Bank of America 4Q24 Financial Results January 16, 2025

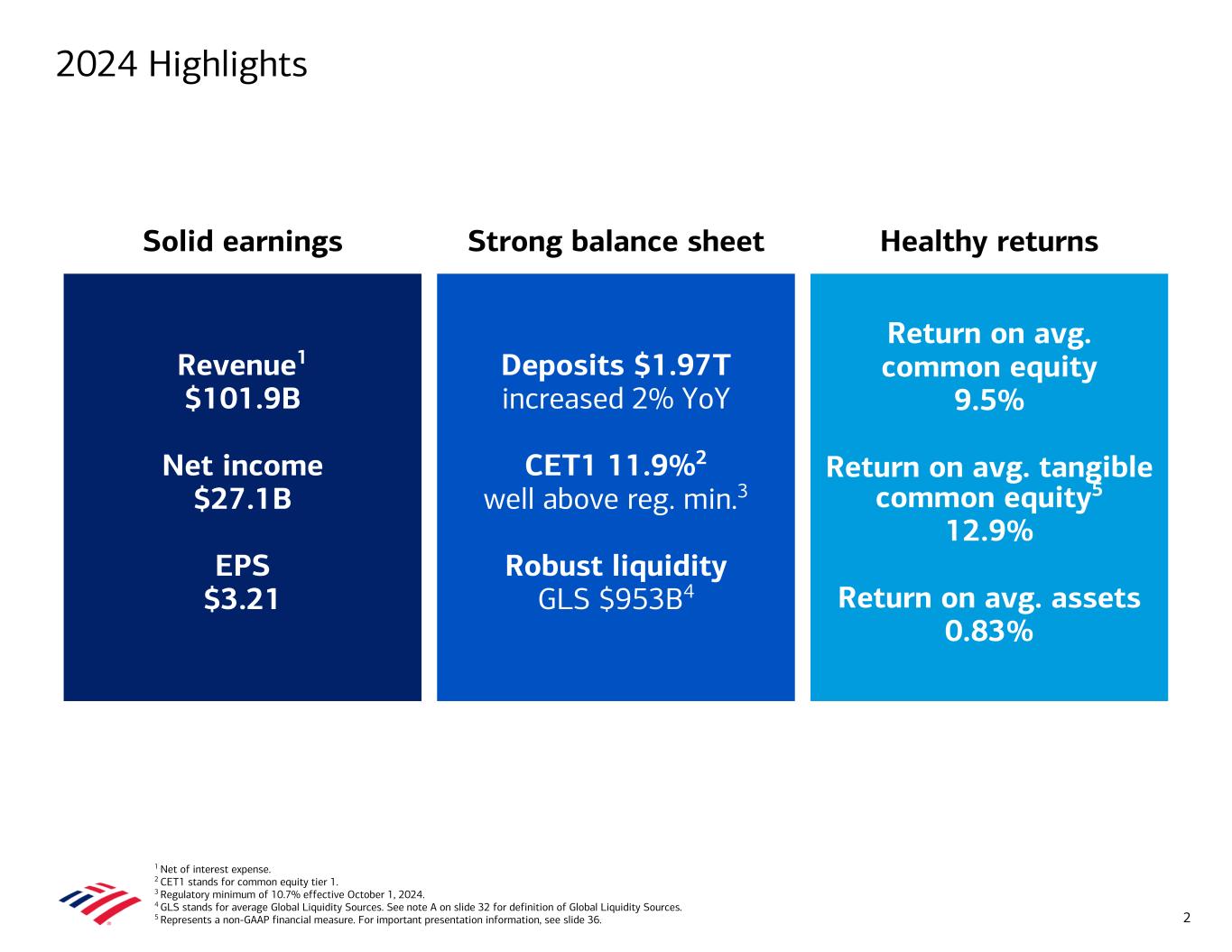

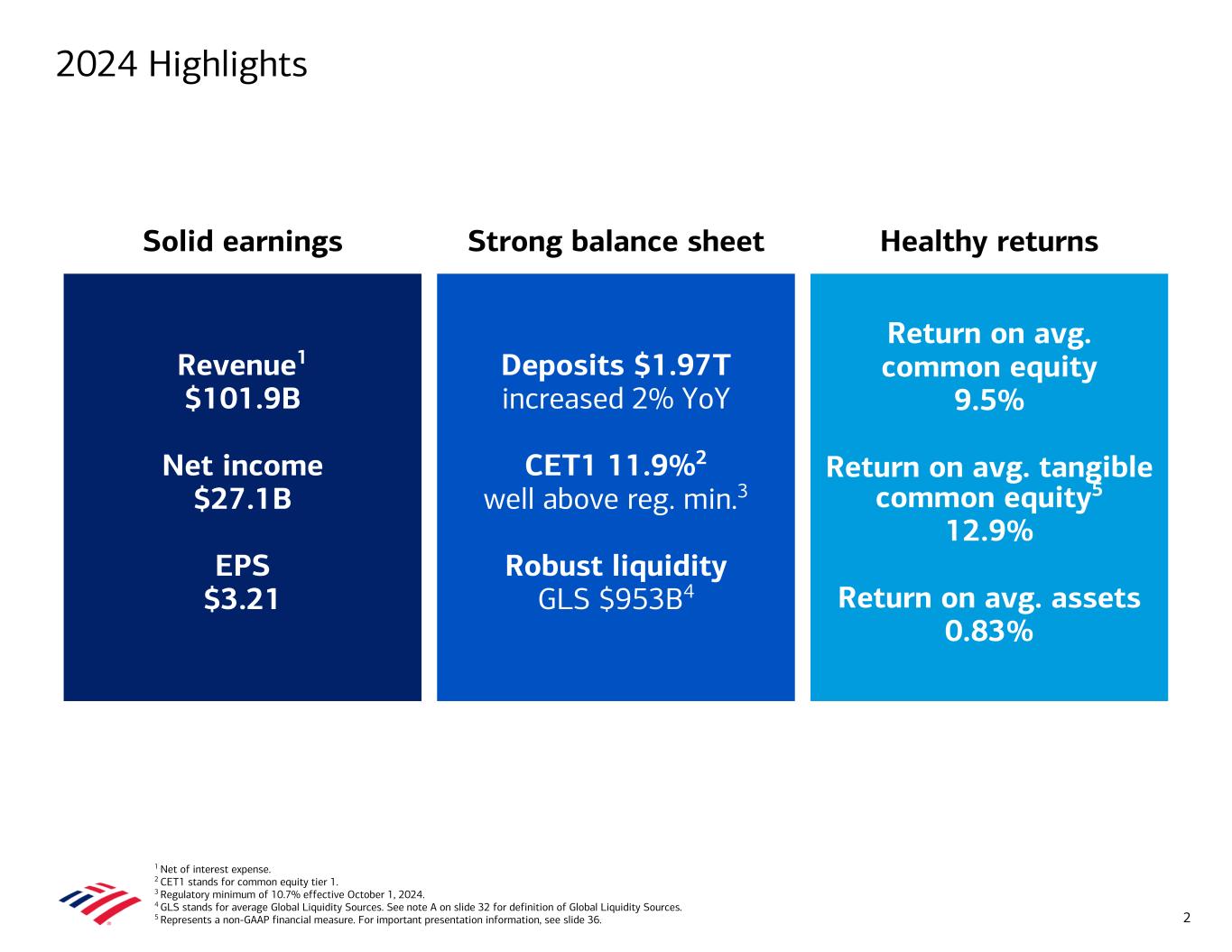

1 Net of interest expense. 2 CET1 stands for common equity tier 1. 3 Regulatory minimum of 10.7% effective October 1, 2024. 4 GLS stands for average Global Liquidity Sources. See note A on slide 32 for definition of Global Liquidity Sources. 5 Represents a non-GAAP financial measure. For important presentation information, see slide 36. Solid earnings Strong balance sheet Healthy returns Revenue1 $101.9B Net income $27.1B EPS $3.21 Deposits $1.97T increased 2% YoY CET1 11.9%2 well above reg. min.3 Robust liquidity GLS $953B4 Return on avg. common equity 9.5% Return on avg. tangible common equity5 12.9% Return on avg. assets 0.83% 2024 Highlights 2

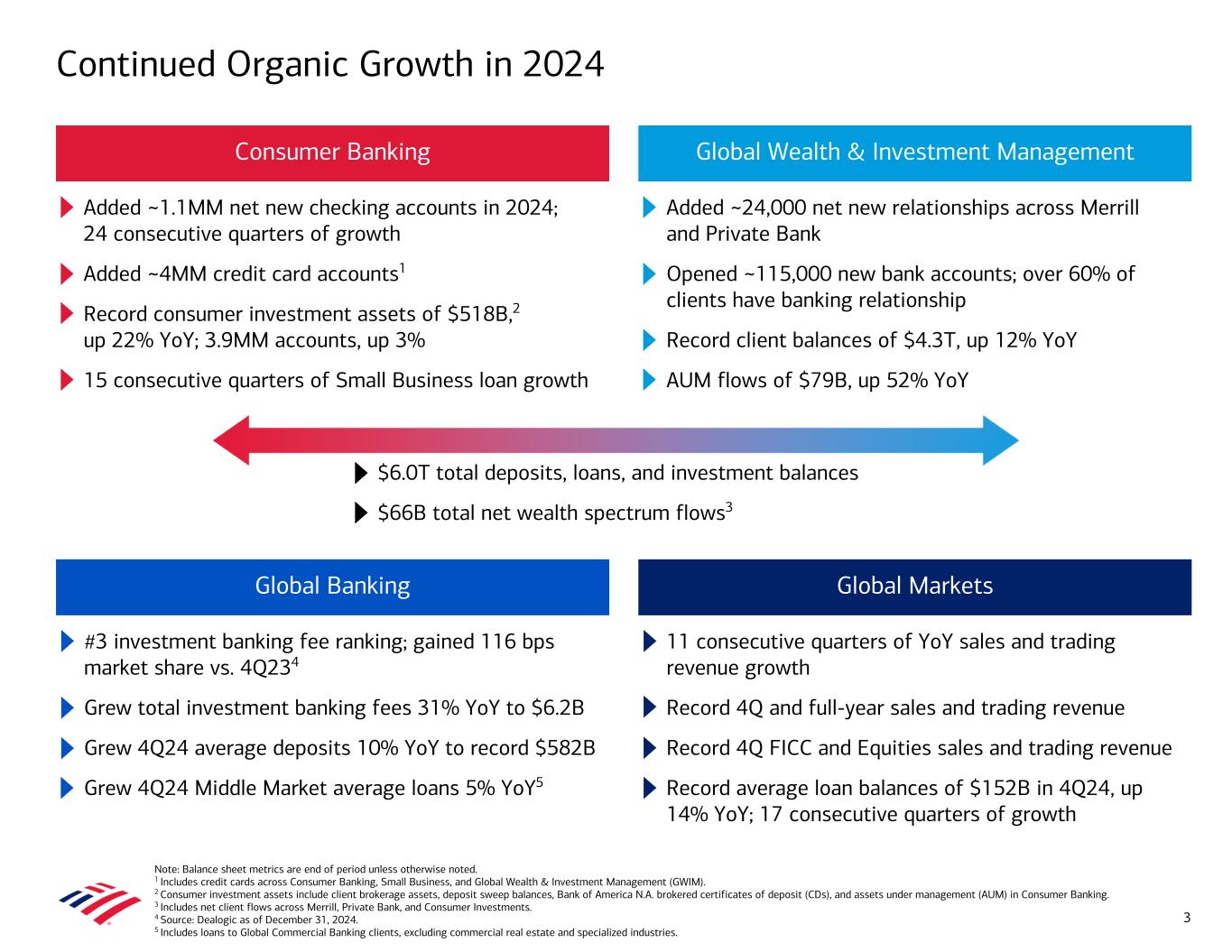

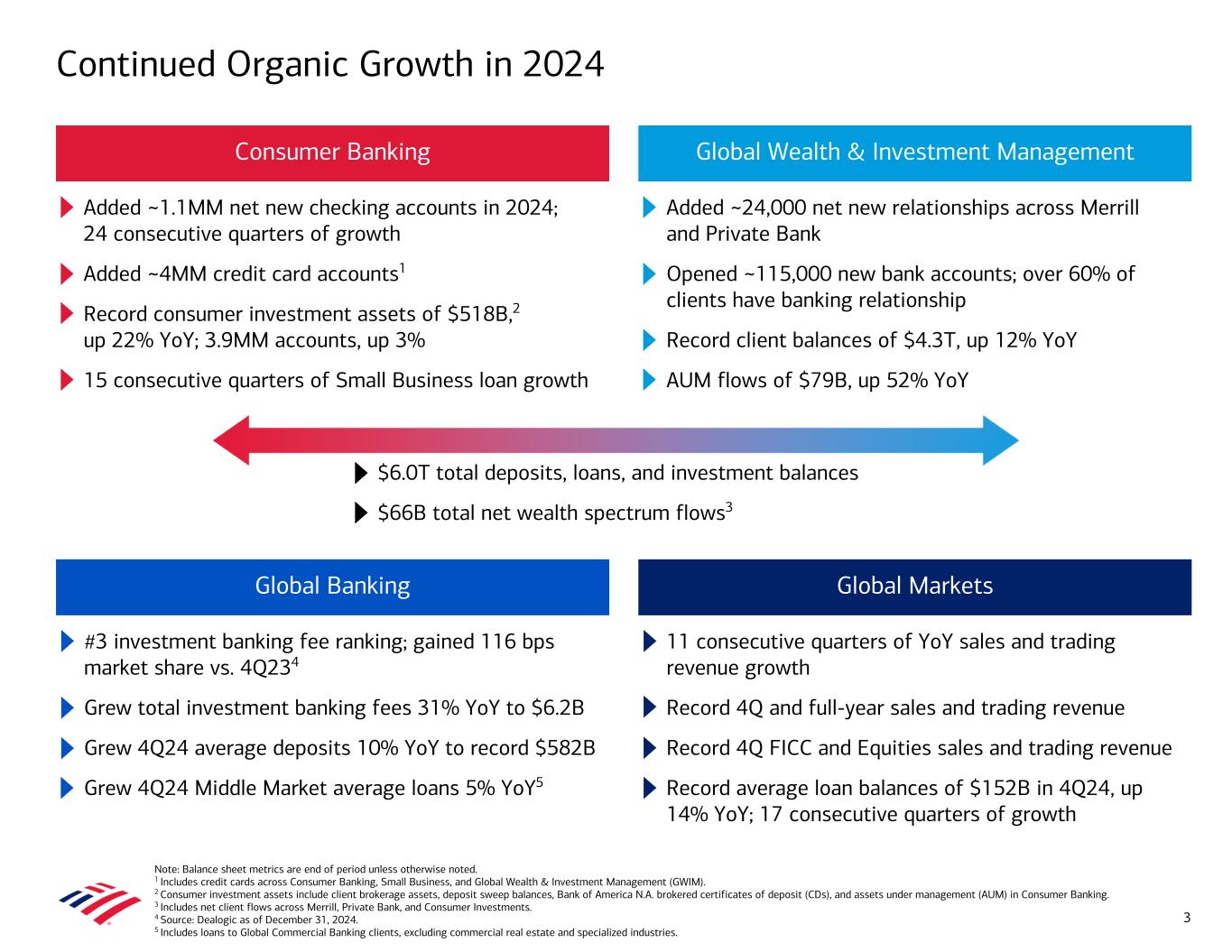

11 consecutive quarters of YoY sales and trading revenue growth Record 4Q and full-year sales and trading revenue Record 4Q FICC and Equities sales and trading revenue Record average loan balances of $152B in 4Q24, up 14% YoY; 17 consecutive quarters of growth Added ~24,000 net new relationships across Merrill and Private Bank Opened ~115,000 new bank accounts; over 60% of clients have banking relationship Record client balances of $4.3T, up 12% YoY AUM flows of $79B, up 52% YoY Continued Organic Growth in 2024 3 Consumer Banking Global Wealth & Investment Management Global Banking Global Markets Added ~1.1MM net new checking accounts in 2024; 24 consecutive quarters of growth Added ~4MM credit card accounts1 Record consumer investment assets of $518B,2 up 22% YoY; 3.9MM accounts, up 3% 15 consecutive quarters of Small Business loan growth $6.0T total deposits, loans, and investment balances $66B total net wealth spectrum flows3 Note: Balance sheet metrics are end of period unless otherwise noted. 1 Includes credit cards across Consumer Banking, Small Business, and Global Wealth & Investment Management (GWIM). 2 Consumer investment assets include client brokerage assets, deposit sweep balances, Bank of America N.A. brokered certificates of deposit (CDs), and assets under management (AUM) in Consumer Banking. 3 Includes net client flows across Merrill, Private Bank, and Consumer Investments. 4 Source: Dealogic as of December 31, 2024. 5 Includes loans to Global Commercial Banking clients, excluding commercial real estate and specialized industries. #3 investment banking fee ranking; gained 116 bps market share vs. 4Q234 Grew total investment banking fees 31% YoY to $6.2B Grew 4Q24 average deposits 10% YoY to record $582B Grew 4Q24 Middle Market average loans 5% YoY5

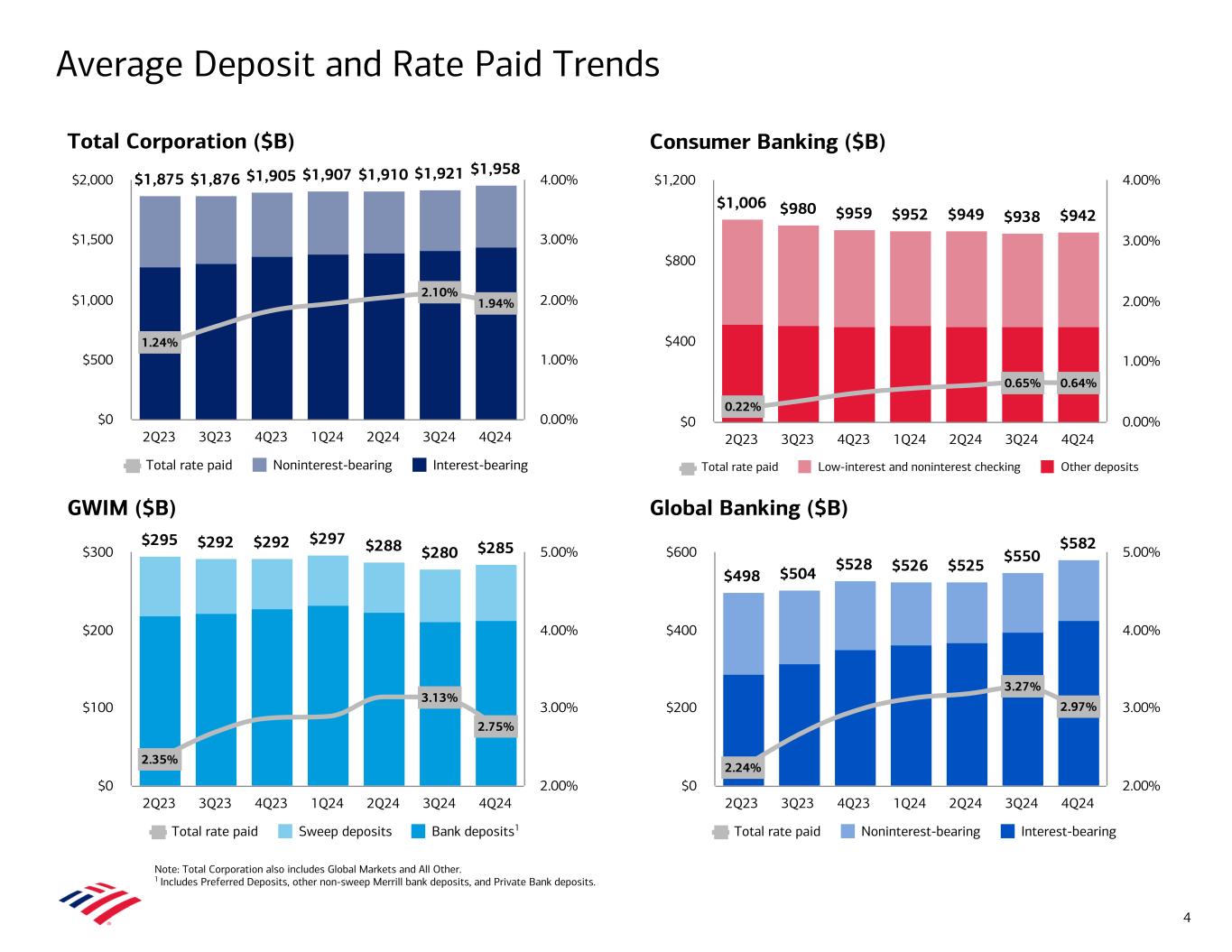

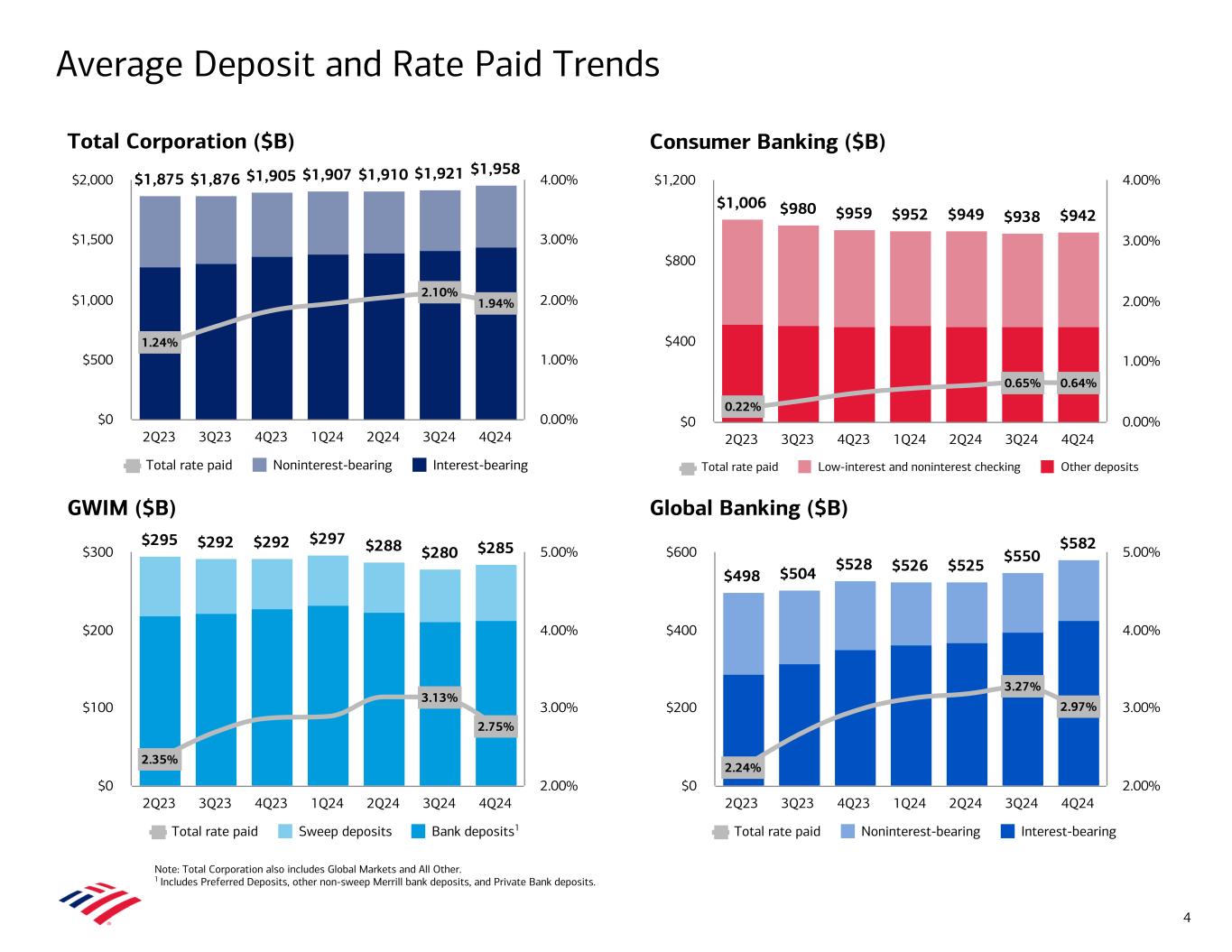

$1,875 $1,876 $1,905 $1,907 $1,910 $1,921 $1,958 Total rate paid Noninterest-bearing Interest-bearing 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $500 $1,000 $1,500 $2,000 0.00% 1.00% 2.00% 3.00% 4.00% Consumer Banking ($B) GWIM ($B) Global Banking ($B) Total Corporation ($B) Average Deposit and Rate Paid Trends 4 $1,006 $980 $959 $952 $949 $938 $942 Total rate paid Low-interest and noninterest checking Other deposits 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $400 $800 $1,200 0.00% 1.00% 2.00% 3.00% 4.00% $295 $292 $292 $297 $288 $280 $285 Total rate paid Sweep deposits Bank deposits 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $100 $200 $300 2.00% 3.00% 4.00% 5.00% $498 $504 $528 $526 $525 $550 $582 Total rate paid Noninterest-bearing Interest-bearing 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $200 $400 $600 2.00% 3.00% 4.00% 5.00% Note: Total Corporation also includes Global Markets and All Other. 1 Includes Preferred Deposits, other non-sweep Merrill bank deposits, and Private Bank deposits. 1 1.94% 0.64% 2.75% 2.97% 2.10% 3.13% 3.27% 0.65% 1.24% 0.22% 2.35% 2.24%

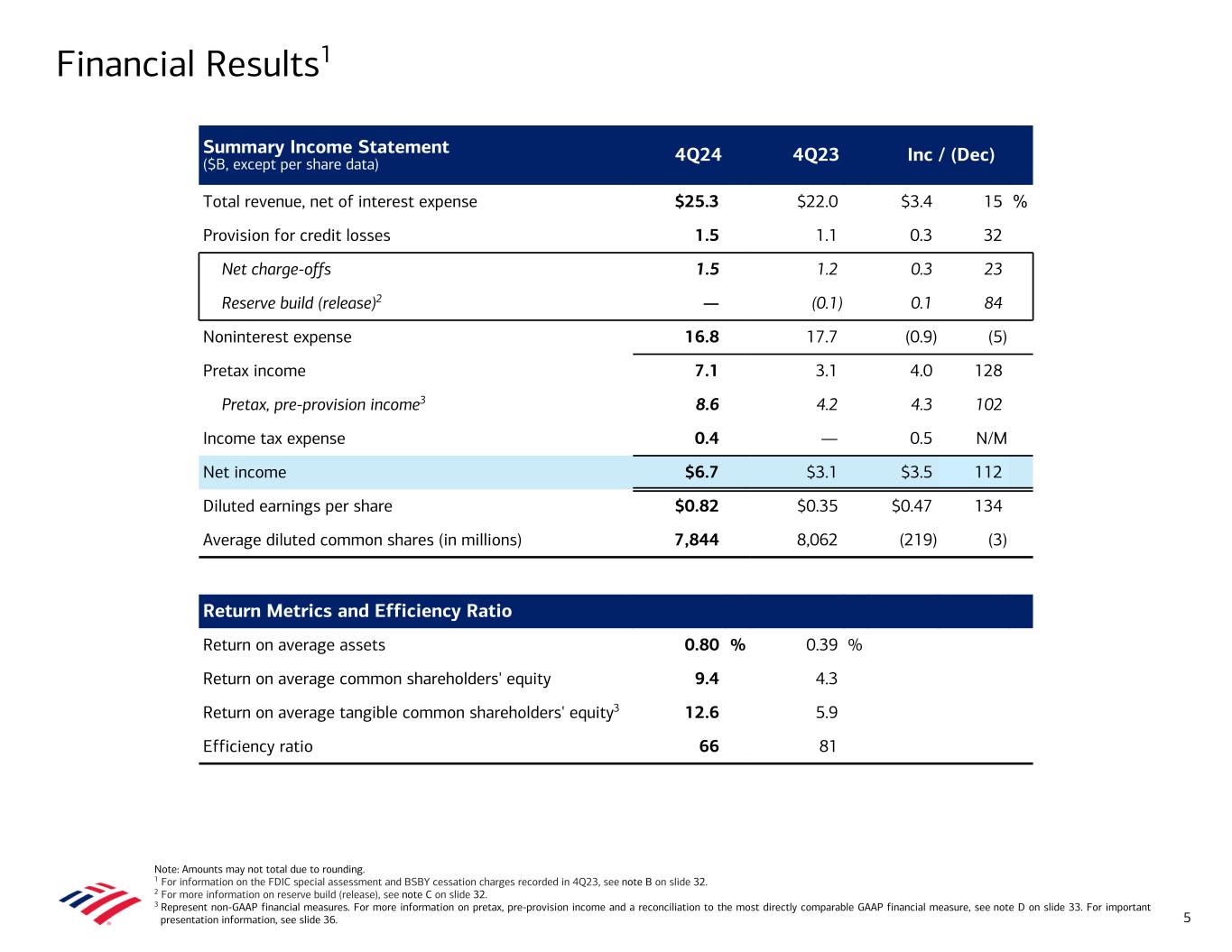

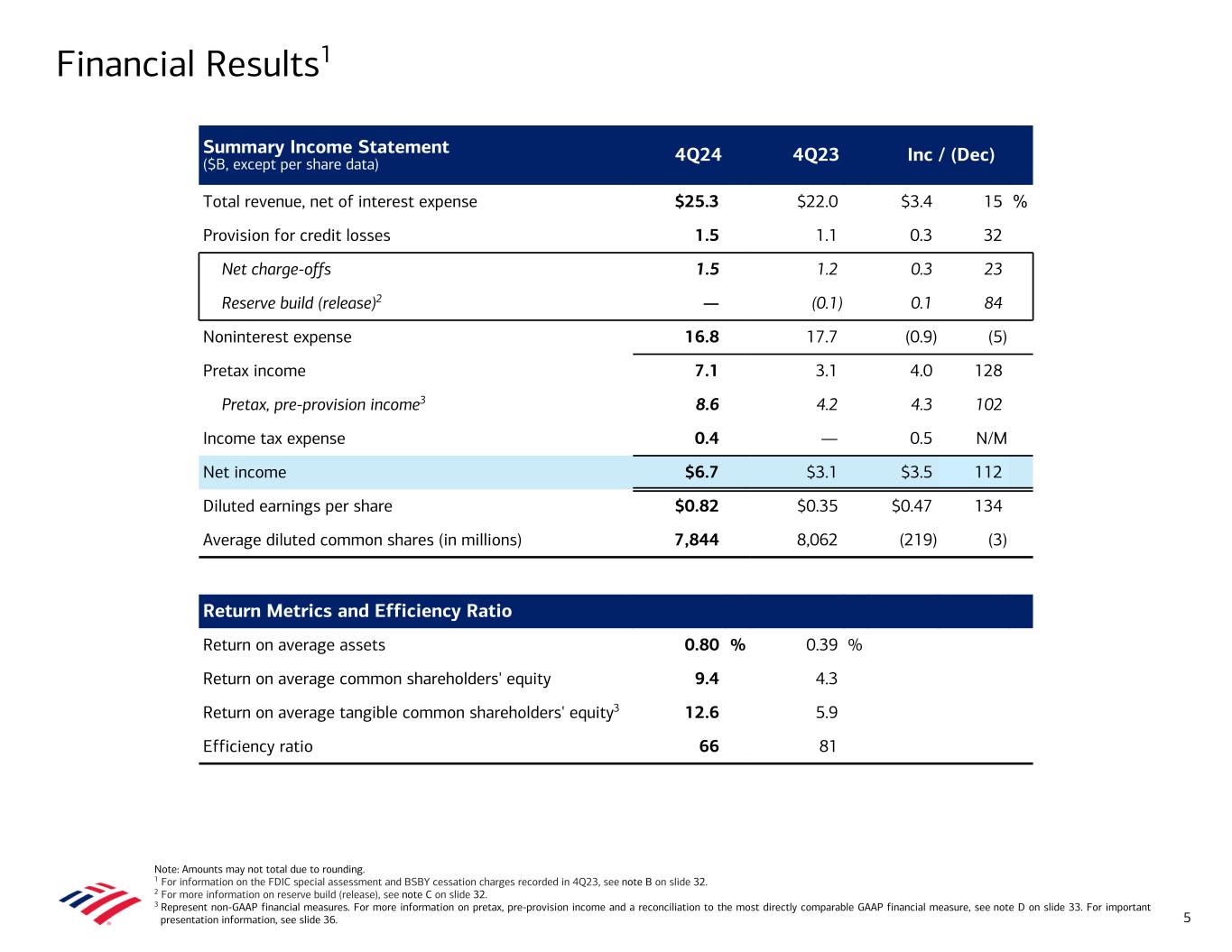

Note: Amounts may not total due to rounding. 1 For information on the FDIC special assessment and BSBY cessation charges recorded in 4Q23, see note B on slide 32. 2 For more information on reserve build (release), see note C on slide 32. 3 Represent non-GAAP financial measures. For more information on pretax, pre-provision income and a reconciliation to the most directly comparable GAAP financial measure, see note D on slide 33. For important presentation information, see slide 36. Summary Income Statement ($B, except per share data) 4Q24 4Q23 Inc / (Dec) Total revenue, net of interest expense $25.3 $22.0 $3.4 15 % Provision for credit losses 1.5 1.1 0.3 32 Net charge-offs 1.5 1.2 0.3 23 Reserve build (release)2 — (0.1) 0.1 84 Noninterest expense 16.8 17.7 (0.9) (5) Pretax income 7.1 3.1 4.0 128 Pretax, pre-provision income3 8.6 4.2 4.3 102 Income tax expense 0.4 — 0.5 N/M Net income $6.7 $3.1 $3.5 112 Diluted earnings per share $0.82 $0.35 $0.47 134 Average diluted common shares (in millions) 7,844 8,062 (219) (3) Return Metrics and Efficiency Ratio Return on average assets 0.80 % 0.39 % Return on average common shareholders' equity 9.4 4.3 Return on average tangible common shareholders' equity3 12.6 5.9 Efficiency ratio 66 81 Financial Results1 5

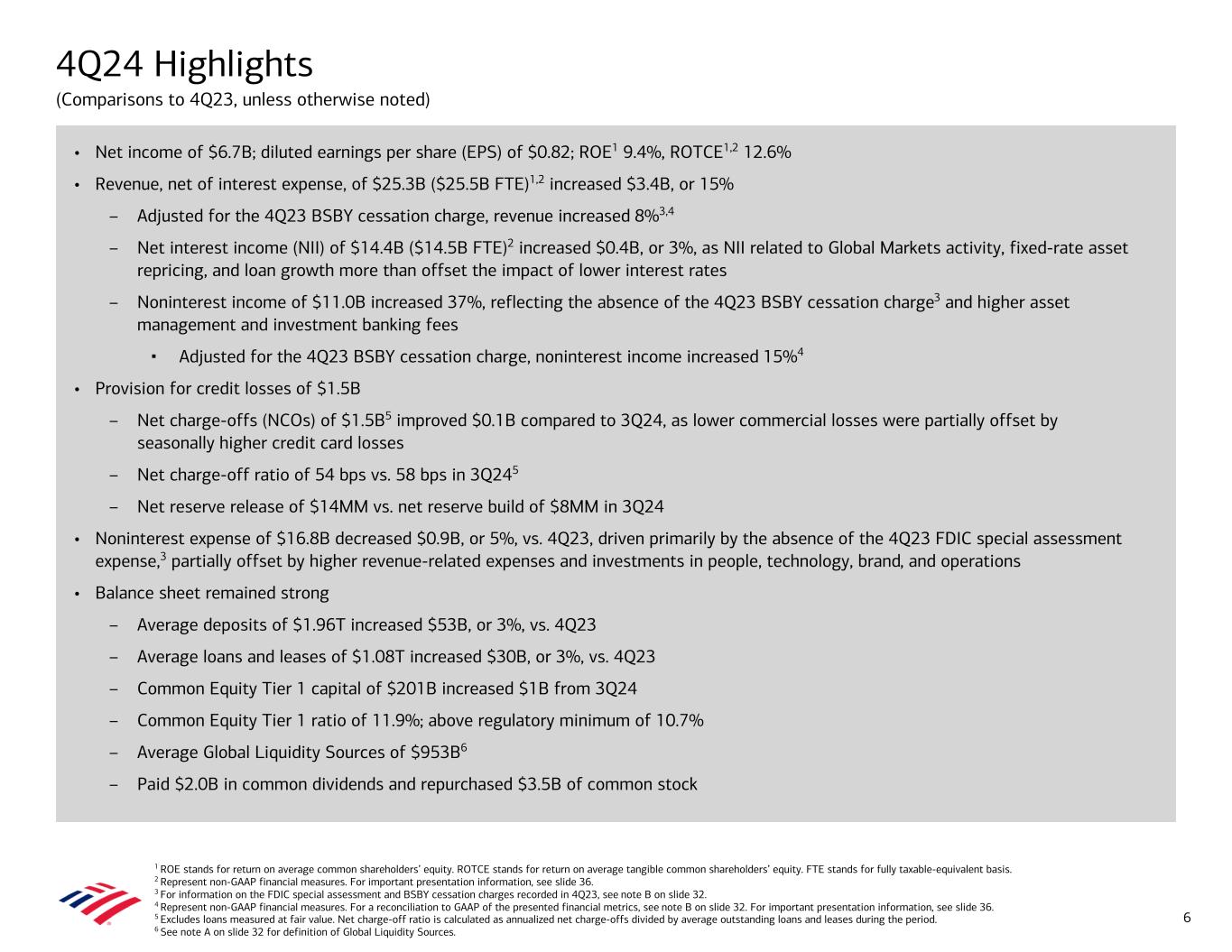

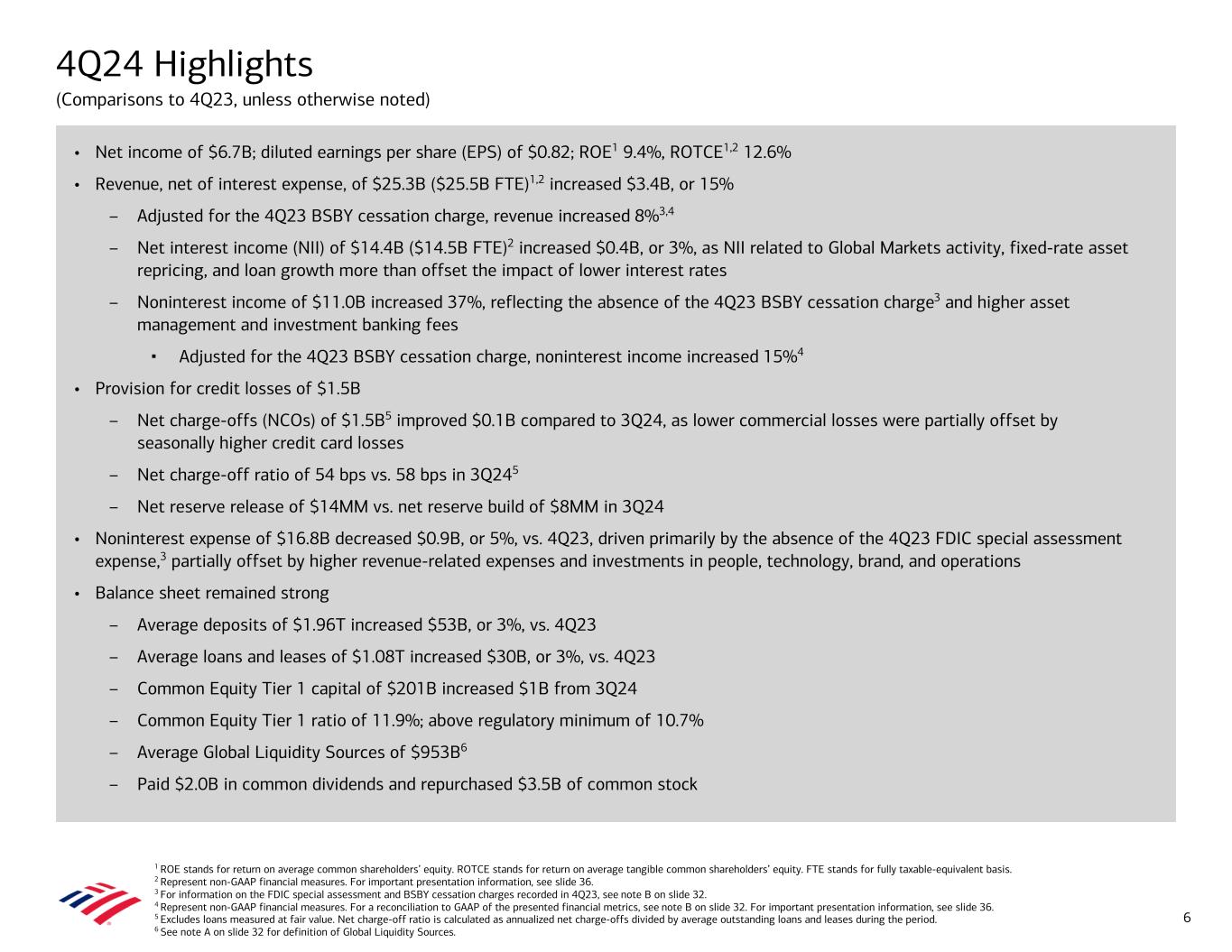

1 ROE stands for return on average common shareholders’ equity. ROTCE stands for return on average tangible common shareholders’ equity. FTE stands for fully taxable-equivalent basis. 2 Represent non-GAAP financial measures. For important presentation information, see slide 36. 3 For information on the FDIC special assessment and BSBY cessation charges recorded in 4Q23, see note B on slide 32. 4 Represent non-GAAP financial measures. For a reconciliation to GAAP of the presented financial metrics, see note B on slide 32. For important presentation information, see slide 36. 5 Excludes loans measured at fair value. Net charge-off ratio is calculated as annualized net charge-offs divided by average outstanding loans and leases during the period. 6 See note A on slide 32 for definition of Global Liquidity Sources. 4Q24 Highlights (Comparisons to 4Q23, unless otherwise noted) • Net income of $6.7B; diluted earnings per share (EPS) of $0.82; ROE1 9.4%, ROTCE1,2 12.6% • Revenue, net of interest expense, of $25.3B ($25.5B FTE)1,2 increased $3.4B, or 15% – Adjusted for the 4Q23 BSBY cessation charge, revenue increased 8%3,4 – Net interest income (NII) of $14.4B ($14.5B FTE)2 increased $0.4B, or 3%, as NII related to Global Markets activity, fixed-rate asset repricing, and loan growth more than offset the impact of lower interest rates – Noninterest income of $11.0B increased 37%, reflecting the absence of the 4Q23 BSBY cessation charge3 and higher asset management and investment banking fees ▪ Adjusted for the 4Q23 BSBY cessation charge, noninterest income increased 15%4 • Provision for credit losses of $1.5B – Net charge-offs (NCOs) of $1.5B5 improved $0.1B compared to 3Q24, as lower commercial losses were partially offset by seasonally higher credit card losses – Net charge-off ratio of 54 bps vs. 58 bps in 3Q245 – Net reserve release of $14MM vs. net reserve build of $8MM in 3Q24 • Noninterest expense of $16.8B decreased $0.9B, or 5%, vs. 4Q23, driven primarily by the absence of the 4Q23 FDIC special assessment expense,3 partially offset by higher revenue-related expenses and investments in people, technology, brand, and operations • Balance sheet remained strong – Average deposits of $1.96T increased $53B, or 3%, vs. 4Q23 – Average loans and leases of $1.08T increased $30B, or 3%, vs. 4Q23 – Common Equity Tier 1 capital of $201B increased $1B from 3Q24 – Common Equity Tier 1 ratio of 11.9%; above regulatory minimum of 10.7% – Average Global Liquidity Sources of $953B6 – Paid $2.0B in common dividends and repurchased $3.5B of common stock 6

Balance Sheet Metrics 4Q24 3Q24 4Q23 Basel 3 Capital ($B)4 4Q24 3Q24 4Q23 Assets ($B) Common equity tier 1 capital $201 $200 $195 Total assets $3,262 $3,324 $3,180 Standardized approach Total loans and leases 1,096 1,076 1,054 Risk-weighted assets (RWA) $1,696 $1,689 $1,651 Cash and cash equivalents 290 296 333 CET1 ratio 11.9 % 11.8 % 11.8 % Total debt securities 917 893 871 Advanced approaches Carried at fair value 359 325 277 Risk-weighted assets $1,491 $1,482 $1,459 Held-to-maturity, at cost 559 568 595 CET1 ratio 13.5 % 13.5 % 13.4 % Supplementary leverage Funding & Liquidity ($B) Supplementary Leverage Ratio 5.9 % 5.9 % 6.1 % Total deposits $1,965 $1,930 $1,924 Long-term debt 283 297 302 Global Liquidity Sources (average)2 953 947 897 Equity ($B) Common shareholders' equity $272 $272 $263 Common equity ratio 8.4 % 8.2 % 8.3 % Tangible common shareholders' equity3 $202 $202 $193 Tangible common equity ratio3 6.3 % 6.2 % 6.2 % Per Share Data Book value per common share $35.79 $35.37 $33.34 Tangible book value per common share3 26.58 26.25 24.46 Common shares outstanding (in billions) 7.61 7.69 7.90 1 EOP stands for end of period. 2 See note A on slide 32 for definition of Global Liquidity Sources. 3 Represent non-GAAP financial measures. For important presentation information, see slide 36. 4 Regulatory capital ratios at December 31, 2024, are preliminary. Bank of America Corporation (Corporation) reports regulatory capital ratios under both the Standardized and Advanced approaches. Capital adequacy is evaluated against the lower of the Standardized or Advanced approaches compared to their respective regulatory capital ratio requirements. The Corporation’s binding ratio was the Total capital ratio under the Standardized approach for all periods presented. Balance Sheet, Liquidity, and Capital (EOP1 basis unless noted) 7 • CET1 ratio of 11.9% was modestly higher vs. 3Q244 – CET1 capital of $201B increased $1B – Standardized RWA of $1.7T increased $8B • Book value per share of $35.79 improved 7% from 4Q23; tangible book value per share of $26.58 improved 9% from 4Q233 • Average Global Liquidity Sources of $953B increased $6B compared to 3Q242

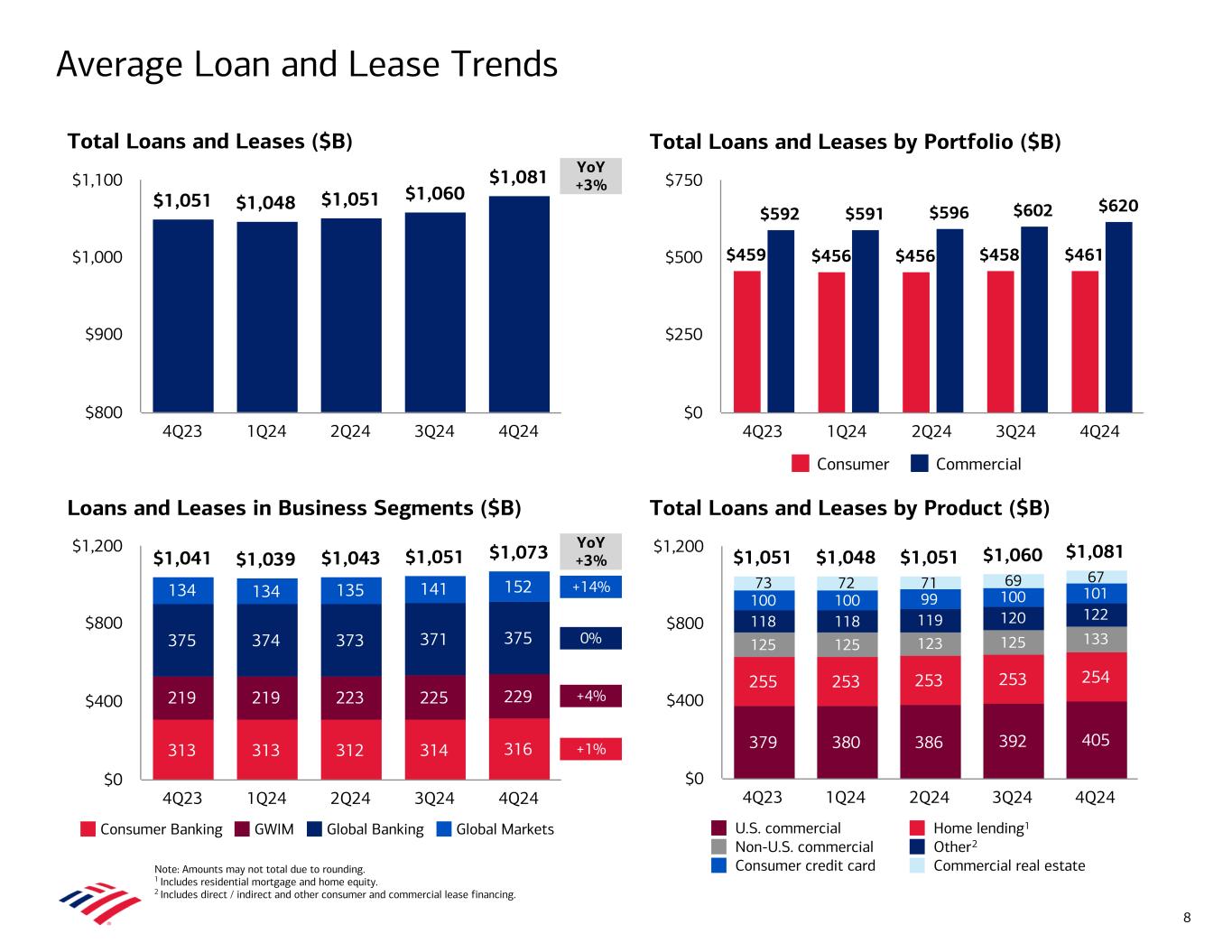

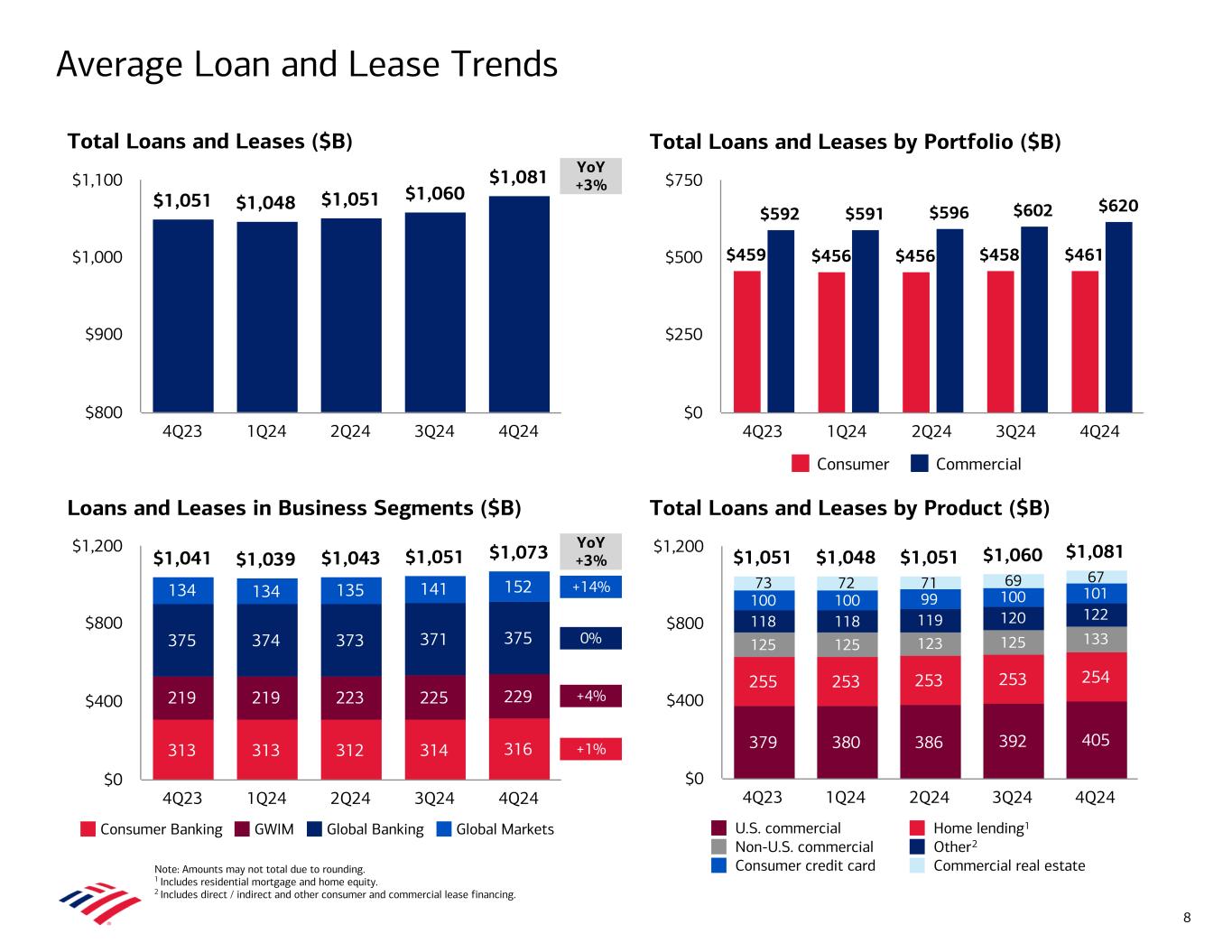

$1,041 $1,039 $1,043 $1,051 $1,073 313 313 312 314 316 219 219 223 225 229 375 374 373 371 375 134 134 135 141 152 Consumer Banking GWIM Global Banking Global Markets 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $400 $800 $1,200 $1,051 $1,048 $1,051 $1,060 $1,081 4Q23 1Q24 2Q24 3Q24 4Q24 $800 $900 $1,000 $1,100 +1% +4% 0% +14% Average Loan and Lease Trends YoY +3% YoY +3% Note: Amounts may not total due to rounding. 1 Includes residential mortgage and home equity. 2 Includes direct / indirect and other consumer and commercial lease financing. Total Loans and Leases by Product ($B) Loans and Leases in Business Segments ($B) Total Loans and Leases by Portfolio ($B)Total Loans and Leases ($B) $459 $456 $456 $458 $461 $592 $591 $596 $602 $620 Consumer Commercial 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $250 $500 $750 8 $1,051 $1,048 $1,051 $1,060 $1,081 379 380 386 392 405 255 253 253 253 254 125 125 123 125 133 118 118 119 120 122 100 100 99 100 101 73 72 71 69 67 U.S. commercial Home lending Non-U.S. commercial Other Consumer credit card Commercial real estate 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $400 $800 $1,200 2 1

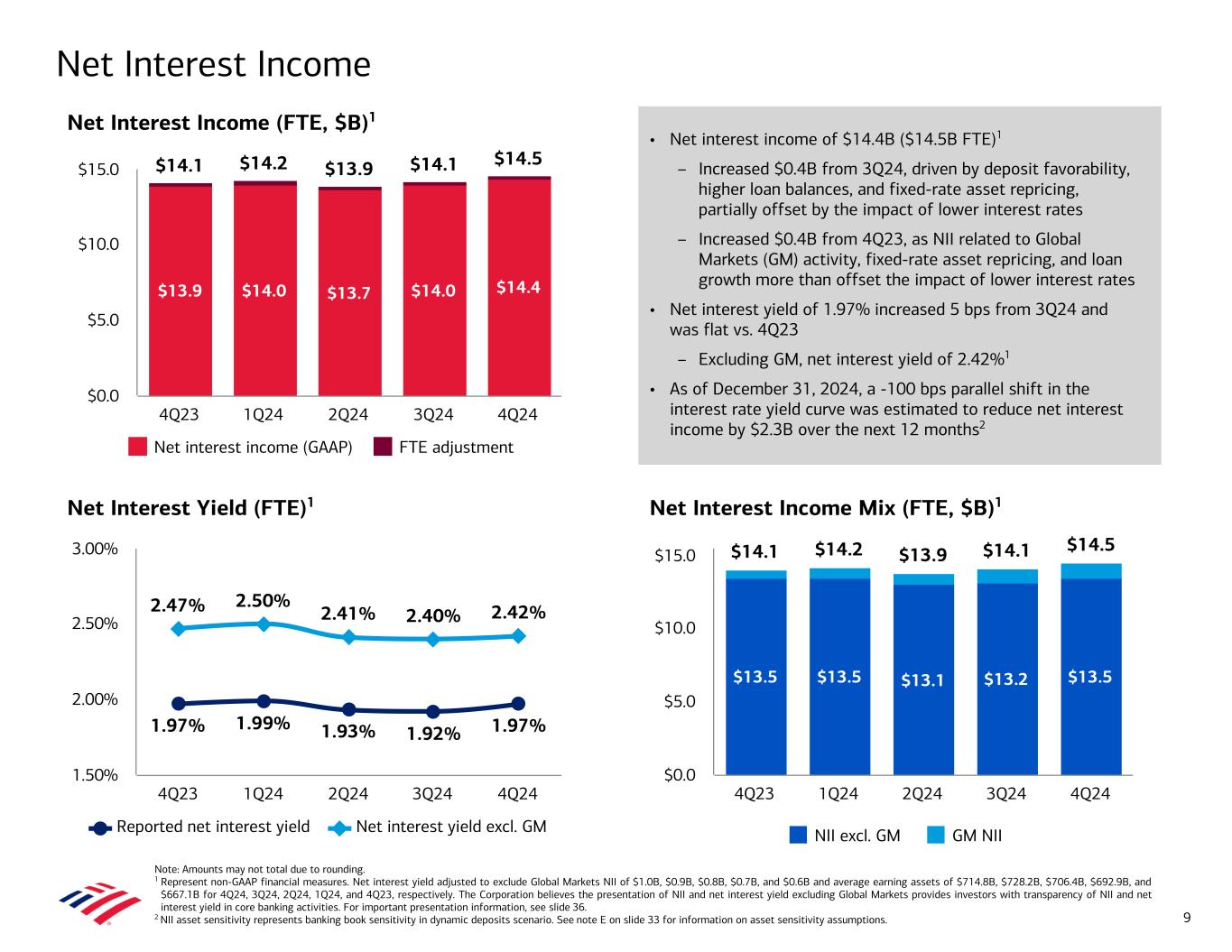

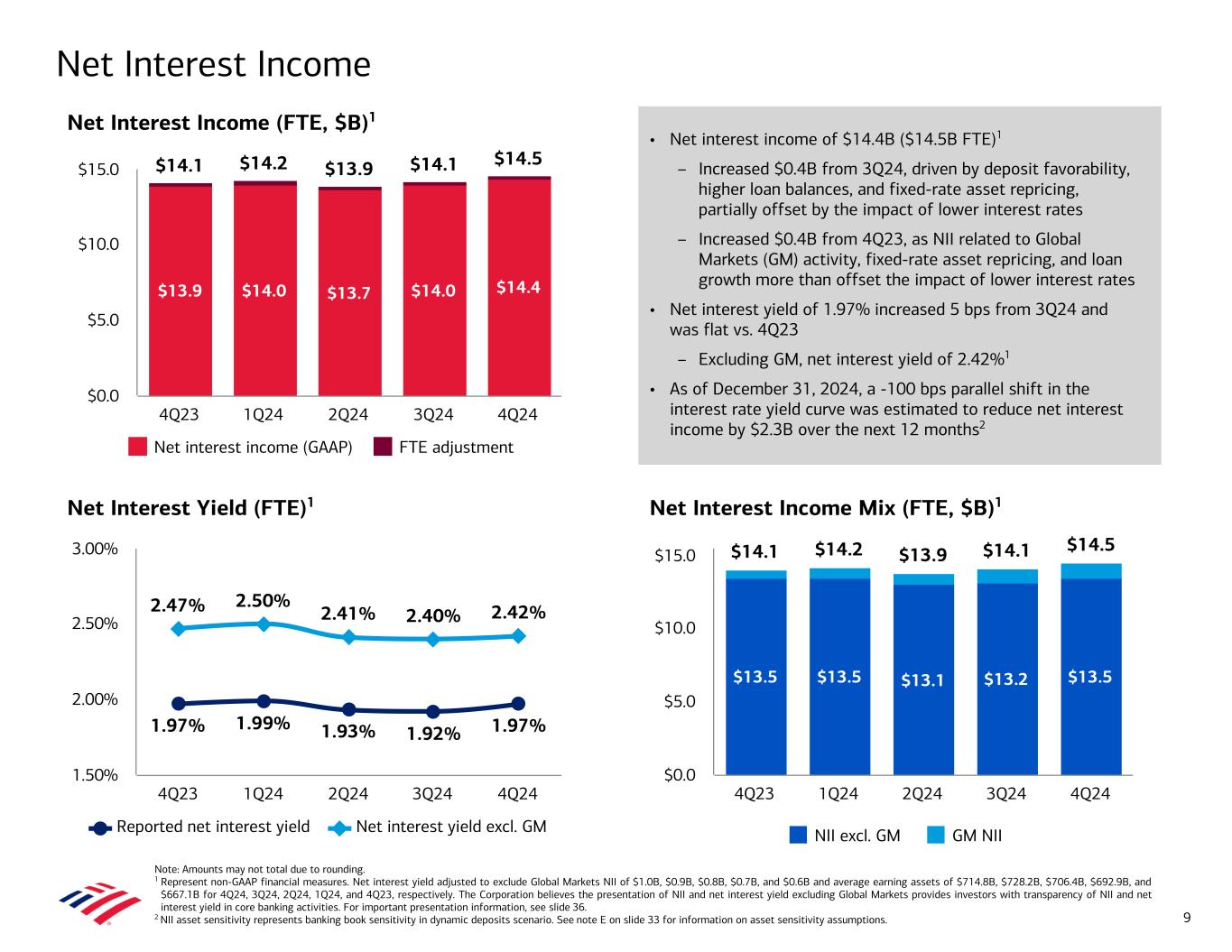

• Net interest income of $14.4B ($14.5B FTE)1 – Increased $0.4B from 3Q24, driven by deposit favorability, higher loan balances, and fixed-rate asset repricing, partially offset by the impact of lower interest rates – Increased $0.4B from 4Q23, as NII related to Global Markets (GM) activity, fixed-rate asset repricing, and loan growth more than offset the impact of lower interest rates • Net interest yield of 1.97% increased 5 bps from 3Q24 and was flat vs. 4Q23 – Excluding GM, net interest yield of 2.42%1 • As of December 31, 2024, a -100 bps parallel shift in the interest rate yield curve was estimated to reduce net interest income by $2.3B over the next 12 months2 Net Interest Income (FTE, $B)1 Net Interest Income Net Interest Yield (FTE)1 Note: Amounts may not total due to rounding. 1 Represent non-GAAP financial measures. Net interest yield adjusted to exclude Global Markets NII of $1.0B, $0.9B, $0.8B, $0.7B, and $0.6B and average earning assets of $714.8B, $728.2B, $706.4B, $692.9B, and $667.1B for 4Q24, 3Q24, 2Q24, 1Q24, and 4Q23, respectively. The Corporation believes the presentation of NII and net interest yield excluding Global Markets provides investors with transparency of NII and net interest yield in core banking activities. For important presentation information, see slide 36. 2 NII asset sensitivity represents banking book sensitivity in dynamic deposits scenario. See note E on slide 33 for information on asset sensitivity assumptions. 1.97% 1.99% 1.93% 1.92% 1.97% 2.47% 2.50% 2.41% 2.40% 2.42% Reported net interest yield Net interest yield excl. GM 4Q23 1Q24 2Q24 3Q24 4Q24 1.50% 2.00% 2.50% 3.00% $14.1 $14.2 $13.9 $14.1 $14.5 $13.9 $14.0 $13.7 $14.0 $14.4 Net interest income (GAAP) FTE adjustment 4Q23 1Q24 2Q24 3Q24 4Q24 $0.0 $5.0 $10.0 $15.0 9 Net Interest Income Mix (FTE, $B)1 $14.1 $14.2 $13.9 $14.1 $14.5 $13.5 $13.5 $13.1 $13.2 $13.5 NII excl. GM GM NII 4Q23 1Q24 2Q24 3Q24 4Q24 $0.0 $5.0 $10.0 $15.0

• 4Q24 noninterest expense of $16.8B – Increased $0.3B, or 2%, vs. 3Q24, driven primarily by higher revenue-related expenses and investments in the franchise, including technology and operations, partially offset by the $0.3B release of the FDIC special assessment accrual2 – Decreased $0.9B, or 5%, vs. 4Q23, driven primarily by the absence of the 4Q23 FDIC special assessment expense,2 partially offset by higher revenue-related expenses and investments in people, technology, brand, and operations $17.7 $17.2 $16.3 $16.5 $16.8 9.5 10.2 9.8 9.9 10.2 6.1 6.3 6.5 6.6 6.9 2.1 0.7 Compensation and benefits Other FDIC special assessment 4Q23 1Q24 2Q24 3Q24 4Q24 $0.0 $10.0 $20.0 66% 64% 64% 65% 67% 4Q23 1Q24 2Q24 3Q24 4Q24 55% 60% 65% 70% Total Noninterest Expense ($B) Efficiency Ratio Expense and Efficiency 10 1 1 Represent non-GAAP financial measures. For important presentation information, see slide 36. Adjusted 4Q24 efficiency ratio is calculated as the reported 4Q24 efficiency ratio of 66% less (118 bps) for the impact of the FDIC special assessment reduction. Adjusted 1Q24 efficiency ratio is calculated as the reported 1Q24 efficiency ratio of 67% less 271 bps for the impact of the FDIC special assessment accrual. Adjusted 4Q23 efficiency ratio is calculated as the reported 4Q23 efficiency ratio of 81% less 1,430 bps for the combined impact of the net pretax charge of $1.6B recorded in noninterest income related to the future cessation of BSBY and the $2.1B pretax noninterest expense for the FDIC special assessment accrual. 2 For more information on the FDIC special assessment and BSBY cessation charges recorded in 4Q23, see note B on slide 32. 1 (0.3) 1

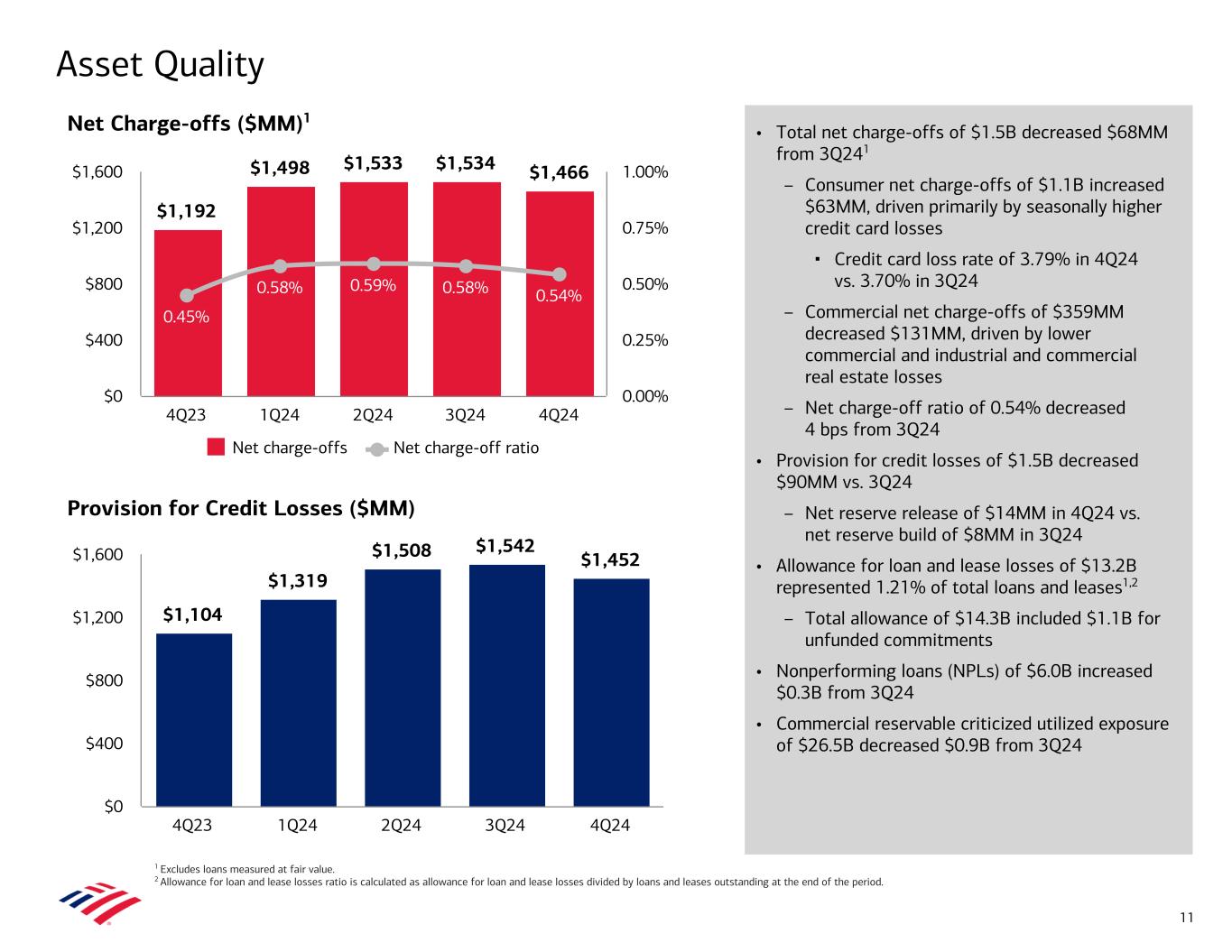

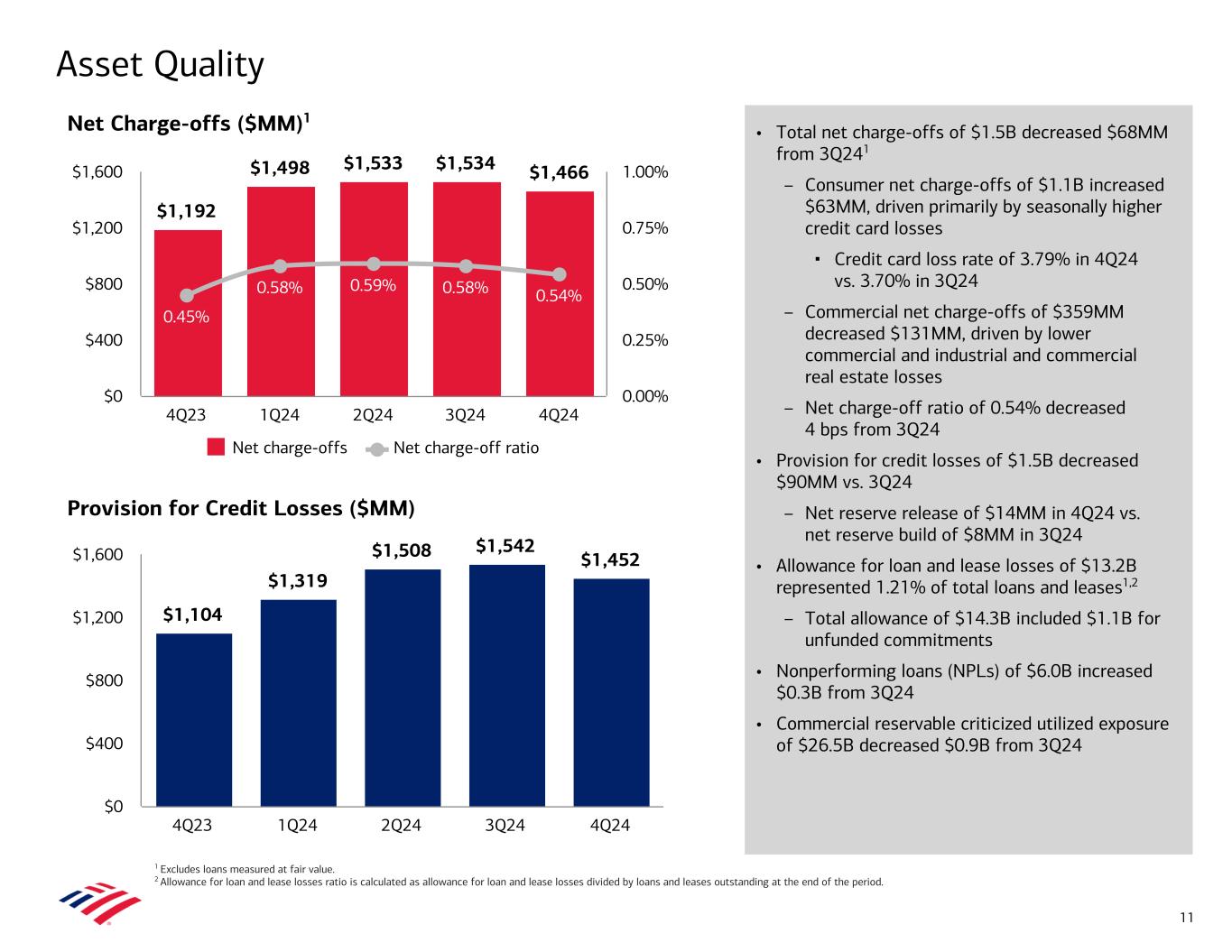

Asset Quality 1 Excludes loans measured at fair value. 2 Allowance for loan and lease losses ratio is calculated as allowance for loan and lease losses divided by loans and leases outstanding at the end of the period. Provision for Credit Losses ($MM) Net Charge-offs ($MM)1 $1,104 $1,319 $1,508 $1,542 $1,452 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $400 $800 $1,200 $1,600 $1,192 $1,498 $1,533 $1,534 $1,466 0.45% 0.58% 0.59% 0.58% 0.54% Net charge-offs Net charge-off ratio 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $400 $800 $1,200 $1,600 0.00% 0.25% 0.50% 0.75% 1.00% 11 • Total net charge-offs of $1.5B decreased $68MM from 3Q241 – Consumer net charge-offs of $1.1B increased $63MM, driven primarily by seasonally higher credit card losses ▪ Credit card loss rate of 3.79% in 4Q24 vs. 3.70% in 3Q24 – Commercial net charge-offs of $359MM decreased $131MM, driven by lower commercial and industrial and commercial real estate losses – Net charge-off ratio of 0.54% decreased 4 bps from 3Q24 • Provision for credit losses of $1.5B decreased $90MM vs. 3Q24 – Net reserve release of $14MM in 4Q24 vs. net reserve build of $8MM in 3Q24 • Allowance for loan and lease losses of $13.2B represented 1.21% of total loans and leases1,2 – Total allowance of $14.3B included $1.1B for unfunded commitments • Nonperforming loans (NPLs) of $6.0B increased $0.3B from 3Q24 • Commercial reservable criticized utilized exposure of $26.5B decreased $0.9B from 3Q24

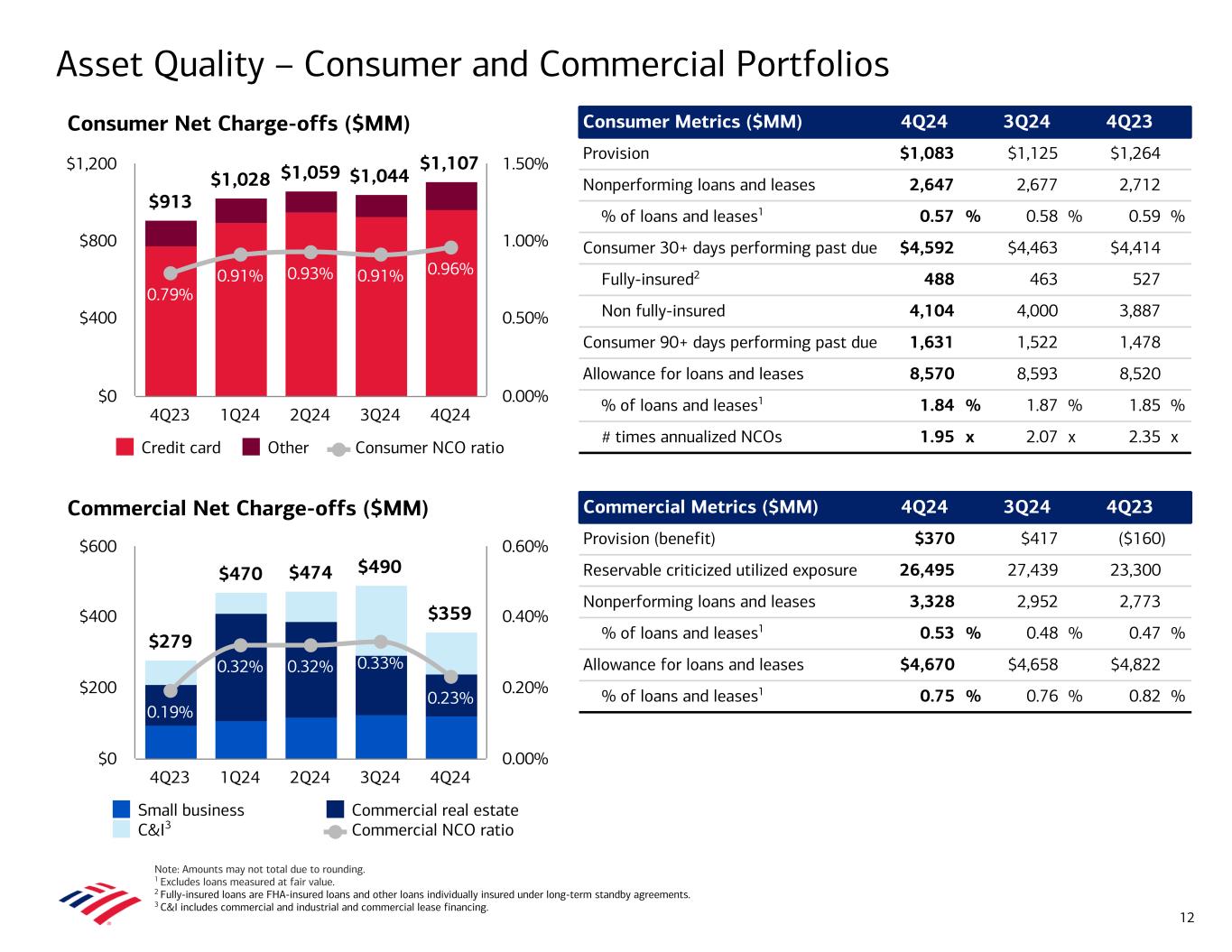

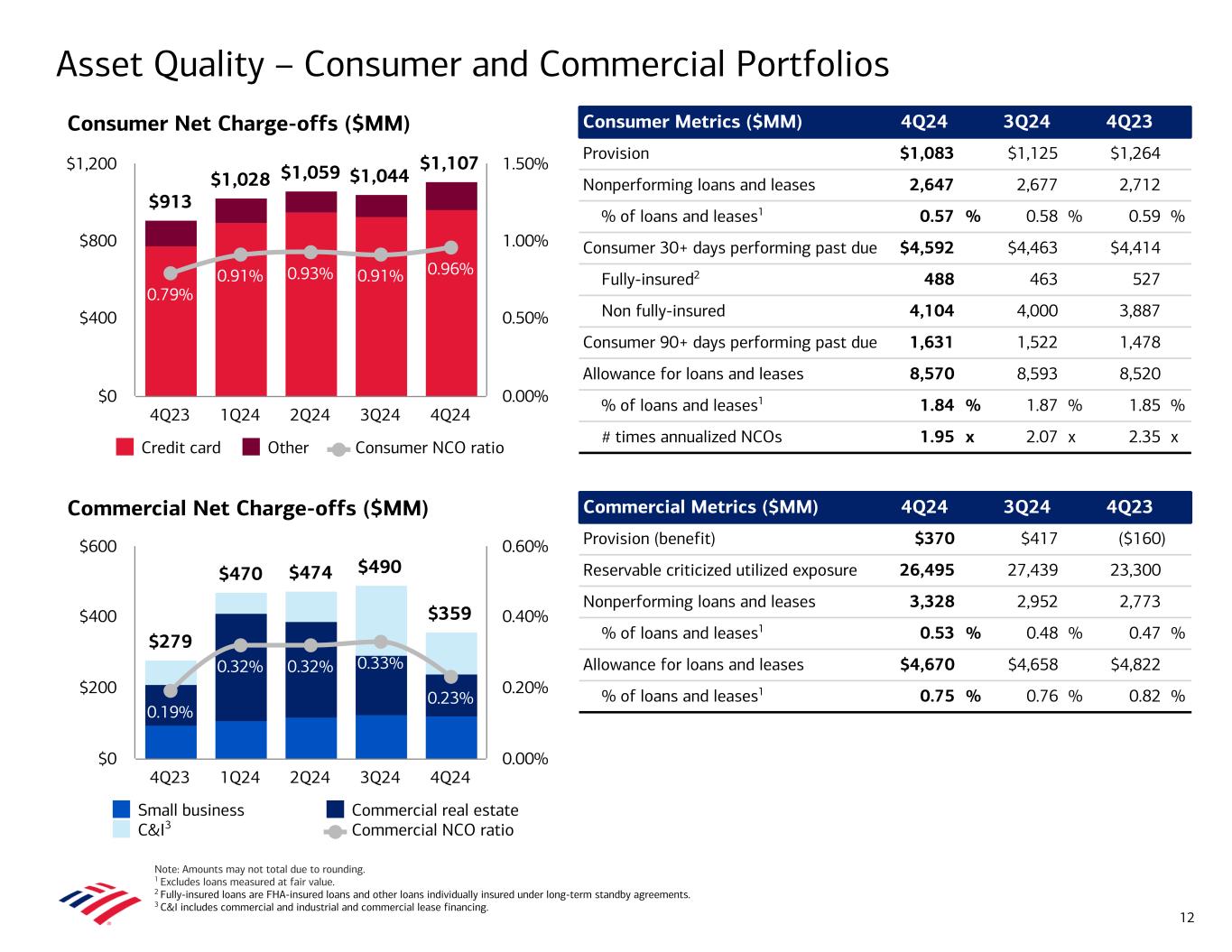

Commercial Net Charge-offs ($MM) Consumer Net Charge-offs ($MM) Asset Quality – Consumer and Commercial Portfolios $279 $470 $474 $490 $359 0.19% 0.32% 0.32% 0.33% 0.23% Small business Commercial real estate C&I Commercial NCO ratio 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $200 $400 $600 0.00% 0.20% 0.40% 0.60% $913 $1,028 $1,059 $1,044 $1,107 0.79% 0.91% 0.93% 0.91% 0.96% Credit card Other Consumer NCO ratio 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $400 $800 $1,200 0.00% 0.50% 1.00% 1.50% Commercial Metrics ($MM) 4Q24 3Q24 4Q23 Provision (benefit) $370 $417 ($160) Reservable criticized utilized exposure 26,495 27,439 23,300 Nonperforming loans and leases 3,328 2,952 2,773 % of loans and leases1 0.53 % 0.48 % 0.47 % Allowance for loans and leases $4,670 $4,658 $4,822 % of loans and leases1 0.75 % 0.76 % 0.82 % Consumer Metrics ($MM) 4Q24 3Q24 4Q23 Provision $1,083 $1,125 $1,264 Nonperforming loans and leases 2,647 2,677 2,712 % of loans and leases1 0.57 % 0.58 % 0.59 % Consumer 30+ days performing past due $4,592 $4,463 $4,414 Fully-insured2 488 463 527 Non fully-insured 4,104 4,000 3,887 Consumer 90+ days performing past due 1,631 1,522 1,478 Allowance for loans and leases 8,570 8,593 8,520 % of loans and leases1 1.84 % 1.87 % 1.85 % # times annualized NCOs 1.95 x 2.07 x 2.35 x 12 3 Note: Amounts may not total due to rounding. 1 Excludes loans measured at fair value. 2 Fully-insured loans are FHA-insured loans and other loans individually insured under long-term standby agreements. 3 C&I includes commercial and industrial and commercial lease financing.

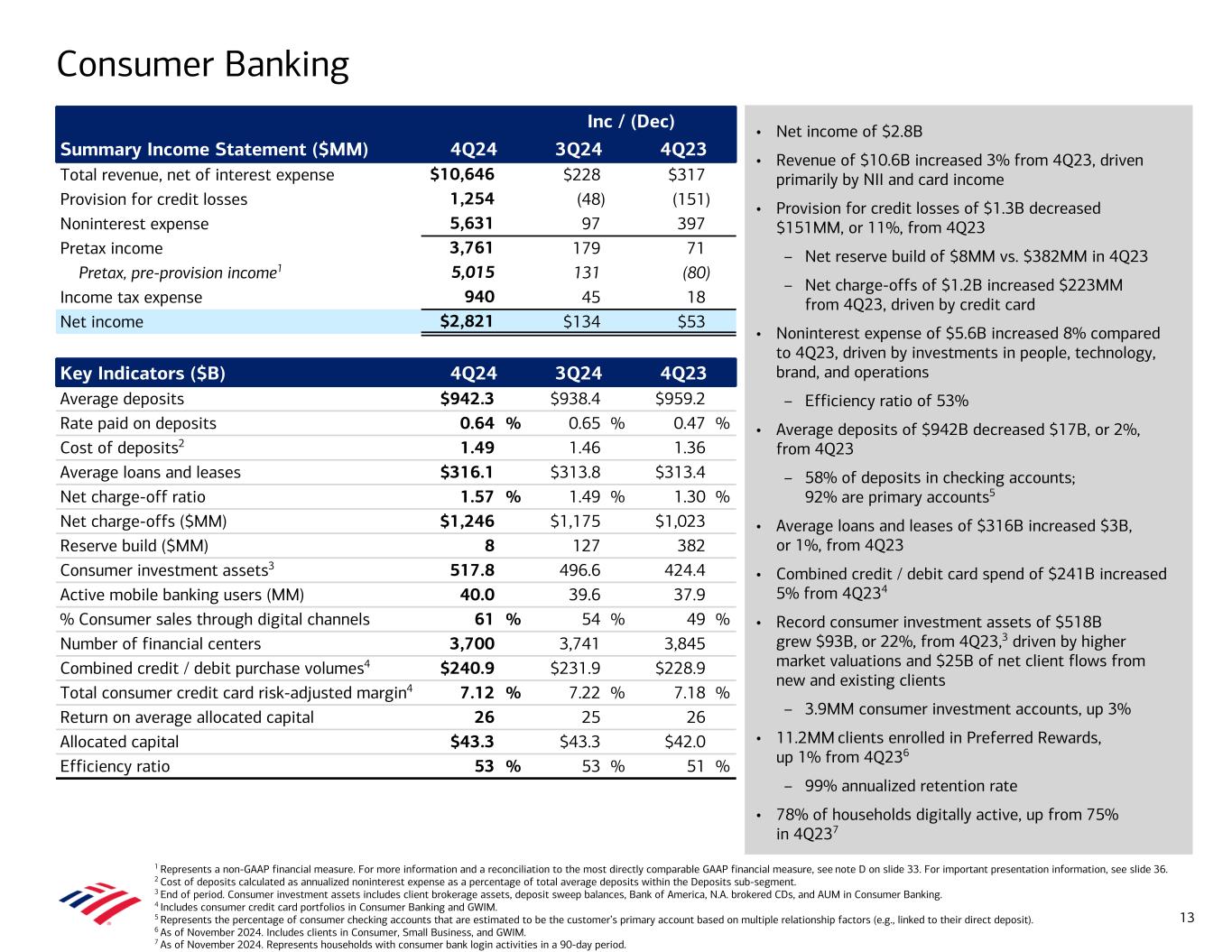

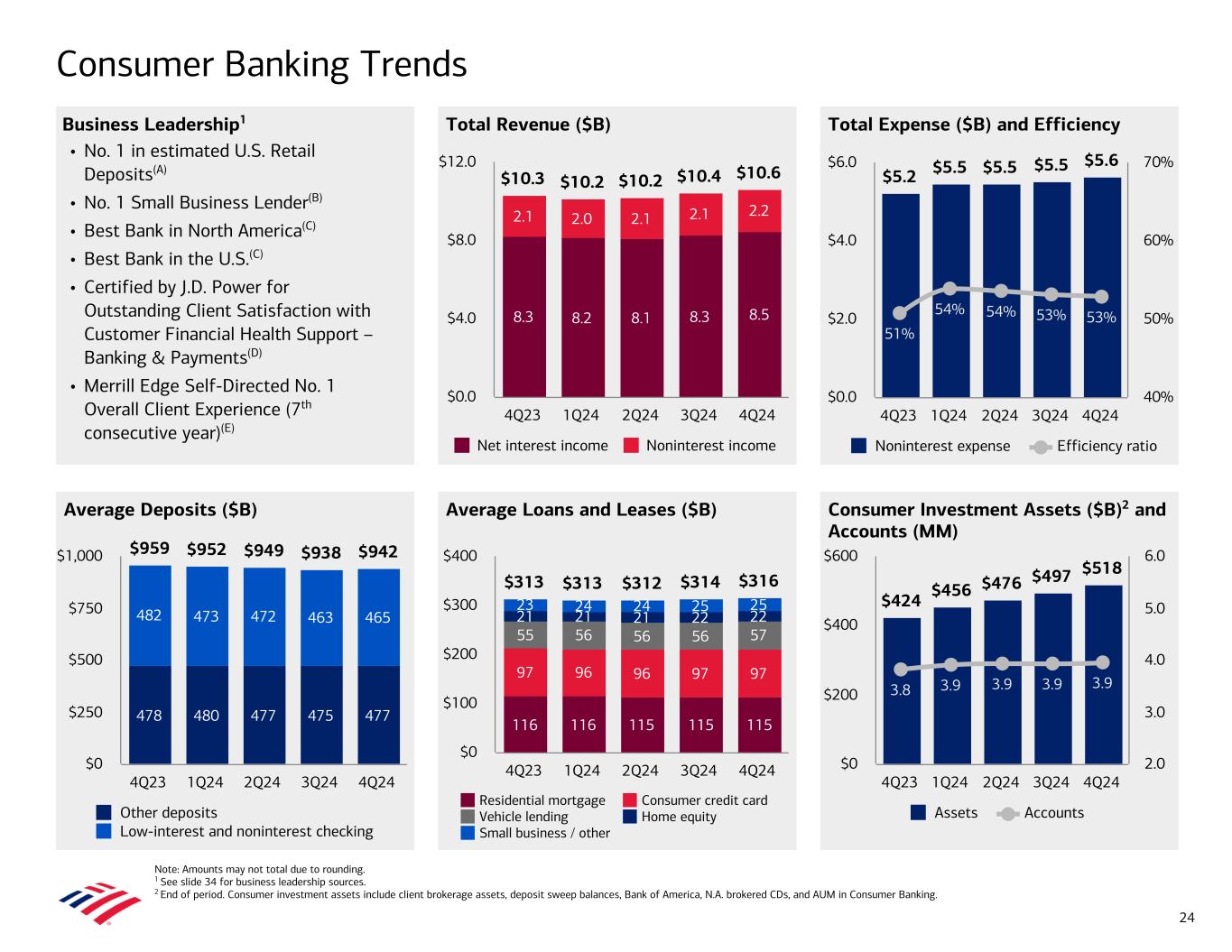

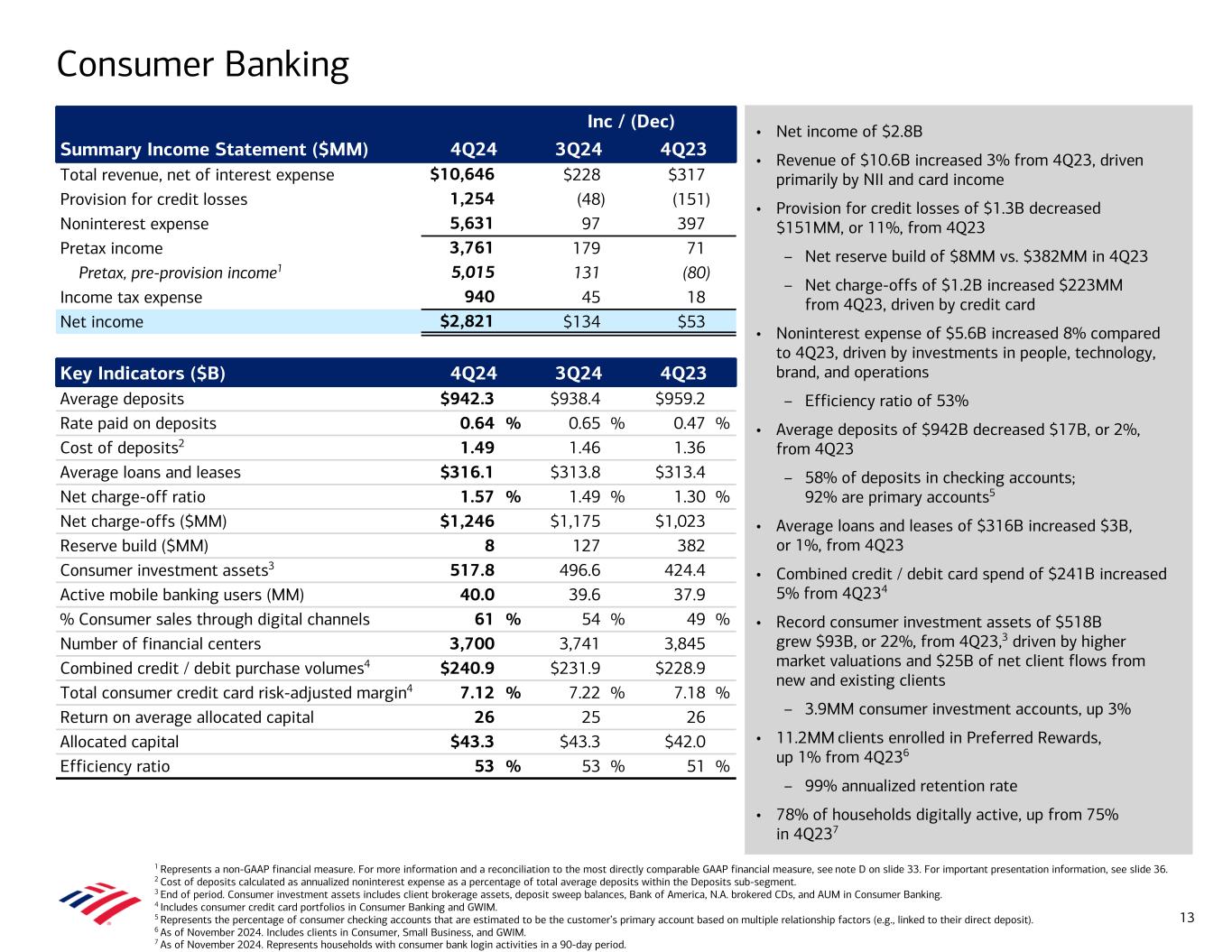

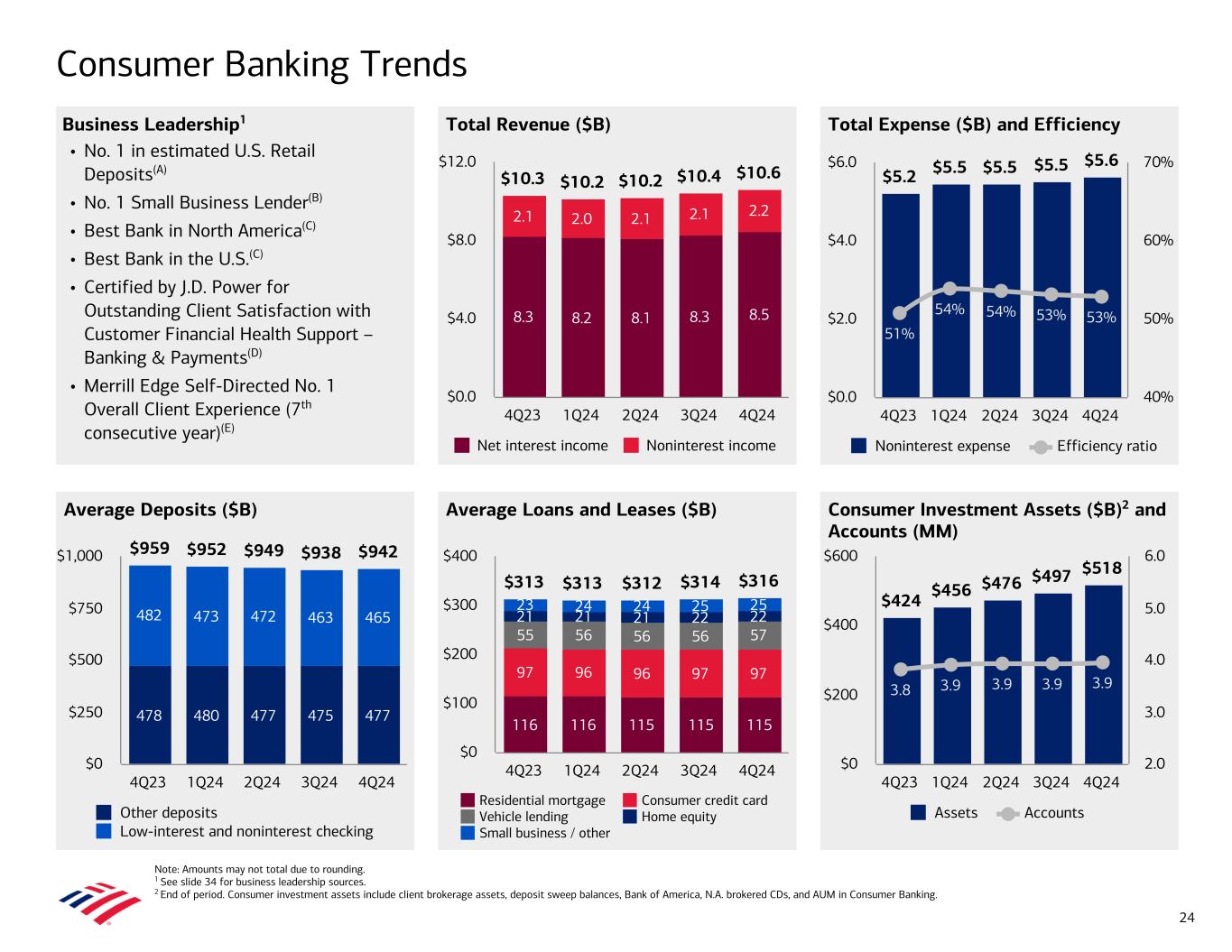

• Net income of $2.8B • Revenue of $10.6B increased 3% from 4Q23, driven primarily by NII and card income • Provision for credit losses of $1.3B decreased $151MM, or 11%, from 4Q23 – Net reserve build of $8MM vs. $382MM in 4Q23 – Net charge-offs of $1.2B increased $223MM from 4Q23, driven by credit card • Noninterest expense of $5.6B increased 8% compared to 4Q23, driven by investments in people, technology, brand, and operations – Efficiency ratio of 53% • Average deposits of $942B decreased $17B, or 2%, from 4Q23 – 58% of deposits in checking accounts; 92% are primary accounts5 • Average loans and leases of $316B increased $3B, or 1%, from 4Q23 • Combined credit / debit card spend of $241B increased 5% from 4Q234 • Record consumer investment assets of $518B grew $93B, or 22%, from 4Q23,3 driven by higher market valuations and $25B of net client flows from new and existing clients – 3.9MM consumer investment accounts, up 3% • 11.2MM clients enrolled in Preferred Rewards, up 1% from 4Q236 – 99% annualized retention rate • 78% of households digitally active, up from 75% in 4Q237 Consumer Banking 1 Represents a non-GAAP financial measure. For more information and a reconciliation to the most directly comparable GAAP financial measure, see note D on slide 33. For important presentation information, see slide 36. 2 Cost of deposits calculated as annualized noninterest expense as a percentage of total average deposits within the Deposits sub-segment. 3 End of period. Consumer investment assets includes client brokerage assets, deposit sweep balances, Bank of America, N.A. brokered CDs, and AUM in Consumer Banking. 4 Includes consumer credit card portfolios in Consumer Banking and GWIM. 5 Represents the percentage of consumer checking accounts that are estimated to be the customer’s primary account based on multiple relationship factors (e.g., linked to their direct deposit). 6 As of November 2024. Includes clients in Consumer, Small Business, and GWIM. 7 As of November 2024. Represents households with consumer bank login activities in a 90-day period. Inc / (Dec) Summary Income Statement ($MM) 4Q24 3Q24 4Q23 Total revenue, net of interest expense $10,646 $228 $317 Provision for credit losses 1,254 (48) (151) Noninterest expense 5,631 97 397 Pretax income 3,761 179 71 Pretax, pre-provision income1 5,015 131 (80) Income tax expense 940 45 18 Net income $2,821 $134 $53 Key Indicators ($B) 4Q24 3Q24 4Q23 Average deposits $942.3 $938.4 $959.2 Rate paid on deposits 0.64 % 0.65 % 0.47 % Cost of deposits2 1.49 1.46 1.36 Average loans and leases $316.1 $313.8 $313.4 Net charge-off ratio 1.57 % 1.49 % 1.30 % Net charge-offs ($MM) $1,246 $1,175 $1,023 Reserve build ($MM) 8 127 382 Consumer investment assets3 517.8 496.6 424.4 Active mobile banking users (MM) 40.0 39.6 37.9 % Consumer sales through digital channels 61 % 54 % 49 % Number of financial centers 3,700 3,741 3,845 Combined credit / debit purchase volumes4 $240.9 $231.9 $228.9 Total consumer credit card risk-adjusted margin4 7.12 % 7.22 % 7.18 % Return on average allocated capital 26 25 26 Allocated capital $43.3 $43.3 $42.0 Efficiency ratio 53 % 53 % 51 % 13

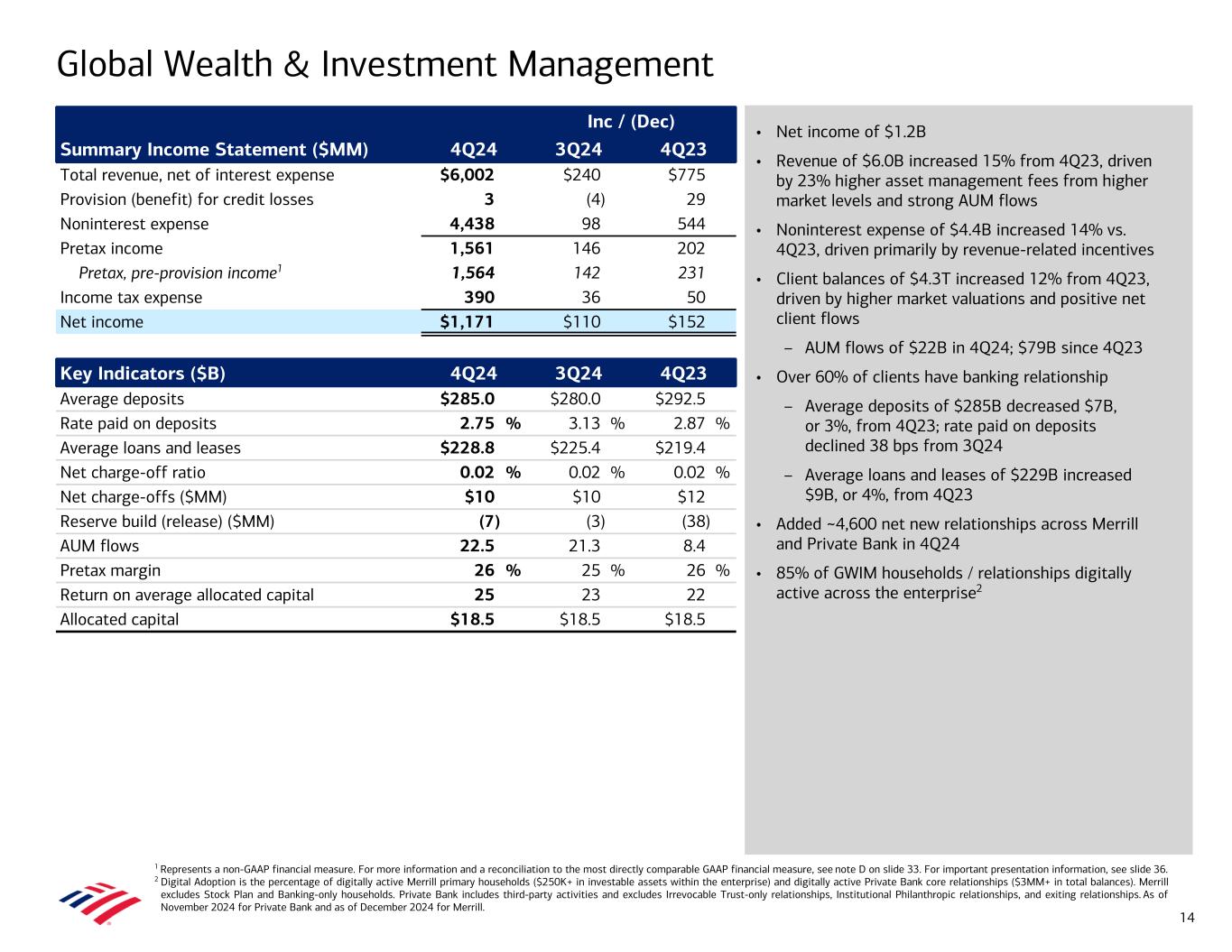

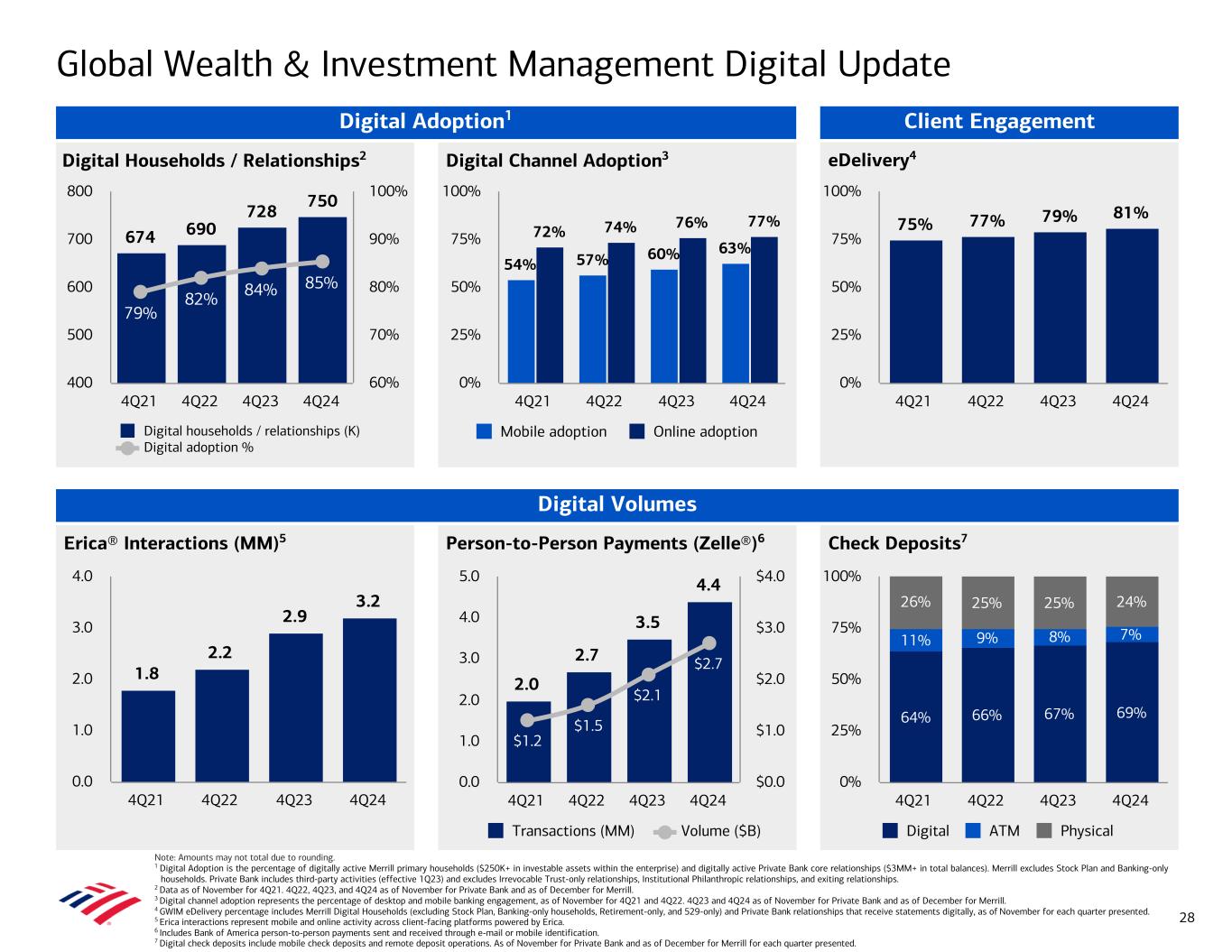

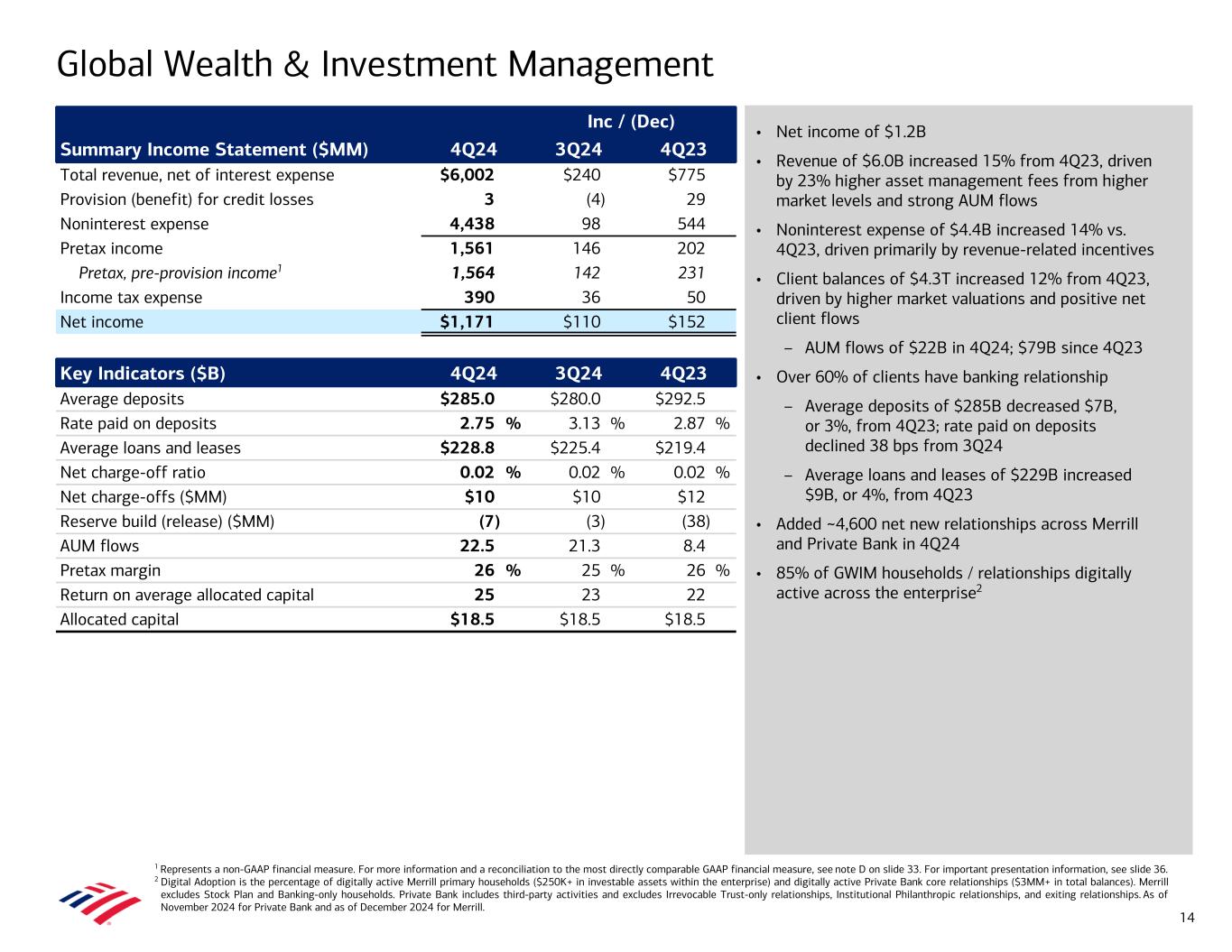

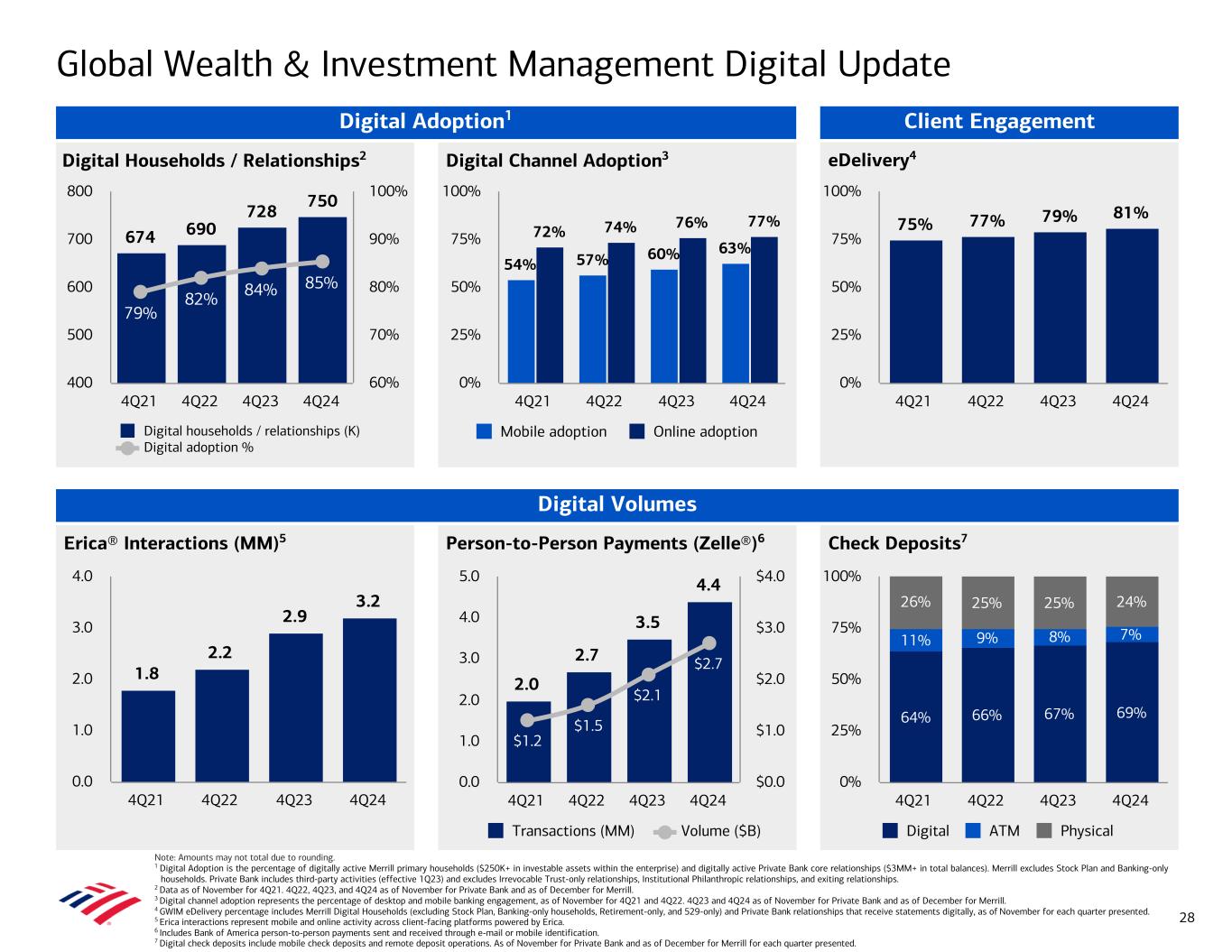

• Net income of $1.2B • Revenue of $6.0B increased 15% from 4Q23, driven by 23% higher asset management fees from higher market levels and strong AUM flows • Noninterest expense of $4.4B increased 14% vs. 4Q23, driven primarily by revenue-related incentives • Client balances of $4.3T increased 12% from 4Q23, driven by higher market valuations and positive net client flows – AUM flows of $22B in 4Q24; $79B since 4Q23 • Over 60% of clients have banking relationship – Average deposits of $285B decreased $7B, or 3%, from 4Q23; rate paid on deposits declined 38 bps from 3Q24 – Average loans and leases of $229B increased $9B, or 4%, from 4Q23 • Added ~4,600 net new relationships across Merrill and Private Bank in 4Q24 • 85% of GWIM households / relationships digitally active across the enterprise2 Global Wealth & Investment Management 1 Represents a non-GAAP financial measure. For more information and a reconciliation to the most directly comparable GAAP financial measure, see note D on slide 33. For important presentation information, see slide 36. 2 Digital Adoption is the percentage of digitally active Merrill primary households ($250K+ in investable assets within the enterprise) and digitally active Private Bank core relationships ($3MM+ in total balances). Merrill excludes Stock Plan and Banking-only households. Private Bank includes third-party activities and excludes Irrevocable Trust-only relationships, Institutional Philanthropic relationships, and exiting relationships. As of November 2024 for Private Bank and as of December 2024 for Merrill. Inc / (Dec) Summary Income Statement ($MM) 4Q24 3Q24 4Q23 Total revenue, net of interest expense $6,002 $240 $775 Provision (benefit) for credit losses 3 (4) 29 Noninterest expense 4,438 98 544 Pretax income 1,561 146 202 Pretax, pre-provision income1 1,564 142 231 Income tax expense 390 36 50 Net income $1,171 $110 $152 Key Indicators ($B) 4Q24 3Q24 4Q23 Average deposits $285.0 $280.0 $292.5 Rate paid on deposits 2.75 % 3.13 % 2.87 % Average loans and leases $228.8 $225.4 $219.4 Net charge-off ratio 0.02 % 0.02 % 0.02 % Net charge-offs ($MM) $10 $10 $12 Reserve build (release) ($MM) (7) (3) (38) AUM flows 22.5 21.3 8.4 Pretax margin 26 % 25 % 26 % Return on average allocated capital 25 23 22 Allocated capital $18.5 $18.5 $18.5 14

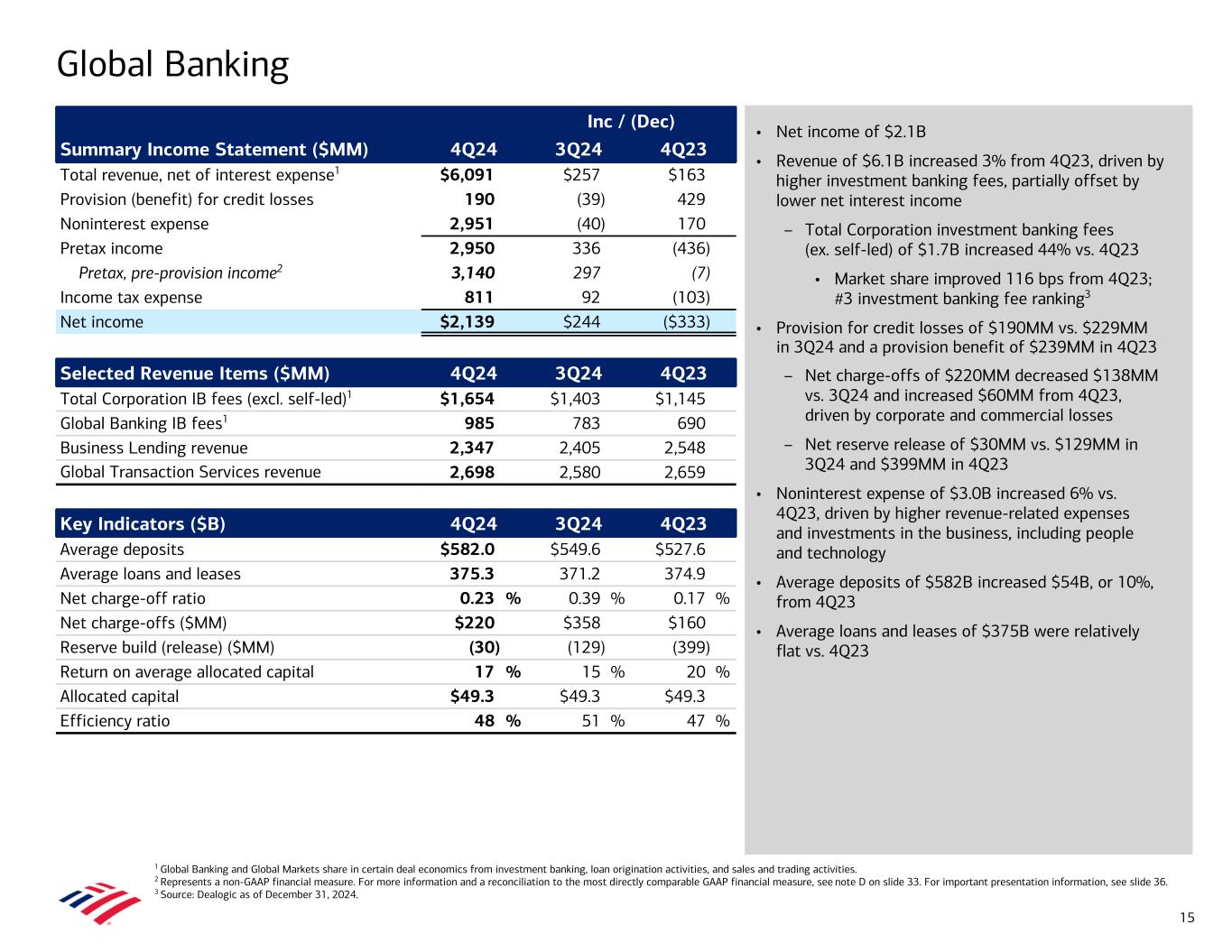

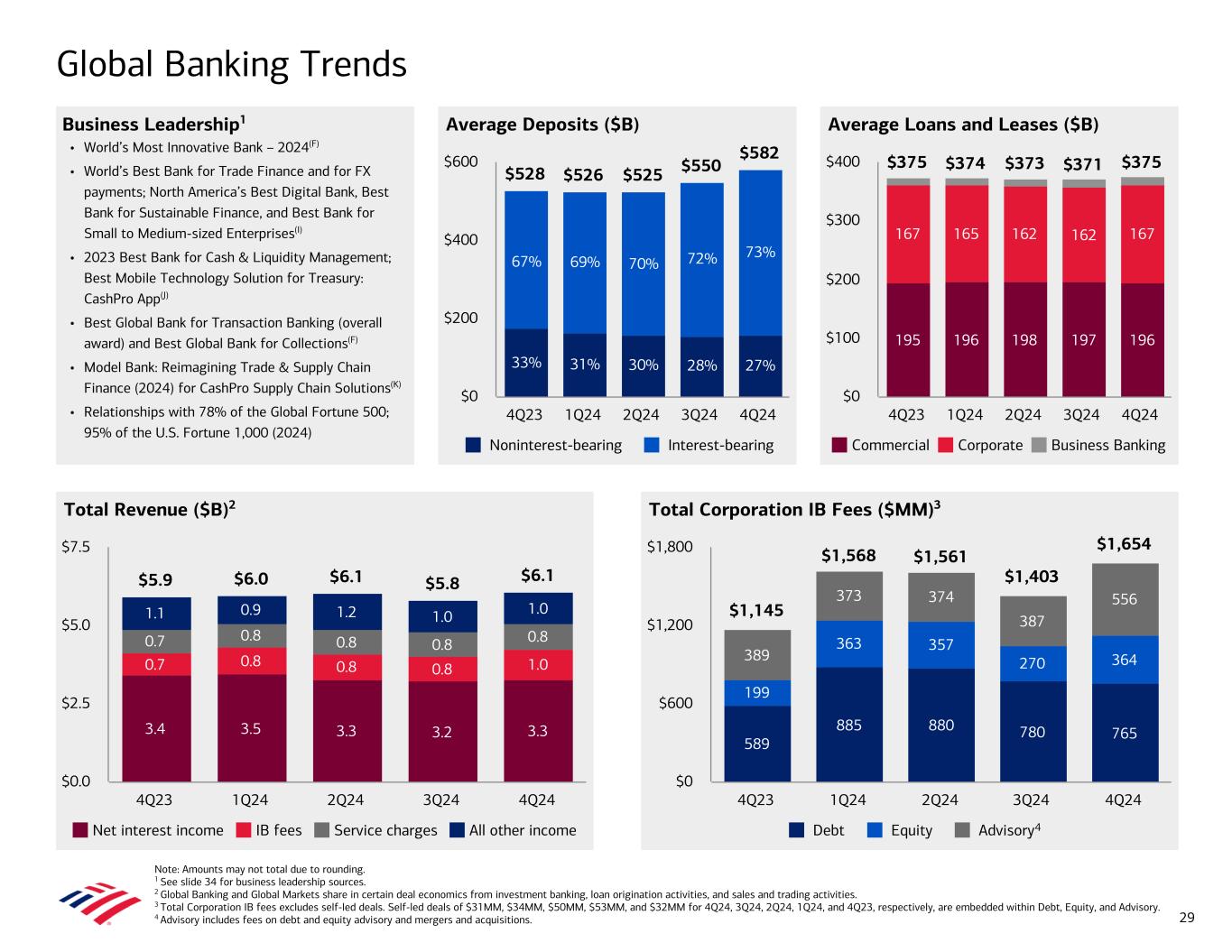

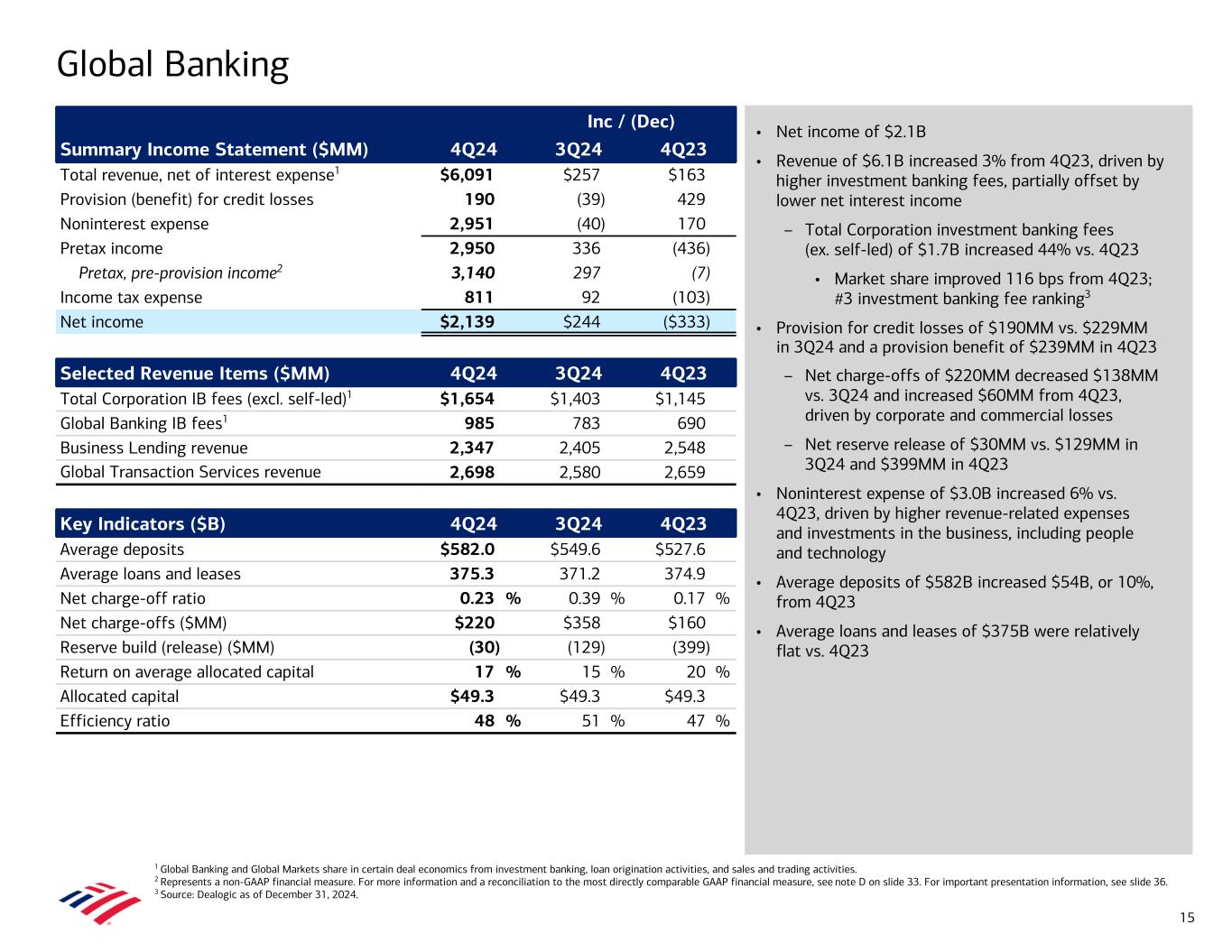

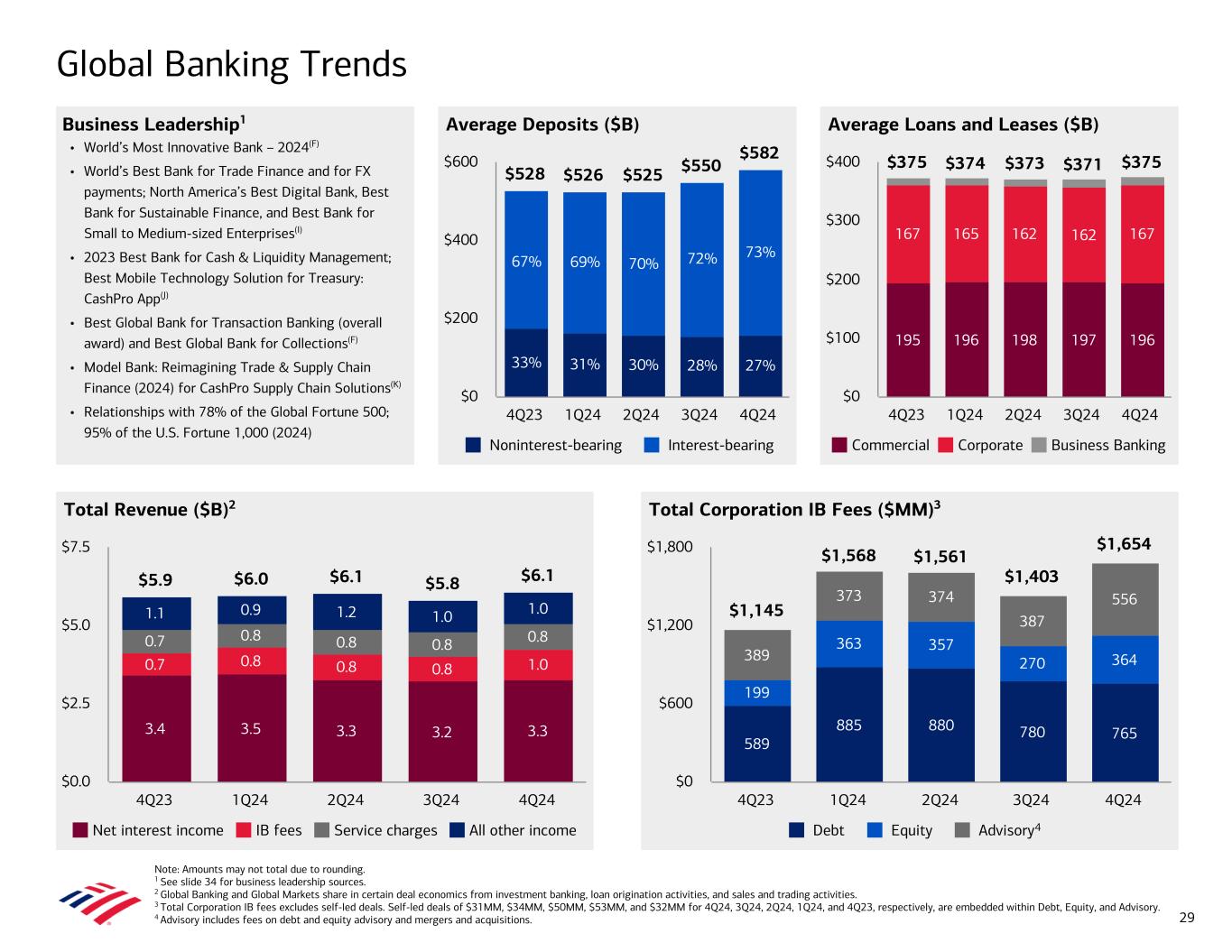

• Net income of $2.1B • Revenue of $6.1B increased 3% from 4Q23, driven by higher investment banking fees, partially offset by lower net interest income – Total Corporation investment banking fees (ex. self-led) of $1.7B increased 44% vs. 4Q23 • Market share improved 116 bps from 4Q23; #3 investment banking fee ranking3 • Provision for credit losses of $190MM vs. $229MM in 3Q24 and a provision benefit of $239MM in 4Q23 – Net charge-offs of $220MM decreased $138MM vs. 3Q24 and increased $60MM from 4Q23, driven by corporate and commercial losses – Net reserve release of $30MM vs. $129MM in 3Q24 and $399MM in 4Q23 • Noninterest expense of $3.0B increased 6% vs. 4Q23, driven by higher revenue-related expenses and investments in the business, including people and technology • Average deposits of $582B increased $54B, or 10%, from 4Q23 • Average loans and leases of $375B were relatively flat vs. 4Q23 Global Banking 1 Global Banking and Global Markets share in certain deal economics from investment banking, loan origination activities, and sales and trading activities. 2 Represents a non-GAAP financial measure. For more information and a reconciliation to the most directly comparable GAAP financial measure, see note D on slide 33. For important presentation information, see slide 36. 3 Source: Dealogic as of December 31, 2024. Inc / (Dec) Summary Income Statement ($MM) 4Q24 3Q24 4Q23 Total revenue, net of interest expense1 $6,091 $257 $163 Provision (benefit) for credit losses 190 (39) 429 Noninterest expense 2,951 (40) 170 Pretax income 2,950 336 (436) Pretax, pre-provision income2 3,140 297 (7) Income tax expense 811 92 (103) Net income $2,139 $244 ($333) Selected Revenue Items ($MM) 4Q24 3Q24 4Q23 Total Corporation IB fees (excl. self-led)1 $1,654 $1,403 $1,145 Global Banking IB fees1 985 783 690 Business Lending revenue 2,347 2,405 2,548 Global Transaction Services revenue 2,698 2,580 2,659 Key Indicators ($B) 4Q24 3Q24 4Q23 Average deposits $582.0 $549.6 $527.6 Average loans and leases 375.3 371.2 374.9 Net charge-off ratio 0.23 % 0.39 % 0.17 % Net charge-offs ($MM) $220 $358 $160 Reserve build (release) ($MM) (30) (129) (399) Return on average allocated capital 17 % 15 % 20 % Allocated capital $49.3 $49.3 $49.3 Efficiency ratio 48 % 51 % 47 % 15

• Net income of $0.9B ($1.0B excluding net DVA)3 • Revenue of $4.8B increased 18% from 4Q23, driven by higher sales and trading revenue and investment banking fees • Sales and trading revenue of $4.1B increased 13% from 4Q23; excluding net DVA, up 10%3 – FICC revenue increased 19% (ex. DVA, up 13%)3 to $2.5B, driven by improved trading performance in macro products and continued strength in credit products – Equities revenue increased 7% (ex. DVA, up 6%)3 to $1.6B, driven by an increase in trading performance and client activity • Noninterest expense of $3.5B increased 7% vs. 4Q23, driven by higher revenue-related expenses and investments in the business, including technology • Average VaR of $75MM in 4Q245 Global Markets1 1 The explanations for current period-over-period changes for Global Markets are the same for amounts including and excluding net DVA. 2 Global Banking and Global Markets share in certain deal economics from investment banking, loan origination activities, and sales and trading activities. 3 Represent non-GAAP financial measures. Reported FICC sales and trading revenue was $2.5B, $2.9B, and $2.1B for 4Q24, 3Q24, and 4Q23, respectively. Reported Equities sales and trading revenue was $1.6B, $2.0B, and $1.5B for 4Q24, 3Q24, and 4Q23, respectively. See note F on slide 33 and slide 36 for important presentation information. 4 Represents a non-GAAP financial measure. For more information and a reconciliation to the most directly comparable GAAP financial measure, see note D on slide 33. For important presentation information, see slide 36. 5 See note G on slide 33 for the definition of VaR. Inc / (Dec) Summary Income Statement ($MM) 4Q24 3Q24 4Q23 Total revenue, net of interest expense2 $4,840 ($790) $752 Net DVA (19) (11) 113 Total revenue (excl. net DVA)2,3 4,859 (779) 639 Provision (benefit) for credit losses 10 3 70 Noninterest expense 3,505 62 234 Pretax income 1,325 (855) 448 Pretax, pre-provision income4 1,335 (852) 518 Income tax expense 384 (248) 143 Net income $941 ($607) $305 Net income (excl. net DVA)3 $955 ($599) $219 Selected Revenue Items ($MM)2 4Q24 3Q24 4Q23 Sales and trading revenue $4,106 $4,930 $3,619 Sales and trading revenue (excl. net DVA)3 4,125 4,938 3,751 FICC (excl. net DVA)3 2,482 2,942 2,206 Equities (excl. net DVA)3 1,643 1,996 1,545 Global Markets IB fees 639 589 439 Key Indicators ($B) 4Q24 3Q24 4Q23 Average total assets $918.7 $924.1 $868.0 Average trading-related assets 620.9 645.6 615.4 Average 99% VaR ($MM)5 75 78 79 Average loans and leases 152.4 140.8 133.6 Net charge-offs ($MM) 2 1 8 Reserve build (release) ($MM) 8 6 (68) Return on average allocated capital 8 % 14 % 6 % Allocated capital $45.5 $45.5 $45.5 Efficiency ratio 72 % 61 % 80 % 16

• Net loss of $0.4B improved from a net loss of $3.8B in 4Q23, driven primarily by the absence of the 4Q23 FDIC special assessment and BSBY cessation charges and the benefit of a $0.3B release of the FDIC special assessment accrual in 4Q243 • Total corporate effective tax rate (ETR) for the quarter was approximately 6%; total corporate ETR for the full year was approximately 7% – Excluding discrete tax items and recurring tax credits primarily related to investments in renewable energy and affordable housing, the ETR for the quarter would have been approximately 26% and for the full year would have been approximately 25% All Other1 1 All Other primarily consists of asset and liability management (ALM) activities, liquidating businesses, and certain expenses not otherwise allocated to a business segment. ALM activities encompass interest rate and foreign currency risk management activities for which substantially all of the results are allocated to our business segments. 2 Represents a non-GAAP financial measure. For more information and a reconciliation to the most directly comparable GAAP financial measure, see note D on slide 33. For important presentation information, see slide 36. 3 For more information on the FDIC special assessment and BSBY cessation charges recorded in 4Q23, see note B on slide 32. Inc / (Dec) Summary Income Statement ($MM) 4Q24 3Q24 4Q23 Total revenue, net of interest expense ($2,078) $74 $1,390 Provision (benefit) for credit losses (5) (2) (29) Noninterest expense 262 91 (2,289) Pretax income (loss) (2,335) (15) 3,708 Pretax, pre-provision income (loss)2 (2,340) (17) 3,679 Income tax expense (benefit) (1,928) 97 364 Net income (loss) ($407) ($112) $3,344 17

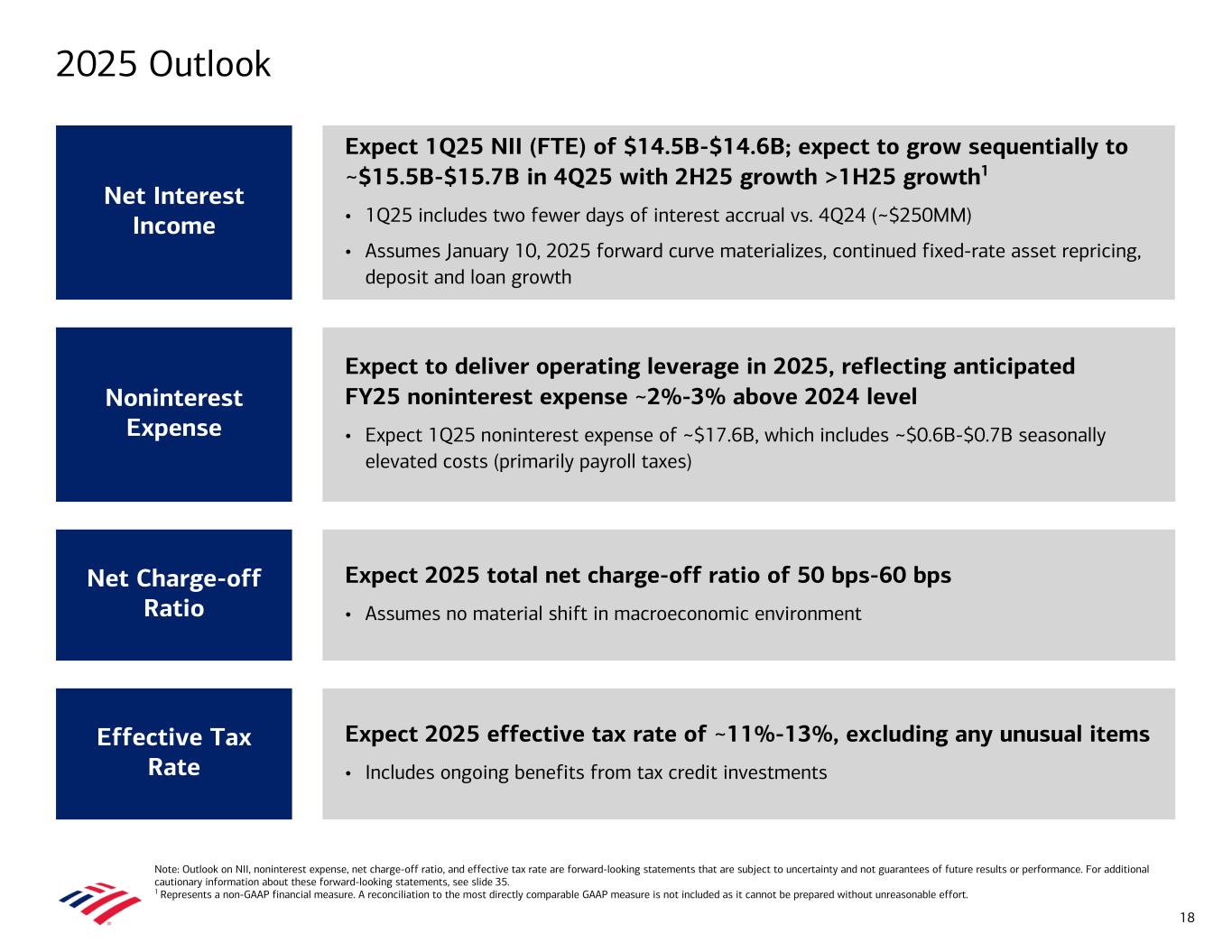

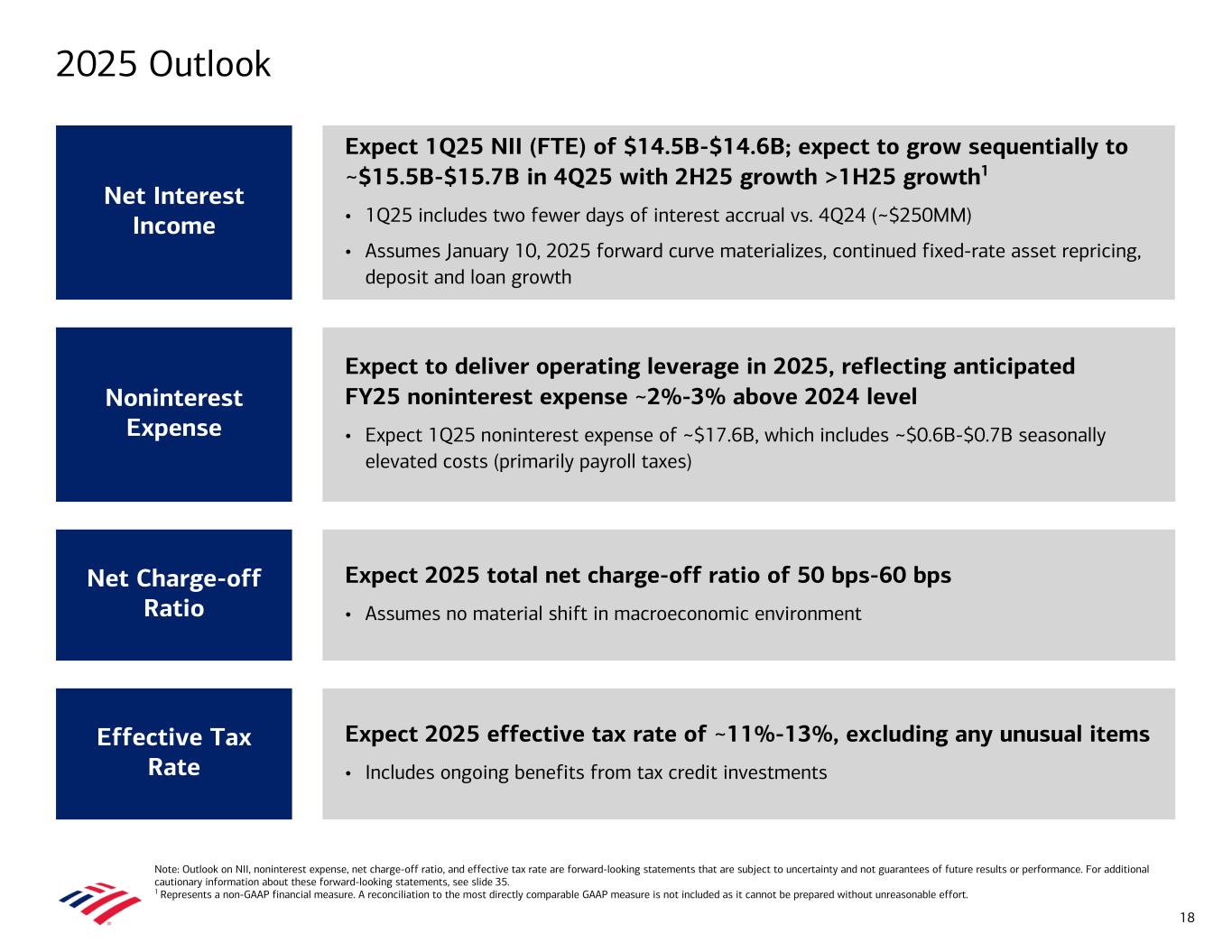

Expect 2025 total net charge-off ratio of 50 bps-60 bps • Assumes no material shift in macroeconomic environment Expect to deliver operating leverage in 2025, reflecting anticipated FY25 noninterest expense ~2%-3% above 2024 level • Expect 1Q25 noninterest expense of ~$17.6B, which includes ~$0.6B-$0.7B seasonally elevated costs (primarily payroll taxes) Expect 1Q25 NII (FTE) of $14.5B-$14.6B; expect to grow sequentially to ~$15.5B-$15.7B in 4Q25 with 2H25 growth >1H25 growth1 • 1Q25 includes two fewer days of interest accrual vs. 4Q24 (~$250MM) • Assumes January 10, 2025 forward curve materializes, continued fixed-rate asset repricing, deposit and loan growth 2025 Outlook 18 Net Interest Income Noninterest Expense Net Charge-off Ratio Effective Tax Rate Expect 2025 effective tax rate of ~11%-13%, excluding any unusual items • Includes ongoing benefits from tax credit investments Note: Outlook on NII, noninterest expense, net charge-off ratio, and effective tax rate are forward-looking statements that are subject to uncertainty and not guarantees of future results or performance. For additional cautionary information about these forward-looking statements, see slide 35. 1 Represents a non-GAAP financial measure. A reconciliation to the most directly comparable GAAP measure is not included as it cannot be prepared without unreasonable effort.

Additional Presentation Information

Commercial Real Estate Loans 6% of Total Loans and Leases 20 Geographic Distribution ($B) $14.7 22% $13.7 21% $11.3 17% $7.7 12% $5.5 8% $6.1 9% Northeast California Southeast Southwest Midwest Midsouth Northwest Other Non-U.S. $15.1 23%$13.2 20% $11.0 17% $5.6 9% $4.7 7% $13.2 20% Office Industrial / Warehouse Multi-family rental Shopping centers / Retail Hotel / Motels Multi-use Residential Other ~$66B Distribution by Property Type ($B) $2.2 3% $2.0 3% $2.5 4% $0.9 1% $2.2 3% • ~75% Class A property type • ~55% origination LTV • ~11% NPL to loans • $5.1B reservable criticized exposure, with ~85% LTV1 • 2H24 NCOs of $0.3B, down 46% vs. 1H24 Note: Amounts may not total due to rounding. 1 Based on properties appraised between January 1, 2024, and December 31, 2024. Office ~$66B

• Deposits in excess of loans were $870B in 4Q24 • Excess deposits stored in cash and investment securities – 54% cash and AFS and 46% HTM in 4Q24 – Cash levels of $290B remained well above pre-pandemic ($162B in 4Q19) • AFS securities mostly hedged with floating rate swaps, which substantially eliminates regulatory capital impacts; duration less than 0.5 years • HTM securities book has declined $125B since peaking at $683B in 3Q21; down $36B vs. 4Q23 and $9B vs. 3Q24 – MBS1 of $430B down $9B, and U.S. Treasuries and other securities of $129B flat vs. 3Q24 • Blended cash and securities yield is 146 bps above deposit rate paid 4Q19 4Q21 4Q24 $0.5T $2.5T 216 675 568 559 256 308 325 359 162 348 296 290 4Q19 4Q24 21 3.40% 1.94% Cash & securities yield Total deposit rate paid 4Q19 4Q24 0.00% 2.00% 4.00% Managing Excess Deposits Deposits in Excess of Loans (EOP) Cash and Securities Portfolios ($B)1 Cash & Securities Yield vs. Deposit Rate Paid 2 $451B $1,085B $870B Deposits Loans HTM securities AFS & other securities Cash & cash equivalentsDeposits in excess of loans 4Q21 4Q21 $1,207 $1,331 $634 Note: Amounts may not total due to rounding. 1 HTM stands for held-to-maturity. AFS stands for available-for-sale. MBS stands for mortgage-backed securities. 2 Yields based on average balances. Yield on cash represents yield on interest-bearing deposits with the Federal Reserve, non-U.S. central banks, and other banks. $1,189

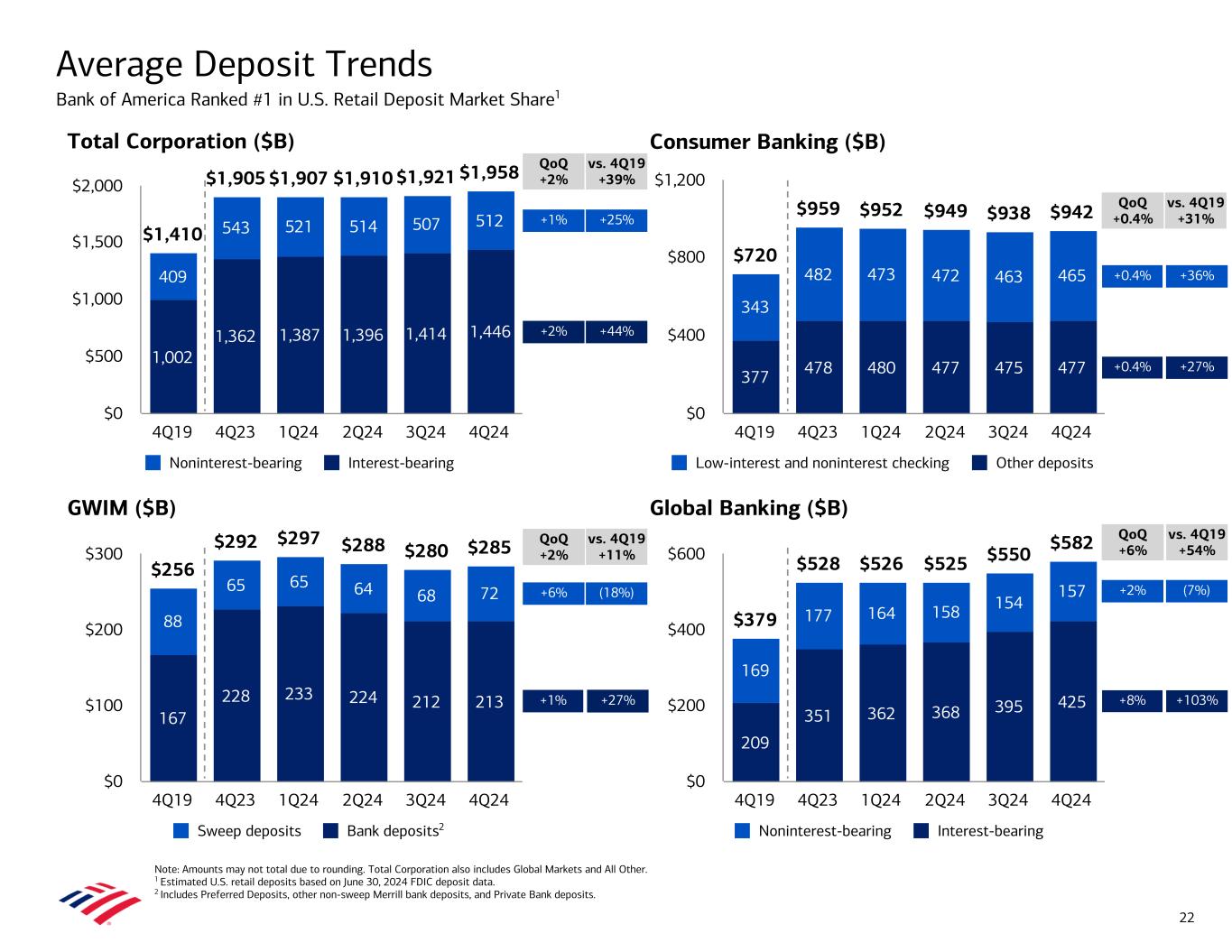

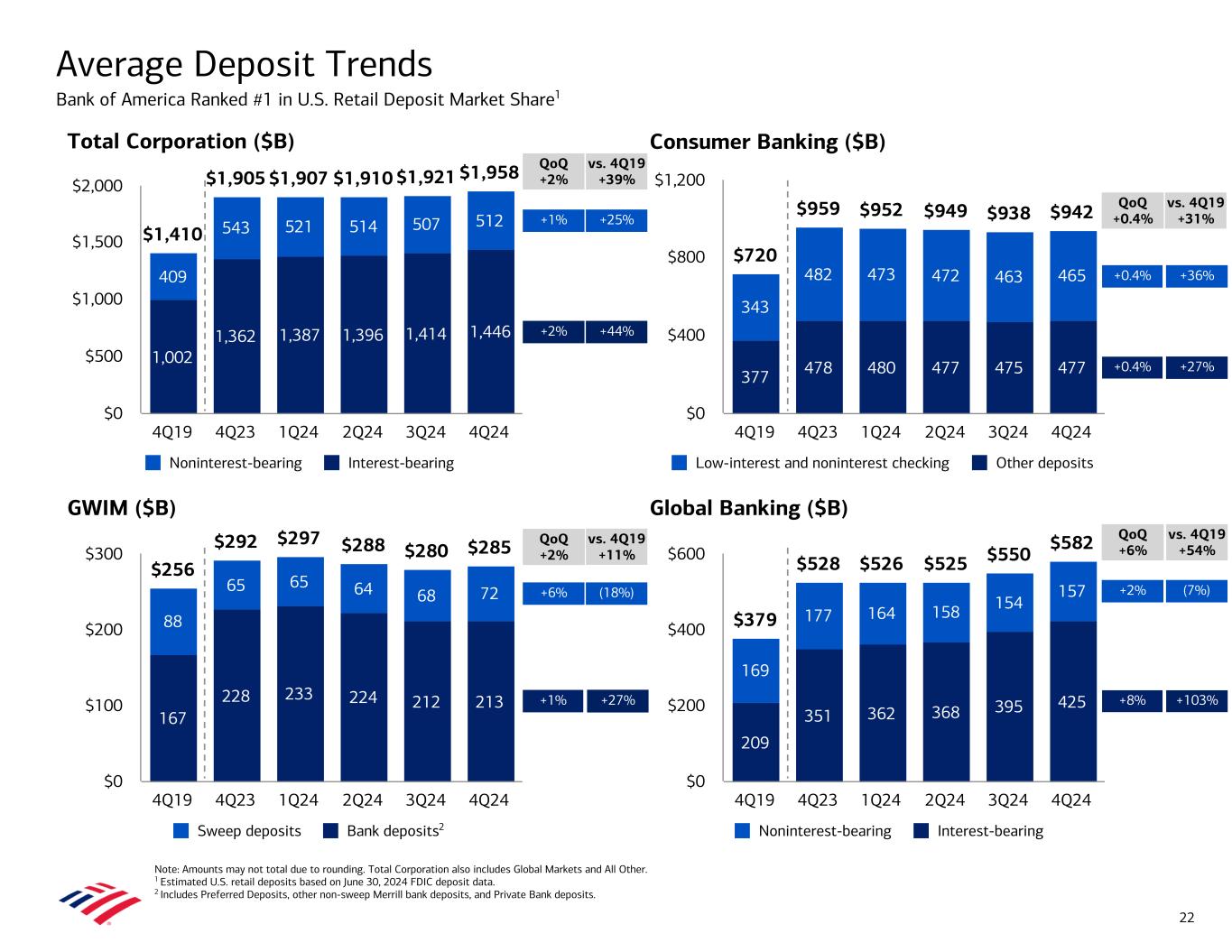

Consumer Banking ($B) GWIM ($B) Global Banking ($B) Total Corporation ($B) Average Deposit Trends Bank of America Ranked #1 in U.S. Retail Deposit Market Share1 Note: Amounts may not total due to rounding. Total Corporation also includes Global Markets and All Other. 1 Estimated U.S. retail deposits based on June 30, 2024 FDIC deposit data. 2 Includes Preferred Deposits, other non-sweep Merrill bank deposits, and Private Bank deposits. $256 $292 $297 $288 $280 $285 167 228 233 224 212 213 88 65 65 64 68 72 Sweep deposits Bank deposits 4Q19 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $100 $200 $300 $1,410 $1,905 $1,907 $1,910 $1,921 $1,958 1,002 1,362 1,387 1,396 1,414 1,446 409 543 521 514 507 512 Noninterest-bearing Interest-bearing 4Q19 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $500 $1,000 $1,500 $2,000 $379 $528 $526 $525 $550 $582 209 351 362 368 395 425 169 177 164 158 154 157 Noninterest-bearing Interest-bearing 4Q19 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $200 $400 $600 +1% +6% +2% +1% QoQ +2% QoQ +2% QoQ +0.4% +8% +2% +0.4% QoQ +6% 22 $720 $959 $952 $949 $938 $942 377 478 480 477 475 477 343 482 473 472 463 465 Low-interest and noninterest checking Other deposits 4Q19 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $400 $800 $1,200 +0.4% +44% +25% vs. 4Q19 +39% +27% (18%) vs. 4Q19 +11% +27% +36% vs. 4Q19 +31% +103% (7%) vs. 4Q19 +54% 2

Supplemental Business Segment Trends

Total Expense ($B) and Efficiency Total Revenue ($B) Average Deposits ($B) Consumer Investment Assets ($B)2 and Accounts (MM) Average Loans and Leases ($B) Consumer Banking Trends Note: Amounts may not total due to rounding. 1 See slide 34 for business leadership sources. 2 End of period. Consumer investment assets include client brokerage assets, deposit sweep balances, Bank of America, N.A. brokered CDs, and AUM in Consumer Banking. $10.3 $10.2 $10.2 $10.4 $10.6 8.3 8.2 8.1 8.3 8.5 2.1 2.0 2.1 2.1 2.2 Net interest income Noninterest income 4Q23 1Q24 2Q24 3Q24 4Q24 $0.0 $4.0 $8.0 $12.0 $5.2 $5.5 $5.5 $5.5 $5.6 51% 54% 54% 53% 53% Noninterest expense Efficiency ratio 4Q23 1Q24 2Q24 3Q24 4Q24 $0.0 $2.0 $4.0 $6.0 40% 50% 60% 70% $959 $952 $949 $938 $942 478 480 477 475 477 482 473 472 463 465 Other deposits Low-interest and noninterest checking 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $250 $500 $750 $1,000 $313 $313 $312 $314 $316 116 116 115 115 115 97 96 96 97 97 55 56 56 56 57 21 21 21 22 22 23 24 24 25 25 Residential mortgage Consumer credit card Vehicle lending Home equity Small business / other 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $100 $200 $300 $400 24 $424 $456 $476 $497 $518 3.8 3.9 3.9 3.9 3.9 Assets Accounts 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $200 $400 $600 2.0 3.0 4.0 5.0 6.0 Business Leadership1 • No. 1 in estimated U.S. Retail Deposits(A) • No. 1 Small Business Lender(B) • Best Bank in North America(C) • Best Bank in the U.S.(C) • Certified by J.D. Power for Outstanding Client Satisfaction with Customer Financial Health Support – Banking & Payments(D) • Merrill Edge Self-Directed No. 1 Overall Client Experience (7th consecutive year)(E)

889 998 951 970 900 4Q23 1Q24 2Q24 3Q24 4Q24 0 500 1,000 1,500 Home Equity1 New Originations ($B)5 Consumer Credit Update 1 Includes loan production within Consumer Banking and GWIM. Consumer credit card balances include average balances of $3.5B, $3.4B, and $3.4B in 4Q24, 3Q24, and 4Q23, respectively, within GWIM. 2 Calculated as the difference between total revenue, net of interest expense, and net credit losses divided by average loans. 3 Digitally-enabled sales represent percentage of sales initiated and / or booked via our digital platforms. CVL excludes Dealer sales. 4 Represents Consumer Banking only. 5 Amounts represent the unpaid principal balance of loans and in the case of home equity, the principal amount of the total line of credit. Consumer Vehicle Lending4 New Originations ($B) Consumer Credit Card1 New Accounts (K) 25 Residential Mortgage1 New Originations ($B)5 Key Stats 4Q23 3Q24 4Q24 Average outstandings ($B) 100.4 99.9 100.9 NCO ratio 3.07% 3.70% 3.79% Risk-adjusted margin2 7.18% 7.22% 7.12% Average line FICO 775 778 778 Digitally-enabled sales3 68% 73% 76% $6.1 $6.6 $6.0 $7.9 $6.8 4Q23 1Q24 2Q24 3Q24 4Q24 $0.0 $2.5 $5.0 $7.5 $10.0 Key Stats 4Q23 3Q24 4Q24 Average outstandings ($B) 55.5 56.0 56.8 NCO ratio 0.37% 0.43% 0.50% Average booked FICO 799 801 802 Digitally-enabled sales3 88% 89% 89% $3.9 $3.4 $5.7 $5.3 $6.6 4Q23 1Q24 2Q24 3Q24 4Q24 $0.0 $2.5 $5.0 $7.5 Key Stats 4Q23 3Q24 4Q24 Average outstandings ($B)4 116.3 114.9 114.8 NCO ratio4 0.03% 0.01% 0.01% Average FICO 775 772 775 Average booked loan-to-value (LTV) 72% 72% 71% Digitally-enabled sales3 78% 76% 78% $2.3 $1.9 $2.4 $2.3 $2.3 4Q23 1Q24 2Q24 3Q24 4Q24 $0.0 $1.0 $2.0 $3.0 Key Stats 4Q23 3Q24 4Q24 Average outstandings ($B)4 21.3 21.6 21.8 NCO ratio4 (0.03%) 0.00% 0.00% Average FICO 788 791 793 Average booked combined LTV 57% 55% 55% Digitally-enabled sales3 58% 52% 49%

Erica® Active Users and Interactions6 Checks vs. Zelle® Sent Transactions (MM) Digitally-Enabled Sales5Digital Users2 and Households3 Digital Channel Usage4 1,461 1,579 1,397 1,789 49% 49% 49% 61% Digital unit sales (K) Digital as a % of total sales 4Q21 4Q22 4Q23 4Q24 0 500 1,000 1,500 2,000 0% 25% 50% 75% 100% 2,740 3,046 3,339 3,865 Digital channel usage (MM) 4Q21 4Q22 4Q23 4Q24 1,000 2,000 3,000 4,000 41 44 46 48 54 56 57 58 70% 73% 75% 78% Active users (MM) Verified users (MM) Household adoption % 4Q21 4Q22 4Q23 4Q24 20 30 40 50 60 50% 60% 70% 80% 90% 100% Client Engagement Person-to-Person Payments (Zelle®)7 Digital Volumes 218 273 342 424 $65 $81 $101 $127 Transactions (MM) Volume ($B) 4Q21 4Q22 4Q23 4Q24 0 150 300 450 $0 $50 $100 $150 Consumer1 Digital Update 1 Includes all households / relationships with Consumer platform activity, except where otherwise noted. 2 Digital active users represents Consumer and Merrill mobile and / or online 90-day active users. Verified users represents Consumer and Merrill users with a digital identification and password. 3 Household adoption represents households with consumer bank login activities in a 90-day period, as of November for each quarter presented. 4 Digital channel usage represents the total number of desktop and mobile banking sessions on the Consumer Banking platform. 5 Digitally-enabled sales represent sales initiated and / or booked via our digital platforms. 6 Erica engagement represents mobile and online activity across client facing platforms powered by Erica. 7 Includes Bank of America person-to-person payments sent and received through e-mail or mobile identification. Zelle® users represent 90-day active users. 15.8 18.2 21.5 23.7 users (MM) 26 Digital Adoption 122.9 146.0 170.0 171.5 Erica® interactions (MM) 4Q21 4Q22 4Q23 4Q24 0.0 50.0 100.0 150.0 200.0 129 115 105 95 144 178 220 270 Checks written Zelle® sent transactions 4Q21 4Q22 4Q23 4Q24 0 100 200 300 ~2.8x 14.0 16.5 18.5 19.7 users (MM)

Note: Amounts may not total due to rounding. 1 See slide 34 for business leadership sources. 2 End of period. Loans and leases includes margin receivables which are classified in customer and other receivables on the Consolidated Balance Sheet. 3 Managed deposits in investment accounts of $45B, $37B, $36B, $36B, and $39B for 4Q24, 3Q24, 2Q24, 1Q24, and 4Q23, respectively, are included in both AUM and Deposits. Total client balances only include these balances once. Average Deposits ($B) Global Wealth & Investment Management Trends Business Leadership1 • No. 1 on Forbes' Top Women Wealth Advisors (2024), Best-in-State Wealth Management Teams (2024), and Top Next Generation Advisors (2024) • No. 1 on Barron's Top 1200 Wealth Financial Advisors List (2024) • No. 1 on the Financial Planning's 'Top 40 Advisors Under 40' List (2024) • No. 1 in Managed Personal Trust AUM(B) • Best Private Bank (U.S.); Best Private Bank for Philanthropy and Family Office Services(F) • Best Private Bank for Family Offices, Philanthropy Services, and Next Generation (North America)(G) • Digital Innovation Award for Digital Presence: A Robust Ecosystem for Client Acquisition(H) Average Loans and Leases ($B) Total Revenue ($B) Client Balances ($B)2,3 $5.2 $5.6 $5.6 $5.8 $6.0 1.7 1.8 1.7 1.7 1.8 3.0 3.2 3.3 3.5 3.6 0.6 0.6 0.6 0.6 0.6 Net interest income Asset management fees Brokerage / other 4Q23 1Q24 2Q24 3Q24 4Q24 $0.0 $2.5 $5.0 $7.5 1,618 1,730 1,759 1,861 1,882 1,689 1,759 1,780 1,857 1,888 300 298 281 283 292 222 223 228 230 234$3,789 $3,973 $4,012 $4,194 $4,252 AUM Brokerage / other Deposits Loans and leases 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $219 $219 $223 $225 $229 108 108 108 109 109 49 48 49 50 51 60 59 62 64 65 Consumer real estate Securities-based lending Custom lending Credit card 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $50 $100 $150 $200 $250 $292 $297 $288 $280 $285 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $100 $200 $300 27

Erica® Interactions (MM)5 1.8 2.2 2.9 3.2 4Q21 4Q22 4Q23 4Q24 0.0 1.0 2.0 3.0 4.0 Person-to-Person Payments (Zelle®)6 Check Deposits7 eDelivery4Digital Households / Relationships2 Digital Channel Adoption3 75% 77% 79% 81% 4Q21 4Q22 4Q23 4Q24 0% 25% 50% 75% 100% 54% 57% 60% 63% 72% 74% 76% 77% Mobile adoption Online adoption 4Q21 4Q22 4Q23 4Q24 0% 25% 50% 75% 100% 674 690 728 750 79% 82% 84% 85% Digital households / relationships (K) Digital adoption % 4Q21 4Q22 4Q23 4Q24 400 500 600 700 800 60% 70% 80% 90% 100% Client Engagement Digital Volumes Global Wealth & Investment Management Digital Update 28 Digital Adoption1 2.0 2.7 3.5 4.4 $1.2 $1.5 $2.1 $2.7 Transactions (MM) Volume ($B) 4Q21 4Q22 4Q23 4Q24 0.0 1.0 2.0 3.0 4.0 5.0 $0.0 $1.0 $2.0 $3.0 $4.0 64% 66% 67% 69% 11% 9% 8% 7% 26% 25% 25% 24% Digital ATM Physical 4Q21 4Q22 4Q23 4Q24 0% 25% 50% 75% 100% Note: Amounts may not total due to rounding. 1 Digital Adoption is the percentage of digitally active Merrill primary households ($250K+ in investable assets within the enterprise) and digitally active Private Bank core relationships ($3MM+ in total balances). Merrill excludes Stock Plan and Banking-only households. Private Bank includes third-party activities (effective 1Q23) and excludes Irrevocable Trust-only relationships, Institutional Philanthropic relationships, and exiting relationships. 2 Data as of November for 4Q21. 4Q22, 4Q23, and 4Q24 as of November for Private Bank and as of December for Merrill. 3 Digital channel adoption represents the percentage of desktop and mobile banking engagement, as of November for 4Q21 and 4Q22. 4Q23 and 4Q24 as of November for Private Bank and as of December for Merrill. 4 GWIM eDelivery percentage includes Merrill Digital Households (excluding Stock Plan, Banking-only households, Retirement-only, and 529-only) and Private Bank relationships that receive statements digitally, as of November for each quarter presented. 5 Erica interactions represent mobile and online activity across client-facing platforms powered by Erica. 6 Includes Bank of America person-to-person payments sent and received through e-mail or mobile identification. 7 Digital check deposits include mobile check deposits and remote deposit operations. As of November for Private Bank and as of December for Merrill for each quarter presented.

Global Banking Trends Note: Amounts may not total due to rounding. 1 See slide 34 for business leadership sources. 2 Global Banking and Global Markets share in certain deal economics from investment banking, loan origination activities, and sales and trading activities. 3 Total Corporation IB fees excludes self-led deals. Self-led deals of $31MM, $34MM, $50MM, $53MM, and $32MM for 4Q24, 3Q24, 2Q24, 1Q24, and 4Q23, respectively, are embedded within Debt, Equity, and Advisory. 4 Advisory includes fees on debt and equity advisory and mergers and acquisitions. Average Deposits ($B)Business Leadership1 • World’s Most Innovative Bank – 2024(F) • World’s Best Bank for Trade Finance and for FX payments; North America’s Best Digital Bank, Best Bank for Sustainable Finance, and Best Bank for Small to Medium-sized Enterprises(I) • 2023 Best Bank for Cash & Liquidity Management; Best Mobile Technology Solution for Treasury: CashPro App(J) • Best Global Bank for Transaction Banking (overall award) and Best Global Bank for Collections(F) • Model Bank: Reimagining Trade & Supply Chain Finance (2024) for CashPro Supply Chain Solutions(K) • Relationships with 78% of the Global Fortune 500; 95% of the U.S. Fortune 1,000 (2024) Average Loans and Leases ($B) Total Revenue ($B)2 Total Corporation IB Fees ($MM)3 $5.9 $6.0 $6.1 $5.8 $6.1 3.4 3.5 3.3 3.2 3.3 0.7 0.8 0.8 0.8 1.0 0.7 0.8 0.8 0.8 0.8 1.1 0.9 1.2 1.0 1.0 Net interest income IB fees Service charges All other income 4Q23 1Q24 2Q24 3Q24 4Q24 $0.0 $2.5 $5.0 $7.5 589 885 880 780 765 199 363 357 270 364389 373 374 387 556 $1,145 $1,568 $1,561 $1,403 $1,654 Debt Equity Advisory 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $600 $1,200 $1,800 195 196 198 197 196 167 165 162 162 167 $375 $374 $373 $371 $375 Commercial Corporate Business Banking 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $100 $200 $300 $400 4 $528 $526 $525 $550 $582 Noninterest-bearing Interest-bearing 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $200 $400 $600 29 33% 31% 30% 28% 27% 67% 69% 70% 72% 73%

1 Digital adoption is the percentage of clients digitally active. Digital active clients represents 90-day active clients across CashPro and BA360 platforms. Data as of November for each quarter presented. Relationship clients defined as clients meeting revenue threshold for Global Commercial Banking and Business Banking, and all clients in Global Corporate and Investment Banking. 2 Includes CashPro, BA360, and Global Card Access. BA360 as of November for each quarter presented. 3 Erica technology integrated into CashPro Chat starting in August 2023. 4 Includes CashPro alert volume and CashPro online reports and statements scheduled, BA360 90-day Erica Insights and alerts, and Global Card Access alert volume for online and mobile. BA360 as of November for each quarter presented. 5 Percent of U.S. Dollar Investment Grade Debt Global Capital Markets investor bond orders received and fully processed digitally for Global Banking and Global Markets clients. Capital Markets Digital Bond Orders (%)5 Erica® Interactions on CashPro® Chat (K)3 Proactive Alerts and Insights (MM)2,4 13% 20% 36% 4Q22 4Q23 4Q24 0% 10% 20% 30% 40% 18.0 19.2 21.8 23.8 4Q21 4Q22 4Q23 4Q24 0.0 6.0 12.0 18.0 24.0 30.0 29.7 32.5 32.5 1Q24 2Q24 3Q24 4Q24 0.0 10.0 20.0 30.0 40.0 CashPro® App PaymentsBusiness Adoption % Mobile App Sign-ins (K)2 $133 $181 $245 $284 2.6 3.2 3.7 4.5 Value ($B) Volume (MM) 4Q21 4Q22 4Q23 4Q24 $0 $100 $200 $300 0.0 2.0 4.0 6.0 8.0 913 1,403 1,676 2,119 4Q21 4Q22 4Q23 4Q24 0 500 1,000 1,500 2,000 2,500 75% 75% 75% 75% 4Q21 4Q22 4Q23 4Q24 0% 25% 50% 75% 100% Client Engagement Digital Volumes Global Banking Digital Update 30 Digital Adoption1 86%Relationship clients:

Global Markets Trends and Revenue Mix Note: Amounts may not total due to rounding. S&T stands for sales and trading. 1 See slide 34 for business leadership sources. 2 Represents a non-GAAP financial measure. Reported Global Markets revenue was $21.8B for 2024. Global Markets revenue ex. net DVA was $21.9B for 2024. Reported sales and trading revenue was $18.8B, $17.4B, $16.5B, and $15.2B for 2024, 2023, 2022, and 2021, respectively. Reported FICC sales and trading revenue was $11.4B, $10.9B, $9.9B, and $8.8B for 2024, 2023, 2022, and 2021, respectively. Reported Equities sales and trading revenue was $7.4B, $6.5B, $6.6B, and $6.4B for 2024, 2023, 2022, and 2021, respectively. Revenue mix percentages are the same including and excluding net DVA. See note F on slide 33 and slide 36 for important presentation information. 3 Macro includes currencies, interest rates, and commodities products. 4 See note G on slide 33 for definition of VaR. 2024 Global Markets Revenue Mix (excl. net DVA)2 Business Leadership1 • World's Best Bank for Markets(I) • World's Best Bank for FX Payments(I) • Equity Derivatives House of the Year(L) • No. 1 All-America Trading(M) • No. 2 Top Global Research Firm(M) • Rising Issuer Award(N) • Best Non-Traditional Index Provider(N) 2024 Total FICC S&T Revenue Mix (excl. net DVA)2 Total Sales and Trading Revenue (excl. net DVA) ($B)2 Average Trading-Related Assets ($B) and VaR ($MM)4 $15.2 $16.5 $17.6 $18.9 8.8 9.9 11.1 11.5 6.4 6.6 6.5 7.5 FICC Equities 2021 2022 2023 2024 $0.0 $5.0 $10.0 $15.0 $20.0 $549 $601 $618 $634 $73 $108 $83 $81 Avg. trading-related assets Avg. VaR 2021 2022 2023 2024 $0 $200 $400 $600 $800 $0 $50 $100 $150 $200 63% 37% U.S. / Canada International 45% 55% Credit / Other Macro 31 3

A Global Liquidity Sources (GLS) include cash and high-quality, liquid, unencumbered securities, inclusive of U.S. government securities, U.S. agency securities, U.S. agency MBS, and a select group of non-U.S. government and supranational securities, and other investment-grade securities, and are readily available to meet funding requirements as they arise. It does not include Federal Reserve Discount Window or Federal Home Loan Bank borrowing capacity. Transfers of liquidity among legal entities may be subject to certain regulatory and other restrictions. B In 4Q23, the FDIC imposed a special assessment to recover losses to the Deposit Insurance Fund arising from the protection of uninsured depositors of Silicon Valley Bank and Signature Bank associated with their closures. Accordingly, the Corporation recorded pretax noninterest expense of $2.1B in 4Q23 for its estimated assessment amount. Additionally, the Corporation recorded a net pretax charge of $1.6B in 4Q23 to noninterest income related to interest rate swaps used in cash flow hedges of certain loans that are indexed to the Bloomberg Short- Term Bank Yield Index (BSBY) following the 4Q23 announcement that BSBY would permanently cease effective November 15, 2024. The Corporation has presented certain non-GAAP financial measures (labeled as “adj.” in the tables below) that exclude the impacts of the FDIC special assessment (FDIC SA) and / or the BSBY charge, and has provided a reconciliation of these non-GAAP financial measures as set forth below. The Corporation believes the use of non-GAAP financial measures adjusting for the impact of the FDIC SA and the BSBY charge provide additional information for evaluating its results of operations and comparing its operational performance between periods by excluding these impacts that may not be reflective of its underlying operating performance. C Reserve build (or release) is calculated by subtracting net charge-offs for the period from the provision for credit losses recognized in that period. The period-end allowance, or reserve, for credit losses reflects the beginning of the period allowance adjusted for net charge-offs recorded in that period plus the provision for credit losses and other valuation accounts recognized in that period. Notes 32 Reconciliation ($ in billions, except per share data) 2023 Reported 4Q23 Reported FDIC SA 2023 adj. FDIC SA 4Q23 adj. FDIC SA BSBY Charge 2023 adj. BSBY Charge 4Q23 adj. BSBY Charge FDIC SA & BSBY Charge 2023 adj. FDIC SA & BSBY Charge 4Q23 adj. FDIC SA & BSBY Charge Noninterest income $41.7 $8.0 $— $41.7 $8.0 ($1.6) $43.2 $9.6 ($1.6) $43.3 $9.6 Total revenue, net of interest expense 98.6 22.0 — 98.6 22.0 (1.6) 100.2 23.5 (1.6) 100.2 23.5 Noninterest expense 65.8 17.7 2.1 63.8 15.6 — 65.8 17.7 2.1 63.8 15.6 Income before income taxes 28.3 3.1 (2.1) 30.4 5.2 (1.6) 29.9 4.7 (3.7) 32.0 6.8 Pretax, pre-provision income1 32.7 4.2 (2.1) 34.8 6.3 (1.6) 34.3 5.8 (3.7) 36.4 7.9 Income tax expense (benefit) 1.8 — (0.5) 2.3 0.5 (0.4) 2.2 0.4 (0.9) 2.7 0.9 Net income 26.5 3.1 (1.6) 28.1 4.7 (1.2) 27.7 4.3 (2.8) 29.3 5.9 Net income applicable to common shareholders 24.9 2.8 (1.6) 26.5 4.5 (1.2) 26.1 4.1 (2.8) 27.7 5.6 Diluted earnings per share2 $3.08 $0.35 ($0.20) $3.27 $0.55 ($0.15) $3.23 $0.50 ($0.35) $3.42 $0.70 Reconciliation of return metrics and efficiency ratio ($ in billions) 2023 Reported 4Q23 Reported 2023 FDIC SA & BSBY Charge 2023 adj. FDIC SA & BSBY Charge 4Q23 FDIC SA & BSBY Charge 4Q23 adj. FDIC SA & BSBY Charge Return on average assets3 0.84 % 0.39 % (9) bps 0.93 % (34) bps 0.73 % Return on average common shareholders’ equity4 9.8 % 4.3 % (109) bps 10.8 % (425) bps 8.6 % Return on average tangible common shareholders’ equity5 13.5 % 5.9 % (151) bps 15.0 % (582) bps 11.7 % Efficiency ratio6 67 % 81 % 314 bps 64 % 1,430 bps 66 % Note: Amounts may not total due to rounding. 1 Represents a non-GAAP financial measure. For more information and a reconciliation to GAAP, see note D on slide 33. For important presentation information, see slide 36. 2 Calculated as net income applicable to common shareholders divided by average diluted common shares. Average diluted common shares of 8,081MM and 8,062MM for 2023 and 4Q23. 3 Calculated as net income divided by average assets. Average assets were $3,154B and $3,213B for 2023 and 4Q23. 4 Calculated as net income applicable to common shareholders divided by average common shareholders’ equity. Average common shareholders’ equity was $255B and $260B for 2023 and 4Q23. 5 Calculated as net income applicable to common shareholders divided by average tangible common shareholders’ equity. Average tangible common shareholders’ equity was $185B and $190B for 2023 and 4Q23. Average tangible common shareholders’ equity represents a non-GAAP financial measure. For important presentation information on non-GAAP measures, see slide 36. 6 Calculated as noninterest expense divided by revenue, net of interest expense.

D Pretax, pre-provision income (PTPI) at the consolidated level is a non-GAAP financial measure calculated by adjusting consolidated pretax income to add back provision for credit losses. Similarly, PTPI at the segment level is a non-GAAP financial measure calculated by adjusting the segments’ pretax income to add back provision for credit losses. Management believes that PTPI (both at the consolidated and segment level) is a useful financial measure as it enables an assessment of the Corporation’s ability to generate earnings to cover credit losses through a credit cycle as well as provides an additional basis for comparing the Corporation's results of operations between periods by isolating the impact of provision for credit losses, which can vary significantly between periods. See reconciliation below. E Interest rate sensitivity as of December 31, 2024, reflects the potential pretax impact to forecasted net interest income over the next 12 months from December 31, 2024, resulting from an instantaneous parallel shock to the market-based forward curve. As part of our asset and liability management activities, we use securities, certain residential mortgages, and interest rate and foreign exchange derivatives in managing interest rate sensitivity. The sensitivity analysis assumes that we take no action in response to this rate shock and does not assume any change in other macroeconomic variables normally correlated with changes in interest rates. The sensitivity analysis incorporates potential movements in customer behavior that could result in changes in both total customer deposit balances and balance mix in various interest rate scenarios. In lower rate scenarios, the analysis assumes that a portion of higher-yielding deposits or market-based funding are replaced with low-cost or noninterest-bearing deposits. F Revenue for all periods included net debit valuation adjustments (DVA) on derivatives, as well as amortization of own credit portion of purchase discount and realized DVA on structured liabilities. Net DVA gains (losses) were ($19MM), ($8MM), and ($132MM) for 4Q24, 3Q24, and 4Q23, respectively, and ($113MM), ($236MM), $20MM, and ($54MM) for 2024, 2023, 2022, and 2021, respectively. Net DVA gains (losses) included in FICC revenue were ($18MM), ($8MM), and ($127MM) for 4Q24, 3Q24, and 4Q23, respectively, and ($97MM), ($226MM), $19MM, and ($49MM) for 2024, 2023, 2022, and 2021, respectively. Net DVA gains (losses) included in Equities revenue were ($1MM), $0, and ($5MM) for 4Q24, 3Q24, and 4Q23, respectively, and ($16MM), ($10MM), $1MM, and ($5MM) for 2024, 2023, 2022, and 2021, respectively. G VaR model uses a historical simulation approach based on three years of historical data and an expected shortfall methodology equivalent to a 99% confidence level. Using a 95% confidence level, average VaR was $38MM, $39MM, and $42MM for 4Q24, 3Q24, and 4Q23 respectively, and $42MM, $41MM, $36MM, and $28MM for 2024, 2023, 2022, and 2021, respectively. Notes $ Millions 4Q24 3Q24 4Q23 Pretax Income (GAAP) Provision for Credit Losses (GAAP) Pretax, Pre-provision Income Pretax Income (GAAP) Provision for Credit Losses (GAAP) Pretax, Pre-provision Income Pretax Income (GAAP) Provision for Credit Losses (GAAP) Pretax, Pre-provision Income Consumer Banking $ 3,761 $ 1,254 $ 5,015 $ 3,582 $ 1,302 $ 4,884 $ 3,690 $ 1,405 $ 5,095 Global Wealth & Investment Management 1,561 3 1,564 1,415 7 1,422 1,359 (26) 1,333 Global Banking 2,950 190 3,140 2,614 229 2,843 3,386 (239) 3,147 Global Markets 1,325 10 1,335 2,180 7 2,187 877 (60) 817 All Other (2,335) (5) (2,340) (2,320) (3) (2,323) (6,043) 24 (6,019) Total Corporation $ 7,108 $ 1,452 $ 8,560 $ 7,324 $ 1,542 $ 8,866 $ 3,124 $ 1,104 $ 4,228 33

Business Leadership Sources (A) Estimated U.S. retail deposits based on June 30, 2024 FDIC deposit data. (B) FDIC, 3Q24. (C) Global Finance, April 2024. (D) J.D. Power 2024 Financial Health Support CertificationSM is based on exceeding customer experience benchmarks using client surveys and a best practices verification. For more information, visit jdpower.com/awards.* (E) StockBrokers.com 2024 Annual Broker Review.* (F) Global Finance, 2024. (G) Professional Wealth Management, 2024. (H) Money Management Institute (MMI)/Barron’s Digital Innovation Awards, 2024. (I) Euromoney, 2024. (J) Treasury Management International, 2024. (K) Celent, 2024. (L) Risk Awards, 2025. (M) Extel, 2024. (N) SPi, 2024. 34 * Website content is not incorporated by reference into this presentation.

Forward-Looking Statements Bank of America Corporation (the Corporation) and its management may make certain statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “anticipates,” “targets,” “expects,” “hopes,” “estimates,” “intends,” “plans,” “goals,” “believes,” “continue” and other similar expressions or future or conditional verbs such as “will,” “may,” “might,” “should,” “would” and “could.” Forward-looking statements represent the Corporation’s current expectations, plans or forecasts of its future results, revenues, liquidity, net interest income, provision for credit losses, expenses, efficiency ratio, capital measures, strategy, deposits, assets, and future business and economic conditions more generally, and other future matters. These statements are not guarantees of future results or performance and involve certain known and unknown risks, uncertainties and assumptions that are difficult to predict and are often beyond the Corporation’s control. Actual outcomes and results may differ materially from those expressed in, or implied by, any of these forward-looking statements. You should not place undue reliance on any forward-looking statement and should consider the following uncertainties and risks, as well as the risks and uncertainties more fully discussed under Item 1A. Risk Factors of the Corporation’s 2023 Annual Report on Form 10-K and in any of the Corporation’s subsequent Securities and Exchange Commission filings: the Corporation’s potential judgments, orders, settlements, penalties, fines and reputational damage, which are inherently difficult to predict, resulting from pending, threatened or future litigation and regulatory investigations, proceedings and enforcement actions, of which the Corporation is subject to in the ordinary course of business, including matters related to our processing of unemployment benefits for California and certain other states, the features of our automatic credit card payment service, the adequacy of the Corporation’s anti-money laundering and economic sanctions programs, the processing of electronic payments and related fraud and the rates paid on uninvested cash in investment advisory accounts that is swept into interest-paying bank deposits, which are in various stages; the possibility that the Corporation's future liabilities may be in excess of its recorded liability and estimated range of possible loss for litigation, and regulatory and government actions; the possibility that the Corporation could face increased claims from one or more parties involved in mortgage securitizations; the Corporation’s ability to resolve representations and warranties repurchase and related claims; the risks related to the discontinuation of reference rates, including increased expenses and litigation and the effectiveness of hedging strategies; uncertainties about the financial stability and growth rates of non-U.S. jurisdictions, the risk that those jurisdictions may face difficulties servicing their sovereign debt, and related stresses on financial markets, currencies and trade, and the Corporation’s exposures to such risks, including direct, indirect and operational; the impact of U.S. and global interest rates (including the potential for ongoing adjustments in interest rates), inflation, currency exchange rates, economic conditions, trade policies and tensions, including tariffs and potential significant increases thereto, and potential geopolitical instability; the impact of the interest rate, inflationary, macroeconomic, banking and regulatory environment on the Corporation’s assets, business, financial condition and results of operations; the impact of adverse developments affecting the U.S. or global banking industry, including bank failures and liquidity concerns, resulting in worsening economic and market volatility, and regulatory responses thereto; the possibility that future credit losses may be higher than currently expected due to changes in economic assumptions, customer behavior, adverse developments with respect to U.S. or global economic conditions and other uncertainties, including the impact of supply chain disruptions, inflationary pressures and labor shortages on economic conditions and our business; potential losses related to the Corporation’s concentration of credit risk; the Corporation's ability to achieve its expense targets and expectations regarding revenue, net interest income, provision for credit losses, net charge-offs, effective tax rate, loan growth or other projections; variances to the underlying assumptions and judgments used in estimating banking book net interest income sensitivity; adverse changes to the Corporation’s credit ratings from the major credit rating agencies; an inability to access capital markets or maintain deposits or borrowing costs; estimates of the fair value and other accounting values, subject to impairment assessments, of certain of the Corporation’s assets and liabilities; the estimated or actual impact of changes in accounting standards or assumptions in applying those standards; uncertainty regarding the content, timing and impact of regulatory capital and liquidity requirements; the impact of adverse changes to total loss-absorbing capacity requirements, stress capital buffer requirements and / or global systemically important bank surcharges; the potential impact of actions of the Board of Governors of the Federal Reserve System on the Corporation’s capital plans; the effect of changes in or interpretations of income tax laws and regulations; the impact of implementation and compliance with U.S. and international laws, regulations and regulatory interpretations, including, but not limited to, recovery and resolution planning requirements, Federal Deposit Insurance Corporation assessments, the Volcker Rule, fiduciary standards, derivatives regulations and potential changes to loss allocations between financial institutions and customers, including for losses incurred from the use of our products and services, including electronic payments and payment of checks, that were authorized by the customer but induced by fraud; the impact of failures or disruptions in or breaches of the Corporation’s operations or information systems, or those of third parties, including as a result of cybersecurity incidents; the risks related to the development, implementation, use and management of emerging technologies, including artificial intelligence and machine learning; the risks related to the transition and physical impacts of climate change; our ability to achieve environmental, social and governance goals and commitments or the impact of any changes in the Corporation's sustainability strategy or commitments generally; the impact of uncertain or changing political conditions or any future federal government shutdown and uncertainty regarding the federal government’s debt limit or changes in fiscal, monetary or regulatory policy; the emergence or continuation of widespread health emergencies or pandemics; the impact of natural disasters, extreme weather events, military conflicts (including the Russia / Ukraine conflict, the conflict in the Middle East, the possible expansion of such conflicts and potential geopolitical consequences), terrorism or other geopolitical events; and other matters. Forward-looking statements speak only as of the date they are made, and the Corporation undertakes no obligation to update any forward-looking statement to reflect the impact of circumstances or events that arise after the date the forward-looking statement was made. 35

Important Presentation Information 36 • The information contained herein is preliminary and based on Corporation data available at the time of the earnings presentation. It speaks only as of the particular date or dates included in the accompanying slides. Bank of America does not undertake an obligation to, and disclaims any duty to, update any of the information provided. • The Corporation may present certain metrics and ratios, including year-over-year comparisons of revenue, noninterest expense, and pretax income, excluding certain items (e.g., DVA) that are non-GAAP financial measures. The Corporation believes the use of these non-GAAP financial measures provides additional clarity in understanding its results of operations and trends. For more information about the non-GAAP financial measures contained herein, please see the presentation of the most directly comparable financial measures calculated in accordance with GAAP and accompanying reconciliations in the earnings press release for the quarter and year ended December 31, 2024, and other earnings-related information available through the Bank of America Investor Relations website at: https://investor.bankofamerica.com/quarterly-earnings, the content of which is not incorporated by reference into this presentation. • The Corporation presents certain key financial and nonfinancial performance indicators (KPIs) that management uses when assessing consolidated and / or segment results. The Corporation believes this information is useful because it provides management with information about underlying operational performance and trends. KPIs are presented herein, including in the 2024 Highlights on slide 2, Financial Results on slide 5, and on the Summary Income Statement for each segment. • The Corporation also views net interest income and related ratios and analyses on a fully taxable-equivalent (FTE) basis, which when presented on a consolidated basis are non-GAAP financial measures. The Corporation believes managing the business with net interest income on an FTE basis provides investors with meaningful information on the interest margin for comparative purposes. The Corporation believes that the presentation allows for comparison of amounts from both taxable and tax-exempt sources and is consistent with industry practices. The FTE adjustment was $154MM, $147MM, $160MM, $158MM, and $145MM for 4Q24, 3Q24, 2Q24, 1Q24, and 4Q23, respectively. • The Corporation allocates capital to its business segments using a methodology that considers the effect of regulatory capital requirements in addition to internal risk-based capital models. Allocated capital is reviewed periodically and refinements are made based on multiple considerations that include, but are not limited to, risk-weighted assets measured under Basel 3 Standardized and Advanced approaches, business segment exposures and risk profile, and strategic plans. As a result of this process, in the first quarter of 2024, the Corporation adjusted the amount of capital being allocated to its business segments.