UNITED STATES

SECURITES AND EXCHANGE COMMISSION

Washington, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

| | 1. | Name of the Registrant: |

BANK OF AMERICA CORPORATION

| | 2. | Name of the person relying on exemption: |

FINGER INTERESTS NUMBER ONE, LTD.

| | 3. | Address of person relying on exemption: |

520 Post Oak Blvd., Suite 750, Houston, TX 77027

| | 4. | Written Materials. Attach written material required to be submitted pursuant to Rule 14a-6(g)(1). |

Dear Shareholder:

We have modified the Powerpoint Presentation on our website, www.bacProxyVote.com. The updated Powerpoint Presentation is attached, and incorporates many of the slides that were in different sections of our website. Also, we believe the graphs at the end of the Powerpoint presentation are of particular significance.

We continue to urge you to VOTE AGAINST three directors that are standing for re-election at the Annual Meeting of Bank of America on April 29, 2009:

Vote AGAINST the election of KENNETH D. LEWIS to the board of directors

Vote AGAINST the election of O. TEMPLE SLOAN, JR. to the board of directors

Vote AGAINST the election of JACKIE M. WARD to the board of directors

SLIDESHOW PRESENTATION TO FELLOW

SHAREHOLDERS

UPDATED MARCH 25, 2009

www.BACPROXYVOTE.com

Table of Contents

— Our Thesis / Our Goals Pages 3-4

— The Case For Change Page 5

— Risky & Overpriced Acquisitions Pages 6-11

— Credit Risk Assumed through Acquisitions Pages 12-14

— Concealed Information on Merrill Acqusition Pages 15-16

— Securities Law Questions Pages 17-19

— Our Goals Page 20

— Actions taken to Date Page 21

— Appendix - Graphs (important)

÷ Permanent Destruction of Shareholder Value Pages 22-25

www.BACPROXYVOTE.com

2

Our Thesis

— Management has embarked on a program of premium

priced and high risk acquisitions, with the consent and

support of the board of directors.

— Misguided Emphasis on size, market share and “footprint”

rather than Tangible Book Value, Return on Equity,

Earnings Per Share and Protecting Shareholder Value.

— These actions by management and the board have caused

shareholder dilution that will result in the Permanent

Destruction of Shareholder Value.

— Thus, the Board has failed in its primary duty to

shareholders to protect and preserve shareholder value.

www.BACPROXYVOTE.com

3

Our Goals

— We are long-term holders of 1.1 MM shares of BAC stock since 1996.

We want to improve the Company and its governance.

— We are focused on Accountability to shareholders. This board

collectively failed to function properly as a decision making body that

was responsible for protecting the interests of shareholders, first and

foremost.

— We are seeking to change the culture of corporate governance at the

Company, so that the board of directors oversees management more

firmly and fulfills its duty to shareholders.

— For the April 29 Annual Meeting, we recommend shareholders:

¡ Vote “Against” 3 directors - Ken Lewis, Temple Sloan, Jackie Ward

(Item 1)

¡ Vote to Separate Chairman & CEO position (Item 8)

¡ Vote to Limit Executive Compensation (Items 3, 5, 11)

www.BACPROXYVOTE.com

4

The Case for Change

• Risky and Overpriced Acquisitions

• Assumption of Massive Credit risk Through Acquisitions

• We believe Management & Board Concealed Information

from Shareholders About Losses at Merrill Lynch prior to

December 5th merger vote

• Possible Violations of Securities Laws regarding disclosure

of Material Information related to new TARP Funds and

Merrill Q4 losses

• Prior knowledge regarding significant bonus payments to

Merrill executives

• The above actions have resulted in Permanent Destruction

of Shareholder Value

www.BACPROXYVOTE.com

5

Risky and Overpriced Acquistions

— LaSalle Acquistion

— Countrywide Acquisition

— Merrill Lynch Acquisition

www.BACPROXYVOTE.com

6

LaSalle Acquisition

— Full Price Paid

¡ 20.3x LTM Earnings

¡ Cash Acquisition - no common equity issued in transaction

¡ Over $11 BN of Goodwill created by Transaction

¡ Tangible Book Value Dropped by $3.5BN due to goodwill

created + lack of common equity issued

¡ Tangible Common Equity / Assets fell from 3.5% at 9/30/07 to

2.99% at 12/31/07

¡ Poorly Executed Transaction

÷ Assumption of Large Commercial Loan Book

÷ Multiple Management Defections / Lost Clients

¡ Thus, Dilutive to Shareholders

www.BACPROXYVOTE.com

7

Countrywide Acquisition

— Unknown Litigation Risk / Costs Prior to Close

¡ 5 States Attorney General Suits Prior to Closing

¡ At least 6 Subsequent AG Suits

¡ October 2008 Agreement with 11 Attorneys General to modify

$8.4Billion in Loans, 400,000 borrowers

¡ $220Million Reserved for Settlements to Date

— Very Negative Impact to Tangible Capital Ratios

¡ Tangible Common Equity drops from $46.6BN at 6/30/08 to

$24.8BN at 9/30/08 due to $4.1 BN increase in goodwill and

$16 BN increase in “other intangibles” (including mtg. serv. rights)

¡ Tangible Common Equity ratio drops from 4.62% of total

assets at 6/30/08 to 2.6% of total assets at 9/30/08

www.BACPROXYVOTE.com

8

Merrill Lynch Acquisition #1

— Inability to do Due Diligence

¡ Less than 48 hours of negotiations and Due Diligence

¡ If due diligence was attempted, it was inadequate and faulty

¡ Offer price per share = 60% premium to prior closing share

price in unstable and declining stock markets

÷ Pending failure of Lehman

÷ Frozen Credit Markets

÷ Funding Uncertainty for Broker Dealer Firms

¡ Significant Credit Risk Assets Acquired, and yet:

÷ Did they have time & expertise to evaluate assets and risks?

÷ Did they properly assess their ability to hedge risks assumed?

www.BACPROXYVOTE.com

9

Merrill Lynch Acquisition#2

— Before factoring in unexpected Q4 writedowns, our calculations

show this acquisition to be permanently dilutive to shareholders

¡ 1.4 Billion new shares issued to MER shareholders

¡ Required Pretax Earnings of $9.7 BN to be non-dilutive to Earnings

Per Share for Bank of America stockholders

¡ MER pretax earnings at “artificial peak” in 2006 = $9.8 BN,

including $7.2 BN of non-recurring “Trading Revenues” related to

Asset Backed Securities Operations, all of which (and more) has been

subsequently written off as losses

¡ MER Profits appear highly dependent upon capital markets activity

requiring capital at risk, i.e. proprietary trading, securitizations, etc.

(volatile, low multiple stream of earnings)

¡ Planned $7 + billion of cost savings often result in declining revenues

¡ Added cost of retaining best producers

www.BACPROXYVOTE.com

10

Merrill Lynch Acquisition#3

— True Cost of MER Deal (our calculation):

¡ BAC Stock issued to Merrill shareholders $19.4 BN

¡ Merrill Preferred Stock Assumed $ 9.7 BN

¡ Drop in BAC Stock ($33=>$22 x 5 bn shrs) $55 BN

÷ (1 day after announcement of deal)

¡ Cost of Retention Bonuses Paid to MER Brokers $ 3.7 BN

¡ Cost of New Gov’t TARP Money (new pfd stock @ 8%) $20 BN

¡ After tax cost of MER 4th Qtr Asset Write Downs / Loss $15.5 BN

¡ Disputed Merrill Bonuses - Thain / Cuomo $ 3.6 BN

¡ Purchase of Gov’t Asset Protection (TARP) $4 BN

¡ TARP insured future MER Losses (75% x deductible) $15 BN

÷ Total Cost $146 BN

¡ True Cost per MER share $104 / share

— Drop in BAC Market Capitalization Since Deal $145 BN

www.BACPROXYVOTE.com

11

Credit Risk Assumed Through Acquisitions

— Countrywide Acquisition

— Merrill Lynch Acquisition

www.BACPROXYVOTE.com

Countrywide - Credit Risk Assumed

— Acquired Unknown Credit Risks to Balance Sheet

¡ Pay Option Arm Loans (negative amortization) $26.4 BN

¡ Sub Prime Loans $2.4 BN

¡ Home Equity + 2nd Lien Loans $33.4 BN

¡ Level 3 Derivative Assets Acquired - Excluding

Mortgage Servicing Rights $15 BN

¡ Total of $77.2 BN in assets listed above EXCEED 1.6x Tangible

Book Value ($46.6BN at 6/30/08) before acquisition

— Worsening Credit Trends at Acquisition Date

¡ Charge offs rose by over 700% for six months ended 6/30/08 as

compared to prior year

¡ $750 MM Additional Charges in Q4 2008 for asset quality

deterioration (after purchase accounting adjustments)

www.BACPROXYVOTE.com

Merrill Lynch Credit Risk Assumed

— (dollars in BN)

— Transitory Leveraged Lending $5.65

— Commercial Real Estate $9.7

— First Republic - Real Estate $3.1

— Unhedged Super Senior ABS CDO $0.8

— Hedged Super Senior ABS CDO $1.0

— CDS with Monoline Guarantors On US & non

US ABS CDO’s $9.2

— Investment Portfolio $10.4

¡ Sum of Credit Risk Assumed $39.9

¡ Equal to 85% of tangible capital at 9/30/08

Source: BAC investor presentations

www.BACPROXYVOTE.com

Concealed Information on Merrill Lynch Losses #1

— WSJ reports on Merrill losses in 2/5/09 article:

¡ In Merrill Deal, U.S. Played Hardball, By Dan Fitzpatrick

¡ http://online.wsj.com/article/SB123379687205650255.html

— Financial Times reports that Bank of America

involved in determining Merrill Q4 Losses

¡ Bank of America directly linked to Merrill's final

writedown, By Greg Farrell in New York, Published: March 20 2009

¡ http://www.ft.com/cms/s/0/ca0e8f8c-14ee-11de-8cd1-0000779fd2ac.html

www.BACPROXYVOTE.com

15

Concealed Information on Merrill Lynch Losses #2

— Failure to Disclose Material Information to Shareholders

¡ October & November 2008 were two of the worst months in fixed income

and credit market history

¡ On November 12, Henry Paulson announces TARP will not buy assets, asset

prices go into freefall

¡ Losses in Merrill portfolio would have been evident well before December

5th, 2008 shareholder vote to approve merger

¡ Wall Street Journal article dated 2/5/09 details timing of losses in Merrill

Portfolio (see article)

¡ Bank of America had a full team of accountants at Merrill’s offices reviewing

the portfolio marks daily starting in September

¡ Ken Lewis claims losses not evident until Dec. 15th. Credit and fixed income

markets improved during December

¡ BAC & Board do not disclose losses until 1/16/09. 47% of shares trade in the

period 12/15/08 to 1/16/09. Creates significant legal exposure to BAC.

www.BACPROXYVOTE.com

16

Securities Law Questions

— Failure to Amend Proxy Statement prior to 12/5 vote

— Use of TARP Funds to Complete Acquisition is a

material change in transaction terms. Should have

been resubmitted to shareholders for approval

— 47% of shares trade during period between 12/17 and

1/16/09 without disclosure of Merrill losses and

accepting more TARP funds

www.BACPROXYVOTE.com

17

Securities Law Questions

Failure to Disclose Material Information

— Finger Interests has alleged in a class action lawsuit

that certain officers and directors failed to disclose

material information to shareholders.

¡ Management and the board of directors withheld material

information that would have affected stockholders’ decisions

to buy, hold or sell their shares of Bank of America common

stock.

¡ Management and the board of directors filed an inaccurate

proxy statement dated October 31, 2008, and failed, either by

omission or affirmative act, to amend the proxy statement to

reflect material changes in the financial condition of Merrill

Lynch.

¡ A copy of the lawsuit is under the “Our Lawsuit” tab.

www.BACPROXYVOTE.com

Securities Law Questions #2

Failure to Disclose Material Information

— We have been advised by counsel that such omissions by certain

officers and directors may be a violation of the disclosure

requirements under section 14 (a) of the Exchange Act and SEC rule

14(a)-9(a).

— We believe the decision by the board to not amend the merger proxy

statement dated October 31, 2008 was also a failure of board to fulfill

its fiduciary duty to protect the interests of shareholders.

— We further believe this failure by the board is generally reflective of

the board’s willingness to acquiesce to management’s wishes with

respect to acquisitions and other matters of great significance to the

interests of shareholders.

— As such, we urge shareholders to vote for change.

www.BACPROXYVOTE.com

Our Goals

— Change in Governance

¡ Vote “Against” election of Three Directors (Item 1)

÷ Ken Lewis - Current Chairman / CEO, architect of Countrywide

and Merrill Deals

÷ Temple Sloan - Lead Director

÷ Jackie Ward - Chair, Asset Quality Committee

¡ Separate Chairman and CEO - New Chairman/Lead Director

willing to Protect Shareholders and Challenge Management (item 8)

¡ Tie Compensation to Long Term Share Performance (Items 3,5,11)

— Change Culture

¡ Greater Focus on Building Shareholder Value

¡ Greater Focus on Risk - Reward Analysis in use of Capital

¡ Promote Greater Transparency and Disclosure

www.BACPROXYVOTE.com

20

Actions to Date

— Legal Action

¡ Filed Class Action Lawsuit regarding Securities Law issues

¡ Initial Contacts with Regulatory Agencies

— Launched Campaign to Communicate with

Shareholders

¡ Web site - www.bacProxyVote.com

¡ Exempt Solicitation Filing with Securities Exchange Commission

÷ http://idea.sec.gov/Archives/edgar/data/70858/000095013409005879/d66927px14a6g.htm

¡ Public Relations Firm

¡ Initial Contact with Regulatory Bodies

¡ Targeting Proxy Voting Services

¡ Communications with Significant Shareholders

www.BACPROXYVOTE.com

21

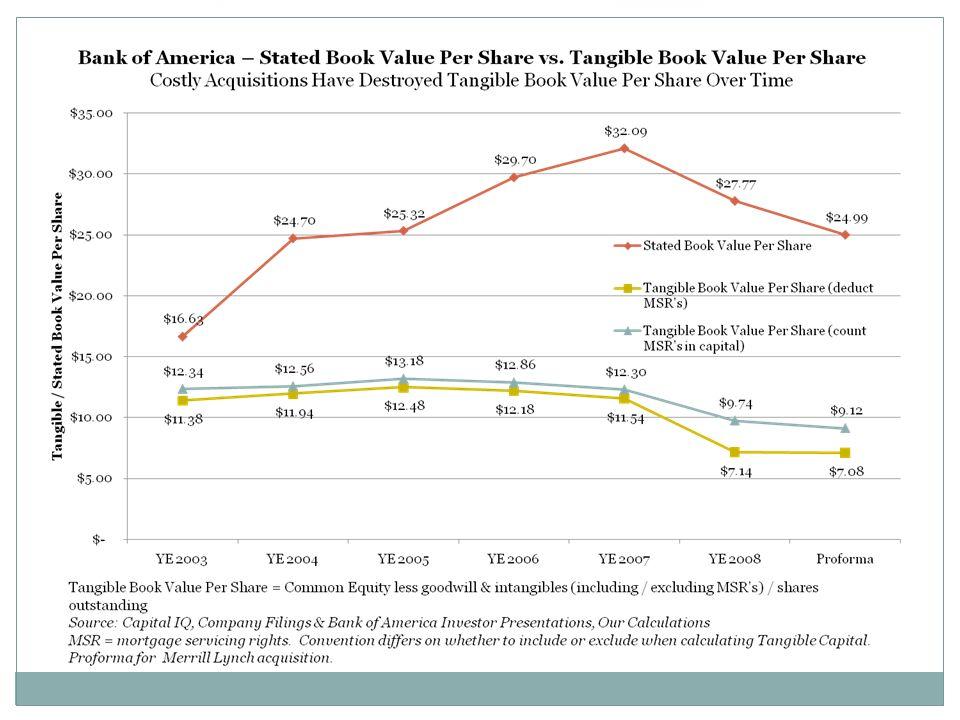

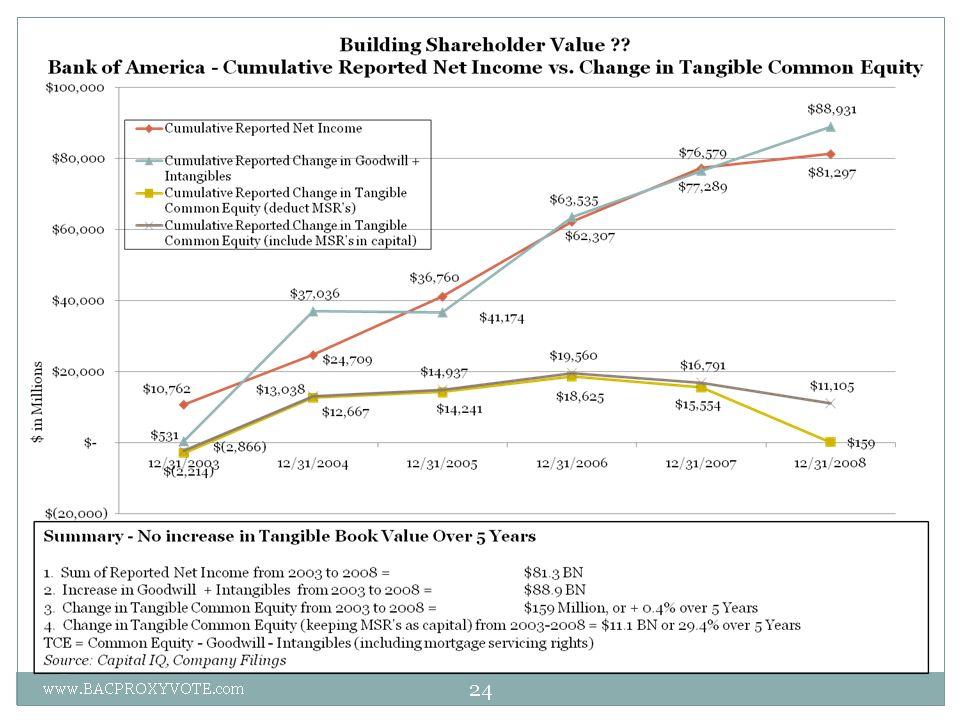

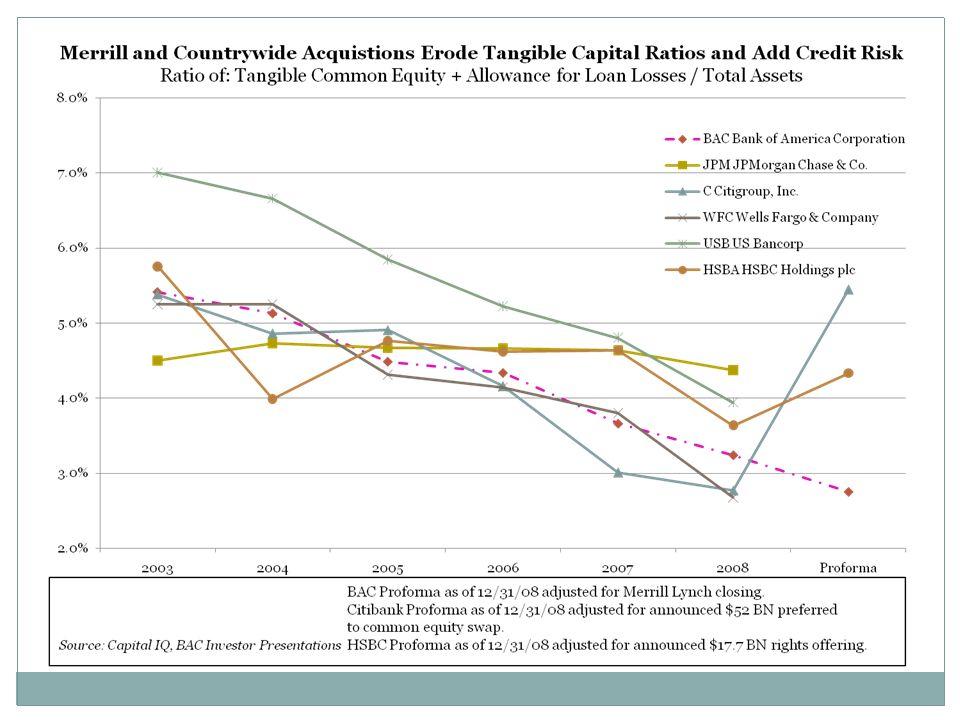

Appendix - Graphs

Permanent Destruction of Shareholder

Value

÷ Graph of Tangible Book Value Per Share

÷ Graph Reported Net Income vs Change in Goodwill

vs Change in Tangible Common Equity

÷ Graph Ratio of Tangible Common Equity +

Allowance for Loan Loss / Total Assets

www.BACPROXYVOTE.com

22