1 Q1 2015 EARNINGS CONFERENCE CALL BILL NUTI, CHAIRMAN AND CEO BOB FISHMAN, CFO April 28, 2015

2 NOTES TO INVESTORS FORWARD-LOOKING STATEMENTS. Comments made during this conference call and in these materials contain forward- looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that describe or relate to NCR's future plans, goals, intentions, strategies or financial outlook, and statements that do not relate to historical or current fact, are examples of forward-looking statements. The forward-looking statements in these materials include statements about the expected benefits of NCR's Kalpana ATM technology; industry investment trends and market conditions affecting NCR and its business; expectations for the growth of NCR's Retail Solutions business; expectations regarding the transformation of NCR's sales and services functions; the success of NCR's ongoing restructuring plan; foreign currency fluctuations and their impact on NCR's results and NCR's FY 2015 overall, FY 2015 segment and Q2 2015 financial outlook. Forward-looking statements are based on our current beliefs, expectations and assumptions, which may not prove to be accurate, and involve a number of known and unknown risks and uncertainties, many of which are out of NCR's control. Forward-looking statements are not guarantees of future performance, and there are a number of important factors that could cause actual outcomes and results to differ materially from the results contemplated by such forward-looking statements, including those factors listed in Item 1a "Risk Factors" of NCR's Annual Report on Form 10-K and those factors detailed from time to time in NCR's other SEC reports. These materials are dated April 28, 2015, and NCR does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. NON-GAAP MEASURES. While NCR reports its results in accordance with generally accepted accounting principles in the United States (GAAP), comments made during this conference call and these materials will include the following "non-GAAP" measures: non- pension operating income (NPOI), non-GAAP diluted earnings per share (non-GAAP diluted EPS), free cash flow (FCF), operational gross margin, operational gross margin rate, expenses (non-GAAP), adjusted EBITDA, effective tax rate, non-GAAP net income and selected measures expressed on a constant currency basis. These measures are included to provide additional useful information regarding NCR's financial results, and are not a substitute for their comparable GAAP measures. Explanations of these non-GAAP measures and reconciliations of these non-GAAP measures to their directly comparable GAAP measures are included in the accompanying "Supplementary Non-GAAP Materials" and are available on the Investor Relations page of NCR's website at www.ncr.com. Descriptions of many of these non-GAAP measures are also included in NCR's SEC reports. USE OF CERTAIN TERMS. As used in these materials, (i) the term "software-related revenue" includes software license, software maintenance, cloud, and professional services revenue associated with software delivery, (ii) the term "recurring revenue" means the sum of cloud, hardware maintenance and software maintenance revenue, (iii) the terms "cloud" and "cloud revenue" are used to describe NCR’s software-as-a-service offerings and the revenue associated therewith (prior earnings releases and presentation materials referred to these offerings and revenues as "SaaS" and "SaaS revenue") and (iv) the term "CC" means constant currency. These presentation materials and the associated remarks made during this conference call are integrally related and are intended to be presented and understood together.

3 Q1 2015 FINANCIAL RESULTS REVENUE Q1 2014 Q1 2015 $1.52 billion Revenue down 3% y/y, up 3% CC Recurring revenue down 2% y/y, up 4% CC, 45% of total OPERATIONAL GROSS MARGIN Q1 2014 Q1 2015 28.6% 27.6% Down 100 bps y/y, down ~75 bps CC NPOI NPOI down 6% y/y, up 6% CC Non-GAAP EPS down 14% y/y, up 2% CC FREE CASH FLOW FCF improvement driven by cash from operations, capital expenditures, and disc ops Q1 2014 Q1 2015 $155 million $146 million Q1 2014 Q1 2015 ($51) million $24 million $1.48 billion NON-GAAP EPS Q1 2014 Q1 2015 $0.43 $0.50 FX Impact ~($95M) FX Impact ~($0.08) FX Impact ~($18M) FX Impact ~(25 bps)

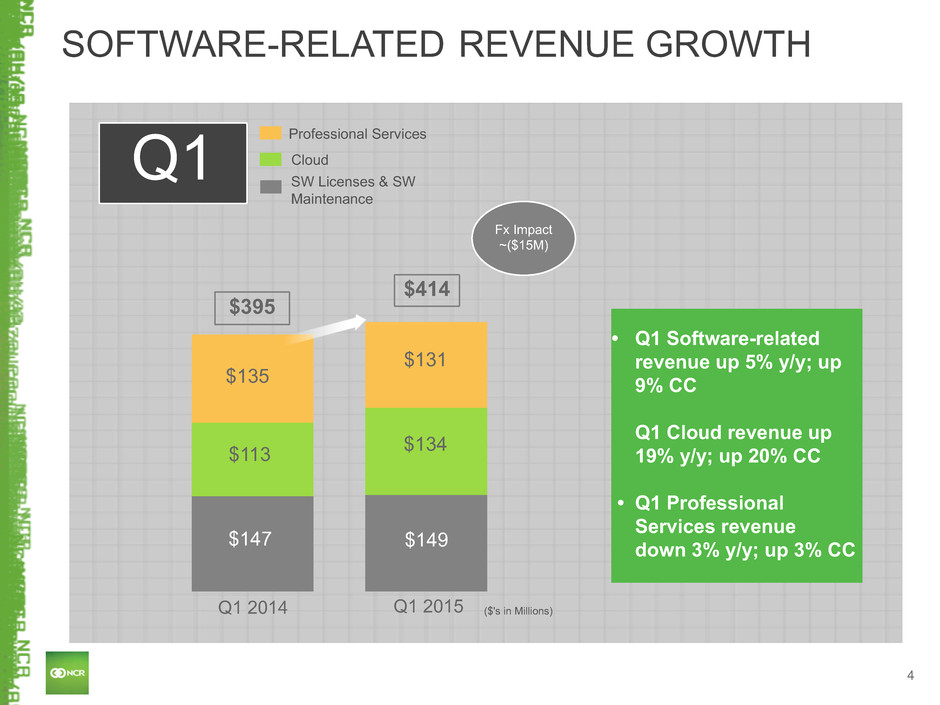

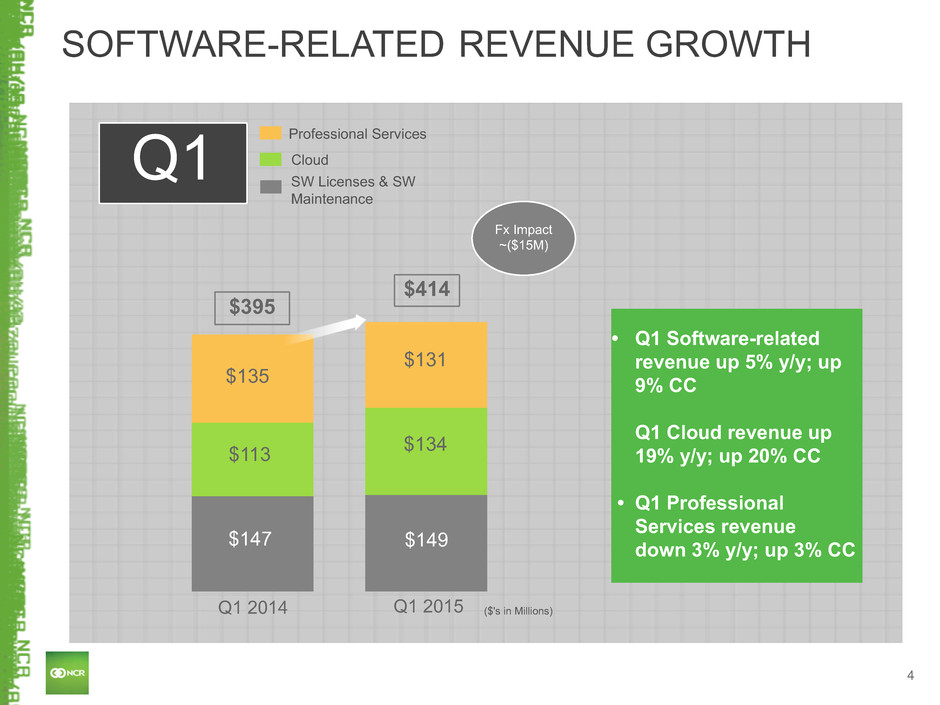

4 SOFTWARE-RELATED REVENUE GROWTH Q1 2015 Q1 2014 $113 Q1 • Q1 Software-related revenue up 5% y/y; up 9% CC Q1 Cloud revenue up 19% y/y; up 20% CC • Q1 Professional Services revenue down 3% y/y; up 3% CC $414 Cloud Professional Services SW Licenses & SW Maintenance $147 ($'s in Millions) $135 $131 $134 $149 $395 Fx Impact ~($15M)

5 NCR Kalpana is here! Making omni-channel a reality NCR Kalpana software enables the best consumer experience at the lowest cost to serve INTEGRATION SECURITY SPEED SAVINGS • Seamlessly integrates the experience across all channels • Enables institutions to run a combination of conventional ATMs and the tablet-like, ultra-thin client Cx110 • Delivers the world’s first ATM security certification to PCI 4.0, and is designed to eliminate malware • Controls and originates all software updates at the server level • Eliminates legacy PC architecture that is inefficient and complex • Runs ATMs remotely, enabling new customer services to be brought to market twice as fast as before • Cloud-driven creation, delivery and processing of transactions • Management of self- service channel moved to the cloud; eliminates costly onsite service visits • Reduces operating costs by up to 40%

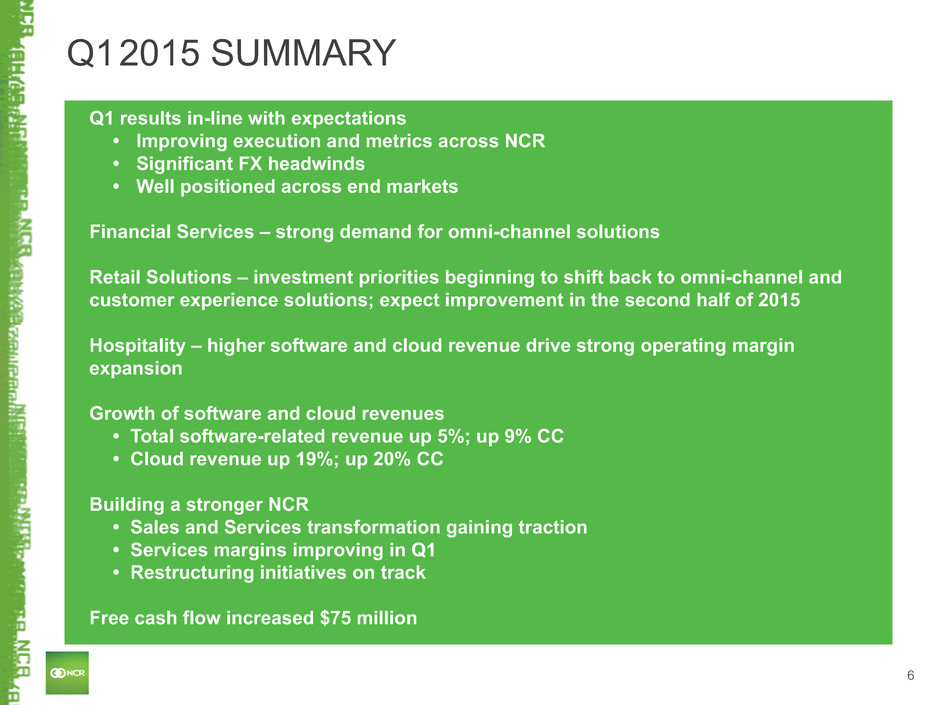

6 Q1 2015 SUMMARY Q1 results in-line with expectations • Improving execution and metrics across NCR • Significant FX headwinds • Well positioned across end markets Financial Services – strong demand for omni-channel solutions Retail Solutions – investment priorities beginning to shift back to omni-channel and customer experience solutions; expect improvement in the second half of 2015 Hospitality – higher software and cloud revenue drive strong operating margin expansion Growth of software and cloud revenues • Total software-related revenue up 5%; up 9% CC • Cloud revenue up 19%; up 20% CC Building a stronger NCR • Sales and Services transformation gaining traction • Services margins improving in Q1 • Restructuring initiatives on track Free cash flow increased $75 million

7 For the Three Months Ended March 31 2015 2014 As Reported Constant Currency Revenue $1,476 $1,518 (3)% 3% Operational Gross Margin 407 434 (6)% 1% Operational Gross Margin Rate 27.6% 28.6% Expenses (non-GAAP) 261 279 (6)% (2)% % of Revenue 17.7% 18.4% NPOI 146 155 (6)% 6% % of Revenue 9.9% 10.2% -30 bps +30 bps Interest and other expense (51) (50) 2% 2% Non-GAAP Diluted EPS (1) $0.43 $0.50 (14)% 2% Q1 OPERATIONAL RESULTS (1) Effective tax rate of 21% in Q1 2015 and 17% in Q1 2014. $ millions, except per share amounts

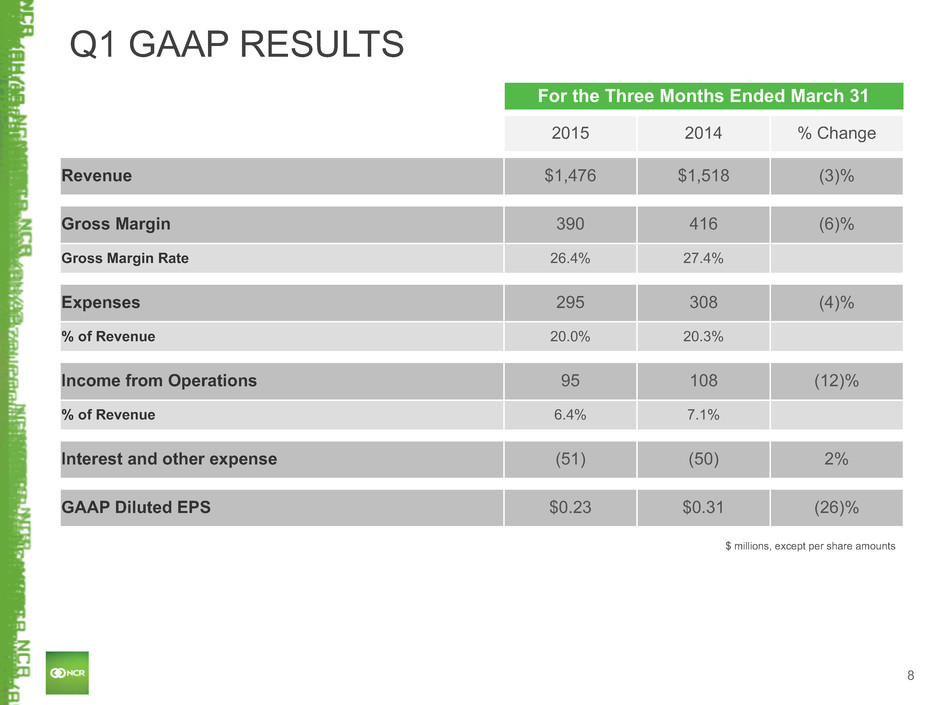

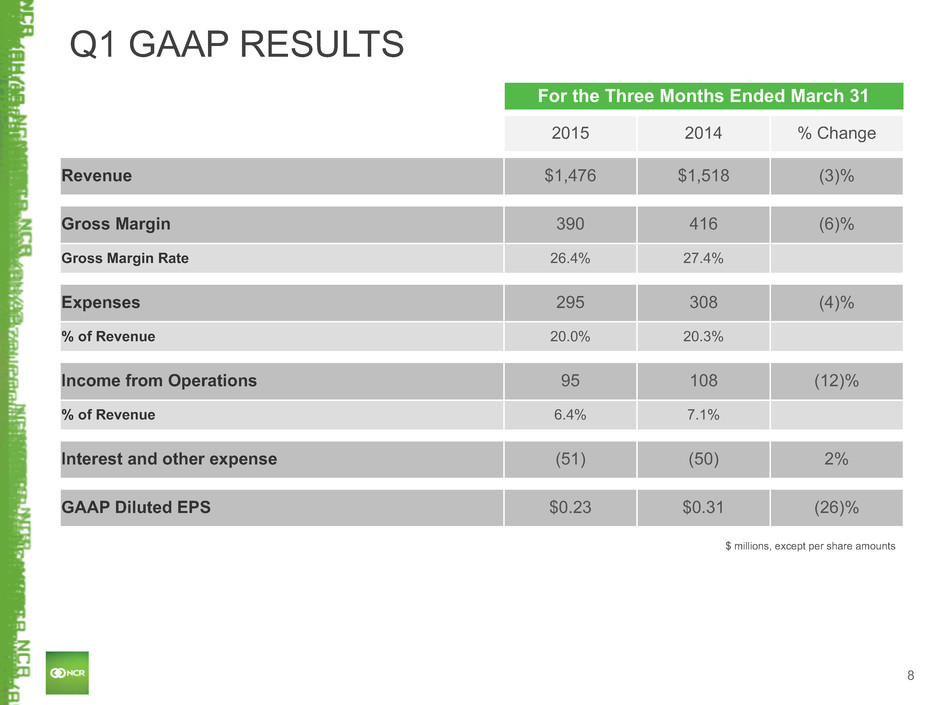

8 For the Three Months Ended March 31 2015 2014 % Change Revenue $1,476 $1,518 (3)% Gross Margin 390 416 (6)% Gross Margin Rate 26.4% 27.4% Expenses 295 308 (4)% % of Revenue 20.0% 20.3% Income from Operations 95 108 (12)% % of Revenue 6.4% 7.1% Interest and other expense (51) (50) 2% GAAP Diluted EPS $0.23 $0.31 (26)% Q1 GAAP RESULTS $ millions, except per share amounts

9 FINANCIAL SERVICES Q1 2015 Update • Revenue up 1% as reported and up 9% CC: Growth in Americas, Europe and Middle East Africa driven by increased software-related revenue • Operating income up 2% as reported and up 15% CC due to a higher mix of omni-channel solutions ▪ Performance in key markets ▪ Growth in U.S., Middle East / Africa, Brazil and Western Europe ▪ Continued challenges in China and Russia • Key elements of solution portfolio • Branch Transformation and software license revenues were up significantly Y/Y ▪ Record end user growth in Digital banking ▪ Initial KalpanaTM win closed Key Market Developments Financial Results Q1 2015 Q1 2014 As Reported Constant Currency Revenue $798M $794M 1% 9% Operating Income $105M $103M 2% 15% Operating Income as a % of Revenue 13.2% 13.0% +20 bps +70 bps • Cloud revenue up 19%; up 19% CC • Software-related revenue up 10%; up 15% CC Key Metrics

10 RETAIL SOLUTIONS Q1 2015 Update • Revenue down 9% as reported and down 4% CC; Decline in all theaters due to reduced spending by retailers • Operating income down 56% as reported and down 44% CC due to lower volume and a less favorable mix of software-related revenue • As expected, challenging retail market impacting results in Q1 with improvement forecasted in the second half of 2015; Positive momentum in orders in Q1 • Improving demand for our omni-channel and self-checkout solutions in Greater China, Southeast Asia and Russia • Significant Services win in Q1 resulting from strong Customer Service execution Key Market Developments Financial Results Q1 2015 Q1 2014 As Reported Constant Currency Revenue $445M $490M (9%) (4%) Operating Income $16M $36M (56%) (44%) Operating Income as a % of Revenue 3.6% 7.3% -370 bps -300 bps • Cloud revenue flat; up 4% CC • Software-related revenue down 3%; up 1% CC Key Metrics

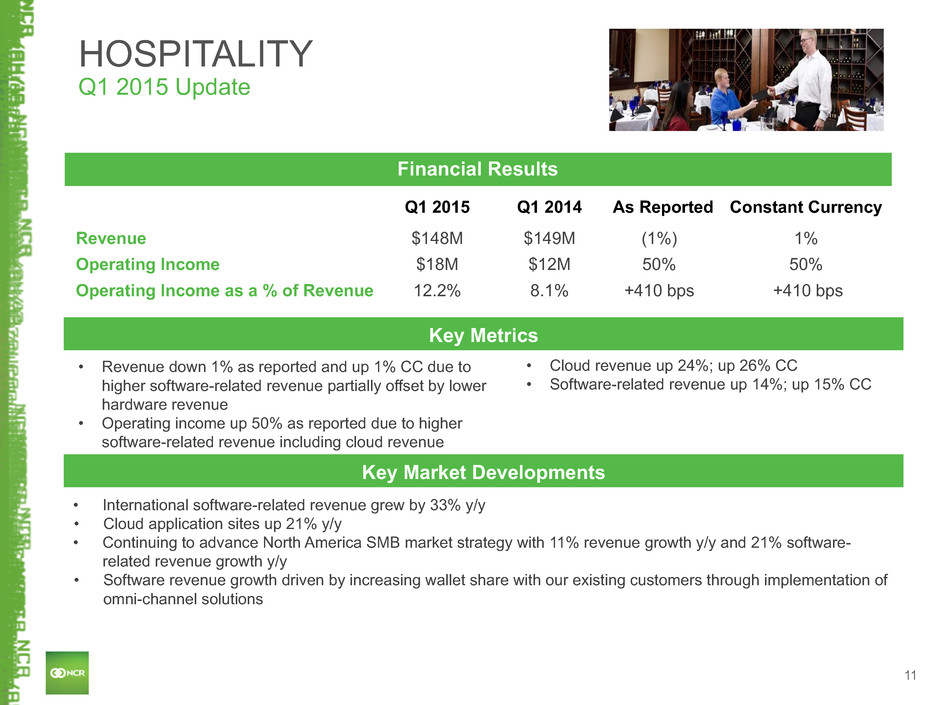

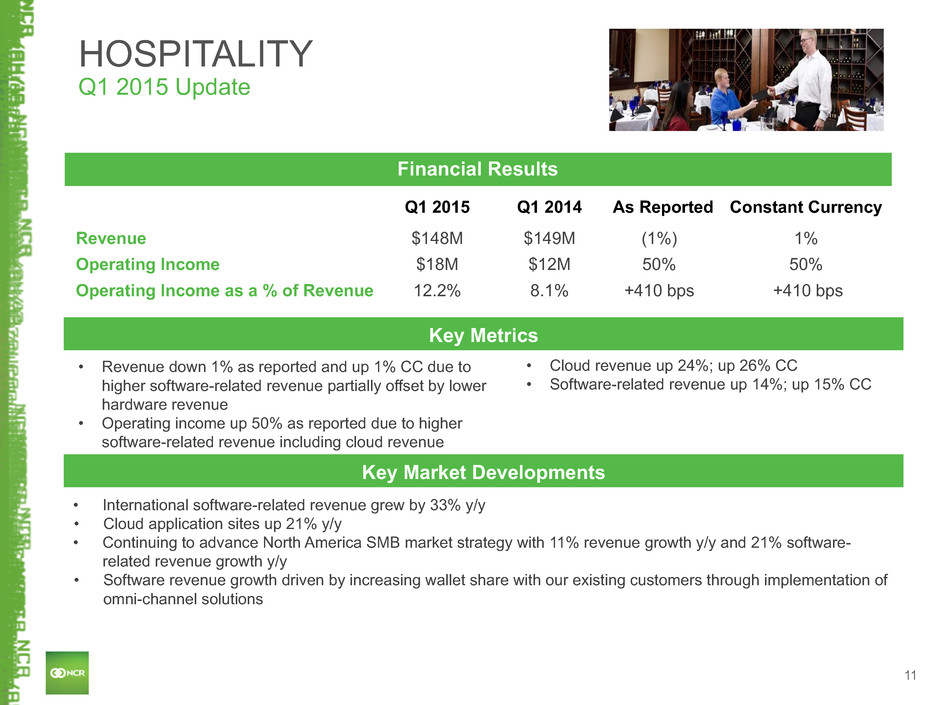

11 HOSPITALITY Q1 2015 Update • Revenue down 1% as reported and up 1% CC due to higher software-related revenue partially offset by lower hardware revenue • Operating income up 50% as reported due to higher software-related revenue including cloud revenue • International software-related revenue grew by 33% y/y • Cloud application sites up 21% y/y • Continuing to advance North America SMB market strategy with 11% revenue growth y/y and 21% software- related revenue growth y/y • Software revenue growth driven by increasing wallet share with our existing customers through implementation of omni-channel solutions Key Market Developments Financial Results Q1 2015 Q1 2014 As Reported Constant Currency Revenue $148M $149M (1%) 1% Operating Income $18M $12M 50% 50% Operating Income as a % of Revenue 12.2% 8.1% +410 bps +410 bps • Cloud revenue up 24%; up 26% CC • Software-related revenue up 14%; up 15% CC Key Metrics

12 EMERGING INDUSTRIES Q1 2015 Update • Revenue flat as reported and up 8% CC; Growth driven by Telecom & Technology revenue, up 6% Telecom & Technology ▪ Base expansion wins in new portfolios: Advanced and Managed Services ▪ Added two new Telecom expansion accounts Travel ▪ Delivered a record 40M mobile airline boarding passes in Q1 2015, up 172% y/y Small Business (NCR Silver) • Increased adoption of NCR Silver; Customer base up 11% over Q4 2014 and up 127% y/y Key Market Developments Financial Results Q1 2015 Q1 2014 As Reported Constant Currency Revenue $85M $85M —% 8% Operating Income $7M $4M 75% 125% Operating Income as a % of Revenue 8.2% 4.7% +350 bps +510 bps Key Metrics • Operating income up 75% as reported and up 125% CC due to higher services margins

13 Q1 SUPPLEMENTAL REVENUE INFORMATION For the Periods Ended March 31 Three Months 2015 2014 % Change % Change (Constant Currency) Cloud $134 $113 19% 20% Software License and Software Maintenance 149 147 1% 6% Professional Services 131 135 (3%) 3% Total Software-Related Revenue 414 395 5% 9% Hardware 539 570 (5%) 2% Other Services 523 553 (5%) 2% Total Revenue $1,476 $1,518 (3%) 3% $ millions

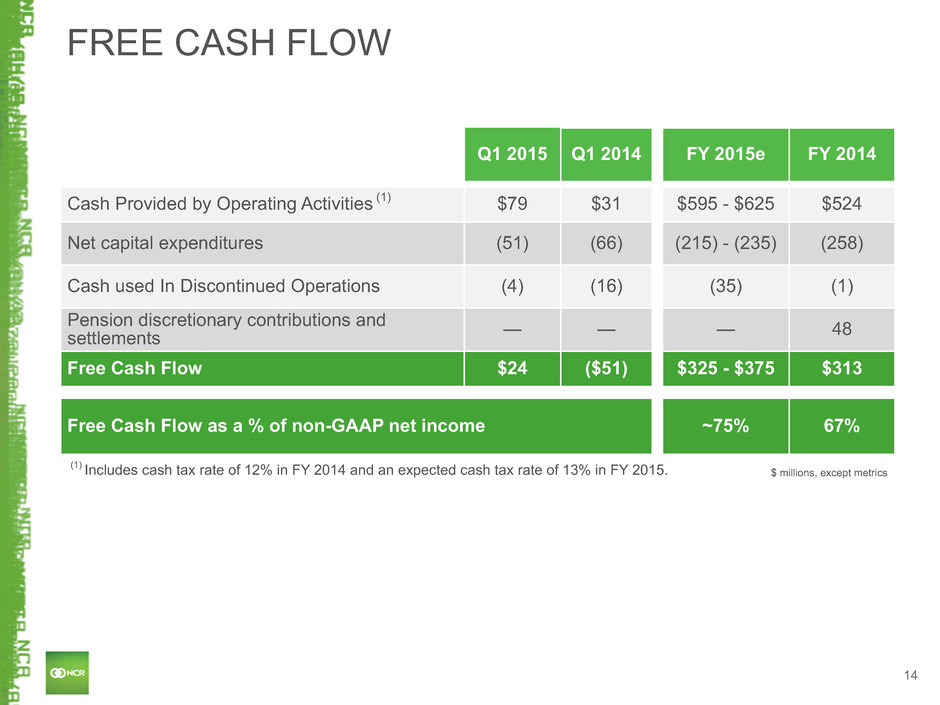

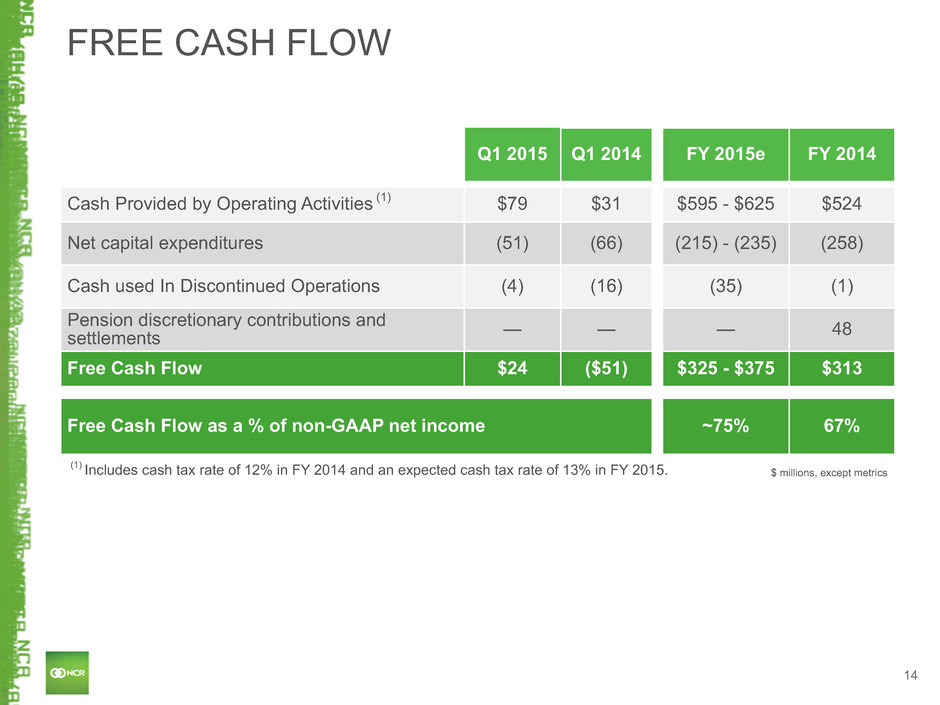

14 FREE CASH FLOW Q1 2015 Q1 2014 FY 2015e FY 2014 Cash Provided by Operating Activities (1) $79 $31 $595 - $625 $524 Net capital expenditures (51) (66) (215) - (235) (258) Cash used In Discontinued Operations (4) (16) (35) (1) Pension discretionary contributions and settlements — — — 48 Free Cash Flow $24 ($51) $325 - $375 $313 Free Cash Flow as a % of non-GAAP net income ~75% 67% $ millions, except metrics (1) Includes cash tax rate of 12% in FY 2014 and an expected cash tax rate of 13% in FY 2015.

15 RESTRUCTURING PROGRESS UPDATE Expected Savings • ~$18M in 2014, ~$70M in 2015 and ~$105M in 2016 • ~50% of the savings benefiting NPOI in each year GAAP Income Statement Impact • Total charge of $200M to $225M from 2014 through 2015; • $16M in Q1 2015 • ~$21M to ~$46M remaining in FY 2015 Cash Impact • Total cash impact of $100M to $115M from 2014 through 2015; • $16M in Q1 2015 • ~$55M to ~$70M remaining in FY 2015

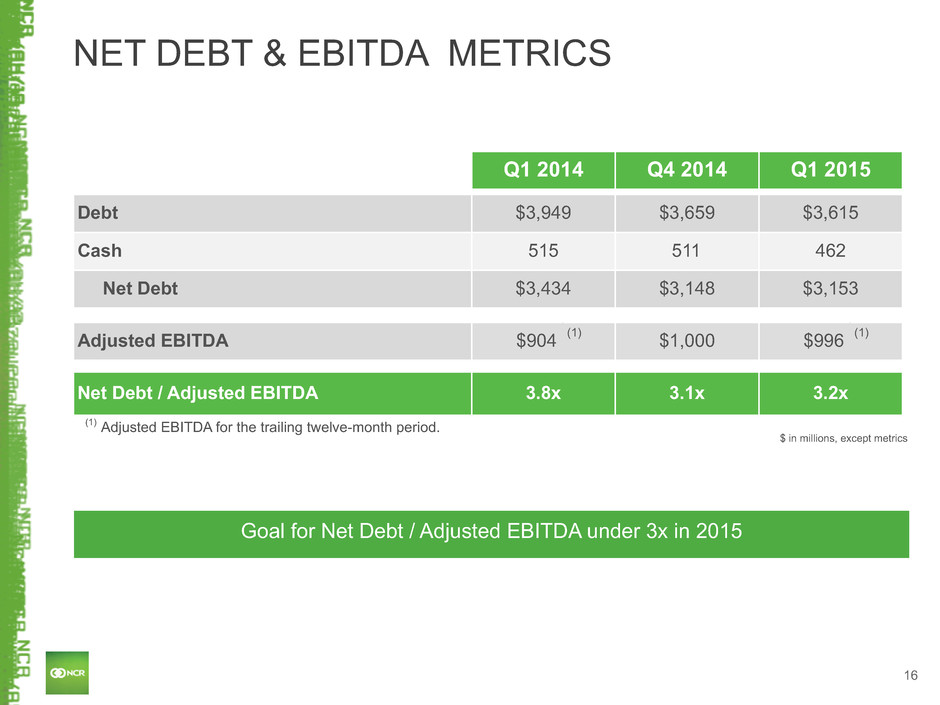

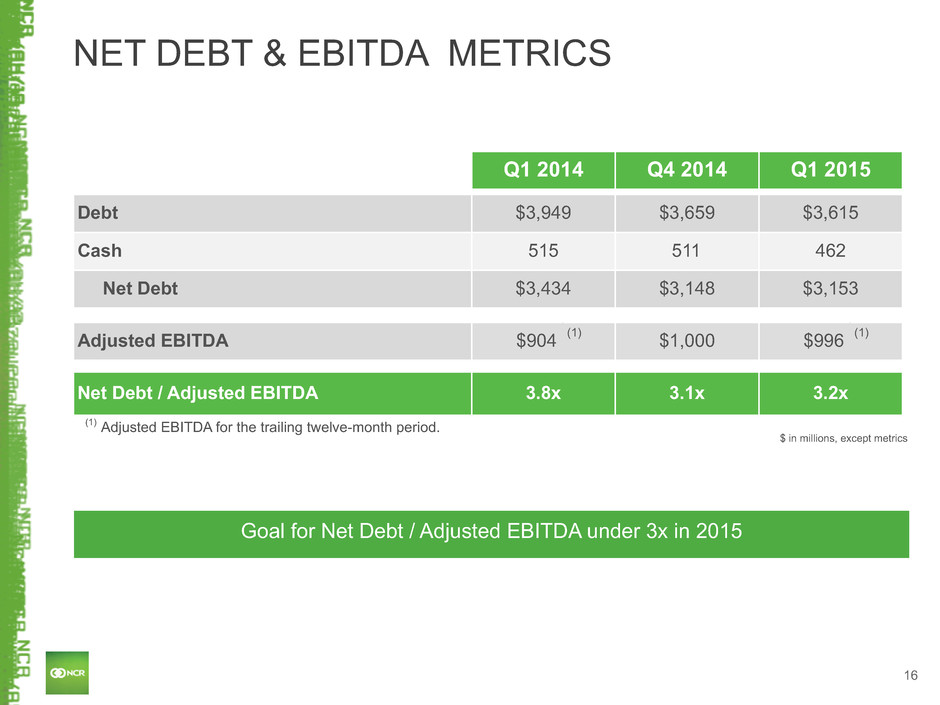

16 NET DEBT & EBITDA METRICS Q1 2014 Q4 2014 Q1 2015 Debt $3,949 $3,659 $3,615 Cash 515 511 462 Net Debt $3,434 $3,148 $3,153 Adjusted EBITDA $904 (1) $1,000 $996 (1) Net Debt / Adjusted EBITDA 3.8x 3.1x 3.2x $ in millions, except metrics (1) Adjusted EBITDA for the trailing twelve-month period. Goal for Net Debt / Adjusted EBITDA under 3x in 2015

17 2015 Guidance 2014 Revenue $6,525 - $6,675 $6,591 Year-over-Year Revenue Growth (1%) to 1% 8% Constant Currency Year-Over-Year Revenue Growth 5% to 7% (1) 10% Income from Operations (GAAP)(2) $625 - $690 $353 Non-Pension Operating Income (NPOI) $830 - $870 $820 Adjusted EBITDA $1,047 - $1,087 $1,000 Diluted EPS (GAAP)(2) $1.80 - $2.10 $1.06 Non-GAAP Diluted EPS(3) $2.60 - $2.80 $2.74 Cash Flow from Operating Activities $595 - $625 $524 Free Cash Flow $325 - $375 $313 FY 2015 GUIDANCE $ in millions, except per share amounts (1) Expected constant currency growth has been adjusted from 4% to 6% to 5% to 7% to reflect an increase of 1% in anticipated unfavorable foreign currency impact. We previously expected unfavorable foreign currency impacts of approximately 5% in revenue and now expect unfavorable foreign currency impacts of approximately 6% in revenue. (2) Income from operations and diluted earnings per share guidance excludes the impact of the actuarial mark to market pension adjustment that will be determined in the fourth quarter of 2015 and the impact of the transfer of the UK London plan to an insurer that is expected to occur in 2015 or early 2016. The UK London plan was approximately $420 million overfunded as of December 31, 2014. (3) 2015 guidance includes expected other expense (income), net (OIE) of $215M to $220M, a 25% tax rate and a share count of 175M. 2014 results include OIE of $213M, a 22% tax rate and a share count of 171.2M.

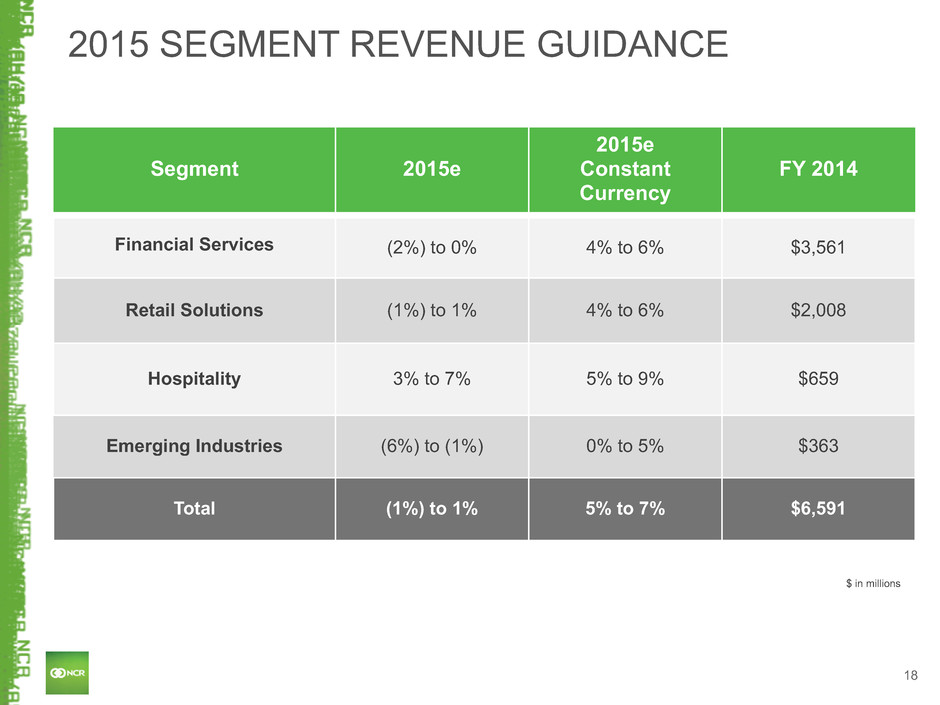

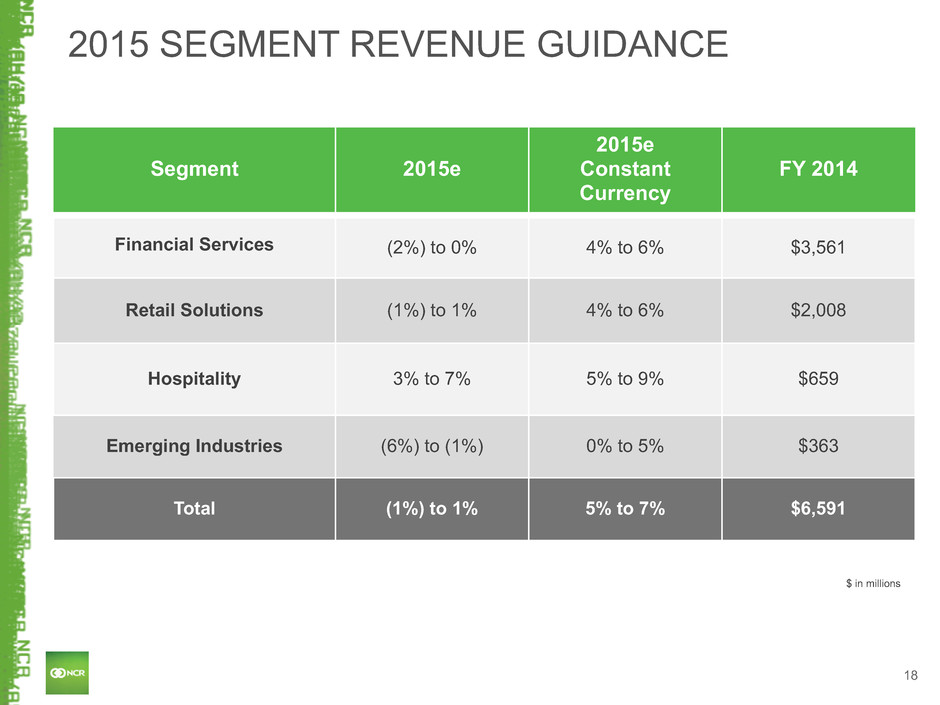

18 2015 SEGMENT REVENUE GUIDANCE Segment 2015e 2015e Constant Currency FY 2014 Financial Services (2%) to 0% 4% to 6% $3,561 Retail Solutions (1%) to 1% 4% to 6% $2,008 Hospitality 3% to 7% 5% to 9% $659 Emerging Industries (6%) to (1%) 0% to 5% $363 Total (1%) to 1% 5% to 7% $6,591 $ in millions

19 Q2 2015 GUIDANCE Q2 2015e Q2 2014 Income from Operations (GAAP) $140 - $150 (1) $169 Non-Pension Operating Income (Non-GAAP) $190 - $200 (2) $210 Tax rate 28% 27% Other expense ~$55 $49 $ millions(1) Includes an estimated pre-tax charge of $14M in Q2 2015 related to the ongoing restructuring plan. (2) Includes an estimated unfavorable foreign currency impact of approximately $20M in NPOI in Q2 2015.

SUPPLEMENTARY NON-GAAP MATERIALS

21 NON-GAAP MEASURES While NCR reports its results in accordance with generally accepted accounting principles (GAAP) in the United States, comments made during this conference call and in these materials will include non-GAAP measures. These measures are included to provide additional useful information regarding NCR's financial results, and are not a substitute for their comparable GAAP measures. NPOI, Non-GAAP Diluted EPS, Operational Gross Margin, Operational Gross Margin Rate, Expenses (non-GAAP), Effective Tax Rate and Non-GAAP Net Income. NCR's non-pension operating income (NPOI), non-GAAP net income and non-GAAP diluted earnings per share (non-GAAP diluted EPS) are determined by excluding pension expense and special items, including amortization of acquisition related intangibles, from NCR's GAAP income (loss) from operations. NCR also determines operational gross margin, operational gross margin rate, expenses (non-GAAP) and effective tax rate (non-GAAP) by excluding pension expense and these special items from its GAAP gross margin, gross margin rate, expenses and effective tax rate. Due to the significant change in its pension expense from year to year and the non-operational nature of pension expense and these special items, NCR's management uses these non-GAAP measures to evaluate year-over-year operating performance. NCR also uses NPOI and non-GAAP diluted EPS to manage and determine the effectiveness of its business managers and as a basis for incentive compensation. NCR believes these measures are useful for investors because they provide a more complete understanding of NCR's underlying operational performance, as well as consistency and comparability with NCR's past reports of financial results. Free Cash Flow. NCR defines free cash flow as net cash provided by/used in operating activities and cash flow provided by/ used in discontinued operations less capital expenditures for property, plant and equipment, additions to capitalized software, discretionary pension contributions and settlements. NCR's management uses free cash flow to assess the financial performance of the Company and believes it is useful for investors because it relates the operating cash flow of the Company to the capital that is spent to continue and improve business operations. In particular, free cash flow indicates the amount of cash generated after capital expenditures which can be used for, among other things, investment in the Company's existing businesses, strategic acquisitions, strengthening the Company's balance sheet, repurchase of Company stock and repayment of the Company's debt obligations. Free cash flow does not represent the residual cash flow available for discretionary expenditures since there may be other nondiscretionary expenditures that are not deducted from the measure. Free cash flow (FCF) do not have uniform definitions under GAAP and, therefore, NCR's definition may differ from other companies' definition of this measure.

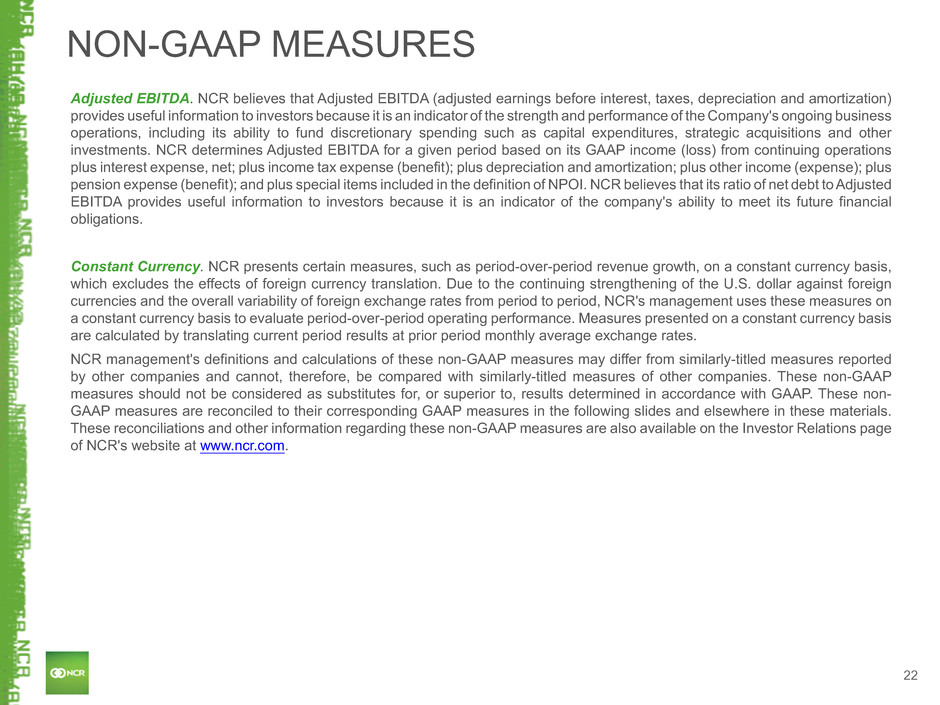

22 NON-GAAP MEASURES Adjusted EBITDA. NCR believes that Adjusted EBITDA (adjusted earnings before interest, taxes, depreciation and amortization) provides useful information to investors because it is an indicator of the strength and performance of the Company's ongoing business operations, including its ability to fund discretionary spending such as capital expenditures, strategic acquisitions and other investments. NCR determines Adjusted EBITDA for a given period based on its GAAP income (loss) from continuing operations plus interest expense, net; plus income tax expense (benefit); plus depreciation and amortization; plus other income (expense); plus pension expense (benefit); and plus special items included in the definition of NPOI. NCR believes that its ratio of net debt to Adjusted EBITDA provides useful information to investors because it is an indicator of the company's ability to meet its future financial obligations. Constant Currency. NCR presents certain measures, such as period-over-period revenue growth, on a constant currency basis, which excludes the effects of foreign currency translation. Due to the continuing strengthening of the U.S. dollar against foreign currencies and the overall variability of foreign exchange rates from period to period, NCR's management uses these measures on a constant currency basis to evaluate period-over-period operating performance. Measures presented on a constant currency basis are calculated by translating current period results at prior period monthly average exchange rates. NCR management's definitions and calculations of these non-GAAP measures may differ from similarly-titled measures reported by other companies and cannot, therefore, be compared with similarly-titled measures of other companies. These non-GAAP measures should not be considered as substitutes for, or superior to, results determined in accordance with GAAP. These non- GAAP measures are reconciled to their corresponding GAAP measures in the following slides and elsewhere in these materials. These reconciliations and other information regarding these non-GAAP measures are also available on the Investor Relations page of NCR's website at www.ncr.com.

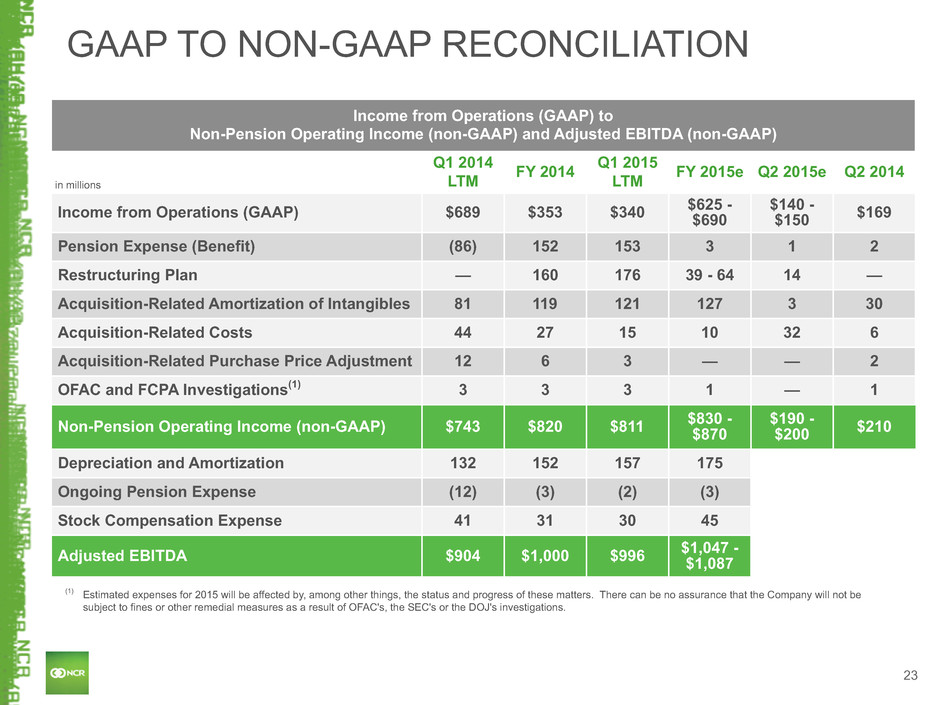

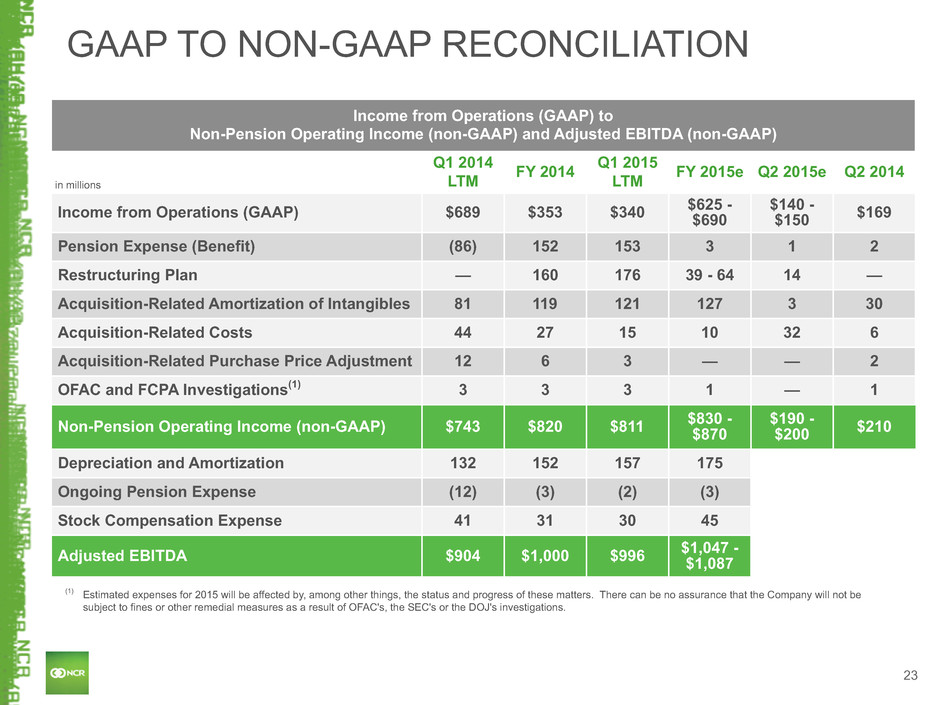

23 Income from Operations (GAAP) to Non-Pension Operating Income (non-GAAP) and Adjusted EBITDA (non-GAAP) in millions Q1 2014 LTM FY 2014 Q1 2015 LTM FY 2015e Q2 2015e Q2 2014 Income from Operations (GAAP) $689 $353 $340 $625 -$690 $140 - $150 $169 Pension Expense (Benefit) (86) 152 153 3 1 2 Restructuring Plan — 160 176 39 - 64 14 — Acquisition-Related Amortization of Intangibles 81 119 121 127 3 30 Acquisition-Related Costs 44 27 15 10 32 6 Acquisition-Related Purchase Price Adjustment 12 6 3 — — 2 OFAC and FCPA Investigations(1) 3 3 3 1 — 1 Non-Pension Operating Income (non-GAAP) $743 $820 $811 $830 -$870 $190 - $200 $210 Depreciation and Amortization 132 152 157 175 Ongoing Pension Expense (12) (3) (2) (3) Stock Compensation Expense 41 31 30 45 Adjusted EBITDA $904 $1,000 $996 $1,047 -$1,087 GAAP TO NON-GAAP RECONCILIATION (1) Estimated expenses for 2015 will be affected by, among other things, the status and progress of these matters. There can be no assurance that the Company will not be subject to fines or other remedial measures as a result of OFAC's, the SEC's or the DOJ's investigations.

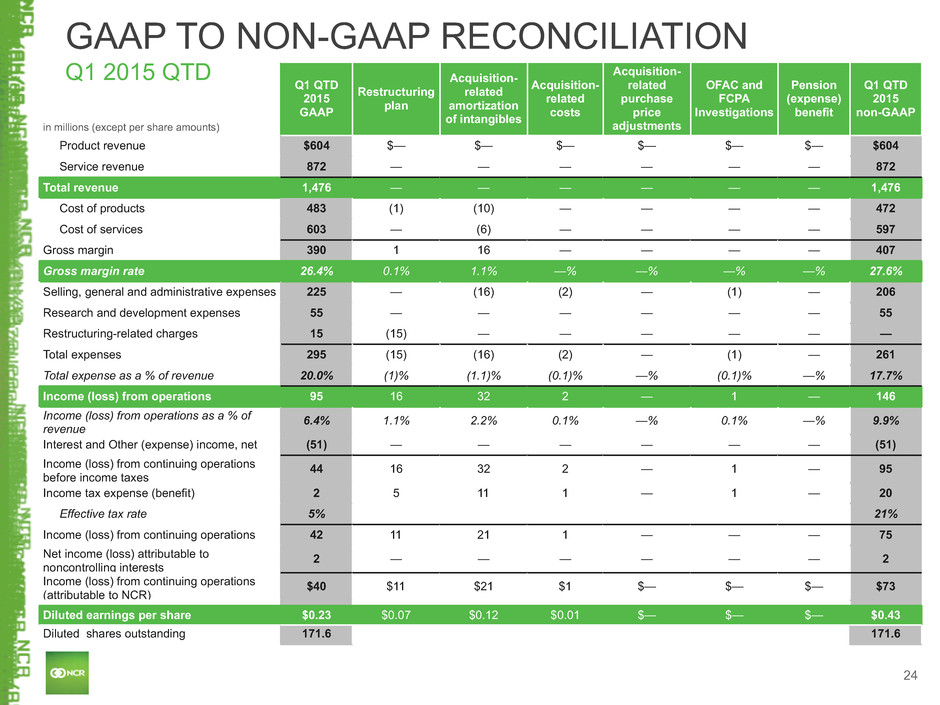

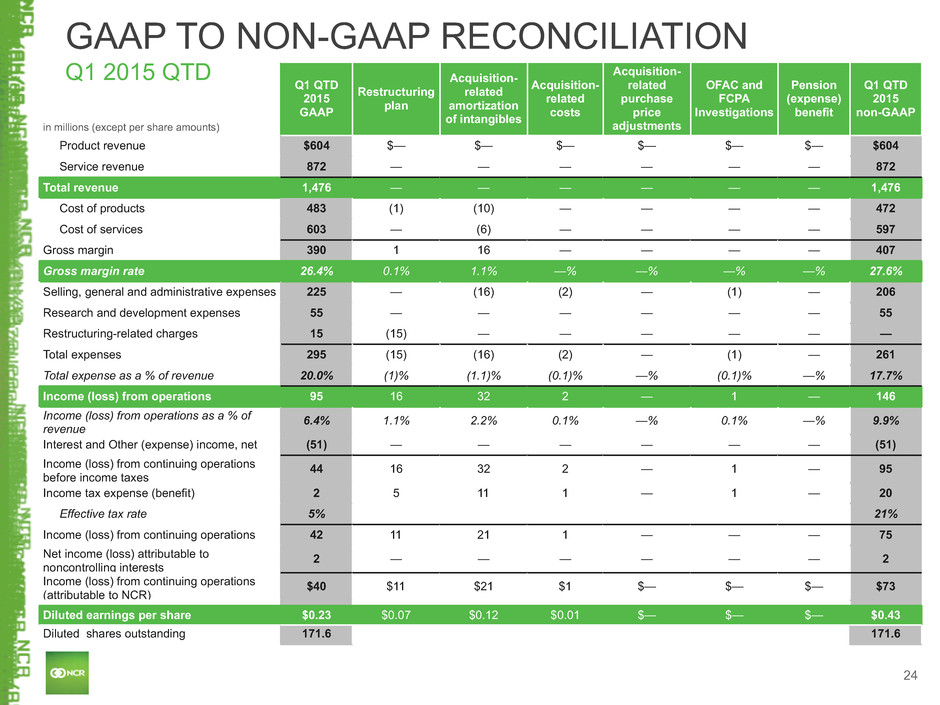

24 in millions (except per share amounts) Q1 QTD 2015 GAAP Restructuring plan Acquisition- related amortization of intangibles Acquisition- related costs Acquisition- related purchase price adjustments OFAC and FCPA Investigations Pension (expense) benefit Q1 QTD 2015 non-GAAP Product revenue $604 $— $— $— $— $— $— $604 Service revenue 872 — — — — — — 872 Total revenue 1,476 — — — — — — 1,476 Cost of products 483 (1) (10) — — — — 472 Cost of services 603 — (6) — — — — 597 Gross margin 390 1 16 — — — — 407 Gross margin rate 26.4% 0.1% 1.1% —% —% —% —% 27.6% Selling, general and administrative expenses 225 — (16) (2) — (1) — 206 Research and development expenses 55 — — — — — — 55 Restructuring-related charges 15 (15) — — — — — — Total expenses 295 (15) (16) (2) — (1) — 261 Total expense as a % of revenue 20.0% (1)% (1.1)% (0.1)% —% (0.1)% —% 17.7% Income (loss) from operations 95 16 32 2 — 1 — 146 Income (loss) from operations as a % of revenue 6.4% 1.1% 2.2% 0.1% —% 0.1% —% 9.9% Interest and Other (expense) income, net (51) — — — — — — (51) Income (loss) from continuing operations before income taxes 44 16 32 2 — 1 — 95 Income tax expense (benefit) 2 5 11 1 — 1 — 20 Effective tax rate 5% 21% Income (loss) from continuing operations 42 11 21 1 — — — 75 Net income (loss) attributable to noncontrolling interests 2 — — — — — — 2 Income (loss) from continuing operations (attributable to NCR) $40 $11 $21 $1 $— $— $— $73 Diluted earnings per share $0.23 $0.07 $0.12 $0.01 $— $— $— $0.43 Diluted shares outstanding 171.6 171.6 GAAP TO NON-GAAP RECONCILIATION Q1 2015 QTD

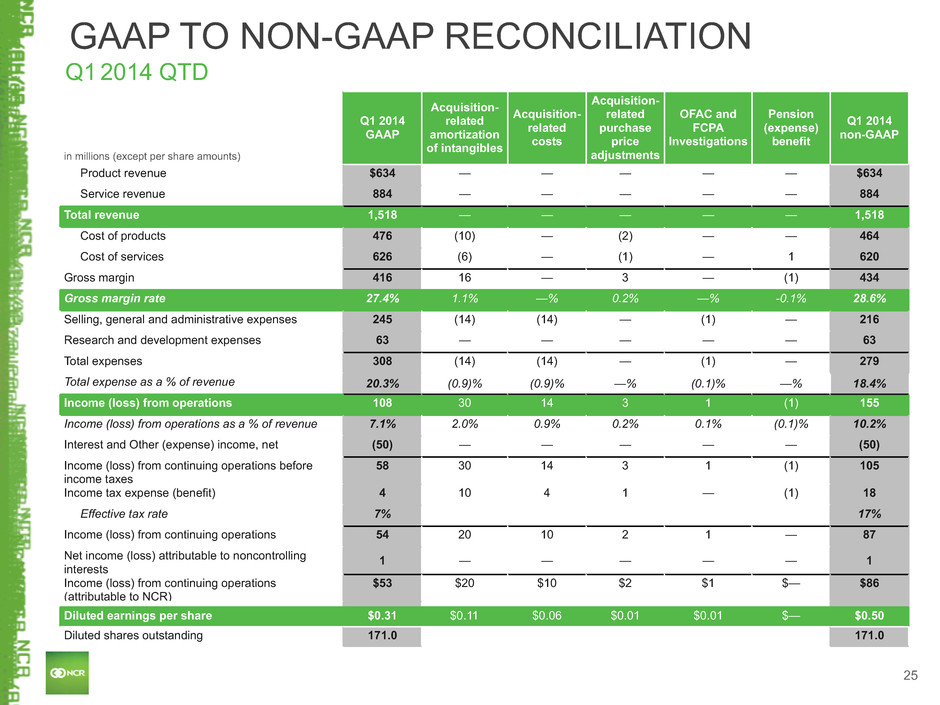

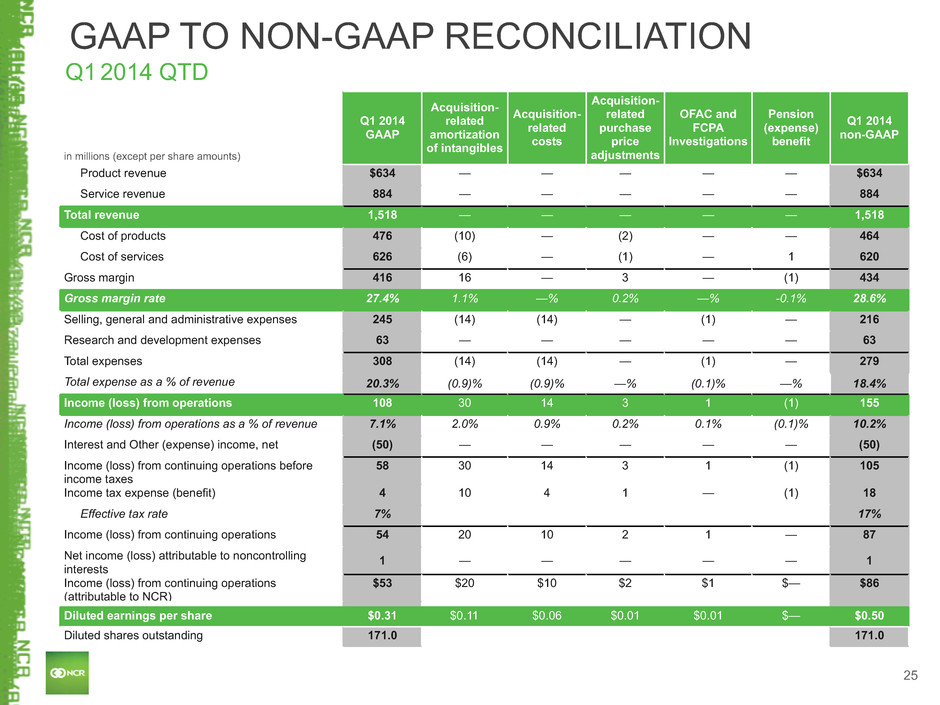

25 in millions (except per share amounts) Q1 2014 GAAP Acquisition- related amortization of intangibles Acquisition- related costs Acquisition- related purchase price adjustments OFAC and FCPA Investigations Pension (expense) benefit Q1 2014 non-GAAP Product revenue $634 — — — — — $634 Service revenue 884 — — — — — 884 Total revenue 1,518 — — — — — 1,518 Cost of products 476 (10) — (2) — — 464 Cost of services 626 (6) — (1) — 1 620 Gross margin 416 16 — 3 — (1) 434 Gross margin rate 27.4% 1.1% —% 0.2% —% -0.1% 28.6% Selling, general and administrative expenses 245 (14) (14) — (1) — 216 Research and development expenses 63 — — — — — 63 Total expenses 308 (14) (14) — (1) — 279 Total expense as a % of revenue 20.3% (0.9)% (0.9)% —% (0.1)% —% 18.4% Income (loss) from operations 108 30 14 3 1 (1) 155 Income (loss) from operations as a % of revenue 7.1% 2.0% 0.9% 0.2% 0.1% (0.1)% 10.2% Interest and Other (expense) income, net (50) — — — — — (50) Income (loss) from continuing operations before income taxes 58 30 14 3 1 (1) 105 Income tax expense (benefit) 4 10 4 1 — (1) 18 Effective tax rate 7% 17% Income (loss) from continuing operations 54 20 10 2 1 — 87 Net income (loss) attributable to noncontrolling interests 1 — — — — — 1 Income (loss) from continuing operations (attributable to NCR) $53 $20 $10 $2 $1 $— $86 Diluted earnings per share $0.31 $0.11 $0.06 $0.01 $0.01 $— $0.50 Diluted shares outstanding 171.0 171.0 GAAP TO NON-GAAP RECONCILIATION Q1 2014 QTD

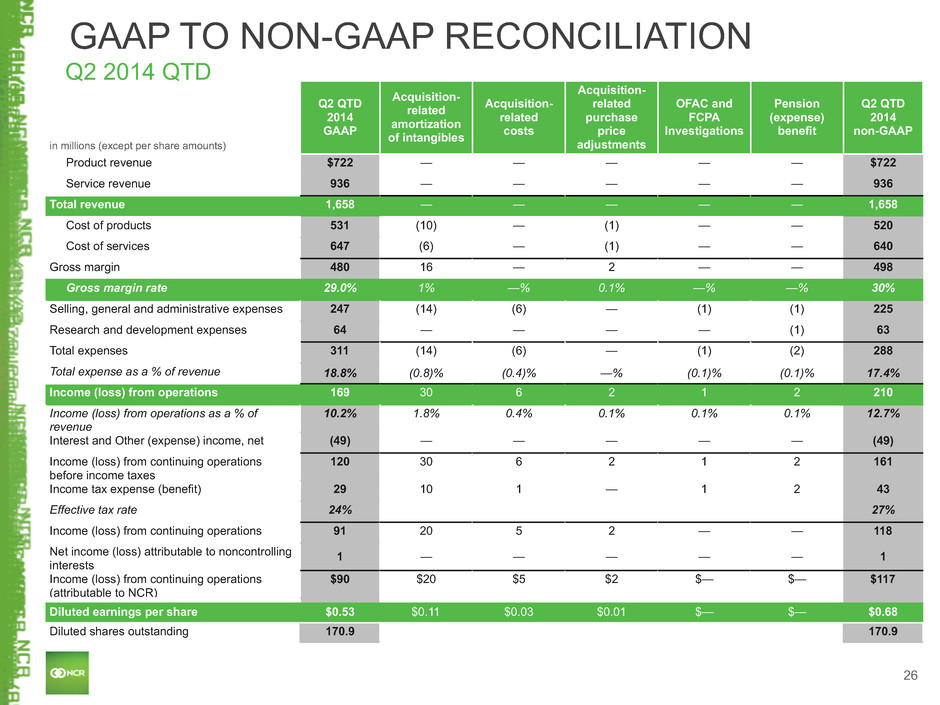

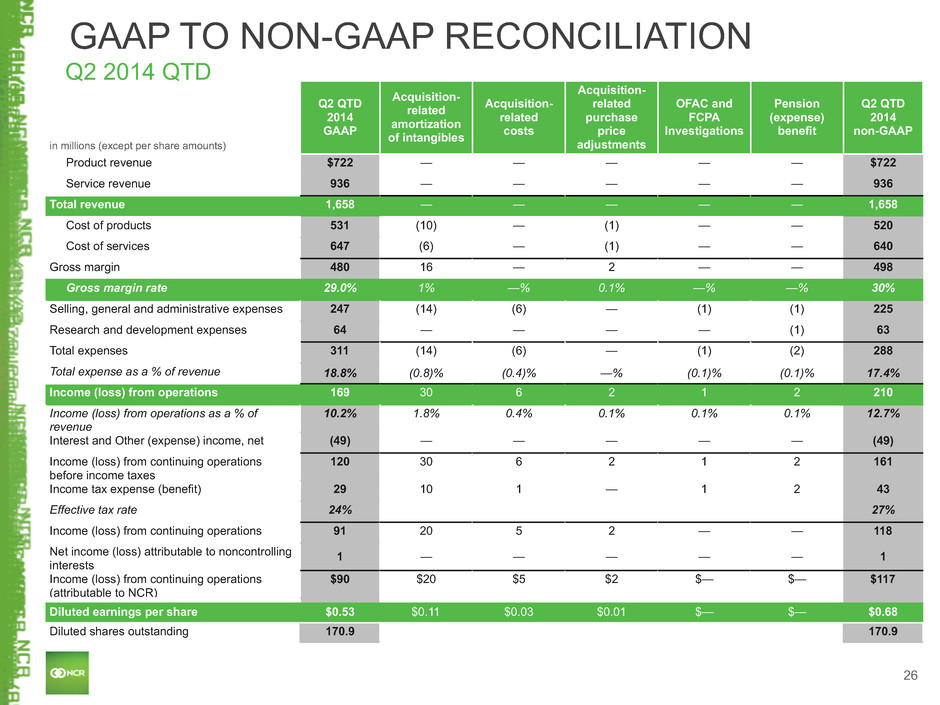

26 in millions (except per share amounts) Q2 QTD 2014 GAAP Acquisition- related amortization of intangibles Acquisition- related costs Acquisition- related purchase price adjustments OFAC and FCPA Investigations Pension (expense) benefit Q2 QTD 2014 non-GAAP Product revenue $722 — — — — — $722 Service revenue 936 — — — — — 936 Total revenue 1,658 — — — — — 1,658 Cost of products 531 (10) — (1) — — 520 Cost of services 647 (6) — (1) — — 640 Gross margin 480 16 — 2 — — 498 Gross margin rate 29.0% 1% —% 0.1% —% —% 30% Selling, general and administrative expenses 247 (14) (6) — (1) (1) 225 Research and development expenses 64 — — — — (1) 63 Total expenses 311 (14) (6) — (1) (2) 288 Total expense as a % of revenue 18.8% (0.8)% (0.4)% —% (0.1)% (0.1)% 17.4% Income (loss) from operations 169 30 6 2 1 2 210 Income (loss) from operations as a % of revenue 10.2% 1.8% 0.4% 0.1% 0.1% 0.1% 12.7% Interest and Other (expense) income, net (49) — — — — — (49) Income (loss) from continuing operations before income taxes 120 30 6 2 1 2 161 Income tax expense (benefit) 29 10 1 — 1 2 43 Effective tax rate 24% 27% Income (loss) from continuing operations 91 20 5 2 — — 118 Net income (loss) attributable to noncontrolling interests 1 — — — — — 1 Income (loss) from continuing operations (attributable to NCR) $90 $20 $5 $2 $— $— $117 Diluted earnings per share $0.53 $0.11 $0.03 $0.01 $— $— $0.68 Diluted shares outstanding 170.9 170.9 GAAP TO NON-GAAP RECONCILIATION Q2 2014 QTD

27 in millions (except per share amounts) FY 2014 GAAP Restructuring plan Acquisition- related amortization of intangibles Acquisition- related costs Acquisition- related purchase price adjustments OFAC and FCPA Investigations Pension (expense) benefit FY 2014 non-GAAP Product revenue $2,892 — — — — — — $2,892 Service revenue 3,699 — — — — — — 3,699 Total revenue 6,591 — — — — — — 6,591 Cost of products 2,153 (9) (39) — (4) — (3) 2,098 Cost of services 2,706 (47) (24) — (2) — (82) 2,551 Gross margin 1,732 56 63 — 6 — 85 1,942 Gross margin rate 26.3% 0.8% 1% —% 0.1% —% 1.3% 29.5% Selling, general and administrative expenses 1,012 — (56) (27) — (3) (48) 878 Research and development expenses 263 — — — — — (19) 244 Restructuring-related charges 104 (104) — — — — — — Total expenses 1,379 (104) (56) (27) — (3) (67) 1,122 Total expense as a % of revenue 20.9% (1.6)% (0.8)% (0.4)% —% —% (1.1)% 17% Income (loss) from operations 353 160 119 27 6 3 152 820 Income (loss) from operations as a % of revenue 5.4% 2.4% 1.8% 0.4% 0.1% —% 2.3% 12.4% Interest and Other (expense) income, net (216) 3 — — — — — (213) Income (loss) from continuing operations before income taxes 137 163 119 27 6 3 152 607 Income tax expense (benefit) (48) 45 39 7 2 1 86 132 Effective tax rate (35)% 22% Income (loss) from continuing operations 185 118 80 20 4 2 66 475 Net income (loss) attributable to noncontrolling interests 4 2 — — — — — 6 Income (loss) from continuing operations (attributable to NCR) $181 $116 $80 $20 $4 $2 $66 $469 Diluted earnings per share $1.06 $0.68 $0.47 $0.12 $0.02 $0.01 $0.38 $2.74 Diluted shares outstanding 171.2 171.2 GAAP TO NON-GAAP RECONCILIATION FY 2014

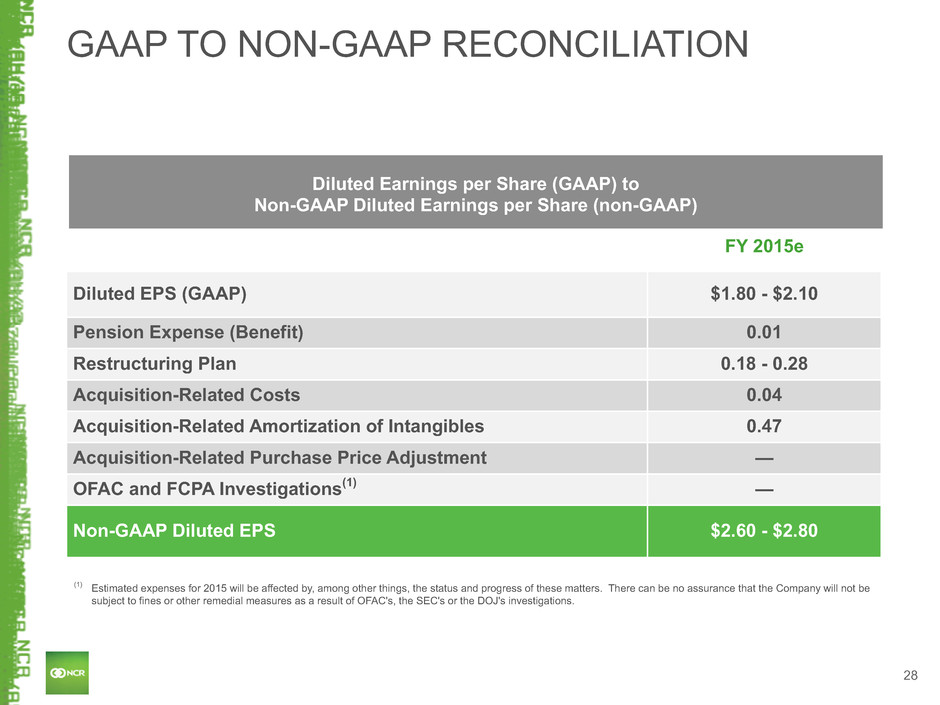

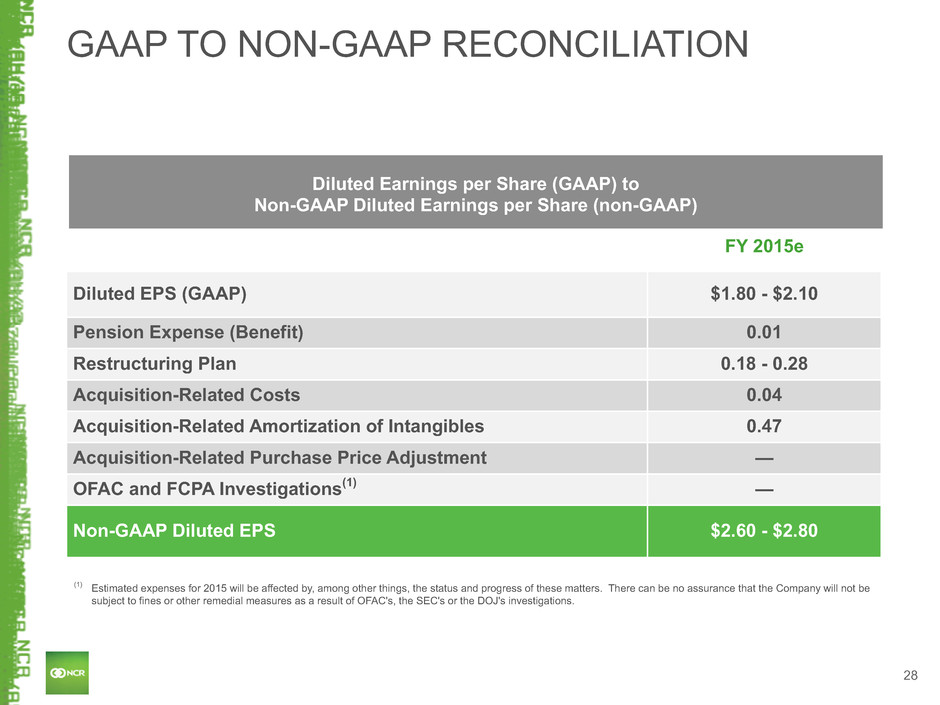

28 GAAP TO NON-GAAP RECONCILIATION FY 2015e Diluted EPS (GAAP) $1.80 - $2.10 Pension Expense (Benefit) 0.01 Restructuring Plan 0.18 - 0.28 Acquisition-Related Costs 0.04 Acquisition-Related Amortization of Intangibles 0.47 Acquisition-Related Purchase Price Adjustment — OFAC and FCPA Investigations(1) — Non-GAAP Diluted EPS $2.60 - $2.80 Diluted Earnings per Share (GAAP) to Non-GAAP Diluted Earnings per Share (non-GAAP) (1) Estimated expenses for 2015 will be affected by, among other things, the status and progress of these matters. There can be no assurance that the Company will not be subject to fines or other remedial measures as a result of OFAC's, the SEC's or the DOJ's investigations.

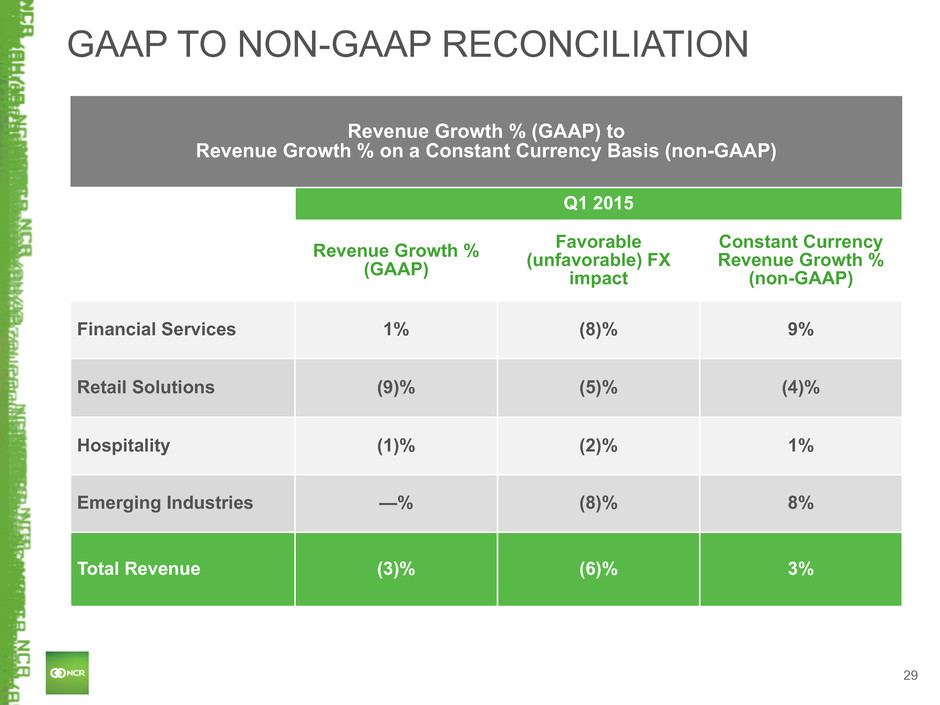

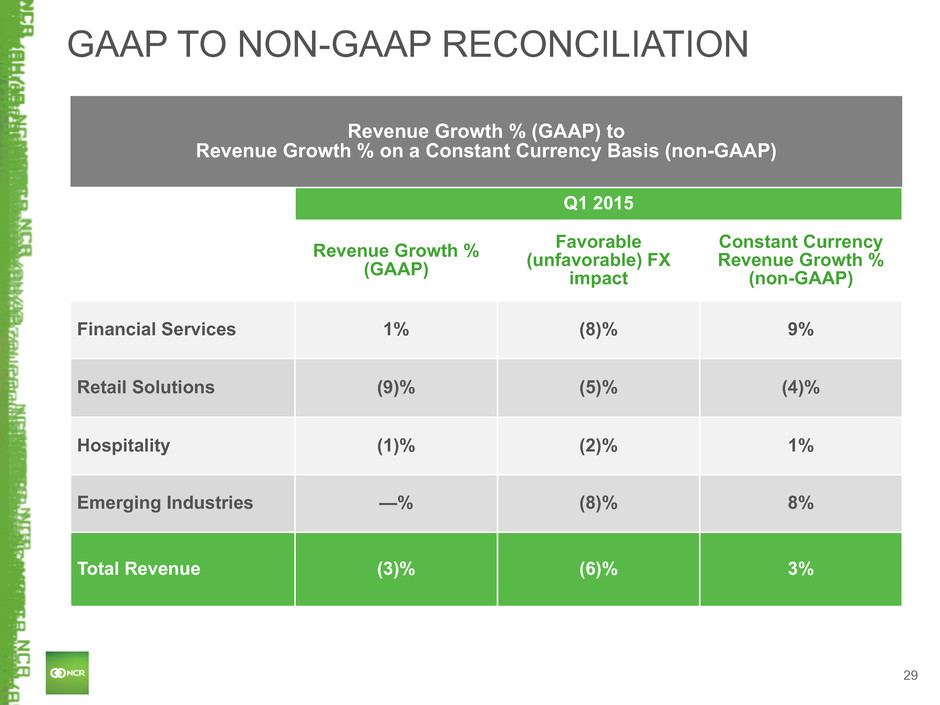

29 GAAP TO NON-GAAP RECONCILIATION Revenue Growth % (GAAP) to Revenue Growth % on a Constant Currency Basis (non-GAAP) Q1 2015 Revenue Growth % (GAAP) Favorable (unfavorable) FX impact Constant Currency Revenue Growth % (non-GAAP) Financial Services 1% (8)% 9% Retail Solutions (9)% (5)% (4)% Hospitality (1)% (2)% 1% Emerging Industries —% (8)% 8% Total Revenue (3)% (6)% 3%

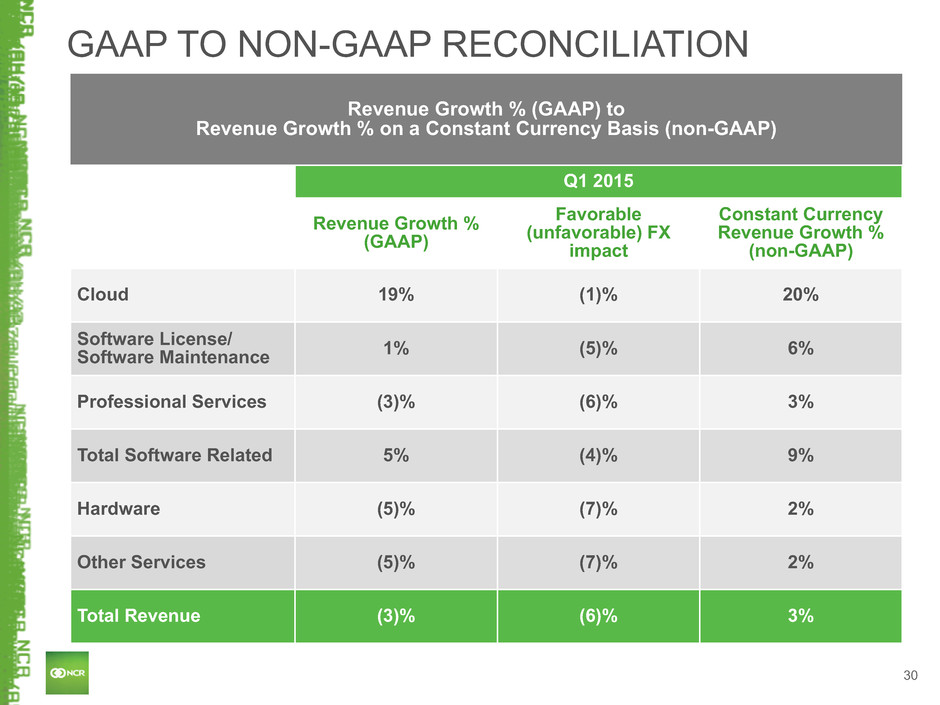

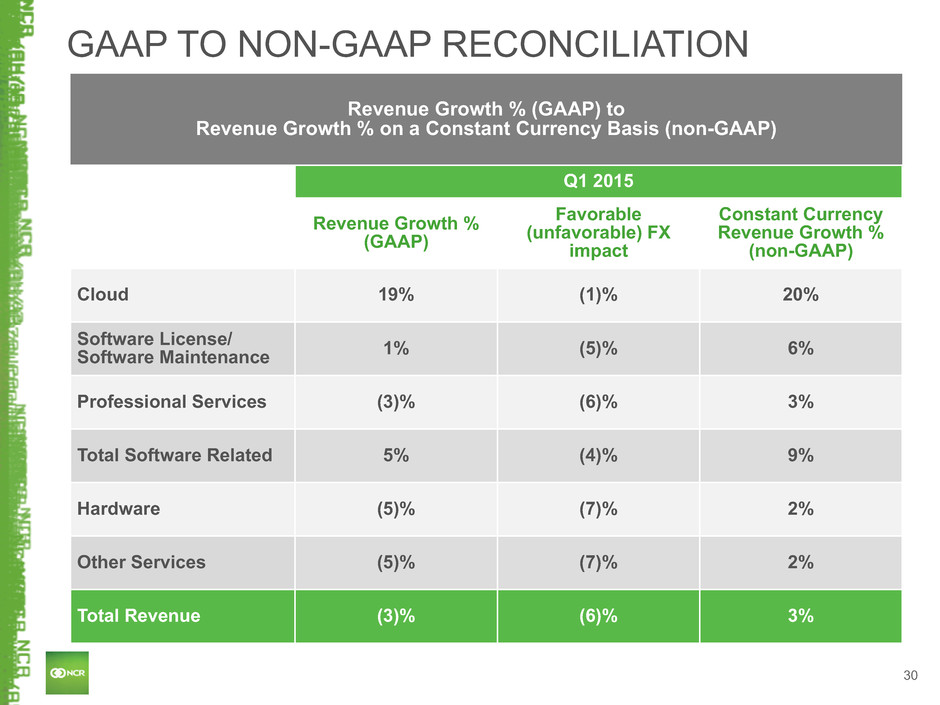

30 GAAP TO NON-GAAP RECONCILIATION Revenue Growth % (GAAP) to Revenue Growth % on a Constant Currency Basis (non-GAAP) Q1 2015 Revenue Growth % (GAAP) Favorable (unfavorable) FX impact Constant Currency Revenue Growth % (non-GAAP) Cloud 19% (1)% 20% Software License/ Software Maintenance 1% (5)% 6% Professional Services (3)% (6)% 3% Total Software Related 5% (4)% 9% Hardware (5)% (7)% 2% Other Services (5)% (7)% 2% Total Revenue (3)% (6)% 3%

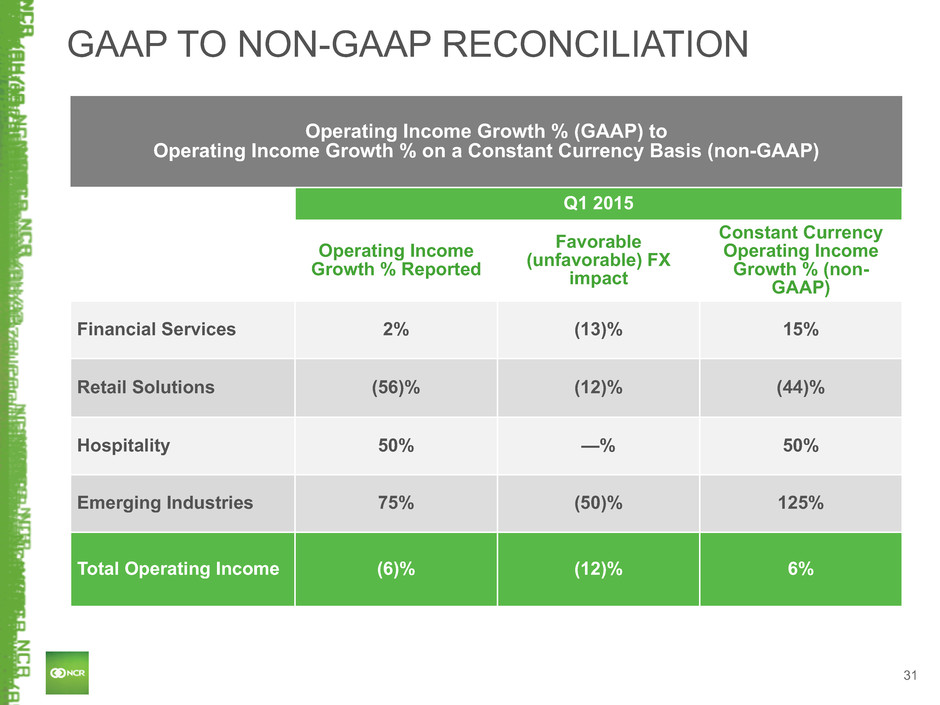

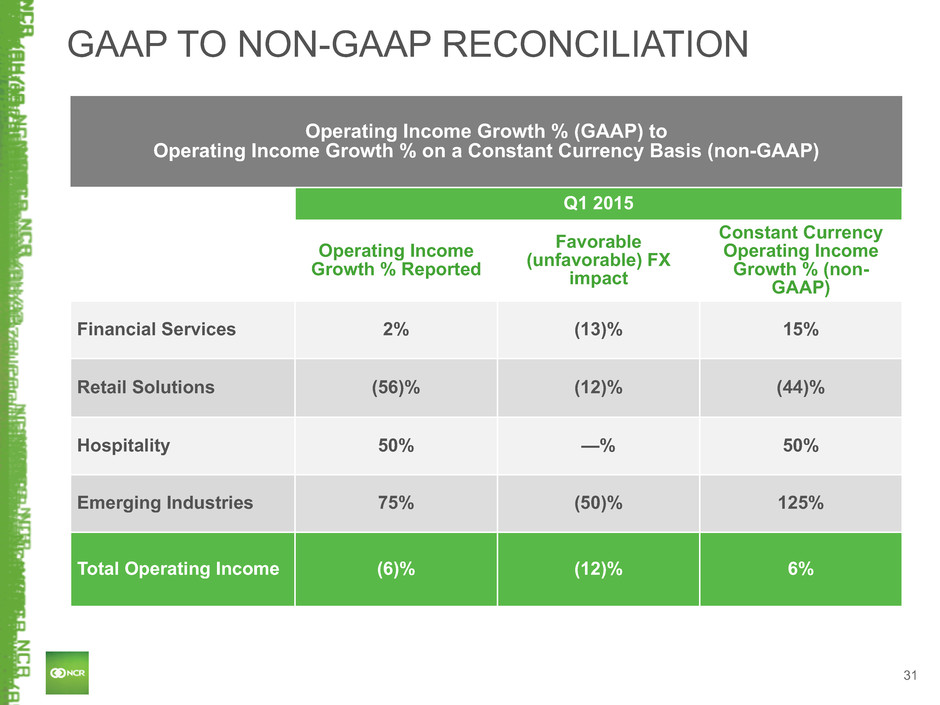

31 GAAP TO NON-GAAP RECONCILIATION Operating Income Growth % (GAAP) to Operating Income Growth % on a Constant Currency Basis (non-GAAP) Q1 2015 Operating Income Growth % Reported Favorable (unfavorable) FX impact Constant Currency Operating Income Growth % (non- GAAP) Financial Services 2% (13)% 15% Retail Solutions (56)% (12)% (44)% Hospitality 50% —% 50% Emerging Industries 75% (50)% 125% Total Operating Income (6)% (12)% 6%

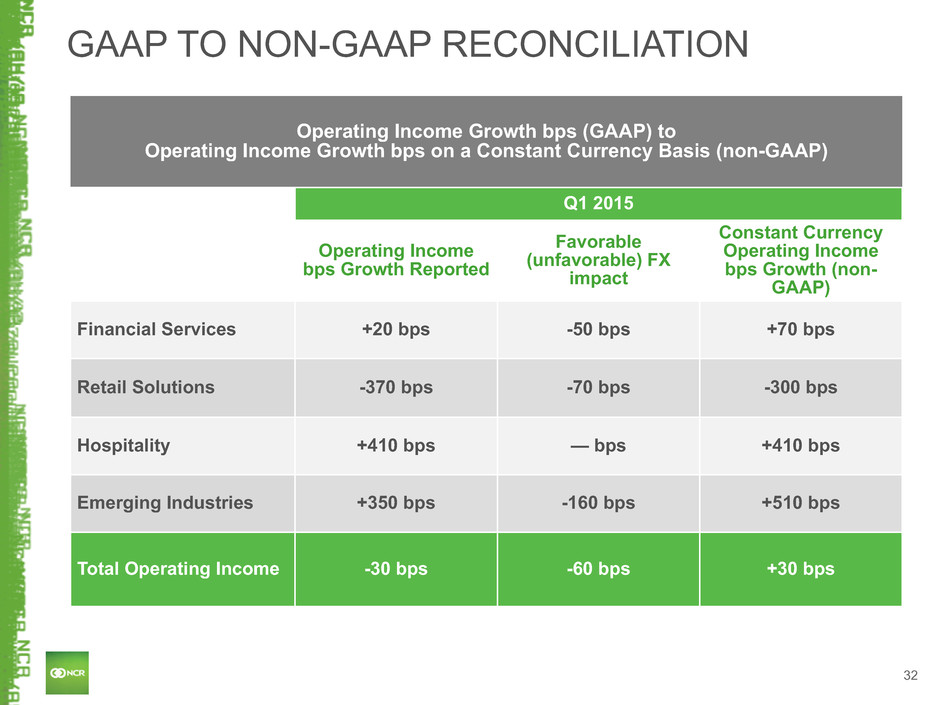

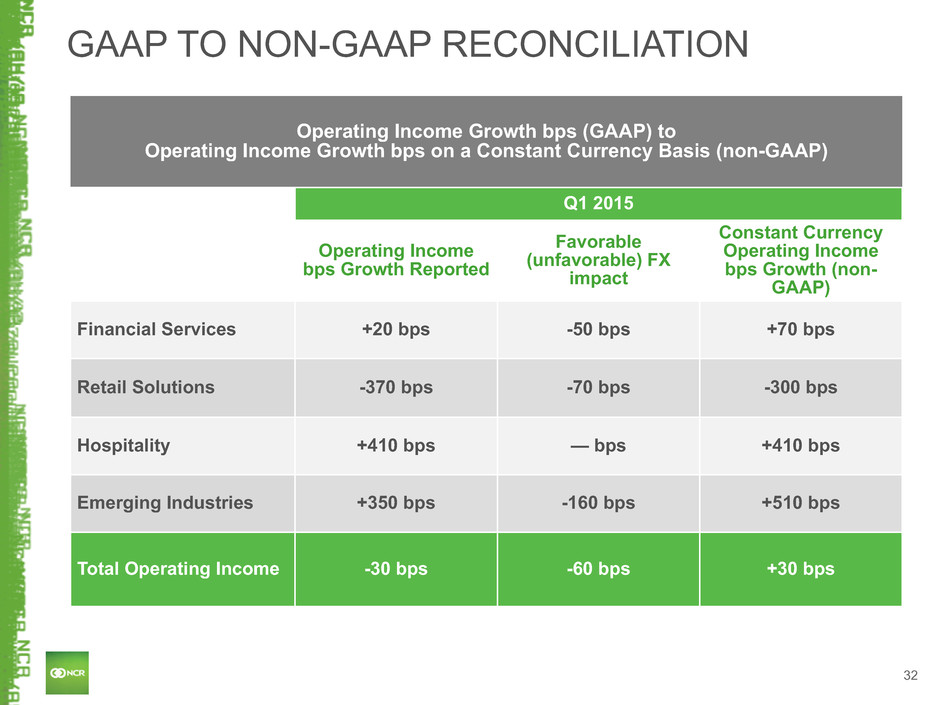

32 GAAP TO NON-GAAP RECONCILIATION Operating Income Growth bps (GAAP) to Operating Income Growth bps on a Constant Currency Basis (non-GAAP) Q1 2015 Operating Income bps Growth Reported Favorable (unfavorable) FX impact Constant Currency Operating Income bps Growth (non- GAAP) Financial Services +20 bps -50 bps +70 bps Retail Solutions -370 bps -70 bps -300 bps Hospitality +410 bps — bps +410 bps Emerging Industries +350 bps -160 bps +510 bps Total Operating Income -30 bps -60 bps +30 bps

33