Consolidated operating expenses decreased $404,000, or 1.4%, primarily as a result of the pandemic-related decline in travel and other business development activities.

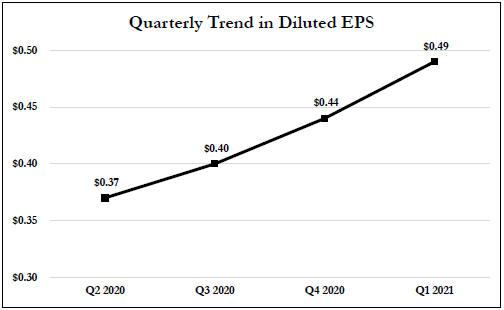

“Despite the pandemic and historically low interest rates, Cass has been able to steadily grow its customer base, revenue and earnings since the second quarter of 2020,” noted Eric H. Brunngraber, Cass chairman and chief executive officer. “These achievements are a testament to the ability of our team to innovate and successfully adapt when faced with an uphill challenge.”

Cash Dividend Declared

On April 20, 2021, the company’s board of directors declared a second quarter dividend of $.27 per share payable June 15, 2021 to shareholders of record June 4, 2021. Cass has continuously paid regularly scheduled cash dividends since 1934.

About Cass Information Systems

Cass Information Systems, Inc. is a leading provider of integrated information and payment management solutions. Cass enables enterprises to achieve visibility, control and efficiency in their supply chains, communications networks, facilities and other operations. Disbursing more than $60 billion annually on behalf of clients, and with total assets of $2 billion, Cass is uniquely supported by Cass Commercial Bank. Founded in 1906 and a wholly owned subsidiary, Cass Bank provides sophisticated financial exchange services to the parent organization and its clients. Cass is part of the Russell 2000®. More information is available at www.cassinfo.com.

Note to Investors

Certain matters set forth in this news release may contain forward-looking statements that are provided to assist in the understanding of anticipated future financial performance. However, such performance involves risks and uncertainties that may cause actual results to differ materially from those in such statements. These risks and uncertainties include the scope, duration and ultimate impact of the COVID-19 pandemic as well as economic and market conditions, risks of credit deterioration, interest rate changes, governmental actions, market volatility, security breaches and technology interruptions, energy prices and competitive factors, among others, as set forth in the Company’s most