Bank of America 3Q15 Financial Results October 14, 2015

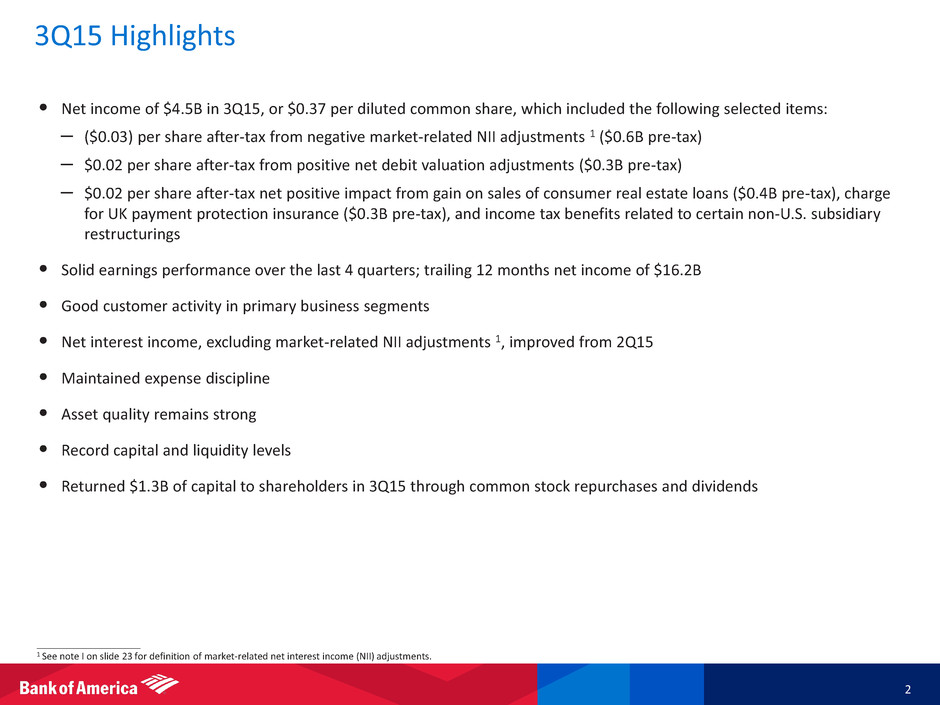

3Q15 Highlights 2 • Net income of $4.5B in 3Q15, or $0.37 per diluted common share, which included the following selected items: – ($0.03) per share after-tax from negative market-related NII adjustments 1 ($0.6B pre-tax) – $0.02 per share after-tax from positive net debit valuation adjustments ($0.3B pre-tax) – $0.02 per share after-tax net positive impact from gain on sales of consumer real estate loans ($0.4B pre-tax), charge for UK payment protection insurance ($0.3B pre-tax), and income tax benefits related to certain non-U.S. subsidiary restructurings • Solid earnings performance over the last 4 quarters; trailing 12 months net income of $16.2B • Good customer activity in primary business segments • Net interest income, excluding market-related NII adjustments 1, improved from 2Q15 • Maintained expense discipline • Asset quality remains strong • Record capital and liquidity levels • Returned $1.3B of capital to shareholders in 3Q15 through common stock repurchases and dividends ____________________ 1 See note I on slide 23 for definition of market-related net interest income (NII) adjustments.

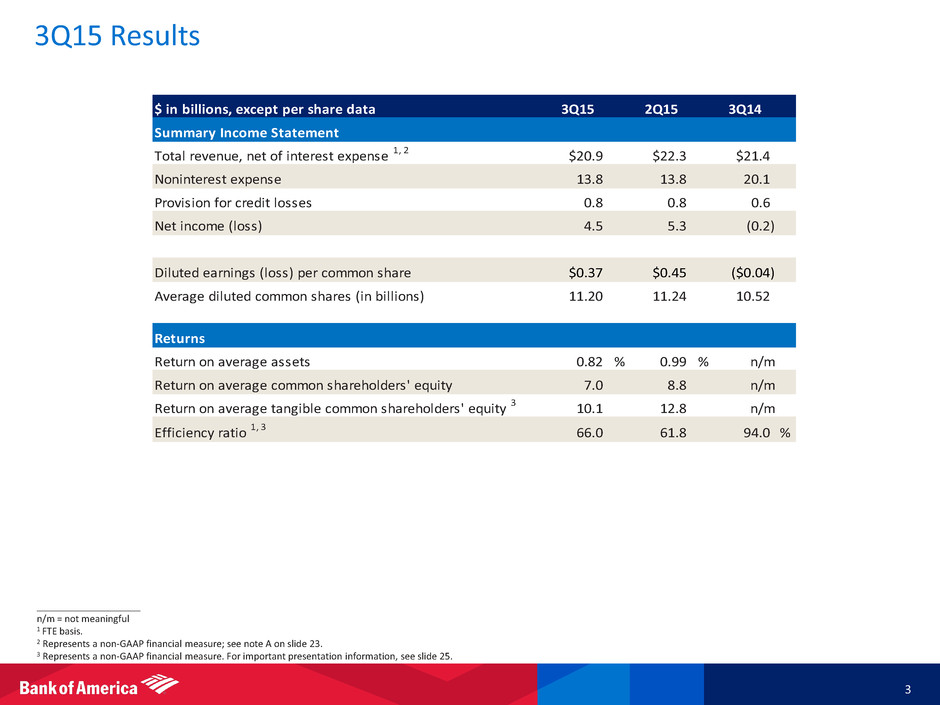

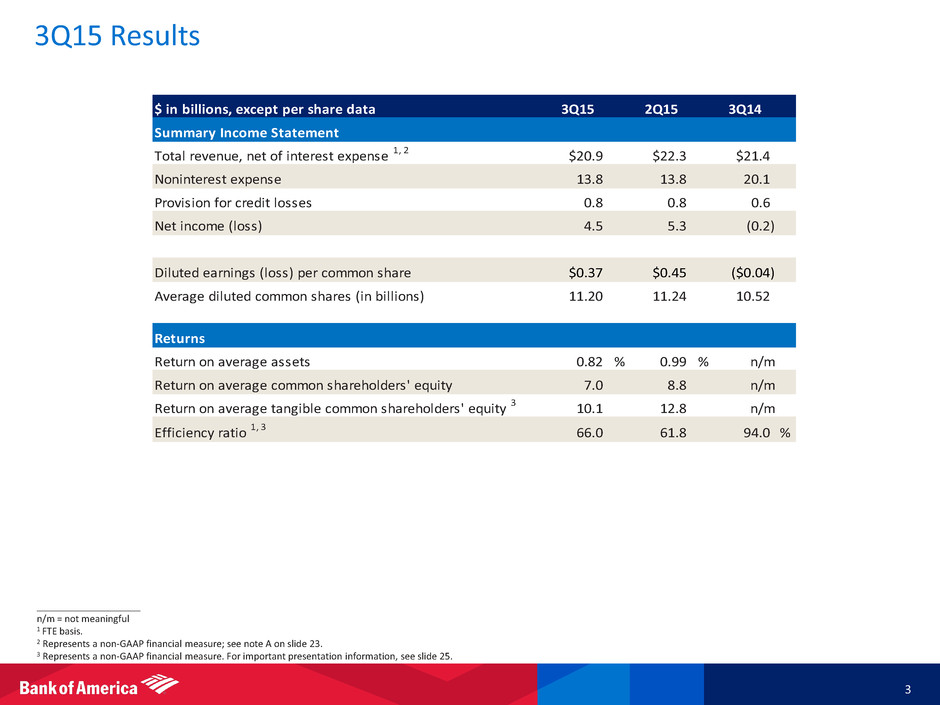

3Q15 Results 3 ____________________ n/m = not meaningful 1 FTE basis. 2 Represents a non-GAAP financial measure; see note A on slide 23. 3 Represents a non-GAAP financial measure. For important presentation information, see slide 25. $ in billions, except per share data 3Q15 2Q15 3Q14 Summary Income Statement Total revenue, net of interest expense 1, 2 $20.9 $22.3 $21.4 Noninterest expense 13.8 13.8 20.1 Provision for credit losses 0.8 0.8 0.6 Net income (loss) 4.5 5.3 (0.2) Diluted earnings (loss) per common share $0.37 $0.45 ($0.04) Average diluted common shares (in billions) 11.20 11.24 10.52 Returns Return on average assets 0.82 % 0.99 % n/m Return on average common shareholders' equity 7.0 8.8 n/m Return on average tangible common shareholders' equity 3 10.1 12.8 n/m Efficiency ratio 1, 3 66.0 61.8 94.0 %

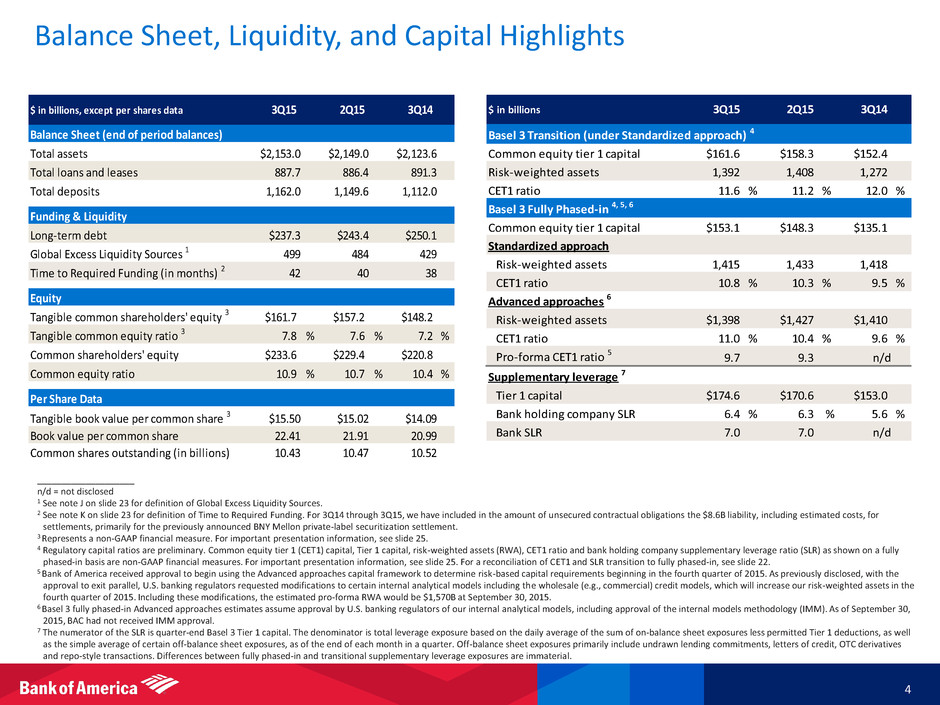

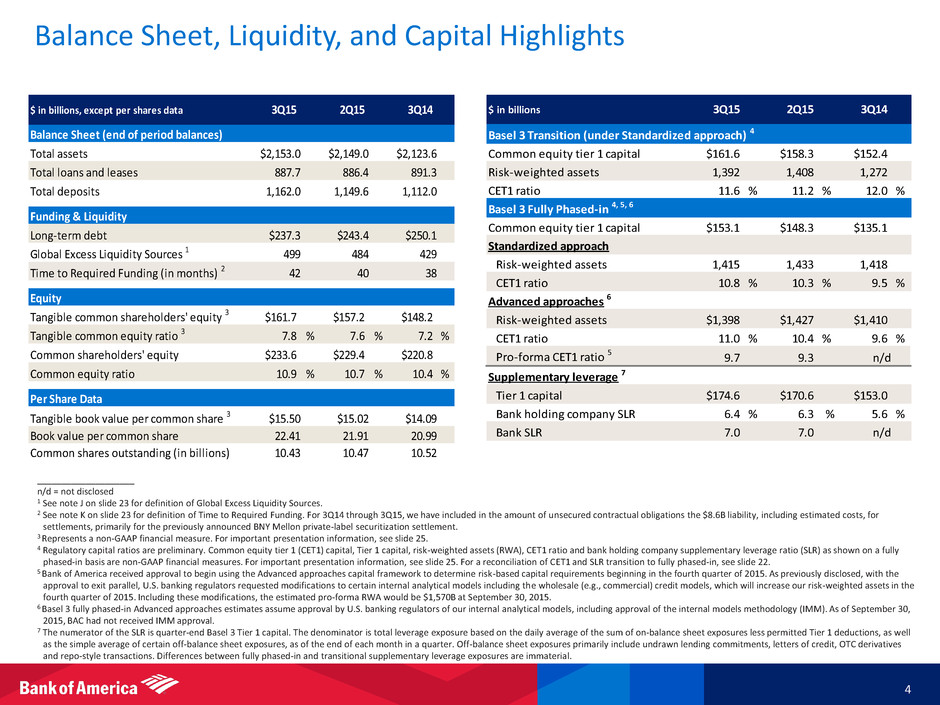

Balance Sheet, Liquidity, and Capital Highlights 4 $ in billions, except per shares data Balance Sheet (end of period balances) Total assets $2,153.0 $2,149.0 $2,123.6 Total loans and leases 887.7 886.4 891.3 Total deposits 1,162.0 1,149.6 1,112.0 Funding & Liquidity Long-term debt $237.3 $243.4 $250.1 Global Excess Liquidity Sources 1 499 484 429 Time to Required Funding (in months) 2 42 40 38 Equity Tangible common shareholders' equity 3 $161.7 $157.2 $148.2 Tangible common equity ratio 3 7.8 % 7.6 % 7.2 % Common shareholders' equity $233.6 $229.4 $220.8 Common equity ratio 10.9 % 10.7 % 10.4 % Per Share Data Tangible book value per common share 3 $15.50 $15.02 $14.09 Book value per common share 22.41 21.91 20.99 Common shares outstanding (in billions) 10.43 10.47 10.52 3Q15 2Q15 3Q14 ____________________ n/d = not disclosed 1 See note J on slide 23 for definition of Global Excess Liquidity Sources. 2 See note K on slide 23 for definition of Time to Required Funding. For 3Q14 through 3Q15, we have included in the amount of unsecured contractual obligations the $8.6B liability, including estimated costs, for settlements, primarily for the previously announced BNY Mellon private-label securitization settlement. 3 Represents a non-GAAP financial measure. For important presentation information, see slide 25. 4 Regulatory capital ratios are preliminary. Common equity tier 1 (CET1) capital, Tier 1 capital, risk-weighted assets (RWA), CET1 ratio and bank holding company supplementary leverage ratio (SLR) as shown on a fully phased-in basis are non-GAAP financial measures. For important presentation information, see slide 25. For a reconciliation of CET1 and SLR transition to fully phased-in, see slide 22. 5 Bank of America received approval to begin using the Advanced approaches capital framework to determine risk-based capital requirements beginning in the fourth quarter of 2015. As previously disclosed, with the approval to exit parallel, U.S. banking regulators requested modifications to certain internal analytical models including the wholesale (e.g., commercial) credit models, which will increase our risk-weighted assets in the fourth quarter of 2015. Including these modifications, the estimated pro-forma RWA would be $1,570B at September 30, 2015. 6 Basel 3 fully phased-in Advanced approaches estimates assume approval by U.S. banking regulators of our internal analytical models, including approval of the internal models methodology (IMM). As of September 30, 2015, BAC had not received IMM approval. 7 The numerator of the SLR is quarter-end Basel 3 Tier 1 capital. The denominator is total leverage exposure based on the daily average of the sum of on-balance sheet exposures less permitted Tier 1 deductions, as well as the simple average of certain off-balance sheet exposures, as of the end of each month in a quarter. Off-balance sheet exposures primarily include undrawn lending commitments, letters of credit, OTC derivatives and repo-style transactions. Differences between fully phased-in and transitional supplementary leverage exposures are immaterial. $ in billions Basel 3 Transition (under Standardized approach) 4 Common equity tier 1 capital $161.6 $158.3 $152.4 Risk-weighted assets 1,392 1,408 1,272 CET1 ratio 11.6 % 11.2 % 12.0 % Basel 3 Fully Phased-in 4, 5, 6 Common equity tier 1 capital $153.1 $148.3 $135.1 Standardized approach Risk-weighted assets 1,415 1,433 1,418 CET1 ratio 10.8 % 10.3 % 9.5 % Advanced approaches 6 Risk-weighted assets $1,398 $1,427 $1,410 CET1 ratio 11.0 % 10.4 % 9.6 % Pr -forma CET1 ratio 5 9.7 9.3 n/d Supplementary leverage 7 Tier 1 capital $174.6 $170.6 $153.0 Bank holding company SLR 6.4 % 6.3 % 5.6 % Bank SLR 7.0 7.0 n/d 3Q15 2Q15 3Q14

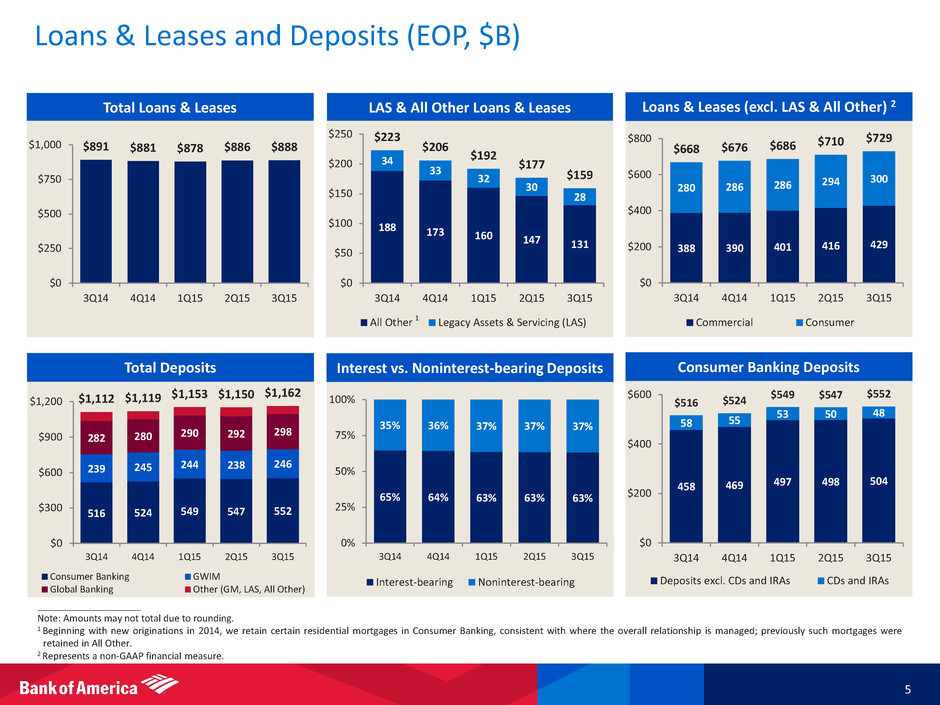

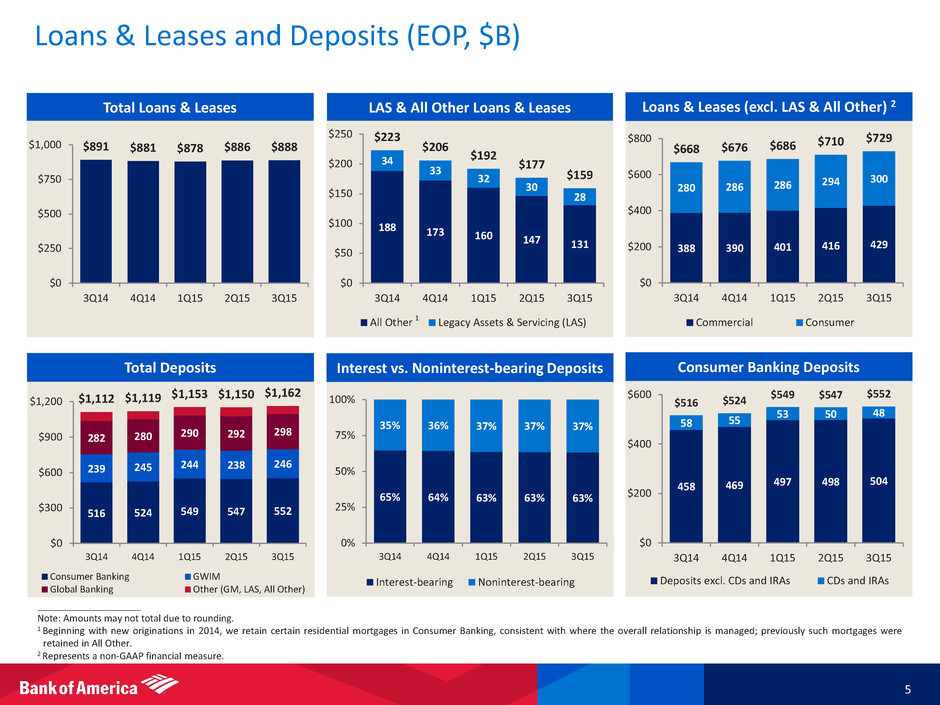

Loans & Leases and Deposits (EOP, $B) 5 ____________________ Note: Amounts may not total due to rounding. 1 Beginning with new originations in 2014, we retain certain residential mortgages in Consumer Banking, consistent with where the overall relationship is managed; previously such mortgages were retained in All Other. 2 Represents a non-GAAP financial measure. Total Loans & Leases LAS & All Other Loans & Leases $891 $881 $878 $886 $888 $0 $250 $500 $750 $1,000 3Q14 4Q14 1Q15 2Q15 3Q15 188 173 160 147 131 34 33 32 30 28 $223 $206 $192 $177 $159 $0 $50 $100 $150 $200 $250 3Q14 4Q14 1Q15 2Q15 3Q15 All Other Legacy Assets & Servicing (LAS) 388 390 401 416 429 280 286 286 294 300 $668 $676 $686 $710 $729 $0 $200 $400 $600 $800 3Q14 4Q14 1Q15 2Q15 3Q15 Commercial Consumer Consumer Banking Deposits 458 469 497 498 504 58 55 53 50 48 $516 $524 $549 $547 $552 $0 $200 $400 $600 3Q14 4Q14 1Q15 2Q15 3Q15 Deposits excl. CDs and IRAs CDs and IRAs Total Deposits 516 524 549 547 552 239 245 244 238 246 282 280 290 292 298 $1,112 $1,119 $1,153 $1,150 $1,162 $0 $300 $600 $900 $1,200 3Q14 4Q14 1Q15 2Q15 3Q15 Consumer Banking GWIM Global Banking Other (GM, LAS, All Other) Interest vs. Noninterest-bearing Deposits 65% 64% 63% 63% 63% 35% 36% 37% 37% 37% 0% 25% 50% 75% 100% 3Q14 4Q14 1Q15 2Q15 3Q15 Interest-bearing Noninterest-bearing 1 Loans & Leases (excl. LAS & All Other) 2

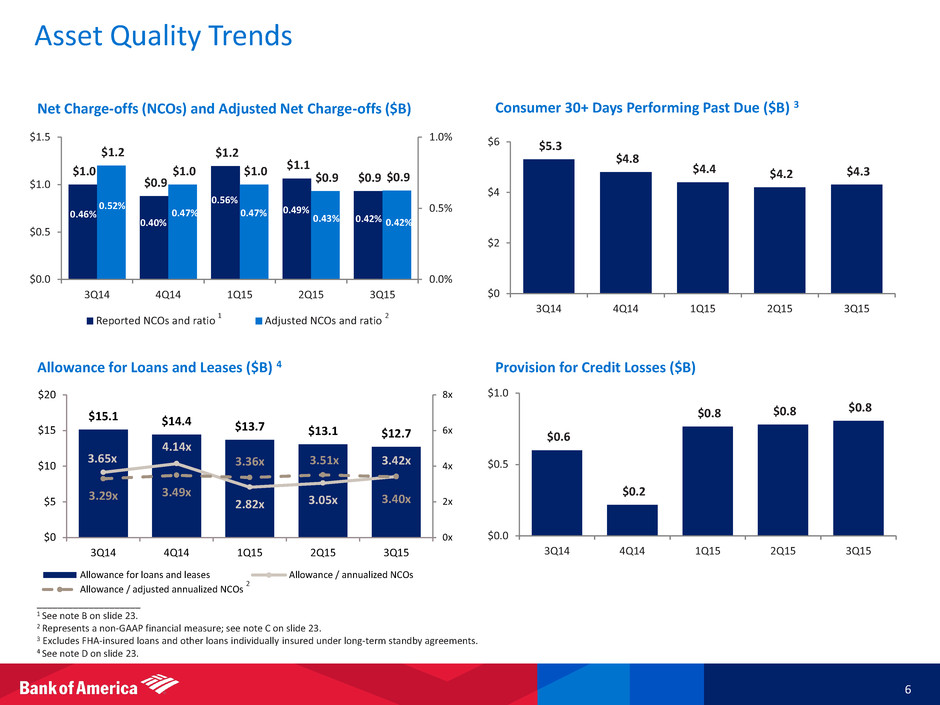

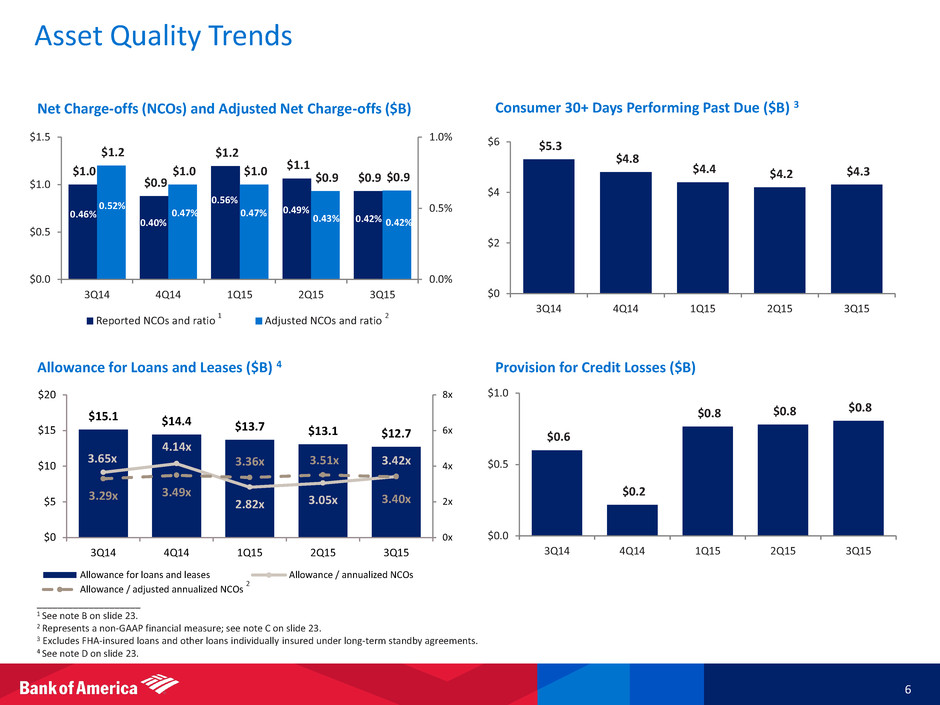

$1.0 $0.9 $1.2 $1.1 $0.9 $1.2 $1.0 $1.0 $0.9 $0.9 0.52% 0.47% 0.47% 0.43% 0.42% 0.46% 0.40% 0.56% 0.49% 0.42% 0.0% 0.5% 1.0% $0.0 $0.5 $1.0 $1.5 3Q14 4Q14 1Q15 2Q15 3Q15 Reported NCOs and ratio Adjusted NCOs and ratio ____________________ 1 See note B on slide 23. 2 Represents a non-GAAP financial measure; see note C on slide 23. 3 Excludes FHA-insured loans and other loans individually insured under long-term standby agreements. 4 See note D on slide 23. Asset Quality Trends 6 Net Charge-offs (NCOs) and Adjusted Net Charge-offs ($B) Allowance for Loans and Leases ($B) 4 Provision for Credit Losses ($B) Consumer 30+ Days Performing Past Due ($B) 3 $0.6 $0.2 $0.8 $0.8 $0.8 $0.0 $0.5 $1.0 3Q14 4Q14 1Q15 2Q15 3Q15 $5.3 $4.8 $4.4 $4.2 $4.3 $0 $2 $4 $6 3Q14 4Q14 1Q15 2Q15 3Q15 $15.1 $14.4 $13.7 $13.1 $12.7 3.65x 4.14x 2.82x 3.05x 3.42x 3.29x 3.49x 3.36x 3.51x 3.40x 0x 2x 4x 6x 8x $0 $5 $10 $15 $20 3Q14 4Q14 1Q15 2Q15 3Q15 T h o u s a n d s Allowance for loans and leases Allowance / annualized NCOs Allowance / adjusted annualized NCOs 2 1 2

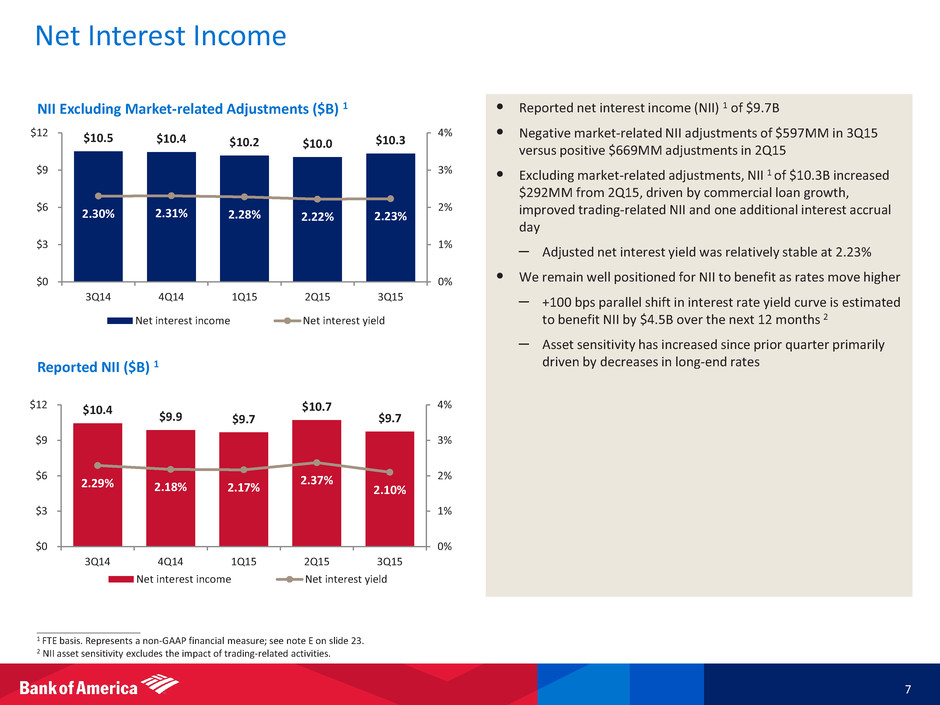

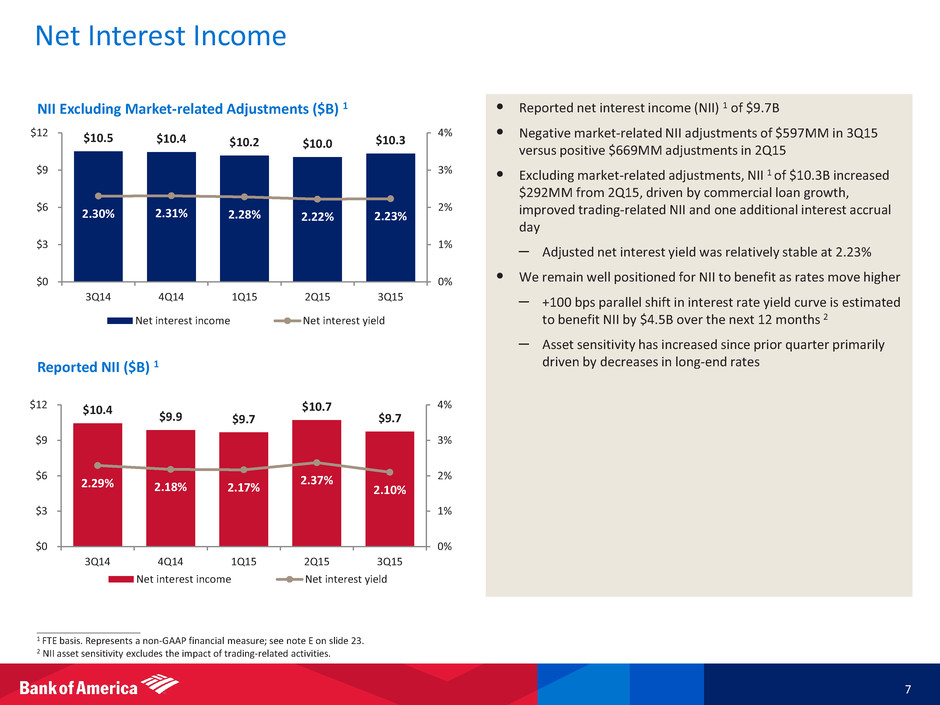

Net Interest Income 7 • Reported net interest income (NII) 1 of $9.7B • Negative market-related NII adjustments of $597MM in 3Q15 versus positive $669MM adjustments in 2Q15 • Excluding market-related adjustments, NII 1 of $10.3B increased $292MM from 2Q15, driven by commercial loan growth, improved trading-related NII and one additional interest accrual day – Adjusted net interest yield was relatively stable at 2.23% • We remain well positioned for NII to benefit as rates move higher – +100 bps parallel shift in interest rate yield curve is estimated to benefit NII by $4.5B over the next 12 months 2 – Asset sensitivity has increased since prior quarter primarily driven by decreases in long-end rates ____________________ 1 FTE basis. Represents a non-GAAP financial measure; see note E on slide 23. 2 NII asset sensitivity excludes the impact of trading-related activities. Reported NII ($B) 1 NII Excluding Market-related Adjustments ($B) 1 $10.4 $9.9 $9.7 $10.7 $9.7 2.29% 2.18% 2.17% 2.37% 2.10% 0% 1% 2% 3% 4% $0 $3 $6 $9 $12 3Q14 4Q14 1Q15 2Q15 3Q15 Net interest income Net interest yield $10.5 $10.4 $10.2 $10.0 $10.3 2.30% 2.31% 2.28% 2.22% 2.23% 0% 1% 2% 3% 4% $0 $3 $6 $9 $12 3Q14 4Q14 1Q15 2Q15 3Q15 Net interest income Net interest yield

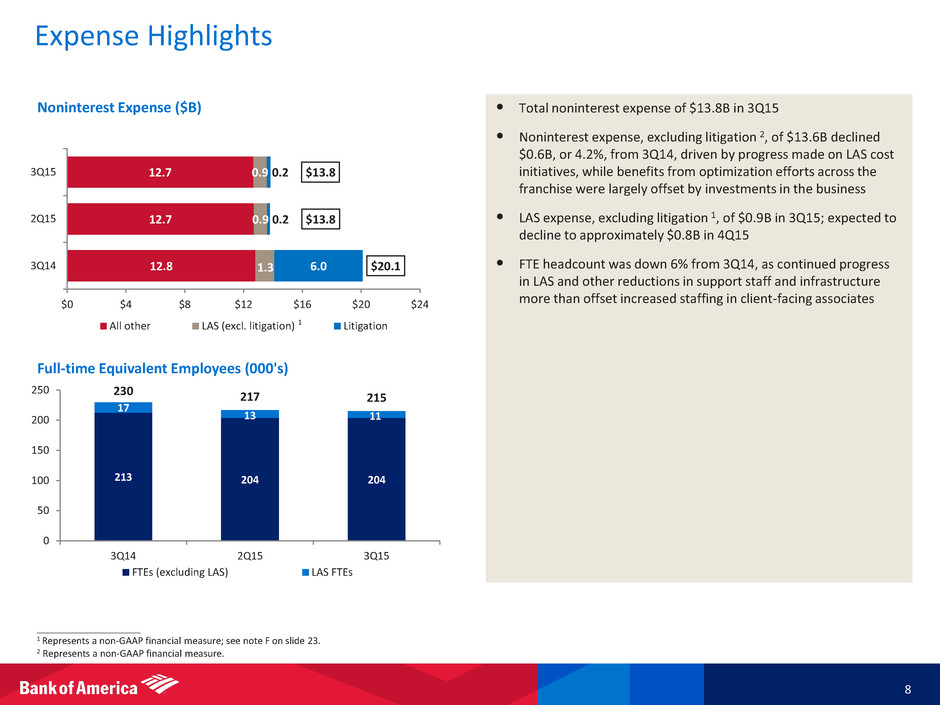

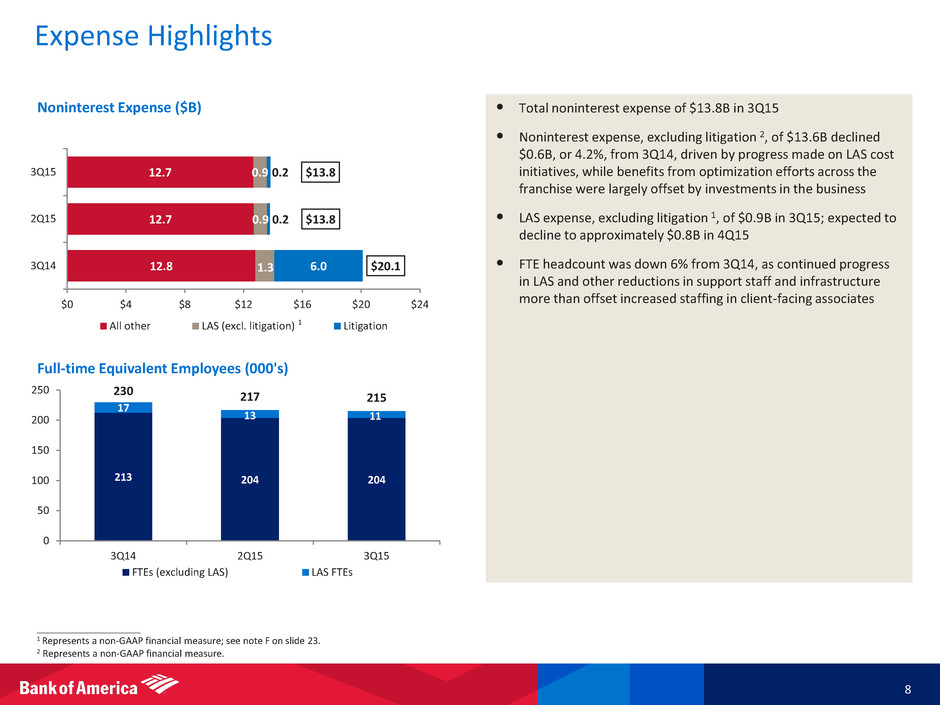

12.8 12.7 12.7 1.3 0.9 0.9 6.0 0.2 0.2 $20.1 $13.8 $13.8 $0 $4 $8 $12 $16 $20 $24 3Q14 2Q15 3Q15 All other LAS (excl. litigation) Litigation Expense Highlights ____________________ 1 Represents a non-GAAP financial measure; see note F on slide 23. 2 Represents a non-GAAP financial measure. • Total noninterest expense of $13.8B in 3Q15 • Noninterest expense, excluding litigation 2, of $13.6B declined $0.6B, or 4.2%, from 3Q14, driven by progress made on LAS cost initiatives, while benefits from optimization efforts across the franchise were largely offset by investments in the business • LAS expense, excluding litigation 1, of $0.9B in 3Q15; expected to decline to approximately $0.8B in 4Q15 • FTE headcount was down 6% from 3Q14, as continued progress in LAS and other reductions in support staff and infrastructure more than offset increased staffing in client-facing associates Noninterest Expense ($B) Full-time Equivalent Employees (000's) 8 1 213 204 204 17 13 11 230 217 215 0 50 100 150 200 250 3Q14 2Q15 3Q15 FTEs (excluding LAS) LAS FTEs

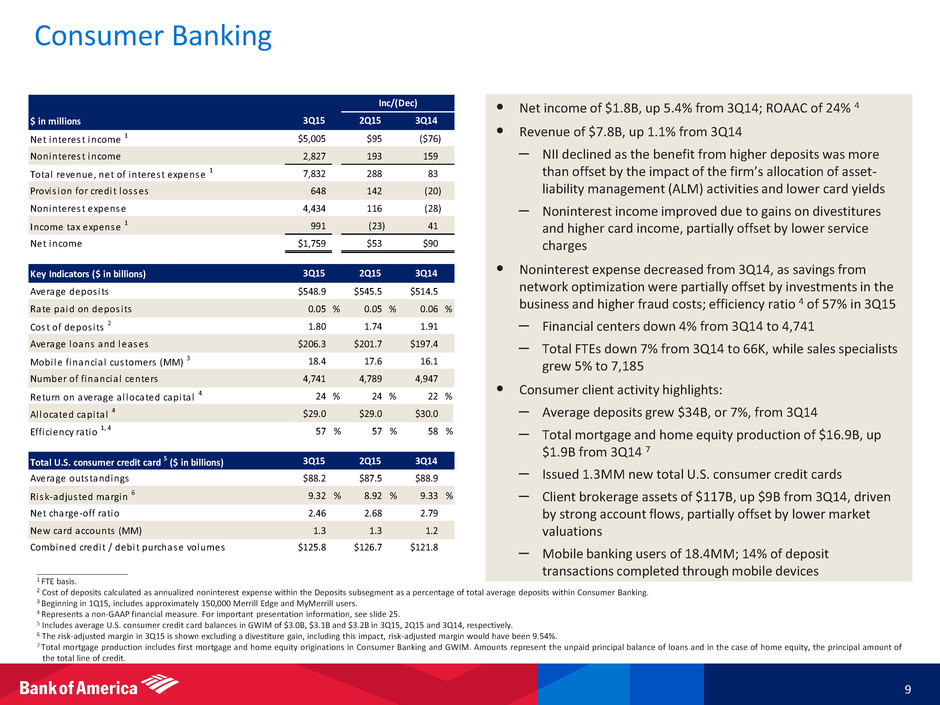

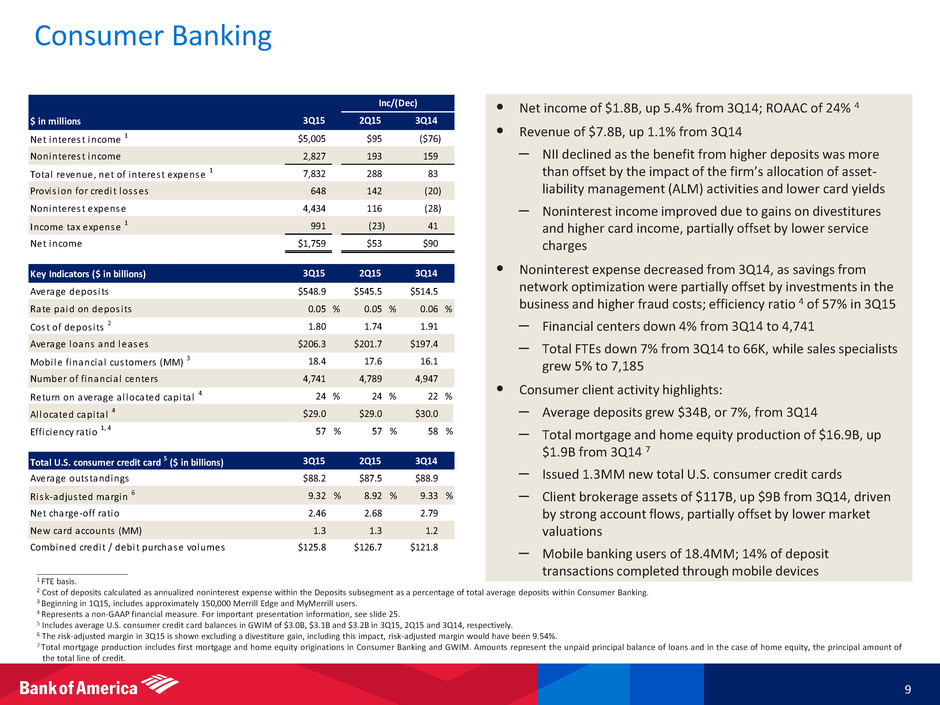

Consumer Banking 9 ____________________ 1 FTE basis. 2 Cost of deposits calculated as annualized noninterest expense within the Deposits subsegment as a percentage of total average deposits within Consumer Banking. 3 Beginning in 1Q15, includes approximately 150,000 Merrill Edge and MyMerrill users. 4 Represents a non-GAAP financial measure. For important presentation information, see slide 25. 5 Includes average U.S. consumer credit card balances in GWIM of $3.0B, $3.1B and $3.2B in 3Q15, 2Q15 and 3Q14, respectively. 6 The risk-adjusted margin in 3Q15 is shown excluding a divestiture gain, including this impact, risk-adjusted margin would have been 9.54%. 7 Total mortgage production includes first mortgage and home equity originations in Consumer Banking and GWIM. Amounts represent the unpaid principal balance of loans and in the case of home equity, the principal amount of the total line of credit. • [ Bullets to come ] • Net income of $1.8B, up 5.4% from 3Q14; ROAAC of 24% 4 Revenue f $7.8B, up 1.1% from 3Q14 – NII declined as the benefit from higher deposits was more than offset by the impact of the firm’s allocation of asset- liability management (ALM) activities and lower card yields – Noninterest income improved due to gains on divestitures and higher card income, partially offset by lower service charges • Noninterest expense decreased from 3Q14, as savings from network optimization were partially offset by investments in the business and higher fraud costs; efficiency ratio 4 of 57% in 3Q15 – Financial centers down 4% from 3Q14 to 4,741 – Total FTEs down 7% from 3Q14 to 66K, while sales specialists grew 5% to 7,185 • Consumer client activity highlights: – Average deposits grew $34B, or 7%, from 3Q14 – Total mortgage and home equity production of $16.9B, up $1.9B from 3Q14 7 – Issued 1.3MM new total U.S. consumer credit cards – Client brokerage assets of $117B, up $9B from 3Q14, driven by strong account flows, partially offset by lower market valuations – Mobile banking users of 18.4MM; 14% of deposit transactions completed through mobile devices $ in millions Net interest income 1 $5,005 $95 ($76) Noninterest income 2,827 193 159 Total revenue, net of interest expense 1 7,832 288 83 Provis ion for credit losses 648 142 (20) Noninterest expense 4,434 116 (28) Income tax expense 1 991 (23) 41 Net income $1,759 $53 $90 Key Indicators ($ in billions) Average depos its $548.9 $545.5 $514.5 Rate paid on depos its 0.05 % 0.05 % 0.06 % Cost of depos its 2 1.80 1.74 1.91 Average loans and leases $206.3 $201.7 $197.4 Mobi le financia l customers (MM) 3 18.4 17.6 16.1 Number of financia l centers 4,741 4,789 4,947 Return on average a l located capita l 4 24 % 24 % 22 % Al located capita l 4 $29.0 $29.0 $30.0 Efficiency ratio 1, 4 57 % 57 % 58 % Total U.S. consumer credit card 5 ($ in billions) Average outstandings $88.2 $87.5 $88.9 Risk-adjusted margin 6 9.32 % 8.92 % 9.33 % Net charge-off ratio 2.46 2.68 2.79 New card accounts (MM) 1.3 1.3 1.2 Combined credit / debit purchase volumes $125.8 $126.7 $121.8 3Q15 2Q15 3Q14 Inc/(Dec) 3Q15 2Q15 3Q14 3Q15 2Q15 3Q14

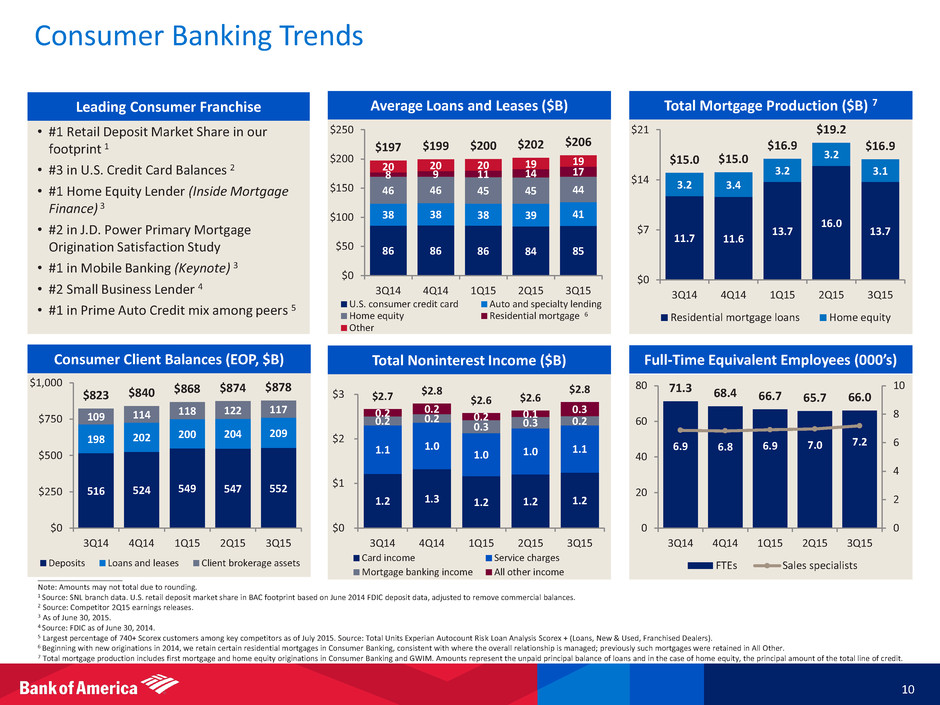

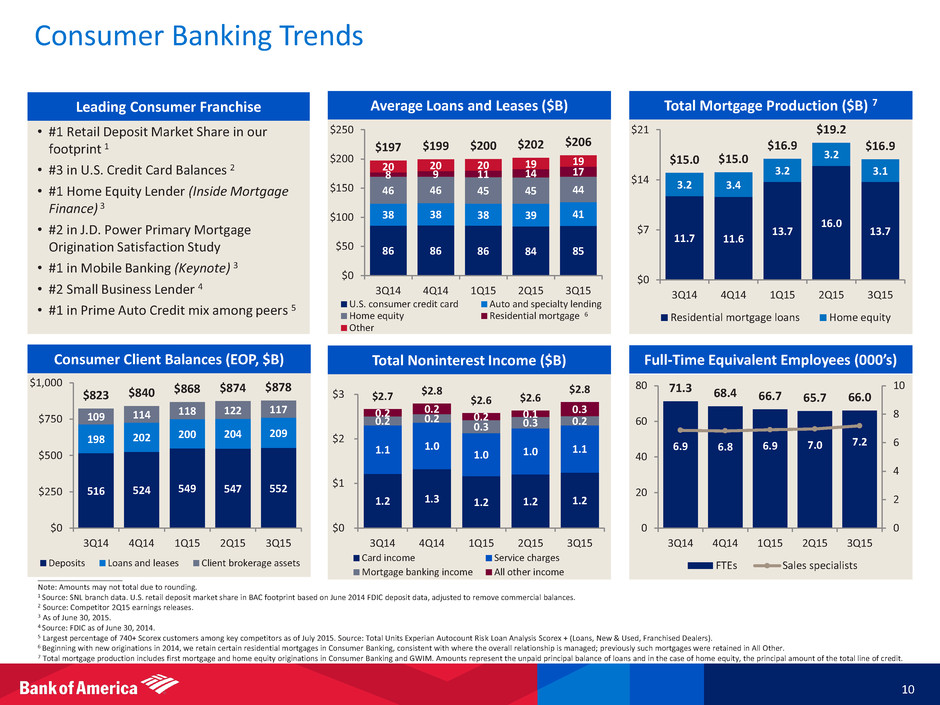

71.3 68.4 66.7 65.7 66.0 6.9 6.8 6.9 7.0 7.2 0 2 4 6 8 10 0 20 40 60 80 3Q14 4Q14 1Q15 2Q15 3Q15 Th o u sa n d s Th o u sa n d s FTEs Sales specialists Consumer Banking Trends 10 • #1 Retail Deposit Market Share in our footprint 1 • #3 in U.S. Credit Card Balances 2 • #1 Home Equity Lender (Inside Mortgage Finance) 3 • #2 in J.D. Power Primary Mortgage Origination Satisfaction Study • #1 in Mobile Banking (Keynote) 3 • #2 Small Business Lender 4 • #1 in Prime Auto Credit mix among peers 5 1.2 1.3 1.2 1.2 1.2 1.1 1.0 1.0 1.0 1.1 0.2 0.2 0.3 0.3 0.2 0.2 0.2 0.2 0.1 0.3 $2.7 $2.8 $2.6 $2.6 $2.8 $0 $1 $2 $3 3Q14 4Q14 1Q15 2Q15 3Q15 Card income Service charges Mortgage banking income All other income 11.7 11.6 13.7 16.0 13.7 3.2 3.4 3.2 3.2 3.1 $15.0 $15.0 $16.9 $19.2 $16.9 $0 $7 $14 $21 3Q14 4Q14 1Q15 2Q15 3Q15 Residential mortgage loans Home equity 516 524 549 547 552 198 202 200 204 209 109 114 118 122 117 $823 $840 $868 $874 $878 $0 $250 $500 $750 $1,000 3Q14 4Q14 1Q15 2Q15 3Q15 Deposits Loans and leases Client brokerage assets ____________________ Note: Amounts may not total due to rounding. 1 Source: SNL branch data. U.S. retail deposit market share in BAC footprint based on June 2014 FDIC deposit data, adjusted to remove commercial balances. 2 Source: Competitor 2Q15 earnings releases. 3 As of June 30, 2015. 4 Source: FDIC as of June 30, 2014. 5 Largest percentage of 740+ Scorex customers among key competitors as of July 2015. Source: Total Units Experian Autocount Risk Loan Analysis Scorex + (Loans, New & Used, Franchised Dealers). 6 Beginning with new originations in 2014, we retain certain residential mortgages in Consumer Banking, consistent with where the overall relationship is managed; previously such mortgages were retained in All Other. 7 Total mortgage production includes first mortgage and home equity originations in Consumer Banking and GWIM. Amounts represent the unpaid principal balance of loans and in the case of home equity, the principal amount of the total line of credit. 86 86 86 84 85 38 38 38 39 41 46 46 45 45 44 8 9 11 14 17 20 20 20 19 19 $197 $199 $200 $202 $206 $0 $50 $100 $150 $200 $250 3Q14 4Q14 1Q15 2Q15 3Q15 U.S. consumer credit card Auto and specialty lending Home equity Residential mortgage Other Leading Consumer Franchise Total Mortgage Production ($B) 7 Average Loans and Leases ($B) Total Noninterest Income ($B) Consumer Client Balances (EOP, $B) Full-Time Equivalent Employees (000’s) 6

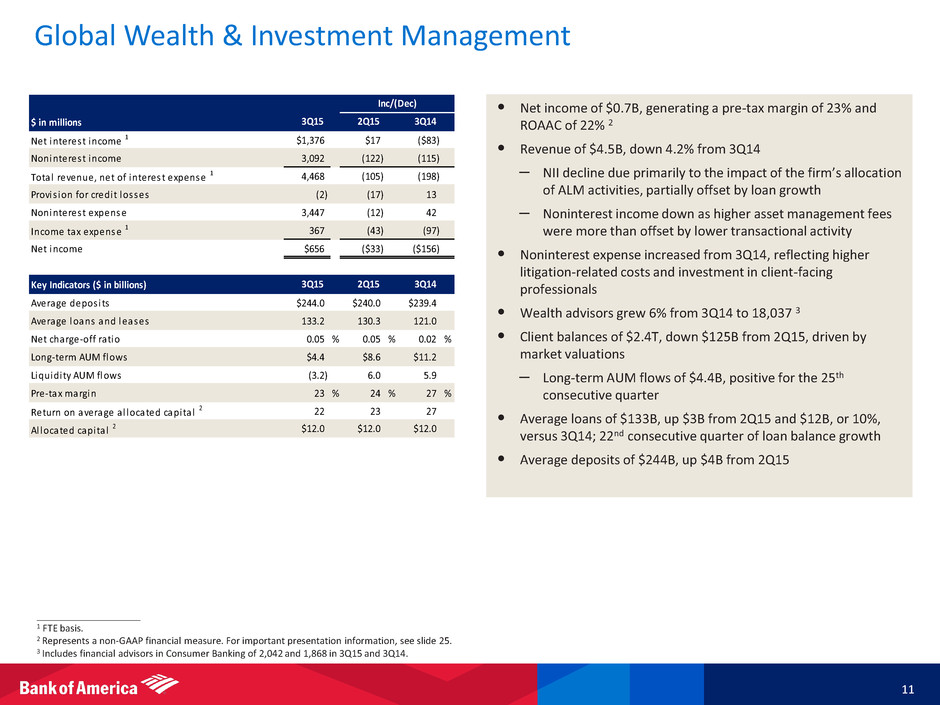

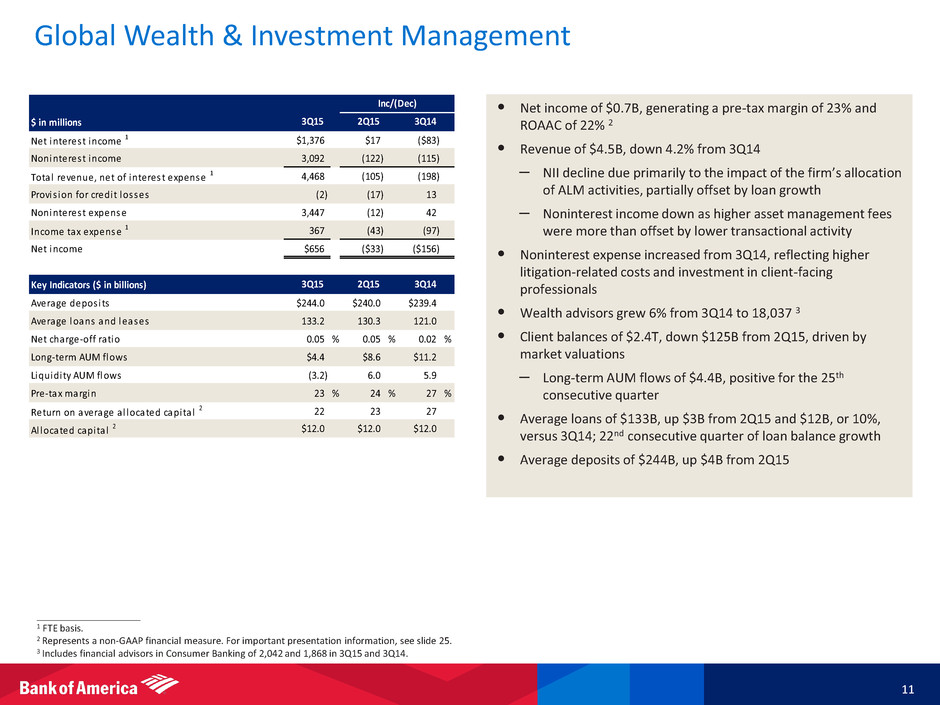

Global Wealth & Investment Management 11 ____________________ 1 FTE basis. 2 Represents a non-GAAP financial measure. For important presentation information, see slide 25. 3 Includes financial advisors in Consumer Banking of 2,042 and 1,868 in 3Q15 and 3Q14. • Net income of $0.7B, generating a pre-tax margin of 23% and ROAAC of 22% 2 • Revenue of $4.5B, down 4.2% from 3Q14 – NII decline due primarily to the impact of the firm’s allocation of ALM activities, partially offset by loan growth – Noninterest income down as higher asset management fees were more than offset by lower transactional activity • Noninterest expense increased from 3Q14, reflecting higher litigation-related costs and investment in client-facing professionals • Wealth advisors grew 6% from 3Q14 to 18,037 3 • Client balances of $2.4T, down $125B from 2Q15, driven by market valuations – Long-term AUM flows of $4.4B, positive for the 25th consecutive quarter • Average loans of $133B, up $3B from 2Q15 and $12B, or 10%, versus 3Q14; 22nd consecutive quarter of loan balance growth • Average deposits of $244B, up $4B from 2Q15 $ in millions Net interest income 1 $1,376 $17 ($83) Noninterest income 3,092 (122) (115) Total revenue, net of interest expense 1 4,468 (105) (198) Provis ion for credit losses (2) (17) 13 Noninterest expense 3,447 (12) 42 Income tax expense 1 367 (43) (97) Net income $656 ($33) ($156) Key Indicators ($ in billions) Average depos its $244.0 $240.0 $239.4 Average loans and leases 133.2 130.3 121.0 Net charge-off ratio 0.05 % 0.05 % 0.02 % Long-term AUM flows $4.4 $8.6 $11.2 Liquidi ty AUM flows (3.2) 6.0 5.9 Pre-tax margin 23 % 24 % 27 % Return on average a l l cated capita l 2 22 23 27 Al located capita l 2 $12.0 $12.0 $12.0 Inc/(Dec) 3Q15 2Q15 3Q14 3Q15 2Q15 3Q14

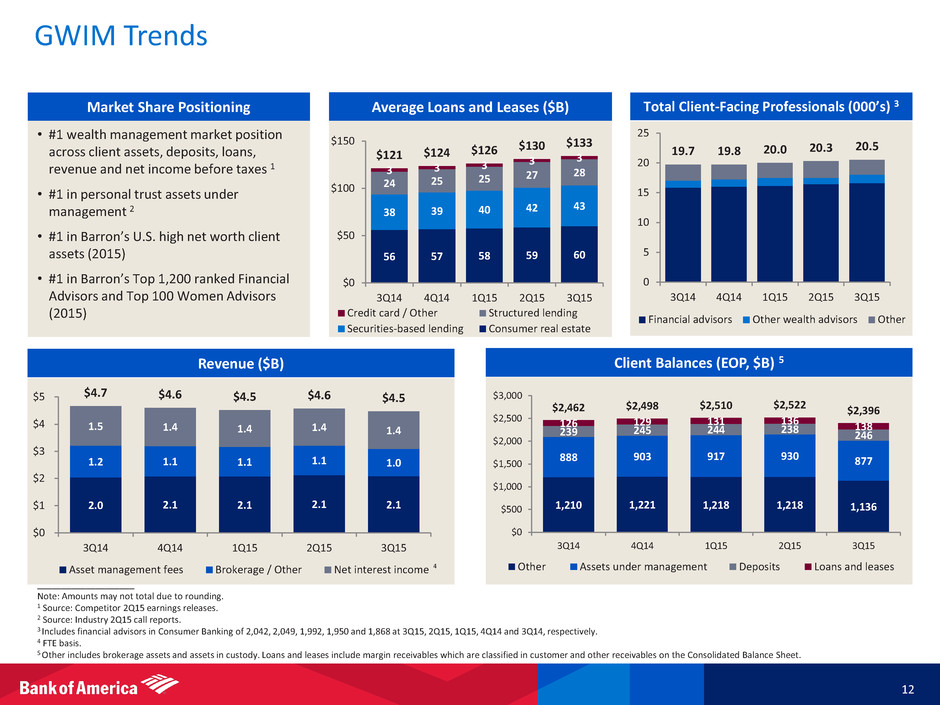

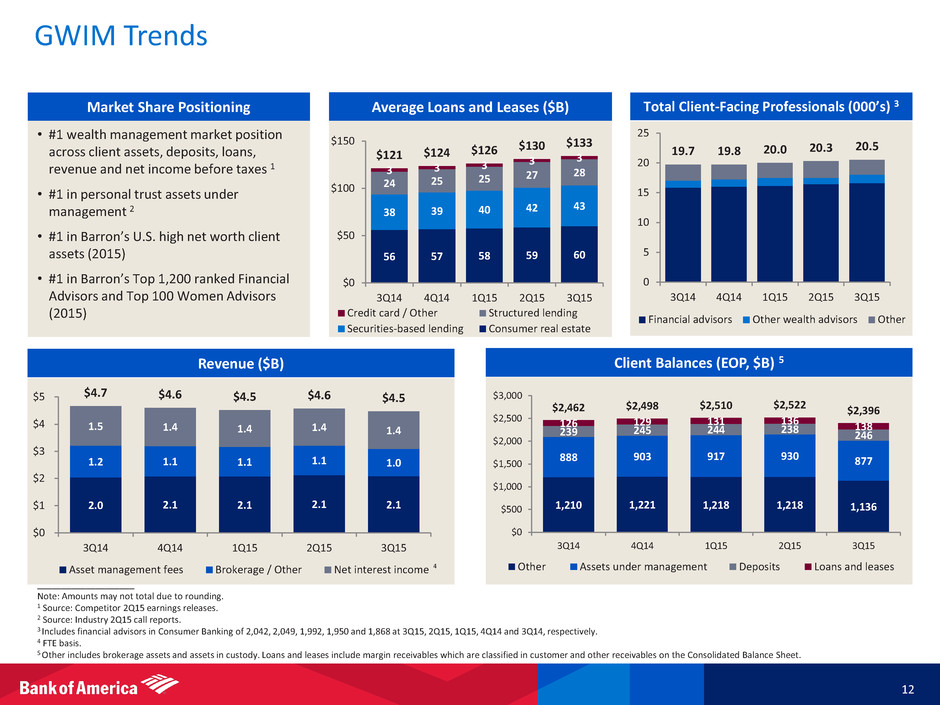

GWIM Trends 12 Market Share Positioning Average Loans and Leases ($B) Total Client-Facing Professionals (000’s) 3 • #1 wealth management market position across client assets, deposits, loans, revenue and net income before taxes 1 • #1 in personal trust assets under management 2 • #1 in Barron’s U.S. high net worth client assets (2015) • #1 in Barron’s Top 1,200 ranked Financial Advisors and Top 100 Women Advisors (2015) 1,210 1,221 1,218 1,218 1,136 888 903 917 930 877 239 245 244 238 246 126 129 131 136 138 $2,462 $2,498 $2,510 $2,522 $2,396 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 3Q14 4Q14 1Q15 2Q15 3Q15 Other Assets under management Deposits Loans and leases Client Balances (EOP, $B) 5 56 57 58 59 60 38 39 40 42 43 24 25 25 27 28 3 3 3 3 3 $121 $124 $126 $130 $133 $0 $50 $100 $150 3Q14 4Q14 1Q15 2Q15 3Q15 Credit card / Other Structured lending Securities-based lending Consumer real estate ____________________ Note: Amounts may not total due to rounding. 1 Source: Competitor 2Q15 earnings releases. 2 Source: Industry 2Q15 call reports. 3 Includes financial advisors in Consumer Banking of 2,042, 2,049, 1,992, 1,950 and 1,868 at 3Q15, 2Q15, 1Q15, 4Q14 and 3Q14, respectively. 4 FTE basis. 5 Other includes brokerage assets and assets in custody. Loans and leases include margin receivables which are classified in customer and other receivables on the Consolidated Balance Sheet. 2.0 2.1 2.1 2.1 2.1 1.2 1.1 1.1 1.1 1.0 1.5 1.4 1.4 1.4 1.4 $4.7 $4.6 $4.5 $4.6 $4.5 $0 $1 $2 $3 $4 $5 3Q14 4Q14 1Q15 2Q15 3Q15 Asset management fees Brokerage / Other Net interest income Revenue ($B) 19.7 19.8 20.0 20.3 20.5 0 5 10 15 20 25 3Q14 4Q14 1Q15 2Q15 3Q15 Th o u sa n d s Financial advisors Other wealth advisors Other 4

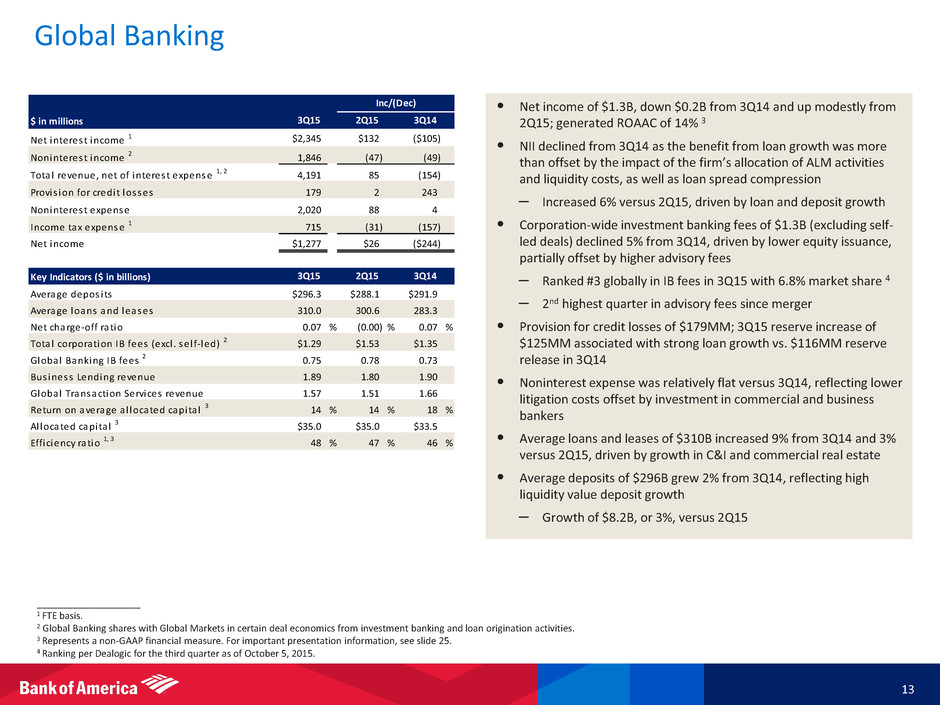

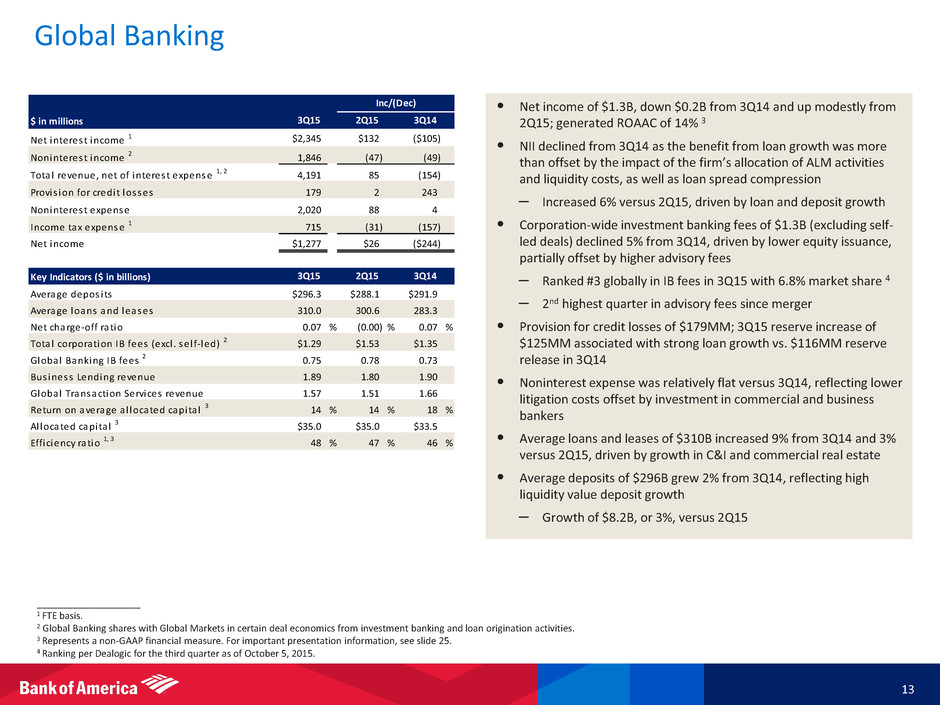

Global Banking 13 ____________________ 1 FTE basis. 2 Global Banking shares with Global Markets in certain deal economics from investment banking and loan origination activities. 3 Represents a non-GAAP financial measure. For important presentation information, see slide 25. 4 Ranking per Dealogic for the third quarter as of October 5, 2015. • [ Bullets to come ] • Net income of $1.3B, down $0.2B from 3Q14 and up modestly from 2Q15; generated ROAAC of 14% 3 • NII declined from 3Q14 as the benefit from loan growth was more than offset by the impact of the firm’s allocation of ALM activities and liquidity costs, as well as loan spread compression – Increased 6% versus 2Q15, driven by loan and deposit growth • Corporation-wide investment banking fees of $1.3B (excluding self- led deals) declined 5% from 3Q14, driven by lower equity issuance, partially offset by higher advisory fees – Ranked #3 globally in IB fees in 3Q15 with 6.8% market share 4 – 2nd highest quarter in advisory fees since merger • Provision for credit losses of $179MM; 3Q15 reserve increase of $125MM associated with strong loan growth vs. $116MM reserve release in 3Q14 • Noninterest expense was relatively flat versus 3Q14, reflecting lower litigation costs offset by investment in commercial and business bankers • Average loans and leases of $310B increased 9% from 3Q14 and 3% versus 2Q15, driven by growth in C&I and commercial real estate • Average deposits of $296B grew 2% from 3Q14, reflecting high liquidity value deposit growth – Growth of $8.2B, or 3%, versus 2Q15 $ in millions Net interest income 1 $2,345 $132 ($105) Noninterest income 2 1,846 (47) (49) Total revenue, net of interest expense 1, 2 4,191 85 (154) Provis ion for credit losses 179 2 243 Noninterest expense 2,020 88 4 Income tax expense 1 715 (31) (157) Net income $1,277 $26 ($244) Key Indicators ($ in billions) Average depos its $296.3 $288.1 $291.9 Average loans and leases 310.0 300.6 283.3 Net charge-off ratio 0.07 % (0.00) % 0.07 % Total corporation IB fees (excl . sel f-led) 2 $1.29 $1.53 $1.35 Global Banking IB fees 2 0.75 0.78 0.73 Bus iness Lending revenue 1.89 1.80 1.90 Global Transaction Services revenu 1.57 1.51 1.66 Return on average a l loca ed capita l 3 14 % 14 % 18 % Al located capita l 3 $35.0 $35.0 $33.5 Efficiency ratio 1, 3 48 % 47 % 46 % Inc/(Dec) 2Q15 3Q143Q15 3Q15 2Q15 3Q14

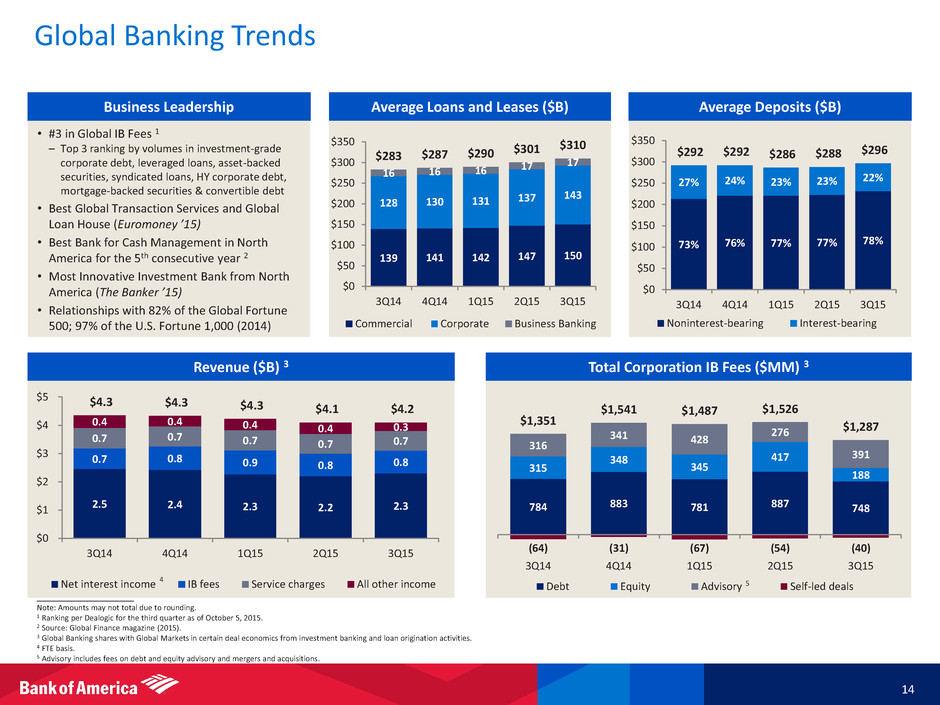

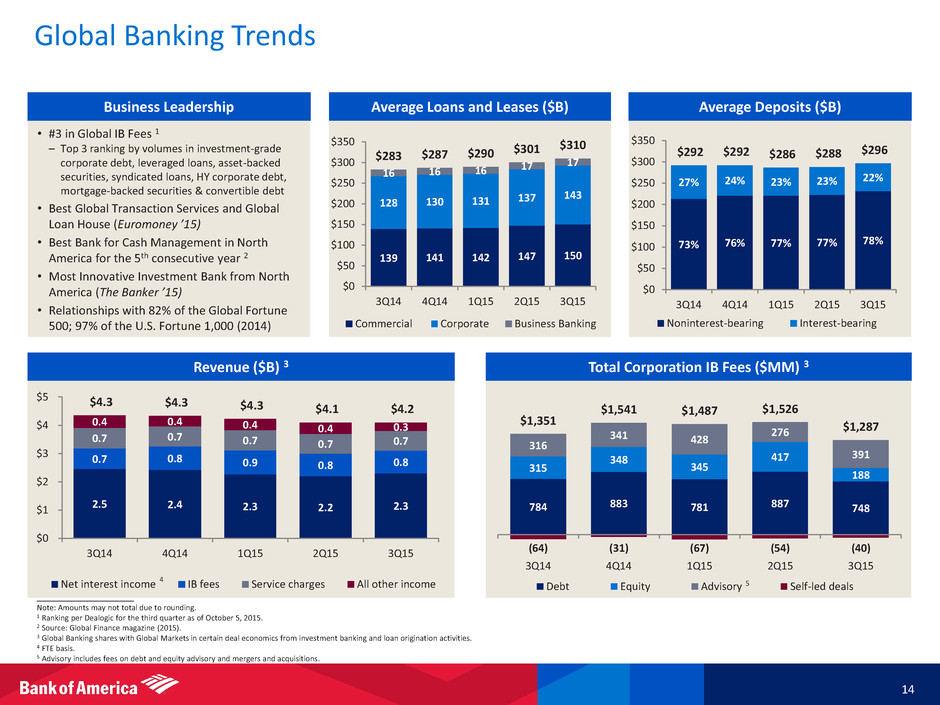

Global Banking Trends 14 ____________________ Note: Amounts may not total due to rounding. 1 Ranking per Dealogic for the third quarter as of October 5, 2015. 2 Source: Global Finance magazine (2015). 3 Global Banking shares with Global Markets in certain deal economics from investment banking and loan origination activities. 4 FTE basis. 5 Advisory includes fees on debt and equity advisory and mergers and acquisitions. 73% 76% 77% 77% 78% 27% 24% 23% 23% 22% $292 $292 $286 $288 $296 $0 $50 $100 $150 $200 $250 $300 $350 3Q14 4Q14 1Q15 2Q15 3Q15 Noninterest-bearing Interest-bearing 784 883 781 887 748 315 348 345 417 188 316 341 428 276 391 (64) (31) (67) (54) (40) $1,351 $1,541 $1,487 $1,526 $1,287 3Q14 4Q14 1Q15 2Q15 3Q15 Debt Equity Advisory Self-led deals Total Corporation IB Fees ($MM) 3 • #3 in Global IB Fees 1 – Top 3 ranking by volumes in investment-grade corporate debt, leveraged loans, asset-backed securities, syndicated loans, HY corporate debt, mortgage-backed securities & convertible debt • Best Global Transaction Services and Global Loan House (Euromoney ’15) • Best Bank for Cash Management in North America for the 5th consecutive year 2 • Most Innovative Investment Bank from North America (The Banker ’15) • Relationships with 82% of the Global Fortune 500; 97% of the U.S. Fortune 1,000 (2014) 2.5 2.4 2.3 2.2 2.3 0.7 0.8 0.9 0.8 0.8 0.7 0.7 0.7 0.7 0.7 0.4 0.4 0.4 0.4 0.3 $4.3 $4.3 $4.3 $4.1 $4.2 $0 $1 $2 $3 $4 $5 3Q14 4Q14 1Q15 2Q15 3Q15 Net interest income IB fees Service charges All other income Revenue ($B) 3 5 Average Deposits ($B) Business Leadership Average Loans and Leases ($B) 139 141 142 147 150 128 130 131 137 143 16 16 16 17 17 $283 $287 $290 $301 $310 $0 $50 $100 $150 $200 $250 $300 $350 3Q14 4Q14 1Q15 2Q15 3Q15 Commercial Corporate Business Banking 4

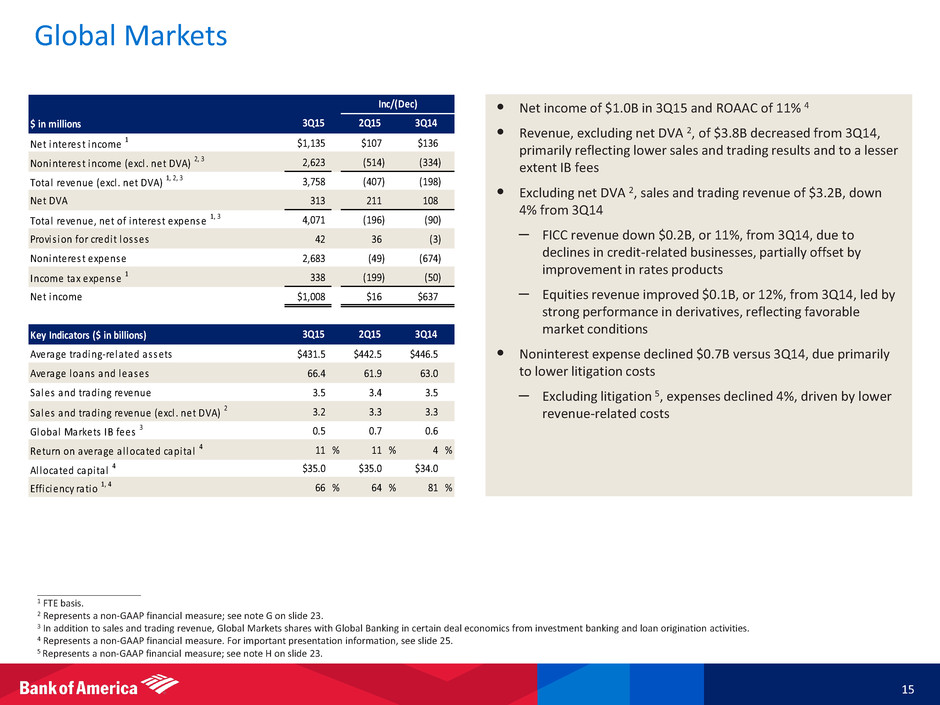

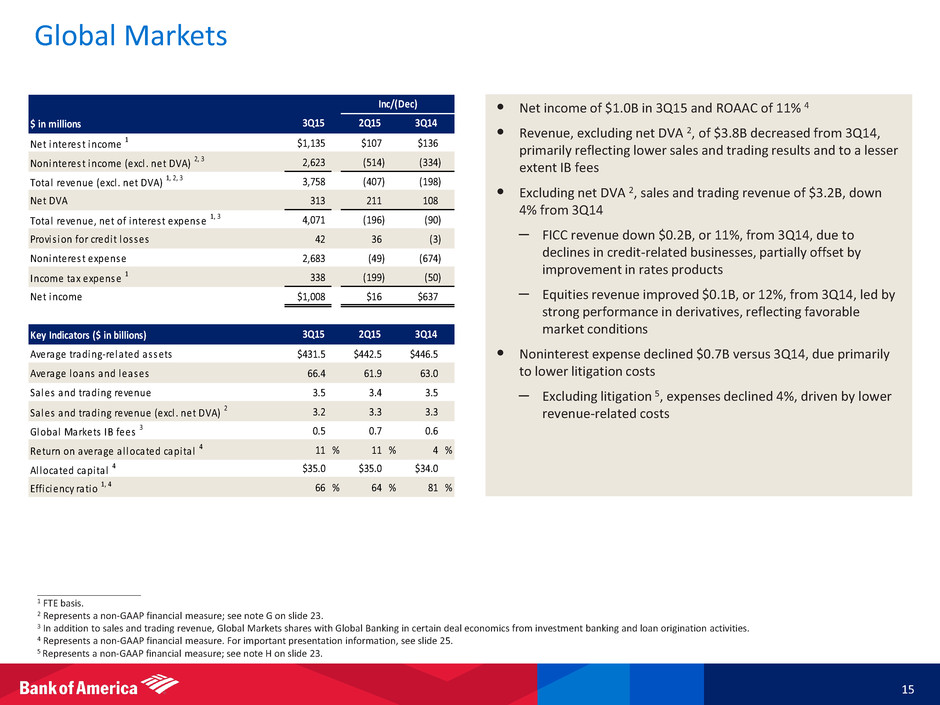

Global Markets 15 • [ Bullets to come ] ____________________ 1 FTE basis. 2 Represents a non-GAAP financial measure; see note G on slide 23. 3 In addition to sales and trading revenue, Global Markets shares with Global Banking in certain deal economics from investment banking and loan origination activities. 4 Represents a non-GAAP financial measure. For important presentation information, see slide 25. 5 Represents a non-GAAP financial measure; see note H on slide 23. • Net income of $1.0B in 3Q15 and ROAAC of 11% 4 Revenue, excluding net DVA 2, of $3.8B decreased from 3Q14, primarily reflecting lower sales and trading results and to a lesser extent IB fees • Excluding net DVA 2, sales and trading revenue of $3.2B, down 4% from 3Q14 – FICC revenue down $0.2B, or 11%, from 3Q14, due to declines in credit-related businesses, partially offset by improvement in rates products – Equities revenue improved $0.1B, or 12%, from 3Q14, led by strong performance in derivatives, reflecting favorable market conditions • Noninterest expense declined $0.7B versus 3Q14, due primarily to lower litigation costs – Excluding litigation 5, expenses declined 4%, driven by lower revenue-related costs $ in millions Net interest income 1 $1,135 $107 $136 Noninterest income (excl . net DVA) 2, 3 2,623 (514) (334) Total revenue (excl . net DVA) 1, 2, 3 3,758 (407) (198) Net DVA 313 211 108 Total revenue, net of interest expense 1, 3 4,071 (196) (90) Provis ion for credit losses 42 36 (3) Noninterest expense 2,683 (49) (674) Income tax expense 1 338 (199) (50) Net income $1,008 $16 $637 Key Indicators ($ in billions) Average trading-related assets $431.5 $442.5 $446.5 Average loans and leases 66.4 61.9 63.0 Sales and trading revenue 3.5 3.4 3.5 Sales and trading re nu (excl . net DVA) 2 3.2 3.3 3.3 Global Markets IB fees 3 0.5 0.7 0.6 Return on average a l l cated capita l 4 11 % 11 % 4 % Al located capita l 4 $35.0 $35.0 $34.0 Efficiency ratio 1, 4 66 % 64 % 81 % Inc/(Dec) 3Q15 2Q15 3Q14 3Q15 2Q15 3Q14

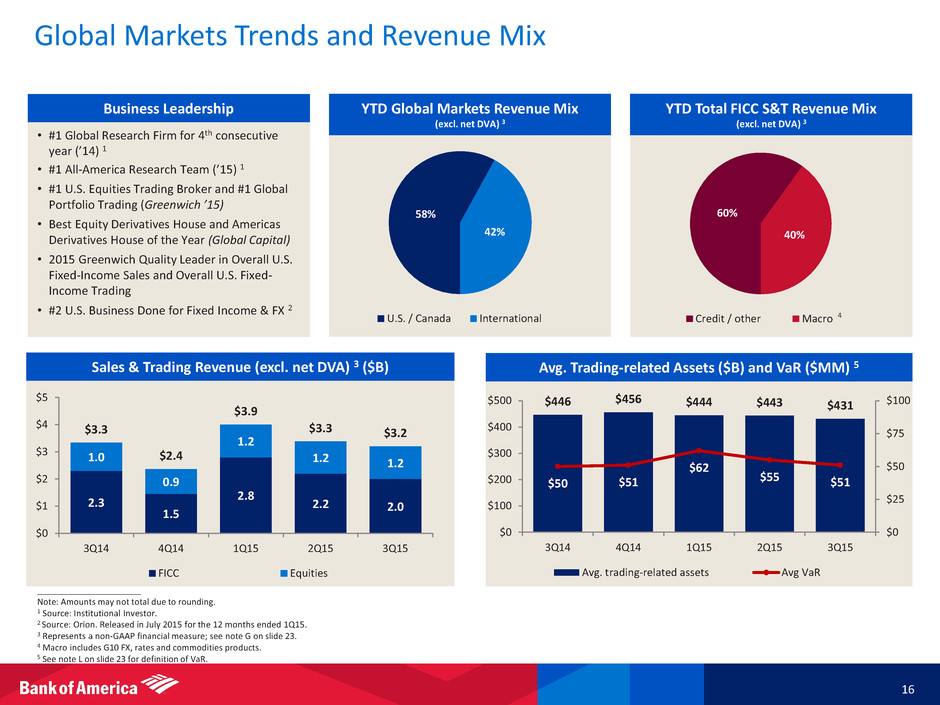

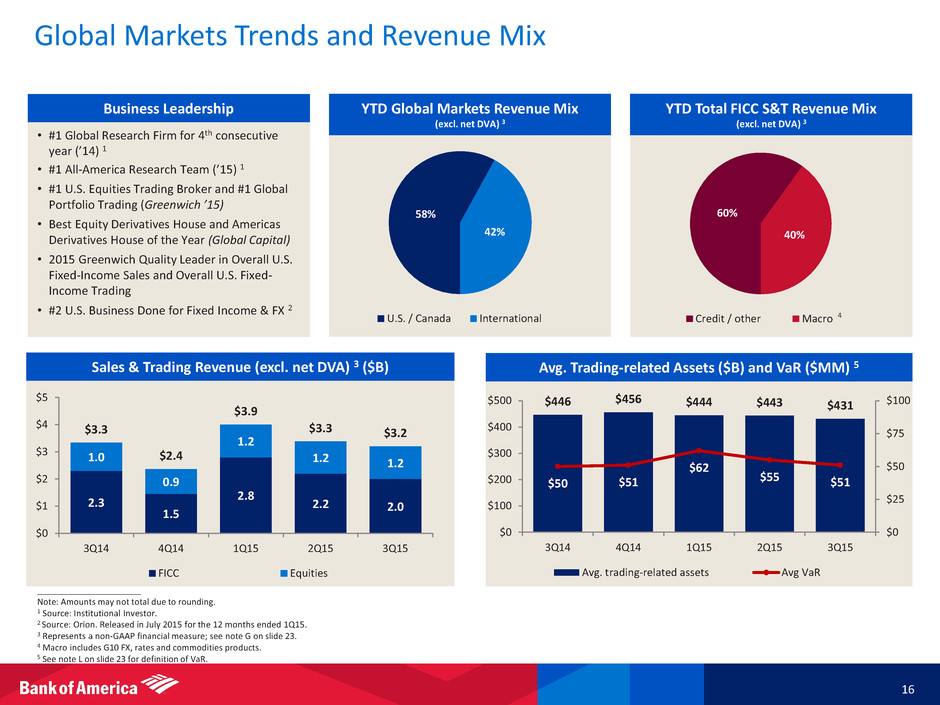

Global Markets Trends and Revenue Mix 16 2.3 1.5 2.8 2.2 2.0 1.0 0.9 1.2 1.2 1.2 $3.3 $2.4 $3.9 $3.3 $3.2 $0 $1 $2 $3 $4 $5 3Q14 4Q14 1Q15 2Q15 3Q15 FICC Equities $446 $456 $444 $443 $431 $50 $51 $62 $55 $51 $0 $25 $50 $75 $100 $0 $100 $200 $300 $400 $500 3Q14 4Q14 1Q15 2Q15 3Q15 Avg. trading-related assets Avg VaR • #1 Global Research Firm for 4th consecutive year (’14) 1 • #1 All-America Research Team (’15) 1 • #1 U.S. Equities Trading Broker and #1 Global Portfolio Trading (Greenwich ’15) • Best Equity Derivatives House and Americas Derivatives House of the Year (Global Capital) • 2015 Greenwich Quality Leader in Overall U.S. Fixed-Income Sales and Overall U.S. Fixed- Income Trading • #2 U.S. Business Done for Fixed Income & FX 2 ____________________ Note: Amounts may not total due to rounding. 1 Source: Institutional Investor. 2 Source: Orion. Released in July 2015 for the 12 months ended 1Q15. 3 Represents a non-GAAP financial measure; see note G on slide 23. 4 Macro includes G10 FX, rates and commodities products. 5 See note L on slide 23 for definition of VaR. 60% 40% Credit / other Macro 58% 42% U.S. / Canada International Sales & Trading Revenue (excl. net DVA) 3 ($B) Avg. Trading-related Assets ($B) and VaR ($MM) 5 Business Leadership YTD Total FICC S&T Revenue Mix (excl. net DVA) 3 YTD Global Markets Revenue Mix (excl. net DVA) 3 4

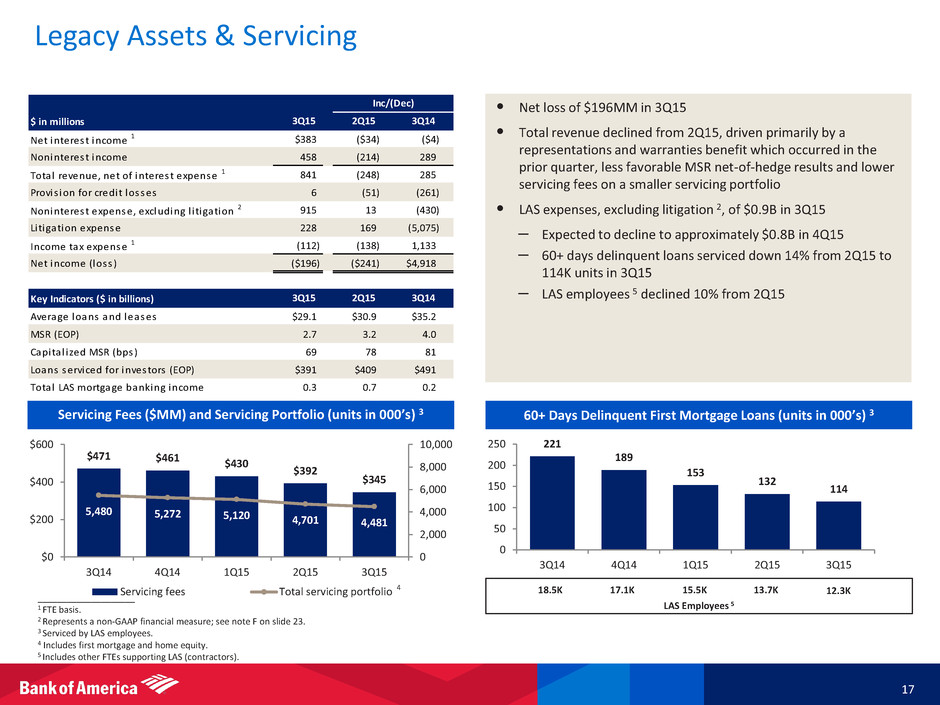

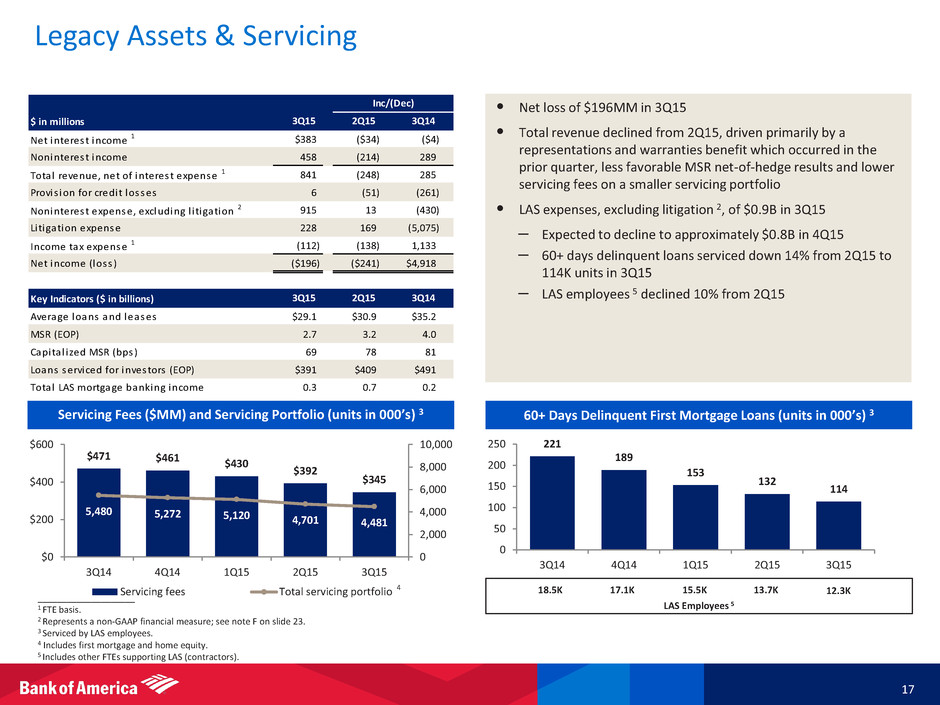

Legacy Assets & Servicing 17 • Net loss of $196MM in 3Q15 • Total revenue declined from 2Q15, driven primarily by a representations and warranties benefit which occurred in the prior quarter, less favorable MSR net-of-hedge results and lower servicing fees on a smaller servicing portfolio • LAS expenses, excluding litigation 2, of $0.9B in 3Q15 – Expected to decline to approximately $0.8B in 4Q15 – 60+ days delinquent loans serviced down 14% from 2Q15 to 114K units in 3Q15 – LAS employees 5 declined 10% from 2Q15 ____________________ 1 FTE basis. 2 Represents a non-GAAP financial measure; see note F on slide 23. 3 Serviced by LAS employees. 4 Includes first mortgage and home equity. 5 Includes other FTEs supporting LAS (contractors). $ in millions Net interest income 1 $383 ($34) ($4) Noninterest income 458 (214) 289 Total revenue, net of interest expense 1 841 (248) 285 Provis ion for credit losses 6 (51) (261) Noninterest expense, excluding l i tigation 2 915 13 (430) Li tigation expense 228 169 (5,075) Income tax expense 1 (112) (138) 1,133 Net income (loss ) ($196) ($241) $4,918 Key Indicators ($ in billions) Average loans and leases $29.1 $30.9 $35.2 MSR (EOP) 2.7 3.2 4.0 Capita l i zed MSR (bps) 69 78 81 Loans serviced for investors (EOP) $391 $409 $491 Total LAS mortgage banking income 0.3 0.7 0.2 3Q15 3Q14 Inc/(Dec) 3Q15 2Q15 3Q14 2Q15 221 189 153 132 114 0 50 100 150 200 250 3Q14 4Q14 1Q15 2Q15 3Q15 LAS Employees 5 18.5K 17.1K 15.5K 13.7K 12.3K $471 $461 $430 $392 $345 5,480 5,272 5,120 4,701 4,481 0 2,000 4,000 6,000 8,000 10,000 $0 $200 $400 $600 3Q14 4Q14 1Q15 2Q15 3Q15 Servicing fees Total servicing portfolio Servicing Fees ($MM) and Servicing Portfolio (units in 000’s) 3 60+ Days Delinquent First Mortgage Loans (units in 000’s) 3 4

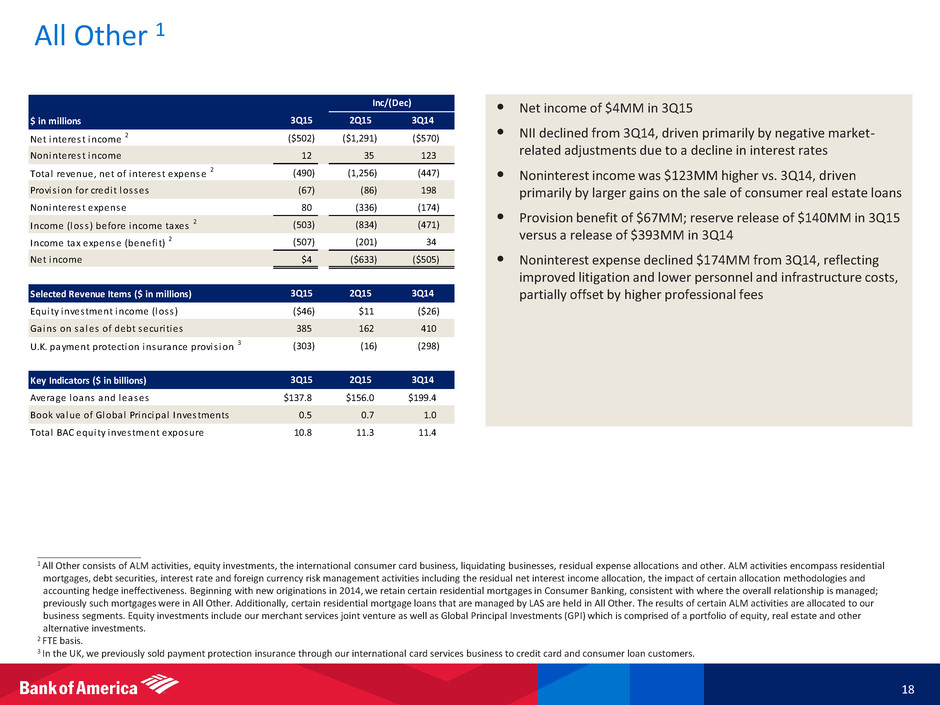

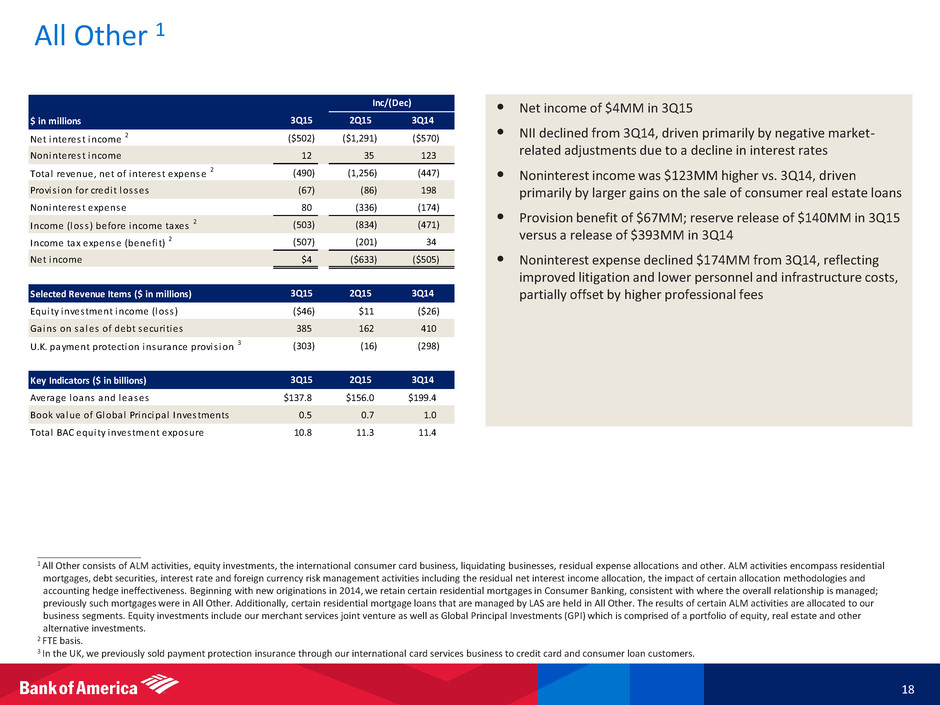

• Net income of $4MM in 3Q15 • NII declined from 3Q14, driven primarily by negative market- related adjustments due to a decline in interest rates • Noninterest income was $123MM higher vs. 3Q14, driven primarily by larger gains on the sale of consumer real estate loans • Provision benefit of $67MM; reserve release of $140MM in 3Q15 versus a release of $393MM in 3Q14 • Noninterest expense declined $174MM from 3Q14, reflecting improved litigation and lower personnel and infrastructure costs, partially offset by higher professional fees ____________________ 1 All Other consists of ALM activities, equity investments, the international consumer card business, liquidating businesses, residual expense allocations and other. ALM activities encompass residential mortgages, debt securities, interest rate and foreign currency risk management activities including the residual net interest income allocation, the impact of certain allocation methodologies and accounting hedge ineffectiveness. Beginning with new originations in 2014, we retain certain residential mortgages in Consumer Banking, consistent with where the overall relationship is managed; previously such mortgages were in All Other. Additionally, certain residential mortgage loans that are managed by LAS are held in All Other. The results of certain ALM activities are allocated to our business segments. Equity investments include our merchant services joint venture as well as Global Principal Investments (GPI) which is comprised of a portfolio of equity, real estate and other alternative investments. 2 FTE basis. 3 In the UK, we previously sold payment protection insurance through our international card services business to credit card and consumer loan customers. 18 All Other 1 $ in millions Net interest income 2 ($502) ($1,291) ($570) Noninterest income 12 35 123 Total revenue, net of interest expense 2 (490) (1,256) (447) Provis ion for credit losses (67) (86) 198 Noninterest expense 80 (336) (174) Income (loss ) before income taxes 2 (503) (834) (471) Income tax expense (benefi t) 2 (507) (201) 34 Net income $4 ($633) ($505) Selected Revenue Items ($ in millions) Equity investment income (loss ) ($46) $11 ($26) Gains on sa les of debt securi ties 385 162 410 U.K. payment protection insurance provis ion 3 (303) (16) (298) Key Indicators ($ in billions) Average loans and leases $137.8 $156.0 $199.4 Book va lue of Global Principal Investments 0.5 0.7 1.0 Total BAC equity investment exposure 10.8 11.3 11.4 Inc/(Dec) 2Q15 3Q14 3Q15 2Q15 3Q14 3Q15 3Q15 2Q15 3Q14

Key Takeaways 19 • Results reflect continued solid performance and good customer activity • In challenging rate environment, net interest income, excluding market-related adjustments, improved from 2Q15 • Managing expenses while continuing to invest in the business • Asset quality remains strong • Record capital and liquidity levels • Focused on responsible growth

Appendix

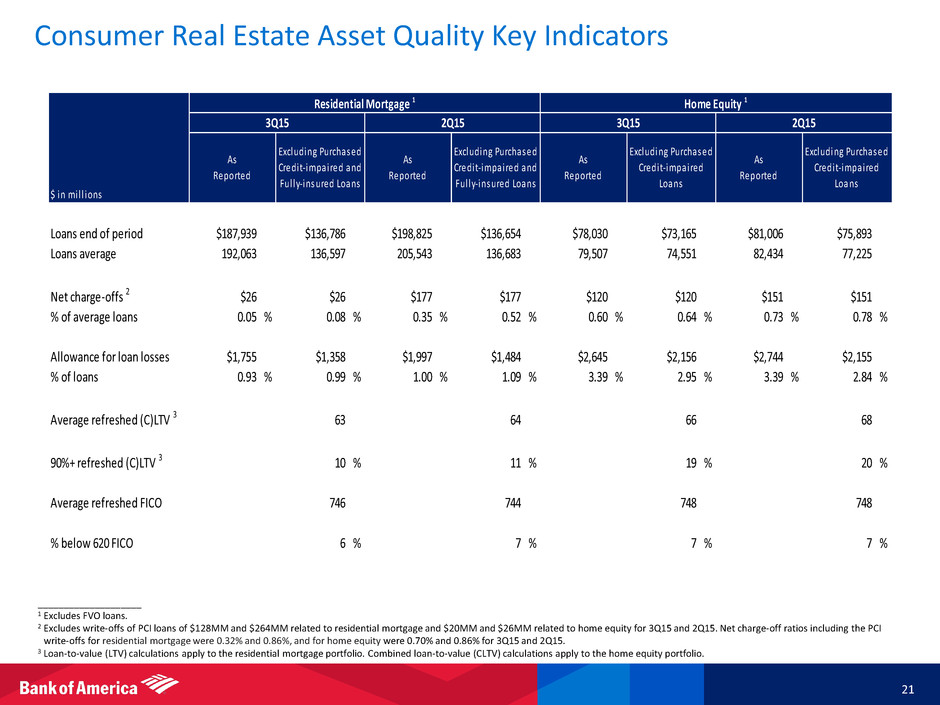

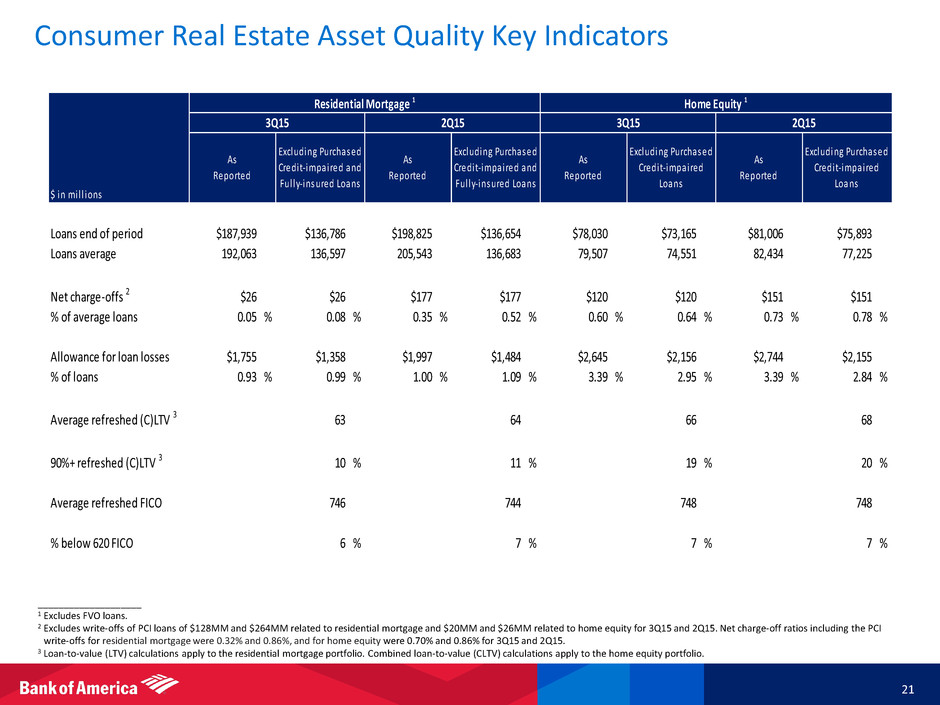

____________________ 1 Excludes FVO loans. 2 Excludes write-offs of PCI loans of $128MM and $264MM related to residential mortgage and $20MM and $26MM related to home equity for 3Q15 and 2Q15. Net charge-off ratios including the PCI write-offs for residential mortgage were 0.32% and 0.86%, and for home equity were 0.70% and 0.86% for 3Q15 and 2Q15. 3 Loan-to-value (LTV) calculations apply to the residential mortgage portfolio. Combined loan-to-value (CLTV) calculations apply to the home equity portfolio. Consumer Real Estate Asset Quality Key Indicators 21 Loans end of period $187,939 $136,786 $198,825 $136,654 $78,030 $73,165 $81,006 $75,893 Loans average 192,063 136,597 205,543 136,683 79,507 74,551 82,434 77,225 Net charge-offs 2 $26 $26 $177 $177 $120 $120 $151 $151 % of average loans 0.05 % 0.08 % 0.35 % 0.52 % 0.60 % 0.64 % 0.73 % 0.78 % Allowance for loan losses $1,755 $1,358 $1,997 $1,484 $2,645 $2,156 $2,744 $2,155 % of loans 0.93 % 0.99 % 1.00 % 1.09 % 3.39 % 2.95 % 3.39 % 2.84 % Average refreshed (C)LTV 3 63 64 66 68 90%+ refre hed (C)LTV 3 10 % 11 % 19 % 20 % Average refreshed FICO 746 744 748 748 % below 620 FICO 6 % 7 % 7 % 7 % $ in mi l l ions Residential Mortgage 1 Home Equity 1 3Q15 2Q15 3Q15 2Q15 As Reported Excluding Purchased Credit-impaired and Ful ly-insured Loans As Reported Excluding Purchased Credit-impaired and Ful ly-insured Loans As Reported Excluding Purchased Credit-impaired Loans As Reported Excluding Purchased Credit-impaired Loans

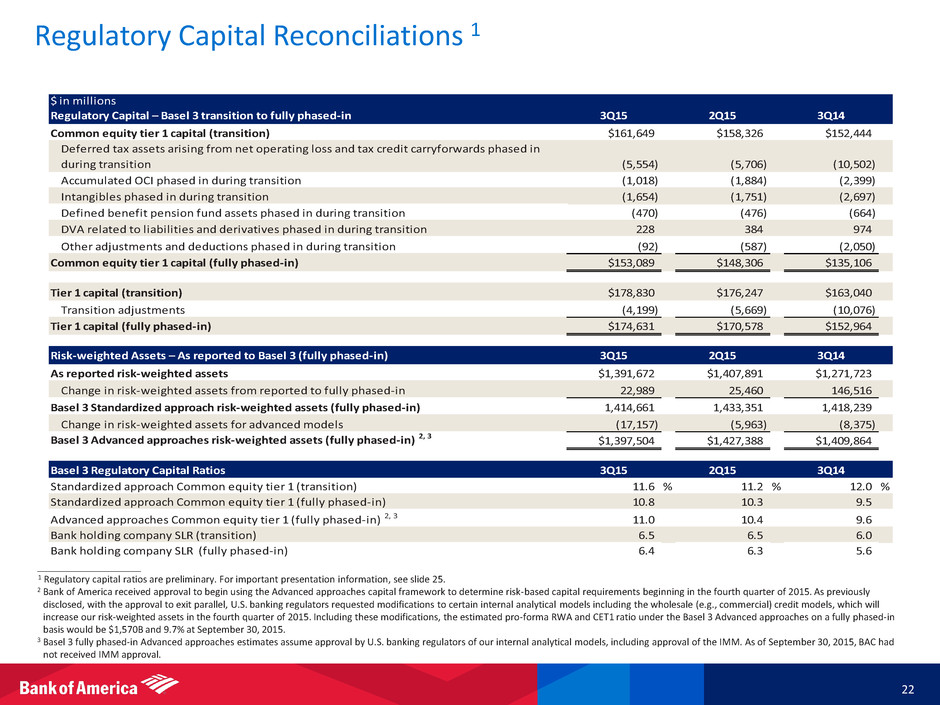

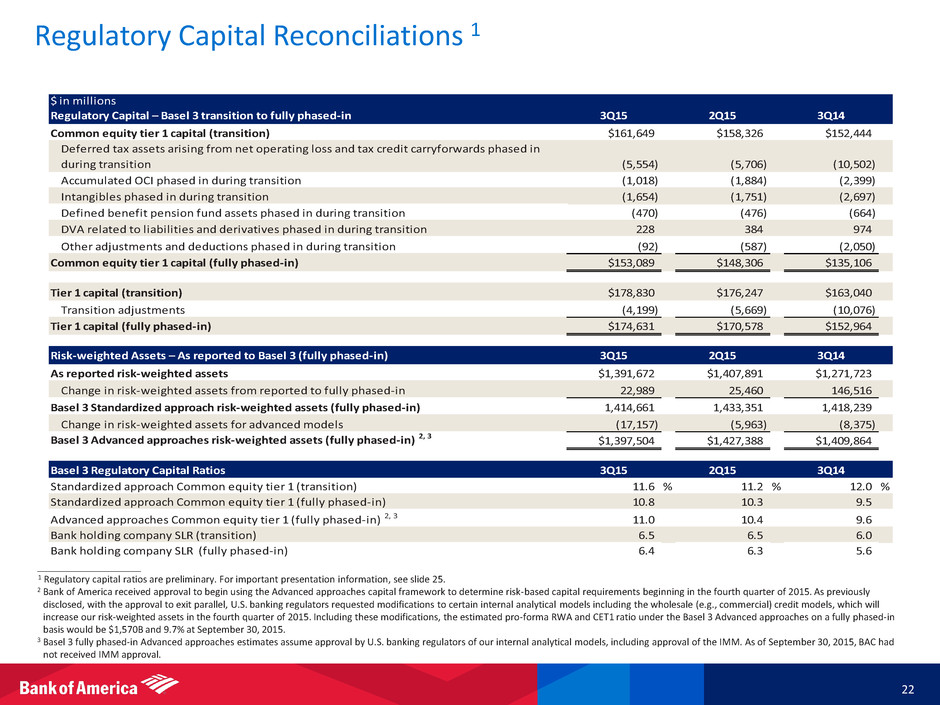

____________________ 1 Regulatory capital ratios are preliminary. For important presentation information, see slide 25. 2 Bank of America received approval to begin using the Advanced approaches capital framework to determine risk-based capital requirements beginning in the fourth quarter of 2015. As previously disclosed, with the approval to exit parallel, U.S. banking regulators requested modifications to certain internal analytical models including the wholesale (e.g., commercial) credit models, which will increase our risk-weighted assets in the fourth quarter of 2015. Including these modifications, the estimated pro-forma RWA and CET1 ratio under the Basel 3 Advanced approaches on a fully phased-in basis would be $1,570B and 9.7% at September 30, 2015. 3 Basel 3 fully phased-in Advanced approaches estimates assume approval by U.S. banking regulators of our internal analytical models, including approval of the IMM. As of September 30, 2015, BAC had not received IMM approval. $ in millions Regulatory Capital – Basel 3 transition to fully phased-in 3Q15 2Q15 3Q14 Common equity tier 1 capital (transition) $161,649 $158,326 $152,444 Deferred tax assets arising from net operating loss and tax credit carryforwards phased in during transition (5,554) (5,706) (10,502) Accumulated OCI phased in during transition (1,018) (1,884) (2,399) Intangibles phased in during transition (1,654) (1,751) (2,697) Defined benefit pension fund assets phased in during transition (470) (476) (664) DVA related to liabilities and derivatives phased in during transition 228 384 974 Other adjustments and deductions phased in during transition (92) (587) (2,050) Common equity tier 1 capital (fully phased-in) $153,089 $148,306 $135,106 Tier 1 capital (transition) $178,830 $176,247 $163,040 Transition adjustments (4,199) (5,669) (10,076) Tier 1 capital (fully phased-in) $174,631 $170,578 $152,964 Risk-weighted Assets – As reported to Basel 3 (fully phased-in) 3Q15 2Q15 3Q14 As reported risk-weighted assets $1,391,672 $1,407,891 $1,271,723 Change in risk-weighted assets from reported to fully phased-in 22,989 25,460 146,516 Basel 3 Standardized approach risk-weighted assets (fully phased-in) 1,414,661 1,433,351 1,418,239 Change in risk-weighted assets for advanced models (17,157) (5,963) (8,375) Basel 3 Advanced approaches risk-weighted assets (fully phased-in) 2, 3 $1,397,504 $1,427,388 $1,409,864 Basel 3 Regulatory Capital Ratios 3Q15 2Q15 3Q14 Standardized approach Common equity tier 1 (transition) 11.6 % 11.2 % 12.0 % Standardized approach Common equity tier 1 (fully phased-in) 10.8 10.3 9.5 Advanced approaches Common equity tier 1 (fully phased-in) 2, 3 11.0 10.4 9.6 Bank holding company SLR (transition) 6.5 6.5 6.0 Bank holding company SLR (fully phased-in) 6.4 6.3 5.6 22 Regulatory Capital Reconciliations 1

Notes 23 Non-GAAP Financial Measures For reconciliations to GAAP financial measures, see the accompanying reconciliations in the earnings press release and other earnings-related information. A On a GAAP basis, total revenue, net of interest expense was $20.7B, $22.1B and $21.2B for 3Q15, 2Q15 and 3Q14, respectively. B Net charge-offs exclude write-offs of PCI loans of $148MM, $290MM, $288MM, $13MM and $246MM for 3Q15, 2Q15, 1Q15, 4Q14 and 3Q14, respectively. Including the write-offs of PCI loans, total annualized net charge-offs and PCI write-offs as a percentage of total average loans and leases outstanding were 0.49%, 0.62%, 0.70%, 0.40% and 0.57% for 3Q15, 2Q15, 1Q15, 4Q14 and 3Q14, respectively. C Adjusted net charge-offs exclude DoJ settlement impacts of $53MM, $166MM, $230MM and $151MM in 3Q15, 2Q15, 1Q15 and 4Q14, respectively, and recoveries from NPL sales and other recoveries of $58MM, $27MM, $40MM $314MM and $114MM in 3Q15, 2Q15, 1Q15, 4Q14 and 3Q14, respectively. D The allowance / annualized net charge-offs and PCI write-offs ratios were 2.95x, 2.40x, 2.28x, 4.08x and 2.95x, and the allowance (excluding valuation allowance for PCI loans) / annualized net charge-offs (excluding PCI loans) ratios were 3.18x, 2.79x, 2.55x, 3.66x and 3.27x, which excludes valuation allowance on PCI loans of $886MM, $1.1B, $1.3B, $1.7B and $1.6B for 3Q15, 2Q15, 1Q15, 4Q14 and 3Q14, respectively. E On a GAAP basis, reported NII was $9.5B, $10.5B, $9.5B, $9.6B and $10.2B for 3Q15, 2Q15, 1Q15, 4Q14 and 3Q14, respectively. Market-related adjustments of premium amortization and hedge ineffectiveness were ($0.6B), $0.7B, ($0.5B), ($0.6B) and ($0.1B) for 3Q15, 2Q15, 1Q15, 4Q14 and 3Q14, respectively. F LAS noninterest expense was $1.1B, $961MM and $6.6B for 3Q15, 2Q15 and 3Q14, respectively. LAS litigation expense was $228MM, $59MM and $5.3B for 3Q15, 2Q15 and 3Q14, respectively. G Net DVA represents the combined total of net DVA on derivatives and structured liabilities. In 4Q14, a funding valuation adjustment (FVA) on uncollateralized derivative transactions was implemented, and a transitional charge of $497MM related to the adoption was recorded. Net DVA gains (losses) were $313MM, $102MM, $19MM, ($626MM) and $205MM for 3Q15, 2Q15, 1Q15, 4Q14 and 3Q14, respectively. Net DVA gains (losses) included in FICC revenue were $278MM, $83MM, $4MM, ($577MM) and $133MM for 3Q15, 2Q15, 1Q15, 4Q14 and 3Q14, respectively. Net DVA gains (losses) included in equities revenue were $35MM, $19MM, $15MM, ($49MM) and $72MM for 3Q15, 2Q15, 1Q15, 4Q14 and 3Q14, respectively. H Global Markets noninterest expense was $2.7B and $3.4B for 3Q15 and 3Q14. Global Markets litigation expense was $32MM and $601MM for 3Q15 and 3Q14. The majority of the litigation expense recorded in 3Q14 was non-deductible for tax purposes. Definitions I Market-related NII adjustments include retrospective changes to debt security premium or discount amortization resulting from changes in estimated prepayments, due primarily to changes in interest rates, and hedge ineffectiveness. Amortization of premiums and accretion of discounts is included in interest income. When a change is made to the estimated lives of the securities, primarily as a result of changes in interest rates, the related premium or discount is adjusted, with a corresponding charge or benefit to interest income, to the appropriate amount had the current estimated lives been applied since the purchase of the securities. For more information, see Note 1 – Summary of Significant Accounting Principles to the Consolidated Financial Statements of the Corporation’s 2014 Annual Report on Form 10-K. J Global Excess Liquidity Sources include cash and high-quality, liquid, unencumbered securities, limited to U.S. government securities, U.S. agency securities, U.S. agency MBS, and a select group of non-U.S. government and supranational securities, and are readily available to meet funding requirements as they arise. It does not include Federal Reserve Discount Window or Federal Home Loan Bank borrowing capacity. Transfers of liquidity from the bank or other regulated entities are subject to certain regulatory restrictions. K Time to Required Funding (TTF) is a debt coverage measure and is expressed as the number of months unsecured holding company obligations of Bank of America Corporation can be met using only the BAC parent company’s Global Excess Liquidity Sources without issuing debt or sourcing additional liquidity. We define unsecured contractual obligations for purposes of this metric as maturities of senior or subordinated debt issued or guaranteed by Bank of America Corporation. L VaR model uses historical simulation approach based on three years of historical data and an expected shortfall methodology equivalent to a 99% confidence level. Using a 95% confidence level, average VaR was $24MM, $23MM, $30MM, $24MM and $26MM for 3Q15, 2Q15, 1Q15, 4Q14 and 3Q14, respectively.

Forward-Looking Statements 24 Bank of America and its management may make certain statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “anticipates,” “targets,” “expects,” “hopes,” “estimates,” “intends,” “plans,” “goals,” “believes,” “continue” and other similar expressions or future or conditional verbs such as “will,” “may,” “might,” “should,” “would” and “could.” Forward-looking statements represent Bank of America's current expectations, plans or forecasts of its future results and revenues, and future business and economic conditions more generally, and other future matters. These statements are not guarantees of future results or performance and involve certain known and unknown risks, uncertainties and assumptions that are difficult to predict and are often beyond Bank of America's control. Actual outcomes and results may differ materially from those expressed in, or implied by, any of these forward-looking statements. You should not place undue reliance on any forward-looking statement and should consider the following uncertainties and risks, as well as the risks and uncertainties more fully discussed under Item 1A. Risk Factors of Bank of America's 2014 Annual Report on Form 10-K, and in any of Bank of America's subsequent Securities and Exchange Commission filings: the Company's ability to resolve representations and warranties repurchase and related claims, including claims brought by investors or trustees seeking to distinguish certain aspects of the ACE Securities Corp. v. DB Structured Products, Inc. (ACE) ruling or to assert other claims seeking to avoid the impact of the ACE ruling; the possibility that the Company could face related servicing, securities, fraud, indemnity, contribution or other claims from one or more counterparties, including trustees, purchasers of loans, underwriters, issuers, other parties involved in securitizations, monolines or private-label and other investors; the possibility that future representations and warranties losses may occur in excess of the Company's recorded liability and estimated range of possible loss for its representations and warranties exposures; the possibility that the Company may not collect mortgage insurance claims; potential claims, damages, penalties, fines and reputational damage resulting from pending or future litigation and regulatory proceedings, including the possibility that amounts may be in excess of the Company’s recorded liability and estimated range of possible losses for litigation exposures; the possibility that the European Commission will impose remedial measures in relation to its investigation of the Company's competitive practices; the possible outcome of LIBOR, other reference rate and foreign exchange inquiries and investigations; uncertainties about the financial stability and growth rates of non-U.S. jurisdictions, the risk that those jurisdictions may face difficulties servicing their sovereign debt, and related stresses on financial markets, currencies and trade, and the Company's exposures to such risks, including direct, indirect and operational; the impact of U.S. and global interest rates, currency exchange rates and economic conditions; the impact on the Company's business, financial condition and results of operations of a potential higher interest rate environment; adverse changes to the Company's credit ratings from the major credit rating agencies; estimates of the fair value of certain of the Company's assets and liabilities; uncertainty regarding the content, timing and impact of regulatory capital and liquidity requirements, including the potential adoption of total loss-absorbing capacity requirements; the potential for payment protection insurance exposure to increase as a result of Financial Conduct Authority actions; the possible impact of Federal Reserve actions on the Company’s capital plans; the impact of implementation and compliance with new and evolving U.S. and international regulations, including but not limited to recovery and resolution planning requirements, the Volcker Rule, and derivatives regulations; the impact of recent proposed UK tax law changes, including a reduction to the UK corporate tax rate and the creation of a bank surcharge tax, which together, if enacted, will result in a tax charge upon enactment and higher tax expense going forward, as well as a reduction in the bank levy; a failure in or breach of the Company’s operational or security systems or infrastructure, or those of third parties, including as a result of cyber attacks; and other similar matters. Forward-looking statements speak only as of the date they are made, and Bank of America undertakes no obligation to update any forward-looking statement to reflect the impact of circumstances or events that arise after the date the forward-looking statement was made.

• The information contained herein is preliminary and based on Company data available at the time of the earnings presentation. It speaks only as of the particular date or dates included in the accompanying slides. Bank of America does not undertake an obligation to, and disclaims any duty to, update any of the information provided. • Certain prior period amounts have been reclassified to conform to current period presentation. • The Company’s fully phased-in Basel 3 estimates and the supplementary leverage ratio are based on the Standardized and Advanced approaches under Basel 3 and supplementary leverage ratio final rules. Under the Basel 3 Advanced approaches, risk-weighted assets are determined primarily for market risk and credit risk, similar to the Standardized approach, but also incorporate operational risk and a credit valuation adjustment component. Market risk capital measurements are consistent with the Standardized approach, except for securitization exposures, where the Supervisory Formula Approach is also permitted. Credit risk exposures are measured using internal ratings-based models to determine the applicable risk weight by estimating the probability of default, loss given default and, in certain instances, exposure at default. The internal analytical models primarily rely on internal historical default and loss experience. The calculations under Basel 3 require management to make estimates, assumptions and interpretations, including the probability of future events based on historical experience. Actual results could differ from those estimates and assumptions. Bank of America received approval to begin using the Advanced approaches capital framework to determine risk-based capital requirements beginning in the fourth quarter of 2015. As previously disclosed, with the approval to exit parallel, U.S. banking regulators requested modifications to certain internal analytical models including the wholesale (e.g., commercial) credit models, which will increase our risk-weighted assets in the fourth quarter of 2015. Including these modifications, the estimated pro-forma RWA and CET1 ratio under the Basel 3 Advanced approaches on a fully phased-in basis would be $1,570B and 9.7% at September 30, 2015. These Basel 3 Advanced approaches estimates assume approval by U.S. banking regulators of our internal analytical models, including approval of the internal models methodology (IMM). As of September 30, 2015, BAC had not received IMM approval. Our estimates under the Basel 3 Advanced approaches may be refined over time as a result of further rulemaking or clarification by U.S. banking regulators. • Certain financial measures contained herein represent non-GAAP financial measures. For more information about the non-GAAP financial measures contained herein, please see the presentation of the most directly comparable financial measures calculated in accordance with GAAP and accompanying reconciliations in the earnings press release for the quarter ended September 30, 2015 and other earnings-related information available through the Bank of America Investor Relations web site at: http://investor.bankofamerica.com. • The Company allocates capital to its business segments using a methodology that considers the effect of regulatory capital requirements in addition to internal risk-based capital models. The Company's internal risk-based capital models use a risk-adjusted methodology incorporating each segment's credit, market, interest rate, business and operational risk components. Allocated capital is reviewed periodically and refinements are made based on multiple considerations that include, but are not limited to, risk-weighted assets measured under Basel 3 Standardized and Advanced approaches, business segment exposures and risk profile and strategic plans. As a result of this process, in the first quarter 2015, the Company adjusted the amount of capital being allocated to its business segments, primarily LAS. Important Presentation Information 25