1N Y S E : V Y X Q4 2024 Earnings Report February 27, 2025

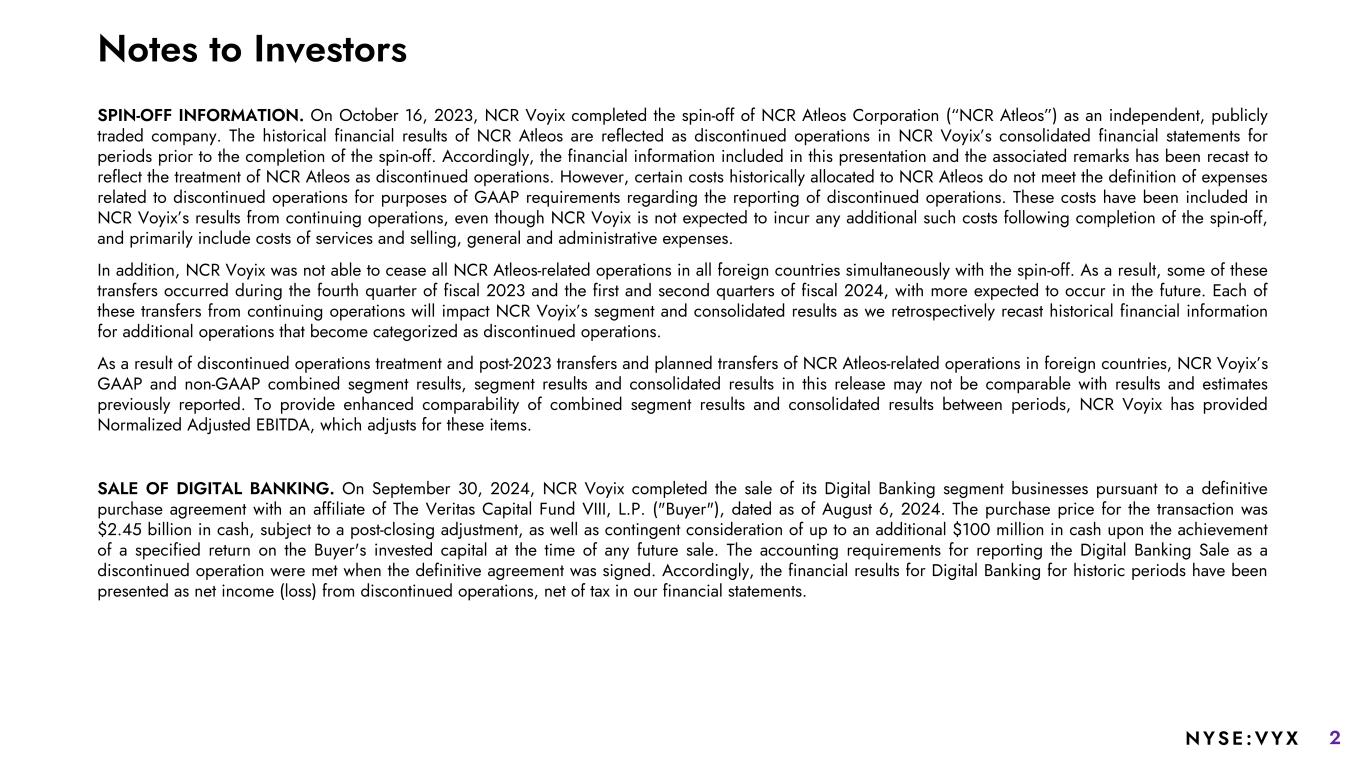

2NYSE :VYX SPIN-OFF INFORMATION. On October 16, 2023, NCR Voyix completed the spin-off of NCR Atleos Corporation (“NCR Atleos”) as an independent, publicly traded company. The historical financial results of NCR Atleos are reflected as discontinued operations in NCR Voyix’s consolidated financial statements for periods prior to the completion of the spin-off. Accordingly, the financial information included in this presentation and the associated remarks has been recast to reflect the treatment of NCR Atleos as discontinued operations. However, certain costs historically allocated to NCR Atleos do not meet the definition of expenses related to discontinued operations for purposes of GAAP requirements regarding the reporting of discontinued operations. These costs have been included in NCR Voyix’s results from continuing operations, even though NCR Voyix is not expected to incur any additional such costs following completion of the spin-off, and primarily include costs of services and selling, general and administrative expenses. In addition, NCR Voyix was not able to cease all NCR Atleos-related operations in all foreign countries simultaneously with the spin-off. As a result, some of these transfers occurred during the fourth quarter of fiscal 2023 and the first and second quarters of fiscal 2024, with more expected to occur in the future. Each of these transfers from continuing operations will impact NCR Voyix’s segment and consolidated results as we retrospectively recast historical financial information for additional operations that become categorized as discontinued operations. As a result of discontinued operations treatment and post-2023 transfers and planned transfers of NCR Atleos-related operations in foreign countries, NCR Voyix’s GAAP and non-GAAP combined segment results, segment results and consolidated results in this release may not be comparable with results and estimates previously reported. To provide enhanced comparability of combined segment results and consolidated results between periods, NCR Voyix has provided Normalized Adjusted EBITDA, which adjusts for these items. SALE OF DIGITAL BANKING. On September 30, 2024, NCR Voyix completed the sale of its Digital Banking segment businesses pursuant to a definitive purchase agreement with an affiliate of The Veritas Capital Fund VIII, L.P. ("Buyer"), dated as of August 6, 2024. The purchase price for the transaction was $2.45 billion in cash, subject to a post-closing adjustment, as well as contingent consideration of up to an additional $100 million in cash upon the achievement of a specified return on the Buyer's invested capital at the time of any future sale. The accounting requirements for reporting the Digital Banking Sale as a discontinued operation were met when the definitive agreement was signed. Accordingly, the financial results for Digital Banking for historic periods have been presented as net income (loss) from discontinued operations, net of tax in our financial statements. Notes to Investors

3NYSE :VYX Notes to Investors NON-GAAP MEASURES. While the Company reports its results in accordance with generally accepted accounting principles in the United States, or GAAP, comments made during this presentation and in the associated remarks will include or make reference to certain “non-GAAP” measures, including selected measures such as adjusted EBITDA, adjusted EBITDA margin, adjusted free cash flow-unrestricted, adjusted free cash flow conversion, non-GAAP earnings per share, adjusted net debt, normalized revenue, normalized adjusted EBITDA, and normalized adjusted EBITDA margin. In addition, we present supplemental full year 2024 financial information on a pro forma basis to give effect to the divestiture of the Digital Banking business and the application of the proceeds from the sale to pay down outstanding indebtedness, the ongoing expense reduction actions and the transition of the Company's POS and SCO hardware businesses to an outsourced design and manufacturing (ODM) model, as if all such transactions and actions had occurred on January 1, 2024. These pro forma non-GAAP measures include pro forma revenue, pro forma adjusted EBITDA, pro forma adjusted EBITDA margin, pro forma net leverage ratio, and pro forma adjusted free cash flow-unrestricted. These measures are included to provide additional useful information regarding the Company’s financial results and are not a substitute for their comparable GAAP measures. NCR Voyix’s definitions and calculations of these non-GAAP measures may differ from similarly-titled measures reported by other companies and cannot, therefore, be compared with similarly-titled measures of other companies. These non-GAAP measures should not be considered as substitutes for, or superior to, results determined in accordance with GAAP. Explanations of these non-GAAP measures, as well as a statement of usefulness and purpose of each such measure are included in the appendix of this presentation. These presentation materials and the associated remarks made during this presentation are integrally related and are intended to be presented and understood together.

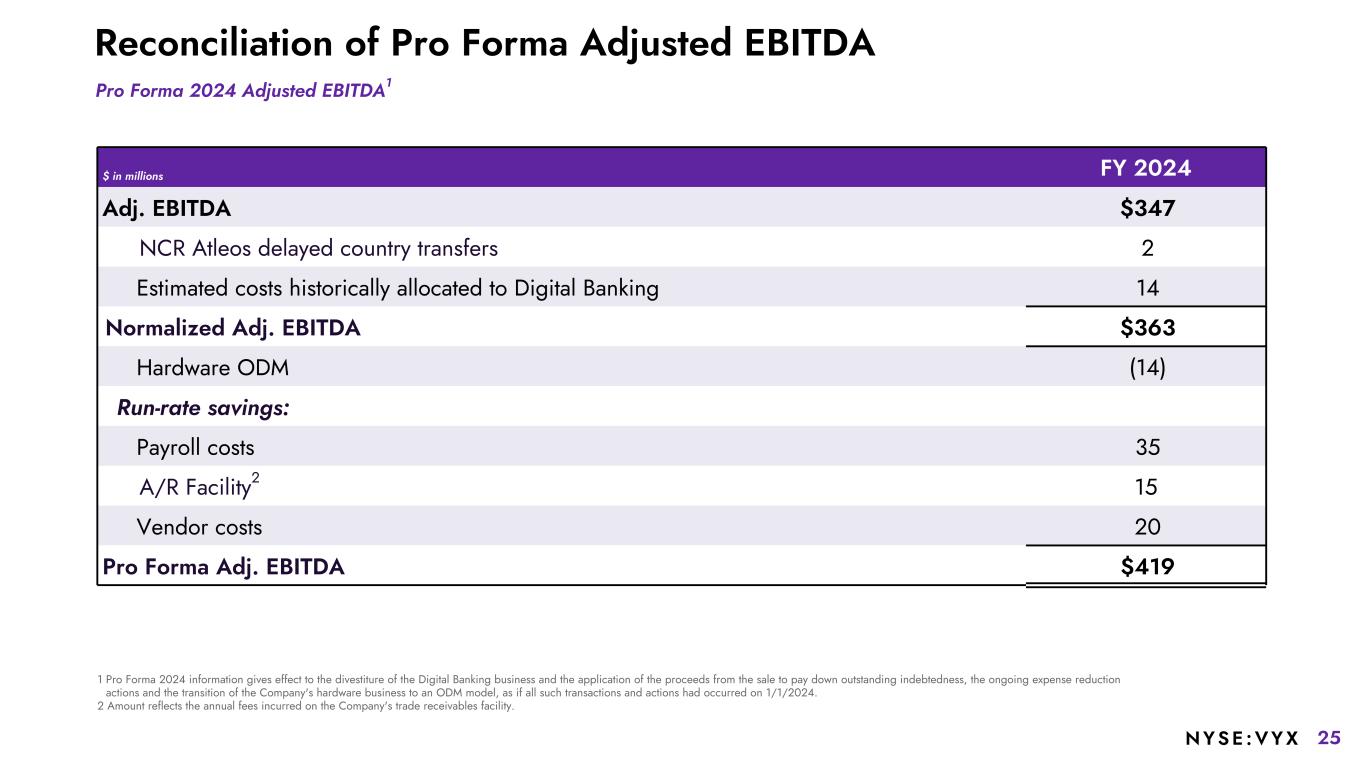

4NYSE :VYX Notes to Investors GUIDANCE AND PRO FORMA INFORMATION. The Company’s 2025 outlook assumes hardware recognition for the full-year 2025. Upon fully implementing the hardware ODM agreement with Ennoconn later this year, the Company will update its 2025 outlook to reflect net hardware commission revenue. The 2025 outlook does not include any potential impact for the pending trade tariffs (including, but not limited to, tariffs on Mexico and Canada) that have been imposed or announced by the U.S. government given the current uncertainty regarding the timing and ultimate structure of any such tariffs as well as the Company’s potential to mitigate the impact of tariffs. In addition, the Company is providing supplemental full year 2024 financial information on a pro forma basis to give effect to the divestiture of the Digital Banking business and the application of the proceeds from the sale to pay down outstanding indebtedness, the ongoing expense reduction actions and the transition of the Company’s POS and SCO hardware businesses to an outsourced design and manufacturing (ODM) model, as if all such transactions and actions had occurred on January 1, 2024, in order to enhance investors’ ability to evaluate and compare the Company’s operations on a go-forward basis, reflecting the impact of these transactions and actions. With respect to our Adjusted EBITDA outlook for full year for our anticipated Adjusted EBITDA and Adjusted EBITDA margin and our adjusted free cash flow- unrestricted, we do not provide a reconciliation of the respective GAAP measures because we are not able to predict with reasonable certainty the reconciling items that may affect GAAP net income from continuing operations and GAAP cash flow provided by (used in) from operating activities without unreasonable effort. The reconciling items are primarily the future impact of special tax items, capital structure transactions, restructuring, pension mark-to-market transactions, acquisitions or divestitures, or other events. These reconciling items are uncertain, depend on various factors and could significantly impact, either individually or in the aggregate, the GAAP measures. The Company also believes such reconciliations would imply a degree of precision that would be confusing or misleading to investors. Further, the FY 2025 performance outlook and supplemental non-GAAP pro forma financial information in this presentation is not necessarily indicative of the operating results of the Company were the divestiture of the Digital Banking business and the application of the proceeds from the sale to pay off outstanding indebtedness, the ongoing expense reduction actions and the transition of the Company's POS and SCO hardware businesses to an ODM model effected as of or before January 1, 2024 or of the operating results of the Company in the future. The supplemental non-GAAP pro forma financial information is not pro forma information prepared in accordance with Article 11 of Regulation S-X of the SEC, and the preparation of information in accordance with Article 11 would result in a different presentation. The Company has published historical pro forma financial information prepared in connection with Article 11 of Regulation S-X of the SEC to give effect to the divestiture of the Digital Banking business in connection with the closing of the transaction.

5NYSE :VYX FORWARD-LOOKING STATEMENTS. This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”). Statements can generally be identified as forward-looking because they include words such as “expect,” “target,” “anticipate,” “outlook,” “guidance,” “intend,” “plan,” “confident,” “believe,” “will,” “should,” “would,” “potential,” “positioning,” “proposed,” “planned,” “objective,” “likely,” “could,” “may,” or words of similar meaning. NCR Voyix Corporation (“NCR Voyix” or the “Company”) intends for these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Act. Statements that describe or relate to the Company’s plans, targets, goals, intentions, strategies, prospects, or financial outlook, including modeling considerations, and statements that do not relate to historical or current fact, are examples of forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements regarding: our expectations regarding our fiscal 2025 performance outlook, our capital allocation plans and priorities, our expectations following the divestiture of our digital banking business, the transition of our hardware business to an outsourced design and manufacturing model, and our expectations regarding other strategic initiatives and our growth strategies. Forward-looking statements are subject to assumptions, risks and uncertainties that may cause actual results to differ materially from those contemplated by such forward-looking statements. The factors that could cause the Company’s actual results to differ materially include, among others, the following: our ability to successfully execute our growth strategy; our ability to successfully develop new solutions that achieve market acceptance and keep pace with technological developments; our ability to maintain a consistently high level of customer service; our ability to achieve some or all of the expected benefits of our cost reduction initiatives; the success of our strategic relationships with third parties and our ability to integrate with third-party applications and software; the failure of our acquisitions, divestitures and other strategic transactions or future acquisitions to produce anticipated results; our ability to realize the anticipated cost savings or other benefits related to the Hardware Business Transition on a timely basis or at all; our ability to perform under our agreements with NCR Atleos; potential indemnification obligations to NCR Atleos or a refusal of NCR Atleos to indemnify us pursuant to agreements executed in the spin-off; our ability to protect our systems and data from cybersecurity threats or other technological risks; risks related to evolving global laws and regulations relating to data privacy, data protection and information security; our ability to protect our intellectual property; extensive competition in our markets; disruptions in our data center hosting and public cloud facilities; risks related to defects, errors, installation difficulties or development delays; the failure of our artificial intelligence capabilities to operate as anticipated; changes in U.S. or foreign trade policies; our ability to maintain and update our information technology systems; our ability to retain key employees, or to recruit, develop and retain qualified employees; the inability of third party suppliers to fulfill our needs; risks related to our level or indebtedness; our ability to continue to access or renew financing sources and obtain capital; our failure to maintain effective internal control over financial reporting; and other factors identified in “Risk Factors” in the Company’s filings with the U.S. Securities and Exchange Commission, which are available at https://www.sec.gov. You should consider these factors carefully in evaluating forward-looking statements and are cautioned not to place undue reliance on such statements. The Company assumes no obligation to update any forward-looking statements, which speak only as of the date of this presentation. Notes to Investors

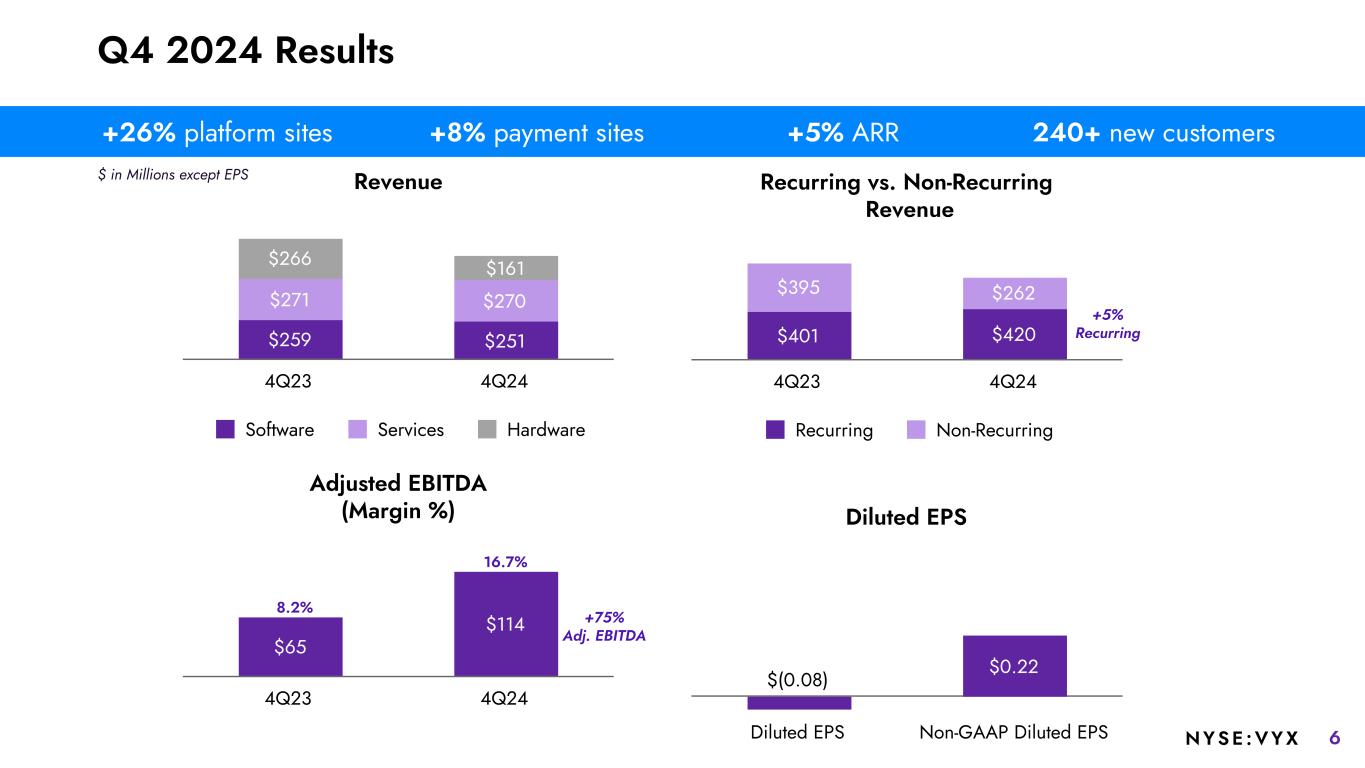

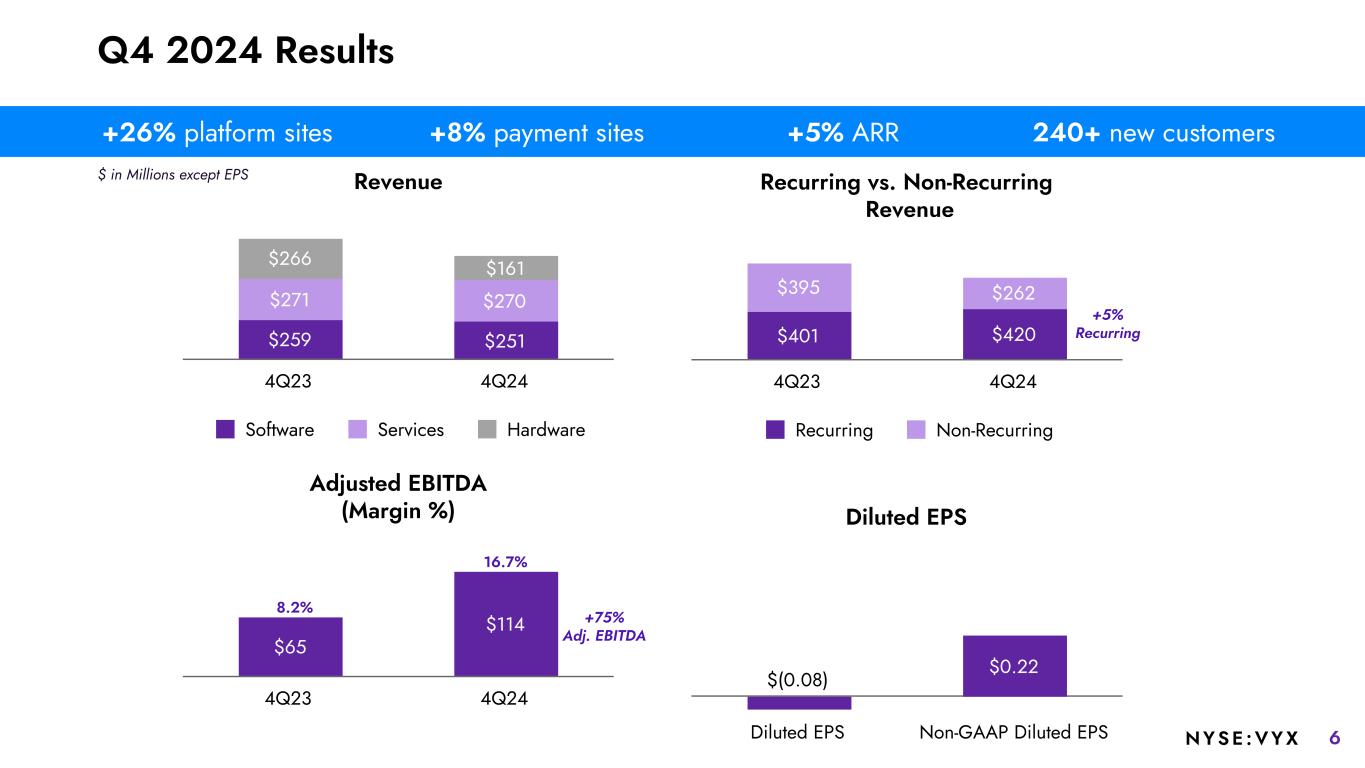

6NYSE :VYX Q4 2024 Results $ in Millions except EPS +26% platform sites +8% payment sites +5% ARR 240+ new customers Revenue $259 $251 $271 $270 $266 $161 Software Services Hardware 4Q23 4Q24 Diluted EPS $0.22 Diluted EPS Non-GAAP Diluted EPS Adjusted EBITDA (Margin %) $65 $114 4Q23 4Q24 Recurring vs. Non-Recurring Revenue $401 $420 $395 $262 Recurring Non-Recurring 4Q23 4Q24 16.7% 8.2% +5% Recurring +75% Adj. EBITDA $(0.08)

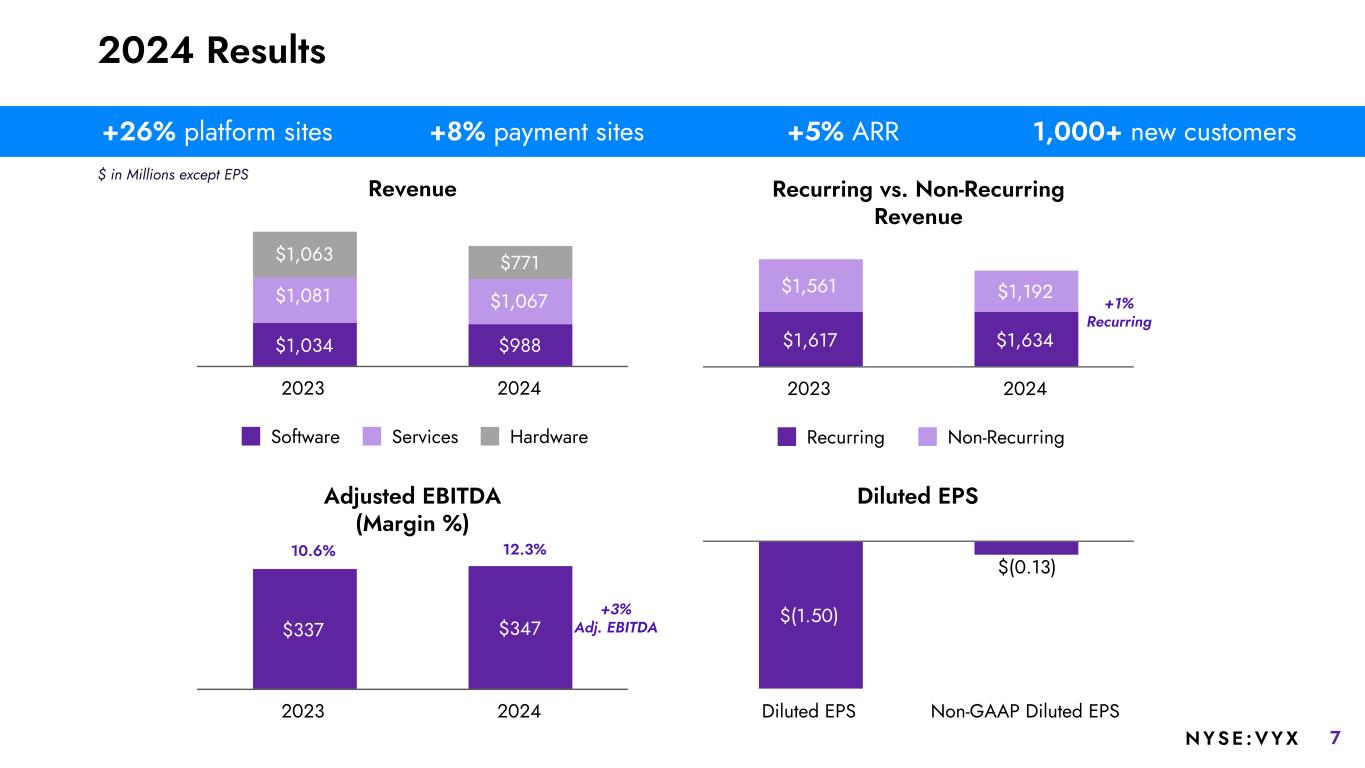

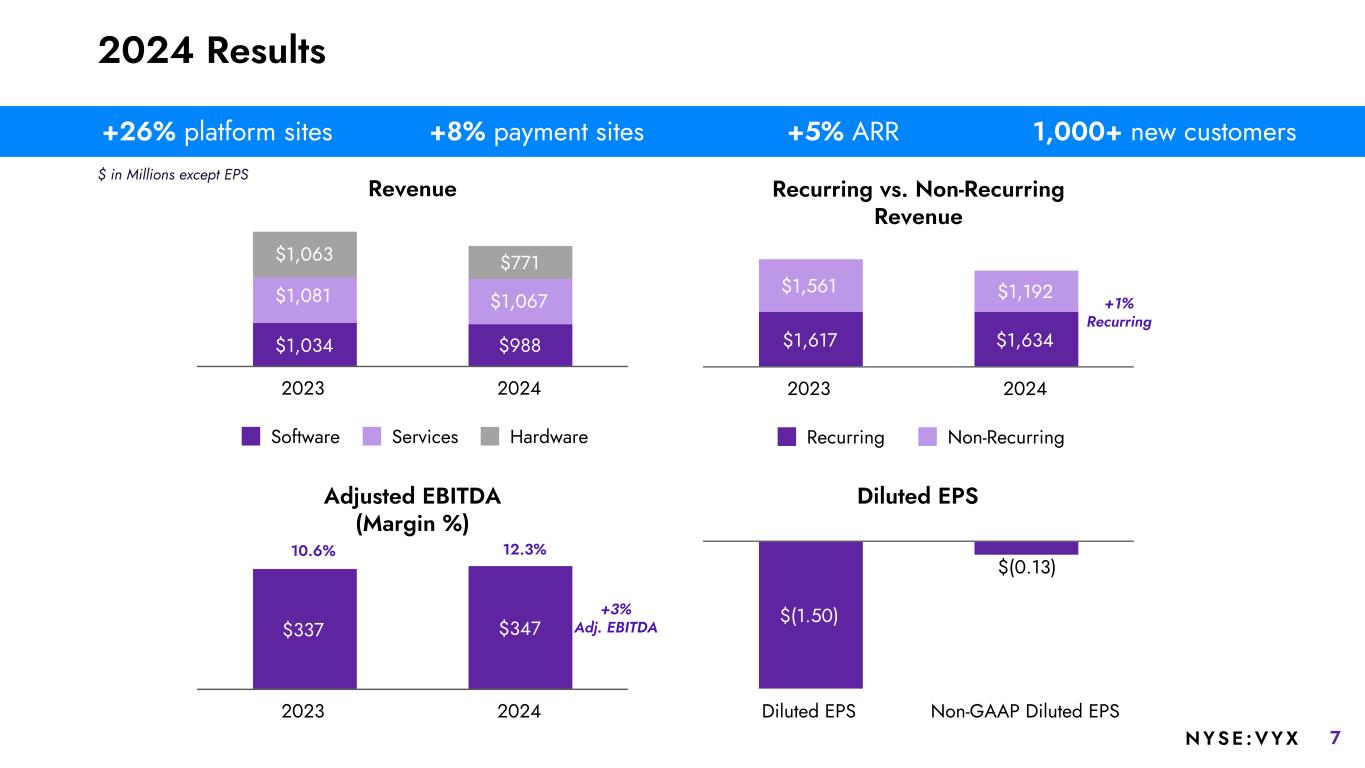

7NYSE :VYX Revenue $1,034 $988 $1,081 $1,067 $1,063 $771 Software Services Hardware 2023 2024 2024 Results $ in Millions except EPS Diluted EPS $(1.50) Diluted EPS Non-GAAP Diluted EPS Adjusted EBITDA (Margin %) $337 $347 2023 2024 Recurring vs. Non-Recurring Revenue $1,617 $1,634 $1,561 $1,192 Recurring Non-Recurring 2023 2024 10.6% 12.3% +1% Recurring +3% Adj. EBITDA $(0.13) +26% platform sites +8% payment sites +5% ARR 1,000+ new customers

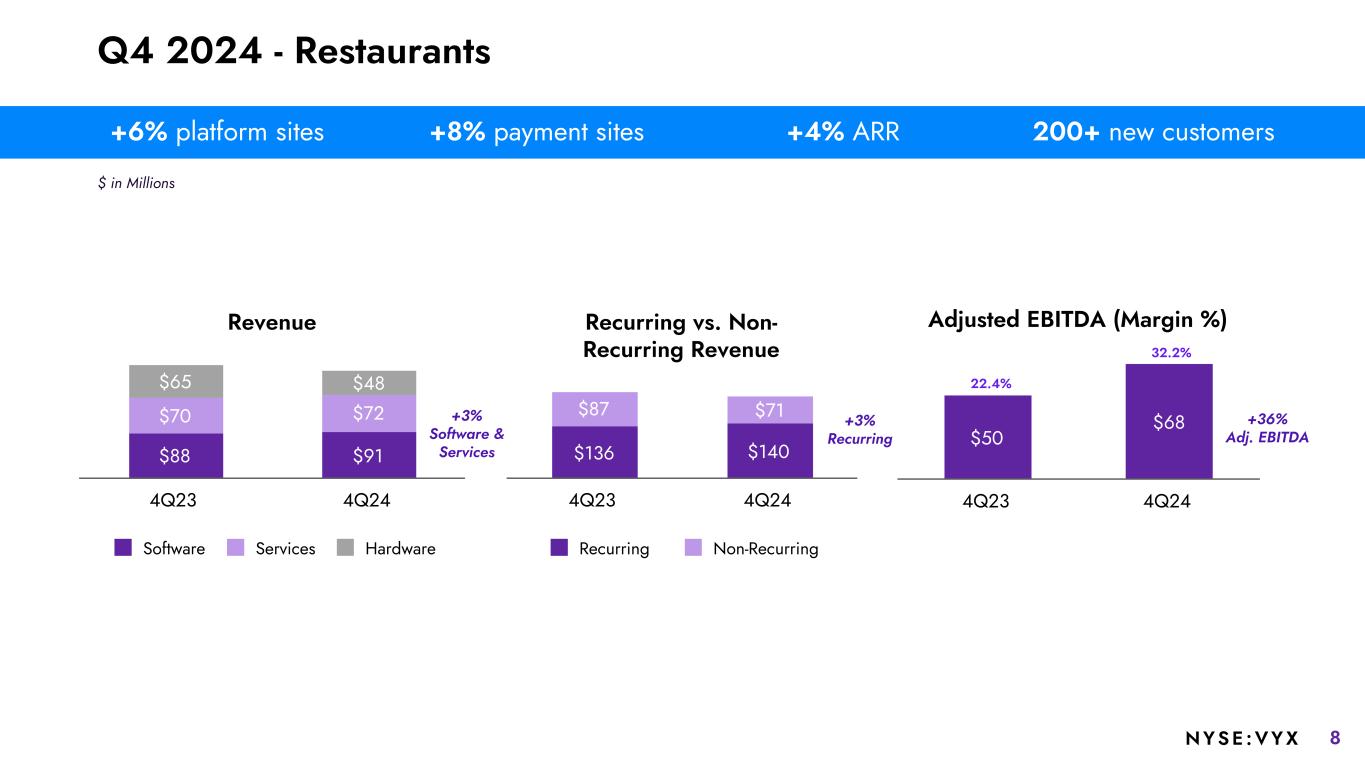

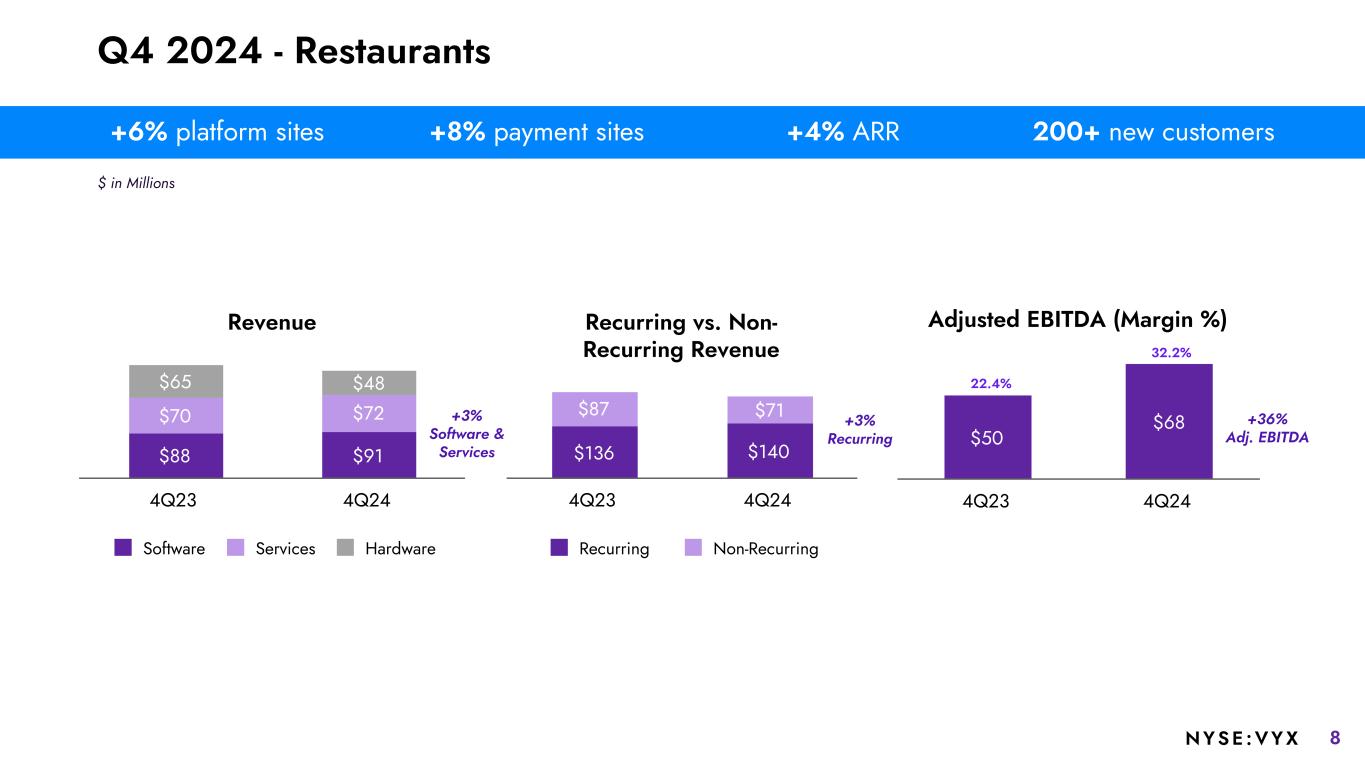

8NYSE :VYX Q4 2024 - Restaurants Revenue $88 $91 $70 $72 $65 $48 Software Services Hardware 4Q23 4Q24 Adjusted EBITDA (Margin %) $50 $68 4Q23 4Q24 Recurring vs. Non- Recurring Revenue $136 $140 $87 $71 Recurring Non-Recurring 4Q23 4Q24 +3% Software & Services +3% Recurring +36% Adj. EBITDA 32.2% 22.4% +6% platform sites +8% payment sites +4% ARR 200+ new customers $ in Millions

9NYSE :VYX Q4 2024 - Retail Revenue $160 $155 $186 $193 $198 $113 Software Services Hardware 4Q23 4Q24 Recurring vs. Non- Recurring Revenue $257 $270 $287 $191 Recurring Non-Recurring 4Q23 4Q24 +1% Software & Services +5% Recurring +13% Adj. EBITDA22.1% 16.5% +46% platform sites +6% ARR 35+ new customers Adjusted EBITDA (Margin %) $90 $102 4Q23 4Q24 22.1% 16.5% $ in Millions

10NYSE :VYX Cash and Debt Information For a definition of non-GAAP metrics and a reconciliation of GAAP to non-GAAP financial metrics, see Appendix. 1 Available cash is defined as cash on the balance sheet as of December 31, 2024 of $724 million less estimated cash taxes to be paid of $300 million in 2025 in connection with the sale of Digital Banking. 2 Amount reflects Pro Forma Adjusted EBITDA shown on slide 25. 3 Pro forma Net Leverage is calculated as adjusted net debt divided by Pro Forma Adjusted EBITDA. Debt Term Structure $650 $403 $52 Debt Maturity 2028 2029 2030 $— $250 $500 $750 Weighted Avg Rate: 5.06% Fixed Rate Debt: 100% Avg Maturity: 4.1 years Leverage and Cash Flow 12/31/2024 Total Debt $1,105 Available Cash1 (424) Adjusted Net Debt $681 Pro Forma 2024 Adj. EBITDA2 $419 Pro Forma Net Leverage Ratio3 1.6x 4Q24 Cash Flows Provided By (Used In) Operations (GAAP) $(170) 4Q24 Adjusted Free Cash Flow - Unrestricted (non-GAAP) $45 4Q24 Adjusted Free Cash Flow - Unrestricted Before Restructuring (non-GAAP) $72 Capital Allocation Priorities • Leverage ratio at or below 2.0x • Investments in platform and platform-related applications • Share repurchases (common and preferred shares) $ in Millions

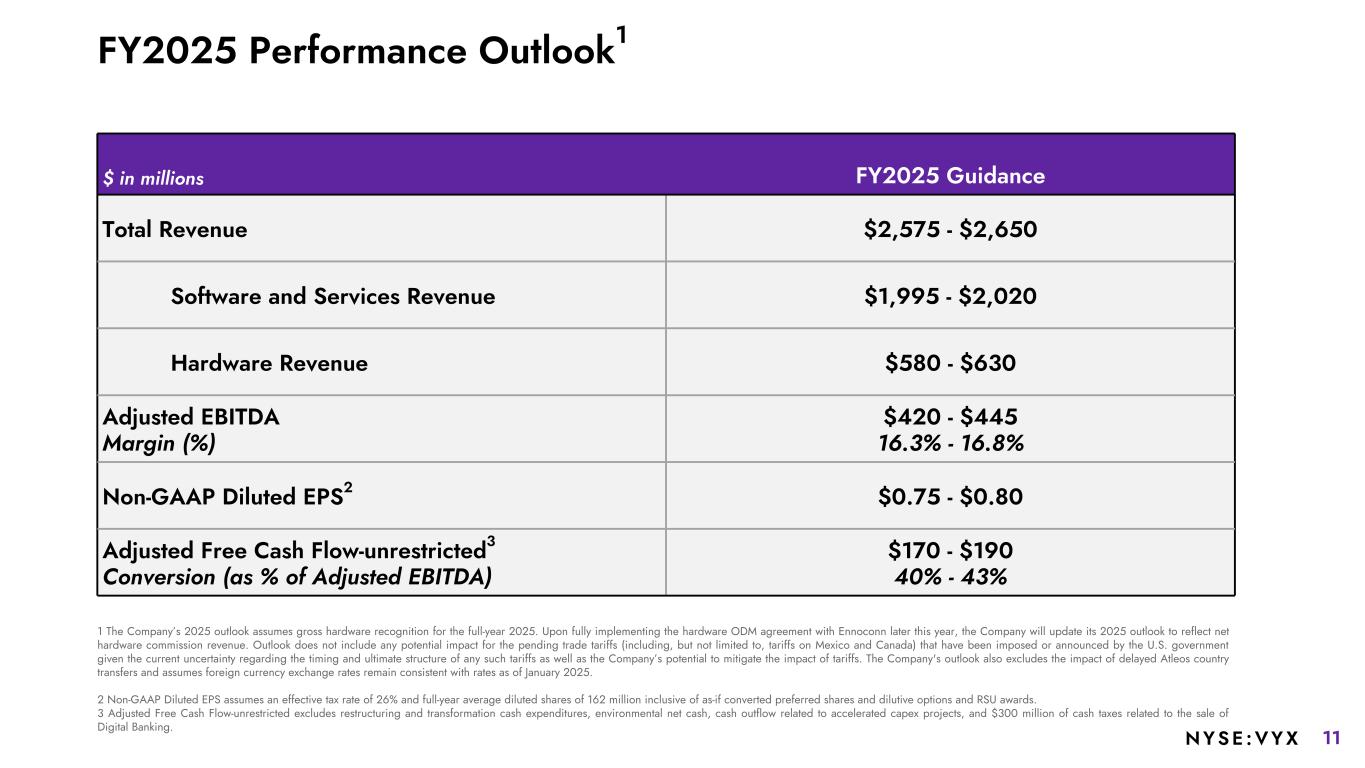

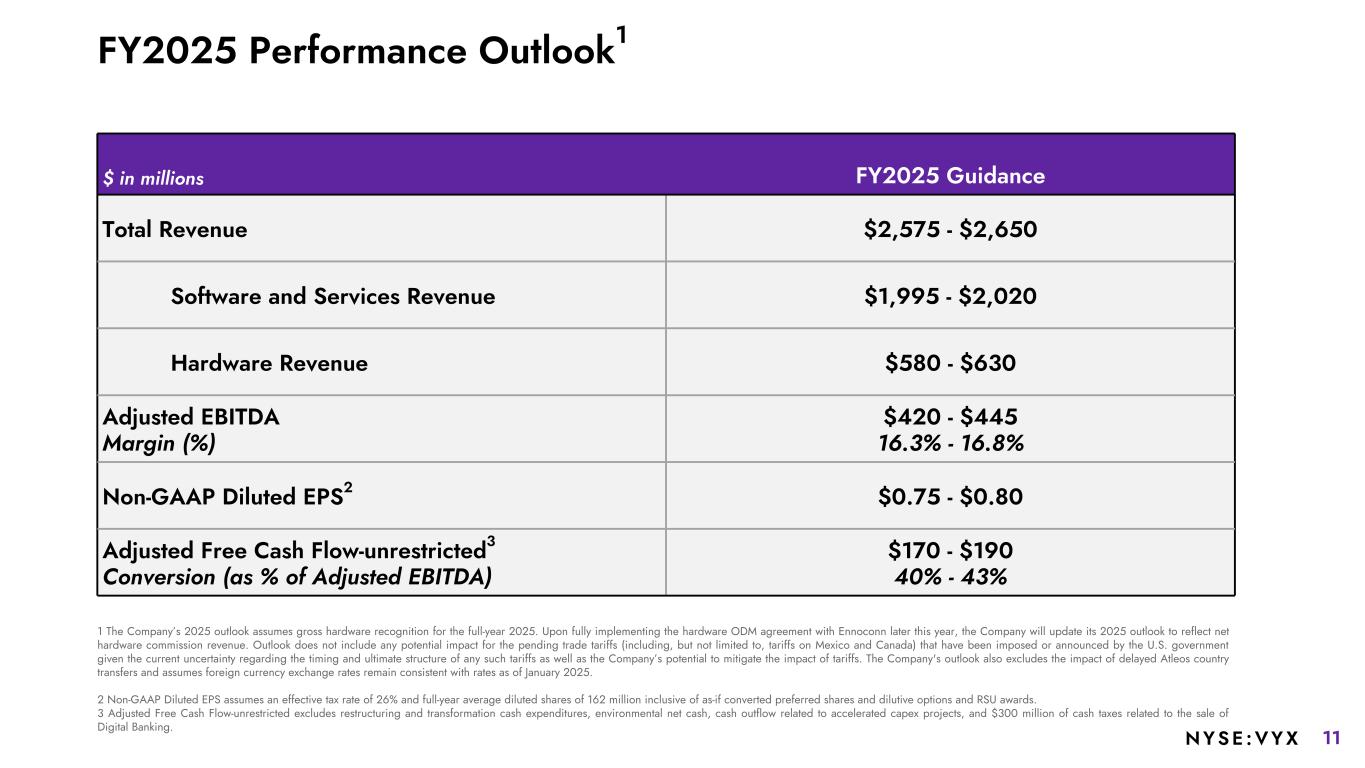

11NYSE :VYX $ in millions FY2025 Guidance Total Revenue $2,575 - $2,650 Software and Services Revenue $1,995 - $2,020 Hardware Revenue $580 - $630 Adjusted EBITDA Margin (%) $420 - $445 16.3% - 16.8% Non-GAAP Diluted EPS2 $0.75 - $0.80 Adjusted Free Cash Flow-unrestricted3 Conversion (as % of Adjusted EBITDA) $170 - $190 40% - 43% FY2025 Performance Outlook1 1 The Company’s 2025 outlook assumes gross hardware recognition for the full-year 2025. Upon fully implementing the hardware ODM agreement with Ennoconn later this year, the Company will update its 2025 outlook to reflect net hardware commission revenue. Outlook does not include any potential impact for the pending trade tariffs (including, but not limited to, tariffs on Mexico and Canada) that have been imposed or announced by the U.S. government given the current uncertainty regarding the timing and ultimate structure of any such tariffs as well as the Company’s potential to mitigate the impact of tariffs. The Company's outlook also excludes the impact of delayed Atleos country transfers and assumes foreign currency exchange rates remain consistent with rates as of January 2025. 2 Non-GAAP Diluted EPS assumes an effective tax rate of 26% and full-year average diluted shares of 162 million inclusive of as-if converted preferred shares and dilutive options and RSU awards. 3 Adjusted Free Cash Flow-unrestricted excludes restructuring and transformation cash expenditures, environmental net cash, cash outflow related to accelerated capex projects, and $300 million of cash taxes related to the sale of Digital Banking.

12N Y S E : V Y X Appendix

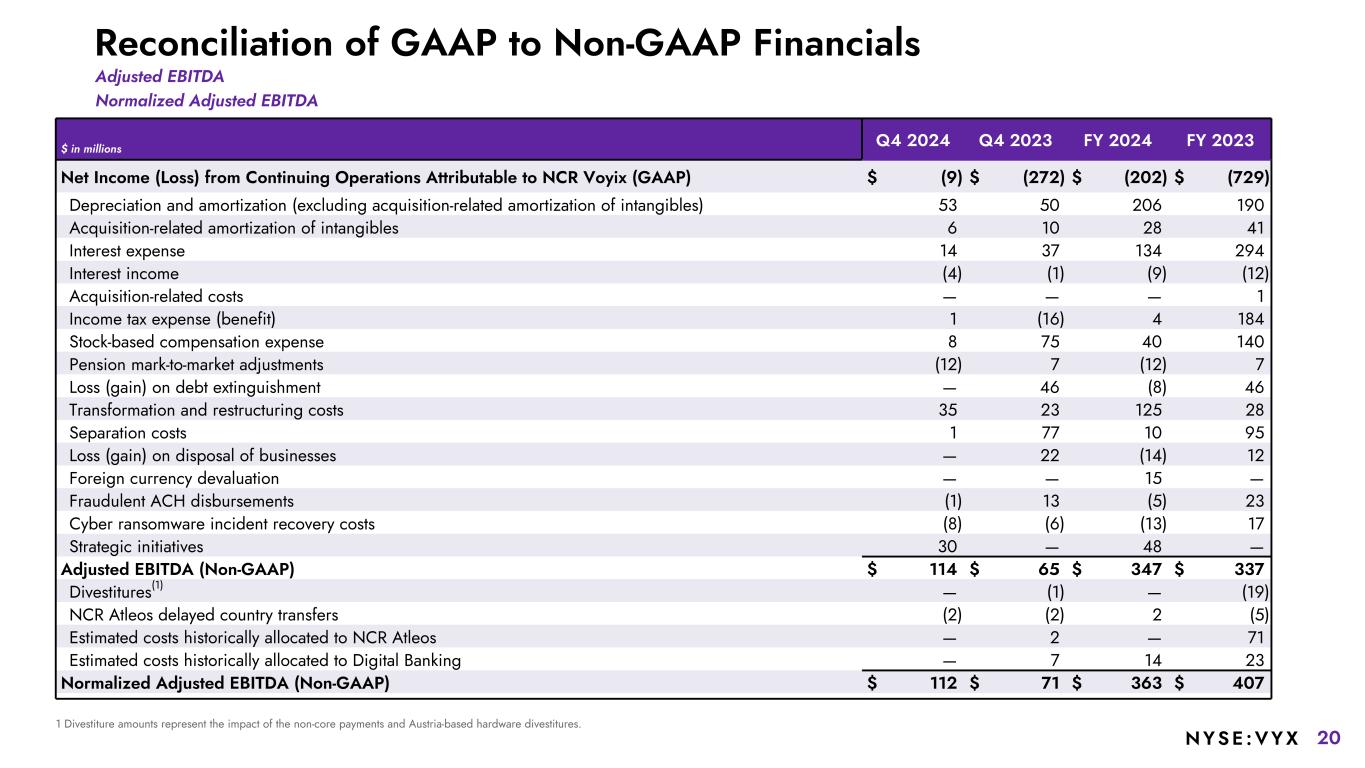

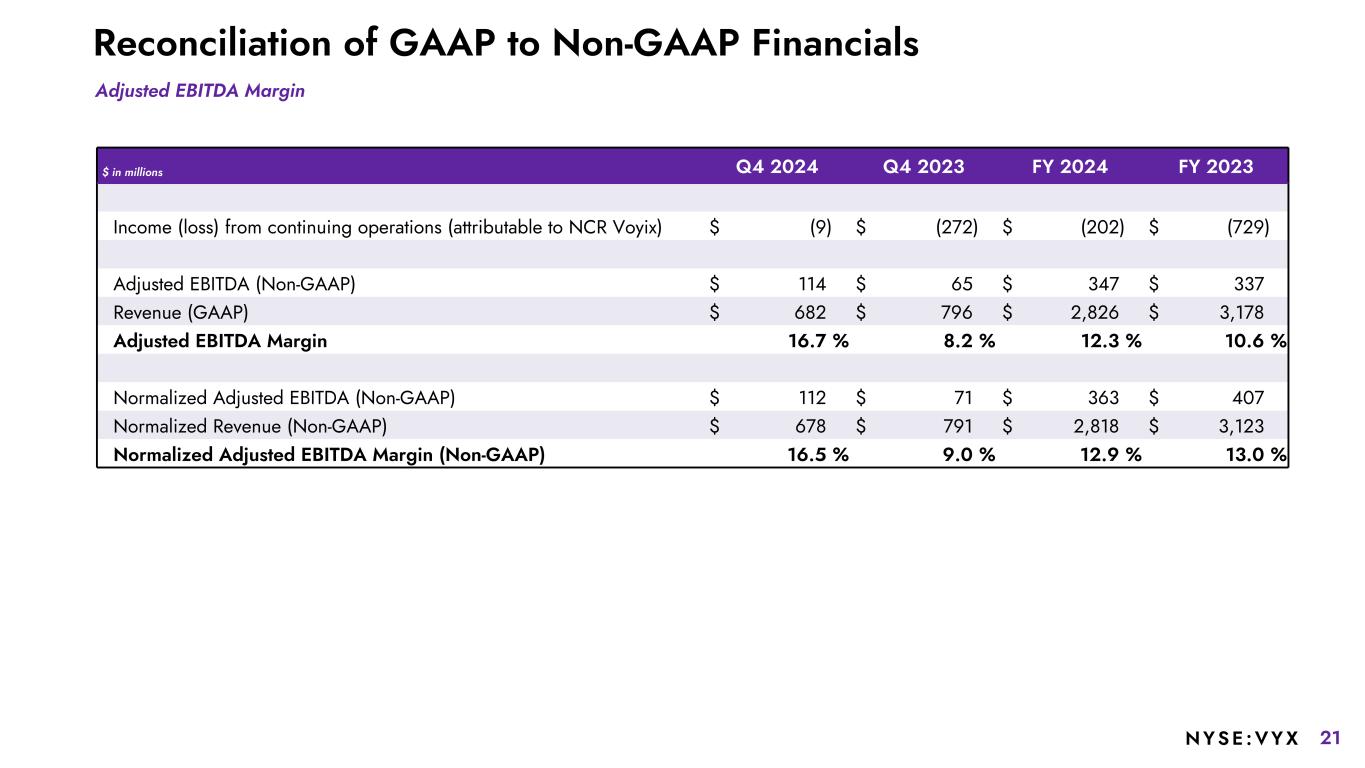

13NYSE :VYX While NCR Voyix reports its results in accordance with generally accepted accounting principles (GAAP) in the United States, comments made during this conference call and in these materials will include non-GAAP measures. These measures are included to provide additional useful information regarding NCR Voyix’s financial results and are not a substitute for their comparable GAAP measures. Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA) NCR Voyix determines Adjusted EBITDA for a given period based on its GAAP net income from continuing operations plus interest expense, net; plus income tax expense (benefit); plus pension mark-to-market adjustments and other special items, including amortization of acquisition-related intangibles, acquisition-related costs, loss (gain) on disposal of businesses, separation-related costs, cyber ransomware incident recovery costs net of insurance recoveries, fraudulent ACH disbursements costs net of recoveries, foreign currency devaluation, transformation and restructuring charges (which includes integration, severance and other exit and disposal costs), and strategic initiative costs, among others. Separation-related costs include costs incurred as a result of the spin-off. Professional and other fees to effect the spin-off including separation management, organizational design, and legal fees have been classified within discontinued operations through October 16, 2023, the separation date. The historical financial information and any forecasted financial information included in this presentation were determined based on the Retail and Restaurants segment results including an estimate of corporate costs, perimeter adjustments as well as the impact from commercial agreements between NCR Voyix and NCR Atleos. The actual historical results may differ from the periods presented based on the GAAP requirements for reporting discontinued operations. NCR Voyix uses Adjusted EBITDA to evaluate and measure the ongoing performance of its business segments. NCR Voyix also uses Adjusted EBITDA to manage and determine the effectiveness of its business managers and as a basis for incentive compensation. NCR Voyix believes that Adjusted EBITDA provides useful information to investors because it is an indicator of the strength and performance of the Company’s ongoing business operations, including its ability to fund discretionary spending such as capital expenditures, strategic acquisitions, and other investments, and excludes certain items whose fluctuation from period to period do not necessarily correspond to changes in the operations of our business segments. In addition, we believe Adjusted EBITDA is useful to investors because it and similar measures are commonly used by industry analysts, investors, and lenders to assess the financial performance of companies in our industry. Adjusted EBITDA margin is calculated based on Adjusted EBITDA as a percentage of total revenue. Normalized measures generally The Company presents certain Normalized figures, including Normalized Revenue and Normalized Adjusted EBITDA on both a segment and consolidated basis, in this presentation. Normalized figures for a given period are calculated by adjusting for estimated amounts historically allocated to NCR Atleos that do not meet the definition of amounts related to discontinued operations for purposes of GAAP requirements regarding the reporting of discontinued operations. Normalized measures also remove revenue and costs associated with the transfer or pending transfer of NCR Atleos-related operations in all foreign countries that had not occurred by December 31, 2024 and adjust for all divestitures that occurred in prior periods that are not treated as discontinued operations under GAAP. The Company uses these Normalized figures to estimate the performance of the continuing business following the spin-off. The Company believes that Normalized figures provide useful information to investors because it is an indicator of the strength and performance of the Company’s ongoing business operations following the spin-off and allow for more easy comparisons period over period. Non-GAAP Measures

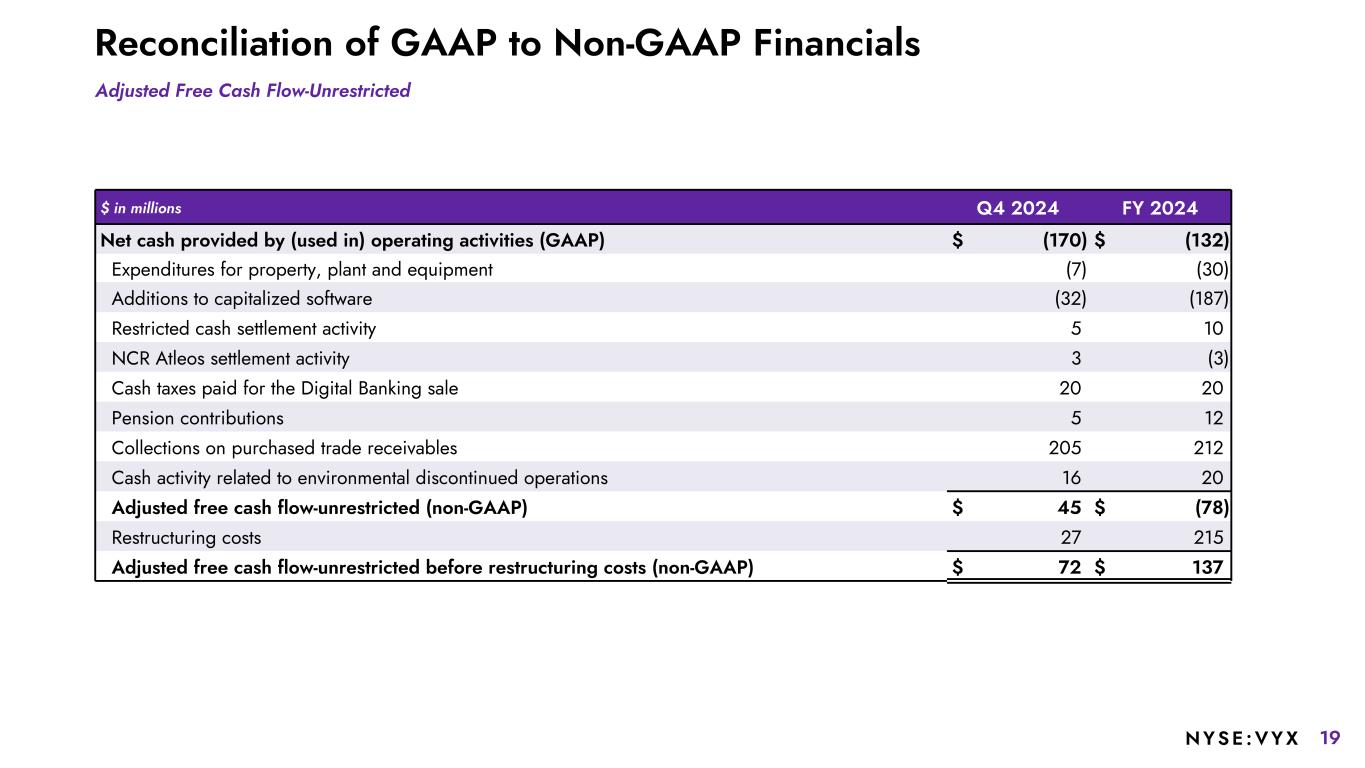

14NYSE :VYX Adjusted Free Cash Flow-Unrestricted: NCR Voyix management uses the non-GAAP measure called “adjusted free cash flow-unrestricted” to assess the financial performance of the Company. We define adjusted free cash flow-unrestricted as net cash provided by (used in) operating activities less capital expenditures for property, plant and equipment, less additions to capitalized software, plus/minus collections of previously sold trade receivables purchased from third parties, restricted cash settlement activity, NCR Atleos settlement activity, cash taxes paid for the Digital Banking Sale, cash activity related to environmental discontinued operations plus acquisition-related items, and plus pension contributions and settlements. NCR Atleos settlement activity relates to changes in amounts owed to and amounts due from NCR Atleos for activity related to items governed by the separation and distribution agreement. Activity from the commercial and transition services agreements are not included in this adjustment. We believe adjusted free cash flow-unrestricted provides useful information to investors because it relates the operating cash flows from the Company’s continuing and discontinued operations to the capital that is spent to continue and improve business operations. In particular, adjusted free cash flow-unrestricted indicates the amount of cash available after capital expenditures for, among other things, investments in the Company’s existing businesses, strategic acquisitions, and repayment of debt obligations. Free cash flow does not represent the residual cash flow available for discretionary expenditures, since there may be other non-discretionary expenditures that are not deducted from the measure. Adjusted free cash flow-unrestricted does not have uniform definitions under GAAP, and therefore the Company’s definitions may differ from other companies’ definitions of these measures. Adjusted Free Cash Flow Conversion is defined as Adjusted Free Cash Flow-Unrestricted divided by Adjusted EBITDA. Adjusted Net Debt, Net Debt and Net Leverage Ratio: NCR Voyix management uses non-GAAP measures called "adjusted net debt", "net debt" and "net leverage ratio" to assess the financial performance of the Company. We define net debt as total debt minus cash and cash equivalents. We define adjusted net debt as total debt minus available cash (cash and cash equivalents less cash to be paid for taxes in connection with the Digital Banking Sale). NCR Voyix's management considers net debt to be an important measure of liquidity and an indicator of our ability to meet ongoing obligations. Net leverage ratio is calculated as net debt divided by last-twelve-months Adjusted EBITDA. NCR Voyix's management considers net leverage ratio to be an important indicator of the Company’s indebtedness in relation to its operating performance. The Company’s definition of net debt and net leverage ratio may differ from other companies’ definitions of each measure, and each measure should not be considered a substitute for, or superior to, comparable GAAP metrics. Non-GAAP Diluted EPS The Company determines Non-GAAP Diluted EPS by excluding, as applicable, pension mark-to-market adjustments, pension settlements, pension curtailments and pension special termination benefits, as well as other special items, including amortization of acquisition related intangibles, stock-based compensation expense, separation-related costs, cyber ransomware incident recovery costs, fraudulent ACH disbursements costs, strategic initiative costs, foreign currency devaluation costs, gains or losses related to the disposal of businesses, and transformation and restructuring activities, from the Company’s GAAP earnings per share. Due to the non-operational nature of these pension and other special items, the Company’s management uses these non-GAAP measures to evaluate year-over-year operating performance. The Company believes this measure is useful for investors because it provides a more complete understanding of the Company’s underlying operational performance, as well as consistency and comparability with the Company’s past reports of financial results. Non-GAAP Measures

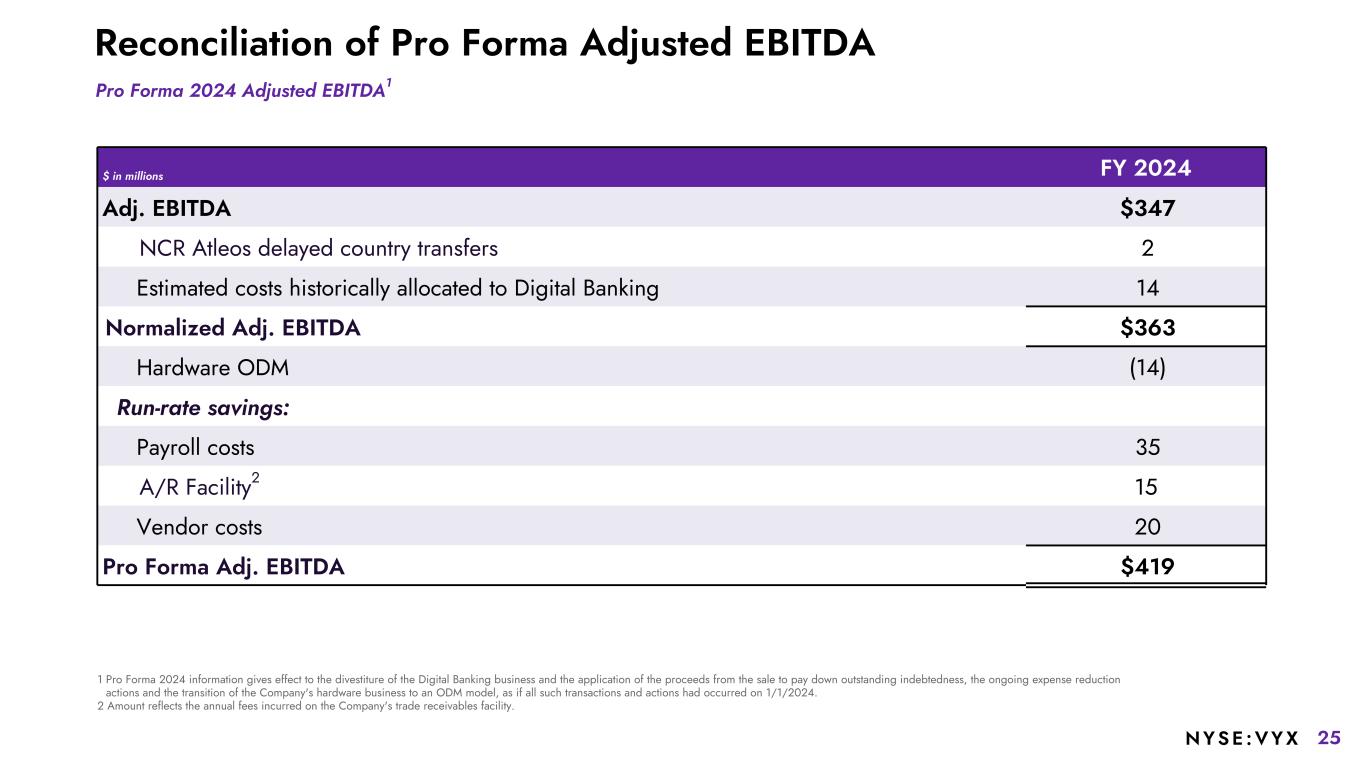

15NYSE :VYX Pro Forma Financial Measures: In this presentation, we present supplemental full year 2024 financial information on a pro forma basis to give effect to the divestiture of the Digital Banking business and the application of the proceeds from the sale to pay down outstanding indebtedness, the ongoing expense reduction actions and the transition of the Company's POS and SCO hardware businesses to an outsourced design and manufacturing (ODM) model, as if all such transactions and actions had occurred on January 1, 2024. These pro forma non-GAAP measures include pro forma revenue, pro forma adjusted EBITDA, pro forma adjusted EBITDA margin, pro forma net leverage ratio, and pro forma adjusted free cash flow-unrestricted. Non-GAAP Reconciliations: The Company’s definitions and calculations of these non-GAAP measures may differ from similarly-titled measures reported by other companies and cannot, therefore, be compared with similarly-titled measures of other companies. These non-GAAP measures should not be considered as substitutes for, or superior to, results determined in accordance with GAAP. With respect to our 2025 performance outlook for Adjusted EBITDA, Adjusted EBITDA margin, Non-GAAP diluted EPS, Adjusted free cash flow-unrestricted, and Adjusted Free Cash Flow Conversion, we are not providing a reconciliation to GAAP net income or Cash flows from Operating Activities because we are not able to predict with reasonable certainty the reconciling items that may affect the GAAP net income from continuing operations or Cash flows from Operating Activities without unreasonable effort. For additional information, refer to Slide 3. USE OF CERTAIN TERMS. As used in these materials: The term “recurring revenue” includes all revenue streams from contracts where there is a predictable revenue pattern that will occur at regular intervals with a relatively high degree of certainty. This includes hardware and software maintenance revenue, cloud revenue, payment processing revenue, and certain professional services arrangements, as well as term-based software license arrangements that include customer termination rights. The Company believes this metric may be useful to investors in evaluating the achievement of strategic goals related to the conversion of the Retail and Restaurant businesses to recurring revenue streams over time. The term “annual recurring revenue” or “ARR” is recurring revenue, excluding software licenses (SWL) sold as a subscription, for the last three months times four. In addition, plus the rolling four quarters of term-based SWL arrangements that include customer termination rights. The term "Software ARR" includes recurring software license revenue, software maintenance revenue, SaaS revenue, standalone hosted contract revenue, professional services recurring revenue and payments revenue. The term “Software & Services Revenue” includes all software, services and payments revenue and excludes hardware revenue. The term “platform sites” includes all sites for which we bill for use of our Commerce platform. The term “payment sites” includes all sites which utilizes NCR Voyix’s payment processing capabilities. Non-GAAP Measures

16NYSE :VYX Reconciliation of GAAP to Non-GAAP Financials Normalized Revenue Normalized Software & Services Revenue: Normalized for comparisons for all divestitures and delayed transfers to NCR Atleos $ in millions Q4 2024 Q4 2023 FY 2024 FY 2023 Reported Revenue $682 $796 $2,826 $3,178 Less: Divestitures(1) — (3) — (44) Less: NCR Atleos delayed country transfers (4) (2) (8) (11) Normalized Revenue $678 $791 $2,818 $3,123 $ in millions Q4 2024 Q4 2023 FY 2024 FY 2023 Reported Software & Services Revenue $521 $530 $2,055 $2,115 Less: Divestitures(1) — (2) — (36) Less: NCR Atleos delayed country transfers (3) (2) (5) (8) Normalized Software & Services Revenue $518 $526 $2,050 $2,071 Less: Commercial agreement with NCR Atleos 1 (11) (9) (11) Normalized Software & services revenue, excluding commercial agreements $519 $515 $2,041 $2,060 1 Divestiture amounts represent the impact of the non-core payments and Austria-based hardware divestitures.

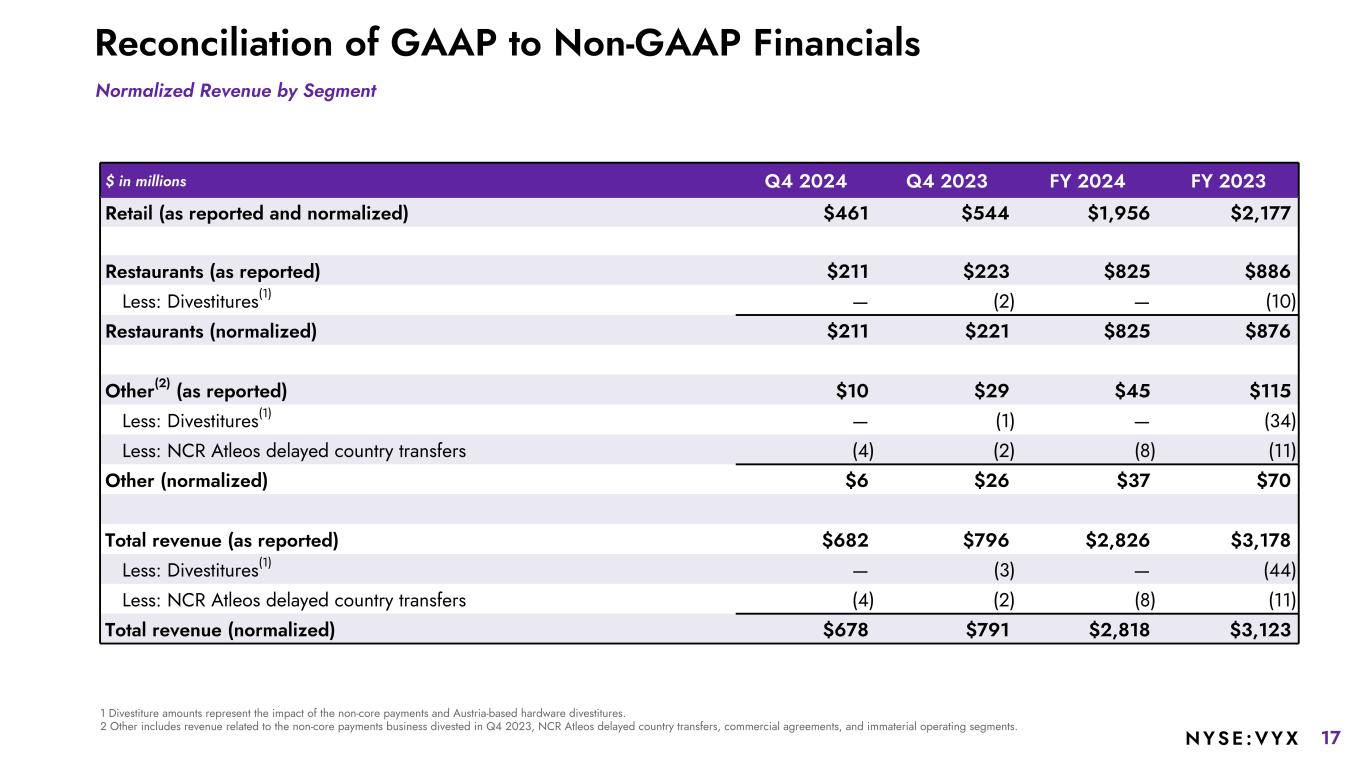

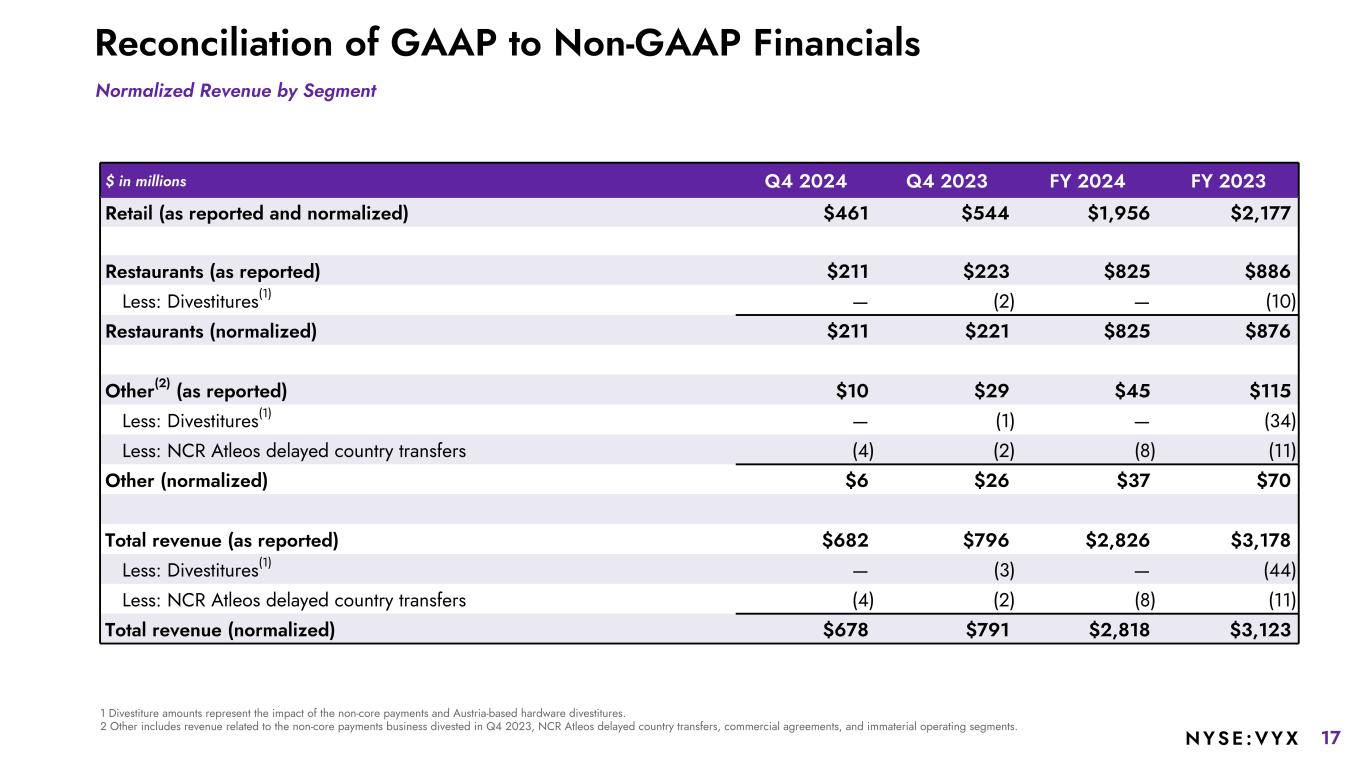

17NYSE :VYX Reconciliation of GAAP to Non-GAAP Financials $ in millions Q4 2024 Q4 2023 FY 2024 FY 2023 Retail (as reported and normalized) $461 $544 $1,956 $2,177 Restaurants (as reported) $211 $223 $825 $886 Less: Divestitures(1) — (2) — (10) Restaurants (normalized) $211 $221 $825 $876 Other(2) (as reported) $10 $29 $45 $115 Less: Divestitures(1) — (1) — (34) Less: NCR Atleos delayed country transfers (4) (2) (8) (11) Other (normalized) $6 $26 $37 $70 Total revenue (as reported) $682 $796 $2,826 $3,178 Less: Divestitures(1) — (3) — (44) Less: NCR Atleos delayed country transfers (4) (2) (8) (11) Total revenue (normalized) $678 $791 $2,818 $3,123 1 Divestiture amounts represent the impact of the non-core payments and Austria-based hardware divestitures. 2 Other includes revenue related to the non-core payments business divested in Q4 2023, NCR Atleos delayed country transfers, commercial agreements, and immaterial operating segments. Normalized Revenue by Segment

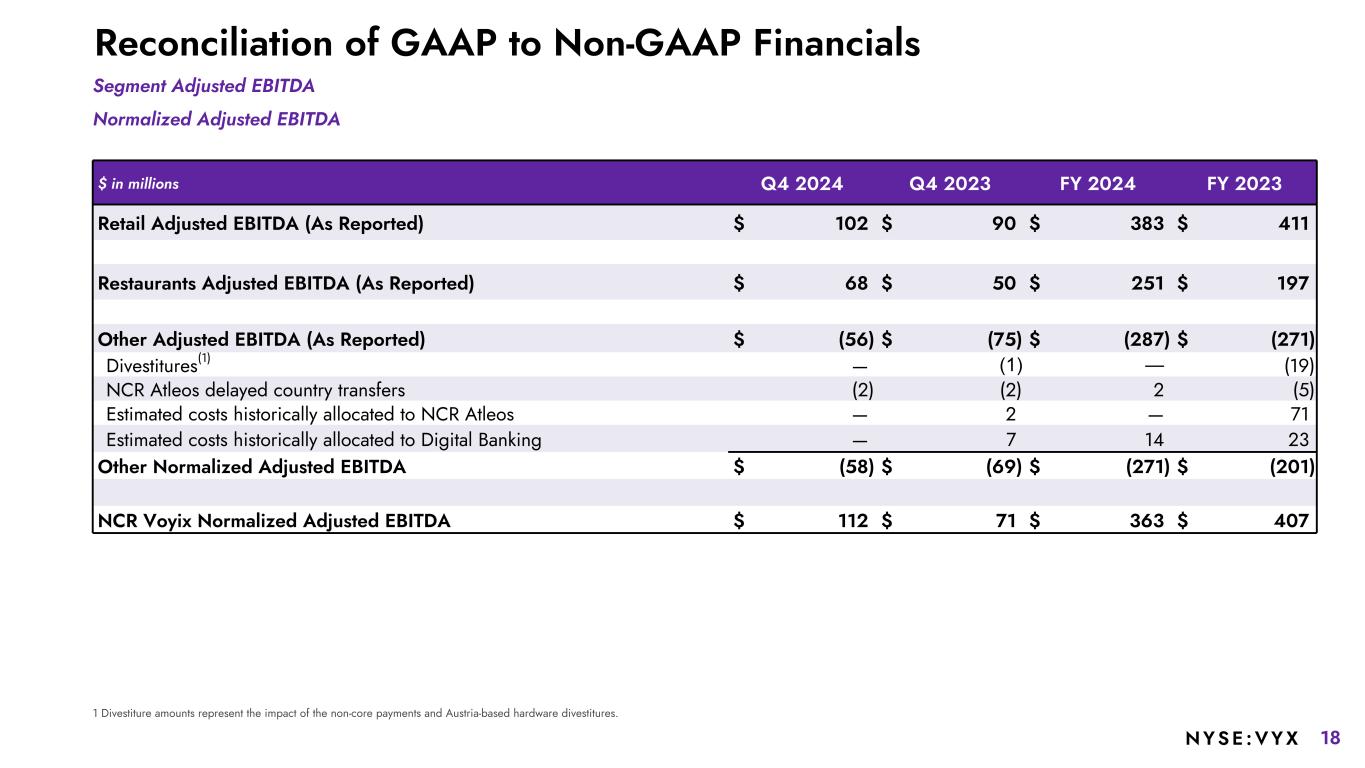

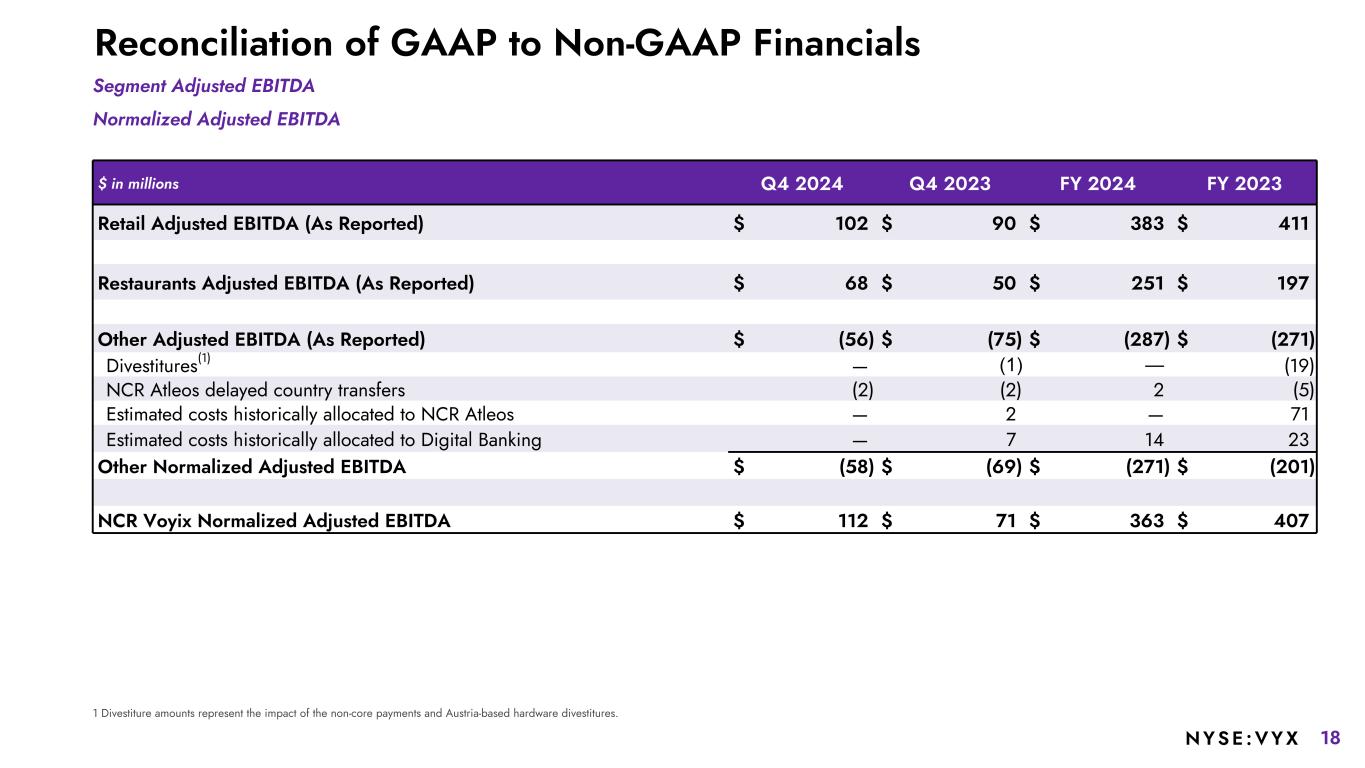

18NYSE :VYX Reconciliation of GAAP to Non-GAAP Financials $ in millions Q4 2024 Q4 2023 FY 2024 FY 2023 Retail Adjusted EBITDA (As Reported) $ 102 $ 90 $ 383 $ 411 Restaurants Adjusted EBITDA (As Reported) $ 68 $ 50 $ 251 $ 197 Other Adjusted EBITDA (As Reported) $ (56) $ (75) $ (287) $ (271) Divestitures(1) — (1) — (19) NCR Atleos delayed country transfers (2) (2) 2 (5) Estimated costs historically allocated to NCR Atleos — 2 — 71 Estimated costs historically allocated to Digital Banking — 7 14 23 Other Normalized Adjusted EBITDA $ (58) $ (69) $ (271) $ (201) NCR Voyix Normalized Adjusted EBITDA $ 112 $ 71 $ 363 $ 407 Segment Adjusted EBITDA Normalized Adjusted EBITDA 1 Divestiture amounts represent the impact of the non-core payments and Austria-based hardware divestitures.

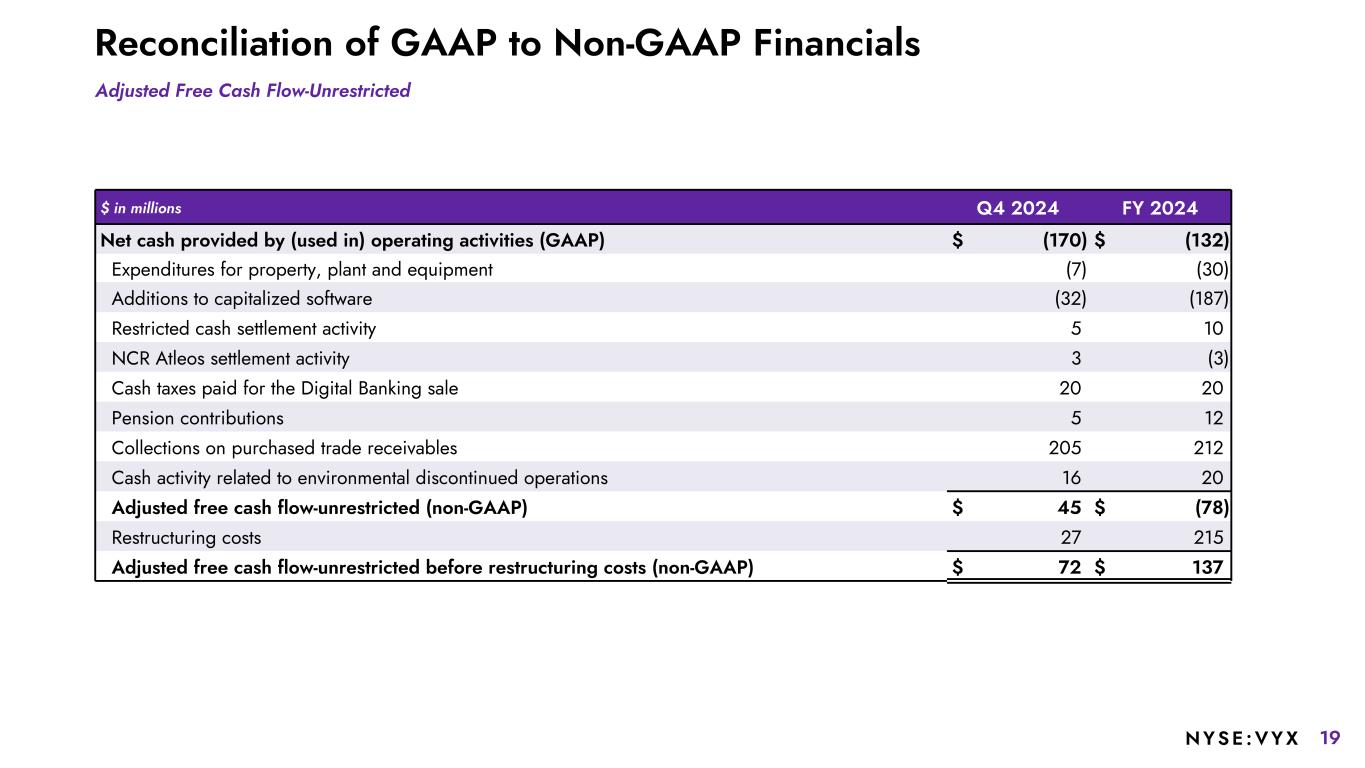

19NYSE :VYX Reconciliation of GAAP to Non-GAAP Financials Adjusted Free Cash Flow-Unrestricted $ in millions Q4 2024 FY 2024 Net cash provided by (used in) operating activities (GAAP) $ (170) $ (132) Expenditures for property, plant and equipment (7) (30) Additions to capitalized software (32) (187) Restricted cash settlement activity 5 10 NCR Atleos settlement activity 3 (3) Cash taxes paid for the Digital Banking sale 20 20 Pension contributions 5 12 Collections on purchased trade receivables 205 212 Cash activity related to environmental discontinued operations 16 20 Adjusted free cash flow-unrestricted (non-GAAP) $ 45 $ (78) Restructuring costs 27 215 Adjusted free cash flow-unrestricted before restructuring costs (non-GAAP) $ 72 $ 137

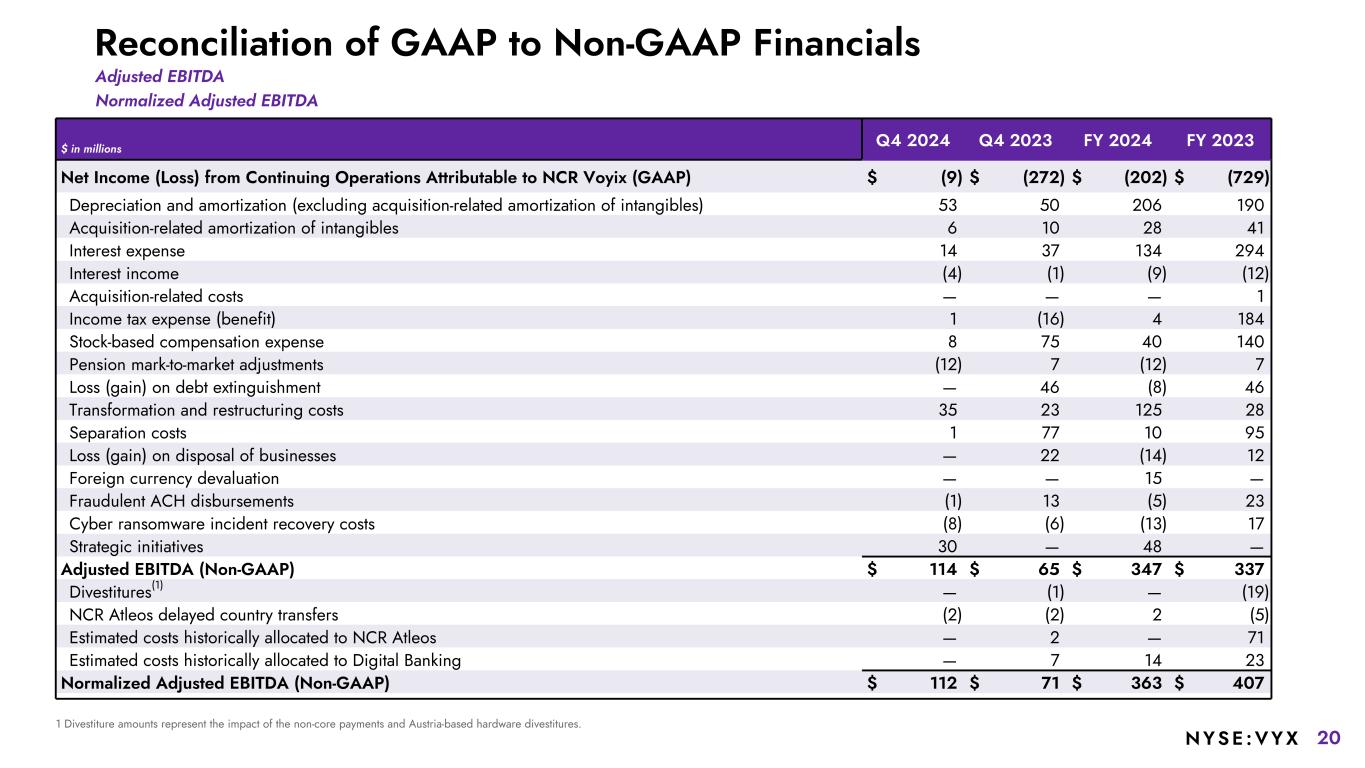

20NYSE :VYX Reconciliation of GAAP to Non-GAAP Financials $ in millions Q4 2024 Q4 2023 FY 2024 FY 2023 Net Income (Loss) from Continuing Operations Attributable to NCR Voyix (GAAP) $ (9) $ (272) $ (202) $ (729) Depreciation and amortization (excluding acquisition-related amortization of intangibles) 53 50 206 190 Acquisition-related amortization of intangibles 6 10 28 41 Interest expense 14 37 134 294 Interest income (4) (1) (9) (12) Acquisition-related costs — — — 1 Income tax expense (benefit) 1 (16) 4 184 Stock-based compensation expense 8 75 40 140 Pension mark-to-market adjustments (12) 7 (12) 7 Loss (gain) on debt extinguishment — 46 (8) 46 Transformation and restructuring costs 35 23 125 28 Separation costs 1 77 10 95 Loss (gain) on disposal of businesses — 22 (14) 12 Foreign currency devaluation — — 15 — Fraudulent ACH disbursements (1) 13 (5) 23 Cyber ransomware incident recovery costs (8) (6) (13) 17 Strategic initiatives 30 — 48 — Adjusted EBITDA (Non-GAAP) $ 114 $ 65 $ 347 $ 337 Divestitures(1) — (1) — (19) NCR Atleos delayed country transfers (2) (2) 2 (5) Estimated costs historically allocated to NCR Atleos — 2 — 71 Estimated costs historically allocated to Digital Banking — 7 14 23 Normalized Adjusted EBITDA (Non-GAAP) $ 112 $ 71 $ 363 $ 407 1 Divestiture amounts represent the impact of the non-core payments and Austria-based hardware divestitures. Adjusted EBITDA Normalized Adjusted EBITDA

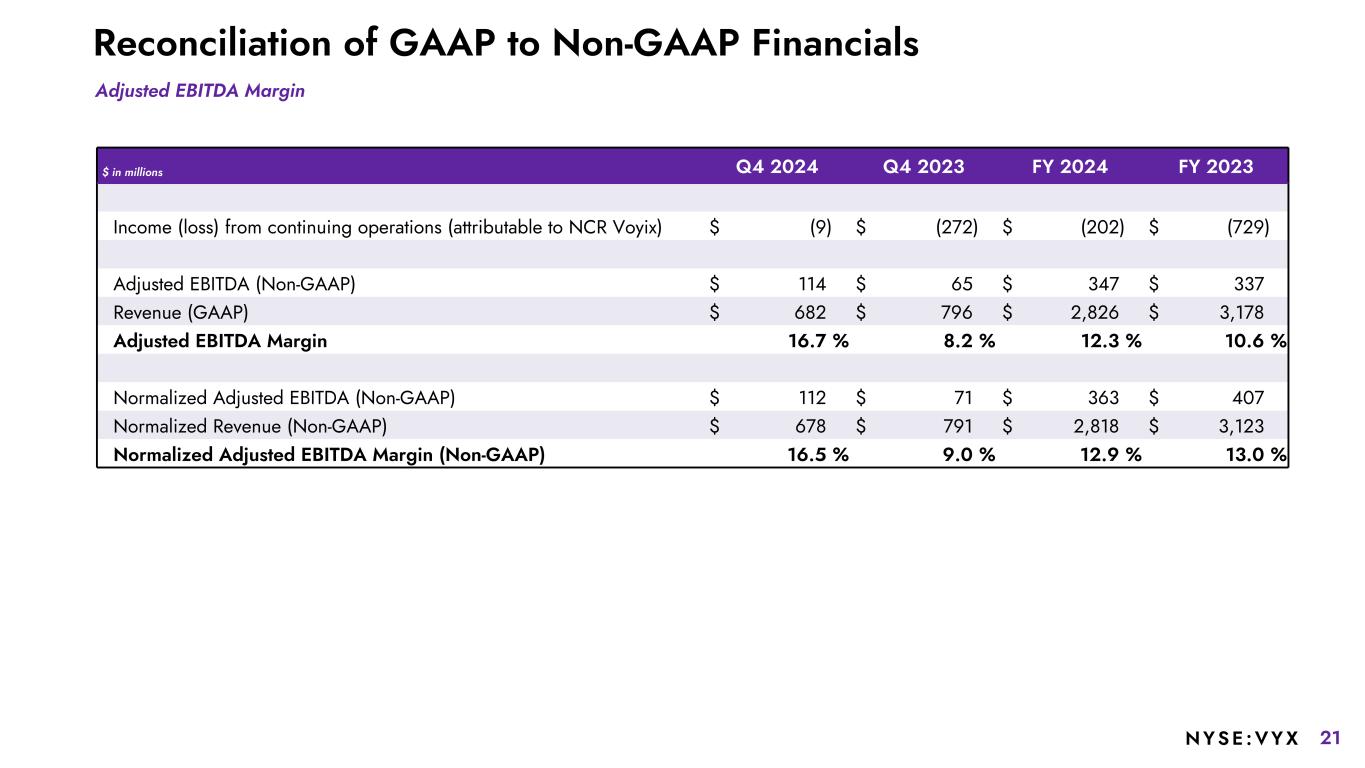

21NYSE :VYX Reconciliation of GAAP to Non-GAAP Financials $ in millions Q4 2024 Q4 2023 FY 2024 FY 2023 Income (loss) from continuing operations (attributable to NCR Voyix) $ (9) $ (272) $ (202) $ (729) Adjusted EBITDA (Non-GAAP) $ 114 $ 65 $ 347 $ 337 Revenue (GAAP) $ 682 $ 796 $ 2,826 $ 3,178 Adjusted EBITDA Margin 16.7 % 8.2 % 12.3 % 10.6 % Normalized Adjusted EBITDA (Non-GAAP) $ 112 $ 71 $ 363 $ 407 Normalized Revenue (Non-GAAP) $ 678 $ 791 $ 2,818 $ 3,123 Normalized Adjusted EBITDA Margin (Non-GAAP) 16.5 % 9.0 % 12.9 % 13.0 % Adjusted EBITDA Margin

22NYSE :VYX Reconciliation of GAAP to Non-GAAP Financials $ in millions (except EPS) Q4 2024 Q4 2024 Non-GAAP2 FY 2024 FY 2024 Non-GAAP2 Income (loss) from continuing operations attributable to NCR Voyix common stockholders Income (loss) from continuing operations (attributable to NCR Voyix) $ (9) $ 36 $ (202) $ (21) Dividends on convertible preferred shares (3) — (15) — Income (loss) from continuing operations attributable to NCR Voyix common stockholders $ (12) $ 36 $ (217) $ (21) Weighted average outstanding shares: Weighted average diluted shares outstanding 144.9 147.6 144.7 147.5 Weighted as-if converted preferred shares — 15.9 — 15.9 Total shares used in diluted earnings per share 144.9 163.5 144.7 163.4 Diluted earnings per share from continuing operations(1) $ (0.08) $ 0.22 $ (1.50) $ (0.13) 1 GAAP EPS is determined using the most dilutive measure, either including the impact of the dividends or deemed dividends on NCR Voyix's Series A Convertible Preferred Shares in the calculation of net income or loss available to common stockholders or including the impact of the conversion of such preferred stock into common stock in the calculation of the weighted average diluted shares outstanding. Non-GAAP diluted EPS is always determined using the as-if converted preferred shares and shares that would be issued for stock compensation awards. Therefore, GAAP diluted EPS and non-GAAP diluted EPS may be calculated using different methods, and may not mathematically reconcile. 2 Refer to slide 23 for a reconciliation of 2024 Non-GAAP Income (loss) from continuing operations (attributable to NCR Voyix).

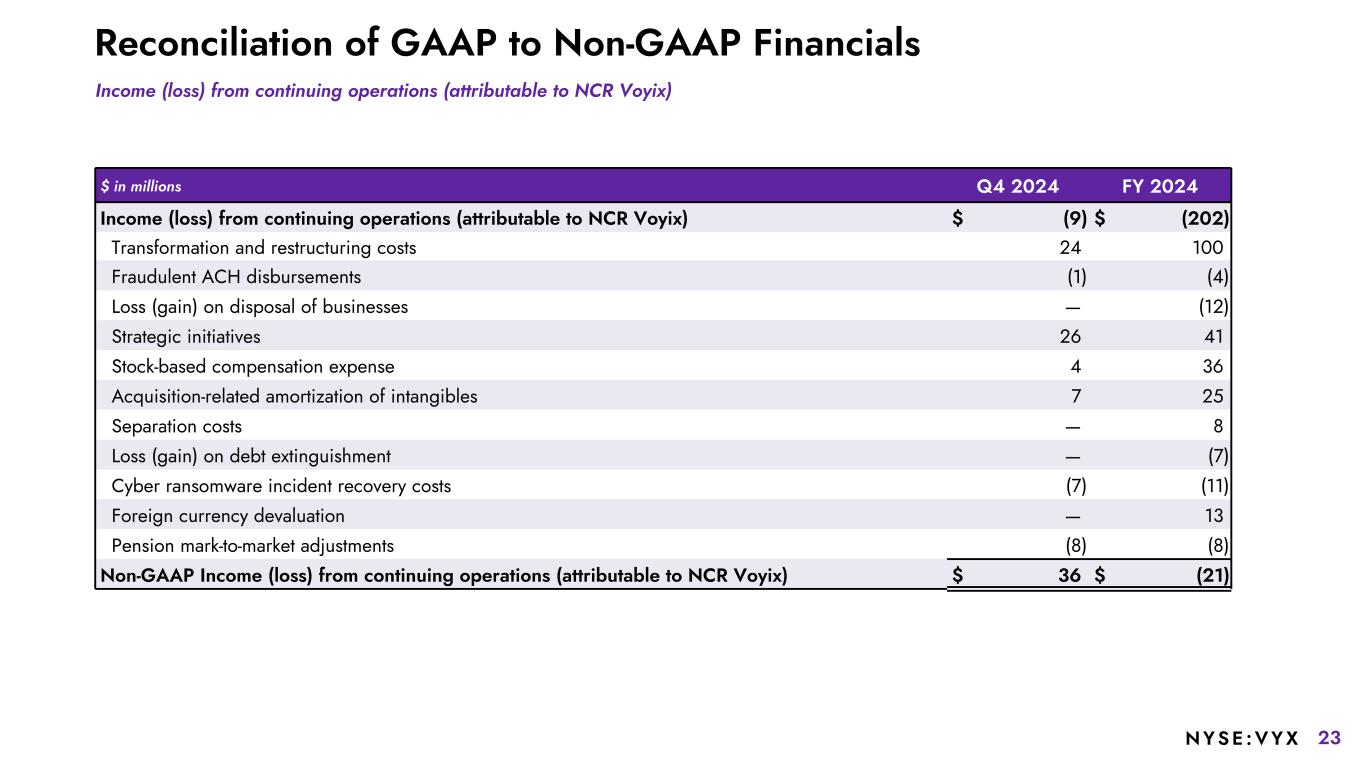

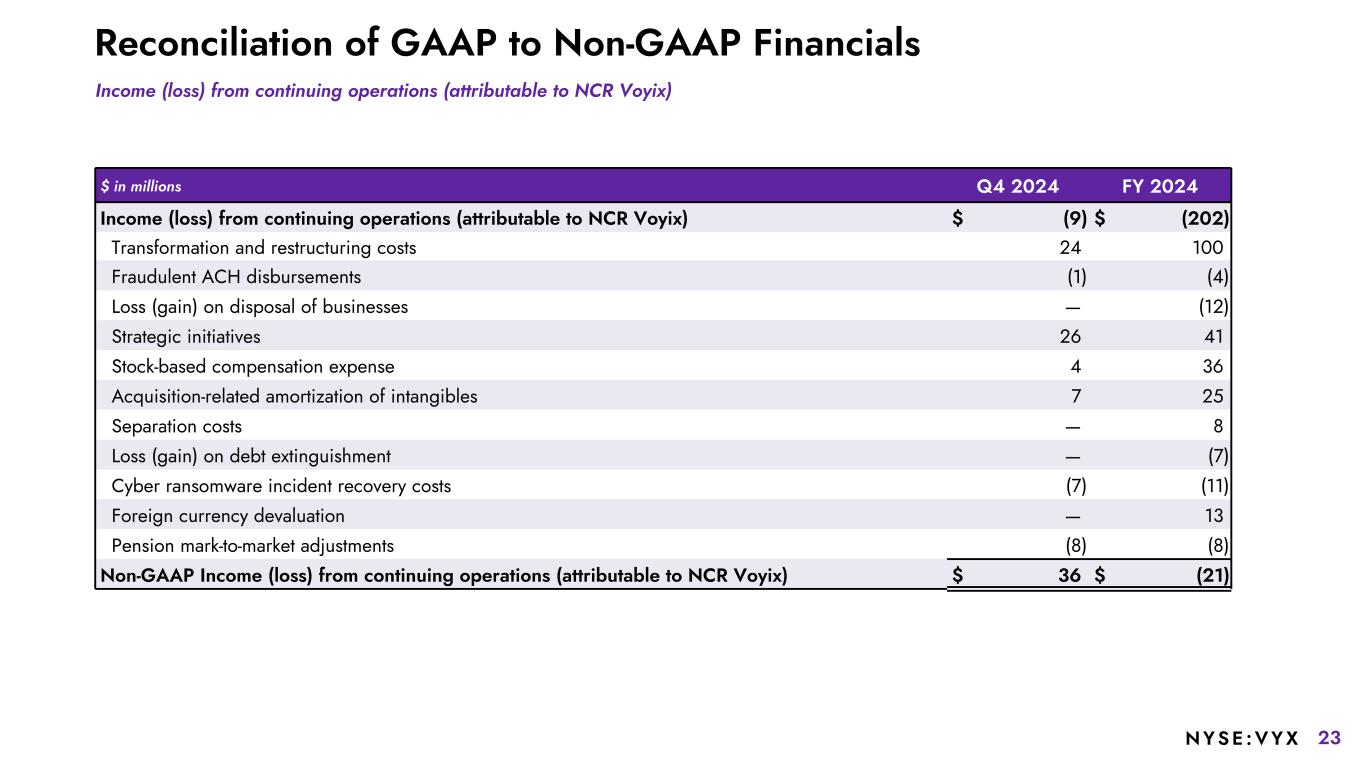

23NYSE :VYX Reconciliation of GAAP to Non-GAAP Financials Income (loss) from continuing operations (attributable to NCR Voyix) $ in millions Q4 2024 FY 2024 Income (loss) from continuing operations (attributable to NCR Voyix) $ (9) $ (202) Transformation and restructuring costs 24 100 Fraudulent ACH disbursements (1) (4) Loss (gain) on disposal of businesses — (12) Strategic initiatives 26 41 Stock-based compensation expense 4 36 Acquisition-related amortization of intangibles 7 25 Separation costs — 8 Loss (gain) on debt extinguishment — (7) Cyber ransomware incident recovery costs (7) (11) Foreign currency devaluation — 13 Pension mark-to-market adjustments (8) (8) Non-GAAP Income (loss) from continuing operations (attributable to NCR Voyix) $ 36 $ (21)

24NYSE :VYX Reconciliation of GAAP to Non-GAAP Financials Adjusted Net Debt $ in millions December 31, 2024 Total Debt $ 1,105 Available Cash Cash and cash equivalents $724 Estimated cash taxes to be paid for Digital Banking Sale (300) Available Cash $424 Adjusted Net Debt $681

25NYSE :VYX $ in millions FY 2024 Adj. EBITDA $347 NCR Atleos delayed country transfers 2 Estimated costs historically allocated to Digital Banking 14 Normalized Adj. EBITDA $363 Hardware ODM (14) Run-rate savings: Payroll costs 35 A/R Facility2 15 Vendor costs 20 Pro Forma Adj. EBITDA $419 $ in Millions 1 Pro Forma 2024 information gives effect to the divestiture of the Digital Banking business and the application of the proceeds from the sale to pay down outstanding indebtedness, the ongoing expense reduction actions and the transition of the Company's hardware business to an ODM model, as if all such transactions and actions had occurred on 1/1/2024. 2 Amount reflects the annual fees incurred on the Company's trade receivables facility. Reconciliation of Pro Forma Adjusted EBITDA Pro Forma 2024 Adjusted EBITDA1