NCR to Acquire Retalix November 28, 2012 Bill Nuti – Chairman & CEO Bob Fishman – CFO John Bruno –CTO & EVP Corporate Development Scott Kingsfield – SVP & GM, Retail Exhibit 99.2

1 Note to investors Comments made during this conference call and in the related presentation materials may contain forward- looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements use words such as “seek,” “potential,” “expect,” “strive,” “continue,” “continuously,” “accelerate,” “anticipate,” “outlook,” “intend,” “plan,” “target” and other similar expressions or future or conditional verbs such as “will,” “should,” “would” and “could.” They include statements about NCR’s plans for the business of Retalix; anticipated financial and other results from the acquisition of Retalix and its integration into NCR; the strategic fit of NCR and Retalix, expectations regarding revenue and cost synergies resulting from the acquisition; discussion of other strategic initiatives and related actions; and discussions of our beliefs, expectations, intentions and strategies, among other things. Forward-looking statements are based on management’s current beliefs, expectations and assumptions, and involve a number of known and unknown risks and uncertainties, many of which are out of NCR’s control. These forward-looking statements are not guarantees of future performance, and there are a number of risk factors, including those detailed from time to time in NCR’s SEC reports, including those listed in Item 1a “Risk Factors” of its Annual Report on Form 10-K, that could cause actual outcomes and results to differ materially from the results contemplated by such forward-looking statements. These materials are dated November 28, 2012, and NCR does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. While NCR and Retalix report their respective results in accordance with generally accepted accounting principles in the United States, or GAAP, comments made during this conference call and the related presentation materials will include non-GAAP measures in an effort to provide additional useful information regarding NCR’s and Retalix’s financial results. An explanation of these non-GAAP measures and a reconciliation of these non-GAAP measures to comparable GAAP measures are included in the portion of these presentation materials entitled “Supplementary Non-GAAP Materials.” NCR’s reconciliations of its non-GAAP measures to comparable GAAP measures are also available on the Investor Relations page of NCR’s website at www.ncr.com, and in NCR’s SEC reports. These presentation materials and the associated remarks made during this conference call are integrally related and are intended to be presented and understood together.

2 NCR corporate strategy

3 Strategic fit with NCR • We are executing on our strategy – Aligns extremely well with our overall strategy – to become a hardware-enabled, software- driven business – and builds upon our successful acquisition and integration of Radiant – Strong strategic fit for our company – takes advantage of our core competencies, our core assets – and the combination will drive significant value for our customers – Furthers our strategy to grow into market adjacencies, expands our omni-channel capabilities, improves our revenue mix with a higher percentage of software and services, and supports balanced portfolio growth • Retalix expands opportunities to drive revenue growth and operating efficiencies – Enables potential NCR product pull through for future Retalix customers – Ability to cross-sell to the combined installed base – Software model drives significant margin improvement – Captures efficiencies in administrative functions across the combined company – Leverages R&D best practices

4 Compelling market position and opportunity • Founded in 1982 and headquartered in Ra’anana, Israel • Provider of a retail platform focused on high volume and high complexity retailers in grocery, convenience, general merchandise, apparel and drug • 70K store locations with 400K+ lanes in 50+ countries • 13 of the top 30 global retailers are Retalix customers • Growing footprint in emerging markets like China and Russia • Talented employee base with strong culture of innovation • Blue-chip customer base: A global leader in retail Substantial market opportunity Source: IDC, Worldwide Retail IT Spending Guide, 2012 (1) Revenues for year ended December 31, 2011 (2) Grocery, C-Stores, Fuel & General Merchandise; Software and maintenance in the relevant applications for Retalix (3) Dept. & Drug Stores; Software and maintenance in the relevant applications for Retalix (4) Relevant services for traditional and new segments Retalix(1) $236m Services (4) $7.2bn New Segments (3) $1.4bn Traditional Segments (2) $2.4bn Demonstrated track record of growth 162 18 2009 2010 2011 YTD 9/30/11 YTD 9/30/12 Hardware (8%) ($’s in Millions) $192 $207 $236 $174 $204 18 Software: 36% Services: 19% Growth 20 24 Source: Retalix Annual Reports on Form 20-F for the fiscal years ended December 31, 2009, 2010 and 2011; quarterly earnings release for the quarter ended September 30, 2012; and earnings call transcripts for the quarters ended September 30, 2011 and 2012 Note: Services includes revenue from SaaS 136

5 Product-led services business Unique services business model Comprehensive product portfolio Services offering tightly linked to software • Fast growing business • Winning new customers • Increasing share of wallet • More strategic to customers R10 Store Suite Omni-channel platform; Customer- centric retail applications Fuel On-site fuel station and supermarket services HQ Manages store pricing, inventories and vendors Customer & Marketing Promotional marketing campaigns PocketOffice Handheld monitoring software Power Enterprise ERP solution SCM Supply chain execution and electronic commerce solutions Channel Partners In-store connected services Retalix 10 offers wide-ranging benefits to retailers • Consistent customer experience across multi‐touch points and channels • Comprehensive range of advanced retail applications • Flexible deployment alternatives (Thick / Thin / Cloud) Demand Driven Replenishment Inventory optimization

6 Financial profile • 10.8% Revenue growth • 27.0% Non-GAAP GM(1) • 10.0% NPOI margin(1) • 17.8% Revenue growth • 44.0% Non-GAAP GM(1) • 9.9% Non-GAAP OI margin(1) • 11.1% Revenue growth • 27.8% Non-GAAP GM(1) • 10.3% NPOI margin(1) (2) Geography Industry verticals Improved NCR business profile Americas 50% AMEA 25% North America 53% EMEA & APAC 38% Retail (3) 100% Financial Services 53% Retail Solutions 32% Hospitality 9% Note: Financial profile based on NCR and Retalix YTD metrics as of 9/30/12, geography and industry breakdowns as of 6/30/12 (1) See reconciliation of GAAP to non-GAAP measures in the non-GAAP supplemental materials (2) Pro forma NPOI margin includes run-rate annual cost synergies of $20 million (3) Includes food service distribution Emerging Industries 7% Financial Services 56% Hospitality 9% Retail Solutions 28% Emerging Industries 6% Americas 50% International 50% Israel 9% Europe 25%

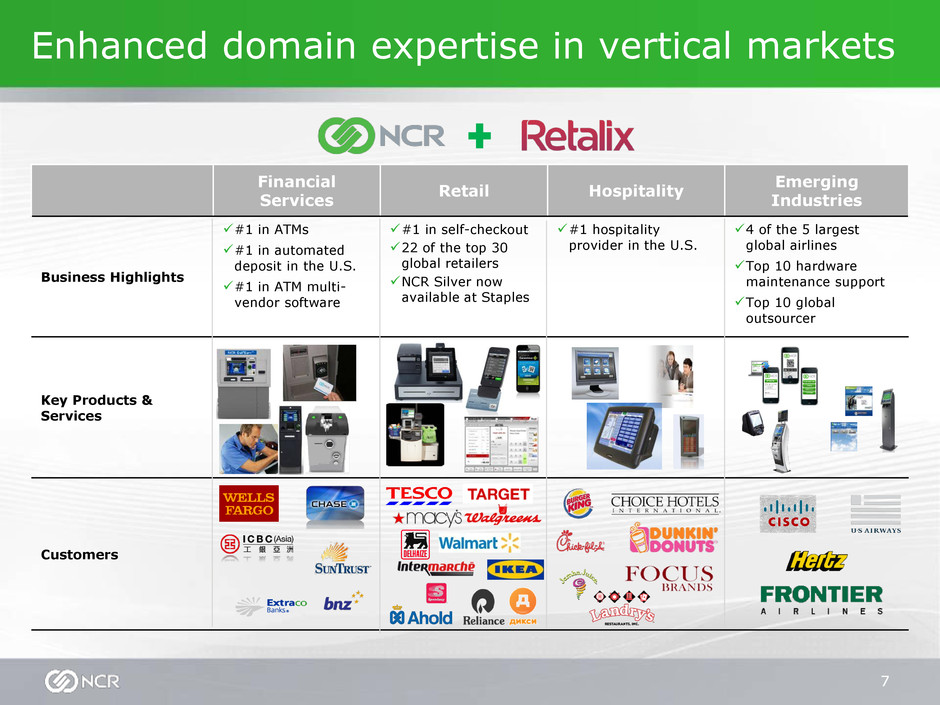

7 Enhanced domain expertise in vertical markets Financial Services Retail Hospitality Emerging Industries Business Highlights #1 in ATMs #1 in automated deposit in the U.S. #1 in ATM multi- vendor software #1 in self-checkout 22 of the top 30 global retailers NCR Silver now available at Staples #1 hospitality provider in the U.S. 4 of the 5 largest global airlines Top 10 hardware maintenance support Top 10 global outsourcer Key Products & Services Customers

8 Transaction overview • NCR to acquire Retalix in a merger transaction for $30.00 per share in cash – Represents a 37% premium to 11/27/12 closing price of $21.90 – Implies a transaction value of ~$650 million (~17x 2013E EBITDA(1)) • The Boards of Directors of both companies have approved the transaction • Key Retalix shareholders holding ~38% of outstanding Retalix shares have entered into voting agreements in support of the transaction • Accretive to non-GAAP earnings(2) for FY2013 • Transaction subject to Retalix shareholder approval, regulatory approval and closing conditions and is expected to close in Q1 2013 (1) Non-GAAP earnings before interest, taxes, depreciation and amortization (2) NCR defines non-GAAP earnings as earnings excluding pension and special items

9 Financing summary Goal is to deliver strong operating performance while maintaining a conservative credit profile • Acquisition financed through a combination of revolver debt and cash on hand • Plan to raise additional debt in the capital markets to extend maturities and reduce usage of the revolver • Will also seek to optimize use of Retalix cash ($134 million on balance sheet as of 9/30/12) to fund a portion of the purchase price • Focus on maintaining a strong capital structure post-transaction – LTM leverage below 2.75x debt / EBITDA(1) on a pro forma basis returning to lower levels within 18 months – Strong free cash flow(2) generation supports deleveraging over time – Continue to have active dialogue with both S&P and Moody’s – Committed to maintaining strong balance sheet with healthy liquidity levels (1) NCR defines EBITDA as income from continuing operations plus interest expense (net), income tax expense (benefit), depreciation and amortization and other adjustments (2) NCR defines free cash flow as net cash provided by operating activities and discontinued operations, less capital expenditures for property, plant, and equipment and additions to capitalized software

10 Financial benefits summary Revenue synergies • Accelerate NCR’s growth with comprehensive end-to-end software, hardware and services offering • Enable NCR product pull through for future Retalix customers • Cross-sell to the combined installed base • Leverage NCR’s scale and brand Cost synergies • Increase hardware margins from direct sales • Capture efficiencies in administrative functions across the combined company • Leverage R&D best practices Meaningful upside from cross-selling and hardware revenue synergy opportunities Approximately $5-$10 million of pre-tax cost synergies in 2013 Annualized pre-tax cost synergies of approximately $20-25 million to be realized over three years One-time costs of approximately $30 million

11 Closing comments • Strengthens NCR position as a global leader in retail software and services; builds on the success of our Radiant acquisition • Maintains our commitment to a balanced strategic execution program; orchestrating investments in growth initiatives while eliminating legacy issues • Demonstrates commitment of NCR to be the leader in omni- channel retail solutions enabling effortless transactions across multiple touch points and channels • Furthers NCR’s strategy to grow into market adjacencies and expand its software (SaaS) and services offerings • Bolsters software domain expertise and management bench strength in retail • Expected to be accretive to non-GAAP earnings(1) for FY2013 (1) NCR defines non-GAAP earnings as earnings excluding pension and special items

12 Supplementary Non-GAAP materials While NCR and Retalix report their respective results in accordance with generally accepted accounting principles in the United States, or GAAP, comments made during this conference call and the related presentation materials will include non-GAAP measures in an effort to provide additional useful information regarding NCR's and Retalix’s financial results. The calculation of these non-GAAP measures by NCR’s management and Retalix’s management, respectively, may differ from each other, and from similarly-titled measures reported by other companies and cannot, therefore, be compared with each other or with similarly-titled measures of other companies. These non-GAAP measures should not be considered as substitutes for or superior to results determined in accordance with GAAP. NCR’s reconciliations of its non-GAAP measures to comparable GAAP measures and other related information on these slides are also available on the Investor Relations page of NCR's website at www.ncr.com. Reconciliations of Retalix’s non-GAAP measures to comparable GAAP measures are available in these non-GAAP supplemental materials. NCR’s NPOI Margin. The NPOI margin for NCR included in these materials excludes the impact of pension expense and certain special items. Due to the significant change in its pension expense from year to year and the non-operational nature of pension expense and these special items, including amortization of acquisition related intangibles, NCR’s management uses non-pension operating income, or NPOI, to evaluate year-over-year operating performance. NCR may, in addition, segregate special items from its GAAP results from time to time to reflect the ongoing earnings per share performance of the company. NCR also uses non- pension operating income to manage and determine the effectiveness of its business managers and as a basis for incentive compensation. NCR determines non-pension operating income based on its GAAP income (loss) from operations excluding pension and special items. Retalix’s Non-GAAP OI Margin. The non-GAAP OI margin for Retalix included in these materials excludes the impact of non-cash equity based compensation, acquisition-related costs and amortization of intangibles related to acquisitions.

13 Non-GAAP reconciliations Gross margin as a Percentage of Revenue (GAAP) to Gross margin excluding special items and pension expense as a Percentage of Revenue (non-GAAP) NCR 9.30.12 Retalix 9.30.12 NCR + Retalix 9.30.12 (pro forma) Gross margin as a Percentage of Revenue (GAAP) 24.8% 42.1% 25.6% Acquisition-related amortization of intangibles 0.3 1.5 0.4 Pension expense 1.9 -- 1.8 Stock-based compensation expense -- 0.4 -- Gross margin excluding special items and pension expense as a Percentage of Revenue (non-GAAP) 27.0% 44.0% 27.8%

14 Non-GAAP reconciliations (continued) Income from Continuing Operations as a Percentage of Revenue (GAAP) to Non-Pension Operating Income as a Percentage of Revenue (non-GAAP) NCR 9.30.12 Retalix 9.30.12 NCR + Retalix 9.30.12 (pro forma) Income from Continuing Operations as a Percentage of Revenue (GAAP) 5.8% 6.7% 5.9% Pension Expense 3.1 -- 3.0 Acquisition-related Amortization of Intangibles 0.7 1.5 0.7 Acquisition-related Integration Costs 0.3 0.6 0.3 Stock-based Compensation Expenses -- 1.1 -- Estimated Annualized Cost Synergies -- -- 0.3 Non-Pension and non-GAAP Operating Income as a Percentage of Revenue 10.0% 9.9% 10.3%