QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant / / |

| Filed by a Party other than the Registrant / / |

Check the appropriate box: |

| / / | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| /x/ | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material Pursuant to §240.14a-12

|

ALCIDE CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| /x/ | | No fee required |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| / / | | Fee paid previously with preliminary materials. |

| / / | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Alcide Corporation

8561 154th Avenue, NE

Redmond, Washington 98052

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

October 16, 2001

To the Stockholders:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Alcide Corporation (the "Company") will be held at The University Club located at 1 West 54th Street, New York, NY on Tuesday, October 16, 2001 at 9:00 a.m. Eastern time.

- (1)

- To elect four directors of the Board of Directors for the ensuing year;

- (2)

- To consider and approve the Company's proposed 2001 Stock Incentive Plan;

- (3)

- To ratify the selection of Arthur Andersen LLP as the Company's independent auditors for the fiscal year ending May 31, 2002; and

- (4)

- To transact such other business as may properly come before the meeting or any adjournment thereof.

The Board of Directors has designated the close of business on August 31, 2001 as the record date for determination of stockholders of the Company entitled to notice of and to vote at the meeting and any adjournment thereof. The stock transfer books will not be closed. A list of stockholders entitled to vote at the meeting will be available for inspection at the meeting.

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. THE BOARD OF DIRECTORS EXTENDS A CORDIAL INVITATION TO ALL STOCKHOLDERS TO BE PRESENT AT THE MEETING. ALL STOCKHOLDERS, WHETHER OR NOT THEY EXPECT TO ATTEND THE MEETING, ARE REQUESTED TO FILL IN, DATE AND SIGN THE ENCLOSED PROXY AND MAIL IT IN THE RETURN ENVELOPE PROVIDED AS PROMPTLY AS POSSIBLE. STOCKHOLDERS WHO ATTEND THE MEETING MAY WITHDRAW THEIR PROXIES AND VOTE IN PERSON.

Redmond, Washington

August 31, 2001

ALCIDE CORPORATION

8561 154th Avenue, NE

Redmond, Washington 98052

PROXY STATEMENT

For Annual Meeting of Stockholders

October 16, 2001

The accompanying proxy is being solicited on behalf of the Board of Directors of ALCIDE CORPORATION (the "Company"), for use at the Annual Meeting of Stockholders to be held at The University Club located at 1 West 54th Street, New York, NY, on Tuesday, October 16, 2001 at 9:00 a.m. Eastern time and at any adjournment thereof. Each stockholder giving a proxy has the power to revoke the same by written notice to the Secretary of the Company at any time before it is voted. Furthermore, any stockholder giving a proxy may revoke the same prior to its use at the Annual Meeting by attending the meeting and voting in person. Subject to such revocation, properly executed proxies will be voted in the manner directed by such stockholder and, if no direction is made, will be voted in favor of Items 1, 2 and 3, described in this Proxy Statement. All expenses in connection with the solicitation will be borne by the Company. The Company will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses incurred in connection with forwarding proxies to beneficial owners of shares of the Company's Common Stock (the "Common Stock"). The Company has retained Computershare Trust Company, Inc. to assist in the solicitation at a cost that is not expected to exceed $10,000 plus reasonable out-of-pocket expenses.

This Proxy Statement and the accompanying form of proxy are being first mailed or given to the holders of the Company's Common Stock on or about August 31, 2001.

VOTING SECURITIES

Only stockholders of record at the close of business on August 31, 2001 will be entitled to notice of, and to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote. At the election of directors, each holder of Common Stock (the "Common Stockholder(s)") may cumulate such Common Stockholder's votes and give one nominee a number of votes equal to the number of directors to be elected multiplied by the number of votes to which the Common Stockholder's shares are entitled, or may distribute the Common Stockholder's votes on the same principle among as many nominees as the Common Stockholder sees fit.

A majority of the outstanding shares of Common Stock present in person or by proxy constitutes a quorum for the transaction of business at the Annual Meeting. Abstentions and broker nonvotes will be included in determining the presence of a quorum at the Annual Meeting. The four nominees who receive the greatest number of votes, present in person or by proxy at the Annual Meeting, will be elected directors. Abstentions from voting and broker nonvotes on the election of directors will have no impact on the outcome of this item since they have not been cast in favor of any nominee. The affirmative vote of holders of a majority of the shares of Common Stock, present in person or by proxy and entitled to vote at the Annual Meeting, is required to approve the 2001 Stock Incentive Plan and to ratify the selection of independent auditors. Abstention from voting on these matters will have the practical effect of voting against these proposals since shares are present at the meeting and entitled to vote but are not voting in favor of the proposals. Broker nonvotes will have no effect on the outcome of these proposals since they are not considered shares entitled to vote on the proposals. Broker nonvotes are shares held by a broker or nominee that are represented at the meeting, but with respect to which such broker or nominee is not empowered to vote on a particular proposal.

On August 1, 2001 there were 2,632,129 shares of Alcide Common Stock outstanding, net of Treasury Stock.

1

SHARE OWNERSHIP BY DIRECTORS, EXECUTIVE OFFICERS

AND CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information regarding the beneficial ownership, as of August 1, 2001, of the Common Stock by (a) each person known by the Board of Directors to beneficially own more than 5% of the outstanding Common Stock; (b) each director and nominee for director; (c) each of the executive officers included in the Summary Compensation Table, and (d) all directors and executive officers as a group. Each of the named persons has sole voting and investment power with respect to the shares shown, except as stated below.

| | COMMON STOCK

| |

|---|

Name

| | No. of Shares

Common Stock

| | Percentage of

Common Stock

| |

|---|

Thomas L. Kempner

Loeb Partners Corp.

61 Broadway, 24th Floor

New York, NY 10006 | | 480,143 | 1 | 18.2 | |

Joseph A. Sasenick |

|

126,812 |

2 |

4.8 |

|

John P. Richards |

|

100,674 |

3 |

3.8 |

|

G. Kere Kemp, BVSc, MRCVS |

|

35,079 |

4 |

1.3 |

|

William G. Spears |

|

13,885 |

5 |

.5 |

|

Kenneth N. May |

|

6,755 |

6 |

.2 |

|

James L. Winter |

|

0 |

|

0 |

|

Charles A. Baker |

|

0 |

|

0 |

|

|

|

|

|

|

|

| |

TOTAL |

|

728,208 |

7,8 |

28.8 |

7,8 |

|

|

|

|

|

|

- 1

- 201,946 shares of Common Stock are held by Loeb Investors Company V and 26,964 shares are held by Loeb Investors Company 105 for which entities Mr. Kempner serves as Managing Partner. 30,562 shares are held by Mr. Kempner individually. 206,373 shares are held in family trusts and other entities for which Mr. Kempner serves as either a trustee or has shared voting and dispositive power. Mr. Kempner disclaims any beneficial interest as to 280,024 shares of the above listed Common Stock.

Also includes 14,298 shares issuable upon exercise of stock options that are exercisable within 60 days following August 1, 2001. Of these, 1,448 options were granted to Mr. Kempner as director's fees and 13,150 options were granted to Loeb Partners Corporation for services rendered to the Company.

- 2

- Includes 50,000 shares issuable upon exercise of stock options that are exercisable within 60 days following August 1, 2001. Also includes 35,140 shares owned by the Alcide Corporation Employee Stock Ownership Plan, of which Mr. Sasenick is Joint Trustee with Mr. Richards. Mr. Sasenick disclaims any beneficial interest with respect to 26,024 of these shares.

- 3

- Includes 42,000 shares issuable upon exercise of stock options that are exercisable within 60 days following August 1, 2001. Also includes 35,140 shares owned by the Alcide Corporation Employee Stock Ownership Plan, of which Mr. Richards is Joint Trustee with Mr. Sasenick. Mr. Richards disclaims any beneficial interest with respect to 27,814 of these shares.

2

- 4

- Includes 30,834 shares issuable upon exercise of stock options that are exercisable within 60 days following August 1, 2001.

- 5

- Includes 8,117 shares issuable upon exercise of stock options that are exercisable within 60 days following August 1, 2001.

- 6

- Includes 3,000 shares issuable upon exercise of stock options that are exercisable within 60 days following August 1, 2001.

- 7

- Includes 148,249 shares issuable upon exercise of stock options that are exercisable within 60 days following August 1, 2001.

- 8

- The total does not equal the sum of the amounts listed above for directors and executive officers because Mr. Sasenick and Mr. Richards have joint voting power of the 35,140 shares owned by the Alcide ESOP, which shares have been listed under the totals for both Mr. Sasenick and Mr. Richards but are counted only once in the total.

COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") requires directors, certain of the Company's officers and persons who own more than 10% of a registered class of the Company's securities, to file reports of ownership and changes in ownership of Common Stock and other equity securities of the Company with the Securities and Exchange Commission (the "Commission"). Directors, officers, and greater than 10% stockholders are required by the Commission regulation to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on the Company's review of the copies of such reports it has received, or written representations from certain reporting persons that no forms were required for those persons, the Company believes that during the previous fiscal year all filing requirements applicable to its directors, certain officers, or greater than 10% beneficial owners were complied with by such persons.

3

ITEM 1—ELECTION OF DIRECTORS

The Board of Directors presently consists of four members, three of whom are up for re-election to serve until the next Annual Meeting of Stockholders or until their successors are elected and qualified. Dr. Kenneth May informed the Board on July 19, 2001 of his intention not to stand for re-election. It is intended that the proxies received will be voted, unless directed otherwise, for the four nominees indicated below. However, should any nominee become unavailable or prove unable to serve for any reason, proxies will be voted for the election of such other person or persons as the Board of Directors may select to replace such nominee. The Board has not been informed that any of the nominees will not be available or will be unable to serve.

Each person named as a nominee for director has advised the Company of his willingness to serve if elected. The age of each nominee as of June 1, 2001, his position with the Company, the year in which he first became a director of the Company, his business experience during the past five years and other directorships he holds are set forth below.

Thomas L. Kempner, 61 Broadway, New York, NY 10006

Age 74. Director of the Company since 1983. Chairman of the Board of Directors from 1990 until April, 2001; Chairman and Chief Executive Officer of Loeb Partners Corporation, a private investment banking firm, since 1979. Presently serves as a director on the following Boards: IGENE Biotechnology, Inc.; Roper Starch Worldwide, Inc.; Intermagnetics General; Northwest Airlines, Inc. (Emeritus); CCC Information Services Group, Inc.; Evercel, Inc.; Fuel Cell Energy, and Insight Communications Company, Inc.

Joseph A. Sasenick, 8561 154th Avenue, NE, Redmond, WA 98052

Age 61. Chairman of the Board of Directors and Chief Executive Officer of the Company since April, 2001; President and Chief Executive Officer of the Company from February, 1992 until April 2001; Director of the Company since 1991; President and Chief Operating Officer of the Company from February, 1991 to February 1992. Chief Executive Officer and Chairman of the Board of Alcide Food Safety, Inc. since January, 1999. Presently serves on the Board of Directors of the Washington Biotechnology and Biomedical Association, Genespan Corporation and the Technology Alliance, a special program of the Greater Seattle Chamber of Commerce. Previously held senior management positions at Abbott Laboratories and The Gillette Company.

William G. Spears, 45 Rockefeller Plaza, New York, NY 10111

Age 63. Director of the Company since 1989. Principal of Spears Grisanti & Brown LLC since July 1, 1999. Chairman of Key Asset Management, the investment advisory subsidiary of KeyCorp 1996 - 2001. Presently serves on the Board of Directors of United Health Group and Avatar Holdings, Inc. Also serves as Chairman, Quinnipiac University, Life Trustee, Choate Rosemary Hall and Life Trustee, HealthCare Chaplaincy.

Charles A. Baker, RD 2, Box 4830, Province Line Road, Princeton, NJ 08540.

Age 68. Served as Chairman, President and CEO of the Liposome Company, Inc., a biotechnology company developing and commercializing proprietary lipid-and liposome-based pharmaceuticals, from 1989 until September 2000. Previously served in a senior management capacity in various companies including tenures as Group Vice President, Squibb Corporation (now Bristol Myers Squibb) and President, Squibb International. Also held senior executive positions at Abbott Laboratories and Pfizer, Inc. Mr. Baker is currently a member of the Board of Directors of Regeneron Pharmaceuticals, Inc. and Progenics Pharmaceuticals, Inc., both biotechnology companies. He is a member of the council of visitors of the Marine Biological Laboratory at Woods Hole, MA, a not-for-profit organization.

The Board of Directors recommends a vote FOR the election of the director nominees.

4

MEETINGS OF THE BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

The Board of Directors met three times during the fiscal year ended May 31, 2001 and held one telephonic meeting. Mr. Sasenick, Mr. Kempner, Mr. Spears and Dr. May participated in all four meetings of the Board of Directors and the total number of meetings held by all committees of the Board of Directors on which they served.

The Company's Board of Directors has Audit and Compensation/Stock Option Committees. Pertinent information relating to each committee is as follows:

The Audit Committee recommends to the Board of Directors the selection of the Company's independent public accountants and reviews with such accountants the scope and results of their audit, the scope and results of the Company's internal audit procedures, and the adequacy of the Company's system of internal control. In addition, the Committee approves non-audit professional services performed by the Company's independent public accountants and reviews the fees for audit and non-audit services rendered to the Company by the independent public accountants. Audit Committee members during fiscal year 2001 were Thomas L. Kempner, Chairman, William G. Spears and Kenneth N. May. The Committee held a discussion at a Board of Directors meeting one time during the past fiscal year.

The Compensation/Stock Option Committee approves management contracts, changes in management compensation, management incentive awards and employee stock options. Committee members during fiscal year 2001 were Thomas L. Kempner, Chairman, and William G. Spears. The Committee met one time during the fiscal year.

REPORT OF THE AUDIT COMMITTEE

The members of the Audit Committee of the Board of Directors are independent as that term is defined in Rule 4200(a) (14) of the National Association of Securities Dealers Marketplace Rules. On July 18, 2000, the Audit Committee adopted a written Audit Committee charter, a copy of which is provided herewith as Exhibit A. The Audit Committee has reviewed and discussed the audited financial statements for fiscal year 2001 with the Company's management. In addition, the Audit Committee has discussed with the Company's independent public accountants, Arthur Andersen LLP, the matters required by Statement on Auditing Standards No. 61. The Audit Committee has received the written disclosures and the letter from Arthur Andersen LLP required by Independence Standards Board Standard No. 1 and has discussed, with Arthur Andersen LLP, their independence. The audit committee considered the compatibility of nonaudit services with the auditors' independence. Based on the discussions and reviews referenced above, the Audit Committee recommended to the Company's Board of Directors that the audited financial statements for fiscal year 2001 be included in the Company's Annual Report on Form 10-K for 2001.

Submitted by the Audit Committee of the Company's Board of Directors:

COMPENSATION OF DIRECTORS

For the fiscal year ended May 31, 2001, directors who do not have a consulting or an employment agreement with the Company received $1,000 cash compensation per Board meeting attended, a $6,000 cash retainer and a grant of stock options having an aggregate exercise price of $25,000. In the past fiscal year, this compensation applied to Mr. William G. Spears. It did not apply to Mr. Thomas L. Kempner or Dr. Kenneth N. May, each of whom has a consulting arrangement with the Company, or to Mr. Joseph A. Sasenick, who received salary as an officer of the Company.

5

EXECUTIVE COMPENSATION

The following table summarizes compensation earned in fiscal years ended May 31, 2001, 2000 and 1999 by the Chief Executive Officer and three other executive officers whose aggregate salary and bonus each exceeded $100,000 in the most recent fiscal year (the "Named Executive Officers").

Summary Compensation Table

| |

| | Fiscal Year Compensation

| |

|

|---|

| |

| | Long-Term

Compensation Awards

Number of Shares

Underlying Options (#)

|

|---|

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($) *

|

|---|

Joseph A.Sasenick

Chairman/

Chief Executive Officer | | 2001

2000

1999 | | 241,212

230,627

218,796 | | 110,554

112,513

170,000 | | 5,000

5,000

5,000 |

John P. Richards

President/

Chief Financial Officer |

|

2001

2000

1999 |

|

156,428

149,557

141,885 |

|

71,691

72,963

75,000 |

|

4,000

4,000

4,000 |

G. Kere Kemp

Executive Vice President/

Chief Scientific Officer |

|

2001

2000

1999 |

|

120,563

115,282

109,355 |

|

55,272

56,250

75,000 |

|

4,000

4,000

4,000 |

James L. Winter

Corporate Vice President/

General Manager—

Animal Health |

|

2001 |

|

36,384 |

1 |

0 |

|

0 |

- 1

- Mr. Winter joined the Company on February 1, 2001.

- *

- Fiscal year 2001 Bonus comprised of $12,107 in cash and the balance in common stock at an average per share price of $16.71.

6

Option Grants in the Last Fiscal Year

The following table summarizes the Named Executive Officers' stock option grants during fiscal year 2001.

| | Options Granted in Fiscal Year 2001

|

|---|

| | Individual Grants(1)

| | Potential Realizable Value

at Assumed Annual Rates of

Stock Price Appreciation

for Option Term(3)

|

|---|

| | Number of

Shares

Underlying

Options

| | Percent of

Total Options

Granted to

Employees(2)

| |

| |

|

|---|

Name

| | Exercise

Price

Per Share

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Joseph A. Sasenick | | 5,000 | | 11 | % | $ | 18.188 | | 2010 | | $ | 148,129 | | $ | 235,874 |

John P. Richards |

|

4,000 |

|

9 |

% |

$ |

18.188 |

|

2010 |

|

$ |

118,505 |

|

$ |

207,569 |

G. Kere Kemp |

|

4,000 |

|

9 |

% |

$ |

18.188 |

|

2010 |

|

$ |

118,505 |

|

$ |

207,569 |

James L. Winter |

|

5,000 |

|

11 |

% |

$ |

29.25 |

|

2010 |

|

$ |

238,225 |

|

|

379,334 |

- 1

- The options have terms of 10 years from the date of grant and become exercisable in equal annual installments over a period of five years. All options were granted with an exercise price equal to the fair market value of the Common Stock on the date of grant. Upon the occurrence of certain corporation transactions, the exercisability of the options may be accelerated.

- 2

- Based on an aggregate of 43,500 shares subject to options granted to employees during the fiscal year ended May 31, 2001.

- 3

- The dollar amounts under these columns are the result of calculations at the 5% and 10% rates required by applicable regulations of the Commission and, therefore, are not intended to forecast possible future appreciation, if any, of the Common Stock price. Actual gains, if any, on stock option exercises depend on the future performance of the Common Stock and overall stockmarket conditions, as well as the option holders' continued employment during the vesting period. The amounts reflected in this table may not necessarily be achieved.

Option Year-End Values Table

The following table provides information on option exercises during the last fiscal year by the Named Executive Officers and options outstanding at May 31, 2001.

| | Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

|

|---|

| |

| |

| | Number of Shares Covered

by Unexercised Options at

May 31, 2001 (#)

| | Value of Unexercised

In-the-Money Options

at May 31, 2001 ($)(2)

|

|---|

Name

| | Shares

Acquired on

Exercise (#)

| | Value

Realized

($)(1)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Joseph A. Sasenick | | 34,080 | | $ | 779,511 | | 45,000 | | 15,000 | | $ | 642,969 | | $ | 104,337 |

| John P. Richards | | 1,500 | | $ | 35,812 | | 43,000 | | 12,000 | | $ | 654,825 | | $ | 96,750 |

| G. Kere Kemp | | 0 | | $ | 0 | | 27,034 | | 11,800 | | $ | 357,890 | | $ | 95,250 |

| James L. Winter | | 0 | | $ | 0 | | 0 | | 0 | | $ | 0 | | $ | 0 |

- 1

- These amounts represent the aggregate number of options exercised, multiplied by the market price of the Common Stock at the time of exercise minus the exercise price for each option.

- 2

- These amounts are based on the difference between the applicable option exercise price and the closing price of a share of Common Stock as reported on the Nasdaq Stock Market on May 31, 2001 ($30.00).

7

REPORT OF THE COMPENSATION COMMITTEE

Compensation programs at Alcide Corporation are designed to attract, motivate and retain the executive talent needed to optimize stockholder value in a competitive environment. The programs support the goal of increasing stockholder value of the Company by achieving specific financial and strategic objectives.

Executive compensation programs are designed to provide:

- •

- levels of base compensation competitive with comparable health care companies;

- •

- annual incentive compensation that correlates with the financial performance of the Company; and

- •

- long-term incentive compensation that focuses executive efforts on building stockholder value through meeting long-term financial and strategic goals.

In designing and administering its executive compensation program, the Company attempts to strike an appropriate balance among these various elements, each of which is discussed in greater detail below.

Base Salary

Base salary programs are consistent with comparable companies. Alcide's salary increase program is designed to reflect individual performance consistent with the Company's overall financial performance as well as competitive practice. Annual performance reviews and formal merit increase guidelines determine individual salary increases.

The Management Incentive Plan

The Management Incentive Plan is designed to reward management-level employees for their contributions to corporate and individual results. Each eligible employee's award is expressed as a percentage of the participant's base salary for the plan year.

Individual performance is measured against objectives, which reflect what executives must accomplish in order for the Company to meet its annual operating plan and long-term growth plans. A participant's individual award may vary from zero to 100 percent. For fiscal year-end 2001 the Committee approved bonuses for three participating employees.

Stock Option Plan

The 1993 Stock Option Plan authorizes the granting of various stock-based incentive awards to key employees of the Company. The plan has been designed to:

- •

- link the executive's financial success to that of the stockholders;

- •

- encourage and create ownership and retention of the Company's stock;

- •

- balance long-term with short-term decision making; and

- •

- focus attention on building stockholder value through meeting long-term financial and strategic goals.

8

Committee Activities

The following summarizes the Committee's activities during the past fiscal year:

- •

- approved the Merit Increase Guidelines, which set salary grades, ranges and increases;

- •

- reviewed and determined salary increases for each corporate officer based on performance;

- •

- determined fiscal 2001 management incentive awards based on assessment of executive performance against approved goals; and

- •

- determined stock option awards to employees.

Compensation of the Chairman/Chief Executive Officer

The Chief Executive Officer received a salary increase of 5% effective September 1, 2000, and was awarded a bonus of $110,554 to be paid during fiscal year 2001 in the form of stock at an average price of $16.71 per share pursuant to the Management Incentive Plan. Mr. Sasenick was also awarded options to purchase 5,000 shares of the Company's Common Stock.

Compensation Committee Interlocks and Insider Participation

No member of the Company's Compensation Committee is an employee of the Company. Mr. Kempner is an outside director and Mr. Spears is an outside director. There are no Compensation Committee interlocks between the Company and other entities involving Alcide executive officers or Alcide Board members who serve as executives of other entities.

Compensation Committee

Thomas L. Kempner, Chairman

William G. Spears

9

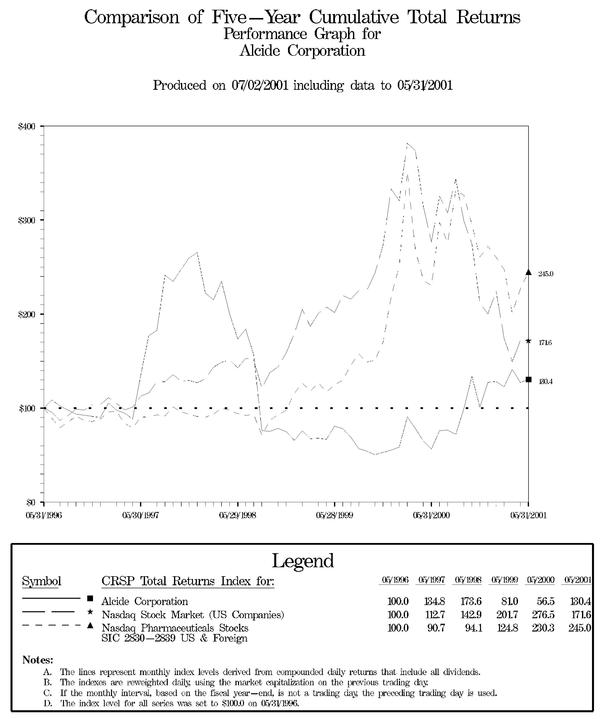

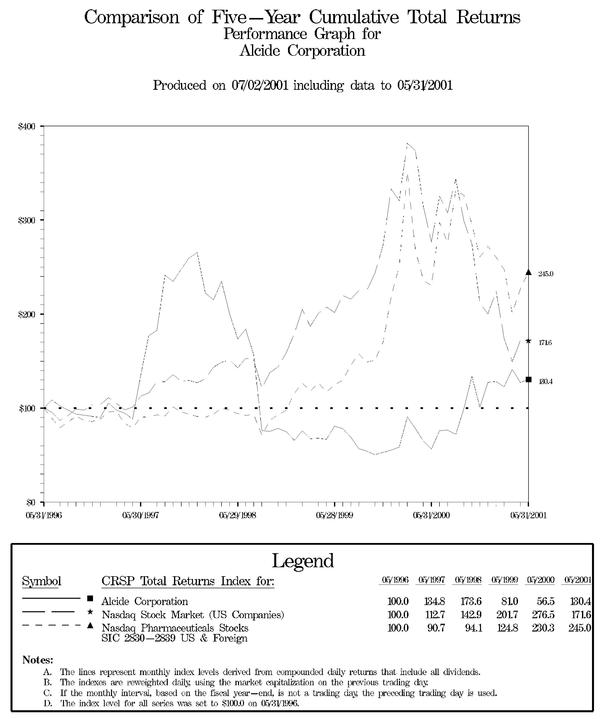

Stock Performance Graph

Set forth below is a line graph comparing the performance of the Company's Common Stock during the period May 31, 1996 through May 31, 2001 with the NASDAQ Stock Market Index for U.S. companies and the NASDAQ Stock Market Index for U.S. and foreign pharmaceutical stocks. The total return indices reflect reinvested dividends and are weighted on a market capitalization basis at the time of each reported data point. The stock price performance depicted in the performance graph shown below is not necessarily indicative of future price performance.

Prepared by CRSP (www.crsp.uchicago.edu), Center for Research in Security Prices, Graduate School of Business, The University of Chicago. Used with permission. All rights reserved. © Copyright 2001

10

EMPLOYMENT AGREEMENTS

JOSEPH A. SASENICK. Pursuant to an agreement entered into on February 4, 1991 and amended on February 4, 1992, February 4, 1993, February 4, 1994 and August 14, 1995, which can be terminated by the Company for cause and by Mr. Sasenick with 90-days' notice, Mr. Sasenick holds the position of Chairman of the Board and Chief Executive Officer, receiving a salary of $243,227 per annum. In addition to the base salary, bonus compensation of 100% of base salary can be earned. The awarding of such bonus shall be at the absolute and sole discretion of the Board of Directors.

JOHN P. RICHARDS. Pursuant to an agreement entered into on July 29, 1991 and revised January 1, 1993, January 1, 1994 and August 14, 1995, which will expire at the option of either party provided reasonable notice is given, Mr. Richards receives a salary of $157,728 per annum. In addition to base salary, bonus compensation of 100% of base salary can be earned. The awarding of such bonus is dependent on a level of corporate profitability and individual performance.

G. KERE KEMP. Pursuant to a letter agreement entered into on March 1, 1998, which will expire at the option of either party provided reasonable notice is given, Dr. Kemp receives a salary of $121,551 per annum. In addition to base salary, bonus compensation of 100% of base salary can be earned. The awarding of such bonus is dependent on a level of corporate profitability and individual performance.

JAMES L. WINTER. Pursuant to a letter agreement entered into on February 1, 2001, which will expire at the option of either party provided reasonable notice is given, Mr. Winter receives a salary of $110,000 per annum. In addition to base salary, bonus compensation of 100% of base salary can be earned. The awarding of such bonus is dependent on a level of corporate profitability and individual performance.

CERTAIN TRANSACTIONS

Consulting Agreements

LOEB PARTNERS CORPORATION. During the fiscal year ended May 31, 2001, the Company paid Loeb Partners Corporation $60,000 in cash for executive and management services provided by Mr. Kempner and Mr. Norman N. Mintz. Mr. Kempner holds approximately 51% of the voting equity of Loeb Holding Corporation, of which Loeb Partners is a 100% wholly-owned operating subsidiary.

The Company believes that the terms of its consulting agreement with Loeb are at least as favorable to the Company as could have been provided by unaffiliated third parties. The consulting agreement provides the Company with the sole option of paying Loeb either in cash or in stock options for executive services. Additionally, whenever an issue arose which, in the opinion of a majority of disinterested members of the Board of Directors, presented a potential conflict of interest between Loeb and the Company, Mr. Kempner abstained from voting on such issue.

KENNETH N. MAY. During the fiscal year ending May 31, 2001, Dr. May earned $36,000 for consulting services in the field of pathogen control on poultry and other food products.

The Company believes that the terms of its consulting agreement with Dr. May are at least as favorable to the Company as could have been provided by unaffiliated third parties.

ITEM 2—PROPOSAL TO APPROVE THE 2001 STOCK INCENTIVE PLAN

The Board adopted, subject to stockholder approval, the 2001 Stock Incentive Plan (the "2001 Plan") on July 19, 2001. When approved by stockholders, the 2001 Plan will replace the 1993 Alcide Stock Option Plan (the "1993 Plan"). The Board believes the 2001 Plan will help the Company attract

11

and retain the services of eligible individuals and provide added incentive to them by encouraging them to acquire and maintain stock ownership in the Company. The following description of the 2001 Plan is qualified in its entirety by reference to the complete text which is available at the Company's offices at 8561 154thAvenue NE, Redmond, Washington 98052.

Summary of the 2001 Plan

Purpose. The 2001 Plan is an employee benefit program that allows participants to buy or receive shares of Common Stock of the Company. The purpose of the 2001 Plan is to enhance the long-term stockholder value of the Company by offering opportunities to selected individuals to participate in the Company's growth and success. The 2001 Plan's purpose is also to attract and retain participants' services and to encourage them to acquire and maintain ownership in the Company.

Administration. The 2001 Plan is administered by the entire Board of Directors or a committee designated by the Board. The plan administrator has the full and exclusive power to interpret the 2001 Plan and to establish the rules for its operation, including the power to select the individuals to be granted awards and to determine the form, amount and other terms and conditions of such awards.

Types of Awards. The 2001 Plan permits the grant of both stock options and awards of Common Stock, which may or may not be subject to certain restrictions.

Eligibility. Awards under the 2001 Plan may be granted to employees, directors, officers, consultants, agents, advisors and independent contractors of the Company or a related company. Incentive stock options may only be granted to employees.

Shares Reserved. A total of 275,000 shares of Common Stock are available for issuance under the 2001 Plan. In addition, (a) any authorized shares not issued or subject to outstanding options under the 1993 Plan as of the date the Board adopted the 2001 Plan plus (b) any shares subject to outstanding options under the 1993 Plan that cease to be subject to such options (other than by reason of exercise of the options), up to an aggregate maximum of 50,000 shares, will cease to be available for grant and issuance under the 1993 Plan, but will then be available for issuance under the 2001 Plan. No more than 27,000 shares may be subject to options and stock awards granted to any one individual in a single year, to the extent such limitations are required for compliance with Section 162(m) of the Internal Revenue Code (the "Code"). Any shares of Common Stock that have been made subject to an award that cease to be subject to the award (other than by reason of exercise or payment of the award to the extent it is exercised for or settled in shares) may be issued in connection with future awards under the 2001 Plan.

Stock Options. Options granted under the 2001 Plan may be either incentive stock options under the federal tax laws or nonqualified stock options. The plan administrator has the authority to determine the following:

- •

- the terms and conditions of each option granted;

- •

- the exercise price;

- •

- the vesting provisions; and

- •

- the option term.

For incentive stock options, the exercise price must be at least equal to the fair market value of the Company's Common Stock on the date of grant (and not less than 110% of fair market value for holders of over ten percent of the Company's voting stock). The exercise price for nonqualified stock options must be at least 85% of the fair market value of the Common Stock on the date of grant. Fair market value is the closing sales price for the Common Stock as reported by the Nasdaq National

12

Market on a single trading day. On August 1, 2001, the closing sales price of a share of Common Stock was $33.04.

The option exercise price may be paid by any form of consideration acceptable to the plan administrator, which may include payment by cash or check, by tendering shares of Common Stock that the holder has owned for at least six months or by a broker-assisted cashless exercise. Except for terminations by reason of disability or death, the unvested portion of an option will terminate automatically upon an optionee's termination of employment or services with the Company. If an optionee terminates employment or services due to disability or death, the option will automatically become fully vested and exercisable. Unless otherwise provided by the plan administrator, and to the extent permitted by law for incentive stock options, the vested portion of options generally will expire on the earliest of:

- •

- ten years from the date of grant (five years for holders of over 10% of the Company's voting stock);

- •

- one year after the optionee's retirement, death or disability;

- •

- immediately upon notice to the optionee of termination for cause; and

- •

- three months after other terminations.

Stock Awards. The plan administrator is authorized under the 2001 Plan to issue shares of Common Stock to eligible participants with terms, conditions and restrictions established by the plan administrator in its sole discretion. Restrictions may be based on continuous service with the Company or the achievement of performance goals and may also include repurchase or forfeiture rights in favor of the Company. Holders of restricted stock are stockholders of the Company and have, subject to established restrictions, all the rights of stockholders with respect to such shares.

Transferability. Except as otherwise determined by the plan administrator and to the extent permitted by Section 422 of the Code, options or stock awards are not assignable or otherwise transferable by the holder other than by will or the laws of descent and distribution and, during the holder's lifetime, may be exercised only by the holder.

Adjustments. The plan administrator will make proportional adjustments to the aggregate number of shares issuable under the 2001 Plan and to outstanding awards in the event of stock splits or other capital adjustments.

Corporate Transactions. Unless individual letter agreements provide otherwise, in the event of certain corporate transactions, such as a merger or sale of the Company's securities or assets, each outstanding option under the 2001 Plan may be assumed or an equivalent option substituted by a successor company. If the successor company does not assume or provide an equivalent substitute for the options, outstanding options will automatically accelerate and become 100% vested and exercisable immediately before the corporate transaction and, to the extent such options are not exercised, they will terminate.

Term, Amendment and Termination. The 2001 Plan will terminate on July 18, 2011, except with respect to awards then outstanding, and no grants may be made under the 2001 Plan after that date. The 2001 Plan may be modified, amended, or terminated by the Board at any time, except that an amendment or modification will not affect previously granted awards without a participant's consent. Stockholder approval is required for any amendment that increases the number of shares under the 2001 Plan, changes the class of employees eligible to receive options, or otherwise requires stockholder approval under any applicable law or regulation.

13

Federal Income Tax Consequences

The material U.S. Federal income tax consequences to the Company and to any person granted an award under the 2001 Plan who is subject to taxation in the United States under existing applicable provisions of the Code and underlying Treasury regulations are substantially as follows. The following summary does not address state, local or foreign tax consequences and is based on present law and regulations as in effect on the date of this Proxy Statement.

Nonqualified Stock Options. A participant receiving a nonqualified stock option does not recognize taxable income upon the grant of the option, and the Company will not be entitled to a deduction for federal income tax purposes at that time. Upon the exercise of a nonqualified stock option, ordinary income generally will be recognized by the optionee in an amount equal to the excess of the fair market value of the shares acquired over the exercise price. Upon the subsequent disposition of shares acquired by the exercise of a nonqualified stock option, any gain or loss will be long-term or short-term capital gain or loss depending on whether the optionee has held the shares for more than twelve months.

If an optionee exercises a nonqualified stock option by delivering previously acquired Common Stock of the Company as part or all of the payment of the exercise price, no gain or loss will be recognized by the optionee with respect to the shares delivered to the Company. The optionee's tax basis in the same number of new shares received in exchange for the number of shares surrendered will be the same as the optionee's basis in the surrendered shares, and the optionee's holding period in such shares for purposes of determining long-term or short-term capital gain will include the holding period for the shares surrendered. Any new shares received by the optionee in excess of the number of shares surrendered will result in the recognition of ordinary income in an amount equal to the fair market value of such excess shares on the date such shares are transferred. The optionee's basis in such excess shares will be equal to the sum of the ordinary income recognized and any cash paid as part of the exercise price, apportioned pro rata among the excess shares, and the holding period for such shares will begin on the date such shares are transferred.

Incentive Stock Options. A participant granted an incentive stock option (an "ISO") does not recognize regular taxable income at the time the option is granted or, in general, at the time the option is exercised if the option is exercised either while the participant is an employee of the Company or within three months (one year in the case of death or permanent disability) thereafter. The excess of the fair market value of the shares on the date the option is exercised over the exercise price may, however, be an item of tax preference for purposes of the alternative minimum tax provisions.

Provided the optionee does not dispose of the shares acquired upon exercise of an ISO during the "statutory holding period," any gain or loss upon disposition of the shares will be long-term capital gain or loss. The statutory holding period is two years from date the ISO is granted and one year from the date the shares are transferred to the optionee pursuant to the exercise of such option.

If the optionee disposes of the acquired stock or applies it to the exercise of another ISO without complying with the statutory holding period requirements described above (a "Disqualifying Disposition"), the optionee will generally recognize ordinary income in the year of the Disqualifying Disposition in an amount equal to the difference, if any, between (i) the fair market value of the stock on the date of exercise and (ii) the exercise price. Any remaining gain is treated as a long-term or short-term capital gain depending on whether the shares have been held for more than twelve months. If the optionee disposes of the stock in a Disqualifying Disposition for less than its fair market value on the date the option was exercised, then generally only the amount of the difference between the amount realized and the exercise price is treated as ordinary income.

Under proposed Treasury regulations, if an ISO is exercised by delivering previously acquired Common Stock as part or all of the payment of the exercise price, no gain or loss will be recognized

14

with respect to the shares delivered to the Company. The optionee's tax basis in the same number of new shares received in exchange for the number of shares surrendered will be the same as such optionee's basis in the surrendered shares increased, if applicable, by any amount included in the optionee's gross income as compensation pursuant to either Sections 421 through 425 or Section 83 of the Code. The optionee's holding period in the same number of new shares received in exchange for the number of shares surrendered will include the holding period for the shares surrendered. Any new shares received by the optionee in excess of the number of shares surrendered will have a zero basis and a holding period beginning on the date such shares are transferred to the optionee. Any disposition of any of the shares received upon exercise of an ISO involving delivery of Common Stock as part or all of the payment therefore prior to satisfying the statutory holding period requirements described above will be considered to be a Disqualifying Disposition of the shares so received with the lowest basis.

Stock Awards. Depending on the terms of the stock award, taxable ordinary income may or may not be recognized by the participant upon the grant of the award.

For stock awards subject to vesting and similar restrictions, the participant will recognize ordinary income when the shares cease to be subject to the restrictions in an amount equal to the excess of the fair market value of the shares at that time over the amount paid for the shares. Alternatively, the participant may elect, under Section 83(b) of the Code, to recognize ordinary income at the time of the transfer in an amount equal to the excess of the fair market value of the shares at that time over the amount paid for the shares. In that case, no additional income is recognized upon the lapse of restrictions on the shares, but if the shares are subsequently forfeited, the participant may not deduct the income recognized at the time of receipt of the shares, and the participant will have a capital loss equal to the amount paid for the shares. For stock awards that are not subject to restrictions, other than restrictions on transfer, the participant generally recognizes ordinary income at the time of receipt. The holding period for the shares begins at the time income is recognized, and the tax basis in the shares is the amount of ordinary income so recognized plus the amount, if any, paid for the shares.

Company Deduction. In all the foregoing cases the Company will be entitled to a deduction at the same time and in the same amount as the participant recognizes in ordinary income, subject to certain limitations. Among these limitations is Section 162(m) of the Code, under which certain compensation payments in excess of $1 million are not deductible by the Company. This limitation on deductibility applies with respect to that portion of a compensation payment for a taxable year in excess of $1 million paid to either the Company's chief executive officer or any one of the other four most highly compensated executive officers. Certain performance-based compensation is not subject to the limitation on deductibility. The 2001 Plan has been drafted to allow compliance with those performance-based criteria.

Special Rules for Awards Granted to Insiders. Participants who are subject to U.S. federal insider trading laws or similar transfer restrictions should consult their tax advisors regarding the effect of those restrictions on the amount and the timing of income to be recognized in connection with such awards.

The Board of Directors recommends a vote FOR the 2001 Stock Incentive Plan.

15

ITEM 3—RATIFICATION OF SELECTION OF ALCIDE AUDITORS

The Board of Directors, upon the recommendation of the Company's Audit Committee, has appointed Arthur Andersen LLP as the Company's certified independent public accountants for the 2002 fiscal year. It is not expected that a representative from Arthur Andersen LLP will attend the Annual Meeting.

The Board of Directors recommends a vote FOR the ratification of the selection of the auditors.

AUDIT AND RELATED FEES

Audit Fees: The aggregate fees billed by Arthur Andersen LLP for the audit of the Company's annual financial statements for the fiscal year ended May 31, 2001, and for the reviews of the financial statements included in the Company's Quarterly Reports on form 10-Q for that fiscal year were $55,000.

Financial Information Systems Design and Implementation Fees: There were no fees billed by Arthur Andersen LLP for professional services rendered for information technology services relating to financial information systems design and implementation for the fiscal year ended May 31, 2001.

All Other Fees: The aggregate fees billed by Arthur Andersen LLP for services rendered to the Company, other than the services described above, for the fiscal year ended May 31, 2001 were $11,934.

ANNUAL REPORT

The annual report of the Company for the fiscal year ended May 31, 2001 including audited financial statements and all other information required to be included in the Company's annual report on Form 10-K, are being mailed concurrently to stockholders of record.

ITEM 4—OTHER MATTERS

The Board of Directors does not know of any business which will be presented at the meeting other than those matters set forth in the accompanying Notice of the Annual Meeting of Stockholders. If any other matters are properly presented at the meeting for action, it is intended that the persons named in the accompanying form of proxy and acting thereunder will vote in accordance with their best judgment on such matters.

STOCKHOLDER PROPOSALS

The 2002 Annual Meeting of Stockholders is presently scheduled to be held on October 16, 2002. Under rules promulgated by the Securities and Exchange Commission, stockholders who desire to submit proposals for inclusion in the Company's Proxy Statement of the Board of Directors to be utilized in connection with the 2002 Annual Meeting of Stockholders must submit such proposals to the Secretary of the Company no later than May 3, 2002. Alternatively, pursuant to the Commission rules that became effective on June 29, 1998, if the Company receives notice of stockholder proposals after July 17, 2002, then the persons named as proxies in such Proxy Statement and proxy will have discretionary authority to vote on such stockholder proposals, without discussion of the matters in the Proxy Statement and without such proposals appearing as separate items on the proxy card. Stockholder proposals should be directed to the Company's secretary, at the address of the Company set forth on the first page of this Proxy Statement.

16

EXHIBIT A

Audit Committee Charter

- 1.

- The Audit Committee of the Board of Directors of Alcide Corporation shall consist of 3 outside directors, each director being financially literate and having a familiarity with financial controls exercised in publicly owned companies.

- 2.

- The Committee shall be responsible for selecting the Company's outside auditor. Such selection shall be submitted to shareholders for approval as part of the Company's annual proxy. The outside auditor is ultimately accountable to the Board of Directors and the Audit Committee as representatives of the shareholders and consequently the committee has the ultimate authority and responsibility to select, evaluate and where appropriate, recommend replacement of the outside auditor to shareholders.

- 3.

- The Audit Committee is responsible for insuring its receipt from the outside auditors of a formal, written statement delineating all relationships between the auditor and the Company consistent with Independent Standards Board Standard #1. The Audit Committee is also responsible for actively engaging in a dialogue with the auditor with respect to any disclosed relationships or services that may impact the objectivity and independence of the auditor and for taking or recommending that the full Board take appropriate action to insure the independence of the outside auditor.

- 4.

- The Committee shall require that the Company's outside auditors discuss with the Audit Committee the quality, not just the acceptability, of the Company's accounting principles as applied in the financial reporting. The discussions should include such issues as the clarity of the Company's financial disclosures and the degree of aggressiveness or conservatism of the Company's accounting principles and underlying estimates and other significant decisions made by management in preparation of the financial disclosure as reviewed by the outside auditors.

- 5.

- The Committee shall prepare a letter for incorporation in the Company's annual report/form 10-K disclosing whether or not with respect to the prior fiscal year:

- a)

- Management has reviewed the audited financial statements with the Audit Committee including a discussion of the quality of the accounting principles as applied and significant judgments affecting the Company's financial statements.

- b)

- The outside auditors have discussed with the Audit Committee the outside auditors judgments of the quality of those principles as applied and judgments referenced in (a) above.

- c)

- The members of the Audit Committee have discussed among themselves without management or the outside auditors present, the information disclosed in the Audit Committee reviews described in (a) and (b) above.

- d)

- The Audit Committee, in reliance on the review and discussions conducted with management and the outside auditors pursuant to (a) and (b) above, believes that the Company's financial statements are fairly presented in conformity with generally accepted accounting principles in all material respects.

- 6.

- The Audit Committee shall oversee and be familiar with management's processes for identifying, sourcing and measuring business risks as well as management's overall business risk management process.

17

PROXY

ALCIDE CORPORATION

8561 154th Avenue NE, Redmond, WA 98052

This Proxy is Solicited on Behalf of the Board of Directors

for the Annual Meeting of the Stockholders, October 16, 2001

The undersigned hereby appoints John P. Richards and Norman N. Mintz as proxies each with power of substitution in each of them, to vote for and on behalf of the undersigned at the Annual Meeting of the Stockholders of the Company to be held on October 16, 2001, and at any adjournment thereof, upon matters properly coming before the meeting, as set forth in the related Notice of Meeting and Proxy Statement, which has been received by the undersigned. Without otherwise limiting the general authorization given hereby, said proxies are instructed to vote as follows:

1. Election of the Board's nominees for Directors.

(The Board of Directors recommends a vote "FOR")

/ / FOR all nominees listed below (except as marked to the contrary below) / / WITHHOLD AUTHORITY to vote for all nominees listed below

| |

|

|---|

| Nominees: | | Thomas L. Kempner, Joseph A. Sasenick, William G. Spears and Charles A. Baker |

|

|

|

| INSTRUCTION: | | To withhold authority to vote for any individual nominee listed above, write that nominee's name in the space provided below. |

|

|

|

| | |

|

| | | {Continued and to be dated and signed on reverse side.} |

2. Approval of the 2001 Stock Incentive Plan

| |

| |

|

|---|

| (The Board of Directors recommends a vote "FOR") |

| FOR / / | | AGAINST / / | | ABSTAIN / / |

3. Ratification of the selection of Arthur Andersen LLP as the independent auditors of the Company for the fiscal year ending May 31, 2002.

| |

| |

|

|---|

| (The Board of Directors recommends a vote "FOR") |

| FOR / / | | AGAINST / / | | ABSTAIN / / |

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting.

This proxy when properly executed will be voted in the manner directed herein by the undersigned holder.

If no direction is made, the proxy will be voted for Proposals 1, 2, and 3.

Please sign exactly as name appears below. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by authorized person.

|

|

|

|

|

|

|

|

|

|

|

| | | | | | |

Signature |

|

|

|

|

|

|

|

|

|

|

|

| | | | | | |

Signature if held jointly |

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | Dated: | | | | , 2001 |

| | | | | | | | |

| | |

| | | | | | | | | | | |

| | | | | | | PLEASE MARK, SIGN, DATE, AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE

|

QuickLinks

VOTING SECURITIESSHARE OWNERSHIP BY DIRECTORS, EXECUTIVE OFFICERS AND CERTAIN BENEFICIAL OWNERSCOMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACTITEM 1—ELECTION OF DIRECTORSMEETINGS OF THE BOARD OF DIRECTORS AND COMMITTEES OF THE BOARDREPORT OF THE AUDIT COMMITTEECOMPENSATION OF DIRECTORSEXECUTIVE COMPENSATIONSummary Compensation TableREPORT OF THE COMPENSATION COMMITTEEStock Performance GraphEMPLOYMENT AGREEMENTSCERTAIN TRANSACTIONS Consulting AgreementsITEM 2—PROPOSAL TO APPROVE THE 2001 STOCK INCENTIVE PLANSummary of the 2001 PlanFederal Income Tax ConsequencesITEM 3—RATIFICATION OF SELECTION OF ALCIDE AUDITORSAUDIT AND RELATED FEESANNUAL REPORTITEM 4—OTHER MATTERSSTOCKHOLDER PROPOSALSEXHIBIT A Audit Committee Charter