NCR Confidential Q3 2013 EARNINGS CONFERENCE CALL BILL NUTI, CHAIRMAN AND CEO October 24, 2013

NCR Confidential NOTES TO INVESTORS 2 Comments made during this conference call and in these materials may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements use words such as “seek,” “potential,” “expect,” “strive,” “continue,” “continuously,” “accelerate,” “anticipate,” “outlook,” “intend,” “plan,” “target,” “believe,” “estimate,” “forecast,” “pursue” and other similar expressions or future or conditional verbs such as “will,” “should,” “would” and “could.” They include statements as to NCR’s anticipated or expected results, growth and financial performance, including its outlook for 2013; projections of revenue, profit growth and other financial items, including its anticipated software revenue growth and its expectations regarding margin expansion; future business segment performance; expected benefits from the acquisition of Retalix Ltd., including with respect to cost synergy targets and the acquisition’s effect on the strength of its solutions portfolio; revenue and solution diversification and differentiation and the anticipated benefits thereof; strategies and intentions regarding its pension plans and the effects thereof, including with respect to “Phase III” of its pension strategy; discussion of other strategic initiatives and related actions; and beliefs, expectations, intentions and strategies, among other things. Forward-looking statements are based on management’s current beliefs, expectations and assumptions, and involve a number of known and unknown risks and uncertainties, many of which are out of NCR’s control. These forward-looking statements are not guarantees of future performance, and there are a number of factors, risks and uncertainties, including those detailed from time to time in NCR’s SEC reports, including those listed in Item 1a “Risk Factors” of its Annual Report on Form 10-K, that could cause actual outcomes and results to differ materially from the results contemplated by such forward- looking statements. These materials are dated October 24, 2013, and NCR does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. While NCR reports its results in accordance with generally accepted accounting principles (GAAP) in the United States, comments made during this conference call and the related presentation materials will include “non-GAAP” measures, including non-pension operating income (or NPOI) and free cash flow (FCF), in an effort to provide additional useful information regarding NCR’s financial results. An explanation of these non-GAAP measures and a reconciliation of these non-GAAP measures to comparable GAAP measures are included in the portion of these presentation materials entitled “Supplementary Non-GAAP Materials” and are available on the Investor Relations page of NCR’s website at www.ncr.com. Descriptions of many of these non-GAAP measures, including free cash flow, are also included in NCR’s SEC reports. These presentation materials and the associated remarks made during this conference call are integrally related and are intended to be presented and understood together.

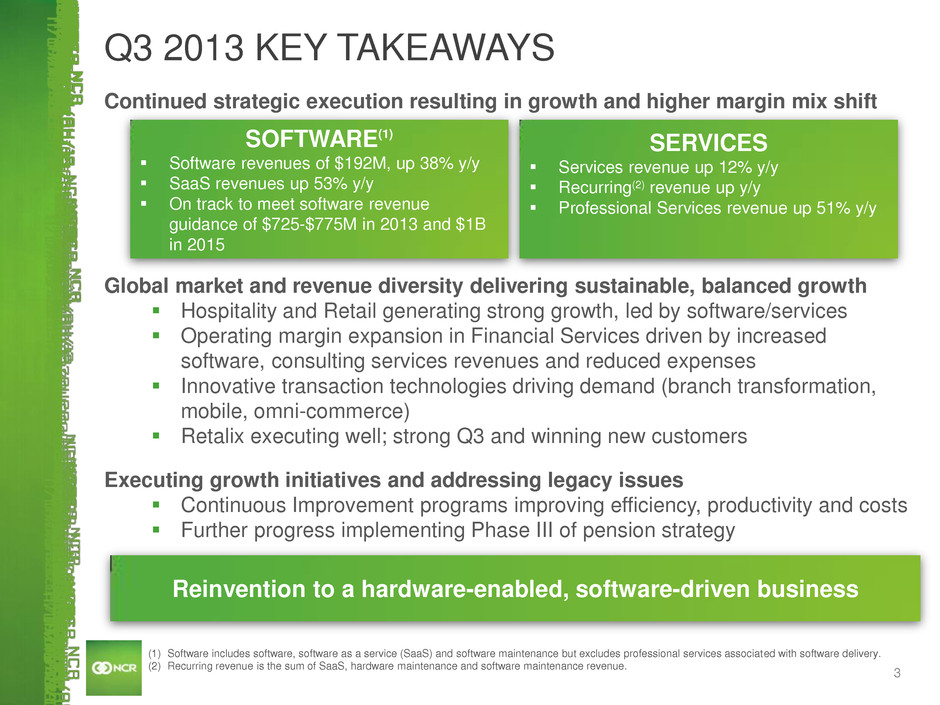

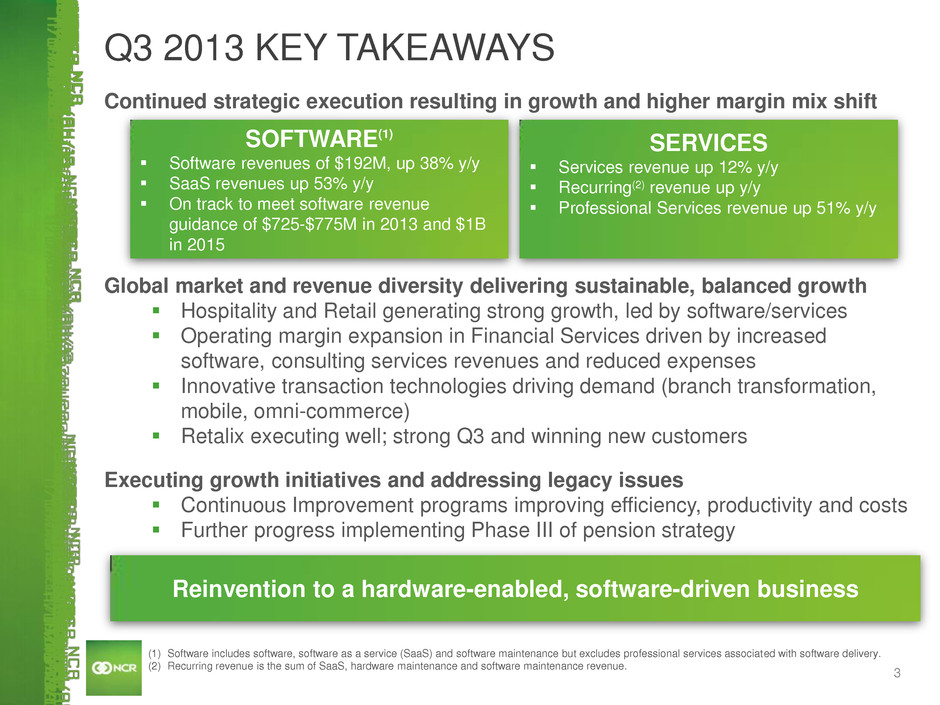

NCR Confidential 3 Q3 2013 KEY TAKEAWAYS Continued strategic execution resulting in growth and higher margin mix shift (1) Software includes software, software as a service (SaaS) and software maintenance but excludes professional services associated with software delivery. (2) Recurring revenue is the sum of SaaS, hardware maintenance and software maintenance revenue. Global market and revenue diversity delivering sustainable, balanced growth Hospitality and Retail generating strong growth, led by software/services Operating margin expansion in Financial Services driven by increased software, consulting services revenues and reduced expenses Innovative transaction technologies driving demand (branch transformation, mobile, omni-commerce) Retalix executing well; strong Q3 and winning new customers Executing growth initiatives and addressing legacy issues Continuous Improvement programs improving efficiency, productivity and costs Further progress implementing Phase III of pension strategy SOFTWARE(1) Software revenues of $192M, up 38% y/y SaaS revenues up 53% y/y On track to meet software revenue guidance of $725-$775M in 2013 and $1B in 2015 SERVICES Services revenue up 12% y/y Recurring(2) revenue up y/y Professional Services revenue up 51% y/y Reinvention to a hardware-enabled, software-driven business

NCR Confidential Full-year 2013 guidance(4) reaffirmed 4 Q3 2013 FINANCIAL HIGHLIGHTS Q3 2012 Q3 2013 REVENUE $1.51 billion $1.44 billion Q3 2012 Q3 2013 GROSS MARGIN(1) 28.6% 27.3% Q3 2012 Q3 2013 NPOI(1) $185 million $153 million (1) See reconciliation of GAAP to non-GAAP measures in the Supplementary Non-GAAP Materials and/or on the investor relations page of NCR’s website. (2) Post AT&T Spin-off, excluding Teradata. (3) NPOI as a percentage of revenue. (4) See earnings release of NCR Corporation dated October 24, 2013. Up 5% y/y 7% on a constant currency(1) basis Up 130 bpts y/y Up 21% y/y All-time high(2) NPOI margin(3) of 12.3%

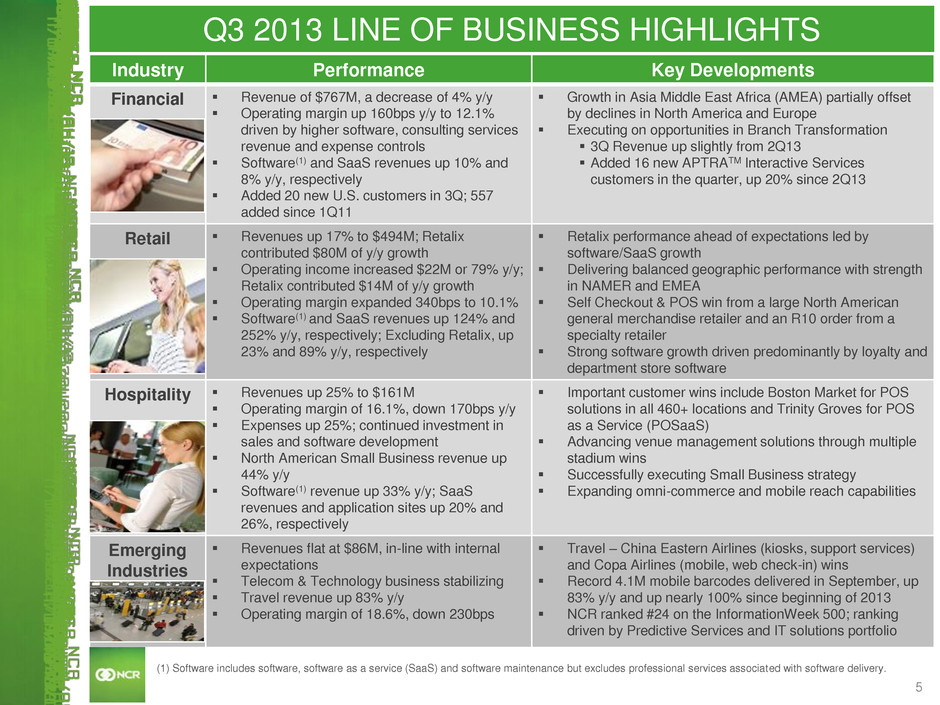

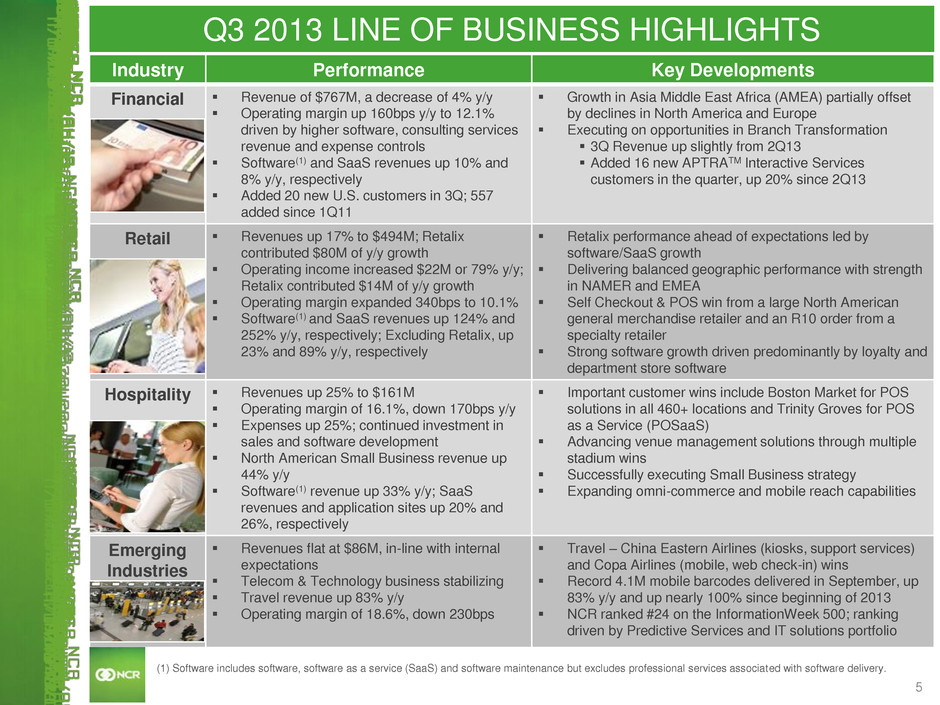

NCR Confidential Industry Performance Key Developments Financial Revenue of $767M, a decrease of 4% y/y Operating margin up 160bps y/y to 12.1% driven by higher software, consulting services revenue and expense controls Software(1) and SaaS revenues up 10% and 8% y/y, respectively Added 20 new U.S. customers in 3Q; 557 added since 1Q11 Growth in Asia Middle East Africa (AMEA) partially offset by declines in North America and Europe Executing on opportunities in Branch Transformation 3Q Revenue up slightly from 2Q13 Added 16 new APTRATM Interactive Services customers in the quarter, up 20% since 2Q13 Retail Revenues up 17% to $494M; Retalix contributed $80M of y/y growth Operating income increased $22M or 79% y/y; Retalix contributed $14M of y/y growth Operating margin expanded 340bps to 10.1% Software(1) and SaaS revenues up 124% and 252% y/y, respectively; Excluding Retalix, up 23% and 89% y/y, respectively Retalix performance ahead of expectations led by software/SaaS growth Delivering balanced geographic performance with strength in NAMER and EMEA Self Checkout & POS win from a large North American general merchandise retailer and an R10 order from a specialty retailer Strong software growth driven predominantly by loyalty and department store software Hospitality Revenues up 25% to $161M Operating margin of 16.1%, down 170bps y/y Expenses up 25%; continued investment in sales and software development North American Small Business revenue up 44% y/y Software(1) revenue up 33% y/y; SaaS revenues and application sites up 20% and 26%, respectively Important customer wins include Boston Market for POS solutions in all 460+ locations and Trinity Groves for POS as a Service (POSaaS) Advancing venue management solutions through multiple stadium wins Successfully executing Small Business strategy Expanding omni-commerce and mobile reach capabilities Emerging Industries Revenues flat at $86M, in-line with internal expectations Telecom & Technology business stabilizing Travel revenue up 83% y/y Operating margin of 18.6%, down 230bps Travel – China Eastern Airlines (kiosks, support services) and Copa Airlines (mobile, web check-in) wins Record 4.1M mobile barcodes delivered in September, up 83% y/y and up nearly 100% since beginning of 2013 NCR ranked #24 on the InformationWeek 500; ranking driven by Predictive Services and IT solutions portfolio 5 Q3 2013 LINE OF BUSINESS HIGHLIGHTS (1) Software includes software, software as a service (SaaS) and software maintenance but excludes professional services associated with software delivery.

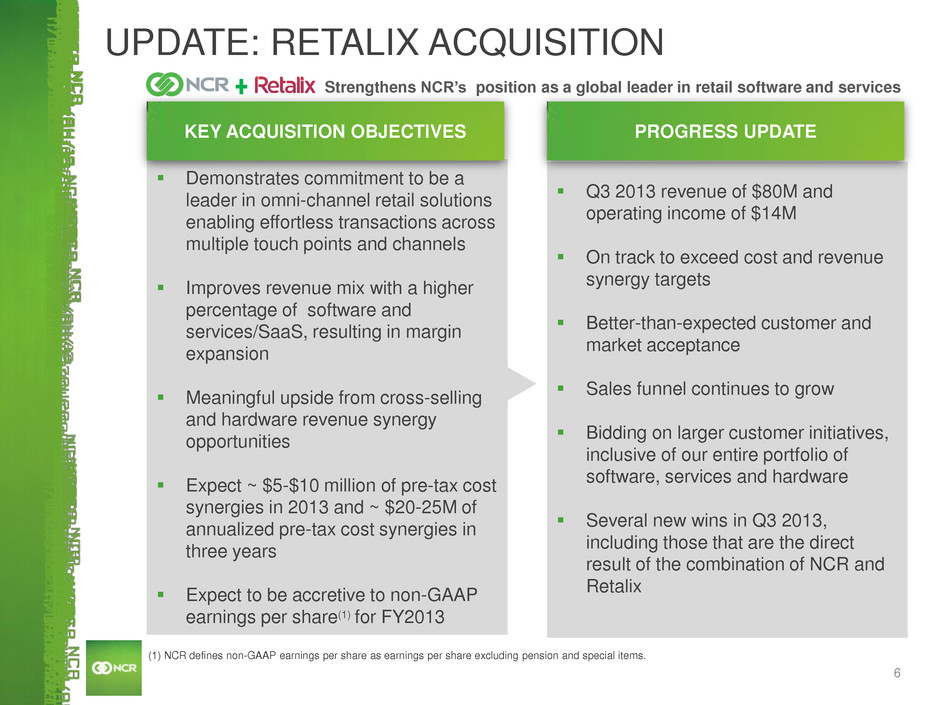

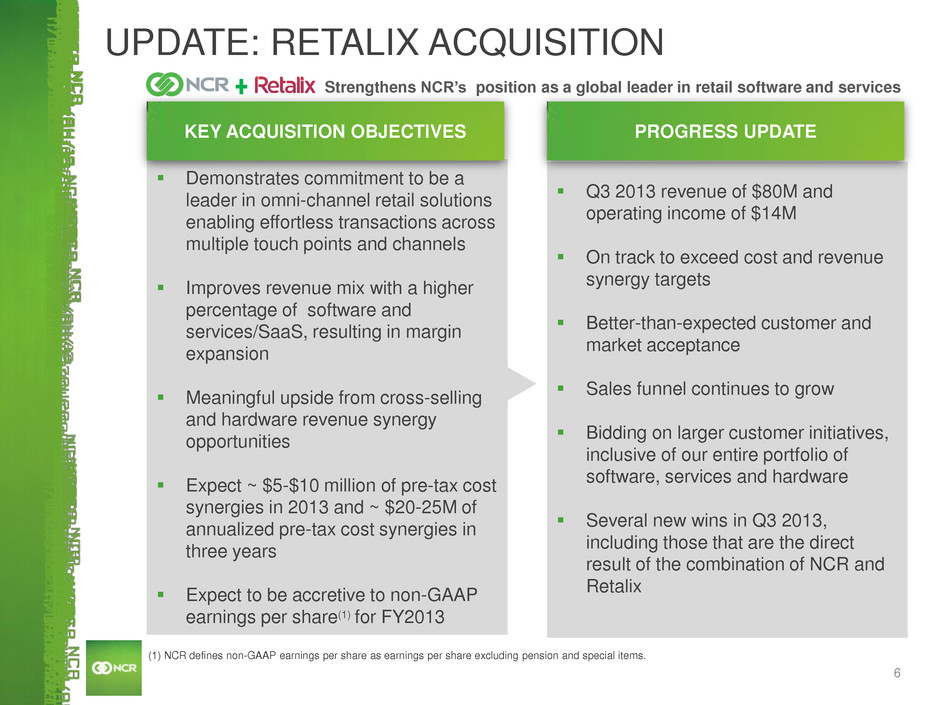

NCR Confidential 6 UPDATE: RETALIX ACQUISITION Demonstrates commitment to be a leader in omni-channel retail solutions enabling effortless transactions across multiple touch points and channels Improves revenue mix with a higher percentage of software and services/SaaS, resulting in margin expansion Meaningful upside from cross-selling and hardware revenue synergy opportunities Expect ~ $5-$10 million of pre-tax cost synergies in 2013 and ~ $20-25M of annualized pre-tax cost synergies in three years Expect to be accretive to non-GAAP earnings per share(1) for FY2013 Q3 2013 revenue of $80M and operating income of $14M On track to exceed cost and revenue synergy targets Better-than-expected customer and market acceptance Sales funnel continues to grow Bidding on larger customer initiatives, inclusive of our entire portfolio of software, services and hardware Several new wins in Q3 2013, including those that are the direct result of the combination of NCR and Retalix (1) NCR defines non-GAAP earnings per share as earnings per share excluding pension and special items. Strengthens NCR’s position as a global leader in retail software and services KEY ACQUISITION OBJECTIVES PROGRESS UPDATE

NCR Confidential 7 EXECUTING REINVENTION STRATEGY Building a great technology company; Delivering sustainable/profitable growth Executing Software, SaaS and Services strategy Expanding operating margins Quality and productivity improvement programs deliver savings Investing to deliver differentiated value in the market over the long term Commitment to innovation/R&D and empowering customers Increased R&D spending as a percent of revenue Strengthening Services and Sales organizations Diversification & differentiation = Reduced risk and increased customer value Revenue diversification gives balance and breadth across a number of industries, geographies and channels Innovative solutions and software offerings provide competitive differentiation, drive sales and yield tangible business process efficiencies for our customers Orchestrating a balance between growth & legacy initiatives Eliminating a significant number of old legacy issues internally Putting pension behind us; progress implementing Phase III

NCR Confidential SUPPLEMENTARY NON-GAAP MATERIALS

NCR Confidential NON-GAAP MEASURES 9 While NCR reports its results in accordance with generally accepted accounting principles (GAAP) in the United States, comments made during this conference call and the related presentation materials will include non-GAAP measures in an effort to provide additional useful information regarding NCR’s financial results. NCR’s management evaluates the Company’s results excluding certain items, such as pension expense and the effect of foreign currency translation, to assess the financial performance of the Company and believes this information is useful for investors because it provides a more complete understanding of NCR’s underlying operational performance, as well as consistency and comparability with NCR’s past reports of financial results. In addition, management uses certain of these measures to manage and determine effectiveness of its business managers and as a basis for incentive compensation. NCR management’s calculation of these non-GAAP measures may differ from similarly- titled measures reported by other companies and cannot, therefore, be compared with similarly-titled measures of other companies. These non-GAAP measures should not be considered as substitutes for or superior to results determined in accordance with GAAP. The reconciliations of non-GAAP measures to comparable GAAP measures and other related information on the following slides are also available on the Investor Relations page of NCR’s website at www.ncr.com.

NCR Confidential NON-GAAP MEASURES 10 NPOI and Operational Gross Margin. The non-GAAP income from operations (i.e., non-pension operating income, or NPOI) and operational gross margin included in these materials exclude the impact of pension expense and certain special items. Due to the significant change in its pension expense from year to year and the non- operational nature of pension expense and these special items, including amortization of acquisition related intangibles, NCR’s management uses non-pension operating income to evaluate year-over-year operating performance. NCR may, in addition, segregate special items from its GAAP results from time to time to reflect the ongoing earnings per share performance of the company. NCR also uses non-pension operating income to manage and determine the effectiveness of its business managers and as a basis for incentive compensation. NCR determines non-pension operating income based on its GAAP income (loss) from operations excluding pension expense and special items. Free Cash Flow. Free cash flow (or FCF) does not have a uniform definition under GAAP. NCR defines free cash flow as net cash provided by/used in operating activities and cash flow provided by/used in discontinued operations less capital expenditures for property, plant and equipment, and additions to capitalized software. NCR’s management uses free cash flow to assess the financial performance of the company and believes it is useful for investors because it relates the operating cash flow of the company to the capital that is spent to continue and improve business operations. In particular, free cash flow indicates the amount of cash generated after capital expenditures which can be used for, among other things, investment in the company’s existing businesses, strategic acquisitions, strengthening the company’s balance sheet, repurchase of company stock and repayment of the company’s debt obligations. Free cash flow does not represent the residual cash flow available for discretionary expenditures since there may be other nondiscretionary expenditures that are not deducted from the measure. Constant Currency. NCR’s period-over-period revenue growth on a constant currency basis excludes the effects of foreign currency translation. Due to the variability of foreign exchange rates from period to period, NCR’s management uses revenue on a constant currency basis to evaluate period-over-period operating performance. Revenue growth on a constant currency basis is calculated by translating prior period revenue at current period monthly average exchange rates.

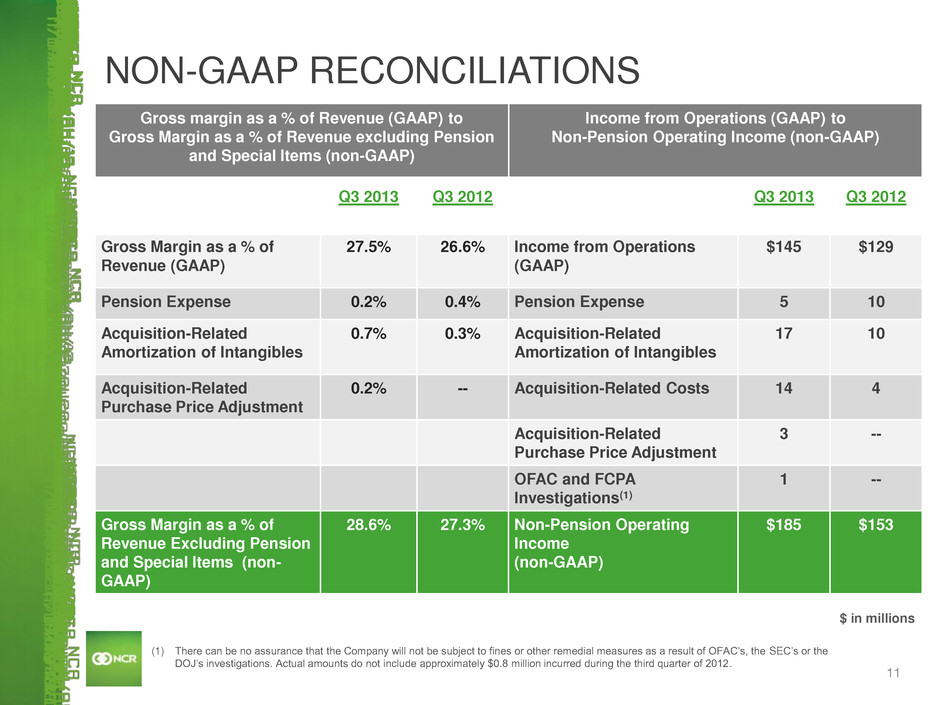

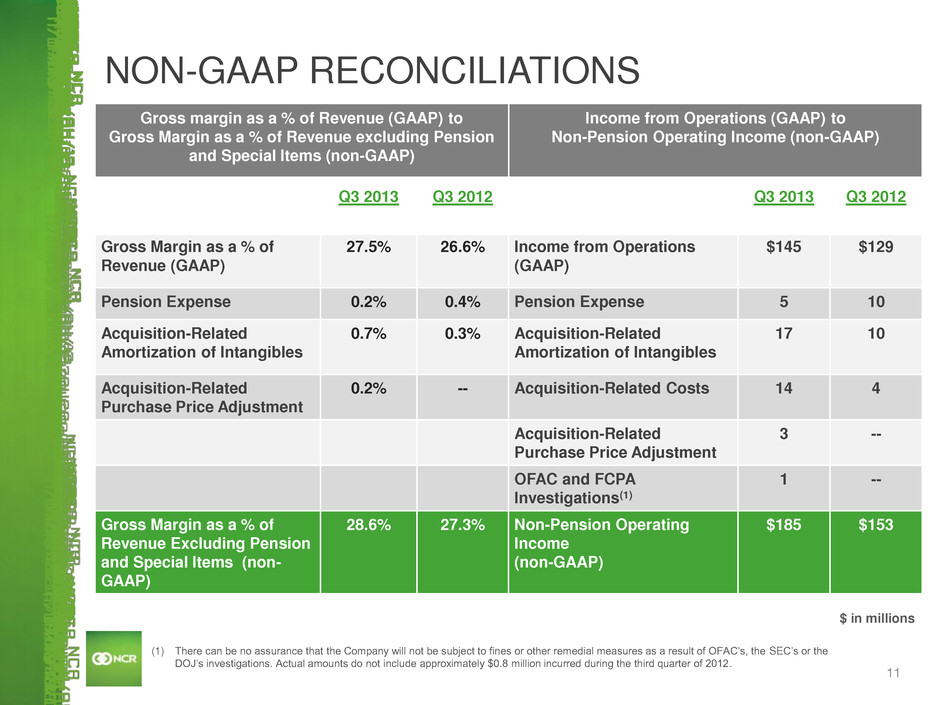

NCR Confidential NON-GAAP RECONCILIATIONS 11 Q3 2013 Q3 2012 Q3 2013 Q3 2012 Gross Margin as a % of Revenue (GAAP) 27.5% 26.6% Income from Operations (GAAP) $145 $129 Pension Expense 0.2% 0.4% Pension Expense 5 10 Acquisition-Related Amortization of Intangibles 0.7% 0.3% Acquisition-Related Amortization of Intangibles 17 10 Acquisition-Related Purchase Price Adjustment 0.2% -- Acquisition-Related Costs 14 4 Acquisition-Related Purchase Price Adjustment 3 -- OFAC and FCPA Investigations(1) 1 -- Gross Margin as a % of Revenue Excluding Pension and Special Items (non- GAAP) 28.6% 27.3% Non-Pension Operating Income (non-GAAP) $185 $153 $ in millions Gross margin as a % of Revenue (GAAP) to Gross Margin as a % of Revenue excluding Pension and Special Items (non-GAAP) Income from Operations (GAAP) to Non-Pension Operating Income (non-GAAP) (1) There can be no assurance that the Company will not be subject to fines or other remedial measures as a result of OFAC’s, the SEC’s or the DOJ’s investigations. Actual amounts do not include approximately $0.8 million incurred during the third quarter of 2012.

NCR Confidential 12 NON-GAAP RECONCILIATIONS Revenue Growth % (GAAP) to Constant Currency Revenue Growth % (non-GAAP) Q3 2013 Revenue growth % (GAAP) 5% Unfavorable foreign currency fluctuation impact 2% Constant currency revenue growth % (non-GAAP) 7%