Filed pursuant to Rule 424(b)(5)

Registration No. 333-277673

| | |

| | Pricing Supplement (To Prospectus dated March 28, 2024 and Prospectus Supplement dated March 28, 2024) January 17, 2025 |

$10,000,000,000

Medium-Term Notes, Series N

$750,000,000 Floating Rate Senior Notes, due January 2029

$2,500,000,000 4.979% Fixed/Floating Rate Senior Notes, due January 2029

$500,000,000 Floating Rate Senior Notes, due January 2031

$2,750,000,000 5.162% Fixed/Floating Rate Senior Notes, due January 2031

$3,500,000,000 5.511% Fixed/Floating Rate Senior Notes, due January 2036

This pricing supplement describes five series of our senior notes that will be issued under our Medium-Term Note Program, Series N. We refer to our Floating Rate Senior Notes, due January 2029 as the “4-year floating rate notes,” to our 4.979% Fixed/Floating Rate Senior Notes, due January 2029 as the “4-year fixed/floating rate notes,” to our Floating Rate Senior Notes, due January 2031 as the “6-year floating rate notes,” to our 5.162% Fixed/Floating Rate Senior Notes, due January 2031 as the “6-year fixed/floating rate notes” and to our 5.511% Fixed/Floating Rate Senior Notes, due January 2036 as the “11-year fixed/floating rate notes.” We refer to the 4-year floating rate notes and the 6-year floating rate notes together as the “floating rate notes,” to the 4-year fixed/floating rate notes, the 6-year fixed/floating rate notes and the 11-year fixed/floating rate notes collectively as the “fixed/floating rate notes,” and to the floating rate notes and the fixed/floating rate notes collectively as the “notes.”

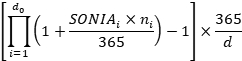

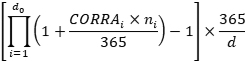

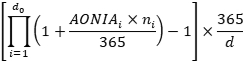

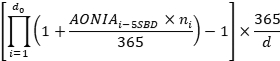

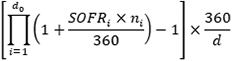

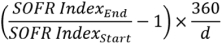

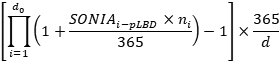

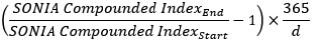

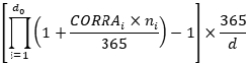

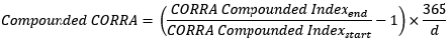

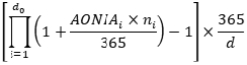

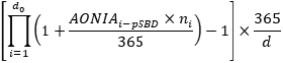

The 4-year floating rate notes mature on January 24, 2029. We will pay interest on the 4-year floating rate notes at a floating rate per annum equal to compounded SOFR, plus 0.830%, payable quarterly. The 4-year fixed/floating rate notes mature on January 24, 2029. We will pay interest on the 4-year fixed/floating rate notes (a) from, and including, January 24, 2025 to, but excluding, January 24, 2028, at a fixed rate of 4.979% per annum, payable semi-annually, and (b) from, and including, January 24, 2028 to, but excluding, the maturity date, at a floating rate per annum equal to compounded SOFR, plus 0.830%, payable quarterly. The 6-year floating rate notes mature on January 24, 2031. We will pay interest on the 6-year floating rate notes at a floating rate per annum equal to compounded SOFR, plus 1.010%, payable quarterly. The 6-year fixed/floating rate notes mature on January 24, 2031. We will pay interest on the 6-year fixed/floating rate notes (a) from, and including, January 24, 2025 to, but excluding, January 24, 2030, at a fixed rate of 5.162% per annum, payable semi-annually, and (b) from, and including, January 24, 2030 to, but excluding, the maturity date, at a floating rate per annum equal to compounded SOFR, plus 1.000%, payable quarterly. The 11-year fixed/floating rate notes mature on January 24, 2036. We will pay interest on the 11-year fixed/floating rate notes (a) from, and including, January 24, 2025 to, but excluding, January 24, 2035, at a fixed rate of 5.511% per annum, payable semi-annually, and (b) from, and including, January 24, 2035 to, but excluding, the maturity date, at a floating rate per annum equal to compounded SOFR, plus 1.310%, payable quarterly.

We will have the option to redeem each series of the notes prior to the applicable stated maturity as described in this pricing supplement under the heading “—Optional Redemption” for each series of the notes.

The notes are unsecured and rank equally in right of payment with all of our other unsecured and unsubordinated obligations from time to time outstanding, except obligations that are subject to any priorities or preferences by law. We do not intend to list the notes on any securities exchange.

Investing in the notes involves risks. See “Risk Factors Relating to the Notes” beginning on page S-9 of the accompanying prospectus supplement and “Risk Factors” beginning on page 8 of the accompanying prospectus.

None of the Securities and Exchange Commission, any state securities commission, or any other regulatory body has approved or disapproved of the notes or passed upon the adequacy or accuracy of this pricing supplement, the accompanying prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 4-Year

Floating Rate Notes | | | 4-Year Fixed/

Floating Rate Notes | | | 6-Year

Floating Rate Notes | |

| | | Per Note | | | Total | | | Per Note | | | Total | | | Per Note | | | Total | |

Public Offering Price | | | 100.000 | % | | $ | 750,000,000 | | | | 100.000 | % | | $ | 2,500,000,000 | | | | 100.000 | % | | $ | 500,000,000 | |

Selling Agents’ Commission | | | 0.250 | % | | $ | 1,875,000 | | | | 0.250 | % | | $ | 6,250,000 | | | | 0.350 | % | | $ | 1,750,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Proceeds (before expenses) | | | 99.750 | % | | $ | 748,125,000 | | | | 99.750 | % | | $ | 2,493,750,000 | | | | 99.650 | % | | $ | 498,250,000 | |

| | | | | | | | | | | | | | | | | | | | |

| | | 6-Year Fixed/

Floating Rate Notes | | | 11-Year Fixed/

Floating Rate Notes | |

| | | Per Note | | | Total | | | Per Note | | | Per Note | |

Public Offering Price | | | 100.000 | % | | $ | 2,750,000,000 | | | | 100.000 | % | | $ | 3,500,000,000 | |

Selling Agents’ Commission | | | 0.350 | % | | $ | 9,625,000 | | | | 0.450 | % | | $ | 15,750,000 | |

| | | | | | | | | | | | | | | | |

Proceeds (before expenses) | | | 99.650 | % | | $ | 2,740,375,000 | | | | 99.550 | % | | $ | 3,484,250,000 | |

We expect to deliver the notes in book-entry only form through the facilities of The Depository Trust Company on January 24, 2025.

Sole Book-Runner

BofA Securities

| | | | |

| Academy Securities | | CastleOak Securities, L.P. | | Falcon Square Capital |

| Independence Point Securities | | | | Ramirez & Co., Inc. |

| | | | | | | | |

| ANZ Securities | | BMO Capital Markets | | Capital One Securities | | CIBC Capital Markets | | Danske Markets |

| Fifth Third Securities | | HSBC | | Huntington Capital Markets | | ING | | IMI—Intesa Sanpaolo |

| M&T Securities | | Mizuho | | nabSecurities, LLC | | Natixis | | Nomura |

| Nordea | | PNC Capital Markets LLC | | Santander | | Scotiabank | | SOCIETE GENERALE |

| | | | | | | | | | |

| SMBC Nikko | | Standard Chartered Bank | | TD Securities | | Truist Securities | | UniCredit Capital Markets | | Westpac Capital Markets LLC |