Exhibit 99.2

Supplemental Information

Third Quarter 2009

This information is preliminary and based on company data available at the time of the presentation. It speaks only as of the particular date or dates included in the accompanying pages. Bank of America does not undertake an obligation to, and disclaims any duty to, update any of the information provided. Any forward-looking statements in this information are subject to the forward-looking language contained in Bank of America’s reports filed with the SEC pursuant to the Securities Exchange Act of 1934, which are available at the SEC’s website (www.sec.gov) or at Bank of America’s website (www.bankofamerica.com). Bank of America’s future financial performance is subject to risks and uncertainties as described in its SEC filings.

| | |

| Bank of America Corporation and Subsidiaries | | |

| Table of Contents | | Page |

| |

Consolidated Financial Highlights | | 2 |

Supplemental Financial Data | | 3 |

Consolidated Statement of Income | | 4 |

Consolidated Balance Sheet | | 5 |

Capital Management | | 6 |

Core Net Interest Income - Managed Basis | | 7 |

Quarterly Average Balances and Interest Rates | | 8 |

Quarterly Average Balances and Interest Rates - Isolating Hedge Income/Expense | | 9 |

Year-to-Date Average Balances and Interest Rates | | 10 |

Year-to-Date Average Balances and Interest Rates - Isolating Hedge Income/Expense | | 11 |

Debt Securities and Available-for-Sale Marketable Equity Securities | | 12 |

Quarterly Results by Business Segment | | 13 |

Year-to-Date Results by Business Segment | | 14 |

Deposits | | |

Total Segment Results | | 15 |

Key Indicators | | 16 |

Global Card Services | | |

Total Segment Results | | 17 |

Key Indicators | | 18 |

Home Loans & Insurance | | |

Total Segment Results | | 19 |

Key Indicators | | 20 |

Global Banking | | |

Total Segment Results | | 21 |

Key Indicators | | 22 |

Investment Banking Product Rankings | | 23 |

Global Markets | | |

Total Segment Results | | 24 |

Off-Balance Sheet Special Purpose Entities Liquidity Exposure | | 25 |

Super Senior Collateralized Debt Obligation Exposure | | 26 |

Unhedged Subprime Super Senior Collateralized Debt Obligation Carrying Values | | 27 |

Global Wealth & Investment Management | | |

Total Segment Results | | 28 |

Quarter-to-Date Business Results | | 29 |

Year-to-Date Business Results | | 30 |

Key Indicators | | 31 |

All Other | | |

Total Segment Results | | 32 |

Equity Investments | | 33 |

Outstanding Loans and Leases | | 34 |

Quarterly Average Loans and Leases by Business Segment | | 35 |

Commercial Credit Exposure by Industry | | 36 |

Net Credit Default Protection by Maturity Profile and Credit Exposure Debt Rating | | 37 |

Selected Emerging Markets | | 38 |

Nonperforming Assets | | 39 |

Nonperforming Asset Activity | | 40 |

Quarterly Net Charge-offs/Losses and Net Charge-off/Loss Ratios | | 41 |

YTD Net Charge-offs/Losses and Net Charge-off/Loss Ratios | | 42 |

Allocation of the Allowance for Credit Losses by Product Type | | 43 |

| |

Exhibit A: Non-GAAP Reconciliations | | 44 |

| |

Appendix: Selected Slides from the Third Quarter 2009 Earnings Release Presentation | | 46 |

Bank of America Corporation and Subsidiaries

Consolidated Financial Highlights

(Dollars in millions, except per share information; shares in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Nine Months Ended

September 30 | | | | Third

Quarter

2009(1) | | | | | Second

Quarter

2009 | | | | | First

Quarter

2009 | | | | Fourth

Quarter

2008(1) | | | | | Third

Quarter

2008 | | |

| | | 2009 | | | | | 2008 | | | | | | | | | | | | |

Income statement | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | $ | 35,550 | | | | | $ | 32,254 | | | | $ | 11,423 | | | | | $ | 11,630 | | | | | $ | 12,497 | | | | $ | 13,106 | | | | | $ | 11,642 | | |

Noninterest income | | | 59,017 | | | | | | 24,848 | | | | | 14,612 | | | | | | 21,144 | | | | | | 23,261 | | | | | 2,574 | | | | | | 7,979 | | |

Total revenue, net of interest expense | | | 94,567 | | | | | | 57,102 | | | | | 26,035 | | | | | | 32,774 | | | | | | 35,758 | | | | | 15,680 | | | | | | 19,621 | | |

Provision for credit losses | | | 38,460 | | | | | | 18,290 | | | | | 11,705 | | | | | | 13,375 | | | | | | 13,380 | | | | | 8,535 | | | | | | 6,450 | | |

Noninterest expense, before merger and restructuring charges | | | 48,140 | | | | | | 29,953 | | | | | 15,712 | | | | | | 16,191 | | | | | | 16,237 | | | | | 10,641 | | | | | | 11,413 | | |

Merger and restructuring charges | | | 2,188 | | | | | | 629 | | | | | 594 | | | | | | 829 | | | | | | 765 | | | | | 306 | | | | | | 247 | | |

Income tax expense (benefit) | | | (691 | ) | | | | | 2,433 | | | | | (975 | ) | | | | | (845 | ) | | | | | 1,129 | | | | | (2,013 | ) | | | | | 334 | | |

Net income (loss) | | | 6,470 | | | | | | 5,797 | | | | | (1,001 | ) | | | | | 3,224 | | | | | | 4,247 | | | | | (1,789 | ) | | | | | 1,177 | | |

Preferred stock dividends | | | 3,478 | | | | | | 849 | | | | | 1,240 | | | | | | 805 | | | | | | 1,433 | | | | | 603 | | | | | | 473 | | |

Net income (loss) applicable to common shareholders | | | 2,992 | | | | | | 4,948 | | | | | (2,241 | ) | | | | | 2,419 | | | | | | 2,814 | | | | | (2,392 | ) | | | | | 704 | | |

Diluted earnings (loss) per common share | | | 0.39 | | | | | | 1.09 | | | | | (0.26 | ) | | | | | 0.33 | | | | | | 0.44 | | | | | (0.48 | ) | | | | | 0.15 | | |

Average diluted common shares issued and outstanding | | | 7,449,911 | | | | | | 4,477,994 | | | | | 8,633,834 | | | | | | 7,269,518 | | | | | | 6,431,027 | | | | | 4,957,049 | | | | | | 4,547,578 | | |

Dividends paid per common share | | $ | 0.03 | | | | | $ | 1.92 | | | | $ | 0.01 | | | | | $ | 0.01 | | | | | $ | 0.01 | | | | $ | 0.32 | | | | | $ | 0.64 | | |

| | | | | | | | | | | | | | |

Performance ratios | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Return on average assets | | | 0.35 | | | % | | | 0.43 | | % | | | n/m | | | % | | | 0.53 | | | % | | | 0.68 | | % | | | n/m | | | % | | | 0.25 | | % |

Return on average common shareholders’ equity | | | 2.26 | | | | | | 4.68 | | | | | n/m | | | | | | 5.59 | | | | | | 7.10 | | | | | n/m | | | | | | 1.97 | | |

Return on average tangible common shareholders’ equity(2) | | | 10.42 | | | | | | 14.29 | | | | | n/m | | | | | | 16.90 | | | | | | 24.37 | | | | | n/m | | | | | | 8.92 | | |

Return on average tangible shareholders’ equity(2) | | | 5.83 | | | | | | 10.50 | | | | | n/m | | | | | | 8.86 | | | | | | 12.42 | | | | | n/m | | | | | | 6.11 | | |

At period end | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Book value per share of common stock | | $ | 22.99 | | | | | $ | 30.01 | | | | $ | 22.99 | | | | | $ | 22.71 | | | | | $ | 25.98 | | | | $ | 27.77 | | | | | $ | 30.01 | | |

Tangible book value per share of common stock(2) | | | 12.00 | | | | | | 10.50 | | | | | 12.00 | | | | | | 11.66 | | | | | | 10.88 | | | | | 10.11 | | | | | | 10.50 | | |

Market price per share of common stock: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Closing price | | $ | 16.92 | | | | | $ | 35.00 | | | | $ | 16.92 | | | | | $ | 13.20 | | | | | $ | 6.82 | | | | $ | 14.08 | | | | | $ | 35.00 | | |

High closing price for the period | | | 17.98 | | | | | | 45.03 | | | | | 17.98 | | | | | | 14.17 | | | | | | 14.33 | | | | | 38.13 | | | | | | 37.48 | | |

Low closing price for the period | | | 3.14 | | | | | | 18.52 | | | | | 11.84 | | | | | | 7.05 | | | | | | 3.14 | | | | | 11.25 | | | | | | 18.52 | | |

Market capitalization | | | 146,363 | | | | | | 159,672 | | | | | 146,363 | | | | | | 114,199 | | | | | | 43,654 | | | | | 70,645 | | | | | | 159,672 | | |

| | | | | | | | | | | | | | |

Number of banking centers - domestic | | | 6,008 | | | | | | 6,139 | | | | | 6,008 | | | | | | 6,109 | | | | | | 6,145 | | | | | 6,139 | | | | | | 6,139 | | |

Number of branded ATMs - domestic | | | 18,254 | | | | | | 18,584 | | | | | 18,254 | | | | | | 18,426 | | | | | | 18,532 | | | | | 18,685 | | | | | | 18,584 | | |

Full-time equivalent employees | | | 281,863 | | | | | | 247,024 | | | | | 281,863 | | | | | | 282,408 | | | | | | 286,625 | | | | | 240,202 | | | | | | 247,024 | | |

| (1) | Due to a net loss for the three months ended September 30, 2009 and December 31, 2008, the impact of antidilutive equity instruments were excluded from diluted earnings per share and average diluted common shares. |

| (2) | Tangible equity ratios and tangible book value per share of common stock are non-GAAP measures. For corresponding reconciliations of average tangible common shareholders’ equity and tangible shareholders’ equity to GAAP financial measures, see Supplemental Financial Data on page 3. We believe the use of these non-GAAP measures provides additional clarity in assessing the results of the Corporation. |

n/m = not meaningful

Certain prior period amounts have been reclassified to conform to current period presentation.

Information for periods beginning July 1, 2008 includes the Countrywide acquisition. Information for periods beginning January 1, 2009 includes the

Merrill Lynch acquisition. Prior periods have not been restated.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 2 |

Bank of America Corporation and Subsidiaries

Supplemental Financial Data

(Dollars in millions)

Fully taxable-equivalent basis data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Nine Months Ended

September 30 | | | | | | | Third

Quarter | | | | | Second

Quarter | | | | | First

Quarter | | | | | Fourth

Quarter | | | | | Third

Quarter | | | |

| | | 2009 | | | | | 2008 | | | | | | 2009 | | | | 2009 | | | | 2009 | | | | 2008 | | | | 2008 | | |

Net interest income | | $ | 36,514 | | | | | $ | 33,148 | | | | | | | $ | 11,753 | | | | | $ | 11,942 | | | | | $ | 12,819 | | | | | $ | 13,406 | | | | | $ | 11,920 | | | |

Total revenue, net of interest expense | | | 95,531 | | | | | | 57,996 | | | | | | | | 26,365 | | | | | $ | 33,086 | | | | | | 36,080 | | | | | | 15,980 | | | | | | 19,899 | | | |

Net interest yield | | | 2.65 | | | % | | | 2.86 | | | % | | | | | 2.61 | | | % | | | 2.64 | | | % | | | 2.70 | | | % | | | 3.31 | | | % | | | 2.93 | | | % |

Efficiency ratio | | | 52.68 | | | | | | 52.73 | | | | | | | | 61.84 | | | | | | 51.44 | | | | | | 47.12 | | | | | | 68.51 | | | | | | 58.60 | | | |

Reconciliation to GAAP financial measures The Corporation evaluates its business based upon ratios that utilize tangible equity which is a non-GAAP measure. Return on average tangible shareholders’ equity measures the Corporation’s earnings contribution as a percentage of shareholders’ equity reduced by goodwill and intangible assets (excluding mortgage servicing rights), net of related deferred tax liabilities. The tangible equity ratio and the tangible common equity ratio represent shareholders’ equity, common or total as applicable, less goodwill and intangible assets (excluding mortgage servicing rights), net of related deferred tax liabilities divided by total assets less goodwill and intangible assets (excluding mortgage servicing rights), net of related deferred tax liabilities. These measures are used to evaluate the Corporation’s use of equity (i.e., capital). In addition, profitability, relationship, and investment models all use return on average tangible shareholders’ equity as key measures to support our overall growth goals. Also, the efficiency ratio measures the costs expended to generate a dollar of revenue. We believe the use of these non-GAAP measures provides additional clarity in assessing the results of the Corporation. Other companies may define or calculate supplemental financial data differently. See the tables below for supplemental financial data and corresponding reconciliations to GAAP financial measures for the three months ended September 30, 2009, June 30, 2009, March 31, 2009, December 31, 2008 and September 30, 2008, and the nine months ended September 30, 2009 and 2008. Reconciliation of average shareholders’ equity to average tangible shareholders’ equity |

Shareholders’ equity | | $ | 242,638 | | | | | $ | 160,890 | | | | | | | $ | 255,983 | | | | | $ | 242,867 | | | | | $ | 228,766 | | | | | $ | 176,566 | | | | | $ | 166,454 | | | |

Goodwill | | | (86,028 | ) | | | | | (79,150 | ) | | | | | | | (86,170 | ) | | | | | (87,314 | ) | | | | | (84,584 | ) | | | | | (81,841 | ) | | | | | (81,977 | ) | | |

Intangible assets (excluding MSRs) | | | (12,107 | ) | | | | | (9,731 | ) | | | | | | | (13,223 | ) | | | | | (13,595 | ) | | | | | (9,461 | ) | | | | | (8,818 | ) | | | | | (9,547 | ) | | |

Related deferred tax liabilities | | | 3,873 | | | | | | 1,738 | | | | | | | | 3,725 | | | | | | 3,916 | | | | | | 3,977 | | | | | | 1,913 | | | | | | 1,683 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tangible shareholders’ equity | | $ | 148,376 | | | | | $ | 73,747 | | | | | | | $ | 160,315 | | | | | $ | 145,874 | | | | | $ | 138,698 | | | | | $ | 87,820 | | | | | $ | 76,613 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reconciliation of average common shareholders’ equity to average tangible common shareholders’ equity |

Common shareholders’ equity | | $ | 177,289 | | | | | $ | 141,337 | | | | | | | $ | 197,230 | | | | | $ | 173,497 | | | | | $ | 160,739 | | | | | $ | 142,535 | | | | | $ | 142,303 | | | |

Goodwill | | | (86,028 | ) | | | | | (79,150 | ) | | | | | | | (86,170 | ) | | | | | (87,314 | ) | | | | | (84,584 | ) | | | | | (81,841 | ) | | | | | (81,977 | ) | | |

Intangible assets (excluding MSRs) | | | (12,107 | ) | | | | | (9,731 | ) | | | | | | | (13,223 | ) | | | | | (13,595 | ) | | | | | (9,461 | ) | | | | | (8,818 | ) | | | | | (9,547 | ) | | |

Related deferred tax liabilities | | | 3,873 | | | | | | 1,738 | | | | | | | | 3,725 | | | | | | 3,916 | | | | | | 3,977 | | | | | | 1,913 | | | | | | 1,683 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tangible common shareholders’ equity | | $ | 83,027 | | | | | $ | 54,194 | | | | | | | $ | 101,562 | | | | | $ | 76,504 | | | | | $ | 70,671 | | | | | $ | 53,789 | | | | | $ | 52,462 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reconciliation of period end shareholders’ equity to period end tangible shareholders’ equity |

Shareholders’ equity | | $ | 257,683 | | | | | $ | 161,039 | | | | | | | $ | 257,683 | | | | | $ | 255,152 | | | | | $ | 239,549 | | | | | $ | 177,052 | | | | | $ | 161,039 | | | |

Goodwill | | | (86,009 | ) | | | | | (81,756 | ) | | | | | | | (86,009 | ) | | | | | (86,246 | ) | | | | | (86,910 | ) | | | | | (81,934 | ) | | | | | (81,756 | ) | | |

Intangible assets (excluding MSRs) | | | (12,715 | ) | | | | | (9,167 | ) | | | | | | | (12,715 | ) | | | | | (13,245 | ) | | | | | (13,703 | ) | | | | | (8,535 | ) | | | | | (9,167 | ) | | |

Related deferred tax liabilities | | | 3,714 | | | | | | 1,914 | | | | | | | | 3,714 | | | | | | 3,843 | | | | | | 3,958 | | | | | | 1,854 | | | | | | 1,914 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tangible shareholders’ equity | | $ | 162,673 | | | | | $ | 72,030 | | | | | | | $ | 162,673 | | | | | $ | 159,504 | | | | | $ | 142,894 | | | | | $ | 88,437 | | | | | $ | 72,030 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reconciliation of period end common shareholders’ equity to period end tangible common shareholders’ equity |

Common shareholders’ equity | | $ | 198,843 | | | | | $ | 136,888 | | | | | | | $ | 198,843 | | | | | $ | 196,492 | | | | | $ | 166,272 | | | | | $ | 139,351 | | | | | $ | 136,888 | | | |

Goodwill | | | (86,009 | ) | | | | | (81,756 | ) | | | | | | | (86,009 | ) | | | | | (86,246 | ) | | | | | (86,910 | ) | | | | | (81,934 | ) | | | | | (81,756 | ) | | |

Intangible assets (excluding MSRs) | | | (12,715 | ) | | | | | (9,167 | ) | | | | | | | (12,715 | ) | | | | | (13,245 | ) | | | | | (13,703 | ) | | | | | (8,535 | ) | | | | | (9,167 | ) | | |

Related deferred tax liabilities | | | 3,714 | | | | | | 1,914 | | | | | | | | 3,714 | | | | | | 3,843 | | | | | | 3,958 | | | | | | 1,854 | | | | | | 1,914 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tangible common shareholders’ equity | | $ | 103,833 | | | | | $ | 47,879 | | | | | | | $ | 103,833 | | | | | $ | 100,844 | | | | | $ | 69,617 | | | | | $ | 50,736 | | | | | $ | 47,879 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reconciliation of period end assets to period end tangible assets |

Assets | | $ | 2,251,043 | | | | | $ | 1,831,177 | | | | | | | $ | 2,251,043 | | | | | $ | 2,254,394 | | | | | $ | 2,321,963 | | | | | $ | 1,817,943 | | | | | $ | 1,831,177 | | | |

Goodwill | | | (86,009 | ) | | | | | (81,756 | ) | | | | | | | (86,009 | ) | | | | | (86,246 | ) | | | | | (86,910 | ) | | | | | (81,934 | ) | | | | | (81,756 | ) | | |

Intangible assets (excluding MSRs) | | | (12,715 | ) | | | | | (9,167 | ) | | | | | | | (12,715 | ) | | | | | (13,245 | ) | | | | | (13,703 | ) | | | | | (8,535 | ) | | | | | (9,167 | ) | | |

Related deferred tax liabilities | | | 3,714 | | | | | | 1,914 | | | | | | | | 3,714 | | | | | | 3,843 | | | | | | 3,958 | | | | | | 1,854 | | | | | | 1,914 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tangible assets | | $ | 2,156,033 | | | | | $ | 1,742,168 | | | | | | | $ | 2,156,033 | | | | | $ | 2,158,746 | | | | | $ | 2,225,308 | | | | | $ | 1,729,328 | | | | | $ | 1,742,168 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Certain prior period amounts have been reclassified to conform to current period presentation.

Information for periods beginning July 1, 2008 includes the Countrywide acquisition. Information for periods beginning January 1, 2009 includes the

Merrill Lynch acquisition. Prior periods have not been restated.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 3 |

Bank of America Corporation and Subsidiaries

Consolidated Statement of Income

(Dollars in millions, except per share information; shares in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Nine Months Ended

September 30 | | | | | Third

Quarter

2009(1) | | | Second

Quarter

2009 | | | First

Quarter

2009 | | | Fourth

Quarter

2008(1) | | | Third

Quarter

2008 | |

| | | 2009 | | | 2008 | | | | | | | | |

Interest income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest and fees on loans and leases | | $ | 37,298 | | | $ | 41,797 | | | | | $ | 11,620 | | | $ | 12,329 | | | $ | 13,349 | | | $ | 14,220 | | | $ | 14,261 | |

Interest on debt securities | | | 10,088 | | | | 9,295 | | | | | | 2,975 | | | | 3,283 | | | | 3,830 | | | | 3,851 | | | | 3,621 | |

Federal funds sold and securities borrowed or purchased under agreements to resell | | | 2,567 | | | | 2,920 | | | | | | 722 | | | | 690 | | | | 1,155 | | | | 393 | | | | 912 | |

Trading account assets | | | 6,223 | | | | 6,937 | | | | | | 1,843 | | | | 1,952 | | | | 2,428 | | | | 2,120 | | | | 2,344 | |

Other interest income | | | 4,095 | | | | 3,133 | | | | | | 1,363 | | | | 1,338 | | | | 1,394 | | | | 1,018 | | | | 1,058 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest income | | | 60,271 | | | | 64,082 | | | | | | 18,523 | | | | 19,592 | | | | 22,156 | | | | 21,602 | | | | 22,196 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest expense | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Deposits | | | 6,335 | | | | 11,954 | | | | | | 1,710 | | | | 2,082 | | | | 2,543 | | | | 3,296 | | | | 3,846 | |

Short-term borrowings | | | 4,854 | | | | 10,452 | | | | | | 1,237 | | | | 1,396 | | | | 2,221 | | | | 1,910 | | | | 3,223 | |

Trading account liabilities | | | 1,484 | | | | 2,250 | | | | | | 455 | | | | 450 | | | | 579 | | | | 524 | | | | 661 | |

Long-term debt | | | 12,048 | | | | 7,172 | | | | | | 3,698 | | | | 4,034 | | | | 4,316 | | | | 2,766 | | | | 2,824 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest expense | | | 24,721 | | | | 31,828 | | | | | | 7,100 | | | | 7,962 | | | | 9,659 | | | | 8,496 | | | | 10,554 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | | 35,550 | | | | 32,254 | | | | | | 11,423 | | | | 11,630 | | | | 12,497 | | | | 13,106 | | | | 11,642 | |

| | | | | | | | |

Noninterest income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Card income | | | 6,571 | | | | 10,212 | | | | | | 1,557 | | | | 2,149 | | | | 2,865 | | | | 3,102 | | | | 3,122 | |

Service charges | | | 8,282 | | | | 7,757 | | | | | | 3,020 | | | | 2,729 | | | | 2,533 | | | | 2,559 | | | | 2,722 | |

Investment and brokerage services | | | 8,905 | | | | 3,900 | | | | | | 2,948 | | | | 2,994 | | | | 2,963 | | | | 1,072 | | | | 1,238 | |

Investment banking income | | | 3,955 | | | | 1,645 | | | | | | 1,254 | | | | 1,646 | | | | 1,055 | | | | 618 | | | | 474 | |

Equity investment income (loss) | | | 7,988 | | | | 1,330 | | | | | | 843 | | | | 5,943 | | | | 1,202 | | | | (791 | ) | | | (316 | ) |

Trading account profits (losses) | | | 10,760 | | | | (1,810 | ) | | | | | 3,395 | | | | 2,164 | | | | 5,201 | | | | (4,101 | ) | | | (384 | ) |

Mortgage banking income | | | 7,139 | | | | 2,564 | | | | | | 1,298 | | | | 2,527 | | | | 3,314 | | | | 1,523 | | | | 1,674 | |

Insurance income | | | 2,057 | | | | 1,092 | | | | | | 707 | | | | 662 | | | | 688 | | | | 741 | | | | 678 | |

Gains on sales of debt securities | | | 3,684 | | | | 362 | | | | | | 1,554 | | | | 632 | | | | 1,498 | | | | 762 | | | | 10 | |

Other income (loss) | | | 1,870 | | | | (206 | ) | | | | | (1,167 | ) | | | 724 | | | | 2,313 | | | | (1,448 | ) | | | (317 | ) |

Other-than-temporary impairment losses on AFS debt securities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total other-than-temporary impairment losses on AFS debt securities | | | (2,671 | ) | | | (1,998 | ) | | | | | (847 | ) | | | (1,110 | ) | | | (714 | ) | | | (1,463 | ) | | | (922 | ) |

Portion of other-than-temporary impairment losses recognized in OCI on AFS debt securities | | | 477 | | | | — | | | | | | 50 | | | | 84 | | | | 343 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net impairment losses recognized in earnings on AFS debt securities | | | (2,194 | ) | | | (1,998 | ) | | | | | (797 | ) | | | (1,026 | ) | | | (371 | ) | | | (1,463 | ) | | | (922 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total noninterest income | | | 59,017 | | | | 24,848 | | | | | | 14,612 | | | | 21,144 | | | | 23,261 | | | | 2,574 | | | | 7,979 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenue, net of interest expense | | | 94,567 | | | | 57,102 | | | | | | 26,035 | | | | 32,774 | | | | 35,758 | | | | 15,680 | | | | 19,621 | |

| | | | | | | | |

Provision for credit losses | | | 38,460 | | | | 18,290 | | | | | | 11,705 | | | | 13,375 | | | | 13,380 | | | | 8,535 | | | | 6,450 | |

| | | | | | | | |

Noninterest expense | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Personnel | | | 24,171 | | | | 14,344 | | | | | | 7,613 | | | | 7,790 | | | | 8,768 | | | | 4,027 | | | | 5,198 | |

Occupancy | | | 3,567 | | | | 2,623 | | | | | | 1,220 | | | | 1,219 | | | | 1,128 | | | | 1,003 | | | | 926 | |

Equipment | | | 1,855 | | | | 1,208 | | | | | | 617 | | | | 616 | | | | 622 | | | | 447 | | | | 440 | |

Marketing | | | 1,490 | | | | 1,813 | | | | | | 470 | | | | 499 | | | | 521 | | | | 555 | | | | 605 | |

Professional fees | | | 1,511 | | | | 1,071 | | | | | | 562 | | | | 544 | | | | 405 | | | | 521 | | | | 424 | |

Amortization of intangibles | | | 1,546 | | | | 1,357 | | | | | | 510 | | | | 516 | | | | 520 | | | | 477 | | | | 464 | |

Data processing | | | 1,861 | | | | 1,905 | | | | | | 592 | | | | 621 | | | | 648 | | | | 641 | | | | 755 | |

Telecommunications | | | 1,033 | | | | 814 | | | | | | 361 | | | | 345 | | | | 327 | | | | 292 | | | | 288 | |

Other general operating | | | 11,106 | | | | 4,818 | | | | | | 3,767 | | | | 4,041 | | | | 3,298 | | | | 2,678 | | | | 2,313 | |

Merger and restructuring charges | | | 2,188 | | | | 629 | | | | | | 594 | | | | 829 | | | | 765 | | | | 306 | | | | 247 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total noninterest expense | | | 50,328 | | | | 30,582 | | | | | | 16,306 | | | | 17,020 | | | | 17,002 | | | | 10,947 | | | | 11,660 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | 5,779 | | | | 8,230 | | | | | | (1,976 | ) | | | 2,379 | | | | 5,376 | | | | (3,802 | ) | | | 1,511 | |

Income tax expense (benefit) | | | (691 | ) | | | 2,433 | | | | | | (975 | ) | | | (845 | ) | | | 1,129 | | | | (2,013 | ) | | | 334 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 6,470 | | | $ | 5,797 | | | | | $ | (1,001 | ) | | $ | 3,224 | | | $ | 4,247 | | | $ | (1,789 | ) | | $ | 1,177 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Preferred stock dividends | | | 3,478 | | | | 849 | | | | | | 1,240 | | | | 805 | | | | 1,433 | | | | 603 | | | | 473 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) applicable to common shareholders | | $ | 2,992 | | | $ | 4,948 | | | | | $ | (2,241 | ) | | $ | 2,419 | | | $ | 2,814 | | | $ | (2,392 | ) | | $ | 704 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Per common share information | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Earnings (loss) | | $ | 0.39 | | | $ | 1.09 | | | | | $ | (0.26 | ) | | $ | 0.33 | | | $ | 0.44 | | | $ | (0.48 | ) | | $ | 0.15 | |

Diluted earnings (loss) | | | 0.39 | | | | 1.09 | | | | | | (0.26 | ) | | | 0.33 | | | | 0.44 | | | | (0.48 | ) | | | 0.15 | |

Dividends paid | | | 0.03 | | | | 1.92 | | | | | | 0.01 | | | | 0.01 | | | | 0.01 | | | | 0.32 | | | | 0.64 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Average common shares issued and outstanding | | | 7,423,341 | | | | 4,469,517 | | | | | | 8,633,834 | | | | 7,241,515 | | | | 6,370,815 | | | | 4,957,049 | | | | 4,543,963 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Average diluted common shares issued and outstanding | | | 7,449,911 | | | | 4,477,994 | | | | | | 8,633,834 | | | | 7,269,518 | | | | 6,431,027 | | | | 4,957,049 | | | | 4,547,578 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Due to a net loss for the three months ended September 30, 2009 and December 31, 2008, the impact of antidilutive equity instruments were excluded from diluted earnings per share and average diluted common shares. |

Certain prior period amounts have been reclassified to conform to current period presentation.

Information for periods beginning July 1, 2008 includes the Countrywide acquisition. Information for periods beginning January 1, 2009 includes the

Merrill Lynch acquisition. Prior periods have not been restated.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 4 |

Bank of America Corporation and Subsidiaries

Consolidated Balance Sheet

(Dollars in millions)

| | | | | | | | | | | | |

| | | September 30

2009 | | | June 30

2009 | | | September 30

2008 | |

Assets | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 152,412 | | | $ | 140,366 | | | $ | 39,341 | |

Time deposits placed and other short-term investments | | | 22,992 | | | | 25,710 | | | | 11,709 | |

Federal funds sold and securities borrowed or purchased under agreements to resell | | | 187,761 | | | | 184,685 | | | | 87,038 | |

Trading account assets | | | 204,838 | | | | 175,934 | | | | 155,719 | |

Derivative assets | | | 94,855 | | | | 101,707 | | | | 45,792 | |

Debt securities: | | | | | | | | | | | | |

Available-for-sale | | | 247,200 | | | | 257,519 | | | | 257,427 | |

Held-to-maturity, at cost | | | 9,545 | | | | 9,719 | | | | 1,250 | |

Total debt securities | | | 256,745 | | | | 267,238 | | | | 258,677 | |

Loans and leases, net of allowance: | | | | | | | | | | | | |

Loans and leases | | | 914,266 | | | | 942,248 | | | | 942,676 | |

Allowance for loan and lease losses | | | (35,832 | ) | | | (33,785 | ) | | | (20,346 | ) |

Total loans and leases, net of allowance | | | 878,434 | | | | 908,463 | | | | 922,330 | |

Premises and equipment, net | | | 15,373 | | | | 15,667 | | | | 13,000 | |

Mortgage servicing rights (includes$17,539, $18,535 and $20,811 measured at fair value) | | | 17,850 | | | | 18,857 | | | | 21,131 | |

Goodwill | | | 86,009 | | | | 86,246 | | | | 81,756 | |

Intangible assets | | | 12,715 | | | | 13,245 | | | | 9,167 | |

Loans held-for-sale | | | 40,124 | | | | 50,994 | | | | 27,414 | |

Other assets | | | 280,935 | | | | 265,282 | | | | 158,103 | |

Total assets | | $ | 2,251,043 | | | $ | 2,254,394 | | | $ | 1,831,177 | |

| | | |

Liabilities | | | | | | | | | | | | |

Deposits in domestic offices: | | | | | | | | | | | | |

Noninterest-bearing | | $ | 246,729 | | | $ | 248,757 | | | $ | 201,025 | |

Interest-bearing | | | 652,730 | | | | 650,725 | | | | 577,503 | |

Deposits in foreign offices: | | | | | | | | | | | | |

Noninterest-bearing | | | 4,889 | | | | 4,560 | | | | 3,524 | |

Interest-bearing | | | 70,551 | | | | 66,700 | | | | 91,999 | |

Total deposits | | | 974,899 | | | | 970,742 | | | | 874,051 | |

Federal funds purchased and securities loaned or sold under agreements to repurchase | | | 249,578 | | | | 263,639 | | | | 225,729 | |

Trading account liabilities | | | 71,672 | | | | 50,000 | | | | 63,881 | |

Derivative liabilities | | | 52,624 | | | | 51,300 | | | | 26,466 | |

Commercial paper and other short-term borrowings | | | 62,280 | | | | 96,236 | | | | 145,812 | |

Accrued expenses and other liabilities (includes$1,567, $1,992 and $427 of reserve for unfunded lending commitments) | | | 126,019 | | | | 120,138 | | | | 76,489 | |

Long-term debt | | | 456,288 | | | | 447,187 | | | | 257,710 | |

Total liabilities | | | 1,993,360 | | | | 1,999,242 | | | | 1,670,138 | |

Shareholders’ equity | | | | | | | | | | | | |

Preferred stock, $0.01 par value; authorized - 100,000,000 shares; issued and outstanding - 5,760,660, 5,760,731 and 7,602,067 shares | | | 58,840 | | | | 58,660 | | | | 24,151 | |

Common stock and additional paid-in capital, $0.01 par value; authorized -10,000,000,000, 10,000,000,000, and 7,500,000,000 shares; issued and outstanding -8,650,314,133, 8,651,459,122 and 4,562,054,554 shares | | | 128,823 | | | | 128,717 | | | | 65,361 | |

Retained earnings | | | 76,881 | | | | 79,210 | | | | 77,695 | |

Accumulated other comprehensive income (loss) | | | (6,705 | ) | | | (11,227 | ) | | | (5,647 | ) |

Other | | | (156 | ) | | | (208 | ) | | | (521 | ) |

Total shareholders’ equity | | | 257,683 | | | | 255,152 | | | | 161,039 | |

Total liabilities and shareholders’ equity | | $ | 2,251,043 | | | $ | 2,254,394 | | | $ | 1,831,177 | |

Certain prior period amounts have been reclassified to conform to current period presentation.

Information for periods beginning July 1, 2008 includes the Countrywide acquisition. Information for periods beginning January 1, 2009 includes the

Merrill Lynch acquisition. Prior periods have not been restated.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 5 |

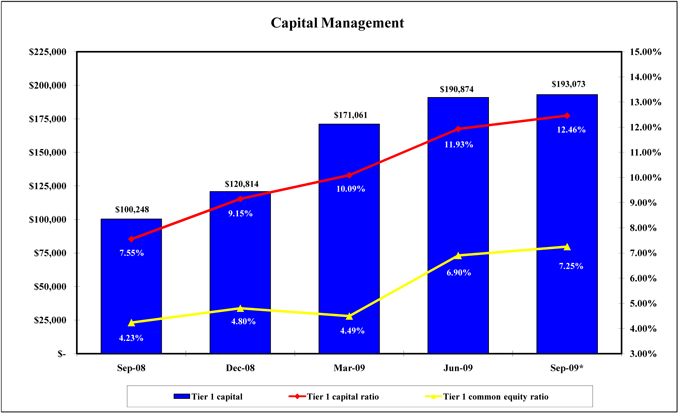

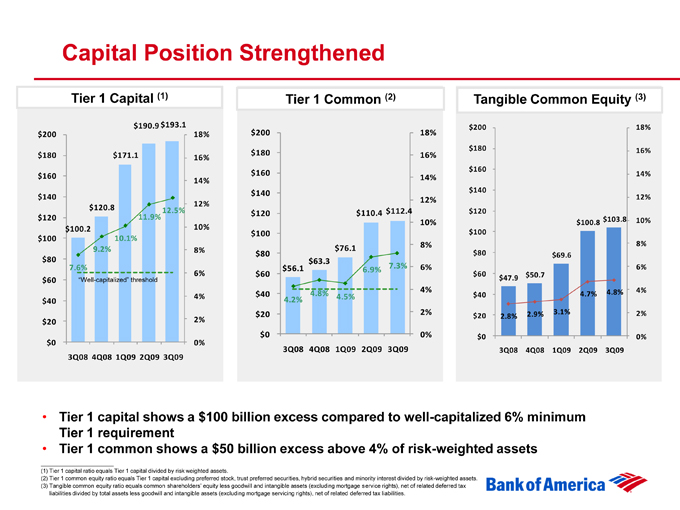

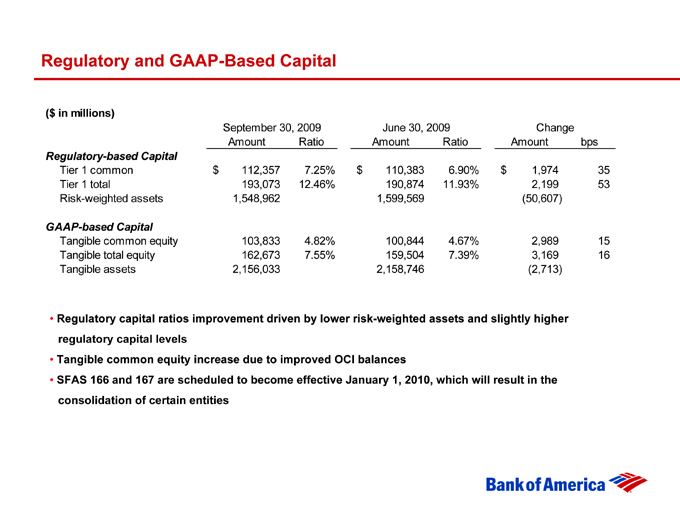

Bank of America Corporation and Subsidiaries

Capital Management

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Third

Quarter

2009(1) | | | | Second

Quarter

2009 | | | | First

Quarter

2009 | | | | Fourth

Quarter

2008 | | | | Third

Quarter

2008 | | |

Risk-based capital: | | | | | | | | | | | | | | | | | | | | | | | | | |

Tier 1 common | | $ | 112,357 | | | | $ | 110,383 | | | | $ | 76,145 | | | | $ | 63,339 | | | | $ | 56,139 | | |

Tier 1 capital | | | 193,073 | | | | | 190,874 | | | | | 171,061 | | | | | 120,814 | | | | | 100,248 | | |

Total capital | | | 258,568 | | | | | 255,701 | | | | | 237,905 | | | | | 171,661 | | | | | 153,318 | | |

Risk-weighted assets | | | 1,548,962 | | | | | 1,599,569 | | | | | 1,695,192 | | | | | 1,320,824 | | | | | 1,328,084 | | |

Tier 1 common equity ratio(2) | | | 7.25 | | % | | | 6.90 | | % | | | 4.49 | | % | | | 4.80 | | % | | | 4.23 | | % |

Tier 1 capital ratio | | | 12.46 | | | | | 11.93 | | | | | 10.09 | | | | | 9.15 | | | | | 7.55 | | |

Total capital ratio | | | 16.69 | | | | | 15.99 | | | | | 14.03 | | | | | 13.00 | | | | | 11.54 | | |

Tier 1 leverage ratio | | | 8.39 | | | | | 8.21 | | | | | 7.07 | | | | | 6.44 | | | | | 5.51 | | |

Tangible equity ratio(3) | | | 7.55 | | | | | 7.39 | | | | | 6.42 | | | | | 5.11 | | | | | 4.13 | | |

Tangible common equity ratio(3) | | | 4.82 | | | | | 4.67 | | | | | 3.13 | | | | | 2.93 | | | | | 2.75 | | |

| (1) | Preliminary data on risk-based capital |

| (2) | Tier 1 common equity ratio equals Tier 1 capital excluding preferred stock, trust preferred securities, hybrid securities and minority interest divided by risk-weighted assets. |

| (3) | Tangible equity ratio equals period end tangible shareholders’ equity divided by period end tangible assets. Tangible common equity equals period end tangible common shareholders’ equity divided by period end tangible assets. Tangible shareholders’ equity and tangible assets are non-GAAP measures. For corresponding reconciliations of tangible shareholders’ equity and tangible assets to GAAP financial measures, see Supplemental Financial Data on page 3. We believe the use of these non-GAAP measures provide additional clarity in assessing the results of the Corporation. |

| | * | Preliminary data on risk-based capital |

Outstanding Common Stock

No common shares were repurchased in the third quarter of 2009.

75.0 million shares remain outstanding under the 2008 authorized share repurchase program.

Certain prior period amounts have been reclassified to conform to current period presentation.

Information for periods beginning July 1, 2008 includes the Countrywide acquisition. Information for periods beginning January 1, 2009 includes the

Merrill Lynch acquisition. Prior periods have not been restated.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 6 |

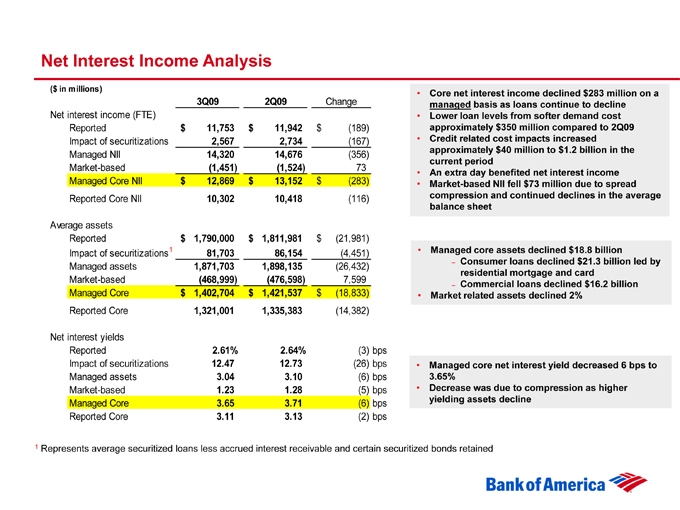

Bank of America Corporation and Subsidiaries

Core Net Interest Income - Managed Basis

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Nine Months Ended

September 30 | | | | | Third

Quarter

2009 | | | | | Second

Quarter

2009 | | | | | First

Quarter

2009 | | | | | Fourth

Quarter

2008 | | | | | Third

Quarter

2008 | | | |

| | | 2009 | | | | | 2008 | | | | | | | | | | | | | | | | | | |

Net interest income(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As reported | | $ | 36,514 | | | | | $ | 33,148 | | | | | $ | 11,753 | | | | | $ | 11,942 | | | | | $ | 12,819 | | | | | $ | 13,406 | | | | | $ | 11,920 | | | |

Impact of market-based net interest income(2) | | | (4,868 | ) | | | | | (3,477 | ) | | | | | (1,451 | ) | | | | | (1,524 | ) | | | | | (1,893 | ) | | | | | (1,462 | ) | | | | | (1,234 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Core net interest income | | | 31,646 | | | | | | 29,671 | | | | | | 10,302 | | | | | | 10,418 | | | | | | 10,926 | | | | | | 11,944 | | | | | | 10,686 | | | |

Impact of securitizations(3) | | | 8,050 | | | | | | 6,654 | | | | | | 2,567 | | | | | | 2,734 | | | | | | 2,749 | | | | | | 2,257 | | | | | | 2,310 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Core net interest income - managed basis | | $ | 39,696 | | | | | $ | 36,325 | | | | | $ | 12,869 | | | | | $ | 13,152 | | | | | $ | 13,675 | | | | | $ | 14,201 | | | | | $ | 12,996 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Average earning assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As reported | | $ | 1,837,706 | | | | | $ | 1,544,617 | | | | | $ | 1,790,000 | | | | | $ | 1,811,981 | | | | | $ | 1,912,483 | | | | | $ | 1,616,646 | | | | | $ | 1,622,466 | | | |

Impact of market-based earning assets(2) | | | (478,448 | ) | | | | | (377,148 | ) | | | | | (468,999 | ) | | | | | (476,598 | ) | | | | | (489,979 | ) | | | | | (311,582 | ) | | | | | (369,921 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Core average earning assets | | | 1,359,258 | | | | | | 1,167,469 | | | | | | 1,321,001 | | | | | | 1,335,383 | | | | | | 1,422,504 | | | | | | 1,305,064 | | | | | | 1,252,545 | | | |

Impact of securitizations(4) | | | 86,438 | | | | | | 102,481 | | | | | | 81,703 | | | | | | 86,154 | | | | | | 91,567 | | | | | | 93,189 | | | | | | 101,743 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Core average earning assets - managed basis | | $ | 1,445,696 | | | | | $ | 1,269,950 | | | | | $ | 1,402,704 | | | | | $ | 1,421,537 | | | | | $ | 1,514,071 | | | | | $ | 1,398,253 | | | | | $ | 1,354,288 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Net interest yield contribution(1, 5) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As reported | | | 2.65 | | | % | | | 2.86 | | | % | | | 2.61 | | | % | | | 2.64 | | | % | | | 2.70 | | | % | | | 3.31 | | | % | | | 2.93 | | | % |

Impact of market-based activities(2) | | | 0.46 | | | | | | 0.53 | | | | | | 0.50 | | | | | | 0.49 | | | | | | 0.39 | | | | | | 0.34 | | | | | | 0.47 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Core net interest yield on earning assets | | | 3.11 | | | | | | 3.39 | | | | | | 3.11 | | | | | | 3.13 | | | | | | 3.09 | | | | | | 3.65 | | | | | | 3.40 | | | |

Impact of securitizations | | | 0.56 | | | | | | 0.43 | | | | | | 0.54 | | | | | | 0.58 | | | | | | 0.54 | | | | | | 0.40 | | | | | | 0.43 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Core net interest yield on earning assets - managed basis | | | 3.67 | | | % | | | 3.82 | | | % | | | 3.65 | | | % | | | 3.71 | | | % | | | 3.63 | | | % | | | 4.05 | | | % | | | 3.83 | | | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Fully taxable-equivalent basis |

| (2) | Represents the impact of market-based amounts included in Global Markets. |

| (3) | Represents the impact of securitizations utilizing actual bond costs. This is different from the business segment view which utilizes funds transfer pricing methodologies. |

| (4) | Represents average securitized loans less accrued interest receivable and certain securitized bonds retained. |

| (5) | Calculated on an annualized basis. |

Certain prior period amounts have been reclassified to conform to current period presentation.

Information for periods beginning July 1, 2008 includes the Countrywide acquisition. Information for periods beginning January 1, 2009 includes the

Merrill Lynch acquisition. Prior periods have not been restated.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 7 |

Bank of America Corporation and Subsidiaries

Quarterly Average Balances and Interest Rates - Fully Taxable-equivalent Basis

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Third Quarter 2009 | | Second Quarter 2009 | | Third Quarter 2008 | | |

| | | Average

Balance | | Interest

Income/

Expense | | Yield/

Rate | | | | Average

Balance | | Interest

Income/

Expense | | Yield/

Rate | | | | Average

Balance | | Interest

Income/

Expense | | Yield/

Rate | | |

Earning assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Time deposits placed and other short-term investments | | $ | 29,485 | | $ | 133 | | 1.79 | | % | | $ | 25,604 | | $ | 169 | | 2.64 | | % | | $ | 11,361 | | $ | 101 | | 3.54 | | % |

Federal funds sold and securities borrowed or purchased under agreements to resell | | | 223,039 | | | 722 | | 1.28 | | | | | 230,955 | | | 690 | | 1.20 | | | | | 136,322 | | | 912 | | 2.67 | | |

Trading account assets | | | 212,488 | | | 1,909 | | 3.58 | | | | | 199,820 | | | 2,028 | | 4.07 | | | | | 189,715 | | | 2,390 | | 5.03 | | |

Debt securities(1) | | | 263,712 | | | 3,048 | | 4.62 | | | | | 255,159 | | | 3,353 | | 5.26 | | | | | 266,013 | | | 3,672 | | 5.52 | | |

Loans and leases(2): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Residential mortgage(3) | | | 241,924 | | | 3,258 | | 5.38 | | | | | 253,803 | | | 3,489 | | 5.50 | | | | | 260,779 | | | 3,683 | | 5.65 | | |

Home equity | | | 153,269 | | | 1,614 | | 4.19 | | | | | 156,599 | | | 1,722 | | 4.41 | | | | | 151,111 | | | 2,153 | | 5.67 | | |

Discontinued real estate | | | 16,570 | | | 219 | | 5.30 | | | | | 18,309 | | | 303 | | 6.61 | | | | | 22,031 | | | 399 | | 7.25 | | |

Credit card - domestic | | | 49,751 | | | 1,349 | | 10.76 | | | | | 51,721 | | | 1,380 | | 10.70 | | | | | 63,414 | | | 1,682 | | 10.55 | | |

Credit card - foreign | | | 21,189 | | | 562 | | 10.52 | | | | | 18,825 | | | 501 | | 10.66 | | | | | 17,075 | | | 535 | | 12.47 | | |

Direct/Indirect consumer (4) | | | 100,012 | | | 1,439 | | 5.71 | | | | | 100,302 | | | 1,532 | | 6.12 | | | | | 85,392 | | | 1,790 | | 8.34 | | |

Other consumer(5) | | | 3,331 | | | 60 | | 7.02 | | | | | 3,298 | | | 63 | | 7.77 | | | | | 3,723 | | | 80 | | 8.78 | | |

Total consumer | | | 586,046 | | | 8,501 | | 5.77 | | | | | 602,857 | | | 8,990 | | 5.97 | | | | | 603,525 | | | 10,322 | | 6.82 | | |

Commercial - domestic | | | 216,332 | | | 2,132 | | 3.91 | | | | | 231,639 | | | 2,176 | | 3.77 | | | | | 224,117 | | | 2,852 | | 5.06 | | |

Commercial real estate(6) | | | 74,276 | | | 600 | | 3.20 | | | | | 75,559 | | | 627 | | 3.33 | | | | | 63,220 | | | 727 | | 4.57 | | |

Commercial lease financing | | | 22,068 | | | 178 | | 3.22 | | | | | 22,026 | | | 260 | | 4.72 | | | | | 22,585 | | | 53 | | 0.93 | | |

Commercial - foreign | | | 31,533 | | | 297 | | 3.74 | | | | | 34,024 | | | 360 | | 4.24 | | | | | 33,467 | | | 377 | | 4.48 | | |

Total commercial | | | 344,209 | | | 3,207 | | 3.70 | | | | | 363,248 | | | 3,423 | | 3.78 | | | | | 343,389 | | | 4,009 | | 4.64 | | |

Total loans and leases | | | 930,255 | | | 11,708 | | 5.01 | | | | | 966,105 | | | 12,413 | | 5.15 | | | | | 946,914 | | | 14,331 | | 6.03 | | |

Other earning assets | | | 131,021 | | | 1,333 | | 4.05 | | | | | 134,338 | | | 1,251 | | 3.73 | | | | | 72,141 | | | 1,068 | | 5.90 | | |

Total earning assets(7) | | | 1,790,000 | | | 18,853 | | 4.19 | | | | | 1,811,981 | | | 19,904 | | 4.40 | | | | | 1,622,466 | | | 22,474 | | 5.52 | | |

Cash and cash equivalents | | | 196,116 | | | | | | | | | | 204,354 | | | | | | | | | | 36,030 | | | | | | | |

Other assets, less allowance for loan and lease losses | | | 404,559 | | | | | | | | | | 403,982 | | | | | | | | | | 247,195 | | | | | | | |

Total assets | | $ | 2,390,675 | | | | | | | | | $ | 2,420,317 | | | | | | | | | $ | 1,905,691 | | | | | | | |

| | | | | | | | | | | | |

Interest-bearing liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Domestic interest-bearing deposits: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Savings | | $ | 34,170 | | $ | 49 | | 0.57 | | % | | $ | 34,367 | | $ | 54 | | 0.63 | | % | | $ | 32,297 | | $ | 58 | | 0.72 | | % |

NOW and money market deposit accounts | | | 356,873 | | | 353 | | 0.39 | | | | | 342,570 | | | 376 | | 0.44 | | | | | 278,552 | | | 973 | | 1.39 | | |

Consumer CDs and IRAs | | | 214,284 | | | 1,100 | | 2.04 | | | | | 229,392 | | | 1,409 | | 2.46 | | | | | 218,862 | | | 1,852 | | 3.37 | | |

Negotiable CDs, public funds and other time deposits | | | 48,905 | | | 118 | | 0.95 | | | | | 39,100 | | | 124 | | 1.28 | | | | | 36,039 | | | 291 | | 3.21 | | |

Total domestic interest-bearing deposits | | | 654,232 | | | 1,620 | | 0.98 | | | | | 645,429 | | | 1,963 | | 1.22 | | | | | 565,750 | | | 3,174 | | 2.23 | | |

Foreign interest-bearing deposits: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Banks located in foreign countries | | | 15,941 | | | 29 | | 0.73 | | | | | 19,261 | | | 37 | | 0.76 | | | | | 36,230 | | | 266 | | 2.91 | | |

Governments and official institutions | | | 6,488 | | | 4 | | 0.23 | | | | | 7,379 | | | 4 | | 0.22 | | | | | 11,847 | | | 72 | | 2.43 | | |

Time, savings and other | | | 53,013 | | | 57 | | 0.42 | | | | | 54,307 | | | 78 | | 0.58 | | | | | 48,209 | | | 334 | | 2.76 | | |

Total foreign interest-bearing deposits | | | 75,442 | | | 90 | | 0.47 | | | | | 80,947 | | | 119 | | 0.59 | | | | | 96,286 | | | 672 | | 2.78 | | |

Total interest-bearing deposits | | | 729,674 | | | 1,710 | | 0.93 | | | | | 726,376 | | | 2,082 | | 1.15 | | | | | 662,036 | | | 3,846 | | 2.31 | | |

Federal funds purchased and securities loaned or sold under agreements to repurchase and other short-term borrowings | | | 411,063 | | | 1,237 | | 1.19 | | | | | 503,451 | | | 1,396 | | 1.11 | | | | | 465,511 | | | 3,223 | | 2.76 | | |

Trading account liabilities | | | 73,290 | | | 455 | | 2.46 | | | | | 62,778 | | | 450 | | 2.87 | | | | | 73,702 | | | 661 | | 3.57 | | |

Long-term debt | | | 449,974 | | | 3,698 | | 3.27 | | | | | 444,131 | | | 4,034 | | 3.64 | | | | | 264,934 | | | 2,824 | | 4.26 | | |

Total interest-bearing liabilities(7) | | | 1,664,001 | | | 7,100 | | 1.70 | | | | | 1,736,736 | | | 7,962 | | 1.84 | | | | | 1,466,183 | | | 10,554 | | 2.86 | | |

Noninterest-bearing sources: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Noninterest-bearing deposits | | | 259,621 | | | | | | | | | | 248,516 | | | | | | | | | | 195,809 | | | | | | | |

Other liabilities | | | 211,070 | | | | | | | | | | 192,198 | | | | | | | | | | 77,245 | | | | | | | |

Shareholders’ equity | | | 255,983 | | | | | | | | | | 242,867 | | | | | | | | | | 166,454 | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 2,390,675 | | | | | | | | | $ | 2,420,317 | | | | | | | | | $ | 1,905,691 | | | | | | | |

Net interest spread | | | | | | | | 2.49 | | % | | | | | | | | 2.56 | | % | | | | | | | | 2.66 | | % |

Impact of noninterest-bearing sources | | | | | | | | 0.12 | | | | | | | | | | 0.08 | | | | | | | | | | 0.27 | | |

Net interest income/yield on earning assets | | | | | $ | 11,753 | | 2.61 | | % | | | | | $ | 11,942 | | 2.64 | | % | | | | | $ | 11,920 | | 2.93 | | % |

| (1) | Yields on AFS debt securities are calculated based on fair value rather than historical cost balances. The use of fair value does not have a material impact on net interest yield. |

| (2) | Nonperforming loans are included in the respective average loan balances. Income on these nonperforming loans is recognized on a cash basis. Purchased impaired loans were written down to fair value upon acquisition and accrete interest income over the remaining life of the loan. |

| (3) | Includes foreign residential mortgages of $662 million and $650 million for the third and second quarters of 2009. |

| (4) | Includes foreign consumer loans of $8.4 billion and $8.0 billion in the third and second quarters of 2009, and $2.6 billion in the third quarter of 2008. |

| (5) | Includes consumer finance loans of $2.4 billion and $2.5 billion in the third and second quarters of 2009, and $2.7 billion in the third quarter of 2008; and other foreign consumer loans of $700 million and $640 million in the third and second quarters of 2009, and $725 million in the third quarter of 2008. |

| (6) | Includes domestic commercial real estate loans of $70.7 billion and $72.8 billion in the third and second quarters of 2009, and $62.2 billion in the third quarter of 2008, and foreign commercial real estate loans of $3.6 billion and $2.8 billion in the third and second quarters of 2009, and $1.0 billion in the third quarter of 2008. |

| (7) | Interest income includes the impact of interest rate risk management contracts, which decreased interest income on the underlying assets $136 million and $11 million in the third and second quarters of 2009, and $12 million in the third quarter of 2008. Interest expense includes the impact of interest rate risk management contracts, which increased (decreased) interest expense on the underlying liabilities $(873) million and $(550) million in the third and second quarters of 2009, and $86 million in the third quarter of 2008. |

Certain prior period amounts have been reclassified to conform to current period presentation.

Information for periods beginning July 1, 2008 includes the Countrywide acquisition. Information for periods beginning January 1, 2009 includes the

Merrill Lynch acquisition. Prior periods have not been restated.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 8 |

Bank of America Corporation and Subsidiaries

Quarterly Average Balances and Interest Rates - Fully Taxable-equivalent Basis - Isolating Hedge Income/Expense(1)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Third Quarter 2009 | | | | Second Quarter 2009 | | | | Third Quarter 2008 | | | |

| | | Average

Balance | | Interest

Income/

Expense | | | Yield/

Rate | | | | Average

Balance | | Interest

Income/

Expense | | | Yield/

Rate | | | | Average

Balance | | Interest

Income/

Expense | | | Yield/

Rate | | | |

Earning assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Time deposits placed and other short-term investments(2) | | $ | 29,485 | | $ | 133 | | | 1.79 | | % | | $ | 25,604 | | $ | 172 | | | 2.69 | | % | | $ | 11,361 | | $ | 105 | | | 3.68 | | | % |

Federal funds sold and securities borrowed or purchased under agreements to resell (2) | | | 223,039 | | | 627 | | | 1.11 | | | | | 230,955 | | | 628 | | | 1.09 | | | | | 136,322 | | | 948 | | | 2.78 | | | |

Trading account assets (2) | | | 212,488 | | | 1,915 | | | 3.59 | | | | | 199,820 | | | 2,028 | | | 4.07 | | | | | 189,715 | | | 2,390 | | | 5.03 | | | |

Debt securities(2) | | | 263,712 | | | 3,261 | | | 4.94 | | | | | 255,159 | | | 3,387 | | | 5.31 | | | | | 266,013 | | | 3,675 | | | 5.52 | | | |

Loans and leases: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Residential mortgage | | | 241,924 | | | 3,258 | | | 5.38 | | | | | 253,803 | | | 3,489 | | | 5.50 | | | | | 260,779 | | | 3,683 | | | 5.65 | | | |

Home equity | | | 153,269 | | | 1,614 | | | 4.19 | | | | | 156,599 | | | 1,722 | | | 4.41 | | | | | 151,111 | | | 2,153 | | | 5.67 | | | |

Discontinued real estate | | | 16,570 | | | 219 | | | 5.30 | | | | | 18,309 | | | 303 | | | 6.61 | | | | | 22,031 | | | 399 | | | 7.25 | | | |

Credit card - domestic | | | 49,751 | | | 1,349 | | | 10.76 | | | | | 51,721 | | | 1,380 | | | 10.70 | | | | | 63,414 | | | 1,682 | | | 10.55 | | | |

Credit card - foreign | | | 21,189 | | | 562 | | | 10.52 | | | | | 18,825 | | | 501 | | | 10.66 | | | | | 17,075 | | | 535 | | | 12.47 | | | |

Direct/Indirect consumer | | | 100,012 | | | 1,439 | | | 5.71 | | | | | 100,302 | | | 1,532 | | | 6.12 | | | | | 85,392 | | | 1,790 | | | 8.34 | | | |

Other consumer | | | 3,331 | | | 60 | | | 7.02 | | | | | 3,298 | | | 63 | | | 7.77 | | | | | 3,723 | | | 80 | | | 8.78 | | | |

Total consumer | | | 586,046 | | | 8,501 | | | 5.77 | | | | | 602,857 | | | 8,990 | | | 5.97 | | | | | 603,525 | | | 10,322 | | | 6.82 | | | |

Commercial - domestic (2) | | | 216,332 | | | 2,144 | | | 3.93 | | | | | 231,639 | | | 2,212 | | | 3.83 | | | | | 224,117 | | | 2,820 | | | 5.01 | | | |

Commercial real estate | | | 74,276 | | | 600 | | | 3.20 | | | | | 75,559 | | | 627 | | | 3.33 | | | | | 63,220 | | | 727 | | | 4.57 | | | |

Commercial lease financing | | | 22,068 | | | 178 | | | 3.22 | | | | | 22,026 | | | 260 | | | 4.72 | | | | | 22,585 | | | 53 | | | 0.93 | | | |

Commercial - foreign | | | 31,533 | | | 297 | | | 3.74 | | | | | 34,024 | | | 360 | | | 4.24 | | | | | 33,467 | | | 377 | | | 4.48 | | | |

Total commercial | | | 344,209 | | | 3,219 | | | 3.71 | | | | | 363,248 | | | 3,459 | | | 3.82 | | | | | 343,389 | | | 3,977 | | | 4.61 | | | |

Total loans and leases | | | 930,255 | | | 11,720 | | | 5.01 | | | | | 966,105 | | | 12,449 | | | 5.16 | | | | | 946,914 | | | 14,299 | | | 6.02 | | | |

Other earning assets(2) | | | 131,021 | | | 1,333 | | | 4.05 | | | | | 134,338 | | | 1,251 | | | 3.73 | | | | | 72,141 | | | 1,069 | | | 5.90 | | | |

Total earning assets - excluding hedge impact | | | 1,790,000 | | | 18,989 | | | 4.22 | | | | | 1,811,981 | | | 19,915 | | | 4.40 | | | | | 1,622,466 | | | 22,486 | | | 5.53 | | | |

Net hedge income (expense) on assets | | | | | | (136 | ) | | | | | | | | | | (11 | ) | | | | | | | | | | (12 | ) | | | | | |

Total earning assets - including hedge impact | | | 1,790,000 | | | 18,853 | | | 4.19 | | | | | 1,811,981 | | | 19,904 | | | 4.40 | | | | | 1,622,466 | | | 22,474 | | | 5.52 | | | |

Cash and cash equivalents | | | 196,116 | | | | | | | | | | | 204,354 | | | | | | | | | | | 36,030 | | | | | | | | | |

Other assets, less allowance for loan and lease losses | | | 404,559 | | | | | | | | | | | 403,982 | | | | | | | | | | | 247,195 | | | | | | | | | |

Total assets | | $ | 2,390,675 | | | | | | | | | | $ | 2,420,317 | | | | | | | | | | $ | 1,905,691 | | | | | | | | | |

| | | | | | | | | | | | |

Interest-bearing liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Domestic interest-bearing deposits: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Savings | | $ | 34,170 | | $ | 49 | | | 0.57 | | % | | $ | 34,367 | | $ | 54 | | | 0.63 | | % | | $ | 32,297 | | $ | 58 | | | 0.72 | | | % |

NOW and money market deposit accounts (2) | | | 356,873 | | | 353 | | | 0.39 | | | | | 342,570 | | | 376 | | | 0.44 | | | | | 278,552 | | | 973 | | | 1.39 | | | |

Consumer CDs and IRAs (2) | | | 214,284 | | | 1,054 | | | 1.95 | | | | | 229,392 | | | 1,350 | | | 2.36 | | | | | 218,862 | | | 1,765 | | | 3.21 | | | |

Negotiable CDs, public funds and other time deposits (2) | | | 48,905 | | | 114 | | | 0.92 | | | | | 39,100 | | | 119 | | | 1.24 | | | | | 36,039 | | | 288 | | | 3.18 | | | |

Total domestic interest-bearing deposits | | | 654,232 | | | 1,570 | | | 0.95 | | | | | 645,429 | | | 1,899 | | | 1.18 | | | | | 565,750 | | | 3,084 | | | 2.17 | | | |

Foreign interest-bearing deposits: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Banks located in foreign countries (2) | | | 15,941 | | | 14 | | | 0.37 | | | | | 19,261 | | | 24 | | | 0.48 | | | | | 36,230 | | | 279 | | | 3.07 | | | |

Governments and official institutions | | | 6,488 | | | 4 | | | 0.23 | | | | | 7,379 | | | 4 | | | 0.22 | | | | | 11,847 | | | 72 | | | 2.43 | | | |

Time, savings and other | | | 53,013 | | | 57 | | | 0.42 | | | | | 54,307 | | | 78 | | | 0.58 | | | | | 48,209 | | | 334 | | | 2.76 | | | |

Total foreign interest-bearing deposits | | | 75,442 | | | 75 | | | 0.40 | | | | | 80,947 | | | 106 | | | 0.52 | | | | | 96,286 | | | 685 | | | 2.84 | | | |

Total interest-bearing deposits | | | 729,674 | | | 1,645 | | | 0.90 | | | | | 726,376 | | | 2,005 | | | 1.11 | | | | | 662,036 | | | 3,769 | | | 2.27 | | | |

Federal funds purchased and securities loaned or sold under agreements to repurchase and other short-term borrowings(2) | | | 411,063 | | | 1,059 | | | 1.02 | | | | | 503,451 | | | 1,157 | | | 0.92 | | | | | 465,511 | | | 2,938 | | | 2.51 | | | |

Trading account liabilities | | | 73,290 | | | 455 | | | 2.46 | | | | | 62,778 | | | 450 | | | 2.87 | | | | | 73,702 | | | 661 | | | 3.57 | | | |

Long-term debt (2) | | | 449,974 | | | 4,814 | | | 4.26 | | | | | 444,131 | | | 4,900 | | | 4.42 | | | | | 264,934 | | | 3,100 | | | 4.68 | | | |

Total interest-bearing liabilities - excluding hedge impact | | | 1,664,001 | | | 7,973 | | | 1.90 | | | | | 1,736,736 | | | 8,512 | | | 1.96 | | | | | 1,466,183 | | | 10,468 | | | 2.84 | | | |

Net hedge (income) expense on liabilities | | | | | | (873 | ) | | | | | | | | | | (550 | ) | | | | | | | | | | 86 | | | | | | |

Total interest-bearing liabilities - including hedge impact | | | 1,664,001 | | | 7,100 | | | 1.70 | | | | | 1,736,736 | | | 7,962 | | | 1.84 | | | | | 1,466,183 | | | 10,554 | | | 2.86 | | | |

Noninterest-bearing sources: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Noninterest-bearing deposits | | | 259,621 | | | | | | | | | | | 248,516 | | | | | | | | | | | 195,809 | | | | | | | | | |

Other liabilities | | | 211,070 | | | | | | | | | | | 192,198 | | | | | | | | | | | 77,245 | | | | | | | | | |

Shareholders’ equity | | | 255,983 | | | | | | | | | | | 242,867 | | | | | | | | | | | 166,454 | | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 2,390,675 | | | | | | | | | | $ | 2,420,317 | | | | | | | | | | $ | 1,905,691 | | | | | | | | | |

Net interest spread | | | | | | | | | 2.32 | | | | | | | | | | | 2.44 | | | | | | | | | | | 2.69 | | | |

Impact of noninterest-bearing sources | | | | | | | | | 0.12 | | | | | | | | | | | 0.08 | | | | | | | | | | | 0.27 | | | |

Net interest income/yield on earning assets - excluding hedge impact | | | | | $ | 11,016 | | | 2.44 | | % | | | | | $ | 11,403 | | | 2.52 | | % | | | | | $ | 12,018 | | | 2.96 | | | % |

Net impact of hedge income (expense) | | | | | | 737 | | | 0.17 | | | | | | | | 539 | | | 0.12 | | | | | | | | (98 | ) | | (0.03 | ) | | |

Net interest income/yield on earning assets | | | | | $ | 11,753 | | | 2.61 | | % | | | | | $ | 11,942 | | | 2.64 | | % | | | | | $ | 11,920 | | | 2.93 | | | % |

(1) This table presents a non-GAAP financial measure. The impact of interest rate risk management derivatives is shown separately. Interest income and interest expense amounts, and the yields and rates have been adjusted. Management believes this presentation is useful to investors because it adjusts for the impact of our hedging decisions and provides a better understanding of our hedging activities. The impact of interest rate risk management derivatives is not material to the average balances presented above. (2) The impact of interest rate risk management derivatives on interest income and interest expense is presented below. Interest income excludes the impact of interest rate risk management contracts, which increased (decreased) interest income on: |

| | | | | Third

Quarter 2009 | | | | | | | | | Second

Quarter 2009 | | | | | | | | | Third

Quarter 2008 | | | | | | |

Time deposits placed and other short-term investments | | | | | $ | — | | | | | | | | | | $ | (3 | ) | | | | | | | | | $ | (4 | ) | | | | | |

Federal funds sold and securities borrowed or purchased under agreements to resell | | | | | | 95 | | | | | | | | | | | 62 | | | | | | | | | | | (36 | ) | | | | | |

Trading account assets | | | | | | (6 | ) | | | | | | | | | | — | | | | | | | | | | | — | | | | | | |

Debt securities | | | | | | (213 | ) | | | | | | | | | | (34 | ) | | | | | | | | | | (3 | ) | | | | | |

Commercial - domestic | | | | | | (12 | ) | | | | | | | | | | (36 | ) | | | | | | | | | | 32 | | | | | | |

Other earning assets | | | | | | 0 | | | | | | | | | | | — | | | | | | | | | | | (1 | ) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net hedge income (expense) on assets | | | | | $ | (136 | ) | | | | | | | | | $ | (11 | ) | | | | | | | | | $ | (12 | ) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Interest expense excludes the impact of interest rate risk management contracts, which increased (decreased) interest expense on: |

| | | | | | | | | | | | |

NOW and money market deposit accounts | | | | | $ | — | | | | | | | | | | $ | — | | | | | | | | | | $ | — | | | | | | |

Consumer CDs and IRAs | | | | | | 46 | | | | | | | | | | | 59 | | | | | | | | | | | 87 | | | | | | |

Negotiable CDs, public funds and other time deposits | | | | | | 4 | | | | | | | | | | | 5 | | | | | | | | | | | 3 | | | | | | |

Banks located in foreign countries | | | | | | 15 | | | | | | | | | | | 13 | | | | | | | | | | | (13 | ) | | | | | |

Federal funds purchased and securities loaned or sold under agreements to repurchase and other short-term borrowings | | | | | | 178 | | | | | | | | | | | 239 | | | | | | | | | | | 285 | | | | | | |

Long-term debt | | | | | | (1,116 | ) | | | | | | | | | | (866 | ) | | | | | | | | | | (276 | ) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net hedge (income) expense on liabilities | | | | | $ | (873 | ) | | | | | | | | | $ | (550 | ) | | | | | | | | | $ | 86 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Certain prior period amounts have been reclassified to conform to current period presentation.

Information for periods beginning July 1, 2008 includes the Countrywide acquisition. Information for periods beginning January 1, 2009 includes the

Merrill Lynch acquisition. Prior periods have not been restated.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 9 |

Bank of America Corporation and Subsidiaries

Year-to-Date Average Balances and Interest Rates - Fully Taxable-equivalent Basis

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | |

| | | Nine Months Ended September 30 | | |

| | | 2009 | | | | 2008 | | |

| | | Average

Balance | | Interest

Income/

Expense | | Yield/

Rate | | | | Average

Balance | | Interest

Income/

Expense | | Yield/

Rate | | |

Earning assets | | | | | | | | | | | | | | | | | | | | |

Time deposits placed and other short-term investments | | $ | 27,094 | | $ | 493 | | 2.43 | | % | | $ | 10,758 | | $ | 282 | | 3.50 | | % |

Federal funds sold and securities borrowed or purchased under agreements to resell | | | 232,680 | | | 2,567 | | 1.47 | | | | | 135,846 | | | 2,920 | | 2.87 | | |

Trading account assets | | | 216,462 | | | 6,436 | | 3.97 | | | | | 188,894 | | | 7,089 | | 5.01 | | |

Debt securities(1) | | | 268,291 | | | 10,303 | | 5.12 | | | | | 240,347 | | | 9,470 | | 5.25 | | |

Loans and leases(2): | | | | | | | | | | | | | | | | | | | | |

Residential mortgage (3) | | | 253,531 | | | 10,427 | | 5.49 | | | | | 262,488 | | | 11,061 | | 5.62 | | |

Home equity | | | 156,128 | | | 5,123 | | 4.38 | | | | | 129,392 | | | 5,652 | | 5.83 | | |

Discontinued real estate | | | 18,078 | | | 908 | | 6.70 | | | | | 7,397 | | | 399 | | 7.19 | | |

Credit card - domestic | | | 53,444 | | | 4,330 | | 10.83 | | | | | 62,784 | | | 5,059 | | 10.76 | | |

Credit card - foreign | | | 18,973 | | | 1,517 | | 10.69 | | | | | 16,297 | | | 1,521 | | 12.47 | | |

Direct/Indirect consumer (4) | | | 100,349 | | | 4,655 | | 6.20 | | | | | 82,242 | | | 5,220 | | 8.48 | | |

Other consumer(5) | | | 3,346 | | | 187 | | 7.43 | | | | | 3,908 | | | 251 | | 8.58 | | |

Total consumer | | | 603,849 | | | 27,147 | | 6.00 | | | | | 564,508 | | | 29,163 | | 6.90 | | |

Commercial - domestic | | | 229,462 | | | 6,793 | | 3.96 | | | | | 218,702 | | | 8,812 | | 5.38 | | |

Commercial real estate(6) | | | 74,021 | | | 1,777 | | 3.21 | | | | | 62,746 | | | 2,351 | | 5.00 | | |

Commercial lease financing | | | 22,050 | | | 717 | | 4.33 | | | | | 22,364 | | | 557 | | 3.32 | | |

Commercial - foreign | | | 33,878 | | | 1,119 | | 4.42 | | | | | 32,254 | | | 1,130 | | 4.68 | | |

Total commercial | | | 359,411 | | | 10,406 | | 3.87 | | | | | 336,066 | | | 12,850 | | 5.11 | | |

Total loans and leases | | | 963,260 | | | 37,553 | | 5.21 | | | | | 900,574 | | | 42,013 | | 6.23 | | |

Other earning assets | | | 129,919 | | | 3,883 | | 3.99 | | | | | 68,198 | | | 3,202 | | 6.27 | | |

Total earning assets(7) | | | 1,837,706 | | | 61,235 | | 4.45 | | | | | 1,544,617 | | | 64,976 | | 5.61 | | |

Cash and cash equivalents | | | 184,650 | | | | | | | | | | 34,598 | | | | | | | |

Other assets, less allowance for loan and lease losses | | | 420,549 | | | | | | | | | | 229,550 | | | | | | | |

Total assets | | $ | 2,442,905 | | | | | | | | | $ | 1,808,765 | | | | | | | |

| | | | | | | | |

Interest-bearing liabilities | | | | | | | | | | | | | | | | | | | | |

Domestic interest-bearing deposits: | | | | | | | | | | | | | | | | | | | | |

Savings | | $ | 33,645 | | $ | 161 | | 0.64 | | % | | $ | 32,419 | | $ | 172 | | 0.71 | | % |

NOW and money market deposit accounts | | | 347,603 | | | 1,169 | | 0.45 | | | | | 261,918 | | | 2,968 | | 1.51 | | |

Consumer CDs and IRAs | | | 226,555 | | | 4,219 | | 2.49 | | | | | 195,318 | | | 5,569 | | 3.81 | | |

Negotiable CDs, public funds and other time deposits | | | 39,649 | | | 391 | | 1.32 | | | | | 30,838 | | | 806 | | 3.49 | | |

Total domestic interest-bearing deposits | | | 647,452 | | | 5,940 | | 1.23 | | | | | 520,493 | | | 9,515 | | 2.44 | | |

Foreign interest-bearing deposits: | | | | | | | | | | | | | | | | | | | | |

Banks located in foreign countries | | | 20,381 | | | 114 | | 0.75 | | | | | 36,401 | | | 938 | | 3.44 | | |

Governments and official institutions | | | 7,893 | | | 14 | | 0.23 | | | | | 12,758 | | | 281 | | 2.94 | | |

Time, savings and other | | | 55,214 | | | 267 | | 0.65 | | | | | 52,211 | | | 1,220 | | 3.12 | | |

Total foreign interest-bearing deposits | | | 83,488 | | | 395 | | 0.63 | | | | | 101,370 | | | 2,439 | | 3.21 | | |

Total interest-bearing deposits | | | 730,940 | | | 6,335 | | 1.16 | | | | | 621,863 | | | 11,954 | | 2.57 | | |

Federal funds purchased and securities loaned or sold under agreements to repurchase and other short-term borrowings | | | 501,485 | | | 4,854 | | 1.29 | | | | | 454,355 | | | 10,452 | | 3.07 | | |

Trading account liabilities | | | 68,530 | | | 1,484 | | 2.90 | | | | | 75,553 | | | 2,250 | | 3.98 | | |

Long-term debt | | | 447,038 | | | 12,048 | | 3.60 | | | | | 223,017 | | | 7,172 | | 4.29 | | |

Total interest-bearing liabilities(7) | | | 1,747,993 | | | 24,721 | | 1.89 | | | | | 1,374,788 | | | 31,828 | | 3.09 | | |

Noninterest-bearing sources: | | | | | | | | | | | | | | | | | | | | |

Noninterest-bearing deposits | | | 245,242 | | | | | | | | | | 188,800 | | | | | | | |

Other liabilities | | | 207,032 | | | | | | | | | | 84,287 | | | | | | | |

Shareholders’ equity | | | 242,638 | | | | | | | | | | 160,890 | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 2,442,905 | | | | | | | | | $ | 1,808,765 | | | | | | | |

Net interest spread | | | | | | | | 2.56 | | % | | | | | | | | 2.52 | | % |

Impact of noninterest-bearing sources | | | | | | | | 0.09 | | | | | | | | | | 0.34 | | |

Net interest income/yield on earning assets | | | | | $ | 36,514 | | 2.65 | | % | | | | | $ | 33,148 | | 2.86 | | % |

| (1) | Yields on AFS debt securities are calculated based on fair value rather than historical cost balances. The use of fair value does not have a material impact on net interest yield. |

| (2) | Nonperforming loans are included in the respective average loan balances. Income on these nonperforming loans is recognized on a cash basis. Purchased impaired loans were written down to fair value upon acquisition and accrete interest income over the remaining life of the loan. |

| (3) | Includes foreign residential mortgages of $647 million for the nine months ended September 30, 2009. |

| (4) | Includes foreign consumer loans of $7.8 billion and $3.0 billion for the nine months ended September 30, 2009 and 2008. |

| (5) | Includes consumer finance loans of $2.5 billion and $2.8 billion, and other foreign consumer loans of $646 million and $814 million for the nine months ended September 30, 2009 and 2008. |

| (6) | Includes domestic commercial real estate loans of $71.5 billion and $61.6 billion, and foreign commercial real estate loans of $2.5 billion and $1.1 billion for the nine months ended September 30, 2009 and 2008. |

| (7) | Interest income includes the impact of interest rate risk management contracts, which decreased interest income on the underlying assets $208 million and $219 million for the nine months ended September 30, 2009 and 2008. Interest expense includes the impact of interest rate risk management contracts, which increased (decreased) interest expense on the underlying liabilities $(1.9) billion and $172 million for the nine months ended September 30, 2009 and 2008. |

Certain prior period amounts have been reclassified to conform to current period presentation.

Information for periods beginning July 1, 2008 includes the Countrywide acquisition. Information for periods beginning January 1, 2009 includes the

Merrill Lynch acquisition. Prior periods have not been restated.

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | 10 |

Bank of America Corporation and Subsidiaries

Year-to-Date Average Balances and Interest Rates - Fully Taxable-equivalent Basis - Isolating Hedge Income/Expense(1)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Nine Months Ended September 30 | | | |

| | | 2009 | | 2008 | | | |

| | | Average

Balance | | Interest

Income/

Expense | | | Yield/

Rate | | | | Average

Balance | | Interest

Income/

Expense | | | Yield/

Rate | | | |

Earning assets | | | | | | | | | | | | | | | | | | | | | | | |

Time deposits placed and other short-term investments (2) | | $ | 27,094 | | $ | 496 | | | 2.45 | | % | | $ | 10,758 | | $ | 294 | | | 3.65 | | | % |

Federal funds sold and securities borrowed or purchased under agreements to resell (2) | | | 232,680 | | | 2,413 | | | 1.39 | | | | | 135,846 | | | 3,093 | | | 3.04 | | | |

Trading account assets(2) | | | 216,462 | | | 6,442 | | | 3.97 | | | | | 188,894 | | | 7,089 | | | 5.01 | | | |

Debt securities(2) | | | 268,291 | | | 10,578 | | | 5.26 | | | | | 240,347 | | | 9,474 | | | 5.26 | | | |

Loans and leases: | | | | | | | | | | | | | | | | | | | | | | | |

Residential mortgage | | | 253,531 | | | 10,427 | | | 5.49 | | | | | 262,488 | | | 11,061 | | | 5.62 | | | |

Home equity | | | 156,128 | | | 5,123 | | | 4.38 | | | | | 129,392 | | | 5,652 | | | 5.83 | | | |

Discontinued real estate | | | 18,078 | | | 908 | | | 6.70 | | | | | 7,397 | | | 399 | | | 7.19 | | | |

Credit card - domestic | | | 53,444 | | | 4,330 | | | 10.83 | | | | | 62,784 | | | 5,059 | | | 10.76 | | | |

Credit card - foreign | | | 18,973 | | | 1,517 | | | 10.69 | | | | | 16,297 | | | 1,521 | | | 12.47 | | | |

Direct/Indirect consumer | | | 100,349 | | | 4,655 | | | 6.20 | | | | | 82,242 | | | 5,220 | | | 8.48 | | | |

Other consumer | | | 3,346 | | | 187 | | | 7.43 | | | | | 3,908 | | | 251 | | | 8.58 | | | |

Total consumer | | | 603,849 | | | 27,147 | | | 6.00 | | | | | 564,508 | | | 29,163 | | | 6.90 | | | |

Commercial - domestic (2) | | | 229,462 | | | 6,871 | | | 4.00 | | | | | 218,702 | | | 8,840 | | | 5.40 | | | |

Commercial real estate | | | 74,021 | | | 1,777 | | | 3.21 | | | | | 62,746 | | | 2,351 | | | 5.00 | | | |

Commercial lease financing | | | 22,050 | | | 717 | | | 4.33 | | | | | 22,364 | | | 557 | | | 3.32 | | | |

Commercial - foreign | | | 33,878 | | | 1,119 | | | 4.42 | | | | | 32,254 | | | 1,130 | | | 4.68 | | | |

Total commercial | | | 359,411 | | | 10,484 | | | 3.90 | | | | | 336,066 | | | 12,878 | | | 5.12 | | | |

Total loans and leases | | | 963,260 | | | 37,631 | | | 5.22 | | | | | 900,574 | | | 42,041 | | | 6.21 | | | |

Other earning assets (2) | | | 129,919 | | | 3,883 | | | 3.99 | | | | | 68,198 | | | 3,204 | | | 6.27 | | | |

Total earning assets - excluding hedge impact | | | 1,837,706 | | | 61,443 | | | 4.47 | | | | | 1,544,617 | | | 65,195 | | | 5.62 | | | |

Net hedge income (expense) on assets | | | | | | (208 | ) | | | | | | | | | | (219 | ) | | | | | |

Total earning assets - including hedge impact | | | 1,837,706 | | | 61,235 | | | 4.45 | | | | | 1,544,617 | | | 64,976 | | | 5.61 | | | |

Cash and cash equivalents | | | 184,650 | | | | | | | | | | | 34,598 | | | | | | | | | |

Other assets, less allowance for loan and lease losses | | | 420,549 | | | | | | | | | | | 229,550 | | | | | | | | | |

Total assets | | $ | 2,442,905 | | | | | | | | | | $ | 1,808,765 | | | | | | | | | |

| | | | | | | | |

Interest-bearing liabilities | | | | | | | | | | | | | | | | | | | | | | | |

Domestic interest-bearing deposits: | | | | | | | | | | | | | | | | | | | | | | | |

Savings | | $ | 33,645 | | $ | 161 | | | 0.64 | | % | | $ | 32,419 | | $ | 172 | | | 0.71 | | | % |

NOW and money market deposit accounts (2) | | | 347,603 | | | 1,170 | | | 0.45 | | | | | 261,918 | | | 2,958 | | | 1.51 | | | |

Consumer CDs and IRAs (2) | | | 226,555 | | | 4,050 | | | 2.39 | | | | | 195,318 | | | 5,250 | | | 3.59 | | | |

Negotiable CDs, public funds and other time deposits (2) | | | 39,649 | | | 379 | | | 1.28 | | | | | 30,838 | | | 799 | | | 3.46 | | | |

Total domestic interest-bearing deposits | | | 647,452 | | | 5,760 | | | 1.19 | | | | | 520,493 | | | 9,179 | | | 2.36 | | | |

Foreign interest-bearing deposits: | | | | | | | | | | | | | | | | | | | | | | | |

Banks located in foreign countries (2) | | | 20,381 | | | 79 | | | 0.52 | | | | | 36,401 | | | 949 | | | 3.48 | | | |

Governments and official institutions | | | 7,893 | | | 14 | | | 0.23 | | | | | 12,758 | | | 281 | | | 2.94 | | | |

Time, savings and other | | | 55,214 | | | 267 | | | 0.65 | | | | | 52,211 | | | 1,220 | | | 3.12 | | | |

Total foreign interest-bearing deposits | | | 83,488 | | | 360 | | | 0.58 | | | | | 101,370 | | | 2,450 | | | 3.23 | | | |

Total interest-bearing deposits | | | 730,940 | | | 6,120 | | | 1.12 | | | | | 621,863 | | | 11,629 | | | 2.50 | | | |

Federal funds purchased and securities loaned or sold under agreements to repurchase and other short-term borrowings(2) | | | 501,485 | | | 4,131 | | | 1.10 | | | | | 454,355 | | | 10,052 | | | 2.95 | | | |

Trading account liabilities | | | 68,530 | | | 1,484 | | | 2.90 | | | | | 75,553 | | | 2,250 | | | 3.98 | | | |

Long-term debt (2) | | | 447,038 | | | 14,921 | | | 4.46 | | | | | 223,017 | | | 7,725 | | | 4.62 | | | |

Total interest-bearing liabilities - excluding hedge impact | | | 1,747,993 | | | 26,656 | | | 2.04 | | | | | 1,374,788 | | | 31,656 | | | 3.07 | | | |

Net hedge (income) expense on liabilities | | | | | | (1,935 | ) | | | | | | | | | | 172 | | | | | | |

Total interest-bearing liabilities - including hedge impact | | | 1,747,993 | | | 24,721 | | | 1.89 | | | | | 1,374,788 | | | 31,828 | | | 3.09 | | | |

Noninterest-bearing sources: | | | | | | | | | | | | | | | | | | | | | | | |

Noninterest-bearing deposits | | | 245,242 | | | | | | | | | | | 188,800 | | | | | | | | | |

Other liabilities | | | 207,032 | | | | | | | | | | | 84,287 | | | | | | | | | |

Shareholders’ equity | | | 242,638 | | | | | | | | | | | 160,890 | | | | | | | | | |