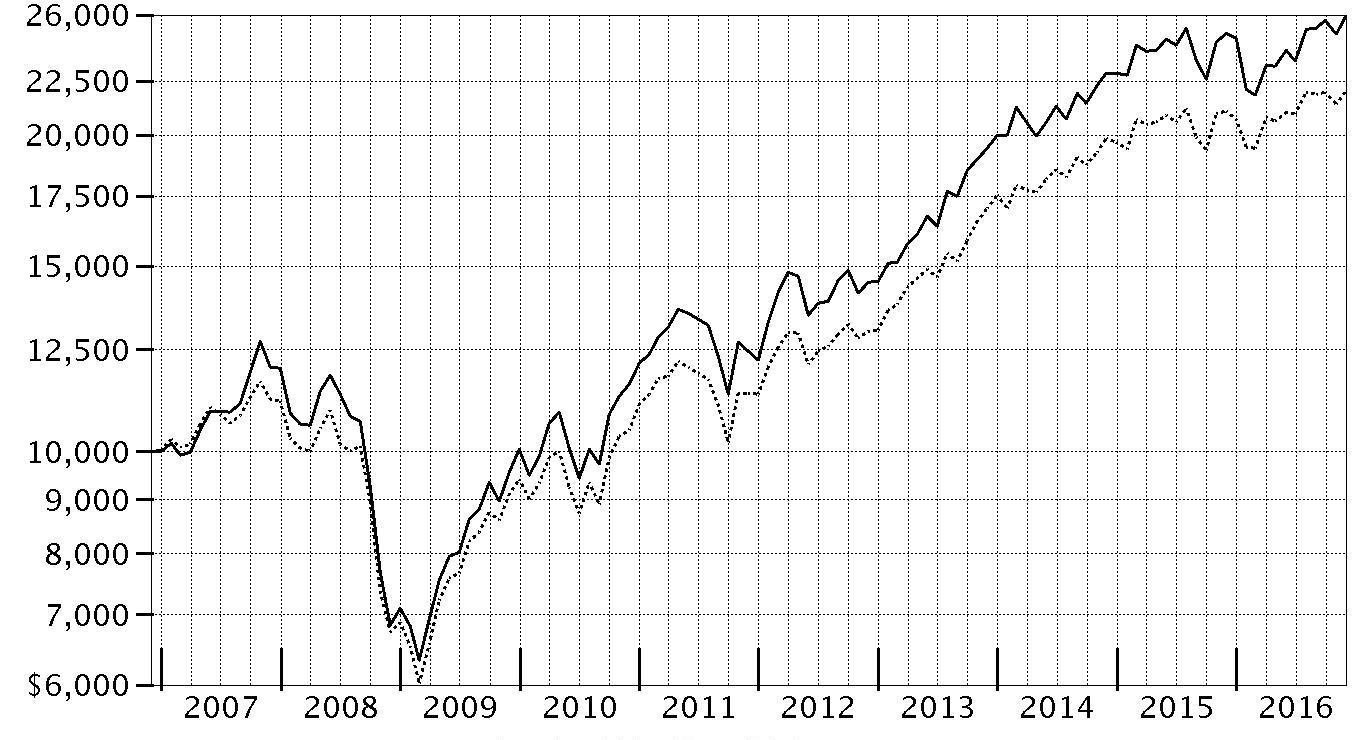

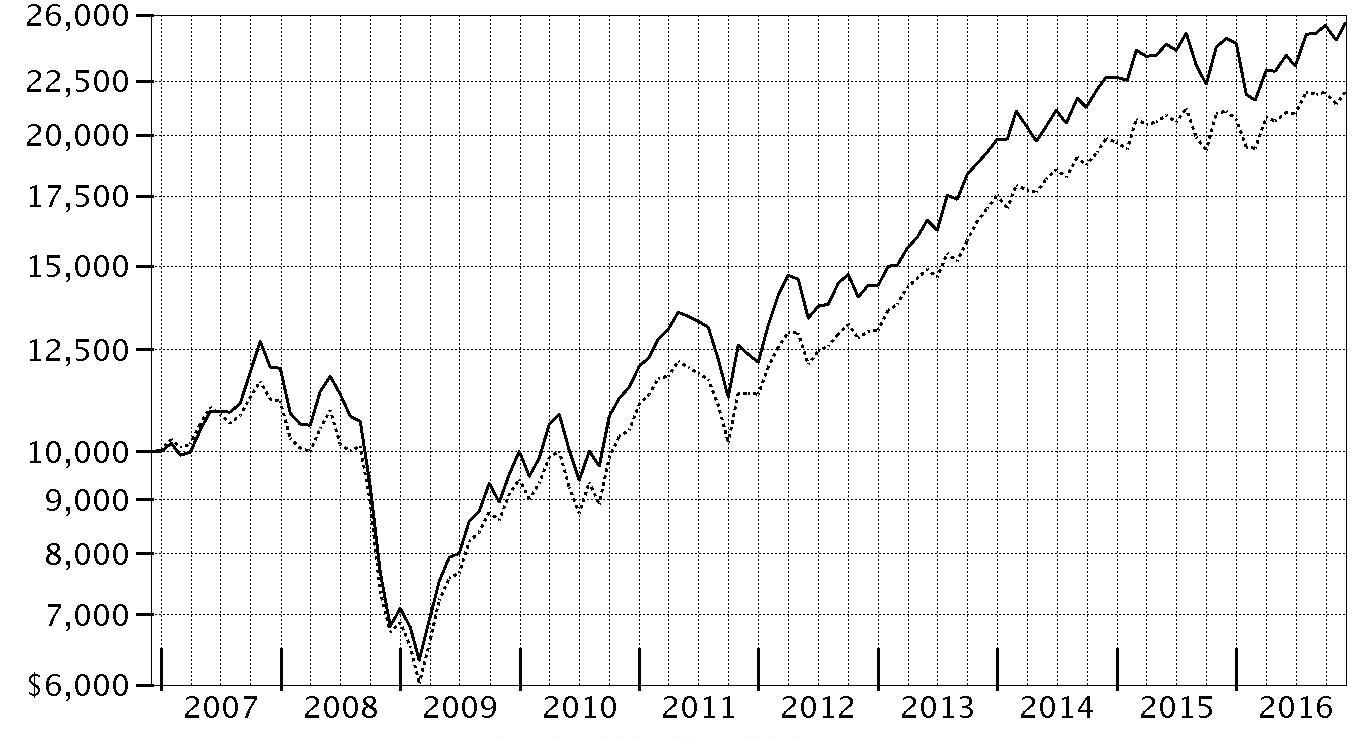

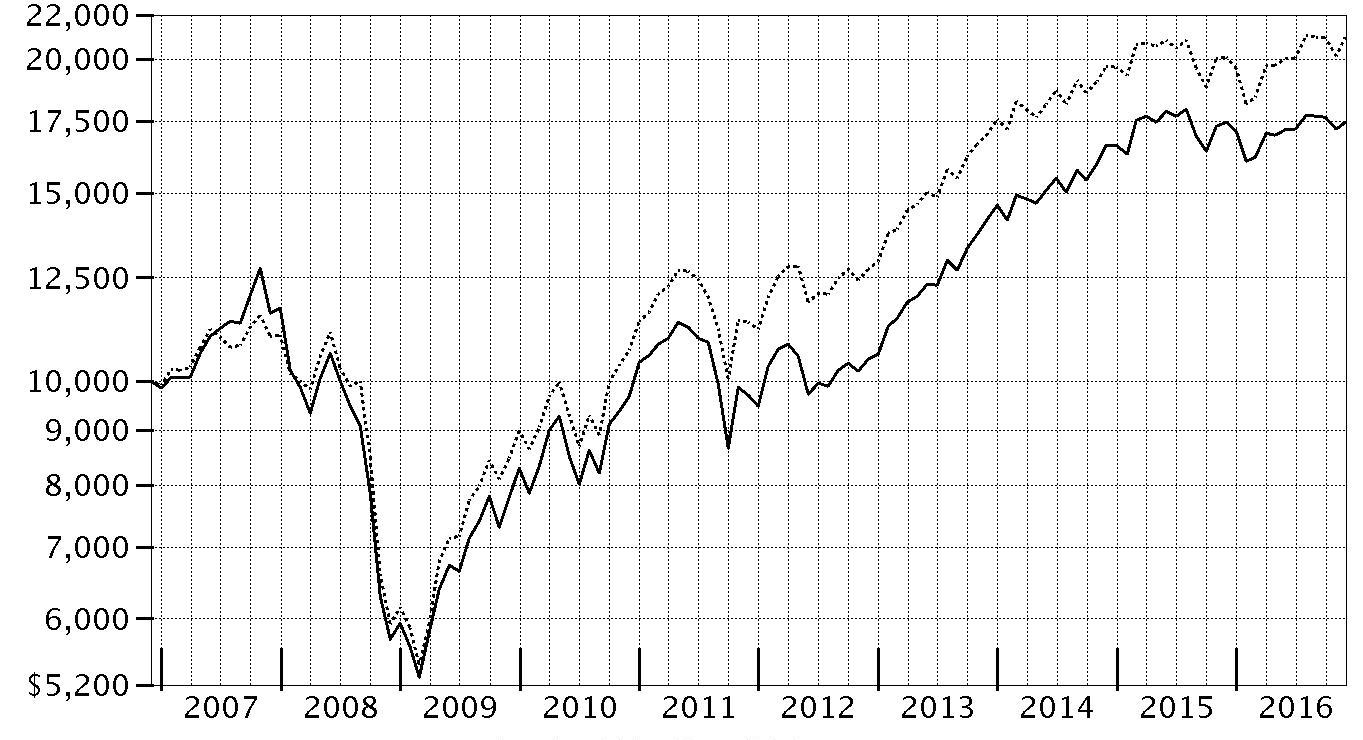

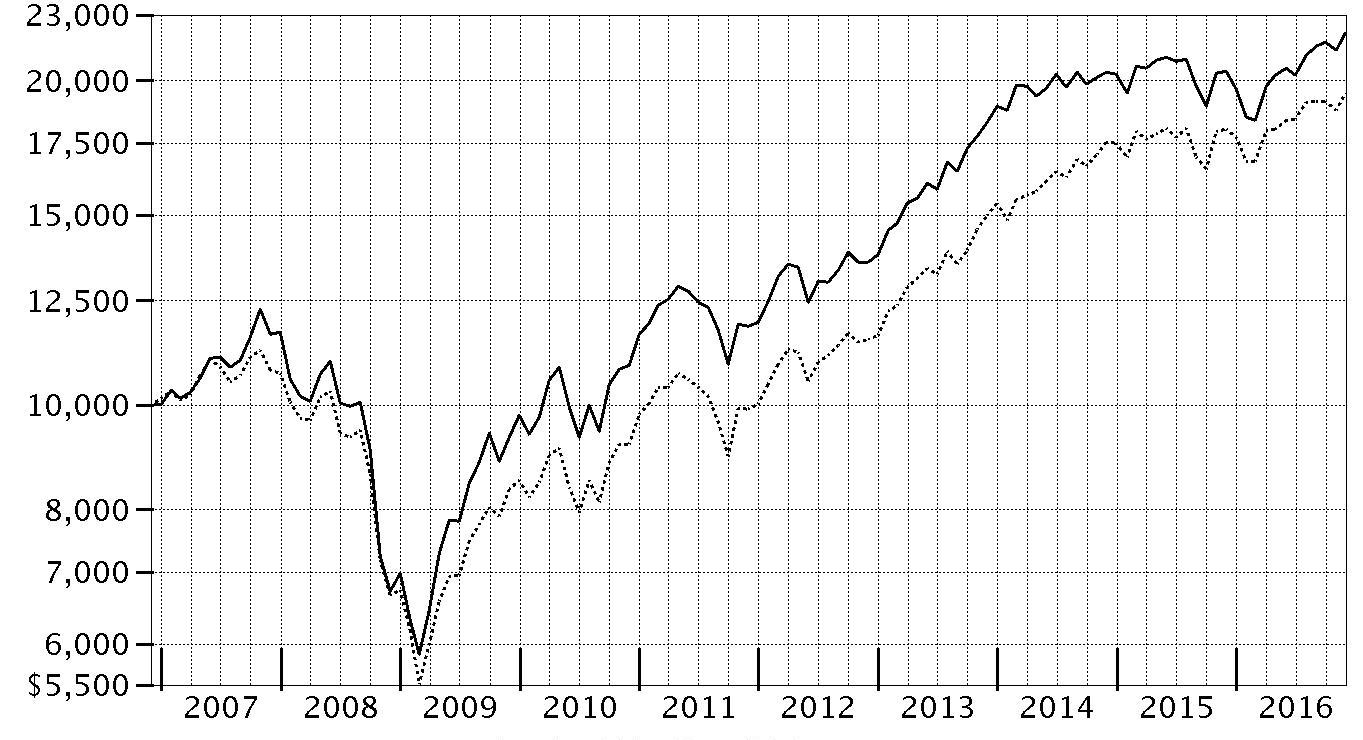

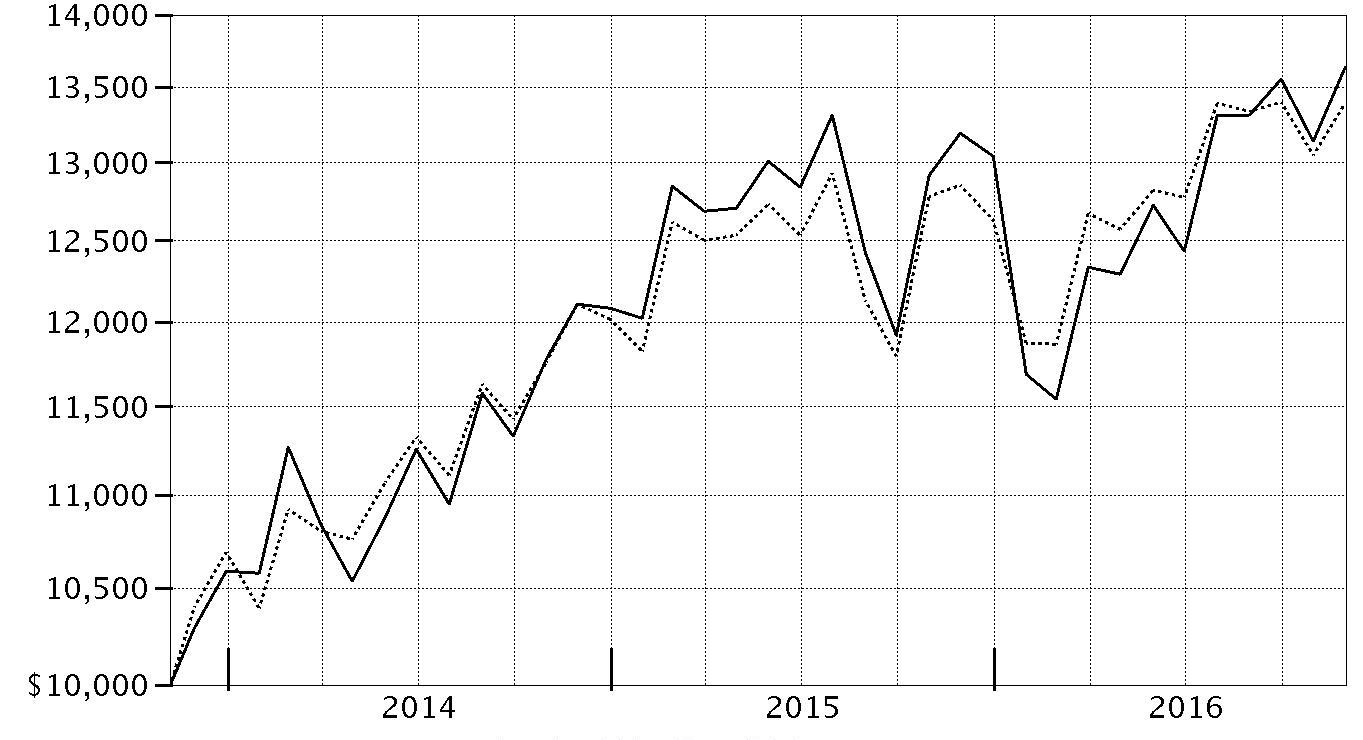

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity® Growth Company Fund - Class K on November 30, 2006. The chart shows how the value of your investment would have changed, and also shows how the Russell 3000® Growth Index performed over the same period. See above for additional information regarding the performance of Class K.

| Period Ending Values |

| $25,866 | Fidelity® Growth Company Fund - Class K |

| $21,953 | Russell 3000® Growth Index |

Management's Discussion of Fund Performance

Market Recap: The S&P 500

® index returned 8.06% for the 12 months ending November 30, 2016, rising sharply in the final month on post-election optimism for economic growth. The period began during a fairly volatile stretch, with stocks hampered by persistent oil-price weakness and U.S.-dollar strength. Markets regained positive momentum in February amid U.S. job gains, a rally in energy and other stimuli that helped keep the roughly seven-year uptrend intact. Markets tumbled briefly following the U.K.'s June 23 vote to exit the European Union – dubbed "Brexit" – then recovered quickly and settled into a flattish stretch until the November 8 U.S. presidential election. For the year, 10 of the 11 sectors in the S&P 500

® advanced, with six posting double-digit gains. Telecommunication services (+16%) led the way, its strength attributable to demand for dividend-paying equities early in the period, as well as to company-specific news. Cyclical sectors including industrials (+15%), financials (+14%), energy (+13%) and materials (+12%) posted strong gains, the latter two driven by a rebound in commodity prices. Conversely, real estate (+1%) lagged the index due to a late-period slump related to expectations for rising interest rates. Consumer discretionary (+3%) also underperformed, as competitive pressure continued to weigh on brick-and-mortar retailers.

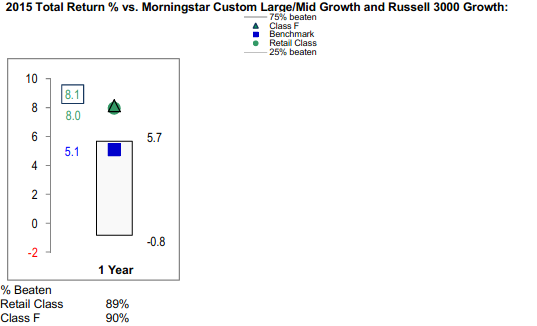

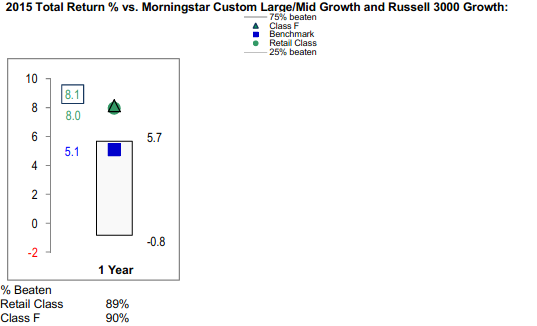

Comments from Portfolio Manager Steven Wymer: For the year, the fund’s share classes returned about 4%, modestly underperforming the 4.25% gain of the benchmark Russell 3000 Growth Index. Versus the benchmark, positioning in the pharmaceuticals, biotechnology & life sciences industry weighed most on performance, attributed to stock-specific events and industrywide drug-pricing pressures. Positioning in industrials also hurt. Drugmaker Alnylam Pharmaceuticals was the fund’s biggest relative detractor. Alnylam's shares were cut roughly in half in October when a late-stage trial revealed potential safety issues with one of its drug candidates that sought to treat rare hereditary diseases. The fund's second-largest detractor this period was Regeneron Pharmaceuticals, one of our largest holdings. The firm faced a number of setbacks, including patent infringement woes and concerns about slowing sales growth for its key drug Eylea

®, used to treat macular (retinal) degeneration. Turning to the positive, graphics chipmaker Nvidia was the largest relative contributor to fund performance by far. The company's share price more than doubled this period, boosted by consecutive quarters of better-than-expected financial results.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Investment Summary (Unaudited)

Top Ten Stocks as of November 30, 2016

| | % of fund's net assets | % of fund's net assets 6 months ago |

| NVIDIA Corp. | 7.7 | 4.6 |

| Apple, Inc. | 4.8 | 4.3 |

| Amazon.com, Inc. | 4.5 | 4.4 |

| Alphabet, Inc. Class A | 3.9 | 4.0 |

| Facebook, Inc. Class A | 3.0 | 3.3 |

| Salesforce.com, Inc. | 3.0 | 4.7 |

| adidas AG | 2.2 | 1.2 |

| Microsoft Corp. | 2.2 | 1.3 |

| Alphabet, Inc. Class C | 2.0 | 2.0 |

| Alkermes PLC | 1.6 | 1.3 |

| | 34.9 | |

Top Five Market Sectors as of November 30, 2016

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Information Technology | 40.5 | 37.9 |

| Consumer Discretionary | 19.9 | 20.8 |

| Health Care | 19.0 | 18.7 |

| Industrials | 6.9 | 7.5 |

| Consumer Staples | 6.1 | 8.7 |

Prior period industry classifications reflect the categories in place as of the date indicated and have not been adjusted to reflect current industry classifications.

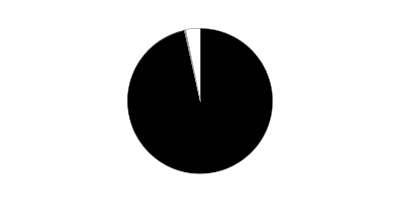

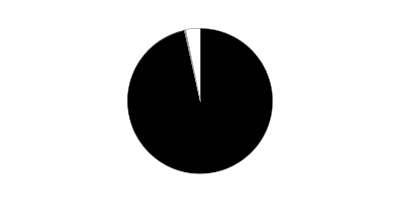

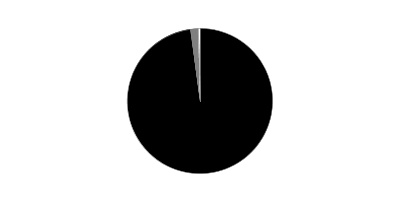

Asset Allocation (% of fund's net assets)

| As of November 30, 2016* |

| | Stocks | 97.3% |

| | Convertible Securities | 2.4% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 0.3% |

* Foreign investments - 8.9%

| As of May 31, 2016* |

| | Stocks | 97.4% |

| | Convertible Securities | 2.3% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 0.3% |

* Foreign investments - 7.9%

Investments November 30, 2016

Showing Percentage of Net Assets

| Common Stocks - 97.3% | | | |

| | | Shares | Value (000s) |

| CONSUMER DISCRETIONARY - 19.8% | | | |

| Auto Components - 0.0% | | | |

| Adient PLC (a) | | 49,986 | $2,677 |

| Automobiles - 0.7% | | | |

| Tesla Motors, Inc. (a)(b) | | 1,401,100 | 265,368 |

| Hotels, Restaurants & Leisure - 3.2% | | | |

| Buffalo Wild Wings, Inc. (a) | | 598,800 | 100,958 |

| China Lodging Group Ltd. ADR | | 367,600 | 19,255 |

| Chipotle Mexican Grill, Inc. (a) | | 145,000 | 57,468 |

| Dave & Buster's Entertainment, Inc. (a) | | 362,342 | 16,976 |

| Del Taco Restaurants, Inc. (a) | | 1,329,800 | 19,309 |

| Domino's Pizza, Inc. | | 278,700 | 46,833 |

| Dunkin' Brands Group, Inc. | | 434,540 | 23,591 |

| Hyatt Hotels Corp. Class A (a) | | 186,940 | 9,597 |

| Las Vegas Sands Corp. | | 907,100 | 56,848 |

| McDonald's Corp. | | 1,399,300 | 166,895 |

| Panera Bread Co. Class A (a)(b) | | 305,400 | 64,778 |

| Papa John's International, Inc. | | 1,020,300 | 90,154 |

| Shake Shack, Inc. Class A (a)(b) | | 177,400 | 6,543 |

| Starbucks Corp. | | 4,985,300 | 288,998 |

| Wingstop, Inc. | | 334,388 | 10,262 |

| Yum China Holdings, Inc. | | 2,587,400 | 72,758 |

| Yum! Brands, Inc. | | 1,281,600 | 81,241 |

| | | | 1,132,464 |

| Household Durables - 0.1% | | | |

| Newell Brands, Inc. | | 231,654 | 10,890 |

| Sony Corp. sponsored ADR | | 1,275,200 | 37,070 |

| | | | 47,960 |

| Internet & Direct Marketing Retail - 6.9% | | | |

| Amazon.com, Inc. (a) | | 2,178,101 | 1,634,817 |

| Ctrip.com International Ltd. ADR (a) | | 1,361,700 | 61,590 |

| Etsy, Inc. (a) | | 222,100 | 2,754 |

| Expedia, Inc. | | 1,099,000 | 136,331 |

| Groupon, Inc. Class A (a) | | 9,796,400 | 38,892 |

| JD.com, Inc. sponsored ADR (a) | | 305,500 | 8,209 |

| Netflix, Inc. (a) | | 2,028,500 | 237,335 |

| Priceline Group, Inc. (a) | | 137,768 | 207,159 |

| The Honest Co., Inc. (a)(c) | | 39,835 | 1,242 |

| TripAdvisor, Inc. (a) | | 126,600 | 6,112 |

| Vipshop Holdings Ltd. ADR (a) | | 4,699,000 | 52,723 |

| Wayfair LLC Class A (a)(b) | | 2,753,967 | 100,382 |

| | | | 2,487,546 |

| Leisure Products - 0.1% | | | |

| Callaway Golf Co. | | 2,565,900 | 31,176 |

| NJOY, Inc. (a)(c) | | 17,666,069 | 0 |

| | | | 31,176 |

| Media - 1.6% | | | |

| Comcast Corp. Class A | | 5,375,700 | 373,665 |

| Lions Gate Entertainment Corp. (b) | | 231,492 | 5,417 |

| The Walt Disney Co. | | 1,850,700 | 183,441 |

| Twenty-First Century Fox, Inc. Class A | | 404,800 | 11,379 |

| | | | 573,902 |

| Multiline Retail - 0.3% | | | |

| Dollar General Corp. | | 244,700 | 18,920 |

| Dollar Tree, Inc. (a) | | 595,400 | 52,490 |

| Target Corp. | | 284,689 | 21,989 |

| | | | 93,399 |

| Specialty Retail - 1.5% | | | |

| AutoNation, Inc. (a) | | 317,600 | 14,184 |

| CarMax, Inc. (a)(b) | | 319,721 | 18,477 |

| DavidsTea, Inc. (a) | | 982,600 | 9,384 |

| Home Depot, Inc. | | 2,574,700 | 333,166 |

| L Brands, Inc. | | 695,400 | 48,831 |

| Restoration Hardware Holdings, Inc. (a)(b)(d) | | 2,151,049 | 77,545 |

| TJX Companies, Inc. | | 386,000 | 30,239 |

| | | | 531,826 |

| Textiles, Apparel & Luxury Goods - 5.4% | | | |

| adidas AG | | 5,275,500 | 777,258 |

| Aritzia LP (a) | | 1,620,800 | 21,236 |

| Columbia Sportswear Co. | | 171,000 | 9,725 |

| Kate Spade & Co. (a) | | 3,704,715 | 55,015 |

| lululemon athletica, Inc. (a)(d) | | 8,984,923 | 512,051 |

| NIKE, Inc. Class B | | 3,772,700 | 188,899 |

| Skechers U.S.A., Inc. Class A (sub. vtg.) (a) | | 9,868,940 | 224,814 |

| Tory Burch LLC: | | | |

| Class A unit (a)(c)(e) | | 950,844 | 52,810 |

| Class B(a)(c)(e) | | 324,840 | 19,241 |

| Under Armour, Inc.: | | | |

| Class A (sub. vtg.) (a)(b) | | 430,500 | 13,259 |

| Class C (non-vtg.) | | 417,804 | 10,771 |

| VF Corp. | | 582,800 | 31,768 |

| | | | 1,916,847 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 7,083,165 |

|

| CONSUMER STAPLES - 6.1% | | | |

| Beverages - 2.4% | | | |

| Constellation Brands, Inc. Class A (sub. vtg.) | | 360,600 | 54,501 |

| Dr. Pepper Snapple Group, Inc. | | 200,400 | 17,383 |

| Monster Beverage Corp. (a) | | 9,123,318 | 408,268 |

| PepsiCo, Inc. | | 1,161,640 | 116,280 |

| The Coca-Cola Co. | | 6,155,300 | 248,366 |

| | | | 844,798 |

| Food & Staples Retailing - 1.2% | | | |

| Costco Wholesale Corp. | | 1,404,300 | 210,799 |

| CVS Health Corp. | | 1,057,100 | 81,280 |

| Drogasil SA | | 2,947,473 | 56,203 |

| Kroger Co. | | 381,950 | 12,337 |

| Sprouts Farmers Market LLC (a) | | 66,200 | 1,325 |

| Walgreens Boots Alliance, Inc. | | 669,900 | 56,761 |

| Whole Foods Market, Inc. | | 699,600 | 21,261 |

| | | | 439,966 |

| Food Products - 0.7% | | | |

| Campbell Soup Co. | | 148,100 | 8,425 |

| General Mills, Inc. | | 173,800 | 10,591 |

| Mead Johnson Nutrition Co. Class A | | 1,095,000 | 78,939 |

| Mondelez International, Inc. | | 681,400 | 28,101 |

| The Hain Celestial Group, Inc. (a) | | 349,300 | 13,689 |

| The Hershey Co. | | 296,800 | 28,683 |

| The Kraft Heinz Co. | | 513,900 | 41,960 |

| Tyson Foods, Inc. Class A | | 380,100 | 21,593 |

| | | | 231,981 |

| Household Products - 0.3% | | | |

| Church & Dwight Co., Inc. | | 923,500 | 40,440 |

| Colgate-Palmolive Co. | | 481,700 | 31,421 |

| Kimberly-Clark Corp. | | 284,300 | 32,868 |

| Procter & Gamble Co. | | 148,100 | 12,212 |

| | | | 116,941 |

| Personal Products - 0.7% | | | |

| Coty, Inc. Class A | | 8,797,900 | 164,609 |

| Herbalife Ltd. (a) | | 1,637,110 | 80,268 |

| | | | 244,877 |

| Tobacco - 0.8% | | | |

| Altria Group, Inc. | | 2,884,580 | 184,411 |

| Japan Tobacco, Inc. | | 412,600 | 14,304 |

| Philip Morris International, Inc. | | 527,680 | 46,584 |

| Reynolds American, Inc. | | 1,008,726 | 54,572 |

| | | | 299,871 |

|

| TOTAL CONSUMER STAPLES | | | 2,178,434 |

|

| ENERGY - 2.6% | | | |

| Energy Equipment & Services - 0.8% | | | |

| Baker Hughes, Inc. | | 2,258,800 | 145,309 |

| Halliburton Co. | | 546,200 | 28,998 |

| Schlumberger Ltd. | | 204,000 | 17,146 |

| U.S. Silica Holdings, Inc. | | 1,655,100 | 83,765 |

| | | | 275,218 |

| Oil, Gas & Consumable Fuels - 1.8% | | | |

| Anadarko Petroleum Corp. | | 505,500 | 34,955 |

| Cabot Oil & Gas Corp. | | 1,458,400 | 32,260 |

| Concho Resources, Inc. (a) | | 653,500 | 93,464 |

| Continental Resources, Inc. (a) | | 715,200 | 41,489 |

| EOG Resources, Inc. | | 1,534,600 | 157,327 |

| Hess Corp. | | 268,600 | 15,031 |

| Noble Energy, Inc. | | 1,161,711 | 44,331 |

| PDC Energy, Inc. (a) | | 531,200 | 39,548 |

| Pioneer Natural Resources Co. | | 647,207 | 123,642 |

| Range Resources Corp. | | 1,606,900 | 56,531 |

| Valero Energy Corp. | | 243,700 | 15,002 |

| | | | 653,580 |

|

| TOTAL ENERGY | | | 928,798 |

|

| FINANCIALS - 2.4% | | | |

| Banks - 1.0% | | | |

| Citigroup, Inc. | | 577,780 | 32,581 |

| HDFC Bank Ltd. sponsored ADR | | 1,601,474 | 103,327 |

| JPMorgan Chase & Co. | | 2,005,300 | 160,765 |

| Signature Bank (a) | | 64,385 | 9,652 |

| Wells Fargo & Co. | | 866,900 | 45,876 |

| | | | 352,201 |

| Capital Markets - 1.3% | | | |

| BlackRock, Inc. Class A | | 448,800 | 166,411 |

| BM&F BOVESPA SA | | 5,757,397 | 28,276 |

| Charles Schwab Corp. | | 6,684,675 | 258,430 |

| RPI International Holdings LP (c) | | 130,847 | 17,149 |

| | | | 470,266 |

| Consumer Finance - 0.1% | | | |

| American Express Co. | | 255,548 | 18,410 |

| Discover Financial Services | | 112,644 | 7,634 |

| | | | 26,044 |

|

| TOTAL FINANCIALS | | | 848,511 |

|

| HEALTH CARE - 18.1% | | | |

| Biotechnology - 13.8% | | | |

| AbbVie, Inc. | | 1,068,200 | 64,947 |

| AbbVie, Inc. (f) | | 642,091 | 38,649 |

| ACADIA Pharmaceuticals, Inc. (a)(d) | | 2,929,105 | 79,057 |

| ACADIA Pharmaceuticals, Inc. (a)(b)(d) | | 4,036,694 | 108,950 |

| Adaptimmune Therapeutics PLC sponsored ADR (a) | | 685,400 | 2,858 |

| Adverum Biotechnologies, Inc. (a) | | 986,400 | 2,811 |

| Agios Pharmaceuticals, Inc. (a)(b) | | 1,529,287 | 89,020 |

| Aimmune Therapeutics, Inc. (a) | | 211,900 | 4,810 |

| Alder Biopharmaceuticals, Inc. (a)(b) | | 450,600 | 10,612 |

| Alexion Pharmaceuticals, Inc. (a) | | 1,864,860 | 228,613 |

| Alkermes PLC (a)(d) | | 9,933,061 | 564,496 |

| Alnylam Pharmaceuticals, Inc. (a)(d) | | 4,824,103 | 211,633 |

| Amgen, Inc. | | 1,895,000 | 273,013 |

| Array BioPharma, Inc. (a) | | 6,163,770 | 49,896 |

| aTyr Pharma, Inc. (a)(b)(d) | | 562,107 | 1,743 |

| aTyr Pharma, Inc. (a)(d)(f) | | 1,469,144 | 4,554 |

| BeiGene Ltd. ADR (b) | | 1,884,861 | 59,750 |

| Biogen, Inc. (a) | | 354,500 | 104,248 |

| bluebird bio, Inc. (a)(b)(d) | | 2,434,481 | 146,921 |

| Celgene Corp. (a) | | 1,263,088 | 149,689 |

| Celldex Therapeutics, Inc. (a)(b) | | 5,853,416 | 22,302 |

| Cellectis SA sponsored ADR (a) | | 701,962 | 11,835 |

| Chimerix, Inc. (a)(d) | | 2,915,257 | 14,256 |

| Coherus BioSciences, Inc. (a)(b) | | 2,029,917 | 54,605 |

| Corvus Pharmaceuticals, Inc. | | 330,300 | 5,097 |

| CytomX Therapeutics, Inc. (a) | | 678,978 | 7,564 |

| CytomX Therapeutics, Inc. (f) | | 794,033 | 8,846 |

| Dicerna Pharmaceuticals, Inc. (a) | | 875,550 | 2,609 |

| Editas Medicine, Inc. | | 1,264,682 | 18,047 |

| Exelixis, Inc. (a)(d) | | 18,229,867 | 308,449 |

| Fate Therapeutics, Inc. (a)(b) | | 1,676,206 | 4,928 |

| Five Prime Therapeutics, Inc. (a) | | 1,119,055 | 64,368 |

| Galapagos Genomics NV sponsored ADR (a) | | 1,120,098 | 66,220 |

| Genocea Biosciences, Inc. (a)(b) | | 518,900 | 2,086 |

| Gilead Sciences, Inc. | | 2,919,795 | 215,189 |

| Global Blood Therapeutics, Inc. (a) | | 668,417 | 12,800 |

| Heron Therapeutics, Inc. (a)(b) | | 918,591 | 14,100 |

| Intellia Therapeutics, Inc. (a)(b) | | 1,382,500 | 21,774 |

| Intercept Pharmaceuticals, Inc. (a)(b) | | 158,654 | 16,043 |

| Intrexon Corp. (a)(b) | | 551,275 | 16,086 |

| Ionis Pharmaceuticals, Inc. (a)(b)(d) | | 8,098,427 | 354,387 |

| Ironwood Pharmaceuticals, Inc. Class A (a) | | 6,028,193 | 94,070 |

| Lexicon Pharmaceuticals, Inc. (a)(b)(d) | | 6,811,148 | 103,734 |

| Macrogenics, Inc. (a) | | 157,921 | 4,095 |

| Merrimack Pharmaceuticals, Inc. (a)(b)(d) | | 7,509,421 | 41,377 |

| Momenta Pharmaceuticals, Inc. (a)(d) | | 5,402,265 | 76,442 |

| Opko Health, Inc. (a) | | 422,498 | 4,390 |

| PhaseRx, Inc. (b) | | 298,252 | 626 |

| Protagonist Therapeutics, Inc. | | 270,458 | 6,748 |

| Prothena Corp. PLC (a)(d) | | 2,145,423 | 126,623 |

| Regeneron Pharmaceuticals, Inc. (a) | | 1,271,218 | 482,097 |

| Regulus Therapeutics, Inc. (a)(d) | | 3,115,245 | 7,632 |

| Rigel Pharmaceuticals, Inc. (a)(d) | | 8,211,095 | 21,349 |

| Sage Therapeutics, Inc. (a)(b)(d) | | 1,997,456 | 100,093 |

| Seattle Genetics, Inc.(a) | | 3,503,836 | 227,084 |

| Seres Therapeutics, Inc. (a) | | 1,321,311 | 13,200 |

| Seres Therapeutics, Inc. (f) | | 572,827 | 5,723 |

| Shire PLC sponsored ADR | | 101,316 | 17,690 |

| Spark Therapeutics, Inc. (a)(b) | | 352,788 | 19,407 |

| Syros Pharmaceuticals, Inc. (b)(d) | | 816,234 | 11,084 |

| Syros Pharmaceuticals, Inc. (d) | | 938,008 | 12,101 |

| TESARO, Inc. (a) | | 122,793 | 16,662 |

| Ultragenyx Pharmaceutical, Inc. (a)(b) | | 838,000 | 65,607 |

| Versartis, Inc. (a) | | 590,494 | 7,352 |

| Vertex Pharmaceuticals, Inc. (a) | | 335,967 | 27,418 |

| | | | 4,930,465 |

| Health Care Equipment & Supplies - 1.4% | | | |

| Abbott Laboratories | | 529,900 | 20,173 |

| Align Technology, Inc. (a) | | 151,256 | 14,074 |

| Baxter International, Inc. | | 508,100 | 22,544 |

| Danaher Corp. | | 1,518,200 | 118,678 |

| DexCom, Inc. (a) | | 537,900 | 35,119 |

| Entellus Medical, Inc. (a)(b) | | 407,300 | 7,507 |

| Genmark Diagnostics, Inc. (a) | | 1,340,553 | 15,577 |

| Insulet Corp. (a) | | 1,980,482 | 66,643 |

| Intuitive Surgical, Inc. (a) | | 98,293 | 63,275 |

| Novocure Ltd. (a)(b) | | 1,262,000 | 9,781 |

| Novocure Ltd. (f) | | 571,461 | 4,429 |

| Penumbra, Inc. (a)(b) | | 1,267,087 | 78,433 |

| Presbia PLC (a)(d) | | 1,183,529 | 5,184 |

| St. Jude Medical, Inc. | | 402,400 | 31,870 |

| Zeltiq Aesthetics, Inc. (a)(b) | | 427,300 | 18,805 |

| | | | 512,092 |

| Health Care Providers & Services - 0.9% | | | |

| Apollo Hospitals Enterprise Ltd. | | 720,000 | 12,549 |

| Cardinal Health, Inc. | | 767,700 | 54,514 |

| Express Scripts Holding Co. (a) | | 352,003 | 26,710 |

| Laboratory Corp. of America Holdings (a) | | 178,000 | 22,401 |

| McKesson Corp. | | 478,900 | 68,871 |

| UnitedHealth Group, Inc. | | 897,300 | 142,061 |

| | | | 327,106 |

| Health Care Technology - 0.3% | | | |

| athenahealth, Inc. (a)(b) | | 757,700 | 71,678 |

| Castlight Health, Inc. Class B (a)(b) | | 2,420,594 | 11,256 |

| Cerner Corp. (a) | | 206,100 | 10,260 |

| | | | 93,194 |

| Life Sciences Tools & Services - 0.1% | | | |

| Divi's Laboratories Ltd. | | 124,668 | 2,132 |

| Illumina, Inc. (a) | | 180,838 | 24,077 |

| | | | 26,209 |

| Pharmaceuticals - 1.6% | | | |

| Adimab LLC unit (a)(c)(e) | | 3,162,765 | 76,033 |

| Allergan PLC | | 318,038 | 61,795 |

| Avexis, Inc. (b) | | 934,341 | 55,238 |

| Bristol-Myers Squibb Co. | | 2,952,500 | 166,639 |

| Castle Creek Pharmaceuticals, LLC Class A-2 unit (c)(e) | | 46,864 | 15,465 |

| Cempra, Inc. (a)(b) | | 401,900 | 2,612 |

| Endocyte, Inc. (a)(b) | | 1,837,415 | 4,888 |

| Intra-Cellular Therapies, Inc. (a)(b)(d) | | 3,416,199 | 47,622 |

| Jazz Pharmaceuticals PLC (a) | | 451,900 | 46,830 |

| Kolltan Pharmaceuticals, Inc. rights (a) | | 7,940,644 | 1,334 |

| Mylan N.V. (a) | | 117,800 | 4,313 |

| Stemcentrx, Inc. rights 12/31/21 (a) | | 2,065,715 | 5,701 |

| Teva Pharmaceutical Industries Ltd. sponsored ADR | | 631,800 | 23,819 |

| The Medicines Company (a) | | 1,961,778 | 68,858 |

| Theravance Biopharma, Inc. (a)(b) | | 312,600 | 8,703 |

| | | | 589,850 |

|

| TOTAL HEALTH CARE | | | 6,478,916 |

|

| INDUSTRIALS - 6.6% | | | |

| Aerospace & Defense - 0.8% | | | |

| Lockheed Martin Corp. | | 562,400 | 149,177 |

| Northrop Grumman Corp. | | 74,221 | 18,529 |

| Space Exploration Technologies Corp. Class A (a)(c) | | 356,922 | 37,116 |

| The Boeing Co. | | 653,400 | 98,376 |

| | | | 303,198 |

| Air Freight & Logistics - 0.4% | | | |

| FedEx Corp. | | 106,300 | 20,375 |

| United Parcel Service, Inc. Class B | | 1,148,600 | 133,146 |

| | | | 153,521 |

| Airlines - 2.6% | | | |

| Allegiant Travel Co. | | 387,800 | 63,367 |

| Delta Air Lines, Inc. | | 1,400,600 | 67,481 |

| InterGlobe Aviation Ltd. (a) | | 632,349 | 7,923 |

| JetBlue Airways Corp. (a) | | 10,018,423 | 201,270 |

| Ryanair Holdings PLC sponsored ADR | | 551,152 | 44,004 |

| Southwest Airlines Co. | | 3,188,315 | 148,607 |

| Spirit Airlines, Inc. (a) | | 2,294,460 | 127,572 |

| United Continental Holdings, Inc. (a) | | 2,607,500 | 179,787 |

| Wheels Up Partners Holdings LLC Series B unit (a)(c)(e) | | 6,703,518 | 18,032 |

| Wizz Air Holdings PLC (a)(d) | | 3,073,536 | 64,452 |

| | | | 922,495 |

| Building Products - 0.1% | | | |

| Tyco International Ltd. | | 500,066 | 22,493 |

| Electrical Equipment - 0.3% | | | |

| AMETEK, Inc. | | 76,300 | 3,613 |

| Eaton Corp. PLC | | 506,800 | 33,707 |

| Emerson Electric Co. | | 440,700 | 24,873 |

| Fortive Corp. | | 759,300 | 41,754 |

| | | | 103,947 |

| Industrial Conglomerates - 0.9% | | | |

| 3M Co. | | 1,014,400 | 174,213 |

| Honeywell International, Inc. | | 1,325,500 | 151,027 |

| | | | 325,240 |

| Machinery - 1.2% | | | |

| Caterpillar, Inc. | | 2,962,400 | 283,087 |

| Cummins, Inc. | | 137,400 | 19,481 |

| Deere & Co. | | 383,500 | 38,427 |

| Illinois Tool Works, Inc. | | 342,700 | 42,899 |

| Wabtec Corp. | | 242,600 | 20,541 |

| Xylem, Inc. | | 761,700 | 39,288 |

| | | | 443,723 |

| Road & Rail - 0.3% | | | |

| Union Pacific Corp. | | 905,000 | 91,704 |

|

| TOTAL INDUSTRIALS | | | 2,366,321 |

|

| INFORMATION TECHNOLOGY - 39.4% | | | |

| Communications Equipment - 0.4% | | | |

| Arista Networks, Inc. (a) | | 68,400 | 6,485 |

| Cisco Systems, Inc. | | 666,200 | 19,866 |

| Infinera Corp. (a)(d) | | 12,561,828 | 106,776 |

| Palo Alto Networks, Inc. (a) | | 86,300 | 11,596 |

| | | | 144,723 |

| Electronic Equipment & Components - 0.2% | | | |

| TE Connectivity Ltd. | | 129,900 | 8,786 |

| Trimble, Inc. (a) | | 1,648,200 | 46,463 |

| | | | 55,249 |

| Internet Software & Services - 10.7% | | | |

| Actua Corp. (a)(d) | | 3,188,221 | 43,200 |

| Akamai Technologies, Inc. (a) | | 260,800 | 17,395 |

| Alibaba Group Holding Ltd. sponsored ADR (a) | | 1,411,700 | 132,728 |

| Alphabet, Inc.: | | | |

| Class A (a) | | 1,786,778 | 1,386,325 |

| Class C (a) | | 925,883 | 701,856 |

| Apptio, Inc. (d) | | 881,266 | 15,712 |

| Apptio, Inc. Class A (d) | | 414,600 | 8,213 |

| Baidu.com, Inc. sponsored ADR (a) | | 22,698 | 3,789 |

| Criteo SA sponsored ADR (a)(b) | | 307,783 | 12,702 |

| Dropbox, Inc. (a)(c) | | 1,105,082 | 14,057 |

| eBay, Inc. (a) | | 3,167,700 | 88,094 |

| Facebook, Inc. Class A (a) | | 9,149,291 | 1,083,459 |

| GoDaddy, Inc. (a) | | 447,800 | 15,825 |

| Hortonworks, Inc. (a)(b) | | 272,500 | 2,477 |

| NAVER Corp. | | 9,827 | 6,659 |

| New Relic, Inc. (a)(b) | | 519,279 | 16,466 |

| Nutanix, Inc.: | | | |

| Class A (a)(b)(d) | | 964,600 | 30,867 |

| Class B (d) | | 1,151,309 | 33,158 |

| Shopify, Inc. Class A (a) | | 3,912,942 | 163,052 |

| Tencent Holdings Ltd. | | 791,500 | 19,709 |

| Twitter, Inc. (a)(b) | | 42,590 | 787 |

| Wix.com Ltd. (a) | | 1,019,000 | 50,441 |

| | | | 3,846,971 |

| IT Services - 2.7% | | | |

| Cognizant Technology Solutions Corp. Class A (a) | | 1,055,032 | 58,111 |

| IBM Corp. | | 169,700 | 27,529 |

| MasterCard, Inc. Class A | | 2,877,800 | 294,111 |

| PayPal Holdings, Inc. (a) | | 3,626,600 | 142,453 |

| Visa, Inc. Class A | | 5,528,405 | 427,456 |

| | | | 949,660 |

| Semiconductors & Semiconductor Equipment - 11.2% | | | |

| Advanced Micro Devices, Inc. (a) | | 4,636,400 | 41,310 |

| Applied Materials, Inc. | | 224,300 | 7,222 |

| Applied Micro Circuits Corp. (a)(d) | | 6,066,489 | 53,082 |

| ASML Holding NV | | 230,693 | 23,791 |

| Broadcom Ltd. | | 707,402 | 120,605 |

| Cavium, Inc. (a) | | 2,477,460 | 141,290 |

| Cirrus Logic, Inc. (a) | | 3,013,367 | 165,735 |

| Cree, Inc. (a) | | 3,479,371 | 88,098 |

| Intel Corp. | | 392,200 | 13,609 |

| KLA-Tencor Corp. | | 288,300 | 23,018 |

| M/A-COM Technology Solutions Holdings, Inc. (a) | | 292,414 | 14,568 |

| Mellanox Technologies Ltd. (a) | | 809,889 | 33,570 |

| Micron Technology, Inc. (a) | | 327,300 | 6,392 |

| NVIDIA Corp. (d) | | 30,031,051 | 2,768,858 |

| NXP Semiconductors NV (a) | | 285,000 | 28,258 |

| Qorvo, Inc. (a) | | 269,400 | 14,389 |

| Rambus, Inc. (a) | | 2,837,000 | 37,307 |

| Silicon Laboratories, Inc. (a)(d) | | 3,247,273 | 215,457 |

| Skyworks Solutions, Inc. | | 146,031 | 11,222 |

| Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | | 1,451,700 | 43,101 |

| Texas Instruments, Inc. | | 2,278,900 | 168,479 |

| | | | 4,019,361 |

| Software - 9.2% | | | |

| Activision Blizzard, Inc. | | 7,699,808 | 281,890 |

| Adobe Systems, Inc. (a) | | 1,478,736 | 152,029 |

| Appirio, Inc. Escrow(c) | | 389,363 | 94 |

| Atlassian Corp. PLC | | 233,800 | 6,345 |

| Autodesk, Inc. (a) | | 716,800 | 52,047 |

| CyberArk Software Ltd. (a) | | 1,429,900 | 72,939 |

| Electronic Arts, Inc. (a) | | 2,409,152 | 190,901 |

| HubSpot, Inc. (a)(d) | | 1,782,554 | 100,001 |

| Intuit, Inc. | | 545,200 | 61,978 |

| Microsoft Corp. | | 12,868,617 | 775,463 |

| Oracle Corp. | | 1,156,100 | 46,464 |

| Paylocity Holding Corp. (a) | | 203,700 | 6,745 |

| Proofpoint, Inc. (a) | | 475,000 | 36,580 |

| Red Hat, Inc. (a) | | 4,684,986 | 370,629 |

| Salesforce.com, Inc. (a) | | 14,997,612 | 1,079,828 |

| ServiceNow, Inc. (a) | | 535,600 | 44,535 |

| Zendesk, Inc. (a) | | 1,649,500 | 35,118 |

| | | | 3,313,586 |

| Technology Hardware, Storage & Peripherals - 5.0% | | | |

| Apple, Inc. | | 15,573,548 | 1,721,189 |

| Pure Storage, Inc. Class A (a) | | 4,463,819 | 62,270 |

| Samsung Electronics Co. Ltd. | | 12,683 | 18,805 |

| Western Digital Corp. | | 109,213 | 6,952 |

| | | | 1,809,216 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 14,138,766 |

|

| MATERIALS - 1.4% | | | |

| Chemicals - 1.4% | | | |

| AdvanSix, Inc. (a) | | 77,124 | 1,442 |

| CF Industries Holdings, Inc. | | 1,226,525 | 35,496 |

| E.I. du Pont de Nemours & Co. | | 1,422,800 | 104,732 |

| Monsanto Co. | | 926,271 | 95,137 |

| Praxair, Inc. | | 213,300 | 25,660 |

| The Dow Chemical Co. | | 1,403,800 | 78,220 |

| The Mosaic Co. | | 307,200 | 8,724 |

| The Scotts Miracle-Gro Co. Class A | | 1,595,000 | 145,576 |

| | | | 494,987 |

| REAL ESTATE - 0.3% | | | |

| Equity Real Estate Investment Trusts (REITs) - 0.3% | | | |

| American Tower Corp. | | 1,131,500 | 115,719 |

| TELECOMMUNICATION SERVICES - 0.6% | | | |

| Diversified Telecommunication Services - 0.1% | | | |

| Verizon Communications, Inc. | | 1,223,000 | 61,028 |

| Wireless Telecommunication Services - 0.5% | | | |

| T-Mobile U.S., Inc. (a) | | 3,147,500 | 170,626 |

|

| TOTAL TELECOMMUNICATION SERVICES | | | 231,654 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $19,399,252) | | | 34,865,271 |

|

| Preferred Stocks - 2.4% | | | |

| Convertible Preferred Stocks - 2.4% | | | |

| CONSUMER DISCRETIONARY - 0.1% | | | |

| Hotels, Restaurants & Leisure - 0.0% | | | |

| MOD Super Fast Pizza Holdings LLC Series 3 Preferred unit (c)(e) | | 56,343 | 7,719 |

| Household Durables - 0.1% | | | |

| Roku, Inc.: | | | |

| Series F, 8.00% (a)(c) | | 17,901,305 | 31,327 |

| Series G, 8.00% (a)(c) | | 2,750,007 | 4,813 |

| Series H (c) | | 823,979 | 1,442 |

| | | | 37,582 |

| Internet & Direct Marketing Retail - 0.0% | | | |

| The Honest Co., Inc.: | | | |

| Series C (a)(c) | | 92,950 | 3,061 |

| Series D (a)(c) | | 69,363 | 2,530 |

| | | | 5,591 |

| Media - 0.0% | | | |

| Turn, Inc. Series E (a)(c) | | 984,774 | 3,121 |

| TOTAL CONSUMER DISCRETIONARY | | | 54,013 |

| CONSUMER STAPLES - 0.0% | | | |

| Food & Staples Retailing - 0.0% | | | |

| Blue Apron, Inc. Series D (a)(c) | | 750,363 | 10,858 |

| FINANCIALS - 0.0% | | | |

| Diversified Financial Services - 0.0% | | | |

| UNITY Biotechnology, Inc. Series B (c) | | 2,214,616 | 8,194 |

| HEALTH CARE - 0.9% | | | |

| Biotechnology - 0.8% | | | |

| 10X Genomics, Inc. Series C (c) | | 2,105,333 | 10,085 |

| Immunocore Ltd. Series A (a)(c) | | 67,323 | 14,865 |

| Intarcia Therapeutics, Inc.: | | | |

| Series CC (a)(c) | | 1,051,411 | 63,085 |

| Series DD (a)(c) | | 1,543,687 | 92,621 |

| Moderna Therapeutics, Inc.: | | | |

| Series D (c) | | 4,688,230 | 41,163 |

| Series E (c) | | 5,651,170 | 49,617 |

| Series F (c) | | 140,212 | 1,231 |

| RaNA Therapeutics LLC Series B (a)(c) | | 4,408,601 | 3,042 |

| | | | 275,709 |

| Health Care Providers & Services - 0.1% | | | |

| Mulberry Health, Inc. Series A8 (c) | | 2,790,742 | 18,224 |

| Health Care Technology - 0.0% | | | |

| Codiak Biosciences, Inc.: | | | |

| Series A (c) | | 589,863 | 1,557 |

| Series B (c) | | 1,917,058 | 5,061 |

| | | | 6,618 |

| TOTAL HEALTH CARE | | | 300,551 |

| INDUSTRIALS - 0.3% | | | |

| Aerospace & Defense - 0.1% | | | |

| Space Exploration Technologies Corp. Series G (a)(c) | | 216,276 | 22,491 |

| Commercial Services & Supplies - 0.1% | | | |

| Domo, Inc. Series D (a)(c) | | 2,990,903 | 20,317 |

| Professional Services - 0.1% | | | |

| YourPeople, Inc. Series C (c) | | 5,833,137 | 55,590 |

| TOTAL INDUSTRIALS | | | 98,398 |

| INFORMATION TECHNOLOGY - 1.1% | | | |

| Internet Software & Services - 0.7% | | | |

| Jet.Com, Inc. Series B1 Escrow(c) | | 7,578,338 | 2,489 |

| Uber Technologies, Inc.: | | | |

| Series D, 8.00% (a)(c) | | 4,770,180 | 232,652 |

| Series E, 8.00% (a)(c) | | 209,216 | 10,204 |

| | | | 245,345 |

| IT Services - 0.1% | | | |

| AppNexus, Inc. Series E (a)(c) | | 923,523 | 24,012 |

| Software - 0.3% | | | |

| Appirio, Inc. Series E Escrow(c) | | 2,725,544 | 730 |

| Cloudera, Inc. Series F (a)(c) | | 529,285 | 15,901 |

| Cloudflare, Inc. Series D 0.08% (a)(c) | | 1,429,726 | 8,564 |

| Dataminr, Inc. Series D (a)(c) | | 1,773,901 | 12,291 |

| MongoDB, Inc. Series F, 8.00% (a)(c) | | 1,913,404 | 16,194 |

| Snapchat, Inc. Series F (a)(c) | | 1,985,264 | 60,987 |

| Taboola.Com Ltd. Series E (a)(c) | | 1,337,420 | 17,530 |

| | | | 132,197 |

| TOTAL INFORMATION TECHNOLOGY | | | 401,554 |

| TELECOMMUNICATION SERVICES - 0.0% | | | |

| Wireless Telecommunication Services - 0.0% | | | |

| Altiostar Networks, Inc. Series E (c) | | 835,497 | 3,860 |

|

| TOTAL CONVERTIBLE PREFERRED STOCKS | | | 877,428 |

|

| Nonconvertible Preferred Stocks - 0.0% | | | |

| CONSUMER DISCRETIONARY - 0.0% | | | |

| Textiles, Apparel & Luxury Goods - 0.0% | | | |

| C. Wonder LLC Class A-1 (a)(c)(e) | | 619,048 | 0 |

| HEALTH CARE - 0.0% | | | |

| Biotechnology - 0.0% | | | |

| Yumanity Holdings LLC Class A (c) | | 464,607 | 3,587 |

|

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | | | 3,587 |

|

| TOTAL PREFERRED STOCKS | | | |

| (Cost $615,570) | | | 881,015 |

| | | Principal Amount (000s) | Value (000s) |

|

| Convertible Bonds - 0.0% | | | |

| CONSUMER DISCRETIONARY - 0.0% | | | |

| Media - 0.0% | | | |

| Turn, Inc. 1.48% 3/2/23(c) | | | |

| (Cost $306) | | 306 | 306 |

| | | Shares | Value (000s) |

|

| Money Market Funds - 1.3% | | | |

| Fidelity Cash Central Fund, 0.39% (g) | | 62,860,972 | 62,874 |

| Fidelity Securities Lending Cash Central Fund 0.48% (g)(h) | | 401,706,108 | 401,786 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $464,586) | | | 464,660 |

| TOTAL INVESTMENT PORTFOLIO - 101.0% | | | |

| (Cost $20,479,714) | | | 36,211,252 |

| NET OTHER ASSETS (LIABILITIES) - (1.0)% | | | (358,266) |

| NET ASSETS - 100% | | | $35,852,986 |

Values shown as $0 may reflect amounts less than $500.

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $1,132,560,000 or 3.2% of net assets.

(d) Affiliated company

(e) Investment is owned by a wholly-owned subsidiary (Subsidiary) that is treated as a corporation for U.S. tax purposes.

(f) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $62,201,000 or 0.2% of net assets.

(g) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(h) Investment made with cash collateral received from securities on loan.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost (000s) |

| 10X Genomics, Inc. Series C | 2/23/16 | $9,428 |

| Adimab LLC unit | 9/17/14 - 6/5/15 | $47,869 |

| Altiostar Networks, Inc. Series E | 9/26/16 | $3,860 |

| Appirio, Inc. Escrow | 11/24/16 | $94 |

| Appirio, Inc. Series E Escrow | 11/24/16 | $730 |

| AppNexus, Inc. Series E | 8/1/14 | $18,500 |

| Blue Apron, Inc. Series D | 5/18/15 | $10,000 |

| C. Wonder LLC Class A-1 | 12/27/12 - 6/25/13 | $19,500 |

| Castle Creek Pharmaceuticals, LLC Class A-2 unit | 9/29/16 | $15,465 |

| Cloudera, Inc. Series F | 2/5/14 | $7,706 |

| Cloudflare, Inc. Series D 0.08% | 11/5/14 | $8,758 |

| Codiak Biosciences, Inc. Series A | 11/12/15 | $590 |

| Codiak Biosciences, Inc. Series B | 11/12/15 | $5,751 |

| Dataminr, Inc. Series D | 2/18/15 - 3/6/15 | $22,617 |

| Domo, Inc. Series D | 1/24/14 | $12,362 |

| Dropbox, Inc. | 5/2/12 | $10,000 |

| Immunocore Ltd. Series A | 7/27/15 | $12,669 |

| Intarcia Therapeutics, Inc. Series CC | 11/14/12 | $14,331 |

| Intarcia Therapeutics, Inc. Series DD | 3/17/14 | $50,000 |

| Jet.Com, Inc. Series B1 Escrow | 9/19/16 | $2,489 |

| MOD Super Fast Pizza Holdings LLC Series 3 Preferred unit | 11/3/16 | $7,719 |

| Moderna Therapeutics, Inc. Series D | 11/6/13 | $20,615 |

| Moderna Therapeutics, Inc. Series E | 12/18/14 | $24,850 |

| Moderna Therapeutics, Inc. Series F | 8/10/16 | $617 |

| MongoDB, Inc. Series F, 8.00% | 10/2/13 | $32,000 |

| Mulberry Health, Inc. Series A8 | 1/20/16 | $18,851 |

| NJOY, Inc. | 6/7/13 - 2/14/14 | $19,365 |

| RaNA Therapeutics LLC Series B | 7/17/15 | $4,761 |

| Roku, Inc. Series F, 8.00% | 5/7/13 - 5/28/13 | $16,212 |

| Roku, Inc. Series G, 8.00% | 10/1/14 | $3,574 |

| Roku, Inc. Series H | 11/9/15 | $1,260 |

| RPI International Holdings LP | 5/21/15 - 3/23/16 | $16,269 |

| Snapchat, Inc. Series F | 3/25/15 - 2/12/16 | $60,987 |

| Space Exploration Technologies Corp. Class A | 10/16/15 | $31,766 |

| Space Exploration Technologies Corp. Series G | 1/20/15 | $16,753 |

| Taboola.Com Ltd. Series E | 12/22/14 | $13,943 |

| The Honest Co., Inc. | 8/21/14 | $1,078 |

| The Honest Co., Inc. Series C | 8/21/14 | $2,515 |

| The Honest Co., Inc. Series D | 8/3/15 | $3,174 |

| Tory Burch LLC Class A unit | 5/14/15 | $67,653 |

| Tory Burch LLC Class B | 12/31/12 | $17,505 |

| Turn, Inc. Series E | 12/30/13 | $8,213 |

| Turn, Inc. 1.48% 3/2/23 | 3/2/16 | $306 |

| Uber Technologies, Inc. Series D, 8.00% | 6/6/14 | $74,000 |

| Uber Technologies, Inc. Series E, 8.00% | 12/5/14 | $6,971 |

| UNITY Biotechnology, Inc. Series B | 10/14/16 | $9,102 |

| Wheels Up Partners Holdings LLC Series B unit | 9/18/15 | $19,040 |

| YourPeople, Inc. Series C | 5/1/15 | $86,920 |

| Yumanity Holdings LLC Class A | 2/8/16 | $3,140 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| | (Amounts in thousands) |

| Fidelity Cash Central Fund | $387 |

| Fidelity Securities Lending Cash Central Fund | 8,248 |

| Total | $8,635 |

Other Affiliated Issuers

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows:

| Affiliate (Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds* | Dividend Income | Value, end of period |

| ACADIA Pharmaceuticals, Inc. | $107,666 | $45,035 | $9,227 | $-- | $108,950 |

| ACADIA Pharmaceuticals, Inc. | 111,160 | -- | -- | -- | 79,057 |

| Actua Corp. | 41,096 | 316 | 4,200 | -- | 43,200 |

| Alkermes PLC | 745,876 | 30,702 | 40,718 | -- | 564,496 |

| Alnylam Pharmaceuticals, Inc. | 512,375 | 20,379 | 24,688 | -- | 211,633 |

| Applied Micro Circuits Corp. | 46,056 | 2,819 | 5,030 | -- | 53,082 |

| Apptio, Inc. | -- | -- | -- | -- | 15,712 |

| Apptio, Inc. Class A | -- | 9,342 | 358 | -- | 8,213 |

| aTyr Pharma, Inc. | 5,110 | 28 | 182 | -- | 1,743 |

| aTyr Pharma, Inc. | 12,502 | -- | -- | -- | 4,554 |

| bluebird bio, Inc. | 205,014 | 17,452 | 11,087 | -- | 146,921 |

| Castlight Health, Inc. Class B | 10,480 | -- | 834 | -- | -- |

| Cavium, Inc. | 191,120 | 11,391 | 29,770 | -- | -- |

| Chimerix, Inc. | 105,837 | 2,702 | 1,369 | -- | 14,256 |

| Chuy's Holdings, Inc. | 45,305 | -- | 40,835 | -- | -- |

| Cree, Inc. | 184,985 | 13,676 | 92,905 | -- | -- |

| Dicerna Pharmaceuticals, Inc. | 14,490 | -- | 880 | -- | -- |

| Eleven Biotherapeutics, Inc. | 3,828 | -- | 432 | -- | -- |

| Exelixis, Inc. | 83,646 | 61,927 | 13,126 | -- | 308,449 |

| Fate Therapeutics, Inc. | 7,602 | -- | 368 | -- | -- |

| Homeinns Hotel Group ADR | 78,489 | -- | 1,627 | -- | -- |

| HubSpot, Inc. | 67,790 | 29,259 | 7,091 | -- | 100,001 |

| Infinera Corp. | 290,889 | 7,900 | 14,292 | -- | 106,776 |

| Intra-Cellular Therapies, Inc. | 128,584 | 50,651 | 5,589 | -- | 47,622 |

| Ionis Pharmaceuticals, Inc. | 509,728 | 15,932 | 26,521 | -- | 354,387 |

| Kate Spade & Co. | 155,897 | 725 | 73,788 | -- | -- |

| Lexicon Pharmaceuticals, Inc. | 81,561 | 21,165 | 7,969 | -- | 103,734 |

| lululemon athletica, Inc. | 453,130 | 30,692 | 58,783 | -- | 512,051 |

| Marketo, Inc. | 67,012 | -- | 77,045 | -- | -- |

| Merrimack Pharmaceuticals, Inc. | 75,878 | 401 | 4,211 | -- | 41,377 |

| Momenta Pharmaceuticals, Inc. | 101,247 | 1,762 | 5,424 | -- | 76,442 |

| Nutanix, Inc. Class A | -- | 29,557 | 645 | -- | 30,867 |

| Nutanix, Inc. Class B | -- | -- | -- | -- | 33,158 |

| NVIDIA Corp. | 1,195,282 | 17,321 | 538,182 | 16,902 | 2,768,858 |

| PhaseRx, Inc. | -- | 3,096 | 618 | -- | -- |

| Presbia PLC | 5,504 | 1,483 | 419 | -- | 5,184 |

| Prothena Corp. PLC | 145,362 | 11,961 | 9,600 | -- | 126,623 |

| Regulus Therapeutics, Inc. | 33,318 | 350 | 1,186 | -- | 7,632 |

| Restoration Hardware Holdings, Inc. | 185,808 | 9,247 | 6,720 | -- | 77,545 |

| Rigel Pharmaceuticals, Inc. | 16,099 | 9,760 | 1,836 | -- | 21,349 |

| Sage Therapeutics, Inc. | 78,768 | 22,178 | 6,834 | -- | 100,093 |

| Silicon Laboratories, Inc. | 184,882 | 5,791 | 15,410 | -- | 215,457 |

| Syros Pharmaceuticals, Inc. | -- | 11,698 | 573 | -- | 11,084 |

| Syros Pharmaceuticals, Inc. | -- | 2,451 | -- | -- | 12,101 |

| Transition Therapeutics, Inc. | 5,321 | -- | 131 | -- | -- |

| Wizz Air Holdings PLC | 77,780 | 10,502 | 5,993 | -- | 64,452 |

| Total | $6,372,477 | $509,651 | $1,146,496 | $16,902 | $6,377,059 |

* Includes the value of securities delivered through in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of November 30, 2016, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| (Amounts in thousands) | | | | |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Consumer Discretionary | $7,137,178 | $6,232,614 | $777,258 | $127,306 |

| Consumer Staples | 2,189,292 | 2,164,130 | 14,304 | 10,858 |

| Energy | 928,798 | 928,798 | -- | -- |

| Financials | 856,705 | 831,362 | -- | 25,343 |

| Health Care | 6,783,054 | 6,314,952 | 65,431 | 402,671 |

| Industrials | 2,464,719 | 2,303,250 | 7,923 | 153,546 |

| Information Technology | 14,540,320 | 14,056,036 | 68,579 | 415,705 |

| Materials | 494,987 | 494,987 | -- | -- |

| Real Estate | 115,719 | 115,719 | -- | -- |

| Telecommunication Services | 235,514 | 231,654 | --�� | 3,860 |

| Corporate Bonds | 306 | -- | -- | 306 |

| Money Market Funds | 464,660 | 464,660 | -- | -- |

| Total Investments in Securities: | $36,211,252 | $34,138,162 | $933,495 | $1,139,595 |

The following are reconciliations of Investments in Securities for which Level 3 inputs were used in determining value:

| (Amounts in thousands) | | | | |

| Investments in Securities: | |

| Equities - Health Care | |

| Beginning Balance | $313,457 |

| Net Realized Gain (Loss) on Investment Securities | 10,928 |

| Net Unrealized Gain (Loss) on Investment Securities | 120,425 |

| Cost of Purchases | 103,181 |

| Proceeds of Sales | (145,320) |

| Amortization/Accretion | -- |

| Transfers into Level 3 | -- |

| Transfers out of Level 3 | -- |

| Ending Balance | $402,671 |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at November 30, 2016 | $120,426 |

| Equities - Information Technology | |

| Beginning Balance | $397,096 |

| Net Realized Gain (Loss) on Investment Securities | 28,619 |

| Net Unrealized Gain (Loss) on Investment Securities | 63,675 |

| Cost of Purchases | 50,400 |

| Proceeds of Sales | (124,085) |

| Amortization/Accretion | -- |

| Transfers into Level 3 | -- |

| Transfers out of Level 3 | -- |

| Ending Balance | $415,705 |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at November 30, 2016 | $55,414 |

| Other Investments in Securities | |

| Beginning Balance | $312,135 |

| Net Realized Gain (Loss) on Investment Securities | 5,790 |

| Net Unrealized Gain (Loss) on Investment Securities | 24,973 |

| Cost of Purchases | 133,549 |

| Proceeds of Sales | (155,228) |

| Amortization/Accretion | -- |

| Transfers into Level 3 | -- |

| Transfers out of Level 3 | -- |

| Ending Balance | $321,219 |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at November 30, 2016 | $13,376 |

The information used in the above reconciliations represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period, and proceeds of sales includes securities delivered through in-kind transactions. See Note (4) of the Notes to Financial Statements. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliations are included in Net Gain (Loss) on the Fund's Statement of Operations.

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| Amounts in thousands (except per-share amounts) | | November 30, 2016 |

| Assets | | |

Investment in securities, at value (including securities loaned of $383,378) — See accompanying schedule:

Unaffiliated issuers (cost $16,914,451) | $29,670,418 | |

| Fidelity Central Funds (cost $464,586) | 464,660 | |

| Other affiliated issuers (cost $3,100,677) | 6,076,174 | |

| Total Investments (cost $20,479,714) | | $36,211,252 |

| Restricted cash | | 250 |

| Receivable for investments sold | | 96,501 |

| Receivable for fund shares sold | | 22,572 |

| Dividends receivable | | 31,578 |

| Interest receivable | | 3 |

| Distributions receivable from Fidelity Central Funds | | 484 |

| Prepaid expenses | | 86 |

| Other receivables | | 1,754 |

| Total assets | | 36,364,480 |

| Liabilities | | |

| Payable to custodian bank | $286 | |

| Payable for investments purchased | 43,258 | |

| Payable for fund shares redeemed | 41,698 | |

| Accrued management fee | 19,029 | |

| Other affiliated payables | 3,493 | |

| Other payables and accrued expenses | 2,023 | |

| Collateral on securities loaned, at value | 401,707 | |

| Total liabilities | | 511,494 |

| Net Assets | | $35,852,986 |

| Net Assets consist of: | | |

| Paid in capital | | $18,116,189 |

| Undistributed net investment income | | 35,263 |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | 1,970,037 |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 15,731,497 |

| Net Assets | | $35,852,986 |

| Growth Company: | | |

| Net Asset Value, offering price and redemption price per share ($21,113,864 ÷ 147,893 shares) | | $142.76 |

| Class K: | | |

| Net Asset Value, offering price and redemption price per share ($14,739,122 ÷ 103,258 shares) | | $142.74 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Amounts in thousands | | Year ended November 30, 2016 |

| Investment Income | | |

| Dividends (including $16,902 earned from other affiliated issuers) | | $302,739 |

| Interest | | 3 |

| Income from Fidelity Central Funds | | 8,635 |

| Total income | | 311,377 |

| Expenses | | |

| Management fee | | |

| Basic fee | $204,424 | |

| Performance adjustment | 21,329 | |

| Transfer agent fees | 40,712 | |

| Accounting and security lending fees | 2,305 | |

| Custodian fees and expenses | 639 | |

| Independent trustees' fees and expenses | 164 | |

| Registration fees | 221 | |

| Audit | 260 | |

| Legal | 75 | |

| Interest | 1 | |

| Miscellaneous | 317 | |

| Total expenses before reductions | 270,447 | |

| Expense reductions | (667) | 269,780 |

| Net investment income (loss) | | 41,597 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 3,976,805 | |

| Fidelity Central Funds | 21 | |

| Other affiliated issuers | 434,753 | |

| Foreign currency transactions | (56) | |

| Total net realized gain (loss) | | 4,411,523 |

Change in net unrealized appreciation (depreciation) on:

Investment securities | (3,344,116) | |

| Assets and liabilities in foreign currencies | 14 | |

| Total change in net unrealized appreciation (depreciation) | | (3,344,102) |

| Net gain (loss) | | 1,067,421 |

| Net increase (decrease) in net assets resulting from operations | | $1,109,018 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Amounts in thousands | Year ended November 30, 2016 | Year ended November 30, 2015 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $41,597 | $13,855 |

| Net realized gain (loss) | 4,411,523 | 4,437,105 |

| Change in net unrealized appreciation (depreciation) | (3,344,102) | (841,705) |

| Net increase (decrease) in net assets resulting from operations | 1,109,018 | 3,609,255 |

| Distributions to shareholders from net investment income | (13,792) | (57,135) |

| Distributions to shareholders from net realized gain | (1,582,394) | (1,421,834) |

| Total distributions | (1,596,186) | (1,478,969) |

| Share transactions - net increase (decrease) | (4,759,956) | (3,437,067) |

| Total increase (decrease) in net assets | (5,247,124) | (1,306,781) |

| Net Assets | | |

| Beginning of period | 41,100,110 | 42,406,891 |

| End of period | $35,852,986 | $41,100,110 |

| Other Information | | |

| Undistributed net investment income end of period | $35,263 | $12,121 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Growth Company Fund

| Years ended November 30, | 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $143.47 | $136.46 | $124.69 | $95.80 | $85.29 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .09 | (.01) | .15 | .29 | .15 |

| Net realized and unrealized gain (loss) | 4.71 | 11.72 | 20.49 | 31.23 | 13.12 |

| Total from investment operations | 4.80 | 11.71 | 20.64 | 31.52 | 13.27 |

| Distributions from net investment income | – | (.13) | (.21) | (.19) | (.05) |

| Distributions from net realized gain | (5.51) | (4.57) | (8.67) | (2.44) | (2.71) |

| Total distributions | (5.51) | (4.70) | (8.87)B | (2.63) | (2.76) |

| Net asset value, end of period | $142.76 | $143.47 | $136.46 | $124.69 | $95.80 |

| Total ReturnC | 3.48% | 8.90% | 17.80% | 33.85% | 16.24% |

| Ratios to Average Net AssetsD,E | | | | | |

| Expenses before reductions | .77% | .88% | .82% | .83% | .90% |

| Expenses net of fee waivers, if any | .77% | .87% | .82% | .83% | .90% |

| Expenses net of all reductions | .77% | .87% | .82% | .83% | .90% |

| Net investment income (loss) | .07% | (.01)% | .12% | .27% | .16% |

| Supplemental Data | | | | | |

| Net assets, end of period (in millions) | $21,114 | $23,513 | $24,165 | $22,936 | $22,952 |

| Portfolio turnover rateF | 19%G | 18%G | 12%G | 26% | 33% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $8.87 per share is comprised of distributions from net investment income of $.207 and distributions from net realized gain of $8.666 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Growth Company Fund Class K

| Years ended November 30, | 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $143.42 | $136.41 | $124.68 | $95.82 | $85.35 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .23 | .12 | .29 | .42 | .27 |

| Net realized and unrealized gain (loss) | 4.71 | 11.72 | 20.48 | 31.21 | 13.10 |

| Total from investment operations | 4.94 | 11.84 | 20.77 | 31.63 | 13.37 |

| Distributions from net investment income | (.11) | (.26) | (.37) | (.34) | (.19) |

| Distributions from net realized gain | (5.51) | (4.57) | (8.67) | (2.44) | (2.71) |

| Total distributions | (5.62) | (4.83) | (9.04) | (2.77)B | (2.90) |

| Net asset value, end of period | $142.74 | $143.42 | $136.41 | $124.68 | $95.82 |

| Total ReturnC | 3.59% | 9.01% | 17.93% | 34.02% | 16.38% |

| Ratios to Average Net AssetsD,E | | | | | |

| Expenses before reductions | .66% | .77% | .71% | .71% | .77% |

| Expenses net of fee waivers, if any | .66% | .77% | .71% | .71% | .77% |

| Expenses net of all reductions | .66% | .77% | .71% | .71% | .77% |

| Net investment income (loss) | .17% | .09% | .24% | .39% | .29% |

| Supplemental Data | | | | | |

| Net assets, end of period (in millions) | $14,739 | $17,587 | $18,242 | $21,951 | $15,454 |

| Portfolio turnover rateF | 19%G | 18%G | 12%G | 26% | 33% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $2.77 per share is comprised of distributions from net investment income of $.336 and distributions from net realized gain of $2.438 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended November 30, 2016

(Amounts in thousands except percentages)

1. Organization.

Fidelity Growth Company Fund (the Fund) is a fund of Fidelity Mt. Vernon Street Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Growth Company and Class K shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy. Equity securities, including restricted securities, for which observable inputs are not available are valued using alternate valuation approaches, including the market approach and the income approach and are categorized as Level 3 in the hierarchy. The market approach generally consists of using comparable market transactions while the income approach generally consists of using the net present value of estimated future cash flows, adjusted as appropriate for liquidity, credit, market and/or other risk factors.

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Corporate bonds are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

The following provides information on Level 3 securities held by the Fund that were valued at period end based on unobservable inputs. These amounts exclude valuations provided by a broker.

| Asset Type | Fair Value at 11/30/16 | Valuation Technique(s) | Unobservable Input | Amount or Range/Weighted Average | Impact to Valuation from an Increase in Input(a) |

| Corporate Bonds | $ 306 | Market approach | Transaction Price | $100.00

| Increase

|

| Equities | 1,139,289 | Discounted cash flow | Discount rate | 8.0% - 22.1% / 18.1

| Decrease |

| | | | Weighted average cost of capital (WACC) | 11.5% | Decrease |

| | | | Discount for lack of marketability | 10.0% - 25.0% / 23.7% | Decrease |

| | | | Growth rate | 2.0% - 2.5% / 2.1% | Increase |

| | | Market approach | Discount rate | 3.0% - 50.0% / 13.7% | Decrease

|

| | | | Transaction price | $1.08 - $330.00 / $51.61 | Increase

|

| | | | Tender price | $24.04 | Increase

|

| | | | Discount for lack of marketability | 10.0% - 20.0% / 15.5% | Decrease |

| | | | Liquidity preference

| $6.75 - $68.25 / $59.82 | Increase

|

| | | | Premium rate

| 6.0% - 169.0% / 46.1% | Increase

|

| | | | Proxy discount

| 12.0% - 36.1% / 19.6% | Decrease

|

| | | | Proxy premium | 21.5% | Increase |

| | | Market comparable | Price/Earnings multiple (P/E)

| 10.5 | Increase |

| | | | Enterprise value/EBITDA multiple

| 9.3

| Increase

|

| | | | Enterprise value/Sales multiple (EV/S) | 0.6 - 15.3 / 4.9 | Increase

|

| | | | Enterprise value/Gross profit multiple (EV/GP) | 5.1 | Increase

|

| | | Recovery value | Recovery value | 0.0% - 0.3% / 0.3% | Increase |

(a) Represents the expected directional change in the fair value of the Level 3 investments that would result from an increase in the corresponding input. A decrease to the unobservable input would have the opposite effect. Significant changes in these inputs could result in significantly higher or lower fair value measurements.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of November 30, 2016, as well as a roll forward of Level 3 investments, is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), independent Trustees may elect to defer receipt of a portion of their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees are included in the accompanying Statement of Assets and Liabilities.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of November 30, 2016, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. In addition, the Fund claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, passive foreign investment companies (PFIC), redemptions in kind, partnerships, deferred trustees compensation and losses deferred due to wash sales.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

| Gross unrealized appreciation | $17,351,013 |

| Gross unrealized depreciation | (1,661,098) |

| Net unrealized appreciation (depreciation) on securities | $15,689,915 |

| Tax Cost | $20,521,337 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | $36,945 |

| Undistributed long-term capital gain | $2,011,660 |

| Net unrealized appreciation (depreciation) on securities and other investments | $15,689,874 |

The tax character of distributions paid was as follows:

| | November 30, 2016 | November 30, 2015 |

| Ordinary Income | $13,792 | $ 57,135 |

| Long-term Capital Gains | 1,582,394 | 1,421,834 |

| Total | $1,596,186 | $ 1,478,969 |

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

Consolidated Subsidiary. The Fund invests in certain investments through a wholly-owned subsidiary ("Subsidiary"), which may be subject to federal and state taxes upon disposition.