Filed pursuant to Rule 424(b)(5)

Registration No. 333-257399

| | |

| | Pricing Supplement (To Prospectus dated August 4, 2021 and Prospectus Supplement dated August 4, 2021) July 19, 2022 |

$10,000,000,000

Medium-Term Notes, Series N

$2,000,000,000 4.827% Fixed/Floating Rate Senior Notes, due July 2026

$3,000,000,000 4.948% Fixed/Floating Rate Senior Notes, due July 2028

$5,000,000,000 5.015% Fixed/Floating Rate Senior Notes, due July 2033

This pricing supplement describes three series of our senior notes that will be issued under our Medium-Term Note Program, Series N. We refer to our 4.827% Fixed/Floating Rate Senior Notes, due July 2026 as the “4-year fixed/floating rate notes,” to our 4.948% Fixed/Floating Rate Senior Notes, due July 2028 as the “6-year fixed/floating rate notes” and to our 5.015% Fixed/Floating Rate Senior Notes, due July 2033 as the “11-year fixed/floating rate notes.” We refer to the 4-year fixed/floating rate notes, the 6-year fixed/floating rate notes and the 11-year fixed/floating rate notes collectively as the “notes.”

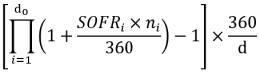

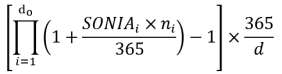

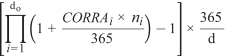

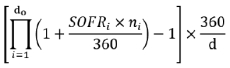

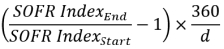

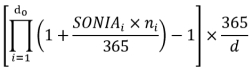

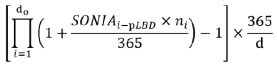

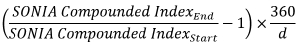

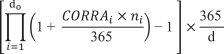

The 4-year fixed/floating rate notes mature on July 22, 2026. We will pay interest on the 4-year fixed/floating rate notes (a) from, and including, July 22, 2022 to, but excluding, July 22, 2025, at a fixed rate of 4.827% per annum, payable semi-annually, and (b) from, and including, July 22, 2025 to, but excluding, the maturity date, at a floating rate per annum equal to compounded SOFR, plus 1.75%, payable quarterly. The 6-year fixed/floating rate notes mature on July 22, 2028. We will pay interest on the 6-year fixed/floating rate notes (a) from, and including, July 22, 2022 to, but excluding, July 22, 2027, at a fixed rate of 4.948% per annum, payable semi-annually, and (b) from, and including, July 22, 2027 to, but excluding, the maturity date, at a floating rate per annum equal to compounded SOFR, plus 2.04%, payable quarterly. The 11-year fixed/floating rate notes mature on July 22, 2033. We will pay interest on the 11-year fixed/floating rate notes (a) from, and including, July 22, 2022 to, but excluding, July 22, 2032, at a fixed rate of 5.015% per annum, payable semi-annually, and (b) from, and including, July 22, 2032 to, but excluding, the maturity date, at a floating rate per annum equal to compounded SOFR, plus 2.16%, payable quarterly.

We will have the option to redeem each series of the notes prior to the applicable stated maturity as described in this pricing supplement under the heading “—Optional Redemption” for each series of the notes.

The notes are unsecured and rank equally in right of payment with all of our other unsecured and unsubordinated obligations from time to time outstanding, except obligations that are subject to any priorities or preferences by law. We do not intend to list the notes on any securities exchange.

Investing in the notes involves risks. See “Risk Factors Relating to the Notes” beginning on page S-9 of the accompanying prospectus supplement and “Risk Factors” beginning on page 8 of the accompanying prospectus.

None of the Securities and Exchange Commission, any state securities commission, or any other regulatory body has approved or disapproved of the notes or passed upon the adequacy or accuracy of this pricing supplement, the accompanying prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 4-Year Fixed/

Floating Rate Notes | | | 6-Year Fixed/

Floating Rate Notes | | | 11-Year Fixed/

Floating Rate Notes | |

| | | Per Note | | | Total | | | Per Note | | | Total | | | Per Note | | | Total | |

Public Offering Price | | | 100.000 | % | | $ | 2,000,000,000 | | | | 100.000 | % | | $ | 3,000,000,000 | | | | 100.000 | % | | $ | 5,000,000,000 | |

Selling Agents’ Commission | | | 0.250 | % | | $ | 5,000,000 | | | | 0.350 | % | | $ | 10,500,000 | | | | 0.450 | % | | $ | 22,500,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Proceeds (before expenses) | | | 99.750 | % | | $ | 1,995,000,000 | | | | 99.650 | % | | $ | 2,989,500,000 | | | | 99.550 | % | | $ | 4,977,500,000 | |

We expect to deliver the notes in book-entry only form through the facilities of The Depository Trust Company on July 22, 2022.

Sole Book-Runner

BofA Securities

| | | | |

| AmeriVet Securities | | Cabrera Capital Markets, LLC | | CastleOak Securities, L.P. |

| C.L. King & Associates | | Mischler Financial Group, Inc. | | R. Seelaus & Co., LLC |

| | | | | | | | |

| Banco Sabadell | | BBVA | | BNY Mellon Capital Markets, LLC | | Capital One Securities | | CIBC Capital Markets |

| Citizens Capital Markets | | Danske Markets | | HSBC | | Huntington Capital Markets | | ING |

| Lloyds Securities | | Mashreqbank psc | | Mizuho Securities | | MUFG | | Natixis |

| NatWest Markets | | Nomura | | Nordea | | PNC Capital Markets LLC | | Scotiabank |

| SOCIETE GENERALE | | SMBC Nikko | | Standard Chartered Bank | | SVB Securities | | UniCredit Capital Markets |