UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the Quarterly Period Ended September 30, 2002

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Commission file number: 1-6523

Exact name of registrant as specified in its charter:

Bank of America Corporation

State of incorporation:

Delaware

IRS Employer Identification Number:

56-0906609

Address of principal executive offices:

Bank of America Corporate Center

Charlotte, North Carolina 28255

Registrant’s telephone number, including area code:

(704) 386-8486

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

On October 31, 2002, there were 1,496,698,614 shares of Bank of America Corporation Common Stock outstanding.

Bank of America Corporation

September 30, 2002 Form 10-Q

INDEX

Part I Financial Information

| | | | | Page

|

|

| Item 1. | | Financial Statements: | | |

|

| | | | | 2 |

|

| | | | | 3 |

|

| | | | | 4 |

|

| | | | | 5 |

|

| | | | | 6 |

|

| | Management’s Discussion and Analysis of Results of Operations and Financial Condition | | 17 |

|

| | Quantitative and Qualitative Disclosures about Market Risk | | 65 |

|

| | Controls and Procedures | | 65 |

|

Part II Other Information |

|

| | Legal Proceedings | | 65 |

|

| | Changes in Securities and Use of Proceeds | | 66 |

|

| | Exhibits and Reports on Form 8-K | | 67 |

|

| | 68 |

|

| | 69 |

|

| | 70 |

|

| | 71 |

Part I. Financial Information Item 1. Financial Statements

Bank of America Corporation and Subsidiaries

Consolidated Statement of Income

| | | Three Months Ended

September 30

| | Nine Months Ended

September 30

|

(Dollars in millions, except per share information) | | 2002

| | | 2001

| | 2002

| | | 2001

|

Interest income | | | | | | | | | | | | | | |

| Interest and fees on loans and leases | | $ | 5,553 | | | $ | 6,543 | | $ | 16,528 | | | $ | 21,455 |

| Interest and dividends on securities | | | 1,104 | | | | 892 | | | 2,974 | | | | 2,631 |

| Federal funds sold and securities purchased under agreements to resell | | | 177 | | | | 321 | | | 662 | | | | 1,161 |

| Trading account assets | | | 1,006 | | | | 930 | | | 2,832 | | | | 2,712 |

| Other interest income | | | 345 | | | | 636 | | | 1,044 | | | | 1,529 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| Total interest income | | | 8,185 | | | | 9,322 | | | 24,040 | | | | 29,488 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Interest expense | | | | | | | | | | | | | | |

| Deposits | | | 1,414 | | | | 2,097 | | | 4,142 | | | | 7,173 |

| Short-term borrowings | | | 526 | | | | 869 | | | 1,532 | | | | 3,467 |

| Trading account liabilities | | | 342 | | | | 285 | | | 971 | | | | 887 |

| Long-term debt | | | 601 | | | | 867 | | | 1,846 | | | | 3,088 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| Total interest expense | | | 2,883 | | | | 4,118 | | | 8,491 | | | | 14,615 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Net interest income | | | 5,302 | | | | 5,204 | | | 15,549 | | | | 14,873 |

Noninterest income | | | | | | | | | | | | | | |

| Consumer service charges | | | 763 | | | | 712 | | | 2,189 | | | | 2,120 |

| Corporate service charges | | | 585 | | | | 528 | | | 1,717 | | | | 1,538 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| Total service charges | | | 1,348 | | | | 1,240 | | | 3,906 | | | | 3,658 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| Consumer investment and brokerage services | | | 373 | | | | 386 | | | 1,174 | | | | 1,164 |

| Corporate investment and brokerage services | | | 174 | | | | 142 | | | 522 | | | | 415 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| Total investment and brokerage services | | | 547 | | | | 528 | | | 1,696 | | | | 1,579 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| Mortgage banking income | | | 218 | | | | 109 | | | 545 | | | | 426 |

| Investment banking income | | | 318 | | | | 305 | | | 1,123 | | | | 1,106 |

| Equity investment gains (losses) | | | (216 | ) | | | 22 | | | (226 | ) | | | 340 |

| Card income | | | 685 | | | | 618 | | | 1,881 | | | | 1,792 |

Trading account profits(1) | | | 71 | | | | 433 | | | 679 | | | | 1,508 |

| Other income | | | 249 | | | | 174 | | | 537 | | | | 541 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| Total noninterest income | | | 3,220 | | | | 3,429 | | | 10,141 | | | | 10,950 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Total revenue | | | 8,522 | | | | 8,633 | | | 25,690 | | | | 25,823 |

Provision for credit losses | | | 804 | | | | 1,251 | | | 2,532 | | | | 2,886 |

Gains on sales of securities | | | 189 | | | | 97 | | | 326 | | | | 82 |

Noninterest expense | | | | | | | | | | | | | | |

| Personnel | | | 2,368 | | | | 2,304 | | | 7,200 | | | | 7,239 |

| Occupancy | | | 457 | | | | 448 | | | 1,330 | | | | 1,309 |

| Equipment | | | 291 | | | | 273 | | | 832 | | | | 835 |

| Marketing | | | 210 | | | | 165 | | | 550 | | | | 516 |

| Professional fees | | | 126 | | | | 144 | | | 339 | | | | 411 |

| Amortization of intangibles | | | 54 | | | | 219 | | | 164 | | | | 665 |

| Data processing | | | 295 | | | | 175 | | | 726 | | | | 552 |

| Telecommunications | | | 119 | | | | 121 | | | 361 | | | | 368 |

| Other general operating | | | 700 | | | | 757 | | | 2,102 | | | | 2,186 |

| Business exit costs | | | — | | | | 1,305 | | | — | | | | 1,305 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| Total noninterest expense | | | 4,620 | | | | 5,911 | | | 13,604 | | | | 15,386 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Income before income taxes | | | 3,287 | | | | 1,568 | | | 9,880 | | | | 7,633 |

Income tax expense | | | 1,052 | | | | 727 | | | 3,245 | | | | 2,899 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Net income | | $ | 2,235 | | | $ | 841 | | $ | 6,635 | | | $ | 4,734 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Net income available to common shareholders | | $ | 2,233 | | | $ | 839 | | $ | 6,631 | | | $ | 4,730 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Per common share information | | | | | | | | | | | | | | |

| Earnings | | $ | 1.49 | | | $ | 0.52 | | $ | 4.34 | | | $ | 2.95 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| Diluted earnings | | $ | 1.45 | | | $ | 0.51 | | $ | 4.22 | | | $ | 2.90 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| Dividends | | $ | 0.60 | | | $ | 0.56 | | $ | 1.80 | | | $ | 1.68 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Average common shares issued and outstanding (in thousands) | | | 1,504,017 | | | | 1,599,692 | | | 1,526,946 | | | | 1,603,340 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

(1) | | Trading account profits for the nine months ended September 30, 2001 included the $83 million, or $0.03 per share, transition adjustment loss resulting from the adoption of Statement of Financial Accounting Standards No. 133, "Accounting for Derivative Instruments and Hedging Activities," (SFAS 133) on January 1, 2001. |

See accompanying notes to consolidated financial statements.

2

Bank of America Corporation and Subsidiaries Consolidated Balance Sheet

(Dollars in millions) | | September 30 2002

| | | December 31 2001

| |

Assets | | | | | | | | |

| Cash and cash equivalents | | $ | 24,469 | | | $ | 26,837 | |

| Time deposits placed and other short-term investments | | | 6,397 | | | | 5,932 | |

Federal funds sold and securities purchased under agreements to resell (includes$40,353 and $27,910 pledged as collateral) | | | 40,371 | | | | 28,108 | |

Trading account assets (includes$21,758 and $22,550 pledged as collateral) | | | 56,907 | | | | 47,344 | |

| Derivative assets | | | 32,838 | | | | 22,147 | |

| Securities: | | | | | | | | |

Available-for-sale (includes$49,610 and $37,422 pledged as collateral) | | | 88,571 | | | | 84,450 | |

Held-to-maturity, at cost (market value — $975 and $1,009) | | | 1,010 | | | | 1,049 | |

| | |

|

|

| |

|

|

|

| Total securities | | | 89,581 | | | | 85,499 | |

| | |

|

|

| |

|

|

|

| Loans and leases | | | 341,091 | | | | 329,153 | |

| Allowance for credit losses | | | (6,861 | ) | | | (6,875 | ) |

| | |

|

|

| |

|

|

|

| Loans and leases, net of allowance for credit losses | | | 334,230 | | | | 322,278 | |

| | |

|

|

| |

|

|

|

| Premises and equipment, net | | | 6,758 | | | | 6,414 | |

| Mortgage banking assets | | | 2,129 | | | | 3,886 | |

| Goodwill | | | 11,389 | | | | 10,854 | |

| Core deposits and other intangibles | | | 1,127 | | | | 1,294 | |

| Other assets | | | 53,812 | | | | 61,171 | |

| | |

|

|

| |

|

|

|

Total assets | | $ | 660,008 | | | $ | 621,764 | |

| | |

|

|

| |

|

|

|

Liabilities | | | | | | | | |

| Deposits in domestic offices: | | | | | | | | |

| Noninterest-bearing | | $ | 116,847 | | | $ | 112,064 | |

| Interest-bearing | | | 228,174 | | | | 220,703 | |

| Deposits in foreign offices: | | | | | | | | |

| Noninterest-bearing | | | 1,928 | | | | 1,870 | |

| Interest-bearing | | | 30,466 | | | | 38,858 | |

| | |

|

|

| |

|

|

|

| Total deposits | | | 377,415 | | | | 373,495 | |

| | |

|

|

| |

|

|

|

| Federal funds purchased and securities sold under agreements to repurchase | | | 61,823 | | | | 47,727 | |

| Trading account liabilities | | | 26,031 | | | | 19,452 | |

| Derivative liabilities | | | 23,701 | | | | 14,868 | |

| Commercial paper | | | 149 | | | | 1,558 | |

| Other short-term borrowings | | | 34,272 | | | | 20,659 | |

| Accrued expenses and other liabilities | | | 22,393 | | | | 27,459 | |

| Long-term debt | | | 59,954 | | | | 62,496 | |

| Trust preferred securities | | | 6,031 | | | | 5,530 | |

| | |

|

|

| |

|

|

|

Total liabilities | | | 611,769 | | | | 573,244 | |

| | |

|

|

| |

|

|

|

| Commitments and contingencies (Note Seven) | | | | | | | | |

|

Shareholders’ equity | | | | | | | | |

Preferred stock, $0.01 par value; authorized — 100,000,000 shares; issued and outstanding — 1,391,749 and 1,514,478 shares | | | 60 | | | | 65 | |

Common stock, $0.01 par value; authorized — 5,000,000,000 shares; issued and outstanding —

1,502,161,891 and 1,559,297,220 shares | | | 674 | | | | 5,076 | |

| Retained earnings | | | 46,870 | | | | 42,980 | |

| Accumulated other comprehensive income | | | 613 | | | | 437 | |

| Other | | | 22 | | | | (38 | ) |

| | |

|

|

| |

|

|

|

Total shareholders’ equity | | | 48,239 | | | | 48,520 | |

| | |

|

|

| |

|

|

|

Total liabilities and shareholders’ equity | | $ | 660,008 | | | $ | 621,764 | |

| | |

|

|

| |

|

|

|

See accompanying notes to consolidated financial statements.

3

Bank of America Corporation and Subsidiaries Consolidated Statement of Changes in Shareholders' Equity

(Dollars in millions, shares in thousands) | | Preferred Stock

| | | Common Stock

| | | Retained Earnings

| | | Accumulated Other Comprehensive Income (Loss)(1)

| | | Other

| | | Total Shareholders' Equity

| | | Comprehensive Income

| |

| | | Shares

| | | Amount

| | | | | | |

Balance, December 31, 2000 | | $ | 72 | | | 1,613,632 | | | $ | 8,613 | | | $ | 39,815 | | | $ | (746 | ) | | $ | (126 | ) | | $ | 47,628 | | | | | |

| Net income | | | | | | | | | | | | | | 4,734 | | | | | | | | | | | | 4,734 | | | $ | 4,734 | |

| Other comprehensive income, net of tax: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net unrealized gains on available-for-sale and marketable equity securities | | | | | | | | | | | | | | | | | | 1,029 | | | | | | | | 1,029 | | | | 1,029 | |

| Net unrealized losses on foreign currency translation adjustments | | | | | | | | | | | | | | | | | | (4 | ) | | | | | | | (4 | ) | | | (4 | ) |

| Net gains on derivatives | | | | | | | | | | | | | | | | | | 1,452 | | | | | | | | 1,452 | | | | 1,452 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

| Comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 7,211 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

| Cash dividends: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common | | | | | | | | | | | | | | (2,691 | ) | | | | | | | | | | | (2,691 | ) | | | | |

| Preferred | | | | | | | | | | | | | | (4 | ) | | | | | | | | | | | (4 | ) | | | | |

| Common stock issued under employee plans | | | | | | 22,096 | | | | 830 | | | | | | | | | | | | 73 | | | | 903 | | | | | |

| Common stock repurchased | | | | | | (53,826 | ) | | | (3,016 | ) | | | | | | | | | | | | | | | (3,016 | ) | | | | |

| Conversion of preferred stock | | | (5 | ) | | 226 | | | | 5 | | | | | | | | | | | | | | | | | | | | | |

| Other | | | | | | 1 | | | | 59 | | | | 3 | | | | | | | | 58 | | | | 120 | | | | | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | | | |

Balance, September 30, 2001 | | $ | 67 | | | 1,582,129 | | | $ | 6,491 | | | $ | 41,857 | | | $ | 1,731 | | | $ | 5 | | | $ | 50,151 | | | | | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | | | |

|

Balance, December 31, 2001 | | $ | 65 | | | 1,559,297 | | | $ | 5,076 | | | $ | 42,980 | | | $ | 437 | | | $ | (38 | ) | | $ | 48,520 | | | | | |

| Net income | | | | | | | | | | | | | | 6,635 | | | | | | | | | | | | 6,635 | | | $ | 6,635 | |

| Other comprehensive income, net of tax: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net unrealized gains on available-for-sale and marketable equity securities | | | | | | | | | | | | | | | | | | 1,256 | | | | | | | | 1,256 | | | | 1,256 | |

| Net unrealized gains on foreign currency translation adjustments | | | | | | | | | | | | | | | | | | 2 | | | | | | | | 2 | | | | 2 | |

| Net losses on derivatives | | | | | | | | | | | | | | | | | | (1,082 | ) | | | | | | | (1,082 | ) | | | (1,082 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

| Comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 6,811 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

| Cash dividends: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common | | | | | | | | | | | | | | (2,744 | ) | | | | | | | | | | | (2,744 | ) | | | | |

| Preferred | | | | | | | | | | | | | | (4 | ) | | | | | | | | | | | (4 | ) | | | | |

| Common stock issued under employee plans | | | | | | 41,834 | | | | 2,143 | | | | | | | | | | | | 14 | | | | 2,157 | | | | | |

| Common stock repurchased | | | | | | (99,200 | ) | | | (6,798 | ) | | | | | | | | | | | | | | | (6,798 | ) | | | | |

| Conversion of preferred stock | | | (5 | ) | | 206 | | | | 5 | | | | | | | | | | | | | | | | | | | | | |

| Other | | | | | | 25 | | | | 248 | | | | 3 | | | | | | | | 46 | | | | 297 | | | | | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | | | |

Balance, September 30, 2002 | | $ | 60 | | | 1,502,162 | | | $ | 674 | | | $ | 46,870 | | | $ | 613 | | | $ | 22 | | | $ | 48,239 | | | | | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | | | |

(1) | | At September 30, 2002 and December 31, 2001, Accumulated Other Comprehensive Income (Loss) consisted of net unrealized gains (losses) on available-for-sale and marketable equity securities of $776 and $(480), respectively; foreign currency translation adjustments of $(169) and $(171), respectively; and net gains on derivatives of $6 and $1,088, respectively. |

See accompanying notes to consolidated financial statements.

4

Bank of America Corporation and Subsidiaries Consolidated Statement of Cash Flows

| | | Nine Months Ended September 30

| |

(Dollars in millions) | | 2002

| | | 2001

| |

Operating activities | | | | | | | | |

| Net income | | $ | 6,635 | | | $ | 4,734 | |

| Reconciliation of net income to net cash used in operating activities: | | | | | | | | |

| Provision for credit losses | | | 2,532 | | | | 2,886 | |

| Gains on sales of securities | | | (326 | ) | | | (82 | ) |

| Business exit costs | | | — | | | | 1,305 | |

| Depreciation and premises improvements amortization | | | 663 | | | | 641 | |

| Amortization of intangibles | | | 164 | | | | 665 | |

| Deferred income tax expense | | | 278 | | | | 272 | |

| Net increase in trading and hedging instruments | | | (5,049 | ) | | | (19,788 | ) |

| Net increase in other assets | | | (4,153 | ) | | | (11,412 | ) |

| Net increase (decrease) in accrued expenses and other liabilities | | | (6,188 | ) | | | 16,135 | |

| Other operating activities, net | | | 5,105 | | | | 2,628 | |

| | |

|

|

| |

|

|

|

| Net cash used in operating activities | | | (339 | ) | | | (2,016 | ) |

| | |

|

|

| |

|

|

|

Investing activities | | | | | | | | |

| Net (increase) decrease in time deposits placed and other short-term investments | | | (465 | ) | | | 819 | |

| Net (increase) decrease in federal funds sold and securities purchased under | | | | | | | | |

| agreements to resell | | | (12,263 | ) | | | 1,605 | |

| Proceeds from sales of available-for-sale securities | | | 104,085 | | | | 95,361 | |

| Proceeds from maturities of available-for-sale securities | | | 17,191 | | | | 5,632 | |

| Purchases of available-for-sale securities | | | (123,058 | ) | | | (99,971 | ) |

| Proceeds from maturities of held-to-maturity securities | | | 39 | | | | 40 | |

| Proceeds from sales and securitizations of loans and leases | | | 20,904 | | | | 9,874 | |

| Other changes in loans and leases, net | | | (24,581 | ) | | | 11,565 | |

| Purchases and originations of mortgage banking assets | | | (648 | ) | | | (932 | ) |

| Net purchases of premises and equipment | | | (757 | ) | | | (580 | ) |

| Proceeds from sales of foreclosed properties | | | 117 | | | | 230 | |

| Acquisition of business activities | | | (110 | ) | | | (417 | ) |

| | |

|

|

| |

|

|

|

| Net cash provided by (used in) investing activities | | | (19,546 | ) | | | 23,226 | |

| | |

|

|

| |

|

|

|

Financing activities | | | | | | | | |

| Net increase (decrease) in deposits | | | 3,920 | | | | (4,374 | ) |

| Net increase in federal funds purchased and securities sold under | | | | | | | | |

| agreements to repurchase | | | 14,096 | | | | 10,428 | |

| Net increase (decrease) in commercial paper and other short-term borrowings | | | 12,204 | | | | (19,258 | ) |

| Proceeds from issuance of long-term debt and trust preferred securities | | | 8,556 | | | | 10,905 | |

| Retirement of long-term debt and trust preferred securities | | | (13,824 | ) | | | (18,239 | ) |

| Proceeds from issuance of common stock | | | 2,157 | | | | 903 | |

| Common stock repurchased | | | (6,798 | ) | | | (3,016 | ) |

| Cash dividends paid | | | (2,748 | ) | | | (2,695 | ) |

| Other financing activities, net | | | (29 | ) | | | (77 | ) |

| | |

|

|

| |

|

|

|

| Net cash provided by (used in) financing activities | | | 17,534 | | | | (25,423 | ) |

| | |

|

|

| |

|

|

|

| Effect of exchange rate changes on cash and cash equivalents | | | (17 | ) | | | (20 | ) |

| | |

|

|

| |

|

|

|

| Net decrease in cash and cash equivalents | | | (2,368 | ) | | | (4,233 | ) |

| Cash and cash equivalents at January 1 | | | 26,837 | | | | 27,513 | |

| | |

|

|

| |

|

|

|

Cash and cash equivalents at September 30 | | $ | 24,469 | | | $ | 23,280 | |

| | |

|

|

| |

|

|

|

Net transfers of loans and leases from loans held for sale (included in other assets) to the loan portfolio amounted to $11,022 for the nine months ended September 30, 2002. Net transfers of loans and leases from the loan portfolio to loans held for sale amounted to $18,651 for the same period in 2001.There were no loans and loans held for sale securitized and retained in the available-for-sale portfolio for the nine months ended September 30, 2002. Loans and loans held for sale securitized and retained in the available-for-sale securities portfolio amounted to $9,237 for the nine months ended September 30, 2001.

See accompanying notes to consolidated financial statements.

5

Notes to Consolidated Financial Statements Bank of America Corporation and Subsidiaries

Bank of America Corporation and its subsidiaries (the Corporation), through its banking and nonbanking subsidiaries, provide a diverse range of financial services and products throughout the U.S. and in selected international markets. At September 30, 2002, the Corporation operated its banking activities primarily under two charters: Bank of America, N.A. and Bank of America, N.A. (USA).

Note One — Accounting Policies

Principles of Consolidation and Basis of Presentation

The consolidated financial statements include the accounts of the Corporation and its majority-owned subsidiaries. All significant intercompany accounts and transactions have been eliminated.

The information contained in the consolidated financial statements is unaudited. In the opinion of management, all normal recurring adjustments necessary for a fair statement of the interim period results have been made. Certain prior period amounts have been reclassified to conform to current period classifications.

Special Purpose Entities

As part of its normal risk management activities, the Corporation enters into certain transactions that are facilitated through a special purpose entity (SPE). Generally, an SPE provides the investors in the transaction protection from creditors of the Corporation in the event of bankruptcy or receivership of the Corporation. The Corporation consolidates certain of these SPEs when it believes, under the current accounting guidance, that consolidation is appropriate. At September 30, 2002, assets of consolidated SPEs were approximately $3.9 billion.

Co-Branding Credit Card Arrangements

The Corporation has co-brand arrangements that entitle a cardholder to earn airline frequent-flyer points based on purchases made with the card. These arrangements have remaining terms not exceeding six years. The Corporation may pay one-time fees which would be deferred ratably over the term of the arrangement. The Corporation makes monthly payments to the co-brand partners based on the volume of cardholders’ purchases and on the number of points awarded to cardholders. Such payments are expensed as incurred and are recorded as contra-revenue.

Other Accounting Policies

Additional accounting policies followed in the presentation of financial results are detailed on pages 82 through 87 of the Corporation’s 2001 Annual Report. See Goodwill and Other Intangibles beginning on page 6 of the Corporation’s Form 10-Q for the three months ended March 31, 2002 for a discussion of changes in accounting for goodwill and other intangibles effective January 1, 2002.

Note Two — Trading Activities

Trading-Related Revenue

Trading account profits represents the net amount earned from the Corporation’s trading positions, which include trading account assets and liabilities as well as derivative positions and mortgage banking certificates. Trading account profits, as reported in the Consolidated Statement of Income, does not include the net interest income recognized on interest-earning and interest-bearing trading positions or the related funding charge or benefit. Trading account profits and trading-related net interest income (“trading-related revenue”) are presented in the following table as they are both considered in evaluating the overall profitability of the Corporation’s trading positions. Trading-related revenue is derived from foreign exchange spot, forward and cross-currency contracts,

6

fixed income and equity securities, and derivative contracts in interest rates, equities, credit and commodities. Trading account profits for the nine months ended September 30, 2001 included an $83 million transition adjustment net loss recorded as a result of the implementation of SFAS 133.

| | | Three Months Ended September 30

| | Nine Months Ended September 30

|

(Dollars in millions) | | 2002

| | 2001

| | 2002

| | 2001

|

| Trading account profits — as reported | | $ | 71 | | $ | 433 | | $ | 679 | | $ | 1,508 |

Trading-related net interest income(1) | | | 485 | | | 417 | | | 1,387 | | | 1,182 |

| | |

|

| |

|

| |

|

| |

|

|

Total trading-related revenue | | $ | 556 | | $ | 850 | | $ | 2,066 | | $ | 2,690 |

| | |

|

| |

|

| |

|

| |

|

|

Trading-related revenue by product | | | | | | | | | | | | |

| Foreign exchange | | $ | 126 | | $ | 138 | | $ | 389 | | $ | 419 |

| Interest rate | | | 96 | | | 229 | | | 585 | | | 608 |

Credit(2) | | | 255 | | | 267 | | | 717 | | | 768 |

| Equities | | | 77 | | | 190 | | | 318 | | | 743 |

| Commodities | | | 2 | | | 26 | | | 57 | | | 152 |

| | |

|

| |

|

| |

|

| |

|

|

Total trading-related revenue | | $ | 556 | | $ | 850 | | $ | 2,066 | | $ | 2,690 |

| | |

|

| |

|

| |

|

| |

|

|

(1) Presented on a taxable-equivalent basis. |

(2) Credit includes fixed income and credit default swaps and hedges of credit exposure. |

Trading Account Assets and Liabilities

The fair values of the components of trading account assets and liabilities at September 30, 2002 and December 31, 2001 were:

(Dollars in millions) | | September 30 2002

| | December 31 2001

|

Trading account assets | | | | | | |

| U.S. Government & Agency securities | | $ | 17,705 | | $ | 15,009 |

| Foreign sovereign debt | | | 8,613 | | | 6,809 |

| Corporate & other debt securities | | | 11,366 | | | 11,596 |

| Equity securities | | | 4,725 | | | 2,976 |

| Mortgage-backed securities | | | 4,991 | | | 3,070 |

| Other | | | 9,507 | | | 7,884 |

| | |

|

| |

|

|

Total | | $ | 56,907 | | $ | 47,344 |

| | |

|

| |

|

|

Trading account liabilities | | | | | | |

| U.S. Government & Agency securities | | $ | 12,940 | | $ | 4,121 |

| Foreign sovereign debt | | | 2,255 | | | 3,096 |

| Corporate & other debt securities | | | 2,683 | | | 1,501 |

| Equity securities | | | 3,151 | | | 6,151 |

| Other | | | 5,002 | | | 4,583 |

| | |

|

| |

|

|

Total | | $ | 26,031 | | $ | 19,452 |

| | |

|

| |

|

|

See Note Three below for additional information on derivative positions, including credit risk.

7

Note Three — Derivatives

Credit risk associated with derivatives is measured as the net replacement cost should the counterparties with contracts in a net gain position to the Corporation completely fail to perform under the terms of those contracts, assuming no recoveries of underlying collateral. A detailed discussion of derivative trading and asset and liability management activities is presented in Note 5 of the consolidated financial statements on pages 91 through 93 of the Corporation’s 2001 Annual Report.

The following table presents the contract / notional and credit risk amounts at September 30, 2002 and December 31, 2001 of the Corporation’s derivative positions held for trading and hedging purposes. These derivative positions are primarily executed in the over-the-counter market. The credit risk amounts presented in the following table do not consider the value of any collateral held but take into consideration the effects of legally enforceable master netting agreements. The Corporation held $14.9 billion of collateral on derivative positions, of which only $10.0 billion could be applied against credit risk at September 30, 2002.

Derivatives(1) | | | | | | | | | | | | |

| | | September 30, 2002

| | December 31, 2001

|

(Dollars in millions) | | Contract/ Notional

| | Credit Risk

| | Contract/ Notional

| | Credit Risk

|

Interest rate contracts | | | | | | | | | | | | |

| Swaps | | $ | 6,219,606 | | $ | 18,249 | | $ | 5,267,608 | | $ | 9,550 |

| Futures and forwards | | | 2,517,913 | | | 416 | | | 1,663,109 | | | 67 |

| Written options | | | 985,494 | | | — | | | 678,242 | | | — |

| Purchased options | | | 855,444 | | | 3,406 | | | 704,159 | | | 2,165 |

Foreign exchange contracts | | | | | | | | | | | | |

| Swaps | | | 166,708 | | | 2,342 | | | 140,778 | | | 2,274 |

| Spot, futures and forwards | | | 689,154 | | | 1,676 | | | 654,026 | | | 2,496 |

| Written options | | | 74,184 | | | — | | | 57,963 | | | — |

| Purchased options | | | 72,608 | | | 392 | | | 55,050 | | | 496 |

Equity contracts | | | | | | | | | | | | |

| Swaps | | | 14,905 | | | 999 | | | 14,504 | | | 562 |

| Futures and forwards | | | 81,379 | | | — | | | 46,970 | | | 44 |

| Written options | | | 22,481 | | | — | | | 21,009 | | | — |

| Purchased options | | | 26,670 | | | 2,673 | | | 28,902 | | | 2,511 |

Commodity contracts | | | | | | | | | | | | |

| Swaps | | | 11,515 | | | 1,029 | | | 6,600 | | | 1,152 |

| Futures and forwards | | | 4,393 | | | — | | | 2,176 | | | — |

| Written options | | | 18,390 | | | — | | | 8,231 | | | — |

| Purchased options | | | 23,907 | | | 351 | | | 8,219 | | | 199 |

Credit derivatives | | | 82,399 | | | 1,305 | | | 57,182 | | | 631 |

| | |

|

| |

|

| |

|

| |

|

|

Net replacement cost | | | | | $ | 32,838 | | | | | $ | 22,147 |

| | | | | |

|

| | | | |

|

|

(1) Includes both long and short derivative positions. |

The average fair value of derivative assets for the nine months ended September 30, 2002 and 2001 was $23.6 billion and $17.9 billion, respectively. The average fair value of derivative liabilities for the nine months ended September 30, 2002 and 2001 was $15.8 billion and $17.3 billion, respectively.

Fair Value and Cash Flow Hedges

The Corporation uses various types of interest rate and foreign currency exchange rate derivative contracts to protect against changes in the fair value of its fixed-rate assets and liabilities due to fluctuations in interest rates and exchange rates. The Corporation also uses these contracts to protect against changes in the cash flows of its variable-rate assets and liabilities and anticipated transactions. For the nine months ended September 30, 2002 and 2001, there were no significant gains or losses recognized which represented the ineffective portion of fair value hedges.

8

For the nine months ended September 30, 2002, the Corporation recognized in the Consolidated Statement of Income a net loss of $12 million (included in interest income and mortgage banking income) which represented the ineffective portion of cash flow hedges. For the same period in 2001, there were no significant gains or losses recognized which represented the ineffective portion of cash flow hedges. At September 30, 2002 and December 31, 2001, the Corporation has determined that there were no cash flow hedging positions where it was probable that certain forecasted transactions may not occur within the originally designated time period.

For cash flow hedges, gains and losses on derivative contracts reclassified from accumulated other comprehensive income to current period earnings are included in the line item in the Consolidated Statement of Income in which the hedged item is recorded and in the same period the hedged item affects earnings. Deferred net gains on derivative instruments of approximately $165 million included in accumulated other comprehensive income at September 30, 2002 are expected to be reclassified into earnings during the next twelve months. These net gains reclassified into earnings are expected to increase income or reduce expense on the hedged items.

Hedges of Net Investments in Foreign Operations

The Corporation uses forward exchange contracts, currency swaps and nonderivative cash instruments that provide an economic hedge on its net investments in foreign operations against adverse movements in foreign currency exchange rates. For the nine months ended September 30, 2002 and 2001, the Corporation experienced net foreign currency pre-tax gains of $60 million and pre-tax losses of $153 million, respectively, related to its net investments in foreign operations. These gains and losses were recorded as a component of the foreign currency translation adjustment in other comprehensive income. These gains and losses were largely offset by net pre-tax losses of $59 million and net pre-tax gains of $136 million related to derivative and non-derivative instruments designated as hedges of this currency exposure during these same periods.

Note Four — Outstanding Loans and Leases

Outstanding loans and leases at September 30, 2002 and December 31, 2001 were: |

| | | September 30, 2002

| | | December 31, 2001

| |

(Dollars in millions) | | Amount

| | Percent

| | | Amount

| | Percent

| |

| Commercial — domestic | | $ | 105,240 | | 30.8 | % | | $ | 118,205 | | 35.9 | % |

| Commercial — foreign | | | 20,677 | | 6.1 | | | | 23,039 | | 7.0 | |

| Commercial real estate — domestic | | | 20,707 | | 6.1 | | | | 22,271 | | 6.8 | |

| Commercial real estate — foreign | | | 447 | | 0.1 | | | | 383 | | 0.1 | |

| | |

|

| |

|

| |

|

| |

|

|

| Total commercial | | | 147,071 | | 43.1 | | | | 163,898 | | 49.8 | |

| | |

|

| |

|

| |

|

| |

|

|

| Residential mortgage | | | 105,617 | | 31.0 | | | | 78,203 | | 23.8 | |

| Home equity lines | | | 23,464 | | 6.9 | | | | 22,107 | | 6.7 | |

| Direct/Indirect consumer | | | 30,417 | | 8.9 | | | | 30,317 | | 9.2 | |

| Consumer finance | | | 9,495 | | 2.8 | | | | 12,652 | | 3.9 | |

| Bankcard | | | 23,062 | | 6.8 | | | | 19,884 | | 6.0 | |

| Foreign consumer | | | 1,965 | | 0.5 | | | | 2,092 | | 0.6 | |

| | |

|

| |

|

| |

|

| |

|

|

| Total consumer | | | 194,020 | | 56.9 | | | | 165,255 | | 50.2 | |

| | |

|

| |

|

| |

|

| |

|

|

Total outstanding loans and leases | | $ | 341,091 | | 100.0 | % | | $ | 329,153 | | 100.0 | % |

| | |

|

| |

|

| |

|

| |

|

|

9

The following table summarizes the changes in the allowance for credit losses for the three months and nine months ended September 30, 2002 and 2001:

| | | Three Moths Ended September 30

| | | Nine Months Ended September 30

| |

(Dollars in millions) | | 2002

| | | 2001

| | | 2002

| | | 2001

| |

| Balance, beginning of period | | $ | 6,873 | | | $ | 6,911 | | | $ | 6,875 | | | $ | 6,838 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Loans and leases charged off | | | (1,002 | ) | | | (1,654 | ) | | | (3,147 | ) | | | (3,523 | ) |

| Recoveries of loans and leases previously charged off | | | 198 | | | | 163 | | | | 615 | | | | 473 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net charge-offs | | | (804 | ) | | | (1,491 | ) | | | (2,532 | ) | | | (3,050 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Provision for credit losses | | | 804 | | | | 1,251 | | | | 2,532 | | | | 2,886 | |

| Other, net | | | (12 | ) | | | (6 | ) | | | (14 | ) | | | (9 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Balance, September 30 | | $ | 6,861 | | | $ | 6,665 | | | $ | 6,861 | | | $ | 6,665 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

The following table presents the recorded investment in specific loans that were considered individually impaired at September 30, 2002 and December 31, 2001 in accordance with Statement of Financial Accounting Standards No. 114, “Accounting by Creditors for Impairment of a Loan,” (SFAS 114), as described in the Corporation’s 2001 Annual Report on pages 84 to 85:

(Dollars in millions) | | September 30, 2002

| | December 31, 2001

|

| Commercial — domestic | | $ | 2,991 | | $ | 3,138 |

| Commercial — foreign | | | 882 | | | 501 |

| Commercial real estate — domestic | | | 214 | | | 240 |

| Commercial real estate — foreign | | | 2 | | | — |

| | |

|

| |

|

|

Total impaired loans | | $ | 4,089 | | $ | 3,879 |

| | |

|

| |

|

|

At September 30, 2002 and December 31, 2001, nonperforming loans, including certain loans which were considered impaired, totaled $4.8 billion and $4.5 billion, respectively. Included in other assets was $184 million and $1.0 billion of nonperforming assets at September 30, 2002 and December 31, 2001, respectively. Foreclosed properties amounted to $282 million and $402 million at September 30, 2002 and December 31, 2001, respectively.

Note Five — Goodwill and Other Intangibles

In accordance with Statement of Financial Accounting Standards No. 142, “Goodwill and Other Intangible Assets” (SFAS 142), no goodwill amortization was recorded for the nine months ended September 30, 2002. Goodwill amortization expense for the nine months ended September 30, 2001 was $502 million. Net income for the nine months ended September 30, 2001 was $4.7 billion or $2.95 per share ($2.90 per share diluted). Net income adjusted to exclude goodwill amortization expense would have been $5.2 billion or $3.24 per share ($3.19 per share diluted) for the nine months ended September 30, 2001. The impact of goodwill amortization on net income for the nine months ended September 30, 2001 was $467 million or $0.29 per share (basic and diluted).

Goodwill amortization expense for the three months ended September 30, 2001 was $165 million. Net income for the three months ended September 30, 2001 was $841 million or $0.52 per share ($0.51 per share diluted). Net income adjusted to exclude goodwill amortization expense would have been $994 million or $0.62 per share ($0.61 per share diluted) for the three months ended September 30, 2001. The impact of goodwill amortization on net income for the three months ended September 30, 2001 was $153 million or $0.10 per share ($0.09 per share diluted). See Goodwill and Other Intangibles beginning on page 6 of the Corporation’s Form 10-Q for the three months ended March 31, 2002 for a discussion of changes in accounting for goodwill and other intangibles effective January 1, 2002.

10

The following table shows the changes in goodwill by business segment during the nine months ended September 30, 2002:

(Dollars in millions) | | Total Corporation

| | | Consumer and Commercial Banking

| | Asset Management

| | | Global Corporate and Investment Banking

| | | Equity Investments

|

Balance, January 1, 2002 | | $ | 10,854 | | | $ | 7,726 | | $ | 943 | | | $ | 2,051 | | | $ | 134 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| |

|

|

| Goodwill additions | | | 550 | | | | — | | | 550 | | | | — | | | | — |

Other(1) | | | (15 | ) | | | — | | | (1 | ) | | | (14 | ) | | | — |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| |

|

|

Balance, September 30, 2002 | | $ | 11,389 | | | $ | 7,726 | | $ | 1,492 | | | $ | 2,037 | | | $ | 134 |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| |

|

|

(1) | | Includes certain other reclassifications. |

In connection with the acquisition of the remaining 50 percent of Marsico Capital Management, LLC in 2001 for $1.1 billion, goodwill of $550 million, representing final contingent consideration, was recorded in theAsset Management business segment during the nine months ended September 30, 2002. All conditions related to this contingent consideration have been met.

The gross carrying value and accumulated amortization related to core deposits and other intangibles at September 30, 2002 and December 31, 2001 are presented below:

| | | September 30, 2002

| | December 31, 2001

|

(Dollars in millions) | | Gross Carrying Value

| | Accumulated Amortization

| | Gross Carrying Value

| | Accumulated Amortization

|

| Core deposits | | $ | 1,495 | | $ | 686 | | $ | 1,495 | | $ | 566 |

| Other intangibles | | | 735 | | | 417 | | | 730 | | | 365 |

| | |

|

| |

|

| |

|

| |

|

|

Total core deposits and other intangibles | | $ | 2,230 | | $ | 1,103 | | $ | 2,225 | | $ | 931 |

| | |

|

| |

|

| |

|

| |

|

|

Amortization expense on core deposits and other intangibles was $164 million and $163 million for the nine months ended September 30, 2002 and 2001, respectively. The Corporation estimates that aggregate amortization expense will be $218 million for 2002, $212 million for 2003, $208 million for 2004, $207 million for 2005 and $206 million for 2006.

Note Six — Short-Term Borrowings, Long-Term Debt and Trust Preferred Securities

During the nine months ended September 30, 2002, Bank of America Corporation (Parent Company only) issued $5.0 billion in senior and subordinated long-term debt, domestically and internationally, with maturities ranging from 2003 to 2032. The $5.0 billion was converted from fixed rates ranging from 4.32 percent to 6.90 percent to floating rates through interest rate swaps at spreads ranging from 44 basis points below to 62 basis points over three-month London InterBank Offered Rate (LIBOR).

At September 30, 2002, Bank of America Corporation was authorized to issue approximately $24.8 billion of additional corporate debt and other securities under its existing shelf registration statements.

Bank of America Corporation had a 300 billion yen-denominated (approximately U.S. $3 billion at the time of filing) shelf registration in Japan. In addition, Bank of America Corporation allocated $2 billion of a joint Euro medium-term note program to be used exclusively for secondary offerings to non-United States residents for a shelf registration statement filed in Japan. Bank of America Corporation had $420 million outstanding under these programs at both September 30, 2002 and December 31, 2001. Both of these shelf registration statements expired on October 23, 2002.

Bank of America, N.A. maintains a domestic program to offer up to a maximum of $50.0 billion, at any one time, of bank notes with fixed or floating rates and maturities ranging from seven days or more from date of issue. Short-term bank notes outstanding under this program totaled $1.5 billion at September 30, 2002 compared to $2.5

11

billion at December 31, 2001. These short-term bank notes, along with Treasury tax and loan notes and term federal funds purchased, are reflected in other short-term borrowings in the Consolidated Balance Sheet. Long-term debt under current and former programs totaled $3.1 billion at September 30, 2002 compared to $4.5 billion at December 31, 2001. During 2002, Bank of America N.A. issued $404 million senior long-term bank notes at fixed rates ranging from 2.00 percent to 3.66 percent to mature in 2003.

Bank of America Corporation and Bank of America, N.A. maintain a joint Euro medium-term note program to offer up to $25.0 billion of senior or subordinated notes exclusively to non-United States residents. The notes bear interest at fixed or floating rates and may be denominated in U.S. dollars or foreign currencies. Bank of America Corporation uses foreign currency contracts to convert certain foreign-denominated debt into U.S. dollars. Bank of America Corporation’s notes outstanding under this program totaled $5.6 billion at September 30, 2002 compared to $6.3 billion at December 31, 2001. Bank of America, N.A.’s notes outstanding under this program totaled $1.3 billion at September 30, 2002 compared to $1.4 billion at December 31, 2001. At September 30, 2002, Bank of America Corporation and Bank of America, N.A. were authorized to issue approximately $9.4 billion and $8.7 billion, respectively. At September 30, 2002 and December 31, 2001, $687 million and $2.0 billion, respectively, were outstanding under the former BankAmerica Corporation Euro medium-term note program. No additional debt securities will be offered under that program.

At September 30, 2002 and December 31, 2001, Bank of America Oregon, N.A. maintained $6.0 billion in Federal Home Loan Bank advances from the Home Loan Bank in Seattle, Washington. At September 30, 2002 and December 31, 2001, Bank of America Georgia, N.A. maintained $2.8 billion and $2.3 billion, respectively, in Federal Home Loan Bank advances from the Home Loan Bank in Atlanta, Georgia.

The Corporation issued $1.4 billion of trust preferred securities during the nine months ended September 30, 2002. Of this amount, $900 million was issued by BAC Capital Trust II, a wholly-owned grantor trust of Bank of America Corporation. The annual dividend rate is seven percent and is paid quarterly on February 1, May 1, August 1 and November 1 of each year, commencing May 1, 2002. BAC Capital Trust III, a wholly-owned grantor trust of Bank of America Corporation, issued $500 million in trust preferred securities. The annual dividend rate is seven percent and is paid quarterly on February 15, May 15, August 15 and November 15 of each year, commencing November 15, 2002.

The Corporation redeemed the 7.84 percent Trust Originated Preferred Securities issued by NB Capital Trust I and the 7.75 percent Trust Originated Preferred Securities issued by BankAmerica Capital I on March 15, 2002. On the redemption date, NB Capital Trust I and Bank America Capital I had aggregate principal balances of $600 million and $300 million, respectively, and redemption prices of $25 per security plus accrued and unpaid distributions up to but excluding the redemption date of March 15, 2002.

Note Seven — Commitments and Contingencies

In the normal course of business, the Corporation enters into a number of off-balance sheet commitments. These commitments expose the Corporation to varying degrees of credit and market risk and are subject to the same credit and market risk limitation reviews as those recorded on the balance sheet.

Credit Extension Commitments

The Corporation enters into commitments to extend credit such as loan commitments, standby letters of credit (SBLCs) and commercial letters of credit to meet the financing needs of its customers. For each of these types of instruments, the Corporation’s maximum exposure to credit loss is represented by the contractual amount of these instruments. Many of the commitments are collateralized and most commercial commitments are expected to expire without being drawn upon; therefore, the total commitment amounts do not necessarily represent risk of loss or future cash requirements. The unfunded commitments shown in the following table have been reduced by amounts participated to other financial institutions. The following table summarizes outstanding unfunded commitments to extend credit at September 30, 2002 and December 31, 2001.

12

(Dollars in millions) | | September 30

2002

| | December 31

2001

|

| Loan commitments | | $ | 220,477 | | $ | 221,529 |

| Standby letters of credit and financial guarantees | | | 31,179 | | | 32,416 |

| Commercial letters of credit | | | 3,970 | | | 3,581 |

| | |

|

| |

|

|

Legally binding commitments | | $ | 255,626 | | $ | 257,526 |

| | |

|

| |

|

|

| Credit card lines | | $ | 73,120 | | $ | 73,644 |

| | |

|

| |

|

|

Total commitments | | $ | 328,746 | | $ | 331,170 |

| | |

|

| |

|

|

Legally binding commitments to extend credit generally have specified rates and maturities. Certain of these commitments have adverse change clauses which help to protect the Corporation against deterioration in the borrowers’ ability to pay. SBLCs and financial guarantees are issued to support the debt obligations of customers. If a SBLC or financial guarantee is drawn upon, the Corporation looks to its customer for payment. Commercial letters of credit, issued primarily to facilitate customer trade finance activities, are collateralized by the underlying goods being shipped to the customer and are generally short-term. Credit card lines are unsecured commitments that are not legally binding. Management reviews credit card lines at least annually, and upon evaluation of the customers’ creditworthiness, the Corporation has the right to terminate or change the terms of the credit card lines.

The Corporation manages the credit risk on unfunded commitments by subjecting these commitments to the same credit approval and monitoring processes used for on-balance sheet loans. At September 30, 2002 and December 31, 2001, there were no unfunded legally binding commitments to any industry or foreign country greater than 10 percent of total unfunded commitments to extend credit.

Other Commitments

When-issued securities are commitments to purchase or sell securities during the time period between the announcement of a securities offering and the issuance of those securities. Changes in market price between commitment date and issuance are reflected in trading account profits. At September 30, 2002, the Corporation had commitments to purchase and sell when-issued securities of $156.3 billion and $159.5 billion, respectively. At December 31, 2001, the Corporation had commitments to purchase and sell when-issued securities of $45.0 billion and $39.6 billion, respectively. The increase during the nine months ended September 30, 2002 was primarily attributable to an increase in agency mortgage-backed securities activity resulting from higher volumes of refinancings in the lower interest rate environment.

At September 30, 2002, the Corporation had forward whole mortgage loan purchase commitments of $6.5 billion. Of these commitments, $4.9 billion were settled in October 2002. The remaining commitments of $1.6 billion will be settled in November 2002. At September 30, 2002, the Corporation had forward whole mortgage loan sale commitments of $1.7 billion. These commitments were settled in October 2002.

Litigation

For updated information on litigation see Part II, Item 1 beginning on page 65.

Note Eight — Shareholders’ Equity and Earnings Per Common Share

Pre-tax net gains recorded in other comprehensive income related to available-for-sale and marketable equity securities, foreign currency translation adjustments and derivatives were $1.4 billion and $3.9 billion for the nine months ended September 30, 2002 and 2001, respectively. Pre-tax reclassification adjustments to net income of $531 million and $251 million were recorded for the nine months ended September 30, 2002 and 2001, respectively.

13

The related income tax expense was $686 million and $1.1 billion for the nine months ended September 30, 2002 and 2001, respectively.

The Corporation sells put options on its common stock to independent third parties. The put option program was designed to partially offset the cost of share repurchases. The put options give the holders the right to sell shares of the Corporation’s common stock to the Corporation on certain dates at specified prices. The put option contracts allow the Corporation to determine the method of settlement, and the premiums received are reflected as a component of other shareholders’ equity. The put options are accounted for as permanent equity, and accordingly, there is no impact on the income statement. No other derivative contracts are used in the Corporation’s repurchase programs.

The calculation of earnings per common share and diluted earnings per common share for the three months and nine months ended September 30, 2002 and 2001 is presented below:

| | | Three Months Ended

September 30

| | | Nine Months Ended

September 30

| |

(Dollars in millions, except per share information; shares in thousands) | | 2002

| | | 2001

| | | 2002

| | | 2001

| |

Earnings per common share | | | | | | | | | | | | | | | | |

| Net income | | $ | 2,235 | | | $ | 841 | | | $ | 6,635 | | | $ | 4,734 | |

| Preferred stock dividends | | | (2 | ) | | | (2 | ) | | | (4 | ) | | | (4 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net income available to common shareholders | | $ | 2,233 | | | $ | 839 | | | $ | 6,631 | | | $ | 4,730 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Average common shares issued and outstanding | | | 1,504,017 | | | | 1,599,692 | | | | 1,526,946 | | | | 1,603,340 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Earnings per common share | | $ | 1.49 | | | $ | 0.52 | | | $ | 4.34 | | | $ | 2.95 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Diluted earnings per common share | | | | | | | | | | | | | | | | |

| Net income available to common shareholders | | $ | 2,233 | | | $ | 839 | | | $ | 6,631 | | | $ | 4,730 | |

| Preferred stock dividends | | | 2 | | | | 2 | | | | 4 | | | | 4 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net income available to common shareholders and assumed conversions | | $ | 2,235 | | | $ | 841 | | | $ | 6,635 | | | $ | 4,734 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Average common shares issued and outstanding | | | 1,504,017 | | | | 1,599,692 | | | | 1,526,946 | | | | 1,603,340 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Incremental shares from assumed conversions: | | | | | | | | | | | | | | | | |

| Convertible preferred stock | | | 2,346 | | | | 2,633 | | | | 2,415 | | | | 2,705 | |

| Stock options | | | 39,984 | | | | 31,738 | | | | 43,842 | | | | 26,883 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Dilutive potential common shares(1) | | | 42,330 | | | | 34,371 | | | | 46,257 | | | | 29,588 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Total diluted average common shares issued and outstanding | | | 1,546,347 | | | | 1,634,063 | | | | 1,573,203 | | | | 1,632,928 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Diluted earnings per common share | | $ | 1.45 | | | $ | 0.51 | | | $ | 4.22 | | | $ | 2.90 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

(1) | | For the three months and nine months ended September 30, 2002, average options to purchase 23 million and 22 million shares, respectively, were outstanding but not included in the computation of earnings per share because they were antidilutive. For the three months and nine months ended September 30, 2001, average options to purchase 43 million and 87 million shares, respectively, were outstanding but not included in the computation of earnings per share because they were antidilutive. |

Note Nine — Business Segment Information

The Corporation reports the results of its operations through four business segments:Consumer and Commercial Banking, Asset Management, Global Corporate and Investment Banking andEquity Investments. Certain operating segments have been aggregated into a single business segment.

Consumer and Commercial Banking provides a diversified range of products and services to individuals and small businesses through multiple delivery channels and commercial lending and treasury management services to middle market companies with annual revenue between $10 million and $500 million.Asset Management offers investment, fiduciary and comprehensive banking and credit expertise; asset management services to institutional clients, high-net-worth individuals and retail customers; and investment, securities and financial planning services to affluent and high-net-worth individuals.Global Corporate and Investment Banking provides capital raising

14

solutions, advisory services, derivatives capabilities, equity and debt sales and trading as well as traditional bank deposit and loan products, cash management and payment services to large corporations and institutional clients.Equity Investments includes Principal Investing which makes both direct and indirect equity investments in a wide variety of companies at all stages of the business cycle.Equity Investments also includes the Corporation’s strategic alliances and investment portfolio.

Corporate Other consists primarily of gains and losses associated with managing the balance sheet of the Corporation, certain consumer finance and commercial lending businesses being liquidated and certain residential mortgages originated by the mortgage group or otherwise acquired and held for asset/liability management purposes.

See Table Eight in the Business Segment Operations section of Management’s Discussion and Analysis beginning on page 31 for results of operations and average total assets for the three months and nine months ended September 30, 2002 and 2001 for each business segment.

A reconciliation of the four business segments’ net income to consolidated net income follows:

| | | Three Months Ended September 30

| | | Nine Months Ended September 30

| |

(Dollars in millions) | | 2002

| | | 2001

| | | 2002

| | | 2001

| |

| Segments’ net income | | $ | 1,920 | | | $ | 1,841 | | | $ | 5,970 | | | $ | 5,589 | |

| Adjustments, net of taxes: | | | | | | | | | | | | | | | | |

| Earnings associated with unassigned capital | | | 94 | | | | 38 | | | | 300 | | | | 151 | |

| Asset/liability management mortgage portfolio | | | 165 | | | | 89 | | | | 273 | | | | 224 | |

| Liquidating businesses | | | (1 | ) | | | 48 | | | | 20 | | | | 82 | |

| SFAS 133 transition adjustment net loss | | | — | | | | — | | | | — | | | | (68 | ) |

| Provision for credit losses in excess of net charge-offs | | | — | | | | — | | | | — | | | | (49 | ) |

| Gains on sales of securities | | | 137 | | | | 67 | | | | 234 | | | | 70 | |

| Exit charges | | | — | | | | (1,250 | ) | | | — | | | | (1,250 | ) |

| Other | | | (80 | ) | | | 8 | | | | (162 | ) | | | (15 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Consolidated net income | | $ | 2,235 | | | $ | 841 | | | $ | 6,635 | | | $ | 4,734 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

The adjustments presented in the table above include consolidated income and expense amounts not specifically allocated to individual business segments.

Note Ten — Securitizations

The Corporation securitizes, sells and services interests in consumer finance, commercial, bankcard and residential mortgage loans. When the Corporation securitizes assets, it may retain a portion or all of the securities, subordinated tranches, interest only strips and, in some cases, a cash reserve account, all of which are considered retained interests in the securitized assets. See Note One of the Corporation’s 2001 Annual Report for a more detailed discussion of securitizations.

Excess Spread Certificates (the Certificates) of $2.1 billion at September 30, 2002 are classified as mortgage banking assets and marked to market with the unrealized gains or losses recorded in trading account profits. The fair value of the Certificates decreased $1.8 billion compared to December 31, 2001 primarily due to an increase in mortgage prepayments and expected future prepayments, driven by a significant decrease in mortgage interest rates. At September 30, 2002, key economic assumptions and the sensitivities of the fair value of the Certificates to immediate changes in those assumptions were analyzed. The sensitivity analysis included the impact on fair value of modeled prepayment and discount rate changes under favorable and adverse conditions. A decrease of 10 percent and 20 percent in modeled prepayments would result in an increase in value ranging from $202 million to $438 million, and an increase in modeled prepayments of 10 percent and 20 percent would result in a decrease in value ranging from $174 million to $324 million. A decrease of 100 and 200 basis points in the discount rate would result in an increase in value ranging from $84 million to $176 million, and an increase in the discount rate of 100 and 200

15

basis points would result in a decrease in value ranging from $78 million to $150 million. See Note One of the Corporation’s 2001 Annual Report for additional disclosures related to the Certificates.

The sensitivities related to the Certificates are hypothetical and should be used with caution. As the amounts indicate, changes in fair value based on variations in assumptions generally cannot be extrapolated because the relationship of the change in assumption to the change in fair value may not be linear. Also, the effect of a variation in a particular assumption on the fair value of the retained interest is calculated without changing any other assumption. In reality, changes in one factor may result in changes in another, which might magnify or counteract the sensitivities. Additionally, the Corporation has the ability to hedge interest rate risk associated with the Certificates. The above sensitivities do not reflect any hedge strategies that may be undertaken to mitigate such risk.

16

Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION

This report on Form 10-Q contains certain forward-looking statements that are subject to risks and uncertainties and include information about possible or assumed future results of operations. Many possible events or factors could affect the future financial results and performance of Bank of America Corporation (the Corporation). This could cause results or performance to differ materially from those expressed in our forward-looking statements. Words such as “expects,” “anticipates,” “believes,” “estimates,” variations of such words and other similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in, or implied by, such forward-looking statements. Readers of the Corporation’s Form 10-Q should not rely solely on the forward-looking statements and should consider all uncertainties and risks discussed throughout this report, as well as those discussed in the Corporation’s 2001 Annual Report. These statements are representative only on the date hereof, and the Corporation undertakes no obligation to update any forward-looking statements made.

The possible events or factors include the following: the Corporation’s loan growth is dependent on general economic conditions as well as various discretionary factors such as decisions to securitize, sell or purchase certain loans or loan portfolios; syndications or participations of loans; retention of residential mortgage loans; and the management of borrower, industry, product and geographic concentrations and the mix of the loan portfolio. The level of nonperforming assets, charge-offs and provision expense can be affected by local, regional and international economic and market conditions, including the concentrations of borrowers, industries, products and geographic locations, the mix of the loan portfolio and management’s judgments regarding the collectibility of loans. Liquidity requirements may change as a result of fluctuations in assets and liabilities and off-balance sheet exposures, which will impact the capital and debt financing needs of the Corporation and the mix of funding sources. Decisions to purchase, hold or sell securities are also dependent on liquidity requirements and market volatility, as well as on- and off-balance sheet positions. Factors that may impact interest rate risk include local, regional and international economic conditions, levels, mix, maturities, yields or rates of assets and liabilities, utilization and effectiveness of interest rate contracts and the wholesale and retail funding sources of the Corporation. The Corporation is also exposed to the potential of losses arising from adverse changes in market rates and prices which can adversely impact the value of financial products, including securities, loans, deposits, debt and derivative financial instruments, such as futures, forwards, swaps, options and other financial instruments with similar characteristics. The Corporation is also exposed to potential litigation liabilities, including costs, expenses, settlements and judgments, that may adversely affect the Corporation. The Corporation may be adversely affected by changes in domestic or foreign tax laws, rules and regulations as well as Internal Revenue Service or other governmental agencies’ interpretations thereof. In addition, the banking industry in general is subject to various monetary and fiscal policies and regulations, which include those determined by the Federal Reserve Board, the Office of the Comptroller of Currency, the Federal Deposit Insurance Corporation, state regulators and the Office of Thrift Supervision, whose policies and regulations could affect the Corporation’s results. Other factors that may cause actual results to differ from the forward-looking statements include the following: competition with other local, regional and international banks, thrifts, credit unions and other nonbank financial institutions, such as investment banking firms, investment advisory firms, brokerage firms, investment companies and insurance companies, as well as other entities which offer financial services, located both within and outside the United States and through alternative delivery channels such as the Internet; interest rate, market and monetary fluctuations; inflation; market volatility; general economic conditions and economic conditions in the geographic regions and industries in which the Corporation operates; introduction and acceptance of new banking-related products, services and enhancements; fee pricing strategies, mergers and acquisitions and their integration into the Corporation; and management’s ability to manage these and other risks.

17

Overview

The Corporation is a Delaware corporation, a bank holding company and a financial holding company and is headquartered in Charlotte, North Carolina. The Corporation operates in 21 states and the District of Columbia and has offices located in 30 countries. The Corporation provides a diversified range of banking and certain nonbanking financial services and products both domestically and internationally through four business segments: Consumer and Commercial Banking,Asset Management,Global Corporate and Investment Banking andEquity Investments. At September 30, 2002, the Corporation had $660 billion in assets and approximately 134,000 full-time equivalent employees. Refer to Table One for selected financial data for the three months and nine months ended September 30, 2002 and 2001.

Key performance highlights for the nine months ended September 30, 2002 compared to the same period in 2001:

| • | | Net income totaled $6.6 billion, or $4.22 per common share (diluted), compared to $4.7 billion, or $2.90 per common share (diluted). The return on average common shareholders’ equity was 18.71 percent. Net income for the three months ended September 30, 2002 totaled $2.2 billion, or $1.45 per common share (diluted), compared to $841 million, or $0.51 per common share (diluted) for the three months ended September 30, 2001. The return on average common shareholders’ equity was 19.02 percent. As a result of the adoption of Statement of Financial Accounting Standards No. 142, “Goodwill and Other Intangible Assets” on January 1, 2002, the Corporation no longer amortizes goodwill. The impact of goodwill amortization on net income was $467 million or $0.29 per share (diluted) for the nine months ended September 30, 2001 and $153 million or $0.09 per share (diluted) for the three months ended September 30, 2001. Prior year results also included $1.25 billion of after-tax business exit charges in the third quarter of 2001, which impacted diluted earnings per share by $0.77 and $0.76 for the three months and nine months ended September 30, 2001, respectively. |

| • | | Total revenue includes net interest income and noninterest income. Total revenue was $25.7 billion, a decrease of $133 million. |

| | • | | Net interest income increased $676 million to $15.5 billion. The increase was driven by the net impact of higher discretionary portfolio levels and interest rate changes, higher levels of core deposit funding, consumer loan growth, losses associated with auto lease financing in 2001 and the margin impact of higher trading-related activities, partially offset by the securitization of subprime real estate loans and reduced commercial loan levels. |

| | • | | Noninterest income was $10.1 billion, an $809 million decrease. This decrease was primarily due to a sharp decline in trading account profits and higher equity investment impairment charges, partially offset by increases in service charges, investment and brokerage services, mortgage banking income and card income. |

| • | | The provision for credit losses decreased $354 million to $2.5 billion, primarily due to $395 million in 2001 associated with exiting the subprime real estate lending business. Net charge-offs were $2.5 billion, or 1.01 percent of average loans and leases, a decrease of seven basis points. The decrease in net charge-offs of $518 million was primarily due to $635 million of charge-offs in 2001 related to exiting the subprime real estate lending business and decreases in commercial — domestic and consumer finance net charge-offs, partially offset by increases in bankcard and commercial — foreign net charge-offs. |

| • | | Nonperforming assets were $5.1 billion, or 1.50 percent of loans, leases and foreclosed properties at September 30, 2002, a $223 million increase from December 31, 2001. Nonperforming assets continued to be affected by the weakened economic environment. The allowance for credit losses totaled $6.9 billion, or 2.01 percent of total loans and leases, at September 30, 2002 compared to 2.09 percent at December 31, 2001. |

| • | | Noninterest expense was $13.6 billion, a decrease of $1.8 billion. Excluding goodwill amortization of $502 million in 2001, noninterest expense declined $1.3 billion, or nine percent, in 2002 compared to the prior year, primarily due to $1.30 billion of business exit costs in 2001 and reductions in professional fees, partially offset by increased data processing expense. |

18

Table One

Selected Financial Data(1)

| | | Three Months Ended September 30

| | | Nine Months Ended September 30

| |

(Dollars in millions, except per share information) | | 2002

| | | 2001

| | | 2002

| | | 2001

| |

Income statement | | | | | | | | | | | | | | | | |

| Net interest income | | $ | 5,302 | | | $ | 5,204 | | | $ | 15,549 | | | $ | 14,873 | |

| Noninterest income | | | 3,220 | | | | 3,429 | | | | 10,141 | | | | 10,950 | |

| Total revenue | | | 8,522 | | | | 8,633 | | | | 25,690 | | | | 25,823 | |

| Provision for credit losses | | | 804 | | | | 1,251 | | | | 2,532 | | | | 2,886 | |

| Gains on sales of securities | | | 189 | | | | 97 | | | | 326 | | | | 82 | |

| Noninterest expense | | | 4,620 | | | | 5,911 | | | | 13,604 | | | | 15,386 | |

| Income before income taxes | | | 3,287 | | | | 1,568 | | | | 9,880 | | | | 7,633 | |

| Income tax expense | | | 1,052 | | | | 727 | | | | 3,245 | | | | 2,899 | |

| Net income | | | 2,235 | | | | 841 | | | | 6,635 | | | | 4,734 | |

| Average common shares issued and outstanding (in thousands) | | | 1,504,017 | | | | 1,599,692 | | | | 1,526,946 | | | | 1,603,340 | |

| Average diluted common shares issued and outstanding (in thousands) | | | 1,546,347 | | | | 1,634,063 | | | | 1,573,203 | | | | 1,632,928 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Performance ratios | | | | | | | | | | | | | | | | |

| Return on average assets | | | 1.33 | % | | | 0.52 | % | | | 1.36 | % | | | 0.98 | % |

| Return on average common shareholders' equity | | | 19.02 | | | | 6.78 | | | | 18.71 | | | | 13.03 | |

| Efficiency ratio (taxable-equivalent basis) | | | 53.19 | | | | 67.79 | | | | 52.09 | | | | 59.00 | |

| Total equity to total assets (period end) | | | 7.31 | | | | 7.83 | | | | 7.31 | | | | 7.83 | |

| Total average equity to total average assets | | | 6.97 | | | | 7.66 | | | | 7.29 | | | | 7.49 | |

| Dividend payout ratio | | | 40.25 | | | | 106.49 | | | | 41.37 | | | | 56.88 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Per common share data | | | | | | | | | | | | | | | | |

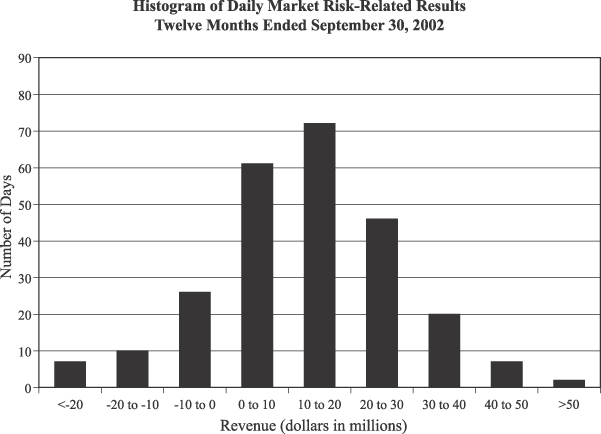

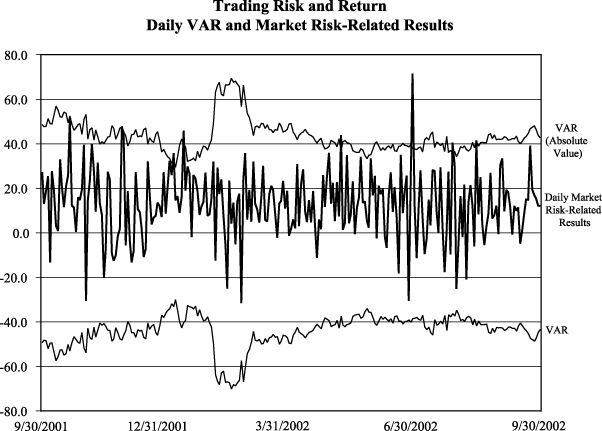

| Earnings | | $ | 1.49 | | | $ | 0.52 | | | $ | 4.34 | | | $ | 2.95 | |