UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03583

Fidelity Mt. Vernon Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | November 30 |

|

|

Date of reporting period: | November 30, 2020 |

Item 1.

Reports to Stockholders

Fidelity® Growth Company Fund

Annual Report

November 30, 2020

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you’re an individual investing directly with Fidelity, call 1-800-835-5092 if you’re a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you’re an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, global governments and central banks took unprecedented action to help support consumers, businesses, and the broader economies, and to limit disruption to financial systems.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended November 30, 2020 | Past 1 year | Past 5 years | Past 10 years |

| Fidelity® Growth Company Fund | 66.23% | 25.08% | 20.70% |

| Class K | 66.37% | 25.20% | 20.83% |

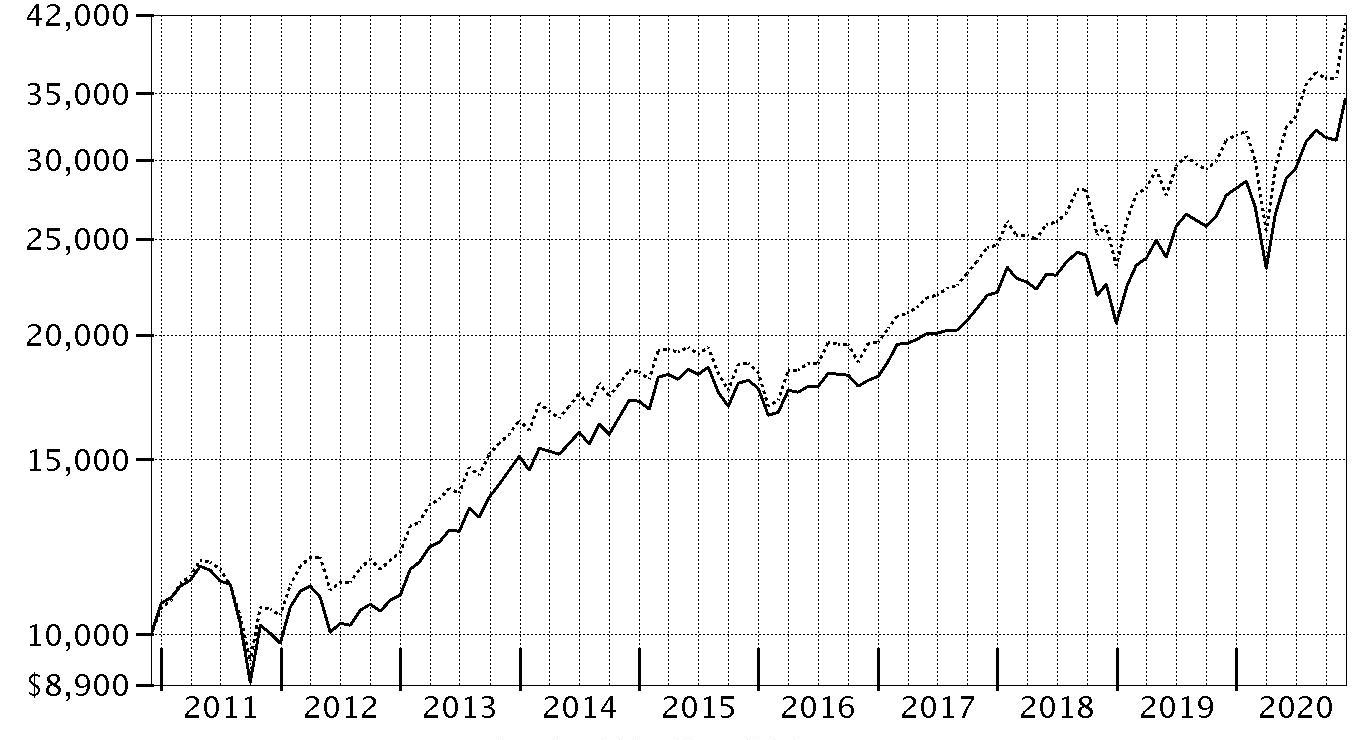

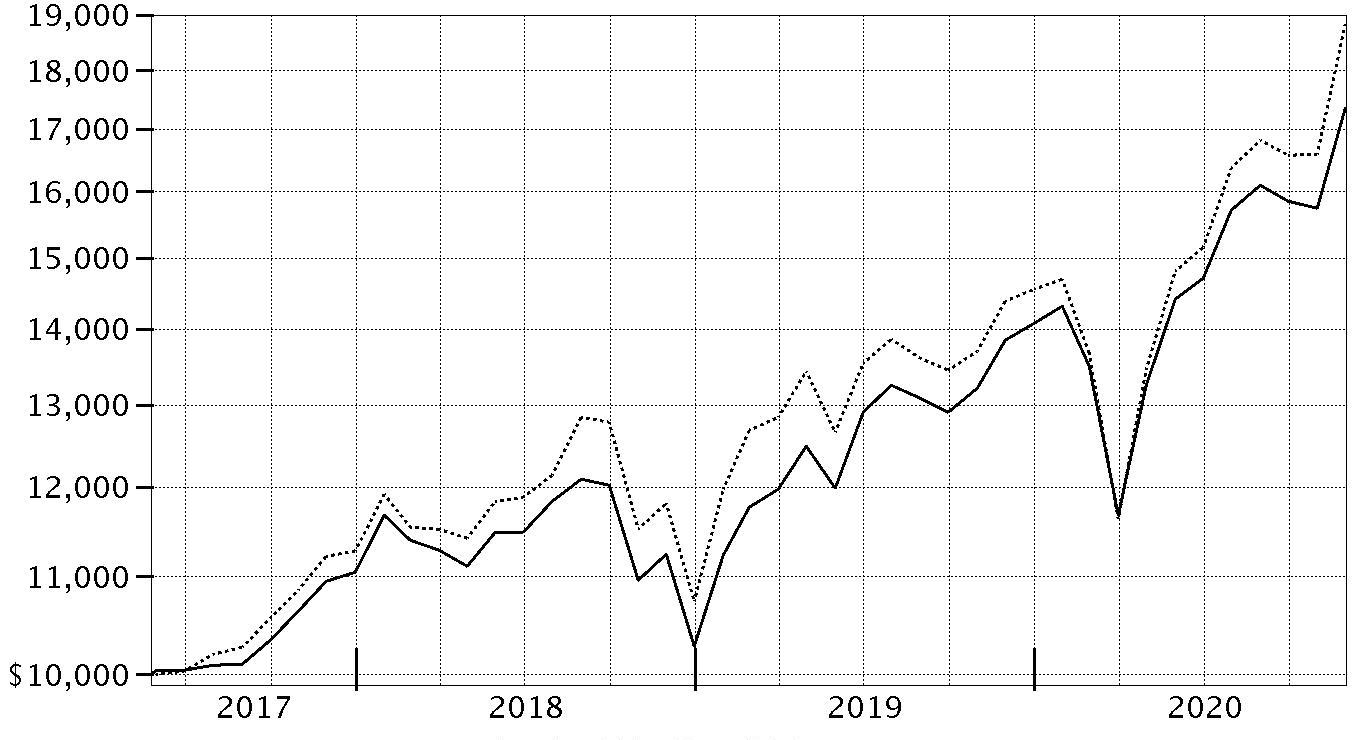

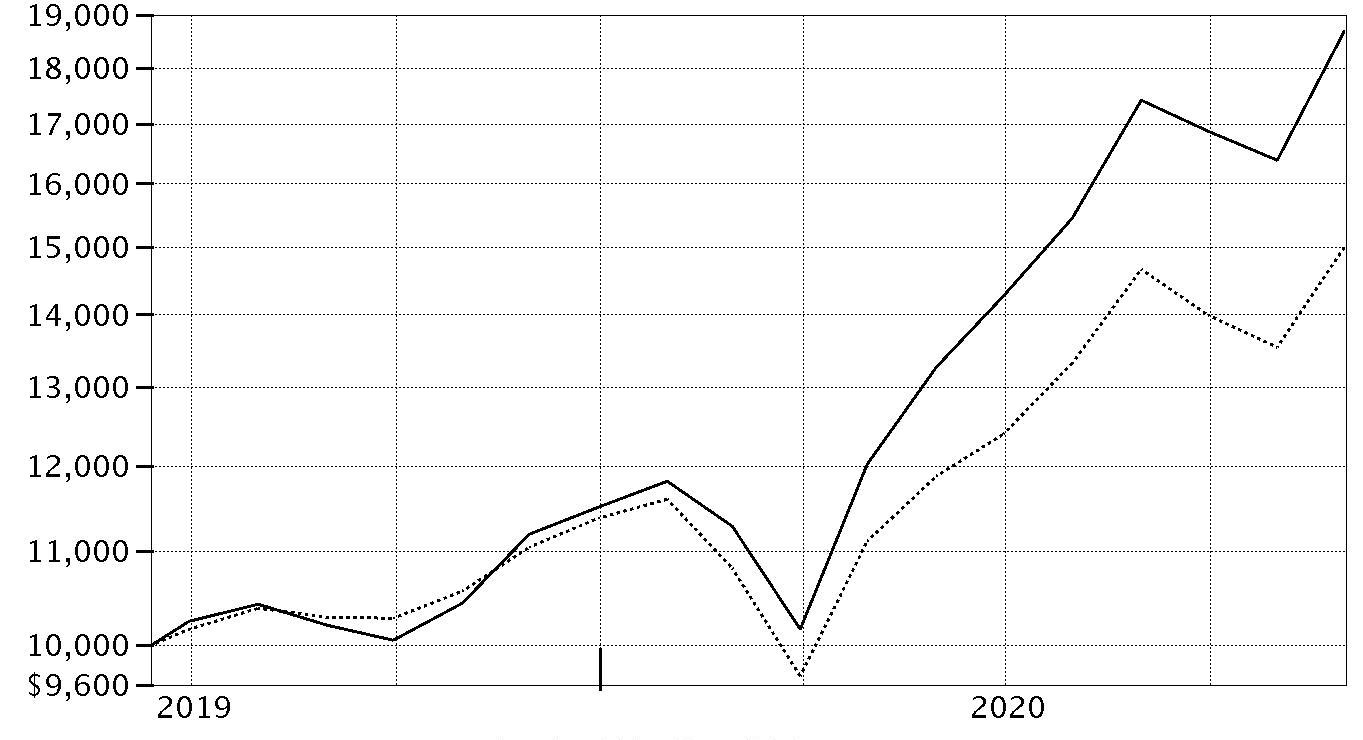

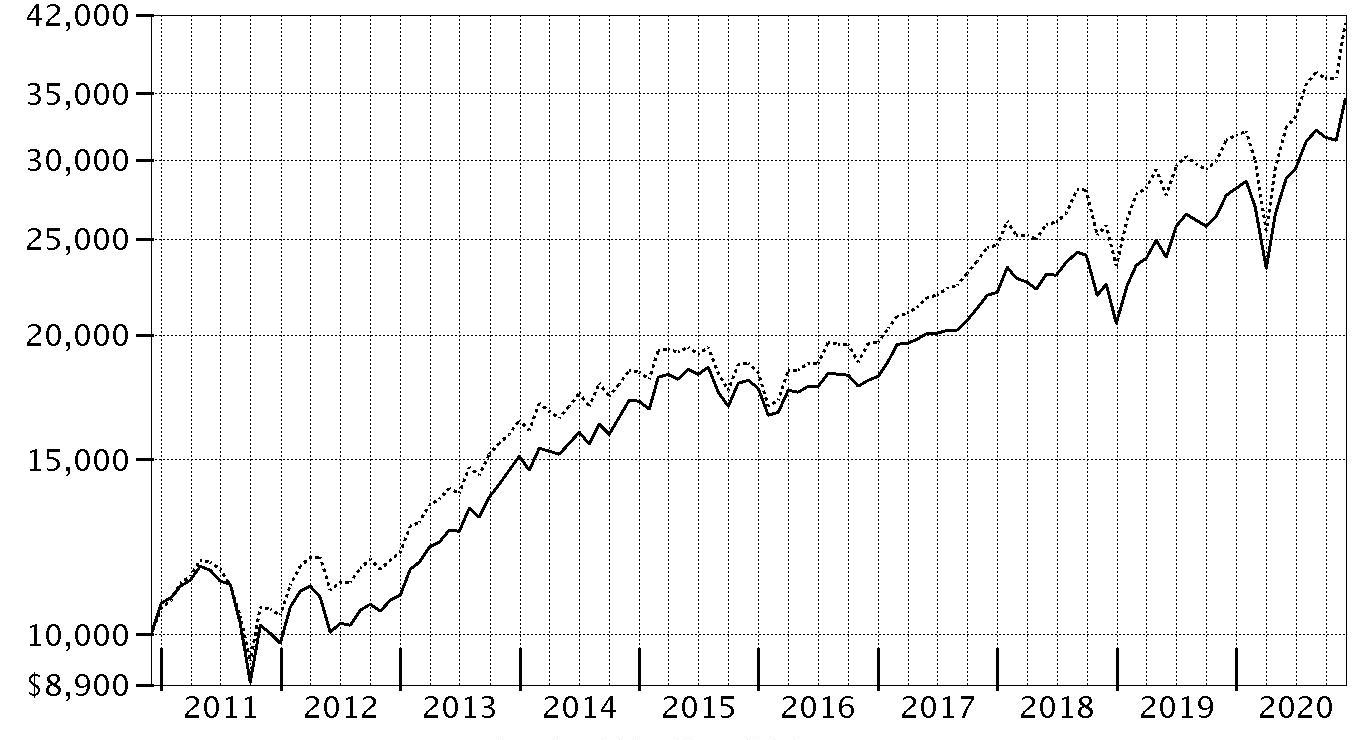

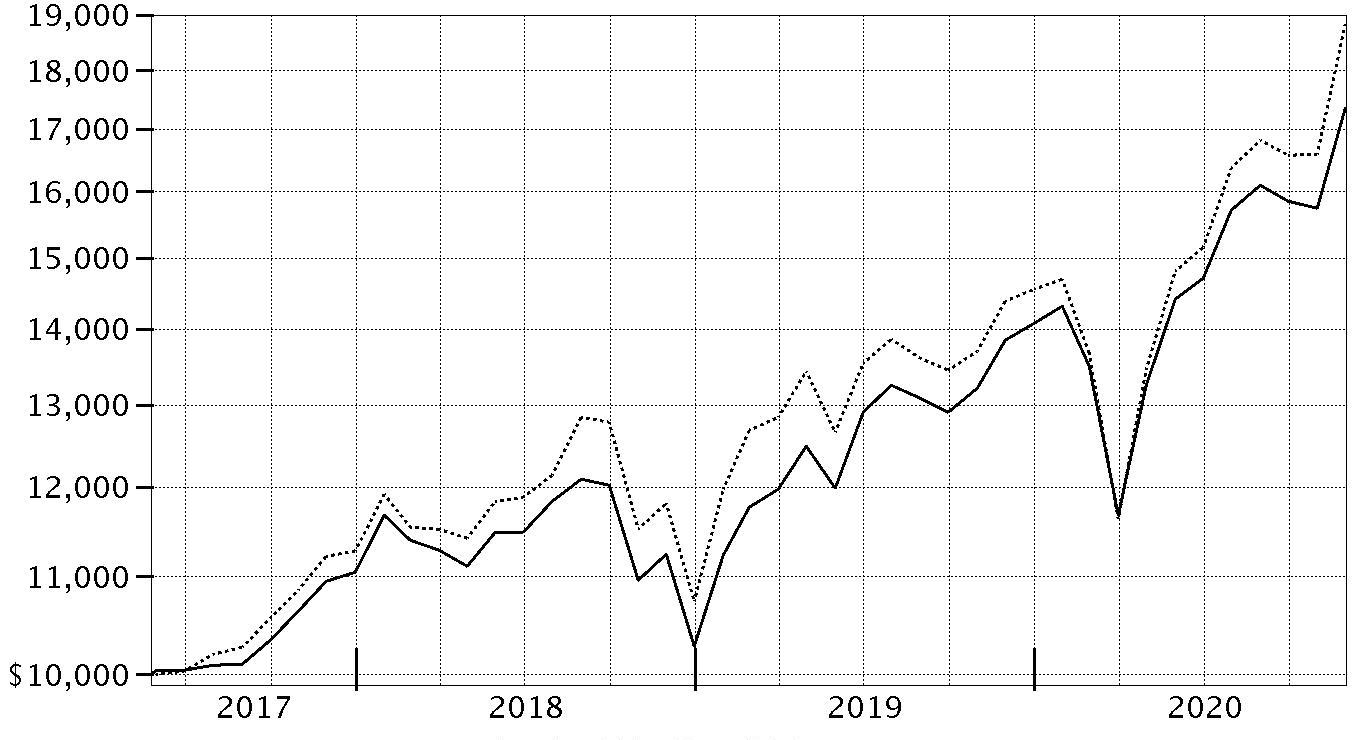

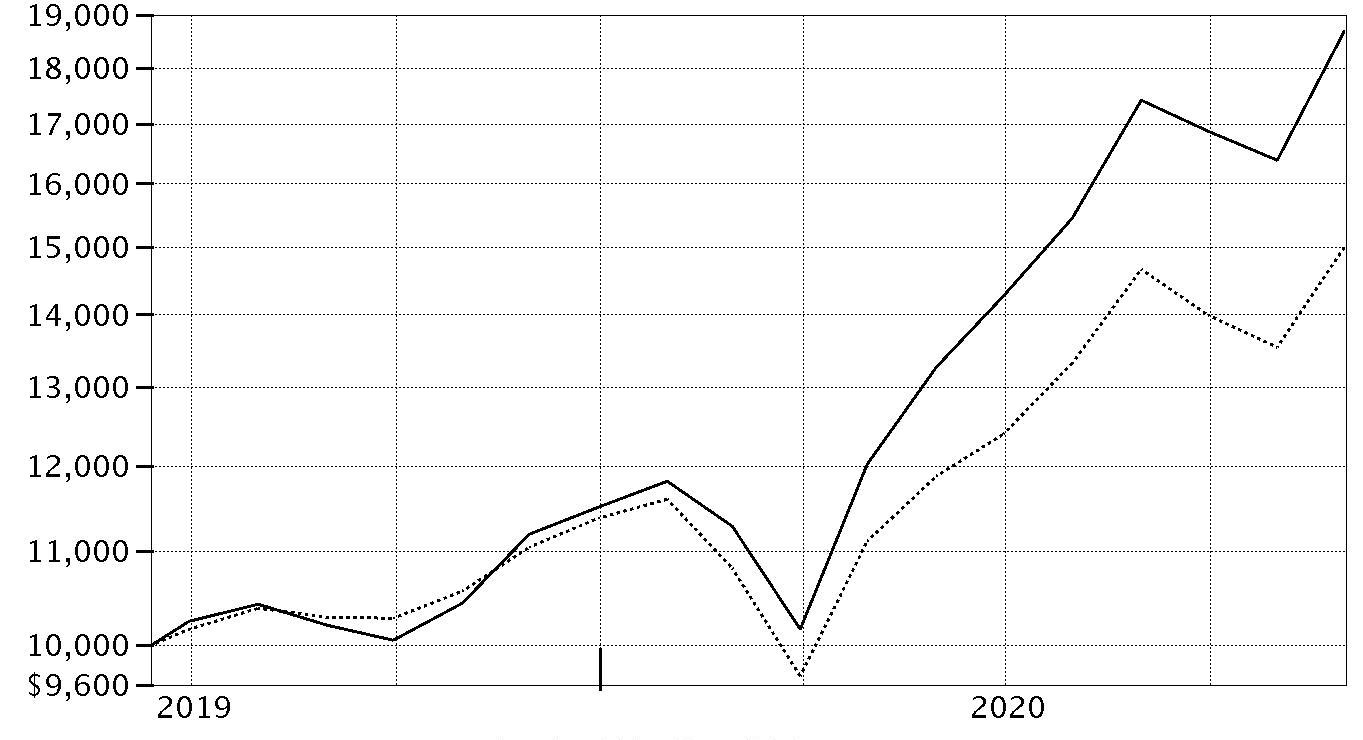

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity® Growth Company Fund, a class of the fund, on November 30, 2010.

The chart shows how the value of your investment would have changed, and also shows how the Russell 3000® Growth Index performed over the same period.

| Period Ending Values |

| $65,643 | Fidelity® Growth Company Fund |

| $48,133 | Russell 3000® Growth Index |

Management's Discussion of Fund Performance

Market Recap: The S&P 500

® index gained 17.46% for the year ending November 30, 2020, a volatile period marked by a steep but brief decline due to the early-2020 outbreak and spread of the coronavirus, followed by a historic rebound. Declared a pandemic on March 11, the COVID-19 crisis and containment efforts caused broad contraction in economic activity, along with extreme uncertainty, volatility and dislocation in financial markets. A rapid and expansive U.S. monetary/fiscal-policy response provided a partial offset to the economic disruption and fueled a sharp uptrend beginning March 24. Other supporting factors included resilient corporate earnings, near-term potential for a COVID-19 vaccine breakthrough and traction on a broader economic reopening. The rally lasted until September 2, when the S&P 500 began a two-month retreat. The loss of momentum reflected Congress’s inability to reach a deal on additional fiscal stimulus, as well as concerns about election uncertainty, indications the U.S. economic recovery was stalling and a new wave of COVID-19 cases. November was a much different story, as investors reacted favorably to election results and encouraging updates on the efficacy of two COVID-19 vaccine candidates. The index rose 11%, one of its biggest monthly gains ever. By sector for the full year, information technology (+42%) and consumer discretionary (+34%) led, driven by a handful of large growth stocks. In contrast, energy shares (-33%) struggled along with global oil demand and pricing.

Comments from Portfolio Manager Steven Wymer: For the fiscal year ending November 30, 2020, the fund's share classes gained about 66%, outperforming the 35.73% result of the benchmark Russell 3000

® Growth index. Versus the benchmark, security selection was the primary contributor, especially within the information technology sector. Strong picks in the health care sector, especially within the pharmaceuticals, biotechnology & life sciences industry, also lifted the fund's relative result. Also bolstering the fund's relative result was security selection and an overweighting in consumer discretionary. The biggest individual relative contributor was an overweight position in Nvidia (+148%), the fund's largest holding. Another top relative contributor was an out-of-benchmark stake in Shopify (+219%). This was among the fund's biggest holdings. Other notable relative contributors include overweightings in Moderna and Tesla. Both were sizable period-end holdings. In contrast, the largest detractor from performance versus the benchmark was an overweighting in energy. An overweighting in the health care sector, especially within the pharmaceuticals, biotechnology & life sciences industry, also hurt the fund's relative result. Also hurting the fund's relative result were stock picks in the financials sector. The biggest individual relative detractor was an underweight position in Apple (+80%), which was among our largest holdings. Another notable relative detractor was an outsized stake in Sage Therapeutics (-52%). Another notable relative detractor was an overweighting in Ionis Pharmaceuticals (-21%). Notable changes in positioning include increased exposure to the consumer discretionary sector.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Investment Summary (Unaudited)

Top Ten Stocks as of November 30, 2020

| | % of fund's net assets |

| NVIDIA Corp. | 7.4 |

| Apple, Inc. | 6.8 |

| Amazon.com, Inc. | 6.6 |

| Microsoft Corp. | 4.0 |

| lululemon athletica, Inc. | 3.8 |

| Moderna, Inc. | 3.4 |

| Alphabet, Inc. Class A | 3.3 |

| Salesforce.com, Inc. | 2.9 |

| Shopify, Inc. Class A | 2.7 |

| Tesla, Inc. | 2.5 |

| | 43.4 |

Top Five Market Sectors as of November 30, 2020

| | % of fund's net assets |

| Information Technology | 36.8 |

| Consumer Discretionary | 23.2 |

| Health Care | 18.8 |

| Communication Services | 11.3 |

| Industrials | 4.8 |

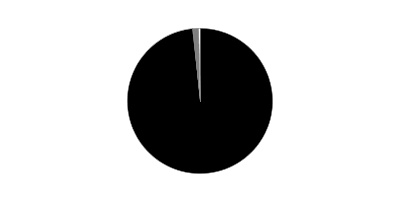

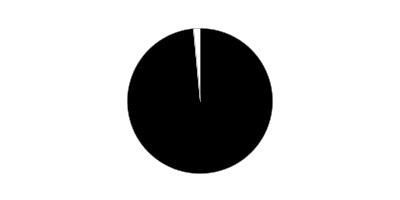

Asset Allocation (% of fund's net assets)

| As of November 30, 2020* |

| | Stocks | 98.8% |

| | Convertible Securities | 1.1% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 0.1% |

* Foreign investments - 9.9%

Schedule of Investments November 30, 2020

Showing Percentage of Net Assets

| Common Stocks - 98.7% | | | |

| | | Shares | Value (000s) |

| COMMUNICATION SERVICES - 11.3% | | | |

| Entertainment - 3.2% | | | |

| Activision Blizzard, Inc. | | 2,217,147 | $176,219 |

| Electronic Arts, Inc. | | 410,123 | 52,393 |

| NeoGames SA | | 110,911 | 2,431 |

| NetEase, Inc. ADR | | 591,924 | 53,492 |

| Netflix, Inc. (a) | | 791,050 | 388,168 |

| Nintendo Co. Ltd. | | 34,533 | 19,593 |

| Roku, Inc. Class A (a) | | 3,107,610 | 912,301 |

| Sea Ltd. ADR (a) | | 1,776,285 | 320,389 |

| The Walt Disney Co. | | 544,906 | 80,652 |

| Zynga, Inc. (a) | | 1,176,419 | 9,705 |

| | | | 2,015,343 |

| Interactive Media & Services - 7.4% | | | |

| Alphabet, Inc.: | | | |

| Class A (a) | | 1,156,897 | 2,029,660 |

| Class C (a) | | 681,666 | 1,200,237 |

| Facebook, Inc. Class A (a) | | 3,899,737 | 1,080,110 |

| InterActiveCorp (a) | | 198,873 | 28,238 |

| Match Group, Inc. (a) | | 64,075 | 8,920 |

| Pinterest, Inc. Class A (a) | | 91,088 | 6,378 |

| Snap, Inc. Class A (a) | | 1,744,115 | 77,474 |

| Tencent Holdings Ltd. | | 548,059 | 39,952 |

| Twitter, Inc. (a) | | 517,084 | 24,050 |

| Zillow Group, Inc. Class C (a)(b) | | 583,095 | 62,863 |

| | | | 4,557,882 |

| Media - 0.0% | | | |

| Comcast Corp. Class A | | 192,189 | 9,656 |

| Wireless Telecommunication Services - 0.7% | | | |

| T-Mobile U.S., Inc. | | 3,050,354 | 405,514 |

|

| TOTAL COMMUNICATION SERVICES | | | 6,988,395 |

|

| CONSUMER DISCRETIONARY - 23.0% | | | |

| Automobiles - 2.7% | | | |

| DiamondPeak Holdings Corp. (c) | | 2,232,387 | 52,171 |

| Neutron Holdings, Inc. warrants (a)(c)(d) | | 1,546,251 | 0 |

| Tesla, Inc. (a) | | 2,718,191 | 1,542,845 |

| XPeng, Inc. ADR (a)(b) | | 923,436 | 54,261 |

| | | | 1,649,277 |

| Hotels, Restaurants & Leisure - 1.1% | | | |

| Chipotle Mexican Grill, Inc. (a) | | 43,840 | 56,529 |

| Hyatt Hotels Corp. Class A | | 127,553 | 9,180 |

| Marriott International, Inc. Class A | | 1,172,576 | 148,765 |

| McDonald's Corp. | | 3,490 | 759 |

| Penn National Gaming, Inc. (a) | | 2,468,310 | 172,782 |

| Planet Fitness, Inc. (a) | | 165,841 | 12,098 |

| Shake Shack, Inc. Class A (a)(b) | | 84,625 | 6,910 |

| Starbucks Corp. | | 1,937,744 | 189,938 |

| Vail Resorts, Inc. | | 96,634 | 26,656 |

| Yum China Holdings, Inc. | | 708,299 | 39,934 |

| | | | 663,551 |

| Household Durables - 0.7% | | | |

| D.R. Horton, Inc. | | 1,135,274 | 84,578 |

| KB Home | | 1,338,470 | 47,114 |

| Lennar Corp. Class A | | 3,093,658 | 234,685 |

| PulteGroup, Inc. | | 267,590 | 11,675 |

| Toll Brothers, Inc. | | 1,341,605 | 63,525 |

| | | | 441,577 |

| Internet & Direct Marketing Retail - 9.7% | | | |

| Alibaba Group Holding Ltd. sponsored ADR (a) | | 976,816 | 257,254 |

| Amazon.com, Inc. (a) | | 1,289,708 | 4,085,847 |

| Etsy, Inc. (a) | | 260,309 | 41,832 |

| Farfetch Ltd. Class A (a) | | 1,729,637 | 94,525 |

| JD.com, Inc. sponsored ADR (a) | | 1,991,022 | 169,934 |

| Ocado Group PLC (a) | | 3,401,226 | 100,000 |

| Ozon Holdings PLC ADR | | 245,800 | 9,837 |

| Pinduoduo, Inc. ADR (a) | | 44,166 | 6,131 |

| Revolve Group, Inc. (a) | | 837,673 | 19,769 |

| The Booking Holdings, Inc. (a) | | 71,583 | 145,203 |

| The Honest Co., Inc. (a)(c)(d) | | 39,835 | 863 |

| The RealReal, Inc. (a) | | 1,269,649 | 17,585 |

| THG Holdings Ltd. | | 2,107,597 | 17,597 |

| Wayfair LLC Class A (a)(b) | | 4,044,073 | 1,028,650 |

| | | | 5,995,027 |

| Leisure Products - 0.3% | | | |

| Peloton Interactive, Inc. Class A (a) | | 1,765,037 | 205,362 |

| Multiline Retail - 0.5% | | | |

| Dollar General Corp. | | 214,649 | 46,918 |

| Dollar Tree, Inc. (a) | | 317,794 | 34,716 |

| Ollie's Bargain Outlet Holdings, Inc. (a) | | 1,460,436 | 128,606 |

| Target Corp. | | 548,254 | 98,428 |

| | | | 308,668 |

| Specialty Retail - 2.4% | | | |

| Carvana Co. Class A (a) | | 1,100,342 | 275,317 |

| Cazoo Holdings Ltd. (c)(d) | | 224,106 | 3,174 |

| Five Below, Inc. (a) | | 193,266 | 30,227 |

| Floor & Decor Holdings, Inc. Class A (a) | | 952,855 | 76,314 |

| Lowe's Companies, Inc. | | 1,983,044 | 308,998 |

| RH (a) | | 774,145 | 350,812 |

| The Home Depot, Inc. | | 1,194,179 | 331,277 |

| TJX Companies, Inc. | | 1,775,706 | 112,775 |

| Williams-Sonoma, Inc. | | 245,197 | 26,842 |

| | | | 1,515,736 |

| Textiles, Apparel & Luxury Goods - 5.6% | | | |

| adidas AG | | 1,023,178 | 326,541 |

| Allbirds, Inc. (a)(c)(d) | | 307,430 | 3,554 |

| Canada Goose Holdings, Inc. (a)(b) | | 1,496,072 | 49,754 |

| Deckers Outdoor Corp. (a) | | 286,354 | 72,903 |

| lululemon athletica, Inc. (a) | | 6,323,193 | 2,340,973 |

| NIKE, Inc. Class B | | 1,961,877 | 264,265 |

| On Holding AG (c)(d) | | 900 | 9,854 |

| Skechers U.S.A., Inc. Class A (sub. vtg.) (a) | | 8,814,273 | 295,014 |

| Tory Burch LLC: | | | |

| Class A (a)(c)(d)(e) | | 950,844 | 62,623 |

| Class B (c)(d)(e) | | 324,840 | 22,963 |

| Under Armour, Inc. Class C (non-vtg.) (a) | | 382,313 | 5,563 |

| VF Corp. | | 231,203 | 19,282 |

| | | | 3,473,289 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 14,252,487 |

|

| CONSUMER STAPLES - 2.2% | | | |

| Beverages - 1.0% | | | |

| Boston Beer Co., Inc. Class A (a) | | 61,934 | 57,651 |

| Fever-Tree Drinks PLC | | 660,576 | 20,270 |

| Keurig Dr. Pepper, Inc. | | 2,762,650 | 84,123 |

| Monster Beverage Corp. (a) | | 2,632,811 | 223,210 |

| PepsiCo, Inc. | | 332,003 | 47,885 |

| The Coca-Cola Co. | | 3,585,659 | 185,020 |

| | | | 618,159 |

| Food & Staples Retailing - 0.5% | | | |

| Costco Wholesale Corp. | | 608,465 | 238,378 |

| Kroger Co. | | 592,485 | 19,552 |

| Performance Food Group Co. (a) | | 1,175,804 | 51,006 |

| | | | 308,936 |

| Food Products - 0.3% | | | |

| Beyond Meat, Inc. (a)(b) | | 98,714 | 13,810 |

| Bunge Ltd. | | 719,867 | 42,393 |

| Darling Ingredients, Inc. (a) | | 961,916 | 46,441 |

| Freshpet, Inc. (a) | | 194,573 | 26,633 |

| JDE Peet's BV | | 545,695 | 21,075 |

| Laird Superfood, Inc. | | 433,597 | 20,990 |

| Mondelez International, Inc. | | 145,634 | 8,367 |

| | | | 179,709 |

| Household Products - 0.2% | | | |

| Church & Dwight Co., Inc. | | 232,016 | 20,364 |

| Colgate-Palmolive Co. | | 205,084 | 17,563 |

| Procter & Gamble Co. | | 589,198 | 81,822 |

| | | | 119,749 |

| Personal Products - 0.0% | | | |

| Yatsen Holding Ltd. ADR (b) | | 215,256 | 3,597 |

| Tobacco - 0.2% | | | |

| Altria Group, Inc. | | 2,636,126 | 104,997 |

| JUUL Labs, Inc. Class A (a)(c)(d) | | 44,067 | 2,827 |

| Philip Morris International, Inc. | | 323,733 | 24,523 |

| | | | 132,347 |

|

| TOTAL CONSUMER STAPLES | | | 1,362,497 |

|

| ENERGY - 0.5% | | | |

| Energy Equipment & Services - 0.0% | | | |

| Halliburton Co. | | 356,100 | 5,908 |

| Schlumberger Ltd. | | 500,000 | 10,395 |

| | | | 16,303 |

| Oil, Gas & Consumable Fuels - 0.5% | | | |

| EOG Resources, Inc. | | 692,548 | 32,467 |

| Hess Corp. | | 2,888,256 | 136,268 |

| Reliance Industries Ltd. | | 4,034,380 | 104,404 |

| Reliance Industries Ltd. | | 268,958 | 3,793 |

| | | | 276,932 |

|

| TOTAL ENERGY | | | 293,235 |

|

| FINANCIALS - 1.1% | | | |

| Banks - 0.5% | | | |

| Bank of America Corp. | | 2,379,716 | 67,013 |

| HDFC Bank Ltd. sponsored ADR (a) | | 1,479,689 | 102,099 |

| JPMorgan Chase & Co. | | 1,411,027 | 166,332 |

| Wells Fargo & Co. | | 318,197 | 8,703 |

| | | | 344,147 |

| Capital Markets - 0.4% | | | |

| BlackRock, Inc. Class A | | 202,130 | 141,157 |

| BM&F BOVESPA SA | | 5,356,500 | 56,121 |

| Charles Schwab Corp. | | 1,073,947 | 52,387 |

| Edelweiss Financial Services Ltd. (a) | | 1,939,864 | 1,814 |

| | | | 251,479 |

| Consumer Finance - 0.0% | | | |

| Discover Financial Services | | 95,547 | 7,278 |

| Diversified Financial Services - 0.2% | | | |

| Ant International Co. Ltd. Class C (a)(c)(d) | | 1,658,265 | 13,449 |

| dMY Technology Group, Inc. (a)(f) | | 1,463,569 | 23,402 |

| Kensington Capital Acquisition Corp. (c)(f) | | 1,738,239 | 73,528 |

| | | | 110,379 |

| Insurance - 0.0% | | | |

| Root, Inc. (b) | | 70,618 | 1,250 |

|

| TOTAL FINANCIALS | | | 714,533 |

|

| HEALTH CARE - 18.4% | | | |

| Biotechnology - 11.7% | | | |

| AbbVie, Inc. | | 418,722 | 43,790 |

| ACADIA Pharmaceuticals, Inc. (a) | | 7,283,607 | 412,689 |

| ADC Therapeutics SA (a) | | 913,104 | 34,068 |

| Akouos, Inc. (a) | | 1,163,317 | 24,057 |

| Akouos, Inc. | | 362,038 | 7,113 |

| Alector, Inc. (a) | | 855,903 | 11,221 |

| Allovir, Inc. (a) | | 1,150,252 | 45,561 |

| Allovir, Inc. | | 822,551 | 30,952 |

| Alnylam Pharmaceuticals, Inc. (a) | | 4,171,453 | 541,913 |

| ALX Oncology Holdings, Inc. (a) | | 133,778 | 10,292 |

| Amgen, Inc. | | 819,475 | 181,956 |

| Annexon, Inc. (a) | | 220,110 | 5,327 |

| Arcutis Biotherapeutics, Inc. (a) | | 554,986 | 15,051 |

| Argenx SE ADR (a) | | 518,705 | 148,775 |

| Arrowhead Pharmaceuticals, Inc. (a) | | 96,377 | 6,026 |

| Ascendis Pharma A/S sponsored ADR (a) | | 73,675 | 12,431 |

| Atea Pharmaceuticals, Inc. | | 1,891,718 | 63,032 |

| aTyr Pharma, Inc. (a) | | 378,263 | 1,649 |

| Avidity Biosciences, Inc. | | 930,633 | 27,863 |

| Axcella Health, Inc. (a)(f) | | 2,215,467 | 12,628 |

| BeiGene Ltd. ADR (a) | | 1,695,571 | 433,541 |

| BioNTech SE ADR (a)(b) | | 1,332,816 | 165,589 |

| BioXcel Therapeutics, Inc. (a) | | 748,946 | 32,954 |

| Bridgebio Pharma, Inc. (a)(b) | | 203,404 | 10,219 |

| Burning Rock Biotech Ltd. ADR | | 45,923 | 1,310 |

| C4 Therapeutics, Inc. | | 155,612 | 5,322 |

| Calyxt, Inc. (a) | | 1,360,151 | 5,060 |

| Cerevel Therapeutics Holdings (a) | | 321,318 | 4,537 |

| Cerevel Therapeutics Holdings (c) | | 1,384,300 | 18,569 |

| ChemoCentryx, Inc. (a) | | 3,171,370 | 174,901 |

| Cibus Corp.: | | | |

| Series C (a)(c)(d)(e) | | 4,523,810 | 7,616 |

| Series D (a)(c)(d)(e) | | 2,741,040 | 3,426 |

| Crinetics Pharmaceuticals, Inc. (a) | | 117,986 | 1,577 |

| CRISPR Therapeutics AG (a)(b) | | 55,385 | 7,029 |

| Cyclerion Therapeutics, Inc. (a) | | 314,804 | 970 |

| Cyclerion Therapeutics, Inc. (a)(c) | | 543,695 | 1,675 |

| Denali Therapeutics, Inc. (a) | | 380,962 | 23,227 |

| Evelo Biosciences, Inc. (a) | | 2,242,056 | 11,502 |

| Exact Sciences Corp. (a) | | 194,650 | 23,564 |

| Exelixis, Inc. (a) | | 209,662 | 4,017 |

| Fate Therapeutics, Inc. (a) | | 2,067,842 | 120,896 |

| Foghorn Therapeutics, Inc. | | 440,348 | 8,895 |

| Foghorn Therapeutics, Inc. | | 361,607 | 6,574 |

| Fusion Pharmaceuticals, Inc. (a) | | 525,630 | 7,101 |

| Generation Bio Co. | | 777,050 | 37,469 |

| Generation Bio Co. | | 934,248 | 44,599 |

| Homology Medicines, Inc. (a) | | 383,372 | 3,772 |

| Inhibrx, Inc. (a) | | 665,706 | 18,320 |

| Intarcia Therapeutics, Inc. warrants 12/6/24 (a)(d) | | 156,370 | 0 |

| Ionis Pharmaceuticals, Inc. (a)(f) | | 8,055,861 | 407,063 |

| Iovance Biotherapeutics, Inc. (a) | | 359,003 | 13,933 |

| Ironwood Pharmaceuticals, Inc. Class A (a) | | 587,022 | 6,762 |

| iTeos Therapeutics, Inc. (a) | | 232,120 | 6,218 |

| Karuna Therapeutics, Inc. (a)(f) | | 1,541,326 | 153,778 |

| Keros Therapeutics, Inc. | | 328,299 | 24,823 |

| Kronos Bio, Inc. | | 342,427 | 10,982 |

| Kronos Bio, Inc. | | 284,978 | 8,225 |

| Kymera Therapeutics, Inc. (a) | | 142,109 | 6,628 |

| Lexicon Pharmaceuticals, Inc. (a)(b) | | 3,753,685 | 5,743 |

| Moderna, Inc. (a)(b) | | 13,602,872 | 2,077,703 |

| Morphic Holding, Inc. (a) | | 870,921 | 27,321 |

| Olema Pharmaceuticals, Inc. | | 262,284 | 13,376 |

| ORIC Pharmaceuticals, Inc. (a) | | 1,188,819 | 40,313 |

| Passage Bio, Inc. | | 322,628 | 6,617 |

| PMV Pharmaceuticals, Inc. | | 121,942 | 4,297 |

| Poseida Therapeutics, Inc. (a) | | 1,267,229 | 14,713 |

| Poseida Therapeutics, Inc. | | 906,572 | 9,999 |

| Praxis Precision Medicines, Inc. | | 1,226,564 | 50,853 |

| Prelude Therapeutics, Inc. | | 237,637 | 12,231 |

| Protagonist Therapeutics, Inc. (a) | | 647,341 | 15,640 |

| Prothena Corp. PLC (a) | | 389,012 | 4,404 |

| PTC Therapeutics, Inc. (a) | | 703,663 | 44,028 |

| Regeneron Pharmaceuticals, Inc. (a) | | 536,227 | 276,709 |

| Relay Therapeutics, Inc. (a) | | 518,430 | 27,638 |

| Repare Therapeutics, Inc. | | 85,743 | 2,561 |

| Repligen Corp. (a) | | 143,128 | 27,147 |

| Revolution Medicines, Inc. | | 913,926 | 39,875 |

| Rigel Pharmaceuticals, Inc. (a)(f) | | 9,452,817 | 28,642 |

| Rubius Therapeutics, Inc. (a)(b)(f) | | 4,400,257 | 27,590 |

| Sage Therapeutics, Inc. (a) | | 2,447,083 | 181,304 |

| Sarepta Therapeutics, Inc. (a) | | 305,235 | 42,995 |

| Scholar Rock Holding Corp. (a) | | 1,158,045 | 57,694 |

| Seagen, Inc. (a) | | 48,410 | 8,245 |

| Seres Therapeutics, Inc. (a) | | 4,243,058 | 117,151 |

| Shattuck Labs, Inc. | | 823,351 | 29,772 |

| Springworks Therapeutics, Inc. (a) | | 1,114,305 | 72,920 |

| Spruce Biosciences, Inc. | | 220,981 | 6,331 |

| Stoke Therapeutics, Inc. (a) | | 131,500 | 6,850 |

| Syros Pharmaceuticals, Inc. (a) | | 1,147,882 | 9,355 |

| Syros Pharmaceuticals, Inc. (a)(g) | | 938,007 | 7,645 |

| Syros Pharmaceuticals, Inc. warrants 10/10/22 (a) | | 116,798 | 236 |

| Taysha Gene Therapies, Inc. | | 1,087,498 | 24,599 |

| Taysha Gene Therapies, Inc. | | 360,588 | 7,341 |

| TG Therapeutics, Inc. (a) | | 247,619 | 7,265 |

| Translate Bio, Inc. (a) | | 2,159,188 | 47,977 |

| Turning Point Therapeutics, Inc. (a) | | 108,747 | 11,582 |

| Ultragenyx Pharmaceutical, Inc. (a) | | 75,316 | 8,928 |

| uniQure B.V. (a) | | 823,214 | 39,580 |

| UNITY Biotechnology, Inc. (a) | | 2,083,237 | 12,562 |

| Vaxcyte, Inc. | | 1,189,493 | 38,183 |

| Vertex Pharmaceuticals, Inc. (a) | | 419,957 | 95,645 |

| Xencor, Inc. (a) | | 1,280,271 | 54,181 |

| Zai Lab Ltd. ADR (a) | | 1,077,278 | 119,341 |

| Zentalis Pharmaceuticals, Inc. | | 427,544 | 21,788 |

| | | | 7,245,907 |

| Health Care Equipment & Supplies - 3.2% | | | |

| Abbott Laboratories | | 397,895 | 43,060 |

| Danaher Corp. | | 1,214,935 | 272,911 |

| DexCom, Inc. (a) | | 609,527 | 194,854 |

| Genmark Diagnostics, Inc. (a) | | 1,455,950 | 19,466 |

| Insulet Corp. (a) | | 1,836,818 | 473,366 |

| Intuitive Surgical, Inc. (a) | | 370,144 | 268,743 |

| Novocure Ltd. (a) | | 3,755,348 | 471,859 |

| Outset Medical, Inc. | | 456,700 | 29,229 |

| Outset Medical, Inc. | | 676,392 | 38,960 |

| Penumbra, Inc. (a) | | 451,729 | 100,239 |

| Presbia PLC (a)(f) | | 1,099,338 | 12 |

| Pulmonx Corp. | | 76,485 | 4,145 |

| Shockwave Medical, Inc. (a) | | 1,048,204 | 102,546 |

| | | | 2,019,390 |

| Health Care Providers & Services - 1.0% | | | |

| 1Life Healthcare, Inc. (a) | | 1,213,061 | 39,873 |

| Alignment Healthcare Partners unit (c)(d) | | 870,575 | 13,006 |

| Centene Corp. (a) | | 669,473 | 41,273 |

| Humana, Inc. | | 81,744 | 32,740 |

| Oak Street Health, Inc. (a) | | 84,167 | 3,970 |

| Oak Street Health, Inc. | | 768,963 | 34,458 |

| Progyny, Inc. (a) | | 293,092 | 10,402 |

| UnitedHealth Group, Inc. | | 1,270,964 | 427,476 |

| | | | 603,198 |

| Health Care Technology - 0.0% | | | |

| Castlight Health, Inc. Class B (a) | | 1,239,360 | 1,562 |

| Codiak Biosciences, Inc. (f) | | 735,311 | 8,610 |

| Codiak Biosciences, Inc. (b)(f) | | 371,594 | 4,834 |

| GoodRx Holdings, Inc. | | 178,796 | 6,741 |

| | | | 21,747 |

| Life Sciences Tools & Services - 1.5% | | | |

| 10X Genomics, Inc. (a) | | 1,056,246 | 161,722 |

| 10X Genomics, Inc. Class B (g) | | 2,870,040 | 439,432 |

| Adaptive Biotechnologies Corp. (a) | | 130,780 | 6,306 |

| Berkeley Lights, Inc. (a) | | 90,020 | 7,459 |

| Bruker Corp. | | 277,459 | 14,042 |

| Nanostring Technologies, Inc. (a) | | 443,989 | 22,040 |

| Sartorius Stedim Biotech | | 31,636 | 11,407 |

| Sotera Health Co. | | 110,700 | 2,996 |

| Thermo Fisher Scientific, Inc. | | 289,561 | 134,640 |

| WuXi AppTec Co. Ltd. (H Shares) (g) | | 1,197,808 | 17,935 |

| Wuxi Biologics (Cayman), Inc. (a)(g) | | 10,205,271 | 101,030 |

| | | | 919,009 |

| Pharmaceuticals - 1.0% | | | |

| Adimab LLC (c)(d)(e) | | 3,162,765 | 160,629 |

| Bristol-Myers Squibb Co. | | 513,593 | 32,048 |

| Dragonfly Therapeutics, Inc. (c)(d) | | 481,725 | 14,620 |

| Fulcrum Therapeutics, Inc. (a) | | 707,759 | 8,090 |

| Hansoh Pharmaceutical Group Co. Ltd. (a)(g) | | 2,515,539 | 12,071 |

| Harmony Biosciences Holdings, Inc. (a) | | 226,902 | 9,814 |

| Harmony Biosciences Holdings, Inc. | | 1,743,448 | 71,634 |

| Intra-Cellular Therapies, Inc. (a) | | 3,775,644 | 89,256 |

| Jiangsu Hengrui Medicine Co. Ltd. (A Shares) | | 257,184 | 3,362 |

| Kaleido Biosciences, Inc. (a)(b) | | 1,546,142 | 12,184 |

| Nektar Therapeutics (a)(b) | | 3,267,847 | 53,560 |

| OptiNose, Inc. (a)(b)(f) | | 2,861,492 | 11,589 |

| Pliant Therapeutics, Inc. | | 623,191 | 17,150 |

| Royalty Pharma PLC (c)(d) | | 9,467 | 0 |

| Royalty Pharma PLC | | 786,401 | 33,501 |

| Royalty Pharma PLC | | 1,213,800 | 49,122 |

| Sienna Biopharmaceuticals, Inc. (a)(f) | | 1,871,387 | 11 |

| Stemcentrx, Inc. rights 12/31/21 (a)(d) | | 2,065,715 | 0 |

| Theravance Biopharma, Inc. (a) | | 1,876,870 | 31,137 |

| UCB SA | | 127,115 | 13,603 |

| | | | 623,381 |

|

| TOTAL HEALTH CARE | | | 11,432,632 |

|

| INDUSTRIALS - 4.7% | | | |

| Aerospace & Defense - 0.2% | | | |

| Axon Enterprise, Inc. (a) | | 110,349 | 13,870 |

| Space Exploration Technologies Corp. Class A (a)(c)(d) | | 418,210 | 112,917 |

| The Boeing Co. | | 94,384 | 19,888 |

| | | | 146,675 |

| Air Freight & Logistics - 0.4% | | | |

| FedEx Corp. | | 387,447 | 111,035 |

| United Parcel Service, Inc. Class B | | 920,389 | 157,451 |

| | | | 268,486 |

| Airlines - 1.3% | | | |

| Delta Air Lines, Inc. | | 3,101,105 | 124,819 |

| JetBlue Airways Corp. (a) | | 7,690,554 | 116,050 |

| Ryanair Holdings PLC sponsored ADR (a) | | 236,232 | 24,514 |

| Southwest Airlines Co. | | 5,199,874 | 240,962 |

| Spirit Airlines, Inc. (a) | | 1,252,848 | 28,352 |

| United Airlines Holdings, Inc. (a) | | 1,209,914 | 54,507 |

| Wheels Up Partners Holdings LLC: | | | |

| Series B (a)(c)(d)(e) | | 6,703,518 | 24,669 |

| Series C (a)(c)(d)(e) | | 3,466,281 | 12,756 |

| Series D (a)(c)(d)(e) | | 2,655,848 | 9,774 |

| Wizz Air Holdings PLC (a)(g) | | 2,324,418 | 139,185 |

| | | | 775,588 |

| Building Products - 0.3% | | | |

| Carrier Global Corp. | | 406,087 | 15,460 |

| Resideo Technologies, Inc. (a) | | 662,377 | 12,247 |

| The AZEK Co., Inc. | | 250,382 | 8,944 |

| Trane Technologies PLC | | 858,516 | 125,549 |

| | | | 162,200 |

| Electrical Equipment - 0.3% | | | |

| AMETEK, Inc. | | 137,366 | 16,282 |

| Eaton Corp. PLC | | 233,296 | 28,254 |

| Emerson Electric Co. | | 527,271 | 40,505 |

| Generac Holdings, Inc. (a) | | 245,831 | 53,001 |

| Rockwell Automation, Inc. | | 88,878 | 22,714 |

| | | | 160,756 |

| Industrial Conglomerates - 0.2% | | | |

| 3M Co. | | 464,544 | 80,241 |

| Honeywell International, Inc. | | 350,153 | 71,403 |

| | | | 151,644 |

| Machinery - 1.0% | | | |

| Caterpillar, Inc. | | 488,041 | 84,719 |

| Cummins, Inc. | | 157,354 | 36,376 |

| Deere & Co. | | 664,300 | 173,794 |

| Fortive Corp. | | 432,392 | 30,324 |

| Illinois Tool Works, Inc. | | 697,336 | 147,201 |

| Ingersoll Rand, Inc. (a) | | 280,002 | 12,396 |

| Nikola Corp. (a)(b) | | 1,346,464 | 27,481 |

| Xylem, Inc. | | 957,219 | 91,864 |

| | | | 604,155 |

| Professional Services - 0.0% | | | |

| CoStar Group, Inc. (a) | | 6,684 | 6,086 |

| Road & Rail - 1.0% | | | |

| CSX Corp. | | 344,523 | 31,024 |

| Kansas City Southern | | 250,582 | 46,651 |

| Lyft, Inc. (a) | | 1,305,029 | 49,813 |

| Uber Technologies, Inc. (a) | | 5,460,327 | 271,160 |

| Union Pacific Corp. | | 1,179,114 | 240,634 |

| | | | 639,282 |

|

| TOTAL INDUSTRIALS | | | 2,914,872 |

|

| INFORMATION TECHNOLOGY - 36.5% | | | |

| Communications Equipment - 0.4% | | | |

| Arista Networks, Inc. (a) | | 28,142 | 7,618 |

| Ciena Corp. (a) | | 2,060,362 | 92,304 |

| Infinera Corp. (a)(f) | | 12,595,899 | 106,561 |

| Lumentum Holdings, Inc. (a) | | 408,787 | 35,311 |

| | | | 241,794 |

| Electronic Equipment & Components - 0.2% | | | |

| Arlo Technologies, Inc. (a) | | 1,435,963 | 7,553 |

| II-VI, Inc. (a) | | 740,064 | 50,065 |

| TE Connectivity Ltd. | | 16,495 | 1,880 |

| Trimble, Inc. (a) | | 946,924 | 56,692 |

| Vontier Corp. (a) | | 100,500 | 3,334 |

| | | | 119,524 |

| IT Services - 6.9% | | | |

| Accenture PLC Class A | | 120,154 | 29,929 |

| Actua Corp. (a)(d) | | 1,516,928 | 76 |

| BigCommerce Holdings, Inc. (a)(b) | | 60,638 | 4,891 |

| Black Knight, Inc. (a) | | 421,303 | 38,600 |

| MasterCard, Inc. Class A | | 1,598,002 | 537,744 |

| MongoDB, Inc. Class A (a) | | 23,508 | 6,754 |

| Nuvei Corp. (a)(g) | | 172,304 | 8,098 |

| Okta, Inc. (a) | | 204,876 | 50,203 |

| PayPal Holdings, Inc. (a) | | 4,218,669 | 903,301 |

| Riskified Ltd. (a)(c)(d) | | 719,400 | 8,273 |

| Riskified Ltd. warrants (a)(c)(d) | | 4,733 | 0 |

| Shopify, Inc. Class A (a) | | 1,587,851 | 1,708,979 |

| Snowflake Computing, Inc. (b) | | 39,060 | 12,727 |

| Snowflake Computing, Inc. Class B | | 32,508 | 9,533 |

| Square, Inc. (a) | | 1,449,550 | 305,797 |

| Twilio, Inc. Class A (a) | | 28,037 | 8,974 |

| Visa, Inc. Class A | | 2,814,219 | 591,971 |

| Wix.com Ltd. (a) | | 167,413 | 42,762 |

| Worldline SA (a)(g) | | 391,249 | 36,225 |

| | | | 4,304,837 |

| Semiconductors & Semiconductor Equipment - 10.8% | | | |

| Advanced Micro Devices, Inc. (a) | | 6,758,027 | 626,199 |

| Applied Materials, Inc. | | 1,292,228 | 106,583 |

| Array Technologies, Inc. | | 617,616 | 28,151 |

| ASML Holding NV | | 300,535 | 131,553 |

| Broadcom, Inc. | | 128,174 | 51,472 |

| Cirrus Logic, Inc. (a) | | 1,597,049 | 127,924 |

| Cree, Inc. (a) | | 322,763 | 29,175 |

| First Solar, Inc. (a) | | 422,348 | 39,460 |

| Intel Corp. | | 62,804 | 3,037 |

| KLA-Tencor Corp. | | 196,862 | 49,603 |

| Marvell Technology Group Ltd. | | 2,853,272 | 132,078 |

| Micron Technology, Inc. (a) | | 1,289,600 | 82,650 |

| NVIDIA Corp. | | 8,557,265 | 4,587,197 |

| Qualcomm, Inc. | | 747,609 | 110,026 |

| Silicon Laboratories, Inc. (a)(f) | | 2,810,208 | 329,384 |

| Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | | 1,110,247 | 107,716 |

| Teradyne, Inc. | | 118,019 | 13,022 |

| Texas Instruments, Inc. | | 586,335 | 94,547 |

| Xilinx, Inc. | | 226,989 | 33,038 |

| | | | 6,682,815 |

| Software - 11.2% | | | |

| 2U, Inc. (a)(b) | | 292,611 | 9,454 |

| Adobe, Inc. (a) | | 976,197 | 467,081 |

| Agora, Inc. ADR (a)(b) | | 71,079 | 2,733 |

| Atlassian Corp. PLC (a) | | 87,258 | 19,637 |

| Autodesk, Inc. (a) | | 677,277 | 189,793 |

| Avalara, Inc. (a) | | 123,986 | 21,295 |

| Bill.Com Holdings, Inc. (a) | | 14,839 | 1,821 |

| Cloudflare, Inc. (a) | | 6,093,153 | 457,474 |

| Coupa Software, Inc. (a) | | 77,967 | 25,644 |

| Crowdstrike Holdings, Inc. (a) | | 145,556 | 22,311 |

| Datadog, Inc. Class A (a) | | 51,266 | 5,071 |

| DocuSign, Inc. (a) | | 46,905 | 10,689 |

| Elastic NV (a) | | 169,609 | 20,998 |

| Epic Games, Inc. (c)(d) | | 51,800 | 29,785 |

| HubSpot, Inc. (a) | | 695,062 | 274,084 |

| Intuit, Inc. | | 369,040 | 129,909 |

| JFrog Ltd. (b) | | 73,561 | 5,176 |

| LivePerson, Inc. (a) | | 919,529 | 53,719 |

| Medallia, Inc. (a)(b) | | 216,424 | 7,573 |

| Microsoft Corp. | | 11,626,004 | 2,488,779 |

| Nutanix, Inc. Class A (a) | | 12,819,262 | 351,120 |

| Oracle Corp. | | 1,737,557 | 100,292 |

| Paycom Software, Inc. (a) | | 49,001 | 20,437 |

| Paylocity Holding Corp. (a) | | 102,162 | 20,085 |

| Pluralsight, Inc. (a) | | 884,573 | 14,489 |

| RingCentral, Inc. (a) | | 37,128 | 11,029 |

| Salesforce.com, Inc. (a) | | 7,363,044 | 1,809,836 |

| Slack Technologies, Inc. Class A (a) | | 176,700 | 7,577 |

| The Trade Desk, Inc. (a) | | 19,453 | 17,529 |

| Workday, Inc. Class A (a) | | 118,970 | 26,743 |

| Zendesk, Inc. (a) | | 940,373 | 125,540 |

| Zoom Video Communications, Inc. Class A (a) | | 241,490 | 115,519 |

| Zscaler, Inc. (a) | | 349,491 | 54,433 |

| | | | 6,917,655 |

| Technology Hardware, Storage & Peripherals - 7.0% | | | |

| Apple, Inc. | | 35,268,572 | 4,198,723 |

| Pure Storage, Inc. Class A (a) | | 7,332,861 | 133,971 |

| Samsung Electronics Co. Ltd. | | 439,235 | 26,429 |

| | | | 4,359,123 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 22,625,748 |

|

| MATERIALS - 0.8% | | | |

| Chemicals - 0.2% | | | |

| Albemarle Corp. U.S. | | 53,663 | 7,297 |

| Corteva, Inc. | | 1,086,442 | 41,632 |

| Dow, Inc. | | 380,335 | 20,162 |

| DuPont de Nemours, Inc. | | 630,913 | 40,025 |

| | | | 109,116 |

| Containers & Packaging - 0.2% | | | |

| Ball Corp. | | 955,810 | 91,767 |

| Sealed Air Corp. | | 645,428 | 29,083 |

| | | | 120,850 |

| Metals & Mining - 0.4% | | | |

| Barrick Gold Corp. (Canada) | | 4,800,868 | 110,198 |

| Freeport-McMoRan, Inc. | | 6,078,613 | 142,179 |

| | | | 252,377 |

|

| TOTAL MATERIALS | | | 482,343 |

|

| REAL ESTATE - 0.2% | | | |

| Equity Real Estate Investment Trusts (REITs) - 0.1% | | | |

| American Tower Corp. | | 269,903 | 62,402 |

| Simon Property Group, Inc. | | 110,500 | 9,124 |

| | | | 71,526 |

| Real Estate Management & Development - 0.1% | | | |

| KE Holdings, Inc. ADR (a) | | 975,731 | 63,745 |

|

| TOTAL REAL ESTATE | | | 135,271 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $17,833,413) | | | 61,202,013 |

|

| Preferred Stocks - 1.2% | | | |

| Convertible Preferred Stocks - 1.1% | | | |

| COMMUNICATION SERVICES - 0.0% | | | |

| Diversified Telecommunication Services - 0.0% | | | |

| Starry, Inc.: | | | |

| Series B (a)(c)(d) | | 9,869,159 | 14,113 |

| Series C (a)(c)(d) | | 5,234,614 | 7,485 |

| Series D (a)(c)(d) | | 10,743,446 | 15,363 |

| | | | 36,961 |

| CONSUMER DISCRETIONARY - 0.2% | | | |

| Automobiles - 0.1% | | | |

| Rivian Automotive, Inc. Series E (c)(d) | | 2,713,913 | 42,039 |

| Hotels, Restaurants & Leisure - 0.0% | | | |

| MOD Super Fast Pizza Holdings LLC: | | | |

| Series 3 (a)(c)(d)(e) | | 56,343 | 10,431 |

| Series 4 (a)(c)(d)(e) | | 5,142 | 890 |

| Series 5 % (a)(c)(d)(e) | | 20,652 | 3,332 |

| Topgolf International, Inc. Series F (a)(c) | | 819,532 | 14,596 |

| | | | 29,249 |

| Internet & Direct Marketing Retail - 0.1% | | | |

| Instacart, Inc. Series H (c)(d) | | 72,310 | 4,339 |

| Reddit, Inc. Series B (a)(c)(d) | | 384,303 | 19,035 |

| The Honest Co., Inc.: | | | |

| Series C (a)(c)(d) | | 92,950 | 3,593 |

| Series D (a)(c)(d) | | 69,363 | 3,174 |

| | | | 30,141 |

| Specialty Retail - 0.0% | | | |

| Fanatics, Inc. Series E (c)(d) | | 558,178 | 9,651 |

| Textiles, Apparel & Luxury Goods - 0.0% | | | |

| Allbirds, Inc.: | | | |

| Series A (a)(c)(d) | | 121,335 | 1,403 |

| Series B (a)(c)(d) | | 21,315 | 246 |

| Series C (a)(c)(d) | | 203,730 | 2,355 |

| Series D (c)(d) | | 260,897 | 3,016 |

| Series Seed (a)(c)(d) | | 406,151 | 4,695 |

| Freenome, Inc. Series C (c)(d) | | 900,884 | 5,958 |

| | | | 17,673 |

| TOTAL CONSUMER DISCRETIONARY | | | 128,753 |

| CONSUMER STAPLES - 0.1% | | | |

| Food & Staples Retailing - 0.1% | | | |

| Blink Health LLC Series C (c)(d) | | 643,820 | 24,581 |

| Sweetgreen, Inc.: | | | |

| Series C (a)(c)(d) | | 5,291 | 79 |

| Series D (a)(c)(d) | | 85,105 | 1,264 |

| Series H (a)(c)(d) | | 705,259 | 10,473 |

| Series I (a)(c)(d) | | 200,582 | 2,979 |

| | | | 39,376 |

| Food Products - 0.0% | | | |

| Agbiome LLC Series C (a)(c)(d) | | 1,060,308 | 6,716 |

| Tobacco - 0.0% | | | |

| JUUL Labs, Inc. Series E (a)(c)(d) | | 22,033 | 1,413 |

| TOTAL CONSUMER STAPLES | | | 47,505 |

| FINANCIALS - 0.1% | | | |

| Diversified Financial Services - 0.1% | | | |

| Paragon Biosciences Emalex Capital, Inc. Series B (a)(c)(d) | | 416,094 | 6,495 |

| Sonder Holdings, Inc.: | | | |

| Series D1 (c)(d) | | 965,896 | 10,400 |

| Series E (c)(d) | | 1,478,345 | 15,917 |

| | | | 32,812 |

| Insurance - 0.0% | | | |

| Clover Health Series D (a)(c) | | 863,631 | 15,753 |

| TOTAL FINANCIALS | | | 48,565 |

| HEALTH CARE - 0.3% | | | |

| Biotechnology - 0.2% | | | |

| 23andMe, Inc. Series F (a)(c)(d) | | 590,383 | 10,243 |

| Adagio Theraputics, Inc.: | | | |

| Series A (c)(d) | | 413,930 | 23,478 |

| Series B (c)(d) | | 149,500 | 8,480 |

| Ambrx, Inc.: | | | |

| Series A (c)(d) | | 1,353,862 | 2,228 |

| Series B (c)(d) | | 1,218,475 | 2,005 |

| Element Biosciences, Inc. Series B (c)(d) | | 1,096,312 | 6,775 |

| EQRx, Inc. Series B (c)(d) | | 6,908,598 | 18,943 |

| Immunocore Ltd. Series A (a)(c)(d) | | 70,105 | 13,621 |

| Inscripta, Inc. Series D (c)(d) | | 1,690,173 | 7,724 |

| Intarcia Therapeutics, Inc.: | | | |

| Series CC (a)(c)(d) | | 1,051,411 | 0 |

| Series DD (a)(c)(d) | | 1,543,687 | 0 |

| Nuvation Bio, Inc. Series A (a)(c) | | 13,044,100 | 21,914 |

| Seer, Inc. Series D1 (c) | | 696,611 | 11,912 |

| Silverback Therapeutics, Inc. Series C (c) | | 168,380 | 3,182 |

| | | | 130,505 |

| Health Care Providers & Services - 0.1% | | | |

| Conformal Medical, Inc. Series C (c)(d) | | 1,067,180 | 3,913 |

| Mulberry Health, Inc. Series A-8 (a)(c)(d) | | 2,790,742 | 12,694 |

| | | | 16,607 |

| Health Care Technology - 0.0% | | | |

| PrognomIQ, Inc.: | | | |

| Series A5 (c)(d) | | 372,687 | 1,032 |

| Series B (c)(d) | | 1,111,446 | 3,079 |

| Vor Biopharma, Inc. (c)(d) | | 5,507,079 | 2,864 |

| | | | 6,975 |

| Pharmaceuticals - 0.0% | | | |

| Castle Creek Pharmaceutical Holdings, Inc.: | | | |

| Series B (a)(c)(d) | | 16,803 | 8,104 |

| Series C (c)(d) | | 13,100 | 6,318 |

| Nohla Therapeutics, Inc. Series B (a)(c)(d) | | 9,124,200 | 0 |

| Vera Therapeutics, Inc. Series C (c)(d) | | 3,591,850 | 2,126 |

| | | | 16,548 |

| TOTAL HEALTH CARE | | | 170,635 |

| INDUSTRIALS - 0.1% | | | |

| Aerospace & Defense - 0.1% | | | |

| Space Exploration Technologies Corp. Series G (a)(c)(d) | | 216,276 | 58,395 |

| Professional Services - 0.0% | | | |

| YourPeople, Inc. Series C (a)(c)(d) | | 5,833,137 | 13,941 |

| TOTAL INDUSTRIALS | | | 72,336 |

| INFORMATION TECHNOLOGY - 0.3% | | | |

| IT Services - 0.1% | | | |

| AppNexus, Inc. Series E (Escrow) (a)(c)(d) | | 923,523 | 29 |

| ByteDance Ltd. Series E1 (c)(d)(h) | | 403,450 | 44,208 |

| Riskified Ltd.: | | | |

| Series D (c)(d) | | 157,100 | 1,807 |

| Series E (a)(c)(d) | | 564,050 | 6,487 |

| | | | 52,531 |

| Software - 0.2% | | | |

| Bird Rides, Inc.: | | | |

| Series C (a)(c)(d) | | 348,328 | 4,114 |

| Series D (a)(c)(d) | | 415,100 | 4,902 |

| Dataminr, Inc. Series D (a)(c)(d) | | 1,773,901 | 19,513 |

| Jet.Com, Inc. Series B1 (Escrow) (a)(c)(d) | | 7,578,338 | 0 |

| Nuvia, Inc. Series B (c)(d) | | 1,235,787 | 4,782 |

| Taboola.Com Ltd. Series E (a)(c)(d) | | 1,337,420 | 66,363 |

| UiPath, Inc.: | | | |

| Series A1 (a)(c)(d) | | 587,070 | 10,916 |

| Series B1 (a)(c)(d) | | 29,247 | 544 |

| Series B2 (a)(c)(d) | | 145,650 | 2,708 |

| | | | 113,842 |

| TOTAL INFORMATION TECHNOLOGY | | | 166,373 |

|

| TOTAL CONVERTIBLE PREFERRED STOCKS | | | 671,128 |

|

| Nonconvertible Preferred Stocks - 0.1% | | | |

| CONSUMER DISCRETIONARY - 0.0% | | | |

| Automobiles - 0.0% | | | |

| Neutron Holdings, Inc. Series 1D (c)(d) | | 17,893,728 | 358 |

| Waymo LLC Series A2 (c)(d) | | 44,767 | 3,844 |

| | | | 4,202 |

| Specialty Retail - 0.0% | | | |

| Cazoo Holdings Ltd.: | | | |

| Series A (c)(d) | | 7,316 | 104 |

| Series B (c)(d) | | 128,092 | 1,814 |

| Series C (c)(d) | | 2,600 | 37 |

| Series D (c)(d) | | 457,593 | 6,482 |

| | | | 8,437 |

| TOTAL CONSUMER DISCRETIONARY | | | 12,639 |

| HEALTH CARE - 0.1% | | | |

| Biotechnology - 0.0% | | | |

| Yumanity Holdings LLC: | | | |

| Class A (a)(c)(d) | | 464,607 | 1,979 |

| Class B (a)(c)(d) | | 336,308 | 1,456 |

| Series C (c)(d) | | 478,304 | 1,914 |

| | | | 5,349 |

| Pharmaceuticals - 0.1% | | | |

| Castle Creek Pharmaceutical Holdings, Inc. Series A4 (a)(c)(d) | | 46,864 | 22,602 |

| Faraday Pharmaceuticals, Inc. Series B (d) | | 641,437 | 975 |

| | | | 23,577 |

| TOTAL HEALTH CARE | | | 28,926 |

|

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | | | 41,565 |

|

| TOTAL PREFERRED STOCKS | | | |

| (Cost $670,339) | | | 712,693 |

| | | Principal Amount (000s) | Value (000s) |

|

| Convertible Bonds - 0.0% | | | |

| CONSUMER DISCRETIONARY - 0.0% | | | |

| Automobiles - 0.0% | | | |

| Neutron Holdings, Inc.: | | | |

| 4% 5/22/27 (c)(d) | | 3,596 | 3,596 |

| 4% 6/12/27 (c)(d) | | 743 | 743 |

| TOTAL CONVERTIBLE BONDS | | | |

| (Cost $4,339) | | | 4,339 |

|

| Preferred Securities - 0.0% | | | |

| COMMUNICATION SERVICES - 0.0% | | | |

| Diversified Telecommunication Services - 0.0% | | | |

| Starry, Inc. 3% (c)(d)(i) | | 1,900 | 1,913 |

| HEALTH CARE - 0.0% | | | |

| Biotechnology - 0.0% | | | |

| Intarcia Therapeutics, Inc. 6% 7/18/21 (c)(d) | | 13,682 | 18,851 |

| TOTAL PREFERRED SECURITIES | | | |

| (Cost $15,582) | | | 20,764 |

| | | Shares | Value (000s) |

|

| Money Market Funds - 1.0% | | | |

| Fidelity Cash Central Fund 0.09% (j) | | 108,296,722 | 108,318 |

| Fidelity Securities Lending Cash Central Fund 0.09% (j)(k) | | 510,682,165 | 510,733 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $619,047) | | | 619,051 |

| TOTAL INVESTMENT IN SECURITIES - 100.9% | | | |

| (Cost $19,142,720) | | | 62,558,860 |

| NET OTHER ASSETS (LIABILITIES) - (0.9)% | | | (577,431) |

| NET ASSETS - 100% | | | $61,981,429 |

Values shown as $0 in the Schedule of Investments may reflect amounts less than $500.

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $1,399,537,000 or 2.3% of net assets.

(d) Level 3 security

(e) Investment is owned by a wholly-owned subsidiary (Subsidiary) that is treated as a corporation for U.S. tax purposes.

(f) Affiliated company

(g) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $761,621,000 or 1.2% of net assets.

(h) Security or a portion of the security purchased on a delayed delivery or when-issued basis.

(i) Security is perpetual in nature with no stated maturity date.

(j) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(k) Investment made with cash collateral received from securities on loan.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost (000s) |

| 23andMe, Inc. Series F | 8/31/17 | $8,197 |

| Adagio Theraputics, Inc. Series A | 7/15/20 | $3,311 |

| Adagio Theraputics, Inc. Series B | 11/4/20 | $8,480 |

| Adimab LLC | 9/17/14 - 6/5/15 | $47,869 |

| Agbiome LLC Series C | 6/29/18 | $6,716 |

| Alignment Healthcare Partners unit | 2/28/20 | $10,550 |

| Allbirds, Inc. | 10/9/18 | $3,372 |

| Allbirds, Inc. Series A | 10/9/18 | $1,331 |

| Allbirds, Inc. Series B | 10/9/18 | $234 |

| Allbirds, Inc. Series C | 10/9/18 | $2,234 |

| Allbirds, Inc. Series D | 12/23/19 | $3,362 |

| Allbirds, Inc. Series Seed | 10/9/18 - 1/23/20 | $4,077 |

| Ambrx, Inc. Series A | 11/6/20 | $2,116 |

| Ambrx, Inc. Series B | 11/6/20 | $2,116 |

| Ant International Co. Ltd. Class C | 5/16/18 | $9,303 |

| AppNexus, Inc. Series E (Escrow) | 8/1/14 | $0 |

| Bird Rides, Inc. Series C | 12/21/18 | $4,091 |

| Bird Rides, Inc. Series D | 9/30/19 | $5,362 |

| Blink Health LLC Series C | 11/7/19 | $24,578 |

| ByteDance Ltd. Series E1 | 11/18/20 | $44,208 |

| Castle Creek Pharmaceutical Holdings, Inc. Series A4 | 9/29/16 | $15,506 |

| Castle Creek Pharmaceutical Holdings, Inc. Series B | 10/9/18 | $6,920 |

| Castle Creek Pharmaceutical Holdings, Inc. Series C | 12/9/19 | $5,395 |

| Cazoo Holdings Ltd. | 9/30/20 | $3,072 |

| Cazoo Holdings Ltd. Series A | 9/30/20 | $100 |

| Cazoo Holdings Ltd. Series B | 9/30/20 | $1,756 |

| Cazoo Holdings Ltd. Series C | 9/30/20 | $36 |

| Cazoo Holdings Ltd. Series D | 9/30/20 | $6,274 |

| Cerevel Therapeutics Holdings | 10/27/20 | $13,843 |

| Cibus Corp. Series C | 2/16/18 | $9,500 |

| Cibus Corp. Series D | 5/10/19 | 3,426 |

| Clover Health Series D | 6/7/17 | $8,099 |

| Conformal Medical, Inc. Series C | 7/24/20 | $3,913 |

| Cyclerion Therapeutics, Inc. | 4/2/19 | $8,052 |

| Dataminr, Inc. Series D | 2/18/15 - 3/6/15 | $22,617 |

| DiamondPeak Holdings Corp. | 10/23/20 | $22,324 |

| Dragonfly Therapeutics, Inc. | 12/19/19 | $12,746 |

| Element Biosciences, Inc. Series B | 12/13/19 | $5,745 |

| Epic Games, Inc. | 7/13/20 - 7/30/20 | $29,785 |

| EQRx, Inc. Series B | 11/19/20 | $18,943 |

| Fanatics, Inc. Series E | 8/13/20 | $9,651 |

| Freenome, Inc. Series C | 8/14/20 | $5,958 |

| Immunocore Ltd. Series A | 7/27/15 | $12,669 |

| Inscripta, Inc. Series D | 11/13/20 | $7,724 |

| Instacart, Inc. Series H | 11/13/20 | $4,339 |

| Intarcia Therapeutics, Inc. Series CC | 11/14/12 | $14,331 |

| Intarcia Therapeutics, Inc. Series DD | 3/17/14 | $50,000 |

| Intarcia Therapeutics, Inc. 6% 7/18/21 | 2/26/19 | $13,682 |

| Jet.Com, Inc. Series B1 (Escrow) | 3/19/18 | $0 |

| JUUL Labs, Inc. Class A | 7/6/18 | $1,299 |

| JUUL Labs, Inc. Series E | 7/6/18 | $650 |

| Kensington Capital Acquisition Corp. | 11/25/20 | $17,382 |

| MOD Super Fast Pizza Holdings LLC Series 3 | 11/3/16 | $7,719 |

| MOD Super Fast Pizza Holdings LLC Series 4 | 12/14/17 | 720 |

| MOD Super Fast Pizza Holdings LLC Series 5 | 5/15/19 | 2,943 |

| Mulberry Health, Inc. Series A-8 | 1/20/16 | $18,851 |

| Neutron Holdings, Inc. Series 1D | 1/25/19 | $4,339 |

| Neutron Holdings, Inc. warrants | 6/4/20 | $0 |

| Neutron Holdings, Inc. 4% 5/22/27 | 6/4/20 | $3,596 |

| Neutron Holdings, Inc. 4% 6/12/27 | 6/12/20 | $743 |

| Nohla Therapeutics, Inc. Series B | 5/1/18 | $4,161 |

| Nuvation Bio, Inc. Series A | 6/17/19 | $10,062 |

| Nuvia, Inc. Series B | 9/18/20 | $3,964 |

| On Holding AG | 2/6/20 | $8,202 |

| Paragon Biosciences Emalex Capital, Inc. Series B | 9/18/19 | $4,240 |

| PrognomIQ, Inc. Series A5 | 8/20/20 | $225 |

| PrognomIQ, Inc. Series B | 9/11/20 | $2,540 |

| Reddit, Inc. Series B | 7/26/17 | $5,456 |

| Riskified Ltd. | 12/20/19 - 4/15/20 | $6,506 |

| Riskified Ltd. Series D | 11/18/20 | $1,807 |

| Riskified Ltd. Series E | 10/28/19 | $5,367 |

| Riskified Ltd. warrants | 10/28/19 | $0 |

| Rivian Automotive, Inc. Series E | 7/10/20 | $42,039 |

| Royalty Pharma PLC | 5/21/15 | $1,116 |

| Seer, Inc. Series D1 | 5/12/20 | $5,590 |

| Silverback Therapeutics, Inc. Series C | 9/22/20 | $2,132 |

| Sonder Holdings, Inc. Series D1 | 12/20/19 | $10,138 |

| Sonder Holdings, Inc. Series E | 4/3/20 - 5/6/20 | $15,917 |

| Space Exploration Technologies Corp. Class A | 10/16/15 - 4/6/17 | $38,201 |

| Space Exploration Technologies Corp. Series G | 1/20/15 | $16,753 |

| Starry, Inc. Series B | 12/1/16 | $5,339 |

| Starry, Inc. Series C | 12/8/17 | $4,826 |

| Starry, Inc. Series D | 3/6/19 - 7/30/20 | $15,363 |

| Starry, Inc. 3% | 9/4/20 | $1,900 |

| Sweetgreen, Inc. Series C | 9/13/19 | $90 |

| Sweetgreen, Inc. Series D | 9/13/19 | $1,455 |

| Sweetgreen, Inc. Series H | 11/9/18 | $9,197 |

| Sweetgreen, Inc. Series I | 9/13/19 | $3,430 |

| Taboola.Com Ltd. Series E | 12/22/14 | $13,943 |

| The Honest Co., Inc. | 8/21/14 | $1,078 |

| The Honest Co., Inc. Series C | 8/21/14 | $2,515 |

| The Honest Co., Inc. Series D | 8/3/15 | $3,174 |

| Topgolf International, Inc. Series F | 11/10/17 | $11,337 |

| Tory Burch LLC Class A | 5/14/15 | 67,653 |

| Tory Burch LLC Class B | 12/31/12 | $17,505 |

| UiPath, Inc. Series A1 | 6/14/19 | $7,701 |

| UiPath, Inc. Series B1 | 6/14/19 | $384 |

| UiPath, Inc. Series B2 | 6/14/19 | $1,911 |

| Vera Therapeutics, Inc. Series C | 10/29/20 | $2,126 |

| Vor Biopharma, Inc. | 6/30/20 | $2,864 |

| Waymo LLC Series A2 | 5/8/20 | $3,844 |

| Wheels Up Partners Holdings LLC Series B | 9/18/15 | $19,040 |

| Wheels Up Partners Holdings LLC Series C | 6/22/17 | 10,815 |

| Wheels Up Partners Holdings LLC Series D | 5/16/19 | 9,242 |

| YourPeople, Inc. Series C | 5/1/15 | $86,920 |

| Yumanity Holdings LLC Class A | 2/8/16 | $3,140 |

| Yumanity Holdings LLC Class B | 6/19/18 | $2,815 |

| Yumanity Holdings LLC Series C | 6/19/20 | $1,914 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| | (Amounts in thousands) |

| Fidelity Cash Central Fund | $297 |

| Fidelity Securities Lending Cash Central Fund | 4,824 |

| Total | $5,121 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Other Affiliated Issuers

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows:

| Affiliate (Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds(a) | Dividend Income | Realized Gain (loss) | Change in Unrealized appreciation (depreciation) | Value, end of period |

| ACADIA Pharmaceuticals, Inc. | $356,627 | $12,074 | $37,899 | $-- | $18,742 | $63,145 | $-- |

| Actua Corp. | 453 | -- | 13 | -- | 13 | (377) | -- |

| Akcea Therapeutics, Inc. | 101,194 | -- | 47,778 | -- | (11,547) | 4,180 | -- |

| Arlo Technologies, Inc. | 14,633 | -- | 9,725 | -- | (25,549) | 28,194 | -- |

| Axcella Health, Inc. | 3,821 | 6,452 | 445 | -- | 130 | 2,670 | 12,628 |

| Codiak Biosciences, Inc. | -- | -- | -- | -- | -- | (7,914) | 8,610 |

| Codiak Biosciences, Inc. | -- | 5,119 | 28 | | (4) | (253) | 4,834 |

| Codiak Biosciences, Inc. Series A 8.00% | 2,141 | -- | -- | -- | -- | (1,550) | -- |

| Codiak Biosciences, Inc. Series B 8.00% | 6,959 | -- | -- | -- | -- | (1,208) | -- |

| Codiak Biosciences, Inc. Series C 8.00% | 9,758 | -- | -- | -- | -- | 424 | -- |

| dMY Technology Group, Inc. | -- | 16,893 | 288 | -- | 55 | 6,742 | 23,402 |

| Infinera Corp. | 79,794 | 5,518 | 5,312 | -- | 1,438 | 25,123 | 106,561 |

| Ionis Pharmaceuticals, Inc. | 528,346 | 33,987 | 42,601 | -- | 15,123 | (127,792) | 407,063 |

| Karuna Therapeutics, Inc. | 86,032 | 6,264 | 7,829 | -- | 6,673 | 58,376 | 153,778 |

| Karuna Therapeutics, Inc. | 24,967 | -- | -- | -- | -- | (20,705) | -- |

| Kensington Capital Acquisition Corp. | -- | 17,383 | -- | -- | -- | 56,145 | 73,528 |

| Lexicon Pharmaceuticals, Inc. | 20,529 | -- | 4,164 | -- | (25,430) | 14,808 | -- |

| lululemon athletica, Inc. | 1,492,234 | 43,181 | 122,085 | -- | 102,953 | 824,690 | -- |

| Momenta Pharmaceuticals, Inc. | 100,894 | 27,945 | 74,501 | -- | 246,584 | 3,599 | -- |

| OptiNose, Inc. | 24,547 | 2,644 | 1,021 | -- | (195) | (14,386) | 11,589 |

| Presbia PLC | 7 | 1 | 1 | -- | (183) | 188 | 12 |

| Rigel Pharmaceuticals, Inc. | 23,046 | -- | 1,841 | -- | (1,799) | 9,236 | 28,642 |

| Rubius Therapeutics, Inc. | 30,122 | 6,827 | 2,440 | -- | (2,249) | (4,670) | 27,590 |

| Sienna Biopharmaceuticals, Inc. | 336 | -- | 3 | -- | (307) | (15) | 11 |

| Silicon Laboratories, Inc. | 318,613 | 15,925 | 36,814 | -- | 10,895 | 20,765 | 329,384 |

| Syros Pharmaceuticals, Inc. | 6,242 | -- | 610 | -- | 40 | 3,683 | -- |

| Syros Pharmaceuticals, Inc. | 4,784 | -- | -- | -- | -- | 2,861 | -- |

| Translate Bio, Inc. | 30,813 | 2,479 | 14,819 | -- | 2,460 | 27,044 | -- |

| UNITY Biotechnology, Inc. | 17,120 | 3,644 | 3,214 | -- | (7,030) | 2,042 | -- |

| | $3,284,012 | $206,336 | $413,431 | $-- | $330,813 | $975,045 | $1,187,632 |

(a) Includes the value of securities delivered through in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of November 30, 2020, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| (Amounts in thousands) | | | | |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Communication Services | $7,025,356 | $6,928,850 | $59,545 | $36,961 |

| Consumer Discretionary | 14,393,879 | 13,653,147 | 510,905 | 229,827 |

| Consumer Staples | 1,410,002 | 1,318,325 | 41,345 | 50,332 |

| Energy | 293,235 | 185,038 | 108,197 | -- |

| Financials | 763,098 | 625,742 | 91,095 | 46,261 |

| Health Care | 11,632,193 | 10,740,885 | 529,458 | 361,850 |

| Industrials | 2,987,208 | 2,615,571 | 139,185 | 232,452 |

| Information Technology | 22,792,121 | 22,541,856 | 45,758 | 204,507 |

| Materials | 482,343 | 482,343 | -- | -- |

| Real Estate | 135,271 | 135,271 | -- | -- |

| Corporate Bonds | 4,339 | -- | -- | 4,339 |

| Preferred Securities | 20,764 | -- | -- | 20,764 |

| Money Market Funds | 619,051 | 619,051 | -- | -- |

| Total Investments in Securities: | $62,558,860 | $59,846,079 | $1,525,488 | $1,187,293 |

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value:

| (Amounts in thousands) | |

| Investments in Securities: | |

| Beginning Balance | $991,561 |

| Net Realized Gain (Loss) on Investment Securities | 33,710 |

| Net Unrealized Gain (Loss) on Investment Securities | (14,963) |

| Cost of Purchases | 306,750 |

| Proceeds of Sales | (73,317) |

| Amortization/Accretion | -- |

| Transfers into Level 3 | 34,887 |

| Transfers out of Level 3 | (121,261) |

| Ending Balance | $1,187,293 |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at November 30, 2020 | $14,797 |

The information used in the above reconciliations represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Cost of purchases and proceeds of sales may include securities received and/or delivered through in-kind transactions. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliations are included in Net Gain (Loss) on the Fund's Statement of Operations.

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| Amounts in thousands (except per-share amounts) | | November 30, 2020 |

| Assets | | |

Investment in securities, at value (including securities loaned of $502,809) — See accompanying schedule:

Unaffiliated issuers (cost $17,496,558) | $60,752,177 | |

| Fidelity Central Funds (cost $619,047) | 619,051 | |

| Other affiliated issuers (cost $1,027,115) | 1,187,632 | |

| Total Investment in Securities (cost $19,142,720) | | $62,558,860 |

| Restricted cash | | 100 |

| Receivable for investments sold | | 110,772 |

| Receivable for fund shares sold | | 52,172 |

| Dividends receivable | | 22,652 |

| Interest receivable | | 85 |

| Distributions receivable from Fidelity Central Funds | | 353 |

| Prepaid expenses | | 76 |

| Other receivables | | 2,637 |

| Total assets | | 62,747,707 |

| Liabilities | | |

| Payable to custodian bank | $352 | |

| Payable for investments purchased | | |

| Regular delivery | 121,386 | |

| Delayed delivery | 44,208 | |

| Payable for fund shares redeemed | 45,612 | |

| Accrued management fee | 33,541 | |

| Other affiliated payables | 4,898 | |

| Other payables and accrued expenses | 5,605 | |

| Collateral on securities loaned | 510,676 | |

| Total liabilities | | 766,278 |

| Net Assets | | $61,981,429 |

| Net Assets consist of: | | |

| Paid in capital | | $13,592,313 |

| Total accumulated earnings (loss) | | 48,389,116 |

| Net Assets | | $61,981,429 |

| Net Asset Value and Maximum Offering Price | | |

| Growth Company: | | |

| Net Asset Value, offering price and redemption price per share ($43,532,668 ÷ 1,262,158 shares) | | $34.49 |

| Class K: | | |

| Net Asset Value, offering price and redemption price per share ($18,448,761 ÷ 533,638 shares) | | $34.57 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Amounts in thousands | | Year ended November 30, 2020 |

| Investment Income | | |

| Dividends | | $201,855 |

| Interest | | 85 |

| Income from Fidelity Central Funds (including $4,824 from security lending) | | 5,121 |

| Total income | | 207,061 |

| Expenses | | |

| Management fee | | |

| Basic fee | $260,238 | |

| Performance adjustment | 83,353 | |

| Transfer agent fees | 47,287 | |

| Accounting fees | 2,357 | |

| Custodian fees and expenses | 662 | |

| Independent trustees' fees and expenses | 260 | |

| Registration fees | 359 | |

| Audit | 122 | |

| Legal | 56 | |

| Interest | 43 | |

| Miscellaneous | 443 | |

| Total expenses before reductions | 395,180 | |

| Expense reductions | (890) | |

| Total expenses after reductions | | 394,290 |

| Net investment income (loss) | | (187,229) |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 7,643,883 | |

| Fidelity Central Funds | 28 | |

| Other affiliated issuers | 330,813 | |

| Foreign currency transactions | (485) | |

| Total net realized gain (loss) | | 7,974,239 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers (net of increase in deferred foreign taxes of $999) | 16,965,686 | |

| Fidelity Central Funds | (5) | |

| Other affiliated issuers | 975,045 | |

| Assets and liabilities in foreign currencies | 389 | |

| Total change in net unrealized appreciation (depreciation) | | 17,941,115 |

| Net gain (loss) | | 25,915,354 |

| Net increase (decrease) in net assets resulting from operations | | $25,728,125 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Amounts in thousands | Year ended November 30, 2020 | Year ended November 30, 2019 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $(187,229) | $(72,013) |

| Net realized gain (loss) | 7,974,239 | 4,402,258 |

| Change in net unrealized appreciation (depreciation) | 17,941,115 | 4,056,258 |

| Net increase (decrease) in net assets resulting from operations | 25,728,125 | 8,386,503 |

| Distributions to shareholders | (1,648,937) | (2,255,301) |

| Share transactions - net increase (decrease) | (5,730,222) | (3,581,880) |

| Total increase (decrease) in net assets | 18,348,966 | 2,549,322 |

| Net Assets | | |

| Beginning of period | 43,632,463 | 41,083,141 |

| End of period | $61,981,429 | $43,632,463 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Growth Company Fund

| Years ended November 30, | 2020 | 2019 | 2018 A | 2017 A | 2016 A |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $21.54 | $18.79 | $18.53 | $14.28 | $14.35 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)B | (.10) | (.04) | (.01)C | (.01) | .01 |

| Net realized and unrealized gain (loss) | 13.87 | 3.81 | 1.12 | 5.08 | .47 |

| Total from investment operations | 13.77 | 3.77 | 1.11 | 5.07 | .48 |

| Distributions from net investment income | – | – | – | (.01) | – |

| Distributions from net realized gain | (.82) | (1.02) | (.85) | (.81) | (.55) |

| Total distributions | (.82) | (1.02) | (.85) | (.82) | (.55) |

| Net asset value, end of period | $34.49 | $21.54 | $18.79 | $18.53 | $14.28 |

| Total ReturnD | 66.23% | 22.05% | 6.19% | 37.34% | 3.48% |

| Ratios to Average Net AssetsE,F | | | | | |

| Expenses before reductions | .83% | .83% | .85% | .85% | .77% |

| Expenses net of fee waivers, if any | .83% | .83% | .85% | .85% | .77% |

| Expenses net of all reductions | .83% | .83% | .85% | .85% | .77% |

| Net investment income (loss) | (.41)% | (.20)% | (.07)%C | (.04)% | .07% |

| Supplemental Data | | | | | |

| Net assets, end of period (in millions) | $43,533 | $28,861 | $25,615 | $25,256 | $21,114 |

| Portfolio turnover rateG | 18%H | 16%H | 18%H | 15%H | 19%H |

A Per share amounts have been adjusted to reflect the impact of the 10 for 1 share split that occurred on August 10, 2018.

B Calculated based on average shares outstanding during the period.

C Net investment income per share reflects one or more large, non-recurring dividend(s) which amounted to $.03 per share. Excluding such non-recurring dividend(s), the ratio of net investment income (loss) to average net assets would have been (.19) %.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

G Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

H Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Fidelity Growth Company Fund Class K

| Years ended November 30, | 2020 | 2019 | 2018 A | 2017 A | 2016 A |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $21.57 | $18.80 | $18.52 | $14.27 | $14.34 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)B | (.08) | (.02) | –C,D | .01 | .02 |

| Net realized and unrealized gain (loss) | 13.90 | 3.81 | 1.13 | 5.07 | .47 |

| Total from investment operations | 13.82 | 3.79 | 1.13 | 5.08 | .49 |

| Distributions from net investment income | – | – | –D | (.02) | (.01) |

| Distributions from net realized gain | (.82) | (1.02) | (.85) | (.81) | (.55) |

| Total distributions | (.82) | (1.02) | (.85) | (.83) | (.56) |

| Net asset value, end of period | $34.57 | $21.57 | $18.80 | $18.52 | $14.27 |

| Total ReturnE | 66.37% | 22.15% | 6.28% | 37.47% | 3.59% |

| Ratios to Average Net AssetsF,G | | | | | |

| Expenses before reductions | .75% | .75% | .76% | .75% | .66% |

| Expenses net of fee waivers, if any | .75% | .75% | .76% | .75% | .66% |

| Expenses net of all reductions | .75% | .75% | .76% | .75% | .66% |

| Net investment income (loss) | (.33)% | (.12)% | .02%C | .06% | .17% |

| Supplemental Data | | | | | |

| Net assets, end of period (in millions) | $18,449 | $14,772 | $15,468 | $16,416 | $14,739 |

| Portfolio turnover rateH | 18%I | 16%I | 18%I | 15%I | 19%I |

A Per share amounts have been adjusted to reflect the impact of the 10 for 1 share split that occurred on August 10, 2018.

B Calculated based on average shares outstanding during the period.

C Net investment income per share reflects one or more large, non-recurring dividend(s) which amounted to $.03 per share. Excluding such non-recurring dividend(s), the ratio of net investment income (loss) to average net assets would have been (.11) %.

D Amount represents less than $.005 per share.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

I Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended November 30, 2020

(Amounts in thousands except percentages)

1. Organization.

Fidelity Growth Company Fund (the Fund) is a fund of Fidelity Mt. Vernon Street Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Growth Company and Class K shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class.

Effective January 1, 2020:

Investment advisers Fidelity Investments Money Management, Inc., FMR Co., Inc., and Fidelity SelectCo, LLC, merged with and into Fidelity Management & Research Company. In connection with the merger transactions, the resulting, merged investment adviser was then redomiciled from Massachusetts to Delaware, changed its corporate structure from a corporation to a limited liability company, and changed its name to "Fidelity Management & Research Company LLC".

Fidelity Investments Institutional Operations Company, Inc. converted from a Massachusetts corporation to a Massachusetts LLC, and changed its name to "Fidelity Investments Institutional Operations Company LLC".

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date ranged from less than .005% to .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investment Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund: