The Power to Deliver Solutions Around the world, leading enterprises rely on Cass for our vertical expertise, processing power, and global payment network to execute critical financial transactions while driving greater control and efficiency across critical business expenses. Q4 2024 INVESTOR PRESENTATION

Forward-Looking Statements Cass at a Glance Financial Performance Revenue & Expenses Balance Sheet Capital Leadership and Shareholder Information TABLE OF CONTENTS 2 3 4 6 9 14 19 20 www.cassinfo.com / © 2024 Cass Information Systems

This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements contain words such as “anticipate,” “believe,” “can,” “would,” “should,” “could,” “may,” “predict,” “seek,” “potential,” “will,” “estimate,” “target,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “intend” or similar expressions that relate to the Company’s strategy, plans or intentions. Forward-looking statements involve certain important risks, uncertainties, and other factors, any of which could cause actual results to differ materially from those in such statements. Such factors include, without limitation, the “Risk Factors” referenced in our most recent Form 10-K filed with the Securities and Exchange Commission (SEC), other risks and uncertainties listed from time to time in our reports and documents filed with the SEC, and the following factors: ability to execute our business strategy; business and economic conditions; effects of a prolonged government shutdown; economic, market, operational, liquidity, credit and interest rate risks associated with the Company’s business; effects of any changes in trade, monetary and fiscal policies and laws; changes imposed by regulatory agencies to increase capital standards; effects of inflation, as well as, interest rate, securities market and monetary supply fluctuations; changes in the economy or supply-demand imbalances affecting local real estate values; changes in consumer and business spending; the Company's ability to realize anticipated benefits from enhancements or updates to its core operating systems from time to time without significant change in client service or risk to the Company's control environment; the Company's dependence on information technology and telecommunications systems of third-party service providers and the risk of systems failures, interruptions or breaches of security; the Company’s ability to achieve organic fee income, loan and deposit growth and the composition of such growth; changes in sources and uses of funds; increased competition in the payments and banking industries; the effect of changes in accounting policies and practices; the share price of the Company’s stock; the Company's ability to realize deferred tax assets or the need for a valuation allowance; ability to maintain or increase market share and control expenses; costs and effects of changes in laws and regulations and of other legal and regulatory developments; technological changes; the timely development and acceptance of new products and services; the Company’s continued ability to attract, hire and maintain qualified personnel; ability to implement and/or improve operational management and other internal risk controls and processes and reporting system and procedures; regulatory limitations on dividends from the Company's bank subsidiary; changes in estimates of future loan reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; widespread natural and other disasters, pandemics, dislocations, political instability, acts of war or terrorist activities, cyberattacks or international hostilities; impact of reputational risk; and success at managing the risks involved in the foregoing items. The Company can give no assurance that any goal or plan or expectation set forth in forward-looking statements can be achieved, and readers are cautioned not to place undue reliance on such statements. The forward-looking statements are made as of the date of original publication of this presentation, and the Company does not intend, and assumes no obligation, to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law. This presentation is a high-level summary of our recent and historical financial results and current business developments. For more detailed information, please refer to our press releases and filings with the SEC. FORWARD LOOKING STATEMENTS 3www.cassinfo.com / © 2024 Cass Information Systems

4www.cassinfo.com / © 2024 Cass Information Systems CASS AT A GLANCE

+ Cass is an information services company that processes freight and facility payments for a number of the largest global companies + The information systems business has a 70-year legacy + As a result of its $90B of payments, Cass generates $1B+ of average non-interest bearing float + Cass continues to operate a strong and profitable commercial bank founded in 1906 Note: Balance sheet metrics as of December 31, 2024. Income statement metrics are through period ended December 31, 2024 as indicated. Market. Cap. $550M Assets $2.4B YTD ROE 8.37% TTM NI $19.2M YTD % Fees/ Rev. 63.2% % AVG NIB Funding 69.5% INFORMATION SYSTEMS / PAYMENTS + Transportation information systems provides freight invoice audit and payment services + Facilities expense management provides invoice management, payment and business intelligence for all types of utility and facility related expenses + CassPay provides complex treasury management and payment services for fintech and other payment companies COMMERCIAL BANK + Cass Commercial Bank operates in three primary niches ‒ St. Louis C&I market ‒ Faith based organizations across the U.S. ‒ McDonalds’ franchisees + Strong track record of asset quality $90B Annual payments volume 50M Annual invoice volume $126M TTM fee revenue $1.0B YTD average float $1.1B Loans $1.0B Deposits 1.93% YTD cost of deposits $0 Charge-offs OVERVIEW 5www.cassinfo.com / © 2024 Cass Information Systems

6www.cassinfo.com / © 2024 Cass Information Systems FINANCIAL PERFORMANCE

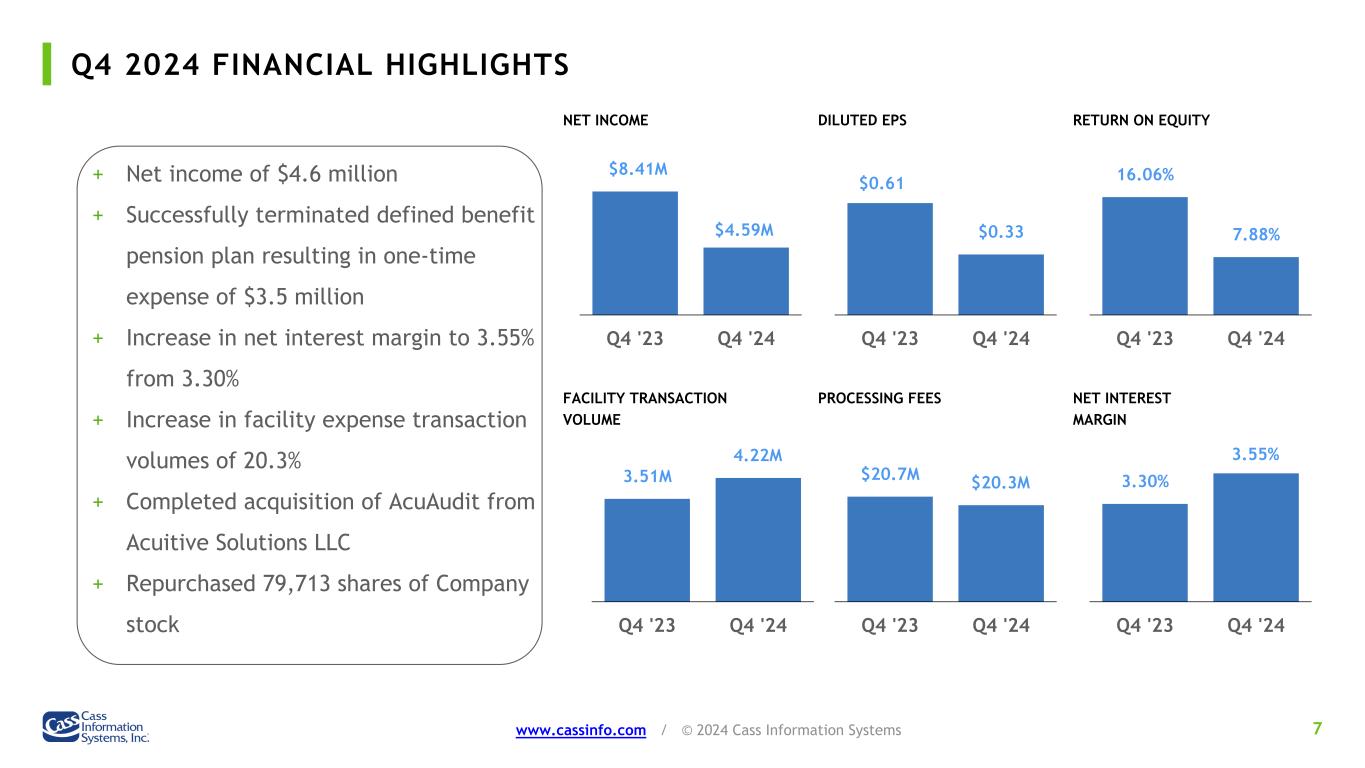

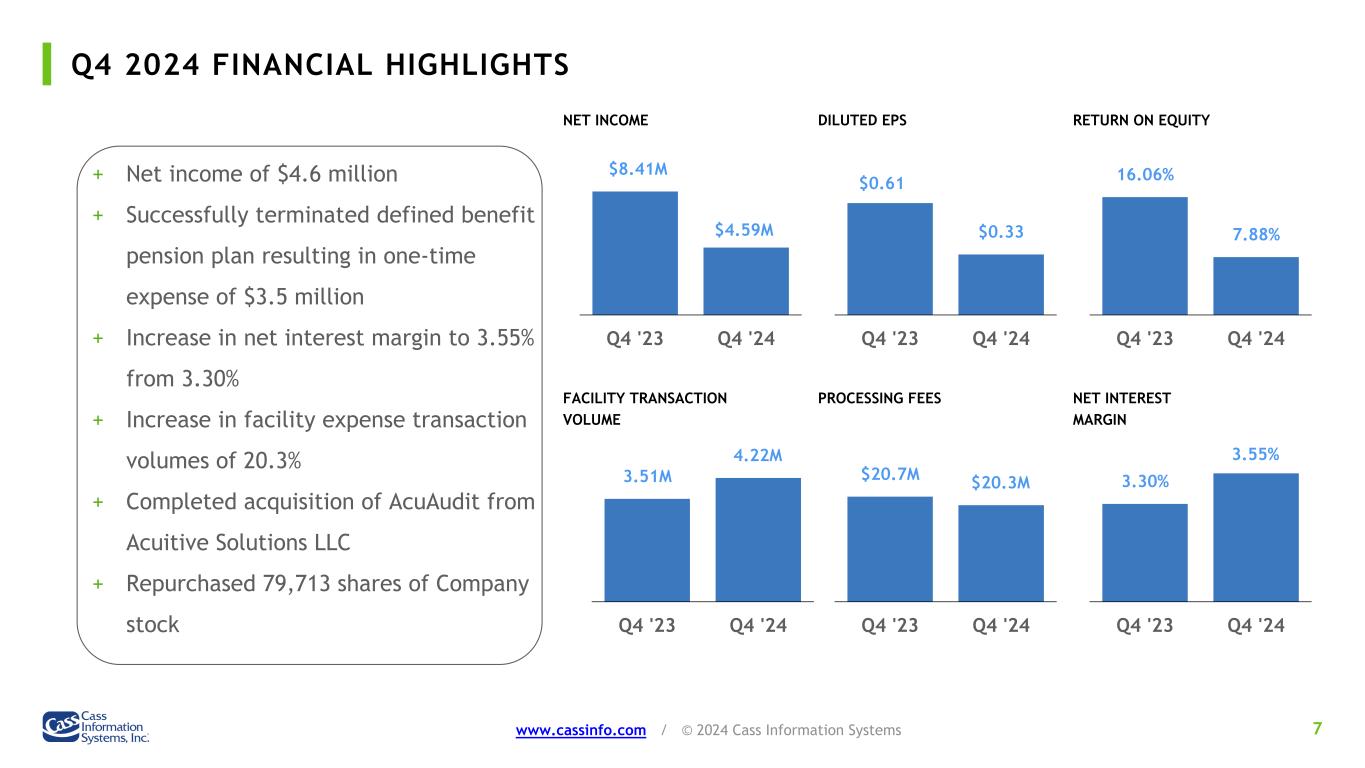

Q4 2024 FINANCIAL HIGHLIGHTS 7www.cassinfo.com / © 2024 Cass Information Systems $8.41M $4.59M Q4 '23 Q4 '24 $0.61 $0.33 Q4 '23 Q4 '24 16.06% 7.88% Q4 '23 Q4 '24 NET INCOME DILUTED EPS RETURN ON EQUITY + Net income of $4.6 million + Successfully terminated defined benefit pension plan resulting in one-time expense of $3.5 million + Increase in net interest margin to 3.55% from 3.30% + Increase in facility expense transaction volumes of 20.3% + Completed acquisition of AcuAudit from Acuitive Solutions LLC + Repurchased 79,713 shares of Company stock $20.7M $20.3M Q4 '23 Q4 '24 FACILITY TRANSACTION VOLUME PROCESSING FEES 3.30% 3.55% Q4 '23 Q4 '24 NET INTEREST MARGIN 3.51M 4.22M Q4 '23 Q4 '24

QUARTERLY FINANCIAL PERFORMANCE 8www.cassinfo.com / © 2024 Cass Information Systems $40.4M $40.7M $42.8M $46.9M $44.6M Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 $8.41M $7.15M $4.48M $2.94M $4.59M Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q34'24 16.05% 12.66% 8.01% 5.04% 7.88% Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 1.38% 1.20% 0.78% 0.50% 0.77% Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 TOTAL OPERATING EXPENSE NET INCOME RETURN ON EQUITY ROAA $50.7M $49.7M $48.6M $50.6M $50.4M Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 TOTAL REVENUE $0.61 $0.52 $0.32 $0.21 $0.33 Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 DILUTED EPS

9www.cassinfo.com / © 2024 Cass Information Systems REVENUE & EXPENSES

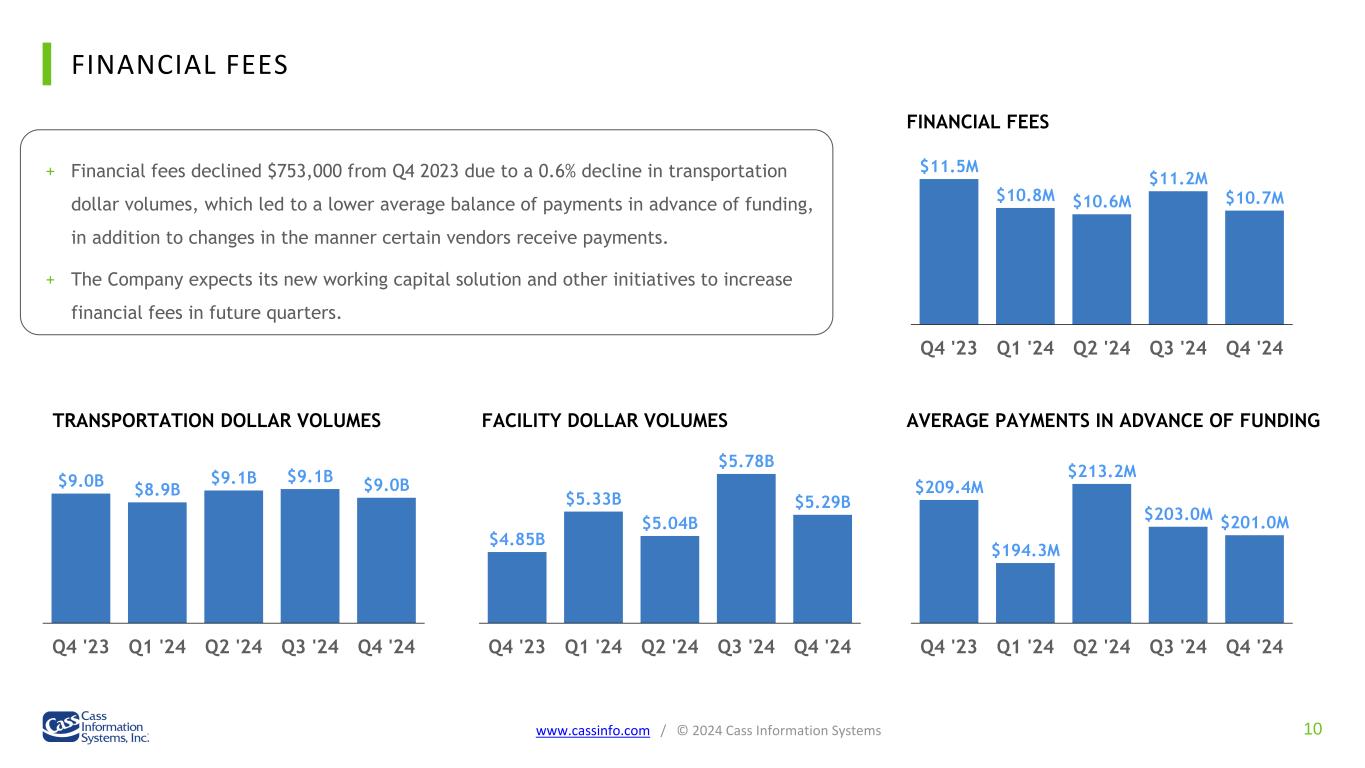

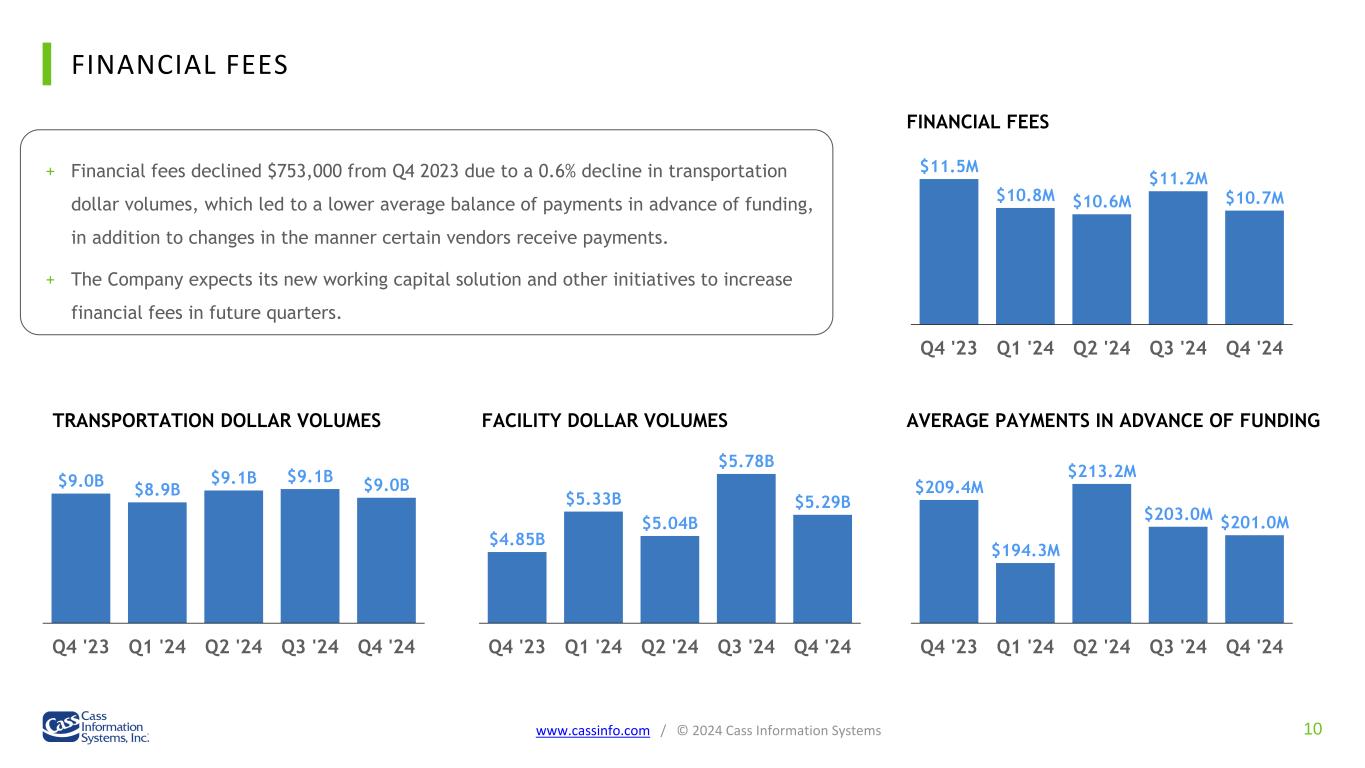

FINANCIAL FEES 10www.cassinfo.com / © 2024 Cass Information Systems + Financial fees declined $753,000 from Q4 2023 due to a 0.6% decline in transportation dollar volumes, which led to a lower average balance of payments in advance of funding, in addition to changes in the manner certain vendors receive payments. + The Company expects its new working capital solution and other initiatives to increase financial fees in future quarters. $9.0B $8.9B $9.1B $9.1B $9.0B Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 $4.85B $5.33B $5.04B $5.78B $5.29B Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 $209.4M $194.3M $213.2M $203.0M $201.0M Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 TRANSPORTATION DOLLAR VOLUMES FACILITY DOLLAR VOLUMES AVERAGE PAYMENTS IN ADVANCE OF FUNDING $11.5M $10.8M $10.6M $11.2M $10.7M Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 FINANCIAL FEES

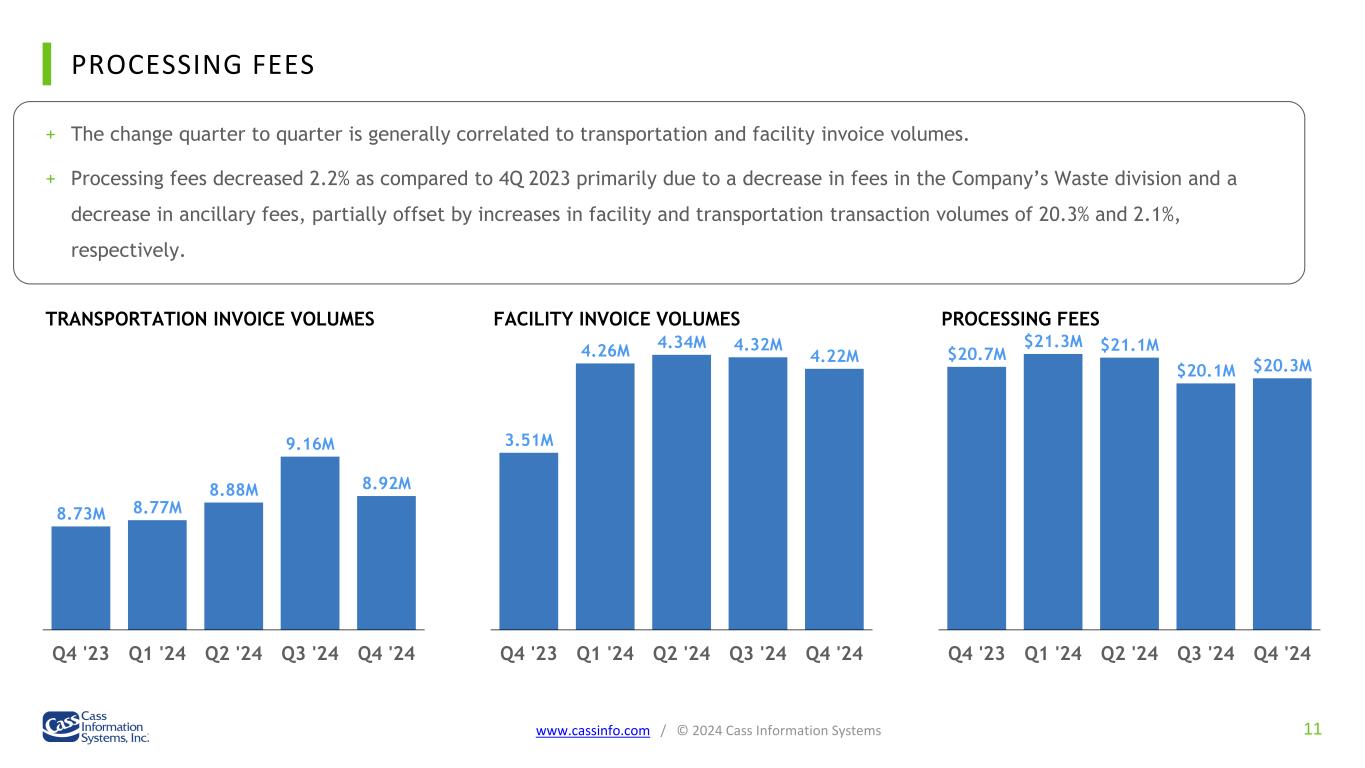

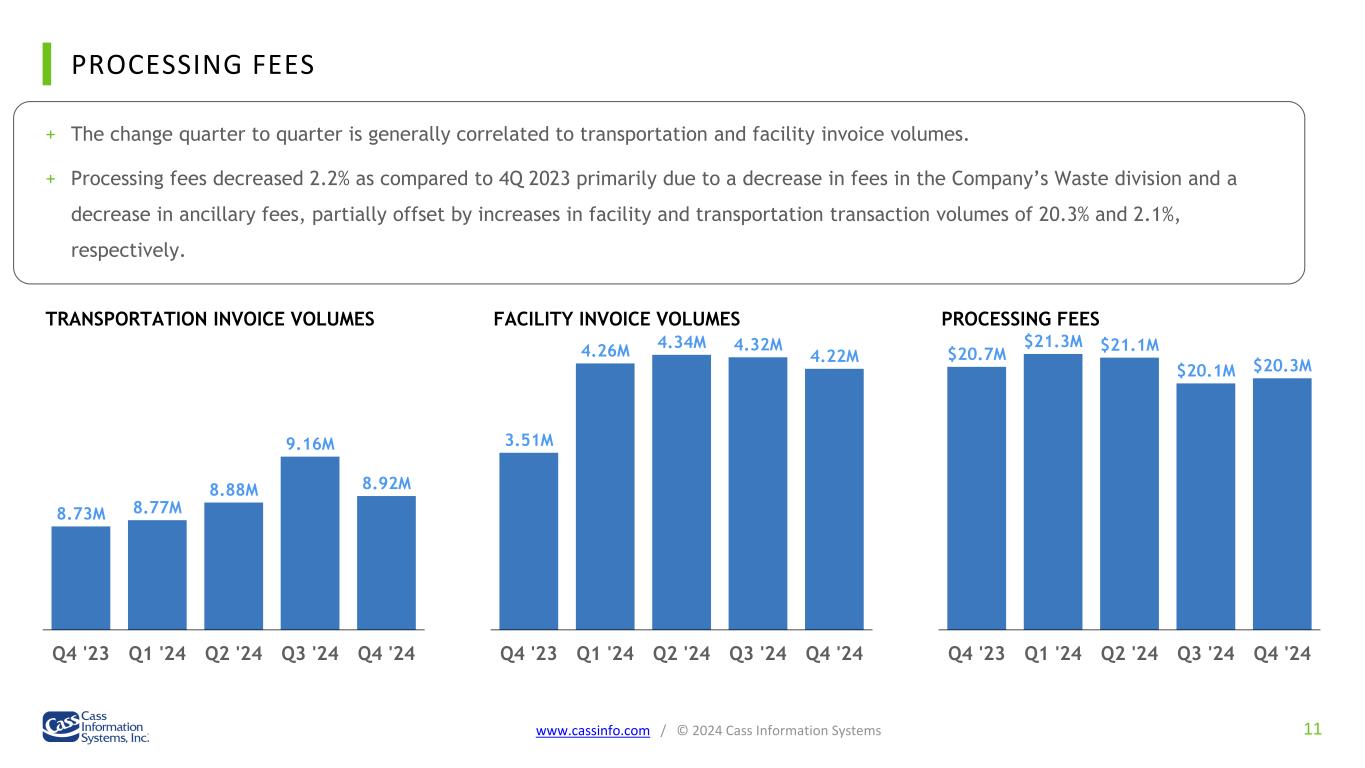

PROCESSING FEES 11www.cassinfo.com / © 2024 Cass Information Systems + The change quarter to quarter is generally correlated to transportation and facility invoice volumes. + Processing fees decreased 2.2% as compared to 4Q 2023 primarily due to a decrease in fees in the Company’s Waste division and a decrease in ancillary fees, partially offset by increases in facility and transportation transaction volumes of 20.3% and 2.1%, respectively. 8.73M 8.77M 8.88M 9.16M 8.92M Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 3.51M 4.26M 4.34M 4.32M 4.22M Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 $20.7M $21.3M $21.1M $20.1M $20.3M Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 TRANSPORTATION INVOICE VOLUMES FACILITY INVOICE VOLUMES PROCESSING FEES

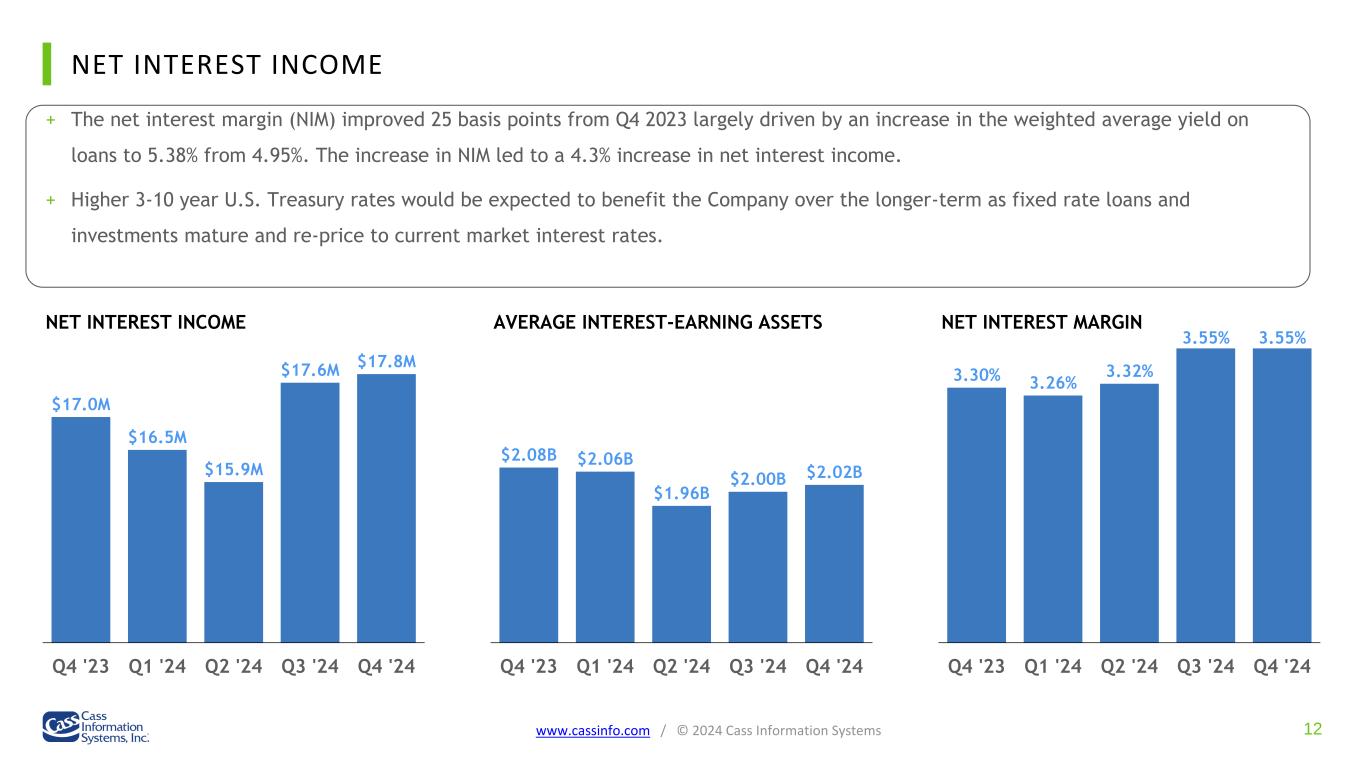

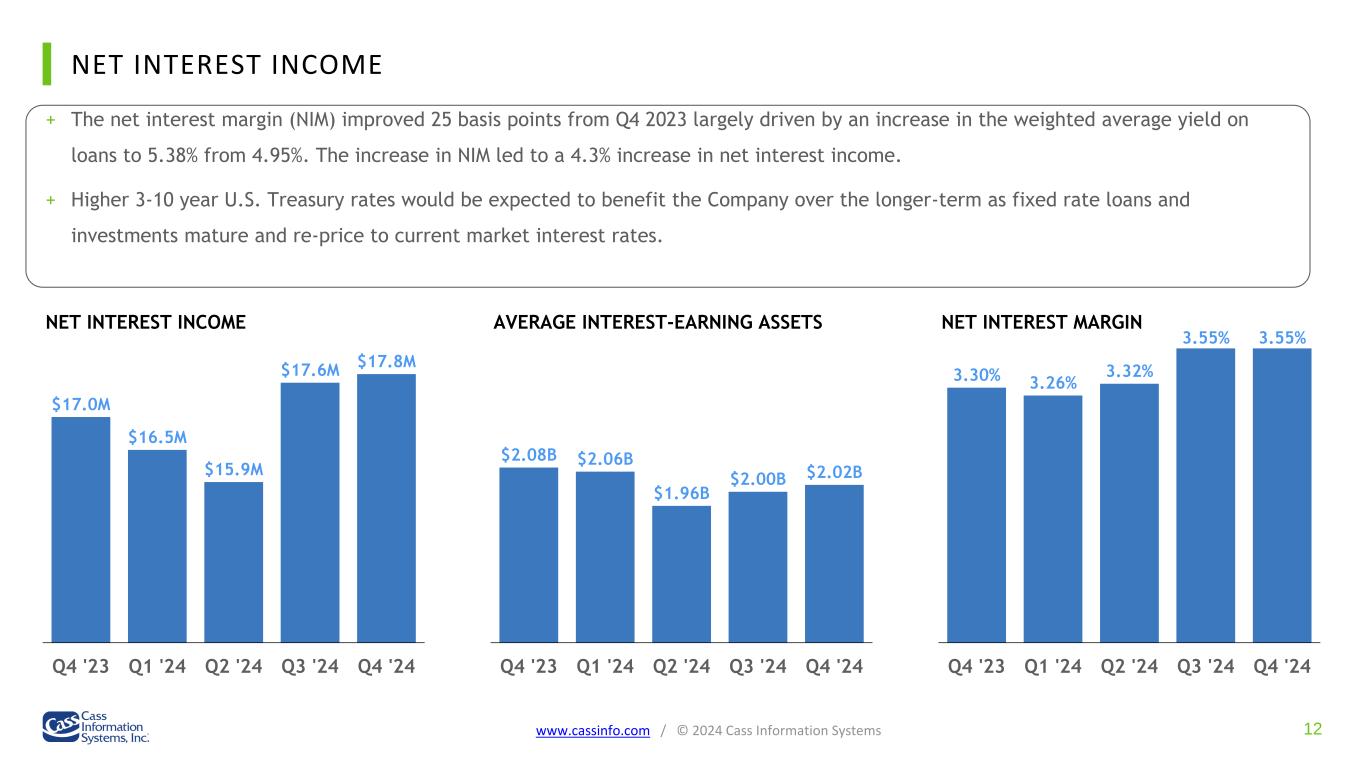

NET INTEREST INCOME 12www.cassinfo.com / © 2024 Cass Information Systems + The net interest margin (NIM) improved 25 basis points from Q4 2023 largely driven by an increase in the weighted average yield on loans to 5.38% from 4.95%. The increase in NIM led to a 4.3% increase in net interest income. + Higher 3-10 year U.S. Treasury rates would be expected to benefit the Company over the longer-term as fixed rate loans and investments mature and re-price to current market interest rates. $17.0M $16.5M $15.9M $17.6M $17.8M Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 $2.08B $2.06B $1.96B $2.00B $2.02B Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 3.30% 3.26% 3.32% 3.55% 3.55% Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 NET INTEREST INCOME AVERAGE INTEREST-EARNING ASSETS NET INTEREST MARGIN

NET INTEREST INCOME (CONTINUED) 13www.cassinfo.com / © 2024 Cass Information Systems + As can be seen in the graph below, the Company’s net interest margin has historically trended above the average 5-year UST. With the rise in short and long-term bond yields over the last 3 years, the yield on many of the Company’s fixed rate loans and investment securities is below current market interest rates. If mid and longer-term bond yields remain at or close to current levels, as the Company’s interest-earning assets mature and re-price to current market rates over the coming quarters and years, the Company’s NIM should benefit, thereby increasing net interest income. 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 CASS NIM Compared to Average 5-Year UST CASS NIM Avg 5-year UST

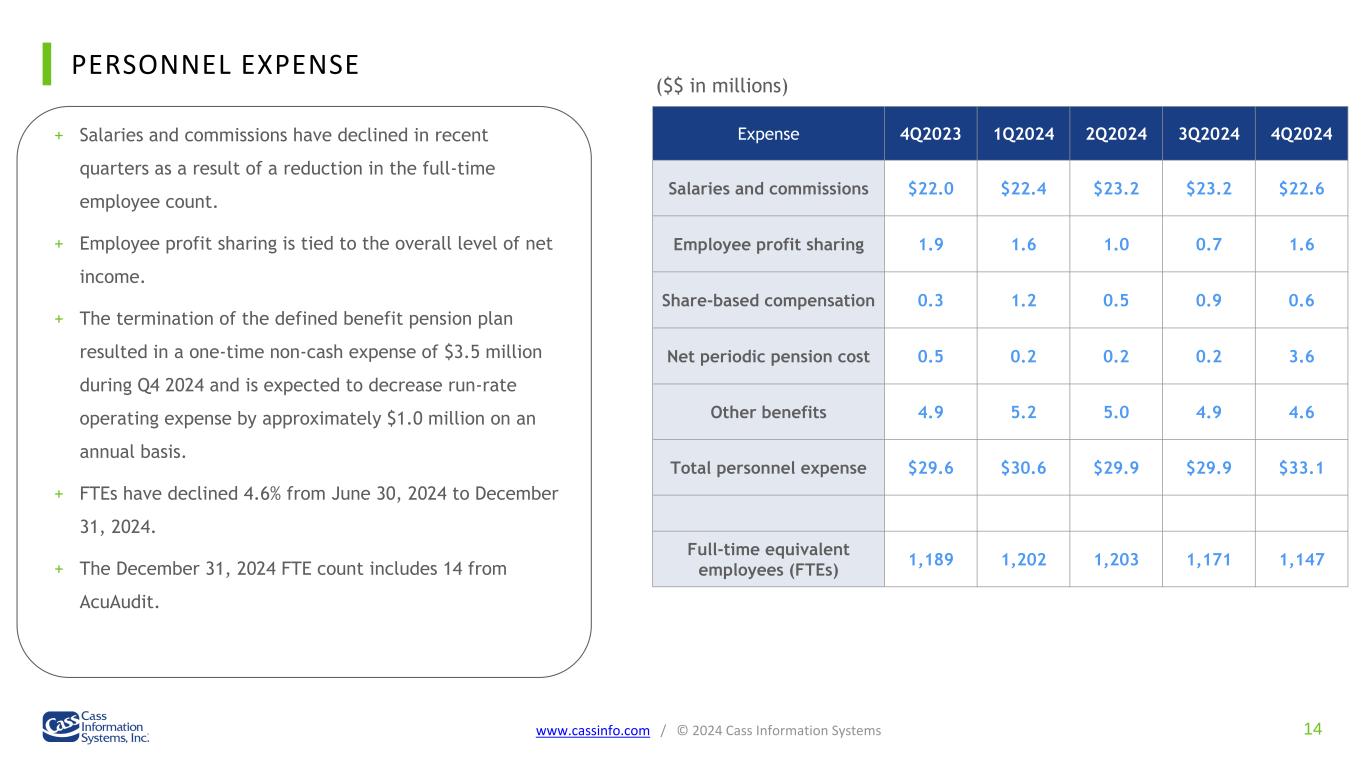

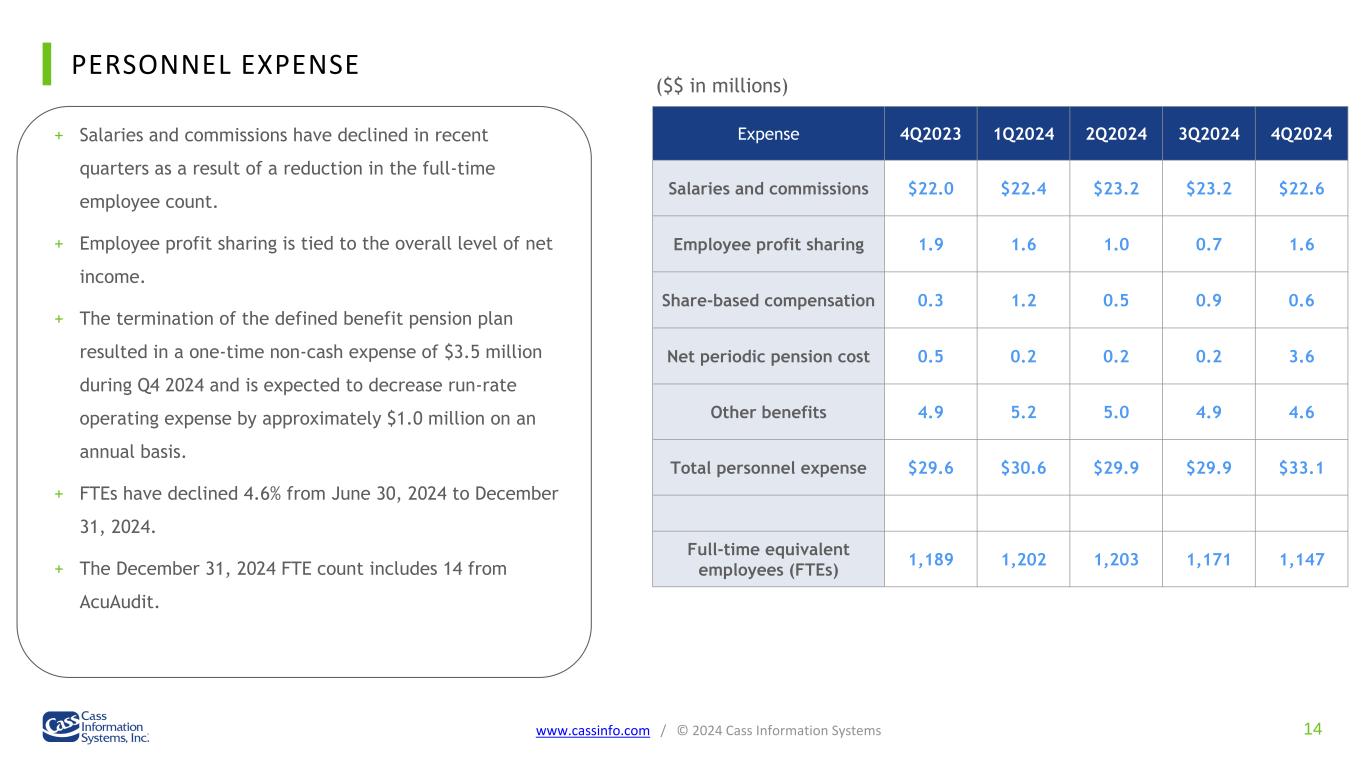

PERSONNEL EXPENSE 14www.cassinfo.com / © 2024 Cass Information Systems + Salaries and commissions have declined in recent quarters as a result of a reduction in the full-time employee count. + Employee profit sharing is tied to the overall level of net income. + The termination of the defined benefit pension plan resulted in a one-time non-cash expense of $3.5 million during Q4 2024 and is expected to decrease run-rate operating expense by approximately $1.0 million on an annual basis. + FTEs have declined 4.6% from June 30, 2024 to December 31, 2024. + The December 31, 2024 FTE count includes 14 from AcuAudit. Expense 4Q2023 1Q2024 2Q2024 3Q2024 4Q2024 Salaries and commissions $22.0 $22.4 $23.2 $23.2 $22.6 Employee profit sharing 1.9 1.6 1.0 0.7 1.6 Share-based compensation 0.3 1.2 0.5 0.9 0.6 Net periodic pension cost 0.5 0.2 0.2 0.2 3.6 Other benefits 4.9 5.2 5.0 4.9 4.6 Total personnel expense $29.6 $30.6 $29.9 $29.9 $33.1 Full-time equivalent employees (FTEs) 1,189 1,202 1,203 1,171 1,147 ($$ in millions)

NON-PERSONNEL EXPENSE 15www.cassinfo.com / © 2024 Cass Information Systems + Equipment expense has increased as a result of an increase in depreciation expense related to technology projects now in production. + Bad debt expense relates to a full write-off of a funding receivable related to a facility client. The Company is in the process of litigation to collect the receivable. + Other expense during Q2 2024 included $1.3 million of estimated late fees to be incurred on facility transactions as described in the Q2 2024 earnings release. Expense 4Q2023 1Q2024 2Q2024 3Q2024 4Q2024 Occupancy expense $0.9 $0.9 $0.8 $0.9 $0.9 Equipment expense 2.0 1.9 2.0 2.1 2.3 Bad debt expense 0.0 0.0 1.3 6.6 0.0 Other expense 7.9 7.3 8.9 7.4 8.4 Total non-personnel expense $10.8 $10.1 $13.0 $17.0 $11.6 ($$ in millions)

16www.cassinfo.com / © 2024 Cass Information Systems BALANCE SHEET

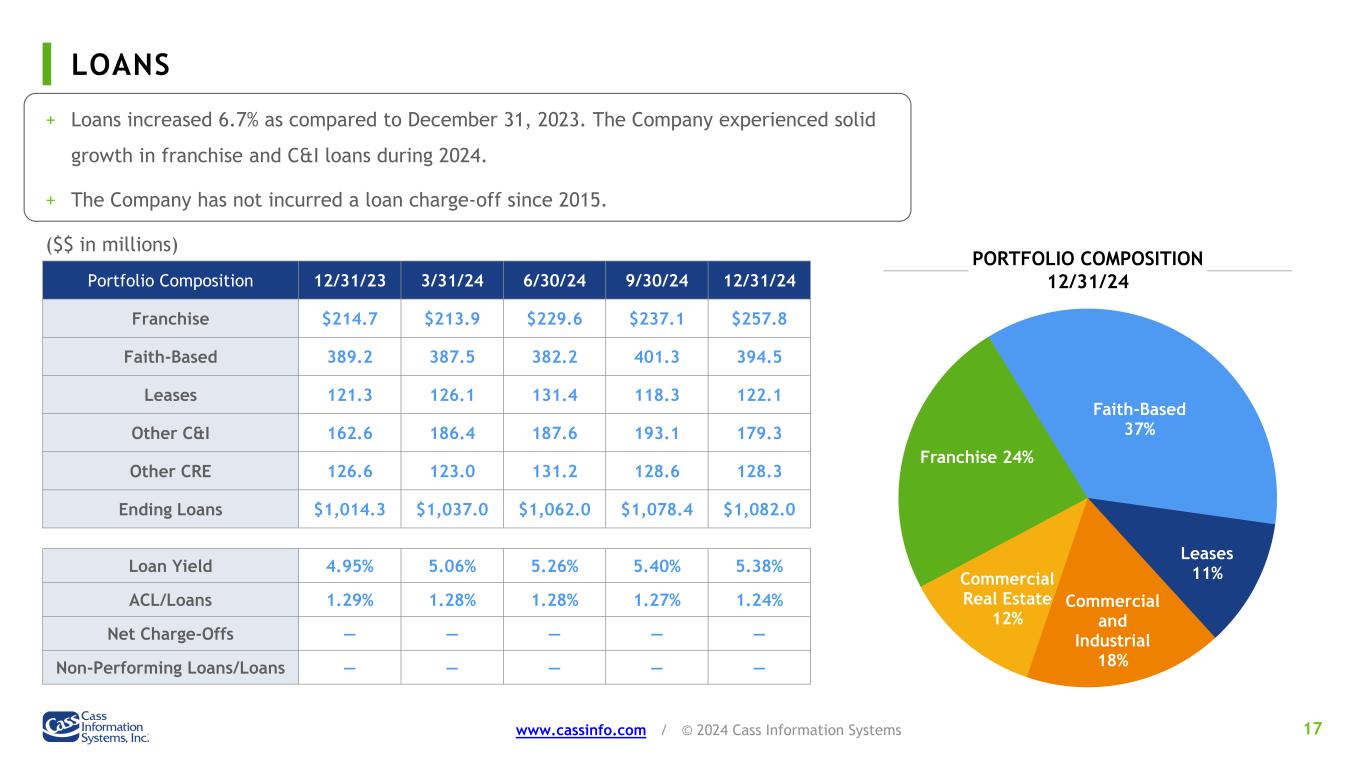

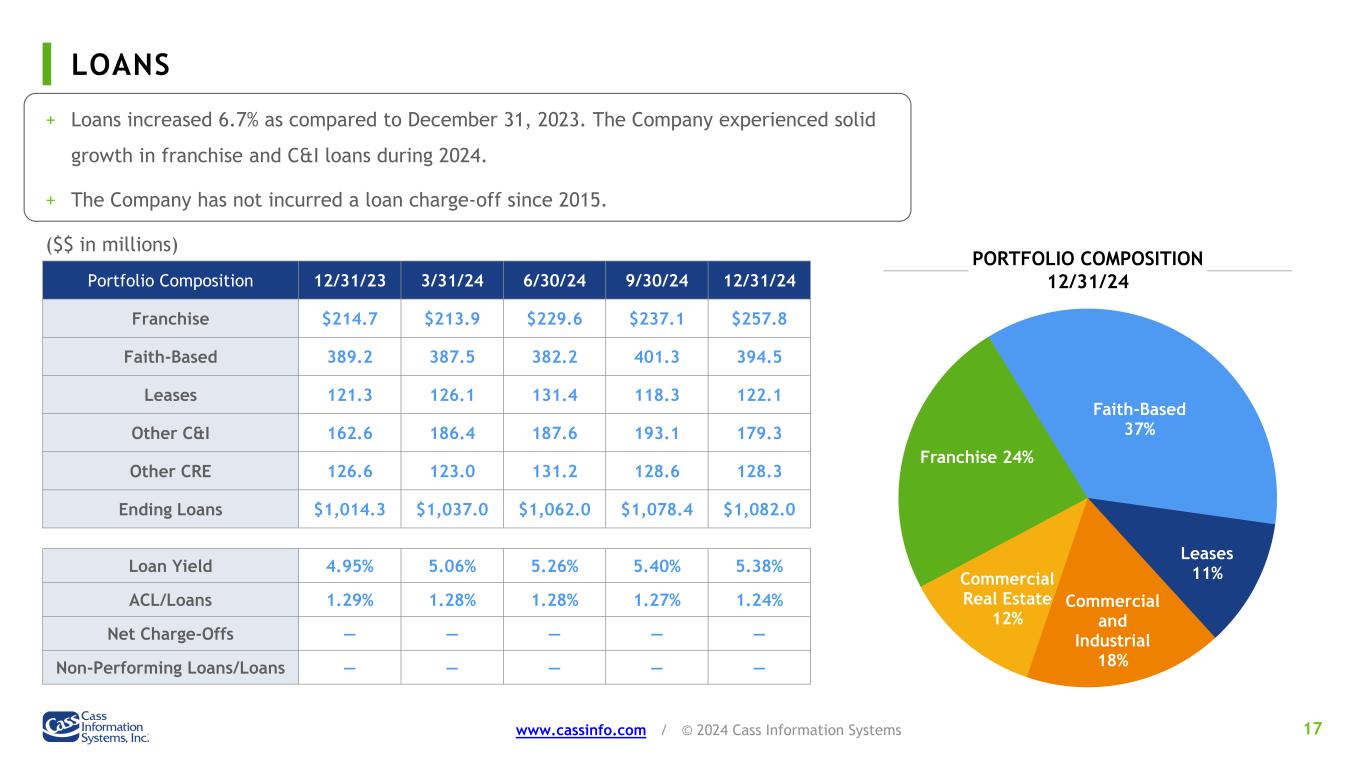

LOANS 17www.cassinfo.com / © 2024 Cass Information Systems + Loans increased 6.7% as compared to December 31, 2023. The Company experienced solid growth in franchise and C&I loans during 2024. + The Company has not incurred a loan charge-off since 2015. Portfolio Composition 12/31/23 3/31/24 6/30/24 9/30/24 12/31/24 Franchise $214.7 $213.9 $229.6 $237.1 $257.8 Faith-Based 389.2 387.5 382.2 401.3 394.5 Leases 121.3 126.1 131.4 118.3 122.1 Other C&I 162.6 186.4 187.6 193.1 179.3 Other CRE 126.6 123.0 131.2 128.6 128.3 Ending Loans $1,014.3 $1,037.0 $1,062.0 $1,078.4 $1,082.0 Loan Yield 4.95% 5.06% 5.26% 5.40% 5.38% ACL/Loans 1.29% 1.28% 1.28% 1.27% 1.24% Net Charge-Offs — — — — — Non-Performing Loans/Loans — — — — — Franchise 24% Faith-Based 37% Leases 11% Commercial and Industrial 18% Commercial Real Estate 12% PORTFOLIO COMPOSITION 12/31/24 ($$ in millions)

INVESTMENT PORTFOLIO COMPOSITION 18www.cassinfo.com / © 2024 Cass Information Systems + All investment securities are classified as available-for-sale. The overall weighted-average repricing term is 4.0 years and the average yield for 4Q2024 was 2.87%. The portfolio had unrealized losses of $59.7 million at December 31, 2024 resulting in a total fair value for the portfolio of $528.0 million. + The asset-backed securities are backed by student loans in the FFELP program with a minimum 97% guaranty by the U.S. Department of Education. Theses securities have long maturities but are floating rate assets. + Of the total $95.8 million portfolio of high-quality corporate bonds, $28.0 million are floating rate. + The mortgage-backed securities portfolio has an estimated average life of 4.9 years. + 99% of the municipal securities are an investment grade of “A” or higher. PORTFOLIO COMPOSITION (BOOK VALUE) State and Political $188.9M MBS $267.4M Corporate Bonds $95.8M Asset-Backed $35.6M

FUNDING 19www.cassinfo.com / © 2024 Cass Information Systems + For 4Q2024, 69.5% of average funding was non-interest bearing, a strategic advantage in the current interest rate environment. + Average accounts and drafts payable declined during 4Q2024 as a result of a cyber event at a CassPay client during Q1 2024, resulting in the loss of approximately $100.0 million of balances, in addition to a decrease in transportation dollar volumes of 0.6%, partially offset by an increase in facility dollar volumes of 9.1%. AVERAGE DEPOSITS AND ACCOUNTS & DRAFTS PAYABLE FUNDING COMPOSITION $1.4B IN NON- INTEREST FUNDING $1.11B $1.04B $1.00B $1.03B $1.06B $1.06B $1.08B $1.05B $1.03B $1.04B Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 AVERAGE DEPOSITS AVERAGE ACCOUNTS & DRAFTS PAYABLE $2.17B $2.12B $2.05B $2.1B $2.06B Int-DDA, MM, Savings $635.2M Non-Interest $251.2M Accts & Drafts Payable $1,149.3M Time Deposits $81.5M

KEY FUNDING POINTS 20www.cassinfo.com / © 2024 Cass Information Systems + Accounts and drafts payable represents float generated by our payments businesses and have proven a very stable source of funding over a long period of time. + Deposits are generated from core Bank and CassPay clients. These deposits almost entirely consist of operating accounts from core faith-based and other C&I clients as well as CassPay clients where the Company generates float. + The cost of deposits for the fourth quarter of 2024 was 1.77%. + The Bank participates in the CDARS and ICS programs offered by Promontory Interfinancial Network, LLC, enabling FDIC insurance up to $100 million on money market accounts and $50 million on certificates of deposit. + There are no brokered deposits or wholesale borrowings. + The Bank has a $184 million secured line of credit with the FHLB collateralized by commercial mortgage loans. + The Company has $250.0 million of unused lines of credit collateralized by investment securities.

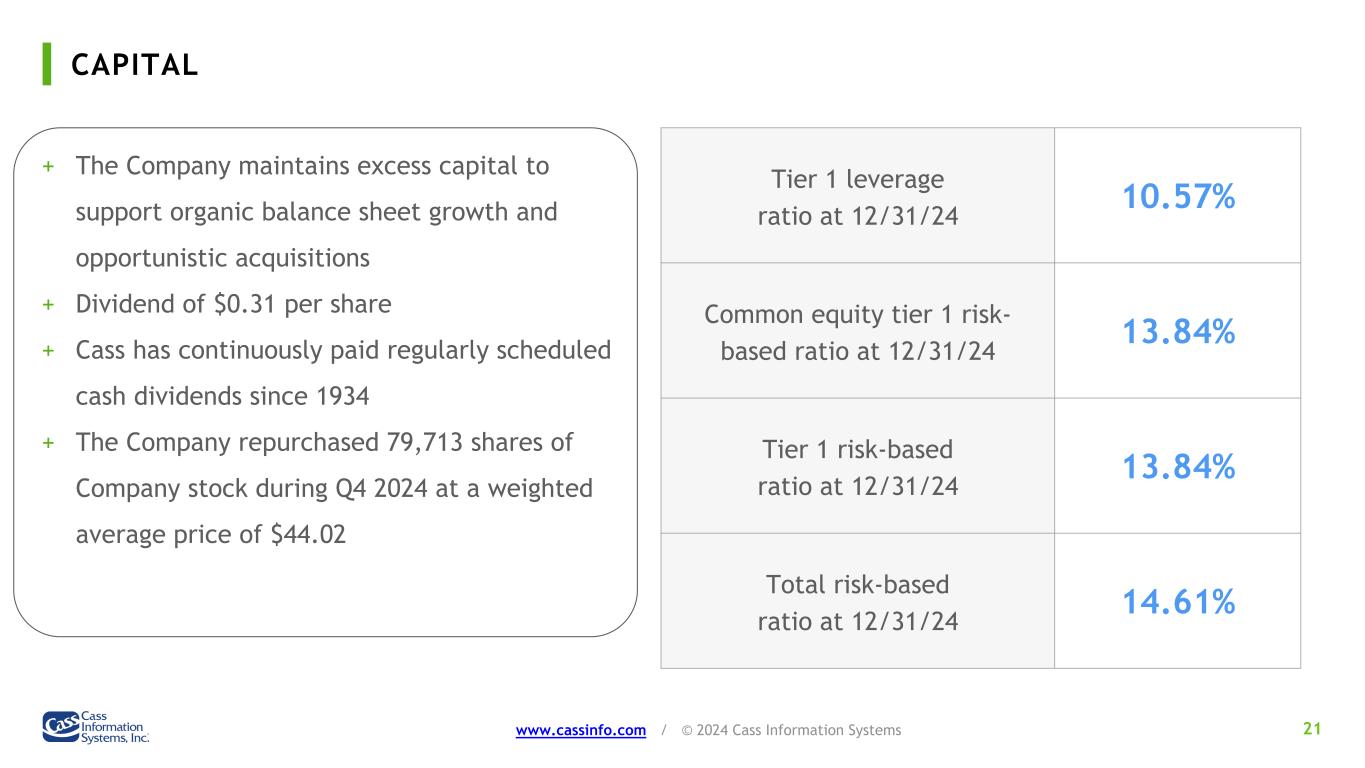

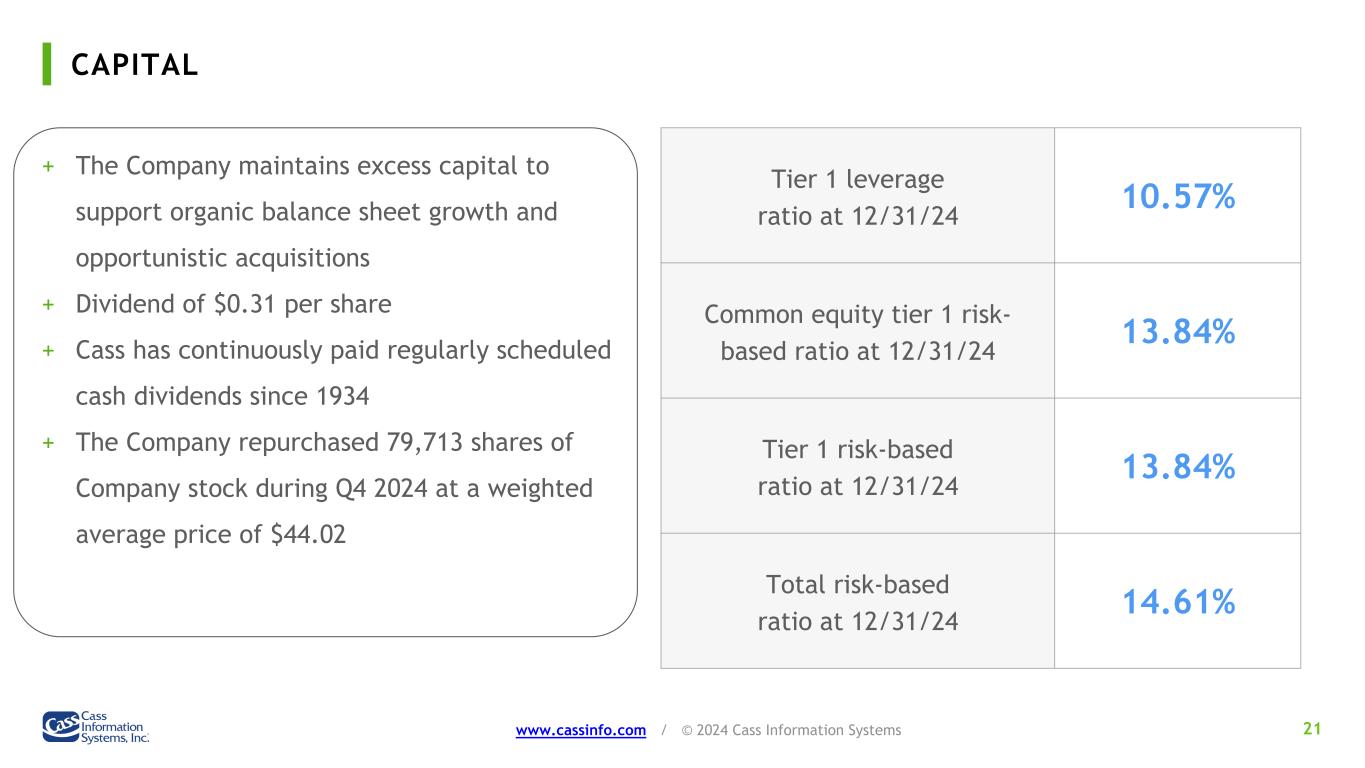

CAPITAL 21www.cassinfo.com / © 2024 Cass Information Systems + The Company maintains excess capital to support organic balance sheet growth and opportunistic acquisitions + Dividend of $0.31 per share + Cass has continuously paid regularly scheduled cash dividends since 1934 + The Company repurchased 79,713 shares of Company stock during Q4 2024 at a weighted average price of $44.02 Tier 1 leverage ratio at 12/31/24 10.57% Common equity tier 1 risk- based ratio at 12/31/24 13.84% Tier 1 risk-based ratio at 12/31/24 13.84% Total risk-based ratio at 12/31/24 14.61%

LEADERSHIP AND SHAREHOLDER INFORMATION 22www.cassinfo.com / © 2024 Cass Information Systems

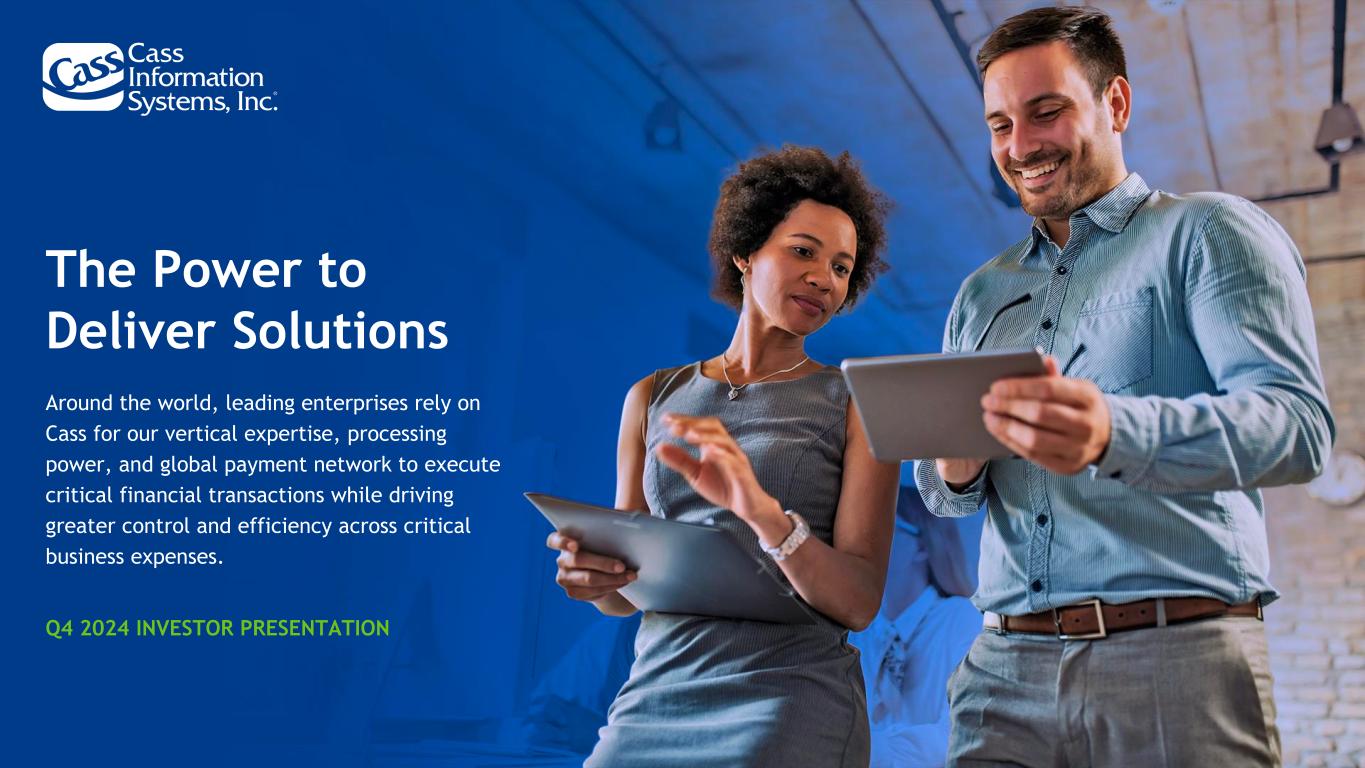

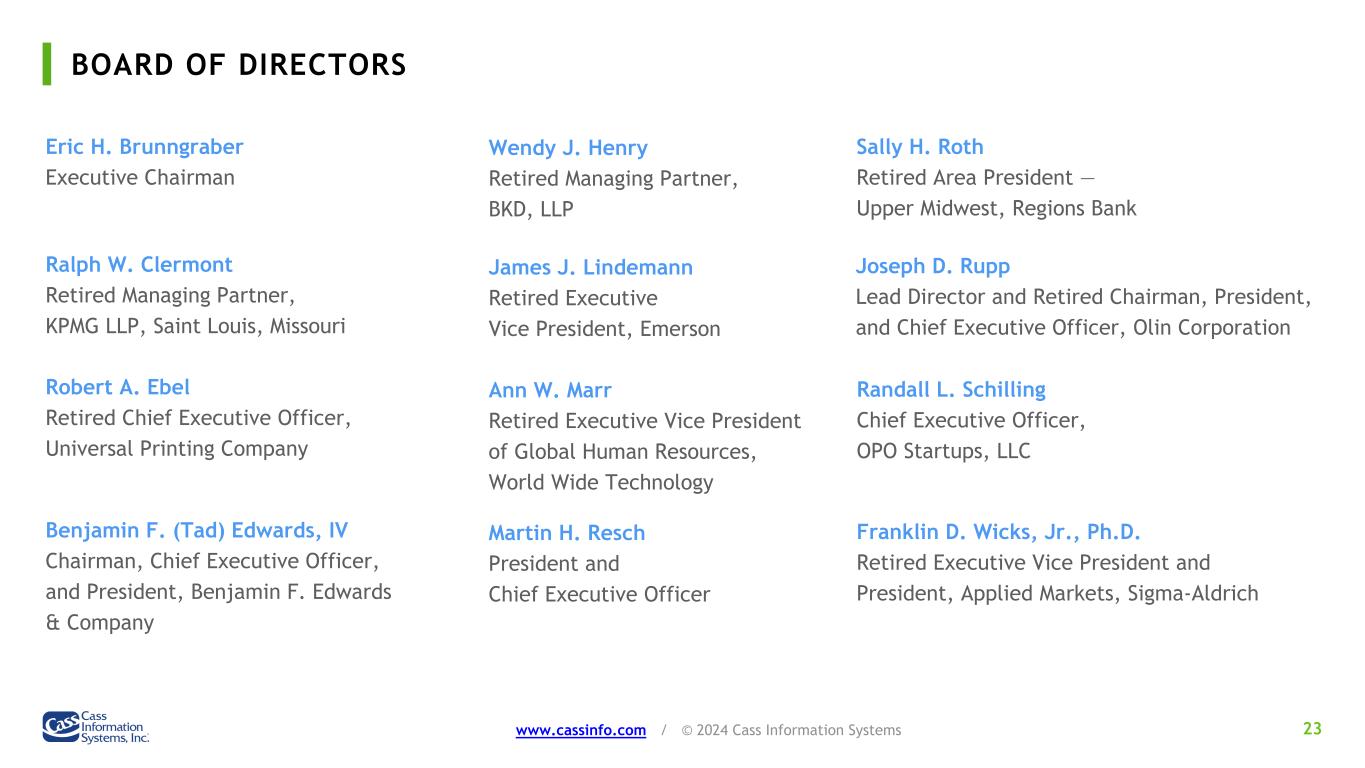

BOARD OF DIRECTORS 23 Eric H. Brunngraber Executive Chairman Ralph W. Clermont Retired Managing Partner, KPMG LLP, Saint Louis, Missouri Robert A. Ebel Retired Chief Executive Officer, Universal Printing Company Wendy J. Henry Retired Managing Partner, BKD, LLP James J. Lindemann Retired Executive Vice President, Emerson Sally H. Roth Retired Area President — Upper Midwest, Regions Bank Joseph D. Rupp Lead Director and Retired Chairman, President, and Chief Executive Officer, Olin Corporation Randall L. Schilling Chief Executive Officer, OPO Startups, LLC Franklin D. Wicks, Jr., Ph.D. Retired Executive Vice President and President, Applied Markets, Sigma-Aldrich Benjamin F. (Tad) Edwards, IV Chairman, Chief Executive Officer, and President, Benjamin F. Edwards & Company www.cassinfo.com / © 2024 Cass Information Systems Ann W. Marr Retired Executive Vice President of Global Human Resources, World Wide Technology Martin H. Resch President and Chief Executive Officer

LEADERSHIP COUNCIL 24 Cory J. Bricker Senior Vice President and President - CassPay Carl N. Friedholm Senior Vice President and President - Telecom Expense Management Christi A. Reiter Senior Vice President - Human Resources Nicole M. Jennings Vice President - Internal Audit and Risk Management Martin H. Resch President and Chief Executive Officer Mark A. Campbell Senior Vice President and President – Government Payables Jeanne M. Scannell Chief Credit Officer - Cass Commercial Bank James M. Cavellier Executive Vice President and Chief Information Officer Teresa D. Meares Senior Vice President and President - Waste Expense Management Matthew S. Schuckman Executive Vice President, General Counsel, and Corporate Secretary Dwight D. Erdbruegger President and Chief Operating Officer, Cass Commercial Bank Michael J. Normile Executive Vice President and Chief Financial Officer Anthony G. Urban Executive Vice President - Transportation Information Services www.cassinfo.com / © 2024 Cass Information Systems Ross M. Miller Senior Vice President and President - TouchPoint Sean M. Mullins Vice President – Chief Information Security Officer Todd J. Wills Senior Vice President and President - Utility Expense Management

SHAREHOLDER INFORMATION 25www.cassinfo.com / © 2024 Cass Information Systems CORPORATE HEADQUARTERS Cass Information Systems, Inc. 12444 Powerscourt Drive, Suite 550 Saint Louis, Missouri 63131 314.506.5500 www.cassinfo.com INVESTOR RELATIONS ir@cassinfo.com COMMON STOCK The company’s common stock trades on the NASDAQ stock market under the symbol CASS. INDEPENDENT AUDITORS KPMG LLP 10 South Broadway, Suite 900 Saint Louis, Missouri 63102 TRANSFER AGENT Shareholder correspondence should be mailed to: Computershare P.O. Box 43006 Providence, RI 02940-3006 Overnight correspondence should be mailed to: Computershare 150 Royall St, Suite 101 Canton, MA 02021 SHAREHOLDER WEBSITE www.computershare.com/investor SHAREHOLDER ONLINE INQUIRIES www-us.computershare.com /investor/Contact TOLL-FREE PHONE 866.323.8170

Thank You for Your Time