Bank of America 1Q14 Financial Results April 16, 2014

1Q14 Results 2 ____________________ 1 Amounts may not total due to rounding. 2 FTE basis. Represents a non-GAAP financial measure. 3 Represents a non-GAAP financial measure. On a GAAP basis, net interest income; total revenue, net of interest expense; and income tax benefit were $10.1B, $22.6B and $405MM for 1Q14, respectively. For reconciliations of these measures to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information. 4 The diluted earnings (loss) per share excluded the effect of any equity instruments that are antidilutive to earnings per share. The number of antidilutive equity instruments was higher in the first quarter of 2014 due to the net loss. 1Q14 Net interest income 2, 3 $10.3 Noninterest income 12.5 Total revenue, net of interest expense 2, 3 22.8 Noninterest expense 22.2 Pre-tax, pre-provision earnings 2 0.5 Provision for credit losses 1.0 Loss before income taxes (0.5) Income tax expense (benefit) 2, 3 (0.2) Net loss ($0.3) Diluted earnings (loss) per share 4 ($0.05) Average diluted common shares (in billions) 4 10.6 Summary Income Statement ($B except EPS) 1 • 1Q14 net loss of $0.05 per diluted share included pre-tax litigation expense of $6.0B, or $0.40 per share after-tax – $3.6B pre-tax expense associated with previously announced FHFA settlement – $2.4B pre-tax expense for additional reserves primarily for previously disclosed legacy mortgage-related matters

____________________ 1 Represents a non-GAAP financial measure. For reconciliations to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information. n/m = not meaningful Balance Sheet Highlights 3 • Total assets increased $47.6B from 4Q13, driven by higher cash and securities balances, which we grew in anticipation of liquidity requirements • Total loans and leases declined $12.0B from 4Q13 due to lower discretionary mortgage balances and seasonally lower card balances • Record deposits of $1.1T, up $14.4B from 4Q13 • Long-term debt increased $5.1B from 4Q13, driven by increased bank issuance • Tangible common equity ratio decreased slightly to 7.00% 1, as a result of growth in liquidity • Tangible book value per share increased to $13.811 • Returned approximately $1.4B of capital through 87MM common share repurchases during 1Q14 • Previously announced capital actions include common stock dividend increase to $0.05 per share in 2Q14 and a new $4.0B common stock repurchase program $ in billions, except for share amounts; end of period balances Balance Sheet Total assets $2,149.9 $2,102.3 $2,174.8 Total loans and leases 916.2 928.2 911.6 Total deposits 1,133.7 1,119.3 1,095.2 Long-term debt 254.8 249.7 279.6 Preferred stock 13.4 13.4 18.8 Per Share Data Tangible book value per common share 1 $13.81 $13.79 $13.36 Book value per common share 20.75 20.71 20.19 Common shares outstanding (in billions) 10.53 10.59 10.82 Capital Tangible common shareholders' equity 1 $145.5 $146.1 $144.6 Tangible common equity ratio 1 7.00 % 7.20 % 6.88 % Common shareholders' equity $218.5 $219.3 $218.5 Common equity ratio 10.17 % 10.43 % 10.05 % Returns Return on average assets n/m 0.64 % 0.27 % Return on average common shareholders' equity n/m 5.74 2.06 Return on average t gible common shareholders' equity 1 n/m 8.61 3.12 1Q14 4Q13 1Q13

Basel 3 Transition (under Standardized approach) 1 • Common equity tier 1 capital (CET1) ratio grew to 11.8% from pro-forma 4Q13 2 Basel 3 Fully Phased-in 3 • Under the fully phased-in Standardized approach, the estimated CET1 ratio improved to 9.3% from 4Q13 • Under the fully phased-in Advanced approaches, the estimated CET1 ratio decreased to 9.9% from 4Q13, largely driven by an increase in operational risk-weighted assets Supplementary Leverage Ratio (SLR) 4, 5 • In connection with the final U.S. rule and proposed NPR issued on April 8, 2014, on a fully phased-in basis, we estimate our bank holding company ratio is above the 5% required minimum and both primary bank subsidiaries are in excess of the 6% required minimum Regulatory Capital 4 ____________________ 1 On January 1, 2014, the Basel 3 rules became effective, subject to transition provisions primarily related to regulatory deductions and adjustments impacting common equity tier 1 capital and Tier 1 capital. Regulatory capital ratios are preliminary until filed with the Federal Reserve on Form Y-9C. 2 Pro-forma 4Q13 capital ratios include the estimated impact of the Basel 3 transition provisions applicable for 2014 as if in effect for 4Q13 and represent a non-GAAP financial measure. 3 Represents a non-GAAP financial measure. For important presentation information, see slide 25 and reconciliations on slide 23. 4 The 8.5% common equity tier 1 capital ratio minimum includes the 2.5% capital conservation buffer, 0% countercyclical buffer and an estimated 1.5% SIFI buffer (based on the Financial Stability Board’s “Update of group of global systemically important banks (G-SIBs)” issued on November 11, 2013). The 5.0% Bank Holding Company SLR minimum includes the 2.0% leverage buffer. 5 Only 1Q14 includes the estimated increase to the supplementary leverage exposure as proposed by banking regulators on April 8, 2014. The 1Q14 ratio is measured using quarter-end tier 1 capital calculated under Basel 3 on a fully phased-in basis while the 4Q13 ratio uses the simple average for each month end in the quarter. For both periods, the denominator is calculated as the simple average of the sum of on-balance sheet assets and certain off-balance sheet exposures, including, among other items, derivative and securities financing transactions, at the end of each month in the quarter. Basel 3 Transition (under standardized approach) 1 $ in billions Common equity tier 1 capital $151.6 $153.5 Risk-weighted assets 1,282.5 1,316.0 Common equity tier 1 capital ratio 11.8 % 11.7 % Tier 1 capital ratio 12.1 % 12.1 % Tier 1 leverage ratio 7.6 % 7.7 % Basel 3 Fully Phased-in $ in billions Common equity tier 1 capital 3 $134.2 $132.3 Risk-weighted assets (under standardized approach) 3 1,448.1 1,462.0 Common equity tier 1 capital ratio (under standardized approach) 9.3 % 9.1 % Bank Holding Company SLR 5 > 5.0 % > 5.0 % Bank SLR 5 > 6.0 % > 6.0 % 8.5% by 2019 5% by 2018 6% by 2018 1Q14 Pro-forma 4Q13 2 1Q14 4Q13 Required Minimum 4

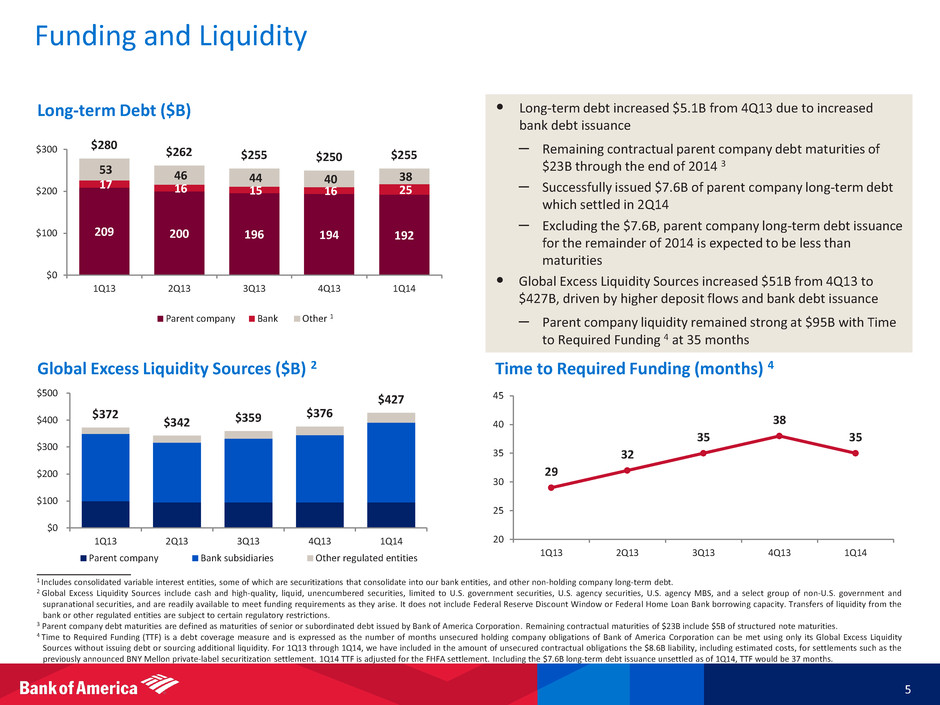

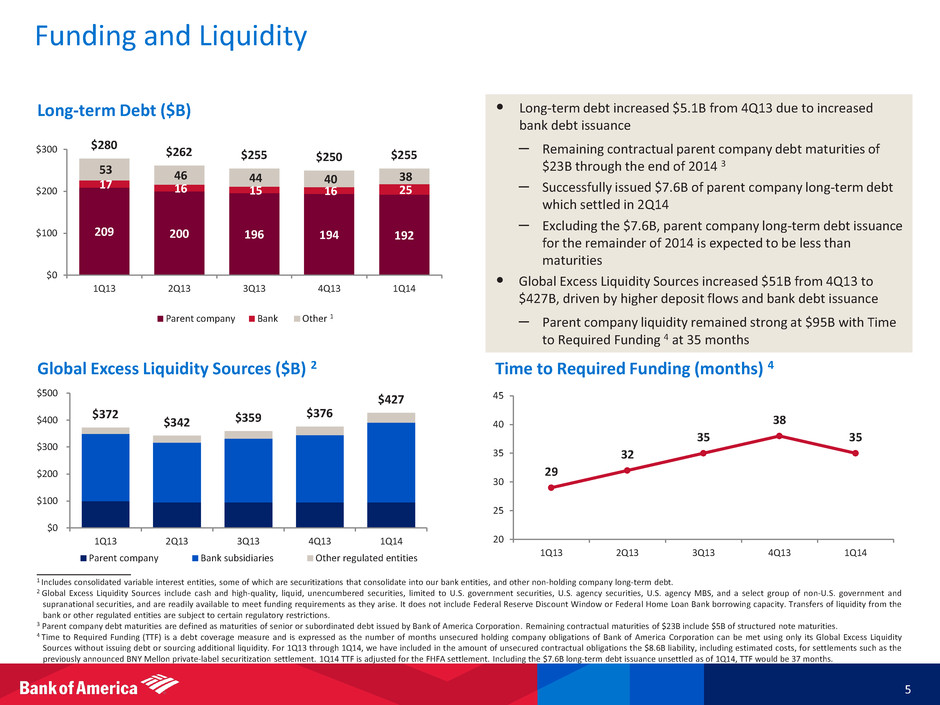

Funding and Liquidity 5 Global Excess Liquidity Sources ($B) 2 • Long-term debt increased $5.1B from 4Q13 due to increased bank debt issuance – Remaining contractual parent company debt maturities of $23B through the end of 2014 3 – Successfully issued $7.6B of parent company long-term debt which settled in 2Q14 – Excluding the $7.6B, parent company long-term debt issuance for the remainder of 2014 is expected to be less than maturities • Global Excess Liquidity Sources increased $51B from 4Q13 to $427B, driven by higher deposit flows and bank debt issuance – Parent company liquidity remained strong at $95B with Time to Required Funding 4 at 35 months 1 Includes consolidated variable interest entities, some of which are securitizations that consolidate into our bank entities, and other non-holding company long-term debt. 2 Global Excess Liquidity Sources include cash and high-quality, liquid, unencumbered securities, limited to U.S. government securities, U.S. agency securities, U.S. agency MBS, and a select group of non-U.S. government and supranational securities, and are readily available to meet funding requirements as they arise. It does not include Federal Reserve Discount Window or Federal Home Loan Bank borrowing capacity. Transfers of liquidity from the bank or other regulated entities are subject to certain regulatory restrictions. 3 Parent company debt maturities are defined as maturities of senior or subordinated debt issued by Bank of America Corporation. Remaining contractual maturities of $23B include $5B of structured note maturities. 4 Time to Required Funding (TTF) is a debt coverage measure and is expressed as the number of months unsecured holding company obligations of Bank of America Corporation can be met using only its Global Excess Liquidity Sources without issuing debt or sourcing additional liquidity. For 1Q13 through 1Q14, we have included in the amount of unsecured contractual obligations the $8.6B liability, including estimated costs, for settlements such as the previously announced BNY Mellon private-label securitization settlement. 1Q14 TTF is adjusted for the FHFA settlement. Including the $7.6B long-term debt issuance unsettled as of 1Q14, TTF would be 37 months. Long-term Debt ($B) Time to Required Funding (months) 4 $372 $342 $359 $376 $427 $0 $100 $200 $300 $400 $500 1Q13 2Q13 3Q13 4Q13 1Q14 Parent company Bank subsidiaries Other regulated entities 209 200 196 194 192 17 16 15 16 25 53 46 44 40 38 $280 $262 $255 $250 $255 $0 $100 $200 $300 1Q13 2Q13 3Q13 4Q13 1Q14 Parent company Bank Other 29 32 35 38 35 20 25 30 35 40 45 1Q13 2Q13 3Q13 4Q13 1Q14 1

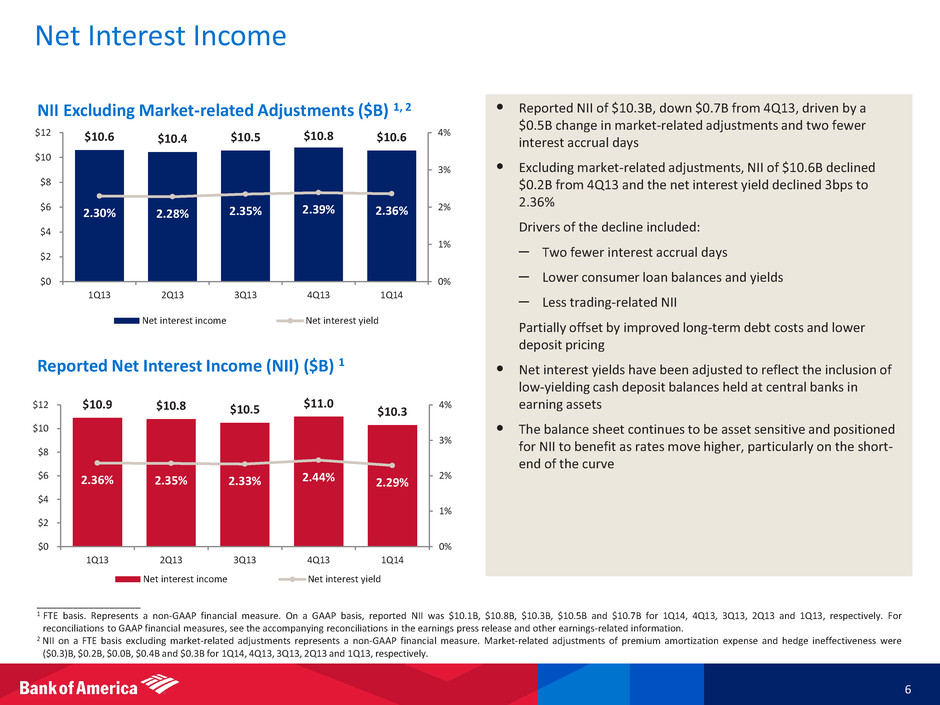

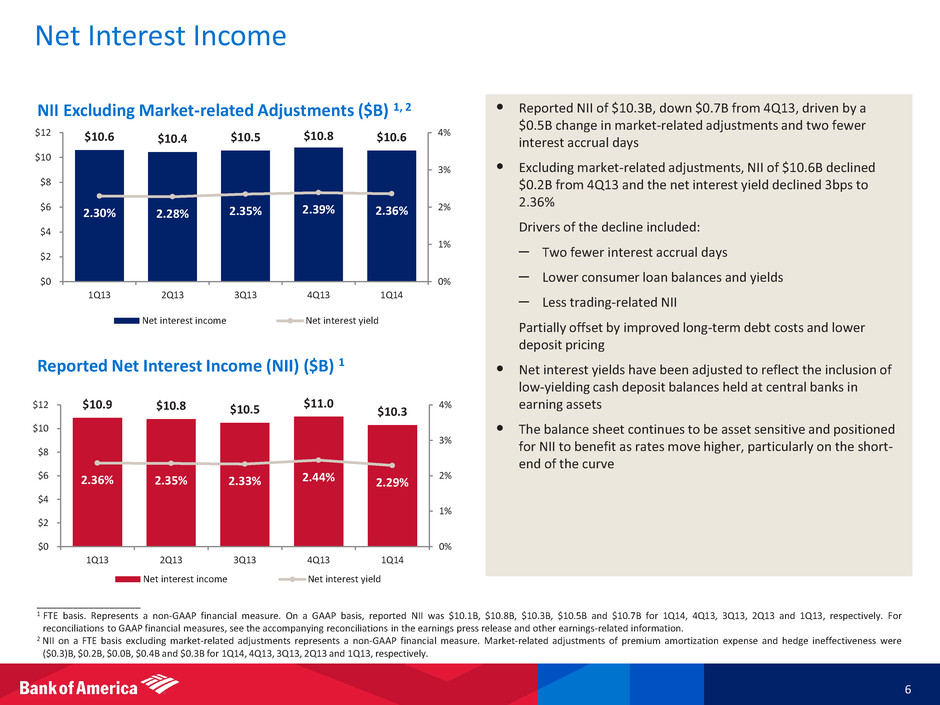

Net Interest Income 6 • Reported NII of $10.3B, down $0.7B from 4Q13, driven by a $0.5B change in market-related adjustments and two fewer interest accrual days • Excluding market-related adjustments, NII of $10.6B declined $0.2B from 4Q13 and the net interest yield declined 3bps to 2.36% Drivers of the decline included: – Two fewer interest accrual days – Lower consumer loan balances and yields – Less trading-related NII Partially offset by improved long-term debt costs and lower deposit pricing • Net interest yields have been adjusted to reflect the inclusion of low-yielding cash deposit balances held at central banks in earning assets • The balance sheet continues to be asset sensitive and positioned for NII to benefit as rates move higher, particularly on the short- end of the curve ____________________ 1 FTE basis. Represents a non-GAAP financial measure. On a GAAP basis, reported NII was $10.1B, $10.8B, $10.3B, $10.5B and $10.7B for 1Q14, 4Q13, 3Q13, 2Q13 and 1Q13, respectively. For reconciliations to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information. 2 NII on a FTE basis excluding market-related adjustments represents a non-GAAP financial measure. Market-related adjustments of premium amortization expense and hedge ineffectiveness were ($0.3)B, $0.2B, $0.0B, $0.4B and $0.3B for 1Q14, 4Q13, 3Q13, 2Q13 and 1Q13, respectively. Reported Net Interest Income (NII) ($B) 1 NII Excluding Market-related Adjustments ($B) 1, 2 $10.9 $10.8 $10.5 $11.0 $10.3 2.36% 2.35% 2.33% 2.44% 2.29% 0% 1% 2% 3% 4% $0 $2 $4 $6 $8 $10 $12 1Q13 2Q13 3Q13 4Q13 1Q14 Net interest income Net interest yield $10.6 $10.4 $10.5 $10.8 $10.6 2.30% 2.28% 2.35% 2.39% 2.36% 0% 1% 2% 3% 4% $0 $2 $4 $6 $8 $10 $12 1Q13 2Q13 3Q13 4Q13 1Q14 Net interest income Net interest yield

13.8 13.2 13.6 0.9 1.0 2.6 1.8 1.6 2.2 2.3 6.0 $19.5 $17.3 $22.2 $0 $5 $10 $15 $20 $25 1Q13 4Q13 1Q14 All Other Retirement-eligible costs LAS (excl. litigation) Litigation Expense Highlights ____________________ 1 Represents a non-GAAP financial measure. LAS noninterest expense was $7.4B, $3.0B and $4.6B in 1Q14, 4Q13 and 1Q13, respectively. LAS mortgage-related litigation expense was $5.8B, $1.2B and $2.0B in 1Q14, 4Q13 and 1Q13, respectively. 2 Represents a non-GAAP financial measure. • Total noninterest expense of $22.2B in 1Q14 increased from both 4Q13 and 1Q13 due to increased litigation expense • Litigation expense of $6.0B in 1Q14 included: – $3.6B associated with the previously announced FHFA settlement – $2.4B net increase in reserves primarily for previously disclosed legacy mortgage-related matters • 1Q14 and 1Q13 expense includes annual retirement-eligible incentive compensation costs • Excluding litigation and retirement-eligible incentive compensation costs 2, noninterest expense declined $1.2B from 1Q13, as LAS expense of $1.6B declined $1.0B from 1Q13 • All other expense of $13.6B in 1Q14 decreased $0.2B compared to 1Q13, but increased from 4Q13 due to seasonally higher incentive accruals aligned with sales and trading results • Expense program targets remain unchanged – Quarterly LAS expense, excluding litigation 2, expected to decline to $1.1B by 4Q14 – Quarterly New BAC cost savings of $2.0B expected to be achieved by mid-2015 Noninterest Expense ($B) Full-time Equivalent Employees (000's) 7 1 227.3 216.6 215.2 35.5 25.5 23.4 262.8 242.1 238.6 0 50 100 150 200 250 300 1Q13 4Q13 1Q14 FTEs (excluding LAS) LAS FTEs

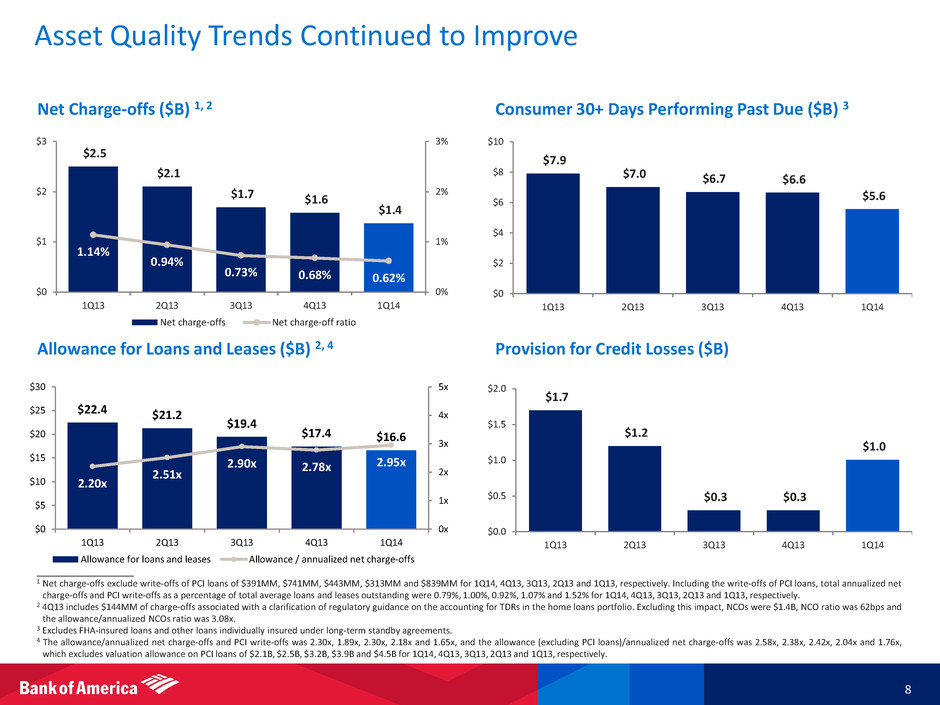

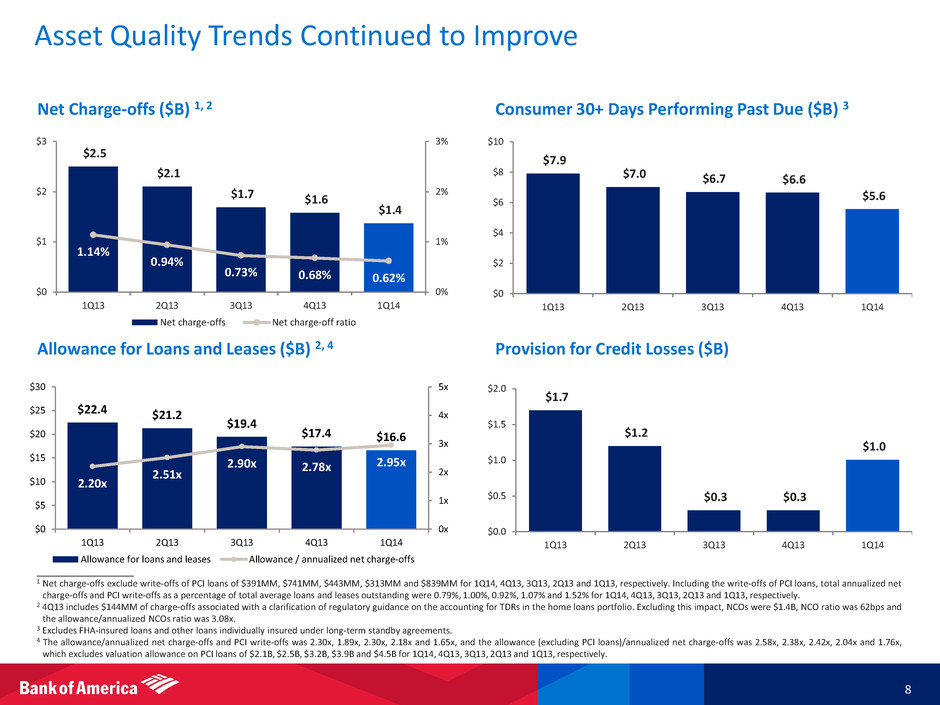

$22.4 $21.2 $19.4 $17.4 $16.6 2.20x 2.51x 2.90x 2.78x 2.95x 0x 1x 2x 3x 4x 5x $0 $5 $10 $15 $20 $25 $30 1Q13 2Q13 3Q13 4Q13 1Q14 T h o u s a n d s Allowance for loans and leases Allowance / annualized net charge-offs $2.5 $2.1 $1.7 $1.6 $1.4 1.14% 0.94% 0.73% 0.68% 0.62% 0% 1% 2% 3% $0 $1 $2 $3 1Q13 2Q13 3Q13 4Q13 1Q14 Net charge-offs Net charge-off ratio ____________________ 1 Net charge-offs exclude write-offs of PCI loans of $391MM, $741MM, $443MM, $313MM and $839MM for 1Q14, 4Q13, 3Q13, 2Q13 and 1Q13, respectively. Including the write-offs of PCI loans, total annualized net charge-offs and PCI write-offs as a percentage of total average loans and leases outstanding were 0.79%, 1.00%, 0.92%, 1.07% and 1.52% for 1Q14, 4Q13, 3Q13, 2Q13 and 1Q13, respectively. 2 4Q13 includes $144MM of charge-offs associated with a clarification of regulatory guidance on the accounting for TDRs in the home loans portfolio. Excluding this impact, NCOs were $1.4B, NCO ratio was 62bps and the allowance/annualized NCOs ratio was 3.08x. 3 Excludes FHA-insured loans and other loans individually insured under long-term standby agreements. 4 The allowance/annualized net charge-offs and PCI write-offs was 2.30x, 1.89x, 2.30x, 2.18x and 1.65x, and the allowance (excluding PCI loans)/annualized net charge-offs was 2.58x, 2.38x, 2.42x, 2.04x and 1.76x, which excludes valuation allowance on PCI loans of $2.1B, $2.5B, $3.2B, $3.9B and $4.5B for 1Q14, 4Q13, 3Q13, 2Q13 and 1Q13, respectively. Asset Quality Trends Continued to Improve 8 Net Charge-offs ($B) 1, 2 Allowance for Loans and Leases ($B) 2, 4 Provision for Credit Losses ($B) Consumer 30+ Days Performing Past Due ($B) 3 $1.7 $1.2 $0.3 $0.3 $1.0 $0.0 $0.5 $1.0 $1.5 $2.0 1Q13 2Q13 3Q13 4Q13 1Q14 $7.9 $7.0 $6.7 $6.6 $5.6 $0 $2 $4 $6 $8 $10 1Q13 2Q13 3Q13 4Q13 1Q14

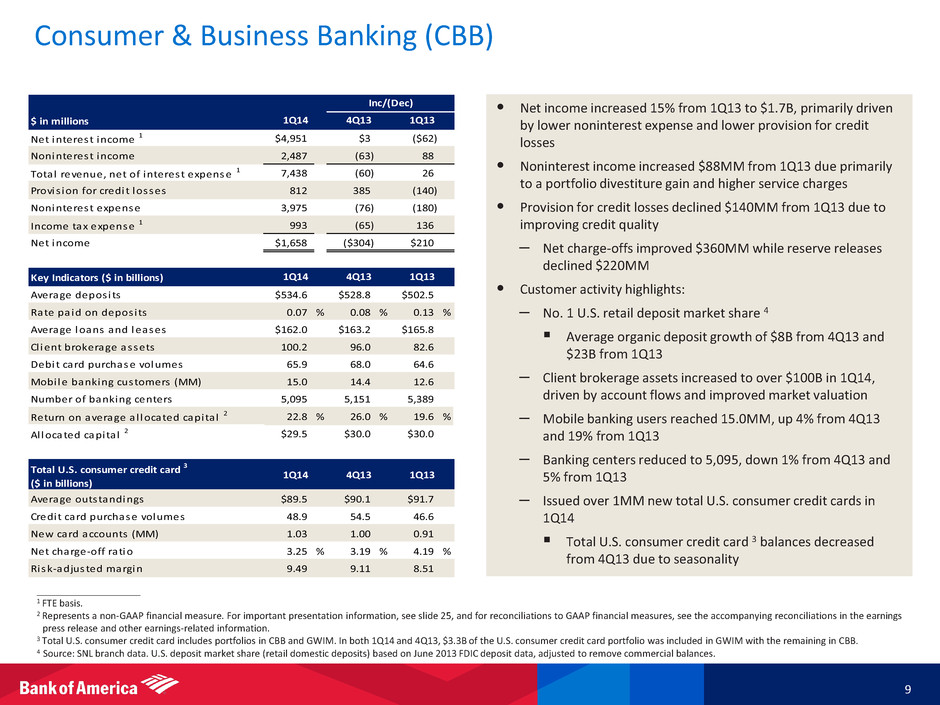

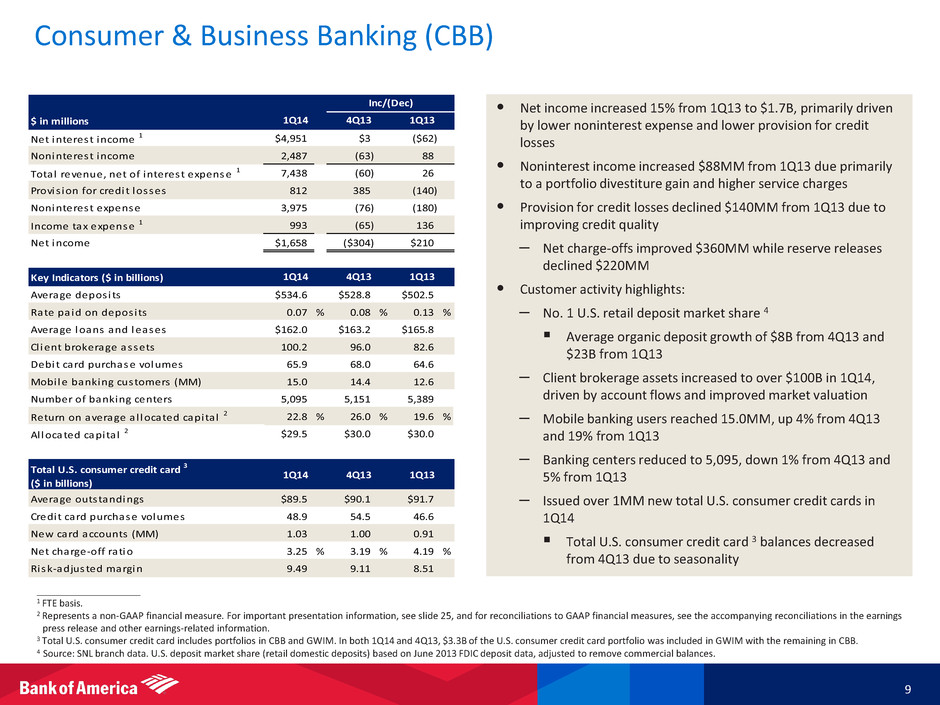

Consumer & Business Banking (CBB) 9 ____________________ 1 FTE basis. 2 Represents a non-GAAP financial measure. For important presentation information, see slide 25, and for reconciliations to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information. 3 Total U.S. consumer credit card includes portfolios in CBB and GWIM. In both 1Q14 and 4Q13, $3.3B of the U.S. consumer credit card portfolio was included in GWIM with the remaining in CBB. 4 Source: SNL branch data. U.S. deposit market share (retail domestic deposits) based on June 2013 FDIC deposit data, adjusted to remove commercial balances. • [ Bullets to come ] • Net income increased 15% from 1Q13 to $1.7B, primarily driven by lower noninterest expense and lower provision for credit losses • Noninterest income increased $88MM from 1Q13 due primarily to a portfolio divestiture gain and higher service charges • Provision for credit losses declined $140MM from 1Q13 due to improving credit quality – Net charge-offs improved $360MM while reserve releases declined $220MM • Customer activity highlights: – No. 1 U.S. retail deposit market share 4 Average organic deposit growth of $8B from 4Q13 and $23B from 1Q13 – Client brokerage assets increased to over $100B in 1Q14, driven by account flows and improved market valuation – Mobile banking users reached 15.0MM, up 4% from 4Q13 and 19% from 1Q13 – Banking centers reduced to 5,095, down 1% from 4Q13 and 5% from 1Q13 – Issued over 1MM new total U.S. consumer credit cards in 1Q14 Total U.S. consumer credit card 3 balances decreased from 4Q13 due to seasonality $ in millions Net interest income 1 $4,951 $3 ($62) Noninterest income 2,487 (63) 88 Total revenue, net of interest expense 1 7,438 (60) 26 Provis ion for credit losses 812 385 (140) Noninterest expense 3,975 (76) (180) Income tax expense 1 993 (65) 136 Net income $1,658 ($304) $210 Key Indicators ($ in billions) Average depos its $534.6 $528.8 $502.5 Rate paid on depos its 0.07 % 0.08 % 0.13 % Average loans and leases $162.0 $163.2 $165.8 Cl ient brokerage assets 100.2 96.0 82.6 Debit card purchase volumes 65.9 68.0 64.6 Mobi le banking customers (MM) 15.0 14.4 12.6 Number of banking centers 5,095 5,151 5,389 Return on average a l located capita l 2 22.8 % 26.0 % 19.6 % Al located capita l 2 $29.5 $30.0 $30.0 Total U.S. consumer credit card 3 ($ in billions) Average outstandings $89.5 $90.1 $91.7 Credit card purchase volu es 48.9 54.5 46.6 New card accounts (MM) 1.03 1.00 0.91 Net charge-off ratio 3.25 % 3.19 % 4.19 % Risk-adjusted margin 9.49 9.11 8.51 1Q14 4Q13 1Q13 Inc/(Dec) 1Q14 4Q13 1Q13 1Q14 4Q13 1Q13

Consumer Real Estate Services (CRES) 1 10 • 1Q14 net loss of $5.0B increased $4.0B from 4Q13, primarily driven by increased litigation expense • Total first-lien retail mortgage originations 4 were $8.9B, down 24% from 4Q13 – Origination pipeline at the end of 1Q14 was up 23% vs. 4Q13 • Core production revenue declined $131MM from 4Q13 • Representations and warranties provision of $178MM in 1Q14, up from $70MM in 4Q13, primarily as a result of the FHFA settlement • Servicing income declined $205MM from 4Q13 due to the continued decline in the size of the servicing portfolio combined with less favorable MSR net hedge results • Provision for credit losses increased from 4Q13 due to slowing pace of credit quality improvement – $528MM lower reserve release in 1Q14 vs. 4Q13 • LAS expense, excluding litigation 3, declined to $1.6B from 4Q13 – 60+ days delinquent loans serviced dropped by 48K, or 15%, to 277K in 1Q14 • Total staffing declined 11% from 4Q13, due primarily to continued reductions in LAS, as well as actions taken in sales and fulfillment as refinance demand slowed ____________________ 1 CRES includes Home Loans and Legacy Assets & Servicing. 2 FTE basis. 3 Represents a non-GAAP financial measure. CRES noninterest expense was $8.1B, $3.8B and $5.4B in 1Q14, 4Q13 and 1Q13, respectively. CRES litigation expense was $5.8B, $1.2B and $2.0B for 1Q14, 4Q13 and 1Q13, respectively. LAS noninterest expense was $7.4B, $3.0B and $4.6B in 1Q14, 4Q13 and 1Q13, respectively. LAS litigation expense was $5.8B, $1.2B and $2.0B for 1Q14, 4Q13 and 1Q13, respectively. 4 Home loan originations include loan production in CRES with the remaining first mortgage and home equity loan production primarily in GWIM. 5 Core production revenue excludes representations and warranties provision. 6 Includes other FTEs supporting LAS (contractors and offshore). $ in millions Net interest income 2 $701 ($15) ($42) Noninterest income 491 (505) (1,078) Total revenue, net of interest expense 2 1,192 (520) (1,120) Provis ion for credit losses 25 499 (310) Noninterest expense, excluding l i tigation 3 2,290 (303) (1,081) Li tigation expense 5,839 4,644 3,805 Income tax expense (benefi t) 2 (1,935) (1,391) (663) Net loss ($5,027) ($3,969) ($2,871) Key Indicators ($ in billions) Average loans and leases $88.9 $89.7 $93.0 Total home loan originations 4 : Fi rs t mortgage 8.9 11.6 23.9 Home equity 2.0 1.9 1.1 Core production revenue 5 0.3 0.4 0.8 Servicing income 0.4 0.6 0.9 Firs t l ien servicing portfol io (# loans in MM) 4.2 4.4 6.4 MSR, end of period (EOP) 4.6 5.0 5.8 Capita l i zed MSR (bps) 87 92 61 Serviced for investors (EOP, in tri l l ions) 0.5 0.6 0.9 LAS expense (excluding l i tigation) 3 1.6 1.8 2.6 60+ days del inquent fi rs t l ien loans (000's ) 277 325 667 LAS employees (000's ) 6 26.2 28.8 42.6 1Q14 1Q13 Inc/(Dec) 1Q14 4Q13 1Q13 4Q13

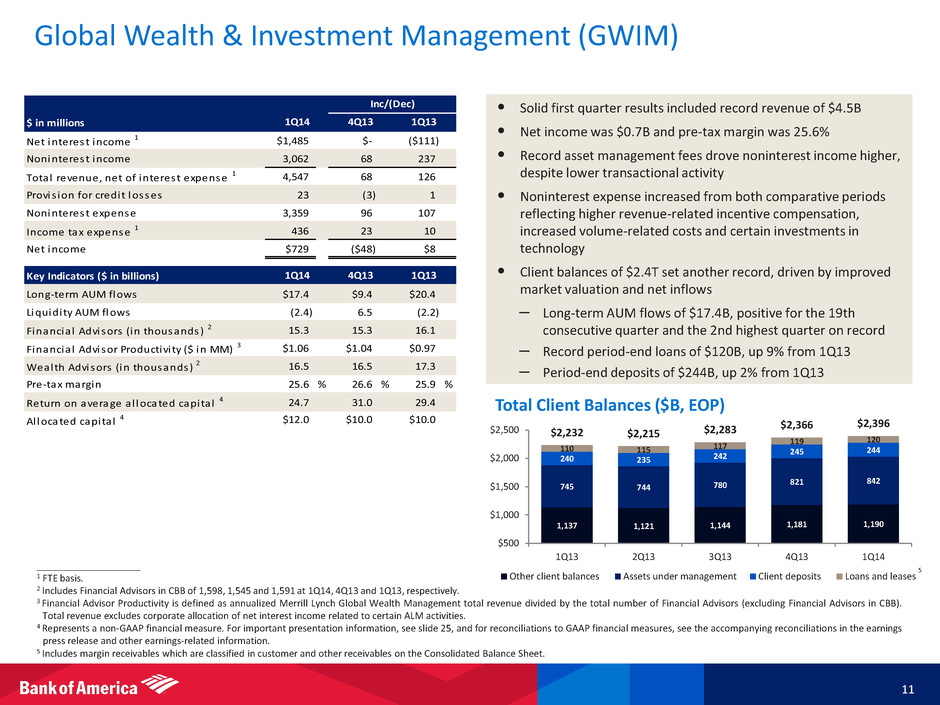

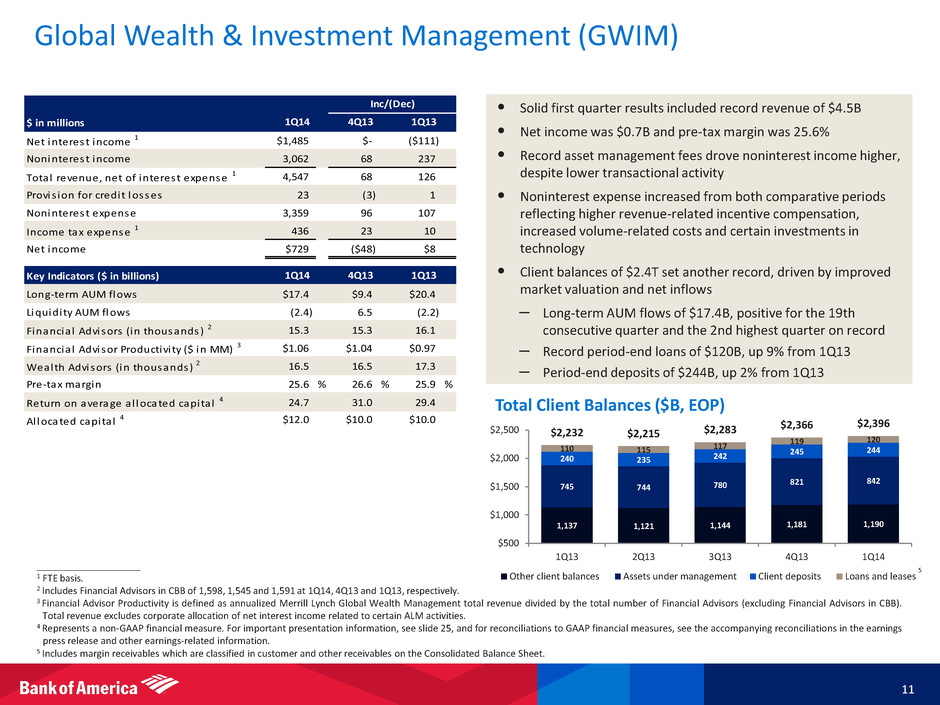

1,137 1,121 1,144 1,181 1,190 745 744 780 821 842 240 235 242 245 244 110 115 117 119 120 $2,232 $2,215 $2,283 $2,366 $2,396 $500 $1,000 $1,500 $2,000 $2,500 1Q13 2Q13 3Q13 4Q13 1Q14 Other client balances Assets under management Client deposits Loans and leases Global Wealth & Investment Management (GWIM) 11 ____________________ 1 FTE basis. 2 Includes Financial Advisors in CBB of 1,598, 1,545 and 1,591 at 1Q14, 4Q13 and 1Q13, respectively. 3 Financial Advisor Productivity is defined as annualized Merrill Lynch Global Wealth Management total revenue divided by the total number of Financial Advisors (excluding Financial Advisors in CBB). Total revenue excludes corporate allocation of net interest income related to certain ALM activities. 4 Represents a non-GAAP financial measure. For important presentation information, see slide 25, and for reconciliations to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information. 5 Includes margin receivables which are classified in customer and other receivables on the Consolidated Balance Sheet. Total Client Balances ($B, EOP) • Solid first quarter results included record revenue of $4.5B • Net income was $0.7B and pre-tax margin was 25.6% • Record asset management fees drove noninterest income higher, despite lower transactional activity • Noninterest expense increased from both comparative periods reflecting higher revenue-related incentive compensation, increased volume-related costs and certain investments in technology • Client balances of $2.4T set another record, driven by improved market valuation and net inflows – Long-term AUM flows of $17.4B, positive for the 19th consecutive quarter and the 2nd highest quarter on record – Record period-end loans of $120B, up 9% from 1Q13 – Period-end deposits of $244B, up 2% from 1Q13 $ in millions Net interest income 1 $1,485 $- ($111) Noninterest income 3,062 68 237 Total revenue, net of interest expense 1 4,547 68 126 Provis ion for credit losses 23 (3) 1 Noninterest expense 3,359 96 107 Income tax expense 1 436 23 10 Net income $729 ($48) $8 Key Indicators ($ in billions) Long-term AUM flows $17.4 $9.4 $20.4 Liquidi ty AUM flows (2.4) 6.5 (2.2) Financia l Advisors (in thousands) 2 15.3 15.3 16.1 Financia l Advisor Productivi ty ($ in MM) 3 $1.06 $1.04 $0.97 Wealth Advisors (in thousands) 2 16.5 16.5 17.3 Pre-tax margin 25.6 % 26.6 % 25.9 % Return on average a l loc ted capita l 4 24.7 31.0 29.4 Al located capita l 4 $12.0 $10.0 $10.0 Inc/(Dec) 1Q14 4Q13 1Q13 1Q14 4Q13 1Q13 5

Global Banking 12 ____________________ 1 FTE basis. 2 Represents a non-GAAP financial measure. For important presentation information, see slide 25, and for reconciliations to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information. • [ Bullets to come ] • Net income of $1.2B Revenue f $4.3B increased 6% vs. 1Q13, primarily due to higher NII from solid loan growth • Maintained leadership position with $1.5B in corporation-wide IB fees (excluding self-led) – Record Investment Grade underwriting fees • Provision for credit losses increased from 1Q13 driven by increased reserves • Noninterest expense increased $186MM from 1Q13 due to technology investments in Global Treasury Services and lending platforms, additional client-facing personnel and higher litigation expense • Average loans and leases increased $27.4B from 1Q13 due to growth in Commercial & Industrial, Commercial Real Estate and Leasing • Average deposits increased 16% vs. 1Q13 benefitting from increased customer liquidity • Return on average allocated capital of 16.2% in 1Q14 reflects earnings stability and 35% increase in allocated capital $ in millions Net interest income 1 $2,301 $- $142 Noninterest income 1,968 (34) 97 Total revenue, net of interest expense 1 4,269 (34) 239 Provis ion for credit losses 265 (176) 116 Noninterest expense 2,028 102 186 Income tax expense 1 740 70 (18) Net income $1,236 ($30) ($45) Key Indicators ($ in billions) Average loans and leases $271.5 $268.8 $244.1 Average depos its 256.3 259.1 221.3 Bus iness Lending revenue 1.9 1.8 1.8 Treasury Services revenue 1.5 1.5 1.4 Return on average a l located capita l 2 16.2 % 21.8 % 22.6 % Al located capita l 2 $31.0 $23.0 $23.0 Net charge-off ratio (0.03) % 0.01 % 0.12 % Reservable cri ticized $9.5 $9.4 $10.3 Nonperforming assets 0.7 0.6 1.6 Corporation-wide IB Fees ($ in millions) Advisory $286 $356 $257 Debt 1,025 986 1,022 Equity 313 461 323 Gross IB fees (incl . sel f-led) 1,624 1,803 1,602 Sel f-led (82) (65) (67) Net IB fees (excl . sel f-led) $1,542 $1,738 $1,535 1Q14 4Q13 1Q13 Inc/(Dec) 4Q13 1Q131Q14 1Q14 4Q13 1Q13

Global Markets 13 • [ Bullets to come ] ____________________ 1 FTE basis. 2 Represents a non-GAAP financial measure. During 1Q14, the management of structured liabilities and the associated DVA were moved into Global Markets from All Other to better align the performance risk of these instruments. As such, net DVA represents the combined total of net DVA on derivatives and structured liabilities. Prior periods have been reclassified to conform to current period presentation. Net DVA results were gains (losses) of $112MM, ($617)MM and ($145)MM for 1Q14, 4Q13 and 1Q13, respectively. 3 In addition to sales and trading revenue, Global Markets shares with Global Banking in certain deal economics from investment banking and loan origination activities. 4 For this presentation, sales and trading revenue excludes net DVA gains (losses), which represents a non-GAAP financial measure. Net DVA included in FICC revenue were gains (losses) of $80MM, ($535)MM and ($149)MM for 1Q14, 4Q13 and 1Q13, respectively. Net DVA included in equities revenue were gains (losses) of $32MM, ($82)MM and $4MM for 1Q14, 4Q13 and 1Q13, respectively. 5 VaR model uses historical simulation approach based on three years of historical data and an expected shortfall methodology equivalent to a 99% confidence level. Using a 95% confidence level, average VaR was $37MM, $39MM and $44MM for 1Q14, 4Q13 and 1Q13, respectively. 6 Represents a non-GAAP financial measure. For important presentation information, see slide 25, and for reconciliations to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings- related information. n/m = not meaningful • Net income of $1.3B improved versus both comparative periods – Excluding net DVA 2, net income of $1.2B, up modestly from 1Q13 and $894MM higher vs. 4Q13 • Excluding net DVA 2,4, sales and trading revenue of $4.1B decreased $47MM, or 1%, from 1Q13 and increased $1.1B or 37% vs. 4Q13 – FICC revenue decreased $51MM, or 2%, vs. 1Q13, driven by weaker results in Rates and Currencies due to declines in market volumes and volatility; revenue increased $870MM vs. 4Q13 from seasonally stronger results Adjusting for the 1Q13 impact of a monoline receivable write-down, revenue declined 15% vs. 1Q13 – Equities revenue was flat compared to 1Q13; revenue increased 28% vs. 4Q13 on seasonally higher client activity • Noninterest expense declined $202MM from 4Q13 and was flat to 1Q13; excluding litigation expense of $655MM in 4Q13, expenses increased $453MM due to seasonally higher incentive accruals aligned to sales and trading results $ in millions Net interest income 1 $1,000 ($143) ($110) Noninterest income (excl . net DVA) 2 3,903 1,219 88 Total revenue (excl . net DVA) 2, 3 4,903 1,076 (22) Net DVA 112 729 257 Total revenue, net of interest expense 1 5,015 1,805 235 Provis ion for credit losses 19 (85) 14 Noninterest expense 3,078 (202) 4 Income tax expense 1 608 739 19 Net income $1,310 $1,353 $198 Net income (excl . net DVA) 2 $1,240 $894 $37 Key Indicators ($ in billions) Average trading-related assets $437.1 $438.9 $504.3 Average loans and leases 63.7 66.5 52.7 IB fees 0.7 0.8 0.7 Sales and trading revenue 4.2 2.4 4.0 Sales and trading revenue (excl . net DVA) 2 4.1 3.0 4.2 FICC (excl . net DVA) 4 3.0 2.1 3.0 Equities (excl . net DVA) 4 1.2 0.9 1.1 Average VaR ($ in MM) 5 71 73 79 Return on average a l locat capita l 6 15.7 % n/m 15.1 % Excluding net DVA 2 14.8 4.6 % 16.3 Al located capita l 6 $34.0 $30.0 $30.0 Inc/(Dec) 1Q14 4Q13 1Q13 1Q14 4Q13 1Q13

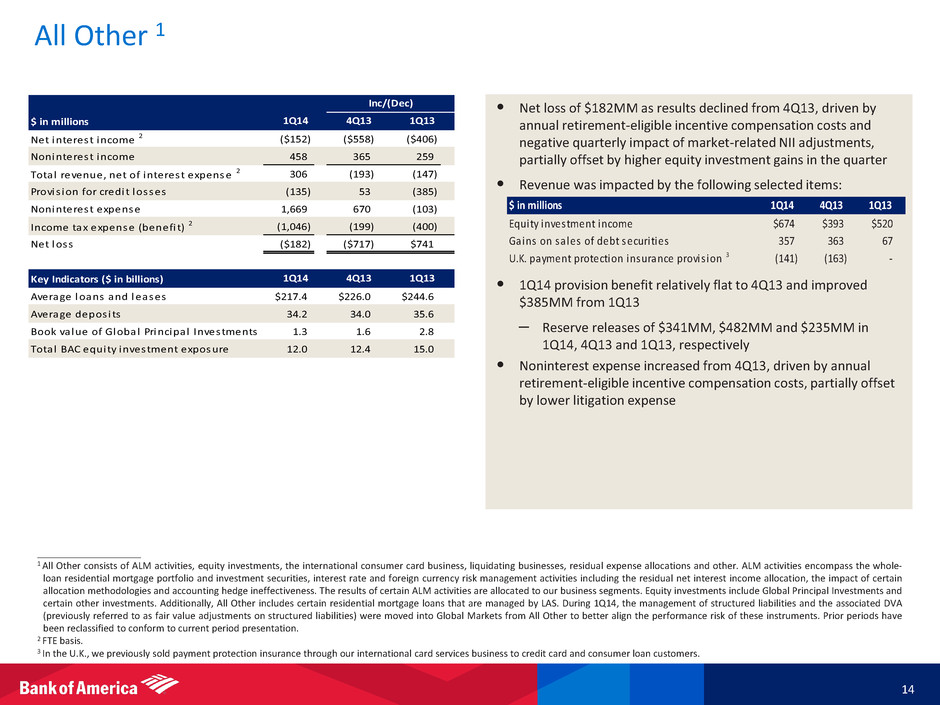

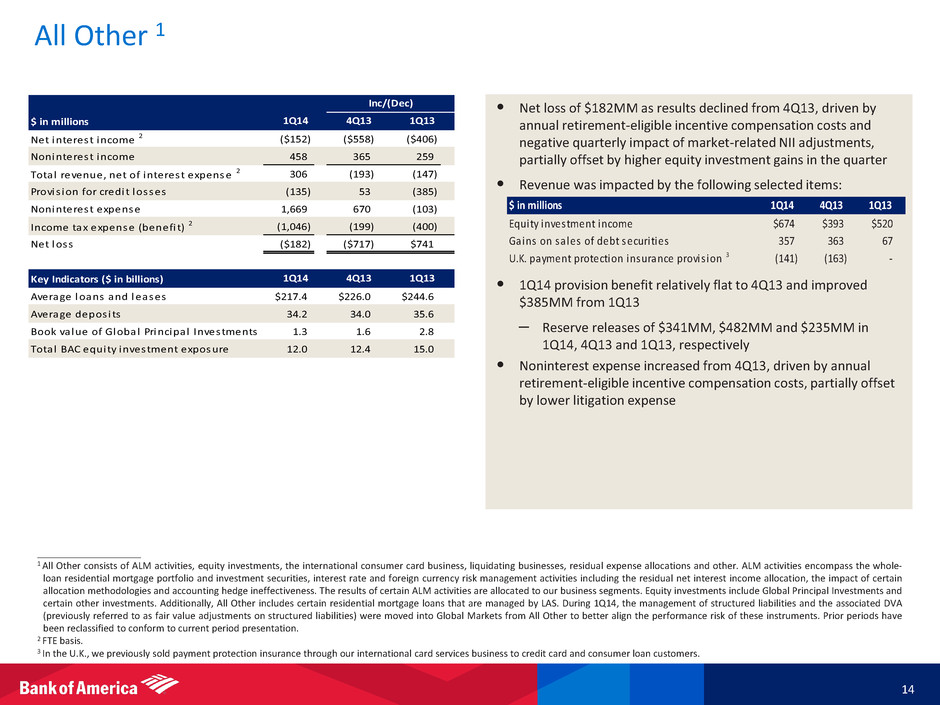

• Net loss of $182MM as results declined from 4Q13, driven by annual retirement-eligible incentive compensation costs and negative quarterly impact of market-related NII adjustments, partially offset by higher equity investment gains in the quarter • Revenue was impacted by the following selected items: • 1Q14 provision benefit relatively flat to 4Q13 and improved $385MM from 1Q13 – Reserve releases of $341MM, $482MM and $235MM in 1Q14, 4Q13 and 1Q13, respectively • Noninterest expense increased from 4Q13, driven by annual retirement-eligible incentive compensation costs, partially offset by lower litigation expense $ in millions Equity investment income $674 $393 $520 Gains on sales of debt securi ties 357 363 67 U.K. payment protection insurance provis ion 3 (141) (163) - 1Q14 4Q13 1Q13 ____________________ 1 All Other consists of ALM activities, equity investments, the international consumer card business, liquidating businesses, residual expense allocations and other. ALM activities encompass the whole- loan residential mortgage portfolio and investment securities, interest rate and foreign currency risk management activities including the residual net interest income allocation, the impact of certain allocation methodologies and accounting hedge ineffectiveness. The results of certain ALM activities are allocated to our business segments. Equity investments include Global Principal Investments and certain other investments. Additionally, All Other includes certain residential mortgage loans that are managed by LAS. During 1Q14, the management of structured liabilities and the associated DVA (previously referred to as fair value adjustments on structured liabilities) were moved into Global Markets from All Other to better align the performance risk of these instruments. Prior periods have been reclassified to conform to current period presentation. 2 FTE basis. 3 In the U.K., we previously sold payment protection insurance through our international card services business to credit card and consumer loan customers. 14 All Other 1 $ in millions Net interest income 2 ($152) ($558) ($406) Noninterest income 458 365 259 Total revenue, net of interest expense 2 306 (193) (147) Provis ion for credit losses (135) 53 (385) Noninterest expense 1,669 670 (103) Income tax expense (benefi t) 2 (1,046) (199) (400) Net loss ($182) ($717) $741 Key Indicators ($ in billi ns) Average loans and leases $217.4 $226.0 $244.6 Average depos its 34.2 34.0 35.6 Book va lue of Global Princip l Investments 1.3 1.6 2.8 Total BAC equity investment exposure 12.0 12.4 15.0 Inc/(Dec) 4Q13 1Q13 1Q14 4Q13 1Q13 1Q14

Appendix

____________________ 1 FTE basis. FTE basis for the Total Corporation and pre-tax, pre-provision earnings are non-GAAP financial measures. 2 For reconciliations to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information. Results by Business Segment $ in millions Total Corporation CBB CRES GWIM Global Banking Global Markets All Other Net interest income 1, 2 $10,286 $4,951 $701 $1,485 $2,301 $1,000 ($152) Card income 1,393 1,162 - 53 83 9 86 Service charges 1,826 1,045 - 20 687 73 1 Investment and brokerage services 3,269 61 - 2,604 25 561 18 Investment banking income (loss) 1,542 1 - 66 822 736 (83) Equity investment income 784 24 - 2 55 29 674 Trading account profits 2,467 - 2 47 44 2,367 7 Mortgage banking income (loss) 412 - 469 - - 1 (58) Gains on sales of debt securities 377 - 10 - - 10 357 All other income (loss) 411 194 10 270 252 229 (544) Total noninterest income 12,481 2,487 491 3,062 1,968 4,015 458 Total revenue, net of interest expense 1, 2 22,767 7,438 1,192 4,547 4,269 5,015 306 Total noninterest expense 22,238 3,975 8,129 3,359 2,028 3,078 1,669 Pre-tax, pre-provision earnings (loss) 1 529 3,463 (6,937) 1,188 2,241 1,937 (1,363) Provision for credit losses 1,009 812 25 23 265 19 (135) Income (loss) before income taxes (480) 2,651 (6,962) 1,165 1,976 1,918 (1,228) Income tax expense (benefit) 1, 2 (204) 993 (1,935) 436 740 608 (1,046) Net income (loss) ($276) $1,658 ($5,027) $729 $1,236 $1,310 ($182) 1Q14 16

Business Metrics Reflect Progress Consumer Metrics 17 Avg. Consumer and Business Banking Deposits ($B) and Rate Paid (bps) Mobile Banking Active Accounts (units in MM) 1 Banking Centers 5,651 5,389 5,095 3,000 4,000 5,000 6,000 1Q12 1Q13 1Q14 $73.4 $82.6 $100.2 $0 $20 $40 $60 $80 $100 $120 1Q12 1Q13 1Q14 $464 $503 $535 20 13 7 0 10 20 30 40 $0 $100 $200 $300 $400 $500 $600 1Q12 1Q13 1Q14 Average deposits Rate paid on deposits (bps) 782 906 1,027 60% 64% 63% 0% 25% 50% 75% 100% 0 300 600 900 1,200 1Q12 1Q13 1Q14 New card issuance % w/existing relationship 9.7 12.6 15.0 6% 10% 0% 5% 10% 15% 20% 0 5 10 15 20 1Q12 1Q13 1Q14 Mobile banking active accounts Mobile % of total deposit transactions 1,105 1,137 1,190 678 745 842 240 240 244 101 110 120 $2,124 $2,232 $2,396 $500 $1,000 $1,500 $2,000 $2,500 1Q12 1Q13 1Q14 Other client balances Assets under management Client deposits Loans and leases Merrill Edge Brokerage Assets ($B) Total U.S. Consumer New Card Issuance (units in 000’s) GWIM Client Balances ($B) 2, 3 ____________________ 1 Mobile check deposits capability launched in mid-2012. 2 1Q12 client balances include $18.6B end of period deposits that were migrated to Consumer and Business Banking, primarily in 1Q13. 3 Loans and leases include margin receivables which are classified in customer and other receivables on the Consolidated Balance Sheet.

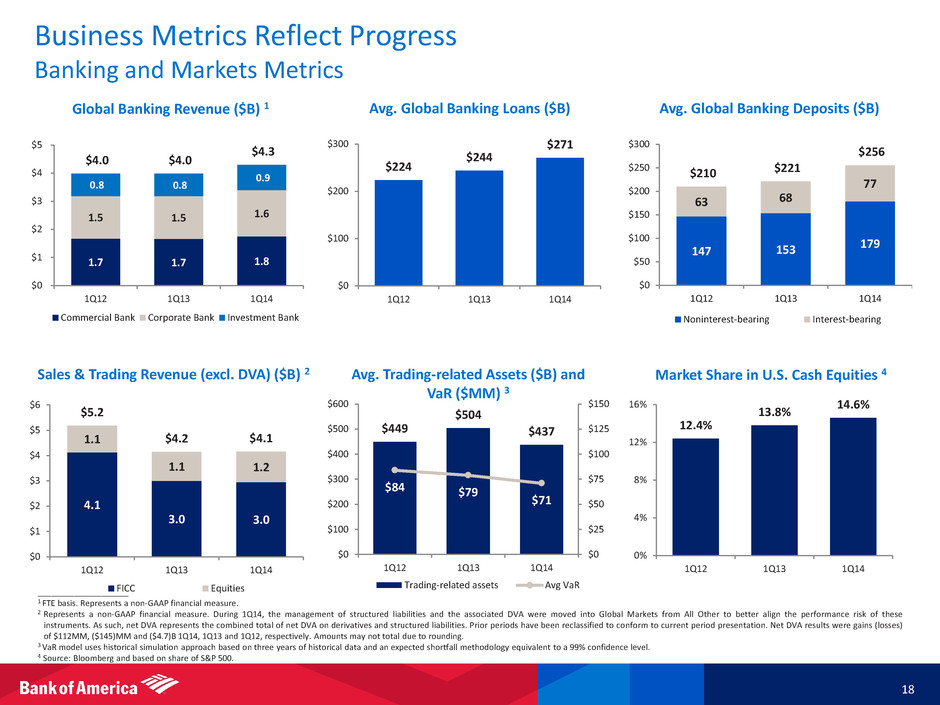

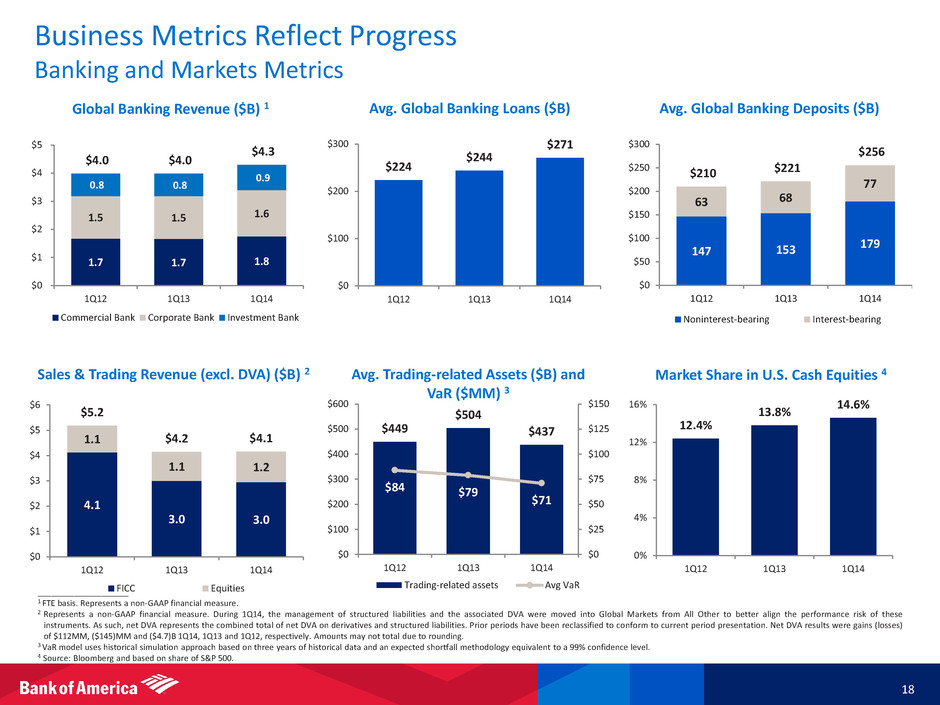

Business Metrics Reflect Progress Banking and Markets Metrics 18 ____________________ 1 FTE basis. Represents a non-GAAP financial measure. 2 Represents a non-GAAP financial measure. During 1Q14, the management of structured liabilities and the associated DVA were moved into Global Markets from All Other to better align the performance risk of these instruments. As such, net DVA represents the combined total of net DVA on derivatives and structured liabilities. Prior periods have been reclassified to conform to current period presentation. Net DVA results were gains (losses) of $112MM, ($145)MM and ($4.7)B 1Q14, 1Q13 and 1Q12, respectively. Amounts may not total due to rounding. 3 VaR model uses historical simulation approach based on three years of historical data and an expected shortfall methodology equivalent to a 99% confidence level. 4 Source: Bloomberg and based on share of S&P 500. Market Share in U.S. Cash Equities 4 Avg. Global Banking Loans ($B) Global Banking Revenue ($B) 1 Sales & Trading Revenue (excl. DVA) ($B) 2 Avg. Global Banking Deposits ($B) Avg. Trading-related Assets ($B) and VaR ($MM) 3 12.4% 13.8% 14.6% 0% 4% 8% 12% 16% 1Q12 1Q13 1Q14 1.7 1.7 1.8 1.5 1.5 1.6 0.8 0.8 0.9 $4.0 $4.0 $4.3 $0 $1 $2 $3 $4 $5 1Q12 1Q13 1Q14 Commercial Bank Corporate Bank Investment Bank 4.1 3.0 3.0 1.1 1.1 1.2 $5.2 $4.2 $4.1 $0 $1 $2 $3 $4 $5 $6 1Q12 1Q13 1Q14 FICC Equities 147 153 179 63 68 77 $210 $221 $256 $0 $50 $100 $150 $200 $250 $300 1Q12 1Q13 1Q14 Noninterest-bearing Interest-bearing $449 $504 $437 $84 $79 $71 $0 $25 $50 $75 $100 $125 $150 $0 $100 $200 $300 $400 $500 $600 1Q12 1Q13 1Q14 Trading-related assets Avg VaR $224 $244 $271 $0 $100 $200 $300 1Q12 1Q13 1Q14

Line of Business Allocated Capital 19 ____________________ 1 Represents a non-GAAP financial measure. For reconciliations to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information. 2 Allocations are subject to change over time, but the Corporation used 12/31/13 as a base for 1Q14 allocated capital when tangible common shareholders’ equity was $146B while the previous 2013 allocated capital utilized 12/31/12 tangible common shareholders’ equity of $144B. • The capital allocated to the Corporation's business segments is referred to as allocated capital, a non-GAAP financial measure, and is subject to change over time • Capital allocations consider the effect of regulatory capital requirements in addition to internal risk-based capital models. The Corporation's internal risk-based capital models use a risk-adjusted methodology incorporating each segment's credit, market, interest rate, business and operational risk components • Allocated capital is reviewed periodically and refinements are made based on multiple considerations that include, but are not limited to, business segment exposures and risk profile, regulatory constraints and strategic plans. Effective January 1, 2014, on a prospective basis, the Corporation adjusted the amount of capital being allocated to the business segments 2014 Allocated Capital ($B) - $146B 1, 2 $31 $34 $12 $30 $23 $11 $5 Global Banking All Other Global Markets GWIM CBB CRES Unallocated 2013 Allocated Capital ($B) - $144B 1, 2 $23 $30 $10 $30 $24 $11 $16 Global Banking All Other Global Markets GWIM CBB CRES Unallocated

Settlement with Financial Guaranty Insurance Co. (FGIC) and Certain Securitization Trusts 20 • On April 11, 2014, BAC reached a settlement with Financial Guaranty Insurance Co. (FGIC), as well as separate settlements with the Trustee for certain second-lien residential mortgage-backed securities (RMBS) securitization trusts. The agreements resolve all outstanding litigation between FGIC and BAC, as well as outstanding and potential claims by FGIC and the Trustee related to alleged representations and warranties breaches and other claims involving trusts for which FGIC provided financial guarantee insurance • Under the terms of the agreements, BAC agreed to make total cash payments of up to approximately $950MM, of which $584MM was paid to FGIC, with the remainder paid in connection with the trust settlements • Seven of the nine trust settlements have been completed, and the remaining two trust settlements are subject to additional investor approvals in a process that is expected to be completed within 45 days. In addition to the $584MM paid to FGIC, BAC has made payments totaling approximately $300MM under the seven completed trust settlements and will pay up to an additional approximately $50MM if the remaining two trust settlements are completed • The costs of the FGIC and trust settlements are covered by previously established reserves

Representations and Warranties Exposure 1 21 ____________________ 1 Exposures identified above relate only to repurchase claims associated with purported representations and warranties breaches. They do not include any exposures associated with related litigation matters; separate foreclosure costs and related costs and assessments; or possible losses related to potential claims for breaches of performance of servicing obligations, potential securities law or fraud claims, potential indemnity or other claims against us, including claims related to loans guaranteed by the FHA. If adverse to us, the aforementioned items could have a material adverse effect on our financial results in future periods. 2 Mix for new claim trends is calculated based on last four quarters. 3 Level of reserves established and RPL are subject to adjustments in future periods based on a number of factors including ultimate resolution of the BNY Mellon settlement, changes in estimated repurchase rates, economic conditions, home prices, consumer and counterparty behavior, and a variety of judgmental factors. 4 Does not include litigation reserves established. In addition, the company currently estimates the RPL could be up to $4B over accruals at March 31, 2014, unchanged from December 31, 2013. Following the FHLMC and FNMA settlements, the remaining RPL covers principally non-GSE exposures. 5 Refer to pages 54-57 of the Corporation’s 2013 Annual Report on Form 10-K on file with the SEC for additional disclosures. $ in millions 1Q13 2Q13 3Q13 4Q13 1Q14 GSEs $1,100 $1,035 $998 $170 $124 Private 13,387 13,826 14,649 17,953 18,604 Monolines 2,481 1,535 1,533 1,532 1,536 Total $16,968 $16,396 $17,180 $19,655 $20,264 Outstanding Claims by Counterparty (UPB) $ in millions Pre 2005 $26 $30 $48 $42 $96 3 % 2005 217 37 207 278 74 8 2006 720 430 826 1,614 973 49 2007 703 561 303 1,826 50 35 2008 43 39 112 30 11 2 Post 2008 127 74 60 38 48 3 New Claims $1,836 $1,171 $1,556 $3,828 $1,252 % GSEs 23 % 40 % 32 % 10 % 12 % Rescinded claims $392 $409 $412 $442 $162 Approved repurchases 303 351 269 299 177 New Claim Trends (UPB) Mix 24Q13 1Q142Q131Q13 3Q13 Counterparty Original Balance Outstanding Balance Have Paid Reserves Established 3, 4 Commentary 3, 5 GSE - Whole loans $1,118 $229 FHLMC and FNMA Agreements S cond-lien monoline 81 10 Completed agreements with Assured, Syncora and MBIA Subsequent to 3/31/14, completed agreement with FGIC Whole loans sold 55 10 Reserves established Private lab l (CFC issued) 409 106 BNY Mellon settlement received court approval and pending appeal Pr vate label (non CFC bank issued) 244 44 Reserves established; Included in RPL Pri ate l bel ( rd party issued) 176 44 Reserves established; Included in RPL $2,083 $443 $22.8 $13.4 Reserves Established (Balances Shown for 2004-2008 Originations) ($B) 1Q14 and 4Q13 include new claims of $0.9B and $2.7B which were submitted without individual loan file reviews 1Q14 includes outstanding claims of $5.1B submitted without individual loan file reviews

____________________ 1 Excludes FVO loans. 2 Excludes write-offs of PCI loans of $281MM and $437MM related to residential mortgage and $110MM and $304MM related to home equity for 1Q14 and 4Q13. Net charge-off ratios including the PCI write-offs for residential mortgage were 0.67% and 1.02%, and for home equity were 1.81% and 2.64% for 1Q14 and 4Q13. 3 4Q13 includes the impact of a clarification of regulatory guidance on accounting for TDRs of $56 million for residential mortgage loans and $88 million for home equity loans. Excluding this impact, 4Q13 net charge-off ratios for residential mortgage were 0.24% and 0.42% including and excluding the PCI and fully-insured portfolios. 4Q13 home equity net charge-off ratios were 1.01% and 1.09% including and excluding the PCI portfolio. 4 Loan-to-value (LTV) calculations apply to the residential mortgage portfolio. Combined loan-to-value (CLTV) calculations apply to the home equity portfolio. Home Loans Asset Quality Key Indicators 22 Loans end of period $242,977 $141,428 $248,066 $142,147 $91,476 $85,141 $93,672 $87,079 Loans average 245,562 143,336 251,841 144,859 92,592 86,160 95,244 88,403 Net charge-offs 2, 3 $127 $127 $209 $209 $302 $302 $331 $331 % of average loans 3 0.21 % 0.36 % 0.33 % 0.57 % 1.32 % 1.42 % 1.38 % 1.49 % Allowance for loan losses $3,502 $2,337 $4,084 $2,638 $4,054 $3,117 $4,434 $3,387 % of loans 1.44 % 1.65 % 1.65 % 1.86 % 4.43 % 3.66 % 4.73 % 3.89 % Average refreshed (C)LTV 4 66 68 70 72 90%+ refreshed (C)LTV 4 15 % 17 % 26 % 28 % Average refreshed FICO 729 727 746 746 % below 620 FICO 11 % 11 % 7 % 8 % $ in mi l l ions Residential Mortgage 1 Home Equity 1 1Q14 4Q13 1Q14 4Q13 As Reported Excluding Purchased Credit-impaired and Ful ly-insured Loans As Reported Excluding Purchased Credit-impaired and Ful ly-insured Loans As Reported Excluding Purchased Credit-impaired Loans As Reported Excluding Purchased Credit-impaired Loans

Regulatory Capital Reconciliation 1, 2 ____________________ 1 Regulatory capital ratios are preliminary until filed with the Federal Reserve on Form Y-9C. For important presentation information, see slide 25. 2 On January 1, 2014, the Basel 3 rules became effective, subject to transition provisions primarily related to regulatory deductions and adjustments impacting common equity tier 1 capital and Tier 1 capital. We reported under Basel 1 (which included the Market Risk Final Rules) at December 31, 2013. n/a = not applicable $ in mill ions Regulatory Capital – Basel 1 to Basel 3 (fully phased-in) Basel 1 Tier 1 capital $161,456 Deduction of qualifying preferred stock and trust preferred securities (16,221) Basel 1 Tier 1 common capital 145,235 Deduction of defined benefit pension assets (829) DTA and other threshold deductions (DTA temporary differences, MSRs and significant investments) (4,803) Net unrealized losses in accumulated OCI on AFS debt and certain marketable equity securities, and employee benefit plans (5,668) Other deductions, net (1,620) Basel 3 (fully phased-in) Tier 1 common capital $132,315 Regulatory Capital – Basel 3 transition to fully phased-in Common equity tier 1 capital (transition) $151,642 Adjustments and deductions recognized in Tier 1 capital during transition (9,284) Other adjustments and deductions phased in during transition (8,197) Common equity tier 1 capital (fully phased-in) $134,161 Risk-weighted Assets – As reported to Basel 3 (fully phased-in) As reported risk-weighted assets $1,282,492 $1,297,534 Change in risk-weighted assets from reported to fully phased-in 165,596 164,449 Basel 3 Standardized approach risk-weighted assets (fully phased-in) 1,448,088 1,461,983 Change in risk-weighted assets for advanced models (86,201) (132,939) Basel 3 Advanced approaches risk-weighted assets (fully phased-in) $1,361,887 1,329,044$ Regulatory Capital Ratios Basel 1 Tier 1 common n/a 11.2 % Basel 3 Standardized approach common equity tier 1 (transition) 11.8 % n/a Basel 3 Standardized approach common equity tier 1 (fully phased-in) 9.3 9.1 Basel 3 Advanced approaches common equity tier 1 (fully phased-in) 9.9 10.0 March 31 2014 March 31 2014 December 31 2013 December 31 2013 23

Forward-Looking Statements 24 Bank of America and its management may make certain statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “anticipates,” “targets,” “expects,” “hopes,” “estimates,” “intends,” “plans,” “goals,” “believes,” “continue” and other similar expressions or future or conditional verbs such as “will,” “may,” “might,” “should,” “would” and “could.” The forward-looking statements made in this presentation represent Bank of America's current expectations, plans or forecasts of its future results and revenues, and future business and economic conditions more generally, and other matters. These statements are not guarantees of future results or performance and involve certain risks, uncertainties and assumptions that are difficult to predict and are often beyond Bank of America’s control. Actual outcomes and results may differ materially from those expressed in, or implied by, any of these forward-looking statements. You should not place undue reliance on any forward-looking statement and should consider the following uncertainties and risks, as well as the risks and uncertainties more fully discussed under Item 1A. Risk Factors of Bank of America's 2013 Annual Report on Form 10-K, and in any of Bank of America's subsequent Securities and Exchange Commission filings: the Company's ability to resolve representations and warranties repurchase claims made by monolines and private-label and other investors, including as a result of any adverse court rulings, and the chance that the Company could face related servicing, securities, fraud, indemnity or other claims from one or more counterparties, including monolines or private-label and other investors; the possibility that final court approval of negotiated settlements is not obtained; the possibility that the court decision with respect to the BNY Mellon Settlement is overturned on appeal in whole or in part; potential claims, damages, penalties and fines resulting from pending or future litigation and regulatory proceedings, including proceedings instituted by the U.S. Department of Justice, state Attorneys General and other members of the RMBS Working Group of the Financial Fraud Enforcement Task Force concerning mortgage-related matters; the possibility that the European Commission will impose remedial measures in relation to its investigation of the Company's competitive practices; the possible outcome of LIBOR, other reference rate and foreign exchange inquiries and investigations; the possibility that future representations and warranties losses may occur in excess of the Company's recorded liability and estimated range of possible loss for its representations and warranties exposures; the possibility that the Company may not collect mortgage insurance claims; the possibility that future claims, damages, penalties and fines may occur in excess of the Company’s recorded liability and estimated range of possible losses for litigation exposures; uncertainties about the financial stability and growth rates of non-U.S. jurisdictions, the risk that those jurisdictions may face difficulties servicing their sovereign debt, and related stresses on financial markets, currencies and trade, and the Company's exposures to such risks, including direct, indirect and operational; uncertainties related to the timing and pace of Federal Reserve tapering of quantitative easing, and the impact on global interest rates, currency exchange rates, and economic conditions in a number of countries; the possibility of future inquiries or investigations regarding pending or completed foreclosure activities; the possibility that unexpected foreclosure delays could impact the rate of decline of default-related servicing costs; uncertainty regarding timing and the potential impact of regulatory capital and liquidity requirements (including Basel 3); the negative impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act on the Company's businesses and earnings, including as a result of additional regulatory interpretation and rulemaking and the success of the Company's actions to mitigate such impacts; the potential impact of implementing and conforming to the Volcker Rule; the potential impact of future derivative regulations; adverse changes to the Company's credit ratings from the major credit rating agencies; estimates of the fair value of certain of the Company's assets and liabilities; reputational damage that may result from negative publicity, fines and penalties from regulatory violations and judicial proceedings; the Company's ability to fully realize the cost savings and other anticipated benefits from Project New BAC, including in accordance with currently anticipated timeframes; a failure in or breach of the Company’s operational or security systems or infrastructure, or those of third parties with which we do business, including as a result of cyber attacks; the impact on the Company's business, financial condition and results of operations of a potential higher interest rate environment; and other similar matters. Forward-looking statements speak only as of the date they are made, and Bank of America undertakes no obligation to update any forward-looking statement to reflect the impact of circumstances or events that arise after the date the forward-looking statement was made.

• The information contained herein is preliminary and based on Company data available at the time of the earnings presentation. It speaks only as of the particular date or dates included in the accompanying slides. Bank of America does not undertake an obligation to, and disclaims any duty to, update any of the information provided. • Certain prior period amounts have been reclassified to conform to current period presentation. • The Company's fully phased-in Basel 3 estimates and the supplementary leverage ratio are based on its current understanding of the Standardized and Advanced approaches under the Basel 3 rules, assuming all relevant regulatory model approvals, except for the potential reduction to risk-weighted assets resulting from removal of the Comprehensive Risk Measure surcharge. These estimates will evolve over time as the Company's businesses change and as a result of further rulemaking or clarification by U.S. regulatory agencies. The Basel 3 rules require approval by banking regulators of certain models used as part of risk-weighted asset calculations. If these models are not approved, the Company's capital ratio would likely be adversely impacted, which in some cases could be significant. These estimates assist management, investors and analysts in assessing capital adequacy and comparability under Basel 3 to other financial services companies. The Company continues to evaluate the potential impact of proposed rules and anticipates it will be in compliance with any final rules by the proposed effective dates. • Certain financial measures contained herein represent non-GAAP financial measures. For more information about the non-GAAP financial measures contained herein, please see the presentation of the most directly comparable financial measures calculated in accordance with GAAP and accompanying reconciliations in the earnings press release for the quarter ended March 31, 2014 and other earnings-related information available through the Bank of America Investor Relations web site at: http://investor.bankofamerica.com. • The Company allocates capital to its business segments using a methodology that considers the effect of regulatory capital requirements in addition to internal risk-based capital models. The Company's internal risk-based capital models use a risk-adjusted methodology incorporating each segment's credit, market, interest rate, business and operational risk components. Allocated capital is reviewed periodically and refinements are made based on multiple considerations that include, but are not limited to, business segment exposures and risk profile, regulatory constraints and strategic plans. As part of this process, in the first quarter of 2014, the Company adjusted the amount of capital being allocated to its business segments. This change resulted in a reduction of the unallocated capital, which is reflected in All Other, and an aggregate increase to the amount of capital being allocated to the business segments. Prior periods were not restated. Important Presentation Information 25