Exhibit 99.2

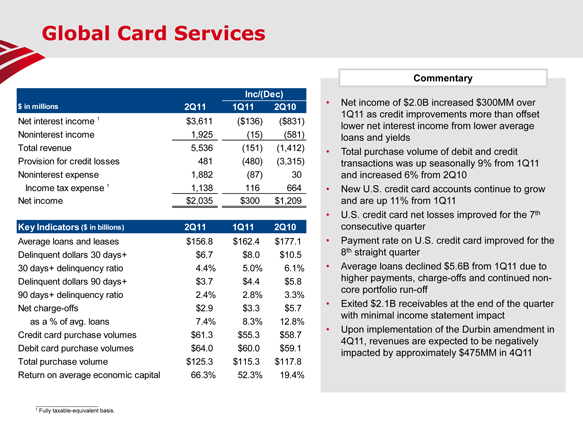

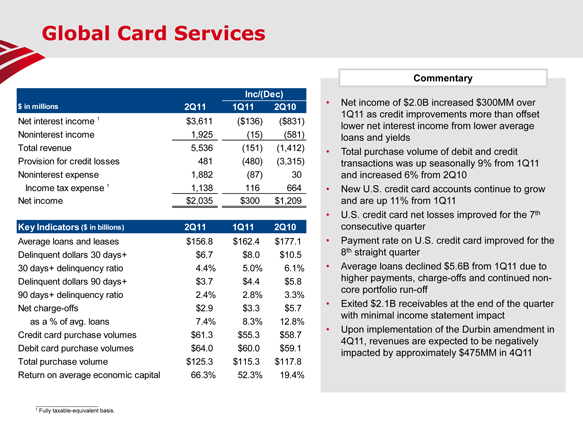

Global Card Services

Inc/(Dec)

$ in millions 2Q11 1Q11 2Q10

Net interest income 1 $3,611 ($136) ($831)

Noninterest income 1,925 (15) (581)

Total revenue 5,536 (151) (1,412)

Provision for credit losses 481 (480) (3,315)

Noninterest expense 1,882 (87) 30

Income tax expense 1 1,138 116 664

Net income $2,035 $300 $1,209

Key Indicators ($ in billions) 2Q11 1Q11 2Q10

Average loans and leases $156.8 $162.4 $177.1

Delinquent dollars 30 days+ $6.7 $8.0 $10.5

30 days+ delinquency ratio 4.4% 5.0% 6.1%

Delinquent dollars 90 days+ $3.7 $4.4 $5.8

90 days+ delinquency ratio 2.4% 2.8% 3.3%

Net charge-offs $2.9 $3.3 $5.7

as a % of avg. loans 7.4% 8.3% 12.8%

Credit card purchase volumes $61.3 $55.3 $58.7

Debit card purchase volumes $64.0 $60.0 $59.1

Total purchase volume $125.3 $115.3 $117.8

Return on average economic capital 66.3% 52.3% 19.4%

Commentary

Net income of $2.0B increased $300MM over 1Q11 as credit improvements more than offset lower net interest income from lower average loans and yields Total purchase volume of debit and credit transactions was up seasonally 9% from 1Q11 and increased 6% from 2Q10

New U.S. credit card accounts continue to grow and are up 11% from 1Q11 U.S. credit card net losses improved for the 7th consecutive quarter Payment rate on U.S. credit card improved for the 8th straight quarter Average loans declined $5.6B from 1Q11 due to higher payments, charge-offs and continued non-core portfolio run-off Exited $2.1B receivables at the end of the quarter with minimal income statement impact Upon implementation of the Durbin amendment in 4Q11, revenues are expected to be negatively impacted by approximately $475MM in 4Q11

1 Fully taxable-equivalent basis.

Home Price Impacts

The market median shows a decline in home prices of a little more than 3% in 2011 with a 1% increase in 2012, largely in the second-half, which is consistent with our assumptions

From a near-term perspective, direct impacts from changes in HPI would primarily impact a pool of $40B of consumer real estate loans

$13B of nonperforming loans greater than 180 days past due that have been written down to net realizable value

$27B carrying value of PCI loans (currently carried at 66%)

Additionally, for each 1% change in home prices, the liability for representations and warranties on unsettled GSE originations is estimated to be impacted by $125MM based on projected collateral losses and defect rates

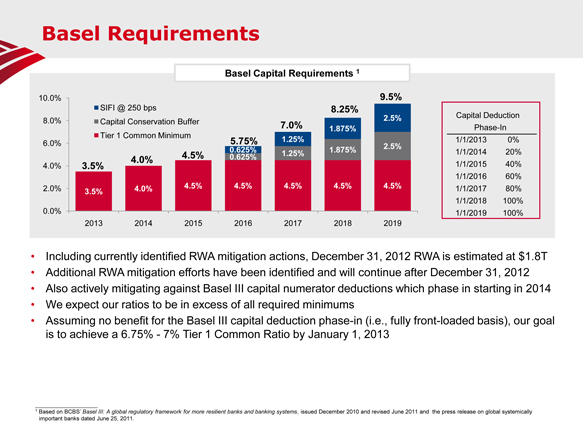

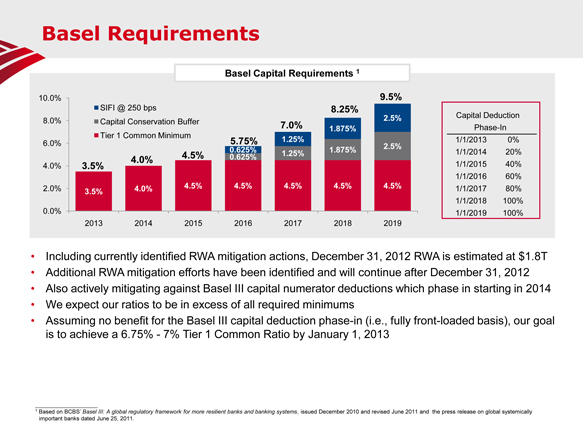

Basel Requirements

Basel Capital Requirements 1

10.0% 9.5%

SIFI @ 250 bps 8.25%

8.0% Capital Conservation Buffer 2.5%

7.0% 1.875%

Tier 1 Common Minimum

6.0% 5.75% 1.25% 2.5%

0.625% 1.875%

4.5% 0.625% 1.25%

4.0% 3.5% 4.0%

2.0% 4.0% 4.5% 4.5% 4.5% 4.5% 4.5%

3.5%

0.0%

2013 2014 2015 2016 2017 2018 2019

Capital Deduction

Phase-In

1/1/2013 0%

1/1/2014 20%

1/1/2015 40%

1/1/2016 60%

1/1/2017 80%

1/1/2018 100%

1/1/2019 100%

Including currently identified RWA mitigation actions, December 31, 2012 RWA is estimated at $1.8T

Additional RWA mitigation efforts have been identified and will continue after December 31, 2012

Also actively mitigating against Basel III capital numerator deductions which phase in starting in 2014

We expect our ratios to be in excess of all required minimums

Assuming no benefit for the Basel III capital deduction phase-in (i.e., fully front-loaded basis), our goal is to achieve a 6.75% - 7% Tier 1 Common Ratio by January 1, 2013

1 Based on BCBS’Basel III: A global regulatory framework for more resilient banks and banking systems, issued December 2010 and revised June 2011 and the press release on global systemically important banks dated June 25, 2011.

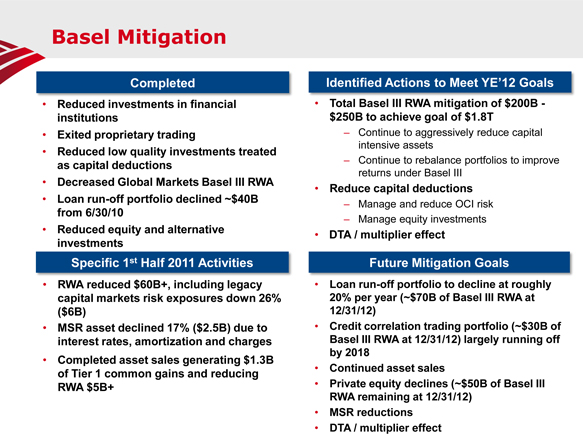

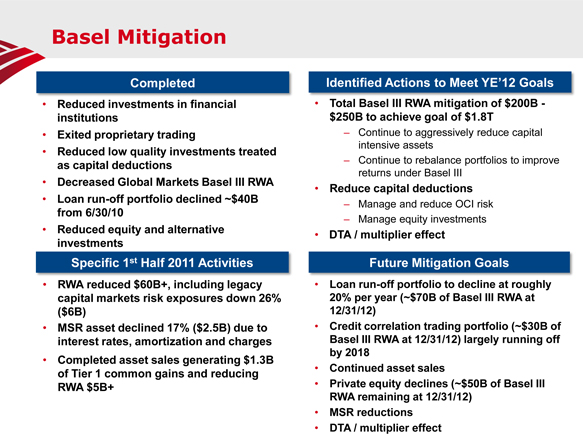

Basel Mitigation

Completed

Reduced investments in financial institutions

Exited proprietary trading

Reduced low quality investments treated as capital deductions

Decreased Global Markets Basel III RWA

Loan run-off portfolio declined ~$40B from 6/30/10

Reduced equity and alternative investments

Specific 1st Half 2011 Activities

RWA reduced $60B+, including legacy capital markets risk exposures down 26% ($6B)

MSR asset declined 17% ($2.5B) due to interest rates, amortization and charges

Completed asset sales generating $1.3B of Tier 1 common gains and reducing RWA $5B+

Identified Actions to Meet YE’12 Goals

Total Basel III RWA mitigation of $200B - $250B to achieve goal of $1.8T

Continue to aggressively reduce capital intensive assets

Continue to rebalance portfolios to improve returns under Basel III

Reduce capital deductions

Manage and reduce OCI risk

Manage equity investments

DTA / multiplier effect

Future Mitigation Goals

Loan run-off portfolio to decline at roughly 20% per year (~$70B of Basel III RWA at 12/31/12)

Credit correlation trading portfolio (~$30B of Basel III RWA at 12/31/12) largely running off by 2018

Continued asset sales

Private equity declines (~$50B of Basel III RWA remaining at 12/31/12)

MSR reductions

DTA / multiplier effect

Representations and Warranties

Liability for Representations and Warranties ($MM)

2Q10 3Q10 4Q10 1Q11 2Q11

Beginning Balance $3,325 $3,939 $4,402 $5,438 $6,220

Additions for new sales 8 6 8 7 3

Provision 1,248 872 4,140 1,013 14,037

Charge-offs (642) (415) (3,028) (238) (2,480)

Other - - (84) - -

Ending Balance $3,939 $4,402 $5,438 $6,220 $17,780

New Claim Trends ($MM)

2Q10 3Q10 4Q10 1Q11 2Q11 Mix

Pre 2005 $125 $147 $455 $130 $210 5%

2005 710 589 957 409 431 13%

2006 1,276 1,442 2,105 1,584 763 32%

2007 2,329 1,664 1,775 2,253 1,746 40%

2008 278 320 351 483 389 8%

Post 2008 47 56 105 128 158 2%

New Claims $4,765 $4,218 $5,748 $4,987 $3,697

% GSEs 77% 82% 57% 88% 90%

Rescinded

claims $1,592 $1,531 $4,106 $934 $3,772

Approved

repurchases 855 1,005 3,934 1,109 2,002

Outstanding

claims 11,166 12,948 10,687 13,564 11,580

% GSEs 50% 53% 26% 39% 44%

Outstanding Claims by Counterparty ($MM)

2Q10 3Q10 4Q10 1Q11 2Q11

GSEs $5,624 $6,819 $2,821 $5,350 $5,081

Monolines 4,114 4,304 4,799 5,251 3,533

Other 1,428 1,825 3,067 2,963 2,966

Total $11,166 $12,948 $10,687 1 $13,564 1 $11,580 1

Commentary

2Q11 representations and warranties provision of $14.0B includes

$8.6B non-GSE settlement with BNY Mellon on legacy Countrywide non-GSE private-label securitizations

$5.4B additional reserve for other non-GSE exposure as a result of the private-label settlement and to a lesser extent GSE exposure

Estimated range of possible loss related to non-GSE representations and warranties exposure could be up to $5B over existing accruals at June 30, 2011. This estimate does not include reasonably possible litigation losses. The company is not currently able to reasonably estimate the possible loss or range of possible loss with respect to GSE representations and warranties exposure over existing accruals at June 30, 2011.

Outstanding claims decreased $2.0B primarily driven by the Assured settlement early in the quarter

Increase in rescissions in 2Q11 was primarily due to the Assured settlement

Increase in approvals in 2Q11 was due to an increase in throughput in processing GSEs’ claims driven by significant claims received from GSEs during the quarter, the increase in approvals did not result in a proportional decrease in claims outstanding

1 Includes $1.7B in demands from private-label securitization investors who do not have the right to demand repurchase of loans directly. However, inclusion of these claims does not mean we believe that the claimant has satisfied the contractual thresholds to direct the securitization trustee to take action or that these claims are otherwise procedurally or substantively valid. A claimant has filed litigation against the company relating to certain of these claims. These claims related to loans underlying securitizations included in the settlement with Bank of New York Mellon, as trustee. If the settlement is approved by the court, these claims will be resolved by the settlement.