affect the value of the Market Measure or a Basket Component, the market value of your notes prior to maturity or whether the notes will be called, if applicable, or reduce the payments on the notes.

Our trading, hedging and other business activities, and those of the Guarantor and any of our other affiliates, including the selling agents, may create conflicts of interest with you. We, the Guarantor or one or more of our other affiliates, including the selling agents, may engage in trading activities related to the Market Measure or a Basket Component, as applicable, and to components included in the Market Measure or a Basket Component (and related futures and options contracts on the Market Measure, a Basket Component or their respective components) that are not for your account or on your behalf. We, the Guarantor or one or more of our other affiliates, including the selling agents, also may issue or underwrite other financial instruments with returns based upon the applicable Market Measure, Basket Component or their respective components. These trading and other business activities may present a conflict of interest between your interest in the notes and the interests we, the Guarantor and our other affiliates, including the selling agents, may have in our or their proprietary accounts, in facilitating transactions, including block trades, for our or their other customers, and in accounts under our or their management. These trading and other business activities, if they influence the value of the Market Measure, a Basket Component or secondary trading in your notes, could be adverse to your interests as a beneficial owner of the notes.

We, the Guarantor and one or more of our other affiliates, including the selling agents, expect to enter into arrangements or adjust or close out existing transactions to hedge our obligations under the notes. We, the Guarantor or our other affiliates, including the selling agents, also may enter into hedging transactions relating to other notes or instruments that we or they issue, some of which may have returns calculated in a manner related to that of a particular issue of the notes. We may enter into such hedging arrangements with one or more of our affiliates. Our affiliates may enter into additional hedging transactions with other parties relating to the notes and the applicable Market Measure or Basket Component. This hedging activity is expected to result in a profit to those engaging in the hedging activity, which could be more or less than initially expected, but could also result in a loss. We, the Guarantor and our affiliates, including the selling agents, will price these hedging transactions with the intent to realize a profit, regardless of whether the value of the notes increases or decreases, whether the notes will be automatically called, if applicable, or whether the Redemption Amount on the notes is more or less than the principal amount of the notes. Any profit in connection with such hedging activities will be in addition to any other compensation that we, the Guarantor and any of our other affiliates, including the selling agents, receive for the sale of the notes, which creates an additional incentive to sell notes to you.

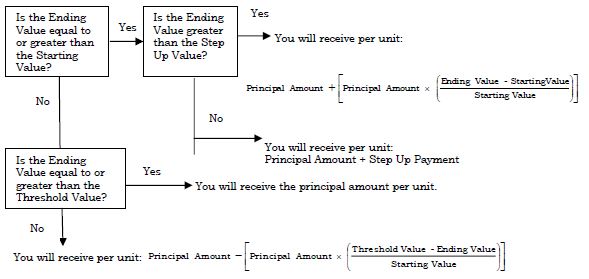

There may be potential conflicts of interest involving the calculation agent, which is an affiliate of ours. We have the right to appoint and remove the calculation agent. One of our affiliates will be the calculation agent for the notes and, as such, will make determinations with respect to the notes, including the Starting Value, the Step Up Value, the Threshold Value, the Ending Value, the Redemption Amount and, if applicable, the Call Levels, the Call Premiums, each Observation Level and whether the notes will be automatically called. Under some circumstances, these duties could result in a conflict of interest between its status as our affiliate and its responsibilities as calculation agent. These conflicts could occur, for instance, in connection with the calculation agent’s determination as to whether a Market Disruption Event has occurred, or in connection with judgments that it would be required to make if the publication of a Market Measure or Basket Component is discontinued. See the sections entitled “Description of the Notes—Market Disruption Events,” “—Adjustments to a Market Measure,” and “—Discontinuance of a Market Measure”. The calculation agent will be required

PS-16