Bank of America and its management may make certain statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “anticipates,” “targets,” “expects,” “hopes,” “estimates,” “intends,” “plans,” “goals,” “believes,” “continue” and other similar expressions or future or conditional verbs such as “will,” “should,” “would” and “could.” The forward-looking statements made represent Bank of America's current expectations, plans or forecasts of its future results and revenues, the company's focus in 2012 to continue to build capital, grow core business, reduce costs and reduce residual risks; streamline the balance sheet and deliver earnings growth; continued addition of wealth management advisors and small business bankers; that advisor growth will be muted in 2012; continued reductions in the size of the company’s mortgage servicing portfolio; the implementation and completion of, and expected impact from, Project New BAC; the persistence of “headwinds” of global economies, an adverse housing market, low interest rates, substantial regulatory challenges and the Eurozone debt crisis; continued generation of strong core customer results, more customers and more depth in customer relationships, along with good returns on capital; the substantial completion of the non-core asset sales, although there will be targeted sales activity in certain areas; the approximately $189 billion in additional liquidity that is available to the company’s banking entities via pledging assets to the home loan banks and the Federal Reserve discount window; liquidity will remain high in 2012 even as we continue to reduce long-term debt; the need to replace only a small portion of parent company debt maturities; target of zero issuance of parent company and broker/dealer short-term unsecured funding; that risk management efforts will continue to produce solid improvement, including credit risk as legacy portfolios continue to run-off and a reduction in the negative earnings; continued management of mortgage issues and reliance on reserves built in 2011; 2012 outlook, including the following: efficiency improvements; headcount levels, including expecting the impact of reduced headcount levels in the first quarter of 2012; the first quarter will include the annual retirement eligible stock compensation; net interest income compression from replacement of higher-yielding maturing assets, offset with continued reductions in long-term debt; net interest income expected to be muted and highly dependent on the rate environment; parent company unsecured debt issuances in the single digit billions; continued consumer loan run-off, which should be partially offset by loan growth in our commercial businesses; lower levels of long-term debt, including reductions of an additional $50-$100 billion by the end of 2013; the correlation of revenue with economic growth, including consumer noninterest revenue lines; market-related revenue of investment banking, sales and trading, and investment and brokerage is expected to be dependent on market environment; that investment banking is expected to be more consistent with activity last year; the company hopes to see better results in sales and trading but that is dependent on global conditions and health of the recovery; the decline in equity investment income; that expense will benefit from Project New BAC savings and expected lower legacy mortgage-related costs; continued reductions in bank branches; that Legacy Asset Servicing costs are expected to decline over the four quarters of 2012; that Project New BAC will generate $5 billion in annual savings by 2014 and that the company will exceed the $1 billion cost saving goal expected to be achieved in 2012; the Phase 2 lower cost savings; that lower head count and Project New BAC, along with an improving mortgage environment are expected to result in substantial costs savings in the second half of 2012; that we will continue to make progress in reducing delinquent serviced loans as modifications, foreclosures and short sales outpace new entrants; that improvement in charge-offs is expected to slow but continue to improve; our belief that credit quality (including charge-offs) will continue to improve over the next few quarters, although at a slowing pace; slowing reserve releases; continued capital and capital ratio growth primarily through earnings and, to a lesser extent, lower risk-weighted assets throughout 2012; that we expect the effective tax rate to be around 30 percent; Basel III expectations to be between 7.25% and 7.5% on fully phased-in basis and above 8% on a reported basis by the end of 2012; that the company continues to work very hard to prepare itself for the new Basel capital requirements; continued reductions in risk-weighted assets, including a December 31, 2012 goal of $1.75 trillion, and other deductions from capital; that additional risk-weighted asset mitigation efforts will continue after 2012; the estimated range of possible loss for non-GSE representations and warranties exposure; representations and warranties reserves, expenses and repurchase activity; and other similar matters. These statements are not guarantees of future results or performance and involve certain risks, uncertainties and assumptions that are difficult to predict and are often beyond Bank of America's control. Actual outcomes and results may differ materially from those expressed in, or implied by, any of these forward-looking statements. You should not place undue reliance on any forward-looking statement and should consider all of the following uncertainties and risks, as well as those more fully discussed under Item 1A. “Risk Factors” of Bank of America's 2010 Annual Report on Form 10-K and Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2011 and in any of Bank of America's subsequent SEC filings: the company's ability to implement, manage and realize the anticipated benefits and expense savings from Project New BAC; the company's timing and determinations regarding any potential revised comprehensive capital plan submission and the Federal Reserve Board's response; the impact and ultimate resolution of the private-label securitization settlement (the settlement) with the Bank of New York Mellon (BNY Mellon) and of any additional claims not addressed by the BNY Mellon settlement or other prior settlement agreements; the company's ability to resolve any representations and warranties claims from GSEs, monolines and private investors; increased repurchase claims and repurchases due to mortgage insurance cancellations, rescissions and denials; the company's failure to satisfy its obligations as servicer in the residential mortgage securitization process; the foreclosure review and assessment process, the effectiveness of the company's response to such process and any governmental or private third-party claims asserted in connection with these foreclosure matters; the ability to achieve resolution in negotiations with law enforcement authorities and federal agencies, including the U.S. Department of Justice and the U.S. Department of Housing and Urban Development, involving mortgage servicing practices, including the timing and any settlement terms; the company's mortgage modification policies, loss mitigation strategies and related results; and any measures or steps taken by federal regulators or other governmental authorities with regard to mortgage loans, servicing agreements and standards, or other matters; the risk of any additional credit ratings downgrades of the U.S. government; the company's credit ratings and the credit ratings of its securitizations, including the risk that the company or its securities will be the subject of additional or further credit ratings downgrades; the impact resulting from international and domestic sovereign credit uncertainties, including the current challenges facing European economies; the level and volatility of the capital markets, interest rates, currency values and other market indices; changes in consumer, investor and counterparty confidence in, and the related impact on, financial markets and institutions, including the company as well as its business partners; legislative and regulatory actions in the U.S and internationally, including the identification and effectiveness of any initiatives to mitigate the negative impacts; the impact of litigation and regulatory investigations, including costs, expenses, settlements and judgments as well as any collateral effects on its ability to do business and access the capital markets; negative economic conditions generally including continued weakness in the U.S. housing market, high unemployment in the U.S., as well as economic challenges in many non-U.S. countries in which we operate; various monetary, tax and fiscal policies of the U.S. and non-U.S. governments. Forward-looking statements speak only as of the date they are made, and Bank of America undertakes no obligation to update any forward-looking statement to reflect the impact of circumstances or events that arise after the date the forward-looking statement was made. Forward-Looking Statements

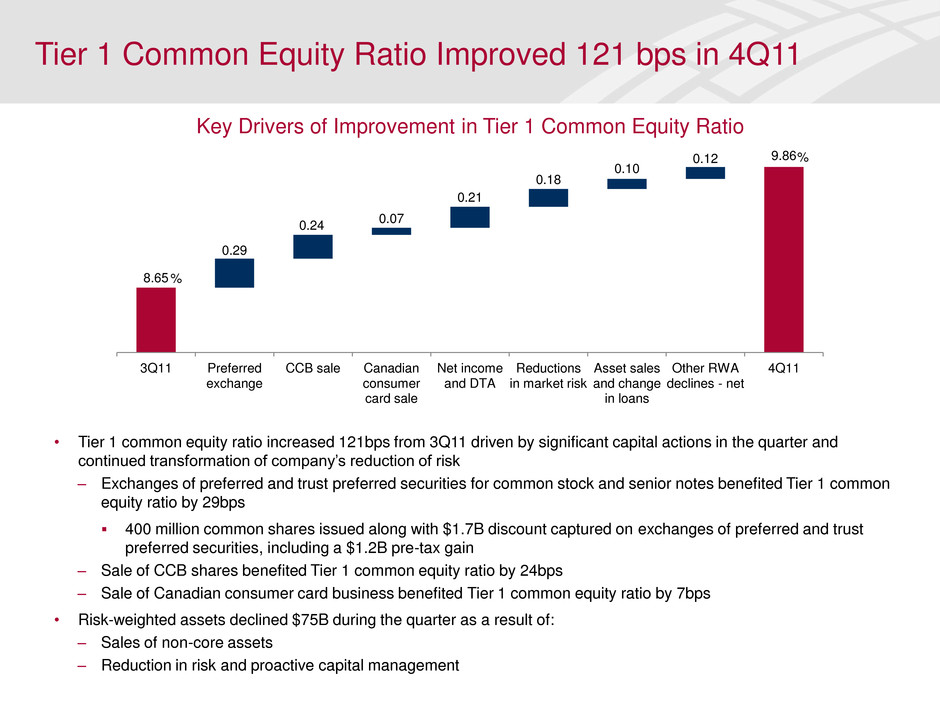

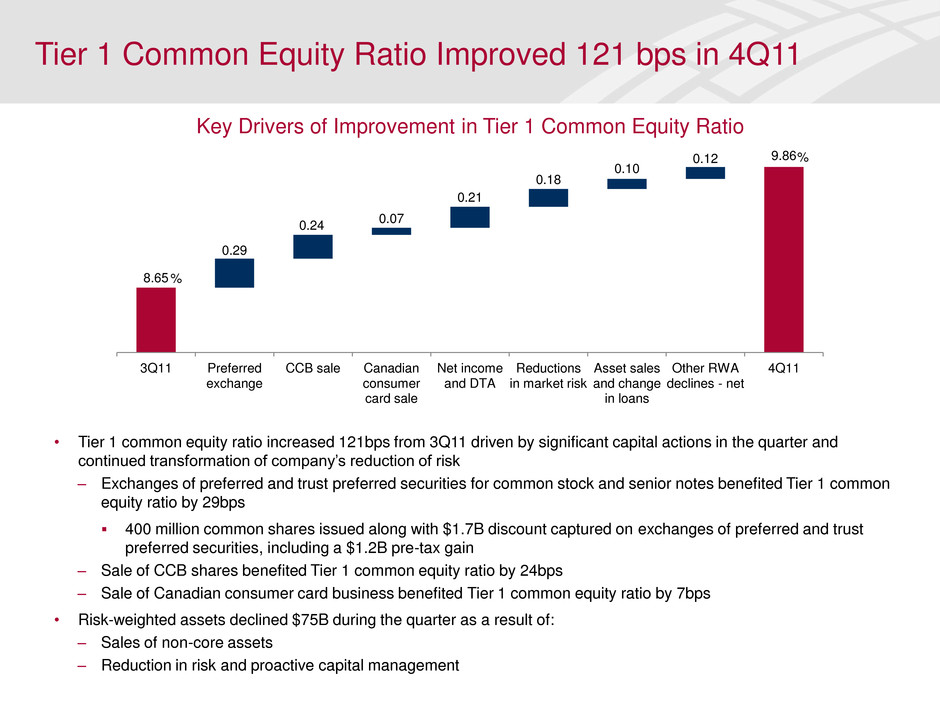

Tier 1 Common Equity Ratio Improved 121 bps in 4Q11 8.65 9.86 0.29 0.24 0.07 0.21 0.18 0.10 0.12 3Q11 Preferred exchange CCB sale Canadian consumer card sale Net income and DTA Reductions in market risk Asset sales and change in loans Other RWA declines - net 4Q11 • Tier 1 common equity ratio increased 121bps from 3Q11 driven by significant capital actions in the quarter and continued transformation of company’s reduction of risk – Exchanges of preferred and trust preferred securities for common stock and senior notes benefited Tier 1 common equity ratio by 29bps 400 million common shares issued along with $1.7B discount captured on exchanges of preferred and trust preferred securities, including a $1.2B pre-tax gain – Sale of CCB shares benefited Tier 1 common equity ratio by 24bps – Sale of Canadian consumer card business benefited Tier 1 common equity ratio by 7bps • Risk-weighted assets declined $75B during the quarter as a result of: – Sales of non-core assets – Reduction in risk and proactive capital management Key Drivers of Improvement in Tier 1 Common Equity Ratio % %

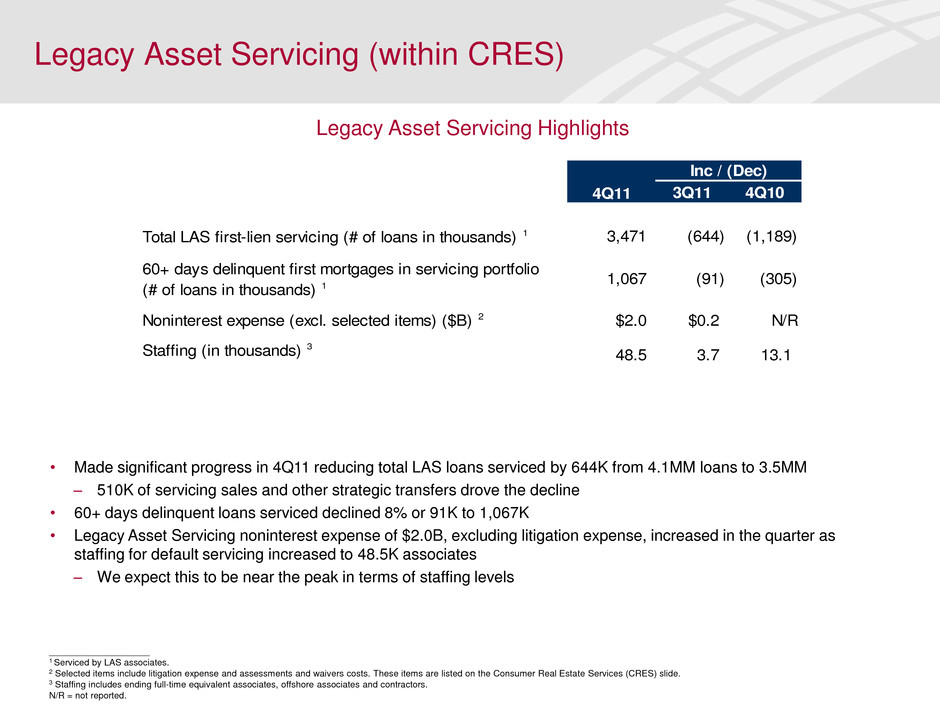

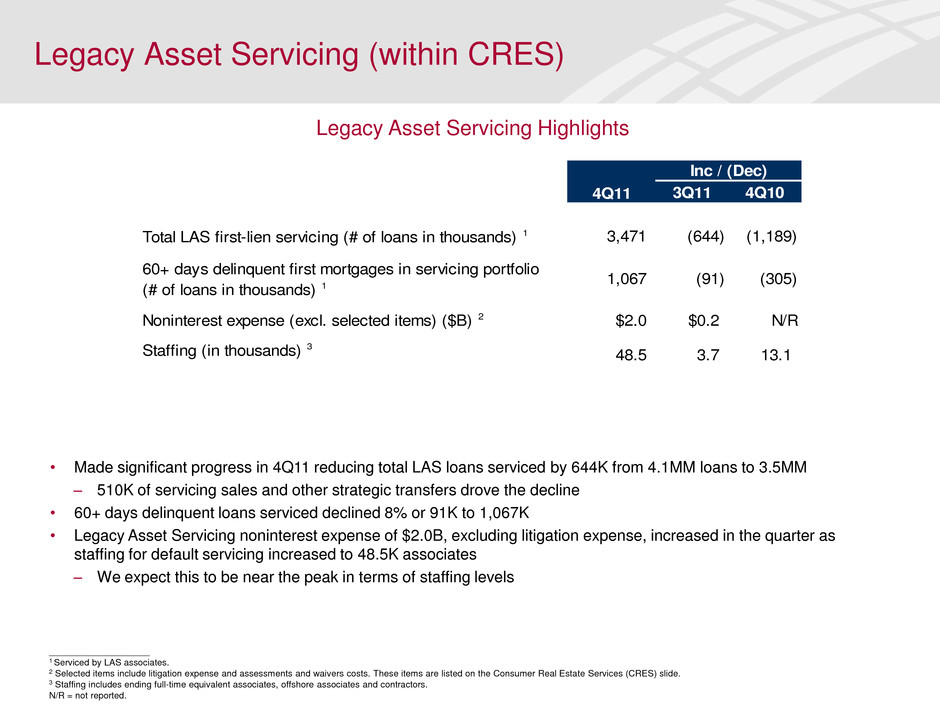

Legacy Asset Servicing (within CRES) ____________________ 1 Serviced by LAS associates. 2 Selected items include litigation expense and assessments and waivers costs. These items are listed on the Consumer Real Estate Services (CRES) slide. 3 Staffing includes ending full-time equivalent associates, offshore associates and contractors. N/R = not reported. • Made significant progress in 4Q11 reducing total LAS loans serviced by 644K from 4.1MM loans to 3.5MM – 510K of servicing sales and other strategic transfers drove the decline • 60+ days delinquent loans serviced declined 8% or 91K to 1,067K • Legacy Asset Servicing noninterest expense of $2.0B, excluding litigation expense, increased in the quarter as staffing for default servicing increased to 48.5K associates – We expect this to be near the peak in terms of staffing levels 3Q11 4Q10 Total LAS first-lien servicing (# of loans in thousands) 1 3,471 (644) (1,189) 60+ days delinquent first mortgages in servicing portfolio (# of loans in thousands) 1 1,067 (91) (305) Noninterest expense (excl. selected items) ($B) 2 $2.0 $0.2 N/R Staffing (in thousands) 3 48.5 3.7 13.1 Inc / (Dec) 4Q11 Legacy Asset Servicing Highlights

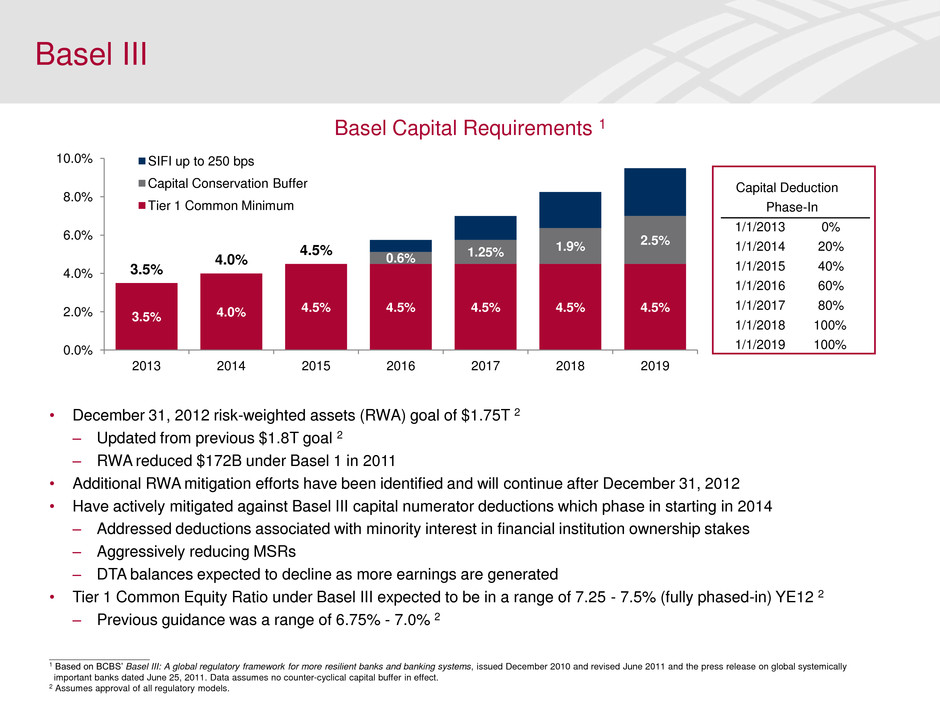

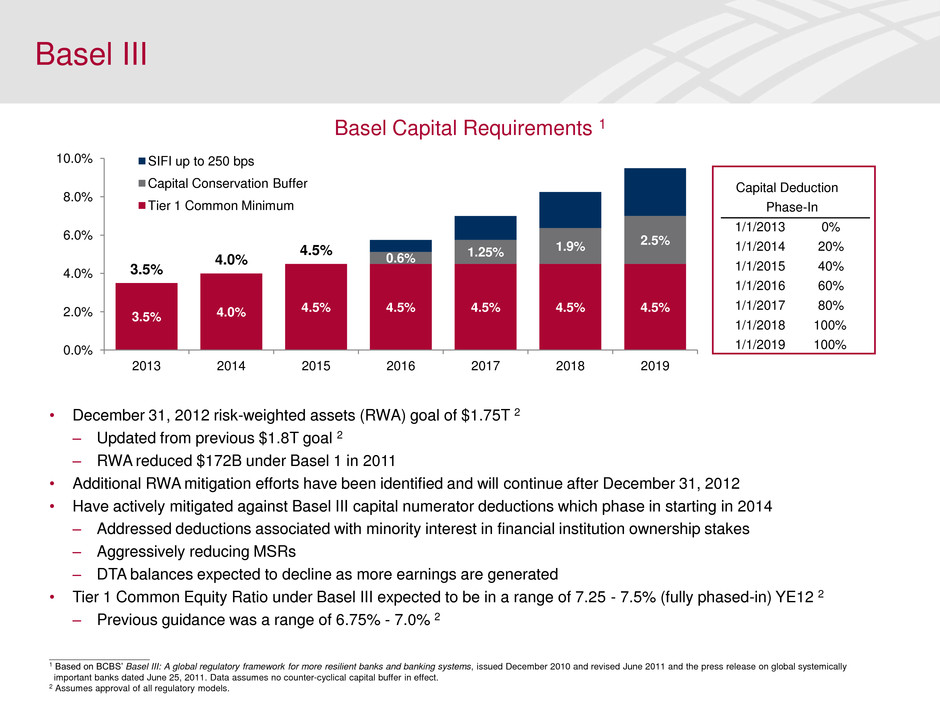

3.5% 4.0% 4.5% 4.5% 4.5% 4.5% 4.5% 0.6% 1.25% 1.9% 2.5% 3.5% 4.0% 4.5% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 2013 2014 2015 2016 2017 2018 2019 SIFI up to 250 bps Capital Conservation Buffer Tier 1 Common Minimum 1/1/2013 0% 1/1/2014 20% 1/1/2015 40% 1/1/2016 60% 1/1/2017 80% 1/1/2018 100% 1/1/2019 100% Capital Deduction Phase-In Basel III • December 31, 2012 risk-weighted assets (RWA) goal of $1.75T 2 – Updated from previous $1.8T goal 2 – RWA reduced $172B under Basel 1 in 2011 • Additional RWA mitigation efforts have been identified and will continue after December 31, 2012 • Have actively mitigated against Basel III capital numerator deductions which phase in starting in 2014 – Addressed deductions associated with minority interest in financial institution ownership stakes – Aggressively reducing MSRs – DTA balances expected to decline as more earnings are generated • Tier 1 Common Equity Ratio under Basel III expected to be in a range of 7.25 - 7.5% (fully phased-in) YE12 2 – Previous guidance was a range of 6.75% - 7.0% 2 Basel Capital Requirements 1 ____________________ 1 Based on BCBS’ Basel III: A global regulatory framework for more resilient banks and banking systems, issued December 2010 and revised June 2011 and the press release on global systemically important banks dated June 25, 2011. Data assumes no counter-cyclical capital buffer in effect. 2 Assumes approval of all regulatory models.

2012 Commentary • Headwinds of global economies, housing prices, interest rates and Eurozone debt crisis persist • Net interest income expected to remain muted ‒ Modest core loan growth expected to partially offset divestitures and run-off portfolios ‒ Compression as higher yielding assets mature will be partially offset by continued reductions in long- term debt footprint • Consumer noninterest revenue lines expected to be highly correlated with economy • Market-related revenue of investment banking, sales and trading, and investment and brokerage is dependent on market environment • Charge-off improvement is expected to continue while reserve releases are expected to slow • Expense expected to benefit from heightened focus on savings including New BAC savings and lower legacy mortgage-related costs compared to 2011 • Entering 2012 with higher capital, liquidity and combined reserves for credit, representations and warranties, and litigation than any year in company history

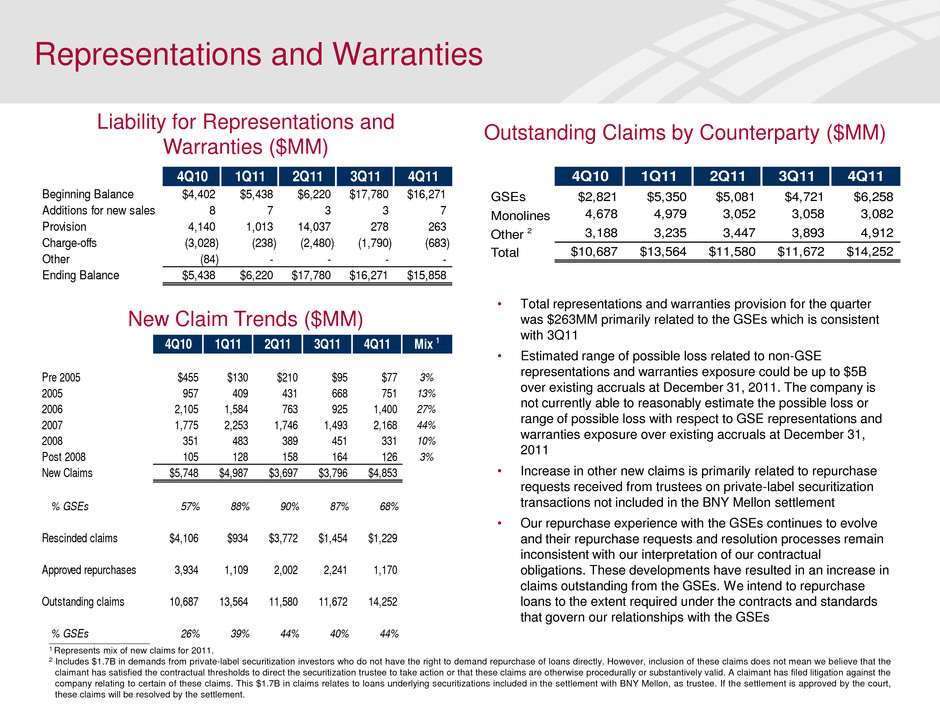

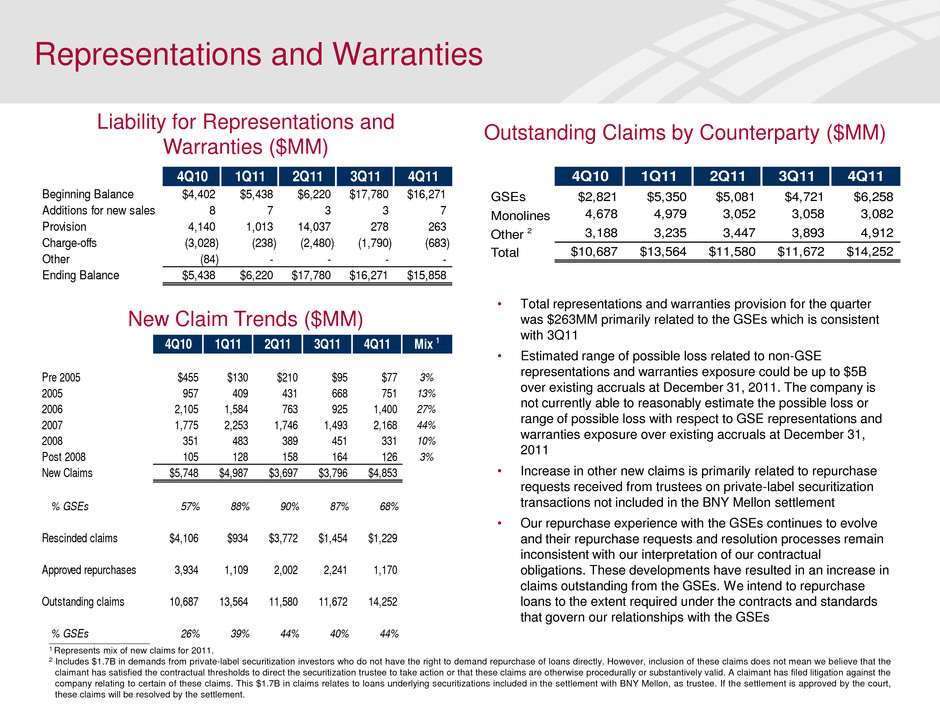

• Total representations and warranties provision for the quarter was $263MM primarily related to the GSEs which is consistent with 3Q11 • Estimated range of possible loss related to non-GSE representations and warranties exposure could be up to $5B over existing accruals at December 31, 2011. The company is not currently able to reasonably estimate the possible loss or range of possible loss with respect to GSE representations and warranties exposure over existing accruals at December 31, 2011 • Increase in other new claims is primarily related to repurchase requests received from trustees on private-label securitization transactions not included in the BNY Mellon settlement • Our repurchase experience with the GSEs continues to evolve and their repurchase requests and resolution processes remain inconsistent with our interpretation of our contractual obligations. These developments have resulted in an increase in claims outstanding from the GSEs. We intend to repurchase loans to the extent required under the contracts and standards that govern our relationships with the GSEs Liability for Representations and Warranties ($MM) Outstanding Claims by Counterparty ($MM) New Claim Trends ($MM) Representations and Warranties ____________________ 1 Represents mix of new claims for 2011. 2 Includes $1.7B in demands from private-label securitization investors who do not have the right to demand repurchase of loans directly. However, inclusion of these claims does not mean we believe that the claimant has satisfied the contractual thresholds to direct the securitization trustee to take action or that these claims are otherwise procedurally or substantively valid. A claimant has filed litigation against the company relating to certain of these claims. This $1.7B in claims relates to loans underlying securitizations included in the settlement with BNY Mellon, as trustee. If the settlement is approved by the court, these claims will be resolved by the settlement. 4Q10 1Q11 2Q11 3Q11 4Q11 Beginning Balance $4,402 $5,438 $6,220 $17,780 $16,271 Additions for new sales 8 7 3 3 7 Provision 4,140 1,013 14,037 278 263 Charge-offs (3,028) (238) (2,480) (1,790) (683) Other (84) - - - - Ending Balance $5,438 $6,220 $17,780 $16,271 $15,858 Q10 1Q11 Q11 3Q11 4Q11 GSEs $2,821 $5,350 $5,081 $4,721 $6,258 Monolines 4,678 4,979 3,052 3,058 ,082 Other 2 3,188 3,235 3,447 3,893 4,912 Total $10,687 $13,564 $11,580 $11,672 $14,252 4Q10 1Q11 2Q11 3Q11 4Q11 Mix 1 Pre 2005 $455 $130 $210 $95 $77 3% 2005 957 409 431 668 751 13% 2006 2,105 1,584 763 925 1,400 27% 2007 1,775 2,253 1,746 1,493 2,168 44% 2008 351 483 389 451 331 10% Post 2008 105 128 158 164 126 3% New Claims $5,748 $4,987 $3,697 $3,796 $4,853 % GSEs 57% 88% 90% 87% 68% Rescinded claims $4,106 $934 $3,772 $1,454 $1,229 Approved repurchases 3,934 1,109 2,002 2,241 1,170 Outstanding claims 10,687 13,564 11,580 11,672 14,252 % GSEs 26% 39% 44% 40% 44%

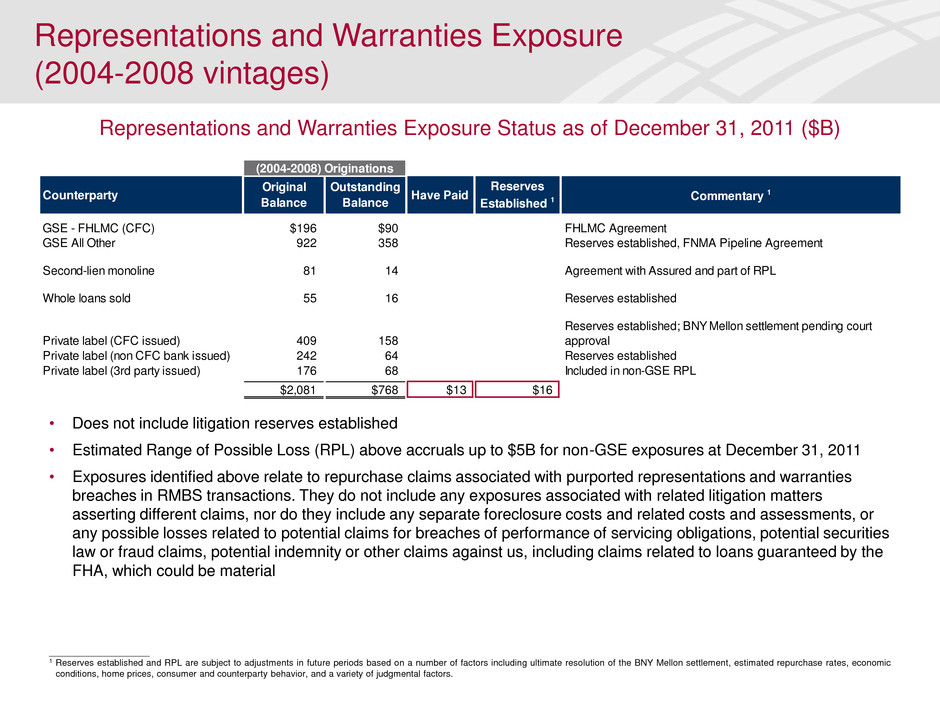

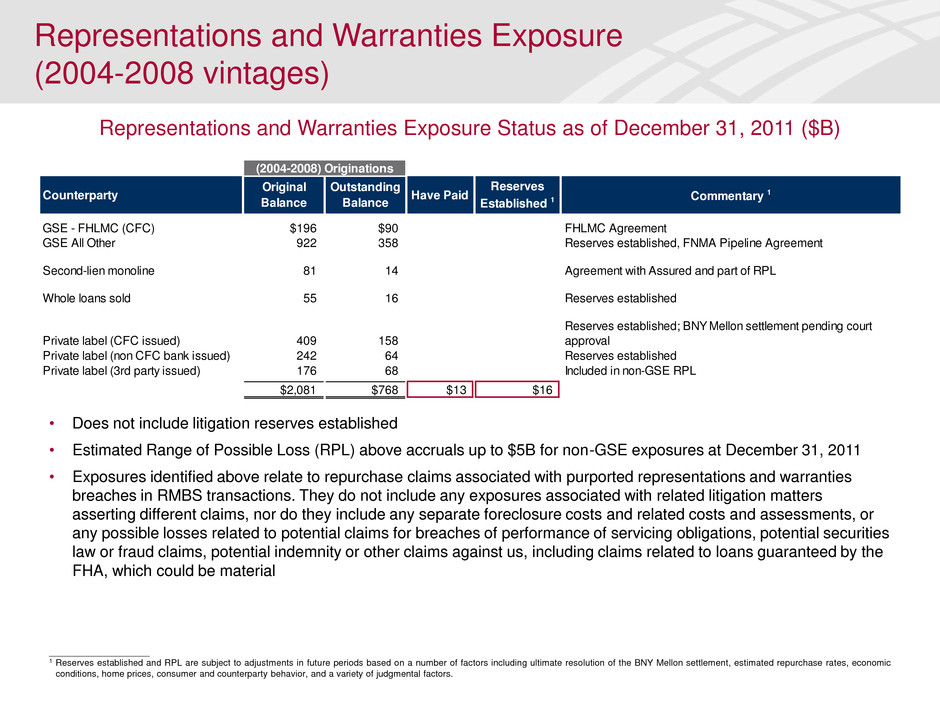

• Does not include litigation reserves established • Estimated Range of Possible Loss (RPL) above accruals up to $5B for non-GSE exposures at December 31, 2011 • Exposures identified above relate to repurchase claims associated with purported representations and warranties breaches in RMBS transactions. They do not include any exposures associated with related litigation matters asserting different claims, nor do they include any separate foreclosure costs and related costs and assessments, or any possible losses related to potential claims for breaches of performance of servicing obligations, potential securities law or fraud claims, potential indemnity or other claims against us, including claims related to loans guaranteed by the FHA, which could be material ____________________ 1 Reserves established and RPL are subject to adjustments in future periods based on a number of factors including ultimate resolution of the BNY Mellon settlement, estimated repurchase rates, economic conditions, home prices, consumer and counterparty behavior, and a variety of judgmental factors. Representations and Warranties Exposure Status as of December 31, 2011 ($B) Representations and Warranties Exposure (2004-2008 vintages) Counterparty Original Balance Outstanding Balance Have Paid Reserves Established 1 Commentary 1 GSE - FHLMC (CFC) $196 $90 FHLMC Agreement GSE All Other 922 358 Reserves established, FNMA Pipeline Agreement Second-lien monoline 81 14 Agreement with Assured and part of RPL Whole loans sold 55 16 Reserves established Private l bel (CFC issued) 409 158 Reserves established; BNY Mellon settlement pending court approval Private label (non CFC bank issued) 242 64 Reserves established Private label (3rd party issued) 176 68 Included in non-GSE RPL $2,081 $768 $13 $16 (2004-2008) Originations