Bank of America Reports Quarterly Earnings of $3.5 Billion, EPS of $0.37 Provision for Credit Losses of $5.1 Billion Includes a $4.0 Billion Reserve Build(A) CET1 Ratio 11.4%, Average Global Liquidity Sources Grew $244 Billion to $796 Billion(B,C) Q2-20 Financial Highlights1 Q2-20 Business Segment Highlights(1,2,D) • Net income of $3.5 billion, or $0.37 per diluted Consumer Banking share, includes the impact of a $4.0 billion reserve • Net income of $71 million, impacted by a reserve build and lower NII build primarily associated with a weaker economic outlook related to COVID-19 • Loans up 8% to $322 billion; deposits up 15% to $811 billion • Consumer investment assets up 12% to $246 billion, driven by flows – Pretax income declined 58% to $3.8 billion of $23 billion since Q2-19 and market performance – Pretax, pre-provision income down 9% to $8.9 3 • Client Support Actions: billion – Completed ~334,000 Paycheck Protection Program (PPP) loans YTD • Provision for credit losses increased to $5.1 billion, to deliver $25 billion in funding to small business owners driven by $4.0 billion reserve build – Processed ~1.8 million payment deferrals YTD, of which ~1.7 • Revenue, net of interest expense, decreased 3% to million were still in place as of July 9 $22.3 billion Global Wealth and Investment Management – Net interest income (NII)(E) declined 11% to $10.8 billion, driven by lower interest rates, • Net income of $624 million partially offset by loan and deposit growth • Client balances increased 1% to $2.9 trillion, driven by client flows – Noninterest income rose 5% to $11.5 billion, led – AUM flows of $4 billion in Q2-20 by strong capital markets results • Loans up 10% to $182 billion; deposits up 13% to $287 billion • Noninterest expense increased 1% to $13.4 billion; • Merrill added nearly 6,000 net new households, and Private Bank efficiency ratio of 60% added nearly 500 net new relationships • Client Support Actions: • Loan and lease balances in the business segments – 77% of Wealth Management clients used online or mobile platform rose $96 billion, or 11%, to $1.0 trillion – WebEx meetings hosted by Merrill Lynch Wealth Management • Deposits rose $282.7 billion, or 21%, to $1.7 Financial Advisors up 419% trillion – Private Bank teams averaged 1,900 client interactions/day • Common equity tier 1 (CET1) ratio increased from the prior quarter to 11.4% (Advanced approaches), Global Banking versus 9.5% required minimum(B) • Net income of $726 million • Book value per common share rose 6% to $27.96; • Record firmwide investment banking fees (excl. self-led) up 57% to tangible book value per common share rose 5% to $2.2 billion; No. 3 ranking in investment banking fees(F) $19.90(4) • Loans up 14% to $424 billion; deposits up 36% to $494 billion From Chairman and CEO Brian Moynihan: • Client Support Actions: "In the most tumultuous period since the Great – Approved nearly $160 billion in new or expanded commercial Depression, we delivered for our clients, our commitments across business segments in the first half of 2020 employees, our communities and our shareholders. – Raised $461 billion in capital in first-half 2020 on behalf of clients – Issued $1 billion social bond; first bond issued by a U.S. commercial "Strong capital markets results provided an important bank entirely focused on fighting COVID-19 counterbalance to the COVID-19-related impacts on Global Markets our Consumer business, and our industry-leading digital capabilities allowed us to support clients amid • Net income of $1.9 billion difficult working conditions. • Sales and trading revenue of $4.2 billion, including net debit valuation adjustments (DVA) losses of $261 million "We provided billions in credit to clients; announced a • Excluding net DVA, sales and trading revenue increased 35% to $4.4 $1 billion, four-year commitment to drive economic billion(G) and racial equality in our communities; strengthened – FICC increased 50% to $3.2 billion(G) our balance sheet by increasing deposits, capital and (G) – Equities increased 7% to $1.2 billion loan loss reserves; invested in technology and • Client Support Action: equipment to help keep our employees safe; and delivered for shareholders, earning more than twice – Supported clients by providing liquidity and a strong and resilient our quarterly dividend." trading platform during period of heightened market activity See page 10 for endnotes. 1 Financial Highlights and Business Segment Highlights are compared to the year-ago quarter unless noted. Loan and deposit balances are shown on an average basis unless noted. 2 The Corporation reports the results of operations of its four business segments and All Other on a fully taxable-equivalent (FTE) basis. 3 Pretax, pre-provision income (PTPI) represents a non-GAAP financial measure. For more information, see endnote H on page 10. 4 Tangible book value per common share represents a non-GAAP financial measure. For more information, see page 18. 1

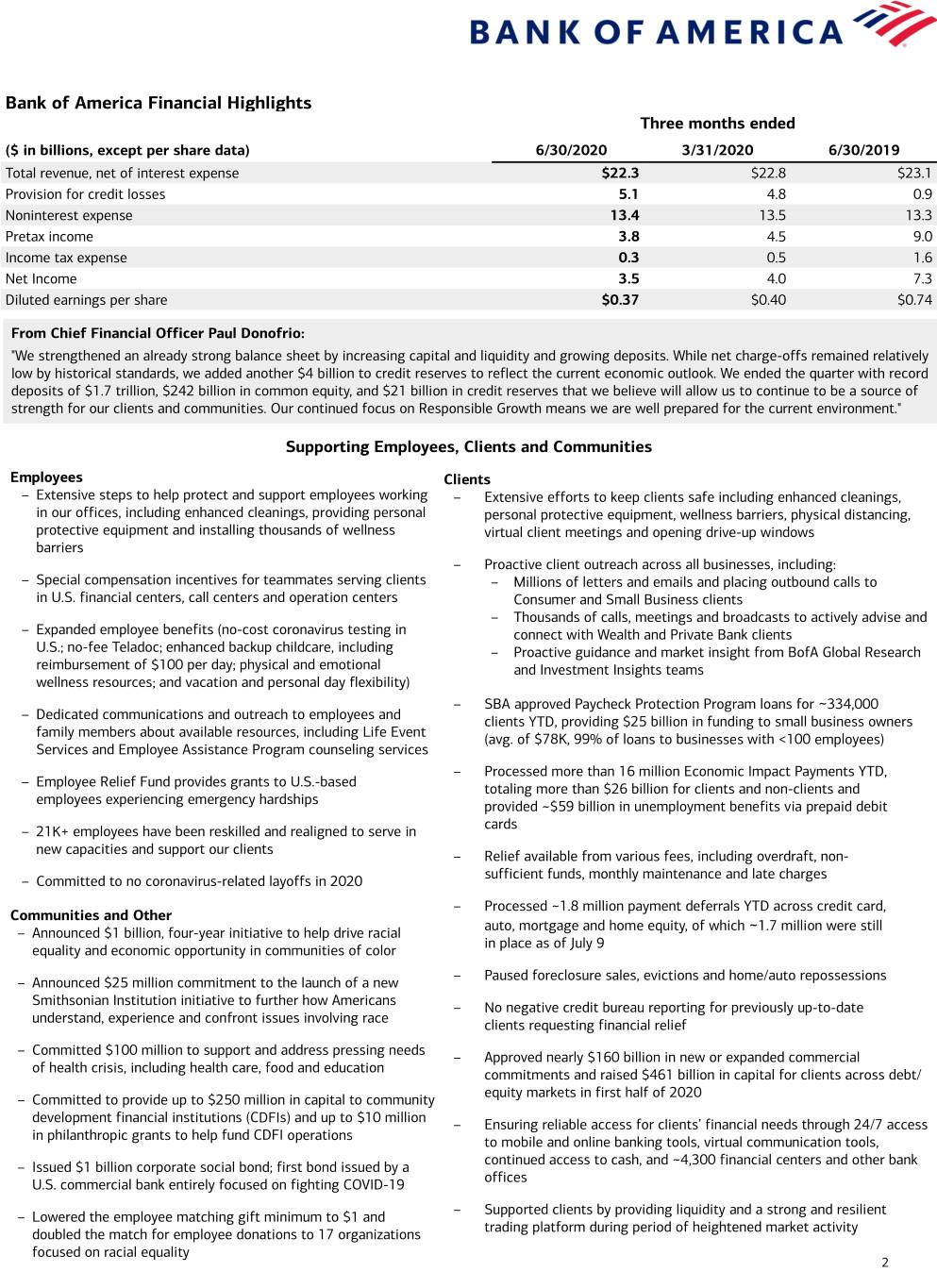

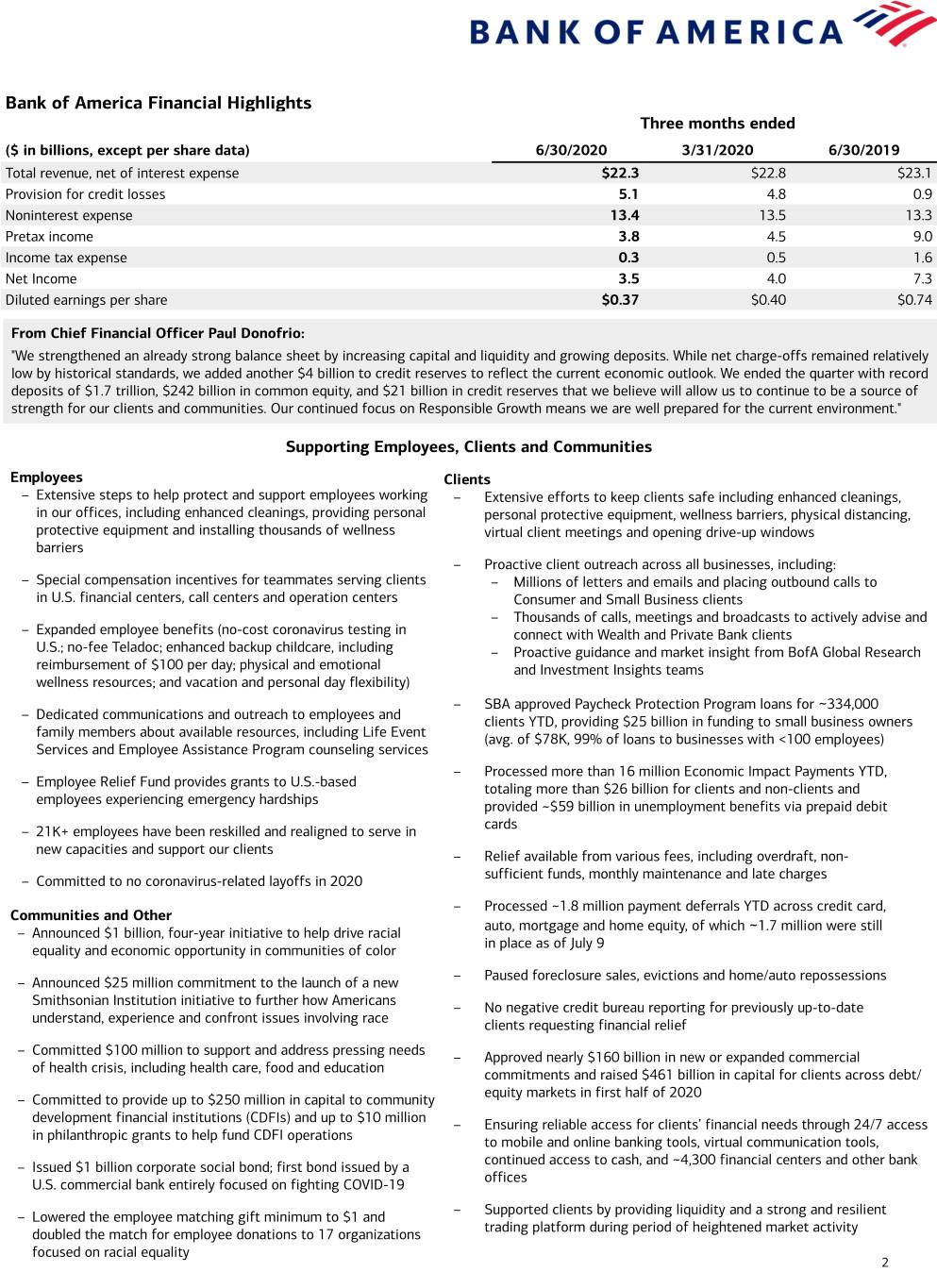

Bank of America Financial Highlights Three months ended ($ in billions, except per share data) 6/30/2020 3/31/2020 6/30/2019 Total revenue, net of interest expense $22.3 $22.8 $23.1 Provision for credit losses 5.1 4.8 0.9 Noninterest expense 13.4 13.5 13.3 Pretax income 3.8 4.5 9.0 Income tax expense 0.3 0.5 1.6 Net Income 3.5 4.0 7.3 Diluted earnings per share $0.37 $0.40 $0.74 From Chief Financial Officer Paul Donofrio: "We strengthened an already strong balance sheet by increasing capital and liquidity and growing deposits. While net charge-offs remained relatively low by historical standards, we added another $4 billion to credit reserves to reflect the current economic outlook. We ended the quarter with record deposits of $1.7 trillion, $242 billion in common equity, and $21 billion in credit reserves that we believe will allow us to continue to be a source of strength for our clients and communities. Our continued focus on Responsible Growth means we are well prepared for the current environment." Supporting Employees, Clients and Communities Employees Clients – Extensive steps to help protect and support employees working – Extensive efforts to keep clients safe including enhanced cleanings, in our offices, including enhanced cleanings, providing personal personal protective equipment, wellness barriers, physical distancing, protective equipment and installing thousands of wellness virtual client meetings and opening drive-up windows barriers – Proactive client outreach across all businesses, including: – Special compensation incentives for teammates serving clients – Millions of letters and emails and placing outbound calls to in U.S. financial centers, call centers and operation centers Consumer and Small Business clients – Thousands of calls, meetings and broadcasts to actively advise and – Expanded employee benefits (no-cost coronavirus testing in connect with Wealth and Private Bank clients U.S.; no-fee Teladoc; enhanced backup childcare, including – Proactive guidance and market insight from BofA Global Research reimbursement of $100 per day; physical and emotional and Investment Insights teams wellness resources; and vacation and personal day flexibility) – SBA approved Paycheck Protection Program loans for ~334,000 – Dedicated communications and outreach to employees and clients YTD, providing $25 billion in funding to small business owners family members about available resources, including Life Event (avg. of $78K, 99% of loans to businesses with <100 employees) Services and Employee Assistance Program counseling services – Processed more than 16 million Economic Impact Payments YTD, – Employee Relief Fund provides grants to U.S.-based totaling more than $26 billion for clients and non-clients and employees experiencing emergency hardships provided ~$59 billion in unemployment benefits via prepaid debit cards – 21K+ employees have been reskilled and realigned to serve in new capacities and support our clients – Relief available from various fees, including overdraft, non- sufficient funds, monthly maintenance and late charges – Committed to no coronavirus-related layoffs in 2020 – Processed ~1.8 million payment deferrals YTD across credit card, Communities and Other auto, mortgage and home equity, of which 1.7 million were still – Announced $1 billion, four-year initiative to help drive racial ~ in place as of July 9 equality and economic opportunity in communities of color – Paused foreclosure sales, evictions and home/auto repossessions – Announced $25 million commitment to the launch of a new Smithsonian Institution initiative to further how Americans – No negative credit bureau reporting for previously up-to-date understand, experience and confront issues involving race clients requesting financial relief – Committed $100 million to support and address pressing needs – Approved nearly $160 billion in new or expanded commercial of health crisis, including health care, food and education commitments and raised $461 billion in capital for clients across debt/ equity markets in first half of 2020 – Committed to provide up to $250 million in capital to community development financial institutions (CDFIs) and up to $10 million – Ensuring reliable access for clients’ financial needs through 24/7 access in philanthropic grants to help fund CDFI operations to mobile and online banking tools, virtual communication tools, continued access to cash, and ~4,300 financial centers and other bank – Issued $1 billion corporate social bond; first bond issued by a offices U.S. commercial bank entirely focused on fighting COVID-19 – Supported clients by providing liquidity and a strong and resilient – Lowered the employee matching gift minimum to $1 and trading platform during period of heightened market activity doubled the match for employee donations to 17 organizations focused on racial equality 2

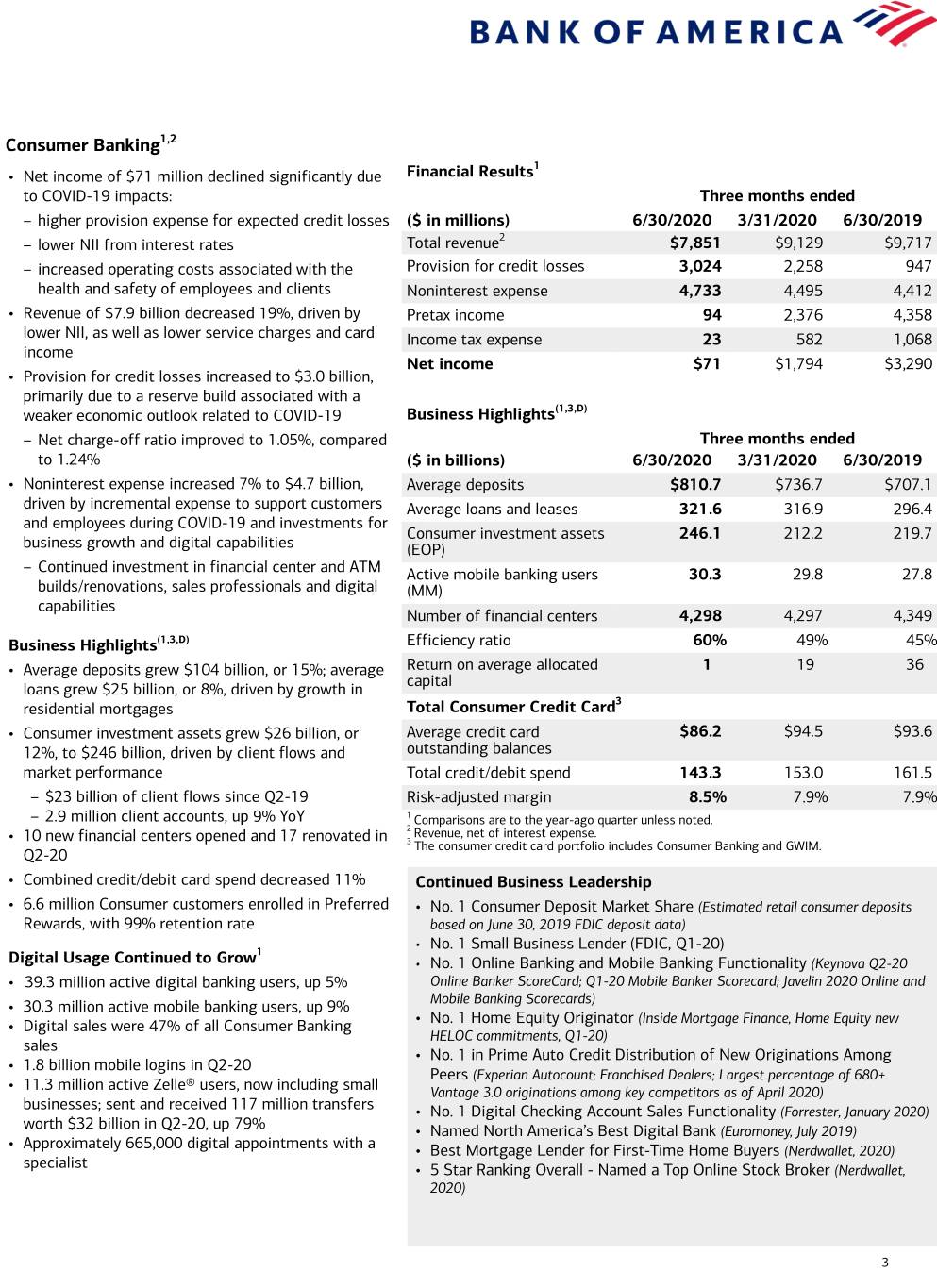

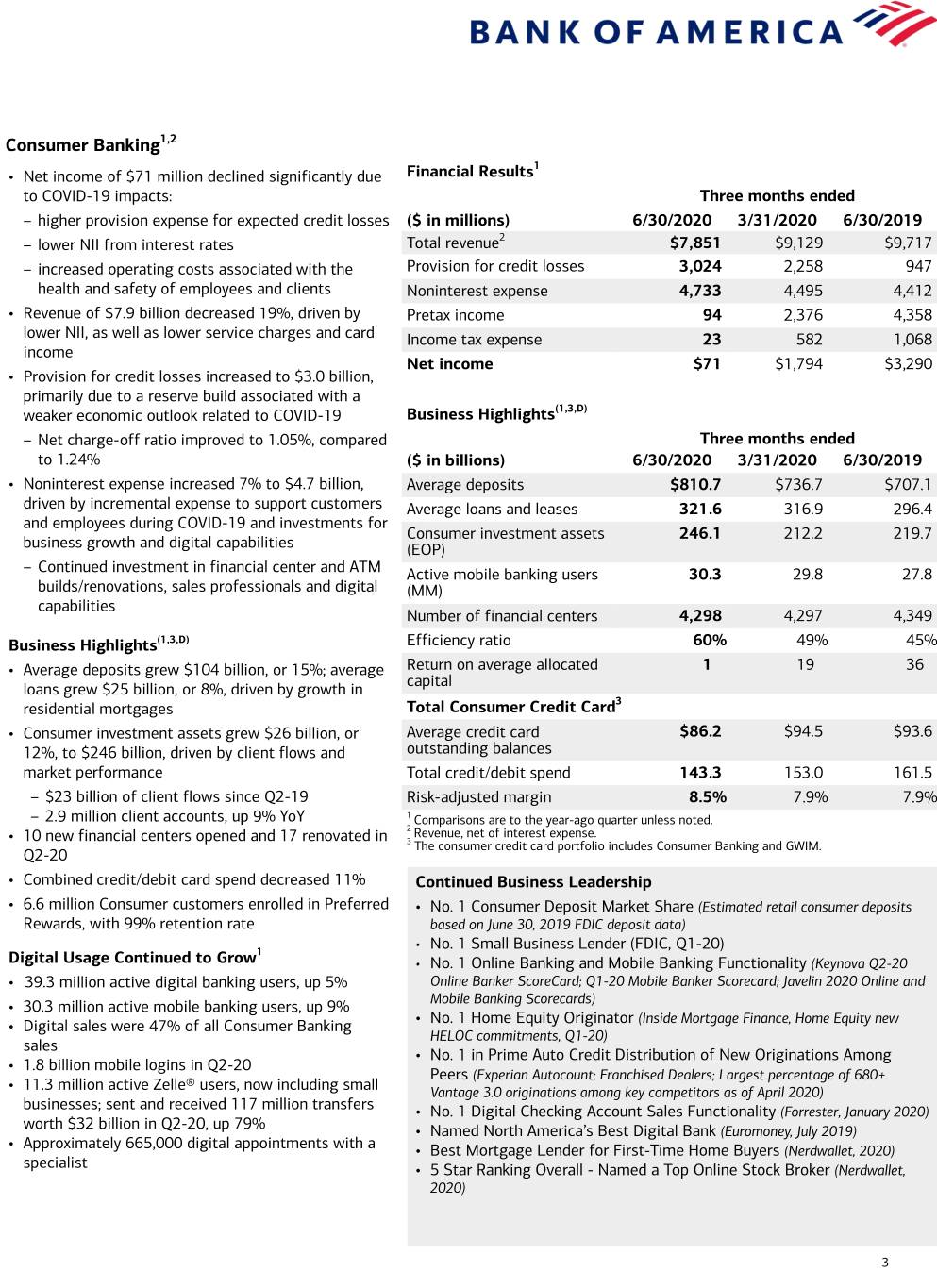

Consumer Banking1,2 1 • Net income of $71 million declined significantly due Financial Results to COVID-19 impacts: Three months ended – higher provision expense for expected credit losses ($ in millions) 6/30/2020 3/31/2020 6/30/2019 2 – lower NII from interest rates Total revenue $7,851 $9,129 $9,717 – increased operating costs associated with the Provision for credit losses 3,024 2,258 947 health and safety of employees and clients Noninterest expense 4,733 4,495 4,412 • Revenue of $7.9 billion decreased 19%, driven by Pretax income 94 2,376 4,358 lower NII, as well as lower service charges and card Income tax expense 23 582 1,068 income Net income $71 $1,794 $3,290 • Provision for credit losses increased to $3.0 billion, primarily due to a reserve build associated with a weaker economic outlook related to COVID-19 Business Highlights(1,3,D) – Net charge-off ratio improved to 1.05%, compared Three months ended to 1.24% ($ in billions) 6/30/2020 3/31/2020 6/30/2019 • Noninterest expense increased 7% to $4.7 billion, Average deposits $810.7 $736.7 $707.1 driven by incremental expense to support customers Average loans and leases 321.6 316.9 296.4 and employees during COVID-19 and investments for Consumer investment assets 246.1 212.2 219.7 business growth and digital capabilities (EOP) – Continued investment in financial center and ATM Active mobile banking users 30.3 29.8 27.8 builds/renovations, sales professionals and digital (MM) capabilities Number of financial centers 4,298 4,297 4,349 Business Highlights(1,3,D) Efficiency ratio 60% 49% 45% • Average deposits grew $104 billion, or 15%; average Return on average allocated 1 19 36 capital loans grew $25 billion, or 8%, driven by growth in 3 residential mortgages Total Consumer Credit Card • Consumer investment assets grew $26 billion, or Average credit card $86.2 $94.5 $93.6 12%, to $246 billion, driven by client flows and outstanding balances market performance Total credit/debit spend 143.3 153.0 161.5 – $23 billion of client flows since Q2-19 Risk-adjusted margin 8.5% 7.9% 7.9% – 2.9 million client accounts, up 9% YoY 1 Comparisons are to the year-ago quarter unless noted. • 10 new financial centers opened and 17 renovated in 2 Revenue, net of interest expense. 3 The consumer credit card portfolio includes Consumer Banking and GWIM. Q2-20 • Combined credit/debit card spend decreased 11% Continued Business Leadership • 6.6 million Consumer customers enrolled in Preferred • No. 1 Consumer Deposit Market Share (Estimated retail consumer deposits Rewards, with 99% retention rate based on June 30, 2019 FDIC deposit data) • 1 No. 1 Small Business Lender (FDIC, Q1-20) Digital Usage Continued to Grow • No. 1 Online Banking and Mobile Banking Functionality (Keynova Q2-20 • 39.3 million active digital banking users, up 5% Online Banker ScoreCard; Q1-20 Mobile Banker Scorecard; Javelin 2020 Online and • 30.3 million active mobile banking users, up 9% Mobile Banking Scorecards) • No. 1 Home Equity Originator (Inside Mortgage Finance, Home Equity new • Digital sales were 47% of all Consumer Banking HELOC commitments, Q1-20) sales • No. 1 in Prime Auto Credit Distribution of New Originations Among • 1.8 billion mobile logins in Q2-20 Peers (Experian Autocount; Franchised Dealers; Largest percentage of 680+ • 11.3 million active Zelle® users, now including small Vantage 3.0 originations among key competitors as of April 2020) businesses; sent and received 117 million transfers • No. 1 Digital Checking Account Sales Functionality (Forrester, January 2020) worth $32 billion in Q2-20, up 79% • Named North America’s Best Digital Bank (Euromoney, July 2019) • Approximately 665,000 digital appointments with a • Best Mortgage Lender for First-Time Home Buyers (Nerdwallet, 2020) specialist • 5 Star Ranking Overall - Named a Top Online Stock Broker (Nerdwallet, 2020) 3

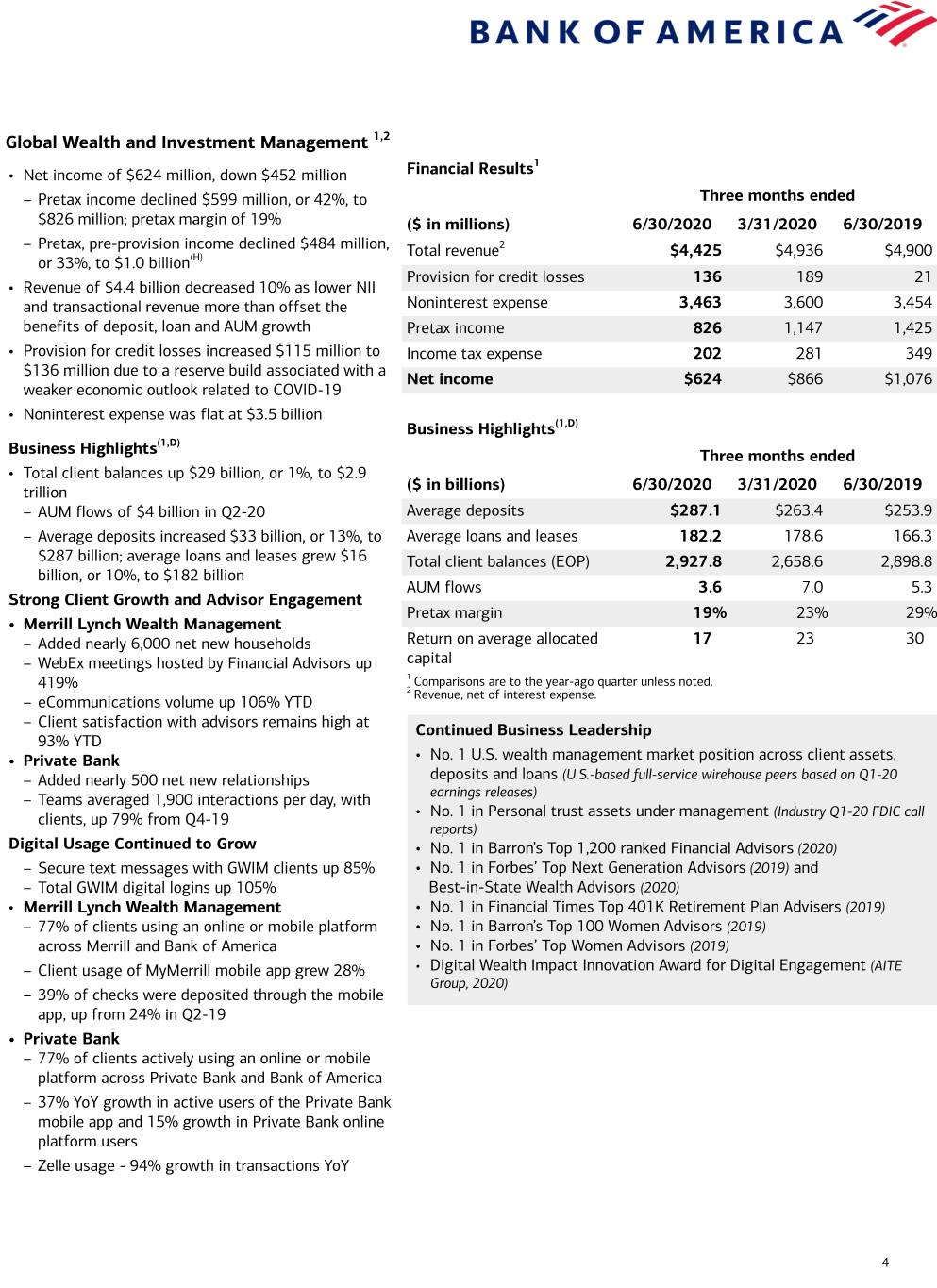

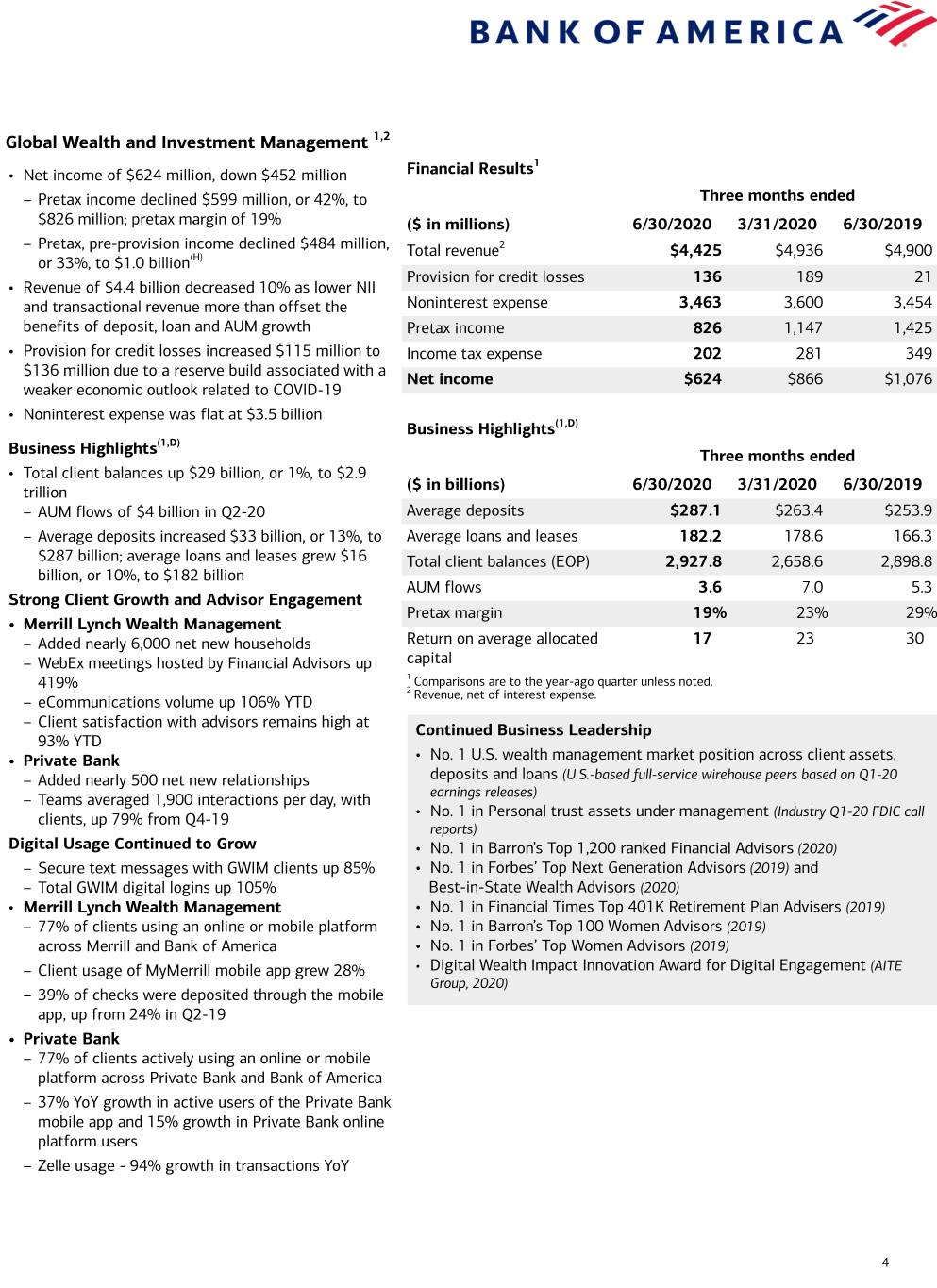

Global Wealth and Investment Management 1,2 1 • Net income of $624 million, down $452 million Financial Results – Pretax income declined $599 million, or 42%, to Three months ended $826 million; pretax margin of 19% ($ in millions) 6/30/2020 3/31/2020 6/30/2019 – Pretax, pre-provision income declined $484 million, Total revenue2 $4,425 $4,936 $4,900 or 33%, to $1.0 billion(H) Provision for credit losses 136 189 21 • Revenue of $4.4 billion decreased 10% as lower NII and transactional revenue more than offset the Noninterest expense 3,463 3,600 3,454 benefits of deposit, loan and AUM growth Pretax income 826 1,147 1,425 • Provision for credit losses increased $115 million to Income tax expense 202 281 349 $136 million due to a reserve build associated with a Net income $624 $866 $1,076 weaker economic outlook related to COVID-19 • Noninterest expense was flat at $3.5 billion Business Highlights(1,D) (1,D) Business Highlights Three months ended • Total client balances up $29 billion, or 1%, to $2.9 trillion ($ in billions) 6/30/2020 3/31/2020 6/30/2019 – AUM flows of $4 billion in Q2-20 Average deposits $287.1 $263.4 $253.9 – Average deposits increased $33 billion, or 13%, to Average loans and leases 182.2 178.6 166.3 $287 billion; average loans and leases grew $16 Total client balances (EOP) 2,927.8 2,658.6 2,898.8 billion, or 10%, to $182 billion AUM flows 3.6 7.0 5.3 Strong Client Growth and Advisor Engagement Pretax margin 19% 23% 29% • Merrill Lynch Wealth Management – Added nearly 6,000 net new households Return on average allocated 17 23 30 – WebEx meetings hosted by Financial Advisors up capital 1 Comparisons are to the year-ago quarter unless noted. 419% 2 – eCommunications volume up 106% YTD Revenue, net of interest expense. – Client satisfaction with advisors remains high at Continued Business Leadership 93% YTD • Private Bank • No. 1 U.S. wealth management market position across client assets, – Added nearly 500 net new relationships deposits and loans (U.S.-based full-service wirehouse peers based on Q1-20 – Teams averaged 1,900 interactions per day, with earnings releases) • No. 1 in Personal trust assets under management (Industry Q1-20 FDIC call clients, up 79% from Q4-19 reports) Digital Usage Continued to Grow • No. 1 in Barron’s Top 1,200 ranked Financial Advisors (2020) – Secure text messages with GWIM clients up 85% • No. 1 in Forbes’ Top Next Generation Advisors (2019) and – Total GWIM digital logins up 105% Best-in-State Wealth Advisors (2020) • Merrill Lynch Wealth Management • No. 1 in Financial Times Top 401K Retirement Plan Advisers (2019) – 77% of clients using an online or mobile platform • No. 1 in Barron’s Top 100 Women Advisors (2019) across Merrill and Bank of America • No. 1 in Forbes’ Top Women Advisors (2019) – Client usage of MyMerrill mobile app grew 28% • Digital Wealth Impact Innovation Award for Digital Engagement (AITE Group, 2020) – 39% of checks were deposited through the mobile app, up from 24% in Q2-19 • Private Bank – 77% of clients actively using an online or mobile platform across Private Bank and Bank of America – 37% YoY growth in active users of the Private Bank mobile app and 15% growth in Private Bank online platform users – Zelle usage - 94% growth in transactions YoY 4

Global Banking1,2 1 • Net income decreased $1.2 billion to $726 million Financial Results – Pretax income declined $1.6 billion, or 62%, to Three months ended $995 million ($ in millions) 6/30/2020 3/31/2020 6/30/2019 – Pretax, pre-provision income increased $104 Total revenue2,3 $5,091 $4,600 $4,975 million, or 4%, to $2.9 billion(H) Provision for credit losses 1,873 2,093 125 • Revenue of $5.1 billion increased 2%, as higher Noninterest expense 2,223 2,321 2,211 investment banking fees and portfolio valuations more than offset lower net interest income Pretax income 995 186 2,639 • Provision for credit losses increased $1.7 billion to Income tax expense 269 50 713 $1.9 billion, primarily due to a reserve build Net income $726 $136 $1,926 associated with a weaker economic outlook related to COVID-19 (1,2,D) • Noninterest expense increased 1% to $2.2 billion Business Highlights Three months ended Business Highlights(1,2,D) ($ in billions) 6/30/2020 3/31/2020 6/30/2019 • Average deposits increased $131 billion, or 36%, to Average deposits $493.9 $382.4 $362.6 $494 billion, reflecting client flight to safety, Average loans and leases 423.6 386.5 372.5 government stimulus and placement of credit draws Total Corp. IB fees (excl. self- 2.2 1.4 1.4 • Average loans and leases grew $51 billion, or 14%, to led)2 $424 billion, driven by revolver draws at the end of Global Banking IB fees2 the prior quarter, which have been partially paid down 1.2 0.8 0.7 throughout Q2-20 Business Lending revenue 1.9 2.0 2.1 • Record total corporation investment banking fees of Global Transaction Services 1.8 2.0 2.2 $2.2 billion (excl. self-led) increased 57%, driven by revenue increases in advisory, debt and equity underwriting Efficiency ratio 44% 50% 44% fees Return on average allocated 7 1 19 – Participated in 9 of the top 10 equity deals and 6 capital of the top 10 debt deals(F) 1 Comparisons are to the year-ago quarter unless noted. 2 Global Banking and Global Markets share in certain deal economics from investment banking, 1 loan origination activities, and sales and trading activities. Digital Usage Continued to Grow 3 Revenue, net of interest expense. • ~500k CashPro® Online users (digital banking platform) across our commercial, corporate and Continued Business Leadership business banking businesses • North America’s Best Bank for Small to Medium-sized Enterprises • CashPro Mobile Active Users increased 50% and (Euromoney, 2020) logins increased 77% (rolling 12 months, YoY) • Best Overall Brand Middle Market Banking (Greenwich, 2020) • CashPro Mobile Payment Approvals value of $184 • North America and Latin America's Best Bank for Transaction Services billion, with volumes increasing 244% (rolling 12 (Euromoney, 2020) months, YoY) • North America’s Best Bank for Financing (Euromoney, 2019) • Number of checks deposited via CashPro Mobile • 2019 Quality, Share and Excellence Awards for U.S. Large Corporate up 133%, and dollar volume increased 181% Banking and Cash Management (Greenwich, 2019) (rolling 12 months, YoY) • Relationships with 77% of the Global Fortune 500 and 95% of the U.S. • 14 million incoming receivables were digitally Fortune 1000 (2019) matched in last 12 months using Intelligent Receivables, which uses AI to match payments and accounts receivables (May 2020) • Mobile Wallet adoption for commercial cards grew by 115% YoY (May 2020) 5

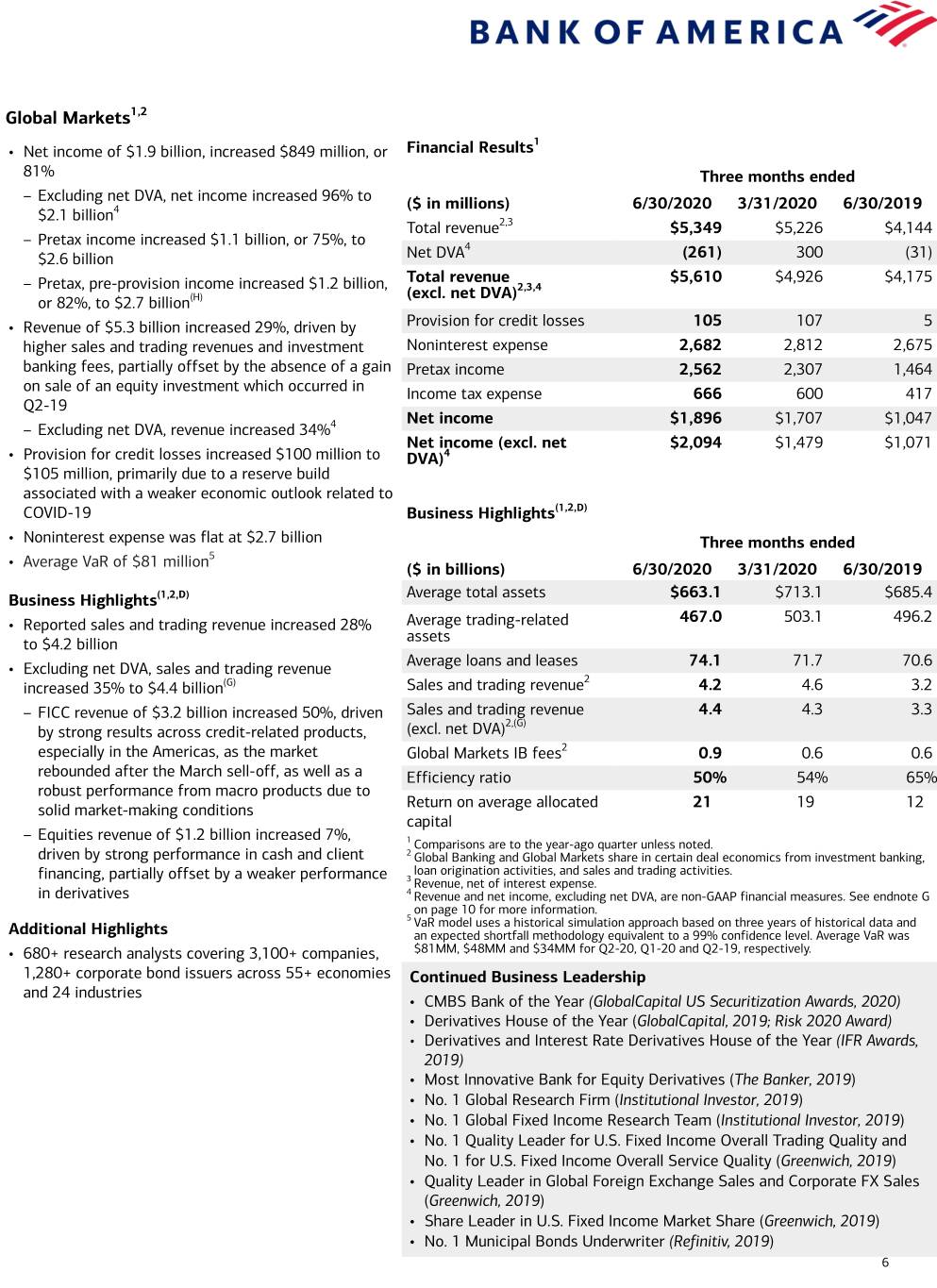

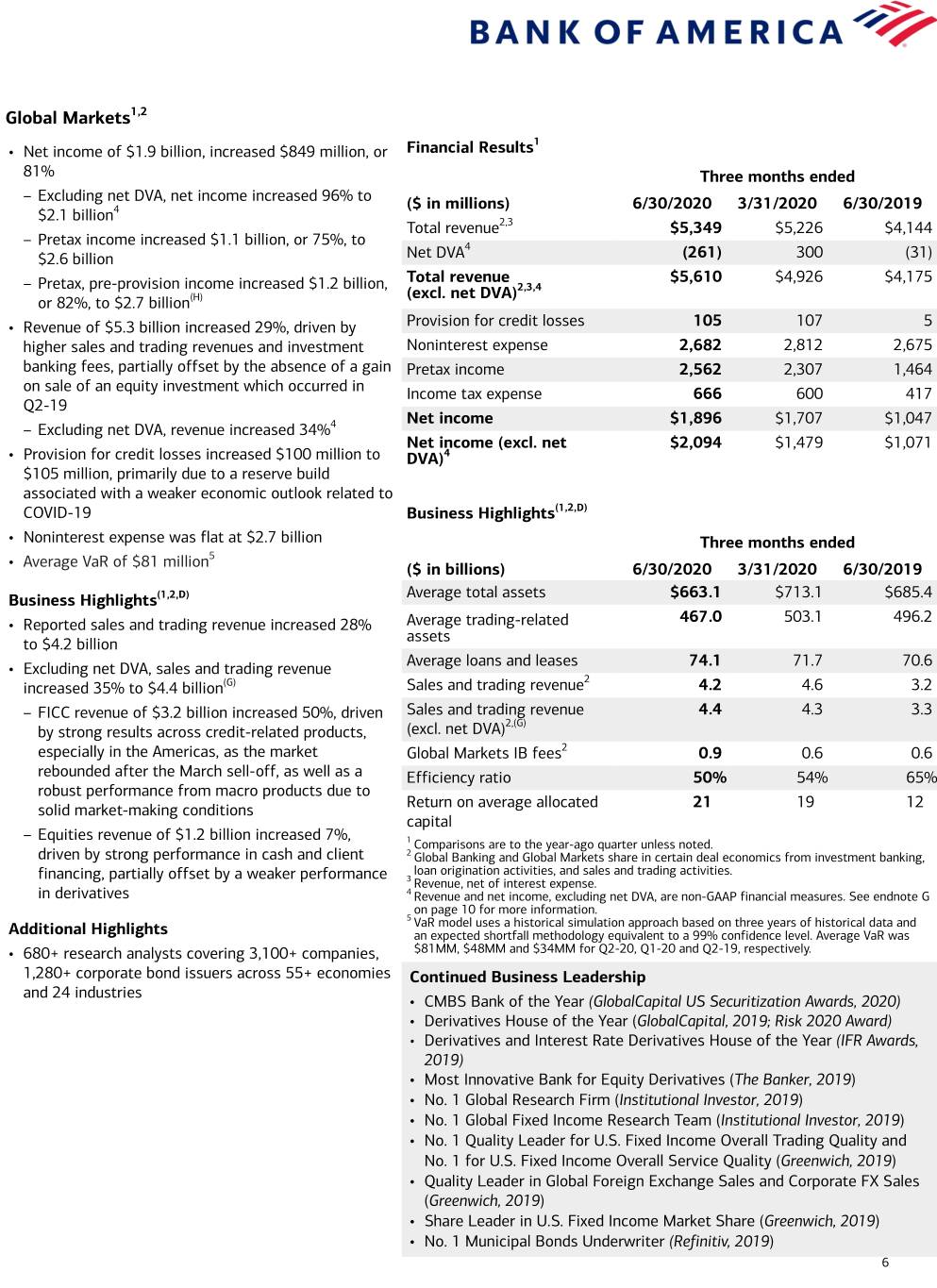

Global Markets1,2 1 • Net income of $1.9 billion, increased $849 million, or Financial Results 81% Three months ended – Excluding net DVA, net income increased 96% to ($ in millions) 6/30/2020 3/31/2020 6/30/2019 $2.1 billion4 Total revenue2,3 $5,349 $5,226 $4,144 – Pretax income increased $1.1 billion, or 75%, to 4 $2.6 billion Net DVA (261) 300 (31) – Pretax, pre-provision income increased $1.2 billion, Total revenue $5,610 $4,926 $4,175 (excl. net DVA)2,3,4 or 82%, to $2.7 billion(H) • Revenue of $5.3 billion increased 29%, driven by Provision for credit losses 105 107 5 higher sales and trading revenues and investment Noninterest expense 2,682 2,812 2,675 banking fees, partially offset by the absence of a gain Pretax income 2,562 2,307 1,464 on sale of an equity investment which occurred in Income tax expense 666 600 417 Q2-19 Net income $1,896 $1,707 $1,047 – Excluding net DVA, revenue increased 34%4 Net income (excl. net $2,094 $1,479 $1,071 • Provision for credit losses increased $100 million to DVA)4 $105 million, primarily due to a reserve build associated with a weaker economic outlook related to COVID-19 Business Highlights(1,2,D) • Noninterest expense was flat at $2.7 billion Three months ended 5 • Average VaR of $81 million ($ in billions) 6/30/2020 3/31/2020 6/30/2019 (1,2,D) Average total assets $663.1 $713.1 $685.4 Business Highlights 467.0 503.1 496.2 • Reported sales and trading revenue increased 28% Average trading-related assets to $4.2 billion Average loans and leases 74.1 71.7 70.6 • Excluding net DVA, sales and trading revenue 2 increased 35% to $4.4 billion(G) Sales and trading revenue 4.2 4.6 3.2 – FICC revenue of $3.2 billion increased 50%, driven Sales and trading revenue 4.4 4.3 3.3 2,(G) by strong results across credit-related products, (excl. net DVA) especially in the Americas, as the market Global Markets IB fees2 0.9 0.6 0.6 rebounded after the March sell-off, as well as a Efficiency ratio 50% 54% 65% robust performance from macro products due to Return on average allocated 21 19 12 solid market-making conditions capital – Equities revenue of $1.2 billion increased 7%, 1 Comparisons are to the year-ago quarter unless noted. driven by strong performance in cash and client 2 Global Banking and Global Markets share in certain deal economics from investment banking, financing, partially offset by a weaker performance loan origination activities, and sales and trading activities. 3 Revenue, net of interest expense. in derivatives 4 Revenue and net income, excluding net DVA, are non-GAAP financial measures. See endnote G on page 10 for more information. 5 VaR model uses a historical simulation approach based on three years of historical data and Additional Highlights an expected shortfall methodology equivalent to a 99% confidence level. Average VaR was • 680+ research analysts covering 3,100+ companies, $81MM, $48MM and $34MM for Q2-20, Q1-20 and Q2-19, respectively. 1,280+ corporate bond issuers across 55+ economies Continued Business Leadership and 24 industries • CMBS Bank of the Year (GlobalCapital US Securitization Awards, 2020) • Derivatives House of the Year (GlobalCapital, 2019; Risk 2020 Award) • Derivatives and Interest Rate Derivatives House of the Year (IFR Awards, 2019) • Most Innovative Bank for Equity Derivatives (The Banker, 2019) • No. 1 Global Research Firm (Institutional Investor, 2019) • No. 1 Global Fixed Income Research Team (Institutional Investor, 2019) • No. 1 Quality Leader for U.S. Fixed Income Overall Trading Quality and No. 1 for U.S. Fixed Income Overall Service Quality (Greenwich, 2019) • Quality Leader in Global Foreign Exchange Sales and Corporate FX Sales (Greenwich, 2019) • Share Leader in U.S. Fixed Income Market Share (Greenwich, 2019) • No. 1 Municipal Bonds Underwriter (Refinitiv, 2019) 6

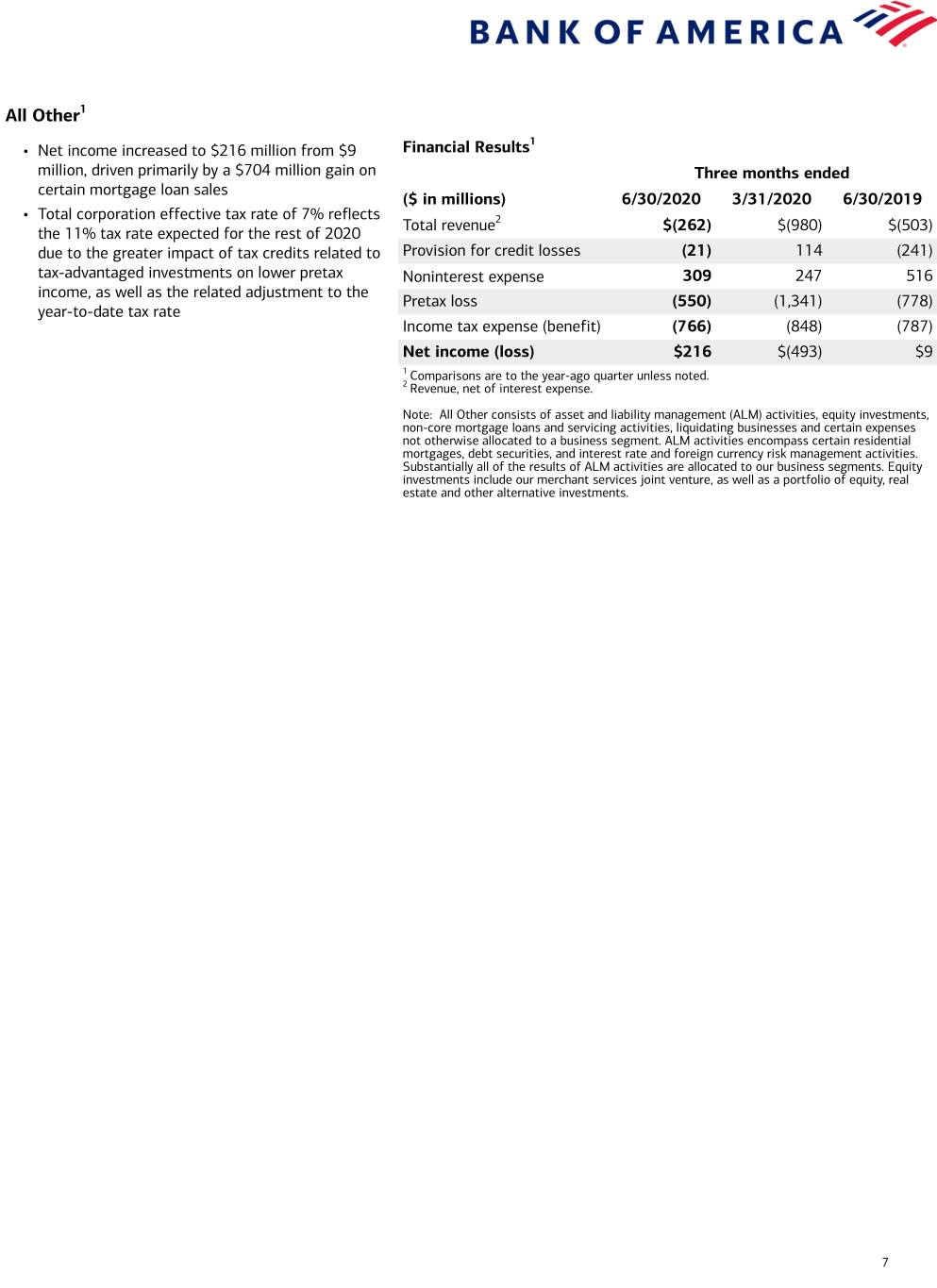

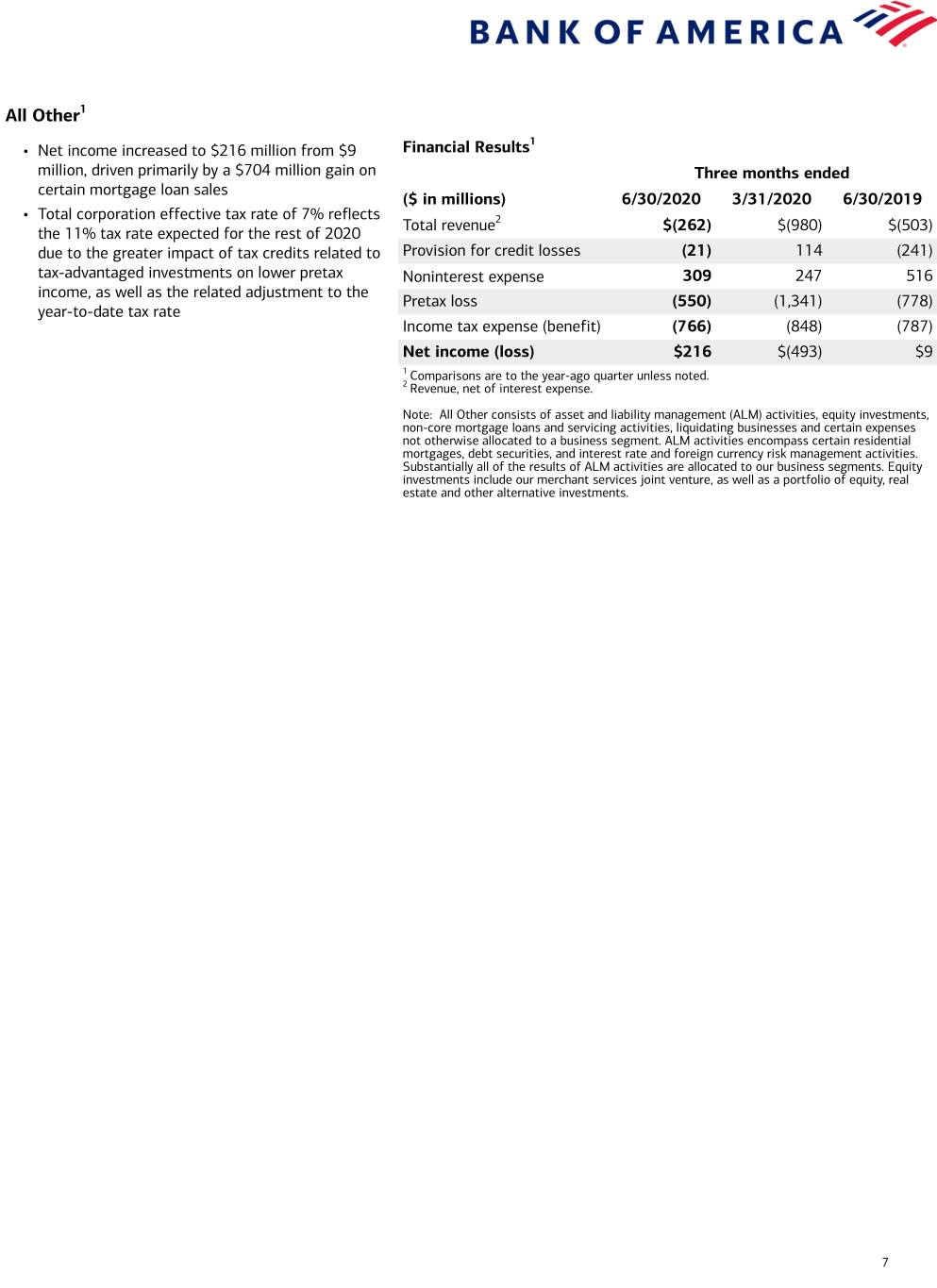

All Other1 1 • Net income increased to $216 million from $9 Financial Results million, driven primarily by a $704 million gain on Three months ended certain mortgage loan sales ($ in millions) 6/30/2020 3/31/2020 6/30/2019 • Total corporation effective tax rate of 7% reflects Total revenue2 $(262) $(980) $(503) the 11% tax rate expected for the rest of 2020 due to the greater impact of tax credits related to Provision for credit losses (21) 114 (241) tax-advantaged investments on lower pretax Noninterest expense 309 247 516 income, as well as the related adjustment to the Pretax loss (550) (1,341) (778) year-to-date tax rate Income tax expense (benefit) (766) (848) (787) Net income (loss) $216 $(493) $9 1 Comparisons are to the year-ago quarter unless noted. 2 Revenue, net of interest expense. Note: All Other consists of asset and liability management (ALM) activities, equity investments, non-core mortgage loans and servicing activities, liquidating businesses and certain expenses not otherwise allocated to a business segment. ALM activities encompass certain residential mortgages, debt securities, and interest rate and foreign currency risk management activities. Substantially all of the results of ALM activities are allocated to our business segments. Equity investments include our merchant services joint venture, as well as a portfolio of equity, real estate and other alternative investments. 7

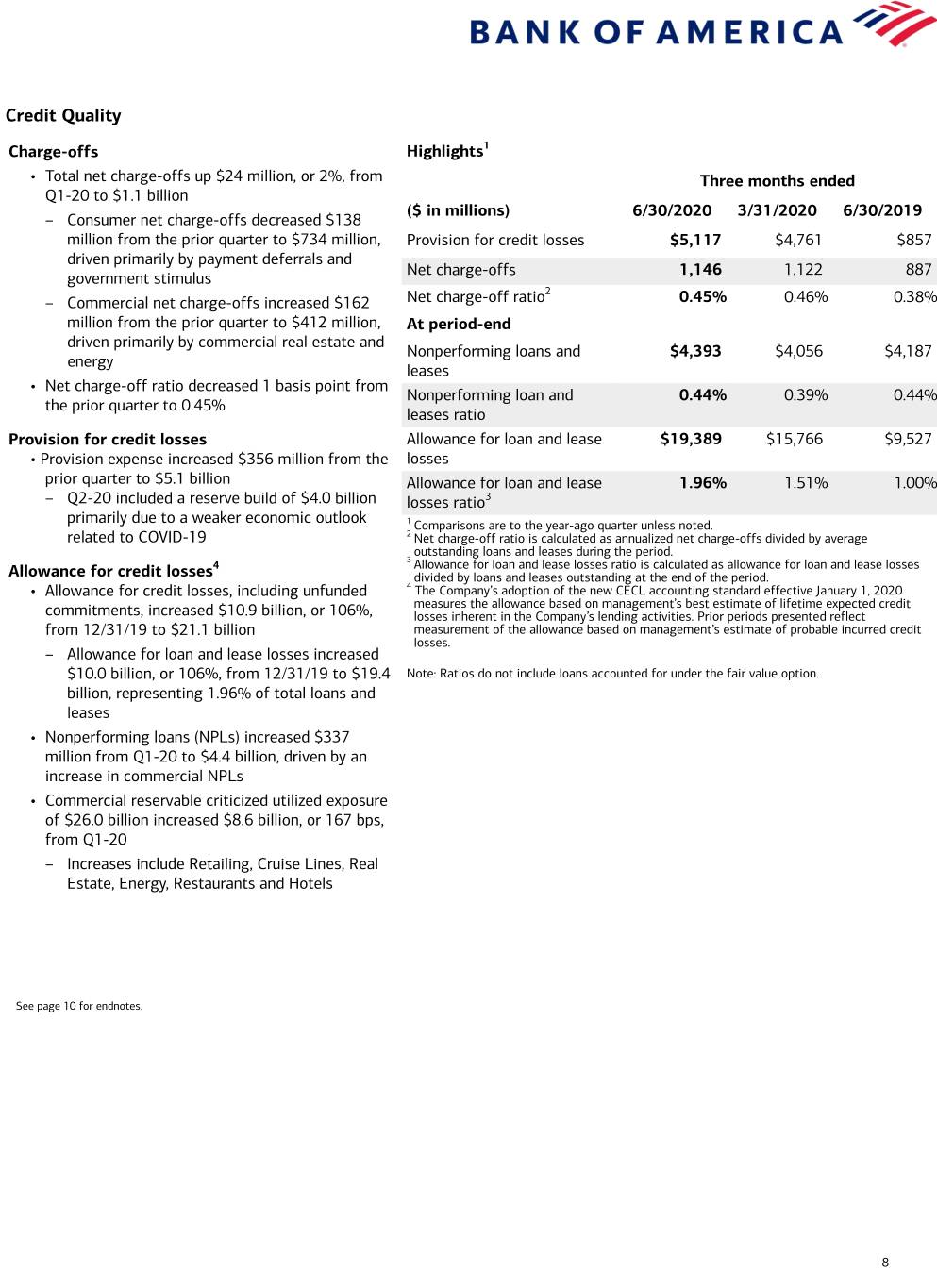

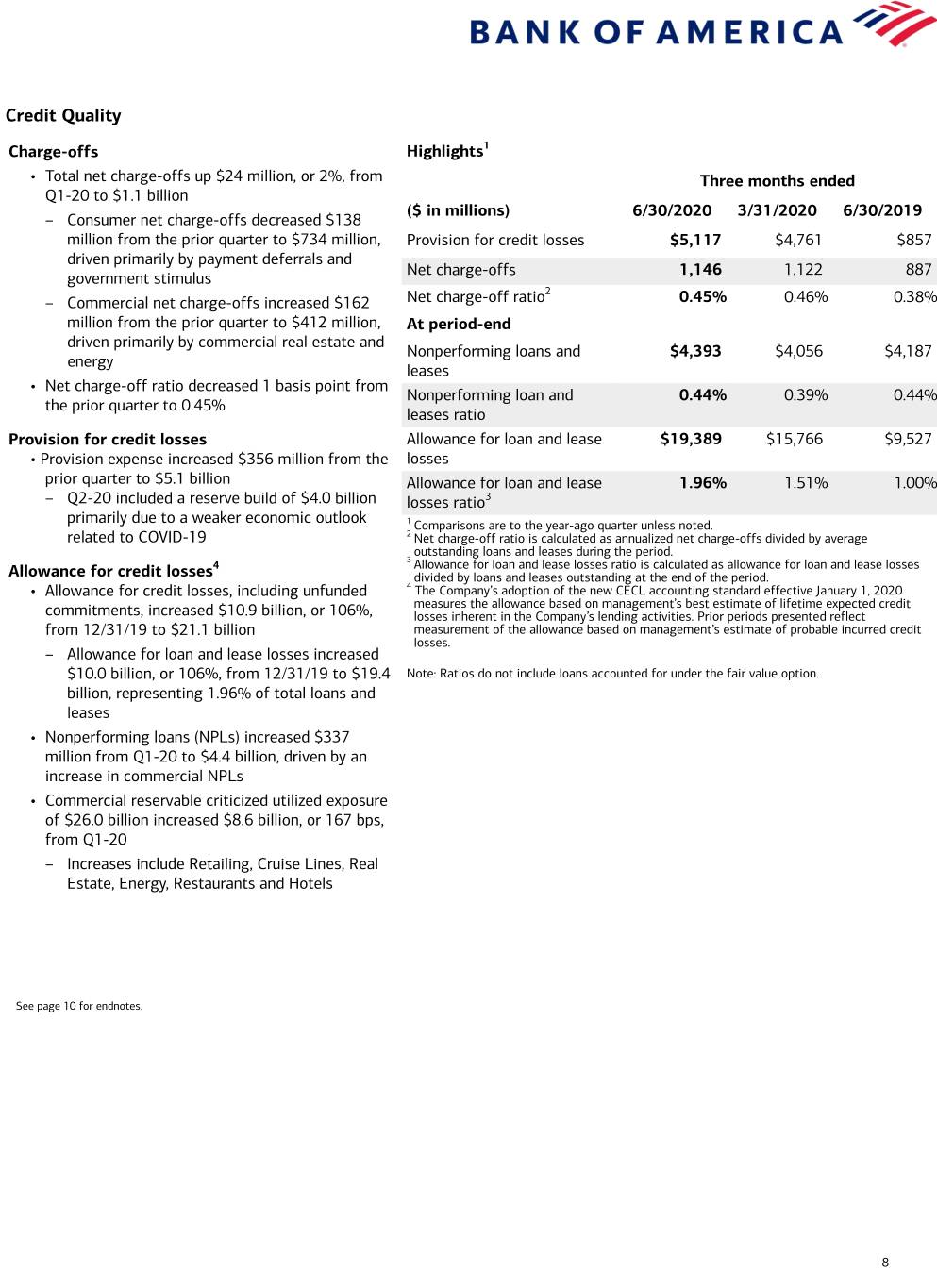

Credit Quality Charge-offs Highlights1 • Total net charge-offs up $24 million, or 2%, from Three months ended Q1-20 to $1.1 billion ($ in millions) 6/30/2020 3/31/2020 6/30/2019 – Consumer net charge-offs decreased $138 million from the prior quarter to $734 million, Provision for credit losses $5,117 $4,761 $857 driven primarily by payment deferrals and Net charge-offs 1,146 1,122 887 government stimulus 2 – Commercial net charge-offs increased $162 Net charge-off ratio 0.45% 0.46% 0.38% million from the prior quarter to $412 million, At period-end driven primarily by commercial real estate and Nonperforming loans and $4,393 $4,056 $4,187 energy leases • Net charge-off ratio decreased 1 basis point from Nonperforming loan and 0.44% 0.39% 0.44% the prior quarter to 0.45% leases ratio Provision for credit losses Allowance for loan and lease $19,389 $15,766 $9,527 • Provision expense increased $356 million from the losses prior quarter to $5.1 billion Allowance for loan and lease 1.96% 1.51% 1.00% – Q2-20 included a reserve build of $4.0 billion losses ratio3 primarily due to a weaker economic outlook 1 Comparisons are to the year-ago quarter unless noted. related to COVID-19 2 Net charge-off ratio is calculated as annualized net charge-offs divided by average outstanding loans and leases during the period. 3 4 Allowance for loan and lease losses ratio is calculated as allowance for loan and lease losses Allowance for credit losses divided by loans and leases outstanding at the end of the period. • Allowance for credit losses, including unfunded 4 The Company’s adoption of the new CECL accounting standard effective January 1, 2020 measures the allowance based on management’s best estimate of lifetime expected credit commitments, increased $10.9 billion, or 106%, losses inherent in the Company’s lending activities. Prior periods presented reflect from 12/31/19 to $21.1 billion measurement of the allowance based on management’s estimate of probable incurred credit losses. – Allowance for loan and lease losses increased $10.0 billion, or 106%, from 12/31/19 to $19.4 Note: Ratios do not include loans accounted for under the fair value option. billion, representing 1.96% of total loans and leases • Nonperforming loans (NPLs) increased $337 million from Q1-20 to $4.4 billion, driven by an increase in commercial NPLs • Commercial reservable criticized utilized exposure of $26.0 billion increased $8.6 billion, or 167 bps, from Q1-20 – Increases include Retailing, Cruise Lines, Real Estate, Energy, Restaurants and Hotels See page 10 for endnotes. 8

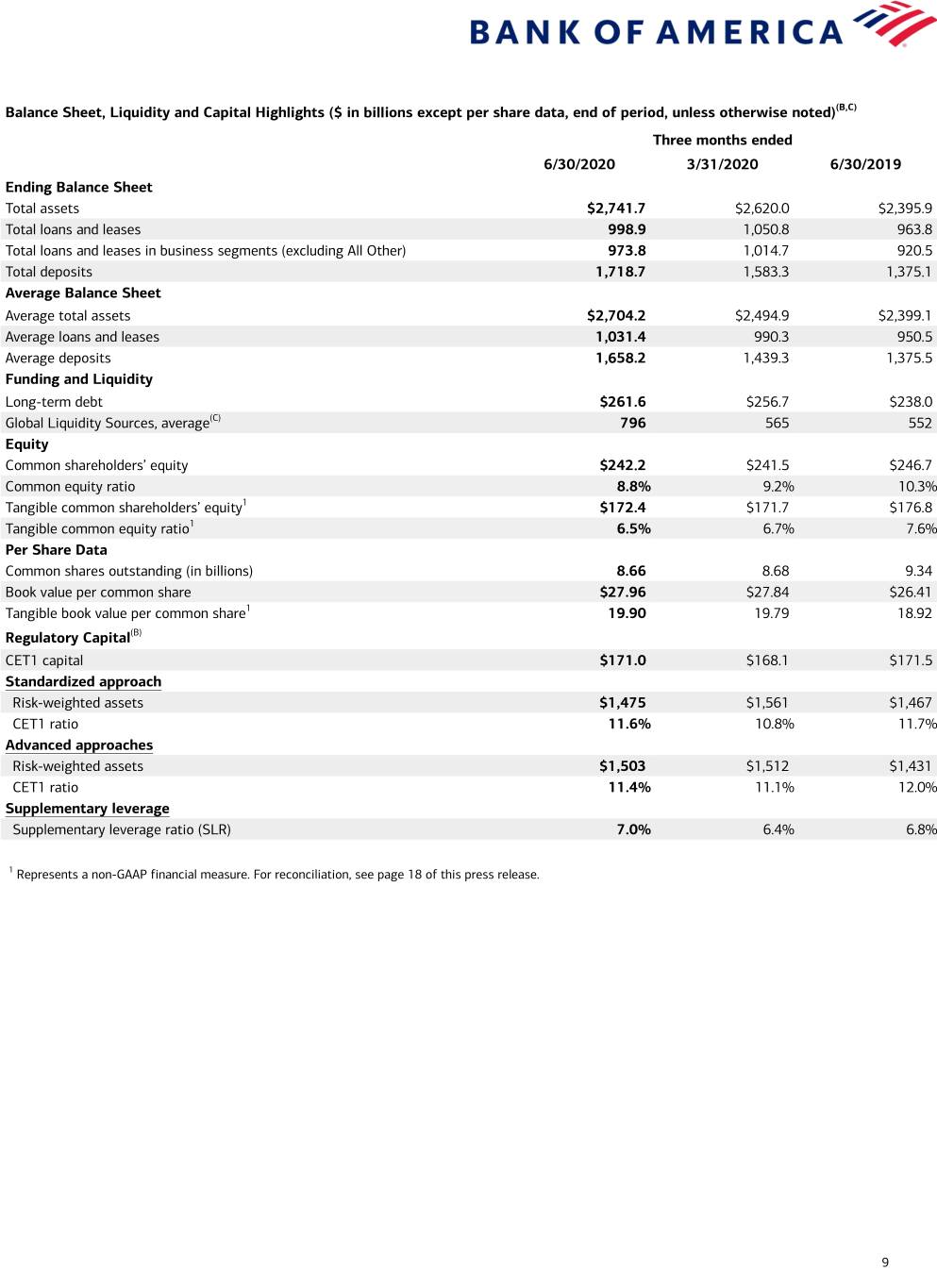

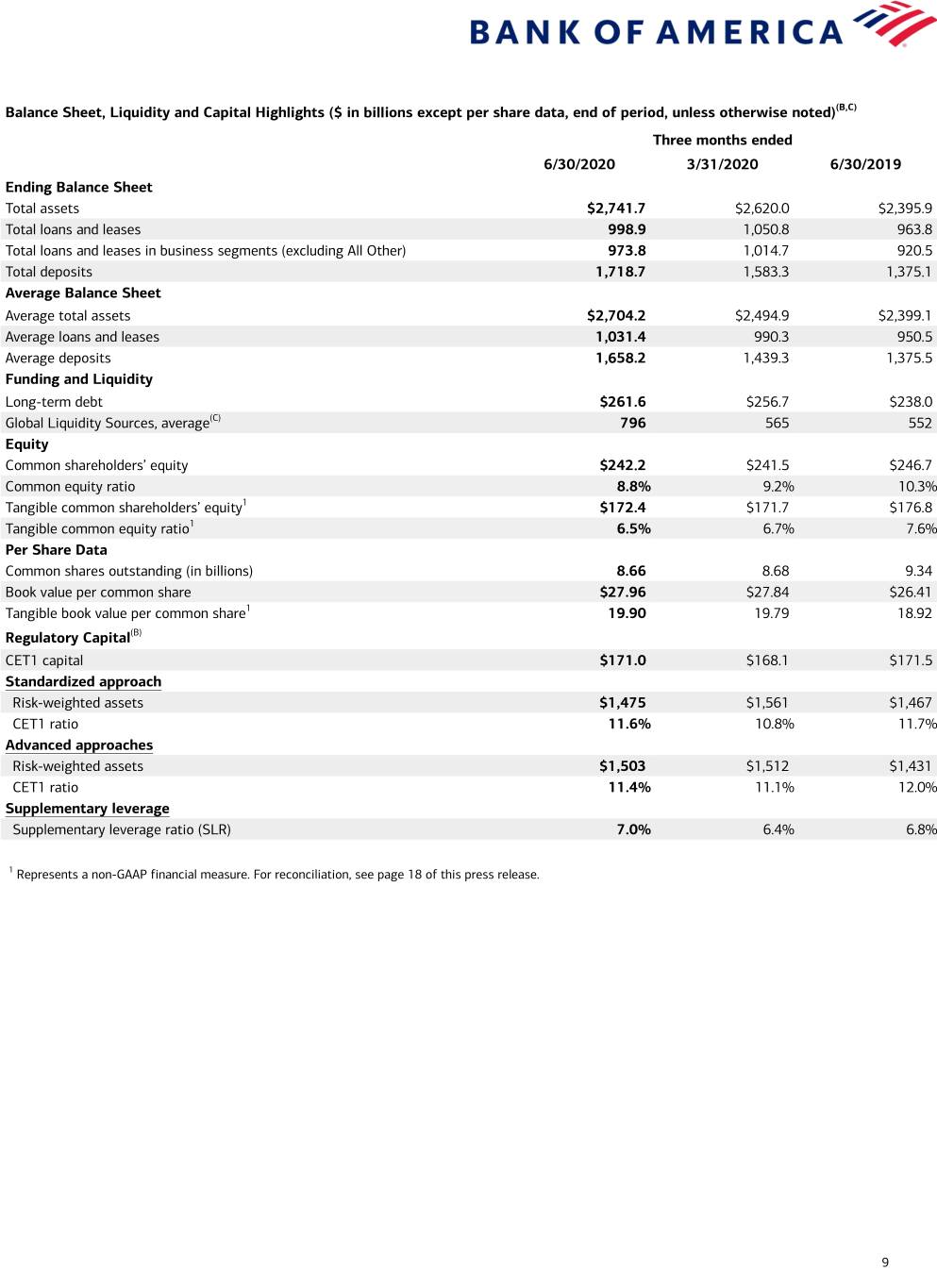

Balance Sheet, Liquidity and Capital Highlights ($ in billions except per share data, end of period, unless otherwise noted)(B,C) Three months ended 6/30/2020 3/31/2020 6/30/2019 Ending Balance Sheet Total assets $2,741.7 $2,620.0 $2,395.9 Total loans and leases 998.9 1,050.8 963.8 Total loans and leases in business segments (excluding All Other) 973.8 1,014.7 920.5 Total deposits 1,718.7 1,583.3 1,375.1 Average Balance Sheet Average total assets $2,704.2 $2,494.9 $2,399.1 Average loans and leases 1,031.4 990.3 950.5 Average deposits 1,658.2 1,439.3 1,375.5 Funding and Liquidity Long-term debt $261.6 $256.7 $238.0 Global Liquidity Sources, average(C) 796 565 552 Equity Common shareholders’ equity $242.2 $241.5 $246.7 Common equity ratio 8.8% 9.2% 10.3% Tangible common shareholders’ equity1 $172.4 $171.7 $176.8 Tangible common equity ratio1 6.5% 6.7% 7.6% Per Share Data Common shares outstanding (in billions) 8.66 8.68 9.34 Book value per common share $27.96 $27.84 $26.41 Tangible book value per common share1 19.90 19.79 18.92 Regulatory Capital(B) CET1 capital $171.0 $168.1 $171.5 Standardized approach Risk-weighted assets $1,475 $1,561 $1,467 CET1 ratio 11.6% 10.8% 11.7% Advanced approaches Risk-weighted assets $1,503 $1,512 $1,431 CET1 ratio 11.4% 11.1% 12.0% Supplementary leverage Supplementary leverage ratio (SLR) 7.0% 6.4% 6.8% 1 Represents a non-GAAP financial measure. For reconciliation, see page 18 of this press release. 9

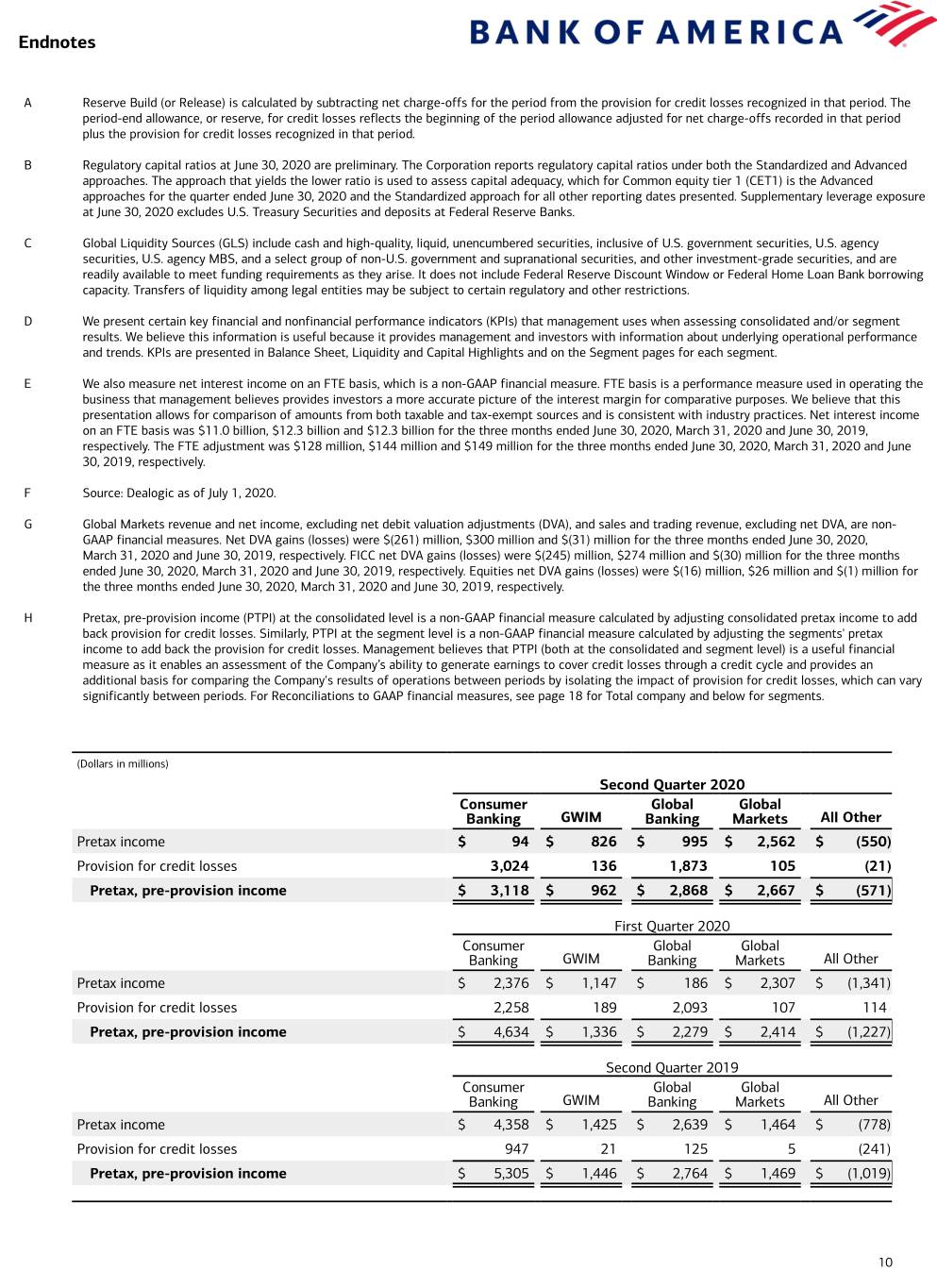

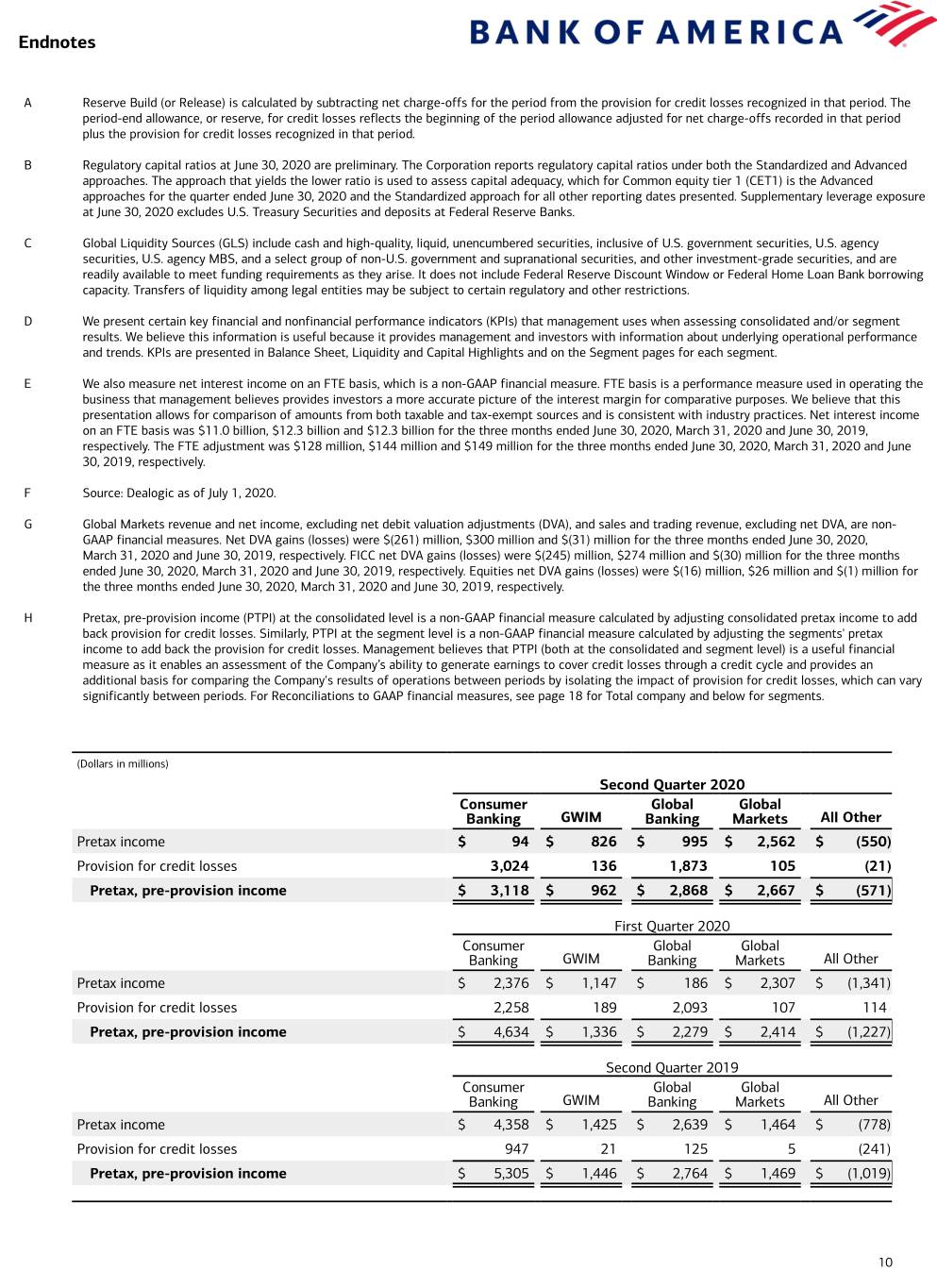

Endnotes A Reserve Build (or Release) is calculated by subtracting net charge-offs for the period from the provision for credit losses recognized in that period. The period-end allowance, or reserve, for credit losses reflects the beginning of the period allowance adjusted for net charge-offs recorded in that period plus the provision for credit losses recognized in that period. B Regulatory capital ratios at June 30, 2020 are preliminary. The Corporation reports regulatory capital ratios under both the Standardized and Advanced approaches. The approach that yields the lower ratio is used to assess capital adequacy, which for Common equity tier 1 (CET1) is the Advanced approaches for the quarter ended June 30, 2020 and the Standardized approach for all other reporting dates presented. Supplementary leverage exposure at June 30, 2020 excludes U.S. Treasury Securities and deposits at Federal Reserve Banks. C Global Liquidity Sources (GLS) include cash and high-quality, liquid, unencumbered securities, inclusive of U.S. government securities, U.S. agency securities, U.S. agency MBS, and a select group of non-U.S. government and supranational securities, and other investment-grade securities, and are readily available to meet funding requirements as they arise. It does not include Federal Reserve Discount Window or Federal Home Loan Bank borrowing capacity. Transfers of liquidity among legal entities may be subject to certain regulatory and other restrictions. D We present certain key financial and nonfinancial performance indicators (KPIs) that management uses when assessing consolidated and/or segment results. We believe this information is useful because it provides management and investors with information about underlying operational performance and trends. KPIs are presented in Balance Sheet, Liquidity and Capital Highlights and on the Segment pages for each segment. E We also measure net interest income on an FTE basis, which is a non-GAAP financial measure. FTE basis is a performance measure used in operating the business that management believes provides investors a more accurate picture of the interest margin for comparative purposes. We believe that this presentation allows for comparison of amounts from both taxable and tax-exempt sources and is consistent with industry practices. Net interest income on an FTE basis was $11.0 billion, $12.3 billion and $12.3 billion for the three months ended June 30, 2020, March 31, 2020 and June 30, 2019, respectively. The FTE adjustment was $128 million, $144 million and $149 million for the three months ended June 30, 2020, March 31, 2020 and June 30, 2019, respectively. F Source: Dealogic as of July 1, 2020. G Global Markets revenue and net income, excluding net debit valuation adjustments (DVA), and sales and trading revenue, excluding net DVA, are non- GAAP financial measures. Net DVA gains (losses) were $(261) million, $300 million and $(31) million for the three months ended June 30, 2020, March 31, 2020 and June 30, 2019, respectively. FICC net DVA gains (losses) were $(245) million, $274 million and $(30) million for the three months ended June 30, 2020, March 31, 2020 and June 30, 2019, respectively. Equities net DVA gains (losses) were $(16) million, $26 million and $(1) million for the three months ended June 30, 2020, March 31, 2020 and June 30, 2019, respectively. H Pretax, pre-provision income (PTPI) at the consolidated level is a non-GAAP financial measure calculated by adjusting consolidated pretax income to add back provision for credit losses. Similarly, PTPI at the segment level is a non-GAAP financial measure calculated by adjusting the segments' pretax income to add back the provision for credit losses. Management believes that PTPI (both at the consolidated and segment level) is a useful financial measure as it enables an assessment of the Company’s ability to generate earnings to cover credit losses through a credit cycle and provides an additional basis for comparing the Company's results of operations between periods by isolating the impact of provision for credit losses, which can vary significantly between periods. For Reconciliations to GAAP financial measures, see page 18 for Total company and below for segments. (Dollars in millions) Second Quarter 2020 Consumer Global Global Banking GWIM Banking Markets All Other Pretax income $ 94 $ 826 $ 995 $ 2,562 $ (550) Provision for credit losses 3,024 136 1,873 105 (21) Pretax, pre-provision income $ 3,118 $ 962 $ 2,868 $ 2,667 $ (571) First Quarter 2020 Consumer Global Global Banking GWIM Banking Markets All Other Pretax income $ 2,376 $ 1,147 $ 186 $ 2,307 $ (1,341) Provision for credit losses 2,258 189 2,093 107 114 Pretax, pre-provision income $ 4,634 $ 1,336 $ 2,279 $ 2,414 $ (1,227) Second Quarter 2019 Consumer Global Global Banking GWIM Banking Markets All Other Pretax income $ 4,358 $ 1,425 $ 2,639 $ 1,464 $ (778) Provision for credit losses 947 21 125 5 (241) Pretax, pre-provision income $ 5,305 $ 1,446 $ 2,764 $ 1,469 $ (1,019) 10

Contact Information and Investor Conference Call Invitation Investor Call Note: Chief Executive Officer Brian Moynihan and Chief Financial Officer Paul Donofrio will discuss second- Information quarter 2020 financial results in a conference call at 8:30 a.m. ET today. The presentation and supporting materials can be accessed on the Bank of America Investor Relations website at http://investor.bankofamerica.com. For a listen-only connection to the conference call, dial 1.877.200.4456 (U.S.) or 1.785.424.1732 (international). The conference ID is 79795. Please dial in 10 minutes prior to the start of the call. Investors can access replays of the conference call by visiting the Investor Relations website or by calling 1.800.934.4850 (U.S.) or 1.402.220.1178 (international) from July 16 through July 25. Investors May Contact: Reporters May Contact: Lee McEntire, Bank of America, 1.980.388.6780 Jerry Dubrowski, Bank of America, 1.646.855.1195 (office) or lee.mcentire@bofa.com 1.508.843.5626 (mobile) jerome.f.dubrowski@bofa.com Jonathan Blum, Bank of America (Fixed Income), 1.212.449.3112 jonathan.blum@bofa.com Bank of America Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 66 million consumer and small business clients with approximately 4,300 retail financial centers, including approximately 3,000 lending centers, 2,600 financial centers with a Consumer Investment Financial Solutions Advisor and approximately 2,200 business centers; approximately 16,900 ATMs; and award-winning digital banking with approximately 39 million active users, including approximately 30 million mobile users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry- leading support to approximately 3 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and approximately 35 countries. Bank of America Corporation stock (NYSE: BAC) is listed on the New York Stock Exchange. Forward-Looking Statements Bank of America Corporation (the “Company”) and its management may make certain statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “anticipates,” “targets,” “expects,” “hopes,” “estimates,” “intends,” “plans,” “goals,” “believes,” “continue” and other similar expressions or future or conditional verbs such as “will,” “may,” “might,” “should,” “would” and “could.” Forward-looking statements represent the Company’s current expectations, plans or forecasts of its future results, revenues, expenses, efficiency ratio, capital measures, strategy, and future business and economic conditions more generally, and other future matters. These statements are not guarantees of future results or performance and involve certain known and unknown risks, uncertainties and assumptions that are difficult to predict and are often beyond the Company’s control. Actual outcomes and results may differ materially from those expressed in, or implied by, any of these forward-looking statements. 11

You should not place undue reliance on any forward-looking statement and should consider the following uncertainties and risks, as well as the risks and uncertainties more fully discussed under Item 1A. Risk Factors of the Company’s 2019 Annual Report on Form 10-K and in any of the Company’s subsequent Securities and Exchange Commission filings: the Company’s potential judgments, claims, damages, penalties, fines and reputational damage resulting from pending or future litigation and regulatory and government actions, including as a result of our participation in and execution of government programs related to the COVID-19 pandemic; the possibility that the Company’s future liabilities may be in excess of its recorded liability and estimated range of possible loss for litigation, regulatory, and representations and warranties exposures; the possibility that the Company could face increased servicing, fraud, indemnity, contribution or other claims from one or more counterparties, including trustees, purchasers of loans, underwriters, issuers, monolines, private-label and other investors, or other parties involved in securitizations; the Company’s ability to resolve representations and warranties repurchase and related claims, including claims brought by investors or trustees seeking to avoid the statute of limitations for repurchase claims; the risks related to the discontinuation of the London InterBank Offered Rate and other reference rates, including increased expenses and litigation and the effectiveness of hedging strategies; uncertainties about the financial stability and growth rates of non-U.S. jurisdictions, the risk that those jurisdictions may face difficulties servicing their sovereign debt, and related stresses on financial markets, currencies and trade, and the Company’s exposures to such risks, including direct, indirect and operational; the impact of U.S. and global interest rates, inflation, currency exchange rates, economic conditions, trade policies and tensions, including tariffs, and potential geopolitical instability; the impact of the interest rate environment on the Company’s business, financial condition and results of operations; the possibility that future credit losses may be higher than currently expected due to changes in economic assumptions, customer behavior, adverse developments with respect to U.S. or global economic conditions and other uncertainties; the Company’s ability to achieve its expense targets and expectations regarding net interest income, provision for credit losses, net charge-offs, effective tax rate, loan growth or other projections; adverse changes to the Company’s credit ratings from the major credit rating agencies; an inability to access capital markets or maintain deposits or borrowing costs; estimates of the fair value and other accounting values, subject to impairment assessments, of certain of the Company’s assets and liabilities; the estimated or actual impact of changes in accounting standards or assumptions in applying those standards; uncertainty regarding the content, timing and impact of regulatory capital and liquidity requirements; the impact of adverse changes to total loss-absorbing capacity requirements, stress capital buffer requirements and/or global systemically important bank surcharges; the potential impact of actions of the Board of Governors of the Federal Reserve System on the Company’s capital plans; the effect of regulations, other guidance or additional information on the impact from the Tax Cuts and Jobs Act; the impact of implementation and compliance with U.S. and international laws, regulations and regulatory interpretations, including, but not limited to, recovery and resolution planning requirements, Federal Deposit Insurance Corporation assessments, the Volcker Rule, fiduciary standards, derivatives regulations and the Coronavirus Aid, Relief, and Economic Security Act and any similar or related rules and regulations; a failure or disruption in or breach of the Company’s operational or security systems or infrastructure, or those of third parties, including as a result of cyber-attacks or campaigns; the impact on the Company’s business, financial condition and results of operations from the United Kingdom's exit from the European Union; the impact of any future federal government shutdown and uncertainty regarding the federal government’s debt limit; the emergence of widespread health emergencies or pandemics, including the magnitude and duration of the COVID-19 pandemic and its impact on the U.S. and/or global economy, financial market conditions and our business, results of operations and financial condition; the impact of natural disasters, military conflict, terrorism or other geopolitical events; and other matters. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update any forward-looking statement to reflect the impact of circumstances or events that arise after the date the forward-looking statement was made. “Bank of America” and “BofA Securities” are the marketing names used by the Global Banking and Global Markets divisions of Bank of America Corporation. Lending, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, BofA Securities, Inc. and Merrill Lynch Professional Clearing Corp., both of which are registered broker-dealers and Members of SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. and Merrill Lynch Professional Clearing Corp. are registered as futures commission merchants with the CFTC and are members of the NFA. Investment products offered by Investment Banking Affiliates: Are Not FDIC Insured · May Lose Value · Are Not Bank Guaranteed. Bank of America Corporation’s broker-dealers are not banks and are separate legal entities from their bank affiliates. The obligations of the broker-dealers are not obligations of their bank affiliates (unless explicitly stated otherwise), and these bank affiliates are not responsible for securities sold, offered, or recommended by the broker-dealers. The foregoing also applies to other non-bank affiliates. For more Bank of America news, including dividend announcements and other important information, visit the Bank of America newsroom at https://newsroom.bankofamerica.com. www.bankofamerica.com 12

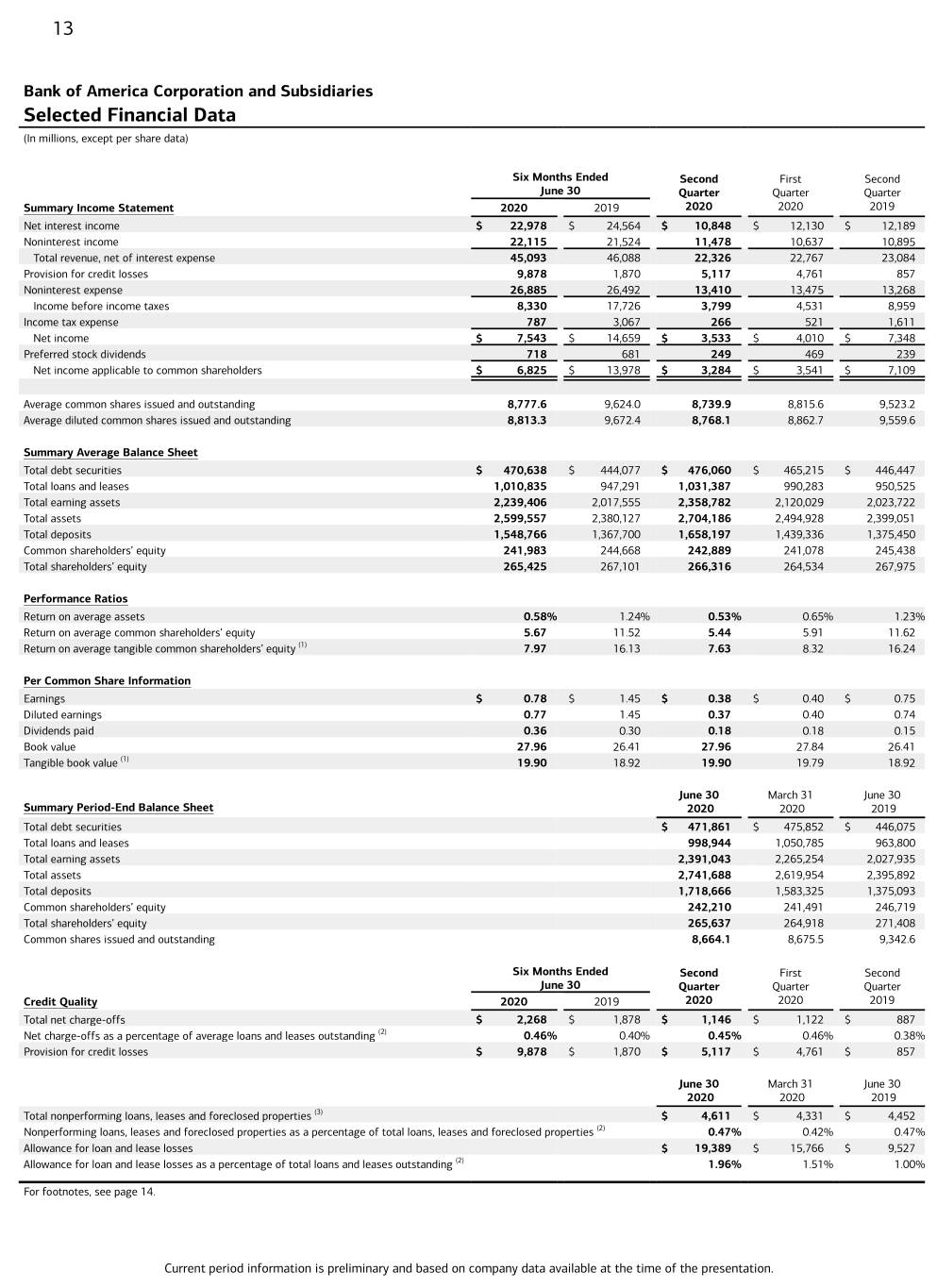

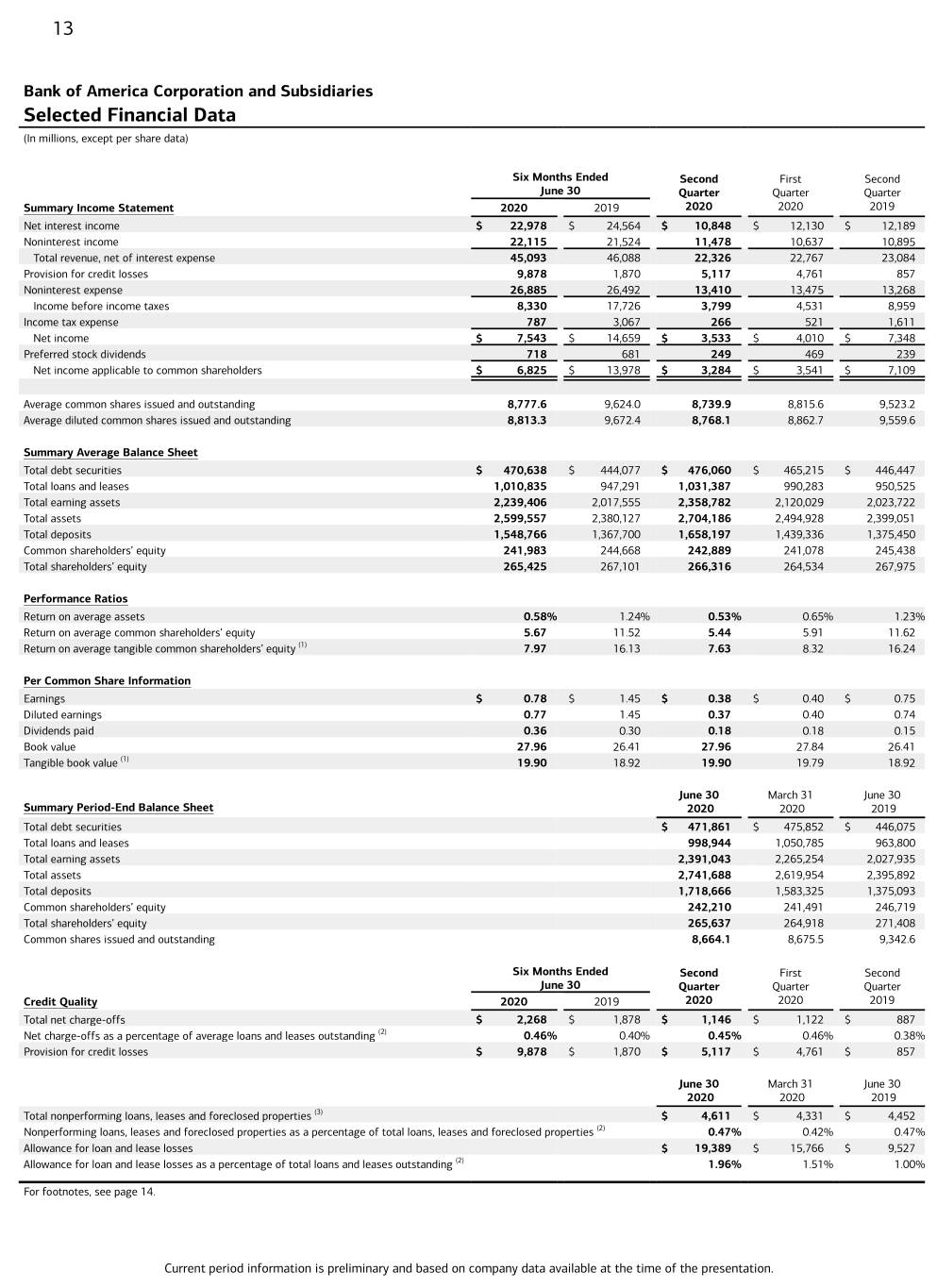

13 Bank of America Corporation and Subsidiaries Selected Financial Data (In millions, except per share data) Six Months Ended Second First Second June 30 Quarter Quarter Quarter Summary Income Statement 2020 2019 2020 2020 2019 Net interest income $ 22,978 $ 24,564 $ 10,848 $ 12,130 $ 12,189 Noninterest income 22,115 21,524 11,478 10,637 10,895 Total revenue, net of interest expense 45,093 46,088 22,326 22,767 23,084 Provision for credit losses 9,878 1,870 5,117 4,761 857 Noninterest expense 26,885 26,492 13,410 13,475 13,268 Income before income taxes 8,330 17,726 3,799 4,531 8,959 Income tax expense 787 3,067 266 521 1,611 Net income $ 7,543 $ 14,659 $ 3,533 $ 4,010 $ 7,348 Preferred stock dividends 718 681 249 469 239 Net income applicable to common shareholders $ 6,825 $ 13,978 $ 3,284 $ 3,541 $ 7,109 Average common shares issued and outstanding 8,777.6 9,624.0 8,739.9 8,815.6 9,523.2 Average diluted common shares issued and outstanding 8,813.3 9,672.4 8,768.1 8,862.7 9,559.6 Summary Average Balance Sheet Total debt securities $ 470,638 $ 444,077 $ 476,060 $ 465,215 $ 446,447 Total loans and leases 1,010,835 947,291 1,031,387 990,283 950,525 Total earning assets 2,239,406 2,017,555 2,358,782 2,120,029 2,023,722 Total assets 2,599,557 2,380,127 2,704,186 2,494,928 2,399,051 Total deposits 1,548,766 1,367,700 1,658,197 1,439,336 1,375,450 Common shareholders’ equity 241,983 244,668 242,889 241,078 245,438 Total shareholders’ equity 265,425 267,101 266,316 264,534 267,975 Performance Ratios Return on average assets 0.58% 1.24% 0.53% 0.65% 1.23% Return on average common shareholders’ equity 5.67 11.52 5.44 5.91 11.62 Return on average tangible common shareholders’ equity (1) 7.97 16.13 7.63 8.32 16.24 Per Common Share Information Earnings $ 0.78 $ 1.45 $ 0.38 $ 0.40 $ 0.75 Diluted earnings 0.77 1.45 0.37 0.40 0.74 Dividends paid 0.36 0.30 0.18 0.18 0.15 Book value 27.96 26.41 27.96 27.84 26.41 Tangible book value (1) 19.90 18.92 19.90 19.79 18.92 June 30 March 31 June 30 Summary Period-End Balance Sheet 2020 2020 2019 Total debt securities $ 471,861 $ 475,852 $ 446,075 Total loans and leases 998,944 1,050,785 963,800 Total earning assets 2,391,043 2,265,254 2,027,935 Total assets 2,741,688 2,619,954 2,395,892 Total deposits 1,718,666 1,583,325 1,375,093 Common shareholders’ equity 242,210 241,491 246,719 Total shareholders’ equity 265,637 264,918 271,408 Common shares issued and outstanding 8,664.1 8,675.5 9,342.6 Six Months Ended Second First Second June 30 Quarter Quarter Quarter Credit Quality 2020 2019 2020 2020 2019 Total net charge-offs $ 2,268 $ 1,878 $ 1,146 $ 1,122 $ 887 Net charge-offs as a percentage of average loans and leases outstanding (2) 0.46% 0.40% 0.45% 0.46% 0.38% Provision for credit losses $ 9,878 $ 1,870 $ 5,117 $ 4,761 $ 857 June 30 March 31 June 30 2020 2020 2019 Total nonperforming loans, leases and foreclosed properties (3) $ 4,611 $ 4,331 $ 4,452 Nonperforming loans, leases and foreclosed properties as a percentage of total loans, leases and foreclosed properties (2) 0.47% 0.42% 0.47% Allowance for loan and lease losses $ 19,389 $ 15,766 $ 9,527 Allowance for loan and lease losses as a percentage of total loans and leases outstanding (2) 1.96% 1.51% 1.00% For footnotes, see page 14. Current period information is preliminary and based on company data available at the time of the presentation.

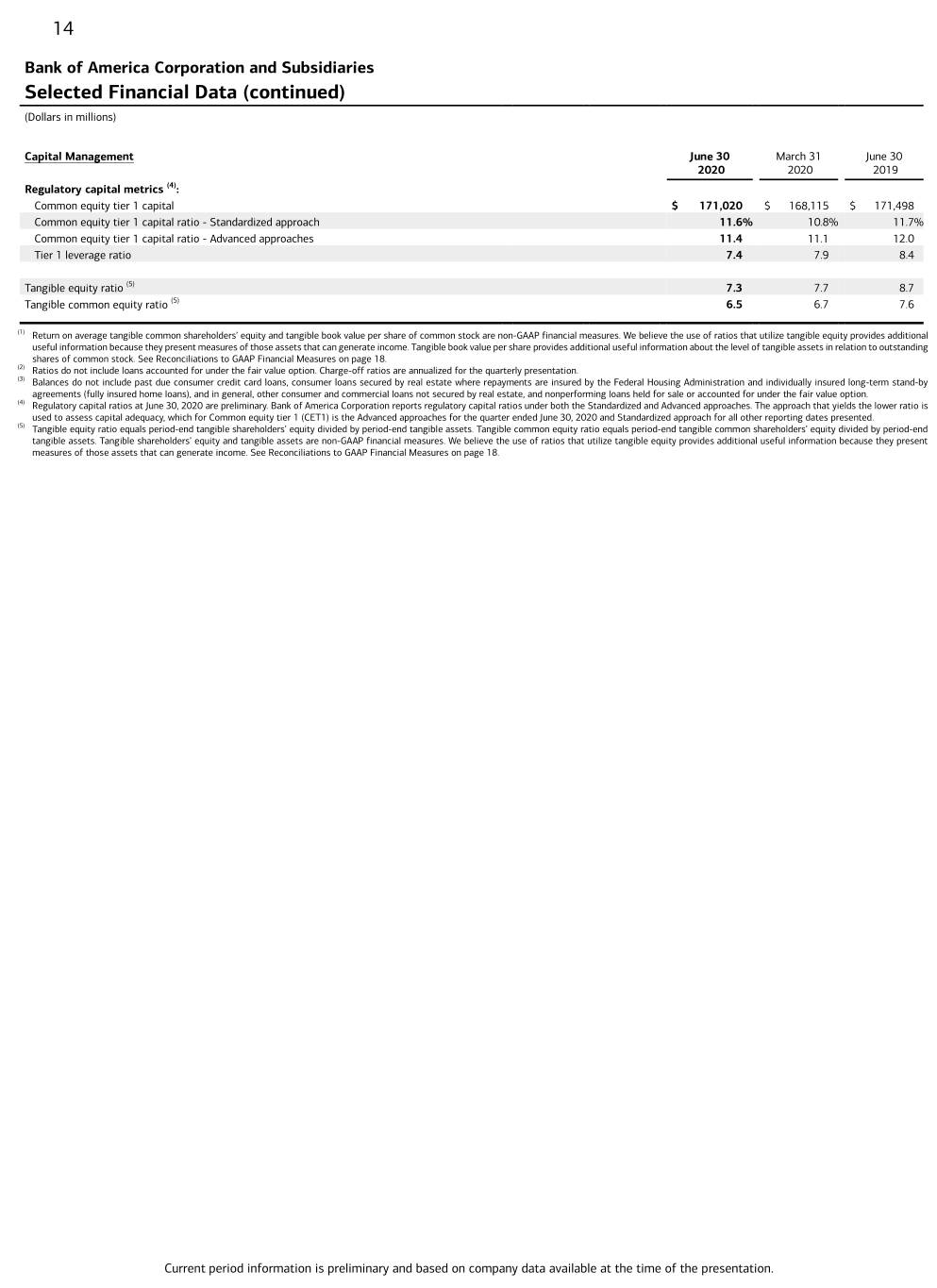

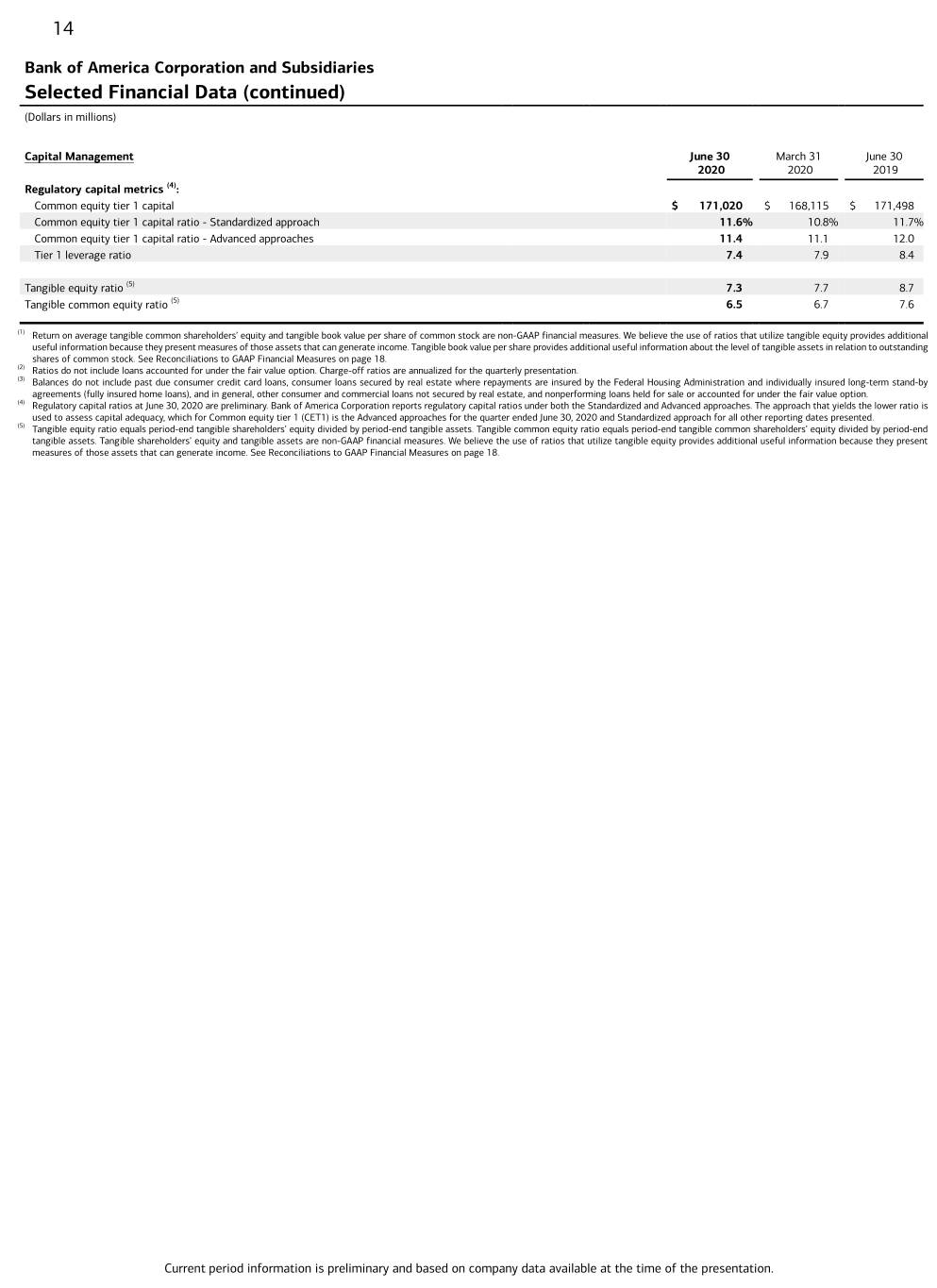

14 Bank of America Corporation and Subsidiaries Selected Financial Data (continued) (Dollars in millions) Capital Management June 30 March 31 June 30 2020 2020 2019 Regulatory capital metrics (4): Common equity tier 1 capital $ 171,020 $ 168,115 $ 171,498 Common equity tier 1 capital ratio - Standardized approach 11.6% 10.8% 11.7% Common equity tier 1 capital ratio - Advanced approaches 11.4 11.1 12.0 Tier 1 leverage ratio 7.4 7.9 8.4 Tangible equity ratio (5) 7.3 7.7 8.7 Tangible common equity ratio (5) 6.5 6.7 7.6 (1) Return on average tangible common shareholders’ equity and tangible book value per share of common stock are non-GAAP financial measures. We believe the use of ratios that utilize tangible equity provides additional useful information because they present measures of those assets that can generate income. Tangible book value per share provides additional useful information about the level of tangible assets in relation to outstanding shares of common stock. See Reconciliations to GAAP Financial Measures on page 18. (2) Ratios do not include loans accounted for under the fair value option. Charge-off ratios are annualized for the quarterly presentation. (3) Balances do not include past due consumer credit card loans, consumer loans secured by real estate where repayments are insured by the Federal Housing Administration and individually insured long-term stand-by agreements (fully insured home loans), and in general, other consumer and commercial loans not secured by real estate, and nonperforming loans held for sale or accounted for under the fair value option. (4) Regulatory capital ratios at June 30, 2020 are preliminary. Bank of America Corporation reports regulatory capital ratios under both the Standardized and Advanced approaches. The approach that yields the lower ratio is used to assess capital adequacy, which for Common equity tier 1 (CET1) is the Advanced approaches for the quarter ended June 30, 2020 and Standardized approach for all other reporting dates presented. (5) Tangible equity ratio equals period-end tangible shareholders’ equity divided by period-end tangible assets. Tangible common equity ratio equals period-end tangible common shareholders’ equity divided by period-end tangible assets. Tangible shareholders’ equity and tangible assets are non-GAAP financial measures. We believe the use of ratios that utilize tangible equity provides additional useful information because they present measures of those assets that can generate income. See Reconciliations to GAAP Financial Measures on page 18. Current period information is preliminary and based on company data available at the time of the presentation.

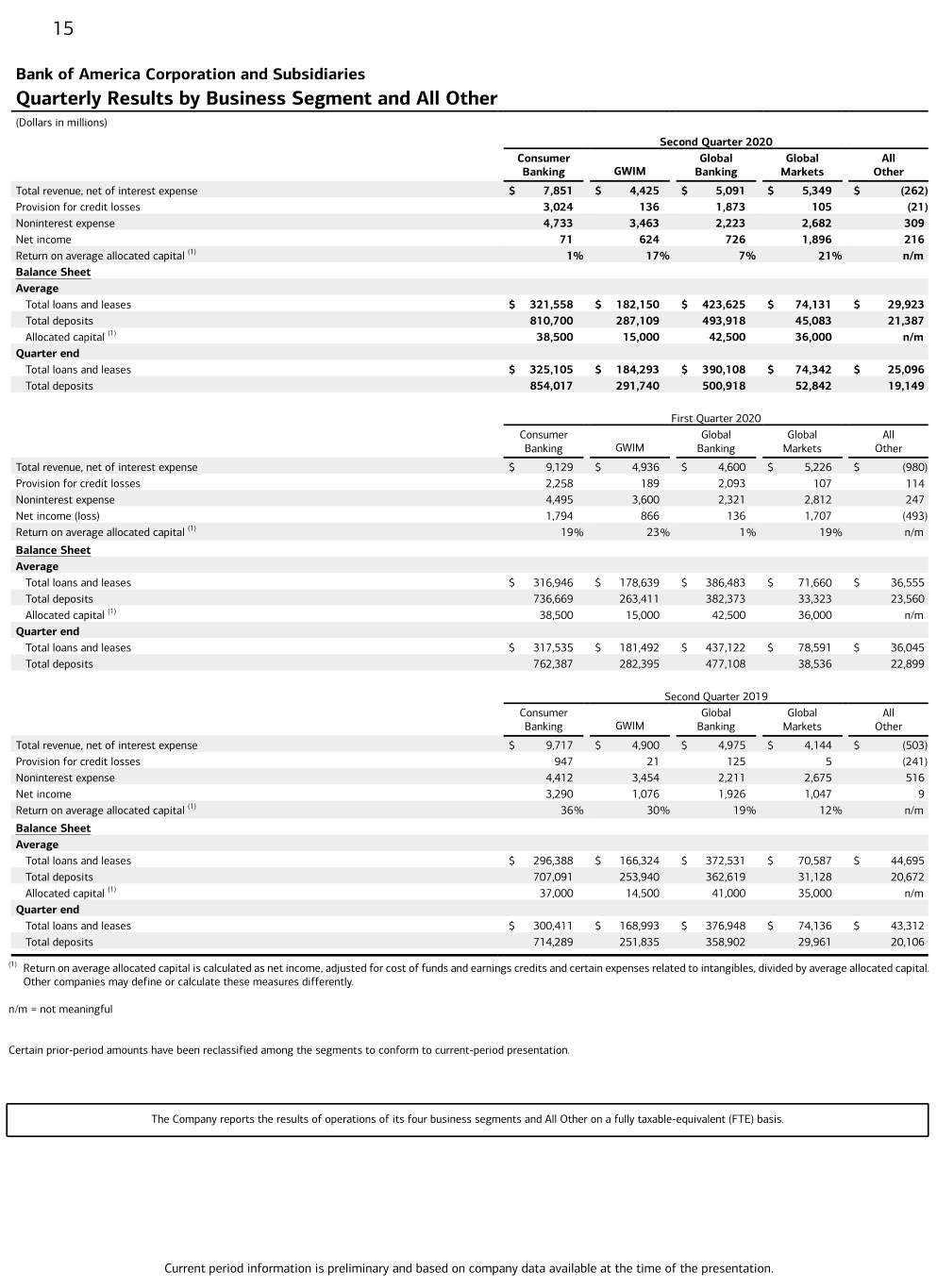

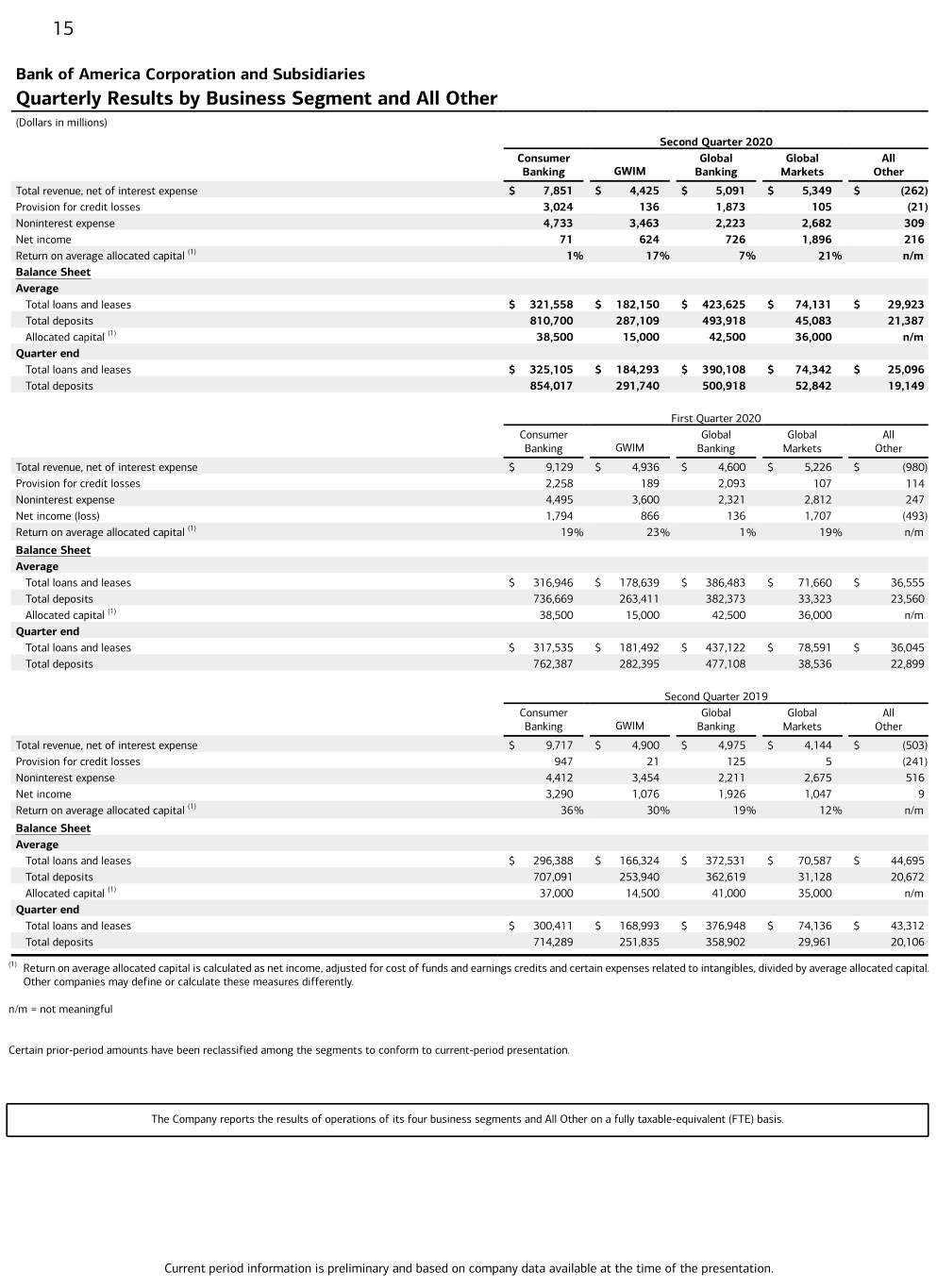

15 Bank of America Corporation and Subsidiaries Quarterly Results by Business Segment and All Other (Dollars in millions) Second Quarter 2020 Consumer Global Global All Banking GWIM Banking Markets Other Total revenue, net of interest expense $ 7,851 $ 4,425 $ 5,091 $ 5,349 $ (262) Provision for credit losses 3,024 136 1,873 105 (21) Noninterest expense 4,733 3,463 2,223 2,682 309 Net income 71 624 726 1,896 216 Return on average allocated capital (1) 1% 17% 7% 21% n/m Balance Sheet Average Total loans and leases $ 321,558 $ 182,150 $ 423,625 $ 74,131 $ 29,923 Total deposits 810,700 287,109 493,918 45,083 21,387 Allocated capital (1) 38,500 15,000 42,500 36,000 n/m Quarter end Total loans and leases $ 325,105 $ 184,293 $ 390,108 $ 74,342 $ 25,096 Total deposits 854,017 291,740 500,918 52,842 19,149 First Quarter 2020 Consumer Global Global All Banking GWIM Banking Markets Other Total revenue, net of interest expense $ 9,129 $ 4,936 $ 4,600 $ 5,226 $ (980) Provision for credit losses 2,258 189 2,093 107 114 Noninterest expense 4,495 3,600 2,321 2,812 247 Net income (loss) 1,794 866 136 1,707 (493) Return on average allocated capital (1) 19% 23% 1% 19% n/m Balance Sheet Average Total loans and leases $ 316,946 $ 178,639 $ 386,483 $ 71,660 $ 36,555 Total deposits 736,669 263,411 382,373 33,323 23,560 Allocated capital (1) 38,500 15,000 42,500 36,000 n/m Quarter end Total loans and leases $ 317,535 $ 181,492 $ 437,122 $ 78,591 $ 36,045 Total deposits 762,387 282,395 477,108 38,536 22,899 Second Quarter 2019 Consumer Global Global All Banking GWIM Banking Markets Other Total revenue, net of interest expense $ 9,717 $ 4,900 $ 4,975 $ 4,144 $ (503) Provision for credit losses 947 21 125 5 (241) Noninterest expense 4,412 3,454 2,211 2,675 516 Net income 3,290 1,076 1,926 1,047 9 Return on average allocated capital (1) 36% 30% 19% 12% n/m Balance Sheet Average Total loans and leases $ 296,388 $ 166,324 $ 372,531 $ 70,587 $ 44,695 Total deposits 707,091 253,940 362,619 31,128 20,672 Allocated capital (1) 37,000 14,500 41,000 35,000 n/m Quarter end Total loans and leases $ 300,411 $ 168,993 $ 376,948 $ 74,136 $ 43,312 Total deposits 714,289 251,835 358,902 29,961 20,106 (1) Return on average allocated capital is calculated as net income, adjusted for cost of funds and earnings credits and certain expenses related to intangibles, divided by average allocated capital. Other companies may define or calculate these measures differently. n/m = not meaningful Certain prior-period amounts have been reclassified among the segments to conform to current-period presentation. The Company reports the results of operations of its four business segments and All Other on a fully taxable-equivalent (FTE) basis. Current period information is preliminary and based on company data available at the time of the presentation.

16 Bank of America Corporation and Subsidiaries Year-to-Date Results by Business Segment and All Other (Dollars in millions) Six Months Ended June 30, 2020 Consumer Global Global All Banking GWIM Banking Markets Other Total revenue, net of interest expense $ 16,980 $ 9,361 $ 9,691 $ 10,575 $ (1,242) Provision for credit losses 5,282 325 3,966 212 93 Noninterest expense 9,228 7,063 4,544 5,494 556 Net income (loss) 1,865 1,490 862 3,603 (277) Return on average allocated capital (1) 10% 20% 4% 20% n/m Balance Sheet Average Total loans and leases $ 319,252 $ 180,395 $ 405,054 $ 72,896 $ 33,238 Total deposits 773,685 275,260 438,145 39,203 22,473 Allocated capital (1) 38,500 15,000 42,500 36,000 n/m Period end Total loans and leases $ 325,105 $ 184,293 $ 390,108 $ 74,342 $ 25,096 Total deposits 854,017 291,740 500,918 52,842 19,149 Six Months Ended June 30, 2019 Consumer Global Global All Banking GWIM Banking Markets Other Total revenue, net of interest expense $ 19,349 $ 9,720 $ 10,130 $ 8,326 $ (1,135) Provision for credit losses 1,921 26 236 (18) (295) Noninterest expense 8,779 6,887 4,478 5,432 916 Net income (loss) 6,530 2,119 3,954 2,082 (26) Return on average allocated capital (1) 36% 30% 19% 12% n/m Balance Sheet Average Total loans and leases $ 294,339 $ 165,369 $ 371,326 $ 70,335 $ 45,922 Total deposits 702,074 257,868 355,866 31,246 20,646 Allocated capital (1) 37,000 14,500 41,000 35,000 n/m Period end Total loans and leases $ 300,411 $ 168,993 $ 376,948 $ 74,136 $ 43,312 Total deposits 714,289 251,835 358,902 29,961 20,106 (1) Return on average allocated capital is calculated as net income, adjusted for cost of funds and earnings credits and certain expenses related to intangibles, divided by average allocated capital. Other companies may define or calculate these measures differently. n/m = not meaningful Certain prior-period amounts have been reclassified among the segments to conform to current-period presentation. Current period information is preliminary and based on company data available at the time of the presentation.

17 Bank of America Corporation and Subsidiaries Supplemental Financial Data (Dollars in millions) Six Months Ended Second First Second June 30 Quarter Quarter Quarter FTE basis data (1) 2020 2019 2020 2020 2019 Net interest income $ 23,250 $ 24,866 $ 10,976 $ 12,274 $ 12,338 Total revenue, net of interest expense 45,365 46,390 22,454 22,911 23,233 Net interest yield 2.09% 2.48% 1.87% 2.33% 2.44% Efficiency ratio 59.26 57.11 59.72 58.82 57.11 June 30 March 31 June 30 Other Data 2020 2020 2019 Number of financial centers - U.S. 4,298 4,297 4,349 Number of branded ATMs - U.S. 16,862 16,855 16,561 Headcount 212,796 208,931 208,984 (1) FTE basis is a non-GAAP financial measure. FTE basis is a performance measure used by management in operating the business that management believes provides investors with a more accurate picture of the interest margin for comparative purposes. The Corporation believes that this presentation allows for comparison of amounts from both taxable and tax-exempt sources and is consistent with industry practices. Net interest income includes FTE adjustments of $272 million and $302 million for the six months ended June 30, 2020 and 2019, respectively; $128 million and $144 million for the second and first quarters of 2020, respectively, and $149 million for the second quarter of 2019. Certain prior-period amounts have been reclassified to conform to current-period presentation. Current period information is preliminary and based on company data available at the time of the presentation.

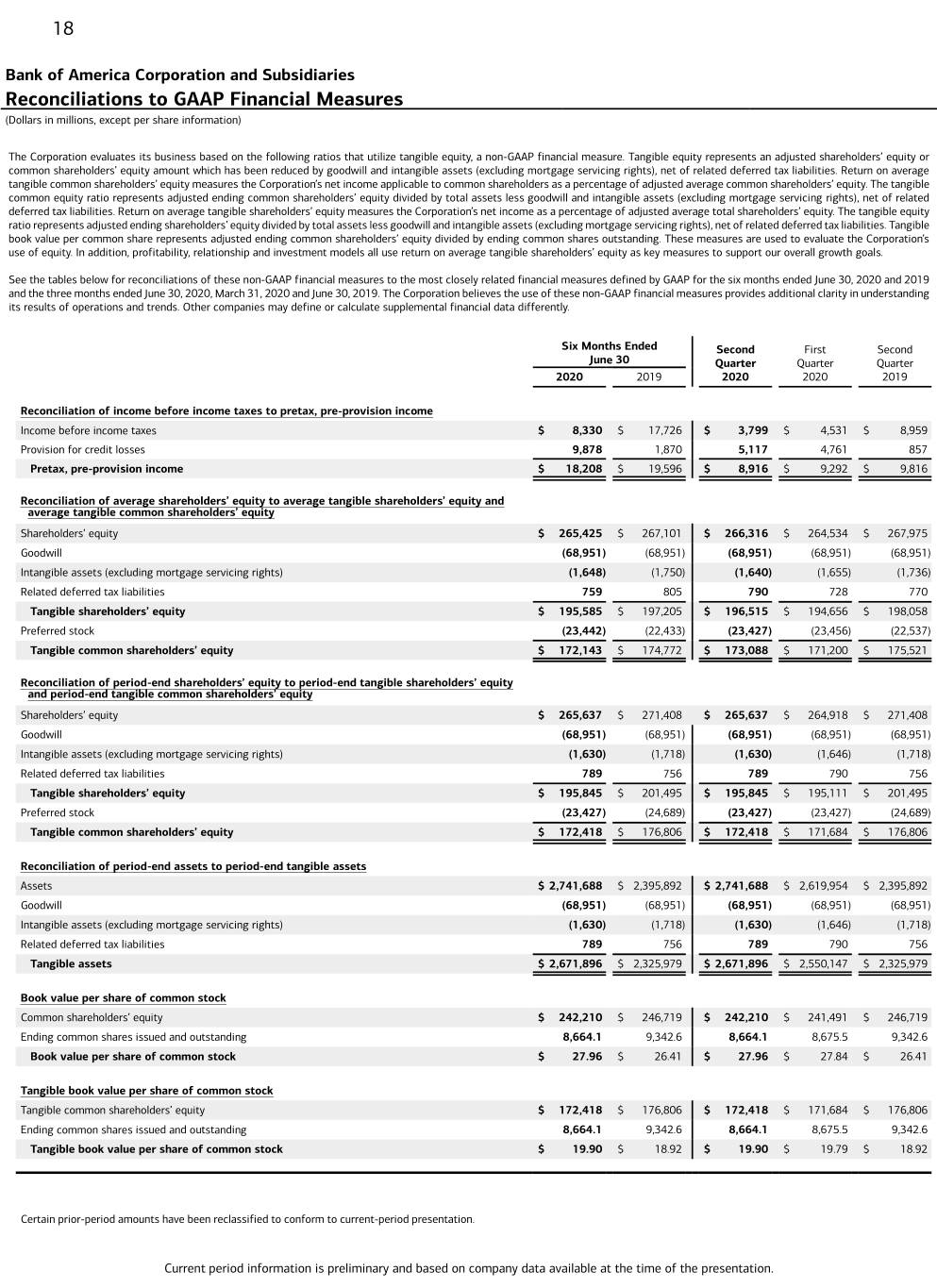

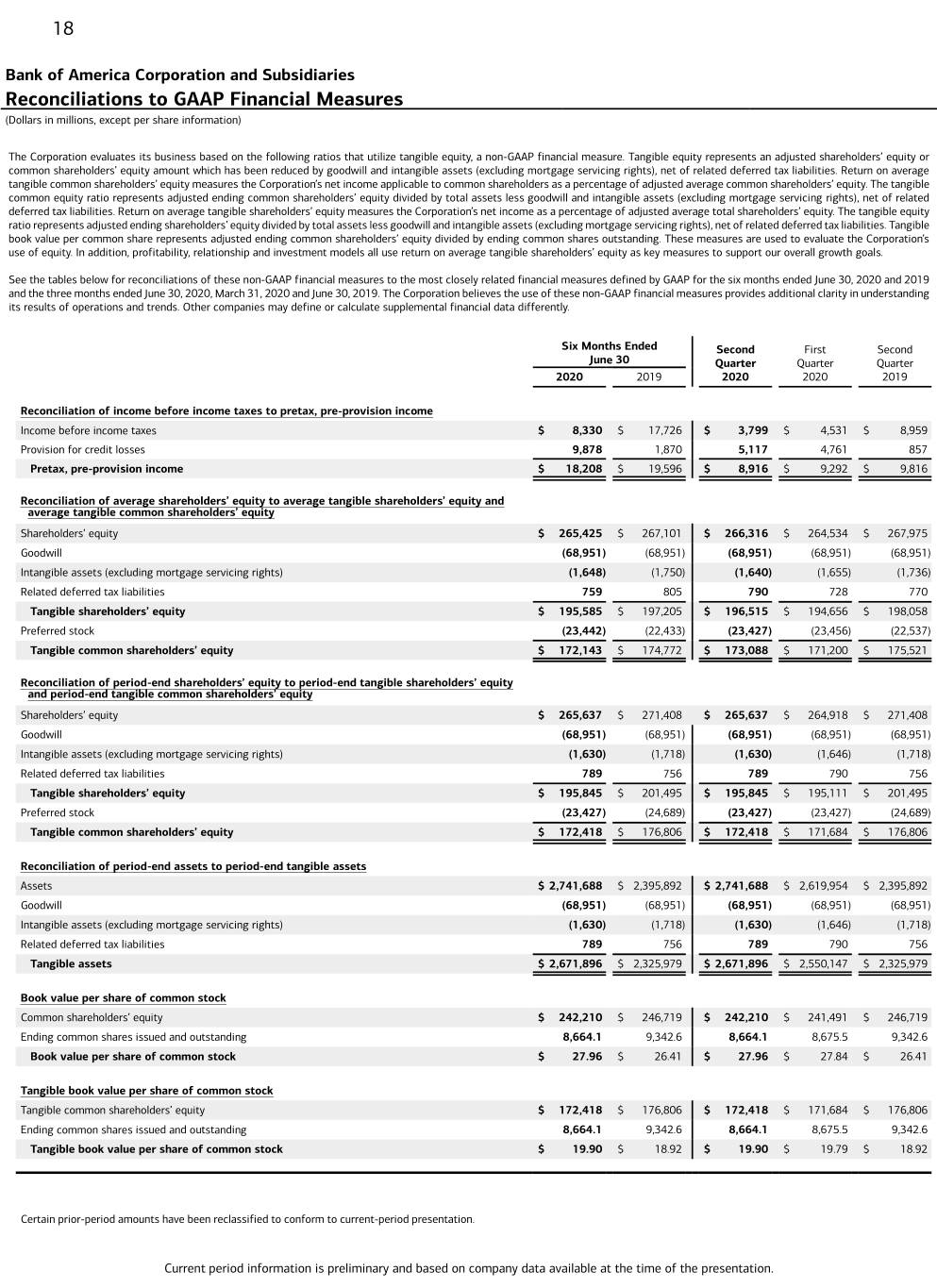

18 Bank of America Corporation and Subsidiaries Reconciliations to GAAP Financial Measures (Dollars in millions, except per share information) The Corporation evaluates its business based on the following ratios that utilize tangible equity, a non-GAAP financial measure. Tangible equity represents an adjusted shareholders’ equity or common shareholders’ equity amount which has been reduced by goodwill and intangible assets (excluding mortgage servicing rights), net of related deferred tax liabilities. Return on average tangible common shareholders’ equity measures the Corporation’s net income applicable to common shareholders as a percentage of adjusted average common shareholders’ equity. The tangible common equity ratio represents adjusted ending common shareholders’ equity divided by total assets less goodwill and intangible assets (excluding mortgage servicing rights), net of related deferred tax liabilities. Return on average tangible shareholders’ equity measures the Corporation’s net income as a percentage of adjusted average total shareholders’ equity. The tangible equity ratio represents adjusted ending shareholders’ equity divided by total assets less goodwill and intangible assets (excluding mortgage servicing rights), net of related deferred tax liabilities. Tangible book value per common share represents adjusted ending common shareholders’ equity divided by ending common shares outstanding. These measures are used to evaluate the Corporation’s use of equity. In addition, profitability, relationship and investment models all use return on average tangible shareholders’ equity as key measures to support our overall growth goals. See the tables below for reconciliations of these non-GAAP financial measures to the most closely related financial measures defined by GAAP for the six months ended June 30, 2020 and 2019 and the three months ended June 30, 2020, March 31, 2020 and June 30, 2019. The Corporation believes the use of these non-GAAP financial measures provides additional clarity in understanding its results of operations and trends. Other companies may define or calculate supplemental financial data differently. Six Months Ended Second First Second June 30 Quarter Quarter Quarter 2020 2019 2020 2020 2019 Reconciliation of income before income taxes to pretax, pre-provision income Income before income taxes $ 8,330 $ 17,726 $ 3,799 $ 4,531 $ 8,959 Provision for credit losses 9,878 1,870 5,117 4,761 857 Pretax, pre-provision income $ 18,208 $ 19,596 $ 8,916 $ 9,292 $ 9,816 Reconciliation of average shareholders’ equity to average tangible shareholders’ equity and average tangible common shareholders’ equity Shareholders’ equity $ 265,425 $ 267,101 $ 266,316 $ 264,534 $ 267,975 Goodwill (68,951) (68,951) (68,951) (68,951) (68,951) Intangible assets (excluding mortgage servicing rights) (1,648) (1,750) (1,640) (1,655) (1,736) Related deferred tax liabilities 759 805 790 728 770 Tangible shareholders’ equity $ 195,585 $ 197,205 $ 196,515 $ 194,656 $ 198,058 Preferred stock (23,442) (22,433) (23,427) (23,456) (22,537) Tangible common shareholders’ equity $ 172,143 $ 174,772 $ 173,088 $ 171,200 $ 175,521 Reconciliation of period-end shareholders’ equity to period-end tangible shareholders’ equity and period-end tangible common shareholders’ equity Shareholders’ equity $ 265,637 $ 271,408 $ 265,637 $ 264,918 $ 271,408 Goodwill (68,951) (68,951) (68,951) (68,951) (68,951) Intangible assets (excluding mortgage servicing rights) (1,630) (1,718) (1,630) (1,646) (1,718) Related deferred tax liabilities 789 756 789 790 756 Tangible shareholders’ equity $ 195,845 $ 201,495 $ 195,845 $ 195,111 $ 201,495 Preferred stock (23,427) (24,689) (23,427) (23,427) (24,689) Tangible common shareholders’ equity $ 172,418 $ 176,806 $ 172,418 $ 171,684 $ 176,806 Reconciliation of period-end assets to period-end tangible assets Assets $ 2,741,688 $ 2,395,892 $ 2,741,688 $ 2,619,954 $ 2,395,892 Goodwill (68,951) (68,951) (68,951) (68,951) (68,951) Intangible assets (excluding mortgage servicing rights) (1,630) (1,718) (1,630) (1,646) (1,718) Related deferred tax liabilities 789 756 789 790 756 Tangible assets $ 2,671,896 $ 2,325,979 $ 2,671,896 $ 2,550,147 $ 2,325,979 Book value per share of common stock Common shareholders’ equity $ 242,210 $ 246,719 $ 242,210 $ 241,491 $ 246,719 Ending common shares issued and outstanding 8,664.1 9,342.6 8,664.1 8,675.5 9,342.6 Book value per share of common stock $ 27.96 $ 26.41 $ 27.96 $ 27.84 $ 26.41 Tangible book value per share of common stock Tangible common shareholders’ equity $ 172,418 $ 176,806 $ 172,418 $ 171,684 $ 176,806 Ending common shares issued and outstanding 8,664.1 9,342.6 8,664.1 8,675.5 9,342.6 Tangible book value per share of common stock $ 19.90 $ 18.92 $ 19.90 $ 19.79 $ 18.92 Certain prior-period amounts have been reclassified to conform to current-period presentation. Current period information is preliminary and based on company data available at the time of the presentation.