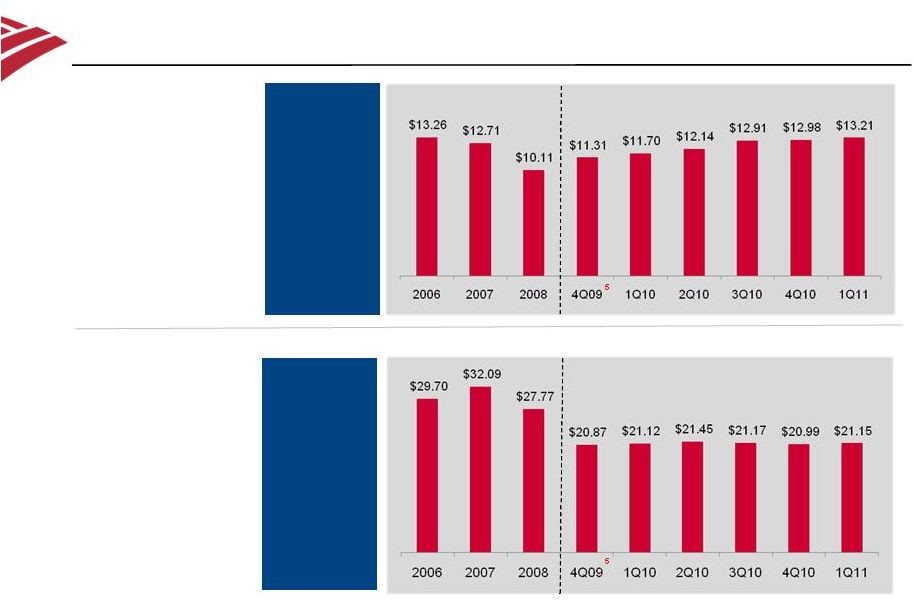

Forward-Looking Statements 12 Certain statements in this Presentation represent the current expectations, plans or forecasts of Bank of America and are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements often use words like “expects,” “anticipates,” “believes,” “estimates,” “targets,” “intends,” “plans,” “predict,” “goal” and other similar expressions or future or conditional verbs such as “will,” “may,” “might,” “should,” “would” and “could.” The forward-looking statements made in this Presentation include, without limitation, statements concerning: the preliminary information about Bank of America’s results of operations and financial condition for the quarter ending June 30, 2011 and related trends, including Bank of America’s expected net loss and including Bank of America’s expected net income if the settlement, other mortgage-related charges, and proceeds from asset-sales are excluded, the expected amount and sufficiency of the charges to be recorded in the quarter ending June 30, 2011 related to the settlement agreement, the related expected increase in the reserve for representations and warranties expense and the estimated costs associated with the additional servicing and documentation obligations undertaken in connection with the settlement and the corresponding expected write-down of the valuation of the mortgage servicing rights (MSR), the expected amount and sufficiency of the additional charge for representation and warranty expense in the quarter ending June 30, 2011 for both GSE and non-GSE-exposures, the expected other mortgage-related costs to be recorded in the quarter ending June 30, 2011, including the expected elimination in the quarter ending June 30, 2011 of the balance of the goodwill in the Consumer Real Estate Services business segment and the amount of the goodwill impairment charge expected to be recorded, Bank of America’s expected tangible book value per share, book value per share, tangible common equity ratio, common equity ratio, Tier 1 common ratio (Basel I) for the quarter ending June 30, 2011 and the estimated capital recovery period, estimated RWA, ratio goals and expectations, and the expected trends outside of the mortgage area, including Bank of America’s expectations regarding net interest income, sales and trading results, core expenses, provision expense, gains from the sale of Balboa and BlackRock, debt securities gains, dividends from strategic investment and fair value option gains on certain structured liabilities; the portion of Bank of America’s repurchase obligations for residential mortgage obligations sold by Bank of America and its affiliates to investors that has been paid or reserved after giving effect to the settlement agreement and the expected charges in the quarter ending June 30, 2011; the estimated range of possible loss over existing accruals related to non-GSE representation and warranty exposure; the expected impact of the settlement agreement and the institutional investor agreement; expected support of the institutional investors; whether and to what extent challenges will be made to the settlement and the timing of the court approval process; whether the conditions to the settlement will be satisfied, including the receipt of final court approval and tax opinions; and the potential assertion and impact of claims not addressed by the settlement agreement. Forward-looking statements speak only as of the date they are made, and Bank of America undertakes no obligation to update any forward-looking statement to reflect the impact of circumstances or events that arise after the date the forward-looking statement was made. These statements are not guarantees of future results or performance and involve certain risks, uncertainties and assumptions that are difficult to predict and are often beyond Bank of America’s control. Actual outcomes and results may differ materially from those expressed in, or implied by, any of these forward-looking statements. You should not place undue reliance on any forward-looking statement and should consider all of the following uncertainties and risks, as well as those more fully discussed under Item 1A. “Risk Factors” of Bank of America’s 2010 Annual Report on Form 10-K and in any of Bank of America’s other subsequent Securities and Exchange (SEC) filings: the accuracy and variability of estimates and assumptions in determining the expected total cost of the settlement to Bank of America; the adequacy of the liability reserves for the representations and warranties exposures to the GSEs, monolines and private-label and other investors; the accuracy and variability of estimates and assumptions in determining the estimated range of possible loss over existing accruals related to non-GSE representation and warranty exposure; the accuracy and variability of estimates and assumptions in determining the portion of Bank of America’s repurchase obligations for residential mortgage obligations sold by Bank of America and its affiliates to investors that has been paid or reserved after giving effect to the settlement agreement and the expected charges in the quarter ending June 30, 2011; whether and to what extent challenges will be made to the settlement and the timing of the court approval process, including the nature and timing of any appeals that may follow an initial court decision; whether the conditions to the settlement will be satisfied, including the receipt of final court approval and a private letter rulings from the IRS and other tax opinions; whether conditions in the settlement agreement that would permit Bank of America and legacy Countrywide to withdraw from the settlement will occur and whether Bank of America and legacy Countrywide will determine to withdraw from the settlement if such conditions occur; the impact of performance and enforcement of obligations under, and provisions contained in, the settlement agreement and the institutional investor Agreement, including performance of obligations under the settlement agreement by Bank of America (and certain of its affiliates) and the Trustee and the performance of obligations under the institutional investor agreement by Bank of America (and certain of it affiliates) and the investor group; Bank of America’s and certain of its affiliates’ ability to comply with the servicing and documentation obligations under the settlement agreement; the potential assertion and impact of additional claims not addressed by the settlement agreement or any of the prior agreements entered into between Bank of America (and/or certain of its affiliates) and the GSEs, monoline insurers and other investors; Bank of America’s mortgage modification policies, loss mitigation strategies and related results; the foreclosure review and assessment process, the effectiveness of Bank of America’s response to such process, and any governmental or private third-party claims asserted in connection with these foreclosure matters; and any measures or steps taken by federal regulators or other governmental authorities with regard to mortgage loans, servicing agreements and standards, or other matters. |