dividends or the distribution of assets upon liquidation, dissolution or winding-up, or to reclassify any authorized capital stock into any such shares of such capital stock or issue any obligation or security convertible into or evidencing the right to purchase any such shares of capital stock. In addition, so long as any shares of the Series HH Preferred Stock remain outstanding, the affirmative vote of the holders of at least 66 2/3 % of the voting power of the Series HH Preferred Stock shall be necessary to amend, alter or repeal any provision of the certificate of designations for the Series HH Preferred Stock or our certificate of incorporation so as to adversely affect the powers, preferences or special rights of the Series HH Preferred Stock.

Distributions. In the event of our voluntary or involuntary liquidation, dissolution, or winding up, holders of Series HH Preferred Stock will be entitled to receive out of assets legally available for distribution to stockholders, before any distribution or payment out of our assets may be made to or set aside for the holders of our capital stock ranking junior to the Series HH Preferred Stock as to distributions, a liquidating distribution in the amount of the liquidation preference of $25,000 per share, plus any declared and unpaid dividends, without accumulation of any undeclared dividends, to the date of liquidation. Shares of Series HH Preferred Stock will not be subject to a sinking fund.

Redemption. We may redeem the Series HH Preferred Stock, in whole or in part, at our option, at any time on or after July 24, 2023, at the redemption price equal to $25,000 per share, plus any accrued and unpaid dividends, for the then-current dividend period to but excluding the redemption date, without accumulation of any undeclared dividends. In addition, at any time within 90 days after a “capital treatment event,” as described in the certificate of designations for the Series HH Preferred Stock, we may redeem the Series HH Preferred Stock, in whole but not in part, at a redemption price equal to $25,000 per share, plus any accrued and unpaid dividends for the then-current dividend period to but excluding the redemption date, without accumulation of any undeclared dividends.

Series JJ Preferred Stock

Preferential Rights. The Series JJ Preferred Stock ranks senior to our common stock and equally with the Series B Preferred Stock, Series E Preferred Stock, Series F Preferred Stock, Series G Preferred Stock, Series L Preferred Stock, Series U Preferred Stock, Series X Preferred Stock, Series Z Preferred Stock, Series AA Preferred Stock, Series DD Preferred Stock, Series FF Preferred Stock, Series GG Preferred Stock, Series HH Preferred Stock, Series KK Preferred Stock, Series LL Preferred Stock, Series MM Preferred Stock, Series NN Preferred Stock, Series PP Preferred Stock, Series 1 Preferred Stock, Series 2 Preferred Stock, Series 4 Preferred Stock, and Series 5 Preferred Stock as to dividends and distributions on our liquidation, dissolution, or winding up. Series JJ Preferred Stock is not convertible into or exchangeable for any shares of our common stock or any other class of our capital stock. Holders of the Series JJ Preferred Stock do not have any preemptive rights. We may issue stock with preferences equal to the Series JJ Preferred Stock without the consent of the holders of the Series JJ Preferred Stock.

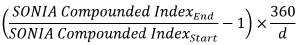

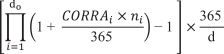

Dividends. Holders of the Series JJ Preferred Stock are entitled to receive cash dividends, when, as, and if declared by our board of directors or a duly authorized committee thereof, (i) for each semi-annual dividend period from the issue date to, but excluding, June 20, 2024, at a rate of 5.125% per annum on the liquidation preference of $25,000 per share, payable semiannually in arrears, and, (ii) for each quarterly dividend period from June 20, 2024 through the redemption date of the Series JJ Preferred Stock, at a floating rate equal to three-month U.S. dollar LIBOR plus a spread of 3.292% per annum on the liquidation preference of $25,000 per share, payable quarterly in arrears. If a “benchmark transition event” and its related “benchmark replacement date,” each as defined in the certificate of designations for the Series JJ Preferred Stock, occur with respect to three-month U.S. dollar LIBOR, then dividends on the Series JJ Preferred Stock for each

72