The Power to Deliver Solutions Around the world, leading enterprises rely on Cass for our vertical expertise, processing power, and global payment network to execute critical financial transactions while driving greater control and efficiency across critical business expenses. Q1 2023 INVESTOR PRESENTATION

Forward-Looking Statements Cass at a Glance Financial Performance Revenue & Expenses Balance Sheet Capital ESG Highlights Leadership and Shareholder Information TABLE OF CONTENTS 2 3 4 6 10 15 21 22 www.cassinfo.com / © 2023 Cass Information Systems 23

This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements contain words such as “anticipate,” “believe,” “can,” “would,” “should,” “could,” “may,” “predict,” “seek,” “potential,” “will,” “estimate,” “target,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “intend” or similar expressions that relate to the Company’s strategy, plans or intentions. Forward-looking statements involve certain important risks, uncertainties, and other factors, any of which could cause actual results to differ materially from those in such statements. Such factors include, without limitation, the “Risk Factors” referenced in our most recent Form 10-K filed with the Securities and Exchange Commission (SEC), other risks and uncertainties listed from time to time in our reports and documents filed with the SEC, and the following factors: ability to execute our business strategy; business and economic conditions; effects of a prolonged government shutdown; economic, market, operational, liquidity, credit and interest rate risks associated with the Company’s business; effects of any changes in trade, monetary and fiscal policies and laws; changes imposed by regulatory agencies to increase capital standards; effects of inflation, as well as, interest rate, securities market and monetary supply fluctuations; changes in the economy or supply-demand imbalances affecting local real estate values; changes in consumer and business spending; the Company's ability to realize anticipated benefits from enhancements or updates to its core operating systems from time to time without significant change in client service or risk to the Company's control environment; the Company's dependence on information technology and telecommunications systems of third-party service providers and the risk of systems failures, interruptions or breaches of security; the Company’s ability to achieve organic fee income, loan and deposit growth and the composition of such growth; changes in sources and uses of funds; increased competition in the payments and banking industries; the effect of changes in accounting policies and practices; the share price of the Company’s stock; the Company's ability to realize deferred tax assets or the need for a valuation allowance; ability to maintain or increase market share and control expenses; costs and effects of changes in laws and regulations and of other legal and regulatory developments; technological changes; the timely development and acceptance of new products and services; the Company’s continued ability to attract, hire and maintain qualified personnel; ability to implement and/or improve operational management and other internal risk controls and processes and reporting system and procedures; regulatory limitations on dividends from the Company's bank subsidiary; changes in estimates of future loan reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; widespread natural and other disasters, pandemics, dislocations, political instability, acts of war or terrorist activities, cyberattacks or international hostilities; impact of reputational risk; and success at managing the risks involved in the foregoing items. The Company can give no assurance that any goal or plan or expectation set forth in forward-looking statements can be achieved, and readers are cautioned not to place undue reliance on such statements. The forward-looking statements are made as of the date of original publication of this presentation, and the Company does not intend, and assumes no obligation, to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law. This presentation is a high-level summary of our recent and historical financial results and current business developments. For more detailed information, please refer to our press releases and filings with the SEC. FORWARD LOOKING STATEMENTS 3www.cassinfo.com / © 2023 Cass Information Systems

4www.cassinfo.com / © 2023 Cass Information Systems CASS AT A GLANCE

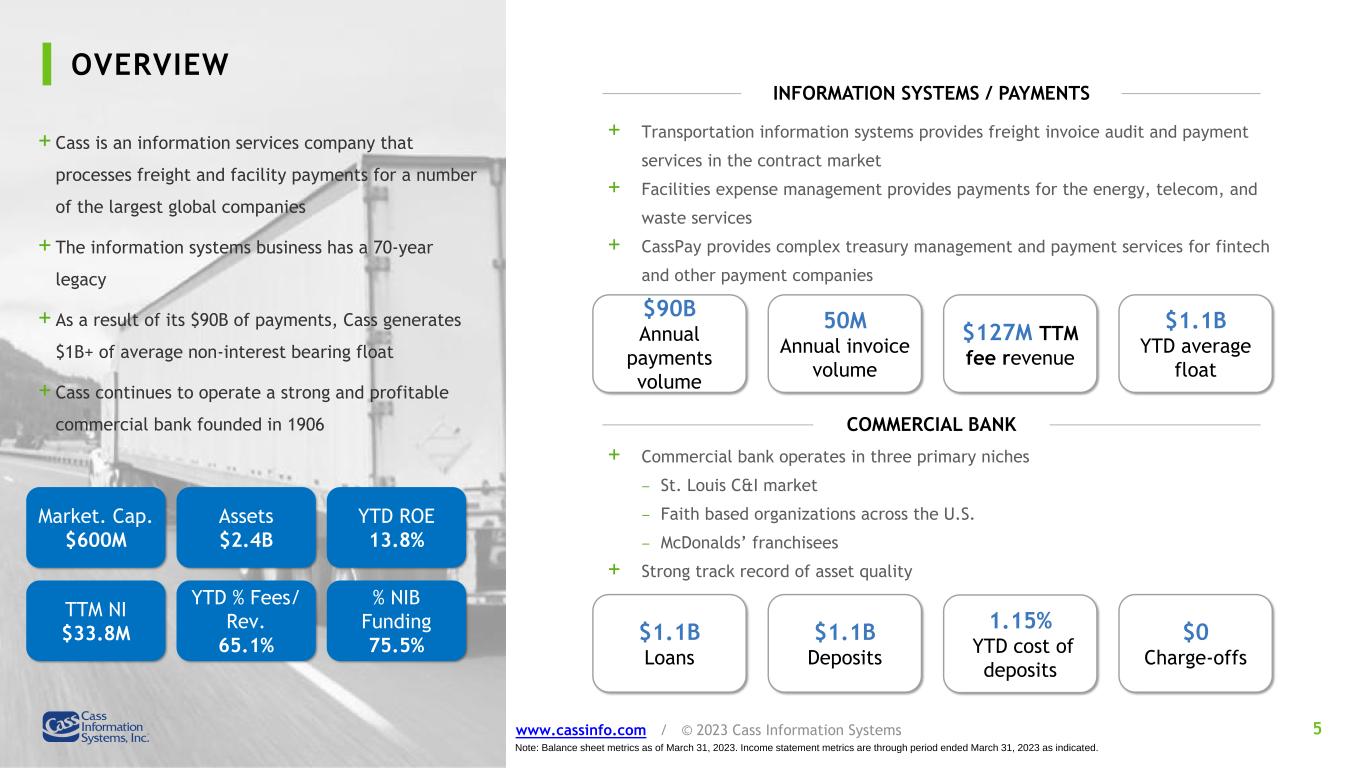

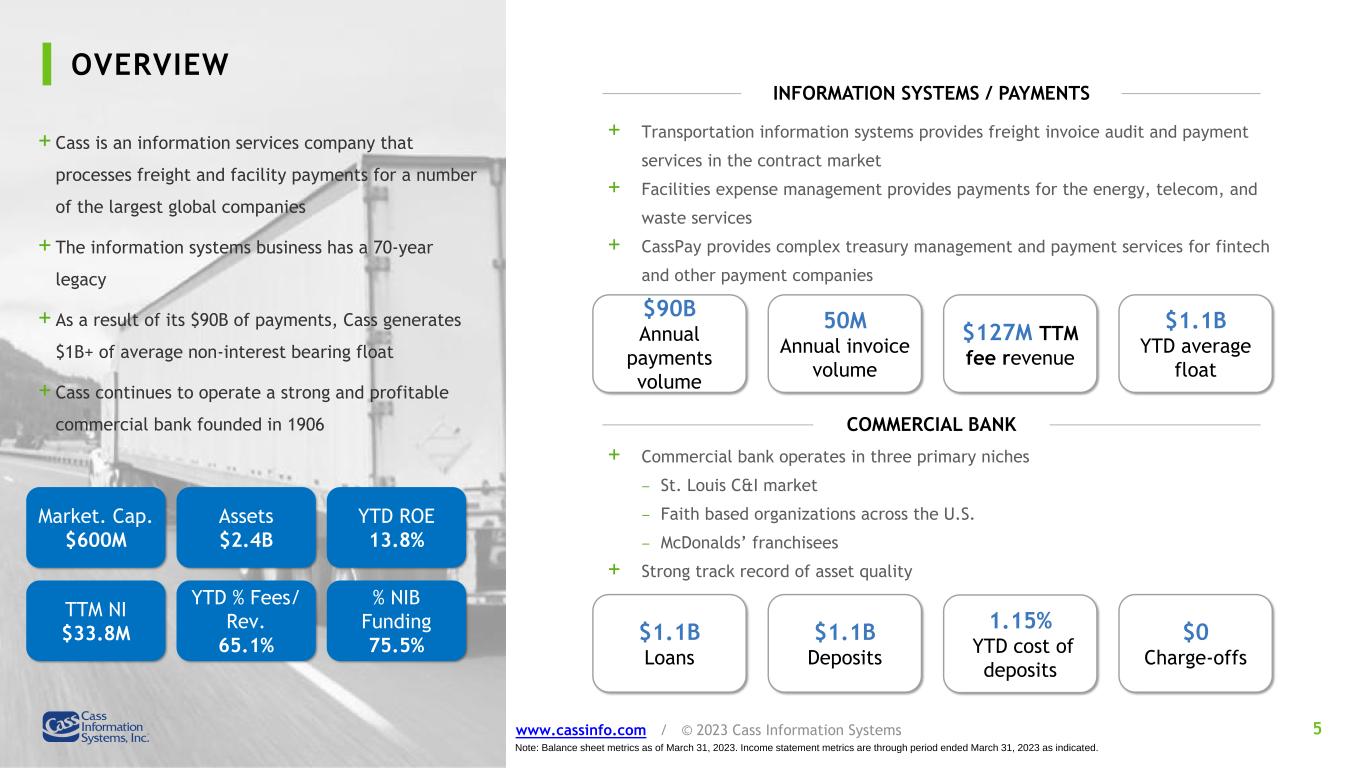

+ Cass is an information services company that processes freight and facility payments for a number of the largest global companies + The information systems business has a 70-year legacy + As a result of its $90B of payments, Cass generates $1B+ of average non-interest bearing float + Cass continues to operate a strong and profitable commercial bank founded in 1906 Note: Balance sheet metrics as of March 31, 2023. Income statement metrics are through period ended March 31, 2023 as indicated. Market. Cap. $600M Assets $2.4B YTD ROE 13.8% TTM NI $33.8M YTD % Fees/ Rev. 65.1% % NIB Funding 75.5% INFORMATION SYSTEMS / PAYMENTS + Transportation information systems provides freight invoice audit and payment services in the contract market + Facilities expense management provides payments for the energy, telecom, and waste services + CassPay provides complex treasury management and payment services for fintech and other payment companies COMMERCIAL BANK + Commercial bank operates in three primary niches ‒ St. Louis C&I market ‒ Faith based organizations across the U.S. ‒ McDonalds’ franchisees + Strong track record of asset quality $90B Annual payments volume 50M Annual invoice volume $127M TTM fee revenue $1.1B YTD average float $1.1B Loans $1.1B Deposits 1.15% YTD cost of deposits $0 Charge-offs OVERVIEW 5www.cassinfo.com / © 2023 Cass Information Systems

6www.cassinfo.com / © 2023 Cass Information Systems FINANCIAL PERFORMANCE

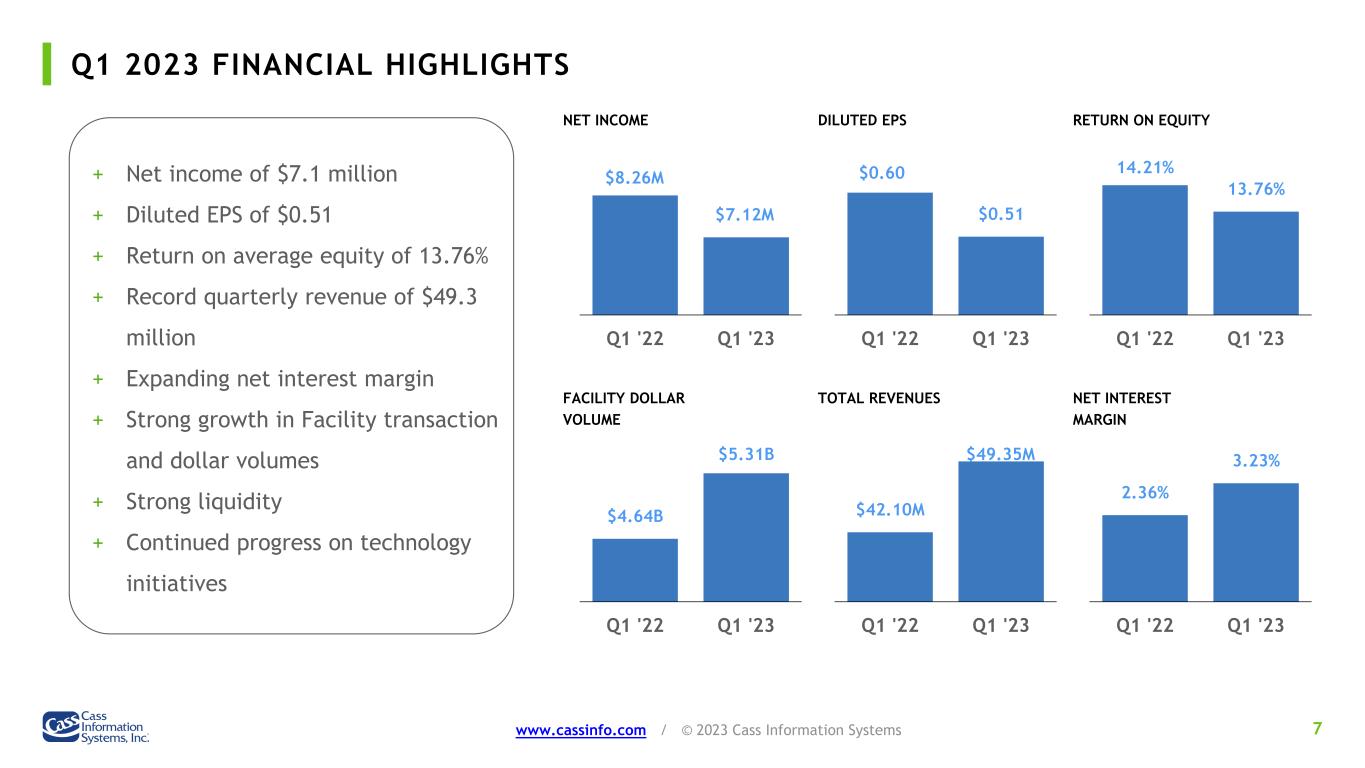

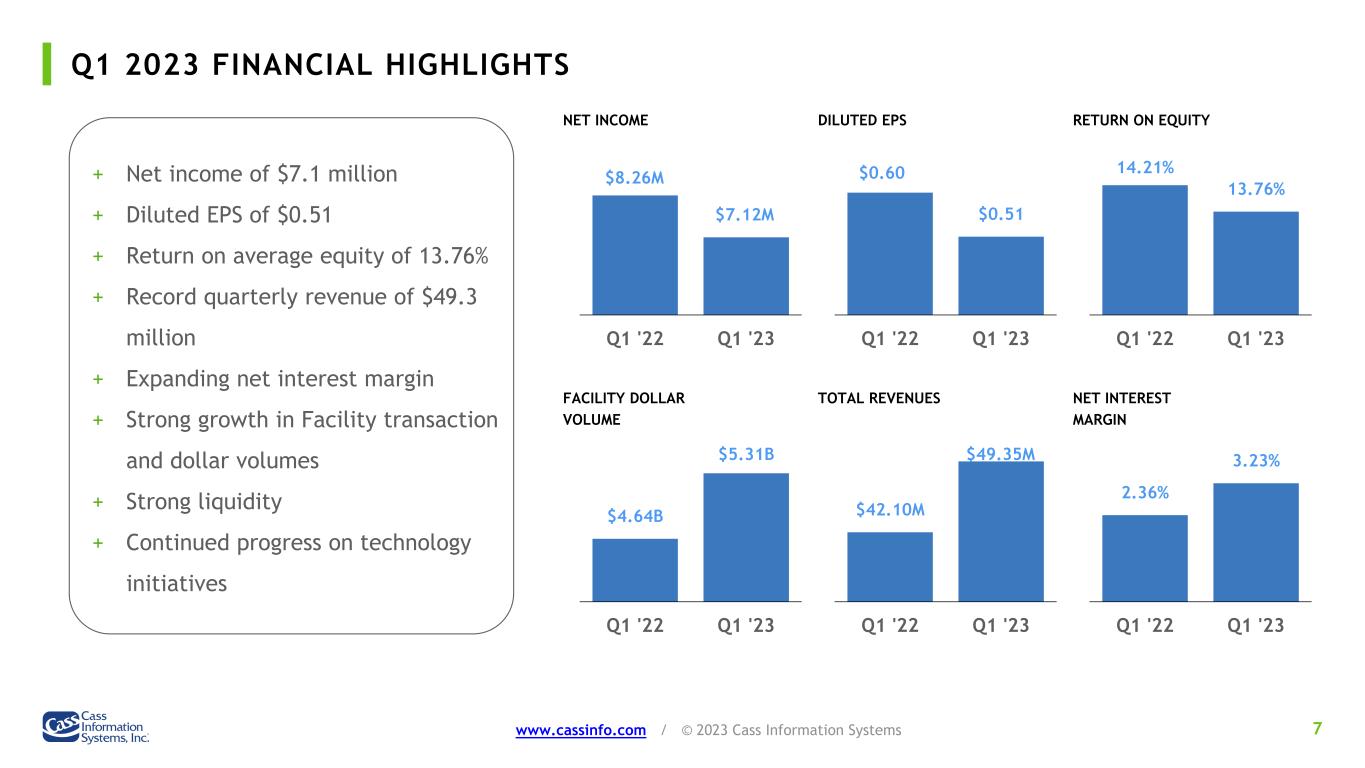

Q1 2023 FINANCIAL HIGHLIGHTS 7www.cassinfo.com / © 2023 Cass Information Systems $8.26M $7.12M Q1 '22 Q1 '23 $0.60 $0.51 Q1 '22 Q1 '23 14.21% 13.76% Q1 '22 Q1 '23 NET INCOME DILUTED EPS RETURN ON EQUITY + Net income of $7.1 million + Diluted EPS of $0.51 + Return on average equity of 13.76% + Record quarterly revenue of $49.3 million + Expanding net interest margin + Strong growth in Facility transaction and dollar volumes + Strong liquidity + Continued progress on technology initiatives $4.64B $5.31B Q1 '22 Q1 '23 $42.10M $49.35M Q1 '22 Q1 '23 FACILITY DOLLAR VOLUME TOTAL REVENUES 2.36% 3.23% Q1 '22 Q1 '23 NET INTEREST MARGIN

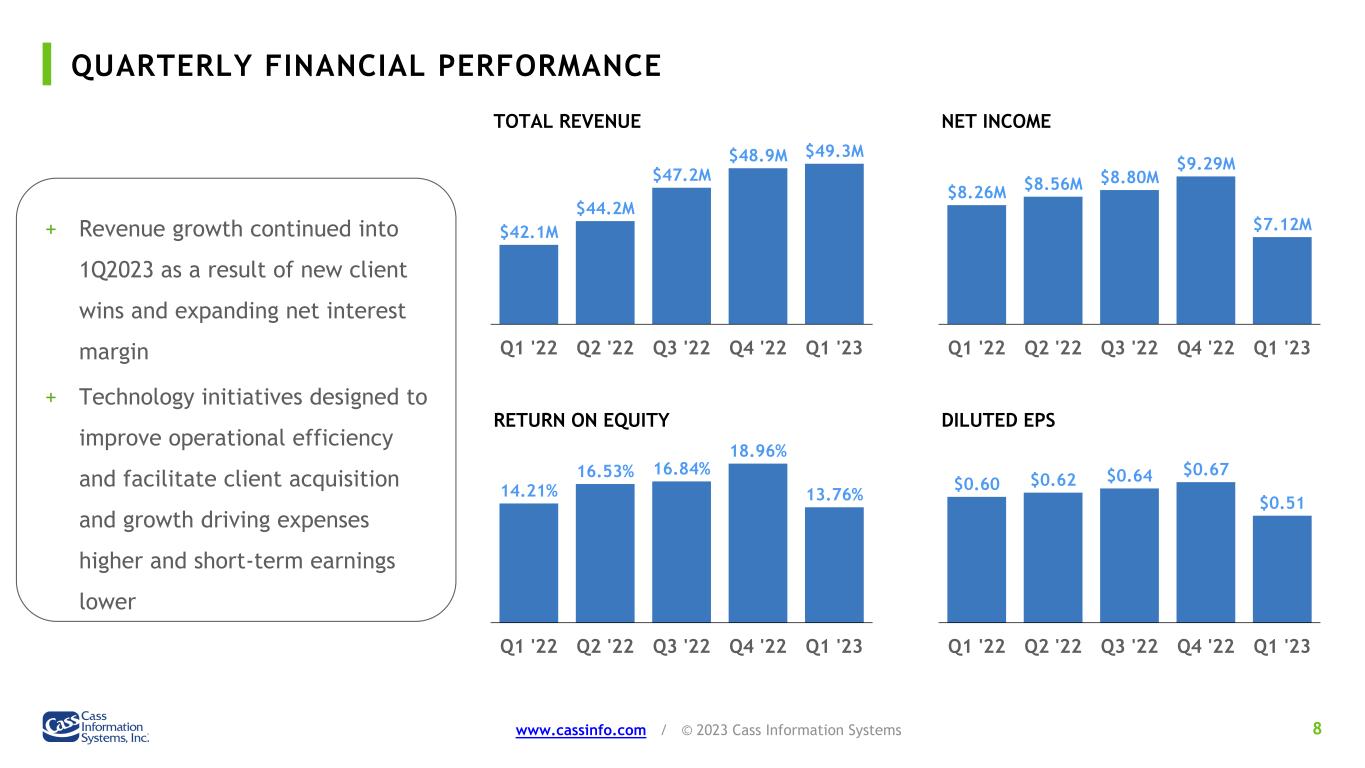

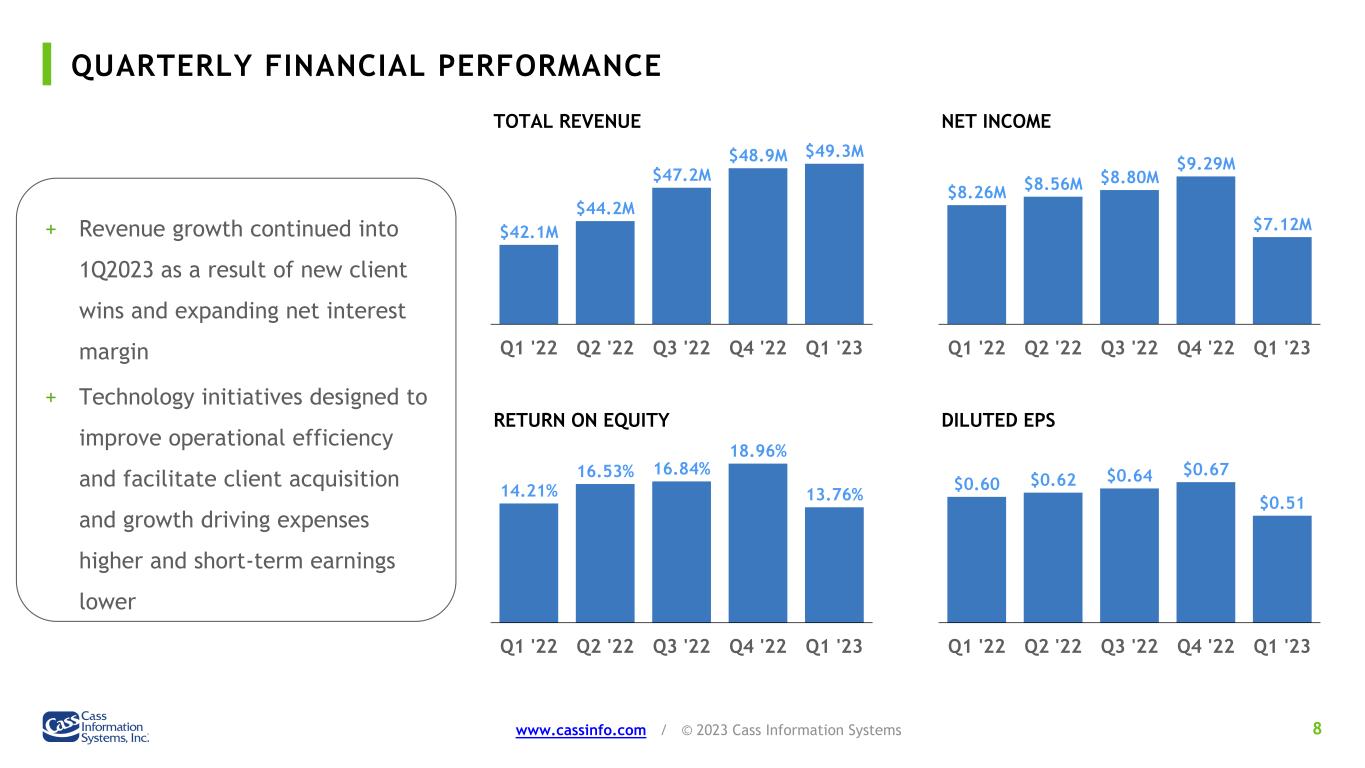

QUARTERLY FINANCIAL PERFORMANCE 8www.cassinfo.com / © 2023 Cass Information Systems $42.1M $44.2M $47.2M $48.9M $49.3M Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 $8.26M $8.56M $8.80M $9.29M $7.12M Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 14.21% 16.53% 16.84% 18.96% 13.76% Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 $0.60 $0.62 $0.64 $0.67 $0.51 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 TOTAL REVENUE NET INCOME RETURN ON EQUITY DILUTED EPS + Revenue growth continued into 1Q2023 as a result of new client wins and expanding net interest margin + Technology initiatives designed to improve operational efficiency and facilitate client acquisition and growth driving expenses higher and short-term earnings lower

TECHNOLOGY INVESTMENT UPDATE 9www.cassinfo.com / © 2023 Cass Information Systems + The Company has moved into production multiple technology projects involving automated invoice retrieval, automated extraction of data, general ledger mapping platform, and improving the transportation rating engine for clients. + The Company believes the successful roll out to enterprise-wide use of these initiatives will lead to improved revenue growth as a result of faster client onboarding and solidification of its competitive advantages as well as improved operating leverage as a result of an anticipated reduction in the cost of processing invoices. + The Company believes it will begin experiencing improved profitability as a result of these initiatives beginning in late 2023.

10www.cassinfo.com / © 2023 Cass Information Systems REVENUE & EXPENSES

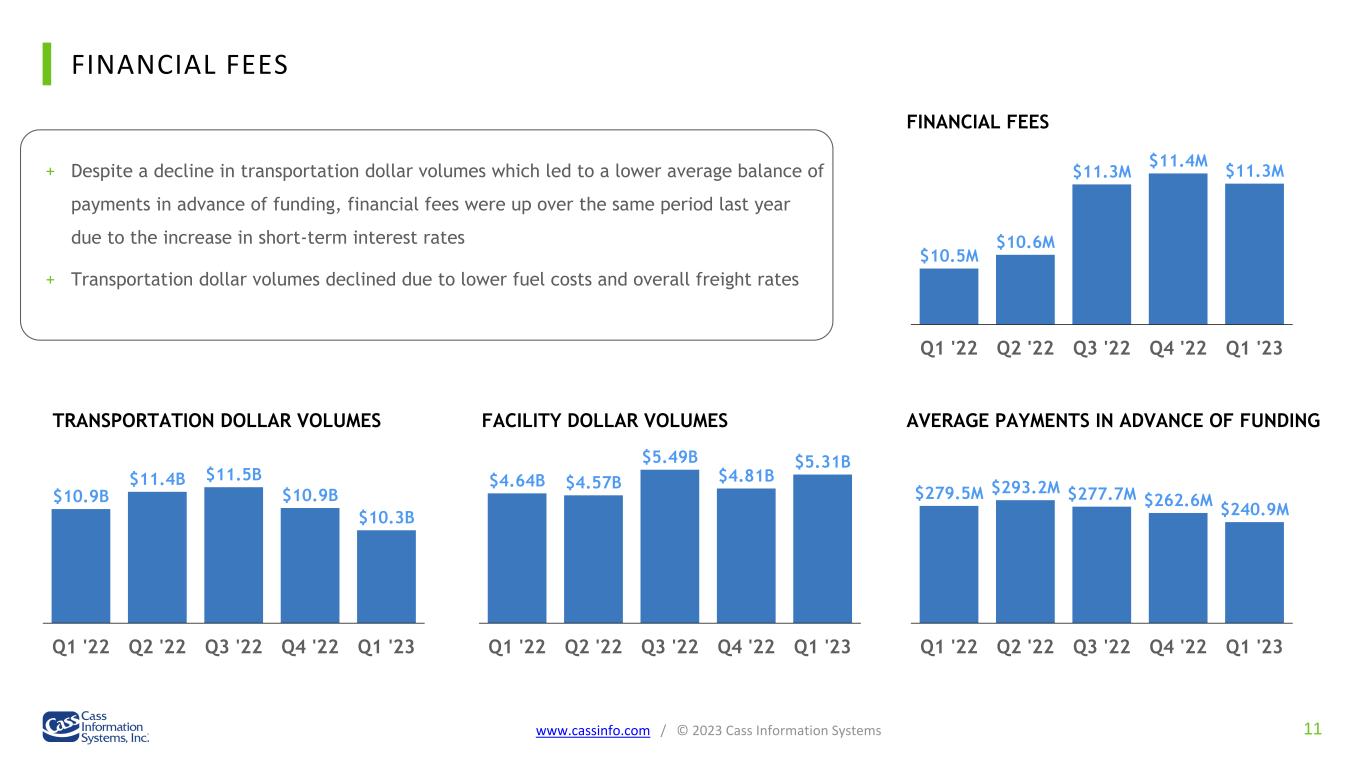

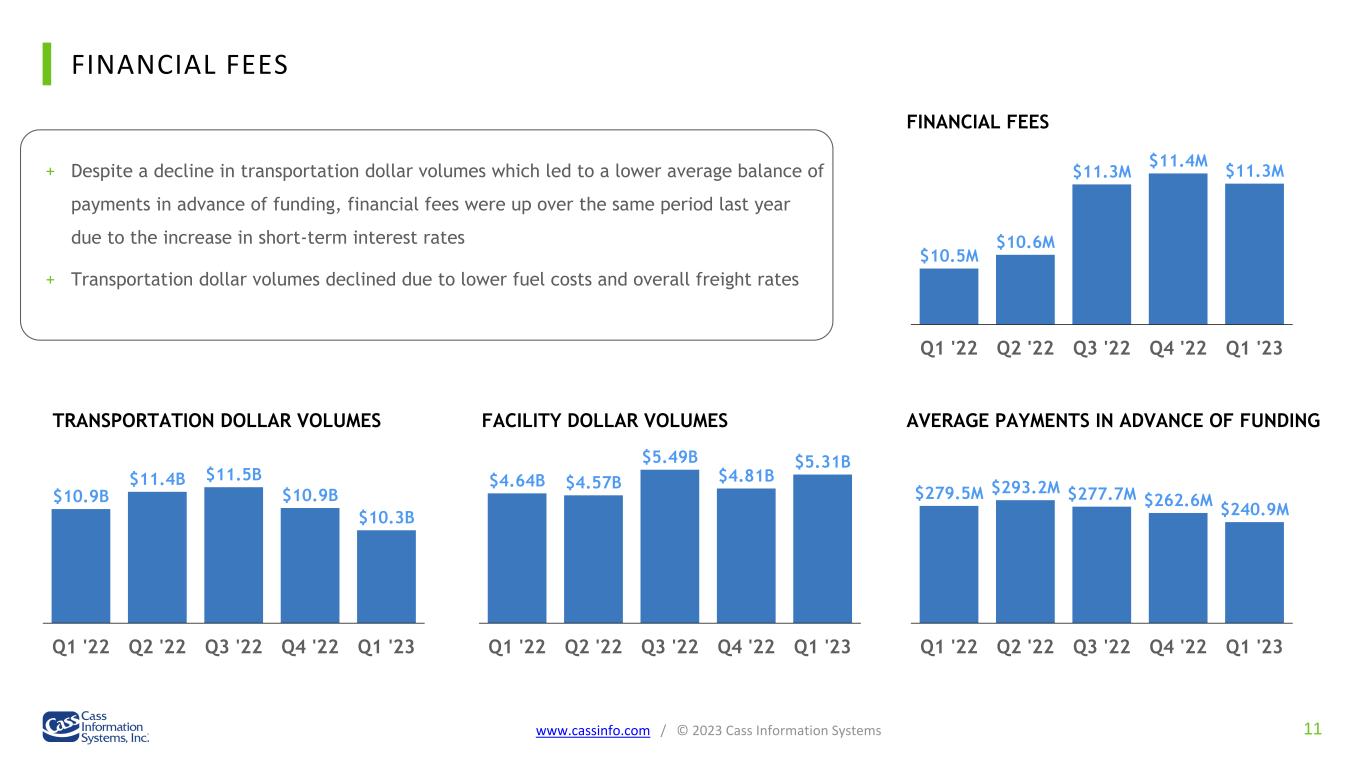

FINANCIAL FEES 11www.cassinfo.com / © 2023 Cass Information Systems + Despite a decline in transportation dollar volumes which led to a lower average balance of payments in advance of funding, financial fees were up over the same period last year due to the increase in short-term interest rates + Transportation dollar volumes declined due to lower fuel costs and overall freight rates $10.9B $11.4B $11.5B $10.9B $10.3B Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 $4.64B $4.57B $5.49B $4.81B $5.31B Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 $279.5M $293.2M $277.7M $262.6M $240.9M Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 TRANSPORTATION DOLLAR VOLUMES FACILITY DOLLAR VOLUMES AVERAGE PAYMENTS IN ADVANCE OF FUNDING $10.5M $10.6M $11.3M $11.4M $11.3M Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 FINANCIAL FEES

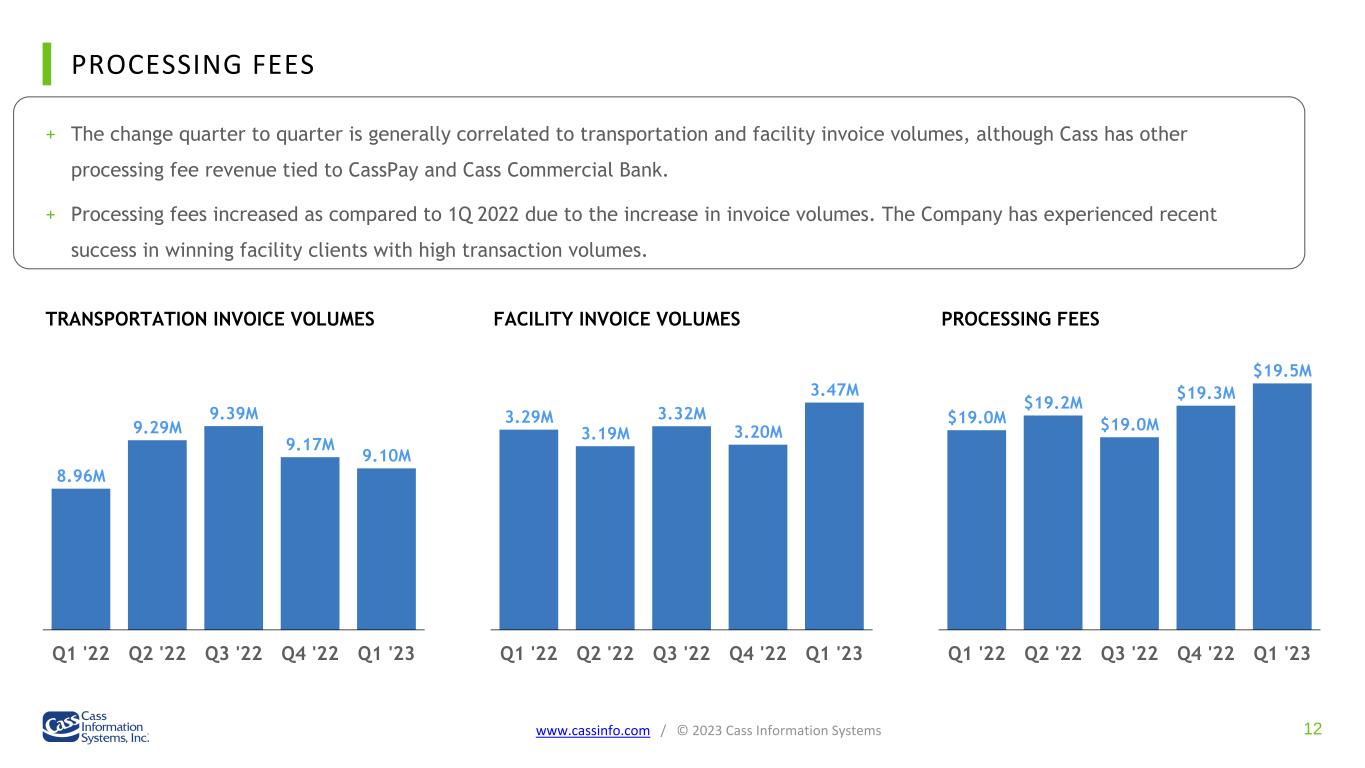

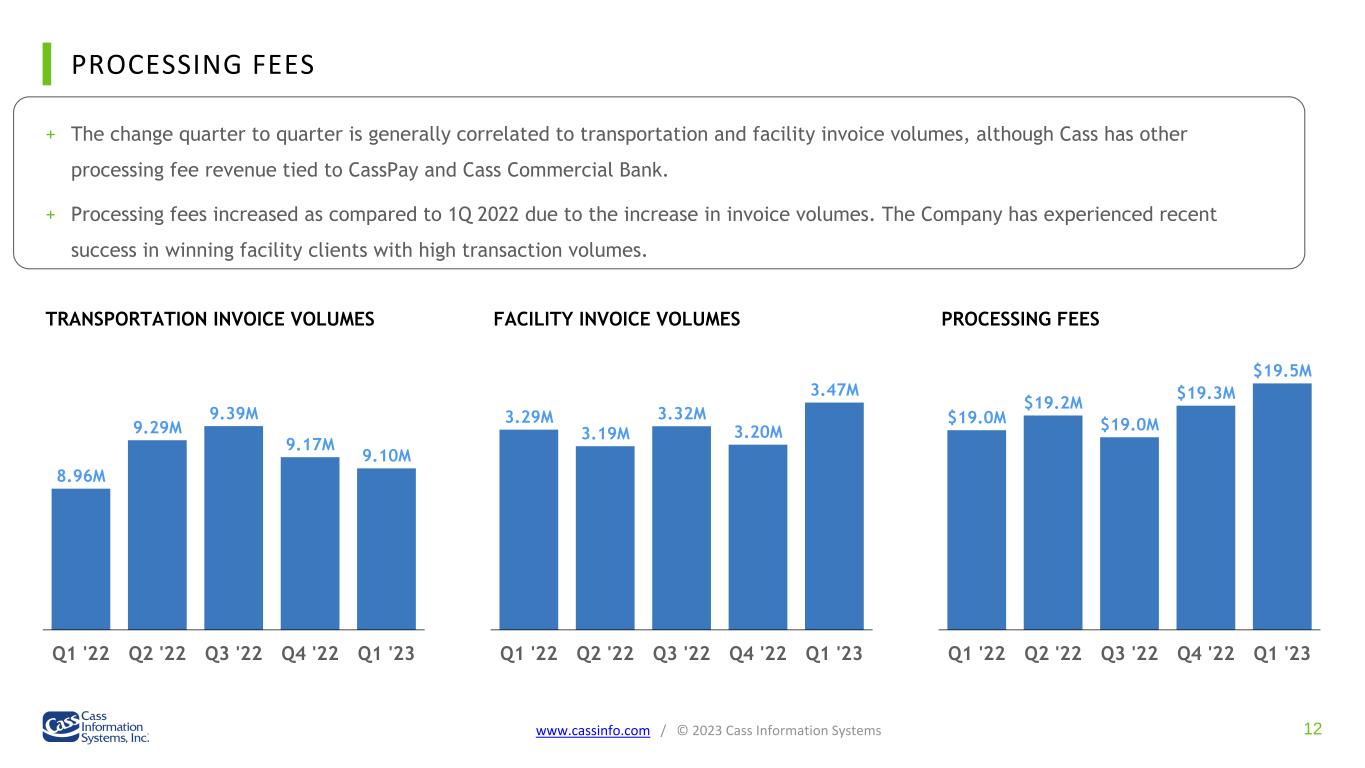

PROCESSING FEES 12www.cassinfo.com / © 2023 Cass Information Systems + The change quarter to quarter is generally correlated to transportation and facility invoice volumes, although Cass has other processing fee revenue tied to CassPay and Cass Commercial Bank. + Processing fees increased as compared to 1Q 2022 due to the increase in invoice volumes. The Company has experienced recent success in winning facility clients with high transaction volumes. 8.96M 9.29M 9.39M 9.17M 9.10M Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 3.29M 3.19M 3.32M 3.20M 3.47M Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 $19.0M $19.2M $19.0M $19.3M $19.5M Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 TRANSPORTATION INVOICE VOLUMES FACILITY INVOICE VOLUMES PROCESSING FEES

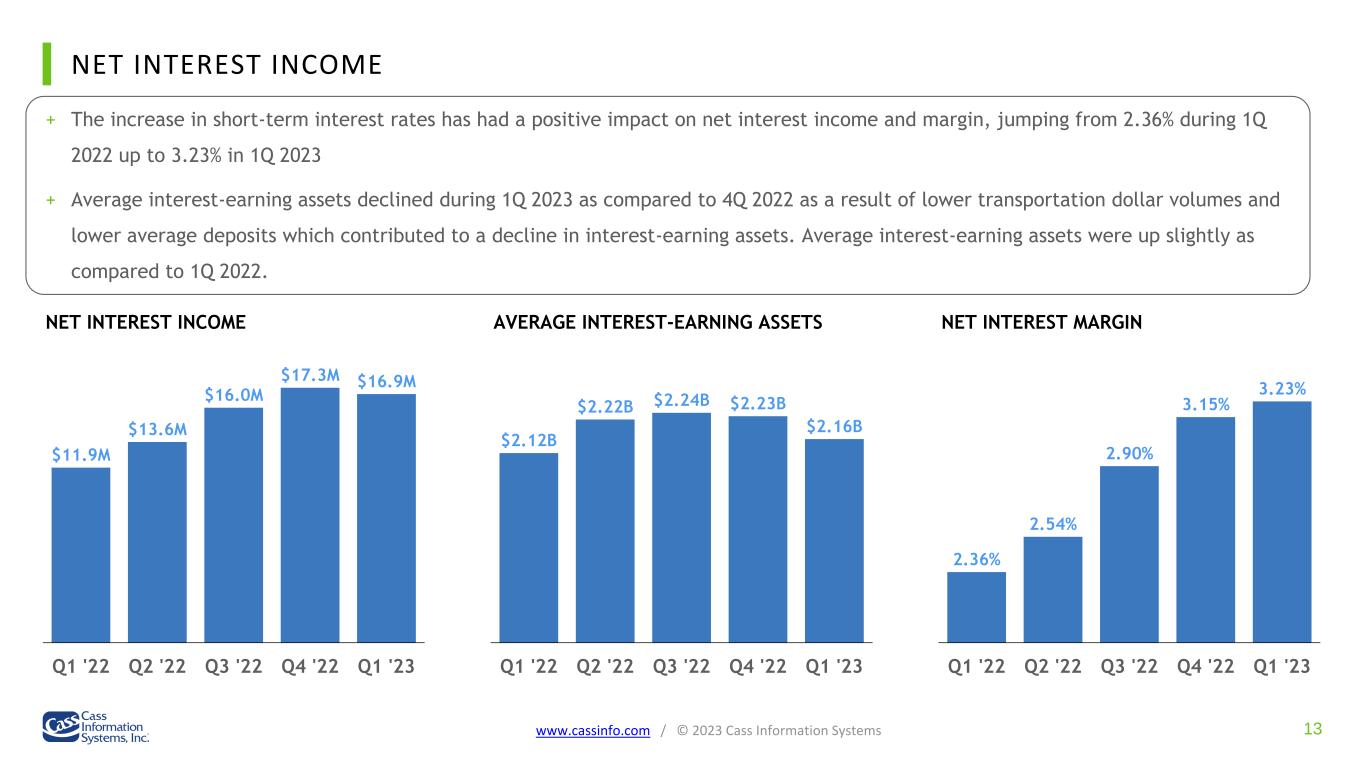

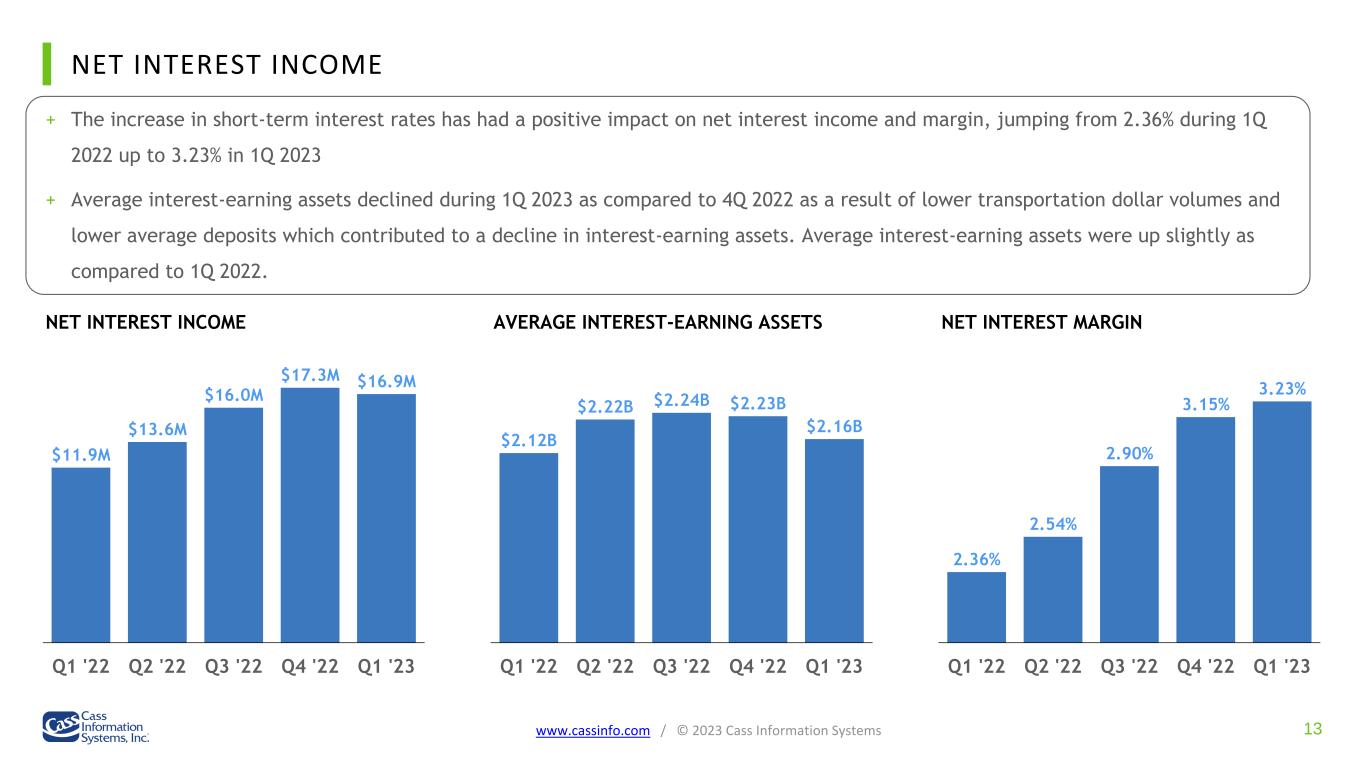

NET INTEREST INCOME 13www.cassinfo.com / © 2023 Cass Information Systems + The increase in short-term interest rates has had a positive impact on net interest income and margin, jumping from 2.36% during 1Q 2022 up to 3.23% in 1Q 2023 + Average interest-earning assets declined during 1Q 2023 as compared to 4Q 2022 as a result of lower transportation dollar volumes and lower average deposits which contributed to a decline in interest-earning assets. Average interest-earning assets were up slightly as compared to 1Q 2022. $11.9M $13.6M $16.0M $17.3M $16.9M Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 $2.12B $2.22B $2.24B $2.23B $2.16B Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 2.36% 2.54% 2.90% 3.15% 3.23% Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 NET INTEREST INCOME AVERAGE INTEREST-EARNING ASSETS NET INTEREST MARGIN

OPERATING EXPENSE 14www.cassinfo.com / © 2023 Cass Information Systems + Salaries and commissions as well as other benefits have increased due to average FTEs being up 13.2% as compared to 1Q 2022, primarily due to the Touchpoint acquisition and various technology initiatives. + Share-based compensation has increased due to executive succession matters. + Despite the pension plan being frozen resulting in no service cost, expense is up due to the accounting impact of the decline in plan assets during 2022. + Other operating expenses are also elevated as Cass invests in, and transitions to, improved technology which Cass anticipates will result in improved operating leverage beginning in late 2023. Expense 3/31/22 6/30/22 9/30/22 12/31/22 3/31/23 Salaries and commissions 19.6 20.9 22.0 23.0 22.6 Share-based compensation 1.3 1.8 1.3 2.3 2.0 Net periodic pension cost (benefit) (0.6) (0.6) (0.6) (0.6) 0.1 Other benefits 4.4 3.9 4.3 4.0 5.3 Total personnel expense 24.7 26.0 27.0 28.7 30.0 Occupancy expense 0.9 0.9 1.0 0.9 0.9 Equipment expense 1.7 1.7 1.6 1.7 2.1 Other expense 4.5 5.0 6.7 6.5 7.4 Total operating expense 31.8 33.6 36.3 37.8 40.4 ($$ in millions)

15www.cassinfo.com / © 2023 Cass Information Systems BALANCE SHEET

LOANS 16www.cassinfo.com / © 2023 Cass Information Systems + Cass experienced good organic loan growth in 2022, in particular its specialty franchise, faith-based and investment grade lease niches + Cass has not incurred a loan charge-off since 2015 Portfolio Composition 3/31/22 6/30/22 9/30/22 12/31/22 3/31/23 Franchise 198.2 189.0 230.9 223.3 223.7 Faith-Based 380.9 369.6 373.4 395.3 386.2 Leases 86.3 92.4 136.0 160.7 145.0 Other C&I 186.0 184.3 172.4 177.6 180.2 Other CRE 125.8 124.2 124.4 126.0 135.3 Ending Loans 977.2 959.5 1,037.1 1,082.9 1,070.4 Loan Yield 3.71% 3.75% 4.03% 4.37% 4.61% ACL/Loans 1.27% 1.31% 1.26% 1.25% 1.24% Net Charge-Offs — — — — — Non-Performing Loans/Loans — — — 0.11% — Franchise 21% Faith-Based 36% Leases 13% Commercial and Industrial 17% Commercial Real Estate 13% PORTFOLIO COMPOSITION 3/31/23 ($$ in millions)

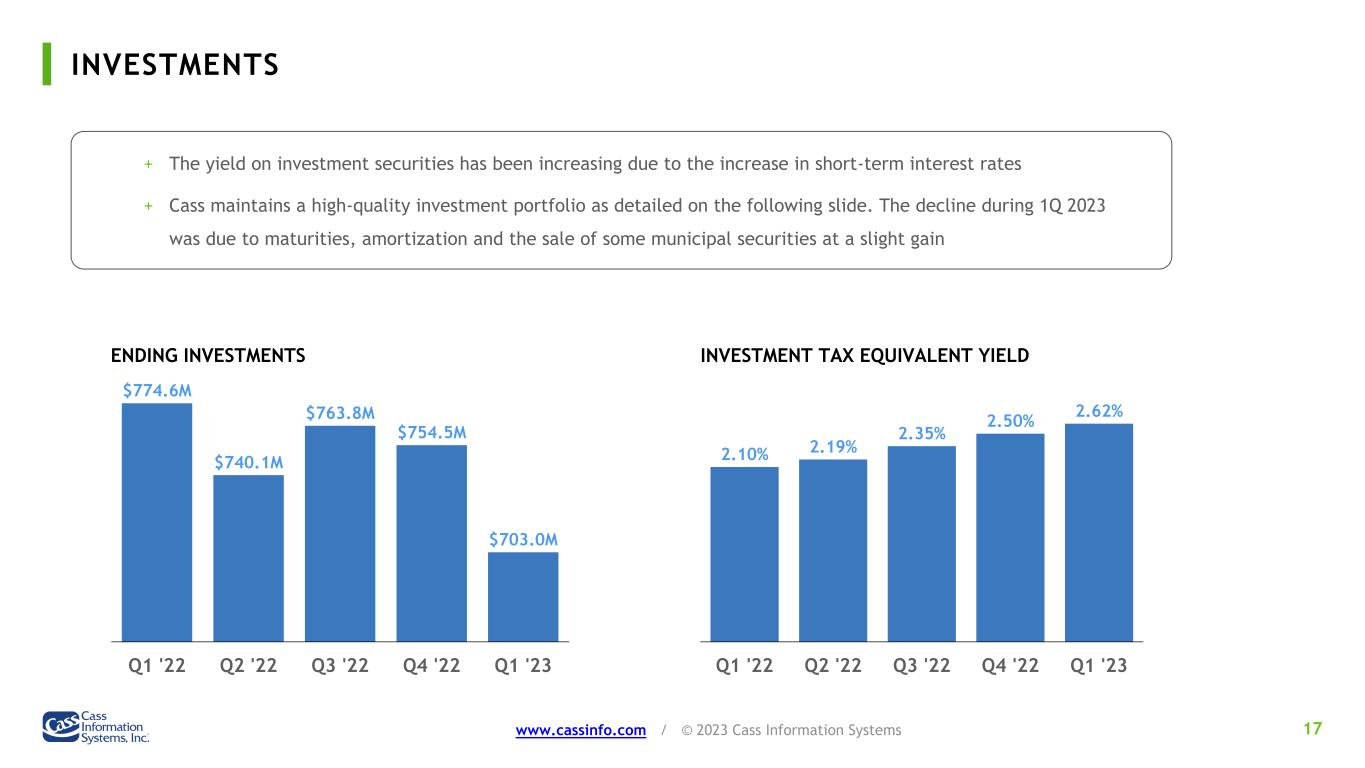

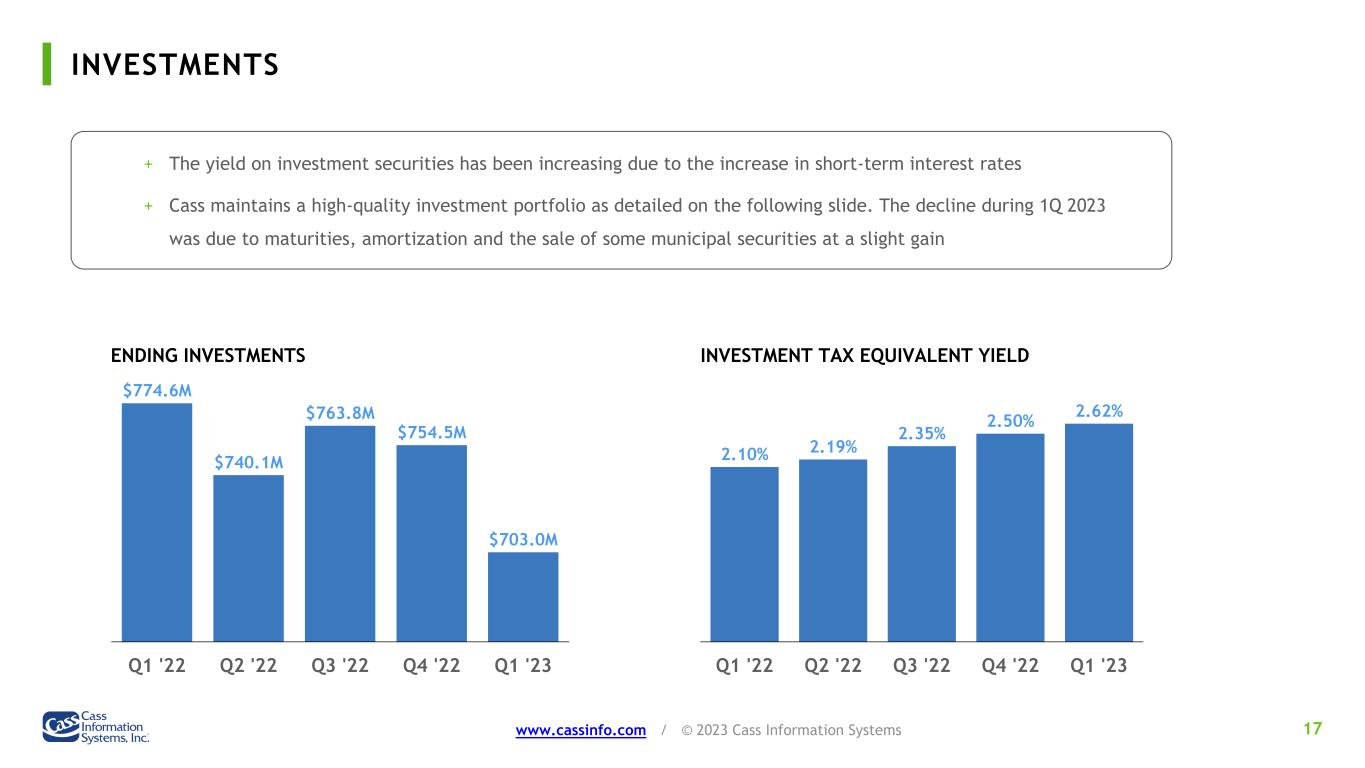

INVESTMENTS 17www.cassinfo.com / © 2023 Cass Information Systems + The yield on investment securities has been increasing due to the increase in short-term interest rates + Cass maintains a high-quality investment portfolio as detailed on the following slide. The decline during 1Q 2023 was due to maturities, amortization and the sale of some municipal securities at a slight gain $774.6M $740.1M $763.8M $754.5M $703.0M Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 ENDING INVESTMENTS INVESTMENT TAX EQUIVALENT YIELD 2.10% 2.19% 2.35% 2.50% 2.62% Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23

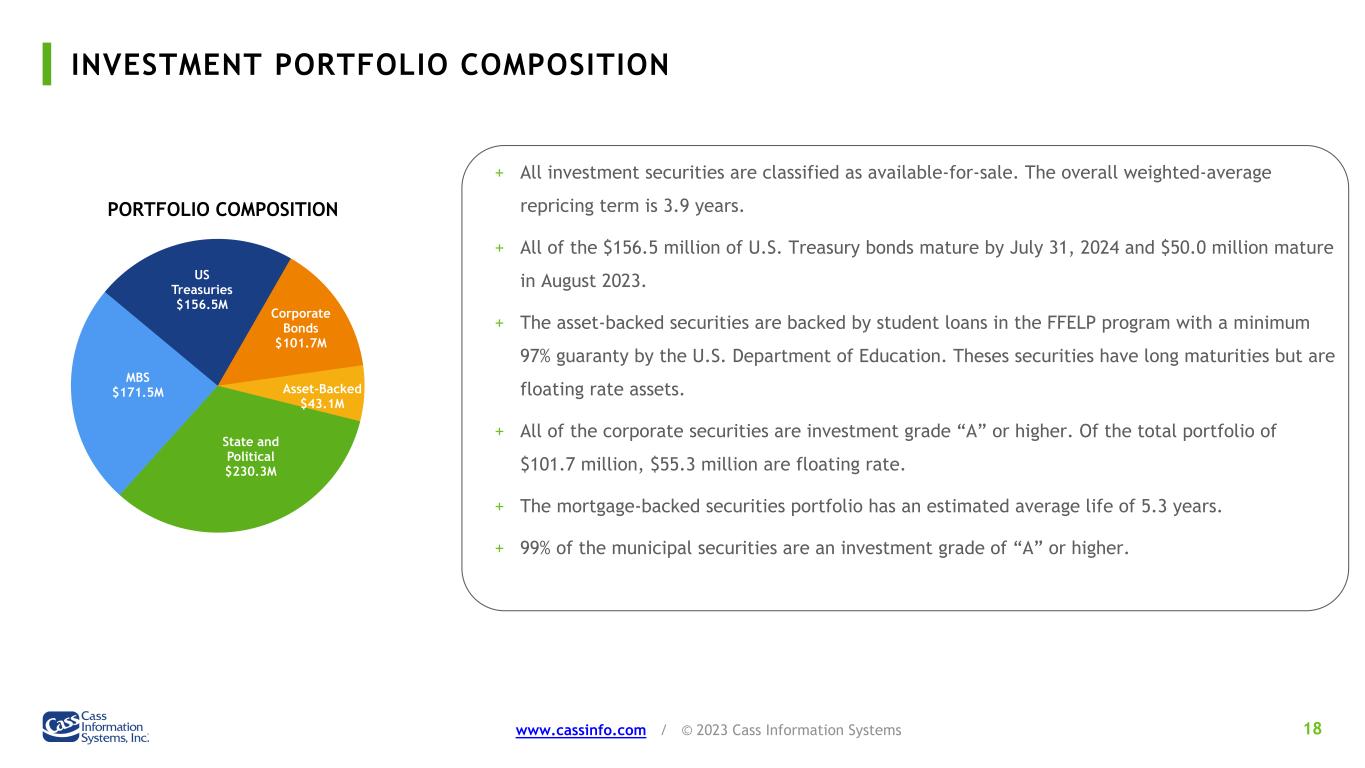

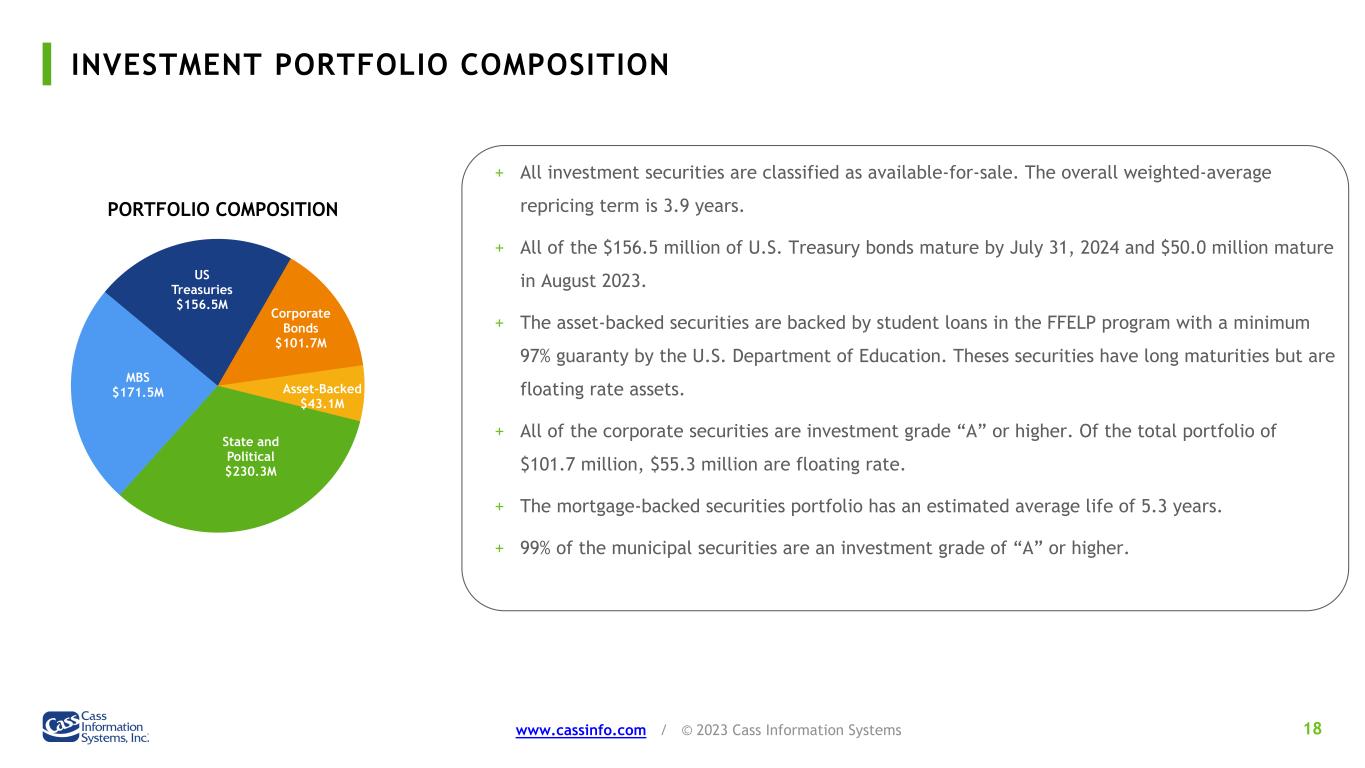

INVESTMENT PORTFOLIO COMPOSITION 18www.cassinfo.com / © 2023 Cass Information Systems + All investment securities are classified as available-for-sale. The overall weighted-average repricing term is 3.9 years. + All of the $156.5 million of U.S. Treasury bonds mature by July 31, 2024 and $50.0 million mature in August 2023. + The asset-backed securities are backed by student loans in the FFELP program with a minimum 97% guaranty by the U.S. Department of Education. Theses securities have long maturities but are floating rate assets. + All of the corporate securities are investment grade “A” or higher. Of the total portfolio of $101.7 million, $55.3 million are floating rate. + The mortgage-backed securities portfolio has an estimated average life of 5.3 years. + 99% of the municipal securities are an investment grade of “A” or higher. PORTFOLIO COMPOSITION State and Political $230.3M MBS $171.5M US Treasuries $156.5M Corporate Bonds $101.7M Asset-Backed $43.1M

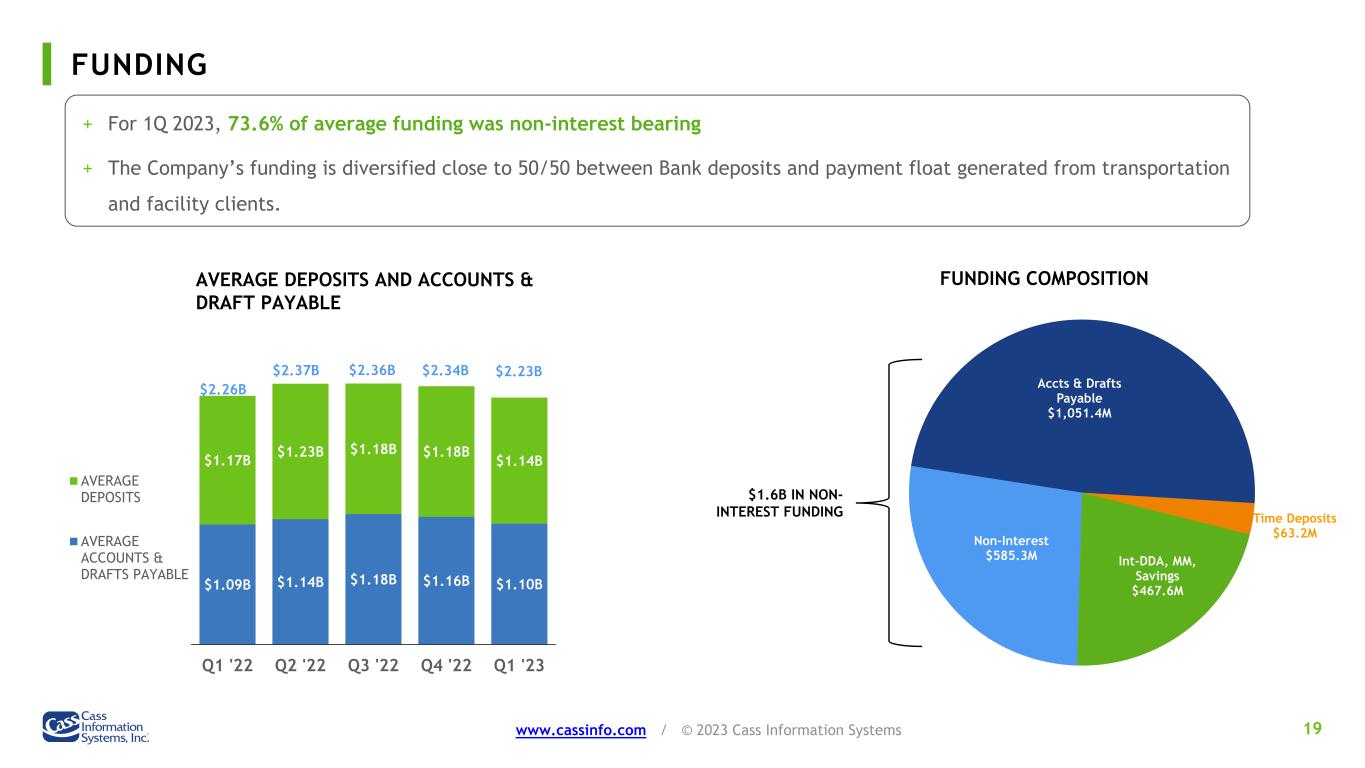

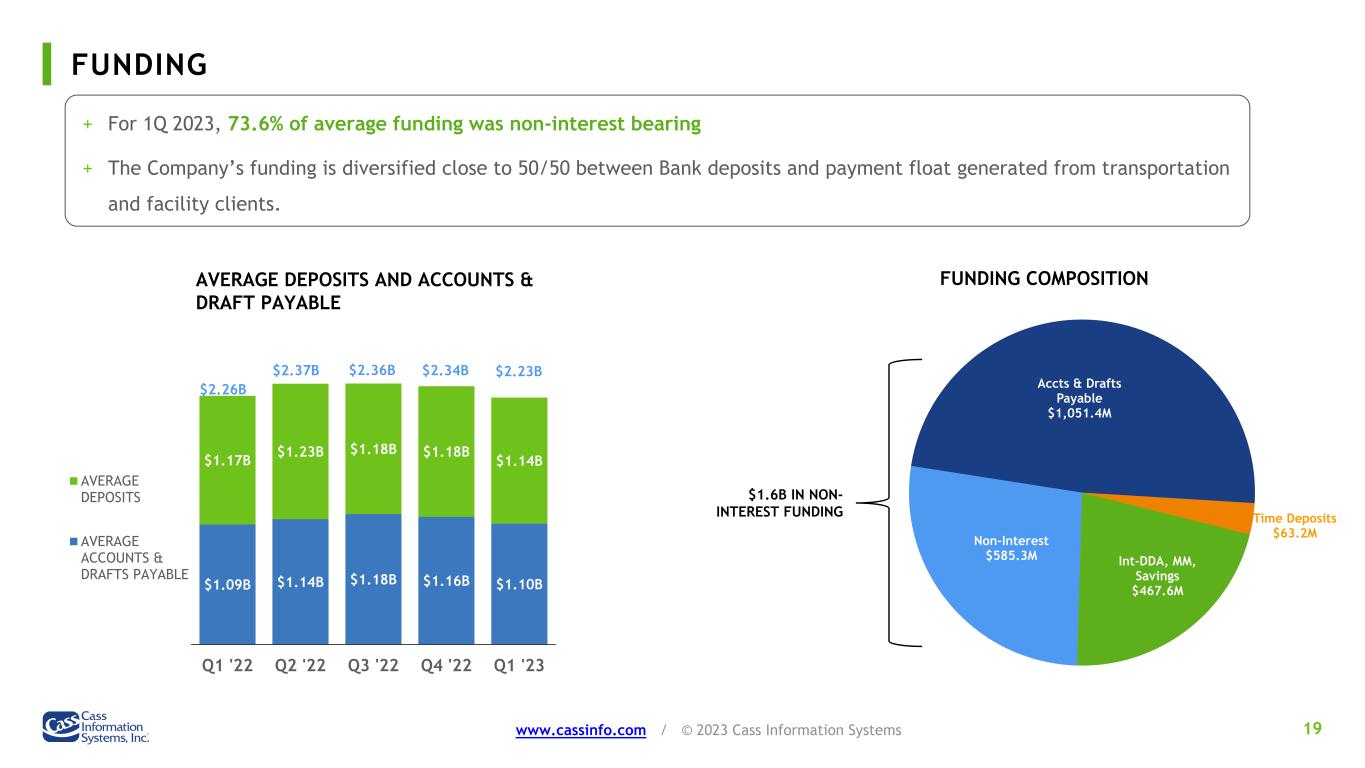

FUNDING 19www.cassinfo.com / © 2023 Cass Information Systems + For 1Q 2023, 73.6% of average funding was non-interest bearing + The Company’s funding is diversified close to 50/50 between Bank deposits and payment float generated from transportation and facility clients. AVERAGE DEPOSITS AND ACCOUNTS & DRAFT PAYABLE FUNDING COMPOSITION $1.6B IN NON- INTEREST FUNDING $1.09B $1.14B $1.18B $1.16B $1.10B $1.17B $1.23B $1.18B $1.18B $1.14B Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 AVERAGE DEPOSITS AVERAGE ACCOUNTS & DRAFTS PAYABLE $2.26B $2.37B $2.36B $2.23B$2.34B Int-DDA, MM, Savings $467.6M Non-Interest $585.3M Accts & Drafts Payable $1,051.4M Time Deposits $63.2M

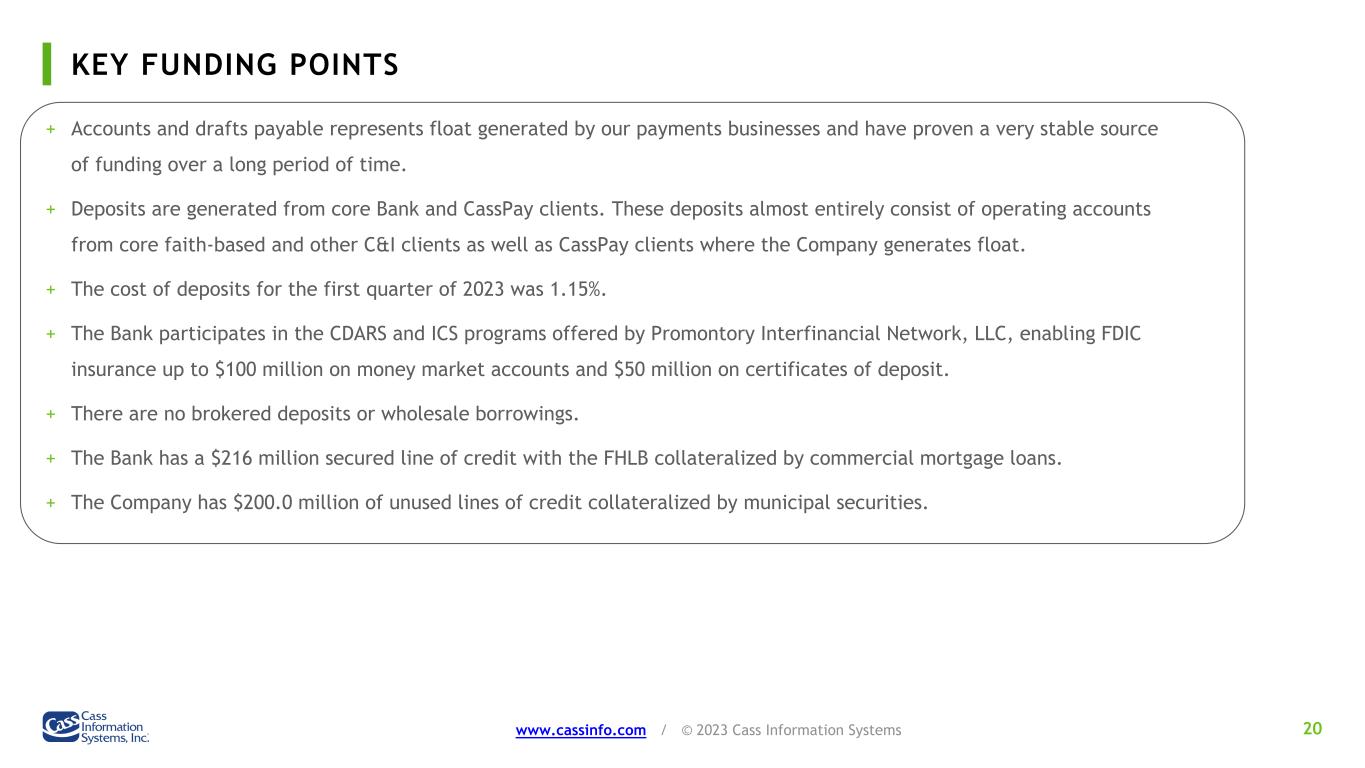

KEY FUNDING POINTS 20www.cassinfo.com / © 2023 Cass Information Systems + Accounts and drafts payable represents float generated by our payments businesses and have proven a very stable source of funding over a long period of time. + Deposits are generated from core Bank and CassPay clients. These deposits almost entirely consist of operating accounts from core faith-based and other C&I clients as well as CassPay clients where the Company generates float. + The cost of deposits for the first quarter of 2023 was 1.15%. + The Bank participates in the CDARS and ICS programs offered by Promontory Interfinancial Network, LLC, enabling FDIC insurance up to $100 million on money market accounts and $50 million on certificates of deposit. + There are no brokered deposits or wholesale borrowings. + The Bank has a $216 million secured line of credit with the FHLB collateralized by commercial mortgage loans. + The Company has $200.0 million of unused lines of credit collateralized by municipal securities.

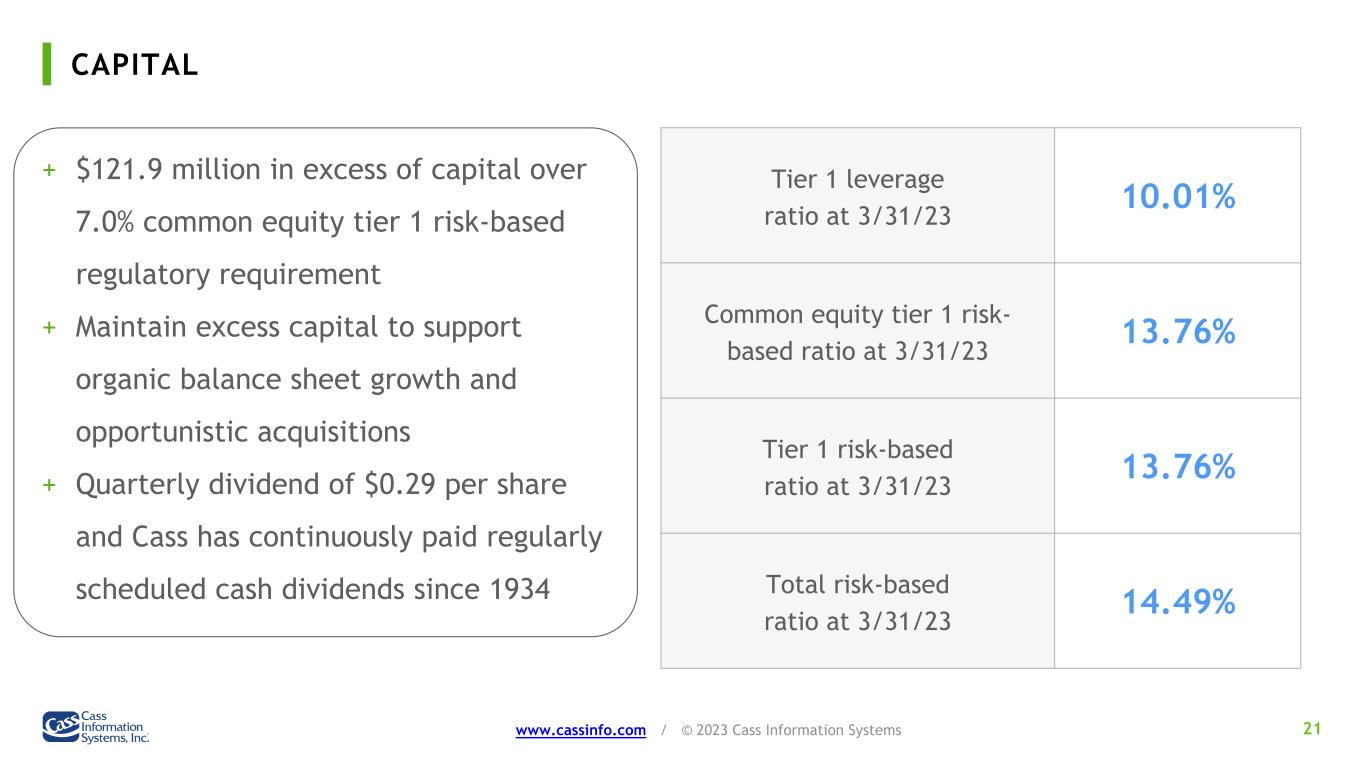

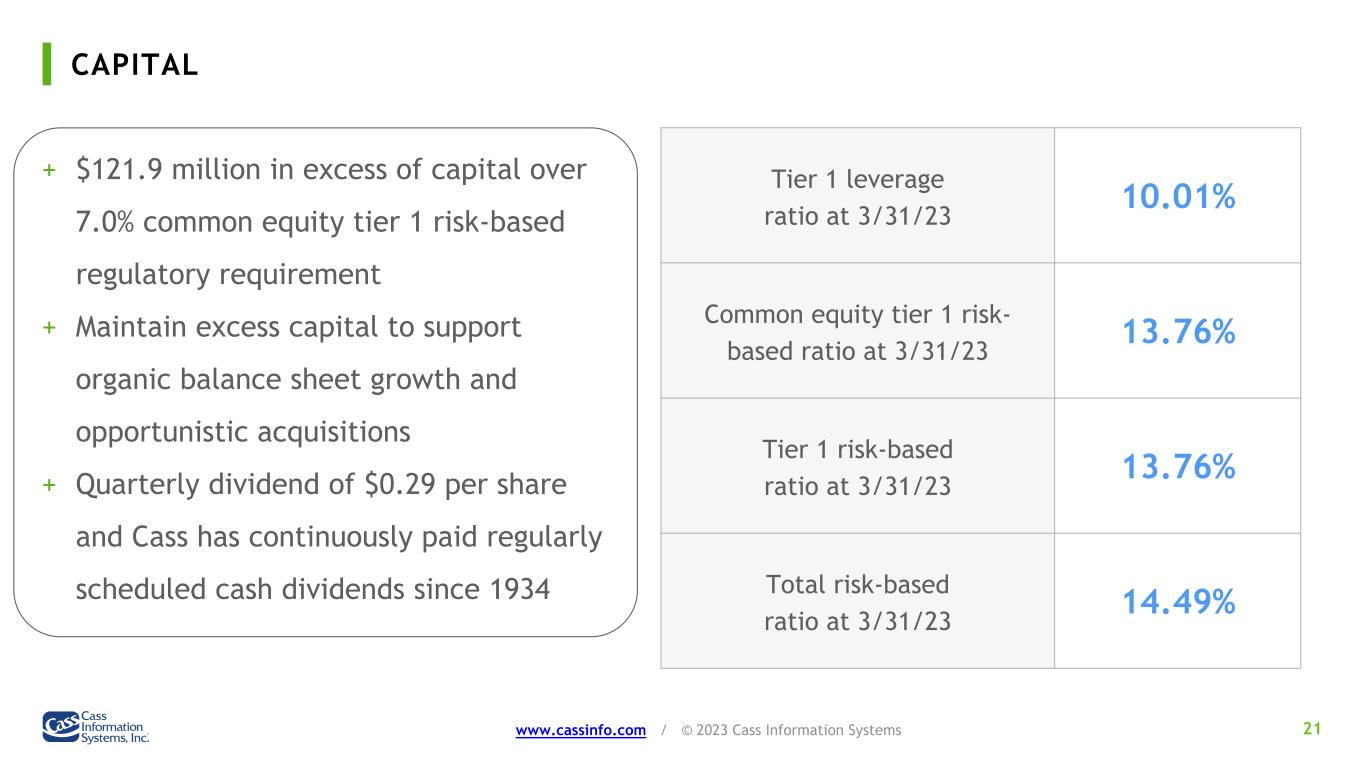

CAPITAL 21www.cassinfo.com / © 2023 Cass Information Systems + $121.9 million in excess of capital over 7.0% common equity tier 1 risk-based regulatory requirement + Maintain excess capital to support organic balance sheet growth and opportunistic acquisitions + Quarterly dividend of $0.29 per share and Cass has continuously paid regularly scheduled cash dividends since 1934 Tier 1 leverage ratio at 3/31/23 10.01% Common equity tier 1 risk- based ratio at 3/31/23 13.76% Tier 1 risk-based ratio at 3/31/23 13.76% Total risk-based ratio at 3/31/23 14.49%

During March 2023, we published our annual ESG report, a copy of which is available on our Investor Relations site. To read more from the Cass ESG report, please follow this link to cassinfo.com ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) HIGHLIGHTS 22www.cassinfo.com / © 2023 Cass Information Systems

LEADERSHIP AND SHAREHOLDER INFORMATION 23www.cassinfo.com / © 2023 Cass Information Systems

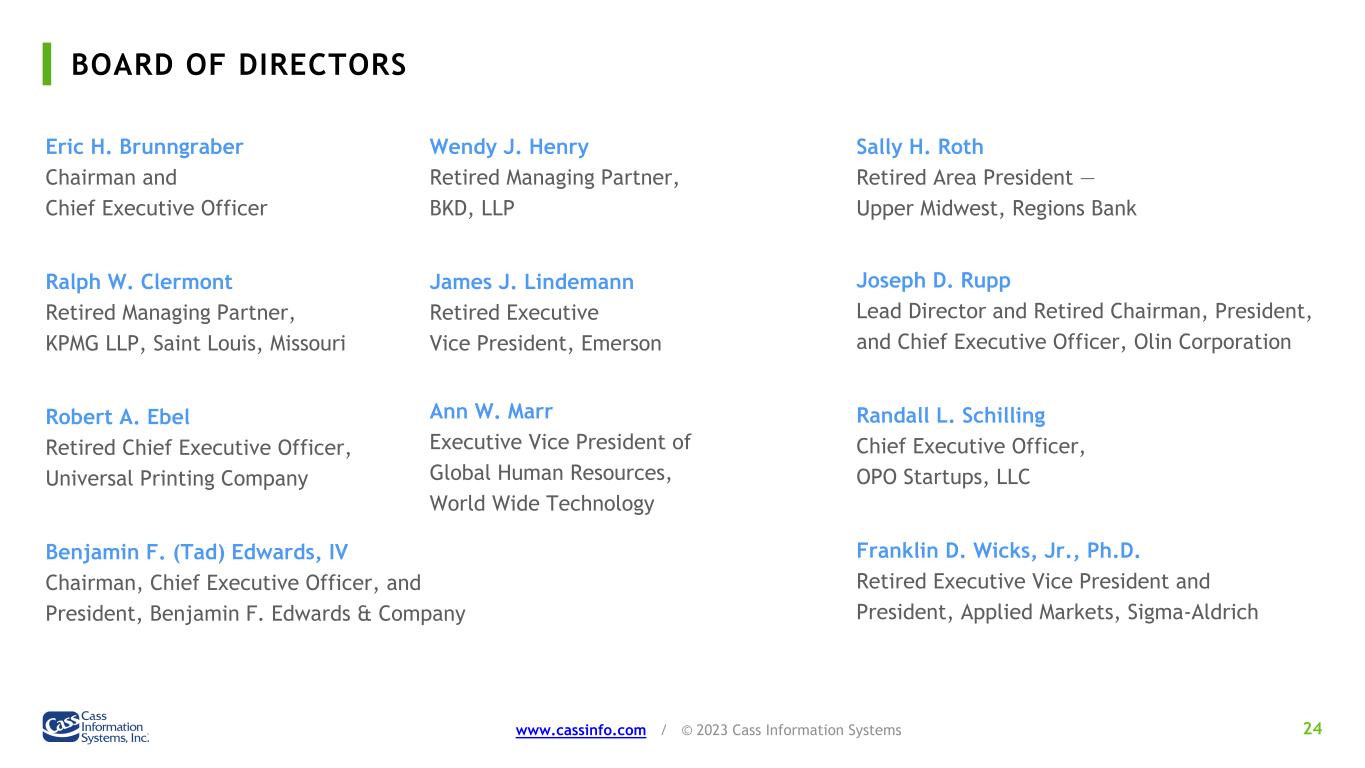

BOARD OF DIRECTORS 24 Eric H. Brunngraber Chairman and Chief Executive Officer Ralph W. Clermont Retired Managing Partner, KPMG LLP, Saint Louis, Missouri Robert A. Ebel Retired Chief Executive Officer, Universal Printing Company Wendy J. Henry Retired Managing Partner, BKD, LLP James J. Lindemann Retired Executive Vice President, Emerson Sally H. Roth Retired Area President — Upper Midwest, Regions Bank Joseph D. Rupp Lead Director and Retired Chairman, President, and Chief Executive Officer, Olin Corporation Randall L. Schilling Chief Executive Officer, OPO Startups, LLC Franklin D. Wicks, Jr., Ph.D. Retired Executive Vice President and President, Applied Markets, Sigma-Aldrich Benjamin F. (Tad) Edwards, IV Chairman, Chief Executive Officer, and President, Benjamin F. Edwards & Company www.cassinfo.com / © 2023 Cass Information Systems Ann W. Marr Executive Vice President of Global Human Resources, World Wide Technology

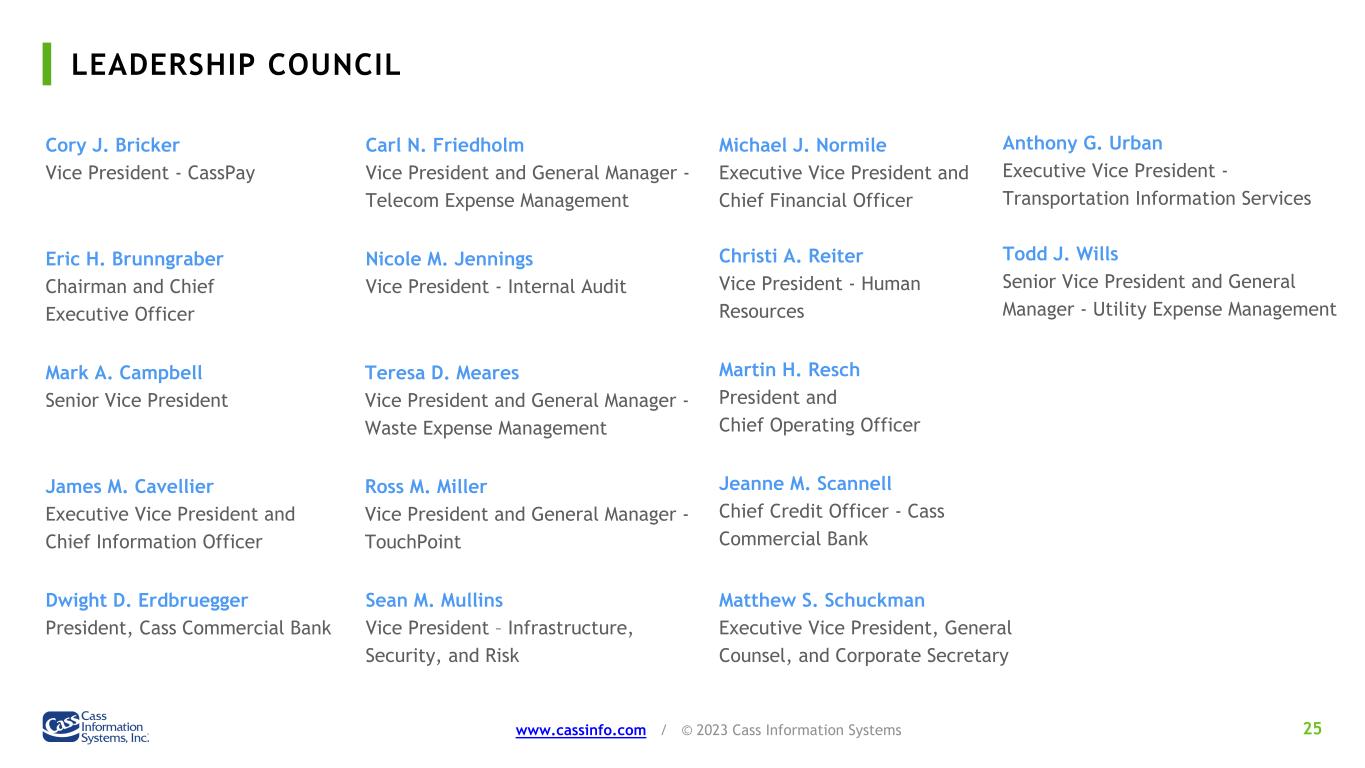

LEADERSHIP COUNCIL 25 Cory J. Bricker Vice President - CassPay Carl N. Friedholm Vice President and General Manager - Telecom Expense Management Christi A. Reiter Vice President - Human Resources Eric H. Brunngraber Chairman and Chief Executive Officer Nicole M. Jennings Vice President - Internal Audit Martin H. Resch President and Chief Operating Officer Mark A. Campbell Senior Vice President Jeanne M. Scannell Chief Credit Officer - Cass Commercial Bank James M. Cavellier Executive Vice President and Chief Information Officer Teresa D. Meares Vice President and General Manager - Waste Expense Management Matthew S. Schuckman Executive Vice President, General Counsel, and Corporate Secretary Dwight D. Erdbruegger President, Cass Commercial Bank Michael J. Normile Executive Vice President and Chief Financial Officer Anthony G. Urban Executive Vice President - Transportation Information Services www.cassinfo.com / © 2023 Cass Information Systems Ross M. Miller Vice President and General Manager - TouchPoint Sean M. Mullins Vice President – Infrastructure, Security, and Risk Todd J. Wills Senior Vice President and General Manager - Utility Expense Management

SHAREHOLDER INFORMATION 26www.cassinfo.com / © 2023 Cass Information Systems CORPORATE HEADQUARTERS Cass Information Systems, Inc. 12444 Powerscourt Drive, Suite 550 Saint Louis, Missouri 63131 314.506.5500 www.cassinfo.com INVESTOR RELATIONS ir@cassinfo.com COMMON STOCK The company’s common stock trades on the NASDAQ stock market under the symbol CASS. INDEPENDENT AUDITORS KPMG LLP 10 South Broadway, Suite 900 Saint Louis, Missouri 63102 TRANSFER AGENT Shareholder correspondence should be mailed to: Computershare P.O. Box 43006 Providence, RI 02940-3006 Overnight correspondence should be mailed to: Computershare 150 Royall St, Suite 101 Canton, MA 02021 SHAREHOLDER WEBSITE www.computershare.com/investor SHAREHOLDER ONLINE INQUIRIES www-us.computershare.com /investor/Contact TOLL-FREE PHONE 866.323.8170

Thank You for Your Time